1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

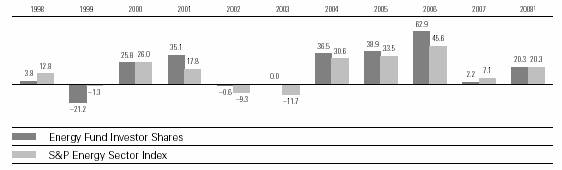

The steady climb in oil prices to record levels during the fiscal six months ended July 31, 2007, helped drive Vanguard Energy Fund’s return to 20.3% for the period. The fund’s advance matched that of the S&P Energy Sector Index and was slightly below the average return of natural resources funds.

Integrated oil companies provided the bulk of the fund’s return. These huge enterprises are engaged in most, if not all, of the process of bringing oil products to market, including exploration, drilling, production, refining, and distribution. Because the Energy Fund is more highly diversified than the S&P Energy Sector Index, the fund provided an equivalent return without overly concentrating in the industry’s largest stocks: Integrated oil companies accounted for about 52% of fund assets, compared with an almost 63% weighting in the index; and the fund’s investments span the globe, while the index only tracks domestic companies.

U.S. stocks produced modest returns for the past six months, as a downturn at the end of the period erased most of the gains recorded earlier. The market stumbled as trouble with low-quality mortgage loans and related securities amplified investors’ risk-aversion.

The broad U.S. stock market returned 1.9% for the fiscal half-year. Large-capitalization stocks bested small-caps, and growth-oriented stocks outperformed

their value-oriented counterparts. International stock markets sidestepped most of the U.S. turmoil, generating excellent six-month returns.

As investors sought a safe haven from some of the financial markets’ riskier precincts, including bonds backed by mortgage loans made to borrowers with poor credit ratings, U.S. Treasury bond prices rose slightly and yields fell. The declines in yield were most pronounced among Treasury securities with maturities of less than 5 years.

These interest rate dynamics helped restore the yield curve—which illustrates the relationship between short- and long-term bond yields—to its typical, upward-sloping pattern. At the start of the period, the curve had been mildly inverted. The broad taxable bond market returned 1.9% for the half-year. Tax-exempt municipal securities returned a bit less.

It’s said that a rising tide raises all boats. The same can be said of the relationship between oil prices and the returns provided by oil-sector companies, especially the integrated oil firms.

Oil prices started the fiscal half-year under $60 per barrel (as measured by West Texas Intermediate crude oil, an industry benchmark) and steadily rose to a record $78.22 per barrel on July 31. Among the factors underlying the oil-price surge were strong global demand, especially from

1 Annualized.

fast-developing countries such as China and India, and concerns relating to the Middle East, Venezuela, and elsewhere. (Natural gas prices, by contrast, declined because of a warm winter and higher levels of inventory.)

The fund’s holdings of integrated oil companies accounted for almost half of the fund’s return. The largest contributors among these oil giants were ConocoPhillips, Chevron, and ExxonMobil.

Rising oil prices also bolstered exploration and production companies as well as equipment and services companies; each of these sectors also made significant contributions to the fund’s return. In oil-field services, Schlumberger and Weatherford International were standout stocks.

The fund also holds several companies with a presence in oil but whose primary business is outside the field. One of these, BHP Billiton, an Australian commodities company, contributed significantly to the fund’s return.

Investors in Vanguard Energy Fund have benefited from handsome returns in recent years. It’s important to remember, however, that the fund’s focus on a specific economic sector means that its returns can

1 Fund expense ratio reflects the six months ended July 31, 2007. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2006.

be especially volatile owing to specific industry-related events as well as to such factors as the weather, political turmoil, and global economic conditions.

A modest investment of assets in a sector fund, particularly a low-cost one like the Energy Fund, can play a role in your portfolio—perhaps to fill a gap in your overall portfolio’s diversification or to provide the opportunity to meet other specialized investment objectives.

No matter how you choose to use a sector fund, your portfolio planning should aim to strike the right balance between the potential for return and risk. One of the best ways to accomplish this is through a balanced allocation of assets among stock, bond, and money market funds diversified within each of those asset classes.

Thank you for investing with Vanguard.

John J. Brennan

During the six months ended July 31, 2007, Vanguard Energy Fund returned 20.3%—a remarkable result. The performance reflected the combined efforts of your fund’s two advisors. The use of multiple advisors enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the six-month period and of how their portfolio positioning reflects this assessment.

Portfolio Manager: Karl E. Bandtel, Senior Vice President

James A. Bevilacqua, Senior Vice President

The environment for energy investing has remained positive over the last six months. After beginning the period with slightly softer prices due to weak, weather-related demand, oil prices staged a late rally driven by rising global demand and constrained supply. This was in stark contrast to the run-up this time last year based on geopolitical tensions. Natural gas prices fluctuated with weather-related demand trends and ended the period down. Inventories remained above the five-year average.

Despite the pronounced increase in oil prices over the last few years, global oil demand is rising. Continuing solid demand tests the petroleum industry’s ability to provide adequate supplies and increases the likelihood of high and volatile prices. In the short term, prices will depend in part on OPEC’s willingness to maintain production cuts. With the industry operating at near capacity, prices will remain sensitive to potential supply disruptions.

The U.S. refinery industry’s spring maintenance period has extended into the summer, leading to high gasoline prices and strong industry profits. Tougher federal regulations, skilled labor shortages, and wear and tear on aging equipment are all contributing to lower capacity-utilization levels.

Our purchases over the fiscal six months were concentrated in companies with direct access to productive capacity and whose management teams demonstrate an ability to capture resources. We added a new name in Questar and increased our existing positions in OAO Gazprom and Royal Dutch Shell. We eliminated holdings in CNOOC, based on a disappointing change in its production profile, and in Sinopec (formally known as China Petroleum & Chemical).

James D. Troyer, CFA, Principal

Our quantitative investment process evaluates a security’s attractiveness on three dimensions: valuation, sentiment, and balance-sheet prospects. Our experience is that each of our underlying models performs well over long time frames, but that their effectiveness varies over shorter periods. Overall, our model enjoyed modest success relative to the ebullient market during the past six months, despite the increased volatility.

A key characteristic of our strategy is that we do not maintain a “view” on the overall market for energy shares. This is reflected in our portfolio; we are always fully invested. We apply a rigorous risk-control process to neutralize our exposure to market-capitalization, volatility, and industry risks relative to our energy benchmark. In our opinion, such risk exposures are not justified by the potential rewards. We attempt to further reduce risk relative to the benchmark by diversifying our model across three uncorrelated components. Our portfolio strategy boils down to pure stock picking. We make many small investments in individual stocks in an attempt to capture the market’s tendency to overreact or underreact to new information.

During the six months ended July 31, overseas energy stocks performed particularly well. Our portion of the portfolio benefited from its positions in Santos, which was highlighted in the January 31, 2007, annual report as a poor performer, and in Schlumberger and CNOOC. These successes were offset slightly by positions in SEACOR Holdings and Nabors Industries.

1 S&P Energy Sector Index.

2 Dow Jones Wilshire 5000 Index.

3 Annualized.

4 Short-term reserves exclude futures and currency contracts held by the fund.

5 Sector percentages combine U.S. and international holdings.

7 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

1 Short-term reserves exclude futures and currency contracts held by the fund.

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

1 Six months ended July 31, 2007.

2 Total returns do not reflect the 1% fee assessed on redemptions of shares held less than one year; nor do they include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Return since inception.

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

2 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At July 31, 2007, the value of this security represented 0.1% of net assets.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

4 The issuer operates under a congressional charter; its securities are neither issued nor guaranteed by the U.S. government. If needed, access to additional funding from the U.S. Treasury (beyond the issuer’s line of credit) would require congressional action.

5 Securities with a value of $17,372,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

1 Dividends are net of foreign withholding taxes of $6,952,000.

2 Interest income from an affiliated company of the fund was $6,093,000.

1 Includes fiscal 2008 and 2007 short-term gain distributions totaling $21,240,000 and $6,548,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

1 Includes increases from redemption fees of $.01, $.03, $.03, $.02, $.00, and $.01.

2 Total returns do not reflect the 1% fee assessed on redemptions of shares held for less than one year; nor do they include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

1 Includes increases from redemption fees of $.01, $.05, $.03, $.03, $.01, and $.02.

2 Total returns do not reflect the 1% fee assessed on redemptions of shares held for less than one year.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund files reports with the SEC under the company name Vanguard Specialized Funds. The fund may invest in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of United States corporations. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

4. Repurchase Agreements: The fund may invest in repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $158,000 for the six months ended July 31, 2007.

For the six months ended July 31, 2007, the aggregate investment advisory fee represented an effective annual rate of 0.07% of the fund’s average net assets.

During the six months ended July 31, 2007, the fund realized net foreign currency gains of $136,000, which increased distributable net income for tax purposes; accordingly, such gains have been reclassified from undistributed net investment income to accumulated net realized gains.

At July 31, 2007, the cost of investment securities for tax purposes was $6,215,089,000. Net unrealized appreciation of investment securities for tax purposes was $6,381,975,000, consisting of unrealized gains of $6,385,554,000 on securities that had risen in value since their purchase and $3,579,000 in unrealized losses on securities that had fallen in value since their purchase.

At July 31, 2007, the aggregate settlement value of open futures contracts expiring in September 2007 and the related unrealized appreciation (depreciation) were:

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

1 Net of redemption fees of $1,120,000 and $3,975,000, respectively (fund totals).

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

1 These calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.25% for Investor Shares and 0.18% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month peiod, then divided by the number of days in the most recent 12-month period.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

The board of trustees of Vanguard Energy Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (through its Quantitative Equity Group). The board also approved an amended investment advisory agreement with Wellington Management Company, LLP, effective May 1, 2007. The amended agreement contains a new advisory fee schedule that increases the advisory fee paid to Wellington Management and adds a performance adjustment to the fee arrangement. The board determined that renewing the fund’s advisory arrangement with Vanguard, retaining Wellington Management, and amending Wellington Management’s advisory agreement were in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decision.

The board considered the quality of the fund’s investment management over both short- and long-term periods, and took into account the organizational depth and stability of each advisor. The board noted the following:

George U. Sauter, Vanguard managing director and chief investment officer, has been in the investment management business since 1985, and has led the Quantitative Equity Group since 1987. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth. Vanguard has managed a portion of the fund since 2005.

The board concluded that the existing advisory fee schedule should be adjusted to reflect the fair- market value of Wellington Management’s services. The new fee arrangement will enable Wellington Management to enhance the organizational depth and stability of the fund’s portfolio management team by retaining top investment talent and by hiring new investment professionals on an as-needed basis. The addition of a performance adjustment will better align the interests of Wellington Management and the fund’s shareholders by increasing or decreasing the asset-based fee proportionately with the performance of the portion of the fund managed by Wellington Management. A full discussion of the board’s decision to amend Wellington Management’s advisory agreement, including the terms of the agreement, appeared in the fund’s annual report for the year ended January 31, 2007.

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that each advisor has carried out its investment strategy in disciplined fashion, and the results provided

The board does not conduct a “profitability” analysis of Vanguard because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders. The board did not consider profitability of Wellington Management in determining whether to approve the advisory fee, because Wellington Management is independent of Vanguard, and the advisory fee is the result of arm’s-length negotiations.

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the advisory fee schedule with Wellington Management. The breakpoints reduce the effective rate of the fee as the fund’s assets managed by Wellington Management increase. The board also concluded that the fund’s low-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as the fund’s assets managed by Vanguard increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

This page intentionally left blank.

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

1 Officers of the funds are “interested persons” as defined in the Investment Company Act of 1940.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

| |

Vanguard® Precious Metals | |

and Mining Fund | |

| |

| |

> Semiannual Report | |

| |

| |

| |

July 31, 2007 | |

| |

> | During the six months ended July 31, 2007, Vanguard Precious Metals and Mining Fund returned 16.0%, below that of its benchmark index but ahead of the average return for gold-oriented funds. |

> | The fund’s return substantially outpaced the result of the broad stock market. |

> | Concentrated holdings in platinum mining and processing accounted for about one-third of the fund’s return. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisor’s Report | 6 |

Fund Profile | 8 |

Performance Summary | 9 |

Financial Statements | 10 |

About Your Fund’s Expenses | 19 |

Trustees Approve Advisory Agreement | 21 |

Glossary | 22 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended July 31, 2007 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard Precious Metals and Mining Fund | VGPMX | 16.0% |

S&P/Citigroup Custom Metals and Mining Index | | 24.7 |

Average Gold-Oriented Fund1 | | 5.6 |

Dow Jones Wilshire 5000 Index | | 1.9 |

Your Fund’s Performance at a Glance | | | | |

January 31, 2007–July 31, 2007 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Precious Metals and Mining Fund | $28.64 | $32.43 | $0.050 | $0.662 |

| | | | | |

1 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

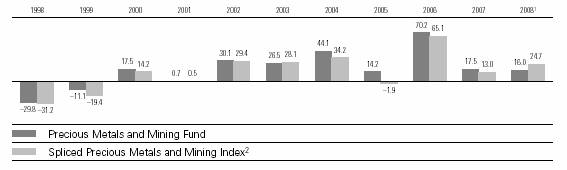

Vanguard Precious Metals and Mining Fund advanced 16.0% for the fiscal half-year ended July 31, 2007, well ahead of the 1.9% return for the overall U.S. stock market. The return of the fund, which is broadly diversified across metals and mining operations, lagged its benchmark index, but outpaced the average return for gold-oriented funds.

The fund remained closed to new investors, although existing shareholders can make additional share purchases.

For the U.S. stock market, a nervous finish to the half-year

U.S. stocks produced modest returns for the past six months, as a downturn at the end of the period erased most of the gains recorded earlier. The market stumbled as trouble with low-quality mortgage loans and related securities amplified investors’ risk-aversion.

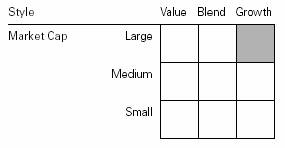

The broad U.S. stock market returned 1.9% for the fiscal half-year. Large-capitalization stocks bested small-caps, and growth-oriented stocks outperformed their value-oriented counterparts. International stock markets sidestepped most of the U.S. turmoil, generating excellent six-month returns.

For bonds, a return to a more typical yield curve

As investors sought a safe haven from some of the financial markets’ riskier precincts, including bonds backed by mortgage loans made to borrowers with poor credit ratings, U.S. Treasury

2

bond prices rose slightly and yields fell. The declines in yield were most pronounced among Treasury securities with maturities of less than 5 years.

These interest rate dynamics helped restore the yield curve—which illustrates the relationship between short- and long-term bond yields—to its typical, upward-sloping pattern. At the start of the period, the curve had been mildly inverted. The broad taxable bond market returned 1.9% for the half-year. Tax-exempt municipal securities returned a bit less.

A focus on platinum paid off, as did a variety of other holdings

Within the parameters of its metals-and-mining mandate, Vanguard Precious Metals and Mining Fund is, on the one hand, highly diversified in terms of the overall industry and geography. The fund’s investments focus on a wide range of products—from precious metals, including gold, to agricultural chemicals and coal—and span the globe from developed countries to South Africa, Peru, and Indonesia. On the other hand, the fund is highly concentrated: It owned only 46 stocks as of July 31, about a quarter of which accounted for the bulk of its return in the fiscal six months.

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended July 31, 2007 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 1.9% | 16.5% | 12.3% |

Russell 2000 Index (Small-caps) | –2.5 | 12.1 | 16.0 |

Dow Jones Wilshire 5000 Index (Entire market) | 1.9 | 16.8 | 13.1 |

MSCI All Country World Index ex USA (International) | 11.8 | 28.5 | 22.3 |

| | | |

Bonds | | | |

Lehman U.S. Aggregate Bond Index (Broad taxable market) | 1.9% | 5.6% | 4.4% |

Lehman Municipal Bond Index | 1.2 | 4.3 | 4.5 |

Citigroup 3-Month Treasury Bill Index | 2.5 | 5.1 | 2.7 |

| | | |

CPI | | | |

Consumer Price Index | 2.9% | 2.4% | 3.0% |

| | | | |

1 Annualized.

3

Four of the fund’s six largest holdings—mining companies Lonmin, Impala Platinum Holdings, and Anglo Platinum, and processor Johnson Matthey—are involved in producing or processing platinum, and they accounted for about one-third of the fund’s return. Platinum’s major use is in catalytic converters in cars, buses, and trucks. The converters, for which long-term demand is strong worldwide, turn emissions into nontoxic compounds.

Other significant contributors to the fund’s return were Rio Tinto, a diversified international mining company; Eramet, which produces nickel and other nonferrous metals; and CONSOL Energy, a coal and gas company. Fertilizer producers K+S AG and Agrium, and steel companies

BlueScope Steel and Sims Group, also provided a boost. The major detractor from the fund’s return was Centerra Gold.

Sector funds can play a role in a balanced portfolio

Investors in Vanguard Precious Metals and Mining Fund have benefited from handsome returns in recent years. It’s important to remember, however, that the fund’s focus on a specific industry means that its returns can be especially volatile, buffeted by events that may not affect other parts of the economy.

A modest allocation to a low-cost sector fund can play a role in your portfolio—perhaps to help achieve diversification or to provide an opportunity to meet specialized investment objectives.

Annualized Expense Ratios1 | | |

Your fund compared with its peer group | | |

| | Average |

| | Gold-Oriented |

| Fund | Fund |

Precious Metals and Mining Fund | 0.32% | 1.59% |

1 Fund expense ratio reflects the six months ended July 31, 2007. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2006.

4

No matter how you choose to use a sector fund, your portfolio planning should aim to strike the right balance between the potential for return and the potential for risk. This can best be done by establishing a balanced allocation of assets among stock, bond, and money market funds, and diversifying within each of those asset classes.

Thank you for investing with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

August 13, 2007

5

Advisor’s Report

Vanguard Precious Metals and Mining Fund produced a return of 16.0% during the six-month period. This was behind the benchmark index’s return of 24.7%, but ahead of the 5.6% result of the average gold-oriented fund.

The investment environment

The price of gold bullion remained at historically high levels, but was broadly unchanged during the half-year. The prices of a number of other metals, including platinum and copper, gained ground. Nickel was an exception; its price fell sharply from April onward due to oversupply in the nickel-intensive stainless steel industry. In spite of volatility in underlying metal prices, shares of broader mining companies advanced strongly. As a group, mining companies continued to generate excellent returns against a backdrop of sustained demand from industrializing and developed economies alike. China is still the driving force behind global demand. By contrast, gold equities continued to underperform as the gold sector remained focused on growth, rather than profitability, and struggled to overcome rising costs and operational inefficiencies.

The fund’s performance

Against this background of metal price strength, French nickel group Eramet, one of the few remaining independent producers in this highly consolidated industry, made a strong contribution as investors looked beyond the extreme volatility in the price of nickel and focused on the long-term value of the company’s assets. The fund’s long-standing and significant positions in United Kingdom platinum producer Lonmin and in South

African producer Anglo Platinum, as well as a more recently added position in U.K. platinum processor Johnson Matthey, all benefited, based on the extremely strong supply/demand balance for the metal.

Outside the traditional metals and mining arena, positions in German potash miner K+S and Canadian potash miner Agrium added significant value, as both benefited from intensifying demand for fertilizers to improve land yields. Sentiment was also buoyed by expectations of rising biofuel production as an alternative fuel source to gasoline. Finally, our lack of exposure to U.S. gold producer Newmont Mining, a poor performer, continued to have a positive impact on relative performance. The company has struggled to effectively combat higher costs in the face of falling production.

By contrast, our holding in Canadian gold producer Centerra Gold was the main detractor from the fund’s performance, due to concerns over government involvement at one of the company’s mines in the Kyrgyz Republic, in Central Asia. We are nevertheless confident that a positive outcome can be achieved for shareholders. The fund’s significant holding in Canadian diamond-producer Aber Diamond also had a negative impact, as the market continued to come to terms with the company’s shift into diamond retailing. In addition, concerns about rising input costs persist. In spite of this, the company continues to exceed production targets, and fundamentals for the diamond industry remain extremely compelling.

6

The fund’s positioning

We remained focused on increasing our holdings among metals and minerals companies with healthy cash flows and exposure to strategically important materials. We established new positions in Minerals Technologies, a U.S. industrial minerals producer with a highly respected new chief executive, and in AUR Resources, a well-managed copper miner that aims to improve returns from its assets in Chile and Canada. Near the end of the fiscal half-year, AUR received a bid at a significant premium. Within the precious metals sector, we added to our positions in Northam Platinum, a midsized producer of platinum-group metals in South Africa that we believe has exciting expansion opportunities; and the Russian gold-mining company Peter Hambro Mining, whose significant reserves and emphasis on efficiency should enable it to generate significantly higher returns than most of the gold industry. We also added substantially to Johnson Matthey, a recent addition to our portfolio, as noted earlier. The company processes platinum for use in catalytic converters in automobiles, an area in which demand is being boosted by tighter global emissions legislation.

We sold holdings that had performed exceptionally well or in which we believed the company’s fundamentals had deteriorated. Significant disposals included those of Australian diversified mining company Rio Tinto, which was sold due to fears that it was overpaying in its $43 billion bid for Canadian aluminium-producer Alcan; previously mentioned Agrium and Anglo Platinum; and Canadian-listed copper-gold miner First Quantum Minerals. In each of these cases, valuation levels appeared less attractive following extremely strong performance.

In spite of heightened levels of volatility during the period, the fund’s investment environment remains supportive. The appetite for raw materials from both emerging and developed nations continues apace, driven primarily by China’s extraordinary industrial expansion. In the meantime, supply remains tightly controlled as a result of ongoing consolidation in the broader mining sector and years of under-investment in new projects. Consequently, we remain confident about the long-term outlook for a number of commodities, a scenario that provides a favorable environment for the mining groups that supply these assets. And we continue to monitor the profitability of the gold industry, which, as recent earnings announcements attest, has remained poor compared with the broader mining industry.

Graham E. French, Portfolio Manager

M&G Investment Management Ltd.

August 30, 2007

7

Fund Profile

As of July 31, 2007

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 46 | 255 | 4,902 |

Median Market Cap | $6.9B | $17.9B | $32.9B |

Price/Earnings Ratio | 21.0x | 18.0x | 17.4x |

Price/Book Ratio | 3.4x | 3.4x | 2.7x |

Return on Equity | 18.2% | 18.4% | 18.4% |

Earnings Growth Rate | 23.2% | 31.7% | 21.0% |

Foreign Holdings | 82.1% | 0.0% | 0.0% |

Turnover Rate | 16%3 | — | — |

Expense Ratio | 0.32%3 | — | — |

Short-Term Reserves | 5% | — | — |

Market Diversification (% of portfolio) | |

| |

United Kingdom | 20% |

Australia | 15 |

United States | 15 |

South Africa | 15 |

Canada | 14 |

France | 9 |

Germany | 5 |

Peru | 2 |

Short-Term Reserves | 5% |

Volatility Measures4 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.81 | 0.36 |

Beta | 0.80 | 1.53 |

Ten Largest Holdings5 (% of total net assets) |

| |

Lonmin PLC | 10.8% |

Impala Platinum Holdings Ltd. ADR | 7.0 |

Johnson Matthey PLC | 6.5 |

Eramet SLN | 6.0 |

Aber Diamond Corp. | 5.9 |

Anglo Platinum Ltd. ADR | 5.1 |

K+S AG | 4.6 |

Barrick Gold Corp. | 4.2 |

Sims Group Ltd. | 3.5 |

CONSOL Energy, Inc. | 3.4 |

Top Ten | 57.0% |

1 S&P/Citigroup Custom Metals and Mining Index.

2 Dow Jones Wilshire 5000 Index.

3 Annualized.

4 For an explanation of R-squared, beta, and other terms used here, see the Glossary on page 22.

5 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

8

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

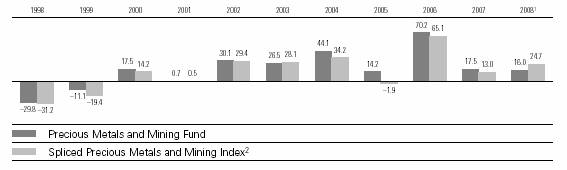

Fiscal-Year Total Returns (%): January 31, 1997–July 31, 2007

Average Annual Total Returns: Periods Ended June 30, 2007

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

Precious Metals and Mining Fund3 | 5/23/1984 | 30.41% | 33.02% | 18.05% |

1 Six months ended July 31, 2007.

2 S&P/Citigroup World Equity Gold Index through June 30, 2005; S&P/Citigroup Custom Metals and Mining Index thereafter.

3 Total return figures do not reflect the 1% redemption fee assessed on redemptions of shares held less than one year, and do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

Note: See Financial Highlights table on page 14 for dividend and capital gains information.

9

Financial Statements (unaudited)

Statement of Net Assets

As of July 31, 2007

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (95.1%) | | |

Australia (15.7%) | | |

| Sims Group Ltd. | 6,000,000 | 136,741 |

^ | Rio Tinto Ltd. | 1,700,000 | 132,516 |

| BlueScope Steel Ltd. | 12,000,000 | 110,899 |

^,1 | Iluka Resources Ltd | 17,150,000 | 86,280 |

| CSR Ltd. | 30,000,000 | 84,619 |

^,1 | Centennial Coal Co., Ltd. | 15,775,000 | 44,933 |

*^ | St. Barbara Ltd. | 31,800,000 | 13,446 |

| Consolidated | | |

| Minerals Ltd. | 1,500,000 | 4,656 |

* | Tanami Gold NL | 18,170,000 | 1,896 |

| Oxiana Ltd. | 250,000 | 778 |

* | Magnesium | | |

| International Ltd. | 1,678,671 | 109 |

| | | 616,873 |

Canada (14.0%) | | |

1 | Aber Diamond Corp. | 6,200,000 | 231,076 |

| Barrick Gold Corp. | 5,000,000 | 164,229 |

*1 | Centerra Gold Inc. | 12,865,000 | 84,657 |

| AUR Resources Inc. | 1,060,000 | 40,431 |

| Sherritt International Corp. | 1,175,000 | 17,931 |

*1 | Claude Resources, Inc. | 3,650,000 | 5,329 |

* | SouthernEra | | |

| Diamonds, Inc. | 7,022,900 | 4,279 |

* | Arizona Star Resource Corp. | 200,000 | 2,236 |

| | | 550,168 |

France (8.9%) | | |

| Eramet SLN | 776,773 | 234,523 |

| Imerys SA | 1,160,000 | 113,675 |

| | | 348,198 |

Germany (4.6%) | | |

| K+S AG | 1,230,000 | 181,398 |

| | | |

Indonesia (0.2%) | | |

| PT International Nickel | | |

| Indonesia Tbk | 1,250,000 | 7,593 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

Papua New Guinea (0.0%) | | |

* | Bougainville Copper Ltd. | 2,000,000 | 1,448 |

| | | |

Peru (1.7%) | | |

| Compañia de Minas | | |

| Buenaventura S.A.u. ADR | 1,700,000 | 67,847 |

| | | |

South Africa (14.7%) | | |

| Impala Platinum | | |

| Holdings Ltd. ADR | 9,400,000 | 272,730 |

| Anglo Platinum Ltd. ADR | 1,450,000 | 198,805 |

| Northam Platinum Ltd. | 8,936,800 | 66,234 |

| Gold Fields Ltd. ADR | 2,425,000 | 40,061 |

| | | 577,830 |

United Kingdom (20.4%) | | |

| Lonmin PLC | 6,069,413 | 425,384 |

| Johnson Matthey PLC | 7,450,000 | 255,510 |

*^ | Peter Hambro Mining PLC | 2,867,368 | 55,323 |

| Rio Tinto PLC | 475,000 | 34,270 |

| Vedanta Resources PLC | 270,000 | 9,657 |

| Hochschild Mining PLC | 823,081 | 5,955 |

* | Kenmare Resources PLC | 4,550,000 | 5,665 |

* | Gem Diamond Ltd. | 171,428 | 3,644 |

* | Zambezi Resources Ltd. | 4,895,833 | 2,449 |

* | Mwana Africa PLC | 100,000 | 161 |

| | | 798,018 |

United States (14.9%) | | |

| CONSOL Energy, Inc. | 3,230,000 | 134,530 |

| Peabody Energy Corp. | 2,700,000 | 114,102 |

| FMC Corp. | 1,175,000 | 104,728 |

1 | Minerals Technologies, Inc. | 1,277,000 | 82,584 |

* | Meridian Gold Inc. | 2,450,000 | 69,164 |

| AMCOL International Corp. | 1,400,000 | 40,082 |

| Arch Coal, Inc. | 1,200,000 | 35,868 |

| | | 581,058 |

Total Common Stocks | | |

(Cost $2,129,931) | | 3,730,431 |

10

| | Market |

| | Value• |

| Shares | ($000) |

Precious Metals (0.1%) | | |

* Platinum Bullion (In Ounces) | 2,009 | 2,591 |

Total Precious Metals | | |

(Cost $1,213) | | 2,591 |

Temporary Cash Investments (8.8%) | | |

2 Vanguard Market Liquidity Fund, 5.302% | 146,328,435 | 146,328 |

2 Vanguard Market Liquidity Fund, 5.302%—Note F | 200,244,119 | 200,244 |

Total Temporary Cash Investments | | |

(Cost $346,572) | | 346,572 |

Total Investments (104.0%) | | |

(Cost $2,477,716) | | 4,079,594 |

Other Assets and Liabilities—Net (–4.0%) | | (157,055) |

Net Assets (100%) | | |

Applicable to 120,965,031 outstanding | | |

$.001 par value shares of beneficial | | |

interest (unlimited authorization) | | 3,922,539 |

Net Asset Value Per Share | | $32.43 |

| | |

Statement of Assets and Liabilities | | |

Assets | | |

Investments in Securities, at Value | | 4,079,594 |

Receivables for Investment | | |

Securities Sold | | 62,043 |

Receivables for Capital Shares Issued | | 2,445 |

Other Assets—Note C | | 33,795 |

Total Assets | | 4,177,877 |

Liabilities | | |

Security Lending Collateral | | |

Payable to Brokers—Note F | | 200,244 |

Payables for Investment | | |

Securities Purchased | | 25,167 |

Other Liabilities | | 29,927 |

Total Liabilities | | 255,338 |

Net Assets | | 3,922,539 |

At July 31, 2007, net assets consisted of:3 | |

| Amount | Per |

| ($000) | Share |

Paid-in Capital | 2,145,464 | $17.75 |

Undistributed Net | | |

Investment Income | 9,871 | .08 |

Accumulated Net | | |

Realized Gains | 164,999 | 1.36 |

Unrealized Appreciation | | |

Investment Securities | 1,601,878 | 13.24 |

Foreign Currencies | 327 | — |

Net Assets | 3,922,539 | $32.43 |

• | See Note A in Notes to Financial Statements. |

* | Non-income-producing security. |

^ | Part of security position is on loan to broker-dealers. See Note F in Notes to Financial Statements. |

1 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company. See Note H in Notes to Financial Statements.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 See Note D in Notes to Financial Statements for the tax-basis components of net assets.

ADR—American Depositary Receipt.

11

Statement of Operations

| Six Months Ended |

| July 31, 2007 |

| ($000) |

Investment Income | |

Income | |

Dividends1,2 | 46,948 |

Interest2 | 1,841 |

Security Lending | 989 |

Total Income | 49,778 |

Expenses | |

Investment Advisory Fees—Note B | |

Basic Fee | 2,400 |

Performance Adjustment | 62 |

The Vanguard Group—Note C | |

Management and Administrative | 3,008 |

Marketing and Distribution | 393 |

Custodian Fees | 206 |

Shareholders’ Reports | 25 |

Trustees’ Fees and Expenses | 2 |

Total Expenses | 6,096 |

Net Investment Income | 43,682 |

Realized Net Gain (Loss) | |

Investment Securities Sold2 | 205,420 |

Foreign Currencies | (308) |

Realized Net Gain (Loss) | 205,112 |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | 293,846 |

Foreign Currencies | 269 |

Change in Unrealized Appreciation (Depreciation) | 294,115 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 542,909 |

1 Dividends are net of foreign withholding taxes of $1,676,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $4,828,000, $1,841,000, and $0, respectively.

12

Statement of Changes in Net Assets

| Six Months Ended | Year Ended |

| July 31, | January 31, |

| 2007 | 2007 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 43,682 | 63,302 |

Realized Net Gain (Loss) | 205,112 | 373,021 |

Change in Unrealized Appreciation (Depreciation) | 294,115 | 81,090 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 542,909 | 517,413 |

Distributions | | |

Net Investment Income | (5,961) | (54,699) |

Realized Capital Gain1 | (78,921) | (284,886) |

Total Distributions | (84,882) | (339,585) |

Capital Share Transactions—Note G | | |

Issued | 225,798 | 585,297 |

Issued in Lieu of Cash Distributions | 78,928 | 314,309 |

Redeemed2 | (283,748) | (930,593) |

Net Increase (Decrease) from Capital Share Transactions | 20,978 | (30,987) |

Total Increase (Decrease) | 479,005 | 146,841 |

Net Assets | | |

Beginning of Period | 3,443,534 | 3,296,693 |

End of Period3 | 3,922,539 | 3,443,534 |

1 Includes fiscal 2008 and 2007 short-term gain distributions totaling $596,000 and $127,033,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net of redemption fees of $209,000 and $3,932,000.

3 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $9,871,000 and ($27,542,000).

13

Financial Highlights

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | July 31, | Year Ended January 31, |

Throughout Each Period | 2007 | 2007 | 2006 | 2005 | 2004 | 2003 |

Net Asset Value, Beginning of Period | $28.64 | $27.08 | $16.46 | $15.29 | $11.25 | $9.31 |

Investment Operations | | | | | | |

Net Investment Income | .360 | .560 | .3371 | .1851 | .194 | .25 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments2 | 4.142 | 4.027 | 11.080 | 1.988 | 4.780 | 2.18 |

Total from Investment Operations | 4.502 | 4.587 | 11.417 | 2.173 | 4.974 | 2.43 |

Distributions | | | | | | |

Dividends from Net Investment Income | (.050) | (.490) | (.240) | (.144) | (.934) | (.49) |

Distributions from Realized Capital Gains | (.662) | (2.537) | (.557) | (.859) | — | — |

Total Distributions | (.712) | (3.027) | (.797) | (1.003) | (.934) | (.49) |

Net Asset Value, End of Period | $32.43 | $28.64 | $27.08 | $16.46 | $15.29 | $11.25 |

| | | | | | |

Total Return3 | 15.98% | 17.48% | 70.19% | 14.20% | 44.07% | 26.51% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $3,923 | $3,444 | $3,297 | $921 | $608 | $537 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.32%4,* | 0.35%4 | 0.40% | 0.48% | 0.55% | 0.60% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 2.29%* | 1.88% | 1.68% | 1.32% | 1.61% | 2.14% |

Portfolio Turnover Rate | 16%* | 24% | 20% | 36% | 15% | 43% |

1 Calculated based on average shares outstanding.

2 Includes increases from redemption fees of $.00, $.03, $.01, $.01, $.00, and $.02.

3 Total returns do not reflect the 1% fee assessed on redemptions of shares held for less than one year, or the account service fee that may be applicable to certain accounts with balances below $10,000.

4 Includes performance-based investment advisory fee increases of 0.00% and 0.01%.

See accompanying Notes, which are an integral part of the Financial Statements.

14

Notes to Financial Statements

Vanguard Precious Metals and Mining Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund files reports with the SEC under the company name Vanguard Specialized Funds. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of United States corporations.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Precious metals are valued at the mean of the latest quoted bid and asked prices. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

15

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

B. M&G Investment Management Ltd. provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance since January 31, 2006, relative to the S&P/Citigroup Custom Metals and Mining Index. For the six months ended July 31, 2007, the investment advisory fee represented an effective annual basic rate of 0.13% of the fund’s average net assets before an increase of $62,000 based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At July 31, 2007, the fund had contributed capital of $356,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.36% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes. The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year.

During the six months ended July 31, 2007, the fund realized net foreign currency losses of $308,000, which permanently decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to undistributed net investment income.

Certain of the fund’s investments are in securities considered to be “passive foreign investment companies,” for which any unrealized appreciation and/or realized gains are required to be included in distributable net income for tax purposes. Unrealized appreciation through January 31, 2007, on passive foreign investment company holdings at July 31, 2007, was $29,932,000, which has been distributed and is reflected in the balance of undistributed net investment income.

During 2001, the fund elected to use a provision of the Taxpayer Relief Act of 1997 to mark to market certain appreciated securities held on January 1, 2001; such securities were treated as sold and repurchased, with unrealized gains of $46,006,000 becoming realized, for tax purposes. The mark-to-market created a difference between the cost of investments for financial statement and tax purposes, which will reverse when the securities are sold. Through July 31, 2007, the fund realized gains on the sale of these securities of $18,280,000 for financial statement purposes, which were included in prior year mark-to-market gains for tax purposes. The remaining difference of $27,726,000 is reflected in the balance of accumulated net realized gains; the corresponding difference between the securities’ cost for financial statement and tax purposes is reflected in unrealized appreciation.

16

At July 31, 2007, the cost of investment securities for tax purposes was $2,535,374,000. Net unrealized appreciation of investment securities for tax purposes was $1,544,220,000, consisting of unrealized gains of $1,563,821,000 on securities that had risen in value since their purchase and $19,601,000 in unrealized losses on securities that had fallen in value since their purchase or since being marked to market for tax purposes.

E. During the six months ended July 31, 2007, the fund purchased $287,394,000 of investment securities and sold $438,425,000 of investment securities other than temporary cash investments.

F. The market value of securities on loan to broker-dealers at July 31, 2007, was $193,873,000, for which the fund received cash collateral of $200,244,000.

G. Capital shares issued and redeemed were:

| Six Months Ended | Year Ended |

| July 31, 2007 | January 31, 2007 |

| Shares | Shares |

| (000) | (000) |

Issued | 7,014 | 20,497 |

Issued in Lieu of Cash Distributions | 2,689 | 11,406 |

Redeemed | (8,975) | (33,402) |

Net Increase (Decrease) in Shares Outstanding | 728 | (1,499) |

H. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of these companies were as follows:

| | | Current Period Transactions | |

| Jan. 31, 2007 | | Proceeds from | | July 31, 2007 |

| Market | Purchases | Securities | Dividend | Market |

| Value | at Cost | Sold | Income | Value |

| ($000) | ($000) | ($000) | ($000) | ($000) |

Aber Diamond Corp. | 217,068 | 21,136 | — | 2,565 | 231,076 |

Centennial Coal Co. Ltd. | 34,777 | — | — | 438 | 44,933 |

Centerra Gold Inc. | 143,974 | — | — | — | 84,657 |

Claude Resources, Inc. | n/a1 | 1,093 | — | — | 5,329 |

Iluka Resources Ltd. | 83,373 | — | — | 1,697 | 86,280 |

Minerals Technologies Inc | 69,142 | 5,005 | — | 128 | 82,584 |

| 548,334 | | | 4,828 | 534,859 |

1 At January 31, 2007, the issuer was not an affiliated company of the fund.

17

I. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements, effective for the fund’s current fiscal year. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended January 31, 2005–2007) for purposes of implementing FIN 48, and has concluded that no provision for income tax is required in the fund’s financial statements.

18

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended July 31, 2007 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

Precious Metals and Mining Fund | 1/31/2007 | 7/31/2007 | Period1 |

Based on Actual Fund Return | $1,000.00 | $1,159.80 | $1.71 |

Based on Hypothetical 5% Return | 1,000.00 | 1,023.21 | 1.61 |

1 These calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.32%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month peiod, then divided by the number of days in the most recent 12-month period.

19

Note that the expenses shown in the table on page 19 are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the 1% fee on redemptions of shares held for less than one year, nor do they include any account service fee described in the prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate fund prospectus.

20

Trustees Approve Advisory Agreement

The board of trustees of Vanguard Precious Metals and Mining Fund has renewed the fund’s investment advisory agreement with M&G Investment Management Limited. The board determined that the retention of M&G was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of M&G’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the agreement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term and took into account the organizational depth and stability of the advisor. The board noted that M&G, founded in 1931, specializes in managing equity and fixed income portfolios for both institutional and retail clients worldwide. The firm has advised the fund since the fund’s inception in 1984. The advisor continues to employ a sound process, selecting companies that are broadly representative of the metals and mining industries and emphasizing large, stable, and diversified companies. The advisor’s internal research team—comprising the portfolio manager, Graham E. French, and a team of six global equity analysts—conducts intensive fundamental analysis of companies in the industry; their research includes regular company visits.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory agreement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that the advisor has carried out the fund’s investment strategy in disciplined fashion, and that performance results have allowed the fund to remain competitive versus its benchmark. The board noted that the fund is more broadly diversified than its competitors—with the ability to invest up to half of the fund’s assets in non-precious metals and mining stocks—but continues to remain competitive versus gold-oriented peer funds. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The board noted that the fund’s advisory fee rate was also well below the peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the advisory fee rate.

The board did not consider profitability of M&G in determining whether to approve the advisory fee, because M&G is independent of Vanguard, and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedule. The breakpoints reduce the effective rate of the fee as the fund’s assets increase.

The board will consider whether to renew the advisory agreement again after a one-year period.

21

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. A fund’s beta should be reviewed in conjunction with its R-squared (see definition below). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

22

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

Chairman of the Board, Chief Executive Officer, and Trustee |

| |

John J. Brennan1 | |