As filed with the Securities and Exchange Commission on March 6, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4255

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST

(Exact Name of the Registrant as Specified in Charter)

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices - Zip Code)

Robert Conti, Chief Executive Officer

Neuberger Berman Advisers Management Trust

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Jeffrey S. Puretz, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

(Names and Addresses of agents for service)

Registrant's Telephone Number, including area code: (212) 476-8800

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (the "Act") (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid

Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. | REPORTS TO SHAREHOLDERS |

| | |

The following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Advisers Management Trust

Balanced Portfolio

I Class Shares

Annual Report

December 31, 2008

B1014 02/09

Balanced Portfolio Managers' Commentary

In a difficult market environment, the Neuberger Berman Advisers Management Trust (AMT) Balanced Portfolio posted a negative return for 2008. The Portfolio's equity component outperformed the Russell Midcap(R) Growth Index while its fixed income component trailed the Merrill Lynch 1-3 Year Treasury Index.

Equities

The past year was characterized by tremendous rotation -- among the sectors, capitalization ranges and fundamental characteristics of the stocks that moved in and out of favor. For the full year, other than micro-caps, mid-cap stocks were the poorest performers by market capitalization. Growth stocks underperformed value stocks for the year and, within growth, the types of stocks we favor -- the higher quality, highest growth rate names --were out of favor.

Sectors that were most positive for the Portfolio's equity component included Industrials, Materials and Energy. Avoiding Utilities was also beneficial relative to the Russell Midcap Growth Index.

Within Industrials our high quality names, with good earnings visibility and cash flows, and self-sustaining business models, contributed to relative return for the year. Within Materials, strong stock selection was also a benefit. Although Energy was one of the worst performing market sectors for the year, our Energy holdings were helpful on a relative basis overall. Oil and gas holdings with good earnings visibility have continued to do fairly well even as commodities prices have dropped. Services companies -- among our poorest performers -- did not perform as well, as their margins began to erode as oil prices deteriorated.

Sectors that negatively impacted performance included Financials, Health Care and Telecommunications. In Financials, especially within banking, changes over the past year have meant that there are now fewer stocks to choose from within the mid-cap market. Many companies are now either too small or have been acquired by companies that are too large. Currently, our focus in the sector is asset management.

As we move into 2009, we are selectively shifting the Portfolio's equity component away from last year's defensive stance and beginning to position it for a more constructive market environment. As such, within Consumer Discretionary, we may move some focus away from our successful secondary education theme in favor of the more aggressive gaming, lodging and retail sectors. We are likely to add to Telecommunications as well. Within Information Technology, where our focus was primarily defensive during the year, we currently plan to add beta through areas that tend to move with the market, such as semiconductors.

Despite performance runs seen in lower quality stocks, we continue to believe that, longer term, stock selection will be highly important and that the market will reward companies that possess strong fundamentals and quality growth characteristics. The companies that meet our fundamental criteria generally have strong balance sheets in that they possess good cash flow characteristics and are underleveraged and, therefore, do not have to go to the market for financing - -- which should benefit them on a competitive basis longer term. We continue to monitor credit spreads for indications that the various rescue packages are beginning to positively influence the economic situation. We are also looking for indications that the stimulus packages are beginning to positively impact the consumer, creating jobs, spurring consumer spending and, finally, restoring consumer confidence. As we see these developments, we intend to move the Portfolio's equity component from its current relatively defensive positioning.

Fixed Income

As is typical during times of stress, investors flocked to ultra-safe short-term Treasuries during 2008, driving their yields lower and their prices higher. During the year, the yield on the two-year Treasury fell from 3.05% to 0.76%. Meanwhile, many fixed income sectors that in normal times are considered safe havens saw their spreads widen dramatically relative to Treasuries. Even higher rated securities with strong underlying credit fundamentals performed poorly during periods of indiscriminate selling over the course of the year.

1

Given this backdrop, the relative underperformance by the Portfolio's fixed income component versus the Merrill Lynch 1-3 Year Treasury Index was not surprising, given that the index is comprised entirely of Treasury securities. Although we built a modest Treasury position during the year, the vast majority of the Portfolio component's assets were in spread products (non-Treasury securities) such as mortgage-related securities and investment grade corporate bonds. During the year, we maintained our high quality bias throughout the year, with holdings rated AA+ on average as of December 31, 2008.

Despite current negative economic data, we are encouraged that the Federal Reserve, Treasury and other government agencies continue to work aggressively to stimulate the economy, unfreeze the credit markets and restore confidence in the financial system. During 2008, the Fed lowered the Fed Funds rate seven times, bringing the rate from 4.25% to a range of 0% to 0.25%, an historic low. In terms of policy intervention, the government has introduced numerous programs such the Troubled Asset Relief Program, which included a direct capital infusion into certain financial institutions, as well as the Term Asset-Backed Securities Loan Facility to facilitate the purchase of certain asset-backed securities.

It is important to note that it will take some time for these initiatives to work their way through the economy. In addition, the transition to the new administration in Washington could result in periods of heightened volatility in the financial markets. That said, toward the end of 2008, we began to see some thawing of the credit markets, increased liquidity and improved performance by the spread sectors, which led to better performance for the Portfolio's fixed income component in December.

While we are disappointed with our fixed income performance for 2008, we remain confident in our disciplined investment process. We also believe that emphasizing spread product is appropriate in seeking to generate the highest available current income, consistent with liquidity and low risk to principal.

Sincerely,

Kenneth J. Turek, Thomas Sontag

Michael Foster and Richard Grau

Portfolio Co-Managers

2

Balanced Portfolio

ASSET DIVERSIFICATION

| (% of Market Value) | |

| Asset Backed | | | 3.8 | % | |

| Common Stock | | | 65.5 | | |

| Mortgage-Backed Securities | | | 23.5 | | |

| U.S. Government Agency Securities | | | 2.2 | | |

| Short-Term Investments | | | 2.0 | | |

| Repurchase Agreements | | | 3.0 | | |

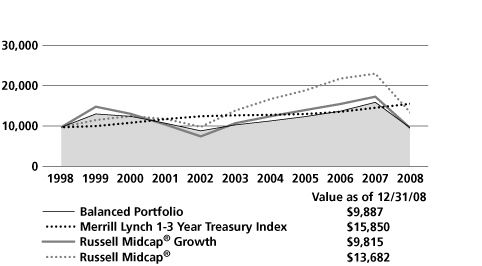

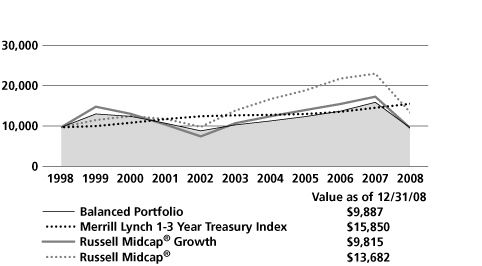

AVERAGE ANNUAL TOTAL RETURN1

| | | Inception

Date | | 1 Year | | 5 Year | | 10 Year | | Life of

Fund* | |

| Balanced Portfolio | | 02/28/89 | | | (39.15 | %) | | | (1.46 | %) | | | (0.11 | %) | | | 5.39 | % | |

Merrill Lynch 1-3 Year

Treasury Index2 | | | | | 6.61 | % | | | 4.06 | % | | | 4.71 | % | | | 6.04 | % | |

| Russell Midcap(R) Growth2 | | | | | (44.32 | %) | | | (2.33 | %) | | | (0.19 | %) | | | 8.00 | % | |

| Russell Midcap(R)2 | | | | | (41.46 | %) | | | (0.71 | %) | | | 3.18 | % | | | 9.49 | % | |

Performance data quoted represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. Results are shown on a "total return" basis and include reinvestment of all dividends and capital gain distributions.

Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end, please visit https://www.nb.com.

* Index returns are as of the inception date 02/28/89.

As stated in the Portfolio's most recent prospectus, the total annual fund operating expense ratio for fiscal year 2007 was 1.17% for Class I shares (prior to any fee waivers or expense reimbursements). Neuberger Berman Management LLC has contractually agreed to limit certain expenses of the Portfolio through 12/31/2011.

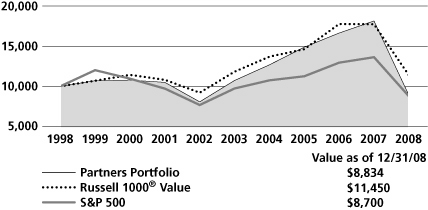

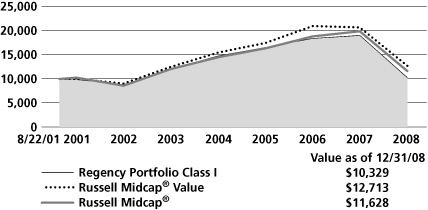

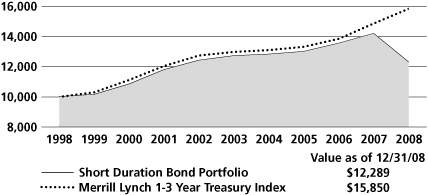

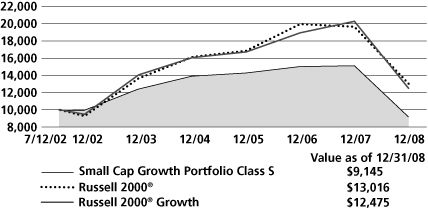

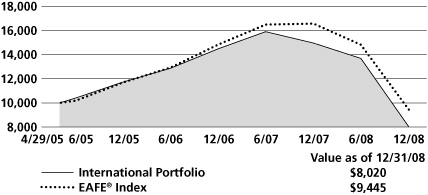

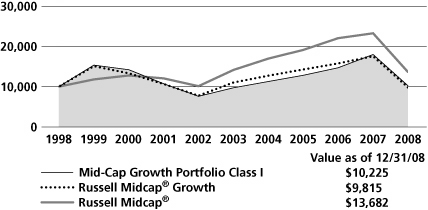

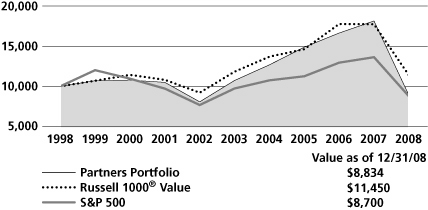

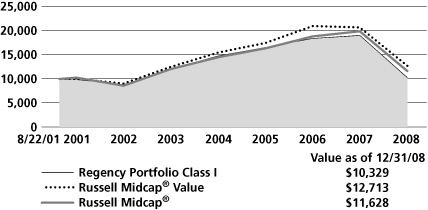

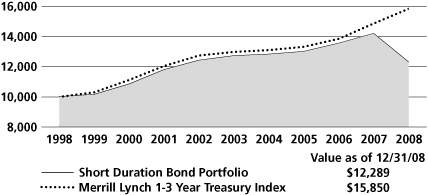

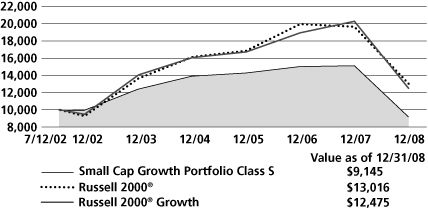

COMPARISON OF A $10,000 INVESTMENT

The chart shows the value of a hypothetical $10,000 investment in the Portfolio over the past 10 fiscal years, or since the Portfolio's inception, if it has not operated for 10 years. The result is compared with benchmarks, which may include a broad-based market index and/or a narrower index. Please note that market indexes do not include expenses. All results include the reinvestment of dividends and capital gain distributions. Results represent past performance and do not indicate future results. The chart and table do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

Please see Endnotes for additional information.

3

Endnotes

1 "Total Return" includes reinvestment of all income dividends and capital gain distributions. Results represent past performance and do not indicate future results. The value of an investment in the Portfolio and the return on the investment both will fluctuate, and redemption process may be higher or lower than an investor's original cost. The performance information does not reflect fees and expenses of the variable annuity and variable life insurance policies or the pension plans whose proceeds are invested in the Portfolio. Neuberger Berman Management LLC ("NBM LLC") has agreed to absorb certain expenses of the AMT Portfolios, including the Portfolio. Without this arrangement, which is subject to change, the total returns of the Portfolio may have been less.

2 The Russell Midcap(R) Growth Index measures the performance of those Russell Midcap(R) Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000(R) Index, which represents approximately 31% of the total market capitalization of the Russell 1000(R) Index (which, in turn, consists of the 1,000 largest U.S. companies, based on the market capitalization). The Merrill Lynch 1-3 Year Treasury Index is an unmanaged total return market value index consisting of all coupon-bearing U.S. Treasury publicly placed debt securities with maturities between 1 to 3 years. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and that individuals cannot invest directly in any index. Data about the performance of these indices are prepared or obtained by NBM LLC and include reinvestment of all dividends and capital gain distributions. The Portfolio may invest in many securities not included in the above described indices.

Any ratios or other measurements using a factor of forecasted earnings of a company discussed herein are based on consensus estimates, not NBM LLC's own projections, and they may or may not be realized. In addition, any revision to a forecast could affect the market price of a security. By quoting them herein, NBM LLC does not offer an opinion as to the accuracy of and does not guarantee these forecasted numbers. The investments for the Portfolio are managed by the same portfolio manager(s) who manage one or more other mutual funds that have similar names, investment objectives and investment styles as the Portfolio. You should be aware that the Portfolio is likely to differ from the other mutual funds in size, cash flow pattern and tax matters.

Accordingly, the holdings and performance of the Portfolio can be expected to vary from those of the other mutual funds. The composition, industries and holdings of the Portfolio are subject to change. Shares of the separate AMT Portfolios are sold only through the currently effective prospectus and are not available to the general public. Shares of this Portfolio may be purchased only by life insurance companies to be used with their separate accounts that fund variable annuity and variable life insurance policies and by certain qualified pension and retirement plans.

(c) 2009 Neuberger Berman Management LLC, distributor. All rights reserved.

4

Information About Your Fund's Expenses

This table is designed to provide information regarding costs related to your investments. All mutual funds incur operating expenses, which include management fees, fees for administrative services and costs of shareholder reports, among others. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended December 31, 2008 and held for the entire period. The table illustrates the fund's costs in two ways:

| Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the fund's actual performance during the period. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

|

Hypothetical Example for

Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in this fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

|

Please note that the expenses in the table are meant to highlight your ongoing costs only. The table and the expense example do not include any transactional costs, such as fees and expenses that are, or may be, imposed under your variable contract or qualified pension plan. Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Information as of 12/31/08 (Unaudited)

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST BALANCED PORTFOLIO

| Actual | | Beginning Account

Value

7/1/08 | | Ending Account

Value

12/31/08 | | Expenses Paid During

the Period*

7/1/08 - 12/31/08 | |

| Class I | | $ | 1,000.00 | | | $ | 667.20 | | | $ | 6.54 | | |

| Hypothetical (5% annual return before expenses)** | |

| Class I | | $ | 1,000.00 | | | $ | 1,017.29 | | | $ | 7.91 | | |

* Expenses are equal to the annualized expense ratio of 1.56%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period shown).

** Hypothetical 5% annual return before expenses is calculated by multiplying the number of days in the most recent half year divided by 366.

5

Schedule of Investments Balanced Portfolio

| NUMBER OF SHARES | | | | MARKET VALUEt | |

| Common Stocks (65.1%) | | | |

| Aerospace & Defense (0.5%) | | | |

| | 1,400 | | | Precision Castparts | | $ | 83,272 | | |

| Air Freight & Logistics (1.8%) | | | |

| | 3,400 | | | C.H. Robinson Worldwide | | | 187,102 | | |

| | 2,900 | | | Expeditors International | | | 96,483 | | |

| | | | 283,585 | | |

| Beverages (0.2%) | | | |

| | 1,350 | | | Central European Distribution | | | 26,595 | * | |

| Biotechnology (2.9%) | | | |

| | 1,800 | | | Alexion Pharmaceuticals Inc. | | | 65,142 | * | |

| | 1,350 | | | Cephalon, Inc. | | | 104,004 | * | |

| | 2,800 | | | Myriad Genetics | | | 185,528 | * | |

| | 650 | | | United Therapeutics | | | 40,657 | * | |

| | 1,900 | | | Vertex Pharmaceuticals | | | 57,722 | * | |

| | | | 453,053 | | |

| Capital Markets (2.4%) | | | |

| | 650 | | | BlackRock, Inc. | | | 87,198 | | |

| | 5,300 | | | Lazard Ltd. | | | 157,622 | oo | |

| | 2,400 | | | Northern Trust | | | 125,136 | | |

| | | | 369,956 | | |

| Chemicals (2.1%) | | | |

| | 4,300 | | | Airgas, Inc. | | | 167,657 | oo | |

| | 4,300 | | | Ecolab Inc. | | | 151,145 | oo | |

| | | | 318,802 | | |

| Commercial Services & Supplies (5.5%) | | | |

| | 1,500 | | | Clean Harbors | | | 95,160 | * | |

| | 1,500 | | | Copart, Inc. | | | 40,785 | * | |

| | 6,000 | | | Corrections Corporation of

America | | | 98,160 | * | |

| | 2,400 | | | CoStar Group | | | 79,056 | * | |

| | 4,800 | | | Covanta Holding | | | 105,408 | * | |

| | 6,700 | | | Iron Mountain | | | 165,691 | * | |

| | 3,800 | | | Stericycle, Inc. | | | 197,904 | *oo | |

| | 2,300 | | | Waste Connections | | | 72,611 | * | |

| | | | 854,775 | | |

| Communications Equipment (1.8%) | | | |

| | 4,500 | | | Harris Corp. | | | 171,225 | oo | |

| | 5,800 | | | Juniper Networks | | | 101,558 | * | |

| | | | 272,783 | | |

| Construction & Engineering (0.8%) | | | |

| | 2,500 | | | Jacobs Engineering Group | | | 120,250 | * | |

| NUMBER OF SHARES | | | | MARKET VALUEt | |

| Construction Materials (0.2%) | | | |

| | 350 | | | Martin Marietta Materials | | $ | 33,978 | | |

| Containers & Packaging (0.4%) | | | |

| | 2,500 | | | Pactiv Corp. | | | 62,200 | * | |

| Diversified Consumer Services (3.0%) | | | |

| | 1,500 | | | American Public Education | | | 55,785 | * | |

| | 3,500 | | | DeVry, Inc. | | | 200,935 | | |

| | 1,000 | | | Strayer Education | | | 214,410 | | |

| | | | 471,130 | | |

| Diversified Financial Services (0.9%) | | | |

| | 1,100 | | | IntercontinentalExchange Inc. | | | 90,684 | * | |

| | 2,000 | | | Nasdaq OMX Group | | | 49,420 | * | |

| | | | 140,104 | | |

| Electrical Equipment (0.8%) | | | |

| | 3,800 | | | AMETEK, Inc. | | | 114,798 | | |

Electronic Equipment, Instruments &

Components (3.7%) | | | |

| | 4,800 | | | Dolby Laboratories | | | 157,248 | * | |

| | 4,000 | | | FLIR Systems | | | 122,720 | * | |

| | 1,400 | | | Itron, Inc. | | | 89,236 | * | |

| | 500 | | | Mettler-Toledo International | | | 33,700 | * | |

| | 2,200 | | | National Instruments | | | 53,592 | | |

| | 5,500 | | | Trimble Navigation | | | 118,855 | * | |

| | | | 575,351 | | |

| Energy Equipment & Services (1.7%) | | | |

| | 2,400 | | | CARBO Ceramics | | | 85,272 | | |

| | 1,150 | | | Core Laboratories N.V. | | | 68,839 | | |

| | 2,900 | | | IHS Inc. | | | 108,518 | * | |

| | | | 262,629 | | |

| Food & Staples Retailing (1.7%) | | | |

| | 1,900 | | | BJ's Wholesale Club | | | 65,094 | * | |

| | 5,300 | | | Shoppers Drug Mart | | | 197,423 | | |

| | | | 262,517 | | |

| Food Products (1.4%) | | | |

| | 3,800 | | | Ralcorp Holdings | | | 221,920 | *oo | |

| Health Care Equipment & Supplies (4.9%) | | | |

| | 1,800 | | | C.R. Bard | | | 151,668 | | |

| | 2,900 | | | Gen-Probe | | | 124,236 | * | |

| | 2,400 | | | IDEXX Laboratories | | | 86,592 | * | |

| | 800 | | | Intuitive Surgical | | | 101,592 | * | |

| | 2,900 | | | Masimo Corp. | | | 86,507 | * | |

| | 1,750 | | | NuVasive, Inc. | | | 60,637 | * | |

| | 7,200 | | | Wright Medical Group | | | 147,096 | * | |

| | | | 758,328 | | |

See Notes to Schedule of Investments 6

| NUMBER OF SHARES | | | | MARKET VALUEt | |

| Health Care Providers & Services (2.4%) | | | |

| | 2,400 | | | Express Scripts | | $ | 131,952 | * | |

| | 1,200 | | | HMS Holdings | | | 37,824 | * | |

| | 3,000 | | | Psychiatric Solutions | | | 83,550 | * | |

| | 5,800 | | | VCA Antech | | | 115,304 | * | |

| | | | 368,630 | | |

| Hotels, Restaurants & Leisure (2.4%) | | | |

| | 3,750 | | | Penn National Gaming | | | 80,175 | * | |

| | 8,600 | | | WMS Industries | | | 231,340 | *oo | |

| | 1,550 | | | Wynn Resorts | | | 65,503 | * | |

| | | | 377,018 | | |

| Household Products (0.5%) | | | |

| | 1,450 | | | Church & Dwight | | | 81,374 | | |

| Insurance (1.1%) | | | |

| | 2,000 | | | Aon Corp. | | | 91,360 | | |

| | 300 | | | Everest Re Group | | | 22,842 | | |

| | 1,750 | | | Fidelity National Financial Class A | | | 31,063 | | |

| | 1,000 | | | W.R. Berkley | | | 31,000 | | |

| | | | 176,265 | | |

| Internet Software & Services (0.9%) | | | |

| | 1,500 | | | Equinix, Inc. | | | 79,785 | * | |

| | 3,500 | | | VistaPrint Ltd. | | | 65,135 | * | |

| | | | 144,920 | | |

| IT Services (2.6%) | | | |

| | 3,000 | | | Alliance Data Systems | | | 139,590 | *oo | |

| | 6,000 | | | Cognizant Technology Solutions | | | 108,360 | * | |

| | 450 | | | MasterCard, Inc. Class A | | | 64,318 | | |

| | 4,500 | | | SAIC Inc. | | | 87,660 | * | |

| | | | 399,928 | | |

| Life Science Tools & Services (0.5%) | | | |

| | 3,000 | | | Illumina, Inc. | | | 78,150 | * | |

| Machinery (0.9%) | | | |

| | 2,400 | | | Danaher Corp. | | | 135,864 | oo | |

| Metals & Mining (0.3%) | | | |

| | 1,000 | | | Agnico-Eagle Mines | | | 51,330 | | |

| Multiline Retail (0.3%) | | | |

| | 1,400 | | | Kohl's Corp. | | | 50,680 | * | |

| Oil, Gas & Consumable Fuels (3.3%) | | | |

| | 5,300 | | | Concho Resources | | | 120,946 | * | |

| | 1,900 | | | Continental Resources | | | 39,349 | * | |

| | 2,900 | | | Range Resources | | | 99,731 | | |

| | 5,800 | | | Southwestern Energy | | | 168,026 | *oo | |

| | 2,400 | | | XTO Energy | | | 84,648 | | |

| | | | 512,700 | | |

| Personal Products (0.2%) | |

| | 500 | | | Chattem, Inc. | | | 35,765 | * | |

| NUMBER OF SHARES | | | | MARKET VALUEt | |

| Pharmaceuticals (1.1%) | | | |

| | 5,300 | | | Perrigo Co. | | $ | 171,243 | | |

| Professional Services (0.6%) | | | |

| | 2,000 | | | FTI Consulting | | | 89,360 | * | |

| Road & Rail (0.6%) | | | |

| | 3,400 | | | J.B. Hunt Transport Services | | | 89,318 | | |

| Semiconductors (0.3%) | | | |

| | 2,000 | | | Lam Research | | | 42,560 | * | |

Semiconductors & Semiconductor

Equipment (1.2%) | | | |

| | 4,050 | | | Microchip Technology | | | 79,097 | | |

| | 4,000 | | | Microsemi Corp. | | | 50,560 | * | |

| | 2,250 | | | Silicon Laboratories | | | 55,755 | * | |

| | | | 185,412 | | |

| Software (2.5%) | | | |

| | 14,000 | | | Activision Blizzard | | | 120,960 | * | |

| | 4,800 | | | ANSYS, Inc. | | | 133,872 | * | |

| | 2,200 | | | Blackboard Inc. | | | 57,706 | * | |

| | 2,350 | | | Salesforce.com, Inc. | | | 75,224 | * | |

| | | | 387,762 | | |

| Specialty Retail (2.8%) | | | |

| | 3,800 | | | GameStop Corp. Class A | | | 82,308 | * | |

| | 3,000 | | | Gap Inc. | | | 40,170 | | |

| | 4,300 | | | Ross Stores | | | 127,839 | | |

| | 2,000 | | | Staples, Inc. | | | 35,840 | | |

| | 2,000 | | | TJX Cos. | | | 41,140 | | |

| | 6,700 | | | Urban Outfitters | | | 100,366 | * | |

| | | | 427,663 | | |

| Trading Companies & Distributors (0.8%) | | | |

| | 3,400 | | | Fastenal Co. | | | 118,490 | | |

| Wireless Telecommunication Services (3.1%) | | | |

| | 6,500 | | | American Tower | | | 190,580 | * | |

| | 2,000 | | | Metropcs Communications | | | 29,700 | * | |

| | 6,500 | | | NII Holdings | | | 118,170 | * | |

| | 9,000 | | | SBA Communications | | | 146,880 | * | |

| | | | 485,330 | | |

| |

| | | Total Common Stocks

(Cost $10,920,287) | | | 10,095,788 | | |

See Notes to Schedule of Investments 7

| PRINCIPAL AMOUNT | | | | MARKET VALUEt | |

| Mortgage-Backed Securities (25.5%) | | | |

| Adjustable Alt-A Conforming Balance (1.6%) | | | |

| $ | 535,549 | | | Countrywide Home Loans Mortgage Pass-Through Trust, Ser. 2007-HYB2, Class 2A1,

5.38%, due 1/2/09 | | $ | 254,505 | m | |

| Adjustable Alt-A Mixed Balance (6.1%) | | | |

| | 534,218 | | | Bear Stearns ALT-A Trust, Ser. 2007-2, Class 2A1, 5.57%, due 1/2/09 | | | 264,884 | m | |

| | 542,913 | | | Bear Stearns ALT-A Trust, Ser. 2006-4, Class 32A1, 6.47%, due 1/2/09 | | | 267,292 | moo | |

| | 306,007 | | | First Horizon Alternative Mortgage Securities Trust, Ser. 2006-AA7, Class A1,

6.52%, due 1/2/09 | | | 143,767 | m | |

| | 555,596 | | | Nomura Asset Acceptance Corp., Ser. 2006-AR2, Class 2A2, 6.56%, due 1/2/09 | | | 264,468 | moo | |

| | | | 940,411 | | |

| Adjustable Alt-B Mixed Balance (0.6%) | | | |

| | 150,304 | | | Lehman XS Trust, Floating Rate, Ser. 2005-1, Class 2A1, 1.97%, due 1/2/09 | | | 89,057 | m | |

| Adjustable Conforming Balance (2.1%) | | | |

| | 287,282 | | | Adjustable Rate Mortgage Trust, Ser. 2005-10, Class 4A1, 5.37%, due 1/2/09 | | | 179,088 | m | |

| | 262,399 | | | IndyMac INDX Mortgage Loan Trust, Ser. 2005-AR23, Class 2A1, 5.48%, due 1/2/09 | | | 140,745 | m | |

| | | | 319,833 | | |

| Adjustable Jumbo Balance (2.5%) | | | |

| | 118,142 | | | Banc of America Funding Corp., Ser. 2005-F, Class 4A1, 5.33%, due 1/2/09 | | | 68,046 | m | |

| | 321,431 | | | Banc of America Funding Corp., Ser. 2006-H, Class 2A3, 6.68%, due 1/2/09 | | | 180,902 | moo | |

| | 287,152 | | | Harborview Mortgage Loan Trust, Ser. 2006-3, Class 1A1A, 6.34%, due 1/2/09 | | | 138,014 | m | |

| | | | 386,962 | | |

| Adjustable Mixed Balance (8.1%) | | | |

| | 275,078 | | | Banc of America Funding Corp., Ser. 2005-H, Class 7A1, 5.66%, due 1/2/09 | | | 155,874 | m | |

| | 200,419 | | | Banc of America Funding Corp., Ser. 2006-A, Class 3A2, 5.85%, due 1/2/09 | | | 106,522 | m | |

| | 422,964 | | | Countrywide Home Loan Mortgage Pass-Through Trust, Ser. 2006-HYB3, Class 1A1A,

5.31%, due 1/2/09 | | | 195,355 | m | |

| | 329,134 | | | Credit Suisse First Boston Mortgage Securities Corp., Ser. 2004-AR4, Class 2A1,

4.77%, due 1/2/09 | | | 201,048 | m | |

| | 315,991 | | | First Horizon Mortgage Pass-Through Trust, Ser. 2005-AR5, Class 2A1, 5.45%, due 1/2/09 | | | 225,167 | m | |

| | 279,053 | | | GMAC Mortgage Corp. Loan Trust, Ser. 2006-AR1, Class 1A1, 5.60%, due 1/2/09 | | | 140,986 | m | |

| | 17,967 | | | Harborview Mortgage Loan Trust, Ser. 2004-4, Class 3A, 2.65%, due 1/2/09 | | | 8,218 | m | |

| | 520,963 | | | IndyMac INDX Mortgage Loan Trust, Ser. 2006-AR3, Class 2A1A, 6.30%, due 1/2/09 | | | 231,665 | moo | |

| | | | 1,264,835 | | |

| Mortgage-Backed Non-Agency (1.3%) | | | |

| | 143,287 | | | Countrywide Home Loans, Ser. 2005-R2, Class 2A4, 8.50%, due 6/25/35 | | | 139,122 | noo | |

| | 58,649 | | | GSMPS Mortgage Loan Trust, Ser. 2005-RP3, Class 1A4, 8.50%, due 9/25/35 | | | 53,187 | n | |

| | | | 192,309 | | |

| Fannie Mae (1.0%) | | | |

| | 143,527 | | | Whole Loan, Ser. 2004-W8, Class PT, 10.42%, due 1/2/09 | | | 158,183 | moo | |

See Notes to Schedule of Investments 8

| PRINCIPAL AMOUNT | | | | MARKET VALUEt | |

| Freddie Mac (2.2%) | | | |

| $ | 186,756 | | | Pass-Through Certificates, 8.00%, due 11/1/26 | | $ | 197,833 | oo | |

| | 129,902 | | | Pass-Through Certificates, 8.50%, due 10/1/30 | | | 140,175 | oo | |

| | | | 338,008 | | |

| | | | | Total Mortgage-Backed Securities (Cost $7,007,272) | | | 3,944,103 | | |

| Asset-Backed Securities (3.9%) | | | |

| | 250,000 | | | ACE Securities Corp. Home Equity Loan Trust, Ser. 2006-ASP5, Class A2B,

0.60%, due 1/26/09 | | | 183,996 | moo | |

| | 100,000 | | | ACE Securities Corp. Home Equity Loan Trust, Ser. 2006-OP1, Class A2C,

0.62%, due 1/26/09 | | | 65,582 | moo | |

| | 200,000 | | | Carrington Mortgage Loan Trust, Ser. 2007-FRE1, Class A3, 0.73%, due 1/26/09 | | | 84,772 | moo | |

| | 113,596 | | | Impac Secured Assets Corp., Ser. 2006-3, Class A4, 0.56%, due 1/26/09 | | | 99,566 | m | |

| | 185,687 | | | Residential Asset Mortgage Products, Inc., Ser. 2006-RS1, Class AI2, 0.70%, due 1/26/09 | | | 144,877 | moo | |

| | 75,000 | | | Securitized Asset Backed Receivables LLC Trust, Ser. 2006-WM4, Class A2C,

0.63%, due 1/26/09 | | | 20,341 | m | |

| | | | | Total Asset-Backed Securities (Cost $907,740) | | | 599,134 | | |

| Repurchase Agreements (3.0%) | | | |

| | 470,000 | | | Repurchase Agreement with Fixed Income Clearing Corp., 0.01%, due 1/2/09,

dated 12/31/08, Maturity Value $470,000 Collateralized by $470,000 Fannie Mae,

4.33%, due 7/28/11 (Collateral Value $488,213) (Cost $470,000) | | | 470,000 | # | |

| NUMBER OF SHARES | | | | | |

| Short-Term Investments (2.0%) | | | |

| | 313,321 | | | Neuberger Berman Prime Money Fund Trust Class (Cost $313,321) | | | 313,321 | a | |

| | | | | Total Investments (99.5%) (Cost $19,618,620) | | | 15,422,346 | ## | |

| | | | | Cash, receivables and other assets, less liabilities (0.5%) | | | 82,511 | | |

| | | | | Total Net Assets (100.0%) | | $ | 15,504,857 | | |

See Notes to Schedule of Investments 9

Notes to Schedule of Investments Balanced Portfolio

t Investments in equity securities by Neuberger Berman Advisers Management Trust Balanced Portfolio (the "Fund") are valued by obtaining valuations from an independent pricing service. The independent pricing service values equity securities at the latest sale price when that price is readily available. Securities traded primarily on the NASDAQ Stock Market are normally valued by the Fund at the NASDAQ Official Closing Price ("NOCP") provided by NASDAQ each business day. The NOCP is the most recently reported price as of 4:00:02 p.m., Eastern time, unless that price is outside the range of the "inside" bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, NASDAQ will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. If there is no reported sale of a security on a particular day, the independent pricing service may value the security based on reported market quotations. If a valuation is not available from an independent pricing service, the Fund seeks to obtain quotations from principal market makers. Investments in debt securities are valued daily by obtaining valuations from independent pricing services based on readily available bid quotations, or if quotations are not available, by methods which include considerations such as: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. If a valuation is not available from an independent pricing service, the Fund seeks to obtain quotations from principal market makers. For both debt and equity securities, if such quotations are not readily available, securities are valued using methods the Board of Trustees of Neuberger Berman Advisers Management Trust (the "Board") has approved on the belief that they reflect fair value. Numerous factors may be considered when determining the fair value of a security, including available analyst, media or other reports, trading in futures or ADRs and whether the issuer of the security being fair valued has other securities outstanding. Foreign security prices are furnished by independent quotation services and expressed in local currency values. Foreign security prices are currently translated from the local currency into U.S. dollars using the exchange rate as of 4:00 p.m., Eastern time. The Board has approved the use of Interactive Data Pricing and Reference Data, Inc. ("Interactive") to assist in determining the fair value of the Fund's foreign equity securities when changes in the value of a certain index suggest that the closing prices on the foreign exchanges may no longer represent the amount that the Fund could expect to receive for those securities. In this event, Interactive will provide adjusted prices for certain foreign equity securities using a statistical analysis of historical correlations of multiple factors. In the absence of precise information about the market values of these foreign securities as of the close of the New York Stock Exchange, the Board has determined on the basis of available data that prices adjusted in this way are likely to be closer to the prices the Fund could realize on a current sale than are the prices of those securities established at the close of the foreign markets in which the securities primarily trade. Fair value prices are necessarily estimates, and there is no assurance that such a price will be at or close to the price at which the security is next quoted or next trades. Short-term debt securities with less than 60 days until maturity may be valued at cost which, when combined with interest earned, approximates market value.

The Fund adopted Financial Accounting Standards Board ("FASB") Statement of Financial Accounting Standards No. 157, Fair Value Measurements ("FAS 157"), effective January 1, 2008. In accordance with FAS 157, "fair value" is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. Various inputs are used in determining the value of the Fund's investments.

In addition to defining fair value, FAS 157 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

. Level 1 - quoted prices in active markets for identical investments

. Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, amortized cost, etc.)

. Level 3 - significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

See Notes to Financial Statements10

Notes to Schedule of Investments Balanced Portfolio (cont'd)

The inputs or methodology used for valuing an investment are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund's investments as of December 31, 2008:

| Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments** | |

| Level 1 - Quoted Prices | | $ | 10,095,788 | | | $ | 20,672 | | |

| Level 2 - Other Significant Observable Inputs | | | 5,326,558 | | | | -- | | |

| Level 3 - Significant Unobservable Inputs | | | -- | | | | -- | | |

| Total | | $ | 15,422,346 | | | $ | 20,672 | | |

Following is a reconciliation between the beginning and ending balances of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | Investments

in Securities | |

| Beginning balance, as of 1/1/08 | | $ | 23,725 | | |

| Accrued discounts/premiums | | | -- | | |

| Realized gain/loss and change in unrealized appreciation/depreciation | | | 4,385 | | |

| Net purchases/sales | | | (28,110 | ) | |

| Net transfers in and/or out of Level 3 | | | -- | | |

| Balance, as of 12/31/08 | | $ | -- | | |

| Net change in unrealized appreciation/depreciation from investments still held as of 12/31/08 | | $ | -- | | |

** Other financial instruments include financial futures contracts.

# At cost, which approximates market value.

## At December 31, 2008, the cost of investments for U.S. federal income tax purposes was $19,723,448. Gross unrealized appreciation of investments was $971,722, and gross unrealized depreciation of investments was $5,272,824, resulting in net unrealized depreciation of $4,301,102, based on cost for U.S. federal income tax purposes.

* Security did not produce income during the last twelve months.

n Restricted security subject to restrictions on resale under federal securities laws. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers under Rule 144A under the Securities Act of 1933, as amended, and have been deemed by the investment manager to be liquid. At December 31, 2008, these securities amounted to $192,309 or 1.2% of net assets for the Fund.

oo All or a portion of this security is segregated as collateral for financial futures contracts.

m Floating rate securities are securities whose yields vary with a designated market index or market rate. These securities are shown at their current rates as of December 31, 2008.

a Neuberger Berman Prime Money Fund ("Prime Money") is also managed by Neuberger Berman Management LLC and may be considered an affiliate since it has the same officers, Board members, and investment manager as the Fund and because, at times, the Fund may own 5% or more of the outstanding voting securities of Prime Money (see Notes A & F of Notes to Financial Statements).

See Notes to Financial Statements11

Statement of Assets and Liabilities

Neuberger Berman Advisers Management Trust

| | | BALANCED

PORTFOLIO | |

| | | December 31, 2008 | |

| Assets | |

| Investments in securities, at market value* (Notes A & F)-see Schedule of Investments: | |

| Unaffiliated issuers | | $ | 15,109,025 | | |

| Affiliated issuers | | | 313,321 | | |

| | | | 15,422,346 | | |

| Cash | | | 11,199 | | |

| Foreign currency | | | 8,617 | | |

| Dividends and interest receivable | | | 39,762 | | |

| Receivable for securities sold | | | 137,158 | | |

| Receivable for Fund shares sold | | | 149 | | |

| Prepaid expenses and other assets | | | 1,299 | | |

| Total Assets | | | 15,620,530 | | |

| Liabilities | |

| Payable for securities purchased | | | 43,788 | | |

| Payable for Fund shares redeemed | | | 1,164 | | |

| Payable to investment manager-net (Notes A & B) | | | 6,942 | | |

| Payable to administrator (Note B) | | | 3,798 | | |

| Payable for variation margin on open futures contracts (Note A) | | | 281 | | |

| Accrued expenses and other payables | | | 59,700 | | |

| Total Liabilities | | | 115,673 | | |

| Net Assets at value | | $ | 15,504,857 | | |

| Net Assets consist of: | |

| Paid-in capital | | $ | 36,235,362 | | |

| Undistributed net investment income (loss) | | | 498,378 | | |

| Accumulated net realized gains (losses) on investments | | | (17,034,641 | ) | |

| Net unrealized appreciation (depreciation) in value of investments | | | (4,194,242 | ) | |

| Net Assets at value | | $ | 15,504,857 | | |

| Shares Outstanding ($.001 par value; unlimited shares authorized) | | | 2,045,692 | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.58 | | |

| *Cost of Investments: | |

| Unaffiliated issuers | | $ | 19,305,299 | | |

| Affiliated issuers | | | 313,321 | | |

| Total cost of investments | | $ | 19,618,620 | | |

| Total cost of foreign currency | | $ | 10,348 | | |

See Notes to Financial Statements 12

Statement of Operations

Neuberger Berman Advisers Management Trust

| | | BALANCED

PORTFOLIO | |

| | | For the

Year Ended

December 31, 2008 | |

| Investment Income: | |

| Income (Note A): | |

| Dividend income-unaffiliated issuers | | $ | 100,617 | | |

| Interest income-unaffiliated issuers | | | 971,637 | | |

| Income from investments in affiliated issuers (Note F) | | | 25,648 | | |

| Foreign taxes withheld | | | (1,963 | ) | |

| Total income | | $ | 1,095,939 | | |

| Expenses: | |

| Investment management fees (Notes A & B) | | | 286,989 | | |

| Administration fees (Note B) | | | 156,540 | | |

| Shareholder servicing agent fees | | | 1,661 | | |

| Audit fees | | | 40,493 | | |

| Custodian fees (Note B) | | | 73,496 | | |

| Insurance expense | | | 1,978 | | |

| Legal fees | | | 12,967 | | |

| Registration and filing fees | | | 24,675 | | |

| Shareholder reports | | | 27,275 | | |

| Trustees' fees and expenses | | | 38,132 | | |

| Miscellaneous | | | 9,585 | | |

| Total expenses | | | 673,791 | | |

| Investment management fees waived (Note A) | | | (712 | ) | |

| Expenses reduced by custodian fee expense offset and commission recapture arrangements (Note B) | | | (2,354 | ) | |

| Total net expenses | | | 670,725 | | |

| Net investment income (loss) | | $ | 425,214 | | |

| Realized and Unrealized Gain (Loss) on Investments (Note A) | |

| Net realized gain (loss) on: | |

| Sales of investment securities of unaffiliated issuers | | | 3,116,174 | | |

| Financial futures contracts | | | 203,053 | | |

| Foreign currency | | | 403 | | |

| Change in net unrealized appreciation (depreciation) in value of: | |

| Unaffiliated investment securities | | | (20,259,886 | ) | |

| Financial futures contracts | | | 18,687 | | |

| Foreign currency | | | (19,662 | ) | |

| Net gain (loss) on investments | | | (16,941,231 | ) | |

| Net increase (decrease) in net assets resulting from operations | | $ | (16,516,017 | ) | |

See Notes to Financial Statements 13

Statements of Changes in Net Assets

Neuberger Berman Advisers Management Trust

| | | BALANCED PORTFOLIO | |

| | | Year Ended

December 31,

2008 | | Year Ended

December 31,

2007 | |

| Increase (Decrease) in Net Assets: | |

| From Operations: | |

| Net investment income (loss) | | $ | 425,214 | | | $ | 755,304 | | |

| Net realized gain (loss) on investments | | | 3,319,630 | | | | 9,353,619 | | |

| Change in net unrealized appreciation (depreciation) of investments | | | (20,260,861 | ) | | | 751,870 | | |

| Net increase (decrease) in net assets resulting from operations | | | (16,516,017 | ) | | | 10,860,793 | | |

| Distributions to Shareholders From (Note A): | |

| Net Investment Income | | | (836,556 | ) | | | (875,654 | ) | |

| From Fund Share Transactions (Note D): | |

| Proceeds from shares sold | | | 5,241,056 | | | | 8,058,112 | | |

| Proceeds from reinvestment of dividends and distributions | | | 836,556 | | | | 875,654 | | |

| Payments for shares redeemed | | | (51,583,340 | ) | | | (12,821,907 | ) | |

| Net increase (decrease) from Fund share transactions | | | (45,505,728 | ) | | | (3,888,141 | ) | |

| Net Increase (Decrease) in Net Assets | | | (62,858,301 | ) | | | 6,096,998 | | |

| Net Assets: | |

| Beginning of year | | | 78,363,158 | | | | 72,266,160 | | |

| End of year | | $ | 15,504,857 | | | $ | 78,363,158 | | |

| Undistributed net investment income (loss) at end of year | | $ | 498,378 | | | $ | 835,933 | | |

See Notes to Financial Statements 14

Notes to Financial Statements Balanced Portfolio

Note A--Summary of Significant Accounting Policies:

1 General: Balanced Portfolio (the "Fund") is a separate operating series of Neuberger Berman Advisers Management Trust (the "Trust"), a Delaware statutory trust organized pursuant to a Trust Instrument dated May 23, 1994. The Trust is currently comprised of ten separate operating series (each a "Series," collectively, the "Funds") each of which is diversified. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"), and its shares are registered under the Securities Act of 1933, as amended. The Fund currently offers only Class I shares. The Board of Trustees of the Trust (the "Board") may establish additional series or classes of shares without the approval of shareholders.

The assets of each Series belong only to that Series, and the liabilities of each Series are borne solely by that Series and no other.

The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires Neuberger Berman Management LLC ("Management") to make estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates.

Management, the investment manager of the Fund, and Neuberger Berman, LLC ("Neuberger"), the Fund's sub-adviser, are wholly owned subsidiaries of Lehman Brothers Holdings Inc. ("Lehman Brothers"), a publicly owned holding company. On September 15, 2008, Lehman Brothers filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code. On December 3, 2008, NBSH Acquisition, LLC ("NBSH"), an entity organized by key members of Neuberger Berman's senior management, was selected as the successful bidder in the public auction to acquire a majority interest in Neuberger Berman's business and the fixed income and certain alternative asset management businesses of Lehman Brothers' Investment Management Division (together with Neuberger Berman, the "Acquired Businesses") (the "Proposed Acquisition"). On December 22, 2008, the bankruptcy court having jurisdiction over the Lehman Brothers matter approved the sale of the Acquired Businesses to NBSH (or its successor or assign), as the successful bidder. At the closing of the Proposed Acquisition, a majority interest in the Acquired Businesses will be directly or indirectly owned by portfolio managers, Neuberger Berman's management team and certain key members and senior professionals of the former Investment Management Division, as well as by Lehman Brothers and certain affiliates of Lehman Brothers. The transaction is subject to certain conditions and approvals.

These events, while affecting Lehman Brothers, have not had a material impact on the Fund or its operations. Management and Neuberger will continue to operate in the ordinary course of business as the investment manager and sub-adviser of the Fund.

Included in the Acquired Businesses are Management and Neuberger. The consummation of the Proposed Acquisition has been deemed to result in an "assignment" of the Fund's Management and Sub-Advisory Agreements which would, by law, automatically terminate those agreements. Accordingly, the Board, including the Trustees who are not "interested persons" of the Fund's investment manager and its affiliates or the Fund, has approved the new Management Agreements and Sub-Advisory Agreements for the Fund. The new agreements also will require the approval of the Fund's shareholders.

2 Portfolio valuation: Investment securities are valued as indicated in the notes following the Schedule of Investments.

3 Foreign currency translation: The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are currently translated into U.S. dollars using the exchange rates as of 4:00 p.m., Eastern time, to determine the value of investments, other assets and liabilities. Purchase and sale prices of securities, and income and expenses, are translated into U.S. dollars at the prevailing rate of exchange on the respective dates of such transactions. Net unrealized foreign currency gain (loss) arises from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates and is stated separately in the Statement of Operations.

15

4 Securities transactions and investment income: Securities transactions are recorded on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date or, for certain foreign dividends, as soon as the Fund becomes aware of the dividends. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including accretion of discount (adjusted for original issue discount, where applicable), and accretion of market discount on long-term bonds and short-term investments, is recorded on the accrual basis. Realized gains and losses from securities transactions and foreign currency transactions, if any, are recorded on the basis of identified cost and stated separately in the Statement of Operations. Included in net realized gain (loss) on investments are proceeds from the settlements of class action litigation in which the Fund participated as a plaintiff. The amount of such proceeds for the year ended December 31, 2008 was $36,687.

5 Forward foreign currency contracts: The Fund may enter into forward foreign currency contracts ("contracts") in connection with planned purchases or sales of securities to hedge the U.S. dollar value of portfolio securities denominated in a foreign currency. The gain or loss arising from the difference between the original contract price and the closing price of such contract is included in net realized gains or losses on foreign currency transactions on settlement date. Fluctuations in the value of such contracts are recorded for financial reporting purposes as unrealized gains or losses by the Fund until the contractual settlement date. The Fund could be exposed to risks if a counter party to a contract were unable to meet the terms of its contract or if the value of the foreign currency changes unfavorably. The U.S. dollar value of foreign currency underlying all contractual commitments held by the Fund is determined using forward foreign currency exchange rates supplied by an independent pricing service.

6 Income tax information: The Funds are treated as separate entities for U.S. federal income tax purposes. It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its earnings to its shareholders. Therefore, no federal income or excise tax provision is required.

The Fund has adopted the provisions of Financial Accounting Standards Board Interpretation No. 48 ("FIN 48") "Accounting for Uncertainty in Income Taxes -- an interpretation of FASB Statement No. 109". FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken, or expected to be taken, in a tax return. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as an income tax expense in the Statement of Operations. The Fund is subject to examination by U.S. federal and state tax authorities for returns filed for the prior three fiscal years 2005 - 2007. As of December 31, 2008, the Fund did not have any unrecognized tax benefits.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole. The Fund may also utilize earnings and profits distributed to shareholders on redemption of shares as a part of the dividends paid deduction for income tax purposes.

As determined on December 31, 2008, permanent differences resulting primarily from different book and tax accounting for foreign currency gains and losses, paydown gains and losses, amortization of bond premium and partnership basis adjustments, were reclassified at fiscal year-end. These reclassifications had no effect on net income, net asset value or net asset value per share of the Fund.

The tax character of distributions paid during the years ended December 31, 2008 and December 31, 2007 was as follows:

| Ordinary Income | | Total | |

| 2008 | | 2007 | | 2008 | | 2007 | |

| $ | 836,556 | | | $ | 875,654 | | | $ | 836,556 | | | $ | 875,654 | | |

16

As of December 31, 2008, the components of distributable earnings (accumulated losses) on a U.S. federal income tax basis were as follows:

Undistributed

Ordinary

Income | | Unrealized

Appreciation

(Depreciation) | | Loss

Carryforwards

and Deferrals | | Total | |

| $ | 498,378 | | | $ | (4,319,738 | ) | | $ | (16,909,145 | ) | | $ | (20,730,505 | ) | |

The difference between book basis and tax basis distributable earnings is attributable primarily to timing differences of wash sales, mark to market on certain futures contracts, amortization of bond premium, partnership basis adjustments, capital loss carryforwards and post October loss deferral.

To the extent the Fund's net realized capital gains, if any, can be offset by capital loss carryforwards, it is the policy of the Fund not to distribute such gains. As determined at December 31, 2008, the Fund had unused capital loss carryforwards available for federal income tax purposes to offset net realized capital gains, if any, as follows:

| | | Expiring in: | |

| | | | 2009 | | | | 2010 | | |

| | | $ | 2,806,578 | | | $ | 13,734,011 | | |

Under current tax law, the use of these losses to offset future gains may be limited in a given year.

During the year ended December 31, 2008, the Fund utilized capital loss carryforwards of $3,649,862.

Under current tax law, certain net capital and net foreign currency losses realized after October 31 within the taxable year may be deferred and treated as occurring on the first day of the following tax year. For the year ended December 31, 2008, the Fund elected to defer $368,556 of net capital losses arising between November 1, 2008 and December 31, 2008.

7 Distributions to shareholders: The Fund may earn income, net of expenses, daily on its investments. Distributions from net investment income and net realized capital gains, if any, generally are distributed in October. Income distributions and capital gain distributions to shareholders are recorded on the ex-date.

8 Foreign taxes: Foreign taxes withheld represent amounts withheld by foreign tax authorities, net of refunds recoverable.

9 Expense allocation: Certain expenses are applicable to multiple funds. Expenses directly attributable to a Series are charged to that Series. Expenses of the Trust that are not directly attributed to a Series are allocated among the Funds, on the basis of relative net assets, except where a more appropriate allocation of expenses to each of the Funds can otherwise be made fairly. Expenses borne by the complex of related investment companies, which includes open-end and closed-end investment companies for which Management serves as investment manager, that are not directly attributed to a Series or the Trust are allocated among the Fund and the other investment companies in the complex or series thereof on the basis of relative net assets, except where a more appropriate allocation of expenses to each investment company in the complex or series thereof can otherwise be made fairly.

10 Financial futures contracts: The Fund may buy and sell financial futures contracts to hedge against changes in securities prices resulting from changes in prevailing interest rates. At the time the Fund enters into a financial futures contract, it is required to deposit with the futures commission merchant a specified amount of cash or liquid securities, known as "initial margin," ranging upward from 1.1% of the value of the financial futures contract being traded. Each day, the futures contract is valued at the official settlement price of the board of trade or U.S. commodity exchange on which such futures contract is traded. Subsequent payments, known as "variation margin," to and from the broker are made on a daily basis as the market price of the financial futures contract fluctuates. Daily variation margin adjustments, arising from this "mark to market," are recorded by the Fund as unrealized gains or losses.

Although some financial futures contracts by their terms call for actual delivery or acceptance of financial instruments, in most cases the contracts are closed out prior to delivery by offsetting purchases or sales of matching

17

financial futures contracts. When the contracts are closed, the Fund recognizes a gain or loss. Risks of entering into futures contracts include the possibility there may be an illiquid market, possibly at a time of rapidly declining prices, and/or a change in the value of the contract may not correlate with changes in the value of the underlying securities.

For U.S. federal income tax purposes, the futures transactions undertaken by the Fund may cause the Fund to recognize gains or losses from marking contracts to market even though its positions have not been sold or terminated, may affect the character of the gains or losses recognized as long-term or short-term, and may affect the timing of some capital gains and losses realized by the Fund. Also, the Fund's losses on transactions involving futures contracts may be deferred rather than being taken into account currently in calculating the Fund's taxable income.

During the year ended December 31, 2008, the Fund entered into financial futures contracts. At December 31, 2008, open positions in financial futures contracts were:

| Expiration | | Open Contracts | | Position | | Unrealized

Appreciation | |

| March 2009 | | 9 U.S. Treasury Notes, 2 Year | | Long | | $ | 20,672 | | |

At December 31, 2008, the Fund had deposited $65,955 in Fannie Mae Whole Loan, 10.42%, due 1/2/09, to cover margin requirements on open financial futures contracts.

11 Security lending: A third party, eSecLending, has assisted the Fund in conducting a bidding process to identify agents/principals that would pay a guaranteed amount to the Fund in consideration of the Fund entering into an exclusive securities lending arrangement.

For part of the year, eSecLending served as exclusive lending agent for the Fund. The Fund was not guaranteed any particular level of income from the lending program.

12 Repurchase agreements: The Fund may enter into repurchase agreements with institutions that Management has determined are creditworthy. Each repurchase agreement is recorded at cost. The Fund requires that the securities purchased in a repurchase agreement be transferred to the custodian in a manner sufficient to enable the Fund to assert a perfected security interest in those securities in the event of a default under the repurchase agreement. The Fund monitors, on a daily basis, the value of the securities transferred to ensure that their value, including accrued interest, is greater than amounts owed to the Fund under each such repurchase agreement.

13 Transactions with other funds managed by Neuberger Berman Management LLC: Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund may invest in a money market fund managed by Management or an affiliate. The Fund invests in Neuberger Berman Prime Money Fund ("Prime Money"), as approved by the Board. Prime Money seeks to provide the highest available current income consistent with safety and liquidity. For any cash that the Fund invests in Prime Money, Management waives a portion of its management fee equal to the management fee it receives from Prime Money on those assets (the "Arrangement"). For the year ended December 31, 2008, management fees waived under this Arrangement amounted to $712 and are reflected in the Statement of Operations under the caption "Investment management fees waived." For the year ended December 31, 2008, income earned under this Arrangement amounted to $25,648 and is reflected in the Statement of Operations under the caption "Income from investments in affiliated issuers."

14 Dollar rolls: The Fund may enter into dollar roll transactions with respect to mortgage-backed securities. In a dollar roll transaction, the Fund sells securities for delivery in the current month and simultaneously agrees to repurchase substantially similar (i.e., same type and coupon) securities on a specified future date from the same party. During the period before the repurchase, the Fund foregoes principal and interest payments on the securities. The Fund is compensated by the difference between the current sales price and the forward price for the future purchase (often referred to as the "drop"), as well as by the interest earned on the cash proceeds of the initial sale. Dollar rolls may increase fluctuations in the Fund's net asset value and may be viewed as a form of leverage. There is a risk that the counter party will be unable or unwilling to complete the transaction as scheduled, which may result in losses to the Fund.

18

15 Indemnifications: Like many other companies, the Trust's organizational documents provide that its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, both in some of its principal service contracts and in the normal course of its business, the Trust enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Trust's maximum exposure under these arrangements is unknown as this could involve future claims against the Trust.

Note B--Management Fees, Administration Fees, Distribution Arrangements, and Other Transactions With Affiliates:

Fund shares are issued and redeemed in connection with investments in and payments under certain variable annuity contracts and variable life insurance policies issued through separate accounts of life insurance companies and are also offered directly to qualified pension and retirement plans.

The Fund retains Management as its investment manager under a Management Agreement. For such investment management services, the Fund pays Management a fee at the annual rate of 0.55% of the first $250 million of the Fund's average daily net assets, 0.525% of the next $250 million, 0.50% of the next $250 million, 0.475% of the next $250 million, 0.45% of the next $500 million, 0.425% of the next $2.5 billion, and 0.40% of average daily net assets in excess of $4 billion.

The Fund retains Management as its administrator under an Administration Agreement. The Fund pays Management an administration fee at the annual rate of 0.30% of its average daily net assets under this agreement. Additionally, Management retains State Street Bank and Trust Company ("State Street") as its sub-administrator under a Sub-Administration Agreement. Management pays State Street a fee for all services received under this agreement.

The Board adopted a non-fee distribution plan for the Fund.

Management has contractually undertaken through December 31, 2011 to forgo current payment of fees and/or reimburse the Fund for its operating expenses (excluding the fees payable to Management, interest, taxes, brokerage commissions, extraordinary expenses, and transaction costs) ("Operating Expenses") which exceed, in the aggregate, 1.00% per annum of the Fund's average daily net assets (the "Expense Limitation"). For the year ended December 31, 2008, no reimbursement to the Fund was required. The Fund has agreed to repay Management through December 31, 2014 for fees and expenses foregone and/or its excess Operating Expenses previously reimbursed by Management, so long as its annual Operating Expenses during that period do not exceed its Expense Limitation, and the repayment is made within three years after the year in which Management issued the reimbursement or waived fees. During the year ended December 31, 2008, there was no repayment to Management under this agreement. At December 31, 2008, the Fund had no contingent liability to Management under this agreement.

Neuberger is retained by Management to furnish it with investment recommendations and research information without added cost to the Fund. Several individuals who are officers and/or trustees of the Trust are also employees of Neuberger and/or Management.

The Fund had entered into a commission recapture program, which enabled it to pay some of its operational expenses by recouping a portion of the commissions it paid to a broker that was not a related party of the Fund. Pursuant to the agreement, brokers paid recaptured commissions to the Fund's custodian and the custodian directed these amounts toward payment of expenses such as custodial, transfer agency or accounting services. Effective April 1, 2008, this commission recapture program was terminated. For the period ended March 31, 2008, the impact of this arrangement was a reduction of expenses of $2,073.

The Fund has an expense offset arrangement in connection with its custodian contract. For the year ended December 31, 2008, the impact of this arrangement was a reduction of expenses of $281.

19

Note C--Securities Transactions:

Cost of purchases and proceeds of sales and maturities of long-term securities (excluding short-term securities, financial futures contracts and foreign currency contracts) for the year ended December 31, 2008 were as follows:

Purchases of

U.S. Government

and Agency

Obligations | | Purchases excluding

U.S. Government

and Agency

Obligations | | Sales and Maturities

of U.S. Government

and Agency

Obligations | | Sales and Maturities

excluding

U.S. Government

and Agency

Obligations | |

| $ | 4,121,287 | | | $ | 23,735,176 | | | $ | 5,466,047 | | | $ | 65,600,335 | | |

During the year ended December 31, 2008, brokerage commissions on securities transactions paid to affiliated brokers were as follows: Neuberger received $0 and Lehman Brothers Inc. received $2,692.

Note D--Fund Share Transactions:

Share activity for the years ended December 31, 2008 and December 31, 2007 was as follows:

| | | For the Year Ended December 31, | |

| | | 2008 | | 2007 | |

| Shares Sold | | | 436,916 | | | | 632,711 | | |

| Shares Issued on Reinvestment of Dividends and Distributions | | | 99,828 | | | | 65,250 | | |

| Shares Redeemed | | | (4,480,615 | ) | | | (1,025,707 | ) | |

| Total | | | (3,943,871 | ) | | | (327,746 | ) | |

Note E--Line of Credit:

At December 31, 2008, the Fund was a participant in a single committed, unsecured $150,000,000 line of credit with State Street, to be used only for temporary or emergency purposes. Other investment companies managed by Management also participate in this line of credit on the same terms. Interest is charged on borrowings under this line of credit at the overnight Federal Funds Rate plus 0.50% per annum. A facility fee of 0.07% (as of September 19, 2008, 0.09%) per annum of the available line of credit is charged, of which the Fund has agreed to pay its pro rata share, based on the ratio of its individual net assets to the net assets of all participants at the time the fee is due and payable. The fee is paid quarterly in arrears. Because several investment companies participate, there is no assurance that an individual Fund will have access to all or any part of the $150,000,000 at any particular time. There were no loans outstanding pursuant to this line of credit at December 31, 2008. During the year ended December 31, 2008, the Fund did not utilize this line of credit.

Note F--Investments in Affiliates:

| Name of Issuer | | Balance of

Shares

Held

December 31,

2007 | | Gross

Purchases

and

Additions | | Gross

Sales

and

Reductions | | Balance of

Shares

Held

December 31,

2008 | | Value

December 31,

2008 | | Income from

Investments in

Affiliated

Issuers

Included in

Total Income | |

Neuberger Berman Prime

Money Fund Trust Class* | | | 1,561,262 | | | | 10,001,742 | | | | 11,249,683 | | | | 313,321 | | | $ | 313,321 | | | $ | 25,648 | | |

* Prime Money is also managed by Management and may be considered an affiliate since it has the same officers, Board members, and investment manager as the Fund and because, at times, the Fund may own 5% or more of the outstanding voting securities of Prime Money.

20

Note G--Recent Accounting Pronouncement:

In March 2008, Statement of Financial Accounting Standards No. 161, "Disclosures about Derivative Instruments and Hedging Activities - an amendment of FASB Statement No. 133" ("FAS 161"), was issued. FAS 161 is intended to improve financial reporting for derivative instruments by requiring enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity's results of operations and financial position. In September 2008, FASB Staff Position No. 133-1 and FASB Interpretation No. 45-4 (the "FSP"), "Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date of FASB Statement No. 161" was issued. Certain provisions of the FSP amend FASB Statement No. 133, "Accounting for Derivative Instruments and Hedging Activities," to require disclosures by sellers of credit derivatives, including credit derivatives embedded in hybrid instruments. These FSP provisions are effective for fiscal years and interim periods ending after November 15, 2008. At this time, Management has assessed the implication of these FSP provisions and determined there is no impact to the Fund's financial statements. The FSP also clarifies the effective date of FAS 161, whereby disclosures required by FAS 161 are effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The impact of FAS 161 on the Fund's financial statement disclosures, if any, is currently being assessed.

Note H--Recent Market Events:

The year covered by this report witnessed an unusually high degree of volatility in the financial markets and the net asset values of many mutual funds, including to some extent the Fund. Both domestic and international equity markets have been experiencing heightened volatility and turmoil, with issuers that have exposure to the real estate, mortgage and credit markets particularly affected. In addition to the recent turbulence in financial markets, the reduced liquidity in credit and fixed income markets has negatively affected many issuers worldwide. The Fund's investments in certain issuers, as reflected in the Fund's schedule of investments, and the financial markets in general, expose investors to the volatile performance resulting from these market conditions and related events.

21

Financial Highlights

Balanced Portfolio

The following table includes selected data for a share outstanding throughout each year and other performance information derived from the Financial Statements.

| | | Year Ended December 31, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| Net Asset Value, Beginning of Year | | $ | 13.08 | | | $ | 11.44 | | | $ | 10.42 | | | $ | 9.64 | | | $ | 8.93 | | |

| Income From Investment Operations: | |

| Net Investment Income (Loss)t | | | .09 | | | | .12 | | | | .11 | | | | .04 | | | | .05 | | |

Net Gains or Losses on Securities

(both realized and unrealized) | | | (5.17 | ) | | | 1.67 | | | | 1.00 | | | | .84 | | | | .77 | | |

| Total From Investment Operations | | | (5.08 | ) | | | 1.79 | | | | 1.11 | | | | .88 | | | | .82 | | |

| Less Distributions From: | |

| Net Investment Income | | | (.42 | ) | | | (.15 | ) | | | (.09 | ) | | | (.10 | ) | | | (.11 | ) | |

| Net Asset Value, End of Year | | $ | 7.58 | | | $ | 13.08 | | | $ | 11.44 | | | $ | 10.42 | | | $ | 9.64 | | |

| Total Returntt | | | (39.15 | )% | | | 15.60 | % | | | 10.67 | % | | | 9.18 | % | | | 9.31 | % | |

| Ratios/Supplemental Data | |

| Net Assets, End of Year (in millions) | | $ | 15.5 | | | $ | 78.4 | | | $ | 72.3 | | | $ | 73.7 | | | $ | 81.1 | | |

| Ratio of Gross Expenses to Average Net Assets# | | | 1.29 | % | | | 1.16 | % | | | 1.19 | % | | | 1.14 | % | | | 1.10 | % | |

| Ratio of Net Expenses to Average Net AssetsS | | | 1.29 | % | | | 1.16 | % | | | 1.18 | % | | | 1.13 | % | | | 1.09 | % | |

Ratio of Net Investment Income (Loss) to Average

Net Assets | | | .81 | % | | | 1.00 | % | | | 1.01 | % | | | .41 | % | | | .56 | % | |

| Portfolio Turnover Rate | | | 57 | % | | | 54 | % | | | 62 | % | | | 82 | % | | | 110 | % | |

See Notes to Financial Highlights 22

Notes to Financial Highlights Balanced Portfolio

tt Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period and assumes dividends and other distributions, if any, were reinvested. Results represent past performance and do not guarantee future results. Current returns may be lower or higher than the performance data quoted. Investment returns and principal may fluctuate and shares when redeemed may be worth more or less than original cost. Total return would have been lower if Management had not waived certain expenses. The total return information shown does not reflect charges and other expenses that apply to the separate account or the related insurance policies, and the inclusion of these charges and other expenses would reduce the total return for all fiscal periods shown. For the year ended December 31, 2006, Management reimbursed the Fund for losses incurred in connection with the disposition of foreign currency contracts, which had no impact on total return.

# The Fund is required to calculate an expense ratio without taking into consideration any expense reductions related to expense offset arrangements.

t Calculated based on the average number of shares outstanding during each fiscal period.

S After waiver of a portion of the investment management fee by Management. Had Management not undertaken such action, the annualized ratios of net expenses to average daily net assets would have been:

| | | Year Ended December 31, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | 1.29 | % | | | 1.16 | % | | | 1.18 | % | | | 1.13 | % | | | 1.09 | % | |

23

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of

Neuberger Berman Advisers Management Trust and

Shareholders of Balanced Portfolio

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Balanced Portfolio, one of the series constituting Neuberger Berman Advisers Management Trust (the "Trust"), as of December 31, 2008, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.