Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

| | Neuberger Berman Income Funds |

| | | |

| | | |

| | Investor Class Shares | Class A Shares |

| | Trust Class Shares | Class C Shares |

| | Institutional Class Shares | Class R3 Shares |

| | | |

| | | |

| | | |

| | | |

| | Core Bond Fund | Municipal Intermediate Bond Fund |

| | Floating Rate Income Fund | Short Duration Bond Fund |

| | High Income Bond Fund | Strategic Income Fund |

| | | |

| | Annual Report | |

| | | |

| | October 31, 2011 | |

| | Contents | |

| | THE FUNDS | |

| | President's Letter | 1 |

| | | |

| | PORTFOLIO COMMENTARY | |

| | Core Bond Fund | 2 |

| | | |

| | Floating Rate Income Fund | 5 |

| | | |

| | High Income Bond Fund | 8 |

| | | |

| | Municipal Intermediate Bond Fund | 11 |

| | | |

| | Short Duration Bond Fund | 14 |

| | | |

| | Strategic Income Fund | 17 |

| | | |

| | FUND EXPENSE INFORMATION | 25 |

| | | |

| | SCHEDULE OF INVESTMENTS | |

| | Core Bond Fund | 27 |

| | | |

| | Floating Rate Income Fund | 33 |

| | | |

| | High Income Bond Fund | 40 |

| | | |

| | Municipal Intermediate Bond Fund | 49 |

| | | |

| | Short Duration Bond Fund | 54 |

| | | |

| | Strategic Income Fund | 58 |

| | | |

| | FINANCIAL STATEMENTS | 90 |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2011 Neuberger Berman Management LLC. All rights reserved.

| | FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA | |

| | | |

| | Core Bond Fund | 110 |

| | | |

| | Floating Rate Income Fund | 110 |

| | | |

| | High Income Bond Fund | 112 |

| | | |

| | Municipal Intermediate Bond Fund | 114 |

| | | |

| | Short Duration Bond Fund | 114 |

| | | |

| | Strategic Income Fund | 116 |

| | | |

| | Reports of Independent Registered Public Accounting Firms | 122 |

| | | |

| | Directory | 124 |

| | | |

| | Trustees and Officers | 125 |

| | | |

| | Proxy Voting Policies and Procedures | 134 |

| | | |

| | Quarterly Portfolio Schedule | 134 |

| | | |

| | Notice to Shareholders | 134 |

| | | |

| | Board Consideration of the Management and Sub-Advisory Agreements | 135 |

| | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2011 Neuberger Berman Management LLC. All rights reserved.

President's Letter (Unaudited)

Dear Fellow Shareholder,

The fixed income market was often driven by macro factors that caused investor sentiment to shift during the 12 months ended October 31, 2011. This, in turn, triggered periods of heightened volatility and mixed results for non-Treasury securities.

Despite several flights to quality, Treasury yields rose and non-Treasury securities generated solid results over the first half of the reporting period. Fundamentals for non-Treasuries did not meaningfully change during the second half of the period, as the economy continued to expand, corporate balance sheets were generally flush with cash and profits remained strong. However, this was overshadowed at times by concerns regarding the global economy, the ongoing European sovereign debt crisis and the downgrade of U.S. debt by Standard & Poor's. Collectively, this sparked risk aversion as investors sold non-Treasuries in favor of the safety of U.S. government securities. At one point in September 2011, the yield on the 10-year Treasury fell to a level not seen since the 1940s. All told, Treasury yields moved lower over the 12 months ended October 31, 2011. While non-Treasuries produced positive results over that period, they generally lagged equal duration Treasuries.

Overall, our Fixed Income Funds were overweighted in non-Treasuries. This was largely beneficial during the first half of the fiscal year given spread tightening (the difference in yield between Treasuries and other securities). However, the aforementioned macro issues caused this strategy to produce mixed results during the second half of the fiscal year.

Looking ahead, we anticipate growth to remain modest, but positive, as the economy adjusts to tighter fiscal conditions. Easy monetary conditions, ample liquidity and stronger balance sheets for both consumers and corporations should, in our view, provide an improved environment for consumer spending and, thus, U.S. growth.

Given our expectations for the economy, relatively benign inflation and generally positive underlying fundamentals, we continue to favor certain non-Treasury securities. That being said, the financial markets could experience periods of volatility given the uncertain macro environment. However, with the Federal Reserve vowing to keep short term interest rates anchored at a historically low range between zero and 0.25% until mid-2013, we believe that investor demand for non-Treasuries will generally be strong. We also anticipate overall solid demand for tax-free bonds given their relatively attractive yields.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

Core Bond Fund Commentary (Unaudited)

Neuberger Berman Core Bond Fund Institutional Class generated a 4.82% total return for the 12 months ended October 31, 2011 and underperformed its benchmark, the Barclays Capital U.S. Aggregate Index, which provided a 5.00% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The fixed income market experienced periods of heightened volatility during the reporting period. These were often triggered by macro events, such as the sovereign debt crisis in Europe, Standard & Poor's downgrade of U.S. debt, natural disasters and geopolitical unrest. During the spikes in market volatility, investors typically sought refuge in Treasury securities. However, increased risk aversion was often quickly replaced with renewed risk appetite as investors looked for ways to generate incremental yield in the low interest rate environment. Overall, non-Treasury securities generated solid returns during the reporting period, but many sectors lagged equal-duration Treasuries.

While the Fund benefited from an overweight in non-Treasuries during the first half of the Fund's fiscal year, this positioning produced mixed results as the reporting period progressed. A portion of the Fund's non-Treasury gains were negated in August and September 2011, as concerns regarding a double-dip recession and the escalating European debt crisis caused credit spreads (the difference in yield between Treasuries and other bond sectors) to widen. For the 12-month period as a whole, the Fund's investment grade corporate bonds detracted from results. In particular, the Fund's overweight to the financials subsector and lower-rated industries were not rewarded. Additive to performance was the Fund's exposure to commercial mortgage-backed securities (CMBS), as their spreads narrowed during the 12-month reporting period. The Fund's allocation to Treasury Inflation Protected Securities (TIPS) also contributed to performance. They were supported by periods of increased inflation expectations and the flight to quality that occurred during the second half of the reporting period.

A number of adjustments were made to the portfolio during the reporting period. The Fund's allocation to U.S. government agency mortgages was increased as we found them to be attractively valued. While we maintained an overweight to the investment grade corporate bond sector, we pared our exposure given macro uncertainties. The Fund sold Treasury futures during the reporting period to assist in managing its duration positioning, which detracted slightly from returns.

Looking ahead, we believe the economy will avert a recession. However, given ongoing headwinds, such as elevated unemployment and weakness in the housing market, growth could remain modest. We anticipate maintaining our overweight exposure to non-Treasuries given our expectations for continued economic growth, benign inflation and solid investor demand.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Core Bond Fund (Unaudited)

| TICKER SYMBOLS |

| Investor Class | | NCRIX | |

| Institutional Class | | NCRLX | |

| Class A | | NCRAX | |

| Class C | | NCRCX | |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Net Assets) | |

| Asset-Backed Securities | 0.5 | % | |

| Corporate Debt Securities | 24.0 | | |

| Mortgage-Backed Securities | 51.7 | | |

| U.S. Treasury Securities | 18.7 | | |

| Short-Term Investments | 24.6 | | |

Liabilities, less cash, receivables and other assets | (19.5 | ) | |

| Total | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS3,10 |

| | Inception | Average Annual Total Return Ended 10/31/2011 | |

| | Date | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | 02/01/1997 | 4.41 | % | | 6.23 | % | | 5.20 | % | | 5.72 | % | |

| Institutional Class | 10/01/1995 | 4.82 | % | | 6.67 | % | | 5.63 | % | | 6.12 | % | |

Class A15 | 12/20/2007 | 4.32 | % | | 6.28 | % | | 5.44 | % | | 6.00 | % | |

Class C15 | 12/20/2007 | 3.54 | % | | 5.69 | % | | 5.14 | % | | 5.81 | % | |

| With Sales Charge | |

Class A15 | | -0.10 | % | | 5.37 | % | | 4.98 | % | | 5.71 | % | |

Class C15 | | 2.54 | % | | 5.69 | % | | 5.14 | % | | 5.81 | % | |

| Index | |

Barclays Capital U.S. Aggregate Index13,14 | 5.00 | % | | 6.41 | % | | 5.46 | % | | 6.33 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2011, the 30-day SEC yield was 2.07%, 2.47%, 1.98% and 1.32% for Investor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 2.00%, 2.40%, 1.92% and 1.26% for Investor Class, Institutional Class, Class A and Class C shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal 2010 were 1.21%, 0.72%, 1.11% and 1.86% for Investor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.87%, 0.47%, 0.87% and 1.62% for Investor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2021 for Investor Class, Institutional Class, Class A and Class C shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

Core Bond Fund (Unaudited)

| COMPARISON OF A $1,000,000 INVESTMENT |

| (000's omitted) |

|

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Floating Rate Income Fund Commentary (Unaudited)

Neuberger Berman Floating Rate Income Fund Institutional Class generated a 3.16% total return for the 12 months ended October 31, 2011 and outperformed its benchmark, the S&P/LSTA Leveraged Loan Index, which provided a 3.12% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

During the Fund's fiscal year, the performance of the floating rate bank loan market, not unlike other markets, was quite volatile. Throughout the reporting period, there were several occasions of robust investor risk appetite, followed by periods of increased risk aversion. The unusually high level of volatility in the floating rate loan market was, typically, not due to underlying fundamentals, but rather to investor emotions and macro events, such as fears of a double-dip recession and the sovereign debt crisis in Europe. In fact, fundamentals in the market remained quite strong, as corporate earnings were generally solid, corporate balance sheets were often flush with cash, and floating rate loan defaults declined. During the reporting period, the default rate among the securities in the benchmark fell from approximately 2.3% to 0.3%. Higher-quality securities outperformed their lower-quality counterparts. For the 12 months ended October 31, 2011, BB rated securities in the index gained 3.56% and CCC rated securities rose 2.90%.

The Fund continued to allocate a portion of its assets to non-floating rate securities. We have the flexibility to allocate up to 20% of the portfolio in these securities, usually fixed-rate senior secured bonds, as they may help the Fund generate incremental yield. The Fund's non-floating rate allocation was approximately 15% midway through the reporting period. We started reducing this allocation in August 2011 and ended the fiscal year at approximately 8% of total net assets. This adjustment was made when floating rate loan yields became more attractive on a relative basis as their rates moved higher when investor risk aversion increased.

We continued to actively participate in the new issuance market. For much of the period, we emphasized securities in the primary rather than the secondary bank loan market due to the former's higher current yields. However, during the second half of the period we increased our purchases in the secondary market as those yields became increasingly attractive and the primary market saw limited issuance.

Throughout the Fund's fiscal year, the portfolio was overweighted in single B rated securities and underweighted in BB and CCC rated securities relative to the benchmark. We thought this positioning was appropriate given the solid fundamental environment and certain company-specific concerns we had regarding CCC rated issuers. Overall, the Fund's B rated overweight benefited performance.

From a sector perspective, security selection in publishing, business equipment and financials was the largest contributor to performance. In contrast, an overweight in radio and television, coupled with security selection in autos and gaming, detracted the most from results.

Looking ahead, we continue to have a positive outlook for the floating rate loan market. As we saw during the reporting period, the market is not immune to macro events. However, over the longer-term, we feel that fundamentals, which we view generally as being positive, will support floating rate loan prices. Despite recent moderating economic growth, corporate profits have remained solid, balance sheets are often cash-rich and default rates have remained well below their annual 4% average. Furthermore, we believe that the U.S. economy has enough momentum to avert a recession. We also feel that supply and demand for bank loans technicals is largely balanced. However, with the Federal Reserve vowing to keep short-term rates at a historically low range until at least mid-2013, overall demand for higher yielding floating rate loans should, in our view, be solid as investors search for income and securities with defensive characteristics.

Sincerely,

Stephen J. Casey, Ann H. Benjamin, Thomas P. O'Reilly and Joseph P. Lynch

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Floating Rate Income Fund (Unaudited)

| TICKER SYMBOLS |

| Institutional Class | | NFIIX | |

| Class A | | NFIAX | |

| Class C | | NFICX | |

| PORTFOLIO BY MATURITY DISTRIBUTION |

| (as a % of Total Investments) | |

| Less than One Year | | | 7.2 | % | |

| One to less than Five Years | | | 36.7 | | |

| Five to less than Ten Years | | | 56.1 | | |

| Total | | | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS6 |

| | Inception | | Average Annual Total Return Ended 10/31/2011 | |

| | Date | | 1 Year | | Life of Fund | |

| At NAV | |

Institutional Class17 | 12/30/2009 | | 3.16 | % | | 5.10 | % | |

| Class A | 12/29/2009 | | 2.77 | % | | 4.68 | % | |

Class C17 | 12/30/2009 | | 1.98 | % | | 3.99 | % | |

| With Sales Charge | |

| Class A | | | -1.59 | % | | 2.26 | % | |

Class C17 | | | 1.00 | % | | 3.99 | % | |

| Index | |

S&P/LSTA Leveraged Loan Index13,14 | | 3.12 | % | | 6.45 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2011, the 30-day SEC yield was 5.68%, 5.08% and 4.58% for Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 5.59%, 4.99% and 4.42% for Institutional Class, Class A and Class C shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.66%, 2.04% and 3.19% for Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.71%, 1.08% and 1.83% for Institutional Class, Class A and Class C, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2014 for Institutional Class shares and through 10/31/2021 for Class A and Class C shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

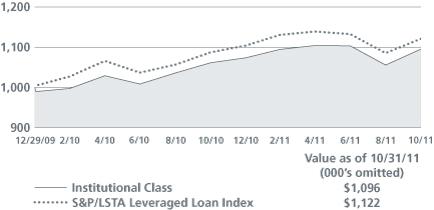

Floating Rate Income Fund (Unaudited)

| COMPARISON OF A $1,000,000 INVESTMENT |

| (000's omitted) |

|

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

High Income Bond Fund Commentary (Unaudited)

Neuberger Berman High Income Bond Fund Investor Class generated a 3.09% total return for the 12 months ended October 31, 2011 and lagged its benchmark, the BofA Merrill Lynch U.S. High Yield Master II Constrained Index, which provided a 4.82% return for the period. The Fund also underperformed its previous benchmark, the Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index, which returned 5.16% for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The high yield market experienced periods of heightened volatility during the Fund's fiscal year. There were several occasions of robust investor risk appetite, followed by periods of increased risk aversion. These gyrations were typically not due to underlying fundamentals, but rather to investor emotions and macro events, such as fears of a double-dip recession and the sovereign debt crisis in Europe. In fact, credit fundamentals in the market remained quite strong, as corporate earnings were generally solid, corporate balance sheets were often flush with cash and high yield defaults declined (according to JPMorgan, the high yield default rate fell from approximately 2.4% to 1.0% during the reporting period). Overall, the high yield market generated a positive return during the reporting period, but lagged equal-duration Treasuries. Higher-quality securities outperformed their lower-quality counterparts. For the 12 months ended October 31, 2011, BB rated (rated higher) and CCC (a relatively low rating) rated securities in the benchmark returned 5.03% and 2.93%, respectively.

For the Fund, underweight positions in banking and paper, along with security selection in packaging, provided the largest positive contributions to performance relative to the benchmark. In contrast, security selection in telecommunications, technology and broadcasting detracted the most from relative results.

We made several adjustments to the portfolio during the Fund's fiscal year. At the beginning of the period, the Fund's overall credit quality was similar to that of its index. Following the December 2010 extension of the Bush-era tax cuts, we became more optimistic about the overall economy. Against this backdrop, we increased the Fund's exposure to CCC rated securities. We also increased our allocation to more cyclical sectors of the market, as we thought they would be beneficiaries of the ongoing economic expansion. Conversely, we pared the Fund's exposure to areas of the market that we felt had become less attractively valued. In August, however, expectations for the U.S. economy became bleaker and we took a number of actions to protect the portfolio. These included moving to an underweight in CCC rated securities and paring our exposure to those issuers who we thought might be more vulnerable in a weaker economic environment. We also shifted to an overweight position in higher quality BB rated securities. From a sector perspective, we cut back our exposure to more cyclical parts of the media, telecommunication and technology sectors, while increasing our allocation to more defensive industries, such as energy. Finally, we sold positions in issuers that we identified as having significant currency exposure to a weakening euro.

Given the underlying fundamentals and current valuations, we have a positive outlook for the high yield market. From a fundamental perspective, despite moderating economic growth, corporate profits have generally been solid and leverage levels are manageable. Furthermore, in our view, most companies have significant liquidity on their balance sheets, which provides something of a cushion if economic growth weakens further. We also believe that implied default levels are overstated. In our opinion, the supply and demand for high income bonds is supportive. From a new supply perspective, by and large we think issuers will be opportunistic—not forced—borrowers, as they'll tap the market when rates are favorable. To a great extent, we expect new issuance to be driven by refinancing to extend maturities at attractive rates. We're also optimistic about investor demand. To be sure, the high yield market is not immune to macro issues, such as those that impacted the financial markets at times during the reporting period. However, when and if some of the clouds surrounding the economy and the crisis in Europe lift, we anticipate seeing generally solid demand, especially in light of the Federal Reserve's vow to keep short-term rates on hold until at least mid-2013.

Sincerely,

Ann H. Benjamin, Thomas P. O'Reilly and Russ Covode

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

High Income Bond Fund (Unaudited)

| TICKER SYMBOLS |

| Investor Class | | NHINX | |

| Institutional Class | | NHILX | |

| Class A | | NHIAX | |

| Class C | | NHICX | |

| Class R3 | | NHIRX | |

| PORTFOLIO BY MATURITY DISTRIBUTION |

| (as a % of Total Investments) | |

| Less than One Year | | | 1.3 | % | |

| One to less than Five Years | | | 47.1 | | |

| Five to less than Ten Years | | | 48.1 | | |

| Ten Years or Greater | | | 3.5 | | |

| Total | | | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS2,9 |

| | | Inception | | Average Annual Total Return Ended 10/31/2011 | |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | | 02/01/1992 | | | 3.09 | % | | | 8.52 | % | | | 7.83 | % | | | 8.01 | % | |

Institutional Class12 | | 05/27/2009 | | | 3.23 | % | | | 8.64 | % | | | 7.89 | % | | | 8.04 | % | |

Class A12 | | 05/27/2009 | | | 2.83 | % | | | 8.41 | % | | | 7.77 | % | | | 7.98 | % | |

Class C12 | | 05/27/2009 | | | 2.06 | % | | | 8.03 | % | | | 7.59 | % | | | 7.89 | % | |

Class R312 | | 05/27/2009 | | | 2.58 | % | | | 8.29 | % | | | 7.71 | % | | | 7.95 | % | |

| With Sales Charge | |

Class A12 | | | | | -1.53 | % | | | 7.47 | % | | | 7.31 | % | | | 7.74 | % | |

Class C12 | | | | | 1.10 | % | | | 8.03 | % | | | 7.59 | % | | | 7.89 | % | |

| Index | |

Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index13,14 | | | 5.16 | % | | | 8.22 | % | | | 9.26 | % | | | N/A | | |

BofA Merrill Lynch U.S. High Yield Master II Constrained Index13,14 | | | 4.82 | % | | | 8.05 | % | | | 9.01 | % | | | N/A | | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

The Fund's broad-based index used for comparison purposes has been changed from Barclays Capital U.S. Corporate High Yield 2% Issuer Cap Index to the BofA Merrill Lynch U.S. High Yield Master II Constrained Index because the new index more closely resembles the characteristics for the Fund's investments.

For the period ended October 31, 2011, the 30-day SEC yield was 6.35%, 6.41%, 5.87%, 5.36% and 5.85% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 6.35%, 6.41%, 5.87%, 5.38% and 5.81% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 0.96%, 0.78%, 1.17%, 1.94% and 1.73% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.96%, 0.76%, 1.13%, 1.88% and 1.38% for Investor Class, Institutional Class, Class A, Class C and Class R3 shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2014 for Investor Class, Institutional Class, Class A, Class C and Class R3 shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

High Income Bond Fund (Unaudited)

| COMPARISON OF A $10,000 INVESTMENT |

|

| This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Municipal Intermediate Bond Fund Commentary (Unaudited)

Neuberger Berman Municipal Intermediate Bond Fund Investor Class generated a 3.53% total return for the 12 months ended October 31, 2011 and lagged its benchmark, the Barclays Capital 7-Year General Obligation Index, which provided a 4.04% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

After posting very weak results during the first three months of the Fund's fiscal year, the municipal market then rebounded and generated positive returns during seven of the last nine months of the period. A number of issues caused the municipal market to initially perform poorly, including rising interest rates given expectations for improving economic growth, a large increase in issuance of Build America Bonds at the end of 2010, and weak demand due to fears of substantially higher municipal defaults. The municipal market then strengthened, as an increase in defaults never materialized, tax revenues increased and a number of states took actions to reduce spending and shore up their budgets. In addition, new issuance fell sharply and demand increased as investors were drawn to the relatively attractive yields offered by many municipal securities. The market also was a beneficiary of the flight to quality that occurred toward the end of the Fund's fiscal year.

The Fund's duration and yield curve positioning produced mixed results during the reporting period. Having a modestly longer duration than that of its benchmark was a detractor from performance during the first half of the fiscal year as longer-term municipal securities lagged their shorter-term counterparts. However, the Fund's longer duration later enhanced its results given the declining interest rate environment in the second half of the period. In terms of the Fund's yield curve positioning, we utilized a barbell approach (investing in shorter and longer maturities). In contrast, the Fund's benchmark is concentrated in the six- to eight-year portion of the curve, which was among the best-performing portions of the municipal yield curve.

The Fund's overall higher quality than that of the benchmark was rewarded in the 12- to 14-year portion of the municipal yield curve as higher quality bonds outperformed lower quality securities. This strategy was less successful in the two- to three-year portion of the yield curve where lower quality bonds outperformed.

From a sector perspective, we continued to emphasize higher quality revenue and general obligation bonds that tend to perform relatively well during difficult economic environments. Having an underweight to lower quality tobacco bonds (municipal bonds secured by tobacco settlement payments) was a positive for results as they lagged the benchmark.

We made minor adjustments to the portfolio during the reporting period. For example, we added to the Fund's allocation in high quality general obligation bonds in the seven to 13 year maturity range. Given the persistently low level of absolute yield available on the short end of the curve, the additional yield generated by these bonds was additive to the Fund's performance.

While certain economic and credit challenges remain, we have a generally positive outlook for the municipal market. The municipal yield curve remains steep from a historical perspective and, in our view, supply could remain fairly muted in 2012. In addition, municipal bonds are attractively valued versus their U.S. Treasury counterparts. While a number of macro uncertainties could negatively impact investor sentiment at times, we anticipate demand to remain generally solid given what we feel will be a slow growth/low interest rate environment. While we do not anticipate a double-dip scenario, further economic softening or higher-than-expected inflation could impact the municipal market. Should the economy stumble, tax revenues would decline and this would put additional strains on municipalities that are still repairing their budgets following the lengthy recession. In terms of inflation, we anticipate it will be relatively benign. That being said, given the Federal Reserve's accommodative policies and the potential for a third round of quantitative easing, higher inflation and, by extension, higher interest rates, cannot be ruled out.

Sincerely,

James L. Iselin and S. Blake Miller

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Municipal Intermediate Bond Fund (Unaudited)

| TICKER SYMBOLS |

| Investor Class | | NMUIX | |

| Institutional Class | | NMNLX | |

| Class A | | NMNAX | |

| Class C | | NMNCX | |

| PORTFOLIO BY STATE AND TERRITORY |

| (as a % of Total Investments) | |

| Arizona | 1.6 | % | |

| California | 11.2 | | |

| Colorado | 1.3 | | |

| District of Columbia | 0.1 | | |

| Florida | 4.0 | | |

| Georgia | 1.0 | | |

| Illinois | 9.0 | | |

| Indiana | 3.6 | | |

| Iowa | 1.2 | | |

| Kansas | 1.6 | | |

| Louisiana | 1.2 | | |

| Maryland | 1.1 | | |

| Massachusetts | 7.6 | | |

| Michigan | 4.3 | | |

| Minnesota | 1.3 | | |

| Mississippi | 0.9 | | |

| Missouri | 1.5 | | |

| Nebraska | 1.1 | | |

| Nevada | 1.8 | | |

| New Jersey | 4.7 | | |

| New Mexico | 0.7 | | |

| New York | 8.6 | | |

| North Carolina | 0.9 | | |

| Ohio | 1.0 | | |

| Oregon | 1.7 | | |

| Pennsylvania | 1.9 | | |

| Puerto Rico | 1.8 | | |

| Rhode Island | 1.0 | | |

| South Carolina | 0.8 | | |

| Tennessee | 3.0 | | |

| Texas | 9.8 | | |

| Virginia | 4.1 | | |

| Washington | 4.6 | | |

| Total | 100.0 | % | |

PERFORMANCE HIGHLIGHTS1,7,8 |

| | | Inception | | Average Annual Total Return Ended 10/31/2011 | |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | | 07/09/1987 | | | 3.53 | % | | | 4.01 | % | | | 3.75 | % | | | 5.17 | % | |

Institutional Class18 | | 06/21/2010 | | | 3.60 | % | | | 4.03 | % | | | 3.76 | % | | | 5.18 | % | |

Class A18 | | 06/21/2010 | | | 3.22 | % | | | 3.95 | % | | | 3.72 | % | | | 5.16 | % | |

Class C18 | | 06/21/2010 | | | 2.54 | % | | | 3.73 | % | | | 3.62 | % | | | 5.11 | % | |

| With Sales Charge | |

Class A18 | | | | | -1.13 | % | | | 3.05 | % | | | 3.27 | % | | | 4.97 | % | |

Class C18 | | | | | 1.54 | % | | | 3.73 | % | | | 3.62 | % | | | 5.11 | % | |

| Index | |

Barclays Capital 7-Year General Obligation Index13,14 | | | 4.04 | % | | | 5.72 | % | | | 5.11 | % | | | 6.17 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2011, the 30-day SEC yield was 2.22%, 2.37%, 1.92% and 1.25% for Investor Class, Institutional Class, Class A and Class C shares, respectively. The tax-equivalent yield was 3.42%, 3.65%, 2.95% and 1.92% for Investor Class, Institutional Class, Class A and Class C shares, respectively, for an investor in the highest federal income tax bracket (35%). Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 2.02%, 2.15%, -2.75% and -0.06% for Investor Class, Institutional Class, Class A and Class C shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.02%, 0.64%, 1.01% and 1.76% for Investor Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.65%, 0.50%, 0.87% and 1.62% for the Investor Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2014 for Investor Class, Institutional Class, Class A and Class C shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

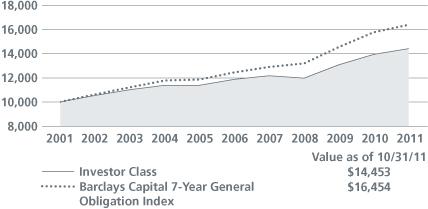

Municipal Intermediate Bond Fund (Unaudited)

| COMPARISON OF A $10,000 INVESTMENT |

|

| This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Short Duration Bond Fund Commentary (Unaudited)

Neuberger Berman Short Duration Bond Fund Investor Class generated a 0.20% total return for the 12 months ended October 31, 2011 and underperformed its benchmark, the Barclays Capital 1-3 Year U.S. Government/Credit Index, which provided a 1.21% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The fixed income market experienced periods of heightened volatility during the reporting period. These were often triggered by macro events, such as the sovereign debt crisis in Europe, Standard & Poor's downgrade of U.S. debt, natural disasters and geopolitical unrest. During the spikes in market volatility, investors typically sought refuge in Treasury securities. However, increased risk aversion was often quickly replaced with renewed risk appetite as investors looked for ways to generate incremental yield in the low interest rate environment. Some non-Treasury securities generated solid returns during the reporting period, but many sectors lagged equal-duration Treasuries.

While the Fund benefited from an overweight in non-Treasuries during the first half of the Fund's fiscal year, this positioning produced mixed results as the reporting period progressed. A large portion of the Fund's non-Treasury gains were given back in August and September 2011, as concerns regarding a double-dip recession and the escalating European debt crisis caused credit spreads (the difference in yield between Treasuries and other bond sectors) to widen. For the 12-month period as a whole, the Fund's non-agency mortgage-backed securities (MBS) and asset-backed securities detracted from results. Having a shorter duration than the benchmark was also a drag on results, as interest rates declined. On the upside, the Fund's exposure to commercial mortgage-backed securities (CMBS) was beneficial, as their spreads narrowed during the 12-month reporting period. The Fund's investment grade corporate bonds also contributed to performance, albeit to a lesser extent.

A number of adjustments were made to the portfolio during the reporting period. We increased the Fund's exposures to CMBS, traditional asset-backed securities backed by auto loans and credit cards, U.S. government agency MBS and investment grade corporate bonds in the financial and industrial subsectors. We pared the Fund's allocation to Treasury securities. The Fund sold Treasury futures during the reporting period to assist in managing its duration positioning, which detracted slightly from returns.

Looking ahead, we believe the economy will avert a recession. However, given ongoing headwinds, such as elevated unemployment and weakness in the housing market, growth could remain modest. We anticipate maintaining our overweight exposure to non-Treasuries given our expectations for continued economic growth, benign inflation and solid investor demand.

Sincerely,

Thomas Sontag, Michael Foster and Richard Grau

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Short Duration Bond Fund (Unaudited)

| TICKER SYMBOLS |

| Investor Class | | NSBIX | |

| Trust Class | | NSBTX | |

| Institutional Class | | NSHLX | |

| Class A | | NSHAX | |

| Class C | | NSHCX | |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Net Assets) | |

| Asset-Backed Securities | | 11.8 | % | |

| Corporate Debt Securities | | 28.2 | | |

| U.S. Government Agency Securities | | 3.7 | | |

| Mortgage-Backed Securities | | 40.6 | | |

| U.S. Treasury Securities | | 13.7 | | |

| Short-Term Investments | | 6.5 | | |

Liabilities, less cash, receivables and other assets | | (4.5) | | |

| Total | | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS5 |

| | | Inception | | Average Annual Total Return Ended 10/31/2011 | |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

| At NAV | |

| Investor Class | | 06/09/1986 | | | 0.20 | % | | | 1.42 | % | | | 2.03 | % | | | 4.80 | % | |

Trust Class16 | | 08/30/1993 | | | 0.10 | % | | | 1.34 | % | | | 1.93 | % | | | 4.73 | % | |

Institutional Class16 | | 06/21/2010 | | | 0.40 | % | | | 1.47 | % | | | 2.05 | % | | | 4.81 | % | |

Class A16 | | 06/21/2010 | | | -0.10 | % | | | 1.36 | % | | | 2.00 | % | | | 4.79 | % | |

Class C16 | | 06/21/2010 | | | -0.84 | % | | | 1.15 | % | | | 1.89 | % | | | 4.74 | % | |

| With Sales Charge | |

Class A16 | | | | | -2.62 | % | | | 0.85 | % | | | 1.74 | % | | | 4.68 | % | |

Class C16 | | | | | -1.82 | % | | | 1.15 | % | | | 1.89 | % | | | 4.74 | % | |

| Index | |

Barclays Capital 1-3 Year U.S. Government/Credit Index13,14 | | | 1.21 | % | | | 4.11 | % | | | 3.60 | % | | | 5.82 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance.

For the period ended October 31, 2011, the 30-day SEC yield was 1.86%, 1.76%, 2.04%, 1.67% and 0.95% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 1.53%, 1.28%, 1.64%, 0.33% and 0.49% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.28%, 1.49%, 0.78%, 1.15% and 1.90% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 0.71%, 0.81%, 0.51%, 0.88% and 1.63% for Investor Class, Trust Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2014 for Investor Class, Trust Class, Institutional Class, Class A and Class C shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

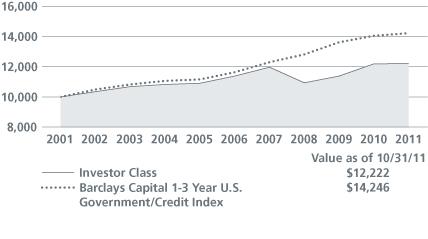

Short Duration Bond Fund (Unaudited)

| COMPARISON OF A $10,000 INVESTMENT |

|

| This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Strategic Income Fund Commentary (Unaudited)

Neuberger Berman Strategic Income Fund Institutional Class generated a 3.96% total return for the 12 months ended October 31, 2011 and underperformed its benchmark, the Barclays Capital U.S. Aggregate Index, which provided a 5.00% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The fixed income market experienced periods of heightened volatility during the reporting period. These were often triggered by macro events, such as the sovereign debt crisis in Europe, Standard & Poor's downgrade of U.S. debt, natural disasters and geopolitical unrest. During the spikes in market volatility, investors typically sought refuge in Treasury securities. However, increased risk aversion was often quickly replaced with renewed risk appetite as investors looked for ways to generate incremental yield in the low interest rate environment. Overall, non-Treasury securities generated solid returns during the reporting period, but many sectors lagged equal-duration Treasuries.

While the Fund benefited from an overweight in non-Treasuries during the first half of the Fund's fiscal year, this positioning produced mixed results as the reporting period progressed. A portion of the Fund's non-Treasury gains were negated in August and September 2011, as concerns regarding a double-dip recession and the escalating European debt crisis caused credit spreads (the difference in yield between Treasuries and other bond sectors) to widen. For the 12-month period as a whole, the Fund's investment grade corporate bonds detracted from results. In particular, the Fund's overweight to the financials subsector and lower-rated industries were not rewarded. The Fund's non-agency mortgage-backed securities (MBS) exposure hurt performance. Additive to results, however, were the Fund's exposures to high yield bonds, emerging market debt and commercial mortgage-backed securities (CMBS), as their spreads narrowed during the 12-month reporting period.

A number of adjustments were made to the portfolio during the reporting period. We shortened the Fund's duration as we believed that interest rates were unsustainably low. The Fund's allocation to non-agency MBS was increased as we found them to be attractively valued. To further diversify the Fund's below investment-grade exposure, we pared its allocation to high yield bonds and increased its holding of bank loans. The Fund sold Treasury futures during the reporting period to assist in managing its duration positioning, which detracted slightly from returns.

Looking ahead, we believe the economy will avert a recession. However, given ongoing headwinds, such as elevated unemployment and weakness in the housing market, growth will likely remain modest. We anticipate maintaining our overweight exposure to non-Treasuries given our expectations for continued economic growth, benign inflation and solid investor demand.

Sincerely,

Thanos Bardas, David M. Brown, Andrew A. Johnson and Bradley C. Tank

Portfolio Co-Managers

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The composition, industries and holdings of the Fund are subject to change.

Strategic Income Fund (Unaudited)

| TICKER SYMBOLS |

| Trust Class | | NSTTX | |

| Institutional Class | | NSTLX | |

| Class A | | NSTAX | |

| Class C | | NSTCX | |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Net Assets) | |

| Asset-Backed Securities | | 3.3 | % | |

| Corporate Debt Securities | | 38.8 | | |

| Bank Loan Obligations | | 13.4 | | |

| Government Securities | | 2.4 | | |

| Mortgage-Backed Securities | | 40.9 | | |

| U.S. Treasury Securities | | 5.0 | | |

| Short-Term Investments | | 9.1 | | |

Liabilities, less cash, receivables and other assets | | (12.9 | ) | |

| Total | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS4 |

| | | Inception | | Average Annual Total Return Ended 10/31/2011 | |

| | | Date | | 1 Year | | 5 Years | | Life of Fund | |

| At NAV | |

Trust Class11 | | 04/02/2007 | | | 3.60 | % | | | 7.71 | % | | | 8.18 | % | |

| Institutional Class | | 07/11/2003 | | | 3.96 | % | | | 8.04 | % | | | 8.38 | % | |

Class A11 | | 12/20/2007 | | | 3.55 | % | | | 7.72 | % | | | 8.19 | % | |

Class C11 | | 12/20/2007 | | | 2.83 | % | | | 7.11 | % | | | 7.82 | % | |

| With Sales Charge | |

Class A11 | | | | | -0.86 | % | | | 6.78 | % | | | 7.62 | % | |

Class C11 | | | | | 1.85 | % | | | 7.11 | % | | | 7.82 | % | |

| Index | |

Barclays Capital U.S. Aggregate Index13,14 | | | 5.00 | % | | | 6.41 | % | | | 5.17 | % | |

Performance data quoted represent past performance and do not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all income dividends and distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit www.nb.com/performance. Because the Fund had a different goal and strategy, which included managing assets by an asset allocation committee, prior to February 29, 2008, its performance during that time might have been different if current policies had been in effect.

For the period ended October 31, 2011, the 30-day SEC yield was 3.85%, 4.20%, 3.64% and 3.11% for Trust Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC currently absorbs certain expenses of the Fund. Absent such arrangements, the 30-day SEC yield would have been 3.66%, 4.02%, 3.48% and 2.91% for Trust Class, Institutional Class, Class A and Class C shares, respectively, and average annual returns may have been lower.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2010 were 1.37%, 0.97%, 1.38% and 2.11% for Trust Class, Institutional Class, Class A and Class C shares, respectively (prior to any fee waivers and/or expense reimbursements, if any). The expense ratios net of waivers and/or reimbursements were 1.11%, 0.76%, 1.16% and 1.86% for Trust Class, Institutional Class, Class A and Class C shares, respectively. Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Fund through 10/31/2014 for Trust Class shares and through 10/31/2021 for Institutional Class, Class A and Class C shares. Absent these caps, returns may have been lower.

Total Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

The results shown in the table do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares.

Strategic Income Fund (Unaudited)

| COMPARISON OF A $1,000,000 INVESTMENT |

| (000's omitted) |

|

| This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years or, if the Fund has operated for less than 10 fiscal years, since the Fund's inception. The graph is based on the Fund's Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see the Performance Highlights table on the previous page). The graph also shows how a broad-based market index and, if applicable, a more narrowly-based index performed over the same period. The index results have not been reduced to reflect any fees or expenses. The results shown in the graph include the reinvestment of income dividends and distributions, but do not reflect the effect of taxes an investor would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results. |

Endnotes (Unaudited)

1 | Neuberger Berman Management LLC ("Management") has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Municipal Intermediate Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 0.65%, 0.50%, 0.87% and 1.62% of average daily net assets for the Investor Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2014. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, there were no repayments of expenses to Management. |

| | |

| 2 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman High Income Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 1.00%, 0.75%, 1.12%, 1.87% and 1.37% of average daily net assets for the Investor Class, Institutional Class, Class A, Class C and Class R3, respectively. These undertakings last until October 31, 2014. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, the Institutional Class, Class A and Class R3 of the Fund reimbursed Management $51,305, $38,618 and $257, respectively. |

| | |

| 3 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Core Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 0.85%, 0.45%, 0.85% and 1.60% of average daily net assets for the Investor Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2021. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, there were no repayments of expenses to Management. Effective May 1, 2011, Management has voluntarily agreed to waive its management fee in the amount of 0.06% of the average daily net assets of the Fund. Management may, at its sole discretion, modify or terminate this voluntary waiver without notice to the Fund. Effective November 1, 2010, Management had voluntarily agreed to waive its management fee in the amount of 0.12% of the average daily net assets of the Fund. Prior to March 3, 2010, Management had voluntarily agreed to waive its management fee in the amount of 0.25% of the average daily net assets of the Fund. Prior to March 1, 2006, Management had voluntarily agreed to waive its management fee in the amount of 0.20% of the average daily net assets of the Fund. Absent such waiver, the performance of each class of the Fund would have been lower. |

| | |

| 4 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Strategic Income Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, |

| | |

| | acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 1.10%, 0.75% (effective March 1, 2008, and 0.85% through February 29, 2008), 1.15% and 1.85% of average daily net assets for the Trust Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2014 for the Trust Class and until October 31, 2021 for the Institutional Class, Class A and Class C. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, there were no repayments of expenses to Management. |

| | |

| 5 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Short Duration Bond Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 0.70%, 0.80%, 0.50%, 0.87% and 1.62% of average daily net assets for the Investor Class, Trust Class, Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2014. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, there were no repayments of expenses to Management. |

| | |

| 6 | Management has contractually undertaken to forgo current payment of fees and/or reimburse Neuberger Berman Floating Rate Income Fund so that its total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any; consequently, net expenses may exceed the contractual expense limitations) ("Operating Expenses") are limited to 0.70%, 1.07% and 1.82% of average daily net assets for the Institutional Class, Class A and Class C, respectively. These undertakings last until October 31, 2014 for the Institutional Class and until October 31, 2021 for Class A and Class C. Each class of the Fund has agreed to repay Management for fees and expenses forgone and/or its excess Operating Expenses previously reimbursed by Management, pursuant to the contractual expense limitation, so long as its annual Operating Expenses during the period do not exceed its above-stated expense limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. Absent such forgone fees and/or reimbursements, the performance of each class of the Fund would have been lower. For the year ended October 31, 2011, there were no repayments of expenses to Management. |

| | |

| 7 | Tax-equivalent effective yield is the taxable effective yield that an investor would have had to receive in order to realize the same level of yield after federal income taxes at the highest federal tax rate, currently 35%, assuming that all of the Fund's income is exempt from federal income taxes. |

| | |

| 8 | A portion of the income may be a tax preference item for purposes of the federal alternative minimum tax for certain investors. |

| | |

| 9 | The Fund is the successor to Lipper High Income Bond Fund ("Lipper Fund"). The total return data for the periods prior to September 7, 2002, are those of Lipper Fund Premier Class. The performance information for Investor Class is that of Lipper Fund Premier Class for the period April 1, 1996, through September 6, 2002. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects the same as those of Lipper Fund. Returns would have been lower if the manager of Lipper Fund had not waived certain of its fees during the periods shown. |

| | |

| 10 | The Fund is the successor to Ariel Premier Bond Fund ("Ariel Bond Fund"). The total return data for the periods prior to June 13, 2005, are those of Ariel Bond Fund Institutional Class and Ariel Bond Fund Investor Class. The performance information for Institutional Class is that of Ariel Bond Fund Institutional Class for the period October 1, 1995 (date of inception) through June 10, 2005. The performance information for Investor Class is that of Ariel Bond Fund Institutional Class for the period October 1, 1995 through January 31, 1997 (the period prior to the class' commencement of operations), and that of Ariel Bond Fund Investor Class for the period February 1, 1997 (class' commencement of operations) through June 10, 2005. Ariel Bond Fund Institutional Class had lower expenses and typically higher returns than Ariel Bond Fund Investor Class. The investment policies, guidelines and restrictions of the Fund are in all material respects the same as those of Ariel Bond Fund. Returns would have been lower if the manager of Ariel Bond Fund had not waived certain of its fees during the periods shown. |

| | |

| 11 | The Trust Class, Class A and Class C of Neuberger Berman Strategic Income Fund commenced operations on April 2, 2007, December 20, 2007 and December 20, 2007, respectively. The performance information for Trust Class, Class A and Class C prior to the class' commencement of operations is that of the Institutional Class of Neuberger Berman Strategic Income Fund. In making this translation, the performance information of the Institutional Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Institutional Class has lower expenses and typically higher returns than Trust Class, Class A or Class C. |

| | |

| 12 | The Institutional Class, Class A, Class C and Class R3 of Neuberger Berman High Income Bond Fund each commenced operations on May 27, 2009. The performance information for Institutional Class, Class A, Class C and Class R3 prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman High Income Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A, Class C or Class R3. The Investor Class has higher expenses and typically lower returns than Institutional Class. |

| | |

| 13 | The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class. |

| | |

| 14 | Please see "Glossary of Indices" starting on page 24 for a description of indices. Please note that indices do not take into account any fees and expenses or tax consequences of investing in the individual securities that they track, and that individuals cannot invest directly in any index. Data about the performance of these indices are prepared or obtained by Management and include reinvestment of all income dividends and distributions. The Fund may invest in securities not included in the described indices or may not invest in all securities included in the described indices. |

| | |

| 15 | Class A and Class C of Neuberger Berman Core Bond Fund each commenced operations on December 20, 2007. The performance information for Class A and Class C prior to the class' commencement of operations is that of the Institutional Class of Neuberger Berman Core Bond Fund. In making this translation, the performance information for the Institutional Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Institutional Class has lower expenses and typically higher returns than Class A or Class C. |

| | |

| 16 | The Trust Class of Short Duration Bond Fund commenced operations on August 30, 1993. The Institutional Class, Class A and Class C of Neuberger Berman Short Duration Bond Fund each commenced operations on June 21, 2010. The performance information for Trust Class, Institutional Class, Class A and Class C prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman Short Duration Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Trust Class, Class A or Class C. The Investor Class has higher expenses and typically lower returns than Institutional Class. |

| | |

| 17 | The Institutional Class and Class C of Neuberger Berman Floating Rate Income Fund each commenced operations on December 30, 2009. The performance information for Institutional Class and Class C prior to the class' commencement of operations is that of Class A of Neuberger Berman Floating Rate Income Fund. In making this translation, the performance information (at NAV) of Class A has been adjusted to reflect the appropriate sales charge applicable to Class C shares, but has not been adjusted to take into account differences in class specific operating expenses (such as 12b-1 fees). Class A has higher expenses and typically lower returns (at NAV) than Institutional Class. Class A has lower expenses and typically higher returns (at NAV) than Class C. |

| | |

| 18 | The Institutional Class, Class A and Class C of Neuberger Berman Municipal Intermediate Bond Fund each commenced operations on June 21, 2010. The performance information for Institutional Class, Class A and Class C prior to the class' commencement of operations is that of the Investor Class of Neuberger Berman Municipal Intermediate Bond Fund. In making this translation, the performance information of the Investor Class has been adjusted to reflect the appropriate sales charge applicable to Class A and Class C shares, but has not been adjusted to take into account differences in class specific Operating Expenses (such as 12b-1 fees). The Investor Class has lower expenses and typically higher returns than Class A and Class C. The Investor Class has higher expenses and typically lower returns than Institutional Class. |

| | |

| For more complete information on any of the Neuberger Berman Income Funds, call Neuberger Berman Management LLC at (800) 877-9700, or visit our website at www.nb.com. |

| | |

Glossary of Indices (Unaudited)