UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2018 |

| |

| Date of reporting period: | | 10/31/2018 |

Item 1 – Reports to Stockholders

PGIM QMA INTERNATIONAL EQUITY FUND

(Formerly known as Prudential QMA International Equity Fund)

ANNUAL REPORT

OCTOBER 31, 2018

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.pgiminvestments.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an e-mail request to PGIM Investments at shareholderreports@pgim.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary or follow instructions included with this notice to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

| Objective: Long-term growth of capital |

Highlights (unaudited)

| • | | The Fund benefited from its stock selection in the large-cap universe, particularly in the financials sector and in emerging markets such as Brazil. |

| • | | China also contributed significantly to performance, driven by stock selection in financials and underweights in the consumer discretionary and information technology sectors, each of which declined. |

| • | | The Fund’s allocation to small caps, where stock selection was particularly challenging in developed markets such as Germany and the United Kingdom, detracted from results. |

| • | | Although valuation improved, particularly later on in the period, the component still lagged for the past 12 months. The performance was further hurt by the weakening of growth factors, which had been instrumental in tempering the valuation shortfall. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. QMA is the primary business name of Quantitative Management Associates LLC, a registered investment adviser and a wholly owned subsidiary of PGIM, Inc., a Prudential Financial company. © 2018 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

PGIM FUNDS — UPDATE

The Board of Directors/Trustees for the Fund has approved the implementation of an automatic conversion feature for Class C shares, effective as of April 1, 2019. To reflect these changes, effective April 1, 2019, the section of the Fund’s Prospectus entitled “How to Buy, Sell and Exchange Fund Shares—How to Exchange Your Shares—Frequent Purchases and Redemptions of Fund Shares” is restated to read as follows:

This supplement should be read in conjunction with your Summary Prospectus, Statutory Prospectus and Statement of Additional Information, be retained for future reference and is in addition to any existing Fund supplements.

| | 1. | In each Fund’s Statutory Prospectus, the following is added at the end of the section entitled “Fund Distributions And Tax Issues—If You Sell or Exchange Your Shares”: |

Automatic Conversion of Class C Shares

The conversion of Class C shares into Class A shares—which happens automatically approximately 10 years after purchase—is not a taxable event for federal income tax purposes. For more information about the automatic conversion of Class C shares, see Class C Shares Automatically Convert to Class A Shares in How to Buy, Sell and Exchange Fund Shares.

| | 2. | In each Fund’s Statutory Prospectus, the following sentence is added at the end of the section entitled “How to Buy, Sell and Exchange Shares—Closure of Certain Share Classes to New Group Retirement Plans”: |

Shareholders owning Class C shares may continue to hold their Class C shares until the shares automatically convert to Class A shares under the conversion schedule, or until the shareholder redeems their Class C shares.

| | 3. | In each Fund’s Statutory Prospectus, the following disclosure is added immediately following the section entitled “How to Buy, Sell and Exchange Shares—How to Buy Shares—Class B Shares Automatically Convert to Class A Shares”: |

Class C Shares Automatically Convert to Class A Shares

Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. All such automatic conversions of Class C shares will constitute tax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have

| | | | |

| PGIM QMA International Equity Fund | | | 3 | |

transparency into how long a shareholder has held Class C shares for purposes of determining whether such Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares (see Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus). Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

| | 4. | In Part II of each Fund’s Statement of Additional Information, the following disclosure is added immediately following the section entitled “Purchase, Redemption and Pricing of Fund Shares—Share Classes—Automatic Conversion of Class B Shares”: |

AUTOMATIC CONVERSION OF CLASS C SHARES. Starting on or about April 1, 2019 (the “Effective Date”), Class C shares will be eligible for automatic conversion into Class A shares on a monthly basis approximately ten years after the original date of purchase (the “Conversion Date”). Conversion will take place based on the relative NAV of the two classes, without the imposition of any sales load, fee or other charge. Class C shares of a Fund acquired through automatic reinvestment of dividends or distributions will convert to Class A shares of the Fund on the Conversion Date pro rata with the converting Class C shares of the Fund that were not acquired through reinvestment of dividends or distributions. All such automatic conversions of Class C shares will constitute tax-free exchanges for federal income tax purposes.

For shareholders investing in Class C shares through retirement plans or omnibus accounts, and in certain other instances, the Fund and its agents may not have transparency into how long a shareholder has held Class C shares for purposes of determining whether such Class C shares are eligible for automatic conversion into Class A shares, and the relevant financial intermediary may not have the ability to track purchases in order to credit individual shareholders’ holding periods. In these circumstances, the

| | |

| 4 | | Visit our website at pgiminvestments.com |

Fund will not be able to automatically convert Class C shares into Class A shares as described above. In order to determine eligibility for conversion in these circumstances, it is the responsibility of the financial intermediary to notify the Fund that the shareholder is eligible for the conversion of Class C shares to Class A shares, and the financial intermediary may be required to maintain and provide the Fund with records that substantiate the holding period of Class C shares. It is the financial intermediary’s (and not the Fund’s) responsibility to keep records of transactions made in accounts it holds and to ensure that the shareholder is credited with the proper holding period based on such records or those provided to the financial intermediary by the shareholder. Please consult with your financial intermediary for the applicability of this conversion feature to your shares.

Class C shares were generally closed to investments by new group retirement plans effective June 1, 2018. Group retirement plans (and their successor, related and affiliated plans) that have Class C shares of the Fund available to participants on or before the Effective Date may continue to open accounts for new participants in such share class and purchase additional shares in existing participant accounts.

The Fund has no responsibility for monitoring or implementing a financial intermediary’s process for determining whether a shareholder meets the required holding period for conversion. A financial intermediary may sponsor and/or control accounts, programs or platforms that impose a different conversion schedule or different eligibility requirements for the exchange of Class C shares for Class A shares, as set forth on Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries of the Prospectus. In these cases, Class C shareholders may have their shares exchanged for Class A shares under the policies of the financial intermediary. Financial intermediaries will be responsible for making such exchanges in those circumstances. Please consult with your financial intermediary if you have any questions regarding your shares’ conversion from Class C shares to Class A shares.

LR1094

- Not part of the Annual Report -

| | | | |

| PGIM QMA International Equity Fund | | | 5 | |

Table of Contents

| | |

| 6 | | Visit our website at pgiminvestments.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for PGIM QMA International Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2018.

We have important information to share with you. Effective June 11, 2018, Prudential Mutual Funds were renamed PGIM Funds. This renaming is part of our ongoing effort to further build our reputation and establish our global brand, which began when our firm adopted PGIM Investments as its name in April 2017. Please note that only the Fund’s name has changed. Your Fund’s management and operation, along with its symbols, remained the same.*

During the reporting period, the global economy continued to grow, and central banks gradually tightened monetary policy. In the US, the economy expanded and employment increased. In September, the Federal Reserve hiked interest rates for the eighth time since 2015, based on confidence in the economy.

Equity returns on the whole were strong, due to optimistic earnings expectations and investor sentiment. Global equities, including emerging markets, generally posted positive returns. However, they trailed the performance of US equities, which rose on higher corporate profits, new regulatory policies, and tax reform benefits. Volatility spiked briefly early in the period on inflation concerns, rising interest rates, and a potential global trade war, and again late in the period on worries that profit growth might slow in 2019.

The overall bond market declined modestly during the period, as measured by the Bloomberg Barclays US Aggregate Bond Index. The best performance came from higher-yielding, economically sensitive sectors, such as high yield bonds and bank loans, which posted small gains. US investment-grade corporate bonds and US Treasury bonds both finished the period with negative returns. A major trend during the period was the flattening of the US Treasury yield curve, which increased the yield on fixed income investments with shorter maturities and made them more attractive to investors.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM QMA International Equity Fund

December 14, 2018

*The Prudential Day One Funds did not change their names.

| | | | |

| PGIM QMA International Equity Fund | | | 7 | |

Your Fund’s Performance (unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

| | | Average Annual Total Returns as of 10/31/18 (with sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| Class A | | –15.71 | | | –0.28 | | | | 5.42 | | | | — | |

| Class B | | –16.25 | | | –0.15 | | | | 5.22 | | | | — | |

| Class C | | –12.39 | | | 0.12 | | | | 5.27 | | | | — | |

| Class Z | | –10.59 | | | 1.15 | | | | 6.31 | | | | — | |

| Class R6* | | –10.43 | | | N/A | | | | N/A | | | | 7.34 (12/28/16) | |

| MSCI All Country World Ex-US Index | |

| | –8.24 | | | 1.63 | | | | 6.92 | | | | — | |

| Lipper International Multi-Cap Core Funds Average | |

| | | –8.49 | | | 1.67 | | | | 6.64 | | | | — | |

| | | | | | | | | | | | | | |

| | | Average Annual Total Returns as of 10/31/18 (without sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| Class A | | –10.81 | | | 0.85 | | | | 6.02 | | | | — | |

| Class B | | –11.90 | | | 0.04 | | | | 5.22 | | | | — | |

| Class C | | –11.52 | | | 0.12 | | | | 5.27 | | | | — | |

| Class Z | | –10.59 | | | 1.15 | | | | 6.31 | | | | — | |

| Class R6* | | –10.43 | | | N/A | | | | N/A | | | | 7.34 (12/28/16) | |

| MSCI All Country World Ex-US Index | |

| | –8.24 | | | 1.63 | | | | 6.92 | | | | — | |

| Lipper International Multi-Cap Core Funds Average | |

| | | –8.49 | | | 1.67 | | | | 6.64 | | | | — | |

| | |

| 8 | | Visit our website at pgiminvestments.com |

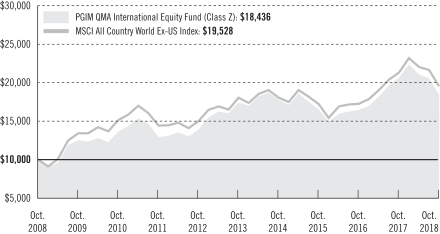

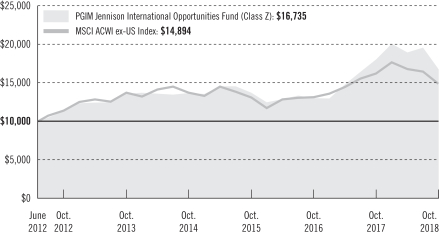

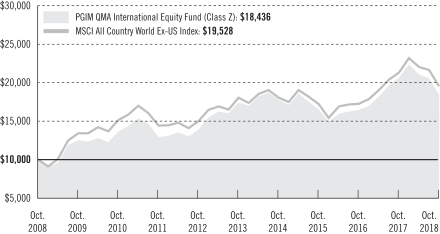

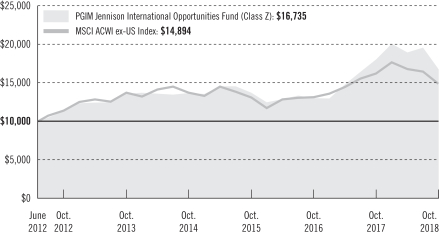

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the MSCI All Country World Ex-US Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2008) and the account values at the end of the current fiscal year (October 31, 2018) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

*Formerly known as Class Q shares.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the class’ inception date.

| | | | |

| PGIM QMA International Equity Fund | | | 9 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | |

| | | Class A | | Class B* | | Class C | | Class Z | | Class R6** |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase

price or net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 5.00% (Yr.1) 4.00% (Yr.2) 3.00% (Yr.3) 2.00% (Yr.4) 1.00% (Yr.5) 1.00% (Yr.6) 0.00% (Yr.7) | | 1.00% on sales made within 12 months of purchase | | None | | None |

Annual distribution and service (12b-1) fees

(shown as a percentage of average daily net assets) | | 0.30% | | 1.00% | | 1.00% | | None | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

**Formerly known as Class Q shares.

Benchmark Definitions

MSCI All Country World Ex-US Index—The Morgan Stanley Capital International All Country World ex-US Index (MSCI ACWI ex-US Index) is an unmanaged free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the US. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class R6 shares is 7.02%.

Lipper International Multi-Cap Core Funds Average—The Lipper International Multi-Cap Core Funds Average (Lipper Average) is based on the average return of all funds in the Lipper International Multi-Cap Core Funds universe for the periods noted. Funds in the Lipper Average are funds that, by portfolio practice, invest in a variety of market-capitalization ranges without concentrating 75% of their equity assets in any one market-capitalization range over an extended period of time. International multi-cap core funds typically have above-average characteristics compared to the MSCI EAFE Index. The average annual total return for the Lipper Average measured from the month-end closest to the inception date of the Fund’s Class R6 shares is 6.30%.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses of a mutual fund, but not sales charges or taxes.

| | |

| 10 | | Visit our website at pgiminvestments.com |

Presentation of Fund Holdings

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 10/31/18 (%) | |

Novartis AG, Pharmaceuticals | | | 1.7 | |

Roche Holding AG, Pharmaceuticals | | | 1.6 | |

Toyota Motor Corp., Automobiles | | | 1.3 | |

Toronto-Dominion Bank (The), Banks | | | 1.2 | |

Sanofi, Pharmaceuticals | | | 1.2 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 10/31/18 (%) | |

Banks | | | 13.7 | |

Oil, Gas & Consumable Fuels | | | 7.8 | |

Pharmaceuticals | | | 7.0 | |

Metals & Mining | | | 5.2 | |

Insurance | | | 4.2 | |

Industry weightings reflect only long-term investments and are subject to change.

| | | | |

| PGIM QMA International Equity Fund | | | 11 | |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM QMA International Equity Fund’s Class Z shares returned –10.59% for the 12-month period that ended October 31, 2018, underperforming the –8.24% return of the MSCI All Country World Ex-US (MSCI ACWI Ex-US) Index (the Index) and the –8.49% return of the Lipper International Multi-Cap Core Funds Average.

What were the market conditions?

| • | | While 2017 was characterized as a year of synchronized global recovery, 2018 may be best described as a year of divergence. With the US Congress’ fiscal stimulus in late 2017 boosting economic activity, the US stands out among the world’s major economies with accelerating growth, even as other major economies appear to be slowing—at least in the near term. |

| • | | Anxiety regarding a global trade war emerged in March 2018, eased in May, but intensified again in June on the heels of unprecedented acrimony at the G7 summit and the Trump administration’s threat to impose round after round of tariffs on Chinese goods. The G7, or Group of Seven, is a forum of the world’s largest industrialized economies and consists of Canada, France, Germany, Italy, Japan, the United Kingdom (the UK), and the US. Retaliatory measures by China ignited fears of a tit-for-tat escalation cycle, which would have been destructive for global growth. |

| • | | Fears of trade wars abated toward the end of the summer with good news heralded by an agreement with Mexico, lower-than-expected tariffs on $200 billion of Chinese goods, and, lastly, a trade agreement with Canada that concluded renegotiation of NAFTA (North American Free Trade Agreement). US equity markets surged again, rising more than 7% from July through September and reaching new highs on reduced geopolitical anxiety and more good news on the earnings front. |

| • | | US equities were volatile in October 2018, declining amid investor concerns about the pace of US economic growth and the outlook for corporate earnings. Toward the end of the month, US equities retraced some of their losses on positive economic news and solid earnings reports. |

| • | | This singular strength of the US economy, accompanied by rising US interest rates and the stronger dollar, have put a strain on emerging markets. The rising rates have caused capital outflows from these markets, leading to sharp currency depreciation and unleashing a vicious cycle of inflation and rate hikes. This was especially the case in countries with significant political problems, economic imbalances, and limited reserves, such as Turkey and Argentina. Trade tensions and high oil prices exacerbated the problem, even in stronger emerging market countries, by putting additional pressure on foreign currency reserves. Nevertheless, the emerging markets crisis has been contained so far thanks to China’s commitment to doing “whatever it takes” to keep its economy stable and a proactive stance by other emerging market central banks. |

| | |

| 12 | | Visit our website at pgiminvestments.com |

| • | | On an absolute basis, based on the performance of their respective MSCI indexes, developed equity markets outpaced their emerging market counterparts, and larger- capitalization companies outpaced smaller MSCI index constituents—a reversal of 2017 (emerging markets was the exception on a size basis). |

What worked?

| • | | The Fund’s stock selection was effective in the larger-capitalization space. This was most notable in emerging markets, where Brazil far outpaced its peers on the back of a rebound in the energy sector, which rose significantly, and selection in financials, which staged a comeback in the last few months of the period. The country suffered significant setbacks this year as it struggled with widespread political scandal and economic uncertainty. |

| • | | China also contributed significantly to performance, driven by stock selection in financials and underweights in the consumer discretionary and information technology sectors, each of which declined. |

What didn’t work?

| • | | The challenging environment for valuation measures throughout the better part of the period was worsened by decreasing effectiveness from growth metrics. The measures fared the worst in the small capitalization space, which drove the Fund’s underperformance. This is an about-face from the market segment’s significant contributions in 2017. |

| • | | The Fund’s allocation to small-cap stocks (an out-of-benchmark position), where factors weakened considerably during the period, drove the Fund’s underperformance. This segment contributed the most to the Fund’s notable gains in 2017. |

| • | | Stock selection was the most challenged among small-cap stocks in developed markets, particularly in Germany (in the information technology and financials sectors) and in the UK, where selection was broadly difficult. |

Current outlook

| • | | The global economy entered the last quarter of 2018 with good momentum. However, QMA believes growth has become less synchronized, more uneven, and less robust than in 2017, with economic activity accelerating in the US; moderating in the eurozone, UK, and Japan; and slowing in China and other emerging markets. |

| • | | Trade tensions and the ongoing crisis in emerging markets top the downside risks. Trade uncertainty has now seeped into the gross domestic product (GDP) and business confidence data for Europe and Japan, while the combination of trade tensions, fears of Turkish lira contagion, and Federal Reserve rate hikes have contributed to slowdowns in a number of emerging markets, including China. However, QMA believes that, on balance, the near-term risk of a global downturn remains very low but that storm clouds are gathering. |

| | | | |

| PGIM QMA International Equity Fund | | | 13 | |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2018. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the

| | |

| 14 | | Visit our website at pgiminvestments.com |

period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

PGIM QMA

International

Equity Fund | | Beginning Account

Value

May 1, 2018 | | | Ending Account

Value

October 31, 2018 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 874.40 | | | | 1.32 | % | | $ | 6.24 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.55 | | | | 1.32 | % | | $ | 6.72 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 868.80 | | | | 2.53 | % | | $ | 11.92 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,012.45 | | | | 2.53 | % | | $ | 12.83 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 870.20 | | | | 2.10 | % | | $ | 9.90 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.62 | | | | 2.10 | % | | $ | 10.66 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 875.30 | | | | 1.00 | % | | $ | 4.73 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.16 | | | | 1.00 | % | | $ | 5.09 | |

| Class R6** | | Actual | | $ | 1,000.00 | | | $ | 875.50 | | | | 0.78 | % | | $ | 3.69 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.27 | | | | 0.78 | % | | $ | 3.97 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2018, and divided by the 365 days in the Fund's fiscal year ended October 31, 2018 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**Formerly known as Class Q shares.

| | | | |

| PGIM QMA International Equity Fund | | | 15 | |

Schedule of Investments

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 99.3% | | | | | | | | |

| | |

COMMON STOCKS 96.9% | | | | | | | | |

| | |

Australia 4.8% | | | | | | | | |

AGL Energy Ltd. | | | 96,027 | | | $ | 1,227,069 | |

Aristocrat Leisure Ltd. | | | 84,472 | | | | 1,591,023 | |

BHP Billiton PLC | | | 22,181 | | | | 441,925 | |

BlueScope Steel Ltd. | | | 104,507 | | | | 1,071,654 | |

CIMIC Group Ltd. | | | 2,764 | | | | 92,567 | |

CSL Ltd. | | | 13,576 | | | | 1,821,490 | |

Goodman Group, REIT | | | 134,976 | | | | 990,585 | |

Macquarie Group Ltd. | | | 23,516 | | | | 1,961,664 | |

Rio Tinto Ltd. | | | 5,546 | | | | 301,901 | |

Rio Tinto PLC | | | 34,589 | | | | 1,680,928 | |

Stockland, REIT | | | 32,981 | | | | 84,191 | |

WPP AUNZ Ltd. | | | 336,587 | | | | 133,592 | |

| | | | | | | | |

| | | | | | | 11,398,589 | |

| | |

Austria 0.1% | | | | | | | | |

EVN AG | | | 12,056 | | | | 210,267 | |

| | |

Belgium 0.1% | | | | | | | | |

UCB SA | | | 2,506 | | | | 210,260 | |

| | |

Brazil 2.1% | | | | | | | | |

Banco Bradesco SA | | | 12,300 | | | | 99,286 | |

Banco do Brasil SA | | | 51,900 | | | | 594,796 | |

Banco Santander Brasil SA, UTS | | | 152,100 | | | | 1,725,966 | |

Engie Brasil Energia SA | | | 120,900 | | | | 1,292,979 | |

Petroleo Brasileiro SA | | | 40,600 | | | | 329,688 | |

SLC Agricola SA | | | 33,800 | | | | 513,607 | |

Transmissora Alianca de Energia Eletrica SA, UTS | | | 65,500 | | | | 394,954 | |

| | | | | | | | |

| | | | | | | 4,951,276 | |

| | |

Canada 6.2% | | | | | | | | |

Bank of Montreal | | | 8,400 | | | | 628,062 | |

Canadian Imperial Bank of Commerce | | | 20,500 | | | | 1,770,246 | |

Canadian National Railway Co. | | | 23,100 | | | | 1,974,761 | |

Canadian Pacific Railway Ltd. | | | 4,000 | | | | 820,297 | |

Corus Entertainment, Inc. (Class B Stock) | | | 162,500 | | | | 612,253 | |

Genworth MI Canada, Inc. | | | 10,100 | | | | 331,513 | |

Husky Energy, Inc. | | | 62,700 | | | | 886,359 | |

Loblaw Cos. Ltd. | | | 2,400 | | | | 120,032 | |

Rogers Communications, Inc. (Class B Stock) | | | 2,600 | | | | 133,886 | |

Royal Bank of Canada | | | 34,900 | | | | 2,542,905 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Canada (cont’d.) | | | | | | | | |

Shopify, Inc. (Class A Stock)* | | | 1,100 | | | $ | 151,967 | |

Sun Life Financial, Inc. | | | 7,300 | | | | 267,335 | |

Suncor Energy, Inc. | | | 6,300 | | | | 211,332 | |

Teck Resources Ltd. (Class B Stock) | | | 66,400 | | | | 1,372,436 | |

Toronto-Dominion Bank (The) | | | 51,500 | | | | 2,856,960 | |

| | | | | | | | |

| | | | | | | 14,680,344 | |

| | |

Chile 0.2% | | | | | | | | |

Colbun SA | | | 2,233,388 | | | | 419,014 | |

| | |

China 7.2% | | | | | | | | |

Alibaba Group Holding Ltd., ADR* | | | 6,100 | | | | 867,908 | |

Anhui Conch Cement Co. Ltd. (Class H Stock) | | | 17,500 | | | | 91,072 | |

Asia Cement China Holdings Corp. | | | 723,000 | | | | 622,932 | |

Bank of Shanghai Co. Ltd. (Class A Stock) | | | 78,200 | | | | 137,322 | |

BOC Hong Kong Holdings Ltd. | | | 44,500 | | | | 166,621 | |

China BlueChemical Ltd. (Class H Stock) | | | 1,676,000 | | | | 575,311 | |

China Communications Services Corp. Ltd. (Class H Stock) | | | 1,400,000 | | | | 1,133,339 | |

China International Travel Service Corp. Ltd. (Class A Stock) | | | 12,100 | | | | 93,647 | |

China Petroleum & Chemical Corp. (Class H Stock) | | | 1,704,000 | | | | 1,391,107 | |

China Railway Group Ltd. (Class H Stock) | | | 106,000 | | | | 94,904 | |

China Resources Land Ltd. | | | 36,000 | | | | 122,737 | |

China Shenhua Energy Co. Ltd. (Class H Stock) | | | 39,500 | | | | 89,832 | |

China Unicom Hong Kong Ltd. | | | 1,126,000 | | | | 1,173,541 | |

China United Network Communications Ltd. (Class A Stock) | | | 153,600 | | | | 119,717 | |

China Yuhua Education Corp. Ltd., 144A | | | 512,000 | | | | 205,663 | |

Chlitina Holding Ltd. | | | 96,000 | | | | 644,052 | |

CITIC Telecom International Holdings Ltd. | | | 890,000 | | | | 279,786 | |

CNOOC Ltd. | | | 228,000 | | | | 393,358 | |

Country Garden Holdings Co. Ltd. | | | 832,000 | | | | 896,172 | |

Daqin Railway Co. Ltd. (Class A Stock) | | | 101,800 | | | | 117,931 | |

Jiangsu Yanghe Brewery Joint-Stock Co. Ltd. (Class A Stock) | | | 6,558 | | | | 83,567 | |

Lonking Holdings Ltd. | | | 390,000 | | | | 88,017 | |

Momo, Inc., ADR* | | | 7,300 | | | | 245,061 | |

Ping An Insurance Group Co. of China Ltd. (Class H Stock) | | | 65,000 | | | | 616,836 | |

Poly Property Group Co. Ltd. | | | 2,643,000 | | | | 792,219 | |

Postal Savings Bank of China Co. Ltd. (Class H Stock), 144A | | | 2,138,000 | | | | 1,280,772 | |

Powerlong Real Estate Holdings Ltd. | | | 551,000 | | | | 188,727 | |

Sany Heavy Industry Co. Ltd. (Class A Stock) | | | 94,200 | | | | 106,667 | |

Shougang Fushan Resources Group Ltd. | | | 2,122,000 | | | | 429,995 | |

Sinotruk Hong Kong Ltd.(a) | | | 722,000 | | | | 1,044,933 | |

Tencent Holdings Ltd. | | | 35,900 | | | | 1,233,138 | |

Weichai Power Co. Ltd. (Class H Stock) | | | 902,000 | | | | 897,397 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

China (cont’d.) | | | | | | | | |

West China Cement Ltd. | | | 1,296,000 | | | $ | 192,574 | |

Wuliangye Yibin Co. Ltd. (Class A Stock) | | | 11,100 | | | | 76,937 | |

Yanzhou Coal Mining Co. Ltd. (Class H Stock) | | | 86,000 | | | | 81,948 | |

Yuexiu Transport Infrastructure Ltd. | | | 464,000 | | | | 373,216 | |

| | | | | | | | |

| | | | | | | 16,948,956 | |

| | |

Colombia 0.6% | | | | | | | | |

Ecopetrol SA | | | 1,310,210 | | | | 1,532,205 | |

| | |

Denmark 0.7% | | | | | | | | |

H. Lundbeck A/S | | | 3,114 | | | | 145,265 | |

Novo Nordisk A/S (Class B Stock) | | | 21,501 | | | | 928,775 | |

Orsted A/S, 144A | | | 2,270 | | | | 144,371 | |

Scandinavian Tobacco Group A/S, 144A | | | 32,739 | | | | 497,899 | |

| | | | | | | | |

| | | | | | | 1,716,310 | |

| | |

Finland 0.4% | | | | | | | | |

Neste OYJ | | | 3,531 | | | | 290,081 | |

Nordea Bank Abp | | | 37,350 | | | | 324,915 | |

UPM-Kymmene OYJ | | | 13,199 | | | | 425,059 | |

| | | | | | | | |

| | | | | | | 1,040,055 | |

| | |

France 5.8% | | | | | | | | |

AXA SA | | | 41,981 | | | | 1,050,979 | |

Dassault Systemes SE | | | 1,544 | | | | 193,767 | |

Eiffage SA | | | 1,013 | | | | 99,146 | |

Eutelsat Communications SA | | | 47,134 | | | | 957,699 | |

Hermes International | | | 381 | | | | 217,861 | |

IPSOS | | | 8,904 | | | | 237,292 | |

Kering SA | | | 1,080 | | | | 481,277 | |

Klepierre SA, REIT | | | 20,120 | | | | 684,296 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 7,755 | | | | 2,361,427 | |

Peugeot SA | | | 58,551 | | | | 1,393,577 | |

Sanofi | | | 31,733 | | | | 2,827,730 | |

Teleperformance | | | 3,309 | | | | 546,503 | |

TOTAL SA | | | 14,224 | | | | 834,349 | |

Vinci SA | | | 20,238 | | | | 1,808,095 | |

| | | | | | | | |

| | | | | | | 13,693,998 | |

| | |

Germany 5.3% | | | | | | | | |

Allianz SE | | | 13,032 | | | | 2,723,230 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Germany (cont’d.) | | | | | | | | |

Amadeus Fire AG | | | 1,263 | | | $ | 144,452 | |

AURELIUS Equity Opportunities SE & Co. KGaA | | | 14,623 | | | | 681,690 | |

Bayer AG | | | 12,183 | | | | 932,413 | |

Covestro AG, 144A | | | 10,549 | | | | 682,319 | |

Deutsche Lufthansa AG | | | 48,733 | | | | 979,974 | |

Deutsche Pfandbriefbank AG, 144A | | | 58,265 | | | | 775,106 | |

Deutsche Telekom AG | | | 109,187 | | | | 1,792,658 | |

Fresenius Medical Care AG & Co. KGaA | | | 1,163 | | | | 91,184 | |

Henkel AG & Co. KGaA | | | 1,391 | | | | 136,445 | |

Infineon Technologies AG | | | 67,864 | | | | 1,361,691 | |

Nemetschek SE | | | 3,686 | | | | 485,265 | |

SAP SE | | | 958 | | | | 102,541 | |

Siltronic AG | | | 7,630 | | | | 702,022 | |

Sixt SE | | | 6,638 | | | | 676,799 | |

Wirecard AG | | | 1,427 | | | | 268,254 | |

| | | | | | | | |

| | | | | | | 12,536,043 | |

| | |

Hong Kong 1.7% | | | | | | | | |

CK Asset Holdings Ltd. | | | 57,500 | | | | 373,863 | |

CK Hutchison Holdings Ltd. | | | 32,000 | | | | 323,365 | |

Galaxy Entertainment Group Ltd. | | | 402 | | | | 2,183 | |

Hang Seng Bank Ltd. | | | 61,400 | | | | 1,441,123 | |

Kerry Properties Ltd. | | | 29,000 | | | | 91,382 | |

Swire Pacific Ltd. (Class A Stock) | | | 114,500 | | | | 1,192,025 | |

WH Group Ltd., 144A | | | 862,500 | | | | 604,439 | |

Wharf Real Estate Investment Co. Ltd. | | | 15,000 | | | | 93,049 | |

| | | | | | | | |

| | | | | | | 4,121,429 | |

| | |

Hungary 0.2% | | | | | | | | |

Magyar Telekom Telecommunications PLC | | | 272,773 | | | | 372,409 | |

OTP Bank Nyrt | | | 2,746 | | | | 98,716 | |

| | | | | | | | |

| | | | | | | 471,125 | |

| | |

India 2.0% | | | | | | | | |

Endurance Technologies Ltd., 144A | | | 11,950 | | | | 196,153 | |

Graphite India Ltd. | | | 17,648 | | | | 228,299 | |

HCL Technologies Ltd. | | | 92,006 | | | | 1,317,270 | |

Jubilant Foodworks Ltd. | | | 49,386 | | | | 727,292 | |

Larsen & Toubro Infotech Ltd., 144A | | | 33,321 | | | | 798,076 | |

Minda Industries Ltd. | | | 74,836 | | | | 315,288 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

India (cont’d.) | | | | | | | | |

Tata Consultancy Services Ltd. | | | 36,279 | | | $ | 953,596 | |

Tech Mahindra Ltd. | | | 10,180 | | | | 102,734 | |

| | | | | | | | |

| | | | | | | 4,638,708 | |

| | |

Indonesia 0.1% | | | | | | | | |

Ace Hardware Indonesia Tbk PT | | | 2,307,600 | | | | 208,134 | |

| | |

Ireland 0.6% | | | | | | | | |

Bank of Ireland Group PLC | | | 154,762 | | | | 1,095,272 | |

CRH PLC | | | 10,186 | | | | 304,212 | |

| | | | | | | | |

| | | | | | | 1,399,484 | |

| | |

Israel 0.7% | | | | | | | | |

Check Point Software Technologies Ltd.* | | | 12,500 | | | | 1,387,500 | |

Israel Chemicals Ltd. | | | 15,629 | | | | 90,101 | |

Plus500 Ltd. | | | 12,856 | | | | 222,283 | |

| | | | | | | | |

| | | | | | | 1,699,884 | |

| | |

Italy 2.3% | | | | | | | | |

Enel SpA | | | 347,428 | | | | 1,719,112 | |

Eni SpA | | | 99,727 | | | | 1,771,835 | |

Intesa Sanpaolo SpA | | | 174,365 | | | | 385,235 | |

Mediobanca Banca di Credito Finanziario SpA | | | 135,978 | | | | 1,193,806 | |

Poste Italiane SpA, 144A | | | 49,691 | | | | 357,166 | |

| | | | | | | | |

| | | | | | | 5,427,154 | |

| | |

Japan 17.5% | | | | | | | | |

Advantest Corp. | | | 4,900 | | | | 90,450 | |

Asahi Group Holdings Ltd. | | | 4,400 | | | | 193,492 | |

Asahi Kasei Corp. | | | 14,800 | | | | 178,620 | |

Astellas Pharma, Inc. | | | 115,000 | | | | 1,786,140 | |

Capcom Co. Ltd. | | | 6,700 | | | | 139,201 | |

Central Japan Railway Co. | | | 5,300 | | | | 1,029,586 | |

Dai-ichi Life Holdings, Inc. | | | 13,000 | | | | 247,048 | |

Fast Retailing Co. Ltd. | | | 3,800 | | | | 1,924,733 | |

Hitachi Ltd. | | | 57,200 | | | | 1,755,894 | |

Isuzu Motors Ltd. | | | 25,200 | | | | 330,153 | |

ITOCHU Corp. | | | 96,400 | | | | 1,791,992 | |

Japan Tobacco, Inc. | | | 44,200 | | | | 1,132,888 | |

JFE Holdings, Inc. | | | 5,700 | | | | 107,797 | |

JXTG Holdings, Inc. | | | 267,900 | | | | 1,828,662 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 21 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Japan (cont’d.) | | | | | | | | |

Kansai Electric Power Co., Inc. (The) | | | 8,300 | | | $ | 127,154 | |

KDDI Corp. | | | 68,200 | | | | 1,675,551 | |

Kirin Holdings Co. Ltd. | | | 10,600 | | | | 253,153 | |

Kobe Steel Ltd. | | | 35,700 | | | | 288,208 | |

Marubeni Corp. | | | 31,300 | | | | 254,504 | |

Medipal Holdings Corp. | | | 63,800 | | | | 1,369,637 | |

Mitsubishi Chemical Holdings Corp. | | | 187,500 | | | | 1,465,634 | |

Mitsubishi Corp. | | | 71,600 | | | | 2,020,667 | |

Mitsubishi UFJ Financial Group, Inc. | | | 345,300 | | | | 2,097,222 | |

Mitsui & Co. Ltd. | | | 57,700 | | | | 966,156 | |

Mizuho Financial Group, Inc. | | | 293,900 | | | | 506,429 | |

Nippon Telegraph & Telephone Corp. | | | 46,284 | | | | 1,923,847 | |

NTT DOCOMO, Inc. | | | 60,100 | | | | 1,511,071 | |

ORIX Corp. | | | 118,200 | | | | 1,931,078 | |

Resona Holdings, Inc. | | | 27,600 | | | | 145,960 | |

Shin-Etsu Chemical Co. Ltd. | | | 5,600 | | | | 470,904 | |

Shionogi & Co. Ltd. | | | 14,600 | | | | 936,229 | |

Sompo Holdings, Inc. | | | 4,200 | | | | 173,885 | |

Sony Corp. | | | 45,100 | | | | 2,433,509 | |

Sumitomo Corp. | | | 114,800 | | | | 1,745,752 | |

Sumitomo Mitsui Financial Group, Inc. | | | 19,700 | | | | 774,004 | |

Suzuki Motor Corp. | | | 17,200 | | | | 859,583 | |

Taisei Corp. | | | 32,300 | | | | 1,383,918 | |

Tokio Marine Holdings, Inc. | | | 8,400 | | | | 398,071 | |

Toyota Motor Corp. | | | 51,333 | | | | 3,011,636 | |

Toyota Tsusho Corp. | | | 3,000 | | | | 108,372 | |

| | | | | | | | |

| | | | | | | 41,368,790 | |

| | |

Luxembourg 0.6% | | | | | | | | |

ArcelorMittal | | | 55,208 | | | | 1,374,145 | |

| | |

Malaysia 0.1% | | | | | | | | |

Genting Bhd | | | 94,400 | | | | 165,728 | |

| | |

Mexico 0.1% | | | | | | | | |

Concentradora Fibra Danhos SA de CV, REIT | | | 151,700 | | | | 200,890 | |

| | |

Netherlands 3.1% | | | | | | | | |

ABN AMRO Group NV, CVA, 144A | | | 53,234 | | | | 1,308,061 | |

Aegon NV | | | 229,735 | | | | 1,409,752 | |

ASR Nederland NV | | | 18,624 | | | | 847,220 | |

Koninklijke Ahold Delhaize NV | | | 64,771 | | | | 1,483,182 | |

NN Group NV | | | 3,679 | | | | 158,179 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Netherlands (cont’d.) | | | | | | | | |

Royal Dutch Shell PLC (Class A Stock) | | | 56,521 | | | $ | 1,802,010 | |

Royal Dutch Shell PLC (Class B Stock) | | | 6,509 | | | | 212,871 | |

Wolters Kluwer NV | | | 3,399 | | | | 193,145 | |

| | | | | | | | |

| | | | | | | 7,414,420 | |

| | |

New Zealand 0.3% | | | | | | | | |

Metlifecare Ltd. | | | 102,941 | | | | 390,914 | |

Summerset Group Holdings Ltd. | | | 60,451 | | | | 262,612 | |

| | | | | | | | |

| | | | | | | 653,526 | |

| | |

Norway 0.9% | | | | | | | | |

Aker BP ASA | | | 2,685 | | | | 88,350 | |

DNB ASA | | | 65,971 | | | | 1,192,384 | |

Salmar ASA | | | 15,800 | | | | 832,465 | |

| | | | | | | | |

| | | | | | | 2,113,199 | |

| | |

Pakistan 0.3% | | | | | | | | |

Engro Fertilizers Ltd. | | | 323,500 | | | | 198,069 | |

Oil & Gas Development Co. Ltd. | | | 316,000 | | | | 379,818 | |

Pakistan Oilfields Ltd. | | | 43,490 | | | | 179,131 | |

| | | | | | | | |

| | | | | | | 757,018 | |

| | |

Peru 0.1% | | | | | | | | |

Credicorp Ltd. | | | 800 | | | | 180,568 | |

| | |

Philippines 0.3% | | | | | | | | |

SM Prime Holdings, Inc. | | | 969,600 | | | | 612,913 | |

| | |

Poland 0.0% | | | | | | | | |

Stalprodukt SA | | | 1,135 | | | | 109,025 | |

| | |

Portugal 0.3% | | | | | | | | |

Sonae SGPS SA | | | 790,744 | | | | 792,773 | |

| | |

Qatar 0.5% | | | | | | | | |

Industries Qatar QSC | | | 17,424 | | | | 670,841 | |

Qatar Navigation QSC | | | 14,750 | | | | 287,479 | |

United Development Co. QSC | | | 42,641 | | | | 164,001 | |

| | | | | | | | |

| | | | | | | 1,122,321 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 23 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Russia 1.3% | | | | | | | | |

Evraz PLC | | | 120,063 | | | $ | 833,461 | |

Gazprom PJSC, ADR | | | 102,260 | | | | 484,508 | |

Lukoil PJSC, ADR | | | 7,998 | | | | 597,451 | |

Novatek PJSC, GDR | | | 1,121 | | | | 190,009 | |

Sberbank of Russia PJSC, ADR | | | 48,247 | | | | 569,315 | |

Tatneft PJSC, ADR | | | 5,629 | | | | 396,619 | |

| | | | | | | | |

| | | | | | | 3,071,363 | |

| | |

Singapore 1.0% | | | | | | | | |

United Overseas Bank Ltd. | | | 60,200 | | | | 1,061,247 | |

Wilmar International Ltd. | | | 540,500 | | | | 1,235,300 | |

| | | | | | | | |

| | | | | | | 2,296,547 | |

| | |

South Africa 1.3% | | | | | | | | |

Adcock Ingram Holdings Ltd. | | | 55,721 | | | | 216,383 | |

Anglo American PLC | | | 91,214 | | | | 1,952,496 | |

Astral Foods Ltd. | | | 45,569 | | | | 611,890 | |

Kumba Iron Ore Ltd. | | | 8,137 | | | | 159,167 | |

Old Mutual Ltd. | | | 61,014 | | | | 93,763 | |

| | | | | | | | |

| | | | | | | 3,033,699 | |

| | |

South Korea 4.1% | | | | | | | | |

Daishin Securities Co. Ltd. | | | 41,453 | | | | 403,225 | |

Hana Financial Group, Inc. | | | 36,527 | | | | 1,225,372 | |

Industrial Bank of Korea | | | 92,160 | | | | 1,199,358 | |

KB Financial Group, Inc. | | | 28,528 | | | | 1,184,928 | |

Lotte Chemical Corp. | | | 383 | | | | 88,383 | |

Mirae Asset Life Insurance Co. Ltd. | | | 21,961 | | | | 87,771 | |

POSCO | | | 5,979 | | | | 1,353,394 | |

Samsung C&T Corp. | | | 917 | | | | 87,526 | |

Samsung Electronics Co. Ltd. | | | 57,068 | | | | 2,132,191 | |

SK Hynix, Inc. | | | 30,285 | | | | 1,823,989 | |

SK Telecom Co. Ltd. | | | 407 | | | | 95,577 | |

Woori Bank | | | 6,933 | | | | 96,125 | |

| | | | | | | | |

| | | | | | | 9,777,839 | |

| | |

Spain 1.3% | | | | | | | | |

Amadeus IT Group SA | | | 25,095 | | | | 2,023,506 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Spain (cont’d.) | | | | | | | | |

Endesa SA | | | 4,388 | | | $ | 91,928 | |

Repsol SA | | | 52,797 | | | | 945,555 | |

| | | | | | | | |

| | | | | | | 3,060,989 | |

| | |

Sweden 2.7% | | | | | | | | |

Atlas Copco AB (Class B Stock) | | | 5,159 | | | | 118,410 | |

ICA Gruppen AB | | | 12,082 | | | | 427,374 | |

Investor AB (Class B Stock) | | | 32,317 | | | | 1,401,853 | |

Lundin Petroleum AB | | | 3,245 | | | | 98,812 | |

Sandvik AB | | | 87,418 | | | | 1,381,080 | |

Svenska Handelsbanken AB (Class A Stock) | | | 121,959 | | | | 1,326,391 | |

Volvo AB (Class B Stock) | | | 100,392 | | | | 1,501,926 | |

| | | | | | | | |

| | | | | | | 6,255,846 | |

| | |

Switzerland 4.8% | | | | | | | | |

Chocoladefabriken Lindt & Spruengli AG | | | 1 | | | | 79,722 | |

Georg Fischer AG | | | 689 | | | | 641,148 | |

Logitech International SA | | | 11,712 | | | | 432,798 | |

Nestle SA | | | 21,616 | | | | 1,825,826 | |

Novartis AG | | | 44,658 | | | | 3,907,229 | |

Oriflame Holding AG | | | 5,824 | | | | 137,546 | |

Partners Group Holding AG | | | 219 | | | | 155,916 | |

Roche Holding AG | | | 15,130 | | | | 3,679,098 | |

Sonova Holding AG | | | 682 | | | | 111,514 | |

Sunrise Communications Group AG, 144A* | | | 2,716 | | | | 239,177 | |

Swatch Group AG (The) | | | 547 | | | | 184,565 | |

| | | | | | | | |

| | | | | | | 11,394,539 | |

| | |

Taiwan 3.3% | | | | | | | | |

Cathay Financial Holding Co. Ltd. | | | 103,000 | | | | 163,849 | |

Formosa Petrochemical Corp. | | | 29,000 | | | | 114,721 | |

Gigabyte Technology Co. Ltd. | | | 440,000 | | | | 580,727 | |

Lien Hwa Industrial Corp. | | | 645,700 | | | | 637,337 | |

President Chain Store Corp. | | | 143,000 | | | | 1,618,544 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 128,000 | | | | 970,657 | |

Uni-President Enterprises Corp. | | | 615,000 | | | | 1,484,019 | |

Walsin Lihwa Corp. | | | 1,196,000 | | | | 597,924 | |

Yageo Corp. | | | 82,000 | | | | 850,667 | |

Yuanta Financial Holding Co. Ltd. | | | 1,526,000 | | | | 741,748 | |

| | | | | | | | |

| | | | | | | 7,760,193 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 25 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Thailand 1.3% | | | | | | | | |

Electricity Generating PCL | | | 96,700 | | | $ | 674,829 | |

Plan B Media PCL | | | 2,243,000 | | | | 441,711 | |

PTT Global Chemical PCL | | | 150,200 | | | | 351,242 | |

PTT PCL | | | 968,800 | | | | 1,494,933 | |

| | | | | | | | |

| | | | | | | 2,962,715 | |

| | |

Turkey 1.1% | | | | | | | | |

Aygaz A/S | | | 103,398 | | | | 225,198 | |

Eregli Demir ve Celik Fabrikalari TAS | | | 610,246 | | | | 989,429 | |

Ford Otomotiv Sanayi A/S | | | 46,224 | | | | 497,199 | |

Tekfen Holding A/S | | | 198,157 | | | | 754,659 | |

Turkiye Garanti Bankasi A/S | | | 73,538 | | | | 91,997 | |

| | | | | | | | |

| | | | | | | 2,558,482 | |

| | |

United Kingdom 9.2% | | | | | | | | |

3i Group PLC | | | 106,899 | | | | 1,199,113 | |

Berkeley Group Holdings PLC | | | 27,257 | | | | 1,219,810 | |

BP PLC | | | 84,281 | | | | 609,227 | |

British American Tobacco PLC | | | 28,457 | | | | 1,235,202 | |

Britvic PLC | | | 84,628 | | | | 855,448 | |

CNH Industrial NV | | | 12,487 | | | | 129,602 | |

Coca-Cola European Partners PLC | | | 33,700 | | | | 1,533,013 | |

EMIS Group PLC | | | 12,126 | | | | 140,385 | |

Fiat Chrysler Automobiles NV* | | | 14,364 | | | | 219,184 | |

GlaxoSmithKline PLC | | | 40,764 | | | | 788,645 | |

HSBC Holdings PLC | | | 99,115 | | | | 814,769 | |

Hunting PLC | | | 10,767 | | | | 92,898 | |

Imperial Brands PLC | | | 49,831 | | | | 1,689,095 | |

Inchcape PLC | | | 86,474 | | | | 598,198 | |

JD Sports Fashion PLC | | | 139,456 | | | | 728,300 | |

Land Securities Group PLC, REIT | | | 114,922 | | | | 1,253,591 | |

Legal & General Group PLC | | | 438,760 | | | | 1,412,066 | |

Linde PLC* | | | 3,619 | | | | 593,746 | |

Lloyds Banking Group PLC | | | 1,999,812 | | | | 1,460,105 | |

Melrose Industries PLC | | | 59,213 | | | | 127,785 | |

Pearson PLC | | | 110,042 | | | | 1,261,037 | |

Persimmon PLC | | | 45,497 | | | | 1,334,921 | |

Reckitt Benckiser Group PLC | | | 10,555 | | | | 853,970 | |

SSP Group PLC | | | 38,414 | | | | 327,932 | |

Unilever NV, CVA | | | 9,380 | | | | 503,976 | |

Unilever PLC | | | 15,216 | | | | 805,322 | |

| | | | | | | | |

| | | | | | | 21,787,340 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

United States 0.3% | | | | | | | | |

BRP, Inc. | | | 13,400 | | | $ | 539,074 | |

QIAGEN NV* | | | 2,708 | | | | 98,216 | |

| | | | | | | | |

| | | | | | | 637,290 | |

TOTAL COMMON STOCKS

(cost $222,055,123) | | | | | | | 228,765,393 | |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS 1.3% | | | | | | | | |

| | |

United States | | | | | | | | |

iShares MSCI EAFE ETF | | | 39,100 | | | | 2,442,186 | |

iShares MSCI Emerging Markets ETF | | | 17,600 | | | | 689,216 | |

| | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS

(cost $3,210,271) | | | | | | | 3,131,402 | |

| | | | | | | | |

| | |

PREFERRED STOCKS 1.1% | | | | | | | | |

| | |

Brazil 0.9% | | | | | | | | |

Banco do Estado do Rio Grande do Sul SA (PRFC) (Class B Stock) | | | 130,900 | | | | 689,059 | |

Cia Paranaense de Energia (PRFC) (Class B Stock) | | | 14,200 | | | | 99,932 | |

Petroleo Brasileiro SA (PRFC) | | | 178,900 | | | | 1,327,268 | |

| | | | | | | | |

| | | | | | | 2,116,259 | |

| | |

South Korea 0.2% | | | | | | | | |

Samsung Electronics Co. Ltd. (PRFC) | | | 11,500 | | | | 362,090 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(cost $1,841,308) | | | | | | | 2,478,349 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $227,106,702) | | | | | | | 234,375,144 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 0.5% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

PGIM Core Ultra Short Bond Fund(w) | | | 101,342 | | | | 101,342 | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 27 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | |

| Description | | Shares | | | Value | |

AFFILIATED MUTUAL FUNDS (Continued) | | | | | | | | |

PGIM Institutional Money Market Fund

(cost $1,092,106; includes $1,088,646 of cash collateral for securities on loan)(b)(w) | | | 1,092,213 | | | $ | 1,092,213 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $1,193,448) | | | | | | | 1,193,555 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS 99.8%

(cost $228,300,150) | | | | | | | 235,568,699 | |

Other assets in excess of liabilities 0.2% | | | | | | | 463,390 | |

| | | | | | | | |

| | |

NET ASSETS 100.0% | | | | | | $ | 236,032,089 | |

| | | | | | | | |

The following abbreviations are used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

ADR—American Depositary Receipt

CVA—Certificate Van Aandelen (Bearer)

EAFE—Europe, Australasia, Far East

ETF—Exchange Traded Fund

GDR—Global Depositary Receipt

LIBOR—London Interbank Offered Rate

MSCI—Morgan Stanley Capital International

PJSC—Public Joint-Stock Company

PRFC—Preference Shares

REIT—Real Estate Investment Trust

UTS—Unit Trust Security

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $1,059,510; cash collateral of $1,088,646 (included in liabilities) was received with which the Series purchased highly liquid short-term investments. |

| (b) | Represents security purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (w) | PGIM Investments LLC, the manager of the Series, also serves as manager of the PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund. |

Fair Value Measurements:

Various inputs are used in determining the value of the Series’ investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

The following is a summary of the inputs used as of October 31, 2018 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 11,398,589 | | | $ | — | |

Austria | | | — | | | | 210,267 | | | | — | |

Belgium | | | — | | | | 210,260 | | | | — | |

Brazil | | | 4,951,276 | | | | — | | | | — | |

Canada | | | 14,680,344 | | | | — | | | | — | |

Chile | | | 419,014 | | | | — | | | | — | |

China | | | 1,112,969 | | | | 15,835,987 | | | | — | |

Colombia | | | 1,532,205 | | | | — | | | | — | |

Denmark | | | — | | | | 1,716,310 | | | | — | |

Finland | | | — | | | | 1,040,055 | | | | — | |

France | | | — | | | | 13,693,998 | | | | — | |

Germany | | | — | | | | 12,536,043 | | | | — | |

Hong Kong | | | — | | | | 4,121,429 | | | | — | |

Hungary | | | — | | | | 471,125 | | | | — | |

India | | | — | | | | 4,638,708 | | | | — | |

Indonesia | | | — | | | | 208,134 | | | | — | |

Ireland | | | — | | | | 1,399,484 | | | | — | |

Israel | | | 1,387,500 | | | | 312,384 | | | | — | |

Italy | | | — | | | | 5,427,154 | | | | — | |

Japan | | | — | | | | 41,368,790 | | | | — | |

Luxembourg | | | — | | | | 1,374,145 | | | | — | |

Malaysia | | | — | | | | 165,728 | | | | — | |

Mexico | | | 200,890 | | | | — | | | | — | |

Netherlands | | | — | | | | 7,414,420 | | | | — | |

New Zealand | | | — | | | | 653,526 | | | | — | |

Norway | | | — | | | | 2,113,199 | | | | — | |

Pakistan | | | — | | | | 757,018 | | | | — | |

Peru | | | 180,568 | | | | — | | | | — | |

Philippines | | | — | | | | 612,913 | | | | — | |

Poland | | | — | | | | 109,025 | | | | — | |

Portugal | | | — | | | | 792,773 | | | | — | |

Qatar | | | — | | | | 1,122,321 | | | | — | |

Russia | | | 2,237,902 | | | | 833,461 | | | | — | |

Singapore | | | — | | | | 2,296,547 | | | | — | |

South Africa | | | — | | | | 3,033,699 | | | | — | |

South Korea | | | — | | | | 9,777,839 | | | | — | |

Spain | | | — | | | | 3,060,989 | | | | — | |

Sweden | | | — | | | | 6,255,846 | | | | — | |

Switzerland | | | — | | | | 11,394,539 | | | | — | |

Taiwan | | | — | | | | 7,760,193 | | | | — | |

Thailand | | | — | | | | 2,962,715 | | | | — | |

Turkey | | | — | | | | 2,558,482 | | | | — | |

United Kingdom | | | 2,126,759 | | | | 19,660,581 | | | | — | |

United States | | | 539,074 | | | | 98,216 | | | | — | |

Exchange Traded Funds | | | | | | | | | | | | |

United States | | | 3,131,402 | | | | — | | | | — | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 29 | |

Schedule of Investments (continued)

as of October 31, 2018

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities (continued) | | | | | | | | | | | | |

Preferred Stocks | | | | | | | | | | | | |

Brazil | | $ | 2,116,259 | | | $ | — | | | $ | — | |

South Korea | | | — | | | | 362,090 | | | | — | |

Affiliated Mutual Funds | | | 1,193,555 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 35,809,717 | | | $ | 199,758,982 | | | $ | — | |

| | | | | | | | | | | | |

Industry Classification:

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of October 31, 2018 were as follows (unaudited):

| | | | |

Banks | | | 13.7 | % |

Oil, Gas & Consumable Fuels | | | 7.8 | |

Pharmaceuticals | | | 7.0 | |

Metals & Mining | | | 5.2 | |

Insurance | | | 4.2 | |

Food Products | | | 3.4 | |

Diversified Telecommunication Services | | | 3.0 | |

Trading Companies & Distributors | | | 2.9 | |

Automobiles | | | 2.7 | |

Machinery | | | 2.5 | |

IT Services | | | 2.5 | |

Capital Markets | | | 2.2 | |

Household Durables | | | 2.1 | |

Semiconductors & Semiconductor Equipment | | | 2.1 | |

Chemicals | | | 2.0 | |

Real Estate Management & Development | | | 2.0 | |

Road & Rail | | | 1.9 | |

Tobacco | | | 1.9 | |

Food & Staples Retailing | | | 1.8 | |

Construction & Engineering | | | 1.7 | |

Media | | | 1.6 | |

Diversified Financial Services | | | 1.5 | |

Wireless Telecommunication Services | | | 1.5 | |

Technology Hardware, Storage & Peripherals | | | 1.5 | |

Textiles, Apparel & Luxury Goods | | | 1.4 | |

Equity Real Estate Investment Trusts (REITs) | | | 1.3 | |

Exchange Traded Funds | | | 1.3 | |

Beverages | | | 1.2 | |

Hotels, Restaurants & Leisure | | | 1.2 | |

Specialty Retail | | | 1.2 | |

Electric Utilities | | | 1.1 | |

Electronic Equipment, Instruments & Components | | | 1.1 | |

Independent Power & Renewable Electricity Producers | | | 1.1 | |

| | | | |

Software | | | 0.9 | % |

Health Care Providers & Services | | | 0.9 | |

Personal Products | | | 0.8 | |

Biotechnology | | | 0.8 | |

Interactive Media & Services | | | 0.6 | |

Multi-Utilities | | | 0.5 | |

Construction Materials | | | 0.5 | |

Affiliated Mutual Funds (0.5% represents investments purchased with collateral from securities on loan) | | | 0.5 | |

Household Products | | | 0.5 | |

Electrical Equipment | | | 0.5 | |

Thrifts & Mortgage Finance | | | 0.4 | |

Industrial Conglomerates | | | 0.4 | |

Airlines | | | 0.4 | |

Professional Services | | | 0.4 | |

Internet & Direct Marketing Retail | | | 0.4 | |

Distributors | | | 0.3 | |

Leisure Products | | | 0.2 | |

Auto Components | | | 0.2 | |

Paper & Forest Products | | | 0.2 | |

Transportation Infrastructure | | | 0.2 | |

Marine | | | 0.1 | |

Gas Utilities | | | 0.1 | |

Diversified Consumer Services | | | 0.1 | |

Health Care Technology | | | 0.1 | |

Entertainment | | | 0.1 | |

Life Sciences Tools & Services | | | 0.1 | |

Health Care Equipment & Supplies | | | 0.0 | * |

See Notes to Financial Statements.

Industry Classification (cont’d.):

| | | | |

Energy Equipment & Services | | | 0.0 | *% |

| | | | |

| | | 99.8 | |

Other assets in excess of liabilities | | | 0.2 | |

| | | | |

| | | 100.0 | % |

| | | | |

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Series invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity contracts risk. The effect of such derivative instruments on the Series’ financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

The Series did not hold any derivative instruments as of October 31, 2018, accordingly, no derivative positions were presented in the Statement of Assets and Liabilities.

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2018 are as follows:

| | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Rights(1) | |

Equity contracts | | $ | 37,561 | |

| | | | |

| (1) | Included in net realized gain (loss) on investment transactions in the Statement of Operations. |

For the year ended October, 31, 2018, the Series did not have any net change in unrealized appreciation (depreciation) on derivatives in the Statement of Operations.

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Series entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions, where the legal right to set-off exists, is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | | | | | | | |

Description | | Gross

Market

Value of

Recognized

Assets/

(Liabilities) | | | Collateral

Pledged/

(Received)(1) | | | Net Amount | |

Securities on Loan | | $ | 1,059,510 | | | $ | (1,059,510 | ) | | $ | — | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 31 | |

Schedule of Investments (continued)

as of October 31, 2018

| (1) | Collateral amount disclosed by the Series is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

Statement of Assets & Liabilities

as of October 31, 2018

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $1,059,510: | | | | |

Unaffiliated investments (cost $227,106,702) | | $ | 234,375,144 | |

Affiliated investments (cost $1,193,448) | | | 1,193,555 | |

Foreign currency, at value (cost $248,780) | | | 248,262 | |

Tax reclaim receivable | | | 1,110,143 | |

Dividends and interest receivable | | | 744,811 | |

Receivable for Series shares sold | | | 229,791 | |

Receivable for investments sold | | | 30,973 | |

Prepaid expenses | | | 2,157 | |

| | | | |

Total Assets | | | 237,934,836 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 1,088,646 | |

Payable for Series shares reacquired | | | 262,495 | |

Accrued expenses and other liabilities | | | 147,637 | |

Payable for investments purchased | | | 126,467 | |

Management fee payable | | | 112,866 | |

Affiliated transfer agent fee payable | | | 78,152 | |

Distribution fee payable | | | 57,842 | |

Foreign capital gains tax liability accrued | | | 28,642 | |

| | | | |

Total Liabilities | | | 1,902,747 | |

| | | | |

| |

Net Assets | | $ | 236,032,089 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 339,558 | |

Paid-in capital in excess of par | | | 223,356,851 | |

Total distributable earnings (loss) | | | 12,335,680 | |

| | | | |

Net assets, October 31, 2018 | | $ | 236,032,089 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| PGIM QMA International Equity Fund | | | 33 | |

Statement of Assets & Liabilities

as of October 31, 2018

| | | | |

Class A | | | | |

Net asset value and redemption price per share,

($171,325,819 ÷ 24,631,106 shares of common stock issued and outstanding) | | $ | 6.96 | |

Maximum sales charge (5.50% of offering price) | | | 0.41 | |

| | | | |

Maximum offering price to public | | $ | 7.37 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share,

($1,723,081 ÷ 260,170 shares of common stock issued and outstanding) | | $ | 6.62 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share,

($12,530,157 ÷ 1,888,024 shares of common stock issued and outstanding) | | $ | 6.64 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share,

($13,901,035 ÷ 1,979,967 shares of common stock issued and outstanding) | | $ | 7.02 | |

| | | | |

| |

Class R6 | | | | |

Net asset value, offering price and redemption price per share,

($36,551,997 ÷ 5,196,530 shares of common stock issued and outstanding) | | $ | 7.03 | |

| | | | |

See Notes to Financial Statements.

Statement of Operations

Year Ended October 31, 2018

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of $1,031,467 foreign withholding tax) | | $ | 9,296,990 | |

Income from securities lending, net (including affiliated income of $6,204) | | | 62,228 | |

Affiliated dividend income | | | 5,482 | |

| | | | |

Total income | | | 9,364,700 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 2,058,290 | |

Distribution fee(a) | | | 782,590 | |

Transfer agent’s fees and expenses (including affiliated expense of $310,439)(a) | | | 582,132 | |

Custodian and accounting fees | | | 221,867 | |

Registration fees(a) | | | 70,611 | |

Shareholders’ reports | | | 68,974 | |

Audit fee | | | 30,618 | |