|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-3967 |

FIRST INVESTORS INCOME FUNDS

(Exact name of registrant as specified in charter)

40 Wall Street

New York, NY 10005

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

Foresters Investment Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: SEPTEMBER 30

DATE OF REPORTING PERIOD: SEPTEMBER 30, 2016

| |

| Item 1. | Reports to Stockholders |

| | |

| |

| | The annual report to stockholders follows |

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Foresters Investor Services, Inc., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

The views expressed in the portfolio manager letters reflect those views of the portfolio managers only through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: Foresters Financial Services, Inc., 40 Wall Street, New York, NY 10005, or by visiting our website at www.foresters.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund* seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

* Effective October 3, 2016, the Cash Management Fund changed its name to the Government Cash Management Fund.

Foresters FinancialTM and ForestersTM are the trade names and trademarks of The Independent Order of Foresters (Foresters), a fraternal benefit society, 789 Don Mills Road, Toronto, Canada M3C 1T9 and its subsidiaries.

Portfolio Manager’s Letter

CASH MANAGEMENT FUND*

Dear Investor:

This is the annual report for the First Investors Cash Management Fund for the fiscal year ended September 30, 2016. During the period, the Fund’s return on a net asset value basis was 0.00% for Class A shares, 0.00% for Class B shares and 0.00% for Institutional Class shares. The Fund maintained a $1.00 net asset value per share for each class of shares throughout the year.

Economic Overview

Equity and fixed income markets around the world generated strong returns during the 12 months ending September 30th. However, the trajectory of these returns was bumpy, as investor sentiment changed several times during the year. The largest influence on market sentiment during the review period was the market’s expectations of major central bank actions and divergence in their policies. This period also included the unexpected June 23rd Brexit vote for Britain to leave the European Union, which triggered a short-term $3.6 trillion sell-off in global equities. Other dominant factors that affected market returns during the beginning of 2016 included weakness in the Chinese economy and a falling Chinese stock market. Fluctuations in oil and commodity prices were also present for most of the period.

During December 2015, the Federal Reserve (“the Fed”) and the European Central Bank (“ECB”) policies moved in opposite directions. The Fed had completed its easing cycle and moved to tightening its policy by December 2015; meanwhile, major international central banks continued easing their monetary policies. In December 2015, the Fed finally implemented its long awaited interest rate increase of 25 basis points, which was its first rate hike in nine years. This drove the yield on the two-year Treasury note to the highest level in years. At that time, the Fed estimated an additional four increases for the 2016 calendar year. However, the Fed became gradually more pessimistic and concerned about the global economy and has left interest rates unchanged year-to-date. More recently, the Fed and the markets became more confident about a potential increase in rates in December 2016. In December 2015, the ECB cut its deposit rate by an additional 0.1%, resulting in a negative 0.3% rate. In March, it made another 0.1% rate cut which brought the deposit rate to negative 0.4%, and accelerated the rate of its bond purchases from €60 to €80 billion euros per month. The ECB also expanded its purchases to include corporate bonds.

The other major central bank, the Bank of Japan, implemented negative interest rate policy in January, joining the ECB and other European central banks. This move contributed to the decline in interest rates globally. Yields for many international bonds fell into negative territory, which resulted in higher demand from overseas investors for positive yielding U.S. fixed income.

The Fund

Short-term interest rates edged modestly higher over the last year after the Fed raised its target federal funds rate by 25 basis points (.25%) in December of 2015, the first time in nearly a decade. The market struggled with on and off again expectations of additional increases with nearly every new economic report. Ultimately, persistent low inflation and

Portfolio Manager’s Letter (continued)

CASH MANAGEMENT FUND*

slow economic growth despite apparently strong employment gave pause to the Fed and its tightening cycle. The Fed more recently has indicated that a near-term rise in interest rates is likely, while also suggesting that the track to higher short-term rates will be slow, as long as inflation remains subdued and growth below average.

Yields on shorter-maturity money market investments are anchored by the current federal funds target rate which remains very low. Other factors suppressing shorter-term yields are substantial levels of cash in the money market, a general lack of supply and money market regulations that have forced money market mutual fund assets into more defensive and shorter-term investments. Yields on longer-maturity money market instruments reflect, among other things, market expectations related to growth, inflation and the Fed’s policy on short-term interest rates.

The Fund invested conservatively during the period, maintaining a substantial portion of its assets in U.S. Treasury and government agency securities. This was a common theme for the money market mutual fund industry, as pending regulatory changes generated uncertainty and a monumental shift of assets from Prime Money Market Funds to Government Money Market Funds. Low compensation for risk, however, was the significant factor in our decision to overweight these lower-risk products. The Fund also maintained a weighted average maturity of fewer than 60 days during the period in order to comply with Securities and Exchange Commission rules designed to limit interest rate risk.

Foresters Investment Management Company (“FIMCO”) expects the yield to shareholders to be at or near zero for the immediate future based on that outlook. To avoid a negative yield to its shareholders, FIMCO continues to absorb expenses for the Fund and has waived its management fee.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

*In response to amendments to the rules governing money market funds, the Board of Trustees of the First Investors Cash Management Fund approved the conversion of the Fund to a government money market fund, as defined in Rule 2a-7 under the Investment Company Act of 1940. As a result, effective October 3, 2016, the name of the Fund was changed to First Investors Government Cash Management Fund and the Fund adopted a policy to invest at least 99.5% of its total assets in cash, U.S. government securities and/or repurchase agreements that are collateralized fully by cash or U.S. government securities. The Fund intends to operate as a “government money market fund” as defined in Rule 2a-7 under the Investment Company Act of 1940.

Understanding Your Fund’s Expenses (unaudited)

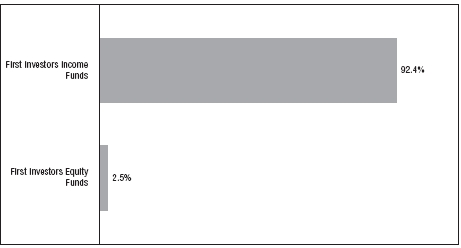

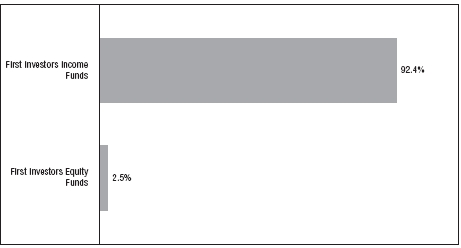

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only) and a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1) (on Class A and Class B shares only); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, April 1, 2016, and held for the entire six-month period ended September 30, 2016. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares of a Fund, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads) or account fees that are charged to certain types of accounts, such as an annual custodial fee of $15 for certain IRA accounts and certain other retirement accounts or an annual custodial fee of $30 for 403(b) custodial accounts (subject to exceptions and certain waivers as described in the Funds’ Statement of Additional Information). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | | |

| |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Expense | Account Value | Account Value | During Period |

| Expense Example | Ratio | (4/1/16) | (9/30/16) | (4/1/16–9/30/16)* |

| Class A Shares | 0.40% | | | |

| Actual | | $1,000.00 | $1,000.00 | $2.00 |

| Hypothetical** | | $1,000.00 | $1,023.00 | $2.02 |

| Class B Shares | 0.40% | | | |

| Actual | | $1,000.00 | $1,000.00 | $2.00 |

| Hypothetical** | | $1,000.00 | $1,023.00 | $2.02 |

| Institutional Class Shares | 0.40% | | | |

| Actual | | $1,000.00 | $1,000.00 | $2.00 |

| Hypothetical** | | $1,000.00 | $1,023.00 | $2.02 |

| |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid during the |

| period are net of expenses waived and/or assumed. |

| |

| ** | Assumed rate of return of 5% before expenses. |

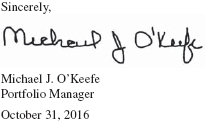

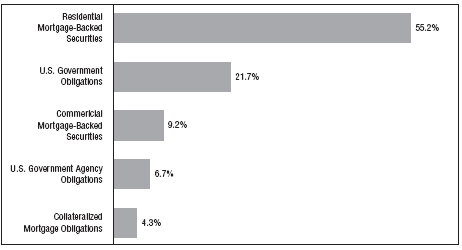

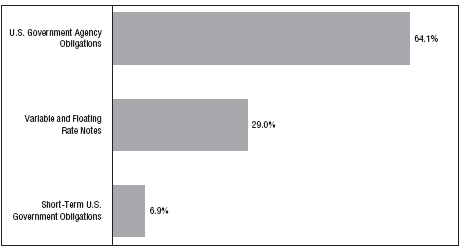

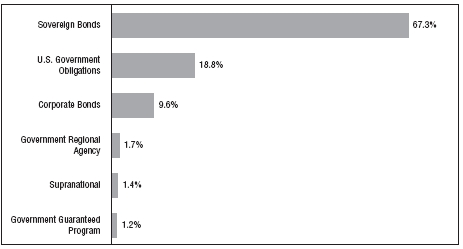

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2016, |

| and are based on the total market value of investments. |

Portfolio of Investments

CASH MANAGEMENT FUND

September 30, 2016

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—63.2% | | | | | |

| $ 1,700M | | Fannie Mae, 12/14/2016 | | | 0.34 | % | $ 1,698,812 |

| | | Federal Home Loan Bank: | | | | | |

| 5,000M | | 10/13/2016 | | | 0.30 | | 4,999,500 |

| 6,000M | | 10/14/2016 | | | 0.30 | | 5,999,361 |

| 4,000M | | 10/21/2016 | | | 0.37 | | 3,999,188 |

| 5,000M | | 10/27/2016 | | | 0.31 | | 4,998,898 |

| 5,000M | | 10/31/2016 | | | 0.31 | | 4,998,708 |

| 4,750M | | 11/18/2016 | | | 0.37 | | 4,747,654 |

| 6,000M | | 11/25/2016 | | | 0.35 | | 5,996,836 |

| 6,000M | | 11/28/2016 | | | 0.40 | | 5,996,179 |

| 2,500M | | 11/30/2016 | | | 0.34 | | 2,498,566 |

| 2,200M | | 12/15/2016 | | | 0.61 | | 2,197,199 |

| 5,000M | | 12/23/2016 | | | 0.51 | | 4,994,136 |

| 5,000M | | 12/28/2016 | | | 0.31 | | 4,996,211 |

| 4,000M | | 1/30/2017 | | | 0.43 | | 3,994,217 |

| | | Freddie Mac: | | | | | |

| 6,917M | | 10/6/2016 | | | 0.30 | | 6,916,711 |

| 6,000M | | 11/18/2016 | | | 0.25 | | 5,997,968 |

| 4,000M | | 12/14/2016 | | | 0.28 | | 3,997,673 |

| Total Value of U.S. Government Agency Obligations (cost $79,027,817) | | 79,027,817 |

| | | VARIABLE AND FLOATING RATE NOTES—28.5% | | |

| | | Federal Farm Credit Bank: | | | | | |

| 5,000M | | 11/15/2016 | | | 0.57 | | 5,000,191 |

| 1,030M | | 12/19/2016 | | | 0.52 | | 1,029,831 |

| 5,500M | | 4/20/2017 | | | 0.59 | | 5,500,613 |

| | | Federal Home Loan Bank: | | | | | |

| 10,000M | | 1/27/2017 | | | 0.51 | | 10,001,361 |

| 3,500M | | 9/5/2017 | | | 0.56 | | 3,502,158 |

| 5,000M | | Mississippi Business Fin. Corp. (Chevron USA, Inc.), | | | | | |

| | | 12/1/2030 | | | 0.78 | | 5,000,000 |

| 5,675M | | Valdez, AK Marine Term. Rev. (Exxon Pipeline Co., | | | | | |

| | | Project B), 12/1/2033 | | | 0.76 | | 5,675,000 |

| Total Value of Variable and Floating Rate Notes (cost $35,709,154) | | | | | 35,709,154 |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

September 30, 2016

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | SHORT-TERM U.S. GOVERNMENT | | | | | |

| | | OBLIGATIONS—6.8% | | | | | |

| | | U.S. Treasury Bills: | | | | | |

| $ 4,000M | | 10/20/2016 | | | 0.25 | % | $ 3,999,480 |

| 4,500M | | 11/3/2016 | | | 0.27 | | 4,498,907 |

| Total Value of Short-Term U.S. Government Obligations (cost $8,498,387) | | 8,498,387 |

| Total Value of Investments (cost $123,235,358)** | 98.5 | % | | | 123,235,358 |

| Other Assets, Less Liabilities | 1.5 | | | | 1,893,965 |

| Net Assets | | | 100.0 | % | | | $125,129,323 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on floating rate notes are adjusted periodically; the rates shown are the rates in effect |

| at September 30, 2016. |

| |

| ** | Aggregate cost for federal income tax purposes is the same. |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets or liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2016:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | $ | — | | $ | 79,027,817 | | $ | — | | $ | 79,027,817 |

| Variable and Floating Rate Notes: | | | | | | | | | | | | |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 25,034,154 | | | — | | | 25,034,154 |

| Municipal Bonds | | | — | | | 10,675,000 | | | — | | | 10,675,000 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 8,498,387 | | | — | | | 8,498,387 |

| Total Investments in Securities | | $ | — | | $ | 123,235,358 | | $ | — | | $ | 123,235,358 |

|

| There were no transfers into or from Level 1 or Level 2 by the Fund for the year ended September 30, |

| 2016. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| See notes to financial statements | 7 |

Portfolio Managers’ Letter

BALANCED INCOME FUND

Dear Investor:

This is the annual report for the First Investors Balanced Income Fund for the fiscal year ended September 30, 2016. During the period, the Fund’s return on a net asset value basis was 8.55% for Class A shares, 8.97% for Advisor Class shares and 9.08% for Institutional Class shares, including dividends of 15.0 cents per share for Class A shares, 16.1 cents per share for Advisor Class shares and 17.2 cents per share for Institutional Class shares. The Fund’s performance this year was driven in substantial part by its policy of allocating its assets among equities, fixed income investments and cash. The Fund typically has a target asset allocation of 55% bonds, 40% equities, and 5% cash.

Economic Overview

Equity and fixed income markets around the world generated strong returns during the 12 months ending September 30th. However, the trajectory of these returns was bumpy, as investor sentiment changed several times during the year. The largest influence on market sentiment during the review period was the market’s expectations of major central bank actions and divergence in their policies. This period also included the unexpected June 23rd Brexit vote for Britain to leave the European Union, which triggered a short-term $3.6 trillion sell off in global equities. Other dominant factors that affected market returns during the beginning of 2016 included weakness in the Chinese economy and a falling Chinese stock market. Fluctuations in oil and commodity prices were also present for most of the period.

During December 2015, the Federal Reserve (“the Fed”) and the European Central Bank (“ECB”) policies moved in opposite directions. The Fed had completed its easing cycle and moved to tightening its policy by December 2015; meanwhile, major international central banks continued easing their monetary policies. In December 2015, the Fed finally implemented its long awaited interest rate increase of 25 basis points, which was its first rate hike in nine years. This drove the yield on the two-year Treasury note to the highest level in years. At that time, the Fed estimated an additional four increases for the 2016 calendar year. However, the Fed became gradually more pessimistic and concerned about the global economy and has left interest rates unchanged year-to-date. More recently, the Fed and the markets became more confident about a potential increase in rates in December 2016. In December 2015, the ECB cut its deposit rate by an additional 0.1%, resulting in a negative 0.3% rate. In March, it made another 0.1% rate cut which brought the deposit rate to negative 0.4 %, and accelerated the rate of its bond purchases from €60 to €80 billion euros per month. The ECB also expanded its purchases to include corporate bonds.

The other major central bank, the Bank of Japan, implemented negative interest rate policy in January, joining the ECB and other European central banks. This move contributed to the decline in interest rates globally. Yields for many international bonds fell into

negative territory, which resulted in higher demand from overseas investors for positive yielding U.S. fixed income.

The Equity Market

Overall, U.S. equities (measured by the S&P 500 TR Index) posted a strong return of 15.43% for the 12 months ending September 30th. However, they experienced turbulent swings during this period. U.S. equity markets started the review period on a strong note, rallying 8.44% in October 2015 as they were recovering from the August and September sell-off. This was later followed by double-digit losses, amid worries about China, global growth and falling oil prices. Most of those fears subsided in mid-February as China’s markets stabilized, oil producers talked about decreasing supply, and Janet Yellen implied there would be fewer rate hikes than expected in 2016. Then, markets strongly rebounded from the February 11th bottom and gained almost 17% by the June 23rd Brexit vote. Markets then lost over 5% in the two days following the Brexit vote, followed by another strong rally which lasted until mid-July. Markets then stayed calm for the rest of the summer before volatility returned in September.

Overall, mid-cap stocks (measured by the S&P Midcap 400 Index) and small caps (Russell 2000 Index) posted similar returns to large caps, returning 15.33% and 15.46% for the period. However, they experienced much wider swings within the period, especially small caps. Large caps led the market during the fourth quarter of 2015, while small caps outperformed during the third quarter of 2016.

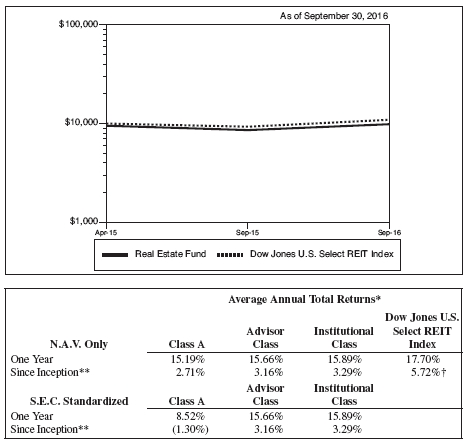

Higher-yielding stocks, including Utilities and real estate investment trusts (“REITs”), outperformed for most of the review period, supported by the low yielding environment and lack of other higher-yielding options. However, they became expensive and fell out of favor in August and September as economic data hinted that the Fed might increase rates by the end of the year. Overall, the Dow Jones U.S. Select Dividend Index and Dow Jones U.S. Select REIT Index returned 22.24% and 17.70%, respectively, for the past 12 months. All of the S&P 500 sectors ended the review period in positive territory, ranging from 7.40% (Financials) to 26.82% (Telecom Services).

International equities were positive as well. Developed markets outside the U.S. and Canada (measured by the MSCI EAFE Index) finished the review period up 7.06%. Emerging markets (measured by the MSCI EM Index) outperformed developed markets with a return of 17.21%. This was a result of negative yields on many developed market bonds which increased demand for emerging market assets with positive yields. Emerging markets also benefited from recovering commodity prices.

The Bond Market

All major fixed income markets were positive for the past 12 months ending September 30th. The U.S. bond market (measured by the BofA Merrill Lynch U.S. Broad Market Index) gained 5.26%.

Portfolio Managers’ Letter (continued)

BALANCED INCOME FUND

Treasuries (measured by the BofA ML US Treasury Index) returned 4.33% during the review period. They did especially well during the first half of 2016 when they were boosted by declining interest rates and aggressive ECB easing. Longer-dated bonds significantly outperformed with 15+ year Treasuries gaining as much as 13.34% during the review period.

The Treasury yield curve flattened with short-term yields rising and long-term yields declining. The 2-year Treasury yield, which is very sensitive to changes in Fed policy, rose 13 basis points from 0.63% as of 9/30/2015 to 0.76% as of 9/30/2016. The benchmark 10-year Treasury yield fell 44 basis points from 2.04% to 1.60%. The route of Treasury yields was very much influenced by the market’s expectations of actions and comments from central banks. Treasury yields reached their highest level of the review period during the end of 2015, when the market was pricing in the possibility that the Fed might raise interest rates four times in 2016. On the other hand, yields bottomed early in July on speculations that soft global growth would encourage major central banks to support economies with stimulus efforts, including continued low interest rates.

The 2-year yield fell to 0.55% while the 10-year yield fell to a new all-time record low of 1.36%. There is an inverse relationship between bond prices and yield changes.

Municipal bonds (measured by the BofA ML Municipal Master Index) returned 5.58%, with the majority of this return happening during the first nine months of the review period. Despite elevated issuance, strong demand from investors looking for yield was a major factor in municipal bond market performance.

Investment grade corporate bonds (measured by the BofA ML Corporate Master Index) posted a strong return of 8.50% for the review period, with the majority of this return occurring between January and August. Low global interest rates and uncertainty caused by the Brexit vote helped this sector perform well as many fixed income investors looked to U.S. markets as a safe haven. In addition, investment grade corporate bonds benefited from the ECB’s corporate bond-buying program, as demand increased for this asset class.

The high yield bond market (measured by the BofA ML HY Cash Pay Constrained Index) showed strong overall performance of 12.80%. Demand for high yield bonds benefited from investors searching for income. This sector also benefited from a rebound in oil prices. The lowest rated high yield bonds (CCC-rated) were the best performers, gaining 18.05%. However, they also experienced the widest swings; they struggled much more during risk-off periods, while significantly outperforming during risk-on periods.

International fixed income posted strong overall returns, supported by falling yields. Non-U.S. sovereign bonds (Citigroup World Government Bond ex-U.S. Index) were up 12.61%. Emerging markets (BofA ML Global Emerging Markets Sovereign Index) outperformed with a return of 17.50%. At the end of the review period there was about $9.3 trillion negative-yielding government debt instruments in the world, all of them

outside the United States. This represents 37% of the Bloomberg Global Developed Sovereign Bond Index and 51% of the all non-U.S. sovereign bonds in the Index.

The Fund

During the period under review, the Fund’s results were driven by a generally favorable market backdrop characterized by periods of extreme low volatility, interrupted by several short-lived market drops and bouts of high volatility, like the UK Brexit vote in June, and the Chinese market sell off in January of 2016. While macro trends showed gradual, but uneven, improving economic conditions over the course of the year, potential interest rate actions from the Fed hung over the markets, keeping stock markets fixated. This also had the effect of perpetuating the “yield” trade, where fixed income and equity investors sought out income producing investments, driving up the prices of that market subsector. The rally also took on the “risk on” flavor, as investors enjoyed continued low borrowing costs to indulge in higher risk (beta), lower quality investments, narrowing the field for long-term market participants.

Both absolute and relative performance was positive, reflecting the strength of the Fund’s strategy during the period under review. The Fund emphasizes high dividend yield as the key determinant, and follows a disciplined growth-at-a-reasonable price, catalyst-focused investment process seeking out exceptional long-term total return. As of period end, the Fund’s investments reflected a 3.4% dividend yield, well above the 2% yield of the S&P 500 Index. This strategy benefited the Fund’s returns during the past year. Overall stock selection was strong, with sector allocations also providing some upside. Among key sectors, Consumer Staples represented the bright spot for the Fund contributing most to return. Investments in the Utilities, Healthcare and Telecommunications sectors also contributed. Among the laggards, shares within the Energy, Consumer Discretionary, Materials and Technology sectors hurt performance. Among market capitalization segments, the Fund’s large and mid-cap stocks outperformed the market, while the small-cap segment was in line. The Fund had allocated 69% of its holdings to large-cap stocks, 16% to mid-cap stocks and 15% to small-cap stocks (ranges defined by Lipper) as of September 30, 2016.

The Fund’s equity holdings returned 18.61%, outperforming the 15.43% return of its benchmark, the S&P 500 Index. Among top performing individual investments, within Consumer Staples shares of tobacco makers Philip Morris International (+23%) and Altria Group (+16%) were the top contributors. Despite consistent results, these shares benefited from the influx of yield-oriented investors seeking dividend plays. Both shares sport dividend yields near 4%. The top performing name in the portfolio was NuSkin Enterprises (+56%), on strong new product rollouts and improved earnings. Among healthcare names, strong pharmaceutical results buoyed Johnson & Johnson, which returned +27% for the year. Additionally large-cap pharmaceutical firm Merck returned +26%. Among Utilities, shares of Black Hills Corporation rallied 48% on a successful merger integration and gas provider SCANA was up 29%. Within Telecom, service provider giants AT&T and Verizon, gained 19% and 24% for the fiscal year, respectively.

Portfolio Managers’ Letter (continued)

BALANCED INCOME FUND

During the review period, the Fund had average bond and cash allocations of 51.1% and 11.2%, respectively. The higher cash allocation reflects the fact that the Fund started operation on October 1, 2015. As a percentage of the Fund’s total assets, investment grade corporate bonds were the largest bond allocation at 29.0%, followed by mortgage-backed securities at 10.6%, U.S. government securities at 10.0%, and high yield bonds at 1.5%.

The Fund’s fixed income holdings returned 6.49%, outperforming the 5.23% return of its benchmark, the BofA Merrill Lynch US Corporate, Government & Mortgage Index. The Fund’s overweight in corporate bonds was a positive contributor to performance. As well, the Fund typically holds longer-maturity bonds to meet its income objective. During the review period, longer-maturity bonds outperformed the broad bond market as interest rates fell (when interest rates fall, bond prices increase).

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

BALANCED INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | | |

| |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Expense | Account Value | Account Value | During Period |

| Expense Example | Ratio | (4/1/16) | (9/30/16) | (4/1/16–9/30/16)* |

| Class A Shares | 1.15% | | | |

| Actual | | $1,000.00 | $1,036.97 | $5.86 |

| Hypothetical** | | $1,000.00 | $1,019.25 | $5.81 |

| Advisor Class Shares | 0.82% | | | |

| Actual | | $1,000.00 | $1,039.43 | $4.18 |

| Hypothetical** | | $1,000.00 | $1,020.90 | $4.14 |

| Institutional Class Shares | 0.69% | | | |

| Actual | | $1,000.00 | $1,040.05 | $3.52 |

| Hypothetical** | | $1,000.00 | $1,021.55 | $3.49 |

| |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid during the |

| period are net of expenses waived and/or assumed. |

| |

| ** | Assumed rate of return of 5% before expenses. |

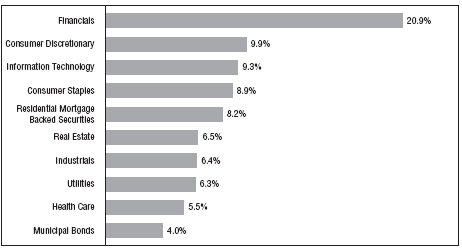

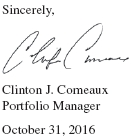

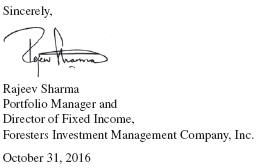

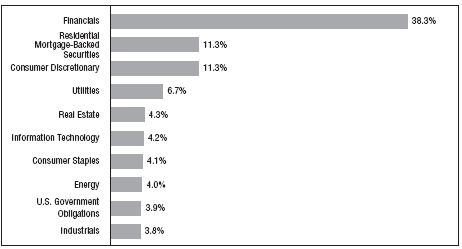

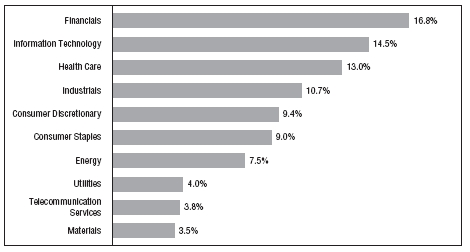

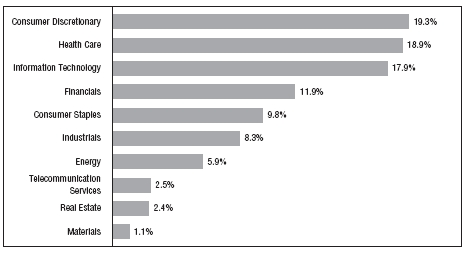

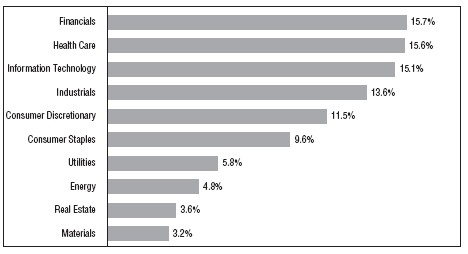

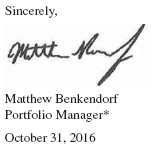

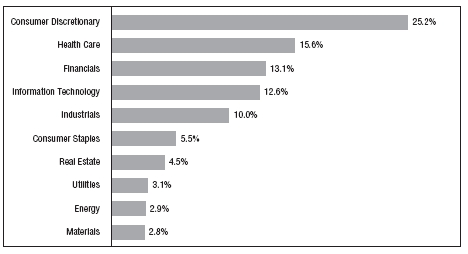

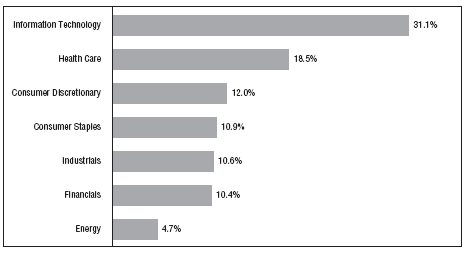

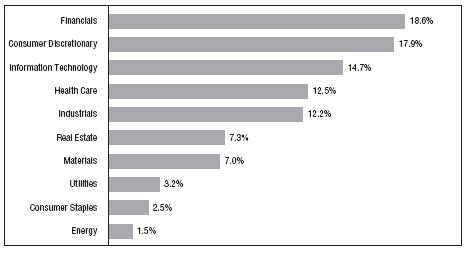

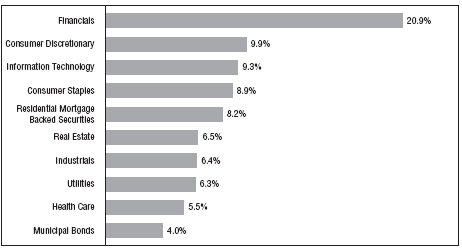

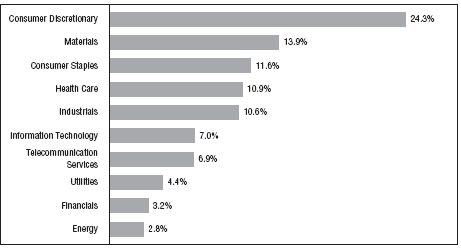

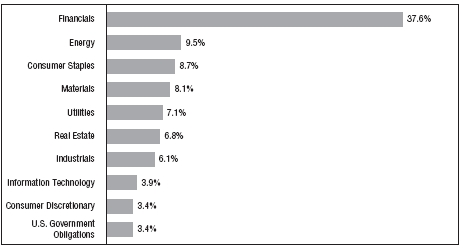

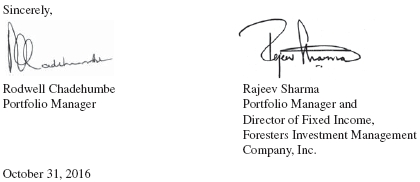

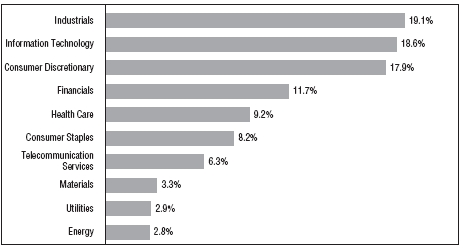

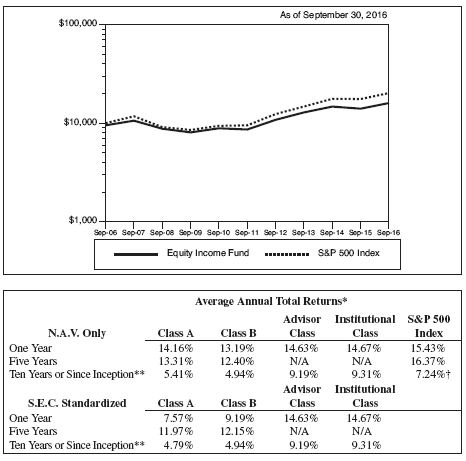

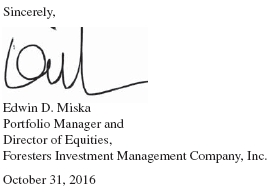

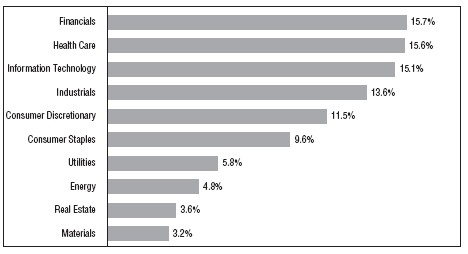

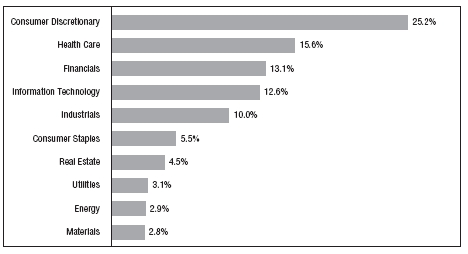

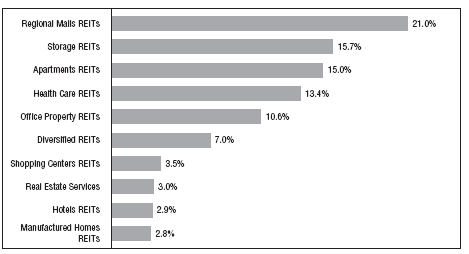

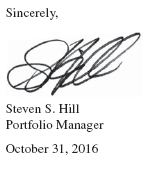

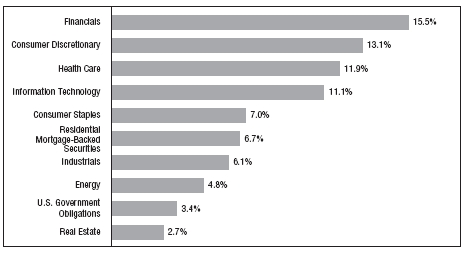

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2016, |

| and are based on the total market value of investments. |

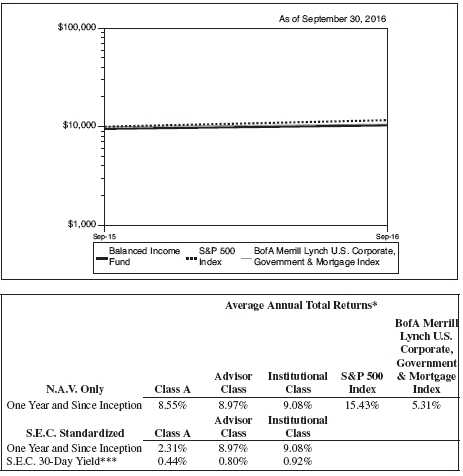

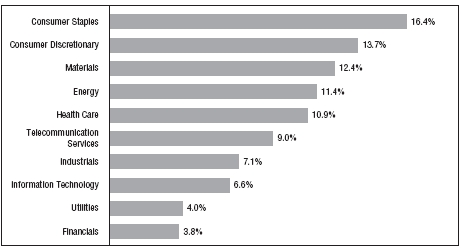

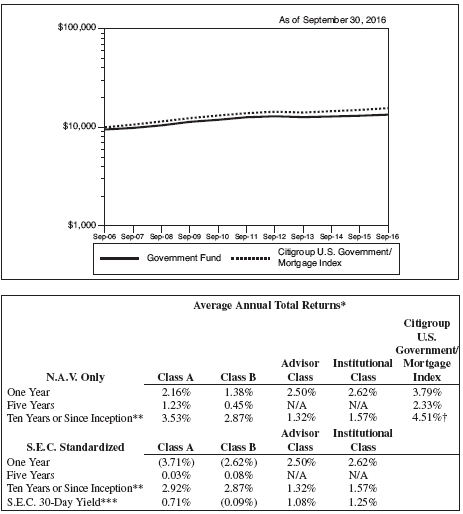

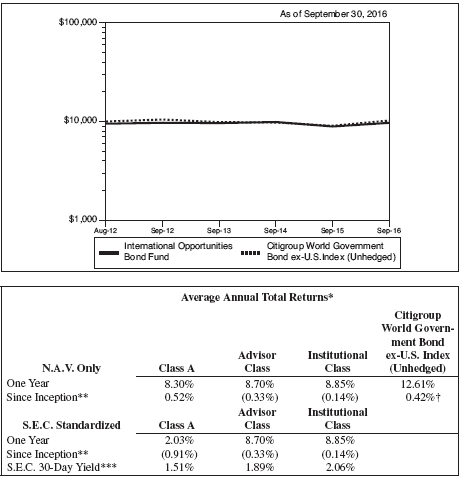

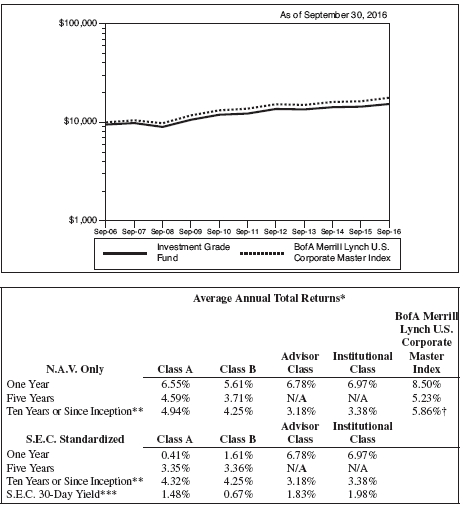

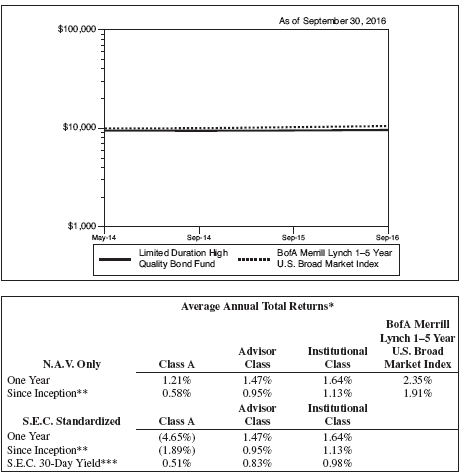

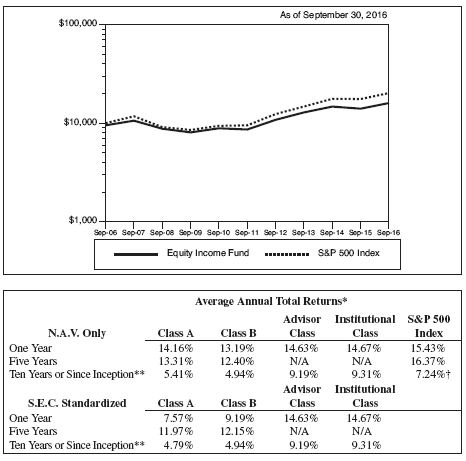

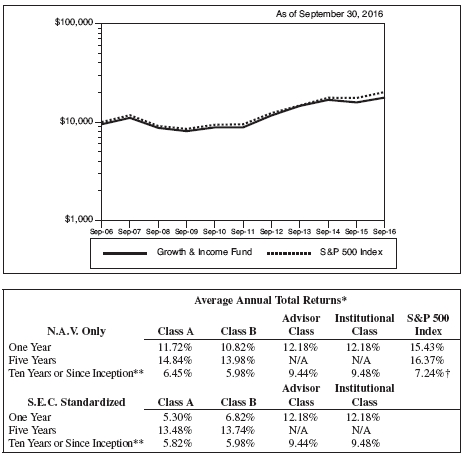

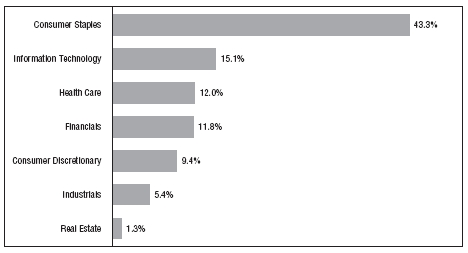

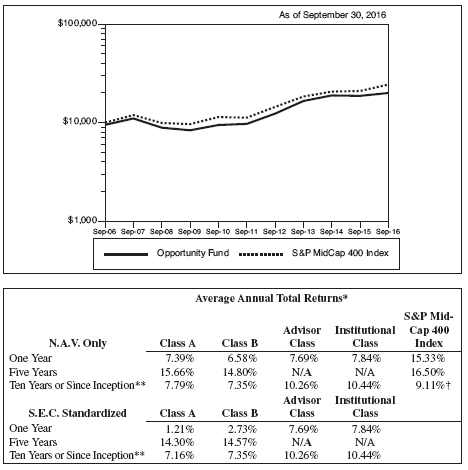

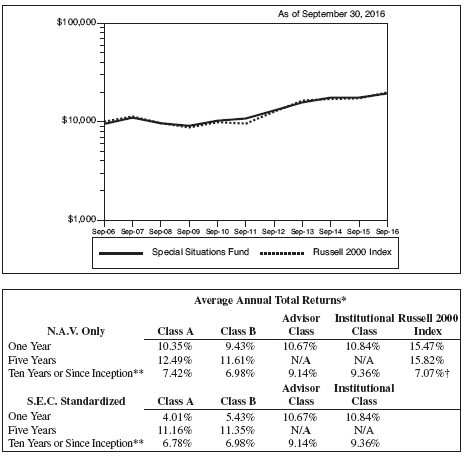

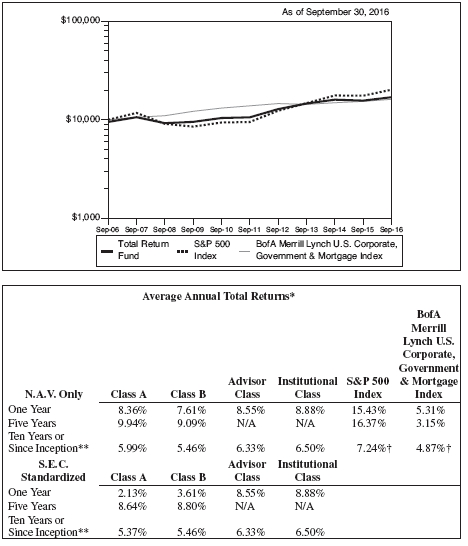

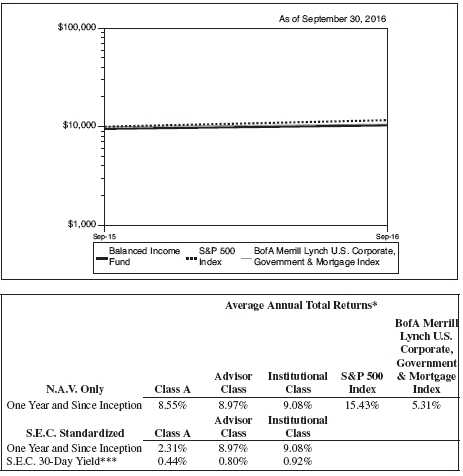

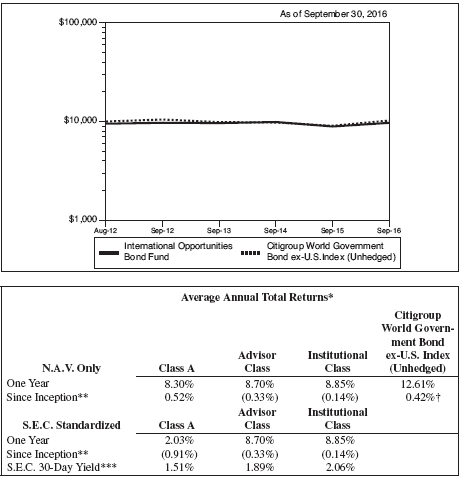

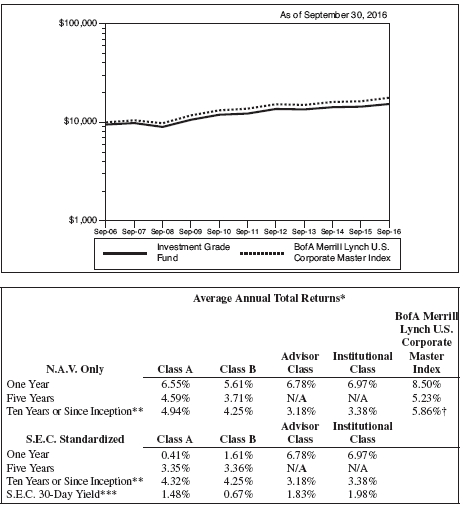

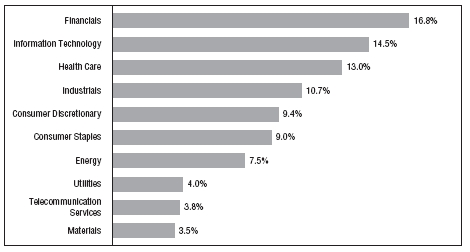

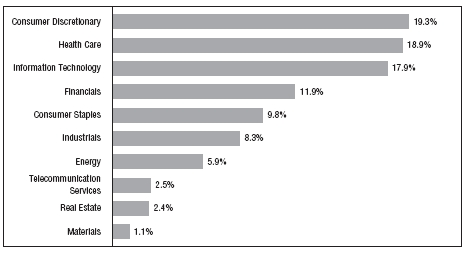

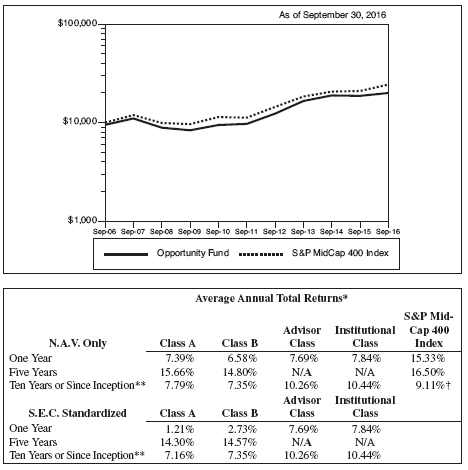

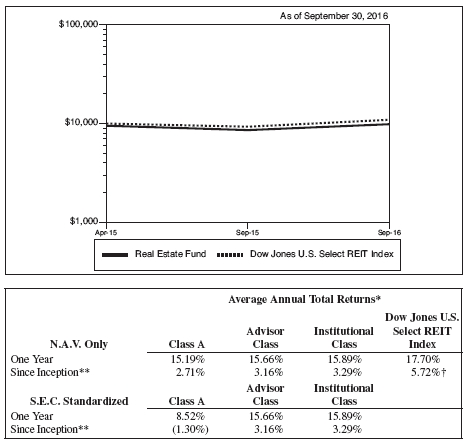

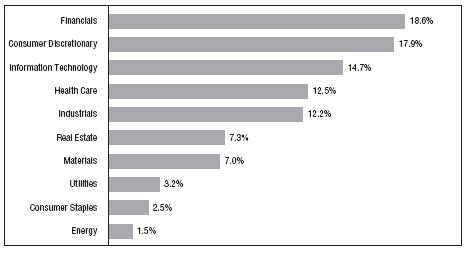

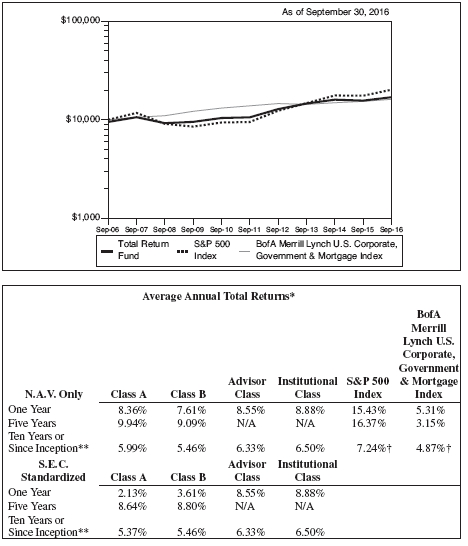

Cumulative Performance Information (unaudited)

BALANCED INCOME FUND

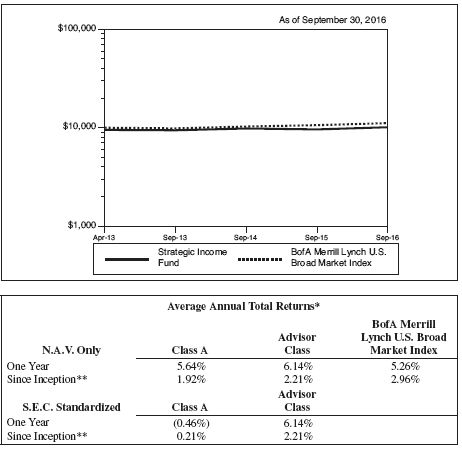

Comparison of change in value of $10,000 investment in the First Investors Balanced Income Fund (Class A shares), the Bank of America (“BofA”) Merrill Lynch U.S. Corporate, Government & Mortgage Index and the Standard & Poor’s 500 Index.

The graph compares a $10,000 investment in the First Investors Balanced Income Fund (Class A shares) beginning 10/1/15 (commencement of operations) with theoretical investments in the BofA Merrill Lynch U.S. Corporate, Government & Mortgage Index and the Standard & Poor’s 500 Index (the “Indices”). The BofA Merrill Lynch U.S. Corporate, Government & Mortgage Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the US domestic market, including U.S. Treasuries, quasi-government securities, corporates, covered bonds and residential mortgage pass-through securities. The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in these Indices. In addition, the Indices do not reflect

fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Advisor Class shares and Institutional Class shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

*Average Annual Total Return figures (for the periods ended 9/30/16) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75%. The Advisor Class and Institutional Class “S.E.C. Standardized” returns shown are the same as the N.A.V. Only returns since these classes are sold without sales charges. During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for One Year and Since Inception would have been 1.22% and the S.E.C. 30-Day Yield for September 2016 would have been (1.21)%. The Advisor Class “S.E.C. Standardized” Average Annual Total Return for One Year and Since Inception would have been 7.81% and the S.E.C. 30-Day Yield for September 2016 would have been (0.85)%. The Institutional Class “S.E.C. Standardized” Average Annual Total Return for One Year and Since Inception would have been 7.84% and the S.E.C. 30-Day Yield for September 2016 would have been (0.91)%. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. BofA Merrill Lynch U.S. Corporate, Government & Mortgage Index figures are from Bank of America Merrill Lynch & Co. and Standard & Poor’s 500 Index figures are from Standard & Poor’s and all other figures are from Foresters Investment Management Company, Inc.

**The Since Inception returns for Class A shares, Advisor Class shares and Institutional Class shares are for the period beginning 10/1/15 (commencement of operations).

***The S.E.C. 30-Day Yield shown is for September 2016.

Portfolio of Investments

BALANCED INCOME FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | CORPORATE BONDS—41.1% | |

| | | Aerospace/Defense—.7% | |

| $ 200M | | Rolls-Royce, PLC, 3.625%, 10/14/2025 (b) | $ 211,596 |

| | | Automotive—1.4% | |

| 100M | | Johnson Controls, Inc., 5%, 3/30/2020 | 109,907 |

| 300M | | O’Reilly Automotive, Inc., 3.55%, 3/15/2026 | 318,653 |

| | | | 428,560 |

| | | Chemicals—1.1% | |

| 200M | | Agrium, Inc., 3.375%, 3/15/2025 | 206,423 |

| 100M | | Dow Chemical Co., 4.25%, 11/15/2020 | 108,670 |

| | | | 315,093 |

| | | Consumer Non-Durables—.7% | |

| 200M | | Newell Brands, Inc., 4.2%, 4/1/2026 | 218,074 |

| | | Energy—.8% | |

| 200M | | Magellan Midstream Partners, LP, 5%, 3/1/2026 | 228,276 |

| | | Financial Services—4.2% | |

| | | American International Group, Inc.: | |

| 100M | | 4.7%, 7/10/2035 | 108,618 |

| 300M | | 3.75%, 7/10/2025 | 315,228 |

| 100M | | Ameriprise Financial, Inc., 5.3%, 3/15/2020 | 111,430 |

| 100M | | Berkshire Hathaway, Inc., 3.4%, 1/31/2022 | 108,379 |

| 200M | | ERAC USA Finance Co., 7%, 10/15/2037 (b) | 273,619 |

| | | General Electric Capital Corp.: | |

| 200M | | 3.1%, 1/9/2023 | 212,656 |

| 100M | | 6.75%, 3/15/2032 | 140,759 |

| | | | 1,270,689 |

| | | Financials—10.8% | |

| 200M | | Bank of America Corp., 5.875%, 2/7/2042 | 261,700 |

| 200M | | Capital One Financial Corp., 3.75%, 4/24/2024 | 212,683 |

| | | Citigroup, Inc.: | |

| 200M | | 4.5%, 1/14/2022 | 221,149 |

| 200M | | 3.7%, 1/12/2026 | 211,500 |

| 200M | | Deutsche Bank AG, 3.7%, 5/30/2024 | 191,834 |

| 200M | | General Motors Financial Co., 5.25%, 3/1/2026 | 220,060 |

| | | Goldman Sachs Group, Inc.: | |

| 200M | | 3.625%, 1/22/2023 | 211,607 |

| 100M | | 6.125%, 2/15/2033 | 126,357 |

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | Financials (continued) | |

| | | JPMorgan Chase & Co.: | |

| $ 100M | | 4.5%, 1/24/2022 | $ 110,810 |

| 100M | | 6.4%, 5/15/2038 | 138,075 |

| | | Morgan Stanley: | |

| 100M | | 5.5%, 7/28/2021 | 114,175 |

| 100M | | 7.25%, 4/1/2032 | 139,098 |

| | | U.S. Bancorp: | |

| 200M | | 3.6%, 9/11/2024 | 214,570 |

| 200M | | 3.1%, 4/27/2026 | 206,853 |

| 300M | | Visa, Inc., 3.15%, 12/14/2025 | 317,270 |

| | | Wells Fargo & Co.: | |

| 200M | | 3.9%, 5/1/2045 | 206,299 |

| 100M | | 5.606%, 1/15/2044 | 119,730 |

| | | | 3,223,770 |

| | | Food/Beverage/Tobacco—1.5% | |

| | | Anheuser-Busch InBev Finance: | |

| 100M | | 3.65%, 2/1/2026 | 107,608 |

| 200M | | 4.7%, 2/1/2036 | 230,699 |

| 100M | | 4.9%, 2/1/2046 | 119,471 |

| | | | 457,778 |

| | | Food/Drug—1.1% | |

| 300M | | CVS Health Corp., 3.875%, 7/20/2025 | 327,183 |

| | | Health Care—.7% | |

| 200M | | Gilead Sciences, Inc., 3.65%, 3/1/2026 | 215,517 |

| | | Information Technology—2.4% | |

| 200M | | Apple, Inc., 2.5%, 2/9/2025 | 202,668 |

| 300M | | Microsoft Corp., 3.7%, 8/8/2046 | 304,472 |

| | | Oracle Corp.: | |

| 100M | | 2.95%, 5/15/2025 | 103,408 |

| 100M | | 2.65%, 7/15/2026 | 100,147 |

| | | | 710,695 |

| | | Media-Broadcasting—.8% | |

| 200M | | Comcast Corp., 4.25%, 1/15/2033 | 222,534 |

| | | Media-Diversified—.7% | |

| 200M | | Time Warner, Inc., 3.6%, 7/15/2025 | 213,133 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | Real Estate—4.9% | |

| $ 300M | | AvalonBay Communities, Inc., 3.5%, 11/15/2024 | $ 314,695 |

| 200M | | Boston Properties, LP, 2.75%, 10/1/2026 | 197,438 |

| 200M | | ERP Operating, LP, 3.375%, 6/1/2025 | 209,141 |

| 300M | | Prologis, LP, 3.75%, 11/1/2025 | 323,367 |

| 200M | | Simon Property Group, LP, 3.375%, 10/1/2024 | 212,615 |

| 200M | | Welltower, Inc., 4%, 6/1/2025 | 212,454 |

| | | | 1,469,710 |

| | | Retail-General Merchandise—1.7% | |

| 200M | | Amazon.com, Inc., 4.8%, 12/5/2034 | 235,710 |

| 200M | | Home Depot, Inc., 5.875%, 12/16/2036 | 274,856 |

| | | | 510,566 |

| | | Telecommunications—2.2% | |

| | | AT&T, Inc.: | |

| 100M | | 3.8%, 3/15/2022 | 107,241 |

| 200M | | 5.15%, 3/15/2042 | 217,802 |

| | | Verizon Communications, Inc.: | |

| 200M | | 5.15%, 9/15/2023 | 233,332 |

| 100M | | 4.125%, 8/15/2046 | 100,452 |

| | | | 658,827 |

| | | Transportation—1.6% | |

| 200M | | Burlington North Santa Fe, LLC, 5.15%, 9/1/2043 | 249,308 |

| 200M | | Cummins, Inc., 4.875%, 10/1/2043 | 237,585 |

| | | | 486,893 |

| | | Utilities—3.8% | |

| 200M | | Dominion Resources, Inc., 3.9%, 10/1/2025 | 215,579 |

| 200M | | Duke Energy Progress, Inc., 4.15%, 12/1/2044 | 219,440 |

| 100M | | Entergy Arkansas, Inc., 4.95%, 12/15/2044 | 106,244 |

| 200M | | Ohio Power Co., 5.375%, 10/1/2021 | 229,122 |

| 100M | | Oklahoma Gas & Electric Co., 4%, 12/15/2044 | 106,685 |

| 200M | | South Carolina Electric & Gas Co., 5.45%, 2/1/2041 | 252,502 |

| | | | 1,129,572 |

| Total Value of Corporate Bonds (cost $12,026,044) | 12,298,466 |

| | | |

| |

| | | | |

| | | | |

| | | | |

| Shares | | Security | Value |

| | | COMMON STOCKS—38.5% | |

| | | Consumer Discretionary—4.6% | |

| 4,500 | | American Eagle Outfitters, Inc. | $ 80,370 |

| 4,800 | | DSW, Inc. – Class “A” | 98,304 |

| 5,800 | | Ford Motor Company | 70,006 |

| 3,214 | | Johnson Controls, Inc. | 149,547 |

| 2,500 | | L Brands, Inc. | 176,925 |

| 3,400 | | Newell Brands, Inc. | 179,044 |

| 1,800 | | Penske Automotive Group, Inc. | 86,724 |

| 3,400 | | Regal Entertainment Group – Class “A” | 73,950 |

| 10,400 | | Stein Mart, Inc. | 66,040 |

| 3,000 | | Tupperware Brands Corporation | 196,110 |

| 550 | | Whirlpool Corporation | 89,188 |

| 1,500 | | Wyndham Worldwide Corporation | 100,995 |

| | | | 1,367,203 |

| | | Consumer Staples—6.2% | |

| 5,200 | | Altria Group, Inc. | 328,796 |

| 4,000 | | B&G Foods, Inc. | 196,720 |

| 3,200 | | Coca-Cola Company | 135,424 |

| 4,700 | | Koninklijke Ahold Delhaize NV (ADR) | 106,455 |

| 1,600 | | Nu Skin Enterprises, Inc. – Class “A” | 103,648 |

| 2,400 | | PepsiCo, Inc. | 261,048 |

| 3,600 | | Philip Morris International, Inc. | 349,992 |

| 1,300 | | Procter & Gamble Company | 116,675 |

| 2,200 | | Sysco Corporation | 107,822 |

| 2,200 | | Wal-Mart Stores, Inc. | 158,664 |

| | | | 1,865,244 |

| | | Energy—1.7% | |

| 500 | | Chevron Corporation | 51,460 |

| 1,000 | | ExxonMobil Corporation | 87,280 |

| 1,150 | | Marathon Petroleum Corporation | 46,679 |

| 550 | | Occidental Petroleum Corporation | 40,106 |

| 2,700 | | PBF Energy, Inc. – Class “A” | 61,128 |

| 500 | | Phillips 66 | 40,275 |

| 1,500 | | Royal Dutch Shell, PLC – Class “A” (ADR) | 75,105 |

| 500 | | Schlumberger, Ltd. | 39,320 |

| 2,100 | | Suncor Energy, Inc. | 58,338 |

| | | | 499,691 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| | | | |

| Shares | | Security | Value |

| | | Financials—3.9% | |

| 1,250 | | Ameriprise Financial, Inc. | $ 124,713 |

| 2,300 | | Berkshire Hills Bancorp, Inc. | 63,733 |

| 900 | | Chubb, Ltd. | 113,085 |

| 2,650 | | Discover Financial Services | 149,857 |

| 2,400 | | JPMorgan Chase & Company | 159,816 |

| 2,600 | | MetLife, Inc. | 115,518 |

| 1,300 | | PNC Financial Services Group, Inc. | 117,117 |

| 3,200 | | U.S. Bancorp | 137,248 |

| 6,100 | | Waddell & Reed Financial, Inc. – Class “A” | 110,776 |

| 2,000 | | Wells Fargo & Company | 88,560 |

| | | | 1,180,423 |

| | | Health Care—4.7% | |

| 4,300 | | Abbott Laboratories | 181,847 |

| 4,000 | | AbbVie, Inc. | 252,280 |

| 4,700 | | GlaxoSmithKline, PLC (ADR) | 202,711 |

| 2,400 | | Johnson & Johnson | 283,512 |

| 3,100 | | Merck & Company, Inc. | 193,471 |

| 9,000 | | Pfizer, Inc. | 304,830 |

| | | | 1,418,651 |

| | | Industrials—4.0% | |

| 1,500 | | 3M Company | 264,345 |

| 5,200 | | General Electric Company | 154,024 |

| 1,600 | | Honeywell International, Inc. | 186,544 |

| 4,400 | | Koninklijke Philips NV (ADR) | 130,196 |

| 1,100 | | Lockheed Martin Corporation | 263,692 |

| 1,700 | | Textainer Group Holdings, Ltd. | 12,733 |

| 8,000 | | Triton International, Ltd. | 105,520 |

| 900 | | United Technologies Corporation | 91,440 |

| | | | 1,208,494 |

| | | Information Technology—7.0% | |

| 2,900 | | Apple, Inc. | 327,845 |

| 4,000 | | Applied Materials, Inc. | 120,600 |

| 7,200 | | Cisco Systems, Inc. | 228,384 |

| 3,600 | | Intel Corporation | 135,900 |

| 1,000 | | International Business Machines Corporation | 158,850 |

| 4,600 | | Maxim Integrated Products, Inc. | 183,678 |

| 5,300 | | Microsoft Corporation | 305,280 |

| 3,600 | | QUALCOMM, Inc. | 246,600 |

| | | |

| |

| | | | |

| | | | |

| | | | |

| Shares | | Security | Value |

| | | Information Technology (continued) | |

| 5,200 | | Symantec Corporation | $ 130,520 |

| 6,400 | | Travelport Worldwide, Ltd. | 96,192 |

| 2,500 | | Western Digital Corporation | 146,175 |

| | | | 2,080,024 |

| | | Materials—.6% | |

| 700 | | Praxair, Inc. | 84,581 |

| 1,600 | | RPM International, Inc. | 85,952 |

| | | | 170,533 |

| | | Real Estate—1.6% | |

| 5,000 | | Brixmor Property Group, Inc. (REIT) | 138,950 |

| 3,200 | | Chesapeake Lodging Trust (REIT) | 73,280 |

| 11,200 | | FelCor Lodging Trust, Inc. (REIT) | 72,016 |

| 6,500 | | Sunstone Hotel Investors, Inc. (REIT) | 83,135 |

| 1,150 | | Tanger Factory Outlet Centers, Inc. (REIT) | 44,804 |

| 3,500 | | Urstadt Biddle Properties, Inc. – Class “A” (REIT) | 77,770 |

| | | | 489,955 |

| | | Telecommunication Services—1.6% | |

| 6,500 | | AT&T, Inc. | 263,965 |

| 4,100 | | Verizon Communications, Inc. | 213,118 |

| | | | 477,083 |

| | | Utilities—2.6% | |

| 2,300 | | Black Hills Corporation | 140,806 |

| 2,200 | | Duke Energy Corporation | 176,088 |

| 3,100 | | Exelon Corporation | 103,199 |

| 4,200 | | NiSource, Inc. | 101,262 |

| 2,000 | | SCANA Corporation | 144,740 |

| 1,700 | | WEC Energy Group, Inc. | 101,796 |

| | | | 767,891 |

| Total Value of Common Stocks (cost $10,797,108) | 11,525,192 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

September 30, 2016

| | | | | | | |

| |

| | | | | | | | |

| Principal | | | | | | | |

| Amount or | | | | | | | |

| Shares | | Security | | | | | Value |

| | | RESIDENTIAL MORTGAGE-BACKED | | | | |

| | | SECURITIES—8.2% | | | | | |

| | | Fannie Mae | | | | | |

| $ 855M | | 3%, 5/1/2029 – 6/1/2046 | | | | | $ 892,118 |

| 757M | | 3.5%, 9/1/2045 – 10/13/2046 (a) | | | | | 799,677 |

| 616M | | 4%, 10/1/2035 – 10/13/2046 (a) | | | | | 666,588 |

| 83M | | 5%, 8/1/2039 | | | | | 92,745 |

| Total Value of Residential Mortgage-Backed Securities (cost $2,435,385) | | | | 2,451,128 |

| | | VARIABLE AND FLOATING RATE NOTES†—4.0% | | | | |

| 1,200M | | Illinois St. Fin. Auth. Rev., 0.85%, 7/1/2038 (cost $1,200,000) | | | | 1,200,000 |

| | | U.S. GOVERNMENT OBLIGATIONS—2.9% | | | | |

| 875M | | U.S. Treasury Notes, 0.5222%, 1/31/2018 (cost $876,295) † | | | | 877,306 |

| | | EXCHANGE TRADED FUNDS—2.0% | | | | | |

| 6,650 | | iShares iBoxx USD High Yield Corporate Bond | | | | |

| | | ETF (ETF) (cost $550,093) | | | | | 580,279 |

| | | SHORT-TERM U.S. GOVERNMENT AGENCY | | | | |

| | | OBLIGATIONS—3.3% | | | | | |

| $1,000M | | Federal Home Loan Bank, 0.295%, 10/21/2016 (cost $999,836) | | | | 999,910 |

| Total Value of Investments (cost $28,884,761) | 100.0 | % | | | 29,932,281 |

| Other Assets, Less Liabilities | .0 | | | | 9,161 |

| Net Assets | | | 100.0 | % | | | $29,941,442 |

| | |

| (a) | A portion or all of the security purchased on a when-issued or delayed delivery basis (see |

| Note 1G). |

| |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

| |

| † | Interest rates on adjustable rate bonds are determined and reset periodically. The interest rates |

| shown are the rates in effect at September 30, 2016. |

| |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| REIT | Real Estate Investment Trust |

| USD | United States Dollar |

Futures contracts outstanding at September 30, 2016:

| | | | | |

| | | | | Value at | Unrealized |

| Number of | | | Value at | September 30, | Appreciation |

| Contracts | Type | Expiration | Trade Date | 2016 | (Depreciation) | | |

| 5 | | 5 Year U.S. | Dec. 2016 | $ | 608,438 | | $ | 609,234 | | $ | 796 | |

| | Treasury Note | | | | |

| 19 | | 10 Year U.S. | Dec. 2016 | 2,488,609 | | 2,485,601 | | (3,008) | |

| | Treasury Note | | | | |

| 6 | | U.S. Treasury | Dec. 2016 | 1,025,438 | | 1,041,861 | | 16,423 | |

| | Long Bond | | | | | | |

| | | | | | $ | 14,211 | | |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets or liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Portfolio of Investments (continued)

BALANCED INCOME FUND

September 30, 2016

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2016:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Corporate Bonds | | $ | — | | $ | 12,298,466 | | $ | — | | $ | 12,298,466 |

| Common Stocks | | | 11,525,192 | | | — | | | — | | | 11,525,192 |

| Residential Mortgage-Backed | | | | | | | | | | | | |

| Securities | | | — | | | 2,451,128 | | | — | | | 2,451,128 |

| Variable and Floating Rate Notes | | | — | | | 1,200,000 | | | — | | | 1,200,000 |

| U.S. Government Obligations | | | — | | | 877,306 | | | — | | | 877,306 |

| Exchange Traded Funds | | | 580,279 | | | — | | | — | | | 580,279 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Agency Obligations | | | — | | | 999,910 | | | — | | | 999,910 |

| Total Investments in Securities* | | $ | 12,105,471 | | $ | 17,826,810 | | $ | — | | $ | 29,932,281 |

| |

| Other Assets | | | | | | | | | | | | |

| Futures Contracts | | $ | 14,211 | | $ | — | | $ | — | | $ | 14,211 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for corporate bonds |

| and common stocks. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the year ended September 30, |

| 2016. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| 24 | See notes to financial statements | |

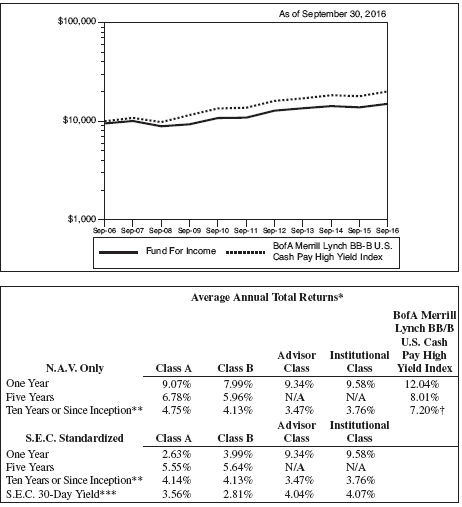

Portfolio Manager’s Letter

FLOATING RATE FUND

Dear Investor:

This is the annual report for the First Investors Floating Rate Fund for the fiscal year ended September 30, 2016. During the period, the Fund’s return on a net asset value basis was 3.69% for Class A shares, 3.92% for Advisor Class shares and 4.14% for Institutional Class shares, including dividends of 27.7 cents per share on Class A shares, 29.8 cents per share on Advisor Class shares and 31.7 cents per share on Institutional Class shares.

In a welcome turn from the 2015 fiscal year, Fund investors in the current year benefited as senior loans delivered attractive positive performance, largely on stabilization of the Oil, Metals and Mining (coal and iron ore) sectors which had declined precipitously in 2015 and created an elevated level of market anxiety around lower-rated companies and defaults. In this environment in which some of the market’s lowest-rated and, in our view, lowest-quality credits outperformed, the Fund underperformed its benchmark. Late in the period, the senior loan market was also buoyed by market anticipation that the Federal Reserve (“the Fed”) may be closer to an interest rate increase.

The Market

U.S. loan market performance can be divided into two distinct periods over the year. The Fund and the markets delivered a modest positive return in October 2015 to start the period, but declined in November, December, January and February, largely on the back of the demise of a highly speculative U.S. mutual fund and weaker oil prices. Negative sentiment was particularly pronounced in January, as oil continued to decline on concerns about a continued supply/demand imbalance and slow Chinese growth.

In mid-February, sentiment shifted dramatically—and seemingly without challenge throughout the rest of the period—as oil prices stabilized, leading to strong market performance through the rest of the period, save for a brief and shallow dip in June 2016. The rally in global risk assets gathered further impetus after the European Central Bank (“ECB”) announced an increase in the size and scope of its current Quantitative Easing program in addition to cutting rates. While not directly buying U.S. dollar high yield paper, the ECB’s continued stimulus of the European economy provided a clear headwind to Fed rate increases in the U.S. and signaled a likely “lower-for-longer” policy that spurred a global move to corporate credit.

Ordinarily, we would not expect senior loans, which have a floating rate coupon that can reset up along with interest rate increases, to benefit from global resignation to low interest rates. However, investors searching for lower-volatility yield opportunities appear to have found senior loans compelling and competitive in a world awash in negative-yielding fixed income. In our view, this trend was exacerbated as the prices of other risk assets, including global high yield bonds, rose steeply after February, causing some investors to look with interest at comparatively attractive senior loan valuations.

Portfolio Manager’s Letter (continued)

FLOATING RATE FUND

June saw some brief pricing volatility around risks outside of the U.S. high yield market. Notably, markets wobbled with the passage of the Brexit vote in which the UK citizenry voted to leave the European Union. Loans benefited thereafter on the back of the market’s sense that the Fed was becoming increasingly likely to impose an interest rate increase. Further, loans have benefited over recent months from a change in money market regulations, which no longer allow money market funds to offer fixed returns. Such regulations have forced LIBOR to rise. As most senior loans compute their coupons on a LIBOR-plus basis, changes in money market regulation have created unforeseen increases in senior loan coupons. These increases have not been directly in line with the rise in LIBOR—from about 22 basis points (“bps”) per annum at the start of the period, to approximately 85 bps per annum at the end of the period—because most loans in the market were already protected by LIBOR floors starting at 75 bps or higher. However, increases have moved approximately 40% of the senior loan market to, or above, their LIBOR-plus floors.

Overall, lower-rated, stressed, Basic Materials (Energy and Metals/Mining) widely outperformed from mid-February and for much of the period, but outperformance slowed toward the period’s end, as those energy companies which did not default became more fully priced and as oil prices softened yet again in the late days of summer.

The Fund

In this year of split returns, the Fund outperformed its Index (the J.P. Morgan BB/B Leveraged Loan Index) when the market was most challenged through mid-February 2016 and underperformed the Index in its more bullish subsequent phase. This result aligns with our core positioning throughout the year in which we generally kept the Fund less risk-exposed than the market to the Energy and Metals/Mining sectors. While our Metals and Mining exposure was generally higher than that of the market, and our Energy exposure less than that of the market, in both of those sectors we attempted to find higher-quality credits we believed could be more reliable even if the price of energy and other commodities did not prove stable at levels that would stem those sectors’ elevated default rates. Outside of these sectors, we committed significant capital to a range of less-cyclical, more defensive industries such as Healthcare, Basic Materials, Telecommunications, and Food and Beverages. Our overweight of Chemicals was perhaps an exception to this defensive positioning.

In general, we also maintained a portfolio with lower-than-market rating risk throughout the year, reflecting our overarching goal to create a portfolio that is less directional over time than the market, and less susceptible to price challenges imposed by risk-off events. We allocated approximately 20% less of the Fund to B-rated credit than did the market. We believe, however, that as loan prices continued to rise through the year, it was important not to chase yield and risk to keep up with the market. We cannot predict when the market will experience volatility, but we believe it far more valuable in the longer

run to be positioned to provide liquidity to the market at those moments than to be fully leveraged to a rising market before such a correction occurs. In short, we have targeted building a portfolio we believe can be more resilient than the market in a re-pricing event, and in which we can take advantage of opportunities we believe are unduly discounted.

Outlook

On a positive note, we actually believe that a challenge to senior loan pricing is most likely to come from outside the loan market at this time, rather than from within the loan market itself. While the credit cycle appears to be maturing, the credit quality of high yield companies borrowing in the senior loan market is generally still fairly solid, with few companies subject to near-term maturities that could become unduly burdensome. Trailing 12-month market default rates are actually falling now that commodity-related defaults appear to be largely completed. Rather, we believe that challenges to the senior loan market are likely to come from any larger event that reduces market liquidity overall. Such an event—whether caused by political outcomes (Brexit, U.S. elections), or even by a single anomalous event such as a terror attack—would likely impact risk assets outside of high yield even more broadly. By contrast, central bank action to increase rates may challenge higher-rated fixed income and risk assets alike, while benefiting investors in senior loans who can benefit from increasing coupons once LIBOR moves above the LIBOR floor rates present in most loans.

The questions remain—what can investors expect in terms of returns going forward and what will drive markets until year-end? We believe given the strong rally of the last few months, investors should expect more of a coupon-like return. Given paltry government yields, however, global corporates remain attractive on a relative basis. Further, loans, with their floating rate capacity, should benefit most directly should rates rise. We expect returns to be driven by technical flows, central bank talk/action and other macro factors like the U.S. election. The world is watching.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

FLOATING RATE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | | |

| |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Expense | Account Value | Account Value | During Period |

| Expense Example | Ratio | (4/1/16) | (9/30/16) | (4/1/16–9/30/16)* |

| Class A Shares | 1.10% | | | |

| Actual | | $1,000.00 | $1,030.76 | $5.58 |

| Hypothetical** | | $1,000.00 | $1,019.50 | $5.55 |

| Advisor Class Shares | 0.90% | | | |

| Actual | | $1,000.00 | $1,032.79 | $4.57 |

| Hypothetical** | | $1,000.00 | $1,020.50 | $4.55 |

| Institutional Class Shares | 0.70% | | | |

| Actual | | $1,000.00 | $1,033.81 | $3.56 |

| Hypothetical** | | $1,000.00 | $1,021.50 | $3.54 |

| |

| * | Expenses are equal to the annualized expense ratio, multiplied by the average account value over |

| the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid during the |

| period are net of expenses waived and/or assumed. |

| |

| ** | Assumed rate of return of 5% before expenses. |

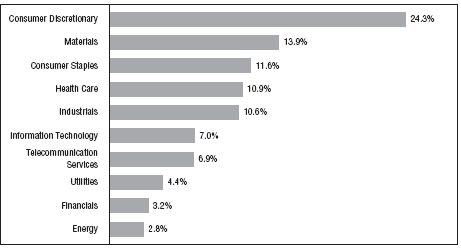

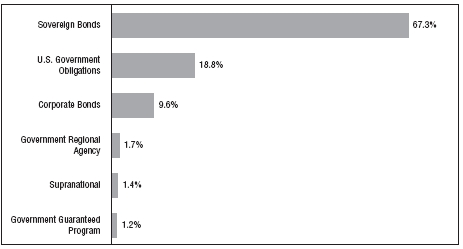

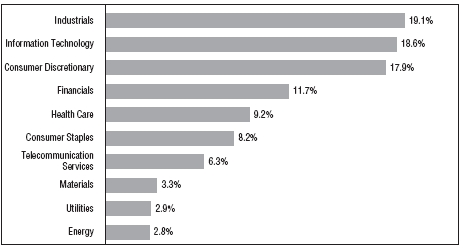

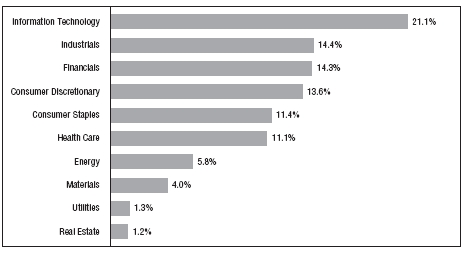

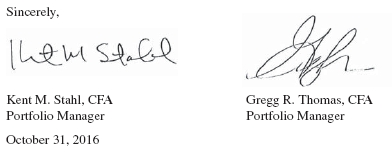

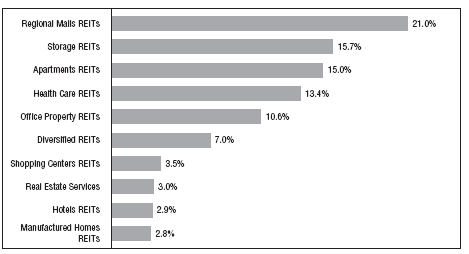

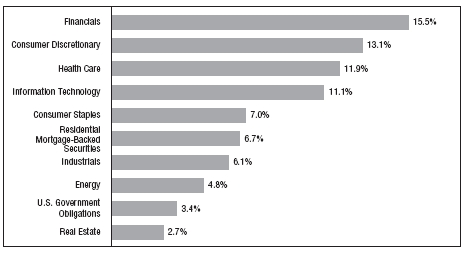

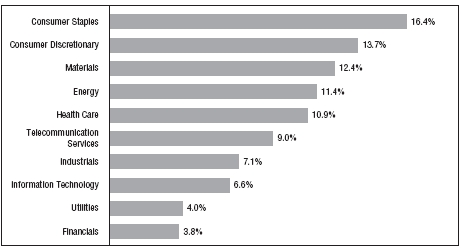

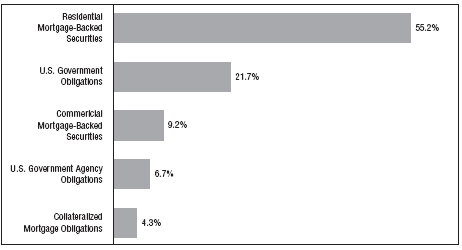

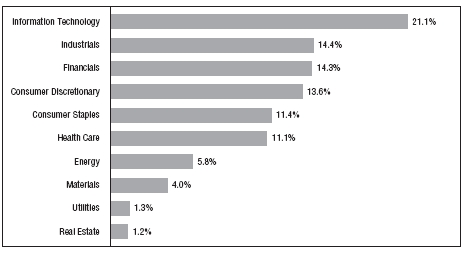

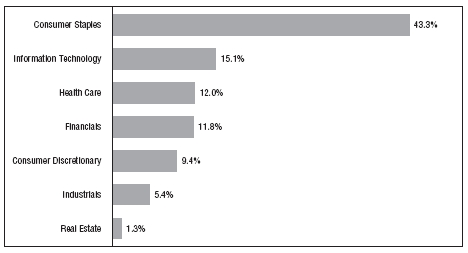

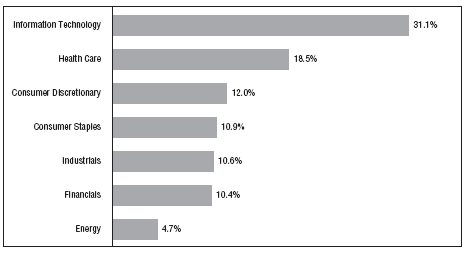

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2016, |

| and are based on the total market value of investments. |

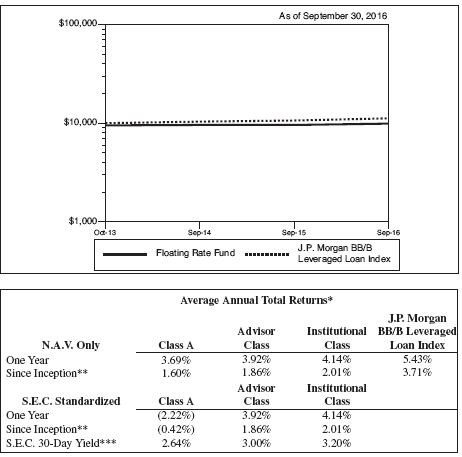

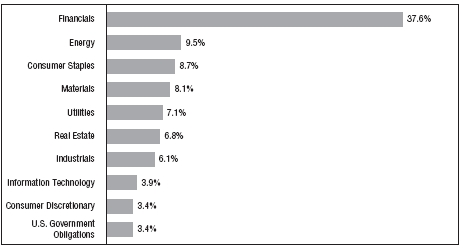

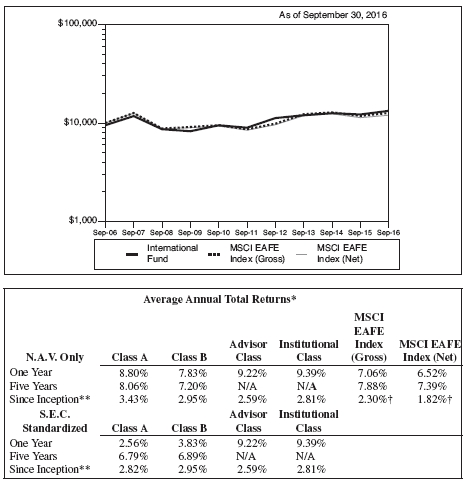

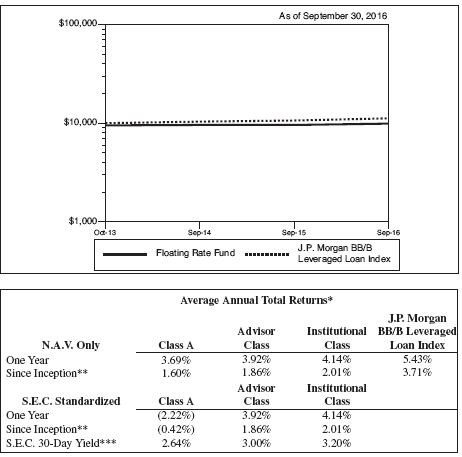

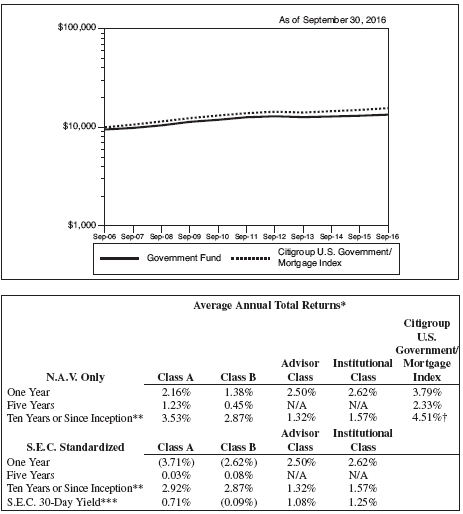

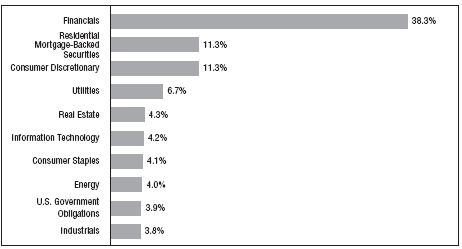

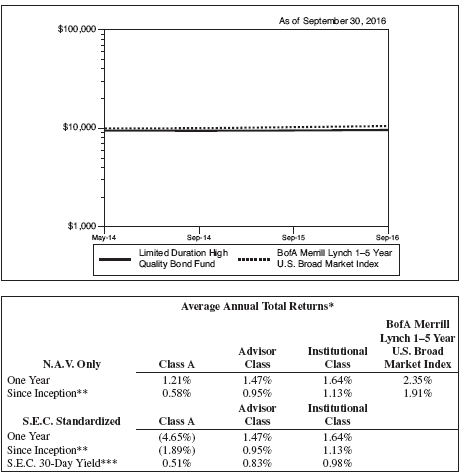

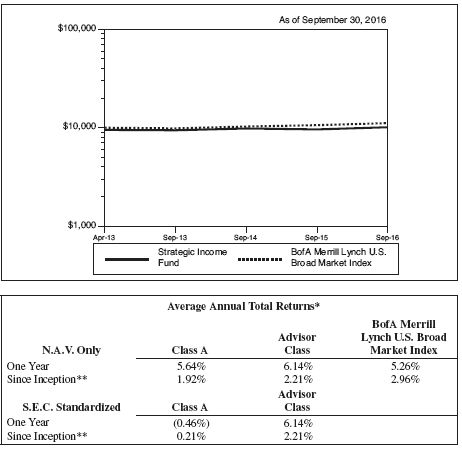

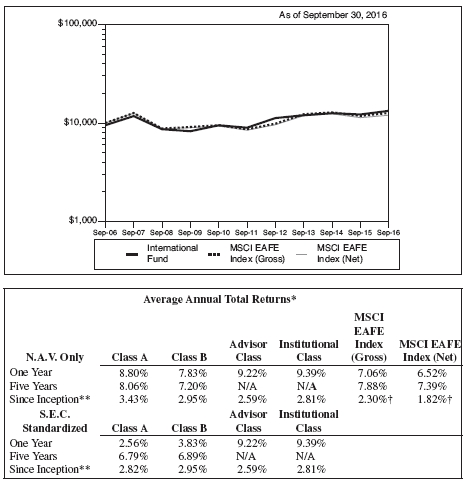

Cumulative Performance Information (unaudited)

FLOATING RATE FUND

Comparison of change in value of $10,000 investment in the First Investors Floating Rate Fund (Class A shares) and the J.P. Morgan BB/B Leveraged Loan Index.

The graph compares a $10,000 investment in the First Investors Floating Rate Fund (Class A shares) beginning 10/21/13 (commencement of operations) with a theoretical investment in the J.P. Morgan BB/B Leveraged Loan Index (the “Index”). The Index is a subset of the J.P. Morgan Leveraged Loan Index, which is designed to represent the investable universe of the U.S. dollar-denominated leveraged loan market. The Index includes U.S. dollar-denominated institutional term loans and fully funded delayed draw term loans which have high yield ratings. However, the most aggressively rated loans and non-rated loans are excluded. Loans can be rated as high as Baa1 and as low as BB3 by Moody’s and also as high as BBB+ and as low as B- by Standard & Poor’s. A loan with the highest allowable rating from each agency will only be included if the company’s overall rating is below investment grade. Loans must be issued by companies domiciled in a developed market, and defaulted loans may remain in the Index only if they remain current on loan obligation payments throughout the default

Cumulative Performance Information (unaudited) (continued)

FLOATING RATE FUND

process. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested. Advisor Class shares and Institutional Class shares performance will be greater than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

*Average Annual Total Return figures (for the periods ended 9/30/16) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75%. The Advisor Class and Institutional Class “S.E.C. Standardized” returns shown are the same as the N.A.V. Only returns since these classes are sold without sales charges. During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for one year and Since Inception would have been (2.39)% and (0.71)%, respectively, and the S.E.C. 30-Day Yield for September 2016 would have been 2.48%. The Advisor Class “S.E.C. Standardized” Average Annual Total Return for one year and Since Inception would have been 3.84% and 1.78%, respectively, and the S.E.C. 30-Day Yield for September 2016 would have been 2.86%. The Institutional Class “S.E.C. Standardized” Average Annual Total Return for one year and Since Inception would have been 4.01% and 1.78%, respectively, and the S.E.C. 30-Day Yield for September 2016 would have been 3.06%. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Index figures are from J.P. Morgan and all other figures are from Foresters Investment Management Company, Inc.

**The Since Inception returns for Class A shares, Advisor Class shares and Institutional Class shares are for the period beginning 10/21/13 (commencement of operations).

*** The S.E.C. 30-Day Yield shown is for September 2016.

Portfolio of Investments (continued)

FLOATING RATE FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | LOAN PARTICIPATIONS†—91.1% | |

| | | Aerospace/Defense—1.7% | |

| $ 539M | | B/E Aerospace, Inc., 3.7867%, 12/16/2021 | $ 546,872 |

| | | TransDigm, Inc.: | |

| 1,363M | | 3.8214%, 2/28/2020 | 1,364,987 |

| 350M | | 3.75%, 5/14/2022 | 350,620 |

| | | | 2,262,479 |

| | | Automotive—4.5% | |

| 1,026M | | CS Intermediate Holdco 2, LLC, 4%, 4/4/2021 | 1,031,989 |

| 1,001M | | FCA U.S., LLC, 3.5%, 5/24/2017 | 1,005,119 |

| 848M | | Federal-Mogul Corp., 4%, 4/15/2018 | 839,874 |

| 987M | | KAR Auction Services, Inc., 4.0625%, 3/11/2021 | 993,964 |

| 836M | | Key Safety Systems, Inc., 5.5%, 8/29/2021 | 846,379 |

| 625M | | Tectum Holdings, Inc., 5.75%, 8/24/2023 (a) | 624,219 |

| 668M | | TI Group Automotive Systems, LLC, 4.5%, 6/30/2022 | 671,174 |

| | | | 6,012,718 |

| | | Building Materials—2.0% | |

| 939M | | Builders FirstSource, Inc., 6%, 7/29/2022 | 945,598 |

| 494M | | Headwaters, Inc., 4%, 3/24/2022 | 496,630 |

| 1,276M | | USIC Holdings, Inc., 4%, 7/10/2020 | 1,271,653 |

| | | | 2,713,881 |

| | | Chemicals—5.2% | |

| 873M | | A. Schulman, Inc., 4%, 6/1/2022 | 874,306 |

| 962M | | Emerald Performance Materials, LLC, 4.5%, 7/30/2021 | 964,022 |

| 496M | | Huntsman International, LLC, 3.75%, 10/1/2021 | 499,411 |

| 650M | | MacDermid, Inc., 4%, 6/7/2020 | 652,946 |

| 668M | | Methanol Holdings Trinidad, Inc., 4.25%, 6/30/2022 | 663,238 |

| 1,247M | | PQ Corp., 5.75%, 11/4/2022 | 1,253,888 |

| 987M | | Trinseo Materials Operating SCA, 4.25%, 11/5/2021 | 998,953 |

| 916M | | Univar USA, Inc., 4.25%, 7/1/2022 | 918,117 |

| 250M | | Versum Material, Inc., 3.25%, 9/21/2023 | 251,875 |

| | | | 7,076,756 |

| | | Consumer Non Durables—2.3% | |

| 900M | | Revlon Consumer Products, Inc., 4.25%,9/7/2023 (a) | 903,151 |

| 1,236M | | Reynolds Group Holdings, Inc., 4.25%, 2/5/2023 (a) | 1,241,024 |

| 950M | | Spectrum Brands, Inc., 3.5029%, 6/23/2022 | 954,385 |

| | | | 3,098,560 |

Portfolio of Investments (continued)

FLOATING RATE FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| |

| | | Energy—2.0% | |

| $ 885M | | Granite Acquisition, Inc., 5%, 12/17/2021 | $ 871,917 |

| 925M | | Jonah Energy, LLC, 7.5%, 5/12/2021 | 834,813 |

| 1,000M | | NRG Energy, Inc., 3.5%, 6/30/2023 (a) | 1,003,625 |

| | | | 2,710,355 |

| | | Financial Services—2.8% | |

| 1,728M | | Delos Finance Sarl, 3.5877%, 3/6/2021 | 1,741,231 |

| 496M | | Ineos U.S. Finance, LLC, 3.75%, 12/15/2020 | 498,077 |

| 1,477M | | RPI Finance Trust, 3.5877%, 11/9/2020 | 1,487,416 |

| | | | 3,726,724 |

| | | Food/Beverage/Tobacco—2.8% | |

| 705M | | Aramark Corp., 3.3377%, 9/7/2019 | 709,105 |

| 533M | | B&G Foods, Inc., 3.8393%, 11/02/2022 | 537,292 |

| 100M | | Chobani, LLC, 5.25%, 9/29/2023 (b) | 99,500 |

| 942M | | Keurig Green Mountain, Inc., 5.25%, 3/3/2023 | 953,573 |

| | | Pinnacle Foods Finance, LLC: | |

| 731M | | 3.25%, 4/29/2020 | 734,679 |

| 744M | | 3.2753%, 1/13/2023 | 751,354 |

| | | | 3,785,503 |

| | | Food/Drug—2.0% | |

| 622M | | Albertson’s, LLC, 4.75%, 12/21/2022 | 628,422 |

| 2,075M | | Rite Aid Corp., 4.875%, 6/21/2021 | 2,081,485 |

| | | | 2,709,907 |

| | | Forest Products/Container—3.5% | |

| 978M | | Ardagh Holdings USA, Inc., 4%, 12/17/2019 | 982,566 |

| | | Berry Plastics Group, Inc.: | |

| 670M | | 3.5%, 2/8/2020 | 671,534 |

| 924M | | 3.75%, 10/1/2022 | 927,497 |

| 715M | | BWAY Holding Co., 5.5%, 8/14/2020 | 720,083 |

| 708M | | Exopack Holdings SA, 4.5%, 5/8/2019 | 709,293 |

| 740M | | Owens Illinois, Inc., 3.5%, 9/1/2022 | 746,614 |

| | | | 4,757,587 |

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | Gaming/Leisure—4.4% | |

| $ 881M | | AMC Entertainment, Inc., 4%, 12/15/2022 | $ 890,058 |

| 1,265M | | Hilton Worldwide Finance, LLC, 3.5%, 10/26/2020 | 1,272,197 |

| 1,072M | | La Quinta Intermediate Holdings, LLC, 3.75%, 4/14/2021 | 1,072,444 |

| 1,472M | | Live Nation Entertainment, Inc., 3.59%, 8/17/2020 | 1,481,044 |

| 272M | | Pinnacle Entertainment, Inc., 3.75%, 4/28/2023 | 272,868 |

| 874M | | Seminole Hard Rock Entertainment, Inc., 3.5877%, 5/14/2020 | 876,939 |

| | | | 5,865,550 |

| | | Health Care—9.8% | |

| 1,016M | | Acadia Healthcare Co., Inc., 3.75%, 2/11/2022 | 1,023,801 |

| | | Community Health Systems, Inc.: | |

| 226M | | 3.75%, 12/31/2019 | 221,721 |

| 766M | | 4%, 1/27/2021 | 753,546 |

| 1,141M | | ConvaTec, Inc., 4.25%, 6/15/2020 | 1,146,333 |

| 275M | | Cotiviti Holdings, Inc., 3.75%, 9/22/2023 (a) | 276,031 |

| 568M | | DaVita Health Care Partners, Inc., 3.5%, 6/24/2021 | 571,643 |

| 1,166M | | Envision Healthcare Corp., 4.5%, 10/28/2022 | 1,172,311 |

| 445M | | ExamWorks Group, Inc., 4.75%, 7/27/2023 | 448,894 |

| 535M | | Grifols Worldwide Operations USA, Inc., 3.4479%, 2/27/2021 | 540,183 |

| 994M | | IMS Health, Inc., 3.5%, 3/17/2021 | 997,892 |

| 569M | | Kindred Healthcare, Inc., 4.25%, 4/9/2021 | 568,482 |

| 568M | | Mallinckrodt International Finance SA, 3.5877%, 3/19/2021 | 568,350 |

| 104M | | Medpace Holdings, Inc., 4.75%, 4/1/2021 | 103,938 |

| 531M | | MultiPlan, Inc., 5%, 6/7/2023 | 538,310 |

| 1,152M | | NBTY, Inc., 5%, 5/5/2023 | 1,159,313 |

| 405M | | Onex Carestream Health, Inc., 5%, 6/7/2019 | 375,917 |

| 546M | | Select Medical Corp., 6%, 6/1/2018 | 547,630 |

| 2,205M | | Valeant Pharmaceuticals International, Inc., 3.5%, 12/11/2019 | 2,212,018 |

| | | | 13,226,313 |

| | | Industrials—.3% | |

| 125M | | GFL Environmental, Inc., 3.75%, 9/27/2023 (a) | 125,234 |

| 250M | | SIG Combibloc Holdings SCA, 4%, 3/11/2022 (a) | 250,656 |

| | | | 375,890 |

| | | Information Technology—7.0% | |

| 331M | | ARRIS Enterprises, Inc., 3.5%, 4/17/2020 | 331,102 |

| 1,181M | | Avago Technologies, Inc., 3.5243%, 2/1/2023 | 1,195,518 |

| 1,600M | | Avast Software BV, 5%, 8/3/2022 (a) | 1,608,000 |

| 881M | | Dell International, LLC, 4%, 9/7/2023 | 886,793 |

| 1,600M | | Dell Software Group, Inc., 7%, 9/27/2022 (a) | 1,588,333 |

Portfolio of Investments (continued)

FLOATING RATE FUND

September 30, 2016

| | | |

| |

| | | | |

| | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | Information Technology (continued) | |

| $1,272M | | Global Payments, Inc., 4.0244%, 4/22/2023 | $ 1,286,651 |

| 489M | | Kronos, Inc., 4.5%, 10/30/2019 | 491,483 |

| 756M | | Match Group, Inc., 5.5%, 11/16/2022 | 760,347 |

| 476M | | Microsemi Corp., 3.75%, 1/15/2023 (a) | 480,805 |

| 738M | | Western Digital Corp., 4.5%, 4/29/2023 | 747,376 |

| | | | 9,376,408 |

| | | Manufacturing—6.9% | |

| 1,121M | | Brand Energy & Infrastructure Services, Inc., 4.75%, 11/26/2020 | 1,111,054 |

| 979M | | Filtration Group, Corp., 4.25%, 11/20/2020 | 982,921 |

| 681M | | Gardner Denver, Inc., 4.25%, 7/30/2020 | 661,506 |

| | | HD Supply, Inc.: | |

| 995M | | 3.75%, 8/13/2021 | 997,694 |

| 248M | | 3.75%, 10/16/2023 (a) | 247,810 |

| 975M | | Husky Injection Molding System, 4.25%, 6/30/2021 | 974,474 |

| 1,019M | | Mirror BidCo Corp., 4.25%, 12/28/2019 | 1,019,166 |

| 937M | | Onex Wizard Acquisition Co. I Sarl, 4.25%, 3/11/2022 | 939,621 |

| 1,185M | | Rexnord, LLC, 4%, 8/21/2020 (a) | 1,187,807 |