| | |

| OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | September 30, 2007 |

Estimated average burden

|

hours per response . . . 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04101

Excelsior Tax-Exempt Funds, Inc.

(Exact name of registrant as specified in charter)

101 Montgomery Street

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

BISYS Fund Services

3435 Stelzer Road

Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-415-627-7000

Date of fiscal year end: March 31, 2007

Date of reporting period: March 31, 2007

| Item 1. | Reports to Stockholders. |

FIXED INCOMEFUNDS

ANNUAL REPORT

March 31, 2007

TABLE OF CONTENTS

For shareholder account information, current price and yield quotations, or to make an initial purchase or obtain a prospectus, call (800) 446-1012, from overseas, call (617) 483-7297.

| · | | Internet Address: http://www.excelsiorfunds.com |

This report must be preceded or accompanied by a current prospectus.

You should consider the Funds’ investment objectives, risks and expenses carefully before you invest. Information about these and other important subjects is in the Funds’ prospectus, which you should read carefully before investing.

Nothing in this report represents a recommendation of a security by the investment adviser. Manager views and portfolio holdings may have changed since the report date.

Investments in fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates.

A description of the policies and procedures that Excelsior Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (800) 446-1012, or (ii) by accessing the Excelsior Funds’ internet address and (iii) on the Commission’s website at http://www.sec.gov.

Excelsior Funds file their June 30 and December 31 schedule of portfolio holdings with the Securities and Exchange Commission, on Form N-Q, within sixty days after the applicable reporting period. Excelsior Funds Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

A schedule of each Fund’s portfolio holdings, as of the end of the prior month, is also available on the Funds’ website at www.excelsiorfunds.com. This schedule is updated monthly, typically by the 15th calendar day, after the end of each month. The Funds may terminate or modify this policy at anytime.

Excelsior Funds, Inc., Excelsior Funds Trust and Excelsior Tax-Exempt Funds, Inc. are distributed by BISYS Fund Services Limited Partnership.

You may write to Excelsior Funds, Inc., Excelsior Funds Trust and Excelsior Tax-Exempt Funds, Inc. at the following address:

Excelsior Funds

P.O. Box 8529

Boston, MA 02266-8529

Notice About Duplicate Mailings

The Excelsior Funds have adopted a policy that allows the Funds to send only one copy of a Fund’s prospectus and annual and semi-annual reports to certain shareholders residing at the same “household.” This reduces Fund expenses, which benefits you and other shareholders. If you do not want your mailings to be “householded,” please call (800) 542-1061 or contact your financial intermediary.

SHARES OF THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK, AND THE SHARES ARE NOT FEDERALLY INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, BANK INSURANCE FUND, FEDERAL RESERVE BOARD, OR ANY OTHER GOVERNMENTAL AGENCY. FUND SHARES ARE NOT INSURED OR GUARANTEED BY THE U.S. GOVERNMENT. AN INVESTMENT IN A FUND IS SUBJECT TO RISK OF PRINCIPAL.

LETTER TO SHAREHOLDERS

March 31, 2007

Dear Valued Excelsior Fund Shareholder,

I am pleased to bring you the annual report for the year ended March 31, 2007 for the Excelsior Funds. The funds in this report are part of the Excelsior Fund family which has over $20 billion in assets as of the end of the reporting period and includes a wide array of asset classes and investment strategies designed to meet the individual investor’s investment needs.

By now, you have received notification that on November 20, 2006, The Charles Schwab Corporation (“Schwab”) announced an agreement to sell the U.S. Trust Corporation (“U.S. Trust”), a wholly-owned subsidiary of Schwab, to the Bank of America Corporation (“Bank of America”) (the “Sale”). The Sale involves all of U.S. Trust’s subsidiaries, including the Excelsior Funds’ investment advisers, UST Advisers, Inc. (“USTA”) and United States Trust Company National Association, on behalf of its asset management division, U.S. Trust New York Asset Management (“USTNA”). Consequently, the Excelsior Funds will need to enter into new investment advisory agreements with USTA and USTNA.

At a meeting held on January 8, 2007, the Board approved new investment advisory agreements under which, subject to approval by the Excelsior Funds’ shareholders, USTA and USTNA will continue to serve as investment advisers to the Excelsior Funds after the Sale is completed. At the same meeting, the Board directed that the new investment advisory agreements be submitted to the shareholders of each Fund for approval.

A Special Meeting of Shareholders of Excelsior Funds, Inc., Excelsior Tax-Exempt Funds, Inc. and Excelsior Funds Trust and each of their funds was held on March 30, 2007. The number of votes necessary to conduct the Special Meeting and approve the new investment advisory agreements was obtained for each fund except the Value and Restructuring, Energy and Natural Resources and Treasury Money Funds. The Special Meeting for Value and Restructuring, Energy and Natural Resources and Treasury Money Funds was adjourned for the purpose of soliciting additional proxies, and we anticipate that the new investment advisory agreements will be approved by the shareholders of these funds at a subsequent Special Meeting.

The integration of U.S. Trust, Bank of America’s private bank and its ultra high net worth extension will create the nation’s largest private wealth management firm with assets under management of over $260 billion and total client assets of almost $420 billion.

We at the Excelsior Funds are excited about our future within Bank of America and remain committed to helping you with your long-term investment goals. Thank you for investing with us.

Sincerely,

Evelyn Dilsaver

President

1

EXCELSIOR FUNDS FIXED INCOME MARKET REVIEW | |

Bond Market Review

Yields generally declined across intermediate and longer maturity levels but rose on the front end of the curve over the course of the fiscal year ended March 31, 2007. The Federal Reserve (Fed) increased the target short-term federal funds rate twice in the period (both times in the second quarter of 2006), raising it from 4.75% to 5.25%, which is where it still stands.

The yield curve ended the fiscal year inverted as money-market rates continued to out-yield longer maturity Treasury issues. After remaining flat for most of the past year, the yield curve steepened towards a more normalized shape from the two-year to 30-year maturity range. In March, the ten-year yield was above the two-year yield, the first time in over six months.

Overall for the fiscal year, bonds earned a solid return of 6.59% as represented by the Lehman Aggregate Index. Investment grade corporate bonds, as represented by the Lehman U.S. Credit Index, returned 7.1% and posted positive excess returns (over duration equivalent Treasuries) of almost 1%. The spread between corporate bond yields and Treasuries remained narrow over the course of the fiscal year, a reflection of continued strong investor demand as corporate default rates hovered near historic lows. A record $1.07 trillion in corporate bonds were issued in 2006, versus $770 billion in 2005, as companies took advantage of relatively low borrowing costs. Commercial mortgage-backed securities (CMBS) was another strong spread sector over the period, generating 0.67% of excess returns. So far in this credit cycle, strong fundamentals and heavy buying by foreign investors have contributed to spread compression.

In the municipal market, low interest rates, narrow intermarket long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest-volume years on record. Foreign buyers, seeking to take advantage of spreads between BMA (the Bond Market Association synthetic municipal yield curve) and LIBOR (the London Interbank Offered Rate), were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, it has been steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market.

Outlook

We believe the U.S. economy is in a period of below-trend growth levels. Going forward much will depend on the employment situation, which continues to hold firm. The timing of any lowering of rates by the Fed will be a function of equity market strength and unemployment reports. We do believe that weakness in the economy will eventually cause the yield curve to steepen and rates to fall, especially at the shorter end of the yield curve. History has shown that after a long period of a stable Fed funds rate (such as we have seen in the past nine months), a reversal of policy (in this case, from tightening to easing) carries a very high probability.

Inflation-protected Treasury securities (TIPSs) are close to their breakeven highs over the near-term. Breakevens should remain near these current levels as the Fed continues to take a vigilant stance towards inflation regardless of the market’s view on forward rates. There should be opportunities to add to this sector later in the year at relatively attractive levels should the Fed enter a period of sustained easing.

2

EXCELSIOR FUNDS FIXED INCOME MARKET REVIEW | |

In lower-grade credits, some caution seems appropriate in the high-yield market. We believe high yield spreads will remain range bound over the quarter as economic activity moderates and the housing situation becomes clearer. Despite spreads widening over the quarter, they remain significantly lower than long-term averages. Should a weak economy materialize, default rates will increase faster than currently expected and high yield spreads likely would expand.

In terms of both residential and commercial mortgage backed securities, the tremors from the sub-prime market have been relatively contained so far this year. Prepayment volatility should remain low as MBS refinancing will not meaningfully accelerate unless rates decline substantially at the longer end of the curve. CMBS spreads appear very attractive relative to corporate bonds, offering similar yield with higher credit quality. We favor shorter-maturity adjustable-rate (Hybrid ARM’s) issues as they continue to offer satisfactory return expectations with substantial protection from volatile markets.

In the municipal bond market, as long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that the refunding of municipal bonds will continue and may put pressure on secondary market profits, particularly in the long end of the market. Should profitability of leveraged tender option bond programs continue to compress, forcing the sale of securities, the long end could come under even greater pressure. Our current view is to maintain a shorter duration profile than the index, with overweightings concentrated on the front end of the yield curve.

3

EXCELSIOR TAX-EXEMPT FUNDS, INC. | CALIFORNIA SHORT-INTERMEDIATE TERM |

TAX-EXEMPT INCOME FUND

Performance Summary

For the first time in many years, the municipal yield curve inverted from zero to five years, with five-year rates offering lower yields than one-year rates. Alternative Minimum Tax (AMT) outperformed non-AMT slightly, and short non-investment grade outperformed high grades. Along the yield curve spectrum, the two- to four-year part of the curve outperformed all other maturities.

Low interest rates, narrow inter-market long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest-volume years on record, with new issue municipal bond supply surging over 49% in Q1 2007 over Q1 2006. In the last quarter of the fiscal year, California was the largest issuer, bringing to market over $20 billion in new bonds. As a result, yields on in-state securities increased slightly more than those on national bonds, narrowing the yield differential between California and national municipals.

Foreign buyers, seeking to take advantage of spreads between BMA and LIBOR, were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, one- to 30-year yields are steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers have leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market.

Performance Attribution and Portfolio Positioning

For the year, the Fund underperformed its benchmark on a net-of-fees basis. Early in the year, the Fund was neutral to slightly short duration relative to the index, and extended out on the yield curve when the Fed began to migrate to a neutral stance on interest rates. The Fund maintained a longer duration until the first calendar quarter of 2007, when duration and average maturity were shortened in anticipation of increased California supply along with seasonal yield increases. The Fund’s underperformance was primarily due to the high overall quality of securities held and its avoidance of purchasing securities which are subject to AMT. Additionally, the Fund did not hold any leveraged securities. Cash was maintained at minimal levels.

Outlook

As long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that refunding of municipal bonds will continue, and may put pressure on secondary market profits, particularly in the long end of the market. Should profitability of leveraged tender option bond programs continue to compress, forcing the sale of securities, the long and long/intermediate part of the curve could come under even greater pressure. We plan to maintain a shorter-duration profile than the index, with curve overweights concentrated on the front end of the yield curve. Although the high yield market has had a stellar run, we believe that credit spreads are too compressed, and so are unwilling to add securities for little return.

Kathleen Meyer

Senior Vice President and

Senior Portfolio Manager

4

EXCELSIOR TAX-EXEMPT FUNDS, INC. | CALIFORNIA SHORT-INTERMEDIATE TERM TAX-EXEMPT INCOME FUND |

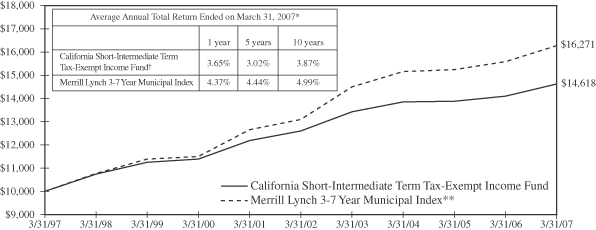

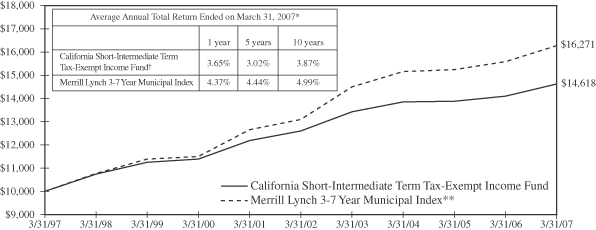

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index for the past ten fiscal year. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.03 | % |

Net Expense Ratio | | 0.50 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.50%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 3-7 Year Municipal Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

5

EXCELSIOR FUNDS, INC. | CORE BOND FUND |

Performance Summary

The Excelsior Core Bond Fund underperformed the Lehman Brothers Aggregate Bond Index for the Fund’s fiscal year ending March 31, 2007.

Yields generally declined across intermediate and longer maturity levels but rose on the front end of the curve over the course of the fiscal year. The Fed increased the target short-term federal funds rate twice in the period, bringing it to 5.25% from 4.75%. Both rate hikes occurred in the second calendar quarter of 2006, and the Fed has left its target short-term interest rate unchanged since that time.

The yield curve ended the fiscal year inverted as money-market rates continue to out-yield longer-maturity Treasury issues. After remaining flat for most of the past year, the yield curve steepened towards a more normalized shape from the two-year to 30-year maturity range. In March, the ten-year yield was above the two-year yield—the first time that’s happened in more than six months.

Overall for the fiscal year, bonds earned a solid return of 6.59% as represented by the Lehman Brothers Aggregate Bond Index. Investment-grade corporate bonds, as represented by the Lehman U.S. Credit Index, returned 7.1% and posted positive excess returns (over duration-equivalent Treasuries) of almost 1%. The spread between corporate bond yields and Treasuries remained narrow throughout the year, a reflection of continued strong investor demand as corporate default rates hovered near historic lows. A record $1.07 trillion in corporate bonds were issued in 2006, compared with $770 billion in 2005 as companies took advantage of relatively low borrowing costs. The commercial mortgage-backed securities (CMBS) sector was also strong in the period, generating 0.67% of excess returns. So far in this credit cycle, strong fundamentals and heavy buying by foreign investors have contributed to spread compression.

Performance Attribution and Portfolio Positioning

Within sectors, the decision to overweight commercial mortgage backed securities proved beneficial as the sector generated strong excess returns in the period. Furthermore, allocation and selection in residential mortgages added to returns, specifically in floating-rate, shorter-maturity issues. Conversely, while the underweight allocation to investment-grade credit detracted from results; issue selection within this sector and exposure to select high yield issues helped results during the year.

We continue to hold overweight positions in mortgages to maintain portfolio yield levels and a high credit quality relative to the benchmark. Portfolios are generally underweight in Treasury and Agency securities. Our strategy has been to underweight the agency and corporate bonds favored by the foreign buyers and find better values in commercial mortgages (CMBS) and residential adjustable-rate mortgages.

During the fiscal year, the Fund’s duration and curve positioning were additive to results. The Fund typically maintained a narrow duration band around the benchmark, yet its tactical moves (longer than benchmark for the second half of 2006) were additive to results. The Fund has been positioned for an eventual steepening of the Treasury yield curve. This positioning has not hurt returns and should be rewarded in the coming months.

The Fund ended the fiscal year positioned slightly shorter duration than the benchmark from a tactical perspective. We expect an end to Fed rate hikes, and ultimately a move to lower market rates, which would warrant moving the Fund to a slightly longer-than-benchmark duration position later in the year. Fund positions have been migrated to better capitalize on our expectation of lower yields and a

6

EXCELSIOR FUNDS, INC. | CORE BOND FUND |

steepening yield curve. We have made no major changes to our overall allocation in the credit sector, although we have actively eliminated select issuers in the auto sector and added to positions in the consumer sector. Throughout the year, the Fund maintained a minimum allocation to securities rated less than single-A, choosing to emphasize higher-quality issues.

The Portfolio yield exceeded that of the benchmark over the course of the year.

Outlook

We believe the U.S. economy is in a period of below-trend growth. Going forward, much will depend on the employment situation, which continues to hold firm. The timing of any lowering of rates by the Fed will be a function of equity market strength and unemployment reports. We do believe that weakness in the economy will eventually cause the yield curve to steepen and rates to fall, especially at the shorter end of the yield curve. History has shown that after a long period of a stable federal funds rate (such as the past nine months), a reversal of policy (in this case, from tightening to easing) carries a high probability.

From a duration standpoint, the Fund is positioned slightly short-duration from its benchmark on a tactical basis due to favorable seasonal patterns. We are positioned for further spread widening and yield-curve steepening in response to the more volatile equity markets and slower economic growth. We have positioned the Fund for a more normally sloped yield curve, which we believe offers the potential for significant reward.

Inflation-protected Treasury securities (TIPSs) are close to their breakeven highs over the near term. Breakevens should remain near these levels as the Fed continues to take a vigilant stance toward inflation regardless of the market’s view on forward rates. There should be opportunities to add to this sector later in the year at relatively attractive levels should the Fed enter a period of sustained easing.

We remain underweight the credit sector in general; corporate bonds present little value at present spread levels. Even with the widening of spreads in the first quarter (fiscal fourth quarter), we are still near the historic tight levels seen over the past decade. Leveraged buyouts and shareholder enhancement activities remain threats for corporate bonds. With event risk already high, the environment could worsen given a sell-off in equities as private equity groups should inevitably increase LBO-related activities.

In lower-grade credits, some caution seems appropriate in the high-yield market, although we do believe it’s prudent to maintain a minimal allocation. We believe high yield spreads will remain range bound over the quarter as economic activity moderates and the housing situation becomes clearer. Despite spreads widening during the first quarter of 2007, they remain significantly lower than long-term averages. Should a weak economy materialize, default rates would increase faster than currently expected and high yield spreads likely would expand.

The Fund remains overweight in both residential and commercial mortgage backed securities. The tremors from the sub-prime market have been relatively contained so far. Prepayment volatility should remain low as MBS refinancing will not meaningfully accelerate unless rates decline substantially at the longer end of the curve. CMBS spreads appear attractive relative to corporate bonds, offering similar yield with higher credit quality. We continue to concentrate on adding older deals that feature better underwriting standards than are prevalent in the current market. We favor shorter-maturity adjustable-rate (Hybrid ARMs) issues as they continue to offer satisfactory return expectations with substantial protection from volatile markets.

Alexander R. Powers

Managing Director

Portfolio Manager and Head of Fixed

Income Investments

7

EXCELSIOR FUNDS, INC. | CORE BOND FUND |

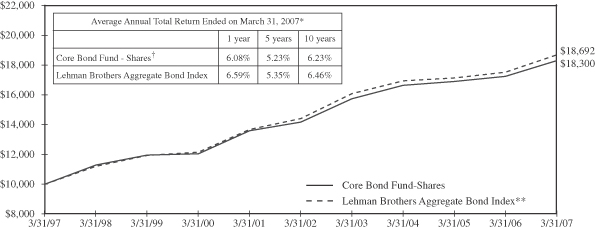

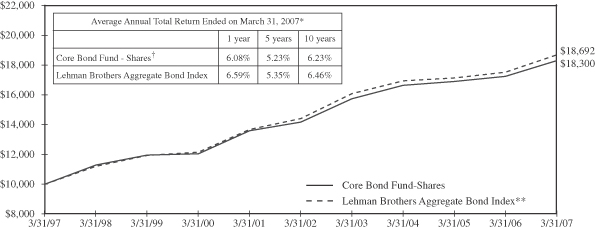

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.30 | % |

Net Expense Ratio | | 0.90 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.90%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Lehman Brothers—the Lehman Brothers Aggregate Bond Index is an unmanaged, fixed income, market value-weighted index that includes treasury issues, agency issues, corporate bond issues and mortgage-backed securities. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

8

EXCELSIOR FUNDS TRUST | HIGH YIELD FUND |

Performance Summary

For the year ended March 31, 2007, the Merrill Lynch High Yield, Cash Pay Index returned almost 12%, with each quarter generating a positive return. Lower-rated credits (CCC and below) significantly outperformed, generating an 18% return for the year; BB-rated debt lagged modestly, returning about 10%. Declining interest rates, particularly in the September quarter, and stable equity markets from August through February were significant contributors to strong performance in high yield. Over the year, the spread of high yield versus U.S. Treasuries declined modestly, with a sharp contraction beginning in September, ending the year at 3.20%. That level is well below the longer term average of 4.75%. Default rates, a key driver of high yield spreads, declined from 2.8% to 1.6% during the year, to near record lows. The best performing sectors during the year were entertainment, automotive, retail, airlines, and cable TV. Rails, gaming, leisure, aerospace, and energy were the weakest performers. Every category generated a positive return for the year. New issue supply was $163 billion. Rating upgrades versus downgrades were fairly constant and slightly positive during the year.

Performance Attribution and Portfolio Positioning

For the fiscal year, the Excelsior High Yield Fund outperformed the Merrill Lynch High Yield, Cash Pay Index. Based on industry categories, the Fund was overweight some underperforming groups; but individual security selection, primarily low single B-rated and CCC-rated issuers in retail and telecom in particular, outperformed their industry categories and the Index. About 1.30% of the Fund’s performance was generated by Ormet Aluminum, a company that emerged from bankruptcy in April 2005; the Fund has held this name for several years. Several developments related to this holding in the 3rd and 4th calendar quarters of 2006 contributed importantly to the outperformance of this name. First, a significant distribution of common equity to original creditors (which included the Fund) was made. Second, a successful rights offering and a 10:1 stock split substantially enhanced the enterprise and per share value of Ormet. The Fund pared its holding in this name when the position grew to over 5% of the Fund as the valuation increased. The objective was to take some profits and moderate Fund volatility. At the end of the year, the holding was reduced to about 3%. We continue to believe there is significant potential upside in this name although probably not before the 3rd calendar quarter of this year.

Outlook

In spite of the current low spread versus U.S. Treasuries and the slowing economy, we remain moderately constructive on the high yield asset class. Over several decades, high yield spreads have tracked closely with default rates, with periods of divergence infrequent and short lived. For a number of recent months, high yield spreads have significantly exceeded default rates. We believe this is due to investor concern that default rates may rise sharply as a consequence of a slowing economy and the result of the recent sharp increase in low-rated debt (historically a precursor of rising defaults). Default rates over the last twelve months currently are near record low levels. We believe that the enormous refinancing of debt maturities at low interest rates that has occurred over the last several years will mitigate the negative effects of slow economic growth, particularly if the economy accelerates in the 2nd half of this year. High yield default rates projected out 12 months by Moody’s and S & P have continued to moderate and now are at levels that remain well below longer term averages. Current high yield spread levels are comparable to projected defaults a year from now. We believe actual defaults likely will fall below current estimates and thereby rationalize or even reduce current spreads. This assumes a modest and temporary economic slowdown. However, until investors become more confident that default rates will not increase sharply, a more cautious approach to high yield is appropriate.

A.K. Rodgers Ratcliffe, CFA

Senior Vice President and Senior Portfolio Manager

Adam Moss

Senior Vice President and Senior Portfolio Manager

9

EXCELSIOR FUNDS TRUST | HIGH YIELD FUND |

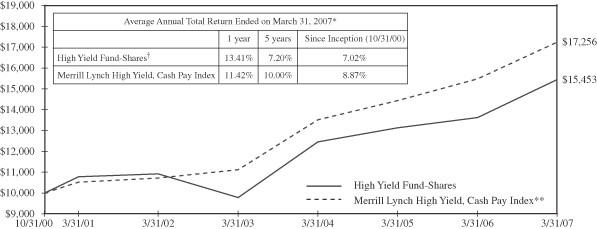

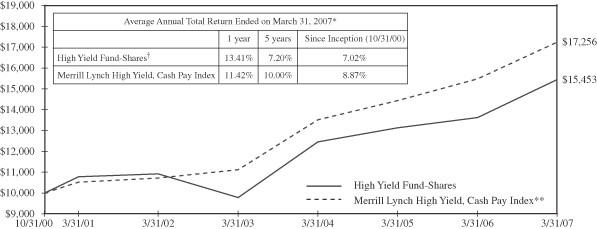

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Securities rated below investment grade generally entail greater market, credit, and liquidity risks than investment grade securities.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 10/31/00 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.29 | % |

Net Expense Ratio | | 1.05 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.05%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—The Merrill Lynch High Yield, Cash Pay Index is an unmanaged index comprised of publicly placed, non-convertible, coupon bearing domestic debt. Issues in the index are less than investment grade as rated by Standard & Poor’s Ratings Group or Moody’s Investors Service, Inc., and must not be in default. Issues have a term to maturity of at least one year. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

10

EXCELSIOR FUNDS, INC. | INTERMEDIATE-TERM BOND FUND |

Performance Summary

The Excelsior Intermediate-Term Bond Fund underperformed the Lehman Intermediate Government/Credit Index for the fiscal year ended March 31, 2007.

Yields generally declined across intermediate and longer maturity levels but rose on the front end of the curve over the course of the fiscal year. The Fed increased the target short-term federal funds rate twice in the period, bringing it to 5.25% from 4.75%. Both rate hikes occurred in the second calendar quarter of 2006, and the Fed has left its target short-term interest rate unchanged since that time.

The yield curve ended the fiscal year inverted as money-market rates continue to out-yield longer-maturity Treasury issues. After remaining flat for most of the past year, the yield curve steepened towards a more normalized shape from the two-year to 30-year maturity range. In March, the ten-year yield was above the two-year yield—the first time that’s happened in more than six months.

Overall for the fiscal year, bonds earned a solid return of 6.59% as represented by the Lehman Brothers Aggregate Bond Index. Investment-grade corporate bonds, as represented by the Lehman U.S. Credit Index, returned 7.1% and posted positive excess returns (over duration-equivalent Treasuries) of almost 1%. The spread between corporate bond yields and Treasuries remained narrow throughout the year, a reflection of continued strong investor demand as corporate default rates hovered near historic lows. A record $1.07 trillion in corporate bonds were issued in 2006, compared with $770 billion in 2005 as companies took advantage of relatively low borrowing costs. The commercial mortgage-backed securities (CMBS) sector was also strong in the period, generating 0.67% of excess returns. So far in this credit cycle, strong fundamentals and heavy buying by foreign investors have contributed to spread compression.

Performance Attribution and Portfolio Positioning

Within sectors, the decision to overweight commercial mortgage backed securities proved beneficial as the sector generated strong excess returns in the period. Furthermore, allocation and selection in residential mortgages added to returns, specifically in floating-rate, shorter-maturity issues. Conversely, while the underweight allocation to investment-grade credit detracted from results; issue selection within this sector and exposure to select high yield issues helped results during the year.

We continue to hold overweight positions in mortgages to maintain portfolio yield levels and a high credit quality relative to the benchmark. Portfolios are generally underweight in Treasury and Agency securities. Our strategy has been to underweight the agency and corporate bonds favored by the foreign buyers and find better values in commercial mortgages (CMBS) and residential adjustable-rate mortgages.

During the fiscal year, the Fund’s duration and curve positioning were additive to results. The Fund typically maintained a narrow duration band around the benchmark, yet its tactical moves (longer than benchmark for the second half of 2006) were additive to results. The Fund has been positioned for an eventual steepening of the Treasury yield curve. This positioning has not hurt returns and should be rewarded in the coming months.

The Fund ended the fiscal year positioned slightly shorter duration than the benchmark from a tactical perspective. We expect an end to Fed rate hikes, and ultimately a move to lower market rates, which would warrant moving the Fund to a slightly longer-than-benchmark duration position later in the year. Fund positions have been migrated to better capitalize on our expectation of lower yields and a

11

EXCELSIOR FUNDS, INC. | INTERMEDIATE-TERM BOND FUND |

steepening yield curve. We have made no major changes to our overall allocation in the credit sector, although we have actively eliminated select issuers in the auto sector and added to positions in the consumer sector. Throughout the year, the Fund maintained a minimum allocation to securities rated less than single-A, choosing to emphasize higher-quality issues.

Outlook

We believe the U.S. economy is in a period of below-trend growth. Going forward, much will depend on the employment situation, which continues to hold firm. The timing of any lowering of rates by the Fed will be a function of equity market strength and unemployment reports. We do believe that weakness in the economy will eventually cause the yield curve to steepen and rates to fall, especially at the shorter end of the yield curve. History has shown that after a long period of a stable federal funds rate (such as the past nine months), a reversal of policy (in this case, from tightening to easing) carries a high probability.

From a duration standpoint, the Fund is positioned slightly short-duration from its benchmark on a tactical basis due to favorable seasonal patterns. We are positioned for further spread widening and yield-curve steepening in response to the more volatile equity markets and slower economic growth. We have positioned the Fund for a more normally sloped yield curve, which we believe offers the potential for significant reward.

Inflation-protected Treasury securities (TIPSs) are close to their breakeven highs over the near term. Breakevens should remain near these levels as the Fed continues to take a vigilant stance toward inflation regardless of the market’s view on forward rates. There should be opportunities to add to this sector later in the year at relatively attractive levels should the Fed enter a period of sustained easing.

We remain underweight the credit sector in general; corporate bonds present little value at present spread levels. Even with the widening of spreads in the first quarter (fiscal fourth quarter), we are still near the historic tight levels seen over the past decade. Leveraged buyouts and shareholder enhancement activities remain threats for corporate bonds. With event risk already high, the environment could worsen given a sell-off in equities as private equity groups would inevitably increase LBO-related activities.

In lower-grade credits, some caution seems appropriate in the high-yield market, although we do believe it’s prudent to maintain a minimal allocation. We believe high yield spreads will remain range bound over the quarter as economic activity moderates and the housing situation becomes clearer. Despite spreads widening during the first quarter of 2007, they remain significantly lower than long-term averages. Should a weak economy materialize, default rates would increase faster than currently expected and high yield spreads likely would expand.

The Fund remains overweight in both residential and commercial mortgage backed securities. The tremors from the sub-prime market have been relatively contained so far. Prepayment volatility should remain low as MBS refinancing will not meaningfully accelerate unless rates decline substantially at the longer end of the curve. CMBS spreads appear attractive relative to corporate bonds, offering similar yield with higher credit quality. We continue to concentrate on adding older deals that feature better underwriting standards than are prevalent in the current market. We favor shorter-maturity adjustable-rate (Hybrid ARMs) issues as they continue to offer satisfactory return expectations with substantial protection from volatile markets.

Alexander R. Powers

Managing Director

Portfolio Manager and Head of Fixed Income Investments

12

EXCELSIOR FUNDS, INC. | INTERMEDIATE-TERM BOND FUND |

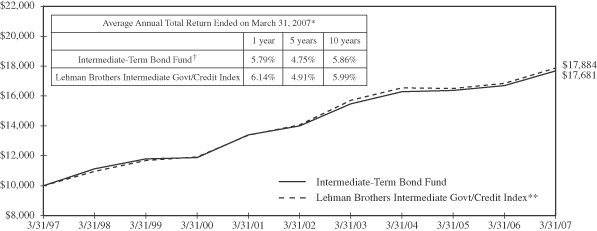

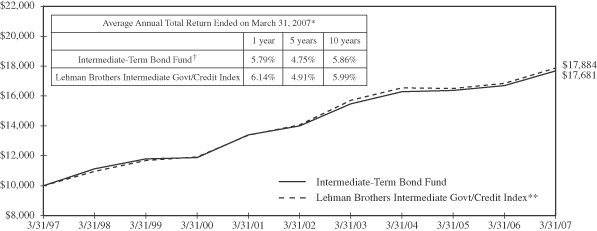

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 0.81 | % |

Net Expense Ratio | | 0.75 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.75%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Lehman Brothers—The Lehman Brothers Intermediate Govt/Credit Index is an unmanaged total return performance benchmark composed of U.S. Government agencies and U.S. Treasury securities and investment grade corporate debt, selected as representative of the market with maturities of one to ten years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

13

EXCELSIOR TAX-EXEMPT FUNDS, INC. | INTERMEDIATE-TERM TAX-EXEMPT FUND |

Performance Summary

For the first time in many years, the municipal yield curve inverted from zero to five years, with five-year rates offering lower yields than one-year rates. Non-investment-grade securities significantly outperformed investment-grade bonds, and AMT bonds slightly outperformed non-AMT. Low interest rates, narrow intermarket long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest volume years on record, with new issue municipal bond supply surging over 49% in Q1 2007 over Q1 2006. Foreign buyers, seeking to take advantage of spreads between BMA (the Bond Market Association synthetic municipal yield curve) and LIBOR, were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, one to 30-year yields are steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market.

Performance Attribution and Portfolio Positioning

For the year, the Fund underperformed its benchmark on a net-of-fees basis. The Fund remained neutral to slightly long duration for most of the year, with most of the overweighting occurring in both the longer and four to six year part of the yield curve. Additionally, the Fund had a slight underweight in two- to three- years, which underperformed during the first half of the year, but significantly outperformed later in the year. Cash was kept in the 3% range in order to maximize yield. Although we strived to increase the Fund’s overall yield through the inclusion of higher yielding securities, the Fund remains of high investment quality. Thus, the Fund maintained a slightly lower yield than the Index throughout the year, with much of the gap due to AMT bonds and higher yielding sectors inherent in the Index. The Fund avoids holding bonds that are subject to the AMT. Additionally, our underweight in housing and airport bonds negatively impacted performance (note that the majority of bonds issued in these sectors are subject to the AMT). The Fund did not hold any leveraged securities during the fiscal year ending March 31, 2007.

Purchases were concentrated on bonds, with long maturities priced to a short call or to a short/intermediate average life. The Fund purchased both New Jersey Tobacco and Golden State Tobacco bonds, which were priced attractively relative to similar bonds issued by other states. While they carry long-term maturities, their turbo sinking fund nature results in an average life of 4.5 years. We believe these bonds offer higher than market yield, with the defensive characteristics of shorter securities. While we held a neutral position in California bonds throughout much of the year, more recently we sold in-state securities in anticipation of large new issue volume during the first half of 2007.

Outlook

As long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that the refunding of municipal bonds will continue and may put pressure on secondary market profits, particularly in the long end of the market. Should profitability of leveraged tender option bond programs continue to compress, forcing the sale of securities, the long and long/intermediate part of the curve could come under even greater pressure. We plan to maintain our overweight in New York relative to California, as the former has initiated long-term planning and proactive budget management,

14

EXCELSIOR TAX-EXEMPT FUNDS, INC. | INTERMEDIATE-TERM TAX-EXEMPT FUND |

which should help provide ballast against any regional economic downturns, while the latter is expected to increase debt issuance over the coming quarter. We plan to maintain a shorter duration profile than the index, with curve overweightings concentrated on the front end of the yield curve. Although the high yield market has had a stellar run, we believe that credit spreads are too compressed; we are not willing to add securities for little return. We also expect to maintain approximately 5% in cash.

Pamela Hunter

Managing Director and Senior Portfolio Manager

15

EXCELSIOR TAX-EXEMPT FUNDS, INC. | INTERMEDIATE-TERM TAX-EXEMPT FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 0.80 | % |

Net Expense Ratio | | 0.65 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.65%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 3-7 Year Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| *** | | Source: Merrill Lynch—the Merrill Lynch 7-12 Year Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of seven to twelve years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

16

EXCELSIOR TAX-EXEMPT FUNDS, INC. | LONG-TERM TAX-EXEMPT FUND |

Performance Summary

For the first time in many years, the municipal yield curve inverted from zero to five years, with five-year rates offering lower yields than one-year rates. Non-investment-grade securities significantly outperformed investment-grade bonds, and AMT bonds slightly outperformed non-AMT. Low interest rates, narrow intermarket long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest-volume years on record, with new issue municipal bond supply surging over 49% in Q1 2007 over Q1 2006. Foreign buyers, seeking to take advantage of spreads between BMA and LIBOR, were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, one to 30-year yields are steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market.

Performance Attribution and Portfolio Positioning

For the year, the Fund was in line with its benchmark, net of fees. A duration that was slightly longer than the Merrill Lynch 22+ Year Municipal Index was maintained through much of the year. During the first half, the Fund maintained a duration underweight in the short end and an underweight in the long end. Yield remained lower than the Index, due to an underweighting in bonds subject to the AMT, as the Fund avoids holding securities which are subject to this tax. Additionally, AMT bonds are issued in higher-yielding sectors. Finally, the Fund was overweighted in California and New York bonds, both of which outperformed the market. Additionally, the Fund did not hold any leveraged securities.

The Fund’s management strove to increase the overall yield by increasing exposure to the health care sector, and to new issuers to the market that carried higher rates than the overall market, including bonds issued to build stadiums (Queens and Yankee stadiums), regional redevelopment (Hudson Yards, NY) and Bay Area Tolls. Additionally, the Fund purchased tobacco bonds in New Jersey and California that were priced attractively relative to similar bonds issued by other states. Their turbo sinking fund nature results in an average life significantly shorter than the overall maturity, and offers the defensive characteristics of shorter bonds.

In addition to increasing yield, purchases were focused across the yield curve in an attempt to diversify risk. As long bonds were the year’s top performers, we overweighted that part of the curve relative to the Index for much of the year. As the curve flattened, we concentrated purchases in the front end of the yield curve and maintained a cash position of approximately 5%, as the spread between short-term and long-term yields compressed.

Outlook

As long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that the refunding of municipal bonds will continue and may put pressure on secondary market profits, particularly in the long end of the market. Should profitability of leveraged tender option bond programs continue to compress, forcing the sale of securities, the long end could come under even greater pressure. We plan to maintain our overweight in New York relative to California, as the former has initiated long term planning and proactive budget management, which will help provide ballast

17

EXCELSIOR TAX-EXEMPT FUNDS, INC. | LONG-TERM TAX-EXEMPT FUND |

against any regional economic downturns. We plan to maintain a shorter duration profile than the index, with overweightings concentrated on the front end of the yield curve. Although the high yield market has had a stellar run, we believe that credit spreads are too compressed and we thus are not willing to add securities for little return. While we expect to maintain cash in the 5% area, over the near-term we will increase our cash exposure to take advantage of seasonal, tax related short-term yield hikes.

Pamela Hunter

Managing Director and Senior Portfolio Manager

18

EXCELSIOR TAX-EXEMPT FUNDS, INC. | LONG-TERM TAX-EXEMPT FUND |

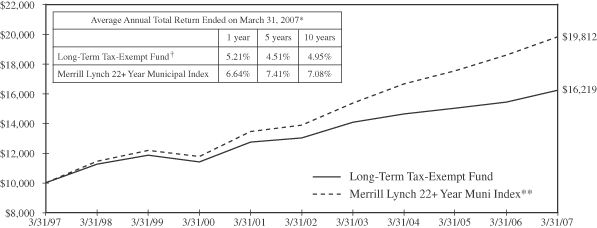

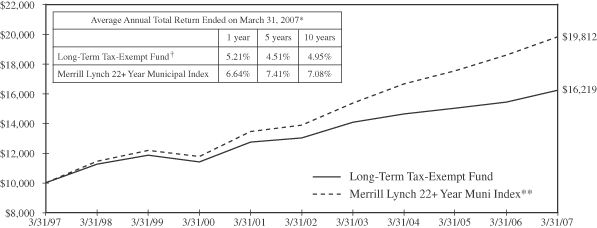

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further, information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.02 | % |

Net Expense Ratio | | 0.80 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.80%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 22+ Year Muni Index consists of bonds with an outstanding par which is greater than or equal to 25 million and a maturity range greater than or equal to 22 years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

19

EXCELSIOR TAX-EXEMPT FUNDS, INC. | NEW YORK INTERMEDIATE-TERM TAX-EXEMPT FUND |

Performance Summary

For the first time in many years, the municipal yield curve inverted from zero to five years, with five-year rates offering lower yields than one-year rates. Non-investment-grade securities significantly outperformed investment-grade bonds, with New York high yield securities returning slightly more than national. AMT bonds slightly outperformed non-AMT. Low interest rates, narrow intermarket long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest-volume years on record, with new issue municipal bond supply surging over 49% in Q1 2007 over Q1 2006. New York new issue supply increased by 40% in the last quarter alone. Foreign buyers, seeking to take advantage of spreads between BMA and LIBOR, were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, one to 30-year yields are steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market.

Performance Attribution and Portfolio Positioning

For the year, the Fund underperformed its benchmarks net of fees. We maintained a duration slightly longer than the Indices for much of the year, until early December, when we switched to a neutral, and then slightly short duration. Much of the later underweighting occurred in the eight to twelve year part of the curve. Additionally, the Fund had a slight underweight in the top performing two to four year part of the curve. This was countered by an overweight in cash and five-year duration exposure. As BMA rates increased, the effect muted curve underperformance, which resulted in an overall positive curve contribution for the year. Although we have increased the Fund’s overall yield, the Fund remained lower in yield relative to the Indices; however, much of the gap was due to an underweight in AMT paper and the higher yielding sectors inherent in the Indices. The Fund avoids holding bonds that are subject to the AMT. The Fund was underweighted in the transportation sector, due to the concentration of NY agency issuers that fell under the auspices of the same obligor. Additionally, the Fund did not hold any leveraged securities.

Purchases were concentrated on bonds maturing across the yield curve, in order to diversify risk. The Fund’s management strove to increase the overall yield by increasing exposure to the health care sector, and to new issuers to the market that carried higher rates than the overall market, including bonds issued to build stadiums (Queens and Yankee stadiums), as well as regional redevelopment (Hudson Yards Redevelopment Project). As long bonds were the year’s top performers, we overweighted that part of the curve relative to the Indices for much of the year. As the curve flattened, we concentrated purchases in the front end of the yield curve and maintained a cash position of approximately 5%, as the spread between short term and long term yields compressed.

Later in the year, we sold some of our long positions in order to hedge against potential mass liquidation of the similar securities by leveraged arbitrageurs. Additionally, agency sales were concentrated in the ten-year part of the yield curve, thus shortening the average maturity of the fund by half a year.

20

EXCELSIOR TAX-EXEMPT FUNDS, INC. | NEW YORK INTERMEDIATE-TERM TAX-EXEMPT FUND |

Outlook

As long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that the refunding of municipal bonds will continue and may put pressure on secondary market profits, particularly in the long end of the market. Should the profitability of leveraged tender option bond programs continue to compress, forcing the sale of securities, the long and long/intermediate part of the curve could come under even greater pressure. We will continue to migrate down the curve to take advantage of steepening from the short end. The State of New York has initiated long term planning and proactive budget management, which should help to provide ballast against any regional economic downturns. In anticipation of potential upgrades, we are concentrating our purchase on state agency debt, keeping in mind diversification restrictions. We plan to maintain a shorter duration profile than the index, with curve overweightings concentrated on the front end of the yield curve. Although the New York high yield market has had a stellar run, we believe that credit spreads are too compressed and are thus unwilling to add securities for little return. We also expect to maintain approximately 5% in cash.

Pamela Hunter

Managing Director and Senior Portfolio Manager

21

EXCELSIOR TAX-EXEMPT FUNDS, INC. | NEW YORK INTERMEDIATE-TERM TAX-EXEMPT FUND |

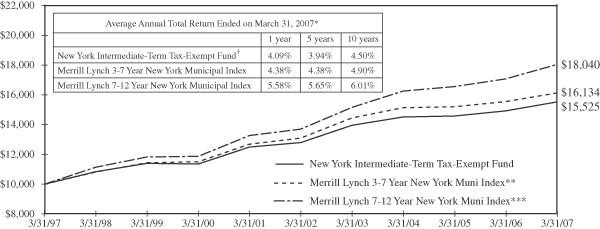

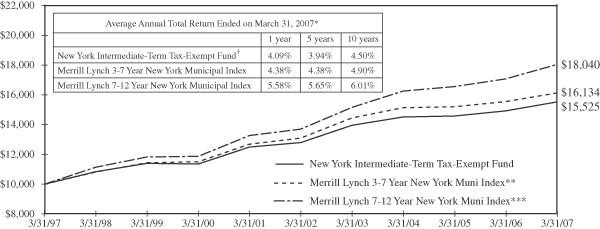

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 0.98 | % |

Net Expense Ratio | | 0.80 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.80%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 3-7 Year New York Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds of New York Municipalities issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of three to seven years. |

| *** | | Source: Merrill Lynch—the Merrill Lynch 7-12 Year New York Muni Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds of New York Municipalities issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of seven to twelve years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

22

EXCELSIOR FUNDS, INC. | SHORT-TERM GOVERNMENT SECURITIES FUND |

Performance Summary

The Excelsior Short-Term Government Fund in the fiscal year ending March 31, 2007, performed in line with its benchmark. The yield-to-maturity of 5.21% at the end of the period represented a yield advantage relative to the Lehman Brothers 1-3 Year Government Bond Index and a slightly longer duration.

Performance Attribution and Portfolio Positioning

The Fund remained overweight mortgage-backed securities throughout the period in an effort to capitalize on the significant yield advantage mortgages offer, especially in periods where rate volatility remains contained. Investments in this asset class included substantial concentrations in hybrid ARMs, so-called because of the fixed/floating-rate nature of their underlying loans. Hybrid ARMs offer similar yield advantages to fixed-rate mortgages but with a lower sensitivity to changes in interest rates. The floating rate nature of the underlying loans offers additional protection to the Fund should rates move substantially in either direction. Positions in callable agency debentures were added midway through the period. They too offer substantial benefits versus their non-callable counterparts when rates remain subdued.

The Fund currently maintains no exposure TIPs. TIPs have performed well of late, but continued vigilance on the part of the Fed should cap breakevens near current levels. We do not expect the circumstances that caused energy prices to spike recently to continue indefinitely. Positive carry seasonally prevalent in the TIPs sector does present an opportunity for the near term.

The combined percentage of mortgage-backed and asset-backed investments in the Fund is currently 58%. In addition to the hybrid ARMs mentioned earlier, positions exist in both premium-priced, non-amortizing fixed-rate mortgage securities and structured mortgage-backed assets with short final maturity dates. Both represent mortgage-backed cash flows that are more bulleted in nature than would otherwise be available in the mortgage-backed market and should perform well in the bull-steepening scenario that we expect to take place. Futures positions exist in the Fund to help protect against losses, should a steepening scenario transpire. The longer rates remain at current levels, the more pressure will begin to build.

Outlook

The U.S. economy has remained resilient in spite of continued deterioration in the housing sector. The Fed has resisted lowering rates in deference to increased concerns regarding the outlook for inflation. Uncertainty regarding the timing of this policy change has kept interest rates range-bound. Moreover, the Fed’s stance has subsequently caused the Treasury yield curve to remain inverted, with yields at the shorter end of the maturity spectrum higher than those at the longer end.

We believe, and market expectations are, that the Federal Reserve will eventually need to lower rates to keep the economy growing. Fallout from the current housing crisis has caused a general tightening of credit, which should ultimately cause the Fed to respond by cutting interest rates, thereby lowering all yields and steepening the yield curve.

Michael Zazzarino

Managing Director and Senior

Portfolio Manager

23

EXCELSIOR FUNDS, INC. | SHORT-TERM GOVERNMENT SECURITIES FUND |

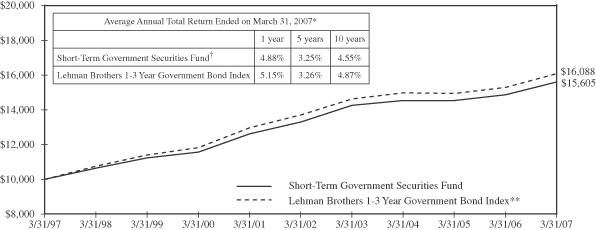

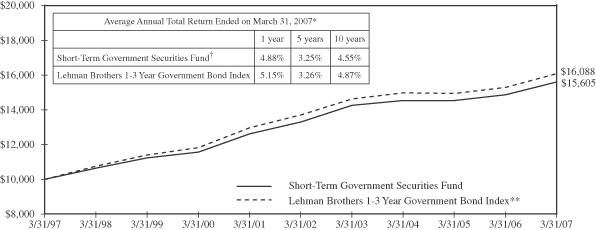

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 0.77 | % |

Net Expense Ratio | | 0.75 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.75%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Lehman Brothers—The Lehman Brothers 1-3 Year Government Bond Index is an unmanaged total return performance benchmark composed of U.S. Government agencies and U.S. Treasury securities with maturities of one to three years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

24

EXCELSIOR TAX-EXEMPT FUNDS, INC. | SHORT-TERM TAX-EXEMPT SECURITIES FUND |

Performance Summary

For the first time in many years, the municipal yield curve inverted from zero to five years, with five-year rates offering lower yields than one-year rates. Non-investment-grade securities significantly outperformed investment-grade bonds on the short end of the curve, doubling the return of investment-grades, and AMT bonds slightly outperformed non-AMT. Along the yield curve spectrum, the four to six year part of the curve was the short end’s top-performing maturity range.

Low interest rates, narrow intermarket long-term yield spreads, tighter credit spreads and issuer use of swaps and other derivatives for funding purposes combined to create one of the highest-volume years on record, with new issue municipal bond supply surging over 49% in Q1 2007 over Q1 2006. Foreign buyers, seeking to take advantage of spreads between BMA and LIBOR, were significant municipal market participants. While the municipal curve is flat by historical domestic market standards, one to 30-year yields are steeper than alternative fixed income vehicles; thus, many foreign and domestic buyers leveraged their holdings. For the same reasons, numerous municipal hedge funds were birthed, adding additional buying support to the market. As a result, the increase in tender option bond programs created for this buying universe also resulted in new variable rate demand note programs (the floating rate portion of tender option bonds), resulting in higher short term yields, as measured by the Bond Market Association’s Index of tax-exempt money market rates.

Performance Attribution and Portfolio Positioning

For the year, the Fund underperformed the benchmark net of fees. The Fund’s duration remained approximately a half year short relative to the Index, with most of the underweighting occurring in the five-year part of the yield curve. As a result, the Fund underperformed the Index. Yields were slightly lower than the Index, due primarily to the AMT holdings in the Index as well as the shorter maturity. Newly created variable rate demand note programs (the floating side of tender option securities) kept BMA rates relatively high; thus, the Fund did not suffer yield underperformance. The Fund avoids holding bonds that are subject to the AMT. Most of the high-yielding sectors fall within the AMT; thus, we did not gain the price appreciation realized by much of the non- and lower-investment-grade sectors. Additionally, the Fund did not hold any leveraged securities. At year end, the Fund held a cash equivalent position of 7%.

Purchases were concentrated on bonds offering higher yields within non-AMT sectors. The Fund added exposure to the tobacco bond sector by purchasing New Jersey Tobaccos with a final maturity of 2010. As the yield curve inverted, we sold longer securities that yielded less than the BMA cash rate.

Outlook

As long as the forces of low interest rates, a flat yield curve and tighter spreads persist, we anticipate that the refunding of municipal bonds will continue, and may put pressure on secondary market profits, particularly in the long end of the market. Should leveraged tender option bond programs begin to unwind, it is likely that variable-rate demand note programs (the floating rate piece of fixed rate synthetics) would be collapsed in turn, creating less cash equivalent supply in the municipal bond market. As we approach the tax season, seasonal selling of municipal money market funds to meet tax

25

EXCELSIOR TAX-EXEMPT FUNDS, INC. | SHORT-TERM TAX-EXEMPT SECURITIES FUND |

obligations should keep pressure on BMA rates near term. Because the forces of supply and demand may be neutralized this year, the Fund is likely to keep cash at around 10% until the high tax season has passed.

Pamela Hunter

Managing Director and Senior Portfolio Manager

26

EXCELSIOR TAX-EXEMPT FUNDS, INC. | SHORT-TERM TAX-EXEMPT SECURITIES FUND |

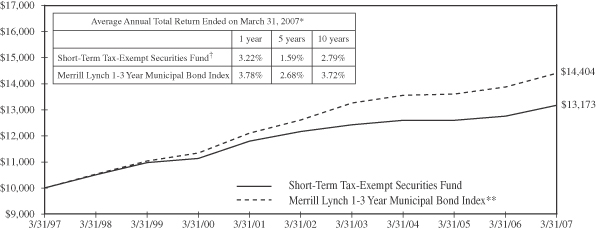

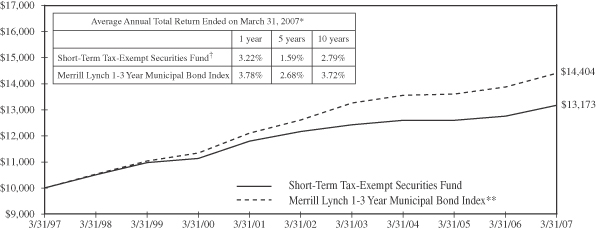

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. A portion of the Fund’s income may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 0.77 | % |

Net Expense Ratio | | 0.60 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 0.60%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Merrill Lynch—the Merrill Lynch 1-3 Year Municipal Bond Index is a widely-accepted unmanaged market-weighted index comprised of fixed-rate, coupon-bearing bonds issued within five years of the most recent month-end with greater than $50 million principal amount having a Moody’s investment grade rating and maturities of one to three years. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

27

Excelsior Tax-Exempt Funds, Inc.

Portfolio of Investments — March 31, 2007

California Short-Intermediate Tax-Exempt Income Fund

| | | | | | | | | | | |

Principal

Amount | | | | Rate | | | Maturity

Date | | Value |

| | | | | | | | | | | |

| | TAX-EXEMPT SECURITIES — 85.19% | | | |

| $ | 1,500,000 | | Anaheim, California, Public Financing Authority Revenue Bonds, Distribution Systems, (AMBAC) | | 5.00 | % | | 10/01/13 | | $ | 1,619,700 |

| | 1,000,000 | | California State Department of Transportation Revenue Bonds, Federal Highway Grant Anticipation Bonds, Series A, (FGIC) | | 4.50 | | | 02/01/13 | | | 1,046,330 |

| | 1,000,000 | | California State Department of Water Resources Central Valley Project Revenue Bonds, Series Y | | 5.00 | | | 12/01/10 | | | 1,051,040 |

| | 1,500,000 | | California State Department of Water Resources Revenue Bonds, Series W, (AMBAC) | | 5.50 | | | 12/01/09 | | | 1,576,620 |

| | 3,000,000 | | California State Economic Recovery, General Obligation Bonds, Series B, (Mandatory Put 07/01/07 @ 100) | | 5.00 | | | 07/01/23 | | | 3,009,720 |