UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

THE MANAGERS FUNDS

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

| Date of fiscal year end: | | DECEMBER 31 |

| |

| Date of reporting period: | | JANUARY 1, 2011 – December 31, 2011 (Annual Shareholder Report) |

Item 1. Reports to Shareholders

The Managers Funds

Annual Report — December 31, 2011

| | | | |

TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 1 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

Managers International Equity Fund | | | 4 | |

| |

Managers Emerging Markets Equity Fund | | | 12 | |

| |

Managers Global Bond Fund | | | 19 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 27 | |

| |

FINANCIAL STATEMENTS: | | | | |

| |

Statements of Assets and Liabilities | | | 33 | |

Funds’ balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statements of Operations | | | 34 | |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the year | | | | |

| |

Statements of Changes in Net Assets | | | 35 | |

Detail of changes in Fund assets for the past two years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 37 | |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 39 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 47 | |

| |

TRUSTEES AND OFFICERS | | | 48 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Our foremost goal at Managers Investment Group (“MIG”) is to structure and manage mutual funds that will help our shareholders and clients successfully reach their investment goals and objectives.

Each of our Funds is geared to provide you with exposure to a specific asset class or style of investing. We believe investors tend to use our Funds as part of their broader portfolio in order to tailor their asset allocation to meet their individual needs. Most of our Funds, like those detailed in this report, are therefore designed to be building blocks.

At MIG, we have overall responsibility for the investment management and administration of the Funds. As a “manager of managers,” we work with external investment managers that make the day-to-day investment decisions in the Funds (the “Portfolio Managers”). We devote considerable resources to our disciplined process of identifying and selecting unaffiliated Portfolio Managers for the Funds. As a manager of managers, MIG performs many activities to monitor the ongoing investment, compliance, and administrative aspects of all of the Funds, which we believe gives our shareholders added confidence in their investments.

Both non-U.S. developed and emerging markets struggled in 2011, with a majority of losses concentrated in the third quarter. Early in the year, markets were surprisingly resilient given significant macroeconomic events such as the Arab Spring and the devastating consequences of the Japanese tsunami. However, markets were not nearly as resilient during the summer months as the fear of European sovereign debt contagion shook equity markets. In addition, the stalemate in Washington involving the U.S. debt ceiling along with the S&P downgrade of U.S. sovereign credit rating had a debilitating effect on non-U.S. equities as well. The end of September and into the fourth quarter, however, featured almost a complete reversal of the “risk off” trade from the summer months with markets responding positively both to the coordinated efforts of European policymakers to head off issues surrounding their collective sovereign debt crisis. International equities, however, were never able to fully recover as they did in the U.S. As for global bond markets, a low interest rate environment throughout the year continued to reinforce the reach for yield. Bond markets were generally positive amidst the volatility and were led by government issues as measured by the Barclays Capital Global Government Bond Index which returned 9.13% for the year.

| | | | | | | | | | | | | | | | | | | | | | | | |

Periods Ended 12/31/11 | | 6 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Inception Date | |

Managers International Equity Fund | | | (17.81) | % | | | (13.98) | % | | | 5.72 | % | | | (7.07) | % | | | 2.69 | % | | | 12/31/1985 | |

MSCI EAFE Index (Net) | | | (16.31) | % | | | (12.14) | % | | | 7.65 | % | | | (4.72) | % | | | 4.67 | % | | | | |

Managers Emerging Markets Equity Fund | | | (20.77) | % | | | (20.31) | % | | | 15.07 | % | | | (2.32) | % | | | 11.01 | % | | | 2/9/1998 | |

MSCI EM Index (Net) | | | (19.13) | % | | | (18.42) | % | | | 20.07 | % | | | 2.40 | % | | | 13.86 | % | | | | |

MSCI EM Index (Gross) | | | (19.01) | % | | | (18.17) | % | | | 20.42 | % | | | 2.70 | % | | | 14.20 | % | | | | |

| |

Managers Global Bond Fund | | | (1.50) | % | | | 3.39 | % | | | 11.28 | % | | | 5.90 | % | | | 7.89 | % | | | 3/25/1994 | |

Barclays Capital Global Aggregate Bond Index | | | 1.21 | % | | | 5.64 | % | | | 6.04 | % | | | 6.46 | % | | | 7.16 | % | | | | |

For the year ended December 31, 2011, the Managers International Equity Fund returned -13.98%, underperforming the return of -12.14% for the MSCI EAFE Index. For the year ended December 31, 2011, the Managers Emerging Markets Equity Fund returned -20.31%, underperforming the return of -18.42% for the MSCI Emerging Markets Index. At a meeting held on January 17, 2012, The Managers Funds Board of Trustees approved a plan to liquidate both the Managers International Equity and Managers Emerging Market Equity Funds. The liquidations are expected to occur on or about March 9, 2012.

Letter to Shareholders (continued)

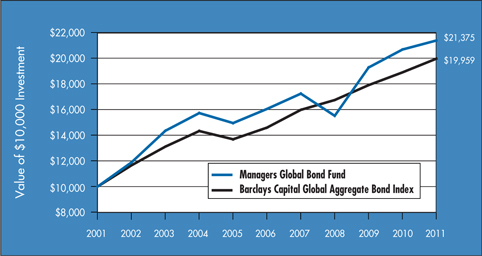

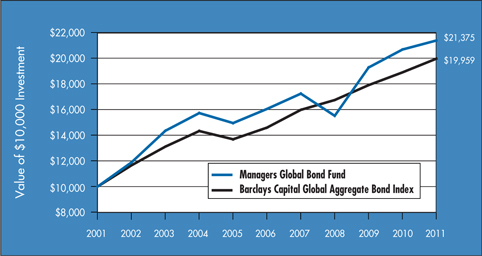

For the year ended December 31, 2011, the Managers Global Bond Fund returned 3.39%, underperforming the return of 5.64% for the Barclays Capital Global Aggregate Bond Index. The major drivers of the Fund’s underperformance relative to the benchmark were its emphasis on higher yielding corporate bonds, with a related underweight to Treasuries, and select positioning among emerging market currencies. Effective February 1, 2012, the name of the Managers Global Bond Fund was changed to Managers Global Income Opportunity Fund. In addition to the name change, the Fund made enhancements to supply the manager with greater flexibility to implement its best global investment ideas in the Fund.

The following report covers the one-year period ended December 31, 2011. Should you have any questions about this report, or if you’d like to receive a prospectus and additional information, including fees and expenses for this or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our web site at www.managersinvest.com. As always, please read the prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit our web site for information on other MIG product offerings. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

Respectfully,

Keitha Kinne

Managing Partner

Managers Investment Group LLC

About Your Fund’s Expenses

| | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. | | |

Actual Expenses | | |

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. | | |

Hypothetical Example for Comparison Purposes | | |

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | | |

Please note that the expenses shown in the table are meant to highlight your on going costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. | | |

| | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2011 | | Expense Ratio

for the Period | | | Beginning

Account Value

07/01/2011 | | | Ending

Account Value

12/31/2011 | | | Expenses Paid

During the

Period* | |

Managers International Equity Fund | |

Based on Actual Fund Return | | | 1.34 | % | | $ | 1,000 | | | $ | 822 | | | $ | 6.15 | |

Based on

Hypothetical 5% Annual Return | | | 1.34 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.82 | |

Managers Emerging Markets Equity Fund | |

Based on Actual Fund Return | | | 1.64 | % | | $ | 1,000 | | | $ | 792 | | | $ | 7.41 | |

Based on

Hypothetical 5% Annual Return | | | 1.64 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.34 | |

Managers Global Bond Fund | |

Based on Actual Fund Return | | | 1.10 | % | | $ | 1,000 | | | $ | 985 | | | $ | 5.50 | |

Based on

Hypothetical 5% Annual Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.60 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

Managers International Equity Fund

Investment Manager’s Comments

The Managers International Equity Fund’s (the “Fund”) investment objective is to achieve long-term capital appreciation. Income is the Fund’s secondary objective.

The Managers International Equity Fund ordinarily invests at least 80% of assets in equity securities, and at least 65% of assets in common and preferred stocks of companies domiciled outside the United States. The Fund intends to diversify investments among both countries and sectors. Investments may be made in companies in developed as well as developing countries. The Fund may also engage in currency-hedging strategies and may invest in companies of any size. The MSCI EAFE Index (the “Index”) is the benchmark for the Fund.

THE PORTFOLIO MANAGERS

The Fund employs multiple portfolio managers who specialize in distinct investment approaches. This “intelligence diversification” not only serves to manage risk, but also helps the Fund tap the market’s full potential by focusing different analytical insights on each potential investment. Fund management strives to achieve its performance goals and diversification while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

AllianceBernstein L.P.’s Investment Research and Management (“AllianceBernstein”)

AllianceBernstein’s approach to investing is value based and research driven. The thesis of AllianceBernstein’s investment philosophy is that human nature leads investors to buy and sell financial assets based on an overreaction to near-term events. They believe investors confuse temporary or cyclical characteristics with the creation of buying opportunities, as investors underestimate the potential for corrective strategies to restore long-term earnings power. The investment team, led by Kevin Simms, attempts to exploit this disconnect by using research to separate fact from emotion.

The primary driver of AllianceBernstein’s performance is research-driven security selection. AllianceBernstein screens their initial universe with a proprietary return model in order to identify the companies with the most attractive value attributes. The model derives an expected return for each company within the universe by assessing companies both from a global industry-based perspective and from a country-based standpoint, evaluating such factors as price-to-cash earnings, price-to-book, return on equity, and price momentum. The ideal company would exhibit strong fundamentals and have strong future business prospects.

Portfolio Construction

| | • | | Initial investable universe is composed of all companies within the countries of the MSCI All Country World Index ex U.S. universe with a market capitalization greater than $750M |

| | • | | Investment team screens this universe using a proprietary-return model to identify the companies with the most attractive value attributes |

| | • | | The model derives an expected return for each company in the universe by assessing companies both from a global industry-based perspective and from a country-based standpoint |

| | • | | Factors include price-to-cash earnings, price-to-book, return on equity, and price momentum |

| | • | | Analysts perform extensive research, focusing on the most attractively valued stocks |

| | • | | They then build detailed spreadsheets of historical and projected balance-sheet and income-statement information in order to estimate: |

| | — | Normalized earnings power |

| | — | Cash flow and asset values for each company for the next five years |

| | • | | Perform simulations to see the potential impact of changes in various financial-statement components |

| | • | | Analysts present their estimates and ratings for each security to the Research Review Committee of the Investment Policy Group |

| | • | | The Committee challenges the analysts’ assumptions and conclusions to ensure they are sound |

The Portfolio

| | • | | Typically holds 30-85 stocks |

| | • | | Initial stock weightings are 0.5% - 3.5% |

Lazard Asset Management, LLC (“Lazard”)

Portfolio Manager William (Willy) Holzer believes that there is a single global economy and marketplace within which everything is connected. Within this single market it is important to distinguish between three types of companies: domestic companies are those that produce, sell, and raise capital all in their home country; international companies are those that produce at home, but sell their products and raise capital anywhere in the world; and global companies are those that produce, sell, and raise capital anywhere in the world. Holzer will invest in any of these types of companies in order to capitalize on a theme. However, he prefers global companies, which generally have the flexibility and resources to exploit global trends.

Willy Holzer can be described as a “top-down” thematic investor whose themes are based on bottom-up observations and company analysis. He views the world as a single global economic unit as opposed to a collection of separate country economies. Willy focuses his efforts by first analyzing the connections within the global economy and from this analysis develops global investment themes. These themes target the segments of the global economy

Managers International Equity Fund

Investment Manager’s Comments (continued)

that he believes are most likely to provide attractive long-term investment returns and that also represent an asymmetric investment opportunity in the investor’s favor.

Portfolio Construction

| | • | | Portfolio Manager leverages stock ideas and research from top-down themes based on bottom-up observations and company analysis |

| | • | | Portfolio is constructed around approximately ten investment themes to diversify opportunity sets and provide risk benefits |

| | • | | Portfolio heavily weights large-capitalization, multi-national companies |

| | • | | Concentrated in the developed markets |

| | • | | May have operations or distribution in the emerging markets |

The Portfolio

| | • | | Portfolio typically holds 90 to 110 stocks |

| | • | | Initial stock weightings are 1.0% to 1.5% |

| | • | | Relatively low turnover in the 30% to 40% annual range |

Martin Currie Inc. (“Martin Currie”)

Martin Currie, based in Edinburgh, Scotland, is a 129- year old firm. It specializes in developed market ex-U.S. mandates and currently manages $8.6B for a global client base of pension funds, family offices, multi-managers, banks, public funds, foundations, sub-advisory clients and wrap programs. Willie Watt, the firm’s Chief Executive Officer, joined the firm in 2000 and was at the forefront of evolving Martin Currie from a firm that focused on adding value via a top-down investment process to its current process, which uses bottom-up stock selection analysis as its primary portfolio management focus.

James Fairweather, Chief Investment Officer, heads the international equity investment team which has four members who have 75 years of total investment experience. The team is supported in their efforts by an experienced 14- person global sector analyst staff with no member having less than 9 years of total investment experience. In addition, regional teams also support the stock selection process by contributing insights and ideas on companies within their specific geographic coverage area. Finally, a separate risk management team helps support the portfolio construction.

Portfolio Construction

| | • | | Focused on identifying companies at the earlier stages of change with the thought that the market usually underestimates the amount by which change will take place |

| | • | | Team uses a fully integrated global approach to stock selection and use a high level of communication across regions to build a truly global portfolio |

| | • | | Focus on speaking a common language when doing all stock level research with the emphasis on quality, value, growth, and change |

| | • | | Risk is managed at every level of the investment process including when conducting stock selection and when constructing the portfolio |

The Portfolio

| | • | | Portfolio typically holds 45 to 80 stocks |

| | • | | Holdings tend to have low cross-stock correlations |

| | • | | Holdings tend to have low sensitivity to macro factors |

| | • | | Forecasted tracking error 4% to 6% relative to MSCI EAFE Index |

THE YEAR IN REVIEW

For the year 2011, the Fund returned -13.98%, underperforming the return of -12.14% for the MSCI EAFE Index. (Note that unless otherwise stated, all performance cited in this commentary is in U.S. Dollars).

International equity markets struggled in 2011, with a majority of losses concentrated in the third quarter. Early in the year, markets were surprisingly resilient given significant macroeconomic events such as the Arab Spring and the devastating consequences of the Japanese tsunami. However, markets were not nearly as resilient during the summer months as the fear of European sovereign debt contagion shook equity markets. In addition, the stalemate in Washington involving the U.S. debt ceiling along with the S&P downgrade of U.S. sovereign credit rating had a debilitating effect on non-U.S. equities as well. The end of September and into the fourth quarter, however, featured almost a complete reversal of the “risk off” trade from the summer months with markets responding positively both to the coordinated efforts of European policymakers to head off issues surrounding their collective sovereign debt crisis. For the full calendar year, there was a sharp dichotomy in performance at the sector level within non-US. equities with the defensive consumer staples (4.5%) and health care (6.3%) sectors offering modest but positive returns while more cyclically geared sectors such as information technology (-18.3%) and materials (-22.6%) struggled amid the uncertainty.

For the year, the Fund’s underperformance was primarily driven by stock selection, particularly within the energy sector. In addition, the Fund’s underweight to the defensive consumer staples sector was a net detractor to performance. The losses were mitigated, however, by strong stock selection within the Fund’s information technology and telecomm holdings. At the manager level, both Lazard and Martin Currie outperformed in 2011 while Bernstein failed to keep pace with the benchmark. Martin Currie, in particular, performed well boosted by strong stock selection as well as by their higher quality focus.

Managers International Equity Fund

Investment Manager’s Comments (continued)

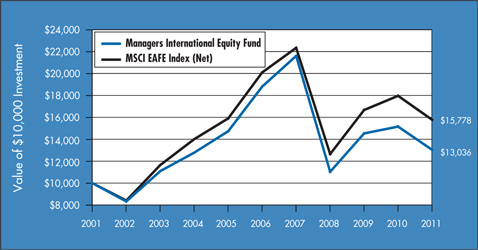

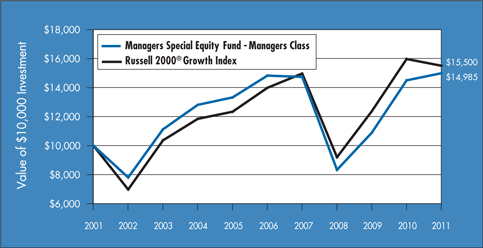

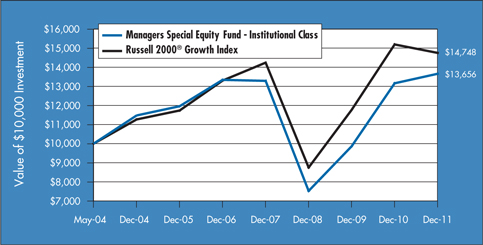

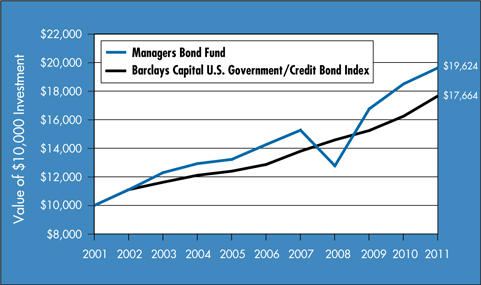

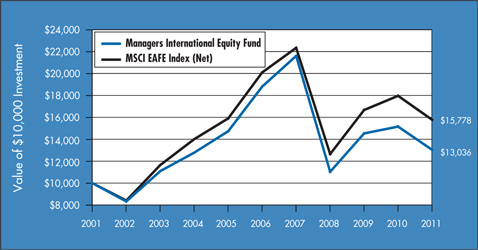

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers International Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in Managers International Equity Fund on December 31, 2001, to a $10,000 investment made in the MSCI EAFE for the same time period. The table is not intended to imply any future performance of the Fund. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for Managers International Equity Fund and the MSCI EAFE Index from December 31, 2001 through December 31, 2011.

| | | | | | | | | | | | |

Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

Managers International Equity Fund2,3,4 | | | (13.98 | )% | | | (7.07 | )% | | | 2.69 | % |

MSCI EAFE Index(Net) | | | (12.14 | )% | | | (4.72 | )% | | | 4.67 | % |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual return. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2011. All returns are in U.S. dollars ($). | |

| 2 | Fund for which, from time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| | |

| | | 3 Investments in foreign securities are subject to additional risks such as changing market conditions, economic and political instability, and currency exchange rate fluctuations. 4 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar security when converted back to U.S. Dollars. The MSCI EAFE® Index (Net) (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI EAFE Index (Net) consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. Unlike the Fund, the MSCI EAFE Index is unmanaged, is not available for investment, and does not incur expenses. All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. Not FDIC insured, nor bank guaranteed. May lose value. |

6

Managers International Equity Fund

Fund Snapshots (unaudited)

December 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers International

Equity Fund** | | | MSCI EAFE Index® | |

Financials | | | 21.5 | % | | | 21.4 | % |

Materials | | | 11.4 | % | | | 10.1 | % |

Consumer Discretionary | | | 10.9 | % | | | 10.0 | % |

Energy | | | 10.5 | % | | | 9.2 | % |

Industrials | | | 9.9 | % | | | 12.5 | % |

Health Care | | | 8.9 | % | | | 10.0 | % |

Consumer Staples | | | 8.4 | % | | | 11.5 | % |

Information Technology | | | 6.3 | % | | | 4.7 | % |

Telecommunication Services | | | 5.7 | % | | | 6.1 | % |

Utilities | | | 2.9 | % | | | 4.5 | % |

Other Assets and Liabilities | | | 3.6 | % | | | 0.0 | % |

** As a percentage of net assets

Top Ten Holdings

| | | | |

Security Name | | % of Net

Assets | |

Vodafone Group PLC* | | | 2.4 | % |

Novartis AG* | | | 2.1 | |

BP PLC | | | 1.9 | |

GlaxoSmithKline PLC | | | 1.8 | |

AstraZeneca PLC* | | | 1.5 | |

Nestle SA, Registered | | | 1.4 | |

Royal Dutch Shell PLC, Class B | | | 1.3 | |

Prudential PLC* | | | 1.2 | |

Air Liquide SA | | | 1.1 | |

ING Groep N.V.* | | | 1.1 | |

| | | | |

Top Ten as a Group | | | 15.8 | % |

| | | | |

| * | Top Ten Holding at June 30, 2011 |

|

| Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report. |

7

Managers International Equity Fund

Fund Snapshots (continued)

Summary of Investments by Country

| | | | | | | | |

Country | | Managers International

Equity Fund* | | | MSCI EAFE Index® | |

Australia | | | 2.6 | % | | | 8.6 | % |

Austria | | | 0.0 | % | | | 1.0 | % |

Belgium | | | 0.2 | % | | | 0.9 | % |

Bermuda | | | 0.4 | % | | | 0.4 | % |

Brazil | | | 3.6 | % | | | 0.0 | % |

Canada | | | 4.4 | % | | | 0.0 | % |

Cayman Islands | | | 0.0 | % | | | 0.8 | % |

China | | | 1.3 | % | | | 0.0 | % |

Denmark | | | 0.0 | % | | | 0.8 | % |

Finland | | | 0.0 | % | | | 0.5 | % |

France | | | 7.1 | % | | | 8.7 | % |

Germany | | | 6.6 | % | | | 7.8 | % |

Greece | | | 0.0 | % | | | 0.3 | % |

Hong Kong | | | 5.1 | % | | | 2.4 | % |

India | | | 0.7 | % | | | 0.0 | % |

Ireland | | | 0.0 | % | | | 0.2 | % |

Israel | | | 0.7 | % | | | 0.7 | % |

Italy | | | 0.8 | % | | | 2.2 | % |

Japan | | | 18.8 | % | | | 21.6 | % |

Jersey, Channel Islands | | | 0.0 | % | | | 0.2 | % |

Luxembourg | | | 0.0 | % | | | 0.1 | % |

Netherlands | | | 5.3 | % | | | 2.7 | % |

New Zealand | | | 0.0 | % | | | 0.1 | % |

Norway | | | 0.4 | % | | | 0.8 | % |

Portugal | | | 0.4 | % | | | 0.2 | % |

Russia | | | 1.9 | % | | | 0.0 | % |

Singapore | | | 1.3 | % | | | 1.5 | % |

South Africa | | | 0.6 | % | | | 0.0 | % |

South Korea | | | 2.8 | % | | | 0.0 | % |

Spain | | | 0.5 | % | | | 3.3 | % |

Supranational & Other | | | 0.1 | % | | | 0.2 | % |

Sweden | | | 1.0 | % | | | 3.0 | % |

Switzerland | | | 7.9 | % | | | 8.5 | % |

Taiwan | | | 2.4 | % | | | 0.0 | % |

Thailand | | | 0.4 | % | | | 0.0 | % |

Turkey | | | 0.2 | % | | | 0.0 | % |

United Kingdom | | | 19.1 | % | | | 22.4 | % |

United States | | | 3.4 | % | | | 0.1 | % |

| | | | | | | | |

| | | 100.0 | % | | | 100.0 | % |

| | | | | | | | |

| * | As a percentage of total market value on December 31, 2011. |

Managers International Equity Fund

Schedule of Portfolio Investments

December 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Common Stocks - 96.4% | | | | | | | | |

Consumer Discretionary - 10.9% | | | | | |

adidas-Salomon AG (Germany) | | | 6,293 | | | $ | 408,875 | |

Bridgestone Corp. (Japan) | | | 29,000 | | | | 656,796 | |

British Sky Broadcasting PLC (United Kingdom) | | | 25,674 | | | | 292,099 | |

Compagnie Financiere Richemont SA (Switzerland) | | | 7,156 | | | | 359,966 | |

Cyrela Brazil Realty, S.A. (Brazil) | | | 22,200 | | | | 176,624 | |

Daimler AG (Germany) | | | 8,623 | | | | 377,760 | |

GKN PLC (United Kingdom) | | | 213,563 | | | | 606,454 | |

Magna International, Inc. (Canada) | | | 9,500 | | | | 317,055 | |

Mazda Motor (Japan)* | | | 151,000 | | | | 265,500 | |

New World Department Store China, Ltd. (Hong Kong) | | | 7,000 | | | | 3,984 | |

Nissan Motor Co., Ltd. (Japan) | | | 53,600 | | | | 479,993 | |

Parkson Retail Group, Ltd. (China) | | | 30,500 | | | | 37,354 | |

Pearson PLC (United Kingdom) | | | 39,216 | | | | 736,026 | |

Persimmon PLC (United Kingdom) | | | 41,547 | | | | 303,098 | |

Renault SA (France) | | | 13,010 | | | | 449,278 | |

Sekisui House, Ltd. (Japan) | | | 42,000 | | | | 373,229 | |

Sharp Corp. (Japan) | | | 52,000 | | | | 453,287 | |

SJM Holdings, Ltd. (Hong Kong) | | | 192,000 | | | | 311,569 | |

Sony Corp. (Japan) | | | 31,100 | | | | 560,764 | |

Volkswagen AG (Germany) | | | 17,300 | | | | 207,744 | |

Vivendi Universal SA (France) | | | 13,250 | | | | 289,241 | |

Sumitomo Rubber Industries, Ltd. (Japan) | | | 3,510 | | | | 524,784 | |

Total Consumer Discretionary | | | | | | | 8,191,480 | |

Consumer Staples - 8.4% | | | | | | | | |

Asahi Breweries, Ltd. (Japan) | | | 13,200 | | | | 289,567 | |

British American Tobacco PLC (United Kingdom) | | | 8,171 | | | | 387,632 | |

Groupe Danone SA (France) | | | 5,771 | | | | 362,144 | |

Heineken N.V. (Netherlands) | | | 8,344 | | | | 386,287 | |

Henkel AG & Co., KGaA (Germany) | | | 6,363 | | | | 366,815 | |

Japan Tobacco, Inc. (Japan) | | | 151 | | | | 710,080 | |

Koninklijke Ahold N.V. (Netherlands) | | | 31,260 | | | | 420,152 | |

Lawson,, Inc. (Japan) | | | 5,900 | | | | 367,602 | |

Metro AG (Germany) | | | 3,148 | | | | 114,786 | |

Nestle SA, Registered (Switzerland) | | | 17,718 | | | | 1,017,430 | |

Seven & i Holdings Co., Ltd. (Japan) | | | 12,500 | | | | 348,372 | |

South African Brewing (United Kingdom) | | | 7,662 | | | | 269,368 | |

Tate & Lyle PLC (United Kingdom) | | | 29,832 | | | | 326,136 | |

Tingyi Cayman Islands Holding Corp. (China) | | | 40,000 | 2 | | | 121,161 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Unilever PLC (United Kingdom) | | | 11,700 | | | $ | 392,346 | |

Uni-President Enterprises Corp. (Taiwan) | | | 136,788 | | | | 199,602 | |

X5 Retail Group, N.V., GDR (Russia)* | | | 9,200 | | | | 209,706 | |

Total Consumer Staples | | | | | | | 6,289,186 | |

Energy - 10.5% | | | | | | | | |

BP PLC (United Kingdom) | | | 200,590 | | | | 1,428,849 | |

Canadian Natural Resources, Ltd. (Canada) | | | 11,400 | | | | 426,906 | |

Cenovus Energy, Inc. (Canada) | | | 12,868 | 2 | | | 427,312 | |

China Shenhua Energy Co., Ltd. (China) | | | 110,000 | | | | 475,670 | |

EnCana Corp. (Canada) | | | 6,768 | 2 | | | 125,494 | |

Gazprom OAO, Sponsored ADR (Russia) | | | 76,669 | | | | 816,826 | |

INPEX Corp. (Japan) | | | 68 | | | | 428,144 | |

Lukoil OAO, Sponsored ADR (Russia) | | | 8,148 | | | | 431,267 | |

Nexen, Inc. (Canada) | | | 21,898 | | | | 348,434 | |

Petrofac, Ltd. (United Kingdom) | | | 22,583 | | | | 505,071 | |

Petroleo Brasileiro, S.A., ADR (Brazil) | | | 14,325 | | | | 336,494 | |

Petroleo Brasileiro, S.A., Sponsored ADR (Brazil) | | | 6,500 | | | | 161,525 | |

Royal Dutch Shell PLC, Class A (Netherlands) | | | 3,400 | | | | 123,933 | |

Royal Dutch Shell PLC, Class B (Netherlands) | | | 24,820 | | | | 944,093 | |

SeaDrill, Ltd. (Bermuda)* | | | 7,910 | | | | 263,791 | |

Technip-Coflexip, ADR (France) | | | 4,584 | | | | 429,749 | |

Woodside Petroleum, Ltd. (Australia) | | | 6,100 | | | | 190,948 | |

Total Energy | | | | | | | 7,864,506 | |

Financials - 21.5% | | | | | | | | |

Aegon (Netherlands)* | | | 66,020 | | | | 263,861 | |

AIA Group, Ltd. (Hong Kong) | | | 238,400 | | | | 742,121 | |

Allianz SE (Germany) | | | 5,810 | | | | 554,878 | |

Banco do Brasil, S.A. (Brazil) | | | 31,200 | | | | 396,430 | |

Banco Santander, S.A. (Brazil) | | | 21,600 | | | | 173,240 | |

Bank of East Asia, Ltd. (Hong Kong) | | | 30,490 | 2 | | | 115,047 | |

Bank of Yokohama, Ltd., The (Japan) | | | 80,000 | | | | 377,439 | |

BNP Paribas SA (France) | | | 13,738 | | | | 534,948 | |

CapitaLand, Ltd. (Singapore) | | | 120,500 | | | | 205,073 | |

CapitaMalls Asia, Ltd. (Singapore) | | | 69,000 | | | | 60,091 | |

Cathay Financial Holding Co., Ltd. (Taiwan) | | | 115,783 | | | | 124,824 | |

China Life Insurance Co., Ltd. (China) | | | 34,000 | | | | 83,795 | |

China Overseas Land & Investment, Ltd. (Hong Kong) | | | 334,189 | | | | 554,614 | |

Chinatrust Financial Holding Co., Ltd. (Taiwan) | | | 235,839 | | | | 146,967 | |

Chuo Mitsui Trust Holdings, Inc. (Japan) | | | 31,760 | | | | 93,137 | |

Dai-ichi Mutual Life Insurance Co., The (Japan) | | | 110 | | | | 107,987 | |

|

The accompanying notes are an integral part of these financial statements. 9 |

Managers International Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Financials—21.5% (continued) | | | | | | | | |

Daiwa House Industry Co., Ltd. (Japan) | | | 17,000 | | | $ | 203,230 | |

Daiwa Securities Group, Inc. (Japan) | | | 16,000 | | | | 49,750 | |

DBS Group Holdings, Ltd. (Singapore) | | | 33,500 | | | | 297,355 | |

Deutsche Boerse AG (Germany)* | | | 915 | | | | 47,889 | |

DnB Holding ASA (Norway) | | | 29,600 | | | | 288,504 | |

Hana Financial Group, Inc. (South Korea) | | | 4,400 | | | | 136,344 | |

Hang Lung Properties, Ltd. (Hong Kong) | | | 29,000 | | | | 82,319 | |

HDFC Bank, Ltd. (India) | | | 22,575 | | | | 181,554 | |

Henderson Land Development Co., Ltd. (Hong Kong) | | | 61,000 | | | | 302,179 | |

Hong Kong Exchanges and Clearing, Ltd. (Hong Kong) | | | 35,900 | | | | 571,241 | |

HSBC Holdings PLC (United Kingdom) | | | 95,783 | | | | 731,206 | |

ING Groep N.V. (Netherlands)* | | | 117,981 | | | | 843,751 | |

Itau Unibanco Holding, S.A. (Brazil) | | | 16,000 | | | | 291,564 | |

Kasikornbank PCL (Thailand) | | | 85,200 | | | | 335,604 | |

KB Financial Group, Inc. (South Korea) | | | 11,395 | | | | 359,061 | |

KBC Bank & Insurance Group, Inc. (Belgium) | | | 10,400 | | | | 130,039 | |

Legal & General Group PLC (United Kingdom) | | | 248,628 | | | | 397,323 | |

Lloyds TSB Group PLC (United Kingdom)* | | | 662,800 | | | | 266,232 | |

Macquarie Group, Ltd. (Australia) | | | 11,527 | | | | 279,910 | |

Mitsubishi Estate Co., Ltd. (Japan) | | | 34,000 | | | | 506,988 | |

Mitsubishi Tokyo Financial Group, Inc. (Japan) | | | 171,300 | | | | 725,195 | |

Mitsui Fudosan Co., Ltd. (Japan) | | | 13,000 | | | | 189,562 | |

Muenchener Rueckversicherungs AG (Germany) | | | 2,670 | | | | 327,188 | |

National Australia Bank, Ltd. (Australia) | | | 22,200 | | | | 528,837 | |

Nomura Holdings, Inc. (Japan) | | | 41,100 | | | | 123,741 | |

Oversea-Chinese Banking Corp., Ltd. (Singapore) | | | 66,000 | | | | 398,036 | |

Prudential PLC (United Kingdom) | | | 93,413 | | | | 924,237 | |

Societe Generale (France) | | | 19,185 | | | | 423,520 | |

Standard Chartered PLC (United Kingdom) | | | 16,035 | | | | 350,723 | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 10,200 | | | | 282,874 | |

Sumitomo Realty & Development Co., Ltd. (Japan) | | | 11,000 | | | | 192,194 | |

Sun Hung Kai Properties, Ltd. (Hong Kong) | | | 26,000 | | | | 324,920 | |

T&D Holdings, Inc. (Japan) | | | 11,200 | | | | 104,282 | |

Turkiye Is Bankasi A.S. (Isbank) (Turkey) | | | 73,200 | | | | 127,693 | |

Zurich Financial Services AG (Switzerland)* | | | 1,197 | | | | 269,693 | |

Total Financials | | | | | | | 16,129,190 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Health Care - 8.9% | | | | | | | | |

Actelion, Ltd. (Switzerland)* | | | 6,531 | | | $ | 223,405 | |

AstraZeneca PLC (United Kingdom) | | | 24,570 | | | | 1,134,929 | |

Fresenius Medical Care AG (Germany) | | | 5,277 | | | | 358,435 | |

GlaxoSmithKline PLC (United Kingdom) | | | 58,109 | | | | 1,324,057 | |

Mindray Medical International, Ltd., Sponsored ADR (China) | | | 10,200 | 2 | | | 261,528 | |

Novartis AG (Switzerland) | | | 27,786 | | | | 1,586,389 | |

Roche Holding AG (Switzerland) | | | 3,500 | | | | 591,914 | |

Sanofi-Aventis SA (France) | | | 9,812 | | | | 717,233 | |

Teva Pharmaceutical Industries, Ltd., Sponsored ADR (Israel) | | | 4,400 | | | | 177,584 | |

Yamanouchi Pharmaceutical Co., Ltd. (Japan) | | | 7,900 | | | | 320,798 | |

Total Health Care | | | | | | | 6,696,272 | |

Industrials - 9.9% | | | | | | | | |

ABB, Ltd. (Switzerland)* | | | 25,367 | | | | 476,551 | |

ABB, Ltd., ADR (Switzerland)* | | | 22,630 | | | | 424,518 | |

Asahi Glass Co., Ltd. (Japan) | | | 52,000 | 2 | | | 434,715 | |

Atlas Copco AB (Sweden) | | | 18,560 | | | | 397,676 | |

Bouygues (France) | | | 17,664 | | | | 555,544 | |

China Merchants Holdings International Co., Ltd. (Hong Kong) | | | 106,000 | | | | 306,586 | |

Daikin Industries, Ltd. (Japan) | | | 10,600 | | | | 289,349 | |

FANUC, Ltd. (Japan) | | | 4,700 | | | | 716,902 | |

Far Eastern New Century Corp. (Taiwan) | | | 123,927 | | | | 143,710 | |

Kajima Corp. (Japan) | | | 26,000 | | | | 79,794 | |

Mitsubishi Corp. (Japan) | | | 13,600 | | | | 274,105 | |

Mitsubishi Heavy Industries., Ltd. (Japan) | | | 59,700 | | | | 253,558 | |

Mitsui & Co., Ltd. (Japan) | | | 29,400 | | | | 455,678 | |

QR National, Ltd. (Australia)* | | | 95,339 | 2 | | | 333,044 | |

Safran SA (France) | | | 9,528 | | | | 284,944 | |

Schneider Electric SA (France) | | | 8,654 | | | | 452,442 | |

Serco Group PLC (United Kingdom) | | | 42,310 | | | | 311,311 | |

Shimizu Corp. (Japan) | | | 20,000 | | | | 84,059 | |

Siemens AG (Germany) | | | 3,360 | | | | 321,470 | |

Sumitomo Electric Industries, Ltd. (Japan) | | | 41,000 | | | | 443,894 | |

Tostem Inax Holding Corp. (Japan) | | | 8,500 | | | | 162,910 | |

Yamato Transport Co., Ltd. (Japan) | | | 11,000 | | | | 185,137 | |

Total Industrials | | | | | | | 7,387,897 | |

|

The accompanying notes are an integral part of these financial statements. 10 |

Managers International Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Information Technology - 6.3% | | | | | | | | |

Advanced Semiconductor Engineering, Inc. (Taiwan) | | | 433,464 | | | $ | 371,362 | |

AU Optronics Corp., Sponsored ADR (Taiwan) | | | 68,053 | | | | 293,989 | |

Check Point Software Technologies, Ltd. (Israel)* | | | 6,200 | | | | 325,748 | |

Companhia Brasileira de Meios de Pagamentos (Brazil) | | | 2,620 | | | | 67,704 | |

Ericsson (LM), Class B (Sweden) | | | 33,370 | | | | 338,392 | |

Fujitsu, Ltd. (Japan) | | | 49,000 | | | | 254,062 | |

Gemalto N.V. (Netherlands) | | | 8,952 | | | | 433,871 | |

Infosys Technologies, Ltd., Sponsored ADR (India) | | | 5,700 | 2 | | | 292,866 | |

LG Display Co., Ltd. (South Korea) | | | 19,370 | | | | 411,146 | |

Redecard, S.A. (Brazil) | | | 4,100 | | | | 64,163 | |

Samsung Electronics Co., Ltd. (South Korea) | | | 730 | | | | 671,483 | |

Samsung Electronics Co., Ltd., GDR (South Korea) | | | 1,108 | | | | 509,500 | |

SAP AG (Germany) | | | 5,170 | | | | 273,449 | |

Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) | | | 31,420 | | | | 405,632 | |

Total Information Technology | | | | | | | 4,713,367 | |

Materials - 11.4% | | | | | | | | |

Air Liquide SA (France) | | | 6,978 | | | | 862,595 | |

Anglo American PLC (United Kingdom) | | | 16,963 | | | | 626,611 | |

Barrick Gold Corp. (Canada)* | | | 8,286 | | | | 375,361 | |

Gold Fields, Ltd. (South Africa) | | | 20,263 | | | | 310,710 | |

Goldcorp, Inc. (Canada) | | | 12,800 | | | | 568,037 | |

Impala Platinum Holdings, Ltd. (South Africa) | | | 5,700 | 2 | | | 117,477 | |

Incitec Pivot, Ltd. (Australia) | | | 74,930 | | | | 237,871 | |

JFE Holdings, Inc. (Japan) | | | 16,400 | | | | 296,512 | |

Johnson Matthey PLC (United Kingdom) | | | 11,089 | | | | 315,946 | |

Kinross Gold Corp. (Canada) | | | 24,881 | | | | 283,643 | |

Koninklijke DSM N.V. (Netherlands) | | | 11,730 | | | | 542,176 | |

Newcrest Mining, Ltd. (Australia) | | | 12,111 | | | | 369,083 | |

Rio Tinto PLC (United Kingdom) | | | 10,930 | | | | 533,889 | |

Syngenta AG (Switzerland)* | | | 2,411 | | | | 708,475 | |

Taiwan Fertilizer Co., Ltd. (Taiwan) | | | 60,900 | | | | 141,550 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

ThyssenKrupp AG (Germany) | | | 25,403 | | | $ | 582,813 | |

Toray Industries, Inc. (Japan) | | | 50,700 | | | | 362,740 | |

Vale, S.A., ADR (Brazil) | | | 31,400 | | | | 646,840 | |

Xstrata PLC (Switzerland) | | | 19,110 | | | | 290,951 | |

Yamana Gold, Inc. (Canada) | | | 26,559 | | | | 391,574 | |

Total Materials | | | | | | | 8,564,854 | |

Telecommunication Services - 5.7% | | | | | | | | |

Bharti Tele-Ventures, Ltd. (India) | | | 13,614 | | | | 87,968 | |

Nippon Telegraph & Telephone Corp. (Japan) | | | 16,400 | | | | 834,923 | |

NTT DoCoMo, Inc. (Japan) | | | 313 | | | | 574,674 | |

Telecom Italia S.p.A. (Italy) | | | 294,260 | | | | 314,522 | |

Telecom Italia S.p.A., RSP (Italy) | | | 349,200 | | | | 312,466 | |

Tim Participacoes, S.A., ADR (Brazil) | | | 14,761 | 2 | | | 380,834 | |

Vodafone Group PLC (United Kingdom) | | | 647,486 | | | | 1,805,247 | |

Total Telecommunication Services | | | | | | | 4,310,634 | |

Utilities - 2.9% | | | | | | | | |

E.ON AG (Germany) | | | 26,900 | | | | 579,698 | |

Eletricidade de Portugal, S.A. (Portugal) | | | 94,300 | | | | 291,233 | |

Gas Natural SDG, S.A. (Spain) | | | 21,700 | 2 | | | 371,913 | |

Hong Kong and China Gas Co., Ltd., The (Hong Kong) | | | 230,470 | | | | 533,624 | |

National Grid PLC (United Kingdom) | | | 40,116 | | | | 387,750 | |

Total Utilities | | | | | | | 2,164,218 | |

Total Common Stocks (cost $78,452,714) | | | | | | | 72,311,604 | |

Exchange Traded Funds - 1.1% | | | | | | | | |

SPDR Gold Shares (United States)* | | | 5,500 | | | | 835,945 | |

Total Exchange Traded Funds (cost $441,409) | | | | | | | 835,945 | |

Short-Term Investments - 6.1%1 | | | | | | | | |

BNY Mellon Overnight Government Fund, 0.04%3 | | | 2,942,388 | | | | 2,942,388 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.05% | | | 1,616,644 | | | | 1,616,644 | |

Total Short-Term Investments (cost $4,559,032) | | | | | | | 4,559,032 | |

Total Investments - 103.6% (cost $83,453,155) | | | | | | | 77,706,581 | |

Other Assets, less Liabilities - (3.6)% | | | | | | | (2,677,259 | ) |

Net Assets - 100.0% | | | | | | $ | 75,029,322 | |

|

The accompanying notes are an integral part of these financial statements. 11 |

Managers Emerging Markets Equity Fund

Investment Manager’s Comments

The Managers Emerging Markets Equity Fund’s (the “Fund”) objective is to achieve long-term capital appreciation.

The Fund invests at least 80% of its assets in equity securities, i.e., common and preferred stocks of companies located in countries included in the MSCI Emerging Markets (“MSCI EM”) Index, mostly countries in Africa, Asia, Latin America, and the Middle East. The Fund may invest in companies of any size. The MSCI EM Index is the benchmark for the Fund.

The Fund employs multiple subadvisors who specialize in distinct investment approaches. This “intelligence diversification” not only serves to manage risk, but also helps the Fund to tap the markets’ full potential by focusing different analytical insights on each prospective investment. Fund management strives to achieve its performance and diversification objectives while ensuring that the Fund operates within the framework of its investment objective and principal investment strategies.

Rexiter Capital Management Limited

The investment team at Rexiter Capital Management Limited (“Rexiter”) believes emerging markets are less efficient than developed markets, and an actively managed portfolio, with respect to both country weightings and stock selection, can add value over a market capitalization-weighted index without materially affecting risk. Rexiter’s approach is active in terms of both asset allocation and stock selection. Investment decisions are based on fundamental analysis of countries and stocks. Portfolio management is controlled by a disciplined process that seeks to add to returns through the exploitation of market inefficiency while constraining risk.

Schroder Investment Management Limited

Schroder Investment Management Limited (“Schroders”) believes that emerging stock markets are inefficient and provide strong potential for adding value through active fund management. This value can be extracted through both country and stock selection. Schroders uses a time-tested quantitative model to aid in their country selection process, and seeks to add value equally over time from both country and stock selection. Schroders further believes that applying a systematic, disciplined approach along with a strong team culture increases the ability to add value. Schroders believes that equal attention should be given to managing both return and risk.

THE YEAR IN REVIEW

The Fund returned -20.31% in 2011, trailing the return of -18.42% for its benchmark, the MSCI EM Index. (Note that unless otherwise stated, all performance cited in this commentary is in U.S. Dollars.)

Emerging market equities had a difficult 2011 amid the global volatility and uncertainty spurred by one off macroeconomic events in the first quarter, such as the Arab Spring and the Japanese tsunami, and market related events in the third quarter including an increasingly untenable sovereign debt situation in Europe and the downgrade of U.S. sovereign debt. As a result, emerging market equities underperformed developed market equities after several years of outperformance. In fact, it was just the second time that emerging markets had underperformed developed markets over the course of the past 10 years. At the country level, there were only a handful of positive performers for the year with several countries in Asia, most notably Indonesia and Malaysia, leading the way. On the downside, the Indian market dropped -37.1% for the year while Egypt, only a minor constituent of the MSCI EM Index, dropped -46.8% partially as fallout from the geopolitical impact on markets from the Arab Spring earlier in the year. On a sector basis, only the defensive minded consumer staples sector added positive performance for the year and modest positive performance at that (0.7%). The worst performing sectors, not surprisingly, were those most closely tied to global growth prospects including industrials (-28.6%) and materials (-27.0%).

The Fund underperformed its benchmark for the year primarily driven by stock selection weakness within the consumer discretionary and materials sectors. The Fund’s underweight to the more defensive consumer staples sector was also a detractor to performance as this was the only sector to post positive returns within emerging markets for the year. At the country level, the Fund was able to add value via both solid stock selection from its holdings in South Korea and by virtue of its overweight to that same market, as South Korea was an outperforming market during 2011.

Managers Emerging Markets Equity Fund

Investment Manager’s Comments (continued)

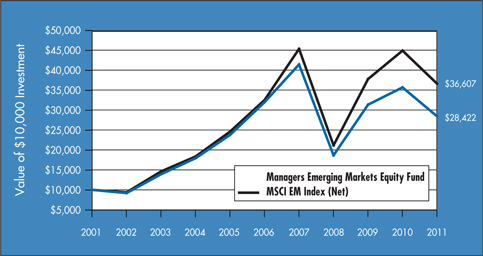

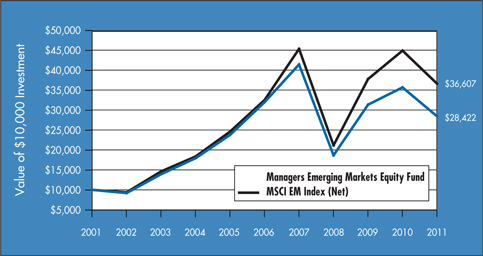

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Emerging Markets Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This chart compares a hypothetical $10,000 investment made in Managers Emerging Markets Equity Fund on December 31, 2000, to a $10,000 investment made in the MSCI EM for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for Managers Emerging Markets Equity Fund and the MSCI EM Index (Net) from December 31, 2001 through December 31, 2011.

| | | | | | | | | | | | |

Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

Managers Emerging Markets Equity Fund2,3.4 | | | (20.31) | % | | | (2.32) | % | | | 11.01 | % |

MSCI EM Index (Net)5,7 | | | (18.42) | % | | | 2.40 | % | | | 13.86 | % |

MSCI EM Index (Gross)6,7 | | | (18.17) | % | | | 2.70 | % | | | 14.20 | % |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA.

| | 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual return. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2011. All returns are in U.S. dollars($). |

|

2 Fund for which, from time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. 4 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar security when converted back to U.S. Dollars. 5 MSCI EM (Net) approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI Barra uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. 6 MSCI EM (Gross) approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits. 7 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Unlike the Fund, the Index is unmanaged, is not available for investment, and does not incur expenses. All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. Not FDIC insured, nor bank guaranteed. May lose value. |

13

Managers Emerging Markets Equity Fund

Fund Snapshots (unaudited)

December 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers Emerging

Markets Equity Fund** | | | MSCI EM Index® | |

Financials | | | 20.9 | % | | | 23.8 | % |

Information Technology | | | 16.1 | % | | | 13.1 | % |

Energy | | | 15.9 | % | | | 14.0 | % |

Materials | | | 12.6 | % | | | 13.3 | % |

Consumer Discretionary | | | 12.0 | % | | | 8.1 | % |

Consumer Staples | | | 6.4 | % | | | 8.1 | % |

Industrials | | | 5.9 | % | | | 6.4 | % |

Telecommunication Services | | | 5.7 | % | | | 8.5 | % |

Utilities | | | 1.8 | % | | | 3.7 | % |

Health Care | | | 0.4 | % | | | 1.0 | % |

Other Assets and Liabilities | | | 2.3 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | % of Net

Assets | |

Samsung Electronics Co., Ltd.* | | | 4.8 | % |

Gazprom OAO, ADR* | | | 2.5 | |

Hyundai Motor Co.* | | | 2.1 | |

Industrial and Commercial Bank of China, Ltd., Class H* | | | 1.9 | |

China Mobile, Ltd. | | | 1.8 | |

China Construction Bank Corp.* | | | 1.8 | |

Itau Unibanco Holding, S.A., ADR* | | | 1.5 | |

America Movil, S.A.B. de C.V., Series L | | | 1.5 | |

Lukoil OAO, Sponsored ADR | | | 1.4 | |

Vale, S.A., Sponsored ADR* | | | 1.4 | |

| | | | |

Top Ten as a Group | | | 20.7 | % |

| | | | |

| * | Top Ten Holding at June 30, 2011 |

|

| Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report. |

14

Managers Emerging Markets Equity Fund

Fund Snapshots (continued)

Summary of Investments by Country

| | | | | | | | |

Country | | Managers

Emerging Markets

Equity Fund* | | | MSCI EM Index® | |

Argentina | | | 0.2 | % | | | 0.0 | % |

Bermuda | | | 0.0 | % | | | 0.6 | % |

Brazil | | | 14.8 | % | | | 14.9 | % |

Cayman Islands | | | 0.0 | % | | | 2.9 | % |

Chile | | | 0.0 | % | | | 1.8 | % |

China | | | 13.4 | % | | | 9.9 | % |

Colombia | | | 0.0 | % | | | 1.0 | % |

Czech Republic | | | 0.0 | % | | | 0.3 | % |

Egypt | | | 0.6 | % | | | 0.3 | % |

Hong Kong | | | 5.8 | % | | | 4.5 | % |

Hungary | | | 0.0 | % | | | 0.3 | % |

India | | | 5.0 | % | | | 6.2 | % |

Indonesia | | | 3.2 | % | | | 3.0 | % |

Kazakhstan | | | 0.1 | % | | | 0.0 | % |

Luxembourg | | | 0.1 | % | | | 0.0 | % |

Malaysia | | | 3.4 | % | | | 3.5 | % |

| | | | | | | | |

Country | | Managers

Emerging Markets

Equity Fund* | | | MSCI EM Index® | |

Mexico | | | 2.4 | % | | | 4.7 | % |

Morocco | | | 0.0 | % | | | 0.2 | % |

Netherlands | | | 0.1 | % | | | 0.0 | % |

Panama | | | 0.7 | % | | | 0.0 | % |

Peru | | | 0.4 | % | | | 0.1 | % |

Philippines | | | 0.4 | % | | | 0.7 | % |

Poland | | | 0.6 | % | | | 1.3 | % |

Russia | | | 9.5 | % | | | 6.0 | % |

Singapore | | | 0.6 | % | | | 0.0 | % |

South Africa | | | 3.6 | % | | | 7.9 | % |

South Korea | | | 17.1 | % | | | 15.0 | % |

Supranational & Other | | | 1.2 | % | | | 0.0 | % |

Taiwan | | | 7.0 | % | | | 10.8 | % |

Thailand | | | 4.3 | % | | | 2.0 | % |

Turkey | | | 2.4 | % | | | 1.2 | % |

United Kingdom | | | 2.1 | % | | | 0.0 | % |

United States | | | 1.0 | % | | | 0.9 | % |

| | | | | | | | |

| | | 100.0 | % | | | 100.0 | % |

| | | | | | | | |

| * | As a percentage of total market value on December 31, 2011. |

Managers Emerging Markets Equity Fund

Schedule of Portfolio Investments

December 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Common Stocks - 97.7% | | | | | | | | |

Consumer Discretionary - 12.0% | | | | | | | | |

Astra International Tbk PT (Indonesia) | | | 23,500 | | | $ | 191,504 | |

Belle International Holdings, Ltd. (Hong Kong) | | | 286,000 | | | | 496,859 | |

Cheil Communications, Inc. (South Korea) | | | 9,370 | | | | 154,285 | |

Ctrip.com International, Ltd. (China)* | | | 7,400 | | | | 173,160 | |

Cyfrowy Polsat SA (Poland)* | | | 12,053 | | | | 47,078 | |

Dongfeng Motor Group Co., Ltd. (China) | | | 140,000 | | | | 239,049 | |

Far Eastern Department Stores, Ltd. (Taiwan) | | | 146,680 | | | | 172,743 | |

Foschini, Ltd. (South Africa)* | | | 3,826 | | | | 49,675 | |

Genting Malaysia Berhad (Malaysia) | | | 174,100 | | | | 603,549 | |

GOME Electrical Appliances Holdings, Ltd. (China) | | | 872,000 | | | | 200,589 | |

Hero Honda Motors, Ltd. (India) | | | 5,162 | | | | 185,092 | |

Hyundai Mobis Co., Ltd. (South Korea) | | | 1,004 | | | | 255,088 | |

Hyundai Motor Co. (South Korea) | | | 5,013 | | | | 928,546 | |

Imperial Holdings, Ltd. (South Africa) | | | 4,146 | | | | 63,432 | |

Kia Motors Corp. (South Korea) | | | 4,806 | | | | 278,881 | |

Kroton Educacional, S.A.

(Brazil)* | | | 29,400 | | | | 289,862 | |

Lojas Renner, S.A. (Brazil) | | | 5,000 | | | | 129,768 | |

Mahindra & Mahindra, Ltd. (India) | | | 4,753 | | | | 60,952 | |

MGM China Holdings, Ltd. (Macau)* | | | 167,200 | | | | 217,512 | |

Mr Price Group, Ltd. (South Africa) | | | 4,787 | | | | 47,282 | |

Naspers, Ltd. (South Africa) | | | 3,490 | | | | 152,448 | |

Parkson Retail Group, Ltd. (China) | | | 85,500 | | | | 104,713 | |

PDG Realty S.A. Empreendimentos e Participacoes (Brazil) | | | 115,941 | | | | 366,735 | |

Total Consumer Discretionary | | | | | | | 5,408,802 | |

Consumer Staples - 6.4% | | | | | | | | |

Anadolu Efes Biracilik ve Malt Sanayii A.S. (Turkey) | | | 27,627 | | | | 332,210 | |

BRF - Brasil Foods, S.A., ADR (Brazil) | | | 6,600 | | | | 129,030 | |

China Mengniu Dairy Co., Ltd. (Hong Kong) | | | 41,000 | | | | 95,756 | |

Companhia de Bebidas das Americas, PR ADR (Brazil) | | | 7,600 | | | | 274,284 | |

CP All PCL (Thailand) | | | 141,400 | | | | 231,667 | |

E-Mart Co., Ltd. (South Korea)* | | | 501 | | | | 121,147 | |

Grupo Bimbo, S.A.B. de C.V., Class A (Mexico) | | | 24,829 | | | | 50,709 | |

Hengan International Group Co. (China) | | | 39,500 | | | | 368,268 | |

Indofood Sukses Makmur Tbk PT (Indonesia) | | | 63,500 | | | | 32,180 | |

KT&G Corp. (South Korea)* | | | 1,934 | | | | 136,656 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

LG Household & Health Care, Ltd. (South Korea) | | | 679 | | | $ | 287,380 | |

Olam International, Inc. (Singapore) | | | 172,000 | | | | 281,937 | |

Perusahaan Perkebunan London Sumatra Indonesia Tbk PT (Indonesia) | | | 315,500 | | | | 78,183 | |

Shinsegae Co., Ltd. (South Korea) | | | 471 | | | | 100,278 | |

Tingyi Cayman Islands Holding Corp. (China) | | | 18,000 | | | | 54,522 | |

Wal-Mart de Mexico S.A.B. de C.V. (Mexico) | | | 84,717 | | | | 232,514 | |

X5 Retail Group, N.V., GDR (Russia)* | | | 3,976 | | | | 90,630 | |

Total Consumer Staples | | | | | | | 2,897,351 | |

Energy - 15.9% | | | | | | | | |

Banpu PCL, NVDR (Thailand) | | | 15,400 | | | | 266,016 | |

China Petroleum and Chemical Corp., Class H (China) | | | 316,000 | | | | 331,725 | |

China Shenhua Energy Co., Ltd. (China) | | | 74,500 | | | | 322,158 | |

CNOOC, Ltd. (Hong Kong) | | | 287,790 | | | | 501,832 | |

Gazprom OAO, ADR (Russia) | | | 106,795 | | | | 1,137,787 | |

Lukoil OAO, Sponsored ADR (Russia) | | | 12,146 | | | | 642,878 | |

NovaTek OAO, Sponsored GDR (Russia) | | | 3,523 | | | | 440,711 | |

OGX Petroleo e Gas Participacoes, S.A. (Brazil)* | | | 40,400 | | | | 295,000 | |

Oil & Natural Gas Corp., Ltd. (India) | | | 46,942 | | | | 226,666 | |

Petroleo Brasileiro, S.A. (Brazil) | | | 12,000 | | | | 147,969 | |

Petroleo Brasileiro, S.A., ADR (Brazil) | | | 11,365 | | | | 266,964 | |

Petroleo Brasileiro, S.A., Sponsored ADR (Brazil) | | | 21,127 | | | | 525,006 | |

PTT PCL, NVDR (Thailand) | | | 37,100 | | | | 373,260 | |

QGEP Participacoes, S.A. (Brazil) | | | 37,500 | | | | 331,725 | |

Reliance Industries, Ltd. (India)* | | | 4,335 | | | | 56,472 | |

Rosneft Oil Co. OAO, GDR (a) (Russia) | | | 33,966 | | | | 226,859 | |

Rosneft Oil Co. OAO, GDR (Russia) | | | 13,900 | | | | 91,477 | |

Sasol, Ltd. (South Africa) | | | 4,210 | | | | 200,409 | |

SK Energy Co., Ltd. (South Korea) | | | 1,214 | | | | 149,891 | |

Thai Oil PCL (Thailand) | | | 64,100 | | | | 118,578 | |

Tupras Turkiye Petrol Rafine (Turkey) | | | 16,995 | | | | 357,956 | |

Ultrapar Participacoes, S.A. (Brazil) | | | 6,252 | | | | 107,292 | |

Ultrapar Participacoes, S.A., ADR (Brazil) | | | 4,000 | | | | 68,800 | |

Total Energy | | | | | | | 7,187,431 | |

Financials - 20.9% | | | | | | | | |

ABSA Group, Ltd. (South Africa) | | | 23,042 | | | | 401,844 | |

Ayala Land, Inc. (Philippines) | | | 226,700 | | | | 78,485 | |

Banco Bradesco, S.A., ADR (Brazil) | | | 25,221 | | | | 420,686 | |

|

The accompanying notes are an integral part of these financial statements. 16 |

Managers Emerging Markets Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Financials - 20.9% (continued) | | | | | | | | |

Bangkok Bank PCL (Thailand) | | | 62,200 | | | $ | 322,847 | |

BR Malls Participacoes, S.A. (Brazil) | | | 14,000 | | | | 136,003 | |

BR Properties, S.A. (Brazil) | | | 48,100 | | | | 477,067 | |

Bumiputra-Commerce Holdings Berhad (Malaysia) | | | 38,200 | | | | 89,574 | |

China Construction Bank Corp. (China) | | | 1,169,907 | | | | 812,631 | |

China Overseas Land & Investment, Ltd. (Hong Kong) | | | 258,000 | | | | 428,172 | |

China Pacific Insurance (Group) Co., Ltd. (China) | | | 56,600 | | | | 160,588 | |

Chinatrust Financial Holding Co., Ltd. (Taiwan) | | | 270,118 | | | | 168,328 | |

Commercial International Bank (Egypt) | | | 29,289 | | | | 91,085 | |

Credicorp, Ltd. (Peru) | | | 761 | | | | 83,307 | |

DGB Financial Group, Inc. (South Korea)* | | | 9,170 | | | | 103,084 | |

EFG-Hermes (Egypt)* | | | 38,965 | | | | 65,244 | |

FirstRand, Ltd. (South Africa) | | | 26,760 | | | | 68,668 | |

Grupo Financiero Banorte, S.A.B. de C.V. (Mexico) | | | 10,400 | | | | 31,488 | |

Grupo Financiero Galicia, S.A., ADR (Argentina) | | | 16,800 | | | | 99,624 | |

Halyk Savings Bank of Kazakhstan, GDR (Kazakhstan)* | | | 7,782 | 2 | | | 37,806 | |

Hana Financial Group, Inc. (South Korea) | | | 13,370 | | | | 414,300 | |

HDFC Bank, Ltd. (India) | | | 36,542 | | | | 293,880 | |

ICICI Bank, Ltd., Sponsored ADR (India) | | | 39 | | | | 1,031 | |

Industrial and Commercial Bank of China, Ltd., Class H (China) | | | 1,420,556 | | | | 839,062 | |

Infrastructure Development Finance Co., Ltd. (India) | | | 159,223 | | | | 274,277 | |

Itau Unibanco Holding, S.A. (Brazil) | | | 5,200 | | | | 94,758 | |

Itau Unibanco Holding, S.A., ADR (Brazil) | | | 36,154 | | | | 671,019 | |

Kasikornbank PCL, NVDR (Thailand) | | | 75,000 | | | | 289,428 | |

Ping An Insurance (Group) Co. of China, Ltd. (China) | | | 42,883 | 2 | | | 281,346 | |

Powszechny Zaklad Ubezpieczen SA (Poland) | | | 1,683 | | | | 150,170 | |

PT Bank Mandiri (Indonesia) | | | 545,906 | | | | 405,712 | |

PT Bank Rakyat Indonesia (Indonesia) | | | 271,000 | | | | 201,441 | |

Public Bank Berhad (Malaysia) | | | 48,369 | | | | 204,064 | |

Public Bank Berhad, Foreign Market (Malaysia) | | | 44,200 | | | | 183,997 | |

Samsung Fire & Marine Insurance Co., Ltd. (South Korea) | | | 1,210 | | | | 221,890 | |

Shinhan Financial Group Co., Ltd. (South Korea) | | | 4,129 | | | | 142,782 | |

Siam Commercial Bank PCL (Thailand) | | | 92,800 | | | | 342,024 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Turkiye Garanti Bankasi A.S. (Turkey) | | | 26,793 | | | $ | 83,296 | |

Turkiye Halk Bankasi A.S. (Turkey) | | | 13,903 | | | | 72,458 | |

VTB Bank, GDR (Russia) | | | 45,817 | | | | 164,933 | |

Warsaw Stock Exchange (Poland) | | | 1,475 | 2 | | | 15,038 | |

Total Financials | | | | | | | 9,423,437 | |

Health Care - 0.4% | | | | | | | | |

Dr. Reddy’s Laboratories, Ltd. (ADR) (India) | | | 6,117 | | | | 181,289 | |

Industrials - 5.9% | | | | | | | | |

China Shipping Development Co., Ltd. (China) | | | 458,000 | | | | 284,882 | |

Companhia de Concessoes Rodoviarias (Brazil) | | | 27,848 | | | | 182,443 | |

Copa Holdings, S.A., Class A (Panama) | | | 5,700 | | | | 334,419 | |

Enka Insaat ve Sanayi A.S. (Turkey)* | | | 35,985 | | | | 77,629 | |

Globaltrans Investment PLC, GDR (Russia) | | | 5,333 | | | | 73,219 | |

GS Engineering & Construction Corp. (South Korea) | | | 2,272 | | | | 182,071 | |

Hyundai Heavy Industries Co., Ltd. (South Korea) | | | 402 | | | | 89,883 | |

Industries Qatar Q.S.C. (Qatar) | | | 3,999 | | | | 146,270 | |

Iochpe-Maxion, S.A. (Brazil) | | | 6,200 | | | | 83,930 | |

Larsen & Toubro, Ltd. (India) | | | 12,279 | | | | 229,678 | |

Orascom Construction Industries, GDR (Egypt) | | | 2,706 | | | | 91,733 | |

Samsung Heavy Industries Co., Ltd. (South Korea) | | | 14,061 | | | | 341,586 | |

Sime Darby Berhad (Malaysia) | | | 68,600 | | | | 199,022 | |

SM Investments Corp. (Philippines) | | | 6,900 | | | | 91,834 | |

TAV Havalimanlari Holding A.S. (Turkey)* | | | 14,238 | | | | 60,444 | |

Weichai Power Co., Ltd. (China) | | | 37,000 | | | | 181,507 | |

Total Industrials | | | | | | | 2,650,550 | |

Information Technology - 16.1% | | | | | | | | |

Asustek Computer, Inc. (Taiwan) | | | 15,873 | | | | 112,787 | |

Baidu.com, Inc.

(China)* | | | 3,800 | | | | 442,586 | |

Daum Communications Corp. (South Korea) | | | 506 | | | | 52,779 | |

Hon Hai Precision Industry Co., Ltd. (Taiwan) | | | 120,296 | | | | 328,978 | |

Hon Hai Precision Industry Co., Ltd., ADR (Taiwan) | | | 23 | | | | 126 | |

Hynix Semiconductor, Inc. (South Korea) | | | 2,950 | | | | 56,326 | |

Infosys Technologies, Ltd. (India) | | | 3,216 | | | | 167,386 | |

Infosys Technologies, Ltd., Sponsored ADR (India) | | | 7,100 | 2 | | | 364,798 | |

Largan Precision Co., Ltd. (Taiwan) | | | 5,000 | | | | 93,349 | |

Lenovo Group, Ltd. (United States) | | | 168,000 | | | | 111,759 | |

LG Display Co., Ltd. (South Korea) | | | 13,000 | | | | 275,937 | |

Mail.Ru Group, Ltd., Reg S, GDR

(Russia)* | | | 11,023 | | | | 286,122 | |

MediaTek, Inc. (Taiwan) | | | 30,067 | | | | 275,203 | |

|

The accompanying notes are an integral part of these financial statements. 17 |

Managers Emerging Markets Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Information Technology - 16.1% (continued) | | | | | | | | |

NCSoft Corp. (South Korea) | | | 1,099 | | | $ | 293,789 | |

Samsung Electronics Co., Ltd. (South Korea) | | | 2,368 | | | | 2,178,176 | |

Siliconware Precision Industries Co., ADR (Taiwan) | | | 51,000 | | | | 222,360 | |

Simplo Technology Co., Ltd. (Taiwan) | | | 53,000 | | | | 308,444 | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 244,584 | | | | 611,118 | |

Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) | | | 24,200 | | | | 312,422 | |

Tencent Holdings, Ltd. (China) | | | 12,500 | | | | 250,292 | |

WPG Holdings, Ltd. (Taiwan) | | | 90,470 | | | | 104,167 | |

Yandex, N.V., Class A (Netherlands)* | | | 1,400 | 2 | | | 27,580 | |

ZTE Corp., Class H (China) | | | 123,000 | 2 | | | 384,195 | |

Total Information Technology | | | | | | | 7,260,679 | |

Materials - 12.6% | | | | | | | | |

AngloGold Ashanti, Ltd. (South Africa) | | | 3,989 | | | | 169,386 | |

Anhui Conch Cement Co., Ltd. (China) | | | 140,308 | 2 | | | 414,021 | |

Antofagasta PLC (United Kingdom) | | | 18,295 | | | | 346,003 | |

Centamin PLC (Channel Islands)* | | | 23,020 | | | | 29,458 | |

Compania de Minas Buenaventura SA (Peru) | | | 2,000 | | | | 76,680 | |

Evraz PLC (United Kingdom)* | | | 32,292 | | | | 187,909 | |

Gerdau, S.A., Sponsored ADR (Brazil) | | | 13,400 | | | | 104,654 | |

Grupo Mexico, S.A.B. de C.V., Class B (Mexico) | | | 35,190 | | | | 92,522 | |

Impala Platinum Holdings, Ltd. (South Africa) | | | 15,584 | | | | 322,650 | |

KG Chemical Co., Ltd. (South Korea) | | | 2,241 | | | | 617,970 | |

KGHM Polska Miedz SA (Poland) | | | 1,206 | | | | 38,469 | |

LSR Group OJSC, GDR (Russia) | | | 15,279 | 2 | | | 51,466 | |

MMC Norilsk Nickel, ADR (Russia) | | | 14,761 | | | | 225,560 | |

MMX Mineracao e Metalicos,

S.A. (Brazil)* | | | 81,600 | | | | 291,796 | |

Mongolian Mining Corp. (Mongolia)* | | | 194,000 | 2 | | | 145,447 | |

Nan Ya Plastics Corp. (Taiwan) | | | 24,000 | | | | 47,596 | |

Polymetal International PLC (Russia)* | | | 4,203 | | | | 71,408 | |

POSCO (South Korea) | | | 948 | | | | 312,708 | |

PT Semen Gresik Persero Tbk (Indonesia) | | | 129,000 | | | | 162,769 | |

Raspadskaya (Russia) | | | 50,441 | | | | 155,280 | |

Taiwan Cement Corp. (Taiwan) | | | 137,216 | | | | 158,365 | |

Tata Steel, Ltd., Reg S, GDR (India) | | | 27,613 | | | | 198,676 | |

Ternium, S.A. (Luxembourg) | | | 3,500 | | | | 64,365 | |

Uralkaliy OAO (Russia) | | | 12,057 | | | | 434,162 | |

Vale, S.A., ADR (Brazil) | | | 15,499 | | | | 319,279 | |

Vale, S.A., Sponsored ADR (Brazil) | | | 29,167 | | | | 625,632 | |

Total Materials | | | | | | | 5,664,231 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | | | | | | | |

Telecommunication Services - 5.7% | | | | | | | | |

America Movil, S.A.B. de C.V., Series L (Mexico) | | | 29,200 | | | $ | 659,920 | |

Axiata Group Berhad (Malaysia) | | | 134,500 | | | | 218,101 | |

China Mobile, Ltd. (Hong Kong) | | | 85,000 | | | | 825,824 | |

Chunghwa Telecom Co., Ltd., ADR (Taiwan) | | | 2,033 | | | | 67,658 | |

Mobile Telesystems OJSC, Sponsored ADR (Russia) | | | 11,400 | | | | 167,352 | |

MTN Group, Ltd. (South Africa) | | | 8,066 | | | | 143,311 | |

Sistema JSFC, Sponsored GDR (United Kingdom)* | | | 4,043 | | | | 67,858 | |

Taiwan Mobile Co., Ltd. (Taiwan) | | | 56,100 | | | | 174,783 | |

Telef Brasil, ADR (Brazil) | | | 4,712 | | | | 128,779 | |

Telekomunikacja Polksa SA (Poland) | | | 5,698 | | | | 28,399 | |

Turk Telekomunikasyon A.S. (Turkey) | | | 25,300 | | | | 93,636 | |

Total Telecommunication Services | | | | | | | 2,575,621 | |

Utilities - 1.8% | | | | | | | | |

China Resources Power Holdings Co. (Hong Kong) | | | 128,000 | | | | 246,451 | |

Companhia Energetica de Minas Gerais, Sponsored ADR (Brazil) | | | 11,390 | | | | 202,628 | |

Perusahaan Gas Negara (Persero) Tbk PT (Indonesia) | | | 1,016,000 | | | | 355,379 | |

Total Utilities | | | | | | | 804,458 | |

Total Common Stocks

(cost $48,178,637) | | | | | | | 44,053,849 | |

Rights - 0.0%# | | | | | | | | |

Kroton Educacional, S.A., Rights (Brazil)* | | | 11,853 | | | | 3,368 | |

Total Rights

(cost $0) | | | | | | | 3,368 | |

Warrants - 0.8% | | | | | | | | |

Sberbank of Russia Warrant, 02/28/18 (United Kingdom)* | | | 138,513 | | | | 340,742 | |

Total Warrants (cost $468,374) | | | | | | | 340,742 | |

Other Investment Companies - 4.4%1 | | | | | | | | |

BNY Mellon Overnight Government Fund, 0.04%3 | | | 1,411,233 | | | | 1,411,233 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.05% | | | 574,404 | | | | 574,404 | |

Total Other Investment Companies

(cost $1,985,637) | | | | | | | 1,985,637 | |

Total Investments - 102.9%

(cost $50,632,648) | | | | | | | 46,383,596 | |

Other Assets, less Liabilities - (2.9)% | | | | | | | (1,290,151 | ) |

Net Assets - 100.0% | | | | | | $ | 45,093,445 | |

|

The accompanying notes are an integral part of these financial statements. 18 |

Managers Global Bond Fund

Investment Manager’s Comments

THE YEAR IN REVIEW