UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OppenheimerFunds, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: December 31

Date of reporting period: 6/29/2012

Item 1. Reports to Stockholders.

June 30, 2012

| | | | |

| | | Oppenheimer Small- & Mid-Cap Growth Fund/VA A Series of Oppenheimer Variable Account Funds | | Semiannual Report |

SEMIANNUAL REPORT

Fund Performance Discussion

Listing of Top Holdings

Financial Statements

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

Portfolio Manager: Ronald J. Zibelli, Jr., CFA

| | | | | | |

Cumulative Total Returns

For the 6-Month Period Ended 6/29/121 |

| Non-Service Shares | | 13.77% | | | | |

| Service Shares | | 13.61 | | | | |

Average Annual Total Returns

For the Periods Ended 6/29/121 | | |

| | | |

| | | 1-Year | | 5-Year | | 10-Year |

| Non-Service Shares | | 0.30% | | –0.46% | | 4.80% |

| Service Shares | | 0.04 | | –0.73 | | 4.52 |

Expense Ratios For the Fiscal Year Ended 12/30/111 | | |

| | | |

| | | Gross

Expense

Ratios | | | | Net

Expense

Ratios |

| Non-Service Shares | | 0.84% | | | | 0.80% |

| Service Shares | | 1.09 | | | | 1.05 |

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance and expense ratios may be lower or higher than the data quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account. Expense ratios are as stated in the Fund’s prospectus current as of the date of this report. The net expense ratios take into account voluntary fee waivers and/or expense reimbursements, without which performance would have been less. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus.

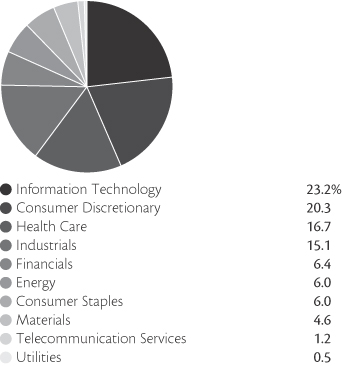

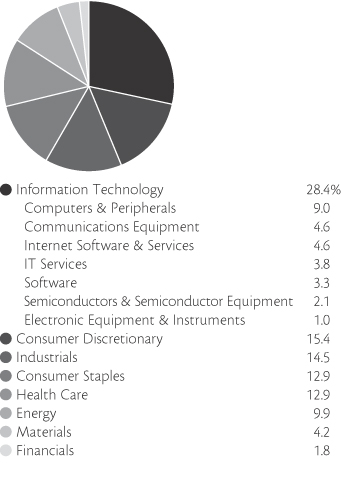

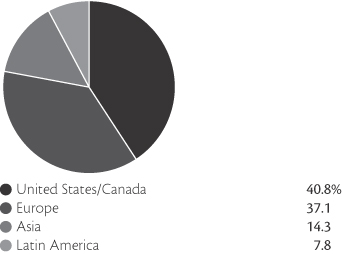

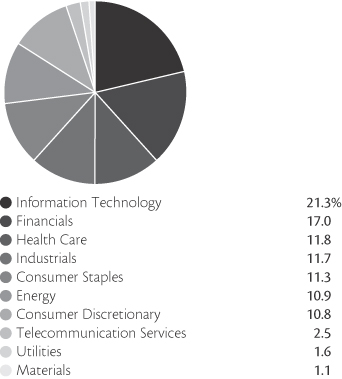

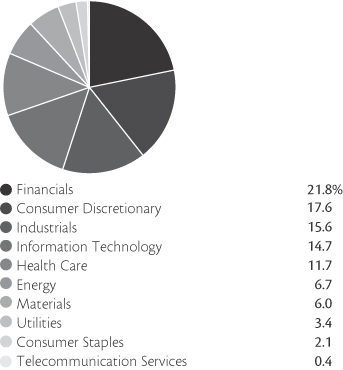

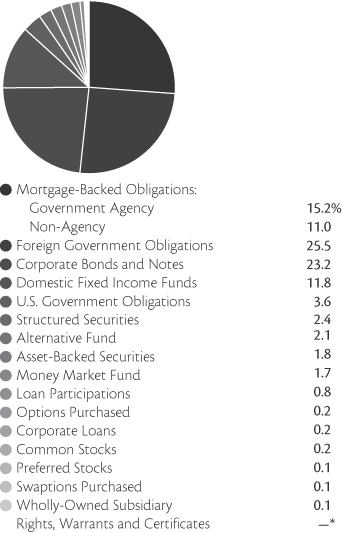

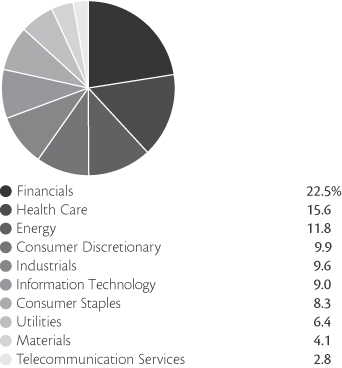

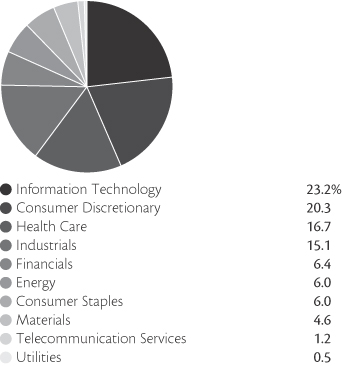

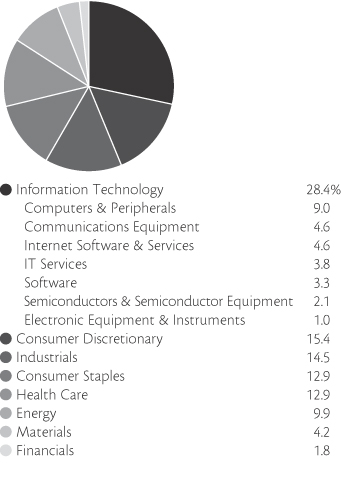

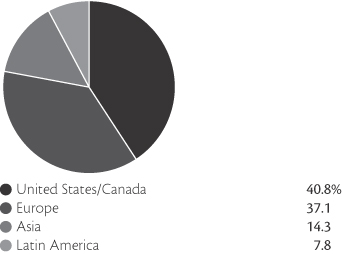

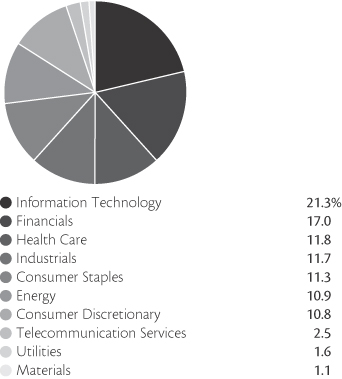

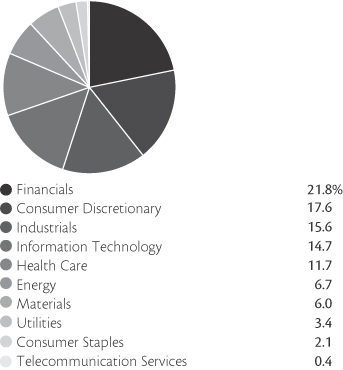

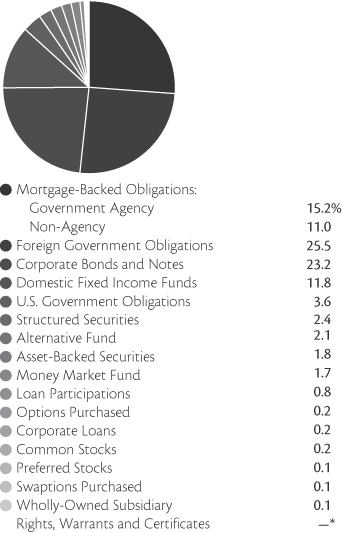

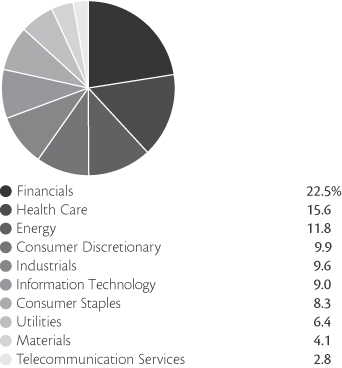

Portfolio holdings and allocations are subject to change. Percentages are as of June 29, 2012, and are based on the total market value of common stocks.

| | |

| Top Ten Common Stock Holdings | | |

| Ulta Salon, Cosmetics & Fragrance, Inc. | | 2.2% |

| Dollar Tree, Inc. | | 2.2 |

| Alexion Pharmaceuticals, Inc. | | 2.2 |

| TransDigm Group, Inc. | | 2.1 |

| Monster Beverage Corp. | | 1.9 |

| Whole Foods Market, Inc. | | 1.9 |

| Chipotle Mexican Grill, Inc., Cl. A | | 1.7 |

| Cerner Corp. | | 1.7 |

| Equinix, Inc. | | 1.6 |

| Teradata Corp. | | 1.6 |

Portfolio holdings and allocations are subject to change. Percentages are as of June 29, 2012, and are based on net assets.

2 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FUND PERFORMANCE DISCUSSION

During the six-month period ended June 29, 2012, the Fund’s Non-Service shares returned 13.77%. In comparison, the Fund outperformed the Russell 2500 Growth Index (the “Index”), which returned 8.44%. The Fund’s outperformance was led by stock selection in the information technology, consumer discretionary and consumer staples sectors. The Fund underperformed the Index in industrials and enjoyed outperformance or roughly equal performance against the Index’s other nine sectors. The Fund also outperformed the Russell 2000 Growth Index and the Russell MidCap Growth Index, which returned 8.81% and 8.10%, respectively.1

Economic and Market Environment

The period began during a time of improved market sentiment in which the United States managed to avoid a return to recession and European policymakers appeared to take steps to address the region’s sovereign debt and banking sector crises. Renewed investor optimism helped produce gains across a number of international equity markets over the first three months of 2012. The rebound across equities gained momentum after the European Central Bank implemented the Long-Term Refinancing Operation (“LTRO”) to enhance liquidity for troubled banks and reduce rates on newly issued sovereign debt securities.

However, the second quarter was a volatile time for global markets. The fear of contagion from the worsening European sovereign debt crisis and a recession across much of Europe drove negative market sentiment, particularly over May and June. Very high unemployment, soaring debt and higher borrowing costs in Greece, Spain and Italy contributed to serious questions over how to implement austerity measures and restructure debt or instead take a different tact and provide some or all of those countries with additional funds. Perhaps most worrisome of all to investors was the possibility of Greece pulling out of the euro and its ramifications for the future of the Eurozone and its common currency. In the U.S., slower than expected first quarter growth also contributed to a sell-off in the U.S. stock market. Consumer confidence dropped as U.S. unemployment figures ticked slightly upwards after showing signs of improvement from the recession highs. However, the period ended on a positive note for the markets. The results of elections in Greece and continued efforts by European policymakers to stabilize the situation in the region appeared to soothe market jitters slightly in the final days of the period.

Fund Review

During the period, the top performing stocks for the Fund were Monster Beverage Corp., SXC Health Solutions Corp. and Alexion Pharmaceuticals, Inc. Monster Beverage, previously known as Hansen Natural Corp., is a producer of energy beverages. The company benefited from strong growth in its core products, as well as a successful roll-out of new products. First quarter financial results featured 28% revenue growth and 41% earnings growth. SXC Health Solutions is a pharmacy benefit manager that reported strong quarterly results during the period. In April, SXC also announced the acquisition of competitor Catalyst Healthcare for $4.4 billion, which led to additional outperformance. The Fund also owned shares of Catalyst Healthcare. Alexion is a global biopharmaceutical company that focuses on developing drugs for ultra-rare diseases. The company’s lead drug Soliris treats patients with rare, life-threatening blood disorders. In addition to growing quickly in its original indication, Soliris was recently approved for patients in a second indication that significantly increases its potential market opportunity.

The two largest underperformers were Nuance Communications, Inc. and Oil States International, Inc. Nuance Communications is a provider of voice and language solutions for businesses and consumers globally. The company’s stock experienced declines this period and we exited our position by period end. Oil States International provides specialty products and services to oil and gas drilling companies. Low gas prices and declining oil prices at the end of the period hampered the company’s stock in May and June. Detractors from performance also included four industrial stocks, which were adversely affected by slowing economic growth and fears of a global recession.

1. June 29, 2012, was the last business day of the Fund’s semiannual period. See Note 1 of the accompanying Notes to Financial Statements. Index returns are calculated through June 30, 2012. December 30, 2011 was the last business day of the Fund’s 2011 fiscal year.

3 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FUND PERFORMANCE DISCUSSION

Outlook

The macroeconomic environment is characterized by modest economic growth, very low interest rates and decelerating profit growth. We believe that this is an environment that favors growth companies and are optimistic regarding the Fund’s investment strategy. We seek dynamic companies with above-average and sustainable revenue and earnings growth that we believe are positioned to outperform. This includes leading firms in structurally attractive industries with committed management teams that have proven records of performance.

Investors should consider the Fund’s investment objective, risks, and charges and expenses carefully before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Fund, and may be obtained by asking your financial advisor or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing.

Total returns include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

4 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FUND EXPENSE

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended June 29, 2012.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| | | | | | | | | | | | |

| Actual | | Beginning

Account

Value

January 1, 2012 | | | Ending

Account

Value

June 29, 2012 | | | Expenses

Paid During

6 Months Ended

June 29, 2012 | |

| Non-Service shares | | $ | 1,000.00 | | | $ | 1,137.70 | | | $ | 4.24 | |

| Service shares | | | 1,000.00 | | | | 1,136.10 | | | | 5.56 | |

| | | |

Hypothetical

(5% return before expenses) | | | | | | | | | |

| Non-Service shares | | | 1,000.00 | | | | 1,020.77 | | | | 4.01 | |

| Service shares | | | 1,000.00 | | | | 1,019.53 | | | | 5.26 | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated fund, based on the 6-month period ended June 29, 2012 are as follows:

| | | | |

| Class | | Expense Ratios | |

| Non-Service shares | | | 0.80 | % |

| Service shares | | | 1.05 | |

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

5 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF INVESTMENTS June 29, 2012* Unaudited

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| | | | | | | | | |

| Common Stocks—98.3% | | | | | | | | |

| Consumer Discretionary—20.0% | | | | | |

| Hotels, Restaurants & Leisure—5.3% | | | | | | | | |

| Bally Technologies, Inc.1 | | | 132,370 | | | $ | 6,176,384 | |

| Chipotle Mexican Grill, Inc., Cl. A1 | | | 27,741 | | | | 10,540,193 | |

| Dunkin’ Brands Group, Inc. | | | 140,030 | | | | 4,808,630 | |

| Panera Bread Co., Cl. A1 | | | 57,660 | | | | 8,040,110 | |

| Tim Hortons, Inc. | | | 56,560 | | | | 2,977,318 | |

| | | | | | |

|

|

|

| | | | | | | | 32,542,635 | |

| Household Durables—0.6% | | | | | |

| Lennar Corp., Cl. A | | | 104,540 | | | | 3,231,331 | |

| Internet & Catalog Retail—0.5% | | | | | |

| TripAdvisor, Inc.1 | | | 68,210 | | | | 3,048,305 | |

| Multiline Retail—2.9% | | | | | | | | |

| Dollar Tree, Inc.1 | | | 245,590 | | | | 13,212,742 | |

| Nordstrom, Inc. | | | 90,190 | | | | 4,481,541 | |

| | | | | | |

|

|

|

| | | | | | | | 17,694,283 | |

| Specialty Retail—7.9% | | | | | | | | |

| Genesco, Inc.1 | | | 44,010 | | | | 2,647,202 | |

| GNC Holdings, Inc., Cl. A | | | 62,480 | | | | 2,449,216 | |

| O’Reilly Automotive, Inc.1 | | | 61,930 | | | | 5,187,876 | |

| PetSmart, Inc. | | | 108,750 | | | | 7,414,575 | |

| Sally Beauty Holdings, Inc.1 | | | 296,220 | | | | 7,624,703 | |

| Tractor Supply Co. | | | 115,290 | | | | 9,575,987 | |

| Ulta Salon, Cosmetics & Fragrance, Inc. | | | 143,490 | | | | 13,399,096 | |

| | | | | | |

|

|

|

| | | | | | | | 48,298,655 | |

| Textiles, Apparel & Luxury Goods—2.8% | |

| lululemon athletica, Inc.1 | | | 73,180 | | | | 4,363,723 | |

| Michael Kors Holdings Ltd.1 | | | 156,950 | | | | 6,566,788 | |

| Under Armour, Inc., Cl. A1 | | | 65,650 | | | | 6,202,612 | |

| | | | | | |

|

|

|

| | | | | | | | 17,133,123 | |

| Consumer Staples—5.9% | | | | | | | | |

| Beverages—1.9% | | | | | | | | |

| Monster Beverage Corp.1 | | | 161,690 | | | | 11,512,328 | |

| Food & Staples Retailing—2.9% | | | | | |

| Fresh Market, Inc. (The)1 | | | 112,880 | | | | 6,053,754 | |

| Whole Foods Market, Inc. | | | 119,990 | | | | 11,437,447 | |

| | | | | | |

|

|

|

| | | | | | | | 17,491,201 | |

| Personal Products—1.1% | | | | | | | | |

| Estee Lauder Cos., Inc. (The), Cl. A | | | 130,860 | | | | 7,082,143 | |

| Energy—5.9% | | | | | | | | |

| Energy Equipment & Services—3.5% | | | | | | | | |

| Atwood Oceanics, Inc.1 | | | 122,510 | | | | 4,635,778 | |

| Core Laboratories NV | | | 41,640 | | | | 4,826,076 | |

| Oceaneering International, Inc. | | | 115,310 | | | | 5,518,737 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Energy Equipment & Services Continued | |

| Oil States International, Inc.1 | | | 99,440 | | | $ | 6,582,928 | |

| | | | | | |

|

|

|

| | | | | | | | 21,563,519 | |

| Oil, Gas & Consumable Fuels—2.4% | | | | | | | | |

| Cabot Oil & Gas Corp., Cl. A | | | 91,220 | | | | 3,594,068 | |

| Concho Resources, Inc.1 | | | 100,430 | | | | 8,548,602 | |

| Laredo Petroleum Holdings, Inc.1 | | | 120,960 | | | | 2,515,968 | |

| | | | | | |

|

|

|

| | | | | | | | 14,658,638 | |

| Financials—6.2% | | | | | | | | |

| Capital Markets—1.5% | | | | | | | | |

| Affiliated Managers Group, Inc.1 | | | 50,160 | | | | 5,490,012 | |

| LPL Financial Holdings, Inc. | | | 106,840 | | | | 3,607,987 | |

| | | | | | |

|

|

|

| | | | | | | | 9,097,999 | |

| Commercial Banks—1.7% | | | | | | | | |

| First Republic Bank1 | | | 99,560 | | | | 3,345,216 | |

| Signature Bank1 | | | 75,060 | | | | 4,576,408 | |

| SVB Financial Group1 | | | 47,940 | | | | 2,815,037 | |

| | | | | | |

|

|

|

| | | | | | | | 10,736,661 | |

| Insurance—2.2% | | | | | | | | |

| Arthur J. Gallagher & Co. | | | 171,690 | | | | 6,021,168 | |

| ProAssurance Corp. | | | 83,240 | | | | 7,415,852 | |

| | | | | | |

|

|

|

| | | | | | | | 13,437,020 | |

| Real Estate Investment Trusts—0.8% | | | | | | | | |

| Digital Realty Trust, Inc. | | | 63,640 | | | | 4,777,455 | |

| Health Care—16.4% | | | | | | | | |

| Biotechnology—3.5% | | | | | | | | |

| Alexion Pharmaceuticals, Inc.1 | | | 132,510 | | | | 13,158,243 | |

| Incyte Corp.1 | | | 132,670 | | | | 3,011,609 | |

| Medivation, Inc.1 | | | 34,400 | | | | 3,144,160 | |

| Onyx Pharmaceuticals, Inc.1 | | | 33,980 | | | | 2,257,971 | |

| | | | | | |

|

|

|

| | | | | | | | 21,571,983 | |

| Health Care Equipment & Supplies—3.8% | | | | | |

| Cooper Cos., Inc. (The) | | | 92,760 | | | | 7,398,538 | |

| Edwards Lifesciences Corp.1 | | | 57,420 | | | | 5,931,486 | |

| IDEXX Laboratories, Inc.1 | | | 56,020 | | | | 5,385,203 | |

| Sirona Dental Systems, Inc.1 | | | 98,340 | | | | 4,426,283 | |

| | | | | | |

|

|

|

| | | | | | | | 23,141,510 | |

Health Care Providers &

Services—3.0% | | | | | |

| Catalyst Health Solutions, Inc.1 | | | 89,900 | | | | 8,400,256 | |

| DaVita, Inc.1 | | | 36,180 | | | | 3,553,238 | |

| HMS Holdings Corp.1 | | | 179,370 | | | | 5,974,815 | |

| | | | | | |

|

|

|

| | | | | | | | 17,928,309 | |

6 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Health Care Technology—2.9% | | | | | |

| Cerner Corp.1 | | | 123,760 | | | $ | 10,230,002 | |

| SXC Health Solutions Corp.1 | | | 74,950 | | | | 7,435,790 | |

| | | | | | |

|

|

|

| | | | | | | | 17,665,792 | |

| Pharmaceuticals—3.2% | | | | | | | | |

| Perrigo Co. | | | 61,520 | | | | 7,255,054 | |

| Salix Pharmaceuticals Ltd.1 | | | 117,750 | | | | 6,410,310 | |

| Watson Pharmaceuticals, Inc.1 | | | 79,960 | | | | 5,916,240 | |

| | | | | | |

|

|

|

| | | | | | | | 19,581,604 | |

| Industrials—14.9% | | | | | | | | |

| Aerospace & Defense—4.6% | | | | | |

| B/E Aerospace, Inc.1 | | | 175,500 | | | | 7,662,330 | |

| Hexcel Corp.1 | | | 288,330 | | | | 7,436,031 | |

| TransDigm Group, Inc.1 | | | 94,160 | | | | 12,645,688 | |

| | | | | | |

|

|

|

| | | | | | | | 27,744,049 | |

| Building Products—0.5% | | | | | | | | |

| Fortune Brands Home & Security, Inc.1 | | | 134,380 | | | | 2,992,643 | |

| Commercial Services & Supplies—1.3% | |

| Clean Harbors, Inc.1 | | | 68,710 | | | | 3,876,618 | |

| Stericycle, Inc.1 | | | 45,320 | | | | 4,154,484 | |

| | | | | | |

|

|

|

| | | | | | | | 8,031,102 | |

| Electrical Equipment—3.0% | | | | | |

| AMETEK, Inc. | | | 180,095 | | | | 8,988,541 | |

| Polypore International, Inc.1 | | | 75,880 | | | | 3,064,793 | |

| Roper Industries, Inc. | | | 64,530 | | | | 6,361,367 | |

| | | | | | |

|

|

|

| | | | | | | | 18,414,701 | |

| Machinery—2.2% | | | | | | | | |

| Timken Co. | | | 115,400 | | | | 5,284,166 | |

| Wabtec Corp. | | | 102,770 | | | | 8,017,088 | |

| | | | | | |

|

|

|

| | | | | | | | 13,301,254 | |

| Professional Services—0.8% | | | | | |

| IHS, Inc., Cl. A1 | | | 45,810 | | | | 4,935,111 | |

| Road & Rail—1.3% | | | | | | | | |

| Kansas City Southern, Inc. | | | 112,950 | | | | 7,856,802 | |

| Trading Companies & Distributors—1.2% | |

| Fastenal Co. | | | 63,610 | | | | 2,564,119 | |

| United Rentals, Inc.1 | | | 144,450 | | | | 4,917,078 | |

| | | | | | |

|

|

|

| | | | | | | | 7,481,197 | |

| Information Technology—22.8% | | | | | |

| Communications Equipment—0.8% | | | | | | | | |

| F5 Networks, Inc.1 | | | 47,380 | | | | 4,717,153 | |

| Internet Software��& Services—5.5% | | | | | | | | |

| Akamai Technologies, Inc.1 | | | 127,570 | | | | 4,050,348 | |

| Equinix, Inc.1 | | | 56,080 | | | | 9,850,452 | |

| IAC/InterActiveCorp | | | 96,550 | | | | 4,402,680 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Internet Software & Services Continued | |

| LinkedIn Corp., Cl. A1 | | | 65,470 | | | $ | 6,957,497 | |

| Mercadolibre, Inc. | | | 34,840 | | | | 2,640,872 | |

| Rackspace Hosting, Inc.1 | | | 126,930 | | | | 5,577,304 | |

| | | | | | |

|

|

|

| | | | | | | | 33,479,153 | |

| IT Services—3.1% | | | | | | | | |

| Alliance Data Systems Corp.1 | | | 37,570 | | | | 5,071,950 | |

| Teradata Corp.1 | | | 135,780 | | | | 9,777,518 | |

| Vantiv, Inc., Cl. A1 | | | 173,360 | | | | 4,037,554 | |

| | | | | | |

|

|

|

| | | | | | | | 18,887,022 | |

| Semiconductors & Semiconductor Equipment—2.8% | |

| Avago Technologies Ltd. | | | 132,640 | | | | 4,761,776 | |

| Mellanox Technologies Ltd.1 | | | 51,640 | | | | 3,658,178 | |

| Skyworks Solutions, Inc.1 | | | 202,030 | | | | 5,529,561 | |

| Teradyne, Inc.1 | | | 223,040 | | | | 3,135,942 | |

| | | | | | |

|

|

|

| | | | | | | | 17,085,457 | |

| Software—10.6% | | | | | | | | |

| Ariba, Inc.1 | | | 136,840 | | | | 6,124,958 | |

| Citrix Systems, Inc.1 | | | 93,560 | | | | 7,853,426 | |

| Commvault Systems, Inc.1 | | | 68,670 | | | | 3,403,972 | |

| Concur Technologies, Inc.1 | | | 128,248 | | | | 8,733,689 | |

| Fortinet, Inc.1 | | | 289,170 | | | | 6,714,527 | |

| MICROS Systems, Inc.1 | | | 61,530 | | | | 3,150,336 | |

| NetSuite, Inc.1 | | | 100,252 | | | | 5,490,802 | |

| Red Hat, Inc.1 | | | 130,150 | | | | 7,350,872 | |

| ServiceNow, Inc.1 | | | 124,922 | | | | 3,073,081 | |

| Solarwinds, Inc.1 | | | 132,120 | | | | 5,755,147 | |

| TIBCO Software, Inc.1 | | | 246,930 | | | | 7,388,146 | |

| | | | | | |

|

|

|

| | | | | | | | 65,038,956 | |

| Materials—4.5% | | | | | | | | |

| Chemicals—3.9% | | | | | | | | |

| Airgas, Inc. | | | 76,190 | | | | 6,400,722 | |

| Albemarle Corp. | | | 58,140 | | | | 3,467,470 | |

| CF Industries Holdings, Inc. | | | 34,140 | | | | 6,614,284 | |

| Cytec Industries, Inc. | | | 25,030 | | | | 1,467,759 | |

| Sigma-Aldrich Corp. | | | 43,990 | | | | 3,252,181 | |

| Westlake Chemical Corp. | | | 48,680 | | | | 2,544,017 | |

| | | | | | |

|

|

|

| | | | | | | | 23,746,433 | |

| Containers & Packaging—0.6% | | | | | |

| Ball Corp. | | | 98,130 | | | | 4,028,237 | |

| Telecommunication Services—1.2% | | | | | | | | |

| Wireless Telecommunication Services—1.2% | | | | | |

| SBA Communications Corp.1 | | | 129,300 | | | | 7,376,565 | |

7 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Utilities—0.5% | | | | | | | | |

| Electric Utilities—0.5% | | | | | | | | |

| ITC Holdings Corp. | | | 44,910 | | | $ | 3,094,748 | |

| | | | | | |

|

|

|

| Total Common Stocks (Cost $416,677,490) | | | | | | | 600,405,077 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Investment Company—2.2% | | | | | |

| Oppenheimer Institutional Money Market Fund, Cl. E, 0.20%2,3 | | | | | | | | |

| (Cost $13,045,599) | | | 13,045,599 | | | $ | 13,045,599 | |

Total Investments, at Value

(Cost $429,723,089) | | | 100.5 | % | | | 613,450,676 | |

| Liabilities in Excess of Other Assets | | | (0.5 | ) | | | (2,788,924 | ) |

| Net Assets | |

| 100.0

| %

| | $

| 610,661,752

|

|

Footnotes to Statement of Investments

* June 29, 2012 represents the last business day of the Fund’s 2012 semiannual period. See Note 1 of accompanying Notes.

1. Non-income producing security.

2. Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended June 29, 2012, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares

December 30, 2011a | | | Gross

Additions | | | Gross

Reductions | | | Shares

June 29, 2012 | |

| Oppenheimer Institutional Money Market Fund, Cl. E | | | 14,138,260 | | | | 104,025,768 | | | | 105,118,429 | | | | 13,045,599 | |

| | | | |

| | | | | | | | | Value | | | Income | |

| Oppenheimer Institutional Money Market Fund, Cl. E | | | | | | | | | | | $13,045,599 | | | | $6,095 | |

a. December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See Note 1 of the accompanying Notes.

3. Rate shown is the 7-day yield as of June 29, 2012.

See accompanying Notes to Financial Statements.

8 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF ASSETS AND LIABILITIES Unaudited

| | | | |

| June 29, 20121 | | | |

| Assets | | | |

| Investments, at value—see accompanying statement of investments: | | | | |

| Unaffiliated companies (cost $416,677,490) | | $ | 600,405,077 | |

| Affiliated companies (cost $13,045,599) | |

| 13,045,599

|

|

| | | | 613,450,676 | |

| Cash | | | 7,432 | |

| Receivables and other assets: | | | | |

| Investments sold | | | 1,950,181 | |

| Shares of beneficial interest sold | | | 332,145 | |

| Dividends | | | 134,892 | |

| Other | |

| 32,873

|

|

| Total assets | | | 615,908,199 | |

| Liabilities | | | |

| Payables and other liabilities: | | | | |

| Investments purchased | | | 4,895,830 | |

| Shares of beneficial interest redeemed | | | 224,954 | |

| Transfer and shareholder servicing agent fees | | | 48,903 | |

| Shareholder communications | | | 32,742 | |

| Trustees’ compensation | | | 25,397 | |

| Distribution and service plan fees | | | 6,863 | |

| Other | |

| 11,758

|

|

| Total liabilities | | | 5,246,447 | |

| Net Assets | | $

| 610,661,752

|

|

| Composition of Net Assets | | | |

| Par value of shares of beneficial interest | | $ | 11,426 | |

| Additional paid-in capital | | | 633,238,478 | |

| Accumulated net investment loss | | | (1,093,327 | ) |

| Accumulated net realized loss on investments | | | (205,222,412 | ) |

| Net unrealized appreciation on investments | |

| 183,727,587

|

|

| Net Assets | | $

| 610,661,752

|

|

| Net Asset Value Per Share | | | |

| Non-Service Shares: | | | | |

Net asset value, redemption price per share and offering price per share (based on net assets of $573,126,023

and 10,705,631 shares of beneficial interest outstanding) | | | $53.54 | |

| Service Shares: | | | | |

Net asset value, redemption price per share and offering price per share (based on net assets of $37,535,729

and 720,723 shares of beneficial interest outstanding) | | | $52.08 | |

1. June 29, 2012 represents the last business day of the Fund’s 2012 semiannual period. See Note 1 of the accompanying Notes

See accompanying Notes to Financial Statements.

9 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF OPERATIONS Unaudited

| | | | |

| For the Six Months Ended June 29, 20121 | | | |

| Investment Income | | | |

| Dividends: | | | | |

| Unaffiliated companies (net of foreign withholding taxes of $7,620) | | $ | 1,446,175 | |

| Affiliated companies | | | 6,095 | |

| Interest | |

| 256

|

|

| Total investment income | | | 1,452,526 | |

| Expenses | | | |

| Management fees | | | 2,220,457 | |

| Distribution and service plan fees—Service shares | | | 47,244 | |

| Transfer and shareholder servicing agent fees: | | | | |

| Non-Service shares | | | 290,456 | |

| Service shares | | | 18,897 | |

| Shareholder communications: | | | | |

| Non-Service shares | | | 8,057 | |

| Service shares | | | 526 | |

| Trustees’ compensation | | | 17,171 | |

| Custodian fees and expenses | | | 1,686 | |

| Administration service fees | | | 750 | |

| Other | |

| 28,069

|

|

| Total expenses | | | 2,633,313 | |

| Less waivers and reimbursements of expenses | |

| (110,514

| )

|

| Net expenses | | | 2,522,799 | |

| Net Investment Loss | | | (1,070,273 | ) |

| Realized and Unrealized Gain | | | |

| Net realized gain on investments from unaffiliated companies | | | 20,134,093 | |

| Net change in unrealized appreciation/depreciation on investments | | | 60,123,428 | |

| | |

| Net Increase in Net Assets Resulting from Operations | | $

| 79,187,248

|

|

1. June 29, 2012 represents the last business day of the Fund’s 2012 semiannual period. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

10 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months

Ended

June 29, 20121

(Unaudited) | | | Year

Ended

December 30,

20111 | |

| Operations | | | | | | |

| Net investment loss | | $ | (1,070,273 | ) | | $ | (3,504,153 | ) |

| Net realized gain | | | 20,134,093 | | | | 77,531,562 | |

| Net change in unrealized appreciation/depreciation | |

| 60,123,428

|

| |

| (62,965,525

| )

|

| Net increase in net assets resulting from operations | | | 79,187,248 | | | | 11,061,884 | |

| Beneficial Interest Transactions | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| Non-Service shares | | | (44,277,733 | ) | | | (80,390,137 | ) |

| Service shares | |

| (3,040,340

| )

| |

| 3,579,422

|

|

| | | | (47,318,073 | ) | | | (76,810,715 | ) |

| Net Assets | | | | | | |

| Total increase (decrease) | | | 31,869,175 | | | | (65,748,831 | ) |

| Beginning of period | |

| 578,792,577

|

| |

| 644,541,408

|

|

| End of period (including accumulated net investment loss of $1,093,327 and $23,054, respectively) | | $

| 610,661,752

|

| | $

| 578,792,577

|

|

1. June 29, 2012 and December 30, 2011 represents the last business days of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

11 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

June 29, 20121 | | | Year Ended

December 30, | | | Year Ended December 31, | |

| Non-Service Shares | | (Unaudited) | | | 20111 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $47.06 | | | | $46.55 | | | | $36.52 | | | | $27.54 | | | | $54.07 | | | | $50.85 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss2 | | | (.09 | ) | | | (.26 | ) | | | (.11 | ) | | | (.05 | ) | | | (.13 | ) | | | (.02 | ) |

| Net realized and unrealized gain (loss) | |

| 6.57

|

| |

| .77

|

| |

| 10.14

|

| |

| 9.03

|

| |

| (26.40

| )

| |

| 3.24

|

|

| Total from investment operations | | | 6.48 | | | | .51 | | | | 10.03 | | | | 8.98 | | | | (26.53 | ) | | | 3.22 | |

| Net asset value, end of period | |

| $53.54

|

| |

| $47.06

|

| |

| $46.55

|

| |

| $36.52

|

| |

| $27.54

|

| |

| $54.07

|

|

| Total Return, at Net Asset Value3 | | 13.77% | | | 1.09% | | | 27.46% | | | 32.61% | | | (49.07)% | | | 6.33% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $573,126 | | | | $543,020 | | | | $611,872 | | | | $547,683 | | | | $461,684 | | | | $1,002,442 | |

| Average net assets (in thousands) | | | $584,275 | | | | $605,083 | | | | $548,739 | | | | $478,968 | | | | $754,170 | | | | $1,045,592 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.33 | )% | | | (0.53 | )% | | | (0.29 | )% | | | (0.17 | )% | | | (0.30 | )% | | | (0.04 | )% |

| Total expenses5 | | | 0.84 | % | | | 0.84 | % | | | 0.85 | % | | | 0.86 | % | | | 0.71 | % | | | 0.69 | % |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.80 | % | | | 0.80 | % | | | 0.76 | % | | | 0.71 | % | | | 0.68 | % | | | 0.69 | % |

| Portfolio turnover rate | | | 34 | % | | | 91 | % | | | 95 | % | | | 102 | % | | | 78 | % | | | 112 | % |

1. June 29, 2012 and December 30, 2011 represent the last business days of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

| Six Months Ended June 29, 2012 | | | 0.84 | % |

| Year Ended December 30, 2011 | | | 0.84 | % |

| Year Ended December 31, 2010 | | | 0.85 | % |

| Year Ended December 31, 2009 | | | 0.86 | % |

| Year Ended December 31, 2008 | | | 0.71 | % |

| Year Ended December 31, 2007 | | | 0.69 | % |

See accompanying Notes to Financial Statements.

12 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

June 29, 20121 | | | Year Ended

December 30, | | | Year Ended December 31, | |

| Service Shares | | (Unaudited) | | | 20111 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Operating Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $45.84 | | | | $45.46 | | | | $35.75 | | | | $27.03 | | | | $53.22 | | | | $50.19 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss2 | | | (.15 | ) | | | (.37 | ) | | | (.20 | ) | | | (.13 | ) | | | (.24 | ) | | | (.17 | ) |

| Net realized and unrealized gain (loss) | |

| 6.39

|

| |

| .75

|

| |

| 9.91

|

| |

| 8.85

|

| |

| (25.95

| )

| |

| 3.20

|

|

| Total from investment operations | | | 6.24 | | | | .38 | | | | 9.71 | | | | 8.72 | | | | (26.19 | ) | | | 3.03 | |

| Net asset value, end of period | |

| $52.08

|

| |

| $45.84

|

| |

| $45.46

|

| |

| $35.75

|

| |

| $27.03

|

| |

| $53.22

|

|

| Total Return, at Net Asset Value3 | | 13.61% | | | 0.83% | | | 27.16% | | | 32.26% | | | (49.21)% | | | 6.04% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $37,536 | | | | $35,773 | | | | $32,669 | | | | $26,098 | | | | $21,952 | | | | $47,270 | |

| Average net assets (in thousands) | | | $38,013 | | | | $37,775 | | | | $27,552 | | | | $22,605 | | | | $35,815 | | | | $49,421 | |

| Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.58 | )% | | | (0.78 | )% | | | (0.53 | )% | | | (0.44 | )% | | | (0.57 | )% | | | (0.31 | )% |

| Total expenses5 | | | 1.09 | % | | | 1.09 | % | | | 1.10 | % | | | 1.12 | % | | | 0.98 | % | | | 0.96 | % |

Expenses after payments, waivers and/or

reimbursements and reduction to custodian expenses | | | 1.05 | % | | | 1.05 | % | | | 1.01 | % | | | 0.97 | % | | | 0.95 | % | | | 0.96 | % |

| Portfolio turnover rate | | | 34 | % | | | 91 | % | | | 95 | % | | | 102 | % | | | 78 | % | | | 112 | % |

1. June 29, 2012 and December 30, 2011 represent the last business days of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

| Six Months Ended June 29, 2012 | | | 1.09 | % |

| Year Ended December 30, 2011 | | | 1.09 | % |

| Year Ended December 31, 2010 | | | 1.10 | % |

| Year Ended December 31, 2009 | | | 1.12 | % |

| Year Ended December 31, 2008 | | | 0.98 | % |

| Year Ended December 31, 2007 | | | 0.96 | % |

See accompanying Notes to Financial Statements.

13 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

NOTES TO FINANCIAL STATEMENTS Unaudited

1. Significant Accounting Policies

Oppenheimer Small- & Mid-Cap Growth Fund/VA (the “Fund”) is a separate series of Oppenheimer Variable Account Funds, an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to seek capital appreciation by investing in “growth type” companies. The Fund’s investment adviser is OppenheimerFunds, Inc. (the “Manager”).

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies consistently followed by the Fund.

Semiannual and Annual Periods. The last day of the Fund’s semiannual period was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

The last day of the Fund’s fiscal year was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

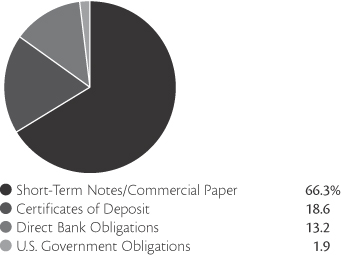

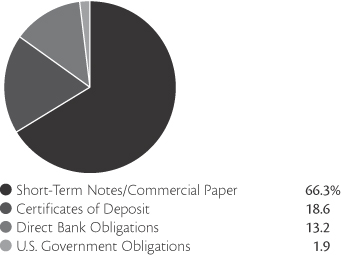

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity. IMMF is a registered open-end management investment company, regulated as a money market fund under the Investment Company Act of 1940, as amended. The Manager is also the investment adviser of IMMF. When applicable, the Fund’s investment in IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remain open for the three preceding fiscal reporting period ends.

During the fiscal year ended December 30, 2011, the Fund utilized $83,964,525 of capital loss carryforward to offset capital gains realized in that fiscal year. The Fund had post-October losses of $7,541,352. Details of the fiscal year ended December 30, 2011 capital loss carryforwards are included in the table below. Capital loss carryforwards with no

14 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

expiration, if any, must be utilized prior to those with expiration dates. Capital losses with no expiration will be carried forward to future years if not offset by gains.

| | | | |

| Expiring | | | |

| 2017 | | $ | 217,070,467 | |

| No expiration | | | 7,541,352 | |

| | |

|

|

|

| Total | | $ | 224,611,819 | |

| | |

|

|

|

As of June 29, 2012, it is estimated that the capital loss carryforwards would be $204,477,726 expiring by 2017. The estimated capital loss carryforward represents the carryforward as of the end of the last fiscal year, increased or decreased by capital losses or gains realized in the first six months of the current fiscal year. During the six months ended June 29, 2012, it is estimated that the Fund will utilize $20,134,093 of capital loss carryforward to offset realized capital gains.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of June 29, 2012 are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| | | | |

| Federal tax cost of securities | | $ | 430,737,442 | |

| | |

|

|

|

| Gross unrealized appreciation | | $ | 190,468,585 | |

| Gross unrealized depreciation | | | (7,755,351) | |

| | |

|

|

|

| Net unrealized appreciation | | $ | 182,713,234 | |

| | |

|

|

|

Trustees’ Compensation. The Board of Trustees has adopted a compensation deferral plan for independent trustees that enables trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of trustees’ fees under the plan will not affect the net assets of the Fund, and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made to shareholders prior to the Fund’s fiscal year end may ultimately be categorized as a tax return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend

15 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

1. Significant Accounting Policies Continued

income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if

16 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange but not listed on a registered U.S. securities exchange is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority); (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| | |

| Security Type | | Standard inputs generally considered by third-party pricing vendors |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. |

| Loans | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

| Event-linked bonds | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

17 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

2. Securities Valuation Continued

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | 1) | Level 1—unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange) |

| | 2) | Level 2—inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.) |

| | 3) | Level 3—significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability). |

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of June 29, 2012 based on valuation input level:

| | | | | | | | | | | | | | | | |

| | | Level 1—

Unadjusted

Quoted Prices | | | Level 2—

Other Significant

Observable Inputs | | | Level 3—

Significant

Unobservable

Inputs | | | Value | |

| Assets Table | | | | | | | | | | | | | | | | |

| Investments, at Value: | | | | | | | | | | | | | | | | |

| Common Stocks | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 121,948,332 | | | $ | — | | | $ | — | | | $ | 121,948,332 | |

Consumer Staples | | | 36,085,672 | | | | — | | | | — | | | | 36,085,672 | |

Energy | | | 36,222,157 | | | | — | | | | — | | | | 36,222,157 | |

Financials | | | 38,049,135 | | | | — | | | | — | | | | 38,049,135 | |

Health Care | | | 99,889,198 | | | | — | | | | — | | | | 99,889,198 | |

Industrials | | | 90,756,859 | | | | — | | | | — | | | | 90,756,859 | |

Information Technology | | | 139,207,741 | | | | — | | | | — | | | | 139,207,741 | |

Materials | | | 27,774,670 | | | | — | | | | — | | | | 27,774,670 | |

Telecommunication Services | | | 7,376,565 | | | | — | | | | — | | | | 7,376,565 | |

Utilities | | | 3,094,748 | | | | — | | | | — | | | | 3,094,748 | |

| Investment Company | | | 13,045,599 | | | | — | | | | — | | | | 13,045,599 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total Assets | | $ | 613,450,676 | | | $ | — | | | $ | — | | | $ | 613,450,676 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Currency contracts and forwards, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. Futures, if any, are reported at their variation

18 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

margin at measurement date, which represents the amount due to/from the Fund at that date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

There have been no significant changes to the fair valuation methodologies of the Fund during the period.

3. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended June 29, 2012 | | | Year Ended December 30, 2011 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Non-Service Shares | | | | | | | | | | | | | | | | |

| Sold | | | 182,639 | | | | $ 9,500,273 | | | | 665,252 | | | | $ 32,309,437 | |

| Redeemed | | | (1,016,411 | ) | | | (53,778,006 | ) | | | (2,270,275 | ) | | | (112,699,574 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net decrease | | | (833,772 | ) | | | $(44,277,733 | ) | | | (1,605,023 | ) | | | $(80,390,137 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Sold | | | 61,579 | | | | $ 3,111,290 | | | | 366,560 | | | | $ 18,018,685 | |

| Redeemed | | | (121,296 | ) | | | (6,151,630 | ) | | | (304,822 | ) | | | (14,439,263 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net increase (decrease) | | | (59,717 | ) | | | $ (3,040,340 | ) | | | 61,738 | | | | $ 3,579,422 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

4. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IMMF, for the six months ended June 29, 2012, were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

| Investment securities | | $ | 206,968,316 | | | $ | 253,865,991 | |

5. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

| | | | |

| Fee Schedule | | | |

| Up to $200 million | | | 0.75 | % |

| Next $200 million | | | 0.72 | |

| Next $200 million | | | 0.69 | |

| Next $200 million | | | 0.66 | |

| Next $700 million | | | 0.60 | |

| Over $1.5 billion | | | 0.58 | |

Administration Service Fees. The Fund pays the Manager a fee of $1,500 per year for preparing and filing the Fund’s tax returns.

Transfer Agent Fees. OppenheimerFunds Services (“OFS”), a division of the Manager, acts as the transfer and shareholder servicing agent for the Fund. For the six months ended June 29, 2012, the Fund paid $310,680 to OFS for services to the Fund.

Distribution and Service Plan for Service Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) in accordance with Rule 12b-1 under the Investment Company Act of 1940 for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of

19 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

5. Fees and Other Transactions with Affiliates Continued

Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on an on-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses. The Manager has voluntarily agreed to limit the Fund’s total annual operating expenses so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% for Non-Service shares and 1.05% for Service shares. During the six months ended June 29, 2012, the Manager waived fees and/or reimbursed the Fund $101,199 and $6,581 for Non-Service and Service shares, respectively.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF. During the six months ended June 29, 2012, the Manager waived fees and/or reimbursed the Fund $2,734 for IMMF management fees.

Some of these undertakings may be modified or terminated at any time; some may not be modified or terminated until after one year from the date of the current prospectus, as indicated therein.

6. Pending Litigation

Since 2009, a number of class action, derivative and individual lawsuits have been pending in federal and state courts against OppenheimerFunds, Inc., the Fund’s investment advisor (the “Manager”), OppenheimerFunds Distributor, Inc., the Fund’s principal underwriter and distributor (the “Distributor”), and certain funds (but not including the Fund) advised by the Manager and distributed by the Distributor (the “Defendant Funds”). Several of these lawsuits also name as defendants certain officers and current and former trustees of the respective Defendant Funds. The lawsuits raise claims under federal securities laws and various states’ securities, consumer protection and common law and allege, among other things, that the disclosure documents of the respective Defendant Funds contained misrepresentations and omissions and that the respective Defendant Funds’ investment policies were not followed. The plaintiffs in these actions seek unspecified damages, equitable relief and awards of attorneys’ fees and litigation expenses.

Other class action and individual lawsuits have been filed since 2008 in various state and federal courts against the Manager and certain of its affiliates by investors seeking to recover investments they allegedly lost as a result of the “Ponzi” scheme run by Bernard L. Madoff and his firm, Bernard L. Madoff Investment Securities, LLC (“BLMIS”). Plaintiffs in these suits allege that they suffered losses as a result of their investments in several funds managed by an affiliate of the Manager and assert a variety of claims, including breach of fiduciary duty, fraud, negligent misrepresentation, unjust enrichment, and violation of federal and state securities laws and regulations, among others. They seek unspecified damages, equitable relief and awards of attorneys’ fees and litigation expenses. Neither the Distributor, nor any of the Oppenheimer mutual funds, their independent trustees or directors are named as defendants in these lawsuits. None of the Oppenheimer mutual funds invested in any funds or accounts managed by Madoff or BLMIS. On February 28, 2011, a stipulation of partial settlement of three groups of consolidated putative class action lawsuits relating to these matters was filed in the U.S. District Court for the Southern District of New York. On August 19, 2011, the court entered an order and final judgment approving the settlement as fair, reasonable and adequate. In September 2011, certain parties filed notices of appeal from the court’s order approving the settlement. On July 29, 2011, a stipulation of settlement between certain affiliates of the Manager and the Trustee appointed under the Securities Investor Protection Act to liquidate BLMIS was filed in the U.S. Bankruptcy Court for the Southern District of New York to resolve purported preference and fraudulent transfer claims by the Trustee. On September 22, 2011, the court entered an order approving the settlement as fair, reasonable and adequate. In October 2011, certain parties filed notices of appeal from the court’s order approving the settlement. The aforementioned settlements do not resolve other outstanding lawsuits against the Manager and its affiliates relating to BLMIS.

20 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

On April 16, 2010, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark IV Funding Limited (“AAArdvark IV”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark IV. Plaintiffs allege breach of contract against the defendants and seek compensatory damages, costs and disbursements, including attorney fees. On July 15, 2011, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark Funding Limited (“AAArdvark I”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark I. The complaint alleges breach of contract against the defendants and seeks compensatory damages, costs and disbursements, including attorney fees. On November 9, 2011, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark XS Funding Limited (“AAArdvark XS”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark XS. The complaint alleges breach of contract against the defendants and seeks compensatory damages, costs and disbursements, including attorney fees.

The Manager believes the lawsuits and appeals described above are without legal merit and, with the exception of actions it has settled, is defending against them vigorously. The Defendant Funds’ Boards of Trustees have also engaged counsel to represent the Funds and the present and former Independent Trustees named in those suits. While it is premature to render any opinion as to the outcome in these lawsuits, or whether any costs that the Defendant Funds may bear in defending the suits might not be reimbursed by insurance, the Manager believes that these suits should not impair the ability of the Manager or the Distributor to perform their respective duties to the Fund, and that the outcome of all of the suits together should not have any material effect on the operations of any of the Oppenheimer mutual funds.

21 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

SPECIAL SHAREHOLDER MEETING Unaudited

On February 29, 2012, a shareholder meeting of the Oppenheimer Variable Account Funds, on behalf of Oppenheimer Small- & Mid-Cap Growth Fund/VA (the “Fund”) was held at which the twelve Trustees identified below were elected to the Trust (Proposal No. 1). At the meeting Proposal No. 2 (including all of its sub-proposals) and Proposal No. 3 were approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| | | | | | | | |

| Nominee/Proposal | | For | | | Withheld | |

| Trustees | | | | | | | | |

| William L. Armstrong | | | 859,155,000 | | | | 36,277,763 | |

| Edward L. Cameron | | | 860,463,149 | | | | 34,969,615 | |

| Jon S. Fossel | | | 861,382,389 | | | | 34,050,375 | |

| Sam Freedman | | | 860,173,958 | | | | 35,258,806 | |

| Richard F. Grabish | | | 862,692,974 | | | | 32,739,789 | |

| Beverly L. Hamilton | | | 862,904,192 | | | | 32,528,571 | |

| Robert J. Malone | | | 862,354,488 | | | | 33,078,275 | |

| F. William Marshall, Jr. | | | 860,997,182 | | | | 34,435,581 | |

| Victoria J. Herget | | | 861,814,105 | | | | 33,618,659 | |

| Karen L. Stuckey | | | 861,434,246 | | | | 33,998,517 | |

| James D. Vaughn | | | 861,208,178 | | | | 34,224,585 | |

| William F. Glavin, Jr. | | | 861,148,846 | | | | 34,283,917 | |

2a: Proposal to revise the fundamental policy relating to borrowing

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,738,046 | | | 994,639 | | | | 734,165 | | | | N/A | |

2b: Proposal to revise the fundamental policy relating to concentration of investments

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,848,738 | | | 999,379 | | | | 618,734 | | | | N/A | |

2c: Proposal to remove the fundamental policy relating to diversification of investments

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,634,507 | | | 1,018,768 | | | | 813,576 | | | | N/A | |

2d: Proposal to revise the fundamental policy relating to lending

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,754,568 | | | 1,023,804 | | | | 688,479 | | | | N/A | |

2e-1: Proposal to revise the fundamental policy relating to real estate and commodities

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,766,185 | | | 1,023,074 | | | | 677,591 | | | | N/A | |

2e-2: Proposal to remove the additional fundamental policy relating to real estate and commodities

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,679,775 | | | 1,039,043 | | | | 748,033 | | | | N/A | |

22 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

2f: Proposal to revise the fundamental policy relating to senior securities

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,726,511 | | | 1,002,845 | | | | 737,495 | | | | N/A | |

2g: Proposal to revise the fundamental policy relating to underwriting

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,757,607 | | | 1,020,891 | | | | 688,353 | | | | N/A | |

2i: Convert the Fund’s investment objective from fundamental to non-fundamental

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,494,590 | | | 1,087,623 | | | | 884,638 | | | | N/A | |

2j: Approve a change in the fund’s investment objective

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 10,733,510 | | | 1,012,791 | | | | 720,549 | | | | N/A | |

Proposal 3: To approve an Agreement and Plan of Reorganization that provides for the reorganization of a Fund from a Maryland corporation or Massachusetts business trust, as applicable, into a Delaware statutory trust.

| | | | | | | | | | | | |

| For | | Against | | | Abstain | | | Broker Non Vote | |

| 821,085,084 | | | 23,597,959 | | | | 50,749,721 | | | | N/A | |

23 | OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|