UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

The Managers Funds

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: May 31

Date of reporting period: July 1, 2010 – May 31, 2011

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Funds

May 31, 2011

Managers Cadence Capital Appreciation Fund

(formerly Allianz CCM Capital Appreciation Fund)

Managers Cadence Focused Growth Fund

(formerly Allianz CCM Focused Growth Fund)

Managers Cadence Mid-Cap Fund

(formerly Allianz CCM Mid-Cap Fund)

Managers Cadence Emerging Companies Fund

(formerly Allianz CCM Emerging Companies Fund)

AR065-0511

[THIS PAGE INTENTIONALLY LEFT BLANK]

The Managers Cadence Funds

Annual Report – May 31, 2011

| | | | |

TABLE OF CONTENTS | | Page | |

| |

| LETTER TO SHAREHOLDERS | | | 1 | |

| |

| ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

| INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

Managers Cadence Capital Appreciation Fund | | | 5 | |

| |

Managers Cadence Focused Growth Fund | | | 11 | |

| |

Managers Cadence Mid-Cap Fund | | | 16 | |

| |

Managers Cadence Emerging Companies Fund | | | 22 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 28 | |

| |

FINANCIAL STATEMENTS: | | | | |

| |

Statements of Assets and Liabilities | | | 29 | |

Funds’ balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statements of Operations | | | 31 | |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the period | | | | |

| |

Statements of Changes in Net Assets | | | 33 | |

Detail of changes in Fund assets for the past two periods | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 35 | |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 43 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 53 | |

| |

TRUSTEES AND OFFICERS | | | 54 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Our foremost goal at Managers Investment Group is to structure and manage mutual funds that will help our shareholders and clients successfully reach their investment goals and objectives.

Each of our Funds is geared to provide you with exposure to a specific asset class or style of investing. Our mutual fund offerings include four that are subadvised by Cadence Capital Management, LLC (“Cadence”) and focus on specific segments of the domestic equity market. The Managers Cadence Capital Appreciation Fund seeks to provide investors with diversified, large-cap growth domestic equity exposure, while the Managers Cadence Focused Growth Fund is a more concentrated portfolio of U.S. large-cap growth stocks. Cadence also oversees the Managers Cadence Mid-Cap Fund, which focuses on domestic mid-cap growth stocks, and the Managers Cadence Emerging Companies Fund, which invests in attractively valued growth stocks in the micro-cap and small-cap space. Cadence has been managing equity portfolios since the late 1980s and has overseen the Funds since their inception. Cadence implements a growth-at-a-reasonable price equity investment process with an initial screen that narrows the universe before in-depth, fundamental research is undertaken to identify the most attractive securities.

Below is a brief overview of the equity markets and the performance results for the Funds. Following this letter, we also provide the Portfolio Managers’ discussion of their investment management approach, performance results and market outlook.

The economic recovery began in 2009 and extended into 2010, thanks in part to a concerted effort by global governments to provide a framework conducive to growth and asset inflation. This accommodative monetary policy proved to be very successful in the short run as economies continued to recover and riskier assets appreciated substantially. That being said, the path higher has been choppy as fears over sovereign debt default and the potential for a double-dip recession weighed on the minds of investors. Fear turned into courage in the second half of 2010, as corporate earnings proved to be better than expected and a sovereign crisis was averted when European government officials agreed to provide the Irish government with an $89 billion rescue package. The risk trade was in favor on the equity side of the ledger and benefited greatly from strong corporate earnings as well as the Federal Reserve’s plan to stimulate the U.S. economy via another round of quantitative easing (QE2). The rising trend continued into 2011 up through the first few weeks of February, before unrest in the Middle East caused oil prices to increase and equity markets to fall. The Japanese catastrophe in mid-March also dragged down equity markets as investors questioned the ripple-effect of a sharp slowdown in Japan and wondered about the potential impact of an evolving nuclear disaster. Equity markets eventually stabilized during April and continued the trend higher. As of late, fear has returned to the forefront causing equity markets to trend downward since late-April. Investors are again concerned about European debt issues, slowing Chinese growth, the sustainability of the U.S. recovery and continued unrest in the Middle East. Nevertheless, the trailing 12-month period has been quite strong for U.S. equities as the Russell 1000® Growth Index appreciated 29.43%, the Russell Midcap® Growth Index returned 36.31% and the Russell 2000 Growth® Index returned 36.79%.

Against this backdrop, the absolute performance of the Managers Cadence Funds was very strong, but the relative returns were somewhat disappointing with the exception of Managers Cadence Emerging Companies Fund. The absolute and relative returns are summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Since | | | Inception | |

Periods Ended 05/31/11 | | 6 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Inception | | | Date | |

Managers Cadence Capital Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 12.35 | % | | | 25.05 | % | | | (2.79 | )% | | | 1.23 | % | | | 1.70 | % | | | 9.34 | % | | | 3/8/1991 | |

Russell 1000® Growth Index | | | 14.36 | % | | | 29.43 | % | | | 2.92 | % | | | 5.55 | % | | | 2.15 | % | | | 9.28 | % | | | | |

Managers Cadence Focused Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 12.60 | % | | | 26.98 | % | | | (2.03 | )% | | | 0.73 | % | | | 2.02 | % | | | 0.89 | % | | | 8/31/1999 | |

Russell 1000® Growth Index | | | 14.36 | % | | | 29.43 | % | | | 2.92 | % | | | 5.55 | % | | | 2.15 | % | | | 0.27 | % | | | | |

Managers Cadence Mid-Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 18.55 | % | | | 35.47 | % | | | (0.43 | )% | | | 3.76 | % | | | 4.52 | % | | | 10.40 | % | | | 8/26/1991 | |

Russell Midcap® Growth Index | | | 18.31 | % | | | 36.31 | % | | | 4.47 | % | | | 6.54 | % | | | 5.70 | % | | | N/A | | | | | |

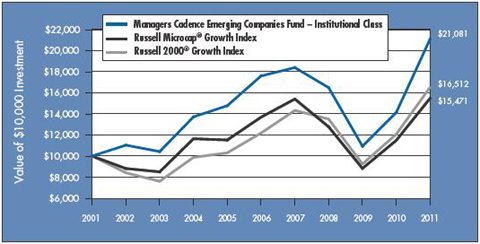

Managers Cadence Emerging Companies Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 24.14 | % | | | 49.20 | % | | | 8.54 | % | | | 3.68 | % | | | 7.74 | % | | | 11.69 | % | | | 6/25/1993 | |

Russell Microcap® Growth Index | | | 20.06 | % | | | 34.69 | % | | | 6.60 | % | | | 2.48 | % | | | 4.46 | % | | | 6.25 | % | | | | |

Russell 2000® Growth Index | | | 19.39 | % | | | 36.79 | % | | | 6.92 | % | | | 6.26 | % | | | 5.14 | % | | | 6.25 | % | | | | |

1

Letter to Shareholders (continued)

For the 12-month period ending May 31, 2011, the Managers Cadence Capital Appreciation Fund Institutional Class returned 25.05%, behind the 29.43% return for the Russell 1000® Growth Index. The Fund’s underperformance is most attributable to poor relative performance in the health care, consumer discretionary and financials sectors. Sector weightings also detracted as an overweight to health care and an underweight to energy hurt relative performance.

For the 12-month period ending May 31, 2011, the Managers Cadence Focused Growth Fund Institutional Class returned 26.98%, underperforming the 29.43% return of the Russell 1000® Growth Index. Like the Managers Cadence Capital Appreciation Fund, the underperformance is due to a combination of poor relative stock performance and sector weightings. Stock performance detracted the most within the health care, materials and financials sectors. Overweights to health care and telecomm along with underweights to energy and materials hurt relative returns too.

For the 12-month period ending May 31, 2011, the Managers Cadence Mid-Cap Fund Institutional Class returned 35.47%, slightly behind the 36.31% return for the Russell Midcap® Growth Index. The primary driver of underperformance was a small allocation to cash as mid-cap growth stocks appreciated sharply. Relative performance within the consumer discretionary, materials and financials sector also hurt performance, but was mostly offset by strong performance in the industrials and energy sectors.

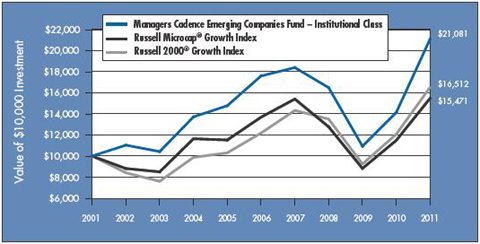

For the 12-month period ending May 31, 2011, the Managers Cadence Emerging Companies Fund Institutional Class returned 49.20%, markedly beating the 34.69% return for the Russell Microcap® Growth Index. The primary driver of the solid results was exceptional strong stock selection in information technology as numerous holdings appreciated more than 100%. Additionally, an underweight to health care and strong performance in the industrials and consumer staples sectors also contributed to relative returns.

Going forward, Cadence believes there is still cause to be cautiously optimistic. While the market is pricing in an economic slowdown, Cadence is confident about the prospects of its individual holdings. In this world of low but rising inflation, improving economic growth and still historically low interest rates, Cadence believes its Funds have the potential to perform well as investors focus more on company fundamentals rather than macro concerns.

Cadence believes the greatest challenge is the extraordinary short-term price volatility and sector rotation, as the market continues to reassess the evolving economic landscape. Longer term, an important concern is potential profit margin compression. Adding to this challenge are the high costs of production in such areas as energy and metals. For these reasons, a company’s ability to raise prices is a key component of Cadence’s investment framework for 2011.

Cadence is emphasizing companies that can manage rising cost inputs by increasing prices and/or controlling costs, in particular, emphasizing companies with specialized or scarce products that can most easily raise prices and companies able to generate significant free cash flow. In the long run, strong free cash flow could prove to be even more attractive as it would mitigate the effect of future high interest rates.

Should you have any questions about this report, or if you’d like to receive a prospectus and additional information, including fees and expenses for this or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our Web site at www.managersinvest.com. As always, please read the prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit the Knowledge Center on our web site. You can rest assured that under all market conditions, our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

|

| Respectfully, |

|

|

John H. Streur Senior Managing Partner Managers Investment Group LLC |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended May 31, 2011 | | Expense Ratio

for the Period | | | Beginning

Account Value

12/01/2010 | | | Ending

Account Value

05/31/2011 | | | Expenses

Paid During

the Period* | |

Managers Cadence Capital Appreciation Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,121 | | | $ | 5.82 | |

Based on Hypothetical 5% Annual Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.54 | |

Class B | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.86 | % | | $ | 1,000 | | | $ | 1,117 | | | $ | 9.84 | |

Based on Hypothetical 5% Annual Return | | | 1.86 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.37 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.82 | % | | $ | 1,000 | | | $ | 1,117 | | | $ | 9.61 | |

Based on Hypothetical 5% Annual Return | | | 1.82 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.15 | |

Class D | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.11 | % | | $ | 1,000 | | | $ | 1,121 | | | $ | 5.89 | |

Based on Hypothetical 5% Annual Return | | | 1.11 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.61 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.71 | % | | $ | 1,000 | | | $ | 1,124 | | | $ | 3.78 | |

Based on Hypothetical 5% Annual Return | | | 0.71 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.60 | |

Administrative Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.96 | % | | $ | 1,000 | | | $ | 1,122 | | | $ | 5.10 | |

Based on Hypothetical 5% Annual Return | | | 0.96 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.86 | |

Class P | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.81 | % | | $ | 1,000 | | | $ | 1,123 | | | $ | 4.28 | |

Based on Hypothetical 5% Annual Return | | | 0.81 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.07 | |

Class R | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.36 | % | | $ | 1,000 | | | $ | 1,120 | | | $ | 7.21 | |

Based on Hypothetical 5% Annual Return | | | 1.36 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.86 | |

Managers Cadence Focused Growth Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.05 | % | | $ | 1,000 | | | $ | 1,124 | | | $ | 5.56 | |

Based on Hypothetical 5% Annual Return | | | 1.05 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.29 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.84 | % | | $ | 1,000 | | | $ | 1,119 | | | $ | 9.71 | |

Based on Hypothetical 5% Annual Return | | | 1.84 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.24 | |

Class D | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,123 | | | $ | 3.96 | |

Based on Hypothetical 5% Annual Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 3.76 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.75 | % | | $ | 1,000 | | | $ | 1,126 | | | $ | 3.96 | |

Based on Hypothetical 5% Annual Return | | | 0.75 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.77 | |

Administrative Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.97 | % | | $ | 1,000 | | | $ | 1,124 | | | $ | 5.16 | |

Based on Hypothetical 5% Annual Return | | | 0.97 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.90 | |

Class P | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,124 | | | $ | 4.28 | |

Based on Hypothetical 5% Annual Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.07 | |

3

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | | | | | |

Six Months Ended May 31, 2011 | | Expense Ratio

for the Period | | | Beginning

Account Value

12/01/2010 | | | Ending

Account Value

05/31/2011 | | | Expenses

Paid During

the Period* | |

Managers Cadence Mid-Cap Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,183 | | | $ | 5.97 | |

Based on Hypothetical 5% Annual Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.52 | |

Class B | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.85 | % | | $ | 1,000 | | | $ | 1,179 | | | $ | 10.04 | |

Based on Hypothetical 5% Annual Return | | | 1.85 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.28 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.82 | % | | $ | 1,000 | | | $ | 1,179 | | | $ | 9.90 | |

Based on Hypothetical 5% Annual Return | | | 1.82 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.16 | |

Class D | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,183 | | | $ | 5.97 | |

Based on Hypothetical 5% Annual Return | | | 1.10 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.53 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.70 | % | | $ | 1,000 | | | $ | 1,186 | | | $ | 3.80 | |

Based on Hypothetical 5% Annual Return | | | 0.70 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.51 | |

Administrative Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.95 | % | | $ | 1,000 | | | $ | 1,185 | | | $ | 5.16 | |

Based on Hypothetical 5% Annual Return | | | 0.95 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.77 | |

Class P | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.78 | % | | $ | 1,000 | | | $ | 1,185 | | | $ | 4.27 | |

Based on Hypothetical 5% Annual Return | | | 0.78 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.95 | |

Class R | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.35 | % | | $ | 1,000 | | | $ | 1,182 | | | $ | 5.71 | |

Based on Hypothetical 5% Annual Return | | | 1.35 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.78 | |

Managers Cadence Emerging Companies Fund | | | | | | | | | | | | | | | | |

Insitutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.41 | % | | $ | 1,000 | | | $ | 1,241 | | | $ | 7.85 | |

Based on Hypothetical 5% Annual Return | | | 1.41 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.07 | |

Administrative Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.68 | % | | $ | 1,000 | | | $ | 1,240 | | | $ | 9.39 | |

Based on Hypothetical 5% Annual Return | | | 1.68 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.45 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. |

4

Managers Cadence Capital Appreciation Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

Over the 12 months ended May 31, 2011, the Managers Cadence Capital Appreciation Fund’s (the “Fund”) Institutional Class returned 25.05%, underperforming the 29.43% return of the Russell 1000® Growth Index.

The trailing 12-month period was a strong one for stocks in general, with major averages posting double-digit returns. The Russell 1000® Index gained 26.8%, while the Russell Midcap® and Russell 2000® Indices advanced 32.6% and 29.8%, respectively. Growth-style indices outperformed their value counterparts overall, with the Russell 1000® Growth, Russell Midcap® Growth and Russell 2000® Growth Indices returning 29.4%, 36.3%, and 36.8%, respectively.

U.S. corporate earnings continued to improve over the 12-month period, first with effective cost-cutting measures and later with productivity enhancements. Perhaps most importantly for active stock pickers, at times, investors seemed to finally focus on company fundamentals – rewarding stocks with above-average earnings growth and reasonable valuations – rather than discounting stocks on a wholesale basis in reaction to distressing macroeconomic events.

What the strong equity market returns don’t show, however, is the wild ride investors took to get there. While the Great Recession formally ended in June 2009, the U.S. recovery has been sluggish, and the economic environment has been difficult for investors, businesses and individuals alike. Unemployment has remained stubbornly high, concerns about credit markets have yet to be resolved and the critical housing sector has yet to return to growth. Indeed, it has been hard to tell at times whether the economy was in fact recovering at all.

If anyone needed yet more proof of the near impossibility of successfully timing the market, they got it over the last 12 months, with the U.S. equity market experiencing several ups and downs. The causes were varied: fears of sovereign debt default in Europe and a double-dip recession in the United States, slowing growth in China, and concern that the policy responses in each of these regions would fail to ensure the emergence of a self-reinforcing, global economic recovery. Lately, the greatest local concerns have been continued weakness in the housing market, high unemployment, four-dollar-per-gallon gas prices and dangerous weather patterns that have caused states-of-emergencies in several areas.

Abroad, the backdrop of events has been nothing short of astounding. In a mere six months, the world was rocked by events ranging from the historic uprisings in the Middle East and the resultant spike in the price of oil; to the horrific natural and nuclear disasters in Japan; to the death of Osama bin Laden. Despite all this, the U.S. market proved to be generally resilient, posting some of the best returns investors have seen since 1999.

After the major benchmarks peaked at the end of April, however, they began to correct in May. The about-face reflects growing concern over the Federal Reserve’s withdrawal of its Quantitative Easing policy (QE2) and questions over the U.S. economy’s ability to self-sustain without the cash infusion. Continued social unrest in the Middle East, decelerating growth in China, continued concerns over sovereign debt and economic and social instability in Greece are adding to the fears. Even if the U.S. does not double dip into a recession (which we don’t believe it will), a modest 2% growth rate will likely continue to feel recessionary to many Americans.

Against this backdrop, the Fund generated a strong absolute return, but lagged its primary benchmark, the Russell 1000® Growth Index, by roughly 400 basis points.

While all sectors within the Fund posted positive absolute returns over the 12-month period, stock selection and sector weightings both contributed to the Fund’s underperformance. The Fund’s health care, consumer discretionary and financials holdings detracted the most from results. Diversified investment services companies Morgan Stanley Co. (-20.2%) and Lincoln National Corp. (-1.6%) dragged down the financials sector, while medical technology company Medtronic, Inc. (-14.2%) and health care device supplier Covidien PLC (-11.5%) detracted from health care holdings. Relative underperformance in the consumer discretionary sector was due in part to losses in electronics retailer Best Buy Co., Inc. (-25.4%) and home furnishings and commercial products manufacturer Leggett & Platt, Inc., (-10.5%). From a sector standpoint, a modest overweight to health care and an underweight to energy were the most notable detractors. The energy sector was the best performing sector within the Russell 1000® Growth Index. As markets retreated the last few months, the overweight to health care has proven beneficial. However, it is one of the laggards (+25.7%) over the entire fiscal year as many other sectors are up over 30%.

Three economically sensitive sectors – energy, materials and industrials – had significant impact on return. The Fund’s energy holdings returned 52.2%, led by National Oilwell Varco, Inc. (+92.0%), an oil service company focused primarily on offshore oil production, and Peabody Energy Corp. (+58.4%), a coal mining and production concern.

5

Managers Cadence Capital Appreciation Fund

Investment Manager’s Comments (continued)

The Fund’s materials holdings returned 40.1%. This sector was led by Cliffs Natural Resources, Inc. (+61.6%), a company which produces both iron ore and coal; and E.I. du Pont de Nemours & Co. (+52.4%), whose markets include seeds and agricultural products, specialty chemicals, coatings and materials. Industrials returned 26.3% overall, led by gains in Joy Global, Inc. (+77.6%), a leader in mining equipment and services and Dover Corp. (+52.7%), a diversified manufacturer of industrial products and engineered systems.

Consumer staples also posted significant gains, advancing 33.9% for the year. Within consumer staples, the Fund’s top-performing holdings included Philip Morris International, Inc. (+70.2%), which manufactures and markets tobacco products outside of the United States and Whole Foods Market, Inc. (+70.4%), natural and organic food supermarkets.

LOOKING FORWARD

Going forward, we at Cadence believe there is still cause to be cautiously optimistic for the second half of the year. While the market is pricing in an economic slowdown, we are constructive on the prospects of our individual holdings. In this world of low but rising inflation, improving economic growth and still historically low interest rates, we believe our Fund will perform well as investors continue to focus more on company fundamentals rather than macro concerns. In particular, our investments in the energy, materials and industrials sectors should benefit most from rising inflation.

We believe the greatest challenge is the extraordinary short-term price volatility and sector rotation, as the market continues to reassess the evolving economic landscape. Longer term, an important concern is the issue of companies’ potential profit margin compression. With economic conditions improving and measures of corporate profit margins at historically high levels, companies will have to start adding to their labor force. While the creation of jobs is good news, it also creates a challenge: adding resources to meet demand. Adding to this challenge are the high costs of production in areas such as energy and metals. For these reasons, a company’s ability to raise prices is a key component of our investment framework for 2011.

Specifically, we are buying more companies that can manage rising cost inputs by increasing prices and/or controlling costs. In particular, we are attracted to companies with specialized or scarce products that can raise prices most easily. We are also focusing on companies that generate significant free cash flow, because they are more able to self-fund their growth and return cash to shareholders in the form of increased dividends and share buybacks. In the long run, strong free cash flow could prove to be even more attractive as it would mitigate the effect of future high interest rates.

In summary, we will continue to seek the right balance between playing offense and defense in the Funds. We will invest in companies that should benefit from global economic expansion but balance them with holdings in defensive sectors such as health care and consumer staples that may act as anchors. Through it all, you can be confident that we will stick to the investment discipline that has seen Cadence clients through challenges and opportunities since 1988.

This commentary reflects the viewpoints of Cadence Capital Management, LLC. The viewpoints and performance figures are based on a 12-month period ending May 31, 2011. The following financial statements presented in this report represent the Fund’s actual 11-month fiscal period from July 1, 2010, to May 31, 2011.

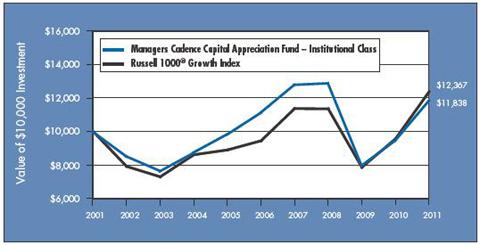

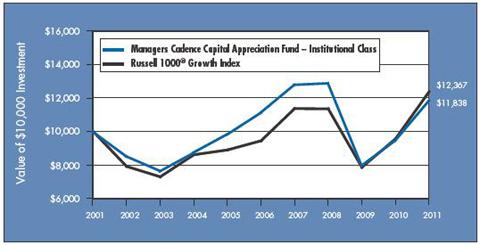

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Cadence Capital Appreciation Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratio and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. The Index assumes reinvestment of dividends. This graph compares a hypothetical $10,000 investment made in Managers Cadence Capital Appreciation Fund’s Institutional Class on May 31, 2001, compared to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

6

Managers Cadence Capital Appreciation Fund

Investment Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

The table below shows the average annual total returns for Managers Cadence Capital Appreciation Fund since inception through May 31, 2011, and the Russell 1000® Growth Index for the same time period.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns1 | |

| | | | | One | | | Five | | | Ten | | | Since | | | Inception | |

| | | | | Year | | | Years | | | Years | | | Inception | | | Date | |

Managers Cadence Capital Appreciation Fund2,3,4,5,6,* | | | | | | | | | | | | | | | | | | | | |

Class A | | No Load | | | 24.58 | % | | | 0.82 | % | | | 1.30 | % | | | 5.37 | % | | | 01/20/97 | |

Class A | | With Load | | | 17.44 | % | | | (0.37 | )% | | | 0.70 | % | | | 4.93 | % | | | | |

Class B | | No Load | | | 23.70 | % | | | 0.06 | % | | | 0.54 | % | | | 4.58 | % | | | 01/20/97 | |

Class B | | With Load | | | 18.70 | % | | | (0.28 | )% | | | 0.54 | % | | | 4.58 | % | | | | |

Class C | | No Load | | | 23.70 | % | | | 0.08 | % | | | 0.55 | % | | | 4.59 | % | | | 01/20/97 | |

Class C | | With Load | | | 22.70 | % | | | 0.08 | % | | | 0.55 | % | | | 4.59 | % | | | | |

Class D | | | | | 24.58 | % | | | 0.82 | % | | | 1.30 | % | | | 3.11 | % | | | 04/08/98 | |

Institutional Class | | | | | 25.05 | % | | | 1.23 | % | | | 1.70 | % | | | 9.34 | % | | | 03/08/91 | |

Administrative Class | | | | | 24.83 | % | | | 0.97 | % | | | 1.48 | % | | | 6.99 | % | | | 07/31/96 | |

Class P | | | | | 25.06 | % | | | — | | | | — | | | | 0.50 | % | | | 07/07/08 | |

Class R | | | | | 24.24 | % | | | 0.57 | % | | | — | | | | 5.93 | % | | | 12/31/02 | |

Russell 1000® Growth Index7 | | | | | 29.43 | % | | | 5.55 | % | | | 2.15 | % | | | 9.28 | % | | | 03/08/91 | † |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect a maximum sales charge of 5.75% on Class A shares, as well as the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. Class C shares held for less than one year are subject to a 1% CDSC.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| † | Date reflects the inception date of the Fund, not the index. |

| * | The Fund changed its fiscal year end from June 30 to May 31 in 2011. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of May 31, 2011. All returns are in U.S. dollars($). |

| 2 | Fund for which, from time to time, the Fund’s advisor has waived its fees and/ or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 4 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

| 5 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 6 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real Estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 7 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratio and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

The Russell 1000® Growth Index is a trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

7

Managers Cadence Capital Appreciation Fund

Fund Snapshots

May 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers Cadence Capital

Appreciation Fund** | | | Russell 1000®

Growth Index | |

Information Technology | | | 31.9 | % | | | 30.2 | % |

Consumer Discretionary | | | 13.6 | % | | | 14.5 | % |

Health Care | | | 12.5 | % | | | 9.9 | % |

Consumer Staples | | | 10.1 | % | | | 9.9 | % |

Industrials | | | 9.6 | % | | | 13.3 | % |

Energy | | | 9.5 | % | | | 11.4 | % |

Materials | | | 5.0 | % | | | 5.1 | % |

Financials | | | 4.1 | % | | | 4.8 | % |

Telecommunication Services | | | 1.2 | % | | | 0.8 | % |

Utilities | | | 0.0 | % | | | 0.1 | % |

Other Assets and Liabilities | | | 2.5 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | Percentage

of Net Assets | |

Apple, Inc.* | | | 4.1 | % |

International Business Machines Corp.* | | | 2.6 | |

Oracle Corp.* | | | 2.3 | |

Exxon Mobil Corp. | | | 2.2 | |

Google, Inc.* | | | 2.2 | |

QUALCOMM, Inc. | | | 2.0 | |

McDonald’s Corp. | | | 1.6 | |

Phillip Morris International, Inc. | | | 1.6 | |

EMC Corp. | | | 1.5 | |

Coco-Cola Co., The | | | 1.5 | |

| | | | |

Top Ten as a Group | | | 21.6 | % |

| | | | |

| * | Top Ten Holding at December 31, 2010 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a special security should not be considered a recommendation to buy or solicitation to sell that security. Special securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

Managers Cadence Capital Appreciation Fund

Schedule of Portfolio Investments

May 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 97.5% | | | | | | | | |

Consumer Discretionary - 13.6% | | | | | | | | |

Amazon.com, Inc.* | | | 52,620 | | | $ | 10,349,828 | |

Coach, Inc. | | | 147,500 | | | | 9,389,850 | |

DIRECTV, Class A* | | | 219,890 | | | | 11,051,671 | |

Ford Motor Co.* | | | 660,720 | | | | 9,857,942 | |

Johnson Controls, Inc. | | | 243,216 | | | | 9,631,354 | |

McDonald’s Corp. | | | 159,640 | | | | 13,017,046 | |

Nike, Inc. | | | 114,290 | | | | 9,651,791 | |

Starbucks Corp. | | | 290,060 | | | | 10,671,307 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 151,580 | | | | 9,243,348 | |

TJX Cos., Inc., The | | | 191,590 | | | | 10,158,102 | |

Walt Disney Co., The | | | 238,770 | | | | 9,939,995 | |

Total Consumer Discretionary | | | | | | | 112,962,234 | |

Consumer Staples - 10.1% | | | | | | | | |

Brown-Forman Corp., Class B | | | 116,910 | | | | 8,473,637 | |

Coca-Cola Co., The | | | 184,200 | | | | 12,306,402 | |

Costco Wholesale Corp. | | | 132,970 | | | | 10,967,366 | |

Estee Lauder Co., Class A | | | 105,530 | | | | 10,817,880 | |

H.J. Heinz Co. | | | 163,970 | | | | 9,005,232 | |

Hershey Foods Corp. | | | 178,470 | | | | 9,946,133 | |

Philip Morris International, Inc. | | | 180,240 | | | | 12,932,220 | |

Whole Foods Market, Inc. | | | 157,150 | | | | 9,611,294 | |

Total Consumer Staples | | | | | | | 84,060,164 | |

Energy - 9.5% | | | | | | | | |

Baker Hughes, Inc. | | | 137,590 | | | | 10,172,029 | |

Chevron Corp. | | | 105,270 | | | | 11,043,876 | |

Exxon Mobil Corp. | | | 224,020 | | | | 18,698,949 | |

Hess Corp. | | | 51,020 | | | | 4,032,110 | |

Marathon Oil Corp. | | | 193,070 | | | | 10,458,602 | |

National Oilwell Varco, Inc. | | | 99,490 | | | | 7,220,984 | |

Occidental Petroleum Corp. | | | 95,960 | | | | 10,349,286 | |

Peabody Energy Corp. | | | 113,130 | | | | 6,941,657 | |

Total Energy | | | | | | | 78,917,493 | |

Financials - 4.1% | | | | | | | | |

American Express Co. | | | 128,500 | | | | 6,630,600 | |

Ameriprise Financial, Inc. | | | 155,550 | | | | 9,524,327 | |

Metlife, Inc. | | | 220,720 | | | | 9,733,752 | |

Morgan Stanley Co. | | | 329,420 | | | | 7,958,787 | |

Total Financials | | | | | | | 33,847,466 | |

Health Care - 12.5% | | | | | | | | |

Allergan, Inc. | | | 109,810 | | | | 9,084,581 | |

Baxter International, Inc. | | | 178,200 | | | | 10,606,464 | |

Cardinal Health, Inc. | | | 255,140 | | | | 11,588,459 | |

CareFusion Corp.* | | | 288,250 | | | | 8,353,485 | |

CR Bard, Inc. | | | 101,940 | | | | 11,394,853 | |

Laboratory Corp. of America Holdings* | | | 110,200 | | | | 11,111,466 | |

Mylan Laboratories, Inc.* | | | 434,810 | | | | 10,237,602 | |

Stryker Corp. | | | 165,880 | | | | 10,350,912 | |

Varian Medical Systems, Inc.* | | | 150,065 | | | | 10,135,390 | |

Waters Corp.* | | | 116,540 | | | | 11,486,182 | |

Total Health Care | | | | | | | 104,349,394 | |

Industrials - 9.6% | | | | | | | | |

Cooper Industries PLC | | | 142,980 | | | | 8,986,293 | |

Deere & Co. | | | 116,540 | | | | 10,031,763 | |

Dover Corp. | | | 158,850 | | | | 10,679,485 | |

Goodrich Corp. | | | 106,680 | | | | 9,312,097 | |

Joy Global, Inc. | | | 109,532 | | | | 9,819,544 | |

Norfolk Southern Corp. | | | 153,400 | | | | 11,245,754 | |

Stericycle, Inc.* | | | 113,530 | | | | 10,114,388 | |

United Parcel Service, Inc., Class B | | | 135,040 | | | | 9,924,090 | |

Total Industrials | | | | | | | 80,113,414 | |

Information Technology - 31.9% | | | | | | | | |

Accenture PLC, Class A | | | 193,720 | | | | 11,117,591 | |

Apple, Inc.* | | | 98,820 | | | | 34,372,561 | |

Applied Materials, Inc. | | | 609,580 | | | | 8,400,012 | |

Autodesk, Inc.* | | | 240,850 | | | | 10,351,733 | |

Avago Technologies, Ltd. | | | 229,610 | | | | 7,758,522 | |

BMC Software, Inc.* | | | 203,010 | | | | 11,334,048 | |

Citrix Systems, Inc.* | | | 90,150 | | | | 7,898,943 | |

Cognizant Technology Solutions Corp.* | | | 129,950 | | | | 9,881,398 | |

Dell, Inc.* | | | 629,590 | | | | 10,123,807 | |

eBay, Inc.* | | | 317,600 | | | | 9,899,592 | |

EMC Corp.* | | | 434,120 | | | | 12,359,396 | |

Google, Inc.* | | | 35,160 | | | | 18,600,343 | |

International Business Machines Corp. | | | 128,280 | | | | 21,670,340 | |

Intuit, Inc.* | | | 124,700 | | | | 6,730,059 | |

Juniper Networks, Inc.* | | | 233,280 | | | | 8,540,381 | |

KLA-Tencor Corp. | | | 232,760 | | | | 10,031,956 | |

NetApp, Inc.* | | | 137,550 | | | | 7,533,614 | |

The accompanying notes are an integral part of these financial statements.

9

Managers Cadence Capital Appreciation Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 31.9% (continued) | | | | | | | | |

Oracle Corp. | | | 569,560 | | | $ | 19,490,343 | |

QUALCOMM, Inc. | | | 276,960 | | | | 16,227,086 | |

Teradata Corp.* | | | 81,630 | | | | 4,554,138 | |

Visa, Inc., Class A | | | 134,930 | | | | 10,937,426 | |

Western Digital Corp.* | | | 228,150 | | | | 8,361,698 | |

Total Information Technology | | | | | | | 266,174,987 | |

Materials - 5.0% | | | | | | | | |

Cliffs Natural Resources, Inc. | | | 46,300 | | | | 4,199,410 | |

E.I. du Pont de Nemours & Co. | | | 190,080 | | | | 10,131,264 | |

Freeport McMoRan Copper & Gold, Inc., Class B | | | 178,542 | | | | 9,219,909 | |

Mosaic Co., The | | | 134,070 | | | | 9,498,860 | |

PPG Industries, Inc. | | | 98,420 | | | | 8,729,854 | |

Total Materials | | | | | | | 41,779,297 | |

Telecommunication Services - 1.2% | | | | | | | | |

American Tower Corp., Class A* | | | 182,030 | | | | 10,099,024 | |

Total Common Stocks (cost $651,340,654) | | | | | | | 812,303,473 | |

Short-Term Investments - 4.0%1 | | | | | | | | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.10% (cost $33,308,617) | | | 33,308,617 | | | | 33,308,617 | |

Total Investments - 101.5%

(cost $684,649,271) | | | | | | | 845,612,090 | |

Other Assets, less Liabilities - (1.5)% | | | | | | | (12,227,468 | ) |

Net Assets - 100.0% | | | | | | $ | 833,384,622 | |

The accompanying notes are an integral part of these financial statements.

10

Managers Cadence Focused Growth Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

Over the 12 months ended May 31, 2011, the Managers Cadence Focused Growth Fund’s (the “Fund”) Institutional Class returned 26.98%, underperforming the 29.43% return of the Russell 1000® Growth Index.

The trailing 12-month period was a strong one for stocks in general, with major averages posting double-digit returns. The Russell 1000® Index gained 26.8%, while the Russell Midcap® and Russell 2000® Indices advanced 32.6% and 29.8%, respectively. Growth-style indices outperformed their value counterparts overall, with the Russell 1000® Growth, Russell Midcap® Growth and Russell 2000® Growth Indices returning 29.4%, 36.3%, and 36.8%, respectively.

U.S. corporate earnings continued to improve over the 12-month period, first with effective cost-cutting measures and later with productivity enhancements. Perhaps most importantly for active stock pickers, at times, investors seemed to finally focus on company fundamentals—rewarding stocks with above-average earnings growth and reasonable valuations—rather than discounting stocks on a wholesale basis in reaction to distressing macroeconomic events.

What the strong equity market returns don’t show, however, is the wild ride investors took to get there. While the Great Recession formally ended in June 2009, the U.S. recovery has been sluggish, and the economic environment has been difficult for investors, businesses and individuals alike. Unemployment has remained stubbornly high, concerns about credit markets have yet to be resolved, and the critical housing sector has yet to return to growth. Indeed, it has been hard to tell at times whether the economy was in fact recovering at all.

If anyone needed yet more proof of the near-impossibility of successfully timing the market, they got it over the last 12 months with the U.S. equity market experiencing several ups and downs. The causes were varied: fears of sovereign debt default in Europe and a double-dip recession in the United States, slowing growth in China, and concern that the policy responses in each of these regions would fail to ensure the emergence of a self-reinforcing, global economic recovery. Lately, the greatest local concerns have been continued weakness in the housing market, high unemployment, four-dollar-per-gallon gas prices and dangerous weather patterns that have caused state-of-emergencies in several areas.

Abroad, the backdrop of events has been nothing short of astounding. In a mere six months, the world was rocked by events ranging from the historic uprisings in the Middle East and the resultant spike in the price of oil; to the horrific natural and nuclear disasters in Japan; to the death of Osama bin Laden. Despite all this, the U.S. market proved to be generally resilient, posting some of the best returns investors have seen since 1999.

After the major benchmarks peaked at the end of April, however, they began to correct in May. The about-face reflects growing concern over the Federal Reserve’s withdrawal of its Quantitative Easing policy (QE2) and questions over the U.S. economy’s ability to self-sustain without the cash infusion. Continued social unrest in the Middle East, decelerating growth in China, continued concerns over sovereign debt, and economic and social instability in Greece are adding to the fears. Even if the U.S. does not double dip into a recession (which we don’t believe it will), a modest 2% growth rate will likely continue to feel recessionary to many Americans.

Against this backdrop, the Fund generated a strong absolute return, but lagged its primary benchmark, the Russell 1000® Growth Index, by roughly 250 basis points. The Fund’s underperformance is attributable to a combination of poor stock selection and sector weightings.

The Fund’s health care, materials and financials holdings detracted most from performance. Within health care, information technology concern McKesson Corp. (+11.7%), biopharmaceutical company Gilead Sciences, Inc. (+7.2%) and global pharmaceutical leader Abbott Laboratories (+0.7%) detracted from overall return. The Financial sector was negatively impacted by diversified financial services companies Morgan Stanley Co. (+20.2%) and investment management organization Blackrock, Inc. (+14.1%). From a sector standpoint, the Fund’s overweights to health care and telecomm detracted from results.

Three economically sensitive sectors—energy, materials and industrials—had significant impact on returns. The Fund’s energy holdings returned 46.20% for the period, led by strong gains in SM Energy Co. (+78.8%), an exploration and production company focused on natural gas and crude oil, and Alpha Natural Resources, Inc. (+42.8%), a leading producer of coal. The Fund’s materials holdings returned 20.5%, driven primarily by E.I. du Pont de Nemours & Co. which gained 52.4% over the 12-month period.

11

Managers Cadence Focused Growth Fund

Investment Manager’s Comments (continued)

Industrials gained 28.8% overall, benefiting from healthy gains in Joy Global, Inc. (+77.6%), a leader in mining equipment and services, and SPX Corp. (+29%), a global manufacturer and supplier of industrial equipment.

LOOKING FORWARD

Going forward, we at Cadence believe there is still cause to be cautiously optimistic for the second half of the year. While the market is pricing in an economic slowdown, we are constructive on the prospects of our individual holdings. In this world of low but rising inflation, improving economic growth and still historically low interest rates, we believe our Fund will perform well as investors continue to focus more on company fundamentals rather than macro concerns. In particular, our investments in the energy, materials and industrials sectors should benefit most from rising inflation.

We believe the greatest challenge is the extraordinary short-term price volatility and sector rotation, as the market continues to reassess the evolving economic landscape. Longer term, an important concern is the issue of companies’ potential profit margin compression. With economic conditions improving and measures of corporate profit margins at historically high levels, companies will have to start adding to their labor force. While the creation of jobs is good news, it also creates a challenge: adding resources to meet demand. Adding to this challenge are the high costs of production in areas such as energy and metals. For these reasons, a company’s ability to raise prices is a key component of our investment framework for 2011.

Specifically, we are buying more companies that can manage rising cost inputs by increasing prices and/or controlling costs. In particular, we are attracted to companies with specialized or scarce products that can raise prices most easily. We are also focusing on companies that generate significant free cash flow, because they are more able to self-fund their growth and return cash to shareholders in the form of increased dividends and share buybacks. In the long run, strong free cash flow could prove to be even more attractive as it would mitigate the effect of future high interest rates.

In summary, we will continue to seek the right balance between playing offense and defense in the Fund. We will invest in companies that should benefit from global economic expansion but balance them with holdings in defensive sectors such as health care and consumer staples that may act as anchors. Through it all, you can be confident that we will stick to the investment discipline that has seen Cadence clients through challenges and opportunities since 1988.

This commentary reflects the viewpoints of Cadence Capital Management, LLC. The viewpoints and performance figures are based on a 12-month period ending May 31, 2011. The following financial statements presented in this report represent the Fund’s actual 11-month fiscal period from July 1, 2010, to May 31, 2011.

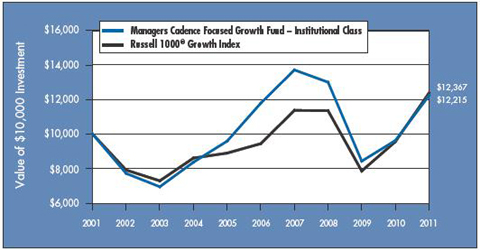

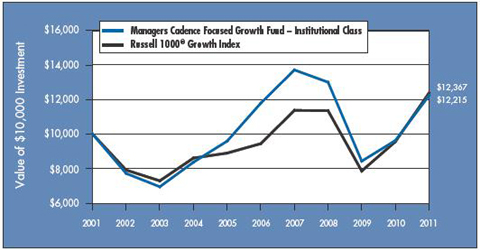

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Cadence Focused Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratio and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. The Index assumes reinvestment of dividends. This graph compares a hypothetical $10,000 investment made in Managers Cadence Focused Growth Fund’s Institutional Class on May 31, 2001, compared to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

12

Managers Cadence Focused Growth Fund

Investment Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

The table below shows the average annual total returns for Managers Cadence Focused Growth Fund since inception through May 31, 2011, and the Russell 1000® Growth Index for the same time period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns1 | |

| | | | | | One | | | Five | | | Ten | | | Since | | | Inception | |

| | | | | | Year | | | Years | | | Years | | | Inception | | | Date | |

Managers Cadence Focused Growth Fund 2,3,4,5,6,* | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | No Load | | | | 26.55 | % | | | — | | | | — | | | | 0.66 | % | | | 07/05/06 | |

Class A | | | With Load | | | | 19.26 | % | | | — | | | | — | | | | (0.55 | )% | | | | |

Class C | | | No Load | | | | 25.47 | % | | | — | | | | — | | | | (0.11 | )% | | | 07/05/06 | |

Class C | | | With Load | | | | 24.47 | % | | | — | | | | — | | | | (0.11 | )% | | | | |

Class D | | | | | | | 26.55 | % | | | — | | | | — | | | | 1.04 | % | | | 07/05/06 | |

Institutional Class | | | | | | | 26.98 | % | | | 0.73 | % | | | 2.02 | % | | | 0.89 | % | | | 08/31/99 | |

Administrative Class | | | | | | | 27.30 | % | | | — | | | | — | | | | 1.31 | % | | | 09/15/06 | |

Class P | | | | | | | 26.91 | % | | | — | | | | — | | | | 0.47 | % | | | 07/07/08 | |

Russell 1000® Growth Index7 | | | | | | | 29.43 | % | | | 5.55 | % | | | 2.15 | % | | | 0.27 | % | | | 08/31/99 | † |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect a maximum sales charge of 5.75% on Class A shares, as well as the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| † | Date reflects the inception date of the Fund, not the index. |

| * | The Fund changed its fiscal year end from June 30 to May 31 in 2011. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of May 31, 2011. All returns are in U.S. dollars($). |

| 2 | Fund for which, from time to time, the Fund’s advisor has waived its fees and/ or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 4 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

| 5 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 6 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 7 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratio and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

The Russell 1000® Growth Index is a trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

13

Managers Cadence Focused Growth Fund

Fund Snapshots

May 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers Cadence

Focused

Growth Fund** | | | Russell 1000®

Growth

Index | |

Information Technology | | | 29.3 | % | | | 30.2 | % |

Consumer Discretionary | | | 15.0 | % | | | 14.5 | % |

Health Care | | | 13.2 | % | | | 9.9 | % |

Consumer Staples | | | 12.8 | % | | | 9.9 | % |

Industrials | | | 10.2 | % | | | 13.3 | % |

Energy | | | 7.5 | % | | | 11.4 | % |

Financials | | | 4.4 | % | | | 4.8 | % |

Materials | | | 4.1 | % | | | 5.1 | % |

Telecommunication Services | | | 2.4 | % | | | 0.8 | % |

Utilities | | | 0.0 | % | | | 0.1 | % |

Other Assets and Liabilities | | | 1.1 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | Percentage of Net

Assets | |

Apple, Inc.* | | | 4.7 | % |

EMC Corp. | | | 2.9 | |

Waters Corp. | | | 2.9 | |

Cardinal Heatlh, Inc. | | | 2.8 | |

QUALCOMM, Inc. | | | 2.8 | |

Exxon Mobil Corp.* | | | 2.7 | |

SPX Corp. | | | 2.7 | |

Phillip Morris International, Inc. | | | 2.7 | |

Marathon Oil Corp. | | | 2.7 | |

United Parcel Service, Inc., Class B* | | | 2.6 | |

| | | | |

Top Ten as a Group | | | 29.5 | % |

| | | | |

| * | Top Ten Holding at December 31, 2010 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

14

Managers Cadence Focused Growth Fund

Schedule of Portfolio Investments

May 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 98.9% | | | | | | | | |

Consumer Discretionary - 15.0% | | | | | | | | |

Amazon.com, Inc.* | | | 2,330 | | | $ | 458,288 | |

DIRECTV, Class A* | | | 9,510 | | | | 477,973 | |

McDonald’s Corp. | | | 5,860 | | | | 477,824 | |

Nike, Inc. | | | 5,490 | | | | 463,631 | |

Starbucks Corp. | | | 12,550 | | | | 461,714 | |

TJX Cos., Inc., The | | | 8,870 | | | | 470,287 | |

Total Consumer Discretionary | | | | | | | 2,809,717 | |

Consumer Staples - 12.8% | | | | | | | | |

Coca-Cola Co., The | | | 7,210 | | | | 481,700 | |

Estee Lauder Co., Class A | | | 4,790 | | | | 491,023 | |

Hershey Foods Corp. | | | 8,580 | | | | 478,163 | |

Philip Morris International, Inc. | | | 6,980 | | | | 500,815 | |

Whole Foods Market, Inc. | | | 7,250 | | | | 443,410 | |

Total Consumer Staples | | | | | | | 2,395,111 | |

Energy - 7.5% | | | | | | | | |

Alpha Natural Resources, Inc.* | | | 6,940 | | | | 380,243 | |

Exxon Mobil Corp. | | | 6,140 | | | | 512,506 | |

Marathon Oil Corp. | | | 9,230 | | | | 499,989 | |

Total Energy | | | | | | | 1,392,738 | |

Financials - 4.4% | | | | | | | | |

Ameriprise Financial, Inc. | | | 7,220 | | | | 442,081 | |

Morgan Stanley Co. | | | 15,550 | | | | 375,688 | |

Total Financials | | | | | | | 817,769 | |

Health Care - 13.2% | | | | | | | | |

Allergan, Inc. | | | 5,870 | | | | 485,625 | |

Cardinal Health, Inc. | | | 11,530 | | | | 523,693 | |

Laboratory Corp. of America Holdings* | | | 4,220 | | | | 425,503 | |

Stryker Corp. | | | 7,810 | | | | 487,344 | |

Waters Corp.* | | | 5,470 | | | | 539,123 | |

Total Health Care | | | | | | | 2,461,288 | |

Industrials - 10.2% | | | | | | | | |

Deere & Co. | | | 5,430 | | | | 467,414 | |

Joy Global, Inc. | | | 4,940 | | | | 442,871 | |

SPX Corp. | | | 6,060 | | | | 502,435 | |

United Parcel Service, Inc., Class B | | | 6,770 | | | | 497,527 | |

Total Industrials | | | | | | | 1,910,247 | |

Information Technology - 29.3% | | | | | | | | |

Apple, Inc.* | | | 2,500 | | | | 869,575 | |

Applied Materials, Inc. | | | 28,640 | | | | 394,659 | |

Citrix Systems, Inc.* | | | 5,220 | | | | 457,376 | |

eBay, Inc.* | | | 13,890 | | | | 432,951 | |

EMC Corp.* | | | 18,970 | | | | 540,076 | |

Google, Inc.* | | | 790 | | | | 417,926 | |

International Business Machines Corp. | | | 2,830 | | | | 478,072 | |

Juniper Networks, Inc.* | | | 10,660 | | | | 390,263 | |

NetApp, Inc.* | | | 9,070 | | | | 496,764 | |

Oracle Corp. | | | 14,060 | | | | 481,133 | |

QUALCOMM, Inc. | | | 8,870 | | | | 519,693 | |

Total Information Technology | | | | | | | 5,478,488 | |

Materials - 4.1% | | | | | | | | |

E.I. du Pont de Nemours & Co. | | | 7,210 | | | | 384,293 | |

Mosaic Co., The | | | 5,380 | | | | 381,173 | |

Total Materials | | | | | | | 765,466 | |

Telecommunication Services - 2.4% | | | | | | | | |

American Tower Corp., Class A* | | | 8,040 | | | | 446,059 | |

Total Common Stocks

(cost $15,287,024) | | | | | | | 18,476,883 | |

Short-Term Investments - 2.1%1 | | | | | | | | |

Dreyfus Cash Management Fund, Institutional | | | | | | | | |

Class Shares, 0.10% (cost $385,022) | | | 385,022 | | | | 385,022 | |

Total Investments - 101.0% | | | | | | | | |

(cost $15,672,046) | | | | | | | 18,861,905 | |

Other Assets, less Liabilities - (1.0)% | | | | | | | (189,757 | ) |

Net Assets - 100.0% | | | | | | $ | 18,672,148 | |

The accompanying notes are an integral part of these financial statements.

15

Managers Cadence Mid-Cap Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

Over the 12 months ended May 31, 2011, the Managers Cadence Mid-Cap Fund’s (the “Fund”) Institutional Class returned 35.47%, slightly underperforming the 36.31% return of the Russell Midcap® Growth Index.

The trailing 12-month period was a strong one for stocks in general, with major averages posting double-digit returns. The Russell 1000® Index gained 26.8%, while the Russell Midcap® and Russell 2000® Indices advanced 32.6% and 29.8%, respectively. Growth-style indices outperformed their value counterparts overall, with the Russell 1000® Growth, Russell Midcap® Growth and Russell 2000® Growth Indices returning 29.4%, 36.3%, and 36.8%, respectively.

U.S. corporate earnings continued to improve over the 12-month period, first with effective cost-cutting measures and later with productivity enhancements. Perhaps most importantly for active stock pickers, at times, investors seemed to finally focus on company fundamentals—rewarding stocks with above-average earnings growth and reasonable valuations—rather than discounting stocks on a wholesale basis in reaction to distressing macroeconomic events.

What the strong equity market returns don’t show, however, is the wild ride investors took to get there. While the Great Recession formally ended in June 2009, the U.S. recovery has been sluggish, and the economic environment has been difficult for investors, businesses and individuals alike. Unemployment has remained stubbornly high, concerns about credit markets have yet to be resolved, and the critical housing sector has yet to return to growth. Indeed, it has been hard to tell at times whether the economy was in fact recovering at all.

If anyone needed yet more proof of the near-impossibility of successfully timing the market, they got it over the last 12 months with the U.S. equity market experiencing several ups and downs. The causes were varied: fears of sovereign debt default in Europe and a double-dip recession in the United States, slowing growth in China and concern that the policy responses in each of these regions would fail to ensure the emergence of a self-reinforcing, global economic recovery. Lately, the greatest local concerns have been continued weakness in the housing market, high unemployment, four-dollar-per-gallon gas prices, and dangerous weather patterns that have caused state-of-emergencies in several areas.

Abroad, the backdrop of events has been nothing short of astounding. In a mere six months, the world was rocked by events ranging from the historic uprisings in the Middle East and the resultant spike in the price of oil; to the horrific natural and nuclear disasters in Japan; to the death of Osama bin Laden. Despite all this, the U.S. market proved to be generally resilient, posting some of the best returns investors have seen since 1999.

After the major benchmarks peaked at the end of April, however, they began to correct in May. The about-face reflects growing concern over the Federal Reserve’s withdrawal of its Quantitative Easing policy (QE2) and questions over the U.S. economy’s ability to self-sustain without the cash infusion. Continued social unrest in the Middle East, decelerating growth in China, continued concerns over sovereign debt, and economic and social instability in Greece are adding to the fears. Even if the U.S. does not double dip into a recession (which we don’t believe it will), a modest 2% growth rate will likely continue to feel recessionary to many Americans.

Against this backdrop, the Fund generated a very strong absolute return, but lagged its primary benchmark, the Russell Midcap® Growth Index, by roughly 90 basis points. The Fund’s modest underperformance is most attributable to its small cash position as mid-cap growth stocks were up sharply. Otherwise the Fund benefited from strong performance in industrials and energy. Strength in those sectors was entirely offset by weakness in consumer discretionary, materials and financials. Excluding the cash drag, portfolio weightings did not meaningfully impact performance.

The Fund’s industrials and energy holdings were the greatest positive contributors to relative performance over the period. Our energy holdings climbed 62.3%, led by gains in Alpha Natural Resources, Inc. (+42.8%), a leading producer of coal, and SM Energy Co. (+54.1%), an exploration and production company focused on natural gas and crude oil.

16

Managers Cadence Mid-Cap Fund

Investment Manager’s Comments (continued)

The Fund’s industrials holdings returned 41.7% for the period. Several companies posted high double-digit returns over the year, including WABCO Holdings, Inc. (+92.0%), a leader in automotive technology and safety systems, and HIS, Inc., Class A (+69.5%), a provider of information and analysis to industrial companies.

While the Fund’s materials, consumer discretionary and financials holdings all posted positive returns on average for the period, they lagged the benchmark on a relative basis. Specialty chemical company Ashland, Inc. (-7.6%) and Titanium Metals Corp. (-15.4%) detracted from the materials sector, while used car retailer CarMax, Inc. (-25.8%) and major appliance manufacturer Whirlpool Corp. (-28.0%) dragged down consumer discretionary stocks. Disappointing relative performance in financials was due in part to losses in investment banking firm Greenhill & Co., Inc. (-25.2%) and insurance provider Genworth Financial, Inc., Class A (-30.5%).

LOOKING FORWARD

Going forward, we at Cadence believe there is still cause to be cautiously optimistic for the second half of the year. While the market is pricing in an economic slowdown, we are constructive on the prospects of our individual holdings. In this world of low but rising inflation, improving economic growth and still historically low interest rates, we believe our Fund will perform well as investors continue to focus more on company fundamentals rather than macro concerns. In particular, our investments in the energy, materials and industrials sectors should benefit most from rising inflation.

We believe the greatest challenge is the extraordinary short-term price volatility and sector rotation, as the market continues to reassess the evolving economic landscape. Longer term, an important concern is the issue of companies’ potential profit margin compression. With economic conditions improving and measures of corporate profit margins at historically high levels, companies will have to start adding to their labor force. While the creation of jobs is good news, it also creates a challenge: adding resources to meet demand. Adding to this challenge are the high costs of production in areas such as energy and metals. For these reasons, a company’s ability to raise prices is a key component of our investment framework for 2011.

Specifically, we are buying more companies that can manage rising cost inputs by increasing prices and/or controlling costs. In particular, we are attracted to companies with specialized or scarce products that can raise prices most easily. We are also focusing on companies that generate significant free cash flow, because they are more able to self-fund their growth and return cash to shareholders in the form of increased dividends and share buybacks. In the long run, strong free cash flow could prove to be even more attractive as it would mitigate the effect of future high interest rates.

In summary, we will continue to seek the right balance between playing offense and defense in the Fund. We will invest in companies that should benefit from global economic expansion but balance them with holdings in defensive sectors such as health care and consumer staples that may act as anchors. Through it all, you can be confident that we will stick to the investment discipline that has seen Cadence clients through challenges and opportunities since 1988.

This commentary reflects the viewpoints of Cadence Capital Management, LLC. The viewpoints and performance figures are based on a 12-month period ending May 31, 2011. The following financial statements presented in this report represent the Fund’s actual 11-month fiscal period from July 1, 2010, to May 31, 2011.

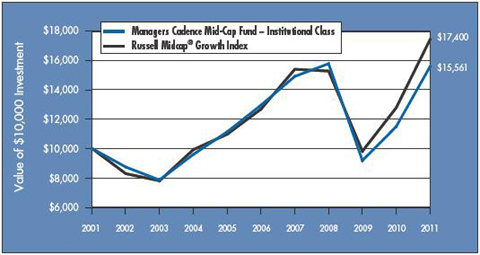

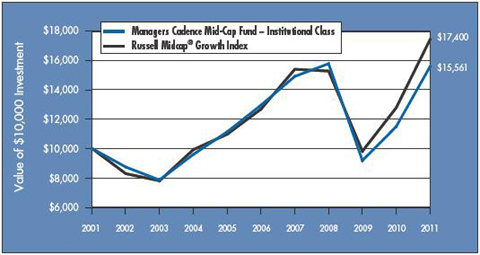

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Cadence Mid-Cap Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The Russell Midcap® Growth Index is a market capitalization weighted index that measures the performance of those Russell Midcap companies with higher price-to-book ratio and higher forecasted growth values. Unlike the Fund, the Russell Midcap® Growth Index is unmanaged, is not available for investment, and does not incur expenses. The Index assumes reinvestment of dividends. This graph compares a hypothetical $10,000 investment made in Managers Cadence Mid-Cap Fund’s Institutional Class on May 31, 2001, compared to a $10,000 investment made in the Russell Midcap® Growth Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

17

Managers Cadence Mid-Cap Fund

Investment Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

The table below shows the average annual total returns for Managers Cadence Mid-Cap Fund since inception through May 31, 2011, and the Russell Midcap® Growth Index for the same time period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns1 | |

| | | | | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

| | | | | | |

Managers Cadence Mid-Cap Fund2,3,4,5,* | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | No Load | | | | 34.90 | % | | | 3.35 | % | | | 4.11 | % | | | 7.35 | % | | | 01/13/97 | |

Class A | | | With Load | | | | 27.15 | % | | | 2.13 | % | | | 3.50 | % | | | 6.91 | % | | | | |

Class B | | | No Load | | | | 33.93 | % | | | 2.58 | % | | | 3.33 | % | | | 6.55 | % | | | 01/13/97 | |

Class B | | | With Load | | | | 28.93 | % | | | 2.25 | % | | | 3.33 | % | | | 6.55 | % | | | | |

Class C | | | No Load | | | | 33.91 | % | | | 2.57 | % | | | 3.33 | % | | | 6.55 | % | | | 01/13/97 | |

Class C | | | With Load | | | | 32.91 | % | | | 2.57 | % | | | 3.33 | % | | | 6.55 | % | | | | |

Class D | | | | | | | 34.87 | % | | | 3.34 | % | | | 4.12 | % | | | 5.36 | % | | | 04/08/98 | |

Institutional Class | | | | | | | 35.47 | % | | | 3.76 | % | | | 4.52 | % | | | 10.40 | % | | | 08/26/91 | |

Administrative Class | | | | | | | 35.16 | % | | | 3.51 | % | | | 4.25 | % | | | 10.21 | % | | | 11/30/94 | |

Class P | | | | | | | 35.31 | % | | | — | | | | — | | | | 3.11 | % | | | 07/07/08 | |

Class R | | | | | | | 34.62 | % | | | 3.09 | % | | | — | | | | 9.12 | % | | | 12/31/02 | |

Russell Midcap® Growth Index6 | | | | | | | 36.31 | % | | | 6.54 | % | | | 5.70 | % | | | — | 7 | | | 08/26/91 | † |