UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04304 |

| | |

| Exact name of registrant as specified in charter: | Delaware Group® Government Fund |

| | |

| Address of principal executive offices: | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | |

| Name and address of agent for service: | David F. Connor, Esq. |

| | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | July 31 |

| | |

| Date of reporting period: | July 31, 2011 |

Item 1. Reports to Stockholders

Annual report Delaware Core Plus Bond Fund July 31, 2011 Fixed income mutual fund |

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Core Plus Bond Fund at www.delawareinvestments.com.

Manage your investments online

24-hour access to your account information

Obtain share prices

Check your account balance and recent transactions

Request statements or literature

Make purchases and redemptions

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Core Plus Bond Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summary | 4 |

| Disclosure of Fund expenses | 8 |

| Security type/sector allocation | 10 |

| Statement of net assets | 12 |

| Statement of assets and liabilities | 39 |

| Statement of operations | 40 |

| Statements of changes in net assets | 42 |

| Financial highlights | 44 |

| Notes to financial statements | 54 |

| Report of independent registered | |

| public accounting firm | 72 |

| Other Fund information | 73 |

| Board of trustees/directors and | |

| officers addendum | 74 |

| About the organization | 84 |

Unless otherwise noted, views expressed herein are current as of July 31, 2011, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2011 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | | |

| Delaware Core Plus Bond Fund | | August 9, 2011 |

| Performance preview (for the year ended July 31, 2011) | | | |

| Delaware Core Plus Bond Fund (Class A shares) | 1-year return | | +6.32% |

| Barclays Capital U.S. Aggregate Index (benchmark) | 1-year return | | +4.44% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Core Plus Bond Fund, please see the table on page 4.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The Fund’s fiscal year ended July 31, 2011, was characterized by an increasingly challenging economic environment. Bonds with lower credit ratings and higher yields enjoyed solid results for much of the fiscal year. However, in the final months of the fiscal year, many investors began to favor higher-quality securities as debt-related troubles heated up in Europe and the U.S. economy slowed.

Mounting data indicated a faltering global economic recovery and raised new fears of a double-dip recession in the United States. The nation’s gross domestic product, which measures the combined dollar value of goods and services the country produces, grew by an estimated 1.3% in the second quarter of 2011, on the heels of a mere 0.4% increase in the first three months of 2011. Unemployment was an especially big trouble spot, with the U.S. jobless rate finishing July 2011 at 9.1%, up from 8.8% as recently as March 2011. (Sources: U.S. Commerce Department, U.S. Labor Department.)

At the start of the Fund’s fiscal year, in an effort to stimulate the economy, the Federal Reserve announced a second round of quantitative easing, commonly known as QE2. The plan involved the Fed purchasing enormous quantities of government bonds to lower long-term interest rates. In conjunction with a payroll tax cut and a two-year

Interest rate positioning is not typically a part of our overall portfolio management approach, but in late 2010, we identified a tactical need to make the Fund less sensitive to rising rates, given the increase in rates taking place at that time. Within several months, the potential for a further rate increase seemed reduced, and we once again attempted to make the portfolio somewhat more sensitive to interest rate movements by purchasing U.S. Treasury futures. We maintained this positioning throughout the rest of the Fund’s fiscal year.

1

Portfolio management review

Delaware Core Plus Bond Fund

extension of federal income-tax rates following last year’s November elections, it led to a rally in riskier assets such as equities and corporate bonds.

Generally, investors remained tolerant of risk for several months during the Fund’s fiscal year. By spring 2011, however, risk aversion gradually returned to the market. Many bond investors once again began to favor higher-quality debt, while returns on assets such as commercial mortgage-backed securities (CMBS), nonagency residential mortgage-backed securities (MBS), high yield corporate bonds, and equities began to lag Treasurys, which generally benefited from their perceived increased safety.

Within the Fund

For the fiscal year, Delaware Core Plus Bond Fund Class A shares returned +6.32% at net asset value and +1.50% at maximum offer price (both returns include reinvested distributions). In comparison, the Fund’s benchmark, the Barclays Capital U.S. Aggregate Index, returned +4.44%. For complete annualized performance for Delaware Core Plus Bond Fund, please see the table on page 4.

Corporate and international government debt contributed

Relative to its benchmark, the Fund benefited from many of its higher-quality corporate bond positions, and from maintaining a significant overweighting in the corporate bond category. More specifically, increased exposure to high-quality U.S. banks and insurance companies helped, as did the Fund’s allocation to utility, natural resource, healthcare, and communication company bonds, as well as its stake in energy pipeline securities in the form of master limited partnerships.

Periodic investments in the government securities of Australia, Canada, and Brazil — three countries that benefited from conservative fiscal management, low deficits, and low debt ratios — also contributed to the Fund’s performance. The decline in the value of the dollar relative to these countries’ currencies also boosted returns for the Fund.

Mortgage-backed underperformance

For much of its fiscal year, the Fund’s portfolio was conservatively positioned with respect to its residential MBS and CMBS allocations. For example, the Fund had little exposure to riskier, nonagency-backed MBS. Among CMBS, we focused on securities with high credit ratings and whose issue dates occurred when underwriting standards were stricter (for example, many CMBS issued during 2006 and 2007 have lower credit quality). This positioning hampered performance for much of the Fund’s fiscal year, as many bond investors looked to obtain additional yield from riskier securities. However, during the final three months of the fiscal year, our defensive positioning helped the Fund close some of the gap.

A second source of underperformance was the Fund’s short position in the euro currency, given our concern about the region’s mounting debt challenges combined with slow economic growth. At times throughout the fiscal year, this strategy was unsuccessful due to what we viewed as the euro’s surprising strength relative to the dollar. Of final note, the Fund’s more-limited exposure to high yield corporate bonds provided an opportunity cost for the first nine months of its fiscal year — essentially, owning more of these securities could have potentially helped relative performance during that time. That

2

said, this more defensive positioning generally proved helpful in the last several months of the Fund’s fiscal year, when many investors favored bonds with less credit risk.

Relatively few adjustments to the Fund

Changes to the Fund’s broad strategic allocations were generally modest throughout the fiscal year. Many of the tactical adjustments we made were more defensive in nature as we sought to reduce the portfolio’s risk exposure. Entering the fiscal year, for example, we had limited the Fund’s exposure to lower-rated, high yielding bonds. We did more of this in spring 2011 to further reduce the portfolio’s credit risk amid increased market volatility and economic uncertainty. Another way in which we attempted to guard against a potential decline in high yield bond prices was to buy credit default swaps. This approach generally worked well in the final months of the fiscal year, as high yield bonds struggled amid an increasingly risk-averse market backdrop. Similarly, we also purchased credit default swaps to help protect the Fund from falling prices in senior-loan bank debt — another category of security we believed was vulnerable.

Interest rate positioning is not typically a part of our overall portfolio management approach, but in late 2010, we identified a tactical need to make the Fund less sensitive to rising rates, given the increase in rates taking place at that time. Within several months, the potential for a further rate increase seemed reduced, and we once again attempted to make the portfolio somewhat more sensitive to interest rate movements by purchasing U.S. Treasury futures. We maintained this positioning throughout the rest of the Fund’s fiscal year.

Two more modest portfolio adjustments were to reduce the Fund’s allocation to U.S. financial company bonds — which we believed were potentially vulnerable to European debt troubles and a slowing U.S. economy — and to focus on higher-rated credits.

Adhering to our approach

At the end of the fiscal year, we believed the Fund’s relatively defensive positioning was appropriate, given the risks we saw to the global economy. Another risk on the horizon was the potential for investors to perceive deterioration in U.S. credit quality, which could lead to higher bond yields in the future.

Despite the uncertainty, we intend to continue following our overall investment approach, concentrating on fixed income securities that we believe offer good value relative to their risks. We continue to focus on high-quality corporate bonds and on certain international bonds issued by what we view as financially healthy nations, while remaining relatively underweight in U.S. government securities as of the end of the Fund’s fiscal year, whose performance potential we viewed as more limited as of that time.

3

| Performance summary | |

| Delaware Core Plus Bond Fund | July 31, 2011 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1, 2 | Average annual total returns through July 31, 2011 |

| | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Aug. 16, 1985) | | | | | | |

| Excluding sales charge | +6.32% | | +7.72% | | +5.81% | | n/a |

| Including sales charge | +1.50% | | +6.72% | | +5.32% | | n/a |

| Class B (Est. May 2, 1994) | | | | | | |

| Excluding sales charge | +5.53% | | +6.93% | | +5.20% | | n/a |

| Including sales charge | +1.53% | | +6.70% | | +5.20% | | n/a |

| Class C (Est. Nov. 29, 1995) | | | | | | |

| Excluding sales charge | +5.53% | | +6.95% | | +5.06% | | n/a |

| Including sales charge | +4.53% | | +6.95% | | +5.06% | | n/a |

| Class R (Est. June 2, 2003) | | | | | | |

| Excluding sales charge | +6.17% | | +7.50% | | n/a | | +4.99% |

| Including sales charge | +6.17% | | +7.50% | | n/a | | +4.99% |

| Institutional Class (Est. June 1, 1992) | | | | | | |

| Excluding sales charge | +6.58% | | +8.02% | | +6.12% | | n/a |

| Including sales charge | +6.58% | | +8.02% | | +6.12% | | n/a |

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table below. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from Nov. 26, 2010, through Nov. 28, 2011. Additionally, the Fund’s Class A shares are subject to a blended 12b-1 fee of 0.10% of average daily net assets on all shares acquired prior to June 1, 1992, and 0.30% of average daily net assets on all shares acquired on or after June 1, 1992. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

4

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% from Nov. 26, 2010, through Nov. 28, 2011.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

5

Performance summary

Delaware Core Plus Bond Fund

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

Per Standard & Poor’s credit rating agency, bonds rated below AAA, including A, are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in higher-rated categories, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics with BB indicating the least degree of speculation.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 0.65% of the Fund’s average daily net assets from Nov. 26, 2010, through Nov. 28, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/ or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | 1.34% | | 2.04% | | 2.04% | | 1.64% | | 1.04% |

| (without fee waivers) | | | | | | | | | |

| Net expenses | 0.90% | | 1.65% | | 1.65% | | 1.15% | | 0.65% |

| (including fee waivers, if any) | | | | | | | | | |

| Type of waiver | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

6

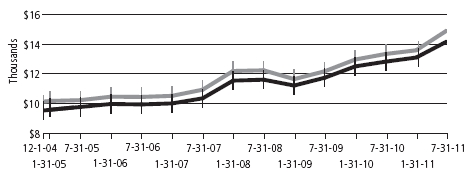

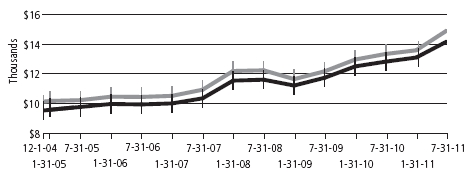

Performance of a $10,000 investment1

Average annual total returns from July 31, 2001, through July 31, 2011

| For period beginning July 31, 2001, through July 31, 2011 | Starting value | Ending value |

| | Barclays Capital U.S. Aggregate Index | $10,000 | $17,369 |

| | Delaware Core Plus Bond Fund — Class A Shares | $9,550 | $16,786 |

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on July 31, 2001, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 4 through 7.

The chart also assumes $10,000 invested in the Barclays Capital U.S. Aggregate Index as of July 31, 2001. The Barclays Capital U.S. Aggregate Index is a broad composite of more than 8,000 securities that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | DEGGX | | 246094205 | |

| Class B | | DEGBX | | 246094601 | |

| Class C | | DUGCX | | 246094700 | |

| Class R | | DUGRX | | 246094809 | |

| Institutional Class | | DUGIX | | 246094502 | |

7

Disclosure of Fund expenses

For the six-month period from February 1, 2011 to July 31, 2011

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from February 1, 2011 to July 31, 2011.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Core Plus Bond Fund

Expense Analysis of an Investment of $1,000

| | | Beginning | | Ending | | | | | Expenses |

| | | Account Value | | Account Value | | Annualized | | Paid During Period |

| | | 2/1/11 | | 7/31/11 | | Expense Ratio | | 2/1/11 to 7/31/11* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,047.50 | | | 0.90 | % | | $ | 4.57 | |

| Class B | | | 1,000.00 | | | | 1,043.70 | | | 1.65 | % | | | 8.36 | |

| Class C | | | 1,000.00 | | | | 1,043.70 | | | 1.65 | % | | | 8.36 | |

| Class R | | | 1,000.00 | | | | 1,047.40 | | | 1.15 | % | | | 5.84 | |

| Institutional Class | | | 1,000.00 | | | | 1,048.80 | | | 0.65 | % | | | 3.30 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.33 | | | 0.90 | % | | $ | 4.51 | |

| Class B | | | 1,000.00 | | | | 1,016.61 | | | 1.65 | % | | | 8.25 | |

| Class C | | | 1,000.00 | | | | 1,016.61 | | | 1.65 | % | | | 8.25 | |

| Class R | | | 1,000.00 | | | | 1,019.09 | | | 1.15 | % | | | 5.76 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.57 | | | 0.65 | % | | | 3.26 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

9

Security type/sector allocation

| Delaware Core Plus Bond Fund | As of July 31, 2011 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type/sector | Percentage of net assets |

| Agency Collateralized Mortgage Obligations | 3.13 | % |

| Agency Mortgage-Backed Securities | 15.27 | % |

| Commercial Mortgage-Backed Securities | 6.03 | % |

| Convertible Bonds | 0.44 | % |

| Corporate Bonds | 48.73 | % |

| Banking | 7.91 | % |

| Basic Industries | 5.07 | % |

| Brokerage | 0.52 | % |

| Capital Goods | 1.36 | % |

| Communications | 6.00 | % |

| Consumer Cyclical | 2.92 | % |

| Consumer Non-Cyclical | 6.02 | % |

| Electric | 4.13 | % |

| Energy | 3.95 | % |

| Finance Companies | 2.14 | % |

| Insurance | 1.46 | % |

| Natural Gas | 2.80 | % |

| Real Estate | 1.66 | % |

| Technology | 1.57 | % |

| Transportation | 1.22 | % |

| Non-Agency Asset-Backed Securities | 2.39 | % |

| Non-Agency Collateralized Mortgage Obligations | 0.89 | % |

| Regional Bonds | 0.97 | % |

| Senior Secured Loans | 3.42 | % |

| Sovereign Bonds | 4.54 | % |

| Supranational Banks | 0.35 | % |

| U.S. Treasury Obligations | 9.94 | % |

| Preferred Stock | 0.54 | % |

| Purchased Options | 0.02 | % |

10

| Security type/sector | Percentage of net assets |

| Short-Term Investments | 12.25 | % |

| Securities Lending Collateral | 6.27 | % |

| Total Value of Securities | 115.18 | % |

| Obligation to Return Securities Lending Collateral | (6.29 | %) |

| Other Liabilities Net of Receivables and Other Assets | (8.89 | %) |

| Total Net Assets | 100.00 | % |

11

Statement of net assets

| Delaware Core Plus Bond Fund | July 31, 2011 |

| | | Principal amount° | | Value (U.S. $) |

| Agency Collateralized Mortgage Obligations – 3.13% | | | | | | |

| | Fannie Mae Grantor Trust | | | | | | |

| | Series 2002-T1 A2 7.00% 11/25/31 | USD | | 88,111 | | $ | 104,540 |

| | Fannie Mae Interest Strip | | | | | | |

| | Series 35-2 12.00% 7/1/18 | | | 39,098 | | | 45,309 |

| | Fannie Mae REMICs | | | | | | |

| | Series 1988-15 A 9.00% 6/25/18 | | | 707 | | | 808 |

| | Series 1996-46 ZA 7.50% 11/25/26 | | | 97,399 | | | 109,499 |

| | Series 2002-83 GH 5.00% 12/25/17 | | | 465,000 | | | 507,088 |

| • | Fannie Mae Whole Loan | | | | | | |

| | Series 2002-W1 2A 7.158% 2/25/42 | | | 90,133 | | | 105,451 |

| | Freddie Mac REMICs | | | | | | |

| | Series 2557 WE 5.00% 1/15/18 | | | 300,000 | | | 330,306 |

| | Series 2662 MA 4.50% 10/15/31 | | | 45,765 | | | 47,221 |

| | Series 3131 MC 5.50% 4/15/33 | | | 200,000 | | | 218,579 |

| | Series 3173 PE 6.00% 4/15/35 | | | 325,000 | | | 363,520 |

| | Series 3337 PB 5.50% 7/15/30 | | | 172,608 | | | 174,714 |

| | Series 3656 PM 5.00% 4/15/40 | | | 235,000 | | | 254,315 |

| w | Freddie Mac Structured Pass Through Securities | | | | | | |

| | Series T-42 A5 7.50% 2/25/42 | | | 34,058 | | | 40,736 |

| | GNMA | | | | | | |

| | Series 2010-42 PC 5.00% 7/20/39 | | | 545,000 | | | 595,403 |

| | Series 2010-113 KE 4.50% 9/20/40 | | | 245,000 | | | 254,984 |

| | NCUA Guaranteed Notes | | | | | | |

| | Series 2010-C1 A2 2.90% 10/29/20 | | | 80,000 | | | 81,646 |

| Total Agency Collateralized Mortgage Obligations | | | | | | |

| | (cost $3,038,530) | | | | | | 3,234,119 |

| | | | | | | | |

| Agency Mortgage-Backed Securities – 15.27% | | | | | | |

| | Fannie Mae 10.50% 6/1/30 | | | 11,000 | | | 13,143 |

| • | Fannie Mae ARM | | | | | | |

| | 4.994% 8/1/35 | | | 72,555 | | | 77,636 |

| | 5.139% 11/1/35 | | | 94,446 | | | 100,742 |

| | 6.256% 7/1/36 | | | 189,479 | | | 206,459 |

| | Fannie Mae S.F. 15 yr | | | | | | |

| | 4.00% 7/1/25 to 11/1/25 | | | 1,003,786 | | | 1,054,942 |

| | 5.00% 5/1/21 | | | 152,570 | | | 165,055 |

| | 8.00% 10/1/16 | | | 71,797 | | | 78,445 |

12

| | | Principal amount° | | Value (U.S. $) |

| Agency Mortgage-Backed Securities (continued) | | | | | | |

| | Fannie Mae S.F. 15 yr TBA | | | | | | |

| | 3.50% 9/1/26 | USD | | 500,000 | | $ | 512,422 |

| | 4.50% 9/1/26 | | | 600,000 | | | 636,281 |

| | Fannie Mae S.F. 20 yr 5.50% 8/1/28 | | | 511,767 | | | 556,364 |

| | Fannie Mae S.F. 30 yr | | | | | | |

| | 5.00% 12/1/36 to 7/1/40 | | | 735,689 | | | 787,915 |

| | 6.00% 11/1/37 | | | 339,043 | | | 374,138 |

| | 8.00% 2/1/30 | | | 21,477 | | | 25,312 |

| | 10.00% 7/1/20 to 2/1/25 | | | 159,892 | | | 181,496 |

| | Fannie Mae S.F. 30 yr TBA | | | | | | |

| | 4.00% 9/1/41 | | | 1,500,000 | | | 1,518,281 |

| | 5.50% 9/1/41 | | | 2,340,000 | | | 2,529,760 |

| | 6.00% 9/1/41 | | | 4,990,000 | | | 5,474,772 |

| • | Freddie Mac ARM | | | | | | |

| | 5.181% 7/1/36 | | | 65,072 | | | 68,371 |

| | 5.808% 10/1/36 | | | 169,460 | | | 182,663 |

| | Freddie Mac S.F. 15 yr | | | | | | |

| | 4.50% 7/1/24 | | | 321,803 | | | 342,167 |

| | 5.00% 6/1/18 to 1/1/24 | | | 153,942 | | | 165,156 |

| | 5.50% 8/1/23 | | | 99,116 | | | 107,021 |

| | Freddie Mac S.F. 30 yr | | | | | | |

| | 8.00% 5/1/31 | | | 126,431 | | | 149,957 |

| | 10.00% 1/1/19 | | | 11,805 | | | 13,570 |

| | 11.50% 6/1/15 to 3/1/16 | | | 27,220 | | | 31,416 |

| | GNMA I GPM | | | | | | |

| | 11.00% 3/15/13 | | | 2,520 | | | 2,537 |

| | 12.25% 3/15/14 | | | 5,051 | | | 5,092 |

| | GNMA I S.F. 15 yr 6.50% 7/15/14 | | | 35,393 | | | 38,722 |

| | GNMA I S.F. 30 yr | | | | | | |

| | 7.50% 1/15/32 | | | 14,352 | | | 16,907 |

| | 8.00% 5/15/30 | | | 13,532 | | | 16,124 |

| | 9.50% 10/15/19 to 3/15/23 | | | 38,756 | | | 45,160 |

| | 10.00% 9/15/18 | | | 8,850 | | | 9,925 |

| | 11.00% 8/15/15 to 9/15/15 | | | 11,233 | | | 11,420 |

| | 11.50% 7/15/15 | | | 2,066 | | | 2,081 |

| | 12.00% 2/15/13 to 11/15/15 | | | 69,703 | | | 73,161 |

| | 12.50% 11/15/13 to 1/15/16 | | | 26,953 | | | 27,481 |

| | GNMA II GPM 10.75% 3/20/16 | | | 4,957 | | | 4,992 |

13

Statement of net assets

Delaware Core Plus Bond Fund

| | | Principal amount° | | Value (U.S. $) |

| Agency Mortgage-Backed Securities (continued) | | | | | | |

| | GNMA II S.F. 30 yr | | | | | | |

| | 7.50% 9/20/30 | USD | | 21,522 | | $ | 25,227 |

| | 8.00% 6/20/30 | | | 10,927 | | | 12,988 |

| | 10.00% 11/20/15 to 6/20/21 | | | 30,077 | | | 35,292 |

| | 10.50% 3/20/16 to 2/20/21 | | | 42,752 | | | 48,422 |

| | 11.00% 5/20/15 to 7/20/19 | | | 971 | | | 978 |

| | 12.00% 3/20/14 to 5/20/15 | | | 4,251 | | | 4,498 |

| | 12.50% 10/20/13 to 7/20/15 | | | 16,002 | | | 16,954 |

| Total Agency Mortgage-Backed Securities | | | | | | |

| | (cost $15,516,150) | | | | | | 15,751,445 |

| | | | | | | | |

| Commercial Mortgage-Backed Securities – 6.03% | | | | | | |

| # | American Tower Trust | | | | | | |

| | Series 2007-1A AFX 144A 5.42% 4/15/37 | | | 300,000 | | | 321,905 |

| | Bank of America Merrill Lynch Commercial | | | | | | |

| | Mortgage Securities | | | | | | |

| | •Series 2004-3 A5 5.536% 6/10/39 | | | 148,522 | | | 160,606 |

| | Series 2004-5 A3 4.561% 11/10/41 | | | 317,874 | | | 318,651 |

| | •Series 2005-1 A5 5.163% 11/10/42 | | | 80,000 | | | 87,225 |

| | •Series 2005-6 A4 5.195% 9/10/47 | | | 40,000 | | | 43,964 |

| | •Series 2006-2 A4 5.731% 5/10/45 | | | 115,000 | | | 128,180 |

| | Series 2006-4 A4 5.634% 7/10/46 | | | 200,000 | | | 219,347 |

| | Bear Stearns Commercial Mortgage Securities | | | | | | |

| | •Series 2005-T20 A4A 5.148% 10/12/42 | | | 60,000 | | | 65,951 |

| | •Series 2006-PW12 A4 5.72% 9/11/38 | | | 55,000 | | | 61,070 |

| | Series 2007-PW15 A4 5.331% 2/11/44 | | | 330,000 | | | 347,558 |

| # | CFCRE Commercial Mortgage Trust | | | | | | |

| | Series 2011-C1 A2 144A 3.759% 4/15/44 | | | 100,000 | | | 102,691 |

| w• | Commercial Mortgage Pass Through Certificates | | | | | | |

| | Series 2005-C6 A5A 5.116% 6/10/44 | | | 210,000 | | | 228,340 |

| • | Credit Suisse Mortgage Capital Certificates | | | | | | |

| | Series 2006-C1 AAB 5.422% 2/15/39 | | | 104,094 | | | 109,583 |

| #• | DBUBS Mortgage Trust | | | | | | |

| | Series 2011-LC1A C 144A 5.557% 11/10/46 | | | 100,000 | | | 96,307 |

| | Goldman Sachs Mortgage Securities II | | | | | | |

| | *•Series 2004-GG2 A6 5.396% 8/10/38 | | | 405,000 | | | 436,811 |

| | Series 2005-GG4 A4A 4.751% 7/10/39 | | | 350,000 | | | 373,600 |

14

| | | Principal amount° | | Value (U.S. $) |

| Commercial Mortgage-Backed Securities (continued) | | | | | | |

| | Goldman Sachs Mortgage Securities II (continued) | | | | | | |

| | •Series 2006-GG6 A4 5.553% 4/10/38 | USD | | 435,000 | | $ | 472,952 |

| | #Series 2010-C1 A2 144A 4.592% 8/10/43 | | | 145,000 | | | 148,033 |

| | #•Series 2010-C1 C 144A 5.635% 8/10/43 | | | 300,000 | | | 281,028 |

| • | Greenwich Capital Commercial Funding | | | | | | |

| | Series 2005-GG5 A5 5.224% 4/10/37 | | | 340,000 | | | 366,465 |

| • | JPMorgan Chase Commercial Mortgage Securities | | | | | | |

| | Series 2005-LDP4 A4 4.918% 10/15/42 | | | 125,000 | | | 135,315 |

| | Series 2005-LDP5 A4 5.205% 12/15/44 | | | 100,000 | | | 109,563 |

| | Lehman Brothers-UBS Commercial Mortgage | | | | | | |

| | Trust Series 2004-C1 A4 4.568% 1/15/31 | | | 180,000 | | | 190,257 |

| | Merrill Lynch Mortgage Trust | | | | | | |

| | Series 2005-CIP1 A2 4.96% 7/12/38 | | | 148,688 | | | 151,560 |

| | Morgan Stanley Capital I | | | | | | |

| | Series 2005-HQ6 A4A 4.989% 8/13/42 | | | 492,000 | | | 529,356 |

| | •Series 2007-T27 A4 5.641% 6/11/42 | | | 275,000 | | | 305,313 |

| # | OBP Depositor Trust | | | | | | |

| | Series 2010-OBP A 144A 4.646% 7/15/45 | | | 120,000 | | | 127,367 |

| # | TimberStar Trust | | | | | | |

| | Series 2006-1A A 144A 5.668% 10/15/36 | | | 155,000 | | | 170,364 |

| # | WF-RBS Commercial Mortgage Trust | | | | | | |

| | Series 2011-C3 A4 144A 4.375% 3/15/44 | | | 135,000 | | | 136,009 |

| Total Commercial Mortgage-Backed Securities | | | | | | |

| | (cost $5,414,062) | | | | | | 6,225,371 |

| | | | | | | | |

| Convertible Bonds – 0.44% | | | | | | |

| Φ | Hologic 2.00% exercise price $38.59, | | | | | | |

| | expiration date 12/15/37 | | | 170,000 | | | 164,263 |

| | Linear Technology 3.00% exercise price $44.11, | | | | | | |

| | expiration date 5/1/27 | | | 225,000 | | | 234,562 |

| | Transocean 1.50% exercise price $166.65, | | | | | | |

| | expiration date 12/15/37 | | | 60,000 | | | 60,075 |

| Total Convertible Bonds (cost $412,084) | | | | | | 458,900 |

15

Statement of net assets

Delaware Core Plus Bond Fund

| | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds – 48.73% | | | | | | |

| Banking – 7.91% | | | | | | |

| | Abbey National Treasury Services | | | | | | |

| | 4.00% 4/27/16 | USD | | 120,000 | | $ | 117,646 |

| # | Bank Nederlandse Gemeenten | | | | | | |

| | 144A 4.375% 2/16/21 | | | 340,000 | | | 362,223 |

| # | Bank of Montreal 144A 2.625% 1/25/16 | | | 250,000 | | | 258,036 |

| | BB&T 5.25% 11/1/19 | | | 227,000 | | | 243,810 |

| • | BB&T Capital Trust IV 6.82% 6/12/57 | | | 250,000 | | | 254,063 |

| • | Bear Stearns 5.44% 12/7/12 | AUD | | 200,000 | | | 217,887 |

| • | Branch Banking & Trust 0.57% 9/13/16 | USD | | 280,000 | | | 259,633 |

| *# | Canadian Imperial Bank of Commerce | | | | | | |

| | 144A 2.75% 1/27/16 | | | 200,000 | | | 207,588 |

| | Capital One Financial 4.75% 7/15/21 | | | 100,000 | | | 101,281 |

| | City National 5.25% 9/15/20 | | | 160,000 | | | 167,325 |

| @# | CoBank 144A 7.875% 4/16/18 | | | 250,000 | | | 295,508 |

| # | Export-Import Bank of Korea | | | | | | |

| | 144A 5.25% 2/10/14 | | | 125,000 | | | 135,062 |

| | Fifth Third Bancorp 3.625% 1/25/16 | | | 220,000 | | | 225,785 |

| • | Fifth Third Capital Trust IV 6.50% 4/15/37 | | | 70,000 | | | 68,600 |

| | Goldman Sachs Group | | | | | | |

| | 5.25% 7/27/21 | | | 150,000 | | | 153,415 |

| | 5.375% 3/15/20 | | | 60,000 | | | 62,331 |

| # | HSBC Bank 144A 3.10% 5/24/16 | | | 205,000 | | | 207,716 |

| | JPMorgan Chase 5.60% 7/15/41 | | | 240,000 | | | 243,077 |

| | JPMorgan Chase Bank 6.00% 10/1/17 | | | 250,000 | | | 281,949 |

| | JPMorgan Chase Capital XXV 6.80% 10/1/37 | | | 271,000 | | | 275,570 |

| | KeyBank 5.45% 3/3/16 | | | 250,000 | | | 276,797 |

| | KeyCorp 5.10% 3/24/21 | | | 280,000 | | | 293,500 |

| | Korea Development Bank 8.00% 1/23/14 | | | 195,000 | | | 222,763 |

| | PNC Bank 6.875% 4/1/18 | | | 250,000 | | | 299,966 |

| | PNC Funding | | | | | | |

| | 5.125% 2/8/20 | | | 210,000 | | | 229,470 |

| | 5.25% 11/15/15 | | | 225,000 | | | 248,406 |

| #• | Rabobank 144A 11.00% 12/29/49 | | | 135,000 | | | 172,964 |

| • | SunTrust Capital VIII 6.10% 12/15/36 | | | 240,000 | | | 234,742 |

| | SVB Financial Group 5.375% 9/15/20 | | | 150,000 | | | 154,880 |

| | U.S. Bank North America 4.95% 10/30/14 | | | 250,000 | | | 275,889 |

| • | USB Capital IX 3.50% 4/15/49 | | | 595,000 | | | 487,143 |

16

| | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | |

| Banking (continued) | | | | | | |

| | Wachovia | | | | | | |

| | •0.619% 10/15/16 | USD | | 95,000 | | $ | 88,889 |

| | 5.25% 8/1/14 | | | 105,000 | | | 113,676 |

| | Wachovia Bank North America 5.60% 3/15/16 | | | 265,000 | | | 292,528 |

| | Wells Fargo 4.60% 4/1/21 | | | 160,000 | | | 166,866 |

| • | Wells Fargo Capital XIII 7.70% 12/29/49 | | | 240,000 | | | 248,700 |

| | Zions Bancorporation | | | | | | |

| | 5.50% 11/16/15 | | | 150,000 | | | 156,115 |

| | *7.75% 9/23/14 | | | 55,000 | | | 60,639 |

| | | | | | | | 8,162,438 |

| Basic Industries – 5.07% | | | | | | |

| * | AK Steel 7.625% 5/15/20 | | | 235,000 | | | 241,463 |

| | Alcoa 6.75% 7/15/18 | | | 325,000 | | | 371,174 |

| | ArcelorMittal 9.85% 6/1/19 | | | 610,000 | | | 795,100 |

| # | Barrick North America Finance 144A | | | | | | |

| | 5.70% 5/30/41 | | | 185,000 | | | 190,875 |

| | CF Industries 7.125% 5/1/20 | | | 100,000 | | | 117,500 |

| # | Codelco 144A 3.75% 11/4/20 | | | 1,161,000 | | | 1,161,990 |

| | Dow Chemical | | | | | | |

| | 4.25% 11/15/20 | | | 229,000 | | | 235,487 |

| | 8.55% 5/15/19 | | | 379,000 | | | 501,448 |

| | duPont (E.I.) deNemours 3.625% 1/15/21 | | | 205,000 | | | 208,234 |

| | Georgia-Pacific | | �� | | | | |

| | 8.00% 1/15/24 | | | 170,000 | | | 210,067 |

| | #144A 5.40% 11/1/20 | | | 195,000 | | | 206,655 |

| * | Hexion Finance 8.875% 2/1/18 | | | 160,000 | | | 170,400 |

| * | International Paper 9.375% 5/15/19 | | | 160,000 | | | 211,863 |

| | Novelis 8.75% 12/15/20 | | | 135,000 | | | 150,863 |

| | Southern Copper 7.50% 7/27/35 | | | 200,000 | | | 227,097 |

| | Teck Resources | | | | | | |

| | 4.75% 1/15/22 | | | 45,000 | | | 47,082 |

| | 6.25% 7/15/41 | | | 105,000 | | | 113,050 |

| | 9.75% 5/15/14 | | | 54,000 | | | 65,857 |

| | | | | | | | 5,226,205 |

| Brokerage – 0.52% | | | | | | |

| | Jefferies Group | | | | | | |

| | 6.25% 1/15/36 | | | 40,000 | | | 38,583 |

| | 6.45% 6/8/27 | | | 275,000 | | | 279,290 |

17

Statement of net assets

Delaware Core Plus Bond Fund

| | | Principal amount° | | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | |

| Brokerage (continued) | | | | | | |

| | Lazard Group 6.85% 6/15/17 | USD | | 196,000 | | $ | 220,223 |

| | | | | | | | 538,096 |

| Capital Goods – 1.36% | | | | | | |

| # | ABB Treasury Center USA 144A 4.00% 6/15/21 | | | 70,000 | | | 70,979 |

| * | Ball 5.75% 5/15/21 | | | 495,000 | | | 501,188 |

| #• | Cemex 144A 5.246% 9/30/15 | | | 150,000 | | | 138,750 |

| # | Meccanica Holdings USA 144A 6.25% 7/15/19 | | | 280,000 | | | 293,771 |

| | Republic Services | | | | | | |

| | 4.75% 5/15/23 | | | 80,000 | | | 82,711 |

| | 5.25% 11/15/21 | | | 105,000 | | | 114,600 |

| # | Votorantim Cimentos 144A 7.25% 4/5/41 | | | 200,000 | | | 202,760 |

| | | | | | | | 1,404,759 |

| Communications – 6.00% | | | | | | |

| | America Movil 5.00% 3/30/20 | | | 285,000 | | | 309,847 |

| | AT&T 4.45% 5/15/21 | | | 125,000 | | | 132,438 |

| | CenturyLink 6.45% 6/15/21 | | | 165,000 | | | 170,479 |

| # | Clearwire Communications 144A | | | | | | |

| | 12.00% 12/1/15 | | | 220,000 | | | 225,775 |

| | Cricket Communications 7.75% 10/15/20 | | | 150,000 | | | 149,250 |

| # | Crown Castle Towers 144A 4.883% 8/15/20 | | | 915,000 | | | 945,952 |

| | CSC Holdings 8.50% 6/15/15 | | | 135,000 | | | 146,475 |

| | DIRECTV Holdings 5.00% 3/1/21 | | | 190,000 | | | 203,148 |

| | Discovery Communications 4.375% 6/15/21 | | | 240,000 | | | 247,903 |

| | DISH 7.875% 9/1/19 | | | 115,000 | | | 126,931 |

| | Intelsat Bermuda 11.25% 2/4/17 | | | 525,000 | | | 563,063 |

| # | NBC Universal Media 144A 4.375% 4/1/21 | | | 205,000 | | | 209,977 |

| | Qwest 8.375% 5/1/16 | | | 345,000 | | | 410,550 |

| * | Sprint Nextel | | | | | | |

| | 6.00% 12/1/16 | | | 110,000 | | | 110,550 |

| | 8.375% 8/15/17 | | | 130,000 | | | 142,675 |

| | Telecom Italia Capital 5.25% 10/1/15 | | | 120,000 | | | 120,155 |

| | Telefonica Emisiones | | | | | | |

| | 5.462% 2/16/21 | | | 115,000 | | | 115,540 |

| | 6.421% 6/20/16 | | | 190,000 | | | 208,762 |

| | Time Warner Cable 8.25% 4/1/19 | | | 200,000 | | | 256,694 |

| # | UPCB Finance III 144A 6.625% 7/1/20 | | | 250,000 | | | 251,875 |

| # | VimpelCom Holdings 144A 7.504% 3/1/22 | | | 200,000 | | | 200,500 |

18

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Communications (continued) | | | | | | | |

| | Virgin Media Secured Finance 6.50% 1/15/18 | | USD | | 500,000 | | $ | 552,500 |

| # | Vivendi 144A 6.625% 4/4/18 | | | | 247,000 | | | 284,173 |

| # | Wind Acquisition Finance 144A 11.75% 7/15/17 | | | | 95,000 | | | 105,806 |

| | | | | | | | | 6,191,018 |

| Consumer Cyclical – 2.92% | | | | | | | |

| | CVS Caremark 5.75% 5/15/41 | | | | 225,000 | | | 235,138 |

| # | Delphi 144A 6.125% 5/15/21 | | | | 100,000 | | | 101,500 |

| | Family Dollar Stores 5.00% 2/1/21 | | | | 90,000 | | | 90,148 |

| | Ford Motor Credit | | | | | | | |

| | 5.00% 5/15/18 | | | | 200,000 | | | 201,589 |

| | 12.00% 5/15/15 | | | | 200,000 | | | 251,308 |

| # | FUEL Trust 144A 3.984% 6/15/16 | | | | 200,000 | | | 202,020 |

| * | Goodyear Tire & Rubber 8.25% 8/15/20 | | | | 200,000 | | | 220,500 |

| | Hanesbrands 6.375% 12/15/20 | | | | 145,000 | | | 145,000 |

| | Historic TW 6.875% 6/15/18 | | | | 185,000 | | | 222,083 |

| | Host Hotels & Resorts | | | | | | | |

| | *6.00% 11/1/20 | | | | 95,000 | | | 97,731 |

| | #144A 5.875% 6/15/19 | | | | 75,000 | | | 76,219 |

| # | Hyundai Capital Services 144A 4.375% 7/27/16 | | | | 260,000 | | | 272,002 |

| | Macy’s Retail Holdings 5.90% 12/1/16 | | | | 154,000 | | | 175,726 |

| | MGM Resorts International | | | | | | | |

| | 11.125% 11/15/17 | | | | 215,000 | | | 248,862 |

| | 11.375% 3/1/18 | | | | 125,000 | | | 145,625 |

| | 13.00% 11/15/13 | | | | 55,000 | | | 65,863 |

| * | Time Warner 4.75% 3/29/21 | | | | 60,000 | | | 63,189 |

| | Wyndham Worldwide | | | | | | | |

| | 5.625% 3/1/21 | | | | 90,000 | | | 92,320 |

| | 5.75% 2/1/18 | | | | 105,000 | | | 111,242 |

| | | | | | | | | 3,018,065 |

| Consumer Non-Cyclical – 6.02% | | | | | | | |

| | Amgen | | | | | | | |

| | 3.45% 10/1/20 | | | | 280,000 | | | 276,135 |

| | 4.10% 6/15/21 | | | | 100,000 | | | 102,880 |

| | Anheuser-Busch InBev Worldwide | | | | | | | |

| | 5.375% 11/15/14 | | | | 205,000 | | | 231,585 |

| | Bio-Rad Laboratories 4.875% 12/15/20 | | | | 115,000 | | | 119,057 |

19

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Consumer Non-Cyclical (continued) | | | | | | | |

| # | Bumble Bee Acquisition 144A 9.00% 12/15/17 | | USD | | 90,000 | | $ | 91,238 |

| | CareFusion 6.375% 8/1/19 | | | | 475,000 | | | 551,609 |

| | Celgene | | | | | | | |

| | 2.45% 10/15/15 | | | | 60,000 | | | 60,808 |

| | 3.95% 10/15/20 | | | | 190,000 | | | 191,041 |

| | Coca-Cola Enterprises 3.50% 9/15/20 | | | | 275,000 | | | 273,336 |

| | Covidien International Finance 4.20% 6/15/20 | | | | 520,000 | | | 545,985 |

| # | Del Monte Foods 144A 7.625% 2/15/19 | | | | 90,000 | | | 93,038 |

| | Express Scripts 3.125% 5/15/16 | | | | 195,000 | | | 199,456 |

| | HCA PIK 9.625% 11/15/16 | | | | 91,000 | | | 97,598 |

| | Hospira 6.40% 5/15/15 | | | | 380,000 | | | 436,759 |

| | Kraft Foods 6.125% 8/23/18 | | | | 180,000 | | | 213,038 |

| | McKesson 4.75% 3/1/21 | | | | 235,000 | | | 255,968 |

| | Medco Health Solutions | | | | | | | |

| | 4.125% 9/15/20 | | | | 100,000 | | | 99,373 |

| | 7.125% 3/15/18 | | | | 460,000 | | | 550,855 |

| # | Mylan 144A 6.00% 11/15/18 | | | | 245,000 | | | 251,738 |

| # | Pernod-Ricard 144A 5.75% 4/7/21 | | | | 175,000 | | | 189,976 |

| | Quest Diagnostics | | | | | | | |

| | 4.70% 4/1/21 | | | | 175,000 | | | 185,765 |

| | 4.75% 1/30/20 | | | | 25,000 | | | 26,770 |

| * | Sara Lee 4.10% 9/15/20 | | | | 67,000 | �� | | 65,857 |

| | Whirlpool 4.85% 6/15/21 | | | | 160,000 | | | 163,413 |

| # | Woolworths 144A | | | | | | | |

| | 3.15% 4/12/16 | | | | 155,000 | | | 160,105 |

| | 4.55% 4/12/21 | | | | 160,000 | | | 167,949 |

| | Yale University 2.90% 10/15/14 | | | | 250,000 | | | 264,636 |

| | Zimmer Holdings 4.625% 11/30/19 | | | | 320,000 | | | 344,401 |

| | | | | | | | | 6,210,369 |

| Electric – 4.13% | | | | | | | |

| | Ameren Illinois 9.75% 11/15/18 | | | | 769,000 | | | 1,029,861 |

| # | American Transmission Systems | | | | | | | |

| | 144A 5.25% 1/15/22 | | | | 190,000 | | | 207,100 |

| | CenterPoint Energy 5.95% 2/1/17 | | | | 140,000 | | | 160,297 |

| | CMS Energy | | | | | | | |

| | 4.25% 9/30/15 | | | | 95,000 | | | 99,560 |

| | 6.25% 2/1/20 | | | | 635,000 | | | 696,097 |

20

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Electric (continued) | | | | | | | |

| | Commonwealth Edison | | | | | | | |

| | 4.00% 8/1/20 | | USD | | 45,000 | | $ | 45,997 |

| | 5.80% 3/15/18 | | | | 60,000 | | | 68,933 |

| | Duke Energy Carolinas 3.90% 6/15/21 | | | | 105,000 | | | 109,112 |

| | Florida Power 5.65% 6/15/18 | | | | 55,000 | | | 64,063 |

| | Great Plains Energy 4.85% 6/1/21 | | | | 195,000 | | | 202,271 |

| *# | Ipalco Enterprises 144A 5.00% 5/1/18 | | | | 75,000 | | | 74,623 |

| | Jersey Central Power & Light 5.625% 5/1/16 | | | | 75,000 | | | 85,555 |

| | Pennsylvania Electric 5.20% 4/1/20 | | | | 175,000 | | | 190,529 |

| | Public Service Electric & Gas 3.50% 8/15/20 | | | | 125,000 | | | 126,958 |

| | Public Service of Oklahoma 5.15% 12/1/19 | | | | 215,000 | | | 237,514 |

| # | Puget Energy 144A 6.00% 9/1/21 | | | | 100,000 | | | 101,848 |

| • | Puget Sound Energy 6.974% 6/1/67 | | | | 240,000 | | | 248,087 |

| | Southern California Edison 5.50% 8/15/18 | | | | 250,000 | | | 290,602 |

| • | Wisconsin Energy 6.25% 5/15/67 | | | | 220,000 | | | 222,026 |

| | | | | | | | | 4,261,033 |

| Energy – 3.95% | | | | | | | |

| | Chesapeake Energy | | | | | | | |

| | 6.125% 2/15/21 | | | | 130,000 | | | 136,013 |

| | 6.625% 8/15/20 | | | | 14,000 | | | 15,190 |

| | 6.875% 11/15/20 | | | | 14,000 | | | 15,260 |

| | 9.50% 2/15/15 | | | | 70,000 | | | 82,600 |

| # | CNOOC Finance 2011 144A 4.25% 1/26/21 | | | | 225,000 | | | 228,902 |

| | Ecopetrol 7.625% 7/23/19 | | | | 43,000 | | | 52,460 |

| # | ENI 144A 4.15% 10/1/20 | | | | 140,000 | | | 134,536 |

| | Noble Energy 8.25% 3/1/19 | | | | 385,000 | | | 504,945 |

| | Pemex Project Funding Master Trust | | | | | | | |

| | 6.625% 6/15/35 | | | | 90,000 | | | 98,533 |

| | Petrobras International Finance | | | | | | | |

| | 5.375% 1/27/21 | | | | 160,000 | | | 171,217 |

| | 5.75% 1/20/20 | | | | 40,000 | | | 44,061 |

| | 5.875% 3/1/18 | | | | 45,000 | | | 50,328 |

| | PetroHawk Energy 7.25% 8/15/18 | | | | 235,000 | | | 274,363 |

| | Pride International 6.875% 8/15/20 | | | | 475,000 | | | 572,548 |

| | Range Resources 8.00% 5/15/19 | | | | 220,000 | | | 244,200 |

| | SandRidge Energy 8.75% 1/15/20 | | | | 235,000 | | | 259,088 |

| | Transocean 6.50% 11/15/20 | | | | 350,000 | | | 411,389 |

| | Weatherford International 9.625% 3/1/19 | | | | 150,000 | | | 201,089 |

21

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Energy (continued) | | | | | | | |

| | Williams | | | | | | | |

| | 7.75% 6/15/31 | | USD | | 50,000 | | $ | 60,455 |

| | 8.75% 3/15/32 | | | | 60,000 | | | 79,003 |

| # | Woodside Finance 144A | | | | | | | |

| | 8.125% 3/1/14 | | | | 280,000 | | | 324,215 |

| | 8.75% 3/1/19 | | | | 85,000 | | | 110,080 |

| | | | | | | | | 4,070,475 |

| Finance Companies – 2.14% | | | | | | | |

| # | CDP Financial 144A | | | | | | | |

| | 4.40% 11/25/19 | | | | 280,000 | | | 296,408 |

| | 5.60% 11/25/39 | | | | 250,000 | | | 270,891 |

| | General Electric Capital | | | | | | | |

| | 4.375% 9/16/20 | | | | 80,000 | | | 81,425 |

| | 5.30% 2/11/21 | | | | 145,000 | | | 154,852 |

| | 6.00% 8/7/19 | | | | 765,000 | | | 866,299 |

| #• | ILFC E-Capital Trust II 144A 6.25% 12/21/65 | | | | 210,000 | | | 180,600 |

| | International Lease Finance | | | | | | | |

| | 6.25% 5/15/19 | | | | 88,000 | | | 87,949 |

| | *8.75% 3/15/17 | | | | 100,000 | | | 112,000 |

| | PHH 9.25% 3/1/16 | | | | 145,000 | | | 159,500 |

| | | | | | | | | 2,209,924 |

| Insurance – 1.46% | | | | | | | |

| | American International Group 8.25% 8/15/18 | | | | 250,000 | | | 297,137 |

| • | Chubb 6.375% 3/29/67 | | | | 270,000 | | | 280,125 |

| | Coventry Health Care 5.45% 6/15/21 | | | | 155,000 | | | 164,358 |

| # | Highmark 144A | | | | | | | |

| | 4.75% 5/15/21 | | | | 130,000 | | | 132,870 |

| | 6.125% 5/15/41 | | | | 30,000 | | | 31,406 |

| • | ING Groep 5.775% 12/29/49 | | | | 85,000 | | | 77,350 |

| | MetLife 6.817% 8/15/18 | | | | 220,000 | | | 263,507 |

| | Prudential Financial | | | | | | | |

| | 3.875% 1/14/15 | | | | 65,000 | | | 68,917 |

| | 4.50% 11/15/20 | | | | 50,000 | | | 51,653 |

| | 6.00% 12/1/17 | | | | 120,000 | | | 138,264 |

| w#=‡@ | Twin Reefs Pass Through Trust | | | | | | | |

| | 144A 0.00% 12/31/49 | | | | 200,000 | | | 0 |

| | | | | | | | | 1,505,587 |

22

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Natural Gas – 2.80% | | | | | | | |

| | El Paso Pipeline Partners Operating | | | | | | | |

| | 6.50% 4/1/20 | | USD | | 110,000 | | $ | 127,004 |

| • | Enbridge Energy Partners 8.05% 10/1/37 | | | | 200,000 | | | 220,351 |

| | Energy Transfer Partners | | | | | | | |

| | 4.65% 6/1/21 | | | | 75,000 | | | 75,122 |

| | 9.70% 3/15/19 | | | | 285,000 | | | 370,051 |

| | Enterprise Products Operating | | | | | | | |

| | •7.034% 1/15/68 | | | | 280,000 | | | 295,432 |

| | 9.75% 1/31/14 | | | | 130,000 | | | 156,045 |

| | Kinder Morgan Energy Partners | | | | | | | |

| | 9.00% 2/1/19 | | | | 340,000 | | | 445,332 |

| | NiSource Finance | | | | | | | |

| | 6.40% 3/15/18 | | | | 115,000 | | | 132,866 |

| | 6.80% 1/15/19 | | | | 115,000 | | | 136,641 |

| | Plains All American Pipeline 8.75% 5/1/19 | | | | 195,000 | | | 251,952 |

| | Sempra Energy 6.15% 6/15/18 | | | | 175,000 | | | 203,336 |

| | TC Pipelines 4.65% 6/15/21 | | | | 100,000 | | | 103,371 |

| | TransCanada Pipelines | | | | | | | |

| | *3.80% 10/1/20 | | | | 100,000 | | | 102,346 |

| | •6.35% 5/15/67 | | | | 260,000 | | | 266,639 |

| | | | | | | | | 2,886,488 |

| Real Estate – 1.66% | | | | | | | |

| | Brandywine Operating Partnership | | | | | | | |

| | 4.95% 4/15/18 | | | | 140,000 | | | 145,503 |

| | Developers Diversified Realty | | | | | | | |

| | *4.75% 4/15/18 | | | | 80,000 | | | 81,239 |

| | 7.875% 9/1/20 | | | | 90,000 | | | 106,681 |

| | 9.625% 3/15/16 | | | | 150,000 | | | 183,724 |

| | Digital Realty Trust | | | | | | | |

| | 5.25% 3/15/21 | | | | 195,000 | | | 199,601 |

| | 5.875% 2/1/20 | | | | 95,000 | | | 102,413 |

| | Health Care REIT 5.25% 1/15/22 | | | | 285,000 | | | 295,956 |

| | Regency Centers | | | | | | | |

| | 4.80% 4/15/21 | | | | 55,000 | | | 57,106 |

| | 5.875% 6/15/17 | | | | 95,000 | | | 107,336 |

| | UDR 4.25% 6/1/18 | | | | 75,000 | | | 76,285 |

| | Ventas Realty 4.75% 6/1/21 | | | | 160,000 | | | 162,779 |

| # | WEA Finance 144A 4.625% 5/10/21 | | | | 190,000 | | | 192,179 |

| | | | | | | | | 1,710,802 |

23

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Corporate Bonds (continued) | | | | | | | |

| Technology – 1.57% | | | | | | | |

| | GXS Worldwide 9.75% 6/15/15 | | USD | | 240,000 | | $ | 243,600 |

| | Hewlett-Packard 4.30% 6/1/21 | | | | 395,000 | | | 417,432 |

| | National Semiconductor 6.60% 6/15/17 | | | | 255,000 | | | 307,645 |

| # | Seagate Technology International | | | | | | | |

| | 144A 10.00% 5/1/14 | | | | 121,000 | | | 139,755 |

| | Symantec 4.20% 9/15/20 | | | | 125,000 | | | 124,733 |

| | Xerox 4.50% 5/15/21 | | | | 375,000 | | | 387,031 |

| | | | | | | | | 1,620,196 |

| Transportation – 1.22% | | | | | | | |

| # | Brambles USA 144A | | | | | | | |

| | 3.95% 4/1/15 | | | | 125,000 | | | 130,648 |

| | 5.35% 4/1/20 | | | | 205,000 | | | 215,435 |

| | Burlington Northern Santa Fe | | | | | | | |

| | 4.70% 10/1/19 | | | | 115,000 | | | 125,589 |

| | 5.75% 3/15/18 | | | | 15,000 | | | 17,353 |

| | CSX | | | | | | | |

| | 4.25% 6/1/21 | | | | 155,000 | | | 160,693 |

| | 5.50% 4/15/41 | | | | 30,000 | | | 31,156 |

| # | ERAC USA Finance 144A 5.25% 10/1/20 | | | | 370,000 | | | 402,852 |

| | Ryder System 3.50% 6/1/17 | | | | 165,000 | | | 170,241 |

| | | | | | | | | 1,253,967 |

| Total Corporate Bonds (cost $48,013,012) | | | | | | | 50,269,422 |

| | | | | | | | | |

| Non-Agency Asset-Backed Securities – 2.39% | | | | | | | |

| • | Ally Master Owner Trust | | | | | | | |

| | Series 2011-1 A1 1.057% 1/15/16 | | | | 140,000 | | | 141,031 |

| # | Avis Budget Rental Car Funding | | | | | | | |

| | Series 2011-2A A 144A 2.37% 11/20/14 | | | | 135,000 | | | 137,142 |

| • | Bank of America Credit Card Trust | | | | | | | |

| | Series 2007-A9 A9 0.227% 11/17/14 | | | | 90,000 | | | 89,949 |

| | Capital Auto Receivables Asset Trust | | | | | | | |

| | Series 2008-1 A3A 3.86% 8/15/12 | | | | 1,959 | | | 1,962 |

| • | Capital One Multi-Asset Execution Trust | | | | | | | |

| | Series 2007-A4 A4 0.217% 3/16/15 | | | | 400,000 | | | 399,642 |

| # | CIT Equipment Collateral 144A | | | | | | | |

| | Series 2009-VT1 A3 3.07% 8/15/16 | | | | 33,965 | | | 34,115 |

| | Series 2010-VT1A A3 2.41% 5/15/13 | | | | 100,000 | | | 100,056 |

24

| | | | Principal amount° | | Value (U.S. $) |

| Non-Agency Asset-Backed Securities (continued) | | | | | | | |

| | Citibank Credit Card Issuance Trust | | | | | | | |

| | Series 2007-A3 A3 6.15% 6/15/39 | | USD | | 135,000 | | $ | 160,533 |

| | Citicorp Residential Mortgage Securities | | | | | | | |

| | Series 2006-3 A5 5.948% 11/25/36 | | | | 300,000 | | | 241,424 |

| | Discover Card Master Trust | | | | | | | |

| | Series 2007-A1 A1 5.65% 3/16/20 | | | | 190,000 | | | 224,156 |

| # | Ford Auto Securitization Trust | | | | | | | |

| | Series 2011-R1A A3 144A 3.02% 2/15/16 | | CAD | | 100,000 | | | 105,381 |

| • | Ford Credit Floorplan Master Owner Trust | | | | | | | |

| | Series 2009-2 A 1.737% 9/15/14 | | USD | | 100,000 | | | 101,263 |

| # | Great America Leasing Receivables | | | | | | | |

| | Series 2011-1 A3 144A 1.69% 2/15/14 | | | | 160,000 | | | 161,290 |

| | Harley Davidson Motorcycle Trust | | | | | | | |

| | Series 2008-1 A4 4.90% 12/15/13 | | | | 107,386 | | | 109,510 |

| | Series 2009-4 A3 1.87% 2/15/14 | | | | 81,052 | | | 81,357 |

| | John Deere Owner Trust | | | | | | | |

| | Series 2010-A A4 2.13% 10/17/16 | | | | 155,000 | | | 158,733 |

| | Series 2011-A A4 1.96% 4/16/18 | | | | 145,000 | | | 148,334 |

| • | MBNA Credit Card Master Note Trust | | | | | | | |

| | Series 2005-A2 A2 0.267% 10/15/14 | | | | 50,000 | | | 49,992 |

| • | Merrill Auto Trust Securitization | | | | | | | |

| | Series 2007-1 A4 0.247% 12/15/13 | | | | 22,761 | | | 22,757 |

| Total Non-Agency Asset-Backed Securities | | | | | | | |

| | (cost $2,414,892) | | | | | | | 2,468,627 |

| | | | | | | | | |

| Non-Agency Collateralized Mortgage Obligations – 0.89% | | | | | | | |

| | American Home Mortgage Investment Trust | | | | | | | |

| | Series 2005-2 5A1 5.064% 9/25/35 | | | | 20,133 | | | 18,524 |

| •@ | Bank of America Funding | | | | | | | |

| | Series 2006-H 1A2 2.839% 9/20/46 | | | | 6,677 | | | 454 |

| | Citicorp Mortgage Securities | | | | | | | |

| | Series 2006-4 3A1 5.50% 8/25/21 | | | | 30,337 | | | 30,563 |

| | First Horizon Asset Securities | | | | | | | |

| | Series 2006-3 1A11 6.25% 11/25/36 | | | | 37,869 | | | 37,500 |

| •# | GSMPS Mortgage Loan Trust 144A | | | | | | | |

| | Series 1998-2 A 7.75% 5/19/27 | | | | 102,995 | | | 107,660 |

| | Series 1999-3 A 8.00% 8/19/29 | | | | 218,053 | | | 219,755 |

| • | JPMorgan Mortgage Trust | | | | | | | |

| | Series 2007-A1 7A4 5.218% 7/25/35 | | | | 348,035 | | | 156,888 |

25

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Non-Agency Collateralized Mortgage Obligations (continued) | | | | | | | |

| | Lehman Mortgage Trust | | | | | | | |

| | Series 2005-2 2A3 5.50% 12/25/35 | | USD | | 35,933 | | $ | 35,013 |

| # | MASTR Reperforming Loan Trust | | | | | | | |

| | Series 2005-1 1A5 144A 8.00% 8/25/34 | | | | 194,278 | | | 197,530 |

| w | Washington Mutual Alternative Mortgage | | | | | | | |

| | Pass Through Certificates | | | | | | | |

| | Series 2005-1 5A2 6.00% 3/25/35 | | | | 149,121 | | | 93,148 |

| • | Wells Fargo Mortgage Backed Securities Trust | | | | | | | |

| | Series 2006-AR5 2A1 2.74% 4/25/36 | | | | 35,078 | | | 27,861 |

| Total Non-Agency Collateralized | | | | | | | |

| | Mortgage Obligations (cost $1,192,811) | | | | | | | 924,896 |

| | | | | | | | | |

| Regional Bonds – 0.97%Δ | | | | | | | |

| Australia – 0.21% | | | | | | | |

| | New South Wales Treasury 6.00% 5/1/20 | | AUD | | 192,000 | | | 219,817 |

| | | | | | | | | 219,817 |

| Canada – 0.76% | | | | | | | |

| | Province of New Brunswick 2.75% 6/15/18 | | USD | | 175,000 | | | 176,902 |

| | Province of Ontario | | | | | | | |

| | 2.30% 5/10/16 | | | | 255,000 | | | 260,999 |

| | 3.00% 7/16/18 | | | | 280,000 | | | 285,183 |

| | Province of Quebec 4.50% | | | | | | | |

| | 4.50% 12/1/19 | | CAD | | 19,000 | | | 21,579 |

| | 4.50% 12/1/20 | | CAD | | 30,000 | | | 33,887 |

| | | | | | | | | 778,550 |

| Total Regional Bonds (cost $936,356) | | | | | | | 998,367 |

| | | | | | | | | |

| «Senior Secured Loans – 3.42% | | | | | | | |

| | Alliance HealthCare Services 5.50% 6/1/16 | | USD | | 99,244 | | | 99,017 |

| | API Technologies Tranche B 3.496% 6/1/16 | | | | 55,000 | | | 54,175 |

| | ATI Holdings 7.50% 3/12/16 | | | | 181,625 | | | 180,792 |

| | BNY ConvergEx Group | | | | | | | |

| | 7.50% 12/16/17 | | | | 70,442 | | | 72,145 |

| | (Eze Castle Software) 8.75% 11/29/17 | | | | 29,558 | | | 30,272 |

| | Brickman Group Holdings Tranche B | | | | | | | |

| | 7.25% 10/14/16 | | | | 99,500 | | | 100,899 |

| | Burlington Coat Factory Warehouse | | | | | | | |

| | Tranche B 6.25% 2/10/17 | | | | 98,997 | | | 99,152 |

26

| | | | Principal amount° | | Value (U.S. $) |

| «Senior Secured Loans (continued) | | | | | | | |

| | Charter Communications Operating Tranche B | | | | | | | |

| | 7.25% 3/6/14 | | USD | | 13,720 | | $ | 13,777 |

| | Chester Downs & Marina 12.375% 12/31/16 | | | | 99,906 | | | 101,904 |

| | Chrysler Group 6.00% 4/28/17 | | | | 200,000 | | | 195,001 |

| | CityCenter Holdings 7.50% 1/10/15 | | | | 140,000 | | | 140,805 |

| | Consolidated Container 5.688% 9/28/14 | | | | 55,000 | | | 50,325 |

| | First Data Tranche B2 2.937% 9/24/14 | | | | 150,175 | | | 140,038 |

| | Frac Tech International Tranche B | | | | | | | |

| | 6.25% 4/19/16 | | | | 178,376 | | | 178,401 |

| | Goodman Global Tranche B 5.75% 10/28/16 | | | | 99,250 | | | 99,888 |

| | Grifols Tranche B 6.00% 6/4/16 | | | | 100,000 | | | 100,500 |

| | HGI Holdings 6.75% 7/27/17 | | | | 87,845 | | | 88,505 |

| | Houghton International Tranche B | | | | | | | |

| | 6.75% 1/11/16 | | | | 99,321 | | | 100,408 |

| | Level 3 Financing Tranche B 11.15% 3/13/14 | | | | 185,000 | | | 195,406 |

| | MGM MIRAGE Tranche E 7.00% 2/21/14 | | | | 125,000 | | | 122,833 |

| | Nortek 5.25% 4/12/17 | | | | 24,938 | | | 24,953 |

| | Nuveen Investment | | | | | | | |

| | 5.757% 5/13/17 | | | | 200,000 | | | 200,107 |

| | 2nd Lien 12.50% 7/9/15 | | | | 85,000 | | | 90,490 |

| | OSI Restaurant Partners | | | | | | | |

| | 2.319% 6/14/13 | | | | 13,254 | | | 12,817 |

| | 2.50% 6/13/14 | | | | 135,881 | | | 131,400 |

| | PQ 6.69% 7/30/15 | | | | 100,000 | | | 98,250 |

| | Reynolds Group Holdings 6.50% 7/7/18 | | | | 255,000 | | | 253,757 |

| | Texas Competitive Electric Holdings | | | | | | | |

| | 3.686% 10/10/14 | | | | 65,000 | | | 51,188 |

| | Toys R Us Tranche B 6.00% 9/1/16 | | | | 99,250 | | | 99,525 |

| | Univision Communications 4.436% 3/29/17 | | | | 132,312 | | | 125,591 |

| | Visant 5.25% 12/31/16 | | | | 273,625 | | | 272,235 |

| Total Senior Secured Loans (cost $3,491,604) | | | | | | | 3,524,556 |

| | | | | | | | | |

| Sovereign Bonds – 4.54%Δ | | | | | | | |

| Australia – 1.53% | | | | | | | |

| | Australian Government | | | | | | | |

| | 4.50% 4/15/20 | | AUD | | 797,000 | | | 859,221 |

| | 5.25% 3/15/19 | | AUD | | 370,000 | | | 421,138 |

| | *6.00% 2/15/17 | | AUD | | 250,000 | | | 294,217 |

| | | | | | | | | 1,574,576 |

27

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| Sovereign Bonds (continued) | | | | | | | |

| Belgium – 0.06% | | | | | | | |

| | Belgium Government 4.25% 9/28/21 | | EUR | | 42,600 | | $ | 60,596 |

| | | | | | | | | 60,596 |

| Brazil – 0.21% | | | | | | | |

| | Republic of Brazil | | | | | | | |

| | 7.125% 1/20/37 | | USD | | 80,000 | | | 103,000 |

| | 8.875% 10/14/19 | | | | 80,000 | | | 111,200 |

| | | | | | | | | 214,200 |

| Canada – 0.35% | | | | | | | |

| | Canadian Government | | | | | | | |

| | 3.75% 6/1/19 | | CAD | | 172,000 | | | 195,430 |

| | 4.00% 6/1/17 | | CAD | | 51,000 | | | 60,620 |

| | 4.00% 6/1/41 | | CAD | | 91,000 | | | 104,663 |

| | | | | | | | | 360,713 |

| Colombia – 0.02% | | | | | | | |

| | Colombia Government International | | | | | | | |

| | 7.75% 4/14/21 | | COP | | 38,000,000 | | | 24,543 |

| | | | | | | | | 24,543 |

| Indonesia – 0.21% | | | | | | | |

| | Indonesia Treasury Bonds | | | | | | | |

| | 10.50% 8/15/30 | | IDR | | 315,000,000 | | | 44,668 |

| | 11.00% 11/15/20 | | IDR | | 1,147,000,000 | | | 170,923 |

| | | | | | | | | 215,591 |

| Mexico – 0.16% | | | | | | | |

| | Mexican Bonos 8.50% 12/13/18 | | MXN | | 1,699,600 | | | 164,220 |

| | | | | | | | | 164,220 |

| Norway – 1.06% | | | | | | | |

| | Eksportfinans 2.375% 5/25/16 | | USD | | 145,000 | | | 148,265 |

| | Norway Government | | | | | | | |

| | 4.50% 5/22/19 | | NOK | | 2,242,000 | | | 469,574 |

| | 5.00% 5/15/15 | | NOK | | 2,330,000 | | | 472,846 |

| | | | | | | | | 1,090,685 |

| Philippines – 0.25% | | | | | | | |

| | Philippines Government International | | | | | | | |

| | 9.50% 10/21/24 | | USD | | 180,000 | | | 259,884 |

| | | | | | | | | 259,884 |

28

| | | | Principal amount° | | Value (U.S. $) |

| Sovereign Bonds (continued) | | | | | | | |

| Poland – 0.11% | | | | | | | |

| | Poland Government 5.50% 10/25/19 | | PLN | | 164,000 | | $ | 58,255 |

| | Poland Government International | | | | | | | |

| | 5.125% 4/21/21 | | USD | | 49,000 | | | 51,083 |

| | | | | | | | | 109,338 |

| Russia – 0.06% | | | | | | | |

| | Russian-Eurobond 7.50% 3/31/30 | | | | 56,225 | | | 67,329 |

| | | | | | | | | 67,329 |

| South Africa – 0.14% | | | | | | | |

| | South Africa Government 8.00% 12/21/18 | | ZAR | | 990,000 | | | 147,321 |

| | | | | | | | | 147,321 |

| Sweden – 0.29% | | | | | | | |

| | Swedish Government | | | | | | | |

| | 3.00% 7/12/16 | | SEK | | 1,000,000 | | | 164,734 |

| | 5.00% 12/1/20 | | SEK | | 680,000 | | | 130,274 |

| | | | | | | | | 295,008 |

| Turkey – 0.09% | | | | | | | |

| | Republic of Turkey | | | | | | | |

| | 6.875% 3/17/36 | | USD | | 55,000 | | | 60,979 |

| | 7.375% 2/5/25 | | | | 30,000 | | | 35,775 |

| | | | | | | | | 96,754 |

| Total Sovereign Bonds (cost $4,177,659) | | | | | | | 4,680,758 |

| | |

| Supranational Banks – 0.35% | | | | | | | |

| | Inter-American Development Bank | | | | | | | |

| | 5.375% 5/27/14 | | AUD | | 232,000 | | | 258,475 |

| | International Bank for Reconstruction & | | | | | | | |

| | Development 3.375% 4/30/15 | | NOK | | 530,000 | | | 99,049 |

| Total Supranational Banks (cost $286,933) | | | | | | | 357,524 |

| | |

| U.S. Treasury Obligations – 9.94% | | | | | | | |

| | U.S. Treasury Bonds | | | | | | | |

| | 4.25% 11/15/40 | | USD | | 335,000 | | | 341,595 |

| | 4.75% 2/15/41 | | | | 291,000 | | | 322,374 |

29

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Principal amount° | | Value (U.S. $) |

| U.S. Treasury Obligations (continued) | | | | | | | |

| | U.S. Treasury Notes | | | | | | | |

| | *1.50% 6/30/16 | | USD | | 6,205,000 | | $ | 6,253,505 |

| | *3.125% 5/15/21 | | | | 3,250,000 | | | 3,339,362 |

| Total U.S. Treasury Obligations (cost $10,052,272) | | | | | | | 10,256,836 |

| |

| | | | Number of shares | | | |

| Preferred Stock – 0.54% | | | | | | | |

| | Alabama Power 5.625% | | | | 3,715 | | | 92,875 |

| # | Ally Financial 144A 7.00% | | | | 200 | | | 181,713 |

| • | PNC Financial Services Group 8.25% | | | | 260,000 | | | 278,777 |

| Total Preferred Stock (cost $536,469) | | | | | | | 553,365 |

| |

| | | | Number of contracts | | | |

| Purchased Options – 0.02% | | | | | | | |

| Put Options – 0.02% | | | | | | | |

| | U.S. 10 yr futures, strike price $123.00, | | | | | | | |

| | expires 8/26/11 | | | | 44 | | | 13,750 |

| | U.S. 10 yr futures, strike price $121.00, | | | | | | | |

| | expires 9/23/11 | | | | 7 | | | 3,281 |

| Total Purchased Options (cost $34,384) | | | | | | | 17,031 |

| |

| | | | Principal amount° | | | |

| Short-Term Investments – 12.25% | | | | | | | |

| ≠Discount Notes – 5.18% | | | | | | | |

| | Federal Home Loan Bank | | | | | | | |

| | 0.006% 8/3/11 | | USD | | 436,128 | | | 436,127 |

| | 0.01% 8/11/11 | | | | 1,326,759 | | | 1,326,749 |

| | 0.015% 9/1/11 | | | | 92,464 | | | 92,456 |

| | 0.02% 9/20/11 | | | | 184,927 | | | 184,901 |

| | 0.04% 11/2/11 | | | | 184,927 | | | 184,870 |

| | 0.05% 8/6/11 | | | | 2,281,361 | | | 2,281,361 |

| | Freddie Mac | | | | | | | |

| | 0.001% 8/15/11 | | | | 221,721 | | | 221,718 |

| | 0.05% 11/2/11 | | | | 612,645 | | | 612,455 |

| | | | | | | | | 5,340,637 |

30

| | | | Principal amount° | | Value (U.S. $) | |

| Short-Term Investments (continued) | | | | | | | | |

| Repurchase Agreement – 0.76% | | | | | | | | |

| | BNP Paribas 0.14%, dated 7/29/11, to be | | | | | | | | |

| | repurchased on 8/1/11, repurchase | | | | | | | | |

| | price $781,009 (collateralized by | | | | | | | | |

| | U.S. government obligations 3.875% | | | | | | | | |

| | 4/15/29, market value $796,259) | | USD | | 780,646 | | $ | 780,646 | |

| | | | | | | | | 780,646 | |

| ≠U.S. Treasury Bills, Bonds, and Notes – 6.31% | | | | | | | | |

| | U.S. Treasury Bills | | | | | | | | |

| | 0.002% 8/11/11 | | | | 2,418,227 | | | 2,418,056 | |

| | 0.037% 8/4/11 | | | | 4,096,502 | | | 4,096,416 | |

| | | | | | | | | 6,514,472 | |

| Total Short-Term Investments (cost $12,636,797) | | | | | | | 12,635,755 | |

| | |

| Total Value of Securities Before Securities | | | | | | | | |

| | Lending Collateral – 108.91% (cost $108,154,015) | | | | | | | 112,356,972 | |

| | |

| | | | Number of shares | | | | |

| Securities Lending Collateral** – 6.27% | | | | | | | | |

| | Investment Companies | | | | | | | | |

| | BNY Mellon SL DBT II Liquidating Fund | | | | 8,195 | | | 7,909 | |

| | Delaware Investments Collateral Fund No. 1 | | | | 6,465,951 | | | 6,465,951 | |

| | @†Mellon GSL Reinvestment Trust II | | | | 12,695 | | | 0 | |

| Total Securities Lending Collateral (cost $6,486,841) | | | | | | | 6,473,860 | |

| | |

| Total Value of Securities – 115.18% | | | | | | | | |

| | (cost $114,640,856) | | | | | | | 118,830,832 | © |

| Obligation to Return Securities | | | | | | | | |

| | Lending Collateral** – (6.29%) | | | | | | | (6,486,841 | ) |

| Other Liabilities Net of Receivables and | | | | | | | | |

| | Other Assets – (8.89%) | | | | | | | (9,175,427 | ) |

| Net Assets Applicable to 12,244,524 | | | | | | | | |

| | Shares Outstanding – 100.00% | | | | | | $ | 103,168,564 | |

31

Statement of net assets

Delaware Core Plus Bond Fund

| | | | Value (U.S. $) | |

| | | |

| Net Asset Value – Delaware Core Plus Bond Fund | | | | |

| | Class A ($74,106,959 / 8,799,228 Shares) | | | | $8.42 | |

| Net Asset Value – Delaware Core Plus Bond Fund | | | | |

| | Class B ($1,921,062 / 228,099 Shares) | | | | $8.42 | |

| Net Asset Value – Delaware Core Plus Bond Fund | | | | |

| | Class C ($10,146,278 / 1,203,390 Shares) | | | | $8.43 | |

| Net Asset Value – Delaware Core Plus Bond Fund | | | | |

| | Class R ($6,789,232 / 803,544 Shares) | | | | $8.45 | |

| Net Asset Value – Delaware Core Plus Bond Fund | | | | |

| | Institutional Class ($10,205,033 / 1,210,263 Shares) | | | | $8.43 | |

| | |

| Components of Net Assets at July 31, 2011: | | | | |

| Shares of beneficial interest (unlimited authorization – no par) | | | $104,099,022 | |

| Undistributed net investment income | | | 681,367 | |

| Accumulated net realized loss on investments | | | (5,940,028 | ) |

| Net unrealized appreciation of investments and foreign currencies | | | 4,328,203 | |

| Total net assets | | | $103,168,564 | |

°Principal amount is stated in the currency in which each security is denominated.

AUD — Australian Dollar

CAD — Canadian Dollar

CHF — Swiss Franc

CLP — Chilean Peso

COP — Colombian Peso

EUR — European Monetary Unit

GBP — British Pound Sterling

IDR — Indonesian Rupiah

JPY — Japanese Yen

KRW — South Korean Won

MXN — Mexican Peso

NOK — Norwegian Kroner

PLN — Polish Zloty

SEK — Swedish Krona

USD — United States Dollar

ZAR — South African Rand

32

| | |

| • | Variable rate security. The rate shown is the rate as of July 31, 2011. Interest rates reset periodically. |

| w | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |