UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3916

Name of Registrant: Vanguard Specialized Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: January 31

Date of reporting period: February 1, 2010 – July 31, 2010

Item 1: Reports to Shareholders

|

| Vanguard Energy Fund |

| Semiannual Report |

|

| July 31, 2010 |

|

|

> Vanguard Energy Fund returned about –2% for the six months ended July 31, 2010.

> The Energy Fund’s return trailed that of its spliced benchmark index, but only slightly lagged the average return of its peer-group funds.

> The fund’s holdings of integrated oil and gas firms, as well as exploration and production companies, were responsible for its substandard performance.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 6 |

| Fund Profile. | 9 |

| Performance Summary. | 11 |

| Financial Statements. | 12 |

| About Your Fund’s Expenses. | 25 |

| Trustees Approve Advisory Arrangements. | 27 |

| Glossary. | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Veronica Coia.

Your Fund’s Total Returns

| |

| Six Months Ended July 31, 2010 | |

| | Total |

| | Returns |

| Vanguard Energy Fund | |

| Investor Shares | -2.03% |

| Admiral™ Shares | -1.99 |

| Spliced Energy Index | -0.40 |

| Global Natural Resources Funds Average | -1.72 |

| Spliced Energy Index: S&P Energy Sector Index through May 31, 2010; MSCI All Country World Energy Index thereafter. | |

| Global Natural Resources Funds Average: Derived from data provided by Lipper Inc. | |

Admiral Shares are a lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| January 31, 2010, Through July 31, 2010 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Energy Fund | | | | |

| Investor Shares | $57.17 | $55.63 | $0.000 | $0.402 |

| Admiral Shares | 107.34 | 104.49 | 0.000 | 0.754 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Energy Fund returned about –2% for the fiscal half-year ended July 31. The fund trailed its index benchmark, but was only a step behind the average return of global natural resources peer funds.

The Energy Fund’s performance for the six-month period was largely influenced by poor results from integrated oil and gas companies and from exploration and production firms. Not surprisingly, the British oil giant BP and its massive oil spill in the Gulf of Mexico weighed heavily on the fund’s performance.

Please note that on June 1, the Energy Fund’s primary benchmark changed from the Standard & Poor’s Energy Sector Index to the MSCI All Country World Energy Index. The fund’s trustees believe the new benchmark, which includes companies domiciled outside the United States, is more consistent with the fund’s investment objective and strategies. The “Spliced Energy Index” shown on page 1 and elsewhere in this report combines the old and new benchmarks for performance-comparison purposes.

Stock markets moved higher, but the journey was tense

Global stock markets emerged from a turbulent six-month stretch with respectable single-digit gains. Prices rallied in early spring, buoyed by rapid growth in corporate earnings, but fell sharply in May and June as Europe’s sovereign debt crisis took center stage.

2

Signs that the U.S. economic recovery might be sputtering also dampened investor spirits. By the end of the half-year, however, stock markets had recouped the previous months’ losses as corporate bellwethers continued to report strong profits, and investors’ moods brightened.

For the full period, the U.S. stock market returned more than 4%. Smaller-company stocks, which are less exposed to global turmoil than large-cap multinationals, returned about 9%. International stocks finished the period with a modestly positive return, as strong performance from emerging markets compensated for weaker returns in Europe.

High-quality bonds rallied amid the search for safety

Turmoil in the stock markets and mixed economic signals drove bond prices higher, and yields lower, as investors sought safety in high-quality government and corporate bonds. At the start of the period, the yield of the benchmark 10-year U.S. Treasury note stood at 3.61%. By the end, it had dipped to 2.91%, and rates on home-mortgage loans were at their lowest levels since the 1950s.

Rising bond prices led to strong six-month returns in both the taxable and municipal bond markets. The returns from money market instruments, by contrast, remained vanishingly small. Yields have hovered near

| | | |

| Market Barometer | | | |

| |

| | | | Total Returns |

| | | Periods Ended July 31, 2010 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 3.84% | 14.51% | 0.02% |

| Russell 2000 Index (Small-caps) | 8.79 | 18.43 | 0.47 |

| Dow Jones U.S. Total Stock Market Index | 4.48 | 15.36 | 0.45 |

| MSCI All Country World Index ex USA (International) | 2.26 | 10.12 | 4.89 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 4.85% | 8.91% | 5.96% |

| Barclays Capital Municipal Bond Index | 4.06 | 9.15 | 4.75 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.12 | 2.58 |

| |

| CPI | | | |

| Consumer Price Index | 0.61% | 1.24% | 2.21% |

3

0% since late 2008, when the Federal Reserve Board set its target for short-term interest rates between 0% and 0.25%.

BP’s troubles in the Gulf hurt the fund’s results

Vanguard Energy Fund began the fiscal half-year on solid footing, plummeted in May and June, and sprang most of the way back in July. The fund was lifted in part by more stable global financial markets and an 8% rise in crude oil prices, as measured by the price of West Texas Intermediate crude.

However, a better-than-expected July could not overcome the earlier weakness among oil and gas companies, which dragged the fund’s overall return for the six months into negative territory.

The second calendar quarter was marked by disappointing economic and industry news. In April, the massive explosion at the Deepwater Horizon oil rig leased by BP in the Gulf of Mexico resulted in the worst environmental disaster of its kind in U.S. history. The steep decline in BP’s stock (about –30%) following the incident cut more than one percentage point from the fund’s total return for the six months.

The Energy Fund’s large stake in BP (about 4% of assets, on average) also hampered its results in comparative terms, as its former benchmark index did not include non-U.S. stocks such as BP. Relative to the Spliced Energy Index, which combines the old and new benchmarks, the fund benefited from having less exposure, on average, to Anadarko Petroleum (–23%), a

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Energy Fund | 0.38% | 0.31% | 1.52% |

The fund expense ratios shown are from the prospectus dated May 28, 2010, and represent estimated costs for the current fiscal year. For the six months ended July 31, 2010, the fund’s annualized expense ratios were 0.35% for Investor Shares and 0.29% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2009.

Peer group: Global Natural Resources Funds.

4

partial owner of the Macondo site where the oil rig is located, and Transocean (–46%), owner of the Deepwater Horizon rig.

The aftermath of BP’s problems in the Gulf, including the possibility of stricter government regulation and a temporary ban on offshore drilling, had ripple effects on the energy sector. But by the end of the period, a general rise in global stock markets and BP’s belated success in controlling its oil gusher helped mitigate some of the declines of big-name oil stocks. Although Exxon Mobil, the fund’s largest holding, ended with a negative return (–6%), some other holdings, including Chevron (+8%) and ConocoPhillips (+19%), performed strongly.

The fund’s selections among natural gas companies helped its performance relative to the spliced index, particularly in the second quarter, when many oil company stocks fell. Although natural gas prices dropped by 8.5% over the six months, according to the Henry Hub (a pricing point for natural gas futures contracts), several companies in this subsector performed well, including EOG Resources (+8%) and Encana (+1%).

Diversification is important amid unpredictable markets

The stock market’s plunge in the spring and rebound in July took many investors by surprise.

Yet the unpredictable movements of the stock market should not shock you, nor should they necessarily affect your investment strategy.

The markets are never truly predictable. That is why, regardless of market conditions, we suggest you develop a portfolio that is consistent with your long-term goals, time horizon, and tolerance for the markets’ unavoidable peaks and valleys. Vanguard encourages investors to maintain a balanced portfolio of low-cost stock, bond, and short-term investments.

While it is impossible to completely shield yourself from gyrations in the market, you can cushion your assets from the brunt of such wild market swings by diversifying your portfolio among, and within, different asset classes. Vanguard Energy Fund, with its low-cost exposure to energy stocks, can play an important supporting role in such a balanced portfolio.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

August 11, 2010

5

Advisors’ Report

The Investor Shares of Vanguard Energy Fund returned –2.03% and the Admiral Shares –1.99% for the fiscal half-year ended July 31, 2010. Your fund is managed by two advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets they manage, and brief descriptions of their investment strategies are presented in the table below. The advisors have also provided a discussion of the investment environment that existed during the six months and of how their portfolio positioning reflects this assessment. These reports were prepared on August 17, 2010.

Wellington Management Company, LLP

Portfolio Manager:

Karl E. Bandtel, Senior Vice President

As concerns about the global economic outlook subsided, crude oil prices rose to nearly $79 a barrel—more than 8% higher than at the beginning of the fiscal half-year. By contrast, natural gas prices ended the period at $4.81 per million BTUs, a decline of 8% for the six-month period.

| | | |

| Vanguard Energy Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Wellington Management | 96 | 10,234 | Emphasizes long-term total-return opportunities from |

| Company, LLP | | | the various energy subsectors: international oils, |

| | | | foreign integrated oils and foreign producers, North |

| | | | American producers, oil services and equipment, |

| | | | transportation and distribution, and refining and |

| | | | marketing. |

| Vanguard Quantitative Equity | 3 | 285 | Employs a quantitative fundamental management |

| Group | | | approach, using models that assess valuation, market |

| | | | sentiment, earnings quality and growth, and |

| | | | management decisions of companies relative to their |

| | | | peers. |

| Cash Investments | 1 | 124 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investments in stock. |

| | | | Each advisor may also maintain a modest cash |

| | | | position. |

6

Angst and uncertainty proved a headwind to some industries within the energy universe. Notably, the energy equipment and services subsector was pressured by concerns about liabilities and drilling policy changes resulting from the Deepwater Horizon oil spill in the Gulf of Mexico. On the other hand, the refining and marketing industry performed better than the energy sector as a whole, as did the transmission and distribution industry.

Top contributors to performance included ConocoPhillips, Baker Hughes, and EOG Resources. EOG shares gained after the company announced promising opportunities for onshore oil development in North America. Detractors for the period included BP, Cabot Oil & Gas, and Exxon Mobil. BP shares skidded lower following the Deepwater Horizon oil spill. The market appears to be overly pessimistic about the likely outcome from that calamity. We trimmed our position in BP soon after the accident occurred, and have subsequently added to our holdings. Exxon Mobil shares fell on concerns regarding potential dilution from its acquisition of XTO Energy.

We opened new positions in Repsol, Statoil, and Inpex, and added to our existing positions in Anadarko Petroleum and Devon Energy, as well as BP. We eliminated holdings in Forest Oil and Williams and reduced our position in Weatherford International. All three stocks had performed strongly, and we found other opportunities in which to invest.

We continue to believe that the direction of oil and natural gas prices will be driven largely by underlying supply concerns, including geologic and political issues. We expect high volatility and uncertainty to continue. Our investment process remains steady, with an emphasis on high-quality management and long-lived resources at reasonable valuations.

Vanguard Quantitative Equity Group

Portfolio Manager:

James D. Troyer, CFA, Principal

The first three months of the fiscal half-year began with energy stocks performing strongly, rising 8% before dropping during the rest of the period. Continuing a theme from last year, stocks in emerging markets outperformed developed-market stocks.

Our investment process identifies individual stocks that we believe are overvalued or undervalued relative to their peers in the energy sector. We use a model with three major components to select these stocks. Each component has several elements. The first component is valuation, for which our model analyzes various earnings, cash flow, and dividend payouts for each stock. Second, the earnings quality component predicts the persistence of earnings by analyzing company financial statements. Finally, the third component is market sentiment, which evaluates signals derived from market participants. These are

7

characteristics such as the stock price movements that follow a company’s earnings announcements.

Because our model is designed to select individual stocks, we do not try to add value in the portfolio by choosing countries or currencies to favor. The resulting portfolio has a lower P/E multiple than the benchmark index with roughly the same return on equity and slightly higher growth characteristics. We believe this is an attractive combination of attributes for long-term investors.

For the period, our model was successful in selecting stocks. Our market sentiment component performed best, followed by valuation and then earnings quality. Our best-performing holdings were Cimarex Energy, Polski Koncern Naftowy, and GS Holdings. The oil spill in the Gulf of Mexico, an event that financial models could not have predicted, led to significant stock declines for BP and Transocean. Their combined performance had a small negative effect on our portion of the fund.

8

Energy Fund

Fund Profile

As of July 31, 2010

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VGENX | VGELX |

| Expense Ratio1 | 0.38% | 0.31% |

| 30-Day SEC Yield | 2.02% | 2.08% |

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | MSCI | U.S. Total |

| | | ACWI | Market |

| | Fund | Energy | Index |

| Number of Stocks | 119 | 160 | 4,101 |

| Median Market Cap | $37.4B | $64.8B | $27.0B |

| Price/Earnings Ratio | 13.6x | 13.0x | 17.4x |

| Price/Book Ratio | 1.7x | 1.7x | 2.0x |

| Return on Equity | 25.0% | 23.6% | 19.0% |

| Earnings Growth Rate | 3.2% | 6.7% | 6.7% |

| Dividend Yield | 1.9% | 2.8% | 1.9% |

| Foreign Holdings | 37.6% | 57.1% | 0.0% |

| Turnover Rate | | | |

| (Annualized) | 33% | — | — |

| Short-Term Reserves | 2.6% | — | — |

| | |

| Volatility Measures | | |

| | | DJ |

| | Spliced | U.S. Total |

| | Energy | Market |

| | Index | Index |

| R-Squared | 0.91 | 0.60 |

| Beta | 1.13 | 1.06 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| Exxon Mobil Corp. | Integrated Oil & | |

| | Gas | 7.0% |

| Chevron Corp. | Integrated Oil & | |

| | Gas | 5.1 |

| Occidental Petroleum | Integrated Oil & | |

| Corp. | Gas | 4.4 |

| BP PLC | Integrated Oil & | |

| | Gas | 3.4 |

| EOG Resources Inc. | Oil & Gas | |

| | Exploration & | |

| | Production | 3.4 |

| Halliburton Co. | Oil & Gas | |

| | Equipment & | |

| | Services | 3.3 |

| Baker Hughes Inc. | Oil & Gas | |

| | Equipment & | |

| | Services | 3.2 |

| Schlumberger Ltd. | Oil & Gas | |

| | Equipment & | |

| | Services | 3.2 |

| ConocoPhillips | Integrated Oil & | |

| | Gas | 2.9 |

| BG Group PLC | Integrated Oil & | |

| | Gas | 2.6 |

| Top Ten | | 38.5% |

The holdings listed exclude any temporary cash investments and equity index products.

1 The expense ratios shown are from the prospectus dated May 28, 2010, and represent estimated costs for the current fiscal year. For the six months ended July 31, 2010, the annualized expense ratios were 0.35% for Investor Shares and 0.29% for Admiral Shares.

9

Energy Fund

| |

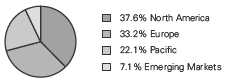

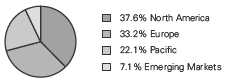

| Market Diversification (% of equity exposure) |

| Europe | |

| United Kingdom | 9.1% |

| France | 2.5 |

| Italy | 1.7 |

| Spain | 1.5 |

| Norway | 1.3 |

| Other | 0.8 |

| Subtotal | 16.9% |

| Pacific | |

| Australia | 2.1% |

| Japan | 1.0 |

| Subtotal | 3.1% |

| Emerging Markets | |

| Brazil | 2.3% |

| Russia | 2.3 |

| China | 2.2 |

| India | 1.0 |

| Other | 0.1 |

| Subtotal | 7.9% |

| North America | |

| United States | 61.7% |

| Canada | 10.4 |

| Subtotal | 72.1% |

| | |

| Subindustry Diversification (% of equity exposure) | |

| | | MSCI |

| | | ACWI |

| | Fund | Energy |

| Coal & Consumable Fuels | 4.4% | 3.1% |

| Industrials | 0.1 | 0.0 |

| Integrated Oil & Gas | 53.0 | 60.7 |

| Materials | 2.1 | 0.0 |

| Oil & Gas Drilling | 0.9 | 2.1 |

| Oil & Gas Equipment & | | |

| Services | 12.1 | 8.8 |

| Oil & Gas Exploration & | | |

| Production | 22.7 | 18.6 |

| Oil & Gas Refining & | | |

| Marketing | 2.1 | 3.5 |

| Oil & Gas Storage & | | |

| Transportation | 0.1 | 3.2 |

| Utilities | 2.0 | 0.0 |

| Other | 0.5 | 0.0 |

10

Energy Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

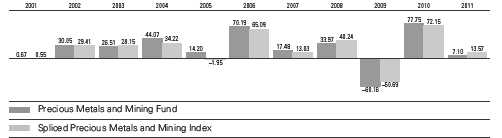

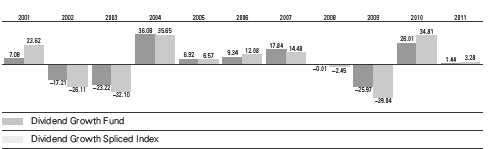

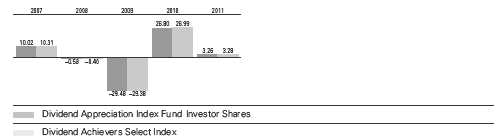

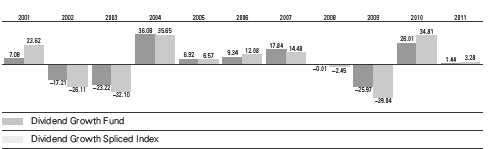

Fiscal-Year Total Returns (%): January 31, 2000, Through July 31, 2010

Spliced Energy Index: S&P Energy Sector Index through May 31, 2010; MSCI All Country World Energy Index thereafter.

Note: For 2011, performance data reflect the six months ended July 31, 2010.

Average Annual Total Returns: Periods Ended June 30, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 5/23/1984 | 3.36% | 5.53% | 12.48% |

| Admiral Shares | 11/12/2001 | 3.43 | 5.60 | 13.641 |

| 1 Return since inception. | | | | |

Vanguard fund returns do not reflect the 1% fee on redemptions of shares held for less than one year.

See Financial Highlights for dividend and capital gains information.

11

Energy Fund

Financial Statements (unaudited)

Statement of Net Assets

As of July 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (97.2%)1 | | |

| United States (59.6%) | | |

| Electric Utilities (0.5%) | | |

| | Exelon Corp. | 1,257,700 | 52,610 |

| |

| Energy Equipment & Services (11.8%) | |

| | Halliburton Co. | 11,670,232 | 348,707 |

| | Baker Hughes Inc. | 7,142,800 | 344,783 |

| | Schlumberger Ltd. | 5,630,764 | 335,931 |

| * | Weatherford | | |

| | International Ltd. | 5,848,600 | 94,747 |

| * | SEACOR Holdings Inc. | 933,908 | 77,346 |

| | National Oilwell Varco Inc. | 1,189,776 | 46,592 |

| | Helmerich & Payne Inc. | 46,500 | 1,885 |

| * | Rowan Cos. Inc. | 71,600 | 1,809 |

| * | Transocean Ltd. | 32,406 | 1,497 |

| | | | 1,253,297 |

| Exchange-Traded Fund (0.5%) | |

| ^,2 | Vanguard Energy ETF | 663,000 | 52,171 |

| |

| Gas Utilities (1.4%) | | |

| | EQT Corp. | 3,714,800 | 136,259 |

| | Questar Corp. | 895,018 | 14,723 |

| | | | 150,982 |

| Oil, Gas & Consumable Fuels (45.4%) | |

| | Coal & Consumable Fuels (3.7%) | |

| | Consol Energy Inc. | 5,866,700 | 219,884 |

| | Peabody Energy Corp. | 3,794,000 | 171,299 |

| |

| | Integrated Oil & Gas (23.6%) | |

| | Exxon Mobil Corp. | 12,397,019 | 739,854 |

| | Chevron Corp. | 7,143,235 | 544,386 |

| | Occidental | | |

| | Petroleum Corp. | 5,988,401 | 466,676 |

| | ConocoPhillips | 5,550,409 | 306,494 |

| | Marathon Oil Corp. | 7,782,091 | 260,311 |

| | Hess Corp. | 3,668,489 | 196,594 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Oil & Gas Exploration & Production (17.1%) |

| | EOG Resources Inc. | 3,685,336 | 359,320 |

| | Noble Energy Inc. | 3,601,600 | 241,523 |

| 3 | Cabot Oil & Gas Corp. | 6,728,131 | 205,006 |

| | Devon Energy Corp. | 3,223,807 | 201,456 |

| | Anadarko Petroleum Corp. 3,756,060 | 184,648 |

| * | Denbury Resources Inc. | 8,785,444 | 139,161 |

| * | Ultra Petroleum Corp. | 2,429,636 | 102,944 |

| | Chesapeake Energy Corp. | 4,211,437 | 88,567 |

| | Range Resources Corp. | 1,855,000 | 68,858 |

| * | Newfield Exploration Co. | 1,190,003 | 63,618 |

| * | Southwestern Energy Co. | 1,513,300 | 55,160 |

| * | QEP Resources Inc. | 895,018 | 30,806 |

| * | Quicksilver Resources Inc. 2,336,973 | 29,422 |

| * | Plains Exploration & | | |

| | Production Co. | 1,202,119 | 27,108 |

| * | SandRidge Energy Inc. | 3,024,400 | 17,844 |

| | Apache Corp. | 53,070 | 5,072 |

| |

| | Oil & Gas Refining & Marketing (1.0%) |

| | Valero Energy Corp. | 5,986,742 | 101,715 |

| | Sunoco Inc. | 18,900 | 674 |

| |

| | Oil & Gas Storage & Transportation (0.0%) |

| | Williams Cos. Inc. | 137,500 | 2,669 |

| | El Paso Corp. | 201,400 | 2,481 |

| | Spectra Energy Corp. | 1,200 | 25 |

| | | | 4,833,575 |

| Total United States | | 6,342,635 |

| International (37.6%) | | |

| Australia (2.1%) | | |

| ^ | BHP Billiton Ltd. ADR | 3,060,000 | 221,024 |

| | Woodside Petroleum Ltd. | 20,644 | 779 |

| | | | 221,803 |

| Austria (0.8%) | | |

| | OMV AG | 2,488,530 | 83,207 |

12

Energy Fund

| | |

| | | Market |

| | | Value |

| | Shares | ($000) |

| Brazil (2.3%) | | |

| Petroleo Brasileiro | | |

| SA ADR | 6,412,800 | 233,426 |

| Petroleo Brasileiro SA | | |

| Prior Pfd. | 310,820 | 4,927 |

| Petroleo Brasileiro SA | 219,342 | 3,982 |

| Petroleo Brasileiro SA | | |

| ADR Type A | 23,450 | 747 |

| | | 243,082 |

| Canada (10.1%) | | |

| Suncor Energy Inc. | 8,177,112 | 269,436 |

| Canadian Natural | | |

| Resources Ltd. | 6,550,518 | 225,469 |

| Cenovus Energy Inc. | 5,289,700 | 149,170 |

| Husky Energy Inc. | 4,765,900 | 117,102 |

| Encana Corp. | 3,011,200 | 91,932 |

| Imperial Oil Ltd. | 1,540,977 | 60,036 |

| Cameco Corp. | 2,347,800 | 59,845 |

| ^ Penn West Energy Trust | 2,482,121 | 48,128 |

| Canadian Oil Sands Trust | 1,599,575 | 42,069 |

| Suncor Energy Inc. | 125,184 | 4,127 |

| Encana Corp. | 128,139 | 3,917 |

| Cenovus Energy Inc. | 131,439 | 3,701 |

| Canadian Natural | | |

| Resources Ltd. | 81,478 | 2,806 |

| TransCanada Corp. | 33,196 | 1,173 |

| Enbridge Inc. | 9,000 | 438 |

| Talisman Energy Inc. | 24,173 | 413 |

| | | 1,079,762 |

| China (2.2%) | | |

| PetroChina Co. Ltd. ADR | 1,918,700 | 219,634 |

| CNOOC Ltd. | 2,797,717 | 4,715 |

| China Petroleum & | | |

| Chemical Corp. | 3,506,000 | 2,829 |

| Yanzhou Coal | | |

| Mining Co. Ltd. | 898,000 | 1,937 |

| PetroChina Co. Ltd. | 1,024,000 | 1,171 |

| China Oilfield Services Ltd. | 708,000 | 933 |

| | | 231,219 |

| Finland (0.0%) | | |

| Neste Oil Oyj | 102,567 | 1,513 |

| |

| France (2.4%) | | |

| Total SA ADR | 4,801,300 | 243,090 |

| Total SA | 262,442 | 13,248 |

| Technip SA | 33,395 | 2,223 |

| | | 258,561 |

| Hungary (0.0%) | | |

| * MOL Hungarian | | |

| Oil and Gas PLC | 21,198 | 1,906 |

| |

| India (1.0%) | | |

| Reliance Industries Ltd. | 4,719,974 | 102,875 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Oil & Natural | | |

| | Gas Corp. Ltd. | 76,693 | 2,055 |

| | Bharat Petroleum Corp. Ltd. | 112,984 | 1,562 |

| | | | 106,492 |

| Indonesia (0.0%) | | |

| | Adaro Energy Tbk PT | 7,842,000 | 1,759 |

| | Indo Tambangraya | | |

| | Megah PT | 372,000 | 1,561 |

| | | | 3,320 |

| Italy (1.7%) | | |

| | ENI SPA ADR | 4,166,750 | 170,462 |

| | ENI SPA | 361,907 | 7,395 |

| | Tenaris SA | 125,252 | 2,502 |

| | Saipem SPA | 6,630 | 238 |

| | | | 180,597 |

| Japan (1.0%) | | |

| ^ | Inpex Corp. | 21,436 | 104,862 |

| * | JX Holdings Inc. | 517,500 | 2,803 |

| | | | 107,665 |

| Malaysia (0.0%) | | |

| | Petronas Dagangan Bhd. | 419,000 | 1,354 |

| |

| Norway (1.3%) | | |

| | Statoil ASA ADR | 6,146,300 | 124,954 |

| | Statoil ASA | 191,560 | 3,875 |

| | Seadrill Ltd. | 100,150 | 2,315 |

| | Aker Solutions ASA | 129,973 | 1,682 |

| | | | 132,826 |

| Poland (0.0%) | | |

| * | Polski Koncern | | |

| | Naftowy Orlen | 156,378 | 1,990 |

| * | Grupa Lotos SA | 97,133 | 1,023 |

| | | | 3,013 |

| Russia (2.2%) | | |

| | Gazprom OAO ADR | 7,466,206 | 161,329 |

| | Rosneft Oil Co. GDR | 9,625,796 | 64,365 |

| | Lukoil OAO ADR | 79,913 | 4,562 |

| | Tatneft ADR | 76,091 | 2,353 |

| | Surgutneftegas OJSC ADR | 156,190 | 1,585 |

| | Surgutneftegas OJSC | | |

| | Prior Pfd. | 2,392,936 | 1,091 |

| | Gazprom OAO | 124,674 | 667 |

| | | | 235,952 |

| South Africa (0.0%) | | |

| | Sasol Ltd. | 22,805 | 904 |

| |

| South Korea (0.0%) | | |

| | GS Holdings | 50,420 | 1,766 |

| |

| Spain (1.5%) | | |

| | Repsol YPF SA ADR | 6,469,900 | 153,013 |

| | Repsol YPF SA | 149,761 | 3,531 |

| | | | 156,544 |

13

Energy Fund

| | |

| | | Market |

| | | Value |

| | Shares | ($000) |

| Thailand (0.1%) | | |

| PTT PCL (Foreign) | 292,100 | 2,305 |

| Banpu PCL | 99,700 | 1,932 |

| PTT Aromatics & | | |

| Refining PCL (Foreign) | 1,913,700 | 1,386 |

| IRPC PCL (Foreign) | 1,628,600 | 196 |

| | | 5,819 |

| Turkey (0.0%) | | |

| Tupras Turkiye | | |

| Petrol Rafine | 84,298 | 1,918 |

| |

| United Kingdom (8.9%) | | |

| BP PLC ADR | 8,992,100 | 345,926 |

| BG Group PLC | 17,489,102 | 280,474 |

| Royal Dutch Shell | | |

| PLC ADR | 3,486,200 | 193,205 |

| Ensco PLC ADR | 1,971,900 | 82,445 |

| BP PLC | 2,266,380 | 14,494 |

| Royal Dutch | | |

| Shell PLC Class A | 325,010 | 8,951 |

| Royal Dutch | | |

| Shell PLC Class B | 325,712 | 8,605 |

| * Hansen Transmissions | | |

| International NV | 6,645,381 | 7,104 |

| Royal Dutch | | |

| Shell PLC Class A | | |

| (Amsterdam Shares) | 93,699 | 2,584 |

| Tullow Oil PLC | 16,160 | 312 |

| | | 944,100 |

| Total International | | 4,003,323 |

| Total Common Stocks | | |

| (Cost $7,548,476) | | 10,345,958 |

| Temporary Cash Investments (4.2%)1 | |

| Money Market Fund (1.5%) | | |

| 4,5 Vanguard Market | | |

| Liquidity Fund, 0.297% | 153,381,718 | 153,382 |

| | | |

| | | Face | Market |

| | | Amount | Value |

| | | ($000) | ($000) |

| Repurchase Agreement (2.5%) | | |

| | Deutsche Bank | | |

| | Securities, Inc. 0.210%, | | |

| | 8/2/10 (Dated 7/30/10, | | |

| | Repurchase Value | | |

| | $268,805,000, collateralized | | |

| | by Government National | | |

| | Mortgage Assn. | | |

| | 5.000%, 6/20/40–7/20/40) | 268,800 | 268,800 |

| |

| U.S. Government and Agency Obligations (0.2%) |

| 6,7 | Fannie Mae Discount | | |

| | Notes, 0.300%, 9/8/10 | 2,000 | 2,000 |

| 6,7 | Freddie Mac Discount | | |

| | Notes, 0.320%, 9/7/10 | 15,390 | 15,387 |

| 6,7 | Freddie Mac Discount | | |

| | Notes, 0.245%, 9/21/10 | 500 | 500 |

| 6,7 | Freddie Mac Discount | | |

| | Notes, 0.361%, 12/16/10 | 2,500 | 2,498 |

| | | | 20,385 |

| Total Temporary Cash Investments | |

| (Cost $442,563) | | 442,567 |

| Total Investments (101.4%) | | |

| (Cost $7,991,039) | | 10,788,525 |

| Other Assets and Liabilities (-1.4%) | |

| Other Assets | | 25,724 |

| Liabilities5 | | (171,352) |

| | | | (145,628) |

| Net Assets (100%) | | 10,642,897 |

14

Energy Fund

| |

| At July 31, 2010, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 7,624,429 |

| Undistributed Net Investment Income | 83,554 |

| Accumulated Net Realized Gains | 134,985 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 2,797,486 |

| Futures Contracts | 2,447 |

| Foreign Currencies | (4) |

| Net Assets | 10,642,897 |

| |

| Investor Shares—Net Assets | |

| Applicable to 112,117,063 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 6,237,331 |

| Net Asset Value Per Share— | |

| Investor Shares | $55.63 |

| |

| Admiral Shares—Net Assets | |

| Applicable to 42,164,284 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 4,405,566 |

| Net Asset Value Per Share— | |

| Admiral Shares | $104.49 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $95,160,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of futures contracts. After giving effect to futures investments, the fund’s effective positions in common stock and temporary cash investments represent 97.9% and 3.5%, respectively, of net assets.

2 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

3 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company.

4 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

5 Includes $98,670,000 of collateral received for securities on loan.

6 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

7 Securities with a value of $20,385,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

15

Energy Fund

| |

| Statement of Operations | |

| |

| | Six Months Ended |

| | July 31, 2010 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1,2 | 117,066 |

| Interest2 | 424 |

| Security Lending | 3,103 |

| Total Income | 120,593 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 7,880 |

| Performance Adjustment | 634 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 5,395 |

| Management and Administrative—Admiral Shares | 2,399 |

| Marketing and Distribution—Investor Shares | 774 |

| Marketing and Distribution—Admiral Shares | 503 |

| Custodian Fees | 303 |

| Shareholders’ Reports—Investor Shares | 37 |

| Shareholders’ Reports—Admiral Shares | 6 |

| Trustees’ Fees and Expenses | 9 |

| Total Expenses | 17,940 |

| Expenses Paid Indirectly | (65) |

| Net Expenses | 17,875 |

| Net Investment Income | 102,718 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | 147,558 |

| Futures Contracts | (1,038) |

| Foreign Currencies | (263) |

| Realized Net Gain (Loss) | 146,257 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | (495,425) |

| Futures Contracts | 13,599 |

| Foreign Currencies | (22) |

| Change in Unrealized Appreciation (Depreciation) | (481,848) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (232,873) |

1 Dividends are net of foreign withholding taxes of $7,658,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $344,000, $160,000, and $0, respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

16

Energy Fund

| | |

| Statement of Changes in Net Assets | | |

| |

| | Six Months Ended | Year Ended |

| | July 31, | January 31, |

| | 2010 | 2010 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 102,718 | 171,663 |

| Realized Net Gain (Loss) | 146,257 | 222,696 |

| Change in Unrealized Appreciation (Depreciation) | (481,848) | 2,364,619 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (232,873) | 2,758,978 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | — | (105,714) |

| Admiral Shares | — | (74,777) |

| Realized Capital Gain1 | | |

| Investor Shares | (45,868) | — |

| Admiral Shares | (31,704) | — |

| Total Distributions | (77,572) | (180,491) |

| Capital Share Transactions | | |

| Investor Shares | (113,794) | 565,224 |

| Admiral Shares | 92,471 | 508,755 |

| Net Increase (Decrease) from Capital Share Transactions | (21,323) | 1,073,979 |

| Total Increase (Decrease) | (331,768) | 3,652,466 |

| Net Assets | | |

| Beginning of Period | 10,974,665 | 7,322,199 |

| End of Period2 | 10,642,897 | 10,974,665 |

1 Includes fiscal 2011 short-term gain distributions totaling $15,050,000. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $83,554,000 and ($18,896,000).

See accompanying Notes, which are an integral part of the Financial Statements.

17

Energy Fund

| | | | | | |

| Financial Highlights | | | | | | |

| |

| Investor Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | July 31, | | | Year Ended January 31, |

| Throughout Each Period | 2010 | 2010 | 2009 | 2008 | 2007 | 2006 |

| Net Asset Value, Beginning of Period | $57.17 | $42.62 | $73.93 | $63.55 | $64.50 | $40.85 |

| Investment Operations | | | | | | |

| Net Investment Income | .529 | .910 | 1.2761 | 1.226 | 1.112 | .813 |

| Net Realized and Unrealized Gain | | | | | | |

| (Loss) on Investments | (1.667) | 14.591 | (28.853) | 14.639 | .405 | 24.606 |

| Total from Investment Operations | (1.138) | 15.501 | (27.577) | 15.865 | 1.517 | 25.419 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | — | (.951) | (1.264) | (1.177) | (1.020) | (.740) |

| Distributions from Realized Capital Gains | (.402) | — | (2.469) | (4.308) | (1.447) | (1.029) |

| Total Distributions | (.402) | (.951) | (3.733) | (5.485) | (2.467) | (1.769) |

| Net Asset Value, End of Period | $55.63 | $57.17 | $42.62 | $73.93 | $63.55 | $64.50 |

| |

| Total Return2 | -2.03% | 36.28% | -38.51% | 25.02% | 2.24% | 62.93% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $6,237 | $6,536 | $4,434 | $7,919 | $6,479 | $6,733 |

| Ratio of Total Expenses to Average | | | | | | |

| Net Assets | 0.35%3,4 | 0.38%3 | 0.28%3 | 0.25% | 0.25% | 0.28% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 1.85%4 | 1.73% | 1.84% | 1.67% | 1.71% | 1.57% |

| Portfolio Turnover Rate5 | 33%4 | 27% | 21% | 22% | 22% | 10% |

1 Calculated based on average shares outstanding.

2 Total returns do not reflect the 1% fee assessed on redemptions of shares held for less than one year, nor do they include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Includes performance-based investment advisory fee increases (decreases) of 0.01% for fiscal 2011, 0.03% for fiscal 2010, and 0.01% for fiscal 2009.

4 Annualized.

5 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Energy Fund

| | | | | | |

| Financial Highlights | | | | | | |

| |

| Admiral Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | July 31, | | | Year Ended January 31, |

| Throughout Each Period | 2010 | 2010 | 2009 | 2008 | 2007 | 2006 |

| Net Asset Value, Beginning of Period | $107.34 | $80.02 | $138.86 | $119.35 | $121.13 | $76.71 |

| Investment Operations | | | | | | |

| Net Investment Income | 1.028 | 1.780 | 2.4801 | 2.418 | 2.180 | 1.561 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | (3.124) | 27.395 | (54.203) | 27.505 | .757 | 46.217 |

| Total from Investment Operations | (2.096) | 29.175 | (51.723) | 29.923 | 2.937 | 47.778 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | — | (1.855) | (2.480) | (2.322) | (2.000) | (1.425) |

| Distributions from Realized Capital Gains | (.754) | — | (4.637) | (8.091) | (2.717) | (1.933) |

| Total Distributions | (.754) | (1.855) | (7.117) | (10.413) | (4.717) | (3.358) |

| Net Asset Value, End of Period | $104.49 | $107.34 | $80.02 | $138.86 | $119.35 | $121.13 |

| |

| Total Return2 | -1.99% | 36.37% | -38.46% | 25.13% | 2.32% | 63.00% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $4,406 | $4,439 | $2,889 | $5,214 | $3,612 | $3,088 |

| Ratio of Total Expenses to | | | | | | |

| Average Net Assets | 0.29%3,4 | 0.31%3 | 0.21%3 | 0.17% | 0.18% | 0.22% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 1.91%4 | 1.80% | 1.91% | 1.75% | 1.78% | 1.63% |

| Portfolio Turnover Rate5 | 33%4 | 27% | 21% | 22% | 22% | 10% |

1 Calculated based on average shares outstanding.

2 Total returns do not reflect the 1% fee assessed on redemptions of shares held for less than one year.

3 Includes performance-based investment advisory fee increases (decreases) of 0.01% for fiscal 2011, 0.03% for fiscal 2010, and 0.01% for fiscal 2009.

4 Annualized.

5 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Energy Fund

Notes to Financial Statements

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxi es (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

20

Energy Fund

4. Repurchase Agreements: The fund may invest in repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (January 31, 2007–2010), and for the period ended July 31, 2010, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Wellington Management Company, LLP, provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee is subject to quarterly adjustments based on the fund’s performance for the preceding three years relative to a combined index composed of the S&P Citigroup BMI World Energy Index and the S&P 500 Energy Equal Weighted Blend Index.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $149,000 for the six months ended July 31, 2010.

For the six months ended July 31, 2010, the aggregate investment advisory fee represented an effective annual basic rate of 0.14% of the fund’s average net assets, before an increase of $634,000 (0.01%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At July 31, 2010, the fund had contributed capital of $1,933,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.77% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

21

Energy Fund

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the six months ended July 31, 2010, these arrangements reduced the fund’s expenses by $65,000 (an annual rate of 0.00% of average net assets).

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of July 31, 2010, based on the inputs used

to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks—United States | 6,342,635 | — | — |

| Common Stocks—International | 3,076,596 | 926,727 | — |

| Temporary Cash Investments | 153,382 | 289,185 | — |

| Futures Contracts—Assets1 | 104 | — | — |

| Futures Contracts—Liabilities1 | (7) | — | — |

| Total | 9,572,710 | 1,215,912 | — |

| 1 Represents variation margin on the last day of the reporting period. | | | |

F. At July 31, 2010, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| S&P 500 Index | September 2010 | 156 | 42,834 | 1,692 |

| E-mini S&P 500 Index | September 2010 | 543 | 29,819 | 755 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

G. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse

22

Energy Fund

at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes. The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year.

During the six months ended July 31, 2010, the fund realized net foreign currency losses of $263,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to undistributed net investment income.

At July 31, 2010, the cost of investment securities for tax purposes was $7,991,039,000. Net unrealized appreciation of investment securities for tax purposes was $2,797,486,000, consisting of unrealized gains of $3,259,761,000 on securities that had risen in value since their purchase and $462,275,000 in unrealized losses on securities that had fallen in value since their purchase.

H. During the six months ended July 31, 2010, the fund purchased $2,065,281,000 of investment securities and sold $1,726,594,000 of investment securities, other than temporary cash investments.

I. Capital share transactions for each class of shares were:

| | | | |

| | Six Months Ended | | Year Ended |

| | | July 31, 2010 | January 31, 2010 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 489,106 | 8,442 | 1,489,177 | 28,171 |

| Issued in Lieu of Cash Distributions | 44,178 | 749 | 101,349 | 1,698 |

| Redeemed1 | (647,078) | (11,398) | (1,025,302) | (19,560) |

| Net Increase (Decrease)—Investor Shares | (113,794) | (2,207) | 565,224 | 10,309 |

| Admiral Shares | | | | |

| Issued | 445,094 | 4,114 | 1,126,454 | 11,663 |

| Issued in Lieu of Cash Distributions | 28,143 | 254 | 65,102 | 582 |

| Redeemed1 | (380,766) | (3,553) | (682,801) | (6,994) |

| Net Increase (Decrease)—Admiral Shares | 92,471 | 815 | 508,755 | 5,251 |

| 1 Net of redemption fees for fiscal 2011 and 2010 of $1,526,000 and $3,460,000, respectively (fund totals). | | |

23

Energy Fund

J. The fund has invested in a company that is considered to be an affiliated company of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of this company were as follows:

| | | | | |

| | | | Current Period Transactions | |

| | Jan. 31, 2010 | | Proceeds from | | July 31, 2010 |

| | Market | Purchases | Securities | Dividend | Market |

| | Value | at Cost | Sold | Income | Value |

| | ($000) | ($000) | ($000) | ($000) | ($000) |

| Cabot Oil & Gas Corp. | N/A1 | 68,009 | — | 344 | 205,006 |

| 1 Not applicable—At January 31, 2010, the issuer was not an affiliated company of the fund. | | |

K. In preparing the financial statements as of July 31, 2010, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

24

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the 1% fee on redemptions of shares held for less than one year, nor do they include the account service fee described in the prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

25

| | | |

| Six Months Ended July 31, 2010 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Energy Fund | 1/31/2010 | 7/31/2010 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $979.70 | $1.72 |

| Admiral Shares | 1,000.00 | 980.08 | 1.42 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,023.06 | $1.76 |

| Admiral Shares | 1,000.00 | 1,023.36 | 1.45 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.35% for Investor Shares and 0.29% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

26

Trustees Approve Advisory Arrangements

The board of trustees of Vanguard Energy Fund has renewed the fund’s investment advisory arrangements with The Vanguard Group, Inc., through its Quantitative Equity Group, and Wellington Management Company, LLP. The board also approved an amended investment advisory agreement with Wellington Management. Effective August 1, 2010, Wellington Management’s compensation benchmark, a composite index made up of 50% S&P Citigroup BMI World Energy Index/50% S&P 500 Energy Equal Weighted Blend Index, was replaced with the MSCI All Country World Energy Index. The board concluded that the new index is a more suitable index because it better reflects the fund’s global focus. This change will not affect the fund’s investment objective, policies, strategies, or risks. The board determined that the retention of the fund’s advisors was in the best interests of the fund and its sha reholders.

The board based its decision upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term, and took into account the organizational depth and stability of each advisor.

Wellington Management Company, LLP. Founded in 1928, Wellington Management is among the nation’s oldest and most respected institutional investment managers. The investment team uses a bottom-up approach in which stocks are selected based on the advisor’s estimates of fundamental investment value. The advisor’s investment process emphasizes company fundamentals, management track record, and security valuation. The firm has advised the fund since the fund’s inception in 1984.

The Vanguard Group, Inc. Vanguard has been managing investments for more than three decades. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth. Vanguard has managed a portion of the fund since 2005.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted the continuation of the advisory arrangements.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that each advisor has carried out its investment strategy in disciplined fashion, and that performance results have been in line with expectations. The fund’s performance has exceeded that of the fund’s benchmark and peer group over the last 3-, 5-, and 10-year periods, although it underperformed both the benchmark and peer group during the most recent 12-month period. Information about the fund’s most recent performance can be found in the Performance Summary portion of this report.

27

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory expense ratio was also well below its peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the fund’s advisory fee rate.

The board did not consider profitability of Wellington Management in determining whether to approve the advisory fee, because Wellington Management is independent of Vanguard, and the advisory fee is the result of arm’s-length negotiations. The board does not conduct a profitability analysis of Vanguard, because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedule for Wellington Management. The breakpoints reduce the effective rate of the fee as the fund’s assets managed by Wellington Management increase. The board also concluded that the fund’s low-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as the fund’s assets managed by Vanguard increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

28

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (in the case of bonds) or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

29

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

30

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 162 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at www.vanguard.com.

| |

| Interested Trustee1 | Amy Gutmann |

| | Born 1949. Trustee Since June 2006. Principal |

| F. William McNabb III | Occupation(s) During the Past Five Years: President |

| Born 1957. Trustee Since July 2009. Chairman of the | of the University of Pennsylvania; Christopher H. |

| Board. Principal Occupation(s) During the Past Five | Browne Distinguished Professor of Political Science |

| Years: Chairman of the Board of The Vanguard Group, | in the School of Arts and Sciences with secondary |

| Inc., and of each of the investment companies served | appointments at the Annenberg School for Commu- |

| by The Vanguard Group, since January 2010; Director | nication and the Graduate School of Education of |

| of The Vanguard Group since 2008; Chief Executive | the University of Pennsylvania; Director of Carnegie |

| Officer and President of The Vanguard Group and of | Corporation of New York, Schuylkill River Development |

| each of the investment companies served by The | Corporation, and Greater Philadelphia Chamber of |

| Vanguard Group since 2008; Director of Vanguard | Commerce; Trustee of the National Constitution Center; |

| Marketing Corporation; Managing Director of The | Chair of the Presidential Commission for the Study of |

| Vanguard Group (1995–2008). | Bioethical Issues. |

| |

| | JoAnn Heffernan Heisen |

| Independent Trustees | Born 1950. Trustee Since July 1998. Principal |

| | Occupation(s) During the Past Five Years: Corporate |

| Emerson U. Fullwood | Vice President and Chief Global Diversity Officer since |

| Born 1948. Trustee Since January 2008. Principal | 2006 (retired 2008) and Member of the Executive |

| Occupation(s) During the Past Five Years: Executive | Committee (retired 2008) of Johnson & Johnson |

| Chief Staff and Marketing Officer for North America | (pharmaceuticals/consumer products); Vice President |

| and Corporate Vice President (retired 2008) of Xerox | and Chief Information Officer of Johnson & Johnson |

| Corporation (document management products and | (1997–2005); Director of the University Medical Center |

| services); Director of SPX Corporation (multi-industry | at Princeton and Women’s Research and Education |

| manufacturing), the United Way of Rochester, | Institute; Member of the Advisory Board of the |

| Amerigroup Corporation (managed health care), | Maxwell School of Citizenship and Public Affairs |

| the University of Rochester Medical Center, and | at Syracuse University. |

| Monroe Community College Foundation. | |

| | F. Joseph Loughrey |

| Rajiv L. Gupta | Born 1949. Trustee Since October 2009. Principal |

| Born 1945. Trustee Since December 2001.2 | Occupation(s) During the Past Five Years: President |

| Principal Occupation(s) During the Past Five Years: | and Chief Operating Officer since 2005 (retired 2009) |

| Chairman and Chief Executive Officer (retired 2009) | and Vice Chairman of the Board (2008–2009) of |

| and President (2006–2008) of Rohm and Haas Co. | Cummins Inc. (industrial machinery); Director of |

| (chemicals); Director of Tyco International, Ltd. | SKF AB (industrial machinery), Hillenbrand, Inc. |

| (diversified manufacturing and services) and Hewlett- | (specialized consumer services), Sauer-Danfoss Inc. |

| Packard Co. (electronic computer manufacturing); | (machinery), the Lumina Foundation for Education, |

| Trustee of The Conference Board; Member of the | and Oxfam America; Chairman of the Advisory Council |

| Board of Managers of Delphi Automotive LLP | for the College of Arts and Letters at the University of |

| (automotive components). | Notre Dame. |

| | |

| André F. Perold | Kathryn J. Hyatt | |

| Born 1952. Trustee Since December 2004. Principal | Born 1955. Treasurer Since November 2008. Principal |

| Occupation(s) During the Past Five Years: George | Occupation(s) During the Past Five Years: Principal |

| Gund Professor of Finance and Banking at the Harvard | of The Vanguard Group, Inc.; Treasurer of each of |

| Business School; Chair of the Investment Committee | the investment companies served by The Vanguard |

| of HighVista Strategies LLC (private investment firm). | Group since 2008; Assistant Treasurer of each of the |

| | investment companies served by The Vanguard Group |

| Alfred M. Rankin, Jr. | (1988–2008). | |

| Born 1941. Trustee Since January 1993. Principal | | |

| Occupation(s) During the Past Five Years: Chairman, | Heidi Stam | |

| President, and Chief Executive Officer of NACCO | Born 1956. Secretary Since July 2005. Principal |

| Industries, Inc. (forklift trucks/housewares/lignite); | Occupation(s) During the Past Five Years: Managing |

| Director of Goodrich Corporation (industrial products/ | Director of The Vanguard Group, Inc., since 2006; |

| aircraft systems and services); Chairman of the Federal | General Counsel of The Vanguard Group since 2005; |