UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2020 |

| |

| Date of reporting period: | | 10/31/2020 |

Item 1 – Reports to Stockholders

PGIM QMA INTERNATIONAL EQUITY FUND

ANNUAL REPORT

OCTOBER 31, 2020

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgim.com/investments), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company, member SIPC. QMA is the primary business name of QMA LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2020 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Effective June 26, 2020, all of the issued and outstanding Class B shares of the Fund converted into Class A shares.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM QMA International Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2020.

During the first four months of the period, the global economy remained healthy—particularly in the US—fueled by rising corporate profits and strong job growth. The outlook changed dramatically in March as the coronavirus outbreak quickly and substantially shut down economic activity worldwide, leading to significant job losses and a steep decline in global growth and earnings. Responding to this disruption, the Federal Reserve (the Fed) cut the federal funds rate target to near zero and flooded capital markets with liquidity; and Congress passed stimulus bills worth approximately $3 trillion that offered an economic lifeline to consumers and businesses.

While stocks climbed throughout the first four months of the period, they fell significantly in March amid a spike in volatility, ending the 11-year-long equity bull market. With stores and factories closing and consumers staying at home to limit the spread of the virus, investors sold stocks on fears that corporate earnings would take a serious hit. Equities rallied around the globe throughout the spring and summer as states reopened their economies, but became more volatile during the last two months of the period as investors worried that a surge in coronavirus infections would stall the economic recovery. For the period overall, large-cap US and emerging market stocks rose, small-cap US stocks were virtually unchanged, and stocks in developed foreign markets declined.

The bond market overall—including US and global bonds as well as emerging market debt—rose during the period as investors sought safety in fixed income. A significant rally in interest rates pushed the 10-year US Treasury yield down to a record low. In March, the Fed took several aggressive actions to keep the bond markets running smoothly, restarting many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM QMA International Equity Fund

December 15, 2020

| | | | |

PGIM QMA International Equity Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/20 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| Class A | | | | | | | | |

| (with sales charges) | | –9.35 | | 1.33 | | 2.48 | | — |

| (without sales charges) | | –4.07 | | 2.48 | | 3.06 | | — |

| Class C | | | | | | | | |

| (with sales charges) | | –6.35 | | 1.61 | | 2.25 | | — |

| (without sales charges) | | –5.42 | | 1.61 | | 2.25 | | — |

| Class Z | | | | | | | | |

| (without sales charges) | | –3.61 | | 2.88 | | 3.40 | | — |

| Class R6 | | | | | | | | |

| (without sales charges) | | –3.26 | | N/A | | N/A | | 4.47 (12/28/16) |

| MSCI All Country World ex-US Index |

| | | –2.61 | | 4.26 | | 3.43 | | — |

| | |

|

| Average Annual Total Returns as of 10/31/20 Since Inception (%) |

| | | Class R6 (12/28/16) |

| MSCI All Country World ex-US Index | | 5.48 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

| | |

| 4 | | Visit our website at pgim.com/investments |

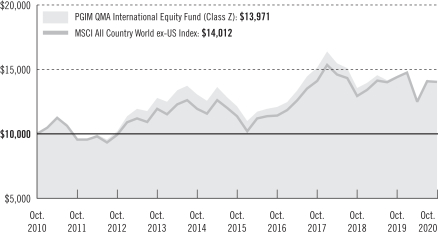

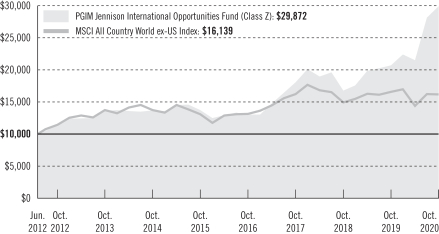

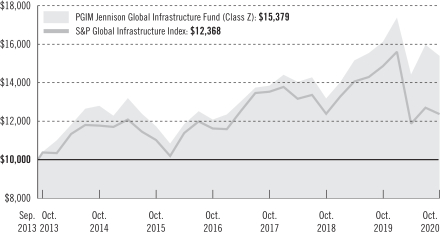

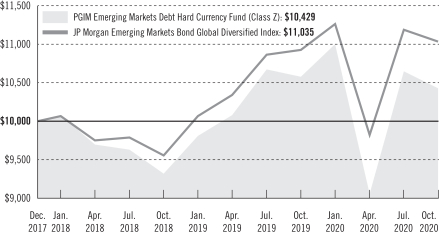

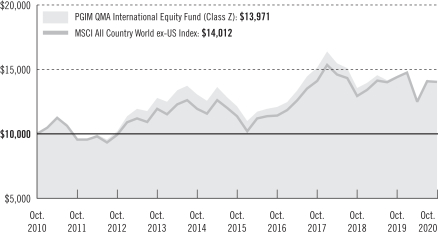

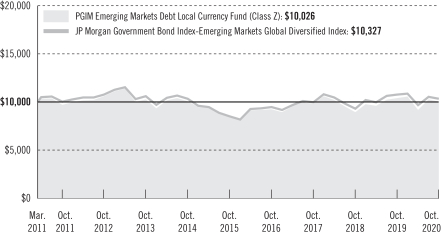

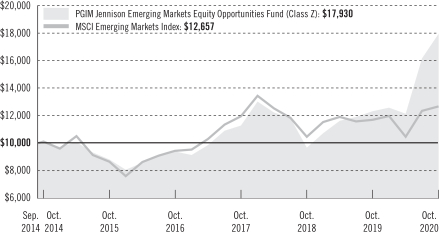

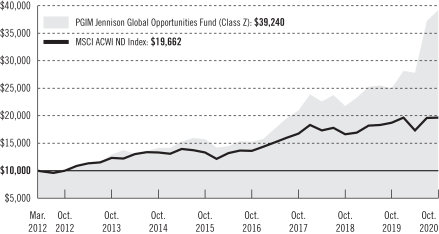

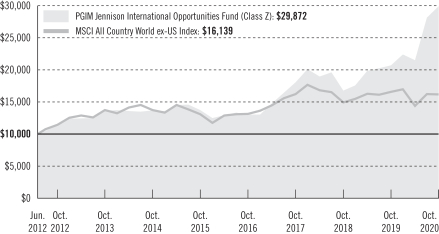

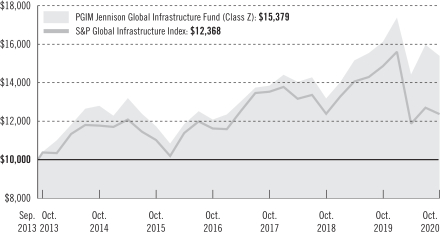

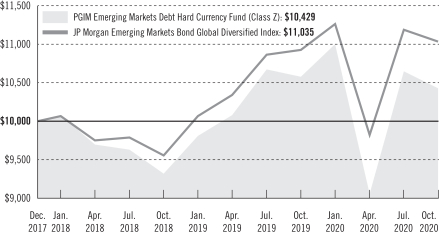

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the MSCI All Country World ex-US Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2010) and the account values at the end of the current fiscal year (October 31, 2020) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

PGIM QMA International Equity Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase

price or the net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | �� | None |

Annual distribution and service (12b-1) fees

(shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | None | | None |

Benchmark Definitions

MSCI All Country World ex-US Index—The Morgan Stanley Capital International All Country World ex-US (MSCI ACWI Ex-US) Index is an unmanaged, market-capitalization weighted index designed to provide a broad measure of stock performance throughout the world, with the exception of US based companies. The MSCI ACWI Ex-US Index includes both developed and emerging markets.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | |

| 6 | | Visit our website at pgim.com/investments |

Presentation of Fund Holdings as of 10/31/20

| | | | | | |

| | | |

| Ten Largest Holdings | | Line of Business | | Country | | % of Net Assets |

| Alibaba Group Holding Ltd., ADR | | Internet & Direct Marketing Retail | | China | | 3.4% |

| iShares MSCI EAFE ETF | | Exchange Traded Funds | | United States | | 2.2% |

| Novartis AG | | Pharmaceuticals | | Switzerland | | 1.4% |

| Roche Holding AG | | Pharmaceuticals | | Switzerland | | 1.4% |

| Tencent Holdings Ltd. | | Interactive Media & Services | | China | | 1.4% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | Semiconductors & Semiconductor Equipment | | Taiwan | | 1.2% |

| Sony Corp. | | Household Durables | | Japan | | 1.2% |

| Nestle SA | | Food Products | | Switzerland | | 1.1% |

| Sanofi | | Pharmaceuticals | | France | | 1.0% |

| Canadian Pacific Railway Ltd. | | Road & Rail | | Canada | | 0.9% |

Holdings reflect only long-term investments and are subject to change.

| | | | |

PGIM QMA International Equity Fund | | | 7 | |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM QMA International Equity Fund’s Class Z shares returned -3.61% in the 12-month reporting period that ended October 31, 2020, underperforming the -2.61% return of the MSCI All Country World ex-US Index (the Index).

What were the market conditions?

| | • | | The reporting period was dominated by the proliferation of COVID-19 infections that began in early 2020. While economists continue to debate the shape of the economic recovery, it clearly has been V-shaped in global equity markets, with many markets fully erasing losses from the severe decline in March 2020 by period-end. (A V-shaped recovery refers to a sharp rise back to previous measures of economic performance after a downturn.) |

| | • | | However, performance among equity market segments was divergent during the period. For example, China’s economy bounced back sooner than the rest of the world, as the country’s draconian lockdown was highly effective at curbing the spread of the virus in February. As a result, China’s economy suffered less damage and is likely to post positive growth for 2020. |

| | • | | In international developed markets, information technology was the best-performing sector during the period, gaining about 30%, while energy stocks fared the worst, declining almost 30%. |

| | • | | Growth significantly outperformed value over the period. Geographically, US stocks outpaced non-US developed markets and emerging markets. Nonetheless, by period-end there were already signs that growth was slowing, as uncertainty remained over when the global economy would resume pre-COVID-19 levels of economic activity. |

What worked?

| | • | | Growth and quality measures contributed to the Fund’s performance, particularly among the high-growth information technology holdings across Taiwan, China, and Japan. |

| | • | | High-quality consumer discretionary positions in China and Sweden, along with Taiwanese communication services holdings, furthered gains. |

What didn’t work?

| | • | | The Fund’s investments in relatively inexpensive stocks offset the gains, and the shortfall was particularly significant given that expensive stocks by far outperformed cheaper stocks over the period. |

| | • | | Thus, favoring cheap Brazilian and United Kingdom financial stocks as well as UK-based healthcare companies was particularly detrimental to performance. |

| | |

| 8 | | Visit our website at pgim.com/investments |

Did the Fund use derivatives?

The Fund did not hold futures during the period. However, the Fund may invest in futures, including for the ease of cash management.

Current outlook

| | • | | QMA believes the current market is crowded and not sustainable, and that diversification and the Fund’s investment strategy should prevail as markets normalize and move past fear and uncertainty. Specifically, QMA sees a correction in the extremely high valuations of the momentum-driven stocks responsible for much of the market’s returns during the period, coupled with the recovery of fundamentals and valuations among cheaper stocks with very high relative and nominal earnings and book-value yields. |

| | • | | While the pathway and timing of events leading to this reversion is hard to predict, QMA views the eventual neutralization of the COVID-19 pandemic as a key catalyst in bringing more balance to the equity markets, an environment where QMA’s strategies have historically performed well. |

| | • | | In QMA’s view, the biggest risk appears to be political, as the results of the US presidential election, particularly if contested or prolonged, and new policies from the subsequent administration could prove disruptive to the US and global economy. |

| | | | |

PGIM QMA International Equity Fund | | | 9 | |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2020. The example is for illustrative purposes only; you should consult the Fund’s Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | |

| 10 | | Visit our website at pgiminvestments.com |

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM QMA

International

Equity Fund | | Beginning Account

Value

May 1, 2020 | | | Ending Account

Value

October 31, 2020 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,119.60 | | | | 1.49 | % | | $ | 7.94 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,017.65 | | | | 1.49 | % | | $ | 7.56 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,111.50 | | | | 2.93 | % | | $ | 15.55 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,010.41 | | | | 2.93 | % | | $ | 14.81 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,121.90 | | | | 1.11 | % | | $ | 5.92 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.56 | | | | 1.11 | % | | $ | 5.63 | |

| Class R6 | | Actual | | $ | 1,000.00 | | | $ | 1,125.20 | | | | 0.79 | % | | $ | 4.22 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.17 | | | | 0.79 | % | | $ | 4.01 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2020, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2020 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

PGIM QMA International Equity Fund | | | 11 | |

Schedule of Investments

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| LONG-TERM INVESTMENTS 99.4% | | | | | | |

| | |

| COMMON STOCKS 96.0% | | | | | | |

| | |

| Australia 4.3% | | | | | | |

Ansell Ltd. | | | 4,556 | | | $ | 128,580 | |

BHP Group Ltd. | | | 25,194 | | | | 598,408 | |

BHP Group PLC | | | 28,452 | | | | 550,746 | |

Charter Hall Group, REIT | | | 30,080 | | | | 260,759 | |

Data#3 Ltd. | | | 22,178 | | | | 97,240 | |

Fortescue Metals Group Ltd. | | | 112,076 | | | | 1,365,026 | |

Goodman Group, REIT | | | 101,567 | | | | 1,313,173 | |

JB Hi-Fi Ltd. | | | 7,668 | | | | 255,671 | |

Magellan Financial Group Ltd. | | | 28,292 | | | | 1,091,909 | |

Newcrest Mining Ltd. | | | 8,656 | | | | 178,230 | |

Platinum Asset Management Ltd. | | | 114,496 | | | | 244,488 | |

Rio Tinto Ltd. | | | 3,508 | | | | 227,895 | |

Rio Tinto PLC | | | 25,628 | | | | 1,446,555 | |

Stockland, REIT | | | 26,500 | | | | 71,596 | |

| | | | | | | | |

| | |

| | | | | | | 7,830,276 | |

| | |

| Belgium 0.9% | | | | | | |

Ageas SA/NV | | | 7,432 | | | | 300,109 | |

Etablissements Franz Colruyt NV | | | 2,145 | | | | 126,858 | |

Euronav NV | | | 89,772 | | | | 659,361 | |

Groupe Bruxelles Lambert SA | | | 2,624 | | | | 215,053 | |

Telenet Group Holding NV | | | 3,535 | | | | 135,982 | |

Tessenderlo Group SA* | | | 5,574 | | | | 189,870 | |

| | | | | | | | |

| | |

| | | | | | | 1,627,233 | |

| | |

| Brazil 2.1% | | | | | | |

B3 SA - Brasil Bolsa Balcao | | | 15,000 | | | | 132,826 | |

Banco do Brasil SA | | | 173,400 | | | | 899,041 | |

Banco Santander Brasil SA, UTS | | | 130,900 | | | | 727,735 | |

Cia de Saneamento do Parana, UTS | | | 54,900 | | | | 226,663 | |

Petroleo Brasileiro SA | | | 33,100 | | | | 109,661 | |

Vale SA | | | 32,100 | | | | 337,618 | |

WEG SA | | | 99,300 | | | | 1,313,513 | |

Wiz Solucoes e Corretagem de Seguros SA | | | 44,000 | | | | 69,168 | |

| | | | | | | | |

| | |

| | | | | | | 3,816,225 | |

| | |

| Canada 6.4% | | | | | | |

Alimentation Couche-Tard, Inc. (Class B Stock) | | | 10,600 | | | | 326,441 | |

B2Gold Corp. | | | 47,400 | | | | 304,900 | |

Bank of Montreal | | | 5,400 | | | | 321,536 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 13 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Canada (cont’d.) | | | | | | |

Canadian National Railway Co. | | | 1,200 | | | $ | 119,207 | |

Canadian Natural Resources Ltd. | | | 22,600 | | | | 359,619 | |

Canadian Pacific Railway Ltd. | | | 5,300 | | | | 1,583,834 | |

CI Financial Corp. | | | 5,400 | | | | 62,945 | |

DREAM Unlimited Corp. (Class A Stock) | | | 7,500 | | | | 99,415 | |

Great-West Lifeco, Inc. | | | 49,300 | | | | 1,004,650 | |

Home Capital Group, Inc.* | | | 8,400 | | | | 153,398 | |

Loblaw Cos. Ltd. | | | 1,600 | | | | 79,646 | |

Magna International, Inc. | | | 23,600 | | | | 1,205,065 | |

Manulife Financial Corp. | | | 86,100 | | | | 1,167,129 | |

Metro Inc. | | | 2,300 | | | | 107,292 | |

National Bank of Canada | | | 20,900 | | | | 1,003,037 | |

North West Co., Inc. (The) | | | 12,500 | | | | 308,208 | |

Quebecor, Inc. (Class B Stock) | | | 3,100 | | | | 71,921 | |

Restaurant Brands International, Inc. | | | 1,200 | | | | 62,355 | |

Ritchie Bros. Auctioneers, Inc. | | | 1,100 | | | | 66,679 | |

Royal Bank of Canada | | | 5,700 | | | | 398,568 | |

Sun Life Financial, Inc. | | | 34,200 | | | | 1,360,761 | |

TC Energy Corp. | | | 24,100 | | | | 948,588 | |

TFI International, Inc. | | | 8,300 | | | | 369,553 | |

Thomson Reuters Corp. | | | 1,600 | | | | 124,392 | |

| | | | | | | | |

| | |

| | | | | | | 11,609,139 | |

| | |

| Chile 0.4% | | | | | | |

AES Gener SA | | | 1,902,787 | | | | 295,273 | |

Engie Energia Chile SA | | | 336,716 | | | | 354,438 | |

| | | | | | | | |

| | |

| | | | | | | 649,711 | |

| | |

| China 13.6% | | | | | | |

Alibaba Group Holding Ltd., ADR* | | | 20,200 | | | | 6,154,738 | |

Anhui Conch Cement Co. Ltd. (Class H Stock) | | | 143,000 | | | | 895,707 | |

Bank of Beijing Co. Ltd. (Class A Stock) | | | 143,900 | | | | 100,385 | |

Bank of Communications Co. Ltd. (Class H Stock) | | | 1,627,000 | | | | 803,081 | |

Bank of Jiangsu Co. Ltd. (Class A Stock) | | | 86,000 | | | | 77,270 | |

Bank of Shanghai Co. Ltd. (Class A Stock) | | | 64,900 | | | | 76,126 | |

BOC Hong Kong Holdings Ltd. | | | 63,500 | | | | 177,046 | |

China Construction Bank Corp. (Class H Stock) | | | 844,000 | | | | 584,779 | |

China Life Insurance Co. Ltd. (Class H Stock) | | | 474,000 | | | | 1,033,381 | |

China Minsheng Banking Corp. Ltd. (Class H Stock) | | | 1,521,000 | | | | 833,919 | |

China Mobile Ltd. | | | 153,000 | | | | 934,661 | |

China National Building Material Co. Ltd. (Class H Stock) | | | 72,000 | | | | 82,844 | |

China Overseas Land & Investment Ltd. | | | 29,000 | | | | 72,966 | |

China Resources Cement Holdings Ltd. | | | 216,000 | | | | 283,595 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| China (cont’d.) | | | | | | |

China Resources Power Holdings Co. Ltd. | | | 330,000 | | | $ | 343,794 | |

China Unicom Hong Kong Ltd. | | | 1,468,000 | | | | 905,891 | |

CNOOC Ltd. | | | 495,000 | | | | 452,775 | |

COSCO SHIPPING Energy Transportation Co. Ltd. (Class H Stock) | | | 544,000 | | | | 214,353 | |

Country Garden Services Holdings Co. Ltd. | | | 175,000 | | | | 1,102,622 | |

Eve Energy Co. Ltd. (Class A Stock) | | | 13,200 | | | | 105,020 | |

Greenland Holdings Corp. Ltd. (Class A Stock) | | | 80,600 | | | | 74,543 | |

Hengan International Group Co. Ltd. | | | 132,500 | | | | 922,981 | |

Hunan Valin Steel Co. Ltd. (Class A Stock) | | | 94,000 | | | | 71,378 | |

Industrial & Commercial Bank of China Ltd. (Class H Stock) | | | 372,000 | | | | 209,863 | |

JD.com, Inc., ADR* | | | 7,300 | | | | 595,096 | |

Jiangsu Hengli Hydraulic Co. Ltd. (Class A Stock) | | | 10,800 | | | | 122,402 | |

Jiangsu Yuyue Medical Equipment & Supply Co. Ltd. (Class A Stock) | | | 14,700 | | | | 67,927 | |

Jinke Properties Group Co. Ltd. (Class A Stock) | | | 65,000 | | | | 75,285 | |

Lens Technology Co. Ltd. (Class A Stock) | | | 22,400 | | | | 111,028 | |

LONGi Green Energy Technology Co. Ltd. (Class A Stock) | | | 10,700 | | | | 121,852 | |

Luxshare Precision Industry Co. Ltd. (Class A Stock) | | | 14,139 | | | | 115,682 | |

Metallurgical Corp. of China Ltd. (Class A Stock) | | | 197,400 | | | | 76,435 | |

Muyuan Foods Co. Ltd. (Class A Stock) | | | 9,000 | | | | 95,370 | |

NetEase, Inc., ADR | | | 7,300 | | | | 633,567 | |

NIO, Inc., ADR* | | | 8,900 | | | | 272,162 | |

Offcn Education Technology Co. Ltd. (Class A Stock) | | | 16,800 | | | | 99,414 | |

Poly Developments & Holdings Group Co. Ltd. (Class A Stock) | | | 53,900 | | | | 123,574 | |

Sany Heavy Industry Co. Ltd. (Class A Stock) | | | 35,500 | | | | 138,039 | |

SF Holding Co. Ltd. (Class A Stock) | | | 8,600 | | | | 106,494 | |

Shaanxi Coal Industry Co. Ltd. (Class A Stock) | | | 72,900 | | | | 95,311 | |

Shanghai Pudong Development Bank Co. Ltd. (Class A Stock) | | | 67,200 | | | | 92,973 | |

Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (Class A Stock) | | | 1,700 | | | | 98,456 | |

Shenzhou International Group Holdings Ltd. | | | 7,200 | | | | 125,543 | |

Shimao Group Holdings Ltd. | | | 161,000 | | | | 571,084 | |

Sinotruk Hong Kong Ltd. | | | 150,000 | | | | 384,666 | |

Tencent Holdings Ltd. | | | 32,600 | | | | 2,483,896 | |

Wens Foodstuffs Group Co. Ltd. (Class A Stock) | | | 23,640 | | | | 67,004 | |

Wilmar International Ltd. | | | 353,600 | | | | 1,048,169 | |

Wuhu Sanqi Interactive Entertainment Network Technology Group Co. Ltd. (Class A Stock) | | | 17,100 | | | | 75,508 | |

Yum China Holdings, Inc. | | | 3,200 | | | | 170,336 | |

Zhejiang Dingli Machinery Co. Ltd. (Class A Stock) | | | 5,800 | | | | 79,181 | |

Zoomlion Heavy Industry Science & Technology Co. Ltd. (Class A Stock) | | | 119,000 | | | | 131,864 | |

| | | | | | | | |

| | |

| | | | | | | 24,692,036 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 15 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Colombia 0.2% | | | | | | |

Ecopetrol SA | | | 926,048 | | | $ | 427,571 | |

| | |

| Denmark 0.8% | | | | | | |

AP Moller - Maersk A/S (Class B Stock) | | | 52 | | | | 83,518 | |

D/S Norden A/S | | | 23,771 | | | | 337,285 | |

Jyske Bank A/S* | | | 5,203 | | | | 155,115 | |

Scandinavian Tobacco Group A/S, 144A | | | 56,090 | | | | 793,672 | |

| | | | | | | | |

| | |

| | | | | | | 1,369,590 | |

| | |

| Finland 1.5% | | | | | | |

Fortum OYJ | | | 39,865 | | | | 750,530 | |

Kone OYJ (Class B Stock) | | | 13,886 | | | | 1,103,366 | |

Neste OYJ | | | 18,559 | | | | 966,146 | |

| | | | | | | | |

| | |

| | | | | | | 2,820,042 | |

| | |

| France 4.8% | | | | | | |

Bouygues SA | | | 2,040 | | | | 66,903 | |

Cie de Saint-Gobain* | | | 28,092 | | | | 1,097,901 | |

Cie Generale des Etablissements Michelin SCA | | | 680 | | | | 73,414 | |

Fnac Darty SA* | | | 10,825 | | | | 465,113 | |

Klepierre SA, REIT(a) | | | 47,528 | | | | 603,228 | |

La Francaise des Jeux SAEM, 144A | | | 1,960 | | | | 73,581 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 316 | | | | 148,127 | |

Mercialys SA, REIT | | | 36,506 | | | | 175,238 | |

Orange SA | | | 87,270 | | | | 978,621 | |

Peugeot SA* | | | 55,066 | | | | 990,370 | |

Sanofi | | | 19,639 | | | | 1,772,612 | |

Sartorius Stedim Biotech | | | 2,039 | | | | 774,144 | |

Schneider Electric SE | | | 4,682 | | | | 569,177 | |

Solutions 30 SE* | | | 4,242 | | | | 75,577 | |

Television Francaise 1* | | | 18,420 | | | | 108,278 | |

TOTAL SE | | | 3,502 | | | | 105,761 | |

Trigano SA | | | 3,561 | | | | 472,818 | |

Virbac SA* | | | 375 | | | | 87,314 | |

| | | | | | | | |

| | |

| | | | | | | 8,638,177 | |

| | |

| Germany 4.7% | | | | | | |

Brenntag AG | | | 15,844 | | | | 1,011,976 | |

CropEnergies AG | | | 22,129 | | | | 300,962 | |

Daimler AG | | | 6,930 | | | | 358,315 | |

Deutsche Post AG | | | 28,593 | | | | 1,266,101 | |

Deutsche Telekom AG | | | 47,762 | | | | 728,013 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Germany (cont’d.) | | | | | | |

Deutsche Wohnen SE | | | 23,336 | | | $ | 1,177,343 | |

Fresenius Medical Care AG & Co. KGaA | | | 13,059 | | | | 997,743 | |

Fresenius SE & Co. KGaA | | | 23,856 | | | | 886,293 | |

HelloFresh SE* | | | 17,424 | | | | 932,373 | |

Henkel AG & Co. KGaA | | | 1,391 | | | | 125,693 | |

Hornbach Holding AG & Co. KGaA | | | 6,458 | | | | 621,991 | |

Vonovia SE | | | 1,870 | | | | 119,269 | |

Zalando SE, 144A* | | | 1,056 | | | | 98,672 | |

| | | | | | | | |

| | |

| | | | | | | 8,624,744 | |

| | |

| Greece 0.1% | | | | | | |

Hellenic Telecommunications Organization SA | | | 5,003 | | | | 66,654 | |

JUMBO SA | | | 8,328 | | | | 115,979 | |

| | | | | | | | |

| | |

| | | | | | | 182,633 | |

| | |

| Hong Kong 1.9% | | | | | | |

CK Infrastructure Holdings Ltd. | | | 165,500 | | | | 779,769 | |

Hong Kong Exchanges & Clearing Ltd. | | | 4,800 | | | | 230,584 | |

K Wah International Holdings Ltd. | | | 239,000 | | | | 113,223 | |

Man Wah Holdings Ltd. | | | 509,600 | | | | 710,354 | |

Techtronic Industries Co. Ltd. | | | 64,000 | | | | 860,545 | |

Vinda International Holdings Ltd. | | | 126,000 | | | | 333,960 | |

VTech Holdings Ltd. | | | 16,000 | | | | 106,487 | |

WH Group Ltd., 144A | | | 402,500 | | | | 317,754 | |

| | | | | | | | |

| | |

| | | | | | | 3,452,676 | |

| | |

| India 2.4% | | | | | | |

Balrampur Chini Mills Ltd. | | | 233,793 | | | | 508,074 | |

EID Parry India Ltd.* | | | 37,771 | | | | 140,967 | |

GAIL India Ltd. | | | 618,731 | | | | 708,073 | |

HCL Technologies Ltd. | | | 58,320 | | | | 663,031 | |

Infosys Ltd. | | | 65,873 | | | | 943,069 | |

Power Grid Corp. of India Ltd. | | | 146,206 | | | | 336,878 | |

Wipro Ltd. | | | 230,120 | | | | 1,055,942 | |

| | | | | | | | |

| | |

| | | | | | | 4,356,034 | |

| | |

| Indonesia 0.1% | | | | | | |

Bank Mandiri Persero Tbk PT | | | 204,000 | | | | 79,711 | |

Gudang Garam Tbk PT* | | | 30,000 | | | | 83,997 | |

| | | | | | | | |

| | |

| | | | | | | 163,708 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Ireland 0.1% | | | | | | |

Kingspan Group PLC* | | | 1,320 | | | $ | 115,028 | |

| | |

| Israel 0.6% | | | | | | |

Check Point Software Technologies Ltd.* | | | 10,400 | | | | 1,181,024 | |

| | |

| Italy 0.7% | | | | | | |

Buzzi Unicem SpA | | | 34,827 | | | | 754,703 | |

De’ Longhi SpA* | | | 5,664 | | | | 181,648 | |

Intesa Sanpaolo SpA* | | | 126,098 | | | | 208,954 | |

Sesa SpA* | | | 1,330 | | | | 125,201 | |

| | | | | | | | |

| | |

| | | | | | | 1,270,506 | |

| | |

| Japan 15.1% | | | | | | |

77 Bank Ltd. (The) | | | 39,400 | | | | 549,086 | |

Astellas Pharma, Inc. | | | 23,100 | | | | 317,569 | |

Chubu Electric Power Co., Inc. | | | 6,100 | | | | 68,329 | |

Chugai Pharmaceutical Co. Ltd. | | | 10,800 | | | | 416,011 | |

EDION Corp. | | | 16,400 | | | | 161,359 | |

Fujimi, Inc. | | | 4,800 | | | | 170,812 | |

Fujitsu Ltd. | | | 10,500 | | | | 1,231,494 | |

IR Japan Holdings Ltd. | | | 1,400 | | | | 155,743 | |

Japan Post Holdings Co. Ltd. | | | 10,500 | | | | 71,881 | |

Japan Post Insurance Co. Ltd. | | | 60,400 | | | | 955,970 | |

Japan Tobacco, Inc. | | | 60,700 | | | | 1,144,862 | |

Kansai Electric Power Co., Inc. (The) | | | 8,300 | | | | 75,606 | |

KDDI Corp. | | | 53,500 | | | | 1,433,215 | |

Kyudenko Corp. | | | 24,500 | | | | 668,820 | |

MCJ Co. Ltd. | | | 82,500 | | | | 757,759 | |

Medipal Holdings Corp. | | | 45,600 | | | | 813,517 | |

Mitsui & Co. Ltd. | | | 68,400 | | | | 1,068,499 | |

Mizuho Financial Group, Inc. | | | 94,990 | | | | 1,168,865 | |

MonotaRO Co. Ltd. | | | 4,200 | | | | 233,433 | |

Nexon Co. Ltd. | | | 37,700 | | | | 1,053,151 | |

Nihon M&A Center, Inc. | | | 1,800 | | | | 105,447 | |

Nintendo Co. Ltd. | | | 2,600 | | | | 1,413,882 | |

Nippon Telegraph & Telephone Corp. | | | 33,068 | | | | 693,939 | |

Nishi-Nippon Financial Holdings, Inc. | | | 10,500 | | | | 70,931 | |

Nitori Holdings Co. Ltd. | | | 5,900 | | | | 1,217,637 | |

Nitto Kogyo Corp. | | | 8,400 | | | | 155,322 | |

Nomura Holdings, Inc. | | | 242,600 | | | | 1,083,542 | |

Ono Pharmaceutical Co. Ltd. | | | 34,000 | | | | 965,419 | |

Orix JREIT, Inc., REIT | | | 50 | | | | 70,149 | |

Otsuka Holdings Co. Ltd. | | | 27,800 | | | | 1,027,840 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Japan (cont’d.) | | | | | | |

Relia, Inc. | | | 11,400 | | | $ | 129,677 | |

SBS Holdings, Inc. | | | 10,500 | | | | 239,152 | |

Secom Co. Ltd. | | | 6,500 | | | | 548,450 | |

Sekisui House Ltd. | | | 5,800 | | | | 95,983 | |

SG Holdings Co. Ltd. | | | 24,200 | | | | 582,645 | |

Shimano, Inc. | | | 3,200 | | | | 728,443 | |

Shionogi & Co. Ltd. | | | 14,000 | | | | 660,096 | |

SoftBank Corp. | | | 23,200 | | | | 269,081 | |

Sompo Holdings, Inc. | | | 2,100 | | | | 78,357 | |

Sony Corp. | | | 25,200 | | | | 2,097,541 | |

Sumitomo Mitsui Financial Group, Inc. | | | 9,100 | | | | 251,589 | |

T&D Holdings, Inc. | | | 7,500 | | | | 74,825 | |

TOKAI Holdings Corp. | | | 18,000 | | | | 178,259 | |

Tokuyama Corp. | | | 36,800 | | | | 818,205 | |

Tokyo Electron Ltd. | | | 4,100 | | | | 1,094,640 | |

Toyota Motor Corp. | | | 4,333 | | | | 282,400 | |

TPR Co. Ltd. | | | 7,100 | | | | 84,726 | |

| | | | | | | | |

| | |

| | | | | | | 27,534,158 | |

| | |

| Jordan 0.4% | | | | | | |

Hikma Pharmaceuticals PLC | | | 20,865 | | | | 678,297 | |

| | |

| Malaysia 0.9% | | | | | | |

Hartalega Holdings Bhd | | | 108,000 | | | | 469,777 | |

MMC Corp. Bhd | | | 640,200 | | | | 111,516 | |

Top Glove Corp. Bhd | | | 473,300 | | | | 978,375 | |

| | | | | | | | |

| | |

| | | | | | | 1,559,668 | |

| | |

| Malta 0.2% | | | | | | |

Kindred Group PLC, SDR* | | | 53,749 | | | | 410,389 | |

| | |

| Mexico 0.7% | | | | | | |

Concentradora Fibra Danhos SA de CV, REIT | | | 129,649 | | | | 117,110 | |

Grupo Financiero Banorte SAB de CV (Class O Stock)* | | | 20,700 | | | | 92,319 | |

Grupo Financiero Inbursa SAB de CV (Class O Stock)* | | | 100,000 | | | | 74,110 | |

Grupo Mexico SAB de CV (Class B Stock) | | | 80,400 | | | | 229,243 | |

Kimberly-Clark de Mexico SAB de CV (Class A Stock) | | | 543,100 | | | | 811,136 | |

| | | | | | | | |

| | |

| | | | | | | 1,323,918 | |

| | |

| Netherlands 1.7% | | | | | | |

ASML Holding NV | | | 329 | | | | 119,101 | |

Koninklijke Ahold Delhaize NV | | | 54,020 | | | | 1,483,390 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Netherlands (cont’d.) | | | | | | |

NN Group NV | | | 28,449 | | | $ | 992,616 | |

Royal Dutch Shell PLC (Class A Stock) | | | 34,824 | | | | 436,639 | |

| | | | | | | | |

| | |

| | | | | | | 3,031,746 | |

| | |

| New Zealand 0.1% | | | | | | |

Fisher & Paykel Healthcare Corp. Ltd. | | | 5,866 | | | | 135,563 | |

| | |

| Norway 0.4% | | | | | | |

DNB ASA* | | | 51,557 | | | | 694,472 | |

Frontline Ltd. | | | 17,746 | | | | 97,946 | |

| | | | | | | | |

| | |

| | | | | | | 792,418 | |

| | |

| Pakistan 0.3% | | | | | | |

Engro Fertilizers Ltd. | | | 397,359 | | | | 159,731 | |

Fauji Fertilizer Co. Ltd. | | | 536,500 | | | | 354,005 | |

| | | | | | | | |

| | |

| | | | | | | 513,736 | |

| | |

| Philippines 0.3% | | | | | | |

PLDT, Inc. | | | 19,475 | | | | 534,590 | |

| | |

| Poland 0.2% | | | | | | |

Asseco Poland SA | | | 15,416 | | | | 250,180 | |

KGHM Polska Miedz SA* | | | 6,040 | | | | 180,486 | |

| | | | | | | | |

| | |

| | | | | | | 430,666 | |

| | |

| Russia 1.1% | | | | | | |

Inter RAO UES PJSC | | | 1,120,000 | | | | 71,581 | |

LUKOIL PJSC | | | 1,387 | | | | 70,765 | |

LUKOIL PJSC, ADR | | | 9,253 | | | | 473,967 | |

Polyus PJSC | | | 459 | | | | 89,976 | |

Sberbank of Russia PJSC | | | 308,530 | | | | 780,612 | |

Surgutneftegas PJSC | | | 1,297,700 | | | | 538,201 | |

| | | | | | | | |

| | |

| | | | | | | 2,025,102 | |

| | |

| Singapore 0.8% | | | | | | |

BW LPG Ltd., 144A | | | 64,915 | | | | 283,530 | |

DBS Group Holdings Ltd. | | | 80,000 | | | | 1,195,418 | |

| | | | | | | | |

| | |

| | | | | | | 1,478,948 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| South Africa 2.1% | | | | | | |

African Rainbow Minerals Ltd. | | | 23,913 | | | $ | 335,161 | |

Anglo American Platinum Ltd. | | | 16,247 | | | | 1,065,601 | |

Anglo American PLC | | | 60,058 | | | | 1,410,216 | |

Impala Platinum Holdings Ltd. | | | 47,172 | | | | 416,910 | |

Kumba Iron Ore Ltd. | | | 20,568 | | | | 610,454 | |

| | | | | | | | |

| | |

| | | | | | | 3,838,342 | |

| | |

| South Korea 4.4% | | | | | | |

BNK Financial Group, Inc. | | | 76,093 | | | | 370,712 | |

DGB Financial Group, Inc. | | | 36,784 | | | | 201,533 | |

Hana Financial Group, Inc. | | | 42,845 | | | | 1,153,326 | |

Hyundai Mobis Co. Ltd. | | | 5,781 | | | | 1,152,012 | |

KB Financial Group, Inc. | | | 18,814 | | | | 668,201 | |

Kia Motors Corp. | | | 29,447 | | | | 1,320,385 | |

Korea Petrochemical Ind Co. Ltd. | | | 959 | | | | 164,787 | |

KT&G Corp. | | | 3,728 | | | | 266,359 | |

LG Innotek Co. Ltd. | | | 4,472 | | | | 602,575 | |

Samsung Electronics Co. Ltd. | | | 21,982 | | | | 1,105,231 | |

Shinhan Financial Group Co. Ltd. | | | 32,870 | | | | 881,590 | |

Taekwang Industrial Co. Ltd. | | | 181 | | | | 113,620 | |

| | | | | | | | |

| | |

| | | | | | | 8,000,331 | |

| | |

| Spain 0.4% | | | | | | |

Iberdrola SA | | | 7,994 | | | | 94,047 | |

Naturgy Energy Group SA | | | 31,072 | | | | 577,669 | |

| | | | | | | | |

| | |

| | | | | | | 671,716 | |

| | |

| Sweden 2.2% | | | | | | |

Atlas Copco AB (Class A Stock) | | | 6,596 | | | | 291,305 | |

Atlas Copco AB (Class B Stock) | | | 3,502 | | | | 134,339 | |

Epiroc AB (Class A Stock) | | | 5,346 | | | | 79,913 | |

Evolution Gaming Group AB, 144A | | | 17,476 | | | | 1,298,256 | |

Husqvarna AB (Class B Stock) | | | 94,240 | | | | 975,315 | |

Investor AB (Class B Stock) | | | 1,200 | | | | 72,196 | |

Svenska Handelsbanken AB (Class A Stock)* | | | 12,774 | | | | 103,811 | |

Swedbank AB (Class A Stock)* | | | 66,058 | | | | 1,035,344 | |

| | | | | | | | |

| | |

| | | | | | | 3,990,479 | |

| | |

| Switzerland 7.8% | | | | | | |

ABB Ltd. | | | 29,253 | | | | 709,531 | |

ALSO Holding AG* | | | 1,126 | | | | 263,771 | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 21 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| Switzerland (cont’d.) | | | | | | |

Chocoladefabriken Lindt & Spruengli AG | | | 1 | | | $ | 86,552 | |

Credit Suisse Group AG | | | 109,299 | | | | 1,029,733 | |

Geberit AG | | | 1,494 | | | | 849,088 | |

LafargeHolcim Ltd.* | | | 19,295 | | | | 826,939 | |

Logitech International SA | | | 11,861 | | | | 1,002,433 | |

Nestle SA | | | 17,425 | | | | 1,960,291 | |

Novartis AG | | | 32,514 | | | | 2,534,627 | |

Roche Holding AG | | | 7,835 | | | | 2,521,163 | |

STMicroelectronics NV | | | 36,934 | | | | 1,126,916 | |

UBS Group AG | | | 111,696 | | | | 1,297,467 | |

| | | | | | | | |

| | |

| | | | | | | 14,208,511 | |

| | |

| Taiwan 4.7% | | | | | | |

Asustek Computer, Inc. | | | 9,000 | | | | 76,427 | |

Delta Electronics, Inc. | | | 107,000 | | | | 711,946 | |

Hon Hai Precision Industry Co. Ltd. | | | 478,000 | | | | 1,291,488 | |

Huaku Development Co. Ltd. | | | 42,000 | | | | 127,189 | |

International Games System Co. Ltd. | | | 40,000 | | | | 1,057,554 | |

Lite-On Technology Corp. | | | 554,000 | | | | 901,726 | |

Lotes Co. Ltd. | | | 9,000 | | | | 138,013 | |

MediaTek, Inc. | | | 16,000 | | | | 379,543 | |

Quanta Computer, Inc. | | | 75,000 | | | | 189,131 | |

Radiant Opto-Electronics Corp. | | | 150,000 | | | | 592,637 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 147,000 | | | | 2,207,266 | |

TCI Co. Ltd. | | | 61,000 | | | | 488,024 | |

United Microelectronics Corp. | | | 208,000 | | | | 224,903 | |

Wistron Corp. | | | 72,000 | | | | 71,679 | |

| | | | | | | | |

| | |

| | | | | | | 8,457,526 | |

| | |

| Thailand 0.0% | | | | | | |

Charoen Pokphand Foods PCL | | | 88,000 | | | | 71,266 | |

| | |

| Turkey 0.6% | | | | | | |

Anadolu Efes Biracilik Ve Malt Sanayii A/S | | | 42,630 | | | | 99,153 | |

Coca-Cola Icecek A/S | | | 107,736 | | | | 579,374 | |

Enerjisa Enerji A/S, 144A | | | 416,363 | | | | 448,008 | |

| | | | | | | | |

| | |

| | | | | | | 1,126,535 | |

| | |

| United Kingdom 5.2% | | | | | | |

AstraZeneca PLC | | | 1,387 | | | | 139,287 | |

Aviva PLC | | | 295,180 | | | | 986,192 | |

Berkeley Group Holdings PLC | | | 10,136 | | | | 531,108 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| COMMON STOCKS (Continued) | | | | | | |

| | |

| United Kingdom (cont’d.) | | | | | | |

British American Tobacco PLC | | | 48,942 | | | $ | 1,548,681 | |

Bunzl PLC | | | 2,712 | | | | 84,300 | |

Computacenter PLC | | | 7,686 | | | | 226,832 | |

Dialog Semiconductor PLC* | | | 14,019 | | | | 535,545 | |

GlaxoSmithKline PLC | | | 94,512 | | | | 1,577,290 | |

Imperial Brands PLC | | | 56,101 | | | | 888,107 | |

JD Sports Fashion PLC | | | 66,953 | | | | 643,541 | |

Kingfisher PLC* | | | 19,000 | | | | 70,683 | |

M&G PLC | | | 190,511 | | | | 362,333 | |

Persimmon PLC | | | 4,520 | | | | 137,009 | |

Spirent Communications PLC | | | 29,610 | | | | 111,223 | |

Tate & Lyle PLC | | | 52,594 | | | | 405,299 | |

Unilever NV | | | 12,154 | | | | 685,749 | |

Unilever PLC | | | 10,499 | | | | 597,841 | |

| | | | | | | | |

| | |

| | | | | | | 9,531,020 | |

| | |

| United States 0.8% | | | | | | |

Ferguson PLC* | | | 13,825 | | | | 1,380,155 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS

(cost $160,569,740) | | | | | | | 174,551,433 | |

| | | | | | | | |

| | |

| EXCHANGE-TRADED FUNDS 3.0% | | | | | | |

| | |

| United States | | | | | | |

iShares MSCI EAFE ETF | | | 63,600 | | | | 3,904,404 | |

iShares MSCI Emerging Markets ETF(a) | | | 33,300 | | | | 1,488,843 | |

| | | | | | | | |

| | |

TOTAL EXCHANGE-TRADED FUNDS

(cost $5,413,551) | | | | | | | 5,393,247 | |

| | | | | | | | |

| | |

| PREFERRED STOCKS 0.4% | | | | | | |

| | |

| Brazil 0.2% | | | | | | |

Cia Paranaense de Energia (PRFC B) | | | 32,800 | | | | 351,554 | |

| | |

| South Korea 0.2% | | | | | | |

Samsung Electronics Co. Ltd. (PRFC) | | | 7,630 | | | | 338,619 | |

| | | | | | | | |

| | |

TOTAL PREFERRED STOCKS

(cost $574,560) | | | | | | | 690,173 | |

| | | | | | | | |

| | |

TOTAL LONG-TERM INVESTMENTS

(cost $166,557,851) | | | | | | | 180,634,853 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 23 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | |

| Description | | Shares | | | Value | |

| | |

| SHORT-TERM INVESTMENT 1.2% | | | | | | |

| | |

| AFFILIATED MUTUAL FUND | | | | | | |

PGIM Institutional Money Market Fund

(cost $2,141,508; includes $2,140,944 of cash collateral for securities on loan)(b)(w) | | | 2,143,034 | | | $ | 2,142,391 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS 100.6%

(cost $168,699,359) | | | | | | | 182,777,244 | |

Liabilities in excess of other assets (0.6)% | | | | | | | (1,052,208 | ) |

| | | | | | | | |

| | |

NET ASSETS 100.0% | | | | | | $ | 181,725,036 | |

| | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

ADR—American Depositary Receipt

EAFE—Europe, Australasia, Far East

ETF—Exchange-Traded Fund

LIBOR—London Interbank Offered Rate

MSCI—Morgan Stanley Capital International

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

REITs—Real Estate Investment Trust

SDR—Sweden Depositary Receipt

UTS—Unit Trust Security

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $2,077,490; cash collateral of $2,140,944 (included in liabilities) was received with which the Series purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Series may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (w) | PGIM Investments LLC, the manager of the Series, also serves as manager of the PGIM Institutional Money Market Fund. |

Fair Value Measurements:

Various inputs are used in determining the value of the Series’ investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

The following is a summary of the inputs used as of October 31, 2020 in valuing such portfolio securities:

| | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 |

| Investments in Securities | | | | | | |

| Assets | | | | | | |

Common Stocks | | | | | | | | | | | | | | | |

Australia | | | $ | — | | | | $ | 7,830,276 | | | | $ | — | |

Belgium | | | | — | | | | | 1,627,233 | | | | | — | |

Brazil | | | | 3,816,225 | | | | | — | | | | | — | |

Canada | | | | 11,609,139 | | | | | — | | | | | — | |

Chile | | | | 649,711 | | | | | — | | | | | — | |

China | | | | 7,825,899 | | | | | 16,866,137 | | | | | — | |

Colombia | | | | 427,571 | | | | | — | | | | | — | |

Denmark | | | | — | | | | | 1,369,590 | | | | | — | |

Finland | | | | — | | | | | 2,820,042 | | | | | — | |

France | | | | — | | | | | 8,638,177 | | | | | — | |

Germany | | | | — | | | | | 8,624,744 | | | | | — | |

Greece | | | | — | | | | | 182,633 | | | | | — | |

Hong Kong | | | | — | | | | | 3,452,676 | | | | | — | |

India | | | | — | | | | | 4,356,034 | | | | | — | |

Indonesia | | | | — | | | | | 163,708 | | | | | — | |

Ireland | | | | — | | | | | 115,028 | | | | | — | |

Israel | | | | 1,181,024 | | | | | — | | | | | — | |

Italy | | | | — | | | | | 1,270,506 | | | | | — | |

Japan | | | | — | | | | | 27,534,158 | | | | | — | |

Jordan | | | | — | | | | | 678,297 | | | | | — | |

Malaysia | | | | — | | | | | 1,559,668 | | | | | — | |

Malta | | | | — | | | | | 410,389 | | | | | — | |

Mexico | | | | 1,323,918 | | | | | — | | | | | — | |

Netherlands | | | | — | | | | | 3,031,746 | | | | | — | |

New Zealand | | | | — | | | | | 135,563 | | | | | — | |

Norway | | | | — | | | | | 792,418 | | | | | — | |

Pakistan | | | | — | | | | | 513,736 | | | | | — | |

Philippines | | | | — | | | | | 534,590 | | | | | — | |

Poland | | | | — | | | | | 430,666 | | | | | — | |

Russia | | | | — | | | | | 2,025,102 | | | | | — | |

Singapore | | | | — | | | | | 1,478,948 | | | | | — | |

South Africa | | | | — | | | | | 3,838,342 | | | | | — | |

South Korea | | | | — | | | | | 8,000,331 | | | | | — | |

Spain | | | | — | | | | | 671,716 | | | | | — | |

Sweden | | | | — | | | | | 3,990,479 | | | | | — | |

Switzerland | | | | — | | | | | 14,208,511 | | | | | — | |

Taiwan | | | | — | | | | | 8,457,526 | | | | | — | |

Thailand | | | | — | | | | | 71,266 | | | | | — | |

Turkey | | | | — | | | | | 1,126,535 | | | | | — | |

United Kingdom | | | | — | | | | | 9,531,020 | | | | | — | |

United States | | | | — | | | | | 1,380,155 | | | | | — | |

Exchange-Traded Funds | | | | | | | | | | | | | | | |

United States | | | | 5,393,247 | | | | | — | | | | | — | |

Preferred Stocks | | | | | | | | | | | | | | | |

Brazil | | | | 351,554 | | | | | — | | | | | — | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 25 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 |

Investments in Securities (continued) | | | | | | | | | | | | | | | |

Assets (continued) | | | | | | | | | | | | | | | |

Preferred Stocks (continued) | | | | | | | | | | | | | | | |

South Korea | | | $ | — | | | | $ | 338,619 | | | | $ | — | |

Affiliated Mutual Fund | | | | 2,142,391 | | | | | — | | | | | — | |

| | | | | | | | | | | | | | | |

Total | | | $ | 34,720,679 | | | | $ | 148,056,565 | | | | $ | — | |

| | | | | | | | | | | | | | | |

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2020 were as follows (unaudited):

| | | | |

Banks | | | 8.7 | % |

Pharmaceuticals | | | 7.2 | |

Metals & Mining | | | 5.2 | |

Insurance | | | 4.3 | |

Internet & Direct Marketing Retail | | | 4.2 | |

Semiconductors & Semiconductor Equipment | | | 3.5 | |

Oil, Gas & Consumable Fuels | | | 3.4 | |

Exchange-Traded Funds | | | 3.0 | |

Capital Markets | | | 2.8 | |

Household Durables | | | 2.7 | |

Tobacco | | | 2.6 | |

Food Products | | | 2.5 | |

Technology Hardware, Storage & Peripherals | | | 2.4 | |

IT Services | | | 2.3 | |

Entertainment | | | 2.3 | |

Trading Companies & Distributors | | | 2.1 | |

Automobiles | | | 2.1 | |

Specialty Retail | | | 2.0 | |

Electronic Equipment, Instruments & Components | | | 1.9 | |

Machinery | | | 1.9 | |

Diversified Telecommunication Services | | | 1.8 | |

Wireless Telecommunication Services | | | 1.8 | |

Electric Utilities | | | 1.7 | |

Electrical Equipment | | | 1.6 | |

Construction Materials | | | 1.6 | |

Personal Products | | | 1.5 | |

Health Care Providers & Services | | | 1.4 | |

Equity Real Estate Investment Trusts (REITs) | | | 1.4 | |

Real Estate Management & Development | | | 1.4 | |

Interactive Media & Services | | | 1.4 | |

Food & Staples Retailing | | | 1.4 | |

Auto Components | | | 1.3 | |

Chemicals | | | 1.3 | |

| | | | |

Air Freight & Logistics | | | 1.2 | % |

Affiliated Mutual Fund (1.2% represents investments purchased with collateral from securities on loan) | | | 1.2 | |

Road & Rail | | | 1.2 | |

Building Products | | | 1.2 | |

Health Care Equipment & Supplies | | | 1.1 | |

Hotels, Restaurants & Leisure | | | 1.0 | |

Commercial Services & Supplies | | | 1.0 | |

Software | | | 0.7 | |

Gas Utilities | | | 0.7 | |

Household Products | | | 0.7 | |

Construction & Engineering | | | 0.4 | |

Life Sciences Tools & Services | | | 0.4 | |

Leisure Products | | | 0.4 | |

Beverages | | | 0.4 | |

Independent Power & Renewable Electricity Producers | | | 0.4 | |

Diversified Financial Services | | | 0.3 | |

Marine | | | 0.3 | |

Professional Services | | | 0.3 | |

Media | | | 0.2 | |

Textiles, Apparel & Luxury Goods | | | 0.2 | |

Water Utilities | | | 0.1 | |

Communications Equipment | | | 0.1 | |

Industrial Conglomerates | | | 0.1 | |

Thrifts & Mortgage Finance | | | 0.1 | |

Transportation Infrastructure | | | 0.1 | |

Diversified Consumer Services | | | 0.1 | |

| | | | |

| | | 100.6 | |

Liabilities in excess of other assets | | | (0.6 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Series invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity contracts risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Series’ financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

The Series did not hold any derivative instruments as of October 31, 2020, accordingly, no derivative positions were presented in the Statement of Assets and Liabilities.

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2020 are as follows:

| | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income |

| | | | | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Rights(1) |

Equity contracts | | | $ | (172,124 | ) |

| | | | | |

| (1) | Included in net realized gain (loss) on investment transactions in the Statement of Operations. |

For the year ended October 31, 2020, the Series did not have any net change in unrealized appreciation (depreciation) on derivatives in the Statement of Operations.

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Series entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | | | | | | | | | | |

Description | | Gross Market

Value of

Recognized

Assets/(Liabilities) | | Collateral

Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | | $ | 2,077,490 | | | | $ | (2,077,490 | ) | | | $ | — | |

| | | | | | | | | | | | | | | |

| (1) | Collateral amount disclosed by the Series is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 27 | |

Statement of Assets and Liabilities

as of October 31, 2020

| | | | | |

Assets | | | | | |

Investments at value, including securities on loan of $2,077,490: | | | | | |

Unaffiliated investments (cost $166,557,851) | | | $ | 180,634,853 | |

Affiliated investments (cost $2,141,508) | | | | 2,142,391 | |

Foreign currency, at value (cost $388,462) | | | | 387,571 | |

Receivable for investments sold | | | | 6,990,608 | |

Tax reclaim receivable | | | | 720,045 | |

Dividends receivable | | | | 404,203 | |

Receivable for Series shares sold | | | | 28,987 | |

Prepaid expenses | | | | 4,889 | |

| | | | | |

Total Assets | | | | 191,313,547 | |

| | | | | |

| |

| Liabilities | | |

Payable for investments purchased | | | | 6,487,489 | |

Payable to broker for collateral for securities on loan | | | | 2,140,944 | |

Payable for Series shares reacquired | | | | 388,636 | |

Loan payable | | | | 193,000 | |

Accrued expenses and other liabilities | | | | 151,702 | |

Management fee payable | | | | 80,378 | |

Affiliated transfer agent fee payable | | | | 53,031 | |

Payable to custodian | | | | 50,832 | |

Distribution fee payable | | | | 41,396 | |

Directors’ fees payable | | | | 1,103 | |

| | | | | |

Total Liabilities | | | | 9,588,511 | |

| | | | | |

| |

Net Assets | | | $ | 181,725,036 | |

| | | | | |

| | | | | |

| | | | | | |

Net assets were comprised of: | | | | | |

Common stock, at par | | | $ | 269,128 | |

Paid-in capital in excess of par | | | | 176,739,767 | |

Total distributable earnings (loss) | | | | 4,716,141 | |

| | | | | |

Net assets, October 31, 2020 | | | $ | 181,725,036 | |

| | | | | |

See Notes to Financial Statements.

| | | | | | |

Class A | | | | | | |

Net asset value and redemption price per share, | | | | | | |

($147,444,794 ÷ 21,862,485 shares of common stock issued and outstanding) | | $ | 6.74 | | | |

Maximum sales charge (5.50% of offering price) | | | 0.39 | | | |

| | | | | | |

Maximum offering price to public | | $ | 7.13 | | | |

| | | | | | |

| | |

Class C | | | | | | |

Net asset value, offering price and redemption price per share, | | | | | | |

($2,381,353 ÷ 372,980 shares of common stock issued and outstanding) | | $ | 6.38 | | | |

| | | | | | |

| | |

Class Z | | | | | | |

Net asset value, offering price and redemption price per share, | | | | | | |

($13,062,061 ÷ 1,918,227 shares of common stock issued and outstanding) | | $ | 6.81 | | | |

| | | | | | |

| | |

Class R6 | | | | | | |

Net asset value, offering price and redemption price per share, | | | | | | |

($18,836,828 ÷ 2,759,062 shares of common stock issued and outstanding) | | $ | 6.83 | | | |

| | | | | | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 29 | |

Statement of Operations

Year Ended October 31, 2020

| | | | | |

Net Investment Income (Loss) | | | | | |

Income | | | | | |

Unaffiliated dividend income (net of $670,708 foreign withholding tax) | | | $ | 5,785,807 | |

Income from securities lending, net (including affiliated income of $10,014) | | | | 62,362 | |

Affiliated dividend income | | | | 7,130 | |

| | | | | |

Total income | | | | 5,855,299 | |

| | | | | |

| |

Expenses | | | | | |

Management fee | | | | 1,435,058 | |

Distribution fee(a) | | | | 502,471 | |

Transfer agent’s fees and expenses (including affiliated expense of $344,518)(a) | | | | 643,079 | |

Custodian and accounting fees | | | | 187,942 | |

Registration fees(a) | | | | 83,546 | |

Shareholders’ reports | | | | 57,629 | |

Audit fee | | | | 30,762 | |

Legal fees and expenses | | | | 20,519 | |

Directors’ fees | | | | 14,032 | |

Miscellaneous | | | | 65,068 | |

| | | | | |

Total expenses | | | | 3,040,106 | |

Less: Fee waiver and/or expense reimbursement(a) | | | | (358,954 | ) |

| | | | | |

Net expenses | | | | 2,681,152 | |

| | | | | |

Net investment income (loss) | | | | 3,174,147 | |

| | | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | | |

Net realized gain (loss) on: | | | | | |

Investment transactions (including affiliated of $(5,089)) (net of foreign capital gains taxes $(5,262)) | | | | (4,578,646 | ) |

Foreign currency transactions | | | | (110,819 | ) |

| | | | | |

| | | | (4,689,465 | ) |

| | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | |

Investments (including affiliated of $714) (net of change in foreign capital gains taxes $24,532) | | | | (8,440,329 | ) |

Foreign currencies | | | | 30,776 | |

| | | | | |

| | | | (8,409,553 | ) |

| | | | | |

Net gain (loss) on investment and foreign currency transactions | | | | (13,099,018 | ) |

| | | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | | $ | (9,924,871 | ) |

| | | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class Z | | Class R6 |

Distribution fee | | | | 470,855 | | | | | 5,214 | | | | | 26,402 | | | | | — | | | | | — | |

Transfer agent’s fees and expenses | | | | 596,167 | | | | | 12,510 | | | | | 10,411 | | | | | 23,071 | | | | | 920 | |

Registration fees | | | | 16,962 | | | | | 14,918 | | | | | 16,783 | | | | | 16,784 | | | | | 18,099 | |

Fee waiver and/or expense reimbursement | | | | (259,556 | ) | | | | (24,371 | ) | | | | (4,366 | ) | | | | (21,423 | ) | | | | (49,238 | ) |

See Notes to Financial Statements.

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended

October 31, | |

| | |

| | | 2020 | | | 2019 | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 3,174,147 | | | $ | 4,919,888 | |

Net realized gain (loss) on investment and foreign currency transactions | | | (4,689,465 | ) | | | (5,932,231 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (8,409,553 | ) | | | 15,303,867 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (9,924,871 | ) | | | 14,291,524 | |

| | | | | | | | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings | | | | | | | | |

Class A | | | (4,101,945 | ) | | | (4,863,764 | ) |

Class B | | | (14,282 | ) | | | (27,709 | ) |

Class C | | | (50,447 | ) | | | (271,975 | ) |

Class Z | | | (386,163 | ) | | | (443,611 | ) |

Class R6 | | | (550,823 | ) | | | (1,275,473 | ) |

| | | | | | | | |

| | | (5,103,660 | ) | | | (6,882,532 | ) |

| | | | | | | | |

Series share transactions (Net of share conversions) | | | | | | | | |

Net proceeds from shares sold | | | 37,395,853 | | | | 9,994,692 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 5,027,591 | | | | 6,792,808 | |

Cost of shares reacquired | | | (42,989,953 | ) | | | (62,908,505 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Series share transactions | | | (566,509 | ) | | | (46,121,005 | ) |

| | | | | | | | |

Total increase (decrease) | | | (15,595,040 | ) | | | (38,712,013 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 197,320,076 | | | | 236,032,089 | |

| | | | | | | | |

End of year | | $ | 181,725,036 | | | $ | 197,320,076 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

PGIM QMA International Equity Fund | | | 31 | |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company and currently consists of seven series: PGIM Jennison Emerging Markets Equity Opportunities Fund, PGIM Jennison Global Infrastructure Fund, PGIM Jennison Global Opportunities Fund, PGIM Jennison International Opportunities Fund and PGIM QMA International Equity Fund, each of which are diversified funds for purposes of the 1940 Act and PGIM Emerging Markets Debt Hard Currency Fund and PGIM Emerging Markets Debt Local Currency Fund, each of which are non-diversified funds for purposes of the 1940 Act, and therefore, may invest a greater percentage of their assets in the securities of a single company or other issuer than a diversified fund. Investing in a non-diversified fund involves greater risk than investing in a diversified fund because a loss resulting from the decline in value of any one security may represent a greater portion of the total assets of a non-diversified fund. These financial statements relate only to the PGIM QMA International Equity Fund (the “Series”).

The investment objective of the Series is to seek long-term growth of capital.

The Series follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Series consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Series holds securities and other assets and liabilities that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Directors (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Series to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly scheduled quarterly meeting.

For the fiscal reporting year-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Series’ foreign investments may change on days when investors cannot purchase or redeem Series shares.

Various inputs determine how the Series’ investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820 - Fair Value Measurements and Disclosures.

Common or preferred stocks, exchange-traded funds and derivative instruments, if applicable, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Series is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments in open-end funds (other than exchange-traded funds) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the

| | | | |

PGIM QMA International Equity Fund | | | 33 | |

Notes to Financial Statements (continued)

general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.