UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-3940 |

| |

| Strategic Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 11/30 | |

Date of reporting period: | 11/30/13 | |

| | | | | | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for these series, as appropriate.

International Stock Fund

Global Stock Fund

Dreyfus U.S. Equity Fund

Dreyfus Select Managers Small Cap Value Fund

FORM N-CSR

Item 1. Reports to Stockholders.

ANNUAL REPORT November 30, 2013

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

|

| Not FDIC-Insured • Not Bank-Guaranteed • May LoseValue |

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | UnderstandingYour Fund’s Expenses |

| 8 | ComparingYour Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 13 | Statement of Assets and Liabilities |

| 14 | Statement of Operations |

| 15 | Statement of Changes in Net Assets |

| 17 | Financial Highlights |

| 21 | Notes to Financial Statements |

| 33 | Report of Independent Registered Public Accounting Firm |

| 34 | Important Tax Information |

| 35 | Information About the Renewal of the Fund’s Management and Sub-Investment Advisory Agreements |

| 41 | Board Members Information |

| 44 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

International

Stock Fund

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for International Stock Fund, covering the 12-month period from December 1, 2012, through November 30, 2013. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Improving global economic conditions drove developed stock markets higher over much of the reporting period. Europe appeared to put the worst of its sovereign debt and banking crises behind it, and Japan embarked on a new economic course designed to reflate its long-stagnant domestic economy. However, the world’s emerging markets struggled with the effects of local economic slowdowns. As a result, equity market returns varied widely from one country to another over the past 12 months.

We currently expect global economic conditions to continue to improve in 2014, with stronger growth in many developed countries fueled by past and continuing monetary ease. The emerging markets seem poised for more moderate economic expansion. In the United States, we anticipate accelerating growth supported by the fading drags of tighter federal fiscal policies and downsizing on the state and local levels. For more information on how these observations may affect your investments, we encourage you to speak with your financial advisor.

Thank you for your continued confidence and support.

J. Charles Cardona

President

The Dreyfus Corporation

December 16, 2013

2

DISCUSSION OF FUND PERFORMANCE

For the reporting period of December 1, 2012, through November 30, 2013, as provided by Charlie Macquaker and Roy Leckie of Walter Scott & Partners Limited (Walter Scott), Sub-investment adviser

Fund and Market Performance Overview

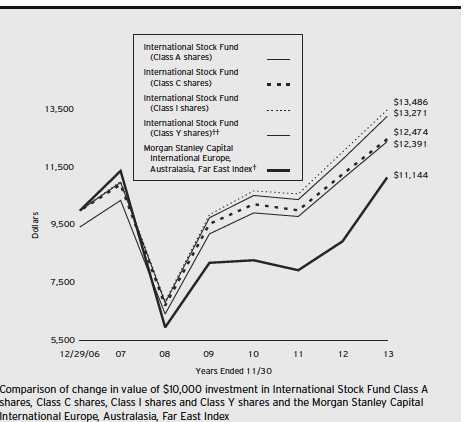

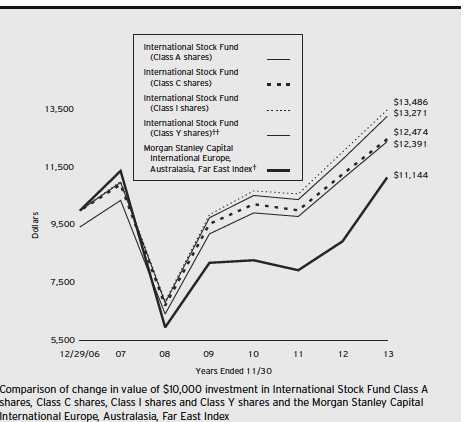

For the 12-month period ended November 30, 2013, International Stock Fund’s Class A shares achieved a return of 11.65%, Class C shares returned 10.78% and Class I shares returned 12.13%.1 In comparison, the fund’s benchmark index, the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “MSCI EAFE Index”), achieved an 24.84% return over the same period.2 The fund’s Class Y shares produced a total return of 8.49% for the period since their inception of July 1, 2013, through November 30, 2013.

Stocks throughout the developed world responded positively to a recovering global economy during the reporting period. The fund’s returns lagged its benchmark, mainly due to its focus on what we determine to be high-quality growth companies at a time when more speculative value-oriented stocks fared better.

The Fund’s Investment Approach

The fund seeks long-term real return by investing in high-quality companies believed to be capable of sustainable growth and wealth creation over a long time horizon.The fund invests in stocks of foreign companies that are predominantly located in the world’s developed markets outside of the United States.When selecting stocks,Walter Scott seeks companies with fundamental strengths that indicate the potential for sustainable growth.The firm focuses on individual stock selection through extensive fundamental research. Candidates are initially selected for research if they meet certain broad absolute and trend criteria. Financial statements are analyzed in an effort to identify the nature of their cash generation and to understand the variables that could add value to their businesses. Companies meeting the financial criteria are subjected to a detailed investigation of products, costs and pricing, competition, industry position, and outlook.

DISCUSSION OF FUND PERFORMANCE (continued)

Recovering Global Economy Fueled Markets’ Gains

International stocks rallied over the reporting period in response to aggressively accommodative monetary policies adopted by many central banks, which produced ample liquidity in financial markets. With bonds considered relatively unattractive due to rising long-term interest rates, investors flocked to equities to put their capital to work. Consequently, stock prices climbed sharply in most developed markets.

Europe seemed to put the worst of its financial crisis behind it, as evidenced by the end of a regional recession and rebounding stock prices in previously hard hit nations. Japan’s stock market was lifted by stimulative fiscal and monetary policies from a new government seeking to end years of economic stagnation. While the United States is not part of the MSCI EAFE Index, it led the global economic recovery as domestic growth was supported by employment gains and rebounding housing markets. In contrast, many emerging markets struggled with economic slowdowns during the reporting period.

Quality Bias Dampened Relative Performance

The fund’s relatively conservative investment approach tends to outperform market averages during downturns but typically lags during rallies.The reporting period was no exception, as industry leaders with histories of consistent growth generally fell out of favor among investors seeking more speculative opportunities. For example, in Japan, the fund maintained its emphasis on multinational companies with leadership positions in key export markets, but investors generally favored domestically focused companies that could benefit from newly stimulative fiscal and monetary policies. In Europe, the fund’s positions in global leaders in core nations trailed their lower quality counterparts in peripheral countries, where stocks rebounded from depressed levels.

Some of the fund’s greatest laggards for the reporting period were domiciled in Japan. Electronics producer Canon encountered competitive pressures in its cameras and printers segments, and energy producer INPEX was hurt by a weakening yen and sluggish demand from nearby emerging markets. In Australia, soft drinks bottler Coca-Cola Amatil encountered intensifying competitive pressures, while medical equipment maker Cochlear saw auditory implant procedures temporarily postponed in anticipation of a new product. In the emerging markets, China Shenhua Energy struggled amid an international glut of coal.

4

The fund achieved better results from Japanese auto parts maker Denso, which prospered in an environment of rising global car and truck sales.Also in Japan, real estate manager Mitsubishi Estate benefited from government efforts to reflate the domestic economy, and electronic equipment manufacturer Keyence proved well positioned for the global trend toward factory automation. Swiss pharmaceutical developer Roche Holding gained value when it more firmly established itself as a leader in oncology, and German apparel maker Adidas raised prices and profit margins.

High Confidence in Portfolio Holdings

Although we at Walter Scott remain more skeptical than the consensus view regarding the sustainability of economic recoveries in Japan and Europe, we have continued to identify opportunities among industry leaders that, in our analysis, are poised to benefit from positive secular trends.As of the reporting period’s end, we have found a number of companies meeting our investment criteria in the energy, consumer staples, consumer discretionary, and health care sectors, but relatively few in the financials, industrials, telecommunications services, and materials sectors. From a regional perspective, the fund held overweighted exposure to the emerging markets,Asia/Pacific markets, and Canada, and underweighted positions in Europe, the United Kingdom, and Japan.

December 16, 2013

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period. Equity funds are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic and social instability, a lack of comprehensive company information, differing auditing and legal standards and less market liquidity.

|

| 1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the |

| maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed |

| on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past |

| performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| fund shares may be worth more or less than their original cost. |

| 2 SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital gain |

| distributions.The Morgan Stanley Capital International Europe,Australasia, Far East (MSCI EAFE) Index is an |

| unmanaged index composed of a sample of companies representative of the market structure of European and Pacific |

| Basin countries. Returns are calculated on a month-end basis. Investors cannot invest directly in any index. |

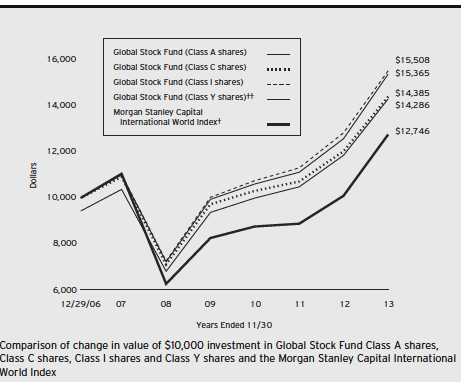

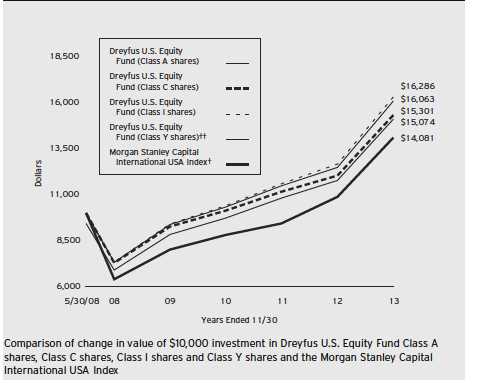

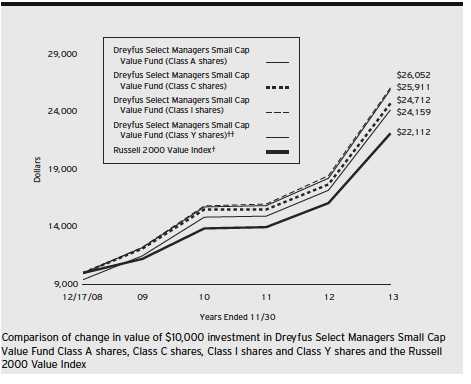

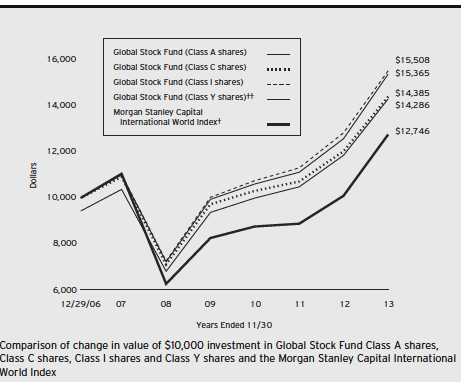

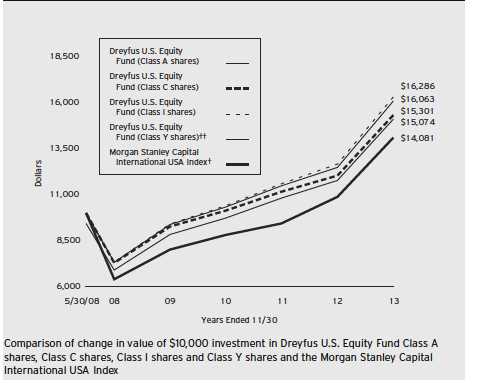

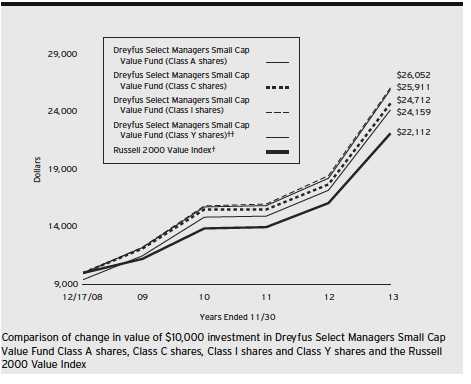

FUND PERFORMANCE

| |

| † | Source: Lipper Inc. |

| †† | The total return figures presented for ClassY shares of the fund reflect the performance of the fund’s Class A shares |

| | for the period prior to 7/1/13 (the inception date for ClassY shares). |

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and ClassY shares of International Stock Fund on 12/29/06 (inception date) to a $10,000 investment made in the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested.

On April 29, 2013, the Board authorized the fund to offer ClassY shares, as a new class of shares, to certain investors, including certain institutional investors. On July 1, 2013, ClassY shares were offered at net asset value and are not subject to certain fees, including Distribution Plan and Shareholder Services Plan fees.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is an unmanaged, market capitalization weighted index that is designed to measure the performance of publicly traded stocks issued by companies in developed markets excluding the U.S. and Canada. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | |

| Average Annual Total Returns as of 11/30/13 | | | | | | |

| |

| | Inception | | | | | From | |

| | Date | 1 Year | | 5 Years | | Inception | |

| Class A shares | | | | | | | |

| with maximum sales charge (5.75%) | 12/29/06 | 5.24 | % | 12.77 | % | 3.15 | % |

| without sales charge | 12/29/06 | 11.65 | % | 14.10 | % | 4.03 | % |

| Class C shares | | | | | | | |

| with applicable redemption charge † | 12/29/06 | 9.78 | % | 13.25 | % | 3.25 | % |

| without redemption | 12/29/06 | 10.78 | % | 13.25 | % | 3.25 | % |

| Class I shares | 12/29/06 | 12.13 | % | 14.52 | % | 4.42 | % |

| Class Y shares | 7/1/13 | 12.72 | %†† | 14.32 | %†† | 4.17 | %†† |

| Morgan Stanley Capital | | | | | | | |

| International Europe, | | | | | | | |

| Australasia, Far East Index | 12/31/06 | 24.84 | % | 13.42 | % | 1.58 | % |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| |

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | date of purchase. |

| †† | The total return performance figures presented for ClassY shares of the fund reflect the performance of the fund’s |

| | Class A shares for the period prior to 7/1/13 (the inception date for ClassY shares). |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in International Stock Fund from June 1, 2013 to November 30, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended November 30, 2013†

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Y |

| Expenses paid per $1,000†† | $ | 6.67 | $ | 10.53 | $ | 4.76 | $ | 3.95 |

| Ending value (after expenses) | $ | 1,062.80 | $ | 1,058.30 | $ | 1,065.00 | $ | 1,084.90 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended November 30, 2013

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Y |

| Expenses paid per $1,000†††† | $ | 6.53 | $ | 10.30 | $ | 4.66 | $ | 4.61 |

| Ending value (after expenses) | $ | 1,018.60 | $ | 1,014.84 | $ | 1,020.46 | $ | 1,020.51 |

| |

| † | From July 1, 2013 (commencement of initial offering) to November 30, 2013 for ClassY shares. |

| †† | Expenses are equal to the fund’s annualized expense ratio of 1.29% for Class A, 2.04% for Class C and .92% |

| | for Class I, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half |

| | year period). Expenses are equal to the fund’s annualized expense ratio of .91% for ClassY, multiplied by the average |

| | account value over the period, multiplied by 152/365 (to reflect the actual days in the period). |

| ††† | Please note that while ClassY shares commenced operations on July 1, 2013, the hypothetical expenses paid during |

| | the period reflect projected activity for the full six month period for purposes of comparability.This projection assumes |

| | that annualized expense ratios were in effect during the period June 1, 2013 to November 30, 2013. |

| †††† Expenses are equal to the fund’s annualized expense ratio of 1.29% for Class A, 2.04% for Class C, .92% for |

| | Class I and .91% for Class Y, multiplied by the average account value over the period, multiplied by 183/365 (to |

| | reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

November 30, 2013

| | |

| Common Stocks—96.9% | Shares | Value ($) |

| Australia—8.0% | | |

| Coca-Cola Amatil | 4,763,000 | 52,416,411 |

| Cochlear | 356,600 | 18,982,312 |

| CSL | 1,019,000 | 63,750,109 |

| Woodside Petroleum | 1,692,000 | 57,601,310 |

| Woolworths | 2,180,100 | 66,855,606 |

| | | 259,605,748 |

| Belgium—1.5% | | |

| Colruyt | 849,000 | 47,875,506 |

| Brazil—1.5% | | |

| Petroleo Brasileiro, ADR | 2,917,800 | 48,260,412 |

| Canada—2.1% | | |

| Suncor Energy | 1,982,200 | 67,941,955 |

| China—3.2% | | |

| China Shenhua Energy, Cl. H | 10,513,000 | 35,664,639 |

| CNOOC | 33,191,000 | 67,987,060 |

| | | 103,651,699 |

| Denmark—2.0% | | |

| Novo Nordisk, Cl. B | 368,000 | 65,928,557 |

| Finland—.9% | | |

| Kone, Cl. B | 318,000 | 29,231,595 |

| France—7.3% | | |

| Air Liquide | 450,100 | 62,750,034 |

| Danone | 815,000 | 59,225,208 |

| Essilor International | 507,576 | 53,251,546 |

| L’Oreal | 366,700 | 61,362,482 |

| | | 236,589,270 |

| Germany—4.3% | | |

| Adidas | 603,300 | 73,385,624 |

| SAP | 791,000 | 65,510,028 |

| | | 138,895,652 |

STATEMENT OF INVESTMENTS (continued)

| | |

| Common Stocks (continued) | Shares | Value ($) |

| Hong Kong—8.4% | | |

| AIA Group | 13,518,200 | 68,527,808 |

| China Mobile | 5,678,500 | 61,161,134 |

| CLP Holdings | 6,249,000 | 51,224,945 |

| Hang Lung Properties | 8,857,000 | 29,761,156 |

| Hong Kong & China Gas | 25,634,026 | 60,443,337 |

| | | 271,118,380 |

| Italy—.5% | | |

| Tenaris, ADR | 388,800 | 17,422,128 |

| Japan—19.5% | | |

| AEON Mall | 953,590 | 27,412,978 |

| Chugai Pharmaceutical | 628,000 | 14,988,140 |

| Daito Trust Construction | 644,500 | 61,150,276 |

| Denso | 1,270,300 | 63,611,099 |

| FANUC | 409,400 | 68,896,051 |

| Honda Motor | 1,597,100 | 67,503,958 |

| INPEX | 5,600,000 | 64,940,212 |

| Keyence | 98,520 | 39,573,410 |

| Komatsu | 2,912,300 | 60,523,078 |

| Mitsubishi Estate | 1,066,000 | 29,593,479 |

| Shimamura | 204,300 | 20,959,471 |

| Shin-Etsu Chemical | 971,500 | 56,140,173 |

| Tokio Marine Holdings | 1,759,700 | 58,401,874 |

| | | 633,694,199 |

| Singapore—1.9% | | |

| DBS Group Holdings | 2,401,226 | 32,874,896 |

| Oversea-Chinese Banking | 3,539,061 | 29,443,995 |

| | | 62,318,891 |

10

| | |

| Common Stocks (continued) | Shares | Value ($) |

| Spain—2.3% | | |

| Inditex | 477,000 | 76,060,480 |

| Sweden—2.2% | | |

| Hennes & Mauritz, Cl. B | 1,718,000 | 72,812,702 |

| Switzerland—9.7% | | |

| Nestle | 879,000 | 64,198,808 |

| Novartis | 839,000 | 66,322,098 |

| Roche Holding | 238,400 | 66,464,784 |

| SGS | 11,090 | 24,996,547 |

| Swatch Group-BR | 52,100 | 34,143,204 |

| Syngenta | 153,000 | 60,092,674 |

| | | 316,218,115 |

| Taiwan—2.0% | | |

| Taiwan Semiconductor Manufacturing, ADR | 3,648,400 | 64,686,132 |

| United Kingdom—19.6% | | |

| BG Group | 3,575,000 | 73,034,992 |

| Burberry Group | 2,506,000 | 62,616,170 |

| Centrica | 9,895,000 | 54,775,228 |

| Compass Group | 4,369,900 | 65,856,330 |

| HSBC Holdings | 5,347,000 | 59,661,926 |

| Reckitt Benckiser Group | 895,900 | 71,964,608 |

| SABMiller | 1,185,000 | 61,137,646 |

| Smith & Nephew | 4,995,000 | 66,653,944 |

| Standard Chartered | 2,544,000 | 60,297,874 |

| Tesco | 10,811,000 | 61,552,983 |

| | | 637,551,701 |

| Total Common Stocks | | |

| (cost $2,632,848,695) | | 3,149,863,122 |

STATEMENT OF INVESTMENTS (continued)

| | | |

| Other Investment—2.9% | Shares | | Value ($) |

| Registered Investment Company; | | | |

| Dreyfus Institutional Preferred | | | |

| Plus Money Market Fund | | | |

| (cost $93,800,000) | 93,800,000 | a | 93,800,000 |

| |

| Total Investments (cost $2,726,648,695) | 99.8 | % | 3,243,663,122 |

| Cash and Receivables (Net) | .2 | % | 6,986,273 |

| Net Assets | 100.0 | % | 3,250,649,395 |

|

| ADR—American Depository Receipts |

| BR—Bearer Certificate |

| a Investment in affiliated money market mutual fund. |

12

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| | Value (%) | | Value (%) |

| Consumer Staples | 16.8 | Materials | 5.5 |

| Consumer Discretionary | 16.5 | Information Technology | 5.2 |

| Financial | 14.1 | Utilities | 5.1 |

| Energy | 13.3 | Money Market Investment | 2.9 |

| Health Care | 12.8 | Telecommunication Services | 1.9 |

| Industrial | 5.7 | | 99.8 |

|

| † Based on net assets. |

| See notes to financial statements. |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| November 30, 2013 |

| | | |

| | Cost | Value | |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments: | | | |

| Unaffiliated issuers | 2,632,848,695 | 3,149,863,122 | |

| Affiliated issuers | 93,800,000 | 93,800,000 | |

| Cash | | 1,327,629 | |

| Cash denominated in foreign currencies | 1,632,744 | 1,622,930 | |

| Dividends receivable | | 5,412,826 | |

| Receivable for shares of Common Stock subscribed | | 2,360,002 | |

| Prepaid expenses | | 133,929 | |

| | | 3,254,520,438 | |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 2,724,229 | |

| Payable for shares of Common Stock redeemed | | 749,714 | |

| Accrued expenses | | 397,100 | |

| | | 3,871,043 | |

| Net Assets ($) | | 3,250,649,395 | |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | 2,762,989,007 | |

| Accumulated undistributed investment income—net | | 36,794,406 | |

| Accumulated net realized gain (loss) on investments | | (66,179,326 | ) |

| Accumulated net unrealized appreciation (depreciation) | | | |

| on investments and foreign currency transactions | | 517,045,308 | |

| Net Assets ($) | | 3,250,649,395 | |

| | | | |

| Net Asset Value Per Share | | | | |

| | Class A | Class C | Class I | Class Y |

| Net Assets ($) | 284,574,952 | 35,904,790 | 2,930,168,568 | 1,085 |

| Shares Outstanding | 18,279,838 | 2,352,710 | 186,332,443 | 69 |

| Net Asset Value Per Share ($) | 15.57 | 15.26 | 15.73 | 15.72 |

| See notes to financial statements. | | | | |

|

| STATEMENT OF OPERATIONS |

| Year Ended November 30, 2013 |

| | |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $5,601,151 foreign taxes withheld at source): | | |

| Unaffiliated issuers | 69,759,988 | |

| Affiliated issuers | 68,608 | |

| Interest | 35,435 | |

| Total Income | 69,864,031 | |

| Expenses: | | |

| Management fee—Note 3(a) | 24,104,015 | |

| Shareholder servicing costs—Note 3(c) | 1,404,473 | |

| Custodian fees—Note 3(c) | 822,894 | |

| Registration fees | 260,014 | |

| Distribution fees—Note 3(b) | 243,922 | |

| Directors’ fees and expenses—Note 3(d) | 213,437 | |

| Professional fees | 169,286 | |

| Prospectus and shareholders’ reports | 97,950 | |

| Loan commitment fees—Note 2 | 27,924 | |

| Miscellaneous | 119,371 | |

| Total Expenses | 27,463,286 | |

| Less—reduction in fees due to earnings credits—Note 3(c) | (294 | ) |

| Net Expenses | 27,462,992 | |

| Investment Income—Net | 42,401,039 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments and foreign currency transactions | (1,708,326 | ) |

| Net realized gain (loss) on forward foreign currency exchange contracts | 1,680,989 | |

| Net Realized Gain (Loss) | (27,337 | ) |

| Net unrealized appreciation (depreciation) on | | |

| investments and foreign currency transactions | 260,328,361 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 260,301,024 | |

| Net Increase in Net Assets Resulting from Operations | 302,702,063 | |

| See notes to financial statements. | | |

14

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended November 30, | |

| | 2013 | a | 2012 | |

| Operations ($): | | | | |

| Investment income—net | 42,401,039 | | 32,588,010 | |

| Net realized gain (loss) on investments | (27,337 | ) | (26,607,763 | ) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 260,328,361 | | 229,692,690 | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 302,702,063 | | 235,672,937 | |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A | (2,453,861 | ) | (1,727,130 | ) |

| Class C | (156,624 | ) | (33,444 | ) |

| Class I | (32,893,538 | ) | (14,304,931 | ) |

| Total Dividends | (35,504,023 | ) | (16,065,505 | ) |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A | 147,162,705 | | 69,431,573 | |

| Class C | 13,865,416 | | 6,334,328 | |

| Class I | 1,149,860,399 | | 952,851,615 | |

| Class Y | 1,000 | | — | |

| Dividends reinvested: | | | | |

| Class A | 2,370,457 | | 1,702,274 | |

| Class C | 110,933 | | 23,020 | |

| Class I | 22,258,109 | | 7,414,889 | |

| Cost of shares redeemed: | | | | |

| Class A | (62,177,277 | ) | (108,468,076 | ) |

| Class C | (4,965,563 | ) | (8,328,062 | ) |

| Class I | (418,895,968 | ) | (338,580,321 | ) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | 849,590,211 | | 582,381,240 | |

| Total Increase (Decrease) in Net Assets | 1,116,788,251 | | 801,988,672 | |

| Net Assets ($): | | | | |

| Beginning of Period | 2,133,861,144 | | 1,331,872,472 | |

| End of Period | 3,250,649,395 | | 2,133,861,144 | |

| Undistributed investment income—net | 36,794,406 | | 29,866,773 | |

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | |

| | Year Ended November 30, | |

| | 2013 | a | 2012 | |

| Capital Share Transactions: | | | | |

| Class Ab | | | | |

| Shares sold | 9,880,843 | | 5,272,552 | |

| Shares issued for dividends reinvested | 164,615 | | 140,566 | |

| Shares redeemed | (4,140,282 | ) | (8,325,957 | ) |

| Net Increase (Decrease) in Shares Outstanding | 5,905,176 | | (2,912,839 | ) |

| Class Cb | | | | |

| Shares sold | 951,707 | | 485,056 | |

| Shares issued for dividends reinvested | 7,807 | | 1,923 | |

| Shares redeemed | (336,282 | ) | (648,380 | ) |

| Net Increase (Decrease) in Shares Outstanding | 623,232 | | (161,401 | ) |

| Class I | | | | |

| Shares sold | 77,060,413 | | 72,715,136 | |

| Shares issued for dividends reinvested | 1,535,042 | | 608,776 | |

| Shares redeemed | (27,918,325 | ) | (25,572,016 | ) |

| Net Increase (Decrease) in Shares Outstanding | 50,677,130 | | 47,751,896 | |

| Class Y | | | | |

| Shares sold | 69 | | — | |

|

| a Effective July 1, 2013, the fund commenced offering ClassY shares. |

| b During the period ended November 30, 2013, 6,275 Class C shares representing $95,883 were exchanged for |

| 6,174 Class A shares. |

See notes to financial statements.

16

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | Year Ended November 30, | | | |

| Class A Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 14.13 | | 12.58 | | 12.83 | | 11.97 | | 8.43 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .17 | | .21 | | .15 | | .09 | | .05 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.46 | | 1.46 | | (.31 | ) | .86 | | 3.58 | |

| Total from Investment Operations | 1.63 | | 1.67 | | (.16 | ) | .95 | | 3.63 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.19 | ) | (.12 | ) | (.09 | ) | (.09 | ) | (.09 | ) |

| Net asset value, end of period | 15.57 | | 14.13 | | 12.58 | | 12.83 | | 11.97 | |

| Total Return (%)b | 11.65 | | 13.40 | | (1.32 | ) | 7.99 | | 43.33 | |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.30 | | 1.31 | | 1.27 | | 1.34 | | 1.43 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.30 | | 1.31 | | 1.27 | | 1.34 | | 1.42 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 1.14 | | 1.62 | | 1.08 | | .69 | | .50 | |

| Portfolio Turnover Rate | 2.58 | | 5.47 | | 5.07 | | 5.91 | | 21.67 | |

| Net Assets, end of period ($ x 1,000) | 284,575 | | 174,825 | | 192,351 | | 124,347 | | 18,059 | |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | Year Ended November 30, | | | |

| Class C Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.86 | | 12.33 | | 12.64 | | 11.83 | | 8.32 | |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—neta | .06 | | .12 | | .04 | | (.02 | ) | (.01 | ) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.43 | | 1.43 | | (.30 | ) | .87 | | 3.53 | |

| Total from Investment Operations | 1.49 | | 1.55 | | (.26 | ) | .85 | | 3.52 | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.09 | ) | (.02 | ) | (.05 | ) | (.04 | ) | (.01 | ) |

| Net asset value, end of period | 15.26 | | 13.86 | | 12.33 | | 12.64 | | 11.83 | |

| Total Return (%)b | 10.78 | | 12.58 | | (2.08 | ) | 7.18 | | 42.31 | |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 2.04 | | 2.06 | | 2.05 | | 2.13 | | 2.25 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 2.04 | | 2.06 | | 2.05 | | 2.13 | | 2.22 | |

| Ratio of net investment income (loss) | | | | | | | | | | |

| to average net assets | .42 | | .90 | | .33 | | (.12 | ) | (.13 | ) |

| Portfolio Turnover Rate | 2.58 | | 5.47 | | 5.07 | | 5.91 | | 21.67 | |

| Net Assets, end of period ($ x 1,000) | 35,905 | | 23,962 | | 23,319 | | 13,959 | | 1,224 | |

| |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

18

| | | | | | | | | | |

| | | | | | Year Ended November 30, | | | |

| Class I Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, | | | | | | | | | | |

| beginning of period | 14.26 | | 12.70 | | 12.93 | | 12.04 | | 8.47 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .23 | | .26 | | .19 | | .14 | | .12 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.48 | | 1.46 | | (.31 | ) | .86 | | 3.57 | |

| Total from Investment Operations | 1.71 | | 1.72 | | (.12 | ) | 1.00 | | 3.69 | |

| Distributions: | | | | | | | | | | |

| Dividends from | | | | | | | | | | |

| investment income—net | (.24 | ) | (.16 | ) | (.11 | ) | (.11 | ) | (.12 | ) |

| Net asset value, end of period | 15.73 | | 14.26 | | 12.70 | | 12.93 | | 12.04 | |

| Total Return (%) | 12.13 | | 13.74 | | (1.01 | ) | 8.38 | | 43.98 | |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .92 | | .93 | | .93 | | .97 | | 1.01 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .92 | | .93 | | .93 | | .97 | | 1.01 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 1.54 | | 1.96 | | 1.41 | | 1.11 | | 1.18 | |

| Portfolio Turnover Rate | 2.58 | | 5.47 | | 5.07 | | 5.91 | | 21.67 | |

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | 2,930,169 | | 1,935,074 | | 1,116,202 | | 688,992 | | 339,535 | |

| |

| a Based on average shares outstanding at each month end. | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

FINANCIAL HIGHLIGHTS (continued)

| |

| | Period Ended |

| Class Y Shares | November 30, 2013a |

| Per Share Data ($): | |

| Net asset value, beginning of period | 14.49 |

| Investment Operations: | |

| Investment income—netb | .06 |

| Net realized and unrealized gain (loss) on investments | 1.17 |

| Total from Investment Operations | 1.23 |

| Net asset value, end of period | 15.72 |

| Total Return (%)c | 8.49 |

| Ratios/Supplemental Data (%): | |

| Ratio of total expenses to average net assetsd | .91 |

| Ratio of net expenses to average net assetsd | .91 |

| Ratio of net investment income to average net assetsd | .93 |

| Portfolio Turnover Rate | 2.58 |

| Net Assets, end of period ($ x 1,000) | 1 |

| |

| a | From July 1, 2013 (commencement of initial offering) to November 30, 2013. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

International Stock Fund (the “fund”) is a separate diversified series of Strategic Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering nine series, including the fund.The fund’s investment objective seeks long-term total return. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Walter Scott & Partners Limited (“Walter Scott”), a subsidiary of BNY Mellon and an affiliate of Dreyfus, serves as the fund’s sub-investment adviser.

At a meeting held on April 29, 2013, the Company’s Board of Directors (the “Board”) approved, effective July 1, 2013: (a) for the fund to offer Class Y shares; and, (b) an increase in the authorized shares of the fund from 400 million to 500 million and authorized 100 million Class Y shares. The Board also approved, effective July 29, 2013, an increase in the authorized shares of the fund from 500 million to 600 million and to increase Class I shares from 200 million to 300 million.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares.The fund is authorized to issue 600 million shares of $.001 par value Common Stock.The fund currently offers four classes of shares: Class A (100 million shares authorized), Class C (100 million shares authorized), Class I (300 million shares authorized) and Class Y (100 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) on Class C shares redeemed within one year of purchase. Class I and ClassY shares are offered at net asset value generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights.

NOTES TO FINANCIAL STATEMENTS (continued)

Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of November 30, 2013, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held all of the outstanding Class Y shares of the fund.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

22

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered invest-

NOTES TO FINANCIAL STATEMENTS (continued)

ment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are categorized within Level 1 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

24

The following is a summary of the inputs used as of November 30, 2013 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Foreign | | | | |

| Common | | | | |

| Stocks† | 3,149,863,122 | — | — | 3,149,863,122 |

| Mutual Funds | 93,800,000 | — | — | 93,800,000 |

| |

| † See Statement of Investments for additional detailed categorizations. | |

At November 30, 2013, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended November 30, 2013 were as follows:

| | | | | |

| Affiliated | | | | | |

| Investment | Value ($) | | | Value | Net |

| Company | 11/30/2012 | Purchases ($) | Sales ($) | 11/30/2013 ($) | Assets (%) |

| Dreyfus | | | | | |

| Institutional | | | | | |

| Preferred | | | | | |

| Plus Money | | | | | |

| Market | | | | | |

| Fund | 47,720,000 | 850,450,000 | 804,370,000 | 93,800,000 | 2.9 |

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S.These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain dis-

26

tributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended November 30, 2013, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended November 30, 2013, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended November 30, 2013 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At November 30, 2013, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $46,743,520, accumulated capital losses $63,676,108 and unrealized appreciation $504,592,976.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute.The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”).As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

NOTES TO FINANCIAL STATEMENTS (continued)

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to November 30, 2013. If not applied, $598,805 of the carryover expires in fiscal year 2016, $15,114,500 expires in fiscal year 2017 and $16,297,830 expires in fiscal year 2019. The fund has $5,721,194 of post-enactment short-term capital losses and $25,943,779 of post-enactment long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended November 30, 2013 and November 30, 2012 were as follows: ordinary income $35,504,023 and $16,065,505, respectively.

During the period ended November 30, 2013, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, the fund increased accumulated undistributed investment income-net by $30,617 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

(h) Accounting Pronouncement: In January 2013, FASB issued Accounting Standards Update No. 2013-01 (“ASU 2013-01”), “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities”, which replaced Accounting Standards Update No. 2011-11 (“ASU 2011-11”), “Disclosures about Offsetting Assets and Liabilities”. ASU 2013-01 is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods.ASU 2011-11 was intended to enhance disclosure requirements on the offsetting of financial assets and liabilities.ASU 2013-01 limits the scope of the new balance sheet offsetting disclosures to derivatives, repurchase agreements, and securities lending transactions to the extent that they are (1) offset in the financial statements or (2) subject to enforceable master netting arrangements (“MNA”) or similar agreements. Management is currently evaluating the application of ASU 2013-01 and its impact on the fund’s financial statements.

28

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $265 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 9, 2013, the unsecured credit facility with Citibank, N.A. was $210 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended November 30, 2013, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at the annual rate of .85% of the value of the fund’s average daily net assets and is payable monthly.

Pursuant to a sub-investment advisory agreement between Dreyfus and Walter Scott, Dreyfus pays Walter Scott a monthly fee at an annual percentage of the value of the fund’s average daily net assets.

During the period ended November 30, 2013, the Distributor retained $15,844 from commissions earned on sales of the fund’s Class A shares and $5,646 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended November 30, 2013, Class C shares were charged $243,922, pursuant to the Distribution Plan.

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended November 30, 2013, Class A and Class C shares were charged $604,029 and $81,307, respectively, pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates DreyfusTransfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended November 30, 2013, the fund was charged $67,590 for transfer agency services and $2,166 for cash management services.These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $291.

The fund compensates The Bank of NewYork Mellon under a custody agreement for providing custodial services for the fund.These fees are determined based on net assets, geographic region and transaction activity. During the period ended November 30, 2013, the fund was charged $822,894 pursuant to the custody agreement.

30

The fund compensated The Bank of New York Mellon under a cash management agreement that was in effect until September 30, 2013 for performing certain cash management services related to fund subscriptions and redemptions. During the period ended November 30, 2013, the fund was charged $1,071 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $3.

During the period ended November 30, 2013, the fund was charged $9,055 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $2,256,243, Distribution Plan fees $22,091, Shareholder Services Plan fees $65,630, custodian fees $355,080, Chief Compliance Officer fees $3,833 and transfer agency fees $21,352.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended November 30, 2013, amounted to $881,721,875 and $70,224,287, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended November 30, 2013 is discussed below.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle

NOTES TO FINANCIAL STATEMENTS (continued)

foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments.The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is generally limited to the unrealized gain on each open contract. At November 30, 2013, there were no forward contracts outstanding.

The following summarizes the average market value of derivatives outstanding during the period ended November 30, 2013:

| |

| | Average Market Value ($) |

| Forward contracts | 10,572,723 |

At November 30, 2013, the cost of investments for federal income tax purposes was $2,739,101,027; accordingly, accumulated net unrealized appreciation on investments was $504,562,095, consisting of $586,893,219 gross unrealized appreciation and $82,331,124 gross unrealized depreciation.

32

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

International Stock Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of International Stock Fund (one of the series comprising Strategic Funds, Inc.) as of November 30, 2013, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2013 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of International Stock Fund at November 30, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

|

| NewYork, NewYork |

| January 27, 2014 |

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund elects to provide each shareholder with their portion of the fund’s foreign taxes paid and the income sourced from foreign countries. Accordingly, the fund hereby reports the following information regarding its fiscal year ended November 30, 2013:

—the total amount of taxes paid to foreign countries was $5,384,262

—the total amount of income sourced from foreign countries was $75,361,140.

Where required by federal tax law rules, shareholders will receive notification of their proportionate share of foreign taxes paid and foreign sourced income for the 2013 calendar year with Form 1099-DIV which will be mailed in early 2014.

For the fiscal year ended November 30, 2013, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $35,504,023 represents the maximum amount that may be considered qualified dividend income.

34

|

| INFORMATION ABOUT THE RENEWAL OF THE |

| FUND’S MANAGEMENT AND SUB-INVESTMENT |

| ADVISORY AGREEMENTS (Unaudited) |

At a meeting of the fund’s Board of Directors held on November 4-5, 2013, the Board considered the renewal of the fund’s Management Agreement, pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”), and the Sub-Investment Advisory Agreement (together, the “Agreements”), pursuant to which Walter Scott & Partners Limited (the “Sub-Adviser”) provides day-to-day management of the fund’s investments.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus and the Sub-Adviser. In considering the renewal of the Agreements, the Board considered all factors that it believed to be relevant, including those discussed below.The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to them at the meeting and in previous presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or Dreyfus) and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations,

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AND |

| SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited) (continued) |

including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board also considered Dreyfus’ extensive administrative, accounting, and compliance infrastructures, as well as Dreyfus’ supervisory activities over the Sub-Adviser.The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended September 30, 2013, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of the date of its analysis. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds.They also noted that performance generally should be considered over longer periods of time, although it is possible that long-term performance can be adversely affected by even one period of significant underperformance so that a single investment decision or theme has the ability to affect disproportionately long-term performance. The Board discussed the results of the comparisons and noted that the fund’s total return performance was below the Performance Group and Performance Universe medians for the one- and two- year periods and above the

36

Performance Group and Performance Universe medians for the three-, four- and five-year periods. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index and noted that the fund’s performance was above the returns of the benchmark in four of the five years.

The Board received a presentation from a representative of the Sub-Adviser describing the fund’s investment strategy and performance generally over the past two calendar years as well as the appeal to fund shareholders of the Sub-Adviser’s low beta and benchmark-agnostic investment approach, as reflected in the fund’s continuing net asset growth since inception. During this presentation, the Board noted how the Sub-Adviser’s benchmark-agnostic investment approach can be expected to result in periods of significant outperformance and underperformance from time to time.

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons.The Board noted that the fund’s contractual management fee was slightly below the Expense Group median, the fund’s actual management fee was at the Expense Group median and slightly above the Expense Universe median, and the fund’s total expenses were below the Expense Group and Expense Universe medians (lowest in the Expense Group).

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Sub-Adviser or its affiliates for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients.They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors.The

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AND |

| SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited) (continued) |

Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

The Board considered the fee to the Sub-Adviser in relation to the fee paid to Dreyfus by the fund and the respective services provided by the Sub-Adviser and Dreyfus.The Board also noted the Sub-Adviser’s fee is paid by Dreyfus (out of its fee from the fund) and not the fund.

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and the resulting profitability percentage for managing the fund and the aggregate profitability percentage to Dreyfus of managing the funds in the Dreyfus fund complex, and the method used to determine the expenses and profit. The Board concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus. The Board also had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board considered on the advice of its counsel the profitability analysis (1) as part of its evaluation of whether the fees under the Agreements bear a reasonable relationship to the mix of services provided by Dreyfus and the Sub-Adviser, including the nature, extent, and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Since Dreyfus, and not the fund, pays the Sub-Adviser pursuant to the Sub-Investment Advisory Agreement, the Board did not consider the Sub-Adviser’s profitability to be relevant to its deliberations. Dreyfus representatives also noted that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on

38

the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level.The Board also considered potential benefits to Dreyfus and the Sub-Adviser from acting as investment adviser and sub-investment adviser, respectively, and noted the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreements. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

The Board concluded that the nature, extent, and quality of the services provided by Dreyfus and the Sub-Adviser are adequate and appropriate.

The Board generally was satisfied with the fund’s overall performance, in light of the considerations described above.

The Board concluded that the fees paid to Dreyfus and the Sub- Adviser were reasonable in light of the considerations described above.

The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

In evaluating the Agreements, the Board considered these conclusions and determinations and also relied on its previous knowledge, gained through meetings and other interactions with Dreyfus and its affiliates and the Sub-Adviser, of the fund and the services provided to the fund by Dreyfus and the Sub-Adviser.The Board also relied on information received on a routine and regular basis throughout the year relating to

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AND |

| SUB-INVESTMENT ADVISORY AGREEMENTS (Unaudited) (continued) |

the operations of the fund and the investment management and other services provided under the Agreements, including information on the investment performance of the fund in comparison to similar mutual funds and benchmark performance indices; general market outlook as applicable to the fund; and compliance reports. In addition, the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of prior or similar agreements during which lengthy discussions took place between the Board and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the same or similar arrangements in prior years.The Board determined that renewal of the Agreements was in the best interests of the fund and its shareholders.

40

BOARD MEMBERS INFORMATION (Unaudited)

|

| Joseph S. DiMartino (70) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (1997-present) |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills |

| and paperboard converting plants, Director (2000-2010) |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director (2005-2009) |

| No. of Portfolios for which Board Member Serves: 141 |