UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

225 Franklin Street

Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 345-6611

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

August 31, 2018

Columbia Contrarian Core Fund

Not FDIC Insured • No bank guarantee • May lose value

Dear Shareholders,

Volatility exists in financial markets and this is not a comfortable fact of life. How investors deal with this reality, including how they react to short term spikes in volatility as well as to longer periods of increased or decreased volatility, may have a significant impact on their overall investing success.

Too often, investors change their investment strategy based on something that’s happening at a moment in time rather than thinking about how that change in strategy might affect their ability to achieve their longer-term financial goals. Emotion replaces logic and reasoning. Investors may sell in reaction to a market drop (fear or panic), locking in low returns which means they won’t be invested when the market returns, or they invest more at a market peak (greed or conviction), essentially when it is expensive to do so. In both cases, selling and buying at the exact wrong time.

We believe the best outcomes come from a consistent approach to investing. Here are five areas where advisors can help us overcome the tendency to react emotionally as we struggle to make the right choices with our investments:

Long-term focus

The further away long-term goals, aspirations and objectives are, the easier it is to stray away from the goals and priorities that we set out. Advisors help us stay focused on what we want to accomplish.

Discipline through up-and-down markets

Advisors help set rules to prevent us from making rash decisions that we may regret later. Knowing ahead of time what you should do in case of certain situations will help you get through volatile markets and not make emotional decisions.

Tax-awareness

Taxes are one of the biggest drags on investment returns and are critical attributes of investing. Yet few of us take the necessary steps to ease the corrosive effect of taxes. Advisors have tools and knowledge that may help us to manage portfolios more tax-efficiently and keep more of what we earn.

Emotional objectivity

Our emotions are very hard to manage and making investment decisions in an emotional state can lead to exceedingly bad outcomes. An objective advisor can help prevent some of the reactionary mistakes emotions often lead us to.

Education and guidance

The role of the advisor is to teach and guide us toward achieving our financial goals. In terms of working through emotions, guidance is by far the most important component.

By understanding our own behaviors and biases, we can prepare for future challenges. Your success is our priority. Talk to your advisor about how working with Columbia Threadneedle Investments may help you stay the course and position your portfolio for consistent, sustainable outcomes, regardless of market conditions.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2018 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia Contrarian Core Fund | Annual Report 2018

Columbia Contrarian Core Fund | Annual Report 2018

Investment objective

Columbia Contrarian Core Fund (the Fund) seeks total return, consisting of long-term capital appreciation and current income.

Portfolio management

Guy Pope, CFA

Portfolio Manager

Managed Fund since 2005

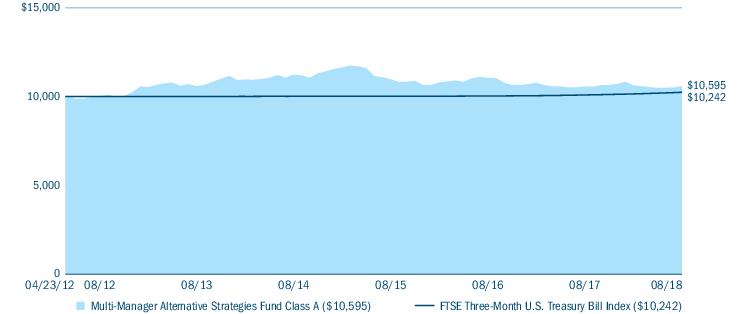

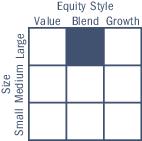

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2018 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended August 31, 2018) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 11/01/98 | 13.09 | 12.90 | 10.95 |

| | Including sales charges | | 6.59 | 11.57 | 10.29 |

| Advisor Class* | 11/08/12 | 13.39 | 13.18 | 11.23 |

| Class C | Excluding sales charges | 12/09/02 | 12.23 | 12.05 | 10.12 |

| | Including sales charges | | 11.23 | 12.05 | 10.12 |

| Institutional Class | 12/14/92 | 13.37 | 13.18 | 11.22 |

| Institutional 2 Class* | 11/08/12 | 13.50 | 13.31 | 11.30 |

| Institutional 3 Class* | 11/08/12 | 13.50 | 13.37 | 11.34 |

| Class R* | 09/27/10 | 12.78 | 12.62 | 10.68 |

| Class T* | Excluding sales charges | 09/27/10 | 13.09 | 12.89 | 10.95 |

| | Including sales charges | | 10.27 | 12.32 | 10.66 |

| Class V | Excluding sales charges | 02/12/93 | 13.09 | 12.88 | 10.91 |

| | Including sales charges | | 6.57 | 11.55 | 10.25 |

| Russell 1000 Index | | 19.82 | 14.36 | 10.93 |

Returns for Class A and Class V shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. Returns for Class T shares are shown with and without the maximum initial sales charge of 2.50% per transaction. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Effective November 1, 2017, Class R4, Class R5, Class Y and Class Z shares were renamed Advisor Class, Institutional 2 Class, Institutional 3 Class and Institutional Class shares, respectively. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information. |

The Russell 1000 Index tracks the performance of 1,000 of the largest U.S. companies, based on market capitalization.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

| 2 | Columbia Contrarian Core Fund | Annual Report 2018 |

Fund at a Glance (continued)

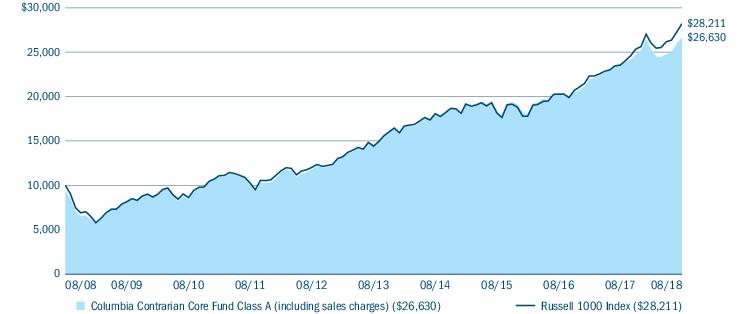

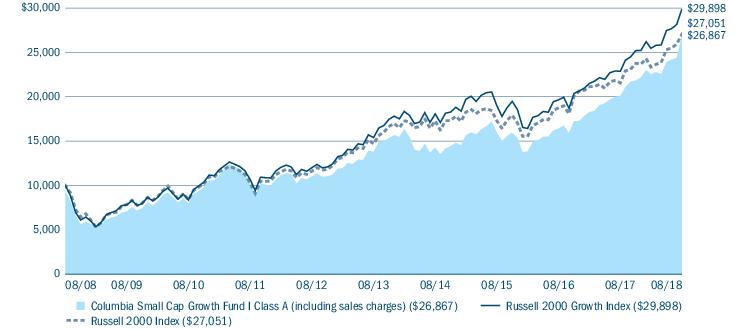

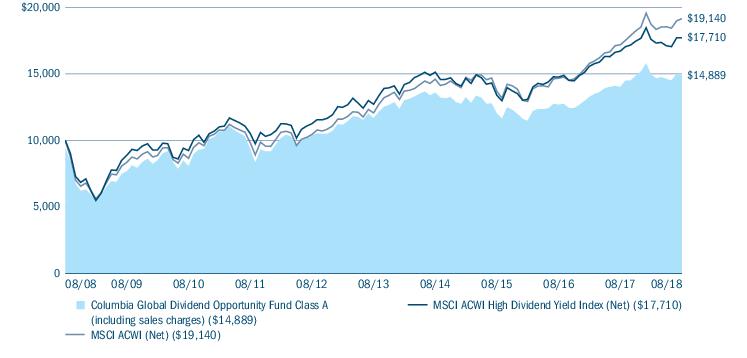

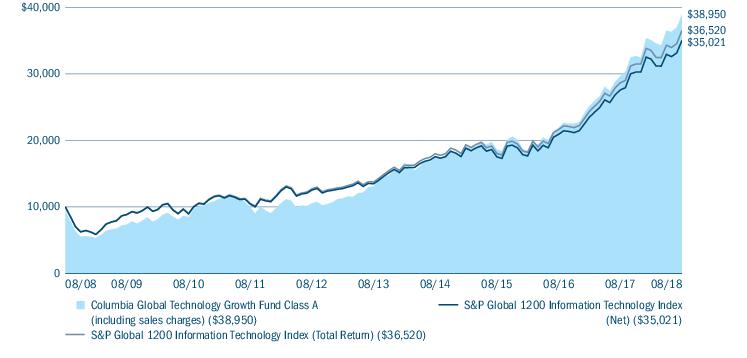

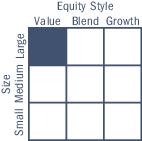

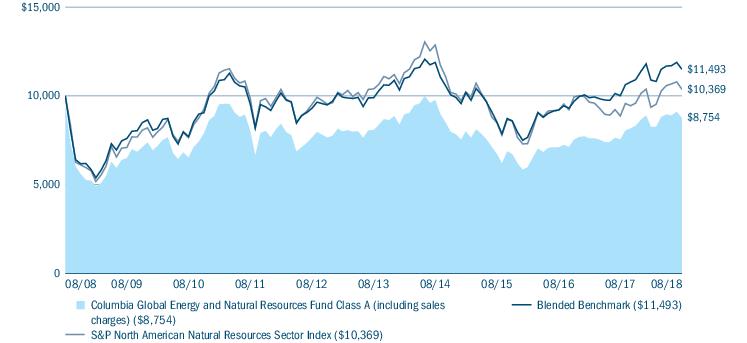

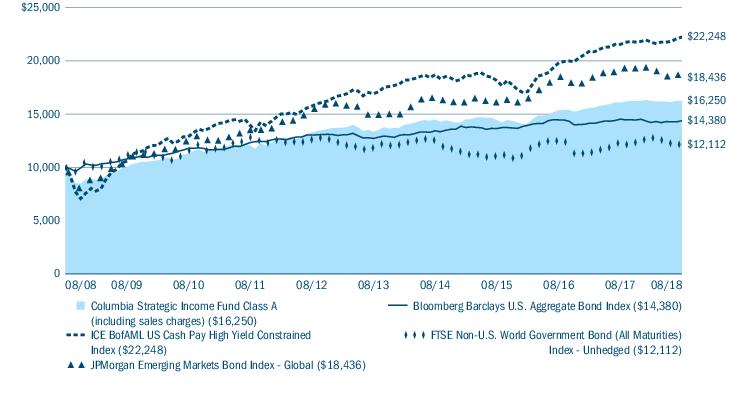

Performance of a hypothetical $10,000 investment (August 31, 2008 — August 31, 2018)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Contrarian Core Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Top 10 holdings (%) (at August 31, 2018) |

| Apple, Inc. | 5.5 |

| Microsoft Corp. | 4.6 |

| Amazon.com, Inc. | 3.6 |

| JPMorgan Chase & Co. | 3.3 |

| Facebook, Inc., Class A | 3.2 |

| Medtronic PLC | 2.9 |

| Alphabet, Inc., Class C | 2.8 |

| Berkshire Hathaway, Inc., Class B | 2.7 |

| Johnson & Johnson | 2.6 |

| MasterCard, Inc., Class A | 2.6 |

Percentages indicated are based upon total investments (excluding Money Market Funds and derivatives, if any).

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.”

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at August 31, 2018) |

| Common Stocks | 99.6 |

| Money Market Funds | 0.4 |

| Total | 100.0 |

Percentages indicated are based upon total investments and exclude investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at August 31, 2018) |

| Consumer Discretionary | 11.2 |

| Consumer Staples | 6.3 |

| Energy | 5.8 |

| Financials | 15.7 |

| Health Care | 16.9 |

| Industrials | 7.8 |

| Information Technology | 27.9 |

| Materials | 3.2 |

| Real Estate | 2.4 |

| Telecommunication Services | 2.1 |

| Utilities | 0.7 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

Columbia Contrarian Core Fund | Annual Report 2018

| 3 |

Manager Discussion of Fund Performance

For the 12-month period that ended August 31, 2018, the Fund’s Class A shares returned 13.09% excluding sales charges. The Fund’s benchmark, the Russell 1000 Index, returned 19.82% for the same period. Stock selection in an environment unfavorable to the Fund’s contrarian style generally accounted for the shortfall relative to the benchmark.

Equity markets moved higher

U.S. equities delivered solid gains for the 12-month period that ended August 31, 2018, hitting record highs along the way. Buoyant corporate earnings, especially in the information technology sector, along with a strengthening domestic economy and a solid global economy, boosted investor sentiment. Consumer confidence was high, jobs data remained strong and personal income increased as the period wore on. Tax cuts approved by Congress late in 2017 had a favorable impact on corporate earnings and helped fuel investor optimism. Concerns that interest rates and inflation might rise faster than expected briefly put a damper on equity markets early in 2018, the first such correction in two years. Equities quickly recovered their lost ground — and then some. For the 12 months ended August 31, 2018, the S&P 500 Index, which measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance, gained 19.66%. Growth stocks outperformed value stocks, and small-cap stocks outperformed large- and mid-cap stocks.

The Federal Reserve (the Fed) raised the federal funds target rate three times during the period, to 1.75% - 2.00%, citing strong job growth and inflation in line with its 2.0% target. The yield on the 10-year U.S. Treasury ended the period at 2.86%.

Contributors and detractors

In a generally favorable period for equities, the Fund generated solid gains. Sector allocation decisions were positive for performance, while stock selection generally accounted for the Fund’s shortfall relative to its benchmark. Market dynamics shifted, and stylistically, it became more challenging to find gems that were consistent with our contrarian philosophy.

An underweight in utilities and good stock selection in the materials sector aided Fund performance. In utilities, we did well because the Fund was underweight and the sector underperformed. In the materials sector, a position in Sherwin Williams aided results, as domestic fundamentals for the paint giant were strong. Elsewhere in the portfolio, disappointments were mostly stock specific. Citigroup, in the financials sector, detracted from performance as investors worried about a global slowdown in economic growth. Citigroup is more international than its peers. Gains from JPMorgan were not enough to offset the loss from Citigroup. In the energy sector, Haliburton was a poor performer, suffering from a slowdown in the pressure pumping business, which faced a deteriorating demand outlook. A significant gain from a position in EOG was not enough to offset this disappointment. An outsized position in Phillip Morris in the consumer staples sector was a drag on performance as the company suffered from a slowdown in its smokeless business. Demand slowed in Japan and a strong dollar hurt expected revenues as well. Despite strong gains from technology positions in Mastercard, Palo Alto, Cisco, Apple and Microsoft, the Fund underperformed the broad sector with significant disappointments from Facebook and Broadcom. A combination of concerns over privacy, which led to increased spending, and slower revenue growth led investors to mark down future earnings expectations for Facebook. Slower growth for semiconductors combined with unmet investor expectations led Broadcom lower. The company’s unsuccessful bid for Qualcomm was not well received, nor was the subsequent acquisition of CA Technologies.

Even though retailers helped boost gains in the consumer discretionary sector, exposure to Comcast was a drag on performance. Investors rejected the company’s efforts to acquire Sky Media and Fox Network. Fears about cable cord cutting also weighed on Comcast’s share price. Good performance from several key health care stocks, namely Abbott Laboratories and Anthem, was more than offset by negative performance from biotechnology holdings Allergan and Celgene. Patent protection figured into the downfall of both stocks. We sold the Fund’s position in Celgene during the period.

At period’s end

Although the Fund underperformed its benchmark, we remain believers in our contrarian philosophy. We plan to stay with our core principles in constructing the portfolio and managing it from day to day, as we believe this discipline has served our shareholders well over the long term.

| 4 | Columbia Contrarian Core Fund | Annual Report 2018 |

Manager Discussion of Fund Performance (continued)

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Growth securities, at times, may not perform as well as value securities or the stock market in general and may be out of favor with investors. Value securities may be unprofitable if the market fails to recognize their intrinsic worth or the portfolio manager misgauged that worth. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Contrarian Core Fund | Annual Report 2018

| 5 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| March 1, 2018 — August 31, 2018 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,051.80 | 1,020.06 | 5.28 | 5.19 | 1.02 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,053.60 | 1,021.32 | 3.99 | 3.92 | 0.77 |

| Class C | 1,000.00 | 1,000.00 | 1,048.20 | 1,016.28 | 9.14 | 9.00 | 1.77 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,053.40 | 1,021.32 | 3.99 | 3.92 | 0.77 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,054.10 | 1,021.78 | 3.52 | 3.47 | 0.68 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,054.00 | 1,022.03 | 3.26 | 3.21 | 0.63 |

| Class R | 1,000.00 | 1,000.00 | 1,050.60 | 1,018.80 | 6.56 | 6.46 | 1.27 |

| Class T | 1,000.00 | 1,000.00 | 1,052.20 | 1,020.06 | 5.28 | 5.19 | 1.02 |

| Class V | 1,000.00 | 1,000.00 | 1,052.00 | 1,020.06 | 5.28 | 5.19 | 1.02 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

| 6 | Columbia Contrarian Core Fund | Annual Report 2018 |

Portfolio of Investments

August 31, 2018

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 99.0% |

| Issuer | Shares | Value ($) |

| Consumer Discretionary 11.2% |

| Hotels, Restaurants & Leisure 1.7% |

| McDonald’s Corp. | 715,303 | 116,043,606 |

| Royal Caribbean Cruises Ltd. | 689,725 | 84,546,490 |

| Total | | 200,590,096 |

| Internet & Direct Marketing Retail 4.1% |

| Amazon.com, Inc.(a) | 205,975 | 414,567,942 |

| Expedia Group, Inc. | 414,350 | 54,072,675 |

| Total | | 468,640,617 |

| Media 1.7% |

| Comcast Corp., Class A | 5,333,531 | 197,287,311 |

| Multiline Retail 0.5% |

| Dollar General Corp. | 475,538 | 51,229,709 |

| Specialty Retail 1.1% |

| AutoZone, Inc.(a) | 72,421 | 55,538,217 |

| Lowe’s Companies, Inc. | 583,939 | 63,503,366 |

| Ulta Beauty, Inc.(a) | 48,558 | 12,625,080 |

| Total | | 131,666,663 |

| Textiles, Apparel & Luxury Goods 2.1% |

| PVH Corp. | 968,908 | 138,708,869 |

| Tapestry, Inc. | 1,955,295 | 99,113,904 |

| Total | | 237,822,773 |

| Total Consumer Discretionary | 1,287,237,169 |

| Consumer Staples 6.2% |

| Beverages 0.3% |

| PepsiCo, Inc. | 257,822 | 28,878,642 |

| Food & Staples Retailing 0.7% |

| SYSCO Corp. | 1,157,416 | 86,597,865 |

| Food Products 3.1% |

| ConAgra Foods, Inc. | 2,149,080 | 78,978,690 |

| General Mills, Inc. | 1,866,620 | 85,883,186 |

| Mondelez International, Inc., Class A | 4,629,410 | 197,768,396 |

| Total | | 362,630,272 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Tobacco 2.1% |

| Philip Morris International, Inc. | 3,110,370 | 242,266,719 |

| Total Consumer Staples | 720,373,498 |

| Energy 5.7% |

| Energy Equipment & Services 1.0% |

| Halliburton Co. | 2,905,339 | 115,893,973 |

| Oil, Gas & Consumable Fuels 4.7% |

| Canadian Natural Resources Ltd. | 4,911,719 | 167,833,438 |

| Chevron Corp. | 1,980,323 | 234,589,063 |

| EOG Resources, Inc. | 1,205,828 | 142,565,044 |

| Total | | 544,987,545 |

| Total Energy | 660,881,518 |

| Financials 15.5% |

| Banks 8.3% |

| Citigroup, Inc. | 3,096,216 | 220,574,428 |

| JPMorgan Chase & Co. | 3,312,558 | 379,552,896 |

| U.S. Bancorp | 2,442,945 | 132,187,754 |

| Wells Fargo & Co. | 3,888,020 | 227,371,409 |

| Total | | 959,686,487 |

| Capital Markets 2.6% |

| Bank of New York Mellon Corp. (The) | 1,565,796 | 81,656,262 |

| BlackRock, Inc. | 189,297 | 90,684,621 |

| Morgan Stanley | 1,393,980 | 68,068,043 |

| S&P Global, Inc. | 276,145 | 57,175,822 |

| Total | | 297,584,748 |

| Diversified Financial Services 2.6% |

| Berkshire Hathaway, Inc., Class B(a) | 1,477,888 | 308,464,783 |

| Insurance 2.0% |

| American International Group, Inc. | 2,079,720 | 110,578,712 |

| Aon PLC | 815,326 | 118,678,853 |

| Total | | 229,257,565 |

| Total Financials | 1,794,993,583 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 7 |

Portfolio of Investments (continued)

August 31, 2018

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Health Care 16.7% |

| Biotechnology 3.4% |

| Alexion Pharmaceuticals, Inc.(a) | 727,220 | 88,895,373 |

| Biogen, Inc.(a) | 626,710 | 221,535,718 |

| Vertex Pharmaceuticals, Inc.(a) | 437,931 | 80,754,476 |

| Total | | 391,185,567 |

| Health Care Equipment & Supplies 3.7% |

| Abbott Laboratories | 1,397,249 | 93,392,123 |

| Medtronic PLC | 3,451,307 | 332,740,508 |

| Total | | 426,132,631 |

| Health Care Providers & Services 2.7% |

| Anthem, Inc. | 709,830 | 187,913,296 |

| CIGNA Corp. | 519,150 | 97,776,711 |

| CVS Health Corp. | 465,675 | 35,037,387 |

| Total | | 320,727,394 |

| Life Sciences Tools & Services 0.4% |

| Agilent Technologies, Inc. | 683,475 | 46,161,902 |

| Pharmaceuticals 6.5% |

| Allergan PLC | 835,385 | 160,151,659 |

| Johnson & Johnson | 2,223,726 | 299,513,655 |

| Pfizer, Inc. | 6,966,814 | 289,262,117 |

| Total | | 748,927,431 |

| Total Health Care | 1,933,134,925 |

| Industrials 7.7% |

| Aerospace & Defense 1.5% |

| General Dynamics Corp. | 441,285 | 85,344,519 |

| Lockheed Martin Corp. | 285,680 | 91,534,729 |

| Total | | 176,879,248 |

| Air Freight & Logistics 1.9% |

| FedEx Corp. | 881,897 | 215,138,773 |

| Airlines 0.6% |

| Southwest Airlines Co. | 1,058,056 | 64,858,833 |

| Electrical Equipment 0.6% |

| Emerson Electric Co. | 943,925 | 72,427,365 |

| Industrial Conglomerates 2.4% |

| Honeywell International, Inc. | 1,722,054 | 273,909,909 |

| Machinery 0.7% |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Caterpillar, Inc. | 612,960 | 85,109,496 |

| Total Industrials | 888,323,624 |

| Information Technology 27.6% |

| Communications Equipment 1.6% |

| Cisco Systems, Inc. | 2,857,110 | 136,484,145 |

| Palo Alto Networks, Inc.(a) | 226,815 | 52,428,287 |

| Total | | 188,912,432 |

| Internet Software & Services 8.4% |

| Alphabet, Inc., Class A(a) | 151,808 | 186,997,094 |

| Alphabet, Inc., Class C(a) | 265,162 | 323,017,697 |

| eBay, Inc.(a) | 2,971,165 | 102,832,021 |

| Facebook, Inc., Class A(a) | 2,072,505 | 364,201,303 |

| Total | | 977,048,115 |

| IT Services 4.4% |

| Fidelity National Information Services, Inc. | 1,393,665 | 150,752,743 |

| First Data Corp., Class A(a) | 1,562,820 | 40,195,730 |

| MasterCard, Inc., Class A | 1,361,649 | 293,517,059 |

| Total System Services, Inc. | 197,185 | 19,154,551 |

| Total | | 503,620,083 |

| Semiconductors & Semiconductor Equipment 2.5% |

| Applied Materials, Inc. | 2,457,327 | 105,714,207 |

| Broadcom, Inc. | 629,490 | 137,877,195 |

| Microchip Technology, Inc. | 534,665 | 45,997,230 |

| Total | | 289,588,632 |

| Software 5.3% |

| Activision Blizzard, Inc. | 1,199,035 | 86,450,424 |

| Microsoft Corp. | 4,661,097 | 523,581,026 |

| Total | | 610,031,450 |

| Technology Hardware, Storage & Peripherals 5.4% |

| Apple, Inc. | 2,741,366 | 624,017,143 |

| Total Information Technology | 3,193,217,855 |

| Materials 3.1% |

| Chemicals 2.7% |

| DowDuPont, Inc. | 2,740,175 | 192,168,473 |

| Sherwin-Williams Co. (The) | 263,064 | 119,846,697 |

| Total | | 312,015,170 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Contrarian Core Fund | Annual Report 2018 |

Portfolio of Investments (continued)

August 31, 2018

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Containers & Packaging 0.3% |

| Sealed Air Corp. | 868,840 | 34,849,172 |

| Metals & Mining 0.1% |

| Nucor Corp. | 224,759 | 14,047,438 |

| Total Materials | 360,911,780 |

| Real Estate 2.4% |

| Equity Real Estate Investment Trusts (REITS) 2.4% |

| American Tower Corp. | 1,393,432 | 207,788,580 |

| Equinix, Inc. | 162,385 | 70,820,970 |

| Total | | 278,609,550 |

| Total Real Estate | 278,609,550 |

| Telecommunication Services 2.1% |

| Diversified Telecommunication Services 1.9% |

| AT&T, Inc. | 715,375 | 22,849,078 |

| Verizon Communications, Inc. | 3,618,933 | 196,761,387 |

| Total | | 219,610,465 |

| Wireless Telecommunication Services 0.2% |

| T-Mobile U.S.A., Inc.(a) | 380,885 | 25,153,645 |

| Total Telecommunication Services | 244,764,110 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Utilities 0.8% |

| Electric Utilities 0.8% |

| American Electric Power Co., Inc. | 1,196,900 | 85,853,637 |

| Total Utilities | 85,853,637 |

Total Common Stocks

(Cost $7,915,216,162) | 11,448,301,249 |

|

| Money Market Funds 0.4% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 2.058%(b),(c) | 40,983,443 | 40,979,344 |

Total Money Market Funds

(Cost $40,979,344) | 40,979,344 |

Total Investments in Securities

(Cost: $7,956,195,506) | 11,489,280,593 |

| Other Assets & Liabilities, Net | | 71,126,837 |

| Net Assets | 11,560,407,430 |

Notes to Portfolio of Investments

| (a) | Non-income producing investment. |

| (b) | The rate shown is the seven-day current annualized yield at August 31, 2018. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended August 31, 2018 are as follows: |

| Issuer | Beginning

shares | Shares

purchased | Shares

sold | Ending

shares | Realized gain

(loss) —

affiliated

issuers ($) | Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($) | Dividends —

affiliated

issuers ($) | Value —

affiliated

issuers

at end of

period ($) |

| Columbia Short-Term Cash Fund, 2.058% |

| | 424,293,769 | 2,529,035,547 | (2,912,345,873) | 40,983,443 | 10,928 | (19,400) | 3,917,758 | 40,979,344 |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 9 |

Portfolio of Investments (continued)

August 31, 2018

Fair value measurements (continued)

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value (NAV) per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Columbia Short-Term Cash Fund prices its shares with a floating NAV and no longer seeks to maintain a stable NAV.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund’s investments at August 31, 2018:

| | Level 1

quoted prices

in active

markets for

identical

assets ($) | Level 2

other

significant

observable

inputs ($) | Level 3

significant

unobservable

inputs ($) | Investments

measured at

net asset

value ($) | Total ($) |

| Investments in Securities | | | | | |

| Common Stocks | | | | | |

| Consumer Discretionary | 1,287,237,169 | — | — | — | 1,287,237,169 |

| Consumer Staples | 720,373,498 | — | — | — | 720,373,498 |

| Energy | 660,881,518 | — | — | — | 660,881,518 |

| Financials | 1,794,993,583 | — | — | — | 1,794,993,583 |

| Health Care | 1,933,134,925 | — | — | — | 1,933,134,925 |

| Industrials | 888,323,624 | — | — | — | 888,323,624 |

| Information Technology | 3,193,217,855 | — | — | — | 3,193,217,855 |

| Materials | 360,911,780 | — | — | — | 360,911,780 |

| Real Estate | 278,609,550 | — | — | — | 278,609,550 |

| Telecommunication Services | 244,764,110 | — | — | — | 244,764,110 |

| Utilities | 85,853,637 | — | — | — | 85,853,637 |

| Total Common Stocks | 11,448,301,249 | — | — | — | 11,448,301,249 |

| Money Market Funds | — | — | — | 40,979,344 | 40,979,344 |

| Total Investments in Securities | 11,448,301,249 | — | — | 40,979,344 | 11,489,280,593 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Contrarian Core Fund | Annual Report 2018 |

Statement of Assets and Liabilities

August 31, 2018

| Assets | |

| Investments in securities, at value | |

| Unaffiliated issuers (cost $7,915,216,162) | $11,448,301,249 |

| Affiliated issuers (cost $40,979,344) | 40,979,344 |

| Receivable for: | |

| Investments sold | 81,465,607 |

| Capital shares sold | 5,282,223 |

| Dividends | 17,096,800 |

| Foreign tax reclaims | 121,672 |

| Prepaid expenses | 73,030 |

| Trustees’ deferred compensation plan | 491,958 |

| Total assets | 11,593,811,883 |

| Liabilities | |

| Due to custodian | 60 |

| Payable for: | |

| Investments purchased | 17,441,172 |

| Capital shares purchased | 13,396,808 |

| Management services fees | 193,053 |

| Distribution and/or service fees | 35,711 |

| Transfer agent fees | 1,542,738 |

| Compensation of chief compliance officer | 739 |

| Other expenses | 302,214 |

| Trustees’ deferred compensation plan | 491,958 |

| Total liabilities | 33,404,453 |

| Net assets applicable to outstanding capital stock | $11,560,407,430 |

| Represented by | |

| Paid in capital | 7,387,321,008 |

| Undistributed net investment income | 66,473,849 |

| Accumulated net realized gain | 573,527,486 |

| Unrealized appreciation (depreciation) on: | |

| Investments - unaffiliated issuers | 3,533,085,087 |

| Total - representing net assets applicable to outstanding capital stock | $11,560,407,430 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 11 |

Statement of Assets and Liabilities (continued)

August 31, 2018

| Class A | |

| Net assets | $1,912,202,854 |

| Shares outstanding | 70,315,998 |

| Net asset value per share | $27.19 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $28.85 |

| Advisor Class | |

| Net assets | $743,515,496 |

| Shares outstanding | 26,662,428 |

| Net asset value per share | $27.89 |

| Class C | |

| Net assets | $708,041,457 |

| Shares outstanding | 28,815,770 |

| Net asset value per share | $24.57 |

| Institutional Class | |

| Net assets | $4,889,699,313 |

| Shares outstanding | 178,306,089 |

| Net asset value per share | $27.42 |

| Institutional 2 Class | |

| Net assets | $894,848,563 |

| Shares outstanding | 32,101,024 |

| Net asset value per share | $27.88 |

| Institutional 3 Class | |

| Net assets | $2,101,809,354 |

| Shares outstanding | 75,351,885 |

| Net asset value per share | $27.89 |

| Class R | |

| Net assets | $145,911,520 |

| Shares outstanding | 5,367,678 |

| Net asset value per share | $27.18 |

| Class T | |

| Net assets | $1,044,101 |

| Shares outstanding | 38,398 |

| Net asset value per share | $27.19 |

| Maximum sales charge | 2.50% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge per transaction for Class T shares) | $27.89 |

| Class V | |

| Net assets | $163,334,772 |

| Shares outstanding | 6,064,756 |

| Net asset value per share | $26.93 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class V shares) | $28.57 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Contrarian Core Fund | Annual Report 2018 |

Statement of Operations

Year Ended August 31, 2018

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $194,140,860 |

| Dividends — affiliated issuers | 3,917,758 |

| Foreign taxes withheld | (670,221) |

| Total income | 197,388,397 |

| Expenses: | |

| Management services fees | 69,747,238 |

| Distribution and/or service fees | |

| Class A | 4,820,995 |

| Class C | 7,502,601 |

| Class R | 701,365 |

| Class T | 2,888 |

| Class V | 397,804 |

| Transfer agent fees | |

| Class A | 2,840,993 |

| Advisor Class | 1,015,812 |

| Class C | 1,105,073 |

| Institutional Class | 7,294,117 |

| Institutional 2 Class | 499,909 |

| Institutional 3 Class | 153,327 |

| Class K | 1,929 |

| Class R | 206,661 |

| Class T | 1,700 |

| Class V | 234,413 |

| Plan administration fees | |

| Class K | 8,271 |

| Compensation of board members | 187,987 |

| Custodian fees | 71,834 |

| Printing and postage fees | 590,837 |

| Registration fees | 274,554 |

| Audit fees | 34,301 |

| Legal fees | 268,515 |

| Compensation of chief compliance officer | 4,489 |

| Other | 263,831 |

| Total expenses | 98,231,444 |

| Expense reduction | (11,763) |

| Total net expenses | 98,219,681 |

| Net investment income | 99,168,716 |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 736,125,600 |

| Investments — affiliated issuers | 10,928 |

| Foreign currency translations | 3,384 |

| Net realized gain | 736,139,912 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | 591,473,814 |

| Investments — affiliated issuers | (19,400) |

| Net change in unrealized appreciation (depreciation) | 591,454,414 |

| Net realized and unrealized gain | 1,327,594,326 |

| Net increase in net assets resulting from operations | $1,426,763,042 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 13 |

Statement of Changes in Net Assets

| | Year Ended

August 31, 2018 | Year Ended

August 31, 2017 |

| Operations | | |

| Net investment income | $99,168,716 | $96,662,160 |

| Net realized gain | 736,139,912 | 476,645,774 |

| Net change in unrealized appreciation (depreciation) | 591,454,414 | 930,041,147 |

| Net increase in net assets resulting from operations | 1,426,763,042 | 1,503,349,081 |

| Distributions to shareholders | | |

| Net investment income | | |

| Class A | (13,688,620) | (19,193,883) |

| Advisor Class | (6,065,193) | (3,562,542) |

| Class C | — | (1) |

| Class I | — | (3,453,777) |

| Institutional Class | (45,538,309) | (38,846,630) |

| Institutional 2 Class | (8,571,940) | (5,967,141) |

| Institutional 3 Class | (20,115,690) | (3,854,161) |

| Class K | (48,187) | (40,230) |

| Class R | (641,230) | (451,640) |

| Class T | (8,444) | (843,456) |

| Class V | (1,127,941) | (968,097) |

| Net realized gains | | |

| Class A | (93,913,407) | (21,919,791) |

| Advisor Class | (31,380,381) | (3,005,305) |

| Class B | — | (42,890) |

| Class C | (40,119,346) | (5,729,742) |

| Class I | — | (2,474,135) |

| Institutional Class | (235,608,254) | (32,770,414) |

| Institutional 2 Class | (40,157,532) | (4,473,015) |

| Institutional 3 Class | (90,640,911) | (2,760,953) |

| Class K | (292,694) | (39,271) |

| Class R | (6,615,240) | (797,594) |

| Class T | (57,932) | (958,481) |

| Class V | (7,738,463) | (1,115,823) |

| Total distributions to shareholders | (642,329,714) | (153,268,972) |

| Decrease in net assets from capital stock activity | (116,288,386) | (392,465,869) |

| Total increase in net assets | 668,144,942 | 957,614,240 |

| Net assets at beginning of year | 10,892,262,488 | 9,934,648,248 |

| Net assets at end of year | $11,560,407,430 | $10,892,262,488 |

| Undistributed net investment income | $66,473,849 | $64,041,928 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Contrarian Core Fund | Annual Report 2018 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | August 31, 2018 | August 31, 2017 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions | 12,208,122 | 316,921,667 | 24,532,402 | 567,339,209 |

| Distributions reinvested | 3,884,229 | 99,008,995 | 1,703,138 | 38,796,444 |

| Redemptions | (22,154,412) | (575,389,741) | (78,222,523) | (1,845,678,165) |

| Net decrease | (6,062,061) | (159,459,079) | (51,986,983) | (1,239,542,512) |

| Advisor Class | | | | |

| Subscriptions | 11,310,517 | 300,451,143 | 10,776,230 | 260,548,555 |

| Distributions reinvested | 1,389,820 | 36,260,392 | 279,486 | 6,506,429 |

| Redemptions | (8,970,419) | (238,568,015) | (4,694,624) | (112,458,762) |

| Net increase | 3,729,918 | 98,143,520 | 6,361,092 | 154,596,222 |

| Class B | | | | |

| Subscriptions | — | — | 10,229 | 211,772 |

| Distributions reinvested | — | — | 2,033 | 42,206 |

| Redemptions | — | — | (309,670) | (6,756,778) |

| Net decrease | — | — | (297,408) | (6,502,800) |

| Class C | | | | |

| Subscriptions | 4,636,954 | 109,134,302 | 8,279,732 | 176,276,614 |

| Distributions reinvested | 1,592,042 | 36,871,699 | 237,660 | 4,945,710 |

| Redemptions | (9,819,541) | (231,021,490) | (9,109,741) | (195,062,192) |

| Net decrease | (3,590,545) | (85,015,489) | (592,349) | (13,839,868) |

| Class I | | | | |

| Subscriptions | — | — | 619,606 | 13,527,383 |

| Distributions reinvested | — | — | 258,970 | 5,927,821 |

| Redemptions | — | — | (16,890,162) | (398,885,486) |

| Net decrease | — | — | (16,011,586) | (379,430,282) |

| Institutional Class | | | | |

| Subscriptions | 32,541,591 | 849,445,217 | 85,852,060 | 2,044,682,517 |

| Distributions reinvested | 10,065,737 | 258,286,816 | 2,284,114 | 52,351,890 |

| Redemptions | (57,893,556) | (1,516,465,968) | (83,135,098) | (2,002,573,073) |

| Net increase (decrease) | (15,286,228) | (408,733,935) | 5,001,076 | 94,461,334 |

| Institutional 2 Class | | | | |

| Subscriptions | 12,831,692 | 340,843,986 | 11,090,361 | 270,140,698 |

| Distributions reinvested | 1,868,398 | 48,709,121 | 448,671 | 10,436,073 |

| Redemptions | (12,546,333) | (332,078,939) | (9,119,270) | (216,839,757) |

| Net increase | 2,153,757 | 57,474,168 | 2,419,762 | 63,737,014 |

| Institutional 3 Class | | | | |

| Subscriptions | 29,449,843 | 779,912,063 | 49,850,577 | 1,240,699,466 |

| Distributions reinvested | 2,580,501 | 67,273,670 | 271,473 | 6,314,467 |

| Redemptions | (17,189,124) | (461,087,450) | (4,056,941) | (98,611,716) |

| Net increase | 14,841,220 | 386,098,283 | 46,065,109 | 1,148,402,217 |

| Class K | | | | |

| Subscriptions | 10,761 | 288,499 | 18,689 | 455,856 |

| Distributions reinvested | 13,282 | 340,682 | 3,468 | 79,454 |

| Redemptions | (269,627) | (7,180,214) | (13,564) | (307,763) |

| Net increase (decrease) | (245,584) | (6,551,033) | 8,593 | 227,547 |

| Class R | | | | |

| Subscriptions | 1,298,152 | 33,613,269 | 2,442,785 | 57,295,465 |

| Distributions reinvested | 229,073 | 5,848,237 | 40,077 | 914,165 |

| Redemptions | (1,370,468) | (35,554,329) | (1,605,994) | (37,805,368) |

| Net increase | 156,757 | 3,907,177 | 876,868 | 20,404,262 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 15 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | August 31, 2018 | August 31, 2017 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Class T | | | | |

| Subscriptions | 726 | 19,043 | 1,447,862 | 32,641,606 |

| Distributions reinvested | 2,595 | 66,153 | 79,099 | 1,801,867 |

| Redemptions | (18,306) | (475,567) | (11,365,827) | (257,363,851) |

| Net decrease | (14,985) | (390,371) | (9,838,866) | (222,920,378) |

| Class V | | | | |

| Subscriptions | 246,930 | 6,375,877 | 49,241 | 1,134,243 |

| Distributions reinvested | 250,684 | 6,329,782 | 64,778 | 1,462,036 |

| Redemptions | (564,074) | (14,467,286) | (633,299) | (14,654,904) |

| Net decrease | (66,460) | (1,761,627) | (519,280) | (12,058,625) |

| Total net decrease | (4,384,211) | (116,288,386) | (18,513,972) | (392,465,869) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Contrarian Core Fund | Annual Report 2018 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

Columbia Contrarian Core Fund | Annual Report 2018

| 17 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Class A |

| Year Ended 8/31/2018 | $25.41 | 0.18 | 3.05 | 3.23 | (0.18) | (1.27) | (1.45) |

| Year Ended 8/31/2017 | $22.29 | 0.19 | 3.25 | 3.44 | (0.15) | (0.17) | (0.32) |

| Year Ended 8/31/2016 | $21.27 | 0.15 | 2.05 | 2.20 | (0.55) | (0.63) | (1.18) |

| Year Ended 8/31/2015 | $22.37 | 0.65 (d) | (0.23) | 0.42 | (0.10) | (1.42) | (1.52) |

| Year Ended 8/31/2014 | $19.15 | 0.14 | 4.32 | 4.46 | (0.11) | (1.13) | (1.24) |

| Advisor Class |

| Year Ended 8/31/2018 | $26.02 | 0.25 | 3.13 | 3.38 | (0.24) | (1.27) | (1.51) |

| Year Ended 8/31/2017 | $22.81 | 0.26 | 3.33 | 3.59 | (0.21) | (0.17) | (0.38) |

| Year Ended 8/31/2016 | $21.74 | 0.21 | 2.09 | 2.30 | (0.60) | (0.63) | (1.23) |

| Year Ended 8/31/2015 | $22.83 | 0.80 (d) | (0.32) | 0.48 | (0.15) | (1.42) | (1.57) |

| Year Ended 8/31/2014 | $19.52 | 0.20 | 4.40 | 4.60 | (0.16) | (1.13) | (1.29) |

| Class C |

| Year Ended 8/31/2018 | $23.09 | (0.01) | 2.76 | 2.75 | — | (1.27) | (1.27) |

| Year Ended 8/31/2017 | $20.28 | 0.01 | 2.97 | 2.98 | (0.00) (e) | (0.17) | (0.17) |

| Year Ended 8/31/2016 | $19.43 | (0.00) (e) | 1.86 | 1.86 | (0.38) | (0.63) | (1.01) |

| Year Ended 8/31/2015 | $20.62 | 0.50 (d) | (0.27) | 0.23 | — | (1.42) | (1.42) |

| Year Ended 8/31/2014 | $17.77 | (0.01) | 3.99 | 3.98 | — | (1.13) | (1.13) |

| Institutional Class |

| Year Ended 8/31/2018 | $25.61 | 0.25 | 3.07 | 3.32 | (0.24) | (1.27) | (1.51) |

| Year Ended 8/31/2017 | $22.45 | 0.25 | 3.29 | 3.54 | (0.21) | (0.17) | (0.38) |

| Year Ended 8/31/2016 | $21.42 | 0.21 | 2.05 | 2.26 | (0.60) | (0.63) | (1.23) |

| Year Ended 8/31/2015 | $22.52 | 0.66 (d) | (0.18) | 0.48 | (0.16) | (1.42) | (1.58) |

| Year Ended 8/31/2014 | $19.27 | 0.19 | 4.35 | 4.54 | (0.16) | (1.13) | (1.29) |

| Institutional 2 Class |

| Year Ended 8/31/2018 | $26.01 | 0.28 | 3.13 | 3.41 | (0.27) | (1.27) | (1.54) |

| Year Ended 8/31/2017 | $22.80 | 0.28 | 3.33 | 3.61 | (0.23) | (0.17) | (0.40) |

| Year Ended 8/31/2016 | $21.73 | 0.24 | 2.09 | 2.33 | (0.63) | (0.63) | (1.26) |

| Year Ended 8/31/2015 | $22.83 | 0.78 (d) | (0.28) | 0.50 | (0.18) | (1.42) | (1.60) |

| Year Ended 8/31/2014 | $19.52 | 0.23 | 4.39 | 4.62 | (0.18) | (1.13) | (1.31) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia Contrarian Core Fund | Annual Report 2018 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Class A |

| Year Ended 8/31/2018 | $27.19 | 13.09% | 1.02% | 1.02% (c) | 0.70% | 63% | $1,912,203 |

| Year Ended 8/31/2017 | $25.41 | 15.61% | 1.04% | 1.04% (c) | 0.82% | 52% | $1,941,062 |

| Year Ended 8/31/2016 | $22.29 | 10.79% | 1.07% | 1.07% (c) | 0.72% | 47% | $2,860,806 |

| Year Ended 8/31/2015 | $21.27 | 1.99% | 1.09% | 1.09% (c) | 2.93% | 60% | $2,297,176 |

| Year Ended 8/31/2014 | $22.37 | 24.15% | 1.11% | 1.11% (c) | 0.69% | 65% | $1,659,841 |

| Advisor Class |

| Year Ended 8/31/2018 | $27.89 | 13.39% | 0.77% | 0.77% (c) | 0.95% | 63% | $743,515 |

| Year Ended 8/31/2017 | $26.02 | 15.91% | 0.80% | 0.80% (c) | 1.07% | 52% | $596,704 |

| Year Ended 8/31/2016 | $22.81 | 11.07% | 0.82% | 0.82% (c) | 0.99% | 47% | $377,946 |

| Year Ended 8/31/2015 | $21.74 | 2.25% | 0.85% | 0.85% (c) | 3.53% | 60% | $227,941 |

| Year Ended 8/31/2014 | $22.83 | 24.44% | 0.86% | 0.86% (c) | 0.94% | 65% | $105,458 |

| Class C |

| Year Ended 8/31/2018 | $24.57 | 12.23% | 1.77% | 1.77% (c) | (0.05%) | 63% | $708,041 |

| Year Ended 8/31/2017 | $23.09 | 14.80% | 1.79% | 1.79% (c) | 0.07% | 52% | $748,148 |

| Year Ended 8/31/2016 | $20.28 | 9.98% | 1.83% | 1.83% (c) | (0.02%) | 47% | $669,226 |

| Year Ended 8/31/2015 | $19.43 | 1.17% | 1.85% | 1.85% (c) | 2.46% | 60% | $409,798 |

| Year Ended 8/31/2014 | $20.62 | 23.22% | 1.86% | 1.86% (c) | (0.06%) | 65% | $222,834 |

| Institutional Class |

| Year Ended 8/31/2018 | $27.42 | 13.37% | 0.77% | 0.77% (c) | 0.95% | 63% | $4,889,699 |

| Year Ended 8/31/2017 | $25.61 | 15.95% | 0.80% | 0.80% (c) | 1.07% | 52% | $4,958,099 |

| Year Ended 8/31/2016 | $22.45 | 11.05% | 0.82% | 0.82% (c) | 0.99% | 47% | $4,234,639 |

| Year Ended 8/31/2015 | $21.42 | 2.24% | 0.84% | 0.84% (c) | 2.97% | 60% | $2,119,278 |

| Year Ended 8/31/2014 | $22.52 | 24.45% | 0.86% | 0.86% (c) | 0.93% | 65% | $1,831,114 |

| Institutional 2 Class |

| Year Ended 8/31/2018 | $27.88 | 13.50% | 0.68% | 0.68% | 1.04% | 63% | $894,849 |

| Year Ended 8/31/2017 | $26.01 | 16.05% | 0.69% | 0.69% | 1.17% | 52% | $779,002 |

| Year Ended 8/31/2016 | $22.80 | 11.22% | 0.70% | 0.70% | 1.12% | 47% | $627,659 |

| Year Ended 8/31/2015 | $21.73 | 2.34% | 0.71% | 0.71% | 3.45% | 60% | $336,043 |

| Year Ended 8/31/2014 | $22.83 | 24.60% | 0.73% | 0.73% | 1.08% | 65% | $209,498 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 19 |

Financial Highlights (continued)

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Institutional 3 Class |

| Year Ended 8/31/2018 | $26.03 | 0.29 | 3.12 | 3.41 | (0.28) | (1.27) | (1.55) |

| Year Ended 8/31/2017 | $22.81 | 0.30 | 3.33 | 3.63 | (0.24) | (0.17) | (0.41) |

| Year Ended 8/31/2016 | $21.75 | 0.27 | 2.06 | 2.33 | (0.64) | (0.63) | (1.27) |

| Year Ended 8/31/2015 | $22.84 | 1.19 (d) | (0.67) | 0.52 | (0.19) | (1.42) | (1.61) |

| Year Ended 8/31/2014 | $19.52 | 0.24 | 4.40 | 4.64 | (0.19) | (1.13) | (1.32) |

| Class R |

| Year Ended 8/31/2018 | $25.41 | 0.12 | 3.04 | 3.16 | (0.12) | (1.27) | (1.39) |

| Year Ended 8/31/2017 | $22.29 | 0.14 | 3.25 | 3.39 | (0.10) | (0.17) | (0.27) |

| Year Ended 8/31/2016 | $21.26 | 0.10 | 2.05 | 2.15 | (0.49) | (0.63) | (1.12) |

| Year Ended 8/31/2015 | $22.37 | 0.65 (d) | (0.29) | 0.36 | (0.05) | (1.42) | (1.47) |

| Year Ended 8/31/2014 | $19.15 | 0.09 | 4.32 | 4.41 | (0.06) | (1.13) | (1.19) |

| Class T |

| Year Ended 8/31/2018 | $25.41 | 0.18 | 3.05 | 3.23 | (0.18) | (1.27) | (1.45) |

| Year Ended 8/31/2017 | $22.29 | 0.17 | 3.27 | 3.44 | (0.15) | (0.17) | (0.32) |

| Year Ended 8/31/2016 | $21.27 | 0.15 | 2.05 | 2.20 | (0.55) | (0.63) | (1.18) |

| Year Ended 8/31/2015 | $22.38 | 0.50 (d) | (0.09) | 0.41 | (0.10) | (1.42) | (1.52) |

| Year Ended 8/31/2014 | $19.16 | 0.14 | 4.32 | 4.46 | (0.11) | (1.13) | (1.24) |

| Class V |

| Year Ended 8/31/2018 | $25.18 | 0.18 | 3.02 | 3.20 | (0.18) | (1.27) | (1.45) |

| Year Ended 8/31/2017 | $22.09 | 0.19 | 3.22 | 3.41 | (0.15) | (0.17) | (0.32) |

| Year Ended 8/31/2016 | $21.08 | 0.15 | 2.04 | 2.19 | (0.55) | (0.63) | (1.18) |

| Year Ended 8/31/2015 | $22.19 | 0.55 (d) | (0.15) | 0.40 | (0.09) | (1.42) | (1.51) |

| Year Ended 8/31/2014 | $19.01 | 0.13 | 4.28 | 4.41 | (0.10) | (1.13) | (1.23) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | The benefits derived from expense reductions had an impact of less than 0.01%. |

| (d) | Net investment income per share includes special dividends. The per share effect of these dividends amounted to: |

| Year Ended | Class A | Advisor

Class | Class C | Institutional

Class | Institutional 2

Class | Institutional 3

Class | Class R | Class T | Class V |

| 08/31/2015 | $ 0.54 | $ 0.63 | $ 0.55 | $ 0.50 | $ 0.58 | $ 0.96 | $ 0.60 | $ 0.40 | $ 0.45 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 20 | Columbia Contrarian Core Fund | Annual Report 2018 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Institutional 3 Class |

| Year Ended 8/31/2018 | $27.89 | 13.50% | 0.63% | 0.63% | 1.10% | 63% | $2,101,809 |

| Year Ended 8/31/2017 | $26.03 | 16.14% | 0.65% | 0.65% | 1.23% | 52% | $1,574,824 |

| Year Ended 8/31/2016 | $22.81 | 11.22% | 0.65% | 0.65% | 1.23% | 47% | $329,514 |

| Year Ended 8/31/2015 | $21.75 | 2.44% | 0.66% | 0.66% | 5.26% | 60% | $53,246 |

| Year Ended 8/31/2014 | $22.84 | 24.71% | 0.68% | 0.68% | 1.12% | 65% | $2,514 |

| Class R |

| Year Ended 8/31/2018 | $27.18 | 12.78% | 1.27% | 1.27% (c) | 0.45% | 63% | $145,912 |

| Year Ended 8/31/2017 | $25.41 | 15.34% | 1.29% | 1.29% (c) | 0.57% | 52% | $132,392 |

| Year Ended 8/31/2016 | $22.29 | 10.55% | 1.32% | 1.32% (c) | 0.49% | 47% | $96,586 |

| Year Ended 8/31/2015 | $21.26 | 1.69% | 1.34% | 1.34% (c) | 2.93% | 60% | $50,048 |

| Year Ended 8/31/2014 | $22.37 | 23.86% | 1.36% | 1.36% (c) | 0.44% | 65% | $30,291 |

| Class T |

| Year Ended 8/31/2018 | $27.19 | 13.09% | 1.02% | 1.02% (c) | 0.69% | 63% | $1,044 |

| Year Ended 8/31/2017 | $25.41 | 15.62% | 1.04% | 1.04% (c) | 0.74% | 52% | $1,357 |

| Year Ended 8/31/2016 | $22.29 | 10.79% | 1.07% | 1.07% (c) | 0.71% | 47% | $220,502 |

| Year Ended 8/31/2015 | $21.27 | 1.95% | 1.09% | 1.09% (c) | 2.26% | 60% | $118,262 |

| Year Ended 8/31/2014 | $22.38 | 24.15% | 1.10% | 1.10% (c) | 0.67% | 65% | $124,021 |

| Class V |

| Year Ended 8/31/2018 | $26.93 | 13.09% | 1.02% | 1.02% (c) | 0.70% | 63% | $163,335 |

| Year Ended 8/31/2017 | $25.18 | 15.61% | 1.04% | 1.04% (c) | 0.82% | 52% | $154,392 |

| Year Ended 8/31/2016 | $22.09 | 10.83% | 1.08% | 1.08% (c) | 0.71% | 47% | $146,879 |

| Year Ended 8/31/2015 | $21.08 | 1.92% | 1.11% | 1.11% (c) | 2.49% | 60% | $143,304 |

| Year Ended 8/31/2014 | $22.19 | 24.06% | 1.16% | 1.16% (c) | 0.63% | 65% | $151,430 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Contrarian Core Fund | Annual Report 2018

| 21 |

Notes to Financial Statements

August 31, 2018

Note 1. Organization

Columbia Contrarian Core Fund (the Fund), a series of Columbia Funds Series Trust I (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Different share classes pay different distribution amounts to the extent the expenses of such share classes differ, and distributions in liquidation will be proportional to the net asset value of each share class. Each share class has its own expense and sales charge structure. The Fund offers each of the share classes identified below.

Class A shares are subject to a maximum front-end sales charge of 5.75% based on the initial investment amount. Class A shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a contingent deferred sales charge (CDSC) if the shares are sold within 18 months after purchase, charged as follows: 1.00% CDSC if redeemed within 12 months after purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase.

Advisor Class shares are not subject to sales charges and are generally available only to omnibus retirement plans and certain investors as described in the Fund’s prospectus. Prior to November 1, 2017, Advisor Class shares were known as Class R4 shares.

Class C shares are subject to a 1.00% CDSC on shares redeemed within 12 months after purchase. Effective July 1, 2018, Class C shares will automatically convert to Class A shares of the same Fund in the month of or the month following the 10-year anniversary of the Class C shares purchase date.

Institutional Class shares are not subject to sales charges and are generally available only to eligible investors, which are subject to different investment minimums as described in the Fund’s prospectus. Prior to November 1, 2017, Institutional Class shares were known as Class Z shares.

Institutional 2 Class shares are not subject to sales charges and are generally available only to investors purchasing through authorized investment professionals and omnibus retirement plans as described in the Fund’s prospectus. Prior to November 1, 2017, Institutional 2 Class shares were known as Class R5 shares.

Institutional 3 Class shares are not subject to sales charges and are available to institutional and certain other investors as described in the Fund’s prospectus. Prior to November 1, 2017, Institutional 3 Class shares were known as Class Y shares.

The Fund no longer accepts investments by existing investors in Class K shares. When available, Class K shares were not subject to sales charges and were made available only to existing investors in Class K shares. On March 9, 2018, Class K shares were redeemed or exchanged for Advisor Class shares of the Fund in a tax free transaction that had no impact on fees and expenses paid by the shareholders.

Class R shares are not subject to sales charges and are generally available only to certain retirement plans and other investors as described in the Fund’s prospectus.

Class T shares are subject to a maximum front-end sales charge of 2.50% per transaction and must be purchased through financial intermediaries that, by written agreement with Columbia Management Investment Distributors, Inc., are specifically authorized to sell Class T shares.

Class V shares are subject to a maximum front-end sales charge of 5.75% based on the investment amount. Class V shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a CDSC if the shares are sold within 18 months after purchase, charged as follows: 1.00% CDSC if redeemed within 12 months after purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase. Class V shares are available only to investors who received (and who have continuously held) Class V shares in connection with previous fund reorganizations.

| 22 | Columbia Contrarian Core Fund | Annual Report 2018 |

Notes to Financial Statements (continued)

August 31, 2018

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

All equity securities are valued at the close of business of the New York Stock Exchange. Equity securities are valued at the last quoted sales price on the principal exchange or market on which they trade, except for securities traded on the NASDAQ Stock Market, which are valued at the NASDAQ official close price. Unlisted securities or listed securities for which there were no sales during the day are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets.

Foreign equity securities are valued based on the closing price on the foreign exchange in which such securities are primarily traded. If any foreign equity security closing prices are not readily available, the securities are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are generally determined at 4:00 p.m. Eastern (U.S.) time. Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In those situations, foreign securities will be fair valued pursuant to a policy adopted by the Board of Trustees, including, if available, utilizing a third party pricing service to determine these fair values. The third party pricing service takes into account multiple factors, including, but not limited to, movements in the U.S. securities markets, certain depositary receipts, futures contracts and foreign exchange rates that have occurred subsequent to the close of the foreign exchange or market, to determine a good faith estimate that reasonably reflects the current market conditions as of the close of the New York Stock Exchange. The fair value of a security is likely to be different from the quoted or published price, if available.

Investments in open-end investment companies, including money market funds, are valued at their latest net asset value.

Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by and under the general supervision of the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Foreign currency transactions and translations

The values of all assets and liabilities denominated in foreign currencies are generally translated into U.S. dollars at exchange rates determined at the close of regular trading on the New York Stock Exchange. Net realized and unrealized gains (losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange

Columbia Contrarian Core Fund | Annual Report 2018

| 23 |

Notes to Financial Statements (continued)

August 31, 2018

rates between trade and settlement dates on securities transactions, gains (losses) arising from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes, the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains (losses) on investments in the Statement of Operations.

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Corporate actions and dividend income are generally recorded net of any non-reclaimable tax withholdings, on the ex-dividend date or upon receipt of ex-dividend notification in the case of certain foreign securities.