Exhibit 99.14

Section G

Québec’s financial situation

| Summary | G.3 |

| 1. Québec’s budgetary situation | G.9 |

| 1.1 Recent developments in the budgetary situation | G.10 |

| 1.2 Detailed adjustments in 2023-2024 | G.20 |

| 2. Restoring fiscal balance | G.31 |

| 3. Revenue and expenditure forecasts | G.35 |

| 3.1 Change in revenue | G.36 |

| 3.1.1 Own-source revenue excluding revenue from government enterprises | G.37 |

| 3.1.2 Revenue from government enterprises | G.42 |

| 3.1.3 Federal transfers | G.43 |

| 3.2 Change in expenditure | G.49 |

| 3.2.1 Portfolio expenditures | G.51 |

| 3.2.2 Debt service | G.59 |

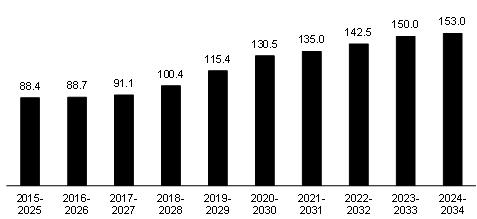

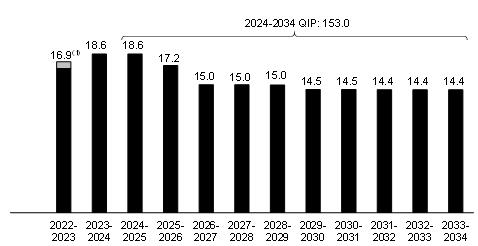

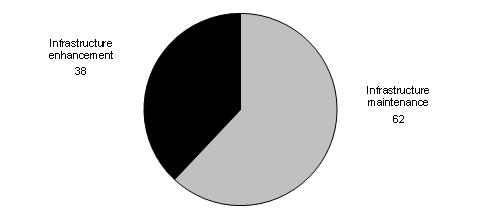

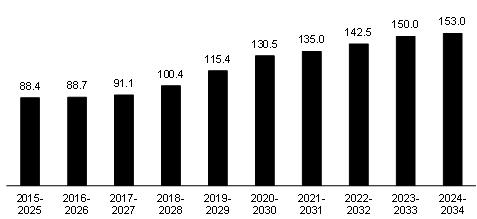

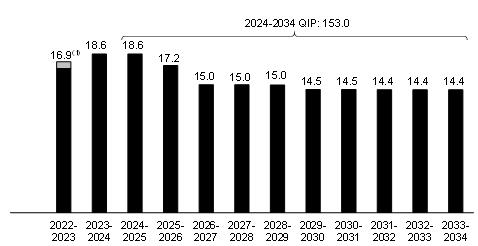

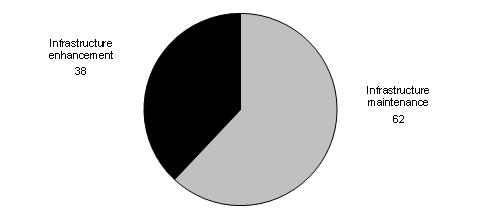

| 4. Public infrastructure investments | G.61 |

| APPENDIX 1: Portfolio expenditures | G.65 |

| APPENDIX 2: Report on the application of the Balanced Budget Act | G.67 |

| APPENDIX 3: Supplementary information | G.71 |

G.1

Summary

Budget 2024-2025 is an opportunity for the government to report on Québec’s economic and budgetary situation and to present its related policy directions in this regard. This section reports on developments in Québec’s budgetary situation for 2023-2024 and presents the budget forecasts up to 2028-2029.

A number of factors are affecting the government’s budgetary outlook, namely stagnant economic activity, low runoff in Hydro-Québec’s basins, major investment in public services, particularly to improve working conditions for public and parapublic sector employees, stronger-than-expected demographic growth and the pace of realization of infrastructure investments. They result in a structural deficit of nearly $4 billion from 2026-2027 to 2028-2029, which will have to be eliminated to restore fiscal balance within the meaning of the Balanced Budget Act, after deposits of dedicated revenues in the Generations Fund.

The government is maintaining its commitment to restore fiscal balance. To that end, it is taking immediate action as part of a gradual approach. A plan to restore fiscal balance will be tabled when Budget 2025-2026 is released. |

| q | A gradual approach to restoring fiscal balance |

The government is maintaining its commitment to restore fiscal balance after deposits of dedicated revenues in the Generations Fund. Given the uncertain economic context, it will table a plan to restore fiscal balance at the same time as Budget 2025-2026. A more favourable growth environment is expected in the second half of 2024.

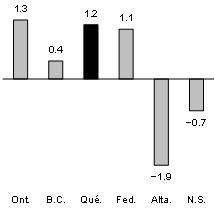

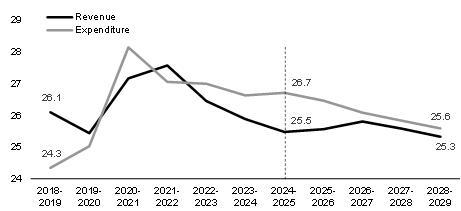

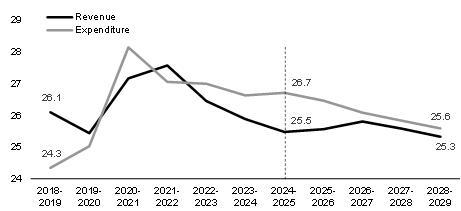

Fiscal balance within the meaning of the Balanced Budget Act will be achieved by 2029-20301 at the latest. To achieve this, the government will need to increase the gap between the average annual growth in revenue and the one in expenditure from 0.4 percentage points to 1.1 percentage points.2

| 1 | See Appendix 2 for the report on the application of the Balanced Budget Act. |

| 2 | To restore fiscal balance, the government must increase the gap between revenue and expenditure. Over the period covered by the financial framework, that is, until 2028-2029, the average annual growth in revenue (AAGR) will reach 3.3%. Meanwhile, average annual growth in expenditure will reach 2.9%. The gap in growth is currently equivalent to 0.4 percentage points. In order to eliminate the structural deficit, the Ministère des Finances estimates that this gap will need to reach 1.1 percentage points by 2028-2029. |

Québec’s Financial

Situation | G.3 |

In the meantime, the government is taking action to achieve fiscal balance in operations by 2027-2028, if no events trigger the use of the contingency reserve. To this end, it is relying on four levers:

| — | it is taking immediate steps representing $2.9 billion over five years to optimize government action, namely: |

| — | adjusting certain tax assistance measures for businesses ($1.0 billion), |

| — | asking government enterprises for optimization efforts ($1.0 billion), |

| — | continuing tobacco control efforts ($300 million), |

| — | ensuring the fairness and integrity of the tax system ($563 million); |

| — | it is launching two review processes in spring 2024, one for tax expenditures and one for budgetary expenditures; |

| — | This exercise will make it possible to identify the first sources of savings that will pave the way to a balanced budget after deposits of dedicated revenues in the Generations Fund by 2029-2030. |

| — | it is continuing to make representations to the federal government to obtain its fair share of federal transfers; |

The federal government must reimburse Québec for the costs incurred for providing services to asylum seekers. It must also increase its transfers to provinces in the areas of health, infrastructure, and workforce development. Québec is also asking for unconditional opt-out with full financial compensation from the Canadian Dental Care Plan and any future Canadian drug benefit plan. |

| — | it is continuing its commitment to create more wealth and increase Québec’s economic potential by investing $1.9 billion to act on economic priorities. |

| G.4 | Budget 2024-2025 Budget Plan |

The first results of these actions will be incorporated into the plan to restore fiscal balance, which will be tabled at the same time as Budget 2025-2026.

| — | At that time, the government is expecting the economic situation to be less uncertain and the Québec economy to be closer to its potential. The government will therefore be in a position to precisely set out the trajectory and additional actions that will result in a balanced budget within the meaning of the Balanced Budget Act by 2029-2030. |

| As a result, fiscal balance will be restored by ensuring stable and predictable funding for the government’s main missions and without increasing the tax burden on Quebecers. |

Québec’s Financial

Situation | G.5 |

| q | Multi-year financial framework |

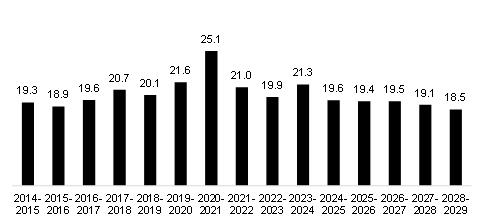

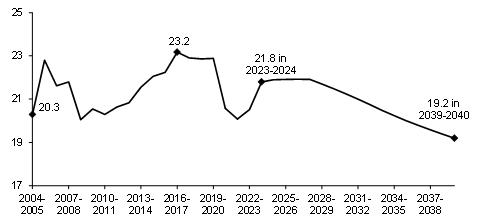

Revenue amounts to $150.3 billion in 2024-2025, with growth of 2.4%. Growth will increase to 4.2% in 2025-2026.

| — | Over the period covered by the financial framework, that is, until 2028-2029, annual revenue growth will average 3.3%. |

Expenditure amounts to $157.6 billion in 2024-2025, with growth of 4.4%. Growth will reach 2.9% in 2025-2026.

| — | From 2024-2025 to 2028-2029, the annual growth in expenditure will average 2.9%. |

| — | The financial framework provides the funding needed to deliver services in the government’s critical missions. As a result, expenditure growth3 for 2024-2025 stands at: |

| — | 4.2% in health and social services; |

| — | 3.5% in higher education. |

The budgetary balance from operations, before the contingency reserve, shows a deficit of $7.3 billion (or 1.2% of GDP) in 2024-2025 and surpluses starting in 2027-2028.

In addition, the financial framework includes a contingency reserve of $1.5 billion per year as of 2024-2025 that could be used, in particular, to offset the effects of more moderate economic growth than anticipated, should this occur, and the uncertainty that could affect longer-term economic and financial forecasts.

| — | In 2024-2025, after the contingency reserve, the budgetary balance from operations shows a deficit of $8.8 billion (or 1.5% of GDP). |

After deposits of dedicated revenues in the Generations Fund, the budgetary balance within the meaning of the Balanced Budget Act shows a deficit of $11.0 billion (or 1.9% of GDP) in 2024-2025. The structural deficit of nearly $4 billion between 2026-2027 and 2028-2029 will have to be eliminated to restore fiscal balance within the meaning of the Balanced Budget Act.

| — | Fiscal balance will be achieved by 2029-2030 at the latest.4 |

To restore fiscal balance, the government will need to increase the gap between average annual growth in revenue and the one in expenditure from 0.4 percentage points to 1.1 percentage points.

| 3 | Detailed explanations for expenditure growth are presented in subsection 3.2. |

| 4 | See Appendix 2 for the report on the application of the Balanced Budget Act. |

| G.6 | Budget 2024-2025 Budget Plan |

TABLE G. 1

Multi-year financial framework

| (millions of dollars, unless otherwise indicated) |

| | 2023-

2024- | 2024-

2025- | 2025-

2026- | 2026-

2027- | 2027-

2028- | 2028-

2029- | AAGR(1) |

| Revenue | | | | | | | |

| Personal income tax | 42 389 | 44 952 | 46 746 | 48 592 | 50 577 | 52 537 | |

| Contributions for health services | 8 298 | 8 670 | 8 991 | 9 248 | 9 526 | 9 778 | |

| Corporate taxes | 11 399 | 12 116 | 12 729 | 13 369 | 13 795 | 14 409 | |

| School property tax | 1 137 | 1 310 | 1 436 | 1 531 | 1 553 | 1 615 | |

| Consumption taxes | 27 118 | 27 991 | 28 994 | 29 888 | 30 859 | 31 889 | |

| Duties and permits | 5 832 | 5 940 | 6 274 | 6 615 | 6 812 | 7 099 | |

| Miscellaneous revenue | 14 116 | 14 507 | 14 703 | 15 106 | 15 704 | 16 238 | |

| Government enterprises | 5 197 | 5 418 | 6 257 | 7 588 | 7 565 | 7 274 | |

| Own-source revenue | 115 486 | 120 904 | 126 130 | 131 937 | 136 391 | 140 839 | |

| % change | −0.1 | 4.7 | 4.3 | 4.6 | 3.4 | 3.3 | 4.0 |

| Federal transfers | 31 290 | 29 397 | 30 428 | 31 883 | 32 112 | 32 006 | |

| % change(2) | 8.9 | −6.0 | 3.5 | 4.8 | 0.7 | −0.3 | 0.5 |

| Total revenue | 146 776 | 150 301 | 156 558 | 163 820 | 168 503 | 172 845 | |

| % change | 1.7 | 2.4 | 4.2 | 4.6 | 2.9 | 2.6 | 3.3 |

| Expenditure | | | | | | | |

| Portfolio expenditures | −141 347 | −147 815 | −152 492 | −155 493 | −159 140 | −162 972 | |

| % change | 3.0 | 4.6 | 3.2 | 2.0 | 2.3 | 2.4 | 2.9 |

| Debt service | −9 650 | −9 762 | −9 583 | −10 117 | −11 003 | −11 642 | |

| % change(3) | −4.1 | 1.2 | −1.8 | 5.6 | 8.8 | 5.8 | 3.8 |

| Total expenditure | −150 997 | −157 577 | −162 075 | −165 610 | −170 143 | −174 614 | |

| % change | 2.5 | 4.4 | 2.9 | 2.2 | 2.7 | 2.6 | 2.9 |

Gap to be bridged

for achieving fiscal balance in operations | — | — | 750 | 1 500 | 1 750 | 2 000 | |

| SURPLUS (DEFICIT) FROM OPERATIONS BEFORE CONTINGENCY RESERVE | −4 221 | −7 276 | −4 767 | −290 | 110 | 231 | |

| Contingency reserve | — | −1 500 | −1 500 | −1 500 | −1 500 | −1 500 | |

| SURPLUS (DEFICIT) FROM OPERATIONS | −4 221 | −8 776 | −6 267 | −1 790 | −1 390 | −1 269 | |

Note: Totals may not add due to rounding.

| (1) | Average annual growth rate, corresponding to the geometric mean over five years, from 2024-2025 to 2028-2029. |

| (2) | The significant increase in federal transfers in 2023-2024 is due, in particular, to the additional amounts for health care announced by the federal government in February 2023 (nearly $1.1 billion more in 2023-2024, including a non-recurring amount of $447 million), the change in the value of the special Québec abatement ($310 million) and the housing agreement ($900 million over four years, including $225 million in 2023-2024). The decrease in 2024-2025 is due, among other things, to a decline in equalization resulting from changes made by the federal government to the program in its 2023 budget. |

| (3) | The −4.1% change in debt service in 2023-2024 is due, in particular, to the non-recurrence of losses on the disposal of assets as part of the activities of the Sinking Fund for Government Borrowing in 2022-2023. |

Québec’s Financial

Situation | G.7 |

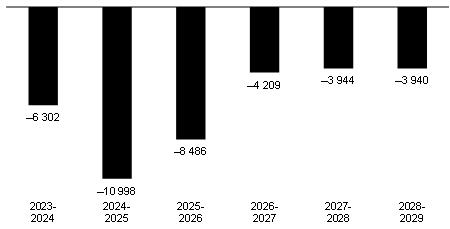

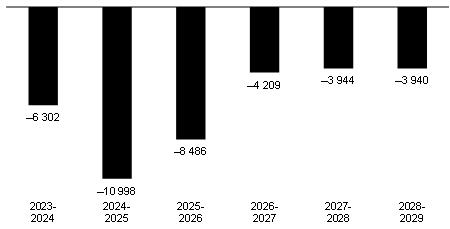

| ■ | Requirements of the Balanced Budget Act |

Under the Balanced Budget Act,5 the budgetary balance corresponds to the surplus or the deficit presented in the public accounts (surplus or deficit from operations) reduced by the amount of revenues dedicated to the Generations Fund and adjusted to take certain accounting changes into consideration, if applicable.

TABLE G. 2

Budgetary balance within the meaning of the Balanced Budget Act

(millions of dollars)

| | 2023-

2024- | 2024-

2025- | 2025-

2026- | 2026-

2027- | 2027-

2028- | 2028-

2029- |

| SURPLUS (DEFICIT) FROM OPERATIONS | −4 221 | −8 776 | −6 267 | −1 790 | −1 390 | −1 269 |

| Deposits of dedicated revenues in the Generations Fund | −2 081 | −2 222 | −2 219 | −2 419 | −2 554 | −2 671 |

BUDGETARY BALANCE WITHIN THE MEANING OF

THE BALANCED BUDGET ACT | −6 302 | −10 998 | −8 486 | −4 209 | −3 944 | −3 940 |

Note: Totals may not add due to rounding.

| 5 | See Appendix 2 for the report on the application of the Balanced Budget Act. |

| G.8 | Budget 2024-2025 Budget Plan |

| 1. | Québec’s budgetary situation |

In 2024-2025, revenue stands at $150.3 billion, while portfolio expenditures, or expenditures tied to the delivery of public services, stand at $147.8 billion.

| — | Debt service amounts to $9.8 billion. |

The budgetary balance from operations, before the contingency reserve, thus shows a deficit of $7.3 billion (or 1.2% of GDP).

In addition, the financial framework includes a contingency reserve of $1.5 billion to offset the effects of more moderate-than-expected economic growth, should it occur.

| — | After the contingency reserve, the budgetary balance from operations shows a deficit of $8.8 billion (or 1.5% of GDP). |

Lastly, deposits of dedicated revenues in the Generations Fund total $2.2 billion.

According to the Balanced Budget Act, the budgetary balance, after deposits of dedicated revenues in the Generations Fund, shows a deficit of $11.0 billion (or 1.9% of GDP) in 2024-2025.

TABLE G.3

Québec’s budget – March 2024

(millions of dollars, unless otherwise indicated)

| | 2024-2025 |

| Revenue | |

| Own-source revenue | 120 904 |

| % change | 4.7 |

| Federal transfers | 29 397 |

| % change | −6.0 |

| Total revenue | 150 301 |

| % change | 2.4 |

| Expenditure | |

| Portfolio expenditures | −147 815 |

| % change | 4.6 |

| Debt service | −9 762 |

| % change | 1.2 |

| Total expenditure | −157 577 |

| % change | 4.4 |

| SURPLUS (DEFICIT) FROM OPERATIONS BEFORE CONTINGENCY RESERVE | −7 276 |

| Contingency reserve | −1 500 |

| SURPLUS (DEFICIT) FROM OPERATIONS | −8 776 |

| BALANCED BUDGET ACT | |

| Deposits of dedicated revenues in the Generations Fund | −2 222 |

| BUDGETARY BALANCE(1) | −10 998 |

| (1) | Budgetary balance within the meaning of the Balanced Budget Act. |

Québec’s Financial

Situation | G.9 |

| 1.1 | Recent developments in the budgetary situation |

Budget 2024-2025 presents significant adjustments resulting essentially from stagnant economic activity, low runoff in Hydro-Québec’s basins, massive government investment in public services—in particular to improve working conditions for public and parapublic sector employees—stronger-than-expected demographic growth and the pace of realization of infrastructure investments.

| q | Significant investments to improve the working conditions of government employees |

Remuneration spending is adjusted significantly for the period covered by the financial framework. As part of the renewal of the 2023-2028 collective agreements, the government is making investments to offer attractive wage parameters and improve working conditions for government employees in return for greater flexibility in the organization of work. The objective is to improve the accessibility and quality of services and become an employer of choice.

| — | For the public and parapublic sector employees who have reached agreements in principle, the government is offering wage parameters of 17.4% over five years and sector enhancements in response to government priorities and employee requests. |

Although negotiations are still underway with certain groups, the financial framework includes an annual adjustment of over $3 billion to portfolio expenditures since the Update on Québec’s Economic and Financial Situation – Fall 2023, essentially to reflect the agreements reached and the negotiations to come. However, the actual long-term financial impact will depend on the agreements reached and advances in work organization for the government.

| q | Pressure on health and social services spending |

The acute phase of the pandemic is over, but its effects are still being felt. To this day, nearly 900 beds are occupied by patients with COVID-19 every day, and catching up on the backlog of surgeries that accumulated during the pandemic continues to require considerable human and financial resources.

The pandemic has also fostered the emergence of innovative solutions benefiting the health and social services system. Some of these innovations are still helping to ease the burden on the health care system, as in the case of screening centres that have been converted into front-line services. However, the sustainability of various additional services developed during the pandemic, particularly in the area of prevention, represents an additional cost for the health care system, which must consequently fund these additional services.

Combined with an aging population, these factors are putting considerable pressure on the costs faced by the health and social services system. In addition, the Canada Health Transfer is insufficient.

| G.10 | Budget 2024-2025 Budget Plan |

| q | Main adjustments from 2023-2024 to 2025-2026 |

Since Budget 2023-2024, the economic and budgetary situation has led to negative adjustments of $2.4 billion in 2023-2024, $5.4 billion in 2024-2025 and $4.0 billion in 2025-2026.

For this period, the government is planning new initiatives of $1.4 billion in 2023-2024, $2.2 billion in 2024-2025 and $3.1 billion in 2025-2026, in particular to ensure funding for health and social services, education and higher education, to support Quebecers and communities, and to act on economic priorities.

| — | These amounts include initiatives from the Update on Québec’s Economic and Financial Situation – Fall 2023 aimed at, among other things, providing better access to housing, combatting homelessness and enhancing food aid, as well as supporting training in specific fields. |

Québec’s Financial

Situation | G.11 |

TABLE G. 4

Adjustments to the financial framework since March 2023

| (millions of dollars) |

| | 2023-2024 | 2024-2025 | 2025-2026 |

| BUDGETARY BALANCE(1) – MARCH 2023 | −3 998 | −2 984 | −1 980 |

| ECONOMIC AND BUDGETARY SITUATION | | | |

| Own-source revenue excluding revenue from government enterprises | | | |

| – Tax revenue | −2 400 | −1 586 | −1 470 |

| – Other revenue | 1 502 | 1 553 | 1 546 |

| Subtotal | −898 | −33 | 76 |

| Revenue from government enterprises | −1 610 | −1 267 | −382 |

| Subtotal – Own-source revenue | −2 508 | −1 300 | −307 |

| Federal transfers | 1 548 | −344 | −480 |

| Subtotal – Revenue | −960 | −1 644 | −787 |

| Portfolio expenditures | −1 532 | −4 097 | −3 905 |

| Debt service | −186 | 163 | 381 |

| Subtotal – Expenditure | −1 718 | −3 934 | −3 524 |

| Deposits of dedicated revenues in the Generations Fund | 292 | 165 | 305 |

| TOTAL ADJUSTMENTS TO THE ECONOMIC AND BUDGETARY SITUATION | −2 386 | −5 413 | −4 005 |

| NOVEMBER 2023 INITIATIVES | −1 101 | −251 | −1 089 |

| MARCH 2024 INITIATIVES | | | |

| Funding health and social services, education and higher education | −188 | −1 058 | −925 |

| Supporting Quebecers and communities | −129 | −438 | −486 |

| Acting on economic priorities | — | −441 | −596 |

| Subtotal | −317 | −1 937 | −2 007 |

| TOTAL INITIATIVES | −1 418 | −2 188 | −3 096 |

| Optimizing government action | — | 86 | 345 |

| Gap to be bridged for achieving fiscal balance in operations | — | — | 750 |

| Contingency reserve | 1 500 | −500 | −500 |

| BUDGETARY BALANCE(1) – MARCH 2024 | −6 302 | −10 998 | −8 486 |

Note: Totals may not add due to rounding. (1) Budgetary balance within the meaning of the Balanced Budget Act. |

| G.12 | Budget 2024-2025 Budget Plan |

| n | Adjustments related to the economic and budgetary situation |

Changes in the economic and budgetary situation since Budget 2023-2024 have led to a downward adjustment of $2.4 billion in 2023-2024, $5.4 billion in 2024-2025 and $4.0 billion in 2025-2026. These adjustments are primarily explained by the following:

| — | a decrease in tax revenue of $2.4 billion in 2023-2024, $1.6 billion in 2024-2025 and $1.5 billion in 2025-2026, due to the economic slowdown; |

| — | a positive adjustment to other revenue of $1.5 billion in 2023-2024, $1.6 billion in 2024-2025 and $1.5 billion in 2025-2026,6 attributable to, among other things, the effect of increased traffic related to the greater-than-expected resumption of post-pandemic activities on the miscellaneous revenue of bodies in the health and social services, education and higher education networks; |

| — | a decrease in revenue from government enterprises of $1.6 billion in 2023-2024, $1.3 billion in 2024-2025 and $382 million in 2025-2026. These decreases are primarily related to Hydro-Québec, whose results have been adjusted downwards over the entire period, due, in particular, to the decrease in the volume of its exports resulting from low runoff in the regions where its main basins are located; |

| — | an increase in federal transfers of $1.5 billion in 2023-2024, followed by decreases of $344 million and $480 million in 2024-2025 and 2025-2026, respectively; |

| — | The increase in 2023-2024 is attributable to a downward adjustment of the value of the special Québec abatement (16.5% of federal personal income tax), which is deducted from federal transfers, as well as the Housing Accelerator Fund agreement ($900 million over four years), among other things. |

| — | The decreases in 2024-2025 and 2025-2026 are due, in particular, to the consideration of population data from the 2021 census. The adjustments are also due to the pace of realization of federally funded infrastructure projects.7 |

| 6. | Pandemic-related public health measures reduced the government’s miscellaneous revenue in 2019-2020 and 2020-2021. The gradual resumption of activities led to sustained growth from 2021-2022 to 2023-2024. In 2022-2023 and 2023-2024, the greater-than-expected increase in traffic has offset the slowdown caused by the pandemic. The 2.8% average growth forecast thereafter, from 2024-2025 to 2028-2029, is lower than in the five years prior to the pandemic, when it stood at 4.4% from 2014-2015 to 2018-2019. |

| 7. | Adjustments to federal transfer revenues stemming from the pace of realization of federally funded infrastructure projects have no impact on the budgetary balance, as a consideration is recorded in expenditures. |

Québec’s Financial

Situation | G.13 |

| — | an increase in portfolio expenditures of $1.5 billion in 2023-2024, $4.1 billion in 2024-2025 and $3.9 billion in 2025-2026; |

| — | These adjustments are primarily attributable to investment in public services—particularly to improve working conditions for public and parapublic sector employees—but also to a stronger-than-expected demographic growth, the pace of realization of infrastructure investments, the increased cost of refundable tax credits and the higher-than-expected post-pandemic resumption of activities for bodies in the health and social services and education networks. |

| — | an increase in debt service of $186 million in 2023-2024 due to higher-than-anticipated interest rates, followed by a decrease of $163 million in 2024-2025 and $381 million in 2025-2026, due, in particular, to better performance of the Retirement Plans Sinking Fund (RPSF) in 2022-2023; |

| — | a reduction of $292 million in deposits of dedicated revenues in the Generations Fund in 2023-2024 due to decreased realized investment income, which is attributable to the lower-than-forecast investment returns and lower water-power royalties. The downward adjustments of $165 million in 2024-2025 and $305 million in 2025-2026 are due, in particular, to decreased investment income attributable to planned withdrawals from the Generations Fund to repay borrowings. |

| G.14 | Budget 2024-2025 Budget Plan |

| n | Budget 2024-2025 initiatives |

In this budget, the government is planning initiatives of $1.9 billion for 2024-2025, that is:

| — | $1.1 billion for funding health and social services, education and higher education; |

| — | $438 million for supporting Quebecers and communities; |

| — | $441 million for acting on economic priorities. |

The total cost of the initiatives since Budget 2023-2024 is $1.4 billion in 2023-2024, $2.2 billion in 2024-2025 and $3.1 billion in 2025-2026.

| n | Steps to optimize government action |

The government is also taking steps to optimize government action8 representing $431 million over three years, and aimed at:

| — | adjusting certain tax assistance measures for businesses; |

| — | asking government enterprises for optimization efforts; |

| — | continuing tobacco control efforts; |

| — | ensuring the fairness and integrity of the tax system. |

| n | Gap to be bridged for achieving fiscal balance in operations |

The government is taking action to achieve fiscal balance in operations by 2027-2028, if no events trigger the use of the contingency reserve.

To this end, it plans to bridge a gap of $750 million in 2025-2026, reaching $2.0 billion in 2028-2029. To achieve this, the government has various levers at its disposal:

| — | it is launching two review processes in spring 2024, one for tax expenditures and one for budgetary expenditures; |

| — | it is continuing to make representations to the federal government to obtain its fair share of federal transfers; |

| — | it is continuing its commitment to create more wealth and increase Québec’s economic potential by investing $1.9 billion to act on economic priorities. |

| 8. | For more details, see Section E, “Optimizing Government Action.” |

Québec’s Financial

Situation | G.15 |

| n | Contingency reserve adjustment |

The $1.5-billion contingency reserve that was provided for in Budget 2023-2024 was fully utilized in 2023-2024. Due to the uncertainty surrounding the economic forecast, the provision of $1.0 billion in the last budget has been adjusted upwards by $500 million for 2024-2025 and 2025-2026.

| — | A contingency reserve of $1.5 billion per year as of 2024-2025, or $7.5 billion over five years, could be used, in particular, to offset the effects of more moderate-than-expected economic growth, should this occur, and the uncertainty that could affect longer-term economic and financial forecasts. |

| G.16 | Budget 2024-2025 Budget Plan |

Budget 2024-2025 initiatives

The initiatives in Budget 2024-2025 total $8.8 billion over six years, as follows:

| – | $4.9 billion for funding health and social services, education and higher education; |

| – | $2.0 billion for supporting Quebecers and communities; |

| – | $1.9 billion for acting on economic priorities. |

The government is also taking steps to optimize its action, representing additional revenue of $2.9 billion over five years.

Financial impact of the initiatives of Budget 2024-2025

| (millions of dollars) |

| | 2023-2024- | 2024-2025- | 2025-2026- | 2026-2027- | 2027-2028- | 2028-2029- | Total |

| Initiatives | | | | | | | |

| Funding health and social services, education and higher education | −188 | −1 058 | −925 | −935 | −907 | −903 | −4 916 |

| Supporting Quebecers and communities | −129 | −438 | −486 | −411 | −282 | −282 | −2 028 |

| Acting on economic priorities | — | −441 | −596 | −285 | −265 | −271 | −1 858 |

| Subtotal – Initiatives | −317 | −1 937 | −2 007 | −1 631 | −1 454 | −1 456 | −8 801 |

| Optimizing government action | — | 86 | 345 | 607 | 847 | 1 017 | 2 903 |

| TOTAL | −317 | −1 851 | −1 662 | −1 023 | −607 | −439 | −5 898 |

Québec’s Financial

Situation | G.17 |

Recap of November 2023 initiatives

In the Update on Québec’s Economic and Financial Situation – Fall 2023, the government announced investments totalling $1.1 billion in 2023-2024, $251 million in 2024-2025 and $1.1 billion in 2025-2026.

These investments have made it possible to introduce initiatives for:

– providing better access to housing;

– combatting homelessness and enhancing food aid;

– supporting training in specific fields;

– sustaining the climate transition and communities;

– fostering business investment.

Financial impact of the initiatives of Budget 2024-2025

| (millions of dollars) |

| | 2023-2024- | 2024-2025- | 2025-2026- | 2026-2027- | 2027-2028- | Total |

| Providing better access to housing | −219 | −15 | −853 | −519 | −243 | −1 848 |

| Combatting homelessness and enhancing food aid | −39 | −26 | −27 | −27 | −27 | −145 |

| Supporting training in specific fields | −199 | −130 | — | — | — | −329 |

| Sustaining the climate transition and communities | −649 | −101 | −77 | −96 | −40 | −961 |

| Fostering business investment | 5 | 21 | −133 | −372 | −516 | −995 |

| TOTAL | −1 101 | −251 | −1 089 | −1 013 | −825 | −4 279 |

| G.18 | Budget 2024-2025 Budget Plan |

Adjustments since the 2023 fall update

Since the publication of the Update on Québec’s Economic and Financial Situation – Fall 2023, adjustments to the financial framework are due, in particular, to stagnant economic activity, major investment in public services, stronger-than-expected demographic growth and the pace of realization of infrastructure investments.

| – | To achieve fiscal balance in operations as early as 2027-2028, the government is taking immediate steps to optimize government action and is implementing two review processes for tax and budgetary expenditures. |

Adjustments to the financial framework since the 2023 fall update

| (millions of dollars) |

| | 2023-2024 | 2024-2025 | 2025-2026 |

| BUDGETARY BALANCE(1) – NOVEMBER 2023 | −3 995 | −2 982 | −1 975 |

| ECONOMIC AND BUDGETARY SITUATION | | | |

| Own-source revenue excluding revenue from government enterprises | | | |

| – Tax revenue | −1 702 | −554 | −297 |

| – Other revenue | 413 | 304 | 273 |

| Subtotal | −1 289 | −250 | −24 |

| Revenue from government enterprises | −779 | −1 060 | −402 |

| Subtotal – Own-source revenue | −2 068 | −1 310 | −426 |

| Federal transfers | −207 | −443 | −1 052 |

| Subtotal – Revenue | −2 275 | −1 753 | −1 478 |

| Portfolio expenditures | −592 | −3 210 | −3 260 |

| Debt service | 217 | 216 | 415 |

| Subtotal – Expenditure | −375 | −2 994 | −2 845 |

| Deposits of dedicated revenues in the Generations Fund | 160 | 82 | 224 |

| TOTAL ADJUSTMENTS TO THE ECONOMIC AND BUDGETARY SITUATION | −2 490 | −4 666 | −4 100 |

| MARCH 2024 INITIATIVES | | | |

| Funding health and social services, education and higher education | −188 | −1 058 | −925 |

| Supporting Quebecers and communities | −129 | −438 | −486 |

| Acting on economic priorities | — | −441 | −596 |

| TOTAL INITIATIVES | −317 | −1 937 | −2 007 |

| Optimizing government action | — | 86 | 345 |

| Gap to be bridged for achieving fiscal balance in operations | — | — | 750 |

| Contingency reserve | 500 | −1 500 | −1 500 |

| BUDGETARY BALANCE(1) – MARCH 2024 | −6 302 | −10 998 | −8 486 |

Note: Totals may not add due to rounding.

| (1) | Budgetary balance within the meaning of the Balanced Budget Act. |

Québec’s Financial

Situation | G.19 |

| 1.2 | Detailed adjustments in 2023-2024 |

In 2023-2024, the budgetary deficit stood at $6.3 billion. This represents a decrease of $2.3 billion compared to the budgetary balance forecast in March 2023, due to the following in particular:

| — | an $893-million reduction in own-source revenue excluding revenue from government enterprises, mainly resulting from the downward adjustment of tax revenue attributable to stagnant economic activity; |

| — | a $1.6-billion decline in revenue from government enterprises, primarily due to the decrease in the value of Hydro-Québec’s exports resulting from low runoff in the regions where its main basins are located; |

| — | a $1.5-billion increase in federal transfers, mainly due to a decrease in the value of the special Québec abatement, which is deducted from federal transfers, the pace of realization of federally funded infrastructure projects, as well as the Housing Accelerator Fund agreement; |

| — | a $3.0-billion increase in portfolio expenditures attributable to: |

| — | higher-than expected expenditures of $1.5 billion, particularly due to the adjustment to the pace of realization of local infrastructure projects and the update to the social housing construction plan, |

| — | targeted initiatives announced in the Update on Québec’s Economic and Financial Situation – Fall 2023 totalling $1.1 billion, in particular to sustain the climate transition and communities as well as to provide better access to housing, |

| — | new initiatives announced in Budget 2024-2025 totalling $317 million, in particular to help students with difficulties going back into the classroom following the strike by school staff and to fund low-rental housing stock renovations; |

| — | a $186-million increase in debt service, primarily due to higher-than-anticipated interest rates; |

| — | the use of the $1.5-billion contingency reserve, which was set aside in March 2023; |

| — | a $292-million decrease in deposits of dedicated revenues in the Generations Fund, primarily due to a decrease in realized investment income and lower water-power royalties. |

| G.20 | Budget 2024-2025 Budget Plan |

TABLE G. 5

Adjustments to the 2023-2024 financial framework since March 2023

| (millions of dollars) |

| | 2023-2024 |

| | March 2023 | Adjustments | March 2024 |

| | | Economic and budgetary

situation | Initiatives

and other

adjustments | Total | |

| Own-source revenue | | | | | |

| Tax revenue | 92 736 | −2 400 | 5 | −2 395 | 90 341 |

| Other revenue | 18 446 | 1 502 | — | 1 502 | 19 948 |

| Subtotal | 111 182 | −898 | 5 | −893 | 110 289 |

| Revenue from government enterprises | 6 807 | −1 610 | — | −1 610 | 5 197 |

| Total own-source revenue | 117 989 | −2 508 | 5 | −2 503 | 115 486 |

| Federal transfers | 29 742 | 1 548 | — | 1 548 | 31 290 |

| Revenue | 147 731 | −960 | 5 | −955 | 146 776 |

| Portfolio expenditures | −138 392 | −1 532 | −1 423 | −2 955 | −141 347 |

| Debt service | −9 464 | −186 | — | −186 | −9 650 |

| Expenditure | −147 856 | −1 718 | −1 423 | −3 141 | −150 997 |

| Contingency reserve | −1 500 | — | 1 500 | 1 500 | — |

| SURPLUS (DEFICIT) FROM OPERATIONS | −1 625 | −2 678 | 82 | −2 596 | −4 221 |

| Deposits of dedicated revenues in the Generations Fund | −2 373 | 292 | — | 292 | −2 081 |

| BUDGETARY BALANCE(1) | −3 998 | −2 386 | 82 | −2 304 | −6 302 |

Note: Totals may not add due to rounding.

| (1) | Budgetary balance within the meaning of the Balanced Budget Act. |

Québec’s Financial

Situation | G.21 |

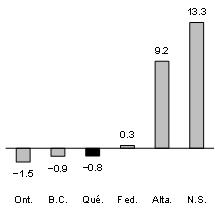

| q | Own-source revenue excluding revenue from government enterprises |

For 2023-2024, own-source revenue excluding revenue from government enterprises is adjusted downwards by $893 million compared to the Budget 2023-2024 forecasts and totals $110.3 billion.

| — | Tax revenue is adjusted downwards by $2.4 billion due to stagnant economic activity. |

| — | Other revenue, namely duties and permits and miscellaneous revenue, is adjusted upwards by $1.5 billion. |

TABLE G. 6

Adjustments in own-source revenue excluding revenue from government enterprises

| (millions of dollars) |

| | 2023-2024 |

| OWN-SOURCE REVENUE(1) – MARCH 2023 | 111 182 |

| Tax revenue | |

| Personal income tax | −737 |

| Contributions for health services | 354 |

| Corporate taxes | −1 793 |

| School property tax | −47 |

| Consumption taxes | −172 |

| Subtotal | −2 395 |

| Other revenue | |

| Duties and permits | 93 |

| Miscellaneous revenue(2),(3) | 1 409 |

| Subtotal | 1 502 |

| Total adjustments | −893 |

| OWN-SOURCE REVENUE(1) – MARCH 2024 | 110 289 |

| (1) | Own-source revenue excluding revenue from government enterprises. |

| (2) | This adjustment is due, in particular, to higher-than-expected revenue for bodies in the health and social services, education and higher education networks, which is attributable to the effect of increased traffic related to the greater-than-expected post-pandemic recovery, among other things. It also stems from the impact of higher interest rates on tax claims administered by Revenu Québec. |

| (3) | This higher revenue is offset by upward adjustments in spending by bodies in the health and social services, education and higher education networks in 2023-2024. |

| G.22 | Budget 2024-2025 Budget Plan |

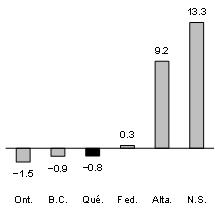

A downward adjustment of more than $2 billion

in tax revenue in 2023-2024

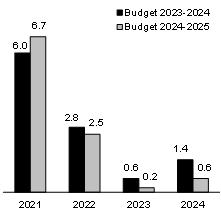

In Québec, persistent inflation and the effects of tighter-than-expected monetary policy moderated economic activity in 2023. After two years of sustained growth, real GDP stagnated in 2023, posting growth of 0.2%.

| – | The economic outlook for 2024 has also deteriorated. Real GDP growth for 2024 has been adjusted downwards compared with what was expected in Budget 2023-2024, from 1.4% to 0.6%. |

The weaker-than-expected economic outlook has a negative impact of around $2.4 billion on tax revenue in 2023-2024, given that it is closely tied to the main economic indicators.

| – | Corporate taxes have been adjusted downwards by $1.8 billion, due to the downward adjustment of 6.1 percentage points in the net operating surplus of corporations in 2023, from −4.9% to −11.0%. |

| – | Personal income tax has been adjusted downwards by $737 million due to lower-than-expected tax revenue since March 2023. |

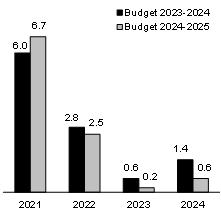

| Real GDP – 2021 to 2024 | | Tax revenue – 2023-2024 |

(percentage change) | (adjustments in millions of dollars

since March 2023) |

|

|

| Notes: TR: tax revenue. CT: corporate taxes.

PIT: personal income tax.

COT: consumption taxes.

HSF: contributions for health services.

SPT: school property tax. |

Québec’s Financial

Situation | G.23 |

For 2023-2024, revenue from personal income tax is adjusted downwards by $737 million compared to the March 2023 forecast.

| — | This adjustment is due to lower-than-expected tax revenue at the end of fiscal 2022-2023 and in 2023-2024, despite the upward adjustment of wages and salaries by 2.3 percentage points in 2023. |

Contributions for health services are adjusted upwards by $354 million in 2023-2024 compared to the March 2023 forecast.

| — | This improvement can be attributed, in particular, to strong wages and salaries, whose growth was adjusted upwards by 2.3 percentage points in 2023, from 3.7% to 6.0%. |

Revenue from corporate taxes is adjusted downwards by $1.8 billion in 2023-2024.

| — | This decrease can primarily be attributed to the net operating surplus of corporations, whose change was adjusted downwards by 11.7 percentage points in 2022, from 1.5% to −10.2%, and by 6.1 percentage points in 2023, from –4.9% to −11.0%. |

Revenue from the school property tax is adjusted downwards by $47 million in 2023-2024.

| — | This decrease is due in part to the additional contribution from the Québec government to limit the average increase in school taxes to 3% for 2023-2024.9 |

Consumption tax revenue, which is derived mainly from the Québec sales tax, is adjusted downwards by $172 million in 2023-2024.

| — | This decrease is primarily due to residential construction investments, whose change was adjusted downwards by 8.7 percentage points in 2023, from −7.1% to −15.8%. |

| — | However, this is offset in part by household consumption,10 whose growth was adjusted upwards by 1.6 percentage points in 2023, from 4.0% to 5.6%. |

| 9 | For more details, see the June 16, 2023 press release “Le gouvernement limite la hausse du compte de taxe scolaire,” [Online] http://www.finances.gouv.qc.ca/documents/Communiques/ fr/COMFR_20230616_1.pdf (in French only). |

| 10 | Household consumption excluding food expenditures and shelter. |

| G.24 | Budget 2024-2025 Budget Plan |

In 2023-2024, revenue from duties and permits is adjusted upwards by $93 million compared to the March 2023 forecast.

This improvement is particularly due to the higher-than-expected revenue from the auction of GHG emission allowances.

Miscellaneous revenue11 is adjusted upwards by $1.4 billion in 2023-2024.

| — | This increase is due, in particular, to higher-than-expected revenue for bodies in the health and social services, education and higher education networks,12 which is attributable to the effect of increased traffic related to the greater-than-expected post-pandemic recovery, among other things. |

| — | It also stems from the impact of higher interest rates on tax claims administered by Revenu Québec. |

| 11 | Miscellaneous revenue includes revenues from interest, the sale of goods and services, tuition fees, user contributions, as well as from fines, forfeitures and recoveries, among other things. |

| 12 | This higher revenue is offset by upward adjustments in spending by bodies in the health and social services, education and higher education networks in 2023-2024. |

Québec’s Financial

Situation | G.25 |

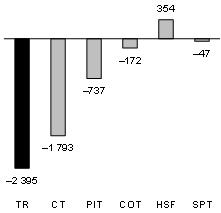

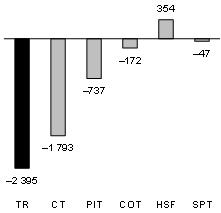

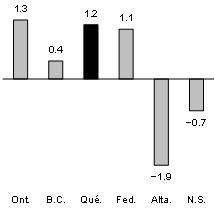

A downward adjustment of own-source revenue in Québec

and other Canadian provinces in 2023-2024

In Québec, own-source revenue1 in 2023-2024 has been adjusted downwards by $893 million, or 0.8%, since the March 2023 budget, due to the following in particular:

| – | the downward adjustment of the net operating surplus of corporations, resulting in a decrease in expected corporate taxes; |

| – | lower-than-expected personal income tax revenues. |

This is also the case for Ontario, which has adjusted its revenue downwards by 1.5%, due to personal income tax and corporate taxes, and British Columbia, which has adjusted its revenue downwards by 0.9%, mainly due to a drop in revenue from natural resources. Alberta, on the other hand, has adjusted its own-source revenue upwards by 9.2%, due, in particular, to tax revenue, investment income and natural resources.

Although an economic environment that is more favourable to growth is expected as of the second half of 2024, a number of risks could influence own-source revenue forecasts in Québec. For example:

| – | higher-than-expected energy prices could impact activity in certain sectors and adversely affect corporate profits, which would have a negative effect on revenue from corporate taxes; |

| – | the impacts of monetary policy on households’ disposable income and purchasing power could be more pronounced than expected, which would have a negative impact on revenue from consumption taxes. |

| Own-source revenue(1) – 2023-2024 | | Nominal GDP – 2023 |

| (adjustment as a percentage of revenue) | | (adjustment in percentage points) |

| |  |

(1) Own-source revenue excluding revenue from government enterprises. Sources: 2024-2025 budgets for Nova Scotia, Alberta, British Columbia and Québec, financial report for the third quarter of 2023 for Ontario and the federal government’s fall update. | | Sources: 2024-2025 budgets for Nova Scotia, Alberta, British Columbia and Québec, financial report for the third quarter of 2023 for Ontario and the federal government’s fall update. |

| 1 | Own-source revenue excluding revenue from government enterprises. |

| G.26 | Budget 2024-2025 Budget Plan |

q | Revenue from government enterprises |

For 2023-2024, revenue from government enterprises is adjusted downwards by $1.6 billion to $5.2 billion.

This adjustment is primarily due to:

| — | a decline in the revenue from Hydro-Québec, in connection to the decrease in its exports resulting from low runoff in the regions where its main basins are located; |

| — | When Hydro-Québec’s reservoirs are lower and it has less electricity to sell, exports are reduced as Hydro-Québec must meet the needs of Quebecers. |

| — | a decline in the revenue from Investissement Québec, due, in particular, to the lower returns on its venture capital portfolios and its investment funds. |

TABLE G.7

Adjustments to revenue from government enterprises

| (millions of dollars) |

| | 2023-2024 |

| REVENUE FROM GOVERNMENT ENTERPRISES – MARCH 2023 | 6 807 |

| Hydro-Québec | −1 525 |

| Loto-Québec | 9 |

| Société des alcools du Québec | −29 |

| Investissement Québec | −107 |

| Société québécoise du cannabis(1) | 9 |

| Other(2) | 33 |

| Total adjustments | −1 610 |

| REVENUE FROM GOVERNMENT ENTERPRISES – MARCH 2024 | 5 197 |

| (1) | Revenue is allocated to the Fund to Combat Addiction. |

| (2) | The other government enterprises are the Société ferroviaire et portuaire de Pointe-Noire, Capital Financière agricole, the Société du parc industriel et portuaire de Bécancour and the Fonds d’investissement Eurêka. |

Québec’s Financial

Situation | G.27 |

In 2023-2024, revenues from federal transfers stand at $31.3 billion, an upward adjustment of $1.5 billion compared to Budget 2023-2024.

This upward adjustment is due to a decrease in the value of the special Québec abatement of $333 million,13 which is deducted from federal transfers. Lower tax revenues stemming from federal personal income tax revenues are indeed expected. The adjustment is also due to the pace of realization of federally funded infrastructure projects,14 as well as the Housing Accelerator Fund agreement, which was signed in November 2023 ($900 million over four years).

TABLE G.8

Adjustments to federal transfer revenues

| (millions of dollars) |

| | 2023-2024 |

| FEDERAL TRANSFERS – MARCH 2023 | 29 742 |

| Equalization | — |

| Health transfers | 118 |

| Transfers for post-secondary education and other social programs | 85 |

| Other programs, including: | 1 345 |

| – Federal transfers of the Société de financement des infrastructures locales | 564 |

| – Housing Accelerator Fund agreement ($900 million over four years) | 225 |

| Total adjustments | 1 548 |

| FEDERAL TRANSFERS – MARCH 2024 | 31 290 |

| 13 | The downward adjustment to the value of the special Québec abatement, which corresponds to 16.5% of the federal personal income tax, led to an increase of $168 million in health transfers, $103 million in transfers for post-secondary education and other social programs, and $62 million for other programs. |

| 14 | Adjustments to federal transfer revenues stemming from the pace of realization of federally funded infrastructure projects have no impact on the budgetary balance, as a consideration is recorded in expenditures. |

| G.28 | Budget 2024-2025 Budget Plan |

For 2023-2024, portfolio expenditures amount to $141.3 billion, which represents an upward adjustment of $3.0 billion compared to the March 2023 forecasts.

The adjustment is primarily due to $1.4 billion in new initiatives announced since Budget 2023-2024, including:

| — | $649 million for sustaining the climate transition and communities; |

| — | $387 million for funding health and social services, education and higher education; |

| — | $387 million for supporting Quebecers and communities. |

In addition, adjustments to the economic and budgetary situation total $1.5 billion and are primarily due to the update to the social housing construction plan and the adjustment to the pace of realization of local infrastructure projects.

TABLE G.9

Adjustments to portfolio expenditures |

| (millions of dollars) |

| | 2023-2024 |

| PORTFOLIO EXPENDITURES – MARCH 2023 | 138 392 |

| New initiatives since March 2023 | |

| Sustaining the climate transition and communities | 649 |

| Funding health and social services, education and higher education | 387 |

| Supporting Quebecers and communities | 387 |

| Subtotal – New initiatives since March 2023 | 1 423 |

| Adjustments to the economic and budgetary situation | |

| Update to the social housing construction plan | 668 |

| Adjustment to the pace of realization of local infrastructure projects(1) | 599 |

| Other items | 265 |

| Subtotal – Adjustments to the economic and budgetary situation | 1 532 |

| Total adjustments | 2 955 |

| PORTFOLIO EXPENDITURES – MARCH 2024 | 141 347 |

Note: Totals may not add due to rounding.

| (1) | Projects financed by the Société de financement des infrastructures locales. These projects benefit in part from federal funding; for this portion, the expenditure has no effect on the budgetary balance, as a consideration is recorded in the federal transfer revenues. |

Québec’s Financial

Situation | G.29 |

For 2023-2024, the debt service is adjusted upwards by $186 million, to $9.7 billion, primarily due to higher-than-anticipated interest rates.

| TABLE G.10 | |

| | |

| Adjustments to debt service | |

(millions of dollars)

| | 2023-2024 |

| DEBT SERVICE – MARCH 2023 | 9 464 |

| Interest on direct debt(1) | 167 |

| Interest on the liability for the retirement plans and other employee future benefits(2) | 19 |

| Total adjustments | 186 |

| DEBT SERVICE – MARCH 2024 | 9 650 |

| (1) | Interest on direct debt includes the income of the Sinking Fund for Government Borrowing. This income, which is deducted from debt service, consists of interest generated on investments as well as gains and losses on disposal. The forecast for this income may be adjusted upwards or downwards since it is closely tied to the change in interest rates and market behaviour. |

| (2) | This corresponds to the interest on obligations relating to the retirement plans and other employee future benefits of public and parapublic sector employees, minus mainly the investment income of the Retirement Plans Sinking Fund (RPSF). |

| G.30 | Budget 2024-2025 Budget Plan |

| 2. | RESTORING FISCAL BALANCE |

The current economic and budgetary context is adding significant pressure to the financial framework, both through a reduction in revenue resulting from the stagnation of the economy and low runoff in Hydro-Québec’s basins, and through an increase in expenditures due, in part, to a major investment in public services aimed in particular at improving the working conditions of employees in the public and parapublic sectors, stronger-than-expected demographic growth and the pace of realization of infrastructure investments.

| q | A gradual approach to restoring fiscal balance |

Given the uncertain economic context, the government will table a plan to restore fiscal balance when Budget 2025-2026 is released. Thus, fiscal balance within the meaning of the Balanced Budget Act will be achieved by 2029-203015 at the latest.

The structural deficit of nearly $4 billion observed from 2026-2027 to 2028-2029 will have to be eliminated to restore fiscal balance within the meaning of the Balanced Budget Act, after deposits of dedicated revenues in the Generations Fund. To achieve this, the government will need to increase the gap between the average annual growth in revenue and the one in expenditure from 0.4 percentage points to 1.1 percentage points.16

CHART G.1

Change in the budgetary balance |

| (millions of dollars) |

|

| 15 | See Appendix 2 for the report on the application of the Balanced Budget Act. |

| 16 | To restore fiscal balance, the government must increase the gap between revenue and expenditure. Over the period covered by the financial framework, that is, until 2028-2029, the average annual growth in revenue (AAGR) will reach 3.3%. Meanwhile, average annual growth in expenditure will reach 2.9%. The gap in growth is currently equivalent to 0.4 percentage points. In order to eliminate the structural deficit, the Ministère des Finances estimates that this gap will need to reach 1.1 percentage points by 2028-2029. |

Québec’s Financial

Situation | G.31 |

In the meantime, the government is taking action to achieve fiscal balance in operations by 2027-2028, if no events trigger the use of the contingency reserve. To this end, it is relying on four levers:

| — | it is taking immediate steps representing $2.9 billion over five years to optimize government action; |

| — | it is launching two review processes in spring 2024, one for tax expenditures and one for budgetary expenditures; |

| — | it is continuing to make representations to the federal government to obtain its fair share of federal transfers; |

| — | it is continuing its commitment to create more wealth and increase Québec’s economic potential by investing $1.9 billion to act on economic priorities. |

| ■ | Steps to optimize government action |

When large deficits are not eliminated, they limit the government’s ability to ensure delivery of public services and intergenerational fairness. As such, in order to optimize government action, in Budget 2024-2025, the government is announcing measures17 totalling nearly $2.9 billion over five years with the aim of:

| — | adjusting certain tax assistance measures for businesses; |

| — | asking government enterprises for optimization efforts; |

| — | continuing tobacco control efforts; |

| — | ensuring the fairness and integrity of the tax system. |

| ■ | Obtaining a fair share of federal transfers |

The government is continuing to make representations to the federal government to obtain its fair share of federal transfers.

The federal government must reimburse Québec for the costs incurred for providing services to asylum seekers. It must also increase its transfers to the provinces in the areas of health, infrastructure and workforce development. Québec is also asking for unconditional opt-out with full financial compensation from the Canadian Dental Care Plan and any future Canadian drug benefit plan.

| — | The weak growth in federal transfers is leading to budgetary pressure, which is increasing the efforts required to restore fiscal balance.18 |

| 17 | For more details, see Section E, “Optimizing Government Action”. |

| 18 | Weak growth in federal transfers is expected between now and 2028-2029. An average annual growth rate of 0.5% over five years, from 2024-2025 to 2028-2029, is anticipated. This contrasts with an average annual growth rate of 5.4% for the past 10 years. |

| G.32 | Budget 2024-2025 Budget Plan |

| ■ | Expected results of government intervention review processes |

The expenditure review processes will begin as of spring 2024. One process will cover tax expenditures related to both the personal and corporate tax systems as well as the consumption tax system, while the second process will cover expenditures by government departments and bodies.19

The two review processes will make it possible to identify the first sources of savings that will pave the way to a balanced budget after deposits of dedicated revenues in the Generations Fund by 2029-2030. They will be incorporated into the plan to restore fiscal balance, which will be tabled at the same time as Budget 2025-2026.

| — | At that time, the government is expecting the economic situation to be less uncertain and the Québec economy to be closer to its potential. The government will therefore be in a better position to identify the path and additional actions that will result in a balanced budget within the meaning of the Balanced Budget Act by 2029-2030. |

As a result, fiscal balance will be restored by ensuring stable, predictable funding for the government’s main missions and without increasing the tax burden on Quebecers.

| q | A prudent and responsible financial framework |

The financial framework presents a fair and transparent portrait of the state of public finances. Despite the deficits anticipated in 2024-2025 and subsequent years, the financial framework remains prudent and responsible.

| — | A contingency reserve of $7.5 billion over five years is included in the financial framework to offset the effects of a temporary decline in economic activity, should one occur, and the uncertainty that could affect longer-term economic and financial forecasts. |

| — | Net debt reduction targets are maintained despite a change to the rate of reduction. |

| — | Deposits in the Generations Fund are continuing. They will reach $2.7 billion in 2028-2029. |

| 19 | For more details, see Section E, “Optimizing Government Action.” |

Québec’s Financial

Situation | G.33 |

| 3. | Revenue and expenditure forecasts |

Budget 2024-2025 presents the short-term change in revenue and expenditure, that is, the three-year outlook for 2023-2024 to 2025-2026.

TABLE G.11

Change in revenue and expenditure

(millions of dollars, unless otherwise indicated)

| | 2023-2024 | 2024-2025 | 2025-2026 | AAGR(1) |

| Revenue | | | | |

| Own-source revenue excluding revenue from government enterprises | 110 289 | 115 486 | 119 873 | |

| % change | 1.2 | 4.7 | 3.8 | 3.2 |

| Revenue from government enterprises | 5 197 | 5 418 | 6 257 | |

| % change | −21.5 | 4.3 | 15.5 | −1.9 |

| Federal transfers | 31 290 | 29 397 | 30 428 | |

| % change | 8.9 | −6.0 | 3.5 | 1.9 |

| Total revenue | 146 776 | 150 301 | 156 558 | |

| % change | 1.7 | 2.4 | 4.2 | 2.8 |

| Expenditure | | | | |

| Portfolio expenditures | −141 347 | −147 815 | −152 492 | |

| % change | 3.0 | 4.6 | 3.2 | 3.6 |

| Debt service | −9 650 | −9 762 | −9 583 | |

| % change | −4.1 | 1.2 | −1.8 | −1.6 |

| Total expenditure | −150 997 | −157 577 | −162 075 | |

| % change | 2.5 | 4.4 | 2.9 | 3.2 |

| Gap to be bridged for achieving fiscal balance in operations | — | — | 750 | |

| SURPLUS (DEFICIT) FROM OPERATIONS BEFORE CONTINGENCY RESERVE | −4 221 | −7 276 | −4 767 | |

| Contingency reserve | — | −1 500 | −1 500 | |

| SURPLUS (DEFICIT) FROM OPERATIONS | −4 221 | −8 776 | −6 267 | |

| Deposits of dedicated revenues in the Generations Fund | −2 081 | −2 222 | −2 219 | |

| BUDGETARY BALANCE(2) | −6 302 | −10 998 | −8 486 | |

| (1) | Average annual growth rate, corresponding to the geometric mean over three years, from 2023-2024 to 2025-2026. |

| (2) | Budgetary balance within the meaning of the Balanced Budget Act. |

| | Québec’s Financial

Situation | G.35 |

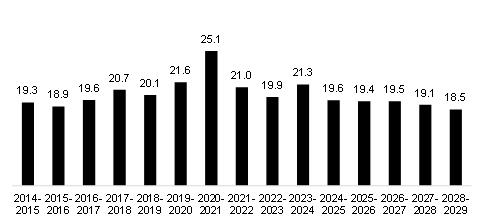

Government revenue encompasses own-source revenue, including revenue from government enterprises, as well as revenue from federal transfers.

Government revenue stands at $146.8 billion in 2023-2024, or $115.5 billion in own-source revenue and $31.3 billion from federal transfers.

| — | In 2023-2024, own-source revenue represents 78.7% of government revenue, while revenue from federal transfers represents 21.3%. |

Government revenue will stand at $150.3 billion in 2024-2025 and $156.6 billion in 2025-2026, representing respective growth of 2.4% and 4.2%.

TABLE G. 12

Change in revenue

| (millions of dollars, unless otherwise indicated) |

| | 2023-2024 | 2024-2025 | 2025-2026 | AAGR(1) |

| Own-source revenue | | | | |

| Own-source revenue excluding revenue from government enterprises | 110 289 | 115 486 | 119 873 | |

| % change(2) | 1.2 | 4.7 | 3.8 | 3.2 |

| Revenue from government enterprises | 5 197 | 5 418 | 6 257 | |

| % change | −21.5 | 4.3 | 15.5 | −1.9 |

| Subtotal | 115 486 | 120 904 | 126 130 | |

| % change | −0.1 | 4.7 | 4.3 | 3.0 |

| Federal transfers | 31 290 | 29 397 | 30 428 | |

| % change | 8.9 | −6.0 | 3.5 | 1.9 |

| TOTAL | 146 776 | 150 301 | 156 558 | |

| % change | 1.7 | 2.4 | 4.2 | 2.8 |

| (1) | Average annual growth rate, corresponding to the geometric mean over three years, from 2023-2024 to 2025-2026. |

| (2) | In 2023-2024, the growth in own-source revenue excluding revenue from government enterprises reflects the stagnation in economic activity in 2023 and the 1-percentage-point decrease in the bottom two tax rates announced in Budget 2023-2024. |

| | Budget 2024-2025 |

| G.36 | Budget Plan |

| 3.1.1 | Own-source revenue excluding revenue

from government enterprises |

Own-source revenue excluding revenue from government enterprises consists mainly of tax revenue, including personal income tax, contributions for health services, corporate taxes, school property tax and consumption taxes.

| — | Changes in own-source revenue generally reflect changes in economic activity in Québec and in the tax system. |

Own-source revenue also includes other sources of revenue:

| — | duties and permits, in particular revenue from the carbon market; |

| — | miscellaneous revenue, such as tuition fees and revenues from interest, the sale of goods and services, as well as fines, forfeitures and recoveries. |

In 2023-2024, own-source revenue stands at $110.3 billion, an increase of 1.2% compared to 2022-2023. It will reach $115.5 billion in 2024-2025 and $119.9 billion in 2025-2026, growing by 4.7% and 3.8%, respectively.

TABLE G. 13

Change in own-source revenue excluding revenue from government enterprises – Summary

| (millions of dollars, unless otherwise indicated) |

| | 2023-2024 | 2024-2025 | 2025-2026 | AAGR(1) |

| Tax revenue | 90 341 | 95 039 | 98 896 | |

| % change(2) | −0.9 | 5.2 | 4.1 | 2.8 |

| Other revenue | 19 948 | 20 447 | 20 977 | |

| % change(3) | 11.9 | 2.5 | 2.6 | 5.6 |

| TOTAL | 110 289 | 115 486 | 119 873 | |

| % change | 1.2 | 4.7 | 3.8 | 3.2 |

| (1) | Average annual growth rate, corresponding to the geometric mean over three years, from 2023-2024 to 2025-2026. |

| (2) | In 2023-2024, the change in tax revenue is due to the 0.3% increase in revenue from personal income tax, stemming, in particular, from the 6.0% increase in wages and salaries in 2023 and the 1-percentage-point decrease in the bottom two tax rates announced in Budget 2023-2024. The change in tax revenue is also attributable to the −13.9% change in corporate tax revenue, associated with the 11.0% decline in the net operating surplus of corporations in 2023. |

| (3) | In 2023-2024, the growth in other revenue is mainly due to the 16.8% increase in miscellaneous revenue, related, in particular, to the increase in the investment income of the Generations Fund, which rose from $283 million in 2022-2023 to $590 million in 2023-2024, the impact of higher interest rates on tax claims administered by Revenu Québec and the increase in miscellaneous revenue from non-budget-funded bodies, special funds and bodies in the health and social services, education and higher education networks. |

| | Québec’s Financial

Situation | G.37 |

In 2023-2024, revenue from personal income tax, the government’s main revenue source, stands at $42.4 billion, up 0.3% compared to 2022-2023. It will reach $45.0 billion in 2024-2025 and $46.7 billion in 2025-2026, growing by 6.0% and 4.0%, respectively. Among other things, this change in revenue from personal income tax reflects:

| — | the increase in household income, including wages and salaries, which will grow by 6.0% in 2023, 5.1% in 2024 and 3.7% in 2025, due to the strong labour market; |

| — | the 1-percentage-point decrease in the bottom two tax rates announced in Budget 2023-2024 and beginning in the 2023 taxation year; |

| — | all the parameters of the personal income tax system, such as indexation and the progressive nature of the tax system. |

Contributions for health services stand at $8.3 billion in 2023-2024, representing an increase of 4.9%. They will reach $8.7 billion in 2024-2025 and $9.0 billion in 2025-2026, representing growth of 4.5% and 3.7%, respectively.

| — | This favourable change is due to the growth in wages and salaries, which stands at 6.0% in 2023 and will reach 5.1% in 2024 and 3.7% in 2025. |

Corporate tax revenue will reach $11.4 billion in 2023-2024, a change of −13.9% from 2022-2023. It will stand at $12.1 billion in 2024-2025 and $12.7 billion in 2025-2026, growing by 6.3% and 5.1%, respectively.

| — | These figures reflect the expected change in the net operating surplus of corporations, which stands at −11.0% in 2023, −2.5% in 2024 and 3.0% in 2025.20 |

Revenue from the school property tax stands at $1.1 billion in 2023-2024, up 2.2% compared to 2022-2023. It will reach $1.3 billion in 2024-2025 and $1.4 billion in 2025-2026, growing by 15.2% and 9.6%, respectively.

| — | This increase is influenced by changes in the amount for financing local needs, which considers the projected growth in student population and in the cost of services funded by the school property tax. |

| — | It also reflects the impact of the additional contribution of nearly $180 million per year from the Québec government to limit the increase in school taxes to 3%, on average, for 2023-2024. |

| 20 | The change in corporate tax revenue also reflects export growth, which stands at 5.4% in 2023, 2.8% in 2024 and 3.2% in 2025. |

| | Budget 2024-2025 |

| G.38 | Budget Plan |

TABLE G. 14

Change in own-source revenue excluding revenue

from government enterprises

| (millions of dollars, unless otherwise indicated) |

| | 2023-

2024 | 2024-

2025 | 2025-

2026 | AAGR(1) | |

| Tax revenue | | | | |

| Personal income tax | 42 389 | 44 952 | 46 746 | | |

| % change(2),(3) | 0.3 | 6.0 | 4.0 | 3.4 | |

| Contributions for health services | 8 298 | 8 670 | 8 991 | | |

| % change | 4.9 | 4.5 | 3.7 | 4.3 | |

| Corporate taxes | 11 399 | 12 116 | 12 729 | | |

| % change(4),(5) | −13.9 | 6.3 | 5.1 | −1.3 | |

| School property tax | 1 137 | 1 310 | 1 436 | | |

| % change(6) | 2.2 | 15.2 | 9.6 | 8.9 | |

| Consumption taxes | 27 118 | 27 991 | 28 994 | | |

| % change | 2.0 | 3.2 | 3.6 | 2.9 | |

| Subtotal | 90 341 | 95 039 | 98 896 | | |

| % change | −0.9 | 5.2 | 4.1 | 2.8 | |

| Other revenue | | | | | |

| Duties and permits | 5 832 | 5 940 | 6 274 | | |

| % change(7),(8) | 1.6 | 1.9 | 5.6 | 3.0 | |

| Miscellaneous revenue(9) | 14 116 | 14 507 | 14 703 | | |

| % change | 16.8 | 2.8 | 1.4 | 6.8 | |

| Subtotal | 19 948 | 20 447 | 20 977 | | |

| % change | 11.9 | 2.5 | 2.6 | 5.6 | |

| TOTAL | 110 289 | 115 486 | 119 873 | | |

| % change | 1.2 | 4.7 | 3.8 | 3.2 | |

| (1) | Average annual growth rate, corresponding to the geometric mean over three years, from 2023-2024 to 2025-2026. |

| (2) | In 2023-2024, the change in revenue from personal income tax is due to the 6.0% increase in wages and salaries in 2023 and the 1-percentage-point decrease in the bottom two tax rates announced in Budget 2023-2024 and beginning in the 2023 taxation year. |

| (3) | In 2024-2025, the growth in revenue from personal income tax is due, in particular, to the 5.1% increase in wages and salaries in 2024. |

| (4) | In 2023-2024, the change in revenue from corporate taxes is due, in particular, to the −11.0% change in the net operating surplus of corporations in 2023. |

| (5) | In 2024-2025, the growth in revenue from corporate taxes is primarily due to the decrease in the cost of certain measures, in particular the accelerated depreciation measure announced in the Update on Québec’s Economic and Financial Situation − Fall 2018 and the expensing measure announced in June 2021. This revenue grew despite the −2.5% change in the net operating surplus of corporations in 2024. |

| (6) | In 2023-2024, the growth in revenue from the school property tax reflects the impact of the additional contribution of nearly $180 million per year from the Québec government to limit the increase in school taxes to an average of 3% for 2023-2024. |

| (7) | In 2023-2024, the growth in revenue from duties and permits is due, in particular, to the increase in revenue from the auction of GHG emission allowances, offset in part by the decrease in revenue from natural resources. |

| (8) | In 2025-2026, the growth in revenue from duties and permits is due, in particular, to the increase in revenue from natural resources. |

| (9) | In 2023-2024, the 16.8% growth in miscellaneous revenue is due, in particular, to the increase in the investment income of the Generations Fund, which was below its usual level in 2022-2023, owing to the effect of higher interest rates on tax claims administered by Revenu Québec and the increase in the miscellaneous revenue of non-budget-funded bodies, special funds and bodies in the health and social services, education and higher education networks. |

| | Québec’s Financial

Situation | G.39 |

Consumption tax revenue totals $27.1 billion in 2023-2024, up 2.0% compared to 2022-2023. It will stand at $28.0 billion in 2024-2025 and $29.0 billion in 2025-2026, an increase of 3.2% and 3.6%, respectively.

The change in consumption tax revenue reflects, in particular:

| — | the projected growth in household consumption,21 which stands at 5.6% in 2023, 2.5% in 2024 and 3.6% in 2025; |

| — | the expected change in residential construction investment, which will fall by 15.8% in 2023 before rising by 2.6% in 2024 and 5.5% in 2025; |

| — | the two increases in the specific tax on tobacco products announced in Budget 2024-2025. |

| 21 | Household consumption excluding food expenditures and shelter. |

| | Budget 2024-2025 |

| G.40 | Budget Plan |

Revenue from duties and permits amounts to $5.8 billion in 2023-2024, an increase of 1.6% compared to 2022-2023. It will stand at $5.9 billion in 2024-2025 and $6.3 billion in 2025-2026, an increase of 1.9% and 5.6%, respectively.

| — | The change in revenue from duties and permits is due to the change in revenue from natural resources and from the auction of GHG emission allowances. |

| — | It is also due to the effect of capping the indexation of government rates at 3% as of January 1, 2023, for a period of four years, from 2023 to 2026. This cap concerns, in particular, driving licences and vehicle registration fees. |

Miscellaneous revenue stands at $14.1 billion in 2023-2024, an increase of 16.8% compared to 2022-2023. It will reach $14.5 billion in 2024-2025 and $14.7 billion in 2025-2026, an increase of 2.8% and 1.4%, respectively.

| — | The positive trend in miscellaneous revenue is attributable to the anticipated revenue of special funds, non-budget-funded bodies and bodies in the health and social services, education and higher education networks. |

| — | For example, the growth in the revenue of the higher education network is influenced by, among other things, tuition fee revenues, the change in clientele and user revenues. |

| — | In addition, growth in miscellaneous revenue in 2023-2024 reflects, among other things, the increase in the investment income of the Generations Fund, which was below its usual level in 2022-2023, as well as the effect of higher interest rates on tax claims administered by Revenu Québec. |

| — | The change in miscellaneous revenue also takes into account the effect of capping the indexation of government rates at 3% until 2026. |

| | Québec’s Financial

Situation | G.41 |

| 3.1.2 | Revenue from government enterprises |

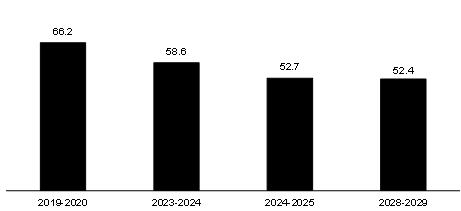

Government enterprises consist of public corporations that play a commercial role, have managerial autonomy and are financially self-sufficient. Revenue from government enterprises corresponds in large part to the net earnings of these enterprises.

This revenue stood at $5.2 billion in 2023-2024, a decrease of 21.5%, $5.4 billion in 2024-2025, an increase of 4.3%, and $6.3 billion in 2025-2026, an increase of 15.5%.

TABLE G.15

Change in revenue from government enterprises

| (millions of dollars, unless otherwise indicated) |

| | 2023-2024 | 2024-2025 | 2025-2026 | AAGR(1) |

| Hydro-Québec | 2 000 | 2 045 | 2 690 | |

| Loto-Québec | 1 507 | 1 514 | 1 529 | |

| Société des alcools du Québec | 1 430 | 1 437 | 1 475 | |

| Investissement Québec | 109 | 308 | 357 | |

| Société québécoise du cannabis(2) | 101 | 95 | 93 | |

| Other(3) | 50 | 19 | 13 | |

| Subtotal | 5 197 | 5 418 | 6 157 | |

| Efforts required | — | — | 100 | |

| TOTAL | 5 197 | 5 418 | 6 257 | |

| % change | −21.5 | 4.3 | 15.5 | −1.9 |

| (1) | Average annual growth rate, corresponding to the geometric mean over three years, from 2023-2024 to 2025-2026. |

| (2) | Revenue is allocated to the Fund to Combat Addiction. |

| (3) | The other government enterprises are the Société ferroviaire et portuaire de Pointe-Noire, Capital Financière agricole, the Société du parc industriel et portuaire de Bécancour and the Fonds d’investissement Eurêka. |

The 21.5% decrease in 2023-2024 is mainly due to the decline in the results of Hydro-Québec, primarily related to the decrease in the value of its exports resulting from low runoff in the regions where its main basins are located.

| — | When Hydro-Québec’s reservoirs are lower and it has less electricity to sell, exports are reduced as Hydro-Québec must meet the needs of Quebecers. |

The 4.3% growth in 2024-2025 is mainly due to the increase in the results of Investissement Québec, due, in particular, to the higher returns expected on its venture capital portfolios as well as its investment funds.

The 15.5% growth in 2025-2026 is mainly due to the expected increase in the results of Hydro-Québec, stemming from the increase in the value of its sales in Québec, as well as the additional gains arising from optimization efforts required from government enterprises.22

| 22 | For more details, see Section E, “Optimizing Government Action." |

| | Budget 2024-2025 |

| G.42 | Budget Plan |

Revenue from federal transfers consists of federal government revenue paid to Québec under the Federal-Provincial Fiscal Arrangements Act, to which is added revenue from other programs under bilateral agreements.

It includes mainly equalization and revenue from the Canada Health Transfer (CHT) and from the Canada Social Transfer (CST).

Revenue from federal transfers will grow by 8.9% in 2023-2024, due, in particular, to a one-time increase in the CHT. The increase is also due to the change in the value of the special Québec abatement,23 which is recorded as a deduction.

In 2024-2025 and in 2025-2026, revenue from federal transfers will vary by −6.0% and 3.5%, respectively. The decrease in 2024-2025 is due, among other things, to a decline in equalization resulting from changes made by the federal government to the program in its 2023 budget.

These changes mainly concern the estimate of the provinces’ fiscal capacity with regard to the non-residential property tax base.

TABLE G. 16

Change in federal transfers

| (millions of dollars, unless otherwise indicated) |

| | 2023-2024- | 2024-2025- | 2025-2026- | 2026-2027- | 2027-2028- | 2028-2029- | AAGR(1) |

| Equalization | 14 037 | 13 316 | 13 975 | 14 339 | 14 981 | 15 263 | |

| % change | 2.7 | −5.1 | 4.9 | 2.6 | 4.5 | 1.9 | 1.7 |

| Health transfers | 8 778 | 8 554 | 8 886 | 9 232 | 9 332 | 9 376 | |

| % change(2) | 23.9 | −2.6 | 3.9 | 3.9 | 1.1 | 0.5 | 1.3 |

| Transfers for post-secondary education and other social programs | 1 451 | 1 351 | 1 340 | 1 330 | 1 316 | 1 300 | |

| % change(3) | 12.1 | −6.9 | −0.8 | −0.7 | −1.1 | −1.2 | −2.2 |

| Other programs | 7 024 | 6 176 | 6 227 | 6 982 | 6 483 | 6 067 | |

| % change(4) | 4.9 | −12.1 | 0.8 | 12.1 | −7.1 | −6.4 | −2.9 |

| TOTAL | 31 290 | 29 397 | 30 428 | 31 883 | 32 112 | 32 006 | |

| % change | 8.9 | −6.0 | 3.5 | 4.8 | 0.7 | −0.3 | 0.5 |

| (1) | Average annual growth rate, corresponding to the geometric mean over five years, from 2024-2025 to 2028-2029. |

| (2) | Health transfers are increasing by 23.9% in 2023-2024 due, in particular, to the increase in the CHT, related to the change in Canada’s nominal GDP and a one-time increase of $2.0 billion (Québec’s share of this one-time increase being $447 million). |

| (3) | Transfers for post-secondary education and other social programs are increasing by 12.1% in 2023-2024, mainly due to the decrease in the value of the special Québec abatement, a portion of which is subtracted from this transfer. |

| (4) | Revenues from other programs are expected to decrease in 2024-2025 due to the non-recurrence of certain types of assistance as well as the pace of realization of federally funded infrastructure projects. |

| 23 | The increase associated with the change in the value of the special abatement in 2023-2024 is $310 million. The special Québec abatement corresponds to 16.5% of the federal personal income tax collected in Québec, and is subtracted from health transfers (8.5%), transfers for post-secondary education and other social programs (5%) and other programs (3%). |

| | Québec’s Financial

Situation | G.43 |

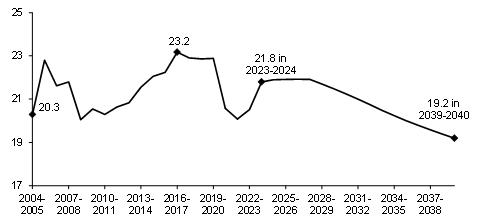

| q | Federal transfers will have weak growth over

the next five years |

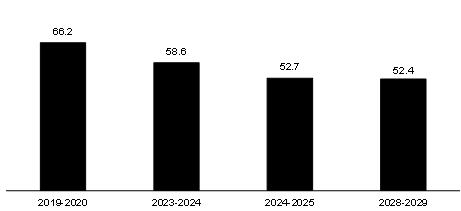

Weak growth in federal transfers is expected between now and 2028-2029. An average annual growth rate of 0.5% over five years, from 2024-2025 to 2028-2029, is anticipated. This contrasts with an average annual growth rate of 5.4% for the past 10 years.

This weak growth is due in particular to:

| — | the federal government’s changes to the equalization formula in its 2023 budget;24 |

| — | insufficient increase of the Canada Health Transfer (CHT); |