UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3759

Variable Insurance Products Fund IV

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2016 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products: Consumer Discretionary Portfolio

Annual Report December 31, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended December 31, 2016 | Past 1 year | Past 5 years | Past 10 years |

| Initial Class | 5.24% | 15.71% | 8.40% |

| Investor Class | 5.12% | 15.61% | 8.31% |

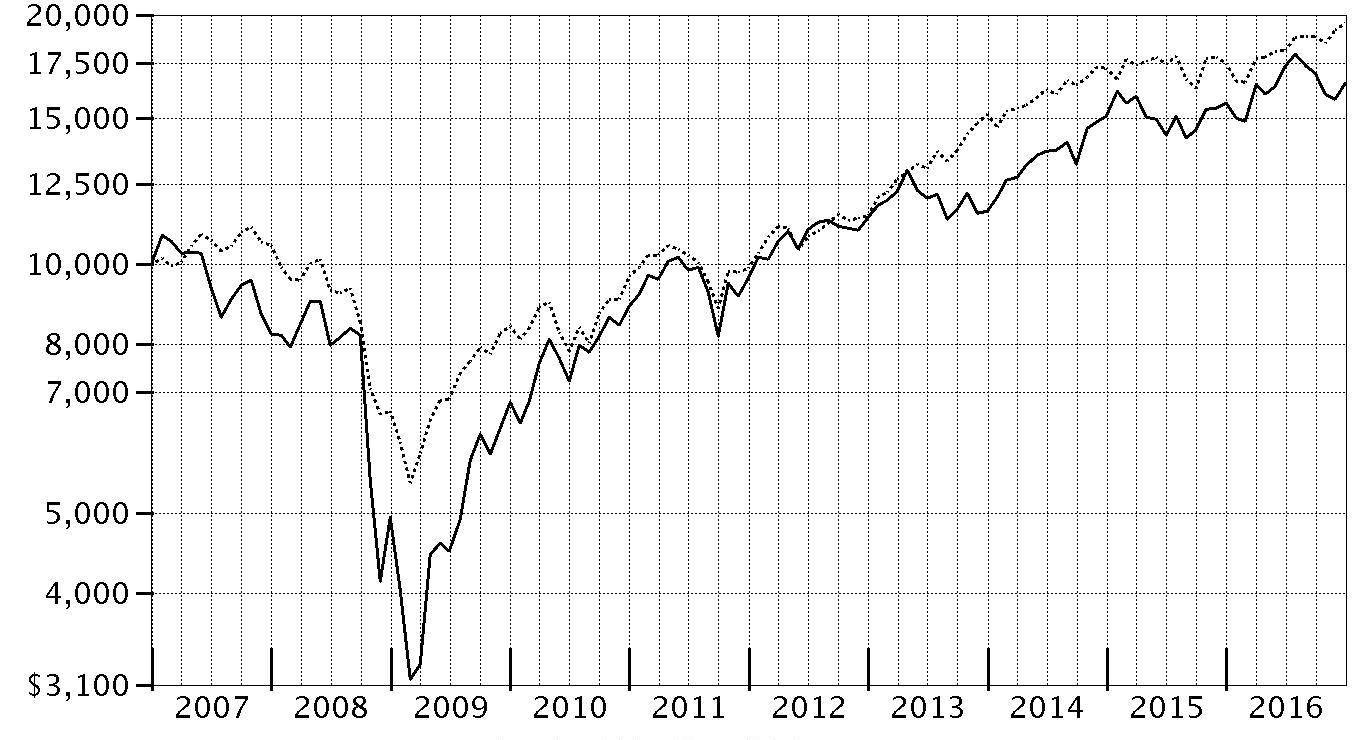

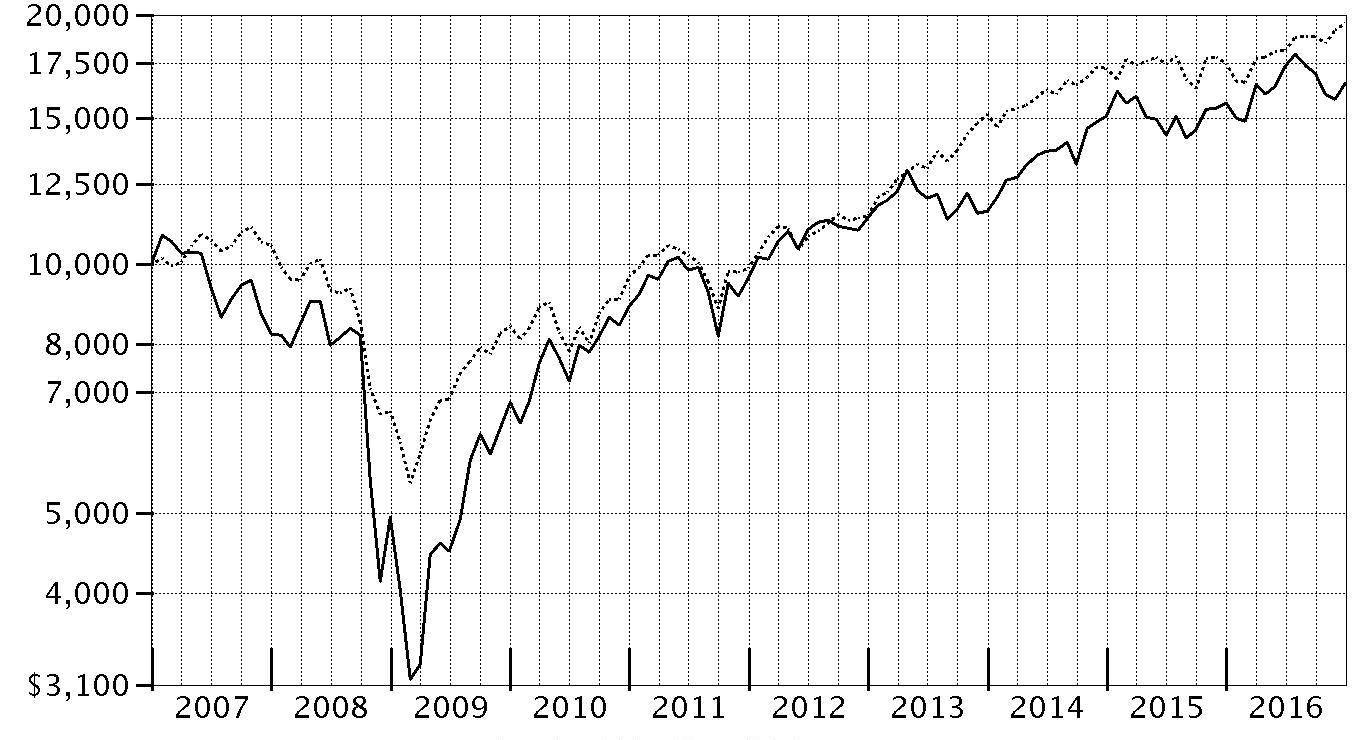

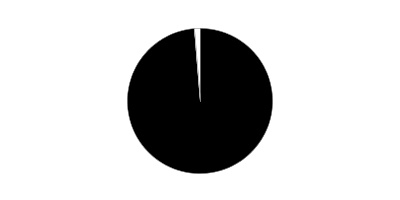

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in VIP Consumer Discretionary Portfolio - Initial Class on December 31, 2006.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values |

| $22,403 | VIP Consumer Discretionary Portfolio - Initial Class |

| $19,572 | S&P 500® Index |

Management's Discussion of Fund Performance

Market Recap: The S&P 500 index returned 11.96% in 2016, rising sharply on post-election optimism for economic growth. The year began during a fairly volatile stretch, with stocks hampered by persistent oil-price weakness and U.S.-dollar strength. Markets regained momentum in February amid U.S. job gains, a rally in energy and other stimuli that helped keep the roughly seven-year uptrend intact. Markets tumbled briefly following the U.K.’s June 23 vote to exit the European Union – dubbed “Brexit” – then recovered quickly and settled into a flattish stretch until the November 8 U.S. presidential election. Stocks reacted to the outcome by reaching a series of all-time highs. For the year, energy (+27%) led the way amid two strong rallies in commodity prices, one in the spring and another in November. Telecommunication services (+23%) was close behind, as demand for dividend-paying equities was high early in the period. Cyclical sectors, including financials (+22%), industrials (+18%) and materials (+17%), also posted strong gains. Conversely, consumer staples (+5%) and consumer discretionary (+6%) lagged the index, the latter hurt as online competition continued to pressure brick-and-mortar retailers. Real estate (+3%) struggled due to expectations for rising interest rates, while health care (-2%) was hampered by an uncertain political and regulatory outlook.

Comments from Portfolio Manager Peter Dixon: For the year, the fund's share classes returned about 5%, underperforming both the 6.72% advance of the MSCI U.S. IMI Consumer Discretionary 25/50 Index. The sector fell short of the broader market but still produced a solid gain amid a number of positives, including wage growth and an improving job market. Versus the MSCI sector index, our biggest relative detractor the past year was major fund holding L Brands. The apparel maker and retailer, whose brands include Bath & Body Works, saw its shares return -27%. Shares began to sell off after the company’s estimates for fiscal-year 2016 were reduced after the management team restructured the Victoria's Secret brand – whose CEO left – and the company decided to exit certain categories. Then, in late October, the company announced disappointing comparable sales for Victoria's Secret. Another major laggard was Nike. The stock suffered amid mounting competition in the athletic apparel and footwear space. Conversely, our biggest individual contributor was large fund holding Charter Communications. Charter’s stock price advanced in August after the company reported solid earnings gains from its roughly $70 billion acquisition of Time Warner Cable (TWC) – along with internet provider Bright House Networks – completed in May. In December, Charter shares further benefited from expectations for greater-than-expected synergies resulting from the TWC acquisition. An overweighting in Amazon.com also boosted relative results.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of December 31, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Amazon.com, Inc. | 14.4 | 15.2 |

| The Walt Disney Co. | 9.7 | 8.4 |

| Home Depot, Inc. | 9.7 | 8.0 |

| Charter Communications, Inc. Class A | 6.8 | 7.1 |

| NIKE, Inc. Class B | 5.3 | 5.1 |

| L Brands, Inc. | 4.9 | 4.4 |

| Hilton Worldwide Holdings, Inc. | 4.6 | 4.1 |

| Ross Stores, Inc. | 3.5 | 4.8 |

| Dollar Tree, Inc. | 3.1 | 0.0 |

| Interpublic Group of Companies, Inc. | 3.0 | 2.8 |

| | 65.0 | |

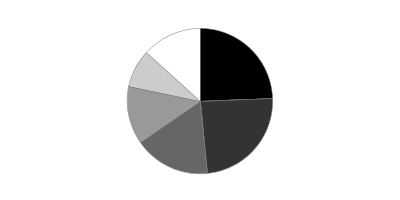

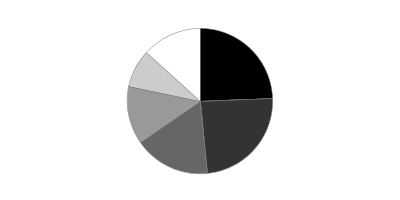

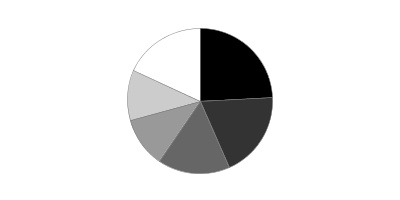

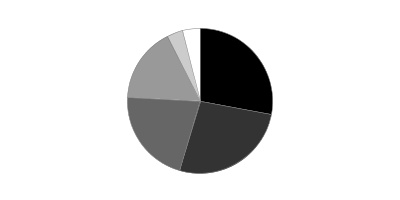

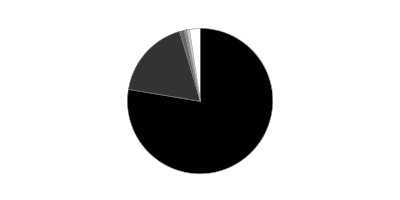

Top Industries (% of fund's net assets)

| As of December 31, 2016 |

| | Media | 24.4% |

| | Specialty Retail | 24.0% |

| | Internet & Direct Marketing Retail | 17.0% |

| | Hotels, Restaurants & Leisure | 12.9% |

| | Textiles, Apparel & Luxury Goods | 8.4% |

| | All Others* | 13.3% |

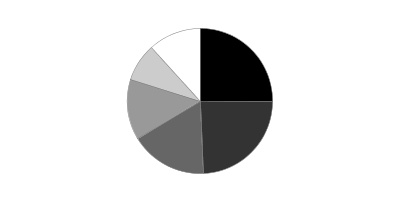

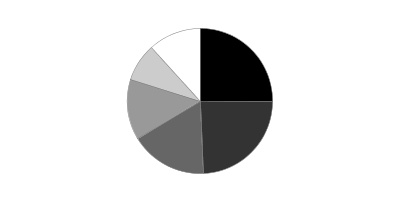

| As of June 30, 2016 |

| | Specialty Retail | 25.1% |

| | Media | 24.2% |

| | Internet & Catalog Retail | 17.0% |

| | Hotels, Restaurants & Leisure | 13.5% |

| | Textiles, Apparel & Luxury Goods | 8.5% |

| | All Others* | 11.7% |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

* Includes short-term investments and net other assets (liabilities).

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Investments December 31, 2016

Showing Percentage of Net Assets

| Common Stocks - 99.0% | | | |

| | | Shares | Value |

| Auto Components - 1.1% | | | |

| Auto Parts & Equipment - 1.1% | | | |

| Tenneco, Inc. (a) | | 26,251 | $1,639,900 |

| Automobiles - 0.4% | | | |

| Automobile Manufacturers - 0.4% | | | |

| Ferrari NV | | 9,600 | 558,144 |

| Beverages - 1.2% | | | |

| Soft Drinks - 1.2% | | | |

| Monster Beverage Corp. (a) | | 40,090 | 1,777,591 |

| Distributors - 1.1% | | | |

| Distributors - 1.1% | | | |

| LKQ Corp. (a) | | 52,400 | 1,606,060 |

| Food & Staples Retailing - 0.1% | | | |

| Food Retail - 0.1% | | | |

| Zhou Hei Ya International Holdings Co. Ltd. | | 169,500 | 147,744 |

| Hotels, Restaurants & Leisure - 12.9% | | | |

| Casinos & Gaming - 1.3% | | | |

| Churchill Downs, Inc. | | 200 | 30,090 |

| Las Vegas Sands Corp. | | 35,159 | 1,877,842 |

| | | | 1,907,932 |

| Hotels, Resorts & Cruise Lines - 4.6% | | | |

| Hilton Worldwide Holdings, Inc. | | 248,840 | 6,768,448 |

| Leisure Facilities - 1.1% | | | |

| Vail Resorts, Inc. | | 10,460 | 1,687,303 |

| Restaurants - 5.9% | | | |

| Buffalo Wild Wings, Inc. (a) | | 12,800 | 1,976,320 |

| Darden Restaurants, Inc. | | 23,100 | 1,679,832 |

| Del Frisco's Restaurant Group, Inc. (a) | | 29,500 | 501,500 |

| Domino's Pizza, Inc. | | 6,500 | 1,035,060 |

| Jack in the Box, Inc. | | 1,100 | 122,804 |

| McDonald's Corp. | | 4,170 | 507,572 |

| Starbucks Corp. | | 50,470 | 2,802,094 |

| U.S. Foods Holding Corp. | | 2,500 | 68,700 |

| | | | 8,693,882 |

|

| TOTAL HOTELS, RESTAURANTS & LEISURE | | | 19,057,565 |

|

| Household Durables - 1.3% | | | |

| Household Appliances - 1.3% | | | |

| Techtronic Industries Co. Ltd. | | 535,908 | 1,917,735 |

| Household Products - 2.0% | | | |

| Household Products - 2.0% | | | |

| Spectrum Brands Holdings, Inc. | | 23,949 | 2,929,681 |

| Internet & Direct Marketing Retail - 17.0% | | | |

| Internet & Direct Marketing Retail - 17.0% | | | |

| Amazon.com, Inc. (a) | | 28,338 | 21,249,817 |

| Liberty Interactive Corp. QVC Group Series A (a) | | 108,300 | 2,163,834 |

| Ocado Group PLC (a)(b) | | 522,047 | 1,699,142 |

| | | | 25,112,793 |

| Leisure Products - 1.3% | | | |

| Leisure Products - 1.3% | | | |

| Mattel, Inc. | | 71,400 | 1,967,070 |

| Media - 24.1% | | | |

| Advertising - 3.0% | | | |

| Interpublic Group of Companies, Inc. | | 192,357 | 4,503,077 |

| Cable & Satellite - 10.9% | | | |

| Charter Communications, Inc. Class A (a) | | 34,977 | 10,070,578 |

| Comcast Corp. Class A | | 50,640 | 3,496,692 |

| DISH Network Corp. Class A (a) | | 13,500 | 782,055 |

| Naspers Ltd. Class N | | 5,240 | 764,996 |

| Sirius XM Holdings, Inc. (b) | | 226,600 | 1,008,370 |

| | | | 16,122,691 |

| Movies & Entertainment - 10.2% | | | |

| The Walt Disney Co. | | 137,957 | 14,377,879 |

| Time Warner, Inc. | | 7,200 | 695,016 |

| | | | 15,072,895 |

|

| TOTAL MEDIA | | | 35,698,663 |

|

| Multiline Retail - 4.0% | | | |

| General Merchandise Stores - 4.0% | | | |

| B&M European Value Retail S.A. | | 386,784 | 1,325,150 |

| Dollar Tree, Inc. (a) | | 59,642 | 4,603,170 |

| | | | 5,928,320 |

| Personal Products - 0.1% | | | |

| Personal Products - 0.1% | | | |

| Herbalife Ltd. (a) | | 3,400 | 163,676 |

| Specialty Retail - 24.0% | | | |

| Apparel Retail - 11.3% | | | |

| Express, Inc. (a) | | 23,600 | 253,936 |

| L Brands, Inc. | | 110,900 | 7,301,656 |

| Ross Stores, Inc. | | 78,500 | 5,149,600 |

| TJX Companies, Inc. | | 49,917 | 3,750,264 |

| Urban Outfitters, Inc. (a) | | 4,500 | 128,160 |

| Zumiez, Inc. (a)(b) | | 10,600 | 231,610 |

| | | | 16,815,226 |

| Automotive Retail - 3.0% | | | |

| Advance Auto Parts, Inc. | | 11,687 | 1,976,505 |

| O'Reilly Automotive, Inc. (a) | | 8,760 | 2,438,872 |

| | | | 4,415,377 |

| Home Improvement Retail - 9.7% | | | |

| Home Depot, Inc. | | 106,900 | 14,333,152 |

|

| TOTAL SPECIALTY RETAIL | | | 35,563,755 |

|

| Textiles, Apparel & Luxury Goods - 8.4% | | | |

| Apparel, Accessories & Luxury Goods - 3.1% | | | |

| G-III Apparel Group Ltd. (a) | | 10,452 | 308,961 |

| Michael Kors Holdings Ltd. (a) | | 10,100 | 434,098 |

| Regina Miracle International Holdings Ltd. (b) | | 258,019 | 213,384 |

| VF Corp. | | 67,500 | 3,601,125 |

| | | | 4,557,568 |

| Footwear - 5.3% | | | |

| NIKE, Inc. Class B | | 155,270 | 7,892,374 |

|

| TOTAL TEXTILES, APPAREL & LUXURY GOODS | | | 12,449,942 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $122,900,860) | | | 146,518,639 |

| | | Principal Amount | Value |

|

| Convertible Bonds - 0.3% | | | |

| Media - 0.3% | | | |

| Cable & Satellite - 0.3% | | | |

| DISH Network Corp. 3.375% 8/15/26 (c) | | | |

| (Cost $410,000) | | $410,000 | 466,631 |

| | | Shares | Value |

|

| Money Market Funds - 2.7% | | | |

| Fidelity Cash Central Fund, 0.60% (d) | | 762,010 | 762,162 |

| Fidelity Securities Lending Cash Central Fund 0.65% (d)(e) | | 3,213,090 | 3,213,412 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $3,975,274) | | | 3,975,574 |

| TOTAL INVESTMENT PORTFOLIO - 102.0% | | | |

| (Cost $127,286,134) | | | 150,960,844 |

| NET OTHER ASSETS (LIABILITIES) - (2.0)% | | | (3,011,919) |

| NET ASSETS - 100% | | | $147,948,925 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $466,631 or 0.3% of net assets.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $10,928 |

| Fidelity Securities Lending Cash Central Fund | 183,377 |

| Total | $194,305 |

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2016, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $146,518,639 | $143,474,780 | $3,043,859 | $-- |

| Convertible Bonds | 466,631 | -- | 466,631 | -- |

| Money Market Funds | 3,975,574 | 3,975,574 | -- | -- |

| Total Investments in Securities: | $150,960,844 | $147,450,354 | $3,510,490 | $-- |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | December 31, 2016 |

| Assets | | |

Investment in securities, at value (including securities loaned of $3,104,935) — See accompanying schedule:

Unaffiliated issuers (cost $123,310,860) | $146,985,270 | |

| Fidelity Central Funds (cost $3,975,274) | 3,975,574 | |

| Total Investments (cost $127,286,134) | | $150,960,844 |

| Receivable for investments sold | | 886,113 |

| Dividends receivable | | 170,638 |

| Interest receivable | | 5,496 |

| Distributions receivable from Fidelity Central Funds | | 7,729 |

| Prepaid expenses | | 829 |

| Other receivables | | 2,757 |

| Total assets | | 152,034,406 |

| Liabilities | | |

| Payable for investments purchased | $73,666 | |

| Payable for fund shares redeemed | 665,021 | |

| Accrued management fee | 69,604 | |

| Other affiliated payables | 22,091 | |

| Other payables and accrued expenses | 42,119 | |

| Collateral on Securities Loaned | 3,212,980 | |

| Total liabilities | | 4,085,481 |

| Net Assets | | $147,948,925 |

| Net Assets consist of: | | |

| Paid in capital | | $126,936,989 |

| Undistributed net investment income | | 244,854 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,906,414) |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 23,673,496 |

| Net Assets | | $147,948,925 |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($23,677,425 ÷ 1,292,056 shares) | | $18.33 |

| Investor Class: | | |

| Net Asset Value, offering price and redemption price per share ($124,271,500 ÷ 6,799,791 shares) | | $18.28 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended December 31, 2016 |

| Investment Income | | |

| Dividends | | $2,371,022 |

| Interest | | 5,500 |

| Income from Fidelity Central Funds (including $183,377 from security lending) | | 194,305 |

| Total income | | 2,570,827 |

| Expenses | | |

| Management fee | $907,893 | |

| Transfer agent fees | 220,399 | |

| Accounting and security lending fees | 66,314 | |

| Custodian fees and expenses | 14,560 | |

| Independent trustees' fees and expenses | 3,637 | |

| Audit | 54,886 | |

| Legal | 3,683 | |

| Miscellaneous | 1,888 | |

| Total expenses before reductions | 1,273,260 | |

| Expense reductions | (7,467) | 1,265,793 |

| Net investment income (loss) | | 1,305,034 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (1,784,098) | |

| Fidelity Central Funds | 896 | |

| Foreign currency transactions | (9,818) | |

| Total net realized gain (loss) | | (1,793,020) |

Change in net unrealized appreciation (depreciation) on:

Investment securities | 6,462,816 | |

| Assets and liabilities in foreign currencies | (123) | |

| Total change in net unrealized appreciation (depreciation) | | 6,462,693 |

| Net gain (loss) | | 4,669,673 |

| Net increase (decrease) in net assets resulting from operations | | $5,974,707 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended December 31, 2016 | Year ended December 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $1,305,034 | $912,511 |

| Net realized gain (loss) | (1,793,020) | 2,600,750 |

| Change in net unrealized appreciation (depreciation) | 6,462,693 | 267,905 |

| Net increase (decrease) in net assets resulting from operations | 5,974,707 | 3,781,166 |

| Distributions to shareholders from net investment income | (1,035,303) | (888,137) |

| Distributions to shareholders from net realized gain | (3,068,756) | (12,074,620) |

| Total distributions | (4,104,059) | (12,962,757) |

| Share transactions - net increase (decrease) | (61,945,625) | 108,756,640 |

| Redemption fees | 48,581 | 73,024 |

| Total increase (decrease) in net assets | (60,026,396) | 99,648,073 |

| Net Assets | | |

| Beginning of period | 207,975,321 | 108,327,248 |

| End of period | $147,948,925 | $207,975,321 |

| Other Information | | |

| Undistributed net investment income end of period | $244,854 | $– |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — VIP Consumer Discretionary Portfolio Initial Class

| Years ended December 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $17.88 | $19.01 | $18.54 | $14.24 | $12.26 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .15 | .13 | .08 | .03 | .07 |

| Net realized and unrealized gain (loss) | .73 | .73 | 1.59 | 5.58 | 2.55 |

| Total from investment operations | .88 | .86 | 1.67 | 5.61 | 2.62 |

| Distributions from net investment income | (.14) | (.09) | (.10) | (.02) | (.05) |

| Distributions from net realized gain | (.30) | (1.91) | (1.11) | (1.30) | (.60) |

| Total distributions | (.44) | (2.00) | (1.20)B | (1.32) | (.65) |

| Redemption fees added to paid in capitalA | .01 | .01 | –C | .01 | .01 |

| Net asset value, end of period | $18.33 | $17.88 | $19.01 | $18.54 | $14.24 |

| Total ReturnD,E | 5.24% | 4.71% | 9.64% | 41.10% | 21.67% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .70% | .70% | .72% | .76% | .89% |

| Expenses net of fee waivers, if any | .70% | .70% | .72% | .75% | .89% |

| Expenses net of all reductions | .70% | .69% | .71% | .75% | .88% |

| Net investment income (loss) | .86% | .69% | .45% | .16% | .53% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $23,677 | $42,048 | $21,446 | $32,004 | $11,950 |

| Portfolio turnover rateH | 43% | 46% | 129% | 122% | 190% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $1.20 per share is comprised of distributions from net investment income of $0.097 and distributions from net realized gain of $1.106 per share.

C Amount represents less than $.005 per share.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — VIP Consumer Discretionary Portfolio Investor Class

| Years ended December 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $17.84 | $18.97 | $18.50 | $14.21 | $12.25 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .14 | .11 | .07 | .01 | .06 |

| Net realized and unrealized gain (loss) | .71 | .74 | 1.59 | 5.58 | 2.53 |

| Total from investment operations | .85 | .85 | 1.66 | 5.59 | 2.59 |

| Distributions from net investment income | (.13) | (.08) | (.08) | (.01) | (.04) |

| Distributions from net realized gain | (.30) | (1.91) | (1.11) | (1.30) | (.60) |

| Total distributions | (.42)B | (1.99) | (1.19) | (1.31) | (.64) |

| Redemption fees added to paid in capitalA | .01 | .01 | –C | .01 | .01 |

| Net asset value, end of period | $18.28 | $17.84 | $18.97 | $18.50 | $14.21 |

| Total ReturnD,E | 5.12% | 4.66% | 9.58% | 41.05% | 21.45% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .78% | .78% | .80% | .83% | .96% |

| Expenses net of fee waivers, if any | .78% | .77% | .79% | .83% | .96% |

| Expenses net of all reductions | .78% | .77% | .78% | .83% | .94% |

| Net investment income (loss) | .78% | .61% | .38% | .08% | .46% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $124,272 | $165,927 | $86,882 | $109,697 | $27,563 |

| Portfolio turnover rateH | 43% | 46% | 129% | 122% | 190% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.42 per share is comprised of distributions from net investment income of $.125 and distributions from net realized gain of $.298 per share.

C Amount represents less than $.005 per share.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended December 31, 2016

1. Organization.

VIP Consumer Discretionary Portfolio (the Fund) is a non-diversified fund of Variable Insurance Products Fund IV (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2016 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2016, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, capital loss carryforwards, certain foreign taxes, losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $29,221,566 |

| Gross unrealized depreciation | (5,675,400) |

| Net unrealized appreciation (depreciation) on securities | $23,546,166 |

| Tax Cost | $127,414,678 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $244,853 |

| Capital loss carryforward | $(2,777,871) |

| Net unrealized appreciation (depreciation) on securities and other investments | $ 23,544,946 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

| Fiscal year of expiration | |

| No expiration | |

| Short-term | $(2,777,871) |

The tax character of distributions paid was as follows:

| | December 31, 2016 | December 31, 2015 |

| Ordinary Income | $1,035,303 | $ 1,510,373 |

| Long-term Capital Gains | 3,068,756 | 11,452,384 |

| Total | $4,104,059 | $ 12,962,757 |

Trading (Redemption) Fees. Shares held by investors less than 60 days may be subject to a redemption fee equal to 1% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $70,694,884 and $126,211,227, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity SelectCo, LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by Fidelity Management & Research Company (FMR) and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .55% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class (with the exception of Investor Class) pays a fee for transfer agent services, typesetting, and printing and mailing of shareholder reports, excluding mailing of proxy statements, equal to an annual rate of .07% (.15% for Investor Class) of class-level average net assets. For the period, transfer agent fees for each class were as follows:

| Initial Class | $18,665 |

| Investor Class | 201,734 |

| | $220,399 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $1,655 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $438 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $6,007 for the period.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $1,460.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended

December 31, 2016 | Year ended

December 31, 2015 |

| From net investment income | | |

| Initial Class | $177,534 | $201,826 |

| Investor Class | 857,769 | 686,311 |

| Total | $1,035,303 | $888,137 |

| From net realized gain | | |

| Initial Class | $586,354 | $2,248,126 |

| Investor Class | 2,482,402 | 9,826,494 |

| Total | $3,068,756 | $12,074,620 |

10. Share Transactions.

Transactions for each class of shares were as follows:

| | Shares | Shares | Dollars | Dollars |

| | Year ended December 31, 2016 | Year ended December 31, 2015 | Year ended December 31, 2016 | Year ended December 31, 2015 |

| Initial Class | | | | |

| Shares sold | 122,020 | 1,350,232 | $2,169,098 | $24,894,236 |

| Reinvestment of distributions | 46,901 | 138,025 | 763,888 | 2,449,952 |

| Shares redeemed | (1,228,235) | (265,236) | (21,325,956) | (4,757,952) |

| Net increase (decrease) | (1,059,314) | 1,223,021 | $(18,392,970) | $22,586,236 |

| Investor Class | | | | |

| Shares sold | 609,221 | 4,742,177 | $10,778,576 | $86,676,987 |

| Reinvestment of distributions | 204,746 | 593,909 | 3,340,171 | 10,512,805 |

| Shares redeemed | (3,316,240) | (614,917) | (57,671,402) | (11,019,388) |

| Net increase (decrease) | (2,502,273) | 4,721,169 | $(43,552,655) | $86,170,404 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, the investment adviser or its affiliates were the owners of record of 100% of the total outstanding shares of the Fund.

Report of Independent Registered Public Accounting Firm

To the Trustees of Variable Insurance Products Fund IV and Shareholders of VIP Consumer Discretionary Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of VIP Consumer Discretionary Portfolio (a fund of Variable Insurance Products Fund IV) (the "Fund") as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 16, 2017

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Each of the Trustees oversees 83 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. Brian B. Hogan is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Michael E. Wiley serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's sector portfolios. Other Boards oversee Fidelity's equity and high income funds, and Fidelity's investment grade bond, money market, and asset allocation funds. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged SelectCo and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through SelectCo, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations and Audit Committees. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), SelectCo's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Brian B. Hogan (1964)

Year of Election or Appointment: 2014

Trustee

Chairman of the Board of Trustees

Mr. Hogan also serves as Trustee or Vice President of other funds. Mr. Hogan serves as a Director of FMR Investment Management (UK) Limited (investment adviser firm, 2015-present) and Fidelity SelectCo, LLC (investment adviser firm, 2014-present) and President of the Equity Division of FMR (investment adviser firm, 2009-present). Previously, Mr. Hogan served as Senior Vice President, Equity Research of FMR (2006-2009) and as a portfolio manager. Mr. Brian B. Hogan is not related to Mr. Colm A. Hogan.

* Determined to be an "Interested Trustee" by virtue of, among other things, his or her affiliation with the trust or various entities under common control with SelectCo.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

David A. Rosow (1942)

Year of Election or Appointment: 2013

Trustee

Mr. Rosow also serves as Trustee of other Fidelity® funds. Prior to his retirement in 2006, Mr. Rosow was the Chief Executive Officer, owner and operator of a number of private companies, which encompassed the oil refining, drilling and marketing of petroleum products (including specialty petroleum products), recreation industry, and real estate development. Mr. Rosow currently serves as a Director of Oxbow Carbon LLC (upgraders, marketers, and distributors of petroleum byproducts of the oil refining process, 2015-present) and Oxbridge Academy of the Palm Beaches (2015-present) and serves as its President and CEO. Previously, Mr. Rosow served on the Fairfield Country Day School Board for 27 years, including as its President for 3 years, stepping down in 2006. Mr. Rosow served as Lead Director and Chairman of the Audit Committee of Hudson United Bancorp (1996-2006), Chairman of the Board of Westport Bank and Trust (1992-1996), and as a Director of TD Banknorth (2006-2007). In addition, Mr. Rosow served as a member (2008-2014) and President (2009-2014) of the Town Council of Palm Beach, Florida. Mr. Rosow also served as a Member of the Advisory Board of certain Fidelity® funds (2012-2013).

Garnett A. Smith (1947)

Year of Election or Appointment: 2013

Trustee

Mr. Smith also serves as Trustee of other Fidelity® funds. Prior to Mr. Smith's retirement, he served as Chairman and Chief Executive Officer of Inbrand Corp. (manufacturer of personal absorbent products, 1990-1997). He also served as President (1986-1990) of Inbrand Corp. Prior to his employment with Inbrand Corp., he was employed by a retail fabric chain and North Carolina National Bank. In addition, Mr. Smith served as a Member of the Advisory Board of certain Fidelity® funds (2012-2013) and as a board member of the Jackson Hole Land Trust (2009-2012).

Michael E. Wiley (1950)

Year of Election or Appointment: 2008

Trustee

Chairman of the Independent Trustees

Mr. Wiley also serves as Trustee of other Fidelity® funds. Mr. Wiley serves as a Director of Tesoro Corporation (independent oil refiner and marketer, 2005-present), a Director of Tesoro Logistics LP (natural resources logistics, 2015-present), and a Director of Bill Barrett Corporation (exploration and production, 2005-present). In addition, Mr. Wiley also serves as a Director of Post Oak Bank (privately-held bank, 2004-present). Previously, Mr. Wiley served as a Trustee of other Fidelity® funds (2008-2013), as a Director of Asia Pacific Exploration Consolidated (international oil and gas exploration and production, 2008-2013), as a member of the Board of Trustees of the University of Tulsa (2000-2006; 2007-2010), as a Senior Energy Advisor of Katzenbach Partners, LLC (consulting, 2006-2007), as an Advisory Director of Riverstone Holdings (private investment), Chairman, President, and CEO of Baker Hughes, Inc. (oilfield services, 2000-2004), and as Director of Spinnaker Exploration Company (exploration and production, 2001-2005).

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Advisory Board Members and Officers:

Correspondence intended for a Member of the Advisory Board may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235. Except for Anthony R. Rochte, correspondence intended for an officer may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. Correspondence intended for Mr. Rochte may be sent to SelectCo, 1225 17th Street, Denver, Colorado 80202-5541. Officers appear below in alphabetical order.

Name, Year of Birth; Principal Occupation

Donald F. Donahue (1950)

Year of Election or Appointment: 2015

Member of the Advisory Board

Mr. Donahue also serves as a Trustee or Member of the Advisory Board of other Fidelity® funds. Mr. Donahue is President and Chief Executive Officer of Miranda Partners, LLC (risk consulting for the financial services industry, 2012-present) and a consultant for the Institute for Defense Analyses (national security, 2012-present). Previously, Mr. Donahue served as Chief Executive Officer (2006-2012), Chief Operating Officer (2003-2006), and Managing Director, Customer Marketing and Development (1999-2003) of The Depository Trust & Clearing Corporation (financial markets infrastructure). Mr. Donahue serves as a Member (2012-present) and Co-Chairman (2016-present) of the Board of Directors of United Way of New York, Member of the Board of Directors of NYC Leadership Academy (2012-present) and Member of the Board of Advisors of Ripple Labs, Inc. (financial services, 2015-present). He also served as Chairman (2010-2012) and Member of the Board of Directors (2012-2013) of Omgeo, LLC (financial services), Treasurer of United Way of New York (2012-2016), and Member of the Board of Directors of XBRL US (financial services non-profit, 2009-2012) and the International Securities Services Association (2009-2012).

Carol B. Tomé (1957)

Year of Election or Appointment: 2017

Member of the Advisory Board

Ms. Tomé also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. Ms. Tomé is Chief Financial Officer (2001-present) and Executive Vice President of Corporate Services (2007-present) of The Home Depot, Inc. (home improvement retailer) and a Director (2003-present) and Chair of the Audit Committee (2004-present) of United Parcel Service, Inc. (package delivery and supply chain management). Previously, Ms. Tomé served as Senior Vice President of Finance and Accounting/Treasurer (2000-2007) and Vice President and Treasurer (1995-2000) of The Home Depot, Inc. and Chair of the Board (2010-2012), Vice Chair of the Board (2009 and 2013), and a Director (2008-2013) of the Federal Reserve Bank of Atlanta. Ms. Tomé is also a director or trustee of many community and professional organizations.

Marc R. Bryant (1966)

Year of Election or Appointment: 2013

Secretary and Chief Legal Officer (CLO)

Mr. Bryant also serves as Secretary and CLO of other funds. Mr. Bryant serves as CLO, Secretary, and Senior Vice President of Fidelity Management & Research Company (investment adviser firm, 2015-present) and FMR Co., Inc. (investment adviser firm, 2015-present); Secretary of Fidelity SelectCo, LLC (investment adviser firm, 2015-present) and Fidelity Investments Money Management, Inc. (investment adviser firm, 2015-present); and CLO of Fidelity Management & Research (Hong Kong) Limited and FMR Investment Management (UK) Limited (investment adviser firms, 2015-present) and Fidelity Management & Research (Japan) Limited (investment adviser firm, 2016-present). He is Senior Vice President and Deputy General Counsel of FMR LLC (diversified financial services company). Previously, Mr. Bryant served as Secretary and CLO of Fidelity Rutland Square Trust II (2010-2014) and Assistant Secretary of Fidelity's Fixed Income and Asset Allocation Funds (2013-2015). Prior to joining Fidelity Investments, Mr. Bryant served as a Senior Vice President and the Head of Global Retail Legal for AllianceBernstein L.P. (2006-2010), and as the General Counsel for ProFund Advisors LLC (2001-2006).

Jeffrey S. Christian (1961)

Year of Election or Appointment: 2016

Assistant Treasurer

Mr. Christian also serves as Assistant Treasurer of other funds. Mr. Christian is an employee of Fidelity Investments (2003-present).

William C. Coffey (1969)

Year of Election or Appointment: 2009

Assistant Secretary

Mr. Coffey also serves as Assistant Secretary of other funds. He is Senior Vice President and Deputy General Counsel of FMR LLC (diversified financial services company, 2010-present), and is an employee of Fidelity Investments. Previously, Mr. Coffey served as Vice President and Associate General Counsel of FMR LLC (2005-2009).

Jonathan Davis (1968)

Year of Election or Appointment: 2010

Assistant Treasurer

Mr. Davis also serves as Assistant Treasurer of other funds, and is an employee of Fidelity Investments. Previously, Mr. Davis served as Vice President and Associate General Counsel of FMR LLC (diversified financial services company, 2003-2010).

Adrien E. Deberghes (1967)

Year of Election or Appointment: 2013

President and Treasurer

Mr. Deberghes also serves as an officer of other funds. He serves as Executive Vice President of Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2016-present) and is an employee of Fidelity Investments (2008-present). Prior to joining Fidelity Investments, Mr. Deberghes was Senior Vice President of Mutual Fund Administration at State Street Corporation (2007-2008), Senior Director of Mutual Fund Administration at Investors Bank & Trust (2005-2007), and Director of Finance for Dunkin' Brands (2000-2005). Previously, Mr. Deberghes served in other fund officer roles.

Joseph DeSantis (1959)

Year of Election or Appointment: 2015

Vice President

Mr. DeSantis also serves as Vice President of other funds. Mr. DeSantis serves as a Director of Fidelity Management & Research (Japan) Limited (investment adviser firm, 2016-present), Chief Investment Officer, Equities (2010-present) and is an employee of Fidelity Investments.

Stephanie J. Dorsey (1969)

Year of Election or Appointment: 2010

Assistant Treasurer

Ms. Dorsey also serves as an officer of other funds. She is an employee of Fidelity Investments (2008-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Dorsey served as Treasurer (2004-2008) of the JPMorgan Mutual Funds and Vice President (2004-2008) of JPMorgan Chase Bank.

Howard J. Galligan III (1966)

Year of Election or Appointment: 2014

Chief Financial Officer

Mr. Galligan also serves as Chief Financial Officer of other funds. Mr. Galligan serves as President of Fidelity Pricing and Cash Management Services (FPCMS) (2014-present) and as a Director of Strategic Advisers, Inc. (investment adviser firm, 2008-present). Previously, Mr. Galligan served as Chief Administrative Officer of Asset Management (2011-2014) and Chief Operating Officer and Senior Vice President of Investment Support for Strategic Advisers, Inc. (2003-2011).

Scott C. Goebel (1968)

Year of Election or Appointment: 2015

Vice President

Mr. Goebel serves as Vice President of other funds and is an employee of Fidelity Investments (2001-present). Previously, Mr. Goebel served as Senior Vice President of Fidelity Management & Research Company (FMR) (investment adviser firm, 2016), Secretary of Fidelity SelectCo, LLC (investment adviser firm, 2013-2015), Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2010-2015), and Fidelity Research and Analysis Company (FRAC) (investment adviser firm, 2010-2015); General Counsel, Secretary, and Senior Vice President of FMR (investment adviser firm, 2008-2015) and FMR Co., Inc. (investment adviser firm, 2008-2015); Assistant Secretary of Fidelity Management & Research (Japan) Limited (investment adviser firm, 2008-2015) and Fidelity Management & Research (U.K.) Inc. (investment adviser firm, 2008-2015); Chief Legal Officer (CLO) of Fidelity Management & Research (Hong Kong) Limited (investment adviser firm, 2008-2015); Secretary and CLO of certain Fidelity® funds (2008-2015); Assistant Secretary of FIMM (2008-2010), FRAC (2008-2010), and certain funds (2007-2008); and as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (2005-2007).

James D. Gryglewicz (1972)

Year of Election or Appointment: 2014

Chief Compliance Officer

Mr. Gryglewicz also serves as Chief Compliance Officer of other funds. Mr. Gryglewicz serves as Compliance Officer of Strategic Advisers, Inc. (investment adviser firm, 2015-present) and Fidelity SelectCo, LLC (investment adviser firm, 2014-present), Senior Vice President of Asset Management Compliance (2009-present), and is an employee of Fidelity Investments (2004-present).

Brian B. Hogan (1964)

Year of Election or Appointment: 2009

Vice President

Mr. Hogan also serves as Trustee or Vice President of other funds. Mr. Hogan serves as a Director of FMR Investment Management (UK) Limited (investment adviser firm, 2015-present) and Fidelity SelectCo, LLC (investment adviser firm, 2014-present) and President of the Equity Division of FMR (investment adviser firm, 2009-present). Previously, Mr. Hogan served as Senior Vice President, Equity Research of FMR (2006-2009) and as a portfolio manager. Mr. Brian B. Hogan is not related to Mr. Colm A. Hogan.

Colm A. Hogan (1973)

Year of Election or Appointment: 2016

Assistant Treasurer

Mr. Hogan also serves as an officer of other funds. Mr. Hogan is an employee of Fidelity Investments (2005-present). Mr. Colm A. Hogan is not related to Mr. Brian B. Hogan.

Chris Maher (1972)

Year of Election or Appointment: 2013

Assistant Treasurer

Mr. Maher serves as Assistant Treasurer of other funds. Mr. Maher is Vice President of Valuation Oversight and is an employee of Fidelity Investments. Previously, Mr. Maher served as Vice President of Asset Management Compliance (2013), Vice President of the Program Management Group of FMR (investment adviser firm, 2010-2013), and Vice President of Valuation Oversight (2008-2010).

John F. Papandrea (1972)

Year of Election or Appointment: 2016

Anti-Money Laundering (AML) Officer

Mr. Papandrea also serves as AML Officer of other funds. Mr. Papandrea is Vice President of FMR LLC (diversified financial services company, 2008-present) and is an employee of Fidelity Investments (2005-present).

Anthony R. Rochte (1968)

Year of Election or Appointment: 2013

Vice President

Mr. Rochte also serves as Vice President of other funds. Mr. Rochte serves as President of Fidelity SelectCo, LLC (investment adviser firm, 2012-present) and is an employee of Fidelity Investments (2012-present). Prior to joining Fidelity Investments, Mr. Rochte served as Senior Managing Director and head of State Street Global Advisors' North American Intermediary Business Group (2006-2012).

Stacie M. Smith (1974)

Year of Election or Appointment: 2013

Assistant Treasurer

Ms. Smith also serves as an officer of other funds. She is an employee of Fidelity Investments (2009-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Smith served as Senior Audit Manager of Ernst & Young LLP (accounting firm, 1996-2009). Previously, Ms. Smith served as Deputy Treasurer of certain Fidelity® funds (2013-2016).

Marc L. Spector (1972)

Year of Election or Appointment: 2017

Assistant Treasurer

Mr. Spector also serves as an officer of other funds. Mr. Spector is an employee of Fidelity Investments (2016-present). Prior to joining Fidelity Investments, Mr. Spector served as Director at the Siegfried Group (accounting firm, 2013-2016), and prior to Siegfried Group as audit senior manager at Deloitte & Touche (accounting firm, 2005-2013).

Renee Stagnone (1975)

Year of Election or Appointment: 2016

Assistant Treasurer

Ms. Stagnone also serves as an officer of other funds. Ms. Stagnone is an employee of Fidelity Investments (1997-present). Previously, Ms. Stagnone served as Deputy Treasurer of certain Fidelity® funds (2013-2016).

Shareholder Expense Example