UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | May 31, 2008 | |

|

Date of reporting period: | May 31, 2008 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Annual Report

May 31, 2008

Columbia High Yield Opportunity Fund

| NOT FDIC INSURED | | May Lose Value | |

|

| NOT BANK ISSUED | | No Bank Guarantee | |

|

Table of Contents

| Economic Update | | | 1 | | |

|

| Fund Profile | | | 2 | | |

|

| Performance Information | | | 3 | | |

|

| Understanding Your Expenses | | | 4 | | |

|

| Portfolio Managers' Report | | | 5 | | |

|

| Investment Portfolio | | | 7 | | |

|

Statement of Assets and

Liabilities | | | 19 | | |

|

| Statement of Operations | | | 20 | | |

|

Statement of Changes in

Net Assets | | | 21 | | |

|

| Financial Highlights | | | 23 | | |

|

| Notes to Financial Statements | | | 27 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 36 | | |

|

| Fund Governance | | | 37 | | |

|

Important Information About

This Report | | | 45 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

We are pleased to provide this financial report for your Columbia Fund. This document provides information that can help support your investment decision-making. Inside, the portfolio managers discuss the fund's investment strategies, performance, and how that performance compared to the broader market. It's been a challenging year for the financial markets, particularly as concerns over a weaker housing market and economic uncertainty make the news headlines daily. For a sense of how Columbia Management's investment professionals have responded to these issues, I encourage you to read the Economic Update and Portfolio Managers' Report. I believe these discussions reflect Columbia Management's investment management expertise as well as its commitment to market research and consistent investment performance.

We understand that many factors drove your decision to invest in Columbia Funds. Columbia Management's commitment is to honor that decision by providing investment solutions designed to exceed expectations. As we review the past year and look forward to those ahead, we hope you will consider how we might support your investment needs beyond the services we provide currently. Some of the many advantages we bring to the table as the fund's investment manager include:

g Broad and deep investment expertise, including dedicated portfolio management, research and trading

g Strategically positioned investment disciplines and processes

g Comprehensive compliance and risk management

g A team-driven culture that draws upon multiple sources to pursue consistent and superior performance

g A comprehensive array of investment solutions, including equity, fixed-income and cash strategies

Working for you, and with you

Team approach—Rather than rely on the talent or judgment of one individual, Columbia Management takes a team-oriented approach to investing. We draw from the diverse experiences and insights of our people—including portfolio managers, research analysts and traders—to bring multiple investment perspectives and deep expertise to all of our investment management activities.

Client focus—At Columbia Management, our philosophy and culture are anchored in focused solutions and personal service. We are committed to putting our clients' interests first and we understand the premium our clients place on reliability—whether it's related to service, investment performance or risk management. Columbia Management is committed to maintaining high standards of reliability on all counts.

While our asset management capabilities are multifaceted and our investment professionals are multitalented, ultimately, everything we do at Columbia Management has a single purpose: to help investors pursue their most important financial goals. We are honored that you've chosen to invest with us and look forward to providing the investment solutions and services necessary to sustain a lasting relationship.

Sincerely,

Christopher L. Wilson

President, Columbia Funds

Economic Update – Columbia High Yield Opportunity Fund

Although economic growth was strong at the beginning of the 12-month period that began June 1, 2007 and ended May 31, 2008, it slowed to a pace of less than 1.0% in 2008. The most severe housing downturn in decades continued to take a toll on growth. Inventories of homes for sale rose, home prices declined and tighter credit standards, the result of turmoil in the subprime mortgage market, made it more difficult for homebuyers to qualify for loans. Energy prices soared to record highs and food prices rose, raising concerns about inflation. Consumer confidence sank to a 16-year low, as measured by the Conference Board. Weakening business and job conditions further dimmed the outlook for consumers.

Consumer spending growth slowed during the period but remained more resilient than most economists expected even though job growth ground to a halt. Approximately 300,000 job losses were reported in the first five months of 2008, and the unemployment rate spiked to 5.5% in May, one full percentage point higher than it was at the beginning of the period. Manufacturing activity also slowed, but appeared to stabilize in May, one positive indicator that weakness might be contained. Federal tax rebates also began to arrive in May, raising hopes for a boost in consumer spending, which could help avert a recession.

In an effort to inspire confidence in the capital markets, loosen the reins on credit and shore up economic growth, the Federal Reserve Board (the Fed) brought a key short-term rate—the federal funds rate—down from 5.25% to 2.0% during the 12-month period. After seven rate cuts, the Fed acknowledged that downside risks to growth remained but also that uncertainty about the inflation outlook had continued to increase and that it would be necessary to continue to monitor inflation developments carefully.

Bonds delivered solid gains

The U.S. bond market seesawed during the 12-month period but delivered a solid gain as investors sought the relative safety of the highest quality sectors. After a weak start, bond prices generally rose and yields declined as economic growth slowed in 2007 and stock market volatility increased. Although the benchmark 10-year U.S. Treasury yield edged back above 4.0% in 2008, it remained well below where it started the period, at 4.9%. In this environment, the Lehman Brothers U.S. Aggregate Bond Index returned 6.89%. High-yield bonds did not perform well in 2007 but regained some ground in 2008. The Credit Suisse High Yield Index returned negative 1.23%. Municipal bonds generated solid returns during most of the period, but gave back some performance early in 2008 as industry-specific events threatened investor confidence. In February, yields on municipal bonds rose above yields on comparable maturity Treasuries—and prices f ell—in a difficult month for the sector. In this environment, the Lehman Brothers Municipal Bond Index returned 3.87% for the one-year period.1

Stocks retreat as economic storm clouds gather

Against a shifting economic backdrop, the U.S. stock market lost 6.70% for the 12-month period, as measured by the S&P 500 Index. Large- cap stocks held up better than small- and mid-cap stocks, as measured by their respective Russell indices.2 Growth stocks also held up better than value stocks by a significant margin. As the dollar fell to a record low against the euro and multi-year lows versus a number of other currencies, investors reaped somewhat better results from investments outside the U.S. The MSCI EAFE Index, a broad gauge of stock market performance in foreign developed markets, lost 2.53% (in U.S. dollars) for the period, as a weak second half wiped out solid gains that had been posted in first half of the 12-month period. Emerging stock markets, both collectively and individually, were the top performers. The MSCI Emerging Markets Index returned 22.00% (in U.S. dollars) as demand for exports as well as domestic infrastructure expansion continued.3

Past performance is no guarantee of future results.

1The Lehman Brothers Municipal Bond Index is considered representative of the broad market for investment grade, tax exempt bonds with a maturities of at least one year.

2The Russell 1000 Index measures the performance of 1,000 of the largest U.S. companies, based on market capitalization. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, as ranked by total market capitalization. The Russell 2000 Index measures the performance of the 2,000 smallest of the 3,000 largest U.S. companies, based on market capitalization.

3The MSCI Emerging Markets Index is a widely accepted index composed of a sample of companies from 25 countries representing the global emerging stock markets.

Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Summary

For the 12-month period ended May 31, 2008

g Despite volatility in many segments of the bond market, the Lehman Brothers U.S. Aggregate Bond Index delivered a solid return. High-yield bonds lost ground, as measured by the Credit Suisse High Yield Index.

Lehman

Index | | Credit Suisse

Index | |

|

| |  | |

|

g The broad U.S. stock market, as measured by the S&P 500 Index, returned negative 6.70%. Global emerging stock markets outside the United States returned negative 2.53%, as measured (in U.S. dollars) by the MSCI EAFE Index. A declining dollar helped offset losses.

| S&P Index | | MSCI Index | |

|

| |  | |

|

The Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

The Credit Suisse High Yield Index is a broad-based index that tracks the performance of high-yield bonds.

The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

The Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada.

1

Fund Profile – Columbia High Yield Opportunity Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 05/31/08

| | | –5.03% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | –1.00% | |

|

| |  | | | JPMorgan Global

High Yield Index | |

|

| | | –1.23% | |

|

| |  | | | Credit Suisse

High Yield Index | |

|

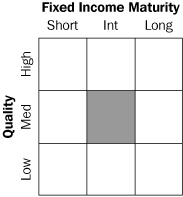

Morningstar Style Box

The Morningstar Style BoxTM reveals a fund's investment strategy. For fixed-income funds the vertical axis shows the average credit quality of the bonds owned, and the horizontal axis shows interest rate sensitivity as measured by a bond's duration (short, intermediate or long). All of these numbers are drawn from the data most recently provided by the fund and entered into Morningstar's database as of quarter-end. Although the data gathered is from reliable sources, Morningstar cannot guarantee its completeness and accuracy. Information shown is as of 12/31/07.

Summary

g For the 12-month period that ended May 31, 2008, the fund's Class A shares returned negative 5.03% without sales charge.

g Performance lagged the fund's benchmarks and peer group average.

g Underweights in strong BB-rated securities and in the casino and gaming industry contributed to the fund's relative underperformance.

Portfolio Management

Thomas A. LaPointe, CFA, has co-managed the fund since February 2003, and has been associated with the advisor or its predecessors or affiliate organizations since February 1999.

Kevin L. Cronk, CFA, has co-managed the fund since February 2003 and has been associated with the advisor or its predecessors or affiliate organizations since August 1999.

2

Performance Information – Columbia High Yield Opportunity Fund

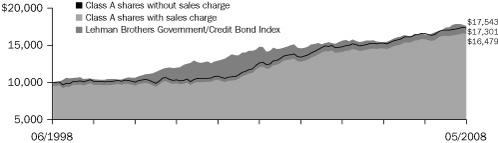

Growth of a $10,000 investment 06/01/98 – 05/31/08

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia High Yield Opportunity Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. The Credit Suisse High Yield Index is a broad-based index that tracks the performance of high-yield bonds. The JPMorgan Global High Yield Index is designed to mirror the investable universe of the US dollar global high-yield corporate debt market, including domestic and international issues. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 06/01/98 – 05/31/08 ($)

| Sales charge | | without | | with | |

| Class A | | | 13,616 | | | | 12,969 | | |

| Class B | | | 12,631 | | | | 12,631 | | |

| Class C | | | 12,823 | | | | 12,823 | | |

| Class Z | | | 13,939 | | | | n/a | | |

Average annual total return as of 05/31/08 (%)

| Share class | | A | | B | | C | | Z | |

| Inception | | 10/21/71 | | 06/08/92 | | 01/15/96 | | 01/08/99 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | –5.03 | | | | –9.54 | | | | –5.73 | | | | –10.14 | | | | –5.59 | | | | –6.48 | | | | –4.79 | | |

| 5-year | | | 7.16 | | | | 6.12 | | | | 6.37 | | | | 6.06 | | | | 6.52 | | | | 6.52 | | | | 7.43 | | |

| 10-year | | | 3.13 | | | | 2.63 | | | | 2.36 | | | | 2.36 | | | | 2.52 | | | | 2.52 | | | | 3.38 | | |

Average annual total return as of 06/30/08 (%)

| Share class | | A | | B | | C | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | –5.21 | | | | –9.71 | | | | –5.90 | | | | –10.30 | | | | –5.77 | | | | –6.65 | | | | –4.97 | | |

| 5-year | | | 6.08 | | | | 5.05 | | | | 5.29 | | | | 4.99 | | | | 5.45 | | | | 5.45 | | | | 6.34 | | |

| 10-year | | | 2.85 | | | | 2.35 | | | | 2.08 | | | | 2.08 | | | | 2.24 | | | | 2.24 | | | | 3.09 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares, the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares.

The returns shown for the Fund's Class Z shares include the returns of the Fund's Class A shares for periods prior to January 8, 1999, the date on which the Fund's Class Z shares were first offered. The returns shown have been adjusted to reflect the fact that Class Z shares are sold without a sales charge. The returns shown have not been adjusted to reflect any differences in expenses between Class Z and Class A shares of the Fund. If differences in expenses had been reflected, the returns shown for periods prior to January 8, 1999 would have been higher.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.12 | | |

| Class B | | | 1.87 | | |

| Class C | | | 1.87 | | |

| Class Z | | | 0.87 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and reimbursements as well as different time periods used in calculating the ratios.

3

Understanding Your Expenses – Columbia High Yield Opportunity Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

12/01/07 – 05/31/08

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 992.50 | | | | 1,019.35 | | | | 5.63 | | | | 5.70 | | | | 1.13 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 988.90 | | | | 1,015.60 | | | | 9.35 | | | | 9.47 | | | | 1.88 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 989.50 | | | | 1,016.35 | | | | 8.60 | | | | 8.72 | | | | 1.73 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 993.70 | | | | 1,020.60 | | | | 4.39 | | | | 4.45 | | | | 0.88 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 366.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

4

Portfolio Managers' Report – Columbia High Yield Opportunity Fund

For the 12-month period that ended May 31, 2008, Class A shares of Columbia High Yield Opportunity Fund returned negative 5.03% without sales charge. The fund's benchmarks, the Credit Suisse High Yield Index and the JPMorgan Global High Yield Index, returned negative 1.23% and negative 1.00%, respectively.1 The average return of the fund's peer group, the Lipper High Current Yield Funds Classification, was negative 2.61% for the same period.2 An underweight in BB-rated securities early in the period, as well as an overweight in the casino and gaming industry, areas that were especially weak, contributed to underperformance. Some company-specific disappointments elsewhere in the portfolio also hurt returns.

Challenging time for high-yield sector

The financial markets became increasing volatile over the year, besieged by a slowing economy, sharply higher food and energy prices and a credit crisis, triggered by rising defaults in the subprime mortgage market. As liquidity tightened, investors became increasingly worried about the ability of companies to make their debt payments or borrow the money they needed to meet their capital requirements. Yields in higher-risk sectors rose to compensate investors for taking on added risk, and the difference between yields in the high-yield and Treasury sectors widened sharply in March shortly before the near-collapse of investment bank Bear Stearns Cos. Market stability improved late in the period, following the Federal Reserve's aggressive short-term interest rate cuts and its efforts to provide more liquidity to investment banks and broker/dealers. The yield difference between high-yield and Treasuries narrowed a bit, but ended th e period with six and one-half percentage points between them. Within the high-yield sector, the highest-risk, lowest-quality (CCC-rated) securities suffered the worst returns.

Lost ground from sector disappointments

During the first half of the period, the fund had less exposure to BB-rated bonds than its benchmarks and, we believe, less than its peers, which hurt performance in a volatile environment. However, we increased the fund's BB-rated holdings late in 2007 and reduced CCC-rated securities during the period. Above-average exposure to casino and gaming companies, which have historically performed well during economic slowdowns, also hampered returns. Many gaming companies increased their debt levels to expand operations in recent years. Investors became worried that some companies might not be able to make timely payments on their debt as consumer spending slowed. The fund also held a few names that suffered sharp downturns related to company-specific credit problems. Quebecor Media, a printing company, filed for bankruptcy as pricing pressure and overcapacity diminished the company's prospects. Univision, the leading Spanish languag e broadcaster in the United States, a recent leveraged buyout (LBO), lost ground even though company results exceeded expectations. The market for highly-levered LBOs, in general, and enterprise values for

1The Credit Suisse High Yield Index is a broad-based index that tracks the performance of high-yield bonds. The JPMorgan Global High Yield Index is designed to mirror the investable universe of the U.S. dollar global high-yield corporate debt market, including domestic and international issues. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 05/31/08 ($)

| Class A | | | 4.17 | | |

| Class B | | | 4.17 | | |

| Class C | | | 4.17 | | |

| Class Z | | | 4.17 | | |

Distributions declared per share

06/01/07 – 05/31/08 ($)

| Class A | | | 0.31 | | |

| Class B | | | 0.28 | | |

| Class C | | | 0.29 | | |

| Class Z | | | 0.32 | | |

Top 10 Issuers

as of 05/31/08 (%)

Texas Competitive

Electric Holdings Co. | | | 1.9 | | |

| Qwest Corp. | | | 1.6 | | |

| Intelsat Bermuda Ltd. | | | 1.6 | | |

| HCA, Inc. | | | 1.4 | | |

| GMAC LLC | | | 1.3 | | |

LVB Acquisition

Merger Sub, Inc. | | | 1.3 | | |

| Freeport – McMoRan | |

| Copper & Gold, Inc. | | | 1.0 | | |

| MGM Mirage | | | 1.0 | | |

| El Paso Corp | | | 0.9 | | |

| CSC Holdings, Inc. | | | 0.9 | | |

Holdings discussed

in this report as of 5/31/08 (%)

| Quebecor Media, Inc. | | | 0.6 | | |

| Freescale Semiconductor, Inc. | | | 0.9 | | |

Freeport-McMoRan

Copper & Gold, Inc. | | | 1.0 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

5

Portfolio Managers' Report (continued) – Columbia High Yield Opportunity Fund

Maturity breakdown

as of 05/31/08 (%)

| 0-1 year | | | 0.3 | | |

| 1-3 years | | | 2.5 | | |

| 3-5 years | | | 12.5 | | |

| 5-7 years | | | 32.6 | | |

| 7-10 years | | | 38.6 | | |

| 10-15 years | | | 1.1 | | |

| 15-20 years | | | 2.1 | | |

| 20-30 years | | | 3.3 | | |

| Other | | | 7.0 | | |

Portfolio structure

as of 05/31/08 (%)

| Corporate Fixed-Income | |

| Bonds & Notes | | | 91.2 | | |

| Municipal Bonds | | | 1.2 | | |

| Common Stocks | | | 0.3 | | |

| Other | | | 7.3 | | |

Quality breakdown

as of 05/31/08 (%)

| AAA* | | | 6.0 | | |

| BBB | | | 0.9 | | |

| BB | | | 23.1 | | |

| B | | | 45.9 | | |

| CCC | | | 20.0 | | |

| CC | | | 0.3 | | |

| Not Rated | | | 2.8 | | |

| Other | | | 1.0 | | |

The fund is actively managed and the composition of its portfolio will change over time. Portfolio structure, top 10 issuers, quality and maturity breakdowns are calculated as a percentage of net assets. Swaps are not included in the maturity breakdown. Ratings shown in the quality breakdown represent the rating assigned to a particular bond by one of the following nationally-recognized rating agencies: Standard & Poor's, a division of The McGraw-Hill Companies, Inc., Moody's Investors Service, Inc. or Fitch Ratings Ltd. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

*Repurchase agreement included.

30-day SEC yields

as of 05/31/08 (%)

| Class A | | | 7.76 | | |

| Class B | | | 7.41 | | |

| Class C | | | 7.56 | | |

| Class Z | | | 8.41 | | |

The 30-day SEC yields reflect the fund's earning power, net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period.

media companies, more specifically, have decreased. The Fund no longer owns any Univision bonds. In the technology sector, Freescale Semiconductor bonds disappointed. The company's wireless and automotive products have been underperformers due to a weak economy and other product-specific factors. A small stake in equities further hindered returns as the Standard & Poor's 500 Index3 returned a disappointing negative 6.70% for the year.

Gains from energy and utilities

Helping to offset some of these losses were returns from oil and gas issues, which benefited as energy prices rose and exploration and production companies reported record earnings. Utility bonds also did well, thanks to strong demand and tight capacity. The fund's top performers included Lyondell, a chemical company, whose bonds were tendered as the result of a merger and resulted in good returns for the fund, and Biomet, a health care and technology holding, which has done well as demand for its orthopedic products remains high. In the metals sector, the bonds of Freeport McMoRan, a copper and gold mining company, benefited from soaring commodity prices, and the company's performance has exceeded market expectations.

Managing risk

Early in 2007, we decided to sell home builders and reduce exposure of the fund to financials and retailers, which helped, as these sectors were among the worst performers in the market downturn. Throughout the year, the fund maintained below-average exposure to these and other high-risk industries, including airlines. During the period we also raised cash to 8.0% of the fund assets. Going forward, we plan to take advantage of buying opportunities among higher quality high-yield bonds that offer the potential for stable income and price appreciation. We believe the outlook for high-yield bonds should improve as economic growth picks up. In the meantime, we believe the sector has the potential to continue to provide high levels of income for investors willing to take on added risk.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yield and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investing in high-yield or "junk" bonds offers the potential for higher income than investments in investment-grade bonds, but also has a higher degree of risk. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer's ability to make timely principal and interest payments. Rising interest rates tend to lower the value of all bonds. International investing involves special risks, including foreign taxation, currency fluctuations, risks associated with possible differences in financial standards and other monetary and political risks.

3The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

6

Investment Portfolio – Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes – 91.2% | |

| | | | | Par (a) | | Value ($) | |

| Basic Materials – 6.7% | |

| Chemicals – 2.7% | |

| Agricultural Chemicals – 0.6% | |

| Mosaic Co. | |

| 7.875% 12/01/16 (b) | | | | | 1,780,000 | | | | 1,931,300 | | |

| Terra Capital, Inc. | |

| 7.000% 02/01/17 | | | | | 315,000 | | | | 313,031 | | |

| | | 2,244,331 | | |

| Chemicals-Diversified – 1.5% | |

| Huntsman International LLC | |

| 6.875% 11/15/13 (b) | | EUR | | | 800,000 | | | | 1,249,267 | | |

| 7.875% 11/15/14 | | | | | 1,665,000 | | | | 1,781,550 | | |

| Ineos Group Holdings PLC | |

| 8.500% 02/15/16 (b) | | | | | 1,660,000 | | | | 1,290,650 | | |

| NOVA Chemicals Corp. | |

| 6.500% 01/15/12 | | | | | 1,500,000 | | | | 1,395,000 | | |

| | | 5,716,467 | | |

| Chemicals-Specialty – 0.6% | |

| Chemtura Corp. | |

| 6.875% 06/01/16 | | | | | 1,475,000 | | | | 1,371,750 | | |

| MacDermid, Inc. | |

| 9.500% 04/15/17 (b) | | | | | 1,015,000 | | | | 984,550 | | |

| | | 2,356,300 | | |

| Chemicals Total | | | 10,317,098 | | |

| Forest Products & Paper – 1.6% | |

| Paper & Related Products – 1.6% | |

| Abitibi-Consolidated, Inc. | |

| 8.375% 04/01/15 | | | | | 1,870,000 | | | | 818,125 | | |

| Domtar Corp. | |

| 7.125% 08/15/15 | | | | | 1,670,000 | | | | 1,594,850 | | |

| Georgia-Pacific Corp. | |

| 8.000% 01/15/24 | | | | | 1,645,000 | | | | 1,587,425 | | |

| NewPage Corp. | |

| 10.000% 05/01/12 (b) | | | | | 755,000 | | | | 804,075 | | |

| 12.000% 05/01/13 | | | | | 795,000 | | | | 840,712 | | |

| NewPage Holding Corp. | |

PIK,

9.986% 11/01/13 (c) | | | | | 560,000 | | | | 546,580 | | |

| | | | 6,191,767 | | |

| Forest Products & Paper Total | | | 6,191,767 | | |

| Iron/Steel – 0.5% | |

| Steel-Producers – 0.5% | |

| Steel Dynamics, Inc. | |

| 7.750% 04/15/16 (b) | | | | | 2,075,000 | | | | 2,080,188 | | |

| | | 2,080,188 | | |

| Iron/Steel Total | | | 2,080,188 | | |

| | | | | Par (a) | | Value ($) | |

| Metals & Mining – 1.9% | |

| Diversified Minerals – 0.6% | �� |

| FMG Finance Ltd. | |

| 10.625% 09/01/16 (b) | | | | | 2,120,000 | | | | 2,459,200 | | |

| | | 2,459,200 | | |

| Metal-Diversified – 1.0% | |

| Freeport-McMoRan Copper & Gold, Inc. | |

| 8.375% 04/01/17 | | | | | 3,600,000 | | | | 3,870,000 | | |

| | | 3,870,000 | | |

| Mining Services – 0.3% | |

| Noranda Aluminium Holding Corp. | |

PIK,

8.578% 11/15/14 (b)(c) | | | | | 1,365,000 | | | | 1,194,375 | | |

| | | 1,194,375 | | |

| Metals & Mining Total | | | 7,523,575 | | |

| Basic Materials Total | | | 26,112,628 | | |

| Communications – 18.3% | |

| Media – 6.7% | |

| Cable TV – 2.8% | |

| Atlantic Broadband Finance LLC | |

| 9.375% 01/15/14 | | | | | 900,000 | | | | 838,125 | | |

| Cablevision Systems Corp. | |

| 8.000% 04/15/12 | | | | | 1,540,000 | | | | 1,497,650 | | |

| Charter Communications Holdings I LLC | |

| 11.000% 10/01/15 | | | | | 1,120,000 | | | | 952,000 | | |

| Charter Communications Holdings II LLC | |

| 10.250% 09/15/10 | | | | | 730,000 | | | | 726,350 | | |

| CSC Holdings, Inc. | |

| 7.625% 04/01/11 | | | | | 2,170,000 | | | | 2,170,000 | | |

| DirecTV Holdings LLC | |

| 6.375% 06/15/15 | | | | | 2,090,000 | | | | 1,982,887 | | |

| EchoStar DBS Corp. | |

| 6.625% 10/01/14 | | | | | 1,935,000 | | | | 1,823,738 | | |

| 7.125% 02/01/16 | | | | | 1,000,000 | | | | 955,000 | | |

| | | 10,945,750 | | |

| Multimedia – 1.4% | |

| CanWest MediaWorks LP | |

| 9.250% 08/01/15 (b) | | | | | 1,730,000 | | | | 1,513,750 | | |

| Lamar Media Corp. | |

| 6.625% 08/15/15 | | | | | 1,900,000 | | | | 1,790,750 | | |

| Quebecor Media, Inc. | |

| 7.750% 03/15/16 | | | | | 2,205,000 | | | | 2,160,900 | | |

| | | 5,465,400 | | |

See Accompanying Notes to Financial Statements.

7

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Publishing-Books – 0.5% | |

| TL Acquisitions, Inc. | |

| 10.500% 01/15/15 (b) | | | | | 2,280,000 | | | | 2,074,800 | | |

| | | 2,074,800 | | |

| Publishing-Periodicals – 1.5% | |

| Dex Media, Inc. | |

(d) 11/15/13

(9.000% 11/15/08) | | | | | 1,230,000 | | | | 953,250 | | |

| Idearc, Inc. | |

| 8.000% 11/15/16 | | | | | 2,295,000 | | | | 1,640,925 | | |

| Penton Media, Inc. | |

| 7.899% 02/01/14 (c)(e) | | | | | 1,000,000 | | | | 700,000 | | |

| R.H. Donnelley Corp. | |

| 8.875% 01/15/16 | | | | | 1,620,000 | | | | 1,109,700 | | |

| 8.875% 10/15/17 (b) | | | | | 2,075,000 | | | | 1,390,250 | | |

| | | | 5,794,125 | | |

| Radio – 0.3% | |

| CMP Susquehanna Corp. | |

| 9.875% 05/15/14 | | | | | 1,405,000 | | | | 990,525 | | |

| | | 990,525 | | |

| Television – 0.2% | |

| Local TV Finance LLC | |

PIK,

9.250% 06/15/15 (b) | | | | | 930,000 | | | | 748,650 | | |

| | | 748,650 | | |

| Media Total | | | 26,019,250 | | |

| Telecommunication Services – 11.6% | |

| Cellular Telecommunications – 3.2% | |

| Cricket Communications, Inc. | |

| 9.375% 11/01/14 | | | | | 2,390,000 | | | | 2,306,350 | | |

| Digicel Group Ltd. | |

| 8.875% 01/15/15 (b) | | | | | 2,365,000 | | | | 2,169,887 | | |

| MetroPCS Wireless, Inc. | |

| 9.250% 11/01/14 | | | | | 2,535,000 | | | | 2,436,769 | | |

| Orascom Telecom Finance SCA | |

| 7.875% 02/08/14 (b) | | | | | 855,000 | | | | 818,663 | | |

| Rural Cellular Corp. | |

| 8.623% 11/01/12 (c) | | | | | 1,315,000 | | | | 1,338,012 | | |

| US Unwired, Inc. | |

| 10.000% 06/15/12 | | | | | 945,000 | | | | 919,013 | | |

| Wind Acquisition Financial SA | |

PIK,

9.984% 12/21/11 (c)(e) | | | | | 2,646,329 | | | | 2,541,264 | | |

| | | 12,529,958 | | |

| | | | | Par (a) | | Value ($) | |

| Satellite Telecommunications – 2.1% | |

| Inmarsat Finance II PLC | |

(d) 11/15/12

(10.375% 11/15/08) | | | | | 1,200,000 | | | | 1,200,000 | | |

| Inmarsat Finance PLC | |

| 7.625% 06/30/12 | | | | | 650,000 | | | | 663,000 | | |

| Intelsat Bermuda Ltd. | |

| 9.250% 06/15/16 | | | | | 715,000 | | | | 722,150 | | |

| 11.250% 06/15/16 | | | | | 3,910,000 | | | | 3,988,200 | | |

| Intelsat Intermediate Holdings Co., Ltd. | |

(d) 02/01/15

(9.250% 02/01/10) | | | | | 1,845,000 | | | | 1,559,025 | | |

| | | 8,132,375 | | |

| Telecommunication Equipment – 0.5% | |

| Lucent Technologies, Inc. | |

| 6.450% 03/15/29 | | | | | 2,405,000 | | | | 1,842,831 | | |

| | | 1,842,831 | | |

| Telecommunication Services – 1.8% | |

| Hellas Telecommunications Luxembourg II | |

| 8.463% 01/15/15 (b)(c) | | | | | 900,000 | | | | 693,000 | | |

| Nordic Telephone Co. Holdings ApS | |

| 8.250% 05/01/16 (b) | | EUR | | | 1,030,000 | | | | 1,530,313 | | |

| 8.875% 05/01/16 (b) | | | | | 1,250,000 | | | | 1,231,250 | | |

| Syniverse Technologies, Inc. | |

| 7.750% 08/15/13 | | | | | 790,000 | | | | 758,400 | | |

| Time Warner Telecom Holdings, Inc. | |

| 9.250% 02/15/14 | | | | | 1,500,000 | | | | 1,552,500 | | |

| West Corp. | |

| 11.000% 10/15/16 | | | | | 1,690,000 | | | | 1,495,650 | | |

| | | 7,261,113 | | |

| Telephone-Integrated – 4.0% | |

| Cincinnati Bell, Inc. | |

| 8.375% 01/15/14 | | | | | 1,500,000 | | | | 1,492,500 | | |

| Citizens Communications Co. | |

| 7.875% 01/15/27 | | | | | 2,145,000 | | | | 1,930,500 | | |

| Hawaiian Telcom Communications, Inc. | |

| 9.750% 05/01/13 | | | | | 1,000,000 | | | | 390,000 | | |

| Qwest Communications International, Inc. | |

| 7.500% 02/15/14 | | | | | 1,780,000 | | | | 1,744,400 | | |

| Qwest Corp. | |

| 7.500% 10/01/14 | | | | | 850,000 | | | | 845,750 | | |

| 7.500% 06/15/23 | | | | | 3,430,000 | | | | 3,164,175 | | |

| 8.875% 03/15/12 | | | | | 605,000 | | | | 633,738 | | |

| Virgin Media Finance PLC | |

| 8.750% 04/15/14 | | EUR | | | 690,000 | | | | 1,025,161 | | |

| 8.750% 04/15/14 | | | | | 680,000 | | | | 668,100 | | |

| 9.125% 08/15/16 | | | | | 1,000,000 | | | | 980,000 | | |

See Accompanying Notes to Financial Statements.

8

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Windstream Corp. | |

| 8.625% 08/01/16 | | | | | 2,540,000 | | | | 2,625,725 | | |

| | | | 15,500,049 | | |

| Telecommunication Services Total | | | 45,266,326 | | |

| Communications Total | | | 71,285,576 | | |

| Consumer Cyclical – 15.4% | |

| Apparel – 0.7% | |

| Apparel Manufacturers – 0.7% | |

| Levi Strauss & Co. | |

| 9.750% 01/15/15 | | | | | 2,710,000 | | | | 2,838,725 | | |

| | | 2,838,725 | | |

| Apparel Total | | | 2,838,725 | | |

| Auto Manufacturers – 1.2% | |

| Auto-Cars/Light Trucks – 1.2% | |

| Ford Motor Co. | |

| 7.450% 07/16/31 | | | | | 1,805,000 | | | | 1,249,963 | | |

| General Motors Corp. | |

| 8.375% 07/15/33 | | | | | 4,810,000 | | | | 3,294,850 | | |

| | | | 4,544,813 | | |

| Auto Manufacturers Total | | | 4,544,813 | | |

| Auto Parts & Equipment – 2.0% | |

| Auto/Truck Parts & Equipment-Original – 1.3% | |

| ArvinMeritor, Inc. | |

| 8.125% 09/15/15 | | | | | 1,090,000 | | | | 930,587 | | |

| Cooper-Standard Automotive, Inc. | |

| 7.000% 12/15/12 | | | | | 1,170,000 | | | | 1,053,000 | | |

| Hayes Lemmerz Finance Luxembourg SA | |

| 8.250% 06/15/15 (b) | | EUR | | | 1,290,000 | | | | 1,706,883 | | |

| TRW Automotive, Inc. | |

| 7.000% 03/15/14 (b) | | | | | 1,435,000 | | | | 1,356,075 | | |

| | | 5,046,545 | | |

| Auto/Truck Parts & Equipment-Replacement – 0.3% | |

| Commercial Vehicle Group, Inc. | |

| 8.000% 07/01/13 | | | | | 1,340,000 | | | | 1,162,450 | | |

| | | 1,162,450 | | |

| Rubber-Tires – 0.4% | |

| Goodyear Tire & Rubber Co. | |

| 8.625% 12/01/11 | | | | | 423,000 | | | | 446,265 | | |

| 9.000% 07/01/15 | | | | | 1,038,000 | | | | 1,113,255 | | |

| | | 1,559,520 | | |

| Auto Parts & Equipment Total | | | 7,768,515 | | |

| | | | | Par (a) | | Value ($) | |

| Distribution/Wholesale – 0.5% | |

| Buhrmann U.S., Inc. | |

| 7.875% 03/01/15 | | | | | 1,065,000 | | | | 1,007,756 | | |

| Nebraska Book Co., Inc. | |

| 8.625% 03/15/12 | | | | | 1,000,000 | | | | 860,000 | | |

| | | | 1,867,756 | | |

| Distribution/Wholesale Total | | | 1,867,756 | | |

| Entertainment – 1.3% | |

| Music – 0.8% | |

| Steinway Musical Instruments, Inc. | |

| 7.000% 03/01/14 (b) | | | | | 1,435,000 | | | | 1,320,200 | | |

| WMG Acquisition Corp. | |

| 7.375% 04/15/14 | | | | | 1,440,000 | | | | 1,180,800 | | |

| WMG Holdings Corp. | |

(d) 12/15/14

(9.500% 12/15/09) | | | | | 1,325,000 | | | | 795,000 | | |

| | | 3,296,000 | | |

| Resorts/Theme Parks – 0.5% | |

| Six Flags, Inc. | |

| 9.625% 06/01/14 | | | | | 1,555,000 | | | | 964,100 | | |

| Universal City Florida Holding | |

| 7.623% 05/01/10 (c) | | | | | 1,000,000 | | | | 982,500 | | |

| | | | 1,946,600 | | |

| Entertainment Total | | | 5,242,600 | | |

| Home Builders – 0.1% | |

| Building-Residential/Commercial – 0.1% | |

| KB Home | |

| 5.875% 01/15/15 | | | | | 435,000 | | | | 380,625 | | |

| | | 380,625 | | |

| Home Builders Total | | | 380,625 | | |

| Home Furnishings – 0.7% | |

| Sealy Mattress Co. | |

| 8.250% 06/15/14 | | | | | 1,625,000 | | | | 1,434,063 | | |

| Simmons Co. | |

| 8.204% 02/15/12 (e) | | | | | 1,700,000 | | | | 1,093,666 | | |

| | | 2,527,729 | | |

| Home Furnishings Total | | | 2,527,729 | | |

| Leisure Time – 0.4% | |

| Cruise Lines – 0.4% | |

| Royal Caribbean Cruises Ltd. | |

| 7.000% 06/15/13 | | | | | 1,475,000 | | | | 1,362,531 | | |

| | | 1,362,531 | | |

| Leisure Time Total | | | 1,362,531 | | |

See Accompanying Notes to Financial Statements.

9

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Lodging – 4.6% | |

| Casino Hotels – 3.5% | |

| Boyd Gaming Corp. | |

| 6.750% 04/15/14 | | | | | 500,000 | | | | 418,125 | | |

| 7.125% 02/01/16 | | | | | 1,000,000 | | | | 782,500 | | |

| Greektown Holdings LLC | |

| 10.750% 12/01/13 (b)(f) | | | | | 850,000 | | | | 586,500 | | |

| Harrah's Operating Co., Inc. | |

| 10.750% 02/01/16 (b) | | | | | 3,215,000 | | | | 2,789,013 | | |

| Jacobs Entertainment, Inc. | |

| 9.750% 06/15/14 | | | | | 1,225,000 | | | | 961,625 | | |

| Majestic Star LLC | |

| 9.750% 01/15/11 | | | | | 3,195,000 | | | | 1,038,375 | | |

| MGM Mirage | |

| 7.500% 06/01/16 | | | | | 4,350,000 | | | | 3,866,062 | | |

| Pinnacle Entertainment, Inc. | |

| 7.500% 06/15/15 (b) | | | | | 1,235,000 | | | | 1,018,875 | | |

| Snoqualmie Entertainment Authority | |

| 6.936% 02/01/14 (b)(c) | | | | | 280,000 | | | | 217,000 | | |

| 9.125% 02/01/15 (b) | | | | | 1,235,000 | | | | 950,950 | | |

| Station Casinos, Inc. | |

| 6.625% 03/15/18 | | | | | 1,985,000 | | | | 1,161,225 | | |

| | | 13,790,250 | | |

| Gambling (Non-Hotel) – 1.1% | |

| Mashantucket Western Pequot Tribe | |

| 8.500% 11/15/15 (b) | | | | | 2,580,000 | | | | 2,386,500 | | |

| Seminole Indian Tribe of Florida | |

| 7.804% 10/01/20 (b) | | | | | 2,000,000 | | | | 1,919,960 | | |

| | | 4,306,460 | | |

| Lodging Total | | | 18,096,710 | | |

| Retail – 3.5% | |

| Retail-Apparel/Shoe – 0.5% | |

| Hanesbrands, Inc. | |

| 8.204% 12/15/14 (c) | | | | | 935,000 | | | | 869,550 | | |

| Phillips-Van Heusen Corp. | |

| 7.250% 02/15/11 | | | | | 425,000 | | | | 429,250 | | |

| 8.125% 05/01/13 | | | | | 565,000 | | | | 581,950 | | |

| | | 1,880,750 | | |

| Retail-Automobiles – 0.9% | |

| AutoNation, Inc. | |

| 4.713% 04/15/13 (c) | | | | | 365,000 | | | | 322,569 | | |

| 7.000% 04/15/14 | | | | | 640,000 | | | | 605,600 | | |

| KAR Holdings, Inc. | |

| 10.000% 05/01/15 | | | | | 1,470,000 | | | | 1,337,700 | | |

| United Auto Group, Inc. | |

| 7.750% 12/15/16 | | | | | 1,450,000 | | | | 1,348,500 | | |

| | | 3,614,369 | | |

| | | | | Par (a) | | Value ($) | |

| Retail-Discount – 0.2% | |

| Dollar General Corp. | |

PIK,

11.875% 07/15/17 | | | | | 1,000,000 | | | | 920,000 | | |

| | | 920,000 | | |

| Retail-Drug Stores – 0.7% | |

| Rite Aid Corp. | |

| 8.625% 03/01/15 | | | | | 1,000,000 | | | | 780,000 | | |

| 9.375% 12/15/15 | | | | | 2,215,000 | | | | 1,727,700 | | |

| | | 2,507,700 | | |

| Retail-Major Department Stores – 0.3% | |

| Saks, Inc. | |

| 9.875% 10/01/11 | | | | | 1,000,000 | | | | 1,045,000 | | |

| | | 1,045,000 | | |

| Retail-Propane Distributors – 0.4% | |

| AmeriGas Partners LP | |

| 7.125% 05/20/16 | | | | | 1,220,000 | | | | 1,183,400 | | |

| 7.250% 05/20/15 | | | | | 420,000 | | | | 408,450 | | |

| | | 1,591,850 | | |

| Retail-Restaurants – 0.3% | |

| Landry's Restaurants, Inc. | |

| 9.500% 12/15/14 | | | | | 1,285,000 | | | | 1,265,725 | | |

| | | 1,265,725 | | |

| Retail-Video Rental – 0.2% | |

| Blockbuster, Inc. | |

| 9.000% 09/01/12 | | | | | 1,000,000 | | | | 832,500 | | |

| | | | 832,500 | | |

| Retail Total | | | 13,657,894 | | |

| Textiles – 0.4% | |

| Textile-Products – 0.4% | |

| INVISTA | |

| 9.250% 05/01/12 (b) | | | | | 1,520,000 | | | | 1,573,200 | | |

| | | 1,573,200 | | |

| Textiles Total | | | 1,573,200 | | |

| Consumer Cyclical Total | | | 59,861,098 | | |

| Consumer Non-Cyclical – 12.9% | |

| Agriculture – 0.2% | |

| Tobacco – 0.2% | |

| Reynolds American, Inc. | |

| 7.625% 06/01/16 | | | | | 740,000 | | | | 772,670 | | |

| | | 772,670 | | |

| Agriculture Total | | | 772,670 | | |

See Accompanying Notes to Financial Statements.

10

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Beverages – 0.5% | |

| Beverages-Non-Alcoholic – 0.2% | |

| Cott Beverages, Inc. | |

| 8.000% 12/15/11 | | | | | 860,000 | | | | 724,550 | | |

| | | 724,550 | | |

| Beverages-Wine/Spirits – 0.3% | |

| Constellation Brands, Inc. | |

| 8.125% 01/15/12 | | | | | 1,100,000 | | | | 1,113,750 | | |

| | | | 1,113,750 | | |

| Beverages Total | | | 1,838,300 | | |

| Biotechnology – 0.4% | |

| Medical-Biomedical/Gene – 0.4% | |

| Bio-Rad Laboratories, Inc. | |

| 7.500% 08/15/13 | | | | | 1,485,000 | | | | 1,499,850 | | |

| | | | 1,499,850 | | |

| Biotechnology Total | | | 1,499,850 | | |

| Commercial Services – 3.9% | |

| Commercial Services – 1.1% | |

| ARAMARK Corp. | |

| 8.500% 02/01/15 | | | | | 1,440,000 | | | | 1,474,200 | | |

| Iron Mountain, Inc. | |

| 7.750% 01/15/15 | | | | | 1,560,000 | | | | 1,591,200 | | |

| 8.625% 04/01/13 | | | | | 1,000,000 | | | | 1,015,000 | | |

| | | 4,080,400 | | |

| Commercial Services-Finance – 0.2% | |

| ACE Cash Express, Inc. | |

| 10.250% 10/01/14 (b) | | | | | 1,025,000 | | | | 794,375 | | |

| | | 794,375 | | |

| Funeral Services & Related Items – 0.6% | |

| Service Corp. International | |

| 6.750% 04/01/16 | | | | | 835,000 | | | | 795,338 | | |

| 7.000% 06/15/17 | | | | | 1,500,000 | | | | 1,455,000 | | |

| 7.375% 10/01/14 | | | | | 135,000 | | | | 135,675 | | |

| | | 2,386,013 | | |

| Private Corrections – 0.5% | |

| Corrections Corp. of America | |

| 6.250% 03/15/13 | | | | | 1,345,000 | | | | 1,324,825 | | |

| GEO Group, Inc. | |

| 8.250% 07/15/13 | | | | | 700,000 | | | | 717,500 | | |

| | | 2,042,325 | | |

| | | | | Par (a) | | Value ($) | |

| Rental Auto/Equipment – 1.3% | |

| Ashtead Holdings PLC | |

| 8.625% 08/01/15 (b) | | | | | 1,390,000 | | | | 1,209,300 | | |

| Hertz Corp. | |

| 8.875% 01/01/14 | | | | | 1,350,000 | | | | 1,343,250 | | |

| Rental Service Corp. | |

| 9.500% 12/01/14 | | | | | 1,800,000 | | | | 1,575,000 | | |

| United Rentals North America, Inc. | |

| 6.500% 02/15/12 | | | | | 965,000 | | | | 890,212 | | |

| | | 5,017,762 | | |

| Schools – 0.2% | |

| Knowledge Learning Corp. | |

| 7.750% 02/01/15 (b) | | | | | 1,000,000 | | | | 945,000 | | |

| | | | 945,000 | | |

| Commercial Services Total | | | 15,265,875 | | |

| Food – 2.0% | |

| Food-Dairy Products – 0.2% | |

| Dean Foods Co. | |

| 7.000% 06/01/16 | | | | | 1,025,000 | | | | 955,812 | | |

| | | 955,812 | | |

| Food-Meat Products – 0.3% | |

| Smithfield Foods, Inc. | |

| 7.750% 07/01/17 | | | | | 1,355,000 | | | | 1,334,675 | | |

| | | 1,334,675 | | |

| Food-Miscellaneous/Diversified – 1.5% | |

| Del Monte Corp. | |

| 6.750% 02/15/15 | | | | | 1,000,000 | | | | 967,500 | | |

| 8.625% 12/15/12 | | | | | 500,000 | | | | 512,500 | | |

| Dole Food Co., Inc. | |

| 8.625% 05/01/09 | | | | | 1,100,000 | | | | 1,078,000 | | |

| Pinnacle Foods Finance LLC | |

| 9.250% 04/01/15 | | | | | 2,055,000 | | | | 1,890,600 | | |

| Reddy Ice Holdings, Inc. | |

(d) 11/01/12

(10.500% 11/01/08) | | | | | 1,420,000 | | | | 1,192,800 | | |

| | | | 5,641,400 | | |

| Food Total | | | 7,931,887 | | |

| Healthcare Services – 3.4% | |

| Dialysis Centers – 0.5% | |

| DaVita, Inc. | |

| 7.250% 03/15/15 | | | | | 1,940,000 | | | | 1,896,350 | | |

| | | 1,896,350 | | |

See Accompanying Notes to Financial Statements.

11

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Medical-Hospitals – 2.7% | |

| Community Health Systems, Inc. | |

| 8.875% 07/15/15 | | | | | 1,855,000 | | | | 1,912,968 | | |

| HCA, Inc. | |

| 9.250% 11/15/16 | | | | | 1,555,000 | | | | 1,642,469 | | |

PIK,

9.625% 11/15/16 | | | | | 3,485,000 | | | | 3,676,675 | | |

| Tenet Healthcare Corp. | |

| 9.875% 07/01/14 | | | | | 3,235,000 | | | | 3,235,000 | | |

| | | 10,467,112 | | |

| Physician Practice Management – 0.2% | |

| U.S. Oncology Holdings, Inc. | |

PIK,

7.949% 03/15/12 (c) | | | | | 1,074,000 | | | | 875,310 | | |

| | | | 875,310 | | |

| Healthcare Services Total | | | 13,238,772 | | |

| Household Products/Wares – 0.8% | |

| Consumer Products-Miscellaneous – 0.8% | |

| American Greetings Corp. | |

| 7.375% 06/01/16 | | | | | 1,220,000 | | | | 1,216,950 | | |

| Jarden Corp. | |

| 7.500% 05/01/17 | | | | | 1,000,000 | | | | 892,500 | | |

| Jostens IH Corp. | |

| 7.625% 10/01/12 | | | | | 1,185,000 | | | | 1,183,519 | | |

| | | | 3,292,969 | | |

| Household Products/Wares Total | | | 3,292,969 | | |

| Pharmaceuticals – 1.7% | |

| Medical-Drugs – 1.0% | |

| Elan Finance PLC | |

| 8.875% 12/01/13 | | | | | 1,995,000 | | | | 1,995,000 | | |

| Warner Chilcott Corp. | |

| 8.750% 02/01/15 | | | | | 1,918,000 | | | | 1,965,950 | | |

| | | 3,960,950 | | |

| Pharmacy Services – 0.4% | |

| Omnicare, Inc. | |

| 6.750% 12/15/13 | | | | | 1,535,000 | | | | 1,439,063 | | |

| | | 1,439,063 | | |

| Vitamins & Nutrition Products – 0.3% | |

| NBTY, Inc. | |

| 7.125% 10/01/15 | | | | | 1,260,000 | | | | 1,209,600 | | |

| | | | 1,209,600 | | |

| Pharmaceuticals Total | | | 6,609,613 | | |

| Consumer Non-Cyclical Total | | | 50,449,936 | | |

| | | | | Par (a) | | Value ($) | |

| Energy – 9.4% | |

| Coal – 1.3% | |

| Arch Western Finance LLC | |

| 6.750% 07/01/13 | | | | | 1,645,000 | | | | 1,624,437 | | |

| Massey Energy Co. | |

| 6.875% 12/15/13 | | | | | 2,650,000 | | | | 2,610,250 | | |

| Peabody Energy Corp. | |

| 7.375% 11/01/16 | | | | | 735,000 | | | | 751,538 | | |

| | | | 4,986,225 | | |

| Coal Total | | | 4,986,225 | | |

| Energy-Alternate Sources – 0.3% | |

| VeraSun Energy Corp. | |

| 9.375% 06/01/17 | | | | | 1,285,000 | | | | 893,075 | | |

| | | | 893,075 | | |

| Energy-Alternate Sources Total | | | 893,075 | | |

| Oil & Gas – 5.6% | |

| Oil & Gas Drilling – 0.3% | |

| Pride International, Inc. | |

| 7.375% 07/15/14 | | | | | 960,000 | | | | 976,800 | | |

| | | 976,800 | | |

| Oil Companies-Exploration & Production – 4.6% | |

| Chesapeake Energy Corp. | |

| 6.375% 06/15/15 | | | | | 1,600,000 | | | | 1,532,000 | | |

| 7.500% 06/15/14 | | | | | 1,145,000 | | | | 1,152,156 | | |

| Cimarex Energy Co. | |

| 7.125% 05/01/17 | | | | | 1,120,000 | | | | 1,114,400 | | |

| Compton Petroleum Corp. | |

| 7.625% 12/01/13 | | | | | 1,840,000 | | | | 1,800,900 | | |

| KCS Energy, Inc. | |

| 7.125% 04/01/12 | | | | | 1,400,000 | | | | 1,365,000 | | |

| Newfield Exploration Co. | |

| 6.625% 04/15/16 | | | | | 1,135,000 | | | | 1,081,088 | | |

| OPTI Canada, Inc. | |

| 8.250% 12/15/14 | | | | | 1,750,000 | | | | 1,802,500 | | |

| PetroHawk Energy Corp. | |

| 7.875% 06/01/15 (b) | | | | | 1,215,000 | | | | 1,213,481 | | |

| 9.125% 07/15/13 | | | | | 340,000 | | | | 353,600 | | |

| Pioneer Natural Resources Co. | |

| 5.875% 07/15/16 | | | | | 1,450,000 | | | | 1,333,591 | | |

| Quicksilver Resources, Inc. | |

| 7.125% 04/01/16 | | | | | 1,780,000 | | | | 1,735,500 | | |

| Range Resources Corp. | |

| 7.500% 05/15/16 | | | | | 1,115,000 | | | | 1,137,300 | | |

| Southwestern Energy Co. | |

| 7.500% 02/01/18 (b) | | | | | 2,430,000 | | | | 2,455,039 | | |

| | | | 18,076,555 | | |

See Accompanying Notes to Financial Statements.

12

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Oil Refining & Marketing – 0.7% | |

| Tesoro Corp. | |

| 6.625% 11/01/15 | | | | | 1,745,000 | | | | 1,603,218 | | |

| United Refining Co. | |

| 10.500% 08/15/12 | | | | | 1,295,000 | | | | 1,236,725 | | |

| | | | 2,839,943 | | |

| Oil & Gas Total | | | 21,893,298 | | |

| Oil & Gas Services – 0.2% | |

| Seismic Data Collection – 0.2% | |

| Seitel, Inc. | |

| 9.750% 02/15/14 | | | | | 880,000 | | | | 796,400 | | |

| | | | 796,400 | | |

| Oil & Gas Services Total | | | 796,400 | | |

| Pipelines – 2.0% | |

| Atlas Pipeline Partners LP | |

| 8.125% 12/15/15 | | | | | 990,000 | | | | 1,022,175 | | |

| El Paso Corp. | |

| 6.875% 06/15/14 | | | | | 1,670,000 | | | | 1,675,812 | | |

| 7.250% 06/01/18 | | | | | 1,960,000 | | | | 1,967,350 | | |

| Kinder Morgan Finance Co. ULC | |

| 5.700% 01/05/16 | | | | | 990,000 | | | | 916,987 | | |

| MarkWest Energy Partners LP | |

| 6.875% 11/01/14 | | | | | 1,070,000 | | | | 1,040,575 | | |

| 8.500% 07/15/16 | | | | | 745,000 | | | | 777,594 | | |

| Williams Companies, Inc. | |

| 6.375% 10/01/10 (b) | | | | | 500,000 | | | | 512,500 | | |

| | | | 7,912,993 | | |

| Pipelines Total | | | 7,912,993 | | |

| Energy Total | | | 36,481,991 | | |

| Financials – 7.0% | |

| Diversified Financial Services – 5.3% | |

| Finance-Auto Loans – 2.2% | |

| Ford Motor Credit Co. | |

| 7.800% 06/01/12 | | | | | 2,595,000 | | | | 2,295,892 | | |

| 8.000% 12/15/16 | | | | | 1,385,000 | | | | 1,162,741 | | |

| GMAC LLC | |

| 6.875% 09/15/11 | | | | | 2,050,000 | | | | 1,728,337 | | |

| 8.000% 11/01/31 (g) | | | | | 4,565,000 | | | | 3,497,160 | | |

| | | 8,684,130 | | |

| Investment Management/Advisor Service – 1.8% | |

| LVB Acquisition Merger Sub, Inc. | |

| 11.625% 10/15/17 (b) | | | | | 2,460,000 | | | | 2,607,600 | | |

PIK,

10.375% 10/15/17 (b) | | | | | 2,170,000 | | | | 2,311,050 | | |

| | | | | Par (a) | | Value ($) | |

| Nuveen Investments, Inc. | |

| 10.500% 11/15/15 (b) | | | | | 2,240,000 | | | | 2,105,600 | | |

| | | 7,024,250 | | |

| Special Purpose Entity – 1.3% | |

| FireKeepers Development Authority | |

| 13.875% 05/01/15 (b) | | | | | 875,000 | | | | 877,188 | | |

| Goldman Sachs Capital II | |

| 5.793% 12/29/49 (c) | | | | | 1,925,000 | | | | 1,446,181 | | |

| Targeted Return Index Securities Trust (TRAIN), | |

| Series HY-1-2006, | | | | | | | | | | | |

| 7.117% 05/01/16 (b)(c) | | | | | 2,760,000 | | | | 2,725,610 | | |

| | | | 5,048,979 | | |

| Diversified Financial Services Total | | | 20,757,359 | | |

| Insurance – 1.0% | |

| Insurance Brokers – 0.4% | |

| HUB International Holdings, Inc. | |

| 10.250% 06/15/15 (b) | | | | | 1,335,000 | | | | 987,900 | | |

| USI Holdings Corp. | |

| 9.750% 05/15/15 (b) | | | | | 905,000 | | | | 733,050 | | |

| | | 1,720,950 | | |

| Property/Casualty Insurance – 0.6% | |

| Asurion Corp. | |

| 9.198% 07/02/15 | | | | | 756,638 | | | | 702,412 | | |

| 9.284% 07/02/15 (c)(e) | | | | | 783,362 | | | | 727,221 | | |

| Crum & Forster Holdings Corp. | |

| 7.750% 05/01/17 | | | | | 860,000 | | | | 821,300 | | |

| | | | 2,250,933 | | |

| Insurance Total | | | 3,971,883 | | |

| Real Estate Investment Trusts (REITs) – 0.7% | |

| REITS-Hotels – 0.5% | |

| Host Marriott LP | |

| 6.750% 06/01/16 | | | | | 1,840,000 | | | | 1,784,800 | | |

| | | 1,784,800 | | |

| REITS-Regional Malls – 0.2% | |

| Rouse Co. LP/TRC Co-Issuer, Inc. | |

| 6.750% 05/01/13 (b) | | | | | 920,000 | | | | 823,871 | | |

| | | | 823,871 | | |

| Real Estate Investment Trusts (REITs) Total | | | 2,608,671 | | |

| Financials Total | | | 27,337,913 | | |

| Industrials – 12.2% | |

| Aerospace & Defense – 0.8% | |

| Aerospace/Defense-Equipment – 0.4% | |

| DRS Technologies, Inc. | |

| 6.875% 11/01/13 | | | | | 1,685,000 | | | | 1,722,913 | | |

| | | | 1,722,913 | | |

See Accompanying Notes to Financial Statements.

13

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Electronics-Military – 0.4% | |

| L-3 Communications Corp. | |

| 6.375% 10/15/15 | | | | | 1,395,000 | | | | 1,344,431 | | |

| | | 1,344,431 | | |

| Aerospace & Defense Total | | | 3,067,344 | | |

| Electrical Components & Equipment – 0.7% | |

| Wire & Cable Products – 0.7% | |

| Belden, Inc. | |

| 7.000% 03/15/17 | | | | | 1,675,000 | | | | 1,633,125 | | |

| General Cable Corp. | |

| 5.073% 04/01/15 (c) | | | | | 635,000 | | | | 568,325 | | |

| 7.125% 04/01/17 | | | | | 635,000 | | | | 619,125 | | |

| | | 2,820,575 | | |

| Electrical Components & Equipment Total | | | 2,820,575 | | |

| Electronics – 0.7% | |

| Electronic Components-Miscellaneous – 0.7% | |

| Flextronics International Ltd. | |

| 6.250% 11/15/14 | | | | | 735,000 | | | | 701,925 | | |

| 7.394% 10/01/14 (b)(e) | | | | | 725,944 | | | | 672,103 | | |

| 7.396% 10/01/14 (b)(e) | | | | | 46,958 | | | | 43,475 | | |

| 7.455% 10/01/14 (b)(e) | | | | | 222,098 | | | | 205,626 | | |

| NXP BV/NXP Funding LLC | |

| 9.500% 10/15/15 | | | | | 1,160,000 | | | | 1,094,750 | | |

| | | 2,717,879 | | |

| Electronics Total | | | 2,717,879 | | |

| Engineering & Construction – 0.3% | |

| Building & Construction-Miscellaneous – 0.3% | |

| Esco Corp. | |

| 8.625% 12/15/13 (b) | | | | | 945,000 | | | | 949,725 | | |

| | | 949,725 | | |

| Engineering & Construction Total | | | 949,725 | | |

| Environmental Control – 1.2% | |

| Non-Hazardous Waste Disposal – 0.7% | |

| Allied Waste North America, Inc. | |

| 7.125% 05/15/16 | | | | | 900,000 | | | | 884,250 | | |

| 7.875% 04/15/13 | | | | | 1,940,000 | | | | 1,983,650 | | |

| | | 2,867,900 | | |

| Recycling – 0.5% | |

| Aleris International, Inc. | |

| 10.000% 12/15/16 | | | | | 1,245,000 | | | | 893,288 | | |

PIK,

9.000% 12/15/14 | | | | | 1,155,000 | | | | 944,212 | | |

| | | 1,837,500 | | |

| Environmental Control Total | | | 4,705,400 | | |

| | | | | Par (a) | | Value ($) | |

| Hand/Machine Tools – 0.2% | |

| Machinery-Electrical – 0.2% | |

| Baldor Electric Co. | |

| 8.625% 02/15/17 | | | | | 915,000 | | | | 933,300 | | |

| | | 933,300 | | |

| Hand/Machine Tools Total | | | 933,300 | | |

| Machinery-Construction & Mining – 0.6% | |

| Terex Corp. | |

| 8.000% 11/15/17 | | | | | 2,345,000 | | | | 2,397,762 | | |

| | | 2,397,762 | | |

| Machinery-Construction & Mining Total | | | 2,397,762 | | |

| Machinery-Diversified – 0.7% | |

| Machinery-General Industry – 0.4% | |

| Manitowoc Co., Inc. | |

| 7.125% 11/01/13 | | | | | 1,520,000 | | | | 1,466,800 | | |

| | | 1,466,800 | | |

| Machinery-Material Handling – 0.3% | |

| Columbus McKinnon Corp. | |

| 8.875% 11/01/13 | | | | | 1,190,000 | | | | 1,246,525 | | |

| | | 1,246,525 | | |

| Machinery-Diversified Total | | | 2,713,325 | | |

| Miscellaneous Manufacturing – 2.1% | |

| Diversified Manufacturing Operators – 1.6% | |

| Bombardier, Inc. | |

| 6.300% 05/01/14 (b) | | | | | 1,981,000 | | | | 1,941,380 | | |

| 8.000% 11/15/14 (b) | | | | | 1,000,000 | | | | 1,050,000 | | |

| Koppers Holdings, Inc. | |

(d) 11/15/14

(9.875% 11/15/09) | | | | | 1,400,000 | | | | 1,288,000 | | |

| Trinity Industries, Inc. | |

| 6.500% 03/15/14 | | | | | 1,836,000 | | | | 1,808,460 | | |

| | | 6,087,840 | | |

| Miscellaneous Manufacturing – 0.5% | |

| American Railcar Industries, Inc. | |

| 7.500% 03/01/14 | | | | | 1,175,000 | | | | 1,098,625 | | |

| TriMas Corp. | |

| 9.875% 06/15/12 | | | | | 1,161,000 | | | | 1,079,730 | | |

| | | 2,178,355 | | |

| Miscellaneous Manufacturing Total | | | 8,266,195 | | |

| Packaging & Containers – 2.5% | |

| Containers-Metal/Glass – 1.4% | |

| Crown Americas LLC & Crown Americas Capital Corp. | |

| 7.750% 11/15/15 | | | | | 2,210,000 | | | | 2,320,500 | | |

See Accompanying Notes to Financial Statements.

14

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Owens-Brockway Glass Container, Inc. | |

| 8.250% 05/15/13 | | | | | 1,470,000 | | | | 1,521,450 | | |

| Owens-Illinois, Inc. | |

| 7.500% 05/15/10 | | | | | 1,480,000 | | | | 1,509,600 | | |

| | | 5,351,550 | | |

| Containers-Paper/Plastic – 1.1% | |

| Berry Plastics Holding Corp. | |

| 10.250% 03/01/16 | | | | | 1,520,000 | | | | 1,216,000 | | |

| Jefferson Smurfit Corp. | |

| 8.250% 10/01/12 | | | | | 1,705,000 | | | | 1,568,600 | | |

| Solo Cup Co. | |

| 8.500% 02/15/14 | | | | | 1,875,000 | | | | 1,668,750 | | |

| | | 4,453,350 | | |

| Packaging & Containers Total | | | 9,804,900 | | |

| Transportation – 2.4% | |

| Transportation-Marine – 0.9% | |

| Navios Maritime Holdings, Inc. | |

| 9.500% 12/15/14 | | | | | 1,805,000 | | | | 1,859,150 | | |

| Ship Finance International Ltd. | |

| 8.500% 12/15/13 | | | | | 1,155,000 | | | | 1,183,875 | | |

| Stena AB | |

| 7.500% 11/01/13 | | | | | 695,000 | | | | 695,000 | | |

| | | 3,738,025 | | |

| Transportation-Railroad – 0.5% | |

| TFM SA de CV | |

| 9.375% 05/01/12 | | | | | 1,755,000 | | | | 1,833,975 | | |

| | | 1,833,975 | | |

| Transportation-Services – 0.8% | |

| CHC Helicopter Corp. | |

| 7.375% 05/01/14 | | | | | 2,070,000 | | | | 2,095,875 | | |

| PHI, Inc. | |

| 7.125% 04/15/13 | | | | | 1,085,000 | | | | 1,047,025 | | |

| | | 3,142,900 | | |

| Transportation-Trucks – 0.2% | |

| QDI LLC | |

| 9.000% 11/15/10 | | | | | 990,000 | | | | 693,000 | | |

| | | 693,000 | | |

| Transportation Total | | | 9,407,900 | | |

| Industrials Total | | | 47,784,305 | | |

| Technology – 2.0% | |

| Computers – 0.8% | |

| Computer Services – 0.8% | |

| Sungard Data Systems, Inc. | |

| 9.125% 08/15/13 | | | | | 3,020,000 | | | | 3,110,600 | | |

| | | 3,110,600 | | |

| Computers Total | | | 3,110,600 | | |

| | | | | Par (a) | | Value ($) | |

| Semiconductors – 1.2% | |

| Electronic Components-Semiconductors – 1.2% | |

| Amkor Technology, Inc. | |

| 9.250% 06/01/16 | | | | | 1,190,000 | | | | 1,181,075 | | |

| Freescale Semiconductor, Inc. | |

PIK,

9.125% 12/15/14 | | | | | 4,220,000 | | | | 3,618,650 | | |

| | | 4,799,725 | | |

| Semiconductors Total | | | 4,799,725 | | |

| Technology Total | | | 7,910,325 | | |

| Utilities – 7.3% | |

| Electric – 6.9% | |

| Electric-Generation – 2.0% | |

| AES Corp. | |

| 7.750% 03/01/14 | | | | | 1,460,000 | | | | 1,460,000 | | |

| 8.000% 10/15/17 | | | | | 855,000 | | | | 858,206 | | |

| Edison Mission Energy | |

| 7.000% 05/15/17 | | | | | 2,225,000 | | | | 2,174,938 | | |

| Intergen NV | |

| 9.000% 06/30/17 (b) | | | | | 3,225,000 | | | | 3,386,250 | | |

| | | 7,879,394 | | |

| Electric-Integrated – 2.2% | |

| CMS Energy Corp. | |

| 6.875% 12/15/15 | | | | | 1,200,000 | | | | 1,191,502 | | |

| Energy Future Holdings Corp. | |

| 10.875% 11/01/17 (b) | | | | | 1,970,000 | | | | 2,053,725 | | |

| Texas Competitive Electric Holdings Co., | |

PIK,

10.500% 11/01/16 (b) | | | | | 5,450,000 | | | | 5,504,500 | | |

| | | 8,749,727 | | |

| Independent Power Producer – 2.7% | |

| Dynegy Holdings, Inc. | |

| 7.125% 05/15/18 | | | | | 2,450,000 | | | | 2,260,125 | | |

| 7.750% 06/01/19 | | | | | 800,000 | | | | 758,000 | | |

| Mirant North America LLC | |

| 7.375% 12/31/13 | | | | | 1,225,000 | | | | 1,234,188 | | |

| NRG Energy, Inc. | |

| 7.250% 02/01/14 | | | | | 960,000 | | | | 940,800 | | |

| 7.375% 02/01/16 | | | | | 1,065,000 | | | | 1,038,375 | | |

| 7.375% 01/15/17 | | | | | 1,495,000 | | | | 1,461,362 | | |

| NSG Holdings LLC/NSG Holdings, Inc. | |

| 7.750% 12/15/25 (b) | | | | | 1,535,000 | | | | 1,515,812 | | |

| Reliant Energy, Inc. | |

| 7.875% 06/15/17 | | | | | 1,180,000 | | | | 1,185,900 | | |

| | | 10,394,562 | | |

| Electric Total | | | 27,023,683 | | |

See Accompanying Notes to Financial Statements.

15

Columbia High Yield Opportunity Fund

May 31, 2008

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | | | Par (a) | | Value ($) | |

| Independent Power Producers – 0.4% | |

| Electric-Integrated – 0.4% | |

| Mirant Americas Generation LLC | |

| 8.500% 10/01/21 | | | | | 1,575,000 | | | | 1,519,875 | | |

| | | 1,519,875 | | |

| Independent Power Producers Total | | | 1,519,875 | | |

| Utilities Total | | | 28,543,558 | | |

Total Corporate Fixed-Income Bonds & Notes

(Cost of $375,829,693) | | | 355,767,330 | | |

| Municipal Bonds – 1.2% | |

| California – 0.9% | |

| CA Cabazon Band Mission Indians | |

| 13.000% 10/01/11 | | | | | 3,250,000 | | | | 3,413,833 | | |

| California Total | | | 3,413,833 | | |

| Virginia – 0.3% | |

| VA Tobacco Settlement Financing Corp. | |

| Series 2007 A1, | | | | | | | | | | | |

| 6.706% 06/01/46 | | | | | 1,565,000 | | | | 1,351,847 | | |

| Virginia Total | | | 1,351,847 | | |

Total Municipal Bonds

(Cost of $4,156,557) | | | 4,765,680 | | |

| Common Stocks – 0.3% | |

| | | | | Shares | | | |

| Consumer Discretionary – 0.3% | |

| Hotels, Restaurants & Leisure – 0.1% | |

| Town Sports International | |

| Holdings, Inc. (i) | | | | | 31,000 | | | | 258,230 | | |

| Hotels, Restaurants & Leisure Total | | | 258,230 | | |

| Media – 0.2% | |

| Idearc, Inc. | | | | | 35,000 | | | | 140,700 | | |

| Spanish Broadcasting System (i) | | | | | 210,000 | | | | 296,100 | | |

| Warner Music Group Corp. | | | | | 35,000 | | | | 314,650 | | |

| Media Total | | | 751,450 | | |

| Consumer Discretionary Total | | | 1,009,680 | | |

| Industrials – 0.0% | |

| Commercial Services & Supplies – 0.0% | |

| Fairlane Management Corp. (h)(j) | | | | | 50,004 | | | | – | | |

| Commercial Services & Supplies Total | | | – | | |

| | | | | Shares | | Value ($) | |

| Road & Rail – 0.0% | |

| Quality Distribution, Inc. (i) | | | | | 13,439 | | | | 47,036 | | |

| Road & Rail Total | | | 47,036 | | |

| Industrials Total | | | 47,036 | | |

| Materials – 0.0% | |

| Metals & Mining – 0.0% | |

| Ormet Corp. (i) | | | | | 380 | | | | 2,892 | | |

| Metals & Mining Total | | | 2,892 | | |

| Materials Total | | | 2,892 | | |

Total Common Stocks

(Cost of $2,997,699) | | | 1,059,608 | | |

| Preferred Stock – 0.0% | |

| Communications – 0.0% | |

| Media – 0.0% | |

| PTV Inc. | |

Series A,

10.000% 01/10/23 | | | | | 18 | | | | 8 | | |

| Media Total | | | 8 | | |

| Communications Total | | | 8 | | |

Total Preferred Stock

(Cost of $-) | | | 8 | | |

| Warrants – 0.0% | |

| | | | | Units | | | |

| Communications – 0.0% | |

| Media – 0.0% | |

| Broadcast Services/Programs – 0.0% | |

| XM Satellite Radio Holdings, Inc. | |

| Expires 03/15/10 (b)(i) | | | | | 2,435 | | | | 3,653 | | |