UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

March 31, 2023

Columbia Select Large Cap Growth Fund

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

If you elect to receive the shareholder report for Columbia Select Large Cap Growth Fund (the Fund) in paper, mailed to you, the Fund mails one shareholder report to each shareholder address, unless such shareholder elects to receive shareholder reports from the Fund electronically via e-mail or by having a paper notice mailed to you (Postcard Notice) that your Fund’s shareholder report is available at the Columbia funds’ website (columbiathreadneedleus.com/investor/). If you would like more than one report in paper to be mailed to you, or would like to elect to receive reports via e-mail or access them through Postcard Notice, please call shareholder services at 800.345.6611 and additional reports will be sent to you.

Proxy voting policies and procedures

The policy of the Board of Trustees is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the Statement of Additional Information (SAI). You may obtain a copy of the SAI without charge by calling 800.345.6611; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the Securities and Exchange Commission (SEC) at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the website of the SEC at sec.gov.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-PORT, is available on columbiathreadneedleus.com/investor/ or can also be obtained without charge, upon request, by calling 800.345.6611.

Additional Fund information

For more information about the Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the Investment Manager)

290 Congress Street

Boston, MA 02210

Fund distributor

Columbia Management Investment Distributors, Inc.

290 Congress Street

Boston, MA 02210

Fund transfer agent

Columbia Management Investment Services Corp.

P.O. Box 219104

Kansas City, MO 64121-9104

Columbia Select Large Cap Growth Fund | Annual Report 2023

Fund at a Glance

(Unaudited)

Investment objective

The Fund seeks long-term capital appreciation.

Portfolio management

Thomas Galvin, CFA

Lead Portfolio Manager

Managed Fund since 2003

Richard Carter

Portfolio Manager

Managed Fund since 2009

Todd Herget

Portfolio Manager

Managed Fund since 2009

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2023 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended March 31, 2023) |

| | | Inception | 1 Year | 5 Years | 10 Years | |

| Class A | Excluding sales charges | 09/28/07 | -10.01 | 8.91 | 11.62 | |

| | Including sales charges | | -15.18 | 7.63 | 10.96 | |

| Advisor Class | 11/08/12 | -9.72 | 9.18 | 11.89 | |

| Class C | Excluding sales charges | 09/28/07 | -10.67 | 8.09 | 10.79 | |

| | Including sales charges | | -11.35 | 8.09 | 10.79 | |

| Institutional Class | 10/01/97 | -9.67 | 9.20 | 11.90 | |

| Institutional 2 Class | 11/08/12 | -9.61 | 9.31 | 12.03 | |

| Institutional 3 Class | 11/08/12 | -9.59 | 9.35 | 12.07 | |

| Class R | 12/31/04 | -10.19 | 8.65 | 11.34 | |

| Russell 1000 Growth Index | | -10.90 | 13.66 | 14.59 | |

Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

The Russell 1000 Growth Index, an unmanaged index, measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 3 |

Fund at a Glance (continued)

(Unaudited)

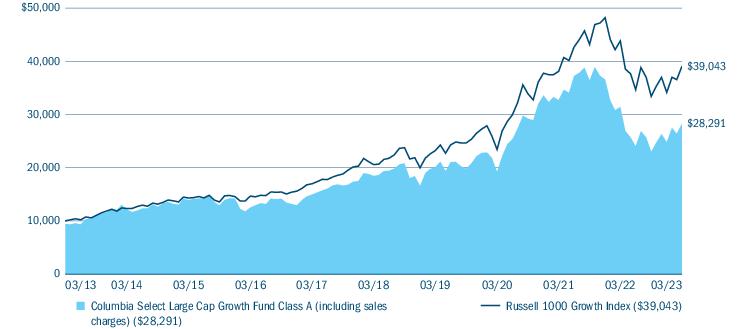

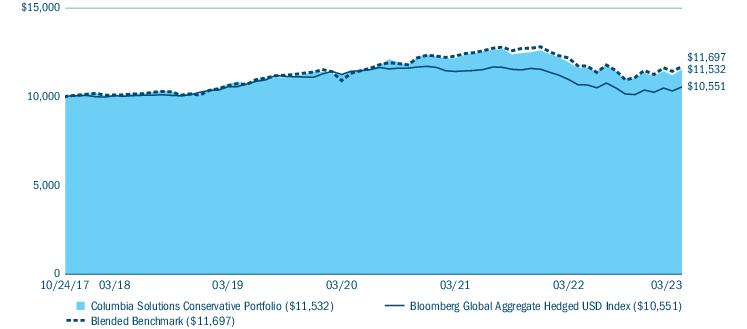

Performance of a hypothetical $10,000 investment (March 31, 2013 — March 31, 2023)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Select Large Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Portfolio breakdown (%) (at March 31, 2023) |

| Common Stocks | 99.4 |

| Money Market Funds | 0.6 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at March 31, 2023) |

| Communication Services | 1.8 |

| Consumer Discretionary | 18.0 |

| Consumer Staples | 7.4 |

| Financials | 8.0 |

| Health Care | 24.7 |

| Industrials | 10.0 |

| Information Technology | 30.1 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Manager Discussion of Fund Performance

(Unaudited)

For the 12-month period that ended March 31, 2023, Class A shares of Columbia Select Large Cap Growth Fund returned -10.01% excluding sales charges. The Fund outperformed its benchmark, the Russell 1000 Growth Index, which returned -10.90% for the same time period.

Market overview

Driven by a series of interest rate hikes by the U.S. Federal Reserve (Fed), decades-high inflation, persistent recession worries, climbing U.S. Treasury yields, supply-chain disruptions, volatile commodity prices, geopolitical tensions resulting from the Russian invasion of Ukraine, and elevated concerns around China’s zero-COVID policy, the U.S. equity market, as measured by the S&P 500 Index, posted negative returns during the annual period ended March 31, 2023. On slowing yet relatively resilient corporate earnings reports, a still-tight U.S. labor market, an economic reopening in China, hopes that Fed interest rate hikes would be smaller and soon pause, and warming notions of a soft economic landing, there were brief respites of equity market rallies, such as those in July into early August 2022, in October and November 2022, and then in January 2023. However, as the realization that interest rates could remain higher for longer set in with investors even as inflation decreased, albeit from high levels, stocks ticked lower again in February 2023. March brought new concerns as regulators shut down tech-focused Silicon Valley Bank and crypto-focused Signature Bank following runs on their deposits. In the days following, several banks, including First Republic and Credit Suisse, were rescued by competitors. At the March Federal Open Market Committee meeting, the Fed raised the federal funds rate by 0.25% to a range of 4.75-5.00%, but also suggested future rate increases this year may be limited. With the Fed taking a less hawkish tone and global banking jitters easing, U.S. equities climbed in March.

The Fund’s notable contributors during the period

| • | The Fund benefited most, relative to the benchmark, from its security selection within the consumer discretionary sector. |

| • | Security selection, along with overweight positioning in, the industrials and health care sectors, also contributed to the Fund’s relative performance during the period. |

| • | An overweighted allocation to the financials sector also aided relative performance during the period. |

| • | Top individual holdings that contributed to performance during the period included biotechnology company BioMarin Pharmaceutical, Inc., heating and cooling manufacturer Trane Technologies PLC, online travel and restaurant reservation company Booking Holdings, Inc., investment data services provider MSCI, Inc. and manufacturer of insulin delivery systems Insulet Corp. |

The Fund’s notable detractors during the period

| • | The information technology sector was the area of largest detraction for the Fund, relative to the benchmark, during the period, due to a combination of security selection and allocation. |

| • | Security selection within the communication services and consumer staples sectors also weighed on relative results. |

| • | Holdings that detracted most from performance, relative to the benchmark, included online dating app provider Match Group, Inc., orthodontic products manufacturer Align Technology, Inc., cloud-based cybersecurity provider Crowdstrike Holdings, Inc., medical devices company Edwards Lifesciences Corp. and cloud-based communications company RingCentral, Inc. The Fund’s holdings in Align Technology and RingCentral were sold during the period. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Growth securities, at times, may not perform as well as value securities or the stock market in general and may be out of favor with investors. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Investments in a limited number of companies or sectors subject the Fund to greater risk of loss. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties who have contributed to this report. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 5 |

Manager Discussion of Fund Performance (continued)

(Unaudited)

parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| October 1, 2022 — March 31, 2023 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,229.80 | 1,019.70 | 5.84 | 5.29 | 1.05 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,231.00 | 1,020.94 | 4.45 | 4.03 | 0.80 |

| Class C | 1,000.00 | 1,000.00 | 1,224.90 | 1,015.96 | 9.98 | 9.05 | 1.80 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,232.20 | 1,020.94 | 4.45 | 4.03 | 0.80 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,232.70 | 1,021.39 | 3.95 | 3.58 | 0.71 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,231.40 | 1,021.64 | 3.67 | 3.33 | 0.66 |

| Class R | 1,000.00 | 1,000.00 | 1,228.00 | 1,018.45 | 7.22 | 6.54 | 1.30 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 7 |

Portfolio of Investments

March 31, 2023

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 99.5% |

| Issuer | Shares | Value ($) |

| Communication Services 1.8% |

| Interactive Media & Services 1.8% |

| Match Group, Inc.(a) | 513,910 | 19,729,005 |

| Total Communication Services | 19,729,005 |

| Consumer Discretionary 18.0% |

| Auto Components 1.4% |

| Aptiv PLC(a) | 143,490 | 16,098,143 |

| Broadline Retail 4.0% |

| Amazon.com, Inc.(a) | 431,078 | 44,526,047 |

| Hotels, Restaurants & Leisure 6.5% |

| Booking Holdings, Inc.(a) | 14,336 | 38,024,950 |

| Chipotle Mexican Grill, Inc.(a) | 19,981 | 34,133,342 |

| Total | | 72,158,292 |

| Textiles, Apparel & Luxury Goods 6.1% |

| lululemon athletica, Inc.(a) | 65,499 | 23,854,081 |

| NIKE, Inc., Class B | 362,713 | 44,483,122 |

| Total | | 68,337,203 |

| Total Consumer Discretionary | 201,119,685 |

| Consumer Staples 7.3% |

| Consumer Staples Distribution & Retail 3.5% |

| Costco Wholesale Corp. | 80,154 | 39,826,118 |

| Personal Care Products 3.8% |

| Estee Lauder Companies, Inc. (The), Class A | 170,964 | 42,135,787 |

| Total Consumer Staples | 81,961,905 |

| Financials 8.0% |

| Capital Markets 3.8% |

| MSCI, Inc. | 77,005 | 43,098,928 |

| Financial Services 4.2% |

| Visa, Inc., Class A | 206,312 | 46,515,104 |

| Total Financials | 89,614,032 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Health Care 24.6% |

| Biotechnology 7.5% |

| BioMarin Pharmaceutical, Inc.(a) | 393,292 | 38,243,714 |

| Exact Sciences Corp.(a) | 452,363 | 30,674,735 |

| Sarepta Therapeutics, Inc.(a) | 112,025 | 15,440,406 |

| Total | | 84,358,855 |

| Health Care Equipment & Supplies 11.1% |

| Edwards Lifesciences Corp.(a) | 458,847 | 37,960,412 |

| Insulet Corp.(a) | 141,916 | 45,265,527 |

| Intuitive Surgical, Inc.(a) | 161,286 | 41,203,735 |

| Total | | 124,429,674 |

| Life Sciences Tools & Services 2.5% |

| Illumina, Inc.(a) | 119,183 | 27,716,007 |

| Pharmaceuticals 3.5% |

| Eli Lilly & Co. | 114,432 | 39,298,237 |

| Total Health Care | 275,802,773 |

| Industrials 9.9% |

| Building Products 2.6% |

| Trane Technologies PLC | 157,259 | 28,932,511 |

| Construction & Engineering 2.6% |

| Quanta Services, Inc. | 176,282 | 29,375,632 |

| Electrical Equipment 1.2% |

| Bloom Energy Corp., Class A(a) | 707,984 | 14,110,121 |

| Professional Services 3.5% |

| CoStar Group, Inc.(a) | 566,406 | 38,997,053 |

| Total Industrials | 111,415,317 |

| Information Technology 29.9% |

| Semiconductors & Semiconductor Equipment 6.9% |

| Advanced Micro Devices, Inc.(a) | 200,150 | 19,616,701 |

| Applied Materials, Inc. | 51,408 | 6,314,445 |

| NVIDIA Corp. | 185,065 | 51,405,505 |

| Total | | 77,336,651 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Portfolio of Investments (continued)

March 31, 2023

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Software 23.0% |

| Adobe, Inc.(a) | 118,585 | 45,699,102 |

| Crowdstrike Holdings, Inc., Class A(a) | 197,777 | 27,146,871 |

| Intuit, Inc. | 107,587 | 47,965,512 |

| Microsoft Corp. | 170,371 | 49,117,960 |

| Palo Alto Networks, Inc.(a) | 194,126 | 38,774,727 |

| ServiceNow, Inc.(a) | 105,099 | 48,841,607 |

| Total | | 257,545,779 |

| Total Information Technology | 334,882,430 |

Total Common Stocks

(Cost $642,924,108) | 1,114,525,147 |

|

| Money Market Funds 0.6% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 4.983%(b),(c) | 6,435,192 | 6,433,905 |

Total Money Market Funds

(Cost $6,432,841) | 6,433,905 |

Total Investments in Securities

(Cost: $649,356,949) | 1,120,959,052 |

| Other Assets & Liabilities, Net | | (806,823) |

| Net Assets | 1,120,152,229 |

Notes to Portfolio of Investments

| (a) | Non-income producing investment. |

| (b) | The rate shown is the seven-day current annualized yield at March 31, 2023. |

| (c) | As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of the holdings and transactions in these affiliated companies during the year ended March 31, 2023 are as follows: |

| Affiliated issuers | Beginning

of period($) | Purchases($) | Sales($) | Net change in

unrealized

appreciation

(depreciation)($) | End of

period($) | Realized gain

(loss)($) | Dividends($) | End of

period shares |

| Columbia Short-Term Cash Fund, 4.983% |

| | 6,975,429 | 375,685,873 | (376,228,455) | 1,058 | 6,433,905 | (726) | 288,708 | 6,435,192 |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 9 |

Portfolio of Investments (continued)

March 31, 2023

Fair value measurements (continued)

The Fund’s Board of Trustees (the Board) has designated the Investment Manager, through its Valuation Committee (the Committee), as valuation designee, responsible for determining the fair value of the assets of the Fund for which market quotations are not readily available using valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. Representatives of Columbia Management Investment Advisers, LLC report to the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The following table is a summary of the inputs used to value the Fund’s investments at March 31, 2023:

| | Level 1 ($) | Level 2 ($) | Level 3 ($) | Total ($) |

| Investments in Securities | | | | |

| Common Stocks | | | | |

| Communication Services | 19,729,005 | — | — | 19,729,005 |

| Consumer Discretionary | 201,119,685 | — | — | 201,119,685 |

| Consumer Staples | 81,961,905 | — | — | 81,961,905 |

| Financials | 89,614,032 | — | — | 89,614,032 |

| Health Care | 275,802,773 | — | — | 275,802,773 |

| Industrials | 111,415,317 | — | — | 111,415,317 |

| Information Technology | 334,882,430 | — | — | 334,882,430 |

| Total Common Stocks | 1,114,525,147 | — | — | 1,114,525,147 |

| Money Market Funds | 6,433,905 | — | — | 6,433,905 |

| Total Investments in Securities | 1,120,959,052 | — | — | 1,120,959,052 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Statement of Assets and Liabilities

March 31, 2023

| Assets | |

| Investments in securities, at value | |

| Unaffiliated issuers (cost $642,924,108) | $1,114,525,147 |

| Affiliated issuers (cost $6,432,841) | 6,433,905 |

| Cash | 6,842 |

| Receivable for: | |

| Capital shares sold | 647,482 |

| Dividends | 164,615 |

| Expense reimbursement due from Investment Manager | 3,916 |

| Prepaid expenses | 15,364 |

| Trustees’ deferred compensation plan | 411,223 |

| Total assets | 1,122,208,494 |

| Liabilities | |

| Payable for: | |

| Capital shares purchased | 1,388,187 |

| Management services fees | 22,297 |

| Distribution and/or service fees | 1,732 |

| Transfer agent fees | 145,187 |

| Compensation of board members | 31,000 |

| Other expenses | 56,639 |

| Trustees’ deferred compensation plan | 411,223 |

| Total liabilities | 2,056,265 |

| Net assets applicable to outstanding capital stock | $1,120,152,229 |

| Represented by | |

| Paid in capital | 599,872,255 |

| Total distributable earnings (loss) | 520,279,974 |

| Total - representing net assets applicable to outstanding capital stock | $1,120,152,229 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 11 |

Statement of Assets and Liabilities (continued)

March 31, 2023

| Class A | |

| Net assets | $158,840,588 |

| Shares outstanding | 22,143,416 |

| Net asset value per share | $7.17 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $7.61 |

| Advisor Class | |

| Net assets | $9,550,326 |

| Shares outstanding | 1,073,200 |

| Net asset value per share | $8.90 |

| Class C | |

| Net assets | $20,478,444 |

| Shares outstanding | 4,945,320 |

| Net asset value per share | $4.14 |

| Institutional Class | |

| Net assets | $680,663,194 |

| Shares outstanding | 83,829,003 |

| Net asset value per share | $8.12 |

| Institutional 2 Class | |

| Net assets | $88,679,957 |

| Shares outstanding | 9,737,980 |

| Net asset value per share | $9.11 |

| Institutional 3 Class | |

| Net assets | $154,171,055 |

| Shares outstanding | 16,360,161 |

| Net asset value per share | $9.42 |

| Class R | |

| Net assets | $7,768,665 |

| Shares outstanding | 1,428,015 |

| Net asset value per share | $5.44 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Statement of Operations

Year Ended March 31, 2023

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $4,074,286 |

| Dividends — affiliated issuers | 288,708 |

| Interfund lending | 145 |

| Total income | 4,363,139 |

| Expenses: | |

| Management services fees | 8,865,863 |

| Distribution and/or service fees | |

| Class A | 388,172 |

| Class C | 237,792 |

| Class R | 36,214 |

| Transfer agent fees | |

| Class A | 252,840 |

| Advisor Class | 20,797 |

| Class C | 38,639 |

| Institutional Class | 1,104,080 |

| Institutional 2 Class | 76,263 |

| Institutional 3 Class | 15,073 |

| Class R | 11,809 |

| Compensation of board members | 33,257 |

| Custodian fees | 8,120 |

| Printing and postage fees | 99,842 |

| Registration fees | 130,484 |

| Accounting services fees | 30,090 |

| Legal fees | 29,947 |

| Interest on interfund lending | 234 |

| Compensation of chief compliance officer | 206 |

| Other | 31,700 |

| Total expenses | 11,411,422 |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | (1,359,968) |

| Fees waived by transfer agent | |

| Institutional 2 Class | (3,580) |

| Institutional 3 Class | (5,838) |

| Expense reduction | (660) |

| Total net expenses | 10,041,376 |

| Net investment loss | (5,678,237) |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 53,109,562 |

| Investments — affiliated issuers | (726) |

| Net realized gain | 53,108,836 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (246,446,103) |

| Investments — affiliated issuers | 1,058 |

| Net change in unrealized appreciation (depreciation) | (246,445,045) |

| Net realized and unrealized loss | (193,336,209) |

| Net decrease in net assets resulting from operations | $(199,014,446) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 13 |

Statement of Changes in Net Assets

| | Year Ended

March 31, 2023 | Year Ended

March 31, 2022 |

| Operations | | |

| Net investment loss | $(5,678,237) | $(11,986,440) |

| Net realized gain | 53,108,836 | 391,699,775 |

| Net change in unrealized appreciation (depreciation) | (246,445,045) | (406,069,309) |

| Net decrease in net assets resulting from operations | (199,014,446) | (26,355,974) |

| Distributions to shareholders | | |

| Net investment income and net realized gains | | |

| Class A | (20,833,919) | (78,918,906) |

| Advisor Class | (1,533,659) | (5,028,694) |

| Class C | (5,334,510) | (22,203,505) |

| Institutional Class | (81,719,629) | (296,318,314) |

| Institutional 2 Class | (18,375,074) | (60,103,958) |

| Institutional 3 Class | (25,431,479) | (142,927,250) |

| Class R | (1,188,225) | (4,419,902) |

| Total distributions to shareholders | (154,416,495) | (609,920,529) |

| Increase (decrease) in net assets from capital stock activity | (208,345,130) | 196,206,640 |

| Total decrease in net assets | (561,776,071) | (440,069,863) |

| Net assets at beginning of year | 1,681,928,300 | 2,121,998,163 |

| Net assets at end of year | $1,120,152,229 | $1,681,928,300 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | March 31, 2023 | March 31, 2022 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions | 3,357,425 | 22,303,218 | 4,408,568 | 53,070,071 |

| Distributions reinvested | 3,117,950 | 18,052,933 | 5,903,906 | 68,734,746 |

| Redemptions | (5,674,645) | (38,655,560) | (6,974,948) | (81,960,563) |

| Net increase | 800,730 | 1,700,591 | 3,337,526 | 39,844,254 |

| Advisor Class | | | | |

| Subscriptions | 299,458 | 2,437,018 | 810,379 | 10,528,998 |

| Distributions reinvested | 195,174 | 1,399,397 | 332,848 | 4,605,905 |

| Redemptions | (945,901) | (7,883,136) | (819,183) | (11,819,817) |

| Net increase (decrease) | (451,269) | (4,046,721) | 324,044 | 3,315,086 |

| Class C | | | | |

| Subscriptions | 772,782 | 3,029,175 | 631,043 | 5,136,991 |

| Distributions reinvested | 1,551,314 | 5,212,415 | 2,772,252 | 21,681,443 |

| Redemptions | (3,146,181) | (12,763,486) | (3,566,921) | (29,913,884) |

| Net decrease | (822,085) | (4,521,896) | (163,626) | (3,095,450) |

| Institutional Class | | | | |

| Subscriptions | 24,459,307 | 183,304,188 | 19,023,932 | 235,113,589 |

| Distributions reinvested | 11,390,689 | 74,495,107 | 20,576,626 | 263,755,395 |

| Redemptions | (36,797,775) | (280,958,674) | (23,407,683) | (306,619,566) |

| Net increase (decrease) | (947,779) | (23,159,379) | 16,192,875 | 192,249,418 |

| Institutional 2 Class | | | | |

| Subscriptions | 3,026,069 | 26,540,782 | 2,997,315 | 39,457,069 |

| Distributions reinvested | 2,505,349 | 18,364,209 | 4,271,244 | 60,086,113 |

| Redemptions | (13,095,935) | (111,098,657) | (3,273,010) | (46,922,281) |

| Net increase (decrease) | (7,564,517) | (66,193,666) | 3,995,549 | 52,620,901 |

| Institutional 3 Class | | | | |

| Subscriptions | 2,367,315 | 20,786,761 | 2,758,862 | 39,965,558 |

| Distributions reinvested | 895,294 | 6,786,325 | 1,870,089 | 27,028,771 |

| Redemptions | (15,932,180) | (140,729,914) | (11,226,988) | (157,002,278) |

| Net decrease | (12,669,571) | (113,156,828) | (6,598,037) | (90,007,949) |

| Class R | | | | |

| Subscriptions | 188,326 | 975,719 | 113,760 | 1,059,632 |

| Distributions reinvested | 270,051 | 1,188,224 | 467,350 | 4,419,902 |

| Redemptions | (213,969) | (1,131,174) | (443,850) | (4,199,154) |

| Net increase | 244,408 | 1,032,769 | 137,260 | 1,280,380 |

| Total net increase (decrease) | (21,410,083) | (208,345,130) | 17,225,591 | 196,206,640 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 15 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The ratios of expenses and net investment income are annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Class A |

| Year Ended 3/31/2023 | $9.36 | (0.05) | (1.13) | (1.18) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $13.58 | (0.10) | 0.11(e) | 0.01 | (4.23) | (4.23) |

| Year Ended 3/31/2021 | $10.37 | (0.09) | 6.94 | 6.85 | (3.64) | (3.64) |

| Year Ended 3/31/2020 | $15.01 | (0.09) | (0.20) | (0.29) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $16.93 | (0.11) | 1.34 | 1.23 | (3.15) | (3.15) |

| Advisor Class |

| Year Ended 3/31/2023 | $11.25 | (0.04) | (1.30) | (1.34) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $15.53 | (0.08) | 0.04(e) | (0.04) | (4.24) | (4.24) |

| Year Ended 3/31/2021 | $11.50 | (0.06) | 7.76 | 7.70 | (3.67) | (3.67) |

| Year Ended 3/31/2020 | $16.16 | (0.07) | (0.24) | (0.31) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $17.96 | (0.07) | 1.43 | 1.36 | (3.16) | (3.16) |

| Class C |

| Year Ended 3/31/2023 | $6.03 | (0.06) | (0.82) | (0.88) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $10.15 | (0.13) | 0.21(e) | 0.08 | (4.20) | (4.20) |

| Year Ended 3/31/2021 | $8.37 | (0.15) | 5.52 | 5.37 | (3.59) | (3.59) |

| Year Ended 3/31/2020 | $13.00 | (0.16) | (0.12) | (0.28) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $15.16 | (0.20) | 1.16 | 0.96 | (3.12) | (3.12) |

| Institutional Class |

| Year Ended 3/31/2023 | $10.38 | (0.03) | (1.22) | (1.25) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $14.63 | (0.07) | 0.06(e) | (0.01) | (4.24) | (4.24) |

| Year Ended 3/31/2021 | $10.97 | (0.06) | 7.39 | 7.33 | (3.67) | (3.67) |

| Year Ended 3/31/2020 | $15.61 | (0.06) | (0.23) | (0.29) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $17.45 | (0.07) | 1.39 | 1.32 | (3.16) | (3.16) |

| Institutional 2 Class |

| Year Ended 3/31/2023 | $11.47 | (0.03) | (1.32) | (1.35) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $15.75 | (0.07) | 0.04(e) | (0.03) | (4.25) | (4.25) |

| Year Ended 3/31/2021 | $11.62 | (0.04) | 7.85 | 7.81 | (3.68) | (3.68) |

| Year Ended 3/31/2020 | $16.27 | (0.05) | (0.25) | (0.30) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $18.05 | (0.06) | 1.45 | 1.39 | (3.17) | (3.17) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Class A |

| Year Ended 3/31/2023 | $7.17 | (10.01%) | 1.18%(c) | 1.06%(c),(d) | (0.69%) | 26% | $158,841 |

| Year Ended 3/31/2022 | $9.36 | (3.91%) | 1.10% | 1.06%(d) | (0.82%) | 32% | $199,667 |

| Year Ended 3/31/2021 | $13.58 | 70.22% | 1.11%(c) | 1.07%(c),(d) | (0.63%) | 31% | $244,546 |

| Year Ended 3/31/2020 | $10.37 | (4.31%) | 1.12%(c) | 1.12%(c),(d) | (0.71%) | 22% | $151,807 |

| Year Ended 3/31/2019 | $15.01 | 8.79% | 1.07%(c) | 1.07%(c),(d) | (0.67%) | 27% | $220,858 |

| Advisor Class |

| Year Ended 3/31/2023 | $8.90 | (9.72%) | 0.92%(c) | 0.81%(c),(d) | (0.45%) | 26% | $9,550 |

| Year Ended 3/31/2022 | $11.25 | (3.73%) | 0.85% | 0.81%(d) | (0.56%) | 32% | $17,145 |

| Year Ended 3/31/2021 | $15.53 | 70.74% | 0.86%(c) | 0.83%(c),(d) | (0.39%) | 31% | $18,638 |

| Year Ended 3/31/2020 | $11.50 | (4.10%) | 0.87%(c) | 0.87%(c),(d) | (0.46%) | 22% | $19,707 |

| Year Ended 3/31/2019 | $16.16 | 9.04% | 0.82%(c) | 0.82%(c),(d) | (0.42%) | 27% | $33,403 |

| Class C |

| Year Ended 3/31/2023 | $4.14 | (10.67%) | 1.92%(c) | 1.81%(c),(d) | (1.45%) | 26% | $20,478 |

| Year Ended 3/31/2022 | $6.03 | (4.66%) | 1.85% | 1.81%(d) | (1.56%) | 32% | $34,758 |

| Year Ended 3/31/2021 | $10.15 | 69.06% | 1.86%(c) | 1.83%(c),(d) | (1.39%) | 31% | $60,193 |

| Year Ended 3/31/2020 | $8.37 | (5.04%) | 1.88%(c) | 1.88%(c),(d) | (1.46%) | 22% | $55,584 |

| Year Ended 3/31/2019 | $13.00 | 7.93% | 1.83%(c) | 1.83%(c),(d) | (1.42%) | 27% | $90,268 |

| Institutional Class |

| Year Ended 3/31/2023 | $8.12 | (9.67%) | 0.93%(c) | 0.81%(c),(d) | (0.45%) | 26% | $680,663 |

| Year Ended 3/31/2022 | $10.38 | (3.77%) | 0.85% | 0.81%(d) | (0.56%) | 32% | $880,232 |

| Year Ended 3/31/2021 | $14.63 | 70.79% | 0.86%(c) | 0.83%(c),(d) | (0.39%) | 31% | $1,003,322 |

| Year Ended 3/31/2020 | $10.97 | (4.12%) | 0.87%(c) | 0.87%(c),(d) | (0.46%) | 22% | $744,099 |

| Year Ended 3/31/2019 | $15.61 | 9.08% | 0.83%(c) | 0.83%(c),(d) | (0.42%) | 27% | $1,311,174 |

| Institutional 2 Class |

| Year Ended 3/31/2023 | $9.11 | (9.61%) | 0.81%(c) | 0.72%(c) | (0.36%) | 26% | $88,680 |

| Year Ended 3/31/2022 | $11.47 | (3.65%) | 0.77% | 0.72% | (0.48%) | 32% | $198,407 |

| Year Ended 3/31/2021 | $15.75 | 71.00% | 0.77%(c) | 0.73%(c) | (0.29%) | 31% | $209,540 |

| Year Ended 3/31/2020 | $11.62 | (4.00%) | 0.77%(c) | 0.75%(c) | (0.34%) | 22% | $144,651 |

| Year Ended 3/31/2019 | $16.27 | 9.14% | 0.73%(c) | 0.72%(c) | (0.32%) | 27% | $166,669 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 17 |

Financial Highlights (continued)

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Institutional 3 Class |

| Year Ended 3/31/2023 | $11.81 | (0.03) | (1.35) | (1.38) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $16.10 | (0.06) | 0.02(e) | (0.04) | (4.25) | (4.25) |

| Year Ended 3/31/2021 | $11.83 | (0.04) | 8.00 | 7.96 | (3.69) | (3.69) |

| Year Ended 3/31/2020 | $16.48 | (0.04) | (0.26) | (0.30) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $18.23 | (0.05) | 1.47 | 1.42 | (3.17) | (3.17) |

| Class R |

| Year Ended 3/31/2023 | $7.45 | (0.05) | (0.95) | (1.00) | (1.01) | (1.01) |

| Year Ended 3/31/2022 | $11.61 | (0.11) | 0.17(e) | 0.06 | (4.22) | (4.22) |

| Year Ended 3/31/2021 | $9.21 | (0.10) | 6.12 | 6.02 | (3.62) | (3.62) |

| Year Ended 3/31/2020 | $13.83 | (0.11) | (0.16) | (0.27) | (4.35) | (4.35) |

| Year Ended 3/31/2019 | $15.87 | (0.14) | 1.24 | 1.10 | (3.14) | (3.14) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | Ratios include interfund lending expense which is less than 0.01%. |

| (d) | The benefits derived from expense reductions had an impact of less than 0.01%. |

| (e) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Institutional 3 Class |

| Year Ended 3/31/2023 | $9.42 | (9.59%) | 0.77%(c) | 0.67%(c) | (0.31%) | 26% | $154,171 |

| Year Ended 3/31/2022 | $11.81 | (3.63%) | 0.72% | 0.67% | (0.43%) | 32% | $342,904 |

| Year Ended 3/31/2021 | $16.10 | 70.96% | 0.72%(c) | 0.69%(c) | (0.24%) | 31% | $573,613 |

| Year Ended 3/31/2020 | $11.83 | (3.93%) | 0.72%(c) | 0.71%(c) | (0.30%) | 22% | $550,287 |

| Year Ended 3/31/2019 | $16.48 | 9.24% | 0.69%(c) | 0.68%(c) | (0.27%) | 27% | $835,068 |

| Class R |

| Year Ended 3/31/2023 | $5.44 | (10.19%) | 1.43%(c) | 1.31%(c),(d) | (0.94%) | 26% | $7,769 |

| Year Ended 3/31/2022 | $7.45 | (4.20%) | 1.35% | 1.31%(d) | (1.06%) | 32% | $8,814 |

| Year Ended 3/31/2021 | $11.61 | 69.94% | 1.36%(c) | 1.32%(c),(d) | (0.88%) | 31% | $12,146 |

| Year Ended 3/31/2020 | $9.21 | (4.59%) | 1.38%(c) | 1.38%(c),(d) | (0.97%) | 22% | $8,892 |

| Year Ended 3/31/2019 | $13.83 | 8.53% | 1.33%(c) | 1.33%(c),(d) | (0.92%) | 27% | $9,830 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 19 |

Notes to Financial Statements

March 31, 2023

Note 1. Organization

Columbia Select Large Cap Growth Fund (the Fund), a series of Columbia Funds Series Trust I (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers each of the share classes listed in the Statement of Assets and Liabilities. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Each share class has its own expense and sales charge structure. Different share classes may have different minimum initial investment amounts and pay different net investment income distribution amounts to the extent the expenses of distributing such share classes vary. Distributions to shareholders in a liquidation will be proportional to the net asset value of each share class.

As described in the Fund’s prospectus, Class A and Class C shares are offered to the general public for investment. Class C shares automatically convert to Class A shares after 8 years. Advisor Class, Institutional Class, Institutional 2 Class, Institutional 3 Class and Class R shares are available for purchase through authorized investment professionals to omnibus retirement plans or to institutional investors and to certain other investors as also described in the Fund’s prospectus.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Equity securities listed on an exchange are valued at the closing price or last trade price on their primary exchange at the close of business of the New York Stock Exchange. Securities with a closing price not readily available or not listed on any exchange are valued at the mean between the closing bid and ask prices. Listed preferred stocks convertible into common stocks are valued using an evaluated price from a pricing service.

Foreign equity securities are valued based on the closing price or last trade price on their primary exchange at the close of business of the New York Stock Exchange. If any foreign equity security closing prices are not readily available, the securities are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are determined at the scheduled closing time of the New York Stock Exchange. Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In those situations, foreign securities will be fair valued pursuant to a policy approved by the Board of Trustees. Under the policy, the Fund may utilize a third-party pricing service to determine these fair values. The third-party pricing service takes into account multiple factors, including, but not limited to, movements in the U.S. securities markets, certain depositary receipts, futures contracts and foreign exchange rates that have occurred subsequent to the close of the foreign exchange or market, to determine a good faith estimate that reasonably reflects the current market conditions as of the close of the New York Stock Exchange. The fair value of a security is likely to be different from the quoted or published price, if available.

Investments in open-end investment companies (other than exchange-traded funds (ETFs)), are valued at the latest net asset value reported by those companies as of the valuation time.

| 20 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

March 31, 2023

Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security, if available.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Corporate actions and dividend income are generally recorded net of any non-reclaimable tax withholdings, on the ex-dividend date or upon receipt of an ex-dividend notification in the case of certain foreign securities.

The Fund may receive distributions from holdings in equity securities, business development companies (BDCs), exchange-traded funds (ETFs), limited partnerships (LPs), other regulated investment companies (RICs), and real estate investment trusts (REITs), which report information as to the tax character of their distributions annually. These distributions are allocated to dividend income, capital gain and return of capital based on actual information reported. Return of capital is recorded as a reduction of the cost basis of securities held. If the Fund no longer owns the applicable securities, return of capital is recorded as a realized gain. With respect to REITs, to the extent actual information has not yet been reported, estimates for return of capital are made by Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). The Investment Manager’s estimates are subsequently adjusted when the actual character of the distributions is disclosed by the REITs, which could result in a proportionate change in return of capital to shareholders.

Awards from class action litigation are recorded as a reduction of cost basis if the Fund still owns the applicable securities on the payment date. If the Fund no longer owns the applicable securities on the payment date, the proceeds are recorded as realized gains.

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of class net asset value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal income tax status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its investment company taxable income and net capital gain, if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its ordinary income, capital gain net income and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 21 |

Notes to Financial Statements (continued)

March 31, 2023

Distributions to shareholders

Distributions from net investment income, if any, are declared and paid each calendar quarter. Net realized capital gains, if any, are distributed at least annually. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Guarantees and indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Recent accounting pronouncement

Tailored Shareholder Reports

In October 2022, the Securities and Exchange Commission (SEC) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Note 3. Fees and other transactions with affiliates

Management services fees

The Fund has entered into a Management Agreement with Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). Under the Management Agreement, the Investment Manager provides the Fund with investment research and advice, as well as administrative and accounting services. The management services fee is an annual fee that is equal to a percentage of the Fund’s daily net assets that declines from 0.77% to 0.57% as the Fund’s net assets increase. The effective management services fee rate for the year ended March 31, 2023 was 0.73% of the Fund’s average daily net assets.

Compensation of board members

Members of the Board of Trustees who are not officers or employees of the Investment Manager or Ameriprise Financial are compensated for their services to the Fund as disclosed in the Statement of Operations. Under a Deferred Compensation Plan (the Deferred Plan), these members of the Board of Trustees may elect to defer payment of up to 100% of their compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of certain funds managed by the Investment Manager. The Fund’s liability for these amounts is adjusted for market value changes and remains in the Fund until distributed in accordance with the Deferred Plan. All amounts payable under the Deferred Plan constitute a general unsecured obligation of the Fund. The expense for the Deferred Plan, which includes Trustees’ fees deferred during the current period as well as any gains or losses on the Trustees’ deferred compensation balances as a result of market fluctuations, is included in "Compensation of board members" in the Statement of Operations.

Compensation of Chief Compliance Officer

The Board of Trustees has appointed a Chief Compliance Officer for the Fund in accordance with federal securities regulations. As disclosed in the Statement of Operations, a portion of the Chief Compliance Officer’s total compensation is allocated to the Fund, along with other allocations to affiliated registered investment companies managed by the Investment Manager and its affiliates, based on relative net assets.

| 22 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

March 31, 2023

Transfer agency fees

Under a Transfer and Dividend Disbursing Agent Agreement, Columbia Management Investment Services Corp. (the Transfer Agent), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, is responsible for providing transfer agency services to the Fund. The Transfer Agent has contracted with SS&C GIDS, Inc. (SS&C GIDS) to serve as sub-transfer agent. Prior to January 1, 2023, SS&C GIDS was known as DST Asset Manager Solutions, Inc. The Transfer Agent pays the fees of SS&C GIDS for services as sub-transfer agent and SS&C GIDS is not entitled to reimbursement for such fees from the Fund (with the exception of out-of-pocket fees).

The Fund pays the Transfer Agent a monthly transfer agency fee based on the number or the average value of accounts, depending on the type of account. In addition, the Fund pays the Transfer Agent a fee for shareholder services based on the number of accounts or on a percentage of the average aggregate value of the Fund’s shares maintained in omnibus accounts up to the lesser of the amount charged by the financial intermediary or a cap established by the Board of Trustees from time to time.

The Transfer Agent also receives compensation from the Fund for various shareholder services and reimbursements for certain out-of-pocket fees. Total transfer agency fees for Institutional 2 Class and Institutional 3 Class shares are subject to an annual limitation of not more than 0.07% and 0.02%, respectively, of the average daily net assets attributable to each share class. In addition, prior to August 1, 2022, Institutional 2 Class shares were subject to a contractual transfer agency fee annual limitation of not more than 0.05% and Institutional 3 Class shares were subject to a contractual transfer agency fee annual limitation of not more than 0.00% of the average daily net assets attributable to each share class.

For the year ended March 31, 2023, the Fund’s effective transfer agency fee rates as a percentage of average daily net assets of each class were as follows:

| | Effective rate (%) |

| Class A | 0.16 |

| Advisor Class | 0.16 |

| Class C | 0.16 |

| Institutional Class | 0.16 |

| Institutional 2 Class | 0.05 |

| Institutional 3 Class | 0.00 |

| Class R | 0.16 |

An annual minimum account balance fee of $20 may apply to certain accounts with a value below the applicable share class’s initial minimum investment requirements to reduce the impact of small accounts on transfer agency fees. These minimum account balance fees are remitted to the Fund and recorded as part of expense reductions in the Statement of Operations. For the year ended March 31, 2023, these minimum account balance fees reduced total expenses of the Fund by $660.

Distribution and service fees

The Fund has entered into an agreement with Columbia Management Investment Distributors, Inc. (the Distributor), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, for distribution and shareholder services. The Board of Trustees has approved, and the Fund has adopted, distribution and shareholder service plans (the Plans) applicable to certain share classes, which set the distribution and service fees for the Fund. These fees are calculated daily and are intended to compensate the Distributor and/or eligible selling and/or servicing agents for selling shares of the Fund and providing services to investors.

Under the Plans, the Fund pays a monthly service fee to the Distributor at the maximum annual rate of 0.25% of the average daily net assets attributable to Class A and Class C shares of the Fund. Also under the Plans, the Fund pays a monthly distribution fee to the Distributor at the maximum annual rates of 0.75% and 0.50% of the average daily net assets attributable to Class C and Class R shares of the Fund, respectively.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 23 |

Notes to Financial Statements (continued)

March 31, 2023

Sales charges (unaudited)

Sales charges, including front-end charges and contingent deferred sales charges (CDSCs), received by the Distributor for distributing Fund shares for the year ended March 31, 2023, if any, are listed below:

| | Front End (%) | CDSC (%) | Amount ($) |

| Class A | 5.75 | 0.50 - 1.00(a) | 95,668 |

| Class C | — | 1.00(b) | 2,084 |

| (a) | This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| (b) | This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

The Fund’s other share classes are not subject to sales charges.

Expenses waived/reimbursed by the Investment Manager and its affiliates

The Investment Manager and certain of its affiliates have contractually agreed to waive fees and/or reimburse expenses (excluding certain fees and expenses described below) for the period(s) disclosed below, unless sooner terminated at the sole discretion of the Board of Trustees, so that the Fund’s net operating expenses, after giving effect to fees waived/expenses reimbursed and any balance credits and/or overdraft charges from the Fund’s custodian, do not exceed the following annual rate(s) as a percentage of the classes’ average daily net assets:

| | August 1, 2022

through

July 31, 2023 | Prior to

August 1, 2022 |

| Class A | 1.05% | 1.07% |

| Advisor Class | 0.80 | 0.82 |

| Class C | 1.80 | 1.82 |

| Institutional Class | 0.80 | 0.82 |

| Institutional 2 Class | 0.71 | 0.73 |

| Institutional 3 Class | 0.66 | 0.68 |

| Class R | 1.30 | 1.32 |

Under the agreement governing these fee waivers and/or expense reimbursement arrangements, the following fees and expenses are excluded from the waiver/reimbursement commitment, and therefore will be paid by the Fund, if applicable: taxes (including foreign transaction taxes), expenses associated with investments in affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds), transaction costs and brokerage commissions, costs related to any securities lending program, dividend expenses associated with securities sold short, inverse floater program fees and expenses, transaction charges and interest on borrowed money, interest, costs associated with shareholder meetings, infrequent and/or unusual expenses and any other expenses the exclusion of which is specifically approved by the Board of Trustees. This agreement may be modified or amended only with approval from the Investment Manager, certain of its affiliates and the Fund. Reflected in the contractual cap commitment, prior to August 1, 2022, is the Transfer Agent’s contractual agreement to limit total transfer agency fees to an annual rate of not more than 0.05% for Institutional 2 Class and 0.00% for Institutional 3 Class of the average daily net assets attributable to each share class. Any fees waived and/or expenses reimbursed under the expense reimbursement arrangements described above are not recoverable by the Investment Manager or its affiliates in future periods.

Note 4. Federal tax information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP because of temporary or permanent book to tax differences.

At March 31, 2023, these differences were primarily due to differing treatment for deferral/reversal of wash sale losses, late-year ordinary losses, trustees’ deferred compensation and net operating loss reclassification. To the extent these differences were permanent, reclassifications were made among the components of the Fund’s net assets. Temporary differences do not require reclassifications.

| 24 | Columbia Select Large Cap Growth Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

March 31, 2023

The following reclassifications were made:

Excess of distributions

over net investment

income ($) | Accumulated

net realized

gain ($) | Paid in

capital ($) |

| 6,976,712 | — | (6,976,712) |

Net investment income (loss) and net realized gains (losses), as disclosed in the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years indicated was as follows:

| Year Ended March 31, 2023 | Year Ended March 31, 2022 |

Ordinary

income ($) | Long-term

capital gains ($) | Total ($) | Ordinary

income ($) | Long-term

capital gains ($) | Total ($) |

| — | 154,416,495 | 154,416,495 | 48,181,003 | 561,739,526 | 609,920,529 |

Short-term capital gain distributions, if any, are considered ordinary income distributions for tax purposes.

At March 31, 2023, the components of distributable earnings on a tax basis were as follows:

Undistributed

ordinary income ($) | Undistributed

long-term

capital gains ($) | Capital loss

carryforwards ($) | Net unrealized

appreciation ($) |

| — | 51,425,762 | — | 470,417,955 |

At March 31, 2023, the cost of all investments for federal income tax purposes along with the aggregate gross unrealized appreciation and depreciation based on that cost was:

Federal

tax cost ($) | Gross unrealized

appreciation ($) | Gross unrealized

(depreciation) ($) | Net unrealized

appreciation ($) |

| 650,541,097 | 475,476,110 | (5,058,155) | 470,417,955 |

Tax cost of investments and unrealized appreciation/(depreciation) may also include timing differences that do not constitute adjustments to tax basis.

Under current tax rules, regulated investment companies can elect to treat certain late-year ordinary losses incurred and post-October capital losses (capital losses realized after October 31) as arising on the first day of the following taxable year. As of March 31, 2023, the Fund will elect to treat the following late-year ordinary losses and post-October capital losses as arising on April 1, 2023.

Late year

ordinary losses ($) | Post-October

capital losses ($) |

| 1,140,844 | — |

Management of the Fund has concluded that there are no significant uncertain tax positions in the Fund that would require recognition in the financial statements. However, management’s conclusion may be subject to review and adjustment at a later date based on factors including, but not limited to, new tax laws, regulations, and administrative interpretations (including relevant court decisions). Generally, the Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Note 5. Portfolio information

The cost of purchases and proceeds from sales of securities, excluding short-term investments and derivatives, if any, aggregated to $316,099,365 and $684,647,892, respectively, for the year ended March 31, 2023. The amount of purchase and sale activity impacts the portfolio turnover rate reported in the Financial Highlights.

Columbia Select Large Cap Growth Fund | Annual Report 2023

| 25 |

Notes to Financial Statements (continued)

March 31, 2023

Note 6. Affiliated money market fund

The Fund invests in Columbia Short-Term Cash Fund, an affiliated money market fund established for the exclusive use by the Fund and other affiliated funds (the Affiliated MMF). The income earned by the Fund from such investments is included as Dividends - affiliated issuers in the Statement of Operations. As an investing fund, the Fund indirectly bears its proportionate share of the expenses of the Affiliated MMF. The Affiliated MMF prices its shares with a floating net asset value. In addition, the Board of Trustees of the Affiliated MMF may impose a fee on redemptions (sometimes referred to as a liquidity fee) or temporarily suspend redemptions (sometimes referred to as imposing a redemption gate) in the event its liquidity falls below regulatory limits.

Note 7. Interfund lending

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Fund participates in a program (the Interfund Program) allowing each participating Columbia Fund (each, a Participating Fund) to lend money directly to and, except for closed-end funds and money market funds, borrow money directly from other Participating Funds for temporary purposes. The amounts eligible for borrowing and lending under the Interfund Program are subject to certain restrictions.