UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

225 Franklin Street

Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 345-6611

Date of fiscal year end: April 30

Date of reporting period: April 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

EXPLANATORY NOTE - The Registrant is filing this amendment to its Form N-CSR for the period ended April 30, 2018, originally filed with the Securities and Exchange Commission on July 3, 2018 (Accession Number 0001193125-18-212081) to amend the financial highlights of series S000012097. The purpose of this amendment is to correct the headers displayed above the financial information in the financial highlights table.

Item 1. Reports to Stockholders.

Annual Report

April 30, 2018

Not FDIC Insured • No bank guarantee • May lose value

Dear Shareholders,

The year 2017 was an extraordinary year in the financial markets. The S&P 500 Index didn’t experience a single down month and returned over 20%. Continuing this trend, January 2018 marked the fastest start for the index ever. Low volatility, which had been a feature of the U.S. equity market for several years, along with the surge in the S&P 500 Index, drove investor sentiment to very high levels. This arguably set the stage for an overdue correction, which we witnessed in February 2018.

A return to volatility

There have been few periods of market upheaval such as were experienced in the first part of 2018. While investors were taken by surprise by the sudden and pronounced market swings, the return to some level of volatility actually marked a resumption of relatively normal market conditions. Having said that, it’s important to distinguish between a good technical correction where excess enthusiasm in the marketplace is being let out, versus a real change in the underlying fundamentals – things like an underperforming economy or weaker corporate earnings. Our view is that the recent market volatility falls into the former category, and the fundamentals remain strong. We’re continuing to see improvements in global economic activity, and we’re seeing corporate earnings expectations continue to rise – and not just because of tax reform.

Consistency is more important than ever

It’s important to keep in mind that when it comes to long-term investing, it’s the destination, not the journey that matters most. If you have a financial goal that you’ve worked out with your financial advisor, and you have a good asset allocation plan to reach it, it’s a question of sticking with your plan rather than become focused on near-term volatility. Bouts of volatility are normal. After all, it’s hard to cross the ocean without hitting an occasional rough patch. You need to focus on the destination.

One final thought. In weathering volatility, it’s the consistency of the return that is essential. Investors who chase higher returns are usually the first to sell when an investment goes through a bad patch, and they therefore don’t tend to benefit from the recovery. More disciplined investors who perhaps panic less or not at all during periods of volatility, tend to have improved long-term results and are more likely to reach their financial goals. Nothing is more important to us than making sure those who have entrusted us to protect and grow their assets are able to do what matters most to them.

Your success is our priority. Talk to your financial advisor about how working with Columbia Threadneedle Investments may help you position your portfolio for consistent, sustainable outcomes, no matter the market conditions.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance. Past performance is no guarantee of future results.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2018 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Bond Fund | Annual Report 2018

Columbia Bond Fund | Annual Report 2018

Investment objective

Columbia Bond Fund (the Fund) seeks current income, consistent with minimal fluctuation of principal.

Portfolio management

Jason Callan

Lead Portfolio Manager

Managed Fund since 2016

Gene Tannuzzo, CFA

Portfolio Manager

Managed Fund since November 2017

| Average annual total returns (%) (for the period ended April 30, 2018) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 03/31/08 | -0.33 | 1.18 | 3.44 |

| | Including sales charges | | -5.04 | 0.20 | 2.94 |

| Advisor Class* | 11/08/12 | -0.08 | 1.43 | 3.70 |

| Class C | Excluding sales charges | 03/31/08 | -1.08 | 0.46 | 2.73 |

| | Including sales charges | | -2.05 | 0.46 | 2.73 |

| Institutional Class | 01/09/86 | -0.08 | 1.43 | 3.70 |

| Institutional 2 Class* | 11/08/12 | 0.13 | 1.54 | 3.76 |

| Institutional 3 Class* | 07/15/09 | 0.19 | 1.62 | 3.83 |

| Class R* | 11/16/11 | -0.58 | 0.92 | 3.12 |

| Class T* | Excluding sales charges | 09/27/10 | -0.33 | 1.18 | 3.46 |

| | Including sales charges | | -2.85 | 0.67 | 3.20 |

| Class V* | Excluding sales charges | 03/07/11 | -0.23 | 1.28 | 3.55 |

| | Including sales charges | | -4.95 | 0.30 | 3.05 |

| Bloomberg Barclays U.S. Aggregate Bond Index | | -0.32 | 1.47 | 3.57 |

Returns for Class A and Class V shares are shown with and without the maximum initial sales charge of 4.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charges for the first year only. The returns for Class T shares are shown with and without the maximum initial sales charge of 2.50% per transaction. The Fund’s other classes are not subject to sales charges and have limited eligibility. Effective November 1, 2017, Class R4, Class R5, Class Y and Class Z shares were renamed Advisor Class, Institutional 2 Class, Institutional 3 Class and Institutional Class shares, respectively. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information. |

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage passthroughs), asset-backed securities, and commercial mortgage-backed securities.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

| 2 | Columbia Bond Fund | Annual Report 2018 |

Fund at a Glance (continued)

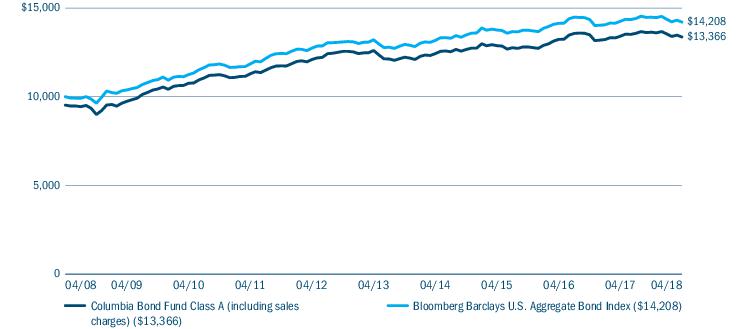

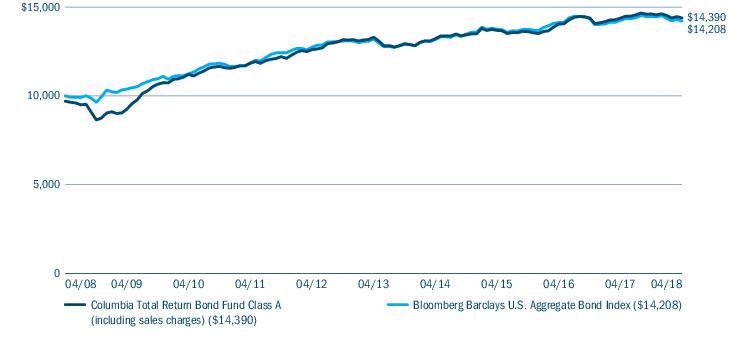

Performance of a hypothetical $10,000 investment (April 30, 2008 — April 30, 2018)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Portfolio breakdown (%) (at April 30, 2018) |

| Asset-Backed Securities — Agency | 3.9 |

| Asset-Backed Securities — Non-Agency | 22.3 |

| Commercial Mortgage-Backed Securities - Agency | 2.6 |

| Commercial Mortgage-Backed Securities - Non-Agency | 5.3 |

| Common Stocks | 0.0 (a) |

| Corporate Bonds & Notes | 20.3 |

| Foreign Government Obligations | 0.6 |

| Money Market Funds | 2.2 |

| Municipal Bonds | 0.3 |

| Residential Mortgage-Backed Securities - Agency | 23.8 |

| Residential Mortgage-Backed Securities - Non-Agency | 14.3 |

| U.S. Government & Agency Obligations | 3.3 |

| U.S. Treasury Obligations | 1.1 |

| Total | 100.0 |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| Quality breakdown (%) (at April 30, 2018) |

| AAA rating | 62.7 |

| AA rating | 7.4 |

| A rating | 9.2 |

| BBB rating | 14.3 |

| Not rated | 6.4 |

| Total | 100.0 |

Percentages indicated are based upon total fixed income investments (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund’s subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

Columbia Bond Fund | Annual Report 2018

| 3 |

Manager Discussion of Fund Performance

For the 12-month period that ended April 30, 2018, the Fund’s Class A shares returned -0.33% excluding sales charges. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, returned -0.32% for the same period. The Fund’s relative performance was aided by positioning with respect to interest rates, allocation across segments of the bond market, and overall security selection.

Credit outperformed as Treasury yields rose

Performance across fixed-income markets for the 12 months ended April 30, 2018 was constrained by an upward move in Treasury yields, which weighed on bond prices. For much of the period, sentiment with respect to credit-oriented segments of the market continued to be supported by positive economic data and the Federal Reserve’s (the Fed) maintenance of an incremental approach as it seeks to restore interest rates to more historically normal levels.

Against a backdrop of strong corporate earnings growth and what is considered to be full employment, the U.S. economy posted annualized growth in the 3% range over each of the last three quarters of 2017. As 2017 drew to a close, risk sentiment was further boosted with the passage of legislation that lowered the maximum corporate tax rate from 35% to 21% and provided a temporary window for companies to accelerate the expensing of capital investments.

The Fed implemented a series of three 25 basis point rate hikes at its June 2017, December 2017 and March 2018 Open Market Committee meetings, which together raised the upper target for the federal funds rate to 1.75%. In addition, in October of 2017, the Fed began the process of allowing its mortgage-backed security and Treasury holdings acquired in the wake of the 2008 financial crisis to gradually roll off its balance sheet. The Fed’s tapering plan was well-signaled, and the markets had little reaction to the actual launch.

As 2018 opened, bond markets continued to rally on the back of the tax reform bill and quiescent inflation indicators. However, January wage growth data surprised to the upside, raising concerns that signs of a potential acceleration in inflation would lead the Fed to step up the pace of its rate hikes. While jitters around inflation eased fairly quickly, the markets were jarred again in early March as President Trump threatened tariffs on Chinese imports, raising the specter of a trade war with the potential to derail global growth. In late April, first quarter 2018 growth was reported at 2.3%, with the drop off from the prior three quarters generally attributed to seasonal factors.

Yields rose along the U.S. Treasury curve over the 12-month period ended April 30, 2018, and the yield curve flattened notably as shorter maturities experienced greater yield increases. To illustrate, the two-year Treasury yield rose 121 basis points from 1.28% to 2.49%, the 10-year rose 66 basis points from 2.29% to 2.95%, the 20-year rose 34 basis points from 2.67% to 3.01%, and the 30-year yield rose 15 basis points from 2.96% to 3.11%. Credit spreads (the incremental yield provided by lower rated bonds relative to comparable maturity U.S. Treasury bonds) narrowed modestly over the 12 months.

Contributors and detractors

The Fund’s performance in the period benefited from an underweighting of U.S. Treasuries, which were most directly and negatively impacted by the upward move in interest rates over the period. In turn, the Fund had overweight exposure to credit-oriented segments of the market, with respect to which sentiment was supported by the ongoing economic recovery and passage of tax reform legislation. In particular, a tilt toward non-agency residential mortgage-backed securities added to relative performance, as these issues benefited from the ongoing strengthening of the housing market and consumer balance sheets.

Security selection within investment-grade corporate securities added to performance, including a modest out-of-benchmark position in preferred securities that were more sensitive to changes in risk sentiment. With respect to the Fund’s allocation to asset-backed securities, performance benefited from a focus on floating rate issues, which experienced strong interest from investors concerned about the potential for higher interest rates.

The Fund’s below-benchmark positioning during the period with respect to overall portfolio duration (and corresponding sensitivity to interest rates) had a modestly positive impact on performance in a rising interest rate environment. In addition, the Fund was underweight in the 2-5 year segment of the yield curve, which was most impacted by rising interest rates.

| 4 | Columbia Bond Fund | Annual Report 2018 |

Manager Discussion of Fund Performance (continued)

We invested in highly-liquid, widely-traded Treasury futures and interest rate swap contracts to help manage portfolio duration. These enabled us to efficiently implement our yield curve opinions and offset unintended yield curve impacts from other investments in the portfolio. We also used indexed exposure to credit default swaps to manage the Fund’s overall level of credit risk. On a standalone basis, the Fund’s use of derivatives had a negative impact on performance during the period.

At period’s end

While the Fed is in the process of tightening monetary conditions, the stimulus baton has been picked up by fiscal policy in the form of lower taxes. This argues for the view that the current period of positive U.S. economic growth has some additional running room. That said, given the extended duration of the economic recovery, we adopted a somewhat cautious stance with respect to corporate credit. We view corporate America as displaying late-cycle characteristics as evidenced by an uptick in the use of leverage to finance mergers and acquisition activity in certain segments, such as food and beverage.

With the improvements in employment conditions and housing prices, the consumer appeared to us to be in an earlier stage of the credit cycle relative to corporations. In this vein, the Fund emphasized segments such as non-agency mortgage-backed securities and asset-backed securities, along with commercial mortgage-backed securities. With the recent rise in interest rates and the Fed continuing to pursue a gradual approach to interest rate normalization, we moved to an essentially neutral stance with respect to duration, as well as with respect to positioning along the yield curve.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Mortgage- and asset-backedsecurities are affected by interest rates, financial health of issuers/originators, creditworthiness of entities providing credit enhancements and the value of underlying assets. Fixed-income securities present issuer default risk. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Prepayment and extension risk exists because the timing of payments on a loan, bond or other investment may accelerate when interest rates fall or decelerate when interest rates rise which may reduce investment opportunities and potential returns. Investing in derivatives is a specialized activity that involves special risks that subject the Fund to significant loss potential, including when used as leverage, and may result in greater fluctuation in Fund value. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Bond Fund | Annual Report 2018

| 5 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| November 1, 2017 — April 30, 2018 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 980.00 | 1,020.53 | 4.22 | 4.31 | 0.86 |

| Advisor Class | 1,000.00 | 1,000.00 | 981.20 | 1,021.77 | 3.00 | 3.06 | 0.61 |

| Class C | 1,000.00 | 1,000.00 | 977.50 | 1,016.81 | 7.89 | 8.05 | 1.61 |

| Institutional Class | 1,000.00 | 1,000.00 | 981.30 | 1,021.77 | 3.00 | 3.06 | 0.61 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 982.80 | 1,022.27 | 2.51 | 2.56 | 0.51 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 983.20 | 1,022.51 | 2.26 | 2.31 | 0.46 |

| Class R | 1,000.00 | 1,000.00 | 978.80 | 1,019.29 | 5.45 | 5.56 | 1.11 |

| Class T | 1,000.00 | 1,000.00 | 980.10 | 1,020.53 | 4.22 | 4.31 | 0.86 |

| Class V | 1,000.00 | 1,000.00 | 981.60 | 1,021.03 | 3.73 | 3.81 | 0.76 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

| 6 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments

April 30, 2018

(Percentages represent value of investments compared to net assets)

Investments in securities

| Asset-Backed Securities — Agency 4.5% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| United States Small Business Administration |

| Series 2012-20G Class 1 |

| 07/01/2032 | 2.380% | | 234,424 | 229,224 |

| Series 2012-20I Class 1 |

| 09/01/2032 | 2.200% | | 243,011 | 235,947 |

| Series 2012-20J Class 1 |

| 10/01/2032 | 2.180% | | 919,811 | 891,995 |

| Series 2012-20L Class 1 |

| 12/01/2032 | 1.930% | | 267,143 | 257,110 |

| Series 2013-20E Class 1 |

| 05/01/2033 | 2.070% | | 153,839 | 148,412 |

| Series 2015-20C Class 1 |

| 03/01/2035 | 2.720% | | 85,572 | 84,080 |

| Series 2015-20E Class 1 |

| 05/01/2035 | 2.770% | | 366,995 | 354,003 |

| Series 2016-20K Class 1 |

| 11/01/2036 | 2.570% | | 3,483,674 | 3,389,267 |

| Series 2016-20L Class 1 |

| 12/01/2036 | 2.810% | | 2,244,083 | 2,204,738 |

| Series 2017-20A Class 1 |

| 01/01/2037 | 2.800% | | 3,810,988 | 3,694,062 |

| Series 2017-20B Class 1 |

| 02/01/2037 | 2.820% | | 1,264,524 | 1,224,314 |

| Series 2017-20E Class 1 |

| 05/01/2037 | 2.880% | | 180,742 | 176,370 |

| Series 2017-20G Class 1 |

| 07/01/2037 | 2.980% | | 1,171,298 | 1,142,060 |

| Series 2017-20H Class 1 |

| 08/01/2037 | 2.750% | | 1,003,390 | 968,884 |

| Series 2017-20I Class 1 |

| 09/01/2037 | 2.590% | | 1,758,964 | 1,682,032 |

| Series 2017-20K Class 1 |

| 11/01/2037 | 2.790% | | 1,855,000 | 1,795,958 |

Total Asset-Backed Securities — Agency

(Cost $18,981,891) | 18,478,456 |

|

| Asset-Backed Securities — Non-Agency 25.7% |

| | | | |

| Ally Master Owner Trust |

| Series 2015-3 Class A |

| 05/15/2020 | 1.630% | | 875,000 | 874,636 |

| Avis Budget Rental Car Funding AESOP LLC(a) |

| Series 2015-2A Class A |

| 12/20/2021 | 2.630% | | 1,195,000 | 1,175,756 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Bain Capital Credit CLO(a),(b) |

| Series 2018-1A Class B |

3-month USD LIBOR + 1.400%

04/23/2031 | 3.762% | | 2,000,000 | 1,994,216 |

| BMW Floorplan Master Owner Trust(a),(b) |

| Series 2015-1A Class A |

1-month USD LIBOR + 0.500%

07/15/2020 | 2.397% | | 981,000 | 981,619 |

| Cabela’s Credit Card Master Note Trust |

| Series 2015-2 Class A1 |

| 07/17/2023 | 2.250% | | 990,000 | 974,079 |

| Capital One Multi-Asset Execution Trust |

| Series 2015-A8 Class A8 |

| 08/15/2023 | 2.050% | | 1,075,000 | 1,053,174 |

| Series 2017-A3 Class A3 |

| 01/15/2025 | 2.430% | | 2,320,000 | 2,268,310 |

| Carlyle Group LP(a),(b) |

| Series 2017-5A Class A2 |

3-month USD LIBOR + 1.400%

01/20/2030 | 3.130% | | 2,000,000 | 1,986,094 |

| CarMax Auto Owner Trust |

| Series 2015-3 Class A3 |

| 05/15/2020 | 1.630% | | 606,196 | 603,895 |

| Series 2016-4 Class A2 |

| 11/15/2019 | 1.210% | | 226,368 | 225,948 |

| Cent CLO Ltd.(a),(b),(c),(d),(e) |

| Series 20 18-C17A Class A2R |

3-month USD LIBOR + 1.600%

04/30/2031 | 3.200% | | 1,800,000 | 1,799,100 |

| Chase Issuance Trust |

| Series 2012-A4 Class A4 |

| 08/16/2021 | 1.580% | | 860,000 | 848,057 |

| Chesapeake Funding II LLC(a) |

| Series 2016-1A Class A1 |

| 03/15/2028 | 2.110% | | 249,452 | 248,754 |

| Series 2016-2A Class A1 |

| 06/15/2028 | 1.880% | | 300,917 | 299,252 |

| Chesapeake Funding II LLC(a),(b) |

| Series 2016-2A Class A2 |

1-month USD LIBOR + 1.000%

06/15/2028 | 2.897% | | 481,467 | 483,038 |

| Series 2017-3A Class A2 |

1-month USD LIBOR + 0.340%

08/15/2029 | 2.237% | | 839,810 | 840,273 |

| Series 2017-4A Class A2 |

1-month USD LIBOR + 0.340%

11/15/2029 | 2.207% | | 910,000 | 908,967 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 7 |

Portfolio of Investments (continued)

April 30, 2018

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Chrysler Capital Auto Receivables Trust(a) |

| Series 2016-BA Class A2 |

| 01/15/2020 | 1.360% | | 28,480 | 28,462 |

| Citibank Credit Card Issuance Trust |

| Series 2014-A1 Class A1 |

| 01/23/2023 | 2.880% | | 3,455,000 | 3,450,567 |

| Series 2014-A6 Class A6 |

| 07/15/2021 | 2.150% | | 475,000 | 472,169 |

| CLUB Credit Trust(a) |

| Series 2017-P2 Class A |

| 01/15/2024 | 2.610% | | 2,796,573 | 2,786,455 |

| Series 2018-NP1 Class A |

| 05/15/2024 | 2.990% | | 2,536,569 | 2,535,229 |

| Conn’s Receivables Funding LLC(a) |

| Series 2017-B Class A |

| 07/15/2020 | 2.730% | | 2,614,791 | 2,613,295 |

| Consumer Loan Underlying Bond Credit Trust(a) |

| Series 2017-NP2 Class A |

| 01/16/2024 | 2.550% | | 994,294 | 993,345 |

| Dell Equipment Finance Trust(a),(b) |

| Series 2017-2 Class A2B |

1-month USD LIBOR + 0.300%

02/24/2020 | 2.198% | | 410,000 | 410,248 |

| Discover Card Execution Note Trust |

| Series 2017-A2 Class A2 |

| 07/15/2024 | 2.390% | | 1,125,000 | 1,098,505 |

| Dryden 57 CLO Ltd.(a),(b) |

| Series 2018-57A Class B |

3-month USD LIBOR + 1.350%

05/15/2031 | 3.240% | | 1,250,000 | 1,236,714 |

| Enterprise Fleet Financing LLC(a) |

| Series 2015-2 Class A2 |

| 02/22/2021 | 1.590% | | 54,746 | 54,711 |

| Ford Credit Auto Lease Trust |

| Series 2017-A Class A3 |

| 04/15/2020 | 1.880% | | 500,000 | 496,732 |

| Ford Credit Auto Owner Trust(a) |

| Series 2015-2 Class A |

| 01/15/2027 | 2.440% | | 970,000 | 958,568 |

| Series 2016-1 Class A |

| 08/15/2027 | 2.310% | | 4,830,000 | 4,731,328 |

| Series 2017-1 Class A |

| 08/15/2028 | 2.620% | | 2,000,000 | 1,960,817 |

| Series 2017-2 Class A |

| 03/15/2029 | 2.360% | | 1,225,000 | 1,182,894 |

| Ford Credit Floorplan Master Owner Trust(a) |

| Series 2013-2 Class A |

| 03/15/2022 | 2.090% | | 1,570,000 | 1,545,026 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Ford Credit Floorplan Master Owner Trust |

| Series 2017-3 Class A |

| 09/15/2024 | 2.480% | | 1,525,000 | 1,481,121 |

| GM Financial Automobile Leasing Trust |

| Series 2015-3 Class A3 |

| 03/20/2019 | 1.690% | | 88,027 | 87,976 |

| Series 2016-3 Class A2A |

| 02/20/2019 | 1.350% | | 62,851 | 62,816 |

| Series 2017-3 Class A3 |

| 11/20/2020 | 2.010% | | 251,000 | 248,156 |

| GM Financial Consumer Automobile Receivables Trust(a) |

| Series 2017-3A Class A3 |

| 05/16/2022 | 1.970% | | 1,690,000 | 1,663,257 |

| GMF Floorplan Owner Revolving Trust(a),(b) |

| Series 2016-1 Class A2 |

1-month USD LIBOR + 0.850%

05/17/2021 | 2.747% | | 730,000 | 734,847 |

| Harley-Davidson Motorcycle Trust |

| Series 2015-1 Class A3 |

| 06/15/2020 | 1.410% | | 92,943 | 92,689 |

| Hertz Fleet Lease Funding LP(a),(b) |

| Series 2016-1 Class A1 |

1-month USD LIBOR + 1.100%

04/10/2030 | 2.997% | | 1,367,709 | 1,372,284 |

| Series 2017-1 Class A1 |

1-month USD LIBOR + 0.650%

04/10/2031 | 2.547% | | 505,000 | 505,378 |

| Hertz Vehicle Financing II LP(a) |

| Series 2015-3A Class A |

| 09/25/2021 | 2.670% | | 1,000,000 | 984,260 |

| Series 2016-2A Class A |

| 03/25/2022 | 2.950% | | 700,000 | 688,470 |

| Honda Auto Receivables Owner Trust |

| Series 2015-2 Class A3 |

| 02/21/2019 | 1.040% | | 22 | 22 |

| Hyundai Auto Receivables Trust |

| Series 2017-A Class A2A |

| 02/18/2020 | 1.480% | | 813,508 | 810,733 |

| Hyundai Floorplan Master Owner Trust(a),(b) |

| Series 2016-1A Class A1 |

1-month USD LIBOR + 0.900%

03/15/2021 | 2.797% | | 330,000 | 332,013 |

| Kubota Credit Owner Trust(a) |

| Series 2016-1A Class A2 |

| 04/15/2019 | 1.250% | | 52,129 | 52,087 |

| Madison Park Funding XXVII Ltd.(a),(b) |

| Series 2018-27A Class A2 |

3-month USD LIBOR + 1.350%

04/20/2030 | 3.397% | | 3,700,000 | 3,660,980 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments (continued)

April 30, 2018

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Marlette Funding Trust(a) |

| Series 2018-1A Class A |

| 03/15/2028 | 2.610% | | 3,263,305 | 3,255,873 |

| Mercedes-Benz Auto Lease Trust |

| Series 2016-B Class A2 |

| 01/15/2019 | 1.150% | | 14,929 | 14,922 |

| New York City Tax Lien Trust(a) |

| Series 2016-A Class A |

| 11/10/2029 | 1.470% | | 74,324 | 73,662 |

| NextGear Floorplan Master Owner Trust(a),(b) |

| Series 2017-2A Class A1 |

1-month USD LIBOR + 0.680%

10/17/2022 | 2.577% | | 440,000 | 434,364 |

| NextGear Floorplan Master Owner Trust(a) |

| Series 2017-2A Class A2 |

| 10/17/2022 | 2.560% | | 730,000 | 718,230 |

| Nissan Auto Lease Trust |

| Series 2016-B Class A2A |

| 12/17/2018 | 1.260% | | 36,568 | 36,552 |

| Series 2017-B Class A3 |

| 09/15/2020 | 2.050% | | 870,000 | 860,809 |

| Nissan Auto Receivables Owner Trust |

| Series 2016-A Class A3 |

| 10/15/2020 | 1.340% | | 467,311 | 463,999 |

| Nissan Master Owner Trust Receivables(b) |

| Series 2017-A Class A |

1-month USD LIBOR + 0.310%

04/15/2021 | 2.207% | | 1,445,000 | 1,446,519 |

| Octagon Investment Partners 35 Ltd.(a),(b) |

| Series 2018-1A Class A2 |

3-month USD LIBOR + 1.400%

01/20/2031 | 3.148% | | 1,820,000 | 1,818,387 |

| Octagon Investment Partners XV Ltd.(a),(b) |

| Series 2013-1A Class A1AR |

3-month USD LIBOR + 1.210%

07/19/2030 | 3.565% | | 2,500,000 | 2,504,795 |

| Octagon Investment Partners XXII Ltd.(a),(b) |

| Series 2014-1A Class BRR |

3-month USD LIBOR + 1.450%

01/22/2030 | 3.812% | | 4,000,000 | 3,972,924 |

| OneMain Financial Issuance Trust(a) |

| Series 2018-1A Class A |

| 03/14/2029 | 3.300% | | 2,140,000 | 2,133,804 |

| OZLM XXI(a),(b) |

| Series 2017-21A Class A1 |

3-month USD LIBOR + 1.150%

01/20/2031 | 2.903% | | 2,500,000 | 2,500,295 |

| Prosper Marketplace Issuance Trust(a) |

| Series 2018-1A Class A |

| 06/17/2024 | 3.110% | | 4,500,000 | 4,496,013 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| RR 3 Ltd.(a),(b) |

| Series 2014-14A Class A1R2 |

3-month USD LIBOR + 1.090%

01/15/2030 | 3.438% | | 4,500,000 | 4,513,549 |

| SoFi Consumer Loan Program LLC(a) |

| Series 2017-3 Class A |

| 05/25/2026 | 2.770% | | 1,282,009 | 1,269,456 |

| SoFi Consumer Loan Program Trust(a) |

| Series 20 18-2 Class A1 |

| 04/26/2027 | 2.930% | | 3,000,000 | 2,999,763 |

| Series 2018-1 Class A1 |

| 02/25/2027 | 2.550% | | 1,920,750 | 1,912,529 |

| SoFi Professional Loan Program LLC(a) |

| Series 2016-A |

| 12/26/2036 | 2.760% | | 715,688 | 706,553 |

| Stewart Park CLO Ltd.(a),(b) |

| Series 2017-1A Class A2R |

3-month USD LIBOR + 1.250%

01/15/2030 | 3.598% | | 3,000,000 | 3,015,570 |

| Synchrony Credit Card Master Note Trust |

| Series 2016-1 Class A |

| 03/15/2022 | 2.040% | | 1,295,000 | 1,288,262 |

| Series 2017-2 Class A |

| 10/15/2025 | 2.620% | | 800,000 | 777,898 |

| USAA Auto Owner Trust |

| Series 2017-1 Class A3 |

| 05/17/2021 | 1.700% | | 565,000 | 558,072 |

| Volvo Financial Equipment LLC(a) |

| Series 2015-1A Class A3 |

| 06/17/2019 | 1.510% | | 120,522 | 120,410 |

| Volvo Financial Equipment Master Owner Trust(a),(b) |

| Series 2017-A Class A |

1-month USD LIBOR + 0.500%

11/15/2022 | 2.397% | | 450,000 | 451,146 |

| Voya Ltd.(a),(b) |

| Series 2012-4A Class A1R |

3-month USD LIBOR + 1.450%

10/15/2028 | 3.798% | | 1,500,000 | 1,505,955 |

| Wheels SPV 2 LLC(a) |

| Series 2016-1A Class A2 |

| 05/20/2025 | 1.590% | | 144,539 | 143,725 |

| World Financial Network Credit Card Master Trust |

| Series 2012-D Class A |

| 04/17/2023 | 2.150% | | 790,000 | 784,149 |

| Series 2015-B Class A |

| 06/17/2024 | 2.550% | | 1,815,000 | 1,792,106 |

| World Omni Auto Receivables Trust |

| Series 2017-A Class A3 |

| 09/15/2022 | 1.930% | | 1,440,000 | 1,419,650 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 9 |

Portfolio of Investments (continued)

April 30, 2018

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| World Omni Automobile Lease Securitization Trust(b) |

| Series 2016-A2B Class A2B |

1-month USD LIBOR + 0.410%

02/15/2019 | 2.307% | | 78,897 | 78,924 |

Total Asset-Backed Securities — Non-Agency

(Cost $105,712,293) | 104,966,187 |

|

| Commercial Mortgage-Backed Securities - Agency 2.9% |

| | | | |

| Federal Home Loan Mortgage Corp. |

| Series K724 Class A1 |

| 03/25/2023 | 2.776% | | 5,338,796 | 5,289,297 |

| Federal Home Loan Mortgage Corp. Multifamily Structured Pass-Through Certificates(f) |

| Series 2017-K070 Class A2 |

| 11/25/2027 | 3.303% | | 2,150,000 | 2,125,846 |

| Federal National Mortgage Association(f) |

| Series 2017-M15 Class ATS2 |

| 11/25/2027 | 3.196% | | 4,750,000 | 4,620,366 |

Total Commercial Mortgage-Backed Securities - Agency

(Cost $12,441,986) | 12,035,509 |

|

| Commercial Mortgage-Backed Securities - Non-Agency 6.1% |

| | | | |

| American Homes 4 Rent Trust(a) |

| Series 2014-SFR2 Class A |

| 10/17/2036 | 3.786% | | 2,567,543 | 2,582,158 |

| Series 2014-SFR3 Class A |

| 12/17/2036 | 3.678% | | 2,923,945 | 2,923,340 |

| Series 2015-SFR2 Class A |

| 10/17/2045 | 3.732% | | 258,468 | 258,825 |

| BX Commercial Mortgage Trust(a),(b) |

| Series 2018-BIOA Class A |

1-month USD LIBOR + 0.671%

03/15/2037 | 2.321% | | 2,000,000 | 1,998,082 |

| CHT 2017-COSMO Mortgage Trust(a),(b) |

| Series 2017-CSMO Class C |

1-month USD LIBOR + 1.500%

11/15/2036 | 3.397% | | 1,600,000 | 1,605,971 |

| Colony Multifamily Mortgage Trust(a) |

| Series 2014-1 Class A |

| 04/20/2050 | 2.543% | | 458,083 | 455,520 |

| Credit Suisse Mortgage Capital Trust(a) |

| Series 2014-USA Class A2 |

| 09/15/2037 | 3.953% | | 1,700,000 | 1,705,007 |

| Invitation Homes Trust(a),(b),(e) |

| Series 2018-SFR2 Class A |

1-month USD LIBOR + 0.800%

06/17/2037 | 2.796% | | 2,850,000 | 2,851,672 |

| JPMBB Commercial Mortgage Securities Trust |

| Series 2013-C14 Class A4 |

| 08/15/2046 | 4.133% | | 1,305,000 | 1,347,203 |

| Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| JPMorgan Chase Commercial Mortgage Securities Trust |

| Series 2012-C6 Class A3 |

| 05/15/2045 | 3.507% | | 1,231,134 | 1,236,434 |

| Morgan Stanley Bank of America Merrill Lynch Trust |

| Series 2013-C12 Class A4 |

| 10/15/2046 | 4.259% | | 2,608,000 | 2,701,635 |

| Progress Residential Trust(a) |

| Series 2017-SFR1 Class A |

| 08/17/2034 | 2.768% | | 718,306 | 705,825 |

| Series 2018-SFR1 Class A |

| 03/17/2035 | 3.255% | | 1,685,000 | 1,653,023 |

| UBS Commercial Mortgage Trust(a),(b) |

| Series 2018-NYCH Class A |

1-month USD LIBOR + 0.850%

02/15/2032 | 2.747% | | 2,000,000 | 2,010,017 |

| Series 2018-NYCH Class B |

1-month USD LIBOR + 1.250%

02/15/2032 | 3.147% | | 900,000 | 904,453 |

Total Commercial Mortgage-Backed Securities - Non-Agency

(Cost $25,222,763) | 24,939,165 |

| Common Stocks 0.0% |

| Issuer | Shares | Value ($) |

| Consumer Staples —% |

| Beverages —% |

| Crimson Wine Group Ltd.(g) | 3 | 28 |

| Total Consumer Staples | 28 |

| Financials —% |

| Diversified Financial Services —% |

| Leucadia National Corp. | 39 | 937 |

| Total Financials | 937 |

Total Common Stocks

(Cost $—) | 965 |

| Corporate Bonds & Notes 23.4% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Aerospace & Defense 0.8% |

| Lockheed Martin Corp. |

| 03/01/2045 | 3.800% | | 525,000 | 485,687 |

| 09/15/2052 | 4.090% | | 310,000 | 294,196 |

| Northrop Grumman Corp. |

| 01/15/2025 | 2.930% | | 1,090,000 | 1,032,644 |

| 01/15/2028 | 3.250% | | 685,000 | 641,551 |

| 10/15/2047 | 4.030% | | 730,000 | 679,847 |

| Total | 3,133,925 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments (continued)

April 30, 2018

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Automotive 0.3% |

| Ford Motor Co. |

| 12/08/2046 | 5.291% | | 420,000 | 403,413 |

| Ford Motor Credit Co. LLC |

| 11/02/2020 | 2.343% | | 860,000 | 837,288 |

| Total | 1,240,701 |

| Banking 3.7% |

| Bank of America Corp.(h) |

| 01/20/2028 | 3.824% | | 2,690,000 | 2,618,282 |

| Capital One Financial Corp. |

| 05/12/2020 | 2.500% | | 1,150,000 | 1,132,839 |

| HBOS PLC(a) |

| Subordinated |

| 05/21/2018 | 6.750% | | 1,395,000 | 1,398,043 |

| HSBC Holdings PLC |

| 01/14/2022 | 4.875% | | 515,000 | 538,777 |

| JPMorgan Chase & Co.(h) |

| 02/01/2028 | 3.782% | | 6,265,000 | 6,071,468 |

| JPMorgan Chase & Co.(b) |

| Junior Subordinated |

3-month USD LIBOR + 0.950%

02/02/2037 | 2.728% | | 362,000 | 329,601 |

| Wells Fargo & Co. |

| 01/30/2020 | 2.150% | | 855,000 | 843,445 |

| 10/23/2026 | 3.000% | | 2,320,000 | 2,137,432 |

| Total | 15,069,887 |

| Cable and Satellite 0.3% |

| Charter Communications Operating LLC/Capital Corp. |

| 10/23/2035 | 6.384% | | 535,000 | 583,447 |

| Comcast Corp. |

| 08/15/2047 | 4.000% | | 720,000 | 661,167 |

| Total | 1,244,614 |

| Chemicals 0.3% |

| LYB International Finance BV |

| 07/15/2043 | 5.250% | | 270,000 | 289,154 |

| LYB International Finance II BV |

| 03/02/2027 | 3.500% | | 737,000 | 699,101 |

| LyondellBasell Industries NV |

| 04/15/2024 | 5.750% | | 343,000 | 372,699 |

| Total | 1,360,954 |

| Consumer Cyclical Services 0.3% |

| Amazon.com, Inc.(a) |

| 02/22/2023 | 2.400% | | 1,135,000 | 1,088,782 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Electric 3.1% |

| Baltimore Gas & Electric Co. |

| 06/15/2033 | 5.200% | | 285,000 | 311,873 |

| CMS Energy Corp. |

| 03/01/2024 | 3.875% | | 485,000 | 485,771 |

| 02/15/2027 | 2.950% | | 15,000 | 13,757 |

| 08/15/2027 | 3.450% | | 405,000 | 387,520 |

| Commonwealth Edison Co. |

| 03/15/2036 | 5.900% | | 325,000 | 403,041 |

| Consolidated Edison Co. of New York, Inc. |

| 08/15/2037 | 6.300% | | 315,000 | 402,492 |

| DTE Energy Co. |

| 10/01/2026 | 2.850% | | 1,585,000 | 1,441,290 |

| Duke Energy Corp. |

| 08/15/2027 | 3.150% | | 585,000 | 546,102 |

| Duke Energy Florida Project Finance LLC |

| 09/01/2029 | 2.538% | | 1,525,000 | 1,403,302 |

| Duke Energy Progress LLC |

| 09/15/2047 | 3.600% | | 260,000 | 242,297 |

| Duke Energy Progress, Inc. |

| 08/15/2045 | 4.200% | | 68,000 | 69,597 |

| E.ON International Finance BV(a) |

| 04/30/2038 | 6.650% | | 325,000 | 410,378 |

| Emera U.S. Finance LP |

| 06/15/2046 | 4.750% | | 1,720,000 | 1,712,317 |

| Enel Finance International NV(a) |

| 05/25/2047 | 4.750% | | 515,000 | 515,708 |

| Indiana Michigan Power Co. |

| 07/01/2047 | 3.750% | | 206,000 | 190,850 |

| Nevada Power Co. |

| 09/15/2040 | 5.375% | | 314,000 | 364,978 |

| Pacific Gas & Electric Co.(a) |

| 12/01/2027 | 3.300% | | 1,194,000 | 1,113,848 |

| 12/01/2047 | 3.950% | | 955,000 | 869,522 |

| Southern Co. (The) |

| 07/01/2026 | 3.250% | | 612,000 | 574,475 |

| 07/01/2036 | 4.250% | | 350,000 | 350,852 |

| WEC Energy Group, Inc. |

| 06/15/2025 | 3.550% | | 150,000 | 147,634 |

| Xcel Energy, Inc. |

| 06/01/2025 | 3.300% | | 665,000 | 644,431 |

| Total | 12,602,035 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 11 |

Portfolio of Investments (continued)

April 30, 2018

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Finance Companies 1.1% |

| GE Capital International Funding Co. Unlimited Co. |

| 11/15/2020 | 2.342% | | 2,885,000 | 2,820,939 |

| 11/15/2035 | 4.418% | | 1,720,000 | 1,648,556 |

| Total | 4,469,495 |

| Food and Beverage 1.4% |

| Anheuser-Busch InBev Finance, Inc. |

| 02/01/2046 | 4.900% | | 787,000 | 815,380 |

| Anheuser-Busch InBev Worldwide, Inc. |

| 04/15/2058 | 4.750% | | 271,000 | 271,103 |

| Bacardi Ltd.(a) |

| 05/15/2048 | 5.300% | | 2,050,000 | 2,022,399 |

| Kraft Heinz Foods Co. |

| 06/01/2046 | 4.375% | | 1,708,000 | 1,525,883 |

| Molson Coors Brewing Co. |

| 07/15/2046 | 4.200% | | 877,000 | 803,222 |

| Tyson Foods, Inc.(b) |

3-month USD LIBOR + 0.450%

08/21/2020 | 2.342% | | 460,000 | 460,742 |

| Total | 5,898,729 |

| Health Care 1.2% |

| Becton Dickinson and Co.(b) |

3-month USD LIBOR + 1.030%

06/06/2022 | 3.055% | | 963,000 | 968,205 |

| Becton Dickinson and Co. |

| 06/06/2027 | 3.700% | | 570,000 | 540,541 |

| 05/15/2044 | 4.875% | | 575,000 | 554,809 |

| Cardinal Health, Inc. |

| 06/15/2027 | 3.410% | | 810,000 | 752,099 |

| 06/15/2047 | 4.368% | | 520,000 | 485,910 |

| CVS Health Corp. |

| 03/25/2048 | 5.050% | | 645,000 | 658,678 |

| Express Scripts Holding Co. |

| 07/15/2046 | 4.800% | | 705,000 | 692,413 |

| New York and Presbyterian Hospital (The) |

| 08/01/2036 | 3.563% | | 245,000 | 231,105 |

| Total | 4,883,760 |

| Independent Energy 0.3% |

| Canadian Natural Resources Ltd. |

| 06/30/2033 | 6.450% | | 110,000 | 129,420 |

| Hess Corp. |

| 02/15/2041 | 5.600% | | 180,000 | 182,118 |

| Noble Energy, Inc. |

| 04/01/2027 | 8.000% | | 809,000 | 988,137 |

| Total | 1,299,675 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Integrated Energy 0.2% |

| Cenovus Energy, Inc. |

| 11/15/2039 | 6.750% | | 855,000 | 972,057 |

| Life Insurance 0.9% |

| Brighthouse Financial, Inc.(a) |

| 06/22/2047 | 4.700% | | 875,000 | 767,682 |

| Massachusetts Mutual Life Insurance Co.(a) |

| Subordinated |

| 04/15/2065 | 4.500% | | 300,000 | 287,952 |

| MetLife, Inc.(a),(h) |

| Junior Subordinated |

| 04/08/2068 | 9.250% | | 41,000 | 55,903 |

| Northwestern Mutual Life Insurance Co. (The)(a) |

| Subordinated |

| 09/30/2047 | 3.850% | | 650,000 | 604,150 |

| Teachers Insurance & Annuity Association of America(a) |

| Subordinated |

| 09/15/2044 | 4.900% | | 110,000 | 117,332 |

| 05/15/2047 | 4.270% | | 745,000 | 724,890 |

| Voya Financial, Inc. |

| 06/15/2026 | 3.650% | | 650,000 | 621,203 |

| 06/15/2046 | 4.800% | | 329,000 | 326,720 |

| Total | 3,505,832 |

| Media and Entertainment 0.0% |

| Discovery Communications LLC |

| 09/20/2047 | 5.200% | | 132,000 | 129,155 |

| Midstream 0.9% |

| Kinder Morgan Energy Partners LP |

| 03/15/2032 | 7.750% | | 190,000 | 234,673 |

| 01/15/2038 | 6.950% | | 195,000 | 230,718 |

| 11/15/2040 | 7.500% | | 350,000 | 427,572 |

| Kinder Morgan, Inc. |

| 02/15/2046 | 5.050% | | 1,155,000 | 1,110,405 |

| Plains All American Pipeline LP/Finance Corp. |

| 10/15/2023 | 3.850% | | 660,000 | 642,386 |

| 05/15/2036 | 6.700% | | 226,000 | 242,187 |

| 06/01/2042 | 5.150% | | 405,000 | 379,817 |

| 02/15/2045 | 4.900% | | 371,000 | 340,709 |

| Southern Natural Gas Co. LLC |

| 03/01/2032 | 8.000% | | 195,000 | 250,789 |

| Total | 3,859,256 |

| Natural Gas 0.8% |

| Boston Gas Co.(a) |

| 08/01/2027 | 3.150% | | 800,000 | 758,408 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments (continued)

April 30, 2018

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| NiSource, Inc. |

| 02/15/2023 | 3.850% | | 685,000 | 688,481 |

| 02/15/2044 | 4.800% | | 50,000 | 52,276 |

| 05/15/2047 | 4.375% | | 991,000 | 980,435 |

| Sempra Energy |

| 11/15/2025 | 3.750% | | 565,000 | 556,373 |

| 06/15/2027 | 3.250% | | 92,000 | 86,326 |

| Total | 3,122,299 |

| Other Industry 0.4% |

| Massachusetts Institute of Technology |

| 07/01/2116 | 3.885% | | 300,000 | 272,642 |

| President and Fellows of Harvard College |

| 10/01/2037 | 3.619% | | 315,000 | 309,718 |

| 07/15/2046 | 3.150% | | 314,000 | 280,252 |

| 07/15/2056 | 3.300% | | 685,000 | 621,698 |

| Total | 1,484,310 |

| Pharmaceuticals 1.8% |

| AbbVie, Inc. |

| 05/14/2020 | 2.500% | | 635,000 | 627,254 |

| Allergan Funding SCS |

| 03/15/2025 | 3.800% | | 1,681,000 | 1,615,296 |

| Amgen, Inc. |

| 05/22/2019 | 2.200% | | 2,911,000 | 2,895,458 |

| 05/01/2045 | 4.400% | | 325,000 | 315,333 |

| 06/15/2048 | 4.563% | | 277,000 | 274,007 |

| Celgene Corp. |

| 02/20/2048 | 4.550% | | 350,000 | 329,744 |

| Gilead Sciences, Inc. |

| 09/20/2019 | 1.850% | | 445,000 | 439,297 |

| Johnson & Johnson |

| 12/05/2033 | 4.375% | | 427,000 | 456,476 |

| 03/03/2037 | 3.625% | | 525,000 | 512,292 |

| Total | 7,465,157 |

| Property & Casualty 0.4% |

| CNA Financial Corp. |

| 08/15/2027 | 3.450% | | 1,748,000 | 1,638,332 |

| Railroads 0.6% |

| Canadian National Railway Co. |

| 02/03/2020 | 2.400% | | 955,000 | 947,787 |

| CSX Corp. |

| 06/01/2027 | 3.250% | | 330,000 | 311,975 |

| 05/30/2042 | 4.750% | | 168,000 | 174,939 |

| 11/01/2046 | 3.800% | | 270,000 | 243,816 |

| 11/01/2066 | 4.250% | | 638,000 | 566,163 |

| Total | 2,244,680 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Restaurants 0.1% |

| McDonald’s Corp. |

| 03/01/2047 | 4.450% | | 520,000 | 522,151 |

| Supermarkets 0.4% |

| Kroger Co. (The) |

| 04/15/2042 | 5.000% | | 172,000 | 169,341 |

| 01/15/2048 | 4.650% | | 1,358,000 | 1,274,782 |

| Total | 1,444,123 |

| Technology 1.9% |

| Apple, Inc. |

| 09/12/2027 | 2.900% | | 632,000 | 594,775 |

| 09/12/2047 | 3.750% | | 385,000 | 359,452 |

| Broadcom Corp./Cayman Finance Ltd. |

| 01/15/2027 | 3.875% | | 3,770,000 | 3,599,559 |

| Cisco Systems, Inc.(b) |

3-month USD LIBOR + 0.340%

09/20/2019 | 2.542% | | 1,430,000 | 1,435,148 |

| Oracle Corp. |

| 11/15/2027 | 3.250% | | 1,355,000 | 1,303,855 |

| 11/15/2047 | 4.000% | | 545,000 | 529,162 |

| Total | 7,821,951 |

| Tobacco 0.3% |

| BAT Capital Corp.(a) |

| 08/14/2020 | 2.297% | | 1,150,000 | 1,125,245 |

| Transportation Services 0.4% |

| ERAC U.S.A. Finance LLC(a) |

| 12/01/2026 | 3.300% | | 480,000 | 454,178 |

| 03/15/2042 | 5.625% | | 443,000 | 494,277 |

| 11/01/2046 | 4.200% | | 287,000 | 264,255 |

| FedEx Corp. |

| 04/01/2046 | 4.550% | | 600,000 | 590,930 |

| Total | 1,803,640 |

| Wireless 0.7% |

| America Movil SAB de CV |

| 03/30/2020 | 5.000% | | 1,515,000 | 1,561,765 |

| Sprint Spectrum Co. I/II/III LLC(a) |

| 09/20/2021 | 3.360% | | 1,473,500 | 1,468,517 |

| Total | 3,030,282 |

| Wirelines 0.8% |

| AT&T, Inc. |

| 03/01/2037 | 5.250% | | 940,000 | 961,122 |

| 03/01/2047 | 5.450% | | 745,000 | 761,587 |

| 08/14/2058 | 5.300% | | 330,000 | 333,885 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 13 |

Portfolio of Investments (continued)

April 30, 2018

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Deutsche Telekom International Finance BV |

| 06/01/2032 | 9.250% | | 190,000 | 285,481 |

| Verizon Communications, Inc. |

| 08/10/2033 | 4.500% | | 1,000,000 | 983,311 |

| Total | 3,325,386 |

Total Corporate Bonds & Notes

(Cost $98,535,070) | 95,786,413 |

|

| Foreign Government Obligations(i) 0.7% |

| | | | |

| Mexico 0.4% |

| Mexico Government International Bond |

| 03/08/2044 | 4.750% | | 250,000 | 235,014 |

| Petroleos Mexicanos |

| 09/21/2023 | 4.625% | | 639,000 | 630,826 |

| 03/13/2027 | 6.500% | | 402,000 | 416,478 |

| 06/15/2035 | 6.625% | | 435,000 | 431,945 |

| 09/21/2047 | 6.750% | | 115,000 | 111,000 |

| Total | 1,825,263 |

| Panama 0.1% |

| Panama Government International Bond |

| 01/26/2036 | 6.700% | | 220,000 | 271,892 |

| Peru 0.1% |

| Peruvian Government International Bond |

| 03/14/2037 | 6.550% | | 385,000 | 485,147 |

| Philippines 0.1% |

| Philippine Government International Bond |

| 10/23/2034 | 6.375% | | 275,000 | 346,075 |

| Uruguay 0.0% |

| Uruguay Government International Bond |

| 11/20/2045 | 4.125% | | 165,000 | 147,541 |

Total Foreign Government Obligations

(Cost $3,144,273) | 3,075,918 |

|

| Municipal Bonds 0.3% |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Local General Obligation 0.0% |

| City of Chicago |

| Unlimited Tax General Obligation Bonds |

| Series 2015B |

| 01/01/2033 | 7.375% | | 100,000 | 107,462 |

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Water & Sewer 0.3% |

| City of Chicago Waterworks |

| Revenue Bonds |

| Build America Bonds |

| Series 2010 |

| 11/01/2040 | 6.742% | | 865,000 | 1,089,865 |

Total Municipal Bonds

(Cost $964,348) | 1,197,327 |

|

| Residential Mortgage-Backed Securities - Agency 27.4% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Federal Home Loan Mortgage Corp. |

03/01/2021-

05/01/2041 | 5.000% | | 575,234 | 613,097 |

09/01/2025-

10/01/2029 | 7.500% | | 23,218 | 25,456 |

11/01/2025-

12/01/2035 | 7.000% | | 224,133 | 249,997 |

| 06/01/2026 | 8.000% | | 285 | 312 |

| 06/01/2043 | 4.000% | | 4,237,434 | 4,354,625 |

01/01/2046-

08/01/2046 | 3.500% | | 4,000,472 | 3,994,790 |

| Federal Home Loan Mortgage Corp.(e) |

| 05/14/2048 | 4.000% | | 7,500,000 | 7,641,797 |

| Federal National Mortgage Association |

10/01/2020-

12/01/2020 | 10.000% | | 3,180 | 3,197 |

08/01/2029-

09/01/2045 | 3.000% | | 10,197,999 | 10,041,275 |

| 10/01/2029 | 7.500% | | 11,310 | 12,924 |

12/01/2029-

05/01/2030 | 8.000% | | 86,279 | 95,699 |

| 01/01/2031 | 2.500% | | 1,301,978 | 1,271,179 |

| 07/01/2038 | 6.000% | | 1,600,555 | 1,783,919 |

| 01/01/2040 | 5.500% | | 2,236,871 | 2,435,599 |

| 09/01/2040 | 5.000% | | 1,647,088 | 1,770,308 |

05/01/2043-

11/01/2046 | 3.500% | | 19,592,776 | 19,517,375 |

| 11/01/2045 | 4.000% | | 2,545,621 | 2,610,335 |

| Federal National Mortgage Association(e) |

| 05/17/2033 | 2.500% | | 4,100,000 | 3,987,810 |

05/17/2033-

05/14/2048 | 3.000% | | 7,478,000 | 7,278,275 |

05/17/2033-

05/14/2048 | 3.500% | | 9,000,000 | 9,011,180 |

| 05/14/2048 | 4.000% | | 11,500,000 | 11,712,929 |

| 05/14/2048 | 4.500% | | 3,000,000 | 3,124,922 |

| Federal National Mortgage Association(j) |

| 08/01/2040 | 4.500% | | 4,047,842 | 4,260,007 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments (continued)

April 30, 2018

| Residential Mortgage-Backed Securities - Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Government National Mortgage Association |

| 08/15/2020 | 9.500% | | 535 | 537 |

11/15/2022-

02/15/2030 | 7.000% | | 75,839 | 80,639 |

05/15/2023-

12/15/2031 | 6.500% | | 88,578 | 99,077 |

06/15/2025-

01/15/2030 | 8.000% | | 116,088 | 127,626 |

04/15/2026-

03/15/2030 | 7.500% | | 96,460 | 98,158 |

| 03/20/2028 | 6.000% | | 37,297 | 42,599 |

| 06/15/2030 | 9.000% | | 16,086 | 16,988 |

| Government National Mortgage Association(b) |

07/20/2021-

07/20/2022 | 2.750% | | 16,394 | 16,670 |

04/20/2022-

06/20/2028 | 2.625% | | 64,056 | 65,107 |

| Government National Mortgage Association(e) |

| 05/21/2048 | 3.500% | | 11,740,000 | 11,754,675 |

| 05/21/2048 | 4.500% | | 4,000,000 | 4,150,312 |

Total Residential Mortgage-Backed Securities - Agency

(Cost $114,048,163) | 112,249,395 |

|

| Residential Mortgage-Backed Securities - Non-Agency 16.5% |

| | | | |

| Ajax Mortgage Loan Trust(a) |

| Series 2017-B Class A |

| 09/25/2056 | 3.163% | | 1,907,691 | 1,878,205 |

| American Mortgage Trust(c),(d),(f) |

| CMO Series 2093-3 Class 3A |

| 07/27/2023 | 8.188% | | 2,887 | 1,750 |

| Angel Oak Mortgage Trust I LLC(a),(f) |

| CMO Series 2018-1 Class A1 |

| 04/27/2048 | 3.258% | | 3,923,401 | 3,947,155 |

| Angel Oak Mortgage Trust LLC(a),(f) |

| CMO Series 2017-3 Class A2 |

| 11/25/2047 | 2.883% | | 3,909,913 | 3,887,478 |

| Bayview Opportunity Master Fund IV Trust(a) |

| CMO Series 2018-RN2 Class A1 |

| 02/25/2033 | 3.598% | | 2,283,114 | 2,284,678 |

| Bayview Opportunity Master Fund IVa Trust(a) |

| CMO Series 2018-RN1 Class A1 |

| 01/28/2033 | 3.278% | | 3,930,073 | 3,930,068 |

| Bayview Opportunity Master Fund IVb Trust(a) |

| CMO Series 2017-SPL3 Class A |

| 11/28/2053 | 4.000% | | 3,795,194 | 3,861,244 |

| BCAP LLC Trust(a),(f) |

| CMO Series 2012-RR10 Class 9A1 |

| 10/26/2035 | 3.619% | | 293,421 | 293,964 |

| Citigroup Mortgage Loan Trust(a),(f) |

| CMO Series 2018-RP2 Class A1 |

| 02/25/2058 | 3.500% | | 995,319 | 995,048 |

| Residential Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Citigroup Mortgage Loan Trust, Inc.(a),(f) |

| CMO Series 2015-A Class A4 |

| 06/25/2058 | 4.250% | | 423,067 | 426,127 |

| COLT Mortgage Loan Trust(a),(f) |

| CMO Series 2017-1 Class A1 |

| 05/27/2047 | 2.614% | | 1,191,122 | 1,156,595 |

| CMO Series 2017-2 Class A3A |

| 10/25/2047 | 2.773% | | 1,207,633 | 1,184,167 |

| COLT Mortgage Loan Trust(a) |

| CMO Series 2018-1 Class A1 |

| 02/25/2048 | 2.930% | | 2,913,767 | 2,893,157 |

| Credit Suisse Mortgage Trust(a),(f) |

| CMO Series 2010-8R Class 1A3 |

| 03/26/2036 | 3.750% | | 308,402 | 307,983 |

| CMO Series 2010-8R Class 1A4 |

| 03/26/2036 | 3.750% | | 3,000,000 | 3,006,153 |

| Deephaven Residential Mortgage Trust(a) |

| CMO Series 2018-1A Class A3 |

| 12/25/2057 | 3.202% | | 3,725,322 | 3,725,174 |

| Grand Avenue Mortgage Loan Trust(a) |

| CMO Series 2017-RPL1 Class A1 |

| 08/25/2064 | 3.250% | | 4,092,705 | 4,020,949 |

| MFA Trust(a),(f) |

| CMO Series 2017-RPL1 Class A1 |

| 02/25/2057 | 2.588% | | 815,988 | 804,669 |

| Mill City Mortgage Loan Trust(a),(f) |

| CMO Series 2018-1 Class A1 |

| 05/25/2062 | 3.250% | | 2,000,000 | 1,992,200 |

| Mill City Mortgage Trust(a) |

| CMO Series 2016-1 Class A1 |

| 04/25/2057 | 2.500% | | 783,498 | 769,278 |

| New Residential Mortgage Loan Trust(a) |

| CMO Series 2014-1A Class A |

| 01/25/2054 | 3.750% | | 1,037,285 | 1,040,543 |

| CMO Series 2016-3A Class A1 |

| 09/25/2056 | 3.750% | | 631,824 | 634,538 |

| Series 2014-2A Class A3 |

| 05/25/2054 | 3.750% | | 500,606 | 502,188 |

| NRZ Excess Spread-Collateralized Notes(a) |

| CMO Series 2018-PLS2 Class A |

| 02/25/2023 | 3.265% | | 2,171,331 | 2,160,694 |

| Series 2018-PLS1 Class A |

| 01/25/2023 | 3.193% | | 2,864,109 | 2,846,312 |

| Preston Ridge Partners Mortgage LLC(a) |

| CMO Series 2018-1A Class A1 |

| 04/25/2023 | 3.750% | | 2,000,000 | 1,990,922 |

| Towd Point Mortgage Trust(a) |

| CMO Series 2016-2 Class A1 |

| 08/25/2055 | 3.000% | | 1,201,266 | 1,189,208 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 15 |

Portfolio of Investments (continued)

April 30, 2018

| Residential Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Vendee Mortgage Trust(f),(k) |

| CMO Series 1998-1 Class 2IO |

| 03/15/2028 | 0.253% | | 1,574,880 | 10,042 |

| CMO Series 1998-3 Class IO |

| 03/15/2029 | 0.103% | | 2,059,224 | 2,164 |

| Verus Securitization Trust(a),(f) |

| CMO Series 2017-2A Class A1 |

| 07/25/2047 | 2.485% | | 523,459 | 517,811 |

| Verus Securitization Trust(a) |

| CMO Series 2017-SG1A Class A1 |

| 11/25/2047 | 2.690% | | 2,867,040 | 2,836,810 |

| CMO Series 2018-1 Class A1 |

| 02/25/2048 | 2.929% | | 4,051,184 | 4,045,098 |

| CMO Series 2018-1 Class A2 |

| 02/25/2048 | 3.031% | | 3,768,543 | 3,768,180 |

| Verus Securitization Trust(a),(d),(f) |

| CMO Series 2018-INV1 Class A1 |

| 03/25/2058 | 3.626% | | 2,800,000 | 2,800,000 |

| WaMu Mortgage Pass-Through Certificates Trust(f) |

| CMO Series 2003-AR8 Class A |

| 08/25/2033 | 3.221% | | 1,634,625 | 1,657,842 |

Total Residential Mortgage-Backed Securities - Non-Agency

(Cost $67,735,549) | 67,368,394 |

|

| U.S. Government & Agency Obligations 3.8% |

| | | | |

| Residual Funding Corp.(l) |

| STRIPS |

| 01/15/2030 | 0.000% | | 3,342,000 | 2,244,397 |

| 04/15/2030 | 0.000% | | 19,725,000 | 13,143,162 |

Total U.S. Government & Agency Obligations

(Cost $16,584,232) | 15,387,559 |

|

| U.S. Treasury Obligations 1.3% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| U.S. Treasury(l) |

| STRIPS |

| 02/15/2040 | 0.000% | | 9,861,000 | 5,129,261 |

Total U.S. Treasury Obligations

(Cost $3,539,628) | 5,129,261 |

| Money Market Funds 2.6% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 1.889%(m),(n) | 10,597,693 | 10,596,633 |

Total Money Market Funds

(Cost $10,596,633) | 10,596,633 |

Total Investments in Securities

(Cost: $477,506,829) | 471,211,182 |

| Other Assets & Liabilities, Net | | (62,079,058) |

| Net Assets | 409,132,124 |

At April 30, 2018, securities and/or cash totaling $399,245 were pledged as collateral.

Investments in derivatives

| Long futures contracts |

| Description | Number of

contracts | Expiration

date | Trading

currency | Notional

amount | Value/Unrealized

appreciation ($) | Value/Unrealized

depreciation ($) |

| U.S. Treasury 5-Year Note | 342 | 06/2018 | USD | 38,912,018 | — | (203,151) |

| U.S. Ultra Bond | 81 | 06/2018 | USD | 12,900,235 | 150,030 | — |

| Total | | | | | 150,030 | (203,151) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Bond Fund | Annual Report 2018 |

Portfolio of Investments (continued)

April 30, 2018

| Short futures contracts |

| Description | Number of

contracts | Expiration

date | Trading

currency | Notional

amount | Value/Unrealized

appreciation ($) | Value/Unrealized

depreciation ($) |

| U.S. Long Bond | (42) | 06/2018 | USD | (6,089,690) | — | (33,233) |

| U.S. Treasury 10-Year Note | (126) | 06/2018 | USD | (15,155,120) | 121,855 | — |

| U.S. Treasury 10-Year Note | (33) | 06/2018 | USD | (3,969,198) | — | (2,641) |

| U.S. Treasury 2-Year Note | (22) | 06/2018 | USD | (4,677,122) | 9,935 | — |

| Total | | | | | 131,790 | (35,874) |

Notes to Portfolio of Investments

| (a) | Represents privately placed and other securities and instruments exempt from SEC registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Private placements may be determined to be liquid under guidelines established by the Fund’s Board of Trustees. At April 30, 2018, the value of these securities amounted to $180,186,698, which represents 44.04% of net assets. |

| (b) | Variable rate security. The interest rate shown was the current rate as of April 30, 2018. |

| (c) | Represents fair value as determined in good faith under procedures approved by the Board of Trustees. At April 30, 2018, the value of these securities amounted to $1,800,850, which represents 0.44% of net assets. |

| (d) | Valuation based on significant unobservable inputs. |

| (e) | Represents a security purchased on a when-issued basis. |

| (f) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. The interest rate shown was the current rate as of April 30, 2018. |

| (g) | Non-income producing investment. |

| (h) | Represents a variable rate security with a step coupon where the rate adjusts according to a schedule for a series of periods, typically lower for an initial period and then increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as of April 30, 2018. |

| (i) | Principal and interest may not be guaranteed by the government. |

| (j) | This security or a portion of this security has been pledged as collateral in connection with derivative contracts. |

| (k) | Represents interest only securities which have the right to receive the monthly interest payments on an underlying pool of mortgage loans. |

| (l) | Zero coupon bond. |

| (m) | The rate shown is the seven-day current annualized yield at April 30, 2018. |

| (n) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended April 30, 2018 are as follows: |

| Issuer | Beginning

shares | Shares

purchased | Shares

sold | Ending

shares | Realized gain

(loss) —

affiliated

issuers ($) | Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($) | Dividends —

affiliated

issuers ($) | Value —

affiliated

issuers

at end of

period ($) |

| Columbia Short-Term Cash Fund, 1.889% |

| | 2,633,674 | 227,607,433 | (219,643,414) | 10,597,693 | 1,410 | (263) | 108,127 | 10,596,633 |

Abbreviation Legend

| CMO | Collateralized Mortgage Obligation |

| STRIPS | Separate Trading of Registered Interest and Principal Securities |

Currency Legend

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2018

| 17 |

Portfolio of Investments (continued)

April 30, 2018

Fair value measurements (continued)

pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value (NAV) per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Columbia Short-Term Cash Fund prices its shares with a floating NAV and no longer seeks to maintain a stable NAV.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.