Exhibit 99.18

Section C

REPORT ON THE APPLICATION OF THE LEGISLATION

RESPECTING A BALANCED BUDGET AND THE

GENERATIONS FUND

| 1. | Balanced Budget Act | C.2 |

| | 1.1 Budgetary balance within the meaning of the Balanced Budget Act | C.2 |

| | 1.2 Stabilization reserve | C.5 |

| 2. | Act to reduce the debt and establish the Generations Fund | C.6 |

| | 2.1 Debt reduction objectives | C.6 |

| | 2.2 Generations Fund | C.8 |

| APPENDIX: Legislative requirements | C.10 |

Pursuant to the Balanced Budget Act, the Minister of Finance must report to the National Assembly, in the budget speech, on the achievement of the objectives of the Act and any variance recorded.

The purpose of the Balanced Budget Act is to oblige the government to maintain a balanced budget and table a balanced financial framework. In general, the Act specifies the calculation of the budgetary balance, establishes a stabilization reserve and sets out the applicable rules in the case of a surplus or an overrun.

| — | The requirements of the Balanced Budget Act are set out in the Appendix. |

| 1.1 | Budgetary balance within the meaning of the Balanced Budget Act |

The objectives of the Balanced Budget Act are achieved if the budgetary balance, calculated in accordance with the Act, is zero or positive.1

| — | The budgetary balance corresponds essentially to the surplus or the deficit presented in the Public Accounts (book balance) reduced by the amount of revenues dedicated to the Generations Fund and adjusted to take certain accounting changes into consideration, if applicable. |

A balanced budget as defined in the Act was maintained in 2020-2021 through the use of the stabilization reserve in the amount of $10.8 billion.

For 2021-2022, the budgetary balance within the meaning of the Act is in deficit by $6.1 billion after use of the $1.2-billion stabilization reserve.

| — | The stabilization reserve was fully used for fiscal 2021-2022. |

For 2022-2023, the budgetary balance shows a deficit of $6.5 billion.

The Balanced Budget Act was amended by Bill 17,2 assented on February 24, 2022, which temporarily suspends certain effects of the Balanced Budget Act from 2021-2022 until the end of the fiscal year determined by the Minister, but no later than the fiscal 2023-2024 Budget Speech.

The desired effects of the suspension include:

| — | the prohibition of an actual or estimated budgetary deficit; |

| — | the tabling of a plan to restore fiscal balance; |

| — | the obligation to implement offsetting measures for overruns. |

| 1 | The budgetary data for 2021-2022 and subsequent years presented in this section are forecasts. |

| 2 | An Act respecting the implementation of certain provisions of the Budget Speech of 25 March 2021 and amending other provisions (S.Q. 2022, c. 3). |

| Budget 2022-2023 |

| C.2 | Additional Information |

TABLE C.1

Budgetary balance within the meaning of the Balanced Budget Act

(millions of dollars)

| | Surplus (deficit)

within the

meaning

of the

Public | | | Dedicated

revenues in

the

Generations | | | Accounting

changes

and | | | Budgetary

balance

within the

meaning | | | Stabilization reserve | | | Budgetary

balance

within the

meaning of

the Act after | |

| Fiscal year | | Accounts | (1) | | Fund | | | other | (2) | | of the Act | | | Allocations | | | Uses | | | reserve | (3) |

| 2011-2012 | | | −2 351 | | | | -840 | | | | 563 | | | | −2 628 | | | | — | | | | — | | | | −2 628 | (4) |

| 2012-2013 | | | −3 141 | | | | –961 | | | | 2 502 | (5) | | | −1 600 | | | | — | | | | — | | | | −1 600 | (6) |

| 2013-2014 | | | −2 100 | | | | −1 121 | | | | 397 | | | | −2 824 | | | | — | | | | — | | | | −2 824 | (6) |

| 2014-2015 | | | –534 | | | | −1 279 | | | | 1 088 | | | | −725 | | | | — | | | | — | | | | −725 | (6) |

| 2015-2016 | | | 3 456 | | | | –1 453 | | | | 188 | | | | 2 191 | | | | −2 191 | | | | — | | | | — | |

| 2016-2017 | | | 4 147 | | | | −2 001 | | | | 215 | | | | 2 361 | | | | −2 361 | | | | — | | | | — | |

| 2017-2018 | | | 3 014 | | | | −2 293 | | | | 1 901 | | | | 2 622 | | | | −2 622 | | | | — | | | | — | |

| 2018-2019 | | | 7 890 | | | | −3 477 | | | | 390 | | | | 4 803 | | | | −4 803 | | | | — | | | | — | |

| 2019-2020 | | | 2 083 | | | | −2 606 | | | | 527 | | | | 4 | | | | −4 | | | | — | | | | — | |

| 2020-2021 | | | −4 226 | | | | −3 313 | | | | −3 221 | | | | –10 760 | | | | — | | | | 10 760 | | | | — | |

| 2021-2022 | | | −3 897 | | | | −3 457 | | | | — | | | | −7 354 | | | | — | | | | 1 221 | | | | −6 133 | (7) |

| 2022-2023 | | | −3 005 | | | | −3 445 | | | | — | | | | −6 450 | | | | — | | | | — | | | | −6 450 | (7) |

| (1) | The annual surpluses (deficits) were restated to take into account the change in the application of the accounting standard respecting transfer payments. |

| (2) | In order to comply with the provisions of the Balanced Budget Act, adjustments to the restated annual surpluses and deficits in the Public Accounts are required to establish the budgetary balance. Adjustments were made to take into account the change in the application of the accounting standard respecting transfer payments and its impact on the accumulated deficit in 2020-2021. |

| (3) | The budgetary balance within the meaning of the Balanced Budget Act after reserve corresponds to the budgetary balance that takes into account allocations to the stabilization reserve and uses of it in order to maintain a balanced budget or reduce the budgetary deficit. |

| (4) | For 2011-2012, the budgetary deficit of $2.6 billion represents an improvement of $1.2 billion compared to the budgetary deficit target of $3.8 billion set in the March 2011 Budget pursuant to the Balanced Budget Act. |

| (5) | The Balanced Budget Act stipulates the exclusion of the exceptional loss of $1 876 million for the closure of the Gentilly-2 nuclear power plant from the calculation of the budgetary balance for fiscal 2012-2013. |

| (6) | The budgetary deficits of $1.6 billion, $2.8 billion and $0.7 billion recorded for 2012-2013, 2013-2014 and 2014-2015, respectively, are allowed pursuant to the Balanced Budget Act. |

| (7) | The Balanced Budget Act was amended in order to suspend the obligation to achieve a balanced budget in 2021-2022 and 2022-2023. |

| Report on the Application of the Legislation Respecting | |

| a Balanced Budget and the Generations Fund | C.3 |

Impact of the change in the application of the accounting standard

respecting transfer payments on the budgetary balance

The application of the accounting standard respecting transfer payments to the government’s financial statements increased the accumulated deficit and net debt by $12 504 million as at April 1, 2020. This is the retroactive impact to 2020-2021.

This accounting change is treated differently for the purpose of calculating the budgetary balance. A portion of the impact, $3 221 million, is considered in the calculation of the budgetary balance. It is added to the budget deficit balance of $7 539 million related to 2020-2021 operations, bringing the balance to $10 760 million. This is explained as follows:

| – | as the Balanced Budget Act does not allow for the restatement of a past budgetary balance, the impact of a retroactive change must be charged in the year of the change; |

| – | since the provisions of the Act did not apply to fiscal years 2009-2010 to 2014-2015, the amounts resulting from the accounting change relating to those fiscal years, $9 283 million in total, must be excluded from the calculation of the budgetary balance as defined in the Act. |

| Budget 2022-2023 |

| C.4 | Additional Information |

Under the Balanced Budget Act, a recorded surplus, that is, a budgetary balance that is greater than zero, must be allocated to the stabilization reserve.

This reserve is a budgetary tool that was established to facilitate multi-year planning of the government’s financial framework.

The balance of the stabilization reserve is adjusted on the basis of recorded surpluses allocated to the reserve or sums used from the reserve for each fiscal year.

The reserve acts like a counter made up of surpluses achieved, but it does not consist of surplus cash, as generated surpluses are used to reduce the debt. In other words, the stabilization reserve is not money in the bank. Its use gives rise to an increase in the debt.

Taking into account the budgetary deficit of $10.8 billion in 2020-2021 and a deficit greater than the balance of the stabilization reserve in 2021-2022, the balance of the stabilization reserve will be zero as at March 31, 2022.

TABLE C.2

Operations of the stabilization reserve

(millions of dollars)

| | | Balance, | | | | | | Uses | | | Balance, | |

| Fiscal year | | beginning

of year | | | Allocations | | | Balanced budget | | | Generations Fund | | | end of

year | |

| 2015-2016 | | | — | | | | 2 191 | | | | — | | | | — | | | | 2 191 | |

| 2016-2017 | | | 2 191 | | | | 2 361 | | | | — | | | | — | | | | 4 552 | |

| 2017-2018 | | | 4 552 | | | | 2 622 | | | | — | | | | — | | | | 7 174 | |

| 2018-2019 | | | 7 174 | | | | 4 803 | | | | — | | | | — | | | | 11 977 | |

| 2019-2020 | | | 11 977 | | | | 4 | | | | — | | | | — | | | | 11 981 | |

| 2020-2021 | | | 11 981 | | | | — | | | | −10 760 | | | | — | | | | 1 221 | |

| 2021-2022 | | | 1 221 | | | | — | | | | −1 221 | | | | — | | | | — | |

| 2022-2023 | | | — | | | | — | | | | — | | | | — | | | | — | |

| Report on the Application of the Legislation Respecting | |

| a Balanced Budget and the Generations Fund | C.5 |

| 2. | Act to reduce the debt and establish the Generations Fund |

| 2.1 | Debt reduction objectives |

The following debt reduction objectives are set forth in the Act to reduce the debt and establish the Generations Fund for fiscal 2025-2026:

| — | the gross debt must not exceed 45% of GDP; |

| — | the debt representing accumulated deficits must not exceed 17% of GDP. |

The requirements of the Act to reduce the debt and establish the Generations Fund are set out in the Appendix.

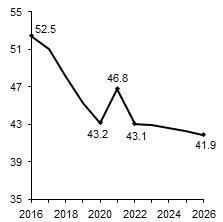

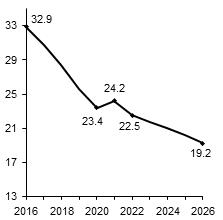

As at March 31, 2022, the gross debt will stand at 43.1% of GDP. Despite the increase in debt caused by the pandemic, the government expects the objective regarding gross debt to be attained. The gross debt-to-GDP ratio will stand at 41.9% as at March 31, 2026, which is below the 45% objective.

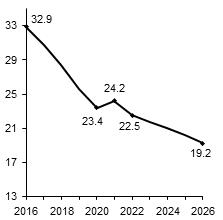

However, the objective for debt representing accumulated deficits to GDP will not be met. It is currently expected to stand at 19.2% as at March 31, 2026, a gap of 2.2 percentage points compared to the 17% objective.3

CHART C. 1

Gross debt as at March 31 | | CHART C. 2

Debt representing accumulated deficits as at March 31 |

| (percentage of GDP) | (percentage of GDP) |

|  |

| | |

| 3 | Section J of the Québec Budget Plan – March 2022 provides detailed information on the Québec government’s debt. |

| Budget Speech |

| C.6 | 2022-2023 |

The government intends to propose changes to the Act to reduce the debt and establish the Generations Fund in Budget 2023-2024. A new debt reduction objective covering the next 10 or 15 years will then be set.

The target will need to consider the challenges facing Québec now and those it will face in the coming years. Among these are population aging, greenhouse gas (GHG) reduction and Québec’s needs in terms of public infrastructure.

Reducing the debt burden remains a priority for the government. Pending the setting of a new debt target, the government intends to pursue a gradual reduction of the debt burden beyond 2025-2026.

| Report on the Application of the Legislation Respecting | |

| a Balanced Budget and the Generations Fund | C.7 |

| ☐ | Deposits in the Generations Fund |

Deposits in the Generations Fund help to reduce the debt and thus to improve intergenerational fairness. Therefore, the government will maintain these deposits.

In 2022-2023, deposits of dedicated revenues in the Generations Fund will amount to $3.4 billion.

Deposits in the Fund come mainly from:

| — | water-power royalties by Hydro-Québec and private producers of hydro-electricity; |

| — | revenue stemming from the indexation of the price of heritage electricity; |

| — | an additional contribution of $215 million per year from Hydro-Québec; |

| — | mining revenues collected by the government; |

| — | an amount of $500 million per year drawn from the specific tax on alcoholic beverages; |

TABLE C.3

Generations Fund

(millions of dollars)

| | | March 2021 | (1) | | | | | March 2022 | |

| | | 2021-2022 | | | Adjustments | | | 2021-2022 | | | 2022-2023 | | | 2023-2024 | | | 2024-2025 | | | 2025-2026 | | | 2026-2027 | |

| Book value, beginning of year(2) | | | 11 913 | | | | 299 | | | | 12 212 | | | | 15 669 | | | | 19 114 | | | | 23 049 | | | | 27 429 | | | | 32 051 | |

| Dedicated revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Water-power royalties | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hydro-Québec | | | 739 | | | | 16 | | | | 755 | | | | 763 | | | | 801 | | | | 830 | | | | 849 | | | | 882 | |

| Private producers | | | 104 | | | | -4 | | | | 100 | | | | 107 | | | | 109 | | | | 111 | | | | 113 | | | | 116 | |

| Subtotal | | | 843 | | | | 12 | | | | 855 | | | | 870 | | | | 910 | | | | 941 | | | | 962 | | | | 998 | |

| Indexation of the price of heritage electricity | | | 495 | | | | -7 | | | | 488 | | | | 535 | | | | 775 | | | | 970 | | | | 1 105 | | | | 1 215 | |

| Additional contribution from Hydro-Québec | | | 215 | | | | — | | | | 215 | | | | 215 | | | | 215 | | | | 215 | | | | 215 | | | | 215 | |

| Mining revenues | | | 395 | | | | 417 | | | | 812 | | | | 484 | | | | 409 | | | | 358 | | | | 375 | | | | 340 | |

| Specific tax on alcoholic beverages | | | 500 | | | | — | | | | 500 | | | | 500 | | | | 500 | | | | 500 | | | | 500 | | | | 500 | |

| Unclaimed property | | | 27 | | | | — | | | | 27 | | | | 55 | | | | 171 | | | | 249 | | | | 111 | | | | 109 | |

| Investment income(3) | | | 605 | | | | -45 | | | | 560 | | | | 786 | | | | 955 | | | | 1 147 | | | | 1 354 | | | | 1 577 | |

| Total dedicated revenues | | | 3 080 | | | | 377 | | | | 3 457 | | | | 3 445 | | | | 3 935 | | | | 4 380 | | | | 4 622 | | | | 4 954 | |

| BOOK VALUE, END OF YEAR | | | 14 993 | | | | 676 | | | | 15 669 | | | | 19 114 | | | | 23 049 | | | | 27 429 | | | | 32 051 | | | | 37 005 | |

| (1) | This is the March 2021 budget forecast. |

| (2) | For information purposes, as at December 31, 2021, the fair value of the Generations Fund was $16.0 billion, $1.3 billion more than its book value. |

| (3) | The investment income of the Generations Fund corresponds to realized investment income (interest income, dividends, gains on the disposal of assets, etc.). Therefore, the forecast may be adjusted upward or downward according to when the gains or losses are actually realized. An annual return of 4.8% is expected, a rate based on five historic years. |

| Budget Speech |

| C.8 | 2022-2023 |

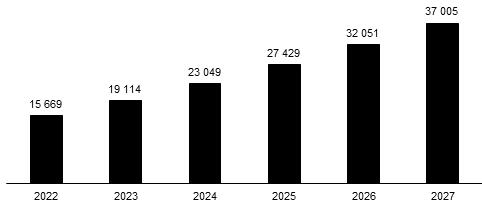

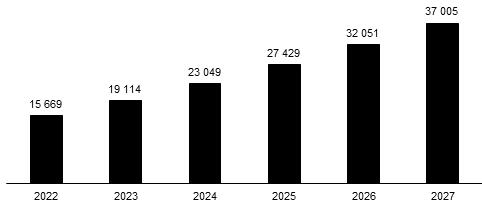

| ☐ | Evolution of the Generations Fund |

Taking into account the deposits made since the creation of the Fund and those forecast, as well as the use of the Fund to repay borrowings on financial markets, the book value of the Generations Fund will stand at $19.1 billion as at March 31, 2023.

CHART C.3

Growth in the book value of the Generations Fund as at March 31 |

| (millions of dollars) |

|

| |

| Report on the Application of the Legislation Respecting | |

| a Balanced Budget and the Generations Fund | C.9 |

APPENDIX: Legislative requirements

The Balanced Budget Act (CQLR, chapter E-12.00001) was passed unanimously by the National Assembly on December 19, 1996. The Act stipulates that the government must table balanced budget estimates and sets out the applicable rules in the case of a surplus or an overrun.

Under the Balanced Budget Act, if an overrun of less than $1 billion is recorded for a fiscal year, the government must achieve an equivalent surplus in the next fiscal year.

The Act stipulates that the government may incur overruns for a period of more than one year, where such overruns total at least $1 billion as a result of circumstances defined in the Act, namely, a disaster having a major impact on revenue or expenditure, a significant deterioration of economic conditions or a change in federal programs of transfer payments to the provinces that would substantially reduce transfer payments to the government.

If there is an overrun of at least $1 billion, the Minister of Finance must report to the National Assembly on the circumstances justifying that the government incur such overruns. In addition, the Minister must present a financial plan allowing those overruns to be offset within a five-year period and apply offsetting measures covering at least $1 billion as of the fiscal year in which such an overrun is anticipated, or the following year in the case where an overrun is recorded. He must offset at least 75% of those overruns within the first four fiscal years of that period.

The Act also establishes a stabilization reserve in order to facilitate the government’s multi-year budget planning and, subsidiarily, to allow sums to be deposited in the Generations Fund. Any surpluses recorded for a fiscal year are automatically allocated to this reserve whose main purpose is to maintain a balanced budget.

Lastly, the Act stipulates that the Minister of Finance must report to the National Assembly, in the budget speech, on the objectives of the Act, their achievement and any variance recorded, and on the operations of the stabilization reserve.

| Budget Speech |

| C.10 | 2022-2023 |

| ☐ | Act to reduce the debt and establish the Generations Fund |

The Act to reduce the debt and establish the Generations Fund (CQLR, chapter R-2.2.0.1) was passed on June 15, 2006. This statute established the Generations Fund, a fund dedicated exclusively to repaying the gross debt.

In 2010, the Act was amended to revise the concepts of debt used and the debt reduction objectives that must be achieved by 2025-2026.

The Act stipulates that, for fiscal 2025-2026, the gross debt must not exceed 45% of GDP, and the debt representing accumulated deficits must not exceed 17% of GDP.

Under the provisions of the Act, the Generations Fund is made up of the following sums from revenue sources dedicated to debt repayment:

| — | water-power royalties paid by Hydro-Québec and private producers of hydro-electricity; |

| — | part of Hydro-Québec’s earnings on the sale of electricity outside Québec as a result of its increased generating capacity;4 |

| — | revenues from the indexation of the price of heritage electricity since 2014; |

| — | fees or charges for water withdrawal;4 |

| — | since 2015-2016, the total fees, duties, rentals and mining royalties provided for in the Mining Tax Act and the Mining Act. This amount is established once the duties allocated to the mining heritage and mining activity management components of the Natural Resources Fund have been subtracted; |

| — | in 2014-2015 and 2015-2016, $100 million a year, increasing to $500 million a year as of 2016-2017, from the specific tax on alcoholic beverages; |

| — | from 2017-2018 to 2043-2044, $215 million per year from Hydro-Québec; |

| — | sale of government assets, rights or securities;4 |

| — | unclaimed property administered by Revenu Québec; |

| — | gifts, legacies and other contributions received by the Minister of Finance; |

| — | income generated by the investment of the sums making up the Generations Fund. |

The Act allows the government to order that a part, which it establishes, of any sum that would otherwise have been attributed to the General Fund of the Consolidated Revenue Fund be allocated to the Generations Fund.

Similarly, that Act authorizes the government, subject to the provisions of the Balanced Budget Act, to use the stabilization reserve to deposit sums in the Generations Fund.

| 4 | A government order is required to set the portion of these amounts that must be allocated to the Generations Fund. |

| Report on the Application of the Legislation Respecting | |

| a Balanced Budget and the Generations Fund | C.11 |

The sums constituting the Generations Fund are deposited with the Caisse de dépôt et placement du Québec and managed in accordance with an investment policy determined by the Minister of Finance, in collaboration with representatives of the Caisse.

The Act also stipulates that the Minister of Finance may take any sum from the Generations Fund and use it to repay the debt.

Lastly, the Act stipulates that the Minister of Finance must report to the National Assembly, in the budget speech, on the evolution of the debt representing accumulated deficits and of the gross debt, on the sums making up the Generations Fund and on any sums used to repay the gross debt.

| Budget Speech |

| C.12 | 2022-2023 |