UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 6th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2022 |

| |

| Date of reporting period: | | 10/31/2022 |

Item 1 – Reports to Stockholders

PGIM QUANT SOLUTIONS INTERNATIONAL EQUITY FUND

ANNUAL REPORT

OCTOBER 31, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company, member SIPC. PGIM Quantitative Solutions LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), is a registered investment adviser and Prudential Financial company. © 2022 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Quant Solutions International Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2022. The attention of the global economy and financial markets pivoted during the period from the COVID-19 pandemic to the challenge of rapidly rising inflation. While job growth remained strong, prices for a wide range of goods and services rose in response to economic re-openings, supply-chain disruptions, governmental stimulus, and Russia s |

invasion of Ukraine. With inflation surging to a 40-year high, the Federal Reserve and other central banks aggressively hiked interest rates, prompting recession concerns.

After rising to record levels at the end of 2021, stocks have fallen sharply in 2022 as investors worried about higher prices, slowing economic growth, geopolitical uncertainty, and new COVID-19 outbreaks. Equities rallied for a time during the summer but began falling again in late August on fears that the Fed would keep raising rates to tame inflation. For the entire 12-month period, equities suffered a broad-based global decline, although large-cap US stocks outperformed their small-cap counterparts. International developed and emerging markets trailed the US market during this time.

Rising rates and economic uncertainty drove fixed income prices broadly lower as well. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted negative returns during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 11th-largest investment manager with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Quant Solutions International Equity Fund

December 15, 2022

PGIM Quant Solutions International Equity Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/22 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | |

Class A | | | | | | | | |

| | | | |

(with sales charges) | | -29.23 | | -3.57 | | 2.01 | | — |

| | | | |

(without sales charges) | | -25.11 | | -2.47 | | 2.59 | | — |

| | | | |

Class C | | | | | | | | |

| | | | |

(with sales charges) | | -26.65 | | -3.48 | | 1.70 | | — |

| | | | |

(without sales charges) | | -25.98 | | -3.48 | | 1.70 | | — |

| | | | |

Class Z | | | | | | | | |

| | | | |

(without sales charges) | | -24.82 | | -2.07 | | 2.95 | | — |

| | | | |

Class R6 | | | | | | | | |

| | | | |

(without sales charges) | | -24.60 | | -1.84 | | N/A | | 2.56 (12/28/2016) |

| | | | |

MSCI All Country World ex-US Index | | | | | | | | |

| | | | |

| | | -24.73 | | -0.60 | | 3.27 | | — |

| | |

|

| Average Annual Total Returns as of 10/31/22 Since Inception (%) |

| |

| | | Class R6 (12/28/2016) |

| |

MSCI All Country World ex-US Index | | 3.14 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

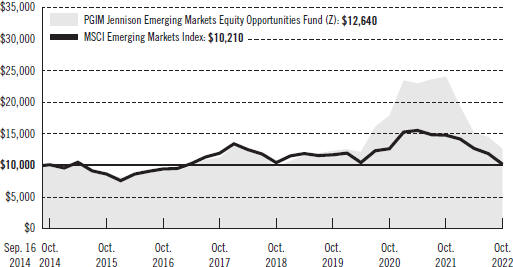

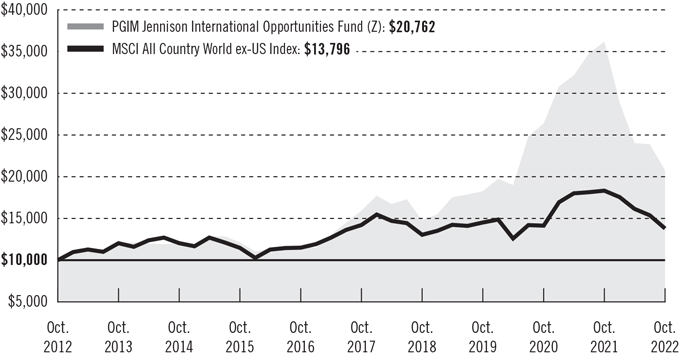

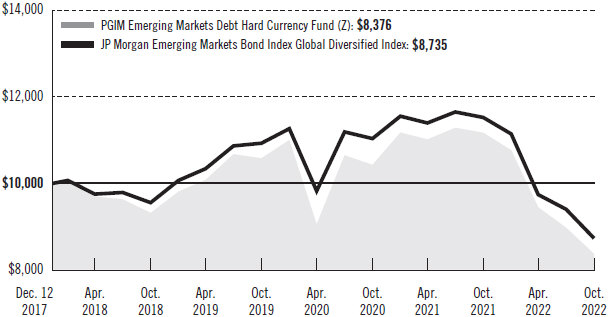

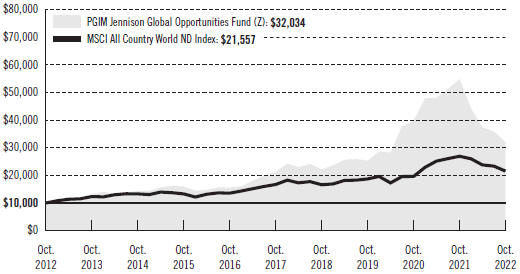

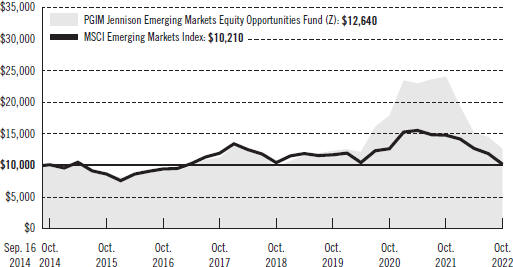

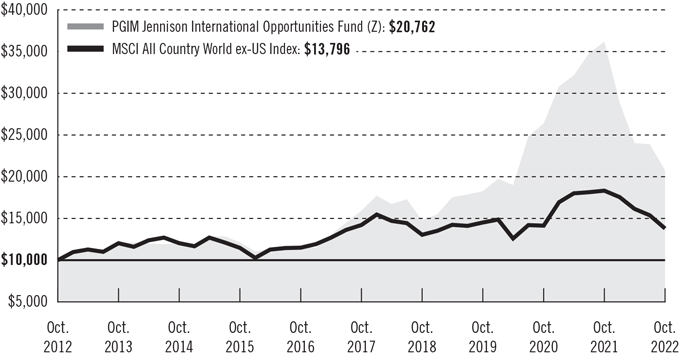

Growth of a $10,000 Investment (unaudited)

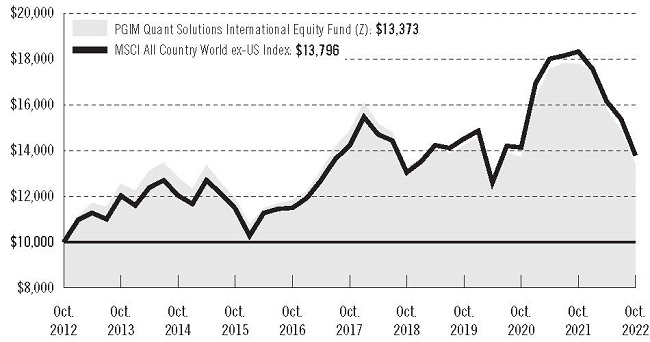

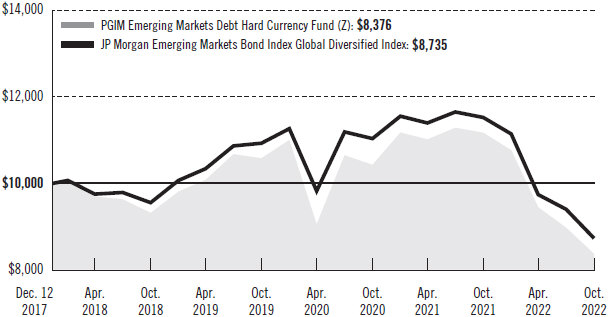

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the MSCI All Country World Ex-US Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2012) and the account values at the end of the current fiscal year (October 31, 2022), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Quant Solutions International Equity Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

| | | | | |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | None | | None |

Benchmark Definition

MSCI All Country World ex-US Index—The Morgan Stanley Capital International All Country World ex-US Index (MSCI ACWI ex-US Index) is an unmanaged, free float-adjusted, market capitalization-weighted index that is designed to provide a broad measure of stock performance throughout the world, with the exception of US-based companies. The Index includes both developed and emerging markets.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

6 Visit our website at pgim.com/investments

Presentation of Fund Holdings as of 10/31/22

| | | | | | |

| | | |

| Ten Largest Holdings | | Line of Business | | Country | | % of Net Assets |

| | | |

Taiwan Semiconductor | | Semiconductors & Semiconductor | | Taiwan | | 1.8% |

| | | |

Manufacturing Co. Ltd. | | Equipment | | | | |

| | | |

Roche Holding AG | | Pharmaceuticals | | United States | | 1.8% |

| | | |

Shell plc | | Oil, Gas & Consumable Fuels | | Netherlands | | 1.3% |

| | | |

Sanofi | | Pharmaceuticals | | France | | 1.1% |

| | | |

British American Tobacco plc | | Tobacco | | United Kingdom | | 1.1% |

| | | |

iShares MSCI EAFE ETF | | Exchange Traded Funds | | United States | | 1.0% |

| | | |

DBS Group Holdings Ltd. | | Banks | | Singapore | | 0.9% |

| | | |

Nestle SA | | Food Products | | United States | | 0.9% |

| | | |

Suncor Energy, Inc. | | Oil, Gas & Consumable Fuels | | Canada | | 0.9% |

| | | |

GSK plc | | Pharmaceuticals | | United States | | 0.8% |

Holdings reflect only long-term investments and are subject to change.

PGIM Quant Solutions International Equity Fund 7

Strategy and Performance Overview* (Unaudited)

How did the Fund perform?

The PGIM Quantitative Solutions International Equity Fund’s Class Z shares returned –24.82% in the 12-month reporting period that ended October 31, 2022, slightly underperforming the – 24.73% return of the MSCI All Country World ex-US Index (the Index).

What were the market conditions?

| • | | Following sharp equity declines in the first half of 2022, global stock markets rebounded early in the third quarter, but generally gave back most of their gains by the end of the reporting period. |

| • | | The persistence of widespread inflationary pressures and global central bank policy tightening remained at the forefront of investor concerns throughout the period, with geopolitical complications, including the prolonged Russia-Ukraine conflict and uncertainty surrounding China’s growth prospects, amplifying recession fears. Amid this challenging environment, the Fund’s allocation and selection factors performed relatively well overall. Performance for value and top-down measures improved considerably during the third quarter of 2022, particularly among small caps, for which August proved exceedingly difficult. Growth was the best-performing component by far, while quality measures failed to gain traction and struggled. |

| • | | In absolute terms, large-cap stocks outpaced small-cap stocks in developed markets (represented by the EAFE and World regions in the MSCI universe) for the month, year-to-date, and one-year periods. The third quarter of 2022 was the exception; the MSCI World Index underperformed the MSCI World Small Cap Index on the back of outperformance of small caps in the US, particularly in the information technology, communication services, and healthcare sectors. In emerging markets, small caps beat large caps across all time periods. |

| • | | By the end of the period, inflation had not declined as expected, and central banks became increasingly hawkish. |

What worked?

| • | | A shift away from the consumer discretionary, financials, and energy sectors in China, along with a tilt toward the energy sector in Brazil, bolstered the Fund’s performance relative to the Index. |

| • | | Favoring reasonably priced, high-quality companies in the energy and utilities sectors also contributed positively to the Fund’s relative returns, as did a shift away from expensive, low-quality companies in the consumer discretionary and communication services sectors. |

What didn’t work?

| • | | Exposure to Russian financials and utilities amid the Russia-Ukraine conflict slightly detracted from the Fund’s results relative to the Index. |

| • | | Favoring high-quality and high-growth consumer discretionary and healthcare companies further undermined the Fund’s relative performance. |

8 Visit our website at pgim.com/investments

Did the Fund use derivatives?

The Fund held fully collateralized index futures during the period that were used for cash-management purposes. They had a negligible impact on performance.

Current outlook

| • | | While equities have already experienced the type of declines one might expect from a mild recession, still-larger declines remain a real possibility given the odds of monetary policy over-tightening (and thus more significant economic contraction) in the current inflationary environment. |

| • | | The US economy suffered two consecutive quarters of negative GDP growth in the first half of 2022, but these negative numbers could be revised upward. For this and other reasons, PGIM Quantitative Solutions does not believe that 2022 will constitute an “official” US recession. However, given the current high level of inflation and the low unemployment rate, it appears unlikely the US will make it through the Federal Reserve’s hiking cycle without a recession. At the same time, PGIM Quantitative Solutions sees little evidence that a recession is imminent and thinks the recession could occur later rather than sooner. |

| • | | Measured inflation remains high in most major developed economies and did not decline as expected late in the reporting period, even as weaker commodity prices relieved some pressure. Japan remains the exception, with inflation still running at reasonable (albeit elevated) rates. In the Eurozone, the economy is wilting under the pressure of rising natural gas and electricity prices stemming from disruptions related to Russia’s ongoing war in Ukraine. More dire outcomes are possible should Russia permanently cut off gas flows to the Eurozone. |

| • | | China’s economy continues to be hobbled by ongoing COVID-19 restrictions and the country’s real estate bust (and associated deleveraging). A host of structural problems—political, economic, geopolitical, and demographic—plague China’s long-term growth prospects. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Quant Solutions International Equity Fund 9

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2022. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

10 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | |

PGIM Quant Solutions International Equity Fund | | Beginning Account Value May 1, 2022 | | Ending Account Value

October 31, 2022 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid

During the Six-Month Period* |

| | | | | |

Class A | | Actual | | $1,000.00 | | $ 844.60 | | 1.58% | | $ 7.35 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,017.24 | | 1.58% | | $ 8.03 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $ 840.30 | | 2.81% | | $13.03 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,011.04 | | 2.81% | | $14.24 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $ 847.40 | | 1.07% | | $ 4.98 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,019.81 | | 1.07% | | $ 5.45 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $ 847.60 | | 0.78% | | $ 3.63 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,021.27 | | 0.78% | | $ 3.97 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2022, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Quant Solutions International Equity Fund 11

Schedule of Investments

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

LONG-TERM INVESTMENTS 97.1% | | | | | | | | |

| | |

COMMON STOCKS 94.3% | | | | | | | | |

| | |

Australia 4.5% | | | | | | | | |

| | |

Aristocrat Leisure Ltd. | | | 31,410 | | | $ | 745,547 | |

Australia & New Zealand Banking Group Ltd. | | | 23,532 | | | | 385,542 | |

BHP Group Ltd. | | | 7,768 | | | | 186,589 | |

BlueScope Steel Ltd. | | | 17,635 | | | | 177,584 | |

Commonwealth Bank of Australia | | | 4,100 | | | | 274,892 | |

Fortescue Metals Group Ltd. | | | 18,396 | | | | 173,309 | |

Genworth Mortgage Insurance Australia Ltd. | | | 486,518 | | | | 844,520 | |

Glencore PLC | | | 86,620 | | | | 496,599 | |

Goodman Group, REIT | | | 88,860 | | | | 966,860 | |

JB Hi-Fi Ltd. | | | 15,765 | | | | 432,150 | |

Macquarie Group Ltd. | | | 4,335 | | | | 470,273 | |

National Australia Bank Ltd. | | | 24,776 | | | | 514,648 | |

Nine Entertainment Co. Holdings Ltd. | | | 102,648 | | | | 135,559 | |

Rio Tinto Ltd. | | | 3,134 | | | | 177,853 | |

Sonic Healthcare Ltd. | | | 45,137 | | | | 944,965 | |

West African Resources Ltd.* | | | 297,147 | | | | 196,752 | |

Whitehaven Coal Ltd. | | | 14,900 | | | | 86,551 | |

WiseTech Global Ltd. | | | 4,005 | | | | 148,117 | |

Woodside Energy Group Ltd. | | | 4,867 | | | | 112,518 | |

Woolworths Group Ltd. | | | 4,704 | | | | 99,338 | |

| | | | | | | | |

| | |

| | | | | | | 7,570,166 | |

| | |

Belgium 0.2% | | | | | | | | |

| | |

Ageas SA/NV | | | 1,920 | | | | 66,467 | |

Solvay SA | | | 1,715 | | | | 154,763 | |

Tessenderlo Group SA* | | | 3,385 | | | | 102,599 | |

| | | | | | | | |

| | |

| | | | | | | 323,829 | |

| | |

Brazil 2.0% | | | | | | | | |

| | |

Banco do Brasil SA | | | 156,200 | | | | 1,120,963 | |

Centrais Eletricas Brasileiras SA | | | 8,800 | | | | 85,027 | |

Cia de Saneamento do Parana, UTS | | | 54,900 | | | | 203,211 | |

CPFL Energia SA | | | 42,000 | | | | 288,239 | |

Marfrig Global Foods SA | | | 53,100 | | | | 109,788 | |

Petroleo Brasileiro SA | | | 33,100 | | | | 212,934 | |

Suzano SA | | | 49,400 | | | | 509,254 | |

Vale SA | | | 23,200 | | | | 301,009 | |

Yara International ASA | | | 11,967 | | | | 534,105 | |

| | | | | | | | |

| | |

| | | | | | | 3,364,530 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 13

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Canada 7.6% | | | | | | | | |

| | |

Alimentation Couche-Tard, Inc. | | | 14,000 | | | $ | 626,858 | |

ARC Resources Ltd. | | | 5,800 | | | | 81,656 | |

Aritzia, Inc.* | | | 29,200 | | | | 1,132,549 | |

Artis Real Estate Investment Trust, REIT | | | 69,200 | | | | 485,088 | |

Brookfield Asset Management, Inc. (Class A Stock) | | | 13,800 | | | | 546,490 | |

Canadian Natural Resources Ltd. | | | 9,600 | | | | 575,782 | |

Canfor Corp.* | | | 52,900 | | | | 794,849 | |

CGI, Inc.* | | | 13,500 | | | | 1,087,452 | |

Dollarama, Inc. | | | 6,200 | | | | 368,400 | |

ECN Capital Corp. | | | 134,000 | | | | 404,257 | |

Element Fleet Management Corp. | | | 69,500 | | | | 925,918 | |

Fairfax Financial Holdings Ltd. | | | 1,500 | | | | 736,694 | |

George Weston Ltd. | | | 5,500 | | | | 605,369 | |

Gildan Activewear, Inc. | | | 7,700 | | | | 242,979 | |

Imperial Oil Ltd. | | | 9,600 | | | | 522,227 | |

Loblaw Cos. Ltd. | | | 12,900 | | | | 1,056,922 | |

National Bank of Canada | | | 1,900 | | | | 129,368 | |

Nutrien Ltd. | | | 1,500 | | | | 126,741 | |

Onex Corp. | | | 4,900 | | | | 246,628 | |

Royal Bank of Canada | | | 1,500 | | | | 138,786 | |

Russel Metals, Inc. | | | 6,100 | | | | 126,357 | |

Suncor Energy, Inc. | | | 43,000 | | | | 1,479,047 | |

TMX Group Ltd. | | | 1,600 | | | | 153,828 | |

Toronto-Dominion Bank (The) | | | 1,200 | | | | 76,800 | |

West Fraser Timber Co. Ltd. | | | 900 | | | | 67,575 | |

| | | | | | | | |

| | |

| | | | | | | 12,738,620 | |

| | |

Chile 0.0% | | | | | | | | |

| | |

Cencosud SA | | | 53,740 | | | | 72,245 | |

| | |

China 7.1% | | | | | | | | |

| | |

Alibaba Group Holding Ltd.* | | | 38,800 | | | | 301,666 | |

Bank of China Ltd. (Class H Stock) | | | 759,000 | | | | 244,457 | |

Bank of Communications Co. Ltd. (Class H Stock) | | | 224,000 | | | | 109,294 | |

Bank of Jiangsu Co. Ltd. (Class A Stock) | | | 65,100 | | | | 61,462 | |

Bank of Shanghai Co. Ltd. (Class A Stock) | | | 315,700 | | | | 240,298 | |

Beijing Enterprises Holdings Ltd. | | | 30,000 | | | | 76,107 | |

BYD Co. Ltd. (Class H Stock) | | | 40,500 | | | | 907,327 | |

China BlueChemical Ltd. (Class H Stock) | | | 1,792,000 | | | | 342,056 | |

China CITIC Bank Corp. Ltd. (Class H Stock) | | | 402,000 | | | | 151,537 | |

China Construction Bank Corp. (Class H Stock) | | | 787,000 | | | | 417,652 | |

China Medical System Holdings Ltd. | | | 386,000 | | | | 421,869 | |

China Shenhua Energy Co. Ltd. (Class H Stock) | | | 272,000 | | | | 714,506 | |

See Notes to Financial Statements.

14

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

China (cont’d.) | | | | | | | | |

| | |

China Tower Corp. Ltd. (Class H Stock), 144A | | | 2,296,000 | | | $ | 207,731 | |

Chlitina Holding Ltd. | | | 105,000 | | | | 479,868 | |

Chongqing Rural Commercial Bank Co. Ltd. (Class A Stock) | | | 360,000 | | | | 171,332 | |

Chow Tai Fook Jewellery Group Ltd. | | | 607,000 | | | | 1,039,230 | |

CITIC Ltd. | | | 926,000 | | | | 828,626 | |

COSCO SHIPPING Holdings Co. Ltd. (Class H Stock) | | | 152,300 | | | | 164,129 | |

CSPC Pharmaceutical Group Ltd. | | | 84,000 | | | | 86,282 | |

Daqo New Energy Corp., ADR* | | | 1,100 | | | | 48,389 | |

Greentown Management Holdings Co. Ltd., 144A | | | 340,000 | | | | 194,644 | |

Hello Group, Inc., ADR | | | 16,200 | | | | 76,140 | |

Henan Shenhuo Coal & Power Co. Ltd. (Class A Stock) | | | 29,400 | | | | 56,255 | |

Industrial Bank Co. Ltd. (Class A Stock) | | | 119,500 | | | | 245,210 | |

Inner Mongolia Yitai Coal Co. Ltd. (Class B Stock) | | | 52,000 | | | | 73,580 | |

Lenovo Group Ltd. | | | 192,000 | | | | 153,448 | |

Metallurgical Corp. of China Ltd. (Class A Stock) | | | 502,900 | | | | 197,772 | |

NetEase, Inc. | | | 17,400 | | | | 193,057 | |

PetroChina Co. Ltd. (Class H Stock) | | | 172,000 | | | | 65,795 | |

PICC Property & Casualty Co. Ltd. (Class H Stock) | | | 160,000 | | | | 147,570 | |

Pinduoduo, Inc., ADR* | | | 15,000 | | | | 822,450 | |

Ping An Bank Co. Ltd. (Class A Stock) | | | 94,600 | | | | 133,585 | |

Shaanxi Coal Industry Co. Ltd. (Class A Stock) | | | 95,300 | | | | 257,661 | |

Shanghai International Port Group Co. Ltd. (Class A Stock) | | | 348,600 | | | | 245,951 | |

SITC International Holdings Co. Ltd. | | | 26,000 | | | | 42,583 | |

TBEA Co. Ltd. (Class A Stock) | | | 76,000 | | | | 211,863 | |

Tencent Holdings Ltd. | | | 19,900 | | | | 522,908 | |

Tencent Music Entertainment Group, ADR* | | | 16,800 | | | | 60,648 | |

Vipshop Holdings Ltd., ADR* | | | 7,200 | | | | 50,184 | |

Wilmar International Ltd. | | | 385,200 | | | | 1,055,276 | |

Xiamen C & D, Inc. (Class A Stock) | | | 101,400 | | | | 165,944 | |

Yankuang Energy Group Co. Ltd. (Class H Stock) | | | 16,000 | | | | 44,984 | |

| | | | | | | | |

| | |

| | | | | | | 12,031,326 | |

| | |

Denmark 1.7% | | | | | | | | |

| | |

AP Moller - Maersk A/S (Class B Stock) | | | 546 | | | | 1,140,688 | |

D/S Norden A/S | | | 3,799 | | | | 196,617 | |

Novo Nordisk A/S (Class B Stock) | | | 9,442 | | | | 1,026,641 | |

Scandinavian Tobacco Group A/S, 144A | | | 25,822 | | | | 432,536 | |

| | | | | | | | |

| | |

| | | | | | | 2,796,482 | |

| | |

Finland 1.6% | | | | | | | | |

| | |

Kesko OYJ (Class B Stock) | | | 3,540 | | | | 68,891 | |

Nokia OYJ | | | 153,465 | | | | 681,986 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 15

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Finland (cont’d.) | | | | | | | | |

| | |

Nordea Bank Abp | | | 74,128 | | | $ | 708,109 | |

Sampo OYJ (Class A Stock) | | | 28,940 | | | | 1,323,361 | |

| | | | | | | | |

| | |

| | | | | | | 2,782,347 | |

| | |

France 7.3% | | | | | | | | |

| | |

AXA SA | | | 20,372 | | | | 503,085 | |

Capgemini SE | | | 5,874 | | | | 962,695 | |

Cie de Saint-Gobain | | | 28,092 | | | | 1,148,428 | |

Coface SA | | | 34,576 | | | | 384,906 | |

Dassault Systemes SE | | | 22,889 | | | | 767,211 | |

Edenred | | | 3,223 | | | | 165,231 | |

Eiffage SA | | | 712 | | | | 64,380 | |

Engie SA | | | 106,266 | | | | 1,380,753 | |

Hermes International | | | 905 | | | | 1,171,419 | |

Ipsen SA | | | 7,043 | | | | 723,794 | |

Klepierre SA, REIT* | | | 3,440 | | | | 69,138 | |

L’Oreal SA | | | 533 | | | | 167,364 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 2,236 | | | | 1,410,905 | |

Publicis Groupe SA | | | 19,555 | | | | 1,095,166 | |

Sanofi | | | 21,641 | | | | 1,862,378 | |

Thales SA | | | 700 | | | | 89,026 | |

Vinci SA | | | 4,266 | | | | 392,630 | |

| | | | | | | | |

| | |

| | | | | | | 12,358,509 | |

| | |

Georgia 0.1% | | | | | | | | |

| | |

Bank of Georgia Group PLC | | | 5,808 | | | | 141,713 | |

| | |

Germany 2.9% | | | | | | | | |

| | |

AURELIUS Equity Opportunities SE & Co. KGaA | | | 4,239 | | | | 89,630 | |

Bayer AG | | | 14,740 | | | | 775,045 | |

Brenntag SE | | | 1,296 | | | | 78,637 | |

Commerzbank AG* | | | 8,316 | | | | 66,442 | |

Deutsche Bank AG | | | 72,366 | | | | 689,774 | |

Deutsche Telekom AG | | | 45,604 | | | | 860,798 | |

E.ON SE | | | 126,081 | | | | 1,055,802 | |

Infineon Technologies AG | | | 10,743 | | | | 260,684 | |

Merck KGaA | | | 6,537 | | | | 1,065,303 | |

| | | | | | | | |

| | |

| | | | | | | 4,942,115 | |

| | |

Greece 0.2% | | | | | | | | |

| | |

Eurobank Ergasias Services and Holdings SA* | | | 78,880 | | | | 77,870 | |

See Notes to Financial Statements.

16

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Greece (cont’d.) | | | | | | | | |

| | |

Hellenic Telecommunications Organization SA | | | 11,079 | | | $ | 173,991 | |

National Bank of Greece SA* | | | 19,800 | | | | 71,741 | |

| | | | | | | | |

| | |

| | | | | | | 323,602 | |

| | |

Hong Kong 1.6% | | | | | | | | |

| | |

CK Asset Holdings Ltd. | | | 148,500 | | | | 820,993 | |

Jardine Matheson Holdings Ltd. | | | 21,500 | | | | 990,462 | |

Orient Overseas International Ltd. | | | 14,500 | | | | 211,890 | |

WH Group Ltd., 144A | | | 1,223,000 | | | | 617,629 | |

| | | | | | | | |

| | |

| | | | | | | 2,640,974 | |

| | |

India 3.5% | | | | | | | | |

| | |

Bajaj Consumer Care Ltd. | | | 56,741 | | | | 109,295 | |

Bharat Electronics Ltd. | | | 63,780 | | | | 82,309 | |

Cipla Ltd. | | | 4,640 | | | | 65,466 | |

Coal India Ltd. | | | 28,200 | | | | 83,714 | |

Divi’s Laboratories Ltd. | | | 1,414 | | | | 61,679 | |

GAIL India Ltd. | | | 622,608 | | | | 686,306 | |

HCL Technologies Ltd. | | | 14,966 | | | | 188,401 | |

Hindalco Industries Ltd. | | | 30,775 | | | | 150,769 | |

ITC Ltd. | | | 19,900 | | | | 83,905 | |

Mahindra & Mahindra Ltd. | | | 34,312 | | | | 560,007 | |

National Aluminium Co. Ltd. | | | 97,975 | | | | 83,063 | |

NTPC Ltd. | | | 389,699 | | | | 815,767 | |

Page Industries Ltd. | | | 313 | | | | 188,298 | |

Power Grid Corp. of India Ltd. | | | 420,298 | | | | 1,159,634 | |

Sun Pharmaceutical Industries Ltd. | | | 41,444 | | | | 509,213 | |

Tata Steel Ltd. | | | 873,530 | | | | 1,071,396 | |

| | | | | | | | |

| | |

| | | | | | | 5,899,222 | |

| | |

Indonesia 0.9% | | | | | | | | |

| | |

Adaro Energy Indonesia Tbk PT | | | 260,000 | | | | 66,331 | |

Astra International Tbk PT | | | 2,359,100 | | | | 1,008,116 | |

Bank Mandiri Persero Tbk PT | | | 132,000 | | | | 89,173 | |

First Pacific Co. Ltd. | | | 902,000 | | | | 238,854 | |

Indo Tambangraya Megah Tbk PT | | | 30,000 | | | | 86,420 | |

| | | | | | | | |

| | |

| | | | | | | 1,488,894 | |

| | |

Israel 1.3% | | | | | | | | |

| | |

Bank Hapoalim BM | | | 9,728 | | | | 93,771 | |

Bank Leumi Le-Israel BM | | | 128,108 | | | | 1,222,117 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 17

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Israel (cont’d.) | | | | | | | | |

| | |

Bezeq The Israeli Telecommunication Corp. Ltd. | | | 468,820 | | | $ | 829,922 | |

Check Point Software Technologies Ltd.* | | | 900 | | | | 116,307 | |

| | | | | | | | |

| | |

| | | | | | | 2,262,117 | |

| | |

Italy 1.1% | | | | | | | | |

| | |

Eni SpA | | | 96,357 | | | | 1,265,527 | |

Ferrari NV | | | 1,120 | | | | 220,795 | |

Moncler SpA | | | 1,662 | | | | 71,706 | |

Poste Italiane SpA, 144A | | | 25,720 | | | | 224,131 | |

| | | | | | | | |

| | |

| | | | | | | 1,782,159 | |

| | |

Japan 11.5% | | | | | | | | |

| | |

Astellas Pharma, Inc. | | | 13,400 | | | | 184,896 | |

BML, Inc. | | | 7,000 | | | | 158,238 | |

Bridgestone Corp. | | | 4,500 | | | | 162,749 | |

Chugai Pharmaceutical Co. Ltd. | | | 34,800 | | | | 806,381 | |

Citizen Watch Co. Ltd. | | | 21,600 | | | | 90,714 | |

Cosmo Energy Holdings Co. Ltd. | | | 3,100 | | | | 79,854 | |

Dai-ichi Life Holdings, Inc. | | | 80,000 | | | | 1,270,620 | |

Dentsu Group, Inc. | | | 2,100 | | | | 65,317 | |

Digital Garage, Inc. | | | 17,400 | | | | 416,638 | |

Fast Retailing Co. Ltd. | | | 800 | | | | 445,713 | |

Fujikura Ltd. | | | 60,600 | | | | 358,811 | |

GMO internet group, Inc. | | | 7,800 | | | | 134,479 | |

GungHo Online Entertainment, Inc. | | | 29,400 | | | | 434,565 | |

Hitachi Construction Machinery Co. Ltd. | | | 8,700 | | | | 170,207 | |

Honda Motor Co. Ltd. | | | 3,500 | | | | 79,809 | |

Information Services International-Dentsu Ltd. | | | 5,400 | | | | 165,157 | |

Inpex Corp. | | | 106,500 | | | | 1,074,840 | |

ITOCHU Corp. | | | 41,000 | | | | 1,059,627 | |

Japan Steel Works Ltd. (The) | | | 4,100 | | | | 84,659 | |

Japan Tobacco, Inc. | | | 59,100 | | | | 989,774 | |

Jeol Ltd. | | | 2,300 | | | | 84,164 | |

Koshidaka Holdings Co. Ltd. | | | 39,600 | | | | 297,610 | |

Makino Milling Machine Co. Ltd. | | | 2,800 | | | | 86,516 | |

Marubeni Corp. | | | 114,700 | | | | 1,004,074 | |

Mitsubishi Motors Corp.* | | | 23,400 | | | | 78,828 | |

Mitsui & Co. Ltd. | | | 63,500 | | | | 1,405,203 | |

MIXI, Inc. | | | 5,000 | | | | 78,385 | |

Mizuno Corp. | | | 7,800 | | | | 133,535 | |

MS&AD Insurance Group Holdings, Inc. | | | 39,000 | | | | 1,032,767 | |

NGK Spark Plug Co. Ltd. | | | 10,100 | | | | 184,265 | |

NTT Data Corp. | | | 70,200 | | | | 1,016,767 | |

See Notes to Financial Statements.

18

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Japan (cont’d.) | | | | | | | | |

| | |

Olympus Corp. | | | 5,900 | | | $ | 124,398 | |

Ono Pharmaceutical Co. Ltd. | | | 3,000 | | | | 70,601 | |

ORIX Corp. | | | 9,800 | | | | 143,939 | |

Pacific Metals Co. Ltd. | | | 5,600 | | | | 69,164 | |

Rohm Co. Ltd. | | | 2,000 | | | | 140,529 | |

Sankyo Co. Ltd. | | | 2,400 | | | | 79,252 | |

Seiko Epson Corp. | | | 29,400 | | | | 399,139 | |

Shimano, Inc. | | | 600 | | | | 92,846 | |

Shin-Etsu Chemical Co. Ltd. | | | 3,100 | | | | 322,183 | |

Shionogi & Co. Ltd. | | | 2,500 | | | | 116,093 | |

SMC Corp. | | | 2,400 | | | | 963,365 | |

Sompo Holdings, Inc. | | | 22,000 | | | | 917,231 | |

Sumitomo Corp. | | | 79,500 | | | | 1,010,745 | |

Takeuchi Manufacturing Co. Ltd. | | | 5,000 | | | | 100,835 | |

TIS, Inc. | | | 2,600 | | | | 70,101 | |

Toridoll Holdings Corp. | | | 43,100 | | | | 838,031 | |

Toyota Motor Corp. | | | 13,665 | | | | 189,597 | |

Transcosmos, Inc. | | | 4,400 | | | | 101,153 | |

| | | | | | | | |

| | |

| | | | | | | 19,384,364 | |

| | |

Kuwait 0.1% | | | | | | | | |

| | |

Humansoft Holding Co. KSC | | | 15,331 | | | | 166,414 | |

Mobile Telecommunications Co. KSCP | | | 37,040 | | | | 71,594 | |

| | | | | | | | |

| | |

| | | | | | | 238,008 | |

| | |

Luxembourg 0.5% | | | | | | | | |

| | |

ArcelorMittal SA | | | 35,566 | | | | 795,030 | |

Eurofins Scientific SE | | | 1,051 | | | | 67,280 | |

| | | | | | | | |

| | |

| | | | | | | 862,310 | |

| | |

Malaysia 0.6% | | | | | | | | |

| | |

Petronas Chemicals Group Bhd | | | 503,600 | | | | 928,450 | |

Telekom Malaysia Bhd | | | 56,700 | | | | 66,686 | |

| | | | | | | | |

| | |

| | | | | | | 995,136 | |

| | |

Netherlands 4.5% | | | | | | | | |

| | |

Arcadis NV | | | 5,125 | | | | 173,928 | |

ASML Holding NV | | | 1,296 | | | | 607,937 | |

Heineken Holding NV | | | 1,000 | | | | 68,234 | |

Heineken NV | | | 2,109 | | | | 176,174 | |

Koninklijke Ahold Delhaize NV | | | 50,420 | | | | 1,406,128 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 19

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Netherlands (cont’d.) | | | | | | | | |

| | |

Koninklijke KPN NV | | | 250,955 | | | $ | 701,948 | |

NN Group NV | | | 24,552 | | | | 1,039,592 | |

OCI NV | | | 1,720 | | | | 65,786 | |

Shell PLC | | | 78,203 | | | | 2,166,349 | |

Wolters Kluwer NV | | | 10,938 | | | | 1,162,257 | |

| | | | | | | | |

| | |

| | | | | | | 7,568,333 | |

| | |

New Zealand 0.0% | | | | | | | | |

| | |

Spark New Zealand Ltd. | | | 27,980 | | | | 83,290 | |

| | |

Nigeria 0.1% | | | | | | | | |

| | |

Airtel Africa PLC, 144A | | | 196,328 | | | | 254,128 | |

| | |

Norway 1.8% | | | | | | | | |

| | |

DNB Bank ASA | | | 59,436 | | | | 1,051,237 | |

Elkem ASA, 144A* | | | 92,160 | | | | 306,179 | |

Equinor ASA | | | 36,343 | | | | 1,324,111 | |

Gjensidige Forsikring ASA | | | 3,580 | | | | 65,438 | |

Kongsberg Gruppen ASA | | | 2,325 | | | | 83,375 | |

Mowi ASA | | | 3,240 | | | | 48,360 | |

Norsk Hydro ASA | | | 11,020 | | | | 69,936 | |

Orkla ASA | | | 9,360 | | | | 63,135 | |

| | | | | | | | |

| | |

| | | | | | | 3,011,771 | |

| | |

Peru 0.0% | | | | | | | | |

| | |

Credicorp Ltd. | | | 500 | | | | 73,180 | |

| | |

Portugal 0.0% | | | | | | | | |

| | |

Sonae SGPS SA | | | 81,802 | | | | 78,562 | |

| | |

Qatar 0.7% | | | | | | | | |

| | |

Industries Qatar QSC | | | 247,955 | | | | 1,073,402 | |

| | |

Ooredoo QPSC | | | 35,300 | | | | 94,639 | |

| | | | | | | | |

| | |

| | | | | | | 1,168,041 | |

| | |

Russia 0.0% | | | | | | | | |

| | |

Inter RAO UES PJSC^ | | | 13,660,000 | | | | 22 | |

LUKOIL PJSC^ | | | 14,283 | | | | — | |

Polyus PJSC*^ | | | 1,450 | | | | — | |

See Notes to Financial Statements.

20

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Russia (cont’d.) | | | | | | | | |

| | |

Rosneft Oil Co. PJSC^ | | | 155,425 | | | $ | — | |

Sberbank of Russia PJSC*^ | | | 366,709 | | | | 1 | |

| | | | | | | | |

| | |

| | | | | | | 23 | |

| | |

Saudi Arabia 0.7% | | | | | | | | |

| | |

SABIC Agri-Nutrients Co. | | | 26,782 | | | | 1,131,591 | |

Sahara International Petrochemical Co. | | | 5,740 | | | | 61,796 | |

| | | | | | | | |

| | |

| | | | | | | 1,193,387 | |

| | |

Singapore 2.1% | | | | | | | | |

| | |

DBS Group Holdings Ltd. | | | 64,300 | | | | 1,554,537 | |

Oversea-Chinese Banking Corp. Ltd. | | | 128,800 | | | | 1,105,631 | |

STMicroelectronics NV | | | 25,806 | | | | 802,411 | |

| | | | | | | | |

| | |

| | | | | | | 3,462,579 | |

| | |

South Africa 0.2% | | | | | | | | |

| | |

African Rainbow Minerals Ltd. | | | 5,680 | | | | 79,986 | |

Sasol Ltd. | | | 7,752 | | | | 130,312 | |

Sibanye Stillwater Ltd. | | | 34,200 | | | | 80,104 | |

| | | | | | | | |

| | |

| | | | | | | 290,402 | |

| | |

South Korea 4.4% | | | | | | | | |

| | |

BNK Financial Group, Inc. | | | 38,013 | | | | 170,826 | |

Cheil Worldwide, Inc. | | | 18,513 | | | | 317,226 | |

DB Insurance Co. Ltd. | | | 12,339 | | | | 486,970 | |

Doosan Bobcat, Inc. | | | 3,040 | | | | 71,346 | |

GOLFZON Co. Ltd. | | | 962 | | | | 77,725 | |

GS Holdings Corp. | | | 4,817 | | | | 155,375 | |

Hana Financial Group, Inc. | | | 36,077 | | | | 1,043,036 | |

Hyundai Mobis Co. Ltd. | | | 1,097 | | | | 168,257 | |

KB Financial Group, Inc. | | | 2,955 | | | | 99,433 | |

Kia Corp. | | | 21,889 | | | | 1,017,199 | |

LG Energy Solution Ltd.* | | | 240 | | | | 88,805 | |

LG Innotek Co. Ltd. | | | 2,272 | | | | 471,359 | |

MegaStudyEdu Co. Ltd. | | | 5,911 | | | | 355,222 | |

POSCO Holdings, Inc. | | | 5,676 | | | | 989,275 | |

Samsung C&T Corp. | | | 780 | | | | 64,749 | |

Samsung Electronics Co. Ltd. | | | 17,996 | | | | 748,991 | |

Samsung Fire & Marine Insurance Co. Ltd. | | | 868 | | | | 121,737 | |

SD Biosensor, Inc. | | | 6,750 | | | | 139,647 | |

Shinhan Financial Group Co. Ltd. | | | 19,321 | | | | 491,073 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 21

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

South Korea (cont’d.) | | | | | | | | |

| | |

SK, Inc. | | | 440 | | | $ | 65,933 | |

Webzen, Inc.* | | | 6,425 | | | | 67,264 | |

Woori Financial Group, Inc. | | | 17,655 | | | | 145,689 | |

| | | | | | | | |

| | |

| | | | | | | 7,357,137 | |

| | |

Spain 0.8% | | | | | | | | |

| | |

Amadeus IT Group SA* | | | 3,762 | | | | 196,208 | |

Endesa SA | | | 4,105 | | | | 68,587 | |

Industria de Diseno Textil SA | | | 45,381 | | | | 1,030,067 | |

| | | | | | | | |

| | |

| | | | | | | 1,294,862 | |

| | |

Sweden 1.5% | | | | | | | | |

| | |

Atlas Copco AB (Class A Stock) | | | 21,655 | | | | 231,129 | |

Atlas Copco AB (Class B Stock) | | | 14,008 | | | | 135,474 | |

Epiroc AB (Class A Stock) | | | 4,600 | | | | 70,419 | |

Evolution AB, 144A | | | 1,408 | | | | 131,342 | |

Investor AB (Class A Stock) | | | 4,011 | | | | 68,206 | |

Inwido AB | | | 9,354 | | | | 84,027 | |

Nibe Industrier AB (Class B Stock) | | | 8,525 | | | | 68,002 | |

Securitas AB (Class B Stock) | | | 7,680 | | | | 62,752 | |

Skandinaviska Enskilda Banken AB (Class A Stock) | | | 43,415 | | | | 457,741 | |

Swedbank AB (Class A Stock) | | | 46,708 | | | | 696,325 | |

Volvo AB (Class B Stock) | | | 33,610 | | | | 550,093 | |

| | | | | | | | |

| | |

| | | | | | | 2,555,510 | |

| | |

Switzerland 2.4% | | | | | | | | |

| | |

Bucher Industries AG | | | 530 | | | | 178,698 | |

Cie Financiere Richemont SA (Class A Stock) | | | 4,685 | | | | 457,882 | |

Kuehne + Nagel International AG | | | 4,721 | | | | 1,004,942 | |

Novartis AG | | | 16,873 | | | | 1,364,870 | |

UBS Group AG | | | 27,492 | | | | 435,862 | |

Zurich Insurance Group AG | | | 1,323 | | | | 563,828 | |

| | | | | | | | |

| | |

| | | | | | | 4,006,082 | |

| | |

Taiwan 4.0% | | | | | | | | |

| | |

Chunghwa Telecom Co. Ltd. | | | 25,000 | | | | 86,198 | |

Compeq Manufacturing Co. Ltd. | | | 382,000 | | | | 516,055 | |

E Ink Holdings, Inc. | | | 62,000 | | | | 393,959 | |

Evergreen Marine Corp. Taiwan Ltd. | | | 134,000 | | | | 570,077 | |

Gold Circuit Electronics Ltd. | | | 109,600 | | | | 290,051 | |

Hon Hai Precision Industry Co. Ltd. | | | 104,000 | | | | 330,312 | |

See Notes to Financial Statements.

22

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Taiwan (cont’d.) | | | | | | | | |

| | |

Taita Chemical Co. Ltd. | | | 200,130 | | | $ | 123,319 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 258,000 | | | | 3,101,730 | |

Unimicron Technology Corp. | | | 12,000 | | | | 46,108 | |

United Microelectronics Corp.* | | | 783,000 | | | | 941,527 | |

Yang Ming Marine Transport Corp. | | | 171,000 | | | | 318,339 | |

| | | | | | | | |

| | |

| | | | | | | 6,717,675 | |

| | |

Thailand 0.1% | | | | | | | | |

| | |

AP Thailand PCL | | | 432,400 | | | | 111,391 | |

Chularat Hospital PCL | | | 744,400 | | | | 69,254 | |

| | | | | | | | |

| | |

| | | | | | | 180,645 | |

| | |

Turkey 2.0% | | | | | | | | |

| | |

Haci Omer Sabanci Holding A/S | | | 616,137 | | | | 1,109,606 | |

Kardemir Karabuk Demir Celik Sanayi ve Ticaret A/S (Class D Stock) | | | 611,960 | | | | 393,264 | |

KOC Holding A/S | | | 147,500 | | | | 440,009 | |

Koza Anadolu Metal Madencilik Isletmeleri A/S* | | | 398,039 | | | | 681,458 | |

Mavi Giyim Sanayi Ve Ticaret A/S (Class B Stock), 144A | | | 22,420 | | | | 105,021 | |

Turk Hava Yollari AO* | | | 63,755 | | | | 347,004 | |

Turkiye Is Bankasi A/S (Class C Stock) | | | 572,000 | | | | 286,543 | |

| | | | | | | | |

| | |

| | | | | | | 3,362,905 | |

| | |

Ukraine 0.0% | | | | | | | | |

| | |

Ferrexpo PLC | | | 63,241 | | | | 74,174 | |

| | |

United Arab Emirates 0.6% | | | | | | | | |

| | |

Dubai Islamic Bank PJSC | | | 41,500 | | | | 65,747 | |

Emaar Properties PJSC | | | 542,284 | | | | 895,179 | |

| | | | | | | | |

| | |

| | | | | | | 960,926 | |

| | |

United Kingdom 7.3% | | | | | | | | |

| | |

3i Group PLC | | | 54,887 | | | | 731,006 | |

AstraZeneca PLC | | | 3,469 | | | | 407,025 | |

BAE Systems PLC | | | 25,760 | | | | 240,948 | |

Barclays PLC | | | 665,522 | | | | 1,130,891 | |

British American Tobacco PLC | | | 45,782 | | | | 1,808,090 | |

Burberry Group PLC | | | 3,560 | | | | 74,180 | |

Compass Group PLC | | | 15,334 | | | | 322,962 | |

Greggs PLC | | | 6,838 | | | | 158,515 | |

Haleon PLC* | | | 67,548 | | | | 207,133 | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 23

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

United Kingdom (cont’d.) | | | | | | | | |

| | |

Imperial Brands PLC | | | 56,338 | | | $ | 1,372,343 | |

Informa PLC | | | 12,213 | | | | 77,820 | |

JD Sports Fashion PLC | | | 152,802 | | | | 170,746 | |

Lloyds Banking Group PLC | | | 2,378,872 | | | | 1,142,497 | |

Morgan Sindall Group PLC | | | 5,863 | | | | 103,453 | |

NatWest Group PLC | | | 375,878 | | | | 1,012,354 | |

Reckitt Benckiser Group PLC | | | 5,922 | | | | 393,008 | |

Safestore Holdings PLC, REIT | | | 32,233 | | | | 333,947 | |

Smiths Group PLC | | | 8,755 | | | | 156,824 | |

SSE PLC | | | 9,243 | | | | 165,181 | |

Unilever PLC | | | 30,921 | | | | 1,405,494 | |

WPP PLC | | | 105,496 | | | | 928,381 | |

| | | | | | | | |

| | |

| | | | | | | 12,342,798 | |

| | |

United States 4.8% | | | | | | | | |

| | |

Computershare Ltd. | | | 4,326 | | | | 70,030 | |

GSK PLC | | | 87,086 | | | | 1,426,564 | |

JBS SA | | | 195,200 | | | | 943,596 | |

Nestle SA | | | 13,850 | | | | 1,507,694 | |

Roche Holding AG | | | 9,012 | | | | 2,990,165 | |

Stellantis NV | | | 88,724 | | | | 1,197,027 | |

| | | | | | | | |

| | |

| | | | | | | 8,135,076 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS

(cost $176,940,231) | | | | | | | 159,170,154 | |

| | | | | | | | |

| | |

EXCHANGE-TRADED FUND 1.0% | | | | | | | | |

| | |

United States | | | | | | | | |

| | |

iShares MSCI EAFE ETF(a)

(cost $1,644,987) | | | 28,200 | | | | 1,672,542 | |

| | | | | | | | |

| | |

PREFERRED STOCKS 1.8% | | | | | | | | |

| | |

Brazil 1.5% | | | | | | | | |

| | |

Cia Energetica de Minas Gerais (PRFC) | | | 389,469 | | | | 856,523 | |

Cia Paranaense de Energia (PRFC B) | | | 232,000 | | | | 332,808 | |

Gerdau SA (PRFC) | | | 16,000 | | | | 79,822 | |

Petroleo Brasileiro SA (PRFC) | | | 215,200 | | | | 1,241,498 | |

| | | | | | | | |

| | |

| | | | | | | 2,510,651 | |

See Notes to Financial Statements.

24

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

PREFERRED STOCKS (Continued) | | | | | | | | |

| | |

Germany 0.1% | | | | | | | | |

| | |

Porsche Automobil Holding SE (PRFC) | | | 3,538 | | | $ | 197,676 | |

| | |

South Korea 0.2% | | | | | | | | |

| | |

Samsung Electronics Co. Ltd. (PRFC) | | | 7,571 | | | | 282,943 | |

| | | | | | | | |

| | |

TOTAL PREFERRED STOCKS

(cost $2,451,960) | | | | | | | 2,991,270 | |

| | | | | | | | |

| | |

TOTAL LONG-TERM INVESTMENTS

(cost $181,037,178) | | | | | | | 163,833,966 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 2.8% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUND 1.0% | | | | | | | | |

PGIM Institutional Money Market Fund

(cost $1,713,796; includes $1,710,408 of cash collateral for securities on loan)(b)(wa) | | | 1,715,341 | | | | 1,713,797 | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| | | Interest Rate | | | Maturity Date | | Principal

Amount (000)# | | | | |

| | | | |

U.S. TREASURY OBLIGATION(k)(n) 0.3% | | | | | | | | | | | | | | |

U.S. Treasury Bills

(cost $448,273) | | | 3.163% | | | 12/15/22 | | | 450 | | | | 448,069 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | Shares | | | | |

| | | | |

UNAFFILIATED FUND 1.5% | | | | | | | | | | | | | | |

Dreyfus Government Cash Management (Institutional Shares)

(cost $2,499,133) | | | | | | | | | 2,499,133 | | | | 2,499,133 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $4,661,202) | | | | | | | | | | | | | 4,660,999 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 99.9%

(cost $185,698,380) | | | | | | | | | | | | | 168,494,965 | |

Other assets in excess of liabilities(z) 0.1% | | | | | | | | | | | | | 196,600 | |

| | | | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | | | $ | 168,691,565 | |

| | | | | | | | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 25

Schedule of Investments (continued)

as of October 31, 2022

ADR—American Depositary Receipt

EAFE—Europe, Australasia, Far East

ETF—Exchange-Traded Fund

GS—Goldman Sachs & Co. LLC

LIBOR—London Interbank Offered Rate

MSCI—Morgan Stanley Capital International

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

REITs—Real Estate Investment Trust

SOFR—Secured Overnight Financing Rate

UTS—Unit Trust Security

| * | Non-income producing security. |

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| ^ | Indicates a Level 3 instrument. The aggregate value of Level 3 instruments is $23 and 0.0% of net assets. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $1,660,680; cash collateral of $1,710,408 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (k) | Represents security, or a portion thereof, segregated as collateral for centrally cleared/exchange-traded derivatives. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

| (wa) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund, if applicable. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

Futures contracts outstanding at October 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | |

Number of Contracts | | Type | | Expiration

Date | | | Current

Notional

Amount | | | Value / Unrealized Appreciation (Depreciation) | |

| | | | | |

Long Positions: | | | | | | | | | | | | | | | | | | | | |

47 | | Mini MSCI EAFE Index | | | Dec. 2022 | | | $ | 4,126,365 | | | | | | | $ | 198,446 | | | | | |

37 | | Mini MSCI Emerging Markets Index | | | Dec. 2022 | | | | 1,579,160 | | | | | | | | (159,697 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | $ | 38,749 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Summary of Collateral for Centrally Cleared/Exchange-traded Derivatives:

Cash and securities segregated as collateral, including pending settlement for closed positions, to cover requirements for centrally cleared/exchange-traded derivatives are listed by broker as follows:

| | | | | | | | | | | | |

Broker | | Cash and/or Foreign Currency | | Securities Market Value |

GS | | | | $— | | | | | | $448,069 | | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

26

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2022 in valuing such portfolio securities:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 7,570,166 | | | | | | | $ | — | | | | | |

Belgium | | | — | | | | 323,829 | | | | | | | | — | | | | | |

Brazil | | | 2,830,425 | | | | 534,105 | | | | | | | | — | | | | | |

Canada | | | 12,738,620 | | | | — | | | | | | | | — | | | | | |

Chile | | | — | | | | 72,245 | | | | | | | | — | | | | | |

China | | | 1,057,811 | | | | 10,973,515 | | | | | | | | — | | | | | |

Denmark | | | — | | | | 2,796,482 | | | | | | | | — | | | | | |

Finland | | | — | | | | 2,782,347 | | | | | | | | — | | | | | |

France | | | — | | | | 12,358,509 | | | | | | | | — | | | | | |

Georgia | | | — | | | | 141,713 | | | | | | | | — | | | | | |

Germany | | | — | | | | 4,942,115 | | | | | | | | — | | | | | |

Greece | | | — | | | | 323,602 | | | | | | | | — | | | | | |

Hong Kong | | | — | | | | 2,640,974 | | | | | | | | — | | | | | |

India | | | — | | | | 5,899,222 | | | | | | | | — | | | | | |

Indonesia | | | — | | | | 1,488,894 | | | | | | | | — | | | | | |

Israel | | | 116,307 | | | | 2,145,810 | | | | | | | | — | | | | | |

Italy | | | — | | | | 1,782,159 | | | | | | | | — | | | | | |

Japan | | | — | | | | 19,384,364 | | | | | | | | — | | | | | |

Kuwait | | | — | | | | 238,008 | | | | | | | | — | | | | | |

Luxembourg | | | — | | | | 862,310 | | | | | | | | — | | | | | |

Malaysia | | | — | | | | 995,136 | | | | | | | | — | | | | | |

Netherlands | | | — | | | | 7,568,333 | | | | | | | | — | | | | | |

New Zealand | | | — | | | | 83,290 | | | | | | | | — | | | | | |

Nigeria | | | — | | | | 254,128 | | | | | | | | — | | | | | |

Norway | | | — | | | | 3,011,771 | | | | | | | | — | | | | | |

Peru | | | 73,180 | | | | — | | | | | | | | — | | | | | |

Portugal | | | — | | | | 78,562 | | | | | | | | — | | | | | |

Qatar | | | — | | | | 1,168,041 | | | | | | | | — | | | | | |

Russia | | | — | | | | — | | | | | | | | 23 | | | | | |

Saudi Arabia | | | — | | | | 1,193,387 | | | | | | | | — | | | | | |

Singapore | | | — | | | | 3,462,579 | | | | | | | | — | | | | | |

South Africa | | | — | | | | 290,402 | | | | | | | | — | | | | | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 27

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities (continued) | | | | | | | | | | | | | | | | | | | | |

Assets (continued) | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments (continued) | | | | | | | | | | | | | | | | | | | | |

Common Stocks (continued) | | | | | | | | | | | | | | | | | | | | |

South Korea | | $ | — | | | $ | 7,357,137 | | | | | | | $ | — | | | | | |

Spain | | | — | | | | 1,294,862 | | | | | | | | — | | | | | |

Sweden | | | — | | | | 2,555,510 | | | | | | | | — | | | | | |

Switzerland | | | — | | | | 4,006,082 | | | | | | | | — | | | | | |

Taiwan | | | — | | | | 6,717,675 | | | | | | | | — | | | | | |

Thailand | | | — | | | | 180,645 | | | | | | | | — | | | | | |

Turkey | | | — | | | | 3,362,905 | | | | | | | | — | | | | | |

Ukraine | | | — | | | | 74,174 | | | | | | | | — | | | | | |

United Arab Emirates | | | — | | | | 960,926 | | | | | | | | — | | | | | |

United Kingdom | | | — | | | | 12,342,798 | | | | | | | | — | | | | | |

United States | | | 943,596 | | | | 7,191,480 | | | | | | | | — | | | | | |

Exchange-Traded Fund | | | | | | | | | | | | | | | | | | | | |

United States | | | 1,672,542 | | | | — | | | | | | | | — | | | | | |

Preferred Stocks | | | | | | | | | | | | | | | | | | | | |

Brazil | | | 2,510,651 | | | | — | | | | | | | | — | | | | | |

Germany | | | — | | | | 197,676 | | | | | | | | — | | | | | |

South Korea | | | — | | | | 282,943 | | | | | | | | — | | | | | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Affiliated Mutual Fund | | | 1,713,797 | | | | — | | | | | | | | — | | | | | |

U.S. Treasury Obligation | | | — | | | | 448,069 | | | | | | | | — | | | | | |

Unaffiliated Fund | | | 2,499,133 | | | | — | | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total | | $ | 26,156,062 | | | $ | 142,338,880 | | | | | | | $ | 23 | | | | | |

| | | | | | | | | | | | |

| | | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | 198,446 | | | $ | — | | | | | | | $ | — | | | | | |

| | | | | | | | | | | | |

| | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (159,697 | ) | | $ | — | | | | | | | $ | — | | | | | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and centrally cleared swap contracts, which are recorded at the unrealized appreciation (depreciation) on the instrument, and OTC swap contracts which are recorded at fair value. |

Industry Classification:

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of October 31, 2022 were as follows:

| | | | |

Banks | | | 11.1 | % |

Pharmaceuticals | | | 8.2 | |

Oil, Gas & Consumable Fuels | | | 6.8 | |

Insurance | | | 5.1 | |

| | | | |

Metals & Mining | | | 3.8 | % |

Semiconductors & Semiconductor Equipment | | | 3.6 | |

Automobiles | | | 3.0 | |

Tobacco | | | 2.9 | |

See Notes to Financial Statements.

28

Industry Classification (continued):

| | | | |

Trading Companies & Distributors | | | 2.8 | % |

Food Products | | | 2.7 | |

Chemicals | | | 2.7 | |

IT Services | | | 2.6 | |

Specialty Retail | | | 2.5 | |

Food & Staples Retailing | | | 2.3 | |

Industrial Conglomerates | | | 2.2 | |

Textiles, Apparel & Luxury Goods | | | 2.2 | |

Marine | | | 2.1 | |

Capital Markets | | | 2.1 | |

Diversified Telecommunication Services | | | 1.8 | |

Electric Utilities | | | 1.8 | |

Machinery | | | 1.7 | |

Media | | | 1.7 | |

Unaffiliated Fund | | | 1.5 | |

Hotels, Restaurants & Leisure | | | 1.5 | |

Multi-Utilities | | | 1.4 | |

Personal Products | | | 1.4 | |

Electronic Equipment, Instruments & Components | | | 1.3 | |

Equity Real Estate Investment Trusts (REITs) | | | 1.1 | |

Real Estate Management & Development | | | 1.1 | |

Affiliated Mutual Fund (1.0% represents investments purchased with collateral from securities on loan) | | | 1.0 | |

Exchange-Traded Fund | | | 1.0 | |

Technology Hardware, Storage & Peripherals | | | 0.9 | |

Diversified Financial Services | | | 0.9 | |

Paper & Forest Products | | | 0.8 | |

Building Products | | | 0.8 | |

Internet & Direct Marketing Retail | | | 0.7 | |

Health Care Providers & Services | | | 0.7 | |

Professional Services | | | 0.7 | |

Software | | | 0.7 | |

| | | | |

Construction & Engineering | | | 0.6 | % |

Thrifts & Mortgage Finance | | | 0.5 | |

Independent Power & Renewable Electricity Producers | | | 0.5 | |

Gas Utilities | | | 0.5 | |

Entertainment | | | 0.4 | |

Communications Equipment | | | 0.4 | |

Electrical Equipment | | | 0.4 | |

Interactive Media & Services | | | 0.4 | |

Diversified Consumer Services | | | 0.3 | |

Auto Components | | | 0.3 | |

Aerospace & Defense | | | 0.3 | |

U.S. Treasury Obligation | | | 0.3 | |

Leisure Products | | | 0.3 | |

Health Care Equipment & Supplies | | | 0.3 | |

Household Products | | | 0.2 | |

Multiline Retail | | | 0.2 | |

Airlines | | | 0.2 | |

Transportation Infrastructure | | | 0.2 | |

Beverages | | | 0.2 | |

Wireless Telecommunication Services | | | 0.1 | |

Water Utilities | | | 0.1 | |

Life Sciences Tools & Services | | | 0.0 | * |

Commercial Services & Supplies | | | 0.0 | * |

| | | | |

| |

| | | 99.9 | |

Other assets in excess of liabilities | | | 0.1 | |

| | | | |

| |

| | | 100.0 | % |

| | | | |

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity contracts risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of October 31, 2022 as presented in the Statement of Assets and Liabilities:

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 29

Schedule of Investments (continued)

as of October 31, 2022

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

| | | | |

Derivatives not accounted for as

hedging instruments, carried at

fair value | | Statement of Assets and

Liabilities Location | | Fair

Value | | | Statement of Assets and

Liabilities Location | | Fair

Value | |

| | | | |

Equity contracts | | Due from/to broker-variation margin futures | | $ | 198,446 | * | | Due from/to broker-variation margin futures | | $ | 159,697 | * |

| | | | | | | | | | | | |

| * | Includes cumulative appreciation (depreciation) as reported in the schedule of open futures and centrally cleared swap contracts. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2022 are as follows:

| | | | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | | | Futures | |

| | |

Equity contracts | | | | $ | (1,502,773 | ) |

| | | | | | |

| | | | | | |

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income |

Derivatives not accounted for as hedging instruments, carried at fair value | | | | | | Futures |

| | | |

Equity contracts | | | | | | $120,294 |

| | | | | | |

For the year ended October 31, 2022, the Fund’s average volume of derivative activities is as follows:

| | |

| Derivative Contract Type | | Average Volume of Derivative Activities* |

Futures Contracts - Long Positions (1) | | $5,531,108 |

| * | Average volume is based on average quarter end balances as noted for the year ended October 31, 2022. |

| (1) | Notional Amount in USD. |

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

See Notes to Financial Statements.

30

| | | | | | |

| Description | | Gross Market Value of Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | $1,660,680 | | $(1,660,680) | | $— |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 31

Statement of Assets and Liabilities

as of October 31, 2022

| | | | |

| |

Assets | | | | |

| |

Investments at value, including securities on loan of $1,660,680: | | | | |

Unaffiliated investments (cost $183,984,584) | | $ | 166,781,168 | |

Affiliated investments (cost $1,713,796) | | | 1,713,797 | |

Foreign currency, at value (cost $1,568,206) | | | 1,569,133 | |

Receivable for investments sold | | | 5,572,572 | |

Tax reclaim receivable | | | 864,935 | |

Dividends and interest receivable | | | 385,301 | |

Receivable for Fund shares sold | | | 199,419 | |

Foreign capital gains tax benefit accrued | | | 294 | |

Prepaid expenses | | | 1,797 | |

| | | | |

| |

Total Assets | | | 177,088,416 | |

| | | | |

| |

Liabilities | | | | |

| |

Payable for investments purchased | | | 5,727,900 | |

Payable to broker for collateral for securities on loan | | | 1,710,408 | |

Payable for Fund shares purchased | | | 578,887 | |

Accrued expenses and other liabilities | | | 159,405 | |

Management fee payable | | | 73,868 | |

Affiliated transfer agent fee payable | | | 71,627 | |

Due to broker—variation margin futures | | | 42,410 | |

Distribution fee payable | | | 31,148 | |

Directors’ fees payable | | | 1,198 | |

| | | | |

| |

Total Liabilities | | | 8,396,851 | |

| | | | |

| |

Net Assets | | $ | 168,691,565 | |

| | | | |

| |

| | | | | |

| |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 292 | |

Paid-in capital in excess of par | | | 201,618,665 | |

Total distributable earnings (loss) | | | (32,927,392 | ) |

| | | | |

| |

Net assets, October 31, 2022 | | $ | 168,691,565 | |

| | | | |

See Notes to Financial Statements.

32

| | | | | | | | |

| | |

Class A | | | | | | | | |

| | |

Net asset value and redemption price per share, ($119,053,039 ÷ 20,662,278 shares of common stock issued and outstanding) | | $ | 5.76 | | | | | |

Maximum sales charge (5.50% of offering price) | | | 0.34 | | | | | |

| | | | | | | | |

| | |

Maximum offering price to public | | $ | 6.10 | | | | | |

| | | | | | | | |

| | |

Class C | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($1,319,492 ÷ 243,602 shares of common stock issued and outstanding) | | $ | 5.42 | | | | | |

| | | | | | | | |

| | |

Class Z | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($11,634,955 ÷ 1,995,276 shares of common stock issued and outstanding) | | $ | 5.83 | | | | | |

| | | | | | | | |

| | |

Class R6 | | | | | | | | |

| | |

Net asset value, offering price and redemption price per share, ($36,684,079 ÷ 6,275,747 shares of common stock issued and outstanding) | | $ | 5.85 | | | | | |

| | | | | | | | |

See Notes to Financial Statements.

PGIM Quant Solutions International Equity Fund 33

Statement of Operations

Year Ended October 31, 2022

| | | | |

| |

Net Investment Income (Loss) | | | | |

| |

Income | | | | |

Unaffiliated dividend income (net of $1,002,624 foreign withholding tax) | | $ | 8,997,332 | |

Income from securities lending, net (including affiliated income of $4,028) | | | 18,395 | |

Interest income | | | 4,755 | |

Affiliated dividend income | | | 922 | |

| | | | |

| |

Total income | | | 9,021,404 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 1,629,471 | |

Distribution fee(a) | | | 465,796 | |

Transfer agent’s fees and expenses (including affiliated expense of $377,464)(a) | | | 635,653 | |

Custodian and accounting fees | | | 168,010 | |

Shareholders’ reports | | | 59,736 | |

Registration fees(a) | | | 56,888 | |

Audit fee | | | 30,600 | |

Legal fees and expenses | | | 25,258 | |

Directors’ fees | | | 12,784 | |

Miscellaneous | | | 79,349 | |

| | | | |

| |

Total expenses | | | 3,163,545 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (330,703 | ) |

| | | | |

| |

Net expenses | | | 2,832,842 | |

| | | | |

| |

Net investment income (loss) | | | 6,188,562 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

| |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $(422)) (net of foreign capital gains taxes $(29,429)) | | | (17,542,112 | ) |

Futures transactions | | | (1,502,773 | ) |

Foreign currency transactions | | | (409,286 | ) |

| | | | |

| |

| | | (19,454,171 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (including affiliated of $1) (net of change in foreign capital gains taxes $188,033) | | | (47,621,210 | ) |

Futures | | | 120,294 | |

Foreign currencies | | | (97,812 | ) |

| | | | |

| |

| | | (47,598,728 | ) |

| | | | |

| |

Net gain (loss) on investment and foreign currency transactions | | | (67,052,899 | ) |

| | | | |

| |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | (60,864,337 | ) |

| | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

Distribution fee | | | 446,502 | | | | 19,294 | | | | — | | | | — | |