OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response...20.6

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4815

Ultra Series Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Kevin S. Thompson

Madison Funds Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant’s telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Certified Financial Statement

| Annual Report |

| December 31, 2018 |

ULTRA SERIES FUND

| | Conservative Allocation Fund |

| | Moderate Allocation Fund |

| | Aggressive Allocation Fund |

| | Core Bond Fund |

| | High Income Fund |

| | Diversified Income Fund |

| | Large Cap Value Fund |

| | Large Cap Growth Fund |

| | Mid Cap Fund |

| | International Stock Fund |

| | Madison Target Retirement 2020 Fund |

| | Madison Target Retirement 2030 Fund |

| | Madison Target Retirement 2040 Fund |

| | Madison Target Retirement 2050 Fund |

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the insurance company that offers your contract may determine that it will no longer send you paper copies of the fund’s shareholder reports like this one, unless you specifically request paper copies from the insurance company or your financial intermediary. Instead, the shareholder reports will be made available on a website and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company or financial intermediary.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. If your insurance company or financial intermediary offers electronic delivery, you may elect to receive shareholder reports and other communications from the insurance company or financial intermediary by following the instructions provided by the insurance company or financial intermediary.

You may elect to receive paper copies of all future reports free of charge from the insurance company or financial intermediary. You can inform the insurance company or financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your insurance company or financial intermediary. Your election to receive reports in paper will apply to all funds held in your account with your insurance company or financial intermediary.

Ultra Series Fund | December 31, 2018

| | | Page |

| Management’s Discussion of Fund Performance | | |

Period in Review | | 2 |

Allocation Funds | | 4 |

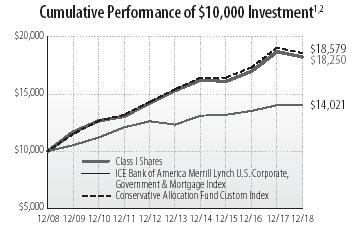

Conservative Allocation Fund | | 4 |

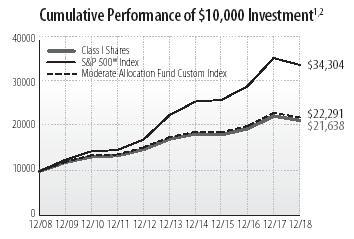

Moderate Allocation Fund | | 5 |

Aggressive Allocation Fund | | 7 |

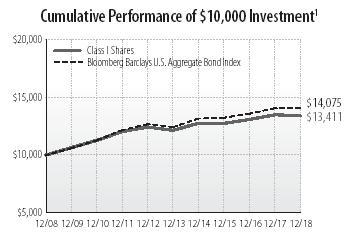

Core Bond Fund | | 8 |

High Income Fund | | 10 |

Diversified Income Fund | | 11 |

Large Cap Value Fund | | 13 |

Large Cap Growth Fund | | 14 |

Mid Cap Fund | | 15 |

International Stock Fund | | 16 |

Madison Target Retirement 2020 Fund | | 19 |

Madison Target Retirement 2030 Fund | | 20 |

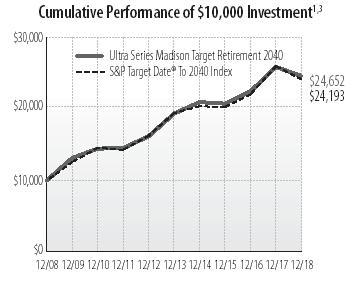

Madison Target Retirement 2040 Fund | | 22 |

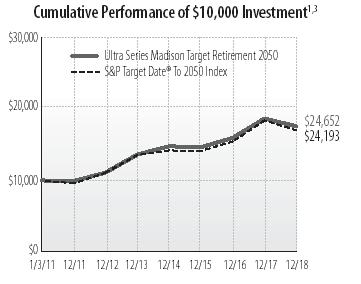

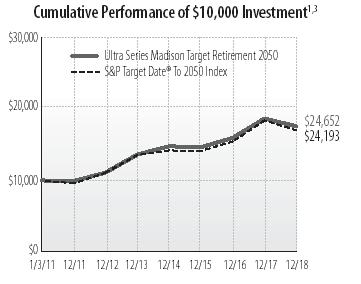

Madison Target Retirement 2050 Fund | | 23 |

Notes to Management’s Discussion of Fund Performance | | 25 |

| Portfolios of Investments | | |

Conservative Allocation Fund | | 28 |

Moderate Allocation Fund | | 29 |

Aggressive Allocation Fund | | 30 |

Core Bond Fund | | 31 |

High Income Fund | | 36 |

Diversified Income Fund | | 38 |

Large Cap Value Fund | | 43 |

Large Cap Growth Fund | | 44 |

Mid Cap Fund | | 45 |

International Stock Fund | | 46 |

Madison Target Retirement 2020 Fund | | 48 |

Madison Target Retirement 2030 Fund | | 48 |

Madison Target Retirement 2040 Fund | | 49 |

Madison Target Retirement 2050 Fund | | 49 |

| Financial Statements | | |

Statements of Assets and Liabilities | | 51 |

Statements of Operations | | 54 |

Statements of Changes in Net Assets | | 56 |

Financial Highlights for a Share of Beneficial Interest Outstanding | | 61 |

| Notes to Financial Statements | | 75 |

| Report of Independent Registered Public Accounting Firm | | 93 |

| Other Information | | 94 |

| Trustees and Officers | | 101 |

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. For more complete information about Ultra Series Fund, including charges and expenses, request a prospectus from your financial advisor or from CMFG Life Insurance Company, 2000 Heritage Way, Waverly, IA 50677. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the investment company. For more current Ultra Series Fund performance information, please call 1-800-SEC-0330. Current performance may be lower or higher than the performance data quoted within. Past performance does not guarantee future results. Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

Ultra Series Fund | December 31, 2018

Management’s Discussion of Fund Performance (unaudited)

PERIOD IN REVIEW

The stock market teetered in the fourth quarter as sentiment overshadowed economic fundamentals and drove market indices sharply lower. During the fourth-quarter, the S&P 500® declined (13.52)%, the Russell Midcap® lost (15.37)%, and the MSCI EAFE® declined (12.54)%. For 2018, the S&P 500® lost (4.38)%, the Russell Midcap® lost (9.06)% and the MSCI EAFE® declined (13.79)% . Bond returns were generally positive during the quarter as longer-dated interest rates actually declined, despite short-term rates continuing to rise. The Bloomberg Barclays Intermediate Government/Credit Index returned 1.65% and the Bloomberg Barclays U.S. Aggregate Bond Index advanced 1.64% during the quarter resulting in full year results of 0.88% and 0.01%, respectively.

As Benjamin Graham, the father of securities analysis, said “in the short run, the stock market is a voting machine, but in the long run it is a weighing machine.” The second half of 2018 was a classic example of the “voting machine” in full effect as markets gyrated based mostly on investor sentiment. A sharp run-up by the S&P 500 of 7.7% in the third quarter was followed by a sharp decline of 13.5% in the fourth quarter. There was no shortage of items for investors to fret about: Fed rate hikes with simultaneous shrinking of its balance sheet, U.S./China trade tensions and the shutdown of the federal government. While economic data generally softened during the quarter, it continued to show growth as third quarter GDP advanced 3.2%, unemployment remained at 3.7%, wages advanced 3.1% (year over year) and third quarter earnings showed robust growth. Still, investor sentiment can have real influence over actual economic performance as confidence often drives consumer and business behavior – which can result in a self-fulfilling situation.

Indeed, 2018 stood in contrast to 2017, when the S&P 500 exhibited a “perfect” year – when every month delivered positive returns – culminating with a 21.8% gain for 2017. Investor psychology was giddy in 2017, not just over stocks but with speculators laying audacious bets on cryptocurrencies (think Bitcoin), VIX (the volatility measure of options on the S&P 500) and high-flying technology stocks. Much of that positive sentiment continued into 2018, reaching a crescendo in the third quarter. Since then, richly valued technology stocks have corrected, Bitcoin has fallen 80% from its peak and VIX has risen from record low levels in 2017, wiping out some investors who placed bets that low volatility would persist. Perhaps the flip-flop in 2018 wasn’t so unusual – from euphoria to fret – and may indeed create a healthier investment backdrop. In fact, if one looks at 2017 and 2018 together, the S&P 500 returned a healthy 7.9% annualized, not far off our longer-range forecast for stock returns of 6-7% per year.

Treasury yields continued to move higher during the third quarter. The 2-year Treasury yield rose 29 basis points (bps) during the period, closing near a decade high level of 2.82%. Longer-term yields also rose. The benchmark 10-year Treasury Note, which began the quarter at 2.86%, advanced 20 bps and closed at 3.06%. As a result, three month returns were mixed, with most high quality bond indices ranging from slightly positive to slightly negative depending on maturity and quality characteristics.

Stock market volatility was mirrored in the bond market as both investment grade and high yield bonds suffered from sharply increasing spreads (risk premiums) over comparable Treasuries. Indeed, for much of this year, the credit markets have been sounding a warning bell on investor preferences for risk assets. The fourth quarter saw a continuation of the trend toward larger risk premiums, especially in the quality tiers at the lower end of the credit spectrum. The lowest rated high yield bonds suffered losses for both the quarter and the year, despite falling Government bond yields during the final three months. We expect this trend toward “up in quality” preference to continue as less-creditworthy borrowers struggle with rising financing costs at a time when the U.S. Government faces growing needs for capital to finance surging fiscal deficits.

Graham opined “in the long run the market is a weighing machine,” meaning that economic fundamentals drive long-term value of a company (i.e., growth of sales, earnings and assets). Overall economic data have remained positive in the U.S. In fact, retail sales this holiday season were the best in six years and both auto sales and heavy truck sales

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

remain strong. Payrolls continued to grow (averaging gains of 170,000 jobs/month in the quarter) and capital goods shipments remain steady. Additionally, with the sharp pullback in equity prices during the fourth quarter, valuation levels have improved with the price-earnings ratio showing one of its sharpest quarterly declines on record. Still, we believe that investors have merit in their concern as central banks withdraw liquidity from the system as they redeem their balance sheet – arguably one of the key drivers of asset prices – and evidence mounts that economic growth is slowing.

Where does this leave investors as we begin 2019? We believe continued volatility should be anticipated as the markets weigh economic growth, solid earnings and strong employment against tighter monetary policy, shifting interest rates, trade tensions and uncertain government policy. Without doubt, the economic expansion will come to an end but predicting that point is near impossible – making market timing a futile endeavor in our opinion. Indeed, it was in this spirit that Graham concluded short-term markets are driven by investor psychology, but long-term markets are driven by economic fundamentals. With this in mind, we continue to believe investors are best served by choosing risk assets based upon investment time horizon and risk tolerance. We believe that approach, along with investing in stocks of lower-risk, higher-quality companies and shorter-duration, higher-quality bonds, will allow investors to participate in the market, while providing some shelter as we experience market volatility.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

ALLOCATION FUNDS

The Ultra Series Conservative Allocation, Moderate Allocation and Aggressive Allocation Funds (the “Funds”) invest primarily in shares of registered investment companies (the “Underlying Funds”). The Funds are diversified among a number of asset classes and their allocation among Underlying Funds is based on an asset allocation model developed by Madison Asset Management, LLC (“Madison”), the Funds’ investment adviser. The team may use multiple analytical approaches to determine the appropriate asset allocation, including:

| • | Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the Funds’ aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| | |

| • | Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the Funds under different economic and market conditions. |

| | |

| • | Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. In addition, Madison has a flexible mandate which permits the Funds, at the sole discretion of Madison, to materially reduce equity risk exposures when and if conditions are deemed to warrant such an action. |

| CONSERVATIVE ALLOCATION FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Ultra Series Conservative Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 35% equity investments and 65% fixed income investments. Underlying Funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including the Madison Funds (the “Affiliated Underlying Funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

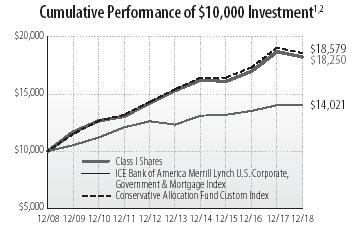

The Ultra Series Conservative Allocation Fund (Class I) returned (2.49)% over the 12-month period, slightly outperforming the Conservative Allocation Fund Custom Index return of (2.60)%. The fund outperformed the Morningstar Conservative Allocation Category peer group, which returned (4.32)%.

After a long absence, volatility reestablished itself with authority over the past 12 months. Markets entered 2018 revved up on fresh U.S. fiscal stimulus provided by sweeping tax law changes and a broad-based synchronized global economic expansion. However, after making a parabolic 12% advance between mid-November 2017 and late January 2018, the S&P 500® experienced an abrupt 10% nosedive over two-weeks. Rising U.S. interest rates and the concern of an even more restrictive Federal Reserve rate hike campaign appeared to be behind the newfound market concerns.

By spring it was clear that economic growth in both Europe and China was slowing and failing to meet expectations, while talk of tariffs and a potential trade war sparked even greater worries on the global stage. The U.S. equity market was able to recover throughout the summer on the back of impressive earnings growth, assisted by the corporate tax cut. International markets, however, continued to decline. Emerging markets were hit especially hard by the combination of a slowing China, stronger U.S. Dollar and a general tightening in financial conditions. In late September, turbulence returned as the markets took the turn of the season to fall quite literally, shaken by a resolute Fed amid signs of slowing U.S. economic data. An historic

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

December decline took the S&P 500 Index from a sizable 11.2% advance at its September peak to a 4.4% loss for the calendar year.

Outside of the U.S., foreign equities were strongly negative as international stocks (MSCI ACWI ex-USA Index®) dropped 14.2% and emerging markets (MSCI EM Index) fell 14.6%. Bonds (Bloomberg Barclays U.S. Aggregate Bond Index), hurt by rising interest rates for the bulk of the year, made a fourth quarter charge to finish flat for 2018.

The Fund held up extremely well during the two larger equity declines, buffered by an underweight allocation to equities and an elevated cash position. Within U.S. equities, overweight allocations to growth stocks boosted returns, as did outperformance from our two core actively managed large cap funds. Timely allocations into Consumer Staples and Health Care were also additive. Detracting from returns were our overweight allocations to midcaps, Energy stocks and Commodities. Unfortunately, our equity composition was leaning a little too heavily on the international side early on, which detracted from returns. However, we quickly reallocated back toward the U.S. as our concerns grew over the potential for trade disruption. We also increased the use of dollar hedging, which aided performance as the dollar strengthened during the year. On the fixed income side, the Fund was rewarded for taking lower interest rate (duration) risk throughout the year as interest rates increased. The largest positive contributions came from our short-term holdings in corporate bonds and Treasuries. Below benchmark performance from our core actively managed holdings provided the largest drag on returns. Positions in TIPS (Treasury Inflation Protected Securities), which were negatively impacted by the steep decline in inflation break-evens late in the year, and longer-term Treasuries also detracted from the Fund’s return.

We are paying close attention to how the U.S. and global economies respond to less accommodative monetary conditions. From an historical perspective, U.S. interest rates are still very low. The notion that the U.S. could readily withstand still higher rates has been the prevailing view of most economists. We’ve long thought otherwise. Due to elevated, if not record, global debt levels, our view remains that interest rate sensitivity is very high. In other words, small increases in interest rates are now disproportionately impactful in slowing economic growth. If true, it could mean that the Fed is already overly restrictive and has possibly made a policy error in raising rates to current levels. Until remedied, this would be a hostile environment for risk assets. We believe recent economic weakness – housing and autos – is potentially corroborating this view. We stand ready to increase our level of defense if the backdrop deteriorates and believe that the Fund is well positioned for today’s increasingly volatile capital markets.

| |

| Average Annual Total Return (%) through December 31, 20181,2 |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Year | | Inception |

| |

| Ultra Series Conservative Allocation, Class I | | -2.49 | | 4.25 | | 3.58 | | 6.20 | | NA |

| |

| Ultra Series Conservative Allocation, Class II | | -2.73 | | 3.99 | | 3.32 | | NA | | 6.00 |

| |

| ICE BofAML US Corp, Govt & Mortg Index | | 0.00 | | 2.07 | | 2.61 | | 3.44 | | 3.54 |

| |

| Conservative Allocation Fund Custom Index | | -2.60 | | 4.15 | | 3.80 | | 6.39 | | 6.55 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

| |

| Alternative Funds | | 1.3 | % |

| Bond Funds | | 61.4 | % |

| Foreign Stock Funds | | 10.5 | % |

| Short-Term Investments | | 5.0 | % |

| Stock Funds | | 22.0 | % |

| Net Other Assets and Liabilities | | (0.2) | % |

| MODERATE ALLOCATION FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Ultra Series Moderate Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

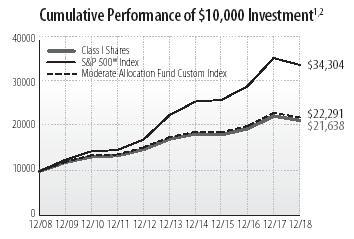

The Ultra Series Moderate Allocation Fund (Class I) returned (4.36)% over the 12-month period, outperforming the Moderate Allocation Fund Custom Index return of (4.58)%. The Fund outperformed the Morningstar Moderate Allocation Category peer group, which returned (5.25)%.

After a long absence, volatility reestablished itself with authority over the past 12 months. Markets entered 2018 revved up on fresh U.S. fiscal stimulus provided by sweeping tax law changes and a broad-based synchronized global economic expansion. However, after making a parabolic 12% advance between mid-November 2017 and late January 2018, the S&P 500® experienced an abrupt 10% nosedive over two-weeks. Rising U.S. interest rates and the concern of an even more restrictive Federal Reserve rate hike campaign appeared to be behind the newfound market concerns.

By spring it was clear that economic growth in both Europe and China was slowing and failing to meet expectations, while talk of tariffs and a potential trade war sparked even greater worries on the global stage. The U.S. equity market was able to recover throughout the summer on the back of impressive earnings growth, assisted by the corporate tax cut. International markets, however, continued to decline. Emerging markets were hit especially hard by the combination of a slowing China, stronger U.S. Dollar and a general tightening in financial conditions. In late September, turbulence returned as the markets took the turn of the season to fall quite literally, shaken by a resolute Fed amid signs of slowing U.S. economic data. An historic December decline took the S&P 500 Index from a sizable 11.2% advance at its September peak to a 4.4% loss for the calendar year.

Outside of the U.S., foreign equities were strongly negative as international stocks (MSCI ACWI ex-USA Index®) dropped 14.2% and emerging markets (MSCI EM Index) fell 14.6%. Bonds (Bloomberg Barclays U.S. Aggregate Bond Index), hurt by rising interest rates for the bulk of the year, made a fourth quarter charge to finish flat for 2018.

The Fund held up extremely well during the two larger equity declines, buffered by an underweight allocation to equities and an elevated cash position. Within U.S. equities, overweight allocations to growth stocks boosted returns, as did outperformance from our two core actively managed large cap funds. Timely allocations into Consumer Staples and Health Care were also additive. Detracting from returns were our overweight allocations to midcaps, Energy stocks and Commodities. Unfortunately, our equity composition was leaning a little too heavily on the international side early on, which detracted from returns. However, we quickly reallocated back toward the U.S. as our concerns grew over the potential for trade disruption. We also increased the use of dollar hedging, which aided performance as the dollar strengthened during the year. On the fixed income side, the Fund was rewarded for taking lower interest rate (duration) risk throughout the year as interest rates increased. The largest positive contributions came from our short-term holdings in corporate bonds and Treasuries. Below benchmark performance from our core actively managed holdings provided the largest drag on returns. Positions in TIPS (Treasury Inflation Protected Securities), which were negatively impacted by the steep decline in inflation break-evens late in the year, and longer-term Treasuries also detracted from the Fund’s return.

We are paying close attention to how the U.S. and global economies respond to less accommodative monetary conditions. From an historical perspective, U.S. interest rates are still very low. The notion that the U.S. could readily withstand still higher rates has been the prevailing view of most economists. We’ve long thought otherwise. Due to elevated, if not record, global debt levels, our view remains that interest rate sensitivity is very high. In other words, small increases in interest rates are now disproportionately impactful in slowing economic growth. If true, it could mean that the Fed is already overly restrictive and has possibly made a policy error in raising rates to current levels. Until remedied, this would be a hostile environment for risk

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

assets. We believe recent economic weakness – housing and autos – is potentially corroborating this view. We stand ready to increase our level of defense if the backdrop deteriorates and believe that the Fund is well positioned for today’s increasingly volatile capital markets.

| |

| Average Annual Total Return (%) through December 31, 20181,2 |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Moderate Allocation, Class I | | -4.36 | | 5.64 | | 4.53 | | 8.02 | | NA |

| |

| Ultra Series Moderate Allocation, Class II | | -4.60 | | 5.38 | | 4.27 | | NA | | 7.89 |

| |

| S&P 500® Index | | -4.38 | | 9.26 | | 8.49 | | 13.12 | | 13.83 |

| |

| Moderate Allocation Fund Custom Index | | -4.58 | | 5.56 | | 4.61 | | 8.35 | | 8.59 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

| |

| Alternative Funds | | 2.2 | % |

| Bond Funds | | 37.8 | % |

| Foreign Stock Funds | | 18.7 | % |

| Short-Term Investments | | 7.3 | % |

| Stock Funds | | 37.7 | % |

| Net Other Assets and Liabilities | | (3.7) | % |

| AGGRESSIVE ALLOCATION FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Ultra Series Aggressive Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including ETFs, with target allocations over time of approximately 80% equity investments and 20% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

The Ultra Series Aggressive Allocation Fund (Class I) returned (6.16)% over the 12-month period, modestly outperforming the Aggressive Allocation Fund Custom Index return of (6.23)%. The Fund outperformed the Morningstar Aggressive Allocation Category peer group, which returned (7.01)%.

After a long absence, volatility reestablished itself with authority over the past 12 months. Markets entered 2018 revved up on fresh U.S. fiscal stimulus provided by sweeping tax law changes and a broad-based synchronized global economic expansion. However, after making a parabolic 12% advance between mid-November 2017 and late January 2018, the S&P 500® experienced an abrupt 10% nosedive over two-weeks. Rising U.S. interest rates and the concern of an even more restrictive Federal Reserve rate hike campaign appeared to be behind the newfound market concerns.

By spring it was clear that economic growth in both Europe and China was slowing and failing to meet expectations, while talk of tariffs and a potential trade war sparked even greater worries on the global stage. The U.S. equity market was able to recover throughout the summer on the back of impressive earnings growth, assisted by the corporate tax cut. International markets, however, continued to decline. Emerging markets were hit especially hard by the combination of a slowing China, stronger U.S. Dollar and a general tightening in financial conditions. In late September, turbulence returned as the markets took the turn of the season to fall quite literally, shaken by a resolute Fed amid signs of slowing U.S. economic data. An historic December decline took the S&P 500 Index from a sizable 11.2% advance at its September peak to a 4.4% loss for the calendar year.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

Outside of the U.S., foreign equities were strongly negative as international stocks (MSCI ACWI ex-USA Index®) dropped 14.2% and emerging markets (MSCI EM Index) fell 14.6%. Bonds (Bloomberg Barclays U.S. Aggregate Bond Index), hurt by rising interest rates for the bulk of the year, made a fourth quarter charge to finish flat for 2018.

The Fund held up extremely well during the two larger equity declines, buffered by an underweight allocation to equities and an elevated cash position. Within U.S. equities, overweight allocations to growth stocks boosted returns, as did outperformance from our two core actively managed large cap funds. Timely allocations into consumer staples and health care were also additive. Detracting from returns were our overweight allocations to midcaps, Energy stocks and Commodities. Unfortunately, our equity composition was leaning a little too heavily on the international side early on, which detracted from returns. However, we quickly reallocated back toward the U.S. as our concerns grew over the potential for trade disruption. We also increased the use of dollar hedging, which aided performance as the dollar strengthened during the year. On the fixed income side, the Fund was rewarded for taking lower interest rate (duration) risk throughout the year as interest rates increased. The largest positive contributions came from our short-term holdings in corporate bonds and Treasuries. Below benchmark performance from our core actively managed holding and our long-term Treasury position provided the largest drag on the Fund’s return.

We are paying close attention to how the U.S. and global economies respond to less accommodative monetary conditions. From an historical perspective, U.S. interest rates are still very low. The notion that the U.S. could readily withstand still higher rates has been the prevailing view of most economists. We’ve long thought otherwise. Due to elevated, if not record, global debt levels, our view remains that interest rate sensitivity is very high. In other words, small increases in interest rates are now disproportionately impactful in slowing economic growth. If true, it could mean that the Fed is already overly restrictive and has possibly made a policy error in raising rates to current levels. Until remedied, this would be a hostile environment for risk assets. We believe recent economic weakness – housing and autos – is potentially corroborating this view. We stand ready to increase our level of defense if the backdrop deteriorates and believe that the Fund is well positioned for today’s increasingly volatile capital markets.

| |

| Average Annual Total Return (%) through December 31, 20181,2 |

| | | | | | | | | | Since |

| | | | | | | | | | 5/1/09 |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Aggressive Allocation, Class I | -6.16 | | 6.58 | | 5.17 | | 9.61 | | NA |

| |

| Ultra Series Aggressive Allocation, Class II | -6.39 | | 6.32 | | 4.90 | | NA | | 9.45 |

| |

| S&P 500® Index | -4.38 | | 9.26 | | 8.49 | | 13.12 | | 13.83 |

| |

| Aggressive Allocation Fund Custom Index | -6.23 | | 6.64 | | 5.21 | | 9.83 | | 10.16 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

| |

| Alternative Funds | | 3.4 | % |

| Bond Funds | | 19.7 | % |

| Collateral for Securities on Loan | | 2.8 | % |

| Foreign Stock Funds | | 24.9 | % |

| Short-Term Investments | | 1.8 | % |

| Stock Funds | | 49.2 | % |

| Net Other Assets and Liabilities | | (1.8) | % |

| CORE BOND FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Ultra Series Core Bond Fund invests at least 80% of its net assets in bonds. To keep current income relatively stable and to limit share price volatility, the Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration. The Fund also strives to add incremental return in the portfolio by making strategic decisions relating to credit risk, sector exposure and yield curve positioning. The Fund may invest in corporate debt securities, U.S. Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed and commercial mortgage-backed securities.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

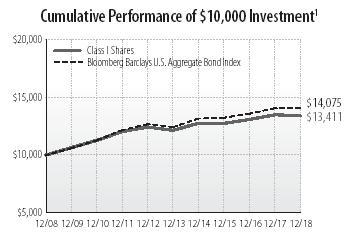

The Ultra Series Core Bond Fund (Class I) returned (0.62)% over the 12-month period, underperforming the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond® Index, which returned 0.01%. The Morningstar Intermediate-Term Bond peer group returned (0.58)% for the period.

Performance in 2017 was strong and the economy was on solid footing and trending higher, leading to optimistic investor sentiment as 2018 began. For much of 2018, risk assets moved higher as the economy grew at a solid rate. However, as investors entered the fourth quarter, risk appetite quickly diminished. Plunging oil prices, the fourth increase in the Federal Funds Rate (FFR) for 2018, a shrinking Federal Reserve (Fed) balance sheet and a continuing trade war all weighed on investor sentiment and cracks began to surface in risk assets. Equity markets turned south first and had one of the worst quarters in a number of years with the S&P 500® returning (13.52)% during the fourth quarter. Equity market weakness and investor worries pushed investment grade credit returns versus Treasuries into negative territory for the year.

2018 was a rough year for risk assets. Equities and both investment grade and high yield credit all had negative returns for the first time since 2015. The Bloomberg Barclay’s U.S. Credit Index® had a total return of (2.11)% and an excess return of (2.11)% versus Treasuries. There was no place to hide on a sector level as Industrials, Utilities and Financials all had negative excess returns. However, there were significant differences in the performance of credit by maturity. Shorter maturity credit significantly outperformed longer credit, both on a total return and excess return versus Treasuries. The Bloomberg Barclay’s 1-3 year U.S. Credit® Index had a total return of 1.64% and an excess return of (0.01)%. This compared favorably to longer credit as the Bloomberg Barclay’s Long U.S. Credit® Index had a total return of (6.76)% and an excess return of (6.06)%. One of the largest drivers of the underperformance was due to the flattening Treasury curve and the additional credit spread needed to offset this flattening.

The high yield sector fared no better with the Bloomberg Barclay’s U.S. Corporate High Yield® Index returning (2.08)% in 2018. High yield held up well for most of the year, but in the fourth quarter equity weakness and increased overall volatility pushed bonds lower. Lower quality triple-C rated bonds significantly underperformed double-B rated bonds as access to the capital markets greatly diminished for highly leveraged firms. Liquidity has become so poor for many firms that there wasn’t a single index eligible high yield bond issued in December. This was the first time since December 2008 that this occurred.

There were also significant money outflows within the investment grade and high yield bond markets during the second half of 2018. According to a Wells Fargo report (Credit Flows: Supply & Demand for the Week of December 20-December 26), money market funds had the largest positive flow for 2018 with leveraged loans, high yield and equities having the largest outflows. The likelihood that foreign investors will pick-up the slack is low given high hedging costs and the large disparity in funding rates from multiple FFR hikes.

Elevated Interest Rate Volatility

Volatility was not isolated to the equity and credit markets. Interest rates swung wildly during the year as market participants attempted to price various paths for the FFR. The Fed increased the FFR four times in 2018 to an effective rate of roughly 2.40% by December. These actions by the Fed put significant pressure on shorter maturities and thus flattened the yield curve. The two-year Treasury yield had increased at one point by over 100 basis points (bps) to 2.97% after starting the year at 1.89%. However, by year-end, the two-year Treasury had fallen to 2.48% after the market began to price in a slowing economy in 2019 and 2020.

Longer Treasuries also rose but not to the same extent as shorter maturities. Ten-year Treasury yields rose 29 bps to 2.69%, and thirty-year Treasuries rose 28 bps to 3.02%. Longer-maturity rates were significantly higher during the fourth-quarter versus year-end levels but as risk off sentiment entered the market, rates fell significantly off the highs.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

Positioning

As we look to 2019, the Fund is currently at 95% duration versus its benchmark, which is the longest relative duration in the last five years. The credit allocation will continue to be scrutinized and opportunities to sell credit and swap into securitized products will be explored. The Fund continues to look for opportunities to move the duration towards neutral versus the benchmark while owning a higher credit quality portfolio versus many of its peers.

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Core Bond, Class I | | -0.62 | | 1.70 | | 2.00 | | 2.98 | | NA |

| |

| Ultra Series Core Bond, Class II | | -0.87 | | 1.45 | | 1.74 | | NA | | 2.75 |

| |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 0.01 | | 2.06 | | 2.52 | | 3.48 | | 3.55 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. | | | | | | | | | | |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 |

| |

| Asset Backed Securities | | 4.9% |

| Collateralized Mortgage Obligations | | 2.2% |

| Commercial Mortgage-Backed Securities | | 2.4% |

| Corporate Notes and Bonds | | 35.1% |

| Long Term Municipal Bonds | | 5.0% |

| Mortgage Backed Securities | | 25.1% |

| Short-Term Investments | | 2.3% |

| U.S. Government and Agency Obligations | | 22.0% |

| Net Other Assets and Liabilities | | 1.0% |

| HIGH INCOME FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series High Income Fund invests primarily in lower-rated, higher-yielding income bearing securities, such as “junk” bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the Fund may rotate securities selection by business sector according to the economic outlook. Under normal market conditions, the Fund invests at least 80% of its net assets in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities.

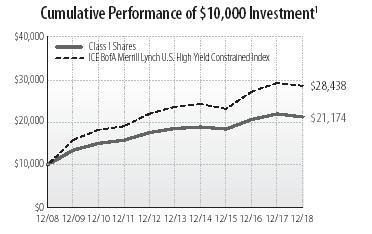

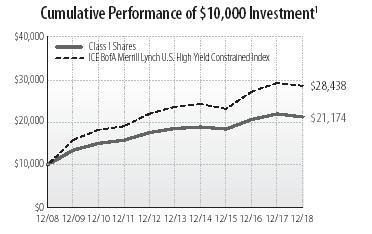

The Ultra Series High Income Fund (Class I) returned (3.20)% during the period, lagging the ICE Bank of America Merrill Lynch U.S. High Yield Constrained® Index’s (2.27)% return. The Fund also trailed its Morningstar High Yield Bond Category peer group, which returned (2.86)%.

The high yield market in 2018 experienced its worst performance since 2015 and only its second annual decline since 2008. This year’s weakness came entirely during the fourth quarter as investor’s began pricing in: 1) a 38% fourth quarter year-over-year decline in the price of crude oil; 2) the prospect for slower grow in the U.S. economy in 2019; 3) an outlook for lower corporate profit growth; 4) higher interest rates along with the potential for additional hikes; and 5) escalating trade war concerns. As a result of these issues, the average spread-over-Treasuries, or the additional yield investor’s receive from assets that carry greater risk than government bonds, ended the year at 537 basis points (bps; 1 basis point equals 0.01%), or 164 bps wider than at the end of 2017.

Within the high yield rating categories, B-rated bonds had the best relative annual total return at (1.54)%, while BB-rated bonds slightly underperformed at (2.46)%. CCC-rated bonds underperformed the most with a (4.15)% total return. The outperformance by the B category was largely driven by a 1.41% total return from shorter maturities (1-5 years), which was supported by an accommodative new issue market throughout most of the year.

On a sector level, the Fund had underexposure to Energy (6.37)%, Metals & Mining (3.31)% and Telecommunications (1.08%). The Fund underperformed in

| Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018 |

its bond selection within the Services, Media and Consumer Goods sectors. Partially offsetting these negatives, the Fund had a positive contribution to performance from an underweight in the Energy and a higher cash balance. The Fund also benefited from bond selection in the Healthcare sector. As of December 31, 2018, the yield-to-worst of the Fund was 7.08% and the average rating within the Fund was B2.

For 2019, the Fund will continue to emphasize BB-rated and B-rated corporate bonds. Even with the recent spread widening, we see little on the near-term horizon to drive material price appreciation. Our targeted total return factors in a conservative fundamental view, as well as the likelihood of another interest rate hike (we view the Federal Reserve’s decisions as a wildcard to the annual performance). Therefore, we anticipate a potential decline in bond prices could offset the positive return generated by coupon income. We intend to maintain our bias towards higher quality credit and a relatively higher cash position.

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series High Income, Class I | | -3.20 | | 4.90 | | 2.75 | | 7.79 | | NA |

| |

| Ultra Series High Income, Class II | | -3.44 | | 4.64 | | 2.49 | | NA | | 6.34 |

| |

| ICE BofAmerica Merrill Lynch US High Yield Constrained Index | | -2.27 | | 7.27 | | 3.83 | | 11.02 | | 9.54 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 |

| |

| Communication Services | | 4.6% |

| Consumer Discretionary | | 20.3% |

| Consumer Staples | | 8.5% |

| Energy | | 10.7% |

| Financials | | 8.4% |

| Health Care | | 7.8% |

| Industrials | | 18.0% |

| Information Technology | | 0.5% |

| Materials | | 5.1% |

| Real Estate | | 2.7% |

| Short-Term Investments | | 12.7% |

| Utilities | | 4.3% |

| Net Other Assets and Liabilities | | (3.6)% |

| DIVERSIFIED INCOME FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series Diversified Income Fund seeks income by investing in a broadly diversified array of securities including bonds, common stocks, real estate securities, foreign market bonds and stocks and money market instruments. Bonds, stock and cash components will vary, reflecting the portfolio managers’ judgments of the relative availability of attractively yielding and priced stocks and bonds; however, under normal market conditions, the Fund’s portfolio managers generally attempt to target a 40% bond and 60% stock investment allocation. Nevertheless, bonds (including investment grade, high yield and mortgage- or asset-backed) may constitute up to 80% of the Fund’s assets, stocks (including common stocks, preferred stocks and convertible bonds) may constitute up to 70% of the Fund’s assets, real estate securities may constitute up to 25% of the Fund’s assets, foreign (including American Depositary Receipts (“ADRs”) and emerging market) stocks and bonds may constitute up to 25% of the Fund’s assets, and money market instruments may constitute up to 25% of the Fund’s assets. Although the Fund is permitted to invest up to 80% of its assets in lower credit quality bonds, under normal circumstances, the Fund intends to limit the investment in lower credit quality bonds to less than 50% of the Fund’s assets. The balance between the two strategies of the Fund (fixed income and equity investing) is determined after reviewing the risks associated with each type of investment, with the goal of meaningful risk reduction as market conditions demand.

| Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018 |

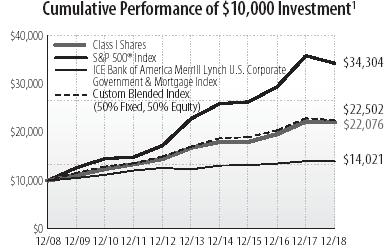

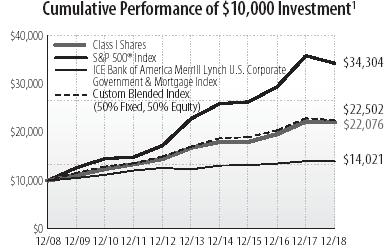

For the twelve month period, the Ultra Series Diversified Income Fund (Class I) returned (0.76)% compared to its custom blended benchmark (50% S&P 500® Index and 50% ICE Bank of America Merrill Lynch U.S. Corporate, Government and Mortgage Index) return of (1.90)%. The Fund’s Morningstar peer group, the Moderate Allocation Category, returned (5.25)% over the same period.

The equity portion of the Fund outpaced its S&P 500 Index® benchmark for the year. Sector allocation was negative and stock selection accounted for all of the outperformance versus the index. Overweight positions in Industrials and Energy detracted from results. In terms of stock selection, there were positive contributions from Health Care, Financials, Consumer Staples, Technology, Industrials and Materials, which were partially offset by weakness in Energy and Utilities. Within Health Care, Merck (MRK) was the best performing stock in the portfolio. Global pharmaceutical firm Pfizer (PFE) also performed well. Both companies have solid drug pipelines and reported better than expected earnings. In Financials, CME Group (CME) was a top performing stock. Within Technology, software firm Microsoft (MSFT) and internet routing company Cisco Systems (CSCO) were notable outperforming stocks. Each firm is benefitting from a transition to its cloud services, which appear to have better growth prospects than traditional hardware products. On the negative side, in Energy, Schlumberger (SLB) negatively impacted performance. The Fund sold SLB as we believed the thesis was unlikely to play out due to low energy prices. Within Financials, regional bank firm Wells Fargo (WFC) was the worst performing stock in the portfolio. While there were market concerns about slowing loan growth and potential margin pressure, we believe the thesis remains intact.

Within Industrials, global conglomerate 3M (MMM) and airfreight and logistics firm UPS (UPS) underperformed due to worries about slowing global growth. Despite the short-term setback, we believe each thesis is intact. Another notable underperforming stock was coffee and pet food manufacturer J.M. Smucker (SJM) in Consumer Staples. The Fund sold SJM as we believe it lacked pricing power and it participated in slow growth categories with little product differentiation. The Fund continues to hold all stocks mentioned above except for SJM and SLB.

The Fixed Income allocation of the Fund lagged its ICE BAML US Corporate, Government & Mortgage Index® benchmark over the last twelve months. Bond performance was aided by a more conservative duration posture relative to the Index and a market value overweight in credit securities which boosted portfolio yield. However, these additive positions were offset by significant credit spread widening as the year ended. The Fund benefited from owning longer Treasuries as the yield curve flattened but this impact was negated by having a lower overall duration than the benchmark as yields on longer-maturity Treasuries rallied sharply in the final months of 2018.

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | Since |

| | | | | | | | | | 5/1/09 |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Diversified Income, Class I | -0.76 | | 7.02 | | 5.62 | | 8.24 | | NA |

| |

| Ultra Series Diversified Income, Class II | -1.01 | | 6.75 | | 5.35 | | NA | | 8.65 |

| |

| S&P 500® Index | -4.38 | | 9.26 | | 8.49 | | 13.12 | | 13.83 |

| |

| ICE BofAML US Corp, Govt & Mortgage Index | 0.00 | | 2.07 | | 2.61 | | 3.44 | | 3.54 |

| |

| Custom Blended Index (50% Fixed, 50% Equity) | -1.90 | | 5.79 | | 5.70 | | 8.45 | | 8.81 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018 |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 |

| |

| Asset Backed Securities | | 1.7% |

| Collateralized Mortgage Obligations | | 1.2% |

| Commercial Mortgage-Backed Securities | | 0.7% |

| Common Stocks | | 63.9% |

| Corporate Notes and Bonds | | 11.5% |

| Long Term Municipal Bonds | | 2.3% |

| Mortgage Backed Securities | | 8.3% |

| Short-Term Investments | | 3.8% |

| U.S. Government and Agency Obligations | | 6.5% |

| Net Other Assets and Liabilities | | 0.1% |

| LARGE CAP VALUE FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series Large Cap Value Fund will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. The Fund follows a “value”approach, meaning the portfolio managers seek to invest in stocks at prices below their perceived intrinsic value as estimated based on fundamental analysis of the issuing company and its prospects. By investing in value stocks, the Fund attempts to limit the downside risk over time but may also produce smaller gains than other stock funds if their intrinsic values are not realized by the market or if growth-oriented investments are favored by investors. The Fund will diversify its holdings among various industries and among companies within those industries.

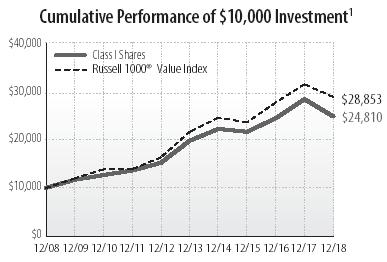

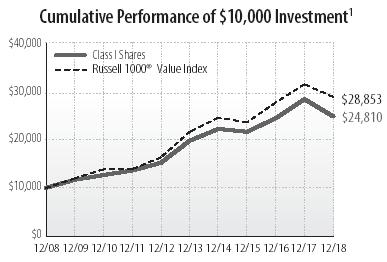

In the past twelve months, the Ultra Series Large Cap Value Fund (Class I) returned (12.59)%, which lagged the Russell 1000® Value Index return of (8.27)%. The Fund underperformed its Morningstar peer group, the Morningstar Large Value Category, which returned (9.28)% for the period.

Sector allocation was positive while stock selection was negative and accounted for all of the performance discrepancy versus the Index. For sector allocation, an overweight position in Utilities and an underweight position in Financials were additive to results. In terms of stock selection, there were positive contributions in Utilities, Health Care, Industrials and Consumer Staples, which were more than offset by negative results in Energy, Materials, Communications Services, Consumer Discretionary and Real Estate. In Utilities, NRG Energy (NRG) was the best performing stock in the portfolio, while AES Corp. (AES) was another stock that performed well in that sector. Within Technology, disk drive manufacturer Seagate Technology (STX) contributed nicely to results. It benefited from strong demand for its hard and solid-state discs that are being used in a variety of different areas within computing. The Fund sold STX after it reached a full valuation. In Health Care, Eli Lilly and Co. (LLY) was a strong performing stock, along with managed care firm Humana (HUM). It benefitted from solid enrollment growth in its Medicare Advantage health plans. On the negative side, the Fund’s Energy and Materials investments underperformed coincident with falling oil prices and slowing global growth expectations. Within Energy, Transocean Ltd. (RIG), Range Resources (RRC), Murphy Oil (MUR) and oilfield service firm Haliburton (HAL) all trailed the Index. The Fund sold HAL, RIG and RRC. Another notable underperforming stock was gold producer Newmont Mining (NEM). It was negatively impacted by falling gold prices early in the year and was sold. The Fund continues to hold AES, HUM, LLY, NRG and MUR.

The fourth quarter, and in turn the full year, was among the most difficult periods we can remember. In general, stocks with strong balance sheets performed the best and, conversely, stocks with the most debt on the balance sheet performed the worst. The Fund sold stocks that had considerable debt outstanding and has repositioned into companies with stronger balance sheets. We believe this will add value in 2019. In prior instances of challenging results, the Fund has recovered well by sticking to our process of owning stocks with rising return on invested capital. We will continue to work hard to find these stocks and improve upon the investment results realized in 2018.

| Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018 |

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | | | | | | | | | | Since |

| | | | | | | | | | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Large Cap Value, Class I | | | -12.59 | | | | 4.71 | | | | 4.66 | | | | 9.51 | | | | NA | |

| |

| Ultra Series Large Cap Value, Class II | | | -12.81 | | | | 4.45 | | | | 4.40 | | | | NA | | | | 10.47 | |

| |

| Russell 1000® Value Index | | | -8.27 | | | | 6.95 | | | | 5.95 | | | | 11.18 | | | | 12.47 | |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 |

| |

| Communication Services | | 11.3% |

| Consumer Staples | | 9.0% |

| Energy | | 7.5% |

| Financials | | 16.1% |

| Health Care | | 18.7% |

| Industrials | | 4.8% |

| Information Technology | | 2.4% |

| Materials | | 6.0% |

| Real Estate | | 3.6% |

| Short-Term Investments | | 5.8% |

| Utilities | | 16.4% |

| Net Other Assets and Liabilities | | (1.6)% |

| LARGE CAP GROWTH FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series Large Cap Growth Fund invests primarily in common stocks of larger companies and will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. The Fund invests in well-established companies with competitive advantages that have demonstrated patterns of consistent growth. To a lesser extent, the Fund may invest in the stocks of less established companies that may offer more rapid growth potential. The Fund invests when a stock trades at a good price in relation to underlying value and the Fund looks to sell or trim a stock when the portfolio manager deems a stock to be overpriced compared to underlying value.

The Ultra Series Large Cap Growth Fund (Class I) returned (0.28)% for the twelve months ended December 31, 2018, beating the Russell 1000 Growth® Index return of (1.51)%. The Fund outperformed its peer group, the Morningstar Large Growth Category, which returned (1.50)% for the same period.

For the first nine months of the year, the market continued to march steadily upward. The Russell 1000® Growth Index was up a robust 17% through September, 2018. The advance was led by strong performance from the large Technology stocks and rapidly growing companies with lofty valuation multiples (“growth stocks”). Volatility finally returned to the markets in October, as investors started to become increasingly worried about escalating trade tensions, emerging market weakness and rising interest rates. The Index fell by double-digits in the fourth quarter, giving back all of its earlier gains. Throughout 2018, we found opportunities to sell and trim holdings deemed expensive and reinvest these proceeds in stocks with more reasonable valuation levels.

The Large Cap Growth strategy also made a number of portfolio changes in early April, when portfolio management duties transitioned over to the Madison U.S. Equity Team. The new composition mirrors the holdings of the Madison Large Cap strategy. This activity led to portfolio turnover of more than 70% during the year, which is well above the range we’d typically expect. However, we believe the turnover has been productive because it related to improving the risk-reward proposition of the Fund.

For the year, the Fund enjoyed strong relative performance from its Industrials and Materials holdings, which held up far better than the benchmark constituents in these sectors. This

| Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018 |

is attributable to the fact that most of the Fund’s Industrial holdings are “asset-light” or service companies rather than cyclical, heavy-industry businesses. These industrial service holdings posted strong sales and earnings performance over the past year. The Fund also enjoyed good returns from its Specialty Retail holdings. We believe that 2017’s pessimism about brick and mortar retailers led to opportunities in our retail stocks that bore fruit in 2018. The Fund’s Real Estate sector holdings also outperformed its sector for the year.

The Fund’s Energy, Health Care and Financial holdings experienced returns that were similar to the corresponding benchmark sectors such that these sectors were roughly neutral to relative performance.

Information Technology was a fairly strong sector for the S&P 500® during 2018. The Fund was underweight Information Technology, and our holdings in the sector underperformed their benchmark comparison in aggregate. We added an Information Technology consulting stock and an analog Semiconductor stock over the course of the year that we expect to contribute positively to future returns. The Fund’s Consumer Staples holdings also underperformed in 2018. This was primarily a result of disappointing volume growth from our food and beverage stocks.

Our goal is to provide superior long-term returns while assuming less risk. We continue to believe in the merit of thinking independently, investing for the long-term, and emphasizing risk management. We believe that this strategy will outperform over a full market cycle.

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | | | | | | | | | | Since |

| | | | | | | | | | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Large Cap Growth, Class I | | | -0.28 | | | | 8.84 | | | | 8.34 | | | | 12.72 | | | | NA | |

| |

| Ultra Series Large Cap Growth, Class II | | | -0.53 | | | | 8.57 | | | | 8.07 | | | | NA | | | | 11.89 | |

| |

| Russell 1000® Growth Index | | | -1.51 | | | | 11.15 | | | | 10.40 | | | | 15.29 | | | | 15.20 | |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 |

| |

| Consumer Discretionary | | 23.0% |

| Financials | | 14.9% |

| Health Care | | 16.3% |

| Industrials | | 9.7% |

| Information Technology | | 21.5% |

| Materials | | 8.4% |

| Real Estate | | 4.1% |

| Short-Term Investments | | 2.0% |

| Net Other Assets and Liabilities | | 0.1% |

| MID CAP FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series Mid Cap Fund generally invests in common stocks of midsize companies and will, under normal market conditions, maintain at least 80% of its net assets in mid cap securities. The Fund seeks attractive long-term returns through bottom-up security selection based on fundamental analysis in a diversified portfolio of high-quality companies with attractive valuations. These will typically be industry leading companies in niches with strong growth prospects. The Fund’s portfolio managers believe in selecting stocks for the Fund that show steady, sustainable growth and reasonable valuations. As a result, stocks of issuers that are believed to have a blend of both value and growth potential will be selected for investment.

The Ultra Series Mid Cap Fund (Class I) returned (1.50)% for the annual period, sharply outperforming its benchmark Russell Midcap® Index’s (9.06)% return. The Fund outperformed its peer group, the Morningstar Mid-Cap Growth category, which returned (4.04)%.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

Strong stock selection was the primary driver of outperformance during the past 12 months. We construct our portfolio using a bottom-up process, and make no attempt to target sector allocations relative to any index except to diversify adequately for prudent risk management.

That being said, the Mid Cap Fund was underweight in the three strongest sectors of the benchmark – Communication Services, Utilities and Information Technology. We were also hurt by an overweighting in Materials, which was one of the worst performing sectors. Excellent relative performance from our holdings in Consumer Discretionary, Industrials and Financials more than offset these allocation headwinds. Our top individual contributors were O’Reilly Automotive, Copart, CDW, TJX Companies and Zoetis. Our largest detractors were Liberty Global, Axalta Coating Systems, Mohawk Industries, Liberty Broadband and Crown Holdings.

O’Reilly Automotive owns and operates auto parts stores. O’Reilly has recently seen same stores sales growth accelerate to mid-single digit rates, which is in-line with historical averages. The stock price has closely followed this improvement in sales. Copart is an auctioneer of salvaged cars. Copart delivered another year of healthy unit volume growth. The robust performance was driven by strength in both core domestic salvage operations and non-salvage operations. CDW is a value-added distributor selling hardware, software and services from thousands of vendors. The company is benefitting from secular growth in Information Technology spending. TJX Companies operates several off-price retail concepts across the globe. Off-price retail has consistently taken share from department stores and specialty apparel stores due to its affordable, exciting and ever-changing assortment of merchandise. Zoetis, the largest global manufacturer of drugs and vaccines for animals, continues to benefit from new product launches and the robust demand for pet medications. Management’s focus on controlling costs has also lead to significant improvements in Zoetis’ profitability over the past several years.

Liberty Global, an international telecom provider, had a tough year due to lackluster subscriber numbers and concerns that regulators will hold up a deal to sell their German and Eastern European assets to Vodafone. Results in the UK have been disappointing and the outcome of the Vodafone transaction is difficult to handicap, but we still think the strategic value of Liberty Global’s assets provides a talented management team with opportunities to unlock shareholder value through asset swaps, asset sales or an outright sale of the company. The recent spike in oil prices has weighed on margins at Mohawk and Axalta. Both of these businesses rely heavily on petroleum-derived inputs in their manufacturing processes. This raw material inflation is largely a cyclical phenomenon. We believe Mohawk and Axalta will eventually improve profitability through price increases and productivity initiatives. Crown Holdings, a global can maker, surprised investors last December when they decided to lever up and acquire a transit packaging company. This news was disappointing, but valuation is now extremely cheap, the integration has gone well and the core business is growing nicely.

| |

| Average Annual Total Return (%) through December 31, 20181 |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series Mid Cap, Class I | | -1.50 | | 8.75 | | 7.38 | | 14.77 | | NA |

| |

| Ultra Series Mid Cap, Class II | | -1.75 | | 8.48 | | 7.11 | | NA | | 13.21 |

| |

| Russell Midcap® Index | | -9.06 | | 7.04 | | 6.26 | | 14.03 | | 13.95 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

| |

| Consumer Discretionary† | | 31.5 | % |

| Consumer Staples | | 0.9 | % |

| Financials | | 23.1 | % |

| Health Care | | 6.9 | % |

| Industrials | | 13.7 | % |

| Information Technology | | 9.3 | % |

| Materials | | 7.5 | % |

| Real Estate | | 2.9 | % |

| Short-Term Investments | | 4.4 | % |

| Net Other Assets and Liabilities | | (0.2) | % |

| |

| †Consumer Discretionary includes securities in the following industries: Household Durables, Media, Multiline Retail and Specialty Retail. |

| INTERNATIONAL STOCK FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series International Stock Fund will invest, under normal market conditions, at least 80% of its net assets in the stock of foreign companies. Typically, a majority of the Fund’s assets are invested in relatively large cap stocks of

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

companies located or operating in developed countries. The Fund may also invest up to 30% of its assets in securities of companies whose principal business activities are located in emerging market countries. The portfolio managers typically maintain this segment of the Fund’s portfolio in such stocks which it believes have a low market price relative to their perceived value based on fundamental analysis of the issuing company and its prospects. The Fund may also invest in foreign debt and other income bearing securities at times when it believes that income bearing securities have greater capital appreciation potential than equity securities.

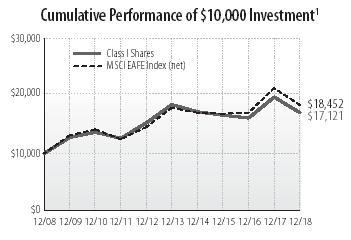

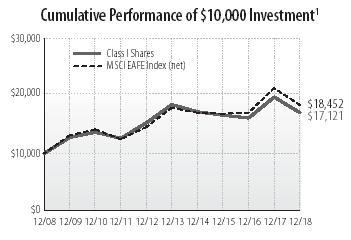

The Ultra Series International Stock Fund (Class I) returned (13.69)% for the past twelve months compared to the MSCI EAFE Index® (net) return of (13.79)%. The Fund outperformed its peer group, the Morningstar Foreign Large Blend Category, which returned (15.30)%.

Global equities declined significantly in 2018 as investor sentiment was undermined by global macroeconomic and geopolitical trends, including interest rate pressures, trade disputes and populism. Riskier assets around the world sold off, with many generating their worst calendar-year performance since the global financial crisis a decade ago. The MSCI EAFE Index® declined 12.5% in the fourth quarter and was down 13.8% in 2018. Emerging markets equities (represented by the MSCI EM Index®) fell less in the fourth quarter by declining 7.5%, but they fell dramatically earlier in the year and ended 2018 down 14.6%. U.S. equities joined the rout, plunging 13.5% in the quarter and ending the year down 4.4%. These returns are notable given the outperformance of U.S. equities over international equities over much of the past decade.

The decline of investor confidence in 2018 was most pronounced in emerging markets equities, which fell 14.6% for the year. Most of these losses occurred earlier in the year before the decline in developed markets. Some of this performance reflected the fact that emerging markets generated extraordinary returns in 2017 and that the asset class is relatively volatile. However, the downturn was also due to a significant shift in investor sentiment from the beginning of the year, when confidence was high as the major global economies appeared to be growing together and investors expected healthy earnings. Within a few months, however, U.S. economic growth, boosted by tax cuts and fiscal stimulus, appeared to diverge from the rest of the world. Relatively strong U.S. growth supported further Fed rate hikes which in turn boosted the U.S. dollar early in the year.

Stock selection in the Consumer Discretionary sector was among the largest drivers of relative returns. Don Quijote, a Japanese discount retailer that focuses on lower cost household items to drive store traffic, performed well, rising almost 20%. The company announced a favorable, significant transaction with Family Mart. This involves Don Quijote taking full control of the struggling Uny chain of stores, while Family Mart tendered for 20% of Don Quijote shares in the market. Elsewhere, stock selection in the Financial sector was additive to relative returns. Aon, the global insurance broker domiciled in the United Kingdom, helped performance during the year. This long-term holding has demonstrated the ability to generate strong free cash flow from operating leverage derived from improving organic growth and disciplined spending and capital allocation. The rising free cash flow has been used for sizable and consistent share buybacks. Also in the sector, DBS Group Holdings, Singapore’s largest bank, outperformed. Our original thesis was predicated on an increase in net interest margins and fading bad debt charges. In a year when most U.S. and European banks saw significant multiple compression, DBS outperformed with higher margins resulting from a consistent focus on increasing digitization, improving credit quality and solid loan demand. Stock selection in the Health Care sector was also beneficial to relative returns as shares of Medtronic, the Irish-domiciled global leader in medical devices, positively impacted

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

performance. Our thesis of improving revenue growth from new product launches, coupled with margin expansion from an increased focus on costs, continued to play out. Lastly, stock selection in the United Kingdom helped relative returns.

In contrast, stock selection in the Consumer Staples sector detracted from relative returns. British American Tobacco declined as the sensitivities around the potential ban of menthol in the U.S. combustibles market made the potential for significant earnings per share (EPS) contraction more of a reality. For several quarters, we had thought the growth algorithm in the combustible business (modest volume declines more than offset by price increases) remained generally intact despite a short-term volume setback early in the year, and the stock represented good relative value. However, due to the fact that management had more recently appeared less confident in their margin outlook, along with the potential menthol ban and high financial leverage of the business model, we deemed the thesis impaired and sold the stock. In the Energy sector, Canadian integrated oil sands and refinery company, Suncor, lagged on the back of a very weak commodity. With cash operating costs below $50 /barrel, however, we believe Suncor will continue to generate significant free cash flow. Management spent the past several years repositioning their portfolio by selling highly valued infrastructure and renewables as well as downstream assets and buying cheap, synergistic oil assets. Lastly, the portfolio’s lower-than-benchmark weights in the Utilities and Health Care sectors detracted from relative returns.

Outlook

The uncertainty and volatility global investors faced last year will likely continue in 2019. We see this, however, as a partly positive development. The fact that investors are pricing in risks leads us to be more constructive about markets going forward given that valuations have come down. We acknowledge challenges for growth, geopolitics and corporate earnings, but we also note that prior market reverses have led to more realistic pricing and, in some cases, opportunities. Over the past 20 years, when valuations have been at the current level or less expensive, the median 3-year forward return for the market has been nearly double that of the overall median market return.

We note that multiples for global equity markets compressed significantly in 2018. From this perspective, non-U.S. markets look attractive, particularly when compared to U.S. markets. EAFE offers historically cheap valuations compared to the United States, more room for margin improvement and lower expectations. We believe that many multiples are attractive and that investor expectations for 2019 earnings look achievable.

| |

| Average Annual Total Return through December 31, 20181 | | | | | | | | | | |

| | | | | | | | | | | Since |

| | | | | | | | | | | 5/1/09 |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| Ultra Series International Stock, Class I | | -13.69 | | 0.89 | | -1.56 | | 5.52 | | NA |

| |

| Ultra Series International Stock, Class II | | -13.91 | | 0.63 | | -1.81 | | NA | | 5.84 |

| |

| MSCI EAFE Index (net) | | -13.79 | | 2.87 | | 0.53 | | 6.32 | | 6.86 |

| |

| See accompanying Notes to Management’s Discussion of Fund Performance. |

| |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

|

| Communication Services | | 6.5 | % |

| Consumer Discretionary | | 14.4 | % |

| Consumer Staples | | 8.1 | % |

| Energy | | 6.5 | % |

| Financials | | 19.3 | % |

| Health Care | | 7.7 | % |

| Industrials | | 15.9 | % |

| Information Technology | | 6.6 | % |

| Materials | | 5.5 | % |

| Real Estate | | 2.7 | % |

| Short-Term Investments | | 5.7 | % |

| Utilities | | 1.8 | % |

| Net Other Assets and Liabilities | | (0.7) | % |

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2018

| |

| GEOGRAPHICAL ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/18 | | | |

|

| United Kingdom | | 17.9 | % |

| Japan | | 12.9 | % |

| France | | 11.2 | % |

| Switzerland | | 7.4 | % |

| Netherlands | | 6.9 | % |

| Canada | | 6.1 | % |

| United States | | 5.7 | % |

| Germany | | 5.5 | % |

| Ireland | | 4.2 | % |

| Sweden | | 3.4 | % |

| Norway | | 3.1 | % |

| Finland | | 2.9 | % |

| Singapore | | 2.7 | % |

| Australia | | 2.0 | % |

| Belgium | | 1.8 | % |

| Spain | | 1.8 | % |

| Denmark | | 1.4 | % |

| India | | 1.4 | % |

| Hong Kong | | 0.9 | % |

| Israel | | 0.8 | % |

| South Korea | | 0.7 | % |

| Net Other Assets and Liabilities | | (0.7) | % |

| MADISON TARGET RETIREMENT 2020 FUND |

|

| INVESTMENT STRATEGY HIGHLIGHTS |

The Ultra Series Madison Target Retirement 2020 Fund invests primarily in shares of registered investment companies according to an asset allocation strategy developed by the Fund’s investment adviser for investors planning to retire in or within a few years of 2020. Over time, the Fund’s asset allocation will gradually shift until it reaches the more conservative allocation target of approximately 10-30% in stock funds and 70-90% in bond funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

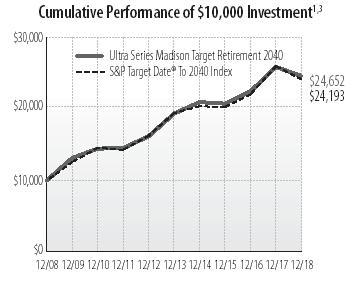

The Ultra Series Target Retirement 2020 Fund (Class I) returned (2.11)% in the 12-month period, outperforming the S&P Target Date® To 2020 Index, which returned (3.22)%, and the Morningstar Target Date 2020 Category peer group which returned (4.54)%.

After a long absence, volatility reestablished itself with authority over the past 12 months. Markets entered 2018 revved up on fresh U.S. fiscal stimulus provided by sweeping tax law changes and a broad-based synchronized global economic expansion. However, after making a parabolic 12% advance between mid-November 2017 and late January 2018, the S&P 500® experienced an abrupt 10% nosedive over two-weeks. Rising U.S. interest rates and the concern of an even more restrictive Federal Reserve rate hike campaign appeared to be behind the newfound market concerns.