UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | January 31, 2017 |

Item 1.

Reports to Stockholders

Fidelity® Growth & Income Portfolio

Class K

Semi-Annual Report January 31, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Microsoft Corp.(a) | 3.5 | 3.3 |

| JPMorgan Chase & Co.(a) | 3.5 | 3.5 |

| Apple, Inc.(a) | 3.2 | 2.7 |

| Bank of America Corp.(a) | 3.2 | 2.7 |

| General Electric Co. | 2.6 | 3.0 |

| Citigroup, Inc.(a) | 2.5 | 2.3 |

| Comcast Corp. Class A(a) | 2.0 | 1.8 |

| Chevron Corp. | 1.9 | 2.3 |

| Procter & Gamble Co. | 1.7 | 1.8 |

| Alphabet, Inc. Class A | 1.7 | 1.7 |

| | 25.8 | |

(a) Security or a portion of the security is pledged as collateral for call options written.

Top Five Market Sectors as of January 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Financials | 22.7 | 21.2 |

| Information Technology | 16.8 | 20.7 |

| Energy | 13.0 | 12.0 |

| Health Care | 12.7 | 14.2 |

| Industrials | 11.9 | 12.5 |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

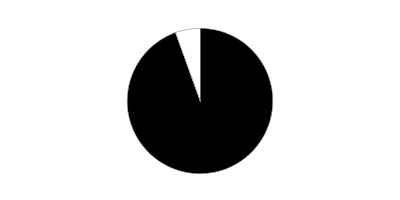

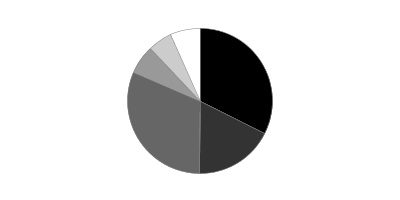

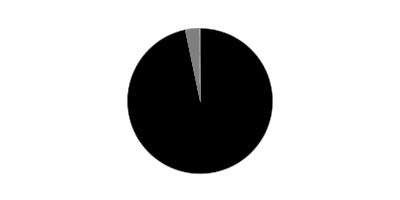

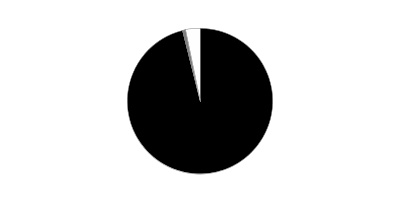

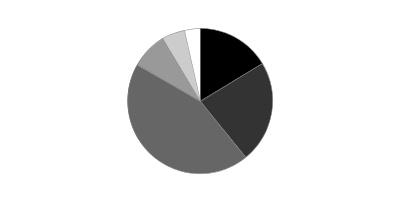

Asset Allocation (% of fund's net assets)

| As of January 31, 2017 *,** |

| | Stocks | 96.9% |

| | Convertible Securities | 1.2% |

| | Other Investments | 0.2% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 1.7% |

* Foreign investments - 9.7%

** Written options - (0.1)%

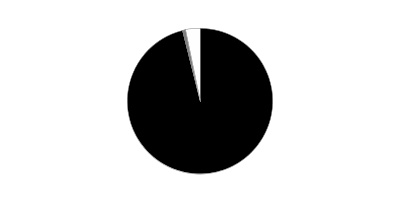

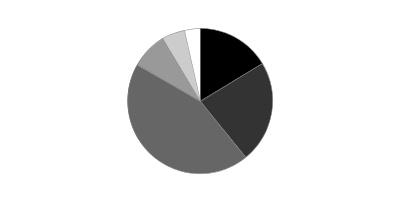

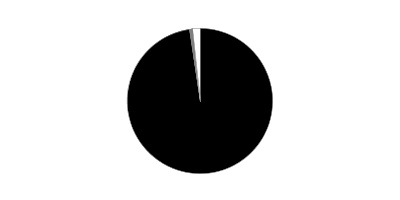

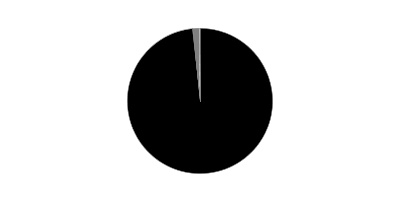

| As of July 31, 2016 *,** |

| | Stocks | 98.4% |

| | Convertible Securities | 1.4% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.2% |

* Foreign investments - 11.7%

** Written options - (0.1)%

Investments January 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 96.9% | | | |

| | | Shares | Value (000s) |

| CONSUMER DISCRETIONARY - 8.3% | | | |

| Auto Components - 0.1% | | | |

| Gentex Corp. | | 332,100 | $6,938 |

| Automobiles - 0.1% | | | |

| General Motors Co. | | 170,100 | 6,227 |

| Hotels, Restaurants & Leisure - 0.3% | | | |

| Cedar Fair LP (depositary unit) | | 37,800 | 2,364 |

| Dunkin' Brands Group, Inc. | | 133,600 | 6,930 |

| Las Vegas Sands Corp. | | 161,800 | 8,507 |

| Wingstop, Inc. | | 125,500 | 3,573 |

| Yum! Brands, Inc. | | 51,444 | 3,371 |

| | | | 24,745 |

| Leisure Products - 0.1% | | | |

| NJOY, Inc. (a)(b) | | 671,364 | 0 |

| Polaris Industries, Inc. (c) | | 119,400 | 10,038 |

| | | | 10,038 |

| Media - 5.1% | | | |

| AMC Networks, Inc. Class A (a) | | 69,000 | 3,957 |

| Comcast Corp. Class A (d) | | 1,914,900 | 144,422 |

| Scripps Networks Interactive, Inc. Class A | | 479,089 | 36,487 |

| Sinclair Broadcast Group, Inc. Class A | | 383,661 | 12,949 |

| The Walt Disney Co. | | 291,100 | 32,210 |

| Time Warner, Inc. (d) | | 1,006,417 | 97,471 |

| Viacom, Inc. Class B (non-vtg.) | | 731,200 | 30,813 |

| | | | 358,309 |

| Multiline Retail - 1.0% | | | |

| Dollar General Corp. | | 48,900 | 3,610 |

| Target Corp. | | 1,017,675 | 65,620 |

| | | | 69,230 |

| Specialty Retail - 1.5% | | | |

| Bed Bath & Beyond, Inc. | | 60,500 | 2,441 |

| Foot Locker, Inc. | | 235,700 | 16,155 |

| L Brands, Inc. | | 294,500 | 17,732 |

| Lowe's Companies, Inc. | | 808,579 | 59,091 |

| TJX Companies, Inc. | | 98,000 | 7,342 |

| | | | 102,761 |

| Textiles, Apparel & Luxury Goods - 0.1% | | | |

| Ralph Lauren Corp. | | 47,100 | 4,165 |

| VF Corp. | | 76,500 | 3,938 |

| | | | 8,103 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 586,351 |

|

| CONSUMER STAPLES - 7.1% | | | |

| Beverages - 2.5% | | | |

| Coca-Cola European Partners PLC | | 61,200 | 2,113 |

| Cott Corp. | | 125,500 | 1,332 |

| Diageo PLC | | 855,326 | 23,759 |

| Dr. Pepper Snapple Group, Inc. | | 138,800 | 12,659 |

| Molson Coors Brewing Co. Class B | | 393,100 | 37,942 |

| PepsiCo, Inc. | | 167,614 | 17,395 |

| The Coca-Cola Co. | | 1,880,803 | 78,185 |

| | | | 173,385 |

| Food & Staples Retailing - 1.4% | | | |

| Costco Wholesale Corp. (d) | | 103,800 | 17,018 |

| CVS Health Corp. | | 693,704 | 54,671 |

| Kroger Co. | | 696,000 | 23,636 |

| Whole Foods Market, Inc. | | 95,900 | 2,898 |

| | | | 98,223 |

| Food Products - 0.6% | | | |

| B&G Foods, Inc. Class A | | 220,300 | 9,770 |

| Hostess Brands, Inc. Class A (a) | | 622,200 | 8,891 |

| Mead Johnson Nutrition Co. Class A | | 297,000 | 20,927 |

| | | | 39,588 |

| Household Products - 1.7% | | | |

| Procter & Gamble Co. | | 1,383,915 | 121,231 |

| Personal Products - 0.1% | | | |

| Edgewell Personal Care Co. (a) | | 99,800 | 7,868 |

| Tobacco - 0.8% | | | |

| Altria Group, Inc. | | 553,600 | 39,405 |

| Reynolds American, Inc. | | 301,400 | 18,123 |

| | | | 57,528 |

|

| TOTAL CONSUMER STAPLES | | | 497,823 |

|

| ENERGY - 12.7% | | | |

| Energy Equipment & Services - 1.0% | | | |

| Baker Hughes, Inc. | | 326,500 | 20,596 |

| National Oilwell Varco, Inc. | | 644,400 | 24,365 |

| Oceaneering International, Inc. | | 654,000 | 18,214 |

| Schlumberger Ltd. | | 85,832 | 7,185 |

| | | | 70,360 |

| Oil, Gas & Consumable Fuels - 11.7% | | | |

| Anadarko Petroleum Corp. | | 229,700 | 15,971 |

| Apache Corp. | | 1,126,868 | 67,409 |

| Cabot Oil & Gas Corp. | | 697,200 | 14,976 |

| Cenovus Energy, Inc. | | 2,563,400 | 34,986 |

| Chevron Corp. | | 1,181,596 | 131,571 |

| ConocoPhillips Co. | | 2,382,200 | 116,156 |

| Golar LNG Ltd. | | 588,500 | 15,219 |

| Imperial Oil Ltd. | | 1,470,300 | 48,338 |

| Kinder Morgan, Inc. (d) | | 3,220,500 | 71,946 |

| Legacy Reserves LP (a) | | 1,099,168 | 2,583 |

| MPLX LP | | 84,947 | 3,215 |

| Plains All American Pipeline LP | | 43,100 | 1,353 |

| PrairieSky Royalty Ltd. | | 681,073 | 15,964 |

| Suncor Energy, Inc. | | 3,598,550 | 111,614 |

| Teekay LNG Partners LP | | 477,300 | 8,687 |

| The Williams Companies, Inc. | | 3,572,272 | 103,024 |

| Williams Partners LP | | 1,485,985 | 60,985 |

| | | | 823,997 |

|

| TOTAL ENERGY | | | 894,357 |

|

| FINANCIALS - 22.7% | | | |

| Banks - 15.4% | | | |

| Bank of America Corp. (d) | | 9,834,156 | 222,645 |

| Citigroup, Inc. (d) | | 3,213,030 | 179,383 |

| Comerica, Inc. | | 418,800 | 28,282 |

| Cullen/Frost Bankers, Inc. | | 35,900 | 3,209 |

| JPMorgan Chase & Co. (d) | | 2,883,092 | 243,996 |

| Lloyds Banking Group PLC | | 1,623,900 | 1,332 |

| M&T Bank Corp. | | 264,700 | 43,032 |

| PNC Financial Services Group, Inc. | | 461,554 | 55,599 |

| Regions Financial Corp. (d) | | 2,674,900 | 38,545 |

| SunTrust Banks, Inc. | | 1,334,866 | 75,847 |

| U.S. Bancorp | | 1,487,273 | 78,305 |

| Wells Fargo & Co. | | 2,115,441 | 119,163 |

| | | | 1,089,338 |

| Capital Markets - 6.5% | | | |

| Apollo Global Management LLC Class A | | 618,000 | 13,126 |

| CBOE Holdings, Inc. | | 263,500 | 20,980 |

| Charles Schwab Corp. | | 1,062,643 | 43,823 |

| Federated Investors, Inc. Class B (non-vtg.) | | 60,100 | 1,563 |

| Goldman Sachs Group, Inc. | | 41,400 | 9,494 |

| KKR & Co. LP | | 2,349,043 | 40,779 |

| Morgan Stanley | | 1,173,397 | 49,858 |

| Northern Trust Corp. | | 831,164 | 68,953 |

| Oaktree Capital Group LLC Class A | | 271,200 | 11,445 |

| S&P Global, Inc. | | 191,200 | 22,978 |

| State Street Corp. | | 1,535,227 | 116,984 |

| The Blackstone Group LP | | 1,862,900 | 57,061 |

| | | | 457,044 |

| Insurance - 0.5% | | | |

| Marsh & McLennan Companies, Inc. | | 368,407 | 25,059 |

| MetLife, Inc. | | 136,839 | 7,445 |

| Principal Financial Group, Inc. | | 37,313 | 2,130 |

| | | | 34,634 |

| Thrifts & Mortgage Finance - 0.3% | | | |

| MGIC Investment Corp. (a) | | 79,277 | 844 |

| Radian Group, Inc. | | 1,063,668 | 19,571 |

| | | | 20,415 |

|

| TOTAL FINANCIALS | | | 1,601,431 |

|

| HEALTH CARE - 11.8% | | | |

| Biotechnology - 2.5% | | | |

| Alexion Pharmaceuticals, Inc. (a) | | 257,100 | 33,598 |

| Amgen, Inc. | | 305,303 | 47,835 |

| Biogen, Inc. (a) | | 116,600 | 32,326 |

| Gilead Sciences, Inc. | | 392,100 | 28,408 |

| Grifols SA | | 201,100 | 4,303 |

| Intercept Pharmaceuticals, Inc. (a) | | 45,126 | 4,953 |

| Shire PLC sponsored ADR | | 110,200 | 18,493 |

| Vertex Pharmaceuticals, Inc. (a) | | 94,800 | 8,140 |

| | | | 178,056 |

| Health Care Equipment & Supplies - 1.9% | | | |

| Abbott Laboratories | | 577,504 | 24,122 |

| Becton, Dickinson & Co. | | 22,100 | 3,918 |

| Boston Scientific Corp. (a) | | 148,600 | 3,575 |

| Medtronic PLC | | 869,230 | 66,079 |

| Meridian Bioscience, Inc. | | 131,100 | 1,717 |

| Zimmer Biomet Holdings, Inc. | | 256,610 | 30,365 |

| | | | 129,776 |

| Health Care Providers & Services - 1.7% | | | |

| Anthem, Inc. | | 211,400 | 32,585 |

| Cigna Corp. | | 257,800 | 37,696 |

| McKesson Corp. | | 263,887 | 36,720 |

| Patterson Companies, Inc. (c) | | 344,670 | 14,342 |

| | | | 121,343 |

| Life Sciences Tools & Services - 0.5% | | | |

| Agilent Technologies, Inc. | | 624,900 | 30,601 |

| Pharmaceuticals - 5.2% | | | |

| Allergan PLC | | 38,900 | 8,515 |

| AstraZeneca PLC sponsored ADR | | 643,200 | 17,514 |

| Bayer AG | | 46,300 | 5,143 |

| Bristol-Myers Squibb Co. | | 874,400 | 42,986 |

| GlaxoSmithKline PLC sponsored ADR | | 2,460,222 | 96,711 |

| Innoviva, Inc. (a) | | 273,800 | 2,902 |

| Johnson & Johnson | | 1,008,869 | 114,254 |

| Novartis AG sponsored ADR | | 27,544 | 2,036 |

| Sanofi SA | | 250,497 | 20,134 |

| Teva Pharmaceutical Industries Ltd. sponsored ADR | | 1,737,620 | 58,089 |

| | | | 368,284 |

|

| TOTAL HEALTH CARE | | | 828,060 |

|

| INDUSTRIALS - 11.7% | | | |

| Aerospace & Defense - 2.2% | | | |

| General Dynamics Corp. | | 103,900 | 18,814 |

| Meggitt PLC | | 245,568 | 1,291 |

| Rolls-Royce Holdings PLC | | 1,190,900 | 10,031 |

| The Boeing Co. (d) | | 345,689 | 56,492 |

| United Technologies Corp. | | 629,482 | 69,035 |

| | | | 155,663 |

| Air Freight & Logistics - 1.4% | | | |

| C.H. Robinson Worldwide, Inc. | | 309,800 | 23,563 |

| Expeditors International of Washington, Inc. | | 249,300 | 12,984 |

| United Parcel Service, Inc. Class B (d) | | 552,804 | 60,328 |

| | | | 96,875 |

| Airlines - 0.2% | | | |

| Copa Holdings SA Class A | | 118,654 | 11,568 |

| Commercial Services & Supplies - 0.1% | | | |

| Aggreko PLC | | 125,100 | 1,585 |

| KAR Auction Services, Inc. | | 186,900 | 8,513 |

| | | | 10,098 |

| Construction & Engineering - 0.1% | | | |

| Fluor Corp. | | 137,500 | 7,631 |

| Electrical Equipment - 0.6% | | | |

| Acuity Brands, Inc. | | 28,200 | 5,844 |

| AMETEK, Inc. | | 324,800 | 16,597 |

| Hubbell, Inc. Class B | | 198,639 | 24,250 |

| | | | 46,691 |

| Industrial Conglomerates - 2.6% | | | |

| General Electric Co. | | 6,121,380 | 181,805 |

| Machinery - 1.1% | | | |

| Burckhardt Compression Holding AG (c) | | 12,950 | 3,818 |

| Caterpillar, Inc. | | 3,500 | 335 |

| Deere & Co. (d) | | 173,100 | 18,530 |

| Donaldson Co., Inc. | | 244,600 | 10,334 |

| Flowserve Corp. | | 547,000 | 26,891 |

| IMI PLC | | 78,200 | 1,147 |

| Wabtec Corp. | | 167,200 | 14,486 |

| | | | 75,541 |

| Professional Services - 0.4% | | | |

| Intertrust NV | | 211,200 | 3,934 |

| Nielsen Holdings PLC | | 294,100 | 12,032 |

| Robert Half International, Inc. | | 214,900 | 10,113 |

| | | | 26,079 |

| Road & Rail - 2.4% | | | |

| CSX Corp. (d) | | 1,400,220 | 64,956 |

| J.B. Hunt Transport Services, Inc. (d) | | 527,340 | 52,249 |

| Norfolk Southern Corp. | | 272,199 | 31,972 |

| Union Pacific Corp. | | 187,900 | 20,026 |

| | | | 169,203 |

| Trading Companies & Distributors - 0.6% | | | |

| Fastenal Co. | | 171,300 | 8,510 |

| Howden Joinery Group PLC | | 106,700 | 507 |

| W.W. Grainger, Inc. (c) | | 31,900 | 8,057 |

| Watsco, Inc. | | 163,992 | 25,048 |

| | | | 42,122 |

|

| TOTAL INDUSTRIALS | | | 823,276 |

|

| INFORMATION TECHNOLOGY - 16.8% | | | |

| Communications Equipment - 1.5% | | | |

| Cisco Systems, Inc. | | 3,517,652 | 108,062 |

| Electronic Equipment & Components - 0.0% | | | |

| Philips Lighting NV | | 55,800 | 1,435 |

| Internet Software & Services - 3.1% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 147,107 | 120,656 |

| Class C (a) | | 118,336 | 94,289 |

| | | | 214,945 |

| IT Services - 3.4% | | | |

| First Data Corp. Class A (a) | | 593,810 | 9,109 |

| MasterCard, Inc. Class A (d) | | 494,200 | 52,548 |

| Paychex, Inc. | | 1,053,552 | 63,519 |

| Sabre Corp. | | 523,500 | 12,826 |

| Unisys Corp. (a) | | 1,179,347 | 15,155 |

| Visa, Inc. Class A | | 1,054,784 | 87,241 |

| | | | 240,398 |

| Semiconductors & Semiconductor Equipment - 1.5% | | | |

| Qualcomm, Inc. | | 1,968,946 | 105,201 |

| Software - 3.7% | | | |

| Microsoft Corp. (d) | | 3,819,199 | 246,911 |

| Oracle Corp. | | 181,253 | 7,270 |

| SS&C Technologies Holdings, Inc. | | 307,000 | 9,864 |

| | | | 264,045 |

| Technology Hardware, Storage & Peripherals - 3.6% | | | |

| Apple, Inc. (d) | | 1,857,494 | 225,407 |

| Western Digital Corp. | | 319,200 | 25,450 |

| | | | 250,857 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 1,184,943 |

|

| MATERIALS - 3.1% | | | |

| Chemicals - 2.6% | | | |

| CF Industries Holdings, Inc. | | 613,400 | 21,647 |

| E.I. du Pont de Nemours & Co. | | 240,746 | 18,176 |

| Johnson Matthey PLC | | 16,600 | 679 |

| LyondellBasell Industries NV Class A | | 380,600 | 35,499 |

| Monsanto Co. | | 466,115 | 50,485 |

| Olin Corp. | | 95,000 | 2,490 |

| Potash Corp. of Saskatchewan, Inc. | | 1,776,000 | 33,043 |

| PPG Industries, Inc. | | 35,400 | 3,540 |

| W.R. Grace & Co. | | 231,100 | 16,024 |

| | | | 181,583 |

| Containers & Packaging - 0.5% | | | |

| Ball Corp. | | 65,300 | 4,980 |

| Graphic Packaging Holding Co. | | 45,800 | 573 |

| Packaging Corp. of America | | 48,300 | 4,452 |

| WestRock Co. | | 433,000 | 23,105 |

| | | | 33,110 |

|

| TOTAL MATERIALS | | | 214,693 |

|

| REAL ESTATE - 0.8% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.8% | | | |

| American Tower Corp. | | 94,800 | 9,812 |

| Crown Castle International Corp. | | 275,000 | 24,153 |

| First Potomac Realty Trust | | 55,018 | 563 |

| Omega Healthcare Investors, Inc. | | 123,500 | 3,961 |

| Public Storage | | 70,700 | 15,201 |

| Sabra Health Care REIT, Inc. | | 183,900 | 4,671 |

| | | | 58,361 |

| TELECOMMUNICATION SERVICES - 1.0% | | | |

| Diversified Telecommunication Services - 1.0% | | | |

| Verizon Communications, Inc. | | 1,485,574 | 72,808 |

| UTILITIES - 0.9% | | | |

| Electric Utilities - 0.9% | | | |

| Exelon Corp. | | 1,776,700 | 63,748 |

| Multi-Utilities - 0.0% | | | |

| Sempra Energy | | 400 | 41 |

|

| TOTAL UTILITIES | | | 63,789 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $5,862,300) | | | 6,825,892 |

|

| Preferred Stocks - 1.0% | | | |

| Convertible Preferred Stocks - 1.0% | | | |

| HEALTH CARE - 0.8% | | | |

| Health Care Equipment & Supplies - 0.8% | | | |

| Alere, Inc. 3.00% (a) | | 178,573 | 56,072 |

| INDUSTRIALS - 0.2% | | | |

| Commercial Services & Supplies - 0.2% | | | |

| Stericycle, Inc. 2.25% | | 185,300 | 12,104 |

| UTILITIES - 0.0% | | | |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Dynegy, Inc. 7.00% (a) | | 41,300 | 2,775 |

|

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | 70,951 |

|

| Nonconvertible Preferred Stocks - 0.0% | | | |

| INDUSTRIALS - 0.0% | | | |

| Aerospace & Defense - 0.0% | | | |

| Rolls-Royce Holdings PLC (C Shares) | | 159,385,280 | 201 |

| TOTAL PREFERRED STOCKS | | | |

| (Cost $64,847) | | | 71,152 |

| | | Principal Amount (000s)(e) | Value (000s) |

|

| Convertible Bonds - 0.2% | | | |

| ENERGY - 0.1% | | | |

| Oil, Gas & Consumable Fuels - 0.1% | | | |

| Amyris, Inc.: | | | |

| 5% 10/15/18 pay-in-kind (b)(f) | | 3,768 | 2,387 |

| 9.5% 4/15/19 pay-in-kind | | 5,075 | 2,709 |

| | | | 5,096 |

| HEALTH CARE - 0.1% | | | |

| Pharmaceuticals - 0.1% | | | |

| Bayer Capital Corp. BV 5.625% 11/22/19 (g) | EUR | 6,700 | 8,109 |

| TOTAL CONVERTIBLE BONDS | | | |

| (Cost $16,000) | | | 13,205 |

| | | Shares | Value (000s) |

|

| Other - 0.2% | | | |

| ENERGY - 0.2% | | | |

| Oil, Gas & Consumable Fuels - 0.2% | | | |

| Utica Shale Drilling Program (non-operating revenue interest) unit(b)(h) | | | |

| (Cost $12,035) | | 12,034,966 | 12,035 |

|

| Money Market Funds - 2.4% | | | |

| Fidelity Cash Central Fund, 0.62% (i) | | 151,922,371 | 151,953 |

| Fidelity Securities Lending Cash Central Fund 0.65% (i)(j) | | 19,519,041 | 19,523 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $171,477) | | | 171,476 |

| TOTAL INVESTMENT PORTFOLIO - 100.7% | | | |

| (Cost $6,126,659) | | | 7,093,760 |

| NET OTHER ASSETS (LIABILITIES) - (0.7)% | | | (45,939) |

| NET ASSETS - 100% | | | $7,047,821 |

| Written Options | | | | |

| | Expiration Date/Exercise Price | Number of Contracts | Premium (000s) | Value (000s) |

| Call Options | | | | |

| Apple, Inc. | 3/17/17 - $125.00 | 1,860 | $257 | $(273) |

| Apple, Inc. | 4/21/17 - $130.00 | 1,860 | 186 | (179) |

| Bank of America Corp. | 4/21/17 - $26.00 | 9,796 | 235 | (147) |

| Citigroup, Inc. | 2/17/17 - $60.00 | 1,689 | 201 | (17) |

| Comcast Corp. Class A | 4/21/17 - $77.50 | 2,789 | 248 | (383) |

| Costco Wholesale Corp. | 4/21/17 - $170.00 | 223 | 63 | (56) |

| CSX Corp. | 5/19/17 - $52.50 | 1,375 | 190 | (156) |

| CSX Corp. | 5/19/17 - $55.00 | 2,080 | 177 | (149) |

| Deere & Co. | 3/17/17 - $110.00 | 1,724 | 483 | (415) |

| J.B. Hunt Transport Services, Inc. | 2/17/17 - $105.00 | 521 | 42 | (8) |

| JPMorgan Chase & Co. | 2/17/17 - $85.00 | 3,310 | 385 | (404) |

| JPMorgan Chase & Co. | 3/17/17 - $95.00 | 2,680 | 123 | (28) |

| Kinder Morgan, Inc. | 3/17/17 - $24.00 | 6,437 | 148 | (132) |

| MasterCard, Inc. Class A | 4/21/17 - $115.00 | 483 | 79 | (25) |

| Microsoft Corp. | 4/21/17 - $70.00 | 5,719 | 200 | (149) |

| Regions Financial Corp. | 2/17/17 - $13.00 | 6,552 | 227 | (949) |

| Regions Financial Corp. | 2/17/17 - $16.00 | 3,424 | 58 | (7) |

| The Boeing Co. | 3/17/17 - $170.00 | 524 | 51 | (64) |

| Time Warner, Inc. | 4/21/17 - $97.50 | 2,005 | 411 | (480) |

| Time Warner, Inc. | 4/21/17 - $100.00 | 1,486 | 163 | (217) |

| United Parcel Service, Inc. Class B | 4/21/17 - $115.00 | 911 | 129 | (85) |

| United Parcel Service, Inc. Class B | 4/21/17 - $120.00 | 483 | 57 | (11) |

| TOTAL WRITTEN OPTIONS | | | $4,113 | $(4,334) |

Currency Abbreviations

EUR – European Monetary Unit

Values shown as $0 may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $14,422,000 or 0.2% of net assets.

(c) Security or a portion of the security is on loan at period end.

(d) Security or a portion of the security is pledged as collateral for call options written. At period end, the value of securities pledged amounted to $295,541,000.

(e) Amount is stated in United States dollars unless otherwise noted.

(f) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $8,109,000 or 0.1% of net assets.

(h) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(i) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(j) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Amyris, Inc. 5% 10/15/18 pay-in-kind | 10/16/13 - 1/6/17 | $3,768 |

| NJOY, Inc. | 2/14/14 | $1,164 |

| Utica Shale Drilling Program (non-operating revenue interest) unit | 10/5/16 - 11/4/16 | $12,035 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $173 |

| Fidelity Securities Lending Cash Central Fund | 177 |

| Total | $350 |

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $586,351 | $586,351 | $-- | $-- |

| Consumer Staples | 497,823 | 474,064 | 23,759 | -- |

| Energy | 894,357 | 894,357 | -- | -- |

| Financials | 1,601,431 | 1,600,099 | 1,332 | -- |

| Health Care | 884,132 | 802,783 | 81,349 | -- |

| Industrials | 835,581 | 825,550 | 10,031 | -- |

| Information Technology | 1,184,943 | 1,184,943 | -- | -- |

| Materials | 214,693 | 214,693 | -- | -- |

| Real Estate | 58,361 | 58,361 | -- | -- |

| Telecommunication Services | 72,808 | 72,808 | -- | -- |

| Utilities | 66,564 | 66,564 | -- | -- |

| Corporate Bonds | 13,205 | -- | 10,818 | 2,387 |

| Other | 12,035 | -- | -- | 12,035 |

| Money Market Funds | 171,476 | 171,476 | -- | -- |

| Total Investments in Securities: | $7,093,760 | $6,952,049 | $127,289 | $14,422 |

| Derivative Instruments: | | | | |

| Liabilities | | | | |

| Written Options | $(4,334) | $(3,843) | $(491) | $-- |

| Total Liabilities | $(4,334) | $(3,843) | $(491) | $-- |

| Total Derivative Instruments: | $(4,334) | $(3,843) | $(491) | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of January 31, 2017. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| (Amounts in thousands) | | |

| Equity Risk | | |

| Written Options(a) | $0 | $(4,334) |

| Total Equity Risk | 0 | (4,334) |

| Total Value of Derivatives | $0 | $(4,334) |

(a) Gross value is presented in the Statement of Assets and Liabilities in the written options, at value line-item.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | January 31, 2017 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $19,014) — See accompanying schedule:

Unaffiliated issuers (cost $5,955,182) | $6,922,284 | |

| Fidelity Central Funds (cost $171,477) | 171,476 | |

| Total Investments (cost $6,126,659) | | $7,093,760 |

| Receivable for investments sold | | 49,122 |

| Receivable for fund shares sold | | 7,160 |

| Dividends receivable | | 5,974 |

| Interest receivable | | 338 |

| Distributions receivable from Fidelity Central Funds | | 55 |

| Prepaid expenses | | 10 |

| Other receivables | | 698 |

| Total assets | | 7,157,117 |

| Liabilities | | |

| Payable for investments purchased | $66,302 | |

| Payable for fund shares redeemed | 14,780 | |

| Accrued management fee | 2,640 | |

| Written options, at value (premium received $4,113) | 4,334 | |

| Other affiliated payables | 958 | |

| Other payables and accrued expenses | 765 | |

| Collateral on Securities Loaned | 19,517 | |

| Total liabilities | | 109,296 |

| Net Assets | | $7,047,821 |

| Net Assets consist of: | | |

| Paid in capital | | $8,128,097 |

| Distributions in excess of net investment income | | (23,203) |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,023,909) |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 966,836 |

| Net Assets | | $7,047,821 |

| Growth and Income: | | |

| Net Asset Value, offering price and redemption price per share ($6,171,164 ÷ 185,674 shares) | | $33.24 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($876,657 ÷ 26,399 shares) | | $33.21 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended January 31, 2017 (Unaudited) |

| Investment Income | | |

| Dividends | | $73,294 |

| Interest | | 974 |

| Income from Fidelity Central Funds | | 350 |

| Total income | | 74,618 |

| Expenses | | |

| Management fee | $14,939 | |

| Transfer agent fees | 4,965 | |

| Accounting and security lending fees | 578 | |

| Custodian fees and expenses | 80 | |

| Independent trustees' fees and expenses | 14 | |

| Appreciation in deferred trustee compensation account | 1 | |

| Registration fees | 78 | |

| Audit | 45 | |

| Legal | 12 | |

| Miscellaneous | 43 | |

| Total expenses before reductions | 20,755 | |

| Expense reductions | (32) | 20,723 |

| Net investment income (loss) | | 53,895 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 235,438 | |

| Fidelity Central Funds | 56 | |

| Foreign currency transactions | (84) | |

| Written options | 2,419 | |

| Total net realized gain (loss) | | 237,829 |

Change in net unrealized appreciation (depreciation) on:

Investment securities | 354,164 | |

| Assets and liabilities in foreign currencies | (9) | |

| Written options | 599 | |

| Total change in net unrealized appreciation (depreciation) | | 354,754 |

| Net gain (loss) | | 592,583 |

| Net increase (decrease) in net assets resulting from operations | | $646,478 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended January 31, 2017 (Unaudited) | Year ended July 31, 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $53,895 | $130,340 |

| Net realized gain (loss) | 237,829 | 409,570 |

| Change in net unrealized appreciation (depreciation) | 354,754 | (566,940) |

| Net increase (decrease) in net assets resulting from operations | 646,478 | (27,030) |

| Distributions to shareholders from net investment income | (71,023) | (127,549) |

| Distributions to shareholders from net realized gain | – | (2,644) |

| Total distributions | (71,023) | (130,193) |

| Share transactions - net increase (decrease) | 179,296 | (973,902) |

| Total increase (decrease) in net assets | 754,751 | (1,131,125) |

| Net Assets | | |

| Beginning of period | 6,293,070 | 7,424,195 |

| End of period | $7,047,821 | $6,293,070 |

| Other Information | | |

| Distributions in excess of net investment income end of period | $(23,203) | $(6,075) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Growth & Income Portfolio

| | Six months ended (Unaudited) January 31, | Years ended July 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $30.48 | $30.85 | $29.02 | $25.66 | $20.13 | $18.58 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .25 | .59 | .55 | .51 | .46 | .36 |

| Net realized and unrealized gain (loss) | 2.84 | (.37) | 1.82B | 3.35 | 5.54 | 1.55 |

| Total from investment operations | 3.09 | .22 | 2.37 | 3.86 | 6.00 | 1.91 |

| Distributions from net investment income | (.33) | (.58) | (.54) | (.50) | (.44) | (.35) |

| Distributions from net realized gain | – | (.01) | – | (.01) | (.03) | (.01) |

| Total distributions | (.33) | (.59) | (.54) | (.50)C | (.47) | (.36) |

| Net asset value, end of period | $33.24 | $30.48 | $30.85 | $29.02 | $25.66 | $20.13 |

| Total ReturnD,E | 10.19% | .88% | 8.23%B | 15.16% | 30.15% | 10.45% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .64%H | .64% | .64% | .65% | .68% | .71% |

| Expenses net of fee waivers, if any | .64%H | .64% | .63% | .65% | .68% | .71% |

| Expenses net of all reductions | .63%H | .64% | .63% | .65% | .67% | .71% |

| Net investment income (loss) | 1.60%H | 2.05% | 1.83% | 1.86% | 2.04% | 1.95% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $6,171 | $5,529 | $6,563 | $6,550 | $6,060 | $4,863 |

| Portfolio turnover rateI | 43%H | 29% | 35% | 41%J | 49% | 62% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.06 per share. Excluding these litigation proceeds, the total return would have been 8.03%.

C Total distributions of $.50 per share is comprised of distributions from net investment income of $.495 and distributions from net realized gain of $.006 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Growth & Income Portfolio Class K

| | Six months ended (Unaudited) January 31, | Years ended July 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $30.46 | $30.82 | $29.00 | $25.64 | $20.12 | $18.57 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .27 | .62 | .59 | .54 | .50 | .40 |

| Net realized and unrealized gain (loss) | 2.83 | (.35) | 1.81B | 3.36 | 5.52 | 1.54 |

| Total from investment operations | 3.10 | .27 | 2.40 | 3.90 | 6.02 | 1.94 |

| Distributions from net investment income | (.35) | (.62) | (.58) | (.53) | (.47) | (.38) |

| Distributions from net realized gain | – | (.01) | – | (.01) | (.03) | (.01) |

| Total distributions | (.35) | (.63) | (.58) | (.54) | (.50) | (.39) |

| Net asset value, end of period | $33.21 | $30.46 | $30.82 | $29.00 | $25.64 | $20.12 |

| Total ReturnC,D | 10.23% | 1.04% | 8.34%B | 15.32% | 30.28% | 10.66% |

| Ratios to Average Net AssetsE,F | | | | | | |

| Expenses before reductions | .52%G | .52% | .52% | .52% | .53% | .54% |

| Expenses net of fee waivers, if any | .52%G | .52% | .52% | .52% | .53% | .54% |

| Expenses net of all reductions | .52%G | .52% | .52% | .52% | .52% | .54% |

| Net investment income (loss) | 1.72%G | 2.17% | 1.95% | 1.99% | 2.19% | 2.13% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $877 | $765 | $862 | $960 | $1,016 | $752 |

| Portfolio turnover rateH | 43%G | 29% | 35% | 41%I | 49% | 62% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.06 per share. Excluding these litigation proceeds, the total return would have been 8.14%.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended January 31, 2017

(Amounts in thousands except percentages)

1. Organization.

Fidelity Growth & Income Portfolio (the Fund) is a fund of Fidelity Securities Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Growth & Income and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Exchange-traded options are valued using the last sale price or, in the absence of a sale, the last offering price and are categorized as Level 1 in the hierarchy. Options traded over-the-counter are valued using broker-supplied valuations and are categorized as Level 2 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of January 31, 2017 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), market discount, equity-debt classifications, partnerships, deferred trustees compensation, certain conversion ratio adjustments, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $1,325,950 |

| Gross unrealized depreciation | (369,760) |

| Net unrealized appreciation (depreciation) on securities | $956,190 |

| Tax cost | $6,137,570 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

| Fiscal year of expiration | |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Consolidated Subsidiary. The Fund invests in certain investments through a wholly-owned subsidiary ("Subsidiary"), which may be subject to federal and state taxes upon disposition.

As of period end, the Fund held an investment of $12,035 in this Subsidiary, representing .17% of the Fund's net assets. The financial statements have been consolidated and include accounts of the Fund and each Subsidiary. Accordingly, all inter-company transactions and balances have been eliminated.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including options. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain OTC derivatives such as options, the Fund attempts to reduce its exposure to counterparty credit risk by entering into an International Swaps and Derivatives Association, Inc. (ISDA) Master Agreement with each of its counterparties. The ISDA Master Agreement gives the Fund the right to terminate all transactions traded under such agreement upon the deterioration in the credit quality of the counterparty beyond specified levels. The ISDA Master Agreement gives each party the right, upon an event of default by the other party or a termination of the agreement, to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net payable by one party to the other. To mitigate counterparty credit risk on bi-lateral OTC derivatives, the Fund receives collateral in the form of cash or securities once the Fund's net unrealized appreciation on outstanding derivative contracts under an ISDA Master Agreement exceeds certain applicable thresholds, subject to certain minimum transfer provisions. The collateral received is held in segregated accounts with the Fund's custodian bank in accordance with the collateral agreements entered into between the Fund, the counterparty and the Fund's custodian bank. The Fund could experience delays and costs in gaining access to the collateral even though it is held by the Fund's custodian bank. The Fund's maximum risk of loss from counterparty credit risk related to bi-lateral OTC derivatives is generally the aggregate unrealized appreciation and unpaid counterparty payments in excess of any collateral pledged by the counterparty to the Fund. The Fund may be required to pledge collateral for the benefit of the counterparties on bi-lateral OTC derivatives in an amount not less than each counterparty's unrealized appreciation on outstanding derivative contracts, subject to certain minimum transfer provisions, and any such pledged collateral is identified in the Schedule of Investments. Counterparty credit risk related to exchange-traded options may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Options. Options give the purchaser the right, but not the obligation, to buy (call) or sell (put) an underlying security or financial instrument at an agreed exercise or strike price between or on certain dates. Options obligate the seller (writer) to buy (put) or sell (call) an underlying instrument at the exercise or strike price or cash settle an underlying derivative instrument if the holder exercises the option on or before the expiration date.

The Fund used exchange-traded and OTC written covered call options to manage its exposure to the market. When the Fund writes a covered call option, the Fund holds the underlying instrument which must be delivered to the holder upon the exercise of the option.

Upon entering into a written options contract, the Fund will receive a premium. Premiums received are reflected as a liability on the Statement of Assets and Liabilities. Options are valued daily and any unrealized appreciation (depreciation) is reflected on the Statement of Assets and Liabilities. When a written option is exercised, the premium is added to the proceeds from the sale of the underlying instrument in determining the gain or loss realized on that investment. When an option is closed the Fund will realize a gain or loss depending on whether the proceeds or amount paid for the closing sale transaction are greater or less than the premium received. When an option expires, gains and losses are realized to the extent of premiums received. The net realized gain (loss) on closed and expired written options and the change in net unrealized appreciation (depreciation) on written options are reflected separately on the Statement of Operations.

Writing call options tends to decrease exposure to the underlying instrument and risk of loss is the change in value in excess of the premium received.

Any open options at period end are presented in the Schedule of Investments under the caption "Written Options".

During the period, the Fund recognized net realized gain (loss) of $2,419 and a change in net unrealized appreciation (depreciation) of $599 related to its investment in written options. This amount is included in the Statement of Operations.

The following is a summary of the Fund's written options activity:

| | Number of Contracts | Amount of Premiums |

| Outstanding at beginning of period | 27 | $2,399 |

| Options Opened | 161 | 10,941 |

| Options Exercised | (77) | (5,162) |

| Options Closed | (38) | (3,183) |

| Options Expired | (15) | (882) |

| Outstanding at end of period | 58 | $4,113 |

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $1,473,758 and $1,407,139, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .20% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .45% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Growth & Income, except for Class K. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of

Class-Level Average

Net Assets(a) |

| Growth and Income | $4,776 | .16 |

| Class K | 189 | .05 |

| | $4,965 | |

(a) Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $33 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $11 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. The value of securities loaned to FCM at period end was $1,244. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $177, including $11 from securities loaned to FCM.

9. Expense Reductions.

During the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $32.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

January 31, 2017 | Year ended July 31, 2016 |

| From net investment income | | |

| Growth and Income | $62,016 | $110,877 |

| Class K | 9,007 | 16,672 |

| Total | $71,023 | $127,549 |

| From net realized gain | | |

| Growth and Income | $– | $2,314 |

| Class K | – | 330 |

| Total | $– | $2,644 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended

January 31, 2017 | Year ended July 31, 2016 | Six months ended

January 31, 2017 | Year ended July 31, 2016 |

| Growth and Income | | | | |

| Shares sold | 14,055 | 4,968 | $444,577 | $141,986 |

| Reinvestment of distributions | 1,838 | 3,798 | 58,975 | 107,836 |

| Shares redeemed | (11,575) | (40,154) | (368,138) | (1,140,777) |

| Net increase (decrease) | 4,318 | (31,388) | $135,414 | $(890,955) |

| Class K | | | | |

| Shares sold | 4,513 | 3,725 | $146,237 | $105,617 |

| Reinvestment of distributions | 281 | 599 | 9,007 | 17,002 |

| Shares redeemed | (3,495) | (7,177) | (111,362) | (205,566) |

| Net increase (decrease) | 1,299 | (2,853) | $43,882 | $(82,947) |

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2016 to January 31, 2017).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Annualized Expense Ratio-A | Beginning

Account Value

August 1, 2016 | Ending

Account Value

January 31, 2017 | Expenses Paid

During Period-B

August 1, 2016

to January 31, 2017 |

| Growth and Income | .64% | | | |

| Actual | | $1,000.00 | $1,101.90 | $3.39 |

| Hypothetical-C | | $1,000.00 | $1,021.98 | $3.26 |

| Class K | .52% | | | |

| Actual | | $1,000.00 | $1,102.30 | $2.76 |

| Hypothetical-C | | $1,000.00 | $1,022.58 | $2.65 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

C 5% return per year before expenses

Corporate Headquarters

245 Summer St.

Boston, MA 02210

www.fidelity.com

GAI-K-SANN-0317

1.863233.108

Fidelity® Real Estate Income Fund

Semi-Annual Report January 31, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Five Stocks as of January 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Equity Lifestyle Properties, Inc. | 3.3 | 3.9 |

| MFA Financial, Inc. | 2.5 | 2.7 |

| Acadia Realty Trust (SBI) | 2.5 | 2.9 |

| Ventas, Inc. | 2.0 | 2.4 |

| Apartment Investment & Management Co. Class A | 1.8 | 1.4 |

| | 12.1 | |

Top 5 Bonds as of January 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| RAIT Financial Trust 4% 10/1/33 | 0.9 | 0.8 |

| IAS Operating Partnership LP 5% 3/15/18 | 0.9 | 0.8 |

| Senior Housing Properties Trust 4.75% 5/1/24 | 0.8 | 0.7 |

| RWT Holdings, Inc. 5.625% 11/15/19 | 0.7 | 0.8 |

| PennyMac Corp. 5.375% 5/1/20 | 0.7 | 0.6 |

| | 4.0 | |

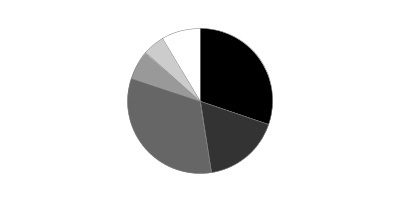

Top Five REIT Sectors as of January 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| REITs - Mortgage | 15.6 | 17.3 |

| REITs - Health Care | 7.7 | 7.9 |

| REITs - Diversified | 6.8 | 5.2 |

| REITs - Apartments | 5.9 | 5.2 |

| REITs - Shopping Centers | 4.1 | 4.6 |

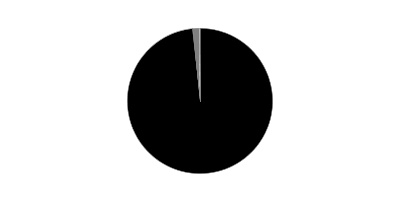

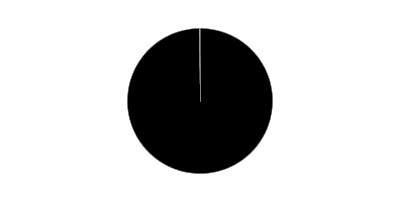

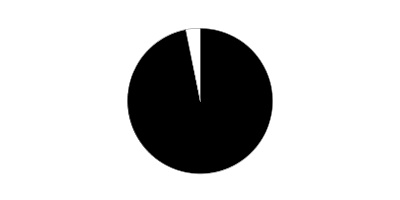

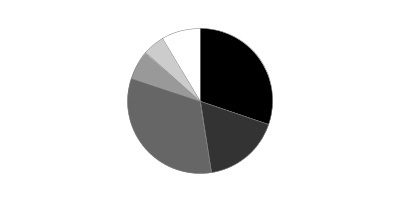

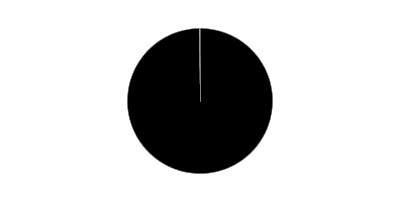

Asset Allocation (% of fund's net assets)

| As of January 31, 2017* |

| | Common Stocks | 30.2% |

| | Preferred Stocks | 17.3% |

| | Bonds | 32.6% |

| | Convertible Securities | 6.4% |

| | Other Investments | 4.8% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 8.7% |

* Foreign investments - 1.6%

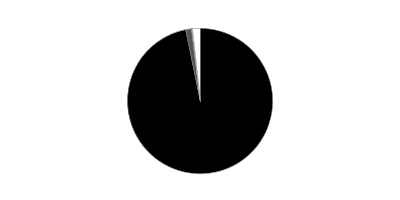

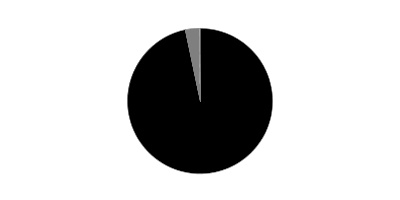

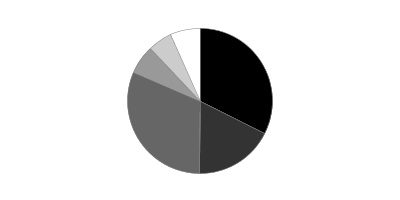

| As of July 31, 2016* |

| | Common Stocks | 32.4% |

| | Preferred Stocks | 17.7% |

| | Bonds | 31.4% |

| | Convertible Securities | 6.5% |

| | Other Investments | 5.3% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 6.7% |

* Foreign investments - 1.1%

Investments January 31, 2017

Showing Percentage of Net Assets

| Common Stocks - 30.2% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Household Durables - 0.2% | | | |

| Stanley Martin Communities LLC Class B (a) | | 4,620 | $9,346,722 |

| FINANCIALS - 6.4% | | | |

| Capital Markets - 0.7% | | | |

| Brookfield Asset Management, Inc. Class A | | 535,900 | 18,532,565 |

| Ellington Financial LLC | | 1,140,284 | 17,879,653 |

| | | | 36,412,218 |

| Mortgage Real Estate Investment Trusts - 5.7% | | | |

| AG Mortgage Investment Trust, Inc. | | 798,000 | 13,980,960 |

| Altisource Residential Corp. Class B | | 1,278,786 | 15,524,462 |

| Anworth Mortgage Asset Corp. | | 1,148,310 | 5,890,830 |

| Arbor Realty Trust, Inc. | | 2,336,394 | 17,242,588 |

| Chimera Investment Corp. | | 897,300 | 15,819,399 |

| CYS Investments, Inc. | | 305,139 | 2,309,902 |