UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2013 |

This report on Form N-CSR relates solely to the Registrant's Fidelity Emerging Europe, Middle East, Africa (EMEA) Fund, Fidelity Emerging Markets Discovery Fund, Fidelity Global Commodity Stock Fund, Fidelity Global Equity Income Fund, Fidelity International Discovery Fund, Fidelity International Growth Fund, Fidelity International Small Cap Fund, Fidelity International Small Cap Opportunities Fund, Fidelity International Value Fund, Fidelity Series Emerging Markets Fund, Fidelity Series International Growth Fund, Fidelity Series International Small Cap Fund, Fidelity Series International Value Fund, Fidelity Total Emerging Markets Fund, and Fidelity Total International Equity Fund (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity®

International Discovery

Fund

Annual Report

October 31, 2013

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

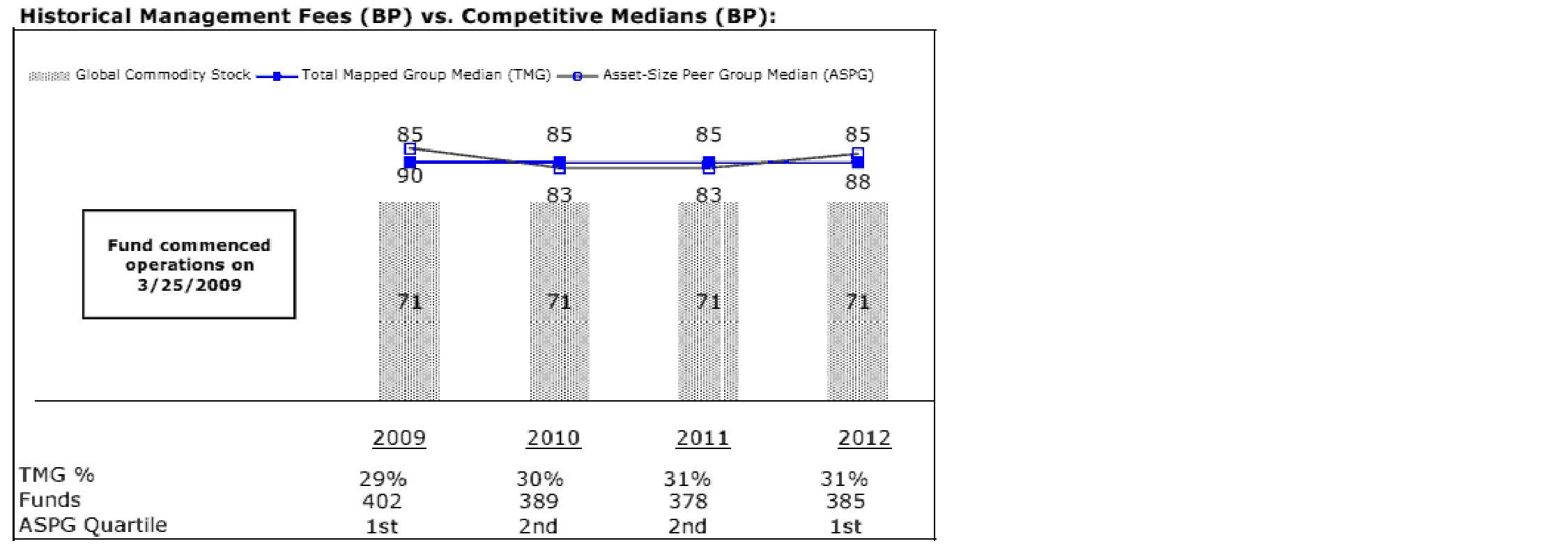

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2013 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

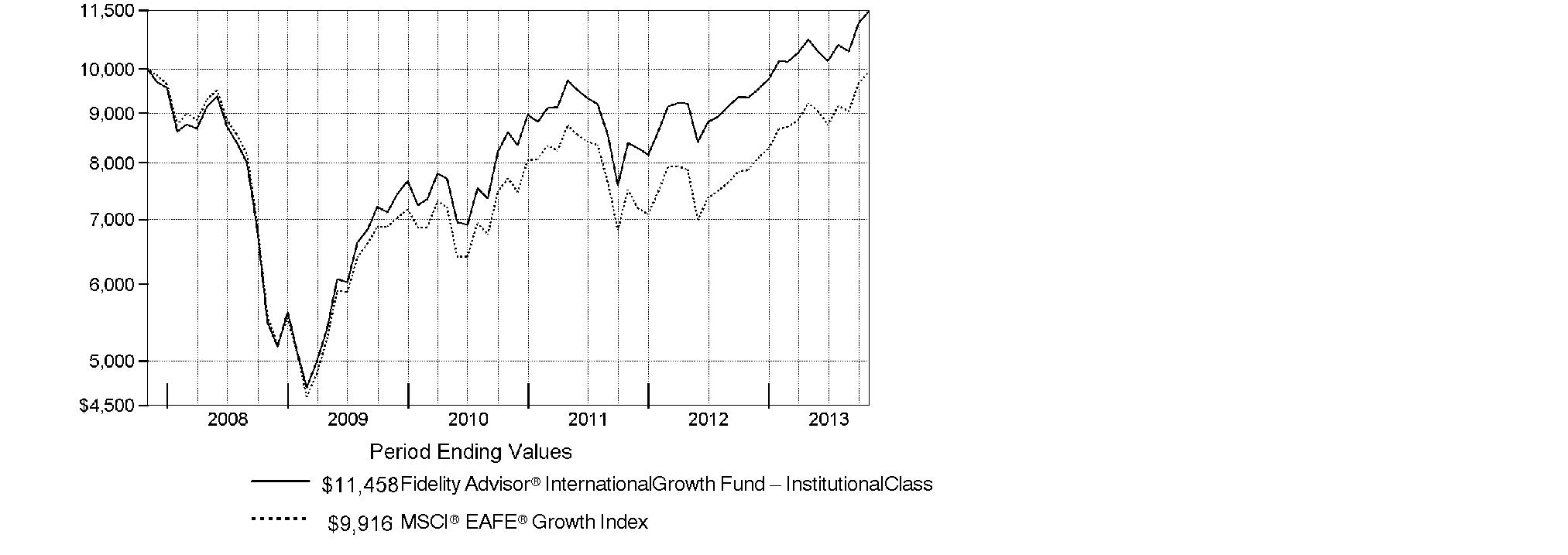

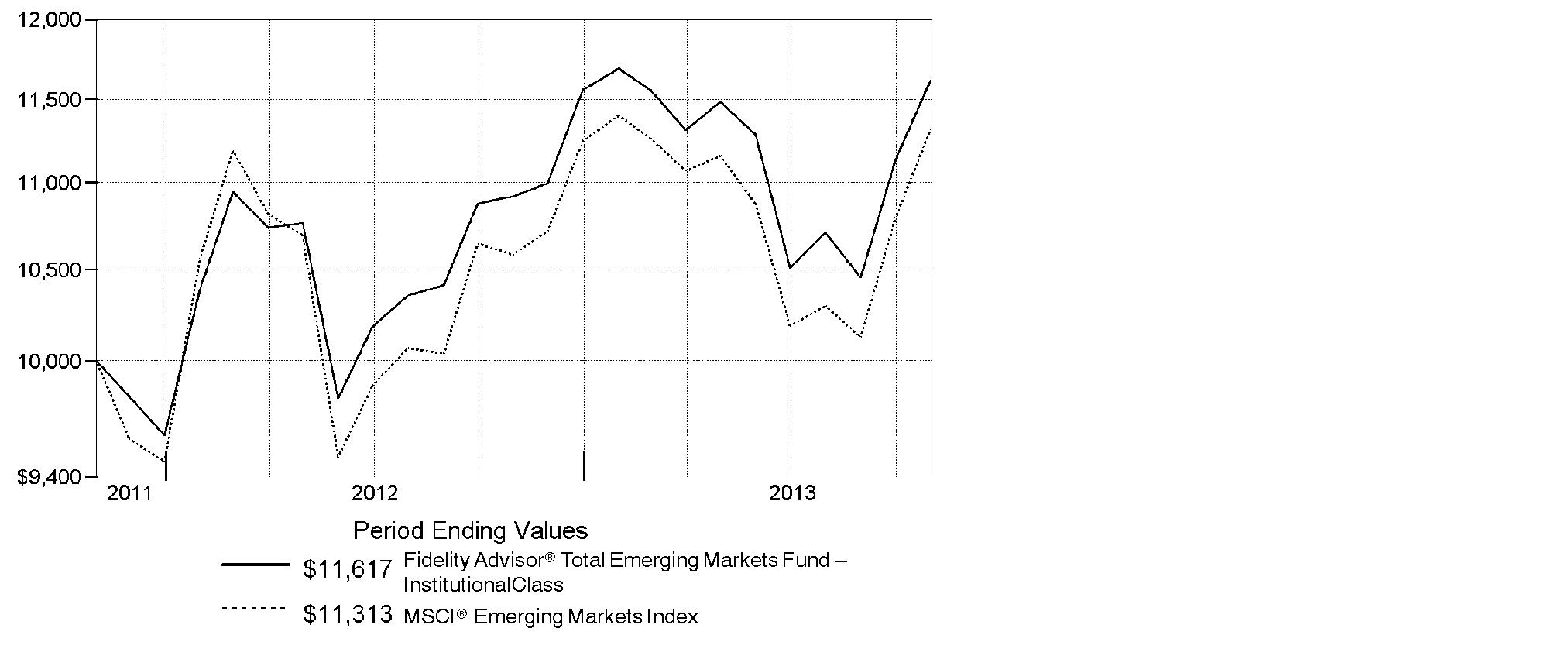

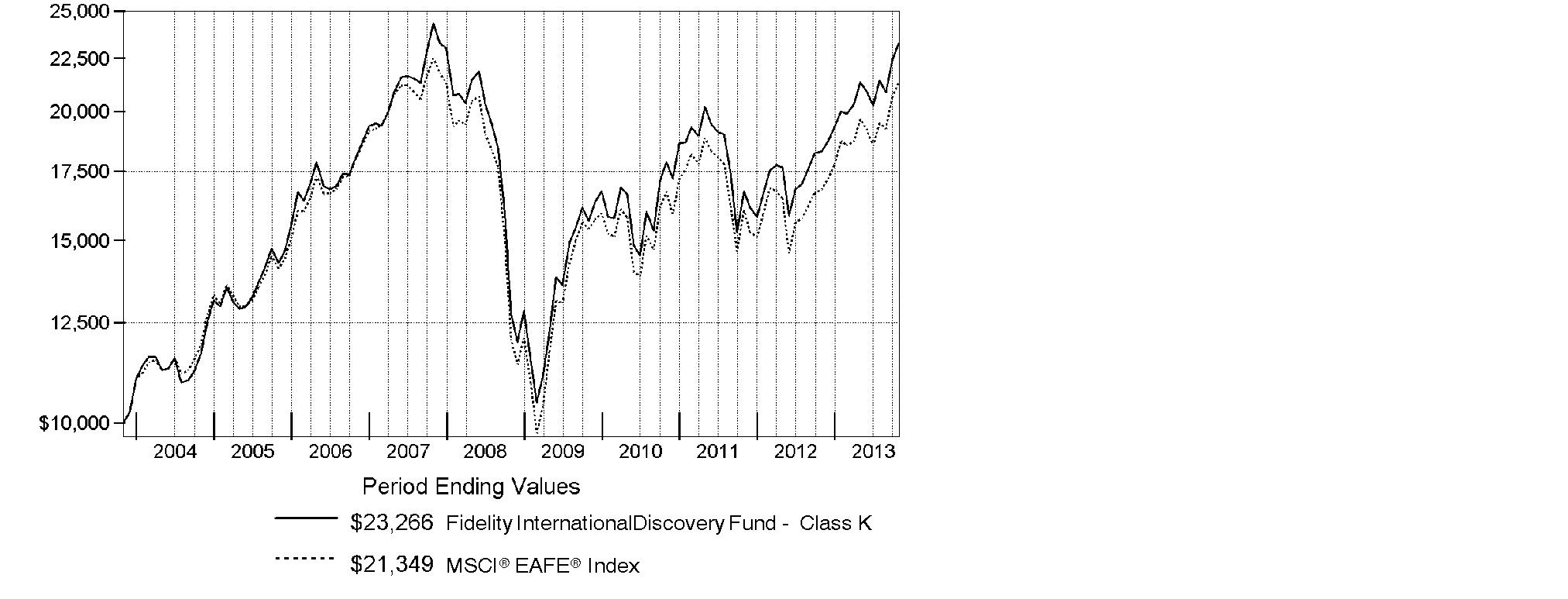

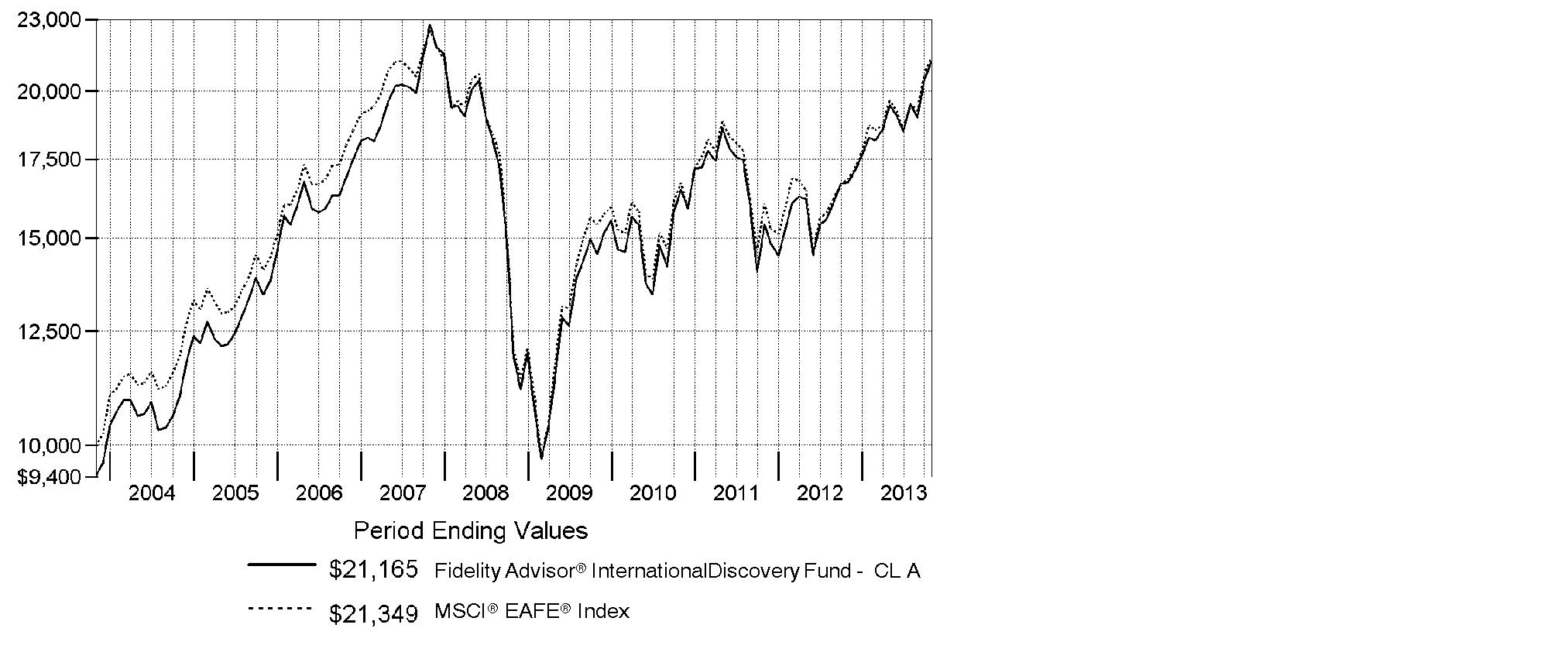

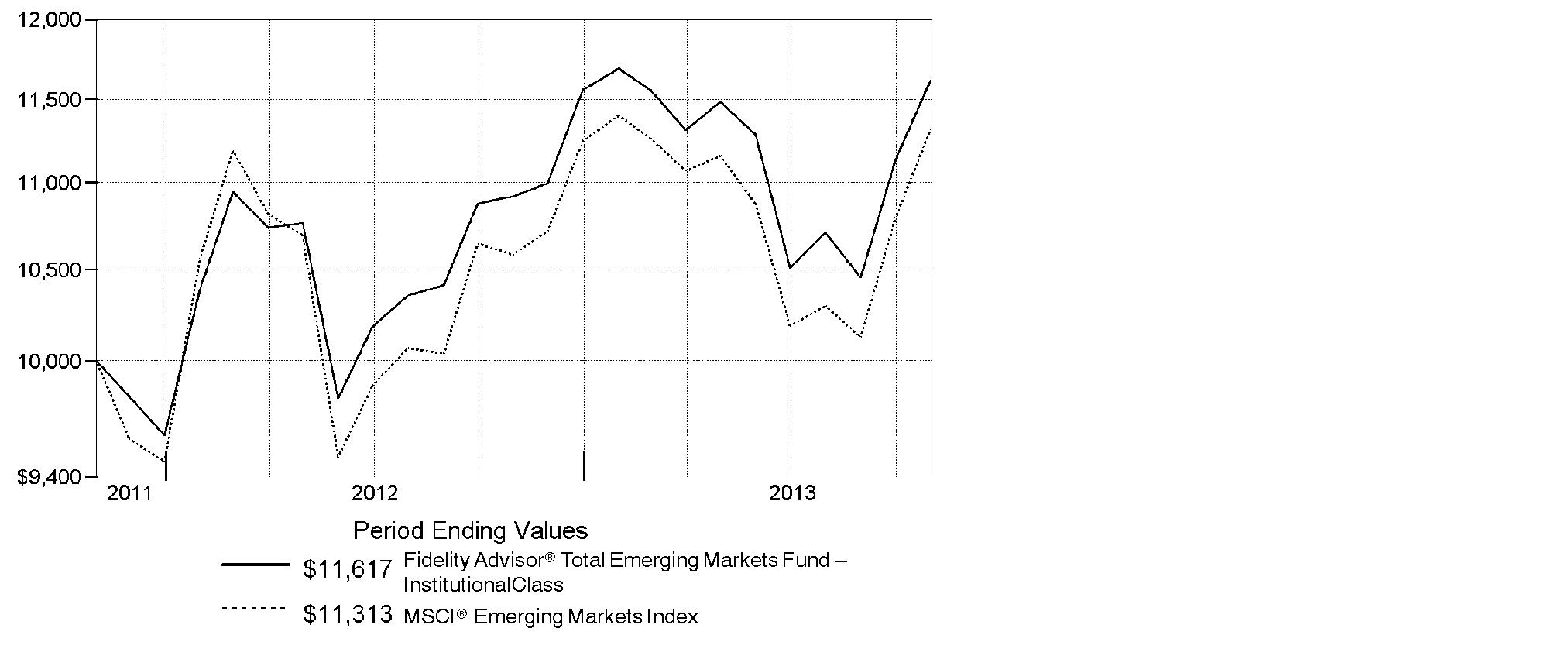

Annual Report

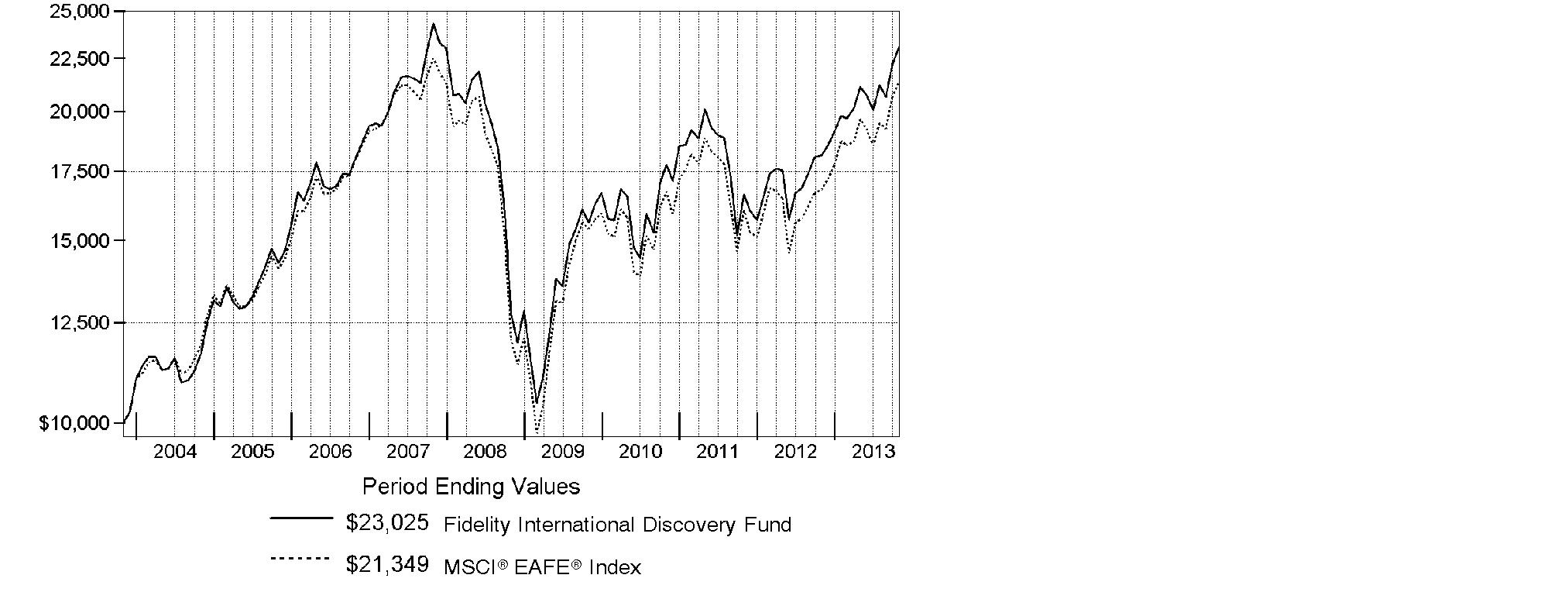

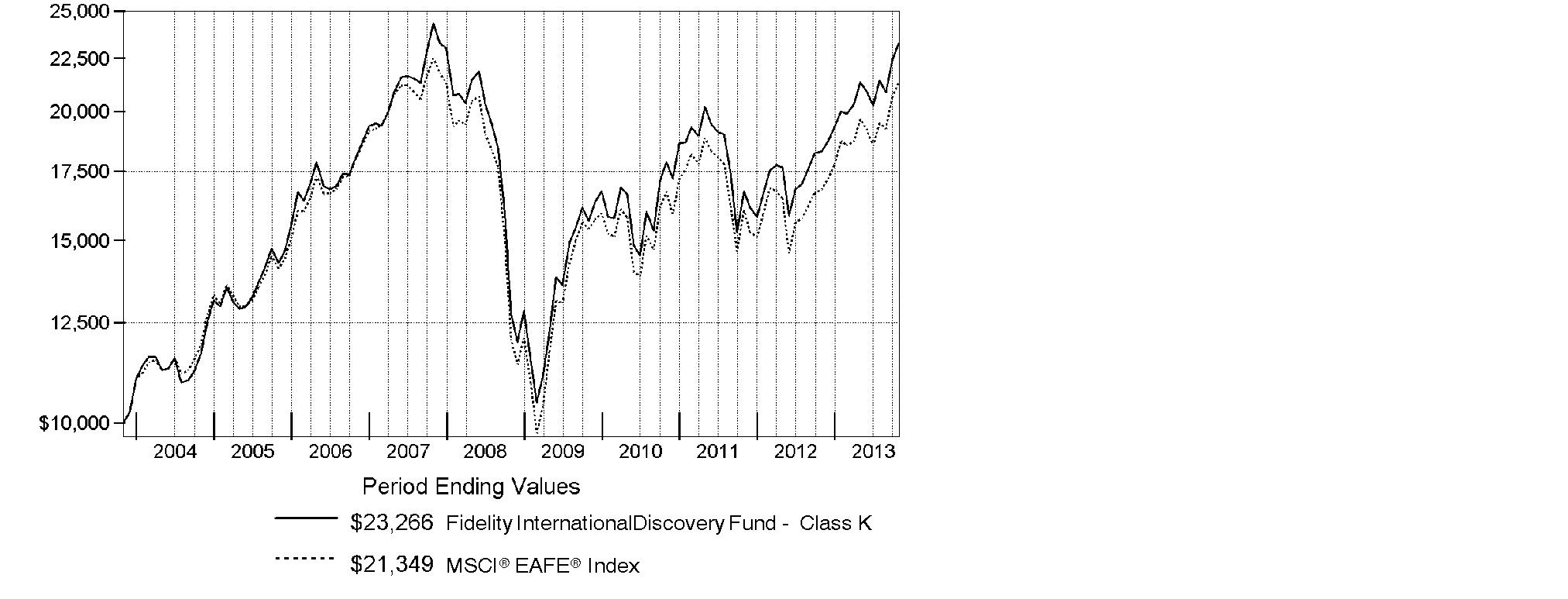

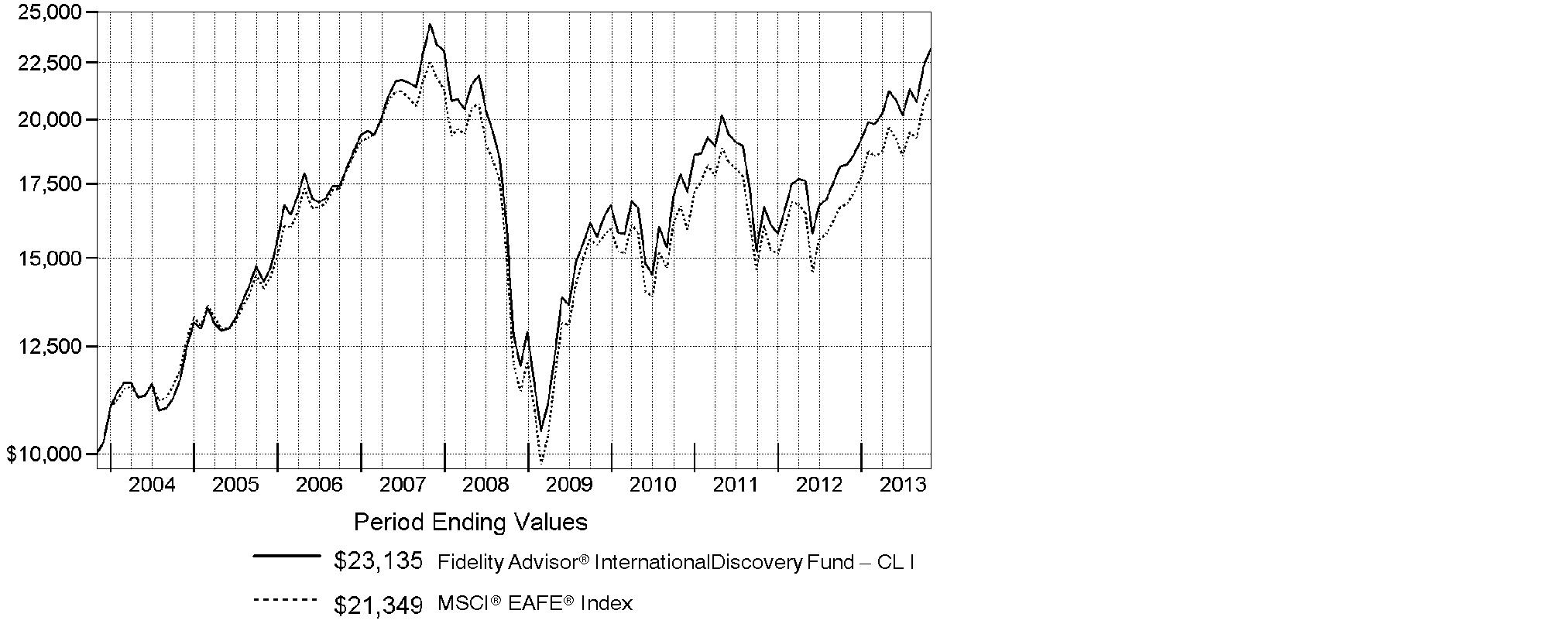

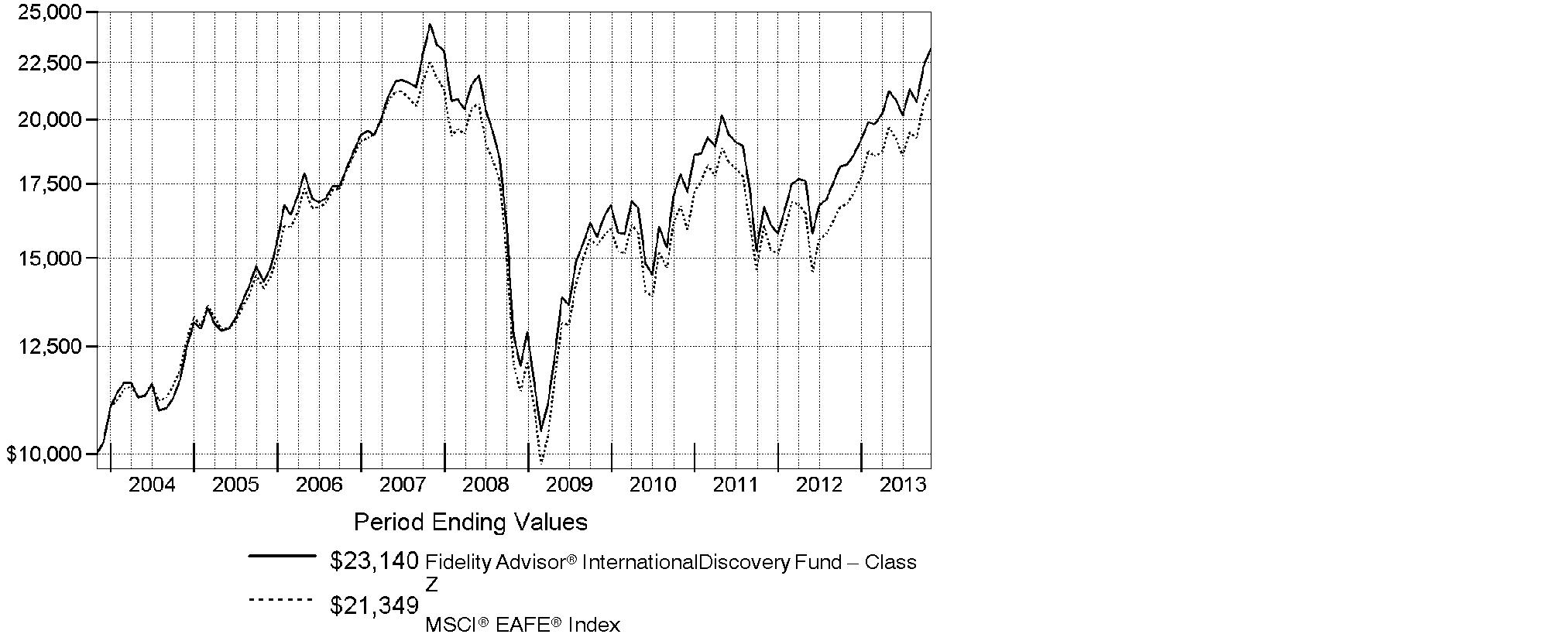

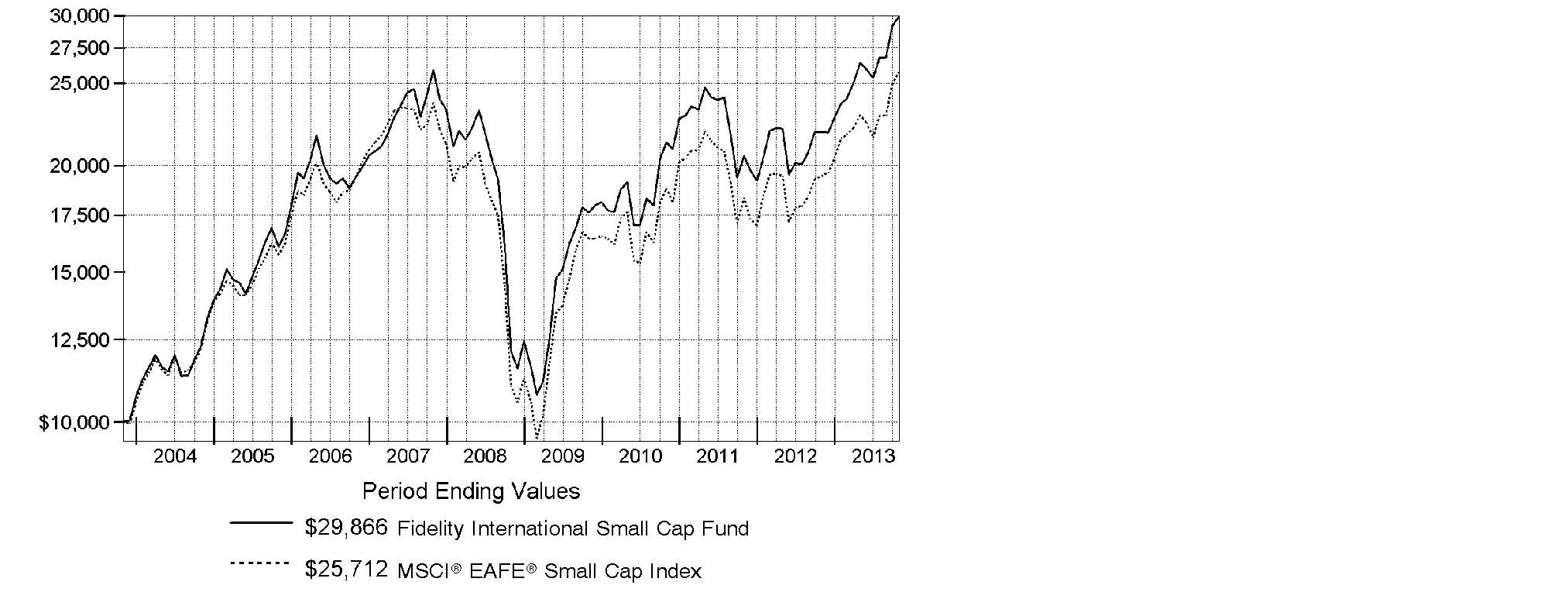

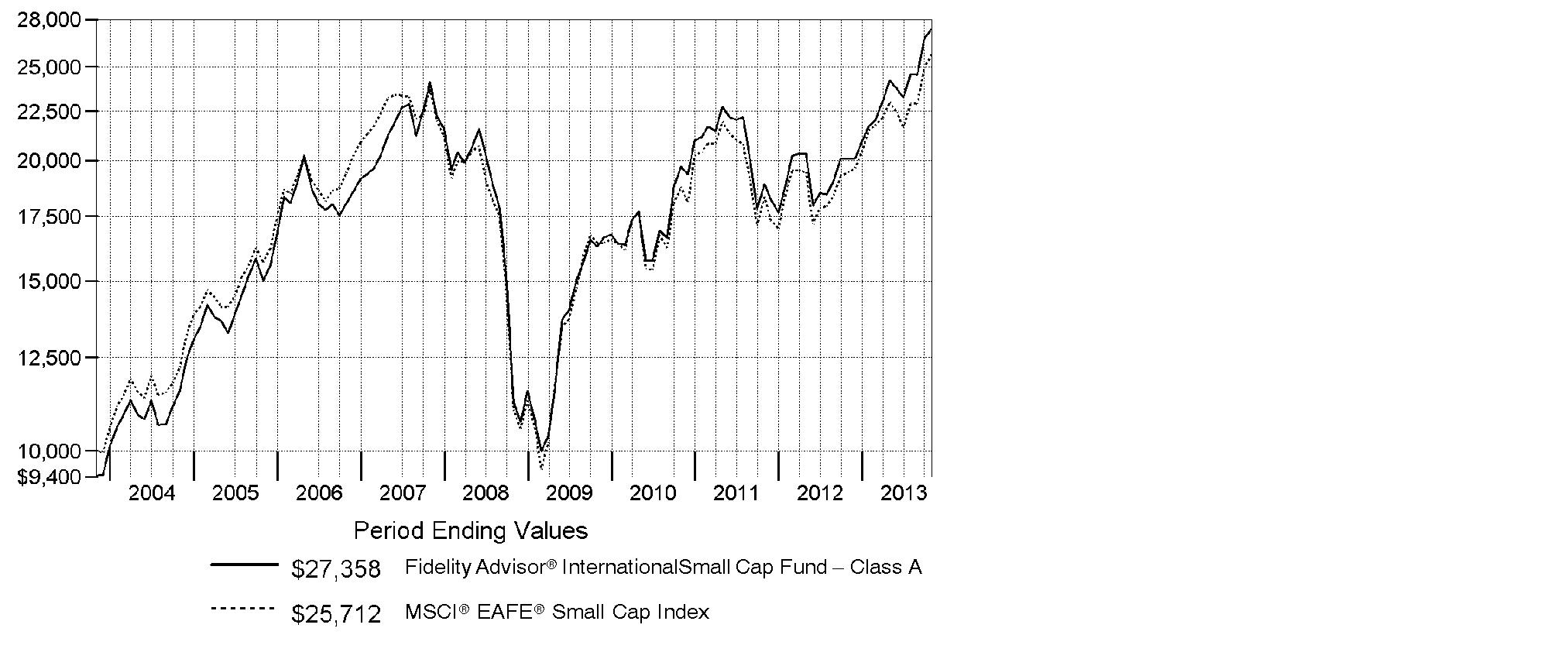

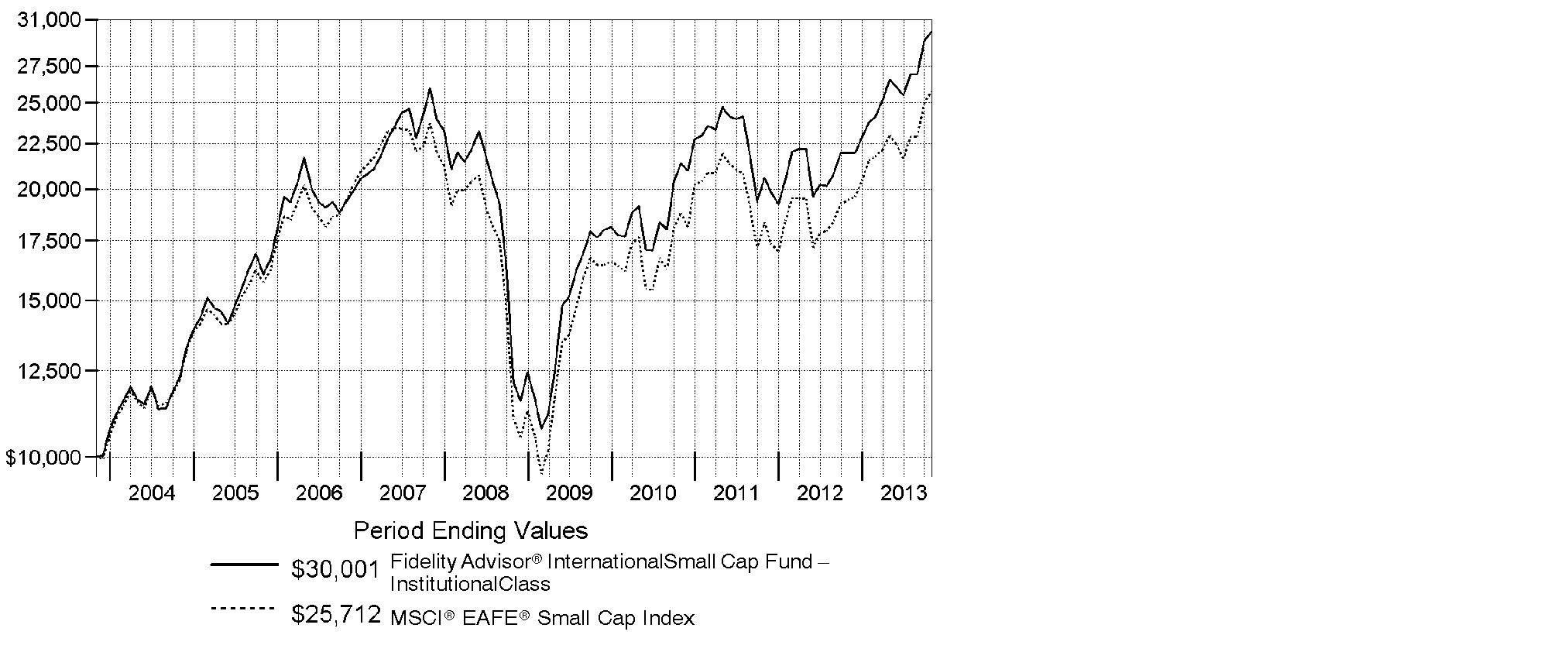

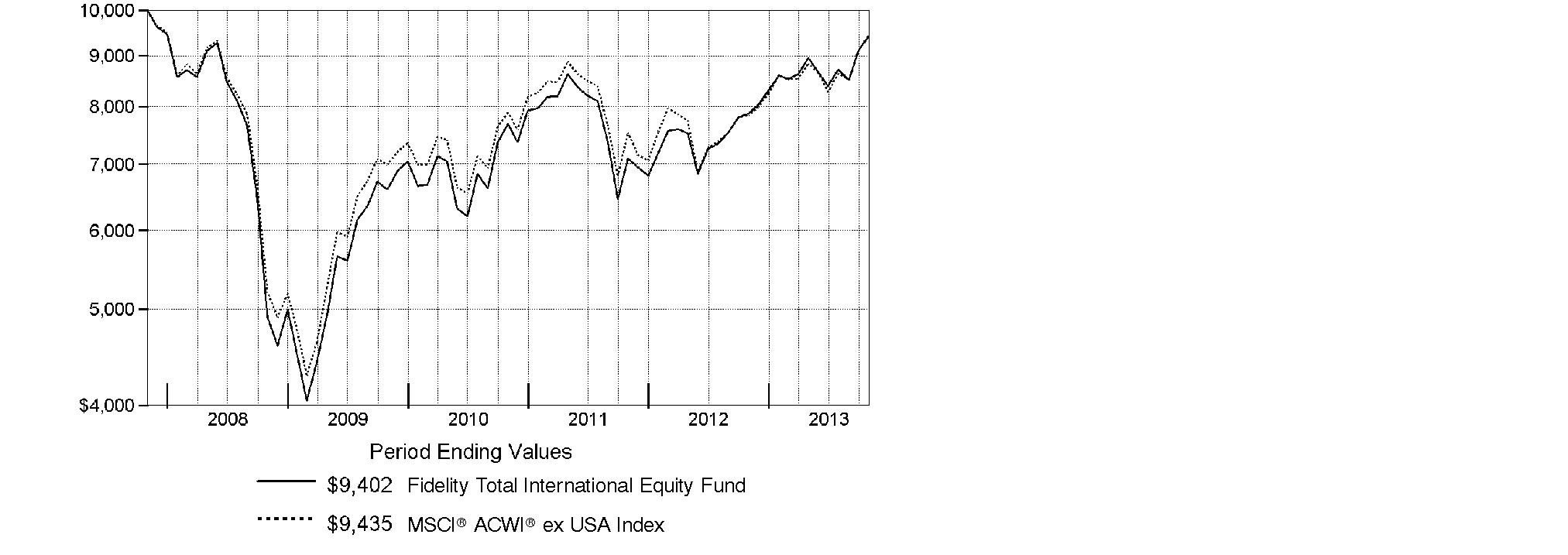

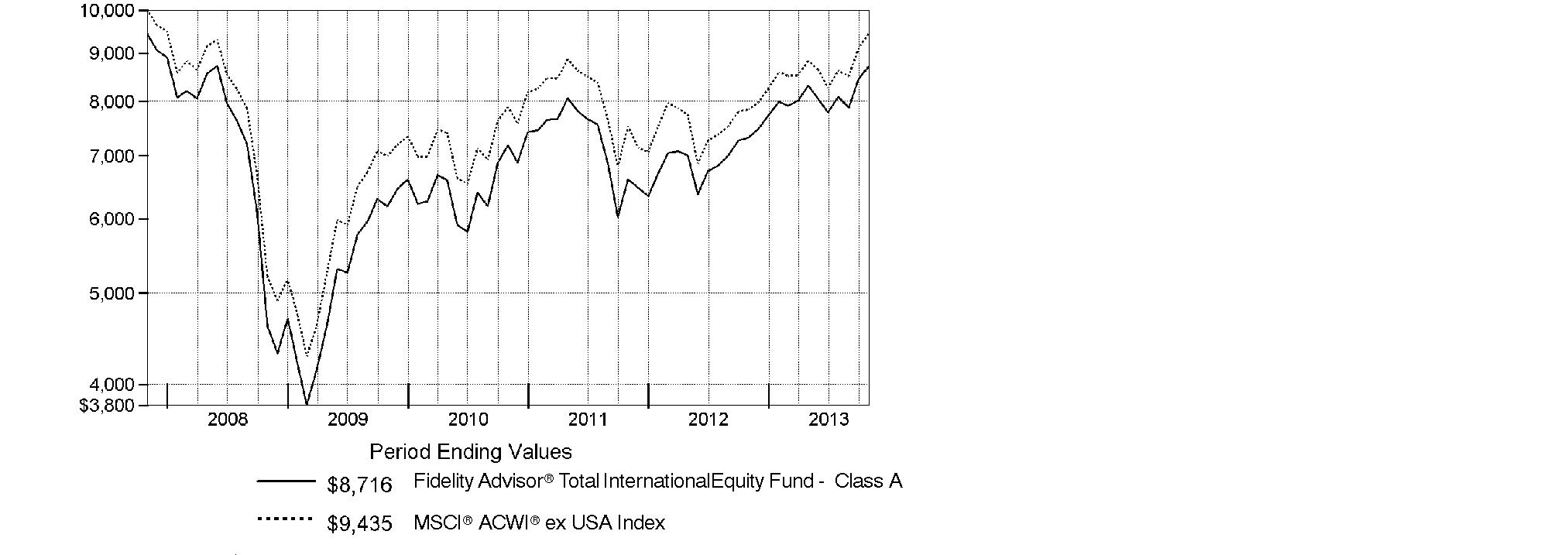

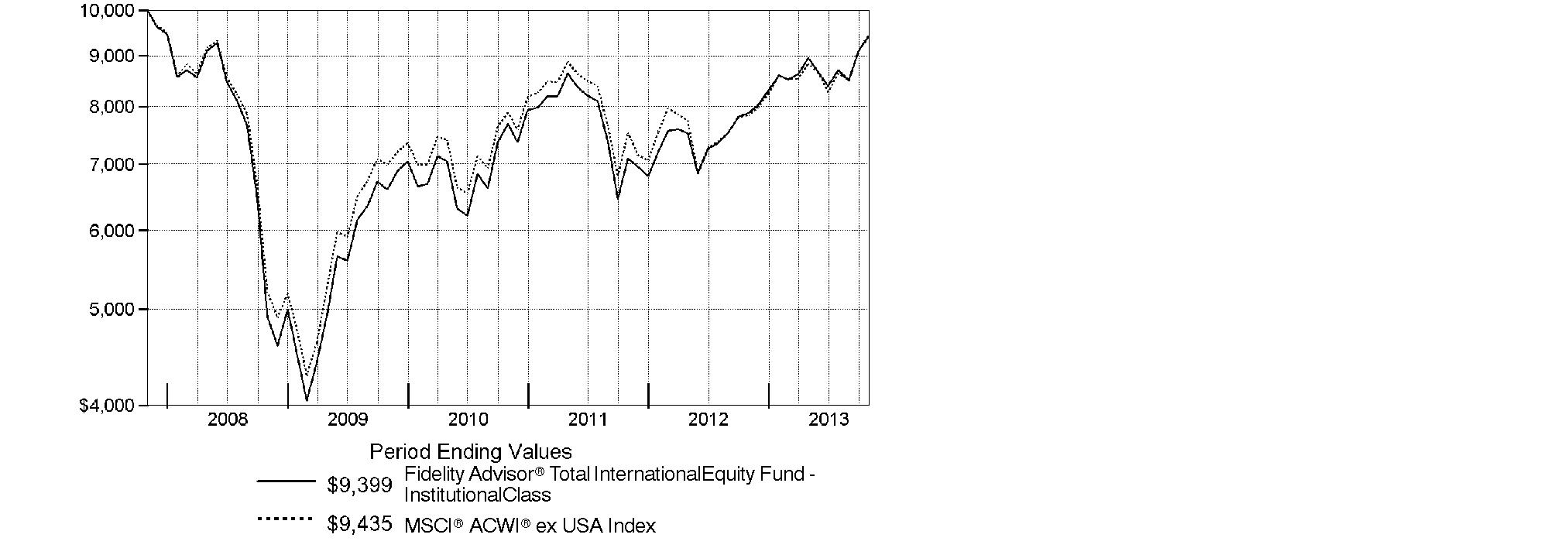

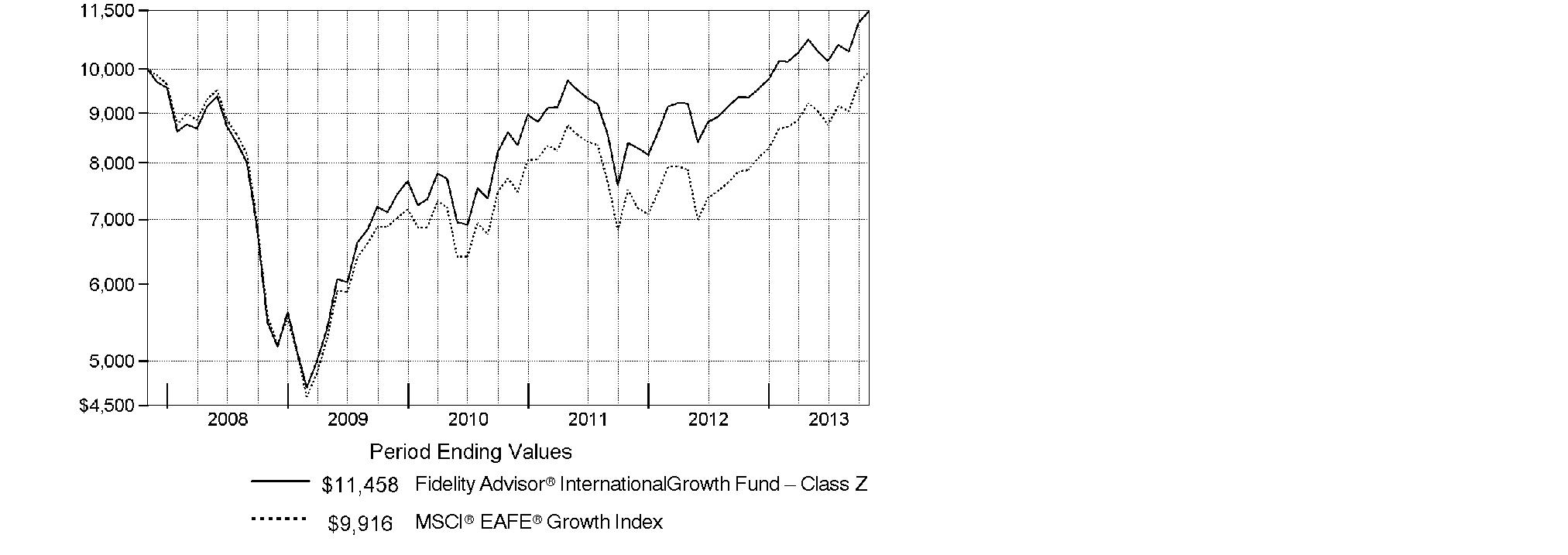

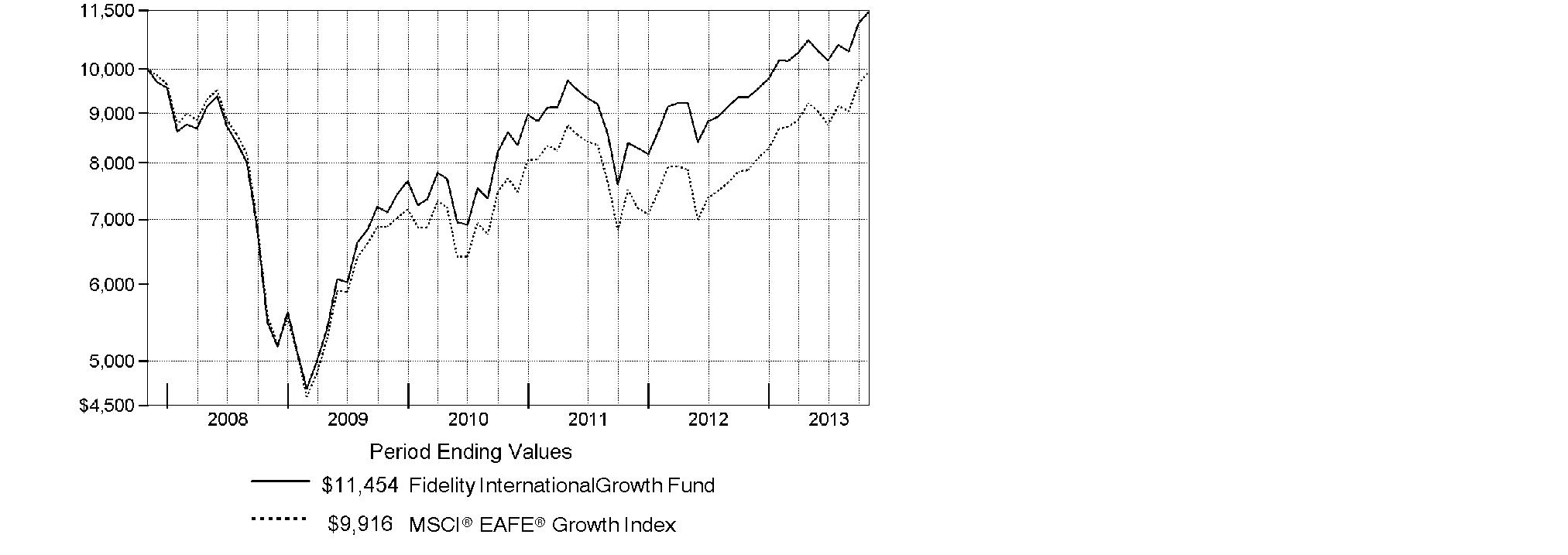

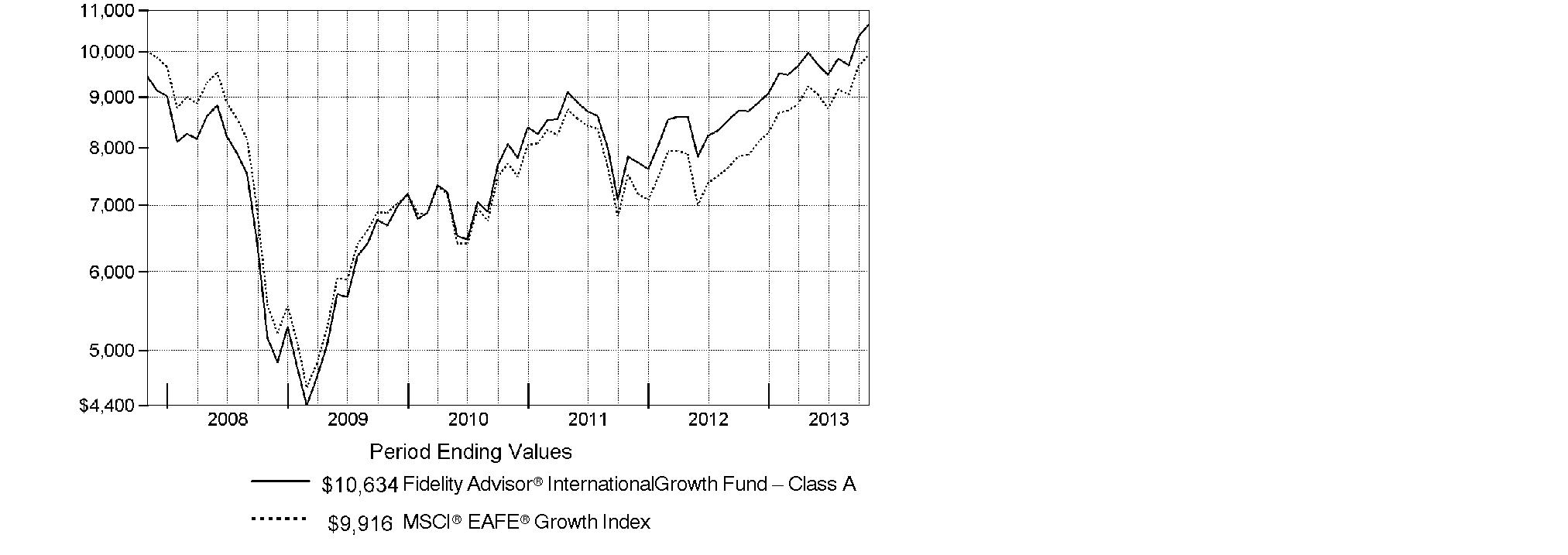

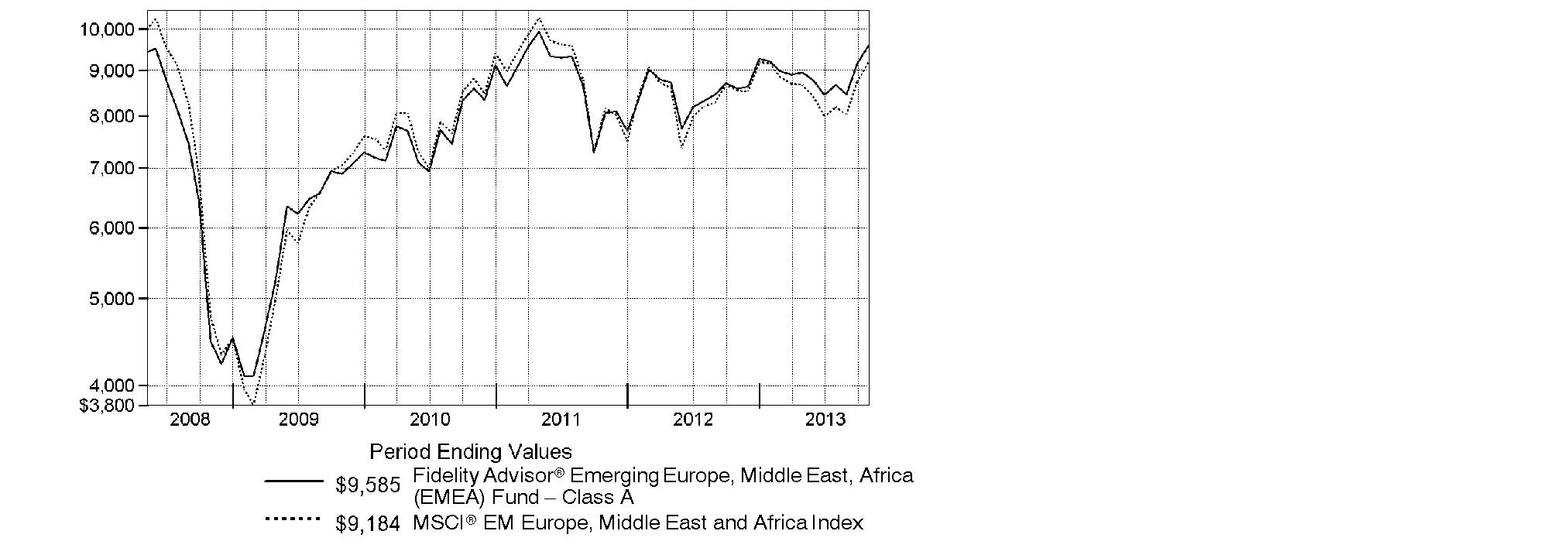

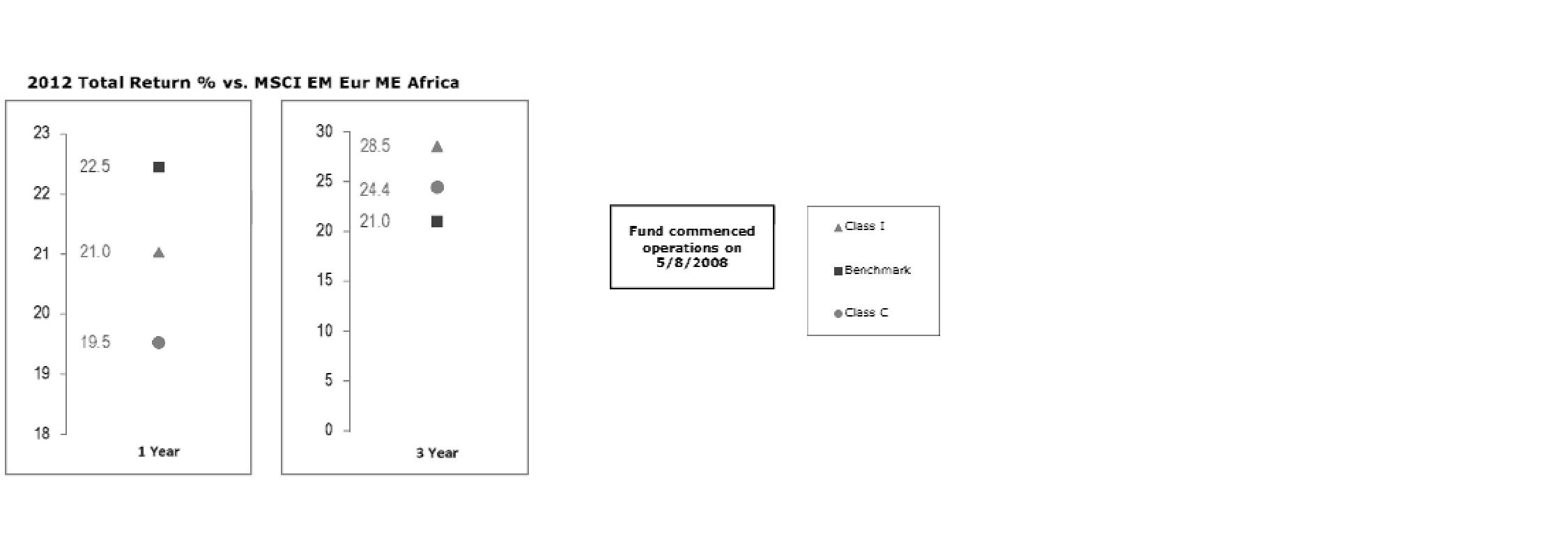

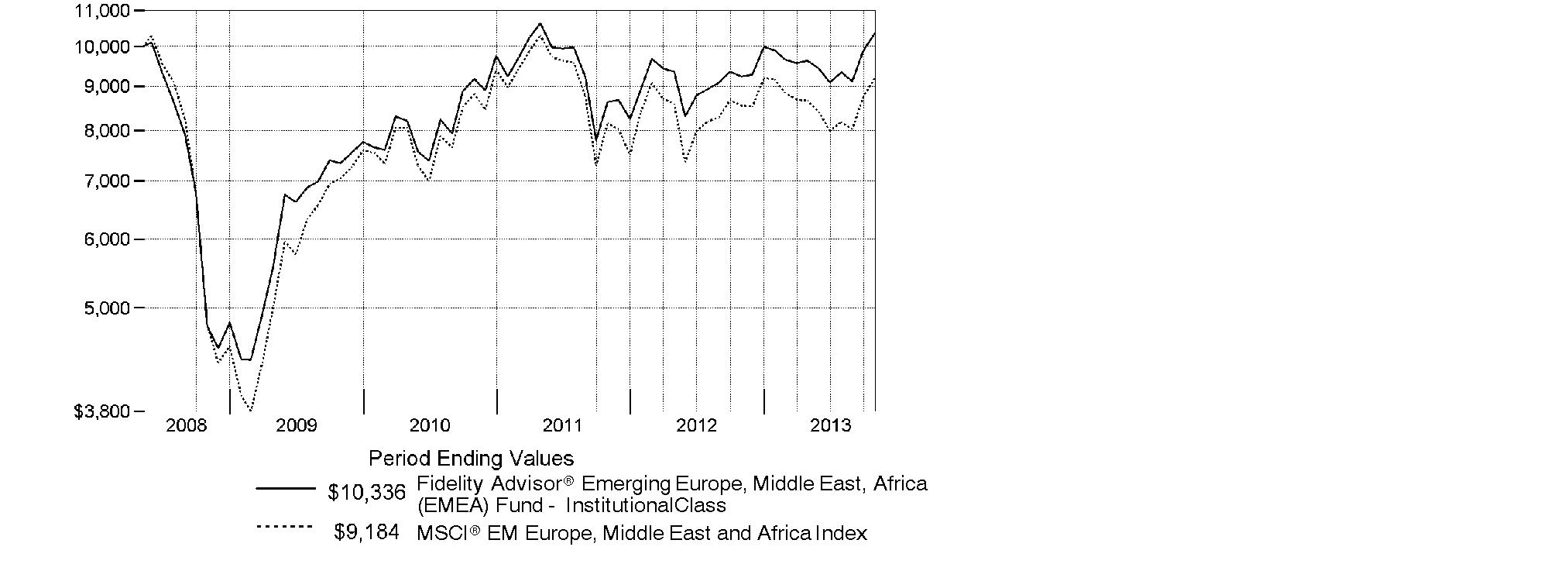

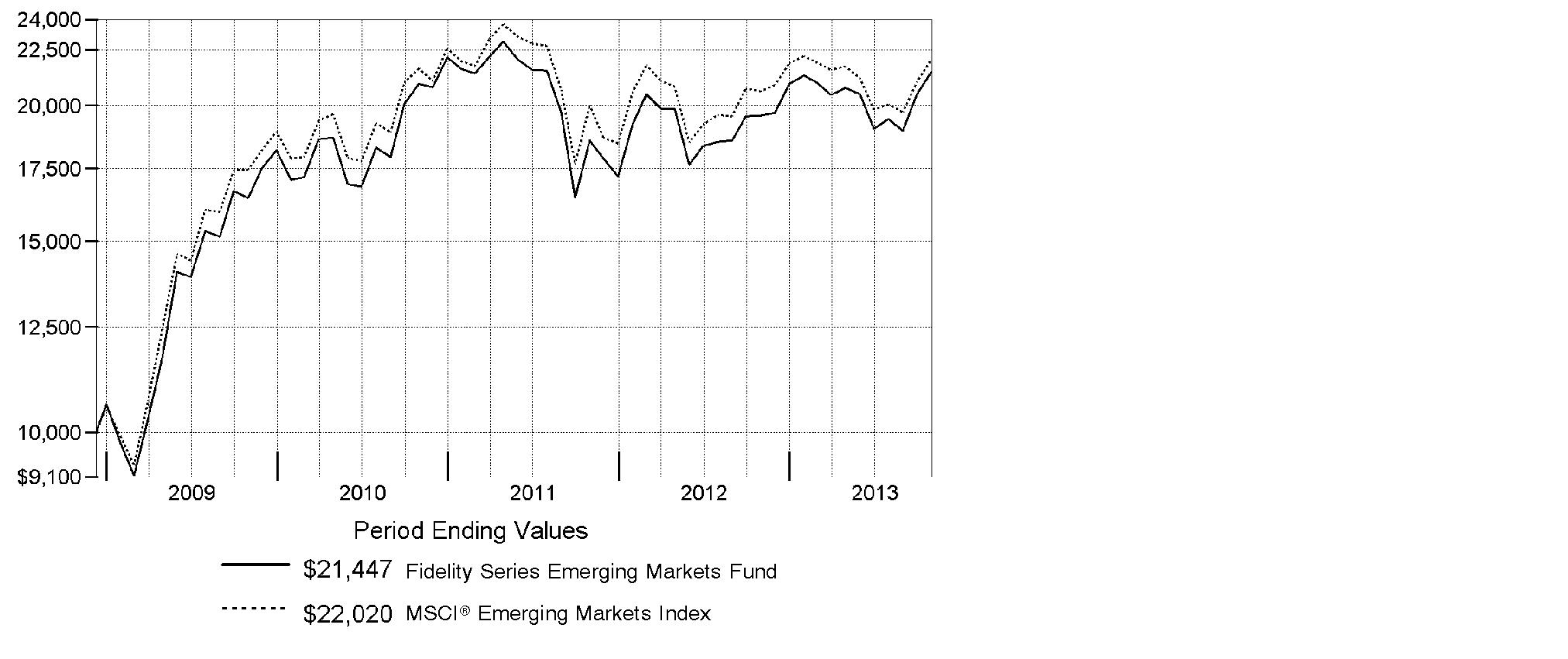

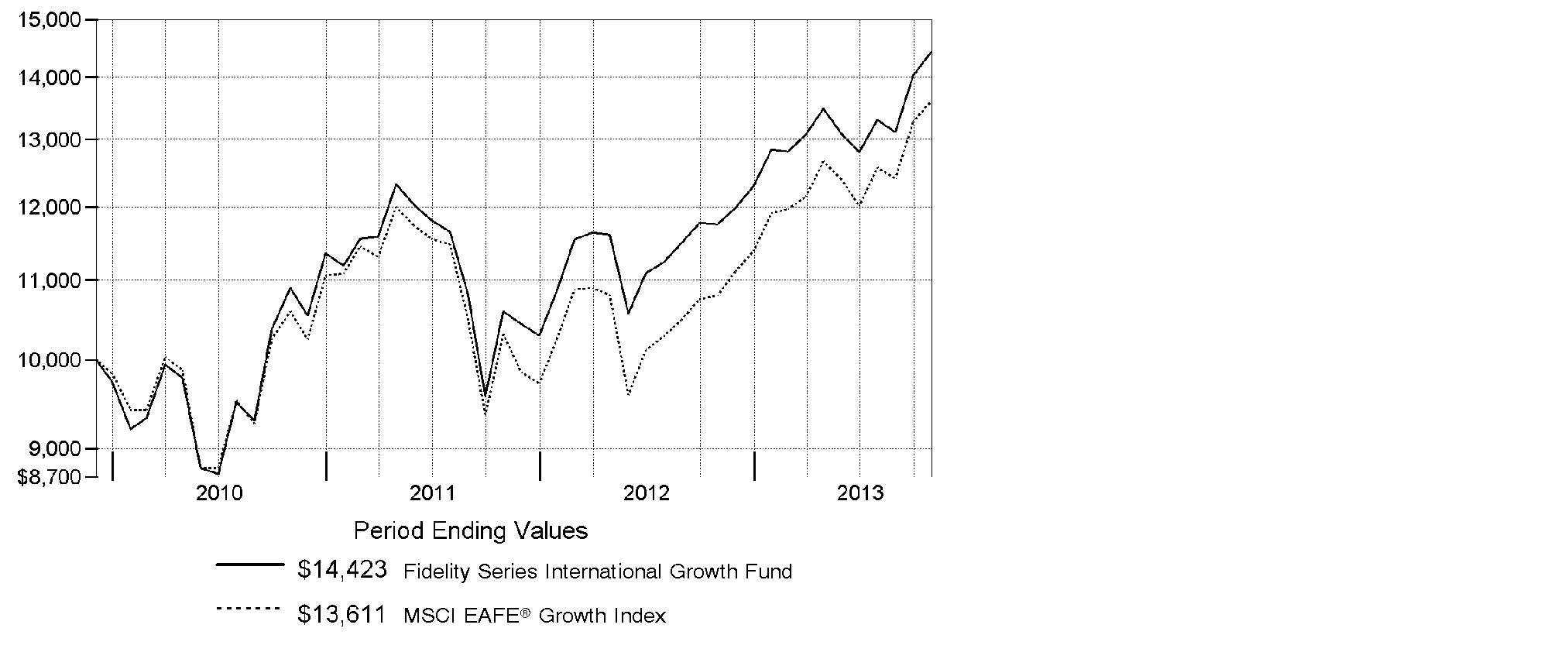

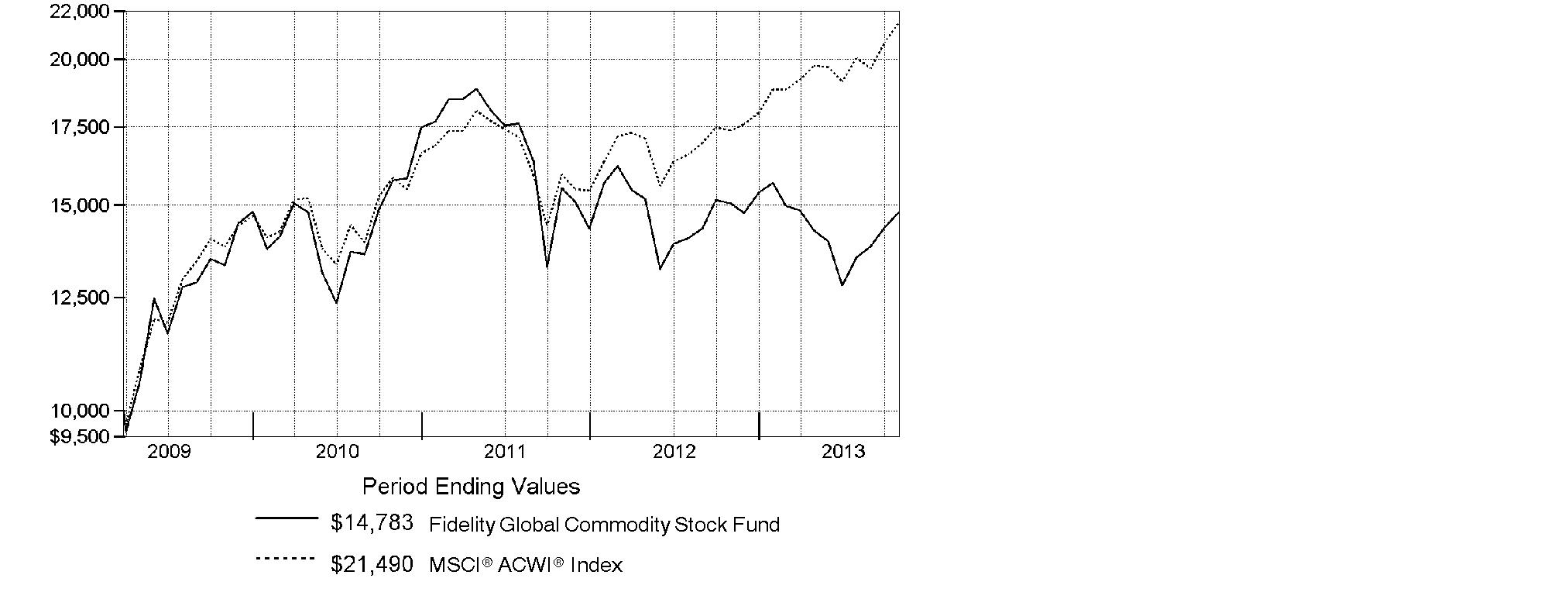

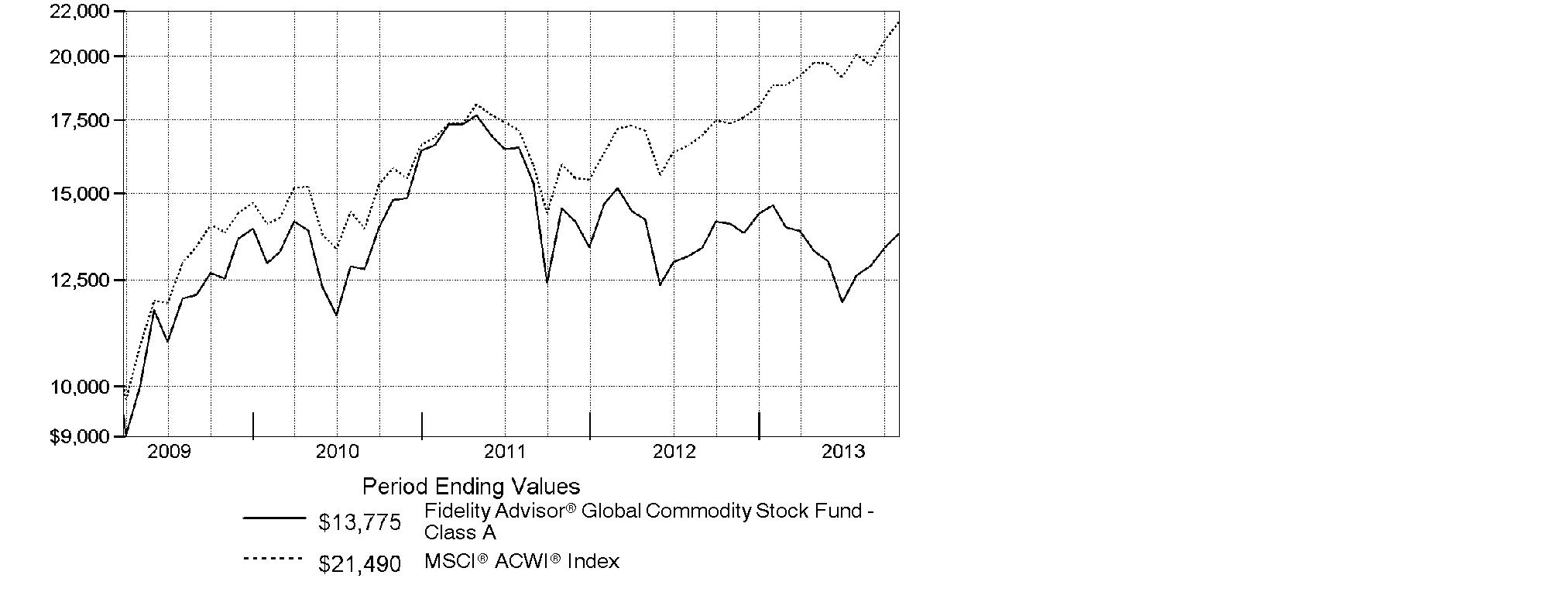

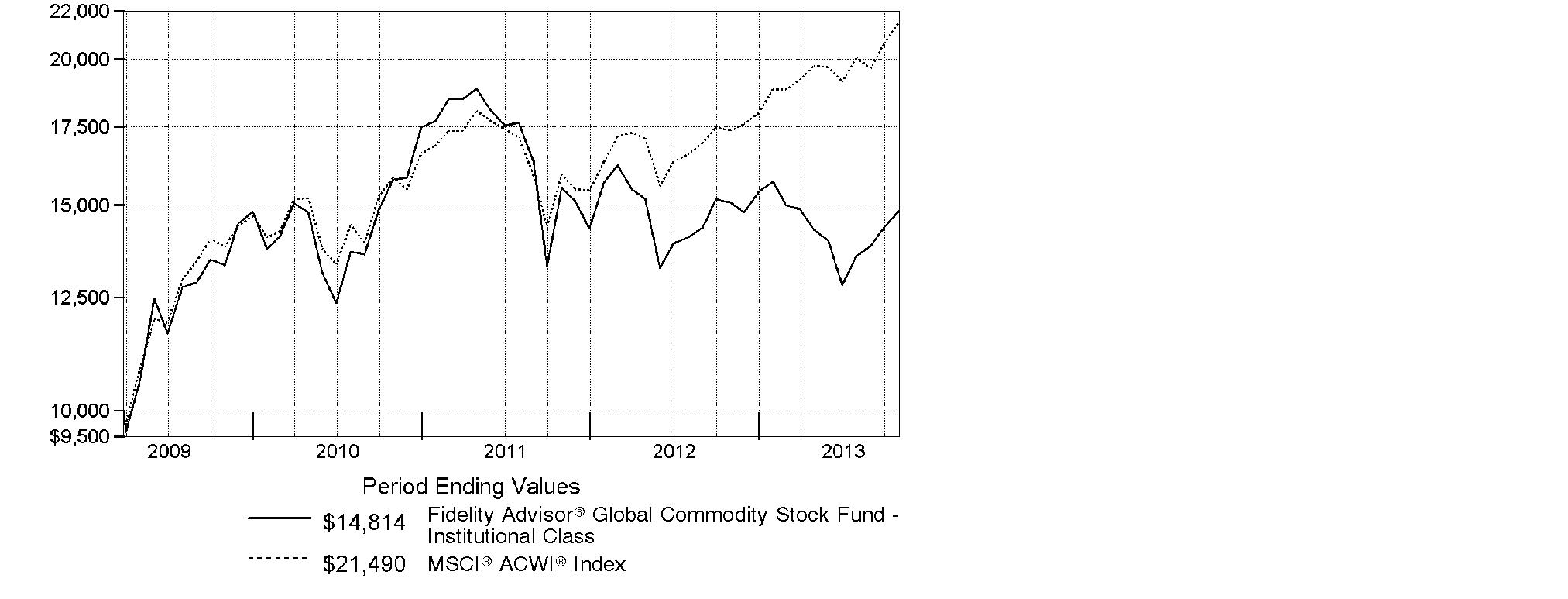

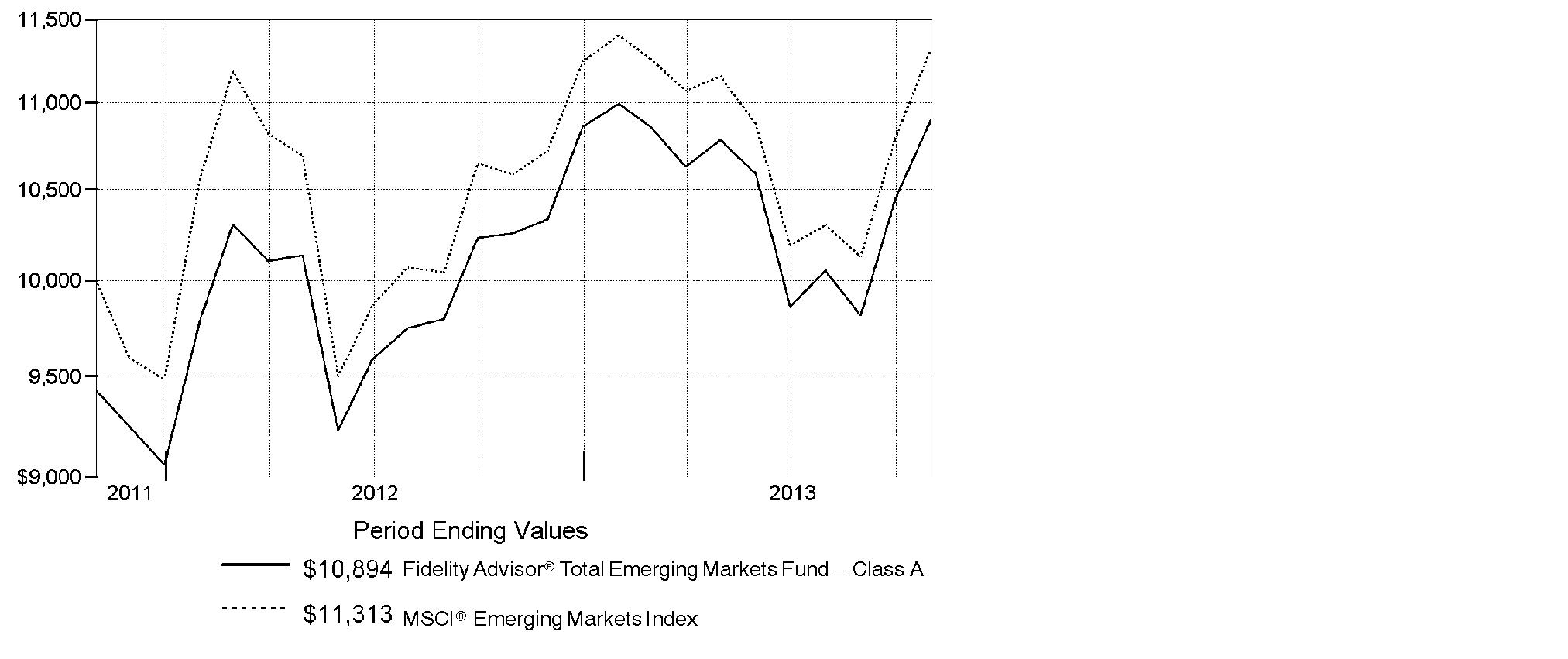

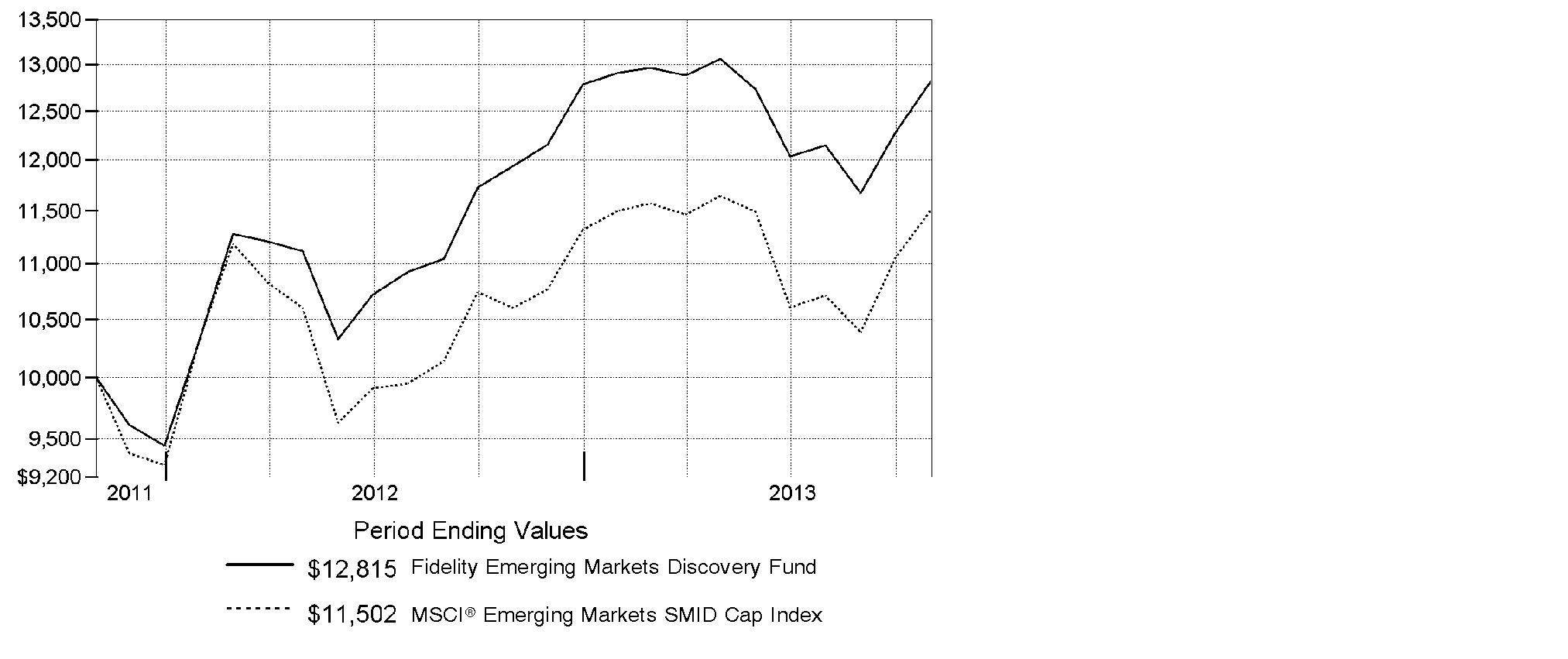

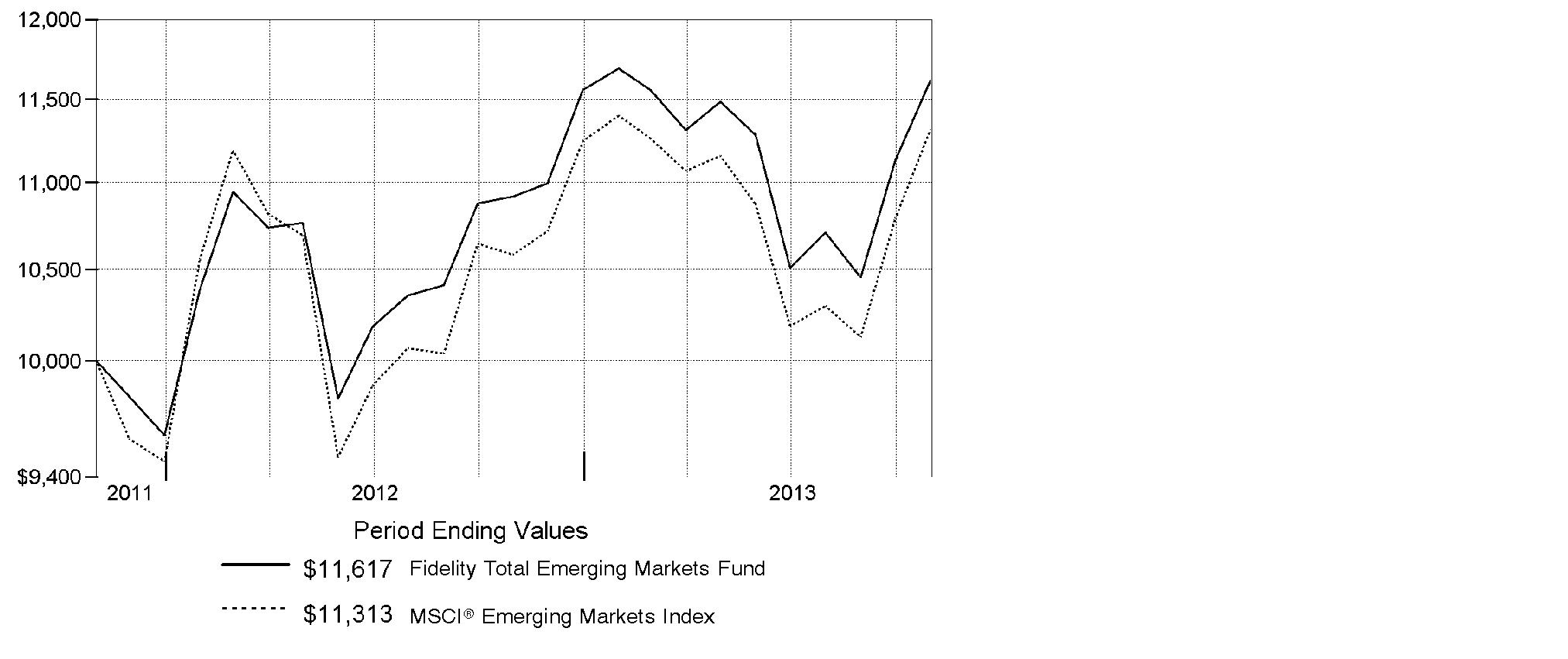

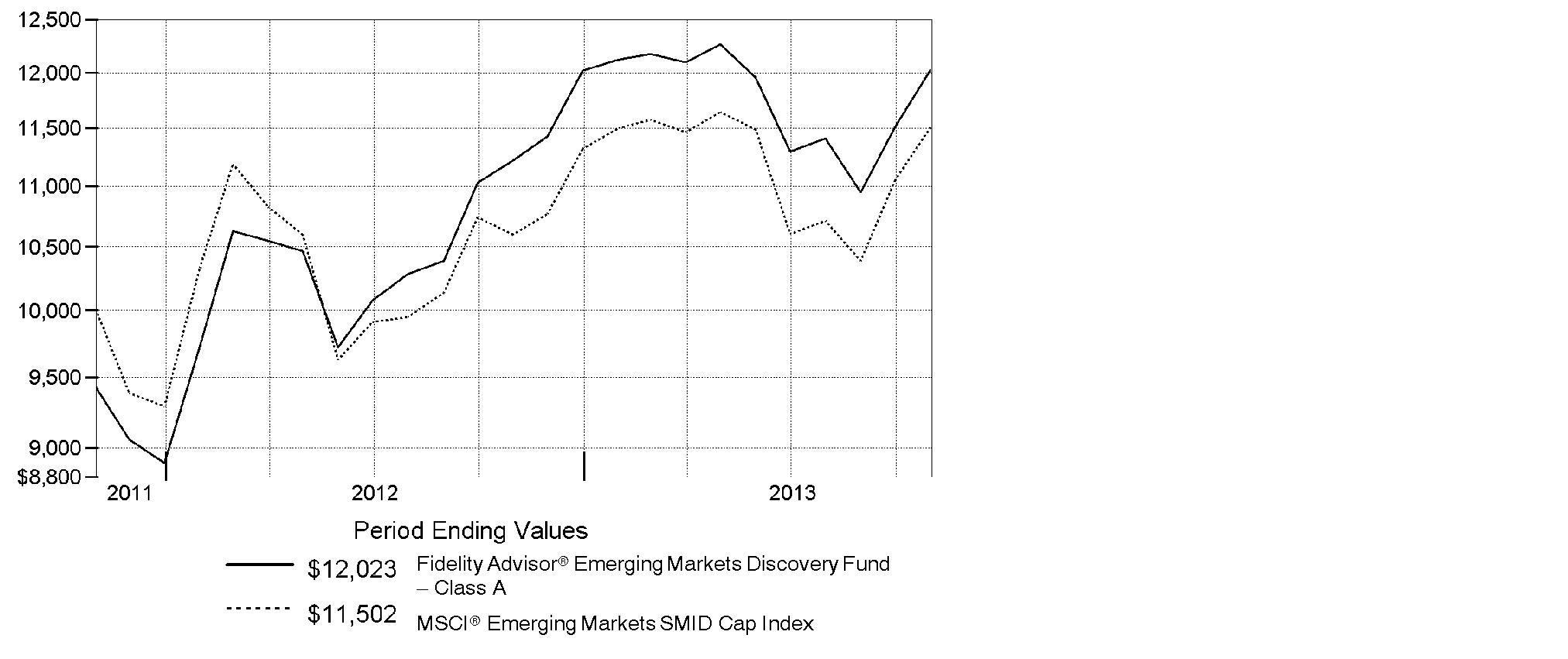

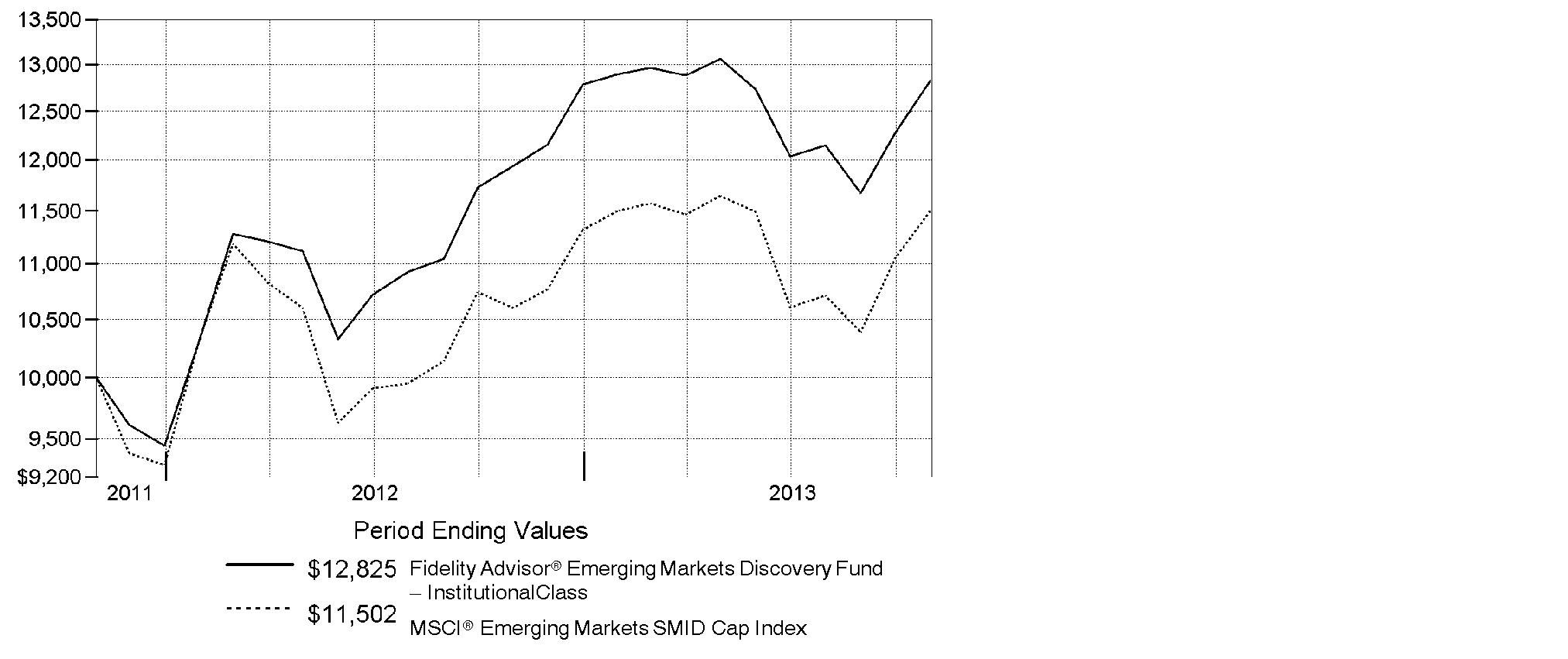

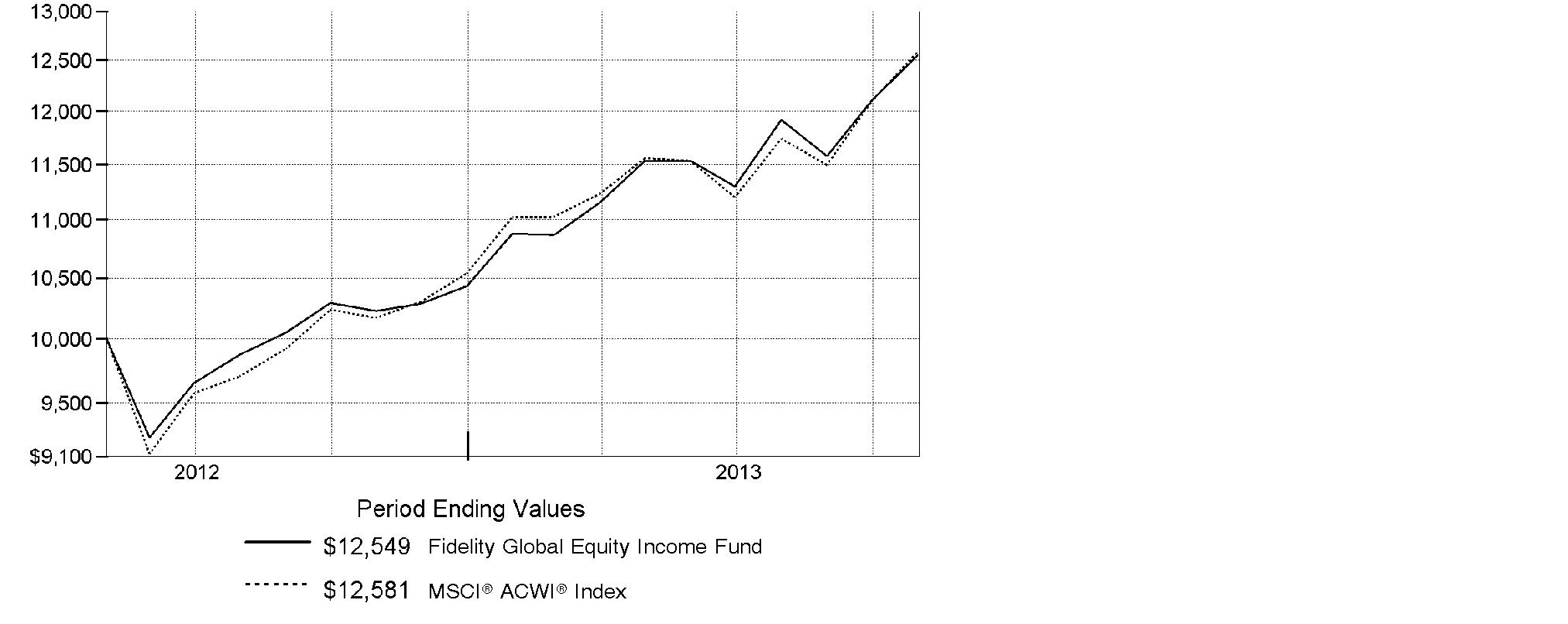

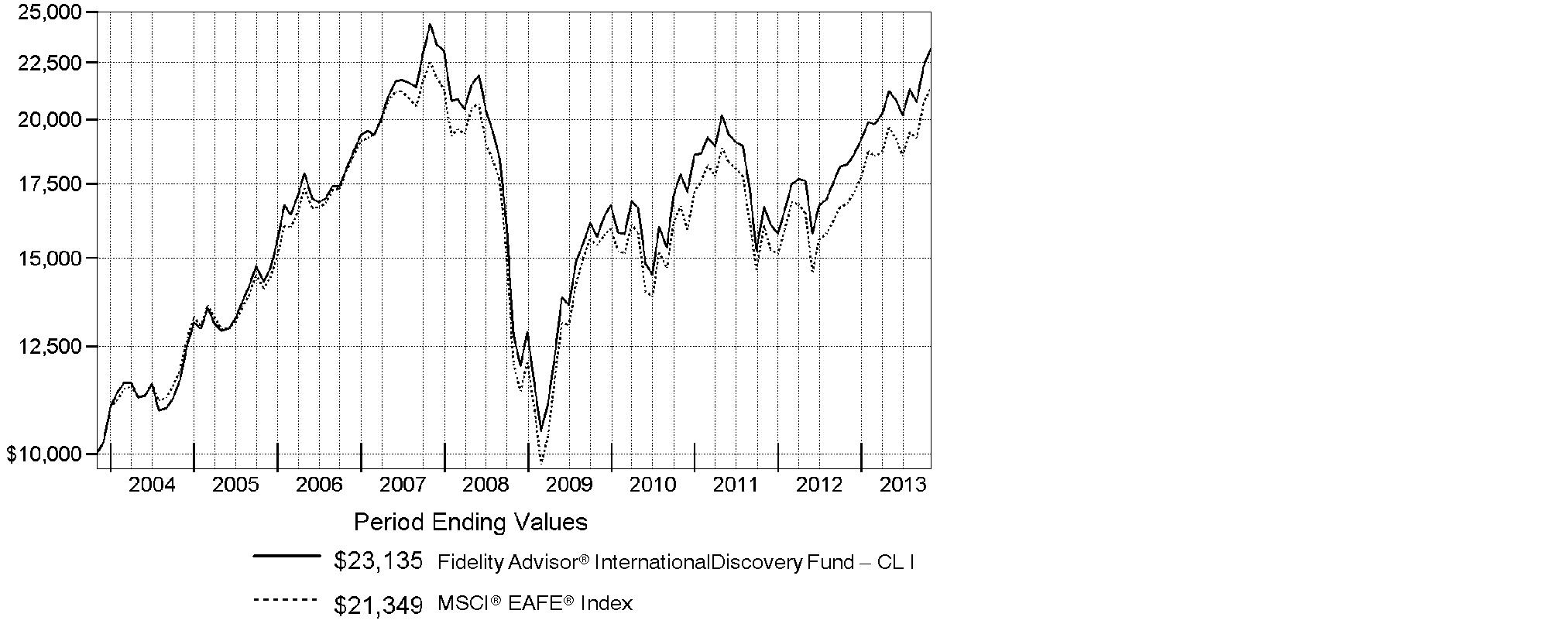

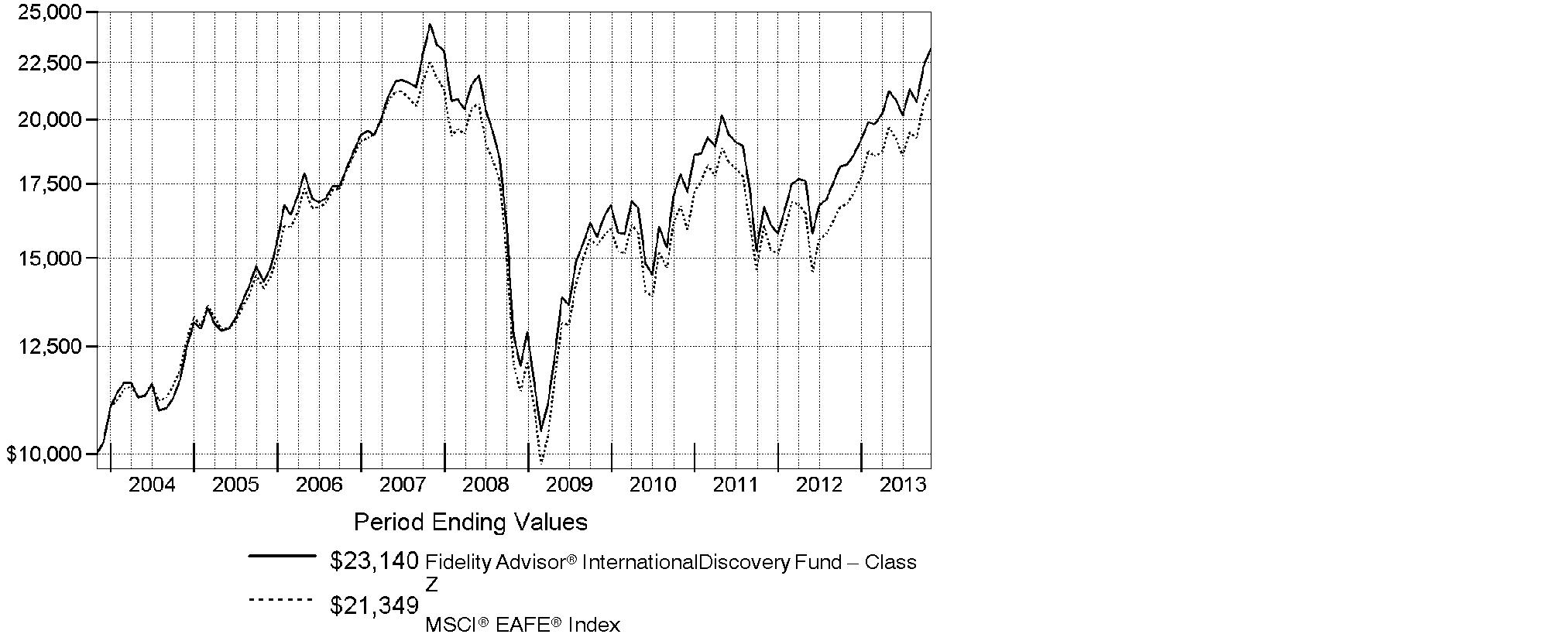

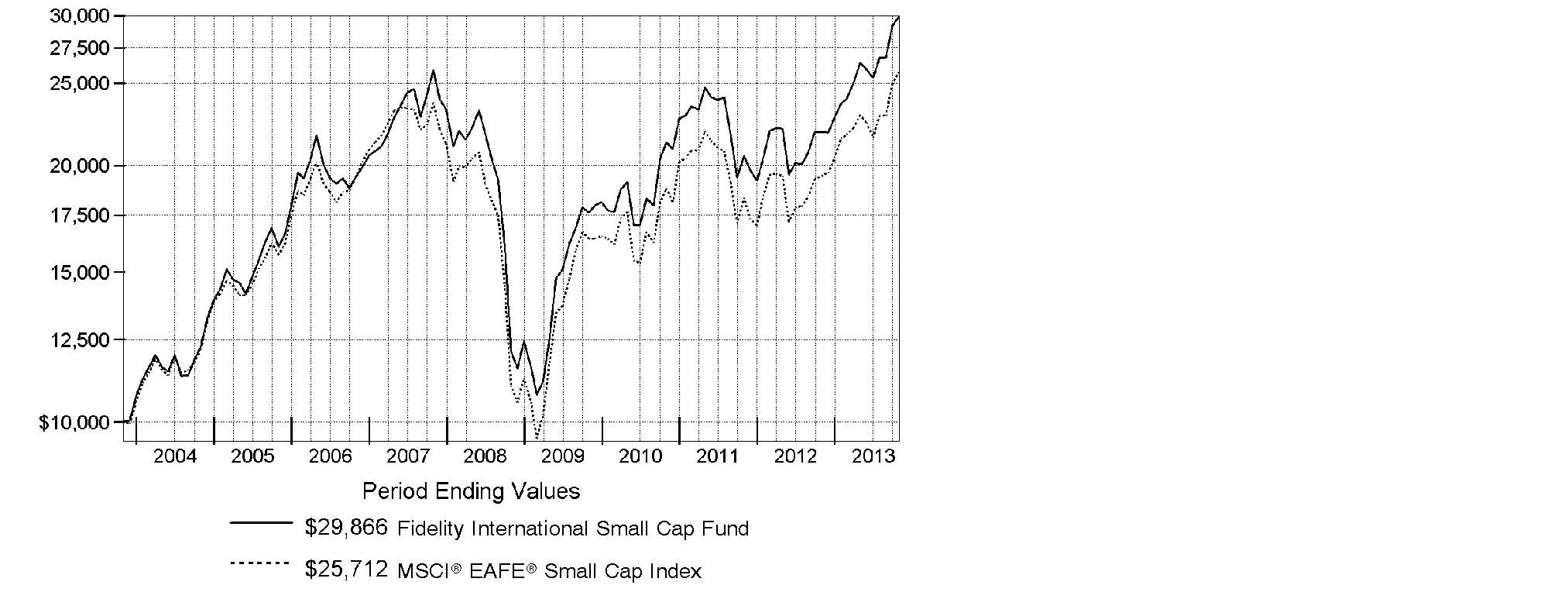

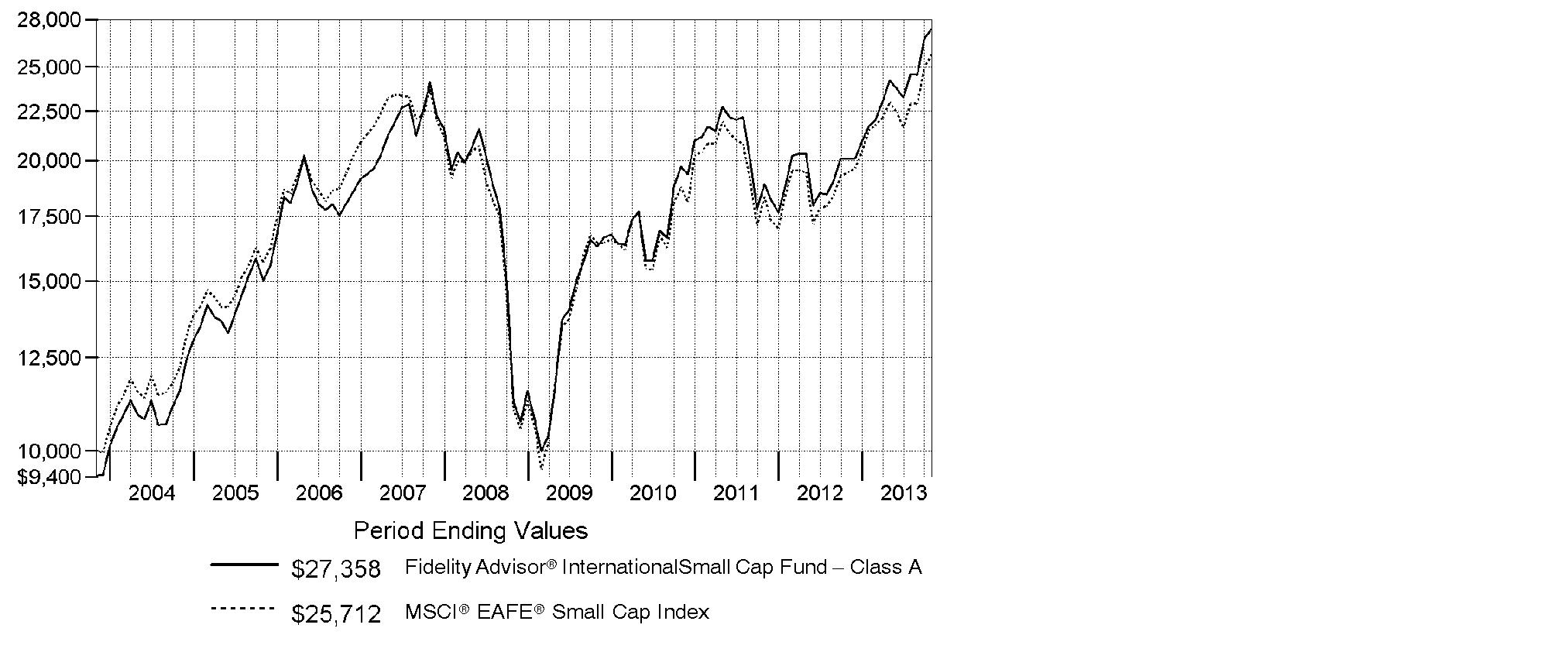

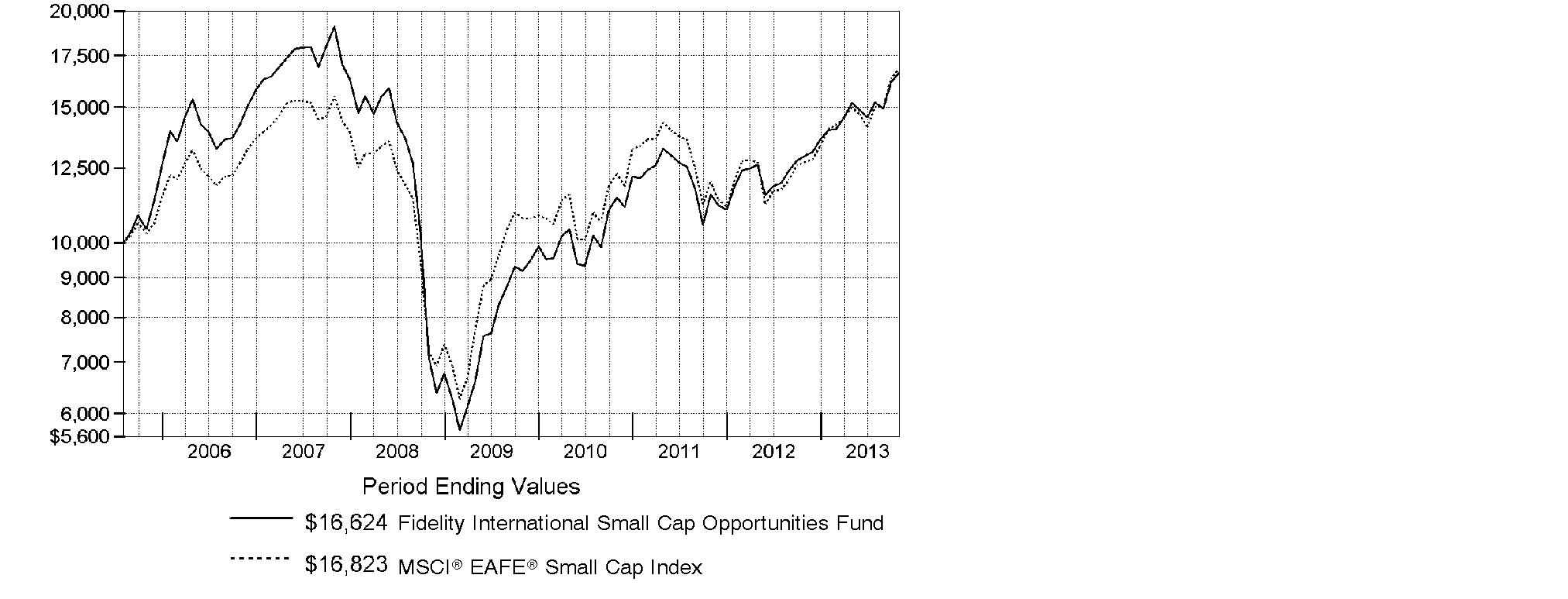

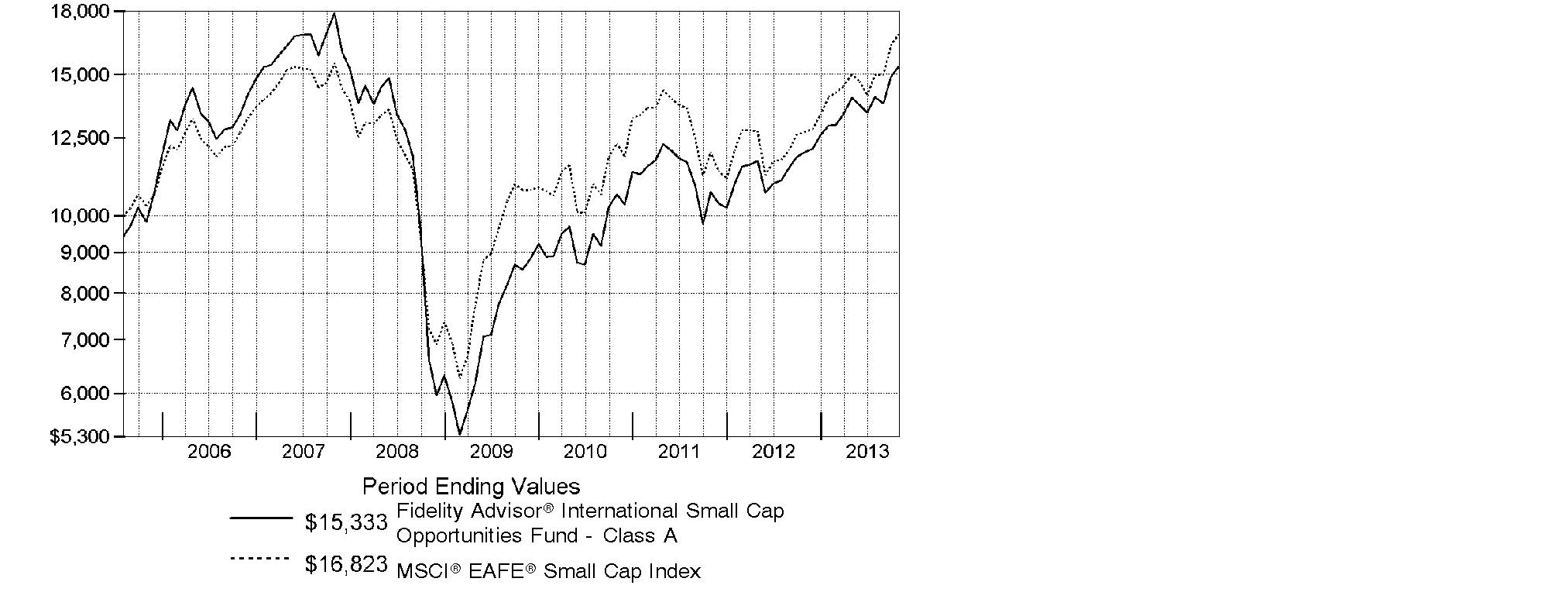

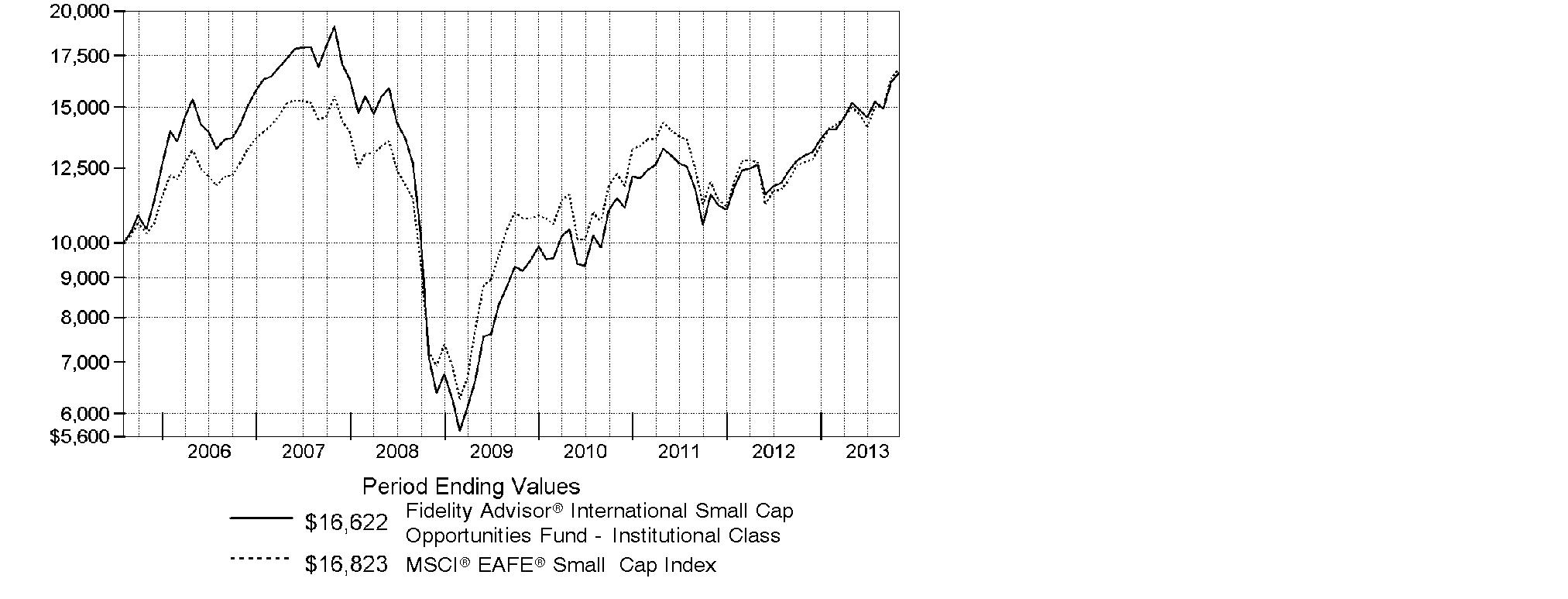

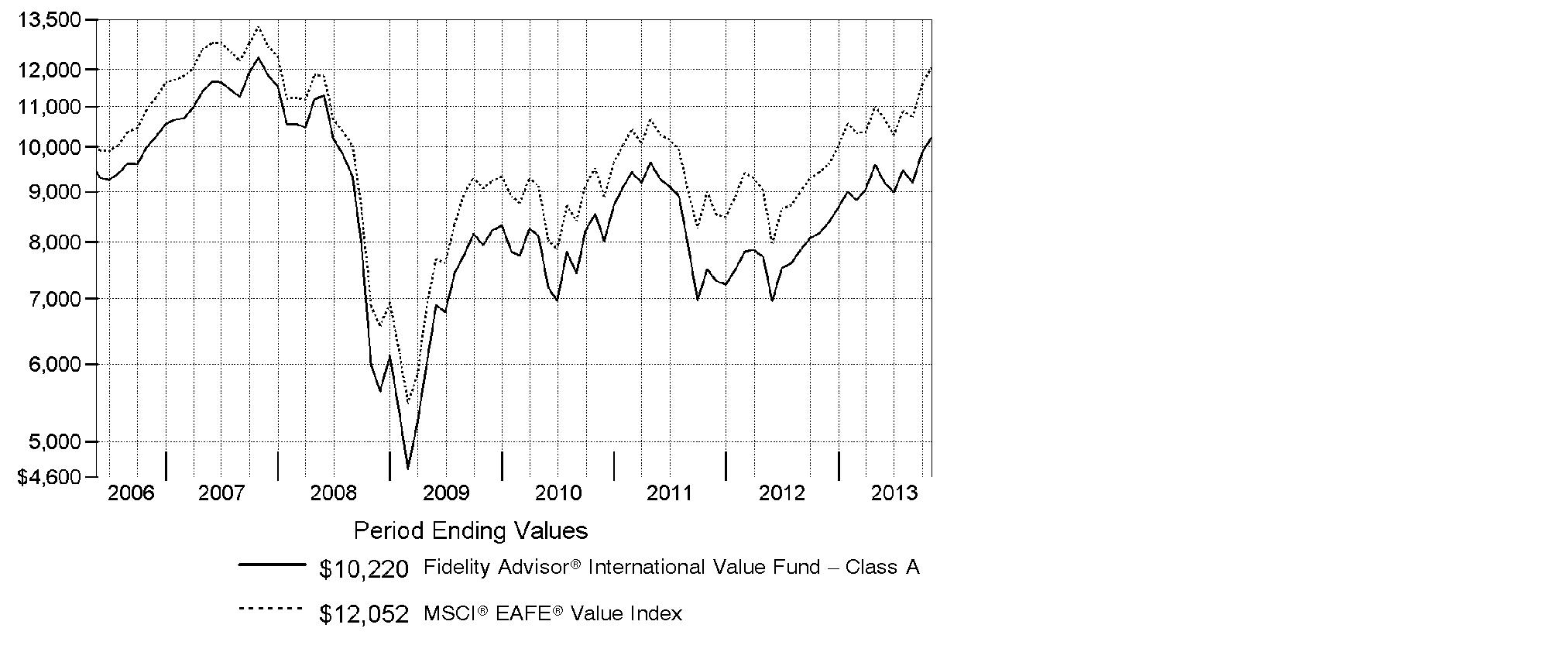

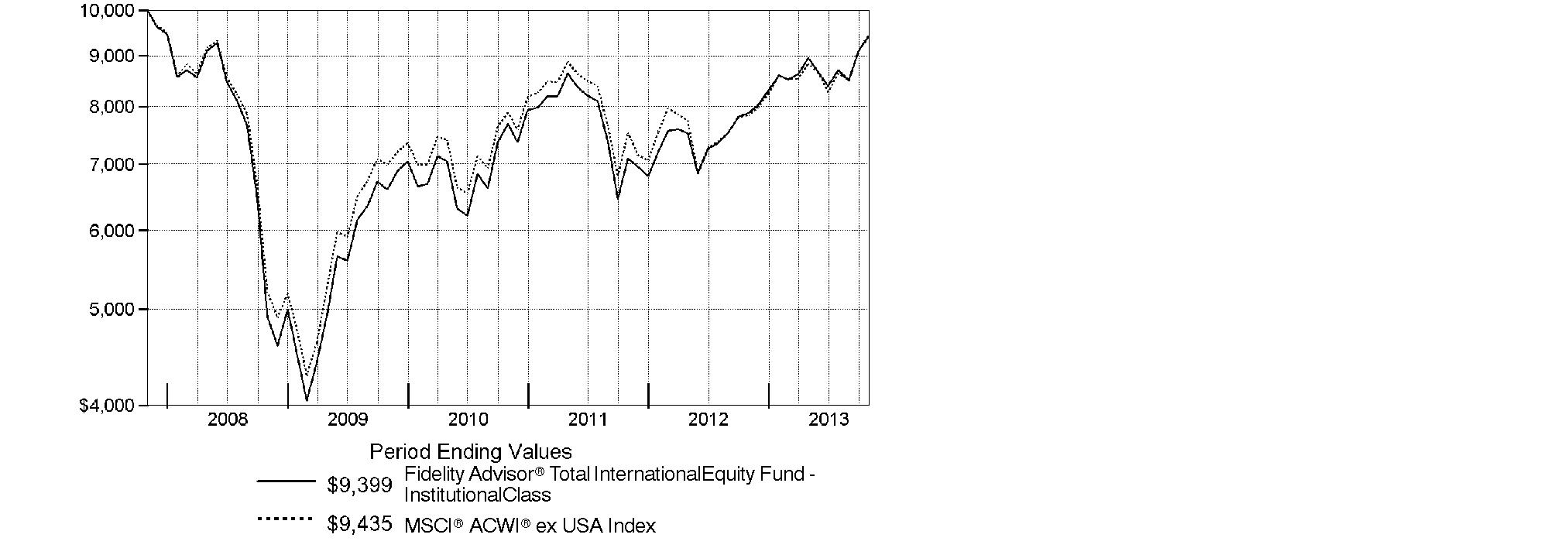

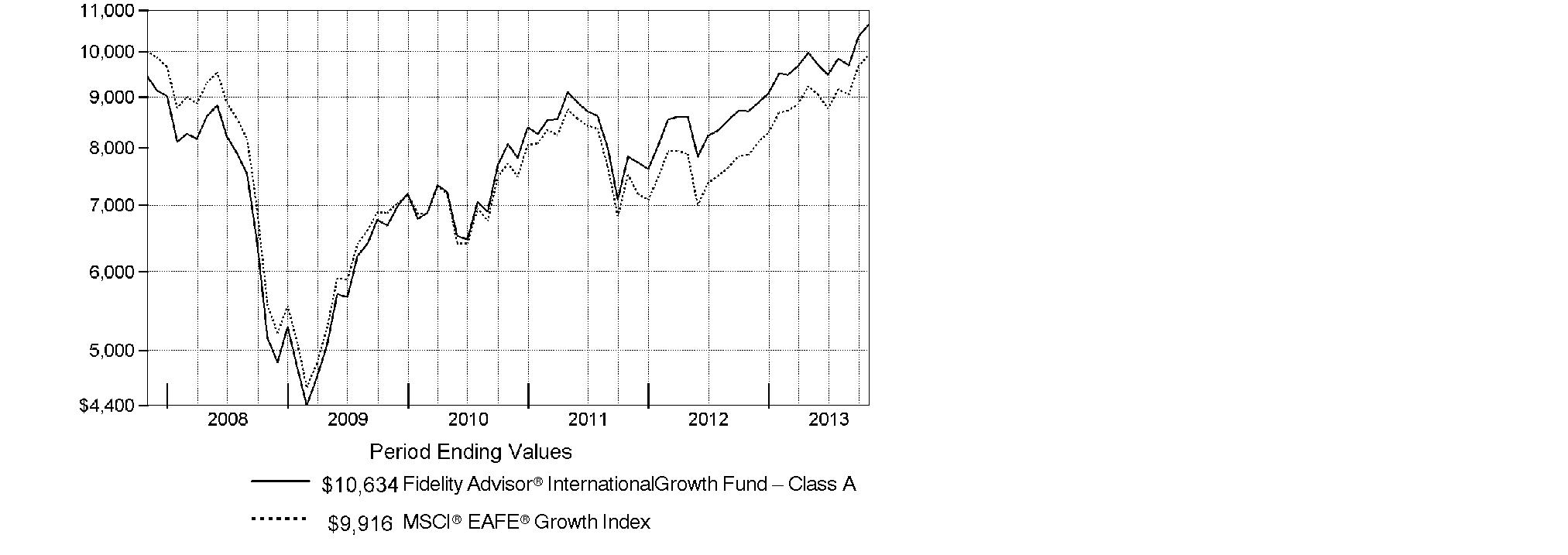

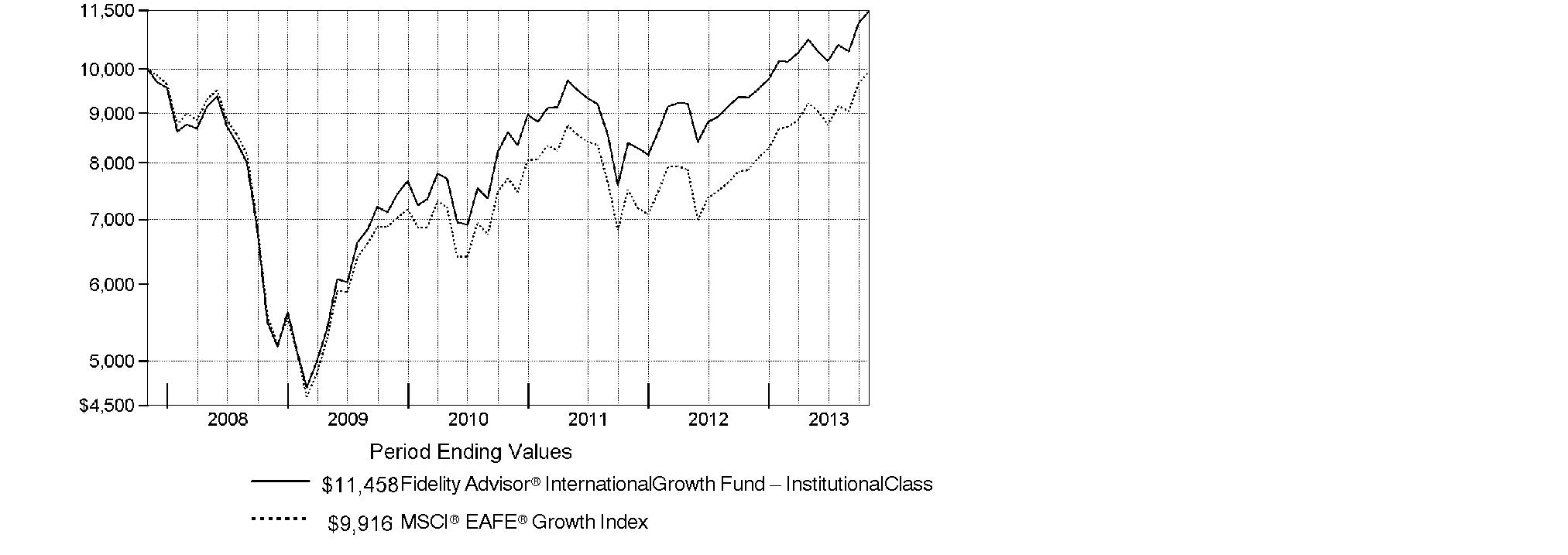

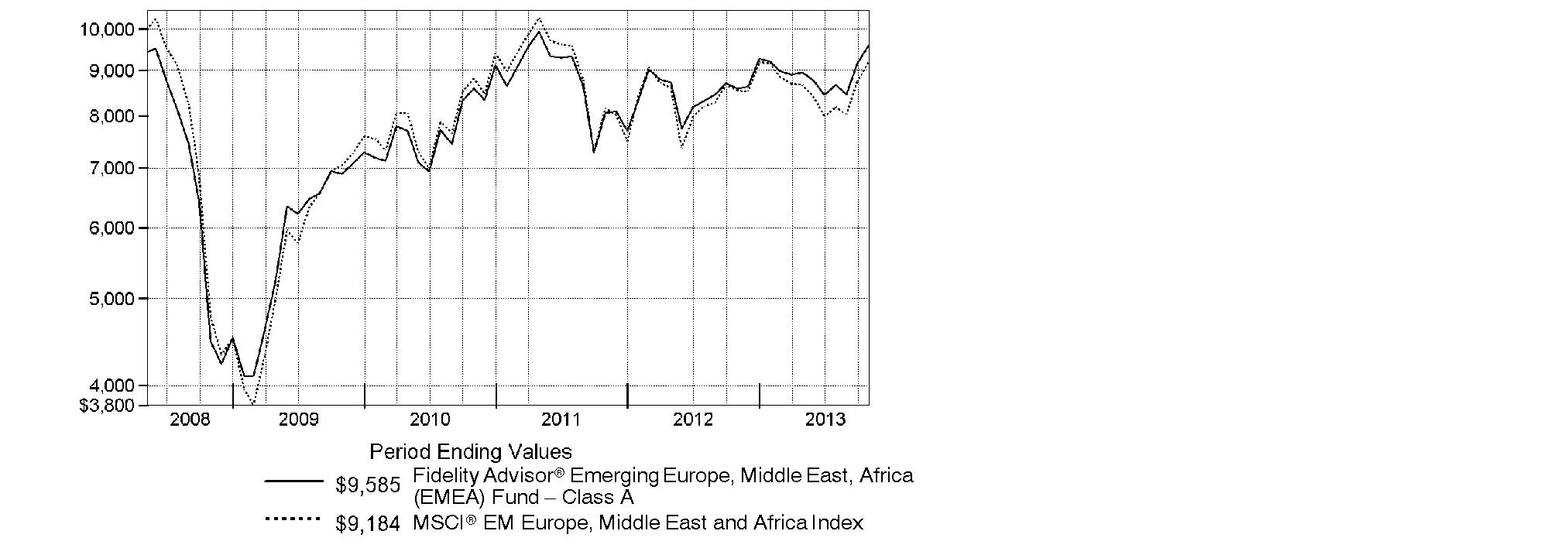

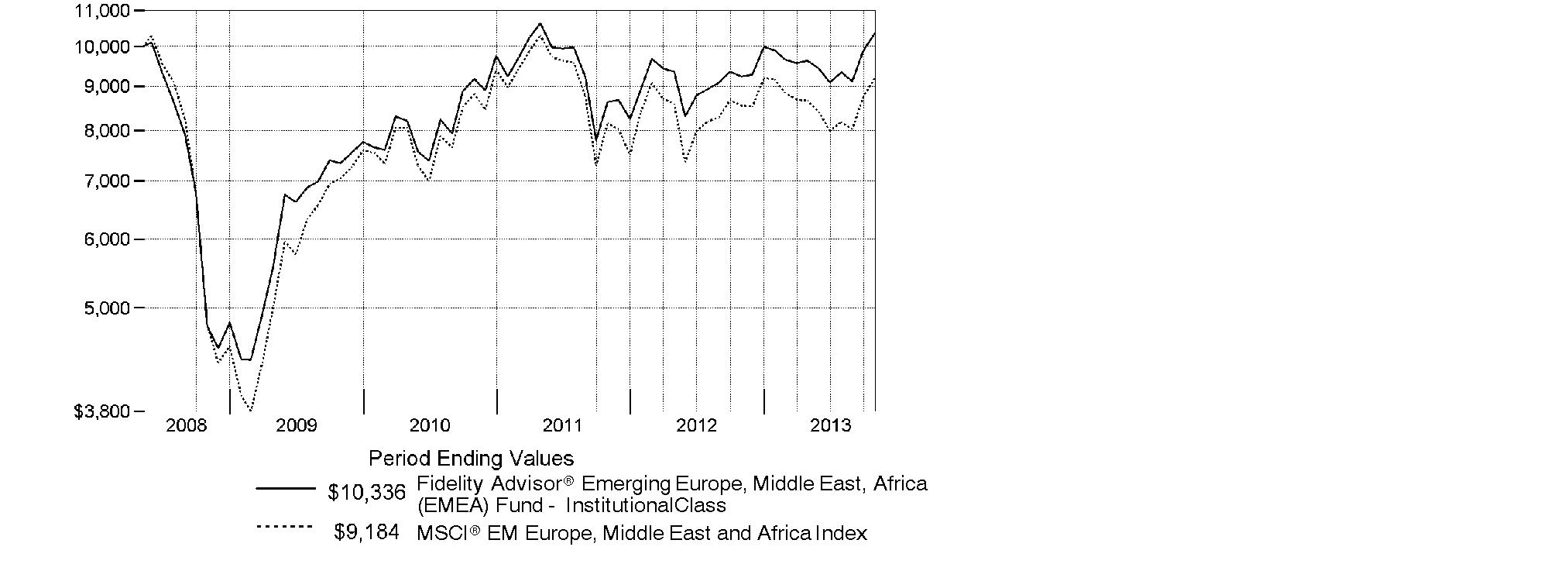

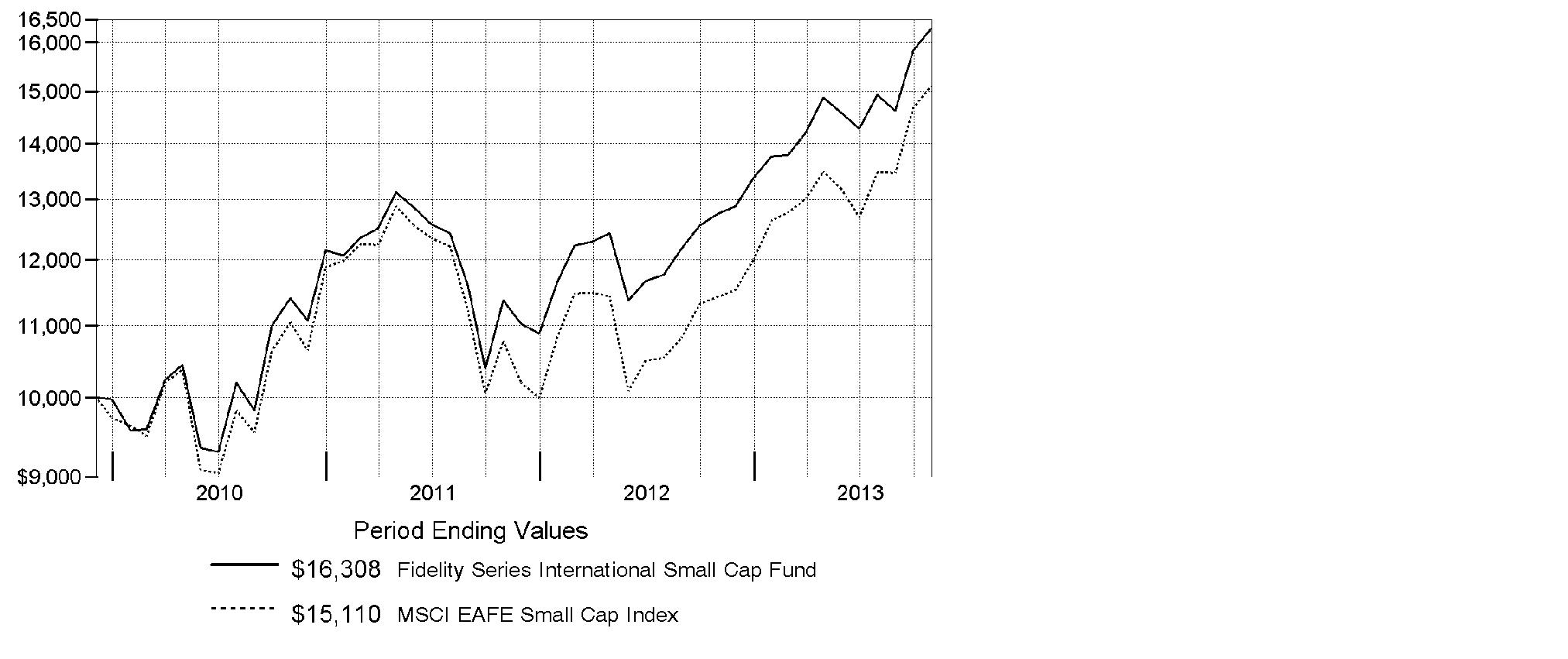

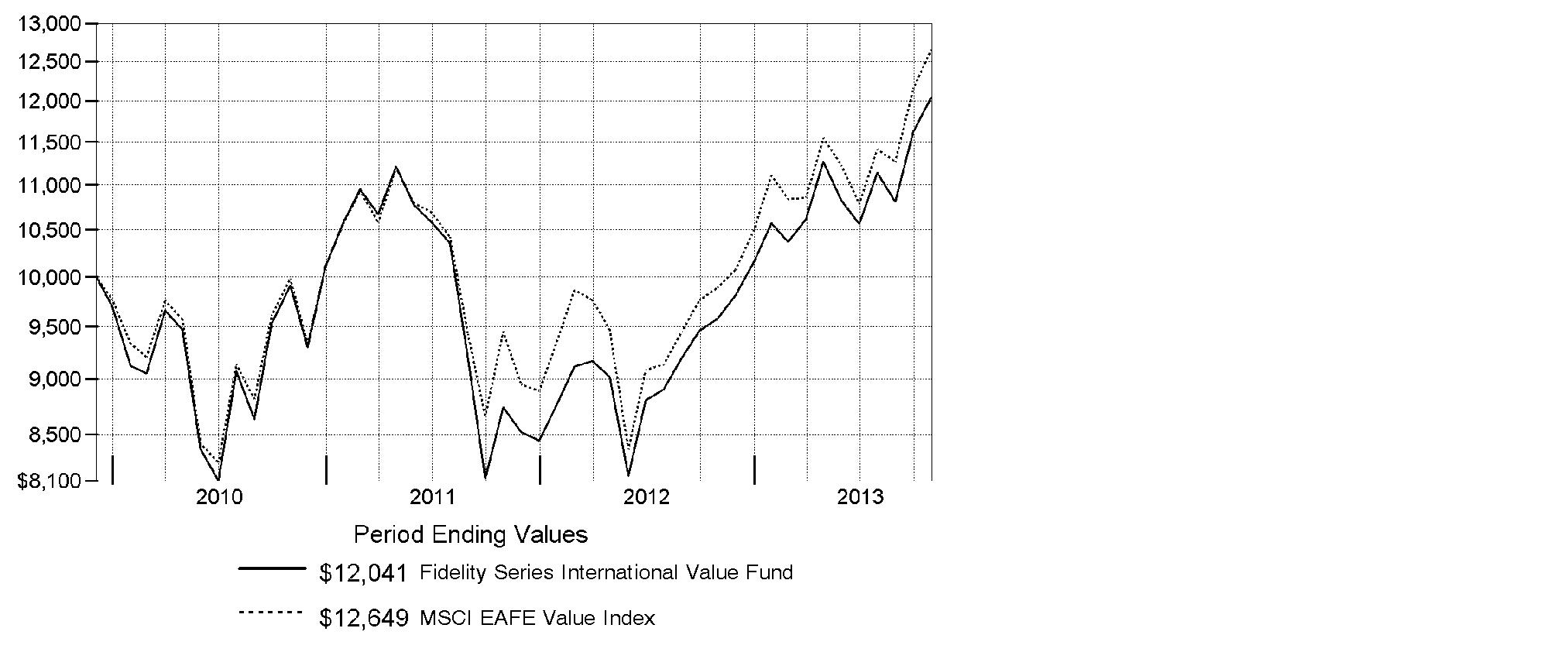

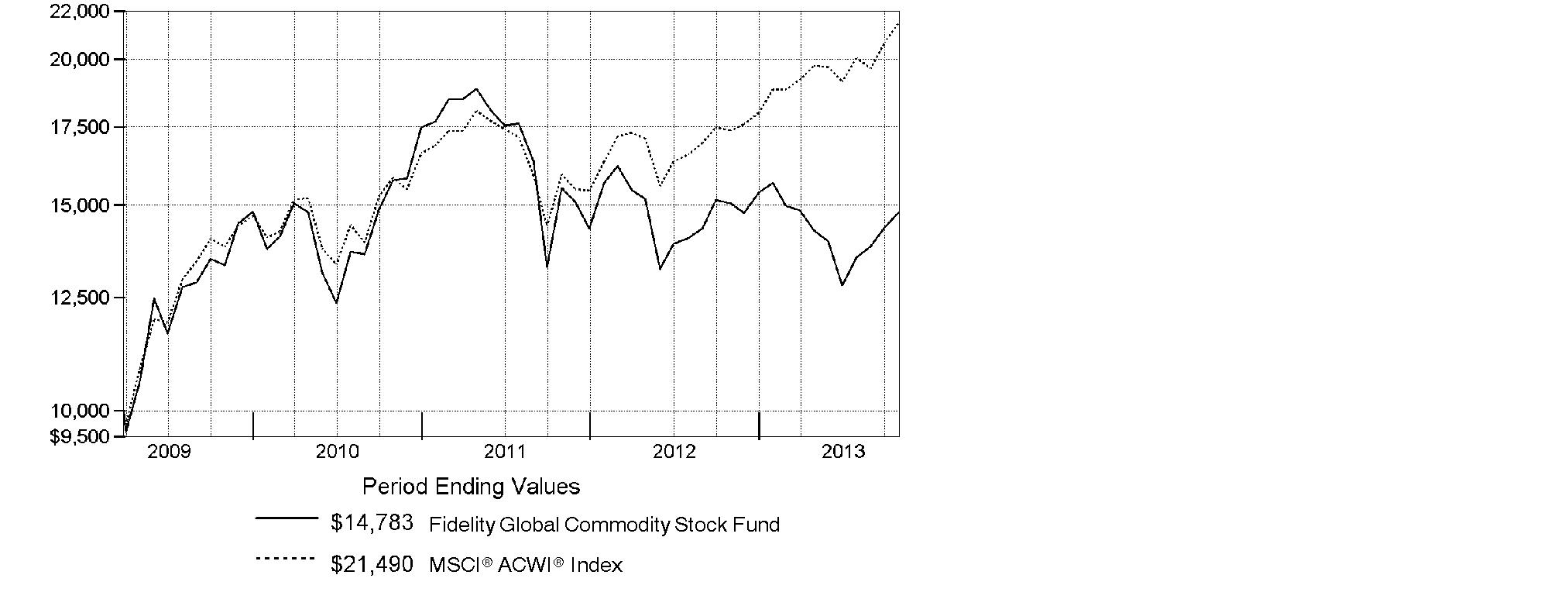

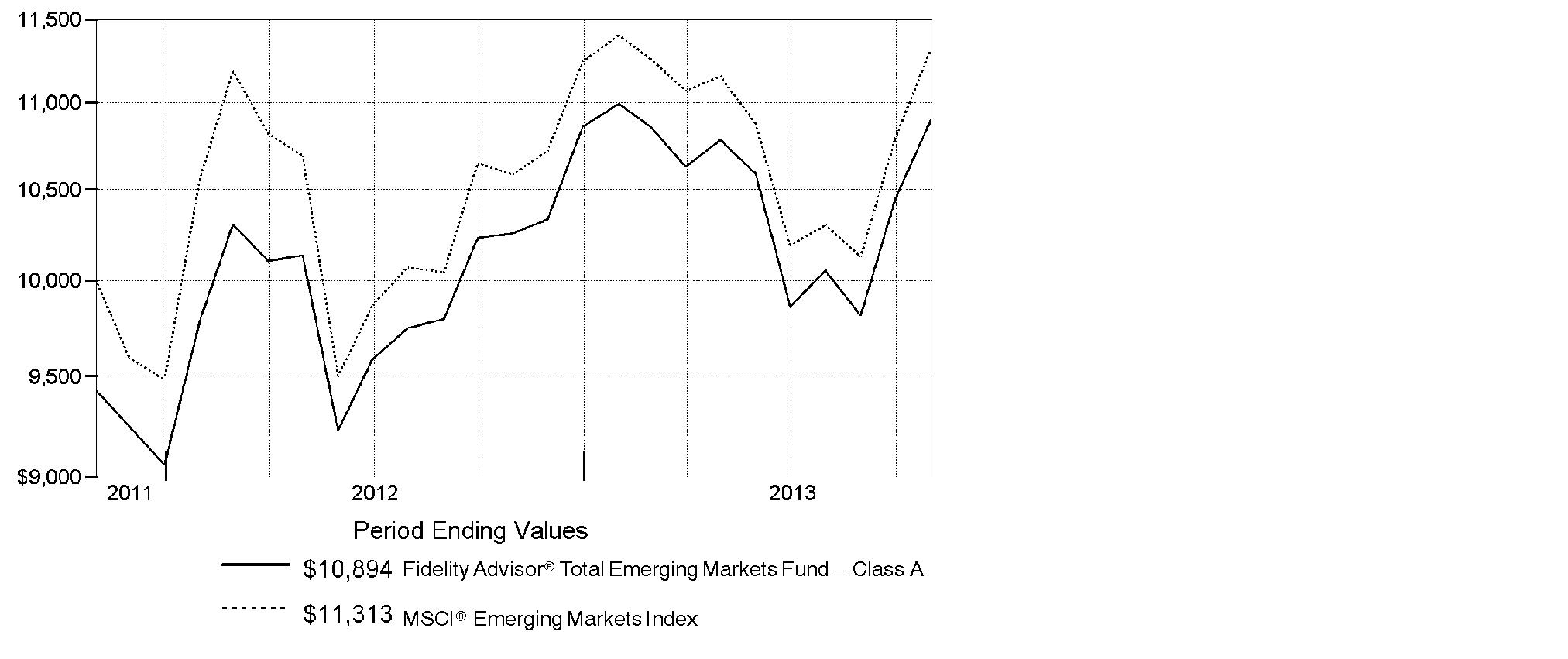

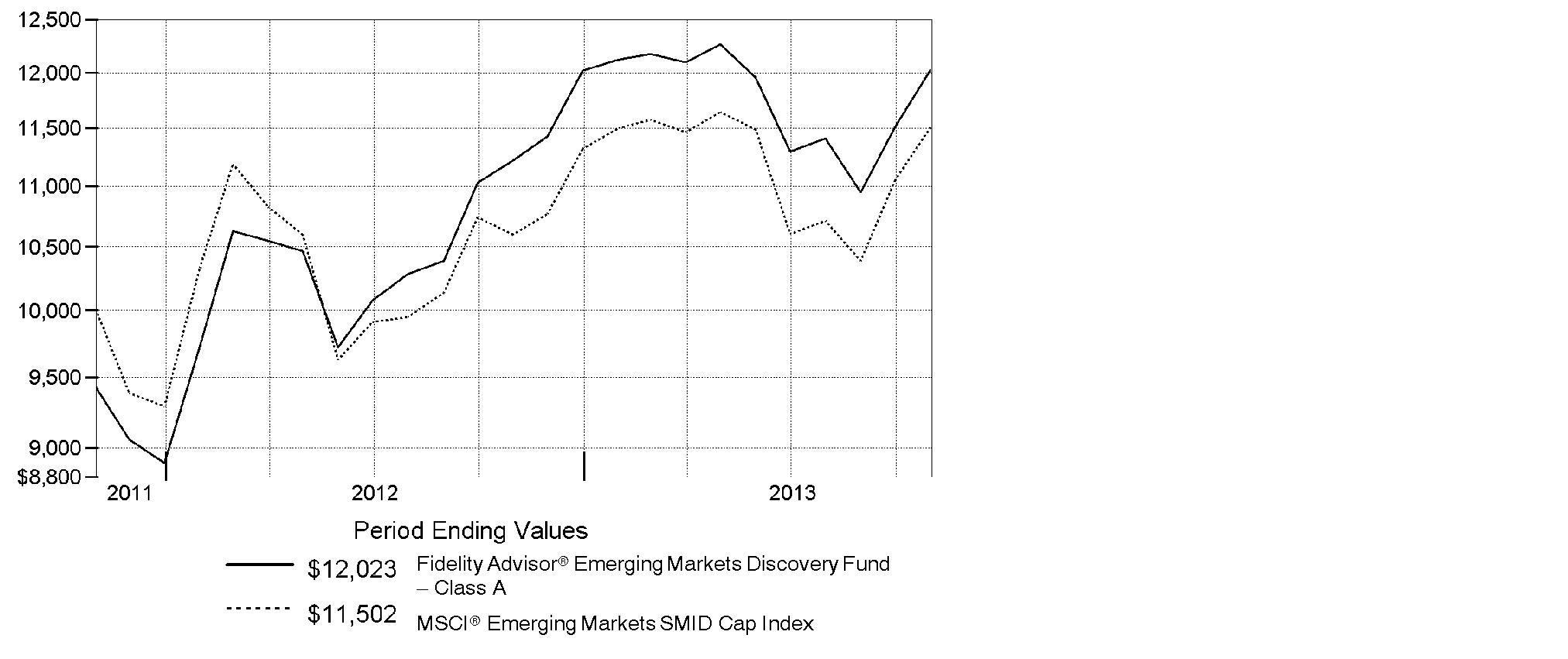

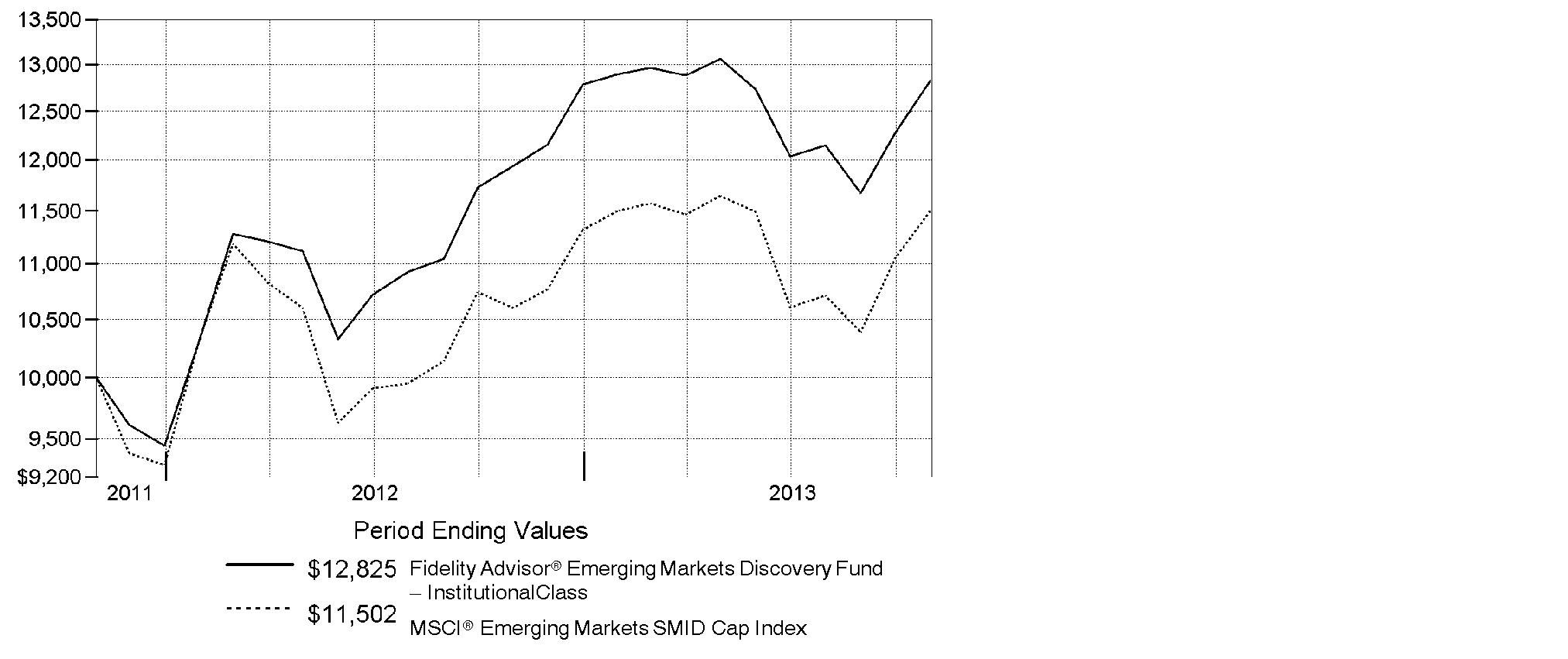

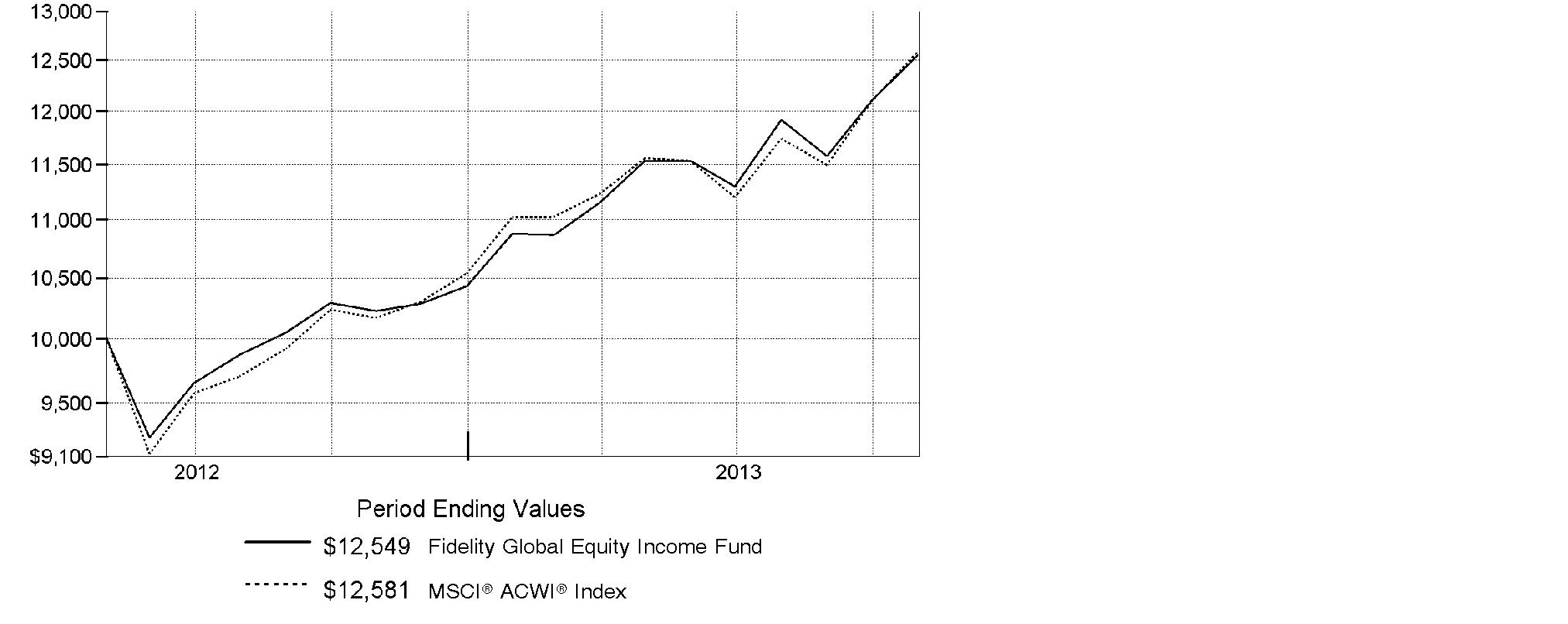

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

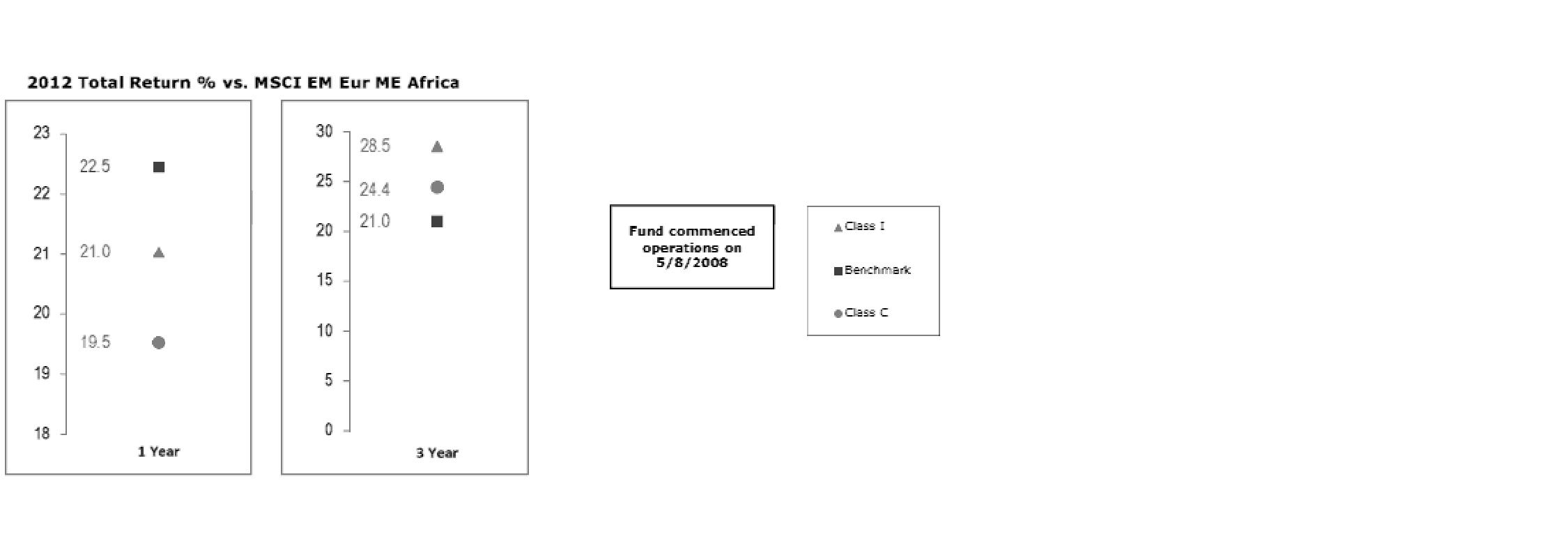

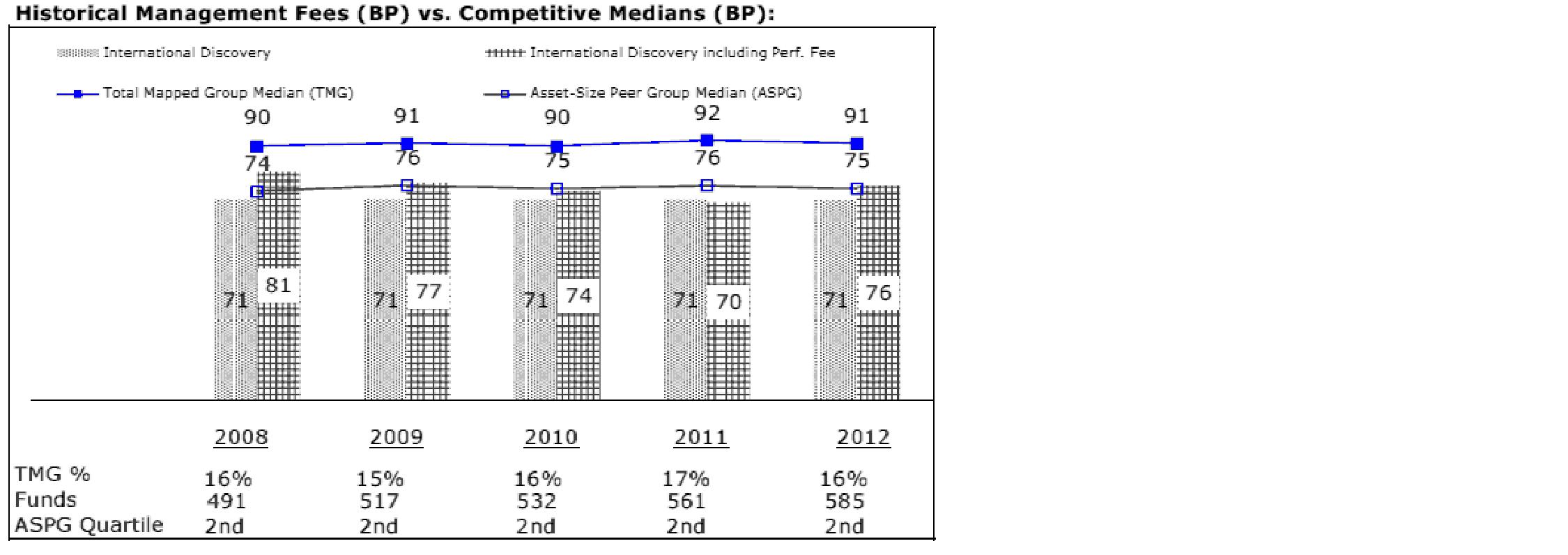

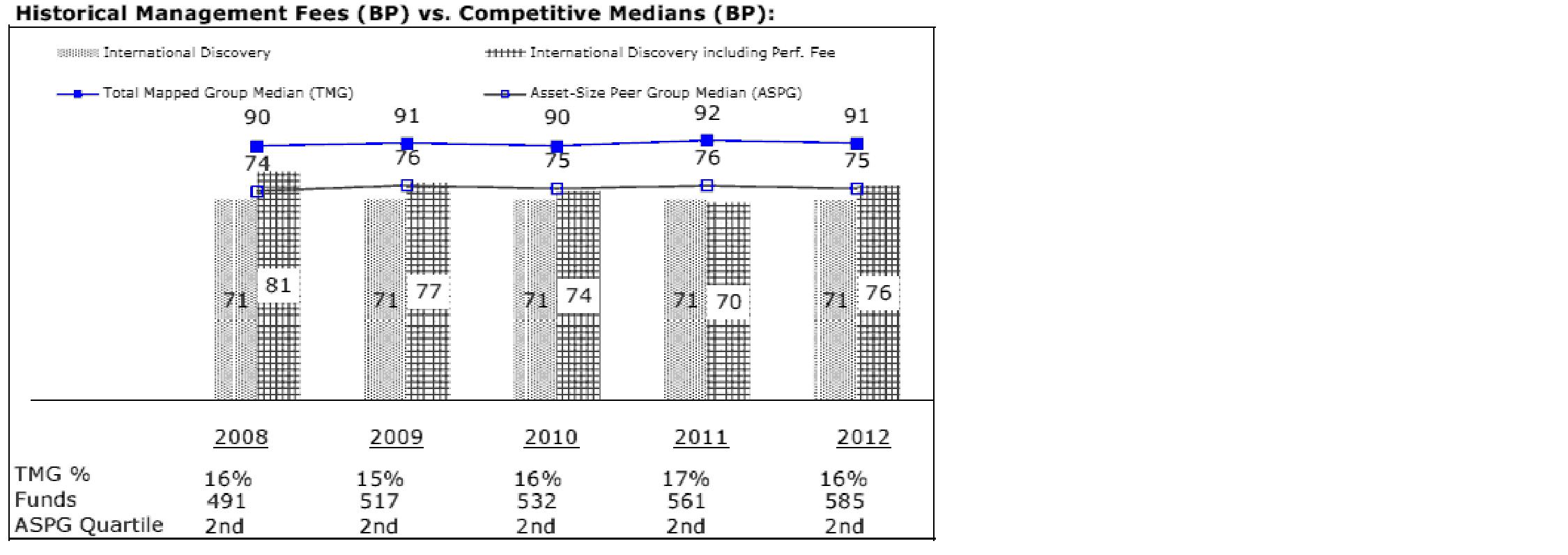

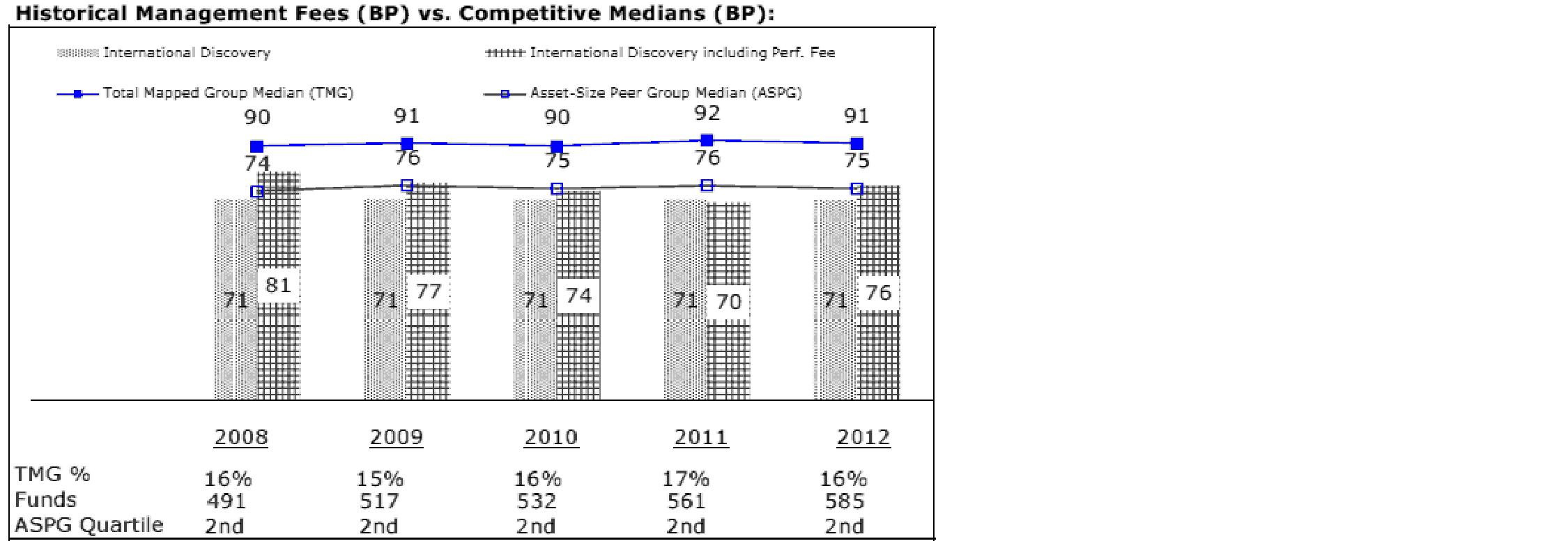

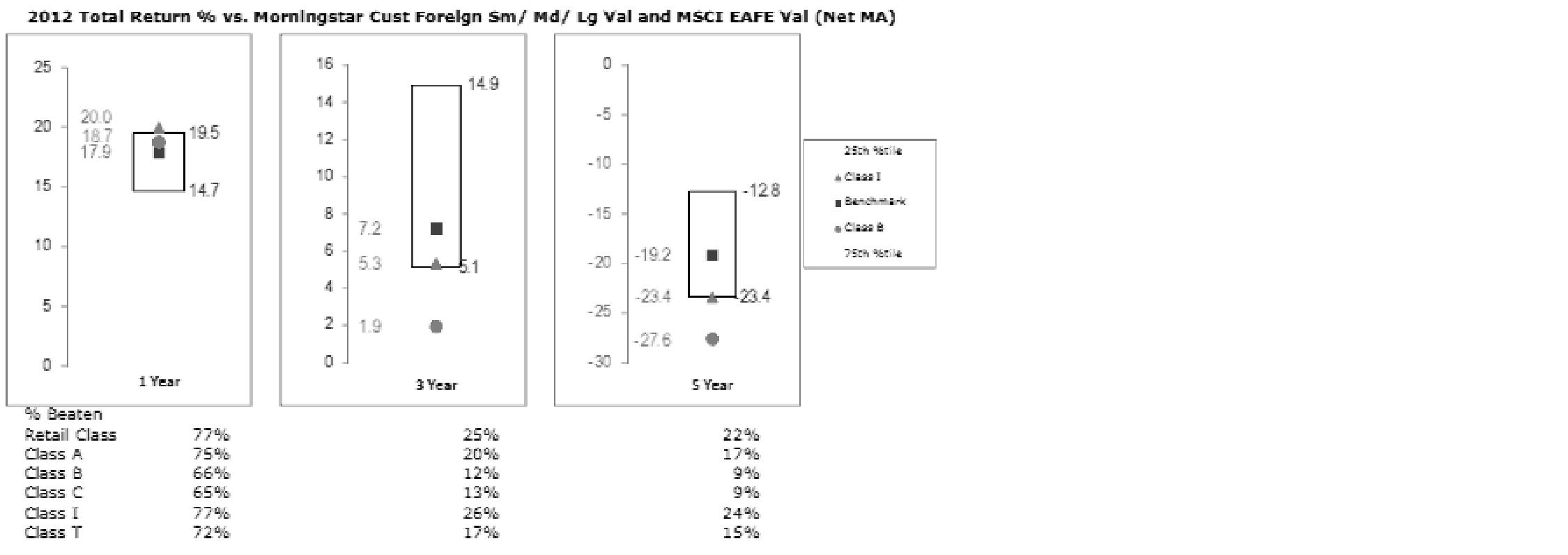

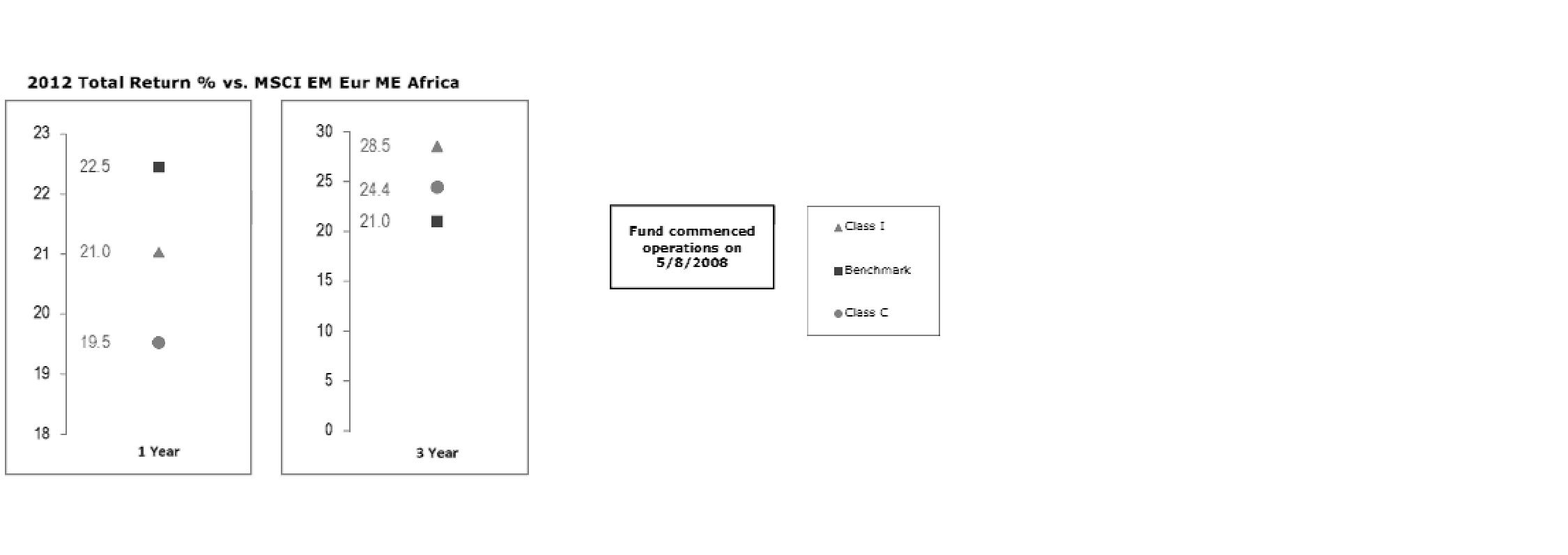

Average Annual Total Returns

Periods ended October 31, 2013 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® International Discovery Fund A | 27.03% | 12.55% | 8.70% |

A Prior to October 1, 2004, Fidelity International Discovery Fund operated under certain different investment policies. The fund's historical performance may not represent its current investment policies.

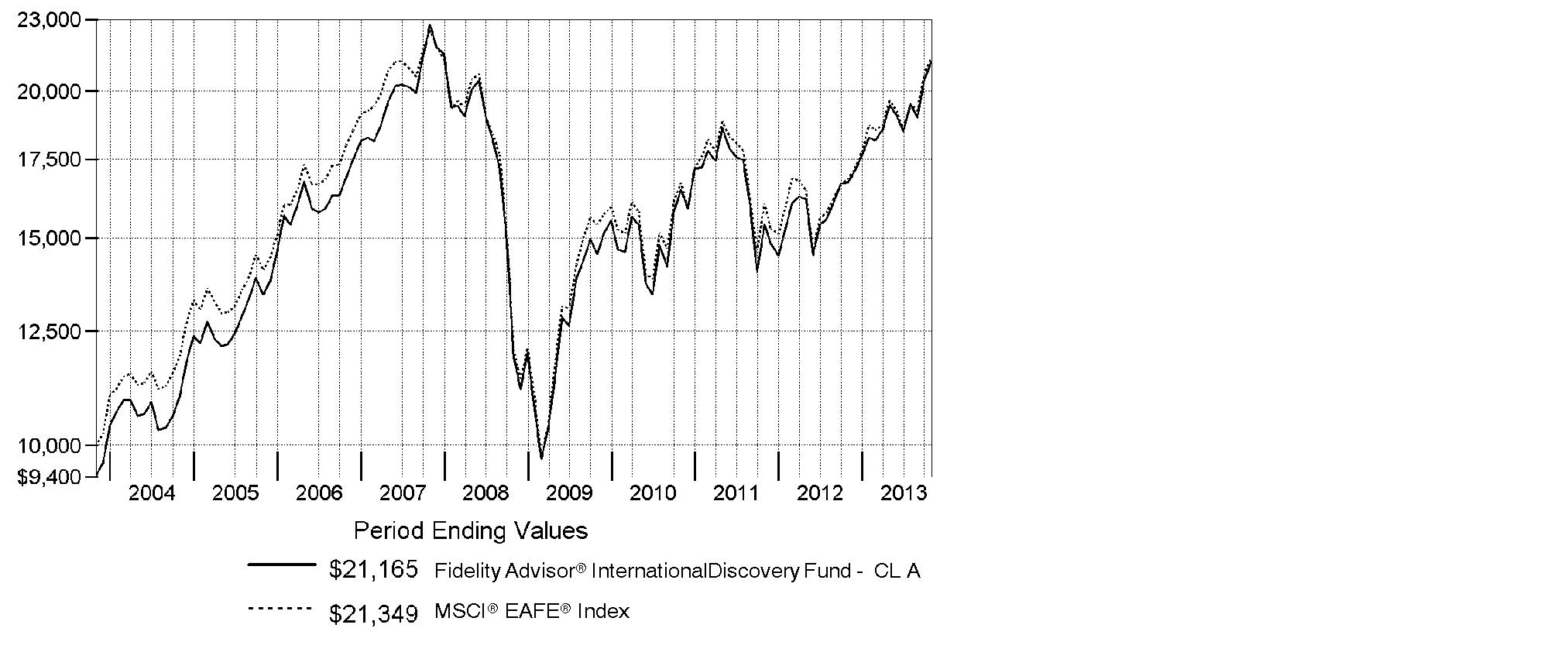

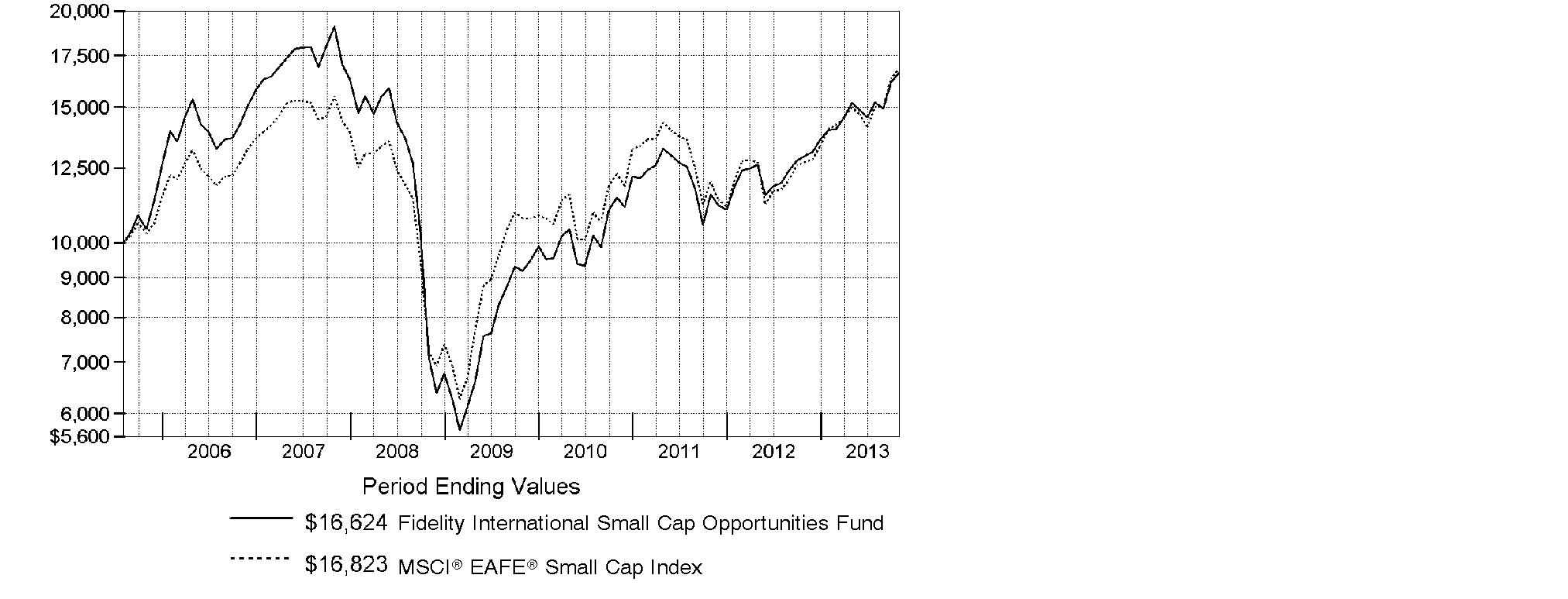

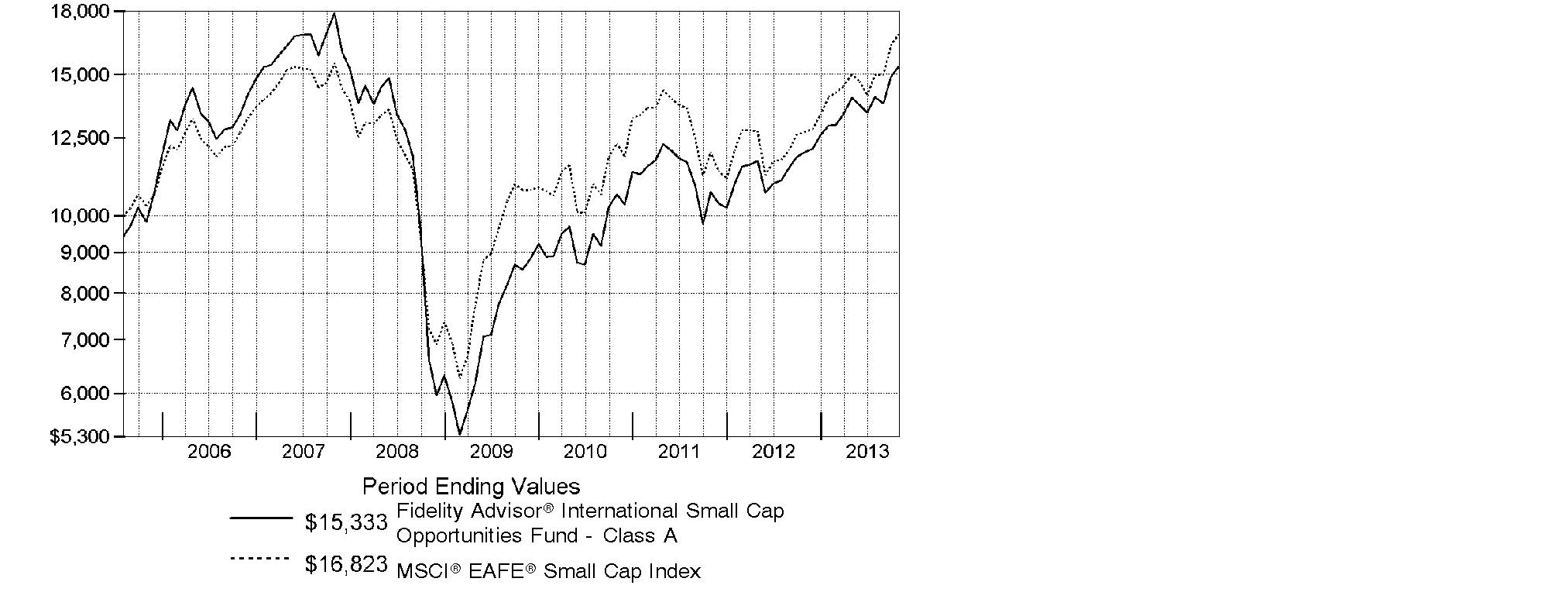

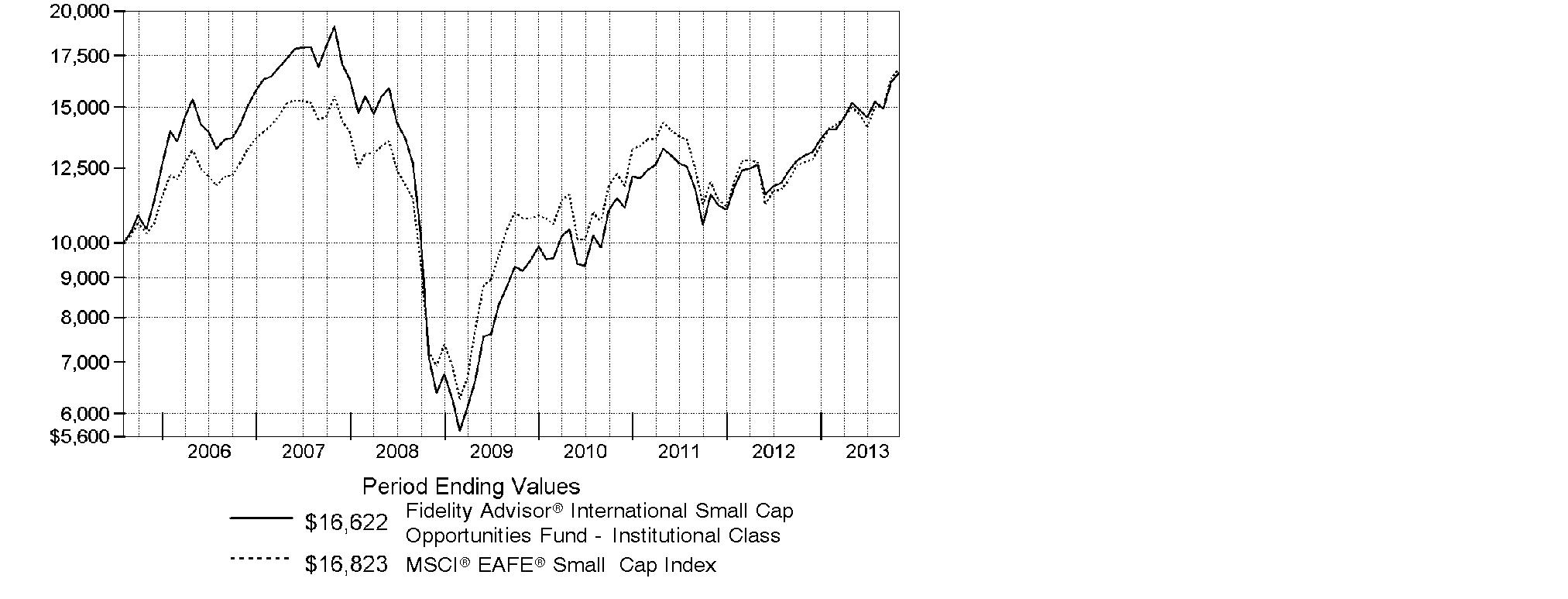

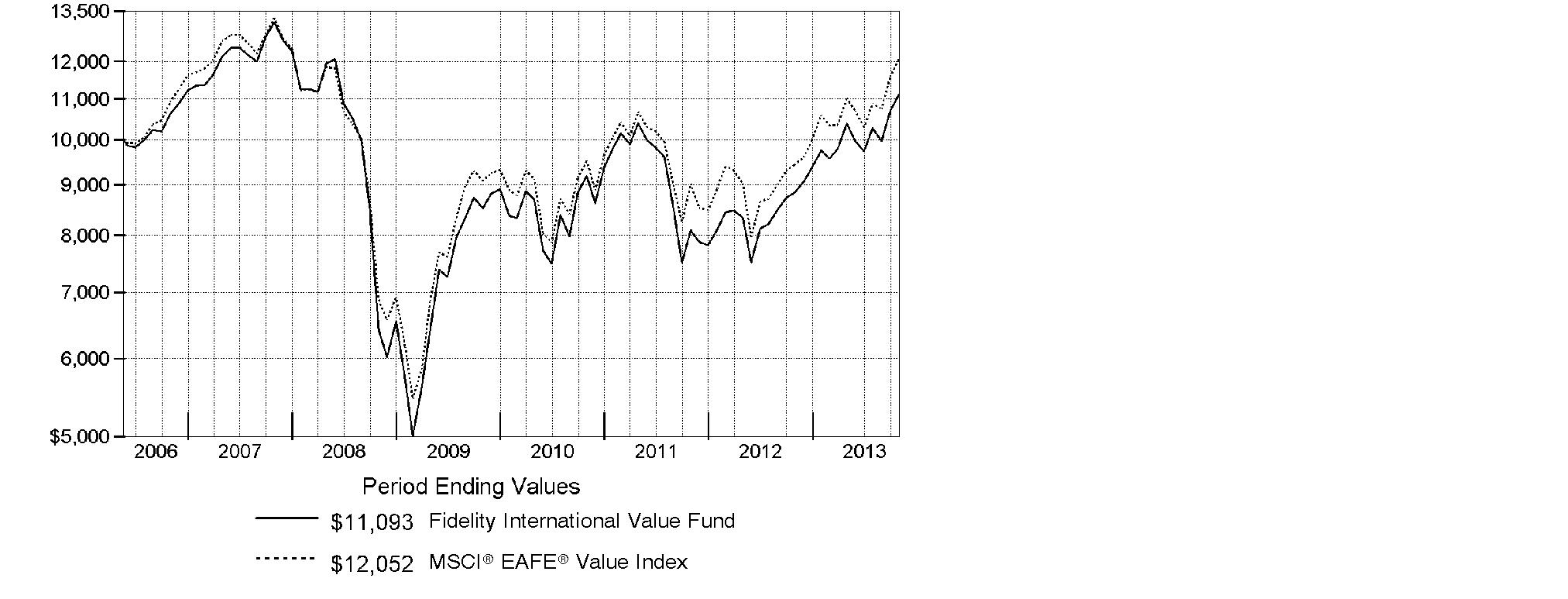

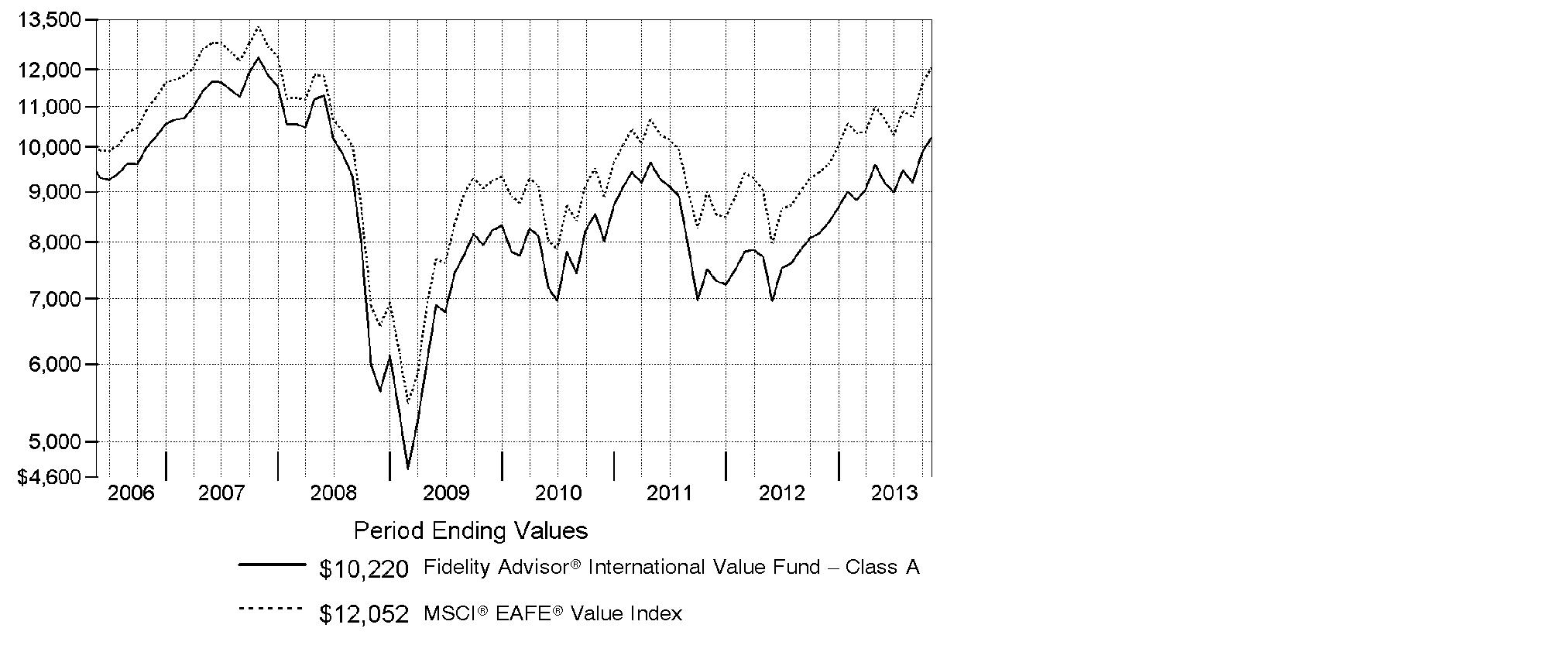

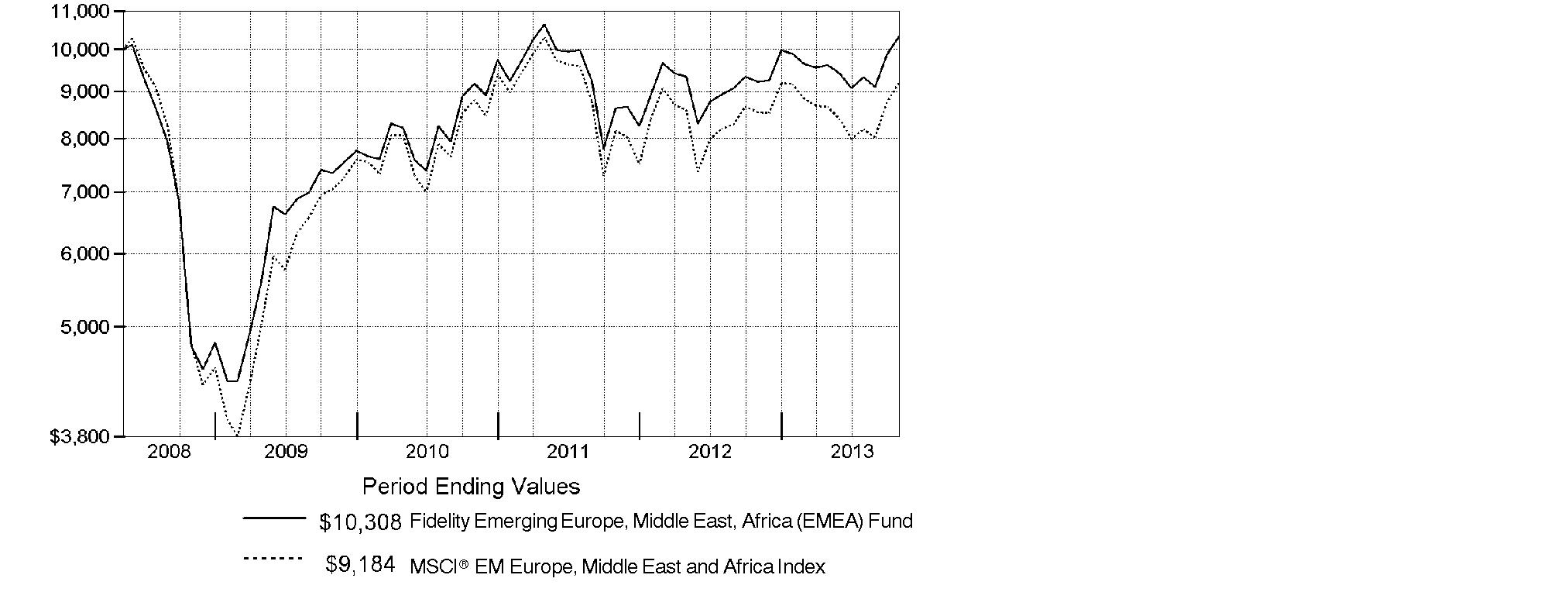

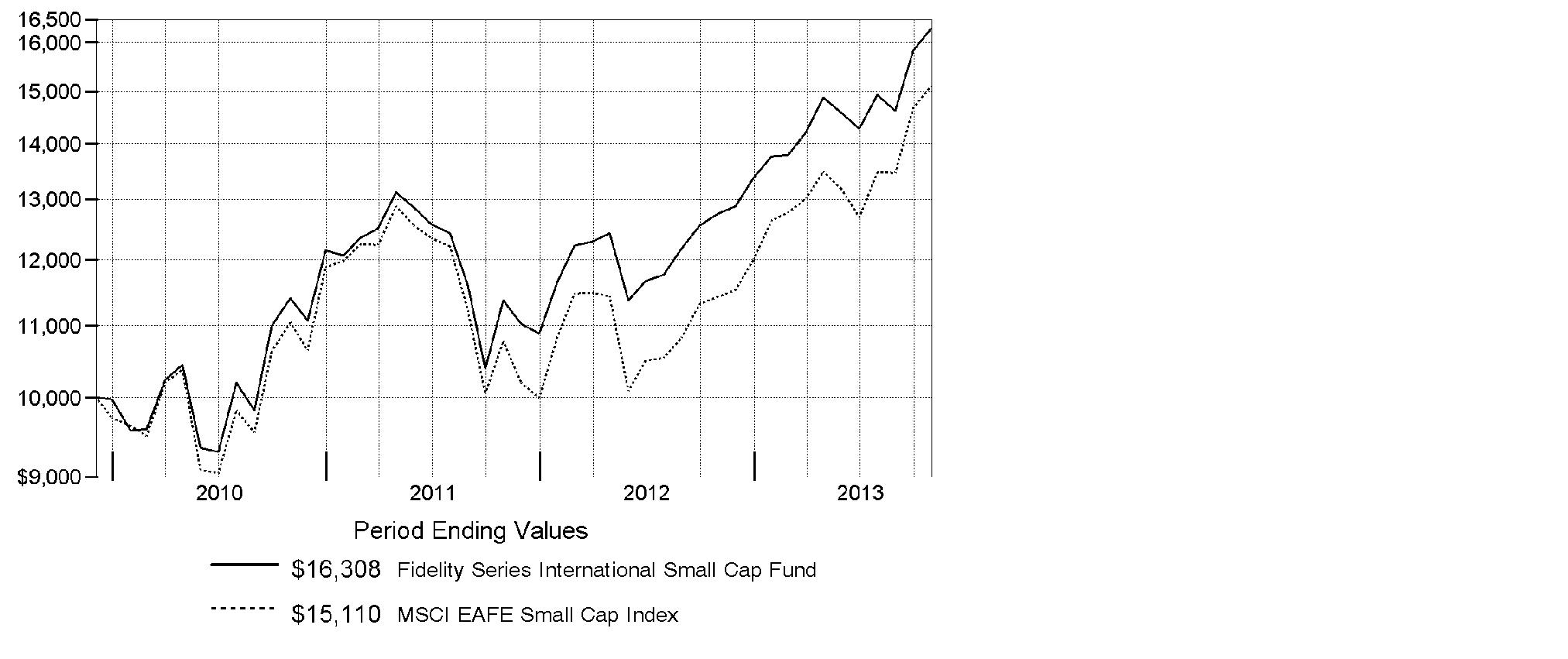

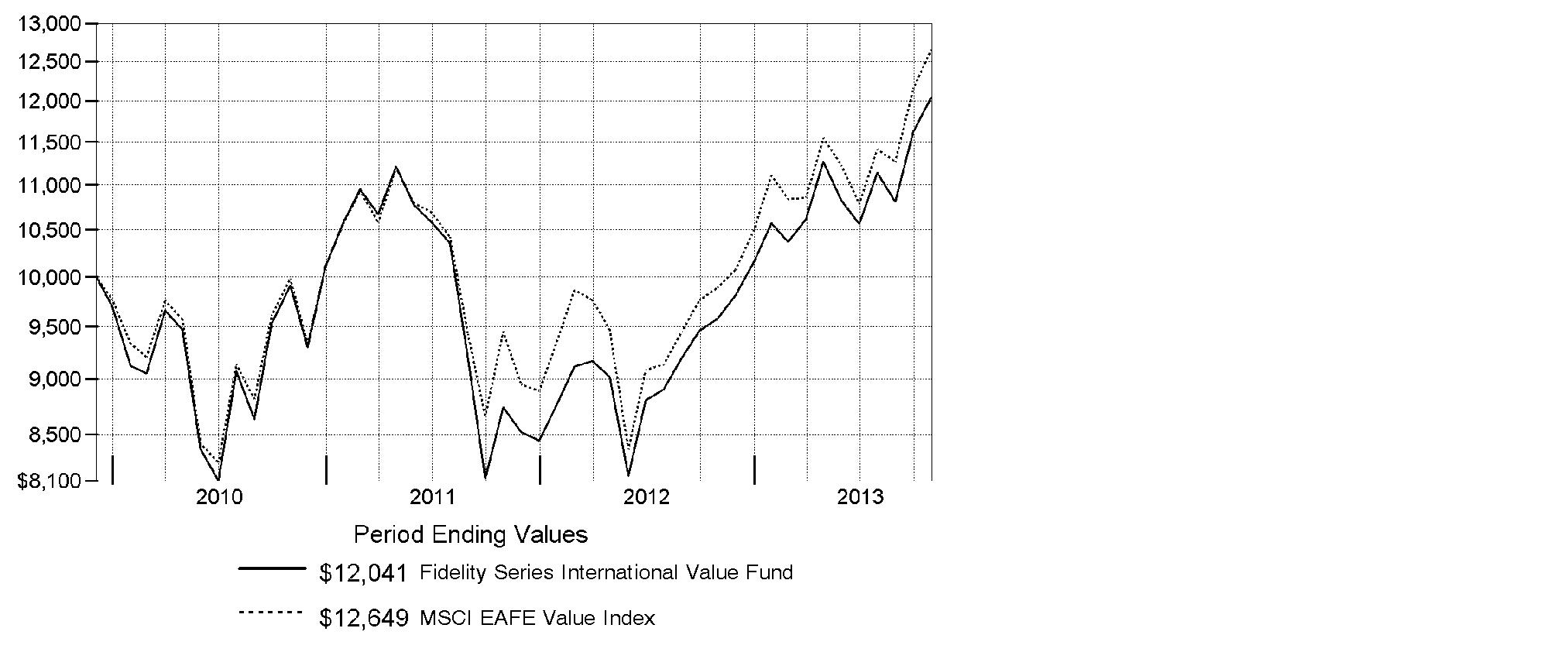

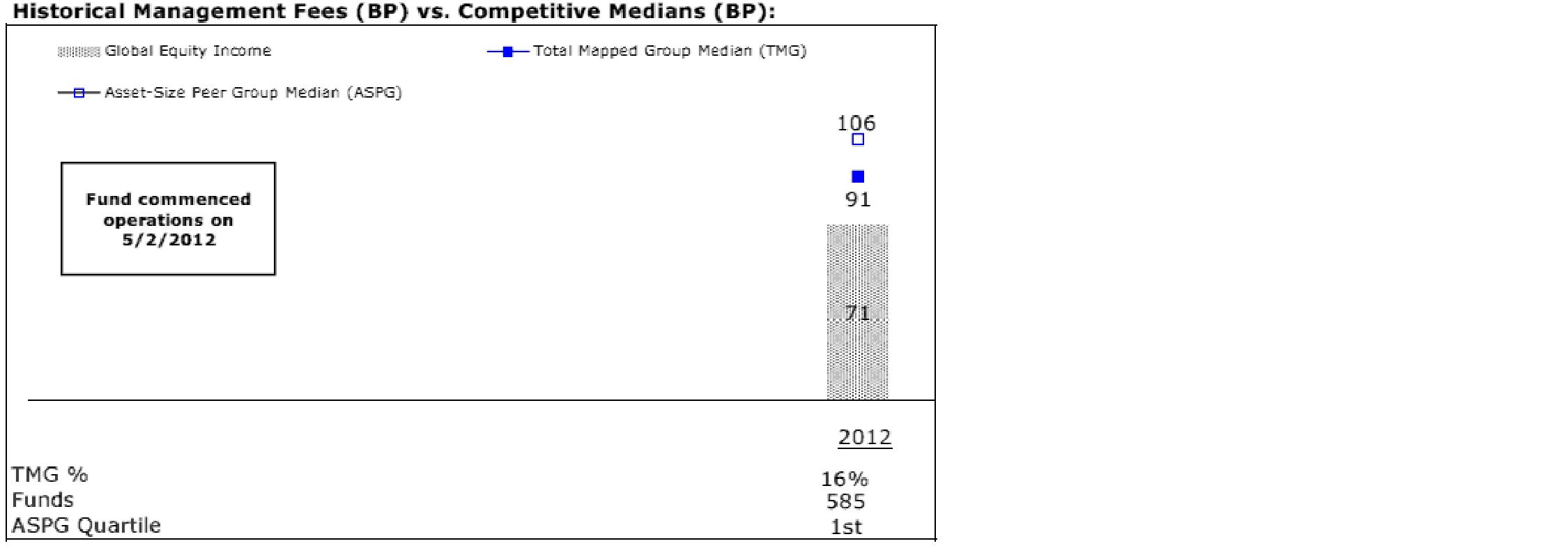

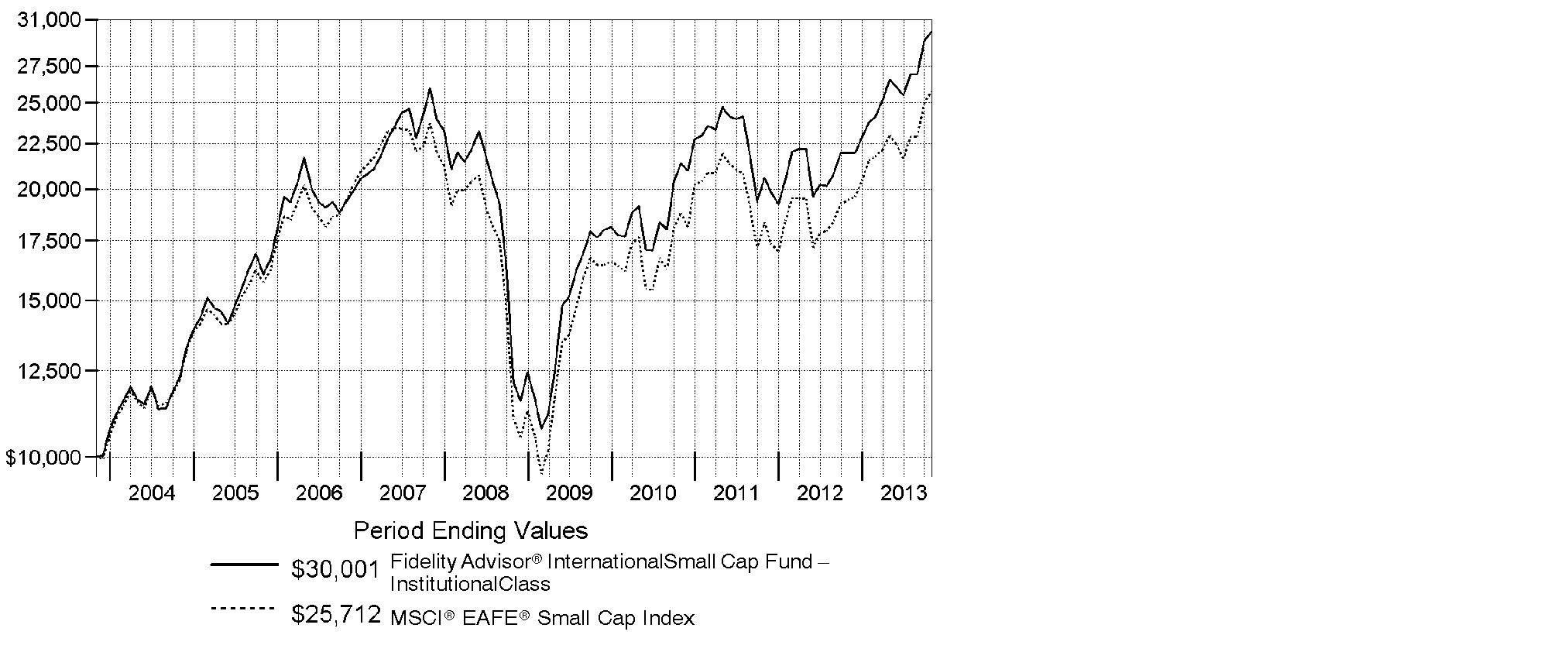

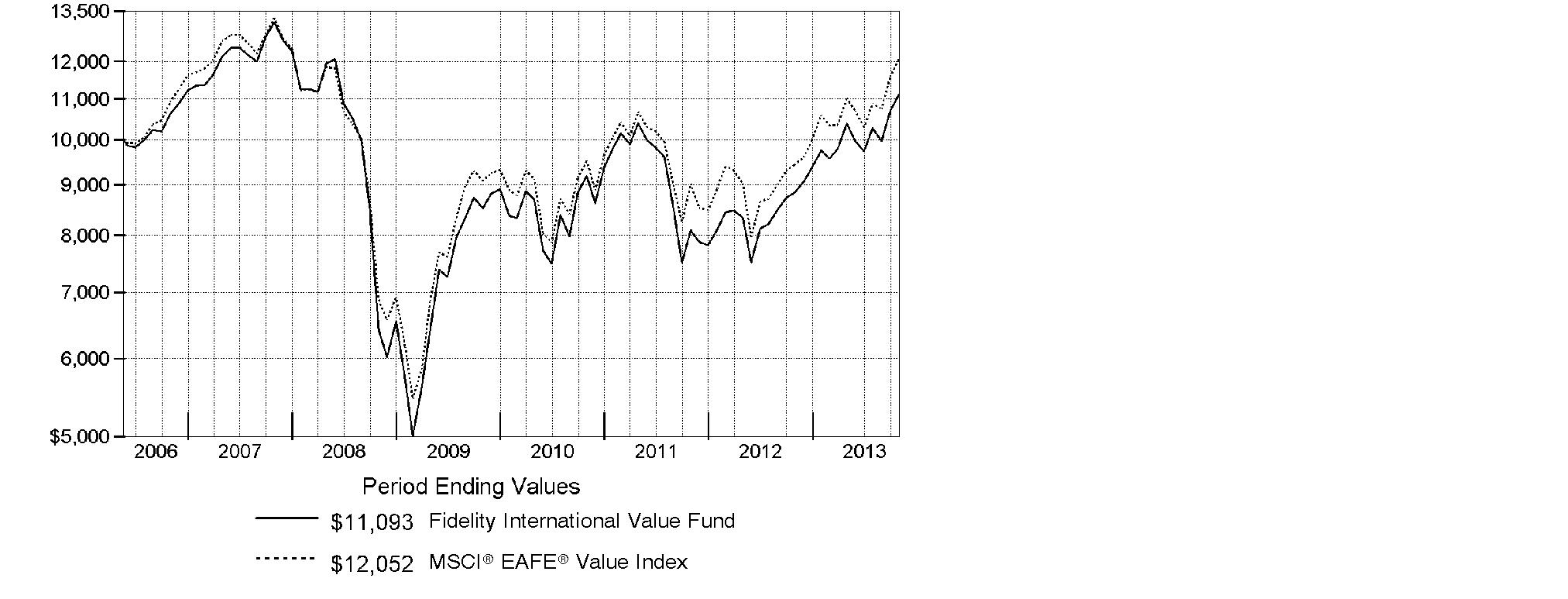

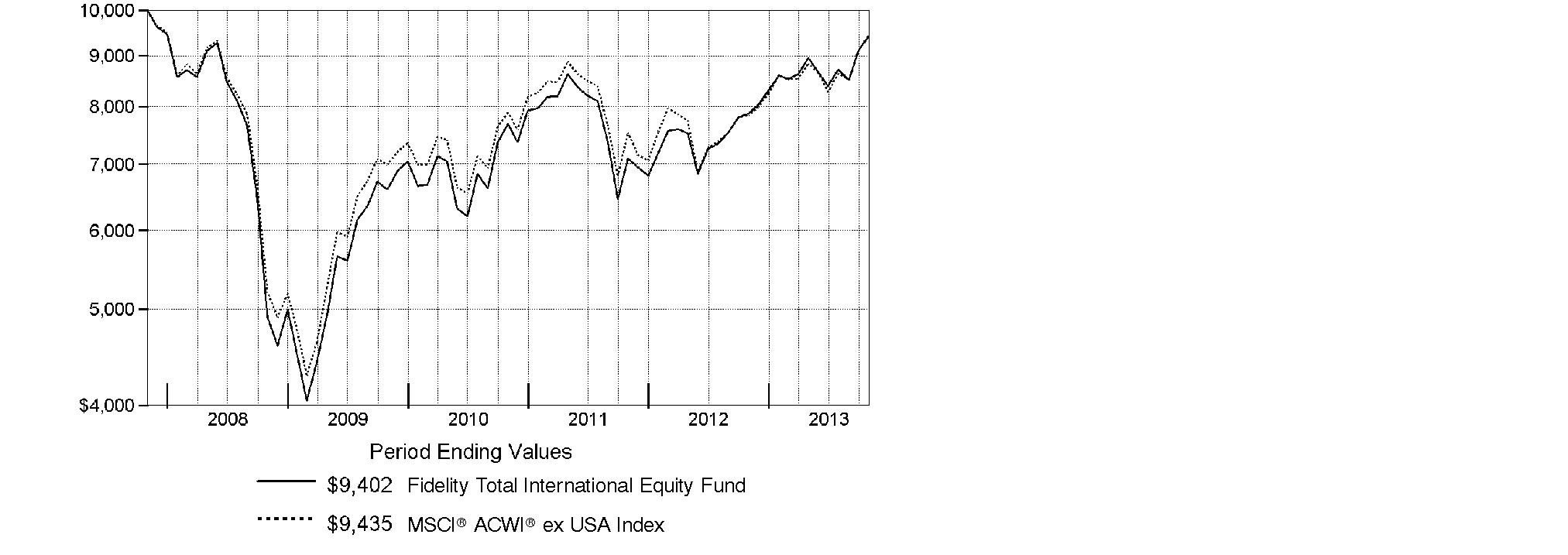

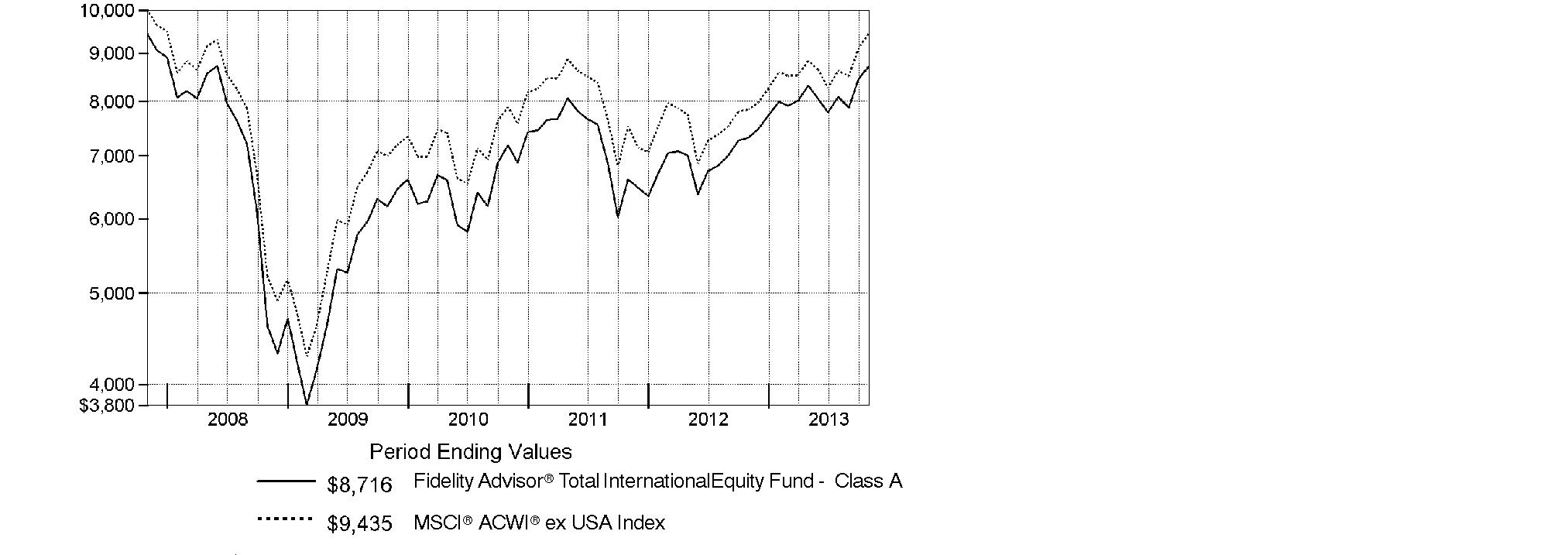

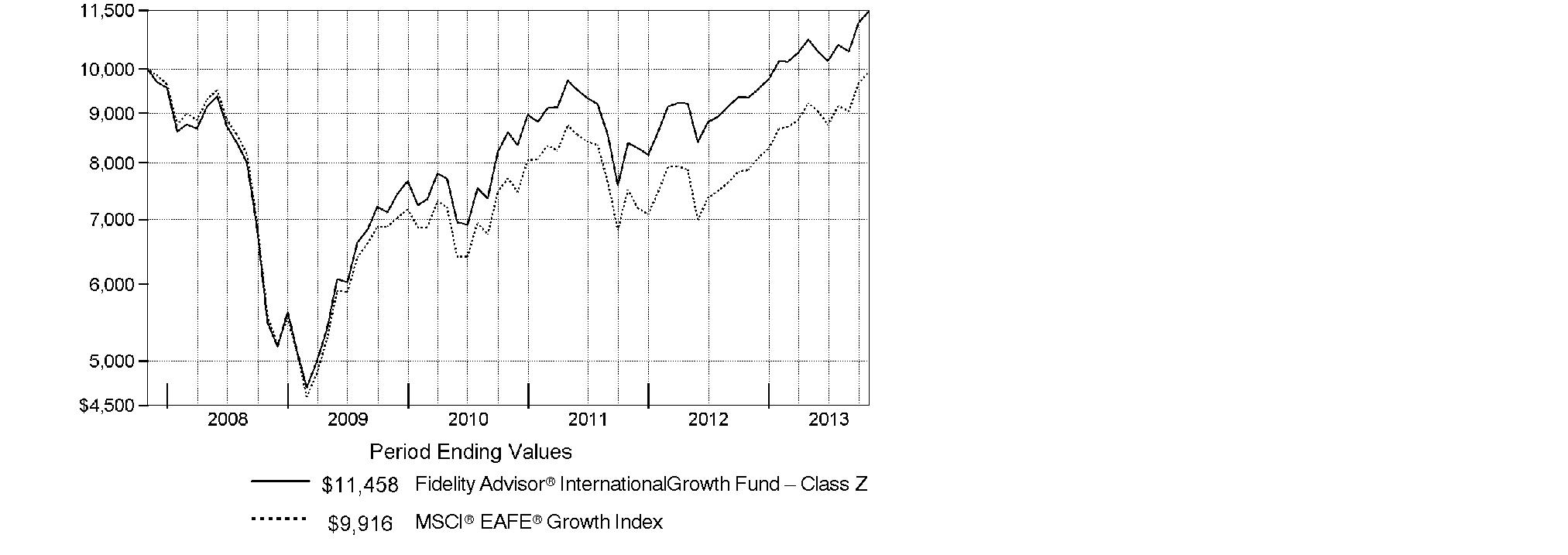

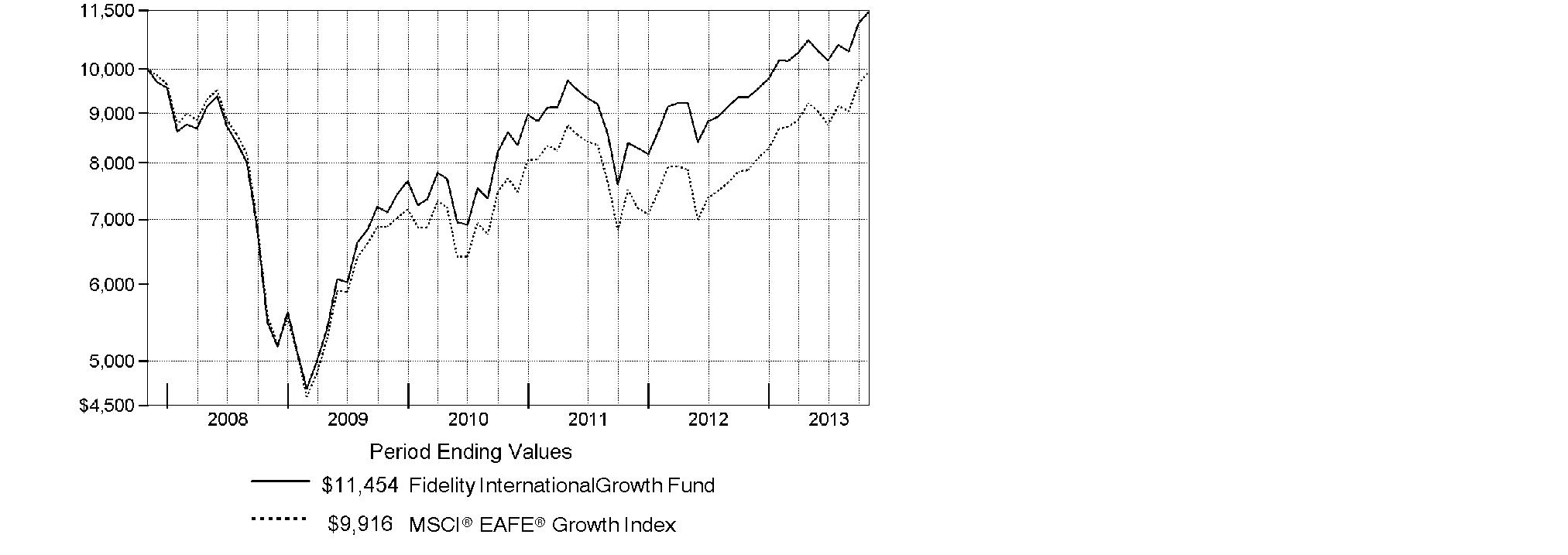

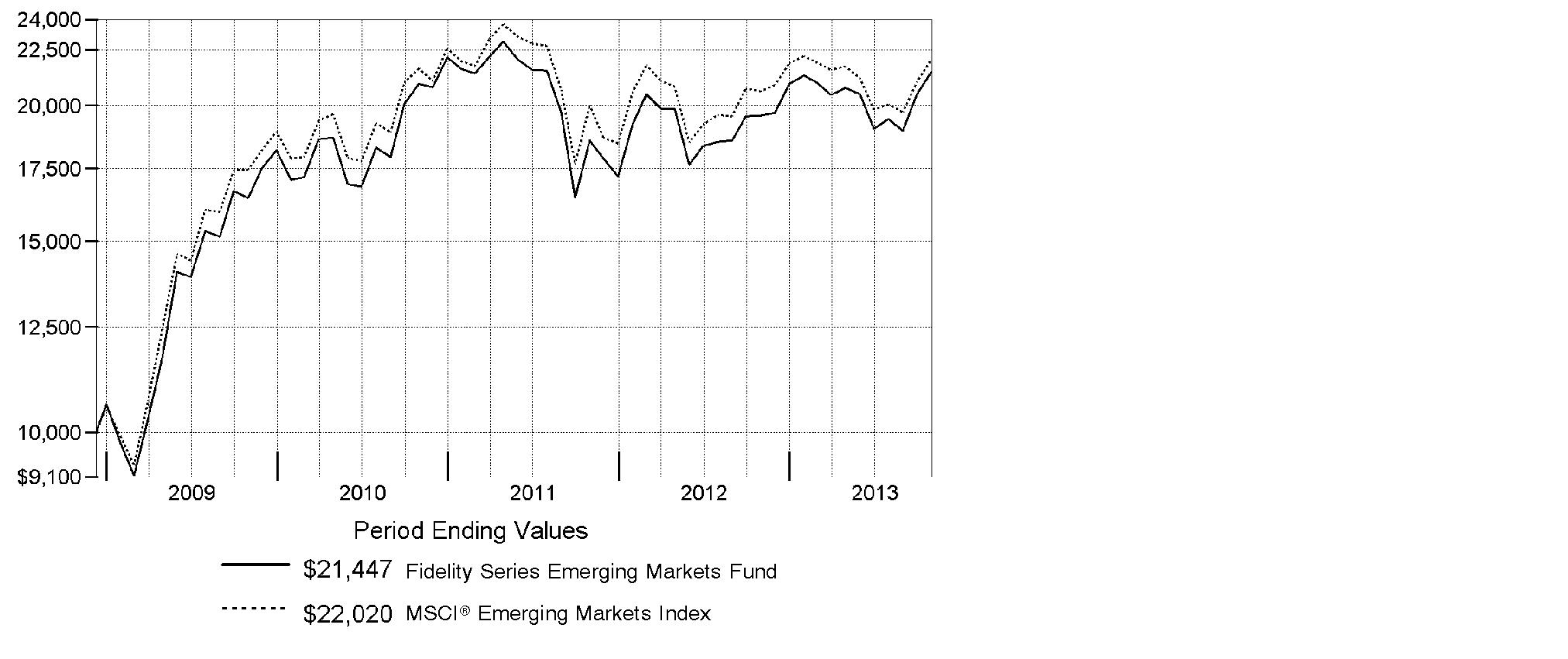

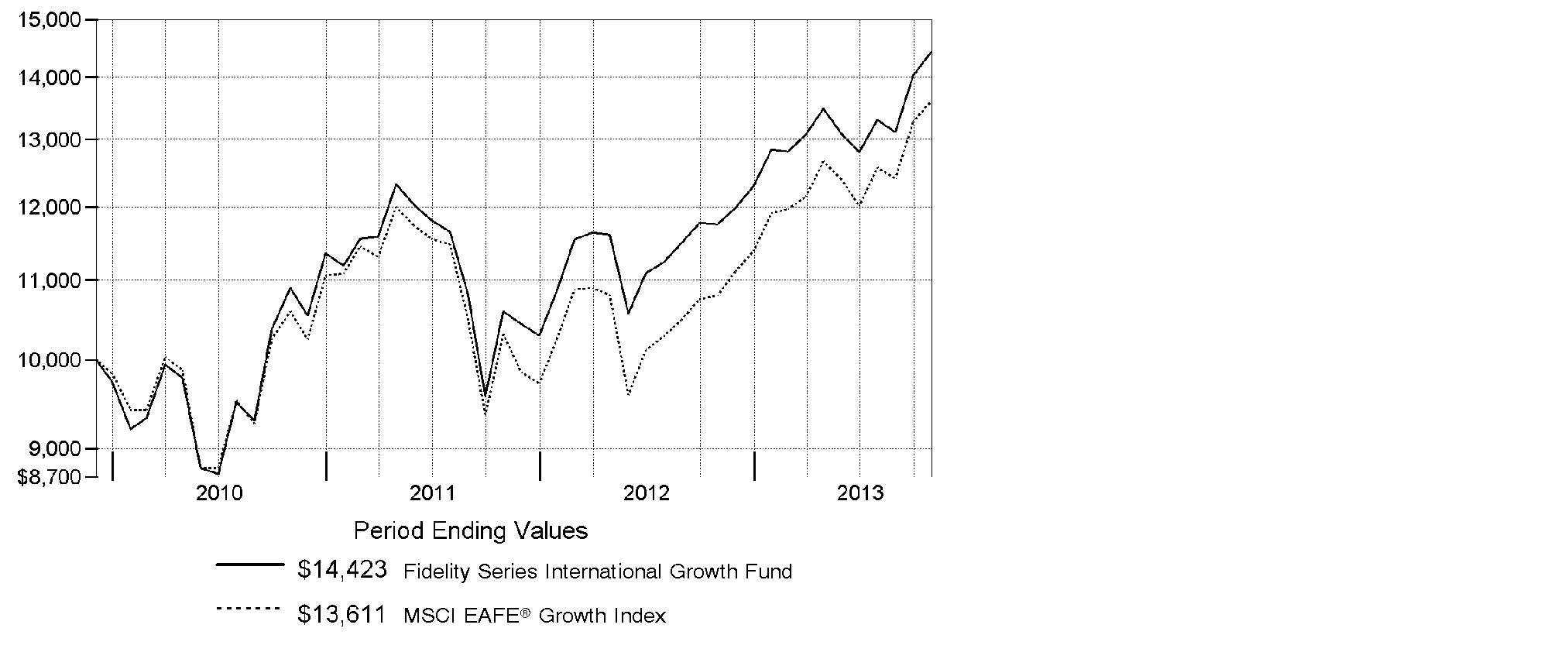

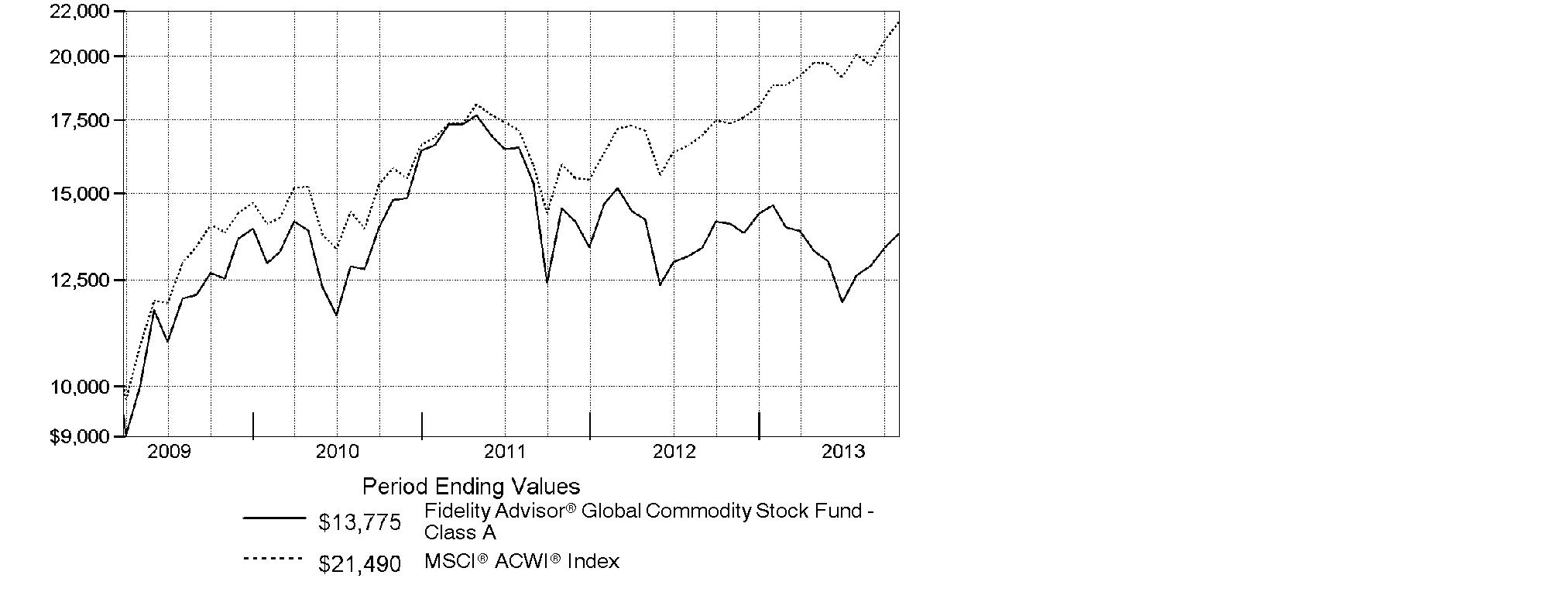

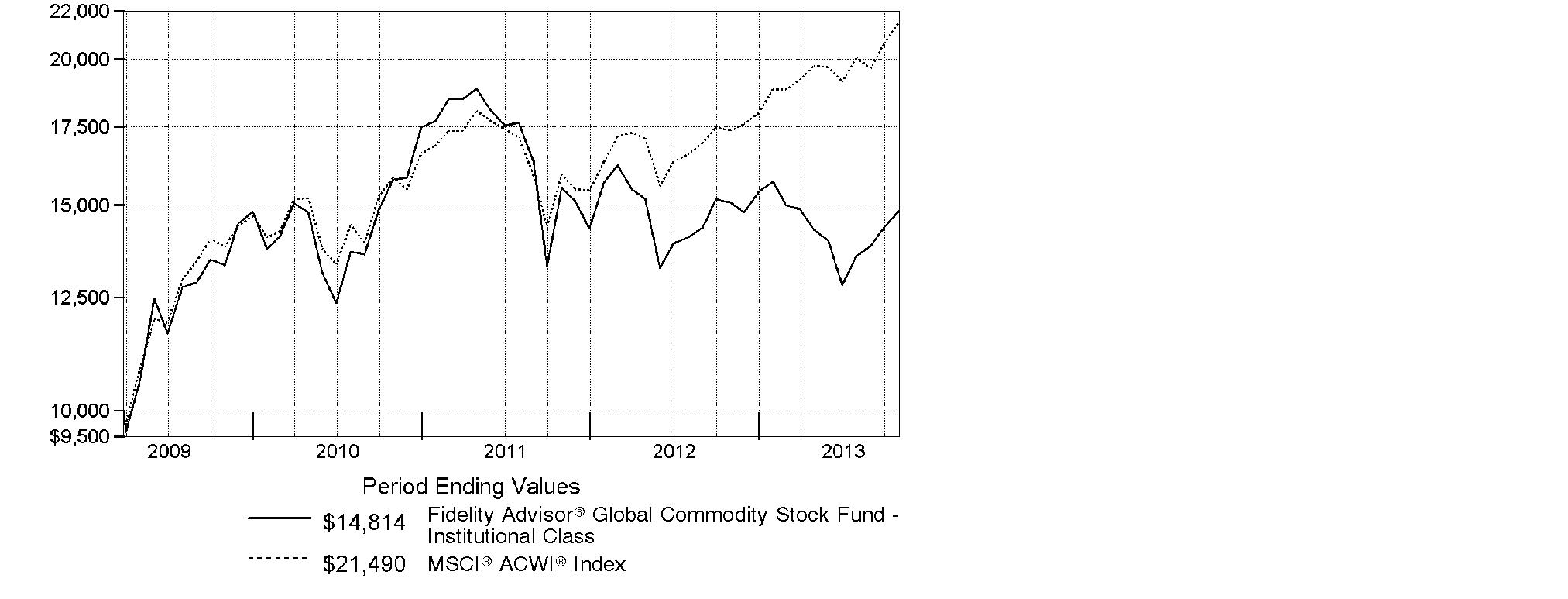

$10,000 Over 10 Years

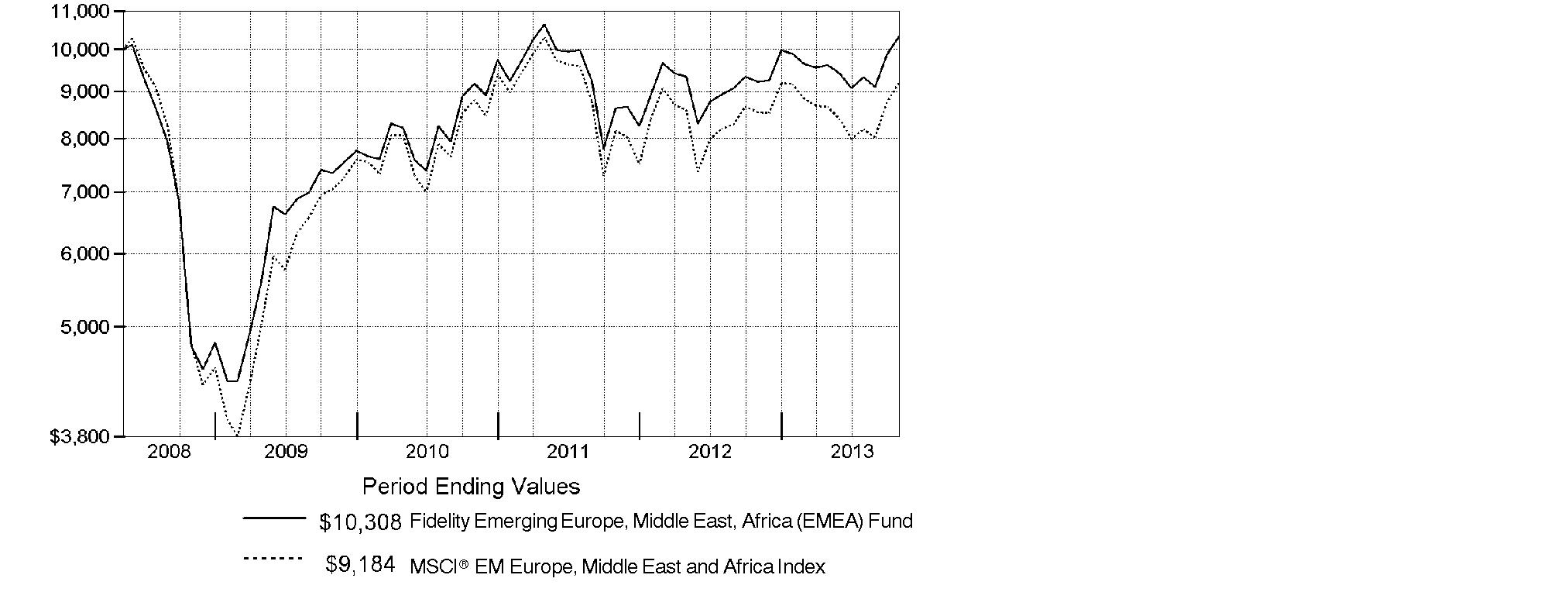

Let's say hypothetically that $10,000 was invested in Fidelity® International Discovery Fund, a class of the fund, on October 31, 2003. The chart shows how the value of your investment would have changed, and also shows how the MSCI® EAFE ® Index performed over the same period.

Annual Report

Market Recap: On balance, global equity markets remained upbeat for the 12-month period ending October 31, 2013. The MSCI® ACWI® (All Country World Index) Index gained 23.75% for the period, amid investor preference for higher-risk assets. The period was not without turbulence, however. In the spring and summer, central banks worldwide, especially in the U.S. and China, made clear their intentions to maintain accommodative monetary policies. That stance, combined with modest cyclical improvements around the globe and generally low valuations, underpinned the broad rally in equities. Europe (+32%) shone brightly, with most markets in the region - large and small - registering solid, index-beating gains. Another bright spot was Japan, which, despite a struggling yen and taking a second-half breather, posted a 34% result for the full year. The U.S. - by far the index's biggest constituent - also outperformed the global market with a roughly 28% advance. Meanwhile, Asia-Pacific ex Japan (+14%) lagged, hurt in part by a slowdown in Australia's mining industry as well as currency headwinds. Foreign-exchange and commodity weakness also curbed results in resource-heavy Canada and emerging markets (EM), both of which were up 7%. Country-level EM performance diverged meaningfully for the period, as evidenced by performance in Brazil (-1%), Russia (+12%), India (+1%) and China (+8%).

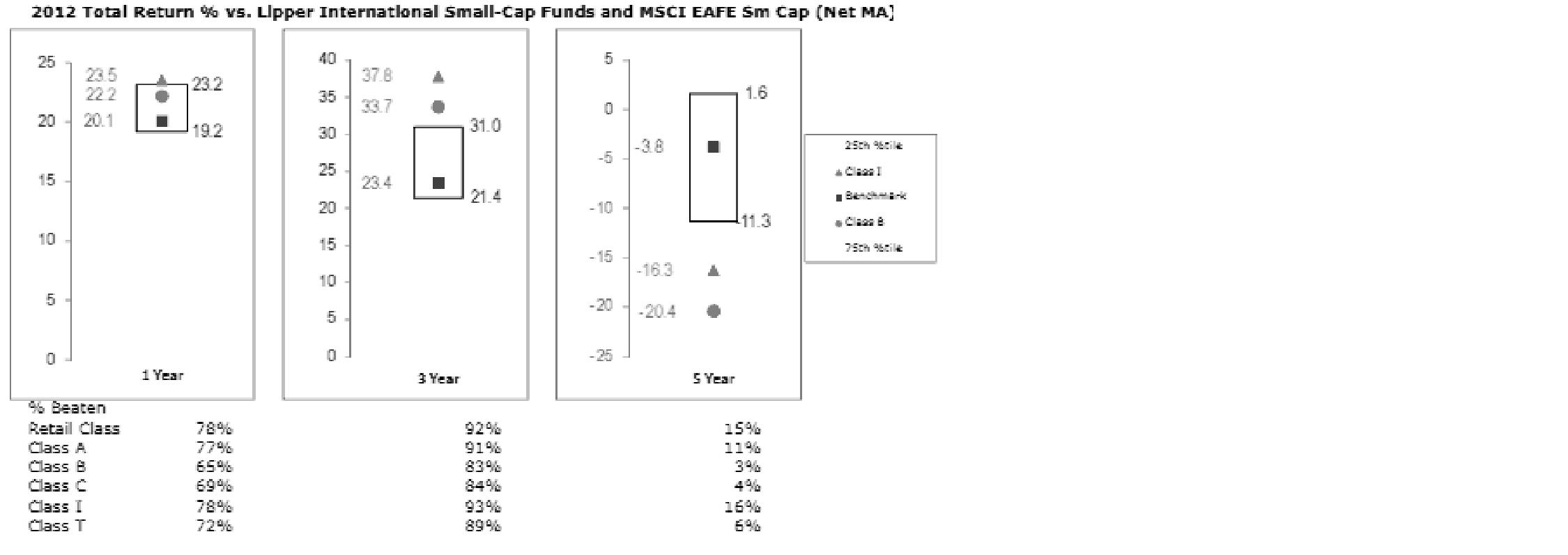

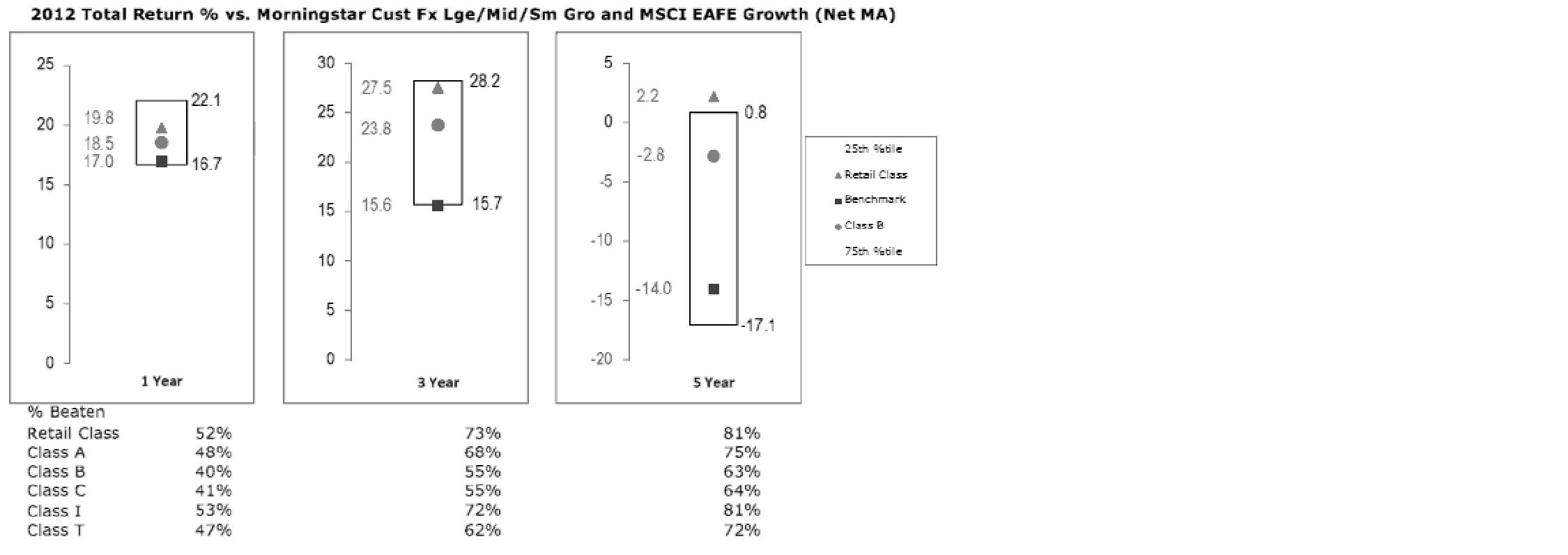

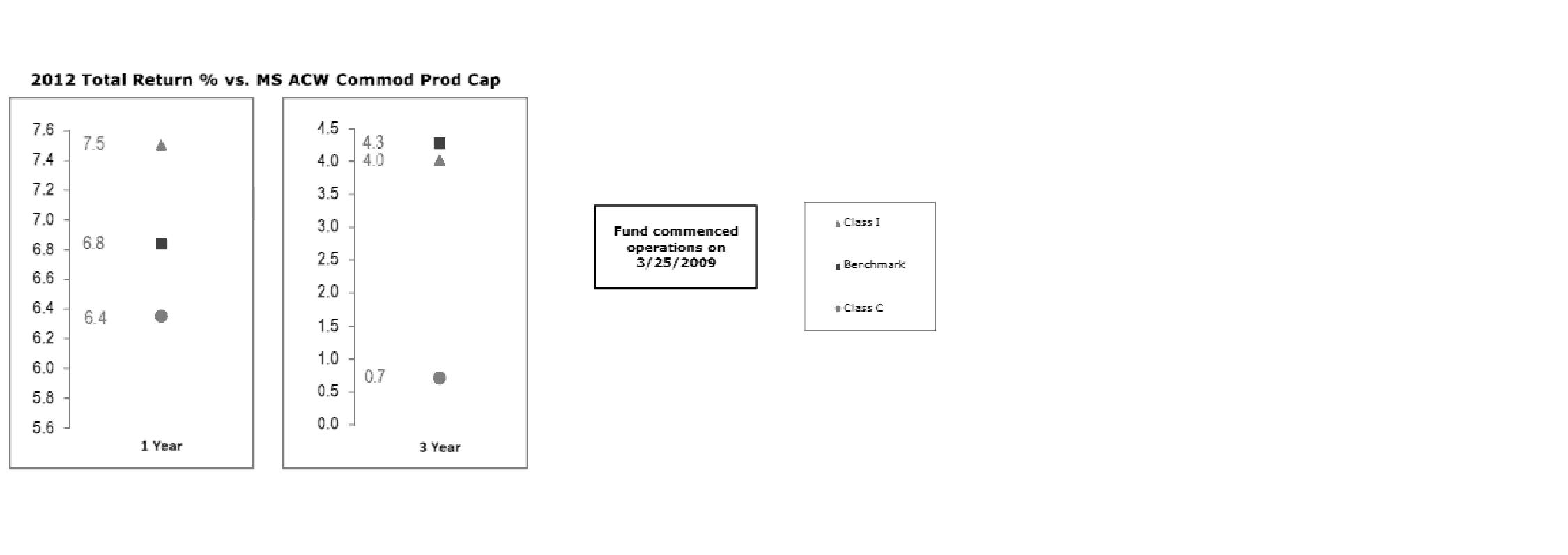

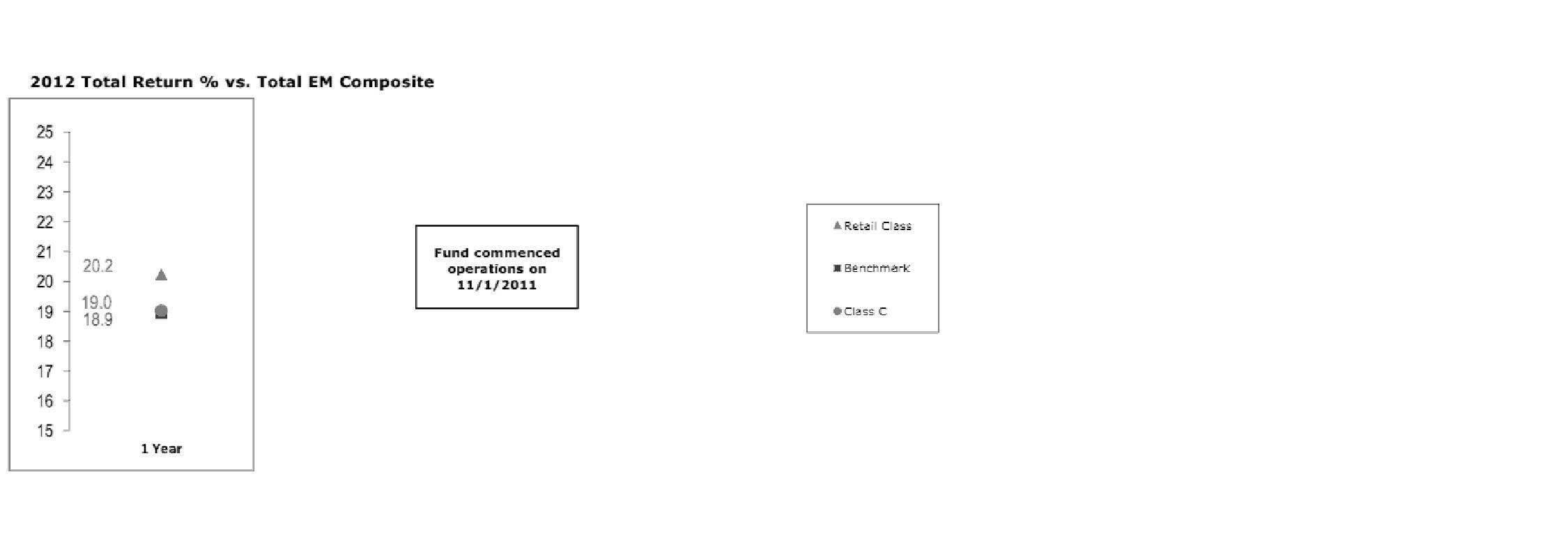

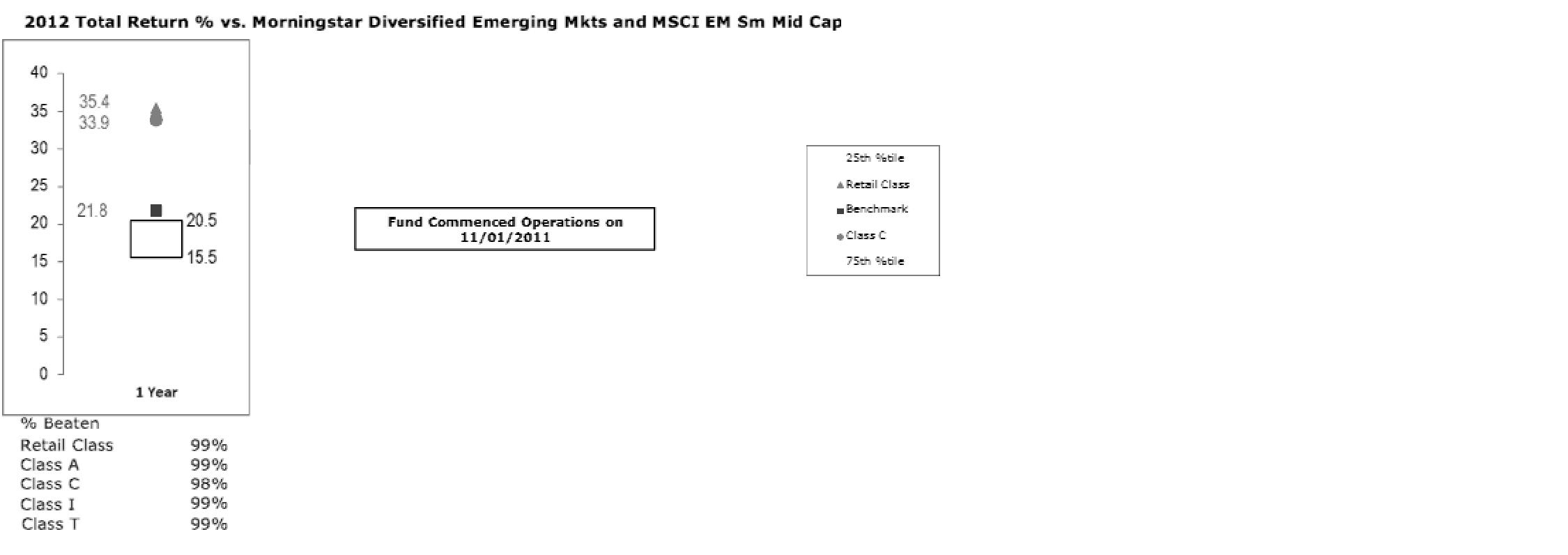

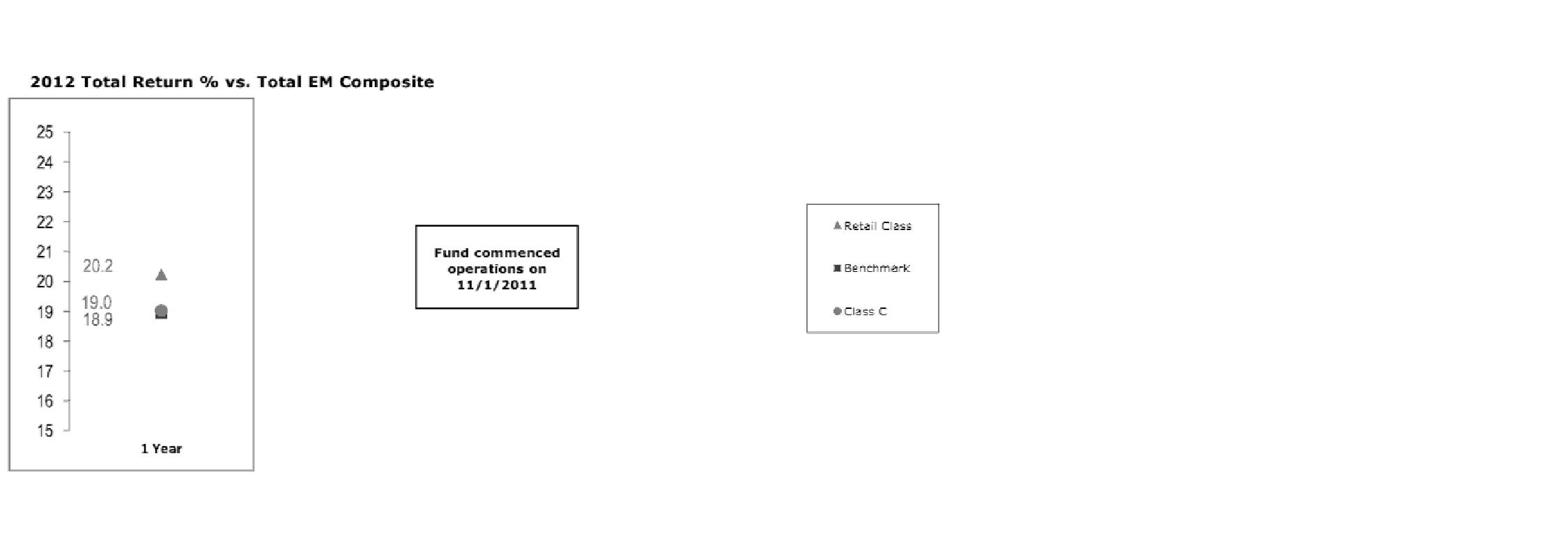

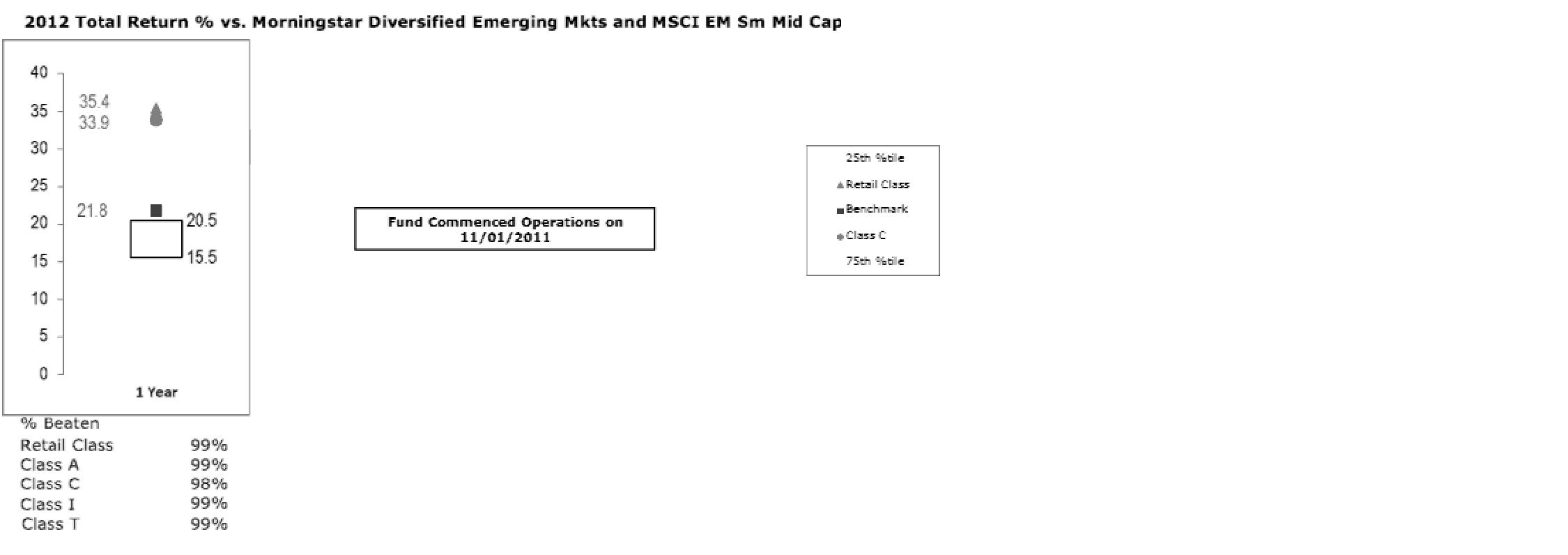

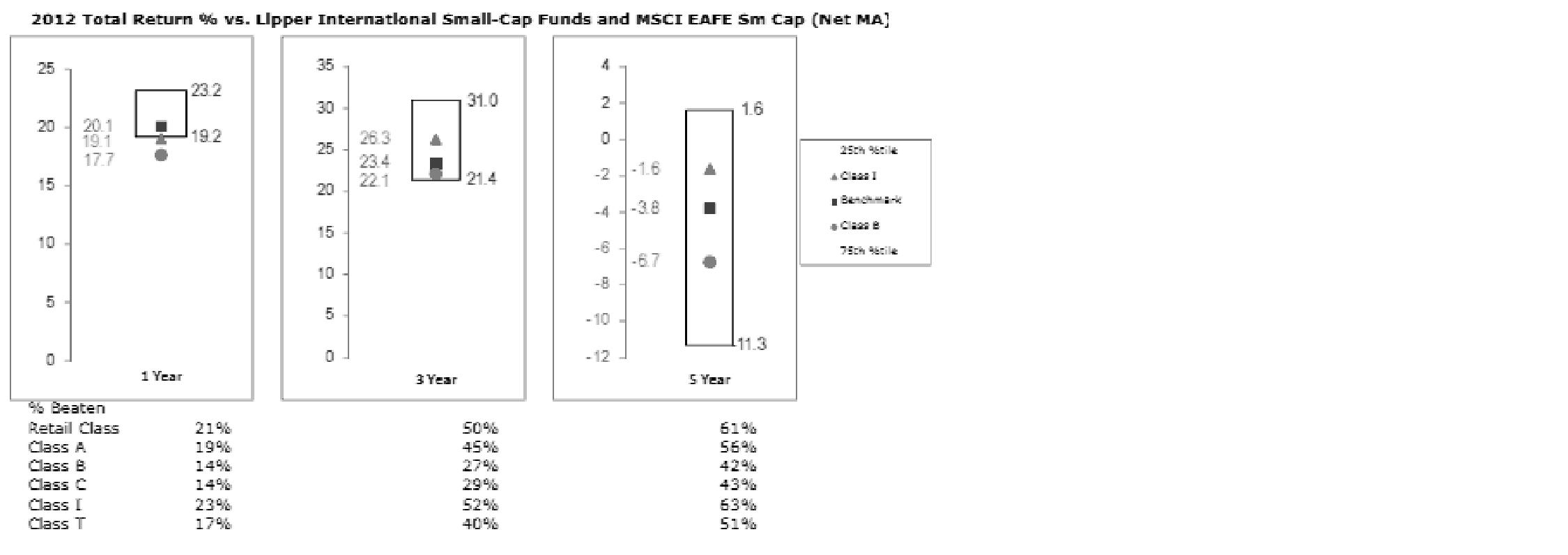

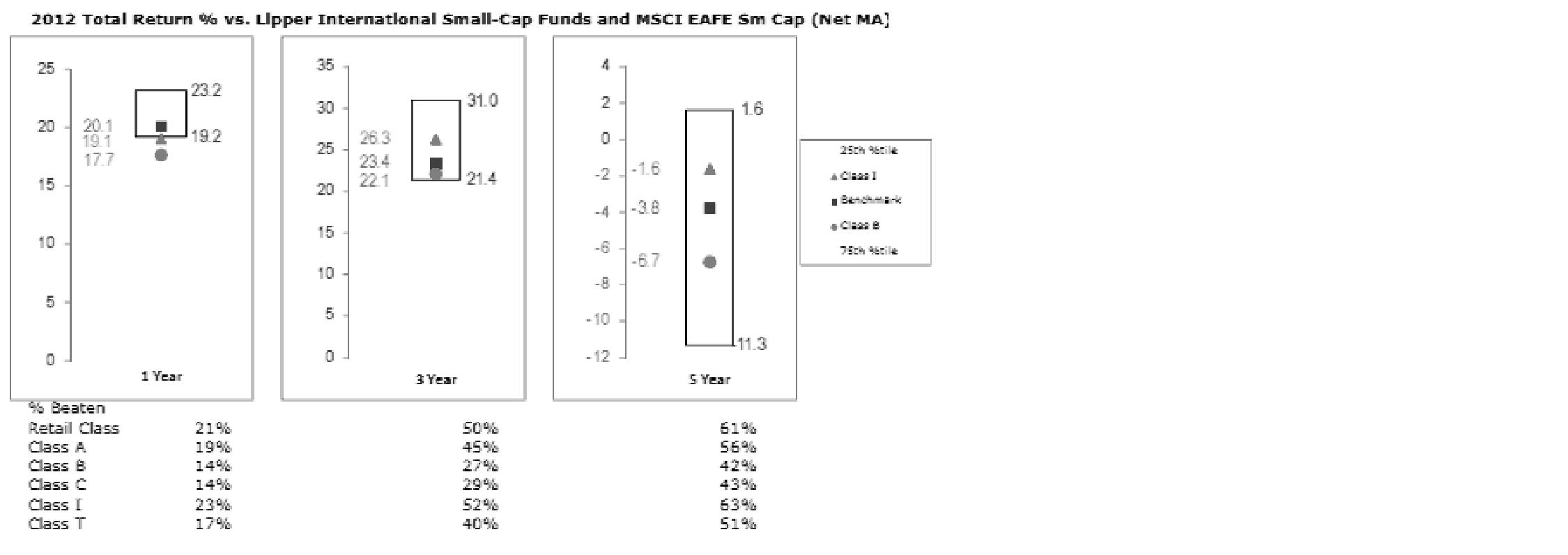

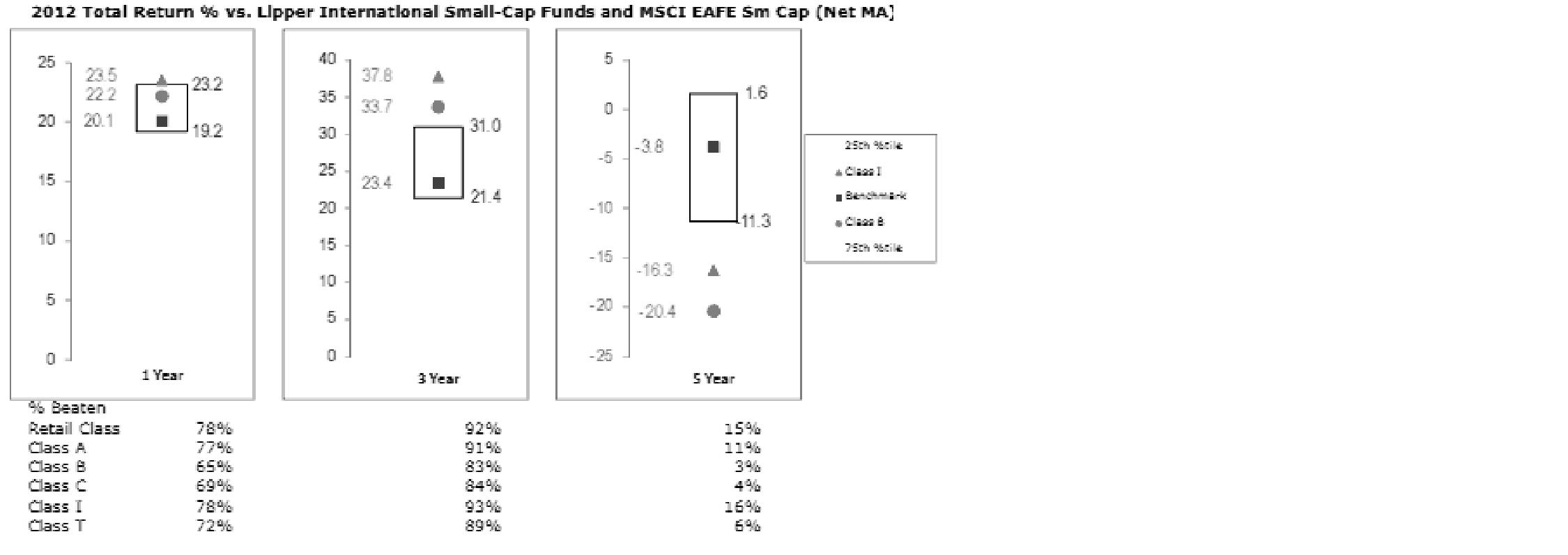

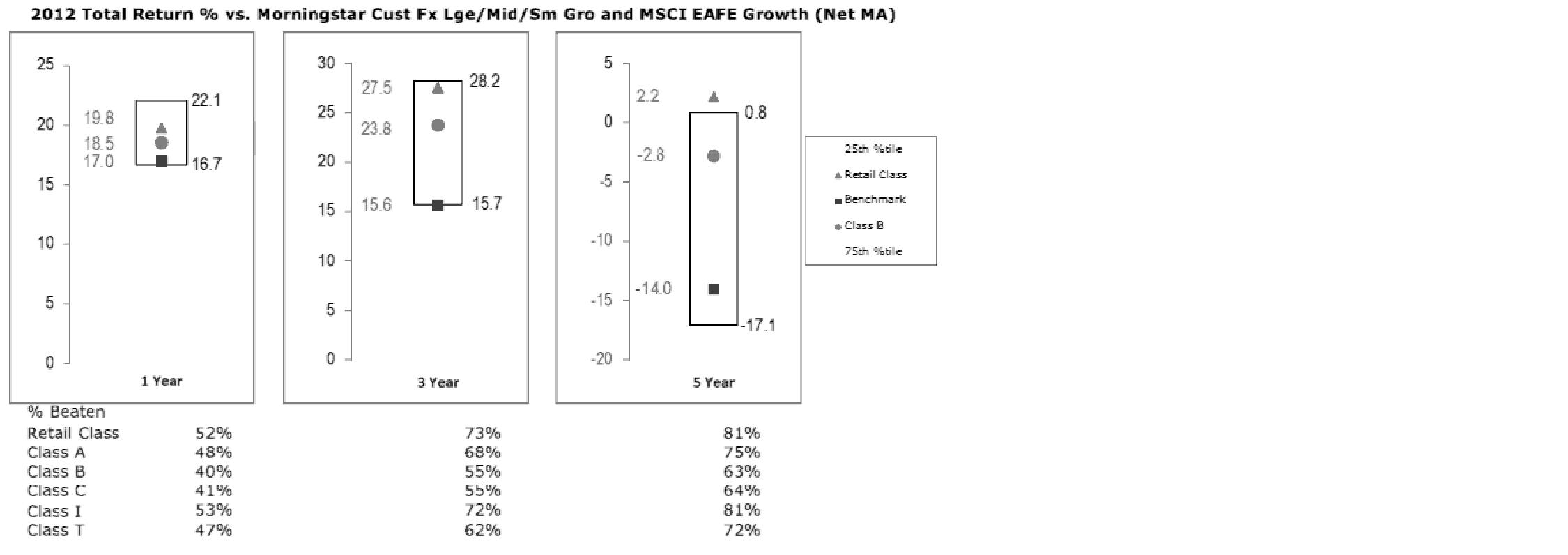

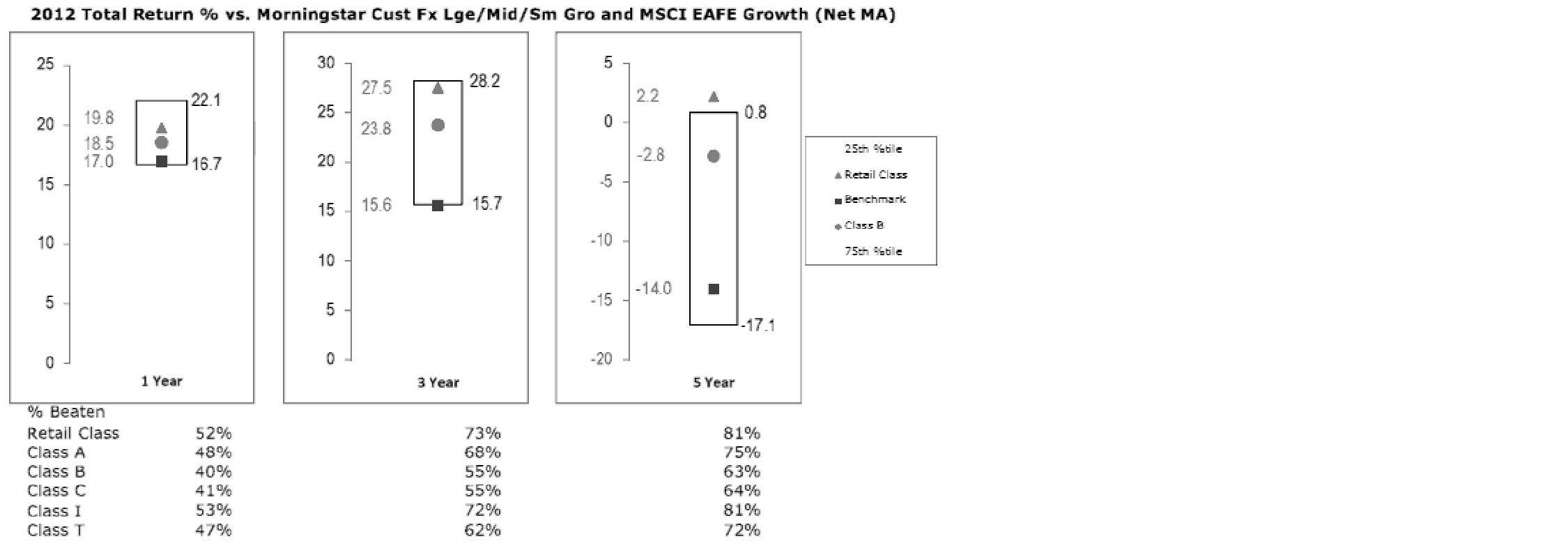

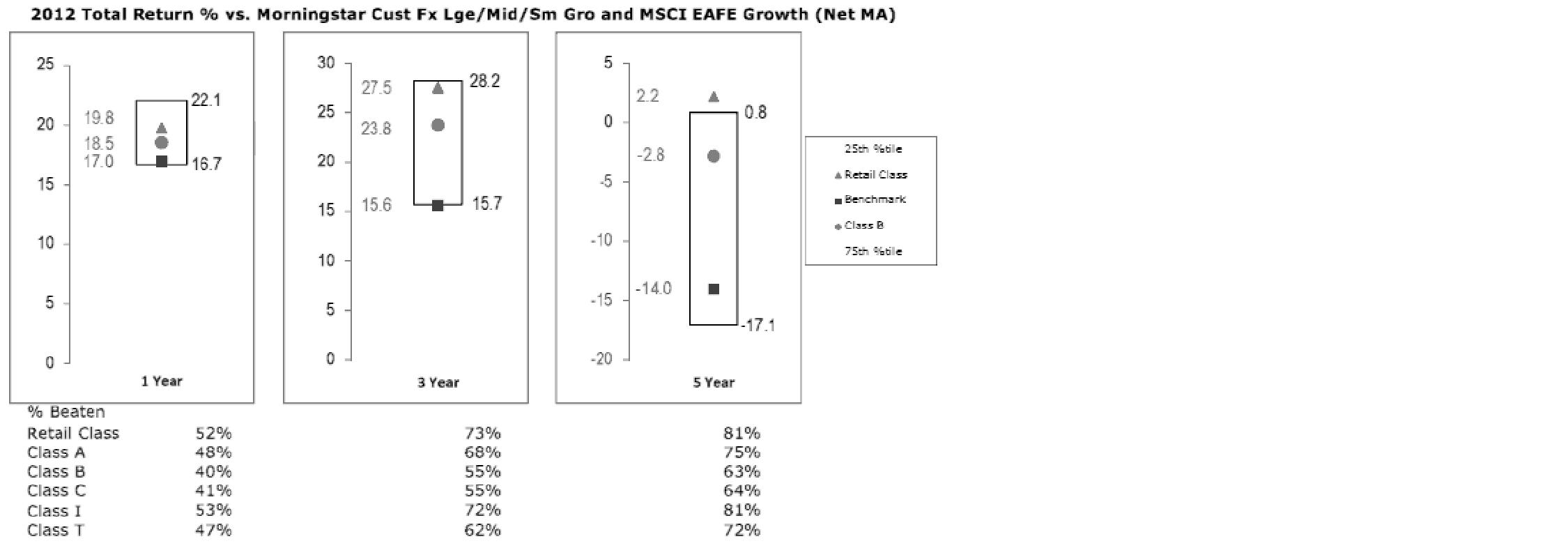

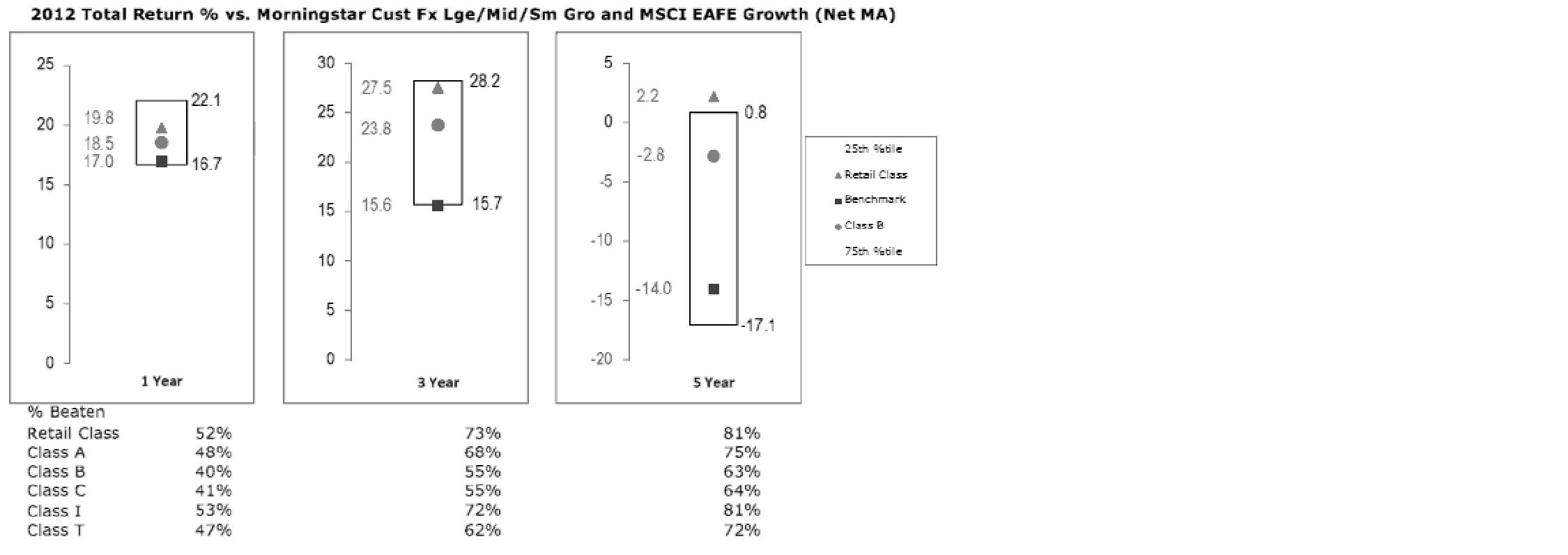

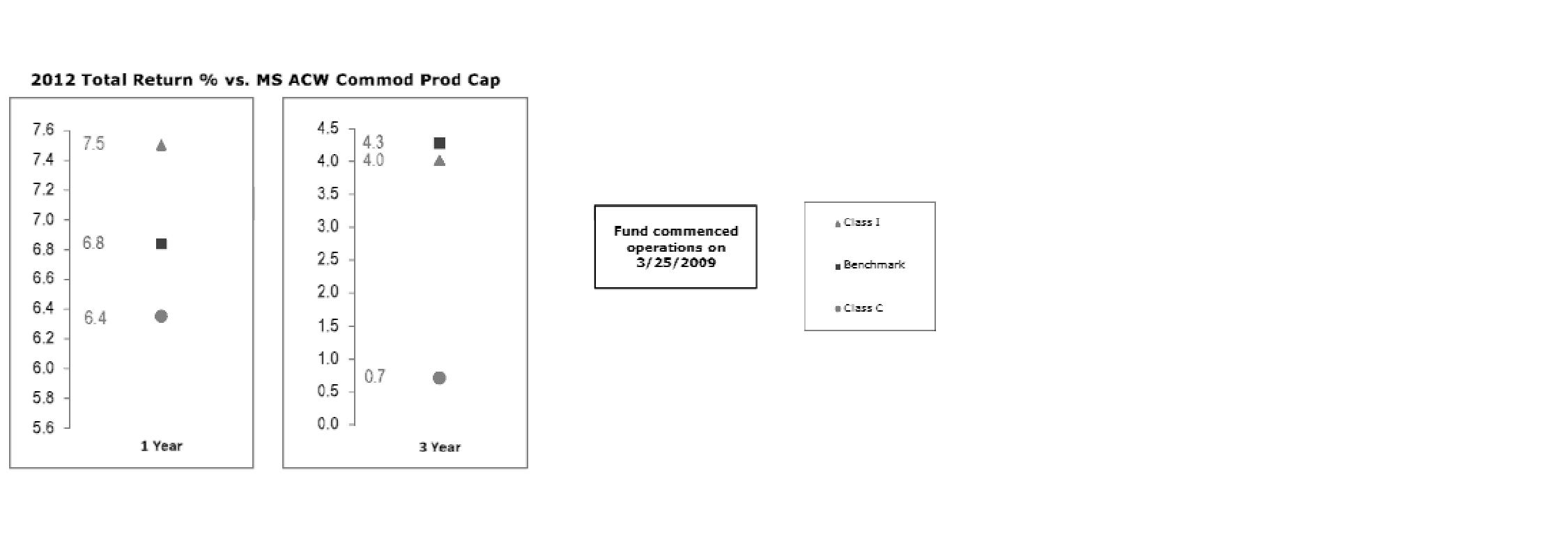

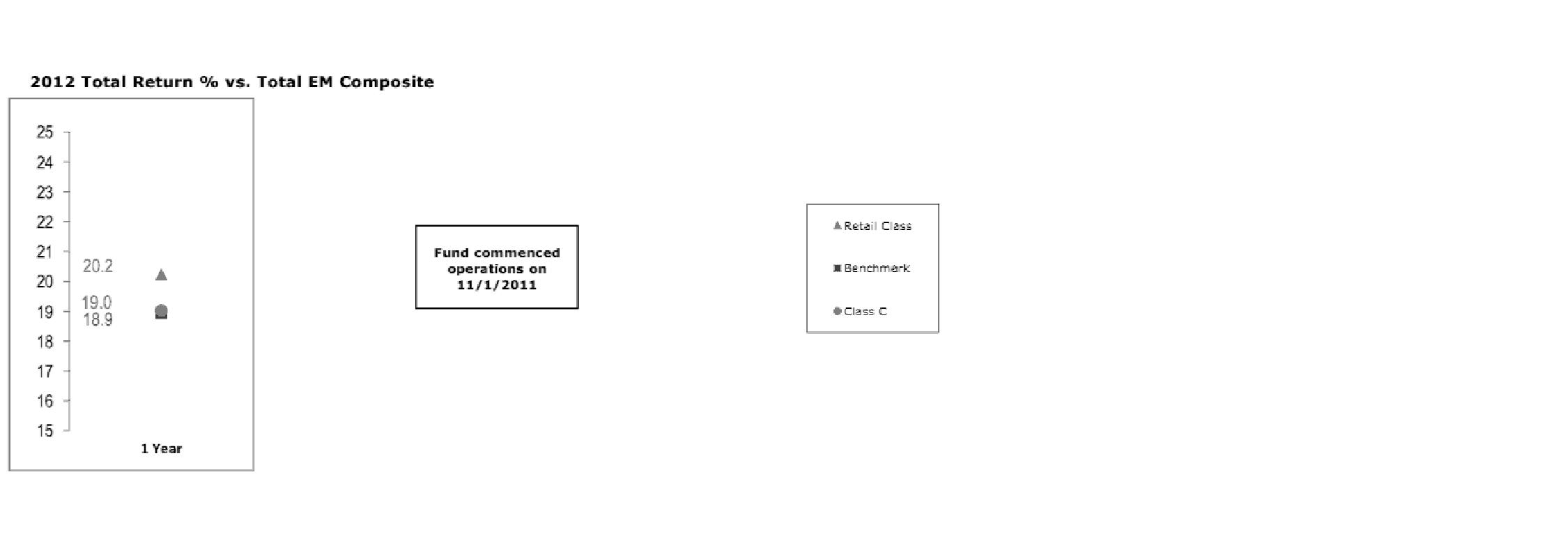

Comments from William Kennedy, Portfolio Manager of Fidelity® International Discovery Fund: For the year, the fund's Retail Class shares returned 27.03%, tracking the 27.02% gain of its benchmark, the MSCI® EAFE® Index. Security selection aided relative performance, with notable outperformance in the U.K. and Japan. Positioning in the Asia Pacific ex Japan region and the materials sector also contributed, as did security selection in information technology. Top individual contributors included U.K.-based online-only supermarket Ocado Group, an out-of-index position that rallied after the company significantly expanded its business capacity. An overweighting in real estate leasing company ORIX stood out, as improved economic activity drove up real estate prices in Japan. By contrast, stock picks in core European countries, emerging markets and the automobiles & components segment of consumer discretionary detracted, along with a small cash position in an up market. Individual disappointments included Housing Development Finance, a large mortgage provider in India, whose stock declined along with the Indian rupee. An average underweighting in Toyota Motor also hurt, as the weakening yen combined with the company's market-share increases to propel the stock higher.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The actual expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2013 to October 31, 2013) for Class A, Class T, Class B, Class C, International Discovery, Class K and Institutional Class and for the period (August 13, 2013 to October 31, 2013) for Class Z. The hypothetical expense Example is based on an investment of $1,000 invested for the one-half year period (May 1, 2013 to October 31, 2013).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Annual Report

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized

Expense Ratio B | Beginning

Account Value | Ending

Account Value

October 31, 2013 | Expenses Paid

During Period |

Class A | 1.34% | | | |

Actual | | $ 1,000.00 | $ 1,089.10 | $ 7.06 C |

HypotheticalA | | $ 1,000.00 | $ 1,018.45 | $ 6.82 D |

Class T | 1.58% | | | |

Actual | | $ 1,000.00 | $ 1,087.90 | $ 8.31 C |

HypotheticalA | | $ 1,000.00 | $ 1,017.24 | $ 8.03 D |

Class B | 2.09% | | | |

Actual | | $ 1,000.00 | $ 1,085.00 | $ 10.98 C |

HypotheticalA | | $ 1,000.00 | $ 1,014.67 | $ 10.61 D |

Class C | 2.09% | | | |

Actual | | $ 1,000.00 | $ 1,085.30 | $ 10.99 C |

HypotheticalA | | $ 1,000.00 | $ 1,014.67 | $ 10.61 D |

International Discovery | .99% | | | |

Actual | | $ 1,000.00 | $ 1,091.00 | $ 5.22 C |

HypotheticalA | | $ 1,000.00 | $ 1,020.21 | $ 5.04 D |

Class K | .85% | | | |

Actual | | $ 1,000.00 | $ 1,092.00 | $ 4.48 C |

HypotheticalA | | $ 1,000.00 | $ 1,020.92 | $ 4.33 D |

Institutional Class | .99% | | | |

Actual | | $ 1,000.00 | $ 1,091.10 | $ 5.22 C |

HypotheticalA | | $ 1,000.00 | $ 1,020.21 | $ 5.04 D |

Class Z | .85% | | | |

Actual | | $ 1,000.00 | $ 1,068.50 | $ 1.93 C |

HypotheticalA | | $ 1,000.00 | $ 1,020.92 | $ 4.33 D |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

Annual Report

Shareholder Expense Example - continued

C Actual expenses are equal to each Class' annualized expense ratio; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) for Class A, Class T, Class B, Class C, International Discovery, Class K and Institutional Class and multiplied by 80/365 (to reflect the period August 13, 2013 to October 31, 2013) for Class Z.

D Hypothetical expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

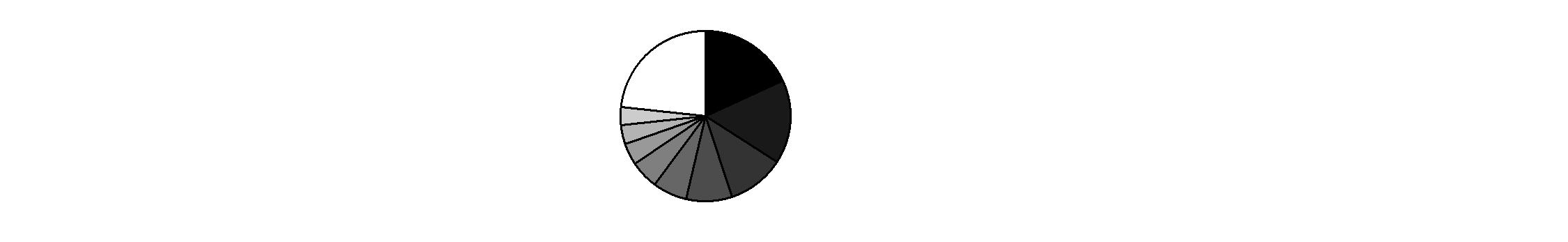

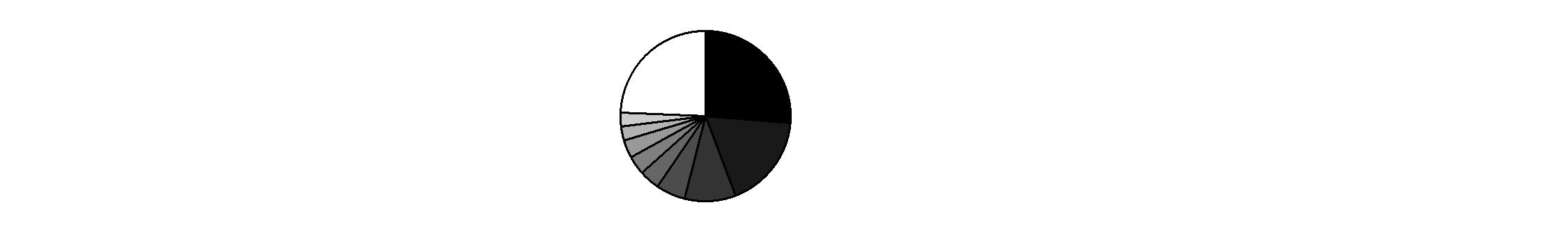

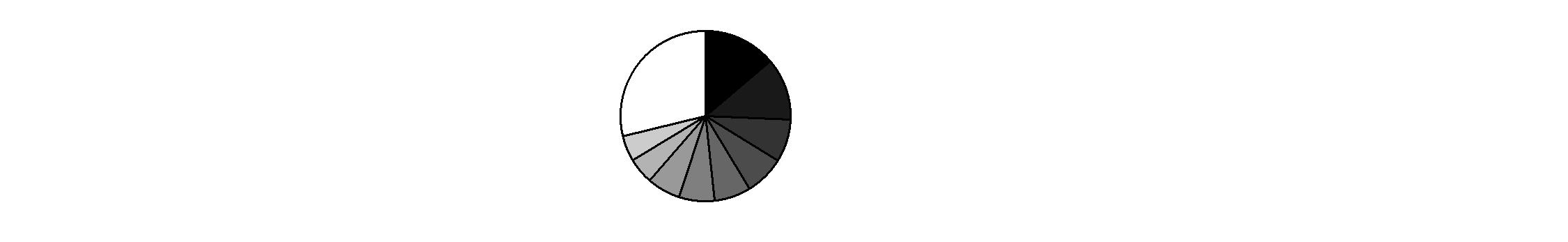

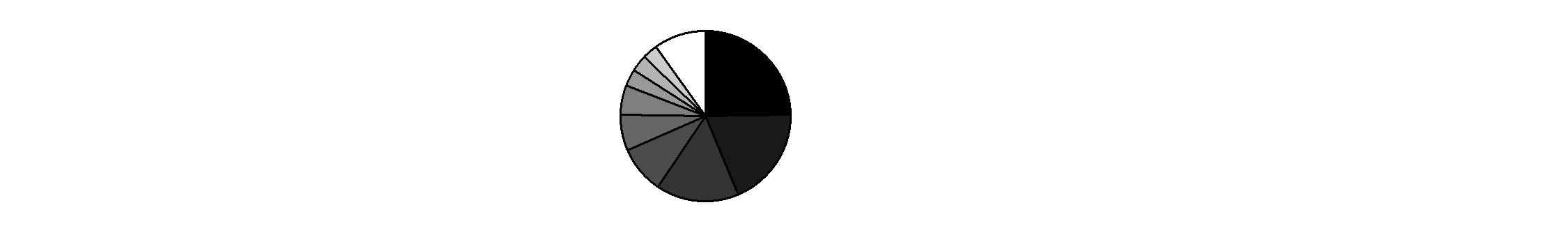

Geographic Diversification (% of fund's net assets) |

As of October 31, 2013 |

| Japan 18.2% | |

| United Kingdom 15.9% | |

| France 10.9% | |

| Germany 8.7% | |

| Switzerland 6.4% | |

| United States of America* 5.5% | |

| Sweden 4.1% | |

| Spain 3.6% | |

| Netherlands 3.3% | |

| Other 23.4% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

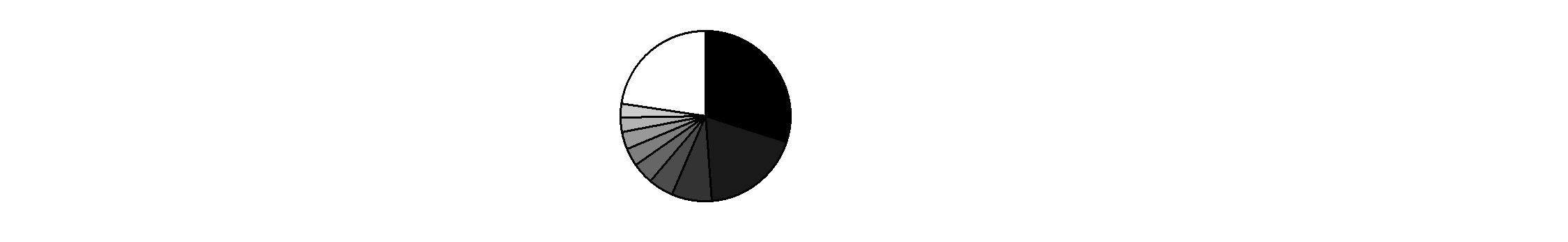

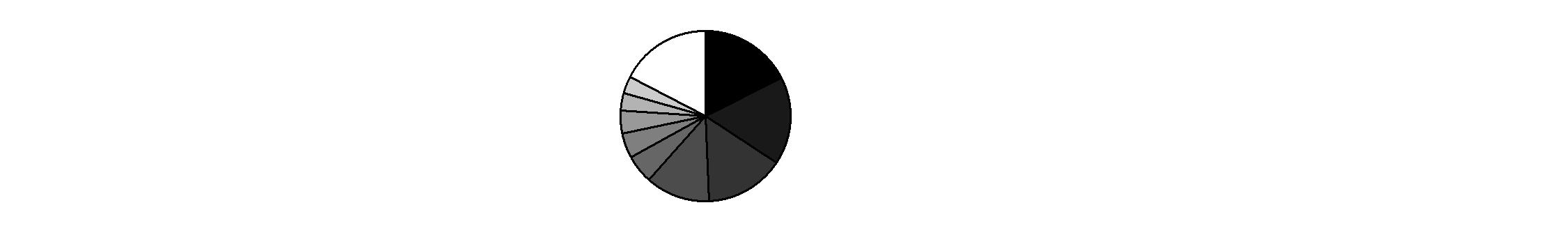

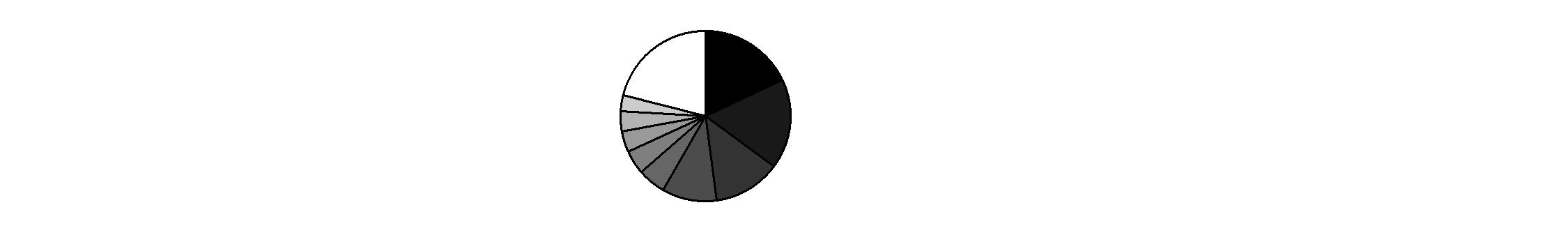

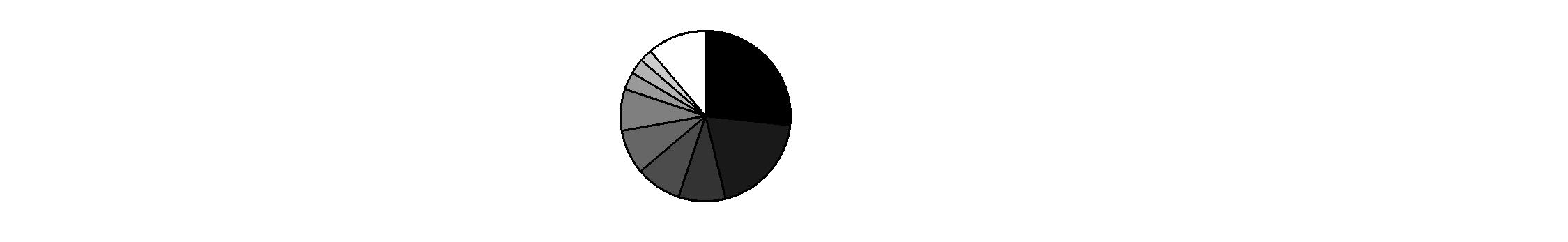

As of April 30, 2013 |

| Japan 20.5% | |

| United Kingdom 16.1% | |

| France 9.7% | |

| Germany 7.5% | |

| Switzerland 6.3% | |

| United States of America* 5.2% | |

| Australia 3.9% | |

| Sweden 2.7% | |

| Netherlands 2.5% | |

| Other 25.6% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

Asset Allocation as of October 31, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks and Equity Futures | 97.2 | 96.6 |

Short-Term Investments and Net Other Assets (Liabilities) | 2.8 | 3.4 |

Top Ten Stocks as of October 31, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 2.0 | 1.0 |

Australia & New Zealand Banking Group Ltd. (Australia, Commercial Banks) | 1.8 | 1.6 |

Bayer AG (Germany, Pharmaceuticals) | 1.6 | 0.8 |

Toyota Motor Corp. (Japan, Automobiles) | 1.6 | 0.7 |

Total SA (France, Oil, Gas & Consumable Fuels) | 1.5 | 0.0 |

Volkswagen AG (Germany, Automobiles) | 1.5 | 0.7 |

UBS AG (Switzerland, Capital Markets) | 1.4 | 1.1 |

ORIX Corp. (Japan, Diversified Financial Services) | 1.4 | 1.1 |

SoftBank Corp. (Japan, Wireless Telecommunication Services) | 1.4 | 0.6 |

Banco Bilbao Vizcaya Argentaria SA (Spain, Commercial Banks) | 1.3 | 0.7 |

| 15.5 | |

Market Sectors as of October 31, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 24.8 | 24.3 |

Consumer Discretionary | 16.4 | 16.5 |

Industrials | 13.0 | 12.1 |

Consumer Staples | 10.1 | 11.3 |

Health Care | 9.5 | 8.9 |

Information Technology | 7.7 | 7.5 |

Materials | 5.2 | 5.7 |

Telecommunication Services | 5.1 | 4.1 |

Energy | 3.8 | 3.0 |

Utilities | 0.6 | 1.1 |

Annual Report

Investments October 31, 2013

Showing Percentage of Net Assets

Common Stocks - 94.7% |

| Shares | | Value (000s) |

Australia - 3.2% |

Ansell Ltd. | 2,268,950 | | $ 41,796 |

Australia & New Zealand Banking Group Ltd. | 6,493,040 | | 207,673 |

Ramsay Health Care Ltd. | 1,619,364 | | 59,385 |

Woodside Petroleum Ltd. | 1,461,485 | | 53,623 |

TOTAL AUSTRALIA | | 362,477 |

Austria - 0.2% |

Andritz AG | 455,300 | | 28,047 |

Bailiwick of Jersey - 2.6% |

Experian PLC | 6,115,400 | | 124,529 |

Wolseley PLC | 1,508,304 | | 81,283 |

WPP PLC | 3,996,700 | | 84,910 |

TOTAL BAILIWICK OF JERSEY | | 290,722 |

Belgium - 2.1% |

Anheuser-Busch InBev SA NV | 1,183,927 | | 122,730 |

KBC Groupe SA | 2,102,810 | | 114,632 |

TOTAL BELGIUM | | 237,362 |

Bermuda - 0.3% |

Cheung Kong Infrastructure Holdings Ltd. | 5,048,000 | | 35,127 |

Brazil - 0.1% |

Arezzo Industria e Comercio SA | 1,051,500 | | 15,724 |

British Virgin Islands - 0.4% |

Mail.Ru Group Ltd. GDR (Reg. S) | 1,193,800 | | 44,027 |

Canada - 1.0% |

Constellation Software, Inc. | 159,200 | | 29,002 |

InterOil Corp. (a)(d) | 204,400 | | 14,196 |

Suncor Energy, Inc. | 2,012,600 | | 73,138 |

TOTAL CANADA | | 116,336 |

Cayman Islands - 1.2% |

Baidu.com, Inc. sponsored ADR (a) | 123,100 | | 19,807 |

Cimc Enric Holdings Ltd. | 16,316,000 | | 22,981 |

ENN Energy Holdings Ltd. | 5,084,000 | | 30,132 |

Eurasia Drilling Co. Ltd. GDR (Reg. S) | 630,200 | | 26,689 |

Greatview Aseptic Pack Co. Ltd. | 26,392,000 | | 16,612 |

Sands China Ltd. | 1,460,800 | | 10,382 |

Youku Tudou, Inc. ADR (a)(d) | 300,200 | | 8,177 |

TOTAL CAYMAN ISLANDS | | 134,780 |

Common Stocks - continued |

| Shares | | Value (000s) |

Cyprus - 0.0% |

SPDI Secure Property Development & Investment PLC (a) | 529,830 | | $ 597 |

Denmark - 0.6% |

Novo Nordisk A/S Series B | 396,489 | | 66,036 |

Finland - 0.7% |

Sampo Oyj (A Shares) | 1,739,800 | | 82,418 |

France - 10.9% |

Arkema SA | 487,670 | | 55,368 |

Atos Origin SA | 388,851 | | 33,198 |

AXA SA | 5,364,600 | | 134,022 |

BNP Paribas SA | 1,544,345 | | 114,361 |

Bureau Veritas SA | 1,413,000 | | 42,667 |

Danone SA | 905,500 | | 67,152 |

Edenred SA | 1,177,900 | | 40,022 |

Havas SA | 5,201,268 | | 43,333 |

Iliad SA | 213,972 | | 48,924 |

Kering SA | 373,000 | | 84,753 |

Lafarge SA (Bearer) (d) | 605,900 | | 41,939 |

LVMH Moet Hennessy - Louis Vuitton SA | 612,502 | | 117,924 |

Sanofi SA | 890,979 | | 94,999 |

Schneider Electric SA | 1,383,800 | | 116,583 |

Technip SA | 192,300 | | 20,144 |

Total SA | 2,831,600 | | 173,727 |

TOTAL FRANCE | | 1,229,116 |

Germany - 7.2% |

Aareal Bank AG (a) | 1,044,895 | | 40,185 |

adidas AG | 541,900 | | 61,863 |

BASF AG | 1,265,455 | | 131,663 |

Bayer AG | 1,471,500 | | 182,890 |

Brenntag AG | 444,700 | | 75,353 |

GEA Group AG | 1,254,770 | | 54,602 |

GSW Immobilien AG | 430,481 | | 20,019 |

HeidelbergCement Finance AG | 860,300 | | 67,818 |

KION Group AG (a) | 577,867 | | 23,538 |

LEG Immobilien AG | 184,948 | | 10,547 |

Siemens AG | 1,110,885 | | 141,963 |

TOTAL GERMANY | | 810,441 |

Common Stocks - continued |

| Shares | | Value (000s) |

Hong Kong - 1.8% |

AIA Group Ltd. | 20,789,200 | | $ 105,515 |

Techtronic Industries Co. Ltd. | 39,683,000 | | 99,809 |

TOTAL HONG KONG | | 205,324 |

India - 0.6% |

Housing Development Finance Corp. Ltd. | 3,139,461 | | 43,561 |

United Spirits Ltd. | 444,545 | | 18,569 |

TOTAL INDIA | | 62,130 |

Indonesia - 0.1% |

PT Tower Bersama Infrastructure Tbk | 17,734,500 | | 8,967 |

Ireland - 2.0% |

Actavis PLC (a) | 308,100 | | 47,626 |

Bank of Ireland (a) | 146,718,100 | | 53,399 |

James Hardie Industries PLC CDI | 6,070,470 | | 62,711 |

Kerry Group PLC Class A | 945,600 | | 60,555 |

TOTAL IRELAND | | 224,291 |

Italy - 1.0% |

De Longhi SpA | 2,248,100 | | 34,797 |

Moleskine SpA | 4,183,000 | | 10,223 |

Tod's SpA | 117,793 | | 19,624 |

UniCredit SpA | 3,689,800 | | 27,754 |

World Duty Free SpA (a) | 2,253,904 | | 24,972 |

TOTAL ITALY | | 117,370 |

Japan - 17.2% |

ABC-MART, Inc. | 826,300 | | 41,324 |

Aozora Bank Ltd. | 16,056,000 | | 46,675 |

ARNEST ONE Corp. (d) | 306,200 | | 8,395 |

Astellas Pharma, Inc. | 768,700 | | 42,852 |

Cosmos Pharmaceutical Corp. | 245,800 | | 29,946 |

Daikin Industries Ltd. | 1,089,400 | | 62,677 |

Don Quijote Co. Ltd. | 1,818,400 | | 121,044 |

Hajime Construction Co. Ltd. | 34,900 | | 2,406 |

Hitachi Ltd. | 5,121,000 | | 35,822 |

Japan Exchange Group, Inc. | 2,589,500 | | 60,201 |

Japan Tobacco, Inc. | 3,948,700 | | 142,879 |

Kakaku.com, Inc. | 1,903,000 | | 36,807 |

KDDI Corp. | 2,082,700 | | 112,792 |

Keyence Corp. | 304,060 | | 130,317 |

Leopalace21 Corp. (a) | 6,899,700 | | 47,901 |

Common Stocks - continued |

| Shares | | Value (000s) |

Japan - continued |

Miraca Holdings, Inc. | 196,700 | | $ 8,863 |

Mitsubishi UFJ Financial Group, Inc. | 18,169,200 | | 115,706 |

Nomura Real Estate Holdings, Inc. | 563,300 | | 14,252 |

Omron Corp. | 1,225,300 | | 46,759 |

ORIX Corp. | 9,072,900 | | 157,152 |

Park24 Co. Ltd. | 1,342,800 | | 26,218 |

Rakuten, Inc. | 5,237,700 | | 68,245 |

Santen Pharmaceutical Co. Ltd. | 1,166,900 | | 59,239 |

Seven & i Holdings Co., Ltd. | 2,167,000 | | 80,198 |

Shinsei Bank Ltd. | 24,904,000 | | 58,308 |

Ship Healthcare Holdings, Inc. | 1,076,700 | | 44,182 |

SoftBank Corp. | 2,099,300 | | 156,773 |

Toyota Motor Corp. | 2,789,300 | | 180,853 |

USS Co. Ltd. | 450,400 | | 6,596 |

TOTAL JAPAN | | 1,945,382 |

Korea (South) - 0.9% |

Hyundai Motor Co. | 206,848 | | 49,311 |

NHN Corp. | 69,296 | | 38,981 |

Orion Corp. | 14,973 | | 14,602 |

TOTAL KOREA (SOUTH) | | 102,894 |

Luxembourg - 0.3% |

Brait SA | 6,048,833 | | 29,465 |

Mexico - 0.2% |

Alsea S.A.B. de CV | 7,662,195 | | 23,831 |

Netherlands - 3.3% |

AEGON NV | 5,028,800 | | 40,014 |

ASML Holding NV | 772,233 | | 73,084 |

European Aeronautic Defence and Space Co. (EADS) NV | 176,700 | | 12,142 |

Koninklijke Ahold NV | 2,412,842 | | 45,930 |

Koninklijke Philips Electronics NV | 2,496,700 | | 88,235 |

Randstad Holding NV | 717,740 | | 44,296 |

Royal DSM NV | 536,200 | | 40,617 |

Yandex NV (a) | 861,400 | | 31,751 |

TOTAL NETHERLANDS | | 376,069 |

New Zealand - 0.4% |

Ryman Healthcare Group Ltd. | 7,311,565 | | 45,597 |

Norway - 1.0% |

DNB ASA | 6,068,755 | | 107,551 |

Common Stocks - continued |

| Shares | | Value (000s) |

Philippines - 0.1% |

Alliance Global Group, Inc. | 26,741,800 | | $ 16,306 |

Russia - 0.5% |

Mobile TeleSystems OJSC sponsored ADR | 2,313,400 | | 52,746 |

Singapore - 0.4% |

Global Logistic Properties Ltd. | 16,214,205 | | 40,333 |

South Africa - 1.1% |

Naspers Ltd. Class N | 1,302,700 | | 121,851 |

Spain - 3.6% |

Amadeus IT Holding SA Class A | 1,319,900 | | 49,014 |

Antena 3 de Television SA | 1,515,400 | | 25,411 |

Banco Bilbao Vizcaya Argentaria SA | 12,546,524 | | 146,630 |

Criteria CaixaCorp SA | 4,210,900 | | 21,892 |

Distribuidora Internacional de Alimentacion SA | 5,726,396 | | 52,349 |

Grifols SA ADR | 1,208,550 | | 36,450 |

Inditex SA (d) | 481,679 | | 79,134 |

TOTAL SPAIN | | 410,880 |

Sweden - 4.1% |

ASSA ABLOY AB (B Shares) | 1,783,400 | | 88,536 |

Intrum Justitia AB | 1,835,800 | | 48,869 |

Investment AB Kinnevik (B Shares) | 2,363,300 | | 87,091 |

Nordea Bank AB | 6,100,600 | | 78,140 |

Svenska Cellulosa AB (SCA) (B Shares) | 3,591,900 | | 101,991 |

Svenska Handelsbanken AB (A Shares) | 1,258,200 | | 57,007 |

TOTAL SWEDEN | | 461,634 |

Switzerland - 6.4% |

Credit Suisse Group | 1,039,246 | | 32,329 |

Lonza Group AG | 476,868 | | 42,623 |

Partners Group Holding AG | 230,056 | | 59,609 |

Roche Holding AG (participation certificate) | 821,773 | | 227,506 |

Schindler Holding AG (participation certificate) | 260,065 | | 36,888 |

SGS SA (Reg.) | 7,770 | | 18,206 |

Swatch Group AG (Bearer) | 36,702 | | 23,481 |

Syngenta AG (Switzerland) | 179,374 | | 72,398 |

UBS AG | 8,311,378 | | 160,751 |

Zurich Insurance Group AG | 180,481 | | 49,907 |

TOTAL SWITZERLAND | | 723,698 |

Common Stocks - continued |

| Shares | | Value (000s) |

Taiwan - 0.6% |

ECLAT Textile Co. Ltd. | 2,457,180 | | $ 27,005 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 11,289,000 | | 41,528 |

TOTAL TAIWAN | | 68,533 |

United Kingdom - 15.9% |

Aberdeen Asset Management PLC | 5,975,132 | | 42,432 |

Alabama Noor Hospitals Group PLC (a) | 1,829,400 | | 24,933 |

Associated British Foods PLC | 1,571,500 | | 57,123 |

Barclays PLC | 22,636,113 | | 95,241 |

BG Group PLC | 3,923,700 | | 80,119 |

BHP Billiton PLC | 2,080,582 | | 64,204 |

British American Tobacco PLC (United Kingdom) | 881,200 | | 48,618 |

Croda International PLC | 630,000 | | 24,607 |

Diageo PLC | 4,394,219 | | 140,077 |

Foxtons Group PLC | 2,178,500 | | 11,134 |

Hikma Pharmaceuticals PLC | 3,197,720 | | 61,578 |

HSBC Holdings PLC (United Kingdom) | 12,266,193 | | 134,454 |

Intertek Group PLC | 893,600 | | 47,741 |

ITV PLC | 11,642,037 | | 35,635 |

Jazztel PLC (a) | 4,681,964 | | 51,364 |

Legal & General Group PLC | 26,720,558 | | 92,671 |

Liberty Global PLC Class A (a) | 610,800 | | 47,868 |

London Stock Exchange Group PLC | 1,729,000 | | 45,521 |

Meggitt PLC | 6,842,366 | | 62,809 |

Next PLC | 781,744 | | 68,250 |

Ocado Group PLC (a) | 8,103,297 | | 56,389 |

Persimmon PLC | 2,082,200 | | 42,233 |

Reckitt Benckiser Group PLC | 788,600 | | 61,300 |

Rolls-Royce Group PLC | 4,197,715 | | 77,402 |

Rotork PLC | 717,800 | | 32,951 |

Royal Mail PLC | 788,800 | | 7,083 |

SABMiller PLC | 1,478,600 | | 77,145 |

Taylor Wimpey PLC | 18,277,100 | | 32,295 |

The Restaurant Group PLC | 1,992,100 | | 18,398 |

Ultra Electronics Holdings PLC | 614,667 | | 19,061 |

Vodafone Group PLC | 36,632,743 | | 134,177 |

TOTAL UNITED KINGDOM | | 1,794,813 |

United States of America - 2.7% |

Beam, Inc. | 387,400 | | 26,072 |

Google, Inc. Class A (a) | 60,100 | | 61,938 |

Illumina, Inc. (a) | 12,500 | | 1,169 |

Common Stocks - continued |

| Shares | | Value (000s) |

United States of America - continued |

MasterCard, Inc. Class A | 160,100 | | $ 114,808 |

McGraw-Hill Companies, Inc. | 488,400 | | 34,032 |

Sohu.com, Inc. (a) | 313,700 | | 21,005 |

Visa, Inc. Class A | 260,000 | | 51,134 |

TOTAL UNITED STATES OF AMERICA | | 310,158 |

TOTAL COMMON STOCKS (Cost $8,462,801) |

10,703,033

|

Nonconvertible Preferred Stocks - 1.5% |

| | | |

Germany - 1.5% |

Volkswagen AG | 650,200 | | 165,262 |

United Kingdom - 0.0% |

Rolls-Royce Group PLC Series C | 361,003,490 | | 579 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $133,620) |

165,841

|

Government Obligations - 0.1% |

| Principal Amount (000s) | | |

United States of America - 0.1% |

U.S. Treasury Bills, yield at date of purchase 0.02% to 0.04% 1/2/14 (e)

(Cost $6,960) | | $ 6,960 | |

6,960

|

Money Market Funds - 4.0% |

| Shares | | |

Fidelity Cash Central Fund, 0.09% (b) | 431,996,301 | | 431,996 |

Fidelity Securities Lending Cash Central Fund, 0.09% (b)(c) | 22,072,034 | | 22,072 |

TOTAL MONEY MARKET FUNDS (Cost $454,068) |

454,068

|

TOTAL INVESTMENT PORTFOLIO - 100.3% (Cost $9,057,449) | | 11,329,902 |

NET OTHER ASSETS (LIABILITIES) - (0.3)% | | (35,016) |

NET ASSETS - 100% | $ 11,294,886 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Purchased |

Equity Index Contracts |

1,572 Nikkei 225 Index Contracts (Japan) | Dec. 2013 | | $ 113,695 | | $ 4,238 |

|

The face value of futures purchased as a percentage of net assets is 1% |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $6,960,000. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 420 |

Fidelity Securities Lending Cash Central Fund | 5,441 |

Total | $ 5,861 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

Boyner Buyuk Magazacilik A/S | $ 10,764 | $ - | $ 16,020 | $ - | $ - |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of October 31, 2013, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 1,843,308 | $ 1,414,445 | $ 418,062 | $ 10,801 |

Consumer Staples | 1,147,236 | 582,788 | 564,448 | - |

Energy | 441,636 | 267,909 | 173,727 | - |

Financials | 2,821,082 | 1,658,069 | 1,163,013 | - |

Health Care | 1,087,724 | 771,553 | 316,171 | - |

Industrials | 1,451,790 | 1,132,697 | 319,093 | - |

Information Technology | 867,159 | 575,926 | 291,233 | - |

Materials | 577,937 | 441,335 | 136,602 | - |

Telecommunication Services | 565,743 | 162,001 | 403,742 | - |

Utilities | 65,259 | 65,259 | - | - |

Government Obligations | 6,960 | - | 6,960 | - |

Money Market Funds | 454,068 | 454,068 | - | - |

Total Investments in Securities: | $ 11,329,902 | $ 7,526,050 | $ 3,793,051 | $ 10,801 |

Derivative Instruments: | | | | |

Assets | | | | |

Futures Contracts | $ 4,238 | $ 4,238 | $ - | $ - |

The following is a summary of transfers between Level 1 and Level 2 for the period ended October 31, 2013. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total (000s) |

Level 1 to Level 2 | $ 712,449 |

Level 2 to Level 1 | $ 0 |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of October 31, 2013. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Primary Risk Exposure /

Derivative Type | Value |

| Asset | Liability |

Equity Risk | | |

Futures Contracts (a) | $ 4,238 | $ - |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | October 31, 2013 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $21,646) - See accompanying schedule: Unaffiliated issuers (cost $8,603,381) | $ 10,875,834 | |

Fidelity Central Funds (cost $454,068) | 454,068 | |

Total Investments (cost $9,057,449) | | $ 11,329,902 |

Foreign currency held at value (cost $934) | | 924 |

Receivable for investments sold | | 8,555 |

Receivable for fund shares sold | | 7,336 |

Dividends receivable | | 20,216 |

Distributions receivable from Fidelity Central Funds | | 122 |

Prepaid expenses | | 35 |

Other receivables | | 4,081 |

Total assets | | 11,371,171 |

| | |

Liabilities | | |

Payable for investments purchased | $ 38,436 | |

Payable for fund shares redeemed | 5,719 | |

Accrued management fee | 6,631 | |

Distribution and service plan fees payable | 128 | |

Payable for daily variation margin for derivative instruments | 983 | |

Other affiliated payables | 1,581 | |

Other payables and accrued expenses | 735 | |

Collateral on securities loaned, at value | 22,072 | |

Total liabilities | | 76,285 |

| | |

Net Assets | | $ 11,294,886 |

Net Assets consist of: | | |

Paid in capital | | $ 9,866,929 |

Undistributed net investment income | | 131,430 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (979,010) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 2,275,537 |

Net Assets | | $ 11,294,886 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | October 31, 2013 |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($346,717.68 ÷ 8,780.120 shares) | | $ 39.49 |

| | |

Maximum offering price per share (100/94.25 of $39.49) | | $ 41.90 |

Class T:

Net Asset Value and redemption price per share ($53,183.51 ÷ 1,355.789 shares) | | $ 39.23 |

| | |

Maximum offering price per share (100/96.50 of $39.23) | | $ 40.65 |

Class B:

Net Asset Value and offering price per share ($6,686.96 ÷ 171.088 shares)A | | $ 39.08 |

| | |

Class C:

Net Asset Value and offering price per share ($36,470.54 ÷ 933.457 shares)A | | $ 39.07 |

| | |

International Discovery:

Net Asset Value, offering price and redemption price per share ($7,799,575.78 ÷ 195,853.386 shares) | | $ 39.82 |

| | |

Class K:

Net Asset Value, offering price and redemption price per share ($2,576,018.46 ÷ 64,786.777 shares) | | $ 39.76 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($476,126.48 ÷ 11,975.218 shares) | | $ 39.76 |

| | |

Class Z:

Net Asset Value, offering price and redemption price per share ($106.86 ÷ 2.687 shares) | | $ 39.77 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended October 31, 2013 |

| | |

Investment Income | | |

Dividends | | $ 233,738 |

Interest | | 3 |

Income from Fidelity Central Funds | | 5,861 |

Income before foreign taxes withheld | | 239,602 |

Less foreign taxes withheld | | (17,198) |

Total income | | 222,404 |

| | |

Expenses | | |

Management fee

Basic fee | $ 67,899 | |

Performance adjustment | 6,089 | |

Transfer agent fees | 16,474 | |

Distribution and service plan fees | 1,432 | |

Accounting and security lending fees | 1,778 | |

Custodian fees and expenses | 1,352 | |

Independent trustees' compensation | 54 | |

Registration fees | 215 | |

Audit | 119 | |

Legal | 24 | |

Miscellaneous | 76 | |

Total expenses before reductions | 95,512 | |

Expense reductions | (2,311) | 93,201 |

Net investment income (loss) | | 129,203 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 671,713 | |

Other affiliated issuers | 4,258 | |

Foreign currency transactions | (1,963) | |

Futures contracts | 51,368 | |

Total net realized gain (loss) | | 725,376 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 1,459,188 | |

Assets and liabilities in foreign currencies | (54) | |

Futures contracts | 4,238 | |

Total change in net unrealized appreciation (depreciation) | | 1,463,372 |

Net gain (loss) | | 2,188,748 |

Net increase (decrease) in net assets resulting from operations | | $ 2,317,951 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

October 31,

2013 | Year ended

October 31,

2012 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 129,203 | $ 143,212 |

Net realized gain (loss) | 725,376 | (207,579) |

Change in net unrealized appreciation (depreciation) | 1,463,372 | 762,141 |

Net increase (decrease) in net assets resulting

from operations | 2,317,951 | 697,774 |

Distributions to shareholders from net investment income | (146,031) | (118,968) |

Distributions to shareholders from net realized gain | (8,413) | - |

Total distributions | (154,444) | (118,968) |

Share transactions - net increase (decrease) | 714,712 | (915,362) |

Redemption fees | 128 | 128 |

Total increase (decrease) in net assets | 2,878,347 | (336,428) |

| | |

Net Assets | | |

Beginning of period | 8,416,539 | 8,752,967 |

End of period (including undistributed net investment income of $131,430 and undistributed net investment income of $126,507, respectively) | $ 11,294,886 | $ 8,416,539 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.66 | $ 29.43 | $ 32.07 | $ 28.57 | $ 23.68 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .34 | .41 | .42 | .31 | .31 |

Net realized and unrealized gain (loss) | 7.97 | 2.11 | (2.52) | 3.51 | 4.84 |

Total from investment operations | 8.31 | 2.52 | (2.10) | 3.82 | 5.15 |

Distributions from net investment income | (.45) | (.29) | (.38) | (.28) | (.26) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.48) | (.29) | (.54) | (.32) | (.26) |

Redemption fees added to paid in capital C,G | - | - | - | - | - |

Net asset value, end of period | $ 39.49 | $ 31.66 | $ 29.43 | $ 32.07 | $ 28.57 |

Total Return A,B | 26.59% | 8.70% | (6.71)% | 13.43% | 22.14% |

Ratios to Average Net Assets D,F | | | | |

Expenses before reductions | 1.35% | 1.34% | 1.30% | 1.33% | 1.37% |

Expenses net of fee waivers, if any | 1.35% | 1.34% | 1.29% | 1.33% | 1.37% |

Expenses net of all reductions | 1.33% | 1.31% | 1.25% | 1.28% | 1.32% |

Net investment income (loss) | .97% | 1.41% | 1.31% | 1.06% | 1.28% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 347 | $ 299 | $ 320 | $ 392 | $ 414 |

Portfolio turnover rate E | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.42 | $ 29.18 | $ 31.81 | $ 28.35 | $ 23.49 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .26 | .34 | .34 | .23 | .24 |

Net realized and unrealized gain (loss) | 7.92 | 2.09 | (2.51) | 3.48 | 4.81 |

Total from investment operations | 8.18 | 2.43 | (2.17) | 3.71 | 5.05 |

Distributions from net investment income | (.34) | (.19) | (.30) | (.21) | (.19) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.37) | (.19) | (.46) | (.25) | (.19) |

Redemption fees added to paid in capital C,G | - | - | - | - | - |

Net asset value, end of period | $ 39.23 | $ 31.42 | $ 29.18 | $ 31.81 | $ 28.35 |

Total Return A,B | 26.31% | 8.41% | (6.96)% | 13.14% | 21.79% |

Ratios to Average Net Assets D,F | | | | |

Expenses before reductions | 1.59% | 1.59% | 1.56% | 1.60% | 1.65% |

Expenses net of fee waivers, if any | 1.59% | 1.59% | 1.55% | 1.60% | 1.65% |

Expenses net of all reductions | 1.57% | 1.56% | 1.51% | 1.56% | 1.60% |

Net investment income (loss) | .73% | 1.16% | 1.05% | .79% | 1.00% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 53 | $ 46 | $ 61 | $ 92 | $ 83 |

Portfolio turnover rate E | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.28 | $ 29.02 | $ 31.60 | $ 28.18 | $ 23.25 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .08 | .19 | .17 | .08 | .12 |

Net realized and unrealized gain (loss) | 7.90 | 2.09 | (2.48) | 3.44 | 4.81 |

Total from investment operations | 7.98 | 2.28 | (2.31) | 3.52 | 4.93 |

Distributions from net investment income | (.15) | (.02) | (.12) | (.06) | - |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.18) | (.02) | (.27) H | (.10) | - |

Redemption fees added to paid in capital C,G | - | - | - | - | - |

Net asset value, end of period | $ 39.08 | $ 31.28 | $ 29.02 | $ 31.60 | $ 28.18 |

Total Return A,B | 25.64% | 7.85% | (7.39)% | 12.52% | 21.20% |

Ratios to Average Net Assets D,F | | | | |

Expenses before reductions | 2.10% | 2.09% | 2.06% | 2.12% | 2.16% |

Expenses net of fee waivers, if any | 2.10% | 2.09% | 2.06% | 2.12% | 2.16% |

Expenses net of all reductions | 2.08% | 2.06% | 2.02% | 2.08% | 2.11% |

Net investment income (loss) | .22% | .66% | .54% | .27% | .49% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 7 | $ 8 | $ 10 | $ 14 | $ 16 |

Portfolio turnover rate E | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

H Total distributions of $.27 per share is comprised of distributions from net investment income of $.115 and distributions from net realized gain of $.155 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.32 | $ 29.08 | $ 31.68 | $ 28.23 | $ 23.31 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .08 | .19 | .18 | .09 | .12 |

Net realized and unrealized gain (loss) | 7.90 | 2.09 | (2.49) | 3.45 | 4.82 |

Total from investment operations | 7.98 | 2.28 | (2.31) | 3.54 | 4.94 |

Distributions from net investment income | (.20) | (.04) | (.14) | (.05) | (.02) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.23) | (.04) | (.29) H | (.09) | (.02) |

Redemption fees added to paid in capital C,G | - | - | - | - | - |

Net asset value, end of period | $ 39.07 | $ 31.32 | $ 29.08 | $ 31.68 | $ 28.23 |

Total Return A,B | 25.65% | 7.86% | (7.37)% | 12.54% | 21.22% |

Ratios to Average Net Assets D,F | | | | |

Expenses before reductions | 2.10% | 2.09% | 2.05% | 2.09% | 2.14% |

Expenses net of fee waivers, if any | 2.09% | 2.09% | 2.04% | 2.09% | 2.14% |

Expenses net of all reductions | 2.07% | 2.06% | 2.00% | 2.05% | 2.09% |

Net investment income (loss) | .23% | .66% | .56% | .30% | .51% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 36 | $ 30 | $ 33 | $ 44 | $ 43 |

Portfolio turnover rate E | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

H Total distributions of $.29 per share is comprised of distributions from net investment income of $.137 and distributions from net realized gain of $.155 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - International Discovery

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.91 | $ 29.69 | $ 32.34 | $ 28.79 | $ 23.88 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .47 | .51 | .53 | .40 | .37 |

Net realized and unrealized gain (loss) | 8.02 | 2.12 | (2.54) | 3.54 | 4.88 |

Total from investment operations | 8.49 | 2.63 | (2.01) | 3.94 | 5.25 |

Distributions from net investment income | (.55) | (.41) | (.48) | (.35) | (.34) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.58) | (.41) | (.64) | (.39) | (.34) |

Redemption fees added to paid in capital B,F | - | - | - | - | - |

Net asset value, end of period | $ 39.82 | $ 31.91 | $ 29.69 | $ 32.34 | $ 28.79 |

Total Return A | 27.03% | 9.03% | (6.39)% | 13.76% | 22.47% |

Ratios to Average Net Assets C,E | | | | |

Expenses before reductions | 1.00% | 1.01% | .97% | 1.05% | 1.12% |

Expenses net of fee waivers, if any | 1.00% | 1.01% | .96% | 1.05% | 1.12% |

Expenses net of all reductions | .98% | .98% | .92% | 1.00% | 1.07% |

Net investment income (loss) | 1.32% | 1.73% | 1.64% | 1.35% | 1.53% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 7,800 | $ 5,965 | $ 6,806 | $ 8,133 | $ 8,114 |

Portfolio turnover rate D | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class K

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.87 | $ 29.66 | $ 32.32 | $ 28.78 | $ 23.90 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .52 | .57 | .58 | .46 | .44 |

Net realized and unrealized gain (loss) | 8.01 | 2.11 | (2.54) | 3.53 | 4.86 |

Total from investment operations | 8.53 | 2.68 | (1.96) | 3.99 | 5.30 |

Distributions from net investment income | (.61) | (.47) | (.55) | (.41) | (.42) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.64) | (.47) | (.70) G | (.45) | (.42) |

Redemption fees added to paid in capital B,F | - | - | - | - | - |

Net asset value, end of period | $ 39.76 | $ 31.87 | $ 29.66 | $ 32.32 | $ 28.78 |

Total Return A | 27.23% | 9.24% | (6.24)% | 13.96% | 22.80% |

Ratios to Average Net Assets C,E | | | | |

Expenses before reductions | .85% | .83% | .80% | .84% | .88% |

Expenses net of fee waivers, if any | .85% | .83% | .79% | .84% | .88% |

Expenses net of all reductions | .83% | .80% | .75% | .79% | .83% |

Net investment income (loss) | 1.47% | 1.91% | 1.81% | 1.55% | 1.77% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 2,576 | $ 1,776 | $ 1,245 | $ 1,078 | $ 674 |

Portfolio turnover rate D | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.01 per share.

G Total distributions of $.70 per share is comprised of distributions from net investment income of $.548 and distributions from net realized gain of $.155 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended October 31, | 2013 | 2012 | 2011 | 2010 | 2009 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 31.87 | $ 29.65 | $ 32.31 | $ 28.77 | $ 23.91 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .47 | .52 | .54 | .41 | .39 |

Net realized and unrealized gain (loss) | 8.01 | 2.11 | (2.55) | 3.55 | 4.86 |

Total from investment operations | 8.48 | 2.63 | (2.01) | 3.96 | 5.25 |

Distributions from net investment income | (.56) | (.41) | (.50) | (.38) | (.39) |

Distributions from net realized gain | (.03) | - | (.16) | (.04) | - |

Total distributions | (.59) | (.41) | (.65) G | (.42) | (.39) |

Redemption fees added to paid in capital B,F | - | - | - | - | - |

Net asset value, end of period | $ 39.76 | $ 31.87 | $ 29.65 | $ 32.31 | $ 28.77 |

Total Return A | 27.03% | 9.07% | (6.39)% | 13.84% | 22.52% |

Ratios to Average Net Assets C,E | | | | |

Expenses before reductions | 1.00% | 1.00% | .95% | .99% | 1.05% |

Expenses net of fee waivers, if any | 1.00% | 1.00% | .94% | .99% | 1.05% |

Expenses net of all reductions | .97% | .97% | .90% | .95% | 1.00% |

Net investment income (loss) | 1.33% | 1.75% | 1.66% | 1.40% | 1.60% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 476 | $ 294 | $ 278 | $ 319 | $ 267 |

Portfolio turnover rate D | 65% | 68% | 75% | 82% | 98% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.01 per share.

G Total distributions of $.65 per share is comprised of distributions from net investment income of $.497 and distributions from net realized gain of $.155 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class Z

Year ended October 31, | 2013 G |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 37.22 |

Income from Investment Operations | |

Net investment income (loss) D | .07 |

Net realized and unrealized gain (loss) | 2.48 |

Total from investment operations | 2.55 |

Redemption fees added to paid in capital D,I | - |

Net asset value, end of period | $ 39.77 |

Total Return B,C | 6.85% |

Ratios to Average Net Assets E,H | |

Expenses before reductions | .85% A |

Expenses net of fee waivers, if any | .85% A |

Expenses net of all reductions | .83% A |

Net investment income (loss) | .76% A |

Supplemental Data | |

Net assets, end of period (000 omitted) | $ 107 |

Portfolio turnover rate F | 65% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period August 13, 2013 (commencement of sale of shares) to October 31, 2013.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2013

(Amounts in thousands except percentages)

1. Organization.

Fidelity International Discovery Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund commenced sale of Class Z shares on August 13, 2013. The Fund offers Class A, Class T, Class C, International Discovery, Class K, Institutional Class and Class Z shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Annual Report

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the FMR Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Investment Valuation - continued

limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. For U.S. government and government agency obligations, pricing vendors utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of October 31, 2013, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is

Annual Report

3. Significant Accounting Policies - continued

Investment Transactions and Income - continued

calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

October 31, 2013, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, foreign currency transactions, passive foreign investment companies (PFIC), market discount, deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales.