As filed with the Securities and Exchange Commission on January 4, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3802

NEUBERGER BERMAN INCOME FUNDS

(Exact Name of the Registrant as Specified in Charter)

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices – Zip Code)

Registrant's telephone number, including area code: (212) 476-8800

Robert Conti, Chief Executive Officer

c/o Neuberger Berman Management LLC

Neuberger Berman Income Funds

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Arthur Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Date of fiscal year end: October 31, 2009

Date of reporting period: October 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders

Neuberger Berman

Income Funds

Investor Class Shares

Institutional Class Shares

Trust Class Shares

Class A Shares

Class C Shares

Class R3 Shares

Core Bond Fund

High Income Bond Fund

Municipal Intermediate Bond Fund

Municipal Money Fund

New York Municipal Money Fund

Short Duration Bond Fund

Strategic Income Fund

Annual Report

October 31, 2009

Contents

THE FUNDS

PORTFOLIO COMMENTARY

| Core Bond Fund | | | 2 | | |

|

| High Income Bond Fund | | | 6 | | |

|

| Municipal Intermediate Bond Fund | | | 9 | | |

|

| Municipal Money Fund | | | 11 | | |

|

| New York Municipal Money Fund | | | 11 | | |

|

| Short Duration Bond Fund | | | 14 | | |

|

| Strategic Income Fund | | | 16 | | |

|

| FUND EXPENSE INFORMATION | | | 23 | | |

|

SCHEDULE OF INVESTMENTS

| Core Bond Fund | | | 25 | | |

|

| High Income Bond Fund | | | 30 | | |

|

| Municipal Intermediate Bond Fund | | | 37 | | |

|

| Municipal Money Fund | | | 41 | | |

|

| New York Municipal Money Fund | | | 46 | | |

|

| Short Duration Bond Fund | | | 48 | | |

|

| Strategic Income Fund | | | 51 | | |

|

| FINANCIAL STATEMENTS | | | 70 | | |

|

"Neuberger Berman" and the Neuberger Berman logo are registered service marks of Neuberger Berman LLC. "Neuberger Berman Management LLC" and the individual fund names in this shareholder report are either service marks or registered service marks of Neuberger Berman Management LLC, formerly Neuberger Berman Management Inc. ©2009 Neuberger Berman Management LLC. All rights reserved. ©2009 Neuberger Berman Fixed Income LLC, formerly known as Lehman Brothers Asset Management LLC. All rights reserved.

FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA

| Core Bond Fund | | | 96 | | |

|

| High Income Bond Fund | | | 96 | | |

|

| Municipal Intermediate Bond Fund | | | 98 | | |

|

| Municipal Money Fund | | | 98 | | |

|

| New York Municipal Money Fund | | | 98 | | |

|

| Short Duration Bond Fund | | | 100 | | |

|

| Strategic Income Fund | | | 100 | | |

|

| Reports of Independent Registered Public Accounting Firms | | | 104 | | |

|

| Directory | | | 106 | | |

|

| Trustees and Officers | | | 107 | | |

|

| Proxy Voting Policies and Procedures | | | 115 | | |

|

| Quarterly Portfolio Schedule | | | 115 | | |

|

| Notice to Shareholders | | | 115 | | |

|

"Neuberger Berman" and the Neuberger Berman logo are registered service marks of Neuberger Berman LLC. "Neuberger Berman Management LLC" and the individual fund names in this shareholder report are either service marks or registered service marks of Neuberger Berman Management LLC, formerly Neuberger Berman Management Inc. ©2009 Neuberger Berman Management LLC. All rights reserved. ©2009 Neuberger Berman Fixed Income LLC, formerly known as Lehman Brothers Asset Management LLC. All rights reserved.

President's Letter

Dear Fellow Shareholder,

It would be difficult to overstate the dramatic events that occurred in the fixed income markets during the fiscal year ended October 31, 2009. As the period began, we were well into one of the most challenging market environments since the Great Depression. This was triggered by the continued fallout from the subprime mortgage market, seizing credit conditions, forced selling by leveraged investors into illiquid markets, and a rapidly weakening global economy. Collectively, this caused risk aversion to reach unprecedented levels, as investors sought refuge in extremely safe short-term U.S. Treasury securities. In contrast, investments that were perceived to be risky were often indiscriminately sold, sometimes at severely depressed prices.

Almost as dramatic was the remarkable shift seen in the markets that started only a few months into the reporting period, as fear was gradually replaced by renewed appetite for risk on the part of investors. This change was reflected in the strength of many non-Treasury sectors, which generated substantial returns and generally recouped their losses from earlier in the fiscal year.

Various factors caused the changes in the financial markets. A major contributor was the aggressive actions taken by the Federal Reserve, U.S. Treasury and other U.S. government entities. Together, they sought to stabilize the financial markets, restore investor confidence and revive the ailing economy. While some of these initiatives moved in fits and starts, as the reporting period continued, we saw progress on a number of fronts. This included the gradual thawing of the once frozen credit markets, some stabilization in the housing market, and the unofficial end of the recession as third quarter Gross Domestic Product (GDP) growth came in at positive 2.8%. In addition, investors were drawn to higher yielding fixed income securities as they looked to capture high yields both relative to Treasuries and on an absolute basis.

While it would have been easy for our portfolio managers to succumb to the market turmoil in late 2008 and follow the herd to U.S. Treasuries, they maintained their investment discipline — and emphasis on non-Treasury sectors. This proved to be rewarding for shareholders, as our Fixed Income Funds were well positioned to benefit from the market reversal that emerged during the reporting period.

As we look ahead, we expect to see continued, albeit tepid, economic growth, coupled with modest inflation. We intend to maintain our time-tested investment processes, which call for actively managing our portfolios and making investment decisions based on thorough fundamental research. We also urge our shareholders to maintain their discipline by avoiding emotion-driven investment decisions and remaining focused on their long-term financial goals.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

1

Core Bond Fund Commentary

For the fiscal year ended October 31, 2009, Neuberger Berman Core Bond Fund posted a strong absolute return and significantly outperformed its benchmark, the Barclays Capital U.S. Aggregate Index.

As the reporting period began, the U.S. fixed income markets were still reeling due to fallout from turmoil in the financial markets, frozen credit conditions, deleveraging and forced selling into illiquid markets. Collectively, this caused risk aversion to remain elevated, as investors favored the safety of short-term U.S. Treasury securities and sold securities that were perceived to be risky.

Conditions in the fixed income markets then gradually started to improve in December 2008, as the government's aggressive initiatives to stabilize financial markets began to bear fruit. In addition, as the reporting period progressed, optimism grew regarding the outlook for the U.S. economy. These factors caused investor sentiment to reverse course, and risk aversion was replaced with increased risk appetite. Against this backdrop, the spread sectors (non-Treasuries) rallied sharply. Aside from a brief period of weakness in February 2009, these sectors outperformed Treasuries during the remainder of the 12-monrh reporting period.

Given our concerns regarding the turmoil in the financial system and the rapidly weakening global economy, the Fund was defensively positioned as the fiscal year began. While the Fund could not avoid the extremely weak performance in the spread sectors, it benefitted from not being more aggressively positioned. Given the significant and, in some cases, historic widening of yield spreads (the difference in yield between Treasuries and other bond sectors), in late 2008 and early 2009, we began to pare the Fund's Treasury and agency mortgage-backed security exposure and redeployed the proceeds into a number of what we considered attractively valued sectors of the market. We emphasized areas where our research indicated that spreads had moved to unsustainable levels and purchased individual securities that we believed had the ability to produce strong risk-adjusted results.

For example, we increased the Fund's exposure to investment grade corporate bonds and, within this sector, favored both financial and industrial securities. This proved to be extremely rewarding, as the sector in general, and financials and industrials in particular, generated extremely strong results over the last eight months of the fiscal year. Another area of emphasis that rallied sharply was the Fund's commercial mortgage-backed securities (CMBS). Their spreads substantially narrowed from elevated levels given expectations for more modest defaults than previously expected. Elsewhere, our Treasury inflation-protected securities (TIPS) performed well as concern increased over the potential for inflation due to the government's stimulus program and accommodative monetary policy. The Fund's underweights in Treasuries and agency securities were also rewarded.

Modestly dampening results was the Fund's exposure to non-agency hybrid adjustable-rate mortgages. While these securities started to rally late in the reporting period, they lagged the benchmark during the fiscal year as a whole.

2

In hindsight, maintaining investment discipline and emphasizing areas of the market that we believed offered attractive value were substantially rewarded during the reporting period. Looking ahead, we expect to see positive, albeit below-average, economic growth in the U.S. and continue to favor spread sectors within the fixed income market.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

3

Core Bond Fund

TICKER SYMBOLS

| Investor Class | | NCRIX | |

| Institutional Class | | NCRLX | |

| Class A | | NCRAX | |

| Class C | | NCRCX | |

RATING SUMMARY

| (% by Ratings) | |

| AAA/Government/Government Agency | | | 65.3 | % | |

| AA | | | 3.2 | | |

| A | | | 12.7 | | |

| BBB | | | 13.9 | | |

| BB | | | 0.3 | | |

| B | | | 0.7 | | |

| CCC | | | 1.2 | | |

| CC | | | 0.0 | | |

| C | | | 0.0 | | |

| D | | | 0.0 | | |

| Short Term | | | 2.7 | | |

| Total | | | 100.0 | | |

AVERAGE ANNUAL TOTAL RETURN ENDED 10/31/093,11,15

| | | Inception

Date | |

1 Year | |

5 Years | |

10 Years | | Life of

Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 02/01/1997 | | | 23.10 | % | | | 4.58 | % | | | 5.59 | % | | | 5.51 | % | |

| Institutional Class | | 10/01/1995 | | | 23.70 | % | | | 5.02 | % | | | 6.03 | % | | | 5.91 | % | |

| Class A | | 12/20/2007 | | | 22.96 | % | | | 4.82 | % | | | 5.93 | % | | | 5.84 | % | |

| Class C | | 12/20/2007 | | | 22.04 | % | | | 4.52 | % | | | 5.78 | % | | | 5.73 | % | |

| With Sales Charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | 17.78 | % | | | 3.91 | % | | | 5.47 | % | | | 5.51 | % | |

| Class C | | | | | 21.04 | % | | | 4.52 | % | | | 5.78 | % | | | 5.73 | % | |

| Barclays Capital U.S. Aggregate Index14 | | | | | 13.79 | % | | | 5.05 | % | | | 6.31 | % | | | 6.30 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions. The composition, industries and holdings of the Fund are subject to change.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ending October 31, 2009, the 30-day SEC yield was 3.42%, 3.81%, 3.26% and 2.67% for Investor Class, Institutional Class, Class A and Class C shares, respectively.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2019 for Investor Class, Institutional Class, Class A and Class C shares. The net expense ratios were 0.87%, 0.47%, 0.87% and 1.63% for Investor Class, Institutional Class, Class A and Class C shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 1.27%, 0.85%, 2.75% and 3.46% for Investor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements).

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

4

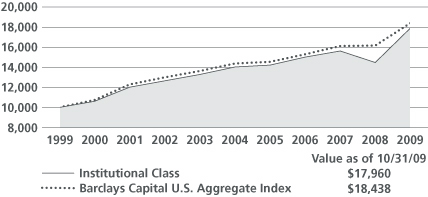

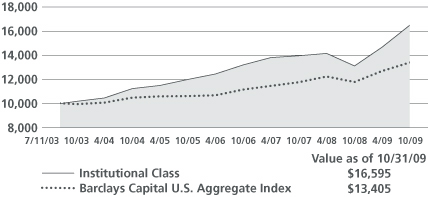

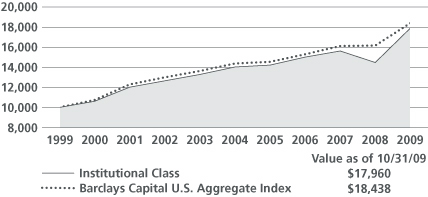

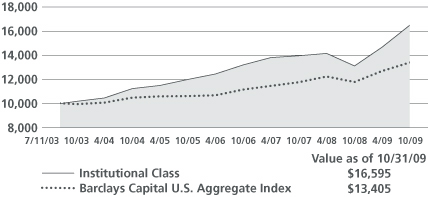

Core Bond Fund

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures (see Average Annual Total Return chart on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Please see Endnotes and Glossary of Indices for additional information.

5

High Income Bond Fund Commentary

For the fiscal year ended October 31, 2009, Neuberger Berman High Income Bond Fund posted an extremely strong absolute return but it lagged its benchmark, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index.

While the high yield market generated exceptionally strong results during the reporting period, the ascent was far from steady. At the outset of the fiscal year in November 2008, the high yield market was in the midst of one of its worst stretches on record. After declining 7.68% and 16.09% in September and October 2008, respectively, the index fell an additional 8.77% in November. Continued turmoil in the financial markets, frozen credit conditions and a rapidly weakening economy led to a massive flight to quality, with investors fleeing securities that were perceived to be risky. While the high yield market regained its footing over the next two months, prices again weakened in February 2009. Over the first four months of the Fund's fiscal year, better rated high yield bonds, on average, outperformed their lower rated counterparts, as BB and CCC rated bonds returned 8.37% and -14.97%, respectively.

The high yield market then quickly reversed course, with the benchmark index posting positive returns during each of the last eight months of the reporting period. This turnaround was triggered by a number of factors, including signs that the credit markets were thawing, optimism that the federal government's aggressive monetary policy would stabilize the economy and some better-than-expected corporate earnings. Investor sentiment continued to improve as the reporting period progressed and risk aversion was replaced by increased risk appetite. This resulted in an impressive rally for lower-rated securities, as BB and CCC rated bonds returned 31.53% and 84.92%, respectively, over the last eight months of the fiscal year. All told, the index gained 48.65% during the 12-month period and BB and CCC rated bonds gained 42.54% and 57.23%, respectively.

For the first half of the reporting period, the Fund was somewhat defensively positioned. This was based on our expectation that economic conditions would remain weak, causing an increase in high yield default rates. However, later in the period, we began adding more cyclical-oriented names to the portfolio. This was due to indications that the economy was stabilizing. In addition, high yield companies were better able to refinance debt in the new-issue market. We also moved from an underweight in CCC securities to a more neutral posture versus the benchmark.

From an industry perspective, an underweight in paper, security selection in chemicals and an overweight in broadcasting were the largest positive contributors to the Fund's relative performance. In contrast, security selection in health care, an underweight and security selection in real estate/homebuilders and an underweight in banking were the largest detractors from relative results.

Looking ahead, we have a relatively positive long-term outlook for the high yield market. We believe a resumption of positive economic growth, low inflation and strong demand, if they occur, could collectively support high yield bond prices and lead to modest spread tightening over the next 12 months. In addition, better access to capital and an improved economic environment lead us to believe that high yield defaults will moderate significantly going forward. As always, we will continue to conduct extensive research on potential portfolio candidates as we seek to generate consistently strong risk-adjusted returns.

Sincerely,

Ann H. Benjamin and Thomas P. O'Reilly

Portfolio Co-Managers

6

High Income Bond Fund

TICKER SYMBOLS

| Investor Class | | NHINX | |

| Institutional Class | | NHILX | |

| Class A | | NHIAX | |

| Class C | | NHICX | |

| Class R3 | | NHIRX | |

RATING SUMMARY

| (% by Ratings) | |

| AAA/Government/Government Agency | | | 0.0 | % | |

| AA | | | 0.0 | | |

| A | | | 0.7 | | |

| BBB | | | 8.5 | | |

| BB | | | 25.6 | | |

| B | | | 37.9 | | |

| CCC | | | 18.8 | | |

| CC | | | 2.3 | | |

| C | | | 0.0 | | |

| D | | | 0.0 | | |

| Short Term | | | 6.2 | | |

| Total | | | 100.0 | | |

AVERAGE ANNUAL TOTAL RETURN ENDED 10/31/092,10,15

| | | Inception

Date | |

1 Year | |

5 Years | |

10 Years | | Life of

Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 02/01/1992 | | | 44.38 | % | | | 5.62 | % | | | 6.94 | % | | | 7.67 | % | |

| Institutional Class13 | | 05/27/2009 | | | 44.90 | % | | | 5.69 | % | | | 6.98 | % | | | 7.69 | % | |

| Class A13 | | 05/27/2009 | | | 44.25 | % | | | 5.60 | % | | | 6.93 | % | | | 7.66 | % | |

| Class C13 | | 05/27/2009 | | | 43.93 | % | | | 5.55 | % | | | 6.91 | % | | | 7.65 | % | |

| Class R313 | | 05/27/2009 | | | 44.32 | % | | | 5.61 | % | | | 6.94 | % | | | 7.66 | % | |

| With Sales Charge | | | | | | | | | | | | | | | | | | | |

| Class A13 | | | | | 38.12 | % | | | 4.69 | % | | | 6.47 | % | | | 7.40 | % | |

| Class C13 | | | | | 42.93 | % | | | 5.55 | % | | | 6.91 | % | | | 7.65 | % | |

Barclays Capital U.S. Corporate

High Yield 2% Issuer Cap Index14 | | | | | 48.65 | % | | | 6.17 | % | | | 6.66 | % | | | N/A | | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions. The composition, industries and holdings of the Fund are subject to change.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ending October 31, 2009, the 30-day SEC yield was 9.40%, 9.64%, 9.10%, 8.45% and 8.98% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2012 for Investor Class and Institutional Class shares and through 10/31/2013 for Class A, Class C and Class R3 shares. The net expense ratios were 0.75%, 1.12%, 1.87% and 1.37% for Institutional Class, Class A, Class C and Class R3 shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratio for fiscal year 2008 were 0.93%, 0.87%, 1.22%, 1.97% and 1.47% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements).

Total returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

7

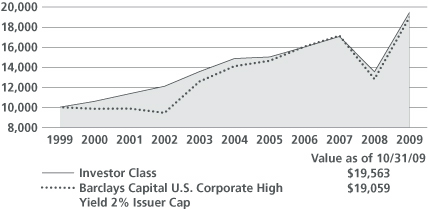

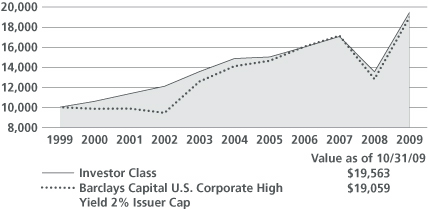

High Income Bond Fund

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures (see Average Annual Total Return chart on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Please see Endnotes and Glossary of Indices for additional information.

8

Municipal Intermediate Bond Fund Commentary

For the fiscal year ended October 31, 2009, Neuberger Berman Municipal Intermediate Bond Fund posted a solid absolute return but lagged its benchmark, the Barclays Capital 7-Year General Obligation Index.

As the reporting period began in November 2008, the municipal market was slowly beginning to emerge from one of its most challenging periods in recent memory. Collectively, the turmoil in the financial markets, frozen credit conditions, forced selling into illiquid markets and the rapidly weakening economy had caused risk aversion to spike. With investors seeking shelter in short-term Treasuries, even high quality municipal bonds where shunned. This, in turn, caused municipal prices to fall and AAA tax-exempt yields to reach 125% to 150% of comparable maturity U.S. Treasury yields.

After largely treading water in November 2008, interest in what we considered attractively valued municipal securities picked up steam in December, and demand remained strong for the remainder of the reporting period. Further supporting municipal bond prices were signs of stabilization in the financial markets, improved liquidity and sharply falling new issuance of tax-exempt bonds. We believe the decline in the new issue calendar for traditional tax-exempt municipal bonds can be partially attributed to the successful launch of the taxable Build America Bond program.

Demand for tax-exempt securities was robust as many investors were seeking better returns than were available in various money market options. In addition, toward the conclusion of the reporting period, there was evidence that the end of the most severe recession since the Great Depression might be at hand. With risk aversion being replaced with increased risk appetite, lower rated municipal bonds outperformed their higher quality counterparts as the fiscal year progressed.

While the Fund posted a nearly double-digit return during the fiscal year, it did not keep pace with its benchmark. This was due, in part, to our defensive positioning. Given our concerns regarding the weakness in the economy and strains on municipal budgets, we believed it was prudent to maintain the Fund's quality bias. For example, the Fund emphasized higher quality revenue and general obligation bonds that have historically held up well in difficult economic environments. While the defensive position was beneficial during the early stages of the reporting period, it detracted from relative results for the fiscal year as a whole.

From a yield curve perspective, we employed a barbell approach due to the steepness of the municipal yield curve. In contrast, the benchmark is concentrated in the six- to eight-year portion of the curve. This positioning was modestly additive to returns and we continue to believe a barbell structure is appropriate as the curve remains steep from an historical perspective.

Looking ahead, we maintain our positive outlook for the long-term prospects of the municipal bond market. We believe the economy appears to have turned the corner and inflation should be well contained for the time being. While we believe valuations are not as compelling as they were when the fiscal year began, we expect municipal bonds to remain appealing given their steady stream of tax-exempt income. In addition, the potential for higher personal income tax rates in the future could support the asset class.

In our opinion, it will take time for state and local municipalities to mend their balance sheets. Therefore, we believe an emphasis on higher quality securities is warranted. As always, we will continue to actively manage the Fund and conduct thorough in-house fundamental research on the underlying credit characteristics of our existing and potential holdings.

Sincerely,

William J. Furrer and James L. Iselin

Portfolio Co-Managers

9

Municipal Intermediate Bond Fund

TICKER SYMBOLS

RATING SUMMARY

| (% by Ratings) | |

| AAA/Government/Government Agency | | | 24.2 | % | |

| AA | | | 48.6 | | |

| A | | | 26.4 | | |

| BBB | | | 0.0 | | |

| BB | | | 0.0 | | |

| B | | | 0.0 | | |

| CCC | | | 0.0 | | |

| CC | | | 0.0 | | |

| C | | | 0.0 | | |

| D | | | 0.0 | | |

| Short Term | | | 0.8 | | |

| Total | | | 100.0 | | |

AVERAGE ANNUAL TOTAL RETURN ENDED 10/31/091,8,9,15

| | | Inception

Date | |

1 Year | |

5 Years | |

10 Years | | Life of

Fund | |

| Investor Class | | | 07/09/1987 | | | | 9.42 | % | | | 2.84 | % | | | 4.36 | % | | | 5.18 | % | |

| Barclays Capital 7-Year GO Index14 | | | | | | | 10.42 | % | | | 4.37 | % | | | 5.50 | % | | | 6.16 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions. The composition, industries and holdings of the Fund are subject to change.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2009, the 30-day SEC yield for Investor Class shares was 2.55% and the tax-equivalent yield was 3.92% for an investor in the highest federal income tax bracket (35%).

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2012 for Investor Class shares. The net expense ratio was 0.65%. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratio for fiscal year 2008 was 1.25% for Investor Class shares (prior to any fee waivers or expense reimbursements).

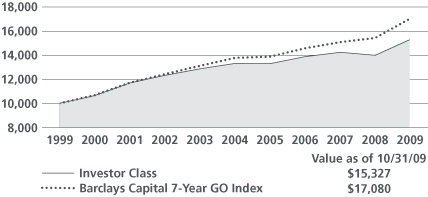

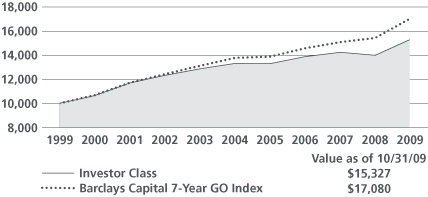

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only. The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Please see Endnotes and Glossary of Indices for additional information.

10

Municipal Money Fund Commentary

New York Municipal Money Fund Commentary

Investors' fears of a potential economic catastrophe gave way to optimism regarding an economic rebound during the eventful fiscal year ended October 31, 2009.

Developments that emerged before the reporting period, including the failure of major financial institutions, mortgage-related losses and a freeze in the credit markets, helped worsen an already weak economy in the early months of the fiscal year. Investors, not surprisingly, struggled at that time in assessing whether stimulus programs and other actions to maintain liquidity and avoid steep economic decline would be effective.

Measures included the federal fiscal stimulus package, various corporate bailouts, the Temporary Guarantee Program for Money Market Funds, the support of struggling banks through the Troubled Asset Relief Program (TARP), and the purchase of vast quantities of mortgage-backed securities. In addition, the Federal Reserve lowered the Federal Funds target rate to an historically low range of 0%–0.25% in December and maintained this range through the end of the reporting period.

Although data releases were mixed for much of the fiscal year, they gradually became more favorable. Most significantly, after several straight quarters of declines, Gross Domestic Product (GDP) moved into positive territory in the third quarter of calendar year 2009. Unemployment trends also improved late in the reporting period, with average monthly job losses for the third quarter of calendar year 2009 falling to 199,000 from 691,000 in the first quarter. Still, unemployment reached 10.2% in October — its highest rate since 1983 — and joblessness remains a significant concern.

In terms of market performance, after fleeing to the perceived safety of Treasuries early in the fiscal year, many investors returned to municipal markets as economic indicators improved and the capital markets overall grew healthier. Variable Rate Demand Notes, as represented by the Securities Industry and Financial Markets Association Municipal Swap Index, started the period with an average yield of 1.82%, which is considerably lower than a nearly 8% yield reached during the credit market freeze in September of 2008. However, yields fell considerably during the reporting period, to only 0.26% by October 31, 2009.

Moving forward, we believe that despite the sizable overall GDP increase in the third quarter of calendar year 2009, which was due largely to economic stimulus dollars, the economy is likely to remain sluggish for a while, due in part to dampened consumer spending, high unemployment and a still sluggish real estate market. That, and limited short-term inflation risk, should in our opinion keep the Federal Reserve from raising the target Federal Funds rate from current low levels until at least early in calendar year 2010.

On a final note, our in-house credit team continues to implement a "belt and suspenders" approach when analyzing potential holdings for the Funds. This involves thoroughly reviewing the underlying credit fundamentals of potential issuers to ensure that they are of the highest quality and have the ability to make timely principal and interest payments. We believe this approach will continue to serve our shareholders well in light of the current economic environment.

Municipal Money Fund5,7,8,9,15

Neuberger Berman Municipal Money Fund returned 0.40% for the 12-month period ended October 31, 2009, compared to the 0.29% return of the Crane Tax Exempt Retail Money Fund Index.

Over the course of the reporting period, the Fund's seven-day tax-equivalent current yield decreased from 2.20% as of October 31, 2008 to 0.05% as of October 31, 2009 (assuming taxation at the highest federal tax bracket). Its seven-day tax-equivalent effective yield (also assuming the highest federal tax bracket) went from 2.22% as of October 31, 2008 to 0.05% as of October 31, 2009. These figures more closely reflect current earnings than one-year figures. During the 12-month period, the Fund's weighted average maturity went from 12.8 days on October 31, 2008 to 8.6 days on October 31, 2009.

New York Municipal Money Fund6,7,8,9,15

Neuberger Berman New York Municipal Fund returned 0.37% for the 12-month period ended October 31, 2009, compared to the 0.32% return of the Crane New York Tax Exempt Money Fund Index. Over the course of the 12-month

11

period, the Fund's seven-day tax-equivalent current yield (assuming taxation at the highest federal, New York State and New York City income tax brackets) decreased from 2.60% as of October 31, 2008 to 0.05% as of October 31, 2009. Its seven-day tax equivalent effective yield (also assuming taxation at the highest federal, New York State and New York City income tax brackets) decreased from 2.63% as of October 31, 2008 to 0.05% as of October 31, 2009. These figures more closely reflect current earnings than one-year figures. The Fund's weighted average maturity went from 8.4 days on October 31, 2008 to 10.2 days on October 31, 2009.

Sincerely,

William J. Furrer and Kristian J. Lind

Portfolio Co-Managers

Current and effective yield more closely reflect current earnings than does total return.

Performance data quoted represent past performance, which is no guarantee of future results. The investment return on an investment in a money market fund will fluctuate. Current performance may be lower or higher than the performance data quoted. For performance data current to the prior business day on which the New York Stock Exchange was open, visit www.nb.com/performance. The composition, industries and holdings of each Fund are subject to change.

An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a Fund.

12

Municipal Money Fund

New York Municipal Money Fund

TICKER SYMBOLS

| Municipal Money Fund | | NMNXX | |

| New York Municipal Money Fund | | NYNXX | |

NB MUNICIPAL MONEY FUND

MATURITY DIVERSIFICATION

| (% by Maturity) | |

| 1 – 7 Days | | | 96.6 | % | |

| 8 – 30 Days | | | 1.6 | | |

| 31 – 90 Days | | | 0.6 | | |

| 91 – 180 Days | | | 0.7 | | |

| 181+ Days | | | 0.5 | | |

NB NEW YORK MUNICIPAL MONEY FUND

MATURITY DIVERSIFICATION

| (% by Maturity) | |

| 1 – 7 Days | | | 97.7 | % | |

| 8 – 30 Days | | | 0.0 | | |

| 31 – 90 Days | | | 0.7 | | |

| 91 – 180 Days | | | 0.0 | | |

| 181+ Days | | | 1.6 | | |

13

Short Duration Bond Fund Commentary

For the fiscal year ended October 31, 2009, Neuberger Berman Short Duration Bond Fund posted a positive return and outperformed its benchmark, the Merrill Lynch 1-3 Year Treasury Index.

At the start of the reporting period in November 2008, volatility in the fixed income markets was at historically high levels due to turmoil in the financial markets, frozen credit conditions, deleveraging and forced selling into illiquid markets. Collectively, this had triggered an extreme flight to quality, as investors favored the safety of short-term U.S. Treasury securities and largely avoided many others.

Conditions in the fixed income markets gradually started to improve in December 2008, as the government's aggressive actions to stabilize financial markets began to bear fruit. In addition, as the fiscal year progressed, optimism grew regarding the outlook for the U.S. economy. These factors caused investor sentiment to abruptly shift and risk aversion was replaced with increased risk appetite. Against this backdrop, the spread sectors (non-Treasuries) rallied sharply. Aside from a brief period of weakness in February 2009, these sectors outperformed Treasuries for the remainder of the reporting period.

To a great extent, the factors that caused the Fund to lag its benchmark early in the fiscal year helped it to generate superior relative results over the full reporting period. Looking back, the Fund's exposure to non-Treasury sectors was detrimental to its results during the flight to quality in late 2008 and in early 2009. In particular, the Fund's commercial mortgage-backed securities, asset-backed securities, and non-agency adjustable-rate mortgages (ARMS) performed poorly.

While it would have been easy to abandon our investment discipline and reallocate the Fund's spread sector holdings into Treasuries, we chose not to do so. This was based on our extensive research which indicated that non-Treasuries had become extremely undervalued, given the intrinsic value of their future cash flows. This decision was rewarded, as these sectors subsequently rebounded and, for the fiscal year as a whole, positively contributed to the Fund's relative results.

In terms of the portfolio positioning, in recent months we have added to the Fund's position in investment grade corporate bonds as we continue to identify compelling opportunities. Toward the end of the fiscal year, we pared some of the Fund's exposure to non-agency ARMS and certain other spread sectors. This was achieved through outright sales as these securities rebounded in price by allowing many of these securities to mature and pay off at par. A majority of those proceeds were then reinvested in U.S. Treasury securities to broaden the diversification of the portfolio.

Looking ahead, we believe the economy will continue to grow, albeit at a modest pace. Given this scenario, we do not expect inflation to be an issue in the near future. However, in our view, the inflation question will primarily be determined by the Federal Reserve's future actions. The timing and the manner of the removal of quantitative easing will be closely monitored by our team.

Sincerely,

Thomas Sontag, Michael Foster and Richard Grau

Portfolio Co-Managers

14

Short Duration Bond Fund

TICKER SYMBOLS

| Investor Class | | NSBIX | |

| Trust Class | | NSBTX | |

RATING SUMMARY

| (% by Ratings) | |

| AAA/Government/Government Agency | | | 63.8 | % | |

| AA | | | 7.4 | | |

| A | | | 15.4 | | |

| BBB | | | 4.0 | | |

| BB | | | 2.2 | | |

| B | | | 5.2 | | |

| CCC | | | 1.1 | | |

| CC | | | 0.0 | | |

| C | | | 0.0 | | |

| D | | | 0.0 | | |

| Short Term | | | 0.9 | | |

| Total | | | 100.0 | | |

AVERAGE ANNUAL TOTAL RETURN ENDED 10/31/091,15

| | | Inception

Date | |

1 Year | |

5 Years | |

10 Years | | Life of

Fund | |

| Investor Class | | 06/09/1986 | | | 4.18 | % | | | 1.02 | % | | | 2.88 | % | | | 4.90 | % | |

| Trust Class | | 08/30/1993 | | | 4.02 | % | | | 0.91 | % | | | 2.78 | % | | | 4.84 | % | |

| Merrill Lynch 1-3 Year Treasury Index14 | | | | | 2.73 | % | | | 4.01 | % | | | 4.53 | % | | | 5.96 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions. The composition, industries and holdings of the Fund are subject to change.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ending October 31, 2009, the 30-day SEC yield for Investor Class shares was 2.59%, and 2.49% for Investor Class and Trust Class shares, respectively.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2012 for Investor Class and Trust Class shares. The net expense ratios were 0.70% and 0.80% for Investor Class and Trust Class shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 0.95% and 1.27% for Investor Class and Trust Class shares, respectively.

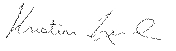

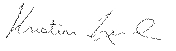

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures (see Average Annual Total Return chart above). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Please see Endnotes and Glossary of Indices for additional information.

15

Strategic Income Fund Commentary

For the fiscal year ended October 31, 2009, Neuberger Berman Strategic Income Fund posted a strong absolute return and significantly outperformed its benchmark, the Barclays Capital U.S. Aggregate Index.

As the reporting period began, the U.S. fixed income markets were still reeling from the fallout from turmoil in the financial markets, frozen credit conditions, deleveraging and forced selling into illiquid markets. Collectively, this caused risk aversion to remain elevated, as investors favored the safety of short-term U.S. Treasury securities and sold securities that were perceived to be risky.

Conditions in the fixed income markets then started to gradually improve in December 2008, as the government's aggressive initiatives to stabilize financial markets began to bear fruit. In addition, as the reporting period progressed, optimism grew regarding the outlook for the U.S. economy. These factors caused investor sentiment to reverse course and risk aversion was replaced with increased risk appetite. Against this backdrop, spread sectors (non-Treasuries) rallied sharply. Aside from a brief period of weakness in February 2009, these sectors outperformed Treasuries during the remainder of the 12-month reporting period.

Given our concerns regarding the turmoil in the financial system and the rapidly weakening global economy, the Fund was conservatively positioned as the fiscal year began. While the Fund could not avoid the extremely weak performance of non-Treasuries, it benefitted from not being more aggressively positioned. With the significant and, in some cases, historic widening of credit spreads (the difference in yield between Treasuries and other fixed income securities), in late 2008 and early 2009 we began to pare the Fund's Treasury and agency mortgage-backed security exposure and opportunistically redeployed the proceeds into a number of what we considered attractively valued market sectors. We emphasized areas where our research indicated that spreads had moved to unsustainable levels and purchased individual securities that we believed had the ability to produce superior risk-adjusted results.

For example, we increased the Fund's exposure to investment grade corporate bonds and, within this sector, favored both financial and industrial securities. This proved to be extremely rewarding, as the sector in general, and financials and industrials in particular, generated strong results over the last eight months of the fiscal year. Moving from a zero weighting to roughly a 10% weighting in the Fund, commercial mortgage-backed securities (CMBS) positively contributed to performance as well. CMBS spreads (yields relative to Treasuries) substantially narrowed from elevated levels given expectations for more modest defaults. Elsewhere, our decision to increase holdings of Treasury inflation-protected securities in the third quarter of calendar year 2009 was helpful; they performed well given concerns about future inflation due to the federal government's stimulus program and accommodative monetary policy. Increasing the Fund's high yield exposure during the second half of the fiscal year was beneficial as well. The Fund's underweights in Treasuries and agency securities were also rewarded.

While the Fund generated very strong absolute and relative results, not all of our strategic allocation decisions were beneficial during the fiscal year. For example, not having an exposure to emerging market debt until late in the period detracted from results as the asset class produced exceptional returns. While we increased the Fund's exposure to the high yield bond market during the second half of the fiscal year, increasing this allocation earlier in the period would have further enhanced the Fund's results.

16

Overall, maintaining our investment discipline and emphasizing areas of the market that we believed offered attractive values were substantially rewarded during the reporting period. Looking ahead, we expect to see positive, albeit below-average, economic growth in the U.S. We remain positive on — and expect to maintain the Fund's overweight position in — non-Treasury sectors, while continuing to underweight Treasury securities.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

17

Strategic Income Fund

TICKER SYMBOLS

| Institutional Class | | NSTLX | |

| Trust Class | | NSTTX | |

| Class A | | NSTAX | |

| Class C | | NSTCX | |

RATING SUMMARY

| (% by Ratings) | |

| AAA/Government/Government Agency | | | 42.0 | % | |

| AA | | | 2.7 | | |

| A | | | 11.9 | | |

| BBB | | | 19.3 | | |

| BB | | | 9.4 | | |

| B | | | 7.4 | | |

| CCC | | | 2.2 | | |

| CC | | | 0.1 | | |

| C | | | 0.0 | | |

| D | | | 0.0 | | |

| Short Term | | | 5.0 | | |

| Total | | | 100.0 | | |

AVERAGE ANNUAL TOTAL RETURN ENDED 10/31/094,15

| | | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

| At NAV | | | | | | | | | | | | | | | |

| Institutional Class | | 07/11/2003 | | | 25.97 | % | | | 8.03 | % | | | 8.35 | % | |

| Trust Class12 | | 04/02/2007 | | | 25.66 | % | | | 7.85 | % | | | 8.21 | % | |

| Class A12 | | 12/20/2007 | | | 25.51 | % | | | 7.88 | % | | | 8.23 | % | |

| Class C12 | | 12/20/2007 | | | 24.47 | % | | | 7.57 | % | | | 7.99 | % | |

| With Sales Charge | | | | | | | | | | | | | | | |

| Class A12 | | | | | 20.17 | % | | | 6.94 | % | | | 7.49 | % | |

| Class C12 | | | | | 23.47 | % | | | 7.57 | % | | | 7.99 | % | |

| Barclays Capital U.S. Aggregate Index14 | | | | | 13.79 | % | | | 5.05 | % | | | 4.75 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be higher or lower than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2009, the 30-day SEC yield was 4.86%, 4.53%, 4.27% and 3.74% for Institutional Class, Trust Class, Class A and Class C shares, respectively.

Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2012 for Trust Class and 10/31/2019 for Institutional Class, Class A and Class C shares. The net expense ratios were 0.82%, 1.17%, 1.23% and 1.94% for Institutional Class, Trust Class, Class A and Class C shares, respectively. As stated in the Fund's most recent prospectus, the total annual fund operating expense ratios for fiscal year 2008 were 4.03%, 9.14%, 7.53% and 8.77% for Institutional Class, Trust Class, Class A and Class C shares, respectively, (prior to any fee waivers or expense reimbursements).

Total returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

COMPARISON OF A $10,000 INVESTMENT

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception, if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures (see Average Annual Total Return above).The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of dividends and capital gain distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Please see Endnotes and Glossary of Indices for additional information.

18

Endnotes

1 Neuberger Berman Management LLC ("Management") has contractually undertaken to forgo current payment of fees and/or reimburse expenses of the following Funds so that the total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 0.70% for Neuberger Berman Short Duration Bond Fund (Investor Class), 0.80% for Neuberger Berman Short Duration Bond Fund (Trust Class), and 0.65% for Neuberger Berman Municipal Intermediate Bond Fund (Investor Class) of average daily net assets. Each undertaking lasts until October 31, 2012. Each of these Funds has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each listed class of each Fund would have been lower. For the year ended October 31, 2009, there were no repayments of expenses to Management.

2 Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman High Income Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 1.00%, 0.75%, 1.12%, 1.87% and 1.37% of average daily net assets for the Investor Class, Institutional Class, Class A, Class C and Class R3, respectively. These undertakings last until October 31, 2012 for Investor Class and Institutional Class and October 31, 2013 for Class A, Class C and Class R3. Each of the classes of the Fund listed above has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower.

3 Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Core Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 0.85%, 0.45%, 0.85% and 1.60% of average daily net assets for the Investor Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2019. Each of the classes of the Fund listed above has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. Management voluntarily agreed to waive its management fee in the amount of 0.25% (0.20% prior to March 1, 2006) of the Fund's average daily net assets through October 31, 2009. Management has agreed to continue this voluntary waiver after this date, but may, at its sole discretion, modify or terminate this voluntary waiver at any time without notice to the Fund. If this voluntary waiver was not in place, performance for the Fund would be lower. For the year ended October 31, 2009, there were no repayments of expenses to Management.

4 Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Strategic Income Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 1.10%, 0.75%, (effective March 1, 2008, and 0.85% through February 28, 2008), 1.15% and 1.85% of average daily net assets for the Trust Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2012 for the Trust Class and until October 31, 2019 for the Institutional Class, Class A and Class C. Each of the classes of the Fund listed above has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating

19

Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2009, there were no repayments of expenses to Management.

5 Management has contractually undertaken to forgo current payment of fees and/or reimburse the Investor Class of Neuberger Berman Municipal Money Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 0.59% of average daily net assets. The undertaking lasts until October 31, 2012. The Investor Class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed the above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of the Investor Class of the Fund would have been lower. For the year ended October 31, 2009, there were no repayments of expenses to Management. In addition, Management has voluntarily undertaken to reimburse and/or waive certain expenses of the Investor Class of the Fund, so that its total annual Operating Expenses are limited to 0.52% of average daily net assets (from June 5, 2006 through January 16, 2007), 0.47% of average daily net assets (from January 17, 2007 through January 21, 2008), 0.50% of average daily net assets (from January 22, 2008 to August 25, 2008) and 0.55% of average daily net assets (effective August 26, 2008). Absent such waivers, the performance of the Investor Class of the Fund would have been lower. In addition to the contractual limitation, Management also voluntarily waived expenses as necessary to maintain a minimum yield for the Fund. Management may, at its sole discretion, modify or terminate this voluntary waiver without notice to the Fund. Absent such waivers, the performance of the Investor Class of the Fund may have been lower.

6 Management has contractually undertaken to forgo current payment of fees and/or reimburse the Investor Class of Neuberger Berman New York Municipal Money Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) ("Operating Expenses") are limited to 0.59% of average daily net assets. The undertaking lasts until October 31, 2012. The Investor Class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed the above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of the Investor Class of the Fund would have been lower. For the year ended October 31, 2009, there were no repayments of expenses to Management. In addition, Management has voluntarily undertaken to reimburse and/or waive certain expenses of the Investor Class of the Fund, so that its total annual Operating Expenses are limited to 0.52% of average daily net assets (from June 5, 2006 through January 16, 2007), 0.47% of average daily net assets (from January 17, 2007 through January 21, 2008), 0.50% of average daily net assets (from January 22, 2008 to August 25, 2008) and 0.55% of average daily net assets (effective August 26, 2008). Absent such waivers, the performance of the Investor Class of the Fund would have been lower. In addition to these contractual and voluntary limitations, Management also voluntarily waived expenses as necessary to maintain a minimum yield for the Fund. Management may, at its sole discretion, modify or terminate this voluntary waiver without notice to the Fund.

7 "Current yield" of a money market fund refers to the income generated by an investment in a fund over a recent 7-day period. This income is then "annualized." The "effective yield" is calculated similarly but, when annualized, the income earned by an investment in the fund is assumed to be reinvested. The "effective yield" will be slightly higher than the "current yield" because of the compounding effect of this assumed reinvestment. Yields of a money market fund will fluctuate and past performance is not a guarantee of future results.

8 Tax-equivalent effective yield is the taxable effective yield that an investor would have had to receive in order to realize the same level of yield after federal income taxes at the highest federal tax rate, currently 35%, assuming that all of a fund's income is exempt from federal income taxes. For Neuberger Berman New York Municipal Money Fund, tax-equivalent yield is calculated based on federal, New York State, and New York City tax rates for a combined rate of 41.8%.

20

9 A portion of the income may be a tax preference item for purposes of the federal alternative minimum tax for certain investors.

10 The Fund is the successor to Lipper High Income Bond Fund ("Lipper Fund"). The total return data for the periods prior to September 7, 2002, are those of Lipper Fund Premier Class. The data reflect performance of Lipper Fund Premier Class for the period April 1, 1996, through September 6, 2002. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects the same as those of Lipper Fund. Returns would have been lower if the manager of Lipper Fund had not waived certain of its fees during the periods shown.

11 The Fund is the successor to Ariel Premier Bond Fund ("Ariel Bond Fund"). The total return data for the periods prior to June 13, 2005, are those of Ariel Bond Fund Investor Class and Institutional Class. The data reflects performance of Ariel Bond Fund Investor Class for the period February 1, 1997 through June 10, 2005 and the performance of Ariel Bond Fund Institutional Class for the period October 1, 1995 (date of inception) through January 31, 1997. The investment policies, guidelines and restrictions of the Fund are in all material respects the same as those of Ariel Bond Fund. Ariel Bond Fund Institutional Class had lower expenses and typically higher returns than Ariel Bond Fund Investor Class. Returns would have been lower if the manager of Ariel Bond Fund had not waived certain of its fees during the periods shown. Class A and Class C of Neuberger Berman Core Bond Fund each commenced operations on December 20, 2007. The performance information for Class A and Class C prior to the class' commencement of operations is for the Institutional Class of Neuberger Berman Core Bond Fund. The performance information shown with a sales charge for Class A and Class C shares has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as Rule 12b-1 fees).

12 The Trust Class, Class A and Class C of Neuberger Berman Strategic Income Fund commenced operations on April 2, 2007, December 20, 2007 and December 20, 2007, respectively. The performance information for Trust Class, Class A and Class C prior to the class' commencement of operations is that of the Institutional Class of Neuberger Berman Strategic Income Fund. In making this translation, the performance information of the Institutional Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Institutional Class has lower expenses and typically higher returns than Class A, Class C or Class R3.

13 The Institutional Class, Class A, Class C and Class R3 of Neuberger Berman High Income Bond Fund commenced operations on May 27, 2009. The performance information for Institutional Class, Class A, Class C and Class R3 prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman High Income Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A, Class C or Class R3. The Institutional Class has lower expenses and typically higher returns than Investor Class.

14 The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class.

15 Please see "Glossary of Indices" starting on page 22 for a description of indices. Please note that indices do not take into account any fees and expenses or tax consequences of investing in the individual securities that they track, and that individuals cannot invest directly in any index. Data about the performance of these indices are prepared or obtained by Neuberger Berman Management LLC ("Management") and include reinvestment of all dividends and capital gain distributions. The Fund may invest in securities not included in the described indices or may not invest in all securities included in the described indices.

21

Glossary of Indices

| Barclays Capital 7-Year General Obligation Index: | | An unmanaged total return performance benchmark for the intermediate-term, 7-year, investment grade General Obligations (State and Local) tax-exempt bond market. | |

|

| Barclays Capital U.S. Aggregate Index: | | An unmanaged index that represents the U.S. domestic investment grade bond market. It is comprised of the Barclays Capital Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million. | |

|

| Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index: | | An unmanaged sub-index of the Barclays Capital U.S. Corporate High Yield Index (which includes all U.S. dollar-denominated, taxable, fixed rate, noninvestment grade debt), capped such that no single issuer accounts for more than 2% of the index weight. | |

|

| Crane New York Tax Exempt Money Fund Index: | | An unmanaged simple average comprised of all money market mutual funds tracked by Crane Data investing primarily in New York municipal and tax-exempt money market securities. | |

|

| Crane Tax Exempt Retail Money Fund Index: | | An unmanaged simple average comprised of all money market mutual funds tracked by Crane Data investing primarily in municipal and tax-exempt money market securities. Crane Data classifies money funds as Retail based on minimum investment (normally less than $1 million), expense ratio (normally 0.35% or greater) and target customer base. | |

|

| Merrill Lynch 1-3 Year Treasury Index: | | An unmanaged total return market value index consisting of all coupon-bearing U.S. Treasury publicly placed debt securities with maturities between 1 and 3 years. | |

|

Please note that indices do not take into account any fees and expenses or any tax consequences of investing in the individual securities that they track and that individuals cannot invest directly in any index. Data about the performance of these indices or averages are prepared or obtained by Management and include reinvestment of all dividends and capital gain distributions. The Funds may invest in securities not included in the above-described indices.

22

Information About Your Fund's Expenses

These tables are designed to provide information regarding costs related to your investments. All mutual funds incur operating expenses, which include management fees, fees for administrative services and costs of shareholder reports, among others. You may also incur transactions costs, such as sales charges (loads). The following examples are intended to help you understand your ongoing costs of investing in a fund, which are the operating expenses described above, and do not include transactions costs. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2009 and held for the entire period. The table illustrates each fund's costs in two ways:

| Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the fund's actual performance during the period. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

|

Hypothetical Example for

Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in these funds versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

|

Please note that the expenses in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

23

Expense Information as of 10/31/09 (Unaudited)

| | | ACTUAL | | HYPOTHETICAL (5% ANNUAL RETURN BEFORE EXPENSES)(2) | |

| | | Beginning

Account

Value

5/1/09 | | Ending

Account

Value

10/31/09 | | Expenses Paid

During the

Period(1)

5/1/09 - 10/31/09 | | Expense

Ratio | | Beginning

Account

Value

5/1/09 | | Ending

Account

Value

10/31/09 | | Expenses Paid

During the

Period(1)

5/1/09 - 10/31/09 | | Expense

Ratio | |

| Neuberger Berman Core Bond Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,139.80 | | | $ | 4.58 | | | | .85 | % | | $ | 1,000.00 | | | $ | 1,020.92 | | | $ | 4.33 | | | | .85 | % | |

| Institutional Class | | $ | 1,000.00 | | | $ | 1,143.00 | | | $ | 2.43 | | | | .45 | % | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 | | | | .45 | % | |

| Class A | | $ | 1,000.00 | | | $ | 1,139.90 | | | $ | 4.58 | | | | .85 | % | | $ | 1,000.00 | | | $ | 1,020.92 | | | $ | 4.33 | | | | .85 | % | |

| Class C | | $ | 1,000.00 | | | $ | 1,135.60 | | | $ | 8.61 | | | | 1.60 | % | | $ | 1,000.00 | | | $ | 1,017.14 | | | $ | 8.13 | | | | 1.60 | % | |

| Neuberger Berman High Income Bond Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,245.50 | | | $ | 5.66 | | | | 1.00 | % | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.09 | | | | 1.00 | % | |

| Institutional Class(3) | | $ | 1,000.00 | | | $ | 1,202.30 | | | $ | 3.57 | | | | .75 | % | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 3.28 | | | | .75 | % | |

| Class A(3) | | $ | 1,000.00 | | | $ | 1,196.90 | | | $ | 5.33 | | | | 1.12 | % | | $ | 1,000.00 | | | $ | 1,016.80 | | | $ | 4.89 | | | | 1.12 | % | |

| Class C(3) | | $ | 1,000.00 | | | $ | 1,194.30 | | | $ | 8.88 | | | | 1.87 | % | | $ | 1,000.00 | | | $ | 1,013.55 | | | $ | 8.15 | | | | 1.87 | % | |

| Class R3(3) | | $ | 1,000.00 | | | $ | 1,197.60 | | | $ | 6.52 | | | | 1.37 | % | | $ | 1,000.00 | | | $ | 1,015.71 | | | $ | 5.98 | | | | 1.37 | % | |

| Neuberger Berman Municipal Intermediate Bond Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,019.30 | | | $ | 3.31 | | | | .65 | % | | $ | 1,000.00 | | | $ | 1,021.93 | | | $ | 3.31 | | | | .65 | % | |

| Neuberger Berman Municipal Money Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,000.60 | | | $ | 2.52 | | | | .50 | % | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | .50 | % | |

| Neuberger Berman New York Municipal Money Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,000.50 | | | $ | 2.22 | | | | .44 | % | | $ | 1,000.00 | | | $ | 1,022.99 | | | $ | 2.24 | | | | .44 | % | |

| Neuberger Berman Short Duration Bond Fund | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,088.10 | | | $ | 3.68 | | | | .70 | % | | $ | 1,000.00 | | | $ | 1,021.68 | | | $ | 3.57 | | | | .70 | % | |

| Trust Class | | $ | 1,000.00 | | | $ | 1,087.90 | | | $ | 4.21 | | | | .80 | % | | $ | 1,000.00 | | | $ | 1,021.17 | | | $ | 4.08 | | | | .80 | % | |

| Neuberger Berman Strategic Income Fund | |

| Institutional Class | | $ | 1,000.00 | | | $ | 1,125.90 | | | $ | 4.02 | | | | .75 | % | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.82 | | | | .75 | % | |

| Trust Class | | $ | 1,000.00 | | | $ | 1,124.00 | | | $ | 5.89 | | | | 1.10 | % | | $ | 1,000.00 | | | $ | 1,019.66 | | | $ | 5.60 | | | | 1.10 | % | |

| Class A | | $ | 1,000.00 | | | $ | 1,124.70 | | | $ | 6.16 | | | | 1.15 | % | | $ | 1,000.00 | | | $ | 1,019.41 | | | $ | 5.85 | | | | 1.15 | % | |

| Class C | | $ | 1,000.00 | | | $ | 1,119.50 | | | $ | 9.88 | | | | 1.85 | % | | $ | 1,000.00 | | | $ | 1,015.88 | | | $ | 9.40 | | | | 1.85 | % | |

(1) For each class of the fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown), unless otherwise indicated.

(2) Hypothetical 5% annual return before expenses is calculated by multiplying the number of days in the most recent period divided by 365.

(3) For each class of the fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 158/365 (to reflect the period shown of May 27, 2009 to October 31, 2009).

24

Schedule of Investments Neuberger Berman Core Bond Fund

| PRINCIPAL AMOUNT | | | | VALUE† | |

| (000's omitted) | | | | (000's omitted) | |

U.S. Treasury Securities-Backed by the Full Faith

and Credit of the U.S. Government (18.3%)+ | |

| $ 7,000 | | | U.S. Treasury Bills, 0.10%, due 3/25/10 | | | $ 6,997 | | |

| | 210 | | | U.S. Treasury Inflation Index Notes, 3.00%, due 7/15/12 | | | 226 | | |

| | 10,793 | | | U.S. Treasury Inflation Index Notes, 2.38%, due 1/15/17 | | | 11,639 | ØØ | |

| | 100 | | | U.S. Treasury Notes, 2.38%, due 9/30/14 | | | 100 | | |

| | | | | Total U.S. Treasury Securities-Backed by the Full Faith and Credit of the U.S. Government (Cost $18,525) | | | 18,962 | | |

| U.S. Government Agency Securities (8.2%) | |

| | 8,500 | | | Freddie Mac, Discount Notes, 0.03%, due 1/20/10 (Cost $8,496) | | | 8,499 | | |

| Mortgage-Backed Securities (43.5%) | |

| Adjustable Rate Mortgages (6.7%) | |