UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity Managed Retirement Income Fund℠

Fidelity Managed Retirement 2010 Fund℠

Fidelity Managed Retirement 2015 Fund℠

Fidelity Managed Retirement 2020 Fund℠

Fidelity Managed Retirement 2025 Fund℠

Fidelity Managed Retirement 2030 Fund℠

Fidelity Managed Retirement 2035 Fund℠

Annual Report

July 31, 2023

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Fidelity Managed Retirement Income Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -5.62% | 0.85% | 2.43% |

| Fidelity Managed Retirement Income Fund℠ | 0.37% | 2.30% | 3.30% |

| Class K | 0.47% | 2.39% | 3.34% |

| Class K6 | 0.57% | 2.47% | 3.38% |

| Class I | 0.37% | 2.31% | 3.30% |

| Class Z6 | 0.57% | 2.47% | 3.38% |

The initial offering of Class K, Class K6 and Class Z6 took place on August 1, 2019. Returns prior to August 1, 2019 are those of Fidelity Managed Retirement Income Fund, Fidelity Managed Retirement Income Fund and Class I, respectively, and have not been restated to reflect current expenses.

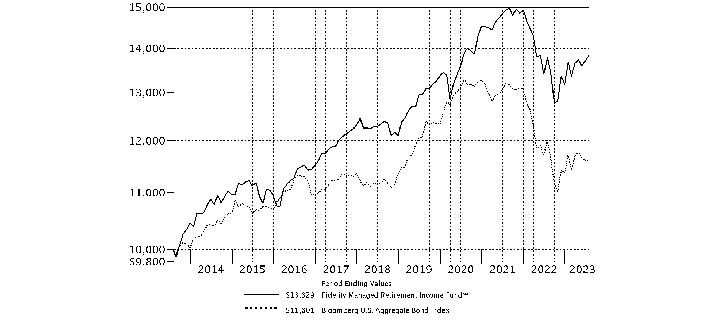

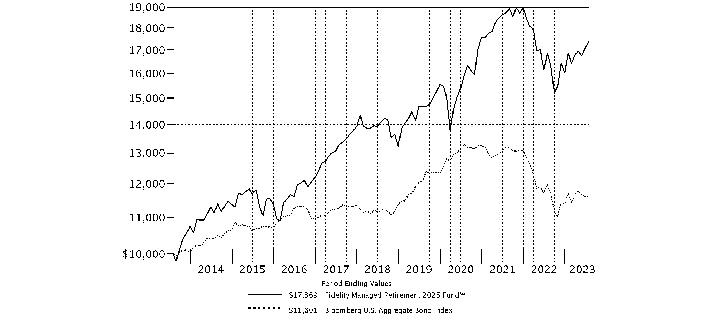

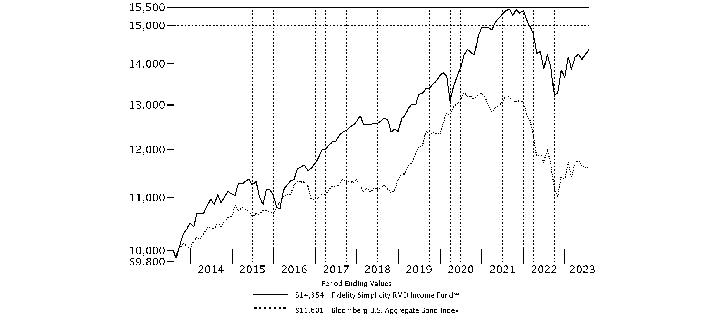

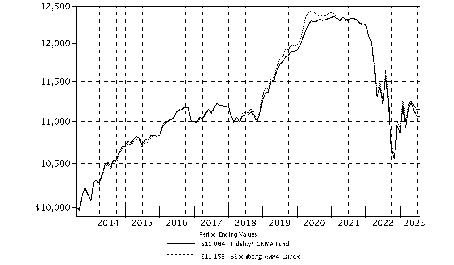

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement Income Fund℠, a class of the fund, on July 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

Fidelity Managed Retirement 2010 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -5.33% | 1.25% | 3.41% |

| Fidelity Managed Retirement 2010 Fund℠ | 0.69% | 2.71% | 4.28% |

| Class K | 0.80% | 2.79% | 4.32% |

| Class K6 | 0.90% | 2.87% | 4.37% |

| Class I | 0.69% | 2.71% | 4.28% |

| Class Z6 | 0.88% | 2.87% | 4.37% |

The initial offering of Class K, Class K6 and Class Z6 took place on August 1, 2019. Returns prior to August 1, 2019 are those of Fidelity Managed Retirement 2010 Fund, Fidelity Managed Retirement 2010 Fund and Class I, respectively, and have not been restated to reflect current expenses.

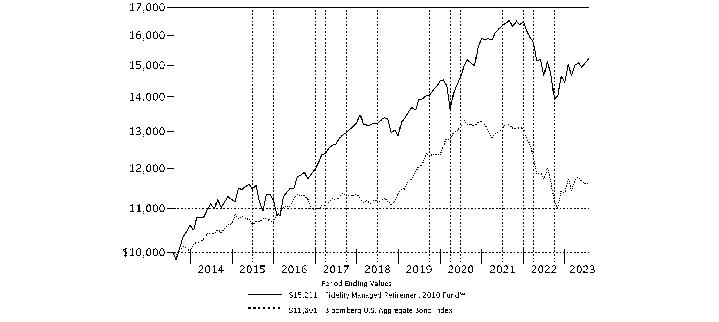

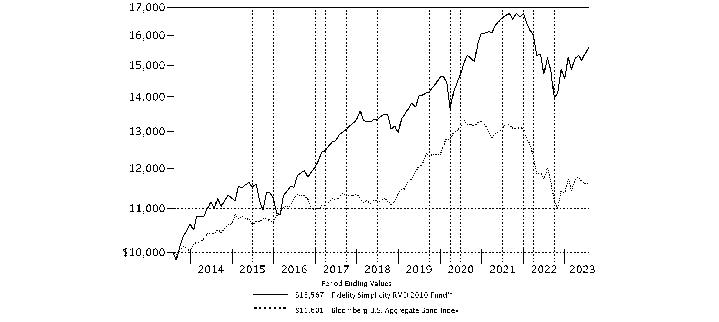

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2010 Fund℠, a class of the fund, on July 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

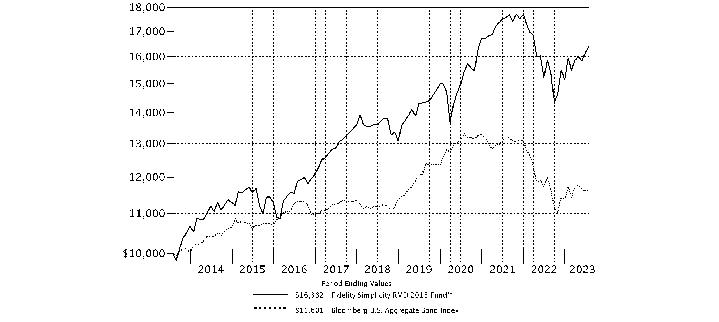

Fidelity Managed Retirement 2015 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -4.57% | 1.81% | 3.93% |

| Fidelity Managed Retirement 2015 Fund℠ | 1.49% | 3.28% | 4.80% |

| Class K | 1.60% | 3.36% | 4.85% |

| Class K6 | 1.70% | 3.45% | 4.89% |

| Class I | 1.48% | 3.28% | 4.80% |

| Class Z6 | 1.69% | 3.44% | 4.89% |

The initial offering of Class K, Class K6 and Class Z6 took place on August 1, 2019. Returns prior to August 1, 2019 are those of Fidelity Managed Retirement 2015 Fund, Fidelity Managed Retirement 2015 Fund and Class I, respectively, and have not been restated to reflect current expenses.

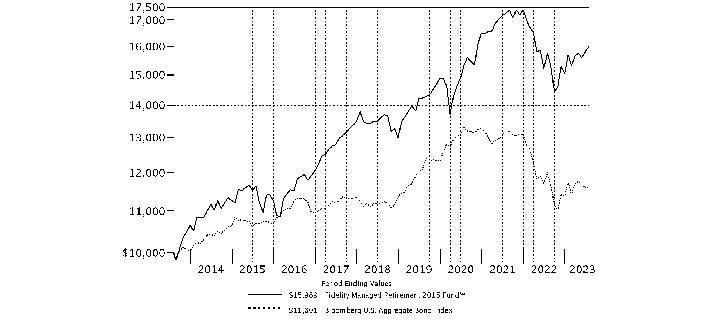

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2015 Fund℠, a class of the fund, on July 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

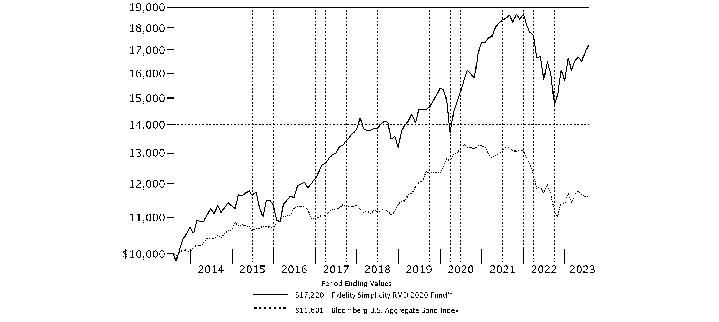

Fidelity Managed Retirement 2020 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -3.83% | 2.33% | 4.39% |

| Fidelity Managed Retirement 2020 Fund℠ | 2.29% | 3.81% | 5.27% |

| Class K | 2.41% | 3.89% | 5.31% |

| Class K6 | 2.50% | 3.97% | 5.35% |

| Class I | 2.30% | 3.81% | 5.27% |

| Class Z6 | 2.48% | 3.97% | 5.35% |

The initial offering of Class K, Class K6 and Class Z6 took place on August 1, 2019. Returns prior to August 1, 2019 are those of Fidelity Managed Retirement 2020 Fund, Fidelity Managed Retirement 2020 Fund and Class I, respectively, and have not been restated to reflect current expenses.

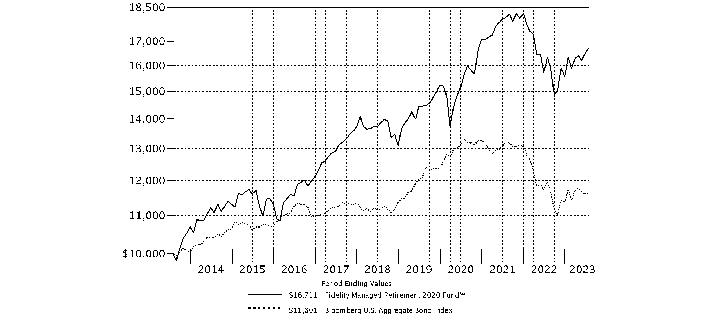

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2020 Fund℠, a class of the fund, on July 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

Fidelity Managed Retirement 2025 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -3.07% | 2.78% | 4.79% |

| Fidelity Managed Retirement 2025 Fund℠ | 3.09% | 4.26% | 5.68% |

| Class K | 3.20% | 4.35% | 5.72% |

| Class K6 | 3.30% | 4.43% | 5.76% |

| Class I | 3.10% | 4.26% | 5.68% |

| Class Z6 | 3.30% | 4.43% | 5.76% |

The initial offering of Class K, Class K6 and Class Z6 took place on August 1, 2019. Returns prior to August 1, 2019 are those of Fidelity Managed Retirement 2025 Fund, Fidelity Managed Retirement 2025 Fund and Class I, respectively, and have not been restated to reflect current expenses.

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2025 Fund℠, a class of the fund, on July 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

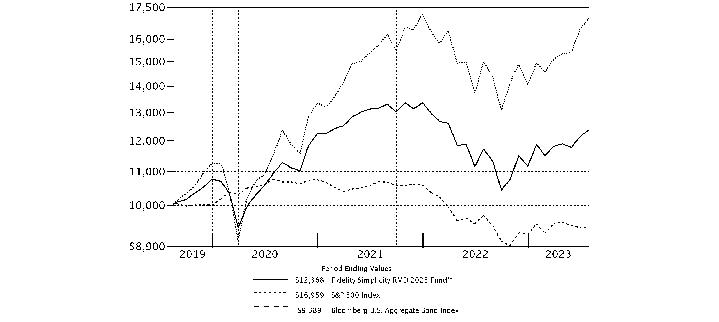

Fidelity Managed Retirement 2030 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended July 31, 2023 | Past 1 year | Life of Fund A |

Class A (incl. 5.75% sales charge) | -2.49% | 3.31% |

| Fidelity Managed Retirement 2030 Fund℠ | 3.71% | 5.12% |

| Class K | 3.82% | 5.23% |

| Class K6 | 3.93% | 5.33% |

| Class I | 3.71% | 5.11% |

| Class Z6 | 3.92% | 5.33% |

A From August 16, 2019

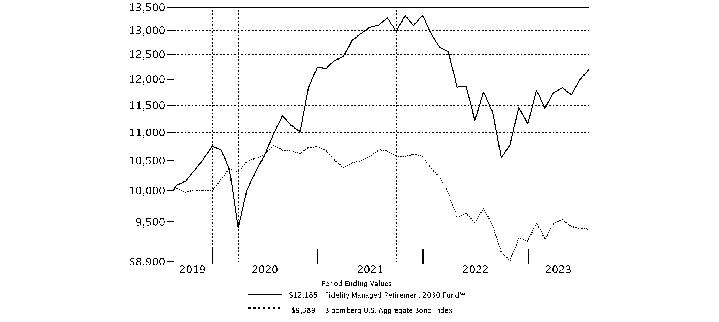

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2030 Fund℠, a class of the fund, on August 16, 2019, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

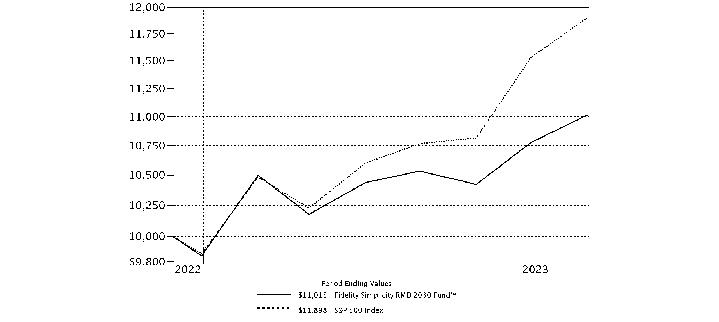

Fidelity Managed Retirement 2035 Fund℠

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average annual total returns for Fidelity Managed Retirement 2035 Fund℠ will be reported once the fund is a year old.

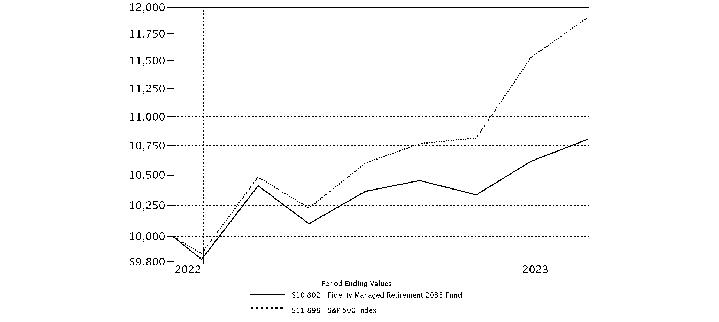

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Managed Retirement 2035 Fund℠, a class of the fund, on December 15, 2022, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period. |

|

|

Market Recap:

For the 12 months ending July 31, 2023, continued global economic expansion, falling commodity prices and a slowing in the pace of inflation provided a favorable backdrop for risk assets. The U.S. Federal Reserve and other central banks aggressively tightened monetary policy throughout the period to combat persistently high inflation, leading to a broad retreat from riskier assets and declining prices for stocks and bonds through September 2022. Since then, markets experienced a sharp reversal amid optimism on moderating inflation and policy easing, allowing risk assets to rally through the first seven months of 2023, with U.S. large-cap stocks leading the way.

International equities rose 13.62% for the 12 months, according to the MSCI ACWI (All Country World Index) ex USA Index. All regions gained, with Europe ex U.K. (+23%) leading the way. Japan (+16%) also outperformed, whereas Canada (+6%) lagged by the widest margin. By sector, industrials (+20%) was the top performer, followed by information technology and consumer discretionary (+18% each). Financials (+17%) also topped the broader index. Conversely, real estate (-5%) fared worst by a wide margin.

U.S. stocks gained 12.62% for the 12 months, as measured by the Dow Jones U.S. Total Stock Market Index, as all but two sectors rose. Information technology (+27%), communication services (+19%) and industrials (+18%) led. Conversely, real estate (-9%) and utilities (-6%) lagged most. Growth stocks outpaced value, while larger-caps topped small-caps. Commodities returned -7.88%, according to the Bloomberg Commodity Index Total Return.

U.S. taxable investment-grade bonds returned -3.37% for the 12 months, per the Bloomberg U.S. Aggregate Bond Index, amid elevated inflation and rising interest rates. Since March 2022, the Fed has hiked its benchmark interest rate 11 times, by 5.25 percentage points, while allowing up to billions in bonds to mature each month without investing the proceeds. Short-term U.S. Treasuries (+3.98%) topped U.S. investment-grade corporate bonds (-1.29%), while commercial mortgage-backed securities (-3.26%) and agencies (-1.30%) also lost ground. Outside the index, leveraged loans (+10.06%), U.S. high-yield bonds (+4.16%) and emerging-markets debt (+5.20%) rose, whereas Treasury Inflation-Protected Securities (-5.39%) declined.

Comments from Co-Portfolio Managers Andrew Dierdorf and Brett Sumsion:

For the fiscal year, returns for the share classes of Fidelity® Managed Retirement Funds (excluding sales charges, if applicable) ranged from about 0% to 4%, with performance trending higher among the Funds for those investors with a longer retirement horizon. Funds for investors with a greater number years to invest in retirement - those that invest in a greater percentage of equities, and less fixed-income and short-term debt exposure - fared a bit better than those with more exposure to fixed-income and short-term securities, and a lower allocation to equities. The Fidelity® Managed Retirement Funds had mixed results versus their Composite indexes the past 12 months. The performance of the underlying investment funds notably contributed to the Funds' performance versus Composite indexes, especially among U.S. equities. In this asset class, an investment in Fidelity® Series Blue Chip Growth Fund (+26.84%) stood out, given its outperformance of the benchmark, the Russell 1000® Growth Index (+17.31%). Among non-U.S. equities, Fidelity® Series Emerging Markets Opportunities Fund (+12.85%) outpaced the 8.39% advance of the MSCI Emerging Markets Index. Among U.S. investment-grade bonds, Fidelity® Series Investment Grade Bond Fund returned -1.86%, topping the -3.37% result of its benchmark, the Bloomberg U.S. Aggregate Bond Index. In contrast, active asset allocation decisions detracted from the Funds' performance versus Composites. Specifically, underweighting U.S. equities hurt the Funds' relative results. An overweight position in long-term U.S. Treasury bonds also weighed on relative performance.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

The information in the following tables is based on the direct Investments of the Fund.

Top Holdings (% of Fund's net assets) |

| |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 20.0 | |

| Fidelity Series Investment Grade Bond Fund | 12.4 | |

| Fidelity Series Government Bond Index Fund | 12.1 | |

| Fidelity Series Investment Grade Securitized Fund | 8.4 | |

| Fidelity Series Corporate Bond Fund | 8.3 | |

| Fidelity Series Treasury Bill Index Fund | 6.6 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| Fidelity Series Emerging Markets Opportunities Fund | 3.9 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.8 | |

| Fidelity Series Government Money Market Fund 5.33% | 2.3 | |

| | 81.7 | |

| |

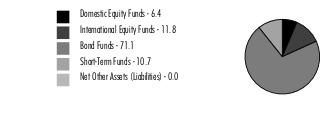

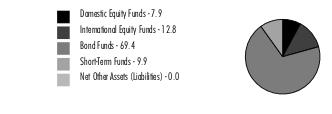

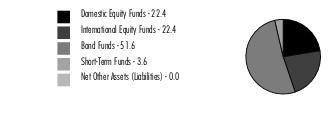

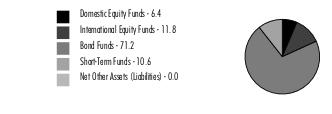

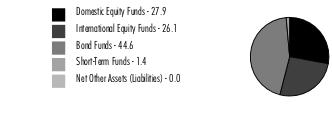

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

|

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments.

Fidelity Managed Retirement Income Fund℠

Showing Percentage of Net Assets

| Domestic Equity Funds - 6.4% |

| | | Shares | Value ($) |

| Fidelity Series Blue Chip Growth Fund (a) | | 14,098 | 207,095 |

| Fidelity Series Commodity Strategy Fund (a) | | 1,199 | 123,398 |

| Fidelity Series Large Cap Growth Index Fund (a) | | 7,264 | 130,833 |

| Fidelity Series Large Cap Stock Fund (a) | | 7,335 | 145,083 |

| Fidelity Series Large Cap Value Index Fund (a) | | 17,992 | 269,527 |

| Fidelity Series Small Cap Core Fund (a) | | 66 | 715 |

| Fidelity Series Small Cap Opportunities Fund (a) | | 4,927 | 66,365 |

| Fidelity Series Value Discovery Fund (a) | | 6,484 | 99,468 |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $880,346) | | | 1,042,484 |

| | | | |

| International Equity Funds - 11.8% |

| | | Shares | Value ($) |

| Fidelity Series Canada Fund (a) | | 7,523 | 110,291 |

| Fidelity Series Emerging Markets Fund (a) | | 18,280 | 159,950 |

| Fidelity Series Emerging Markets Opportunities Fund (a) | | 35,323 | 637,224 |

| Fidelity Series International Growth Fund (a) | | 16,743 | 278,109 |

| Fidelity Series International Index Fund (a) | | 8,921 | 105,177 |

| Fidelity Series International Small Cap Fund (a) | | 5,246 | 87,237 |

| Fidelity Series International Value Fund (a) | | 24,460 | 280,062 |

| Fidelity Series Overseas Fund (a) | | 21,905 | 278,417 |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $1,729,593) | | | 1,936,467 |

| | | | |

| Bond Funds - 71.1% |

| | | Shares | Value ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | | 344,981 | 3,270,413 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | | 12,673 | 99,867 |

| Fidelity Series Corporate Bond Fund (a) | | 150,486 | 1,364,912 |

| Fidelity Series Emerging Markets Debt Fund (a) | | 11,238 | 84,622 |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | | 2,969 | 28,678 |

| Fidelity Series Floating Rate High Income Fund (a) | | 1,867 | 16,783 |

| Fidelity Series Government Bond Index Fund (a) | | 217,610 | 1,984,604 |

| Fidelity Series High Income Fund (a) | | 10,775 | 89,000 |

| Fidelity Series International Credit Fund (a) | | 969 | 7,460 |

| Fidelity Series International Developed Markets Bond Index Fund (a) | | 75,459 | 642,907 |

| Fidelity Series Investment Grade Bond Fund (a) | | 204,223 | 2,027,936 |

| Fidelity Series Investment Grade Securitized Fund (a) | | 155,201 | 1,376,634 |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | | 106,778 | 626,786 |

| Fidelity Series Real Estate Income Fund (a) | | 2,409 | 23,369 |

| TOTAL BOND FUNDS (Cost $12,989,271) | | | 11,643,971 |

| | | | |

| Short-Term Funds - 10.7% |

| | | Shares | Value ($) |

| Fidelity Series Government Money Market Fund 5.33% (a)(b) | | 373,590 | 373,590 |

| Fidelity Series Short-Term Credit Fund (a) | | 30,982 | 298,973 |

| Fidelity Series Treasury Bill Index Fund (a) | | 107,893 | 1,072,458 |

| TOTAL SHORT-TERM FUNDS (Cost $1,759,138) | | | 1,745,021 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $17,358,348) | 16,367,943 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (440) |

| NET ASSETS - 100.0% | 16,367,503 |

| | |

Legend

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur. If an Underlying Funds changes its name, the name presented below is the name in effect at period end.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 3,604,910 | 680,283 | 796,815 | 168,939 | (21,339) | (192,912) | 3,270,413 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 18,229 | 104,446 | 18,968 | 6,570 | (1,069) | (2,771) | 99,867 |

| Fidelity Series Blue Chip Growth Fund | 261,605 | 82,247 | 175,319 | 8,660 | (41,112) | 79,674 | 207,095 |

| Fidelity Series Canada Fund | 149,361 | 24,495 | 67,466 | 4,006 | (20) | 3,921 | 110,291 |

| Fidelity Series Commodity Strategy Fund | 272,004 | 188,208 | 170,560 | 146,920 | (75,909) | (90,345) | 123,398 |

| Fidelity Series Corporate Bond Fund | 1,389,346 | 305,925 | 262,254 | 52,627 | (17,637) | (50,468) | 1,364,912 |

| Fidelity Series Emerging Markets Debt Fund | 94,209 | 14,373 | 25,252 | 5,315 | (6,516) | 7,808 | 84,622 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 31,314 | 2,796 | 9,563 | - | (989) | 5,120 | 28,678 |

| Fidelity Series Emerging Markets Fund | 114,448 | 71,427 | 37,401 | 2,541 | (7,221) | 18,697 | 159,950 |

| Fidelity Series Emerging Markets Opportunities Fund | 1,035,222 | 95,728 | 560,559 | 21,274 | (116,166) | 182,999 | 637,224 |

| Fidelity Series Floating Rate High Income Fund | 17,773 | 5,836 | 7,077 | 1,398 | (287) | 538 | 16,783 |

| Fidelity Series Government Bond Index Fund | 2,040,519 | 465,345 | 391,276 | 46,814 | (19,995) | (109,989) | 1,984,604 |

| Fidelity Series Government Money Market Fund 5.33% | 334,931 | 173,852 | 135,193 | 15,576 | - | - | 373,590 |

| Fidelity Series High Income Fund | 97,582 | 15,482 | 21,346 | 5,911 | (1,435) | (1,283) | 89,000 |

| Fidelity Series International Credit Fund | 7,830 | 435 | - | 435 | - | (805) | 7,460 |

| Fidelity Series International Developed Markets Bond Index Fund | 721,484 | 103,376 | 133,397 | 14,966 | (9,170) | (39,386) | 642,907 |

| Fidelity Series International Growth Fund | 310,909 | 61,062 | 116,955 | 9,596 | (17,948) | 41,041 | 278,109 |

| Fidelity Series International Index Fund | 130,186 | 21,979 | 61,500 | 3,078 | (3,490) | 18,002 | 105,177 |

| Fidelity Series International Small Cap Fund | 95,915 | 17,057 | 27,139 | 5,284 | (5,811) | 7,215 | 87,237 |

| Fidelity Series International Value Fund | 308,251 | 61,463 | 133,913 | 9,396 | (4,252) | 48,513 | 280,062 |

| Fidelity Series Investment Grade Bond Fund | 2,109,226 | 442,793 | 404,922 | 77,454 | (21,368) | (97,793) | 2,027,936 |

| Fidelity Series Investment Grade Securitized Fund | 1,491,968 | 282,212 | 286,589 | 47,190 | (19,537) | (91,420) | 1,376,634 |

| Fidelity Series Large Cap Growth Index Fund | 165,518 | 41,171 | 93,351 | 1,256 | 6,536 | 10,959 | 130,833 |

| Fidelity Series Large Cap Stock Fund | 181,313 | 47,982 | 97,933 | 10,843 | 3,842 | 9,879 | 145,083 |

| Fidelity Series Large Cap Value Index Fund | 346,194 | 103,648 | 188,926 | 10,231 | 7,025 | 1,586 | 269,527 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 795,851 | 219,027 | 283,475 | 20,973 | (61,555) | (43,062) | 626,786 |

| Fidelity Series Overseas Fund | 312,736 | 54,129 | 121,071 | 5,054 | (9,806) | 42,429 | 278,417 |

| Fidelity Series Real Estate Income Fund | 56,336 | 19,363 | 46,529 | 4,334 | (4,880) | (921) | 23,369 |

| Fidelity Series Short-Term Credit Fund | 334,147 | 33,484 | 67,300 | 7,447 | (1,516) | 158 | 298,973 |

| Fidelity Series Small Cap Core Fund | - | 1,691 | 1,044 | - | (13) | 81 | 715 |

| Fidelity Series Small Cap Opportunities Fund | 86,328 | 18,180 | 41,395 | 4,111 | (3,164) | 6,416 | 66,365 |

| Fidelity Series Treasury Bill Index Fund | 1,005,003 | 422,914 | 352,191 | 45,281 | (646) | (2,622) | 1,072,458 |

| Fidelity Series Value Discovery Fund | 127,676 | 36,887 | 65,468 | 5,457 | 1,732 | (1,359) | 99,468 |

| | 18,048,324 | 4,219,296 | 5,202,147 | 768,937 | (453,716) | (240,100) | 16,367,943 |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Domestic Equity Funds | 1,042,484 | 1,042,484 | - | - |

|

| International Equity Funds | 1,936,467 | 1,936,467 | - | - |

|

| Bond Funds | 11,643,971 | 11,643,971 | - | - |

|

| Short-Term Funds | 1,745,021 | 1,745,021 | - | - |

| Total Investments in Securities: | 16,367,943 | 16,367,943 | - | - |

Fidelity Managed Retirement Income Fund℠

| Statement of Assets and Liabilities |

| | | | July 31, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Affiliated issuers (cost $17,358,348) | $ | 16,367,943 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $17,358,348) | | | $ | 16,367,943 |

| Cash | | | | 14 |

| Receivable for investments sold | | | | 119,157 |

| Receivable for fund shares sold | | | | 311 |

Total assets | | | | 16,487,425 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 100,378 | | |

| Payable for fund shares redeemed | | 13,369 | | |

| Accrued management fee | | 6,023 | | |

| Distribution and service plan fees payable | | 152 | | |

| Total Liabilities | | | | 119,922 |

| Net Assets | | | $ | 16,367,503 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 18,058,584 |

| Total accumulated earnings (loss) | | | | (1,691,081) |

| Net Assets | | | $ | 16,367,503 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($807,104 ÷ 14,931.09 shares)(a) | | | $ | 54.06 |

| Maximum offering price per share (100/94.25 of $54.06) | | | $ | 57.36 |

| Fidelity Managed Retirement Income : | | | | |

Net Asset Value, offering price and redemption price per share ($14,669,555 ÷ 271,437 shares) | | | $ | 54.04 |

| Class K : | | | | |

Net Asset Value, offering price and redemption price per share ($130,713 ÷ 2,418.29 shares) | | | $ | 54.05 |

| Class K6 : | | | | |

Net Asset Value, offering price and redemption price per share ($493,702 ÷ 9,132.61 shares) | | | $ | 54.06 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($159,016 ÷ 2,938.95 shares) | | | $ | 54.11 |

| Class Z6 : | | | | |

Net Asset Value, offering price and redemption price per share ($107,413 ÷ 1,988.08 shares) | | | $ | 54.03 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Year ended July 31, 2023 |

| Investment Income | | | | |

| Dividends: | | | | |

| Affiliated issuers | | | $ | 731,503 |

| Expenses | | | | |

| Management fee | $ | 75,062 | | |

| Distribution and service plan fees | | 1,680 | | |

| Independent trustees' fees and expenses | | 62 | | |

| Total expenses before reductions | | 76,804 | | |

| Expense reductions | | (36) | | |

| Total expenses after reductions | | | | 76,768 |

| Net Investment income (loss) | | | | 654,735 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Affiliated issuers | | (453,716) | | |

| Capital gain distributions from underlying funds: | | | | |

| Affiliated issuers | | 37,434 | | |

| Total net realized gain (loss) | | | | (416,282) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Affiliated issuers | | (240,100) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (240,100) |

| Net gain (loss) | | | | (656,382) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (1,647) |

| Statement of Changes in Net Assets |

| |

| | Year ended July 31, 2023 | | Year ended July 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 654,735 | $ | 512,071 |

| Net realized gain (loss) | | (416,282) | | 154,259 |

| Change in net unrealized appreciation (depreciation) | | (240,100) | | (2,331,406) |

| Net increase (decrease) in net assets resulting from operations | | (1,647) | | (1,665,076) |

| Distributions to shareholders | | (850,429) | | (799,835) |

| | | | | |

| Share transactions - net increase (decrease) | | (828,342) | | (1,238,197) |

| Total increase (decrease) in net assets | | (1,680,418) | | (3,703,108) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 18,047,921 | | 21,751,029 |

| End of period | $ | 16,367,503 | $ | 18,047,921 |

| | | | | |

| | | | | |

| Fidelity Advisor Managed Retirement Income Fund℠ Class A |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.44 | $ | 57.74 | $ | 57.55 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 1.924 | | 1.317 | | .309 | | .684 | | 1.029 |

| Net realized and unrealized gain (loss) | | (1.950) | | (6.180) | | 4.009 | | 3.226 | | 1.594 |

| Total from investment operations | | (.026) | | (4.863) | | 4.318 | | 3.910 | | 2.623 |

| Distributions from net investment income | | (1.849) | | (1.252) | | (.329) | | (.776) | | (1.047) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) | | (1.386) |

| Total distributions | | (2.484) | | (2.087) | | (1.238) | | (1.210) | | (2.433) |

| Net asset value, end of period | $ | 54.06 | $ | 56.57 | $ | 63.52 | $ | 60.44 | $ | 57.74 |

Total Return C,D | | .14% | | (7.90)% | | 7.21% | | 6.86% | | 4.78% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | .70% | | .70% | | .70% | | .70% | | .71% |

| Expenses net of fee waivers, if any | | .70% | | .70% | | .70% | | .70% | | .71% |

| Expenses net of all reductions | | .69% | | .70% | | .70% | | .70% | | .71% |

| Net investment income (loss) | | 3.60% | | 2.20% | | .50% | | 1.18% | | 1.83% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 807 | $ | 717 | $ | 716 | $ | 453 | $ | 177 |

Portfolio turnover rate G | | 25% | | 64% | | 31% | | 62% H | | 68% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the sales charges.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HThe portfolio turnover rate does not include the assets acquired in the merger.

| Fidelity Managed Retirement Income Fund℠ |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.42 | $ | 57.73 | $ | 57.54 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 2.055 | | 1.473 | | .464 | | .829 | | 1.170 |

| Net realized and unrealized gain (loss) | | (1.958) | | (6.189) | | 4.011 | | 3.220 | | 1.589 |

| Total from investment operations | | .097 | | (4.716) | | 4.475 | | 4.049 | | 2.759 |

| Distributions from net investment income | | (1.992) | | (1.399) | | (.466) | | (.925) | | (1.183) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) | | (1.386) |

| Total distributions | | (2.627) | | (2.234) | | (1.375) | | (1.359) | | (2.569) |

| Net asset value, end of period | $ | 54.04 | $ | 56.57 | $ | 63.52 | $ | 60.42 | $ | 57.73 |

Total Return C | | .37% | | (7.68)% | | 7.48% | | 7.12% | | 5.04% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .45% | | .45% | | .45% | | .45% | | .46% |

| Expenses net of fee waivers, if any | | .45% | | .45% | | .45% | | .45% | | .46% |

| Expenses net of all reductions | | .45% | | .45% | | .45% | | .45% | | .46% |

| Net investment income (loss) | | 3.84% | | 2.45% | | .75% | | 1.43% | | 2.08% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 14,670 | $ | 16,230 | $ | 19,995 | $ | 13,965 | $ | 6,060 |

Portfolio turnover rate F | | 25% | | 64% | | 31% | | 62% G | | 68% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

GThe portfolio turnover rate does not include the assets acquired in the merger.

| Fidelity Managed Retirement Income Fund℠ Class K |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 56.59 | $ | 63.54 | $ | 60.43 | $ | 57.81 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | 2.105 | | 1.529 | | .526 | | .889 |

| Net realized and unrealized gain (loss) | | (1.955) | | (6.186) | | 4.010 | | 3.146 |

| Total from investment operations | | .150 | | (4.657) | | 4.536 | | 4.035 |

| Distributions from net investment income | | (2.055) | | (1.458) | | (.517) | | (.981) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) |

| Total distributions | | (2.690) | | (2.293) | | (1.426) | | (1.415) |

| Net asset value, end of period | $ | 54.05 | $ | 56.59 | $ | 63.54 | $ | 60.43 |

Total Return D | | .47% | | (7.58)% | | 7.59% | | 7.09% |

Ratios to Average Net Assets C,E,F | | | | | | | | |

| Expenses before reductions | | .35% | | .35% | | .35% | | .35% |

| Expenses net of fee waivers, if any | | .35% | | .35% | | .35% | | .35% |

| Expenses net of all reductions | | .35% | | .35% | | .35% | | .35% |

| Net investment income (loss) | | 3.94% | | 2.55% | | .85% | | 1.53% |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 131 | $ | 106 | $ | 115 | $ | 107 |

Portfolio turnover rate G | | 25% | | 64% | | 31% | | 62% H |

AFor the period August 1, 2019 (commencement of sale of shares) through July 31, 2020.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HThe portfolio turnover rate does not include the assets acquired in the merger.

| Fidelity Managed Retirement Income Fund℠ Class K6 |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 56.60 | $ | 63.55 | $ | 60.42 | $ | 57.81 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | 2.164 | | 1.583 | | .588 | | .941 |

| Net realized and unrealized gain (loss) | | (1.959) | | (6.174) | | 4.005 | | 3.151 |

| Total from investment operations | | .205 | | (4.591) | | 4.593 | | 4.092 |

| Distributions from net investment income | | (2.110) | | (1.524) | | (.554) | | (1.048) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) |

| Total distributions | | (2.745) | | (2.359) | | (1.463) | | (1.482) |

| Net asset value, end of period | $ | 54.06 | $ | 56.60 | $ | 63.55 | $ | 60.42 |

Total Return D | | .57% | | (7.48)% | | 7.69% | | 7.20% |

Ratios to Average Net Assets C,E,F | | | | | | | | |

| Expenses before reductions | | .25% | | .25% | | .25% | | .25% |

| Expenses net of fee waivers, if any | | .25% | | .25% | | .25% | | .25% |

| Expenses net of all reductions | | .25% | | .25% | | .25% | | .25% |

| Net investment income (loss) | | 4.05% | | 2.65% | | .95% | | 1.62% |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 494 | $ | 711 | $ | 539 | $ | 434 |

Portfolio turnover rate G | | 25% | | 64% | | 31% | | 62% H |

AFor the period August 1, 2019 (commencement of sale of shares) through July 31, 2020.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HThe portfolio turnover rate does not include the assets acquired in the merger.

| Fidelity Advisor Managed Retirement Income Fund℠ Class I |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 56.64 | $ | 63.58 | $ | 60.48 | $ | 57.71 | $ | 57.52 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 2.059 | | 1.480 | | .464 | | .828 | | 1.167 |

| Net realized and unrealized gain (loss) | | (1.961) | | (6.193) | | 4.011 | | 3.233 | | 1.593 |

| Total from investment operations | | .098 | | (4.713) | | 4.475 | | 4.061 | | 2.760 |

| Distributions from net investment income | | (1.993) | | (1.392) | | (.466) | | (.857) | | (1.184) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) | | (1.386) |

| Total distributions | | (2.628) | | (2.227) | | (1.375) | | (1.291) | | (2.570) |

| Net asset value, end of period | $ | 54.11 | $ | 56.64 | $ | 63.58 | $ | 60.48 | $ | 57.71 |

Total Return C | | .37% | | (7.66)% | | 7.48% | | 7.14% | | 5.04% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .45% | | .45% | | .45% | | .45% | | .46% |

| Expenses net of fee waivers, if any | | .45% | | .45% | | .45% | | .45% | | .46% |

| Expenses net of all reductions | | .45% | | .45% | | .45% | | .45% | | .46% |

| Net investment income (loss) | | 3.85% | | 2.45% | | .75% | | 1.43% | | 2.08% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 159 | $ | 176 | $ | 270 | $ | 300 | $ | 96 |

Portfolio turnover rate F | | 25% | | 64% | | 31% | | 62% G | | 68% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

GThe portfolio turnover rate does not include the assets acquired in the merger.

| Fidelity Advisor Managed Retirement Income Fund℠ Class Z6 |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.41 | $ | 57.79 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | 2.161 | | 1.587 | | .588 | | .947 |

| Net realized and unrealized gain (loss) | | (1.956) | | (6.181) | | 4.008 | | 3.145 |

| Total from investment operations | | .205 | | (4.594) | | 4.596 | | 4.092 |

| Distributions from net investment income | | (2.110) | | (1.521) | | (.577) | | (1.038) |

| Distributions from net realized gain | | (.635) | | (.835) | | (.909) | | (.434) |

| Total distributions | | (2.745) | | (2.356) | | (1.486) | | (1.472) |

| Net asset value, end of period | $ | 54.03 | $ | 56.57 | $ | 63.52 | $ | 60.41 |

Total Return D | | .57% | | (7.49)% | | 7.69% | | 7.20% |

Ratios to Average Net Assets C,E,F | | | | | | | | |

| Expenses before reductions | | .25% | | .25% | | .25% | | .25% |

| Expenses net of fee waivers, if any | | .25% | | .25% | | .25% | | .25% |

| Expenses net of all reductions | | .25% | | .25% | | .25% | | .25% |

| Net investment income (loss) | | 4.04% | | 2.65% | | .95% | | 1.62% |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 107 | $ | 107 | $ | 115 | $ | 107 |

Portfolio turnover rate G | | 25% | | 64% | | 31% | | 62% H |

AFor the period August 1, 2019 (commencement of sale of shares) through July 31, 2020.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HThe portfolio turnover rate does not include the assets acquired in the merger.

The information in the following tables is based on the direct Investments of the Fund.

Top Holdings (% of Fund's net assets) |

| |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 18.4 | |

| Fidelity Series Investment Grade Bond Fund | 12.1 | |

| Fidelity Series Government Bond Index Fund | 11.8 | |

| Fidelity Series Investment Grade Securitized Fund | 8.2 | |

| Fidelity Series Corporate Bond Fund | 8.1 | |

| Fidelity Series Treasury Bill Index Fund | 6.1 | |

| Fidelity Series Emerging Markets Opportunities Fund | 4.2 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.9 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| Fidelity Series Government Money Market Fund 5.33% | 2.2 | |

| | 78.9 | |

| |

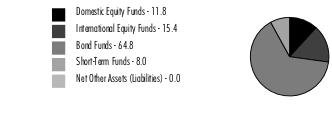

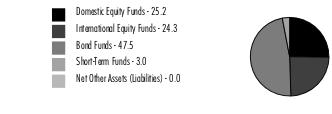

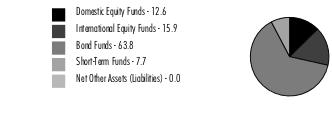

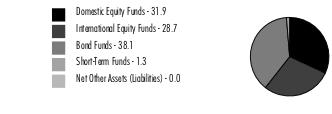

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

|

Domestic Equity Funds category includes Fidelity Series Commodity Strategy Fund which invests in commodity-related investments.

Fidelity Managed Retirement 2010 Fund℠

Showing Percentage of Net Assets

| Domestic Equity Funds - 7.9% |

| | | Shares | Value ($) |

| Fidelity Series Blue Chip Growth Fund (a) | | 6,722 | 98,750 |

| Fidelity Series Commodity Strategy Fund (a) | | 451 | 46,405 |

| Fidelity Series Large Cap Growth Index Fund (a) | | 3,464 | 62,378 |

| Fidelity Series Large Cap Stock Fund (a) | | 3,497 | 69,175 |

| Fidelity Series Large Cap Value Index Fund (a) | | 8,580 | 128,523 |

| Fidelity Series Small Cap Core Fund (a) | | 33 | 352 |

| Fidelity Series Small Cap Opportunities Fund (a) | | 2,349 | 31,634 |

| Fidelity Series Value Discovery Fund (a) | | 3,091 | 47,420 |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $387,828) | | | 484,637 |

| | | | |

| International Equity Funds - 12.8% |

| | | Shares | Value ($) |

| Fidelity Series Canada Fund (a) | | 3,116 | 45,687 |

| Fidelity Series Emerging Markets Fund (a) | | 6,580 | 57,577 |

| Fidelity Series Emerging Markets Opportunities Fund (a) | | 14,378 | 259,375 |

| Fidelity Series International Growth Fund (a) | | 6,947 | 115,383 |

| Fidelity Series International Index Fund (a) | | 3,695 | 43,565 |

| Fidelity Series International Small Cap Fund (a) | | 2,184 | 36,319 |

| Fidelity Series International Value Fund (a) | | 10,139 | 116,088 |

| Fidelity Series Overseas Fund (a) | | 9,088 | 115,511 |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $686,522) | | | 789,505 |

| | | | |

| Bond Funds - 69.4% |

| | | Shares | Value ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | | 119,639 | 1,134,177 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | | 10,430 | 82,192 |

| Fidelity Series Corporate Bond Fund (a) | | 55,247 | 501,092 |

| Fidelity Series Emerging Markets Debt Fund (a) | | 4,227 | 31,828 |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | | 1,116 | 10,782 |

| Fidelity Series Floating Rate High Income Fund (a) | | 701 | 6,301 |

| Fidelity Series Government Bond Index Fund (a) | | 79,888 | 728,582 |

| Fidelity Series High Income Fund (a) | | 4,052 | 33,470 |

| Fidelity Series International Credit Fund (a) | | 667 | 5,135 |

| Fidelity Series International Developed Markets Bond Index Fund (a) | | 28,111 | 239,506 |

| Fidelity Series Investment Grade Bond Fund (a) | | 74,975 | 744,500 |

| Fidelity Series Investment Grade Securitized Fund (a) | | 56,978 | 505,391 |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | | 40,901 | 240,090 |

| Fidelity Series Real Estate Income Fund (a) | | 902 | 8,745 |

| TOTAL BOND FUNDS (Cost $4,718,240) | | | 4,271,791 |

| | | | |

| Short-Term Funds - 9.9% |

| | | Shares | Value ($) |

| Fidelity Series Government Money Market Fund 5.33% (a)(b) | | 133,727 | 133,727 |

| Fidelity Series Short-Term Credit Fund (a) | | 10,229 | 98,710 |

| Fidelity Series Treasury Bill Index Fund (a) | | 38,061 | 378,331 |

| TOTAL SHORT-TERM FUNDS (Cost $615,262) | | | 610,768 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $6,407,852) | 6,156,701 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (125) |

| NET ASSETS - 100.0% | 6,156,576 |

| | |

Legend

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur. If an Underlying Funds changes its name, the name presented below is the name in effect at period end.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 1,177,959 | 218,453 | 192,950 | 55,584 | (6,850) | (61,215) | 1,134,177 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 81,140 | 40,810 | 28,415 | 6,293 | (4,084) | (7,259) | 82,192 |

| Fidelity Series Blue Chip Growth Fund | 131,529 | 30,503 | 83,395 | 4,212 | (15,526) | 35,639 | 98,750 |

| Fidelity Series Canada Fund | 63,755 | 6,761 | 26,566 | 1,672 | 2,338 | (601) | 45,687 |

| Fidelity Series Commodity Strategy Fund | 100,692 | 64,519 | 59,130 | 52,719 | (28,237) | (31,439) | 46,405 |

| Fidelity Series Corporate Bond Fund | 495,223 | 95,264 | 66,004 | 19,069 | (299) | (23,092) | 501,092 |

| Fidelity Series Emerging Markets Debt Fund | 34,850 | 4,092 | 7,635 | 1,984 | (1,860) | 2,381 | 31,828 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 11,534 | 558 | 2,875 | - | (376) | 1,941 | 10,782 |

| Fidelity Series Emerging Markets Fund | 45,177 | 20,541 | 12,262 | 990 | (1,884) | 6,005 | 57,577 |

| Fidelity Series Emerging Markets Opportunities Fund | 409,947 | 25,955 | 204,430 | 8,289 | (26,973) | 54,876 | 259,375 |

| Fidelity Series Floating Rate High Income Fund | 6,700 | 840 | 1,342 | 529 | (48) | 151 | 6,301 |

| Fidelity Series Government Bond Index Fund | 727,371 | 152,573 | 105,851 | 17,019 | (2,006) | (43,505) | 728,582 |

| Fidelity Series Government Money Market Fund 5.33% | 109,031 | 68,050 | 43,354 | 5,397 | - | - | 133,727 |

| Fidelity Series High Income Fund | 36,176 | 4,507 | 6,261 | 2,205 | (493) | (459) | 33,470 |

| Fidelity Series International Credit Fund | 5,389 | 300 | - | 300 | - | (554) | 5,135 |

| Fidelity Series International Developed Markets Bond Index Fund | 267,488 | 25,213 | 35,604 | 5,674 | (3,852) | (13,739) | 239,506 |

| Fidelity Series International Growth Fund | 132,711 | 17,481 | 44,749 | 4,006 | (3,574) | 13,514 | 115,383 |

| Fidelity Series International Index Fund | 55,569 | 5,812 | 23,977 | 1,285 | 791 | 5,370 | 43,565 |

| Fidelity Series International Small Cap Fund | 40,933 | 4,789 | 10,078 | 2,206 | (545) | 1,220 | 36,319 |

| Fidelity Series International Value Fund | 131,571 | 17,802 | 51,949 | 3,923 | 181 | 18,483 | 116,088 |

| Fidelity Series Investment Grade Bond Fund | 751,853 | 139,115 | 105,069 | 28,008 | (1,248) | (40,151) | 744,500 |

| Fidelity Series Investment Grade Securitized Fund | 531,821 | 87,852 | 75,463 | 17,142 | (1,232) | (37,587) | 505,391 |

| Fidelity Series Large Cap Growth Index Fund | 83,223 | 14,284 | 44,301 | 627 | 4,529 | 4,643 | 62,378 |

| Fidelity Series Large Cap Stock Fund | 91,164 | 17,084 | 46,013 | 5,447 | 3,323 | 3,617 | 69,175 |

| Fidelity Series Large Cap Value Index Fund | 174,072 | 34,866 | 84,870 | 5,156 | 6,723 | (2,268) | 128,523 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 301,592 | 70,944 | 93,801 | 7,985 | (19,139) | (19,506) | 240,090 |

| Fidelity Series Overseas Fund | 133,492 | 14,006 | 45,900 | 2,110 | (794) | 14,707 | 115,511 |

| Fidelity Series Real Estate Income Fund | 18,845 | 3,814 | 11,995 | 1,531 | (1,507) | (412) | 8,745 |

| Fidelity Series Short-Term Credit Fund | 108,776 | 6,506 | 16,214 | 2,468 | (351) | (7) | 98,710 |

| Fidelity Series Small Cap Core Fund | - | 872 | 553 | - | (7) | 40 | 352 |

| Fidelity Series Small Cap Opportunities Fund | 43,997 | 6,269 | 20,407 | 1,990 | 114 | 1,661 | 31,634 |

| Fidelity Series Treasury Bill Index Fund | 327,268 | 156,981 | 104,845 | 15,562 | (207) | (866) | 378,331 |

| Fidelity Series Value Discovery Fund | 64,198 | 11,969 | 28,941 | 2,742 | 1,696 | (1,502) | 47,420 |

| | 6,695,046 | 1,369,385 | 1,685,199 | 284,124 | (101,397) | (119,914) | 6,156,701 |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Domestic Equity Funds | 484,637 | 484,637 | - | - |

|

| International Equity Funds | 789,505 | 789,505 | - | - |

|

| Bond Funds | 4,271,791 | 4,271,791 | - | - |

|

| Short-Term Funds | 610,768 | 610,768 | - | - |

| Total Investments in Securities: | 6,156,701 | 6,156,701 | - | - |

Fidelity Managed Retirement 2010 Fund℠

| Statement of Assets and Liabilities |

| | | | July 31, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Affiliated issuers (cost $6,407,852) | $ | 6,156,701 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $6,407,852) | | | $ | 6,156,701 |

| Cash | | | | 56 |

| Receivable for investments sold | | | | 61,054 |

| Receivable for fund shares sold | | | | 216 |

Total assets | | | | 6,218,027 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 46,888 | | |

| Payable for fund shares redeemed | | 12,184 | | |

| Accrued management fee | | 2,322 | | |

| Distribution and service plan fees payable | | 57 | | |

| Total Liabilities | | | | 61,451 |

| Net Assets | | | $ | 6,156,576 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 6,534,673 |

| Total accumulated earnings (loss) | | | | (378,097) |

| Net Assets | | | $ | 6,156,576 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($240,840 ÷ 4,667.79 shares)(a) | | | $ | 51.60 |

| Maximum offering price per share (100/94.25 of $51.60) | | | $ | 54.75 |

| Fidelity Managed Retirement 2010 : | | | | |

Net Asset Value, offering price and redemption price per share ($5,238,900 ÷ 101,451 shares) | | | $ | 51.64 |

| Class K : | | | | |

Net Asset Value, offering price and redemption price per share ($128,559 ÷ 2,490.65 shares) | | | $ | 51.62 |

| Class K6 : | | | | |

Net Asset Value, offering price and redemption price per share ($289,695 ÷ 5,612.44 shares) | | | $ | 51.62 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($93,067 ÷ 1,802.63 shares) | | | $ | 51.63 |

| Class Z6 : | | | | |

Net Asset Value, offering price and redemption price per share ($165,515 ÷ 3,206.96 shares) | | | $ | 51.61 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Year ended July 31, 2023 |

| Investment Income | | | | |

| Dividends: | | | | |

| Affiliated issuers | | | $ | 266,618 |

| Expenses | | | | |

| Management fee | $ | 28,214 | | |

| Distribution and service plan fees | | 728 | | |

| Independent trustees' fees and expenses | | 23 | | |

| Total expenses before reductions | | 28,965 | | |

| Expense reductions | | (2) | | |

| Total expenses after reductions | | | | 28,963 |

| Net Investment income (loss) | | | | 237,655 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Affiliated issuers | | (101,397) | | |

| Capital gain distributions from underlying funds: | | | | |

| Affiliated issuers | | 17,506 | | |

| Total net realized gain (loss) | | | | (83,891) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Affiliated issuers | | (119,914) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (119,914) |

| Net gain (loss) | | | | (203,805) |

| Net increase (decrease) in net assets resulting from operations | | | $ | 33,850 |

| Statement of Changes in Net Assets |

| |

| | Year ended July 31, 2023 | | Year ended July 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 237,655 | $ | 175,948 |

| Net realized gain (loss) | | (83,891) | | 200,489 |

| Change in net unrealized appreciation (depreciation) | | (119,914) | | (952,936) |

| Net increase (decrease) in net assets resulting from operations | | 33,850 | | (576,499) |

| Distributions to shareholders | | (339,967) | | (449,109) |

| | | | | |

| Share transactions - net increase (decrease) | | (232,213) | | 11,415 |

| Total increase (decrease) in net assets | | (538,330) | | (1,014,193) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 6,694,906 | | 7,709,099 |

| End of period | $ | 6,156,576 | $ | 6,694,906 |

| | | | | |

| | | | | |

| Fidelity Advisor Managed Retirement 2010 Fund℠ Class A |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 54.07 | $ | 62.41 | $ | 58.79 | $ | 56.34 | $ | 56.78 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 1.772 | | 1.275 | | .342 | | .777 | | .979 |

| Net realized and unrealized gain (loss) | | (1.646) | | (6.182) | | 5.126 | | 3.204 | | 1.401 |

| Total from investment operations | | .126 | | (4.907) | | 5.468 | | 3.981 | | 2.380 |

| Distributions from net investment income | | (1.726) | | (1.207) | | (.379) | | (.812) | | (1.001) |

| Distributions from net realized gain | | (.870) | | (2.226) | | (1.469) | | (.719) | | (1.819) |

| Total distributions | | (2.596) | | (3.433) | | (1.848) | | (1.531) | | (2.820) |

| Net asset value, end of period | $ | 51.60 | $ | 54.07 | $ | 62.41 | $ | 58.79 | $ | 56.34 |

Total Return C,D | | .45% | | (8.32)% | | 9.46% | | 7.19% | | 4.47% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | .71% | | .71% | | .71% | | .71% | | .75% |

| Expenses net of fee waivers, if any | | .71% | | .71% | | .71% | | .71% | | .75% |

| Expenses net of all reductions | | .71% | | .71% | | .71% | | .71% | | .75% |

| Net investment income (loss) | | 3.48% | | 2.21% | | .56% | | 1.37% | | 1.78% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 241 | $ | 325 | $ | 394 | $ | 188 | $ | 202 |

Portfolio turnover rate G | | 22% | | 54% | | 41% | | 45% | | 62% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the sales charges.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Managed Retirement 2010 Fund℠ |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 54.12 | $ | 62.47 | $ | 58.82 | $ | 56.37 | $ | 56.80 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | 1.899 | | 1.421 | | .493 | | .920 | | 1.113 |

| Net realized and unrealized gain (loss) | | (1.652) | | (6.181) | | 5.129 | | 3.204 | | 1.402 |

| Total from investment operations | | .247 | | (4.760) | | 5.622 | | 4.124 | | 2.515 |

| Distributions from net investment income | | (1.857) | | (1.364) | | (.503) | | (.955) | | (1.126) |

| Distributions from net realized gain | | (.870) | | (2.226) | | (1.469) | | (.719) | | (1.819) |

| Total distributions | | (2.727) | | (3.590) | | (1.972) | | (1.674) | | (2.945) |

| Net asset value, end of period | $ | 51.64 | $ | 54.12 | $ | 62.47 | $ | 58.82 | $ | 56.37 |

Total Return C | | .69% | | (8.08)% | | 9.73% | | 7.46% | | 4.73% |

Ratios to Average Net Assets B,D,E | | | | | | | | | | |

| Expenses before reductions | | .46% | | .46% | | .46% | | .46% | | .50% |

| Expenses net of fee waivers, if any | | .46% | | .46% | | .46% | | .46% | | .50% |

| Expenses net of all reductions | | .46% | | .46% | | .46% | | .46% | | .50% |

| Net investment income (loss) | | 3.73% | | 2.46% | | .81% | | 1.62% | | 2.02% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 5,239 | $ | 5,655 | $ | 6,728 | $ | 7,144 | $ | 9,091 |

Portfolio turnover rate F | | 22% | | 54% | | 41% | | 45% | | 62% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

EExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

FAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Managed Retirement 2010 Fund℠ Class K |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 54.10 | $ | 62.45 | $ | 58.81 | $ | 56.39 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | 1.947 | | 1.474 | | .554 | | .976 |

| Net realized and unrealized gain (loss) | | (1.646) | | (6.173) | | 5.122 | | 3.182 |

| Total from investment operations | | .301 | | (4.699) | | 5.676 | | 4.158 |

| Distributions from net investment income | | (1.911) | | (1.425) | | (.567) | | (1.019) |

| Distributions from net realized gain | | (.870) | | (2.226) | | (1.469) | | (.719) |

| Total distributions | | (2.781) | | (3.651) | | (2.036) | | (1.738) |

| Net asset value, end of period | $ | 51.62 | $ | 54.10 | $ | 62.45 | $ | 58.81 |

Total Return D,E | | .80% | | (7.99)% | | 9.83% | | 7.52% |

Ratios to Average Net Assets C,F,G | | | | | | | | |

| Expenses before reductions | | .36% | | .36% | | .36% | | .36% |

| Expenses net of fee waivers, if any | | .36% | | .36% | | .36% | | .36% |

| Expenses net of all reductions | | .36% | | .36% | | .36% | | .36% |

| Net investment income (loss) | | 3.83% | | 2.56% | | .91% | | 1.72% |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 129 | $ | 109 | $ | 118 | $ | 108 |

Portfolio turnover rate H | | 22% | | 54% | | 41% | | 45% |

AFor the period August 1, 2019 (commencement of sale of shares) through July 31, 2020.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns for periods of less than one year are not annualized.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Managed Retirement 2010 Fund℠ Class K6 |

| |

| Years ended July 31, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 54.10 | $ | 62.46 | $ | 58.82 | $ | 56.39 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | 2.000 | | 1.503 | | .615 | | 1.029 |

| Net realized and unrealized gain (loss) | | (1.650) | | (6.145) | | 5.120 | | 3.191 |

| Total from investment operations | | .350 | | (4.642) | | 5.735 | | 4.220 |

| Distributions from net investment income | | (1.960) | | (1.492) | | (.626) | | (1.071) |

| Distributions from net realized gain | | (.870) | | (2.226) | | (1.469) | | (.719) |

| Total distributions | | (2.830) | | (3.718) | | (2.095) | | (1.790) |

| Net asset value, end of period | $ | 51.62 | $ | 54.10 | $ | 62.46 | $ | 58.82 |

Total Return D,E | | .90% | | (7.90)% | | 9.94% | | 7.64% |

Ratios to Average Net Assets C,F,G | | | | | | | | |

| Expenses before reductions | | .26% | | .26% | | .26% | | .26% |

| Expenses net of fee waivers, if any | | .26% | | .26% | | .26% | | .26% |

| Expenses net of all reductions | | .26% | | .26% | | .26% | | .26% |

| Net investment income (loss) | | 3.93% | | 2.65% | | 1.01% | | 1.82% |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 290 | $ | 337 | $ | 174 | $ | 160 |

Portfolio turnover rate H | | 22% | | 54% | | 41% | | 45% |

AFor the period August 1, 2019 (commencement of sale of shares) through July 31, 2020.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns for periods of less than one year are not annualized.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Fidelity Advisor Managed Retirement 2010 Fund℠ Class I |

| |