UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code:(303)768-3200

Date of fiscal year end:December 31

Date of reporting period:12/31/2018

| Item 1. | Reports to Stockholders. |

| | | | |

| |

| | |

| | |

| | | December 31, 2018 | | |

| | Oppenheimer | | |

| | Discovery Mid Cap Growth Fund/VA | | Annual Report |

| | A Series of Oppenheimer Variable Account Funds | | |

| | | |

| | ANNUAL REPORT | | |

| | |

| | Listing of Top Holdings | | |

| | |

| | Fund Performance Discussion | | |

| | |

| | Financial Statements | | |

PORTFOLIO MANAGERS: Ronald J. Zibelli, Jr., CFA and Justin Livengood, CFA

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 12/31/18

| | | | | | | | | | | | | | |

| | | Inception Date | | 1-Year | | | 5-Year | | | 10-Year | |

Non-Service Shares | | 8/15/86 | | | -6.08% | | | | 6.90% | | | | 14.21 | % |

Service Shares | | 10/16/00 | | | -6.31 | | | | 6.63 | | | | 13.93 | |

Russell Midcap Growth Index | | | | | -4.75 | | | | 7.42 | | | | 15.12 | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account. Returns for periods of less than one year are cumulative and not annualized. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

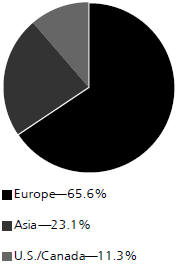

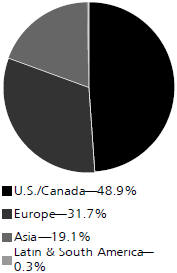

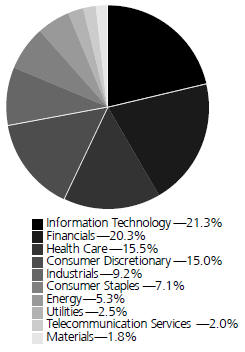

TOP HOLDINGS AND ALLOCATIONS

TOP TEN COMMON STOCK HOLDINGS

| | |

Total System Services, Inc. | | 2.5% |

CoStar Group, Inc. | | 2.3 |

Waste Connections, Inc. | | 2.3 |

Roper Technologies, Inc. | | 2.1 |

Lamb Weston Holdings, Inc. | | 2.1 |

O’Reilly Automotive, Inc. | | 2.0 |

CDW Corp. | | 1.9 |

IDEX Corp. | | 1.9 |

WellCare Health Plans, Inc. | | 1.9 |

Progressive Corp. (The) | | 1.9 |

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2018, and are based on net assets.

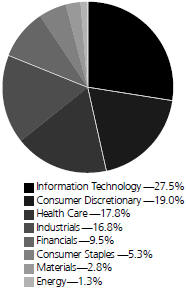

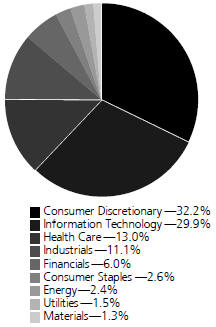

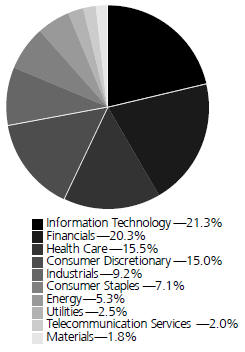

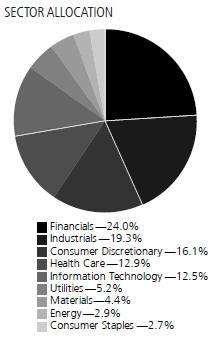

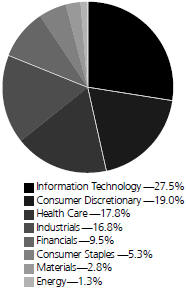

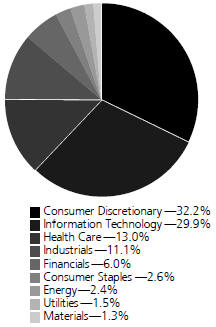

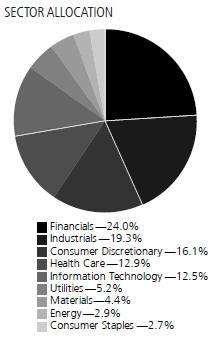

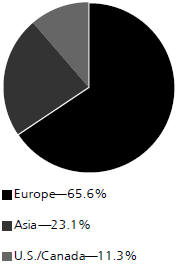

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2018, and are based on the total market value of common stocks.

For more current Fund holdings, please visit oppenheimerfunds.com.

2 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Performance Discussion

The Fund’sNon-Service shares produced a return of-6.08% during the reporting period, underperforming the Russell Midcap Growth Index’s (the “Index”) return of-4.75%. The Fund underperformed the Index within the Industrials and Energy sectors due to stock selection, and in the Information Technology Sector due to an underweight position. Stock selection in the Health Care, Financials, and Communication Services sectors provided favorable performance.

MARKET OVERVIEW

After markets closed 2017 with strong performance, volatility made a comeback in 2018 due to a combination of the U.S. Administration’s trade wars with other nations, a slowing of global economic activity, and the prospect of rising interest rates interrupting the upward march of the equity markets. During the fourth quarter of 2018, equity market volatility spiked and all major equity indices across the world had substantially negative performance.

TOP INDIVIDUAL CONTRIBUTORS

Top performing stocks for the Fund this reporting period included ABIOMED, Atlassian, and ServiceNow.

ABIOMED Inc. is a medical device manufacturer focused on heart pumps. Their Impella pumps provide better outcomes for many patients undergoing heart procedures, and the momentum in using Impella to treat patients remains strong. ABIOMED is an example of our Medical Technology theme.

Atlassian Corp. is an enterprise software company specializing in collaboration, communication, and service management. The company’s JIRA Service Desk is the fastest growing product within their portfolio. The share price continues to increase as the company reports quarter after quarter of impressive growth in revenue and earnings. Atlassian is an example of ourSoftware-as-a-Service (SaaS) theme.

ServiceNow, Inc. is an enterprise software company with a focus on corporate IT service management (ITSM). The company dominates in the ITSM space while also expanding into the operations management functions such as HR and Security. ServiceNow is also an example of our SaaS theme.

TOP INDIVIDUAL DETRACTORS

Detractors from performance this reporting period included Continental Resources, WEX, and GrubHub.

Continental is an exploration and production (E&P) company that produces oil and natural gas. They are mostly focused on drilling in the Bakken Shale in North Dakota and the Woodford Shale in Oklahoma. Continental reported solid financial results during the year, however their oil & natural gas is unhedged unlike some peers. As a result, the stock underperformed due to the significant decline in oil prices in the second half of the period. We continue to own this security.

WEX is a payment processing company. Their primary business is a global fuel card network that allows operators of fleets of trucks to track and manage gasoline purchases. A portion of Wex’s revenue in this business is linked to the price of gasoline, which declined substantially in the second half of the period and led to underperformance. We remain positive on Wex’s overall business.

GrubHub is an online and mobile food ordering company that connects localtake-out restaurants with its online platform. After reaching anall-time high in September, the share price faced downward pressure from investors skeptical of the company’s accelerated buildout of their nationwide delivery network. We maintain a constructive view on the company’s growth potential.

STRATEGY & OUTLOOK

Our long-term investment process remains the same. We seek dynamic companies with above-average and sustainable revenue and earnings growth that we believe are positioned to outperform. This includes leading firms in structurally attractive industries with committed management teams that have proven records of performance.

Looking forward, we expect the growth rate of the U.S. economy to moderate from a solid 2018, while remaining stronger than many other economies around the world. Tighter monetary policy, waning benefit from fiscal stimulus, and trade war fallout are the primary reasons for this slowdown. We believe moderating economic growth and the anniversary of corporate tax cuts will combine to materially slow the pace of earnings growth. The equity markets have started to reflect this scenario with lower valuations and that process could continue in 2019, along with elevated market volatility. We believe that companies with strong secular growth profiles will outperform those in cyclical industries over the intermediate future.

3 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Our opportunity set remains compelling and we expect stock selection to continue to drive our relative performance over the long term. Our holdings growth trajectory remains superior to the current corporate profit environment, with earnings per share (EPS) growth in the most recent quarter of more than 30% in the Fund.

Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Fund, and may be obtained by asking your financial advisor or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing.

Total returns include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown, but do not include the charges associated with the separate account products that offer this Fund.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio managers and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2018, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

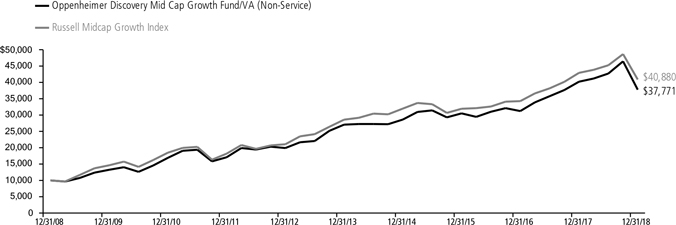

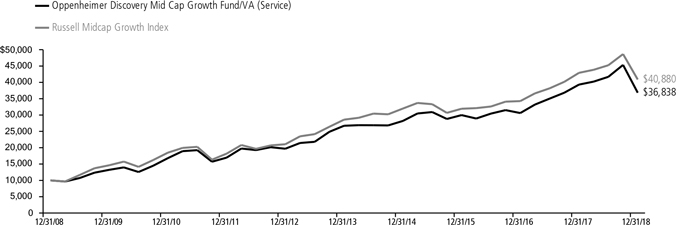

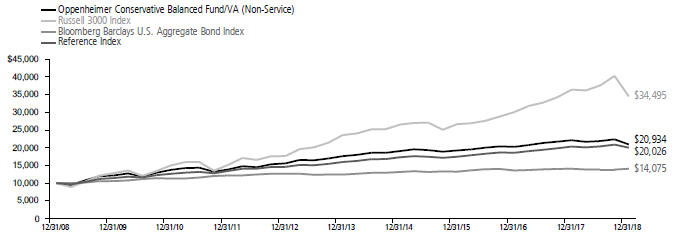

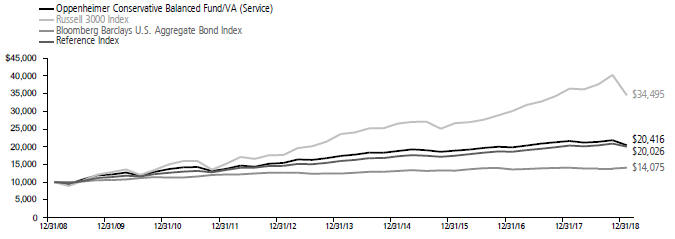

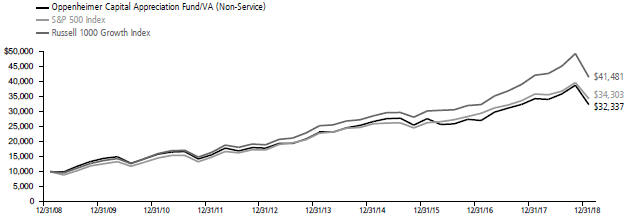

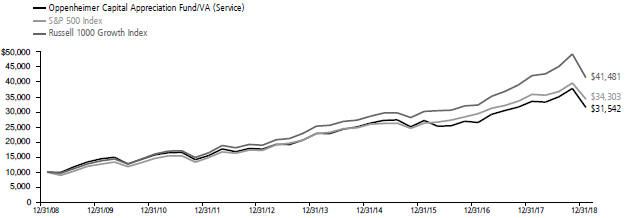

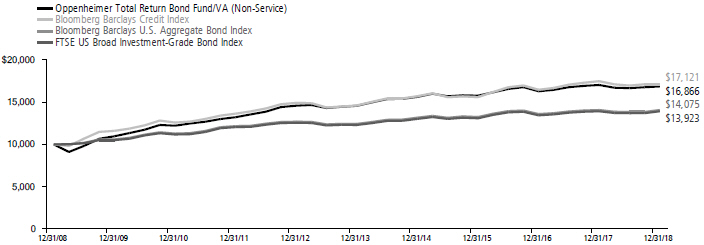

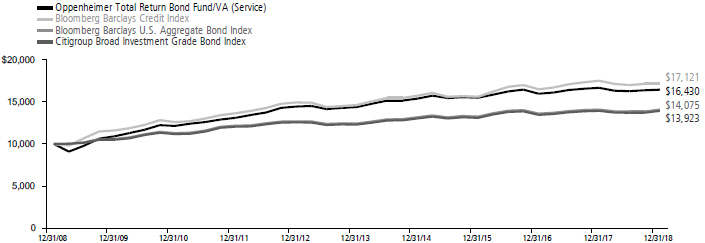

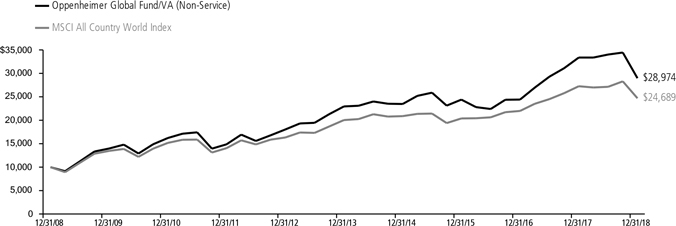

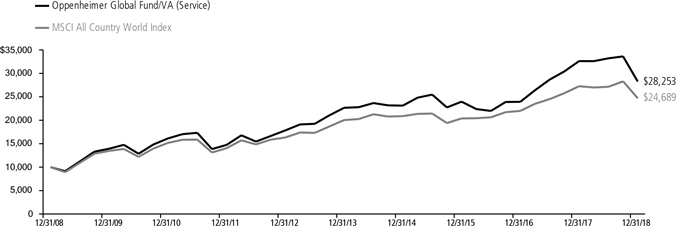

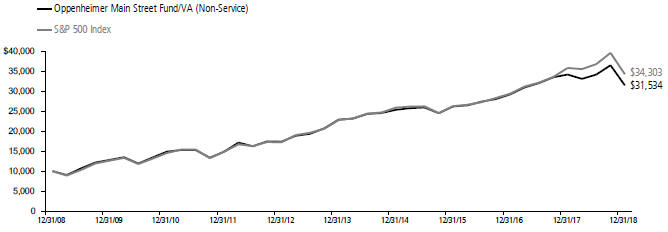

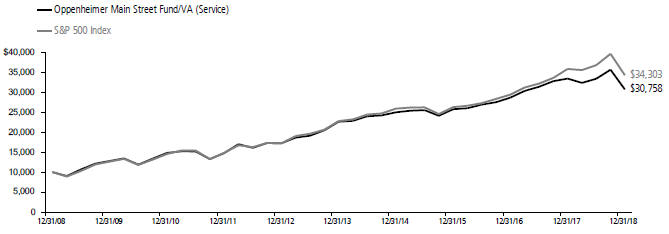

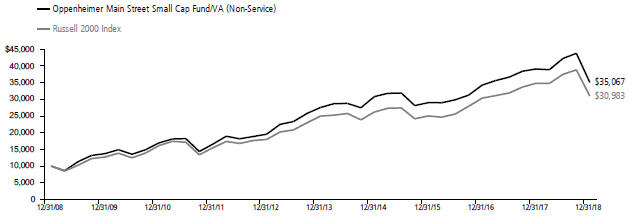

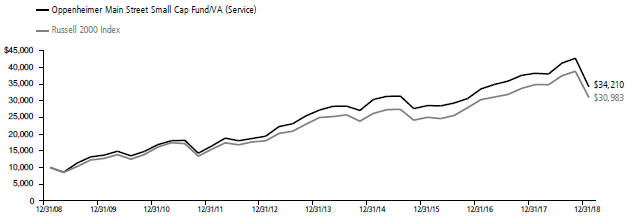

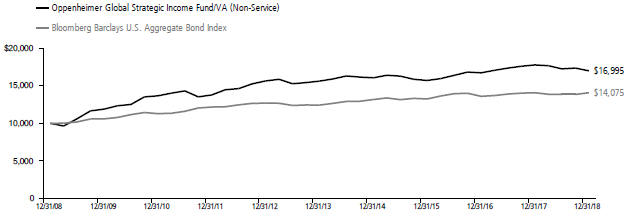

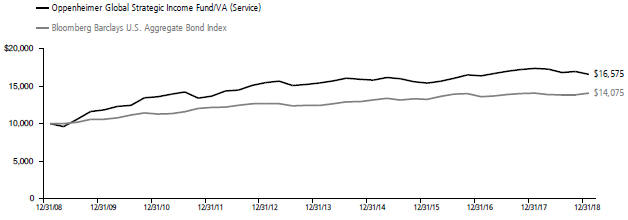

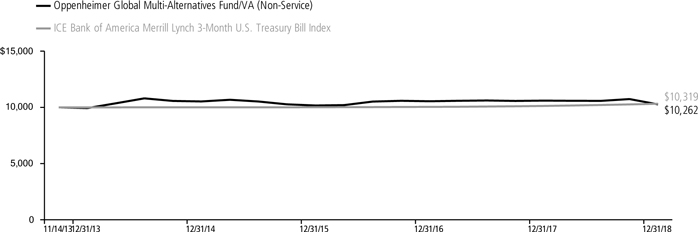

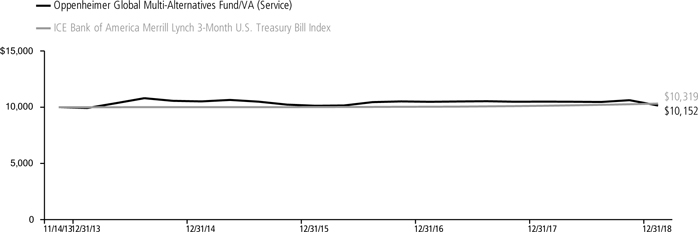

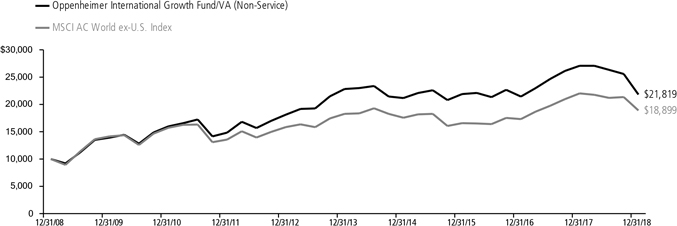

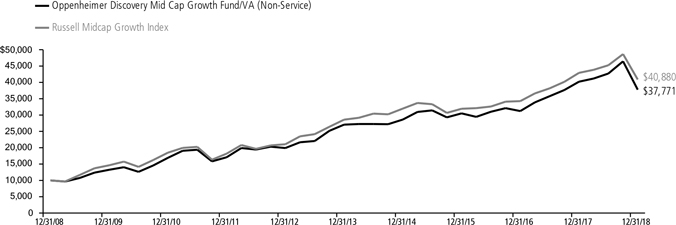

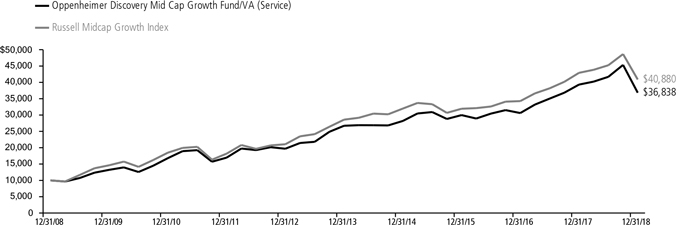

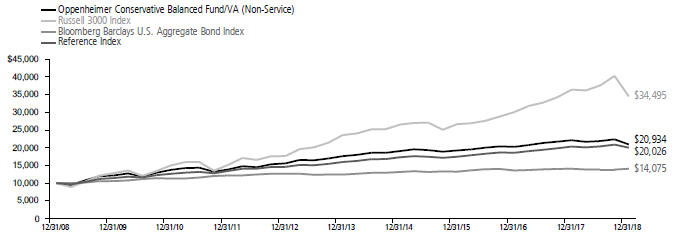

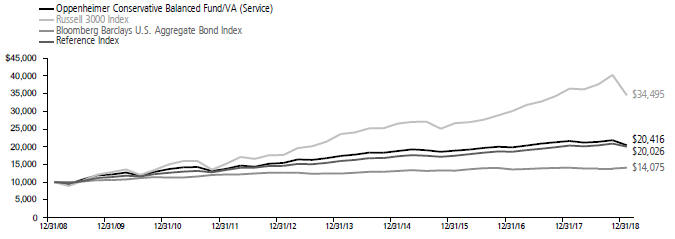

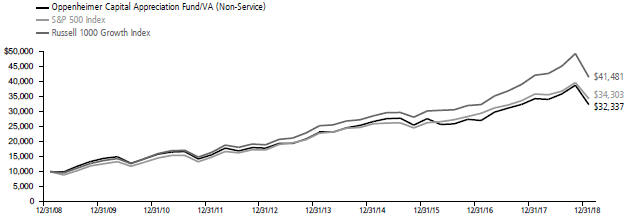

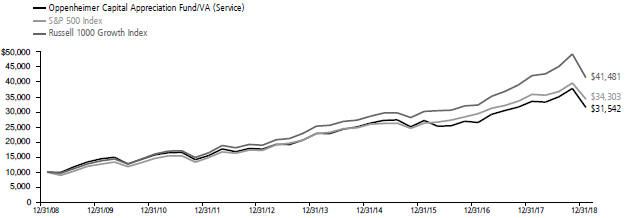

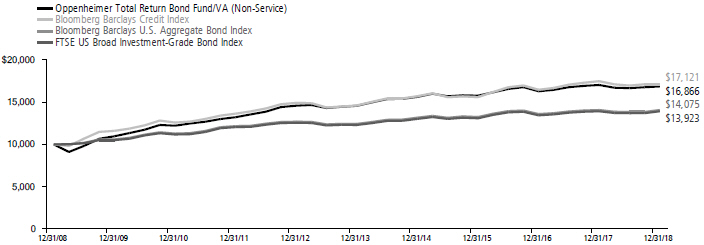

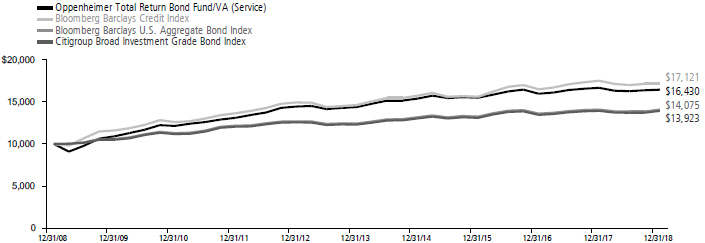

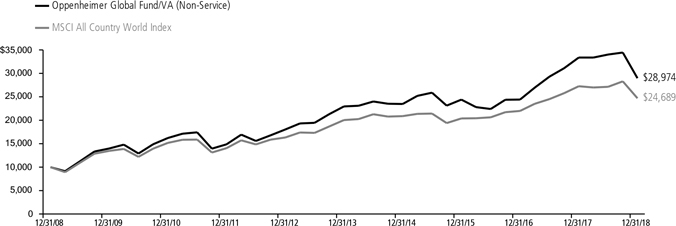

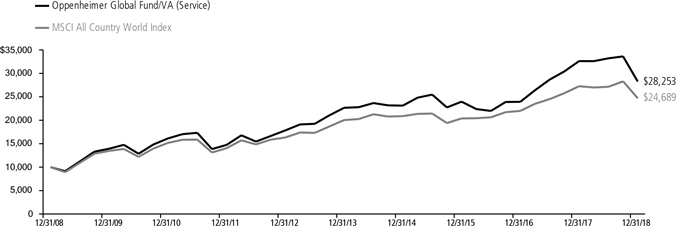

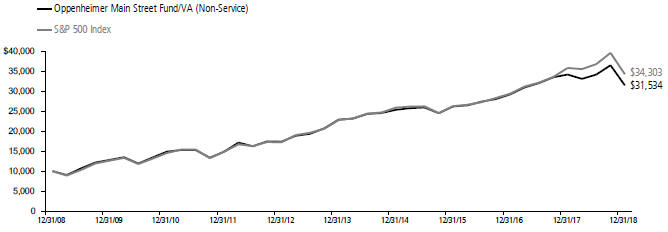

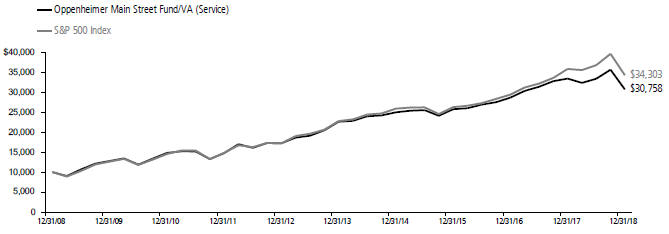

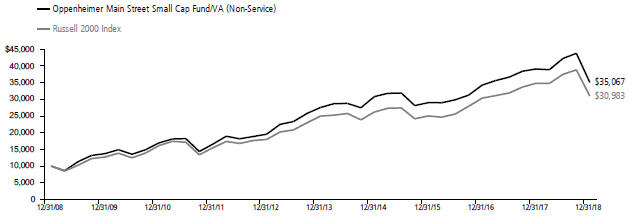

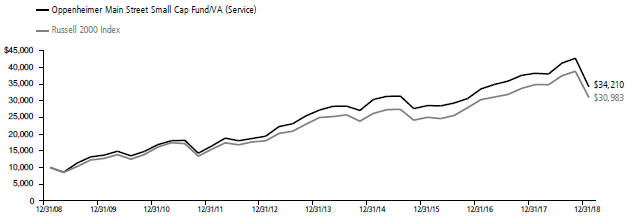

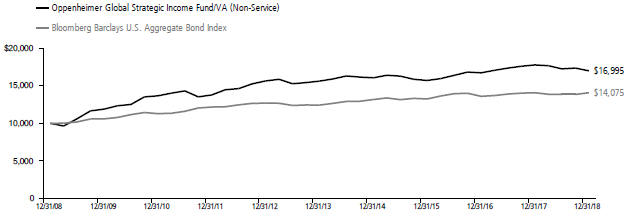

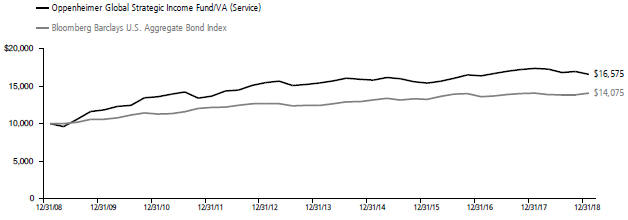

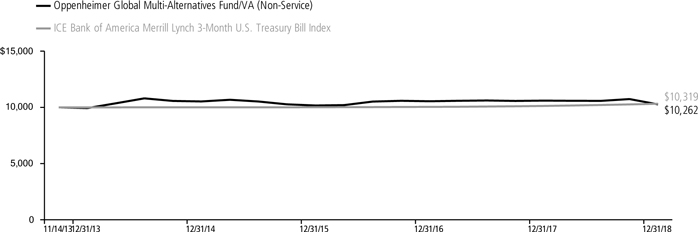

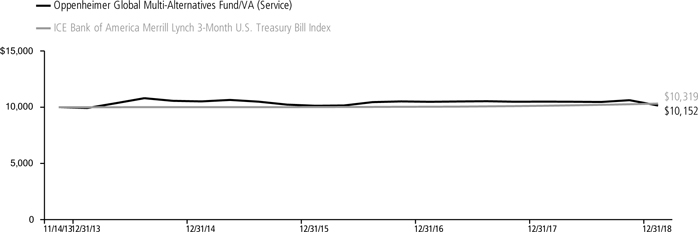

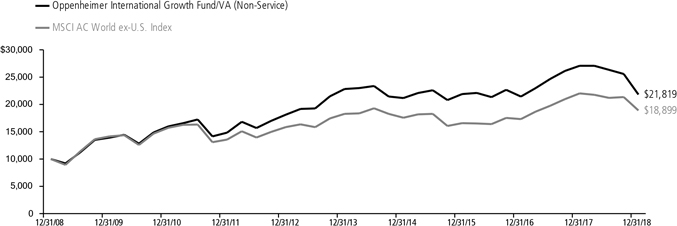

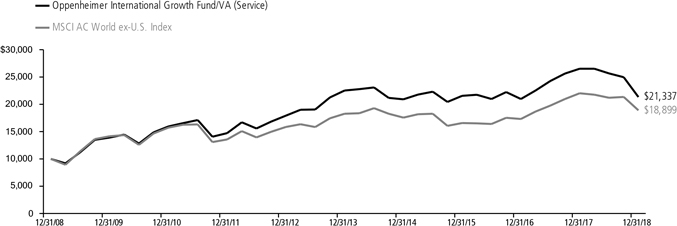

Comparing the Fund’s Performance to the Market.The graphs that follow show the performance of a hypothetical $10,000 investment in each share class of the Fund held until December 31, 2018. Performance is measured over aten-fiscal-year period for both Classes. Performance information does not reflect charges that apply to separate accounts investing in the Fund. If these charges were taken into account, performance would be lower. The graphs assume that all dividends and capital gains distributions were reinvested in additional shares.

The Fund’s performance is compared to the performance of the Russell Midcap Growth Index. The Russell Midcap Growth Index measures the performance of themid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higherprice-to-book ratios and higher forecasted growth values. The Index isunmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising theIndex. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

4 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Average Annual Total Returns ofNon-Service Shares of the Fund at 12/31/18

1-Year -6.08% 5-Year 6.90% 10-Year14.21%

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Average Annual Total Returns of Service Shares of the Fund at 12/31/18

1-Year -6.31% 5-Year 6.63% 10-Year13.93%

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

5 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Expenses

Fund Expenses.As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire6-month period ended December 31, 2018.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended December 31, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Actual | | Beginning

Account

Value July 1, 2018 | | | Ending

Account

Value

December 31, 2018 | | | Expenses

Paid During

6 Months Ended

December 31, 2018 | |

Non-Service shares | | $ | 1,000.00 | | | $ | 884.40 | | | $ | 3.81 | | | | | |

Service shares | | | 1,000.00 | | | | 883.40 | | | | 5.00 | | | | | |

| |

| Hypothetical | | | | |

| (5% return before expenses) | | | | | | | | | | | | |

Non-Service shares | | | 1,000.00 | | | | 1,021.17 | | | | 4.08 | | | | | |

Service shares | | | 1,000.00 | | | | 1,019.91 | | | | 5.36 | | | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the6-month period ended December 31, 2018 are as follows:

| | | | | | | | |

| Class | | Expense Ratios | | | | |

Non-Service shares | | | 0.80% | | | | | |

Service shares | | | 1.05 | | | | | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

6 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF INVESTMENTSDecember 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

| |

| Common Stocks—94.9% | | | | | |

| |

| Consumer Discretionary—18.0% | | | | | |

| |

| Distributors—1.5% | | | | | |

| |

| Pool Corp. | | | 62,310 | | | $ | 9,262,382 | |

|

| |

| Diversified Consumer Services—1.5% | | | | | |

| |

Bright Horizons Family Solutions, Inc.1 | | | 85,780 | | | | 9,560,181 | |

|

| |

Entertainment—0.5% | | | | | | | | |

| |

Live Nation Entertainment, Inc.1 | | | 60,220 | | | | 2,965,835 | |

|

| |

Hotels, Restaurants & Leisure—4.7% | | | | | |

| |

Chipotle Mexican Grill, Inc., Cl. A1 | | | 10,340 | | | | 4,464,709 | |

| |

Domino’s Pizza, Inc. | | | 41,350 | | | | 10,254,386 | |

| |

Planet Fitness, Inc., Cl. A1 | | | 132,410 | | | | 7,099,824 | |

| |

Vail Resorts, Inc. | | | 33,690 | | | | 7,102,526 | |

| | | | | | | | |

| | | | | | | 28,921,445 | |

|

| |

Interactive Media & Services—1.3% | | | | | |

| |

IAC/InterActiveCorp1 | | | 45,370 | | | | 8,304,525 | |

|

| |

Internet & Catalog Retail—0.5% | | | | | |

| |

GrubHub, Inc.1 | | | 43,820 | | | | 3,365,814 | |

|

| |

Multiline Retail—0.9% | | | | | | | | |

| |

Ollie’s Bargain Outlet Holdings, Inc.1 | | | 86,110 | | | | 5,727,176 | |

|

| |

Specialty Retail—5.2% | | | | | | | | |

| |

Burlington Stores, Inc.1 | | | 65,550 | | | | 10,663,018 | |

| |

O’Reilly Automotive, Inc.1 | | | 35,800 | | | | 12,327,014 | |

| |

Tractor Supply Co. | | | 53,940 | | | | 4,500,754 | |

| |

Ulta Beauty, Inc.1 | | | 19,490 | | | | 4,771,932 | |

| | | | | | | | |

| | | | | | | 32,262,718 | |

|

| |

Textiles, Apparel & Luxury Goods—1.9% | | | | | |

| |

Canada Goose Holdings, Inc.1 | | | 57,570 | | | | 2,516,960 | |

| |

lululemon athletica, Inc.1 | | | 74,670 | | | | 9,080,619 | |

| | | | | | | | |

| | | | | | | 11,597,579 | |

|

| |

Consumer Staples—5.1% | | | | | | | | |

| |

Beverages—0.6% | | | | | | | | |

| |

Keurig Dr Pepper, Inc. | | | 149,320 | | | | 3,828,565 | |

|

| |

Food Products—3.4% | | | | | | | | |

| |

Lamb Weston Holdings, Inc. | | | 176,860 | | | | 13,009,821 | |

| |

McCormick & Co., Inc. | | | 55,650 | | | | 7,748,706 | |

| | | | | | | | |

| | | | | | | 20,758,527 | |

|

| |

Household Products—1.1% | | | | | | | | |

| |

Church & Dwight Co., Inc. | | | 102,250 | | | | 6,723,960 | |

|

| |

Energy—1.2% | | | | | | | | |

| |

Oil, Gas & Consumable Fuels—1.2% | | | | | |

| |

Continental Resources, Inc.1 | | | 81,580 | | | | 3,278,700 | |

| |

Diamondback Energy, Inc. | | | 45,103 | | | | 4,181,048 | |

| | | | | | | | |

| | | | | | | 7,459,748 | |

|

| |

Financials—9.0% | | | | | | | | |

| |

Capital Markets—3.3% | | | | | | | | |

| |

E*TRADE Financial Corp. | | | 54,150 | | | | 2,376,102 | |

| |

KKR & Co., Inc., Cl. A | | | 219,630 | | | | 4,311,337 | |

| |

MSCI, Inc., Cl. A | | | 71,410 | | | | 10,527,976 | |

| |

Raymond James Financial, Inc. | | | 46,850 | | | | 3,486,109 | |

| | | | | | | | |

| | | | | | | 20,701,524 | |

|

| |

Commercial Banks—0.5% | | | | | | | | |

| |

SVB Financial Group1 | | | 16,440 | | | | 3,122,285 | |

|

| |

Insurance—3.3% | | | | | | | | |

| |

Arthur J. Gallagher & Co. | | | 119,630 | | | | 8,816,731 | |

| |

Progressive Corp. (The) | | | 191,470 | | | | 11,551,385 | |

| | | | | | | | |

| | | | | | | 20,368,116 | |

|

| |

Real Estate Investment Trusts (REITs)—1.0% | | | | | |

| |

Alexandria Real Estate Equities, Inc. | | | 26,920 | | | | 3,102,261 | |

| |

SBA Communications Corp., Cl. A1 | | | 18,870 | | | | 3,054,864 | |

| | | | | | | | |

| | | | | | | 6,157,125 | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Real Estate Management & Development—0.9% | | | | | |

| |

CBRE Group, Inc., Cl. A1 | | | 142,190 | | | $ | 5,693,287 | |

|

| |

Health Care—16.9% | | | | | | | | |

| |

Biotechnology—0.8% | | | | | | | | |

| |

Neurocrine Biosciences, Inc.1 | | | 31,150 | | | | 2,224,421 | |

| |

Sarepta Therapeutics, Inc.1 | | | 22,760 | | | | 2,483,799 | |

| | | | | | | | |

| | | | | | | 4,708,220 | |

|

| |

Health Care Equipment & Supplies—8.2% | | | | | |

| |

ABIOMED, Inc.1 | | | 13,660 | | | | 4,440,047 | |

| |

Cooper Cos., Inc. (The) | | | 31,470 | | | | 8,009,115 | |

| |

DexCom, Inc.1 | | | 42,460 | | | | 5,086,708 | |

| |

Edwards Lifesciences Corp.1 | | | 38,660 | | | | 5,921,552 | |

| |

ICU Medical, Inc.1 | | | 24,520 | | | | 5,630,528 | |

| |

IDEXX Laboratories, Inc.1 | | | 38,860 | | | | 7,228,737 | |

| |

Insulet Corp.1 | | | 109,360 | | | | 8,674,435 | |

| |

STERIS plc | | | 21,820 | | | | 2,331,467 | |

| |

West Pharmaceutical Services, Inc. | | | 34,130 | | | | 3,345,764 | |

| | | | | | | | |

| | | | | | | 50,668,353 | |

|

| |

Health Care Providers & Services—3.2% | | | | | |

| |

Encompass Health Corp. | | | 56,180 | | | | 3,466,306 | |

| |

Henry Schein, Inc.1 | | | 60,190 | | | | 4,726,119 | |

| |

WellCare Health Plans, Inc.1 | | | 50,380 | | | | 11,894,214 | |

| | | | | | | | |

| | | | | | | 20,086,639 | |

|

| |

Life Sciences Tools & Services—4.7% | | | | | |

| |

Agilent Technologies, Inc. | | | 130,570 | | | | 8,808,252 | |

| |

Bio-Rad Laboratories, Inc., Cl. A1 | | | 20,570 | | | | 4,776,765 | |

| |

ICON plc1 | | | 74,660 | | | | 9,646,819 | |

| |

IQVIA Holdings, Inc.1 | | | 54,230 | | | | 6,299,899 | |

| | | | | | | | |

| | | | | | | 29,531,735 | |

|

| |

Industrials—15.9% | | | | | | | | |

| |

Aerospace & Defense—0.8% | | | | | | | | |

| |

HEICO Corp. | | | 61,580 | | | | 4,771,218 | |

|

| |

Airlines—0.8% | | | | | | | | |

| |

United Continental Holdings, Inc.1 | | | 55,880 | | | | 4,678,832 | |

|

| |

Building Products—0.5% | | | | | | | | |

| |

Lennox International, Inc. | | | 14,400 | | | | 3,151,584 | |

|

| |

Commercial Services & Supplies—4.5% | | | | | |

| |

Cintas Corp. | | | 46,930 | | | | 7,883,771 | |

| |

Copart, Inc.1 | | | 33,260 | | | | 1,589,163 | |

| |

Republic Services, Inc., Cl. A | | | 63,210 | | | | 4,556,809 | |

| |

Waste Connections, Inc. | | | 189,365 | | | | 14,060,351 | |

| | | | | | | | |

| | | | | | | 28,090,094 | |

|

| |

Industrial Conglomerates—2.1% | | | | | |

| |

Roper Technologies, Inc. | | | 50,140 | | | | 13,363,313 | |

|

| |

Machinery—1.9% | | | | | | | | |

| |

IDEX Corp. | | | 94,330 | | | | 11,910,106 | |

|

| |

Professional Services—5.3% | | | | | |

| |

CoStar Group, Inc.1 | | | 42,070 | | | | 14,191,894 | |

| |

IHS Markit Ltd.1 | | | 210,380 | | | | 10,091,929 | |

| |

TransUnion | | | 154,140 | | | | 8,755,152 | |

| | | | | | | | |

| | | | | | | 33,038,975 | |

|

| |

Information Technology—26.1% | | | | | |

| |

Communications Equipment—1.0% | | | | | |

| |

Motorola Solutions, Inc. | | | 53,450 | | | | 6,148,888 | |

|

| |

Electronic Equipment, Instruments, & Components—3.2% | |

| |

CDW Corp. | | | 149,890 | | | | 12,148,584 | |

| |

FLIR Systems, Inc. | | | 55,640 | | | | 2,422,566 | |

| |

Keysight Technologies, Inc.1 | | | 86,490 | | | | 5,369,299 | |

| | | | | | | | |

| | | | | | | 19,940,449 | |

|

| |

IT Services—9.6% | | | | | | | | |

| |

| Booz Allen Hamilton Holding Corp., Cl. A | | | 110,990 | | | | 5,002,319 | |

| |

Broadridge Financial Solutions, Inc. | | | 79,520 | | | | 7,653,800 | |

7 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF INVESTMENTSContinued

| | | | | | | | |

| | | Shares | | | Value | |

IT Services (Continued) | | | | | | | | |

Euronet Worldwide, Inc.1 | | | 37,730 | | | $ | 3,862,797 | |

Fiserv, Inc.1 | | | 109,500 | | | | 8,047,155 | |

Global Payments, Inc. | | | 97,850 | | | | 10,091,271 | |

Total System Services, Inc. | | | 189,940 | | | | 15,440,223 | |

Twilio, Inc., Cl. A1 | | | 50,580 | | | | 4,516,794 | |

WEX, Inc.1 | | | 37,680 | | | | 5,277,461 | |

| | | | | | | | |

| | | | | | | | 59,891,820 | |

Semiconductors & Semiconductor Equipment—2.7% | |

Advanced Micro Devices, Inc.1 | | | 65,310 | | | | 1,205,623 | |

Monolithic Power Systems, Inc. | | | 76,630 | | | | 8,908,237 | |

Xilinx, Inc. | | | 76,480 | | | | 6,513,802 | |

| | | | | | | | |

| | | | | | | | 16,627,662 | |

Software—9.6% | | | | | | | | |

Atlassian Corp. plc, Cl. A1 | | | 75,810 | | | | 6,745,574 | |

Fair Isaac Corp.1 | | | 31,550 | | | | 5,899,850 | |

PTC, Inc.1 | | | 37,220 | | | | 3,085,538 | |

RealPage, Inc.1 | | | 64,410 | | | | 3,103,918 | |

RingCentral, Inc., Cl. A1 | | | 112,750 | | | | 9,295,110 | |

ServiceNow, Inc.1 | | | 55,224 | | | | 9,832,633 | |

Splunk, Inc.1 | | | 39,120 | | | | 4,101,732 | |

Synopsys, Inc.1 | | | 118,880 | | | | 10,014,451 | |

| | | | | | | | |

| | | Shares | | | Value | |

Software (Continued) | | | | | | | | |

Ultimate Software Group, Inc. (The)1 | | | 13,520 | | | $ | 3,310,643 | |

Zendesk, Inc.1 | | | 71,190 | | | | 4,155,360 | |

| | | | | | | | |

| | | | | | | | 59,544,809 | |

Materials—2.7% | | | | | | | | |

Chemicals—1.2% | | | | | | | | |

Ashland Global Holdings, Inc. | | | 52,080 | | | | 3,695,597 | |

Ingevity Corp.1 | | | 43,430 | | | | 3,634,657 | |

| | | | | | | | |

| | | | | | | | 7,330,254 | |

Containers & Packaging—1.5% | | | | | |

Avery Dennison Corp. | | | 44,750 | | | | 4,019,892 | |

Ball Corp. | | | 116,310 | | | | 5,347,934 | |

| | | | | | | | |

| | | | | | | 9,367,826 | |

| | | | | | | | |

Total Common Stocks (Cost $553,159,769) | | | | 589,631,569 | |

| Investment Company—4.2% | | | | | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E, 2.35%2,3(Cost $25,869,936) | | | 25,869,936 | | | | 25,869,936 | |

| Total Investments, at Value (Cost $579,029,705) | | | 99.1% | | | | 615,501,505 | |

| | | | |

Net Other Assets (Liabilities) | | | 0.9 | | | | 5,825,404 | |

| | | | |

Net Assets | | | 100.0% | | | $ | 621,326,909 | |

| | | | |

Footnotes to Statement of Investments

1.Non-income producing security.

2. Rate shown is the7-day yield at period end.

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares

December 31, 2017 | | | Gross

Additions | | | Gross

Reductions | | | Shares

December 31, 2018 | |

| |

Investment Company | | | | | | | | | | | | | | | | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E | | | 7,573,590 | | | | 344,720,474 | | | | 326,424,128 | | | | 25,869,936 | |

| | | | |

| | | Value | | | Income | | | Realized

Gain (Loss) | | | Change in Unrealized

Gain (Loss) | |

| |

Investment Company | | | | | | | | | | | | | | | | |

| Oppenheimer Institutional Government Money Market Fund, Cl. E | | $ | 25,869,936 | | | $ | 329,540 | | | $ | — | | | $ | — | |

See accompanying Notes to Financial Statements.

8 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF ASSETS AND LIABILITIESDecember 31, 2018

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $553,159,769) | | $ | 589,631,569 | |

Affiliated companies (cost $25,869,936) | | | 25,869,936 | |

| | | | |

| | | 615,501,505 | |

| |

Cash | | | 556,156 | |

| |

Receivables and other assets: | | | | |

Shares of beneficial interest sold | | | 4,900,896 | |

Investments sold | | | 1,621,336 | |

Dividends | | | 343,713 | |

Other | | | 79,460 | |

| | | | |

Total assets | | | 623,003,066 | |

| |

Liabilities | | | | |

Payables and other liabilities: | | | | |

Investments purchased | | | 1,238,425 | |

Shares of beneficial interest redeemed | | | 315,051 | |

Trustees’ compensation | | | 66,322 | |

Shareholder communications | | | 16,389 | |

Distribution and service plan fees | | | 7,890 | |

Other | | | 32,080 | |

| | | | |

Total liabilities | | | 1,676,157 | |

| |

Net Assets | | $ | 621,326,909 | |

| | | | |

|

| |

Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 9,084 | |

| |

Additionalpaid-in capital | | | 497,886,928 | |

| |

Total distributable earnings | | | 123,430,897 | |

| | | | |

Net Assets | | $ | 621,326,909 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | |

Non-Service Shares: | | | | |

| Net asset value, redemption price per share and offering price per share (based on net assets of $586,272,572 and 8,539,969 shares of beneficial interest outstanding) | | | $68.65 | |

| |

| |

Service Shares: | | | | |

| |

| Net asset value, redemption price per share and offering price per share (based on net assets of $35,054,337 and 544,259 shares of beneficial interest outstanding) | | | $64.41 | |

See accompanying Notes to Financial Statements.

9 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF OPERATIONSFor the Year Ended December 31, 2018

| | | | |

Investment Income | |

Dividends: | | | | |

Unaffiliated companies (net of foreign withholding taxes of $15,634) | | $ | 3,866,172 | |

Affiliated companies | | | 329,540 | |

| | | | |

Total investment income | | | 4,195,712 | |

|

| |

Expenses | | | | |

Management fees | | | 5,190,248 | |

| |

Distribution and service plan fees -Service shares | | | 102,109 | |

| |

Transfer and shareholder servicing agent fees: | | | | |

Non-Service shares | | | 829,224 | |

| |

Service shares | | | 49,012 | |

| |

Shareholder communications: | | | | |

Non-Service shares | | | 63,456 | |

Service shares | | | 3,801 | |

| |

Trustees’ compensation | | | 26,082 | |

| |

Borrowing fees | | | 23,299 | |

| |

Custodian fees and expenses | | | 5,200 | |

| |

Other | | | 68,973 | |

| | | | |

Total expenses | | | 6,361,404 | |

| |

Less reduction to custodian expenses | | | (511) | |

| |

Less waivers and reimbursements of expenses | | | (380,557) | |

| | | | |

Net expenses | | | 5,980,336 | |

|

| |

Net Investment Loss | | | (1,784,624) | |

|

| |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain on investment transactions in unaffiliated companies | | | 95,224,298 | |

| |

Net change in unrealized appreciation/(depreciation) on investment transactions in unaffiliated companies | | | (128,898,713) | |

| |

Net Decrease in Net Assets Resulting from Operations | | | $ (35,459,039) | |

| | | | |

See accompanying Notes to Financial Statements.

10 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

December 31, 2018 | | | Year Ended

December 31, 20171 | |

| |

Operations | | | | | | | | |

Net investment loss | | $ | (1,784,624) | | | $ | (936,874) | |

| |

Net realized gain | | | 95,224,298 | | | | 111,170,933 | |

| |

Net change in unrealized appreciation/(depreciation) | | | (128,898,713) | | | | 64,493,500 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (35,459,039) | | | | 174,727,559 | |

|

| |

Dividends and/or Distributions to Shareholders | | | | | | | | |

Dividends and distributions declared: | | | | | | | | |

Non-Service shares | | | (95,656,703) | | | | (66,743,996) | |

Service shares | | | (5,963,052) | | | | (3,695,269) | |

| | | | |

| | |

Total dividends and distributions declared | | | (101,619,755) | | | | (70,439,265) | |

|

| |

Beneficial Interest Transactions | | | | | | | | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

| | |

Non-Service shares | | | 20,283,999 | | | | (8,172,895) | |

| | |

Service shares | | | 3,848,119 | | | | 2,197,994 | |

| | | | |

| | |

Total beneficial interest transactions | | | 24,132,118 | | | | (5,974,901) | |

|

| |

Net Assets | | | | | | | | |

Total increase (decrease) | | | (112,946,676) | | | | 98,313,393 | |

| |

Beginning of period | | | 734,273,585 | | | | 635,960,192 | |

| | | | |

End of period | | $ | 621,326,909 | | | $ | 734,273,585 | |

| | | | |

1. Prior period amounts have been conformed to current year presentation. See Notes to Financial Statements, Note 2 – New Accounting Pronouncements for further details.

See accompanying Notes to Financial Statements.

11 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Non-Service Shares | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017 | | | Year Ended

December 31,

2016 | | | Year Ended

December 31,

2015 | | | Year Ended

December 31,

2014 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $84.21 | | | | $72.65 | | | | $76.85 | | | | $78.82 | | | | $74.51 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | (0.19) | | | | (0.10) | | | | 0.03 | | | | (0.19) | | | | (0.29) | |

Net realized and unrealized gain (loss) | | | (3.07) | | | | 20.08 | | | | 1.69 | | | | 5.67 | | | | 4.60 | |

| | | | |

Total from investment operations | | | (3.26) | | | | 19.98 | | | | 1.72 | | | | 5.48 | | | | 4.31 | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | (0.03) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Distributions from net realized gain | | | (12.30) | | | | (8.39) | | | | (5.92) | | | | (7.45) | | | | 0.00 | |

| | | | |

Total dividends and/or distributions to shareholders | | | (12.30) | | | | (8.42) | | | | (5.92) | | | | (7.45) | | | | 0.00 | |

| |

Net asset value, end of period | | | $68.65 | | | | $84.21 | | | | $72.65 | | | | $76.85 | | | | $78.82 | |

| | | | |

| | | | |

| |

Total Return, at Net Asset Value2 | | | (6.08)% | | | | 28.79% | | | | 2.34% | | | | 6.61% | | | | 5.78% | |

| | | | | | | | | | | | | | | | | | | | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | $586,273 | | | | $694,675 | | | | $603,708 | | | | $660,450 | | | | $682,515 | |

| |

Average net assets (in thousands) | | | $690,497 | | | | $661,192 | | | | $621,110 | | | | $695,736 | | | | $688,259 | |

| |

Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.23)% | | | | (0.12)% | | | | 0.04% | | | | (0.24)% | | | | (0.39)% | |

Expenses excluding specific expenses listed below | | | 0.86% | | | | 0.84% | | | | 0.84% | | | | 0.83% | | | | 0.83% | |

Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | |

| | | | |

Total expenses5 | | | 0.86% | | | | 0.84% | | | | 0.84% | | | | 0.83% | | | | 0.83% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.80% | | | | 0.80% | | | | 0.80% | | | | 0.80% | | | | 0.80% | |

| |

Portfolio turnover rate | | | 104% | | | | 105% | | | | 141% | | | | 81% | | | | 113% | |

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Year Ended December 31, 2018 | | | 0.86 | % |

| | Year Ended December 31, 2017 | | | 0.84 | % |

| | Year Ended December 31, 2016 | | | 0.84 | % |

| | Year Ended December 31, 2015 | | | 0.83 | % |

| | Year Ended December 31, 2014 | | | 0.83 | % |

See accompanying Notes to Financial Statements.

12 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

| | | | | | | | | | | | | | | | | | | | |

| Service Shares | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017 | | | Year Ended

December 31,

2016 | | | Year Ended

December 31,

2015 | | | Year Ended

December 31,

2014 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $79.87 | | | | $69.43 | | | | $73.88 | | | | $76.21 | | | | $72.22 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss1 | | | (0.37) | | | | (0.28) | | | | (0.15) | | | | (0.38) | | | | (0.46) | |

Net realized and unrealized gain (loss) | | | (2.79) | | | | 19.11 | | | | 1.62 | | | | 5.50 | | | | 4.45 | |

| | | | |

Total from investment operations | | | (3.16) | | | | 18.83 | | | | 1.47 | | | | 5.12 | | | | 3.99 | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Distributions from net realized gain | | | (12.30) | | | | (8.39) | | | | (5.92) | | | | (7.45) | | | | 0.00 | |

| | | | |

Total dividends and/or distributions to shareholders | | | (12.30) | | | | (8.39) | | | | (5.92) | | | | (7.45) | | | | 0.00 | |

| |

Net asset value, end of period | | | $64.41 | | | | $79.87 | | | | $69.43 | | | | $73.88 | | | | $76.21 | |

| | | | |

|

| |

Total Return, at Net Asset Value2 | | | (6.31)% | | | | 28.46% | | | | 2.08% | | | | 6.35% | | | | 5.53% | |

| | | | | | | | | | | | | | | | | | | | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | $35,054 | | | | $39,599 | | | | $32,252 | | | | $37,029 | | | | $30,964 | |

| |

Average net assets (in thousands) | | | $40,815 | | | | $35,753 | | | | $33,797 | | | | $32,812 | | | | $32,927 | |

| |

Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.48)% | | | | (0.37)% | | | | (0.21)% | | | | (0.49)% | | | | (0.64)% | |

Expenses excluding specific expenses listed below | | | 1.11% | | | | 1.09% | | | | 1.09% | | | | 1.08% | | | | 1.08% | |

Interest and fees from borrowings | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00%4 | | | | 0.00% | |

| | | | |

Total expenses5 | | | 1.11% | | | | 1.09% | | | | 1.09% | | | | 1.08% | | | | 1.08% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.05% | | | | 1.05% | | | | 1.05% | | | | 1.05% | | | | 1.05% | |

| |

Portfolio turnover rate | | | 104% | | | | 105% | | | | 141% | | | | 81% | | | | 113% | |

1. Per share amounts calculated based on the average shares outstanding during the period.

2. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

3. Annualized for periods less than one full year.

4. Less than 0.005%.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | |

| | Year Ended December 31, 2018 | | | 1.11 | % |

| | Year Ended December 31, 2017 | | | 1.09 | % |

| | Year Ended December 31, 2016 | | | 1.09 | % |

| | Year Ended December 31, 2015 | | | 1.08 | % |

| | Year Ended December 31, 2014 | | | 1.08 | % |

See accompanying Notes to Financial Statements.

13 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTSDecember 31, 2018

1. Organization

Oppenheimer Discovery Mid Cap Growth Fund/VA (the “Fund”), a separate series of Oppenheimer Variable Account Funds, is a diversifiedopen-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the“Sub-Adviser”). The Manager has entered into asub-advisory agreement with OFI. Shares of the Fund are sold only to separate accounts of life insurance companies.

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation.All investments in securities are recorded at their estimated fair value, as described in Note 3.

Allocation of Income, Expenses, Gains and Losses.Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on theex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as determined necessary by the Manager.

Investment Income.Dividend income is recorded on theex-dividend date or uponex-dividend notification in the case of certain foreign dividends where theex-dividend date may have passed.Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Withholding taxes on foreign dividends, if any, and capital gains taxes on foreign investments, if any, have been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations. Interest income, if any, is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Return of Capital Estimates.Distributions received from the Fund’s investments in Real Estate Investments Trusts (REITs), generally are comprised of income and return of capital. Any return of capital estimates in excess of cost basis are classified as realized gain. The Fund records investment income and return of capital based on estimates. Such estimates are based on historical information available from each REIT and other industry sources. These estimates may subsequently be revised based on information received from REITs after their tax reporting periods are concluded.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 2.00%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications.The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes.The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended December 31, 2018, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

14 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

2. Significant Accounting Policies (Continued)

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| | | | | | | | | | | | |

Undistributed

Net Investment

Income | | Undistributed

Long-Term

Gain | | | Accumulated

Loss

Carryforward1,2

| | | Net Unrealized

Appreciation

Based on cost of

Securities and

Other Investments

for Federal Income

Tax Purposes | |

| |

$— | | | $89,184,532 | | | | $— | | | | $34,312,678 | |

1. During the reporting period, the Fund did not utilize any capital loss carryforward.

2.During the previous reporting period, the Fund did not utilize any capital loss carryforward.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for the reporting period. Net assets of the Fund were unaffected by the reclassifications.

| | | | |

Increase

toPaid-in Capital | | Reduction

to Accumulated

Net Earnings3 | |

| |

$5,426,486 | | | $5,426,486 | |

3. $7,202,635, all of which was long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the reporting periods:

| | | | | | | | |

| | | Year Ended

December 31, 2018 | | | Year Ended

December 31, 2017 | |

| |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 23,521,359 | | | $ | 202,565 | |

Long-term capital gain | | | 78,098,396 | | | | 70,236,700 | |

| | | | |

Total | | $ | 101,619,755 | | | $ | 70,439,265 | |

| | | | |

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| | | | |

Federal tax cost of securities | | $ | 581,188,827 | |

| | | | |

Gross unrealized appreciation | | $ | 61,686,080 | |

| |

Gross unrealized depreciation | | | (27,373,402) | |

| | | | |

Net unrealized appreciation | | $ | 34,312,678 | |

| | | | |

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements. In March 2017, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”), ASU2017-08. This provides guidance related to the amortization period for certain purchased callable debt securities held at a premium. The ASU is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods. The Manager has evaluated the impacts of these changes on the financial statements and there are no material impacts.

During August 2018, the Securities and Exchange Commission (the “SEC”) issued Final Rule ReleaseNo. 33-10532 (the “Rule”), Disclosure Update and Simplification. The rule amends certain financial statement disclosure requirements to conform to U.S. GAAP. The amendments to Rule6-04.17 of RegulationS-X (balance sheet) remove the requirement to separately state the book basis components of net assets: undistributed (over-distribution of) net investment income (“UNII”), accumulated undistributed net realized gains (losses), and net unrealized appreciation (depreciation) at the balance sheet date. Instead, consistent with U.S. GAAP, funds will be required to disclose total distributable earnings. The amendments to Rule6-09 of RegulationS-X (statement of changes in net assets) remove the requirement to separately state the sources of distributions paid. Instead, consistent with U.S. GAAP, funds will be required to disclose the total amount of distributions paid, except that any tax return of capital must be separately disclosed.

15 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTSContinued

2. Significant Accounting Policies (Continued)

The amendments also remove the requirement to parenthetically state the book basis amount of UNII on the statement of changes in net assets. The requirements of the Rule are effective November 5, 2018, and the Funds’ Statement of Assets and Liabilities and Statement of Changes in Net Assets for the current reporting period have been modified accordingly. In addition, certain amounts within each Fund’s Statement of Changes in Net Assets for the prior fiscal period have been modified to conform to the Rule.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of 4:00 P.M. Eastern Time, on each day the New York Stock Exchange (the “Exchange” or “NYSE”) is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated theday-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a fair valuation for any security for which market quotations are not readily available. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at least quarterly or more frequently, if necessary.

Valuation Methods and Inputs

Securities are valued primarily using unadjusted quoted market prices, when available, as supplied by third party pricing services or broker-dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Equity securities traded on a securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the official closing price on the principal exchange on which the security is traded, as identified by the Manager, prior to the time when the Fund’s assets are valued. If the official closing price is unavailable, the security is valued at the last sale price on the principal exchange on which it is traded, or if no sales occurred, the security is valued at the mean between the quoted bid and asked prices.Over-the-counter equity securities are valued at the last published sale price, or if no sales occurred, at the mean between the quoted bid and asked prices. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the time when the Fund’s assets are valued.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Securities for which market quotations are not readily available, or when a significant event has occurred that would materially affect the value of the security, are fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Those standardized fair valuation methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs may be used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The Fund classifies each of its investments in investment companies which are publicly offered as Level 1. Investment companies that are not publicly offered, if any, are classified as Level 2 in the fair value hierarchy.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

16 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

3. Securities Valuation (Continued)

| | | | | | | | | | | | | | | | |

| | | Level 1— Unadjusted Quoted Prices | | | Level 2—

Other Significant

Observable Inputs | | | Level 3—

Significant

Unobservable

Inputs | | | Value | |

| |

Assets Table | | | | | | | | | | | | | | | | |

Investments, at Value: | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 111,967,655 | | | $ | — | | | $ | — | | | $ | 111,967,655 | |

Consumer Staples | | | 31,311,052 | | | | — | | | | — | | | | 31,311,052 | |

Energy | | | 7,459,748 | | | | — | | | | — | | | | 7,459,748 | |

Financials | | | 56,042,337 | | | | — | | | | — | | | | 56,042,337 | |

Health Care | | | 104,994,947 | | | | — | | | | — | | | | 104,994,947 | |

Industrials | | | 99,004,122 | | | | — | | | | — | | | | 99,004,122 | |

Information Technology | | | 162,153,628 | | | | — | | | | — | | | | 162,153,628 | |

Materials | | | 16,698,080 | | | | — | | | | — | | | | 16,698,080 | |

Investment Company | | | 25,869,936 | | | | — | | | | — | | | | 25,869,936 | |

| | | | |

Total Assets | | $ | 615,501,505 | | | $ | — | | | $ | — | | | $ | 615,501,505 | |

| | | | |

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

For the reporting period, there were no transfers between levels.

4. Investments and Risks

Investments in Affiliated Funds. The Fund is permitted to invest in other mutual funds advised by the Manager (“Affiliated Funds”). Affiliated Funds are management investment companies registered under the 1940 Act, as amended. The Manager is the investment adviser of, and theSub-Adviser provides investment and related advisory services to, the Affiliated Funds. When applicable, the Fund’s investments in Affiliated Funds are included in the Statement of Investments. Shares of Affiliated Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Affiliated Funds’ expenses, including their management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in the Affiliated Funds.

Each of the Affiliated Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Affiliated Fund than in another, the Fund will have greater exposure to the risks of that Affiliated Fund.

Investments in Money Market Instruments.The Fund is permitted to invest its free cash balances in money market instruments to provide liquidity or for defensive purposes. The Fund may invest in money market instruments by investing in Class E shares of Oppenheimer Institutional Government Money Market Fund (“IGMMF”), which is an Affiliated Fund. IGMMF is regulated as a money market fund under the 1940 Act, as amended. The Fund may also invest in money market instruments directly or in other affiliated or unaffiliated money market funds.

Equity Security Risk.Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

Shareholder Concentration.At period end, one shareholder owned 20% or more of the Fund’s total outstanding shares.

The shareholder is a related party of the Fund. Related parties may include, but are not limited to, the investment manager and its affiliates, affiliated broker dealers, fund of funds, and directors or employees. The related party owned 67% of the Fund’s total outstanding shares at period end.

5. Market Risk Factors

The Fund’s investments in securities and/or financial derivatives may expose the Fund to various market risk factors:

Commodity Risk. Commodity risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude oil, heating oil, metals, livestock, and agricultural products.

Credit Risk.Credit risk relates to the ability of the issuer of debt to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield debt securities are subject to credit risk to a greater extent than lower-yield, higher-quality securities.

17 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTSContinued

5. Market Risk Factors (Continued)

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

Interest Rate Risk.Interest rate risk refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter maturities.

Volatility Risk.Volatility risk refers to the magnitude of the movement, but not the direction of the movement, in a financial instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative time period typically indicate greater volatility risk, while small increases or decreases in its price typically indicate lower volatility risk.

6. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2018 | | | Year Ended December 31, 2017 | |

| | | Shares | | | | Amount | | | | Shares | | | | Amount | |

| |

Non-Service Shares | | | | | | | | | | | | | | | | |

Sold | | | 349,932 | | | $ | 26,834,584 | | | | 235,884 | | | $ | 18,341,538 | |

Dividends and/or distributions reinvested | | | 1,182,843 | | | | 95,656,703 | | | | 881,558 | | | | 66,743,996 | |

Redeemed | | | (1,242,422) | | | | (102,207,288) | | | | (1,177,553) | | | | (93,258,429) | |

| | | | |

Net increase (decrease) | | | 290,353 | | | $ | 20,283,999 | | | | (60,111) | | | $ | (8,172,895) | |

| | | | |

|

| |

Service Shares | | | | | | | | | | | | | | | | |

Sold | | | 110,486 | | | $ | 8,346,786 | | | | 69,577 | | | $ | 5,232,152 | |

Dividends and/or distributions reinvested | | | 78,492 | | | | 5,963,052 | | | | 51,387 | | | | 3,695,269 | |

Redeemed | | | (140,477) | | | | (10,461,719) | | | | (89,745) | | | | (6,729,427) | |

| | | | |

Net increase | | | 48,501 | | | $ | 3,848,119 | | | | 31,219 | | | $ | 2,197,994 | |

| | | | |

7. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IGMMF, for the reporting period were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

| |

Investment securities | | $ | 739,476,589 | | | | $840,524,844 | |

8. Fees and Other Transactions with Affiliates

Management Fees.Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

| | |

| Fee Schedule |

|

Up to $200 million | | 0.75% |

Next $200 million | | 0.72 |

Next $200 million | | 0.69 |

Next $200 million | | 0.66 |

Next $700 million | | 0.60 |

Over $1.5 billion | | 0.58 |

The Fund’s effective management fee for the reporting period was 0.71% of average annual net assets before any applicable waivers.

Sub-Adviser Fees.The Manager has retained theSub-Adviser to provide theday-to-day portfolio management of the Fund. Under theSub-Advisory Agreement, the Manager pays theSub-Adviser an annual fee in monthly installments, equal to a percentage of the investment management fee collected by the Manager from the Fund, which shall be calculated after any investment management fee waivers. The fee paid to theSub-Adviser is paid by the Manager, not by the Fund.

Transfer Agent Fees.OFI Global (the “Transfer Agent”) serves as the transfer and shareholder servicing agent for the Fund. The Fund pays the Transfer Agent a fee based on annual net assets. Fees incurred and average net assets for each class with respect to these services are detailed in the Statement of Operations and Financial Highlights, respectively.

Sub-Transfer Agent Fees.The Transfer Agent has retained Shareholder Services, Inc., a wholly-owned subsidiary of OFI (the“Sub-Transfer Agent”),

18 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

8. Fees and Other Transactions with Affiliates (Continued)

to provide theday-to-day transfer agent and shareholder servicing of the Fund. Under theSub-Transfer Agency Agreement, the Transfer Agent pays theSub-Transfer Agent an annual fee in monthly installments, equal to a percentage of the transfer agent fee collected by the Transfer Agent from the Fund, which shall be calculated after any applicable fee waivers. The fee paid to theSub-Transfer Agent is paid by the Transfer Agent, not by the Fund.

Trustees’ Compensation. The Fund’s Board of Trustees (“Board”) has adopted a compensation deferral plan for Independent Trustees that enables Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustees under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustees. The Fund purchases shares of the funds selected for deferral by the Trustees in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of Trustees’ fees under the plan will not affect the net assets of the Fund and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Distribution and Service Plan for Service Shares.The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule12b-1 under the 1940 Act for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on anon-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses.The Manager has contractually agreed to limit the Fund’s expenses after payments, waivers and/or reimbursements and reduction to custodian expenses, excluding any applicable dividend expense, taxes, interest and fees from borrowing, any subsidiary expenses, Acquired Fund Fees and Expenses, brokerage commissions, unusual and infrequent expenses and certain other Fund expenses; so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% forNon-Service shares and 1.05% for Service shares.

During the reporting period, the Manager waived fees and/or reimbursed the Fund as follows:

| | | | |

Non-Service Shares | | $ | 342,812 | |

Service Shares | | | 20,376 | |

This fee waiver and/or expense reimbursement may not be amended or withdrawn for one year from the date of the Fund’s prospectus, unless approved by the Board.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IGMMF. During the reporting period, the Manager waived fees and/or reimbursed the Fund $17,369 for IGMMF management fees.

9. Borrowings and Other Financing

Joint Credit Facility.A number of mutual funds managed by the Manager participate in a $1.95 billion revolving credit facility (the “Facility”) intended to provide short-term financing, if necessary, subject to certain restrictions in connection with atypical redemption activity. Expenses and fees related to the Facility are paid by the participating funds and are disclosed separately or as other expenses on the Statement of Operations. The Fund did not utilize the Facility during the reporting period.

10. Pending Acquisition

On October 18, 2018, Massachusetts Mutual Life Insurance Company, an indirect corporate parent of theSub-Adviser and the Manager, announced that it has entered into an agreement whereby Invesco Ltd. (“Invesco”), a global investment management company, will acquire theSub-Adviser (the “Transaction”). In connection with the Transaction, on January 11, 2019, the Fund’s Board unanimously approved an Agreement and Plan of Reorganization (the “Agreement”), which provides for the transfer of the assets and liabilities of the Fund to a corresponding, newly formed fund (the “Acquiring Fund”) in the Invesco family of funds (the “Reorganization”) in exchange for shares of the corresponding Acquiring Fund of equal value to the value of the shares of the Fund as of the close of business on the closing date. Although the Acquiring Fund will be managed by Invesco Advisers, Inc., the Acquiring Fund will, as of the closing date, have the same investment objective and substantially similar principal investment strategies and risks as the Fund. After the Reorganization, Invesco Advisers, Inc. will be the investment adviser to the Acquiring Fund, and the Fund will be liquidated and dissolved under applicable law and terminate its registration under the Investment Company Act of 1940, as amended. The Reorganization is expected to be atax-free reorganization for U.S. federal income tax purposes.

The Reorganization is subject to the approval of shareholders of the Fund. Shareholders of record of the Fund on January 14, 2019 will be entitled to vote on the Reorganization and will receive a combined prospectus and proxy statement describing the Reorganization, the shareholder meeting, and a discussion of the factors the Fund’s Board considered in approving the Agreement. The combined prospectus and proxy statement is expected to be distributed to shareholders of record on or about February 28, 2019. The anticipated date of the shareholder meeting is on or about April 12, 2019.

19 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTSContinued