UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2016 |

| |

| Date of reporting period: | | 10/31/2016 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS, A PGIM BUSINESS | MUTUAL FUNDS

Prudential QMA International Equity Fund

| | |

| ANNUAL REPORT | | OCTOBER 31, 2016 |

| | |

To enroll in e-delivery, go to prudentialfunds.com/edelivery | |  |

|

| Objective: Long-term growth of capital |

Highlights

PRUDENTIAL QMA INTERNATIONAL EQUITY FUND

| • | | Strong stock selection in the financials sector, led by bank companies, added to performance. Among countries, the Fund benefited from effective stock picking in Germany’s consumer discretionary sector. |

| • | | Valuation factors detracted from the Fund’s performance overall, with growth (analyst revisions), financial momentum, quality, and profitability signals generating mixed results. |

| • | | The Fund was hampered by stock selection in the industrials sector, most notably in Japan, while China was the largest country detractor due to stock picking in the health care, information technology, and utilities sectors. (For a complete list of holdings, refer to the Portfolio of Investments section of this report.) |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2016 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at prudentialfunds.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the Prudential QMA International Equity Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2016.

During the reporting period, the US economy experienced modest growth. Labor markets were healthy, and consumer confidence rose. The housing market brightened somewhat, as momentum continued for the new home market. The Federal Reserve kept interest rates unchanged at its September meeting, but pointed to the strong possibility of a rate hike in December. Internationally, concerns over Brexit—the term used to represent Britain’s decision to leave the European Union—remained in the spotlight.

Equity markets in the US were firmly in positive territory at the end of the reporting period, as US stocks posted strong gains. European stocks struggled earlier, but found some traction in the third quarter. Asian markets also advanced, and emerging markets rose sharply.

US fixed income markets experienced overall gains. High yield bonds posted very strong results. Corporate bonds and Treasuries also performed well. Accommodative monetary policy by central banks helped lift global bond markets.

Given the uncertainty in today’s investment environment, we believe that active professional portfolio management offers a potential advantage. Active managers often have the knowledge and flexibility to find the best investment opportunities in the most challenging markets.

Even so, it’s best if investment decisions are based on your long-term goals rather than on short-term market and economic developments. We also encourage you to work with an experienced financial advisor who can help you set goals, determine your tolerance for risk, build a diversified plan that’s right for you, and make adjustments when necessary.

By having Prudential Investments help you address your goals, you gain the advantage of asset managers that also manage money for many major corporations and pension funds around the world. That means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential QMA International Equity Fund

December 15, 2016

| | | | |

| Prudential QMA International Equity Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | |

| Cumulative Total Returns (Without Sales Charges) as of 10/31/16 | |

| | One Year (%) | | | Five Years (%) | | | | Ten Years (%) | |

| Class A | | –0.93 | | | 25.53 | | | | –3.58 | |

| Class B | | –1.55 | | | 21.24 | | | | –10.08 | |

| Class C | | –1.56 | | | 21.05 | | | | –10.21 | |

| Class Z | | –0.44 | | | 27.45 | | | | –0.89 | |

| MSCI All Country World Ex-US Index | | 0.22 | | | 19.55 | | | | 17.34 | |

| Lipper International Multi-Cap Core Funds Average | | –1.96 | | | 28.62 | | | | 14.46 | |

| | | | | | | | | | |

| Average Annual Total Returns (With Sales Charges) as of 9/30/16 | |

| | One Year (%) | | | Five Years (%) | | | | Ten Years (%) | |

| Class A | | 0.37 | | | 5.73 | | | | –0.46 | |

| Class B | | 0.35 | | | 6.02 | | | | –0.62 | |

| Class C | | 4.53 | | | 6.17 | | | | –0.62 | |

| Class Z | | 6.51 | | | 7.25 | | | | 0.36 | |

| MSCI All Country World Ex-US Index | | 9.26 | | | 6.04 | | | | 2.16 | |

| Lipper International Multi-Cap Core Funds Average | | 6.28 | | | 7.42 | | | | 1.78 | |

| | | | | | | | | | |

| Average Annual Total Returns (With Sales Charges) as of 10/31/16 | |

| | One Year (%) | | | Five Years (%) | | | | Ten Years (%) | |

| Class A | | –6.37 | | | 3.47 | | | | –0.93 | |

| Class B | | –6.43 | | | 3.75 | | | | –1.06 | |

| Class C | | –2.53 | | | 3.89 | | | | –1.07 | |

| Class Z | | –0.44 | | | 4.97 | | | | –0.09 | |

| | |

| 4 | | Visit our website at prudentialfunds.com |

| | | | | | |

| Average Annual Total Returns (Without Sales Charges) as of 10/31/16 |

| | One Year (%) | | Five Years (%) | | Ten Years (%) |

| Class A | | –0.93 | | 4.65 | | –0.36 |

| Class B | | –1.55 | | 3.93 | | –1.06 |

| Class C | | –1.56 | | 3.89 | | –1.07 |

| Class Z | | –0.44 | | 4.97 | | –0.09 |

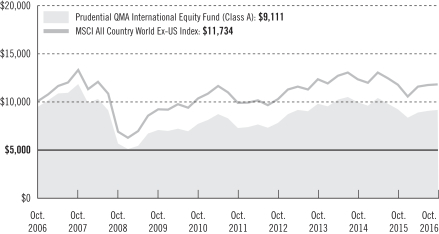

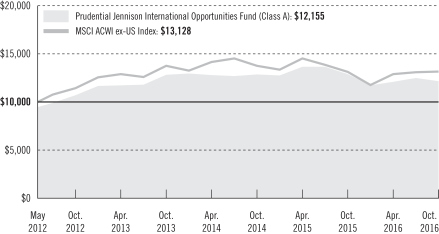

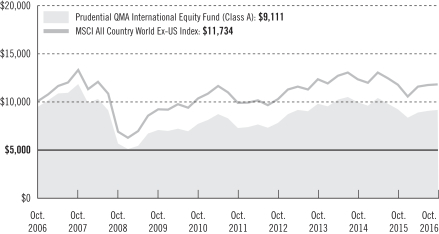

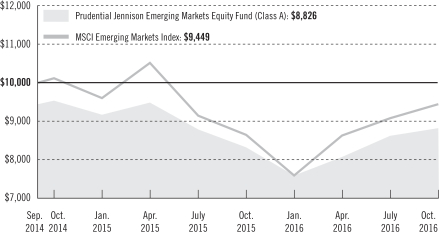

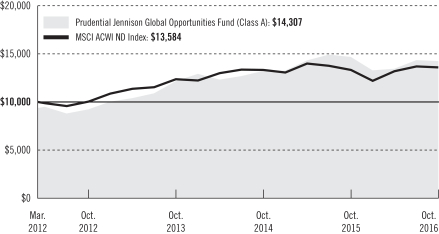

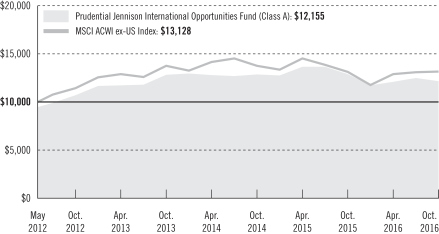

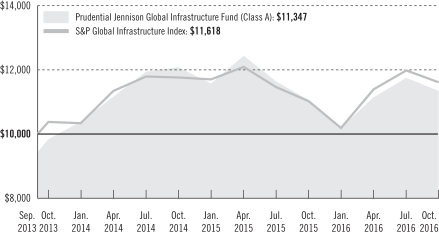

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential QMA International Equity Fund (Class A shares) with a similar investment in the MSCI All Country World Ex-US Index by portraying the initial account values at the beginning of the 10-year period for Class A shares (October 31, 2006) and the account values at the end of the current fiscal year (October 31, 2016) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

| | | | |

| Prudential QMA International Equity Fund | | | 5 | |

Your Fund’s Performance (continued)

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | Class A | | Class B* | | Class C | | Class Z |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase

price or net asset value at redemption) | | 1% on sales of $1 million or more made within 12 months of purchase | | 5% (Yr.1) 4% (Yr.2) 3% (Yr.3) 2% (Yr.4) 1% (Yr.5) 1% (Yr.6) 0% (Yr.7) | | 1% on sales made within 12 months of purchase | | None |

Annual distribution and service (12b-1) fees

(shown as a percentage of average daily net assets) | | .30% | | 1% | | 1% | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

MSCI All Country World Ex-US Index—The Morgan Stanley Capital International All Country World ex-US Index (MSCI ACWI ex-US Index) is an unmanaged free float-adjusted market-capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the US. The MSCI ACWI ex-US Index consists of 45 country indexes. The developed market country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The emerging market country indexes included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates.

| | |

| 6 | | Visit our website at prudentialfunds.com |

Lipper International Multi-Cap Core Funds Average—The Lipper International Multi-Cap Core Funds Average (Lipper Average) is based on the average return of all funds in the Lipper International Multi-Cap Core Funds category for the periods noted. Funds in the Lipper Average are funds that, by portfolio practice, invest in a variety of market-capitalization ranges without concentrating 75% of their equity assets in any one market-capitalization range over an extended period of time. International multi-cap core funds typically have above-average characteristics compared to the MSCI EAFE Index.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 10/31/16 (%) | |

Samsung Electronics Co. Ltd., Technology Hardware, Storage & Peripherals | | | 1.6 | |

| Roche Holding AG, Pharmaceuticals | | | 1.5 | |

| HSBC Holdings PLC, Banks | | | 1.5 | |

| British American Tobacco PLC, Tobacco | | | 1.2 | |

| BP PLC, Oil, Gas & Consumable Fuels | | | 1.1 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 10/31/16 (%) | |

Banks | | | 14.8 | |

| Pharmaceuticals | | | 7.5 | |

| Oil, Gas & Consumable Fuels | | | 6.7 | |

| Insurance | | | 4.1 | |

| Diversified Telecommunication Services | | | 4.0 | |

Industry weightings reflect only long-term investments and are subject to change.

| | | | |

| Prudential QMA International Equity Fund | | | 7 | |

Strategy and Performance Overview

How did the Fund perform?

The Prudential QMA International Equity Fund’s Class A shares returned –0.93% for the 12-month period ended October 31, 2016, lagging the 0.22% return of the MSCI All Country World Ex-US (MSCI ACWI Ex-US) Index (the Index) and outperforming the –1.96% decline of the Lipper International Multi-Cap Core Funds Average.

What were market conditions?

| • | | During the fourth quarter of 2015 when the reporting period began, investors generally focused on the plunge in oil prices and the condition of China’s economy and financial markets. Developed markets stocks advanced for the quarter overall, though European equities posted mixed results as the eurozone continued to face deep structural problems. In Japan, the economy appeared to be bouncing back from recession-like conditions seen in the middle of 2016. Performance varied among emerging markets countries, many of which rely on commodity exports. |

| • | | The first quarter of 2016 was a tale in two parts. At the beginning of the quarter, risk aversion increased amid deteriorating economic data in developed and emerging markets countries, a further drop in commodity prices, and heightened volatility in global financial markets. By March, investor sentiment had improved, commodity prices had regained some ground, and the number of negative economic surprises had diminished. Nevertheless, developed markets stocks posted a decline for the quarter as a whole. Emerging markets stocks generated a solid gain. |

| • | | During the second quarter, fears about the global economy receded in the face of considerable stimulus by China’s policymakers, stronger-than-anticipated first-quarter European economic growth, and signs that the Japanese economy was doing somewhat better than expected. In late June, the UK’s surprise vote to leave the European Union, commonly known as “Brexit,” increased market volatility. Although the Brexit decision raised considerable uncertainty, the macroeconomic fallout appeared to be manageable, if not limited. However, Switzerland, Spain, and Ireland have significant banking system exposure to the UK. Overall, developed markets stocks retreated during the quarter, while emerging markets stocks recorded a modestly positive return. |

| • | | In the third quarter, developed markets and emerging markets stocks gained ground. European stocks performed particularly well, led by Austria, Germany, and France. Countries in the Pacific region turned in mixed results, with positive performance in New Zealand, Hong Kong, Japan, and Australia. |

What worked?

| • | | During the reporting period, the Fund benefited from strong stock selection in the financials sector, with holdings in the banking industry contributing most positively to performance versus the Index. Investments in the capital markets industry and among |

| | |

| 8 | | Visit our website at prudentialfunds.com |

| | real estate investment trusts (REITs) also increased relative returns. Within the telecommunications services sector, the Fund’s overweight in Japan was advantageous. |

| • | | In terms of countries, Fund performance was strongest in Germany, largely because of effective stock selection in the consumer discretionary sector, driven by investments and an overweight in textiles, apparel & luxury goods, and holdings among automobile stocks. Positioning in Brazil, more specifically the Fund’s overweights in the financials and materials sectors, added to relative results. In addition, the Fund was helped by its exposure to Australia, primarily stock selection, and an overweight in the materials sector. |

What didn’t work?

| • | | When evaluating slower-growing stocks, QMA places a heavier emphasis on valuation factors, such as price-to-earnings ratios and dividend yield. For faster-growing stocks, QMA’s analyst revisions factor places a heavier weighting on information about earnings and sales. Quality is also considered important across the growth spectrum. This allows the Fund to potentially add value throughout the full range of slow- to fast-growing companies, while maintaining a core profile. |

| • | | During the period, valuation factors detracted from the Fund’s returns in developed markets. Growth, financial momentum and profitability, and quality factors generated mixed results, after having outperformed in the fourth quarter 2015. |

| • | | Valuation factors also detracted from the Fund’s performance in the emerging markets, especially at the beginning of 2016, although their effectiveness improved toward the end of the period. Growth, financial momentum and profitability, and quality factors provided mixed results. |

| • | | In terms of sectors, the Fund’s performance was weakest in industrials due to difficult stock selection in Japan and Spain, as well as an underweight position in Canada. Within energy, the Fund’s losses were led by stock selection and an underweight in Canada, followed an underweight position in Brazil and stock picking in Norway and Poland. In the information technology sector, the Fund was hurt by stock selection in China, Israel, and Taiwan. |

| • | | Among countries, China was the largest detractor from relative returns as effective stock selection in the financials sector was more than offset by weak stock picking in the health care, information technology, and utilities sectors. The Fund also underperformed in Canada because of difficult stock selection and underweight positions in the energy sector and metals & mining stocks. Another laggard was Japan where the Fund was hampered by stock choices in the industrials sector, an overweight in the banking industry, and selection among household durable names. |

| | | | |

| Prudential QMA International Equity Fund | | | 9 | |

Strategy and Performance Overview (continued)

The percentage points shown in the tables identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| Top Contributors (%) | | Top Detractors (%) |

| Fortescue Metals Group Ltd | | 0.51 | | Universal Health International Group Holding Ltd. | | –0.36 |

| Banco Santander (Brasil) SA | | 0.48 | | Mitsubishi UFJ Financial Group, Inc. | | –0.39 |

| adidas AG | | 0.49 | | Teva Pharmaceutical Industries Limited | | –0.33 |

| Itausa—Investimentos Itau SA Pfd | | 0.46 | | Abengoa S.A. Class B | | –0.20 |

| Evolution Mining Limited | | 0.29 | | Cia Energetica de Minas Gerais Cemig CMIG Pfd | | –0.25 |

Current outlook

| • | | QMA will continue to manage the Fund as a risk-controlled portfolio, using a bottom-up process that focuses on factors within four broad groups: valuation, growth (analyst revisions), financial momentum/profitability, and quality. |

| • | | All overweight and underweight positions in the Fund will be the result of the stock selection process and not a reflection of sentiment on any particular market segment. |

| | |

| 10 | | Visit our website at prudentialfunds.com |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2016, at the beginning of the period, and held through the six-month period ended October 31, 2016. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your

| | | | |

| Prudential QMA International Equity Fund | | | 11 | |

Fees and Expenses (continued)

Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential QMA

International

Equity Fund | | Beginning Account

Value

May 1, 2016 | | | Ending Account

Value

October 31, 2016 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,030.20 | | | | 1.62 | % | | $ | 8.27 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.99 | | | | 1.62 | % | | $ | 8.21 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 1,026.40 | | | | 2.32 | % | | $ | 11.82 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.47 | | | | 2.32 | % | | $ | 11.74 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,026.50 | | | | 2.32 | % | | $ | 11.82 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.47 | | | | 2.32 | % | | $ | 11.74 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,031.50 | | | | 1.32 | % | | $ | 6.74 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.50 | | | | 1.32 | % | | $ | 6.70 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2016, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2016 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 12 | | Visit our website at prudentialfunds.com |

The Fund’s annual expense ratios for the 12-month period ended October 31, 2016, are as follows:

| | | | |

| Class | | Gross Operating Expenses (%) | | Net Operating Expenses (%) |

| A | | 1.66 | | 1.66 |

| B | | 2.36 | | 2.36 |

| C | | 2.36 | | 2.36 |

| Z | | 1.36 | | 1.36 |

Net operating expenses shown above reflect any fee waivers and/or expense reimbursements. Additional information on Fund expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| | | | |

| Prudential QMA International Equity Fund | | | 13 | |

Portfolio of Investments

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

LONG-TERM INVESTMENTS 99.6% | | | | | | | | |

| | |

COMMON STOCKS 96.6% | | | | | | | | |

| | |

Australia 4.5% | | | | | | | | |

Aristocrat Leisure Ltd. | | | 72,001 | | | $ | 838,296 | |

Bluescope Steel Ltd. | | | 103,305 | | | | 612,870 | |

Coca-Cola Amatil Ltd. | | | 140,342 | | | | 1,016,747 | |

Commonwealth Bank of Australia | | | 2,158 | | | | 120,138 | |

Credit Corp. Group Ltd. | | | 26,723 | | | | 359,604 | |

Dexus Property Group, REIT | | | 237,196 | | | | 1,611,303 | |

Fortescue Metals Group Ltd. | | | 479,587 | | | | 2,012,647 | |

Goodman Group, REIT | | | 17,990 | | | | 92,730 | |

Macquarie Group Ltd. | | | 29,364 | | | | 1,775,036 | |

Oz Minerals Ltd. | | | 171,314 | | | | 875,302 | |

Perpetual Ltd. | | | 25,470 | | | | 874,582 | |

Regis Resources Ltd. | | | 239,066 | | | | 602,911 | |

Suncorp Group Ltd. | | | 18,750 | | | | 170,177 | |

Sydney Airport | | | 27,783 | | | | 132,074 | |

Transurban Group | | | 29,211 | | | | 230,490 | |

| | | | | | | | |

| | | | | | | 11,324,907 | |

| | |

Austria 1.2% | | | | | | | | |

Erste Group Bank AG | | | 3,509 | | | | 110,038 | |

Lenzing AG | | | 7,431 | | | | 968,485 | |

UNIQA Insurance Group AG | | | 109,793 | | | | 707,208 | |

voestalpine AG | | | 34,859 | | | | 1,234,923 | |

| | | | | | | | |

| | | | | | | 3,020,654 | |

| | |

Belgium 0.1% | | | | | | | | |

Anheuser-Busch InBev SA/NV | | | 1,473 | | | | 169,057 | |

| | |

Brazil 1.3% | | | | | | | | |

Banco Santander Brasil SA | | | 265,100 | | | | 2,188,404 | |

Smiles SA | | | 56,100 | | | | 1,026,391 | |

| | | | | | | | |

| | | | | | | 3,214,795 | |

| | |

Canada 5.5% | | | | | | | | |

Bank of Montreal | | | 35,200 | | | | 2,240,119 | |

Bank of Nova Scotia (The) | | | 16,500 | | | | 886,692 | |

Canadian National Railway Co. | | | 1,600 | | | | 100,583 | |

CCL Industries, Inc. (Class B Stock) | | | 600 | | | | 106,706 | |

CGI Group, Inc.* | | | 2,600 | | | | 123,497 | |

Genworth MI Canada, Inc.(a) | | | 33,000 | | | | 716,685 | |

Magna International, Inc. | | | 6,000 | | | | 246,343 | |

Metro, Inc. | | | 27,800 | | | | 859,307 | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 15 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Canada (cont’d.) | | | | | | | | |

Open Text Corp. | | | 22,200 | | | $ | 1,378,376 | |

Royal Bank of Canada | | | 42,400 | | | | 2,649,012 | |

Toronto-Dominion Bank (The) | | | 62,800 | | | | 2,849,480 | |

TransCanada Corp. | | | 23,800 | | | | 1,077,415 | |

Turquoise Hill Resources Ltd.* | | | 259,500 | | | | 804,831 | |

| | | | | | | | |

| | | | | | | 14,039,046 | |

| | |

Chile 0.6% | | | | | | | | |

Cencosud SA | | | 389,072 | | | | 1,268,376 | |

Engie Energia Chile SA | | | 200,764 | | | | 356,213 | |

| | | | | | | | |

| | | | | | | 1,624,589 | |

| | |

China 6.0% | | | | | | | | |

Alibaba Group Holding Ltd., ADR*(a) | | | 7,700 | | | | 783,013 | |

Bank of Communications Co. Ltd. (Class H Stock) | | | 2,135,000 | | | | 1,622,757 | |

BYD Electronic International Co. Ltd. | | | 1,092,500 | | | | 859,563 | |

China CITIC Bank Corp. Ltd. (Class H Stock) | | | 1,083,000 | | | | 698,461 | |

China Construction Bank Corp. (Class H Stock) | | | 1,266,000 | | | | 924,493 | |

China Everbright Bank Co. Ltd. (Class H Stock) | | | 744,000 | | | | 339,209 | |

China Lumena New Materials Corp.*(b)(c) | | | 5,060,000 | | | | 6,524 | |

China Railway Group Ltd. (Class H Stock) | | | 129,000 | | | | 99,439 | |

China Telecom Corp. Ltd. (Class H Stock) | | | 792,000 | | | | 408,326 | |

Citic Ltd. | | | 66,000 | | | | 94,708 | |

Guangzhou Automobile Group Co. Ltd. | | | 250,000 | | | | 301,903 | |

Guangzhou R&F Properties Co. Ltd. | | | 802,400 | | | | 1,130,850 | |

Huadian Power International Corp. Ltd. (Class H Stock) | | | 596,000 | | | | 255,441 | |

Huaneng Power International, Inc. (Class H Stock) | | | 1,452,000 | | | | 892,514 | |

JinkoSolar Holding Co. Ltd., ADR*(a) | | | 10,200 | | | | 157,182 | |

Kaisa Group Holdings Ltd.*(a)(b) | | | 1,496,000 | | | | — | |

NetEase, Inc., ADR | | | 1,200 | | | | 308,388 | |

Ping An Insurance Group Co. of China Ltd. (Class H Stock) | | | 245,500 | | | | 1,292,194 | |

Powerlong Real Estate Holdings Ltd. | | | 543,000 | | | | 184,288 | |

Shanghai Pharmaceuticals Holding Co. Ltd. (Class H Stock) | | | 50,500 | | | | 129,953 | |

Sinopec Shanghai Petrochemical Co. Ltd. (Class H Stock) | | | 1,692,000 | | | | 862,503 | |

Tencent Holdings Ltd. | | | 106,000 | | | | 2,809,248 | |

Tianneng Power International Ltd. | | | 266,000 | | | | 240,120 | |

Xinyi Solar Holdings Ltd.(a) | | | 2,064,000 | | | | 764,622 | |

| | | | | | | | |

| | | | | | | 15,165,699 | |

| | |

Colombia 0.3% | | | | | | | | |

Almacenes Exito SA | | | 160,984 | | | | 803,105 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Denmark 1.1% | | | | | | | | |

Novo Nordisk A/S (Class B Stock) | | | 25,422 | | | $ | 905,672 | |

Vestas Wind Systems A/S | | | 25,106 | | | | 2,011,390 | |

| | | | | | | | |

| | | | | | | 2,917,062 | |

| | |

Faroe Islands 0.4% | | | | | | | | |

Bakkafrost P/F | | | 22,630 | | | | 948,814 | |

| | |

Finland 1.7% | | | | | | | | |

Kesko OYJ (Class B Stock) | | | 3,734 | | | | 185,543 | |

Kone OYJ (Class B Stock) | | | 29,832 | | | | 1,372,627 | |

Neste OYJ | | | 2,394 | | | | 103,283 | |

Sponda OYJ | | | 103,438 | | | | 489,725 | |

UPM-Kymmene OYJ | | | 91,926 | | | | 2,138,348 | |

| | | | | | | | |

| | | | | | | 4,289,526 | |

| | |

France 6.5% | | | | | | | | |

Atos SE | | | 1,308 | | | | 135,736 | |

AXA SA | | | 99,025 | | | | 2,234,244 | |

BNP Paribas SA | | | 41,652 | | | | 2,415,131 | |

Orange SA | | | 15,834 | | | | 249,128 | |

Peugeot SA* | | | 92,736 | | | | 1,388,729 | |

Renault SA | | | 8,180 | | | | 711,351 | |

Safran SA | | | 4,517 | | | | 310,822 | |

Sanofi | | | 24,837 | | | | 1,932,795 | |

SEB SA | | | 4,522 | | | | 665,530 | |

Societe Generale SA | | | 48,169 | | | | 1,878,961 | |

Thales SA | | | 1,598 | | | | 150,349 | |

Total SA | | | 46,494 | | | | 2,227,301 | |

Valeo SA | | | 29,094 | | | | 1,678,873 | |

Vinci SA | | | 7,206 | | | | 521,858 | |

| | | | | | | | |

| | | | | | | 16,500,808 | |

| | |

Germany 5.1% | | | | | | | | |

Aareal Bank AG | | | 27,434 | | | | 992,297 | |

adidas AG | | | 12,936 | | | | 2,125,317 | |

Allianz SE | | | 17,794 | | | | 2,777,732 | |

Bayer AG | | | 24,610 | | | | 2,443,531 | |

Deutsche Post AG | | | 13,962 | | | | 432,976 | |

Deutsche Telekom AG | | | 48,567 | | | | 792,385 | |

Evonik Industries AG | | | 3,289 | | | | 103,000 | |

Grammer AG | | | 2,455 | | | | 140,541 | |

Henkel AG & Co. KGaA | | | 2,673 | | | | 294,519 | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 17 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Germany (cont’d.) | | | | | | | | |

Siemens AG | | | 21,942 | | | $ | 2,493,005 | |

Sixt SE | | | 4,092 | | | | 248,306 | |

| | | | | | | | |

| | | | | | | 12,843,609 | |

| | |

Greece 0.6% | | | | | | | | |

JUMBO SA | | | 73,432 | | | | 1,043,498 | |

Motor Oil Hellas Corinth Refineries SA | | | 34,248 | | | | 410,087 | |

| | | | | | | | |

| | | | | | | 1,453,585 | |

| | |

Hong Kong 3.8% | | | | | | | | |

AIA Group Ltd. | | | 122,200 | | | | 768,761 | |

BOC Hong Kong Holdings Ltd. | | | 431,000 | | | | 1,536,196 | |

China High Speed Transmission Equipment Group Co. Ltd. | | | 869,000 | | | | 900,719 | |

Galaxy Entertainment Group Ltd. | | | 402 | | | | 1,646 | |

Henderson Land Development Co. Ltd. | | | 232,100 | | | | 1,372,924 | |

Kingboard Chemical Holdings Ltd. | | | 67,000 | | | | 198,055 | |

Link REIT (The), REIT | | | 202,000 | | | | 1,437,015 | |

Skyworth Digital Holdings Ltd. | | | 1,132,000 | | | | 730,674 | |

Sun Hung Kai Properties Ltd. | | | 12,000 | | | | 178,694 | |

WH Group Ltd., 144A | | | 1,739,500 | | | | 1,408,815 | |

Wheelock & Co. Ltd. | | | 183,000 | | | | 1,126,202 | |

| | | | | | | | |

| | | | | | | 9,659,701 | |

| | |

Hungary 0.3% | | | | | | | | |

Magyar Telekom Telecommunications PLC | | | 425,746 | | | | 703,915 | |

| | |

India 1.5% | | | | | | | | |

Power Finance Corp. Ltd. | | | 720,476 | | | | 1,345,346 | |

Reliance Industries Ltd., GDR, 144A | | | 36,090 | | | | 1,144,053 | |

Reliance Infrastructure Ltd., GDR | | | 5,869 | | | | 143,497 | |

Rural Electrification Corp. Ltd. | | | 485,226 | | | | 980,647 | |

Tata Motors Ltd., ADR | | | 7,700 | | | | 303,457 | |

| | | | | | | | |

| | | | | | | 3,917,000 | |

| | |

Indonesia 0.4% | | | | | | | | |

Gudang Garam Tbk PT | | | 17,100 | | | | 88,971 | |

Telekomunikasi Indonesia Persero Tbk PT | | | 3,189,400 | | | | 1,029,774 | |

| | | | | | | | |

| | | | | | | 1,118,745 | |

| | |

Ireland 0.3% | | | | | | | | |

Paddy Power Betfair PLC | | | 6,590 | | | | 682,657 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Israel 0.7% | | | | | | | | |

Teva Pharmaceutical Industries Ltd. | | | 40,891 | | | $ | 1,707,844 | |

| | |

Italy 1.3% | | | | | | | | |

Atlantia SpA | | | 6,199 | | | | 151,777 | |

Enel SpA | | | 110,951 | | | | 477,018 | |

Intesa Sanpaolo SpA | | | 213,947 | | | | 496,075 | |

Intesa Sanpaolo SpA-RSP | | | 274,305 | | | | 593,887 | |

Recordati SpA | | | 6,196 | | | | 175,217 | |

Telecom Italia SpA-RSP | | | 1,948,690 | | | | 1,383,282 | |

| | | | | | | | |

| | | | | | | 3,277,256 | |

| | |

Japan 16.3% | | | | | | | | |

ANA Holdings, Inc. | | | 49,000 | | | | 137,630 | |

Astellas Pharma, Inc. | | | 123,100 | | | | 1,827,033 | |

Bandai Namco Holdings, Inc. | | | 5,600 | | | | 167,754 | |

Central Japan Railway Co. | | | 9,800 | | | | 1,666,453 | |

Chubu Electric Power Co., Inc. | | | 8,800 | | | | 129,548 | |

Daiichi Sankyo Co. Ltd. | | | 63,000 | | | | 1,513,842 | |

Daiwa House Industry Co. Ltd. | | | 23,300 | | | | 639,505 | |

East Japan Railway Co. | | | 4,000 | | | | 352,114 | |

Fuji Heavy Industries Ltd. | | | 32,400 | | | | 1,266,079 | |

Fujitsu General Ltd. | | | 7,000 | | | | 160,627 | |

Iida Group Holdings Co. Ltd. | | | 64,600 | | | | 1,248,686 | |

ITOCHU Corp. | | | 125,100 | | | | 1,579,850 | |

Japan Tobacco, Inc. | | | 55,900 | | | | 2,125,325 | |

Kajima Corp. | | | 194,000 | | | | 1,308,248 | |

Kao Corp. | | | 14,500 | | | | 746,120 | |

KDDI Corp. | | | 81,900 | | | | 2,489,201 | |

Koito Manufacturing Co. Ltd. | | | 14,800 | | | | 777,028 | |

Konami Holdings Corp. | | | 30,500 | | | | 1,204,518 | |

Matsumotokiyoshi Holdings Co. Ltd. | | | 16,200 | | | | 834,597 | |

Medipal Holdings Corp. | | | 74,900 | | | | 1,279,757 | |

Mitsubishi Corp. | | | 21,600 | | | | 470,123 | |

Mitsui & Co. Ltd. | | | 70,200 | | | | 972,622 | |

Nippon Telegraph & Telephone Corp. | | | 47,484 | | | | 2,105,291 | |

Nissan Motor Co. Ltd. | | | 171,300 | | | | 1,742,547 | |

Nitori Holdings Co. Ltd. | | | 5,200 | | | | 621,150 | |

North Pacific Bank Ltd. | | | 179,400 | | | | 669,053 | |

NTT DOCOMO, Inc. | | | 15,100 | | | | 379,221 | |

Obayashi Corp. | | | 127,300 | | | | 1,226,308 | |

ORIX Corp. | | | 125,400 | | | | 1,987,139 | |

Penta-ocean Construction Co. Ltd. | | | 52,600 | | | | 313,451 | |

Screen Holdings Co. Ltd. | | | 14,000 | | | | 957,732 | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 19 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Japan (cont’d.) | | | | | | | | |

Shimizu Corp. | | | 144,000 | | | $ | 1,279,822 | |

Sumitomo Forestry Co. Ltd. | | | 59,800 | | | | 833,029 | |

Sumitomo Mitsui Financial Group, Inc. | | | 55,700 | | | | 1,931,213 | |

Suzuki Motor Corp. | | | 42,600 | | | | 1,518,959 | |

Taisei Corp. | | | 183,000 | | | | 1,371,594 | |

TDK Corp. | | | 1,700 | | | | 117,377 | |

Tokyo Electron Ltd. | | | 3,200 | | | | 288,656 | |

Tosoh Corp. | | | 47,000 | | | | 306,934 | |

Toyota Motor Corp. | | | 16,033 | | | | 930,022 | |

| | | | | | | | |

| | | | | | | 41,476,158 | |

| | |

Malaysia 0.2% | | | | | | | | |

Padini Holdings Bhd | | | 222,100 | | | | 149,784 | |

Unisem M Bhd | | | 684,200 | | | | 415,400 | |

| | | | | | | | |

| | | | | | | 565,184 | |

| | |

Mexico 0.5% | | | | | | | | |

Fresnillo PLC | | | 5,412 | | | | 108,885 | |

Grupo Aeroportuario Del Centro Norte SAB de CV | | | 141,900 | | | | 828,082 | |

Industrias Bachoco SAB de CV | | | 62,300 | | | | 275,292 | |

| | | | | | | | |

| | | | | | | 1,212,259 | |

| | |

Netherlands 2.2% | | | | | | | | |

ING Groep NV | | | 163,321 | | | | 2,143,928 | |

Royal Dutch Shell PLC (Class A Stock) | | | 63,388 | | | | 1,578,814 | |

Royal Dutch Shell PLC (Class B Stock) | | | 61,779 | | | | 1,593,442 | |

Steinhoff International Holdings NV | | | 24,079 | | | | 129,898 | |

Wolters Kluwer NV | | | 2,543 | | | | 98,339 | |

| | | | | | | | |

| | | | | | | 5,544,421 | |

| | |

New Zealand 0.5% | | | | | | | | |

Auckland International Airport Ltd. | | | 196,817 | | | | 926,920 | |

Spark New Zealand Ltd. | | | 49,465 | | | | 129,369 | |

Xero Ltd.* | | | 18,667 | | | | 236,855 | |

| | | | | | | | |

| | | | | | | 1,293,144 | |

| | |

Norway 0.5% | | | | | | | | |

Austevoll Seafood ASA | | | 111,968 | | | | 1,009,506 | |

Marine Harvest ASA | | | 5,868 | | | | 106,482 | |

Yara International ASA | | | 2,796 | | | | 98,767 | |

| | | | | | | | |

| | | | | | | 1,214,755 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Poland 0.8% | | | | | | | | |

Bank Zachodni WBK SA | | | 5,372 | | | $ | 434,064 | |

Ciech SA | | | 20,036 | | | | 326,777 | |

PGE Polska Grupa Energetyczna SA | | | 489,259 | | | | 1,281,907 | |

Polski Koncern Naftowy Orlen SA | | | 6,998 | | | | 138,647 | |

| | | | | | | | |

| | | | | | | 2,181,395 | |

| | |

Portugal 1.0% | | | | | | | | |

Altri SGPS SA | | | 62,920 | | | | 219,243 | |

Galp Energia SGPS SA | | | 103,943 | | | | 1,409,295 | |

Sonae SGPS SA | | | 1,185,540 | | | | 942,568 | |

| | | | | | | | |

| | | | | | | 2,571,106 | |

| | |

Russia 0.9% | | | | | | | | |

Gazprom PAO, ADR | | | 141,081 | | | | 609,470 | |

Lukoil PJSC, ADR | | | 14,482 | | | | 705,997 | |

Magnit PJSC, GDR, RegS | | | 4,245 | | | | 168,484 | |

MMC Norilsk Nickel PJSC, ADR | | | 7,332 | | | | 110,567 | |

Novatek OAO, GDR, RegS | | | 1,343 | | | | 143,567 | |

Rosneft OAO, GDR, RegS | | | 68,985 | | | | 375,968 | |

Surgutneftegas OAO, ADR | | | 23,126 | | | | 99,396 | |

| | | | | | | | |

| | | | | | | 2,213,449 | |

| | |

Singapore 0.1% | | | | | | | | |

DBS Group Holdings Ltd. | | | 16,000 | | | | 172,459 | |

| | |

South Africa 1.4% | | | | | | | | |

Barclays Africa Group Ltd. | | | 50,620 | | | | 587,417 | |

Nedbank Group Ltd. | | | 13,650 | | | | 223,437 | |

Redefine Properties Ltd., REIT | | | 116,473 | | | | 99,665 | |

Standard Bank Group Ltd. | | | 175,413 | | | | 1,862,060 | |

Telkom SA SOC Ltd. | | | 153,073 | | | | 705,589 | |

| | | | | | | | |

| | | | | | | 3,478,168 | |

| | |

South Korea 4.2% | | | | | | | | |

Korea Electric Power Corp. | | | 36,430 | | | | 1,575,986 | |

KT Corp. | | | 53,617 | | | | 1,512,520 | |

LG Uplus Corp. | | | 83,533 | | | | 860,909 | |

Lotte Chemical Corp. | | | 5,180 | | | | 1,301,488 | |

Samsung Electronics Co. Ltd. | | | 2,740 | | | | 3,919,100 | |

Shinhan Financial Group Co. Ltd. | | | 2,941 | | | | 112,505 | |

Sk Holdings Co. Ltd. | | | 546 | | | | 106,514 | |

SK Innovation Co. Ltd. | | | 9,052 | | | | 1,191,554 | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 21 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

South Korea (cont’d.) | | | | | | | | |

Tongyang Life Insurance Co. Ltd. | | | 9,680 | | | $ | 101,415 | |

| | | | | | | | |

| | | | | | | 10,681,991 | |

| | |

Spain 1.6% | | | | | | | | |

Amadeus IT Holding SA | | | 21,741 | | | | 1,023,219 | |

Gamesa Corp. Tecnologica SA | | | 37,077 | | | | 856,054 | |

Industria de Diseno Textil SA | | | 52,851 | | | | 1,844,107 | |

Telefonica SA | | | 33,273 | | | | 338,075 | |

| | | | | | | | |

| | | | | | | 4,061,455 | |

| | |

Sweden 1.4% | | | | | | | | |

Atlas Copco AB (Class A Stock) | | | 55,274 | | | | 1,619,257 | |

Boliden AB | | | 27,230 | | | | 631,095 | |

Electrolux AB (Class B Stock) | | | 3,866 | | | | 91,502 | |

ICA Gruppen AB(a) | | | 34,055 | | | | 1,057,227 | |

Svenska Cellulosa AB SCA (Class B Stock) | | | 10,839 | | | | 306,991 | |

| | | | | | | | |

| | | | | | | 3,706,072 | |

| | |

Switzerland 4.9% | | | | | | | | |

ABB Ltd. | | | 93,380 | | | | 1,926,470 | |

Nestle SA | | | 31,154 | | | | 2,259,098 | |

Novartis AG | | | 34,554 | | | | 2,452,214 | |

Roche Holding AG | | | 16,716 | | | | 3,839,359 | |

Swiss Re AG | | | 21,260 | | | | 1,973,178 | |

| | | | | | | | |

| | | | | | | 12,450,319 | |

| | |

Taiwan 3.9% | | | | | | | | |

Cheng Shin Rubber Industry Co. Ltd. | | | 324,000 | | | | 659,200 | |

Formosa Chemicals & Fibre Corp. | | | 422,000 | | | | 1,252,921 | |

Formosa Petrochemical Corp. | | | 474,000 | | | | 1,582,627 | |

Foxconn Technology Co. Ltd. | | | 567,620 | | | | 1,645,424 | |

Gourmet Master Co. Ltd. | | | 70,350 | | | | 631,320 | |

Grand Pacific Petrochemical | | | 1,041,000 | | | | 580,297 | |

Largan Precision Co. Ltd. | | | 13,000 | | | | 1,533,677 | |

Lite-On Technology Corp. | | | 250,242 | | | | 358,747 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 98,000 | | | | 588,133 | |

Tripod Technology Corp. | | | 410,000 | | | | 970,599 | |

| | | | | | | | |

| | | | | | | 9,802,945 | |

| | |

Thailand 0.5% | | | | | | | | |

Airports of Thailand PCL | | | 9,100 | | | | 99,002 | |

Charoen Pokphand Foods PCL | | | 294,100 | | | | 264,493 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Thailand (cont’d.) | | | | | | | | |

Kiatnakin Bank PCL | | | 342,300 | | | $ | 571,669 | |

SPCG PCL | | | 540,000 | | | | 314,400 | |

| | | | | | | | |

| | | | | | | 1,249,564 | |

| | |

Turkey 1.2% | | | | | | | | |

Aygaz AS | | | 176,711 | | | | 624,468 | |

Eregli Demir VE Celik Fabrikalari TAS | | | 600,040 | | | | 815,876 | |

Koza Altin Isletmeleri AS*(a) | | | 155,243 | | | | 884,349 | |

Petkim Petrokimya Holding AS | | | 109,748 | | | | 149,120 | |

Trakya Cam Sanayii AS | | | 866,255 | | | | 713,956 | |

| | | | | | | | |

| | | | | | | 3,187,769 | |

| | |

United Kingdom 10.6% | | | | | | | | |

3i Group PLC | | | 104,032 | | | | 852,775 | |

AstraZeneca PLC | | | 3,019 | | | | 169,050 | |

BP PLC | | | 490,546 | | | | 2,899,976 | |

British American Tobacco PLC | | | 51,029 | | | | 2,924,635 | |

Coca-Cola European Partners PLC | | | 2,645 | | | | 101,794 | |

Compass Group PLC | | | 24,320 | | | | 440,055 | |

DCC PLC | | | 1,259 | | | | 102,432 | |

Diageo PLC | | | 59,123 | | | | 1,573,656 | |

GlaxoSmithKline PLC | | | 96,972 | | | | 1,915,624 | |

HSBC Holdings PLC | | | 508,421 | | | | 3,829,003 | |

Imperial Brands PLC | | | 46,542 | | | | 2,251,332 | |

J. Sainsbury PLC | | | 357,244 | | | | 1,095,330 | |

JD Sports Fashion PLC | | | 46,830 | | | | 870,684 | |

Legal & General Group PLC | | | 135,323 | | | | 346,192 | |

National Grid PLC | | | 106,789 | | | | 1,389,093 | |

Reckitt Benckiser Group PLC | | | 10,885 | | | | 973,782 | |

RELX PLC | | | 67,731 | | | | 1,209,013 | |

Safestore Holdings PLC, REIT | | | 26,109 | | | | 114,600 | |

Unilever NV, CVA | | | 23,956 | | | | 1,001,988 | |

Worldpay Group PLC, 144A | | | 361,287 | | | | 1,255,633 | |

WPP PLC | | | 72,931 | | | | 1,583,561 | |

| | | | | | | | |

| | | | | | | 26,900,208 | |

| | |

United States 0.7% | | | | | | | | |

lululemon athletica, Inc.* | | | 48 | | | | 2,748 | |

Mobileye NV* | | | 30,700 | | | | 1,141,426 | |

Shire PLC | | | 11,632 | | | | 656,777 | |

| | | | | | | | |

| | | | | | | 1,800,951 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(cost $221,215,542) | | | | | | $ | 245,146,146 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 23 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

EXCHANGE TRADED FUNDS 0.2% | | | | | | | | |

iShares MSCI EAFE Index Fund | | | 7,800 | | | $ | 450,996 | |

iShares MSCI Emerging Markets Index Fund | | | 3,200 | | | | 118,848 | |

| | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS

(cost $491,546) | | | | | | | 569,844 | |

| | | | | | | | |

| | |

PREFERRED STOCKS 2.8% | | | | | | | | |

| | |

Brazil 1.9% | | | | | | | | |

Banco Bradesco SA (PRFC) | | | 215,210 | | | | 2,256,604 | |

Braskem SA (PRFC) | | | 212,700 | | | | 1,888,445 | |

Itausa—Investimentos Itau SA (PRFC) | | | 216,770 | | | | 639,716 | |

| | | | | | | | |

| | | | | | | 4,784,765 | |

| | |

Colombia 0.1% | | | | | | | | |

Grupo Aval Acciones y Valores SA (PRFC) | | | 691,621 | | | | 285,225 | |

| | |

Germany 0.7% | | | | | | | | |

Volkswagen AG (PRFC) | | | 13,649 | | | | 1,881,872 | |

| | |

South Korea 0.1% | | | | | | | | |

Samsung Electronics Co. Ltd. (PRFC) | | | 131 | | | | 150,620 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(cost $5,119,437) | | | | | | | 7,102,482 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $226,826,525) | | | | | | | 252,818,472 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 1.9% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

Prudential Investment Portfolios 2 - Prudential Core Ultra Short Bond Fund(d) | | | 134 | | | | 134 | |

Prudential Investment Portfolios 2 - Prudential Institutional Money Market Fund

(cost $4,766,513; includes $4,763,332 of cash collateral for securities on loan)(d)(e) | | | 4,766,249 | | | | 4,767,202 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $4,766,647)(Note 3) | | | | | | | 4,767,336 | |

| | | | | | | | |

TOTAL INVESTMENTS 101.5%

(cost $231,593,172)(Note 5) | | | | | | | 257,585,808 | |

Liabilities in excess of other assets (1.5)% | | | | | | | (3,819,096 | ) |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 253,766,712 | |

| | | | | | | | |

The following abbreviations are used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

See Notes to Financial Statements.

RegS—Regulation S. Security was purchased pursuant to Regulation S and may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

ADR—American Depositary Receipt

CVA—Certificate Van Aandelen (Bearer)

EAFE—Europe, Australasia and Far East

GDR—Global Depositary Receipt

MSCI—Morgan Stanley Capital International

PRFC—Preference Shares

REIT—Real Estate Investment Trust

RSP—Risparimo (Savings Shares)

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $4,177,833; cash collateral of $4,763,332 (included in liabilities) was received with which the Series purchased highly liquid short-term investments. Securities on loan are subject to contractual netting arrangements. |

| (b) | Indicates a Level 3 security. The aggregate value of Level 3 securities is $6,524 and 0.0% of net assets. |

| (c) | Indicates a security or securities that have been deemed illiquid. (unaudited) |

| (d) | Prudential Investments LLC, the manager of the Fund, also serves as manager of the Prudential Investment Portfolios 2 - Prudential Core Ultra Short Bond Fund and the Prudential Investment Portfolios 2 - Prudential Institutional Money Market Fund. |

| (e) | Represents security purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

Various inputs are used in determining the value of the Series’ investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2016 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 11,324,907 | | | $ | — | |

Austria | | | — | | | | 3,020,654 | | | | — | |

Belgium | | | 169,057 | | | | — | | | | — | |

Brazil | | | 3,214,795 | | | | — | | | | — | |

Canada | | | 14,039,046 | | | | — | | | | — | |

Chile | | | 1,624,589 | | | | — | | | | — | |

China | | | 1,248,583 | | | | 13,910,592 | | | | 6,524 | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 25 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Common Stocks (continued) | | | | | | | | | | | | |

Colombia | | $ | 803,105 | | | $ | — | | | $ | — | |

Denmark | | | — | | | | 2,917,062 | | | | — | |

Faroe Islands | | | — | | | | 948,814 | | | | — | |

Finland | | | — | | | | 4,289,526 | | | | — | |

France | | | — | | | | 16,500,808 | | | | — | |

Germany | | | — | | | | 12,843,609 | | | | — | |

Greece | | | — | | | | 1,453,585 | | | | — | |

Hong Kong | | | — | | | | 9,659,701 | | | | — | |

Hungary | | | — | | | | 703,915 | | | | — | |

India | | | 1,591,007 | | | | 2,325,993 | | | | — | |

Indonesia | | | — | | | | 1,118,745 | | | | — | |

Ireland | | | — | | | | 682,657 | | | | — | |

Israel | | | — | | | | 1,707,844 | | | | — | |

Italy | | | — | | | | 3,277,256 | | | | — | |

Japan | | | — | | | | 41,476,158 | | | | — | |

Malaysia | | | — | | | | 565,184 | | | | — | |

Mexico | | | 1,103,374 | | | | 108,885 | | | | — | |

Netherlands | | | — | | | | 5,544,421 | | | | — | |

New Zealand | | | — | | | | 1,293,144 | | | | — | |

Norway | | | — | | | | 1,214,755 | | | | — | |

Poland | | | — | | | | 2,181,395 | | | | — | |

Portugal | | | — | | | | 2,571,106 | | | | — | |

Russia | | | 2,213,449 | | | | — | | | | — | |

Singapore | | | — | | | | 172,459 | | | | — | |

South Africa | | | — | | | | 3,478,168 | | | | — | |

South Korea | | | — | | | | 10,681,991 | | | | — | |

Spain | | | — | | | | 4,061,455 | | | | — | |

Sweden | | | — | | | | 3,706,072 | | | | — | |

Switzerland | | | — | | | | 12,450,319 | | | | — | |

Taiwan | | | — | | | | 9,802,945 | | | | — | |

Thailand | | | — | | | | 1,249,564 | | | | — | |

Turkey | | | — | | | | 3,187,769 | | | | — | |

United Kingdom | | | — | | | | 26,900,208 | | | | — | |

United States | | | 1,144,174 | | | | 656,777 | | | | — | |

Exchange Traded Funds | | | | | | | | | | | | |

United States | | | 569,844 | | | | — | | | | — | |

Preferred Stocks | | | | | | | | | | | | |

Brazil | | | 4,784,765 | | | | — | | | | — | |

Colombia | | | 285,225 | | | | — | | | | — | |

Germany | | | — | | | | 1,881,872 | | | | — | |

South Korea | | | — | | | | 150,620 | | | | — | |

Affiliated Mutual Funds | | | 4,767,336 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 37,558,349 | | | $ | 220,020,935 | | | $ | 6,524 | |

| | | | | | | | | | | | |

During the period, there were no Level transfers between Level 1 and Level 2 to report.

See Notes to Financial Statements.

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2016 were as follows (unaudited):

| | | | |

Banks | | | 14.8 | % |

Pharmaceuticals | | | 7.5 | |

Oil, Gas & Consumable Fuels | | | 6.7 | |

Insurance | | | 4.1 | |

Diversified Telecommunication Services | | | 4.0 | |

Automobiles | | | 3.9 | |

Metals & Mining | | | 3.4 | |

Chemicals | | | 2.9 | |

Tobacco | | | 2.9 | |

Food & Staples Retailing | | | 2.8 | |

Food Products | | | 2.6 | |

Technology Hardware, Storage & Peripherals | | | 2.5 | |

Construction & Engineering | | | 2.3 | |

Electrical Equipment | | | 2.2 | |

Real Estate Management & Development | | | 2.0 | |

Affiliated Mutual Funds (including 1.9% of collateral for securities on loan) | | | 1.9 | |

Specialty Retail | | | 1.7 | |

Diversified Financial Services | | | 1.7 | |

Electric Utilities | | | 1.6 | |

Household Durables | | | 1.6 | |

Auto Components | | | 1.6 | |

Software | | | 1.5 | |

Internet Software & Services | | | 1.5 | |

Capital Markets | | | 1.4 | |

Equity Real Estate Investment Trusts (REITs) | | | 1.4 | |

Semiconductors & Semiconductor Equipment | | | 1.2 | |

Trading Companies & Distributors | | | 1.2 | |

Machinery | | | 1.1 | |

Wireless Telecommunication Services | | | 1.1 | |

Beverages | | | 1.1 | |

Electronic Equipment, Instruments & Components | | | 1.1 | % |

Hotels, Restaurants & Leisure | | | 1.1 | |

IT Services | | | 1.1 | |

Industrial Conglomerates | | | 1.0 | |

Media | | | 1.0 | |

Transportation Infrastructure | | | 1.0 | |

Paper & Forest Products | | | 1.0 | |

Road & Rail | | | 0.9 | |

Textiles, Apparel & Luxury Goods | | | 0.8 | |

Personal Products | | | 0.7 | |

Thrifts & Mortgage Finance | | | 0.7 | |

Household Products | | | 0.6 | |

Independent Power & Renewable Electricity Producers | | | 0.6 | |

Health Care Providers & Services | | | 0.6 | |

Multi-Utilities | | | 0.6 | |

Professional Services | | | 0.5 | |

Communications Equipment | | | 0.3 | |

Building Products | | | 0.3 | |

Biotechnology | | | 0.3 | |

Gas Utilities | | | 0.2 | |

Exchange Traded Fund | | | 0.2 | |

Aerospace & Defense | | | 0.2 | |

Air Freight & Logistics | | | 0.2 | |

Consumer Finance | | | 0.1 | |

Leisure Products | | | 0.1 | |

Airlines | | | 0.1 | |

| | | | |

| | | 101.5 | |

Liabilities in excess of other assets | | | (1.5 | ) |

| | | | |

| | | 100.0 | % |

The Series invested in various derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity risk.

The effect of derivative instruments on the Series financial position and financial performance as reflected in Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

The Series did not hold any derivative instruments as of October 31, 2016, accordingly, no derivative positions were presented in the Statement of Assets and Liabilities.

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 27 | |

Portfolio of Investments (continued)

as of October 31, 2016

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2016 are as follows:

| | | | |

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Rights(1) | |

Equity contracts | | $ | 48,338 | |

| | | | |

|

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Rights(2) | |

Equity contracts | | $ | — | |

| | | | |

| (1) | Included in net realized gain (loss) on investment transactions in the Statement of Operations. |

| (2) | Included in net change in unrealized appreciation (depreciation) on investments in the Statement of Operations. |

See Notes to Financial Statements.

This Page Intentionally Left Blank

Statement of Assets & Liabilities

as of October 31, 2016

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $4,177,833: | | | | |

Unaffiliated investments (cost $226,826,525) | | $ | 252,818,472 | |

Affiliated investments (cost $4,766,647) | | | 4,767,336 | |

Foreign currency, at value (cost $89,541) | | | 89,209 | |

Tax reclaim receivable | | | 865,046 | |

Dividends receivable | | | 651,691 | |

Receivable for investments sold | | | 502,709 | |

Receivable for Series shares sold | | | 49,539 | |

Prepaid expenses | | | 2,550 | |

| | | | |

Total Assets | | | 259,746,552 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 4,763,332 | |

Loan payable | | | 392,000 | |

Accrued expenses | | | 237,107 | |

Payable for Series shares reacquired | | | 233,826 | |

Management fee payable | | | 184,419 | |

Affiliated transfer agent fee payable | | | 68,865 | |

Distribution fee payable | | | 63,591 | |

Payable to custodian | | | 36,082 | |

Loan interest payable | | | 486 | |

Payable for investments purchased | | | 132 | |

| | | | |

Total Liabilities | | | 5,979,840 | |

| | | | |

| |

Net Assets | | $ | 253,766,712 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 392,173 | |

Paid-in capital in excess of par | | | 442,332,351 | |

| | | | |

| | | 442,724,524 | |

Undistributed net investment income | | | 3,525,631 | |

Accumulated net realized loss on investment and foreign currency transactions | | | (218,403,512 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 25,920,069 | |

| | | | |

Net assets, October 31, 2016 | | $ | 253,766,712 | |

| | | | |

See Notes to Financial Statements.

| | | | |

Class A | | | | |

Net asset value and redemption price per share

($185,120,180 ÷ 28,559,675 shares of common stock issued and outstanding) | | $ | 6.48 | |

Maximum sales charge (5.50% of offering price) | | | 0.38 | |

| | | | |

Maximum offering price to public | | $ | 6.86 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share

($3,079,630 ÷ 496,233 shares of common stock issued and outstanding) | | $ | 6.21 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share

($15,892,341 ÷ 2,561,343 shares of common stock issued and outstanding) | | $ | 6.20 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share

($49,674,561 ÷ 7,600,064 shares of common stock issued and outstanding) | | $ | 6.54 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 31 | |

Statement of Operations

Year Ended October 31, 2016

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $1,176,019) | | $ | 8,580,695 | |

Income from securities lending, net (including affiliated income of $130,881) | | | 153,870 | |

Affiliated dividend income | | | 2,326 | |

| | | | |

Total income | | | 8,736,891 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 2,218,740 | |

Distribution fee—Class A | | | 569,944 | |

Distribution fee—Class B | | | 37,102 | |

Distribution fee—Class C | | | 164,156 | |

Transfer agent’s fees and expenses (including affiliated expense of $314,300) | | | 763,000 | |

Custodian and accounting fees (net of $6,000 fee credit) | | | 295,000 | |

Registration fees | | | 65,000 | |

Shareholders’ reports | | | 60,000 | |

Audit fee | | | 35,000 | |

Legal fees and expenses | | | 22,000 | |

Directors’ fees | | | 14,000 | |

Insurance expenses | | | 4,000 | |

Loan interest expense | | | 2,730 | |

Miscellaneous | | | 66,637 | |

| | | | |

Total expenses | | | 4,317,309 | |

| | | | |

Net investment income (loss) | | | 4,419,582 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $610) | | | (19,262,647 | ) |

Foreign currency transactions | | | (27,621 | ) |

| | | | |

| | | (19,290,268 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (including affiliated of $689) | | | 11,218,658 | |

Foreign currencies | | | 56,627 | |

| | | | |

| | | 11,275,285 | |

| | | | |

Net gain (loss) on investment and foreign currency transactions | | | (8,014,983 | ) |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | (3,595,401 | ) |

| | | | |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2016 | | | 2015 | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 4,419,582 | | | $ | 4,308,344 | |

Net realized gain (loss) on investment and foreign currency transactions | | | (19,290,268 | ) | | | (7,863,520 | ) |

Net change in unrealized appreciation (depreciation) on investments and

foreign currencies | | | 11,275,285 | | | | (18,763,386 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (3,595,401 | ) | | | (22,318,562 | ) |

| | | | | | | | |

| | |

Dividends from net investment income (Note 1) | | | | | | | | |

Class A | | | (3,287,114 | ) | | | (5,047,051 | ) |

Class B | | | (41,536 | ) | | | (85,958 | ) |

Class C | | | (170,911 | ) | | | (310,179 | ) |

Class Z | | | (1,031,700 | ) | | | (1,263,747 | ) |

| | | | | | | | |

| | | (4,531,261 | ) | | | (6,706,935 | ) |

| | | | | | | | |

| | |

Series share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 10,632,582 | | | | 18,775,253 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 4,447,393 | | | | 6,566,147 | |

Net asset value of shares issued in merger (Note 8) | | | — | | | | 50,163,770 | |

Cost of shares reacquired | | | (42,209,977 | ) | | | (47,581,055 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Series share transactions | | | (27,130,002 | ) | | | 27,924,115 | |

| | | | | | | | |

Total increase (decrease) | | | (35,256,664 | ) | | | (1,101,382 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 289,023,376 | | | | 290,124,758 | |

| | | | | | | | |

End of year(a) | | $ | 253,766,712 | | | $ | 289,023,376 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 3,525,631 | | | $ | 3,178,981 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential QMA International Equity Fund | | | 33 | |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (“1940 Act”) and currently consists of six series: Prudential QMA International Equity Fund (the “Series”, formerly Prudential International Equity Fund), Prudential Jennison Global Infrastructure Fund, Prudential Jennison Global Opportunities Fund, Prudential Jennison International Opportunities Fund, Prudential Jennison Emerging Markets Equity Fund and Prudential Emerging Markets Debt Local Currency Fund. These financial statements relate to the Prudential QMA International Equity Fund. The financial statements of the other series are not presented herein. The Series is a diversified. The investment objective of the Series is to seek long-term growth of capital.

Note 1. Accounting Policies

The Series follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services-Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Series consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Series holds securities and other assets that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Directors (the “Board”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to Prudential Investments LLC (“PI” or “Manager”). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Series to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Series’ investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the table following the Portfolio of Investments.

Common and preferred stocks, exchange-traded funds, and derivative instruments such as futures or options that are traded on a national securities exchange are valued at the last

sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Common and preferred stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stocks discussed above.

Participatory notes (“P-notes”) are generally valued based upon the value of a related underlying security that trades actively in the market and are classified as Level 2 in the fair value hierarchy.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

| | | | |

| Prudential QMA International Equity Fund | | | 35 | |

Notes to Financial Statements (continued)

Restricted and Illiquid Securities: Subject to the guidelines adopted by the Board, the Series may invest up to 15% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, cannot be sold within seven days in the ordinary course of business at approximately the amount at which the Series has valued the investment. Therefore, the Series may find it difficult to sell illiquid securities at the time considered most advantageous by its Subadviser and may incur expenses that would not be incurred in the sale of securities that were freely marketable. Certain securities that would otherwise be considered illiquid because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. These Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(2) of the Securities Act, may be deemed liquid by the Series’ Subadviser under the guidelines adopted by the Directors of the Series. However, the liquidity of the Series’ investments in Rule 144A securities could be impaired if trading does not develop or declines.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses—at the rates of exchange prevailing on the respective dates of such transactions.