Exhibit 99.12

Section A

overview

| Summary | A.3 |

| | |

| 1. | Priorities: Health and education | A.9 |

| | 1.1 | Funding health and social services, education and higher education | A.9 |

| | 1.2 | Supporting Quebecers and communities | A.10 |

| | 1.3 | Acting on economic priorities | A.12 |

| | 1.4 | Optimizing government action | A.13 |

| | | | |

| 2. | Québec’s economic situation | A.15 |

| | | |

| | 2.1 | A more favourable growth environment is expected in the second half of 2024 | A.15 |

| | | | |

| 3. | Québec’s financial situation | A.17 |

| | | |

| | 3.1 | Main adjustments in 2023-2024 | A.17 |

| | 3.2 | Financial framework | A.19 |

| | 3.3 | A gradual approach to restoring fiscal balance | A.21 |

| | 3.4 | Investments in public infrastructure | A.24 |

| | | | |

| 4. | The Québec government’s debt | A.25 |

| | | |

| | 4.1 | The debt burden lower than before the pandemic | A.25 |

| | | | |

| Appendix: | Québec’s economic outlook – 2022 to 2028 | A.27 |

A.1

Summary

In the Québec Budget Plan – March 2024, the government is prioritizing funding for health and education services. It is strengthening its support for Quebecers and communities, and acting on economic priorities while taking steps to optimize government action. It is presenting a fair and transparent portrait of the state of public finances and reiterating its firm commitment to restoring fiscal balance after deposits in the Generations Fund. A plan will be tabled when Budget 2025-2026 is released, with fiscal balance being achieved by 2029-2030 at the latest.

| q | Québec’s economic situation |

The global economy proved resilient in 2023, particularly due to the strong performance of the U.S. economy. The difficulties are nevertheless intensifying as the effects of tighter financial conditions become more pronounced and growth turns sluggish in most economies.

The early months of 2024 will remain difficult. This period of economic weakness will continue to lower pressure on prices. Central banks will start easing their monetary policies gradually as of the second quarter of 2024 in response to moderating inflation in particular.

| — | More stable prices and more advantageous credit conditions will foster the recovery of economic activity in the second half of 2024 and in 2025. |

As a result, real GDP growth is expected to accelerate in 2025 in most economies.

In Québec, real GDP stagnated in 2023. Overall, production rose by just 0.2% for the year as a whole. However, the relative weakness of the economy did not spread to all industries. Moreover, the production declines observed are partly attributable to temporary factors, including major forest fires.

The economy stagnated in 2023, but the labour market remained resilient, as job creation continued (+2.3% in 2023). In addition, Québec’s unemployment rate, at an average of 4.5% in 2023, remained well below that for Canada as a whole (5.4%) and the lowest among the provinces. Overall, Quebecers’ financial situation is solid.

| — | Between 2018 and 2023, household disposable income in real terms rose by 16.8% in Québec, compared to 13.1% in Canada. |

| — | In addition, the household debt ratio, that is, the value of household liabilities as a proportion of disposable income, is significantly lower in Québec (148.3% in 2022) than in Canada (189.1%). |

As a result, Québec’s economy is well positioned to begin a sustainable recovery as of the second half of 2024, in synchronization with the gradual decline in interest rates and lower inflation.

| q | Priorities: Health and education |

The government is making investments to significantly increase wages in exchange for greater flexibility and significant gains in work organization. It is thereby improving the working conditions of government employees, in particular those in the health and social services and education networks.1

| — | These investments will result in better services for the population, through improved work organization and recognition of workers’ expertise and skills. The government is therefore positioning itself as an employer of choice, improving its ability to hire and retain staff. |

As part of the Québec Budget Plan – March 2024, the government is investing $8.8 billion by 2028-2029. Of this amount, nearly $5 billion benefits health, education and higher education.

In recent years, significant steps have been taken to provide better health and social services to Quebecers. More recently, the Act to make the health and social services system more effective was assented to. It will lead to the creation of Santé Québec and allow for a modernization of the network’s governance in an effort to support service delivery and facilitate access to services.

| — | In this budget, investments of nearly $3.7 billion will help improve access to care and services and increase hospital fluidity, ensure the maintenance and quality of care and services for seniors, and consolidate social services for youth and vulnerable individuals. |

The government is committed to the educational success of young people and to supporting student retention. The end of 2023 was marked by disrupted classes for many, and the return to school, after many weeks away for some, poses an additional challenge for students and teachers alike.

| — | Nearly $819 million by 2028-2029 have been earmarked, in particular to help all students make up the educational shortfall by the end of the school year and support the school staff. These funds will also be used to make learning environments more stimulating. |

The government considers graduation rates in college and university as an essential lever, particularly for overcoming labour shortages and fostering Québec’s socioeconomic development.

| — | As part of the budget, investments of more than $420 million over five years will help promote the success and retention of university students, support training in priority fields and digital transformation, increase the number of student housing units and maintain the building inventory. |

| 1 | Details on the renewal of collective agreements are presented in sub-section 1.1 of Section G, “Québec’s Financial Situation.” |

| | Budget 2024-2025 |

A.4 | Budget Plan |

In addition to major investments in health care and education, more than $2 billion by 2028-2029 is provided to support Quebecers and communities.

| | The government is announcing that as of January 1, 2025, the retirement pension reduction will be completely eliminated for seniors with disabilities reaching the age of 65. | |

| — | Nearly $1.3 billion will help facilitate access to housing, support youth and families, and promote the social inclusion of the most vulnerable. |

| — | Investments of more than $755 million are aimed at consolidating the public safety intervention capacity and strengthening legal support and services for vulnerable individuals, showcasing culture and promoting the French language, as well as protecting the environment and facilitating adaptation to climate change. |

The government is also continuing its efforts to increase Québec’s economic potential.

| — | Investments of nearly $1.9 billion by 2028-2029 are planned to support strategic sectors and economic growth, grow the available labour pool and increase productivity in the construction industry, contribute to the prosperity of the regions and foster immigrants’ economic and social integration. |

Lastly, the government is taking steps to generate $2.9 billion in revenue by 2028-2029 in order to optimize government action.

| — | It is adjusting certain tax assistance measures for businesses, asking government enterprises for optimization efforts, continuing its tobacco control efforts and ensuring the fairness and integrity of the tax system. |

| TABLE A. 1 |

| |

| Financial impact of the measures of Budget 2024-2025 |

| (millions of dollars) |

| | 2023-

2024 | 2024- 2025 | 2025-

2026 | 2026-

2027 | 2027-

2028 | 2028-

2029 | Total |

Funding health and social services, education and

higher education | −188 | −1 058 | −925 | −935 | −907 | −903 | −4 916 |

Supporting Quebecers

and communities | −129 | −438 | −486 | −411 | −282 | −282 | −2 028 |

| Acting on economic priorities | — | −441 | −596 | −285 | −265 | −271 | −1 858 |

| Subtotal | −317 | −1 937 | −2 007 | −1 631 | −1 454 | −1 456 | −8 801 |

| Optimizing government action | — | 86 | 345 | 607 | 847 | 1 017 | 2 903 |

| TOTAL | −317 | −1 851 | −1 662 | −1 023 | −607 | −439 | −5 898 |

Note: Totals may not add due to rounding.

| q | A prudent and responsible financial framework |

The financial framework paints a fair and transparent portrait of the state of public finances.2 Despite the deficits anticipated in 2024-2025 and subsequent years, the financial framework remains prudent and responsible.

The government is maintaining its commitment to restore fiscal balance after deposits of dedicated revenues in the Generations Fund. Given the uncertain economic context, it will table a plan to restore fiscal balance when Budget 2025-2026 is released. Fiscal balance within the meaning of the Act will be achieved by 2029-2030 at the latest.3

In the meantime, in addition to taking steps to optimize government action, the government will begin the process of reviewing all its tax and budgetary expenditures in spring 2024.

It will also continue to make representations to the federal government to obtain its fair share of federal transfers, while keeping its commitment to create more wealth and increase Québec’s economic potential by investing $1.9 billion to act on economic priorities.

The government is staying the course on its objective to reduce the net debt burden to 30% of GDP by 2037-2038.4 This will be achieved by restoring fiscal balance, continuing deposits in the Generations Fund and implementing initiatives to accelerate economic growth.

Reducing the debt burden contributes to economic growth by creating a climate of confidence conducive to private investment and higher productivity.

| 2 | Unless otherwise indicated, this document is based on budgetary data available as at February 23, 2024. The data presented for 2023-2024 are preliminary results. The data for 2024-2025 to 2028-2029 are forecasts and those for subsequent years are projections. |

| 3 | The report on the application of the Balanced Budget Act is presented in Appendix 2 of Section G, “Québec’s Financial Situation.” |

| 4 | The Act to reduce the debt and establish the Generations Fund provides that, for fiscal 2037-2038, the net debt presented in the government’s financial statements may not exceed 32.5% of GDP. This ratio corresponds to the upper limit of a net debt reduction target of 30% of GDP announced in Budget Speech 2023-2024. |

| | Budget 2024-2025 |

A.6 | Budget Plan |

| q | Québec’s requests to the federal government |

The government will continue to make representations to the federal government to obtain its fair share of federal transfers. The federal government must reimburse Québec for the costs incurred for providing services to asylum seekers. It must also increase its transfers to the provinces in the areas of health, infrastructure and workforce development. Québec is also asking for unconditional opt-out with full financial compensation from the Canadian Dental Care Plan and any future Canadian drug benefit plan.

For Québec, the amounts offered by the federal government for health care are clearly insufficient. They will not catch up to the historic level of federal funding, nor will they provide sustainable health care funding. The share of provincial health care spending covered by the federal government will continue to shrink due to the larger increase in provincial health care spending.

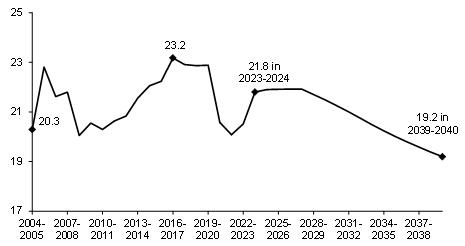

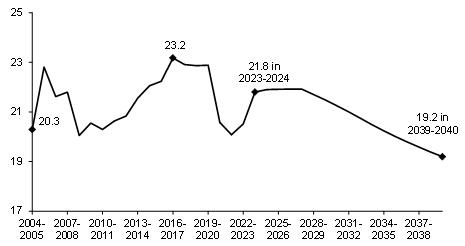

CHART A. 1

Share of the Canada Health Transfer in provincial and territorial health expenditures – 2004-2005 to 2039-2040 |

| (per cent) |

|

| Sources: Canadian Institute for Health Information, Conference Board of Canada and Department of Finance Canada. |

TABLE A.2

Québec’s economic and financial outlook

| (billions of dollars, unless otherwise indicated) |

| | 2022- 2023 | 2023- 2024 | 2024- 2025 | 2025- 2026 | 2026- 2027 | 2027- 2028 | 2028- 2029 |

| FINANCIAL SITUATION | | | | | | | |

| Revenue | 144.3 | 146.8 | 150.3 | 156.6 | 163.8 | 168.5 | 172.8 |

| Expenditure | −147.3 | −151.0 | −157.6 | −162.1 | −165.6 | −170.1 | −174.6 |

| Gap to be bridged | — | — | — | 0.8 | 1.5 | 1.8 | 2.0 |

| Surplus (deficit) from operations before contingency reserve | −3.0 | −4.2 | −7.3 | −4.8 | −0.3 | 0.1 | 0.2 |

| Contingency reserve | — | — | −1.5 | −1.5 | −1.5 | −1.5 | −1.5 |

Surplus (deficit)

from operations | −3.0 | −4.2 | −8.8 | −6.3 | −1.8 | −1.4 | −1.3 |

| % of GDP | 0.6 | 0.7 | 1.5 | 1.0 | 0.3 | 0.2 | 0.2 |

| Deposits of dedicated revenues in the Generations Fund | −3.1 | −2.1 | −2.2 | −2.2 | −2.4 | −2.6 | −2.7 |

Budgetary balance within the meaning

of the Balanced Budget Act(1) | −6.1 | −6.3 | −11.0 | −8.5 | −4.2 | −3.9 | −3.9 |

| % of GDP | 1.1 | 1.1 | 1.9 | 1.4 | 0.7 | 0.6 | 0.6 |

| DEBT | | | | | | | |

| Net debt | 208.7 | 221.1 | 237.8 | 250.9 | 257.5 | 263.5 | 269.4 |

| % of GDP | 38.3 | 39.0 | 40.3 | 41.0 | 40.6 | 40.0 | 39.5 |

| | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| ECONOMIC INDICATORS | | | | | | | |

Real GDP

(% change) | 2.5 | 0.2 | 0.6 | 1.6 | 1.7 | 1.7 | 1.7 |

Nominal GDP

(% change) | 8.4 | 3.9 | 4.0 | 3.8 | 3.7 | 3.7 | 3.6 |

Note: Totals may not add due to rounding.

| (1) | Budgetary balance within the meaning of the Balanced Budget Act, before use of the stabilization reserve. In accordance with the changes to the Balanced Budget Act, the stabilization reserve is abolished as of 2023-2024. |

| | Budget 2024-2025 |

A.8 | Budget Plan |

| 1. | Priorities: Health and education |

As part of the Québec Budget Plan – March 2024, the government is investing nearly $8.8 billion by 2028-2029 for the benefit of Quebecers.

| 1.1 | Funding health and social services, education and higher education |

In recent years, the government has allocated significant amounts to maintain the quality and ensure the continuity and accessibility of public services in its priority missions. In fact, from 2018-2019 to 2023-2024, expenditures of the Santé et Services sociaux portfolio rose by 42.1%, while those of the Éducation and Enseignement supérieur portfolios increased by 37.4% and 35.7%, or an average annual growth5 of 7.3%, 6.6% and 6.3% respectively.

In Budget 2024-2025, the government is continuing to invest and is setting aside nearly $5.0 billion over six years, as follows:

| — | $3.7 billion for supporting a humane and effective organization of health care and social services, particularly by improving access to care and services and hospital fluidity, maintaining the quality of care and services for seniors, and consolidating social services for youth and vulnerable individuals; |

| — | $818.7 million for promoting the educational success of young people, attracting and retaining school staff, supporting partner organizations in education, and enhancing and maintaining the school building inventory; |

| — | $420.5 million for promoting success in higher education, particularly by promoting the success and retention of university students, as well as supporting training in priority fields and digital transformation, increasing the number of student housing units and maintaining the building inventory. |

TABLE A.3

Financial impact of the measures to fund health

and social services, education and higher education

| (millions of dollars) |

| | 2023- 2024 | 2024- 2025 | 2025- 2026 | 2026- 2027 | 2027- 2028 | 2028- 2029 | Total |

| Supporting a humane and effective organization of health care and social services | — | −730.1 | −751.1 | −773.3 | −710.9 | −710.9 | −3 676.3 |

| Fostering the educational success of young people | 188.1 | −293.0 | −109.6 | −78.0 | −77.0 | −73.0 | −818.7 |

| Promoting success in higher education | — | −34.5 | −64.0 | −84.0 | −119.0 | −119.0 | −420.5 |

| TOTAL | 188.1 | −1 057.6 | −924.7 | −935.3 | −906.9 | −902.9 | −4 915.5 |

| 5 | Average annual growth rate, corresponding to the geometric mean over five years, from 2019-2020 to 2023-2024. |

| 1.2 | Supporting Quebecers and communities |

Since fall 2022, the government has announced measures totalling more than $30 billion over seven years to reduce Quebecers’ tax burden and enable them to better cope with inflation.6

| — | As a result, despite strong price growth in recent years, the purchasing power of Québec households increased more than that of Canadian households between 2018 and 2023. |

| — | Quebecers enjoyed a 16.8% increase in their purchasing power, as measured by household disposable income in real terms, compared to 13.1% for Canadians over the same period. |

In Budget 2024-2025, the government is announcing that the retirement pension reduction currently applicable to seniors with disabilities aged 65 or over will be eliminated as of January 1, 2025.

| — | This will enhance the pension offered by up to $5 895 annually, including the previous enhancement announced in Budget 2021-2022, and thus increase disposable income for people with disabilities. |

In addition, to further support Quebecers and communities, Budget 2024-2025 includes initiatives totalling more than $2 billion over the financial framework period, as follows:

| — | nearly $1.3 billion over six years for consolidating support for Quebecers, in particular by promoting access to housing, as well as providing support for families, youth and the most vulnerable individuals; |

| — | $440.5 million over five years for supporting communities by promoting sustainable participation in recreation and sports in a safe environment, increasing the public safety intervention capacity, and strengthening legal support and services for vulnerable individuals; |

| — | $187.1 million over five years for showcasing culture and promoting the French language, in particular by supporting the media, businesses and cultural organizations, disseminating Québec’s culture, and supporting initiatives aimed at promoting and advancing the French language; |

| — | $127.5 million over five years for protecting the environment and adapting to climate change, in particular to ensure safety and promote Québec’s environmental assets.7 |

| 6 | The details are presented in subsection 2.5 of Section C, “Supporting Quebecers and Communities.” |

| 7 | In addition, the government will soon present an update of the implementation plan for the 2030 Plan for a Green Economy in order to ensure that the investments planned for the next five years fund the most promising actions. |

| | Budget 2024-2025 |

A.10 | Budget Plan |

TABLE A.4

Financial impact of the measures to support Quebecers

and communities

| (millions of dollars) |

| | 2023- 2024 | 2024- 2025 | 2025- 2026 | 2026- 2027 | 2027- 2028 | 2028- 2029 | Total |

Supporting seniors

with disabilities | — | — | — | — | — | — | — |

Consolidating support

for Quebecers | −129.2 | −315.6 | −299.7 | −239.4 | −142.5 | −146.5 | −1 272.9 |

| Supporting communities | — | −60.0 | −105.6 | −92.0 | −90.3 | −92.6 | −440.5 |

| Showcasing culture and promoting the French language | — | −41.3 | −53.7 | −41.8 | −28.4 | −21.9 | −187.1 |

| Protecting the environment and adapting to climate change | — | −20.8 | −27.1 | −37.6 | −20.8 | −21.2 | −127.5 |

| TOTAL | −129.2 | −437.7 | −486.1 | −410.8 | −282.0 | −282.2 | −2 028.0 |

|

| 1.3 | Acting on economic priorities |

The government has committed to creating more wealth and increasing Québec’s economic potential. In concrete terms, it aims to reduce the gap in real GDP per capita with Ontario to less than 10% by 2026 and eliminate it by 2036.

Accordingly, major steps have been taken since 2018 to enhance business and government productivity and to foster workers’ integration in the labour market in the context of the labour shortage.

| — | Government action has helped improve Quebecers’ standard of living and significantly reduce the wealth gap with Ontario and the rest of Canada. While the gap was 15.9% with Ontario and 20.2% with the rest of Canada in 2018, it should narrow to 11.9% and 15.3% respectively by 2024. |

In Budget 2024-2025, the government is continuing its efforts by announcing investments totalling nearly $1.9 billion over five years to act on Québec’s economic priorities, namely:

| — | $443.1 million for supporting strategic sectors and economic growth; |

| — | $126.0 million for growing the available labour pool and increasing productivity in the construction industry; |

| — | $888.5 million for contributing to the prosperity of the regions; |

| — | $400.0 million for facilitating immigrants’ economic and social integration. |

These initiatives will add to the amount of $1.3 billion over five years announced in the Update on Québec’s Economic and Financial Situation – Fall 2023 for the renewal of the investment and innovation tax credit (C3i).

TABLE A.5 Financial impact of the measures to act on economic priorities |

| (millions of dollars) |

| | 2024-

2025 | 2025-

2026 | 2026-

2027 | 2027-

2028 | 2028-

2029 | Total |

Supporting strategic sectors and

economic growth | −85.1 | −94.5 | −93.5 | −80.0 | −90.0 | −443.1 |

| | | | | | | |

Growing the available labour pool

and increasing productivity in the

construction industry | −103.0 | −22.0 | −1.0 | — | — | −126.0 |

| Contributing to the prosperity of the regions | −173.3 | −399.3 | −110.2 | −105.2 | −100.5 | −888.5 |

| | | | | | | |

Fostering immigrants’ economic

and social integration | −80.0 | −80.0 | −80.0 | −80.0 | −80.0 | −400.0 |

| TOTAL | −441.4 | −595.8 | −284.7 | −265.2 | −270.5 | −1 857.6 |

| | Budget 2024-2025 |

A.12 | Budget Plan |

| 1.4 | Optimizing government action |

Government interventions must always be geared toward efficiency. Furthermore, government action must remain in step with the socioeconomic environment of the time.

| — | To that end, the government must make the necessary adjustments to be able to act effectively in a way that is consistent with the evolution of society and the new priorities that emerge. |

| — | In this respect, the government is taking major steps to improve the efficiency of its interventions in the Québec tax system and the performance of government enterprises. |

In order to optimize government action, in Budget 2024-2025, the government is announcing measures representing an additional revenue of $2.9 billion over five years, with the aim of:

| — | adjusting certain tax assistance measures for businesses ($1.0 billion); |

| — | asking government enterprises for optimization efforts ($1.0 billion); |

| — | continuing tobacco control efforts ($300 million); |

| — | ensuring the fairness and integrity of the tax system ($563 million). |

In addition, in spring 2024, the government will initiate a review of all its tax and budgetary expenditures. The first steps that come out of this review will be incorporated into the plan to restore fiscal balance that will be presented when Budget 2025-2026 is released.

TABLE A.6

Financial impact of the steps to optimize government action |

| (millions of dollars) |

| | 2024-

2025 | 2025-

2026 | 2026-

2027 | 2027-

2028 | 2028-

2029 | Total |

Adjusting certain tax

assistance measures for businesses | 4.3 | 50.5 | 213.0 | 351.3 | 421.0 | 1 040.1 |

| | | | | | | |

Asking government enterprises

for optimization efforts | — | 100.0 | 200.0 | 300.0 | 400.0 | 1 000.0 |

| Continuing tobacco control efforts | 40.0 | 65.0 | 65.0 | 65.0 | 65.0 | 300.0 |

| | | | | | | |

Ensuring the fairness and integrity

of the tax system | 41.9 | 129.6 | 129.4 | 130.9 | 130.9 | 562.7 |

| Initiating a review of government expenditures(1) | — | — | — | — | — | — |

| TOTAL | 86.2 | 345.1 | 607.4 | 847.2 | 1 016.9 | 2 902.8 |

| (1) | The first steps that come out of this review will be incorporated into the plan to restore fiscal balance that will be presented when Budget 2025-2026 is released. |

| 2. | Québec’s economic situation |

| 2.1 | A more favourable growth environment is expected in the second half of 2024 |

The global economy proved resilient in 2023, particularly due to the strong performance of the U.S. economy. However, difficulties are intensifying as the effects of tighter financial conditions become more pronounced.

| — | As a result, production growth is expected to slow in most regions in 2024. |

This period of economic weakness will continue to moderate pressure on prices. Consequently, central banks will start easing their monetary policies gradually as of the second quarter of 2024. Controlled inflation and more favourable credit conditions should re-establish an environment conducive to growth.

In Québec, real GDP stagnated in 2023. Overall, production rose by just 0.2% for the year as a whole. However, the relative weakness of the economy in 2023 did not spread to all industries. Moreover, the production declines observed are partly attributable to temporary factors, including forest fires.

The economy stagnated, but the labour market remained resilient, with employment growth at 2.3% in 2023. Québec’s financial situation is solid. In fact, the household debt ratio, that is, the value of household liabilities as a proportion of disposable income, is significantly lower in Québec (148.3% in 2022) than in Canada as a whole (189.1%), making Québec households less vulnerable to high interest rates.

As a result, Québec’s economy is well positioned for a sustained recovery as of the second half of 2024, in synchronization with the decline in inflation and the easing of monetary policy. In 2025, real GDP growth is expected to accelerate and reach 1.6%.

| (real GDP, percentage change) |

| | 2022 | 2023 | 2024 | 2025 |

| Québec | 2.5 | 0.2 | 0.6 | 1.6 |

| Canada | 3.8 | 1.1 | 0.7 | 1.9 |

| United States | 1.9 | 2.5 | 1.5 | 1.6 |

| World(1) | 3.5 | 3.0 | 2.8 | 3.0 |

| (1) | Global real GDP is expressed in purchasing power parity. |

| Sources: | Institut de la statistique du Québec, Statistics Canada, International Monetary Fund, S&P Global, LSEG Datastream, Bloomberg, Eurostat and Ministère des Finances du Québec. |

TABLE A.8

Real GDP and its major components in Québec |

| (percentage change and contribution in percentage points) |

| | Change | | Contribution |

| | 2023 | 2024 | 2025 | | 2023 | 2024 | 2025 |

| Domestic demand | −0.1 | 0.9 | 1.7 | | −0.1 | 1.0 | 1.8 |

| Household consumption | 2.3 | 0.8 | 1.8 | | 1.3 | 0.5 | 1.1 |

| Residential investment | −17.8 | 0.4 | 2.6 | | −1.2 | — | 0.1 |

| Non-residential business investment | −1.4 | 2.4 | 2.9 | | −0.1 | 0.2 | 0.3 |

Government spending

and investment | 0.2 | 0.9 | 0.9 | | 0.1 | 0.3 | 0.3 |

| External sector | — | — | — | | 0.7 | 0.1 | 0.1 |

| Exports | 2.3 | 2.0 | 2.2 | | 1.0 | 0.9 | 1.0 |

| Imports | 0.5 | 1.5 | 1.9 | | −0.3 | −0.8 | −1.0 |

| Inventories | — | — | — | | −0.6 | −0.5 | −0.3 |

| REAL GDP | 0.2 | 0.6 | 1.6 | | 0.2 | 0.6 | 1.6 |

Note: Total components may not add due to rounding.

| Sources: | Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

| | Budget 2024-2025 |

A.16 | Budget Plan |

| 3. | Québec’s financial situation |

Budget 2024-2025 presents a deterioration of the financial situation resulting essentially from stagnant economic activity, low runoff in Hydro-Québec’s basins, massive government investment in public services—in particular to improve working conditions for public and parapublic sector employees—stronger-than-expected demographic growth and the pace of infrastructure investments.

| 3.1 | Main adjustments in 2023-2024 |

Since the last budget, the 2023-2024 budgetary deficit has been adjusted upwards, from $4.0 billion to $6.3 billion. The economic and budgetary situation has led to negative adjustments of $2.4 billion in 2023-2024, due in particular to:

| — | an $898.0-million reduction in own-source revenue excluding revenue from government enterprises, mainly resulting from the downward adjustment of tax revenue attributable to stagnant economic activity;8 |

| — | a $1.6-billion decline in revenue from government enterprises, primarily due to the decrease in the value of Hydro-Québec’s exports resulting from low runoff in the regions where its main basins are located; |

| — | a $1.5-billion increase in federal transfers, mainly due to a decrease in the value of the special Québec abatement, which is deducted from federal transfers, the pace of completion of federally funded infrastructure projects, as well as the Housing Accelerator Fund agreement; |

| — | a $1.7-billion increase in expenditures, mainly resulting from higher-than-expected portfolio expenditures of $1.5 billion, particularly due to the adjustment to the pace of local infrastructure projects and the update to the social housing construction plan; |

| — | targeted initiatives of $1.4 billion announced in the Update on Québec’s Economic and Financial Situation – Fall 2023, including support for climate transition and communities and better access to housing, as well as those announced in Budget 2024-2025, including helping students with difficulties going back into the classroom and funding for low-income housing renovations; |

| — | the use of the $1.5-billion contingency reserve, which was set aside in March 2023. |

| 8 | The details are presented in subsection 1.2 of Section G, “Québec’s Financial Situation.” |

TABLE A.9

Adjustments to the financial framework since March 2023

| (millions of dollars) |

| | 2023-2024 |

| BUDGETARY BALANCE(1) – MARCH 2023 | −3 998 |

| ECONOMIC AND BUDGETARY SITUATION | |

| Own-source revenue excluding revenue from government enterprises | |

| – Tax revenue | −2 400 |

| – Other revenue | 1 502 |

| Subtotal | −898 |

| Revenue from government enterprises | −1 610 |

| Subtotal – Own-source revenue | −2 508 |

| Federal transfers | 1 548 |

| Subtotal – Revenue | −960 |

| Portfolio expenditures | −1 532 |

| Debt service | −186 |

| Subtotal – Expenditure | −1 718 |

| Deposits of dedicated revenues in the Generations Fund | 292 |

| TOTAL ADJUSTMENTS TO THE ECONOMIC AND BUDGETARY SITUATION | −2 386 |

| NOVEMBER 2023 INITIATIVES | −1 101 |

| MARCH 2024 INITIATIVES | |

| Funding health and social services, education and higher education | −188 |

| Supporting Quebecers and communities | −129 |

| Acting on economic priorities | — |

| Subtotal | −317 |

| TOTAL INITIATIVES | −1 418 |

| Optimizing government action | — |

| Gap to be bridged for achieving fiscal balance in operations | — |

| Contingency reserve | 1 500 |

| BUDGETARY BALANCE(1) – MARCH 2024 | −6 302 |

Note: Totals may not add due to rounding.

| (1) | Budgetary balance within the meaning of the Balanced Budget Act. |

| | Budget 2024-2025 |

A.18 | Budget Plan |

Budget 2024-2025 presents the revenue and expenditure outlook for the Québec government until 2028-2029.

Revenue amounts to $150.3 billion in 2024-2025, with growth of 2.4%. Growth will increase to 4.2% in 2025-2026.

| — | Over the period covered by the financial framework, that is, until 2028-2029, annual revenue growth will average 3.3%. |

Expenditure amounts to $157.6 billion in 2024-2025, with growth of 4.4%. Growth will reach 2.9% in 2025-2026.

| — | From 2024-2025 to 2028-2029, the annual growth in expenditure will average 2.9%. |

| — | The financial framework provides the funding needed to deliver services in the government’s critical missions. As a result, expenditure growth9 for 2024-2025 stands at: |

| — | 4.2% in health and social services; |

| — | 3.5% in higher education. |

The budgetary balance from operations, before the contingency reserve, shows a deficit of $7.3 billion (or 1.2% of GDP) in 2024-2025 and surpluses starting in 2027-2028.

In addition, the financial framework includes a contingency reserve of $1.5 billion per year starting in 2024-2025 that could be used, in particular, to offset the effects of more moderate economic growth than anticipated, should this occur.

| — | In 2024-2025, after the contingency reserve, the budgetary balance from operations shows a deficit of $8.8 billion (or 1.5% of GDP). |

After deposits of dedicated revenues in the Generations Fund, the budgetary balance within the meaning of the Balanced Budget Act shows a deficit of $11.0 billion in 2024-2025 (or 1.9% of GDP).

| 9 | Detailed explanations for expenditure growth are provided in subsection 3.2 of Section G, “Québec’s Financial Situation.” |

TABLE A.10

Multi-year financial framework

| (millions of dollars, unless otherwise indicated) |

| | 2022-

2023 | 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 | 2027-2028 | 2028-2029 |

| Revenue | | | | | | | |

| Personal income tax | 42 251 | 42 389 | 44 952 | 46 746 | 48 592 | 50 577 | 52 537 |

Contributions for

health services | 7 914 | 8 298 | 8 670 | 8 991 | 9 248 | 9 526 | 9 778 |

| Corporate taxes | 13 243 | 11 399 | 12 116 | 12 729 | 13 369 | 13 795 | 14 409 |

| School property tax | 1 113 | 1 137 | 1 310 | 1 436 | 1 531 | 1 553 | 1 615 |

| Consumption taxes | 26 597 | 27 118 | 27 991 | 28 994 | 29 888 | 30 859 | 31 889 |

| Duties and permits | 5 741 | 5 832 | 5 940 | 6 274 | 6 615 | 6 812 | 7 099 |

| Miscellaneous revenue | 12 083 | 14 116 | 14 507 | 14 703 | 15 106 | 15 704 | 16 238 |

| Government enterprises | 6 620 | 5 197 | 5 418 | 6 257 | 7 588 | 7 565 | 7 274 |

| Own-source revenue | 115 562 | 115 486 | 120 904 | 126 130 | 131 937 | 136 391 | 140 839 |

| % change | 5.4 | −0.1 | 4.7 | 4.3 | 4.6 | 3.4 | 3.3 |

| Federal transfers | 28 737 | 31 290 | 29 397 | 30 428 | 31 883 | 32 112 | 32 006 |

| % change(1) | −1.5 | 8.9 | −6.0 | 3.5 | 4.8 | 0.7 | −0.3 |

| Total revenue | 144 299 | 146 776 | 150 301 | 156 558 | 163 820 | 168 503 | 172 845 |

| % change | 3.9 | 1.7 | 2.4 | 4.2 | 4.6 | 2.9 | 2.6 |

| Expenditure | | | | | | | |

| Portfolio expenditures | −137 243 | −141 347 | −147 815 | −152 492 | −155 493 | −159 140 | −162 972 |

| % change | 7.6 | 3.0 | 4.6 | 3.2 | 2.0 | 2.3 | 2.4 |

| Debt service | −10 058 | −9 650 | −9 762 | −9 583 | −10 117 | −11 003 | −11 642 |

| % change(2) | 16.4 | −4.1 | 1.2 | −1.8 | 5.6 | 8.8 | 5.8 |

| Total expenditure | −147 301 | −150 997 | −157 577 | −162 075 | −165 610 | −170 143 | −174 614 |

| % change | 8.1 | 2.5 | 4.4 | 2.9 | 2.2 | 2.7 | 2.6 |

Gap to be bridged for achieving

fiscal balance in operations | — | — | — | 750 | 1 500 | 1 750 | 2 000 |

SURPLUS (DEFICIT) FROM OPERATIONS BEFORE

CONTINGENCY RESERVE | −3 002 | −4 221 | −7 276 | −4 767 | −290 | 110 | 231 |

| Contingency reserve | — | — | −1 500 | −1 500 | −1 500 | −1 500 | −1 500 |

SURPLUS (DEFICIT)

FROM OPERATIONS | −3 002 | −4 221 | −8 776 | −6 267 | −1 790 | −1 390 | −1 269 |

| BALANCED BUDGET ACT | | | | | | | |

| Deposits of dedicated revenues in the Generations Fund | −3 082 | −2 081 | −2 222 | −2 219 | −2 419 | −2 554 | −2 671 |

| BUDGETARY BALANCE WITHIN THE MEANING OF THE BALANCED BUDGET ACT(3) | −6 084 | −6 302 | −10 998 | −8 486 | −4 209 | −3 944 | −3 940 |

Note: Totals may not add due to rounding.

| (1) | The significant increase in federal transfers in 2023-2024 is due, in particular, to the additional amounts for health care announced by the federal government in February 2023 (nearly $1.1 billion more in 2023-2024, including a non-recurring amount of $447 million), the change in the value of the special Québec abatement ($310 million), and the housing agreement ($900 million over four years, including $225 million in 2023-2024). The decrease in 2024-2025 is due, among other things, to a decline in equalization resulting from changes made by the federal government to the program in its 2023 budget. |

| (2) | The −4.1% change in debt service in 2023-2024 is due, in particular, to the non-recurrence of losses on the disposal of assets as part of the activities of the Sinking Fund for Government Borrowing in 2022-2023. |

| (3) | Budgetary balance within the meaning of the Balanced Budget Act, before use of the stabilization reserve. In accordance with the Balanced Budget Act, the stabilization reserve is abolished as of 2023-2024. |

| | Budget 2024-2025 |

A.20 | Budget Plan |

| 3.3 | A gradual approach to restoring fiscal balance |

The government is maintaining its commitment to restore fiscal balance after deposits of dedicated revenues in the Generations Fund. Given the context of economic uncertainty, it will table a plan to restore fiscal balance when Budget 2025-2026 is released.

A balanced budget within the meaning of the Balanced Budget Act, that is, after deposits of dedicated revenues in the Generations Fund, will be achieved by 2029-2030 at the latest. To do so, the structural deficit of nearly $4 billion observed from 2026-2027 to 2028-2029 will have to be eliminated.

| — | To achieve this, the government will need to increase the gap between average annual growth in revenue and the one in expenditure from 0.4 percentage points to 1.1 percentage points.10 |

In the meantime, the government is taking action to achieve fiscal balance in operations in 2027-2028, if no events trigger the use of the contingency reserve. To this end, it is relying on four levers:

| — | taking immediate steps representing $2.9 billion over five years to optimize government action; |

| — | The government is adjusting certain tax assistance measures for businesses in line with changes to the labour market and recommendations from experts aimed at maximizing economic potential. It is asking government enterprises for optimization efforts and is continuing its tobacco control efforts by increasing the tax on tobacco products. In addition, it is maintaining its efforts to ensure the fairness and integrity of the tax system. |

| — | shortly beginning the review of all its tax and budgetary expenditures; |

| 10 | Over the period covered by the financial framework, that is, until 2028-2029, average annual growth in revenue (AAGR) will reach 3.3%. Meanwhile, average annual growth in expenditure will reach 2.9%. The gap in growth is currently equivalent to 0.4 percentage points. In order to eliminate the structural deficit, the Ministère des Finances estimates that this gap will need to reach 1.1 percentage points by 2028-2029. Details on revenue and expenditure are presented in Section G, “Québec’s Financial Situation.” |

| — | continuing to make representations to the federal government to obtain its fair share of federal transfers; |

| — | The federal government must reimburse Québec for the costs incurred for providing services to asylum seekers. It must also increase its transfers to the provinces in the areas of health, infrastructure and workforce development. Québec is also asking for unconditional opt-out with full financial compensation from the Canadian Dental Care Plan and any future Canadian drug benefit plan. |

| — | The slow growth in federal transfers is leading to budgetary pressure, which is increasing the efforts required to restore fiscal balance.11 |

| — | continuing its commitment to create more wealth and increase Québec’s economic potential by investing $1.9 billion to act on economic priorities. |

The expenditure review process will begin as of spring 2024. On the one hand, it will cover tax expenditures related to both the personal and corporate tax systems as well as the consumption tax system, and, on the other hand, it will cover expenditures by government departments and bodies.

The two reviews will make it possible to identify the first sources of savings that will pave the way to a balanced budget after deposits of dedicated revenues in the Generations Fund by 2029-2030. They will be incorporated into the plan to restore fiscal balance, which will be tabled at the same time as Budget 2025-2026.

| — | At that time, the government is expecting the economic situation to be less uncertain and the Québec economy to be closer to its potential. The government will therefore be in a position to identify the path and additional actions that will result in a balanced budget after deposits in the Generations Fund by 2029-2030. |

Fiscal balance will be restored by ensuring stable, predictable funding for the government’s main missions, without increasing the tax burden on Quebecers.

| 11 | Slow growth in federal transfers is expected by 2028-2029. An average annual growth rate of 0.5% over five years, from 2024-2025 to 2028-2029, is anticipated. This contrasts with an average annual growth rate of 5.4% for the past 10 years. |

| | Budget 2024-2025 |

A.22 | Budget Plan |

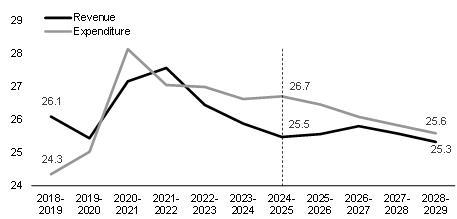

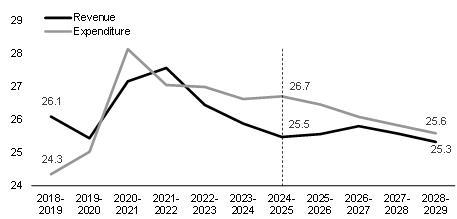

Shares of revenue and expenditure in the economy

The shares of government revenue and expenditure in the economy generally follow similar paths.

In 2018-2019, expenditure amounted to 24.3% of GDP. This was less than the share of revenue in the economy, which stood at 26.1%. This difference was due to the gradual reduction in the share of expenditure in the economy in previous years.

In 2024-2025, expenditure amounts to 26.7% of GDP, which is higher than the share of revenue in the economy of 25.5%.

| – | In particular, the share of expenditure in the economy illustrates the government’s investments aimed at funding public services, notably in health and education, in order to support Quebecers and act on economic priorities. |

| – | As for revenue, its share in the economy is due, in particular, to measures announced in recent years, including the 1-percentage-point reduction in the bottom two personal income tax rates since 2023. |

In subsequent years, the difference between the shares of revenue and expenditure as a percentage of GDP will gradually narrow until 2028-2029, reaching 0.3 percentage points.

The expected results of the process to review tax and budgetary expenditures will equalize the shares of revenue and expenditure in the economy as of 2026-2027, if no events trigger the use of the contingency reserve. They will also ensure stable, predictable funding for the government’s main missions, while reducing the share of expenditure in the economy to a level comparable to that of the pre-pandemic period.

Change in the shares of government revenue and expenditure

in the economy – 2018-2019 to 2028-2029

(percentage of GDP)

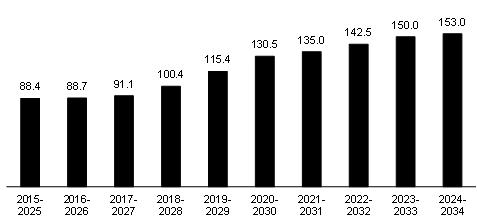

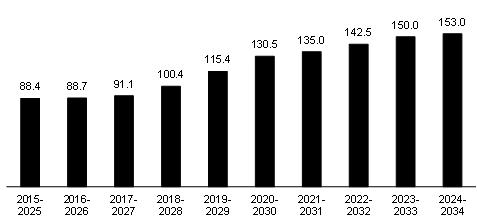

| 3.4 | Investments in public infrastructure |

Québec has major public infrastructure needs. To meet these needs, the government is announcing an increase of $3.0 billion over 10 years in the Québec Infrastructure Plan (QIP).

| — | The 2024-2034 QIP therefore amounts to $153.0 billion, or a little over $15.0 billion per year on average. |

| — | Over the past six years, the QIP has been increased each year, going from $100.4 billion in March 2018 to $153.0 billion in March 2024. This increase was necessary, given the importance of equipping Québec with modern infrastructure and investing more in maintaining the building infrastructure inventory.12 |

| — | 62% of the total investments under the 2024-2034 QIP will be used primarily to maintain the building inventory.13 New infrastructure will account for 38% of the investments. |

The 2024-2034 QIP allocates considerable sums to health and social services, education and higher education, public transit and the road network.14 It also provides for major investments in social housing.

CHART A.2

Change in the Québec Infrastructure Plan |

| (billions of dollars) |

|

| Source: Secrétariat du Conseil du trésor |

| 12 | The asset maintenance deficit is estimated at $37.1 billion in March 2024. |

| 13 | This share excludes the central envelope. |

| 14 | The 2024-2034 Québec Infrastructure Plan published by the Secrétariat du Conseil du trésor provides detailed information on planned investments by sector. |

| | Budget 2024-2025 |

A.24 | Budget Plan |

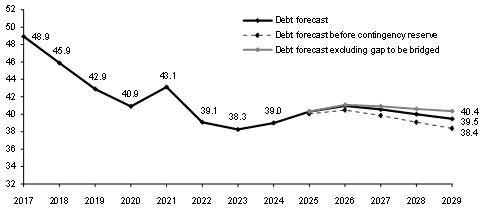

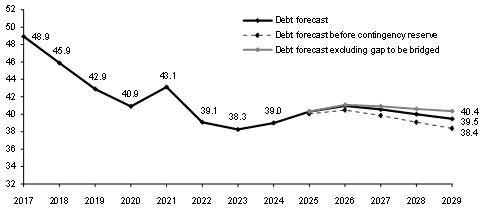

| 4. | The Québec government’s debt |

| 4.1 | The debt burden lower than before the pandemic |

The net debt burden will stand at 39.0% of GDP as at March 31, 2024. This is lower than the pre-pandemic level of 40.9% of GDP as at March 31, 2020.

The net debt-to-GDP ratio will increase until 2025-2026, driven by deficits and major investments in public infrastructure. It will then fall back to 39.5% of GDP as at March 31, 2029.

| — | Excluding the gap to be bridged, the net debt-to-GDP ratio is expected to stand at 40.4% as at March 31, 2029. |

| — | Excluding the contingency reserve of $7.5 billion over five years, from 2024-2025 to 2028-2029, the net debt-to-GDP ratio is expected to stand at 38.4% as at March 31, 2029. |

CHART A.3

Net debt as at March 31 |

| (percentage of GDP) |

|

The government is staying the course on its objective to reduce the net debt burden to 30% of GDP by 2037-2038.15

| — | This will be achieved by restoring fiscal balance, continuing payments to the Generations Fund and implementing initiatives to accelerate economic growth. |

| 15 | The Act to reduce the debt and establish the Generations Fund provides that, for fiscal 2037-2038, the net debt presented in the government’s financial statements may not exceed 32.5% of GDP. This ratio corresponds to the upper limit of a net debt reduction target of 30% of GDP announced in Budget Speech 2023-2024. |

| Appendix: | Québec’s economic outlook – 2022 to 2028 |

TABLE A.11

Economic outlook in Québec |

| (annual average, percentage change, unless otherwise indicated) |

| | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Output | | | | | | | |

| Real GDP | 2.5 | 0.2 | 0.6 | 1.6 | 1.7 | 1.7 | 1.7 |

| Nominal GDP | 8.4 | 3.9 | 4.0 | 3.8 | 3.7 | 3.7 | 3.6 |

| Nominal GDP (billions of dollars) | 545.6 | 567.1 | 589.9 | 612.4 | 634.9 | 658.6 | 682.4 |

| Components of GDP (in real terms) | | | | | | | |

| Final domestic demand | 2.5 | −0.1 | 0.9 | 1.7 | 1.5 | 1.5 | 1.5 |

| – Household consumption | 4.9 | 2.3 | 0.8 | 1.8 | 1.9 | 1.9 | 1.8 |

– Government spending

and investment | 3.0 | 0.2 | 0.9 | 0.9 | 0.3 | 0.5 | 0.6 |

| – Residential investment | −11.7 | −17.8 | 0.4 | 2.6 | 1.3 | 1.2 | 0.9 |

– Non-residential business

investment | 1.3 | −1.4 | 2.4 | 2.9 | 2.9 | 2.8 | 2.5 |

| Exports | 0.5 | 2.3 | 2.0 | 2.2 | 2.5 | 2.3 | 2.0 |

| Imports | 6.0 | 0.5 | 1.5 | 1.9 | 1.8 | 1.6 | 1.6 |

| Labour market | | | | | | | |

| Population (thousands) | 8 672 | 8 875 | 9 124 | 9 185 | 9 237 | 9 283 | 9 328 |

| Population aged 15 and over (thousands) | 7 156 | 7 260 | 7 406 | 7 466 | 7 518 | 7 565 | 7 613 |

| Jobs (thousands) | 4 403 | 4 506 | 4 550 | 4 578 | 4 598 | 4 618 | 4 637 |

| Job creation (thousands) | 129.7 | 103.3 | 43.8 | 28.0 | 20.0 | 19.6 | 18.9 |

| Unemployment rate (per cent) | 4.3 | 4.5 | 5.2 | 4.9 | 4.6 | 4.2 | 4.1 |

Other economic indicators

(in nominal terms) | | | | | |

| Household consumption | 10.6 | 6.1 | 3.0 | 3.6 | 3.7 | 3.7 | 3.5 |

| – Excluding food expenditures and shelter | 12.3 | 5.6 | 2.5 | 3.6 | 3.6 | 3.6 | 3.4 |

| Housing starts (thousands of units) | 57.1 | 38.9 | 42.7 | 43.7 | 43.0 | 42.3 | 41.6 |

| Residential investment | −0.6 | −15.8 | 2.6 | 5.5 | 3.6 | 3.4 | 3.1 |

Non-residential business

investment | 11.3 | 3.6 | 4.3 | 4.2 | 4.4 | 4.6 | 4.5 |

| Wages and salaries | 10.4 | 6.0 | 5.1 | 3.7 | 3.3 | 3.4 | 3.2 |

| Household income | 7.9 | 6.0 | 5.2 | 3.6 | 3.3 | 3.4 | 3.3 |

| Net operating surplus of corporations | −10.2 | −11.0 | −2.5 | 3.0 | 4.0 | 4.2 | 5.4 |

| Consumer price index (CPI) | 6.7 | 4.5 | 2.8 | 2.2 | 2.0 | 2.0 | 2.0 |

| CPI (fiscal year) | 6.6 | 4.1 | 2.5 | 2.1 | 2.0 | 2.0 | 2.0 |

| Sources: Institut de la statistique du Québec, Statistics Canada, Canada Mortgage and Housing Corporation and Ministère des Finances du Québec. |