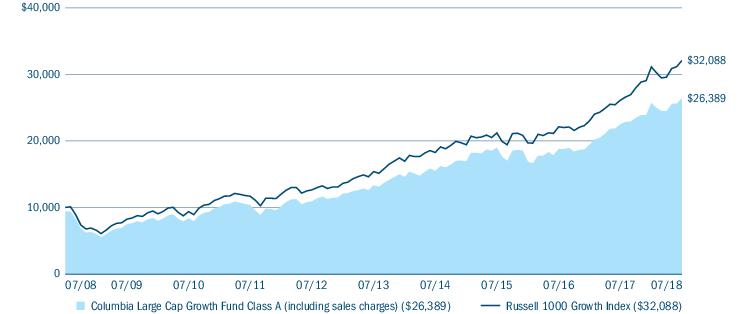

For the 12-month period that ended July 31, 2018, the Fund’s Class A shares returned 17.26% excluding sales charges. The Fund underperformed its benchmark, the Russell 1000 Growth Index, which returned 22.84% over the same period. In a year of strong equity returns, disappointing results from consumer discretionary and biotechnology holdings, mostly in the fourth quarter of 2017, generally accounted for the Fund’s shortfall relative to the benchmark. An overweight in information technology made a significant contribution to Fund gains, as the sector was a performance leader during the period.

Strong earnings, lower taxes pushed equity markets higher

U.S. equities delivered solid gains for the 12-month period that ended July 31, 2018, hitting record highs along the way. Buoyant corporate earnings, especially in the information technology sector, along with a strengthening domestic economy and an improving global economy, boosted investor sentiment. Consumer confidence was high, and jobs data remained strong, as the unemployment rate declined to 3.9%. Tax cuts approved by Congress late in 2017 had a favorable impact on corporate earnings and helped fuel investor optimism. Concerns that interest rates and inflation might rise faster than expected put a damper on equity markets midway through the period, the first decline of such magnitude in two years. However, the pullback was short lived, and equities recovered their lost ground by the end of the period. For the 12 months ended July 31, 2018, the S&P 500 Index — which measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance — gained 16.24%. Growth stocks substantially outperformed value stocks. The yield on the 10-Year U.S. Treasury ended the period at 2.96%. After three Federal Reserve rate increases, the federal funds target rate stood at 1.75%-2.00%.

Contributors and detractors

Holdings in the materials sector led the Fund’s relative returns. Even though the materials sector is a small sector within the benchmark, the Fund did well with positions in Eastman Chemical and Lyondell and benefited from no exposure to some of the sector’s big losers, namely DowDupont, PPG and Ecolab. In the consumer staples sector, we also did well to avoid losers, with no exposure to Coca Cola and Altria, both of which lagged during the period. In addition, a position in Costco benefited returns, as the company had strong top and bottom line results. Information technology was the biggest contributor to Fund gains, and overweights in Micron, Adobe, ServiceNow and NVIDIA aided returns.

Gains from these sectors were partially offset by losses from biotechnology holdings in the health care sector and disappointments from industrials and consumer discretionary positions. Biotechnology accounted for most of the Fund’s shortfall relative to the benchmark, with underperformance from Celgene, Gilead, Alexion and Intercept Pharmaceuticals. Within the consumer discretionary sector, overweight positions in Dish Networks, Newell, Mohawk and Expedia weighed on relative results. An overweight in Amazon boosted returns but those gains were offset by Netflix, which the Fund did not own.

At period’s end

During the period, we pruned from the Fund’s information technology holdings, as we believed that several stocks had moved closer to their individual stock targets. Our strategy remains unchanged: we continue to look for ideas where our internal research conviction is high and where we can find a differentiated research view combined with strong management and an attractive risk/return profile. We seek opportunities in companies that we believe have the potential to drive organic revenue and earnings growth consistently although that growth may be underestimated by the market.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Growth securities, at times, may not perform as well as value securities or the stock market in general and may be out of favor with investors. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to