UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04041

STATE STREET VARIABLE INSURANCE SERIES FUNDS, INC.

(Exact name of registrant as specified in charter)

One Iron Street

Boston, Massachusetts 02210

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Sean O’Malley, Esq. Senior Vice President and Deputy General Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 | | Timothy W. Diggins, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199-3600 |

Registrant’s telephone number, including area code:800-242-0134

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Item 1. Shareholder Reports.

Annual Report

December 31, 2019

State Street S&P 500 Index V.I.S. Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of a Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a Fund’s website (www.ssga.com/geam), and you will be notified by mail each time a report is posted, and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive all future reports in paper free of charge. To do so, contact your Insurance Provider. Your election to receive reports in paper will apply to all funds held in your account.

State Street S&P 500 Index V.I.S. Fund

Annual Report

December 31, 2019

Table of Contents

This report is prepared for Policyholders of certain variable contracts and may be distributed to others only if preceded or accompanied by the variable contract’s current prospectus and the current summary prospectus of the Fund available for investments thereunder.

State Street S&P 500 Index V.I.S. Fund

Notes to Performance — December 31, 2019 (Unaudited)

The information provided on the performance page relates to the State Street S&P 500 Index V.I.S. Fund (the “Fund”).

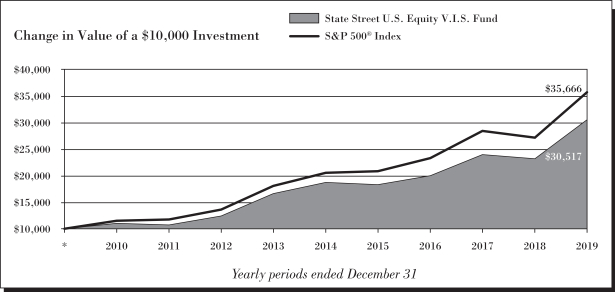

Total return performance shown in this report for the Fund takes into account changes in share price and assumes reinvestment of dividends and capital gains distributions, if any. Total returns shown are net of Fund fees and expenses but do not reflect fees and charges associated with the variable contracts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the Fund’s total returns for all periods shown.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Fund’s website at http://www.ssga.com/geam for the most recent month-end performance data.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. An investment in the Fund is subject to risk, including possible loss of principal invested.

The S&P 500® Index is an unmanaged, market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap U.S. stock market performance.

The Fund is not sponsored, endorsed, sold or promoted by S&P Global Ratings (“S&P”), and S&P makes no representation or warranty, express or implied, to the investors of the Fund or any member of the public regarding the advisability of investing in the securities generally or in this Fund particularly or the ability of the Fund to track general stock market performance.

The results shown for the foregoing index assume the reinvestment of net dividends or interest and do not reflect fees, expenses, or taxes. As such, the index returns do not reflect the actual cost of investing in the instruments that comprise the index.

The views expressed in this document reflect our judgement as of the publication date and are subject to change at any time without notice.

State Street Global Advisors Funds Distributors, LLC, member of FINRA & SIPC is the principal underwriter and distributor of the State Street V.I.S. Funds and an indirect wholly-owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. The Funds pay State Street Bank and Trust Company for its services as custodian and Fund Accounting agent, and pay SSGA Funds Management, Inc. for investment advisory and administrative services.

State Street S&P 500 Index V.I.S. Fund

Management’s Discussion of Fund Performance (Unaudited)

The State Street S&P 500 Index V.I.S. Fund (the “Fund”) seeks growth of capital and accumulation of income that corresponds to the investment return of the Standard & Poor’s 500 Stock Index. The Fund seeks to replicate the return of the S&P 500 Index while holding transaction costs low and minimizing portfolio turnover. The Fund’s benchmark is S&P 500 Index (the “Index”).

For the 12-month period ended December 31, 2019 (the “Reporting Period”), the total return for the Fund was 31.05%, and the Index was 31.49%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, cash drag and cumulative effect of security misweights contributed to the difference between the Fund’s performance and that of the Index

The Index started the new year just a hair above 2,500 in terms of price index levels. As the recovery in stocks took shape amid expectations for easing monetary conditions, technical strategists noted that a level of 2,600 was likely to provide some resistance. Right around mid-January the Index overtook that psychological level, amid some encouraging early signs from fourth-quarter earnings. The progression of both economic data points and earnings releases provided a reasonable amount of fodder for both bulls and bears to latch onto, but a temporary measure to end the US government shutdown and a dovish turn from the Federal Reserve helped the Index eclipse 2,700 by the end of January. This meant the Index returned over 8% for the month. The next two months of Q1 posted positive returns, albeit at a decelerating pace, to end the quarter up 13.65%.

April marked another solid month for growth assets as investors embraced optimism about trade policy between the United States and China, and earnings results continued to outpace analyst estimates. The Index closed the month at a new all-time high. As quickly as the monthly calendar turned, investors were met with increasingly uncomfortable developments. On the very first day of May, Federal Reserve Chair Jerome Powell pushed back on market expectations for interest rate cuts by suggesting that recent low levels of inflation were likely transitory. From there, trade conflict between the United States and the rest of the world took center stage, battering equity markets. As May turned to June, liquidity returned and sent the Index to new all-time highs. The Index after the first six months closed with a positive 18.54% return.

Markets entered the third quarter with a sense of cautious optimism following the G20 summit in Japan, where the United States and China reached a truce on the ongoing trade conflict and also agreed to restart trade negotiations. The favorable sentiment would prevail for much of July, as the Index eclipsed 3,000 for the first time ever. However, as the calendar shifted into August and September the market flattened and barely posted any gain over the next two months.

Apart from some modest hiccups at the beginning of October and end of November, US equities made mostly uninterrupted progress during the fourth quarter. Markets started out with some back and forth price action as investors balanced weak manufacturing data and the likelihood of lower interest rates with third-quarter earnings expectations that were relatively downbeat. An apparent truce in the US/China trade conflict helped lift sentiment in US equities as the US agreed to delay a tariff hike that was scheduled for the middle of October. Turning to November, the S&P 500 Index advanced nearly 1% on the first day of month. US stocks then hit a modest soft patch amidst some negative trade headlines and the passage of the Hong Kong Human Rights and Democracy Act in the US House of Representatives. Equity markets recovered right up until the end of November when news that President Trump had signed that same bill led to a risk-off environment. US markets were still a little jittery in early December as President Trump announced the re-imposition of steel and aluminum tariffs on Brazil and Argentina, but the announcement later in the month of a Phase One trade deal with China carried equity markets into a strong close for 2019. The Index rallied 9.07% in the fourth quarter and added 31.49% for the Reporting Period overall.

The Fund used futures in order to obtain full equity exposure and equitize cash and income receivable. The Fund’s use of futures helped the Fund track the Index.

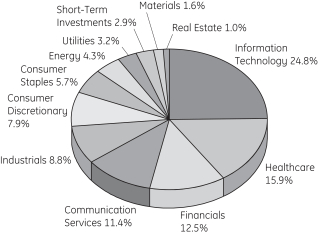

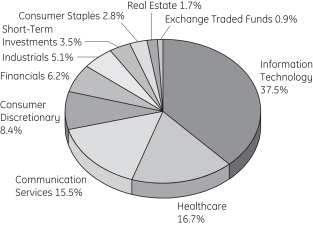

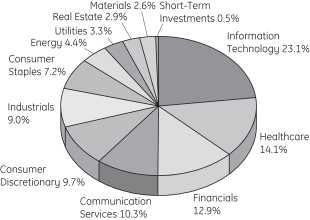

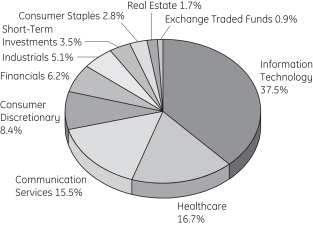

On a sector level, the top positive contributors to the Fund’s performance during the Reporting Period were Information Technology and Financials. The top negative contributors to the Fund’s performance during the Reporting Period were Energy and Materials.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Apple Inc., Facebook, Inc. Class A, and Microsoft Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were Occidental Petroleum Corporation, Pfizer Inc., and AbbVie Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

| | |

| 2 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Understanding Your Fund’s Expenses — December 31, 2019 (Unaudited)

As a shareholder of the Fund, you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entiresix-month period ended December 31, 2019.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. Additionally, the expenses shown do not reflect the fees or charges associated with variable contracts through which shares of the Fund are offered.

| | | | | | | | |

| | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value July 1, 2019 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value December 31, 2019 | | $ | 1,107.40 | | | $ | 1,023.49 | |

Expenses Paid During the Period* | | $ | 1.81 | | | $ | 1.73 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.34% (for the period July 1, 2019 - December 31, 2019), multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period). |

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 3 | |

State Street S&P 500 Index V.I.S. Fund

Performance Summary — December 31, 2019 (Unaudited)

Top Ten Largest Holdings

as of December 31, 2019 (as a % of Fair Value)(a)(b)

| | | | |

Apple Inc. | | | 4.56 | % |

| |

Microsoft Corp. | | | 4.47 | % |

| |

Amazon.com Inc. | | | 2.86 | % |

| |

Facebook Inc., Class A | | | 1.84 | % |

| |

Berkshire Hathaway Inc., Class B | | | 1.65 | % |

| |

JPMorgan Chase & Co. | | | 1.63 | % |

| |

Alphabet Inc., Class A | | | 1.50 | % |

| |

Alphabet Inc., Class C | | | 1.49 | % |

| |

Johnson & Johnson | | | 1.43 | % |

| |

Visa Inc., Class A | | | 1.19 | % |

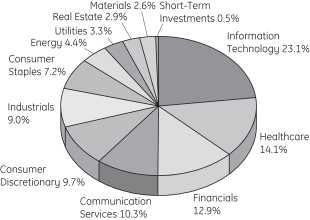

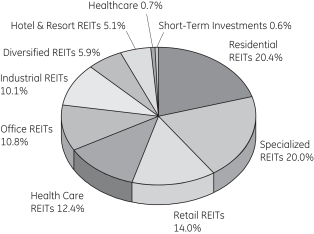

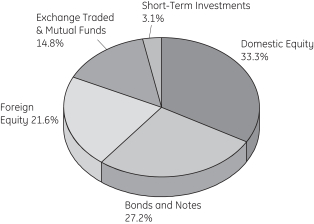

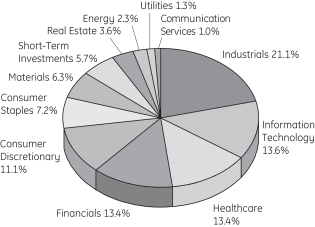

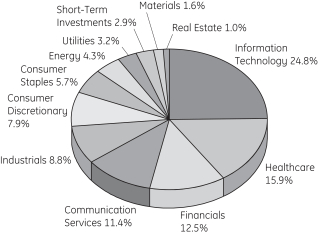

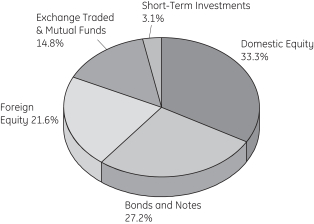

Sector Allocation as of December 31, 2019

Portfolio composition as a % of Fair Value of $186,613 (in thousands) as of December 31, 2019(a)(b)

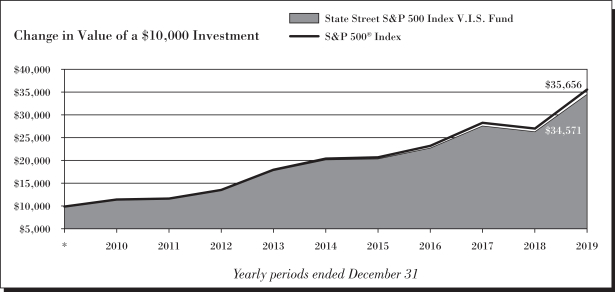

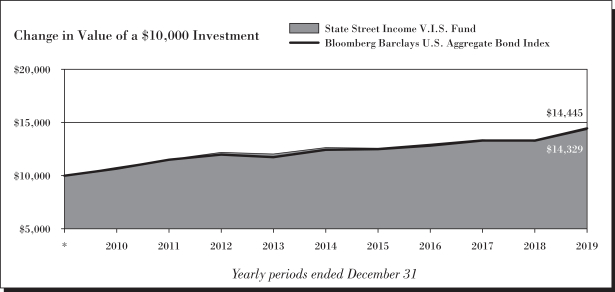

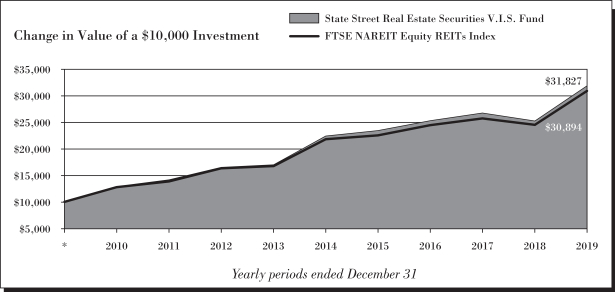

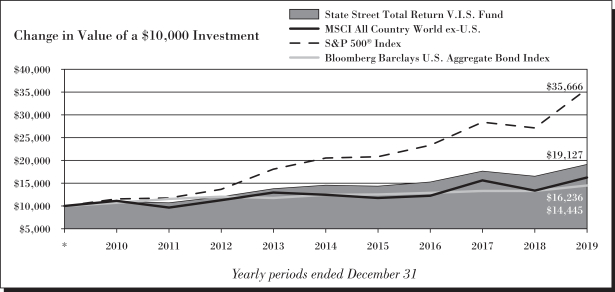

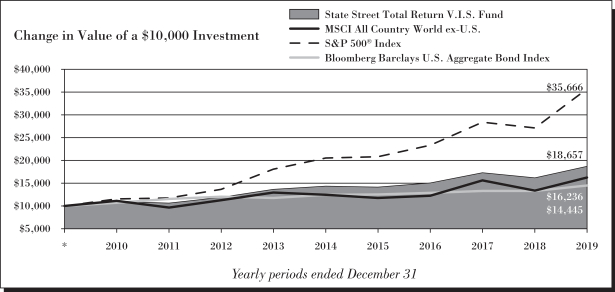

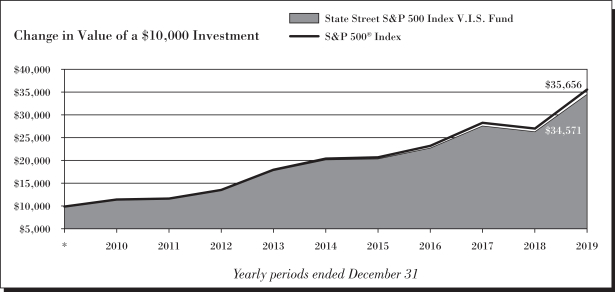

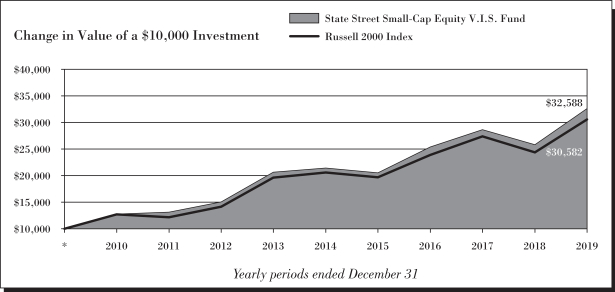

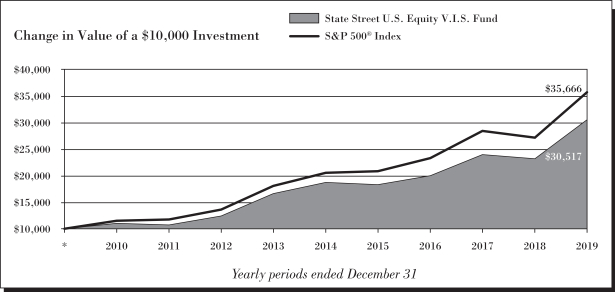

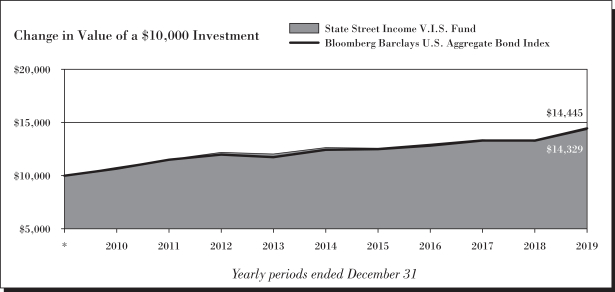

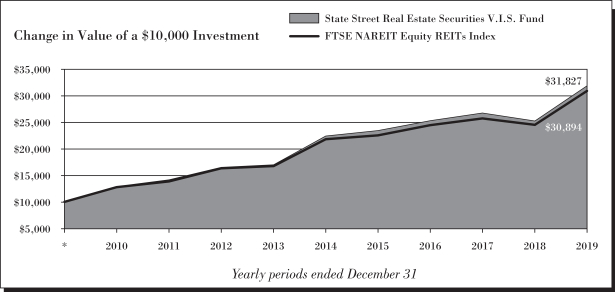

Average Annual Total Return for the periods ended December 31, 2019

Class 1 Shares (Inception date: 4/15/85)

| | | | | | | | | | | | | | | | |

| | | One Year | | | Five Year | | | Ten Year | | | Ending Value

of a $10,000

Investment | |

State Street S&P 500 Index V.I.S. Fund | | | 31.05 | % | | | 11.34 | % | | | 13.21 | % | | $ | 34,571 | |

| | | | |

S&P 500® Index | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % | | $ | 35,656 | |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional Liquid Reserves Fund — Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| | |

| 4 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Performance Summary, continued — December 31, 2019 (Unaudited)

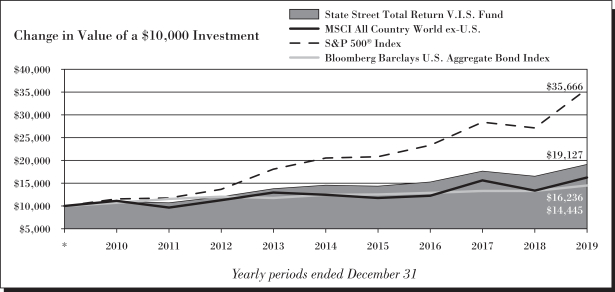

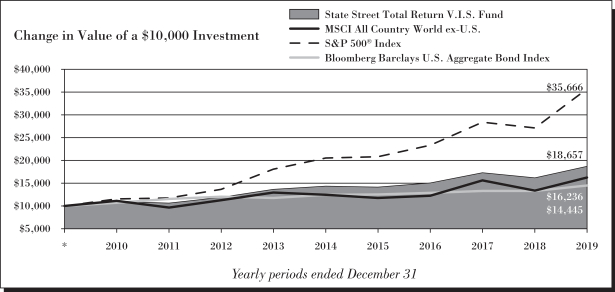

See Notes to Performance beginning on page 1 for further information.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and does not reflect the fees or charges that would be associated with variable contracts through which shares of the Fund are offered.

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 5 | |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

|

| Common Stock - 99.4% † | |

Advertising - 0.1% | |

Omnicom Group Inc. | | | 1,543 | | | | 125,014 | |

The Interpublic Group of Companies Inc. | | | 2,720 | | | | 62,832 | |

| | | | | | | | |

| | | | 187,846 | |

| | | | | | | | |

|

Aerospace & Defense - 2.4% | |

Arconic Inc. | | | 2,788 | | | | 85,787 | |

General Dynamics Corp. | | | 1,612 | | | | 284,276 | |

Huntington Ingalls Industries Inc. | | | 300 | | | | 75,264 | |

L3Harris Technologies Inc. | | | 1,565 | | | | 309,667 | |

Lockheed Martin Corp. | | | 1,731 | | | | 674,017 | |

Northrop Grumman Corp. | | | 1,097 | | | | 377,335 | |

Raytheon Co. | | | 1,961 | | | | 430,910 | |

Textron Inc. | | | 1,525 | | | | 68,015 | |

The Boeing Co. | | | 3,689 | | | | 1,201,729 | |

TransDigm Group Inc. | | | 333 | | | | 186,480 | |

United Technologies Corp. | | | 5,552 | | | | 831,467 | |

| | | | | | | | |

| | | | 4,524,947 | |

| | | | | | | | |

|

Agricultural & Farm Machinery - 0.2% | |

Deere & Co. | | | 2,226 | | | | 385,677 | |

| | | | | | | | |

|

Agricultural Products - 0.1% | |

Archer-Daniels-Midland Co. | | | 3,924 | | | | 181,877 | |

| | | | | | | | |

|

Air Freight & Logistics - 0.5% | |

CH Robinson Worldwide Inc. | | | 1,029 | | | | 80,468 | |

Expeditors International of Washington Inc. | | | 1,199 | | | | 93,546 | |

FedEx Corp. | | | 1,688 | | | | 255,242 | |

United Parcel Service Inc., Class B | | | 4,776 | | | | 559,079 | |

| | | | | | | | |

| | | | 988,335 | |

| | | | | | | | |

|

Airlines - 0.4% | |

Alaska Air Group Inc. (a) | | | 1,000 | | | | 67,750 | |

American Airlines Group Inc. | | | 2,398 | | | | 68,775 | |

Delta Air Lines Inc. | | | 3,906 | | | | 228,423 | |

Southwest Airlines Co. | | | 3,334 | | | | 179,969 | |

United Airlines Holdings Inc. (b) | | | 1,450 | | | | 127,730 | |

| | | | | | | | |

| | | | 672,647 | |

| | | | | | | | |

|

Alternative Carriers - 0.1% | |

CenturyLink Inc. | | | 7,333 | | | | 96,869 | |

| | | | | | | | |

|

Apparel Retail - 0.5% | |

L Brands Inc. | | | 1,488 | | | | 26,962 | |

Ross Stores Inc. | | | 2,577 | | | | 300,014 | |

The Gap Inc. | | | 1,676 | | | | 29,632 | |

The TJX Companies Inc. | | | 8,495 | | | | 518,705 | |

| | | | | | | | |

| | | | 875,313 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Apparel, Accessories & Luxury Goods - 0.3% | |

Capri Holdings Ltd. (b) | | | 1,222 | | | | 46,619 | |

Hanesbrands Inc. | | | 2,400 | | | | 35,640 | |

PVH Corp. | | | 518 | | | | 54,468 | |

Ralph Lauren Corp. | | | 400 | | | | 46,888 | |

Tapestry Inc. | | | 2,289 | | | | 61,735 | |

Under Armour Inc., Class A (b) | | | 1,700 | | | | 36,720 | |

Under Armour Inc., Class C (b) | | | 1,712 | | | | 32,836 | |

VF Corp. | | | 2,202 | | | | 219,451 | |

| | | | | | | | |

| | | | 534,357 | |

| | | | | | | | |

|

Application Software - 1.8% | |

Adobe Inc. (a)(b) | | | 3,309 | | | | 1,091,341 | |

ANSYS Inc. (b) | | | 600 | | | | 154,446 | |

Autodesk Inc. (b) | | | 1,548 | | | | 283,996 | |

Cadence Design Systems Inc. (b) | | | 1,900 | | | | 131,784 | |

Citrix Systems Inc. | | | 907 | | | | 100,586 | |

Intuit Inc. | | | 1,787 | | | | 468,069 | |

salesforce.com Inc. (b) | | | 6,112 | | | | 994,056 | |

Synopsys Inc. (b) | | | 999 | | | | 139,061 | |

| | | | | | | | |

| | | | 3,363,339 | |

| | | | | | | | |

|

Asset Management & Custody Banks - 0.8% | |

Ameriprise Financial Inc. | | | 905 | | | | 150,755 | |

BlackRock Inc. | | | 809 | | | | 406,684 | |

Franklin Resources Inc. | | | 2,000 | | | | 51,960 | |

Invesco Ltd. | | | 2,050 | | | | 36,859 | |

Northern Trust Corp. | | | 1,496 | | | | 158,935 | |

State Street Corp. (c) | | | 2,611 | | | | 206,530 | |

T Rowe Price Group Inc. | | | 1,540 | | | | 187,634 | |

The Bank of New York Mellon Corp. | | | 5,837 | | | | 293,776 | |

| | | | | | | | |

| | | | 1,493,133 | |

| | | | | | | | |

|

Auto Parts & Equipment - 0.1% | |

Aptiv PLC | | | 1,856 | | | | 176,264 | |

BorgWarner Inc. | | | 1,347 | | | | 58,433 | |

| | | | | | | | |

| | | | 234,697 | |

| | | | | | | | |

|

Automobile Manufacturers - 0.3% | |

Ford Motor Co. | | | 27,626 | | | | 256,922 | |

General Motors Co. | | | 8,886 | | | | 325,227 | |

| | | | | | | | |

| | | | 582,149 | |

| | | | | | | | |

|

Automotive Retail - 0.3% | |

Advance Auto Parts Inc. (a) | | | 522 | | | | 83,604 | |

AutoZone Inc. (b) | | | 166 | | | | 197,757 | |

CarMax Inc. (b) | | | 1,190 | | | | 104,327 | |

O’Reilly Automotive Inc. (b) | | | 549 | | | | 240,605 | |

| | | | | | | | |

| | | | 626,293 | |

| | | | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | |

| 6 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Biotechnology - 2.0% | |

AbbVie Inc. (a) | | | 10,163 | | | | 899,832 | |

Alexion Pharmaceuticals Inc. (a)(b) | | | 1,601 | | | | 173,148 | |

Amgen Inc. | | | 4,164 | | | | 1,003,816 | |

Biogen Inc. (b) | | | 1,258 | | | | 373,286 | |

Gilead Sciences Inc. | | | 8,751 | | | | 568,640 | |

Incyte Corp. (b) | | | 1,200 | | | | 104,784 | |

Regeneron Pharmaceuticals Inc. (b) | | | 550 | | | | 206,514 | |

Vertex Pharmaceuticals Inc. (b) | | | 1,800 | | | | 394,110 | |

| | | | | | | | |

| | | | 3,724,130 | |

| | | | | | | | |

|

Brewers - 0.0%* | |

Molson Coors Brewing Co., Class B | | | 1,298 | | | | 69,962 | |

| | | | | | | | |

|

Broadcasting - 0.2% | |

Discovery Inc., Class A (b) | | | 1,106 | | | | 36,210 | |

Discovery Inc., Class C (b) | | | 2,636 | | | | 80,372 | |

Fox Corp., Class A | | | 2,615 | | | | 96,938 | |

Fox Corp., Class B (b) | | | 1,130 | | | | 41,132 | |

ViacomCBS Inc., Class B | | | 3,494 | | | | 146,643 | |

| | | | | | | | |

| | | | 401,295 | |

| | | | | | | | |

|

Building Products - 0.3% | |

Allegion PLC | | | 733 | | | | 91,288 | |

AO Smith Corp. (a) | | | 972 | | | | 46,306 | |

Fortune Brands Home & Security Inc. | | | 1,000 | | | | 65,340 | |

Johnson Controls International PLC | | | 5,142 | | | | 209,331 | |

Masco Corp. | | | 1,824 | | | | 87,533 | |

| | | | | | | | |

| | | | 499,798 | |

| | | | | | | | |

|

Cable & Satellite - 1.1% | |

Charter Communications Inc., Class A (b) | | | 1,105 | | | | 536,014 | |

Comcast Corp., Class A | | | 31,431 | | | | 1,413,452 | |

DISH Network Corp., Class A (b) | | | 1,581 | | | | 56,078 | |

| | | | | | | | |

| | | | 2,005,544 | |

| | | | | | | | |

|

Casinos & Gaming - 0.2% | |

Las Vegas Sands Corp. | | | 2,400 | | | | 165,696 | |

MGM Resorts International | | | 3,500 | | | | 116,445 | |

Wynn Resorts Ltd. | | | 657 | | | | 91,238 | |

| | | | | | | | |

| | | | 373,379 | |

| | | | | | | | |

|

Commodity Chemicals - 0.2% | |

Dow Inc. (b) | | | 5,284 | | | | 289,193 | |

LyondellBasell Industries N.V., Class A | | | 1,762 | | | | 166,474 | |

| | | | | | | | |

| | | | 455,667 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Communications Equipment - 1.0% | |

Arista Networks Inc. (b) | | | 350 | | | | 71,190 | |

Cisco Systems Inc. | | | 29,399 | | | | 1,409,976 | |

F5 Networks Inc. (b) | | | 400 | | | | 55,860 | |

Juniper Networks Inc. | | | 2,247 | | | | 55,344 | |

Motorola Solutions Inc. | | | 1,144 | | | | 184,344 | |

| | | | | | | | |

| | | | | | | 1,776,714 | |

| | | | | | | | |

|

Computer & Electronics Retail - 0.1% | |

Best Buy Company Inc. | | | 1,559 | | | | 136,880 | |

| | | | | | | | |

|

Construction & Engineering - 0.1% | |

Jacobs Engineering Group Inc. | | | 850 | | | | 76,355 | |

Quanta Services Inc. | | | 1,200 | | | | 48,852 | |

| | | | | | | | |

| | | | | | | 125,207 | |

| | | | | | | | |

|

Construction Machinery & Heavy Trucks - 0.6% | |

Caterpillar Inc. | | | 3,908 | | | | 577,133 | |

Cummins Inc. | | | 1,056 | | | | 188,982 | |

PACCAR Inc. | | | 2,403 | | | | 190,077 | |

Westinghouse Air Brake Technologies Corp. | | | 1,297 | | | | 100,907 | |

| | | | | | | | |

| | | | | | | 1,057,099 | |

| | | | | | | | |

|

Construction Materials - 0.1% | |

Martin Marietta Materials Inc. | | | 400 | | | | 111,856 | |

Vulcan Materials Co. | | | 973 | | | | 140,102 | |

| | | | | | | | |

| | | | | | | 251,958 | |

| | | | | | | | |

|

Consumer Electronics - 0.0%* | |

Garmin Ltd. | | | 800 | | | | 78,048 | |

| | | | | | | | |

|

Consumer Finance - 0.7% | |

American Express Co. | | | 4,642 | | | | 577,883 | |

Capital One Financial Corp. | | | 3,295 | | | | 339,088 | |

Discover Financial Services | | | 2,277 | | | | 193,135 | |

Synchrony Financial | | | 4,277 | | | | 154,015 | |

| | | | | | | | |

| | | | | | | 1,264,121 | |

| | | | | | | | |

|

Copper - 0.1% | |

Freeport-McMoRan Inc. | | | 10,498 | | | | 137,734 | |

| | | | | | | | |

|

Data Processing & Outsourced Services - 4.1% | |

Alliance Data Systems Corp. (a) | | | 325 | | | | 36,465 | |

Automatic Data Processing Inc. | | | 3,053 | | | | 520,537 | |

Broadridge Financial Solutions Inc. | | | 800 | | | | 98,832 | |

Fidelity National Information Services Inc. | | | 4,300 | | | | 598,087 | |

Fiserv Inc. (b) | | | 4,058 | | | | 469,227 | |

FleetCor Technologies Inc. (b) | | | 600 | | | | 172,632 | |

Global Payments Inc. | | | 2,088 | | | | 381,185 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 7 | |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Jack Henry & Associates Inc. | | | 600 | | | | 87,402 | |

Mastercard Inc., Class A | | | 6,144 | | | | 1,834,537 | |

Paychex Inc. | | | 2,334 | | | | 198,530 | |

PayPal Holdings Inc. (b) | | | 8,243 | | | | 891,645 | |

The Western Union Co. | | | 3,224 | | | | 86,339 | |

Visa Inc., Class A | | | 11,827 | | | | 2,222,293 | |

| | | | | | | | |

| | | | | | | 7,597,711 | |

| | | | | | | | |

|

Department Stores - 0.1% | |

Kohl’s Corp. | | | 1,273 | | | | 64,859 | |

Macy’s Inc. | | | 2,334 | | | | 39,678 | |

Nordstrom Inc. | | | 592 | | | | 24,231 | |

| | | | | | | | |

| | | | | | | 128,768 | |

| | | | | | | | |

|

Distillers & Vintners - 0.2% | |

Brown-Forman Corp., Class B | | | 1,294 | | | | 87,475 | |

Constellation Brands Inc., Class A | | | 1,179 | | | | 223,715 | |

| | | | | | | | |

| | | | | | | 311,190 | |

| | | | | | | | |

|

Distributors - 0.1% | |

Genuine Parts Co. | | | 945 | | | | 100,387 | |

LKQ Corp. (b) | | | 1,952 | | | | 69,687 | |

| | | | | | | | |

| | | | | | | 170,074 | |

| | | | | | | | |

|

Diversified Banks - 4.4% | |

Bank of America Corp. | | | 56,026 | | | | 1,973,236 | |

Citigroup Inc. | | | 15,032 | | | | 1,200,907 | |

JPMorgan Chase & Co. | | | 21,781 | | | | 3,036,271 | |

U.S. Bancorp | | | 9,749 | | | | 578,018 | |

Wells Fargo & Co. | | | 26,599 | | | | 1,431,026 | |

| | | | | | | | |

| | | | | | | 8,219,458 | |

| | | | | | | | |

|

Diversified Chemicals - 0.0%* | |

Eastman Chemical Co. | | | 918 | | | | 72,761 | |

| | | | | | | | |

|

Diversified Support Services - 0.1% | |

Cintas Corp. | | | 564 | | | | 151,761 | |

Copart Inc. (b) | | | 1,300 | | | | 118,222 | |

| | | | | | | | |

| | | | | | | 269,983 | |

| | | | | | | | |

|

Drug Retail - 0.2% | |

Walgreens Boots Alliance Inc. | | | 5,313 | | | | 313,254 | |

| | | | | | | | |

|

Electric Utilities - 2.0% | |

Alliant Energy Corp. (a) | | | 1,600 | | | | 87,552 | |

American Electric Power Company Inc. | | | 3,483 | | | | 329,178 | |

Duke Energy Corp. | | | 5,082 | | | | 463,529 | |

Edison International | | | 2,442 | | | | 184,151 | |

Entergy Corp. | | | 1,253 | | | | 150,109 | |

Evergy Inc. | | | 1,599 | | | | 104,079 | |

Eversource Energy | | | 2,330 | | | | 198,213 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Exelon Corp. | | | 6,934 | | | | 316,121 | |

FirstEnergy Corp. | | | 3,854 | | | | 187,305 | |

NextEra Energy Inc. | | | 3,402 | | | | 823,828 | |

Pinnacle West Capital Corp. | | | 700 | | | | 62,951 | |

PPL Corp. | | | 5,037 | | | | 180,728 | |

The Southern Co. | | | 7,258 | | | | 462,335 | |

Xcel Energy Inc. | | | 3,606 | | | | 228,945 | |

| | | | | | | | |

| | | | | | | 3,779,024 | |

| | | | | | | | |

|

Electrical Components & Equipment - 0.5% | |

AMETEK Inc. | | | 1,600 | | | | 159,584 | |

Eaton Corporation PLC | | | 2,800 | | | | 265,216 | |

Emerson Electric Co. | | | 4,230 | | | | 322,580 | |

Rockwell Automation Inc. | | | 819 | | | | 165,987 | |

| | | | | | | | |

| | | | | | | 913,367 | |

| | | | | | | | |

|

Electronic Components - 0.2% | |

Amphenol Corp., Class A | | | 2,000 | | | | 216,460 | |

Corning Inc. | | | 5,134 | | | | 149,451 | |

| | | | | | | | |

| | | | | | | 365,911 | |

| | | | | | | | |

|

Electronic Equipment & Instruments - 0.1% | |

FLIR Systems Inc. | | | 1,100 | | | | 57,277 | |

Keysight Technologies Inc. (b) | | | 1,400 | | | | 143,682 | |

Zebra Technologies Corp., Class A (b) | | | 300 | | | | 76,632 | |

| | | | | | | | |

| | | | | | | 277,591 | |

| | | | | | | | |

|

Electronic Manufacturing Services - 0.1% | |

IPG Photonics Corp. (b) | | | 300 | | | | 43,476 | |

TE Connectivity Ltd. | | | 2,254 | | | | 216,023 | |

| | | | | | | | |

| | | | | | | 259,499 | |

| | | | | | | | |

|

Environmental & Facilities Services - 0.3% | |

Republic Services Inc. | | | 1,415 | | | | 126,826 | |

Rollins Inc. | | | 1,200 | | | | 39,792 | |

Waste Management Inc. | | | 2,703 | | | | 308,034 | |

| | | | | | | | |

| | | | | | | 474,652 | |

| | | | | | | | |

|

Fertilizers & Agricultural Chemicals - 0.2% | |

CF Industries Holdings Inc. | | | 1,685 | | | | 80,442 | |

Corteva Inc. (b) | | | 5,417 | | | | 160,127 | |

FMC Corp. | | | 981 | | | | 97,923 | |

The Mosaic Co. | | | 2,500 | | | | 54,100 | |

| | | | | | | | |

| | | | | | | 392,592 | |

| | | | | | | | |

|

Financial Exchanges & Data - 1.1% | |

Cboe Global Markets Inc. | | | 800 | | | | 96,000 | |

CME Group Inc. | | | 2,519 | | | | 505,614 | |

Intercontinental Exchange Inc. | | | 3,813 | | | | 352,893 | |

MarketAxess Holdings Inc. | | | 250 | | | | 94,778 | |

Moody’s Corp. | | | 1,156 | | | | 274,446 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | |

| 8 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

MSCI Inc. | | | 600 | | | | 154,908 | |

Nasdaq Inc. | | | 834 | | | | 89,321 | |

S&P Global Inc. | | | 1,657 | | | | 452,444 | |

| | | | | | | | |

| | | | | | | 2,020,404 | |

| | | | | | | | |

| | |

Food Distributors - 0.2% | | | | | | | | |

Sysco Corp. | | | 3,618 | | | | 309,484 | |

| | | | | | | | |

|

Food Retail - 0.1% | |

The Kroger Co. | | | 5,490 | | | | 159,155 | |

| | | | | | | | |

|

Footwear - 0.5% | |

NIKE Inc., Class B | | | 8,642 | | | | 875,521 | |

| | | | | | | | |

|

Gas Utilities - 0.1% | |

Atmos Energy Corp. | | | 900 | | | | 100,674 | |

| | | | | | | | |

|

General Merchandise Stores - 0.5% | |

Dollar General Corp. | | | 1,812 | | | | 282,636 | |

Dollar Tree Inc. (b) | | | 1,692 | | | | 159,132 | |

Target Corp. | | | 3,495 | | | | 448,094 | |

| | | | | | | | |

| | | | 889,862 | |

| | | | | | | | |

|

Gold - 0.1% | |

Newmont Goldcorp Corp. | | | 5,411 | | | | 235,108 | |

| | | | | | | | |

|

Health Care REITs - 0.3% | |

Healthpeak Properties Inc. | | | 3,274 | | | | 112,855 | |

Ventas Inc. | | | 2,629 | | | | 151,798 | |

Welltower Inc. | | | 2,800 | | | | 228,984 | |

| | | | | | | | |

| | | | 493,637 | |

| | | | | | | | |

|

Healthcare Distributors - 0.2% | |

AmerisourceBergen Corp. | | | 1,061 | | | | 90,206 | |

Cardinal Health Inc. | | | 1,868 | | | | 94,483 | |

Henry Schein Inc. (b) | | | 1,098 | | | | 73,259 | |

McKesson Corp. | | | 1,189 | | | | 164,463 | |

| | | | | | | | |

| | | | 422,411 | |

| | | | | | | | |

|

Healthcare Equipment - 3.3% | |

Abbott Laboratories (a) | | | 12,214 | | | | 1,060,908 | |

ABIOMED Inc. (a)(b) | | | 300 | | | | 51,177 | |

Baxter International Inc. | | | 3,377 | | | | 282,385 | |

Becton Dickinson and Co. | | | 1,883 | | | | 512,120 | |

Boston Scientific Corp. (b) | | | 9,799 | | | | 443,111 | |

Danaher Corp. | | | 4,400 | | | | 675,312 | |

Edwards Lifesciences Corp. (b) | | | 1,400 | | | | 326,606 | |

Hologic Inc. (b) | | | 1,900 | | | | 99,199 | |

IDEXX Laboratories Inc. (b) | | | 622 | | | | 162,423 | |

Intuitive Surgical Inc. (b) | | | 796 | | | | 470,555 | |

Medtronic PLC | | | 9,247 | | | | 1,049,072 | |

ResMed Inc. | | | 986 | | | | 152,801 | |

STERIS PLC | | | 500 | | | | 76,210 | |

Stryker Corp. | | | 2,181 | | | | 457,879 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Teleflex Inc. | | | 300 | | | | 112,932 | |

Varian Medical Systems Inc. (b) | | | 634 | | | | 90,034 | |

Zimmer Biomet Holdings Inc. | | | 1,337 | | | | 200,122 | |

| | | | | | | | |

| | | | 6,222,846 | |

| | | | | | | | |

|

Healthcare Facilities - 0.2% | |

HCA Healthcare Inc. | | | 1,891 | | | | 279,509 | |

Universal Health Services Inc., Class B | | | 558 | | | | 80,050 | �� |

| | | | | | | | |

| | | | 359,559 | |

| | | | | | | | |

|

Healthcare Services - 0.8% | |

Cigna Corp. (b) | | | 2,565 | | | | 524,517 | |

CVS Health Corp. | | | 9,141 | | | | 679,085 | |

DaVita Inc. (b) | | | 558 | | | | 41,866 | |

Laboratory Corporation of America Holdings (b) | | | 700 | | | | 118,419 | |

Quest Diagnostics Inc. | | | 1,000 | | | | 106,790 | |

| | | | | | | | |

| | | | 1,470,677 | |

| | | | | | | | |

|

Healthcare Supplies - 0.2% | |

Align Technology Inc. (a)(b) | | | 461 | | | | 128,638 | |

DENTSPLY SIRONA Inc. | | | 1,532 | | | | 86,696 | |

The Cooper Companies Inc. | | | 315 | | | | 101,206 | |

| | | | | | | | |

| | | | 316,540 | |

| | | | | | | | |

|

Healthcare Technology - 0.1% | |

Cerner Corp. | | | 2,100 | | | | 154,119 | |

| | | | | | | | |

|

Home Building - 0.2% | |

D.R. Horton Inc. | | | 2,400 | | | | 126,600 | |

Lennar Corp., Class A | | | 2,100 | | | | 117,159 | |

NVR Inc. (b) | | | 20 | | | | 76,168 | |

PulteGroup Inc. | | | 1,535 | | | | 59,558 | |

| | | | | | | | |

| | | | 379,485 | |

| | | | | | | | |

|

Home Furnishings - 0.1% | |

Leggett & Platt Inc. | | | 1,000 | | | | 50,830 | |

Mohawk Industries Inc. (b) | | | 400 | | | | 54,552 | |

| | | | | | | | |

| | | | 105,382 | |

| | | | | | | | |

|

Home Improvement Retail - 1.2% | |

Lowe’s Companies Inc. | | | 5,331 | | | | 638,440 | |

The Home Depot Inc. | | | 7,589 | | | | 1,657,286 | |

| | | | | | | | |

| | | | 2,295,726 | |

| | | | | | | | |

|

Hotel & Resort REITs - 0.0%* | |

Host Hotels & Resorts Inc. | | | 4,517 | | | | 83,790 | |

| | | | | | | | |

|

Hotels, Resorts & Cruise Lines - 0.5% | |

Carnival Corp. | | | 2,900 | | | | 147,407 | |

Hilton Worldwide Holdings Inc. | | | 1,900 | | | | 210,729 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 9 | |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Marriott International Inc., Class A | | | 1,882 | | | | 284,991 | |

Norwegian Cruise Line Holdings Ltd. (b) | | | 1,500 | | | | 87,615 | |

Royal Caribbean Cruises Ltd. | | | 1,263 | | | | 168,623 | |

| | | | | | | | |

| | | | 899,365 | |

| | | | | | | | |

|

Household Appliances - 0.0%* | |

Whirlpool Corp. | | | 462 | | | | 68,159 | |

| | | | | | | | |

|

Household Products - 1.7% | |

Church & Dwight Company Inc. | | | 1,838 | | | | 129,285 | |

Colgate-Palmolive Co. | | | 5,853 | | | | 402,920 | |

Kimberly-Clark Corp. | | | 2,412 | | | | 331,771 | |

The Clorox Co. | | | 859 | | | | 131,891 | |

The Procter & Gamble Co. | | | 17,251 | | | | 2,154,650 | |

| | | | | | | | |

| | | | 3,150,517 | |

| | | | | | | | |

|

Housewares & Specialties - 0.0%* | |

Newell Brands Inc. | | | 2,334 | | | | 44,859 | |

| | | | | | | | |

|

Human Resource & Employment Services - 0.0%* | |

Robert Half International Inc. | | | 875 | | | | 55,256 | |

| | | | | | | | |

|

Hypermarkets & Super Centers - 1.1% | |

Costco Wholesale Corp. | | | 2,998 | | | | 881,172 | |

Walmart Inc. | | | 9,848 | | | | 1,170,336 | |

| | | | | | | | |

| | | | 2,051,508 | |

| | | | | | | | |

|

Independent Power Producers & Energy Traders - 0.1% | |

AES Corp. (a) | | | 4,826 | | | | 96,037 | |

NRG Energy Inc. | | | 1,738 | | | | 69,086 | |

| | | | | | | | |

| | | | 165,123 | |

| | | | | | | | |

|

Industrial Conglomerates - 1.3% | |

3M Co. (a) | | | 4,006 | | | | 706,739 | |

General Electric Co. | | | 59,994 | | | | 669,533 | |

Honeywell International Inc. | | | 4,949 | | | | 875,973 | |

Roper Technologies Inc. | | | 728 | | | | 257,879 | |

| | | | | | | | |

| | | | 2,510,124 | |

| | | | | | | | |

|

Industrial Gases - 0.6% | |

Air Products & Chemicals Inc. (a) | | | 1,541 | | | | 362,119 | |

Linde PLC | | | 3,722 | | | | 792,414 | |

| | | | | | | | |

| | | | 1,154,533 | |

| | | | | | | | |

|

Industrial Machinery - 0.8% | |

Dover Corp. | | | 1,009 | | | | 116,297 | |

Flowserve Corp. | | | 900 | | | | 44,793 | |

Fortive Corp. | | | 2,149 | | | | 164,162 | |

IDEX Corp. | | | 500 | | | | 86,000 | |

Illinois Tool Works Inc. | | | 1,960 | | | | 352,075 | |

Ingersoll-Rand PLC | | | 1,600 | | | | 212,672 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Parker-Hannifin Corp. | | | 934 | | | | 192,236 | |

Pentair PLC | | | 1,146 | | | | 52,567 | |

Snap-on Inc. | | | 409 | | | | 69,285 | |

Stanley Black & Decker Inc. | | | 1,099 | | | | 182,148 | |

Xylem Inc. | | | 1,281 | | | | 100,930 | |

| | | | | | | | |

| | | | 1,573,165 | |

| | | | | | | | |

|

Industrial REITs - 0.3% | |

Duke Realty Corp. | | | 2,500 | | | | 86,675 | |

Prologis Inc. REIT | | | 4,457 | | | | 397,297 | |

| | | | | | | | |

| | | | 483,972 | |

| | | | | | | | |

|

Insurance Brokers - 0.5% | |

Aon PLC | | | 1,634 | | | | 340,346 | |

Arthur J Gallagher & Co. | | | 1,227 | | | | 116,847 | |

Marsh & McLennan Companies Inc. | | | 3,526 | | | | 392,832 | |

Willis Towers Watson PLC | | | 858 | | | | 173,264 | |

| | | | | | | | |

| | | | 1,023,289 | |

| | | | | | | | |

|

Integrated Oil & Gas - 2.1% | |

Chevron Corp. | | | 13,193 | | | | 1,589,889 | |

Exxon Mobil Corp. | | | 29,339 | | | | 2,047,275 | |

Occidental Petroleum Corp. | | | 6,029 | | | | 248,455 | |

| | | | | | | | |

| | | | 3,885,619 | |

| | | | | | | | |

|

Integrated Telecommunication Services - 2.0% | |

AT&T Inc. | | | 50,766 | | | | 1,983,935 | |

Verizon Communications Inc. | | | 28,692 | | | | 1,761,689 | |

| | | | | | | | |

| | | | 3,745,624 | |

| | | | | | | | |

|

Interactive Home Entertainment - 0.3% | |

Activision Blizzard Inc. (a) | | | 5,400 | | | | 320,868 | |

Electronic Arts Inc. (b) | | | 2,105 | | | | 226,309 | |

Take-Two Interactive Software Inc. (b) | | | 800 | | | | 97,944 | |

| | | | | | | | |

| | | | 645,121 | |

| | | | | | | | |

|

Interactive Media & Services - 4.9% | |

Alphabet Inc., Class A (a)(b) | | | 2,086 | | | | 2,793,968 | |

Alphabet Inc., Class C (b) | | | 2,072 | | | | 2,770,305 | |

Facebook Inc., Class A (b) | | | 16,749 | | | | 3,437,732 | |

Twitter Inc. (b) | | | 5,100 | | | | 163,455 | |

| | | | | | | | |

| | | | 9,165,460 | |

| | | | | | | | |

|

Internet & Direct Marketing Retail - 3.3% | |

Amazon.com Inc. (b) | | | 2,889 | | | | 5,338,410 | |

Booking Holdings Inc. (b) | | | 293 | | | | 601,743 | |

eBay Inc. | | | 5,260 | | | | 189,938 | |

Expedia Group Inc. | | | 850 | | | | 91,919 | |

| | | | | | | | |

| | | | 6,222,010 | |

| | | | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | |

| 10 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Internet Services & Infrastructure - 0.1% | |

Akamai Technologies Inc. (a)(b) | | | 1,133 | | | | 97,869 | |

VeriSign Inc. (b) | | | 724 | | | | 139,500 | |

| | | | | | | | |

| | | | 237,369 | |

| | | | | | | | |

|

Investment Banking & Brokerage - 0.8% | |

E*TRADE Financial Corp. | | | 1,640 | | | | 74,407 | |

Morgan Stanley | | | 8,329 | | | | 425,778 | |

Raymond James Financial Inc. | | | 904 | | | | 80,872 | |

The Charles Schwab Corp. | | | 7,911 | | | | 376,247 | |

The Goldman Sachs Group Inc. | | | 2,203 | | | | 506,536 | |

| | | | | | | | |

| | | | 1,463,840 | |

| | | | | | | | |

|

IT Consulting & Other Services - 1.2% | |

Accenture PLC, Class A (a) | | | 4,445 | | | | 935,984 | |

Cognizant Technology Solutions Corp., Class A | | | 3,976 | | | | 246,592 | |

DXC Technology Co. | | | 1,824 | | | | 68,564 | |

Gartner Inc. (b) | | | 600 | | | | 92,460 | |

International Business Machines Corp. | | | 6,111 | | | | 819,118 | |

Leidos Holdings Inc. | | | 1,000 | | | | 97,890 | |

| | | | | | | | |

| | | | 2,260,608 | |

| | | | | | | | |

|

Leisure Products - 0.0%* | |

Hasbro Inc. | | | 796 | | | | 84,066 | |

| | | | | | | | |

|

Life & Health Insurance - 0.6% | |

Aflac Inc. (a) | | | 5,226 | | | | 276,455 | |

Globe Life Inc. | | | 666 | | | | 70,097 | |

Lincoln National Corp. | | | 1,560 | | | | 92,056 | |

MetLife Inc. | | | 5,560 | | | | 283,393 | |

Principal Financial Group Inc. | | | 1,711 | | | | 94,105 | |

Prudential Financial Inc. | | | 2,801 | | | | 262,566 | |

Unum Group | | | 1,589 | | | | 46,335 | |

| | | | | | | | |

| | | | 1,125,007 | |

| | | | | | | | |

|

Life Sciences Tools & Services - 1.0% | |

Agilent Technologies Inc. (a) | | | 2,022 | | | | 172,497 | |

Illumina Inc. (b) | | | 1,001 | | | | 332,072 | |

IQVIA Holdings Inc. (b) | | | 1,300 | | | | 200,863 | |

Mettler-Toledo International Inc. (b) | | | 179 | | | | 141,997 | |

PerkinElmer Inc. | | | 711 | | | | 69,038 | |

Thermo Fisher Scientific Inc. | | | 2,728 | | | | 886,245 | |

Waters Corp. (b) | | | 484 | | | | 113,087 | |

| | | | | | | | |

| | | | 1,915,799 | |

| | | | | | | | |

|

Managed Healthcare - 1.7% | |

Anthem Inc. | | | 1,775 | | | | 536,103 | |

Centene Corp. (b) | | | 3,027 | | | | 190,308 | |

Humana Inc. | | | 927 | | | | 339,764 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

UnitedHealth Group Inc. | | | 6,600 | | | | 1,940,268 | |

WellCare Health Plans Inc. (b) | | | 300 | | | | 99,063 | |

| | | | | | | | |

| | | | 3,105,506 | |

| | | | | | | | |

|

Metal & Glass Containers - 0.1% | |

Ball Corp. | | | 2,382 | | | | 154,044 | |

| | | | | | | | |

|

Motorcycle Manufacturers - 0.0%* | |

Harley-Davidson Inc. | | | 1,135 | | | | 42,211 | |

| | | | | | | | |

|

Movies & Entertainment - 1.5% | |

Live Nation Entertainment Inc. (b) | | | 800 | | | | 57,176 | |

Netflix Inc. (b) | | | 2,990 | | | | 967,474 | |

The Walt Disney Co. | | | 12,527 | | | | 1,811,780 | |

| | | | | | | | |

| | | | 2,836,430 | |

| | | | | | | | |

|

Multi-Line Insurance - 0.3% | |

American International Group Inc. | | | 6,229 | | | | 319,735 | |

Assurant Inc. | | �� | 339 | | | | 44,436 | |

The Hartford Financial Services Group Inc. | | | 2,544 | | | | 154,599 | |

| | | | | | | | |

| | | | 518,770 | |

| | | | | | | | |

|

Multi-Sector Holdings - 1.6% | |

Berkshire Hathaway Inc., Class B (b) | | | 13,596 | | | | 3,079,494 | |

| | | | | | | | |

|

Multi-Utilities - 1.0% | |

Ameren Corp. | | | 1,642 | | | | 126,106 | |

CenterPoint Energy Inc. | | | 3,718 | | | | 101,390 | |

CMS Energy Corp. | | | 2,000 | | | | 125,680 | |

Consolidated Edison Inc. | | | 2,255 | | | | 204,010 | |

Dominion Energy Inc. | | | 5,717 | | | | 473,482 | |

DTE Energy Co. | | | 1,280 | | | | 166,233 | |

NiSource Inc. | | | 2,515 | | | | 70,018 | |

Public Service Enterprise Group Inc. | | | 3,492 | | | | 206,202 | |

Sempra Energy | | | 1,800 | | | | 272,664 | |

WEC Energy Group Inc. | | | 2,209 | | | | 203,736 | |

| | | | | | | | |

| | | | 1,949,521 | |

| | | | | | | | |

|

Office REITs - 0.2% | |

Alexandria Real Estate Equities Inc. (a) | | | 800 | | | | 129,264 | |

Boston Properties Inc. | | | 898 | | | | 123,798 | |

SL Green Realty Corp. | | | 600 | | | | 55,128 | |

Vornado Realty Trust | | | 1,211 | | | | 80,532 | |

| | | | | | | | |

| | | | 388,722 | |

| | | | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 11 | |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Oil & Gas Drilling - 0.0%* | |

Helmerich & Payne Inc. | | | 900 | | | | 40,887 | |

| | | | | | | | |

|

Oil & Gas Equipment & Services - 0.4% | |

Baker Hughes Co. | | | 3,481 | | | | 89,218 | |

Halliburton Co. | | | 6,458 | | | | 158,027 | |

National Oilwell Varco Inc. | | | 2,846 | | | | 71,292 | |

Schlumberger Ltd. | | | 9,384 | | | | 377,237 | |

TechnipFMC PLC | | | 2,686 | | | | 57,588 | |

| | | | | | | | |

| | | | 753,362 | |

| | | | | | | | |

|

Oil & Gas Exploration & Production - 1.0% | |

Apache Corp. | | | 2,948 | | | | 75,439 | |

Cabot Oil & Gas Corp. | | | 3,135 | | | | 54,580 | |

Cimarex Energy Co. | | | 700 | | | | 36,743 | |

Concho Resources Inc. | | | 1,500 | | | | 131,355 | |

ConocoPhillips | | | 7,635 | | | | 496,504 | |

Devon Energy Corp. | | | 2,992 | | | | 77,702 | |

Diamondback Energy Inc. | | | 1,100 | | | | 102,146 | |

EOG Resources Inc. | | | 4,100 | | | | 343,416 | |

Hess Corp. | | | 1,818 | | | | 121,461 | |

Marathon Oil Corp. | | | 5,742 | | | | 77,977 | |

Noble Energy Inc. | | | 3,700 | | | | 91,908 | |

Pioneer Natural Resources Co. | | | 1,200 | | | | 181,644 | |

| | | | | | | | |

| | | | 1,790,875 | |

| | | | | | | | |

|

Oil & Gas Refining & Marketing - 0.5% | |

HollyFrontier Corp. | | | 900 | | | | 45,639 | |

Marathon Petroleum Corp. | | | 4,576 | | | | 275,704 | |

Phillips 66 | | | 3,161 | | | | 352,167 | |

Valero Energy Corp. | | | 2,828 | | | | 264,842 | |

| | | | | | | | |

| | | | 938,352 | |

| | | | | | | | |

|

Oil & Gas Storage & Transportation - 0.4% | |

Kinder Morgan Inc. | | | 13,304 | | | | 281,646 | |

ONEOK Inc. | | | 3,000 | | | | 227,010 | |

The Williams Companies Inc. | | | 8,571 | | | | 203,304 | |

| | | | | | | | |

| | | | 711,960 | |

| | | | | | | | |

|

Packaged Foods & Meats - 1.1% | |

Campbell Soup Co. | | | 1,215 | | | | 60,045 | |

Conagra Brands Inc. | | | 3,254 | | | | 111,417 | |

General Mills Inc. | | | 4,136 | | | | 221,524 | |

Hormel Foods Corp. | | | 1,800 | | | | 81,198 | |

Kellogg Co. | | | 1,701 | | | | 117,641 | |

Lamb Weston Holdings Inc. | | | 1,100 | | | | 94,633 | |

McCormick & Company Inc. | | | 900 | | | | 152,757 | |

Mondelez International Inc., Class A | | | 10,136 | | | | 558,291 | |

The Hershey Co. | | | 1,016 | | | | 149,332 | |

The JM Smucker Co. | | | 847 | | | | 88,198 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

The Kraft Heinz Co. | | | 4,395 | | | | 141,211 | |

Tyson Foods Inc., Class A | | | 2,166 | | | | 197,193 | |

| | | | | | | | |

| | | | 1,973,440 | |

| | | | | | | | |

| | |

Paper Packaging - 0.3% | | | | | | | | |

Amcor PLC (b) | | | 11,782 | | | | 127,717 | |

Avery Dennison Corp. | | | 492 | | | | 64,363 | |

International Paper Co. | | | 2,530 | | | | 116,507 | |

Packaging Corporation of America | | | 685 | | | | 76,713 | |

Sealed Air Corp. | | | 931 | | | | 37,082 | |

WestRock Co. | | | 1,775 | | | | 76,165 | |

| | | | | | | | |

| | | | 498,547 | |

| | | | | | | | |

|

Personal Products - 0.2% | |

Coty Inc., Class A | | | 1,910 | | | | 21,487 | |

The Estee Lauder Companies Inc., Class A | | | 1,579 | | | | 326,127 | |

| | | | | | | | |

| | | | 347,614 | |

| | | | | | | | |

|

Pharmaceuticals - 4.6% | |

Allergan PLC | | | 2,249 | | | | 429,941 | |

Bristol-Myers Squibb Co. | | | 16,244 | | | | 1,042,702 | |

Eli Lilly & Co. | | | 5,842 | | | | 767,814 | |

Johnson & Johnson | | | 18,327 | | | | 2,673,360 | |

Merck & Company Inc. | | | 17,568 | | | | 1,597,810 | |

Mylan N.V. (b) | | | 3,904 | | | | 78,470 | |

Perrigo Company PLC | | | 975 | | | | 50,369 | |

Pfizer Inc. | | | 38,535 | | | | 1,509,801 | |

Zoetis Inc. | | | 3,346 | | | | 442,843 | |

| | | | | | | | |

| | | | 8,593,110 | |

| | | | | | | | |

|

Property & Casualty Insurance - 0.8% | |

Chubb Ltd. | | | 3,161 | | | | 492,041 | |

Cincinnati Financial Corp. | | | 1,092 | | | | 114,824 | |

Loews Corp. | | | 1,862 | | | | 97,736 | |

The Allstate Corp. (a) | | | 2,186 | | | | 245,816 | |

The Progressive Corp. | | | 4,103 | | | | 297,016 | |

The Travelers Companies Inc. | | | 1,867 | | | | 255,686 | |

WR Berkley Corp. | | | 1,000 | | | | 69,100 | |

| | | | | | | | |

| | | | 1,572,219 | |

| | | | | | | | |

|

Publishing - 0.0%* | |

News Corp., Class A | | | 2,596 | | | | 36,707 | |

| | | | | | | | |

|

Railroads - 0.9% | |

CSX Corp. | | | 5,400 | | | | 390,744 | |

Kansas City Southern | | | 700 | | | | 107,212 | |

Norfolk Southern Corp. | | | 1,845 | | | | 358,170 | |

Union Pacific Corp. | | | 4,808 | | | | 869,238 | |

| | | | | | | | |

| | | | 1,725,364 | |

| | | | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | |

| 12 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Real Estate Services - 0.1% | |

CBRE Group Inc., Class A (b) | | | 2,321 | | | | 142,254 | |

| | | | | | | | |

|

Regional Banks - 1.2% | |

Citizens Financial Group Inc. | | | 3,000 | | | | 121,830 | |

Comerica Inc. | | | 1,148 | | | | 82,369 | |

Fifth Third Bancorp | | | 4,735 | | | | 145,554 | |

First Republic Bank | | | 1,200 | | | | 140,940 | |

Huntington Bancshares Inc. | | | 6,934 | | | | 104,565 | |

KeyCorp | | | 6,928 | | | | 140,223 | |

M&T Bank Corp. | | | 890 | | | | 151,077 | |

People’s United Financial Inc. | | | 3,200 | | | | 54,080 | |

Regions Financial Corp. | | | 7,168 | | | | 123,003 | |

SVB Financial Group (b) | | | 400 | | | | 100,416 | |

The PNC Financial Services Group Inc. | | | 3,039 | | | | 485,115 | |

Truist Financial Corp. | | | 9,118 | | | | 513,526 | |

Zions Bancorp NA | | | 1,000 | | | | 51,920 | |

| | | | | | | | |

| | | | 2,214,618 | |

| | | | | | | | |

|

Reinsurance - 0.0%* | |

Everest Re Group Ltd. | | | 300 | | | | 83,052 | |

| | | | | | | | |

|

Research & Consulting Services - 0.3% | |

Equifax Inc. | | | 846 | | | | 118,542 | |

IHS Markit Ltd. (b) | | | 2,800 | | | | 210,980 | |

Nielsen Holdings PLC | | | 2,328 | | | | 47,258 | |

Verisk Analytics Inc. | | | 1,200 | | | | 179,208 | |

| | | | | | | | |

| | | | 555,988 | |

| | | | | | | | |

|

Residential REITs - 0.4% | |

Apartment Investment & Management Co., Class A | | | 977 | | | | 50,462 | |

AvalonBay Communities Inc. | | | 972 | | | | 203,829 | |

Equity Residential | | | 2,508 | | | | 202,947 | |

Essex Property Trust Inc. | | | 450 | | | | 135,387 | |

Mid-America Apartment Communities Inc. | | | 800 | | | | 105,488 | |

UDR Inc. | | | 1,900 | | | | 88,730 | |

| | | | | | | | |

| | | | 786,843 | |

| | | | | | | | |

|

Restaurants - 1.2% | |

Chipotle Mexican Grill Inc. (b) | | | 160 | | | | 133,937 | |

Darden Restaurants Inc. | | | 886 | | | | 96,583 | |

McDonald’s Corp. | | | 5,267 | | | | 1,040,812 | |

Starbucks Corp. | | | 8,200 | | | | 720,944 | |

Yum! Brands Inc. | | | 2,174 | | | | 218,987 | |

| | | | | | | | |

| | | | 2,211,263 | |

| | | | | | | | |

|

Retail REITs - 0.4% | |

Federal Realty Investment Trust | | | 500 | | | | 64,365 | |

Kimco Realty Corp. | | | 3,097 | | | | 64,139 | |

Realty Income Corp. | | | 2,000 | | | | 147,260 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Regency Centers Corp. | | | 1,299 | | | | 81,954 | |

Simon Property Group Inc. | | | 2,179 | | | | 324,584 | |

| | | | | | | | |

| | | | 682,302 | |

| | | | | | | | |

| |

Semiconductor Equipment - 0.5% | | | | | |

Applied Materials Inc. | | | 6,438 | | | | 392,976 | |

KLA Corp. | | | 1,078 | | | | 192,067 | |

Lam Research Corp. | | | 1,031 | | | | 301,464 | |

| | | | | | | | |

| | | | 886,507 | |

| | | | | | | | |

|

Semiconductors - 3.7% | |

Advanced Micro Devices Inc. (a)(b) | | | 7,600 | | | | 348,536 | |

Analog Devices Inc. | | | 2,587 | | | | 307,439 | |

Broadcom Inc. | | | 2,768 | | | | 874,743 | |

Intel Corp. | | | 30,101 | | | | 1,801,545 | |

Maxim Integrated Products Inc. | | | 1,800 | | | | 110,718 | |

Microchip Technology Inc. | | | 1,600 | | | | 167,552 | |

Micron Technology Inc. (b) | | | 7,668 | | | | 412,385 | |

NVIDIA Corp. | | | 4,238 | | | | 997,201 | |

Qorvo Inc. (b) | | | 900 | | | | 104,607 | |

QUALCOMM Inc. | | | 7,968 | | | | 703,017 | |

Skyworks Solutions Inc. | | | 1,196 | | | | 144,572 | |

Texas Instruments Inc. | | | 6,409 | | | | 822,211 | |

Xilinx Inc. | | | 1,787 | | | | 174,715 | |

| | | | | | | | |

| | | | 6,969,241 | |

| | | | | | | | |

|

Soft Drinks - 1.6% | |

Monster Beverage Corp. (b) | | | 2,756 | | | | 175,144 | |

PepsiCo Inc. | | | 9,682 | | | | 1,323,239 | |

The Coca-Cola Co. | | | 26,669 | | | | 1,476,129 | |

| | | | | | | | |

| | | | 2,974,512 | |

| | | | | | | | |

|

Specialized Consumer Services - 0.0%* | |

H&R Block Inc. | | | 1,579 | | | | 37,075 | |

| | | | | | | | |

|

Specialized REITs - 1.3% | |

American Tower Corp. | | | 3,081 | | | | 708,075 | |

Crown Castle International Corp. | | | 2,923 | | | | 415,505 | |

Digital Realty Trust Inc. | | | 1,500 | | | | 179,610 | |

Equinix Inc. | | | 596 | | | | 347,885 | |

Extra Space Storage Inc. | | | 800 | | | | 84,496 | |

Iron Mountain Inc. | | | 1,886 | | | | 60,107 | |

Public Storage | | | 1,030 | | | | 219,349 | |

SBA Communications Corp. | | | 733 | | | | 176,646 | |

Weyerhaeuser Co. | | | 4,967 | | | | 150,003 | |

| | | | | | | | |

| | | | 2,341,676 | |

| | | | | | | | |

|

Specialty Chemicals - 0.8% | |

Albemarle Corp. (a) | | | 769 | | | | 56,168 | |

Celanese Corp. | | | 900 | | | | 110,808 | |

DuPont de Nemours Inc. | | | 5,117 | | | | 328,511 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

| | | | |

| State Street S&P 500 Index V.I.S. Fund | | | 13 | |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — December 31, 2019

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Ecolab Inc. | | | 1,702 | | | | 328,469 | |

International Flavors & Fragrances Inc. | | | 647 | | | | 83,476 | |

PPG Industries Inc. | | | 1,659 | | | | 221,460 | |

The Sherwin-Williams Co. | | | 563 | | | | 328,533 | |

| | | | | | | | |

| | | | 1,457,425 | |

| | | | | | | | |

| |

Specialty Stores - 0.1% | | | | | |

Tiffany & Co. | | | 704 | | | | 94,090 | |

Tractor Supply Co. | | | 837 | | | | 78,209 | |

Ulta Salon Cosmetics & Fragrance Inc. (b) | | | 400 | | | | 101,256 | |

| | | | | | | | |

| | | | 273,555 | |

| | | | | | | | |

|

Steel - 0.1% | |

Nucor Corp. | | | 2,259 | | | | 127,137 | |

| | | | | | | | |

|

Systems Software - 5.2% | |

Fortinet Inc. (b) | | | 900 | | | | 96,084 | |

Microsoft Corp. | | | 52,935 | | | | 8,347,850 | |

Nortonlifelock Inc. | | | 3,572 | | | | 91,157 | |

Oracle Corp. | | | 15,213 | | | | 805,985 | |

ServiceNow Inc. (b) | | | 1,300 | | | | 367,016 | |

| | | | | | | | |

| | | | 9,708,092 | |

| | | | | | | | |

|

Technology Distributors - 0.1% | |

CDW Corp. | | | 1,000 | | | | 142,840 | |

| | | | | | | | |

|

Technology Hardware, Storage & Peripherals - 4.9% | |

Apple Inc. | | | 28,981 | | | | 8,510,271 | |

Hewlett Packard Enterprise Co. | | | 9,619 | | | | 152,557 | |

HP Inc. | | | 10,254 | | | | 210,720 | |

NetApp Inc. | | | 1,470 | | | | 91,507 | |

Seagate Technology PLC | | | 1,732 | | | | 103,054 | |

Western Digital Corp. | | | 2,077 | | | | 131,827 | |

Xerox Holdings Corp. (b) | | | 1,211 | | | | 44,650 | |

| | | | | | | | |

| | | | 9,244,586 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Tobacco - 0.8% | |

Altria Group Inc. | | | 12,839 | | | | 640,795 | |

Philip Morris International Inc. | | | 10,737 | | | | 913,611 | |

| | | | | | | | |

| | | | 1,554,406 | |

| | | | | | | | |

|

Trading Companies & Distributors - 0.2% | |

Fastenal Co. | | | 3,900 | | | | 144,105 | |

United Rentals Inc. (b) | | | 564 | | | | 94,058 | |

WW Grainger Inc. | | | 282 | | | | 95,463 | |

| | | | | | | | |

| | | | 333,626 | |

| | | | | | | | |

|

Trucking - 0.1% | |

JB Hunt Transport Services Inc. | | | 520 | | | | 60,726 | |

Old Dominion Freight Line Inc. | | | 400 | | | | 75,912 | |

| | | | | | | | |

| | | | 136,638 | |

| | | | | | | | |

|

Water Utilities - 0.1% | |

American Water Works Company Inc. | | | 1,200 | | | | 147,420 | |

| | | | | | | | |

|

Wireless Telecommunication Services - 0.1% | |

T-Mobile US Inc. (b) | | | 2,200 | | | | 172,524 | |

| | | | | | | | |

| |

Total Common Stock

(Cost $66,522,351) | | | | 185,716,338 | |

| | | | | | | | |

|

| Short-Term Investments - 0.5% | |

State Street Institutional Liquid Reserves Fund - Premier Class 1.73% (d)(e)

(Cost $896,950) | | | 896,863 | | | | 896,953 | |

| | | | | | | | |

| |

Total Investments

(Cost $67,419,301) | | | | 186,613,291 | |

| | | | | | | | |

| |

| Other Assets and Liabilities, net - 0.1% | | | | 157,319 | |

| | | | | | | | |

| |

| NET ASSETS - 100.0% | | | | 186,770,610 | |

| | | | | | | | |

Other Information:

The Fund had the following long futures contracts open at December 31, 2019:

| | | | | | | | | | | | | | | | | | | | |

| Description | | Expiration

date | | | Number of

Contracts | | | Notional

Amount | | | Value | | | Unrealized

Appreciation | |

S&P 500 Emini Index Futures | | | March 2020 | | | | 9 | | | $ | 1,432,370 | | | $ | 1,453,974 | | | $ | 21,604 | |

| | | | | | | | | | | | | | | | | | | | |

During the period ended December 31, 2019, average notional value related to long futures contracts was $2,660,500.

See Notes to Schedule of Investments and Notes to Financial Statements.

| | |

| 14 | | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Notes to Schedule of Investments — December 31, 2019

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities cited may not be representative of the Fund’s future investments and should not be construed as a recommendation to purchase or sell a particular security. See the Fund’s summary prospectus and statutory prospectus for complete descriptions of investment objectives, policies, risks and permissible investments.

| (a) | At December 31, 2019, all or a portion of this security was pledged to cover collateral requirements for futures. |

| (b) | Non-income producing security. |

| (c) | State Street Corp. is the parent company of State Street Bank & Trust Co., the Fund’ssub-administrator, custodian and accounting agent. |

| (d) | Sponsored by SSGA Funds Management, Inc., the Fund’s investment adviser and administrator, and an affiliate of State Street Bank & Trust Co., the Fund’ssub-administrator, custodian and accounting agent. |

| (e) | Coupon amount represents effective yield. |

| † | Percentages are based on net assets as of December 31, 2019. |

Abbreviations:

REIT - Real Estate Investment Trust

The following table presents the Fund’s investments measured at fair value on a recurring basis at December 31, 2019:

| | | | | | | | | | | | | | | | |

Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stock | | $ | 185,716,338 | | | $ | — | | | $ | — | | | $ | 185,716,338 | |

Short-Term Investments | | | 896,953 | | | | — | | | | — | | | | 896,953 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 186,613,291 | | | $ | — | | | $ | — | | | $ | 186,613,291 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Long Futures Contracts - Unrealized Appreciation | | $ | 21,604 | | | $ | — | | | $ | — | | | $ | 21,604 | |

| | | | | | | | | | | | | | | | |

Affiliate Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number

of Shares

Held at

12/31/18 | | | Value At

12/31/18 | | | Cost of

Purchases | | | Proceeds

from

Shares Sold | | | Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation/

Depreciation | | | Number

of Shares

Held at

12/31/19 | | | Value at

12/31/19 | | | Dividend

Income | |

State Street Corp. | | | 2,911 | | | $ | 183,597 | | | $ | — | | | $ | 20,585 | | | $ | (661 | ) | | $ | 44,179 | | | | 2,611 | | | $ | 206,530 | | | $ | 5,311 | |

State Street Institutional Liquid Reserves Fund, Premier Class | | | — | | | | — | | | | 7,978,660 | | | | 7,081,710 | | | | — | | | | 3 | | | | 896,863 | | | | 896,953 | | | | 19,139 | |

State Street Institutional U.S. Government Money Market Fund, Class G Shares | | | 1,781,046 | | | | 1,781,046 | | | | 13,864,380 | | | | 15,645,426 | | | | — | | | | — | | | | — | | | | — | | | | 32,838 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

TOTAL | | | | | | $ | 1,964,643 | | | $ | 21,843,040 | | | $ | 22,747,721 | | | $ | (661 | ) | | $ | 44,182 | | | | | | | $ | 1,103,483 | | | $ | 57,288 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

See Notes to Schedule of Investments and Notes to Financial Statements. | |

| State Street S&P 500 Index V.I.S. Fund | | | 15 | |

State Street S&P 500 Index V.I.S. Fund

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | 12/31/17 | | | 12/31/16 | | | 12/31/15* | |

| Inception date | | | | | | | | | | | | | | | | | | | 4/15/85 | |

| | | | | |

Net asset value, beginning of period | | $ | 38.13 | | | $ | 44.09 | | | $ | 38.22 | | | $ | 36.16 | | | $ | 36.60 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.75 | (a) | | | 0.74 | (a) | | | 0.71 | (a) | | | 0.72 | | | | 0.69 | |

Net realized and unrealized gains/(losses) on investments | | | 11.09 | | | | (2.86 | ) | | | 7.52 | | | | 3.49 | | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total income/(loss) from investment operations | | | 11.84 | | | | (2.12 | ) | | | 8.23 | | | | 4.21 | | | | 0.41 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.62 | | | | 0.80 | | | | 0.79 | | | | 0.73 | | | | 0.85 | |

Net realized gains | | | 2.74 | | | | 3.04 | | | | 1.57 | | | | 1.42 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | 3.36 | | | | 3.84 | | | | 2.36 | | | | 2.15 | | | | 0.85 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 46.61 | | | $ | 38.13 | | | $ | 44.09 | | | $ | 38.22 | | | $ | 36.16 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return(b) | | | 31.05 | % | | | (4.73 | )% | | | 21.50 | % | | | 11.61 | % | | | 1.07 | % |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 186,771 | | | $ | 160,902 | | | $ | 194,117 | | | $ | 180,761 | | | $ | 179,395 | |

| | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net expenses | | | 0.34 | % | | | 0.33 | % | | | 0.32 | % | | | 0.34 | %(c) | | | 0.37 | %(c) |

Gross expenses | | | 0.34 | % | | | 0.33 | % | | | 0.32 | % | | | 0.37 | % | | | 0.42 | % |

Net investment income | | | 1.67 | % | | | 1.62 | % | | | 1.69 | % | | | 1.86 | % | | | 1.72 | % |

Portfolio turnover rate | | | 2 | % | | | 2 | % | | | 2 | % | | | 2 | % | | | 2 | % |

Notes to Financial Highlights

| (a) | | Per share values have been calculated using the average shares method. |

| (b) | | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| (c) | | Reflects a contractual arrangement with GE Asset Management Incorporated, the Fund’s investment adviser and administrator prior to July 1, 2016, to limit the advisory and administrative fee charged to the Fund to 0.30% of the average daily net assets of the Fund. |

| * | | Beginning with the year ended December 31, 2016, the Fund was audited by Ernst & Young LLP. The previous years were audited by another independent registered public accounting firm. |

The accompanying Notes are an integral part of these financial statements.

State Street S&P 500 Index V.I.S. Fund

Statement of Assets and Liabilities — December 31, 2019

| | | | |

Assets | | | | |

Investments in securities, at fair value (cost $66,375,203) | | $ | 185,509,808 | |

Investments in affiliated securities, at fair value (cost $1,044,098) | | | 1,103,483 | |

Net cash collateral on deposit with broker for future contracts | | | 38,511 | |

Receivable for investments sold | | | 208,085 | |

Income receivables | | | 186,975 | |

Receivable for fund shares sold | | | 8,218 | |

Income receivable from affiliated investments | | | 3,173 | |

Receivable for accumulated variation margin on futures contracts | | | 21,625 | |

Other assets | | | 985 | |

| | | | |

| |

Total assets | | | 187,080,863 | |

| | | | |

| |

Liabilities | | | | |

Due to custodian | | | 1,885 | |

Payable for fund shares redeemed | | | 223,158 | |

Payable to the Adviser | | | 39,204 | |

Payable for custody, fund accounting andsub-administration fees | | | 4,465 | |

Accrued other expenses | | | 41,541 | |

| | | | |

| |

Total liabilities | | | 310,253 | |

| | | | |

| | | | |

| |

Net Assets | | $ | 186,770,610 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Capital paid in | | $ | 70,181,874 | |

Total distributable earnings (loss) | | | 116,588,736 | |

| | | | |

| |

Net Assets | | $ | 186,770,610 | |

| | | | |

| | | | |

Shares outstanding ($0.01 par value; unlimited shares authorized) | | | 4,007,110 | |

Net asset value per share | | $ | 46.61 | |

The accompanying Notes are an integral part of these financial statements.

| | | | |

| Statement of Assets and Liabilities | | | 17 | |

State Street S&P 500 Index V.I.S. Fund

Statement of Operations — For the fiscal year ended December 31, 2019

| | | | |

Investment Income | |

Income | |

Dividend | | $ | 3,503,339 | |

Income from affiliated investments | | | 57,288 | |

| | | | |

Total income | | | 3,560,627 | |

| | | | |

|

Expenses | |

Advisory and administration fees | | | 441,437 | |

Directors’ fees | | | 19,212 | |

Custody, fund accounting andsub-administration fees | | | 37,980 | |

Professional fees | | | 38,753 | |

Printing and shareholder reports | | | 24,946 | |

Other expenses | | | 42,488 | |

| | | | |

Total Expenses | | | 604,816 | |

| | | | |

Net investment income | | $ | 2,955,811 | |

| | | | |

|

Net Realized and Unrealized Gain (Loss) on Investments | |

Realized gain (loss) on: | |

Unaffiliated investments | | $ | 10,201,466 | |

Affiliated investments | | | (661 | ) |

Futures | | | 492,014 | |

Increase (decrease) in unrealized appreciation/depreciation on: | |

Unaffiliated investments | | | 33,538,216 | |

Affiliated investments | | | 44,182 | |

Futures | | | 111,735 | |

| | | | |

| |

Net realized and unrealized gain (loss) on investments | | | 44,386,952 | |

| | | | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 47,342,763 | |

| | | | |

The accompanying Notes are an integral part of these financial statements.

| | |

| 18 | | Statement of Operations |

State Street S&P 500 Index V.I.S. Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended December 31,

2019 | | | Year Ended December 31,

2018 | |

Increase (Decrease) in Net Assets | |

|

Operations: | |

Net investment income | | $ | 2,955,811 | | | $ | 3,026,780 | |

Net realized gain (loss) on investments and futures | | | 10,692,819 | | | | 13,212,356 | |

Net increase (decrease) in unrealized appreciation/depreciation on investments and futures | | | 33,694,133 | | | | (23,393,093 | ) |

| | | | | | | | |

Net increase (decrease) from operations | | | 47,342,763 | | | | (7,153,957 | ) |

| | | | | | | | |

|

Distributions to shareholders: | |

Total distributions | | | (12,616,644 | ) | | | (14,751,301 | ) |

| | | | | | | | |

Increase (decrease) in assets from operations and distributions | | | 34,726,119 | | | | (21,905,258 | ) |

| | | | | | | | |

|

Share transactions: | |

Proceeds from sale of shares | | | 4,643,425 | | | | 2,837,356 | |

Value of distributions reinvested | | | 12,616,644 | | | | 14,751,301 | |

Cost of shares redeemed | | | (26,117,849 | ) | | | (28,898,496 | ) |

| | | | | | | | |

Net increase (decrease) from share transactions | | | (8,857,780 | ) | | | (11,309,839 | ) |

| | | | | | | | |

| | |

Total increase (decrease) in net assets | | | 25,868,339 | | | | (33,215,097 | ) |

Net Assets | |

Beginning of year | | | 160,902,271 | | | | 194,117,368 | |

| | | | | | | | |

| | |

End of year | | $ | 186,770,610 | | | $ | 160,902,271 | |

| | | | | | | | |

|

Changes in Fund Shares | |

Shares sold | | | 103,613 | | | | 61,494 | |

Issued for distributions reinvested | | | 269,932 | | | | 389,731 | |

Shares redeemed | | | (586,550 | ) | | | (634,062 | ) |

| | | | | | | | |

Net decrease in fund shares | | | (213,005 | ) | | | (182,837 | ) |

| | | | | | | | |