| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | September 30, 2007 |

Estimated average burden |

hours per response. . . . . .. | | 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04101

Excelsior Tax-Exempt Funds, Inc.

(Exact name of registrant as specified in charter)

United States Trust Company of New York

114 West 47th Street

New York, New York 10036

(Address of principal executive offices) (Zip code)

BISYS Fund Services

3435 Stelzer Road

Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-852-1000

Date of fiscal year end: March 31, 2006

Date of reporting period: March 31, 2006

| Item 1. | Reports to Stockholders. |

FIXED INCOMEFUNDS

ANNUAL REPORT

March 31, 2006

TABLE OF CONTENTS

For shareholder account information, current price and yield quotations, or to make an initial purchase or obtain a prospectus, call 1-800-446-1012, from overseas, call 617-483-7297.

| · | Internet Address: http://www.excelsiorfunds.com |

This report must be preceded or accompanied by a current prospectus.

A description of the policies and procedures that Excelsior Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-446-1012, or (ii) by accessing the Excelsior Funds’ internet address and (iii) on the Commission’s website at http://www.sec.gov.

Excelsior Funds file their June 30 and December 31 schedule of portfolio holdings with the Securities and Exchange Commission, on Form N-Q, within sixty days after the applicable reporting period. Excelsior Funds Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A schedule of each Fund’s portfolio holdings, as of the end of the prior month, is also available on the Funds’ website. This schedule is updated monthly, typically by the 15th calendar day, after the end of each month. The Funds may terminate or modify this policy at anytime.

You should consider the Funds’ investment objectives, risks and expenses carefully before you invest. Information about these and other important subjects is in the Funds’ prospectus, which you should read carefully before investing.

Excelsior Funds, Inc., Excelsior Funds Trust and Excelsior Tax-Exempt Funds, Inc. are distributed by BISYS Fund Services Limited Partnership.

You may write to Excelsior Funds, Inc., Excelsior Funds Trust and Excelsior Tax-Exempt Funds, Inc. at the following address:

Excelsior Funds

P.O. Box 8529

Boston, MA 02266-8529

SHARES IN THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, UNITED STATES TRUST COMPANY OF NEW YORK, U.S. TRUST COMPANY, N.A., THEIR PARENT AND AFFILIATES AND SHARES ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD, OR ANY OTHER AGENCY. INVESTMENTS IN THE FUNDS INVOLVE INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL. FUND SHARES ARE NOT INSURED OR GUARANTEED BY THE U.S. GOVERNMENT.

LETTER TO SHAREHOLDERS

March 31, 2006

Dear Valued Excelsior Fund Shareholder,

I am pleased to bring you the annual report for the year ended March 31, 2006 for the Excelsior Funds. The funds in this report are part of the Excelsior Fund family which had over $18 billion in assets as of the end of the report period and includes a wide array of asset classes and investment strategies designed to meet the individual investor’s needs for performance and tax sensitivity.

By now, you would have received information about changes to the administrative and non-advisory services provided to the Excelsior Funds. As a result, the Excelsior Funds and the Laudus Funds, an affiliated fund family, now share certain complex-wide administrative, compliance, marketing and other functions.

We are pleased with the transition, and remain optimistic that shareholders will approve the board of directors’ recommendation to elect members to jointly oversee the two fund families. It is anticipated that the new unified board will strengthen the oversight provided on behalf of fund shareholders and may result in certain long-term cost and operating efficiencies. All votes are important, so I encourage you to vote your shares as soon as possible if you haven’t already done so.

Given these changes, I want to assure you that the most important aspects of the Excelsior Funds will remain the same. Specifically, the fund management and investment process provided by U.S. Trust, as advisor to the Funds, as well as the funds’ emphasis on enduring performance, will not change.

In closing, we at Excelsior Funds remain committed to helping you reach your long-term investment goals. Thank you for investing with us.

Sincerely,

Evelyn Dilsaver

President

1

FIXED INCOME MARKET REVIEW

The fixed income markets experienced three key trends over the course of the fiscal year ending March 31, 2006. Dominating the market was the Federal Reserve’s continuous monetary tightening, which culminated in its fifteenth federal funds target rate hike, to 4.75%, as the reporting period ended. The result was a shift to higher bond yields across the maturity spectrum.

The second critical aspect of the fixed-income market was the continued flattening of the yield curve, as we expected. The yield curve inverted, with shorter rates higher than longer rates, for a period from the end of 2005 into early 2006. An inverted curve has signaled future recessions in the past, but our thinking concurs with the Fed’s, which identifies a global liquidity surplus as the cause of the inversion. The last critical factor for the markets was limited to municipal bonds, with the first quarter of 2006 experiencing a drop in issuance as higher rates cut off refunding issues. Tighter muni supply is expected to continue over the new fiscal year.

Agency bonds modestly outperformed Treasuries for the past 12 months. Demand was strong from domestic investors who sought a high-quality reserve against future opportunities in other sectors. Foreign buying was very heavy. Inflation indexed bonds (TIPS) signaled an increase in inflation expectations as breakeven yields for 5-year and 10-year issues rose over the reporting period, in particular with short maturity issues. Commercial mortgage backed securities modestly outperformed due to healthy demand as investors moved some funds out of the corporate sector into this sector. Interest rate volatility, a key determinant of value in the mortgage-backed securities market, has continued to decline favoring the prospects for out-performance in this sector. Municipals outperformed Treasuries, as yields on the latter rose more on both an actual and a relative basis. This was caused by a well documented increase in demand on the part of non-traditional municipal investors, in addition to a reduction in new-issue supply. The result was much richer municipal/Treasury yield ratios. This has been especially true for maturities of 10+ years, although all comparative municipal/Treasury bond yield ratios fell to 5-year lows in the quarter.

The 10-year Treasury yield is nearing the high end of the expected range for 2006. Yields should begin to decline later in the year driven by an expected slowdown in economic activity, specifically with respect to housing and the consumer. The Fed’s new Chairman, Ben Bernanke, has stated that going forward, Fed policy will be more data dependent, which could see more tightening than expected, but we believe the Fed is aware of the potential for excessive tightening. Opportunity to profit from the yield curve returning to its more traditional steeper shape is now evident. From a duration standpoint, we are positioned slightly shorter to fixed-income benchmarks, looking for an easing to economic growth rates. We will look to position portfolios longer relative to the benchmarks after the Fed concludes its rate increases. We think a significant yield advantage exists in select mortgage-backed and asset-backed investments and continues to dictate an overweight position in the sector.

2

EXCELSIOR TAX-EXEMPT FUNDS, INC. | CALIFORNIA SHORT-INTERMEDIATE TERM |

TAX-EXEMPT INCOME FUND

Fiscal Year Annual Review

California, the world’s seventh-largest economy, continues to display expansive economic growth, and a new governmental emphasis on reining in deficits has earned the state and its counties, cities and fiscal authorities high marks from bond rating agencies. Our Fund invests primarily in California municipal bonds, including state-guaranteed issuance, where at least 80% of the assets held will be both federally tax-exempt and exempt from California state and local income taxes. Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31, at the end of the Fund’s fiscal year. The tax-exempt market outperformed its taxable counterpart, as long-term municipal yields fell while intermediate and long-term governments and corporates rose.

Performance Attribution

Our investment process is driven by the independent examination of individual securities rather than by an overarching economic view, and we believe the Fund’s high-quality, well-diversified fixed-income portfolio is an outcome of this process. Our portfolio tracks the Merrill Lynch 3-7 Year Muni Index, which we not only use as a benchmark, but also as a comparative quality standard. Underperformance relative to this benchmark reflected our commitment to higher quality issues with a higher basis. The “spread” or yield difference between national and California rates widened to a more normal 15-20 basis points. New issue supply was strong, but demand continued to exceed supply, owing to the presence of new institutional buyers. Average maturity in the portfolio was extended as the manager continued to implement a laddered strategy of distributing fund assets across its maturity range in line with its benchmark.

Outlook

The Fund is beginning to be repositioned to benefit from the end of Fed tightening and a trend towards easing that we expect to develop later this year. The yield curve orientation continues to favor flattening, though to a lesser extent than in past quarters. Our biggest concern is reduced issuance, as higher interest rates have dropped refinancings by 25% since the start of the year. However, California was the number one state issuer for the first quarter of 2006, as it was for all of 2005, and supply remains healthy in both the primary and secondary markets. Our research amply demonstrates the importance of tax-savings on fixed-income returns, and we continue with this emphasis for the benefit of our investors.

3

EXCELSIOR TAX-EXEMPT FUNDS, INC. | CALIFORNIA SHORT-INTERMEDIATE TERM TAX-EXEMPT INCOME FUND |

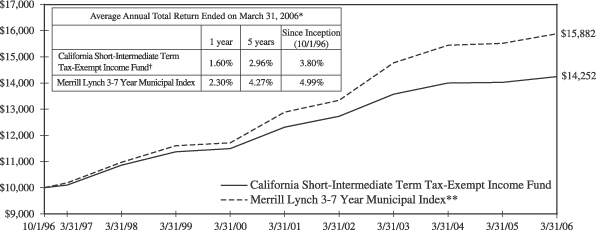

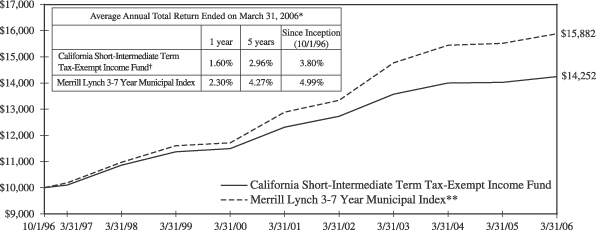

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 10/1/96 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 3-7 Year Municipal Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

4

EXCELSIOR FUNDS, INC. | CORE BOND FUND |

Fiscal Year Annual Review

The Fed’s FOMC increased the target short-term federal funds rate progressively over the past twelve months, culminating in the 15th rate hike since June 2004, to 4.75%. Treasury yields rose from the 3-month T-Bill to the 30-year bond, and the yield curve flattened and then inverted for more than a month. The Fed has said that further hikes under new Chairman Ben Bernanke will be data-dependent, signaling an end to tightening unless inflation numbers gap higher.

Performance Attribution

The Excelsior Core Bond Fund generated strong relative performance that was largely the result of the portfolio’s barbell position and shorter duration, which benefited as yields rose and the Treasury yield curve flattened. The Fund’s defensive posture to rising rates was additive to returns as yields rose. While our moderate underweight allocation in corporate bonds was a slight detractor from returns, our selective holdings in high yield debt aided relative performance. Allocations to asset-backed and commercial mortgage backed securities helped performance as well. Furthermore, the allocation to municipal bonds added value as the current refinancing supply has been light and demand has increased due to higher yields. Our average quality rating remains at AAA. The allocation to BBB rated securities remains minimal, with the portfolio emphasizing higher quality issues. There were no major changes to our sector allocations although some credit positions were selectively reduced while we added to our mortgage position. The moderate corporate underweight allocation was maintained. We have added to our position in hybrid ARMs (adjustable rate mortgages) with interest rates that are fixed for a set period and then float.

Outlook

We believe a significant yield advantage exists in select mortgage-backed and asset-backed investments, which continues to dictate an overweight position in these securities for the Fund. Interest rate volatility, a key determinant of value in the mortgage-backed securities market, has continued to decline, favoring the prospects for out-performance in this sector. Once the Fed ends the tightening phase, we see little change in the fed funds’ target rate for a considerable period thereafter. We continue to favor investments in high-quality commercial mortgages (CMBS), for their attractive yield levels, low event risk, and high quality.

5

EXCELSIOR FUNDS, INC. | CORE BOND FUND |

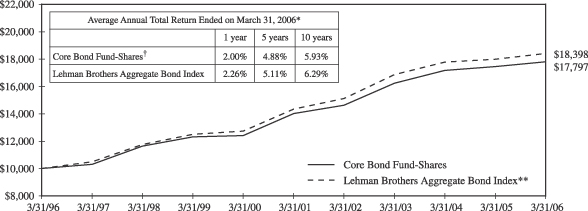

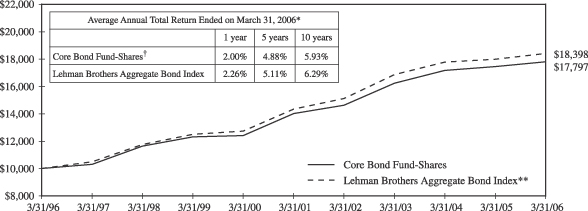

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | * | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| | ** | Source: Lehman Brothers—the Lehman Brothers Aggregate Bond Index is an unmanaged, fixed income, market value-weighted index that includes treasury issues, agency issues, corporate bond issues and mortgage-backed securities. |

| | † | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

6

EXCELSIOR FUNDS, INC. | HIGH YIELD FUND |

Fiscal Year Annual Review

The fiscal year ending March 31 witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, raising it to 4.75%. The high yield market extended its positive momentum from late last year through most of the first quarter of 2006. Solid economic growth and strong equity markets fueled enthusiasm for the high yield asset class. In addition, readily available bank credit allowed a number of high yield issuers to redeem outstanding subordinated debt thereby reducing the supply of fixed-coupon issues. Most importantly, default rates in the sector remained stable and at levels well below the long term average.

Performance Attribution

The key drivers of high yield market performance were the ongoing improvement in default rates and the increase in U.S. interest rates. Relative to the Merrill High Yield Index, we had overweight positions in paper/packaging, chemicals, and metals/mining (to benefit from strong economic growth) and in gaming (to reduce portfolio volatility). We positioned the portfolio for moderate volatility in an environment of solid economic growth and stable or moderately rising interest rates, holding issues with high coupons trading near their call prices. As a result, the Fund did not fully participate in the strong performance of the high yield sector. The Fund’s relative underperformance was almost entirely due to underweight exposure to high-volatility, lower-tier securities. Over the year, the CCC-rated sub sector significantly outperformed the B and particularly BB sub sectors. However, our underweighting of lower-tier credits reflected concerns surrounding possible principal risk from rising interest rates and uncertainty surrounding national and international political events. The best performing industry groups included metals/mining, telecom, automotive, and paper/packaging. The weakest performing groups include financials, food and beverage, gaming and broadcasting.

Outlook

The High Yield Fund has been migrating in the direction of greater diversification and higher overall quality. As a result, the Fund at the start of the year was underweight high-beta CCC and B-rated groups, which were the best performing sub sectors. Currently, the Fund has higher than average exposure to gaming and cyclical/commodity sectors such as metals/mining, and chemicals. Below-market weightings include finance, homebuilding, transportation, and autos/suppliers.

7

EXCELSIOR FUNDS, INC. | HIGH YIELD FUND |

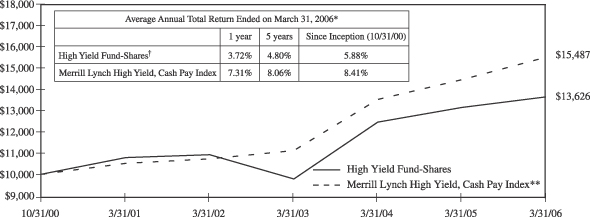

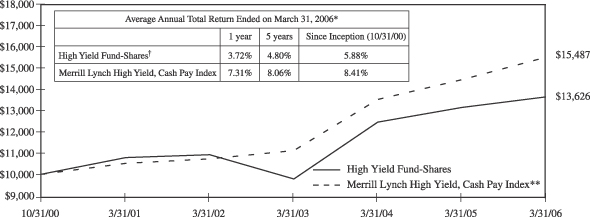

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Securities rated below investment grade generally entail greater market, credit, and liquidity risks than investment grade securities.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 10/31/00 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—The Merrill Lynch High Yield, Cash Pay Index is an unmanaged index comprised of publicly placed, non-convertible, coupon bearing domestic debt. Issues in the index are less than investment grade as rated by Standard & Poor’s Ratings Group or Moody’s Investors Service, Inc., and must not be in default. Issues have a term to maturity of at least one year. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

8

EXCELSIOR FUNDS, INC. | INTERMEDIATE-TERM BOND FUND |

Fiscal Year Annual Review

Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31. The move to higher interest rates has been in place since June 2003, and we believe this Fed tightening cycle is nearing its end. At that point, we anticipate greater opportunity, and will adjust our defensive strategy to take advantage of the new financial environment.

Performance Attribution

Positive contributors to performance during the fiscal year were holdings in mortgage-backed securities and commercial-mortgage backed securities (CMBS). Both sectors were over weighted and had strong performance relative to Treasury issues. An underweight in corporate securities was a drag on results. Securities with call features, such as, mortgages and callable agencies, were overweighted based on valuation levels, and the shorter duration of the overall portfolio aided relative returns. Mortgages and CMBS continue to be overweight for their added yield and high quality. Should the credit cycle turn more cautious, these sectors are expected to have better relative returns. Corporate bonds are under weight and the BBB-rated portion is particularly light at half the index weight. The yield advantage in corporate bonds compared to Treasury bonds is very narrow compared to historic levels.

Outlook

The Fund is beginning to be repositioned to benefit from the end of Fed tightening and a trend towards easing that we expect to develop later this year. The yield curve orientation continues to favor flattening, though to a lesser extent than in past quarters. At quarter end, the Fund had an average credit rating of AAA, a yield-to-worst of 5.38% and a duration of 3.7 years, in line with the benchmark and slightly long versus the Lipper category. We expect the Fund to perform well in the slower economic environment that we foresee.

9

EXCELSIOR FUNDS, INC. | INTERMEDIATE-TERM BOND FUND |

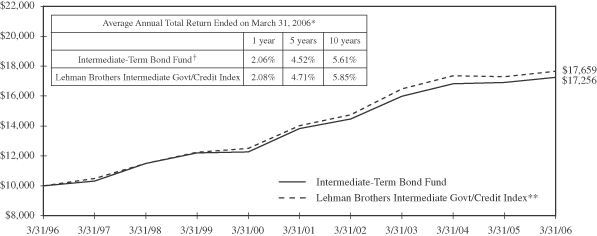

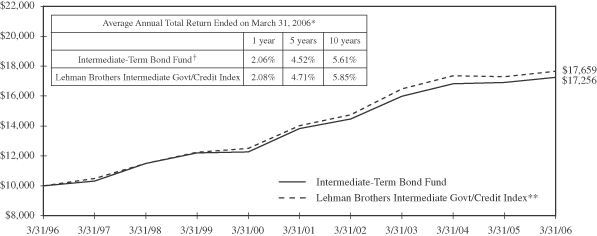

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Lehman Brothers—The Lehman Brothers Intermediate Govt/Credit Index is an unmanaged total return performance benchmark composed of U.S. Government agencies and U.S. Treasury securities and investment grade corporate debt, selected as representative of the market with maturities of one to ten years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

10

EXCELSIOR TAX-EXEMPT FUNDS, INC. | INTERMEDIATE-TERM TAX-EXEMPT FUND |

Fiscal Year Annual Review

The Fund invests primarily in municipal bonds, where at least 80% of the assets held in the Fund will be federally tax-exempt and have an average maturity of five to ten years. Over the fiscal year, we focused on extending the Fund’s average maturity, but we kept duration roughly the same. We sold several bonds with near call dates, and moved out toward bonds with longer (10-year) call provisions. Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31 at the end of the Fund’s fiscal year.

Performance Attribution

Relative underperformance with our benchmark reflects higher quality securities purchased with a higher basis. The Excelsior Intermediate-Term Tax-Exempt Fund ended the first quarter of 2006 almost fully invested, with 5% percent of assets in cash. Average maturity in the portfolio was extended to nearly 9.5 years, as the manager continued to implement a laddered strategy of distributing fund assets across a maturity range in line with our benchmark. Over the long term, this strategy should serve to deliver more stable returns. As the yield curve flattened, and particularly when the yield curve for 5- and 10- year issues leveled, our performance gained. Our investment process is driven by the independent examination of individual securities rather than by an overarching economic view, and we believe the Fund’s high-quality, well-diversified tax-exempt portfolio is an outcome of this process.

Outlook

The Fund is beginning to be repositioned to benefit from the end of Fed tightening and a trend towards easing that we expect to develop later this year. The yield curve orientation continues to favor flattening, though to a lesser extent than in past quarters. Our biggest concern is reduced issuance, as higher interest rates have dropped refinancings by 25% since the start of the year. Still, we expect to find high-quality opportunities in the municipal market.

11

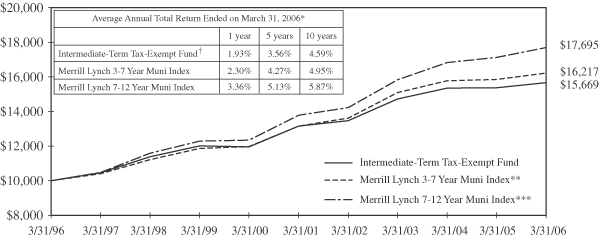

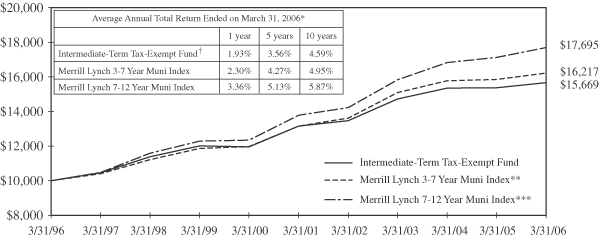

EXCELSIOR TAX-EXEMPT FUNDS, INC. | INTERMEDIATE-TERM TAX-EXEMPT FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 3-7 Year Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| *** | | Source: Merrill Lynch—the Merrill Lynch 7-12 Year Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of seven to twelve years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

12

EXCELSIOR FUNDS, INC. | LONG-TERM TAX-EXEMPT FUND |

Fiscal Year Annual Review

Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31. The tax-exempt market outperformed its taxable counterpart, as long-term municipal yields fell while yields on long-term governments and corporates rose. The Fund invested primarily in municipal bonds as a minimum of 80% of the assets held in the Fund must be exempt from Federal income taxes. Demand kept prices of long-maturity municipals strong during the quarter. More attractive long-term tax-exempt yields created unusual demand from foreign and other non-traditional muni investors, as well as insurance companies and other financial institutions, making our bonds more attractive than their taxable equivalents.

Performance Attribution

In the course of the fiscal year, we focused on extending the Fund’s average maturity, but we kept duration roughly the same. Average maturity rose to nearly 14 years. Transactions during the fiscal year included tax swaps that served to reduce volatility, increase yield, improve quality and achieve diversification objectives. We sold several bonds with near call dates, and moved out toward bonds with longer call provisions. As the yield curve flattened, our performance gained. The Excelsior Long-Term Tax-Exempt Fund ended the annual reporting period almost fully invested with less than ten percent cash. We succeeded in our goal of implementing a laddered strategy of distributing fund assets across a maturity range in line with our benchmark. Relative underperformance with our benchmark reflects higher quality securities purchased with a higher basis.

Outlook

Municipal bond issuance set a record in 2005, at $408 billion, fueled by the refunding of older outstanding issues. The unexpected drop in long-term rates during the year and the lower absolute level of rates allowed more issuers to save on their cost of debt outstanding, driving volume higher. The pace of municipal issuance in 2006 is expected to decline to the $350 billion level, as higher interest rates, and the previous large-scale refunding reduce offerings. Reduced supply should add support, and we are confident in the portfolio’s structure. Finally, we expect the Fund to perform well in the slower economic environment that we foresee.

13

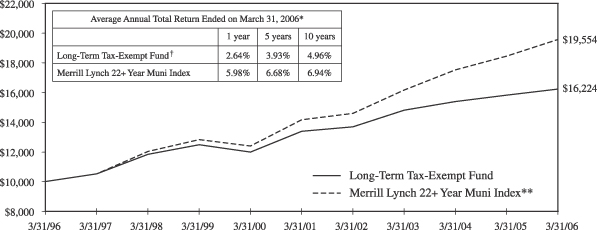

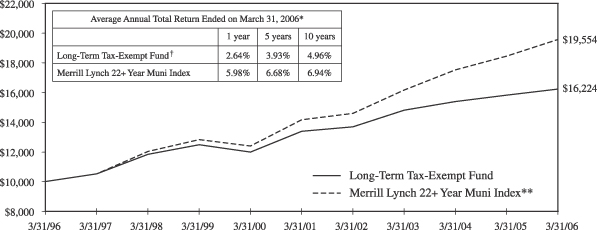

EXCELSIOR TAX-EXEMPT FUNDS, INC. | LONG-TERM TAX-EXEMPT FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further, information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 22+ Year Muni Index consists of bonds with an outstanding par which is greater than or equal to 25 million and a maturity range greater than or equal to 22 years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

14

EXCELSIOR TAX-EXEMPT FUNDS, INC. | NEW YORK INTERMEDIATE-TERM TAX-EXEMPT FUND |

Fiscal Year Annual Review

Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31 at the close of the Fund’s fiscal year. The tax-exempt market outperformed its taxable counterpart, as long-term municipal yields fell while intermediate and long-term governments and corporates rose. The Fund invested primarily in municipal bonds issued by the state, counties, municipalities and other state agencies of New York, per our mandate. A minimum of 80% of the assets held in the Fund must be both federally tax-exempt and exempt from state and local income taxes.

Performance Attribution

The New York tax-exempt market was supported by strong new issue supply, but demand continued to exceed supply. The market outperformed the national market during the fiscal year, as prices rose and spreads tightened to a point well below their historical averages. New issue supply was strong, but demand continued to exceed supply, owing to the presence of new institutional buyers. The Excelsior New York Intermediate Tax-Exempt Fund ended the annual reporting period almost fully invested with less than 10 percent cash. Average maturity in the portfolio was extended as the manager continued to implement a laddered strategy of distributing fund assets across its maturity range in line with its benchmark. During the fiscal year, the Fund moved to increase yield while reducing volatility by investing in bonds with longer maturities but shorter call dates. Underperformance relative to this benchmark reflected our commitment to higher quality issues with a higher basis.

Outlook

The Fund is beginning to be repositioned to benefit from the end of Fed tightening and a trend towards easing that we expect to develop later this year. The yield curve orientation continues to favor flattening, though to a lesser extent than in past quarters. Our biggest concern is reduced issuance, as higher interest rates have dropped refinancings by 25% since the start of the year. While this has provided price support, we think short supply is problematic. We believe the outlook for New York State issuers is positive, as the National Conference of State Legislators confirms, and revenues are either meeting or exceeding budgeted levels. And we expect the Fund to perform well in the slower economic environment that we foresee.

15

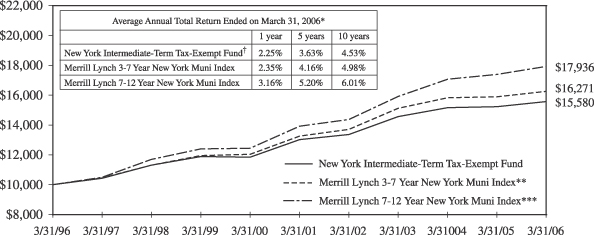

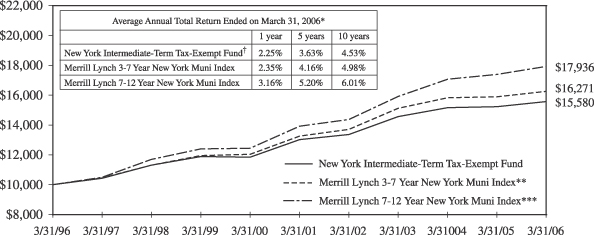

EXCELSIOR TAX-EXEMPT FUNDS, INC. | NEW YORK INTERMEDIATE-TERM TAX-EXEMPT FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | * | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| | ** | Source: Merrill Lynch—the Merrill Lynch 3-7 Year New York Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds of New York Municipalities issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| | *** | Source: Merrill Lynch—the Merrill Lynch 7-12 Year New York Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds of New York Municipalities issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of seven to twelve years. |

| | † | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

16

EXCELSIOR FUNDS, INC. | SHORT-TERM GOVERNMENT SECURITIES FUND |

Fiscal Year Annual Review

Inflation fears have risen over the fiscal year, with indicators, watched by the Fed, close to the upper end of acceptable ranges. Energy costs have climbed significantly, and inflation watchers are looking for pass through. Clearly, prospects of an end to Fed tightening will be dictated by the reported levels of consumer inflation going forward. Yields have increased across the maturity spectrum as the Federal Reserve Board has continued to raise the target rate for Fed funds, bringing it to 4.75% by March 31.

Performance Attribution

Volatility has been driven lower as market participants have begun to price in the prospect that the Federal Reserve is nearing the end of its tightening regimen and will leave the Fed Funds’ target rate unchanged for a considerable period thereafter. Mortgage-backed prices have an inverse relationship to the market level of volatility, and we have benefited with a strategy that focuses on this relationship. The Fund’s duration, or sensitivity to changes in interest rates, was 1.72 years at the end of the quarter, approximately neutral to the benchmark. We think a significant yield advantage exists in both mortgage-backed and asset-backed investments and continues to dictate an overweight position in the Fund. The combined percentage held of both sectors at the end of the period amounted to 62%. Interest rate volatility, a key determinant of value in the mortgage-backed securities market, has continued to decline favoring the prospects for outperformance in the mortgage-backed sector.

Outlook

The shape of the Treasury yield curve has become extremely flat. This situation may persist throughout the near term. An opportunity to profit from the yield curve returning to its more traditional steeper shape may present itself during the new fiscal year, but that possibility is not predicted. The flat yield curve shape eliminates the prospects of adding performance through security “rolldown.” Yield spread, we believe, is presently the best opportunity for excess returns.

17

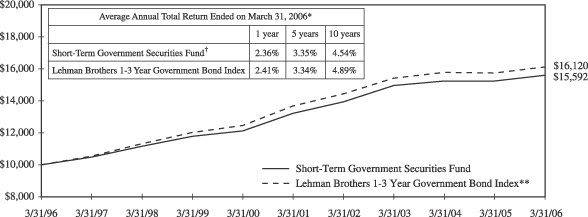

EXCELSIOR FUNDS, INC. | SHORT-TERM GOVERNMENT SECURITIES FUND |

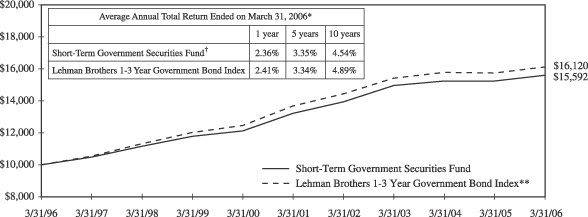

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Lehman Brothers—The Lehman Brothers 1-3 Year Government Bond Index is an unmanaged total return performance benchmark composed of U.S. Government agencies and U.S. Treasury securities with maturities of one to three years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

18

EXCELSIOR TAX-EXEMPT FUNDS, INC. | SHORT-TERM TAX-EXEMPT SECURITIES FUND |

Fiscal Year Annual Review

The Fund invests primarily in municipal bonds, with at least 80% of its assets qualifying for Federal tax-exempt status, and with an average maturity of one to three years. Over the course of the fiscal year, cash inflows to the Fund remained strong, but it was challenging to put cash to work. As the spread between the very short end of the yield curve and the one- to two-year segment was flat, we saw no incentive to relocate. But as rates rose, we extended the Fund’s average maturity, which contributed positively to performance. However, underperformance relative to this benchmark reflected our commitment to higher quality issues with a higher basis. Over the preceding twelve months, investors witnessed a rise in interest rates across the maturity spectrum, with the Fed going as far as its fifteenth 0.25% increase to the federal funds rate target, bringing it to 4.75% on March 31 at the end of the Fund’s fiscal year.

Performance Attribution

By adjusting its cash position during the quarter, the Excelsior Short-Term Tax-Exempt Securities Fund reinvested in the areas of its maturity range that experienced the biggest back-up in rates in response to Federal Reserve rate increases and supply/demand issues in the short-term tax-exempt markets. In anticipation that tax-related money market liquidations would put upward pressure on short-term yields as April 15 approached, the Fund invested 30% in cash equivalents and shortened average maturity to 2.3 years. Over the reporting period, the tax-exempt market outperformed its taxable counterpart, as long-term municipal yields fell while intermediate and long-term governments and corporates rose. The Excelsior Short-Term Tax-Exempt Securities Fund ended the quarter almost fully invested, with 5% percent of assets in cash.

Outlook

The Fund is beginning to be repositioned to benefit from the end of Fed tightening and a trend towards easing that we expect to develop later this year. The yield curve orientation continues to favor flattening, though to a lesser extent than in past quarters. Our biggest concern is reduced issuance, as higher interest rates have dropped refinancings by 25% since the start of the year. Still, we expect to find high-quality opportunities in the municipal market. During 2005, municipal interest rates rose by more than 1% at the short end, with the 2-year maturity rising from 2.20% to 3.20%. While the municipal yield curve did not invert at any time during the year (and is not expected to in 2006), by the end of December, rates across the first two years of the curve were almost identical at about 3.20%. Looking ahead, we’ll maintain the current barbell structure, until we get a better picture on exactly when Fed interest rate hikes are over, at which time we expect to deploy cash at the long-end of our maturity spectrum.

19

EXCELSIOR TAX-EXEMPT FUNDS, INC. | SHORT-TERM TAX-EXEMPT SECURITIES FUND |

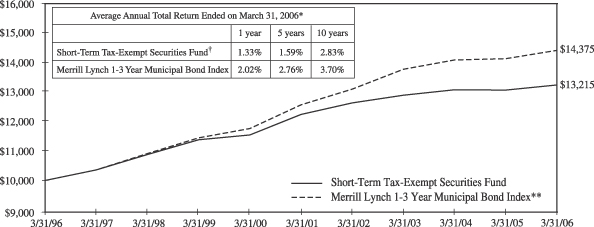

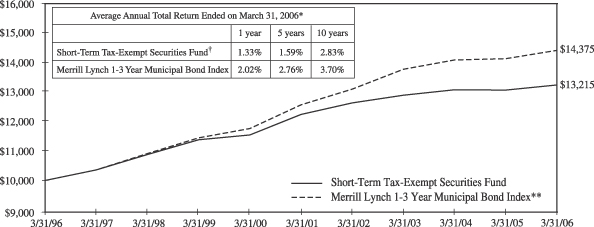

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 1-3 Year Municipal Bond Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of one to three years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

20

Excelsior Tax-Exempt Funds, Inc.

Portfolio of Investments — March 31, 2006

California Short-Intermediate Term Tax-Exempt Income Fund

| | | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

| | | | | | | | | | | | |

| TAX-EXEMPT CASH EQUIVALENT SECURITIES —

BACKED BY LETTERS OF CREDIT (2.03%): | | | |

| $ | 800,000 | | California State General Obligation Bonds, Kindergarten-University, Series B-3, (Citibank N.A.-37%/ State Street Bank & Trust-37%/ National Australia Bank-25%)(a) | | 3.06 | % | | 05/01/34 | | $ | 800,000 |

| | 550,000 | | Orange County, California, Sanitation Districts, Certificate of Participation, (AMBAC) (Societe Generale)(a) | | 3.10 | | | 08/01/16 | | | 550,000 |

| | | | | | | | | | |

|

|

| | | | TOTAL TAX-EXEMPT CASH EQUIVALENT SECURITIES — BACKED BY LETTERS OF CREDIT

(Cost $1,350,000) | | | 1,350,000 |

| | | | | | | | | | |

|

|

| | TAX-EXEMPT SECURITIES (84.25%): | | | |

| | 1,500,000 | | Anaheim, California, Public Financing Authority Revenue Bonds, Distribution Systems, (AMBC) | | 5.00 | | | 10/01/13 | | | 1,615,350 |

| | 1,000,000 | | California State Department of Transportation Revenue Bonds, Federal Highway Grant Anticipation Bonds, Series A, (FGIC) | | 4.50 | | | 02/01/13 | | | 1,042,280 |

| | 1,000,000 | | California State Department of Water Resources Central Valley Project Revenue Bonds, Series Y | | 5.00 | | | 12/01/10 | | | 1,061,230 |

| | 3,000,000 | | California State Department of Water Resources Revenue Bonds, Series W, (AMBAC) | | 5.50 | | | 12/01/09 | | | 3,201,930 |

| | 1,000,000 | | California State Economic Recovery, Special Sales Tax Revenue Bonds, Series A, (FGIC) | | 5.25 | | | 07/01/14 | | | 1,089,870 |

| | 3,000,000 | | California State Economic Recovery, Special Sales Tax Revenue Bonds, Series B | | 5.00 | | | 07/01/23 | | | 3,052,830 |

| | 750,000 | | California State General Obligation Bonds | | 6.25 | | | 04/01/08 | | | 787,373 |

| | | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

| | | | | | | | | | | | |

| | TAX-EXEMPT SECURITIES — (continued) | | | |

| $ | 3,000,000 | | California State General Obligation Bonds | | 5.00 | % | | 02/01/11 | | $ | 3,158,460 |

| | 750,000 | | California State General Obligation Bonds, (MBIA) | | 7.50 | | | 10/01/07 | | | 793,260 |

| | 1,000,000 | | California State University Systemwide Revenue Bonds, Series A, (AMBAC) | | 5.00 | | | 11/01/12 | | | 1,074,000 |

| | 1,000,000 | | California Statewide Communities Development Authority Revenue Bonds, California Endowment | | 5.00 | | | 07/01/13 | | | 1,072,650 |

| | 1,000,000 | | Central Valley, California, School District Financing Authority Revenue Bonds, Series A, (MBIA) | | 6.15 | | | 08/01/09 | | | 1,078,460 |

| | 1,000,000 | | Contra Costa, California, Transportation Authority Sales Tax Revenue Bonds, Series A, (FGIC) | | 6.00 | | | 03/01/08 | | | 1,046,220 |

| | 750,000 | | East Bay, California, Regional Park District Authority General Obligation Bonds | | 5.00 | | | 09/01/07 | | | 765,690 |

| | 975,000 | | Foothill- De Anza, California, Community College District General Obligation Bonds, (FGIC) | | 5.00 | | | 08/01/14 | | | 1,035,655 |

| | 1,000,000 | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Revenue Bonds, Enhanced-Asset Backed, Series A | | 5.00 | | | 06/01/15 | | | 1,002,130 |

| | 3,500,000 | | Los Angeles County, California, Metropolitan Transportation Authority Sales Tax Revenue Bonds, Series A, (FSA) | | 5.25 | | | 07/01/10 | | | 3,709,369 |

| | 1,000,000 | | Los Angeles, California, Department of Water & Power Revenue Bonds, Power System, Series A, Sub-Series A-1, (MBIA) | | 5.00 | | | 07/01/14 | | | 1,070,040 |

See Notes to Financial Statements.

21

Excelsior Tax-Exempt Funds, Inc.

Portfolio of Investments — March 31, 2006

California Short-Intermediate Term Tax-Exempt Income Fund — (continued)

| | | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

| | | | | | | | | | | | |

| | TAX-EXEMPT SECURITIES — (continued) | | | |

| $ | 1,000,000 | | Los Angeles, California, General Obligation Bonds, Series A, (MBIA) | | 4.00 | % | | 09/01/13 | | $ | 1,013,420 |

| | 1,000,000 | | Los Angeles, California, Sanitation Equipment Charge Revenue Bonds, (FGIC) | | 5.00 | | | 02/01/13 | | | 1,072,090 |

| | 1,000,000 | | Los Angeles, California, Sanitation Equipment Charge Revenue Bonds, Series A, (FSA) | | 5.00 | | | 02/01/10 | | | 1,051,720 |

| | 3,000,000 | | Los Angeles, California, Waste Water System Revenue Bonds, Series B, (MBIA) | | 5.00 | | | 06/01/10 | | | 3,167,730 |

| | 1,000,000 | | Metropolitan Water District of Southern California, General Obligation Bonds, Series A | | 3.00 | | | 03/01/08 | | | 987,190 |

| | 960,000 | | Metropolitan Water District of Southern California, Revenue Bonds | | 5.75 | | | 07/01/09 | | | 1,023,110 |

| | 975,000 | | Modesto, California, Irrigation District Financing Authority Revenue Bonds, Series A, (MBIA) | | 5.45 | | | 10/01/07 | | | 1,004,026 |

| | 1,000,000 | | Moulton-Niguel, California, Water District General Obligation Bonds, (AMBAC) | | 4.00 | | | 09/01/10 | | | 1,017,770 |

| | 1,000,000 | | Napa County, California, Flood Protection & Watershed Improvement Authority, General Obligation Bonds, (AMBAC) | | 4.50 | | | 06/15/12 | | | 1,043,880 |

| | 1,100,000 | | Orange County, California, Local Transportation Authority Sales Tax Revenue Bonds, 1st Senior, (AMBAC) | | 6.00 | | | 02/15/08 | | | 1,149,687 |

| | 1,000,000 | | Orange County, California, Local Transportation Authority Sales Tax Revenue Bonds, 2nd Senior, (FGIC) | | 6.00 | | | 02/15/07 | | | 1,021,750 |

| | | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

| | | | | | | | | | | | |

| | TAX-EXEMPT SECURITIES — (continued) | | | |

| $ | 1,000,000 | | Oxnard, California, Wastewater District Financing Authority Revenue Bonds, (FGIC) | | 3.50 | % | | 06/01/09 | | $ | 999,670 |

| | 1,000,000 | | Rancho, California, Water District Financing Authority Revenue Bonds, Series A, (FSA) | | 5.50 | | | 08/01/10 | | | 1,077,030 |

| | 1,000,000 | | San Diego County, California, Certificates of Participation, (AMBAC) | | 5.00 | | | 11/01/11 | | | 1,066,970 |

| | 1,000,000 | | San Diego, California, Public Facilities Financing Authority Sewer Revenue Bonds, (FGIC) | | 5.20 | | | 05/15/13 | | | 1,012,110 |

| | 1,000,000 | | San Diego, California, Public Facilities Financing Authority Water Revenue Bonds, (MBIA) | | 5.00 | | | 08/01/11 | | | 1,066,710 |

| | 1,000,000 | | San Francisco, California, City & County General Obligation Bonds, (FSA) | | 5.00 | | | 06/15/08 | | | 1,031,800 |

| | 1,000,000 | | San Francisco, California, City & County Public Utilities Communication Clean Water Revenue Bond, (MBIA) | | 5.00 | | | 10/01/13 | | | 1,070,510 |

| | 3,000,000 | | San Francisco, California, State Building Authority Lease Revenue Bonds, California State & San Francisco Civic Center, Series A | | 5.00 | | | 12/01/12 | | | 3,173,640 |

| | 1,000,000 | | San Mateo, Foster City, California, School Facilities Financing Authority Revenue Bond, (FSA) | | 4.00 | | | 08/15/12 | | | 1,015,690 |

| | 1,075,000 | | Santa Clara County, California, Financing Authority Lease Revenue Bonds, Multiple Facilities Project, Series A, (AMBAC) | | 4.50 | | | 05/15/12 | | | 1,098,919 |

See Notes to Financial Statements.

22

Excelsior Tax-Exempt Funds, Inc.

Portfolio of Investments — March 31, 2006

California Short-Intermediate Term Tax-Exempt Income Fund — (continued)

| | | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

| | | | | | | | | | | | |

| | TAX-EXEMPT SECURITIES — (continued) | | | |

| $ | 1,000,000 | | Southern California Public Power Authority Revenue Bonds, Transmission Project, Series A, (MBIA) | | 5.25 | % | | 07/01/09 | | $ | 1,045,910 |

| | 1,000,000 | | Southern California Public Power Authority Revenue Bonds, Transmission Project, Series B, (FSA) | | 4.25 | | | 07/01/11 | | | 1,030,250 |

| | | | | | | | | | |

|

|

| | | | TOTAL TAX-EXEMPT SECURITIES

(Cost $56,177,671) | | | 55,898,379 |

| | | | | | | | | | |

|

|

| TAX-EXEMPT SECURITIES — ESCROWED IN U.S.

GOVERNMENTS — 9.58% | | | |

| | 2,000,000 | | Riverside, California, Water Revenue Bonds, (FGIC) (Prerefunded 10/01/11 @ 101) | | 5.00 | | | 10/01/26 | | | 2,147,520 |

| | 1,000,000 | | Sacramento, California, City Financing Authority Revenue Bonds, City Hall, Series A, (FSA) (Prerefunded 12/01/12 @ 100) | | 5.25 | | | 12/01/17 | | | 1,087,580 |

| | 3,000,000 | | San Diego County, California, Water Authority Certificates of Participation, Series A, (FGIC) (Prerefunded 05/01/08 @ 101) | | 5.00 | | | 05/01/14 | | | 3,118,860 |

| | | | | | | | | | |

|

|

| | | | TOTAL TAX-EXEMPT SECURITIES — ESCROWED IN U.S. GOVERNMENTS (Cost $6,426,929) | | | 6,353,960 |

| | | | | | | | | | |

|

|

Shares

| | | | | | | | | |

| | REGISTERED INVESTMENT COMPANIES — 3.11% | | | |

| | 1,175,133 | | BlackRock California Money Fund | | $ | 1,175,133 |

| | 891,058 | | Federated California Money Fund | | | 891,058 |

| | | | | | | | | | |

|

|

| | | | TOTAL REGISTERED INVESTMENT COMPANIES

(Cost $2,066,191) | | | 2,066,191 |

| | | | | | | | | | |

|

|

| | | | | | |

| | | | | |

Value

|

TOTAL INVESTMENTS

(Cost $66,020,791)(b) | | 98.97 | % | | $ | 65,668,530 |

OTHER ASSETS IN EXCESS OF LIABILITIES | | 1.03 | | | | 686,633 |

| | |

|

| |

|

|

NET ASSETS | | 100.00 | % | | $ | 66,355,163 |

| | |

|

| |

|

|

| (a) | Variable Rate Security—The rate disclosed is as of March 31, 2006. |

| (b) | Unrealized appreciation (depreciation) of securities: |

| | | | |

Unrealized

Appreciation

| | Unrealized

(Depreciation)

| | Net Unrealized

Appreciation/

(Depreciation)

|

| $192,808 | | $(545,069) | | $(352,261) |

AMBAC—American Municipal Bond Assurance Corp.

FGIC—Financial Guaranty Insurance Corp.

FSA—Financial Security Assurance

MBIA—Municipal Bond Insurance Association

Notes (The following notes have not been audited by Deloitte & Touche LLP):

These municipal securities meet the three highest ratings assigned by Moody’s Investors Services, Inc. or Standard and Poor’s Corporation or, where not rated, are determined by the Advisor, under the supervision of the Board of Directors, to be of comparable quality at the time of purchase to rated instruments that may be acquired by the Fund.

At March 31, 2006, approximately 12% of the net assets are invested in municipal securities that have letter of credit enhancement features or escrows in U.S. Government securities backing them, on which the Fund relies. Without such features, the securities may or may not meet the quality standards of securities purchased by the Fund.

At March 31, 2006, approximately, 96% of the net assets are invested in California municipal securities. Economic changes affecting the state and certain of its public bodies and municipalities may affect the ability of issuers to pay the required principal and interest payments of the municipal securities.

See Notes to Financial Statements.

23

Excelsior Tax-Exempt Funds, Inc.

Portfolio of Investments — March 31, 2006

California Short-Intermediate Term Tax-Exempt Income Fund — (continued)

The summary of the Fund’s investments as of March 31, 2006 is as follows: (Unaudited)

| | | | | | |

Portfolio Diversification

| | % of

Net

Assets

| | | Value

|

Revenue Bonds | | 60.50 | % | | $ | 40,141,812 |

General Obligation Bonds | | 22.14 | | | | 14,689,597 |

Prerefunded . | | 9.58 | | | | 6,353,960 |

Registered Investment Companies | | 3.11 | | | | 2,066,191 |

Backed by Letter of Credit | | 2.03 | | | | 1,350,000 |

Certificates of Participation | | 1.61 | | | | 1,066,970 |

| | |

|

| |

|

|

Total Investments | | 98.97 | % | | $ | 65,668,530 |

Other Assets in Excess of Liabilities | | 1.03 | | | | 686,633 |

| | |

|

| |

|

|

Net Assets | | 100.00 | % | | $ | 66,355,163 |

| | |

|

| |

|

|

See Notes to Financial Statements.

24

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2006

Core Bond Fund

| | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

ASSET BACKED SECURITIES — 0.10% | | | | | | |

| $ 294,473 | | CIT RV Trust,

1999-A A4 | | 6.16 | % | | 06/15/13 | | $ | 294,413 |

| | | | | | | | | |

|

|

| | | TOTAL ASSET BACKED SECURITIES

(Cost $288,434) | | | 294,413 |

| | | | | | | | | |

|

|

COLLATERALIZED MORTGAGE OBLIGATIONS — 13.02% |

| | | NON-GOVERNMENTAL AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS — 8.61% |

| 2,295,956 | | Citigroup Mortgage Loan Trust, 2004-HYB4 WA(a) | | 4.46 | | | 12/25/34 | | | 2,243,580 |

| 2,192,522 | | Countrywide Alternative Loan Trust, 2004-16CB 1A2 | | 5.50 | | | 07/25/34 | | | 2,152,184 |

| 1,409,477 | | Countrywide Alternative Loan Trust, 2004-22CB 1A1 | | 6.00 | | | 10/25/34 | | | 1,395,569 |

| 7,158,083 | | Indymac Index Mortgage Loan Trust, 2004-AR4 3A(a) | | 4.80 | | | 08/25/34 | | | 7,005,424 |

| 9,127,959 | | JP Morgan Mortgage Trust, 2005-A6 1A1(a) | | 5.15 | | | 09/25/35 | | | 9,008,474 |

| 2,657,887 | | Wells Fargo Mortgage Backed Securities Trust, 2004-EE 3A1 | | 3.99 | | | 12/25/34 | | | 2,578,087 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 24,383,318 |

| | | | | | | | | |

|

|

| | | FEDERAL HOME LOAN MORTGAGE CORPORATION — 3.03% |

| 5,208,627 | | 1602 PH | | 6.00 | | | 04/15/23 | | | 5,220,472 |

| 3,296,147 | | 2333 UZ | | 6.50 | | | 07/15/31 | | | 3,347,404 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 8,567,876 |

| | | | | | | | | |

|

|

| | | FEDERAL NATIONAL MORTGAGE

ASSOCIATION— 0.50% |

| 1,430,000 | | 2003-17 QT | | 5.00 | | | 08/25/27 | | | 1,404,289 |

| | | | | | | | | |

|

|

| | | GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 0.88% |

| 2,450,621 | | 2005-25 B | | 6.21 | | | 03/16/21 | | | 2,486,037 |

| | | | | | | | | |

|

|

| | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $37,574,710) | | | 36,841,520 |

| | | | | | | | | |

|

|

| | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

COMMERCIAL MORTGAGE-BACKED SECURITIES — 14.54% |

| $ 1,477,000 | | Bank of America Commercial Mortgage, Inc., 2004-1 A4 | | 4.76 | % | | 11/10/39 | | $ | 1,400,650 |

| 3,705,581 | | Chase Commercial Mortgage Securities Corp., 1997-2 D | | 6.60 | | | 12/19/29 | | | 3,771,967 |

| 1,000,000 | | Credit Suisse First Boston Mortgage Securities Corp., 2002-CKS4 G(a)(b) | | 6.01 | | | 11/15/36 | | | 1,016,760 |

| 1,689,000 | | Greenwich Capital Commercial Funding Corp., 2004-GG1 A1 | | 5.32 | | | 06/10/36 | | | 1,659,529 |

| 2,000,000 | | Morgan Stanley Capital I, 1997-C1F(b) | | 6.85 | | | 02/15/20 | | | 2,010,911 |

| 3,601,000 | | Morgan Stanley Capital I, 1999-WF1 B | | 6.32 | | | 11/15/31 | | | 3,675,836 |

| 3,150,000 | | Morgan Stanley Dean Witter Capital I, 2000-LIF2 C | | 7.50 | | | 10/15/33 | | | 3,384,305 |

| 1,969,034 | | Mortgage Capital Funding, Inc., 1996-MC1 G | | 7.15 | | | 06/15/06 | | | 1,965,698 |

| 773,095 | | Mortgage Capital Funding, Inc., 1996-MC2 D | | 7.26 | | | 12/21/26 | | | 776,091 |

| 3,061,000 | | Mortgage Capital Funding, Inc., 1998-MC1 C | | 6.95 | | | 03/18/30 | | | 3,137,019 |

| 2,521,000 | | Nomura Asset Securities Corp., 1998-D6 A4(a) | | 6.92 | | | 03/15/30 | | | 2,828,507 |

| 3,601,000 | | Wachovia Bank Commercial Mortgage Trust, 2003-C9 A3 | | 4.61 | | | 12/15/35 | | | 3,463,240 |

| 2,305,000 | | Wachovia Bank Commercial Mortgage Trust, 2004-C12 A3 | | 5.23 | | | 07/15/41 | | | 2,282,884 |

| 10,000,000 | | Wachovia Bank Commercial Mortgage Trust, 2005-C20 A5(a)(c) | | 5.09 | | | 07/15/42 | | | 9,775,846 |

| | | | | | | | | |

|

|

| | | TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $41,540,424) | | | 41,149,243 |

| | | | | | | | | |

|

|

See Notes to Financial Statements.

25

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2006

Core Bond Fund — (continued)

| | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

CORPORATE BONDS — 15.06% |

| $ 1,115,000 | | America Movil S.A. de C.V. | | 5.50 | % | | 03/01/14 | | $ | 1,068,607 |

| 2,000,000 | | Bank One Corp. | | 7.88 | | | 08/01/10 | | | 2,180,832 |

| 3,005,000 | | Bottling Group llc | | 5.50 | | | 04/01/16 | | | 2,966,407 |

| 700,000 | | British Telecommunications plc | | 8.88 | | | 12/15/30 | | | 895,497 |

| 2,800,000 | | Cisco Systems, Inc. | | 5.50 | | | 02/22/16 | | | 2,757,941 |

| 1,081,000 | | CIT Group, Inc. | | 5.88 | | | 10/15/08 | | | 1,093,756 |

| 2,000,000 | | Citigroup, INC. | | 4.25 | | | 07/29/09 | | | 1,937,164 |

| 1,441,000 | | Comcast Cable Communications | | 6.88 | | | 06/15/09 | | | 1,490,246 |

| 2,000,000 | | Comcast Cable Communications | | 6.75 | | | 01/30/11 | | | 2,079,016 |

| 1,441,000 | | DaimlerChrysler N.A. Holding Corp. | | 7.20 | | | 09/01/09 | | | 1,504,655 |

| 600,000 | | Entergy Gulf States | | 5.70 | | | 06/01/15 | | | 575,122 |

| 1,000,000 | | Ford Motor Credit Co. | | 8.63 | | | 11/01/10 | | | 958,056 |

| 2,773,000 | | Household Finance Corp. | | 8.00 | | | 07/15/10 | | | 3,025,750 |

| 1,437,000 | | International Lease Finance Corp. | | 4.50 | | | 05/01/08 | | | 1,412,935 |

| 250,000 | | Iron Mountain, Inc. | | 8.63 | | | 04/01/13 | | | 260,000 |

| 2,881,000 | | Merrill Lynch & Co. MTN | | 5.00 | | | 02/03/14 | | | 2,762,940 |

| 2,800,000 | | Morgan Stanley | | 4.75 | | | 04/01/14 | | | 2,612,380 |

| 2,000,000 | | Morgan Stanley Dean Witter | | 6.75 | | | 04/15/11 | | | 2,105,300 |

| 1,690,000 | | Oracle Corp./ Ozark Holdings(b) | | 5.25 | | | 01/15/16 | | | 1,621,205 |

| 1,441,000 | | Prudential Financial, Inc. | | 5.10 | | | 09/20/14 | | | 1,389,778 |

| 627,000 | | PSEG Energy Holdings, Inc. | | 8.63 | | | 02/15/08 | | | 653,648 |

| 2,000,000 | | RBS Capital Trust III(a) | | 5.51 | | | 09/29/49 | | | 1,929,116 |

| 1,596,000 | | Sprint Capital Corp. | | 8.38 | | | 03/15/12 | | | 1,803,320 |

| 1,153,000 | | Time Warner Cos., Inc. | | 7.25 | | | 10/15/17 | | | 1,233,772 |

| 1,441,000 | | Wal-Mart Stores | | 4.13 | | | 02/15/11 | | | 1,364,284 |

| 950,000 | | Xerox Corp. | | 6.40 | | | 03/15/16 | | | 942,875 |

| | | | | | | | | |

|

|

| | | TOTAL CORPORATE BONDS

(Cost $42,975,196) | | | 42,624,602 |

| | | | | | | | | |

|

|

TAX-EXEMPT SECURITIES — 1.31% |

| 3,600,000 | | University of Texas Revenue Bonds, Series B | | 5.00 | | | 08/15/33 | | | 3,702,456 |

| | | | | | | | | |

|

|

| | | TOTAL TAX-EXEMPT SECURITIES

(Cost $3,691,406) | | | 3,702,456 |

| | | | | | | | | |

|

|

| | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

U.S. GOVERNMENT AGENCY BONDS & NOTES — 1.83% |

| | | FANNIE MAE (1.83%): |

| $ 5,000,000 | | MTN | | 6.25 | % | | 02/01/11 | | $ | 5,185,515 |

| | | | | | | | | |

|

|

| | | TOTAL U.S. GOVERNMENT AGENCY BONDS & NOTES

(Cost $5,341,117) | | | 5,185,515 |

| | | | | | | | | |

|

|

U.S. GOVERNMENT AGENCY MORTGAGE PASS THROUGH SECURITIES — 32.03% |

| | | FEDERAL HOME LOAN MORTGAGE CORPORATION — 17.14% |

| 10,000,000 | | TBA | | 4.50 | | | 04/01/21 | | | 9,543,751 |

| 2,888,445 | | Pool # A20105 | | 5.00 | | | 04/01/34 | | | 2,753,346 |

| 9,843,702 | | Pool # A47411 | | 4.50 | | | 10/01/35 | | | 9,080,373 |

| 4,901,581 | | Pool # A48132 | | 7.00 | | | 12/01/35 | | | 5,045,327 |

| 2,999,380 | | Pool # C01811 | | 5.00 | | | 04/01/34 | | | 2,859,092 |

| 133,535 | | Pool # C71221 | | 5.00 | | | 09/01/32 | | | 127,467 |

| 4,887,002 | | Pool # G01842 | | 4.50 | | | 06/01/35 | | | 4,508,040 |

| 15,004,026 | | Pool # G18105 | | 5.00 | | | 03/01/21 | | | 14,624,096 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 48,541,492 |

| | | | | | | | | |

|

|

| | | FEDERAL NATIONAL MORTGAGE

ASSOCIATION — 12.51% |

| 11,809,993 | | Pool # 357824 | | 5.50 | | | 06/01/35 | | | 11,531,302 |

| 1,257,935 | | Pool # 387203 | | 4.80 | | | 01/01/12 | | | 1,227,747 |

| 1,074,138 | | Pool # 387204 | | 4.80 | | | 01/01/12 | | | 1,048,361 |

| 3,780,015 | | Pool # 618322 | | 6.00 | | | 12/01/31 | | | 3,785,055 |

| 4,974,463 | | Pool # 805386 ARM(a) | | 4.90 | | | 01/01/35 | | | 4,920,909 |

| 764,261 | | Pool # 812268 | | 5.50 | | | 05/01/35 | | | 746,227 |

| 911,766 | | Pool # 820989 | | 5.50 | | | 04/01/35 | | | 890,251 |

| 909,179 | | Pool # 821567 | | 5.50 | | | 06/01/35 | | | 887,724 |

| 11,234,831 | | Pool # 829321 | | 4.50 | | | 09/01/35 | | | 10,367,019 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 35,404,595 |

| | | | | | | | | |

|

|

| | | GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 2.38% |

| 389,975 | | Pool # 2562 | | 6.00 | | | 03/20/28 | | | 394,022 |

| 596,534 | | Pool # 267812 | | 8.50 | | | 06/15/17 | | | 640,097 |

| 2,164,434 | | Pool # 3413 | | 4.50 | | | 07/20/33 | | | 2,018,927 |

| 1,983,052 | | Pool # 3442 | | 5.00 | | | 09/20/33 | | | 1,916,383 |

| 36,385 | | Pool # 532751 | | 9.00 | | | 08/15/30 | | | 39,616 |

| 109,246 | | Pool # 568670 | | 6.50 | | | 04/15/32 | | | 113,284 |

| 300,160 | | Pool # 780548 | | 8.50 | | | 12/15/17 | | | 321,070 |

| 291,452 | | Pool # 780865 | | 9.50 | | | 11/15/17 | | | 318,467 |

| 538,300 | | Pool # 781084 | | 9.00 | | | 12/15/17 | | | 577,178 |

| 390,606 | | Pool # 80311 ARM(a) | | 4.50 | | | 08/20/29 | | | 390,282 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 6,729,326 |

| | | | | | | | | |

|

|

| | | TOTAL U.S. GOVERNMENT AGENCY MORTGAGE PASS THROUGH SECURITIES

(Cost $91,989,929) | | | 90,675,413 |

| | | | | | | | | |

|

|

See Notes to Financial Statements.

26

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2006

Core Bond Fund — (continued)

| | | | | | | | | | |

Principal Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

U.S. GOVERNMENT SECURITIES — 17.81% |

| | | U.S. TREASURY STRIPS — 4.46% |

| $ 22,600,000 | | | | 0.00 | % | | 11/15/17 | | $ | 12,633,174 |

| | | | | | | | | |

|

|

| | | U.S. TREASURY INFLATION PROTECTED

BONDS — 0.83% |

| 300,000 | | | | 4.25 | | | 01/15/10 | | | 379,904 |

| 2,000,000 | | | | 0.88 | | | 04/15/10 | | | 1,982,919 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 2,362,823 |

| | | | | | | | | |

|

|

| | | U.S. TREASURY NOTES — 12.52% |

| 7,700,000 | | | | 3.63 | | | 01/15/10 | | | 7,381,774 |

| 12,000,000 | | | | 4.50 | | | 11/15/10 | | | 11,838,720 |

| 11,955,000 | | (c) | | 7.63 | | | 11/15/22 | | | 15,346,299 |

| 885,000 | | | | 4.50 | | | 02/15/36 | | | 830,379 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 35,397,172 |

| | | | | | | | | |

|

|

| | | TOTAL U.S. GOVERNMENT SECURITIES

(Cost $52,096,327) | | | 50,393,169 |

| | | | | | | | | |

|

|

| | | | |

Shares

| | | | | | | | | |

REGISTERED INVESTMENT COMPANIES — 2.16% |

| 3,052,268 | | Dreyfus Government Cash Management Fund | | | 3,052,268 |

| 3,052,268 | | Fidelity U.S. Treasury II Fund | | | 3,052,267 |

| | | | | | | | | |

|

|

| | | TOTAL REGISTERED INVESTMENT COMPANIES

(Cost $6,104,535) | | | 6,104,535 |

| | | | | | | | | |

|

|

| | | | | | |

| | |

| | | | | | Value

|

TOTAL INVESTMENTS

(Cost $281,602,078)(d) | | 97.86 | % | | $ | 276,970,866 |

OTHER ASSETS IN EXCESS OF LIABILITIES | | 2.14 | | | | 6,045,059 |

| | |

|

| |

|

|

NET ASSETS | | 100.00 | % | | $ | 283,015,925 |

| | |

|

| |

|

|

| (a) | Variable Rate Security—The rate disclosed is as of March 31, 2006. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2006, these securities amounted to $4,648,876 or 1.64% of net assets. |

| (c) | All or part of the security is segregated by the Fund’s custodian to cover future purchase commitments. |

| (d) | Unrealized appreciation (depreciation) of securities: |

| | | | | | | | | |

Unrealized

Appreciation

| | Unrealized

(Depreciation)

| | | Net Unrealized

Appreciation/

(Depreciation)

| |

| $ | 760,868 | | $ | (5,392,080 | ) | | $ | (4,631,212 | ) |

ARM—Adjustable Rate Mortgage

llc—limited liability company

MTN—Medium Term Note

plc—public limited company

STRIPS—Separately Traded Registered Interest and Principal Securities

The summary of the Fund’s investments as of March 31, 2006 is as follows: (Unaudited)

| | | | | | |

Portfolio Diversification

| | % of

Net

Assets

| | | Value

|

U.S. Government & Agency Securities | | 51.67 | % | | $ | 146,254,097 |

Corporate Bonds | | 15.06 | | | | 42,624,602 |

Commercial Mortgage-Backed Securities | | 14.54 | | | | 41,149,243 |

Collateralized Mortgage Obligations | | 13.02 | | | | 36,841,520 |

Registered Investment Companies | | 2.16 | | | | 6,104,535 |

Tax-Exempt Securities | | 1.31 | | | | 3,702,456 |

Asset Backed Securities | | 0.10 | | | | 294,413 |

| | |

|

| |

|

|

Total Investments | | 97.86 | % | | $ | 276,970,866 |

Other Assets in Excess of Liabilities | | 2.14 | | | | 6,045,059 |

| | |

|

| |

|

|

Net Assets | | 100.00 | % | | $ | 283,015,925 |

| | |

|

| |

|

|

See Notes to Financial Statements.

27

Excelsior Funds Trust

Portfolio of Investments — March 31, 2006

High Yield Fund

| | | | | | | | | | |

Principal

Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

CORPORATE BONDS — 88.98% |

| | | ADVERTISING PERIODICALS — 2.16% |

| $2,000,000 | | Dex Media Finance/West | | 8.50 | % | | 08/15/10 | | $ | 2,115,000 |

| 1,000,000 | | RH Donnelley Finance Corp.(a) | | 10.88 | | | 12/15/12 | | | 1,108,750 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 3,223,750 |

| | | | | | | | | |

|

|

| | | AGRICULTURAL CHEMICALS — 0.96% |

| 1,298,000 | | Terra Capital, Inc. | | 11.50 | | | 06/01/10 | | | 1,434,290 |

| | | | | | | | | |

|

|

| | | AUTO – TRUCK PARTS & EQUIPMENT — 0.67% |

| 1,000,000 | | Tenneco Automotive, Inc. | | 8.63 | | | 11/15/14 | | | 1,000,000 |

| | | | | | | | | |

|

|

| | | CABLE TV — 1.32% |

| 1,000,000 | | Charter Communications Holdings II | | 10.25 | | | 09/15/10 | | | 982,500 |

| 1,000,000 | | Echostar DBS Corp.(a) | | 7.13 | | | 02/01/16 | | | 983,750 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 1,966,250 |

| | | | | | | | | |

|

|

| | | CASINO HOTELS — 10.25% |

| 1,000,000 | | Aztar Corp. | | 7.88 | | | 06/15/14 | | | 1,082,500 |

| 1,000,000 | | Boyd Gaming Corp. | | 8.75 | | | 04/15/12 | | | 1,067,500 |

| 2,000,000 | | Caesars Entertainment, Inc. | | 8.88 | | | 09/15/08 | | | 2,140,000 |

| 2,000,000 | | Kerzner International | | 6.75 | | | 10/01/15 | | | 2,105,000 |

| 2,000,000 | | MGM Mirage, Inc. | | 8.50 | | | 09/15/10 | | | 2,139,999 |

| 2,000,000 | | Poster Financial Group | | 8.75 | | | 12/01/11 | | | 2,105,000 |

| 1,000,000 | | Resorts International Hotel and Casino, Inc. | | 11.50 | | | 03/15/09 | | | 1,097,500 |

| 1,000,000 | | River Rock Entertainment | | 9.75 | | | 11/01/11 | | | 1,080,000 |

| 1,000,000 | | Station Casinos | | 6.50 | | | 02/01/14 | | | 988,750 |

| 1,500,000 | | Trump Entertainment Resorts | | 8.50 | | | 06/01/15 | | | 1,458,750 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 15,264,999 |

| | | | | | | | | |

|

|

| | | CELLULAR TELECOM — 2.86% |

| 2,000,000 | | American Cellular Corp. | | 10.00 | | | 08/01/11 | | | 2,170,000 |

| 1,000,000 | | Centennial Cellular Operating Co./Centennial Communications Corp. | | 10.13 | | | 06/15/13 | | | 1,092,500 |

| 1,000,000 | | Dobson Communications Corp. | | 8.88 | | | 10/01/13 | | | 1,005,000 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 4,267,500 |

| | | | | | | | | |

|

|

| | | | | | | | | | |

Principal

Amount

| | | | Rate

| | | Maturity

Date

| | Value

|

CORPORATE BONDS — (continued) |

| | | CHEMICALS – DIVERSIFIED — 3.54% |

| $2,000,000 | | Equistar Chemicals L.P./ Equistar Funding Corp. | | 10.63 | % | | 05/01/11 | | $ | 2,165,000 |

| 500,000 | | Lyondell Chemical Co. | | 9.50 | | | 12/15/08 | | | 520,000 |

| 1,000,000 | | Lyondell Chemical Co. | | 10.50 | | | 06/01/13 | | | 1,107,500 |

| 1,500,000 | | Nell AF Sarl(a) | | 8.38 | | | 08/15/15 | | | 1,488,750 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 5,281,250 |

| | | | | | | | | |

|

|

| | | CHEMICALS – PLASTICS — 0.69% |

| 1,000,000 | | PolyOne Corp. | | 8.88 | | | 05/01/12 | | | 1,025,000 |

| | | | | | | | | |

|

|

| | | CHEMICALS – SPECIALTY — 1.39% |

| 1,000,000 | | Johnsondiversey, Inc., Series B | | 9.63 | | | 05/15/12 | | | 1,026,250 |

| 1,000,000 | | Tronox Worldwide(a) | | 9.50 | | | 12/01/12 | | | 1,050,000 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 2,076,250 |

| | | | | | | | | |

|

|

| | | COAL — 0.33% |

| 500,000 | | Massey Energy Co.(a) | | 6.88 | | | 12/15/13 | | | 490,000 |

| | | | | | | | | |

|

|

| | | COMMERCIAL SERVICES — 2.07% |

| 2,000,000 | | Iron Mountain, Inc. | | 8.63 | | | 04/01/13 | | | 2,080,000 |

| 1,000,000 | | Iron Mountain, Inc. | | 7.75 | | | 01/15/15 | | | 1,007,500 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 3,087,500 |

| | | | | | | | | |

|

|

| | | CONTAINERS – METAL/GLASS — 2.05% |

| 1,000,000 | | Crown Americas llc/Crown Americas Capital Corp.(a). | | 7.75 | | | 11/15/15 | | | 1,037,500 |

| 2,000,000 | | Owens-Illinois, Inc. | | 7.50 | | | 05/15/10 | | | 2,025,000 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 3,062,500 |

| | | | | | | | | |

|

|

| | | CONTAINERS – PAPER/PLASTIC — 2.76% |

| 1,000,000 | | Graham Packaging Co. | | 8.50 | | | 10/15/12 | | | 1,010,000 |

| 1,000,000 | | Pregis Corp.(a) | | 12.38 | | | 10/15/13 | | | 1,050,000 |

| 2,000,000 | | Stone Container Corp. | | 9.75 | | | 02/01/11 | | | 2,055,000 |

| | | | | | | | | |

|

|

| | | | | | | | | | | 4,115,000 |

| | | | | | | | | |

|

|

| | | COSMETICS & TOILETRIES — 0.54% |

| 1,000,000 | | Del Laboratories, Inc. | | 8.00 | | | 02/01/12 | | | 810,000 |

| | | | | | | | | |

|

|

| | | DISTRIBUTION/WHOLESALE — 1.23% |

| 2,000,000 | | Nebraska Book Co. | | 8.63 | | | 03/15/12 | | | 1,840,000 |

| | | | | | | | | |

|

|

| | | ELECTRIC – GENERATION — 1.08% |

| 1,500,000 | | AES Corp. | | 9.50 | | | 06/01/09 | | | 1,616,250 |

| | | | | | | | | |

|

|

See Notes to Financial Statements.

28

Excelsior Funds Trust

Portfolio of Investments — March 31, 2006

High Yield Fund — (continued)

| | | | | | | | | | |

Principal

Amount