| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811- 04345) | |

| | |

| Exact name of registrant as specified in charter: | Putnam Tax Free Income Trust |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: July 31, 2009 | | |

| |

| Date of reporting period: August 1, 2008 — January 31, 2009 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Since 1937, when George Putnam created a prudent mix of stocks and bonds in a single, professionally managed portfolio, we have championed the wisdom of the balanced approach. Today, we offer investors a world of equity, fixed-income, multi-asset, and absolute-return portfolios so investors can pursue a range of financial goals. Our seasoned portfolio managers seek superior results over time, backed by original, fundamental research on a global scale. We believe in service excellence, in the value of experienced financial advice, and in putting clients first in everything we do.

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

Putnam

AMT-Free

Municipal Fund

1 | 31 | 09

Semiannual Report

| | |

| Message from the Trustees | 2 | |

| About the fund | 4 | |

| Performance snapshot | 6 | |

| Interview with your fund’s Portfolio Manager | 7 | |

| Performance in depth. | 12 | |

| Expenses | 14 | |

| Portfolio turnover | 16 | |

| Your fund’s management. | 17 | |

| Terms and definitions | 18 | |

| Trustee approval of management contract | 19 | |

| Other information for shareholders. | 24 | |

| Financial statements | 25 | |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder:

Financial markets have experienced significant upheaval for well over a year now. Responses by governmental and financial authorities have been rapid and often unprecedented in scale, including the recent passage of a nearly $800 billion economic stimulus plan by Congress. Although history reminds us that stability and optimism have always returned to the markets, investors should expect continued volatility in the near term, for we are in the midst of a deep and painful bear market.

Under President and Chief Executive Officer Robert L. Reynolds, Putnam Investments is making the most of these challenging times by instituting several important changes designed to prepare Putnam for the eventual recovery. Key among them has been replacing a team management structure within Putnam equity funds with a more nimble decision-making process that vests responsibility with individual fund managers.

In other moves aimed at achieving performance excellence, Putnam has affirmed a fundamental approach to investing, simplified its equity fund lineup, and hired nearly 20 seasoned equity analysts.

2

We would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam. Although the markets have presented investors with extraordinary challenges, it is Putnam’s belief that the seeds of opportunity are often sown during difficult times like these.

About the fund

Seeking high current income free from federal taxes

Municipal bonds have long been popular investments because they provide income exempt from federal tax, though capital gains are taxable. Putnam AMT-Free Municipal Fund seeks income exempt from traditional income tax as well as from the federal alternative minimum tax, or AMT.

The AMT is a federal tax that operates in tandem with the regular income tax system. Taxpayers subject to the AMT must pay a larger amount in tax determined by AMT rules — and the difference can be thousands of dollars for many with household incomes above $150,000. It is estimated that by 2010, nearly every household with an income of $100,000 or more will be paying the AMT, unless the federal government changes the law.

If you are subject to the AMT, investments that could increase your tax liability include private-activity municipal bonds, which back development projects, including certain housing and resource recovery projects.

Putnam AMT-Free Municipal Fund aims to serve investors subject to the AMT. The fund seeks to avoid bonds whose income would be taxable under AMT rules, though income may be subject to state taxes.

The fund’s portfolio managers research the municipal market to buy bonds that are not subject to the AMT. Pursuing the fund’s mandate, they also keep the fund invested in high-quality bonds, favoring those that have intermediate to long-term maturities. The managers’ goal is to provide an attractive level of income exempt from all federal taxes.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. Income from federally exempt funds may be subject to state and local taxes. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Tax-free funds may not be suitable for IRAs and other non-taxable accounts. Please consult your tax advisor for more information. Shares of this fund are not insured, and their prices will fluctuate with market conditions.

Understanding the AMT

The AMT is a separate, parallel federal income tax system, with two marginal tax rates, 26% and 28%, and different exemption amounts.

Under AMT rules, certain exclusions, exemptions, deductions, and credits that would reduce your regular taxable income are not allowed. You must “adjust” your regular taxable income to arrive at your alternative minimum taxable income (AMTI). Then, after subtracting your AMT exemption amount, if your AMT liability is greater than your regular tax liability, you must pay both your regular tax and the difference. It is important to understand that a higher level of income will not necessarily cause you to owe AMT. Rather, it is the relationship between your income and various trigger items, such as credits and deductions, that determines your AMT liability.

Managing this relationship can help avoid a costly surprise at tax time. Any number of items may trigger the tax, but large capital gains, personal exemptions, and deductions are the worst culprits.

From “class tax” to “mass tax”: By 2010, over 33 million

taxpayers may be subject to the AMT.

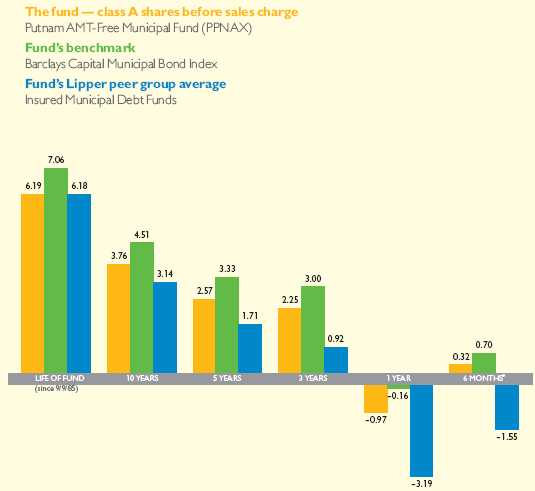

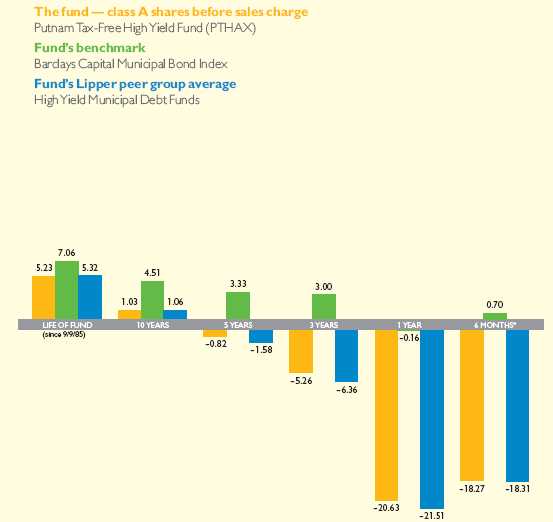

Performance snapshot

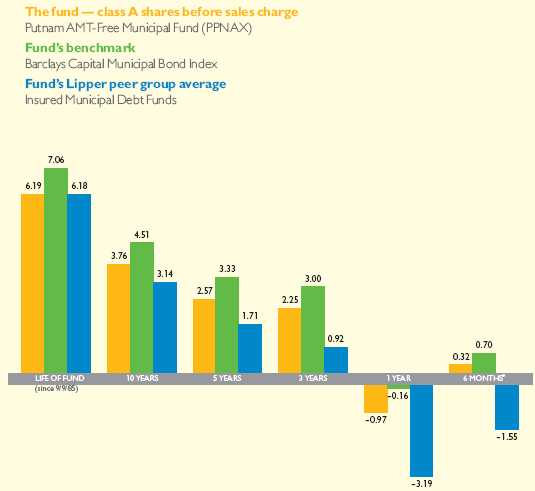

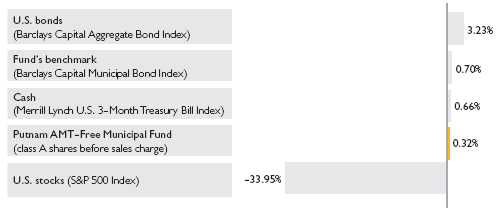

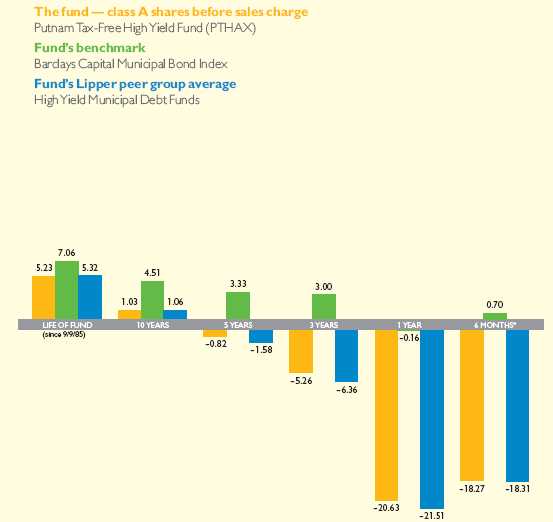

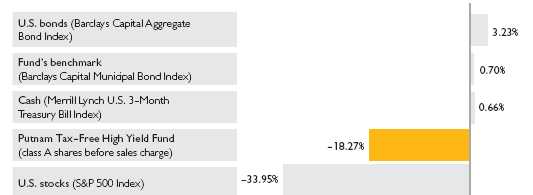

Average annual total return (%) comparison as of 1/31/09

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 7 and 12–14 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

6

Interview with your

fund’s Portfolio Manager

Thalia Meehan

Thank you,Thalia, for talking with us today about Putnam AMT-Free Municipal Fund. How has the fund performed in the past six months?

In a challenging environment for nearly all markets, including municipal bonds, the fund performed well — relative to its peers. For the six months ended January 31, 2009, the fund achieved a positive return, gaining 0.32%. Meanwhile, the fund’s peer group, Lipper Insured Municipal Debt Funds, ended in negative territory, returning –1.55%, with the benchmark, Barclays Capital Municipal Bond Index, returning 0.70%.

Why did the fund perform better than its peer group?

The six-month period continued to be a volatile time for municipal bond funds, but we believe we were able to weather the storm better than many others because we continued to focus on keeping the fund’s overall credit quality high. In general, investors fled to high-quality and shorter maturities as a safe haven. As a result, the fund’s shorter-maturity positions helped

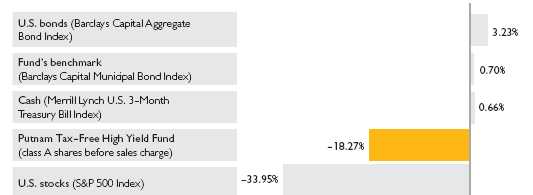

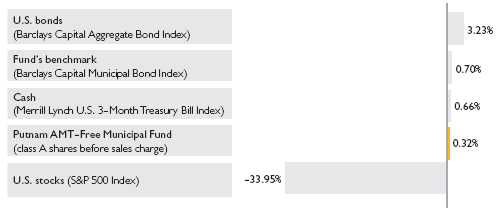

Broad market index and fund performance

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 1/31/09. See page 6 and pages 12–14 for additional fund performance information. Index descriptions can be found on page 18.

7

performance when the yield curve steepened, and prices on shorter-term instruments held up better than longer-maturity bonds. Security selection in the insured sector also aided relative performance. As concerns rose about the claims-paying abilities of monoline insurers [companies that insure issuers of municipal debt], there was growing differentiation among insured issues. Our positioning within insured issues aided performance relative to our peers.

During the period, insured bond issuance also decreased, as the credit quality of monoline insurers became a concern. We believe the decrease of insured issuance has played to one of Putnam’s real strengths: our deep research capabilities. In 2008, insured new issuance fell to just 18% of the overall new issuance market, down from the historical level of nearly 50%. For the municipal bond market, having fewer insured issues means a greater quality dispersion among issues, making analyzing each issue’s risks more important than ever. At Putnam, we believe our in-depth, integrated team of research professionals has already given us an advantage in sizing up these risks and finding true quality for investors.

Overall, why was this such a challenging six months for municipals?

During the period, the municipal bond market endured its worst months ever. We witnessed the subprime credit melt-down extend to all areas of the credit markets. Investors lost faith in credit ratings and insurers to the point that they avoided all asset classes with any credit

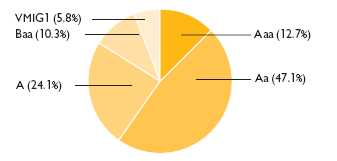

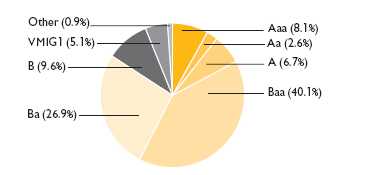

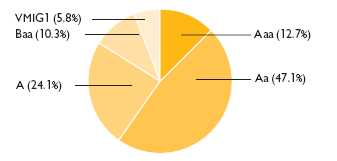

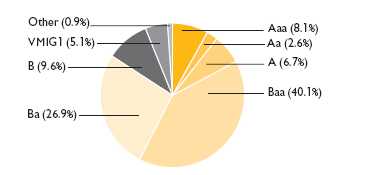

Credit quality overview

Credit qualities shown as a percentage of portfolio value as of 1/31/09. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

8

risk whatsoever, resulting in tax-exempt bonds underperforming U.S. Treasuries by a significant margin. Yet, at the same time that investors shunned the market, other market participants were forced to sell. Hedge funds needed to liquidate positions to raise capital and cover losses; rumors swirled of the potential liquidation of American International Group’s [AIG] estimated $50 billion to $60 billion municipal bond portfolio; and dealer liquidity was constrained by the historic bankruptcy of Lehman, the exit of UBS from the institutional market, and the purchase of Merrill Lynch by Bank of America. All of these factors weighed heavily on the municipal bond market.

Lastly, we saw a temporary lack of primary market supply as municipal bond issuers delayed new issuance due to market conditions. Because new issues typically help establish pricing in the marketplace, as dealers delayed pricing new issues, secondary market liquidity was negatively affected. All of these issues put downward pressure on municipal bond prices, further hurting asset class performance. While we saw a small rally in January, combined with some improvement in liquidity, the market continues to face severe pressures, including budget crises on the state and local levels.

You mentioned that your bias toward higher-quality issuances helped performance during the period. Any notable contributors?

Overall, the winning formula for munis in the period was short maturity and strong credit quality, with a high coupon

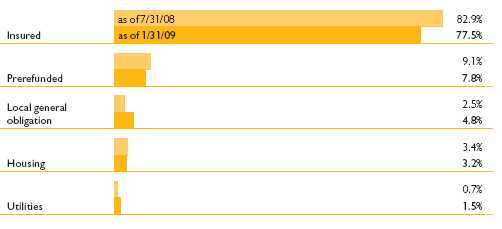

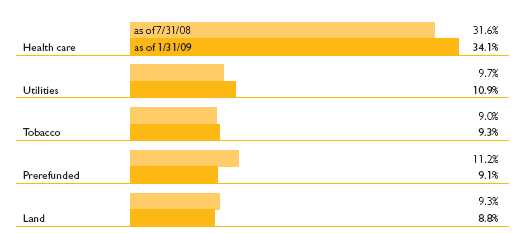

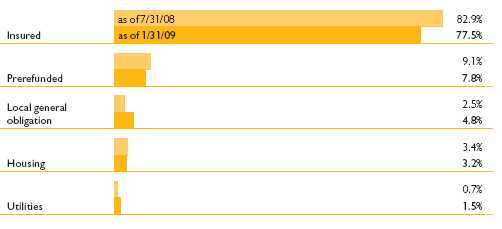

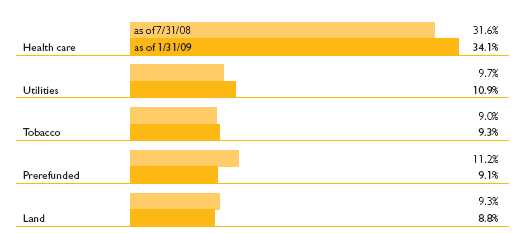

Comparison of top sector weightings

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time. Sector concentrations listed after the portfolio schedule in the Financial Statements section of this shareholder report are exclusive of insured or prerefunded status and may differ from the summary information below.

9

being an added bonus. Prerefunded bonds fit this description perfectly. Prerefunding occurs when a municipality issues a new bond to pay off an older issue at its first call date. The proceeds are then invested in secure investments, typically Aaa-rated U.S. Treasury securities, which mature at the older bond’s first call date, effectively raising the bond’s perceived rating and frequently its market value. Previously prerefunded bonds in the portfolio contributed positively to performance.

Among other notable contributors were Washington Public Power Supply revenue bonds, a high-quality, short-maturity holding that benefited when investors sought out quality during the period. As the yield curve steepened and shorter-maturity issues outperformed their longer-maturity counterparts, this position outperformed on a relative basis.

How about notable detractors?

Bonds used to fund development at the Fleming Island Plantation Community in Florida hurt performance. Two factors spearheaded the decline. First, the bond, which is insured by MBIA Inc., was negatively affected when MBIA’s credit quality came into question. Second, the bond is secured by Florida land, which saw real estate values plummet, further hurting the bond.

MBIA-insured bonds for the Public Highway Authority in Colorado composed another holding that was affected by MBIA’s downgrades. In response to MBIA’s downgrade, Moody’s downgraded the muni bond as well. What’s more, the holding also suffered from its long maturity when the yield curve steepened.

I N T H E N E W S

Congress passed a $787 billion stimulus plan on February 13, 2009, with the goals of creating jobs, helping the unemployed, and cultivating economic growth. Tens of billions of dollars will be spent over the next two years to support Medicaid, help local school districts, and extend jobless bene-fits. Billions of dollars also will fund job-creating investments in“green” technologies, computerizing the nation’s medical-records system, biomedical research, and public works construction projects. The balance of the package is devoted to tax cuts for businesses and individuals, including a $400 payroll tax holiday for workers (married couples filing jointly for less than $150,000 get up to $800). The plan is one of the largest of its kind since Franklin D. Roosevelt launched the New Deal in 1933.

10

What is your outlook for the municipal bond market?

We saw significant changes in the muni market in 2008, and we fully expect a great deal more in 2009. With the Obama administration now in office, all eyes are trained on Washington to see what the ultimate impact of the new stimulus plan will be. The plan’s terms appear to be a net positive for the municipal market — but federal assistance won’t be a panacea. It is also possible that too much good news has already been priced into very high-grade bonds, and that the stimulus package will not do enough to improve prices on more credit-sensitive bond issues.

Despite the immediate challenges facing municipal bonds, we believe municipal bond funds remain particularly attractive. Even with the stimulus package’s immediate tax relief, given the size of the stimulus as well as the fiscal deficit of the government, taxes are likely to go higher, particularly with the Bush tax cuts scheduled to sunset in 2010. Such a scenario makes tax-advantaged municipal bonds an even more attractive asset class relative to taxable fixed income.

Additionally, we believe that municipal bonds have already priced in a great deal of default risk as well as a liquidity premium. Although the municipal bond market could remain volatile in the near term, we feel that at current prices, investors will be rewarded for staying committed to municipals in the long run.

Lastly, given the changes in the municipal bond market in 2008 and the ones we foresee for 2009 — less insured issuance, changes in regulation, pent-up supply, and uncertain demand — we feel there is a significant opportunity for Putnam’s deep research team to add unique value for municipal bond investors. In a climate of change, it’s important to able to analyze and understand the impact of the changes on the marketplace. That’s why we believe Putnam’s strong research capability sets us apart in today’s climate.

Thank you,Thalia, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

11

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2009, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section of www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/09

| | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

| (inception dates) | (9/20/93) | (9/9/85) | (7/26/99) | (6/1/95) | (1/2/08) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average | | | | | | | | | |

| (life of fund) | 6.19% | 6.01% | 5.86% | 5.86% | 5.58% | 5.58% | 5.96% | 5.82% | 5.90% |

|

| 10 years | 44.59 | 38.79 | 36.67 | 36.67 | 33.52 | 33.52 | 40.69 | 36.17 | 37.95 |

| Annual average | 3.76 | 3.33 | 3.17 | 3.17 | 2.93 | 2.93 | 3.47 | 3.14 | 3.27 |

|

| 5 years | 13.55 | 9.12 | 9.97 | 8.12 | 9.16 | 9.16 | 11.83 | 8.24 | 11.00 |

| Annual average | 2.57 | 1.76 | 1.92 | 1.57 | 1.77 | 1.77 | 2.26 | 1.60 | 2.11 |

|

| 3 years | 6.90 | 2.57 | 4.81 | 1.97 | 4.53 | 4.53 | 6.00 | 2.49 | 5.74 |

| Annual average | 2.25 | 0.85 | 1.58 | 0.65 | 1.49 | 1.49 | 1.96 | 0.82 | 1.88 |

|

| 1 year | –0.97 | –4.95 | –1.67 | –6.42 | –1.74 | –2.69 | –1.31 | –4.49 | –0.83 |

|

| 6 months | 0.32 | –3.70 | 0.02 | –4.89 | –0.09 | –1.07 | 0.17 | –3.06 | 0.34 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class Y shares have no initial sales charge or CDSC. Performance for class A, C, M, and Y shares before their inception is derived from the historical performance of class B shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund may have limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

12

| | |

| Comparative index returns For periods ended 1/31/09 | |

| |

| | Barclays Capital | Lipper Insured Municipal Debt |

| | Municipal Bond Index | Funds category average* |

|

| Annual average (life of fund) | 7.06% | 6.18% |

|

| 10 years | 55.42 | 36.54 |

| Annual average | 4.51 | 3.14 |

|

| 5 years | 17.81 | 8.94 |

| Annual average | 3.33 | 1.71 |

|

| 3 years | 9.26 | 2.88 |

| Annual average | 3.00 | 0.92 |

|

| 1 year | –0.16 | –3.19 |

|

| 6 months | 0.70 | –1.55 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 1/31/09, there were 39, 38, 35, 34, 30, and 5 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 1/31/09

| | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 |

|

| Income 1 | $0.287238 | $0.243341 | $0.232976 | $0.268382 | $0.302376 |

|

| Capital gains — Long-term 2 | 0.010300 | 0.010300 | 0.010300 | 0.010300 | 0.010300 |

|

| Capital gains — Short-term 2 | — | — | — | — | — |

|

| Total | $0.297538 | $0.253641 | $0.243276 | $0.278682 | $0.312676 |

| |

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV |

|

| 7/31/08 | $14.33 | $14.93 | $14.35 | $14.36 | $14.37 | $14.85 | $14.34 |

|

| 1/31/09 | 14.07 | 14.66 | 14.09 | 14.10 | 14.11 | 14.58 | 14.07 |

| |

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV |

|

| Current dividend rate 3 | 3.86% | 3.70% | 3.23% | 3.08% | 3.59% | 3.47% | 4.08% |

|

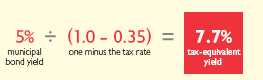

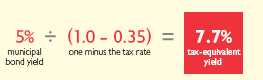

| Taxable equivalent 4 | 5.94 | 5.69 | 4.97 | 4.74 | 5.52 | 5.34 | 6.28 |

|

| Current 30-day SEC yield 5,6 | | | | | | | |

| (with expense limitation) | N/A | 3.49 | 2.98 | 2.82 | N/A | 3.26 | 3.90 |

|

| Taxable equivalent 4 | N/A | 5.37 | 4.58 | 4.34 | N/A | 5.02 | 6.00 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 For some investors, investment income may be subject to the federal alternative minimum tax.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

4 Assumes maximum 35.00% federal tax rate for 2009. Results for investors subject to lower tax rates would not be as advantageous.

5 For a portion of the period, this fund may have limited expenses, without which yields would have been lower.

6 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

13

Fund performance as of the most recent calendar quarter

Total return for periods ended 12/31/08

| | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

| (inception dates) | (9/20/93) | (9/9/85) | (7/26/99) | (6/1/95) | (1/2/08) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV |

|

| Annual average | | | | | | | | | |

| (life of fund) | 6.07% | 5.89% | 5.74% | 5.74% | 5.47% | 5.47% | 5.84% | 5.69% | 5.78% |

|

| 10 years | 41.94 | 36.27 | 34.27 | 34.27 | 31.04 | 31.04 | 38.08 | 33.57 | 35.38 |

| Annual average | 3.56 | 3.14 | 2.99 | 2.99 | 2.74 | 2.74 | 3.28 | 2.94 | 3.08 |

|

| 5 years | 10.61 | 6.22 | 7.14 | 5.34 | 6.39 | 6.39 | 8.90 | 5.42 | 8.08 |

| Annual average | 2.04 | 1.21 | 1.39 | 1.05 | 1.25 | 1.25 | 1.72 | 1.06 | 1.57 |

|

| 3 years | 3.85 | –0.35 | 1.83 | –0.93 | 1.54 | 1.54 | 2.92 | –0.50 | 2.67 |

| Annual average | 1.27 | –0.12 | 0.61 | –0.31 | 0.51 | 0.51 | 0.96 | –0.17 | 0.88 |

|

| 1 year | –3.06 | –6.93 | –3.67 | –8.32 | –3.82 | –4.75 | –3.39 | –6.55 | –2.86 |

|

| 6 months | –2.78 | –6.66 | –3.06 | –7.82 | –3.18 | –4.13 | –3.00 | –6.11 | –2.70 |

|

Fund’s annual operating expenses For the fiscal year ended 7/31/08

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Total annual fund operating expenses | 0.85% | 1.49% | 1.64% | 1.14% | 0.64%* |

|

* Expenses for class Y shares (added 1/2/08) are based on class A shares excluding distribution (12b-1) fees for the last fiscal year.

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

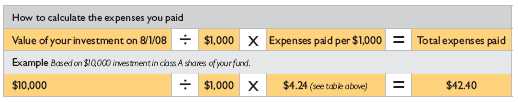

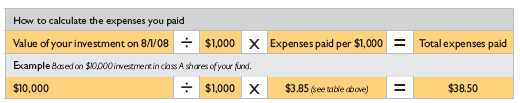

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The following table shows the expenses you would have paid on a $1,000 investment in Putnam AMT-Free Municipal Fund from August 1, 2008, to January 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

14

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $4.24 | $7.46 | $8.21 | $5.70 | $3.18 |

|

| Ending value (after expenses) | $1,003.10 | $1,000.20 | $999.10 | $1,001.70 | $1,003.40 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/09. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

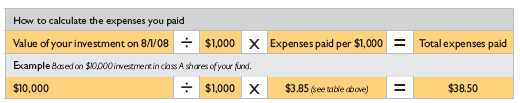

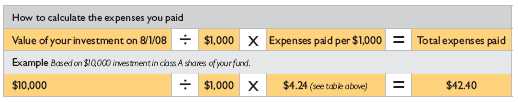

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2009, use the following calculation method. To find the value of your investment on August 1, 2008, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Expenses paid per $1,000* | $4.28 | $7.53 | $8.29 | $5.75 | $3.21 |

|

| Ending value (after expenses) | $1,020.97 | $1,017.74 | $1,016.99 | $1,019.51 | $1,022.03 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/09. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

15

| | | | | |

| | Class A | Class B | Class C | Class M | Class Y |

|

| Your fund’s annualized | | | | | |

| expense ratio | 0.84% | 1.48% | 1.63% | 1.13% | 0.63% |

|

| Average annualized expense | | | | | |

| ratio for Lipper peer group* | 0.85% | 1.49% | 1.64% | 1.14% | 0.64% |

|

* Putnam keeps fund expenses below the Lipper peer group average expense ratio by limiting our fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage/service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times; the fund’s expense ratio shown here is annualized data for the most recent six-month period, while the quarterly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 12/31/08.

Your fund’s portfolio turnover

Putnam funds are actively managed by experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the following table to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons Percentage of holdings that change every year

| | | | | |

| | 2008 | 2007 | 2006 | 2005 | 2004 |

|

| Putnam AMT-Free Municipal Fund | 39% | 19% | 7% | 13% | 27% |

|

| Lipper Insured Municipal Debt Funds | | | | | |

| category average | 47% | 37% | 37% | 39% | 45% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on July 31. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2008 is based on information available as of 12/31/08.

16

Your fund’s management

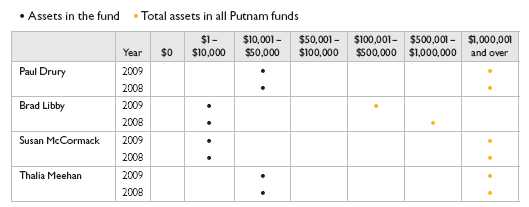

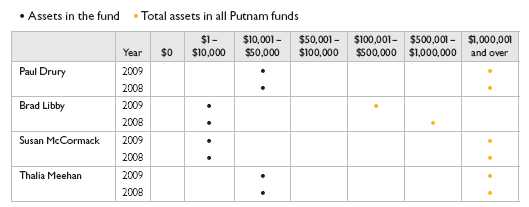

Your fund’s Portfolio Managers are Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack.

Portfolio management fund ownership

The following table shows how much the fund’s current Portfolio Managers have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of January 31, 2009, and January 31, 2008.

Trustee and Putnam employee fund ownership

As of January 31, 2009, all of the Trustees of the Putnam funds owned fund shares. The following table shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | Assets in the fund | Total assets in all Putnam funds |

|

| Trustees | $51,000 | $31,000,000 |

|

| Putnam employees | 66,000 | 342,000,000 |

|

Other Putnam funds managed by the Portfolio Managers

Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack are Portfolio Managers of Putnam’s open-end tax-exempt funds for the following states: Arizona, California, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, and Pennsylvania. The same group also manages Putnam Tax Exempt Income Fund, Putnam Managed Municipal Income Trust, and Putnam Municipal Opportunities Trust.

Thalia Meehan, Paul Drury, Brad Libby, and Susan McCormack may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

17

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Barclays Capital Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

18

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2008, the Contract Committee met several times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2008.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees, were subject to the continued application of certain expense reductions and waivers and other considerations noted below, and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. In this regard,

19

the Trustees also noted that shareholders of your fund voted in 2007 to approve new management contracts containing an identical fee structure. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 30th percentile in management fees and in the 40th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2007 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increas ing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations initially implemented in January 2004. The Trustees have received a commitment from Putnam Management and its parent company to continue this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2008, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2007. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

In addition, the Trustees devoted particular attention to analyzing the Putnam funds’ fees and expenses relative to those of competitors in fund complexes of comparable size and with a comparable mix of asset categories. The Trustees concluded that this analysis did not reveal any matters requiring further attention at the current time.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of the fund (as a percentage of fund assets) declines as the fund grows in size and crosses specified asset thresholds. Conversely, if the fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedule in effect for your fund represented

20

an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process —as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not guarantee favorabl e investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

While the Trustees noted the satisfactory investment performance of certain Putnam funds, they considered the disappointing investment performance of many funds in recent periods, particularly over periods in 2007 and 2008. They discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has taken steps to strengthen its investment personnel and processes to address areas of underperformance, including recent efforts to further centralize Putnam Management’s equity research function. In this regard, the Trustees took into consideration efforts by Putnam Management to improve its ability to assess and mitigate investment risk in individual funds, across asset classes, and across the complex as a whole. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Insured Municipal Debt Funds) (compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-year, three-year and five-year periods ended December 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

21

| | | |

| One-year period | 7th | | |

| | |

| Three-year period | 30th | | |

| | |

| Five-year period | 36th | | |

| | |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report.) Over the one-year, three-year and five-year periods ended December 31, 2007, there were 52, 49, and 49 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered changes made in 2008, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policy, which expanded the permitted categories of brokerage and research services payable with soft dollars and increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage and trends in industry practice to ensur e that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract arrangements also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Insured Municipal Debt Funds category for the one-year, five-year, and ten-year periods ended December 31, 2008, were 27%, 14%, and 6%, respectively. Over the one-year, five-year, and ten-year periods ended December 31, 2008, your fund ranked 11th out of 40, 5th out of 37, and 2nd out of 33 funds, respectively. Unlike the information above, these rankings reflect performance before taxes. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

22

which provides benefits to affiliates of Putnam Management. In the case of the investor servicing agreement, the Trustees considered that certain shareholder servicing functions were shifted to a third-party service provider by PFTC in 2007.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparisons of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different asset classes are typically higher o n average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

23

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2008, are available in the Individual Investors section of www.putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

24

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings —from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

25

The fund’s portfolio 1/31/09 (Unaudited)

| |

| Key to abbreviations | |

| AGO Assured Guaranty, Ltd. | GNMA Coll. Government National Mortgage |

| AMBAC AMBAC Indemnity Corporation | Association Collateralized |

| FGIC Financial Guaranty Insurance Company | G.O. Bonds General Obligation Bonds |

| FHA Insd. Federal Housing Administration Insured | MBIA MBIA Insurance Company |

| FHLMC Coll. Federal Home Loan Mortgage | PSFG Permanent School Fund Guaranteed |

| Corporation Collateralized | U.S. Govt. Coll. U.S. Government Collateralized |

| FNMA Coll. Federal National Mortgage | VRDN Variable Rate Demand Notes |

| Association Collateralized | XLCA XL Capital Assurance |

| FSA Financial Security Assurance | |

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* | Rating** | Principal amount | Value |

|

| Alabama (0.9%) | | | |

| AL Hsg. Fin. Auth. Rev. Bonds (Single Fam. Mtge.) | | | |

| Ser. A-1, GNMA Coll., FNMA Coll., 6.05s, 4/1/17 | Aaa | $310,000 | $300,610 |

| Ser. G, GNMA Coll., FNMA Coll., FHLMC Coll., | | | |

| 5 1/2s, 10/1/37 | Aaa | 2,725,000 | 2,715,844 |

|

| | | | 3,016,454 |

| Alaska (1.6%) | | | |

| AK State Hsg. Fin. Corp. Rev. Bonds, Ser. A, | | | |

| 4.4s, 12/1/31 | Aaa | 1,955,000 | 1,894,180 |

|

| Anchorage, G.O. Bonds, Ser. D, AMBAC, 5s, 8/1/25 | AA | 3,420,000 | 3,486,348 |

|

| | | | 5,380,528 |

| Arizona (0.6%) | | | |

| Glendale, Wtr. & Swr. Rev. Bonds, AMBAC, 5s, 7/1/28 | AA | 2,000,000 | 1,968,180 |

|

| | | | 1,968,180 |

| Arkansas (0.9%) | | | |

| Fayetteville, Sales & Use Tax Cap. Impt. Rev. | | | |

| Bonds, Ser. A, FSA, 4s, 11/1/21 | AAA | 680,000 | 678,620 |

|

| Springdale, Sales & Use Tax Rev. Bonds, FSA, | | | |

| 4.2s, 7/1/24 | AAA | 2,500,000 | 2,346,975 |

|

| | | | 3,025,595 |

| California (13.1%) | | | |

| Beaumont, Fin. Auth. Local Agcy. Special Tax | | | |

| Bonds, Ser. C, AMBAC, 4 3/4s, 9/1/28 | A | 2,370,000 | 1,776,031 |

|

| CA State Dept. of Wtr. Resources Rev. Bonds | | | |

| (Central Valley), Ser. AE, 5s, 12/1/29 | Aaa | 2,500,000 | 2,525,825 |

|

| CA State Pub. Wks. Board Rev. Bonds (Dept. Hlth. | | | |

| Svcs. Richmond Laboratory), Ser. B, XLCA, 5s, 11/1/23 | A2 | 2,445,000 | 2,280,207 |

|

| CA Statewide Cmntys., Dev. Auth. Rev. Bonds | | | |

| (St. Joseph), MBIA, 5 1/8s, 7/1/24 | AA | 2,000,000 | 1,943,320 |

|

| Chino Basin, Regl. Fin. Auth. Rev. Bonds (Inland | | | |

| Empire Util. Agcy.), Ser. A, AMBAC, 5s, 11/1/33 | AA- | 2,000,000 | 1,838,160 |

|

| Garvey, School Dist. G.O. Bonds (Election of 2004), FSA | | | |

| zero %, 8/1/26 | AAA | 1,000,000 | 341,370 |

| zero %, 8/1/25 | AAA | 1,475,000 | 544,791 |

|

| Golden State Tobacco Securitization Corp. Rev. Bonds | | | |

| (Tobacco Settlement), Ser. B, AMBAC, FHLMC Coll., | | | |

| FNMA Coll., 5s, 6/1/38 (Prerefunded) | AAA | 2,475,000 | 2,777,816 |

| Ser. A, AMBAC, zero %, 6/1/24 | Aa2 | 5,000,000 | 2,028,750 |

|

| Grossmont-Cuyamaca, Cmnty. College Dist. G.O. | | | |

| Bonds (Election of 2002), Ser. B, FGIC, zero %, 8/1/17 | AA | 2,100,000 | 1,554,966 |

|

26

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | Principal amount | Value |

|

| California cont. | | | |

| Los Angeles, Unified School Dist. G.O. Bonds | | | |

| (Election of 2004), Ser. C, FGIC, 5s, 7/1/26 | Aa3 | $2,745,000 | $2,676,348 |

|

| Merced, City School Dist. G.O. Bonds (Election | | | |

| of 2003), MBIA | | | |

| zero %, 8/1/25 | AA | 1,190,000 | 450,284 |

| zero %, 8/1/24 | AA | 1,125,000 | 465,615 |

| zero %, 8/1/23 | AA | 1,065,000 | 485,363 |

| zero %, 8/1/22 | AA | 1,010,000 | 506,606 |

|

| Sacramento, City Fin. Auth. Tax Alloc. Bonds, | | | |

| Ser. A, FGIC, zero %, 12/1/21 | AA | 5,500,000 | 2,529,780 |

|

| Sacramento, Muni. Util. Dist. Fin. Auth. Rev. | | | |

| Bonds (Cosumnes), MBIA | | | |

| 5s, 7/1/19 | AA | 3,000,000 | 2,917,680 |

| 5s, 7/1/18 | AA | 4,000,000 | 3,976,120 |

|

| San Diego, Unified School Dist. G.O. Bonds | | | |

| (Election of 1998), Ser. E, FSA, 5 1/4s, | | | |

| 7/1/19 (Prerefunded) | AAA | 2,000,000 | 2,247,900 |

|

| Santa Ana, Fin. Auth. Lease Rev. Bonds (Police | | | |

| Admin. & Hldg. Fac.), Ser. A, MBIA, 6 1/4s, 7/1/17 | AA | 3,680,000 | 4,232,110 |

|

| Walnut Valley, Unified School Dist. G.O. Bonds | | | |

| (Election of 2007), Ser. A, FSA | | | |

| 5s, 8/1/28 | AAA | 1,055,000 | 993,230 |

| 5s, 8/1/27 | AAA | 1,745,000 | 1,687,747 |

|

| Walnut, Energy Ctr. Auth. Rev. Bonds, Ser. A, | | | |

| AMBAC, 5s, 1/1/24 | A1 | 2,000,000 | 2,006,820 |

|

| | | | 42,786,839 |

| Colorado (1.3%) | | | |

| Adams & Arapahoe Cntys., Joint School Dist. G.O. | | | |

| Bonds (No. 28J Aurora), Ser. A, FSA, 5 1/4s, 12/1/18 | AAA | 2,810,000 | 3,058,966 |

|

| CO Pub. Hwy. Auth. Rev. Bonds (E-470 Pub. Hwy.) | | | |

| Ser. C1, MBIA, 5 1/2s, 9/1/24 | AA | 1,000,000 | 785,890 |

| Ser. A, MBIA, zero %, 9/1/34 | AA | 3,525,000 | 393,143 |

|

| | | | 4,237,999 |

| Connecticut (2.5%) | | | |

| CT State Hlth. & Edl. Fac. Auth. VRDN (Yale U.), | | | |

| Ser. V-1, 0.4s, 7/1/36 | VMIG1 | 8,200,000 | 8,200,000 |

|

| | | | 8,200,000 |

| Florida (10.4%) | | | |

| Cape Coral, Wtr.& Swr. Rev. Bonds, AMBAC, | | | |

| 5s, 10/1/26 | A2 | 2,000,000 | 1,910,300 |

|

| Fleming Island, Plantation Cmnty. Dev. Dist. | | | |

| Special Assmt. Bonds, MBIA, 4 1/2s, 5/1/31 | Baa1 | 1,000,000 | 653,960 |

|

| Hernando Cnty., Rev. Bonds (Criminal Justice | | | |

| Complex Fin.), FGIC, 7.65s, 7/1/16 | AA | 13,675,000 | 17,116,314 |

|

| Lee Cnty., Rev. Bonds, XLCA, 5s, 10/1/25 | Aa3 | 2,000,000 | 1,999,860 |

|

| Miami-Dade Cnty., Wtr. & Swr. Rev. Bonds, FSA, | | | |

| XLCA, 5s, 10/1/23 | AAA | 1,000,000 | 1,029,680 |

|

| Orlando & Orange Cnty., Expressway Auth. Rev. | | | |

| Bonds, FGIC, 8 1/4s, 7/1/14 | AA | 5,000,000 | 6,250,250 |

|

| Sumter Cnty., School Dist. Rev. Bonds | | | |

| (Multi-Dist. Loan Program), FSA, 7.15s, 11/1/15 | AAA | 3,935,000 | 4,982,497 |

|

| | | | 33,942,861 |

27

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | Principal amount | Value |

|

| Georgia (2.2%) | | | |

| Burke Cnty., Poll. Control Dev. Auth. Mandatory | | | |

| Put Bonds (Oglethorpe Pwr. Corp.), Class E, | | | |

| MBIA, 4 3/4s, 4/1/11 | AA | $3,000,000 | $3,073,410 |

|

| Fulton Cnty., Dev. Auth. Rev. Bonds (Klaus Pkg. & | | | |

| Fam. Hsg. Project), MBIA, 5 1/4s, 11/1/20 | AA | 3,360,000 | 3,601,013 |

|

| GA Muni. Elec. Pwr. Auth. Rev. Bonds, Ser. Y, | | | |

| AMBAC, U.S. Govt. Coll., 6.4s, 1/1/13 (Prerefunded) | A1 | 415,000 | 467,381 |

|

| | | | 7,141,804 |

| Illinois (9.7%) | | | |

| Chicago, G.O. Bonds, Ser. A, AMBAC, 5 5/8s, 1/1/39 | Aa3 | 155,000 | 155,347 |

|

| Chicago, Board of Ed. G.O. Bonds, Ser. A, MBIA, | | | |

| 5 1/4s, 12/1/19 | AA | 1,500,000 | 1,588,170 |

|

| Chicago, O’Hare Intl. Arpt. Rev. Bonds, Ser. A, | | | |

| FSA, 5s, 1/1/33 | AAA | 4,080,000 | 3,650,906 |

|

| Cicero, G.O. Bonds, Ser. A, XLCA, 5 1/4s, 1/1/21 | BBB+/P | 2,250,000 | 1,800,608 |

|

| Du Page Cnty., Cmnty. High School Dist. G.O. | | | |

| Bonds (Dist. No. 108 - Lake Park), FSA, 5.6s, 1/1/20 | Aa3 | 1,000,000 | 1,074,920 |

|

| IL G.O. Bonds, Ser. 1, MBIA, 5 1/4s, 10/1/19 | AA | 5,000,000 | 5,342,100 |

|

| IL Fin. Auth. Rev. Bonds (Rush U. Med. Ctr.), | | | |

| Ser. B, MBIA, 5 3/4s, 11/1/28 | AA | 2,500,000 | 2,140,350 |

|

| IL State Toll Hwy. Auth. Rev. Bonds, Ser. A-1, FSA | | | |

| 5s, 1/1/23 | AAA | 3,750,000 | 3,898,013 |

| 5s, 1/1/22 | AAA | 2,500,000 | 2,632,625 |

|

| Metro. Pier & Exposition Auth. Dedicated State | | | |

| Tax Rev. Bonds (McCormick), Ser. A, MBIA, | | | |

| zero %, 12/15/22 | AA | 5,500,000 | 2,777,170 |

|

| Regl. Trans. Auth. Rev. Bonds, Ser. A, AMBAC, | | | |

| 8s, 6/1/17 | Aa2 | 5,000,000 | 6,551,500 |

|

| | | | 31,611,709 |

| Indiana (2.6%) | | | |

| Center Grove, Ind. Bldg. Corp. Rev. Bonds | | | |

| (First Mtg.), FGIC, 5s, 7/15/25 | AA+ | 1,345,000 | 1,355,276 |

|

| IN Muni. Pwr. Agcy. Supply Syst. Rev. Bonds, | | | |

| Ser. A, AMBAC, 5s, 1/1/20 | A1 | 5,695,000 | 5,920,522 |

|

| IN State Hsg. Fin. Auth. Rev. Bonds (Single | | | |

| Family Mtge.), Ser. A-1, GNMA Coll., FNMA Coll. | | | |

| 4.2s, 7/1/17 | Aaa | 210,000 | 211,023 |

| 4.15s, 7/1/16 | Aaa | 305,000 | 306,488 |

| 4.1s, 7/1/15 | Aaa | 95,000 | 95,465 |

| 3.95s, 7/1/14 | Aaa | 295,000 | 296,319 |

| 3.9s, 1/1/14 | Aaa | 210,000 | 210,880 |

|

| | | | 8,395,973 |

| Louisiana (3.0%) | | | |

| Ernest N. Morial-New Orleans Exhibit Hall Auth. | | | |

| Special Tax, AMBAC, 5s, 7/15/20 | A | 5,730,000 | 4,963,613 |

|

| LA Rev. Bonds, Ser. A, AMBAC, 5 3/8s, 6/1/19 | Aa3 | 3,000,000 | 3,171,090 |

|

| Lafayette, Pub. Pwr. Auth. Elec. Rev. Bonds, | | | |

| MBIA, 5s, 11/1/32 | AA | 2,000,000 | 1,813,660 |

|

| | | | 9,948,363 |

| Maryland (0.6%) | | | |

| MD State Hlth. & Higher Edl. Fac. Auth. Rev. Bonds | | | |

| (U. of MD Med. Syst.), AMBAC, 5 1/4s, 7/1/28 | A | 2,000,000 | 1,878,520 |

|

| | | | 1,878,520 |

28

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | Principal amount | Value |

|

| Massachusetts (3.1%) | | | |

| MA State Hlth. & Edl. Fac. Auth. Rev. Bonds | | | |

| (Harvard U.), Ser. A, 5 1/2s, 11/15/36 | Aaa | $1,815,000 | $1,904,425 |

| (Care Group), Ser. B-2, MBIA, 5 3/8s, 2/1/28 | AA | 1,000,000 | 815,900 |

|

| MA State Hlth. & Edl. Fac. Auth. VRDN (Harvard | | | |

| U.), Ser. R, 0.4s, 11/1/49 | VMIG1 | 4,300,000 | 4,300,000 |

|

| MA State Special Oblig. Dedicated Tax Rev. Bonds, | | | |

| FGIC, FHLMC Coll., FNMA Coll., 5 1/4s, | | | |

| 1/1/23 (Prerefunded) | A2 | 1,000,000 | 1,141,650 |

|

| MA State Tpk. Auth. Hwy. Syst. Rev. Bonds, | | | |

| Ser. A, MBIA, 5s, 1/1/37 | AA | 2,805,000 | 2,009,726 |

|

| | | | 10,171,701 |

| Michigan (8.3%) | | | |

| Detroit, City School Dist. G.O. Bonds (School | | | |

| Bldg. & Site Impt.), Ser. B, FGIC, 5s, 5/1/25 | AA | 7,990,000 | 7,989,361 |

|

| Kent, Hosp. Fin. Auth. Rev. Bonds (Spectrum Hlth. | | | |

| Care), Ser. A, MBIA, 5 1/2s, 1/15/17 (Prerefunded) | AA | 500,000 | 555,520 |

|

| MI Muni. Board Auth. Rev. Bonds (Clean Wtr. | | | |

| Revolving Fund), 5s, 10/1/25 | Aaa | 1,000,000 | 1,022,270 |

|

| MI State Hosp. Fin. Auth. Rev. Bonds (Mercy | | | |

| Hlth.), Ser. X, MBIA, 6s, 8/15/34 (Prerefunded) | Aa2 | 1,650,000 | 1,710,225 |

|

| MI State Strategic Fund, Ltd. Mandatory Put Bonds | | | |

| (Detroit Edison Co.), AMBAC, 4.85s, 9/1/11 | Baa1 | 3,500,000 | 3,394,335 |

|

| MI State Strategic Fund, Ltd. Rev. Bonds (Detroit | | | |

| Edison Co.), AMBAC, 7s, 5/1/21 | A | 4,000,000 | 4,882,160 |

|

| Midland Cnty., Bldg. Auth. G.O. Bonds, FSA | | | |

| 5s, 10/1/25 | AAA | 1,000,000 | 982,190 |

| 5s, 10/1/24 | AAA | 1,150,000 | 1,147,447 |

|

| Northern Michigan U. Rev. Bonds, Ser. A, FSA, | | | |

| 5s, 12/1/27 | AAA | 1,775,000 | 1,780,130 |

|

| Western MI U. Rev. Bonds, FSA, 5s, 11/15/28 | AAA | 3,500,000 | 3,502,310 |

|

| | | | 26,965,948 |

| Mississippi (1.1%) | | | |

| MS Dev. Bank Rev. Bonds (West Rankin Util. | | | |

| Auth.), FSA, 5s, 1/1/27 | AAA | 1,315,000 | 1,301,140 |

|

| MS Home Corp. Rev. Bonds (Single Fam. Mtge.), | | | |

| Ser. D-1, GNMA Coll., FNMA Coll., 6.1s, 6/1/38 | Aaa | 2,410,000 | 2,444,704 |

|

| | | | 3,745,844 |

| Missouri (2.6%) | | | |

| Jackson Cnty., Special Oblig. Rev. Bonds (Harry S. | | | |

| Truman Sports Complex), AMBAC, 5s, 12/1/22 | Aa3 | 1,285,000 | 1,342,414 |

|

| MO State Hlth. & Edl. Fac. Auth. Rev. Bonds | | | |

| (Washington U. (The)), Ser. A, 5 3/8s, 3/15/39 | Aaa | 2,000,000 | 2,063,120 |

|

| MO State Hlth. & Edl. Fac. Auth. VRDN | | | |

| (Washington U. (The)), Ser. D, 0.6s, 9/1/30 | VMIG1 | 5,000,000 | 5,000,000 |

|

| | | | 8,405,534 |

| New Hampshire (0.4%) | | | |

| NH Muni. Bond Bank Rev. Bonds, Ser. C, MBIA, | | | |

| 5s, 3/15/25 | Aa2 | 1,195,000 | 1,236,251 |

|

| | | | 1,236,251 |

29

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | Principal amount | Value |

| | | |

| New Jersey (1.7%) | | | |

| NJ State Rev. Bonds (Trans. Syst.), Ser. C, | | | |

| AMBAC, zero %, 12/15/24 | AA- | $2,100,000 | $842,940 |

|

| NJ State Tpk. Auth. Rev. Bonds, Ser. A, AMBAC, | | | |

| 5s, 1/1/30 | A | 5,000,000 | 4,737,450 |

|

| | | | 5,580,390 |

| New York (9.4%) | | | |

| Erie Cnty., Indl. Dev. Agcy. School Fac. Rev. | | | |

| Bonds (City School Dist. Buffalo), Ser. A, FSA | | | |

| 5 3/4s, 5/1/28 | AAA | 2,275,000 | 2,286,102 |

| 5 3/4s, 5/1/27 | AAA | 6,590,000 | 6,678,898 |

|

| Nassau Cnty., Hlth. Care Syst. Rev. Bonds (Nassau | | | |

| Hlth. Care Corp.), FSA | | | |

| 6s, 8/1/13 (Prerefunded) | AAA | 4,610,000 | 4,821,137 |

| 6s, 8/1/12 (Prerefunded) | AAA | 2,285,000 | 2,389,653 |

|

| NY City, Hsg. Dev. Corp. Rev. Bonds, Ser. A, | | | |

| MBIA, FGIC, 5s, 7/1/25 | AA+ | 1,000,000 | 976,980 |

|

| NY City, Muni. Wtr. & Swr. Fin. Auth. Rev. Bonds, | | | |

| Ser. B, AMBAC, 5s, 6/15/28 | AAA | 3,000,000 | 3,013,440 |

|

| NY State Dorm. Auth. Rev. Bonds (Brooklyn Law | | | |

| School), Ser. B, XLCA | | | |

| 5 3/8s, 7/1/22 | Baa1 | 2,270,000 | 2,287,139 |

| 5 3/8s, 7/1/20 | Baa1 | 2,215,000 | 2,259,677 |

|

| NY State Dorm. Auth. Personal Income Tax Rev. | | | |

| Bonds (Ed.), Ser. B, 5 3/4s, 3/15/36 | AAA | 2,000,000 | 2,083,940 |

|

| Sales Tax Asset Receivable Corp. Rev. Bonds, | | | |

| Ser. A, AMBAC, 5s, 10/15/29 | AAA | 3,000,000 | 3,030,870 |

|

| Syracuse, Indl. Dev. Agcy. School Fac. Rev. Bonds | | | |

| (Syracuse City School Dist.), Ser. A, FSA, 5s, | | | |

| 5/1/25 | AAA | 1,000,000 | 1,013,970 |

|

| | | | 30,841,806 |

| North Carolina (1.6%) | | | |

| NC State Muni. Pwr. Agcy. Rev. Bonds (No. 1, | | | |

| Catawba Elec.), Ser. A, MBIA, 5 1/4s, 1/1/19 | AA | 5,000,000 | 5,214,700 |

|

| | | | 5,214,700 |

| Ohio (2.2%) | | | |

| Lorain Cnty., Hosp. Rev. Bonds (Catholic), | | | |

| Ser. C-2, FSA, 5s, 4/1/24 | AAA | 2,000,000 | 2,010,160 |

|

| Morley Library Dist. G.O. Bonds (Lake Cnty. Dist. | | | |

| Library), AMBAC, 5 1/4s, 12/1/19 | A2 | 1,535,000 | 1,632,580 |

|

| OH Hsg. Fin. Agcy. Single Fam. Mtge. Rev. Bonds, | | | |

| Ser. 85-A, FGIC, FHA Insd., zero %, 1/15/15 | AAA/P | 45,000 | 25,088 |

|

| U. of Akron Rev. Bonds, Ser. B, FSA, 5 1/4s, | | | |

| 1/1/26 | AAA | 3,375,000 | 3,506,186 |

|

| | | | 7,174,014 |

| Pennsylvania (0.4%) | | | |

| Erie Cnty., Convention Ctr. Auth. Rev. Bonds | | | |

| (Convention Ctr. Hotel), FGIC, 5s, 1/15/22 | AA | 1,415,000 | 1,437,499 |

|

| | | | 1,437,499 |

| Puerto Rico (1.2%) | | | |

| Cmnwlth. of PR, G.O. Bonds, Ser. C-7, MBIA, 6s, | | | |

| 7/1/27 | AA | 1,500,000 | 1,413,794 |

|

| Cmnwlth. of PR, Aqueduct & Swr. Auth. Rev. Bonds, | | | |

| Ser. A, AGO, 5s, 7/1/28 | AAA | 2,750,000 | 2,615,415 |

|

| | | | 4,029,209 |

30

| | | |

| MUNICIPAL BONDS AND NOTES (97.8%)* cont. | Rating** | Principal amount | Value |

|

| South Dakota (0.4%) | | | |

| SD Hsg. Dev. Auth. Rev. Bonds (Home Ownership | | | |

| Mtge.), Ser. J, 4.6s, 5/1/19 | AAA | $1,250,000 | $1,240,850 |

|

| | | | 1,240,850 |

| Texas (9.7%) | | | |

| Dallas Cnty., Util. & Reclaimation Dist. G.O. | | | |

| Bonds, Ser. B, AMBAC, 5 3/8s, 2/15/29 | A | 2,500,000 | 2,132,075 |

|

| Dallas, Indpt. School Dist. G.O. Bonds | | | |

| (School Bldg.), PSFG, 6s, 2/15/27 | Aaa | 2,500,000 | 2,744,600 |

| PSFG, 5 1/4s, 2/15/19 | Aaa | 2,500,000 | 2,663,250 |

|

| Friendswood, Indpt. School Dist. G.O. Bonds | | | |

| (Schoolhouse), PSFG, 5s, 2/15/26 | Aaa | 1,500,000 | 1,543,905 |

|

| Harris Cnty., Cultural Ed. Fac. Fin. Corp. VRDN | | | |

| (Texas Med. Ctr.), Ser. B-1, 0.62s, 9/1/31 | VMIG1 | 1,000,000 | 1,000,000 |

|

| Hays Cnty., G.O. Bonds, FSA, 5s, 8/15/24 | Aa3 | 1,190,000 | 1,222,344 |

|

| Houston, Arpt. Syst. Rev. Bonds, FSA, 5s, 7/1/21 | AAA | 5,280,000 | 5,212,574 |

|

| La Joya, Indpt. School Dist. G.O. Bonds (School | | | |

| Bldg.), PSFG, 5s, 2/15/30 | Aaa | 2,500,000 | 2,510,775 |

|

| Laredo, I S D Pub. Fac. Corp. Rev. Bonds, Ser. C, | | | |

| AMBAC, 5s, 8/1/29 | A | 1,000,000 | 991,140 |

|

| Mansfield, Indpt. School Dist. G.O. Bonds, PSFG, | | | |

| 5s, 2/15/27 | Aaa | 2,000,000 | 2,035,360 |

|

| Mission Cons., Indpt. School Dist. G.O. Bonds, | | | |

| PSFG, 5s, 2/15/23 | Aaa | 1,000,000 | 1,051,360 |

|

| Nacogdoches, Indpt. School Dist. G.O. Bonds, | | | |

| PSFG, 5 1/2s, 2/15/15 | Aaa | 140,000 | 149,962 |

|

| North TX Thruway Auth. Rev. Bonds | | | |

| Ser. A, MBIA, 5 1/8s, 1/1/28 | AA | 1,500,000 | 1,449,705 |

| Ser. D, AGO, zero %, 1/1/28 | AAA | 2,700,000 | 823,446 |

|

| Pharr, San Juan — Alamo, Indpt. School Dist. G.O. | | | |

| Bonds (School Bldg.), PSFG, 5s, 2/1/30 | Aaa | 2,000,000 | 2,008,620 |

|

| San Antonio Wtr. Rev. Bonds, FSA, 5 1/2s, 5/15/20 | AAA | 4,000,000 | 4,284,160 |

|

| | | | 31,823,276 |

| Utah (2.4%) | | | |

| Intermountain Pwr. Agcy. Rev. Bonds, Ser. A, | | | |

| MBIA, U.S. Govt. Coll., 6.15s, 7/1/14 | | | |

| (Prerefunded) | AA | 7,790,000 | 7,790,857 |

|

| | | | 7,790,857 |

| Washington (2.4%) | | | |

| WA State Pub. Pwr. Supply Syst. Rev. Bonds | | | |