UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | August 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Total Bond K6 Fund

Annual Report

August 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

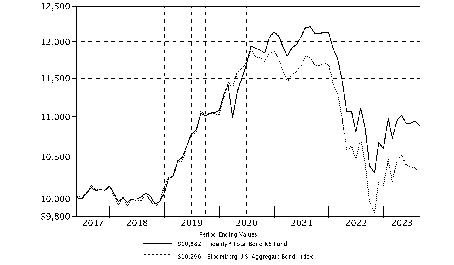

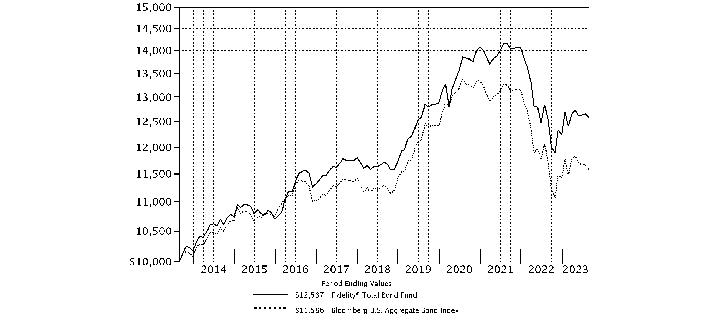

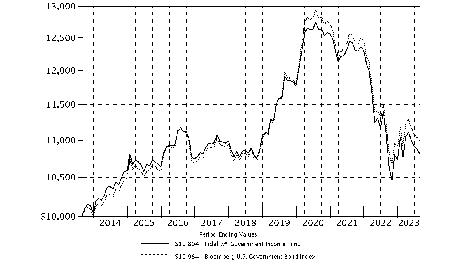

Periods ended August 31, 2023 | Past 1 year | Past 5 years | Life of Fund A |

| Fidelity® Total Bond K6 Fund | 0.25% | 1.57% | 1.36% |

A From May 25, 2017

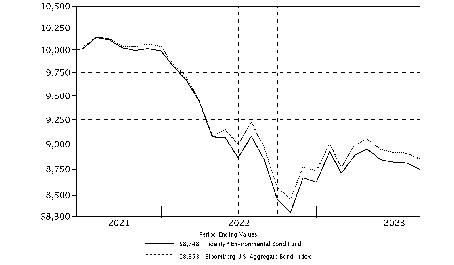

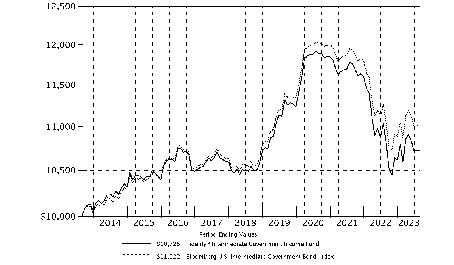

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity® Total Bond K6 Fund, on May 25, 2017, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

|

Market Recap:

U.S. taxable investment-grade bonds returned -1.19% for the 12 months ending August 31, 2023, according to the Bloomberg U.S. Aggregate Bond Index. The first months of the period saw a continuation of the historic bond market downturn that began in early 2022, when the U.S. Federal Reserve began an aggressive series of interest rate hikes to combat persistent inflation. The actions helped push nominal and real U.S. bond yields to their highest levels in more than a decade. Bond prices, which move inversely to yields, fell sharply through October, and credit spreads widened, as investors demanded more yield for buying credit-sensitive assets. In November, the bond market staged a broad rally (+3.68%) when comments by Fed Chair Jerome Powell pointed to a slowdown in the size of future rate hikes. With the market anticipating the end of the hiking cycle by midyear, the index advanced 3.59% in the first four months of 2023, only to fall back in each of the four next months, as cooling but still-high inflation and a strong labor market suggested the Fed may need to keep raising rates for longer than anticipated. To date, the central bank has raised its benchmark rate 11 times, by a total of 5.25 percentage points. For the full 12 months, short-term bonds outperformed long-term issues, while lower-quality bonds bettered higher-quality debt, and risk assets like corporate bonds and asset-backed securities outpaced U.S. Treasuries. Meanwhile, U.S. mortgage-backed securities lagged in the rising-rate environment.

Comments from Co-Portfolio Managers Celso Muñoz and Ford O'Neil:

For the fiscal year ending August 31, 2023, the fund gained 0.25%, net of fees, versus -1.19% for the benchmark, the Bloomberg U.S. Aggregate Bond Index. Allocations to "plus" sectors - including high-yield bonds, leveraged loans and emerging markets debt - notably boosted relative performance given that these segments outperformed the benchmark. The fund had a shorter duration (less interest rate sensitivity), which also helped lift the relative result, given the steep rise in rates the past 12 months. An overweight in asset-backed securities, including collateralized loan obligations and loans backed by airline leases, provided another performance advantage. Among investment-grade securities, sector allocation was a meaningful contributor, led by an overweight to corporate credit, which bested the benchmark, and an underweight to mortgage-backed securities, which trailed it. Among corporate bonds, security selection was helpful as well. Individual standouts included AB InBev and Warner Bros. Discovery in the industrials segment and UBS in the financials segment. In contrast, an underweight in the industrials segment overall, and in technology specifically, detracted from the fund's performance versus the benchmark. Holdings in real estate investment trusts Brandywine Realty Trust and Hudson Pacific Properties also crimped the relative result.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

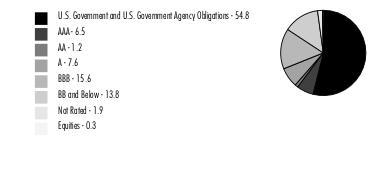

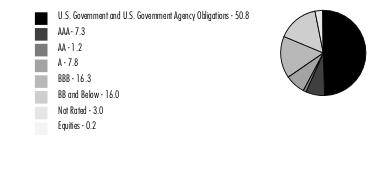

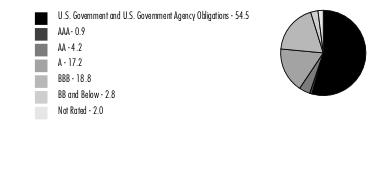

Quality Diversification (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (1.7)%* |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Securities rated BB or below were rated investment grade at the time of acquisition.

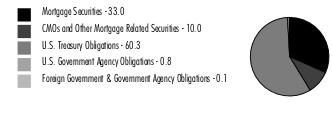

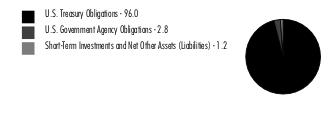

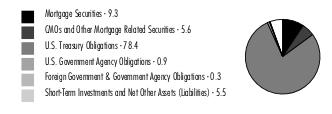

Asset Allocation (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (1.7)% |

Futures and Swaps - 4.5% |

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments. |

|

Showing Percentage of Net Assets

| Nonconvertible Bonds - 22.3% |

| | | Principal Amount (a) | Value ($) |

| COMMUNICATION SERVICES - 1.8% | | | |

| Diversified Telecommunication Services - 0.3% | | | |

| AT&T, Inc.: | | | |

| 2.55% 12/1/33 | | 339,000 | 258,666 |

| 3.8% 12/1/57 | | 4,105,000 | 2,768,412 |

| 4.3% 2/15/30 | | 559,000 | 521,192 |

| 5.15% 11/15/46 | | 1,000,000 | 878,636 |

| Verizon Communications, Inc.: | | | |

| 2.1% 3/22/28 | | 1,151,000 | 1,005,849 |

| 2.55% 3/21/31 | | 1,065,000 | 876,694 |

| 3% 3/22/27 | | 263,000 | 244,461 |

| 4.862% 8/21/46 | | 1,250,000 | 1,100,040 |

| 5.012% 4/15/49 | | 16,000 | 14,350 |

| | | | 7,668,300 |

| Entertainment - 0.1% | | | |

| The Walt Disney Co. 3.8% 3/22/30 | | 2,050,000 | 1,919,626 |

| Media - 1.2% | | | |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | | | |

| 4.4% 4/1/33 | | 6,526,000 | 5,746,156 |

| 4.908% 7/23/25 | | 807,000 | 792,524 |

| 5.25% 4/1/53 | | 2,499,000 | 1,978,113 |

| 5.375% 5/1/47 | | 2,000,000 | 1,598,148 |

| 5.5% 4/1/63 | | 2,499,000 | 1,963,200 |

| 5.75% 4/1/48 | | 861,000 | 725,378 |

| Comcast Corp. 6.45% 3/15/37 | | 365,000 | 398,847 |

| Discovery Communications LLC: | | | |

| 3.625% 5/15/30 | | 708,000 | 621,822 |

| 4.65% 5/15/50 | | 1,913,000 | 1,425,905 |

| Fox Corp.: | | | |

| 4.03% 1/25/24 | | 216,000 | 214,290 |

| 4.709% 1/25/29 | | 312,000 | 300,980 |

| 5.476% 1/25/39 | | 308,000 | 279,525 |

| Magallanes, Inc.: | | | |

| 3.755% 3/15/27 | | 973,000 | 912,594 |

| 4.054% 3/15/29 | | 337,000 | 309,904 |

| 4.279% 3/15/32 | | 8,816,000 | 7,779,587 |

| 5.05% 3/15/42 | | 738,000 | 606,660 |

| 5.141% 3/15/52 | | 1,091,000 | 869,646 |

| Time Warner Cable LLC: | | | |

| 6.75% 6/15/39 | | 545,000 | 527,197 |

| 7.3% 7/1/38 | | 2,420,000 | 2,451,578 |

| | | | 29,502,054 |

| Wireless Telecommunication Services - 0.2% | | | |

| Millicom International Cellular SA 6.25% 3/25/29 (b) | | 1,440,000 | 1,314,576 |

| Rogers Communications, Inc.: | | | |

| 3.2% 3/15/27 | | 1,051,000 | 971,566 |

| 3.8% 3/15/32 | | 917,000 | 784,286 |

| T-Mobile U.S.A., Inc.: | | | |

| 3.75% 4/15/27 | | 1,250,000 | 1,184,743 |

| 3.875% 4/15/30 | | 2,100,000 | 1,916,723 |

| 4.375% 4/15/40 | | 269,000 | 231,176 |

| 4.5% 4/15/50 | | 528,000 | 436,137 |

| | | | 6,839,207 |

TOTAL COMMUNICATION SERVICES | | | 45,929,187 |

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| McDonald's Corp. 3.5% 7/1/27 | | 353,000 | 335,055 |

| Specialty Retail - 0.2% | | | |

| AutoNation, Inc. 4.75% 6/1/30 | | 156,000 | 145,294 |

| AutoZone, Inc. 4% 4/15/30 | | 1,110,000 | 1,027,082 |

| Lowe's Companies, Inc.: | | | |

| 3.35% 4/1/27 | | 149,000 | 140,221 |

| 3.75% 4/1/32 | | 459,000 | 411,251 |

| 4.25% 4/1/52 | | 1,870,000 | 1,479,335 |

| 4.45% 4/1/62 | | 2,116,000 | 1,650,235 |

| O'Reilly Automotive, Inc. 4.2% 4/1/30 | | 246,000 | 230,661 |

| | | | 5,084,079 |

TOTAL CONSUMER DISCRETIONARY | | | 5,419,134 |

| CONSUMER STAPLES - 1.6% | | | |

| Beverages - 0.7% | | | |

| Anheuser-Busch InBev Finance, Inc.: | | | |

| 4.7% 2/1/36 | | 2,133,000 | 2,041,515 |

| 4.9% 2/1/46 | | 4,500,000 | 4,186,121 |

| Anheuser-Busch InBev Worldwide, Inc.: | | | |

| 4.35% 6/1/40 | | 720,000 | 644,116 |

| 4.5% 6/1/50 | | 1,000,000 | 892,368 |

| 4.75% 4/15/58 | | 613,000 | 548,713 |

| 5.45% 1/23/39 | | 800,000 | 812,094 |

| 5.55% 1/23/49 | | 1,824,000 | 1,868,336 |

| 5.8% 1/23/59 (Reg. S) | | 1,933,000 | 2,026,930 |

| Molson Coors Beverage Co. 5% 5/1/42 | | 2,945,000 | 2,662,700 |

| The Coca-Cola Co.: | | | |

| 3.375% 3/25/27 | | 1,279,000 | 1,225,369 |

| 3.45% 3/25/30 | | 713,000 | 663,111 |

| | | | 17,571,373 |

| Consumer Staples Distribution & Retail - 0.1% | | | |

| Sysco Corp.: | | | |

| 5.95% 4/1/30 | | 471,000 | 487,798 |

| 6.6% 4/1/50 | | 710,000 | 782,824 |

| | | | 1,270,622 |

| Food Products - 0.4% | | | |

| JBS U.S.A. Lux SA / JBS Food Co.: | | | |

| 2.5% 1/15/27 | | 1,945,000 | 1,748,351 |

| 3% 5/15/32 | | 1,955,000 | 1,543,851 |

| 3.625% 1/15/32 | | 353,000 | 289,701 |

| 5.125% 2/1/28 | | 735,000 | 714,335 |

| 5.5% 1/15/30 | | 342,000 | 331,140 |

| 5.75% 4/1/33 | | 6,515,000 | 6,200,549 |

| | | | 10,827,927 |

| Tobacco - 0.4% | | | |

| Altria Group, Inc.: | | | |

| 3.875% 9/16/46 | | 1,521,000 | 1,047,353 |

| 4.25% 8/9/42 | | 932,000 | 706,003 |

| 4.5% 5/2/43 | | 632,000 | 492,531 |

| 4.8% 2/14/29 | | 173,000 | 167,625 |

| 5.375% 1/31/44 | | 1,137,000 | 1,055,734 |

| 5.95% 2/14/49 | | 600,000 | 558,668 |

| BAT Capital Corp.: | | | |

| 4.7% 4/2/27 | | 1,252,000 | 1,214,249 |

| 4.906% 4/2/30 | | 1,500,000 | 1,412,616 |

| 5.282% 4/2/50 | | 1,500,000 | 1,201,790 |

| Imperial Tobacco Finance PLC: | | | |

| 4.25% 7/21/25 (b) | | 1,564,000 | 1,512,468 |

| 6.125% 7/27/27 (b) | | 764,000 | 772,364 |

| Reynolds American, Inc. 7.25% 6/15/37 | | 75,000 | 78,833 |

| | | | 10,220,234 |

TOTAL CONSUMER STAPLES | | | 39,890,156 |

| ENERGY - 2.7% | | | |

| Oil, Gas & Consumable Fuels - 2.7% | | | |

| Canadian Natural Resources Ltd.: | | | |

| 2.05% 7/15/25 | | 5,400,000 | 5,058,820 |

| 3.85% 6/1/27 | | 2,700,000 | 2,554,274 |

| 3.9% 2/1/25 | | 525,000 | 510,217 |

| 5.85% 2/1/35 | | 525,000 | 510,234 |

| Cenovus Energy, Inc.: | | | |

| 3.75% 2/15/52 | | 210,000 | 147,379 |

| 5.25% 6/15/37 | | 1,911,000 | 1,742,423 |

| 5.4% 6/15/47 | | 244,000 | 219,332 |

| 6.75% 11/15/39 | | 200,000 | 207,369 |

| Columbia Pipeline Group, Inc. 5.8% 6/1/45 | | 10,000 | 9,261 |

| Columbia Pipelines Operating Co. LLC: | | | |

| 5.927% 8/15/30 (b) | | 290,000 | 292,534 |

| 6.036% 11/15/33 (b) | | 781,000 | 789,005 |

| 6.497% 8/15/43 (b) | | 233,000 | 236,167 |

| 6.544% 11/15/53 (b) | | 420,000 | 429,326 |

| 6.714% 8/15/63 (b) | | 252,000 | 257,595 |

| DCP Midstream Operating LP 5.125% 5/15/29 | | 659,000 | 642,591 |

| Energy Transfer LP: | | | |

| 3.75% 5/15/30 | | 481,000 | 429,594 |

| 4.2% 9/15/23 | | 145,000 | 144,928 |

| 4.95% 6/15/28 | | 494,000 | 478,435 |

| 5% 5/15/50 | | 2,089,000 | 1,719,528 |

| 5.25% 4/15/29 | | 350,000 | 341,960 |

| 5.4% 10/1/47 | | 1,023,000 | 881,160 |

| 5.8% 6/15/38 | | 275,000 | 260,673 |

| 6% 6/15/48 | | 1,279,000 | 1,182,290 |

| 6.125% 12/15/45 | | 100,000 | 93,912 |

| 6.25% 4/15/49 | | 241,000 | 230,711 |

| Exxon Mobil Corp. 3.482% 3/19/30 | | 3,150,000 | 2,912,953 |

| Hess Corp.: | | | |

| 5.6% 2/15/41 | | 549,000 | 516,168 |

| 5.8% 4/1/47 | | 874,000 | 834,108 |

| 7.125% 3/15/33 | | 201,000 | 219,044 |

| 7.3% 8/15/31 | | 2,102,000 | 2,294,814 |

| Kinder Morgan Energy Partners LP 6.55% 9/15/40 | | 1,365,000 | 1,356,182 |

| Kinder Morgan, Inc. 5.55% 6/1/45 | | 415,000 | 375,058 |

| MPLX LP: | | | |

| 4.8% 2/15/29 | | 175,000 | 168,621 |

| 4.875% 12/1/24 | | 272,000 | 268,459 |

| 4.95% 9/1/32 | | 1,463,000 | 1,382,123 |

| 5.5% 2/15/49 | | 525,000 | 467,784 |

| Occidental Petroleum Corp.: | | | |

| 5.55% 3/15/26 | | 831,000 | 824,003 |

| 6.2% 3/15/40 | | 700,000 | 691,404 |

| 6.45% 9/15/36 | | 600,000 | 613,521 |

| 6.6% 3/15/46 | | 807,000 | 830,540 |

| 7.5% 5/1/31 | | 927,000 | 1,004,406 |

| Ovintiv, Inc.: | | | |

| 5.15% 11/15/41 | | 1,916,000 | 1,567,122 |

| 6.625% 8/15/37 | | 350,000 | 348,682 |

| 7.375% 11/1/31 | | 435,000 | 466,526 |

| 8.125% 9/15/30 | | 1,083,000 | 1,202,066 |

| Petroleos Mexicanos: | | | |

| 5.95% 1/28/31 | | 3,510,000 | 2,535,413 |

| 6.35% 2/12/48 | | 3,548,000 | 2,120,019 |

| 6.49% 1/23/27 | | 570,000 | 497,120 |

| 6.5% 3/13/27 | | 20,000 | 17,462 |

| 6.75% 9/21/47 | | 5,720,000 | 3,511,451 |

| 6.84% 1/23/30 | | 6,742,000 | 5,308,651 |

| 6.95% 1/28/60 | | 989,000 | 606,010 |

| 7.69% 1/23/50 | | 2,090,000 | 1,391,522 |

| Phillips 66 Co. 3.85% 4/9/25 | | 125,000 | 121,627 |

| Plains All American Pipeline LP/PAA Finance Corp.: | | | |

| 3.55% 12/15/29 | | 4,767,000 | 4,190,867 |

| 3.6% 11/1/24 | | 266,000 | 258,961 |

| Sabine Pass Liquefaction LLC 4.5% 5/15/30 | | 1,622,000 | 1,526,388 |

| The Williams Companies, Inc.: | | | |

| 3.5% 11/15/30 | | 1,727,000 | 1,529,660 |

| 4.3% 3/4/24 | | 2,000,000 | 1,982,124 |

| 4.55% 6/24/24 | | 70,000 | 69,249 |

| 4.65% 8/15/32 | | 1,526,000 | 1,432,965 |

| 5.3% 8/15/52 | | 346,000 | 311,534 |

| 5.4% 3/2/26 | | 823,000 | 821,689 |

| 5.75% 6/24/44 | | 35,000 | 33,120 |

| Transcontinental Gas Pipe Line Co. LLC 3.25% 5/15/30 | | 207,000 | 182,448 |

| Western Gas Partners LP: | | | |

| 4.5% 3/1/28 | | 200,000 | 188,202 |

| 4.65% 7/1/26 | | 138,000 | 133,467 |

| 4.75% 8/15/28 | | 168,000 | 159,038 |

| | | | 66,642,289 |

| FINANCIALS - 10.6% | | | |

| Banks - 4.9% | | | |

| Bank of America Corp.: | | | |

| 2.299% 7/21/32 (c) | | 1,880,000 | 1,482,667 |

| 3.705% 4/24/28 (c) | | 528,000 | 494,248 |

| 4.376% 4/27/28 (c) | | 10,000,000 | 9,599,035 |

| 5.015% 7/22/33 (c) | | 13,317,000 | 12,817,034 |

| 5.288% 4/25/34 (c) | | 5,000,000 | 4,879,039 |

| Barclays PLC: | | | |

| 2.852% 5/7/26 (c) | | 1,652,000 | 1,561,342 |

| 4.375% 1/12/26 | | 900,000 | 867,560 |

| 5.088% 6/20/30 (c) | | 1,421,000 | 1,301,935 |

| 5.2% 5/12/26 | | 1,318,000 | 1,278,913 |

| 5.829% 5/9/27 (c) | | 2,370,000 | 2,348,270 |

| 6.224% 5/9/34 (c) | | 1,576,000 | 1,556,457 |

| BNP Paribas SA 2.219% 6/9/26 (b)(c) | | 1,520,000 | 1,420,042 |

| Citigroup, Inc.: | | | |

| 3.352% 4/24/25 (c) | | 953,000 | 935,341 |

| 4.3% 11/20/26 | | 6,314,000 | 6,066,152 |

| 4.4% 6/10/25 | | 1,638,000 | 1,597,216 |

| 4.412% 3/31/31 (c) | | 2,221,000 | 2,062,231 |

| 4.45% 9/29/27 | | 4,372,000 | 4,179,028 |

| 4.91% 5/24/33 (c) | | 3,224,000 | 3,064,648 |

| Commonwealth Bank of Australia 3.61% 9/12/34 (b)(c) | | 517,000 | 438,427 |

| First Citizens Bank & Trust Co. 6.125% 3/9/28 | | 210,000 | 210,951 |

| HSBC Holdings PLC 4.95% 3/31/30 | | 298,000 | 286,715 |

| Intesa Sanpaolo SpA: | | | |

| 4.198% 6/1/32 (b)(c) | | 242,000 | 184,430 |

| 5.017% 6/26/24 (b) | | 200,000 | 195,555 |

| 5.71% 1/15/26 (b) | | 3,773,000 | 3,619,457 |

| JPMorgan Chase & Co.: | | | |

| 2.956% 5/13/31 (c) | | 880,000 | 748,018 |

| 3.882% 7/24/38 (c) | | 1,000,000 | 843,143 |

| 4.323% 4/26/28 (c) | | 5,000,000 | 4,807,801 |

| 4.452% 12/5/29 (c) | | 5,500,000 | 5,242,944 |

| 4.493% 3/24/31 (c) | | 3,000,000 | 2,843,721 |

| 4.586% 4/26/33 (c) | | 2,682,000 | 2,508,064 |

| 4.912% 7/25/33 (c) | | 9,234,000 | 8,880,724 |

| 5.299% 7/24/29 (c) | | 2,500,000 | 2,485,719 |

| 5.717% 9/14/33 (c) | | 2,700,000 | 2,698,458 |

| NatWest Group PLC: | | | |

| 3.073% 5/22/28 (c) | | 951,000 | 857,464 |

| 5.847% 3/2/27 (c) | | 3,394,000 | 3,373,851 |

| Rabobank Nederland 4.375% 8/4/25 | | 500,000 | 484,639 |

| Societe Generale: | | | |

| 1.038% 6/18/25 (b)(c) | | 3,800,000 | 3,634,130 |

| 1.488% 12/14/26 (b)(c) | | 1,953,000 | 1,750,053 |

| Synchrony Bank: | | | |

| 5.4% 8/22/25 | | 1,384,000 | 1,337,767 |

| 5.625% 8/23/27 | | 1,253,000 | 1,185,191 |

| Wells Fargo & Co.: | | | |

| 3.526% 3/24/28 (c) | | 2,047,000 | 1,904,575 |

| 4.478% 4/4/31 (c) | | 3,026,000 | 2,830,986 |

| 4.897% 7/25/33 (c) | | 4,711,000 | 4,432,754 |

| 5.013% 4/4/51 (c) | | 2,880,000 | 2,600,570 |

| 5.389% 4/24/34 (c) | | 2,133,000 | 2,077,558 |

| 5.574% 7/25/29 (c) | | 2,500,000 | 2,489,646 |

| Westpac Banking Corp. 4.11% 7/24/34 (c) | | 744,000 | 651,792 |

| | | | 123,116,261 |

| Capital Markets - 2.4% | | | |

| Ares Capital Corp. 3.875% 1/15/26 | | 2,603,000 | 2,434,734 |

| Deutsche Bank AG 4.5% 4/1/25 | | 3,804,000 | 3,665,083 |

| Deutsche Bank AG New York Branch: | | | |

| 4.1% 1/13/26 | | 1,100,000 | 1,049,257 |

| 5.882% 7/8/31 (c) | | 5,000,000 | 4,535,874 |

| 6.72% 1/18/29 (c) | | 980,000 | 992,208 |

| Goldman Sachs Group, Inc.: | | | |

| 2.383% 7/21/32 (c) | | 1,922,000 | 1,519,245 |

| 3.102% 2/24/33 (c) | | 4,272,000 | 3,553,197 |

| 3.691% 6/5/28 (c) | | 4,660,000 | 4,362,476 |

| 3.75% 5/22/25 | | 525,000 | 507,460 |

| 3.8% 3/15/30 | | 3,630,000 | 3,301,969 |

| 3.814% 4/23/29 (c) | | 1,025,000 | 948,437 |

| 4.017% 10/31/38 (c) | | 1,000,000 | 831,540 |

| 4.223% 5/1/29 (c) | | 2,500,000 | 2,355,387 |

| 6.75% 10/1/37 | | 278,000 | 294,724 |

| Moody's Corp.: | | | |

| 3.25% 1/15/28 | | 10,000 | 9,325 |

| 3.75% 3/24/25 | | 1,044,000 | 1,015,998 |

| 4.875% 2/15/24 | | 5,000 | 5,000 |

| Morgan Stanley: | | | |

| 3.125% 7/27/26 | | 1,450,000 | 1,356,892 |

| 3.622% 4/1/31 (c) | | 2,099,000 | 1,865,229 |

| 4.431% 1/23/30 (c) | | 2,242,000 | 2,129,121 |

| 4.889% 7/20/33 (c) | | 5,947,000 | 5,633,585 |

| 5% 11/24/25 | | 4,060,000 | 3,998,516 |

| 5.449% 7/20/29 (c) | | 1,318,000 | 1,310,264 |

| UBS Group AG: | | | |

| 1.494% 8/10/27 (b)(c) | | 1,190,000 | 1,046,412 |

| 2.593% 9/11/25 (b)(c) | | 2,086,000 | 2,011,349 |

| 3.75% 3/26/25 | | 1,200,000 | 1,159,234 |

| 3.869% 1/12/29 (b)(c) | | 1,570,000 | 1,443,319 |

| 4.125% 9/24/25 (b) | | 500,000 | 482,370 |

| 4.194% 4/1/31 (b)(c) | | 2,010,000 | 1,809,859 |

| 4.55% 4/17/26 | | 388,000 | 375,496 |

| 6.537% 8/12/33 (b)(c) | | 5,000,000 | 5,192,834 |

| | | | 61,196,394 |

| Consumer Finance - 1.9% | | | |

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | | | |

| 1.65% 10/29/24 | | 2,378,000 | 2,260,807 |

| 2.45% 10/29/26 | | 868,000 | 780,980 |

| 2.875% 8/14/24 | | 1,196,000 | 1,159,588 |

| 3% 10/29/28 | | 909,000 | 787,705 |

| 3.3% 1/30/32 | | 2,872,000 | 2,333,891 |

| 4.45% 4/3/26 | | 561,000 | 540,439 |

| 5.75% 6/6/28 | | 2,000,000 | 1,982,535 |

| 6.5% 7/15/25 | | 731,000 | 734,481 |

| Ally Financial, Inc.: | | | |

| 1.45% 10/2/23 | | 462,000 | 459,669 |

| 4.75% 6/9/27 | | 2,500,000 | 2,343,383 |

| 5.125% 9/30/24 | | 465,000 | 457,828 |

| 5.75% 11/20/25 | | 1,560,000 | 1,513,152 |

| 5.8% 5/1/25 | | 1,072,000 | 1,055,917 |

| 7.1% 11/15/27 | | 2,060,000 | 2,087,013 |

| 8% 11/1/31 | | 549,000 | 567,653 |

| Capital One Financial Corp.: | | | |

| 2.636% 3/3/26 (c) | | 1,062,000 | 1,003,707 |

| 3.273% 3/1/30 (c) | | 1,358,000 | 1,165,438 |

| 3.65% 5/11/27 | | 2,746,000 | 2,553,770 |

| 3.8% 1/31/28 | | 877,000 | 804,169 |

| 4.927% 5/10/28 (c) | | 2,786,000 | 2,680,036 |

| 4.985% 7/24/26 (c) | | 1,448,000 | 1,415,320 |

| 5.247% 7/26/30 (c) | | 2,210,000 | 2,102,345 |

| Discover Financial Services: | | | |

| 3.95% 11/6/24 | | 4,380,000 | 4,265,605 |

| 4.1% 2/9/27 | | 284,000 | 263,467 |

| 4.5% 1/30/26 | | 803,000 | 771,370 |

| 6.7% 11/29/32 | | 361,000 | 359,288 |

| Ford Motor Credit Co. LLC: | | | |

| 4.063% 11/1/24 | | 4,206,000 | 4,075,158 |

| 5.584% 3/18/24 | | 1,113,000 | 1,106,967 |

| Synchrony Financial: | | | |

| 3.95% 12/1/27 | | 3,042,000 | 2,717,840 |

| 4.375% 3/19/24 | | 1,056,000 | 1,043,251 |

| 5.15% 3/19/29 | | 1,958,000 | 1,795,815 |

| | | | 47,188,587 |

| Financial Services - 1.0% | | | |

| Blackstone Private Credit Fund: | | | |

| 4.7% 3/24/25 | | 3,937,000 | 3,826,844 |

| 7.05% 9/29/25 | | 1,775,000 | 1,787,282 |

| Brixmor Operating Partnership LP: | | | |

| 3.85% 2/1/25 | | 2,100,000 | 2,025,691 |

| 4.05% 7/1/30 | | 1,055,000 | 953,098 |

| 4.125% 5/15/29 | | 1,000,000 | 909,633 |

| Corebridge Financial, Inc.: | | | |

| 3.5% 4/4/25 | | 445,000 | 427,628 |

| 3.65% 4/5/27 | | 1,551,000 | 1,459,011 |

| 3.85% 4/5/29 | | 623,000 | 570,139 |

| 3.9% 4/5/32 | | 4,241,000 | 3,708,285 |

| 4.35% 4/5/42 | | 169,000 | 133,701 |

| 4.4% 4/5/52 | | 498,000 | 385,190 |

| Jackson Financial, Inc.: | | | |

| 3.125% 11/23/31 | | 194,000 | 152,487 |

| 5.17% 6/8/27 | | 682,000 | 668,472 |

| 5.67% 6/8/32 | | 734,000 | 699,116 |

| Park Aerospace Holdings Ltd. 5.5% 2/15/24 (b) | | 5,175,000 | 5,140,463 |

| Pine Street Trust I 4.572% 2/15/29 (b) | | 1,030,000 | 944,021 |

| Pine Street Trust II 5.568% 2/15/49 (b) | | 1,000,000 | 875,473 |

| | | | 24,666,534 |

| Insurance - 0.4% | | | |

| American International Group, Inc.: | | | |

| 2.5% 6/30/25 | | 1,934,000 | 1,830,679 |

| 5.125% 3/27/33 | | 1,500,000 | 1,450,881 |

| Five Corners Funding Trust II 2.85% 5/15/30 (b) | | 2,287,000 | 1,957,936 |

| Marsh & McLennan Companies, Inc. 4.375% 3/15/29 | | 678,000 | 656,414 |

| Pacific LifeCorp 5.125% 1/30/43 (b) | | 950,000 | 866,625 |

| Pricoa Global Funding I 5.375% 5/15/45 (c) | | 1,045,000 | 1,021,731 |

| Swiss Re Finance Luxembourg SA 5% 4/2/49 (b)(c) | | 400,000 | 378,000 |

| TIAA Asset Management Finance LLC 4.125% 11/1/24 (b) | | 80,000 | 78,125 |

| Unum Group: | | | |

| 3.875% 11/5/25 | | 50,000 | 47,738 |

| 4% 6/15/29 | | 852,000 | 780,950 |

| | | | 9,069,079 |

TOTAL FINANCIALS | | | 265,236,855 |

| HEALTH CARE - 1.1% | | | |

| Biotechnology - 0.2% | | | |

| Amgen, Inc.: | | | |

| 5.25% 3/2/30 | | 828,000 | 829,146 |

| 5.25% 3/2/33 | | 934,000 | 929,144 |

| 5.6% 3/2/43 | | 888,000 | 871,324 |

| 5.65% 3/2/53 | | 441,000 | 437,183 |

| 5.75% 3/2/63 | | 804,000 | 793,986 |

| | | | 3,860,783 |

| Health Care Providers & Services - 0.7% | | | |

| Centene Corp.: | | | |

| 2.45% 7/15/28 | | 1,670,000 | 1,429,657 |

| 2.625% 8/1/31 | | 800,000 | 636,423 |

| 3.375% 2/15/30 | | 815,000 | 697,474 |

| 4.25% 12/15/27 | | 880,000 | 823,159 |

| 4.625% 12/15/29 | | 3,670,000 | 3,374,565 |

| Cigna Group: | | | |

| 3.05% 10/15/27 | | 500,000 | 460,856 |

| 4.8% 8/15/38 | | 550,000 | 507,000 |

| CVS Health Corp.: | | | |

| 3% 8/15/26 | | 125,000 | 117,098 |

| 3.625% 4/1/27 | | 375,000 | 354,944 |

| 4.78% 3/25/38 | | 2,092,000 | 1,873,507 |

| 5% 1/30/29 | | 801,000 | 789,145 |

| 5.25% 1/30/31 | | 329,000 | 325,103 |

| HCA Holdings, Inc.: | | | |

| 3.5% 9/1/30 | | 709,000 | 619,259 |

| 3.625% 3/15/32 | | 195,000 | 167,714 |

| 5.625% 9/1/28 | | 1,054,000 | 1,051,730 |

| 5.875% 2/1/29 | | 981,000 | 987,049 |

| Humana, Inc. 3.7% 3/23/29 | | 585,000 | 541,620 |

| Sabra Health Care LP 3.2% 12/1/31 | | 1,971,000 | 1,505,445 |

| Toledo Hospital 5.325% 11/15/28 | | 319,000 | 255,104 |

| | | | 16,516,852 |

| Pharmaceuticals - 0.2% | | | |

| Bayer U.S. Finance II LLC 4.25% 12/15/25 (b) | | 3,209,000 | 3,107,858 |

| Elanco Animal Health, Inc. 6.65% 8/28/28 (c) | | 194,000 | 191,333 |

| Mylan NV 4.55% 4/15/28 | | 450,000 | 423,668 |

| Utah Acquisition Sub, Inc. 3.95% 6/15/26 | | 1,370,000 | 1,294,938 |

| Viatris, Inc.: | | | |

| 2.7% 6/22/30 | | 1,003,000 | 814,568 |

| 3.85% 6/22/40 | | 437,000 | 305,859 |

| | | | 6,138,224 |

TOTAL HEALTH CARE | | | 26,515,859 |

| INDUSTRIALS - 0.7% | | | |

| Aerospace & Defense - 0.4% | | | |

| BAE Systems Holdings, Inc. 3.8% 10/7/24 (b) | | 1,040,000 | 1,016,920 |

| The Boeing Co.: | | | |

| 5.04% 5/1/27 | | 171,000 | 169,118 |

| 5.15% 5/1/30 | | 5,723,000 | 5,630,485 |

| 5.705% 5/1/40 | | 720,000 | 699,973 |

| 5.805% 5/1/50 | | 700,000 | 681,020 |

| 5.93% 5/1/60 | | 720,000 | 695,000 |

| | | | 8,892,516 |

| Trading Companies & Distributors - 0.0% | | | |

| Air Lease Corp. 3.375% 7/1/25 | | 1,294,000 | 1,232,836 |

| Transportation Infrastructure - 0.3% | | | |

| Avolon Holdings Funding Ltd.: | | | |

| 3.95% 7/1/24 (b) | | 380,000 | 370,661 |

| 4.25% 4/15/26 (b) | | 290,000 | 273,487 |

| 4.375% 5/1/26 (b) | | 880,000 | 829,572 |

| 5.25% 5/15/24 (b) | | 730,000 | 720,675 |

| 6.375% 5/4/28 (b) | | 4,704,000 | 4,666,166 |

| | | | 6,860,561 |

TOTAL INDUSTRIALS | | | 16,985,913 |

| INFORMATION TECHNOLOGY - 0.8% | | | |

| Electronic Equipment, Instruments & Components - 0.0% | | | |

| Dell International LLC/EMC Corp.: | | | |

| 6.1% 7/15/27 | | 316,000 | 323,072 |

| 6.2% 7/15/30 | | 418,000 | 430,166 |

| | | | 753,238 |

| Semiconductors & Semiconductor Equipment - 0.5% | | | |

| Broadcom, Inc.: | | | |

| 1.95% 2/15/28 (b) | | 351,000 | 304,392 |

| 2.45% 2/15/31 (b) | | 3,421,000 | 2,757,988 |

| 2.6% 2/15/33 (b) | | 8,032,000 | 6,209,796 |

| 3.5% 2/15/41 (b) | | 2,410,000 | 1,765,508 |

| 3.75% 2/15/51 (b) | | 1,131,000 | 811,098 |

| | | | 11,848,782 |

| Software - 0.3% | | | |

| Oracle Corp.: | | | |

| 1.65% 3/25/26 | | 1,241,000 | 1,130,881 |

| 2.3% 3/25/28 | | 1,961,000 | 1,725,637 |

| 2.8% 4/1/27 | | 1,423,000 | 1,307,062 |

| 2.875% 3/25/31 | | 2,460,000 | 2,078,391 |

| | | | 6,241,971 |

TOTAL INFORMATION TECHNOLOGY | | | 18,843,991 |

| MATERIALS - 0.1% | | | |

| Chemicals - 0.1% | | | |

| Celanese U.S. Holdings LLC: | | | |

| 6.35% 11/15/28 | | 1,024,000 | 1,026,639 |

| 6.55% 11/15/30 | | 1,038,000 | 1,038,511 |

| 6.7% 11/15/33 | | 607,000 | 609,553 |

| | | | 2,674,703 |

| REAL ESTATE - 1.6% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.3% | | | |

| Alexandria Real Estate Equities, Inc. 4.9% 12/15/30 | | 857,000 | 829,514 |

| American Homes 4 Rent LP: | | | |

| 2.375% 7/15/31 | | 153,000 | 121,149 |

| 3.625% 4/15/32 | | 681,000 | 583,430 |

| Boston Properties, Inc.: | | | |

| 3.25% 1/30/31 | | 792,000 | 644,744 |

| 4.5% 12/1/28 | | 605,000 | 558,268 |

| 6.75% 12/1/27 | | 1,120,000 | 1,143,898 |

| Corporate Office Properties LP: | | | |

| 2.25% 3/15/26 | | 348,000 | 314,299 |

| 2.75% 4/15/31 | | 235,000 | 181,122 |

| Healthcare Trust of America Holdings LP: | | | |

| 3.1% 2/15/30 | | 260,000 | 221,478 |

| 3.5% 8/1/26 | | 270,000 | 252,052 |

| Healthpeak OP, LLC: | | | |

| 3.25% 7/15/26 | | 113,000 | 106,877 |

| 3.5% 7/15/29 | | 129,000 | 115,848 |

| Hudson Pacific Properties LP 4.65% 4/1/29 | | 1,473,000 | 1,122,405 |

| Invitation Homes Operating Partnership LP 4.15% 4/15/32 | | 1,026,000 | 913,138 |

| Kite Realty Group Trust 4.75% 9/15/30 | | 79,000 | 72,315 |

| LXP Industrial Trust (REIT) 2.7% 9/15/30 | | 387,000 | 306,664 |

| Omega Healthcare Investors, Inc.: | | | |

| 3.25% 4/15/33 | | 7,742,000 | 5,778,382 |

| 3.375% 2/1/31 | | 701,000 | 566,204 |

| 3.625% 10/1/29 | | 1,155,000 | 978,672 |

| 4.75% 1/15/28 | | 3,349,000 | 3,144,991 |

| 4.95% 4/1/24 | | 2,400,000 | 2,386,954 |

| Piedmont Operating Partnership LP 2.75% 4/1/32 | | 297,000 | 200,600 |

| Realty Income Corp.: | | | |

| 2.2% 6/15/28 | | 172,000 | 149,274 |

| 2.85% 12/15/32 | | 211,000 | 171,010 |

| 3.25% 1/15/31 | | 213,000 | 184,187 |

| 3.4% 1/15/28 | | 320,000 | 296,790 |

| Simon Property Group LP 2.45% 9/13/29 | | 333,000 | 281,847 |

| Store Capital Corp.: | | | |

| 2.75% 11/18/30 | | 424,000 | 311,051 |

| 4.625% 3/15/29 | | 315,000 | 271,121 |

| Sun Communities Operating LP: | | | |

| 2.3% 11/1/28 | | 341,000 | 286,683 |

| 2.7% 7/15/31 | | 880,000 | 698,706 |

| Ventas Realty LP: | | | |

| 3% 1/15/30 | | 1,531,000 | 1,304,400 |

| 3.5% 2/1/25 | | 1,265,000 | 1,216,722 |

| 4% 3/1/28 | | 218,000 | 202,513 |

| 4.75% 11/15/30 | | 2,100,000 | 1,969,396 |

| VICI Properties LP: | | | |

| 4.375% 5/15/25 | | 176,000 | 171,109 |

| 4.75% 2/15/28 | | 1,390,000 | 1,321,803 |

| 4.95% 2/15/30 | | 2,092,000 | 1,967,735 |

| 5.125% 5/15/32 | | 485,000 | 449,507 |

| Vornado Realty LP 2.15% 6/1/26 | | 374,000 | 323,280 |

| WP Carey, Inc.: | | | |

| 3.85% 7/15/29 | | 246,000 | 221,472 |

| 4% 2/1/25 | | 395,000 | 384,554 |

| 4.6% 4/1/24 | | 1,250,000 | 1,240,180 |

| | | | 33,966,344 |

| Real Estate Management & Development - 0.3% | | | |

| Brandywine Operating Partnership LP: | | | |

| 3.95% 11/15/27 | | 421,000 | 346,544 |

| 4.1% 10/1/24 | | 995,000 | 950,001 |

| 4.55% 10/1/29 | | 260,000 | 203,165 |

| 7.55% 3/15/28 | | 1,521,000 | 1,426,178 |

| CBRE Group, Inc. 2.5% 4/1/31 | | 1,070,000 | 859,371 |

| Tanger Properties LP: | | | |

| 2.75% 9/1/31 | | 897,000 | 667,286 |

| 3.125% 9/1/26 | | 2,775,000 | 2,518,237 |

| | | | 6,970,782 |

TOTAL REAL ESTATE | | | 40,937,126 |

| UTILITIES - 1.1% | | | |

| Electric Utilities - 0.7% | | | |

| Alabama Power Co. 3.05% 3/15/32 | | 1,447,000 | 1,241,665 |

| Cleco Corporate Holdings LLC: | | | |

| 3.375% 9/15/29 | | 2,173,000 | 1,840,796 |

| 3.743% 5/1/26 | | 1,337,000 | 1,255,584 |

| Duke Energy Corp. 2.45% 6/1/30 | | 565,000 | 469,983 |

| Duquesne Light Holdings, Inc.: | | | |

| 2.532% 10/1/30 (b) | | 276,000 | 219,963 |

| 2.775% 1/7/32 (b) | | 935,000 | 721,438 |

| Edison International 5.75% 6/15/27 | | 2,985,000 | 2,991,313 |

| Entergy Corp. 2.8% 6/15/30 | | 580,000 | 489,066 |

| Exelon Corp.: | | | |

| 3.35% 3/15/32 | | 389,000 | 334,228 |

| 4.05% 4/15/30 | | 7,865,000 | 7,267,212 |

| 4.1% 3/15/52 | | 288,000 | 222,834 |

| IPALCO Enterprises, Inc. 3.7% 9/1/24 | | 172,000 | 167,365 |

| | | | 17,221,447 |

| Independent Power and Renewable Electricity Producers - 0.2% | | | |

| The AES Corp.: | | | |

| 3.3% 7/15/25 (b) | | 3,530,000 | 3,356,570 |

| 3.95% 7/15/30 (b) | | 2,288,000 | 2,033,694 |

| | | | 5,390,264 |

| Multi-Utilities - 0.2% | | | |

| Berkshire Hathaway Energy Co. 4.05% 4/15/25 | | 2,556,000 | 2,500,804 |

| NiSource, Inc. 2.95% 9/1/29 | | 1,708,000 | 1,502,951 |

| Puget Energy, Inc.: | | | |

| 4.1% 6/15/30 | | 683,000 | 610,881 |

| 4.224% 3/15/32 | | 1,329,000 | 1,171,051 |

| | | | 5,785,687 |

TOTAL UTILITIES | | | 28,397,398 |

| TOTAL NONCONVERTIBLE BONDS (Cost $606,393,373) | | | 557,472,611 |

| | | | |

| U.S. Treasury Obligations - 35.7% |

| | | Principal Amount (a) | Value ($) |

| U.S. Treasury Bonds: | | | |

| 1.125% 5/15/40 | | 8,834,000 | 5,471,214 |

| 1.75% 8/15/41 | | 11,769,000 | 7,907,757 |

| 1.875% 11/15/51 | | 34,881,000 | 21,432,739 |

| 2% 11/15/41 | | 11,400,000 | 7,976,883 |

| 2% 8/15/51 | | 38,514,000 | 24,451,877 |

| 2.25% 2/15/52 | | 24,090,000 | 16,251,340 |

| 2.875% 5/15/52 | | 20,540,000 | 15,944,977 |

| 3% 2/15/47 | | 24,645,000 | 19,591,812 |

| 3.25% 5/15/42 | | 9,100,000 | 7,770,902 |

| 3.625% 2/15/53 | | 14,392,000 | 12,966,293 |

| 3.625% 5/15/53 | | 45,971,000 | 41,460,096 |

| 4.125% 8/15/53 | | 26,241,000 | 25,888,387 |

| U.S. Treasury Notes: | | | |

| 0.75% 8/31/26 | | 433,000 | 387,653 |

| 2.75% 4/30/27 | | 700,000 | 660,707 |

| 2.75% 8/15/32 | | 43,025,000 | 38,619,980 |

| 2.875% 4/30/29 | | 5,411,700 | 5,036,898 |

| 2.875% 5/15/32 | | 2,750,400 | 2,499,533 |

| 3.375% 5/15/33 | | 60,800,000 | 57,275,500 |

| 3.5% 1/31/30 | | 25,000,000 | 23,981,445 |

| 3.5% 4/30/30 | | 20,000,000 | 19,175,000 |

| 3.5% 2/15/33 | | 92,000,000 | 87,615,625 |

| 3.625% 5/31/28 | | 124,200,000 | 120,794,195 |

| 3.625% 3/31/30 | | 20,000,000 | 19,318,750 |

| 3.75% 6/30/30 | | 15,000,000 | 14,594,531 |

| 3.875% 1/15/26 | | 100,000 | 98,109 |

| 3.875% 9/30/29 | | 25,000,000 | 24,499,024 |

| 3.875% 11/30/29 | | 29,650,000 | 29,055,842 |

| 3.875% 12/31/29 | | 100,000,000 | 97,988,281 |

| 3.875% 8/15/33 | | 458,000 | 449,842 |

| 4% 2/15/26 | | 1,500,000 | 1,476,328 |

| 4% 2/29/28 | | 600,000 | 592,617 |

| 4% 6/30/28 | | 20,000,000 | 19,760,938 |

| 4% 2/28/30 | | 40,000,000 | 39,490,625 |

| 4.125% 7/31/28 (d) | | 52,000,000 | 51,695,312 |

| 4.375% 10/31/24 | | 1,400,000 | 1,385,508 |

| 4.375% 8/31/28 (e) | | 25,000,000 | 25,154,297 |

| 4.625% 2/28/25 | | 1,500,000 | 1,489,629 |

| 4.625% 3/15/26 | | 1,740,000 | 1,738,709 |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $974,032,666) | | | 891,949,155 |

| | | | |

| U.S. Government Agency - Mortgage Securities - 19.3% |

| | | Principal Amount (a) | Value ($) |

| Fannie Mae - 6.1% | | | |

| 12 month U.S. LIBOR + 1.360% 3.932% 10/1/35 (c)(f) | | 2,895 | 2,908 |

| 12 month U.S. LIBOR + 1.440% 3.945% 4/1/37 (c)(f) | | 678 | 680 |

| 12 month U.S. LIBOR + 1.460% 3.846% 1/1/35 (c)(f) | | 4,908 | 4,932 |

| 12 month U.S. LIBOR + 1.480% 5.73% 7/1/34 (c)(f) | | 199 | 201 |

| 12 month U.S. LIBOR + 1.550% 5.215% 5/1/44 (c)(f) | | 670 | 676 |

| 12 month U.S. LIBOR + 1.550% 5.803% 6/1/36 (c)(f) | | 1,693 | 1,711 |

| 12 month U.S. LIBOR + 1.560% 4.065% 3/1/37 (c)(f) | | 5,439 | 5,468 |

| 12 month U.S. LIBOR + 1.570% 4.164% 4/1/44 (c)(f) | | 2,052 | 2,069 |

| 12 month U.S. LIBOR + 1.580% 3.83% 1/1/44 (c)(f) | | 1,117 | 1,129 |

| 12 month U.S. LIBOR + 1.580% 4.08% 4/1/44 (c)(f) | | 751 | 756 |

| 12 month U.S. LIBOR + 1.620% 4.537% 5/1/35 (c)(f) | | 1,364 | 1,374 |

| 12 month U.S. LIBOR + 1.630% 3.815% 9/1/36 (c)(f) | | 373 | 379 |

| 12 month U.S. LIBOR + 1.630% 4.911% 11/1/36 (c)(f) | | 2,282 | 2,298 |

| 12 month U.S. LIBOR + 1.640% 3.895% 6/1/47 (c)(f) | | 7,512 | 7,664 |

| 12 month U.S. LIBOR + 1.640% 5.18% 5/1/36 (c)(f) | | 221 | 224 |

| 12 month U.S. LIBOR + 1.680% 4.653% 7/1/43 (c)(f) | | 11,299 | 11,423 |

| 12 month U.S. LIBOR + 1.700% 5.189% 6/1/42 (c)(f) | | 9,090 | 9,203 |

| 12 month U.S. LIBOR + 1.730% 4.021% 3/1/40 (c)(f) | | 5,221 | 5,293 |

| 12 month U.S. LIBOR + 1.750% 4.454% 7/1/35 (c)(f) | | 3,641 | 3,667 |

| 12 month U.S. LIBOR + 1.750% 4.579% 8/1/41 (c)(f) | | 2,111 | 2,135 |

| 12 month U.S. LIBOR + 1.770% 3.995% 2/1/37 (c)(f) | | 12,086 | 12,202 |

| 12 month U.S. LIBOR + 1.800% 4.055% 1/1/42 (c)(f) | | 26,420 | 26,767 |

| 12 month U.S. LIBOR + 1.800% 4.505% 12/1/40 (c)(f) | | 41,424 | 42,090 |

| 12 month U.S. LIBOR + 1.800% 6.05% 7/1/41 (c)(f) | | 3,555 | 3,604 |

| 12 month U.S. LIBOR + 1.810% 4.06% 12/1/39 (c)(f) | | 438 | 443 |

| 12 month U.S. LIBOR + 1.810% 4.068% 9/1/41 (c)(f) | | 2,936 | 3,003 |

| 12 month U.S. LIBOR + 1.810% 4.304% 2/1/42 (c)(f) | | 15,699 | 15,884 |

| 12 month U.S. LIBOR + 1.810% 6.05% 7/1/41 (c)(f) | | 5,793 | 5,880 |

| 12 month U.S. LIBOR + 1.820% 4.295% 2/1/35 (c)(f) | | 1,877 | 1,891 |

| 12 month U.S. LIBOR + 1.830% 4.08% 10/1/41 (c)(f) | | 2,463 | 2,436 |

| 12 month U.S. LIBOR + 1.850% 4.429% 4/1/36 (c)(f) | | 9,432 | 9,518 |

| 12 month U.S. LIBOR + 1.890% 5.057% 8/1/35 (c)(f) | | 8,246 | 8,324 |

| 12 month U.S. LIBOR + 1.950% 5.771% 7/1/37 (c)(f) | | 2,157 | 2,193 |

| 6 month U.S. LIBOR + 1.530% 4.461% 12/1/34 (c)(f) | | 374 | 373 |

| REFINITIV USD IBOR CONSUMER CA + 1.500% 4.724% 1/1/35 (c)(f) | | 1,401 | 1,403 |

| REFINITIV USD IBOR CONSUMER CA + 1.510% 7.023% 2/1/33 (c)(f) | | 186 | 187 |

| REFINITIV USD IBOR CONSUMER CA + 1.550% 6.074% 9/1/33 (c)(f) | | 12,523 | 12,659 |

| REFINITIV USD IBOR CONSUMER CA + 1.620% 4.293% 3/1/33 (c)(f) | | 4,705 | 4,728 |

| REFINITIV USD IBOR CONSUMER CA + 1.740% 5.467% 5/1/36 (c)(f) | | 2,627 | 2,658 |

| REFINITIV USD IBOR CONSUMER CA + 1.960% 4.424% 9/1/35 (c)(f) | | 191 | 193 |

| U.S. TREASURY 1 YEAR INDEX + 2.180% 4.546% 7/1/36 (c)(f) | | 1,187 | 1,197 |

| U.S. TREASURY 1 YEAR INDEX + 2.200% 4.583% 3/1/35 (c)(f) | | 587 | 592 |

| U.S. TREASURY 1 YEAR INDEX + 2.270% 4.395% 6/1/36 (c)(f) | | 987 | 1,005 |

| U.S. TREASURY 1 YEAR INDEX + 2.280% 4.404% 10/1/33 (c)(f) | | 993 | 1,012 |

| U.S. TREASURY 1 YEAR INDEX + 2.460% 5.33% 7/1/34 (c)(f) | | 1,310 | 1,329 |

| 1.5% 11/1/35 to 6/1/51 (g) | | 10,378,264 | 8,243,394 |

| 2% 2/1/28 to 3/1/52 (g) | | 37,334,784 | 31,263,500 |

| 2.5% 1/1/28 to 1/1/52 (e) | | 53,335,848 | 45,295,105 |

| 3% 2/1/31 to 2/1/52 (e) | | 28,949,424 | 25,830,437 |

| 3.5% 9/1/33 to 3/1/52 | | 8,968,647 | 8,232,196 |

| 4% 3/1/36 to 4/1/52 | | 5,736,919 | 5,375,940 |

| 4.5% to 4.5% 6/1/24 to 12/1/52 | | 7,777,176 | 7,438,027 |

| 5% 7/1/33 to 4/1/53 | | 3,794,708 | 3,719,975 |

| 5.279% 8/1/41 (c) | | 27,216 | 27,016 |

| 5.5% 8/1/25 to 8/1/53 | | 14,360,421 | 14,247,821 |

| 6% to 6% 9/1/29 to 6/1/53 | | 2,912,278 | 2,944,281 |

| 6.5% 12/1/23 to 8/1/36 | | 208,227 | 214,194 |

| 6.688% 2/1/39 (c) | | 14,044 | 14,230 |

| 7% to 7% 3/1/24 to 6/1/32 | | 5,411 | 5,582 |

| 7.5% 3/1/26 to 11/1/31 | | 4,519 | 4,616 |

TOTAL FANNIE MAE | | | 153,082,075 |

| Freddie Mac - 3.7% | | | |

| 12 month U.S. LIBOR + 1.320% 3.575% 1/1/36 (c)(f) | | 2,995 | 2,972 |

| 12 month U.S. LIBOR + 1.370% 3.634% 3/1/36 (c)(f) | | 2,677 | 2,673 |

| 12 month U.S. LIBOR + 1.500% 3.824% 3/1/36 (c)(f) | | 1,564 | 1,564 |

| 12 month U.S. LIBOR + 1.660% 4.04% 7/1/36 (c)(f) | | 10,015 | 10,007 |

| 12 month U.S. LIBOR + 1.750% 4% 12/1/40 (c)(f) | | 14,856 | 15,017 |

| 12 month U.S. LIBOR + 1.750% 4% 9/1/41 (c)(f) | | 52,844 | 53,605 |

| 12 month U.S. LIBOR + 1.750% 6% 7/1/41 (c)(f) | | 3,496 | 3,524 |

| 12 month U.S. LIBOR + 1.860% 5.239% 4/1/36 (c)(f) | | 1,062 | 1,071 |

| 12 month U.S. LIBOR + 1.880% 4.13% 9/1/41 (c)(f) | | 4,477 | 4,562 |

| 12 month U.S. LIBOR + 1.880% 4.13% 10/1/41 (c)(f) | | 27,884 | 28,284 |

| 12 month U.S. LIBOR + 1.880% 5.255% 4/1/41 (c)(f) | | 1,149 | 1,157 |

| 12 month U.S. LIBOR + 1.900% 4.936% 10/1/42 (c)(f) | | 19,596 | 19,639 |

| 12 month U.S. LIBOR + 1.910% 5.212% 5/1/41 (c)(f) | | 8,268 | 8,344 |

| 12 month U.S. LIBOR + 1.910% 5.568% 5/1/41 (c)(f) | | 9,420 | 9,512 |

| 12 month U.S. LIBOR + 1.910% 5.698% 6/1/41 (c)(f) | | 8,911 | 9,009 |

| 12 month U.S. LIBOR + 1.910% 6.16% 6/1/41 (c)(f) | | 2,914 | 2,950 |

| 12 month U.S. LIBOR + 2.020% 4.936% 4/1/38 (c)(f) | | 879 | 886 |

| 12 month U.S. LIBOR + 2.030% 4.158% 3/1/33 (c)(f) | | 38 | 38 |

| 12 month U.S. LIBOR + 2.040% 6.256% 7/1/36 (c)(f) | | 7,597 | 7,689 |

| 12 month U.S. LIBOR + 2.200% 4.45% 12/1/36 (c)(f) | | 1,811 | 1,842 |

| REFINITIV USD IBOR CONSUMER CA + 1.660% 4.165% 1/1/37 (c)(f) | | 2,424 | 2,426 |

| REFINITIV USD IBOR CONSUMER CA + 1.660% 7.04% 7/1/35 (c)(f) | | 1,763 | 1,778 |

| REFINITIV USD IBOR CONSUMER CA + 1.880% 4.488% 10/1/36 (c)(f) | | 17,670 | 17,758 |

| REFINITIV USD IBOR CONSUMER CA + 1.990% 5.001% 10/1/35 (c)(f) | | 8,945 | 8,977 |

| REFINITIV USD IBOR CONSUMER CA + 2.010% 6.76% 5/1/37 (c)(f) | | 1,667 | 1,696 |

| REFINITIV USD IBOR CONSUMER CA + 2.020% 7.385% 6/1/37 (c)(f) | | 3,659 | 3,722 |

| REFINITIV USD IBOR CONSUMER CA + 2.680% 7.524% 10/1/35 (c)(f) | | 1,521 | 1,564 |

| U.S. TREASURY 1 YEAR INDEX + 2.030% 4.857% 6/1/33 (c)(f) | | 12,557 | 12,563 |

| U.S. TREASURY 1 YEAR INDEX + 2.230% 5.065% 4/1/34 (c)(f) | | 4,037 | 4,060 |

| U.S. TREASURY 1 YEAR INDEX + 2.260% 5.196% 6/1/33 (c)(f) | | 3,483 | 3,496 |

| U.S. TREASURY 1 YEAR INDEX + 2.430% 5.024% 3/1/35 (c)(f) | | 6,478 | 6,564 |

| U.S. TREASURY 1 YEAR INDEX + 2.540% 6.046% 7/1/35 (c)(f) | | 11,567 | 11,719 |

| 1.5% 8/1/35 to 4/1/51 | | 11,881,599 | 9,272,788 |

| 2% 12/1/35 to 3/1/52 (g) | | 24,683,321 | 20,581,241 |

| 2.5% 1/1/28 to 1/1/52 | | 18,318,652 | 15,670,170 |

| 3% 12/1/30 to 3/1/52 | | 6,554,492 | 5,765,504 |

| 3.5% 3/1/32 to 4/1/52 | | 5,986,076 | 5,502,762 |

| 4% 1/1/36 to 10/1/52 | | 3,868,387 | 3,648,594 |

| 4% 4/1/48 | | 1,139 | 1,069 |

| 4.5% 7/1/25 to 10/1/52 | | 6,142,660 | 5,846,925 |

| 5% 8/1/33 to 8/1/53 | | 11,420,424 | 11,116,603 |

| 5.5% 10/1/52 to 8/1/53 | | 9,496,200 | 9,432,142 |

| 6% 1/1/24 to 7/1/53 | | 3,425,509 | 3,481,057 |

| 6.5% 1/1/32 to 1/1/53 | | 505,976 | 515,301 |

| 7% 8/1/26 to 9/1/36 | | 10,278 | 10,644 |

| 7.5% 1/1/27 | | 16 | 16 |

| 8% 7/1/24 to 8/1/30 | | 167 | 175 |

| 8.5% 8/1/27 | | 100 | 102 |

TOTAL FREDDIE MAC | | | 91,105,761 |

| Ginnie Mae - 3.9% | | | |

| 3.5% 11/20/41 to 12/20/49 | | 1,032,090 | 954,569 |

| 4% 8/15/39 to 5/20/49 | | 1,994,357 | 1,896,362 |

| 4.5% 6/20/33 to 6/20/41 | | 670,626 | 653,877 |

| 5.5% 10/15/35 to 9/15/39 | | 19,868 | 20,122 |

| 7% to 7% 4/15/28 to 8/15/32 | | 5,054 | 5,200 |

| 7.5% to 7.5% 9/15/25 to 1/15/31 | | 1,255 | 1,280 |

| 8% 12/15/23 to 7/15/27 | | 81 | 82 |

| 8.5% 8/15/29 to 7/15/30 | | 40 | 42 |

| 2% 11/20/50 to 4/20/51 | | 7,952,501 | 6,582,548 |

| 2% 9/1/53 (h) | | 5,600,000 | 4,620,002 |

| 2% 9/1/53 (h) | | 7,400,000 | 6,105,003 |

| 2% 9/1/53 (h) | | 1,300,000 | 1,072,501 |

| 2% 9/1/53 (h) | | 1,750,000 | 1,443,751 |

| 2% 9/1/53 (h) | | 2,800,000 | 2,310,001 |

| 2% 9/1/53 (h) | | 2,550,000 | 2,103,751 |

| 2% 10/1/53 (h) | | 750,000 | 619,395 |

| 2% 10/1/53 (h) | | 9,200,000 | 7,597,909 |

| 2.5% 6/20/51 to 12/20/51 | | 3,906,452 | 3,329,038 |

| 2.5% 9/1/53 (h) | | 3,500,000 | 2,979,108 |

| 2.5% 9/1/53 (h) | | 3,500,000 | 2,979,108 |

| 2.5% 9/1/53 (h) | | 3,600,000 | 3,064,225 |

| 2.5% 9/1/53 (h) | | 2,800,000 | 2,383,286 |

| 2.5% 9/1/53 (h) | | 1,900,000 | 1,617,230 |

| 2.5% 9/1/53 (h) | | 1,800,000 | 1,532,112 |

| 2.5% 10/1/53 (h) | | 1,850,000 | 1,576,189 |

| 3% 5/15/42 to 2/20/50 | | 424,749 | 379,115 |

| 3% 9/1/53 (h) | | 4,250,000 | 3,736,998 |

| 3% 9/1/53 (h) | | 2,850,000 | 2,505,987 |

| 3% 9/1/53 (h) | | 2,950,000 | 2,593,916 |

| 3% 9/1/53 (h) | | 1,050,000 | 923,258 |

| 3% 9/1/53 (h) | | 150,000 | 131,894 |

| 3% 9/1/53 (h) | | 1,800,000 | 1,582,729 |

| 3% 10/1/53 (h) | | 4,800,000 | 4,223,423 |

| 3.5% 9/1/53 (h) | | 900,000 | 817,159 |

| 3.5% 9/1/53 (h) | | 2,700,000 | 2,451,477 |

| 3.5% 9/1/53 (h) | | 150,000 | 136,193 |

| 3.5% 9/1/53 (h) | | 775,000 | 703,665 |

| 3.5% 9/1/53 (h) | | 2,100,000 | 1,906,704 |

| 3.5% 9/1/53 (h) | | 1,550,000 | 1,407,329 |

| 3.5% 9/1/53 (h) | | 1,650,000 | 1,498,125 |

| 3.5% 9/1/53 (h) | | 1,625,000 | 1,475,426 |

| 3.5% 10/1/53 (h) | | 1,550,000 | 1,407,632 |

| 4% 9/1/53 (h) | | 2,250,000 | 2,096,750 |

| 4% 9/1/53 (h) | | 1,750,000 | 1,630,806 |

| 4.5% 9/1/53 (h) | | 2,850,000 | 2,716,001 |

| 4.5% 9/1/53 (h) | | 1,050,000 | 1,000,632 |

| 5% 9/20/33 to 4/20/48 | | 370,724 | 369,001 |

| 5% 9/1/53 (h) | | 3,300,000 | 3,211,222 |

| 5% 9/1/53 (h) | | 300,000 | 291,929 |

| 5.47% 8/20/59 (c)(i) | | 167 | 157 |

| 5.5% 9/1/53 (h) | | 1,050,000 | 1,039,664 |

| 5.5% 9/1/53 (h) | | 1,150,000 | 1,138,680 |

| 6% 11/20/31 to 5/15/40 | | 214,654 | 219,121 |

| 6.5% 3/20/31 to 9/15/34 | | 688 | 705 |

TOTAL GINNIE MAE | | | 97,042,389 |

| Uniform Mortgage Backed Securities - 5.6% | | | |

| 1.5% 9/1/53 (h) | | 2,250,000 | 1,696,207 |

| 1.5% 9/1/53 (h) | | 1,850,000 | 1,394,659 |

| 2% 9/1/53 (h) | | 9,000,000 | 7,164,581 |

| 2% 9/1/53 (h) | | 8,800,000 | 7,005,368 |

| 2% 9/1/53 (h) | | 5,850,000 | 4,656,977 |

| 2% 9/1/53 (h) | | 14,500,000 | 11,542,935 |

| 2% 9/1/53 (h) | | 1,400,000 | 1,114,490 |

| 2% 9/1/53 (h) | | 4,250,000 | 3,383,274 |

| 2% 9/1/53 (h) | | 150,000 | 119,410 |

| 2% 9/1/53 (h) | | 7,275,000 | 5,791,369 |

| 2% 9/1/53 (h) | | 5,150,000 | 4,099,732 |

| 2% 9/1/53 (h) | | 3,275,000 | 2,607,111 |

| 2% 9/1/53 (h) | | 2,500,000 | 1,990,161 |

| 2% 9/1/53 (h) | | 1,300,000 | 1,034,884 |

| 2% 9/1/53 (h) | | 925,000 | 736,360 |

| 2% 9/1/53 (h) | | 2,200,000 | 1,751,342 |

| 2% 10/1/53 (h) | | 13,900,000 | 11,081,042 |

| 2% 10/1/53 (h) | | 5,550,000 | 4,424,445 |

| 2% 10/1/53 (h) | | 5,550,000 | 4,424,445 |

| 2% 10/1/53 (h) | | 8,350,000 | 6,656,597 |

| 2.5% 9/1/53 (h) | | 4,250,000 | 3,522,354 |

| 2.5% 9/1/53 (h) | | 3,000,000 | 2,486,367 |

| 2.5% 9/1/53 (h) | | 1,950,000 | 1,616,139 |

| 2.5% 9/1/53 (h) | | 1,150,000 | 953,107 |

| 3% 9/1/53 (h) | | 2,600,000 | 2,239,961 |

| 3% 9/1/53 (h) | | 5,200,000 | 4,479,922 |

| 3% 9/1/53 (h) | | 850,000 | 732,295 |

| 3.5% 9/1/53 (h) | | 10,500,000 | 9,382,324 |

| 3.5% 9/1/53 (h) | | 1,400,000 | 1,250,977 |

| 3.5% 9/1/53 (h) | | 900,000 | 804,199 |

| 4% 9/1/53 (h) | | 5,050,000 | 4,661,781 |

| 4% 9/1/53 (h) | | 2,825,000 | 2,607,828 |

| 4% 9/1/53 (h) | | 2,225,000 | 2,053,953 |

| 4.5% 9/1/53 (h) | | 900,000 | 853,453 |

| 5% 9/1/38 (h) | | 2,400,000 | 2,370,563 |

| 5% 9/1/38 (h) | | 2,600,000 | 2,568,109 |

| 5% 9/1/53 (h) | | 2,900,000 | 2,811,980 |

| 5% 9/1/53 (h) | | 3,150,000 | 3,054,392 |

| 5.5% 9/1/53 (h) | | 800,000 | 790,250 |

| 5.5% 9/1/53 (h) | | 2,400,000 | 2,370,750 |

| 5.5% 9/1/53 (h) | | 4,700,000 | 4,642,719 |

| 5.5% 9/1/53 (h) | | 2,050,000 | 2,025,016 |

TOTAL UNIFORM MORTGAGE BACKED SECURITIES | | | 140,953,828 |

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $496,075,651) | | | 482,184,053 |

| | | | |

| Asset-Backed Securities - 5.3% |

| | | Principal Amount (a) | Value ($) |

| AASET Trust: | | | |

| Series 2018-1A Class A, 3.844% 1/16/38 (b) | | 293,002 | 181,661 |

| Series 2019-1 Class A, 3.844% 5/15/39 (b) | | 305,870 | 214,109 |

| Series 2019-2: | | | |

Class A, 3.376% 10/16/39 (b) | | 844,816 | 708,699 |

Class B, 4.458% 10/16/39 (b) | | 220,258 | 83,995 |

| Series 2021-1A Class A, 2.95% 11/16/41 (b) | | 1,092,192 | 962,243 |

| Series 2021-2A Class A, 2.798% 1/15/47 (b) | | 2,073,691 | 1,791,608 |

| AASET, Ltd. Series 2022-1A Class A, 6% 5/16/47 (b) | | 1,433,694 | 1,376,360 |

| Aimco Series 2021-BA Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6696% 1/15/32 (b)(c)(f) | | 365,000 | 363,853 |

| AIMCO CLO Series 2021-AA Class AR2, CME Term SOFR 3 Month Index + 1.400% 6.7096% 10/17/34 (b)(c)(f) | | 1,889,000 | 1,871,761 |

| AIMCO CLO Ltd. Series 2021-11A Class AR, CME Term SOFR 3 Month Index + 1.390% 6.6996% 10/17/34 (b)(c)(f) | | 869,000 | 863,195 |

| AIMCO CLO Ltd. / AIMCO CLO LLC Series 2021-14A Class A, CME Term SOFR 3 Month Index + 1.250% 6.5778% 4/20/34 (b)(c)(f) | | 2,222,000 | 2,195,056 |

| Allegro CLO XV, Ltd. / Allegro CLO VX LLC Series 2022-1A Class A, CME Term SOFR 3 Month Index + 1.500% 6.8261% 7/20/35 (b)(c)(f) | | 1,188,000 | 1,175,052 |

| Allegro CLO, Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.400% 6.7278% 7/20/34 (b)(c)(f) | | 992,000 | 980,758 |

| American Express Credit Account Master Trust Series 2023-1 Class A, 4.87% 5/15/28 | | 1,220,000 | 1,212,947 |

| American Money Management Corp. Series 2012-11A Class A1R2, CME Term SOFR 3 Month Index + 1.270% 6.6407% 4/30/31 (b)(c)(f) | | 1,587,268 | 1,577,996 |

| Apollo Aviation Securitization Equity Trust Series 2020-1A: | | | |

| Class A, 3.351% 1/16/40 (b) | | 297,964 | 249,995 |

| Class B, 4.335% 1/16/40 (b) | | 138,939 | 71,556 |

| Ares CLO Series 2019-54A Class A, CME Term SOFR 3 Month Index + 1.580% 6.8896% 10/15/32 (b)(c)(f) | | 1,101,000 | 1,099,371 |

| Ares LIX CLO Ltd. Series 2021-59A Class A, CME Term SOFR 3 Month Index + 1.290% 6.6428% 4/25/34 (b)(c)(f) | | 657,000 | 648,526 |

| Ares LV CLO Ltd. Series 2021-55A Class A1R, CME Term SOFR 3 Month Index + 1.390% 6.6996% 7/15/34 (b)(c)(f) | | 1,286,000 | 1,277,379 |

| Ares LVIII CLO LLC Series 2022-58A Class AR, CME Term SOFR 3 Month Index + 1.330% 6.638% 1/15/35 (b)(c)(f) | | 1,808,000 | 1,784,362 |

| Ares XLI CLO Ltd. / Ares XLI CLO LLC Series 2021-41A Class AR2, CME Term SOFR 3 Month Index + 1.330% 6.6396% 4/15/34 (b)(c)(f) | | 3,233,000 | 3,200,647 |

| Ares XXXIV CLO Ltd. Series 2020-2A Class AR2, CME Term SOFR 3 Month Index + 1.510% 6.8196% 4/17/33 (b)(c)(f) | | 460,000 | 458,820 |

| Babson CLO Ltd. Series 2021-1A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 10/15/36 (b)(c)(f) | | 860,000 | 852,587 |

| Bank of America Credit Card Master Trust Series 2023-A1 Class A1, 4.79% 5/15/28 | | 1,700,000 | 1,685,600 |

| Barings CLO Ltd.: | | | |

| Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.280% 6.6328% 4/25/34 (b)(c)(f) | | 1,437,000 | 1,418,545 |

| Series 2021-4A Class A, CME Term SOFR 3 Month Index + 1.480% 6.8078% 1/20/32 (b)(c)(f) | | 1,680,000 | 1,675,785 |

| Beechwood Park CLO Ltd. Series 2022-1A Class A1R, CME Term SOFR 3 Month Index + 1.300% 6.608% 1/17/35 (b)(c)(f) | | 1,857,000 | 1,837,845 |

| BETHP Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.390% 6.6996% 1/15/35 (b)(c)(f) | | 1,299,000 | 1,286,017 |

| Blackbird Capital Aircraft Series 2021-1A Class A, 2.443% 7/15/46 (b) | | 1,836,172 | 1,578,631 |

| Bristol Park CLO, Ltd. Series 2020-1A Class AR, CME Term SOFR 3 Month Index + 1.250% 6.5596% 4/15/29 (b)(c)(f) | | 1,257,171 | 1,252,742 |

| Castlelake Aircraft Securitization Trust Series 2019-1A: | | | |

| Class A, 3.967% 4/15/39 (b) | | 702,823 | 624,993 |

| Class B, 5.095% 4/15/39 (b) | | 488,890 | 312,899 |

| Castlelake Aircraft Structured Trust: | | | |

| Series 2018-1 Class A, 4.125% 6/15/43 (b) | | 255,824 | 232,580 |

| Series 2021-1A Class A, 3.474% 1/15/46 (b) | | 292,376 | 269,726 |

| Cedar Funding Ltd.: | | | |

| Series 2021-10A Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6878% 10/20/32 (b)(c)(f) | | 1,037,000 | 1,032,732 |

| Series 2022-15A Class A, CME Term SOFR 3 Month Index + 1.320% 6.6461% 4/20/35 (b)(c)(f) | | 1,721,000 | 1,698,525 |

| Cedar Funding XII CLO Ltd. / Cedar Funding XII CLO LLC Series 2021-12A Class A1R, CME Term SOFR 3 Month Index + 1.390% 6.7428% 10/25/34 (b)(c)(f) | | 838,000 | 825,808 |

| Cedar Funding Xvii Clo Ltd. Series 2023-17A Class A, CME Term SOFR 3 Month Index + 1.850% 7.2758% 7/20/36 (b)(c)(f) | | 1,424,000 | 1,423,791 |

| CEDF Series 2021-6A Class ARR, CME Term SOFR 3 Month Index + 1.310% 6.6378% 4/20/34 (b)(c)(f) | | 1,199,000 | 1,180,347 |

| Cent CLO Ltd. / Cent CLO Series 2021-29A Class AR, CME Term SOFR 3 Month Index + 1.430% 6.7578% 10/20/34 (b)(c)(f) | | 1,364,000 | 1,342,940 |

| CFMT LLC Series 2023 HB12 Class A, 4.25% 4/25/33 (b) | | 704,171 | 674,070 |

| Columbia Cent CLO 31 Ltd. Series 2021-31A Class A1, CME Term SOFR 3 Month Index + 1.460% 6.7878% 4/20/34 (b)(c)(f) | | 1,620,000 | 1,594,326 |

| Columbia Cent Clo 32 Ltd. / Coliseum Series 2022-32A Class A1, CME Term SOFR 3 Month Index + 1.700% 7.0456% 7/24/34 (b)(c)(f) | | 1,758,000 | 1,749,651 |

| Columbia Cent CLO Ltd. / Columbia Cent CLO Corp. Series 2021-30A Class A1, CME Term SOFR 3 Month Index + 1.570% 6.8978% 1/20/34 (b)(c)(f) | | 2,220,000 | 2,201,374 |

| DB Master Finance LLC Series 2017-1A Class A2II, 4.03% 11/20/47 (b) | | 451,710 | 415,814 |

| Discover Card Execution Note Trust Series 2023-A2 Class A, 4.93% 6/15/28 | | 700,000 | 696,055 |

| Dllaa 2023-1A Series 2023-1A: | | | |

| Class A2, 5.93% 7/20/26 (b) | | 554,000 | 554,446 |

| Class A3, 5.64% 2/22/28 (b) | | 421,000 | 422,699 |

| Dryden 98 CLO Ltd. Series 2022-98A Class A, CME Term SOFR 3 Month Index + 1.300% 6.6261% 4/20/35 (b)(c)(f) | | 2,199,000 | 2,167,836 |

| Dryden CLO, Ltd.: | | | |

| Series 2021-76A Class A1R, CME Term SOFR 3 Month Index + 1.410% 6.7378% 10/20/34 (b)(c)(f) | | 1,790,000 | 1,776,400 |

| Series 2021-83A Class A, CME Term SOFR 3 Month Index + 1.480% 6.7915% 1/18/32 (b)(c)(f) | | 1,259,000 | 1,255,892 |

| Dryden Senior Loan Fund: | | | |

| Series 2020-78A Class A, CME Term SOFR 3 Month Index + 1.440% 6.7496% 4/17/33 (b)(c)(f) | | 900,000 | 896,460 |

| Series 2021-85A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 10/15/35 (b)(c)(f) | | 2,514,000 | 2,490,786 |

| Series 2021-90A Class A1A, CME Term SOFR 3 Month Index + 1.390% 6.7714% 2/20/35 (b)(c)(f) | | 1,503,000 | 1,485,747 |

| Eaton Vance CLO, Ltd.: | | | |

| Series 2021-1A Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6696% 4/15/31 (b)(c)(f) | | 610,000 | 606,324 |

| Series 2021-2A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 1/15/35 (b)(c)(f) | | 1,578,000 | 1,565,092 |

| Eaton Vance CLO, Ltd. / Eaton Vance CLO LLC Series 2021-1A Class A13R, CME Term SOFR 3 Month Index + 1.510% 6.8196% 1/15/34 (b)(c)(f) | | 350,000 | 347,489 |

| Flatiron CLO Ltd. Series 2021-1A: | | | |

| Class A1, 3 month U.S. LIBOR + 1.110% 6.6917% 7/19/34 (b)(c)(f) | | 902,000 | 896,303 |

| Class AR, CME Term SOFR 3 Month Index + 1.340% 6.7134% 11/16/34 (b)(c)(f) | | 1,250,000 | 1,239,919 |

| Flatiron CLO Ltd. / Flatiron CLO LLC Series 2020-1A Class A, CME Term SOFR 3 Month Index + 1.560% 6.9414% 11/20/33 (b)(c)(f) | | 1,956,000 | 1,953,655 |

| Ford Credit Floorplan Master Owner Trust Series 2023-1 Class A1, 4.92% 5/15/28 (b) | | 400,000 | 395,209 |

| GM Financial Automobile Leasing Series 2023-2 Class A2A, 5.44% 10/20/25 | | 509,000 | 507,446 |

| Gm Financial Consumer Automobile Re Series 2023-3 Class A3, 5.45% 6/16/28 | | 869,000 | 873,645 |

| GM Financial Consumer Automobile Receivables Trust Series 2022-4 Class A3, 4.82% 8/16/27 | | 1,000,000 | 990,289 |

| Gm Financial Leasing Trust 202 Series 2023-3 Class A3, 5.38% 11/20/26 | | 419,000 | 418,792 |

| Honda Auto Receivables Series 2023-2 Class A3, 4.93% 11/15/27 | | 834,000 | 828,266 |

| Honda Auto Receivables 2023-3 Series 2023-3 Class A3, 5.41% 2/18/28 | | 500,000 | 501,198 |

| Horizon Aircraft Finance I Ltd. Series 2018-1 Class A, 4.458% 12/15/38 (b) | | 361,463 | 309,519 |

| Horizon Aircraft Finance Ltd. Series 2019-1 Class A, 3.721% 7/15/39 (b) | | 1,559,050 | 1,328,513 |

| Hyundai Auto Lease Securitizat Series 2023-B Class A2A, 5.47% 9/15/25 (b) | | 1,100,000 | 1,096,988 |

| Invesco CLO Ltd. Series 2021-3A Class A, CME Term SOFR 3 Month Index + 1.390% 6.7372% 10/22/34 (b)(c)(f) | | 960,000 | 953,879 |

| KKR CLO Ltd. Series 2022-41A Class A1, CME Term SOFR 3 Month Index + 1.330% 6.638% 4/15/35 (b)(c)(f) | | 2,253,000 | 2,214,636 |

| Lucali CLO Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.470% 6.7796% 1/15/33 (b)(c)(f) | | 820,000 | 818,884 |

| Madison Park Funding Series 2020-19A Class A1R2, CME Term SOFR 3 Month Index + 1.180% 6.5272% 1/22/28 (b)(c)(f) | | 770,534 | 767,430 |

| Madison Park Funding L Ltd. / Madison Park Funding L LLC Series 2021-50A Class A, CME Term SOFR 3 Month Index + 1.400% 6.7217% 4/19/34 (b)(c)(f) | | 1,690,000 | 1,679,248 |

| Madison Park Funding LII Ltd. / Madison Park Funding LII LLC Series 2021-52A Class A, CME Term SOFR 3 Month Index + 1.360% 6.7072% 1/22/35 (b)(c)(f) | | 1,540,000 | 1,519,429 |

| Madison Park Funding XLV Ltd./Madison Park Funding XLV LLC Series 2021-45A Class AR, CME Term SOFR 3 Month Index + 1.380% 6.6896% 7/15/34 (b)(c)(f) | | 1,325,000 | 1,314,282 |

| Madison Park Funding XXXII, Ltd. / Madison Park Funding XXXII LLC Series 2021-32A Class A2R, CME Term SOFR 3 Month Index + 1.460% 6.8072% 1/22/31 (b)(c)(f) | | 364,000 | 360,031 |

| Magnetite CLO LTD Series 2023-36A Class A, CME Term SOFR 3 Month Index + 1.800% 6.9585% 4/22/36 (b)(c)(f) | | 881,000 | 883,017 |

| Magnetite CLO Ltd. Series 2021-27A Class AR, CME Term SOFR 3 Month Index + 1.400% 6.7278% 10/20/34 (b)(c)(f) | | 305,000 | 302,701 |

| Magnetite IX, Ltd. / Magnetite IX LLC Series 2021-30A Class A, CME Term SOFR 3 Month Index + 1.390% 6.7428% 10/25/34 (b)(c)(f) | | 1,565,000 | 1,554,388 |

| Magnetite XXI Ltd. Series 2021-21A Class AR, CME Term SOFR 3 Month Index + 1.280% 6.6078% 4/20/34 (b)(c)(f) | | 1,158,000 | 1,144,858 |

| Magnetite XXIII, Ltd. Series 2021-23A Class AR, CME Term SOFR 3 Month Index + 1.390% 6.7428% 1/25/35 (b)(c)(f) | | 1,132,000 | 1,126,779 |

| Magnetite XXIX, Ltd. / Magnetite XXIX LLC Series 2021-29A Class A, CME Term SOFR 3 Month Index + 1.250% 6.5596% 1/15/34 (b)(c)(f) | | 1,480,000 | 1,468,922 |

| Marlette Funding Trust 2023-3 Series 2023-3A Class A, 6.49% 9/15/33 (b) | | 1,200,000 | 1,199,443 |

| Milos CLO, Ltd. Series 2020-1A Class AR, CME Term SOFR 3 Month Index + 1.330% 6.6578% 10/20/30 (b)(c)(f) | | 1,291,566 | 1,289,986 |

| Peace Park CLO, Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.130% 6.7178% 10/20/34 (b)(c)(f) | | 1,254,000 | 1,244,179 |

| Planet Fitness Master Issuer LLC: | | | |

| Series 2018-1A Class A2II, 4.666% 9/5/48 (b) | | 1,903,095 | 1,827,116 |

| Series 2019-1A Class A2, 3.858% 12/5/49 (b) | | 934,120 | 790,610 |

| Series 2022-1A: | | | |

Class A2I, 3.251% 12/5/51 (b) | | 1,108,963 | 995,216 |

Class A2II, 4.008% 12/5/51 (b) | | 991,450 | 817,542 |

| Project Silver Series 2019-1 Class A, 3.967% 7/15/44 (b) | | 788,418 | 668,373 |

| Rockland Park CLO Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.380% 6.7078% 4/20/34 (b)(c)(f) | | 1,717,000 | 1,704,838 |

| RR 7 Ltd. Series 2022-7A Class A1AB, CME Term SOFR 3 Month Index + 1.340% 6.648% 1/15/37 (b)(c)(f) | | 1,862,000 | 1,837,576 |

| Sapphire Aviation Finance Series 2020-1A: | | | |

| Class A, 3.228% 3/15/40 (b) | | 896,170 | 758,285 |

| Class B, 4.335% 3/15/40 (b) | | 228,997 | 163,742 |

| SBA Tower Trust: | | | |

| Series 2019, 2.836% 1/15/50 (b) | | 1,211,000 | 1,155,345 |

| 1.884% 7/15/50 (b) | | 498,000 | 449,612 |

| 2.328% 7/15/52 (b) | | 381,000 | 327,560 |

| Stratus CLO, Ltd. Series 2022-1A Class A, CME Term SOFR 3 Month Index + 1.750% 7.0761% 7/20/30 (b)(c)(f) | | 248,272 | 248,296 |

| SYMP Series 2022-32A Class A1, CME Term SOFR 3 Month Index + 1.320% 6.6656% 4/23/35 (b)(c)(f) | | 1,936,000 | 1,911,657 |

| Symphony CLO Ltd. Series 2020-22A Class A1A, CME Term SOFR 3 Month Index + 1.550% 6.8615% 4/18/33 (b)(c)(f) | | 3,000,000 | 2,990,142 |

| Symphony CLO XIX, Ltd. / Symphony CLO XIX LLC Series 2018-19A Class A, CME Term SOFR 3 Month Index + 1.220% 6.5296% 4/16/31 (b)(c)(f) | | 771,744 | 766,813 |

| Symphony CLO XXV Ltd. / Symphony CLO XXV LLC Series 2021-25A Class A, CME Term SOFR 3 Month Index + 1.240% 6.5617% 4/19/34 (b)(c)(f) | | 1,453,000 | 1,430,393 |

| Symphony CLO XXVI Ltd. / Symphony CLO XXVI LLC Series 2021-26A Class AR, CME Term SOFR 3 Month Index + 1.340% 6.6678% 4/20/33 (b)(c)(f) | | 1,903,000 | 1,891,474 |

| Tesla Auto Lease Trust 23-A Series 2023-A Class A3, 5.89% 6/22/26 (b) | | 1,000,000 | 997,420 |

| Thunderbolt Aircraft Lease Ltd. Series 2018-A Class A, 4.147% 9/15/38 (b)(c) | | 667,154 | 567,095 |

| Thunderbolt III Aircraft Lease Ltd. Series 2019-1 Class A, 3.671% 11/15/39 (b) | | 1,293,459 | 1,073,648 |

| Toyota Lease Owner Trust Series 2023 A: | | | |

| Class A2, 5.3% 8/20/25 (b) | | 814,000 | 810,322 |

| Class A3, 4.93% 4/20/26 (b) | | 891,000 | 881,775 |

| Valley Stream Park Clo Ltd. / Vy Series 2022-1A Class A, CME Term SOFR 3 Month Index + 2.400% 7.7261% 10/20/34 (b)(c)(f) | | 1,578,000 | 1,579,447 |

| Verizon Master Trust: | | | |

| Series 2021-1 Class A, 0.5% 5/20/27 | | 600,000 | 577,358 |

| Series 2023 2 Class A, 4.89% 4/13/28 | | 500,000 | 495,160 |

| Voya CLO Ltd. Series 2019-2A Class A, CME Term SOFR 3 Month Index + 1.530% 6.8578% 7/20/32 (b)(c)(f) | | 1,290,000 | 1,288,042 |

| Voya CLO Ltd./Voya CLO LLC: | | | |

| Series 2021-2A Class A1R, CME Term SOFR 3 Month Index + 1.420% 6.7417% 7/19/34 (b)(c)(f) | | 851,000 | 845,007 |

| Series 2021-3A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7378% 10/20/34 (b)(c)(f) | | 1,736,000 | 1,722,999 |

| Voya CLO, Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.150% 6.7196% 7/16/34 (b)(c)(f) | | 860,000 | 851,916 |

| World Omni Auto Receivables Trust: | | | |

| Series 2023 B: | | | |

Class A2A, 5.25% 11/16/26 | | 514,000 | 511,519 |

Class A3, 4.66% 5/15/28 | | 944,000 | 930,695 |

| Series 2023-C Class A3, 5.15% 11/15/28 | | 514,000 | 513,162 |

| World Omni Automobile Lease Series 2023-A Class A2A, 5.47% 11/17/25 | | 980,000 | 976,619 |

| TOTAL ASSET-BACKED SECURITIES (Cost $135,840,367) | | | 132,321,111 |

| | | | |

| Collateralized Mortgage Obligations - 1.8% |

| | | Principal Amount (a) | Value ($) |

| Private Sponsor - 0.2% | | | |

| Brass PLC Series 2021-10A Class A1, 0.669% 4/16/69 (b)(c) | | 281,160 | 268,877 |

| Cascade Funding Mortgage Trust: | | | |

| Series 2021-HB5 Class A, 0.8006% 2/25/31 (b) | | 303,943 | 296,043 |

| Series 2021-HB6 Class A, 0.8983% 6/25/36 (b) | | 572,507 | 553,652 |

| CFMT Series 2022-HB10 Class A, 3.25% 11/25/35 (b) | | 976,398 | 931,934 |

| MFA Trust sequential payer Series 2022-RPL1 Class A1, 3.3% 8/25/61 (b) | | 413,309 | 373,791 |

| New Residential Mortgage Loan Trust Series 2020-1A Class A1B, 3.5% 10/25/59 (b) | | 423,023 | 383,949 |

| NYMT Loan Trust sequential payer Series 2021-CP1 Class A1, 2.0424% 7/25/61 (b) | | 235,943 | 209,552 |

| Ocwen Ln Investment Trust 2023-Hb1 Series 2023-HB1 Class A, 3% 6/25/36 (b) | | 351,102 | 330,986 |

| Preston Ridge Partners Mortgage Trust Series 2021-RPL2 Class A1, 1.455% 10/25/51 (b)(c) | | 345,313 | 301,841 |

| Towd Point Mortgage Trust sequential payer Series 2022-K147 Class A2, 3.75% 7/25/62 (b) | | 697,311 | 635,712 |

TOTAL PRIVATE SPONSOR | | | 4,286,337 |

| U.S. Government Agency - 1.6% | | | |

| Fannie Mae: | | | |

| floater: | | | |

Series 1994-42 Class FK, 10-Year Treasury Constant Maturity Rate - 0.500% 3.31% 4/25/24 (c)(f) | | 912 | 907 |

Series 2001-38 Class QF, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.090% 6.3821% 8/25/31 (c)(f) | | 2,207 | 2,213 |

Series 2002-18 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.910% 6.2021% 2/25/32 (c)(f) | | 257 | 256 |

Series 2002-39 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.3445% 3/18/32 (c)(f) | | 479 | 480 |

Series 2002-60 Class FV, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4021% 4/25/32 (c)(f) | | 1,033 | 1,035 |

Series 2002-63 Class FN, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4021% 10/25/32 (c)(f) | | 648 | 649 |

Series 2002-7 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.860% 6.1521% 1/25/32 (c)(f) | | 240 | 239 |

Series 2002-74 Class FV, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.560% 5.8521% 11/25/32 (c)(f) | �� | 10,265 | 10,239 |

Series 2002-75 Class FA, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4021% 11/25/32 (c)(f) | | 1,012 | 1,014 |

Series 2003-118 Class S, 7.980% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.6979% 12/25/33 (c)(j)(k) | | 9,442 | 1,271 |

Series 2006-104 Class GI, 6.560% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2779% 11/25/36 (c)(j)(k) | | 6,780 | 556 |

Series 2010-15 Class FJ, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.040% 6.3321% 6/25/36 (c)(f) | | 195,277 | 195,293 |

| planned amortization class: | | | |

Series 1993-207 Class H, 6.5% 11/25/23 | | 55 | 54 |

Series 1996-28 Class PK, 6.5% 7/25/25 | | 69 | 69 |

Series 1999-17 Class PG, 6% 4/25/29 | | 2,541 | 2,542 |

Series 1999-32 Class PL, 6% 7/25/29 | | 3,046 | 3,055 |

Series 1999-33 Class PK, 6% 7/25/29 | | 2,273 | 2,278 |

Series 2001-52 Class YZ, 6.5% 10/25/31 | | 417 | 424 |

Series 2003-70 Class BJ, 5% 7/25/33 | | 15,347 | 15,035 |

Series 2005-64 Class PX, 5.5% 6/25/35 | | 10,441 | 10,380 |

Series 2005-68 Class CZ, 5.5% 8/25/35 | | 209,922 | 209,955 |

Series 2005-81 Class PC, 5.5% 9/25/35 | | 5,426 | 5,475 |

Series 2006-12 Class BO 10/25/35 (l) | | 7,003 | 5,982 |

Series 2006-15 Class OP 3/25/36 (l) | | 9,355 | 7,793 |

Series 2006-45 Class OP 6/25/36 (l) | | 2,866 | 2,248 |

Series 2006-62 Class KP 4/25/36 (l) | | 4,442 | 3,589 |

Series 2010-118 Class PB, 4.5% 10/25/40 | | 158,310 | 153,511 |

Series 2012-149: | | | |

Class DA, 1.75% 1/25/43 | | 53,473 | 48,026 |

Class GA, 1.75% 6/25/42 | | 58,561 | 52,465 |

Series 2021-69 Class JK, 1.5% 10/25/51 | | 214,497 | 172,007 |

| sequential payer: | | | |

Series 1997-41 Class J, 7.5% 6/18/27 | | 459 | 462 |

Series 1999-25 Class Z, 6% 6/25/29 | | 2,471 | 2,452 |

Series 2001-20 Class Z, 6% 5/25/31 | | 2,916 | 2,930 |

Series 2001-31 Class ZC, 6.5% 7/25/31 | | 1,381 | 1,384 |

Series 2002-16 Class ZD, 6.5% 4/25/32 | | 1,164 | 1,185 |

Series 2002-74 Class SV, 7.430% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.1479% 11/25/32 (c)(j)(k) | | 2,139 | 51 |

Series 2003-117 Class MD, 5% 12/25/23 | | 129 | 128 |

Series 2004-52 Class KZ, 5.5% 7/25/34 | | 74,413 | 73,871 |

Series 2004-91 Class Z, 5% 12/25/34 | | 166,118 | 162,764 |

Series 2005-117 Class JN, 4.5% 1/25/36 | | 18,322 | 17,938 |

Series 2005-14 Class ZB, 5% 3/25/35 | | 51,311 | 50,275 |

Series 2006-72 Class CY, 6% 8/25/26 | | 15,600 | 15,584 |

Series 2009-59 Class HB, 5% 8/25/39 | | 92,031 | 90,744 |

Series 2012-67 Class AI, 4.5% 7/25/27 (j) | | 2,416 | 58 |

Series 2020-101 Class BA, 1.5% 9/25/45 | | 283,905 | 237,021 |

Series 2020-43 Class MA, 2% 1/25/45 | | 699,997 | 613,019 |

Series 2020-49 Class JA, 2% 8/25/44 | | 117,073 | 103,957 |

Series 2020-80 Class BA, 1.5% 3/25/45 | | 422,481 | 354,502 |

Series 2021-68 Class A, 2% 7/25/49 | | 231,459 | 185,630 |

Series 2021-85 Class L, 2.5% 8/25/48 | | 126,518 | 109,139 |

Series 2021-95: | | | |

Class 0, 2.5% 9/25/48 | | 636,615 | 546,688 |

Class BA, 2.5% 6/25/49 | | 953,125 | 819,568 |

Series 2021-96 Class HA, 2.5% 2/25/50 | | 208,695 | 181,162 |

Series 2022-1 Class KA, 3% 5/25/48 | | 203,422 | 180,843 |

Series 2022-11 Class B, 3% 6/25/49 | | 239,675 | 215,059 |

Series 2022-13: | | | |

Class HA, 3% 8/25/46 | | 242,493 | 221,296 |

Class JA, 3% 5/25/48 | | 453,908 | 405,156 |

Class MA, 3% 5/25/44 | | 3,774,567 | 3,480,844 |

Series 2022-3: | | | |

Class D, 2% 2/25/48 | | 956,554 | 820,161 |

Class N, 2% 10/25/47 | | 2,433,495 | 2,034,699 |

Series 2022-30 Class E, 4.5% 7/25/48 | | 532,315 | 511,567 |

Series 2022-4 Class B, 2.5% 5/25/49 | | 152,423 | 130,848 |

Series 2022-49 Class TC, 4% 12/25/48 | | 169,242 | 161,668 |

Series 2022-7: | | | |

Class A, 3% 5/25/48 | | 289,696 | 257,572 |

Class E, 2.5% 11/25/47 | | 946,199 | 828,696 |

Series 2022-9 Class BA, 3% 5/25/48 | | 243,400 | 217,011 |

| Series 06-116 Class SG, 6.520% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2379% 12/25/36 (c)(j)(k) | | 4,369 | 386 |

| Series 07-40 Class SE, 6.320% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.0379% 5/25/37 (c)(j)(k) | | 2,490 | 256 |

| Series 2003-21 Class SK, 7.980% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.6979% 3/25/33 (c)(j)(k) | | 614 | 66 |

| Series 2005-72 Class ZC, 5.5% 8/25/35 | | 37,447 | 37,288 |

| Series 2005-79 Class ZC, 5.9% 9/25/35 | | 21,609 | 21,627 |

| Series 2007-66 Class SA, 38.910% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 7.1876% 7/25/37 (c)(f)(k) | | 3,048 | 3,599 |

| Series 2008-12 Class SG, 6.230% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 0.9479% 3/25/38 (c)(j)(k) | | 15,613 | 1,333 |

| Series 2010-135: | | | |

Class LS, 5.930% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 0.6479% 12/25/40 (c)(j)(k) | | 15,786 | 863 |

Class ZA, 4.5% 12/25/40 | | 8,036 | 7,920 |

| Series 2010-139 Class NI, 4.5% 2/25/40 (j) | | 20,731 | 286 |

| Series 2010-150 Class ZC, 4.75% 1/25/41 | | 77,348 | 75,598 |

| Series 2010-39 Class FG, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.030% 6.3221% 3/25/36 (c)(f) | | 135,877 | 135,779 |

| Series 2010-95 Class ZC, 5% 9/25/40 | | 169,169 | 167,299 |

| Series 2011-39 Class ZA, 6% 11/25/32 | | 10,915 | 11,064 |

| Series 2011-4 Class PZ, 5% 2/25/41 | | 24,367 | 23,191 |

| Series 2011-67 Class AI, 4% 7/25/26 (j) | | 7,216 | 158 |

| Series 2012-100 Class WI, 3% 9/25/27 (j) | | 29,306 | 1,127 |

| Series 2012-14 Class JS, 6.530% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2479% 12/25/30 (c)(j)(k) | | 1,226 | 2 |

| Series 2012-9 Class SH, 6.430% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.1479% 6/25/41 (c)(j)(k) | | 2,901 | 18 |

| Series 2013-133 Class IB, 3% 4/25/32 (j) | | 9,543 | 225 |

| Series 2013-134 Class SA, 5.930% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 0.6479% 1/25/44 (c)(j)(k) | | 10,540 | 989 |

| Series 2013-N1 Class A, 6.600% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.3179% 6/25/35 (c)(j)(k) | | 12,850 | 880 |

| Series 2015-42 Class IL, 6% 6/25/45 (j) | | 65,535 | 11,048 |

| Series 2015-70 Class JC, 3% 10/25/45 | | 73,966 | 68,948 |

| Series 2017-30 Class AI, 5.5% 5/25/47 (j) | | 36,560 | 6,223 |

| Series 2017-74 Class SH, 6.080% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 0.7979% 10/25/47 (c)(j)(k) | | 305,312 | 31,890 |

| Series 2018-45 Class GI, 4% 6/25/48 (j) | | 420,550 | 84,011 |

| Series 2020-45 Class JL, 3% 7/25/40 | | 20,589 | 18,537 |

| Series 2021-59 Class H, 2% 6/25/48 | | 131,241 | 106,986 |

| Series 2021-66: | | | |

Class DA, 2% 1/25/48 | | 141,775 | 115,951 |

Class DM, 2% 1/25/48 | | 150,667 | 123,223 |

| Series 2022-28 Class A, 2.5% 2/25/52 | | 795,565 | 718,956 |

| Series 2023-13 Class CK, 1.5% 11/25/50 | | 1,397,257 | 1,093,542 |

| Fannie Mae Stripped Mortgage-Backed Securities: | | | |

| Series 339 Class 5, 5.5% 7/25/33 (j) | | 2,335 | 373 |

| Series 343 Class 16, 5.5% 5/25/34 (j) | | 2,192 | 352 |

| Series 348 Class 14, 6.5% 8/25/34 (c)(j) | | 1,466 | 283 |

| Series 351 Class 13, 6% 3/25/34 (j) | | 1,363 | 248 |

| Series 384 Class 6, 5% 7/25/37 (j) | | 9,223 | 1,564 |

| Freddie Mac: | | | |

| floater: | | | |

Series 2412 Class FK, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.910% 6.103% 1/15/32 (c)(f) | | 194 | 194 |

Series 2423 Class FA, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.203% 3/15/32 (c)(f) | | 291 | 290 |

Series 2424 Class FM, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.303% 3/15/32 (c)(f) | | 250 | 251 |

Series 2432: | | | |

Class FE, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.203% 6/15/31 (c)(f) | | 461 | 460 |

Class FG, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.203% 3/15/32 (c)(f) | | 159 | 159 |

Series 2526 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.510% 5.703% 11/15/32 (c)(f) | | 3,289 | 3,258 |

Series 2711 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.203% 2/15/33 (c)(f) | | 51,034 | 50,952 |

| floater planned amortization class Series 2770 Class FH, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.510% 5.703% 3/15/34 (c)(f) | | 74,603 | 73,424 |

| floater target amortization class Series 3366 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.360% 5.553% 5/15/37 (c)(f) | | 11,795 | 11,429 |

| planned amortization class: | | | |

Series 2021-5141 Class JM, 1.5% 4/25/51 | | 156,918 | 125,614 |

Series 2021-5148: | | | |

Class AD, 1.5% 10/25/51 | | 211,479 | 169,965 |

Class PC, 1.5% 10/25/51 | | 211,427 | 168,084 |

Series 2095 Class PE, 6% 11/15/28 | | 3,076 | 3,112 |

Series 2101 Class PD, 6% 11/15/28 | | 1,593 | 1,597 |

Series 2121 Class MG, 6% 2/15/29 | | 1,302 | 1,307 |

Series 2131 Class BG, 6% 3/15/29 | | 9,233 | 9,274 |

Series 2137 Class PG, 6% 3/15/29 | | 1,440 | 1,446 |

Series 2154 Class PT, 6% 5/15/29 | | 2,443 | 2,454 |

Series 2162 Class PH, 6% 6/15/29 | | 473 | 474 |

Series 2520 Class BE, 6% 11/15/32 | | 4,678 | 4,760 |

Series 2693 Class MD, 5.5% 10/15/33 | | 10,194 | 10,143 |

Series 2802 Class OB, 6% 5/15/34 | | 9,015 | 9,070 |

Series 2996 Class MK, 5.5% 6/15/35 | | 2,777 | 2,785 |

Series 3002 Class NE, 5% 7/15/35 | | 10,695 | 10,662 |

Series 3110 Class OP 9/15/35 (l) | | 2,390 | 2,208 |

Series 3119 Class PO 2/15/36 (l) | | 10,778 | 8,522 |

Series 3123 Class LO 3/15/36 (l) | | 6,154 | 4,915 |

Series 3189 Class PD, 6% 7/15/36 | | 9,504 | 9,703 |