UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | May 31, 2016 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

May 31, 2016

COLUMBIA HIGH YIELD MUNICIPAL FUND

ABOUT COLUMBIA THREADNEEDLE INVESTMENTS

Columbia Threadneedle Investments is a leading global asset management group that provides a broad range of actively managed investment strategies and solutions for individual, institutional and corporate clients around the world.

With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $464 billion* of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives. We are the 13th largest manager of long-term mutual fund assets in the U.S.** and the 3rd largest manager of retail funds in the U.K.***

Our priority is the investment success of our clients. We aim to deliver the investment outcomes they expect through an investment approach that is team-based, performance-driven and risk-aware. Our culture is dynamic and interactive. By sharing our insights across asset classes and geographies, we generate richer perspectives on global, regional and local investment landscapes. The ability to exchange and debate investment ideas in a collaborative environment enriches our teams' investment processes. More importantly, it results in better informed investment decisions for our clients.

Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

* In U.S. dollars as of March 31, 2016. Source: Ameriprise Q1 Earnings Release. Includes all assets managed by entities in the Columbia and Threadneedle group of companies. Contact us for more current data.

** Source: ICI as of March 31, 2016 for Columbia Management Investment Advisers, LLC.

*** Source: Investment Association as of December 2015 for Threadneedle Asset Management Limited.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

Not part of the shareholder report

Dear Shareholders,

Dear Shareholders,

Volatility comes with the territory for long-term investors. Some investors instinctively want to pull out of the market or sell underperforming investments at the first sign of increased volatility or perhaps even as soon as they perceive it on the horizon. But taking yourself out of the market could mean losing out on potential opportunities, and putting your longer-term investment goals at risk.

Cumulative return is not just about achieving high returns when markets are going up; it's also about remaining invested and minimizing losses during weak or volatile markets so that you can participate on the upside. Developing a deeper understanding of the various risks your portfolio is subject to can help you balance these risks.

Diversification is critical in seeking to achieve that balance. We believe that most portfolios could be more effectively diversified either by introducing holdings with performance profiles unrelated to existing holdings (like alternative products) or by rebalancing existing holdings with an eye toward risk allocation. Over time, distributing risk more evenly may produce a more pronounced diversification benefit and may improve portfolio efficiency. We believe market volatility can create significant opportunities and, in fact, these periods may be some of the very best times to invest.

With this in mind, I thought it important to highlight excerpts from a piece written by Colin Moore, Global Chief Investment Officer, in which he touches on some of these issues emphasizing the importance of a properly constructed portfolio in seeking to effectively manage volatility and to achieve consistency of returns. I encourage you to read the article in its entirety. To access the full article and for other insights on current market, please visit blog.columbiathreadneedleus.com/latest-perspectives.

You need investments that are designed to help you ease the impact of volatile market environments and keep the savings you have worked tirelessly to amass. Columbia Threadneedle Investments provides investment solutions to help you tackle financial challenges and achieve your desired outcome.

Best regards,

Christopher O. Petersen

President, Columbia Funds

Excerpts from:

Taking the scare out of the volatility bogeyman

By Colin Moore, Global Chief Investment Officer

Colin Moore is the global chief investment officer for Columbia Threadneedle Investments. His responsibilities include ensuring that a disciplined investment process is in place across all asset classes, including equity and fixed income. Mr. Moore joined one of the Columbia Threadneedle Investments legacy firms in 2002 as head of equity and was also head of fixed income and liquidity strategies from 2009 – 2010.

n In today's low growth, higher volatility world, the emphasis is shifting from maximization of returns to consistency of returns.

PRESIDENT'S MESSAGE (continued)

n Portfolios should represent the behavioral risk-return tradeoff of investors, remembering that they won't stay invested to realize the return if we get the risk tolerance wrong.

n Holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals.

According to Wikipedia, "The bogeyman is a common allusion to a mythical creature in many cultures used to control behavior. This monster has no specific appearance, and conceptions about it can vary drastically from household to household within the same community; in many cases he has no set appearance in the mind of an adult or child, but is simply a non-specific embodiment of terror." Different cultures have different names and physical representations for the bogeyman, and investors are no different. We have terrible monsters that we fear may destroy our portfolios, and we call one of the scariest of them volatility.

While the bogeyman is mythical (I hope!), volatility is real and can cause serious damage. To understand why investors have such a hard time coping with volatility, we first need to define three cognitive biases at work in today's investment environment:

1) Recency bias — something that has recently come to the forefront of our attention, regardless of how long established it is, suddenly seems to appear with improbable frequency.

2) Negativity bias — we tend to have a greater recall of unpleasant memories than positive memories.

3) Loss aversion — our dissatisfaction with losing money tends to be greater than our satisfaction with making money.

The level of volatility varies dramatically, and so does investor fear and panic selling — waxing when volatility rises, waning when it falls. Recent studies have pointed to demographics as an important driver of panic selling. The theory is that as people get closer to retirement, the prospects of a large (20% – 30%) loss in financial assets can have a much more pronounced effect on their sense of well-being. Wealth preservation instincts kick in much more quickly than for younger (and typically less wealthy) savers.

The reality is that there is little opportunity for return without volatility. Therefore, the bogeyman effect of holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals. This effect tends to be more pronounced during the episodic spikes in volatility. The significant spike in volatility in 2008 and 2009 led to significant withdrawals from long-term investment funds over the same period. Less pronounced effects can also be seen when comparing 2001 – 2003 and 2011 – 2012. Conversely, flows picked up when volatility returned to "normal" levels. Investor behavior of this type is consistent with the three behavioral biases.

I believe average volatility will be higher over the next 10 years than the last 10 years and episodic spikes will increase in frequency because sustainable economic growth will be structurally lower and geopolitical risk higher than any time since World War II. Low growth creates uncertainty while loss aversion will make investors fear that we are one economic mishap or geopolitical event away from no growth or recession. The result will be higher volatility on average. Negativity bias will tend to exacerbate "spike" reactions to event-driven geopolitical news, and the volatility bogeyman will appear more often. Assuming the behavioral biases continue, investor returns are likely to be very disappointing regardless of the total return generated by financial markets due to the bogeyman effect.

To mitigate this effect, we need to focus on portfolio construction and an improved understanding of diversification. I accept that equities are likely to offer the highest return over the next 10 years, but they also offer the highest volatility. Many portfolio construction optimization tools use historical average volatility, which is likely to underestimate the volatility investors will face. The bogeyman emerges when individual asset class volatility spikes and cross correlations rise, the combination of which increases overall portfolio volatility far beyond expectation. Diversification is meant to protect investors against volatility, but what's the point of owning lots of investments if the volatility bogeyman has not been properly estimated?

Most importantly, portfolios should be constructed to properly represent the behavioral risk-return tradeoff of investors, remembering that they won't stay invested to realize the return if we get the risk tolerance wrong. In a low growth, higher volatility world, the emphasis is shifting to return consistency rather than return maximization,

PRESIDENT'S MESSAGE (continued)

and investors are best served through investment approaches that appreciate that distinction. Even though it's a permanent feature of financial markets, volatility is less likely to be the bogeyman we all fear if portfolios are constructed with this understanding.

Please visit blog.columbiathreadneedleus.com/latest-perspectives to read the entire article.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit columbiathreadneedle.com/us. The prospectus should be read carefully before investing.

The views expressed are as of April 2016, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors.

Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that the forecasts are accurate.

Diversification does not guarantee a profit or protect against loss.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved

COLUMBIA HIGH YIELD MUNICIPAL FUND

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiathreadneedle.com/us or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Performance Overview | | | 3 | | |

Manager Discussion of Fund Performance | | | 5 | | |

Understanding Your Fund's Expenses | | | 8 | | |

Portfolio of Investments | | | 9 | | |

Statement of Assets and Liabilities | | | 26 | | |

Statement of Operations | | | 28 | | |

Statement of Changes in Net Assets | | | 29 | | |

Financial Highlights | | | 31 | | |

Notes to Financial Statements | | | 37 | | |

Report of Independent Registered Public Accounting Firm | | | 44 | | |

Federal Income Tax Information | | | 45 | | |

Trustees and Officers | | | 46 | | |

Important Information About This Report | | | 51 | | |

COLUMBIA HIGH YIELD MUNICIPAL FUND

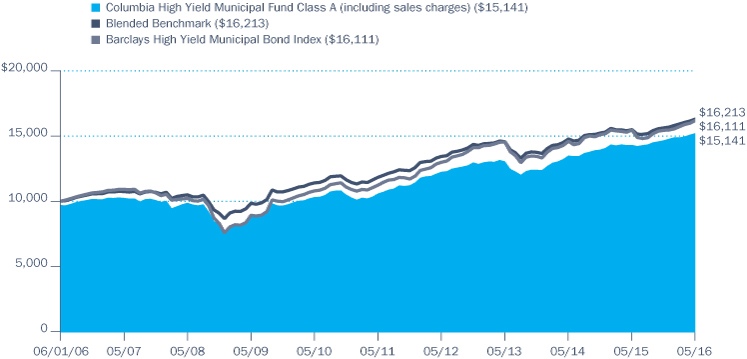

Performance Summary

n Columbia High Yield Municipal Fund (the Fund) Class A shares returned 6.27% excluding sales charges for the 12-month period that ended May 31, 2016. Class Z shares returned 6.48% for the same period.

n The Fund outperformed its Blended Benchmark and the Barclays High Yield Municipal Bond Index, which returned 5.20% and 4.70%, respectively, during the same 12-month period.

n The Fund's underweight position in Puerto Rico-related issues and overweight position in longer maturity bonds were the most important factors in its positive relative performance.

Average Annual Total Returns (%) (for period ended May 31, 2016)

| | | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 07/31/00 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 6.27 | | | | 7.44 | | | | 4.55 | | |

Including sales charges | | | | | | | 3.09 | | | | 6.80 | | | | 4.24 | | |

Class B | | 07/15/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 5.48 | | | | 6.64 | | | | 3.78 | | |

Including sales charges | | | | | | | 0.48 | | | | 6.33 | | | | 3.78 | | |

Class C | | 07/15/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 5.58 | | | | 6.78 | | | | 3.92 | | |

Including sales charges | | | | | | | 4.58 | | | | 6.78 | | | | 3.92 | | |

Class R4* | | 03/19/13 | | | 6.58 | | | | 7.68 | | | | 4.78 | | |

Class R5* | | 11/08/12 | | | 6.67 | | | | 7.75 | | | | 4.81 | | |

Class Z | | 03/05/84 | | | 6.48 | | | | 7.65 | | | | 4.76 | | |

Blended Benchmark | | | | | | | 5.20 | | | | 6.55 | | | | 4.95 | | |

Barclays High Yield Municipal Bond Index | | 05/30/03 | | | 4.70 | | | | 7.51 | | | | 4.88 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 3.00%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/us or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

The Blended Benchmark, established by the Investment Manager, consists of a 60% weighting of the Barclays High Yield Municipal Bond Index and a 40% weighting of the Barclays Municipal Bond Index. The Barclays Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.

The Barclays High Yield Municipal Bond Index is comprised of bonds with maturities greater than one-year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than "BB+" or equivalent by any of the three principal rating agencies.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2016

3

COLUMBIA HIGH YIELD MUNICIPAL FUND

PERFORMANCE OVERVIEW (continued)

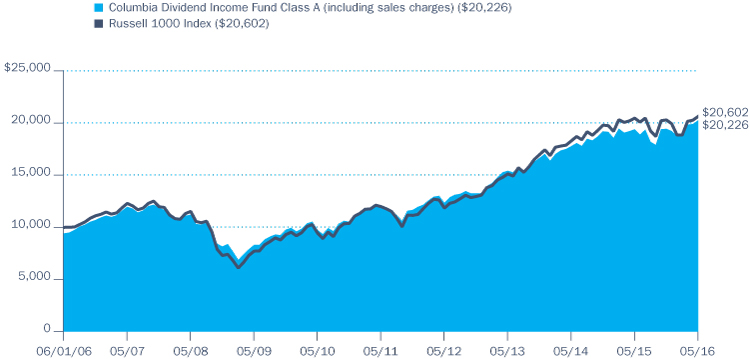

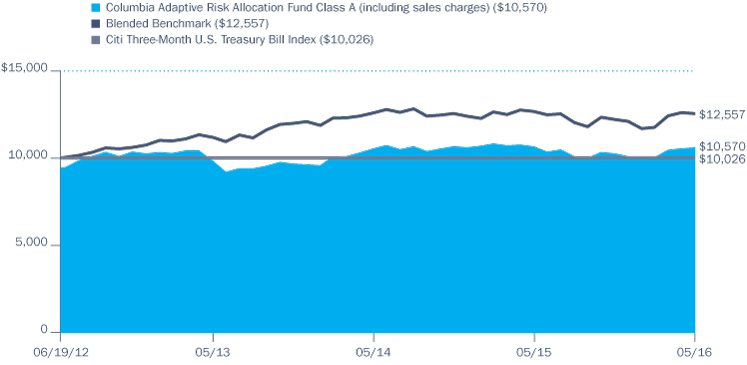

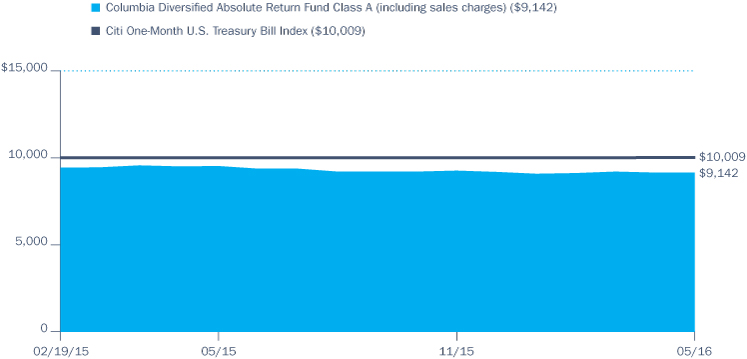

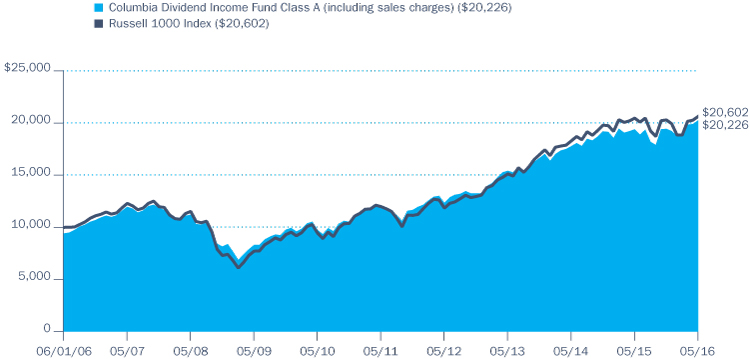

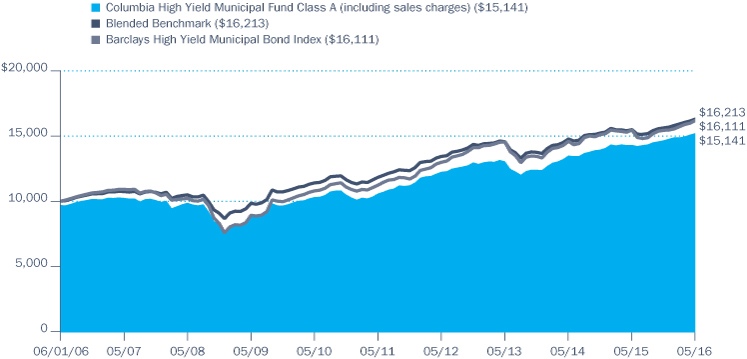

Performance of a Hypothetical $10,000 Investment (June 1, 2006 – May 31, 2016)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia High Yield Municipal Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2016

4

COLUMBIA HIGH YIELD MUNICIPAL FUND

MANAGER DISCUSSION OF FUND PERFORMANCE

For the 12-month period that ended May 31, 2016, Class A shares of the Fund returned 6.27% excluding sales charges. Class Z shares of the Fund returned 6.48% for the same time period. The Fund outperformed its Blended Benchmark and the Barclays High Yield Municipal Bond Index, which returned 5.20% and 4.70%, respectively, during the same 12-month period. The Fund's underweight position in Puerto Rico-related issues and overweight position in longer maturity bonds were the most important factors in its positive relative performance.

Rally in High-Yield Municipal Bonds

High-yield municipal bonds rallied during the 12 months ended May 31, 2016 due to both broader interest-rate trends and developments specific to the tax-exempt market. With regard to the former, investors remained confident that the backdrop of slow growth and low inflation would enable the U.S. Federal Reserve (Fed) to maintain a gradual approach to raising interest rates. U.S. Treasury yields declined as a result, with particularly strong performance occurring in the intermediate- to long-term portions of the yield curve. (Prices rise as yields fall.)

Municipal bonds outperformed Treasury bonds during the period, as the continued improvement in the health of state and local finances provided a sound underpinning for the asset class. In addition, municipal bonds benefited from the combination of low new-issue supply and robust investor demand. High-yield municipals, in general, outpaced the broader market at a time in which upbeat investor sentiment fueled a reach for yield. Tobacco was by far the best performing market segment, with above-average yields and positive fundamental news generating demand for bonds in that sector. On the other end of the spectrum, Puerto Rico's bonds fell in price due to concerns about the growing possibility that the territory will be compelled to default on its debt.

Contributors and Detractors

The Fund's relative outperformance was largely a result of its underweight in Puerto Rico-related issues, which lagged the Blended Benchmark by a wide margin. An overweight in longer maturity bonds further aided returns given that yields declined the most for bonds with maturities of 15 years and higher. Positions in longer maturity, zero-coupon bonds added value, as well. This market segment, which tends to have an above-average sensitivity to movements in prevailing rates, performed very well at a time of falling yields. The Fund's positions in lower rated issues with high coupons also experienced meaningful appreciation due to the stability in credit conditions and the robust demand for higher yielding securities.

The Fund was further boosted by its above-benchmark weighting in bonds issued by continuing care retirement communities (CCRCs). We have held a longstanding overweight to this sector due to its attractive yields and our belief that the aging population will continue to fuel demand for elder-care facilities. One of the Fund's leading contributors was Lutheran Homes, an Ohio-based CCRC whose bonds gained ground after the company announced an advanced refunding of its debt.

The Fund's underweight in the strong-performing tobacco sector detracted from its 12-month results. On a longer term basis, however, we prefer to

Portfolio Management

Chad Farrington, CFA

Top Ten States/Territories (%)

(at May 31, 2016) | |

California | | | 9.9 | | |

Illinois | | | 9.5 | | |

Florida | | | 9.5 | | |

Texas | | | 8.4 | | |

New York | | | 5.2 | | |

Pennsylvania | | | 4.6 | | |

New Jersey | | | 3.9 | | |

Louisiana | | | 3.3 | | |

Missouri | | | 3.0 | | |

Virginia | | | 3.0 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Annual Report 2016

5

COLUMBIA HIGH YIELD MUNICIPAL FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Quality Breakdown (%)

(at May 31, 2016) | |

AAA rating | | | 3.6 | | |

AA rating | | | 9.4 | | |

A rating | | | 16.7 | | |

BBB rating | | | 24.3 | | |

BB rating | | | 6.5 | | |

B rating | | | 1.7 | | |

CCC rating | | | 0.2 | | |

CC rating | | | 2.8 | | |

Not rated | | | 34.8 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total fixed income investments (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody's, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as "Not rated." Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund's subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

keep a smaller weighting in this market segment due to its above-average volatility. Relative performance was also hurt by our decision to maintain a short duration (lower interest-rate sensitivity) versus the Blended Benchmark during a period of positive performance for the overall market. The Fund held a fairly sizable cash balance at times, which further detracted from results given the healthy gain for the Blended Benchmark. In terms of security selection, our investments in three distressed issues — Louisiana Pellets, Allen Academy Charter School (based in Michigan), and Texas Pellets — were among the most notable detractors.

Portfolio Positioning at Period's End

It became more difficult to find attractively valued securities by the end of the period, with benchmark yields at all-time lows, spreads approaching pre-recession levels, and the yield curve flattening. Overall market volatility increased as questions about economic strength and timing of the U.S. Federal Reserve's next rate hike added uncertainty. Despite these potential headwinds, the combination of substantial mutual fund inflows and low new-issue supply provided support for the municipal bond market. Although Puerto Rico is generally viewed as being distinct from U.S.-based municipal issuers, it remained unclear how the territory's likely default will affect the market in the coming months.

We became a bit more cautious in this environment, maintaining a disciplined approach and holding an above-average cash position to take advantage of future buying opportunities in the event that yields rise. We also sought to preserve sufficient liquidity to meet any outflows that typically accompany periods of increased volatility. In addition, we shifted the portfolio's overall credit quality higher to help mitigate the potential for a less favorable investment backdrop. We believe this is the prudent course after an extended period of positive market performance.

Annual Report 2016

6

COLUMBIA HIGH YIELD MUNICIPAL FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Investment Risks

Fixed-income securities present issuer default risk. The Fund invests substantially in municipal securities and will be affected by tax, legislative, regulatory, demographic or political changes, as well as changes impacting a state's financial, economic or other conditions. A relatively small number of tax-exempt issuers may necessitate the Fund investing more heavily in a single issuer and, therefore, be more exposed to the risk of loss than a fund that invests more broadly. Prepayment and extension risk exists because a loan, bond or other investment may be called, prepaid or redeemed before maturity and similar yielding investments may not be available for purchase. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund's income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Federal and state tax rules apply to capital gain distributions and any gains or losses on sales. Income may be subject to state, local or alternative minimum taxes. Market or other (e.g., interest rate) environments may adversely affect the liquidity of Fund investments, negatively impacting their price. Generally, the less liquid the market at the time the Fund sells a holding, the greater the risk of loss or decline of value to the Fund. See the Fund's prospectus for more information on these and other risks.

Annual Report 2016

7

COLUMBIA HIGH YIELD MUNICIPAL FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

December 1, 2015 – May 31, 2016

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,037.30 | | | | 1,020.70 | | | | 4.38 | | | | 4.34 | | | | 0.86 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,033.40 | | | | 1,016.95 | | | | 8.18 | | | | 8.12 | | | | 1.61 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,033.90 | | | | 1,017.45 | | | | 7.68 | | | | 7.62 | | | | 1.51 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,039.30 | | | | 1,021.70 | | | | 3.36 | | | | 3.34 | | | | 0.66 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,039.80 | | | | 1,022.15 | | | | 2.91 | | | | 2.88 | | | | 0.57 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,038.30 | | | | 1,021.70 | | | | 3.36 | | | | 3.34 | | | | 0.66 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2016

8

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS

May 31, 2016

(Percentages represent value of investments compared to net assets)

Municipal Bonds 94.6%

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

ALABAMA 0.9% | |

Lower Alabama Gas District (The)

Revenue Bonds

Series 2016A

09/01/46 | | | 5.000 | % | | | 6,215,000 | | | | 8,070,550 | | |

ALASKA 0.6% | |

City of Koyukuk

Revenue Bonds

Tanana Chiefs Conference Health Care

Series 2011

10/01/41 | | | 7.750 | % | | | 5,000,000 | | | | 5,673,200 | | |

ARIZONA 2.6% | |

City of Glendale Water & Sewer

Refunding Revenue Bonds

Senior Lien

Series 2015

07/01/27 | | | 5.000 | % | | | 2,500,000 | | | | 3,100,175 | | |

Industrial Development Authority of the County of Pima (The)

Refunding Revenue Bonds

Facility-Edkey Charter Schools Project

Series 2013

07/01/33 | | | 6.000 | % | | | 2,000,000 | | | | 2,031,820 | | |

07/01/43 | | | 6.000 | % | | | 2,500,000 | | | | 2,507,650 | | |

07/01/48 | | | 6.000 | % | | | 1,500,000 | | | | 1,500,765 | | |

Revenue Bonds

American Charter Schools Foundation

Series 2007A

07/01/38 | | | 5.625 | % | | | 3,840,000 | | | | 3,747,379 | | |

Industrial Development Authority of the County of Yavapai

Revenue Bonds

Yavapai Regional Medical Center

Series 2008B

08/01/37 | | | 5.625 | % | | | 3,500,000 | | | | 3,697,995 | | |

La Paz County Industrial Development Authority

Revenue Bonds

Charter School Solutions - Harmony Public

Series 2016

02/15/36 | | | 5.000 | % | | | 1,200,000 | | | | 1,313,868 | | |

Maricopa County Pollution Control Corp.

Revenue Bonds

El Paso Electric Co. Project

Series 2009B

04/01/40 | | | 7.250 | % | | | 3,600,000 | | | | 4,177,764 | | |

Surprise Municipal Property Corp.

Revenue Bonds

Series 2007

04/01/32 | | | 4.900 | % | | | 2,000,000 | | | | 2,030,800 | | |

Total | | | | | | | 24,108,216 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

CALIFORNIA 9.4% | |

Agua Caliente Band of Cahuilla Indians

Revenue Bonds

Series 2003(a)(b)

07/01/18 | | | 6.000 | % | | | 1,260,000 | | | | 1,257,367 | | |

Alameda Corridor Transportation Authority

Refunding Revenue Bonds

2nd Subordinated Lien

Series 2016B

10/01/35 | | | 5.000 | % | | | 1,000,000 | | | | 1,197,170 | | |

Cabazon Band Mission Indians(a)(b)(c)

Revenue Bonds

Mortgage Notes

Series 2004

10/01/11 | | | 13.000 | % | | | 384,294 | | | | 191,874 | | |

01/01/16 | | | 8.375 | % | | | 560,000 | | | | 188,602 | | |

10/01/19 | | | 0.000 | % | | | 2,785,000 | | | | 937,682 | | |

Series 2010

10/01/20 | | | 0.000 | % | | | 1,420,000 | | | | 538,450 | | |

California Health Facilities Financing Authority

Refunding Revenue Bonds

Northern California Presbyterian Homes

Series 2015

07/01/39 | | | 5.000 | % | | | 900,000 | | | | 1,060,182 | | |

California Housing Finance Agency(d)

Revenue Bonds

Home Mortgage

Series 2006K AMT

08/01/26 | | | 4.625 | % | | | 4,865,000 | | | | 4,895,406 | | |

Series 2008K AMT

08/01/33 | | | 5.550 | % | | | 560,000 | | | | 567,885 | | |

California Municipal Finance Authority

Revenue Bonds

UTS Renewable Energy-Waste Water Facilities

Series 2011 AMT(a)(d)

12/01/32 | | | 7.500 | % | | | 1,835,000 | | | | 1,705,761 | | |

California Pollution Control Financing Authority

Revenue Bonds

Aemerge Redpak Services Southern California, LLC Project

Series 2016 AMT(a)(d)

12/01/27 | | | 7.000 | % | | | 2,500,000 | | | | 2,525,175 | | |

California State Public Works Board

Refunding Revenue Bonds

Various Capital Projects

Series 2012G

11/01/37 | | | 5.000 | % | | | 1,250,000 | | | | 1,465,713 | | |

California Statewide Communities Development Authority

Prerefunded 01/01/19 Revenue Bonds

Aspire Public Schools

Series 2010

07/01/46 | | | 6.125 | % | | | 2,990,000 | | | | 3,383,903 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

9

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Refunding Revenue Bonds

899 Charleston Project

Series 2014A

11/01/44 | | | 5.250 | % | | | 1,500,000 | | | | 1,602,420 | | |

Revenue Bonds

American Baptist Homes West

Series 2010

10/01/39 | | | 6.250 | % | | | 2,750,000 | | | | 3,151,802 | | |

Loma Linda University Medical Center

Series 2014

12/01/44 | | | 5.250 | % | | | 500,000 | | | | 559,565 | | |

12/01/54 | | | 5.500 | % | | | 5,000,000 | | | | 5,647,400 | | |

Chino Public Financing Authority

Refunding Special Tax Bonds

Series 2012

09/01/34 | | | 5.000 | % | | | 1,775,000 | | | | 1,964,481 | | |

City of Carson

Special Assessment Bonds

Assessment District No. 92-1

Series 1992

09/02/22 | | | 7.375 | % | | | 70,000 | | | | 70,702 | | |

City of Long Beach Marina System

Revenue Bonds

Series 2015

05/15/45 | | | 5.000 | % | | | 500,000 | | | | 564,605 | | |

City of Los Angeles Department of Airports

Revenue Bonds

Senior Series 2015A AMT(d)

05/15/27 | | | 5.000 | % | | | 1,250,000 | | | | 1,536,987 | | |

City of Santa Maria Water & Wastewater

Refunding Revenue Bonds

Series 2012A(e)

02/01/25 | | | 0.000 | % | | | 3,100,000 | | | | 2,212,656 | | |

City of Upland

Certificate of Participation

San Antonio Community Hospital

Series 2011

01/01/41 | | | 6.500 | % | | | 5,000,000 | | | | 5,844,350 | | |

Compton Unified School District

Unlimited General Obligation Bonds

Election of 2002 - Capital Appreciation

Series 2006C(e)

06/01/25 | | | 0.000 | % | | | 2,310,000 | | | | 1,850,864 | | |

County of Sacramento Airport System

Subordinated Revenue Bonds

Series 2009D

07/01/35 | | | 6.000 | % | | | 2,500,000 | | | | 2,753,800 | | |

Empire Union School District

Special Tax Bonds

Communities Facilities District No. 1987-1

Series 2002A (AMBAC)(e)

10/01/21 | | | 0.000 | % | | | 1,665,000 | | | | 1,438,527 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Foothill-Eastern Transportation Corridor Agency

Refunding Revenue Bonds

Junior Lien

Series 2014C

01/15/43 | | | 6.500 | % | | | 5,000,000 | | | | 5,990,150 | | |

Hesperia Public Financing Authority

Tax Allocation Bonds

Redevelopment & Housing Projects

Series 2007A (SGI)

09/01/27 | | | 5.500 | % | | | 5,430,000 | | | | 5,708,939 | | |

M-S-R Energy Authority

Revenue Bonds

Series 2009B

11/01/39 | | | 6.500 | % | | | 5,000,000 | | | | 7,190,000 | | |

Oakdale Public Financing Authority

Tax Allocation Bonds

Central City Redevelopment Project

Series 2004

06/01/33 | | | 5.375 | % | | | 2,000,000 | | | | 2,002,460 | | |

Palomar Health

Certificate of Participation

Series 2010

11/01/41 | | | 6.000 | % | | | 2,500,000 | | | | 2,670,250 | | |

San Diego Public Facilities Financing Authority

Refunding Revenue Bonds

Ballpark

Series 2016

10/15/31 | | | 5.000 | % | | | 650,000 | | | | 795,347 | | |

San Francisco City & County Redevelopment Agency

Prerefunded 08/01/19 Tax Allocation Bonds

Mission Bay South Redevelopment Project

Series 2009D

08/01/39 | | | 6.625 | % | | | 1,500,000 | | | | 1,768,845 | | |

State of California Department of Veterans Affairs

Revenue Bonds

Series 2012A

12/01/25 | | | 3.500 | % | | | 4,355,000 | | | | 4,678,838 | | |

State of California

Unlimited General Obligation Bonds

Various Purpose

Series 2012

04/01/42 | | | 5.000 | % | | | 3,000,000 | | | | 3,507,000 | | |

University of California

Refunding Revenue Bonds

Limited Project

Series 2015I

05/15/27 | | | 5.000 | % | | | 2,000,000 | | | | 2,508,140 | | |

Series 2015AO

05/15/27 | | | 5.000 | % | | | 2,000,000 | | | | 2,523,180 | | |

Total | | | | | | | 88,456,478 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

10

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

COLORADO 1.9% | |

Colorado Health Facilities Authority

Refunding Revenue Bonds

NCMC, Inc. Project

Series 2016

05/15/32 | | | 4.000 | % | | | 3,535,000 | | | | 3,885,177 | | |

Foothills Metropolitan District

Special Assessment Bonds

Series 2014

12/01/38 | | | 6.000 | % | | | 4,250,000 | | | | 4,596,588 | | |

Regional Transportation District

Certificate of Participation

Series 2014A

06/01/39 | | | 5.000 | % | | | 7,000,000 | | | | 8,059,170 | | |

Sierra Ridge Metropolitan District No. 2

Senior Limited General Obligation Bonds

Series 2016A(f)

12/01/46 | | | 5.500 | % | | | 1,500,000 | | | | 1,559,820 | | |

Total | | | | | | | 18,100,755 | | |

CONNECTICUT 0.9% | |

Connecticut State Development Authority

Prerefunded 08/15/17 Revenue Bonds

Alzheimers Resource Center, Inc. Project

Series 2007

08/15/27 | | | 5.500 | % | | | 500,000 | | | | 528,010 | | |

Connecticut State Health & Educational Facility Authority

Revenue Bonds

Church Home of Hartford, Inc. Project

Series 2016(a)

09/01/53 | | | 5.000 | % | | | 1,750,000 | | | | 1,858,028 | | |

Harbor Point Infrastructure Improvement District

Tax Allocation Bonds

Harbor Point Project

Series 2010A

04/01/39 | | | 7.875 | % | | | 4,000,000 | | | | 4,720,000 | | |

Mohegan Tribe of Indians of Connecticut

Revenue Bonds

Public Improvement-Priority Distribution

Series 2003(a)(b)

01/01/33 | | | 5.250 | % | | | 1,000,000 | | | | 961,520 | | |

Total | | | | | | | 8,067,558 | | |

DELAWARE 0.2% | |

Centerline Equity Issuer Trust

Secured AMT(a)(d)

05/15/19 | | | 6.300 | % | | | 1,000,000 | | | | 1,121,640 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

City of Wilmington

Revenue Bonds

Housing-Electra Arms Senior Associates Project

Series 1998 AMT(d)

06/01/28 | | | 6.250 | % | | | 635,000 | | | | 635,451 | | |

Total | | | | | | | 1,757,091 | | |

DISTRICT OF COLUMBIA 0.8% | |

Metropolitan Washington Airports Authority(d)

Refunding Revenue Bonds

Series 2014A AMT

10/01/23 | | | 5.000 | % | | | 2,000,000 | | | | 2,422,500 | | |

Revenue Bonds

Airport System

Series 2012A AMT

10/01/24 | | | 5.000 | % | | | 4,000,000 | | | | 4,746,360 | | |

Total | | | | | | | 7,168,860 | | |

FLORIDA 9.2% | |

Capital Trust Agency, Inc.(a)

Revenue Bonds

1st Mortgage Tallahassee Tapestry Senior Housing Project

Series 2015

12/01/50 | | | 7.125 | % | | | 2,000,000 | | | | 2,071,820 | | |

Capital Trust Agency, Inc.(c)

Revenue Bonds

Atlantic Housing Foundation

Subordinated Series 2008B

07/15/32 | | | 0.000 | % | | | 1,370,000 | | | | 274,082 | | |

City of Lakeland

Refunding Revenue Bonds

1st Mortgage-Carpenters Home Estates

Series 2008

01/01/28 | | | 6.250 | % | | | 675,000 | | | | 717,181 | | |

01/01/43 | | | 6.375 | % | | | 2,250,000 | | | | 2,363,805 | | |

Revenue Bonds

Lakeland Regional Health

Series 2015

11/15/40 | | | 5.000 | % | | | 5,000,000 | | | | 5,737,850 | | |

City of Tallahassee

Revenue Bonds

Tallahassee Memorial Healthcare, Inc. Project

Series 2016

12/01/55 | | | 5.000 | % | | | 3,000,000 | | | | 3,413,010 | | |

County of Miami-Dade

Subordinated Refunding Revenue Bonds

Series 2012B

10/01/37 | | | 5.000 | % | | | 1,530,000 | | | | 1,773,102 | | |

County of Miami-Dade(e)

Revenue Bonds

Capital Appreciation

Subordinated Series 2009B

10/01/41 | | | 0.000 | % | | | 20,000,000 | | | | 7,302,600 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

11

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Florida Development Finance Corp.

Revenue Bonds

Renaissance Charter School

Series 2010A

09/15/40 | | | 6.000 | % | | | 3,750,000 | | | | 3,931,125 | | |

Series 2012A

06/15/43 | | | 6.125 | % | | | 5,500,000 | | | | 6,034,875 | | |

Renaissance Charter School Projects

Series 2013A

06/15/44 | | | 8.500 | % | | | 5,000,000 | | | | 5,856,000 | | |

Florida Development Finance Corp.(a)

Revenue Bonds

Miami Arts Charter School Project

Series 2014A

06/15/44 | | | 6.000 | % | | | 6,100,000 | | | | 6,236,213 | | |

Renaissance Charter School

Series 2015

06/15/46 | | | 6.125 | % | | | 5,000,000 | | | | 5,125,050 | | |

Florida Higher Educational Facilities Financial Authority

Refunding Revenue Bonds

Nova Southeastern University

Series 2016

04/01/35 | | | 5.000 | % | | | 1,190,000 | | | | 1,409,139 | | |

Mid-Bay Bridge Authority

Prerefunded 10/01/21 Revenue Bonds

Series 2011A

10/01/40 | | | 7.250 | % | | | 4,000,000 | | | | 5,192,400 | | |

Middle Village Community Development District

Special Assessment Bonds

Series 2004A

05/01/35 | | | 6.000 | % | | | 1,855,000 | | | | 1,596,227 | | |

Orange County Health Facilities Authority

Refunding Revenue Bonds

Mayflower Retirement Center

Series 2012

06/01/42 | | | 5.125 | % | | | 750,000 | | | | 818,033 | | |

Orlando Health, Inc.

Series 2016A

10/01/34 | | | 5.000 | % | | | 2,000,000 | | | | 2,420,340 | | |

Revenue Bonds

1st Mortgage-Orlando Lutheran Towers

Series 2007

07/01/32 | | | 5.500 | % | | | 350,000 | | | | 356,507 | | |

07/01/38 | | | 5.500 | % | | | 1,750,000 | | | | 1,780,660 | | |

Orange County Industrial Development Authority

Revenue Bonds

VITAG Florida LLC Project

Series 2014 AMT(a)(d)

07/01/36 | | | 8.000 | % | | | 5,000,000 | | | | 5,249,850 | | |

Palm Beach County Health Facilities Authority

Revenue Bonds

Sinai Residences Boca Raton

Series 2014

06/01/49 | | | 7.500 | % | | | 1,250,000 | | | | 1,541,087 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Sarasota County Health Facilities Authority

Refunding Revenue Bonds

Village on the Isle Project

Series 2007

01/01/32 | | | 5.500 | % | | | 4,000,000 | | | | 4,167,280 | | |

Seven Oaks Community Development District II

Special Assessment Bonds

Series 2004A

05/01/35 | | | 5.875 | % | | | 370,000 | | | | 363,436 | | |

South Lake County Hospital District

Revenue Bonds

South Lake Hospital, Inc.

Series 2010A

04/01/39 | | | 6.250 | % | | | 2,000,000 | | | | 2,254,180 | | |

St. Johns County Industrial Development Authority

Refunding Revenue Bonds

Bayview Project

Series 2007A

10/01/41 | | | 5.250 | % | | | 3,725,000 | | | | 3,417,985 | | |

St. Johns County Industrial Development Authority(c)

Refunding Revenue Bonds

Glenmoor Project

Series 2014A

01/01/49 | | | 5.375 | % | | | 3,206,250 | | | | 1,859,561 | | |

Subordinated Series 2014B

01/01/49 | | | 2.500 | % | | | 1,186,427 | | | | 12 | | |

Waterset North Community Development District

Special Assessment Bonds

Series 2007A

05/01/39 | | | 6.600 | % | | | 1,810,000 | | | | 1,813,276 | | |

Westridge Community Development District

Special Assessment Bonds

Series 2005(c)

05/01/37 | | | 0.000 | % | | | 2,650,000 | | | | 1,457,473 | | |

Total | | | | | | | 86,534,159 | | |

GEORGIA 2.5% | |

DeKalb County Hospital Authority

Revenue Bonds

DeKalb Medical Center, Inc. Project

Series 2010

09/01/40 | | | 6.125 | % | | | 4,500,000 | | | | 5,143,860 | | |

Fulton County Residential Care Facilities for the Elderly Authority

Revenue Bonds

1st Mortgage-Lenbrook Project

Series 2006A

07/01/29 | | | 5.000 | % | | | 3,000,000 | | | | 3,032,340 | | |

Georgia State Road & Tollway Authority

Revenue Bonds

I-75 S Expressway

Series 2014S(a)(e)

06/01/49 | | | 0.000 | % | | | 9,100,000 | | | | 5,483,387 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

12

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Municipal Electric Authority of Georgia

Revenue Bonds

Series 1991V Escrowed to Maturity

01/01/18 | | | 6.600 | % | | | 365,000 | | | | 387,586 | | |

Rockdale County Development Authority

Revenue Bonds

Visy Paper Project

Series 2007A AMT(d)

01/01/34 | | | 6.125 | % | | | 5,000,000 | | | | 5,087,200 | | |

Savannah Economic Development Authority

Refunding Revenue Bonds

Marshes Skidaway Island Project

Series 2013

01/01/49 | | | 7.250 | % | | | 3,500,000 | | | | 4,064,235 | | |

Total | | | | | | | 23,198,608 | | |

GUAM 0.6% | |

Guam Department of Education

Certificate of Participation

John F. Kennedy High School

Series 2010A(b)

12/01/40 | | | 6.875 | % | | | 4,750,000 | | | | 5,233,360 | | |

HAWAII 1.3% | |

State of Hawaii Department of Budget & Finance

Revenue Bonds

15 Craigside Project

Series 2009A

11/15/44 | | | 9.000 | % | | | 2,375,000 | | | | 2,900,445 | | |

Hawaii Pacific University

Series 2013A

07/01/43 | | | 6.875 | % | | | 2,800,000 | | | | 3,191,664 | | |

State of Hawaii

Refunding Unlimited General Obligation Bonds

Series 2016FE

10/01/27 | | | 5.000 | % | | | 4,890,000 | | | | 6,288,833 | | |

Total | | | | | | | 12,380,942 | | |

IDAHO 0.5% | |

Idaho Health Facilities Authority

Revenue Bonds

Terraces of Boise Project

Series 2014A

10/01/49 | | | 8.125 | % | | | 4,000,000 | | | | 4,469,880 | | |

ILLINOIS 9.3% | |

Chicago Park District

Limited General Obligation Bonds

Series 2015A

01/01/40 | | | 5.000 | % | | | 3,000,000 | | | | 3,286,890 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Limited General Obligation Refunding Bonds

Limited Tax

Series 2014B

01/01/26 | | | 5.000 | % | | | 1,500,000 | | | | 1,717,410 | | |

City of Chicago Wastewater Transmission

Refunding Revenue Bonds

2nd Lien

Series 2015C

01/01/35 | | | 5.000 | % | | | 1,000,000 | | | | 1,126,150 | | |

City of Chicago

Refunding Revenue Bonds

Series 2002

01/01/30 | | | 5.000 | % | | | 1,000,000 | | | | 1,097,910 | | |

Refunding Unlimited General Obligation Bonds

Series 2005D

01/01/33 | | | 5.500 | % | | | 1,000,000 | | | | 1,010,170 | | |

Unlimited General Obligation Bonds

Project

Series 2011A

01/01/40 | | | 5.000 | % | | | 5,000,000 | | | | 4,924,900 | | |

Series 2009C

01/01/40 | | | 5.000 | % | | | 2,500,000 | | | | 2,462,450 | | |

Series 2015A

01/01/39 | | | 5.500 | % | | | 500,000 | | | | 499,975 | | |

Unlimited General Obligation Refunding Bonds

Project

Series 2014A

01/01/33 | | | 5.250 | % | | | 1,000,000 | | | | 999,950 | | |

01/01/36 | | | 5.000 | % | | | 3,000,000 | | | | 2,970,300 | | |

Projects

Series 2010A

01/01/24 | | | 5.000 | % | | | 2,000,000 | | | | 2,041,960 | | |

Series 2007F

01/01/42 | | | 5.500 | % | | | 1,000,000 | | | | 999,950 | | |

Series 2016C

01/01/38 | | | 5.000 | % | | | 2,500,000 | | | | 2,464,175 | | |

Du Page County Special Service Area No. 31

Special Tax Bonds

Monarch Landing Project

Series 2006

03/01/36 | | | 5.625 | % | | | 750,000 | | | | 751,950 | | |

Illinois Finance Authority

Prerefunded 08/15/19 Revenue Bonds

Silver Cross & Medical Centers

Series 2009

08/15/44 | | | 7.000 | % | | | 5,000,000 | | | | 5,941,850 | | |

Prerefunded 12/01/17 Revenue Bonds

Columbia College

Series 2007 (NPFGC)

12/01/37 | | | 5.000 | % | | | 5,000,000 | | | | 5,312,750 | | |

Revenue Bonds

CHF-Normal LLC-Illinois State University

Series 2011

04/01/43 | | | 7.000 | % | | | 3,450,000 | | | | 3,972,502 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

13

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Provena Health

Series 2009A

08/15/34 | | | 7.750 | % | | | 4,000,000 | | | | 4,762,800 | | |

Riverside Health System

Series 2009

11/15/35 | | | 6.250 | % | | | 3,000,000 | | | | 3,462,750 | | |

Smith Village Project

Series 2005A

11/15/35 | | | 6.250 | % | | | 2,750,000 | | | | 2,759,955 | | |

Illinois Finance Authority(c)

Revenue Bonds

Leafs Hockey Club Project

Series 2007A

03/01/37 | | | 0.000 | % | | | 1,000,000 | | | | 249,610 | | |

Illinois State Toll Highway Authority

Refunding Revenue Bonds

Series 2014-A

12/01/21 | | | 5.000 | % | | | 1,525,000 | | | | 1,810,328 | | |

Illinois State Toll Highway Authority(f)

Senior Revenue Bonds

Series 2016B

01/01/37 | | | 5.000 | % | | | 3,500,000 | | | | 4,190,235 | | |

Metropolitan Pier & Exposition Authority

Refunding Revenue Bonds

McCormick Place Project

Series 2010B-2

06/15/50 | | | 5.000 | % | | | 5,000,000 | | | | 5,258,950 | | |

Railsplitter Tobacco Settlement Authority

Revenue Bonds

Series 2010

06/01/28 | | | 6.000 | % | | | 5,000,000 | | | | 5,955,900 | | |

Southwestern Illinois Development Authority

Prerefunded 02/15/07 Revenue Bonds

Anderson Hospital

Series 2006

08/15/26 | | | 5.125 | % | | | 1,245,000 | | | | 1,284,218 | | |

State of Illinois

Unlimited General Obligation Bonds

Series 2014

05/01/29 | | | 5.000 | % | | | 3,500,000 | | | | 3,823,960 | | |

Series 2016

01/01/41 | | | 5.000 | % | | | 3,830,000 | | | | 4,125,944 | | |

Village of Annawan

Tax Allocation Bonds

Patriot Renewable Fuels LLC Project

Series 2007

01/01/18 | | | 5.625 | % | | | 1,470,000 | | | | 1,470,176 | | |

Village of Hillside

Tax Allocation Bonds

Senior Lien-Mannheim Redevelopment Project

Series 2008

01/01/28 | | | 7.000 | % | | | 5,240,000 | | | | 5,562,784 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Village of Lincolnshire

Special Tax Bonds

Sedgebrook Project

Series 2004

03/01/34 | | | 6.250 | % | | | 649,000 | | | | 651,791 | | |

Total | | | | | | | 86,950,643 | | |

INDIANA 0.1% | |

City of Portage

Prerefunded 07/15/16 Tax Allocation Bonds

Ameriplex Project

Series 2006

07/15/23 | | | 5.000 | % | | | 700,000 | | | | 703,787 | | |

IOWA 0.4% | |

Iowa Finance Authority(c)

Refunding Revenue Bonds

Deerfield Retirement Community

Series 2014

05/15/56 | | | 2.000 | % | | | 401,062 | | | | 321 | | |

Iowa Finance Authority(g)

Refunding Revenue Bonds

Deerfield Retirement Community

Series 2014

11/15/46 | | | 2.700 | % | | | 2,138,019 | | | | 1,810,667 | | |

Iowa Student Loan Liquidity Corp.

Revenue Bonds

Senior Series 2011A-2 AMT(d)

12/01/30 | | | 5.850 | % | | | 1,540,000 | | | | 1,647,292 | | |

Total | | | | | | | 3,458,280 | | |

KANSAS 1.7% | |

City of Lenexa

Revenue Bonds

Lakeview Village, Inc. Project

Series 2009

05/15/29 | | | 7.125 | % | | | 500,000 | | | | 552,240 | | |

05/15/39 | | | 7.250 | % | | | 1,500,000 | | | | 1,652,835 | | |

City of Manhattan

Revenue Bonds

Meadowlark Hills Retirement Foundation

Series 2007A

05/15/29 | | | 5.000 | % | | | 2,680,000 | | | | 2,700,582 | | |

City of Overland Park

Revenue Bonds

Prairiefire-Lionsgate Project

Series 2012

12/15/32 | | | 6.000 | % | | | 6,000,000 | | | | 5,669,520 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

14

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Wyandotte County-Kansas City Unified Government

Revenue Bonds

Legends Village West Project

Series 2006

10/01/28 | | | 4.875 | % | | | 5,185,000 | | | | 5,199,311 | | |

Total | | | | | | | 15,774,488 | | |

KENTUCKY 0.2% | |

Kentucky Economic Development Finance Authority

Revenue Bonds

Louisville Arena

Subordinated Series 2008A-1 (AGM)

12/01/38 | | | 6.000 | % | | | 1,150,000 | | | | 1,238,688 | | |

Paducah Electric Plant Board

Refunding Revenue Bonds

Series 2016A (AGM)(f)

10/01/35 | | | 5.000 | % | | | 1,000,000 | | | | 1,162,190 | | |

Total | | | | | | | 2,400,878 | | |

LOUISIANA 3.2% | |

Juban Crossing Economic Development District

Refunding Revenue Bonds

Drainage Projects

Series 2015B

09/15/44 | | | 7.000 | % | | | 750,000 | | | | 798,450 | | |

General Infrastructure Projects

Series 2015C

09/15/44 | | | 7.000 | % | | | 3,665,000 | | | | 3,901,759 | | |

Road Projects

Series 2015A

09/15/44 | | | 7.000 | % | | | 1,335,000 | | | | 1,421,241 | | |

Louisiana Local Government Environmental Facilities & Community Development Authority

Revenue Bonds

Westlake Chemical Corp.

Series 2010A-2

11/01/35 | | | 6.500 | % | | | 5,000,000 | | | | 6,009,850 | | |

Louisiana Public Facilities Authority

Refunding Revenue Bonds

Nineteenth Judicial District

Series 2015C (AGM)

06/01/42 | | | 5.000 | % | | | 1,000,000 | | | | 1,142,320 | | |

Ochsner Clinic Foundation

Series 2016

05/15/34 | | | 5.000 | % | | | 2,100,000 | | | | 2,484,930 | | |

Louisiana Public Facilities Authority(d)

Revenue Bonds

Impala Warehousing LLC Project

Series 2013 AMT

07/01/36 | | | 6.500 | % | | | 5,000,000 | | | | 5,629,950 | | |

Louisiana Pellets, Inc. Project

Series 2013 AMT

07/01/39 | | | 10.500 | % | | | 5,000,000 | | | | 2,888,250 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

New Orleans Aviation Board

Revenue Bonds

Consolidated Rental Car

Series 2009A

01/01/40 | | | 6.500 | % | | | 5,000,000 | | | | 5,599,950 | | |

Total | | | | | | | 29,876,700 | | |

MARYLAND 0.7% | |

Maryland Economic Development Corp.

Prerefunded 06/01/18 Revenue Bonds

University of Maryland-College Park Projects

Series 2008

06/01/43 | | | 5.875 | % | | | 2,590,000 | | | | 2,849,544 | | |

Maryland Health & Higher Educational Facilities Authority

Refunding Revenue Bonds

University of Maryland Medical System

Series 2015

07/01/34 | | | 5.000 | % | | | 2,750,000 | | | | 3,232,212 | | |

Resolution Trust Corp.

Pass-Through Certificates

Series 1993A

12/01/16 | | | 8.500 | % | | | 455,482 | | | | 455,290 | | |

Total | | | | | | | 6,537,046 | | |

MASSACHUSETTS 2.8% | |

Massachusetts Development Finance Agency

Refunding Revenue Bonds

1st Mortgage-VOA Concord

Series 2007

11/01/41 | | | 5.200 | % | | | 1,000,000 | | | | 1,003,090 | | |

South Shore Hospital

Series 2016I

07/01/36 | | | 4.000 | % | | | 750,000 | | | | 806,708 | | |

Revenue Bonds

Foxborough Regional Charter School

Series 2010A

07/01/42 | | | 7.000 | % | | | 4,200,000 | | | | 4,794,132 | | |

Linden Ponds, Inc. Facility

Series 2011A-2

11/15/46 | | | 5.500 | % | | | 279,667 | | | | 257,103 | | |

Massachusetts Development Finance Agency(e)

Revenue Bonds

Linden Ponds, Inc. Facility

Series 2011B

11/15/56 | | | 0.000 | % | | | 1,391,019 | | | | 7,901 | | |

Massachusetts Educational Financing Authority(d)

Revenue Bonds

Education Loan

Series 2014-I AMT

01/01/21 | | | 5.000 | % | | | 1,885,000 | | | | 2,105,168 | | |

Series 2008H (AGM) AMT

01/01/30 | | | 6.350 | % | | | 1,575,000 | | | | 1,652,726 | | |

Series 2012J AMT

07/01/21 | | | 5.000 | % | | | 3,000,000 | | | | 3,381,840 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

15

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Massachusetts Educational Financing Authority(d)(f)

Refunding Revenue Bonds

Series 2016J AMT

07/01/33 | | | 3.500 | % | | | 6,000,000 | | | | 5,931,540 | | |

Massachusetts Health & Educational Facilities Authority

Prerefunded 07/01/18 Revenue Bonds

Boston Medical Center

Series 2008

07/01/38 | | | 5.250 | % | | | 525,000 | | | | 572,938 | | |

Revenue Bonds

Milford Regional Medical Center

Series 2007E

07/15/32 | | | 5.000 | % | | | 1,250,000 | | | | 1,286,587 | | |

Unrefunded Revenue Bonds

Boston Medical Center

Series 2008

07/01/38 | | | 5.250 | % | | | 4,295,000 | | | | 4,508,204 | | |

Total | | | | | | | 26,307,937 | | |

MICHIGAN 2.2% | |

Allen Academy

Refunding Revenue Bonds

Public School Academy

Series 2013

06/01/33 | | | 6.000 | % | | | 5,750,000 | | | | 4,206,930 | | |

City of Detroit Sewage Disposal System

Refunding Revenue Bonds

Senior Lien

Series 2012A

07/01/39 | | | 5.250 | % | | | 1,375,000 | | | | 1,536,095 | | |

City of Detroit Water Supply System

Revenue Bonds

Senior Lien

Series 2011A

07/01/41 | | | 5.250 | % | | | 1,445,000 | | | | 1,598,632 | | |

Series 2011C

07/01/41 | | | 5.000 | % | | | 1,025,000 | | | | 1,121,975 | | |

Michigan Finance Authority

Refunding Revenue Bonds

Series 2014H1

10/01/22 | | | 5.000 | % | | | 1,075,000 | | | | 1,250,204 | | |

Revenue Bonds

School District of the City of Detroit

Series 2012

06/01/20 | | | 5.000 | % | | | 1,000,000 | | | | 1,099,200 | | |

Michigan State Hospital Finance Authority

Refunding Revenue Bonds

Henry Ford Health System

Series 2006A

11/15/46 | | | 5.250 | % | | | 3,000,000 | | | | 3,060,720 | | |

Michigan Tobacco Settlement Finance Authority

Revenue Bonds

Senior Series 2007A

06/01/34 | | | 6.000 | % | | | 1,000,000 | | | | 990,030 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

06/01/48 | | | 6.000 | % | | | 6,000,000 | | | | 5,907,720 | | |

Total | | | | | | | 20,771,506 | | |

MINNESOTA 1.6% | |

City of Anoka

Revenue Bonds

Homestead Anoka, Inc. Project

Series 2011A

11/01/46 | | | 7.000 | % | | | 4,070,000 | | | | 4,367,517 | | |

City of Blaine

Refunding Revenue Bonds

Crest View Senior Community Project

Series 2015

07/01/45 | | | 6.125 | % | | | 3,500,000 | | | | 3,730,545 | | |

07/01/50 | | | 6.125 | % | | | 1,500,000 | | | | 1,597,680 | | |

City of Eveleth

Refunding Revenue Bonds

Arrowhead Senior Living Community

Series 2007

10/01/27 | | | 5.200 | % | | | 2,375,000 | | | | 2,375,356 | | |

Dakota County Community Development Agency

Revenue Bonds

Sanctuary at West St. Paul Project

Series 2015

08/01/35 | | | 6.000 | % | | | 2,235,000 | | | | 2,306,051 | | |

Housing & Redevelopment Authority of The City of St. Paul

Refunding Revenue Bonds

HealthEast Care System Project

Series 2015

11/15/40 | | | 5.000 | % | | | 265,000 | | | | 306,459 | | |

Minneapolis/St. Paul Housing Finance Board

Revenue Bonds

Mortgage-Backed Securities Program-Cityliving

Series 2006A-2 (GNMA/FNMA) AMT(d)

12/01/38 | | | 5.000 | % | | | 4,848 | | | | 4,850 | | |

Total | | | | | | | 14,688,458 | | |

MISSISSIPPI 0.3% | |

County of Lowndes

Refunding Revenue Bonds

Weyerhaeuser Co. Project

Series 1992A

04/01/22 | | | 6.800 | % | | | 1,995,000 | | | | 2,485,471 | | |

Series 1992B

04/01/22 | | | 6.700 | % | | | 230,000 | | | | 284,232 | | |

Rankin County Five Lakes Utility District

Series 1994

07/15/37 | | | 7.000 | % | | | 230,000 | | | | 230,255 | | |

Total | | | | | | | 2,999,958 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

16

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

MISSOURI 2.8% | |

City of Kansas City

Tax Allocation Bonds

Kansas City-Maincor Project

Series 2007A Escrowed to Maturity

03/01/18 | | | 5.250 | % | | | 500,000 | | | | 527,095 | | |

Shoal Creek Parkway Project

Series 2011

06/01/25 | | | 6.500 | % | | | 1,900,000 | | | | 1,913,908 | | |

City of Manchester

Refunding Tax Allocation Bonds

Highway 141/Manchester Road Project

Series 2010

11/01/39 | | | 6.875 | % | | | 5,000,000 | | | | 5,295,800 | | |

Grundy County Industrial Development Authority

Revenue Bonds

Wright Memorial Hospital

Series 2009

09/01/34 | | | 6.750 | % | | | 2,250,000 | | | | 2,440,215 | | |

Health & Educational Facilities Authority of the State of Missouri

Revenue Bonds

Medical Research-Lutheran Services

Series 2016A

02/01/46 | | | 5.000 | % | | | 2,550,000 | | | | 2,890,374 | | |

Kirkwood Industrial Development Authority

Revenue Bonds

Aberdeen Heights

Series 2010A

05/15/45 | | | 8.250 | % | | | 4,500,000 | | | | 5,074,875 | | |

St. Louis County Industrial Development Authority

Prerefunded 12/01/17 Revenue Bonds

St. Andrews Residence for Seniors

Series 2007A

12/01/41 | | | 6.375 | % | | | 3,000,000 | | | | 3,252,420 | | |

Refunding Revenue Bonds

Ranken Jordan Project

Series 2007

11/15/35 | | | 5.000 | % | | | 1,300,000 | | | | 1,302,028 | | |

St. Andrews Residence for Seniors

Series 2015

12/01/45 | | | 5.125 | % | | | 3,000,000 | | | | 3,153,120 | | |

Total | | | | | | | 25,849,835 | | |

NEBRASKA 1.6% | |

Central Plains Energy Project

Revenue Bonds

Project #3

Series 2012

09/01/42 | | | 5.000 | % | | | 5,000,000 | | | | 5,565,800 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Public Power Generation Agency

Refunding Revenue Bonds

Whelan Energy Center Unit

Series 2015

01/01/28 | | | 5.000 | % | | | 8,000,000 | | | | 9,577,200 | | |

Total | | | | | | | 15,143,000 | | |

NEVADA 0.8% | |

City of Sparks

Tax Anticipation Revenue Bonds

Senior Sales

Series 2008A(a)

06/15/28 | | | 6.750 | % | | | 5,000,000 | | | | 5,305,850 | | |

State of Nevada Department of Business & Industry

Revenue Bonds

Somerset Academy

Series 2015A(a)

12/15/45 | | | 5.125 | % | | | 2,515,000 | | | | 2,570,154 | | |

Total | | | | | | | 7,876,004 | | |

NEW HAMPSHIRE —% | |

New Hampshire Business Finance Authority

Revenue Bonds

Pennichuck Water Works, Inc. Project

Series 1988 Escrowed to Maturity AMT(d)

07/01/18 | | | 7.500 | % | | | 90,000 | | | | 95,739 | | |

NEW JERSEY 3.4% | |

City of Atlantic City

Refunding Unlimited General Obligation Bonds

Tax Appeal

Series 2013

12/01/21 | | | 5.000 | % | | | 2,500,000 | | | | 1,701,125 | | |

Unlimited General Obligation Refunding Bonds

Tax Appeal

Series 2013

12/01/24 | | | 5.000 | % | | | 1,545,000 | | | | 1,051,033 | | |

Middlesex County Improvement Authority(c)

Revenue Bonds

Heldrich Center Hotel

Series 2005C

01/01/37 | | | 0.000 | % | | | 1,250,000 | | | | 37,463 | | |

Subordinated Revenue Bonds

Heldrich Center Hotel

Series 2005B

01/01/25 | | | 0.000 | % | | | 2,750,000 | | | | 108,542 | | |

01/01/37 | | | 0.000 | % | | | 6,450,000 | | | | 254,581 | | |

New Jersey Building Authority

Refunding Revenue Bonds

Series 2016A

06/15/30 | | | 4.000 | % | | | 1,000,000 | | | | 1,013,670 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

17

COLUMBIA HIGH YIELD MUNICIPAL FUND

PORTFOLIO OF INVESTMENTS (continued)

May 31, 2016

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

New Jersey Economic Development Authority

Prerefunded 11/15/16 Revenue Bonds

Seabrook Village, Inc. Facility

Series 2006

11/15/36 | | | 5.250 | % | | | 2,250,000 | | | | 2,297,430 | | |

Revenue Bonds

Provident Group-Rowan Properties LLC

Series 2015

01/01/48 | | | 5.000 | % | | | 960,000 | | | | 1,059,946 | | |

School Facilities Construction

Series 2014UU

06/15/40 | | | 5.000 | % | | | 1,500,000 | | | | 1,619,340 | | |

Series 2015WW

06/15/40 | | | 5.250 | % | | | 375,000 | | | | 413,846 | | |

New Jersey Economic Development Authority(d)

Revenue Bonds

UMM Energy Partners LLC

Series 2012A AMT

06/15/43 | | | 5.125 | % | | | 2,000,000 | | | | 2,090,360 | | |

New Jersey Health Care Facilities Financing Authority

Revenue Bonds

St. Josephs Healthcare Systems

Series 2008

07/01/38 | | | 6.625 | % | | | 3,000,000 | | | | 3,285,540 | | |

New Jersey Higher Education Student Assistance Authority(d)

Revenue Bonds

Senior Series 2013-1A AMT

12/01/21 | | | 5.000 | % | | | 1,500,000 | | | | 1,700,640 | | |

Senior Series 2014-1A-1 AMT

12/01/22 | | | 5.000 | % | | | 1,000,000 | | | | 1,144,440 | | |

Subordinated Revenue Bonds

Series 2013-1B AMT

12/01/43 | | | 4.750 | % | | | 5,000,000 | | | | 5,227,350 | | |

New Jersey Transportation Trust Fund Authority

Revenue Bonds

Transportation Program

Series 2015AA

06/15/45 | | | 5.000 | % | | | 1,750,000 | | | | 1,876,140 | | |

New Jersey Transportation Trust Fund Authority(e)

Revenue Bonds

Capital Appreciation Transportation System

Series 2006C (AGM)

12/15/32 | | | 0.000 | % | | | 10,000,000 | | | | 5,152,300 | | |

Tobacco Settlement Financing Corp.

Revenue Bonds

Capital Appreciation

Series 2007-1C(e)

06/01/41 | | | 0.000 | % | | | 7,500,000 | | | | 1,961,925 | | |

Total | | | | | | | 31,995,671 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

NEW YORK 3.4% | |

Build NYC Resource Corp.

Revenue Bonds

International Leadership Charter School

Series 2013

07/01/43 | | | 6.000 | % | | | 4,330,000 | | | | 4,332,208 | | |

City of New York

Unlimited General Obligation Refunding Bonds

Series 2014J

08/01/23 | | | 5.000 | % | | | 3,000,000 | | | | 3,699,810 | | |

Series 2015C

08/01/27 | | | 5.000 | % | | | 4,000,000 | | | | 4,928,640 | | |

Jefferson County Industrial Development Agency

Revenue Bonds

Green Bonds

Series 2014 AMT(d)

01/01/24 | | | 5.250 | % | | | 1,900,000 | | | | 1,872,849 | | |

Nassau County Tobacco Settlement Corp.

Asset-Backed Revenue Bonds