UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: August 31

Date of reporting period: August 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

August 31, 2023

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

If you elect to receive the shareholder report for Columbia Balanced Fund (the Fund) in paper, mailed to you, the Fund mails one shareholder report to each shareholder address, unless such shareholder elects to receive shareholder reports from the Fund electronically via e-mail or by having a paper notice mailed to you (Postcard Notice) that your Fund’s shareholder report is available at the Columbia funds’ website (columbiathreadneedleus.com/investor/). If you would like more than one report in paper to be mailed to you, or would like to elect to receive reports via e-mail or access them through Postcard Notice, please call shareholder services at 800.345.6611 and additional reports will be sent to you.

Proxy voting policies and procedures

The policy of the Board of Trustees is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the Statement of Additional Information (SAI). You may obtain a copy of the SAI without charge by calling 800.345.6611; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the Securities and Exchange Commission (SEC) at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the website of the SEC at sec.gov.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-PORT, is available on columbiathreadneedleus.com/investor/ or can also be obtained without charge, upon request, by calling 800.345.6611.

Additional Fund information

For more information about the Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the Investment Manager)

290 Congress Street

Boston, MA 02210

Fund distributor

Columbia Management Investment Distributors, Inc.

290 Congress Street

Boston, MA 02210

Fund transfer agent

Columbia Management Investment Services Corp.

P.O. Box 219104

Kansas City, MO 64121-9104

Columbia Balanced Fund | Annual Report 2023

Fund at a Glance

(Unaudited)

Investment objective

The Fund seeks high total return by investing in common stocks and debt securities.

Portfolio management

Guy Pope, CFA

Lead Portfolio Manager

Managed Fund since 1997

Jason Callan

Portfolio Manager

Managed Fund since 2018

Gregory Liechty

Portfolio Manager

Managed Fund since 2011

Ronald Stahl, CFA

Portfolio Manager

Managed Fund since 2005

| Average annual total returns (%) (for the period ended August 31, 2023) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 11/01/02 | 9.99 | 7.42 | 8.09 |

| | Including sales charges | | 3.67 | 6.16 | 7.46 |

| Advisor Class | 11/08/12 | 10.26 | 7.69 | 8.37 |

| Class C | Excluding sales charges | 10/13/03 | 9.18 | 6.62 | 7.29 |

| | Including sales charges | | 8.18 | 6.62 | 7.29 |

| Institutional Class | 10/01/91 | 10.27 | 7.69 | 8.37 |

| Institutional 2 Class | 03/07/11 | 10.30 | 7.73 | 8.44 |

| Institutional 3 Class | 11/08/12 | 10.35 | 7.78 | 8.49 |

| Class R | 09/27/10 | 9.72 | 7.15 | 7.83 |

| Blended Benchmark | | 9.04 | 7.14 | 8.41 |

| S&P 500 Index | | 15.94 | 11.12 | 12.81 |

| Bloomberg U.S. Aggregate Bond Index | | -1.19 | 0.49 | 1.48 |

Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/investor/ or calling 800.345.6611.

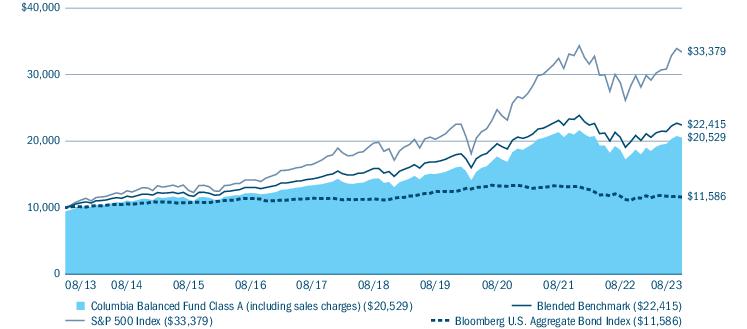

The Blended Benchmark is a weighted custom composite consisting of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage passthroughs), asset-backed securities, and commercial mortgage-backed securities.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia Balanced Fund | Annual Report 2023

| 3 |

Fund at a Glance (continued)

(Unaudited)

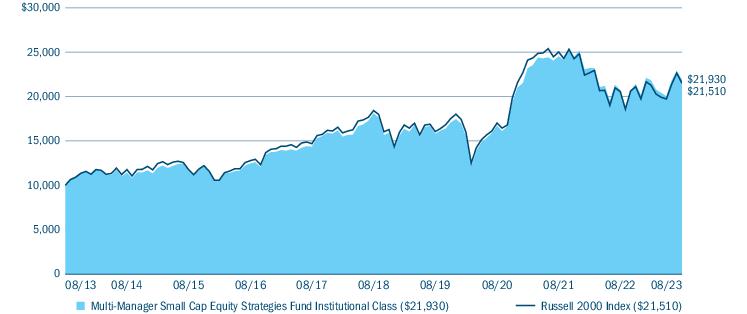

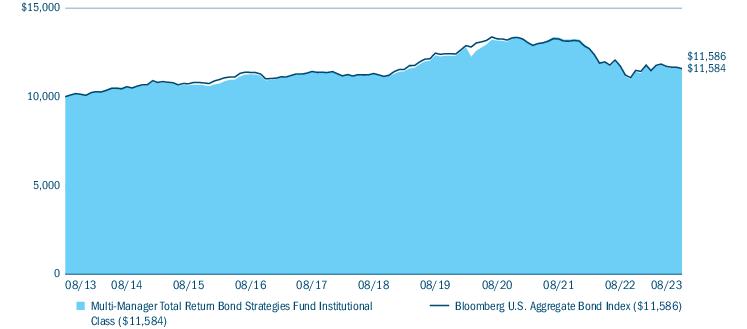

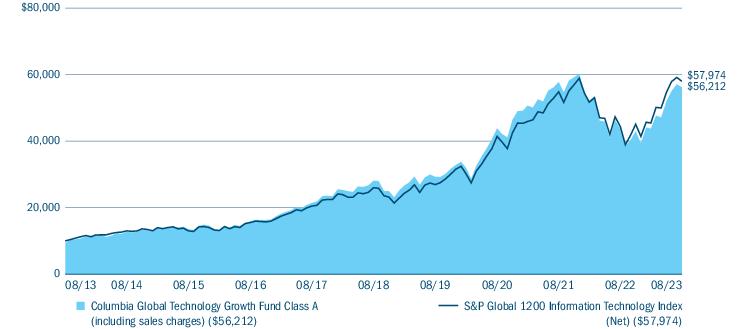

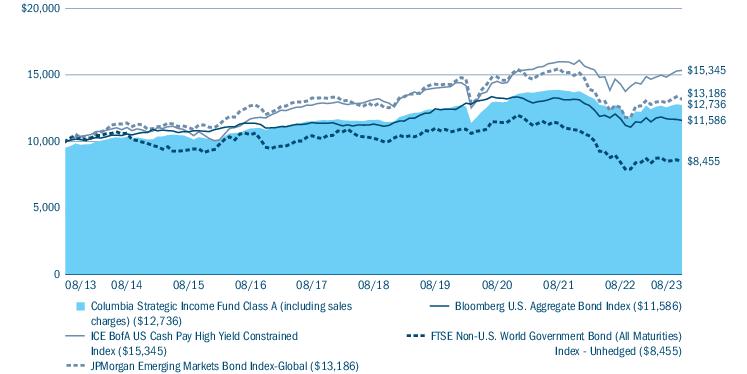

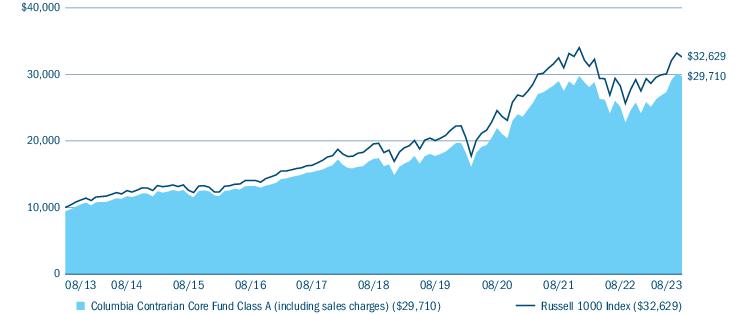

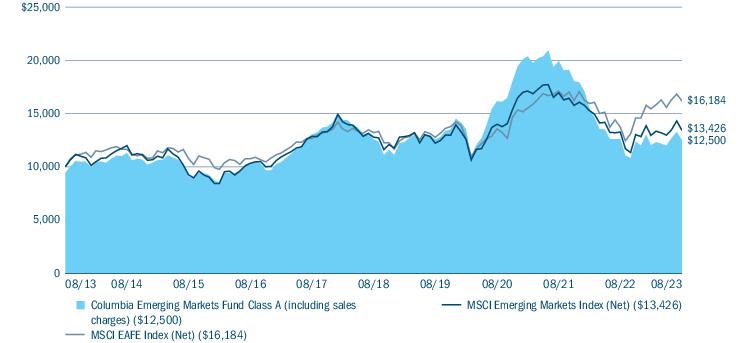

Performance of a hypothetical $10,000 investment (August 31, 2013 — August 31, 2023)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Balanced Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Portfolio breakdown (%) (at August 31, 2023) |

| Asset-Backed Securities — Non-Agency | 5.9 |

| Commercial Mortgage-Backed Securities - Non-Agency | 3.9 |

| Common Stocks | 52.3 |

| Convertible Bonds | 0.0(a) |

| Corporate Bonds & Notes | 6.6 |

| Exchange-Traded Equity Funds | 1.6 |

| Foreign Government Obligations | 0.0(a) |

| Money Market Funds | 9.3 |

| Residential Mortgage-Backed Securities - Agency | 11.7 |

| Residential Mortgage-Backed Securities - Non-Agency | 8.4 |

| Senior Loans | 0.0(a) |

| U.S. Treasury Obligations | 0.3 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 4 | Columbia Balanced Fund | Annual Report 2023 |

Manager Discussion of Fund Performance

(Unaudited)

For the 12-month period that ended August 31, 2023, Class A shares of Columbia Balanced Fund returned 9.99% excluding sales charges. The Fund’s Blended Benchmark returned 9.04%. During the same 12-month period, the Fund’s equity benchmark, the S&P 500 Index, returned 15.94% while the Fund’s fixed-income benchmark, the Bloomberg U.S. Aggregate Bond Index, returned -1.19%.

Market overview

The broad U.S. equity market delivered strong gains during the annual period, despite continued concerns about a future economic slowdown and a series of rate hikes by the U.S. Federal Reserve (Fed) that tapered from aggressive to more measured by period-end to tame stubborn inflation. Market momentum picked up as the period progressed as better-than-feared earnings drove equity gains. The period, however, was far from smooth.

In March 2023, the failure of a pair of U.S. banks and the collapse of European giant Credit Suisse led to fears of a financial crisis. In response, the Fed created a lending facility to support bank liquidity while the market began to price in multiple cuts in the federal funds target rate over the second half of 2023. At its March 2023 meeting, the Fed raised the federal funds target rate by another quarter-point to a range of 4.75% to 5.0%. The rate hike was generally welcomed by investors as a signal that the Fed viewed the financial system as remaining on stable footing.

Inflation continued to decline as the period progressed. Through August 2023, the rate of year-over-year U.S. inflation had decelerated to 3.7%, a meaningful reduction from the four decade high of 9.1% in June 2022, though still higher than the Fed’s 2% inflation target. Nonetheless, with the economy displaying surprising resilience and employment remaining historically robust, the Fed implemented additional 25 basis point increases at its early May and late July meetings, bringing the federal funds target rate to the 5.25% to 5.50% range. (A basis point is 1/100 of a percent.)

Sentiment remained quite positive through the latter months of the period, as the Fed slowed its pace of rate hikes in response to cooling inflation. Investors were further encouraged by the fact that economic growth and corporate earnings — while slowing — did not decline to the extent that the markets had anticipated in late 2022. These factors combined to fuel an impressive gain for equities, but the majority of the positive return was generated by a small group of mega-cap technology-related stocks. Much of the relative strength in this area came from companies expected to benefit from the evolution of artificial intelligence (AI). The growth style strongly outpaced value as a result, with returns of 21.94% and 8.59%, respectively, for the Russell 1000 Growth Index and the Russell 1000 Value Index. The small-cap Russell 2000 Index, which is less influenced by AI-related trends and is more sensitive to concerns about the banking sector, returned 4.65%, unable to keep pace with the rally in large caps.

Within fixed income, sector performance was mixed for the performance period. Lower quality outperformed on an excess return basis, with high yield, emerging markets and investment grade BBB credit performing the best. Asset-backed securities (ABS) and investment-grade corporates produced positive absolute and excess returns over the period. In securitized bonds, agency mortgage-backed securities (MBS) and commercial mortgage-backed securities (CMBS) produced both negative absolute and excess returns. Within the investment-grade corporate market, lower rated securities generated positive excess returns relative to treasuries and outperformed higher quality securities over the period.

The Fund’s notable contributors during the period

| • | The strong performance of the Fund’s equity segment during the period was led by performance of its holdings in the information technology, communication services, industrials, financials and health care sectors. |

| • | Top individual contributors to the performance of the Fund’s equity segment included: |

| ○ | NVIDIA Corp., a semiconductor company that is a leading supplier of artificial intelligence hardware and software; |

| ○ | Microsoft Corp., a multinational technology company that develops and supports software, services, devices and solutions worldwide; and |

| ○ | Eli Lilly & Co., a drug manufacturer that develops and markets human pharmaceuticals worldwide. |

| • | The fixed-income segment of the Fund benefited from owning sectors such as non-agency mortgages, ABS and CMBS, which had positive absolute returns during the period. |

Columbia Balanced Fund | Annual Report 2023

| 5 |

Manager Discussion of Fund Performance (continued)

(Unaudited)

| • | Security selection within the fixed-income segment was positive within the ABS and CMBS sectors. Investment-grade corporate and ABS had positive total returns and excess returns during the reporting period. |

| • | The fixed-income portion of the Fund also benefited from its exposure to high-yield securities as high yield significantly outperformed investment grade during the reporting period. |

The Fund’s notable detractors during the period

| • | The largest detracting areas for the equity portion of the Fund during the period included the real estate, materials and utilities sectors. |

| • | Holdings that detracted most from Fund performance within the equity segment included: |

| ○ | American Tower Corp., a real estate investment trust that owns and operates wireless and broadcast communications infrastructure in several countries worldwide; |

| ○ | CVS Health Corp., a healthcare company which owns CVS Pharmacy, CVS Caremark and Aetna, among many other brands; and |

| ○ | International Flavors & Fragrances, Inc., a chemical company that produces flavors, fragrances and active ingredients for cosmetics. |

| ○ | The Fund’s positions in CVS Health and International Flavors & Fragrances were sold in the second half of the period. |

| • | The fixed-income portion of the Fund was long duration versus its benchmark, which negatively impacted performance in the fixed-income segment of the Fund as interest rates rose during the reporting period. |

| ○ | Compared to August 31, 2022, the 2-year Treasury yield increased 140 basis points (bps) from 3.45% to 4.85% while the 10-year Treasury yield rose 94 bps from 3.15% to 4.09%. The slope of the yield curve flattened. The yield difference between the 10-year Treasury and the 2-year Treasury was -76 bps in August 2023 versus -30 bps in the prior year. |

| • | Agency MBS generated both negative total returns and negative excess returns. The Fund added to them during the year and was overweight, which had a negative impact on performance. We continue to favor agency MBS due to the improved technical situation and cheap valuations versus long term averages. |

| • | Investment-grade corporates significantly outperformed treasuries during the period. The Fund had less exposure to the investment-grade corporate sector versus the benchmark as we believed other sectors were more attractive, which ultimately weighed on relative performance. Security selection within the sector, as noted above, contributed positively to performance. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Investing in derivatives is a specialized activity that involves special risks that subject the Fund to significant loss potential, including when used as leverage, and may result in greater fluctuation in Fund value. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties who contributed to this report. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia Balanced Fund | Annual Report 2023 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| March 1, 2023 — August 31, 2023 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,110.50 | 1,020.52 | 4.95 | 4.74 | 0.93 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,111.70 | 1,021.78 | 3.62 | 3.47 | 0.68 |

| Class C | 1,000.00 | 1,000.00 | 1,106.10 | 1,016.74 | 8.92 | 8.54 | 1.68 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,111.70 | 1,021.78 | 3.62 | 3.47 | 0.68 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,112.00 | 1,021.98 | 3.41 | 3.26 | 0.64 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,112.20 | 1,022.23 | 3.14 | 3.01 | 0.59 |

| Class R | 1,000.00 | 1,000.00 | 1,109.20 | 1,019.26 | 6.27 | 6.01 | 1.18 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Columbia Balanced Fund | Annual Report 2023

| 7 |

Portfolio of Investments

August 31, 2023

(Percentages represent value of investments compared to net assets)

Investments in securities

| Asset-Backed Securities — Non-Agency 6.6% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| ACHV ABS TRUST(a) |

| Series 2023-3PL Class A |

| 08/19/2030 | 6.600% | | 11,684,950 | 11,692,873 |

| Subordinated Series 2023-3PL Class B |

| 08/19/2030 | 7.170% | | 2,550,000 | 2,559,274 |

| ACM Auto Trust(a) |

| Subordinated Series 2022-1A Class C |

| 04/20/2029 | 5.480% | | 5,819,762 | 5,807,482 |

| Affirm Asset Securitization Trust(a) |

| Series 2022-A Class 1A |

| 05/17/2027 | 4.300% | | 4,225,000 | 4,133,751 |

| ALM Ltd.(a),(b) |

| Series 2022-20A Class A2 |

3-month Term SOFR + 2.000%

Floor 2.000%

07/15/2037 | 7.308% | | 8,450,000 | 8,462,979 |

| American Credit Acceptance Receivables Trust(a) |

| Series 2020-1 Class D |

| 03/13/2026 | 2.390% | | 5,169,581 | 5,134,828 |

| Subordinated Series 2021-1 Class C |

| 03/15/2027 | 0.830% | | 1,867,974 | 1,852,201 |

| Subordinated Series 2021-2 Class E |

| 07/13/2027 | 2.540% | | 3,850,000 | 3,640,453 |

| Subordinated Series 2023-3 Class C |

| 10/12/2029 | 6.440% | | 10,050,000 | 10,064,812 |

| Apidos CLO XI(a),(b) |

| Series 2012-11A Class BR3 |

3-month Term SOFR + 1.912%

Floor 1.650%

04/17/2034 | 7.220% | | 12,575,000 | 12,436,713 |

| Apidos CLO XXVIII(a),(b) |

| Series 2017-28A Class A1B |

3-month Term SOFR + 1.412%

Floor 1.150%

01/20/2031 | 6.738% | | 5,925,000 | 5,838,945 |

| Aqua Finance Trust(a) |

| Series 2021-A Class A |

| 07/17/2046 | 1.540% | | 3,199,795 | 2,824,833 |

| ARES XLVII CLO Ltd.(a),(b) |

| Series 2018-47A Class B |

3-month Term SOFR + 1.712%

Floor 1.450%

04/15/2030 | 7.020% | | 3,450,000 | 3,382,708 |

| Avant Loans Funding Trust(a) |

| Subordinated Series 2021-REV1 Class C |

| 07/15/2030 | 2.300% | | 2,100,000 | 1,970,773 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Bain Capital Credit CLO Ltd.(a),(b) |

| Series 2021-7A Class B |

3-month Term SOFR + 1.912%

Floor 1.650%

01/22/2035 | 7.257% | | 15,750,000 | 15,418,982 |

| Ballyrock CLO Ltd.(a),(b) |

| Series 2018-1A Class A1 |

3-month Term SOFR + 1.262%

04/20/2031 | 6.588% | | 3,302,019 | 3,289,019 |

| Barings CLO Ltd.(a),(b) |

| Series 2018-4A Class B |

3-month Term SOFR + 1.962%

Floor 1.700%

10/15/2030 | 7.270% | | 22,000,000 | 21,760,464 |

| Basswood Park CLO Ltd.(a),(b) |

| Series 2021-1A Class A |

3-month Term SOFR + 1.262%

Floor 1.000%

04/20/2034 | 6.588% | | 6,725,000 | 6,630,978 |

| Carbone CLO Ltd.(a),(b) |

| Series 2017-1A Class A1 |

3-month Term SOFR + 1.402%

Floor 1.140%

01/20/2031 | 6.728% | | 11,058,395 | 11,042,427 |

| Carlyle CLO Ltd.(a),(b) |

| Series C17A Class CR |

3-month Term SOFR + 3.062%

Floor 2.800%

04/30/2031 | 8.431% | | 1,925,000 | 1,853,956 |

| Carlyle Group LP(a),(b) |

| Series 2017-5A Class A2 |

3-month Term SOFR + 1.662%

01/20/2030 | 6.988% | | 2,000,000 | 1,960,570 |

| Carmax Auto Owner Trust |

| Subordinated Series 2021-1 Class C |

| 12/15/2026 | 0.940% | | 1,650,000 | 1,510,399 |

| Cascade Funding Mortgage Trust(a) |

| CMO Series 2021-GRN1 Class A |

| 03/20/2041 | 1.100% | | 2,565,801 | 2,386,350 |

| Crossroads Asset Trust(a) |

| Subordinated Series 2021-A Class B |

| 06/20/2025 | 1.120% | | 141,613 | 141,297 |

| Drive Auto Receivables Trust |

| Subordinated Series 2020-2 Class D |

| 05/15/2028 | 3.050% | | 1,875,000 | 1,844,868 |

| Subordinated Series 2021-2 Class D |

| 03/15/2029 | 1.390% | | 22,110,000 | 20,730,099 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Dryden CLO Ltd.(a),(b) |

| Series 2018-55A Class A1 |

3-month Term SOFR + 1.282%

04/15/2031 | 6.590% | | 8,367,571 | 8,340,627 |

| Dryden Senior Loan Fund(a),(b) |

| Series 2016-42A Class BR |

3-month Term SOFR + 1.812%

07/15/2030 | 7.120% | | 6,025,000 | 5,953,652 |

| DT Auto Owner Trust(a) |

| Series 2019-3A Class D |

| 04/15/2025 | 2.960% | | 2,920,918 | 2,907,300 |

| Series 2020-2A Class D |

| 03/16/2026 | 4.730% | | 3,235,000 | 3,198,753 |

| Subordinated Series 2020-1A Class D |

| 11/17/2025 | 2.550% | | 6,847,579 | 6,726,506 |

| Subordinated Series 2020-3A Class D |

| 06/15/2026 | 1.840% | | 6,125,000 | 5,833,189 |

| Exeter Automobile Receivables Trust(a) |

| Series 2019-4A Class D |

| 09/15/2025 | 2.580% | | 3,785,656 | 3,727,717 |

| Subordinated Series 2020-1A Class D |

| 12/15/2025 | 2.730% | | 3,657,356 | 3,588,282 |

| Subordinated Series 2020-2A Class D |

| 04/15/2026 | 4.730% | | 1,695,962 | 1,685,172 |

| Exeter Automobile Receivables Trust |

| Subordinated Series 2020-3A Class D |

| 07/15/2026 | 1.730% | | 3,482,812 | 3,426,564 |

| Subordinated Series 2021-1A Class D |

| 11/16/2026 | 1.080% | | 7,752,000 | 7,381,414 |

| Subordinated Series 2021-3A Class D |

| 06/15/2027 | 1.550% | | 25,630,000 | 23,665,907 |

| Ford Credit Auto Owner Trust(a) |

| Series 2021-2 Class A |

| 05/15/2034 | 1.530% | | 15,305,000 | 13,580,523 |

| Series 2022-1 Class A |

| 11/15/2034 | 3.880% | | 21,500,000 | 20,405,826 |

| Foundation Finance Trust(a) |

| Series 2019-1A Class A |

| 11/15/2034 | 3.860% | | 593,220 | 585,478 |

| Foursight Capital Automobile Receivables Trust(a) |

| Subordinated Series 2021-1 Class D |

| 03/15/2027 | 1.320% | | 5,075,000 | 4,839,728 |

| Freed ABS Trust(a) |

| Subordinated Series 2021-1CP Class C |

| 03/20/2028 | 2.830% | | 325,790 | 323,974 |

| GLS Auto Receivables Issuer Trust(a) |

| Subordinated Series 2019-4A Class C |

| 08/15/2025 | 3.060% | | 2,444,458 | 2,419,958 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Subordinated Series 2020-1A Class C |

| 11/17/2025 | 2.720% | | 4,198,024 | 4,158,854 |

| GoldentTree Loan Management US CLO 1 Ltd.(a),(b) |

| Series 2021-10A Class A |

3-month Term SOFR + 1.362%

Floor 1.100%

07/20/2034 | 6.688% | | 9,175,000 | 9,116,647 |

| Hertz Vehicle Financing LLC(a) |

| Series 2021-1A Class A |

| 12/26/2025 | 1.210% | | 9,606,000 | 9,120,934 |

| Hilton Grand Vacations Trust(a) |

| Series 2018-AA Class A |

| 02/25/2032 | 3.540% | | 856,909 | 831,798 |

| Series 2019-AA Class A |

| 07/25/2033 | 2.340% | | 2,034,921 | 1,896,182 |

| LendingPoint Asset Securitization Trust(a) |

| Subordinated Series 2020-REV1 Class B |

| 10/15/2028 | 4.494% | | 10,200,000 | 10,084,681 |

| LL ABS Trust(a) |

| Series 2021-1A Class A |

| 05/15/2029 | 1.070% | | 885,203 | 865,485 |

| Madison Park Funding XLVIII Ltd.(a),(b) |

| Series 2021-48A Class A |

3-month Term SOFR + 1.412%

Floor 1.150%

04/19/2033 | 6.732% | | 3,025,000 | 3,011,506 |

| Madison Park Funding XXXIII Ltd.(a),(b) |

| Series 2019-33A Class BR |

3-month Term SOFR + 1.800%

Floor 1.800%

10/15/2032 | 7.108% | | 16,325,000 | 15,937,722 |

| Magnetite XII Ltd.(a),(b) |

| Series 2015-12A Class ARR |

3-month Term SOFR + 1.362%

Floor 1.100%

10/15/2031 | 6.670% | | 13,830,000 | 13,797,278 |

| MVW Owner Trust(a) |

| Series 2017-1A Class A |

| 12/20/2034 | 2.420% | | 1,731,982 | 1,687,451 |

| Octagon Investment Partners 39 Ltd.(a),(b) |

| Series 2018-3A Class B |

3-month Term SOFR + 2.112%

Floor 1.650%

10/20/2030 | 7.438% | | 22,575,000 | 22,269,583 |

| OHA Credit Funding Ltd.(a),(b) |

| Series 2021-8A Class A |

3-month Term SOFR + 1.452%

Floor 1.190%

01/18/2034 | 6.762% | | 4,025,000 | 4,011,709 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 9 |

Portfolio of Investments (continued)

August 31, 2023

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| OneMain Financial Issuance Trust(a) |

| Series 2023-2A Class A1 |

| 09/15/2036 | 5.840% | | 22,150,000 | 22,223,033 |

| Pagaya AI Debt Trust(a) |

| Series 2022-1 Class A |

| 10/15/2029 | 2.030% | | 8,351,309 | 8,168,673 |

| Series 2023-5 Class A |

| 04/15/2031 | 7.179% | | 7,775,000 | 7,803,058 |

| Subordinated Series 2022-1 Class B |

| 10/15/2029 | 3.344% | | 4,324,428 | 4,043,279 |

| Palmer Square Loan Funding Ltd.(a),(b) |

| Series 2021-4A Class B |

3-month Term SOFR + 2.012%

Floor 1.750%

10/15/2029 | 7.320% | | 10,000,000 | 9,879,290 |

| Race Point IX CLO Ltd.(a),(b) |

| Series 2015-9A Class A2R |

3-month Term SOFR + 0.712%

Floor 1.450%

10/15/2030 | 6.020% | | 12,200,000 | 11,821,141 |

| Redding Ridge Asset Management Ltd.(a),(b) |

| Series 2018-4A Class A2 |

3-month Term SOFR + 1.812%

04/15/2030 | 7.120% | | 3,000,000 | 2,974,449 |

| Research-Driven Pagaya Motor Asset Trust IV(a) |

| Series 2021-2A Class A |

| 03/25/2030 | 2.650% | | 4,021,731 | 3,561,169 |

| Santander Consumer Auto Receivables Trust(a) |

| Subordinated Series 2021-AA Class C |

| 11/16/2026 | 1.030% | | 1,275,000 | 1,181,807 |

| Subordinated Series 2021-AA Class D |

| 01/15/2027 | 1.570% | | 1,050,000 | 963,544 |

| Santander Drive Auto Receivables Trust |

| Series 2020-2 Class D |

| 09/15/2026 | 2.220% | | 3,667,919 | 3,614,043 |

| Subordinated Series 2020-3 Class D |

| 11/16/2026 | 1.640% | | 34,975,341 | 34,203,998 |

| SCF Equipment Leasing LLC(a) |

| Series 2019-2A Class B |

| 08/20/2026 | 2.760% | | 8,025,000 | 7,868,042 |

| Series 2020-1A Class C |

| 08/21/2028 | 2.600% | | 4,850,000 | 4,554,313 |

| Sierra Timeshare Receivables Funding LLC(a) |

| Series 2018-3A Class A |

| 09/20/2035 | 3.690% | | 381,927 | 374,213 |

| Theorem Funding Trust(a) |

| Subordinated Series 2021-1A Class B |

| 12/15/2027 | 1.840% | | 4,200,000 | 4,116,797 |

| Asset-Backed Securities — Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Upstart Pass-Through Trust(a) |

| Series 2021-ST10 Class A |

| 01/20/2030 | 2.250% | | 8,998,836 | 8,733,378 |

| Series 2021-ST2 Class A |

| 04/20/2027 | 2.500% | | 520,678 | 503,413 |

| Series 2021-ST7 Class A |

| 09/20/2029 | 1.850% | | 1,145,166 | 1,113,808 |

| Series 2021-ST9 Class A |

| 11/20/2029 | 1.700% | | 961,052 | 930,674 |

| Upstart Securitization Trust(a) |

| Series 2020-2 Class A |

| 11/20/2030 | 2.309% | | 936,015 | 924,608 |

| Subordinated Series 2021-2 Class B |

| 06/20/2031 | 1.750% | | 2,270,652 | 2,230,149 |

| Subordinated Series 2021-3 Class B |

| 07/20/2031 | 1.660% | | 2,844,000 | 2,770,153 |

| VSE Voi Mortgage LLC(a) |

| Series 2018-A Class A |

| 02/20/2036 | 3.560% | | 995,445 | 962,704 |

Total Asset-Backed Securities — Non-Agency

(Cost $539,964,649) | 529,272,170 |

|

| Commercial Mortgage-Backed Securities - Non-Agency 4.4% |

| | | | |

| AMSR Trust(a) |

| Subordinated Series 2020-SFR2 Class C |

| 07/17/2037 | 2.533% | | 2,799,000 | 2,606,515 |

| Ashford Hospitality Trust(a),(b) |

| Series 2018-KEYS Class B |

1-month Term SOFR + 1.497%

Floor 1.450%

05/15/2035 | 6.808% | | 16,800,000 | 16,412,004 |

| BBCMS Trust(a),(b) |

| Subordinated Series 2018-BXH Class B |

1-month Term SOFR + 1.364%

Floor 1.250%

10/15/2037 | 6.675% | | 7,370,000 | 7,130,563 |

| Subordinated Series 2018-BXH Class C |

1-month Term SOFR + 1.614%

Floor 1.500%

10/15/2037 | 6.925% | | 3,975,000 | 3,865,752 |

| BB-UBS Trust(a) |

| Series 2012-SHOW Class A |

| 11/05/2036 | 3.430% | | 8,475,000 | 7,748,115 |

| BHMS Mortgage Trust(a),(b) |

| Series 2018-ATLS Class A |

1-month Term SOFR + 1.364%

Floor 1.250%

07/15/2035 | 6.675% | | 14,823,000 | 14,433,793 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| BPR Trust(a),(b) |

| Subordinated Series 2021-TY Class D |

1-month Term SOFR + 2.464%

Floor 2.350%

09/15/2038 | 7.775% | | 6,000,000 | 5,583,136 |

| BX Commercial Mortgage Trust(a),(b) |

| Series 2019-XL Class C |

1-month Term SOFR + 1.364%

Floor 1.250%

10/15/2036 | 6.675% | | 6,056,250 | 6,010,919 |

| BX Mortgage Trust(a),(b) |

| Series 2021-PAC Class D |

1-month Term SOFR + 1.412%

Floor 1.298%

10/15/2036 | 6.723% | | 14,175,000 | 13,586,301 |

| BX Trust(a) |

| Series 2023-LIFE Class A |

| 02/15/2028 | 5.045% | | 7,225,000 | 6,838,767 |

| BX Trust(a),(b) |

| Subordinated Series 2019-ATL Class C |

1-month USD LIBOR + 1.587%

Floor 1.587%

10/15/2036 | 7.012% | | 4,422,000 | 4,245,461 |

| Subordinated Series 2019-ATL Class D |

1-month USD LIBOR + 1.887%

Floor 1.887%

10/15/2036 | 7.312% | | 3,895,000 | 3,671,468 |

| Citigroup Commercial Mortgage Trust(a),(c) |

| Subordinated Series 2020-420K Class C |

| 11/10/2042 | 3.422% | | 2,500,000 | 1,888,198 |

| Subordinated Series 2020-420K Class D |

| 11/10/2042 | 3.422% | | 2,250,000 | 1,605,824 |

| CLNY Trust(a),(b) |

| Subordinated Series 2019-IKPR Class D |

1-month USD LIBOR + 2.025%

Floor 2.025%

11/15/2038 | 7.456% | | 11,925,000 | 11,061,153 |

| COMM Mortgage Trust(a),(c) |

| Subordinated Series 2020-CBM Class D |

| 02/10/2037 | 3.754% | | 2,925,000 | 2,696,969 |

| COMM Mortgage Trust(a) |

| Subordinated Series 2020-CX Class B |

| 11/10/2046 | 2.446% | | 3,275,000 | 2,547,956 |

| Extended Stay America Trust(a),(b) |

| Series 2021-ESH Class E |

1-month Term SOFR + 2.964%

Floor 2.850%

07/15/2038 | 8.275% | | 1,837,044 | 1,804,925 |

| Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Series 2021-ESH Class F |

1-month Term SOFR + 3.814%

Floor 3.700%

07/15/2038 | 9.125% | | 1,908,617 | 1,846,646 |

| FirstKey Homes Trust(a) |

| Subordinated Series 2020-SFR1 Class D |

| 08/17/2037 | 2.241% | | 4,225,000 | 3,856,920 |

| Subordinated Series 2020-SFR2 Class D |

| 10/19/2037 | 1.968% | | 18,600,000 | 16,883,030 |

| GS Mortgage Securities Corp. II(a),(c) |

| Series 2023-SHIP Class A |

| 09/15/2038 | 4.466% | | 6,825,000 | 6,542,125 |

| GS Mortgage Securities Corp. Trust(a) |

| Series 2017-485L Class A |

| 02/10/2037 | 3.721% | | 3,835,000 | 3,333,095 |

| GS Mortgage Securities Corp. Trust(a),(b) |

| Subordinated CMO Series 2021-IP Class D |

1-month Term SOFR + 2.214%

Floor 2.100%

10/15/2036 | 7.525% | | 5,425,000 | 4,965,392 |

| Home Partners of America Trust(a) |

| Subordinated Series 2019-2 Class D |

| 10/19/2039 | 3.121% | | 6,410,403 | 5,605,611 |

| Subordinated Series 2021-2 Class B |

| 12/17/2026 | 2.302% | | 41,015,717 | 36,261,249 |

| JPMorgan Chase Commercial Mortgage Securities Trust(a),(c) |

| Subordinated Series 2021-2NU Class B |

| 01/05/2040 | 2.077% | | 3,800,000 | 2,996,495 |

| Subordinated Series 2021-2NU Class C |

| 01/05/2040 | 2.077% | | 1,500,000 | 1,139,285 |

| KKR Industrial Portfolio Trust(a),(b) |

| Subordinated Series 2021-KDIP Class D |

1-month Term SOFR + 1.364%

Floor 1.250%

12/15/2037 | 6.675% | | 1,921,415 | 1,893,641 |

| Life Mortgage Trust(a),(b) |

| Subordinated Series 2021-BMR Class D |

1-month Term SOFR + 1.514%

Floor 1.400%

03/15/2038 | 6.825% | | 4,472,514 | 4,326,449 |

| Morgan Stanley Bank of America Merrill Lynch Trust |

| Series 2016-C29 Class A3 |

| 05/15/2049 | 3.058% | | 5,928,750 | 5,610,546 |

| Series 2017-C34 Class A3 |

| 11/15/2052 | 3.276% | | 14,135,000 | 12,903,810 |

| Morgan Stanley Capital I Trust(a),(c) |

| Series 2019-MEAD Class D |

| 11/10/2036 | 3.283% | | 7,392,500 | 6,118,161 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 11 |

Portfolio of Investments (continued)

August 31, 2023

| Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| One New York Plaza Trust(a),(b) |

| Subordinated Series 2020-1NYP Class C |

1-month Term SOFR + 2.314%

Floor 2.200%

01/15/2036 | 7.625% | | 6,950,000 | 6,050,869 |

| Subordinated Series 2020-1NYP Class D |

1-month Term SOFR + 2.864%

Floor 2.750%

01/15/2036 | 8.175% | | 2,600,000 | 2,027,817 |

| Progress Residential Trust(a) |

| Series 2019-SFR3 Class C |

| 09/17/2036 | 2.721% | | 4,750,000 | 4,577,251 |

| Series 2019-SFR3 Class D |

| 09/17/2036 | 2.871% | | 7,049,000 | 6,778,862 |

| Series 2019-SFR4 Class C |

| 10/17/2036 | 3.036% | | 17,766,000 | 17,094,006 |

| Series 2020-SFR1 Class C |

| 04/17/2037 | 2.183% | | 2,075,000 | 1,932,763 |

| Series 2020-SFR1 Class D |

| 04/17/2037 | 2.383% | | 4,200,000 | 3,909,400 |

| Subordinated Series 2020-SFR2 Class C |

| 06/17/2037 | 3.077% | | 600,000 | 565,524 |

| Subordinated Series 2020-SFR2 Class D |

| 06/17/2037 | 3.874% | | 775,000 | 737,454 |

| Subordinated Series 2021-SFR8 Class D |

| 10/17/2038 | 2.082% | | 11,910,000 | 10,310,863 |

| RBS Commercial Funding, Inc., Trust(a),(c) |

| Series 2013-GSP Class A |

| 01/15/2032 | 3.961% | | 7,141,000 | 6,943,405 |

| SFO Commercial Mortgage Trust(a),(b) |

| Subordinated Series 2021-555 Class E |

1-month Term SOFR + 3.014%

Floor 2.900%

05/15/2038 | 8.325% | | 3,025,000 | 2,219,512 |

| SPGN TFLM Mortgage Trust(a),(b) |

| Series 2022 Class A |

1-month Term SOFR + 1.550%

Floor 1.550%

02/15/2039 | 6.861% | | 21,925,000 | 20,798,599 |

| STAR Trust(a),(b) |

| Subordinated Series 2022-SFR3 Class B |

1-month Term SOFR + 1.950%

Floor 1.950%

05/17/2024 | 7.261% | | 12,100,000 | 12,019,868 |

| Tricon American Homes(a) |

| Series 2020-SFR1 Class C |

| 07/17/2038 | 2.249% | | 4,100,000 | 3,701,863 |

| Tricon American Homes Trust(a) |

| Subordinated Series 2020-SFR2 Class D |

| 11/17/2039 | 2.281% | | 6,775,000 | 5,784,122 |

| Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Wells Fargo Commercial Mortgage Trust |

| Series 2015-C28 Class A3 |

| 05/15/2048 | 3.290% | | 6,512,659 | 6,311,257 |

| Wells Fargo Commercial Mortgage Trust(a),(b) |

| Series 2020-SDAL Class D |

1-month Term SOFR + 2.204%

Floor 2.090%, Cap 4.500%

02/15/2037 | 7.515% | | 3,400,000 | 3,281,876 |

| Series 2021-FCMT Class A |

1-month Term SOFR + 1.314%

Floor 1.200%

05/15/2031 | 6.625% | | 4,750,000 | 4,532,957 |

| Series 2021-FCMT Class D |

1-month Term SOFR + 3.614%

Floor 3.500%

05/15/2031 | 8.925% | | 3,925,000 | 3,542,463 |

Total Commercial Mortgage-Backed Securities - Non-Agency

(Cost $383,690,095) | 351,141,005 |

| Common Stocks 58.8% |

| Issuer | Shares | Value ($) |

| Communication Services 7.7% |

| Entertainment 1.2% |

| Endeavor Group Holdings, Inc., Class A(d) | 1,509,940 | 33,052,587 |

| Take-Two Interactive Software, Inc.(d) | 467,585 | 66,490,587 |

| Total | | 99,543,174 |

| Interactive Media & Services 5.4% |

| Alphabet, Inc., Class A(d) | 877,491 | 119,487,950 |

| Alphabet, Inc., Class C(d) | 832,980 | 114,409,803 |

| Match Group, Inc.(d) | 545,763 | 25,579,912 |

| Meta Platforms, Inc., Class A(d) | 388,062 | 114,823,665 |

| Pinterest, Inc., Class A(d) | 955,839 | 26,276,014 |

| ZoomInfo Technologies, Inc.(d) | 1,491,523 | 26,877,244 |

| Total | | 427,454,588 |

| Media 0.5% |

| Comcast Corp., Class A | 856,813 | 40,064,576 |

| Wireless Telecommunication Services 0.6% |

| T-Mobile US, Inc.(d) | 350,042 | 47,693,222 |

| Total Communication Services | 614,755,560 |

| Consumer Discretionary 4.2% |

| Automobiles 0.8% |

| Tesla, Inc.(d) | 257,692 | 66,505,151 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Broadline Retail 2.5% |

| Amazon.com, Inc.(d) | 1,422,354 | 196,299,076 |

| Hotels, Restaurants & Leisure 0.2% |

| McDonald’s Corp. | 66,375 | 18,661,331 |

| Specialty Retail 0.3% |

| Lowe’s Companies, Inc. | 84,615 | 19,502,065 |

| Textiles, Apparel & Luxury Goods 0.4% |

| Tapestry, Inc. | 970,220 | 32,327,731 |

| Total Consumer Discretionary | 333,295,354 |

| Consumer Staples 3.5% |

| Consumer Staples Distribution & Retail 1.3% |

| Dollar Tree, Inc.(d) | 40,293 | 4,930,252 |

| Sysco Corp. | 270,216 | 18,820,544 |

| Walmart, Inc. | 497,164 | 80,843,838 |

| Total | | 104,594,634 |

| Food Products 0.6% |

| Mondelez International, Inc., Class A | 610,900 | 43,532,734 |

| Household Products 0.8% |

| Procter & Gamble Co. (The) | 415,116 | 64,069,003 |

| Personal Care Products 0.8% |

| Coty, Inc., Class A(d) | 2,137,453 | 24,708,957 |

| Kenvue, Inc. | 1,788,829 | 41,232,508 |

| Total | | 65,941,465 |

| Total Consumer Staples | 278,137,836 |

| Energy 2.3% |

| Oil, Gas & Consumable Fuels 2.3% |

| Canadian Natural Resources Ltd. | 844,408 | 54,624,754 |

| Chevron Corp. | 530,038 | 85,389,122 |

| EOG Resources, Inc. | 337,607 | 43,423,012 |

| Total | | 183,436,888 |

| Total Energy | 183,436,888 |

| Financials 7.4% |

| Banks 1.4% |

| Bank of America Corp. | 916,297 | 26,270,235 |

| JPMorgan Chase & Co. | 408,854 | 59,827,606 |

| Wells Fargo & Co. | 650,012 | 26,838,995 |

| Total | | 112,936,836 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Capital Markets 1.6% |

| BlackRock, Inc. | 104,823 | 73,432,704 |

| MSCI, Inc. | 22,575 | 12,272,222 |

| S&P Global, Inc. | 102,736 | 40,155,393 |

| Total | | 125,860,319 |

| Consumer Finance 0.3% |

| American Express Co. | 133,221 | 21,047,586 |

| Financial Services 3.6% |

| Berkshire Hathaway, Inc., Class B(d) | 363,358 | 130,881,552 |

| MasterCard, Inc., Class A | 191,857 | 79,167,872 |

| Visa, Inc., Class A | 326,909 | 80,315,003 |

| Total | | 290,364,427 |

| Insurance 0.5% |

| Aon PLC, Class A | 115,207 | 38,408,862 |

| Total Financials | 588,618,030 |

| Health Care 8.3% |

| Biotechnology 1.8% |

| AbbVie, Inc. | 441,306 | 64,854,330 |

| BioMarin Pharmaceutical, Inc.(d) | 296,205 | 27,067,213 |

| Vertex Pharmaceuticals, Inc.(d) | 158,640 | 55,260,657 |

| Total | | 147,182,200 |

| Health Care Equipment & Supplies 1.8% |

| Abbott Laboratories | 252,282 | 25,959,818 |

| Boston Scientific Corp.(d) | 627,237 | 33,833,164 |

| GE HealthCare Technologies, Inc. | 264,708 | 18,648,678 |

| Medtronic PLC | 760,096 | 61,947,824 |

| Total | | 140,389,484 |

| Health Care Providers & Services 1.6% |

| Elevance Health, Inc. | 166,280 | 73,497,423 |

| UnitedHealth Group, Inc. | 108,009 | 51,474,929 |

| Total | | 124,972,352 |

| Life Sciences Tools & Services 1.5% |

| Danaher Corp. | 128,434 | 34,035,010 |

| IQVIA Holdings, Inc.(d) | 151,366 | 33,698,613 |

| Thermo Fisher Scientific, Inc. | 90,690 | 50,523,399 |

| Total | | 118,257,022 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 13 |

Portfolio of Investments (continued)

August 31, 2023

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Pharmaceuticals 1.6% |

| Eli Lilly & Co. | 215,684 | 119,532,073 |

| Johnson & Johnson | 75,342 | 12,181,294 |

| Total | | 131,713,367 |

| Total Health Care | 662,514,425 |

| Industrials 5.4% |

| Aerospace & Defense 0.9% |

| RTX Corp. | 857,787 | 73,803,994 |

| Electrical Equipment 0.6% |

| Emerson Electric Co. | 520,653 | 51,154,157 |

| Ground Transportation 1.8% |

| Uber Technologies, Inc.(d) | 1,485,939 | 70,180,899 |

| Union Pacific Corp. | 332,807 | 73,407,240 |

| Total | | 143,588,139 |

| Industrial Conglomerates 1.2% |

| General Electric Co. | 489,425 | 56,019,585 |

| Honeywell International, Inc. | 191,525 | 35,995,209 |

| Total | | 92,014,794 |

| Machinery 0.9% |

| Parker-Hannifin Corp. | 172,646 | 71,976,117 |

| Total Industrials | 432,537,201 |

| Information Technology 17.0% |

| Electronic Equipment, Instruments & Components 1.1% |

| TE Connectivity Ltd. | 455,590 | 60,315,560 |

| Zebra Technologies Corp., Class A(d) | 88,547 | 24,351,310 |

| Total | | 84,666,870 |

| IT Services 1.3% |

| Accenture PLC, Class A | 151,578 | 49,076,409 |

| International Business Machines Corp. | 382,383 | 56,145,296 |

| Total | | 105,221,705 |

| Semiconductors & Semiconductor Equipment 4.3% |

| Advanced Micro Devices, Inc.(d) | 230,093 | 24,325,432 |

| Entegris, Inc. | 198,029 | 20,054,397 |

| Lam Research Corp. | 86,907 | 61,043,477 |

| Marvell Technology, Inc. | 361,899 | 21,080,617 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| NVIDIA Corp. | 371,849 | 183,526,074 |

| QUALCOMM, Inc. | 294,514 | 33,730,688 |

| Total | | 343,760,685 |

| Software 6.5% |

| Adobe, Inc.(d) | 129,992 | 72,709,725 |

| Intuit, Inc. | 170,589 | 92,426,826 |

| Microsoft Corp. | 998,433 | 327,246,400 |

| Palo Alto Networks, Inc.(d) | 108,411 | 26,376,397 |

| Total | | 518,759,348 |

| Technology Hardware, Storage & Peripherals 3.8% |

| Apple, Inc. | 1,581,945 | 297,200,007 |

| Total Information Technology | 1,349,608,615 |

| Materials 1.5% |

| Chemicals 0.7% |

| Sherwin-Williams Co. (The) | 196,941 | 53,512,808 |

| Containers & Packaging 0.4% |

| Avery Dennison Corp. | 182,233 | 34,329,053 |

| Metals & Mining 0.4% |

| Newmont Corp. | 836,547 | 32,976,683 |

| Total Materials | 120,818,544 |

| Real Estate 0.7% |

| Specialized REITs 0.7% |

| American Tower Corp. | 320,304 | 58,077,521 |

| Total Real Estate | 58,077,521 |

| Utilities 0.8% |

| Electric Utilities 0.2% |

| American Electric Power Co., Inc. | 245,743 | 19,266,251 |

| Multi-Utilities 0.6% |

| DTE Energy Co. | 212,356 | 21,953,364 |

| Public Service Enterprise Group, Inc. | 391,101 | 23,888,449 |

| Total | | 45,841,813 |

| Total Utilities | 65,108,064 |

Total Common Stocks

(Cost $2,636,558,853) | 4,686,908,038 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Convertible Bonds 0.0% |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Cable and Satellite 0.0% |

| DISH Network Corp. |

| Subordinated |

| 08/15/2026 | 3.375% | | 438,000 | 264,990 |

Total Convertible Bonds

(Cost $421,363) | 264,990 |

|

| Corporate Bonds & Notes 7.4% |

| | | | |

| Aerospace & Defense 0.4% |

| BAE Systems PLC(a) |

| 04/15/2030 | 3.400% | | 7,500,000 | 6,690,869 |

| Boeing Co. (The) |

| 05/01/2040 | 5.705% | | 12,700,000 | 12,337,176 |

| Bombardier, Inc.(a) |

| 04/15/2027 | 7.875% | | 285,000 | 284,249 |

| L3Harris Technologies, Inc. |

| 07/31/2033 | 5.400% | | 1,981,000 | 1,984,601 |

| Raytheon Technologies Corp. |

| 03/15/2032 | 2.375% | | 7,268,000 | 5,843,046 |

| 02/27/2033 | 5.150% | | 5,869,000 | 5,796,137 |

| Spirit AeroSystems, Inc. |

| 06/15/2028 | 4.600% | | 129,000 | 104,388 |

| Spirit AeroSystems, Inc.(a) |

| 11/30/2029 | 9.375% | | 135,000 | 140,796 |

| TransDigm, Inc.(a) |

| 03/15/2026 | 6.250% | | 1,044,000 | 1,037,246 |

| 08/15/2028 | 6.750% | | 250,000 | 251,164 |

| 12/15/2030 | 6.875% | | 254,000 | 256,090 |

| TransDigm, Inc. |

| 11/15/2027 | 5.500% | | 369,000 | 350,260 |

| Total | 35,076,022 |

| Airlines 0.0% |

| Air Canada(a) |

| 08/15/2026 | 3.875% | | 183,000 | 168,988 |

| American Airlines, Inc./AAdvantage Loyalty IP Ltd.(a) |

| 04/20/2026 | 5.500% | | 758,244 | 744,147 |

| 04/20/2029 | 5.750% | | 237,298 | 226,820 |

| Hawaiian Brand Intellectual Property Ltd./Miles Loyalty Ltd.(a) |

| 01/20/2026 | 5.750% | | 288,390 | 266,623 |

| United Airlines, Inc.(a) |

| 04/15/2026 | 4.375% | | 245,000 | 231,024 |

| 04/15/2029 | 4.625% | | 252,000 | 224,377 |

| Total | 1,861,979 |

| Automotive 0.1% |

| Ford Motor Co. |

| 02/12/2032 | 3.250% | | 200,000 | 156,072 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Ford Motor Credit Co. LLC |

| 02/10/2025 | 2.300% | | 210,000 | 196,896 |

| 06/16/2025 | 5.125% | | 68,000 | 66,249 |

| 11/13/2025 | 3.375% | | 481,000 | 447,730 |

| 03/06/2026 | 6.950% | | 200,000 | 200,448 |

| 01/09/2027 | 4.271% | | 350,000 | 323,736 |

| 05/28/2027 | 4.950% | | 355,000 | 332,631 |

| 08/17/2027 | 4.125% | | 277,000 | 251,422 |

| 11/04/2027 | 7.350% | | 172,000 | 175,206 |

| 02/16/2028 | 2.900% | | 162,000 | 138,072 |

| 06/10/2030 | 7.200% | | 204,000 | 207,071 |

| 11/13/2030 | 4.000% | | 194,000 | 164,154 |

| IHO Verwaltungs GmbH(a),(e) |

| 09/15/2026 | 4.750% | | 264,544 | 247,753 |

| KAR Auction Services, Inc.(a) |

| 06/01/2025 | 5.125% | | 354,000 | 345,564 |

| Panther BF Aggregator 2 LP/Finance Co., Inc.(a) |

| 05/15/2026 | 6.250% | | 93,000 | 92,269 |

| 05/15/2027 | 8.500% | | 406,000 | 410,558 |

| Total | 3,755,831 |

| Banking 1.8% |

| Bank of America Corp.(f) |

| 04/23/2040 | 4.078% | | 33,000,000 | 27,726,174 |

| Citigroup, Inc.(f) |

| 01/25/2033 | 3.057% | | 13,268,000 | 10,928,903 |

| Goldman Sachs Group, Inc. (The)(f) |

| 02/24/2033 | 3.102% | | 11,000,000 | 9,153,293 |

| HSBC Holdings PLC(f) |

| 05/24/2032 | 2.804% | | 20,800,000 | 16,609,441 |

| JPMorgan Chase & Co.(f) |

| Subordinated |

| 05/13/2031 | 2.956% | | 36,185,000 | 30,725,649 |

| Morgan Stanley(f) |

| 01/22/2031 | 2.699% | | 14,800,000 | 12,464,429 |

| 07/21/2034 | 5.424% | | 2,239,000 | 2,200,401 |

| PNC Financial Services Group, Inc. (The)(f) |

| 06/12/2029 | 5.582% | | 7,946,000 | 7,879,184 |

| US Bancorp(f) |

| 06/12/2034 | 5.836% | | 2,567,000 | 2,560,689 |

| Wells Fargo & Co.(f) |

| 04/24/2034 | 5.389% | | 24,350,000 | 23,721,503 |

| Total | 143,969,666 |

| Brokerage/Asset Managers/Exchanges 0.0% |

| AG TTMT Escrow Issuer LLC(a) |

| 09/30/2027 | 8.625% | | 229,000 | 235,998 |

| Hightower Holding LLC(a) |

| 04/15/2029 | 6.750% | | 293,000 | 254,361 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 15 |

Portfolio of Investments (continued)

August 31, 2023

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| NFP Corp.(a) |

| 08/15/2028 | 4.875% | | 235,000 | 210,500 |

| 08/15/2028 | 6.875% | | 742,000 | 653,811 |

| 10/01/2030 | 7.500% | | 212,000 | 206,041 |

| Total | 1,560,711 |

| Building Materials 0.0% |

| American Builders & Contractors Supply Co., Inc.(a) |

| 11/15/2029 | 3.875% | | 123,000 | 105,722 |

| Beacon Roofing Supply, Inc.(a) |

| 11/15/2026 | 4.500% | | 310,000 | 291,752 |

| 05/15/2029 | 4.125% | | 186,000 | 160,502 |

| 08/01/2030 | 6.500% | | 125,000 | 123,586 |

| Interface, Inc.(a) |

| 12/01/2028 | 5.500% | | 145,000 | 124,536 |

| James Hardie International Finance DAC(a) |

| 01/15/2028 | 5.000% | | 238,000 | 225,018 |

| SRS Distribution, Inc.(a) |

| 07/01/2028 | 4.625% | | 142,000 | 127,111 |

| 07/01/2029 | 6.125% | | 276,000 | 241,747 |

| 12/01/2029 | 6.000% | | 481,000 | 413,940 |

| Standard Industries, Inc.(a) |

| 02/15/2027 | 5.000% | | 61,000 | 57,943 |

| White Cap Buyer LLC(a) |

| 10/15/2028 | 6.875% | | 404,000 | 369,886 |

| Total | 2,241,743 |

| Cable and Satellite 0.2% |

| CCO Holdings LLC/Capital Corp.(a) |

| 05/01/2027 | 5.125% | | 426,000 | 400,552 |

| 02/01/2028 | 5.000% | | 151,000 | 139,158 |

| 03/01/2030 | 4.750% | | 877,000 | 753,836 |

| 08/15/2030 | 4.500% | | 682,000 | 574,459 |

| 03/01/2031 | 7.375% | | 103,000 | 102,364 |

| 02/01/2032 | 4.750% | | 277,000 | 229,827 |

| Comcast Corp. |

| 05/15/2064 | 5.500% | | 3,800,000 | 3,702,426 |

| CSC Holdings LLC(a) |

| 02/01/2028 | 5.375% | | 258,000 | 211,688 |

| 02/01/2029 | 6.500% | | 361,000 | 298,471 |

| 01/15/2030 | 5.750% | | 335,000 | 185,395 |

| 12/01/2030 | 4.125% | | 298,000 | 212,477 |

| 02/15/2031 | 3.375% | | 233,000 | 160,135 |

| DISH DBS Corp.(a) |

| 12/01/2028 | 5.750% | | 388,000 | 302,004 |

| DISH DBS Corp. |

| 06/01/2029 | 5.125% | | 324,000 | 174,994 |

| DISH Network Corp.(a) |

| 11/15/2027 | 11.750% | | 544,000 | 552,358 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Radiate Holdco LLC/Finance, Inc.(a) |

| 09/15/2026 | 4.500% | | 316,000 | 246,143 |

| 09/15/2028 | 6.500% | | 75,000 | 40,828 |

| Sirius XM Radio, Inc.(a) |

| 09/01/2026 | 3.125% | | 204,000 | 183,921 |

| 07/01/2029 | 5.500% | | 289,000 | 260,408 |

| Time Warner Cable LLC |

| 05/01/2037 | 6.550% | | 9,210,000 | 8,739,849 |

| Videotron Ltd.(a) |

| 06/15/2029 | 3.625% | | 197,000 | 169,342 |

| Virgin Media Finance PLC(a) |

| 07/15/2030 | 5.000% | | 299,000 | 242,601 |

| Virgin Media Secured Finance PLC(a) |

| 05/15/2029 | 5.500% | | 303,000 | 277,310 |

| 08/15/2030 | 4.500% | | 192,000 | 161,842 |

| VZ Secured Financing BV(a) |

| 01/15/2032 | 5.000% | | 387,000 | 315,556 |

| Ziggo Bond Co. BV(a) |

| 02/28/2030 | 5.125% | | 241,000 | 186,761 |

| Ziggo Bond Finance BV(a) |

| 01/15/2027 | 6.000% | | 332,000 | 308,046 |

| Ziggo BV(a) |

| 01/15/2030 | 4.875% | | 425,000 | 356,920 |

| Total | 19,489,671 |

| Chemicals 0.1% |

| Avient Corp.(a) |

| 08/01/2030 | 7.125% | | 217,000 | 217,159 |

| Axalta Coating Systems LLC(a) |

| 02/15/2029 | 3.375% | | 119,000 | 100,872 |

| Axalta Coating Systems LLC/Dutch Holding B BV(a) |

| 06/15/2027 | 4.750% | | 553,000 | 520,384 |

| Cheever Escrow Issuer LLC(a) |

| 10/01/2027 | 7.125% | | 209,000 | 197,110 |

| Element Solutions, Inc.(a) |

| 09/01/2028 | 3.875% | | 387,000 | 340,117 |

| HB Fuller Co. |

| 10/15/2028 | 4.250% | | 516,000 | 459,252 |

| Herens Holdco Sarl(a) |

| 05/15/2028 | 4.750% | | 256,000 | 196,392 |

| INEOS Quattro Finance 2 Plc(a) |

| 01/15/2026 | 3.375% | | 162,000 | 148,080 |

| Ingevity Corp.(a) |

| 11/01/2028 | 3.875% | | 267,000 | 226,814 |

| Innophos Holdings, Inc.(a) |

| 02/15/2028 | 9.375% | | 278,000 | 272,266 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Iris Holdings, Inc.(a),(e) |

| 02/15/2026 | 8.750% | | 135,000 | 127,039 |

| Olympus Water US Holding Corp.(a) |

| 10/01/2028 | 4.250% | | 467,000 | 386,085 |

| 11/15/2028 | 9.750% | | 318,000 | 320,614 |

| 10/01/2029 | 6.250% | | 181,000 | 145,663 |

| SPCM SA(a) |

| 03/15/2027 | 3.125% | | 133,000 | 118,052 |

| WR Grace Holdings LLC(a) |

| 06/15/2027 | 4.875% | | 427,000 | 398,452 |

| 08/15/2029 | 5.625% | | 606,000 | 511,568 |

| 03/01/2031 | 7.375% | | 127,000 | 125,466 |

| Total | 4,811,385 |

| Construction Machinery 0.1% |

| H&E Equipment Services, Inc.(a) |

| 12/15/2028 | 3.875% | | 106,000 | 92,574 |

| Herc Holdings, Inc.(a) |

| 07/15/2027 | 5.500% | | 117,000 | 112,444 |

| John Deere Capital Corp. |

| 07/14/2028 | 4.950% | | 5,500,000 | 5,518,514 |

| Ritchie Bros Holdings, Inc.(a) |

| 03/15/2028 | 6.750% | | 54,000 | 54,675 |

| 03/15/2031 | 7.750% | | 224,000 | 231,632 |

| United Rentals North America, Inc. |

| 01/15/2030 | 5.250% | | 198,000 | 188,246 |

| Total | 6,198,085 |

| Consumer Cyclical Services 0.0% |

| Arches Buyer, Inc.(a) |

| 06/01/2028 | 4.250% | | 436,000 | 379,522 |

| 12/01/2028 | 6.125% | | 378,000 | 324,493 |

| Match Group, Inc.(a) |

| 02/15/2029 | 5.625% | | 191,000 | 180,894 |

| Staples, Inc.(a) |

| 04/15/2026 | 7.500% | | 117,000 | 96,486 |

| Uber Technologies, Inc.(a) |

| 05/15/2025 | 7.500% | | 359,000 | 363,259 |

| 01/15/2028 | 6.250% | | 247,000 | 245,041 |

| 08/15/2029 | 4.500% | | 448,000 | 410,193 |

| Total | 1,999,888 |

| Consumer Products 0.0% |

| CD&R Smokey Buyer, Inc.(a) |

| 07/15/2025 | 6.750% | | 473,000 | 459,521 |

| Mattel, Inc.(a) |

| 04/01/2026 | 3.375% | | 113,000 | 105,293 |

| 04/01/2029 | 3.750% | | 222,000 | 197,307 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Newell Brands, Inc. |

| 09/15/2027 | 6.375% | | 79,000 | 77,560 |

| 09/15/2029 | 6.625% | | 111,000 | 109,944 |

| Prestige Brands, Inc.(a) |

| 01/15/2028 | 5.125% | | 399,000 | 378,330 |

| Scotts Miracle-Gro Co. (The) |

| 04/01/2031 | 4.000% | | 65,000 | 51,117 |

| 02/01/2032 | 4.375% | | 136,000 | 107,315 |

| Spectrum Brands, Inc.(a) |

| 10/01/2029 | 5.000% | | 131,000 | 120,338 |

| 07/15/2030 | 5.500% | | 159,000 | 148,230 |

| Total | 1,754,955 |

| Diversified Manufacturing 0.0% |

| Chart Industries, Inc.(a) |

| 01/01/2030 | 7.500% | | 136,000 | 139,468 |

| 01/01/2031 | 9.500% | | 47,000 | 50,710 |

| Emerald Debt Merger Sub LLC(a) |

| 12/15/2030 | 6.625% | | 351,000 | 345,890 |

| Gates Global LLC/Co.(a) |

| 01/15/2026 | 6.250% | | 524,000 | 521,042 |

| Madison IAQ LLC(a) |

| 06/30/2028 | 4.125% | | 152,000 | 134,633 |

| 06/30/2029 | 5.875% | | 213,000 | 179,349 |

| Resideo Funding, Inc.(a) |

| 09/01/2029 | 4.000% | | 554,000 | 465,708 |

| Vertical Holdco GmbH(a) |

| 07/15/2028 | 7.625% | | 237,000 | 220,224 |

| Vertical US Newco, Inc.(a) |

| 07/15/2027 | 5.250% | | 391,000 | 366,173 |

| WESCO Distribution, Inc.(a) |

| 06/15/2025 | 7.125% | | 268,000 | 269,931 |

| 06/15/2028 | 7.250% | | 287,000 | 292,509 |

| Total | 2,985,637 |

| Electric 0.6% |

| Clearway Energy Operating LLC(a) |

| 03/15/2028 | 4.750% | | 368,000 | 339,978 |

| 02/15/2031 | 3.750% | | 479,000 | 394,349 |

| 01/15/2032 | 3.750% | | 102,000 | 83,579 |

| Edison International |

| 11/15/2028 | 5.250% | | 6,940,000 | 6,782,996 |

| Emera US Finance LP |

| 06/15/2046 | 4.750% | | 8,500,000 | 6,655,384 |

| Exelon Corp. |

| 03/15/2052 | 4.100% | | 4,430,000 | 3,412,012 |

| Indiana Michigan Power Co. |

| 03/15/2037 | 6.050% | | 2,500,000 | 2,560,845 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 17 |

Portfolio of Investments (continued)

August 31, 2023

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Leeward Renewable Energy Operations LLC(a) |

| 07/01/2029 | 4.250% | | 80,000 | 70,173 |

| NextEra Energy Operating Partners LP(a) |

| 09/15/2027 | 4.500% | | 340,000 | 315,810 |

| NRG Energy, Inc.(a) |

| 02/15/2029 | 3.375% | | 190,000 | 156,612 |

| 06/15/2029 | 5.250% | | 154,000 | 138,653 |

| 02/15/2031 | 3.625% | | 272,000 | 212,767 |

| 02/15/2032 | 3.875% | | 483,000 | 373,622 |

| Ohio Edison Co.(a) |

| 01/15/2033 | 5.500% | | 7,000,000 | 6,917,408 |

| Pacific Gas and Electric Co. |

| 01/15/2053 | 6.750% | | 7,861,000 | 7,649,067 |

| PG&E Corp. |

| 07/01/2030 | 5.250% | | 220,000 | 195,485 |

| Progress Energy, Inc. |

| 03/01/2031 | 7.750% | | 5,000,000 | 5,602,083 |

| Southern Co. (The) |

| 07/01/2046 | 4.400% | | 8,250,000 | 6,792,585 |

| Vistra Operations Co. LLC(a) |

| 09/01/2026 | 5.500% | | 75,000 | 72,324 |

| 02/15/2027 | 5.625% | | 354,000 | 340,651 |

| 07/31/2027 | 5.000% | | 379,000 | 356,811 |

| Total | 49,423,194 |

| Environmental 0.0% |

| Clean Harbors, Inc.(a) |

| 02/01/2031 | 6.375% | | 39,000 | 38,801 |

| GFL Environmental, Inc.(a) |

| 12/15/2026 | 5.125% | | 319,000 | 308,628 |

| Waste Pro USA, Inc.(a) |

| 02/15/2026 | 5.500% | | 447,000 | 423,413 |

| Total | 770,842 |

| Finance Companies 0.0% |

| Navient Corp. |

| 06/25/2025 | 6.750% | | 200,000 | 199,092 |

| OneMain Finance Corp. |

| 01/15/2029 | 9.000% | | 149,000 | 151,043 |

| 09/15/2030 | 4.000% | | 214,000 | 166,658 |

| Provident Funding Associates LP/Finance Corp.(a) |

| 06/15/2025 | 6.375% | | 247,000 | 218,443 |

| Quicken Loans LLC/Co-Issuer, Inc.(a) |

| 03/01/2031 | 3.875% | | 353,000 | 287,927 |

| Rocket Mortgage LLC/Co-Issuer, Inc.(a) |

| 10/15/2033 | 4.000% | | 587,000 | 465,688 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Springleaf Finance Corp. |

| 03/15/2024 | 6.125% | | 221,000 | 220,614 |

| 11/15/2029 | 5.375% | | 23,000 | 19,905 |

| Total | 1,729,370 |

| Food and Beverage 0.3% |

| Bacardi Ltd.(a) |

| 05/15/2038 | 5.150% | | 8,350,000 | 7,688,771 |

| Bacardi Ltd./Bacardi-Martini BV(a) |

| 06/15/2043 | 5.900% | | 2,756,000 | 2,715,903 |

| Constellation Brands, Inc. |

| 05/01/2033 | 4.900% | | 6,200,000 | 5,976,126 |

| Darling Ingredients, Inc.(a) |

| 06/15/2030 | 6.000% | | 275,000 | 268,791 |

| FAGE International SA/USA Dairy Industry, Inc.(a) |

| 08/15/2026 | 5.625% | | 464,000 | 445,473 |

| Pilgrim’s Pride Corp. |

| 04/15/2031 | 4.250% | | 515,000 | 445,837 |

| 03/01/2032 | 3.500% | | 556,000 | 447,316 |

| Post Holdings, Inc.(a) |

| 03/01/2027 | 5.750% | | 182,000 | 177,779 |

| 01/15/2028 | 5.625% | | 152,000 | 145,794 |

| 04/15/2030 | 4.625% | | 322,000 | 285,139 |

| 09/15/2031 | 4.500% | | 115,000 | 99,112 |

| Primo Water Holdings, Inc.(a) |

| 04/30/2029 | 4.375% | | 621,000 | 545,304 |

| Simmons Foods, Inc./Prepared Foods, Inc./Pet Food, Inc./Feed(a) |

| 03/01/2029 | 4.625% | | 314,000 | 261,807 |

| US Foods, Inc.(a) |

| 04/15/2025 | 6.250% | | 58,000 | 58,163 |

| 02/15/2029 | 4.750% | | 269,000 | 245,724 |

| 06/01/2030 | 4.625% | | 175,000 | 156,068 |

| Total | 19,963,107 |

| Gaming 0.0% |

| Boyd Gaming Corp. |

| 12/01/2027 | 4.750% | | 240,000 | 225,106 |

| Boyd Gaming Corp.(a) |

| 06/15/2031 | 4.750% | | 166,000 | 146,254 |

| Caesars Entertainment, Inc.(a) |

| 10/15/2029 | 4.625% | | 594,000 | 519,531 |

| 02/15/2030 | 7.000% | | 396,000 | 397,620 |

| CDI Escrow Issuer, Inc.(a) |

| 04/01/2030 | 5.750% | | 110,000 | 102,300 |

| Churchill Downs, Inc.(a) |

| 05/01/2031 | 6.750% | | 121,000 | 118,365 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia Balanced Fund | Annual Report 2023 |

Portfolio of Investments (continued)

August 31, 2023

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Colt Merger Sub, Inc.(a) |

| 07/01/2025 | 5.750% | | 310,000 | 310,356 |

| 07/01/2025 | 6.250% | | 516,000 | 512,343 |

| 07/01/2027 | 8.125% | | 269,000 | 273,155 |

| International Game Technology PLC(a) |

| 04/15/2026 | 4.125% | | 122,000 | 115,724 |

| Light & Wonder International, Inc.(a) |

| 09/01/2031 | 7.500% | | 55,000 | 55,758 |

| Midwest Gaming Borrower LLC(a) |

| 05/01/2029 | 4.875% | | 261,000 | 227,175 |

| Scientific Games Holdings LP/US FinCo, Inc.(a) |

| 03/01/2030 | 6.625% | | 434,000 | 382,541 |

| Total | 3,386,228 |

| Health Care 0.4% |

| Acadia Healthcare Co., Inc.(a) |

| 07/01/2028 | 5.500% | | 318,000 | 301,508 |

| 04/15/2029 | 5.000% | | 161,000 | 148,416 |

| AdaptHealth LLC(a) |

| 03/01/2030 | 5.125% | | 325,000 | 269,469 |

| Avantor Funding, Inc.(a) |

| 07/15/2028 | 4.625% | | 283,000 | 262,692 |

| 11/01/2029 | 3.875% | | 339,000 | 297,454 |

| Catalent Pharma Solutions, Inc.(a) |

| 04/01/2030 | 3.500% | | 229,000 | 193,300 |

| Charles River Laboratories International, Inc.(a) |

| 05/01/2028 | 4.250% | | 160,000 | 146,953 |

| 03/15/2029 | 3.750% | | 122,000 | 107,795 |

| CHS/Community Health Systems, Inc.(a) |

| 03/15/2027 | 5.625% | | 75,000 | 66,017 |

| 04/15/2029 | 6.875% | | 240,000 | 146,947 |

| 05/15/2030 | 5.250% | | 587,000 | 462,284 |

| CVS Health Corp. |

| 03/25/2048 | 5.050% | | 14,000,000 | 12,293,348 |

| HCA, Inc. |

| 03/15/2052 | 4.625% | | 12,500,000 | 10,025,838 |

| IQVIA, Inc.(a) |

| 05/15/2027 | 5.000% | | 210,000 | 202,331 |

| 05/15/2030 | 6.500% | | 104,000 | 104,846 |

| Mozart Debt Merger Sub, Inc.(a) |

| 04/01/2029 | 3.875% | | 58,000 | 50,518 |

| 10/01/2029 | 5.250% | | 635,000 | 563,876 |

| Select Medical Corp.(a) |

| 08/15/2026 | 6.250% | | 811,000 | 803,356 |

| Tenet Healthcare Corp. |

| 02/01/2027 | 6.250% | | 370,000 | 364,555 |

| 11/01/2027 | 5.125% | | 237,000 | 225,810 |

| 10/01/2028 | 6.125% | | 271,000 | 261,017 |

| 01/15/2030 | 4.375% | | 186,000 | 165,425 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| 06/15/2030 | 6.125% | | 179,000 | 173,712 |

| Tenet Healthcare Corp.(a) |

| 05/15/2031 | 6.750% | | 225,000 | 224,311 |

| Total | 27,861,778 |

| Healthcare Insurance 0.3% |

| Centene Corp. |

| 10/15/2030 | 3.000% | | 12,000,000 | 9,987,399 |

| UnitedHealth Group, Inc. |

| 04/15/2063 | 5.200% | | 10,000,000 | 9,567,908 |

| Total | 19,555,307 |

| Home Construction 0.0% |

| Meritage Homes Corp. |

| 06/01/2025 | 6.000% | | 302,000 | 301,312 |

| Meritage Homes Corp.(a) |

| 04/15/2029 | 3.875% | | 276,000 | 240,978 |

| Taylor Morrison Communities, Inc.(a) |

| 06/15/2027 | 5.875% | | 70,000 | 68,785 |

| 08/01/2030 | 5.125% | | 201,000 | 185,122 |

| Total | 796,197 |

| Independent Energy 0.1% |

| Baytex Energy Corp.(a) |

| 04/30/2030 | 8.500% | | 219,000 | 221,944 |

| Callon Petroleum Co. |

| 07/01/2026 | 6.375% | | 478,000 | 471,127 |

| Callon Petroleum Co.(a) |

| 06/15/2030 | 7.500% | | 160,000 | 158,199 |

| Centennial Resource Production LLC(a) |

| 04/01/2027 | 6.875% | | 51,000 | 50,900 |

| CNX Resources Corp.(a) |

| 03/14/2027 | 7.250% | | 31,000 | 30,967 |

| 01/15/2029 | 6.000% | | 176,000 | 167,555 |

| 01/15/2031 | 7.375% | | 120,000 | 119,811 |

| Colgate Energy Partners III LLC(a) |

| 07/01/2029 | 5.875% | | 502,000 | 484,336 |

| CrownRock LP/Finance, Inc.(a) |

| 10/15/2025 | 5.625% | | 329,000 | 323,742 |

| 05/01/2029 | 5.000% | | 267,000 | 247,713 |

| Endeavor Energy Resources LP/Finance, Inc.(a) |

| 01/30/2028 | 5.750% | | 346,000 | 338,563 |

| Hilcorp Energy I LP/Finance Co.(a) |

| 11/01/2028 | 6.250% | | 379,000 | 364,312 |

| 02/01/2029 | 5.750% | | 103,000 | 96,452 |

| 04/15/2030 | 6.000% | | 131,000 | 121,807 |

| 04/15/2032 | 6.250% | | 121,000 | 111,235 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Balanced Fund | Annual Report 2023

| 19 |

Portfolio of Investments (continued)

August 31, 2023

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Matador Resources Co. |

| 09/15/2026 | 5.875% | | 425,000 | 414,556 |

| Matador Resources Co.(a) |

| 04/15/2028 | 6.875% | | 129,000 | 128,986 |

| SM Energy Co. |

| 09/15/2026 | 6.750% | | 253,000 | 251,797 |

| Southwestern Energy Co. |

| 02/01/2032 | 4.750% | | 725,000 | 641,855 |

| Total | 4,745,857 |

| Integrated Energy 0.0% |

| Cenovus Energy, Inc. |

| 02/15/2052 | 3.750% | | 3,500,000 | 2,454,628 |

| Leisure 0.1% |

| Carnival Corp.(a) |

| 03/01/2027 | 5.750% | | 502,000 | 472,500 |

| 08/01/2028 | 4.000% | | 341,000 | 305,026 |

| 05/01/2029 | 6.000% | | 274,000 | 247,167 |

| 08/15/2029 | 7.000% | | 90,000 | 91,320 |

| Carnival Holdings Bermuda Ltd.(a) |

| 05/01/2028 | 10.375% | | 181,000 | 196,946 |

| Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium Operations LLC(a) |

| 05/01/2025 | 5.500% | | 139,000 | 137,942 |

| Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium Operations LLC |

| 10/01/2028 | 6.500% | | 359,000 | 346,642 |

| Cinemark USA, Inc.(a) |

| 05/01/2025 | 8.750% | | 54,000 | 54,729 |

| 03/15/2026 | 5.875% | | 411,000 | 395,939 |

| 07/15/2028 | 5.250% | | 9,000 | 7,991 |

| Live Nation Entertainment, Inc.(a) |

| 03/15/2026 | 5.625% | | 291,000 | 282,626 |

| 05/15/2027 | 6.500% | | 204,000 | 203,673 |

| 10/15/2027 | 4.750% | | 109,000 | 101,544 |

| NCL Corp., Ltd.(a) |

| 03/15/2026 | 5.875% | | 127,000 | 119,626 |

| NCL Finance Ltd.(a) |

| 03/15/2028 | 6.125% | | 78,000 | 70,318 |

| Royal Caribbean Cruises Ltd.(a) |

| 07/01/2026 | 4.250% | | 392,000 | 365,820 |

| 08/31/2026 | 5.500% | | 33,000 | 31,685 |

| 07/15/2027 | 5.375% | | 63,000 | 59,318 |

| 04/01/2028 | 5.500% | | 70,000 | 65,662 |

| 01/15/2030 | 7.250% | | 274,000 | 278,352 |

| Royal Caribbean Cruises Ltd. |

| 03/15/2028 | 3.700% | | 208,000 | 180,738 |

| Six Flags Entertainment Corp.(a) |

| 05/15/2031 | 7.250% | | 271,000 | 259,891 |

| Corporate Bonds & Notes (continued) |

| Issuer | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Viking Cruises Ltd.(a) |

| 09/15/2027 | 5.875% | | 240,000 | 224,347 |

| 07/15/2031 | 9.125% | | 81,000 | 83,706 |

| Total | 4,583,508 |

| Life Insurance 0.2% |

| Corebridge Financial, Inc. |

| 04/05/2052 | 4.400% | | 3,200,000 | 2,471,787 |

| Five Corners Funding Trust III(a) |

| 02/15/2033 | 5.791% | | 7,000,000 | 7,072,523 |

| MetLife, Inc. |