| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811- 04345) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Tax Free Income Trust |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: July 31, 2008 | | |

| |

| Date of reporting period: August 1, 2007 — January 31, 2008 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

With a focus on investment performance, below-average expenses, and in-depth information about our funds, we put the interests of investors first and seek to set the standard for integrity and service.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam

AMT-Free Insured

Municipal Fund

1|31|08

Semiannual Report

| |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Performance snapshot | 6 |

| Interview with your fund’s Portfolio Leader | 7 |

| Performance in depth | 13 |

| Expenses | 16 |

| Portfolio turnover | 18 |

| Risk | 19 |

| Your fund’s management | 20 |

| Terms and definitions | 22 |

| Trustee approval of management contract | 24 |

| Other information for shareholders | 30 |

| Financial statements | 31 |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder:

In early 2008, financial markets face clear challenges. What began as a rise in defaults for a limited segment of the U.S. mortgage market has spread across the global financial sector and produced a significant tightening of credit conditions. Forecasts for global growth have been reduced as a result, and markets have reacted by sending stock prices lower. In the United States, the economy weakened sharply in late 2007, raising the chance of a recession this year. Fortunately, policymakers have taken action to stimulate growth: The Federal Reserve Board cut interest rates, and federal lawmakers, working with the president, approved a $168 billion fiscal stimulus plan.

As investors, it is natural to feel discouraged by disappointing short-term results. During these challenging times, it is important to remember the value of a long-term perspective and the counsel of your financial representative. The normal condition of the economy and corporate earnings is one of growth, albeit with occasional interruptions. As in the past, after a period of weakness the economy is likely to regain its momentum and produce the growth and corporate earnings that investors expect.

Starting this month, we have changed the portfolio manager’s commentary in this report to a question-and-answer format. We feel that this makes the information more readable and accessible, and we hope you think so as well.

2

Lastly, we note that Putnam Investments celebrated its 70th anniversary in November. From modest beginnings in Boston, Massachusetts, the company has grown into a global asset manager that serves millions of investors worldwide. Although the mutual fund industry has undergone many changes since George Putnam introduced his innovative balanced fund in 1937, Putnam’s guiding principles have not. As we celebrate this 70-year milestone, we look forward to Putnam continuing its long tradition of prudent money management. Thank you for your support of the Putnam funds.

Putnam AMT-Free Insured Municipal Fund:

Seeking high current income free from federal taxes

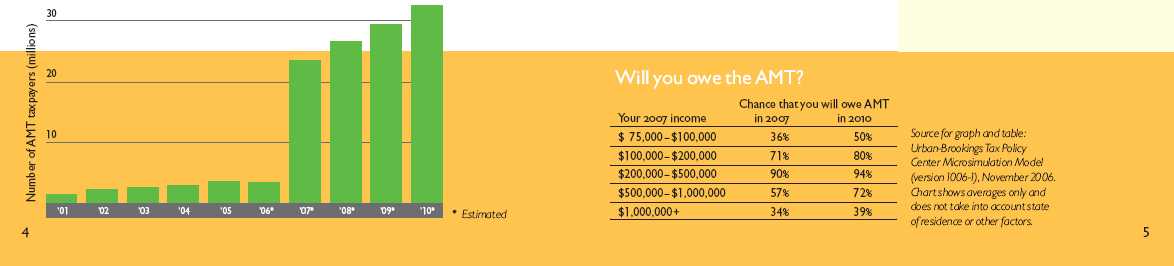

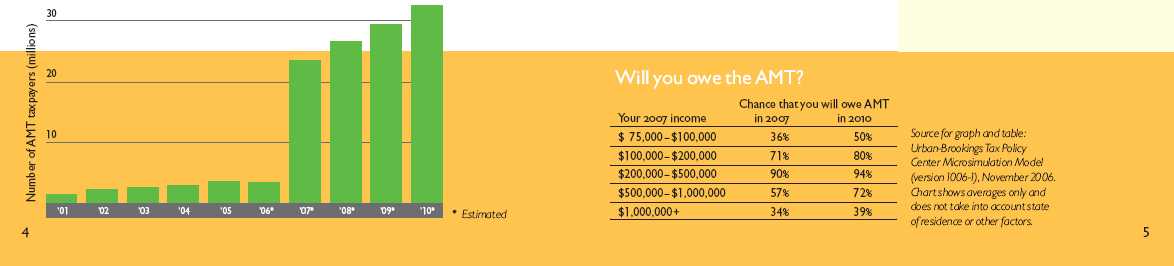

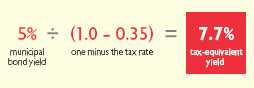

Municipal bonds have long been popular investments because they provide income exempt from federal tax, though capital gains are taxable. Putnam AMT-Free Insured Municipal Fund seeks income exempt from traditional income tax as well as from the federal alternative minimum tax, or AMT.

The AMT is a federal tax that operates in tandem with the regular income tax system. Taxpayers subject to the AMT must pay a larger amount in tax determined by AMT rules — and the difference can be thousands of dollars for many with household incomes above $150,000. It is estimated that by 2010, nearly every household with an income of $100,000 or more will be paying the AMT, unless the federal government changes the law.

If you are subject to the AMT, investments that could increase your tax liability include private-activity municipal bonds, which back development projects, including certain housing and resource recovery projects.

Putnam AMT-Free Insured Municipal Fund aims to serve investors subject to the AMT. The fund seeks to avoid bonds whose income would be taxable under AMT rules, though income may be subject to state taxes.

The fund’s portfolio team of four professionals researches the municipal market to buy bonds that are not subject to the AMT. Pursuing the fund’s mandate, they also keep the fund invested in high-quality bonds, favoring bonds that are insured or carry AAA ratings, or whose payments are backed by U.S. Treasuries. The team’s goal is to provide an attractive level of income exempt from all federal taxes.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. Income from federally exempt funds may be subject to state and local taxes. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Tax-free funds may not be suitable for IRAs and other non-taxable accounts. Please consult your tax advisor for more information. Shares of this fund are not insured, and their prices will fluctuate with market conditions.

Understanding the AMT

The AMT is a separate, parallel federal income tax system, with two marginal tax rates, 26% and 28%, and different exemption amounts.

Under AMT rules, certain exclusions, exemptions, deductions, and credits that would reduce your regular taxable income are not allowed. You must “adjust” your regular taxable income to arrive at your alternative minimum taxable income (AMTI). Then, after subtracting your AMT exemption amount, if your AMT liability is greater than your regular tax liability, you must pay both your regular tax and the difference. It is important to understand that a higher level of income will not necessarily cause you to owe AMT. Rather, it is the relationship between your income and various trigger items, such as credits and deductions, that determines your AMT liability.

Managing this relationship can help avoid a costly surprise at tax time. Any number of items may trigger the tax, but large capital gains, personal exemptions, and deductions are the worst culprits.

From “class tax” to “mass tax”: By 2010, over 32 million

taxpayers may be subject to the AMT.

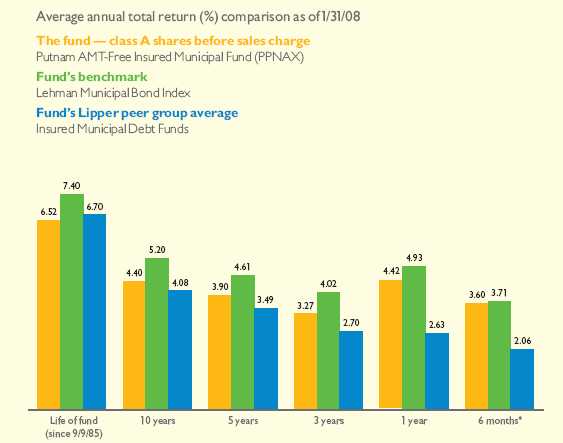

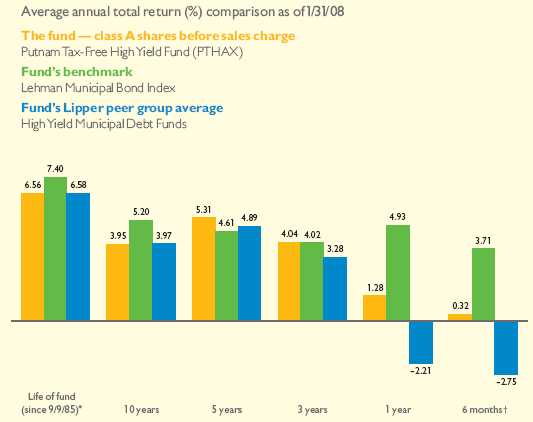

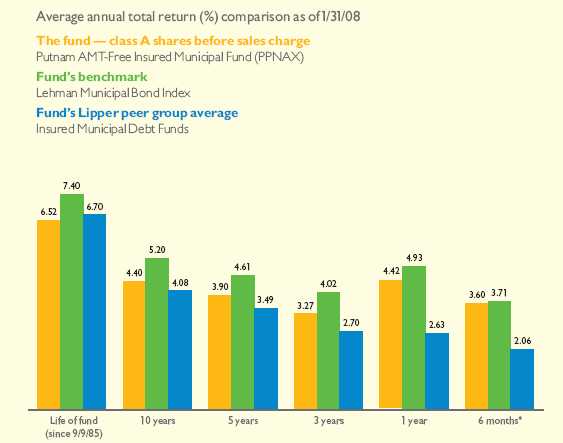

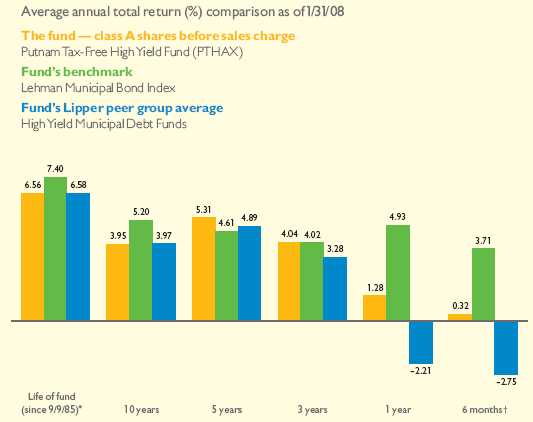

Performance snapshot

Putnam AMT-Free Insured

Municipal Fund

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower.

See pages 13–15 for additional performance information. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com. Performance for class A shares prior to their inception (9/20/93) is derived from the historical performance of class B shares, adjusted for the applicable sales charge (or CDSC).

* Returns for the six-month period are not annualized, but cumulative.

6

The period in review

Thalia, thanks for sitting down with us today to talk about Putnam AMT-Free Insured Municipal Fund. Let’s start by discussing how the fund performed during the period.

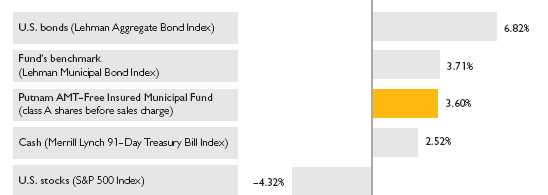

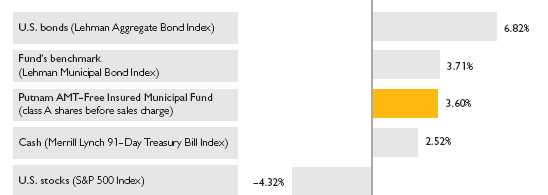

For the six months ended January 31, 2008, the fund returned 3.60%, which was in line with its benchmark, the Lehman Municipal Bond Index. However, when compared to similar funds within its Lipper peer group, Insured Municipal Debt Funds, the fund ranked in the 12th percentile, meaning it outperformed 88% of similar funds for the period.

Given the complexity of the issues that roiled the markets and overall economy, it was an extraordinarily challenging period. With the yield curve steepening during the period, we had positioned the fund in favor of shorter-term bonds, and this helped relative fund performance when long-term yields rose. Our most successful holding during the period was in single-family housing bonds, with

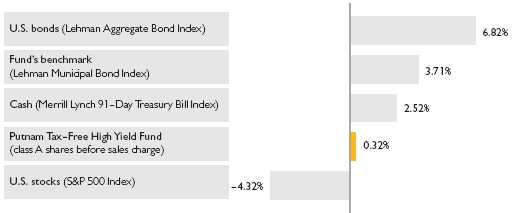

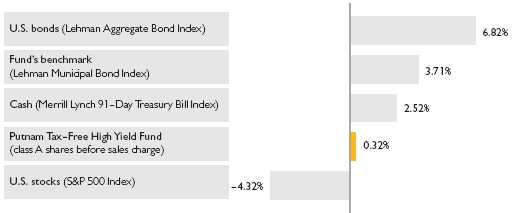

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/08. See page 6 and pages 13–15 for additional fund performance information. Index descriptions can be found on page 23.

7

their strict lending requirements that make borrowers less likely to default, while the fund’s exposure to zero-coupon bonds detracted from performance.

You mention the challenging nature of the past six months. Could you describe the credit market environment?

The credit markets experienced significant volatility over the past several months, as problems related to the crisis in subprime lending worsened. The result was a “liquidity scare.” The subprime mortgage financial crisis started in the United States in late 2006, and grew into a global financial crisis by the summer of 2007. Less stringent mortgage-lending practices in recent years resulted in rising debt for borrowers with weaker credit histories. When mortgage rates were extremely low and home values were rising, the situation was sustainable. But as interest rates rose in early 2007, delinquencies and foreclosures started to spike. Many homeowners were unable or unwilling to meet financial commitments, and many lenders were left without a means to recoup their losses. In past economic cycles, loan defaults have been limited, but the repackaging, securitization, and wide-scale distribution of subprime mortgage debt by U.S. inv estment banks caused the mortgage crisis to take on global proportions.

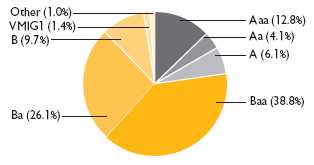

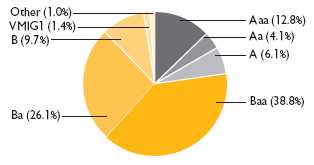

Credit quality overview

Credit qualities shown as a percentage of portfolio value as of 1/31/08. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

8

What impact has the subprime crisis had on the municipal bond market?

There have been growing concerns about the financial health of municipal bond insurers, such as MBIA Inc. and Ambac Financial Group, leading some debt investors to question their ability to maintain their AAA ratings. These companies provide insurance against defaults on bonds issued by municipalities. In recent years, however, these firms also began insuring increasingly complex securities backed by home mortgages. As a result, they have posted billions of dollars of losses related to the subprime crisis.

After the period’s close, both Moody’s Investors Service and Standard & Poor’s downgraded municipal bond insurers FGIC Corp. and XL Capital Assurance Inc. to below AAA, leaving a portion of your fund’s holdings in non-AAA-rated securities. However, we have examined the underlying credits of these securities and are comfortable holding them.

Subprime mortgage crisis aside, how is the overall economy holding up?

There have been signs of an economic slowdown in recent months. As of this report, growth of U.S. GDP was estimated to be only 0.6% in the fourth quarter of 2007. Consumer spending, which plays a significant role in driving the U.S. economy, showed signs of a marked slowdown in December, before rebounding slightly in January. The

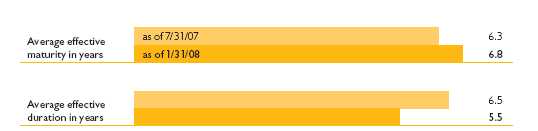

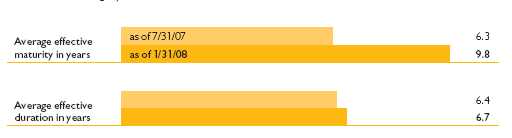

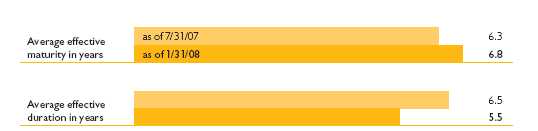

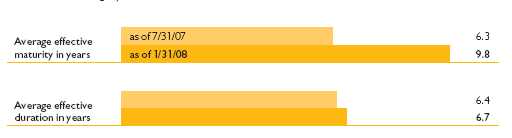

Comparison of the fund’s maturity and duration

This chart compares changes in the fund’s average effective maturity (a weighted average of the holdings’ maturities) and its average effective duration (a measure of its sensitivity to interest-rate changes).

Average effective duration and average effective maturity take into account put and call features, where applicable, and reflect prepayments for mortgage-backed securities. Duration is usually shorter than maturity because it reflects interest payments on a bond prior to its maturity.

9

prospect of weaker consumer spending, along with a slowdown in the service sector, points to the potential for a much weaker economy, and possibly a recession.

How have authorities responded to the liquidity squeeze and signs of an economic downturn?

Starting in September, the Federal Reserve began to cut its target federal funds rate. Citing concerns about risks to the economy, the Fed cut the rate on five occasions during the period. In all, the Fed reduced its target for the federal funds rate from 5.25% in August to 3.0% by the end of January, including a surprise 0.75% cut on January 22. In addition, Congress began work on an economic stimulus package that could pump an estimated $168 billion into the economy by late spring.

How have you positioned the fund to deal with these changing conditions?

Over the past couple of years, insured bonds with lower underlying ratings (BBB) generally yielded an additional 10 to 15 basis points more than the highest-quality AAA-rated bonds. We believed that these yields did not accurately compensate investors for the higher risks, and thus we favored bonds with stronger underlying credit ratings. As concerns about the financial health of municipal bond insurance companies grew over the past few months, bonds with lower underlying ratings suffered. In recent weeks, spreads on insured bonds with BBB underlying ratings have increased to more than 100 basis points, or 1%, versus insured bonds with AA underlying ratings. Therefore, the fund’s bias toward higher-rated bonds had a positive impact on its performance during the period.

As I mentioned earlier, concerns about insurers’ ability to make good on bond guarantees have dampened demand for municipal bonds, causing yields to rise. It’s important to note, however, that municipal bond defaults are extremely rare, so it’s possible that investors have overreacted to these perceived risks. As a result, we have added insured bonds with A and BBB underlying ratings, as spreads on these securities appear attractive.

How did the Fed’s interest-rate cuts affect your strategy?

Due to the Fed’s rate cuts, the yield curve — a graphical representation of how yields of comparable-quality bonds differ by maturity range — steepened. This means that yields on longer-term bonds grew in relation to yields on shorter-term bonds. Keep in mind that when bond yields rise, prices fall. We had positioned the fund’s holdings in favor of shorter-term bonds, and this had a positive impact on relative fund performance when long-term yields rose.

Were there any particular sectors that contributed to the fund’s performance?

We had success with single-family housing bonds. Borrowers under these

10

programs have to meet relatively strict lending requirements, making them far less likely than subprime borrowers to default. Shorter-term single-family housing bonds significantly outperformed long-term bonds when yields rose. On the longer end of the spectrum, we also invested in single-family housing bonds issued by the Mississippi Home Corporation. These bonds offer a relatively high coupon rate of 6.1% and mature in June 2038. We feel there is a good chance that mortgage prepayments may slow, given weakness in the housing market and the economy. If that happens, these bonds may perform well because of their attractive coupon rate.

What sectors detracted from the fund’s returns?

Zero-coupon municipal bonds under-performed during the period. As these bonds typically have underlying credit ratings of A or less, their yields rose when the market began to favor bonds with higher underlying credit ratings. Because zero-coupon bonds offer payment when they mature, rather than semiannual interest payments, they also tend to experience greater price fluctuations and are less liquid than bonds that trade with a coupon.

What is your outlook for the municipal bond market?

We believe that the yield curve may steepen further, either due to a rally in short-term bonds in response to additional Fed rate cuts or weakness in long-term bonds driven by inflation concerns. We have positioned the fund so that we have exposure to those portions of the yield curve that may perform better than others. Recently, that has led us to overweight shorter-term bonds.

I N V E S T M E N T I N S I G H T

An economic recession, according to the National Bureau of Economic Research (NBER), is a significant decline in economic activity spread across the economy and lasting more than a few months. The symptoms of this decline are normally visible in data that tracks income, employment, industrial production, and sales. Compared with expansions, most recessions are brief. The seven recessions since 1960 have lasted an average of 11 months, versus 64 months for the average expansion. Recessions, also defined as two consecutive quarters of contracting GDP, have become increasingly rare in recent decades, as the Fed has become more adept at avoiding them and as technology has enabled businesses to adjust more rapidly to changing market conditions.

11

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Tax-free funds may not be suitable for IRAs and other non-taxable accounts. Shares of this fund are not insured, and their prices will fluctuate with market conditions.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

12

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2008, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance

Total return for periods ended 1/31/08

| | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class Y |

| (inception dates) | (9/20/93) | | (9/9/85) | | (7/26/99) | | (6/1/95) | | (1/2/08) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average | | | | | | | | | |

| (life of fund) | 6.52% | 6.33% | 6.21% | 6.21% | 5.92% | 5.92% | 6.30% | 6.14% | 6.21% |

|

| 10 years | 53.76 | 47.62 | 46.80 | 46.80 | 41.93 | 41.93 | 49.73 | 44.86 | 46.91 |

| Annual average | 4.40 | 3.97 | 3.91 | 3.91 | 3.56 | 3.56 | 4.12 | 3.78 | 3.92 |

|

| 5 years | 21.10 | 16.19 | 17.31 | 15.36 | 16.40 | 16.40 | 19.40 | 15.63 | 17.36 |

| Annual average | 3.90 | 3.05 | 3.24 | 2.90 | 3.08 | 3.08 | 3.61 | 2.95 | 3.25 |

|

| 3 years | 10.12 | 5.69 | 8.03 | 5.10 | 7.58 | 7.58 | 9.18 | 5.70 | 8.10 |

| Annual average | 3.27 | 1.86 | 2.61 | 1.67 | 2.47 | 2.47 | 2.97 | 1.87 | 2.63 |

|

| 1 year | 4.42 | 0.34 | 3.87 | –1.13 | 3.72 | 2.72 | 4.33 | 0.92 | 3.95 |

|

| 6 months | 3.60 | –0.52 | 3.36 | –1.64 | 3.32 | 2.32 | 3.59 | 0.23 | 3.44 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively, as of 1/2/08. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class Y shares have no initial sales charge or CDSC. Performance for class A, C, M, and Y shares before their inception is derived from the historical performance of class B shares, adjusted for the applicable sales charge (or CDSC) and, for class C shares, the higher operating expenses for such shares.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

13

Comparative index returns

For periods ended 1/31/08

| | |

| | | Lipper Insured |

| | Lehman Municipal | Municipal Debt Funds |

| | Bond Index | category average* |

|

| Annual average | | |

| (life of fund) | 7.40% | 6.70% |

|

| 10 years | 66.02 | 49.35 |

| Annual average | 5.20 | 4.08 |

|

| 5 years | 25.30 | 18.78 |

| Annual average | 4.61 | 3.49 |

|

| 3 years | 12.54 | 8.35 |

| Annual average | 4.02 | 2.70 |

|

| 1 year | 4.93 | 2.63 |

|

| 6 months | 3.71 | 2.06 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 1/31/08, there were 52, 52, 49, 49, 44, and 7 funds, respectively, in this Lipper category.

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/07

| | | | | | | | | |

| | Class A | | Class B | | Class C | | Class M | | Class Y |

| (inception dates) | (9/20/93) | | (9/9/85) | | (7/26/99) | | (6/1/95) | | (1/2/08) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average | | | | | | | | | |

| (life of fund) | 6.50% | 6.31% | 6.18% | 6.18% | 5.90% | 5.90% | 6.27% | 6.12% | 6.19% |

|

| 10 years | 53.54 | 47.43 | 46.66 | 46.66 | 41.81 | 41.81 | 49.52 | 44.67 | 46.68 |

| Annual average | 4.38 | 3.96 | 3.90 | 3.90 | 3.55 | 3.55 | 4.10 | 3.76 | 3.91 |

|

| 5 years | 19.34 | 14.47 | 15.50 | 13.58 | 14.72 | 14.72 | 17.63 | 13.81 | 15.49 |

| Annual average | 3.60 | 2.74 | 2.92 | 2.58 | 2.78 | 2.78 | 3.30 | 2.62 | 2.92 |

|

| 3 years | 10.10 | 5.77 | 8.02 | 5.10 | 7.60 | 7.60 | 9.13 | 5.61 | 8.01 |

| Annual average | 3.26 | 1.89 | 2.60 | 1.67 | 2.47 | 2.47 | 2.96 | 1.84 | 2.60 |

|

| 1 year | 3.02 | –1.03 | 2.42 | –2.53 | 2.35 | 1.36 | 2.87 | –0.49 | 2.42 |

|

| 6 months | 3.34 | –0.81 | 3.01 | –1.99 | 3.04 | 2.04 | 3.24 | –0.09 | 3.01 |

|

14

Fund price and distribution information

For the six-month period ended 1/31/08

| | | | | | | |

| | | | | | |

| | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 1 |

|

| Income1 | $0.285683 | $0.238572 | $0.227640 | $0.265072 | $0.050643 |

|

| Capital gains2 | | | | | |

|

| Long-term | 0.020000 | 0.020000 | 0.020000 | 0.020000 | — |

|

| Short-term | — | — | — | — | — |

|

| Total | $0.305683 | $0.258572 | $0.247640 | $0.285072 | $0.050643 |

|

| Share value: | NAV | POP* | NAV | NAV | NAV | POP | NAV |

|

| 7/31/07 | $14.59 | $15.20 | $14.61 | $14.61 | $14.63 | $15.12 | — |

|

| 1/2/08† | — | — | — | — | — | — | $14.71 |

|

| 1/31/08 | 14.81 | 15.43 | 14.84 | 14.84 | 14.86 | 15.36 | 14.82 |

|

| Current yield | | | | | |

| (end of period) | | | | | |

|

| Current dividend rate3 | 3.81% | 3.66% | 3.17% | 3.02% | 3.52% | 3.40% | 3.90% |

|

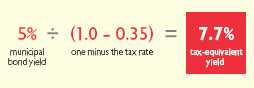

| Taxable equivalent4 | 5.86 | 5.63 | 4.88 | 4.65 | 5.42 | 5.23 | 6.00 |

|

| Current 30-day | | | | | |

| SEC yield5,6 | N/A | 2.93 | 2.41 | 2.26 | N/A | 2.67 | 3.26 |

|

| Taxable equivalent4 | N/A | 4.51 | 3.71 | 3.48 | N/A | 4.11 | 5.02 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

* Reflects an increase in sales charges that took effect on 1/2/08.

† Inception date of class Y shares.

1 For some investors, investment income may be subject to the federal alternative minimum tax.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

4 Assumes maximum 35% federal and state combined tax rate for 2008. Results for investors subject to lower tax rates would not be as advantageous.

5 For a portion of the periods, this fund may have limited expenses, without which yields would have been lower.

6 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund’s annual operating expenses

For the fiscal year ended 7/31/07

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Total annual fund operating expenses | 0.85% | 1.49% | 1.64% | 1.14% | 0.64% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

15

Your fund’s expenses

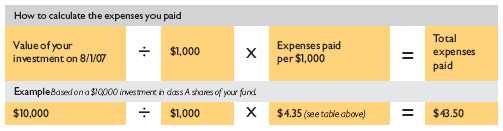

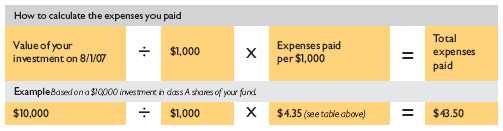

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam AMT-Free Insured Municipal Fund from August 1, 2007, to January 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $ 4.35 | $ 7.57 | $ 8.33 | $ 5.78 | $ 0.52 |

|

| Ending value (after expenses) | $1,036.00 | $1,033.60 | $1,033.20 | $1,035.90 | $1,011.00 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/08 (except for Class Y shares, which is for the period January 2, 2008 (commencement of operations) to January 31, 2008). The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

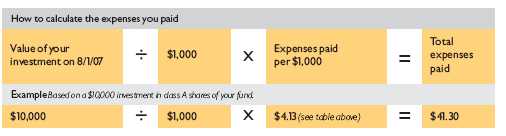

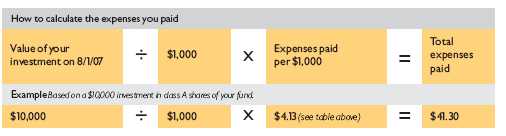

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2008, use the calculation method below. To find the value of your investment on August 1, 2007, call Putnam at 1-800-225-1581.

16

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $ 4.32 | $ 7.51 | $ 8.26 | $ 5.74 | $ 0.52 |

|

| Ending value (after expenses) | $1,020.86 | $1,017.70 | $1,016.94 | $1,019.46 | $1,003.58 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/08 (except for Class Y shares, which is for the period January 2, 2008 (commencement of operations) to January 31, 2008). The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Your fund’s annualized | | | | | |

| expense ratio* | 0.85% | 1.48% | 1.63% | 1.13% | 0.63% |

|

| Average annualized expense | | | | | |

| ratio for Lipper peer group† | 0.88% | 1.51% | 1.66% | 1.16% | 0.66% |

|

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

† Putnam is committed to keeping fund expenses below the Lipper peer group average expense ratio and will limit fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times and for different periods. The fund’s expense ratio shown here is annualized data for the mos t recent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 12/31/07.

17

Your fund’s portfolio turnover

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons

Percentage of holdings that change every year

| | | | | |

| | 2007 | 2006 | 2005 | 2004 | 2003 |

|

| Putnam AMT-Free Insured | | | | | |

| Municipal Fund | 19% | 7% | 13% | 27% | 43% |

|

| Lipper Insured Municipal Debt | | | | | |

| Funds category average | 37% | 37% | 39% | 45% | 62% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on July 31. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2007 is based on information available as of 12/31/07.

18

Your fund’s risk

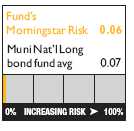

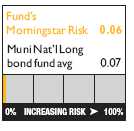

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar® Risk

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of December 31, 2007. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2007 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

19

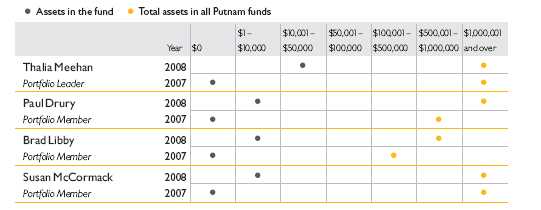

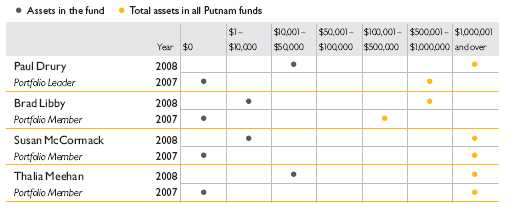

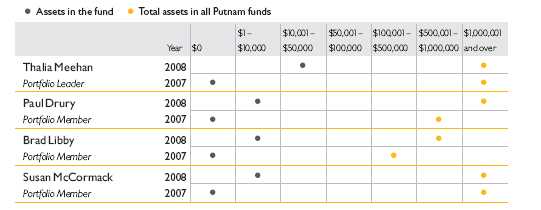

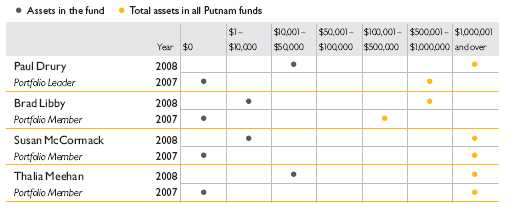

Your fund’s management

Your fund is managed by the members of the Putnam Tax Exempt Fixed-Income Team. Thalia Meehan is the Portfolio Leader, and Paul Drury, Brad Libby, and Susan McCormack are Portfolio Members, of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Tax Exempt Fixed-Income Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investors Web site at www.putnam.com.

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of January 31, 2008, and January 31, 2007.

Trustee and Putnam employee fund ownership

As of January 31, 2008, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $52,000 | $ 90,000,000 |

|

| Putnam employees | $65,000 | $669,000,000 |

|

20

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Thalia Meehan is the Portfolio Leader, and Paul Drury, Brad Libby, and Susan McCormack are Portfolio Members, of Putnam’s open-end tax-exempt funds for the following states: Arizona, California, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, and Pennsylvania. The same group also manages Putnam Investment Grade Municipal Trust, Putnam Municipal Bond Fund, Putnam Municipal Opportunities Trust, and Putnam Tax Exempt Income Fund.

Paul Drury is the Portfolio Leader, and Brad Libby, Susan McCormack, and Thalia Meehan are Portfolio Members, of Putnam High Yield Municipal Trust, Putnam Managed Municipal Income Trust, and Putnam Tax-Free High Yield Fund.

Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

21

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

22

Comparative indexes

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

23

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2007, the Contract Committee met several times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2007.

In addition, in anticipation of the sale of Putnam Investments to Great-West Lifeco, at a series of meetings ending in March 2007, the Trustees reviewed and approved new management and distribution arrangements to take effect upon the change of control. Shareholders of all funds approved the management contracts in May 2007, and the change of control transaction was completed on August 3, 2007. Upon the change of control, the management contracts that were approved by the Trustees in June 2007 automatically terminated and were replaced by new contracts that had been approved by shareholders. In connection with their review for the June 2007 continuance of the Putnam funds’ management contracts, the Trustees did not identify any facts or circumstances that would alter the substance of the conclusions and recommendations they made in their review of the contracts to take effect upon the change of control.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of

24

review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 33rd percentile in management fees and in the 25th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2006 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distributio n (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management had committed to maintain at least through 2007. In anticipation of the change of control of Putnam Investments, the Trustees requested, and received a commitment from Putnam Management and Great-West Lifeco, to extend this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

25

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2007, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2006. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract C ommittee’s stated intent to continue to work with Putnam Management to plan for an eventual resumption in the growth of assets, and to consider the potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment

26

process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperfor-mance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Insured Municipal Debt Funds) (compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-, three- and five-year periods ended March 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | Three-year period | Five-year period |

|

| 36th | 41st | 36th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2007, there were 60, 59 and 59 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.)

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Insured Municipal Debt Funds category for the one-, five-, and ten-year periods ended December 31, 2007, were 10%, 36%, and 29%, respectively. Over the one-, five-, and ten-year periods ended December 31, 2007, the fund ranked 5th out of 52, 18th out of 49, and 13th out of 44 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

27

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the custodian agreement, the Trustees considered that, effective January 1, 2007, the Putnam funds had engaged State Street Bank and Trust Company as custodian and began to transition the responsibility for providing custody services away from PFTC.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients

28

reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

29

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

30

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

31

The fund’s portfolio 1/31/08 (Unaudited)

| | | | | |

|

| Key to abbreviations | | | | | |

| AMBAC AMBAC Indemnity Corporation | FSA Financial Security Assurance | |

| COP Certificate of Participation | GNMA Coll. Government National Mortgage |

| FGIC Financial Guaranty Insurance Company | Association Collateralized | | |

| FHA Insd. Federal Housing Administration Insured | G.O. Bonds General Obligation Bonds | |

| FHLMC Coll. Federal Home Loan Mortgage | MBIA MBIA Insurance Company | |

| Corporation Collateralized | PSFG Permanent School Fund Guaranteed |

| FNMA Coll. Federal National Mortgage | U.S. Govt. Coll. U.S. Government Collateralized |

| Association Collateralized | VRDN Variable Rate Demand Notes | |

| FRN Floating Rate Notes | XLCA XL Capital Assurance | | |

|

| |

| |

| MUNICIPAL BONDS AND NOTES (101.5%)* | | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Alabama (1.1%) | | | | | |

| AL Hsg. Fin. Auth. Rev. Bonds (Single | | | | | |

| Fam. Mtge.) | | | | | |

| Ser. A-1, GNMA Coll., FNMA Coll., | | | | | |

| 6.05s, 4/1/17 | Aaa | $ | 375,000 | $ | 380,044 |

| Ser. G, GNMA Coll., FNMA Coll., FHLMC | | | | | |

| Coll., 5 1/2s, 10/1/37 | Aaa | | 3,000,000 | | 3,140,280 |

| | | | | | 3,520,324 |

|

| |

| Alaska (2.0%) | | | | | |

| AK State Hsg. Fin. Corp. Rev. Bonds, | | | | | |

| Ser. A, 4.4s, 12/1/31 | Aaa | | 2,530,000 | | 2,558,260 |

| Anchorage, G.O. Bonds, Ser. D, AMBAC, | | | | | |

| 5s, 8/1/25 | Aaa | | 3,420,000 | | 3,602,183 |

| | | | | | 6,160,443 |

|

| |

| Arkansas (1.1%) | | | | | |

| Fayetteville, Sales & Use Tax Cap. Impt. | | | | | |

| Rev. Bonds, Ser. A, FSA, 4s, 11/1/21 | Aaa | | 740,000 | | 752,536 |

| Springdale, Sales & Use Tax Rev. Bonds, | | | | | |

| FSA, 4.2s, 7/1/24 | Aaa | | 2,500,000 | | 2,556,450 |

| | | | | | 3,308,986 |

|

| |

| California (14.2%) | | | | | |

| Beaumont, Fin. Auth. Local Agcy. Special | | | | | |

| Tax Bonds, Ser. C, AMBAC, 4 3/4s, 9/1/28 | Aaa | | 2,370,000 | | 2,354,524 |

| CA State Pub. Wks. Board Rev. Bonds (Dept. | | | | | |

| Hlth. Svcs. Richmond Laboratory), Ser. B, | | | | | |

| XLCA, 5s, 11/1/23 | Aaa | | 2,445,000 | | 2,515,929 |

| Chino Basin, Regl. Fin. Auth. Rev. Bonds | | | | | |

| (Inland Empire Util. Agcy.), Ser. A, | | | | | |

| AMBAC, 5s, 11/1/33 ## | Aaa | | 2,000,000 | | 2,032,240 |

32

| | | | | |

| MUNICIPAL BONDS AND NOTES (101.5%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| California continued | | | | | |

| Garvey, School Dist. G.O. Bonds (Election | | | | | |

| of 2004), FSA | | | | | |

| zero %, 8/1/26 | Aaa | $ | 1,000,000 | $ | 408,590 |

| zero %, 8/1/25 | Aaa | | 1,475,000 | | 640,180 |

| Golden State Tobacco Securitization Corp. | | | | | |

| Rev. Bonds (Tobacco Settlement), Ser. B, | | | | | |

| AMBAC, FHLMC Coll., FNMA Coll., 5s, | | | | | |

| 6/1/38 (Prerefunded) | Aaa | | 2,475,000 | | 2,725,668 |

| Grossmont-Cuyamaca, Cmnty. College Dist. | | | | | |

| G.O. Bonds (Election of 2002), Ser. B, | | | | | |

| FGIC, zero %, 8/1/17 | Aaa | | 2,100,000 | | 1,440,789 |

| Los Angeles, Unified School Dist. G.O. | | | | | |

| Bonds (Election of 2004), Ser. C, FGIC, | | | | | |

| 5s, 7/1/26 | Aaa | | 2,745,000 | | 2,854,608 |

| Merced, City School Dist. G.O. Bonds | | | | | |

| (Election of 2003), MBIA | | | | | |

| zero %, 8/1/25 ## | AAA | | 1,190,000 | | 503,418 |

| zero %, 8/1/24 ## | AAA | | 1,125,000 | | 505,586 |

| zero %, 8/1/23 ## | AAA | | 1,065,000 | | 508,516 |

| zero %, 8/1/22 ## | AAA | | 1,010,000 | | 512,312 |

| Norwalk-La Mirada, Unified School Dist. | | | | | |

| G.O. Bonds, Ser. B, FGIC, zero %, 8/1/21 | Aaa | | 5,000,000 | | 2,693,150 |

| Sacramento, City Fin. Auth. Tax Alloc. | | | | | |

| Bonds, Ser. A, FGIC, zero %, 12/1/21 | Aaa | | 5,500,000 | | 2,705,230 |

| Sacramento, Muni. Util. Dist. Fin. Auth. | | | | | |

| Rev. Bonds | | | | | |

| (Cosumnes), MBIA, 5s, 7/1/19 ## | Aaa | | 3,000,000 | | 3,084,840 |

| (Cosumnes), MBIA, 5s, 7/1/18 | Aaa | | 4,000,000 | | 4,149,880 |

| San Diego Cnty., Wtr. Auth. COP, FGIC, | | | | | |

| 5.681s, 4/23/08 | Aaa | | 7,000,000 | | 7,052,780 |

| San Diego, Unified School Dist. G.O. Bonds | | | | | |

| (Election of 1998), Ser. E, FSA, 5 1/4s, | | | | | |

| 7/1/19 (Prerefunded) | Aaa | | 2,000,000 | | 2,243,180 |

| Santa Ana, Fin. Auth. Lease Rev. Bonds | | | | | |

| (Police Admin. & Hldg. Fac.), Ser. A, | | | | | |

| MBIA, 6 1/4s, 7/1/17 | Aaa | | 3,680,000 | | 4,455,376 |

| | | | | | 43,386,796 |

|

| |

| Colorado (1.7%) | | | | | |

| Adams & Arapahoe Cntys., Joint School | | | | | |

| Dist. G.O. Bonds (No. 28J Aurora), | | | | | |

| Ser. A, FSA, 5 1/4s, 12/1/18 | Aaa | | 4,140,000 | | 4,555,035 |

| CO Edl. & Cultural Fac. Auth. VRDN | | | | | |

| (National Jewish Federation Bond), | | | | | |

| Ser. A1, 1.9s, 9/1/33 | VMIG1 | | 760,000 | | 760,000 |

| | | | | | 5,315,035 |

33

| | | | | |

| MUNICIPAL BONDS AND NOTES (101.5%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Florida (10.8%) | | | | | |

| Fleming Island, Plantation Cmnty. Dev. | | | | | |

| Dist. Special Assmt. Bonds, MBIA, | | | | | |

| 4 1/2s, 5/1/31 | Aaa | $ | 1,000,000 | $ | 956,840 |

| Hernando Cnty., Rev. Bonds (Criminal | | | | | |

| Justice Complex Fin.), FGIC, 7.65s, 7/1/16 | Aaa | | 13,675,000 | | 17,845,875 |

| Jacksonville, Sales Tax Rev. Bonds, AMBAC, | | | | | |

| 5 1/2s, 10/1/17 | Aaa | | 2,500,000 | | 2,725,625 |

| Orlando & Orange Cnty., Expressway Auth. | | | | | |

| Rev. Bonds, FGIC, 8 1/4s, 7/1/14 | Aaa | | 5,000,000 | | 6,455,050 |

| Sumter Cnty., School Dist. Rev. Bonds | | | | | |

| (Multi-Dist. Loan Program), FSA, | | | | | |

| 7.15s, 11/1/15 | Aaa | | 3,935,000 | | 5,014,489 |

| | | | | | 32,997,879 |

|

| |

| Georgia (2.0%) | | | | | |

| Atlanta, Wtr. & Waste Wtr. VRDN, Ser. C, | | | | | |

| FSA, 2s, 11/1/41 | VMIG1 | | 2,000,000 | | 2,000,000 |

| Fulton Cnty., Dev. Auth. Rev. Bonds (Klaus | | | | | |

| Pkg. & Fam. Hsg. Project), MBIA, | | | | | |

| 5 1/4s, 11/1/20 | Aaa | | 3,360,000 | | 3,634,075 |

| GA Muni. Elec. Pwr. Auth. Rev. Bonds, | | | | | |

| Ser. Y, AMBAC, U.S. Govt. Coll., 6.4s, | | | | | |

| 1/1/13 (Prerefunded) | Aaa | | 415,000 | | 466,680 |

| | | | | | 6,100,755 |

|

| |

| Idaho (0.1%) | | | | | |

| ID Hlth. Fac. Auth. VRDN (St. Lukes Med. | | | | | |

| Ctr.), FSA, 1.88s, 7/1/30 | VMIG1 | | 375,000 | | 375,000 |

|

| |

| Illinois (9.6%) | | | | | |

| Chicago, G.O. Bonds, Ser. A, AMBAC, | | | | | |

| 5 5/8s, 1/1/39 | Aaa | | 155,000 | | 169,393 |

| Chicago, Board of Ed. G.O. Bonds, Ser. A, | | | | | |

| MBIA, 5 1/4s, 12/1/19 | Aaa | | 1,500,000 | | 1,614,780 |

| Chicago, Board of Ed. VRDN, Ser. C-1, FSA, | | | | | |

| 1.8s, 3/1/31 | VMIG1 | | 1,000,000 | | 1,000,000 |

| Chicago, O’Hare Intl. Arpt. Rev. Bonds, | | | | | |

| Ser. A, FSA, 5s, 1/1/33 | Aaa | | 5,000,000 | | 5,113,500 |

| Cicero, G.O. Bonds, Ser. A, XLCA, | | | | | |

| 5 1/4s, 1/1/21 | Aaa | | 2,250,000 | | 2,420,978 |

| Du Page Cnty., Cmnty. High School Dist. | | | | | |

| G.O. Bonds (Dist. No. 108 — Lake Park), | | | | | |

| FSA, 5.6s, 1/1/20 | Aaa | | 1,000,000 | | 1,092,930 |

| IL G.O. Bonds, Ser. 1, MBIA, 5 1/4s, 10/1/19 | Aaa | | 5,000,000 | | 5,374,900 |

| IL State Toll Hwy. Auth. Rev. Bonds, | | | | | |

| Ser. A-1, FSA, 5s, 1/1/22 | Aaa | | 2,500,000 | | 2,687,975 |

34

| | | | | |

| MUNICIPAL BONDS AND NOTES (101.5%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Illinois continued | | | | | |

| Regl. Trans. Auth. Rev. Bonds, Ser. A, | | | | | |

| AMBAC, 8s, 6/1/17 | Aaa | $ | 5,000,000 | $ | 6,725,150 |

| Will Cnty., School Dist. G.O. Bonds | | | | | |

| (No. 122 New Lenox), Ser. B, FSA, | | | | | |

| zero %, 11/1/21 | Aaa | | 5,590,000 | | 3,086,574 |

| | | | | | 29,286,180 |

|

| |

| Indiana (6.6%) | | | | | |

| Anderson, Indpt. School Bldg. Corp. G.O. | | | | | |

| Bonds (First Mtg.), FSA, 5 1/2s, 1/15/28 | | | | | |

| (Prerefunded) | Aaa | | 1,655,000 | | 1,907,305 |

| Ball State U. Rev. Bonds (Student Fee), | | | | | |

| Ser. N, FSA, 5s, 7/1/26 | Aaa | | 2,090,000 | | 2,206,915 |

| Center Grove, Ind. Bldg. Corp. Rev. Bonds | | | | | |

| (First Mtg.) | | | | | |

| AMBAC, 5 1/2s, 1/15/26 (Prerefunded) | Aaa | | 6,605,000 | | 7,268,736 |

| FGIC, 5s, 7/15/25 | Aaa | | 1,345,000 | | 1,398,518 |

| IN Muni. Pwr. Agcy. Supply Syst. Rev. | | | | | |

| Bonds, Ser. A, AMBAC, 5s, 1/1/20 | Aaa | | 5,695,000 | | 6,117,455 |

| IN State Hsg. Fin. Auth. Rev. Bonds | | | | | |

| (Single Family Mtge.), Ser. A-1, GNMA | | | | | |

| Coll., FNMA Coll. | | | | | |

| 4.2s, 7/1/17 | Aaa | | 240,000 | | 241,063 |

| 4.15s, 7/1/16 | Aaa | | 350,000 | | 352,930 |

| 4.1s, 7/1/15 | Aaa | | 110,000 | | 111,420 |

| 3.95s, 7/1/14 | Aaa | | 335,000 | | 339,345 |

| 3.9s, 1/1/14 | Aaa | | 235,000 | | 237,218 |

| | | | | | 20,180,905 |

|

| |

| Louisiana (3.7%) | | | | | |

| Ernest N. Morial-New Orleans Exhibit Hall | | | | | |

| Auth. Special Tax, AMBAC, 5s, 7/15/20 | AAA | | 5,730,000 | | 5,964,529 |

| LA Rev. Bonds, Ser. A, AMBAC, | | | | | |

| 5 3/8s, 6/1/19 | Aaa | | 3,000,000 | | 3,212,460 |

| Lafayette, Pub. Pwr. Auth. Elec. Rev. | | | | | |

| Bonds, MBIA, 5s, 11/1/32 | Aaa | | 2,000,000 | | 2,055,760 |

| | | | | | 11,232,749 |

|

| |

| Massachusetts (1.3%) | | | | | |

| MA State Special Oblig. Dedicated Tax Rev. | | | | | |

| Bonds, FGIC, FHLMC Coll., FNMA Coll., | | | | | |

| 5 1/4s, 1/1/23 (Prerefunded) | Aaa | | 1,000,000 | | 1,124,370 |

| MA State Tpk. Auth. Hwy. Syst. Rev. Bonds, | | | | | |

| Ser. A, MBIA, 5s, 1/1/37 | Aaa | | 2,805,000 | | 2,805,365 |

| | | | | | 3,929,735 |

35

| | | | | |

| MUNICIPAL BONDS AND NOTES (101.5%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Michigan (9.4%) | | | | | |

| Detroit, City School Dist. G.O. Bonds | | | | | |

| (School Bldg. & Site Impt.), Ser. B, | | | | | |

| FGIC, 5s, 5/1/25 | Aaa | $ | 7,990,000 | $ | 8,129,266 |

| Detroit, Swr. Disp. FRN, Ser. D, FSA, | | | | | |

| 3.768s, 7/1/32 | Aaa | | 1,100,000 | | 842,490 |

| Detroit, Swr. Disp. VRDN, Ser. B, FSA, | | | | | |

| 2s, 7/1/33 | VMIG1 | | 3,100,000 | | 3,100,000 |

| Detroit, Wtr. Supply Syst. Rev. Bonds, | | | | | |

| Ser. B, FGIC, 5 1/4s, 7/1/20 | | | | | |

| (Prerefunded) | Aaa | | 720,000 | | 785,714 |

| Kent, Hosp. Fin. Auth. Rev. Bonds | | | | | |

| (Spectrum Hlth. Care), Ser. A, MBIA, | | | | | |

| 5 1/2s, 1/15/17 (Prerefunded) | Aaa | | 500,000 | | 553,965 |

| MI Muni. Board Auth. Rev. Bonds (Clean | | | | | |

| Wtr. Revolving Fund), 5s, 10/1/25 | Aaa | | 1,000,000 | | 1,060,480 |

| MI State Hosp. Fin. Auth. Rev. Bonds | | | | | |

| (Mercy Hlth.), Ser. X, MBIA | | | | | |

| 6s, 8/15/34 (Prerefunded) | Aaa | | 3,350,000 | | 3,577,331 |

| 6s, 8/15/34 (Prerefunded) | Aaa | | 1,650,000 | | 1,761,969 |

| MI State Strategic Fund, Ltd. Rev. Bonds | | | | | |

| (Detroit Edison Co.), AMBAC | | | | | |

| 7s, 5/1/21 | Aaa | | 4,000,000 | | 5,137,640 |

| 4.85s, 9/1/30 | Aaa | | 3,500,000 | | 3,744,685 |

| | | | | | 28,693,540 |

|

| |

| Mississippi (0.9%) | | | | | |

| MS Home Corp. Rev. Bonds (Single Fam. | | | | | |

| Mtge.), Ser. D-1, GNMA Coll., FNMA Coll., | | | | | |

| 6.1s, 6/1/38 | Aaa | | 2,500,000 | | 2,713,875 |

|

| |

| Missouri (0.9%) | | | | | |

| Jackson Cnty., Special Oblig. Rev. Bonds | | | | | |

| (Harry S. Truman Sports Complex), AMBAC, | | | | | |

| 5s, 12/1/22 | Aaa | | 1,285,000 | | 1,369,823 |

| MO State Hlth. & Edl. Fac. Auth. VRDN (SSM | | | | | |

| Hlth. Care), Ser. C-1, FSA, 2s, 6/1/19 | A-1+ | | 1,300,000 | | 1,300,000 |

| | | | | | 2,669,823 |

|

| |

| Nevada (2.4%) | | | | | |

| Clark Cnty., School Dist. VRDN, Ser. A, | | | | | |

| FSA, 1.7s, 6/15/21 | VMIG1 | | 5,000,000 | | 5,000,000 |

| Washoe Cnty., G.O. Bonds, FGIC, | | | | | |

| 5 3/4s, 5/1/18 | Aaa | | 2,040,000 | | 2,219,051 |

| | | | | | 7,219,051 |

|

| |

| New Hampshire (0.4%) | | | | | |

| NH Muni. Bond Bank Rev. Bonds, Ser. C, | | | | | |

| MBIA, 5s, 3/15/25 | Aaa | | 1,195,000 | | 1,257,702 |

36

| | | | | |

| MUNICIPAL BONDS AND NOTES (101.5%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| New Jersey (6.0%) | | | | | |

| NJ Econ. Dev. Auth. Rev. Bonds | | | | | |