UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3990

Northwestern Mutual Series Fund, Inc.

(Exact name of registrant as specified in charter)

720 East Wisconsin Avenue,

Milwaukee Wisconsin 53202

(Address of principal executive offices) (Zip code)

Barbara E. Courtney, Controller and Chief Accounting Officer Northwestern Mutual Series Fund, Inc.

(Name and address of agent for service)

Registrant’s telephone number, including area code: 414-271-1444

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders |

Annual Report December 31, 2017

Northwestern Mutual Series Fund, Inc.

A Series Fund Offering 27 Portfolios

| | · | | Focused Appreciation Portfolio |

| | · | | Large Cap Core Stock Portfolio |

| | · | | Large Cap Blend Portfolio |

| | · | | Index 500 Stock Portfolio |

| | · | | Large Company Value Portfolio |

| | · | | Domestic Equity Portfolio |

| | · | | Equity Income Portfolio |

| | · | | Mid Cap Growth Stock Portfolio |

| | · | | Index 400 Stock Portfolio |

| | · | | Mid Cap Value Portfolio |

| | · | | Small Cap Growth Stock Portfolio |

| | · | | Index 600 Stock Portfolio |

| | · | | Small Cap Value Portfolio |

| | · | | International Growth Portfolio |

| | · | | Research International Core Portfolio |

| | · | | International Equity Portfolio |

| | · | | Emerging Markets Equity Portfolio |

| | · | | Government Money Market Portfolio |

| | · | | Short-Term Bond Portfolio |

| | · | | Long-Term U.S. Government Bond Portfolio |

| | · | | Inflation Protection Portfolio |

| | · | | High Yield Bond Portfolio |

| | · | | Multi-Sector Bond Portfolio |

| | · | | Asset Allocation Portfolio |

Letter to Contract Holders

December 31, 2017

As 2017 came to a close, the second longest U.S. bull market since 1929 approached its ninth year. The S&P 500 reached all-time highs and posted a positive return in every single month of the year. Volatility remained muted, as business and consumer confidence showed continued improvement throughout the year.

Within the U.S. equity market, the largest of the large capitalization stocks led the broader market, which helped the large cap S&P 500® Index1 outperform the MidCap 400® Index and SmallCap S&P 600® Index. International stocks outperformed domestic stocks, driven by improving global trade and solid economic growth in most nations. In particular, emerging markets posted robust returns, as increased business activity encouraged investors to embrace risk in developing nations.

The bond market, as defined by various Barclays® Indices, delivered a relatively modest positive return by historical standards. In 2017, intermediate and longer-term interest rates remained constrained due to accommodating monetary policies of the world’s central banks and a benign inflation outlook throughout the year.

High yield corporate bonds led the bond market once again, followed by strong performance from high quality corporate bonds. Lower risk and lower yield government debt lagged the higher yielding sectors of the bond market. Nevertheless, all of the major sectors of the bond market managed to post positive returns in 2017.

The U.S. dollar declined steadily during the year, which helped international investment returns, as well as exporters in the U.S. For U.S. investors, a rising dollar decreases the return of foreign investments, while a declining dollar increases the return of foreign investments.

The U.S. economy grew at a 3% pace during the second half of the year, its fastest pace in more than three years. Virtually every segment of the economy, from the manufacturing and industrial sectors to science and technology, experienced sustained growth. The uptick in U.S. economic growth began in early 2016, paused during the election season, and continued to strengthen thereafter, buoyed by improving global growth and hopes that the new administration would enact market-friendly policies.

Synchronized and sustained global growth for the first time since the financial crisis underpinned the optimistic outlook during the year. China’s growth stabilized after a six-year decline, which boosted economies throughout Asia, while Europe and Japan displayed green shoots after several years of weak growth and unprecedented monetary stimulus. Tensions between the U.S. and North Korea raised concerns, while the election results in France, the Netherlands and Australia were generally positive for markets.

In the strong economic environment of 2017, the U.S. Federal Reserve (the “Fed”) sought to normalize monetary policy by reversing some of the extraordinary measures taken over the last several years in response to the 2008 financial crisis. The Fed increased interest rates by 0.25% three times during 2017, to a range of 1.25% to 1.50%, as inflation approached the Fed’s target of 2.0%. In October, the Fed began to reduce its $4 trillion dollar balance sheet by announcing $10 billion in monthly bond sales and plans to gradually increase sales going forward. While the Fed’s announcement was highly anticipated, it marked the end of a ten-year battle against deflation and the beginning of a challenging new era of normalizing monetary policy.

Consumer prices rose approximately 2.0% for the year, putting inflation well below its long-term average. Nevertheless, the annual inflation rate increased from -0.1% in April 2015 to a recent high of 2.7% in February 2017, and inflationary pressures continue to build in the labor market. The U.S. economy created more than 2 million jobs in each of the last six years, which drove the unemployment rate down to 4.1% at the end of 2017. With wages already growing at a 3% annual pace, the strong demand for labor has the potential to drive wages and inflation higher as we move into 2018.

Nine years of strong equity returns and the potential for rising inflation are good reminders for investors to review their financial plans and make sure the risks and potential returns of their investment portfolio are consistent with those plans. Similar to all financial decisions, an investor should approach the reallocating or rebalancing of their investment portfolio with the guidance of a financial professional, to pinpoint the appropriate allocation for their current financial situation and overall financial plan. As always, we encourage you to work closely with your Northwestern Mutual financial professional to navigate the financial markets in 2018, as they can help you develop and adhere to a plan that will be guided by your long-term goals, rather than the short-term fluctuations of the market.

Kate M. Fleming

President of Northwestern Mutual Series Fund, Inc.

1 All indices and/or benchmarks referenced are unmanaged and cannot be invested in directly.

2 A strategy involving portfolio rebalancing cannot assure a profit or protect against loss in a declining market. Not intended to be investment advice.

Northwestern Mutual Series Fund, Inc.

Table of Contents

Mason Street Advisors, LLC (“Mason Street Advisors”), adviser to the Northwestern Mutual Series Fund, Inc., is a wholly owned subsidiary of The Northwestern Mutual Life Insurance Company. Mason Street Advisors is the principal investment adviser for all the Portfolios of the Northwestern Mutual Series Fund, Inc., and has engaged and oversees sub-advisers who provide day-to-day management for certain of the Portfolios. Each sub-adviser may be replaced without the approval of shareholders. Please see the Series Fund prospectus for more information.

The views expressed in the portfolio manager commentaries set forth in the following pages reflect those of the portfolio managers only through the end of the period covered by this report and do not necessarily represent the views of any affiliated organization. The views expressed are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. These views are subject to change at any time based upon market conditions or other events and should not be relied upon as investment advice. Mason Street Advisors disclaims any responsibility to update these views.

Expense Examples (unaudited)

Example

As a shareholder of each Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2017 to December 31, 2017).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each Portfolio provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2017 | | | Ending Account Value

December 31, 2017 | | | Expenses Paid During

Period July 1, 2017 to

December 31, 2017* | | | Annualized

Expense Ratio | |

| | | | |

Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,109.79 | | | | $2.23 | | | | 0.42 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.09 | | | | 2.14 | | | | 0.42 | |

| | | | |

Focused Appreciation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,131.28 | | | | 3.38 | | | | 0.63 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.03 | | | | 3.21 | | | | 0.63 | |

| | | | |

Large Cap Core Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,109.56 | | | | 2.34 | | | | 0.44 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.99 | | | | 2.24 | | | | 0.44 | |

| | | | |

Large Cap Blend Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,097.27 | | | | 4.28 | | | | 0.81 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.12 | | | | 4.13 | | | | 0.81 | |

| | | | |

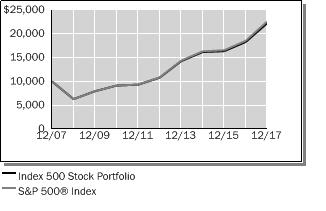

Index 500 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,112.96 | | | | 1.12 | | | | 0.21 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.15 | | | | 1.07 | | | | 0.21 | |

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2017 | | | Ending Account Value

December 31, 2017 | | | Expenses Paid During

Period July 1, 2017 to

December 31, 2017* | | | Annualized

Expense Ratio | |

| | | | |

Large Company Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,061.95 | | | | 3.85 | | | | 0.74 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.48 | | | | 3.77 | | | | 0.74 | |

| | | | |

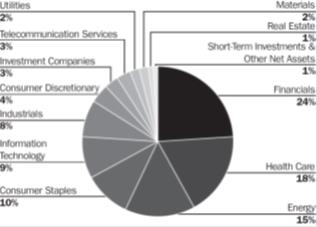

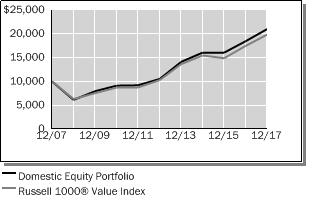

Domestic Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,106.09 | | | | 2.87 | | | | 0.54 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.48 | | | | 2.75 | | | | 0.54 | |

| | | | |

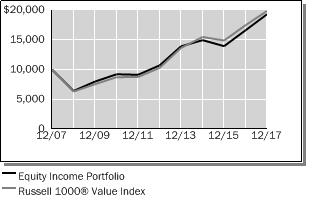

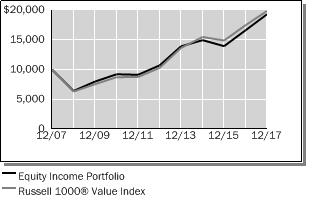

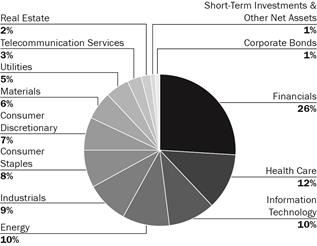

Equity Income Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,101.12 | | | | 3.28 | | | | 0.62 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.08 | | | | 3.16 | | | | 0.62 | |

| | | | |

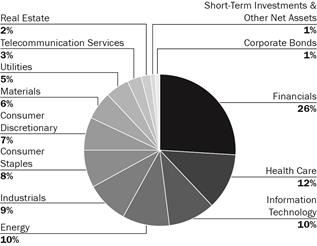

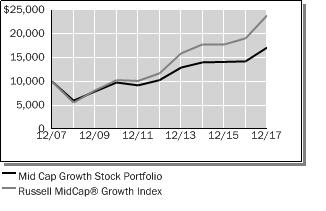

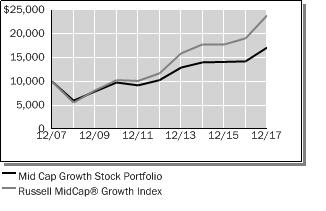

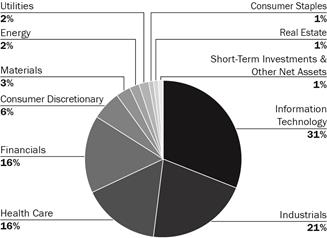

Mid Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,087.05 | | | | 2.84 | | | | 0.54 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.48 | | | | 2.75 | | | | 0.54 | |

| | | | |

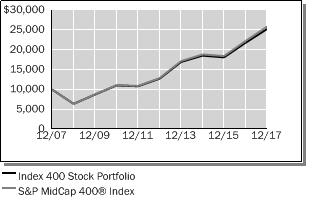

Index 400 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,095.16 | | | | 1.37 | | | | 0.26 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.89 | | | | 1.33 | | | | 0.26 | |

| | | | |

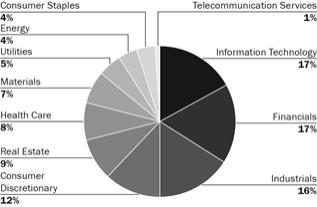

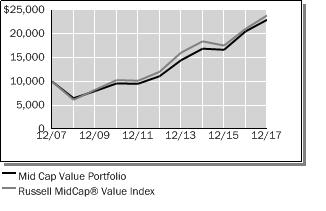

Mid Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,073.94 | | | | 3.97 | | | | 0.76 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.37 | | | | 3.87 | | | | 0.76 | |

| | | | |

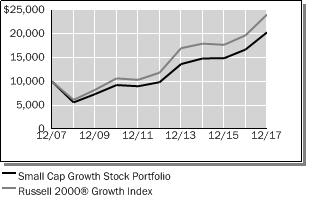

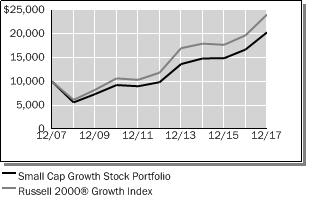

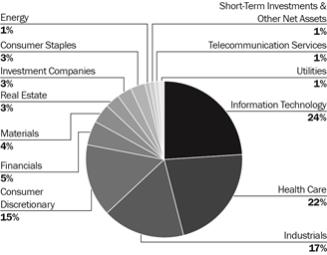

Small Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,092.82 | | | | 2.95 | | | | 0.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.38 | | | | 2.85 | | | | 0.56 | |

| | | | |

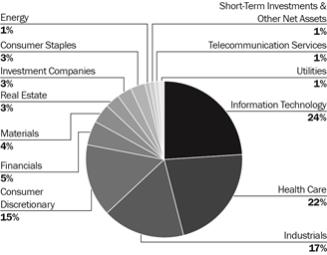

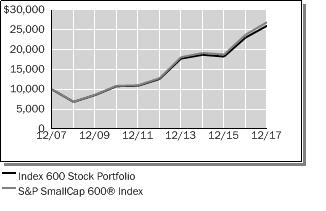

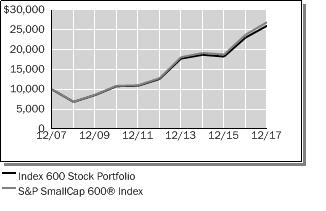

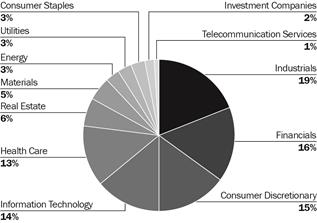

Index 600 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,099.37 | | | | 1.75 | | | | 0.33 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.54 | | | | 1.68 | | | | 0.33 | |

| | | | |

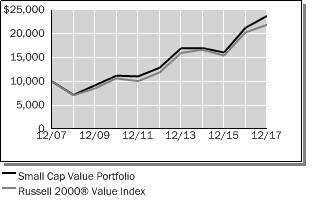

Small Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,099.72 | | | | 4.55 | | | | 0.86 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.87 | | | | 4.38 | | | | 0.86 | |

| | | | |

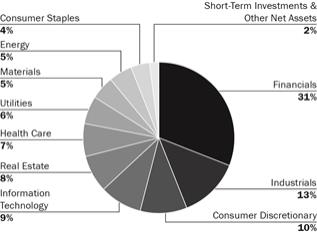

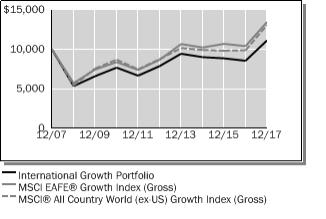

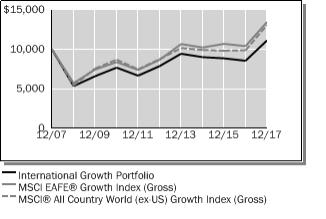

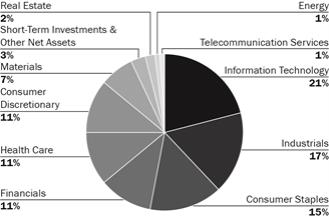

International Growth Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,088.84 | | | | 3.47 | | | | 0.66 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.88 | | | | 3.36 | | | | 0.66 | |

| | | | |

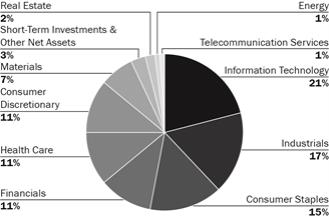

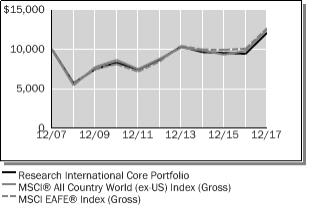

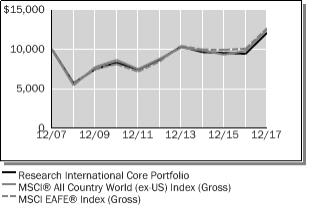

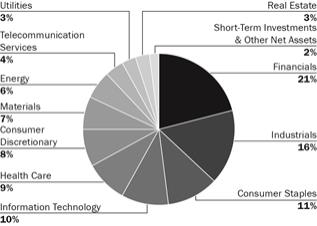

Research International Core Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,103.73 | | | | 4.19 | | | | 0.79 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.22 | | | | 4.02 | | | | 0.79 | |

| | | | |

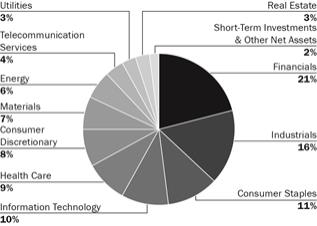

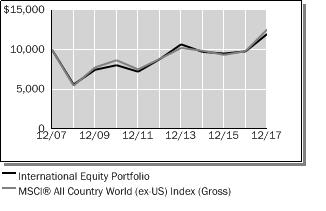

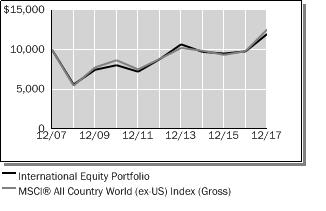

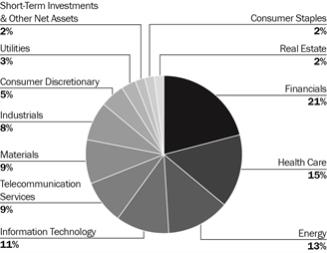

International Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,075.96 | | | | 2.88 | | | | 0.55 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.43 | | | | 2.80 | | | | 0.55 | |

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2017 | | | Ending Account Value

December 31, 2017 | | | Expenses Paid During

Period July 1, 2017 to

December 31, 2017* | | | Annualized

Expense Ratio | |

| | | | |

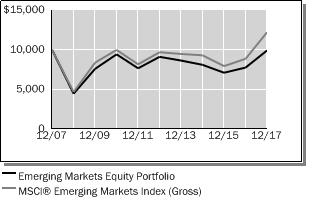

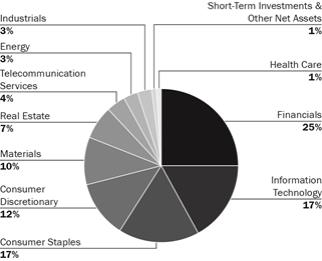

Emerging Markets Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,089.70 | | | | 5.53 | | | | 1.05 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.91 | | | | 5.35 | | | | 1.05 | |

| | | | |

Government Money Market Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,003.89 | | | | 1.67 | | | | 0.33 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.54 | | | | 1.68 | | | | 0.33 | |

| | | | |

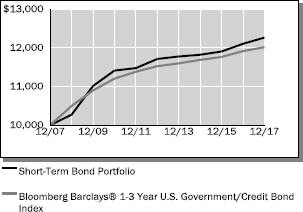

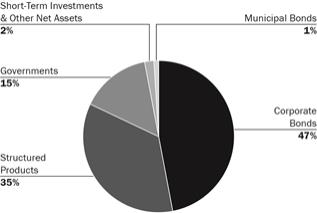

Short-Term Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,003.56 | | | | 2.07 | | | | 0.41 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.14 | | | | 2.09 | | | | 0.41 | |

| | | | |

Select Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,012.46 | | | | 1.57 | | | | 0.31 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.64 | | | | 1.58 | | | | 0.31 | |

| | | | |

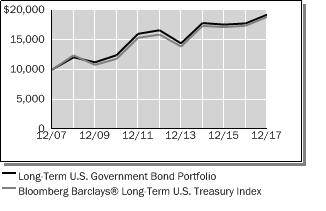

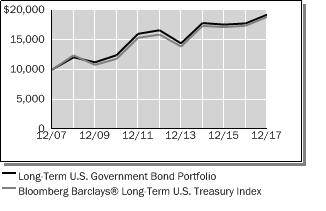

Long-Term U.S. Government Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,027.31 | | | | 4.85 | | | | 0.95 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.42 | | | | 4.84 | | | | 0.95 | |

| | | | |

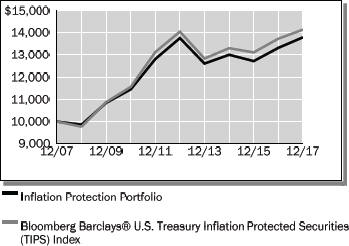

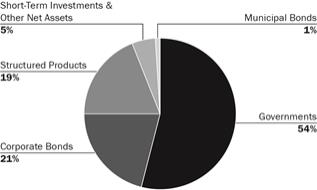

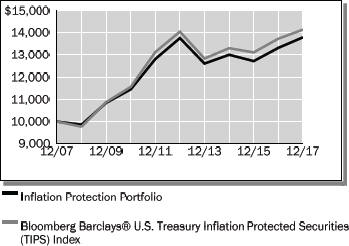

Inflation Protection Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,026.32 | | | | 2.86 | | | | 0.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.38 | | | | 2.85 | | | | 0.56 | |

| | | | |

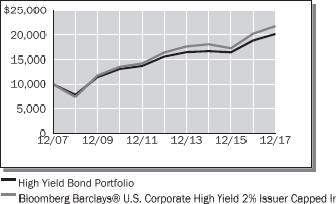

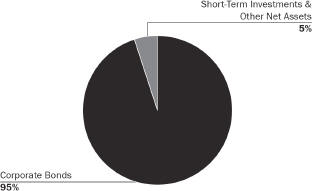

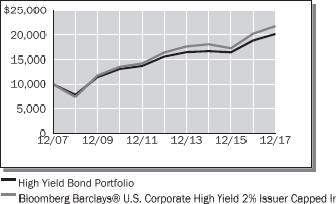

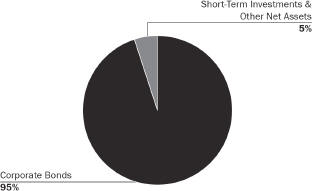

High Yield Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,019.11 | | | | 2.29 | | | | 0.45 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.94 | | | | 2.29 | | | | 0.45 | |

| | | | |

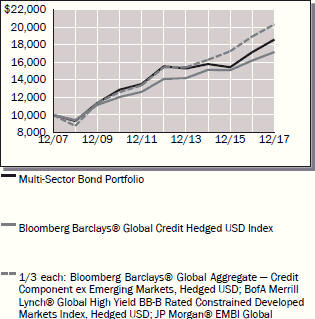

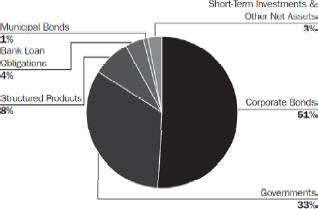

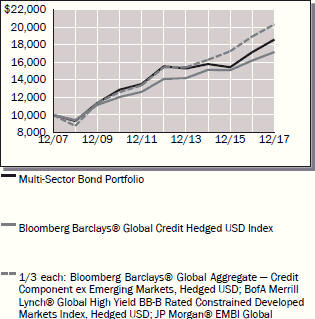

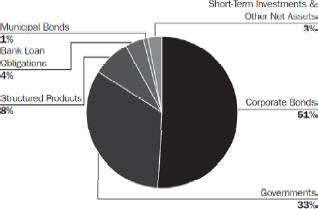

Multi-Sector Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,027.04 | | | | 3.83 | | | | 0.75 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.42 | | | | 3.82 | | | | 0.75 | |

| | | | |

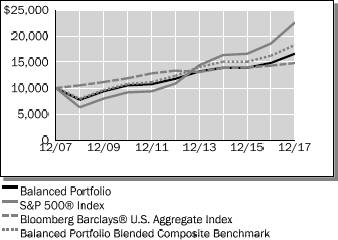

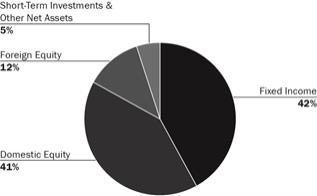

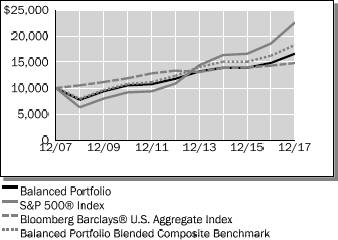

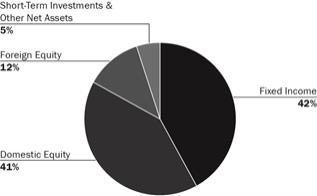

Balanced Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,054.28 | | | | 0.31 | | | | 0.06 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.90 | | | | 0.31 | | | | 0.06 | |

| | | | |

Asset Allocation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,067.85 | | | | 0.47 | | | | 0.09 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.75 | | | | 0.46 | | | | 0.09 | |

| * | Expenses are equal to the Portfolio’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Growth Stock Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital. Current income is a secondary objective. | | Invest in the equity securities of medium and large capitalization companies exhibiting the potential for earnings growth or share price appreciation. | | $960 million |

Portfolio Overview

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Growth Stock Portfolio (the “Portfolio”), has engaged The Boston Company Asset Management, LLC (“The Boston Company”) to act as sub-adviser for the Portfolio. The Portfolio invests in the equity securities of medium and large capitalization companies. The Portfolio invests in stocks selected by a team of global research analysts, with each analyst responsible for investments in his or her area of expertise. These analysts use a fundamental research process to identify investments for the Portfolio. The Portfolio invests in those companies in which the analysts have the highest degree of conviction or have identified the potential for strong earnings growth or share price appreciation in the near-term.

Market Overview

Global equities posted robust results in 2017 as leading economic indicators in both developed and emerging markets beat expectations. The U.S. Federal Reserve’s (the “Fed”) 2% inflation target remained elusive despite better than expected GDP numbers and improving job growth. Consumer confidence nearly reached a two-decade high during the year. As expected, the Fed raised interest rates three times during the year. President Trump appointed Jerome Powell to replace outgoing Fed chair Janet Yellen. At the end of the period, the Trump administration passed sweeping tax reform, lifting sentiment weighed down by delays in policy reforms and fiscal stimulus during the first half of the year.

Portfolio Results

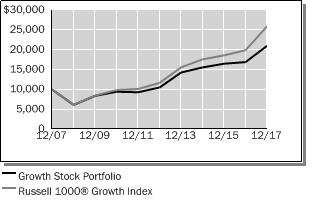

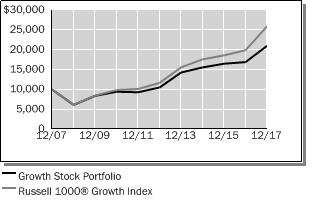

The Portfolio returned 24.27% for the twelve months ended December 31, 2017. By comparison, the Portfolio’s benchmark, the Russell 1000® Growth Index (the “Index”), returned 30.21%. (The Index is unmanaged, cannot be invested in directly and does not include administrative expenses.) According to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency, the average return of the Large Cap Growth Funds peer group was 30.84% for 2017.

Overall, Portfolio positioning in the Health Care and Consumer Discretionary sectors detracted the most from performance versus the Index, while Information Technology, Real Estate and Telecommunication Services contributed to performance during the reporting period.

In the Health Care sector, the health care equipment and supplies and biotechnology industries weighed on relative results. An investment in Dentsply Sirona, Inc., declined on disappointing second quarter results, as operational execution did not meet management’s expectations. An investment in Danaher Corporation also declined following mixed second quarter results, as its dental segment and organic growth remained soft. A position in Celgene Corporation fell on weak third quarter results, missing revenue estimates with sales below expectations.

In the Consumer Discretionary sector, household durables company Newell Brands, Inc., detracted from Portfolio performance as brick-and-mortar retailers continued to see market share loss to e-commerce. Within the hotels, restaurants and leisure industry, an investment in Starbucks Corporation weighed on performance.

In the Information Technology sector, stock selection in the IT services and semiconductors and semiconductor equipment industries primarily drove outperformance. Shares of Square, Inc. rose after posting positive first and second quarter results, driving estimates and the stock higher. The company also increased full-year guidance. Shares of Teradata Corporation also rose following solid third quarter results. Its strategy was gaining momentum as it transitioned to cloud-based offerings. An investment in NVIDIA Corporation also moved higher following solid fiscal second and third quarter results.

The Portfolio’s lack of exposure to the Real Estate sector positively impacted relative returns, as the sector was one of the worst performers in the Index during the year. Elsewhere, the Telecommunication Services sector benefited from positioning in the diversified telecommunication services industry. Specifically, an investment in Verizon Communications, Inc., aided Portfolio returns.

Growth Stock Portfolio (unaudited)

Portfolio Manager Outlook

The following forward-looking comments are the opinion of The Boston Company, the Portfolio’s sub-adviser.

As we look to 2018, synchronized global economic growth appears to be gaining momentum, led by the U.S. and the recent passage of sweeping tax reform, which slashed the corporate tax rate from 35% to 21%. Even before the tax bill passed, U.S. economic data had been encouraging, with positive trends in hours worked, retail sales, housing starts, home prices and unemployment. The consensus estimate for fourth quarter U.S. GDP hovers around 2.7%. However, the Atlanta Fed recently raised estimates to 3.2% from 2.8%, citing stronger U.S. manufacturing PMI and nominal construction spending.

The foregoing growth estimates do not reflect the projected benefits flowing from the recently passed tax bill, which has likely already begun to increase optimism as evidenced by the equity markets’ increase after the passage of the bill. The bottom-up earnings consensus for the S&P 500® Index in the fourth quarter remains steady at $136, a gain of 12% year over year. The consensus number for first quarter 2018 moved higher to $140, an approximately 12% gain, but the tax cut could now increase that number by almost $8 to $148, representing an increase of almost 18%.

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2017 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Growth Stock Portfolio | | | 24.27 | % | | | 14.86 | % | | | 7.70 | % |

Russell 1000® Growth Index | | | 30.21 | % | | | 17.33 | % | | | 10.00 | % |

Lipper® Variable Insurance Products (VIP) Large Cap Growth Funds Average | | | 30.84 | % | | | 16.28 | % | | | 8.72 | % |

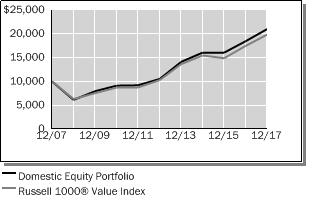

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

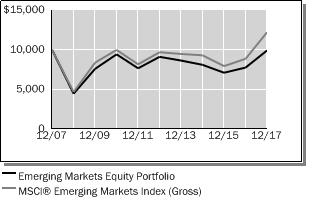

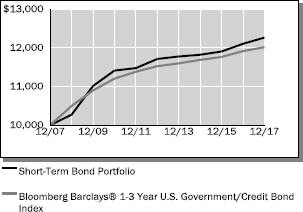

This chart assumes an initial investment of $10,000 made on 12/31/07. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale

loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Equity Holdings 12/31/17

| | | | |

Security Description | | | % of Net Assets | |

Apple, Inc. | | | 6.6 | % |

Microsoft Corp. | | | 5.6 | % |

Amazon.com, Inc. | | | 4.2 | % |

Facebook, Inc. - Class A | | | 4.0 | % |

Alphabet, Inc. - Class C | | | 3.9 | % |

UnitedHealth Group, Inc. | | | 3.0 | % |

Visa, Inc. - Class A | | | 2.8 | % |

Broadcom, Ltd. | | | 2.6 | % |

The Home Depot, Inc. | | | 2.5 | % |

PepsiCo, Inc. | | | 2.4 | % |

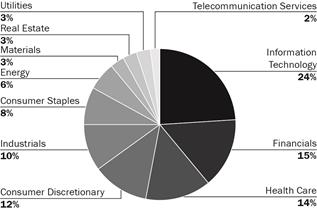

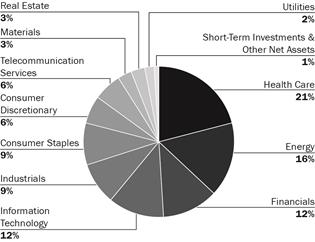

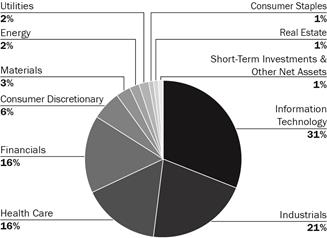

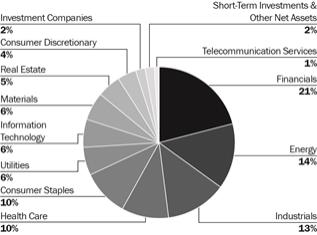

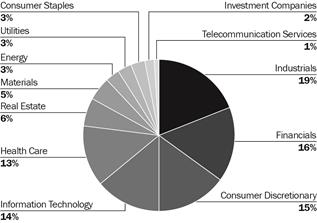

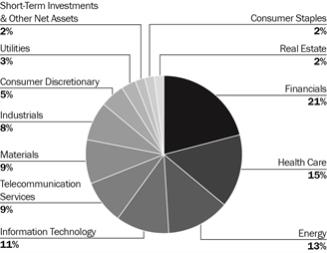

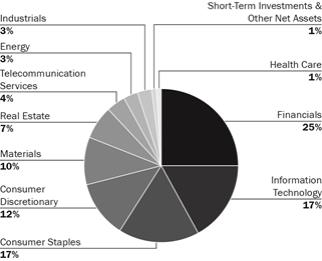

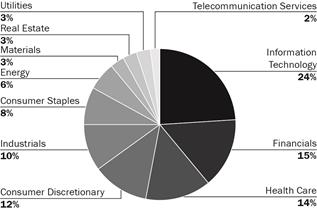

Sector Allocation 12/31/17

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

Growth Stock Portfolio

Schedule of Investments

December 31, 2017

| | | | | | | | |

| Common Stocks (99.5%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

Consumer Discretionary (17.9%) | | | | | |

Amazon.com, Inc.* | | | 34,742 | | | | 40,630 | |

Aptiv PLC | | | 100,992 | | | | 8,567 | |

Charter Communications, Inc. - Class A* | | | 22,030 | | | | 7,401 | |

Comcast Corp. - Class A | | | 444,808 | | | | 17,815 | |

Dollar Tree, Inc.* | | | 107,591 | | | | 11,546 | |

The Home Depot, Inc. | | | 125,661 | | | | 23,816 | |

Las Vegas Sands Corp. | | | 175,155 | | | | 12,171 | |

Nordstrom, Inc. | | | 136,300 | | | | 6,458 | |

The Priceline Group, Inc.* | | | 10,415 | | | | 18,099 | |

PVH Corp. | | | 53,964 | | | | 7,404 | |

Tesla Motors, Inc.* | | | 34,480 | | | | 10,735 | |

Wayfair, Inc.* | | | 88,225 | | | | 7,082 | |

| | | | | | | | |

Total | | | | | | | 171,724 | |

| | | | | | | | |

| |

Consumer Staples (6.0%) | | | | | |

Costco Wholesale Corp. | | | 85,594 | | | | 15,931 | |

The Kraft Heinz Co. | | | 103,478 | | | | 8,046 | |

Monster Beverage Corp.* | | | 172,074 | | | | 10,890 | |

PepsiCo, Inc. | | | 189,798 | | | | 22,761 | |

| | | | | | | | |

Total | | | | | | | 57,628 | |

| | | | | | | | |

| |

Financials (3.4%) | | | | | |

Ameriprise Financial, Inc. | | | 92,244 | | | | 15,633 | |

The Progressive Corp. | | | 295,151 | | | | 16,623 | |

| | | | | | | | |

Total | | | | | | | 32,256 | |

| | | | | | | | |

| |

Health Care (13.7%) | | | | | |

Biogen, Inc.* | | | 54,510 | | | | 17,365 | |

BioMarin Pharmaceutical, Inc.* | | | 64,079 | | | | 5,714 | |

Boston Scientific Corp.* | | | 447,145 | | | | 11,085 | |

Bristol-Myers Squibb Co. | | | 174,489 | | | | 10,693 | |

Celgene Corp.* | | | 137,870 | | | | 14,388 | |

IDEXX Laboratories, Inc.* | | | 61,201 | | | | 9,571 | |

Merck & Co., Inc. | | | 113,877 | | | | 6,408 | |

| | | | | | | | |

| Common Stocks (99.5%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

Health Care continued | | | | | |

Neurocrine Biosciences, Inc.* | | | 99,137 | | | | 7,692 | |

UnitedHealth Group, Inc. | | | 128,998 | | | | 28,439 | |

WellCare Health Plans, Inc.* | | | 45,484 | | | | 9,147 | |

Zoetis, Inc. | | | 152,659 | | | | 10,997 | |

| | | | | | | | |

Total | | | | | | | 131,499 | |

| | | | | | | | |

| |

Industrials (10.6%) | | | | | |

Fortive Corp. | | | 205,409 | | | | 14,861 | |

Honeywell International, Inc. | | | 134,560 | | | | 20,636 | |

PACCAR, Inc. | | | 167,229 | | | | 11,887 | |

Quanta Services, Inc.* | | | 236,148 | | | | 9,236 | |

Raytheon Co. | | | 66,168 | | | | 12,430 | |

Union Pacific Corp. | | | 143,634 | | | | 19,261 | |

United Technologies Corp. | | | 106,566 | | | | 13,594 | |

| | | | | | | | |

Total | | | | | | | 101,905 | |

| | | | | | | | |

| |

Information Technology (41.6%) | | | | | |

Activision Blizzard, Inc. | | | 217,981 | | | | 13,803 | |

Alphabet, Inc. - Class C* | | | 35,823 | | | | 37,485 | |

Apple, Inc. | | | 373,507 | | | | 63,209 | |

Arista Networks, Inc.* | | | 27,675 | | | | 6,520 | |

Broadcom, Ltd. | | | 98,056 | | | | 25,191 | |

Facebook, Inc. - Class A* | | | 215,513 | | | | 38,029 | |

First Data Corp.* | | | 486,383 | | | | 8,127 | |

Fortinet, Inc.* | | | 226,386 | | | | 9,891 | |

HubSpot, Inc.* | | | 99,616 | | | | 8,806 | |

Microsoft Corp. | | | 632,403 | | | | 54,096 | |

NVIDIA Corp. | | | 89,954 | | | | 17,406 | |

PayPal Holdings, Inc.* | | | 249,900 | | | | 18,398 | |

Salesforce.com, Inc.* | | | 156,146 | | | | 15,963 | |

ServiceNow, Inc.* | | | 81,759 | | | | 10,660 | |

Splunk, Inc.* | | | 104,668 | | | | 8,671 | |

Square, Inc.* | | | 192,115 | | | | 6,661 | |

Teradata Corp.* | | | 201,615 | | | | 7,754 | |

Texas Instruments, Inc. | | | 171,557 | | | | 17,917 | |

| | | | | | | | |

| Common Stocks (99.5%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

Information Technology continued | | | | | |

Twilio, Inc.* | | | 174,081 | | | | 4,108 | |

Visa, Inc. - Class A | | | 233,548 | | | | 26,629 | |

| | | | | | | | |

Total | | | | | | | 399,324 | |

| | | | | | | | |

| | |

Materials (3.3%) | | | | | | | | |

DowDuPont, Inc. | | | 192,666 | | | | 13,722 | |

Praxair, Inc. | | | 65,364 | | | | 10,110 | |

Vulcan Materials Co. | | | 65,522 | | | | 8,411 | |

| | | | | | | | |

Total | | | | | | | 32,243 | |

| | | | | | | | |

| |

Telecommunication Services (3.0%) | | | | | |

T-Mobile US, Inc.* | | | 133,394 | | | | 8,472 | |

Verizon Communications, Inc. | | | 380,923 | | | | 20,162 | |

| | | | | | | | |

Total | | | | | | | 28,634 | |

| | | | | | | | |

| | |

Total Common Stocks | | | | | | | | |

(Cost: $739,354) | | | | | | | 955,213 | |

| | | | | |

| |

| Short-Term Investments (1.2%) | | | | |

| |

Money Market Funds (1.2%) | | | | | |

State Street Institutional U.S. Government Money Market Fund - Premier Class, 1.209% # | | | 11,091,855 | | | | 11,092 | |

| | | | | | | | |

Total | | | | | | | 11,092 | |

| | | | | | | | |

| | |

Total Short-Term Investments

| | | | | | | | |

(Cost: $11,092) | | | | | | | 11,092 | |

| | | | | | | | |

| | |

Total Investments (100.7%) | | | | | | | | |

(Cost: $750,446)(a) | | | | | | | 966,305 | |

| | | | | |

Other Assets, Less | | | | | | | | |

Liabilities (-0.7%) | | | | | | | (6,451 | ) |

| | | | | |

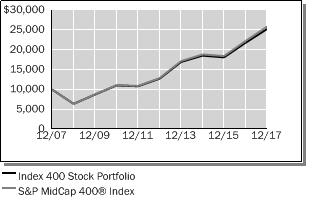

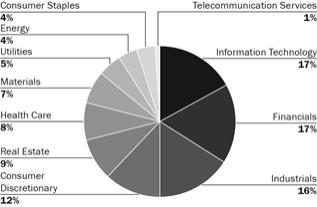

Net Assets (100.0%) | | | | | | | 959,854 | |

| | | | | |

| # | 7-Day yield as of December 31, 2017. |

| (a) | At December 31, 2017, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $750,453 and the net unrealized appreciation of investments based on that cost was $215,853 which is comprised of $223,799 aggregate gross unrealized appreciation and $7,946 aggregate gross unrealized depreciation. |

The Accompanying Notes are an Integral Part of the Financial Statements.

Growth Stock Portfolio

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2017. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 – Significant

Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 955,213 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | 11,092 | | | | - | | | | - | | | |

Total Assets: | | $ | 966,305 | | | $ | - | | | $ | - | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

Focused Appreciation Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital. | | Invest in equity securities selected for their growth potential. | | $945 million |

Portfolio Overview

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Focused Appreciation Portfolio (the “Portfolio”), has engaged Loomis, Sayles & Co., L.P. (“Loomis Sayles”) to act as sub-adviser for the Portfolio. The Portfolio invests primarily in the equity securities of companies selected for their growth potential. The Portfolio focuses on equity securities of large capitalization companies, but may invest in companies of any size. The Portfolio employs a growth style of equity management that emphasizes companies with sustainable competitive advantages, long-term structural growth drivers, profitable cash flow returns, and management teams focused on creating long-term value for shareholders. The Portfolio invests primarily in a core group of 30-40 securities.

Market Overview

U.S. equity markets staged a strong rally in 2017. Volatility generally remained low as investors responded favorably to signs of a continued improvement in global economic conditions and stable central bank policy. The pickup in global growth fed through to corporate results, with companies around the world reporting gains in both revenues and bottom-line profits. Corporate earnings experienced a synchronized, worldwide upturn for the first time since 2006, providing support for somewhat elevated stock market valuations. Growth stocks, particularly those in the Information Technology sector, were key beneficiaries of this trend. In December, the passage of U.S. tax reform propelled U.S. equities to new highs as investors anticipated further earnings growth in 2018 due to lower corporate tax rates, in addition to healthy underlying global growth.

Portfolio Results

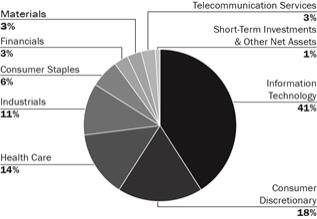

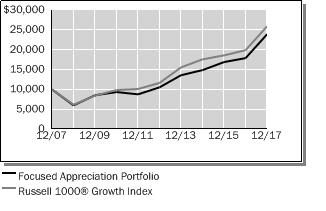

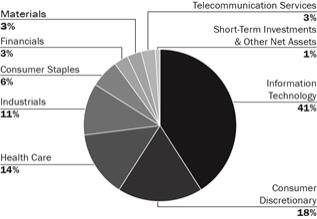

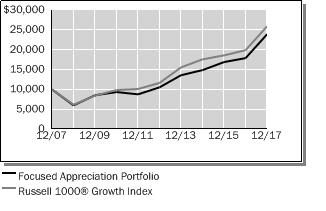

The Portfolio returned 33.62% for the twelve months ended December 31, 2017. By comparison, the Portfolio’s benchmark, the Russell 1000® Growth Index (the “Index”), returned 30.21%. According to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency, the average return in 2017 of the Large Cap Growth Funds peer group was 30.84%.

Alibaba Group Holding, Ltd., Amazon.com, Inc. and Facebook, Inc. were among the top contributors to the Portfolio’s performance for the reporting period. Schlumberger N.V., QUALCOMM, Inc., and Merck & Co., Inc., were among the largest detractors to performance. During the period, the portfolio manager took advantage of price weakness to add to several high quality growth companies, including Schlumberger N.V., Oracle Corp. and Regeneron Pharmaceuticals, Inc. The purchases were funded by trimming Portfolio positions in Amazon.com, Inc., Facebook, Inc. and Alibaba Group Holding, Ltd., as each position approached the Portfolio’s maximum allowable position size.

Stock selection in the Consumer Discretionary, Consumer Staples, Healthcare and Financials sectors, as well as the allocation effect to Information Technology and Consumer Discretionary sectors, contributed to relative performance. Stock selection in the Energy, Industrials and Information Technology sectors, as well as the allocation effect to the Consumer Staples, Energy, Industrials and Healthcare sectors detracted from relative performance.

Portfolio Manager Outlook

The following forward-looking comments are the opinion of Loomis Sayles, the Portfolio’s sub-adviser.

Our investment process is characterized by bottom-up fundamental research and a long-term investment time horizon. All aspects of our quality-growth-valuation investment thesis must be present simultaneously for us to make an investment. Often, our research is completed well in advance of the opportunity to invest. We are patient investors and maintain coverage of high quality businesses in order to take advantage of meaningful price dislocations if and when they occur. The nature of the process leads to a lower turnover Portfolio where sector positioning is the result of stock selection. In comparison to the Index, we are currently overweight in the Information Technology, Consumer Staples, Financials, Energy and Healthcare sectors. We are underweight in the Consumer Discretionary and Industrials sectors. We hold no positions in the Materials, Real Estate, Telecommunication Services and Utilities sectors.

| | | | | | |

| | Focused Appreciation Portfolio | | | 5 | |

Focused Appreciation Portfolio (unaudited)

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2017 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Focused Appreciation Portfolio | | | 33.62 | % | | | 17.81 | % | | | 9.12 | % |

Russell 1000® Growth Index | | | 30.21 | % | | | 17.33 | % | | | 10.00 | % |

Lipper® Variable Insurance Products (VIP) Large Cap Growth Funds Average | | | 30.84 | % | | | 16.28 | % | | | 8.72 | % |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/07. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

As a non-diversified portfolio, the Portfolio may hold fewer securities because of its focused investment strategy. Holding fewer securities increases the risk that the value of the Portfolio could go down because of the poor performance of a single investment.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Equity Holdings 12/31/17

| | | | |

Security Description | | | % of Net Assets | |

Amazon.com, Inc. | | | 7.3 | % |

Facebook, Inc. - Class A | | | 6.6 | % |

Alibaba Group Holding, Ltd., ADR | | | 6.4 | % |

Alphabet, Inc., Various | | | 5.9 | % |

Visa, Inc. - Class A | | | 5.5 | % |

Oracle Corp. | | | 4.9 | % |

Cisco Systems, Inc. | | | 4.8 | % |

Monster Beverage Corp. | | | 4.1 | % |

Novo Nordisk A/S, ADR | | | 3.5 | % |

QUALCOMM, Inc. | | | 3.3 | % |

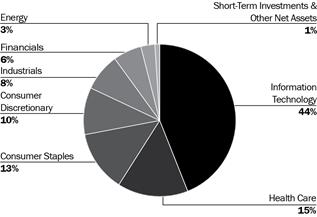

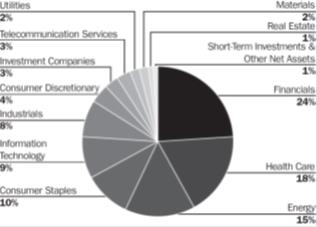

Sector Allocation 12/31/17

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

| | | | |

| 6 | | Focused Appreciation Portfolio | | |

Focused Appreciation Portfolio

Schedule of Investments

December 31, 2017

| | | | | | | | |

| Common Stocks (99.8%) | | Shares/

$ Par | | | Value

$ (000’s) | |

Consumer Discretionary (10.4%) | | | | | |

Amazon.com, Inc.* | | | 58,861 | | | | 68,836 | |

Yum China Holdings, Inc. | | | 307,560 | | | | 12,309 | |

Yum! Brands, Inc. | | | 207,535 | | | | 16,937 | |

| | | | | | | | |

Total | | | | | | | 98,082 | |

| | | | | | | | |

| |

Consumer Staples (12.7%) | | | | | |

The Coca-Cola Co. | | | 556,360 | | | | 25,526 | |

Danone SA, ADR | | | 1,805,359 | | | | 30,276 | |

Monster Beverage Corp.* | | | 608,065 | | | | 38,484 | |

The Procter & Gamble Co. | | | 279,200 | | | | 25,653 | |

| | | | | | | | |

Total | | | | | | | 119,939 | |

| | | | | | | | |

| |

Energy (3.2%) | | | | | |

Schlumberger, Ltd. | | | 442,915 | | | | 29,848 | |

| | | | | | | | |

Total | | | | | | | 29,848 | |

| | | | | | | | |

| |

Financials (6.4%) | | | | | |

American Express Co. | | | 142,271 | | | | 14,129 | |

FactSet Research Systems, Inc. | | | 81,848 | | | | 15,777 | |

SEI Investments Co. | | | 425,575 | | | | 30,582 | |

| | | | | | | | |

Total | | | | | | | 60,488 | |

| | | | | | | | |

| |

Health Care (14.6%) | | | | | |

Amgen, Inc. | | | 93,159 | | | | 16,200 | |

Cerner Corp.* | | | 305,377 | | | | 20,580 | |

| | | | | | | | |

| Common Stocks (99.8%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

Health Care continued | | | | | |

Merck & Co., Inc. | | | 160,390 | | | | 9,025 | |

Novartis AG, ADR | | | 197,248 | | | | 16,561 | |

Novo Nordisk A/S, ADR | | | 607,971 | | | | 32,630 | |

Regeneron Pharmaceuticals, Inc.* | | | 60,501 | | | | 22,746 | |

Varian Medical Systems, Inc.* | | | 183,043 | | | | 20,345 | |

| | | | | | | | |

Total | | | | | | | 138,087 | |

| | | | | | | | |

| |

Industrials (8.0%) | | | | | |

Deere & Co. | | | 181,653 | | | | 28,430 | |

Expeditors International of Washington, Inc. | | | 410,120 | | | | 26,531 | |

United Parcel Service, Inc. - Class B | | | 175,071 | | | | 20,860 | |

| | | | | | | | |

Total | | | | | | | 75,821 | |

| | | | | | | | |

| |

Information Technology (44.5%) | | | | | |

Alibaba Group Holding, Ltd., ADR* | | | 350,382 | | | | 60,416 | |

Alphabet, Inc. - Class A* | | | 26,291 | | | | 27,695 | |

Alphabet, Inc. - Class C* | | | 26,349 | | | | 27,572 | |

Analog Devices, Inc. | | | 45,439 | | | | 4,045 | |

Autodesk, Inc.* | | | 290,361 | | | | 30,438 | |

Automatic Data Processing, Inc. | | | 67,323 | | | | 7,890 | |

Cisco Systems, Inc. | | | 1,187,926 | | | | 45,498 | |

Facebook, Inc. - Class A* | | | 351,133 | | | | 61,961 | |

| | | | | | | | |

| Common Stocks (99.8%) | | Shares/

$ Par | | | Value

$ (000’s) | |

Information Technology continued | | | | | |

Microsoft Corp. | | | 313,243 | | | | 26,795 | |

Oracle Corp. | | | 979,876 | | | | 46,328 | |

QUALCOMM, Inc. | | | 479,345 | | | | 30,688 | |

Visa, Inc. - Class A | | | 453,737 | | | | 51,735 | |

| | | | | | | | |

Total | | | | | | | 421,061 | |

| | | | | | | | |

Total Common Stocks | | | | | | | | |

(Cost: $687,454) | | | | | | | 943,326 | |

| | | | | | | | |

|

| Short-Term Investments (0.7%) | |

| |

Money Market Funds (0.7%) | | | | | |

State Street Institutional U.S. Government Money Market Fund - Premier Class, 1.209% # | | | 6,385,434 | | | | 6,385 | |

| | | | | | | | |

Total | | | | | | | 6,385 | |

| | | | | | | | |

| | |

Total Short-Term Investments | | | | | | | | |

(Cost: $6,385) | | | | | | | 6,385 | |

| | | | | | | | |

| | |

Total Investments (100.5%) | | | | | | | | |

(Cost: $693,839)(a) | | | | | | | 949,711 | |

| | | | | | | | |

Other Assets, Less | | | | | | | | |

Liabilities (-0.5%) | | | | | | | (4,326 | ) |

| | | | | | | | |

Net Assets (100.0%) | | | | | | | 945,385 | |

| | | | | | | | |

| # | 7-Day yield as of December 31, 2017. |

| | ADR after the name of a security represents—American Depositary Receipt. |

| (a) | At December 31, 2017, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $694,637 and the net unrealized appreciation of investments based on that cost was $255,073 which is comprised of $265,594 aggregate gross unrealized appreciation and $10,521 aggregate gross unrealized depreciation. |

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2017. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 943,326 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | 6,385 | | | | - | | | | - | | | |

Total Assets: | | $ | 949,711 | | | $ | - | | | $ | - | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | | | |

| | Focused Appreciation Portfolio | | | 7 | |

Large Cap Core Stock Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in common stocks of large capitalization U.S. and foreign based companies listed on U.S. exchanges. | | $593 Million |

Portfolio Overview

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Large Cap Core Stock Portfolio (the “Portfolio”), has engaged Wellington Management Company LLP (“Wellington”) to act as sub-adviser for the Portfolio. Wellington was appointed sub-adviser to the Portfolio effective October 27, 2017. Prior to that time, the Portfolio was sub-advised by Fayez Sarofim & Co. (“Sarofim & Co.”). The Portfolio allocates its assets across a variety of industries, selecting companies in each industry based on the research of a team of global industry analysts. The Portfolio typically seeks to maintain representation in each major industry represented by broad-based, large cap U.S. equity indices. The Portfolio utilizes a “bottom-up” approach, which is the use of fundamental analysis to identify specific securities for purchase or sale. Fundamental analysis of a company involves the assessment of a variety of factors, including the company’s business environment, management quality, balance sheet, income statement, anticipated earnings, revenues and dividends, and other related measures or indicators of valuation and growth potential. The Portfolio’s sector exposures generally conform with the sector weights present in the Portfolio’s benchmark index.

Market Overview

U.S. equities rose for the fourteenth consecutive month, as measured by the S&P 500® Index, to finish the twelve-month period ending December 31, 2017. The stock market soared following Donald Trump’s victory on hopes of increased fiscal stimulus, reduced regulatory restrictions and lower corporate taxes. The reflation trading theme dominated the narrative heading into 2017, leading to significant equity inflows and the largest exodus from bonds since the “taper tantrum” in 2013. Despite many investors voicing concerns about stretched valuations, heightened U.S. tensions with Russia and North Korea, and overly optimistic policy expectations, the market hit a series of record highs during the year on the back of strong employment data and strong corporate earnings.

In a well-telegraphed move, the U.S. Federal Reserve (the “Fed”) hiked the policy interest rates three times during the period. In August, the Fed announced that its balance sheet normalization program would begin in October, reiterating that the process would be gradual and predictable. In November, Jerome Powell’s nomination as the chair of the Fed provided markets with reasonable assurance that current central bank policies would be maintained in the near term.

Tax reform was a key area of focus during the period, culminating with a $1.5 trillion tax reform bill signed into law by Donald Trump at the end of December. The legislation included the most sweeping changes to the tax code since 1986 and represented a major victory for Republicans.

Returns during the period varied by market cap. Large cap stocks, as measured by the S&P 500® Index outperformed mid and small cap stocks, as measured by the S&P MidCap 400® Index and the S&P SmallCap 600® Index.

Portfolio Results

The Large Cap Core Stock Portfolio returned 24.87% for the twelve months ended December 31, 2017. By comparison, the S&P 500® Index (the “Index”) returned 21.83% for the year. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses.) According to Lipper® Analytical Services, Inc., an independent mutual fund ranking company, the average return in 2017 for the Large Cap Core Funds peer group was 20.69%.

As noted above, prior to October 27, 2017, the Portfolio was managed by Sarofim & Co. With respect to the period prior to October 27, 2017, the Portfolio’s outperformance relative to the Index was primarily attributable to stock selection in the Consumer Staples, Information Technology and Health Care sectors. In the Consumer Staples sector, positioning within the food products and personal products industries was advantageous. The Portfolio’s emphasis on Apple and Facebook produced the largest positive effects in the Information Technology sector. Positive stock selection in Health Care was driven by strong returns from key health care equipment holdings such as Intuitive Surgical and Abbott Laboratories.

The following performance attribution comments relate to the period October 27, 2017 through December 31, 2017, during which Wellington acted as the Portfolio’s sub-adviser.

The Portfolio’s underperformance during the period was due to both stock selection and sector allocation, a residual of the bottom-up stock selection process. Weak stock selection within the Financials, Utilities and Materials sectors was partially offset by strong stock selection within the Consumer Staples and Energy sectors. The Portfolio’s overweight to Utilities and underweight to Consumer Discretionary also detracted from performance during the period.

| | | | |

| 8 | | Large Cap Core Stock Portfolio | | |

Large Cap Core Stock Portfolio (unaudited)

Top individual security detractors from relative returns during the period included Edison International and PG&E. The Portfolio’s underweight to Amazon also held back relative results. Top individual security contributors to relative performance during the period included Coty and Microsoft. Not holding benchmark constituent Merck & Co. also aided performance.

Portfolio Manager Outlook

The following forward-looking comments are the opinion of Wellington, the Portfolio’s sub-adviser.

Our U.S. macro team expects the U.S. economy to expand at a steady clip and believes growth in 2018 could be bolstered by an expansionary fiscal stance. Consumer confidence is high as the job market is strong, wage gains are reasonable, and home prices are rising. Business investment is starting to rebound and projected capital expenditures are robust. Against this backdrop, some combination of tax relief and hurricane-recovery spending is likely to add to growth in 2018. Further, deregulation is likely to be a tailwind for investment spending and growth.

In terms of potential risks, inflation is the wild card. While not our base case, an unexpected rise in inflation could force central banks’ hands toward more aggressive tightening and raise the risk of recession. If the U.S. yield curve flattens further, it would signal tighter financial conditions. Global trade is another risk for markets. The U.S. administration could set off a stagflationary dynamic if it enacts severe trade restrictions. Geopolitics is also a concern, but we think any market disruptions are likely to be temporary.

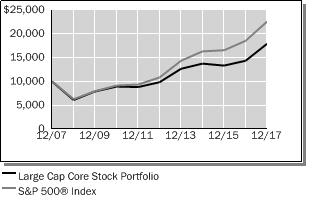

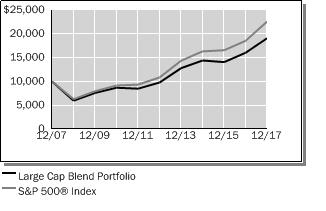

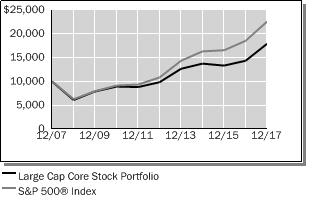

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2017 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Large Cap Core Stock Portfolio | | | 24.87 | % | | | 12.69 | % | | | 6.01 | % |

S&P 500® Index | | | 21.83 | % | | | 15.79 | % | | | 8.50 | % |

Lipper® Variable Insurance Products (VIP) Large Cap Core Funds Average | | | 20.69 | % | | | 14.51 | % | | | 7.48 | % |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/07. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

| | | | | | |

| | Large Cap Core Stock Portfolio | | | 9 | |

Large Cap Core Stock Portfolio (unaudited)

Top 10 Equity Holdings 12/31/17

| | | | | | |

| Security Description | | % of Net Assets | | | |

Bank of America Corp. | | | 2.5 | % | | |

Apple, Inc. | | | 2.4 | % | | |

Alphabet, Inc. - Class A | | | 2.4 | % | | |

Facebook, Inc. - Class A | | | 2.3 | % | | |

Microsoft Corp. | | | 2.2 | % | | |

Amazon.com, Inc. | | | 2.2 | % | | |

Verizon Communications, Inc. | | | 2.0 | % | | |

UnitedHealth Group, Inc. | | | 1.7 | % | | |

The Boeing Co. | | | 1.7 | % | | |

Coty, Inc. - Class A | | | 1.6 | % | | |

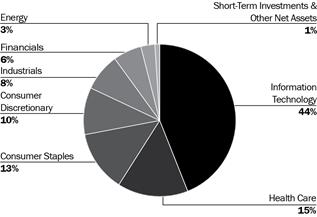

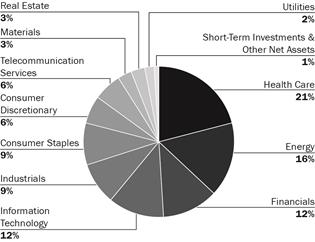

Sector Allocation 12/31/17

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

| | | | |

| 10 | | Large Cap Core Stock Portfolio | | |

Large Cap Core Stock Portfolio

Schedule of Investments

December 31, 2017

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Consumer Discretionary (11.0%) | | | | | | | | |

Amazon.com, Inc.* | | | 11,035 | | | | 12,905 | |

Charter Communications, Inc. - Class A* | | | 12,269 | | | | 4,122 | |

Comcast Corp. - Class A | | | 240,381 | | | | 9,627 | |

Dollar Tree, Inc.* | | | 17,929 | | | | 1,924 | |

Expedia, Inc. | | | 19,835 | | | | 2,376 | |

Harley-Davidson, Inc. | | | 41,751 | | | | 2,124 | |

Hilton Worldwide Holdings, Inc. | | | 25,328 | | | | 2,023 | |

L Brands, Inc. | | | 7,269 | | | | 438 | |

Lennar Corp. - Class A | | | 38,868 | | | | 2,458 | |

Liberty Media Corp. - Liberty Formula One* | | | 24,196 | | | | 827 | |

McDonald’s Corp. | | | 23,540 | | | | 4,052 | |

Mohawk Industries, Inc.* | | | 15,835 | | | | 4,369 | |

Netflix, Inc.* | | | 12,024 | | | | 2,308 | |

NIKE, Inc. - Class B | | | 66,446 | | | | 4,156 | |

Tapestry, Inc. | | | 19,239 | | | | 851 | |

The TJX Cos., Inc. | | | 52,958 | | | | 4,049 | |

Twenty-First Century Fox, Inc. - Class A | | | 71,771 | | | | 2,478 | |

Viacom, Inc. - Class B | | | 95,462 | | | | 2,941 | |

Wynn Resorts, Ltd. | | | 8,234 | | | | 1,388 | |

| | | | | | | | |

Total | | | | | | | 65,416 | |

| | | | | | | | |

| | |

Consumer Staples (9.5%) | | | | | | | | |

Altria Group, Inc. | | | 96,700 | | | | 6,905 | |

Anheuser-Busch InBev NV, ADR | | | 14,250 | | | | 1,590 | |

British American Tobacco PLC, ADR | | | 103,048 | | | | 6,903 | |

Campbell Soup Co. | | | 106,391 | | | | 5,118 | |

Constellation Brands, Inc. - Class A | | | 17,620 | | | | 4,027 | |

Costco Wholesale Corp. | | | 14,963 | | | | 2,785 | |

Coty, Inc. - Class A | | | 485,315 | | | | 9,653 | |

Monster Beverage Corp.* | | | 104,926 | | | | 6,641 | |

PepsiCo, Inc. | | | 52,765 | | | | 6,328 | |

Sysco Corp. | | | 27,930 | | | | 1,696 | |

Unilever NV | | | 78,988 | | | | 4,449 | |

| | | | | | | | |

Total | | | | | | | 56,095 | |

| | | | | | | | |

| | |

Energy (5.7%) | | | | | | | | |

Andeavor | | | 17,898 | | | | 2,047 | |

Antero Resources Corp.* | | | 65,806 | | | | 1,250 | |

BP PLC, ADR | | | 54,685 | | | | 2,299 | |

Chevron Corp. | | | 23,663 | | | | 2,962 | |

Concho Resources, Inc.* | | | 5,633 | | | | 846 | |

Diamondback Energy, Inc.* | | | 21,639 | | | | 2,732 | |

Encana Corp. | | | 37,985 | | | | 506 | |

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Energy continued | | | | | | | | |

Exxon Mobil Corp. | | | 19,240 | | | | 1,609 | |

Hess Corp. | | | 25,600 | | | | 1,215 | |

Kinder Morgan, Inc. | | | 150,825 | | | | 2,725 | |

Marathon Petroleum Corp. | | | 46,162 | | | | 3,046 | |

Newfield Exploration Co.* | | | 179,960 | | | | 5,674 | |

Parsley Energy, Inc. - Class A* | | | 8,584 | | | | 253 | |

Pioneer Natural Resources Co. | | | 1,026 | | | | 177 | |

Suncor Energy, Inc. | | | 56,538 | | | | 2,076 | |

TransCanada Corp. | | | 94,213 | | | | 4,583 | |

| | | | | | | | |

Total | | | | | | | 34,000 | |

| | | | | | | | |

| | |

Financials (12.8%) | | | | | | | | |

The Allstate Corp. | | | 20,232 | | | | 2,118 | |

American Express Co. | | | 44,160 | | | | 4,385 | |

American International Group, Inc. | | | 95,209 | | | | 5,673 | |

Athene Holding, Ltd. - Class A* | | | 21,326 | | | | 1,103 | |

Bank of America Corp. | | | 500,536 | | | | 14,776 | |

BlackRock, Inc. | | | 1,990 | | | | 1,022 | |

Boston Properties, Inc. | | | 20,959 | | | | 2,725 | |

Capital One Financial Corp. | | | 44,748 | | | | 4,456 | |

Citigroup, Inc. | | | 81,983 | | | | 6,100 | |

The Hartford Financial Services Group, Inc. | | | 40,844 | | | | 2,299 | |

Huntington Bancshares, Inc. | | | 192,215 | | | | 2,799 | |

Intercontinental Exchange, Inc. | | | 17,632 | | | | 1,244 | |

Marsh & McLennan Cos., Inc. | | | 64,111 | | | | 5,218 | |

MetLife, Inc. | | | 61,034 | | | | 3,086 | |

Morgan Stanley | | | 28,657 | | | | 1,504 | |

Northern Trust Corp. | | | 10,619 | | | | 1,061 | |

PNC Financial Services Group, Inc. | | | 53,761 | | | | 7,757 | |

Prudential Financial, Inc. | | | 14,550 | | | | 1,673 | |

Simon Property Group, Inc. | | | 12,290 | | | | 2,111 | |

TD Ameritrade Holding Corp. | | | 26,735 | | | | 1,367 | |

XL Group, Ltd. | | | 96,988 | | | | 3,410 | |

| | | | | | | | |

Total | | | | | | | 75,887 | |

| | | | | | | | |

| | |

Health Care (14.4%) | | | | | | | | |

Abbott Laboratories | | | 62,440 | | | | 3,563 | |

Allergan PLC | | | 39,784 | | | | 6,508 | |

Alnylam Pharmaceuticals, Inc.* | | | 7,069 | | | | 898 | |

AstraZeneca PLC, ADR | | | 151,404 | | | | 5,254 | |

Baxter International, Inc. | | | 32,196 | | | | 2,081 | |

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Health Care continued | | | | | | | | |

Biogen, Inc.* | | | 2,771 | | | | 883 | |

Boston Scientific Corp.* | | | 223,886 | | | | 5,550 | |

Bristol-Myers Squibb Co. | | | 127,809 | | | | 7,832 | |

Cardinal Health, Inc. | | | 39,228 | | | | 2,404 | |

Celgene Corp.* | | | 30,882 | | | | 3,223 | |

Cigna Corp. | | | 22,083 | | | | 4,485 | |

Danaher Corp. | | | 19,923 | | | | 1,849 | |

Eli Lilly and Co. | | | 32,575 | | | | 2,751 | |

HCA Healthcare, Inc.* | | | 20,853 | | | | 1,832 | |

Incyte Corp.* | | | 10,894 | | | | 1,032 | |

McKesson Corp. | | | 20,028 | | | | 3,123 | |

Medtronic PLC | | | 90,909 | | | | 7,341 | |

Mylan NV* | | | 82,285 | | | | 3,481 | |

Regeneron Pharmaceuticals, Inc.* | | | 3,141 | | | | 1,181 | |

Stryker Corp. | | | 19,822 | | | | 3,069 | |

Teva Pharmaceutical Industries, Ltd., ADR | | | 56,444 | | | | 1,070 | |

Thermo Fisher Scientific, Inc. | | | 14,654 | | | | 2,783 | |

UnitedHealth Group, Inc. | | | 46,323 | | | | 10,212 | |

Vertex Pharmaceuticals, Inc.* | | | 18,937 | | | | 2,838 | |

| | | | | | | | |

Total | | | | | | | 85,243 | |

| | | | | | | | |

| | |

Industrials (11.4%) | | | | | | | | |

AMETEK, Inc. | | | 43,230 | | | | 3,133 | |

The Boeing Co. | | | 34,297 | | | | 10,114 | |

Caterpillar, Inc. | | | 16,017 | | | | 2,524 | |

Deere & Co. | | | 11,078 | | | | 1,734 | |

Eaton Corp. PLC | | | 36,773 | | | | 2,905 | |

Equifax, Inc. | | | 10,986 | | | | 1,295 | |

FedEx Corp. | | | 12,478 | | | | 3,114 | |

Fortive Corp. | | | 42,944 | | | | 3,107 | |

General Electric Co. | | | 227,871 | | | | 3,976 | |

IHS Markit, Ltd.* | | | 18,704 | | | | 844 | |

Illinois Tool Works, Inc. | | | 15,681 | | | | 2,616 | |

J.B. Hunt Transport Services, Inc. | | | 20,140 | | | | 2,316 | |

Lockheed Martin Corp. | | | 22,964 | | | | 7,373 | |

Masco Corp. | | | 41,951 | | | | 1,843 | |

Norfolk Southern Corp. | | | 27,779 | | | | 4,025 | |

Northrop Grumman Corp. | | | 20,791 | | | | 6,381 | |

PACCAR, Inc. | | | 27,091 | | | | 1,926 | |

Pentair PLC | | | 44,571 | | | | 3,148 | |

Southwest Airlines Co. | | | 15,129 | | | | 990 | |

Union Pacific Corp. | | | 16,552 | | | | 2,220 | |

United Continental Holdings, Inc.* | | | 24,817 | | | | 1,673 | |

| | | | | | | | |

Total | | | | | | | 67,257 | |

| | | | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | | | |

| | Large Cap Core Stock Portfolio | | | 11 | |

Large Cap Core Stock Portfolio

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Information Technology (22.5%) | | | | | | | | |

Accenture PLC - Class A | | | 8,821 | | | | 1,350 | |

Adobe Systems, Inc.* | | | 18,251 | | | | 3,198 | |

Advanced Micro Devices, Inc.* | | | 151,219 | | | | 1,555 | |

Alliance Data Systems Corp. | | | 9,134 | | | | 2,315 | |

Alphabet, Inc. - Class A* | | | 13,497 | | | | 14,218 | |

Apple, Inc. | | | 84,301 | | | | 14,266 | |

Applied Materials, Inc. | | | 42,804 | | | | 2,188 | |

Autodesk, Inc.* | | | 14,055 | | | | 1,473 | |

Cognizant Technology Solutions Corp. - Class A | | | 7,381 | | | | 524 | |

CoStar Group, Inc.* | | | 1,925 | | | | 572 | |

eBay, Inc.* | | | 98,635 | | | | 3,722 | |

Facebook, Inc. - Class A* | | | 77,862 | | | | 13,740 | |

FleetCor Technologies, Inc.* | | | 15,597 | | | | 3,001 | |

Flex, Ltd.* | | | 170,445 | | | | 3,066 | |

Global Payments, Inc. | | | 47,560 | | | | 4,767 | |

KLA-Tencor Corp. | | | 22,172 | | | | 2,330 | |

Marvell Technology Group, Ltd. | | | 180,838 | | | | 3,883 | |

Microchip Technology, Inc. | | | 43,891 | | | | 3,857 | |

Micron Technology, Inc.* | | | 125,134 | | | | 5,146 | |

Microsoft Corp. | | | 151,204 | | | | 12,934 | |

NetApp, Inc. | | | 48,221 | | | | 2,668 | |

NVIDIA Corp. | | | 21,551 | | | | 4,170 | |

PayPal Holdings, Inc.* | | | 47,533 | | | | 3,499 | |

QUALCOMM, Inc. | | | 77,377 | | | | 4,954 | |

Salesforce.com, Inc.* | | | 44,114 | | | | 4,510 | |

ServiceNow, Inc.* | | | 22,363 | | | | 2,916 | |

Total System Services, Inc. | | | 11,605 | | | | 918 | |

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Information Technology continued | | | | | | | | |

Visa, Inc. - Class A | | | 75,060 | | | | 8,558 | |

Workday, Inc. - Class A* | | | 29,926 | | | | 3,045 | |

| | | | | | | | |

Total | | | | | | | 133,343 | |

| | | | | | | | |

| | |

Materials (3.7%) | | | | | | | | |

ArcelorMittal* | | | 21,938 | | | | 709 | |

Ball Corp. | | | 46,000 | | | | 1,741 | |

Celanese Corp. - Class A | | | 27,929 | | | | 2,991 | |

Crown Holdings, Inc.* | | | 29,698 | | | | 1,671 | |

DowDuPont, Inc. | | | 87,164 | | | | 6,208 | |

International Paper Co. | | | 37,353 | | | | 2,164 | |

Martin Marietta Materials, Inc. | | | 1,521 | | | | 336 | |

Monsanto Co. | | | 8,015 | | | | 936 | |

Nucor Corp. | | | 6,563 | | | | 417 | |

PPG Industries, Inc. | | | 18,748 | | | | 2,190 | |

Praxair, Inc. | | | 9,750 | | | | 1,508 | |

Southern Copper Corp. | | | 7,939 | | | | 377 | |

Vulcan Materials Co. | | | 3,377 | | | | 433 | |

| | | | | | | | |

Total | | | | | | | 21,681 | |

| | | | | | | | |

| | |

Real Estate (2.2%) | | | | | | | | |

American Tower Corp. | | | 42,669 | | | | 6,088 | |

Equinix, Inc. | | | 4,767 | | | | 2,161 | |

Invitation Homes, Inc. | | | 127,841 | | | | 3,013 | |

Prologis, Inc. | | | 29,597 | | | | 1,909 | |

| | | | | | | | |

Total | | | | | | | 13,171 | |

| | | | | | | | |

| | |

Telecommunication Services (2.0%) | | | | | | | | |

Verizon Communications, Inc. | | | 227,927 | | | | 12,064 | |

| | | | | | | | |

Total | | | | | | | 12,064 | |

| | | | | | | | |

| | | | | | | | |

| Common Stocks (99.6%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | |

Utilities (4.4%) | | | | | | | | |

Avangrid, Inc. | | | 28,050 | | | | 1,419 | |

Edison International | | | 83,120 | | | | 5,257 | |

Exelon Corp. | | | 71,757 | | | | 2,828 | |

NextEra Energy, Inc. | | | 41,612 | | | | 6,499 | |

NRG Energy, Inc. | | | 140,065 | | | | 3,989 | |

PG&E Corp. | | | 66,429 | | | | 2,978 | |

Sempra Energy | | | 31,215 | | | | 3,337 | |

| | | | | | | | |

Total | | | | | | | 26,307 | |

| | | | | | | | |

| | |

Total Common Stocks

(Cost: $540,257) | | | | | | | 590,464 | |

| | | | | | | | |

| |

| Short-Term Investments (0.5%) | | | | |

| | |

Money Market Funds (0.5%) | | | | | | | | |

State Street Institutional U.S. Government Money Market Fund - Premier Class, 1.209% # | | | 2,906,799 | | | | 2,907 | |

| | | | | | | | |

Total | | | | | | | 2,907 | |

| | | | | | | | |

| | |

Total Short-Term Investments | | | | | | | | |

(Cost: $2,907) | | | | | | | 2,907 | |

| | | | | | | | |

| | |

Total Investments (100.1%)

| | | | | | | | |

(Cost: $543,164)(a) | | | | | | | 593,371 | |

| | | | | | | | |

Other Assets, Less | | | | | | | | |

Liabilities (-0.1%) | | | | | | | (794 | ) |

| | | | | | | | |

Net Assets (100.0%) | | | | | | | 592,577 | |

| | | | | | | | |

| # | 7-Day yield as of December 31, 2017. |

| | ADR after the name of a security represents—American Depositary Receipt. |

| (a) | At December 31, 2017, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $543,397 and the net unrealized appreciation of investments based on that cost was $49,974 which is comprised of $58,772 aggregate gross unrealized appreciation and $8,798 aggregate gross unrealized depreciation. |

| | The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2017. See Note 3 for additional information on portfolio valuation. |

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 – Significant

Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 590,464 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | 2,907 | | | | - | | | | - | | | |

Total Assets: | | $ | 593,371 | | | $ | - | | | $ | - | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | |

| 12 | | Large Cap Core Stock Portfolio | | |

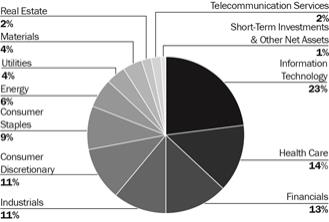

Large Cap Blend Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in equity securities of U.S. large capitalization companies listed or traded on U.S. securities exchanges. | | $176 million |

Portfolio Overview

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Large Cap Blend Portfolio (the “Portfolio”), has engaged Fiduciary Management, Inc. (“FMI”) to act as sub-adviser for the Portfolio. Normally, the Portfolio invests in equity securities of large capitalization companies listed or traded on U.S. securities exchanges. In selecting investments, greater consideration is given to potential appreciation and future dividends than to current income. The Portfolio uses fundamental analysis to look for stocks of good businesses that are selling at value prices. The Portfolio employs a focused investment strategy, typically investing in a core group of 20-30 large capitalization common stocks and ADRs.

Market Overview

We are now 106 months into this bull market that started in March 2009. Over that time period, the S&P 500® Index has gained more than 295%, which makes this the second longest, and second highest bull market recovery on record. For the year, large cap stocks, as represented by the S&P 500® Index, posted a return of 21.83%, outperforming the S&P SmallCap 600® and the S&P MidCap 400® Indices, which returned 13.23% and 16.24%, respectively. Meanwhile, the broader bond market, as represented by the Bloomberg Barclays® U.S. Aggregate Index returned 3.54%, while the Bloomberg Barclays® U.S. Corporate High Yield Index advanced 7.50%.

Portfolio Results

The Portfolio returned 19.02% for the twelve months ended December 31, 2017. By comparison, the Portfolio’s benchmark, the S&P 500® Index (the “Index”) returned 21.83%. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses.) According to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency, the average return in 2017 of the Large Cap Core Funds peer group was 20.69%.

During the year, the market was driven by a handful of growth and momentum stocks, and a primary detractor from Portfolio performance, relative to the Index, was the Portfolio’s failure to own certain key companies. For example, in 2017 not owning the five FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google, now Alphabet) caused the Portfolio to lag the Index by more than 2.0% for the reporting period.

The Portfolio’s investments in the Energy sector, which included Devon Energy and Schlumberger, were detractors for the year. At the end of the year, the Portfolio sold Devon Energy and added to its position in Schlumberger. While Devon Energy operated its business well over the Portfolio’s holding period, the exploration and production industry is highly competitive, with too many highly indebted and undisciplined drillers. Schlumberger, a supplier to the energy industry, was seen as a better business going forward.

The Health Care sector contributed most to the Portfolio’s return for the reporting period, led by insurance company UnitedHealth Group and Cerner Corporation, a provider of electronic patient records. UnitedHealth Group is the largest health insurance provider in the world, measured by revenue, and it has a strong position in each of the core-managed care business segments, including commercial, Medicare and Medicaid. The company also has investments in ancillary health care services such as Pharmacy Benefit Management (PBM), health care IT, and patient and data management. Cerner Corp. is one of three main companies working with hospitals and clinics in implementing and maintaining electronic patient records.

Auto and home insurer Progressive Corporation was the Portfolio’s top individual security performer for the reporting period. Insurance company Progressive continued to grow its market presence and the company’s earnings are expected to benefit from a more disciplined pricing environment following recent insurance industry losses from two major U.S. hurricanes in 2017. Stanley Black & Decker, a provider of building materials, was also a positive contributor to the Portfolio due to continued strength in the home construction and remodeling industry.

Portfolio Manager Outlook

The following forward-looking comments are the opinion of FMI, the Portfolio’s sub-adviser.

Over time, FMI has added the most value by protecting client portfolios in challenging markets. This is accomplished by being sensitive to the valuation paid for a company, and focusing on what could potentially go wrong with each investment, rather

| | | | | | |

| | Large Cap Blend Portfolio | | | 13 | |

Large Cap Blend Portfolio (unaudited)

than what can go right. Today, the Portfolio owns 26 strong business franchises, with solid balance sheets, that over a business cycle should earn a return more than their cost of capital. Businesses with those characteristics have generally held up better when the market corrects.

We continue to believe that valuations are critical, and at some point, investors will lose confidence and money will flow out, rather than into the stock market. That is human nature and from time-eternal, that is how markets have behaved. While we remain strong believers in equities for the long run, we are being as cautious and prudent as possible in the short run. The market will eventually give us the opportunity to reposition and upgrade a handful of existing holdings to even better businesses. We continue to build our idea inventory with high quality businesses that are just too rich to own today.

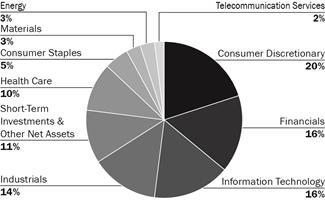

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2017 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Large Cap Blend Portfolio | | | 19.02 | % | | | 14.29 | % | | | 6.69 | % |

S&P 500® Index | | | 21.83 | % | | | 15.79 | % | | | 8.50 | % |

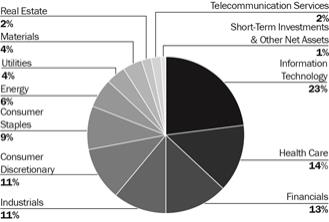

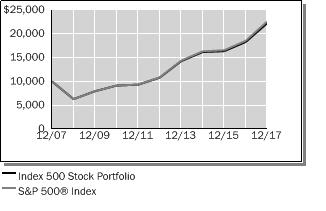

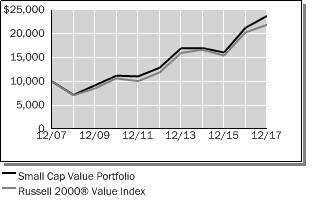

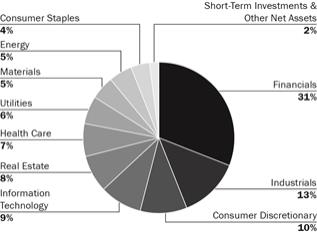

Lipper® Variable Insurance Products (VIP) Large Cap Core Funds Average | | | 20.69 | % | | | 14.51 | % | | | 7.48 | % |