UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-03942 |

|

LORD ABBETT MUNICIPAL INCOME FUND, INC. |

(Exact name of registrant as specified in charter) |

|

90 Hudson Street, Jersey City, NJ | | 07302 |

(Address of principal executive offices) | | (Zip code) |

|

Thomas R. Phillips, Esq., Vice President & Assistant Secretary 90 Hudson Street, Jersey City, NJ 07302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 201-6984 | |

|

Date of fiscal year end: | 9/30 | |

|

Date of reporting period: | 9/30/2008 | |

| | | | | | | | |

Item 1: | Report to Shareholders. |

2008

LORD ABBETT ANNUAL REPORT

Lord Abbett

Municipal Income Fund

Municipal Income Trust

National Tax Free Fund

California Tax Free Fund

Connecticut Tax Free Fund

Hawaii Tax Free Fund

Missouri Tax Free Fund

New Jersey Tax Free Fund

New York Tax Free Fund

Intermediate Tax Free Fund

Georgia Tax Free Trust

High Yield Municipal Bond Fund

Pennsylvania Tax Free Trust

For the fiscal year ended September 30, 2008

Lord Abbett Municipal Income Fund and

Lord Abbett Municipal Income Trust

Annual Report

For the fiscal year ended September 30, 2008

Dear Shareholders: We are pleased to provide you with this overview of the strategies and performance of Lord Abbett Municipal Income Fund and Lord Abbett Municipal Income Trust for the fiscal year ended September 30, 2008. On this page and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Funds please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries of the Funds' portfolio managers.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Q: What were the overall market conditions during the fiscal year ended September 30, 2008?

A: The fixed-income market experienced a severe downturn in liquidity late in the 12-month period ended September 30, 2008. As the value of subprime mortgages and related assets continued to fall, major financial institutions were forced to write down the value of their holdings of these securities. Institutional investors – traditionally a large source of liquidity in the municipal market – reduced their investments on the belief they would need resources to meet future obligations. This led to a severe lack of liquidity in the municipal bond market during the period.

As the crisis in the credit markets unfolded, investors sought the perceived safe haven of Treasury instruments, especially those with shorter maturities. This resulted in a steepening of the yield curve. Yields on municipal bonds with longer maturities rose, and the municipal bond yield curve steepened.

1

The Federal Reserve Board (the Fed) initiated several moves during the period. It began with repeated cuts in the fed funds target rate, and by the end of the period, it had cut that rate six times, from 4.75% to 2.00%.

Banks remained reluctant to lend to each other, so the Fed took additional steps. On December 12, 2007, the Fed implemented the Term Auction Facility to give commercial banks access to short-term loans. In addition, on March 11, 2008, it announced the establishment of the Term Securities Lending Facility. It also said it would accept certain mortgage-backed securities as collateral for these loans. By allowing banks to exchange relatively illiquid and troubled assets for Treasuries, it hoped to reduce the reluctance of banks to lend to each other. Finally, on March 16, 2008, it announced the creation of the Primary Dealer Credit Facility, whereby it would make short-term loans to large investment banks and would accept a broader range of collateral for these loans. Difficulties in the credit markets continued, however, prompting Congress to pass a broad-ranging financial rescue package to purchase troubled mortgage-related assets from banks.

Yields on municipals rose versus Treasuries. As of October 1, 2007, yields on 10-year 'AAA' rated municipals equaled 85% of the yield on 10-year Treasuries. By September 30, 2008, that figure had risen to 108%.

Issuance of new municipal bonds declined during the period, although refinancings increased in April through June of 2008 as a result of large numbers of conversions of auction rate securities. Between October 1, 2007, and September 30, 2008, issuance totaled more than $420 million, down 5.9% from the previous 12-month period.

The monolines experienced pressure on their credit ratings as a result of insurance they had written on mortgage-backed securities. Three of the largest bond insurers, Ambac, MBIA, and FGIC, were downgraded during the period.

Q: How did each Fund perform during the fiscal year ended September 30, 2008?

A: (Please see Table 1 for the relative performance of each Fund.)

2

Table 1: Fund Performance

| | | Class A Shares

@ NAV

9/30/08

12-Mo. Return | | Lipper

Funds

Average1 | | Barclays

Capital Muni

Bond Index2 | | Barclays

Capital Muni

Bond Index:

7 Yr (6-8)3 | | Barclays

Capital

85% HY/

15% Muni

Bond Index4 | | Barclays

Capital HY

Muni

Index5 | |

| National Tax Free Fund | | | -8.41 | % | | | -4.83 | % | | | -1.87 | % | | | — | | | | — | | | | — | | |

| California Tax Free Fund | | | -7.16 | | | | -5.71 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| Connecticut Tax Free Fund | | | -5.77 | | | | -4.11 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| Hawaii Tax Free Fund | | | -3.99 | | | | -4.19 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| Missouri Tax Free Fund | | | -6.45 | | | | -4.59 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| New Jersey Tax Free Fund | | | -7.36 | | | | -4.53 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| New York Tax Free Fund | | | -7.37 | | | | -4.43 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| Intermediate Tax Free Fund | | | 0.43 | | | | -0.77 | | | | — | | | | 2.59 | % | | | — | | | | — | | |

| Georgia Tax Free Trust | | | -6.62 | | | | -4.78 | | | | -1.87 | | | | — | | | | — | | | | — | | |

| HY Municipal Bond Fund | | | -16.33 | | | | -10.51 | | | | — | | | | — | | | | -8.85 | % | | | -10.04 | % | |

| Pennsylvania Tax Free Trust | | | -5.90 | | | | -5.06 | | | | -1.87 | | | | — | | | | — | | | | — | | |

Peer Groups

The Lipper Funds Average for each fund consists of municipal debt funds for the particular state involved, except for the National Tax Free Fund, Hawaii Tax Free Fund, Intermediate Tax Free Fund and High Yield Municipal Bond Fund. In the case of those funds, the applicable Lipper Funds Averages are General Municipal Debt Funds, Other States Municipal Debt Funds, Intermediate Municipal Debt Funds and High Yield Municipal Debt Funds, respectively.

Benchmarks

The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index is applicable for all funds, except the Intermediate Tax Free Fund and the High Yield Municipal Bond Fund. The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 7 Year (6–8) is applicable for the Intermediate Tax Free Fund. The Barclays Capital (formerly Lehman Brothers) 85% High Yield/15% Municipal Bond Index and the Barclays Capital (formerly Lehman Brothers) High Yield Municipal Bond Index are applicable for the High Yield Municipal Bond Fund.

Q. What were the most significant factors affecting performance?

A: The most significant factors affecting each fund's performance were as follows:

National Tax Free Fund

The National Tax Free Fund underperformed its benchmark during the 12-month period ended September 30, 2008. Detracting from performance were holdings of longer maturities and lower quality. Bonds with intermediate and long maturities underperformed those with maturities of five years or less. Bonds of lower quality underperformed those of higher quality. Also detracting from performance were holdings in the healthcare and tobacco sectors. Corporate-backed development bonds also detracted from performance. Contributing to performance were holdings of pre-refunded bonds.6

3

California Tax Free Fund

Municipal market conditions were challenging during the 12-month period. Detracting from performance in the period were the portfolio's holdings in both longer maturities and lower-rated credits. Performance was aided by the portfolio's holding of securities with maturities shorter than nine years and an allocation (the second largest sector allocation) in the pre-refunded sector.

Debt issued by the State of California is currently rated 'A1' by Moody's and 'A+' by Standard & Poor's. These ratings are based on the state's diverse and affluent economy. The state's per capita personal income is $39,300, compared with $36,600 for the United States, and California's economy is the biggest of all the 50 states. Its pension system has a better-than-average funding ratio of more than 88%, and in recent years the state has built up its reserves.

The outlook for California's ratings is stable (according to both S&P & Moody's). However, primarily due to the ailing U.S. housing market, the state's revenues have been below the forecast. As of February 2008, the median price of a single-family home was 26% lower than the year-ago median. Lower real estate values have cost the state an additional $600 million to compensate public schools for lower property taxes.

In May 2008, California revised its budget proposal for 2008–2009, including updated revenue projections and budget solutions. On September 23, 2008, Governor Arnold Schwarzenegger signed the 2008–2009 budget 85 days late due to difficulties passing the proposed budget through the state legislature. The new budget addresses California's $15.2 billion budget shortfall with a combination of cuts and increased revenue. It also includes an increased rainy-day fund.

California's debt levels have remained moderate, but are still increasing. Debt per capita of $1,722 represents nearly a 100% increase during the past five years. As of June 2008, net tax-supported debt for California was about $67 billion. Looking ahead, while expecting to stay within manageable levels, California anticipates continued increases in debt measures.

Connecticut Tax Free Fund

With a steepening yield curve, the exposure of the Connecticut Tax Free Fund portfolio to longer-term bonds detracted from performance for the one-year period. Yields rose much more for longer-term bonds than for shorter-term bonds, resulting in lower total return for longer-term bonds.

Also detracting from performance were the portfolio's holdings in lower-rated bonds. Moreover, while some bond insurance companies were being

4

downgraded or put on "negative" outlook during the period, the Fund's large exposure to the insured bonds also hurt performance. The pre-refunded bond sector added to performance for the year.

Debt issued by the State of Connecticut is currently rated 'Aa3' by Moody's and 'AA' by Standard & Poor's. These healthy ratings are based on a solid state economy with revenue growth in personal income, sales tax, and corporate tax collections. In addition, Connecticut is the wealthiest state in the United States, with operating surpluses, and a rising budget reserve fund level, which reached a record high of nearly $1.4 billion at the end of fiscal year 2007.

The state ended fiscal year 2007 with a budget surplus of $1.1 billion. However, as of May 20, 2008, Connecticut revised its forecast for fiscal 2008, predicting a modest deficit of $52.9 million. Connecticut is feeling less impact from the struggling U.S. housing market than is much of the country. In 2007, Connecticut's construction jobs increased 2.1%, versus a national decrease of 1.0%, while the state's home prices continued to rise at a modest pace. Connecticut's employment gains of 1% in 2007 matched the national level of employment gains.

Connecticut's debt ratios are high. With net tax-supported debt equaling $3,698 per capita, compared with a national median of $889 per capita, the state's debt ratio ranks second in the nation, according to Moody's 2008 State Debt Medians Report. However, taking into account the state's high income levels, its debt ratios are manageable.

The state has made a commitment to fully fund its annual required Teachers' Retirement System contribution. As of June 30, 2006, the State Employees' Retirement Fund (SRF) reported an unfunded pension obligation of 53%, or $7.9 billion.

Hawaii Tax Free Fund

Financial market upheaval during the period resulted in a materially steeper yield curve in the municipal market place during the one-year period. Investors sought safe haven in the very front end of the yield curve, where maturities are 10 years or less. The Hawaii Tax Free Fund's yield curve positioning played a critical role in shaping the returns for the year, as longer-dated maturities negatively affected performance. Historically these bonds have provided higher tax-exempt income and higher potential returns. However, it did not work out that way during this one-year period.

The Fund did benefit from its holding of securities shorter than 10 years. The marketplace also rewarded the Fund for its second largest sector allocation, the pre-refunded sector.

Debt issued by the State of Hawaii is currently rated 'Aa2' by Moody's. These strong ratings are based on the state's track record of fiscal conservatism, sound

5

financial position, and slowing, yet positive, employment trends.

Unaudited results for fiscal year 2008 indicate that total tax revenues increased by 1.2%. Hawaii's economy is slowing. In August 2008, the state reduced its forecasts for tax revenue growth, from 4% to 1%, for fiscal year 2009 due to slower growth of employment and personal income. Even so, the state's July 2008 unemployment rate of 3.9% was among the lowest in the nation. While Hawaii still has very strong reserves, unaudited results for fiscal 2008 report a $162.2 million decline in the state's ending general fund balance, to $331 million.

With debt per capita of $3,663, or 9.9% of personal income, Hawaii ranks third highest in the nation, according to Moody's 2008 State Debt Medians Report. However, Hawaii issues all debt for its schools, which in most other states is provided for on the local level. Hawaii's retirement system funded ratio was below average, at 67.5%, at the end of fiscal year 2007.

Missouri Tax Free Fund

Municipal market conditions were challenging during the one-year period, as financial market turmoil resulted in higher yields for both long-maturity bonds and lower-quality credits. For the period, the Missouri Tax Free Fund holdings in both longer maturities and lower-rated credits negatively affected performance. The Fund did benefit from its holding of securities with maturities of 10 years and less. The marketplace also rewarded the Fund for its sector allocation to the pre-refunded sector.

General obligation (GO) bonds issued by the State of Missouri are currently rated 'AAA' by Standard and Poor's. These strong ratings are based on Missouri's strong, diverse economy, good financial management, strong reserves, and low debt burden. Located in the center of the United States, Missouri's geographic position is valuable for trade and manufacturing. Missouri is the 15th most populous state in the nation, with an estimated 2008 population of more than 5.8 million people. The state's 2007 per capita effective buying income was 94% of the national level. Unemployment in Missouri for 2007 was 5.0%, versus a national average of 4.6%.

Missouri's actual expenditures for fiscal 2008 were under budget, enabling the state to increase its already strong reserves by nearly $166 million. Fiscal 2008 net general revenues were up 3.7% over fiscal 2007. Personal income taxes increased 5.9%, corporate income taxes increased 0.2%, and net sales taxes decreased 1.2%.

The state has two major retirement systems to cover state employees. At the end of fiscal year 2007, the larger of the two plans was funded at 84%, and the smaller was fully funded. Missouri has a low per capita debt level of $613.

6

New Jersey Tax Free Fund

A combination of longer-maturity bonds and widening credit spreads were among the factors detracting from performance for the one-year period. While the Fund did shorten its average maturity by two years during the period, bonds maturing 13 years and longer performed much worse than shorter bonds and detracted from overall performance. While some bond insurance companies were being downgraded or put on "negative" outlook during the period, the Fund's large exposure to insured bonds also had a negative impact upon performance. The Fund benefited from its allocation to pre-refunded bonds, which posted positive returns during the period.

General obligation (GO) debt issued by the State of New Jersey is currently rated 'Aa3' by Moody's and 'AA' by Standard and Poor's. These ratings are based on New Jersey's varied economy, high wealth and income levels, and improving general fund reserves, which reached 6.5% in fiscal 2007. They also reflect an increasing debt burden and a large unfunded pension liability.

New Jersey's job creation rate lags growth nationally. The state's July 2008 unemployment rate was 5.4%, versus a national rate of 5.7%. The state has seen a decline in employment in the financial, manufacturing, and construction sectors. The struggling housing market has caused a sharp decline in housing permits, from 34,000 in 2006 to 25,000 in 2007.

In terms of personal income, New Jersey ranks second among the 50 states, with per capita personal income at $49,194 in 2007. The funded ratio for state pensions is low, at 73.2%. As of June 2008, the state's net tax-supported debt was the third highest in the country, at about $29.7 billion.

New York Tax Free Fund

For the 12 month period, the New York Tax Free Fund underperformed its benchmark. The municipal yield curve steepened dramatically, widening the difference between yields of short-term and long-term bonds. Consequently, the portfolio's holdings in longer-maturity bonds was a negative factor. Typically, longer maturity bonds provide more attractive tax exempt income and total return potential than shorter bonds. However, they do not perform as well when rates rise significantly as they did during this time period.

The portfolio's exposure to lower-rated bonds detracted from performance. Pre-refunded bonds added to performance for the year.

Debt issued by the State of New York is currently rated 'Aa3' by Moody's and 'AA' by Standard & Poor's. These ratings are based on the state's wealthy, mature economy and its highly educated global workforce, as well as its history of conservative budgeting and active

7

expense management, improved finances, and growing budget reserves. Slowing of the national economy has hurt New York's economy, especially due to the state's dependence on the financial and insurance sectors.

For fiscal year 2008 (ended March 31, 2008), New York's revenues were below budget by $4.1 billion. Expenses for 2008 were $4.6 billion under budget, and the total General Fund reserves fell by $291 million, to $2.75 billion, from fiscal year 2007 to fiscal year 2008.

The pension system in New York is well funded when compared with other states. Outstanding tax-supported debt is currently more than $53 billion. New York ranks fifth among the 50 states, according to Moody's 2008 State Debt Medians Report, in terms of both net tax-supported debt per capita and debt burden as a percentage of personal income, which currently is 6.3%.

Intermediate Tax Free Fund

The Intermediate Tax Free Fund underperformed its benchmark, the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 7 Year (6–8), during the 12-month period ended September 30, 2008. Longer maturities underperformed shorter maturities, and low quality underperformed high quality. The Fund's holdings of longer bonds and those of lower quality, therefore, detracted from performance. As the period progressed, the Fund increased its weightings of lower-quality bonds and longer bonds, as those were repriced lower, and increased the overall yield as a result. Contributing to performance were the Fund's holdings of pre-refunded bonds, which are of high quality, and holdings of insured bonds.

Georgia Tax Free Trust

With a steepening yield curve, the Georgia Tax Free Trust's exposure to longer-term bonds detracted from performance for the one-year period. Yields rose much more for longer-term bonds than for shorter-term bonds, resulting in lower total return for longer-term bonds.

Also detracting from performance were the Fund's holdings in lower-rated bonds. The weaker performance of lower-quality bonds was due to decreased demand and lack of liquidity. The portfolio's holdings in pre-refunded bonds contributed to performance for the year.

Debt issued by the State of Georgia is currently rated 'Aaa' by Moody's and 'AAA' by Standard & Poor's. These strong ratings are based on solid revenue growth and reserve levels, consistent employment increases, conservative financial practices, and well-funded employee pensions. While employment growth is still growing faster than the rest of the country, Georgia has experienced a slowdown during 2008, primarily due to weakness in the housing market. However, the diversity of Georgia's economy has helped

8

to offset losses brought on by housing and related sectors.

Georgia's audited tax revenues for fiscal 2007 grew 8.1%, versus fiscal 2006 and the state increased its revenue shortfall reserve to $1.5 billion, or 4.8% of revenues. As of May 2008, the state's year-to-date revenues were $15.83 billion, versus $15.85 billion for the same period of 2007.

While still moderate when compared with the median level for the 50 states as determined in Moody's 2007 State Debt Medians Report, Georgia's level of debt burden is increasing. Georgia has about $8.9 billion in outstanding debt, including $589.9 million in guaranteed debt.

Pension funded status in Georgia ranks among the best in the United States. The state's two largest pension systems are funded at 97% for the Employees' Retirement System of Georgia and at 98% for the Teacher's Retirement System of Georgia as of June 30, 2005.

High Yield Municipal Bond Fund

The High Yield Municipal Bond Fund underperformed its benchmark, the Barclays Capital (formerly Lehman Brothers) High Yield Municipal Bond Index, during the 12-month period. Performance in the high yield market was hurt by a flight to quality during the period. Also detracting from performance were portfolio holdings in lower-quality bonds and in longer maturities, which tend to pay higher yields, as well as holdings in the airline, healthcare, and tobacco sectors.

Pennsylvania Tax Free Trust

With a steepening yield curve, the Pennsylvania Tax Free Fund's exposure to longer-term bonds and lower-quality bonds detracted from performance for the one-year period. Yields rose much more for longer-term bonds than for shorter-term bonds, resulting in lower total return for longer-term bonds. Historically, longer maturities and lower quality bonds have led to higher tax exempt income and stronger total returns. However, that did not happen during the 12-month period.

In addition, credit spreads continued to widen, which caused the Fund's holdings in lower-rated bonds to detract from performance. The weaker performance of lower-quality bonds was due to decreased demand and lack of liquidity. Moreover, while some bond insurance companies were being downgraded or put on "negative" outlook during the period, the Fund's large exposure to insured bonds also hurt performance. Pre-refunded bonds was one of the few sectors that outperformed the benchmark for the year, and added to performance.

Debt issued by the Commonwealth of Pennsylvania is currently rated 'Aa2' by Moody's and 'AA' by Standard & Poor's. These ratings are based on the

9

commonwealth's varied economic base, modestly growing wealth levels, a significant reduction of available reserves, responsive financial management team, and a favorable debt profile relative to other states. While there has been no significant reduction in employment, Pennsylvania's economy has undergone a slowdown in line with the nation's economy. The commonwealth's aggregate nonfarm employment levels rose 0.7% in 2007, versus national growth of 1.1%. At the close of 2007, Pennsylvania's unemployment rate of 4.7% was below the national rate of 5.0%.

On a GAAP (Generally Accepted Accounting Principles) basis, Pennsylvania's total 2007 general fund revenues of $43.5 billion, including federal appropriations, were greater than expenditures of $43.1 billion. As of April 2008, year-to-date revenues were ahead of estimates by $436.6 million, personal income tax collections were 3% higher than estimates, and sales tax revenues were on par with estimates. The commonwealth estimates a 2008 ending balance for an unappropriated general fund of $400 million, or 1.45% of tax revenues.

Pennsylvania's State Employee's Retirement Fund and the Public School Employees Retirement Fund are well funded, with funded ratios of 92.9% and 81.2%, respectively. The commonwealth's ratio of debt to personal income is 2.4%, equal to the Moody's 2008 State Debt Medians Report. Pennsylvania ranks 27th among the states in terms of net tax-supported debt per capita with $870, versus the national median of $889.

Each Fund's portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change.

Note: Class A shares purchased subject to a front-end sales charge have no contingent deferred sales charge (CDSC). However, certain purchases of Class A shares made without a front-end sales charge may be subject to a CDSC of 1% if the shares are redeemed before the first day of the month in which the one-year anniversary of the purchase falls. Please see the prospectus for more information on redemptions that may be subject to a CDSC.

10

A prospectus contains important information about a fund, including its investment objectives, risks, charges, and ongoing expenses, which an investor should carefully consider before investing. To obtain a prospectus on any Lord Abbett mutual fund, please contact your investment professional or Lord Abbett Distributor LLC at 888-522-2388 or visit our Web site at www.lordabbett.com. Read the prospectus carefully before investing.

1 The Lipper Funds Average: Lipper, Inc. is a nationally recognized organization that reports on mutual fund total return performance and calculates fund rankings. Peer averages are based on universes of funds with similar investment objectives. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges.

2 The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index is a broad measure of the municipal bond market with maturities of at least one year. To be included in this index, bonds must have a minimum credit rating of at least Baa, an outstanding par value of at least $3 million, and be issued as part of a transaction of at least $50 million. Includes zero coupon bonds subject to the alternative minimum tax.

3 The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 7 Yr (6-8) is an unmanaged total return performance benchmark for the investment-grade, geographically unrestricted seven-year tax-exempt bond market, consisting of municipal bonds with maturities of 6-8 years.

4 The Barclays Capital (formerly Lehman Brothers) 85% High Yield/15% Municipal Bond Index is a total return benchmark designed for municipal portfolios, which contain both investment and non-investment-grade tax-exempt bonds. The index contains an equal weighting of the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index and the Barclays Capital (formerly Lehman Brothers) Municipal Non-Investment Grade Index.

5 The Barclays Capital (formerly Lehman Brothers) High Yield Municipal Bond Index is an unmanaged index that includes municipal bonds having a maximum quality rating of Ba1, or non-rated, original issue size of $20 million or larger, and maturities of at least one year.

6 Pre-refunded bonds are older, tax-free bonds that typically pay coupons higher than current market rates and that have been refinanced or "prepaid" by the proceeds of a second bond issue. The proceeds of this second issuance are used to "call" or pay off the original issue at its first call date. Until that time, the monies are held in escrow and are usually invested in U.S. Treasuries. As a result, pre-refunded bonds are generally deemed to have virtually no default risk. Typically, when a bond becomes pre-refunded it appreciates in value because of its higher credit quality and improved marketability.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Note: Fees and expense waivers are currently in effect for all the Funds. Had waivers not been in effect, performance would have been lower. See the Funds' prospectuses for a history of fees waived and expenses assumed. Existing expense waivers may be revised or terminated at any time.

Copyright © 2008 by Reuters. All rights reserved. Any copying, republication, or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. An investor cannot invest directly in an average.

Important Performance and Other Information

Performance data quoted reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in a fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to our Web site at www.lordabbett.com.

Except where noted, comparative fund performance does not account for the deduction of sales charges, and would be different if sales charges were included. Each fund offers several classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Funds' prospectuses.

The views of each fund's management and the portfolio holdings described in this report are as of September 30, 2008; these views and holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the funds. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each fund, please see the Funds' prospectuses.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks, including possible loss of principal amount invested.

11

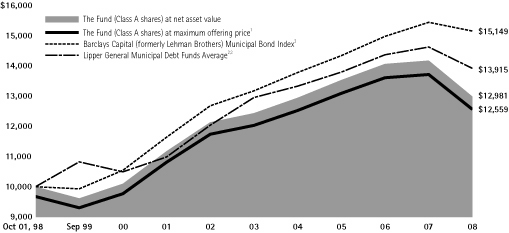

National Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper General Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -11.36 | % | | | 0.20 | % | | | 2.31 | % | | | — | | |

| Class B5 | | | -12.58 | % | | | 0.02 | % | | | 2.14 | % | | | — | | |

| Class C6 | | | -9.01 | % | | | 0.22 | % | | | 1.99 | % | | | — | | |

| Class F7 | | | -8.32 | % | | | — | | | | — | | | | -8.28 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class B | | Class C | | Class F | |

| | 5.23 | % | | | 4.40 | % | | | 4.58 | % | | | 5.35 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

6 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

7 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

12

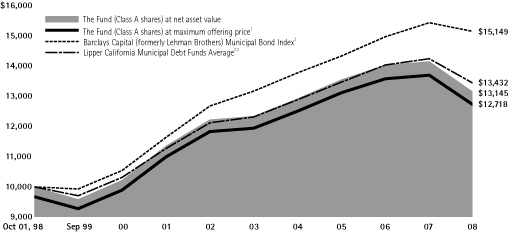

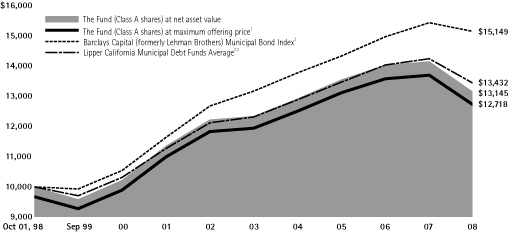

California Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper California Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -10.22 | % | | | 0.60 | % | | | 2.44 | % | | | — | | |

| Class C5 | | | -7.73 | % | | | 0.64 | % | | | 2.14 | % | | | — | | |

| Class F6 | | | -7.07 | % | | | — | | | | — | | | | -7.03 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class C | | Class F | |

| | 4.71 | % | | | 4.06 | % | | | 4.89 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

13

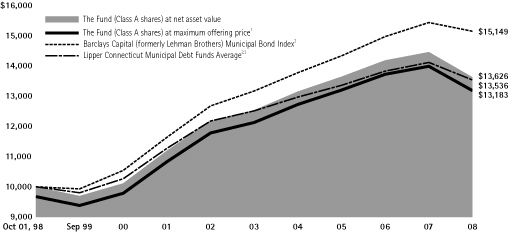

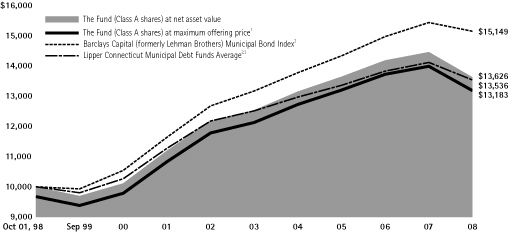

Connecticut Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper Connecticut Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -8.79 | % | | | 1.02 | % | | | 2.80 | % | | | — | | |

| Class F5 | | | -5.77 | % | | | — | | | | — | | | | -5.74 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.93 | % | | | 5.05 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

14

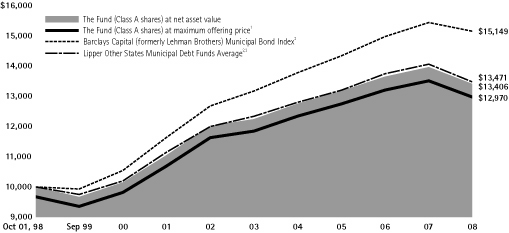

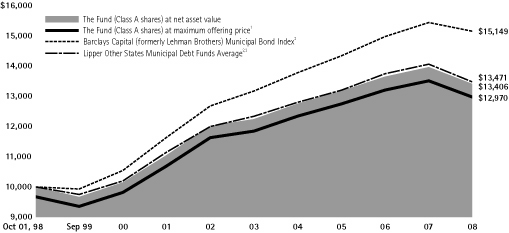

Hawaii Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper Other States Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -7.19 | % | | | 1.16 | % | | | 2.63 | % | | | — | | |

| Class F5 | | | -3.89 | % | | | — | | | | — | | | | -3.87 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.31 | % | | | 4.46 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index and the average are composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

15

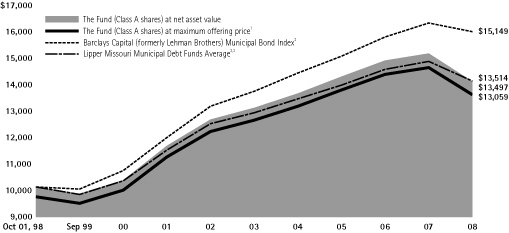

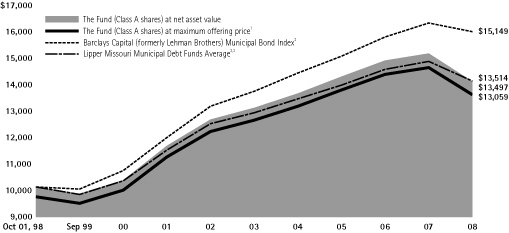

Missouri Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper Missouri Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -9.41 | % | | | 0.68 | % | | | 2.71 | % | | | — | | |

| Class F5 | | | -6.36 | % | | | — | | | | — | | | | -6.32 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.69 | % | | | 4.88 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

16

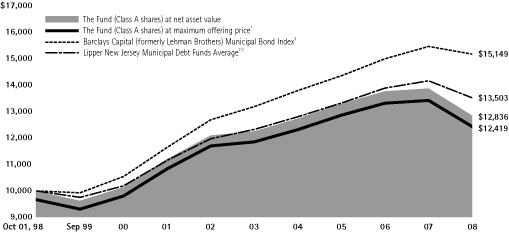

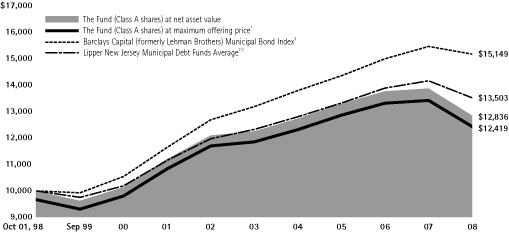

New Jersey Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper New Jersey Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -10.41 | % | | | 0.30 | % | | | 2.18 | % | | | — | | |

| Class F5 | | | -7.27 | % | | | — | | | | — | | | | -7.23 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.66 | % | | | 4.90 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

17

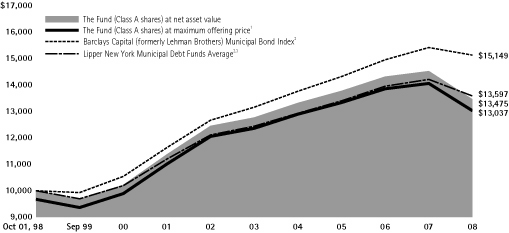

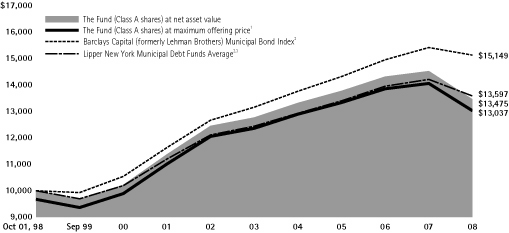

New York Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper New York Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -10.39 | % | | | 0.40 | % | | | 2.69 | % | | | — | | |

| Class C5 | | | -8.02 | % | | | 0.40 | % | | | 2.38 | % | | | — | | |

| Class F6 | | | -7.18 | % | | | — | | | | — | | | | -7.15 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class C | | Class F | |

| | 4.84 | % | | | 4.18 | % | | | 4.97 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

18

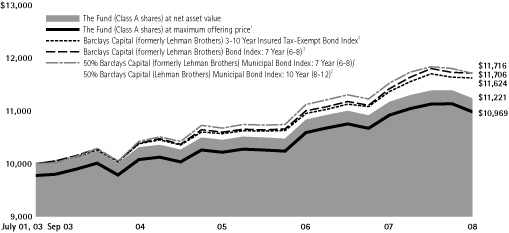

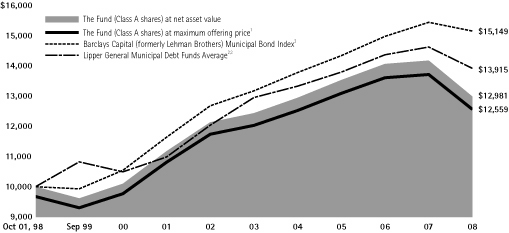

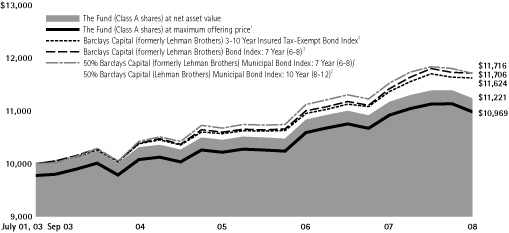

Intermediate Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Capital (formerly Lehman Brothers) 3-10 Year Insured Tax-Exempt Bond Index, the Barclays Capital (formerly Lehman Brothers) Bond Index: 7 Year (6-8) and the 50% Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 7 Year (6-8)/50% Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 10 Year (8-12) assuming reinvestment of all dividends and distributions. The Fund believes that the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index: 7 Year (6-8) is a more appropriate benchmark for the Fund and therefore will remove the Barclays Capital (formerly Lehman Brothers) 3-10 Year Insured Tax-Exempt Bond Index from the next Annual Report. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classe s. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | Life of Class | |

| Class A3 | | | -1.78 | % | | | 1.81 | % | | | 1.76 | % | |

| Class B4 | | | -4.16 | % | | | 1.34 | % | | | 1.28 | % | |

| Class C5 | | | -0.31 | % | | | 1.51 | % | | | 1.43 | % | |

| Class F6 | | | 0.57 | % | | | — | | | | 0.57 | % | |

| Class P7 | | | 0.29 | % | | | 2.09 | % | | | 2.01 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class B | | Class C | | Class F | | Class P | |

| | 4.18 | % | | | 3.41 | % | | | 3.41 | % | | | 4.35 | % | | | 3.95 | % | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund's performance.

3 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for period shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return. The Class A share inception date is June 30, 2003.

4 Class B shares were first offered on June 30, 2003. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and for the life of the Class.

5 Class C shares were first offered on June 30, 2003. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

7 Class P shares were first offered on June 30, 2003. Performance is at net asset value.

19

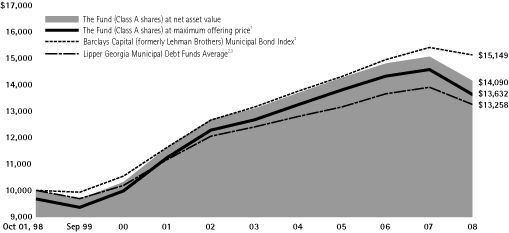

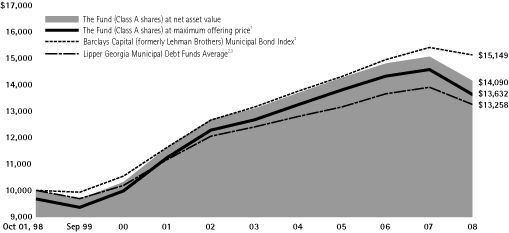

Georgia Tax Free Trust

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper Georgia Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -9.73 | % | | | 0.78 | % | | | 3.15 | % | | | — | | |

| Class F5 | | | -6.53 | % | | | — | | | | — | | | | -6.49 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.68 | % | | | 4.83 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

20

High Yield Municipal Bond Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Capital (formerly Lehman Brothers) 85% High Yield/15% Municipal Bond Index, the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, the Barclays Capital (formerly Lehman Brothers) High Yield Municipal Bond Index, and the Lipper High Yield Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The Fund believes that the Barclays Capital (formerly Lehman Brothers) High Yield Municipal Bond Index is a more appropriate benchmark for the Fund and therefore will remove the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index from the next annual report. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the dedu ction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | Life of Class | |

| Class A4 | | | -19.02 | % | | | -2.13 | % | |

| Class B5 | | | -19.86 | % | | | -2.26 | % | |

| Class C6 | | | -16.77 | % | | | -1.62 | % | |

| Class F7 | | | -16.19 | % | | | -16.11 | % | |

| Class P8 | | | -16.34 | % | | | -1.26 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class B | | Class C | | Class F | | Class P | |

| | 6.36 | % | | | 5.85 | % | | | 5.85 | % | | | 6.47 | % | | | 6.12 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged indexes does not reflect any fees or expenses. The performance of the average or the indexes is not necessarily representative of the Fund's performance. Indexes and average are calculated from December 31, 2004 to September 30, 2008.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for period shown ended September 30, 2008, is calculated using SEC required uniform method to compute such return. The Class A inception date is December 30, 2004.

5 Class B shares were first offered on December 30, 2004. Performance reflects the deduction of a CDSC of 4% for 1 year and 3% for the life of the Class.

6 Class C shares were first offered on December 30, 2004. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

7 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

8 Class P shares were first offered on December 30, 2004. Performance is at net asset value.

21

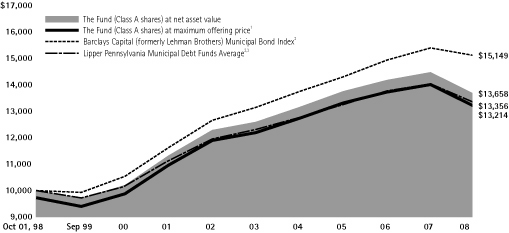

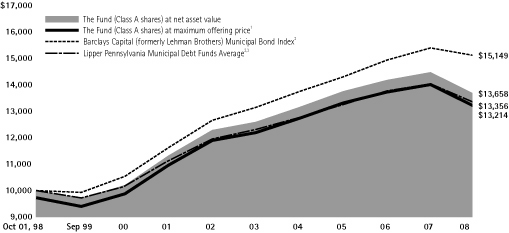

Pennsylvania Tax Free Trust

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in Lipper Pennsylvania Municipal Debt Funds Average and the Barclays Capital (formerly Lehman Brothers) Municipal Bond Index, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such class. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable Sales Charge for the Periods Ended September 30, 2008

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A4 | | | -8.92 | % | | | 0.91 | % | | | 2.82 | % | | | — | | |

| Class F5 | | | -5.81 | % | | | — | | | | — | | | | -5.78 | % | |

Standardized Yield for the Year Ended September 30, 2008

| Class A | | Class F | |

| | 4.72 | % | | | 4.88 | % | |

1 Reflects the deduction of the maximum initial sales charge of 3.25%.

2 Performance for the average or the unmanaged index does not reflect any fees or expenses. The performance of the average or the index is not necessarily representative of the Fund's performance. The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

3 Source: Lipper, Inc.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 3.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2008, is calculated using the SEC required uniform method to compute such return.

5 Class F shares commenced operations and performance for the class began on September 28, 2007. Performance is at net asset value.

22

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes; also, certain Funds do not yet have effective a Rule 12b-1 plan under which distribution and service fees are paid); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2008 through September 30, 2008).

Actual Expenses

For each class of each Fund, the first line of the applicable table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled "Expenses Paid During the Period 4/1/08 – 9/30/08" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the applicable table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

23

National Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 943.30 | | | $ | 5.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.76 | | | $ | 5.30 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 940.40 | | | $ | 8.93 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.79 | | | $ | 9.27 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 940.60 | | | $ | 8.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.65 | | | $ | 8.42 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 943.80 | | | $ | 4.62 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.25 | | | $ | 4.80 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.05% for Class A, 1.84% for Class B, 1.67% for Class C, and 0.95% for Class F) multiplied by the average account value over the period, multiplied by 183/366 for Class A, B, C, and F (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 23.95 | % | |

| Aaa | | | 1.88 | % | |

| AA+ | | | 2.01 | % | |

| Aa1 | | | 2.10 | % | |

| AA | | | 13.09 | % | |

| Aa2 | | | 0.08 | % | |

| AA- | | | 3.75 | % | |

| Aa3 | | | 0.92 | % | |

| A+ | | | 2.62 | % | |

| A1 | | | 0.56 | % | |

| A | | | 1.61 | % | |

| A2 | | | 2.00 | % | |

| A- | | | 2.72 | % | |

| A3 | | | 2.64 | % | |

| BBB+ | | | 3.47 | % | |

| Baa1 | | | 0.98 | % | |

| BBB | | | 7.34 | % | |

| Baa2 | | | 1.71 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| BBB- | | | 3.33 | % | |

| Baa3 | | | 1.47 | % | |

| BB+ | | | 1.37 | % | |

| Ba1 | | | 0.41 | % | |

| BB | | | 1.27 | % | |

| Ba2 | | | 0.48 | % | |

| Ba3 | | | 0.89 | % | |

| B+ | | | 0.38 | % | |

| B2 | | | 0.07 | % | |

| B- | | | 0.63 | % | |

| B3 | | | 0.08 | % | |

| CCC+ | | | 0.44 | % | |

| Caa1 | | | 0.32 | % | |

| CCC | | | 0.47 | % | |

| NR | | | 14.00 | % | |

| Short-Term Investments | | | 0.96 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

24

California Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 954.40 | | | $ | 5.37 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.49 | | | $ | 5.55 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 950.70 | | | $ | 8.44 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.35 | | | $ | 8.72 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 954.80 | | | $ | 5.08 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.25 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.10% for Class A, 1.73% for Class C and 1.04% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 27.11 | % | |

| Aaa | | | 0.45 | % | |

| Aa1 | | | 0.87 | % | |

| AA | | | 17.11 | % | |

| AA- | | | 2.98 | % | |

| Aa3 | | | 0.86 | % | |

| A+ | | | 14.68 | % | |

| A1 | | | 0.69 | % | |

| A | | | 6.71 | % | |

| A2 | | | 0.55 | % | |

| A- | | | 0.23 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| A3 | | | 2.40 | % | |

| BBB+ | | | 2.92 | % | |

| Baa1 | | | 1.94 | % | |

| BBB | | | 4.57 | % | |

| Baa2 | | | 1.37 | % | |

| BBB- | | | 2.37 | % | |

| Baa3 | | | 2.27 | % | |

| BB+ | | | 0.97 | % | |

| NR | | | 8.14 | % | |

| Short-Term Investment | | | 0.81 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

25

Connecticut Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 958.60 | | | $ | 3.43 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.51 | | | $ | 3.54 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 958.00 | | | $ | 2.94 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.99 | | | $ | 3.03 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.70% for Class A and 0.60% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's | | %* | |

| AAA | | | 22.52 | % | |

| Aaa | | | 0.69 | % | |

| AA+ | | | 0.73 | % | |

| AA | | | 34.11 | % | |

| AA- | | | 0.48 | % | |

| Aa3 | | | 3.94 | % | |

| A+ | | | 0.66 | % | |

| A1 | | | 2.51 | % | |

| A | | | 1.34 | % | |

| A2 | | | 1.38 | % | |

| A- | | | 4.65 | % | |

| A3 | | | 5.65 | % | |

| BBB+ | | | 2.77 | % | |

| Baa1 | | | 2.70 | % | |

| BBB | | | 2.37 | % | |

| BBB- | | | 4.71 | % | |

| NR | | | 7.96 | % | |

| Short-Term Investment | | | 0.83 | % | |

| Total | | | 100.00 | % | |

* Represents percent of total investments.

26

Hawaii Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 964.00 | | | $ | 3.83 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.08 | | | $ | 3.94 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 964.40 | | | $ | 2.75 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 2.83 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.78% for Class A and 0.56% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's | | %* | |

| AAA | | | 30.12 | % | |

| Aaa | | | 2.75 | % | |

| AA | | | 27.80 | % | |

| AA- | | | 2.33 | % | |

| Aa3 | | | 3.35 | % | |

| A+ | | | 5.73 | % | |

| A3 | | | 0.76 | % | |

| BBB+ | | | 5.81 | % | |

| Baa1 | | | 2.44 | % | |

| BBB | | | 2.13 | % | |

| BBB- | | | 5.74 | % | |

| B | | | 0.73 | % | |

| NR | | | 10.31 | % | |

| Total | | | 100.00 | % | |

* Represents percent of total investments.

27

Missouri Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 954.50 | | | $ | 3.86 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.06 | | | $ | 3.99 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 954.90 | | | $ | 3.52 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.64 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.79% for Class A and 0.72% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 21.87 | % | |

| Aaa | | | 1.70 | % | |

| AA+ | | | 8.00 | % | |

| AA | | | 23.03 | % | |

| Aa2 | | | 0.70 | % | |

| AA- | | | 2.89 | % | |

| Aa3 | | | 6.56 | % | |

| A+ | | | 1.10 | % | |

| A1 | | | 0.29 | % | |

| A | | | 0.84 | % | |

| A2 | | | 4.95 | % | |

| A- | | | 2.15 | % | |

| A3 | | | 4.58 | % | |

| BBB+ | | | 3.44 | % | |

| Baa1 | | | 1.46 | % | |

| BBB | | | 2.04 | % | |

| Baa2 | | | 1.03 | % | |

| BBB- | | | 5.24 | % | |

| Baa3 | | | 0.03 | % | |

| NR | | | 8.10 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

28

New Jersey Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 947.90 | | | $ | 4.04 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.85 | | | $ | 4.19 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 948.40 | | | $ | 3.46 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.46 | | | $ | 3.59 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.83% for Class A and 0.71% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 17.69 | % | |

| Aaa | | | 7.31 | % | |

| AA+ | | | 2.17 | % | |

| Aa1 | | | 2.55 | % | |

| AA | | | 11.70 | % | |

| AA- | | | 9.04 | % | |

| Aa3 | | | 1.96 | % | |

| A+ | | | 3.11 | % | |

| A1 | | | 1.25 | % | |

| A2 | | | 9.18 | % | |

| A- | | | 2.63 | % | |

| A3 | | | 3.75 | % | |

| BBB+ | | | 1.34 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| Baa1 | | | 1.52 | % | |

| BBB | | | 3.56 | % | |

| Baa2 | | | 0.84 | % | |

| BBB- | | | 6.94 | % | |

| Baa3 | | | 1.11 | % | |

| BB+ | | | 0.53 | % | |

| Ba2 | | | 0.79 | % | |

| B | | | 0.68 | % | |

| B3 | | | 0.18 | % | |

| NR | | | 10.06 | % | |

| Short-Term Investment | | | 0.11 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

29

New York Tax Free Income Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 948.70 | | | $ | 4.63 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.23 | | | $ | 4.80 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 945.70 | | | $ | 7.69 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.08 | | | $ | 7.97 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 950.10 | | | $ | 3.41 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.45 | | | $ | 3.54 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.95% for Class A, 1.58% for Class C and 0.70% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 15.98 | % | |

| Aaa | | | 1.12 | % | |

| AA+ | | | 6.69 | % | |

| Aa1 | | | 2.62 | % | |

| AA | | | 15.44 | % | |

| Aa2 | | | 6.11 | % | |

| AA- | | | 19.98 | % | |

| Aa3 | | | 0.26 | % | |

| A+ | | | 1.87 | % | |

| A | | | 5.01 | % | |

| A3 | | | 1.82 | % | |

| BBB+ | | | 3.41 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| Baa1 | | | 0.41 | % | |

| BBB | | | 3.60 | % | |

| BBB- | | | 4.42 | % | |

| BB+ | | | 1.25 | % | |

| Ba1 | | | 1.91 | % | |

| BB | | | 1.72 | % | |

| B- | | | 0.22 | % | |

| CCC+ | | | 0.47 | % | |

| NR | | | 4.76 | % | |

| Short-Term Investment | | | 0.93 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

30

Intermediate Tax-Free Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 985.40 | | | $ | 1.34 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.64 | | | $ | 1.37 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 981.90 | | | $ | 5.10 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.83 | | | $ | 5.20 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 982.80 | | | $ | 5.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.90 | | | $ | 5.20 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 987.20 | | | $ | 0.65 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,024.37 | | | $ | 0.66 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 984.90 | | | $ | 2.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.63 | | | $ | 2.33 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.27% for Class A, 1.03% for Class B, 1.03% for Class C, 0.13% for Class F and 0.46% for Class P) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 22.77 | % | |

| Aaa | | | 3.78 | % | |

| AA+ | | | 6.55 | % | |

| Aa1 | | | 0.90 | % | |

| AA | | | 9.86 | % | |

| Aa2 | | | 0.68 | % | |

| AA- | | | 15.22 | % | |

| Aa3 | | | 3.39 | % | |

| A+ | | | 3.00 | % | |

| A1 | | | 2.19 | % | |

| A | | | 3.57 | % | |

| A2 | | | 3.05 | % | |

| A- | | | 2.56 | % | |

| A3 | | | 0.66 | % | |

| BBB+ | | | 1.42 | % | |

| Baa1 | | | 1.05 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| BBB | | | 6.84 | % | |

| Baa2 | | | 0.57 | % | |

| BBB- | | | 1.55 | % | |

| Baa3 | | | 0.96 | % | |

| BB+ | | | 0.49 | % | |

| Ba1 | | | 0.52 | % | |

| BB | | | 0.36 | % | |

| Ba2 | | | 0.57 | % | |

| Ba3 | | | 0.74 | % | |

| B+ | | | 0.06 | % | |

| B | | | 0.06 | % | |

| B- | | | 0.77 | % | |

| CCC | | | 0.50 | % | |

| NR | | | 3.50 | % | |

| Short-Term Investment | | | 1.86 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

31

Georgia Tax Free Trust

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 950.60 | | | $ | 4.63 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.27 | | | $ | 4.80 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 951.00 | | | $ | 4.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 4.14 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.95% for Class A and 0.82% for Class F) multiplied by the average account value over the period, multiplied by 183/366 (to reflect one-half year period).

Portfolio Holdings Presented by Credit Rating

September 30, 2008

Credit Rating:

S&P or Moody's(a) | | %* | |

| AAA | | | 22.89 | % | |

| Aaa | | | 2.25 | % | |

| AA+ | | | 2.32 | % | |

| Aa1 | | | 0.33 | % | |

| AA | | | 26.05 | % | |

| Aa2 | | | 3.26 | % | |

| AA- | | | 0.80 | % | |

| Aa3 | | | 2.73 | % | |

| A+ | | | 2.38 | % | |

| A1 | | | 5.02 | % | |

Credit Rating:

S&P or Moody's(a) | | %* | |

| A | | | 4.13 | % | |

| A2 | | | 6.11 | % | |

| A3 | | | 3.69 | % | |

| BBB | | | 4.81 | % | |

| Baa2 | | | 1.03 | % | |

| BBB- | | | 5.66 | % | |

| Ba3 | | | 1.44 | % | |

| B- | | | 0.69 | % | |

| NR | | | 4.41 | % | |

| Total | | | 100.00 | % | |

(a) Certain investments have been rated by Fitch IBCA.

* Represents percent of total investments.

32

High Yield Municipal Bond Fund

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 4/1/08 | | 9/30/08 | | 4/1/08 -

9/30/08 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 929.60 | | | $ | 5.55 | | |