UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-4338

HERITAGE CAPITAL APPRECIATION TRUST

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 573-3800

RICHARD K. RIESS, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

CLIFFORD J. ALEXANDER, ESQ.

Kirkpatrick & Lockhart LLP

1800 Massachusetts Avenue, NW

Washington, D.C. 20036

Date of fiscal year end: August 31

Date of reporting period: August 31, 2003

| Capital |  | |

| Appreciation | ||

| Trust |

The Intelligent Creation of Wealth

Annual Report

and Investment Performance

Review for the Fiscal Year Ended

August 31, 2003

October 2, 2003

Dear Fellow Shareholders,

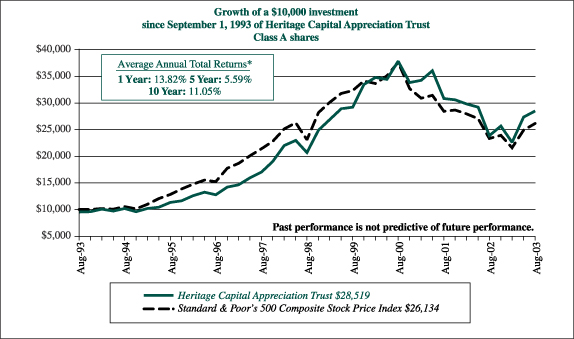

It is my pleasure to report to you that the Heritage Capital Appreciation Trust (the “Fund”) has again outperformed the Standard & Poor’s 500 Composite Stock Price Index(a) (the “S&P 500”). For the fiscal year ended August 31, 2003, the Fund’s Class A shares returned +19.50%(b) (+13.82%(c) after the imposition of the maximum front-end sales charge of 4.75%) as compared to +12.08% for the S&P 500. This marks the fifth time in six years that the Fund has outperformed the S&P 500. During the fiscal year the Fund benefited from its holdings in the telecommunications, media, broadcasting, and cable industries.

In the letter that follows, Herb Ehlers, Chief Investment Officer for Goldman Sachs Asset Management, L.P., comments in further detail on the performance of your Fund. His letter is informative and provides excellent insights into how investments are selected for the Fund. Herb is an outstanding money manager who has provided fund shareholders with some excellent returns since the Fund’s inception on December 12, 1985. In fact, Dan McNeela a market analyst with Morningstar Inc., notes on a research report dated June 20, 2003 that “Heritage Capital Appreciation is simply one of the best growth funds in the business.”(d) On behalf of Heritage, I thank you for your continuing support of the Heritage Capital Appreciation Trust.

Please call your financial advisor or Heritage at (800) 421-4184 if you have any questions.

Sincerely,

Richard K. Riess

President

(a) The Standard & Poor’s 500 Composite Stock Price Index is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

(b) Total returns include the effect of reinvesting dividends. Performance numbers do not reflect a front-end sales charge for Class A shares. Past performance does not guarantee future results. Performance data quoted represents past performance and the investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

(c) Total returns include the effect of reinvesting dividends. Performance numbers reflect the current maximum front-end sales charge for Class A shares of 4.75%. Past performance does not guarantee future results. Performance data quoted represents past performance and the investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

(d) This analyst report titled “Heritage Capital Appreciation is simply one of the best growth funds in the business.” may be obtained by premium members of Morningstar.com or without charge, upon request, by calling Heritage at (800) 421- 4184. Morningstar, Inc. is an independent global investment research firm whose mission is to help investors make better decisions to reach their financial goals.

August 31, 2003

Dear Fellow Shareholders:

For the fiscal year ended August 31, 2003, the Standard & Poor’s 500 Composite Stock Price Index(a) (“S&P 500” or “Index”), is up 12.08% and our Heritage Capital Appreciation Trust (“HCAT” or the “Fund”) portfolio is up 13.82%!(b) For the first time in quite a while we have a positive statement to exclaim at the open of this letter! In the last year equity markets finally seem to be trending in the right direction—up. The question now left on many investors’ minds is, “Where do we go from here?” While we do not focus on trying to predict the economy or the stock market, our long history of investing does allow us to offer some insights. In fact, many trends that we observe in our portfolio of businesses today are strongly reminiscent of previous economic recoveries. Moreover, while we know that every market and cycle is unique, we are encouraged by what we see.

One thing we are observing (and we really enjoy seeing this) is the ever-increasing strength of the companies in the Funds portfolio. During economic downturns, these companies, because of their great balance sheets and free cash flow, are able to gain market share, buy assets at distressed prices, and continue to invest for future growth. In recoveries, their market dominance and operating leverage are that much greater, translating into higher revenues, profit margins and growth. Just as we observed after the downturns in the early 1980s and 1990s, when the economy improves, even small increases in revenue can magnify into meaningful earnings growth when a company has increased its market share and improved its cost structure.

The Fund enjoyed strong absolute and relative performance versus its benchmark, the S&P 500, for the annual period represented by this report ended August 31, 2003. In addition, the Fund has also generated positive excess returns versus the S&P 500 over the past three-, five- and ten-year annualized periods.

For the one-year trailing time period represented by this report ended August 31, 2003, the Class A shares of the Fund climbed 13.82%(b) compared to 12.08% for the S&P 500. For the three-year period ended August 31, 2003, the Class A shares of the Fund were down 10.47%(b) compared to a decline of 11.43% for the S&P 500. The results for the five- and ten-year periods ended August 31, 2003 are strong. For the five-year average annual period, the Class A shares of our Fund returned 5.59%(b) compared to 2.48% for the S&P 500. Over the past ten years, the HCAT has returned an average of 11.05%(b) (Class A shares) per year, versus 10.08% for the Index.

The Fund’s results versus comparable mutual funds continue to be impressive. For the period ended August 31, 2003, the Fund’s Class A shares boast a 4-star Morningstar overall rating(c), which reflects the risk-adjusted performance amongst its peer group of 933 large growth funds. The Fund also received a 4-star rating(c) from Morningstar for the three- and five-year periods, and a 5-star rating(c) for the 10-year period ended August 31, 2003, when compared to a universe of 933, 603 and 190 large growth funds, respectively.

(a) The S&P 500 is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

(b) Total returns are average annual returns and include the effect of reinvesting dividends. Performance numbers reflect the current maximum front-end sales charge for Class A shares of 4.75%. Past performance does not guarantee future results. Performance data quoted represents past performance and the investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

(c) Morningstar Inc. rates mutual funds from one to five stars based on how well they've performed (after adjusting for risk and accounting for all front-end or contingent deferred sales charges) in comparison to similar funds in its category. Within each Morningstar category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star. Funds are rated for up to three time periods—three-, five-, and 10 years—and these ratings are combined to produce an overall rating. Ratings are objective, based on a mathematical evaluation of past performance. Past performance is no guarantee of future results.

2

Media

In the past year, the Fund benefited from strong returns across several sectors with our media and consumer staples companies significantly adding to positive returns. In a welcome departure from recent trends, each one of our media holdings had positive absolute returns. Media companies benefited as the official war in Iraq came to a close. After several years of weakness, there are many indications that this industry is returning to levels that are more robust. Throughout the economic downturn, corporations that cut advertising budgets have recently been able to increase spending in this area. Upfront sales for cable networks have been very strong, which specifically benefits Viacom, Inc., as it owns MTV, VH1, Nickelodeon, and TNN. Cablevision Systems Corp., Univision Communications and Echostar Communications were also up significantly this year and were among the Fund’s top contributors to performance. Investors reacted positively to the Federal Communications Commission’s and the Department of Justice’s approval of the merger between Univision and Hispanic Broadcasting. The merger will join the biggest Spanish-language TV company, the largest Hispanic radio group, the biggest Latin music company and an Internet portal to be the dominant player in Spanish language media. The company is well positioned to take advantage of the growing Spanish-language speaking demographic, as the Hispanic population is growing at five times the rate of the non-Hispanic population.

PepsiCo

Within consumer staples, PepsiCo, Inc. positively contributed to performance this year. In its most recent quarterly earnings report, the company stated that its profitability was due to strength in the Frito-Lay business, as well as cost cutting associated with the Quaker Oats acquisition. Within the Frito-Lay area, the company has benefited from the introduction of new products, which leverage existing brands. Pepsi’s recent success is a result of a strategy that centers on continuing to enhance its core Frito-Lay business, rationalizing the focus of its soft drink business, and making strategic acquisitions that leverage the company’s unparalleled distribution system. In addition, Pepsi is just getting started internationally in its snack business, which should contribute to growth in the years ahead.

Freddie Mac and Fannie Mae

Despite the Fund’s strong returns and outperformance of its Index, HCAT was negatively impacted by the recent weak performance of Freddie Mac and Fannie Mae. In January 2003, Freddie Mac announced that it would be restating its earnings upward because it used an overly conservative accounting method in the amortization of its Treasury bonds used to hedge its portfolio. Freddie Mac indicated that it will be restating its income from 2001 and 2002. Subsequently, in June 2003, the company announced several management changes that consisted of the departure of several chief executives from the firm. In an effort to gain additional perspective on the issues surrounding Freddie Mac, our team’s lead analyst, Derek Pilecki, immediately went to Washington, DC, and participated in a series of meetings with prominent lawmakers, congressional staffers, and lobbyists. With the added perspective of these meetings, the team has gained confidence that legislators are keenly aware of Freddie Mac and Fannie Mae’s roles in sustaining the strong housing market and their importance to the health of the US economy. This reduces the likelihood that lawmakers will enact legislation, which would attack and possibly diminish the companies’ franchise value. We own Freddie Mac and Fannie Mae because 1) their Congressional Charter gives the companies competitive advantages; 2) they have used these competitive advantages to deliver superior returns to shareholders over time and 3) they have enabled the nation’s homebuyers to secure reasonable mortgage terms and this benefits the U.S. economy. In addition, we expect Freddie Mac will restate its earnings in November. This should give investors a better view into Freddie Mac’s financial position and lift additional uncertainty from the stock. We believe Freddie Mac’s risk management is very strong and the economic cash flows are unchanged by the accounting restatements at the company.

The Ratings Agencies

McGraw-Hill and Moody’s

We would like to take the opportunity to highlight two companies that we added to the portfolio in January of this year, McGraw-Hill and Moody’s. Standard and Poor’s (S&P), which is owned by McGraw-Hill, and Moody’s are the world’s two leading credit rating agencies, each with about a 40% market share. Founded nearly

3

100 years ago, both agencies have flourished over the past century to become tremendously influential players in the global debt markets. Today they rate a wide range of entities and securities including corporate debt, municipal bonds, sovereign debt, mortgage and asset backed securities, credit derivatives, and others.

The credit rating agencies of S&P and Moody’s are extremely attractive franchises, possessing many of the key characteristics that we seek in our investments. These are highly reputable institutions with dominant market share. It is not surprising then that they both have been highly profitable and have generated abundant free cash flow. In addition, there are secular trends in place that should enable them to grow at a healthy pace for the next several years.

Quasi-monopoly industry with high barriers to entry

The dominant share of these two leading agencies and the inherent mechanics of the ratings business create an industry environment that can be characterized as a quasi-monopoly. Consider the US market, where S&P and Moody’s each command 40% plus share, Fitch Ratings has a low teens share, and a few other smaller players also exist. On the surface, there are at least the three established Nationally Recognized Statistical Rating Organizations (NRSROs) competing for every rating assignment. In reality, most issuers are required by regulation to seek at least two ratings, and they usually secure these from S&P and Moody’s. Due to the reputation of S&P and Moody’s, the absence of either agency could be a cause for alarm to investors, which would raise the cost of debt (offered yield) for issuers. The cost of a rating is insignificant compared to the potential cost of a higher interest rate. In addition, issuers themselves do not want to feel vulnerable to rating actions of a single agency and therefore prefer using both agencies. The necessity to use at least two ratings, coupled with the clear dominance of the big two agencies, leads to a situation where S&P and Moody’s don’t really compete with each other as they are virtually assured of getting their share of the business.

The industry structure creates, and is also the result of, high barriers to entry. Bond investors have a strong preference for established rating agencies like S&P and Moody’s, which are backed by a long track record. To market their securities, issuers must obtain ratings from these agencies that are considered credible by investors and recognized as acceptable for regulatory purposes. In turn, the regulators do not grant national recognition to an agency unless it is widely recognized by investors and issuers. Investors, issuers, and regulators thus gravitate towards the reputed incumbent agencies, creating an extremely difficult competitive environment for new entrants to gain traction.

Given such a favorable operating environment for S&P and Moody’s, it is easy to understand why these are highly profitable businesses, with Moody’s reporting operating margins of over 50% and net margin of nearly 30%. Let us now discuss the growth outlook for these cash-spinning agencies.

Sustainable growth outlook

Despite their age, rating agencies have continued to grow at healthy double-digit rates. Specifically, Moody’s has grown revenues and operating income at a high teens annual rate over the last 20 years. We believe it is possible that is sustainable for many years, driven by several favorable secular trends. We will briefly discuss one of these trends–international growth.

A combination of factors has fueled rapid growth of the ratings business in the international markets. As economies around the world continue to migrate towards a capitalist model, their domestic debt markets attract a broadening base of investors and issuers, increasing the number of entities and securities that need to obtain credit ratings. Following the U.S. lead, governments worldwide are deregulating and privatizing state owned entities. These privatized entities—often with large funding needs—substitute government funds by public equity or debt, adding to the global pool of rated debt. The ongoing disintermediation of banks, whereby issuers are retiring bank loans by issuing public bonds, is another example where foreign markets are moving towards the U.S. model. This has lead to increased demand for credit ratings as bank loans are usually not rated, but public bonds are. Reflecting its growing contribution, the international market now comprises about a third of S&P’s and Moody’s revenues as compared to one-sixth of revenues just five years ago.

4

After a three-year bear market, the recent rally has certainly intensified the debate on where the market goes from here. Arguments for bull and bear markets often juxtaposed on newspaper op-ed pages demonstrate that no one knows for sure what the market will do. We certainly don’t. Never have, in fact! The inability to consistently predict how the market will move in the short term is exactly why we do not focus on the market by rotating sectors, playing momentum games or deviating from our strategy of buying businesses. Indeed, “momentum investing” is one of the classic oxymorons. History demonstrates that over the long term, a company’s stock price will reflect the underlying fundamentals of its business. We have built portfolios predicated on our ability to identify great businesses that are strategically poised for long-term growth and attractively valued.

Sincerely,

Herbert E. Ehlers

Partner Managing Director

Goldman, Sachs & Co.

Chief Investment Officer

Growth Equity Strategy

Goldman Sachs Asset Management, L.P.

5

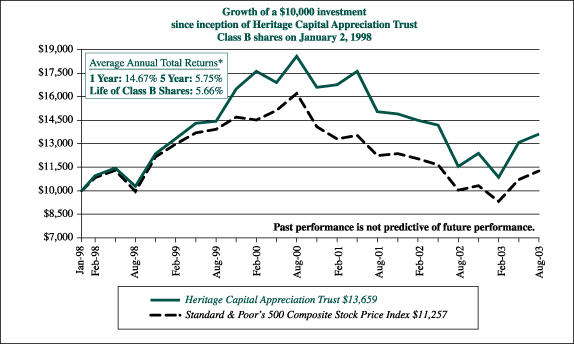

| * | Average annual returns for Heritage Capital Appreciation Trust Class A and B shares are calculated in conformance with Item 21 of Form N-1A, which assumes the maximum front-end sales charge of 4.75% for Class A shares, a contingent deferred sales charge for Class B shares (4% for the one year period, 1% for the five year period and 1% for the life of Class B shares) and reinvestment of dividends for Class A and B shares. Performance presented represents historical data. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s past performance is not indicative of future performance and should be considered in light of the Fund’s investment policy and objectives, the characteristics and quality of its portfolio securities, and the periods selected. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

6

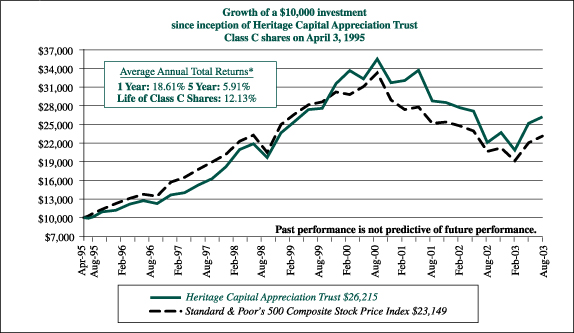

| * | Average annual returns for Heritage Capital Appreciation Trust Class C shares are calculated in conformance with Item 21 of Form N-1A, which assumes reinvestment of dividends for Class C shares. Performance presented represents historical data. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s past performance is not indicative of future performance and should be considered in light of the Fund’s investment policy and objectives, the characteristics and quality of its portfolio securities, and the periods selected. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

7

Heritage Capital Appreciation Trust

Investment Portfolio

August 31, 2003

| Shares | Value | ||||

| Common Stocks—98.3% (a) | |||||

Advertising—2.1% | |||||

| 241,850 | Lamar Advertising Company* | $ | 8,080,208 | ||

Beverages—3.8% | |||||

| 322,000 | PepsiCo, Inc. | 14,341,880 | |||

Broadcasting Services/Programs—8.4% | |||||

| 378,000 | Clear Channel Communications, Inc.* | 17,055,360 | |||

| 1,224,000 | Liberty Media Corporation, Class “A”* | 14,810,400 | |||

| 31,865,760 | |||||

Commercial Services—9.4% | |||||

| 1,172,000 | Cendant Corporation* | 21,072,560 | |||

| 138,729 | Moody’s Corporation | 7,194,486 | |||

| 255,110 | Valassis Communications, Inc.* | 7,495,132 | |||

| 35,762,178 | |||||

Electrical Components & Equipment—0.6% | |||||

| 59,765 | Energizer Holdings, Inc.* | 2,198,157 | |||

Entertainment—3.0% | |||||

| 790,910 | Metro-Goldwyn-Mayer Inc.* | 11,452,377 | |||

Financial Services—11.8% | |||||

| 1,169,949 | Charles Schwab Corporation | 12,705,646 | |||

| 255,000 | Fannie Mae | 16,521,450 | |||

| 293,000 | Freddie Mac | 15,572,950 | |||

| 44,800,046 | |||||

Food—1.7% | |||||

| 130,300 | Wm. Wrigley Jr. Company | 6,912,415 | |||

Insurance—1.0% | |||||

| 55,950 | AMBAC Financial Group, Inc. | 3,632,274 | |||

Internet—0.9% | |||||

| 64,000 | eBay Inc.* | 3,553,920 | |||

Leisure Time—2.2% | |||||

| 376,210 | Sabre Holdings Corporation | 8,509,870 | |||

Lodging—5.5% | |||||

| 466,000 | Harrah’s Entertainment, Inc. | 19,301,720 | |||

| 53,390 | Starwood Hotels & Resorts Worldwide Inc. | 1,806,184 | |||

| 21,107,904 | |||||

Multimedia—13.0% | |||||

| 440,000 | AOL Time Warner Inc.* | 7,198,400 | |||

| 935,490 | Entravision Communications Corporation, Class “A”* | 9,261,351 | |||

| 125,000 | McGraw-Hill Companies, Inc. | 7,625,000 | |||

| Shares | Value | ||||

| Common Stocks (continued) | |||||

Multimedia (continued) | |||||

| 569,159 | Viacom, Inc. Class “B” | 25,612,155 | |||

| 49,696,906 | |||||

Pharmaceuticals—2.1% | |||||

| 118,040 | Eli Lilly & Company | 7,853,201 | |||

Retail—5.1% | |||||

| 193,120 | Dollar Tree Stores Inc.* | 7,576,098 | |||

| 292,000 | Family Dollar Stores Inc. | 11,715,040 | |||

| 19,291,138 | |||||

Savings & Loans—1.0% | |||||

| 45,000 | Golden West Financial Corporation | 3,882,150 | |||

Software—4.2% | |||||

| 415,000 | First Data Corporation | 15,936,000 | |||

Telecommunications—6.1% | |||||

| 2,160,000 | Crown Castle International Corporation* | 23,220,000 | |||

Television, Cable & Radio—16.4% | |||||

| 766,663 | Cablevision Systems Corporation, Class “A”* | 15,448,259 | |||

| 383,890 | Echostar Communications Corporation, Class “A”* | 14,165,541 | |||

| 547,000 | Univision Communications, Inc. Class “A”* | 20,507,030 | |||

| 382,000 | Westwood One, Inc.* | 12,262,200 | |||

| 62,383,030 | |||||

| Total Common Stocks (cost $329,280,558) | 374,479,414 | ||||

| Repurchase Agreement—1.5% (a) | |||||

| Repurchase Agreement with State Street Bank and Trust Company, dated August 29, 2003 @ 0.9% to be repurchased at $5,587,559 on September 2, 2003, collateralized by $4,675,000 United States Treasury Bonds, 7.125% due February 15, 2023, (market value $5,719,459 including interest) (cost $5,587,000) | 5,587,000 | ||||

| Total Investment Portfolio | |||||

(cost $334,867,558) (b), 99.8% (a) | 380,066,414 | ||||

| Other Assets and Liabilities, net, 0.2% (a) | 820,087 | ||||

| Net Assets, 100.0% | $ | 380,886,501 | |||

| * | Non-income producing security. |

| (a) | Percentages indicated are based on net assets. |

| (b) | The aggregate identified cost for federal income tax purposes is $338,211,644. Market value includes net unrealized appreciation of $41,854,770 which consists of aggregate gross unrealized appreciation for all securities in which there is an excess of market value over tax cost of $64,799,828 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over market value of $22,945,058. |

The accompanying notes are an integral part of the financial statements.

8

Heritage Capital Appreciation Trust

Statement of Assets and Liabilities

August 31, 2003

Assets | |||||||

Investments, at value (identified cost $329,280,558) | $ | 374,479,414 | |||||

Repurchase agreement (identified cost $5,587,000) | 5,587,000 | ||||||

Cash | 146 | ||||||

Receivables: | |||||||

Fund shares sold | 1,858,644 | ||||||

Dividends and interest | 124,084 | ||||||

Deferred state qualification expenses | 16,323 | ||||||

Prepaid insurance | | 2,989 | | ||||

Total assets | 382,068,600 | ||||||

Liabilities | |||||||

Payables: | |||||||

Fund shares redeemed | $ | 628,679 | |||||

Accrued management fee | 233,961 | ||||||

Accrued distribution fee | 165,470 | ||||||

Accrued shareholder servicing fee | 94,041 | ||||||

Accrued fund accounting fee | 8,738 | ||||||

Other accrued expenses | | 51,210 | |||||

Total liabilities | | 1,182,099 | | ||||

Net assets, at market value | $ | 380,886,501 | |||||

Net Assets | |||||||

Net assets consist of: | |||||||

Paid-in capital | $ | 381,343,577 | |||||

Accumulated net realized loss | (45,655,932 | ) | |||||

Net unrealized appreciation on investments | | 45,198,856 | | ||||

Net assets, at market value | $ | 380,886,501 | |||||

Class A shares | |||||||

Net asset value and redemption price per share ($248,265,481 divided by | $ | 21.82 | |||||

Maximum offering price per share (100/95.25 of $21.82 ) | $ | 22.91 | |||||

Class B shares | |||||||

Net asset value, offering price and redemption price per share ($36,687,085 divided by | $ | 20.47 | |||||

Class C shares | |||||||

Net asset value, offering price and redemption price per share ($95,933,935 divided by | $ | 20.46 | |||||

The accompanying notes are an integral part of the financial statements.

9

Heritage Capital Appreciation Trust

Statement of Operations

For the Fiscal Year Ended August 31, 2003

Investment Income | |||||||

Income: | |||||||

Dividends | $ | 1,813,748 | |||||

Interest | 87,561 | ||||||

Total income | 1,901,309 | ||||||

Expenses: | |||||||

Management fee | $ | 2,389,282 | |||||

Distribution fee (Class A) | 617,586 | ||||||

Distribution fee (Class B) | 316,328 | ||||||

Distribution fee (Class C) | 729,353 | ||||||

Shareholder servicing fees | 415,238 | ||||||

Professional fees | 78,877 | ||||||

Fund accounting fee | 52,864 | ||||||

State qualification expenses | 45,590 | ||||||

Reports to shareholders | 45,258 | ||||||

Custodian fee | 26,674 | ||||||

Trustees’ fees and expenses | 13,907 | ||||||

Insurance | 11,552 | ||||||

Other | 3,626 | ||||||

Total expenses | 4,746,135 | ||||||

Net investment loss | (2,844,826 | ) | |||||

Realized and Unrealized Gain (Loss) on Investments | |||||||

Net realized loss from investment transactions | (1,109,413 | ) | |||||

Net unrealized appreciation of investments during the fiscal year | 60,409,384 | ||||||

Net gain on investments | 59,299,971 | ||||||

Net increase in net assets resulting from operations | $ | 56,455,145 | |||||

Statements of Changes in Net Assets

| For the Fiscal Years Ended | ||||||||

| August 31, 2003 | August 31, 2002 | |||||||

Increase (decrease) in net assets: | ||||||||

Operations: | ||||||||

Net investment loss | $ | (2,844,826 | ) | $ | (3,632,705 | ) | ||

Net realized loss from investment transactions | (1,109,413 | ) | (29,502,980 | ) | ||||

Net unrealized appreciation (depreciation) of investments during the fiscal year | 60,409,384 | (56,255,787 | ) | |||||

Net increase (decrease) in net assets resulting from operations | 56,455,145 | (89,391,472 | ) | |||||

Increase in net assets from Fund share transactions | 29,100,952 | 31,477,532 | ||||||

Increase (decrease) in net assets | 85,556,097 | (57,913,940 | ) | |||||

Net assets, beginning of fiscal year | 295,330,404 | 353,244,344 | ||||||

Net assets, end of fiscal year | $ | 380,886,501 | $ | 295,330,404 | ||||

The accompanying notes are an integral part of the financial statements.

10

Heritage Capital Appreciation Trust

Financial Highlights

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements.

| Class A Shares | Class B Shares | Class C Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Fiscal Years Ended August 31 | For the Fiscal Years Ended August 31 | For the Fiscal Years Ended August 31 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2003 | 2002 | 2001 | 2000 | 1999 | 2003 | 2002 | 2001 | 2000 | 1999 | 2003 | 2002 | 2001 | 2000 | 1999 | ||||||||||||||||||||||||||||||||||||||||||||||

Net asset value, beginning of fiscal year | $ | 18.26 | $ | 23.61 | $ | 32.41 | $ | 27.18 | $ | 20.34 | $ | 17.25 | $ | 22.47 | $ | 31.20 | $ | 26.40 | $ | 19.91 | $ | 17.25 | $ | 22.46 | $ | 31.19 | $ | 26.39 | $ | 19.90 | ||||||||||||||||||||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net investment loss | (0.12 | ) | (0.17 | ) | (0.16 | ) | (0.16 | ) | (0.10 | ) | (0.24 | ) | (0.31 | ) | (0.29 | ) | (0.29 | ) | (0.19 | ) | (0.21 | ) | (0.30 | ) | (0.29 | ) | (0.29 | ) | (0.19 | ) | ||||||||||||||||||||||||||||||

Net realized and unrealized gain (loss) on investments | 3.68 | (5.18 | ) | (5.44 | ) | 8.01 | 8.26 | 3.46 | (4.91 | ) | (5.24 | ) | 7.71 | 8.00 | 3.42 | (4.91 | ) | (5.24 | ) | 7.71 | 8.00 | |||||||||||||||||||||||||||||||||||||||

Total from Investment Operations | 3.56 | (5.35 | ) | (5.60 | ) | 7.85 | 8.16 | 3.22 | (5.22 | ) | (5.53 | ) | 7.42 | 7.81 | 3.21 | (5.21 | ) | (5.53 | ) | 7.42 | 7.81 | |||||||||||||||||||||||||||||||||||||||

Less Distributions: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Distributions from net realized gains | — | — | (3.20 | ) | (2.62 | ) | (1.32 | ) | — | — | (3.20 | ) | (2.62 | ) | (1.32 | ) | — | — | (3.20 | ) | (2.62 | ) | (1.32 | ) | ||||||||||||||||||||||||||||||||||||

Net asset value, end of fiscal year | $ | 21.82 | $ | 18.26 | $ | 23.61 | $ | 32.41 | $ | 27.18 | $ | 20.47 | $ | 17.25 | $ | 22.47 | $ | 31.20 | $ | 26.40 | $ | 20.46 | $ | 17.25 | $ | 22.46 | $ | 31.19 | $ | 26.39 | ||||||||||||||||||||||||||||||

Total Return (%) (a) | 19.50 | (22.66 | ) | (18.48 | ) | 29.55 | 41.18 | 18.67 | (23.23 | ) | (19.01 | ) | 28.75 | 40.27 | 18.61 | (23.20 | ) | (19.02 | ) | 28.76 | 40.29 | |||||||||||||||||||||||||||||||||||||||

Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Expenses to average daily net assets | 1.26 | 1.23 | 1.22 | 1.24 | 1.29 | 1.97 | 1.93 | 1.91 | 1.90 | 1.92 | 1.97 | 1.93 | 1.91 | 1.90 | 1.92 | |||||||||||||||||||||||||||||||||||||||||||||

Net investment loss to average daily net | (0.66 | ) | (0.80 | ) | (0.68 | ) | (0.55 | ) | (0.45 | ) | (1.37 | ) | (1.50 | ) | (1.36 | ) | (1.21 | ) | (1.10 | ) | (1.37 | ) | (1.50 | ) | (1.37 | ) | (1.21 | ) | (1.10 | ) | ||||||||||||||||||||||||||||||

Portfolio turnover rate (%) | 22 | 31 | 28 | 48 | 44 | 22 | 31 | 28 | 48 | 44 | 22 | 31 | 28 | 48 | 44 | |||||||||||||||||||||||||||||||||||||||||||||

Net assets, end of fiscal year ($ millions) | 248 | 197 | 233 | 244 | 169 | 37 | 32 | 42 | 43 | 20 | 96 | 67 | 78 | 74 | 35 | |||||||||||||||||||||||||||||||||||||||||||||

| (a) | These returns are calculated without the imposition of either front-end or contingent deferred sales charges. |

The accompanying notes are an integral part of the financial statements.

11

Heritage Capital Appreciation Trust

Notes to Financial Statements

| Note 1: | Significant Accounting Policies. Heritage Capital Appreciation Trust (the “Fund”) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund seeks to achieve capital appreciation over the long term by investing 65% of its assets in common stocks. The Fund currently offers Class A, Class B and Class C shares. Class A shares are sold subject to a maximum sales charge of 4.75% of the amount invested payable at the time of purchase. For Class A share investments greater than $1 million, where a maximum sales charge is waived, those shares may be subject to a maximum contingent deferred sales charge of 1% upon redemptions made in less than 18 months of purchase. Class B shares are sold subject to a 5% maximum contingent deferred sales charge (based on the lower of purchase price or redemption price), declining over a six-year period. Class C shares are sold subject to a contingent deferred sales charge of 1% of the lower of net asset value or purchase price payable upon any redemptions made in less than one year of purchase. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies: |

| Security Valuation: The Fund values investment securities at market value based on the last quoted sales price as reported by the principal securities exchange on which the security is traded or the Nasdaq Stock Market. If no sale is reported, market value is based on the most recent quoted bid price and in the absence of a market quote, securities are valued using such methods as the Board of Trustees believes would reflect fair market value. Short-term investments having a maturity of 60 days or less are valued at amortized cost, which approximates market value. |

| Repurchase Agreements: The Fund enters into repurchase agreements whereby the Fund, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. Repurchase agreements involve the risk that the seller will fail to repurchase the security, as agreed. In that case, the Fund will bear the risk of market value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred. |

| Federal Income Taxes: The Fund is treated as a single corporate taxpayer as provided for in the Tax Reform Act of 1986, as amended. The Fund’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended, which are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no provision has been made for federal income and excise taxes. |

| Distribution of Income and Gains: Distributions of net investment income are made annually. Net realized gains from investment transactions during any particular year in excess of available capital loss carryforwards, which, if not distributed, would be taxable to the Fund, will be distributed to shareholders in the following fiscal year. The Fund uses the identified cost method for determining realized gain or loss on investments for both financial and federal income tax reporting purposes. |

| State Qualification Expenses: State qualification expenses are amortized based either on the time period covered by the qualification or as related shares are sold, whichever is appropriate for each state. |

| Expenses: The Fund is charged for those expenses that are directly attributable to it, while other expenses are allocated proportionately among the Heritage mutual funds based upon methods approved by the Board of Trustees. Expenses that are directly attributable to a specific class of shares, such as distribution fees, are charged directly to that class. Other expenses of the Fund are allocated to each class of shares based upon their relative percentage of net assets. |

12

Heritage Capital Appreciation Trust

Notes to Financial Statements

(continued)

| Other: For purposes of these financial statements, investment security transactions are accounted for on a trade date basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income is recorded on the accrual basis. |

| Note 2: | Fund Shares. At August 31, 2003, there were an unlimited number of shares of beneficial interest of no par value authorized. |

| Transactions in Class A, B and C shares of the Fund during the fiscal year ended August 31, 2003, were as follows: |

| Class A Shares | Class B Shares | Class C Shares | |||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||

Shares sold | 4,646,873 | $ | 89,559,885 | 356,096 | $ | 6,589,412 | 2,729,811 | $ | 49,152,786 | ||||||||||||

Shares redeemed | (4,065,889 | ) | (76,359,272 | ) | (391,259 | ) | (6,860,527 | ) | (1,908,256 | ) | (32,981,332 | ) | |||||||||

Net increase (decrease) | 580,984 | $ | 13,200,613 | (35,163 | ) | $ | (271,115 | ) | 821,555 | $ | 16,171,454 | ||||||||||

Shares outstanding: | |||||||||||||||||||||

Beginning of fiscal year | 10,797,557 | 1,827,138 | 3,866,440 | ||||||||||||||||||

End of fiscal year | 11,378,541 | 1,791,975 | 4,687,995 | ||||||||||||||||||

| Transactions in Class A, B and C shares of the Fund during the fiscal year ended August 31, 2002, were as follows: |

| Class A Shares | Class B Shares | Class C Shares | |||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||

Shares sold | 3,625,981 | $ | 78,991,628 | 437,439 | $ | 9,230,847 | 1,393,697 | $ | 29,186,492 | ||||||||||||

Shares redeemed | (2,708,360 | ) | (56,844,759 | ) | (475,522 | ) | (9,420,542 | ) | (1,000,885 | ) | (19,666,134 | ) | |||||||||

Net increase (decrease) | 917,621 | $ | 22,146,869 | (38,083 | ) | $ | (189,695 | ) | 392,812 | $ | 9,520,358 | ||||||||||

Shares outstanding: | |||||||||||||||||||||

Beginning of | 9,879,936 | 1,865,221 | 3,473,628 | ||||||||||||||||||

End of fiscal year | 10,797,557 | 1,827,138 | 3,866,440 | ||||||||||||||||||

| Note 3: | Purchases and Sales of Securities. For the fiscal year ended August 31, 2003, purchases and sales of investment securities (excluding repurchase agreements and short-term obligations) aggregated $88,315,027 and $66,830,499, respectively. |

| Note 4: | Management, Subadvisory, Distribution, Shareholder Servicing Agent, Fund Accounting and Trustees Fees. Under the Fund’s Investment Advisory and Administration Agreement with Heritage Asset Management, Inc. (the “Manager” or “Heritage”), the Fund agrees to pay to the Manager a fee equal to an annualized rate of 0.75% of the Fund’s average daily net assets, computed daily and payable monthly. Pursuant to a contractual agreement dated January 2, 2003, the Manager has agreed to waive its fees and, if necessary, reimburse the Fund to the extent that Class A annual operating expenses exceeded |

13

Heritage Capital Appreciation Trust

Notes to Financial Statements

(continued)

1.60% of the Class A average daily net assets and to the extent that the Class B and Class C annual operating expenses each exceeded 2.10% of those classes’ average daily net assets for the fiscal year ended August 31, 2003. No fees were waived and no expenses were reimbursed for the fiscal year ended August 31, 2003. |

| The Manager entered into a subadvisory agreement with Goldman Sachs Asset Management (the “Subadviser”) to provide to the Fund investment advice, portfolio management services (including the placement of brokerage orders) and certain compliance and other services for a fee payable, by the Manager, equal to 0.25% of the Fund’s average daily net assets, without regard to any reduction due to the imposition of expense limitations. Eagle Asset Management, Inc. (“Eagle”), a wholly owned subsidiary of Raymond James Financial, Inc. (“RJF”), serves as an additional subadviser to the Fund. However, the Manager currently has not allocated any assets of the Fund to Eagle. |

| The Manager also is the Shareholder Servicing Agent and Fund Accountant for the Fund. The Manager charged $415,238 for Shareholder Servicing fees and $52,864 for Fund Accounting services for the fiscal year ended August 31, 2003. |

| Raymond James & Associates, Inc. (the “Distributor” or “RJA”) has advised the Fund that it generated $452,465 in front-end sales charges and $17,755 in contingent deferred sales charges for Class A shares, $105,602 in contingent deferred sales charges for Class B shares and $9,584 in contingent deferred sales charges for Class C shares for the fiscal year ended August 31, 2003. From these fees, the Distributor paid commissions to salespersons and incurred other distribution costs. |

| Pursuant to the Class A Distribution Plan adopted in accordance with Rule 12b-1 of the Investment Company Act of 1940, as amended, the Fund is authorized to pay the Distributor a fee of up to 0.50% of the average daily net assets. The Class B and Class C Distribution Plans provide for payments at an annual rate of up to 1.00% of the average daily net assets. Such fees are accrued daily and payable monthly. Class B shares will convert to Class A shares eight years after the end of the calendar month in which the shareholder’s order to purchase was accepted. The Manager, Distributor, Fund Accountant and Shareholder Servicing Agent are all wholly owned subsidiaries of RJF. |

| Trustees of the Fund also serve as Trustees for Heritage Cash Trust, Heritage Growth and Income Trust, Heritage Income Trust and Heritage Series Trust, investment companies that are also advised by the Manager (collectively referred to as the “Heritage Mutual Funds”). Each Trustee of the Heritage Mutual Funds who is not an employee of the Manager or an employee of an affiliate of the Manager receives an annual fee of $18,000 and an additional fee of $3,000 for each combined quarterly meeting of the Heritage Mutual Funds attended. Trustees’ fees and expenses are paid equally by each portfolio in the Heritage Mutual Funds. |

| Note 5: | Federal Income Taxes. The timing and character of certain income and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. As a result, net investment income (loss) and net realized gain (loss) from investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent in nature. To the extent these differences are permanent; they are charged or credited to paid in capital or accumulated net realized loss, as appropriate, in the period that the differences arise. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended |

14

Heritage Capital Appreciation Trust

Notes to Financial Statements

(continued)

August 31, 2003, to reflect reclassifications arising from permanent book/tax differences attributable to a net operating loss, the Fund increased (credited) accumulated net investment loss $2,844,826 and decreased (debited) paid in capital $2,844,826. As of August 31, 2003, the Fund had net tax basis capital loss carryforwards in the aggregate of $42,311,846. Of this capital loss carryforward, $17,330,040 and $24,981,806 may be applied to any net taxable capital gain until their expiration date of 2010 and 2011, respectively. |

| For income tax purposes, distributions paid during the fiscal years ended August 31, 2003 and 2002 were as follows: |

| Distributions paid from: | 2003 | 2002 | ||||

Ordinary Income | $ | 0 | $ | 0 | ||

Long-Term Capital Gains | $ | 0 | $ | 0 | ||

| As of August 31, 2003, the components of distributable earnings on a tax basis were as follows: |

Undistributed Ordinary Income | $ | 0 | ||||

Accumulated Capital Losses | $ | (42,311,846 | ) | |||

Tax Basis Net Unrealized Appreciation | $ | 41,854,770 | ||||

| The difference between book-basis and tax-basis unrealized appreciation/depreciation is attributable primarily to the tax deferral of losses on wash sales. |

15

Report of Independent Certified Public Accountants

To the Board of Trustees and Shareholders of

Heritage Capital Appreciation Trust

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Heritage Capital Appreciation Trust (the “Fund”) at August 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America, which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2003 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Tampa, Florida

October 6, 2003

16

[THIS PAGE INTENTIONALLY LEFT BLANK]

Heritage Capital Appreciation Trust

Trustees and Officers

Name, Address and Age | Position(s) Held with Fund | Term of Office* and Length of Time Served | Principal Occupation(s) During Past 5 years | Number of Portfolios in Heritage Funds Complex Overseen by Trustee | Other Directorships Held by Trustee | |||||

| Affiliated Trustees ** | ||||||||||

Thomas A. James 880 Carillon Parkway St. Petersburg, FL 33716 (61) | Trustee | Since in 1985 | Chairman of the Board since 1986; Chief Executive Officer of RJF since 1969; Chairman of the Board of RJA since 1986; Chairman of the Board of Eagle since 1984. | 13 | Outback Steakhouse, Inc. | |||||

Richard K. Riess 880 Carillon Parkway St. Petersburg, FL 33716 (54) | President and Trustee | Since Since in 1985 | Executive Vice President and Managing Director for Asset Management of RJF since 1998; CEO of Eagle since 1996; CEO of Heritage since 2000; President of Eagle, 1995 to 2000. | 13 | N/A | |||||

| Independent Trustees | ||||||||||

C. Andrew Graham 880 Carillon Parkway St. Petersburg, FL 33716 (63) | Trustee | Since in 1985 | First Financial Advisors, LLC & Graham Financial Partners LLC (financial planning insurance and investment services) since 1999; Representative of NFP Securities, Inc. (broker-dealer) since 2002; Representative of Multi- Financial Securities Corp. (broker-dealer), 1996 to 2001; V.P. of Financial Designs Ltd., 1996 to 1999. | 13 | N/A | |||||

William J. Meurer 880 Carillon Parkway St. Petersburg, FL 33716 (60) | Trustee | Since 2003 | Private Financial consultant since September 2000; Board of Directors of Tribridge Consulting, Inc. (business consulting services) since 2000; Board of Trustees, St. Joseph’s-Baptist Health Care since 2000; Advisory Board, Bisk Publishing, Inc. (distance learning provider) since 2000; Managing Partner, Central Florida of Arthur Andersen LLP, 1987 to 2000; Managing Partner, Florida Audit and Business Advisory Services of Arthur Anderson, 1997 to 2000. | 13 | Sykes Enterprises, Incorporated (inbound call systems). | |||||

James L. Pappas 880 Carillon Parkway St. Petersburg, FL 33716 (60) | Trustee | Since 1989 | Lykes Professor of Banking and Finance since 1986 at University of South Florida; President, Graduate School of Banking since 1995; Trustee and Chairman of the Board, Tampa Museum of Art. | 13 | N/A | |||||

18

Heritage Capital Appreciation Trust

Trustees and Officers

Name, Address and Age | Position(s) Held with Fund | Term of Office* and Length of Time Served | Principal Occupation(s) During Past 5 years | Number of Portfolios in Heritage Complex Overseen by Trustee | Other Directorships Held by Trustee | |||||

| Independent Trustees (continued) | ||||||||||

David M. Phillips 880 Carillon Parkway St. Petersburg, FL 33716 (64) | Trustee | Since inception in 1985 | Chief Executive Officer of Evare LLC (information services); Chairman Emeritus of CCC Information Services, Inc.; Executive in Residence, University of North Carolina – Wilmington, 2000 to 2003. | 13 | N/A | |||||

Eric Stattin 880 Carillon Parkway St. Petersburg, FL 33716 (70)

| Trustee | Since 1987 | Private Investor since 1988. | 13 | Mill Creek Bank | |||||

Deborah L. Talbot 880 Carillon Parkway St. Petersburg, FL 33716 (53) | Trustee | Since 2002 | Consultant/Advisor; Member, Academy of Senior Professionals, Eckerd College since 1998; Member, Dean’s Advisory Board of Fogelman School of Business, University of Memphis, 1999-2000; Advisory Board Member, Center for Global Studies, Pennsylvania State University, 1996-1999. | 13 | N/A | |||||

| Officers | ||||||||||

K.C. Clark 880 Carillon Parkway St. Petersburg, FL 33716 (44) | Executive Vice President and Principal Officer | Since 2000 | Executive Vice President and Chief Operating Officer of Heritage since 2000; Senior Vice President – Operations and Administration of Heritage, 1998 to 2000; Vice President – Operations and Administration of Heritage, 1993 to 1998. | N/A | N/A | |||||

Andrea N. Mullins 880 Carillon Parkway St. Petersburg, FL 33716 (36) | Treasurer | Since 2003 | Treasurer and Vice President – Finance of Heritage since 2003; Vice President – Fund Accounting of Heritage, 1996 to 2003; | N/A | N/A | |||||

Clifford J. Alexander 1800 Massachusetts Ave. Washington, DC 20036 (60) | Secretary | Since 1985 | Partner, Kirkpatrick & Lockhart LLP (law firm). | N/A | N/A | |||||

19

Heritage Capital Appreciation Trust

Trustees and Officers

Name, Address and Age | Position(s) Held with Fund | Term of Office* and Length of Time Served | Principal Occupation(s) During Past 5 years | Number of Portfolios in Heritage Complex Overseen by Trustee | Other Directorships Held by Trustee | |||||

| Officers (continued) | ||||||||||

Robert J. Zutz 1800 Massachusetts Ave. Washington, DC 20036 (50) | Assistant Secretary | Since 1989 | Partner, Kirkpatrick & Lockhart LLP (law firm). | N/A | N/A | |||||

Deborah A. Malina 880 Carillon Parkway St. Petersburg, FL 33716 (37) | Assistant Secretary | Since 2000 | Compliance Administrator of Heritage since 2000; Assistant Supervisor of Operations, Heritage, from 1997 to 2000. | N/A | N/A | |||||

| * | Trustees serve for the lifetime of the Trust or until they are removed, resign or retire. The Board has adopted a retirement policy that requires Trustees to retire at the age of 72 for those Trustees in office prior to August 2000, and at the age 70 for those Trustees who are elected to office after August 2000. Officers are elected annually for one year terms. The Trust’s Statement of Additional Information includes additional information about the Trustees and officers and is available, without charge, upon request, by calling (800) 421-4184. |

| ** | Messrs. James and Riess are “interested” persons of the Trust as that term is defined by the Investment Company Act of 1940. Mr. James is affiliated with RJA and RJF. Mr. Riess is affiliated with Heritage and RJF. |

20

Heritage Family of FundsTM

The Intelligent Creation of Wealth

Raymond James & Associates, Inc., Distributor

Member New York Stock Exchange/SIPC

880 Carillon Parkway

St. Petersburg, FL 33716

(727) 573-8143 n (800) 421-4184

www.heritagefunds.com

Not FDIC Insured n May Lose Value n No Bank Guarantee

We are pleased that many of you are also investors in the Heritage Family of Funds. For more complete information, including fees, risks and expenses, contact your financial advisor or call Heritage Family of Funds at 800-421-4184 for a prospectus. Read the prospectus carefully before you invest or send money. This report is for the information of shareholders of Heritage Capital Appreciation Trust. It may also be used as sales literature when preceded or accompanied by a prospectus.

27M 08/03 Copyright 2003 Heritage Asset Management, Inc.

Item 2. Code of Ethics

As of the end of the period August 31, 2003, Heritage Capital Appreciation Trust has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to the Principal Executive Officer and Treasurer. A copy of this code of ethics is filed as an exhibit to this Form N-CSR.

Item 3. Audit Committee Financial Expert

The Board of Trustees of Heritage Capital Appreciation Trust has determined that William J. Meurer is an audit committee financial expert, as defined in Item 3 of Form N-CSR, serving on its audit committee. Mr. Meurer is independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services

Form N-CSR disclosure requirement not yet effective with respect to registrant.

Item 5. Audit Committee of Listed Registrants

Not applicable to the registrant.

Item 6. [Reserved]

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-end Management Investment Companies.

Not applicable to the registrant.

Item 8. [Reserved]

Item 9. Controls and Procedures

| (a) | Based on an evaluation of the disclosure controls and procedures (as defined in Rule 30a-2(c) under the Act), the Principal Executive Officer and Treasurer of Heritage Capital Appreciation Trust have concluded that such disclosure controls and procedures are effective as of October 23, 2003. |

| (b) | There was no change in the internal controls over financial reporting (as defined in Rule 30a-3(d) of Heritage Capital Appreciation Trust that occurred during the second half of its fiscal year that has materially affected or is reasonably likely to materially affect, its internal control over financial reporting. |

Item 10. Exhibits

(a)(1) Code of Ethics pursuant to Item 2 of Form N-CSR is filed and attached hereto as Exhibit 99.CODEETH.

(a)(2) The certification required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 is filed and attached hereto as Exhibit 99.CERT.

(b) The certification required by Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 is filed and attached hereto as Exhibit 99.906CERT.

II-1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 22, 2003

| HERITAGE CAPITAL APPRECIATION TRUST |

| /s/ K.C. CLARK |

| K.C. Clark Executive Vice President and Principal Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Date: October 22, 2003

| /s/ K.C. CLARK |

K.C. Clark Executive Vice President and |

Date: October 22, 2003

| /s/ ANDREA N. MULLINS |

| Andrea N. Mullins Treasurer |

II-2