As filed with the Securities and Exchange Commission on January 7, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3802

NEUBERGER BERMAN INCOME FUNDS

(Exact Name of the Registrant as Specified in Charter)

c/o Neuberger Berman Management LLC

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices – Zip Code)

Registrant's telephone number, including area code: (212) 476-8800

Robert Conti

Chief Executive Officer and President

c/o Neuberger Berman Management LLC

Neuberger Berman Income Funds

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Arthur C. Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Date of fiscal year end: October 31, 2010

Date of reporting period: October 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders

| | Neuberger Berman | | |

| | | | |

| | Investor Class Shares | | Class A Shares |

| | Institutional Class Shares | | Class C Shares |

| | Trust Class Shares | | Class R3 Shares |

| | | | |

| | | | |

| | Core Bond Fund Floating Rate Income Fund High Income Bond Fund | | Municipal Intermediate Bond Fund Short Duration Bond Fund Strategic Income Fund |

| | | | |

| | | | |

| | | | |

| | Annual Report October 31, 2010 | | |

| | Contents | |

| | | |

| | THE FUNDS | |

| | | |

| | President's Letter | 1 |

| | | |

| | PORTFOLIO COMMENTARY | |

| | | |

| | Core Bond Fund | 2 |

| | | |

| | Floating Rate Income Fund | 5 |

| | | |

| | High Income Bond Fund | 8 |

| | | |

| | Municipal Intermediate Bond Fund | 11 |

| | | |

| | Short Duration Bond Fund | 14 |

| | | |

| | Strategic Income Fund | 17 |

| | | |

| | FUND EXPENSE INFORMATION | 25 |

| | | |

| | SCHEDULE OF INVESTMENTS | |

| | | |

| | Core Bond Fund | 27 |

| | | |

| | Floating Rate Income Fund | 33 |

| | | |

| | High Income Bond Fund | 39 |

| | | |

| | Municipal Intermediate Bond Fund | 46 |

| | | |

| | Short Duration Bond Fund | 51 |

| | | |

| | Strategic Income Fund | 54 |

| | | |

| | FINANCIAL STATEMENTS | 84 |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2010 Neuberger Berman Management LLC. All rights reserved.

| FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA |

| | | |

| | Core Bond Fund | 106 |

| | | |

| | Floating Rate Income Fund | 106 |

| | | |

| | High Income Bond Fund | 108 |

| | | |

| | Municipal Intermediate Bond Fund | 108 |

| | | |

| | Short Duration Bond Fund | 110 |

| | | |

| | Strategic Income Fund | 112 |

| | | |

| | Reports of Independent Registered Public Accounting Firms | 116 |

| | | |

| | Directory | 118 |

| | | |

| | Trustees and Officers | 119 |

| | | |

| | Proxy Voting Policies and Procedures | 128 |

| | | |

| | Quarterly Portfolio Schedule | 128 |

| | | |

| | Notice to Shareholders | 128 |

| | | |

| | Board Consideration of the Management and Sub-Advisory Agreements | 128 |

| | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2010 Neuberger Berman Management LLC. All rights reserved.

President's Letter

Dear Fellow Shareholder,

The fixed income markets generally provided solid results in the fiscal year ended October 31, 2010. While there were periods of heightened volatility, they were largely offset by robust risk appetite, as investors looked to generate incremental income in the low-interest-rate environment. Against this backdrop, non-Treasury securities outperformed their Treasury counterparts. Also supporting non-Treasuries were the continued economic expansion, benign inflation and strengthening corporate balance sheets.

Our Fixed Income Funds were generally positioned to benefit from the outperformance of non-Treasuries. In particular, exposure to the areas of the market that had lagged the most during the credit crisis enhanced the Funds' results during the reporting period.

Looking ahead, while the lengthiest recession since the Great Depression has finally been declared over, the U.S. economy still faces a number of headwinds. These include continued elevated unemployment and a housing market that is struggling to regain its footing. Despite these challenges, it is our belief that the economy has enough momentum to avoid a double-dip recession. That said, we expect to see growth that is more modest than previous periods exiting a severe recession.

One factor that we believe will support the economy going forward is continued low interest rates. With economic growth moderating during the second half of the reporting period, the Federal Reserve kept the Federal Funds rate at a historically low range of 0% to 0.25%. In addition, during its September 2010 meeting, Federal Reserve Chairman Ben Bernanke indicated that the Fed was "prepared to provide additional accommodation if needed to support the economic recovery..." In November, after the reporting period had concluded, the Federal Reserve announced its intention to purchase $600 billion in Treasuries by the end of June 2011, in an attempt to keep longer-term rates low and support the economy. Whether this plan has its desired effect, of course, remains to be seen.

Against a backdrop of moderately positive economic growth and mild inflation, we believe that non-Treasuries could continue to generate solid results, and our Fixed Income Funds are positioned accordingly. In addition, it is our belief that demand for non-Treasuries will remain strong given the low yields offered by Treasury securities.

In conclusion, as the last few years have shown, the financial markets can experience periods of unsettling volatility. Given uncertainties surrounding the economy and the Federal Reserve's policies, we believe there is a chance that the financial markets will experience higher volatility going forward. Should such volatility occur, we urge shareholders to maintain a long-term perspective.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

Core Bond Fund Commentary (Unaudited)

For the fiscal year ended October 31, 2010, Neuberger Berman Core Bond Fund posted a strong absolute return and outperformed its benchmark, the Barclays Capital U.S. Aggregate Index.

To a great extent, risk appetite was robust during the reporting period as investors were drawn to investments that offered relatively high yields in the low interest rate environment. Two notable exceptions occurred in late April and May, when concerns regarding the European sovereign debt crisis escalated, and again in August, as moderating economic data led to fears of a double-dip recession. However, these proved to be only temporary setbacks and risk aversion was quickly replaced by continued strong demand for non-Treasury fixed income securities. Also supporting non-Treasuries were strengthening corporate balance sheets and better-than-generally-expected corporate profits, continued low interest rates, benign inflation and indications that the Federal Reserve would introduce another round of quantitative easing (QE2) to support the economy. Against this backdrop, non-Treasuries generally outperformed equal-duration Treasuries during the reporting period.

Many of the best performing sectors in the investment grade fixed income market were those that offered the most attractive yields, including commercial mortgage-backed securities (CMBS) and investment grade bonds.

The Fund was well positioned for an environment that favored non-Treasuries. In particular, the Fund's overweight positions versus the benchmark in CMBS and investment-grade bonds enhanced results as their spreads (the difference in yield between Treasuries and other bond sectors) significantly narrowed during the 12-month reporting period. Within the investment grade sector, the Fund's industrial and financial bonds produced the best results.

Also contributing to performance was the Fund's yield curve positioning and an allocation to Treasury Inflation Protected Securities (TIPS). Throughout most of the period, the Fund had an overweight to the intermediate portion of the yield curve. This was beneficial to results as intermediate-term rates declined more than their short- and long-term counterparts. TIPS benefited from a decline in real (excluding inflation) yields and increasing expectations for higher inflation.

Modestly hampering absolute performance was the Fund's exposure to U.S. Treasuries and agency mortgage-backed securities, as lower yielding and higher quality bonds lagged the overall fixed income market during the period.

We made a number of adjustments to the portfolio during the reporting period, such as paring its investment-grade bond exposure to capture profits given the sector's strong results. The proceeds of those sales were used to increase the Fund's exposure to U.S. Treasury securities in October. This was done to broaden diversification and reduce overall risk exposure.

Looking ahead, we believe that the U.S. economy will avert a double-dip recession and that inflation will remain benign. However, we feel economic growth could be muted by historical standards coming out of a severe recession. In addition, the Federal Reserve has signaled that short-term interest rates could remain low "for an extended period" and in our view QE2 could keep longer-term rates relatively low as well. Against this backdrop, we believe that demand for non-Treasuries will remain strong. We feel the portfolio is well positioned for such an environment given our overweight to non-Treasuries as we seek to generate solid risk-adjusted returns.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Core Bond Fund

| TICKER SYMBOLS |

| Investor Class | | NCRIX |

| Institutional Class | | NCRLX |

| Class A | | NCRAX |

| Class C | | NCRCX |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Net Assets) | |

| Asset-Backed | | | 13.1 | % | |

| Corporate Debt | | | 25.8 | | |

| Mortgage-Backed Securities | | | 30.1 | | |

| U.S. Treasury Securities | | | 45.5 | | |

| Short-Term Investments | | | 2.7 | �� | |

Liabilities, less cash, receivables and other assets | | | (17.2 | ) | |

| Total | | | 100.0 | | |

| PERFORMANCE HIGHLIGHTS3,10 |

| | | Average Annual Total Return Ended 10/31/2010 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 02/01/1997 | | | 10.03 | % | | | 6.39 | % | | | 6.01 | % | | | 5.81 | % | |

| Institutional Class | | 10/01/1995 | | | 10.45 | % | | | 6.81 | % | | | 6.45 | % | | | 6.21 | % | |

Class A15 | | 12/20/2007 | | | 10.04 | % | | | 6.53 | % | | | 6.30 | % | | | 6.11 | % | |

Class C15 | | 12/20/2007 | | | 9.31 | % | | | 6.09 | % | | | 6.08 | % | | | 5.97 | % | |

| With Sales Charge | | | | | | | | | | | | | | | | | | | |

Class A15 | | | | | 5.38 | % | | | 5.61 | % | | | 5.84 | % | | | 5.81 | % | |

Class C15 | | | | | 8.31 | % | | | 6.09 | % | | | 6.08 | % | | | 5.97 | % | |

| Index | | | | | | | | | | | | | | | | | | | |

Barclays Capital U.S. Aggregate Index13,14 | | | 8.01 | % | | | 6.45 | % | | | 6.38 | % | | | 6.41 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2010, the 30-day SEC yield was 1.85%, 2.23%, 1.77% and 1.12% for Investor Class, Institutional Class, Class A and Class C shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.17%, 0.72%, 1.13% and 2.45% for Investor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 0.88%, 0.48%, 0.88% and 1.63% for Investor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2020 for Investor Class, Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

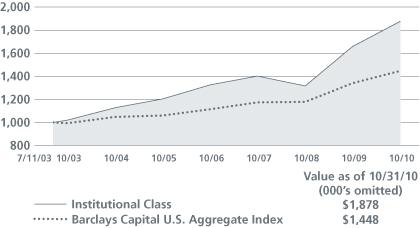

Core Bond Fund

| COMPARISON OF A $1,000,000 INVESTMENT |

| (000's Omitted) |

|

| |

This chart shows the value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures (see Performance Highlights chart on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. R esults represent past performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

Floating Rate Income Fund Commentary (Unaudited)

We are pleased to provide the first annual report for Neuberger Berman Floating Rate Income Fund, which was launched on December 29, 2009. As portfolio managers for the Fund, we seek to generate a high level of current income for shareholders while maintaining a focus on capital preservation. The Fund invests primarily in floating rate senior secured loans that we believe have the potential for attractive risk-adjusted returns. Central to our discipline is rigorous credit research, as we look for companies with historically stable cash flows, liquidity and a tangible asset base.

For the period from its inception through October 31, 2010, the Fund posted a solid absolute return but underperformed its benchmark, the S&P/LSTA Leveraged Loan Index.

While there were periods of volatility, most notably in late April and May given concerns regarding the European debt crisis, the floating rate bank loan market produced strong results during the reporting period. Supporting the market were generally strong demand from investors seeking incremental yields in the low interest rate environment and a contracting supply of floating rate bank loans. There was also a meaningful decline in floating rate loan defaults. During the reporting period, the default rate among the securities in the benchmark fell from approximately 9.6% to 2.3%. As was the case in 2009, lower-quality securities outperformed their higher-quality counterparts. Calendar year-to-date through October 31, 2010, the S&P/LSTA Leveraged Loan Index returned 8.41%, CCC-rated securities in the index gained 16.9% and BB-rated se curities rose 6.6%, respectively.

During the period, we increased the Fund's allocation to non-floating rate securities. We have the flexibility to allocate up to 20% of the portfolio to these securities and within this segment, we invested in fixed-rate senior secured bonds that offered higher yields than the floating rate loans offered by the same issuers. Given our focus on generating high current income, 17.7% of the Fund was held in fixed-rate securities at the end of the reporting period.

We also continued to actively participate in the new issuance market, emphasizing securities in the primary rather than the secondary bank loan market due to the former's higher current yields. In addition, we emphasized larger, highly liquid names that offered attractive yields in order to maintain a liquid portfolio.

Our higher-quality bias detracted from relative performance during the reporting period. Throughout the period, the Fund was underweighted in CCC-rated securities and overweighted in BB and B-rated issues versus the benchmark. We felt this positioning was appropriate given weak economic data and continued economic headwinds, such as elevated unemployment and ongoing strains in the housing market.

From a sector perspective, security selection in radio/TV, building and development, chemicals and aerospace and defense detracted the most from results. In contrast, our security selection in electronics, autos, financial and telecommunications added the most to positive performance.

Looking ahead, we have a positive outlook for the floating rate loan market. In our opinion, the supply/demand dynamics in the market will remain favorable. We expect to see a continued shrinking of the loan market. Moreover, given the likelihood of relatively low interest rates, we feel that demand for the segment will continue to be strong as investors search for higher yields. During the first 11 months of calendar year 2010, roughly $11.3 billion was invested in retail bank loan mutual funds. In contrast, $3.4 billion was invested in these mutual funds during all of 2009. We believe the economy will avert a double-dip recession. This, coupled with strengthening corporate balance sheets, could result in continued low default rates in 2011.

Sincerely,

Stephen J. Casey, Ann H. Benjamin, Thomas P. O'Reilly and Joseph P. Lynch

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Floating Rate Income Fund

| TICKER SYMBOLS |

| Institutional Class | | NFIIX | |

| Class A | | NFIAX | |

| Class C | | NFICX | |

| PORTFOLIO BY MATURITY DISTRIBUTION |

| (as a % of Total Investments) | |

| Less than One Year | | | 12.9 | % | |

| One to Five Years | | | 31.6 | | |

| Five to Ten Years | | | 52.7 | | |

| Ten Years or Greater | | | 2.8 | | |

| Total | | | 100.0 | | |

PERFORMANCE HIGHLIGHTS6 |

| | | Inception Date | | Cumulative Total Return Ended 10/31/2010 Life of Fund | |

| At NAV | | | | | | | |

Institutional Class17 | | 12/30/2009 | | | 6.24 | % | |

| Class A | | 12/29/2009 | | | 5.85 | % | |

Class C17 | | 12/30/2009 | | | 5.39 | % | |

| With Sales Charge | |

| Class A | | | | | 1.39 | % | |

Class C17 | | | | | 4.39 | % | |

| Index | |

S&P/LSTA Leveraged Loan Index13,14 | | | 8.80 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2010, the 30-day SEC yield was 5.16%, 4.56% and 4.05% for Institutional Class, Class A and Class C shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.38%, 1.75% and 2.50% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 0.70%, 1.07% and 1.82% for Institutional Class, Class A and Class C, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2013 for Institutional Class, Class A and Class C.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

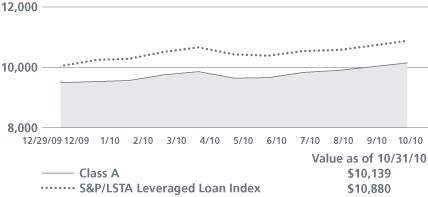

Floating Rate Income Fund

| COMPARISON OF A $10,000 INVESTMENT (WITH SALES CHARGE) |

|

| |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception, if it has not operated for 10 years. The graph is based on the Class A shares only; performance of other classes will vary due to differences in fee structures (see Performance Highlights chart on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

High Income Bond Fund Commentary (Unaudited)

For the fiscal year ended October 31, 2010, Neuberger Berman High Income Bond Fund Investor Class posted a strong absolute return and modestly outperformed its benchmark, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index. (Please see Performance Highlights on next page for performance of all classes.)

To a great extent, the same factors that had triggered the high yield market rally that began in the spring of 2009 continued during the reporting period. These included the stabilizing economy, modest inflation, strengthening corporate balance sheets, better-than-expected profits and falling default rates. Aside from some temporary periods of volatility — triggered by the sovereign debt crisis in Europe and concerns regarding a possible double-dip recession — investor risk appetite was robust, further supporting high yield bond prices. All told, the Fund's benchmark posted positive returns during 11 of the 12 months covered by this report and gained 19.10% overall. The high yield market's gains were broad-based, as bonds rated CCC (a relatively low rating) and BB securities (rated higher) in the index returned 20.2% and 18.9% , respectively.

For the Fund, security selection in non-captive diversified finance, autos and media/non-cable were the largest positive contributors to relative performance. In contrast, an underweight in banking, along with security selection in retail and technology, were the largest detractors from relative results.

We made several adjustments to the portfolio during the reporting period, such as reducing the Fund's exposure to CCC-rated securities. This was accomplished through the sale of certain holdings that had appreciated and reached our target prices. In addition, a number of our holdings rated CCC were upgraded. Given these upgrades, the Fund's exposure to securities rated BB increased during the period. We also focused on buying higher-quality names in the new issue market, as we believed them to be attractively structured and priced. Elsewhere, given signs of moderating economic growth during the second half of the reporting period, we pared our exposure to more cyclical names and increased the Fund's weighting to certain defensive sectors.

Even with its outstanding results over the last two years, we continue to have a positive outlook for the high yield market. We believe that inflation will remain muted and that the U.S. economic recovery will continue, although growth rates could be muted by historical standards coming out of a severe recession. This type of environment has generally been historically positive for high yield bonds. In addition, the Federal Reserve has signaled that short-term interest rates could remain low "for an extended period" and we believe the additional quantitative easing announced in November could keep longer-term rates relatively low as well. Against this backdrop, we believe that demand for high yield bonds will remain strong. Other factors that could support the high yield market, if they continue, could be additional improvements in corpor ate earnings and declining high yield defaults. After peaking at 10.3% in 2009, default rates were approximately 2.4% at the end of the reporting period. We feel that defaults could decline further based on the gradually improving economy and the lack of potential default triggers within high yield issuers' balance sheets.

As always, we will continue to conduct extensive research on potential securities for the portfolio as we seek to generate consistently strong risk-adjusted returns.

Sincerely,

Ann H. Benjamin and Thomas P. O'Reilly

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

High Income Bond Fund

| TICKER SYMBOLS |

| Investor Class | | NHINX | |

| Institutional Class | | NHILX | |

| Class A | | NHIAX | |

| Class C | | NHICX | |

| Class R3 | | NHIRX | |

| PORTFOLIO BY MATURITY DISTRIBUTION | |

| (as a % of Total Investments) | |

| Less than One Year | | | 2.2 | % | |

| One to Five Years | | | 23.9 | | |

| Five to Ten Years | | | 62.2 | | |

| Ten Years or Greater | | | 11.7 | | |

| Total | | | 100.0 | | |

PERFORMANCE HIGHLIGHTS2,9 |

| | | Average Annual Total Return Ended 10/31/2010 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 02/01/1992 | | | 19.71 | % | | | 9.23 | % | | | 8.27 | % | | | 8.28 | % | |

Institutional Class12 | | 05/27/2009 | | | 19.81 | % | | | 9.33 | % | | | 8.32 | % | | | 8.30 | % | |

Class A12 | | 05/27/2009 | | | 19.52 | % | | | 9.18 | % | | | 8.24 | % | | | 8.26 | % | |

Class C12 | | 05/27/2009 | | | 18.60 | % | | | 8.96 | % | | | 8.13 | % | | | 8.20 | % | |

Class R312 | | 05/27/2009 | | | 19.08 | % | | | 9.11 | % | | | 8.21 | % | | | 8.24 | % | |

| With Sales Charge | | | | | | | | | | | | | | | | | | | |

Class A12 | | | | | 14.49 | % | | | 8.23 | % | | | 7.77 | % | | | 8.01 | % | |

Class C12 | | | | | 17.60 | % | | | 8.96 | % | | | 8.13 | % | | | 8.20 | % | |

| Index | | | | | | | | | | | | | | | | | | | |

Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index13,14 | | | 19.10 | % | | | 9.13 | % | | | 8.71 | % | | | N/A | | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2010, the 30-day SEC Yield was 6.22%, 6.46%, 5.83%, 5.35% and 5.85% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.06%, 0.93%, 1.29%, 2.04% and 5.55% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 1.03%, 0.77%, 1.14%, 1.89% and 1.39% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2013 for Investor Class, Institutional Class, Class A, Class C and Class R3 shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

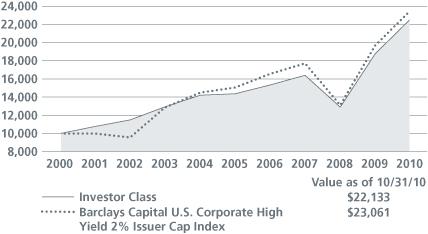

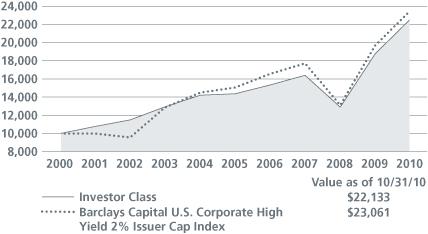

High Income Bond Fund

| COMPARISON OF A $10,000 INVESTMENT |

| |

|

| |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures (see Performance Highlights chart on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results r epresent past performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

Municipal Intermediate Bond Fund Commentary (Unaudited)

For the fiscal year ended October 31, 2010, Neuberger Berman Municipal Intermediate Bond Fund posted a positive return but lagged its benchmark, the Barclays Capital 7-Year General Obligation Index.

Even though numerous states and local municipalities continued to face budgetary challenges, the municipal bond market generated solid results during the reporting period. Investor demand for municipal securities was generally robust as they looked to generate additional yield given the relatively low interest rate environment. Also supporting the market were low inflation and the falling supply of traditional tax-exempt municipal bonds. This was due, in large part, to increased issuance of taxable Build America Bonds (BABs). In many cases, municipalities preferred to issue BABs because the federal government provides cash subsidy payments equal to 35% of the issuing municipality's interest costs.

The Fund's underperformance versus its benchmark was largely the result of its defensive positioning and higher quality bias. With investors looking for higher yields, lower-rated municipal bonds outperformed their higher-rated counterparts. To illustrate, the Barclays Capital BAA Municipal Bond Index gained 11.2% during the reporting period, while the Barclays Capital AAA Municipal Bond Index returned 5.9%. We believed a higher-quality portfolio was warranted given only a modestly improving economy, continued high unemployment and relatively weak tax revenues.

From a sector perspective, we emphasized higher quality revenue and general obligation bonds that tend to perform relatively well in difficult economic times. This was not rewarded, as what we consider lower-quality sectors, such as health care, produced stronger results during the reporting period.

Also detracting from performance was the Fund's yield curve positioning. Throughout the reporting period, we utilized a barbell approach (investing in shorter and longer maturities). In contrast, the benchmark is concentrated in the six- to eight-year portion of the curve, which was among the best-performing portions of the municipal yield curve.

We made a number of adjustments to the portfolio during the reporting period, such as increasing our allocation to single family housing municipal securities. We believe these federally-backed mortgage bonds are high quality, have minimal prepayment risk and are compellingly valued relative to their credit quality.

Looking ahead, we continue to have a positive long-term outlook for the municipal market. While the economy is growing at a modest pace, we do not expect it to fall back into a recession. We also believe that demand for municipal securities will remain strong. This demand could be driven by higher federal, state and local tax rates. In addition, the Federal Reserve has signaled that short-term interest rates could remain low "for an extended period" and we think additional quantitative easing could keep longer-term rates relatively low as well. This could be supportive of continued strong demand for municipal securities. Finally, the municipal market, in our opinion, remains attractively valued when compared to Treasury counterparts.

That is not to say that we will not experience periods of increased volatility in the municipal market. Based on the results of the mid-term elections, there could be less federal government support for financially challenged state and local governments. Less federal assistance, coupled with only a modestly improving economy and relatively weak tax revenues, could result in an increase in municipal bond downgrades. Against this backdrop, we believe that maintaining our defensive posture and what we consider a higher quality portfolio is appropriate. In addition, we believe that active management and thorough, in-house fundamental research on the underlying credit characteristics of our existing and potential holdings will be essential to produce consistently strong risk-adjusted returns.

Sincerely,

James L. Iselin and S. Blake Miller

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Municipal Intermediate Bond Fund

| TICKER SYMBOLS |

| Investor Class | | NMUIX | |

| Institutional Class | | NMNLX | |

| Class A | | NMNAX | |

| Class C | | NMNCX | |

| PORTFOLIO BY STATE AND TERRITORY |

| (as a % of Total Investments) | | | | | |

| Alaska | | | 0.5 | % | |

| Arizona | | | 3.9 | | |

| California | | | 12.2 | | |

| Colorado | | | 4.3 | | |

| District of Columbia | | | 2.5 | | |

| Florida | | | 2.5 | | |

| Georgia | | | 2.0 | | |

| Illinois | | | 10.6 | | |

| Indiana | | | 2.5 | | |

| Iowa | | | 1.2 | | |

| Kansas | | | 3.2 | | |

| Louisiana | | | 0.5 | | |

| Massachusetts | | | 6.0 | | |

| Michigan | | | 3.9 | | |

| Minnesota | | | 1.4 | | |

| Mississippi | | | 1.8 | | |

| Missouri | | | 1.8 | | |

| Nebraska | | | 1.5 | | |

| Nevada | | | 2.3 | | |

| New Jersey | | | 3.7 | | |

| New Mexico | | | 1.9 | | |

| New York | | | 8.7 | | |

| North Carolina | | | 0.9 | | |

| Ohio | | | 0.5 | | |

| Oregon | | | 1.1 | | |

| Pennsylvania | | | 1.4 | | |

| Puerto Rico | | | 2.0 | | |

| Rhode Island | | | 1.0 | | |

| South Carolina | | | 0.1 | | |

| South Dakota | | | 0.8 | | |

| Tennessee | | | 1.5 | | |

| Texas | | | 7.3 | | |

| Virginia | | | 1.4 | | |

| Washington | | | 1.8 | | |

| Wisconsin | | | 1.3 | | |

| Total | | | 100.0 | | |

PERFORMANCE HIGHLIGHTS1,7,8 |

| | | | |

| | | Average Annual Total Return Ended 10/31/2010 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 07/09/1987 | | | 6.56 | % | | | 4.18 | % | | | 4.37 | % | | | 5.24 | % | |

Institutional Class18 | | 06/21/2010 | | | 6.62 | % | | | 4.19 | % | | | 4.38 | % | | | 5.25 | % | |

Class A18 | | 06/21/2010 | | | 6.57 | % | | | 4.18 | % | | | 4.37 | % | | | 5.24 | % | |

Class C18 | | 06/21/2010 | | | 6.18 | % | | | 4.10 | % | | | 4.34 | % | | | 5.23 | % | |

| With Sales Charge | |

Class A18 | | | | | 2.04 | % | | | 3.28 | % | | | 3.92 | % | | | 5.05 | % | |

Class C18 | | | | | 5.18 | % | | | 4.10 | % | | | 4.34 | % | | | 5.23 | % | |

| Index | |

Barclays Capital 7-Year GO Index13,14 | | | 8.45 | % | | | 5.93 | % | | | 5.66 | % | | | 6.26 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2010, the 30-day SEC Yield was 2.17%, 2.32%, 1.95% and 1.23% for Investor Class, Institutional Class, Class A and Class C shares, respectively. The tax-equivalent yield was 3.34%, 3.57%, 3.00% and 1.89% for Investor Class, Institutional Class, Class A and Class C shares, respectively, for an investor in the highest federal income tax bracket (35%).

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.12%, 0.58%, 0.95% and 1.70% for Investor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 0.65%, 0.50%, 0.87% and 1.62% for the Investor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2013 for Investor Class, Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

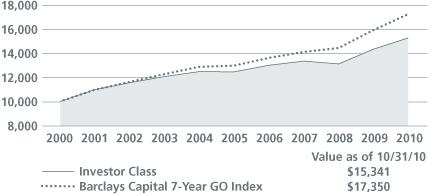

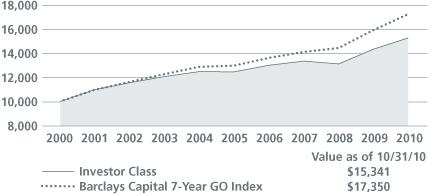

Municipal Intermediate Bond Fund

| COMPARISON OF A $10,000 INVESTMENT |

| |

|

| |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures (see Performance Highlights chart above). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent pa st performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

Short Duration Bond Fund Commentary (Unaudited)

For the fiscal year ended October 31, 2010, Neuberger Berman Short Duration Bond Fund posted a positive return and outperformed its benchmark, the Barclays Capital 1-3 Year U.S. Government/Credit Index. The Fund also outperformed its previous benchmark, the BofA Merrill Lynch 1-3 Year Treasury Index, over the same period.

To a great extent, risk appetite was robust during the reporting period as investors were drawn to investments that offered relatively high yields in the low interest rate environment. Two notable exceptions occurred in late April and May, when concerns regarding the European sovereign debt crisis escalated, and again in August, as moderating economic data led to fears of a double-dip recession. However, these proved to be only temporary setbacks and risk aversion was quickly replaced by continued strong demand for non-Treasury fixed income securities. Also supporting non-Treasuries were strengthening corporate balance sheets and better-than-generally-expected corporate profits, continued low interest rates, benign inflation and indications that the Federal Reserve would introduce another round of quantitative easing (QE2) to support the economy. Against this backdrop, non-Treasuries generally outperformed equal-duration Treasuries during the reporting period.

The Fund was well positioned for an environment that favored non-Treasuries. In particular, the Fund's commercial mortgage-backed securities (CMBS), non-agency mortgage-backed securities, investment-grade bonds and asset-backed securities enhanced results as their spreads (the difference in yield between Treasuries and other bond sectors) significantly narrowed during the 12-month reporting period. Within the investment grade sector, the Fund's financial bonds produced the best results.

Detracting somewhat from results was the Fund's defensive duration positioning. When the reporting period began, the Fund's duration was marginally shorter than that of its benchmark. We adjusted duration even shorter in May as interest rates fell sharply, given that we did not believe they would move substantially lower. However, this positioning was not rewarded as short-term rates fell to historically low levels toward the end of the reporting period. During the period, we used Treasury futures to manage the Fund's duration positioning.

We made a number of adjustments to the Fund during the reporting period, such as opportunistically reducing its weighting in non-agency mortgage-backed securities to take advantage of strengthening prices. We also pared our exposure to investment grade financials and increased its position in BBB-rated industrial bonds, where, in our opinion, we found attractively valued opportunities. The portfolio's exposure to CMBS was also reduced given their strong results. In addition to selling certain CMBS securities, a number of the Fund's positions matured. We largely reinvested the proceeds in a combination of asset-backed securities and corporate bonds.

Looking ahead, we believe the U.S. economy will avert a double-dip recession and inflation will remain benign. However, we feel that economic growth could be muted by historical standards coming out of a severe recession. In addition, the Federal Reserve has signaled that short-term interest rates could remain low "for an extended period" and in our view QE2 could keep longer-term rates relatively low as well. Against this backdrop, we believe that demand for non-Treasuries will remain strong. We feel the portfolio is appropriately positioned for such an environment with our overweight versus the benchmark in non-Treasuries as we seek to generate solid risk-adjusted returns.

Sincerely,

Thomas Sontag, Michael Foster and Richard Grau

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Short Duration Bond Fund

| TICKER SYMBOLS |

| Investor Class | | NSBIX | |

| Trust Class | | NSBTX | |

| Institutional Class | | NSHLX | |

| Class A | | NSHAX | |

| Class C | | NSHCX | |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Net Assets) | |

| Asset-Backed | | | 8.3 | % | |

| Corporate Debt | | | 23.2 | | |

| U.S. Government Agency Securities | | | 4.0 | | |

| Mortgage-Backed Securities | | | 35.8 | | |

| U.S. Treasury Securities | | | 27.6 | | |

| Short-Term Investments | | | 2.4 | | |

Liabilities, less cash, receivables and other assets | | | (1.3 | ) | |

| Total | | | 100.0 | | |

PERFORMANCE HIGHLIGHTS5 |

| | | | |

| | | Average Annual Total Return Ended 10/31/2010 | |

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | | | | | | | | | | | | | | | | | | | |

| Investor Class | | 06/09/1986 | | | 7.08 | % | | | 2.25 | % | | | 3.13 | % | | | 4.99 | % | |

Trust Class16 | | 08/30/1993 | | | 7.01 | % | | | 2.15 | % | | | 3.02 | % | | | 4.93 | % | |

Institutional Class16 | | 06/21/2010 | | | 7.16 | % | | | 2.27 | % | | | 3.14 | % | | | 4.99 | % | |

Class A16 | | 06/21/2010 | | | 7.10 | % | | | 2.26 | % | | | 3.13 | % | | | 4.99 | % | |

Class C16 | | 06/21/2010 | | | 6.81 | % | | | 2.20 | % | | | 3.11 | % | | | 4.98 | % | |

| With Sales Charge | |

Class A16 | | | | | 2.55 | % | | | 1.37 | % | | | 2.69 | % | | | 4.80 | % | |

Class C16 | | | | | 5.81 | % | | | 2.20 | % | | | 3.11 | % | | | 4.98 | % | |

| Index | |

| Barclays Capital 1-3 Year | | | | | | | | | | | | | | | | | | | |

U.S. Government/Credit Index13,14 | | | | | 3.23 | % | | | 4.75 | % | | | 4.60 | % | | | 6.02 | % | |

BofA Merrill Lynch 1-3 Year Treasury Index13,14 | | 2.53 | % | | | 4.40 | % | | | 4.18 | % | | | 5.81 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2010, the 30-day SEC Yield was 1.31%, 1.22%, 1.50%, 1.10% and 0.49% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 1.19%, 1.59%, 0.70%, 1.07% and 1.82% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 0.72%, 0.82%, 0.52%, 0.89% and 1.64% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2013 for Investor Class, Trust Class, Institutional Class, Class A and Class C shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The Fund's broad-based index used for comparison purposes has been changed from the BofA Merrill Lynch 1-3 Year Treasury Index to the Barclays Capital 1-3 Year U.S. Government/Credit Index because the new index more closely resembles the characteristics of the Fund's investments.

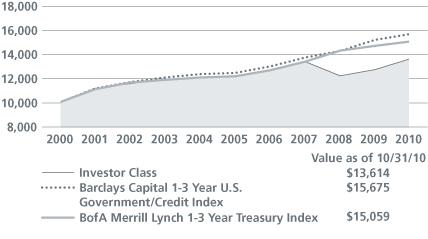

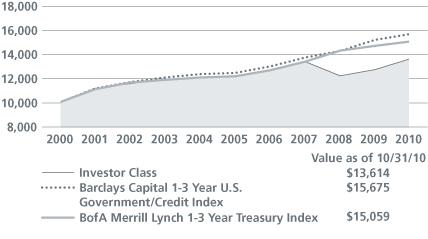

Short Duration Bond Fund

| COMPARISON OF A $10,000 INVESTMENT |

| |

|

| |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The graph is based on the Investor Class shares only; performance of other classes will vary due to differences in fee structures (see Performance Highlights on previous page). The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represe nt past performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

Strategic Income Fund Commentary (Unaudited)

For the fiscal year ended October 31, 2010, Neuberger Berman Strategic Income Fund posted a positive absolute return and outperformed its benchmark, the Barclays Capital U.S. Aggregate Index.

To a great extent, risk appetite was robust during the reporting period as investors were drawn to investments that offered relatively high yields in the low interest rate environment. Two notable exceptions occurred in late April and May, when concerns regarding the European sovereign debt crisis escalated, and again in August, as moderating economic data led to fears of a double-dip recession. However, these proved to be only temporary setbacks and risk aversion was quickly replaced by continued strong demand for non-Treasury fixed income securities. Also supporting non-Treasuries were strengthening corporate balance sheets and better-than-expected corporate profits, continued low interest rates, benign inflation and indications that the Federal Reserve would introduce another round of quantitative easing (QE2) to support the economy. A gainst this backdrop, non-Treasuries generally outperformed equal-duration Treasuries during the reporting period.

Many of the best performing sectors in the fixed income market were those that offered the most attractive yields, including high yield bonds, emerging market debt, commercial mortgage-backed securities (CMBS), investment grade bonds and non-agency mortgage-backed securities.

The Fund was well positioned for an environment that favored non-Treasuries. In particular, the Fund's overweight positions versus the benchmark in CMBS, high yield bonds, emerging market debt and investment-grade bonds enhanced results as their spreads (the difference in yield between Treasuries and other bond sectors) significantly narrowed during the 12-month reporting period. Within the corporate bond market, the Fund's industrial and financial bonds produced the best results.

Also contributing to performance was the Fund's yield curve positioning and an allocation to Treasury Inflation Protected Securities (TIPS). Throughout most of the period, the Fund had an overweight to the intermediate portion of the yield curve. This was beneficial for results as intermediate-term rates declined more than their short- and long-term counterparts. TIPS benefited from a decline in real (excluding inflation) yields and increasing expectations for higher inflation.

Modestly detracting from performance was the Fund's exposure to U.S. Treasuries and agency mortgage-backed securities as lower yielding and higher quality bonds lagged the overall fixed income market during the period.

We made a number of adjustments to the portfolio during the reporting period, such as opportunistically increasing its exposure to high yield bonds. In contrast, we pared the Fund's exposure to TIPS.

Looking ahead, we believe that the U.S. economy will avert a double-dip recession and that inflation will remain benign. However, we feel economic growth could be muted by historical standards coming out of a severe recession. In addition, the Federal Reserve has signaled that short-term interest rates could remain low "for an extended period" and in our view QE2 could keep longer-term rates relatively low as well. Against this backdrop, we believe that demand for non-Treasuries will remain strong. We feel the portfolio is well positioned for such an environment given our overweight in non-Treasuries as we seek to generate solid risk-adjusted returns.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Strategic Income Fund

| TICKER SYMBOLS |

| Institutional Class | | NSTLX | |

| Trust Class | | NSTTX | |

| Class A | | NSTAX | |

| Class C | | NSTCX | |

| PORTFOLIO BY TYPE OF SECURITY | |

| (as a % of Total Net Assets) | |

| Asset-Backed | | | 12.5 | % | |

| Corporate Debt | | | 41.8 | | |

| Bank Loans | | | 12.9 | | |

| Government Securities | | | 2.6 | | |

| Mortgage-Backed Securities | | | 15.0 | | |

| U.S. Treasury Securities | | | 20.9 | | |

| Short-Term Investments | | | 7.0 | | |

Liabilities, less cash, receivables and other assets | | | (12.7 | ) | |

| Total | | | 100.0 | | |

PERFORMANCE HIGHLIGHTS4 |

| | | Average Annual Total Return Ended 10/31/2010 | |

| | | Inception Date | | 1 Year | | 5 Years | | Life of Fund | |

| At NAV | |

| Institutional Class | | 07/11/2003 | | | 13.17 | % | | | 9.31 | % | | | 9.00 | % | |

Trust Class11 | | 04/02/2007 | | | 12.78 | % | | | 9.06 | % | | | 8.82 | % | |

Class A11 | | 12/20/2007 | | | 12.72 | % | | | 9.07 | % | | | 8.84 | % | |

Class C11 | | 12/20/2007 | | | 11.93 | % | | | 8.61 | % | | | 8.52 | % | |

| With Sales Charge | |

Class A11 | | | | | 7.93 | % | | | 8.13 | % | | | 8.19 | % | |

Class C11 | | | | | 10.93 | % | | | 8.61 | % | | | 8.52 | % | |

| Index | |

Barclays Capital U.S. Aggregate Index13,14 | | | 8.01 | % | | | 6.45 | % | | | 5.19 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance. Because the Fund had a different goal and strategy, which included managing assets by an asset allocation committee, prior to February 28, 2008, its performance during that time might have been different if current policies had been in effect.

For the period ended October 31, 2010, the 30-day SEC yield was 3.62%, 3.28%, 3.09% and 2.55% for Institutional Class, Trust Class, Class A and Class C shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2009 were 2.51%, 3.03%, 1.96% and 2.58% for Institutional Class,Trust Class, Class A and Class C shares, respectively (prior to any fee waivers or expense reimbursements). The expense ratios net of waivers and/or reimbursements were 0.78%, 1.13%, 1.18% and 1.88% for Institutional Class, Trust Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2020 for Institutional Class, Class A and Class C shares, and 10/31/2013 for Trust Class shares.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

Strategic Income Fund

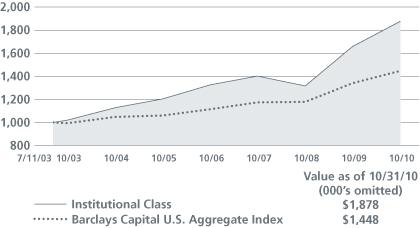

| COMPARISON OF A $1,000,000 INVESTMENT |

| (000's Omitted) |

| |

|

| |

This chart shows the value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception, if it has not operated for 10 years. The graph is based on the Institutional Class shares only; performance of other classes will vary due to differences in fee structures (see Average Annual Total Return above).The result is compared with one or more benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indices have not been reduced to reflect any of the fees and costs of investing. All results include the reinvestment of income dividends and distributions. Neither the Fund's returns nor the market indices shown in the graph and table reflect the effect of taxes an investor would pay on Fu nd distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. Please see Endnotes and Glossary of Indices for additional information. |

Endnotes

| 1 | Neuberger Berman Management LLC ("Management") has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Municipal Intermediate Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 0.65%, 0.50%, 0.87% and 1.62% of average daily net assets for the Investor Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2013. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its abo ve-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, there were no repayments of expenses to Management. |

| | |

| 2 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman High Income Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 1.00%, 0.75%, 1.12%, 1.87% and 1.37% of average daily net assets for the Investor Class, Institutional Class, Class A, Class C and Class R3, respectively. These undertakings last until October 31, 2013. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, the Investor Class of the Fund reimbursed Management $93,652. |

| | |

| 3 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Core Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 0.85%, 0.45%, 0.85% and 1.60% of average daily net assets for the Investor Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2020. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is mad e within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, there were no repayments of expenses to Management. In addition, Management has voluntarily agreed to waive its management fee in the amount of 0.18% (0.25% prior to March 3, 2010 and 0.20% prior to March 1, 2006) of the Fund's average daily net assets. Management may, at its sole discretion, modify or terminate this voluntary waiver at any time without notice to the Fund. Absent such waiver, the performance of each class of the Fund would have been lower. |

| | |

| 4 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Strategic Income Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 1.10%, 0.75% (effective March 1, 2008, and 0.85% through February 28, 2008), 1.15% and 1.85% of average daily net assets for the Trust Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2013 for the Trust Class and until October 31, 2020 for the Institutional Class, Class A and Class C. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the con tractual expense limitation, so long as its annual |

| | Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, there were no repayments of expenses to Management. |

| | |

| 5 | Neuberger Berman Management LLC ("Management") has contractually undertaken to forgo current payment of fees and/or reimburse Short Duration Bond Fund so that the total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 0.70%, 0.50%, 0.80%, 0.87% and 1.62% for the Investor Class, Institutional Class, Trust Class, Class A and Class C, respectively. These undertakings last until October 31, 2013. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, there were no repayments of expenses to Management. |

| | |

| 6 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Floating Rate Income Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) ("Operating Expenses") are limited to 0.70%, 1.07% and 1.82% of average daily net assets for the Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2013. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within thr ee years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2010, there were no repayments of expenses to Management. |

| | |

| 7 | Tax-equivalent effective yield is the taxable effective yield that an investor would have had to receive in order to realize the same level of yield after federal income taxes at the highest federal tax rate, currently 35%, assuming that all of a fund's income is exempt from federal income taxes. |

| | |

| 8 | A portion of the income may be a tax preference item for purposes of the federal alternative minimum tax for certain investors. |

| | |

| 9 | The Fund is the successor to Lipper High Income Bond Fund ("Lipper Fund"). The total return data for the periods prior to September 7, 2002, are those of Lipper Fund Premier Class. The performance information for Investor Class is that of Lipper Fund Premier Class for the period April 1, 1996, through September 6, 2002. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects the same as those of Lipper Fund. Returns would have been lower if the manager of Lipper Fund had not waived certain of its fees during the periods shown. |

| | |

| 10 | The Fund is the successor to Ariel Premier Bond Fund ("Ariel Bond Fund"). The total return data for the periods prior to June 13, 2005, are those of Ariel Bond Fund Institutional Class and Ariel Bond Fund Investor Class. The performance information for Institutional Class is that of Ariel Bond Fund Institutional Class for the period October 1, 1995 (date of inception) through June 10, 2005. The performance information for Investor Class is that of Ariel Bond Fund Institutional Class for the period October 1, 1995 through January 31, 1997 (the period prior to the class' commencement of operations), and that of Ariel Bond Fund Investor Class for the period February 1, 1997 (class' commencement of operations) through June 10, 2005. Ariel Bond Fund Institutional Class had lower expenses and typically higher returns than Ariel Bond Fund Invest or Class. The investment policies, guidelines and restrictions of the Fund are in all material respects the same as those of Ariel Bond Fund. Returns would have been lower if the manager of Ariel Bond Fund had not waived certain of its fees during the periods shown. |

| 11 | The Trust Class, Class A and Class C of Neuberger Berman Strategic Income Fund commenced operations on April 2, 2007, December 20, 2007 and December 20, 2007, respectively. The performance information for Trust Class, Class A and Class C prior to the class' commencement of operations is that of the Institutional Class of Neuberger Berman Strategic Income Fund. In making this translation, the performance information of the Institutional Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Institutional Class has lower expenses and typically higher returns than Class A, Class C or Class R3. |

| | |

| 12 | The Institutional Class, Class A, Class C and Class R3 of Neuberger Berman High Income Bond Fund each commenced operations on May 27, 2009. The performance information for Institutional Class, Class A, Class C and Class R3 prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman High Income Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A, Class C or Class R3. The Institutional Class has lower expenses and typically higher returns than Investor Class. |

| | |

| 13 | The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class. |

| | |

| 14 | Please see "Glossary of Indices" starting on page 24 for a description of indices. Please note that indices do not take into account any fees and expenses or tax consequences of investing in the individual securities that they track, and that individuals cannot invest directly in any index. Data about the performance of these indices are prepared or obtained by Management and include reinvestment of all income dividends and distributions. The Fund may invest in securities not included in the described indices or may not invest in all securities included in the described indices. |

| | |

| 15 | Class A and Class C of Neuberger Berman Core Bond Fund each commenced operations on December 20, 2007. The performance information for Class A and Class C prior to the class' commencement of operations is that of the Institutional Class of Neuberger Berman Core Bond Fund. In making this translation, the performance information for the Institutional Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as Rule 12b-1 fees). The Institutional Class has lower expenses and typically higher returns than Class A or Class C. |

| | |

| 16 | For Neuberger Berman Short Duration Bond Fund, Life of Fund performance shown for the Trust Class, Institutional Class, Class A and Class C is that of the Fund's Investor Class from the inception date of the Investor Class to the inception date of each Class. The Trust Class of Short Duration Bond Fund commenced operations on August 30, 1993. The Institutional Class, Class A and Class C of Neuberger Berman Short Duration Bond Fund each commenced operations on June 21, 2010. The performance information for Trust Class, Institutional Class, Class A and Class C prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman Short Duration Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A or Class C. The Institutional Class has lower expenses and typically higher returns than Investor Class. |

| | |

| 17 | The Institutional Class and Class C of Neuberger Berman Floating Rate Income Fund each commenced operations on December 30, 2009. The performance information for Institutional Class and Class C prior to the class' commencement of operations is that of Class A of Neuberger Berman Floating Rate Income Fund. In making this translation, the performance information (at NAV) of Class A has been adjusted to reflect the appropriate sales charge applicable to Class C shares, but has not been adjusted to take into account differences in class specific operating expenses (such as Rule 12b-1 fees). Class A has higher expenses and typically lower returns (at NAV) than Institutional Class. Class A has lower expenses and typically higher returns (at NAV) than Class C. |

| 18 | The Institutional Class, Class A and Class C of Neuberger Berman Municipal Intermediate Bond Fund each commenced operations on June 21, 2010. The performance information for Institutional Class, Class A and Class C prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman Municipal Intermediate Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A and Class C. The Institutional Class has lower expenses and typically higher returns than Investor Class. |

| | |

Glossary of Indices

Barclays Capital 1-3 Year U.S. Government/Credit Index: | | An unmanaged index that includes all bonds in the U.S. Government/Credit Index with at least one to three years to maturity. The U.S. Government/Credit Index includes all securities in the Government and Credit Indices. The Government Index includes treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year) and agencies (i.e., publicly issued debt of U.S. Government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. Government). The Credit Index includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements. All bonds in the index must meet the following additional criteria: must have at least one year to final maturity regardless of call features; must have at lea st $250 million par amount outstanding; must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Standard & Poor's, Moody's Investors Services, Inc., and Fitch Inc.; must be fixed rate; must be dollar-denominated and non-convertible; and must be publicly issued. | |

| |

Barclays Capital 7-Year General Obligation Index: | | An unmanaged total return performance benchmark for the 7-year (6-8) maturity component of the Barclays Capital General Obligation ("G.O.") Index, which tracks the performance of the investment grade G.O. (state and local) tax-exempt bond market. | |

| |

| Barclays Capital U.S. Aggregate Index: | | An unmanaged index that represents the U.S. domestic investment grade bond market. It is comprised of the Barclays Capital Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million. | |