UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | August 31 | |

|

Date of reporting period: | August 31, 2016 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

August 31, 2016

COLUMBIA DISCIPLINED SMALL CORE FUND

ABOUT COLUMBIA THREADNEEDLE INVESTMENTS

Columbia Threadneedle Investments is a leading global asset management group that provides a broad range of investment strategies and solutions for individual, institutional and corporate clients around the world.

With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $460 billion* of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives. We are the 13th largest manager of long-term mutual fund assets in the U.S.** and the 4th largest manager of retail funds in the U.K.***

Our priority is the investment success of our clients. We aim to deliver the investment outcomes they expect through an investment approach that is team-based, performance-driven and risk-aware. Our culture is dynamic and interactive. By sharing our insights across asset classes and geographies, we generate richer perspectives on global, regional and local investment landscapes. The ability to exchange and debate investment ideas in a collaborative environment enriches our teams' investment processes. More importantly, it results in better informed investment decisions for our clients.

Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

* In U.S. dollars as of June 30, 2016. Source: Ameriprise Q2 Earnings Release. Includes all assets managed by entities in the Columbia and Threadneedle group of companies. Contact us for more current data.

** Source: ICI as of June 30, 2016 for Columbia Management Investment Advisers, LLC.

*** Source: Investment Association as of March 2016 for Threadneedle Asset Management Limited.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

Not part of the shareholder report

Dear Shareholders,

Dear Shareholders,

Volatility comes with the territory for long-term investors. Some investors instinctively want to pull out of the market or sell underperforming investments at the first sign of increased volatility or perhaps even as soon as they perceive it on the horizon. But taking yourself out of the market could mean losing out on potential opportunities, and putting your longer term investment goals at risk.

Cumulative return is not just about achieving high returns when markets are going up; it's also about remaining invested and minimizing losses during weak or volatile markets so that you can participate on the upside. Developing a deeper understanding of the various risks your portfolio is subject to can help you balance these risks.

Diversification is critical in seeking to achieve that balance. We believe that most portfolios could be more effectively diversified either by introducing holdings with performance profiles unrelated to existing holdings (like alternative products) or by rebalancing existing holdings with an eye toward risk allocation. Over time, distributing risk more evenly may produce a more pronounced diversification benefit and may improve portfolio efficiency. We believe market volatility can create significant opportunities and, in fact, these periods may be some of the very best times to invest.

With this in mind, I thought it important to highlight excerpts from a piece written by Colin Moore, Global Chief Investment Officer, in which he touches on some of these issues emphasizing the importance of a properly constructed portfolio in seeking to effectively manage volatility and to achieve consistency of returns. I encourage you to read the article in its entirety. To access the full article and for other insights on current market, please visit blog.columbiathreadneedleus.com/latest-perspectives.

You need investments that are designed to help you ease the impact of volatile market environments and keep the savings you have worked tirelessly to amass. Columbia Threadneedle Investments provides investment solutions to help you tackle financial challenges and achieve your desired outcome.

Best regards,

Christopher O. Petersen

President, Columbia Funds

Excerpts from:

Taking the scare out of the volatility bogeyman

By Colin Moore, Global Chief Investment Officer

Colin Moore is the global chief investment officer for Columbia Threadneedle Investments. His responsibilities include ensuring that a disciplined investment process is in place across all asset classes, including equity and fixed income. Mr. Moore joined one of the Columbia Threadneedle Investments legacy firms in 2002 as head of equity and was also head of fixed income and liquidity strategies from 2009 – 2010.

n In today's low growth, higher volatility world, the emphasis is shifting from maximization of returns to consistency of returns.

PRESIDENT'S MESSAGE (continued)

n Portfolios should represent the behavioral risk-return tradeoff of investors, remembering that they won't stay invested to realize the return if we get the risk tolerance wrong.

n Holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals.

According to Wikipedia, "The bogeyman is a common allusion to a mythical creature in many cultures used to control behavior. This monster has no specific appearance, and conceptions about it can vary drastically from household to household within the same community; in many cases he has no set appearance in the mind of an adult or child, but is simply a non-specific embodiment of terror." Different cultures have different names and physical representations for the bogeyman, and investors are no different. We have terrible monsters that we fear may destroy our portfolios, and we call one of the scariest of them volatility.

While the bogeyman is mythical (I hope!), volatility is real and can cause serious damage. To understand why investors have such a hard time coping with volatility, we first need to define three cognitive biases at work in today's investment environment:

1) Recency bias — something that has recently come to the forefront of our attention, regardless of how long established it is, suddenly seems to appear with improbable frequency.

2) Negativity bias — we tend to have a greater recall of unpleasant memories than positive memories.

3) Loss aversion — our dissatisfaction with losing money tends to be greater than our satisfaction with making money.

The level of volatility varies dramatically, and so does investor fear and panic selling — waxing when volatility rises, waning when it falls. Recent studies have pointed to demographics as an important driver of panic selling. The theory is that as people get closer to retirement, the prospects of a large (20% – 30%) loss in financial assets can have a much more pronounced effect on their sense of well-being. Wealth preservation instincts kick in much more quickly than for younger (and typically less wealthy) savers.

The reality is that there is little opportunity for return without volatility. Therefore, the bogeyman effect of holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals. This effect tends to be more pronounced during the episodic spikes in volatility. The significant spike in volatility in 2008 and 2009 led to significant withdrawals from long-term investment funds over the same period. Less pronounced effects can also be seen when comparing 2001 – 2003 and 2011 – 2012. Conversely, flows picked up when volatility returned to "normal" levels. Investor behavior of this type is consistent with the three behavioral biases.

I believe average volatility will be higher over the next 10 years than the last 10 years and episodic spikes will increase in frequency because sustainable economic growth will be structurally lower and geopolitical risk higher than any time since World War II. Low growth creates uncertainty while loss aversion will make investors fear that we are one economic mishap or geopolitical event away from no growth or recession. The result will be higher volatility on average. Negativity bias will tend to exacerbate "spike" reactions to event-driven geopolitical news, and the volatility bogeyman will appear more often. Assuming the behavioral biases continue, investor returns are likely to be very disappointing regardless of the total return generated by financial markets due to the bogeyman effect.

To mitigate this effect, we need to focus on portfolio construction and an improved understanding of diversification. I accept that equities are likely to offer the highest return over the next 10 years, but they also offer the highest volatility. Many portfolio construction optimization tools use historical average volatility, which is likely to underestimate the volatility investors will face. The bogeyman emerges when individual asset class volatility spikes and cross correlations rise, the combination of which increases overall portfolio volatility far beyond expectation. Diversification is meant to protect investors against volatility, but what's the point of owning lots of investments if the volatility bogeyman has not been properly estimated?

Most importantly, portfolios should be constructed to properly represent the behavioral risk-return trade off of investors, remembering that they won't stay invested to realize the return if we get the risk tolerance wrong. In a low growth, higher volatility world, the emphasis is shifting to return consistency rather than return maximization,

PRESIDENT'S MESSAGE (continued)

and investors are best served through investment approaches that appreciate that distinction. Even though it's a permanent feature of financial markets, volatility is less likely to be the bogeyman we all fear if portfolios are constructed with this understanding.

Please visit blog.columbiathreadneedleus.com/latest-perspectives to read the entire article.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit investor.columbiathreadneedleus.com. The prospectus should be read carefully before investing.

The views expressed are as of April 2016, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors.

Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that the forecasts are accurate.

Diversification does not guarantee a profit or protect against loss.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

COLUMBIA DISCIPLINED SMALL CORE FUND

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit investor.columbiathreadneedleus.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Performance Overview | | | 3 | | |

Manager Discussion of Fund Performance | | | 5 | | |

Understanding Your Fund's Expenses | | | 7 | | |

Portfolio of Investments | | | 8 | | |

Statement of Assets and Liabilities | | | 15 | | |

Statement of Operations | | | 17 | | |

Statement of Changes in Net Assets | | | 18 | | |

Financial Highlights | | | 21 | | |

Notes to Financial Statements | | | 31 | | |

Report of Independent Registered Public Accounting Firm | | | 40 | | |

Federal Income Tax Information | | | 41 | | |

Trustees and Officers | | | 42 | | |

Board Consideration and Approval of Management Agreement | | | 47 | | |

Important Information About This Report | | | 51 | | |

COLUMBIA DISCIPLINED SMALL CORE FUND

Performance Summary

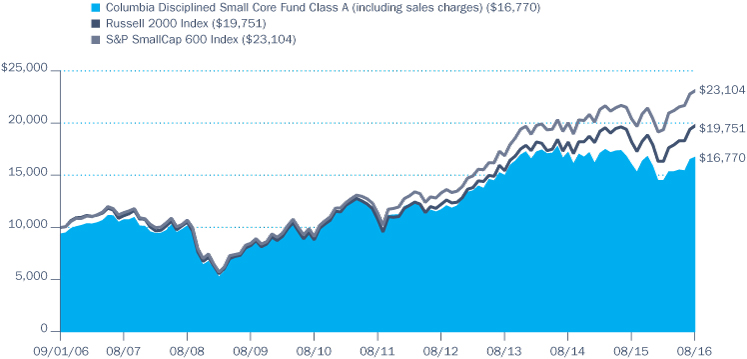

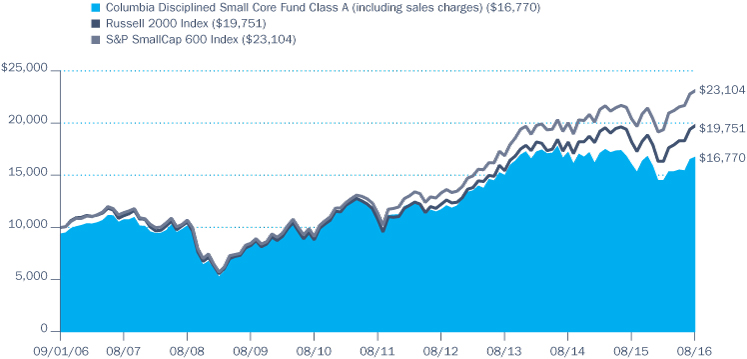

n Columbia Disciplined Small Core Fund (the Fund) Class A shares returned 4.32% excluding sales charges for the 12-month period that ended August 31, 2016.

n The Fund underperformed its benchmarks, the Russell 2000 Index and the S&P SmallCap 600 Index, which returned 8.59% and 13.26%, respectively, for the same 12-month period.

n Security selection in the information technology and consumer discretionary sectors detracted from the Fund's results relative to its Russell benchmark.

Average Annual Total Returns (%) (for period ended August 31, 2016)

| | | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 11/01/98 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 4.32 | | | | 8.79 | | | | 5.93 | | |

Including sales charges | | | | | | | -1.68 | | | | 7.52 | | | | 5.31 | | |

Class B | | 11/01/98 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 3.63 | | | | 7.99 | | | | 5.15 | | |

Including sales charges | | | | | | | 0.46 | | | | 7.79 | | | | 5.15 | | |

Class C | | 11/18/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 3.62 | | | | 7.99 | | | | 5.15 | | |

Including sales charges | | | | | | | 2.99 | | | | 7.99 | | | | 5.15 | | |

Class I* | | 09/27/10 | | | 4.80 | | | | 9.30 | | | | 6.33 | | |

Class R4* | | 11/08/12 | | | 4.64 | | | | 9.07 | | | | 6.20 | | |

Class R5* | | 11/08/12 | | | 4.76 | | | | 9.21 | | | | 6.27 | | |

Class T | | 02/12/93 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 4.35 | | | | 8.75 | | | | 5.89 | | |

Including sales charges | | | | | | | -1.67 | | | | 7.47 | | | | 5.26 | | |

Class W* | | 09/27/10 | | | 4.32 | | | | 8.79 | | | | 5.94 | | |

Class Y* | | 11/08/12 | | | 4.83 | | | | 9.24 | | | | 6.28 | | |

Class Z | | 12/14/92 | | | 4.64 | | | | 9.07 | | | | 6.20 | | |

Russell 2000 Index | | | | | | | 8.59 | | | | 12.85 | | | | 7.04 | | |

S&P SmallCap 600 Index | | | | | | | 13.26 | | | | 15.18 | | | | 8.73 | | |

Returns for Class A and Class T are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/ appended-performance for more information.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes the securities of approximately 2,000 of the smallest companies in the Russell 3000 Index based on a combination of their market capitalization and current index membership.

The S&P SmallCap 600 Index tracks the performance of 600 domestic companies traded on major stock exchanges. The S&P SmallCap 600 is heavily weighted with the stocks of companies with small market capitalizations.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2016

3

COLUMBIA DISCIPLINED SMALL CORE FUND

PERFORMANCE OVERVIEW (continued)

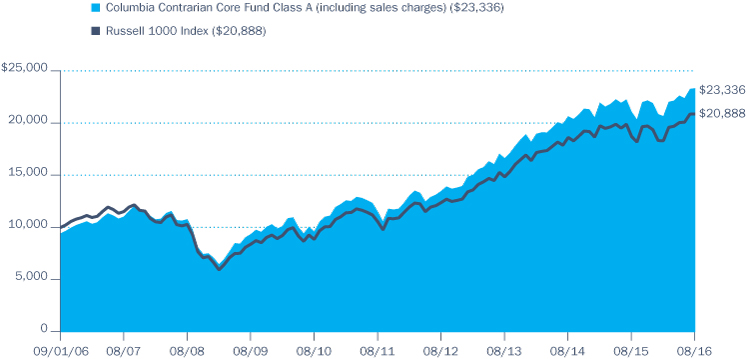

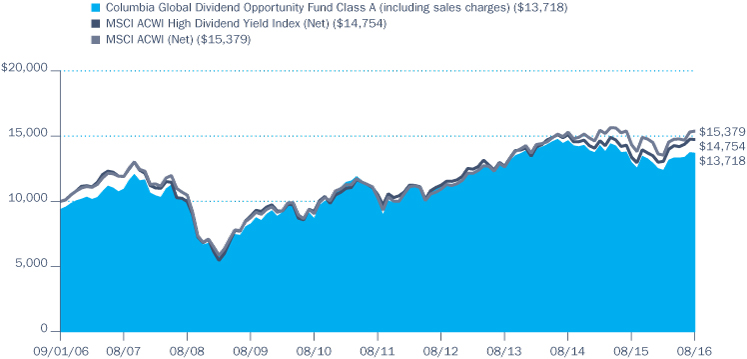

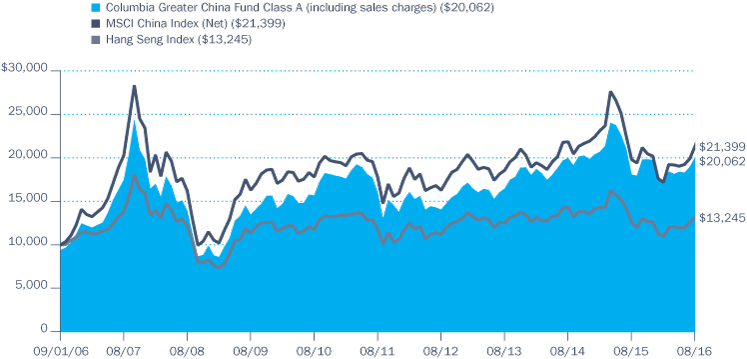

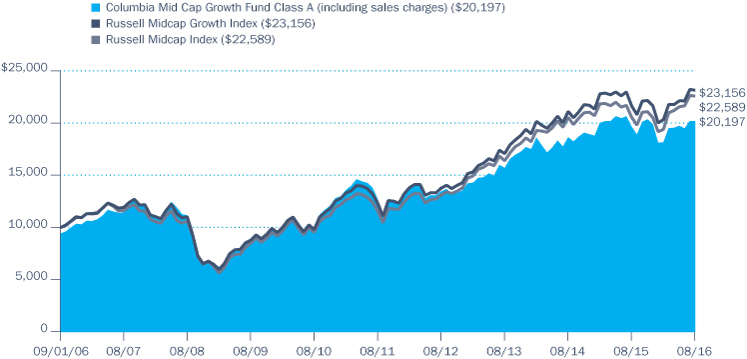

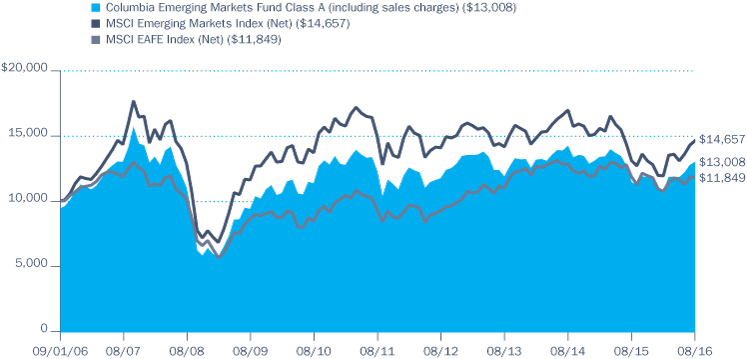

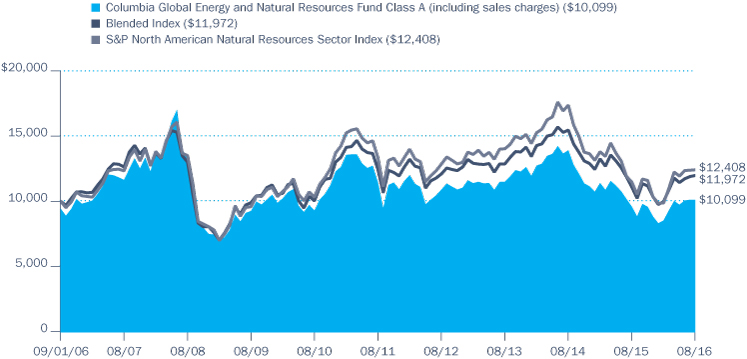

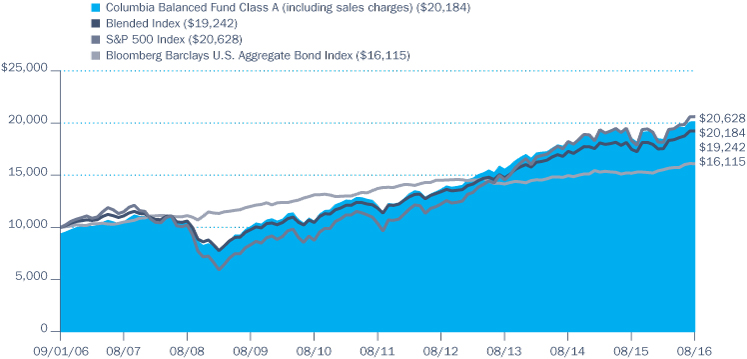

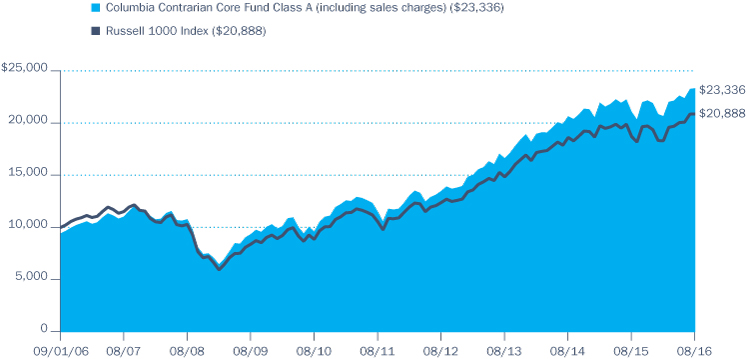

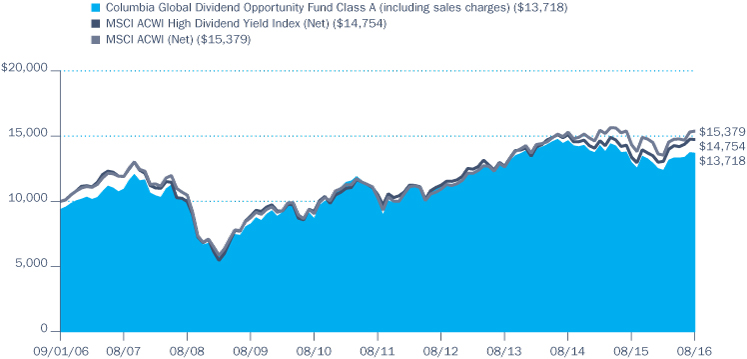

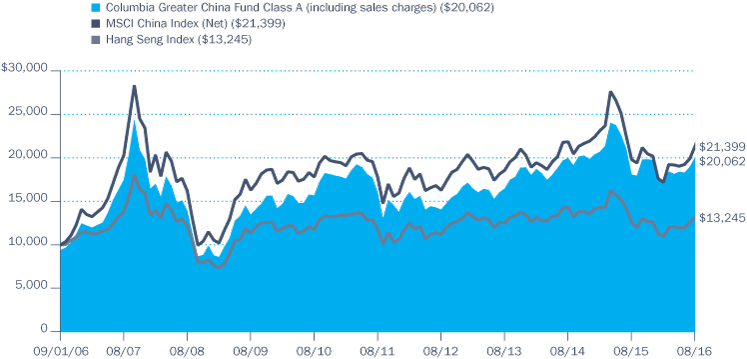

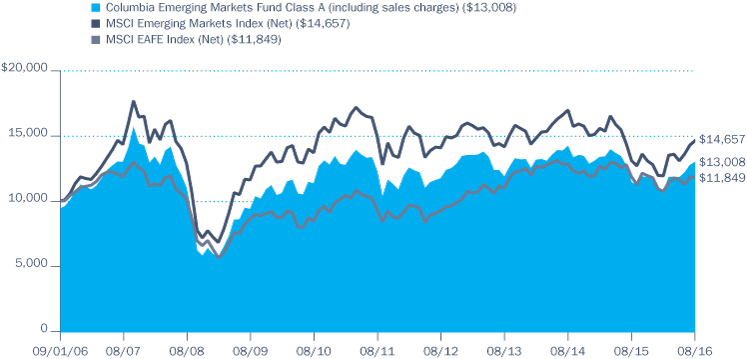

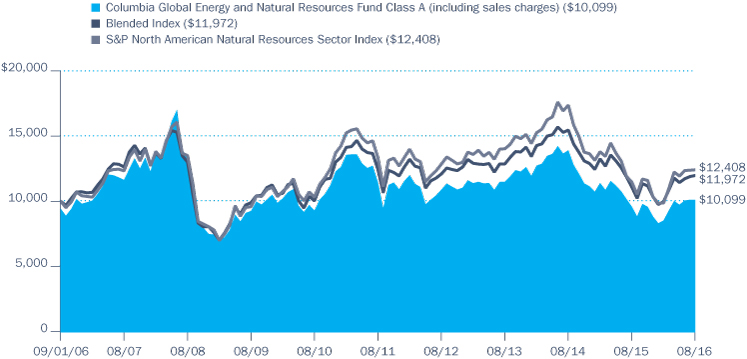

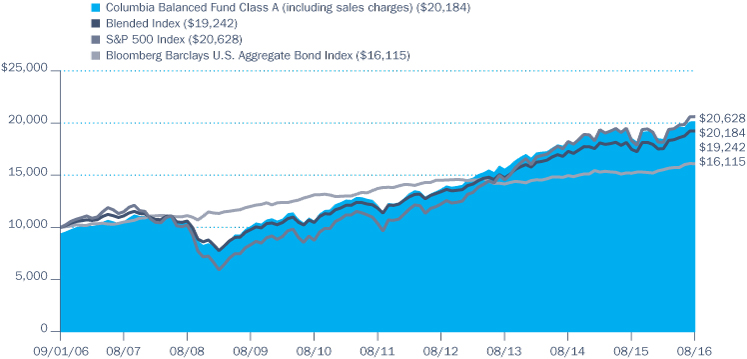

Performance of a Hypothetical $10,000 Investment (September 1, 2006 – August 31, 2016)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Disciplined Small Core Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2016

4

COLUMBIA DISCIPLINED SMALL CORE FUND

MANAGER DISCUSSION OF FUND PERFORMANCE

For the 12-month period that ended August 31, 2016, the Fund's Class A shares returned 4.32% excluding sales charges. By comparison, the Fund's benchmarks, the Russell 2000 Index and the S&P SmallCap 600 Index, posted returns of 8.59% and 13.26%, respectively. Stocks with a high degree of market sensitivity and higher volatility stocks underperformed during the period, which worked against the Fund's portfolio. Security selection in the information technology and consumer discretionary sectors detracted from the Fund's results relative to its Russell benchmark.

Stocks Logged Gains in Volatile Market

Lackluster economic growth, contentious geopolitical conflicts and expectations of a shift in U.S. monetary policy weighed on investors in the first half of the 12-month period. In December 2015, the Federal Reserve (the Fed) raised the target range of its benchmark interest rate by a quarter of a point. But the Fed took no further action as subpar global economic growth continued and mixed economic data undermined confidence at home.

The U.S. economy, however, continued to expand modestly throughout the period, and economic growth in Europe picked up, if ever so slightly. After an earlier slump, the U.S. manufacturing sector regained some traction in the spring, and the U.S. labor markets recovered to full employment for the first time since the Great Recession, despite occasional weaker reports on new job growth. The vote by the United Kingdom to exit the European Union gave markets a jolt in mid-June, but that downdraft was short lived.

Against this backdrop, stocks pulled back three times during the 12-month period. The S&P 500 Index, a broad measure of U.S. stock market performance, rose 12.55% despite these downdrafts. Large-cap stocks outperformed mid- and small-cap stocks. Value stocks outperformed growth stocks, with an especially big advantage for mid-cap and small-cap value stocks versus their growth counterparts.

Contributors and Detractors

We divide the metrics for our stock selection model into three broad categories: 1) valuation — fundamental measures such as earnings and cash flow relative to market values, 2) catalyst — price momentum and business momentum and 3) quality — quality of earnings and financial strength. We then rank the securities within a sector/industry from one (most attractive) to five (least attractive) based upon the metrics within these categories. The period was largely defined by the performance of lower volatility and higher dividend yielding stocks, and these factors aided the portfolio most. Value and quality were both modestly positive for the portfolio. Catalyst results were largely mixed.

On a sector basis, stock selection in the health care and industrials sectors aided performance relative to the Russell benchmark. Quad/Graphics, which provides a diverse range of print and media solutions and logistics services did well after announcing stronger-than-expected earnings and a new streamlined global brand management solution to enhance delivery times and product quality. The market

Portfolio Management

Alfred Alley III, CFA

Brian Condon, CFA

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2016 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Top Ten Holdings (%)

(at August 31, 2016) | |

Aspen Technology, Inc. | | | 1.0 | | |

Universal Insurance

Holdings, Inc. | | | 0.9 | | |

Washington Prime Group, Inc. | | | 0.9 | | |

EnerSys | | | 0.9 | | |

SYNNEX Corp. | | | 0.9 | | |

Trinseo SA | | | 0.9 | | |

REX American Resources Corp. | | | 0.9 | | |

Universal Forest Products, Inc. | | | 0.9 | | |

Radian Group, Inc. | | | 0.9 | | |

Washington Federal, Inc. | | | 0.9 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Annual Report 2016

5

COLUMBIA DISCIPLINED SMALL CORE FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Portfolio Breakdown (%)

(at August 31, 2016) | |

Common Stocks | | | 98.2 | | |

Money Market Funds | | | 1.8 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

Equity Sector Breakdown (%)

(at August 31, 2016) | |

Consumer Discretionary | | | 13.1 | | |

Consumer Staples | | | 3.5 | | |

Energy | | | 3.3 | | |

Financials | | | 26.8 | | |

Health Care | | | 13.5 | | |

Industrials | | | 13.9 | | |

Information Technology | | | 16.6 | | |

Materials | | | 4.6 | | |

Telecommunication Services | | | 1.0 | | |

Utilities | | | 3.7 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Investment Risks

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Investments in small-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund's prospectus for more information on these and other risks.

responded favorably to LSI Industries, which provides corporate visual image solutions through the combination of digital and screen graphics capabilities. LSI Industries began a corporate overhaul at the end of 2014, which included a new CEO and renewed focus on sales and operational efficiency. This push has yielded strong results for the firm's financials and outlook. Spire, a public natural gas utility, was a strong performer, the result of increased net income, the announcement of a new 60 mile pipeline and the acquisition of EnergySouth. We sold the Fund's positions in LSI Industries and Spire during the period.

Stock selection within the information technology and consumer discretionary sectors lagged the Russell benchmark. InvenSense is a major provider of micro electromechanical gyroscopes for motion-tracking devices in consumer electronics, Apple iPhones in particular. An increase in inventory at Apple and the loss of market share to Samsung provided a major headwind to the company's revenue and brought its share price down for the period. We sold the Fund's position in InvenSense during the period. Synaptics, which develops and supplies intuitive human interface solutions for a range of electronic devices and products worldwide, was the discussion of buyout talks, but a disappointing earnings announcement made the deal unattractive and shares tumbled. In the financials sector, Heritage Insurance Holdings, a property and casualty insurance company, lost ground. Heritage posted a 75% decline in net income in the first quarter of 2016 due to an increase in weather-related claims due to severe weather. Litigation concerns also weighed on Heritage shares.

The Fund also invested in futures contracts during the period. The stand-alone impact of these contracts had a positive impact on fund performance.

Fund Strategy

We assumed the day-to-day portfolio management of the Fund in January 2016. The transition of the portfolio to our quantitative model resulted in a portfolio turnover of 112%, which is higher than previous reporting periods. Our strategy is based on individual quantitative stock selection. Consequently, we do not rely on macroeconomic scenarios or market outlooks to make security selections. We do not try to predict when equities, as an asset class, may perform well or when they may perform poorly. Instead, we keep the fund substantially invested at all times. Regardless of economic environment, we seek to identify stocks that we believe have the potential to outperform within each market sector. We also seek to minimize sector weight differences between the Fund and its Russell benchmark. We favor stocks of companies we believe have attractive valuations relative to their peers, strong business and market momentum and good quality of earnings and financial strength.

Annual Report 2016

6

COLUMBIA DISCIPLINED SMALL CORE FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

March 1, 2016 – August 31, 2016

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,153.30 | | | | 1,018.20 | | | | 7.47 | | | | 7.00 | | | | 1.38 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,149.90 | | | | 1,014.43 | | | | 11.51 | | | | 10.79 | | | | 2.13 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,149.50 | | | | 1,014.43 | | | | 11.51 | | | | 10.79 | | | | 2.13 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.90 | | | | 1,020.36 | | | | 5.15 | | | | 4.82 | | | | 0.95 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.40 | | | | 1,019.46 | | | | 6.12 | | | | 5.74 | | | | 1.13 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.60 | | | | 1,020.11 | | | | 5.42 | | | | 5.08 | | | | 1.00 | | |

Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,153.70 | | | | 1,018.20 | | | | 7.47 | | | | 7.00 | | | | 1.38 | | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,153.30 | | | | 1,018.20 | | | | 7.47 | | | | 7.00 | | | | 1.38 | | |

Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,156.40 | | | | 1,020.36 | | | | 5.15 | | | | 4.82 | | | | 0.95 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,155.80 | | | | 1,019.46 | | | | 6.12 | | | | 5.74 | | | | 1.13 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2016

7

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS

August 31, 2016

(Percentages represent value of investments compared to net assets)

Common Stocks 95.7%

Issuer | | Shares | | Value ($) | |

CONSUMER DISCRETIONARY 12.6% | |

Auto Components 3.1% | |

Cooper Tire & Rubber Co. | | | 47,400 | | | | 1,611,126 | | |

Cooper-Standard Holding, Inc.(a) | | | 11,200 | | | | 1,109,360 | | |

Dana, Inc. | | | 151,400 | | | | 2,183,188 | | |

Drew Industries, Inc. | | | 15,500 | | | | 1,578,675 | | |

Superior Industries International, Inc. | | | 56,600 | | | | 1,647,626 | | |

Tenneco, Inc.(a) | | | 4,925 | | | | 274,963 | | |

Total | | | | | 8,404,938 | | |

Diversified Consumer Services 0.6% | |

Capella Education Co. | | | 28,725 | | | | 1,692,477 | | |

Hotels, Restaurants & Leisure 2.7% | |

Bloomin' Brands, Inc. | | | 34,600 | | | | 676,084 | | |

Bob Evans Farms, Inc. | | | 16,150 | | | | 662,150 | | |

Cracker Barrel Old Country Store, Inc. | | | 8,770 | | | | 1,334,005 | | |

Denny's Corp.(a) | | | 100,473 | | | | 1,049,943 | | |

Diamond Resorts International, Inc.(a) | | | 22,450 | | | | 678,214 | | |

Isle of Capri Casinos, Inc.(a) | | | 86,000 | | | | 1,492,100 | | |

Ruth's Hospitality Group, Inc. | | | 99,500 | | | | 1,488,520 | | |

Total | | | | | 7,381,016 | | |

Household Durables 0.1% | |

La-Z-Boy, Inc. | | | 10,800 | | | | 288,036 | | |

Internet & Catalog Retail 0.2% | |

PetMed Express, Inc. | | | 19,485 | | | | 392,818 | | |

Leisure Products 0.1% | |

Sturm Ruger & Co., Inc. | | | 2,200 | | | | 134,838 | | |

Media 1.4% | |

Gannett Co., Inc. | | | 156,700 | | | | 1,869,431 | | |

New York Times Co. (The), Class A | | | 109,300 | | | | 1,414,342 | | |

Nexstar Broadcasting Group, Inc., Class A | | | 9,900 | | | | 521,928 | | |

Total | | | | | 3,805,701 | | |

Multiline Retail 0.6% | |

Big Lots, Inc. | | | 32,500 | | | | 1,602,900 | | |

Specialty Retail 3.2% | |

Abercrombie & Fitch Co., Class A | | | 95,650 | | | | 1,696,831 | | |

American Eagle Outfitters, Inc. | | | 54,200 | | | | 1,004,868 | | |

Cato Corp. (The), Class A | | | 53,300 | | | | 1,827,124 | | |

Children's Place, Inc. (The) | | | 25,525 | | | | 2,077,735 | | |

GNC Holdings, Inc., Class A | | | 24,000 | | | | 504,720 | | |

Pier 1 Imports, Inc. | | | 361,800 | | | | 1,667,898 | | |

Total | | | | | 8,779,176 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Textiles, Apparel & Luxury Goods 0.6% | |

Movado Group, Inc. | | | 76,500 | | | | 1,736,550 | | |

Total Consumer Discretionary | | | | | 34,218,450 | | |

CONSUMER STAPLES 3.3% | |

Food & Staples Retailing 1.0% | |

SpartanNash Co. | | | 36,700 | | | | 1,175,134 | | |

SUPERVALU, Inc.(a) | | | 276,800 | | | | 1,516,864 | | |

Total | | | | | 2,691,998 | | |

Food Products 2.1% | |

Cal-Maine Foods, Inc. | | | 39,225 | | | | 1,801,996 | | |

Dean Foods Co. | | | 100,600 | | | | 1,731,326 | | |

Sanderson Farms, Inc. | | | 23,000 | | | | 2,213,290 | | |

Total | | | | | 5,746,612 | | |

Personal Products 0.2% | |

Usana Health Sciences, Inc.(a) | | | 4,790 | | | | 654,985 | | |

Total Consumer Staples | | | | | 9,093,595 | | |

ENERGY 3.2% | |

Energy Equipment & Services 0.8% | |

Archrock, Inc. | | | 52,200 | | | | 575,244 | | |

Atwood Oceanics, Inc. | | | 188,300 | | | | 1,487,570 | | |

Total | | | | | 2,062,814 | | |

Oil, Gas & Consumable Fuels 2.4% | |

PDC Energy, Inc.(a) | | | 32,050 | | | | 2,128,120 | | |

REX American Resources Corp.(a) | | | 29,100 | | | | 2,340,804 | | |

Western Refining, Inc. | | | 86,350 | | | | 2,172,566 | | |

Total | | | | | 6,641,490 | | |

Total Energy | | | | | 8,704,304 | | |

FINANCIALS 25.7% | |

Banks 5.1% | |

Banc of California, Inc. | | | 101,000 | | | | 2,254,320 | | |

Banco Latinoamericano de

Comercio Exterior SA, Class E | | | 55,900 | | | | 1,614,951 | | |

Central Pacific Financial Corp. | | | 83,350 | | | | 2,132,927 | | |

Chemical Financial Corp. | | | 11,000 | | | | 508,530 | | |

Customers Bancorp, Inc.(a) | | | 66,750 | | | | 1,784,895 | | |

FCB Financial Holdings, Inc., Class A(a) | | | 9,800 | | | | 375,340 | | |

First BanCorp(a) | | | 93,600 | | | | 458,640 | | |

First NBC Bank Holding Co.(a) | | | 56,750 | | | | 741,155 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

8

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Fulton Financial Corp. | | | 72,500 | | | | 1,048,350 | | |

Great Western Bancorp, Inc. | | | 12,100 | | | | 414,304 | | |

Hope Bancorp, Inc. | | | 45,200 | | | | 777,440 | | |

International Bancshares Corp. | | | 61,400 | | | | 1,820,510 | | |

Total | | | | | 13,931,362 | | |

Capital Markets 1.4% | |

Arlington Asset Investment Corp., Class A | | | 91,200 | | | | 1,357,056 | | |

Cowen Group, Inc., Class A(a) | | | 90,300 | | | | 338,625 | | |

KCG Holdings, Inc., Class A(a) | | | 122,200 | | | | 1,765,790 | | |

Piper Jaffray Companies(a) | | | 6,500 | | | | 288,470 | | |

Total | | | | | 3,749,941 | | |

Consumer Finance 0.6% | |

Nelnet, Inc., Class A | | | 48,250 | | | | 1,708,050 | | |

Diversified Financial Services 0.7% | |

Cardtronics PLC, Class A(a) | | | 41,400 | | | | 1,859,274 | | |

Insurance 3.0% | |

American Equity Investment Life

Holding Co. | | | 88,400 | | | | 1,557,608 | | |

Heritage Insurance Holdings, Inc. | | | 91,400 | | | | 1,254,008 | | |

Maiden Holdings Ltd. | | | 143,500 | | | | 1,981,735 | | |

National General Holdings Corp. | | | 36,900 | | | | 840,951 | | |

Universal Insurance Holdings, Inc. | | | 97,400 | | | | 2,413,572 | | |

Total | | | | | 8,047,874 | | |

Real Estate Investment Trusts (REITs) 9.3% | |

Apollo Commercial Real Estate

Finance, Inc. | | | 12,300 | | | | 200,490 | | |

Armada Hoffler Properties, Inc. | | | 34,000 | | | | 468,520 | | |

Ashford Hospitality Prime, Inc. | | | 29,400 | | | | 455,994 | | |

CBL & Associates Properties, Inc. | | | 160,800 | | | | 2,294,616 | | |

Chesapeake Lodging Trust | | | 21,100 | | | | 537,628 | | |

Coresite Realty Corp. | | | 27,100 | | | | 2,114,342 | | |

CYS Investments, Inc. | | | 239,500 | | | | 2,109,995 | | |

DuPont Fabros Technology, Inc. | | | 47,900 | | | | 2,030,960 | | |

Invesco Mortgage Capital, Inc. | | | 75,700 | | | | 1,191,518 | | |

Lexington Realty Trust | | | 67,000 | | | | 722,930 | | |

Mack-Cali Realty Corp. | | | 81,950 | | | | 2,274,932 | | |

National Storage Affiliates Trust | | | 25,100 | | | | 509,781 | | |

PS Business Parks, Inc. | | | 18,230 | | | | 2,019,519 | | |

RLJ Lodging Trust | | | 49,800 | | | | 1,162,332 | | |

Ryman Hospitality Properties, Inc. | | | 16,400 | | | | 884,944 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Select Income REIT | | | 40,700 | | | | 1,110,703 | | |

Summit Hotel Properties, Inc. | | | 151,457 | | | | 2,165,835 | | |

Sunstone Hotel Investors, Inc. | | | 56,000 | | | | 777,840 | | |

Washington Prime Group, Inc. | | | 174,400 | | | | 2,396,256 | | |

Total | | | | | 25,429,135 | | |

Thrifts & Mortgage Finance 5.6% | |

BofI Holding, Inc.(a) | | | 99,600 | | | | 2,141,400 | | |

Essent Group Ltd.(a) | | | 46,900 | | | | 1,246,602 | | |

Flagstar Bancorp, Inc.(a) | | | 73,650 | | | | 2,068,092 | | |

HomeStreet, Inc.(a) | | | 43,150 | | | | 1,124,489 | | |

MGIC Investment Corp.(a) | | | 276,800 | | | | 2,239,312 | | |

Radian Group, Inc. | | | 169,500 | | | | 2,323,845 | | |

Walker & Dunlop, Inc.(a) | | | 63,700 | | | | 1,688,050 | | |

Washington Federal, Inc. | | | 87,300 | | | | 2,313,450 | | |

Total | | | | | 15,145,240 | | |

Total Financials | | | | | 69,870,876 | | |

HEALTH CARE 12.9% | |

Biotechnology 4.2% | |

ACADIA Pharmaceuticals, Inc.(a) | | | 20,550 | | | | 660,271 | | |

Alder Biopharmaceuticals, Inc.(a) | | | 29,635 | | | | 977,066 | | |

Arrowhead Pharmaceuticals, Inc.(a) | | | 138,945 | | | | 962,889 | | |

bluebird bio, Inc.(a) | | | 9,920 | | | | 489,453 | | |

Dynavax Technologies Corp.(a) | | | 48,300 | | | | 756,378 | | |

Insys Therapeutics, Inc.(a) | | | 61,755 | | | | 881,244 | | |

Keryx Biopharmaceuticals, Inc.(a) | | | 189,055 | | | | 775,125 | | |

Kite Pharma, Inc.(a) | | | 11,405 | | | | 657,156 | | |

Ligand Pharmaceuticals, Inc.(a) | | | 11,920 | | | | 1,231,455 | | |

Novavax, Inc.(a) | | | 105,470 | | | | 721,415 | | |

Sage Therapeutics, Inc.(a) | | | 11,405 | | | | 423,924 | | |

Spark Therapeutics, Inc.(a) | | | 18,570 | | | | 1,050,691 | | |

TESARO, Inc.(a) | | | 12,160 | | | | 1,029,830 | | |

Ultragenyx Pharmaceutical, Inc.(a) | | | 12,540 | | | | 826,637 | | |

Total | | | | | 11,443,534 | | |

Health Care Equipment & Supplies 3.3% | |

Analogic Corp. | | | 22,315 | | | | 1,986,035 | | |

Globus Medical, Inc., Class A(a) | | | 36,900 | | | | 857,187 | | |

Halyard Health, Inc.(a) | | | 31,800 | | | | 1,159,110 | | |

Masimo Corp.(a) | | | 21,450 | | | | 1,268,553 | | |

Merit Medical Systems, Inc.(a) | | | 32,200 | | | | 780,528 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

9

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

OraSure Technologies, Inc.(a) | | | 124,700 | | | | 1,068,679 | | |

Orthofix International NV(a) | | | 40,750 | | | | 1,838,232 | | |

Total | | | | | 8,958,324 | | |

Health Care Providers & Services 2.4% | |

Chemed Corp. | | | 3,700 | | | | 499,241 | | |

Kindred Healthcare, Inc. | | | 23,600 | | | | 260,544 | | |

Magellan Health, Inc.(a) | | | 26,948 | | | | 1,539,270 | | |

Molina Healthcare, Inc.(a) | | | 35,275 | | | | 1,898,148 | | |

Owens & Minor, Inc. | | | 22,450 | | | | 771,607 | | |

Triple-S Management Corp., Class B(a) | | | 68,550 | | | | 1,500,559 | | |

Total | | | | | 6,469,369 | | |

Life Sciences Tools & Services 1.6% | |

Cambrex Corp.(a) | | | 11,675 | | | | 500,040 | | |

INC Research Holdings, Inc. Class A(a) | | | 44,125 | | | | 1,925,174 | | |

Pra Health Sciences, Inc.(a) | | | 39,050 | | | | 1,973,978 | | |

Total | | | | | 4,399,192 | | |

Pharmaceuticals 1.4% | |

Aerie Pharmaceuticals, Inc.(a) | | | 50,815 | | | | 983,778 | | |

Impax Laboratories, Inc.(a) | | | 67,000 | | | | 1,620,730 | | |

Supernus Pharmaceuticals, Inc.(a) | | | 62,255 | | | | 1,331,012 | | |

Total | | | | | 3,935,520 | | |

Total Health Care | | | | | 35,205,939 | | |

INDUSTRIALS 13.3% | |

Airlines 0.9% | |

Hawaiian Holdings, Inc.(a) | | | 49,200 | | | | 2,311,416 | | |

Building Products 2.6% | |

Continental Building Product(a) | | | 83,000 | | | | 1,843,430 | | |

Gibraltar Industries, Inc.(a) | | | 34,400 | | | | 1,312,704 | | |

NCI Building Systems, Inc.(a) | | | 102,500 | | | | 1,551,850 | | |

Universal Forest Products, Inc. | | | 21,420 | | | | 2,337,993 | | |

Total | | | | | 7,045,977 | | |

Commercial Services & Supplies 1.7% | |

Brady Corp., Class A | | | 45,300 | | | | 1,517,097 | | |

Knoll, Inc. | | | 15,400 | | | | 407,484 | | |

Quad/Graphics, Inc. | | | 76,300 | | | | 2,066,967 | | |

Tetra Tech, Inc. | | | 18,610 | | | | 656,933 | | |

Total | | | | | 4,648,481 | | |

Construction & Engineering 0.8% | |

Comfort Systems U.S.A., Inc. | | | 3,900 | | | | 110,721 | | |

EMCOR Group, Inc. | | | 37,555 | | | | 2,150,399 | | |

Total | | | | | 2,261,120 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Electrical Equipment 0.9% | |

EnerSys | | | 34,020 | | | | 2,394,328 | | |

Machinery 3.2% | |

Briggs & Stratton Corp. | | | 44,900 | | | | 853,549 | | |

Energy Recovery, Inc.(a) | | | 121,000 | | | | 1,461,680 | | |

Global Brass & Copper Holdings, Inc. | | | 53,100 | | | | 1,490,517 | | |

Greenbrier Companies, Inc. (The) | | | 59,500 | | | | 2,016,455 | | |

Mueller Industries, Inc. | | | 27,950 | | | | 965,952 | | |

Wabash National Corp.(a) | | | 141,621 | | | | 1,975,613 | | |

Total | | | | | 8,763,766 | | |

Marine 0.1% | |

Matson, Inc. | | | 8,150 | | | | 314,508 | | |

Professional Services 1.3% | |

Huron Consulting Group, Inc.(a) | | | 29,900 | | | | 1,879,514 | | |

RPX Corp.(a) | | | 164,000 | | | | 1,717,080 | | |

Total | | | | | 3,596,594 | | |

Road & Rail 0.4% | |

ArcBest Corp. | | | 52,900 | | | | 968,599 | | |

Trading Companies & Distributors 1.4% | |

Applied Industrial Technologies, Inc. | | | 41,730 | | | | 1,983,010 | | |

MRC Global, Inc.(a) | | | 133,600 | | | | 1,959,912 | | |

Total | | | | | 3,942,922 | | |

Total Industrials | | | | | 36,247,711 | | |

INFORMATION TECHNOLOGY 15.9% | |

Communications Equipment 0.8% | |

NETGEAR, Inc.(a) | | | 40,100 | | | | 2,285,700 | | |

Electronic Equipment, Instruments & Components 3.9% | |

Benchmark Electronics, Inc.(a) | | | 88,401 | | | | 2,132,232 | | |

Insight Enterprises, Inc.(a) | | | 34,250 | | | | 1,048,050 | | |

MTS Systems Corp. | | | 20,200 | | | | 1,004,950 | | |

Sanmina Corp.(a) | | | 76,785 | | | | 2,017,910 | | |

SYNNEX Corp. | | | 22,400 | | | | 2,378,208 | | |

Tech Data Corp.(a) | | | 28,025 | | | | 2,080,576 | | |

Total | | | | | 10,661,926 | | |

Internet Software & Services 2.6% | |

EarthLink Holdings Corp. | | | 290,300 | | | | 1,849,211 | | |

j2 Global, Inc. | | | 28,925 | | | | 1,971,817 | | |

LogMeIn, Inc. | | | 15,650 | | | | 1,306,775 | | |

RetailMeNot, Inc.(a) | | | 172,145 | | | | 1,946,960 | | |

Total | | | | | 7,074,763 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

10

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

IT Services 2.6% | |

CSG Systems International, Inc. | | | 31,225 | | | | 1,365,157 | | |

EVERTEC, Inc. | | | 105,200 | | | | 1,794,712 | | |

NeuStar, Inc., Class A(a) | | | 77,000 | | | | 1,956,570 | | |

Sykes Enterprises, Inc.(a) | | | 45,950 | | | | 1,343,119 | | |

Syntel, Inc.(a) | | | 12,500 | | | | 577,125 | | |

Total | | | | | 7,036,683 | | |

Semiconductors & Semiconductor Equipment 3.1% | |

Amkor Technology, Inc.(a) | | | 240,500 | | | | 2,188,550 | | |

Diodes, Inc.(a) | | | 25,500 | | | | 525,045 | | |

Entegris, Inc.(a) | | | 119,000 | | | | 2,027,760 | | |

Silicon Laboratories, Inc.(a) | | | 7,375 | | | | 422,588 | | |

Synaptics, Inc.(a) | | | 39,430 | | | | 2,246,327 | | |

Xcerra Corp.(a) | | | 152,442 | | | | 893,310 | | |

Total | | | | | 8,303,580 | | |

Software 2.9% | |

Aspen Technology, Inc.(a) | | | 58,350 | | | | 2,652,591 | | |

AVG Technologies NV(a) | | | 28,700 | | | | 713,482 | | |

Mentor Graphics Corp. | | | 89,840 | | | | 2,157,058 | | |

MicroStrategy, Inc., Class A(a) | | | 3,800 | | | | 633,802 | | |

Qualys, Inc.(a) | | | 32,800 | | | | 1,128,320 | | |

VASCO Data Security International, Inc.(a) | | | 37,700 | | | | 687,271 | | |

Total | | | | | 7,972,524 | | |

Total Information Technology | | | | | 43,335,176 | | |

MATERIALS 4.4% | |

Chemicals 3.1% | |

Chemtura Corp.(a) | | | 39,150 | | | | 1,174,108 | | |

Ferro Corp.(a) | | | 47,400 | | | | 632,316 | | |

Innophos Holdings, Inc. | | | 7,172 | | | | 302,802 | | |

Innospec, Inc. | | | 36,275 | | | | 2,150,382 | | |

Rayonier Advanced Materials, Inc. | | | 141,800 | | | | 1,744,140 | | |

Trinseo SA | | | 40,850 | | | | 2,363,581 | | |

Total | | | | | 8,367,329 | | |

Construction Materials 0.2% | |

US Concrete, Inc.(a) | | | 8,300 | | | | 440,066 | | |

Metals & Mining 1.1% | |

Carpenter Technology Corp. | | | 23,950 | | | | 868,906 | | |

Commercial Metals Co. | | | 16,900 | | | | 262,288 | | |

Materion Corp. | | | 15,150 | | | | 444,501 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Schnitzer Steel Industries, Inc., Class A | | | 80,500 | | | | 1,511,790 | | |

Total | | | | | 3,087,485 | | |

Total Materials | | | | | 11,894,880 | | |

TELECOMMUNICATION SERVICES 0.9% | |

Diversified Telecommunication Services 0.6% | |

General Communication, Inc., Class A(a) | | | 93,460 | | | | 1,299,094 | | |

Windstream Holdings, Inc. | | | 36,100 | | | | 307,211 | | |

Total | | | | | 1,606,305 | | |

Wireless Telecommunication Services 0.3% | |

Shenandoah Telecommunications Co. | | | 38,050 | | | | 978,646 | | |

Total Telecommunication Services | | | | | 2,584,951 | | |

UTILITIES 3.5% | |

Electric Utilities 1.0% | |

IDACORP, Inc. | | | 26,200 | | | | 1,993,034 | | |

Portland General Electric Co. | | | 16,650 | | | | 701,131 | | |

Total | | | | | 2,694,165 | | |

Gas Utilities 1.7% | |

Chesapeake Utilities Corp. | | | 26,075 | | | | 1,659,674 | | |

Northwest Natural Gas Co. | | | 11,650 | | | | 695,855 | | |

Southwest Gas Corp. | | | 32,075 | | | | 2,239,476 | | |

Total | | | | | 4,595,005 | | |

Independent Power and Renewable Electricity Producers 0.1% | |

Ormat Technologies, Inc. | | | 6,700 | | | | 324,280 | | |

Water Utilities 0.7% | |

SJW Corp. | | | 43,900 | | | | 1,874,091 | | |

Total Utilities | | | | | 9,487,541 | | |

Total Common Stocks

(Cost: $219,446,601) | | | | | 260,643,423 | | |

Money Market Funds 1.8%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.415%(b)(c) | | | 4,822,294 | | | | 4,822,294 | | |

Total Money Market Funds

(Cost: $4,822,294) | | | | | 4,822,294 | | |

Total Investments

(Cost: $224,268,895) | | | | | 265,465,717 | | |

Other Assets & Liabilities, Net | | | | | 6,941,193 | | |

Net Assets | | | | | 272,406,910 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

11

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

At August 31, 2016, cash totaling $572,000 was pledged as collateral.

Investments in Derivatives

Futures Contracts Outstanding at August 31, 2016

Long Futures Contracts Outstanding

Contract Description | | Number of

Contracts | | Trading

Currency | | Notional

Market

Value ($) | | Expiration

Date | | Unrealized

Appreciation ($) | | Unrealized

(Depreciation) ($) | |

Russell 2000 Mini | | | 102 | | | USD | | | | | 12,635,760 | | | 09/2016 | | | 288,884 | | | | — | | |

Notes to Portfolio of Investments

(a) Non-income producing investment.

(b) The rate shown is the seven-day current annualized yield at August 31, 2016.

(c) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company's outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended August 31, 2016 are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From Sales ($) | | Realized

Gain (Loss) ($) | | Ending

Cost ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia

Short-Term

Cash Fund | | | 2,287,779 | | | | 225,929,608 | | | | (223,395,093 | ) | | | — | | | | 4,822,294 | | | | 22,985 | | | | 4,822,294 | | |

Rand Logistics,

Inc.* | | | 5,662,943 | | | | — | | | | (761,844 | ) | | | (4,901,099 | ) | | | — | | | | — | | | | — | | |

Total | | | 7,950,722 | | | | 225,929,608 | | | | (224,156,937 | ) | | | (4,901,099 | ) | | | 4,822,294 | | | | 22,985 | | | | 4,822,294 | | |

*Issuer was not an affiliate for the entire period ended August 31, 2016.

Currency Legend

USD US Dollar

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset's or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

12

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

Fair Value Measurements (continued)

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Investments in Columbia Short-Term Cash Fund may be redeemed on a daily basis without restriction.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

13

COLUMBIA DISCIPLINED SMALL CORE FUND

PORTFOLIO OF INVESTMENTS (continued)

August 31, 2016

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at August 31, 2016:

| | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | |

Level 2

Other Significant

Observable Inputs ($) | |

Level 3

Significant

Unobservable Inputs ($) | |

Total ($) | |

Investments | |

Common Stocks | |

Consumer Discretionary | | | 34,218,450 | | | | — | | | | — | | | | 34,218,450 | | |

Consumer Staples | | | 9,093,595 | | | | — | | | | — | | | | 9,093,595 | | |

Energy | | | 8,704,304 | | | | — | | | | — | | | | 8,704,304 | | |

Financials | | | 69,870,876 | | | | — | | | | — | | | | 69,870,876 | | |

Health Care | | | 35,205,939 | | | | — | | | | — | | | | 35,205,939 | | |

Industrials | | | 36,247,711 | | | | — | | | | — | | | | 36,247,711 | | |

Information Technology | | | 43,335,176 | | | | — | | | | — | | | | 43,335,176 | | |

Materials | | | 11,894,880 | | | | — | | | | — | | | | 11,894,880 | | |

Telecommunication Services | | | 2,584,951 | | | | — | | | | — | | | | 2,584,951 | | |

Utilities | | | 9,487,541 | | | | — | | | | — | | | | 9,487,541 | | |

Total Common Stocks | | | 260,643,423 | | | | — | | | | — | | | | 260,643,423 | | |

Investments measured at net asset value | |

Money Market Funds | | | — | | | | — | | | | — | | | | 4,822,294 | | |

Total Investments | | | 260,643,423 | | | | — | | | | — | | | | 265,465,717 | | |

Derivatives | |

Assets | |

Futures Contracts | | | 288,884 | | | | — | | | | — | | | | 288,884 | | |

Total | | | 260,932,307 | | | | — | | | | — | | | | 265,754,601 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

Derivative instruments are valued at unrealized appreciation (depreciation).

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

14

COLUMBIA DISCIPLINED SMALL CORE FUND

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2016

Assets | |

Investments, at value | |

Unaffiliated issuers (identified cost $219,446,601) | | $ | 260,643,423 | | |

Affiliated issuers (identified cost $4,822,294) | | | 4,822,294 | | |

Total investments (identified cost $224,268,895) | | | 265,465,717 | | |

Cash | | | 1,540 | | |

Margin deposits | | | 572,000 | | |

Receivable for: | |

Investments sold | | | 6,843,014 | | |

Capital shares sold | | | 45,869 | | |

Dividends | | | 163,310 | | |

Variation margin | | | 1,015 | | |

Prepaid expenses | | | 2,564 | | |

Trustees' deferred compensation plan | | | 82,368 | | |

Total assets | | | 273,177,397 | | |

Liabilities | |

Payable for: | |

Capital shares purchased | | | 524,320 | | |

Variation margin | | | 73,840 | | |

Management services fees | | | 6,535 | | |

Distribution and/or service fees | | | 1,367 | | |

Transfer agent fees | | | 38,915 | | |

Compensation of board members | | | 498 | | |

Chief compliance officer expenses | | | 23 | | |

Other expenses | | | 42,621 | | |

Trustees' deferred compensation plan | | | 82,368 | | |

Total liabilities | | | 770,487 | | |

Net assets applicable to outstanding capital stock | | $ | 272,406,910 | | |

Represented by | |

Paid-in capital | | $ | 142,288,479 | | |

Undistributed net investment income | | | 34,621 | | |

Accumulated net realized gain | | | 88,598,104 | | |

Unrealized appreciation (depreciation) on: | |

Investments | | | 41,196,822 | | |

Futures contracts | | | 288,884 | | |

Total — representing net assets applicable to outstanding capital stock | | $ | 272,406,910 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

15

COLUMBIA DISCIPLINED SMALL CORE FUND

STATEMENT OF ASSETS AND LIABILITIES (continued)

August 31, 2016

Class A | |

Net assets | | $ | 74,434,459 | | |

Shares outstanding | | | 6,301,008 | | |

Net asset value per share | | $ | 11.81 | | |

Maximum offering price per share(a) | | $ | 12.53 | | |

Class B | |

Net assets | | $ | 187,114 | | |

Shares outstanding | | | 21,217 | | |

Net asset value per share | | $ | 8.82 | | |

Class C | |

Net assets | | $ | 15,653,841 | | |

Shares outstanding | | | 1,770,923 | | |

Net asset value per share | | $ | 8.84 | | |

Class I | |

Net assets | | $ | 50,390,376 | | |

Shares outstanding | | | 3,952,656 | | |

Net asset value per share | | $ | 12.75 | | |

Class R4 | |

Net assets | | $ | 2,925,669 | | |

Shares outstanding | | | 228,794 | | |

Net asset value per share | | $ | 12.79 | | |

Class R5 | |

Net assets | | $ | 2,875,720 | | |

Shares outstanding | | | 223,823 | | |

Net asset value per share | | $ | 12.85 | | |

Class T | |

Net assets | | $ | 60,070,535 | | |

Shares outstanding | | | 5,262,910 | | |

Net asset value per share | | $ | 11.41 | | |

Maximum offering price per share(a) | | $ | 12.11 | | |

Class W | |

Net assets | | $ | 222,510 | | |

Shares outstanding | | | 18,837 | | |

Net asset value per share | | $ | 11.81 | | |

Class Y | |

Net assets | | $ | 6,735,763 | | |

Shares outstanding | | | 520,491 | | |

Net asset value per share | | $ | 12.94 | | |

Class Z | |

Net assets | | $ | 58,910,923 | | |

Shares outstanding | | | 4,672,776 | | |

Net asset value per share | | $ | 12.61 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 5.75%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

16

COLUMBIA DISCIPLINED SMALL CORE FUND

STATEMENT OF OPERATIONS

Year Ended August 31, 2016

Net investment income | |

Income: | |

Dividends — unaffiliated issuers | | $ | 5,061,923 | | |

Dividends — affiliated issuers | | | 22,985 | | |

Foreign taxes withheld | | | (8,045 | ) | |

Total income | | | 5,076,863 | | |

Expenses: | |

Management services fees | | | 3,199,793 | | |

Distribution and/or service fees | |

Class A | | | 250,214 | | |

Class B | | | 2,399 | | |

Class C | | | 179,472 | | |

Class T | | | 148,334 | | |

Class W | | | 617 | | |

Transfer agent fees | |

Class A | | | 202,427 | | |

Class B | | | 485 | | |

Class C | | | 36,159 | | |

Class R4 | | | 9,042 | | |

Class R5 | | | 2,626 | | |

Class T | | | 118,945 | | |

Class W | | | 496 | | |

Class Z | | | 249,894 | | |

Compensation of board members | | | 24,489 | | |

Custodian fees | | | 20,876 | | |

Printing and postage fees | | | 16,800 | | |

Registration fees | | | 131,285 | | |

Audit fees | | | 30,402 | | |

Legal fees | | | 8,364 | | |

Chief compliance officer expenses | | | 161 | | |

Other | | | 23,186 | | |

Total expenses | | | 4,656,466 | | |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (38,331 | ) | |

Expense reductions | | | (1,791 | ) | |

Total net expenses | | | 4,616,344 | | |

Net investment income | | | 460,519 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | | | 105,089,393 | | |

Investments — affiliated issuers | | | (4,901,099 | ) | |

Futures contracts | | | 1,455,035 | | |

Net realized gain | | | 101,643,329 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | | | (100,474,723 | ) | |

Investments — affiliated issuers | | | 5,631,660 | | |

Futures contracts | | | 288,884 | | |

Net change in unrealized depreciation | | | (94,554,179 | ) | |

Net realized and unrealized gain | | | 7,089,150 | | |

Net increase in net assets resulting from operations | | $ | 7,549,669 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

17

COLUMBIA DISCIPLINED SMALL CORE FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended

August 31,

2016 | | Year Ended

August 31,

2015 | |

Operations | |

Net investment income (loss) | | $ | 460,519 | | | $ | (2,070,151 | ) | |

Net realized gain | | | 101,643,329 | | | | 162,872,105 | | |

Net change in unrealized depreciation | | | (94,554,179 | ) | | | (202,868,866 | ) | |

Net increase (decrease) in net assets resulting from operations | | | 7,549,669 | | | | (42,066,912 | ) | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (42,433 | ) | | | (321,649 | ) | |

Class I | | | (97,723 | ) | | | (143,812 | ) | |

Class R4 | | | (6,447 | ) | | | (12,379 | ) | |

Class R5 | | | (16,055 | ) | | | (60,601 | ) | |

Class T | | | (22,349 | ) | | | (49,306 | ) | |

Class W | | | (98 | ) | | | (404 | ) | |

Class Y | | | (8,228 | ) | | | (44,683 | ) | |

Class Z | | | (197,294 | ) | | | (677,669 | ) | |

Net realized gains | |

Class A | | | (41,007,362 | ) | | | (32,612,168 | ) | |

Class B | | | (117,350 | ) | | | (47,871 | ) | |

Class C | | | (8,161,786 | ) | | | (2,818,598 | ) | |

Class I | | | (17,649,677 | ) | | | (4,823,973 | ) | |

Class R4 | | | (1,795,378 | ) | | | (617,780 | ) | |

Class R5 | | | (3,070,456 | ) | | | (2,214,144 | ) | |

Class T | | | (21,646,956 | ) | | | (6,294,308 | ) | |

Class W | | | (95,357 | ) | | | (39,342 | ) | |

Class Y | | | (1,486,132 | ) | | | (1,519,612 | ) | |

Class Z | | | (54,942,603 | ) | | | (33,818,753 | ) | |

Total distributions to shareholders | | | (150,363,684 | ) | | | (86,117,052 | ) | |

Decrease in net assets from capital stock activity | | | (127,856,394 | ) | | | (505,558,338 | ) | |

Total decrease in net assets | | | (270,670,409 | ) | | | (633,742,302 | ) | |

Net assets at beginning of year | | | 543,077,319 | | | | 1,176,819,621 | | |

Net assets at end of year | | $ | 272,406,910 | | | $ | 543,077,319 | | |

Undistributed (excess of distributions over) net investment income | | $ | 34,621 | | | $ | (83,090 | ) | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

18

COLUMBIA DISCIPLINED SMALL CORE FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended August 31, 2016 | | Year Ended August 31, 2015 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(a) | | | 1,934,628 | | | | 25,392,156 | | | | 6,038,108 | | | | 109,877,216 | | |

Distributions reinvested | | | 2,803,173 | | | | 32,656,967 | | | | 1,663,833 | | | | 29,050,518 | | |

Redemptions | | | (6,661,023 | ) | | | (81,658,515 | ) | | | (20,876,804 | ) | | | (377,368,984 | ) | |

Net decrease | | | (1,923,222 | ) | | | (23,609,392 | ) | | | (13,174,863 | ) | | | (238,441,250 | ) | |

Class B shares | |

Subscriptions | | | 1,204 | | | | 10,534 | | | | 2,626 | | | | 39,372 | | |

Distributions reinvested | | | 12,117 | | | | 106,020 | | | | 2,943 | | | | 42,992 | | |

Redemptions(a) | | | (14,753 | ) | | | (128,703 | ) | | | (18,255 | ) | | | (276,946 | ) | |

Net decrease | | | (1,432 | ) | | | (12,149 | ) | | | (12,686 | ) | | | (194,582 | ) | |

Class C shares | |

Subscriptions | | | 326,960 | | | | 2,898,107 | | | | 218,882 | | | | 3,280,446 | | |

Distributions reinvested | | | 766,645 | | | | 6,723,479 | | | | 155,737 | | | | 2,278,432 | | |

Redemptions | | | (946,397 | ) | | | (8,788,360 | ) | | | (611,233 | ) | | | (9,163,129 | ) | |

Net increase (decrease) | | | 147,208 | | | | 833,226 | | | | (236,614 | ) | | | (3,604,251 | ) | |

Class I shares | |

Subscriptions | | | 128,810 | | | | 1,611,892 | | | | 42,500 | | | | 799,236 | | |

Distributions reinvested | | | 1,415,208 | | | | 17,746,703 | | | | 271,601 | | | | 4,967,583 | | |

Redemptions | | | (766,234 | ) | | | (9,005,922 | ) | | | (206,136 | ) | | | (3,928,603 | ) | |

Net increase | | | 777,784 | | | | 10,352,673 | | | | 107,965 | | | | 1,838,216 | | |

Class R4 shares | |

Subscriptions | | | 64,675 | | | | 865,322 | | | | 227,971 | | | | 4,281,902 | | |

Distributions reinvested | | | 123,477 | | | | 1,554,576 | | | | 30,985 | | | | 569,195 | | |

Redemptions | | | (306,694 | ) | | | (3,972,825 | ) | | | (258,894 | ) | | | (4,808,877 | ) | |

Net increase (decrease) | | | (118,542 | ) | | | (1,552,927 | ) | | | 62 | | | | 42,220 | | |

Class R5 shares | |

Subscriptions | | | 103,468 | | | | 1,514,306 | | | | 633,457 | | | | 12,298,079 | | |

Distributions reinvested | | | 244,186 | | | | 3,086,511 | | | | 123,627 | | | | 2,274,745 | | |

Redemptions | | | (856,763 | ) | | | (11,712,420 | ) | | | (1,373,626 | ) | | | (26,305,125 | ) | |

Net decrease | | | (509,109 | ) | | | (7,111,603 | ) | | | (616,542 | ) | | | (11,732,301 | ) | |

Class T shares | |

Subscriptions | | | 481,678 | | | | 5,434,670 | | | | 119,277 | | | | 2,054,946 | | |

Distributions reinvested | | | 1,347,343 | | | | 15,171,084 | | | | 258,803 | | | | 4,412,598 | | |

Redemptions | | | (557,218 | ) | | | (6,439,026 | ) | | | (503,703 | ) | | | (8,865,381 | ) | |

Net increase (decrease) | | | 1,271,803 | | | | 14,166,728 | | | | (125,623 | ) | | | (2,397,837 | ) | |