Exhibit (c)(3)

Exhibit (c)(3)

Confidential

Project Alchemy

Board Presentation Materials

January 4, 2009

Confidential

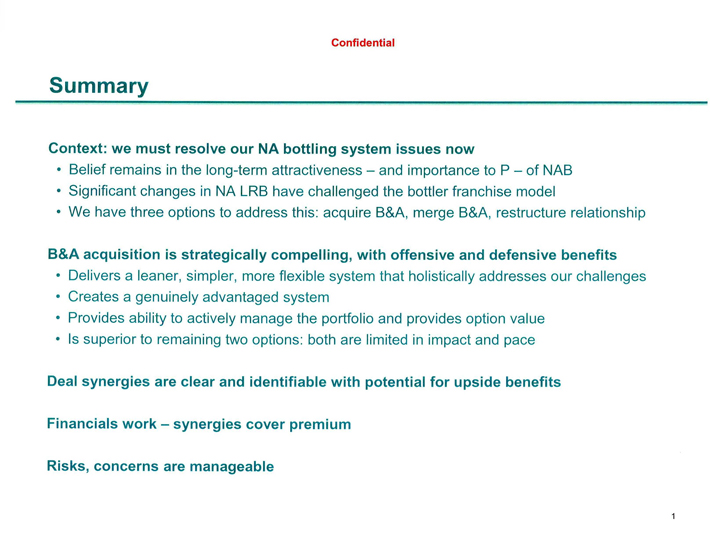

Summary

Context: we must resolve our NA bottling system issues now

• Belief remains in the long-term attractiveness — and importance to P — of NAB

• Significant changes in NA LRB have challenged the bottler franchise model

• We have three options to address this: acquire B&A, merge B&A, restructure relationship

B&A acquisition is strategically compelling, with offensive and defensive benefits

• Delivers a leaner, simpler, more flexible system that holistically addresses our challenges

• Creates a genuinely advantaged system

• Provides ability to actively manage the portfolio and provides option value

• Is superior to remaining two options: both are limited in impact and pace

Deal synergies are clear and identifiable with potential for upside benefits

Financials work—synergies cover premium

Risks, concerns are manageable

1

Confidential Context

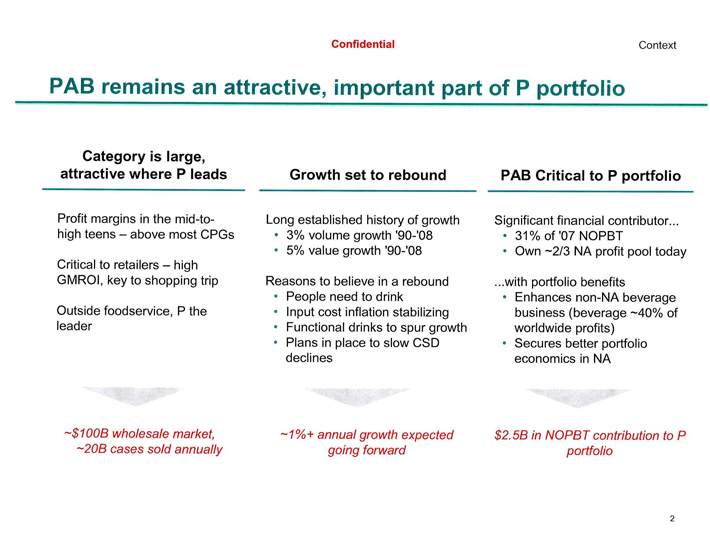

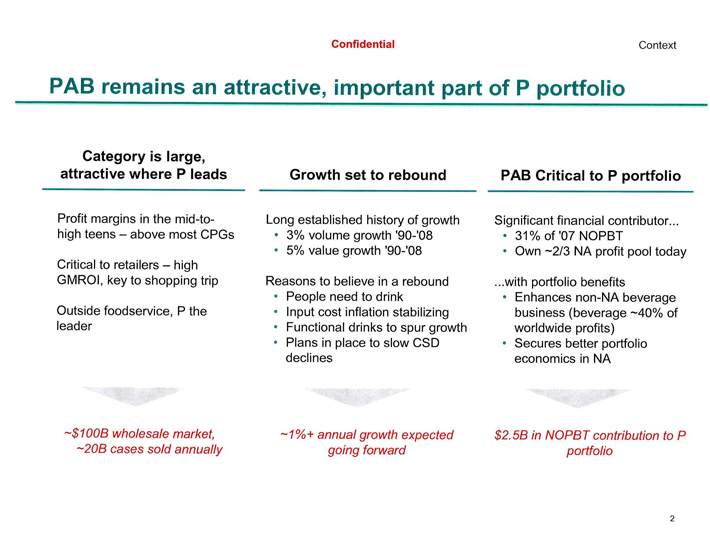

PAB remains an attractive, important part of P portfolio

Category is large, attractive where P leads

Profit margins in the mid-to-high teens – above most CPGs

Critical to retailers – high GMROI, key to shopping trip

Outside foodservice, P the leader

~$100B wholesale market, ~20B cases sold annually

Growth set to rebound

Long established history of growth

• 3% volume growth ‘90-‘08

• 5% value growth ‘90-‘08

Reasons to believe in a rebound

• People need to drink

• Input cost inflation stabilizing

• Functional drinks to spur growth

• Plans in place to slow CSD declines

~1%+ annual growth expected going forward

PAB Critical to P portfolio

Significant financial contributor. . .

• 31% of ‘07 NOPBT

• Own ~2/3 NA profit pool today

. . .with portfolio benefits

• Enhances non-NA beverage business (beverage ~40% of worldwide profits)

• Secures better portfolio economics in NA

$2.5B in NOPBT contribution to P portfolio

2

Confidential Context

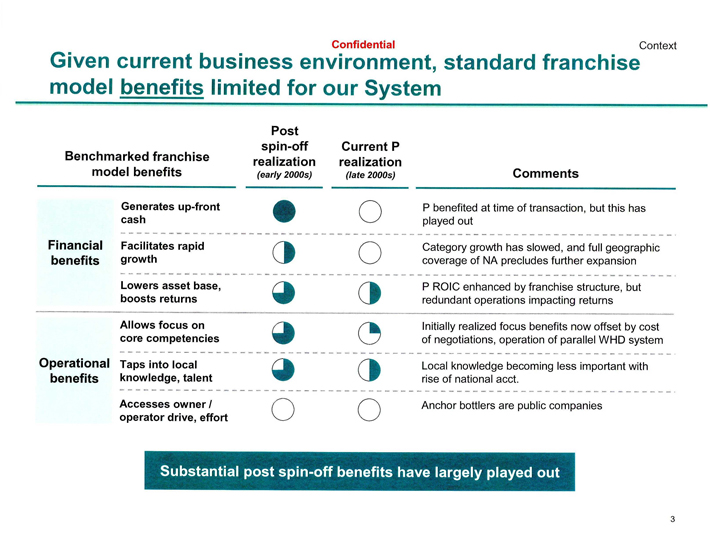

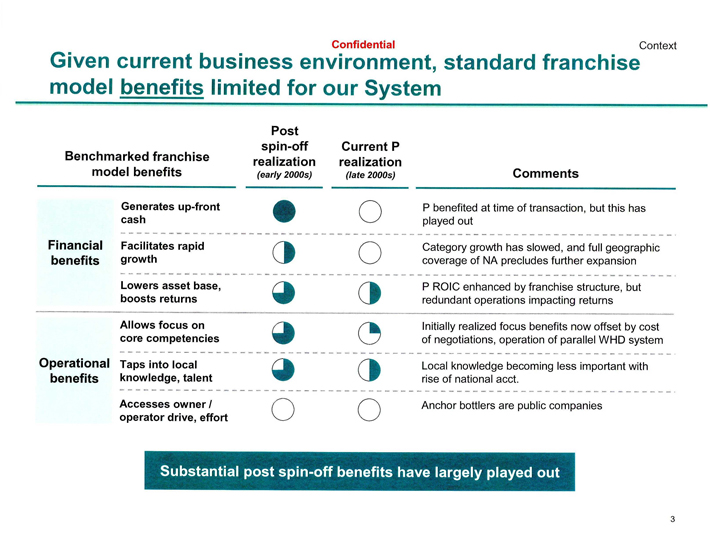

Given current business environment, standard franchise model benefits limited for our System

Benchmarked franchise model benefits

Generates up-front cash

Financial benefits

Facilitates rapid growth

Lowers asset base, boosts returns

Allows focus on core competencies

Operational benefits

Taps into local knowledge, talent

Accesses owner / operator drive, effort

Post spin-off realization (early 2000s)

Current P realization (late 2000s)

Comments

P benefited at time of transaction, but this has played out

Category growth has slowed, and full geographic coverage of NA precludes further expansion

P ROIC enhanced by franchise structure, but redundant operations impacting returns

Initially realized focus benefits now offset by cost of negotiations, operation of parallel WHD system

Local knowledge becoming less important with rise of national acct.

Anchor bottlers are public companies

Substantial post spin-off benefits have largely played out

3

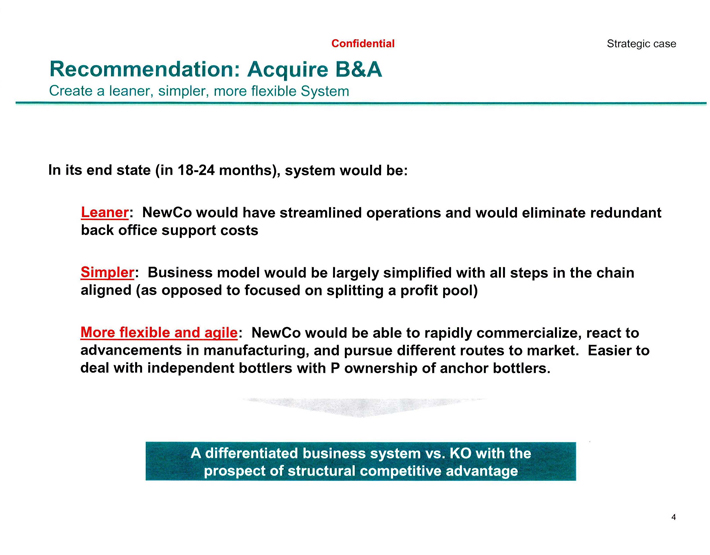

Confidential Strategic case

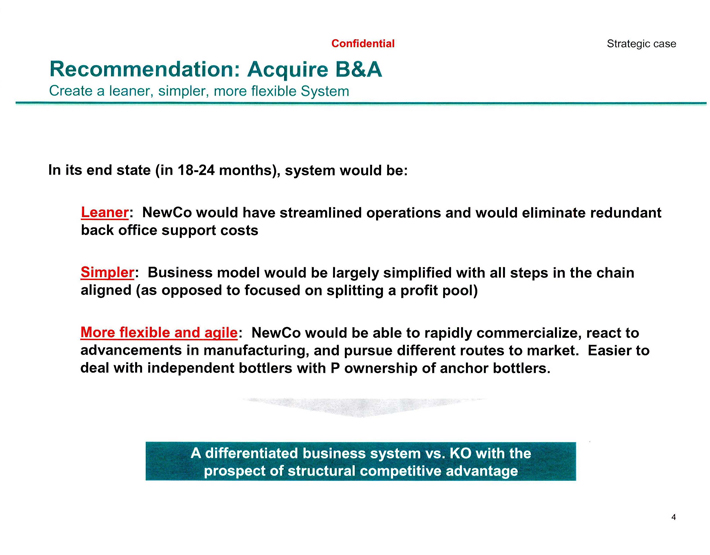

Recommendation: Acquire B&A

Create a leaner, simpler, more flexible System

In its end state (in 18-24 months), system would be:

Leaner: NewCo would have streamlined operations and would eliminate redundant back office support costs

Simpler: Business model would be largely simplified with all steps in the chain aligned (as opposed to focused on splitting a profit pool)

More flexible and agile: NewCo would be able to rapidly commercialize, react to advancements in manufacturing, and pursue different routes to market. Easier to deal with independent bottlers with P ownership of anchor bottlers.

A differentiated business system vs. KO with the prospect of structural competitive advantage

4

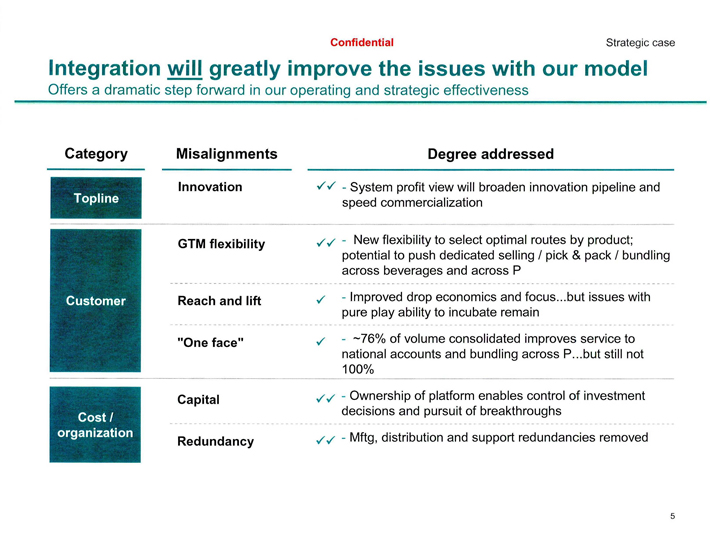

Confidential Strategic case

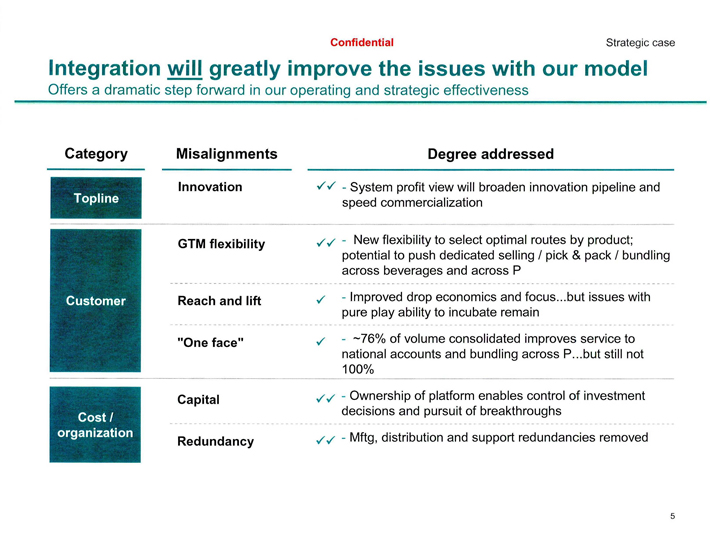

Integration will greatly improve the issues with our model

Offers a dramatic step forward in our operating and strategic effectiveness

Category Misalignments Degree addressed

Topline Customer Cost / organization

Innovationüü - System profit view will broaden innovation pipeline and speed commercialization

GTM flexibilityüü - New flexibility to select optimal routes by product; potential to push dedicated selling / pick & pack / bundling

across beverages and across P

Reach and liftü - Improved drop economics and focus...but issues with pure play ability to incubate remain

“One face”ü - ~76% of volume consolidated improves service to national accounts and bundling across P...but still not 100%

Capitalüü - Ownership of platform enables control of investment decisions and pursuit of breakthroughs

Redundancyüü - Mftg, distribution and support redundancies removed

5

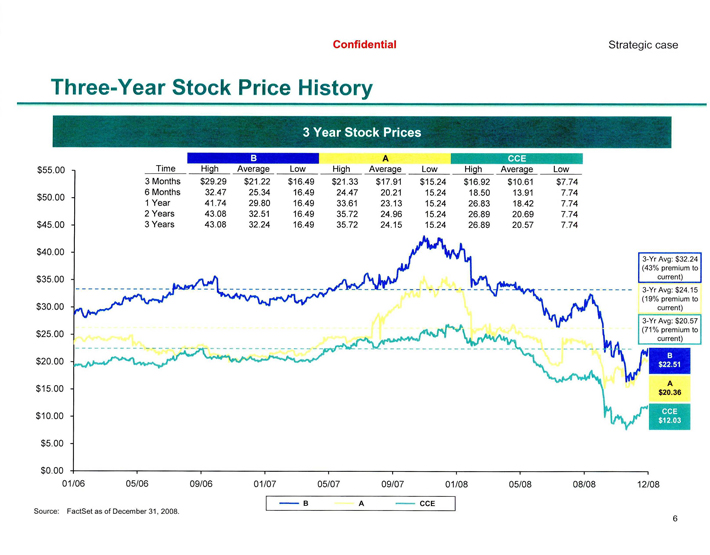

Confidential Strategic case

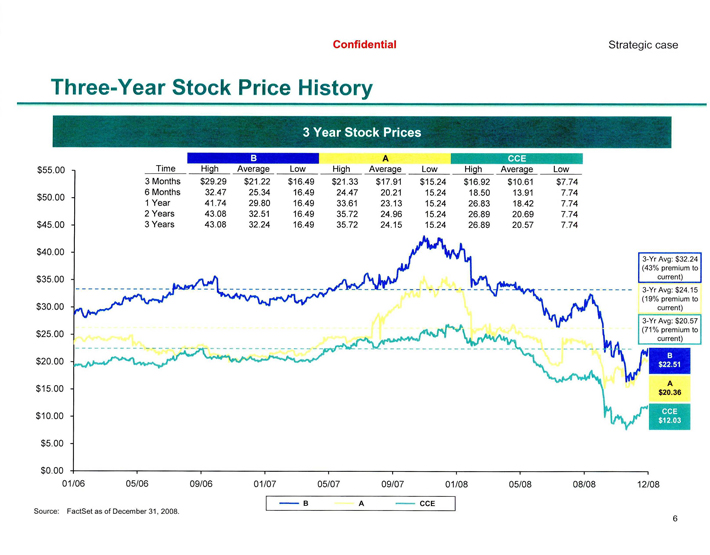

Three-Year Stock Price History

3 Year Stock Prices

B A CCE

Time High Average Low High Low High Average Low

3 Months $29.29 $21.22 $16.49 $21.33 $17.91 $15.24 $16.92 $10.61 $7.74

6 Months 32.47 25.34 16.49 24.47 20.21 15.24 18.50 13.91 7.74

1 Year 41.74 29.80 16.49 33.61 23.13 15.24 26.83 18.42 7.74

2 Years 43.08 32.51 16.49 35.72 24.96 15.24 26.89 20.69 7.74

3 Years 43.08 32.24 16.49 35.72 24.15 15.24 26.89 20.57 7.74

$55.00 $50.00 $45.00 $40.00 $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00

01/06 05/06 09/06 01/07 05/07 09/07 01/08 05/08 08/08 12/08

3-Yr Avg: $32.24

(43% premium to current)

3-Yr Avg: $24.15

(19% premium to current)

3-Yr Avg: $20.57

(71% premium to current)

B

$22.51

A

$20.36

CCE

$12.03

B A CCE

Source: FactSet as of December 31, 2008.

6

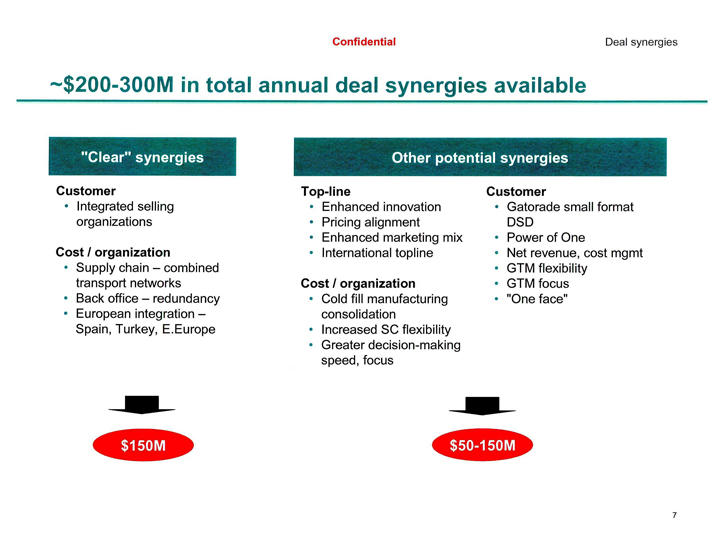

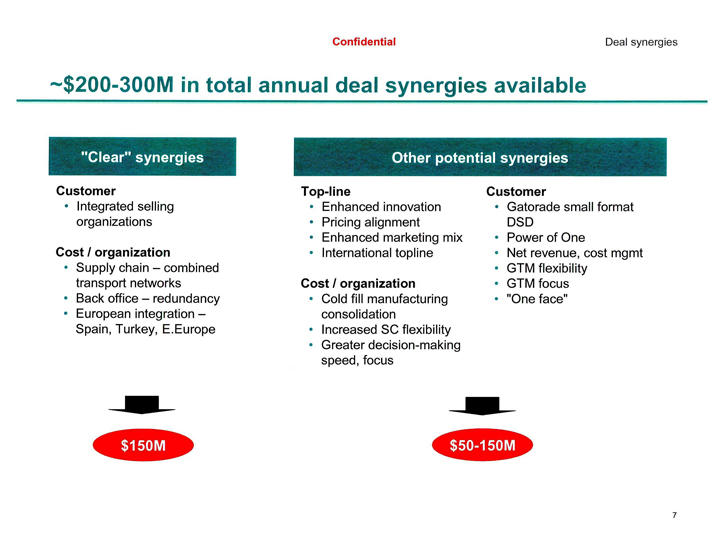

Confidential Deal synergies

~$200-300M in total annual deal synergies available

“Clear” synergies

Customer

• Integrated selling organizations

Cost / organization

• Supply chain — combined transport networks

• Back office — redundancy

• European integration — Spain, Turkey, E.Europe

Other potential synergies

Top-line

• Enhanced innovation

• Pricing alignment

• Enhanced marketing mix

• International topline

Cost / organization

• Cold fill manufacturing consolidation

• Increased SC flexibility

• Greater decision-making speed, focus

Customer

• Gatorade small format DSD

• Power of One

• Net revenue, cost mgmt

• GTM flexibility

• GTM focus

• “One face”

$150M

$50-150M

7

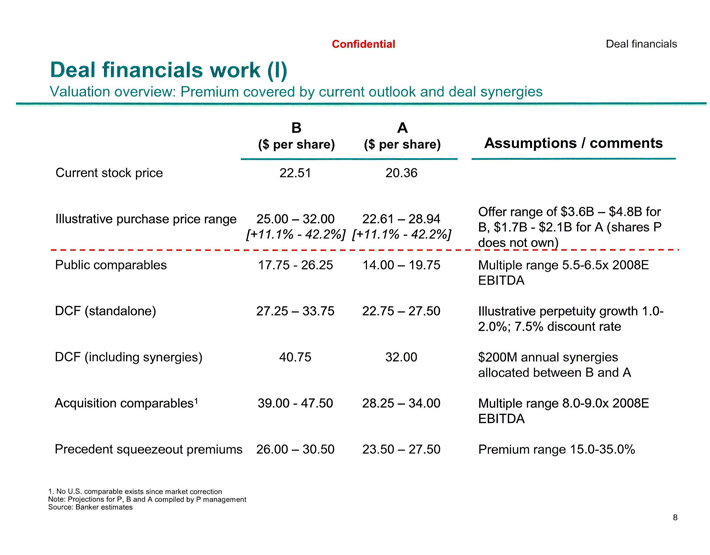

Confidential Deal financials

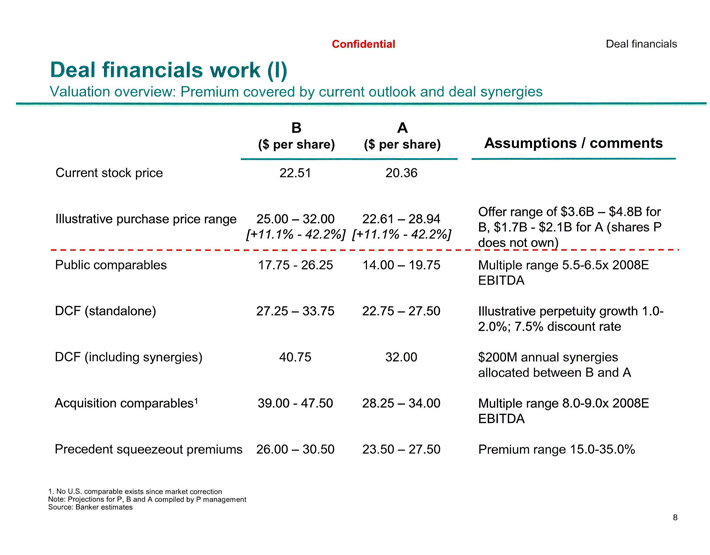

Deal financials work (I)

Valuation overview: Premium covered by current outlook and deal synergies

B A

($ per share) ($ per share) Assumptions / comments

Current stock price 22.51 20.36

Illustrative purchase price range 25.00 – 32.00 22.61 – 28.94

[+11.1% - 42.2%] [+11.1% - 42.2%]

Offer range of $3.6B – $4.8B for B, $1.7B - $2.1B for A (shares P does not own)

Public comparables 17.75 - 26.25 14.00 – 19.75

Multiple range 5.5-6.5x 2008E EBITDA

DCF (standalone) 27.25 – 33.75 22.75 – 27.50

Illustrative perpetuity growth 1.0-2.0%; 7.5% discount rate

DCF (including synergies) 40.75 32.00

$200M annual synergies allocated between B and A

Acquisition comparables1 39.00 - 47.50 28.25 - 34.00

Multiple range 8.0-9.0x 2008E EBITDA

Precedent squeezeout premiums 26.00 – 30.50 23.50 – 27.50

Premium range 15.0-35.0%

1. No U.S. comparable exists since market correction

Note: Projections for P, B and A compiled by P management

Source: Banker estimates

8

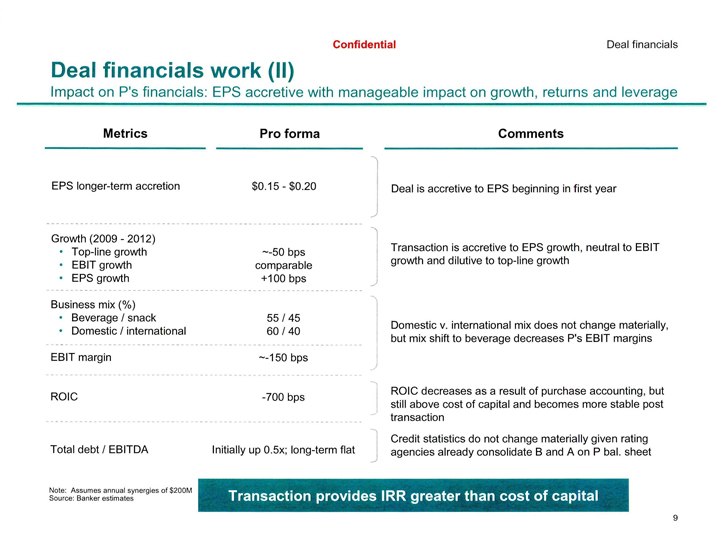

Confidential Deal financials

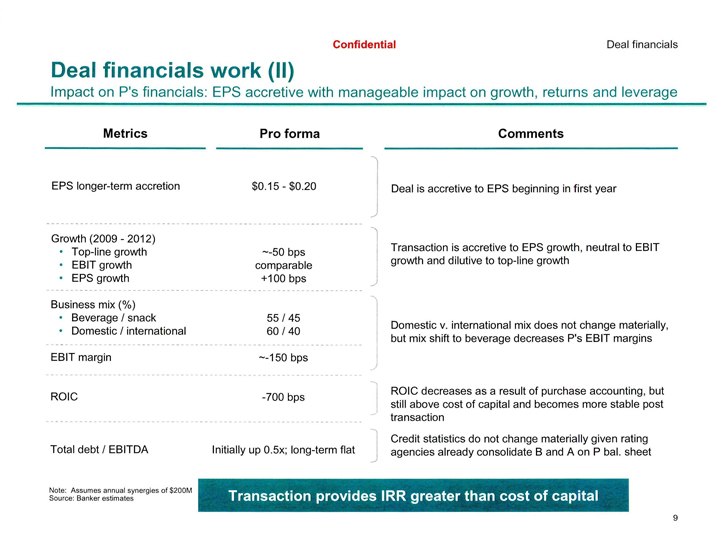

Deal financials work (II)

Impact on P’s financials: EPS accretive with manageable impact on growth, returns and leverage

Metrics Pro forma Comments

EPS longer-term accretion $0.15 - $0.20

Deal is accretive to EPS beginning in first year

Growth (2009 - 2012)

• Top-line growth ~-50 bps

• EBIT growth comparable

• EPS growth +100 bps

Transaction is accretive to EPS growth, neutral to EBIT growth and dilutive to top-line growth

Business mix (%)

• Beverage / snack 55 / 45

• Domestic / international 60 / 40

Domestic v. international mix does not change materially, but mix shift to beverage decreases P’s EBIT margins

EBIT margin ~-150 bps

ROIC -700 bps

ROIC decreases as a result of purchase accounting, but still above cost of capital and becomes more stable post transaction

Total debt / EBITDA Initially up 0.5x; long-term flat

Credit statistics do not change materially given rating agencies already consolidate B and A on P bal. sheet

Note: Assumes annual synergies of $200M

Source: Banker estimates

Transaction provides IRR greater than cost of capital

9

Confidential

Risks and concerns

Risks, concerns about the deal are manageable

Risk

Execution

International

Category

Comments

• Deal has operational / financial risks…

• …as well as organizational / integration risks…

• …But can manage these with a rigorous PMI and strong, experienced leadership

• B&A intl portfolio in several markets with weak PI positions and mixed growth…

• …But we can take steps to mitigate this concern

• Category growth stalled in 2007 and declined in 2008…

• …But we remain confident in the category and the deal rationale

— Confident that LRB is attractive space and can return to low growth

— Deal about flexibility, restructuring & buying franchise rights, not hard assets

— Category challenges amplify need to restructure the system

10

Confidential

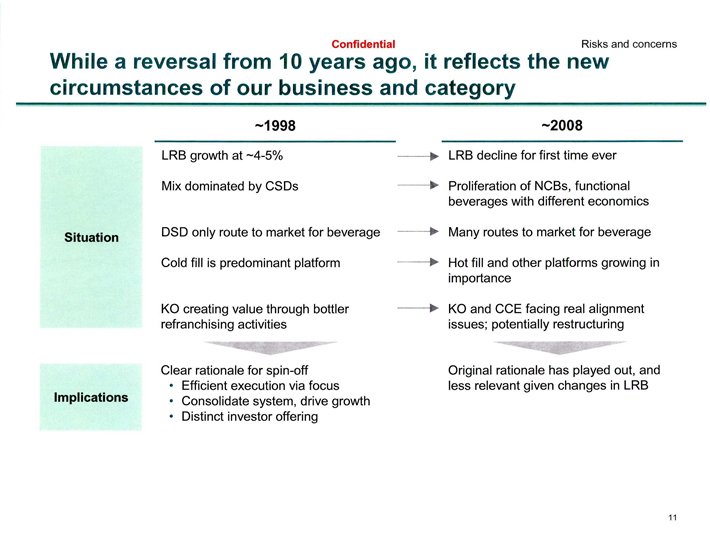

Risks and concerns

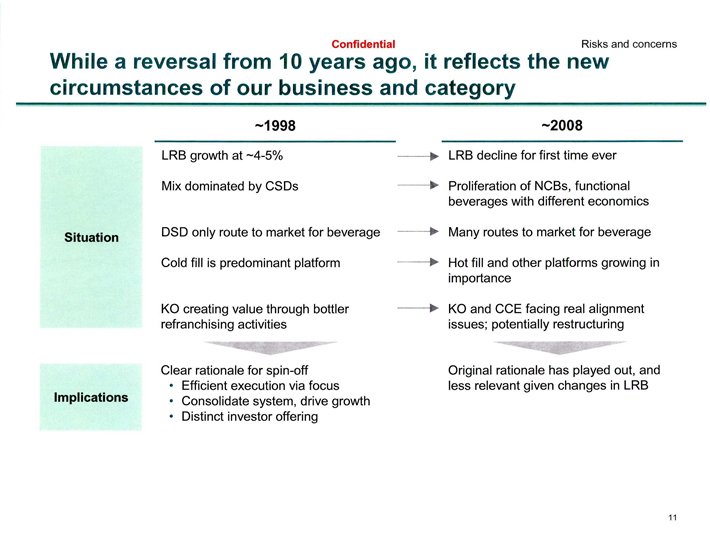

While a reversal from 10 years ago, it reflects the new circumstances of our business and category

Situation

Implications

~1998

LRB growth at ~4-5%

Mix dominated by CSDs

DSD only route to market for beverage

Cold fill is predominant platform

KO creating value through bottler refranchising activities

Clear rationale for spin-off

• Efficient execution via focus

• Consolidate system, drive growth

• Distinct investor offering

~2008

LRB decline for first time ever

Proliferation of NCBs, functional beverages with different economics

Many routes to market for beverage

Hot fill and other platforms growing in importance

KO and CCE facing real alignment issues; potentially restructuring

Original rationale has played out, and less relevant given changes in LRB

11

Confidential

Risks and concerns

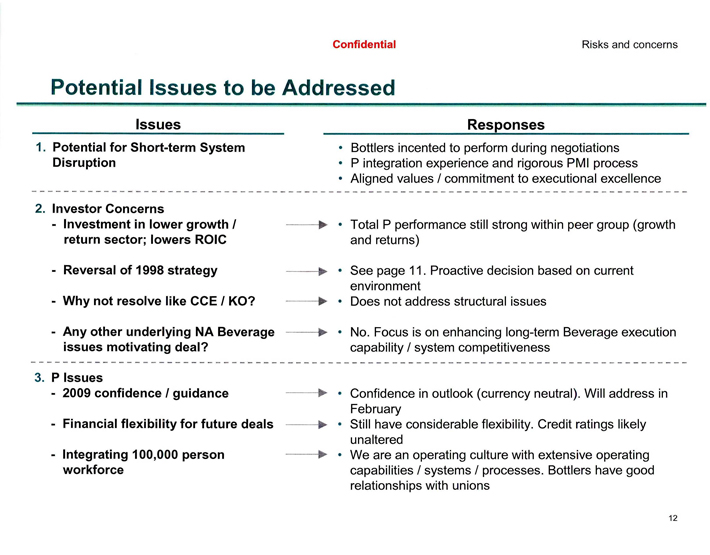

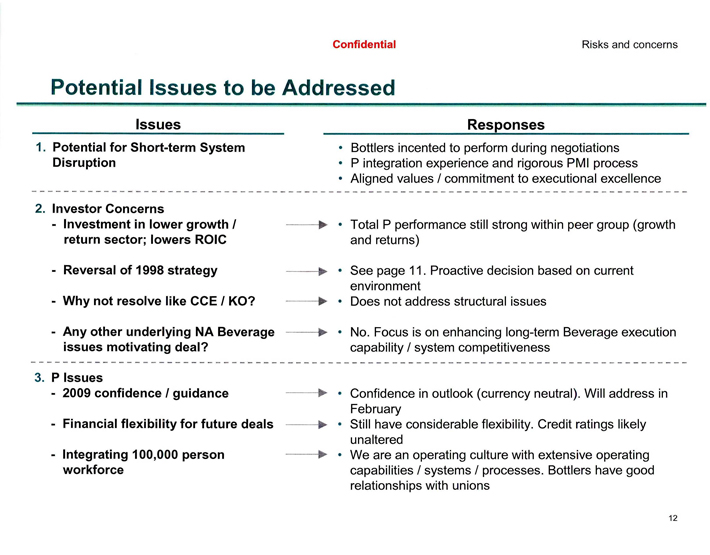

Potential Issues to be Addressed

Issues

1. Potential for Short-term System Disruption

2. Investor Concerns

- Investment in lower growth / return sector; lowers ROIC

- Reversal of 1998 strategy

- Why not resolve like CCE / KO?

- Any other underlying NA Beverage issues motivating deal?

3. P Issues

- 2009 confidence / guidance

- Financial flexibility for future deals

- Integrating 100,000 person workforce

Responses

• Bottlers incented to perform during negotiations

• P integration experience and rigorous PMI process

• Aligned values / commitment to executional excellence

• Total P performance still strong within peer group (growth and returns)

• See page 11. Proactive decision based on current environment

• Does not address structural issues

• No. Focus is on enhancing long-term Beverage execution capability / system competitiveness

• Confidence in outlook (currency neutral). Will address in February

• Still have considerable flexibility. Credit ratings likely unaltered

• We are an operating culture with extensive operating capabilities / systems / processes. Bottlers have good relationships with unions

12

Confidential

Addendum – Detailed deal financials

13

Confidential Addendum—Detailed deal financials

Current market statistics

P

Current Stock Price $54.77

Diluted Shares (MM) (1) 1,574.993

Equity Value $86,262

Enterprise Value (2) $92,048

Adjusted Enterprise Value (3) $89,140

Total Debt / 2008E EBITDA (2) 1.3x

S&P Rating A+

P Management Estimates

EV / Price /

Multiples EBITDA EPS

2008E 9.6x 14.9x

2009E 9.3 14.6

2010E 8.7 13.3

2011E 8.0 12.1

P Management Estimates

Metrics EBITDA EPS

2008E $9,320 $3.67

2009E 9,566 3.74

2010E 10,283 4.12

2011E 11,082 4.54

B Current Stock Price $22.51

Diluted Shares (MM)(1) 213.593

Equity Value $4,808

Enterprise Value (2) $11,455

P Overall Ownership (3) 37.6%

Value of P Equity Stake $1,809

Value of Public Stake $2,999

Total Debt / 2008E EBITDA (2) 3.2x

S&P Rating A

P Management Estimates

EV / Price /

Multiples EBITDA EPS

2008E 6.3x 10.2x

2009E 6.4 10.2

2010E 6.1 9.2

2011E 5.8 8.3

P Management Estimates

Metrics EBITDA EPS

2008E $1,818 $2.21

2009E 1,788 2.20

2010E 1,873 2.45

2011E 1,960 2.71

A

Current Stock Price $20.36

Diluted Shares (MM) (1) 127.752

Equity Value $2,601

Enterprise Value (2) $4,834

P Overall Ownership (3) 42.4%

Value of P Equity Stake $1,100

Value of Public Stake $1,502

Total Debt / 2008E EBITDA (2) 3.0x

S&P Rating A

P Management Estimates

EV / Price /

Multiples EBITDA EPS

2008E 6.6x 10.9x

2009E 6.8 10.8

2010E 6.3 9.6

2011E 6.0 8.7

P Management Estimates

Metrics EBITDA EPS

2008E $729 $1.87

2009E 716 1.88

2010E 764 2.11

2011E 808 2.33

Note: Dollars in millions, except per share amounts. Prices as of December 31, 2008. (1) Diluted shares accounted for under the treasury stock method.

(2) Debt, cash, minority interest and preferred stock balances as of 10-Q filed for period ending September 2008. P leverage based on system debt and EBITDA.

(3) P’s adjusted enterprise value excludes P’s ownership in B and A. Assumes P owns 70.2 million basic B shares and 6.6% direct interest in Bottling LLC and owns 54.0 million basic A shares per P’s management guidance.

14

Confidential Addendum—Detailed deal financials

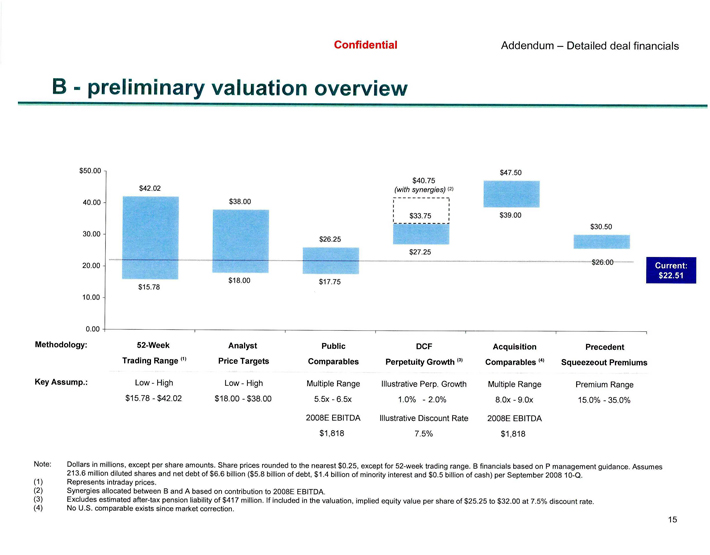

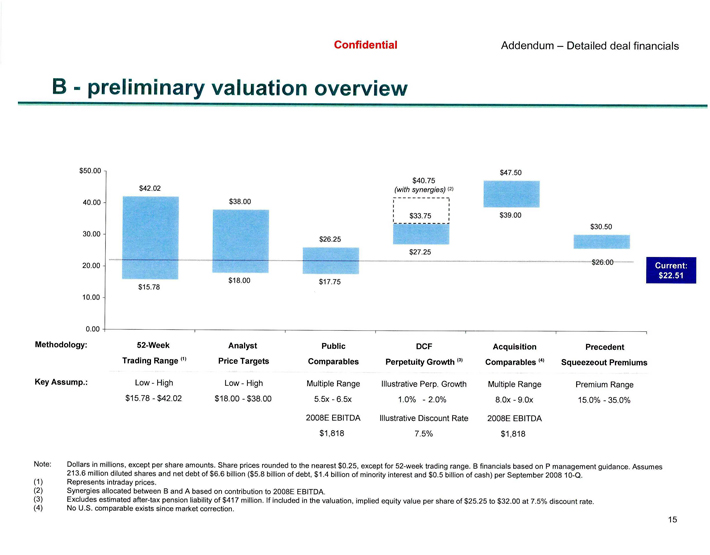

B—preliminary valuation overview

$50.00

40.00

30.00

20.00

10.00

0.00

$42.02

$15.78

$38.00

$18.00

$26.25

$17.75

$40.75

(with synergies) (2)

$33.75

$27.25

$47.50

$39.00

$30.50

$26.00

Current:

$22.51

Methodology:

Key Assump.:

52-Week Trading Range(1)

Low—High

$15.78—$42.02

Analyst

Price Targets

Low—High

$18.00—$38.00

Public

Comparables

Multiple Range

5.5x—6.5x

2008E EBITDA

$1,818

DCF

Perpetuity Growth(3)

Illustrative Perp. Growth

1.0%—2.0%

Illustrative Discount Rate

7.5%

Acquisition

Comparables (4)

Multiple Range

8.0x—9.0x

2008E EBITDA

$1,818

Precedent

Squeezeout Premiums

Premium Range

15.0%—35.0%

Note: Dollars in millions, except per share amounts. Share prices rounded to the nearest $0.25, except for 52-week trading range. B financials based on P management guidance. Assumes 213.6 million diluted shares and net debt of $6.6 billion ($5.8 billion of debt, $1.4 billion of minority interest and $0.5 billion of cash) per September 2008 10-Q.

(1) Represents intraday prices.

(2) Synergies allocated between B and A based on contribution to 2008E EBITDA.

(3) Excludes estimated after-tax pension liability of $417 million. If included in the valuation, implied equity value per share of $25.25 to $32.00 at 7.5% discount rate. (4) No U.S. comparable exists since market correction.

15

Confidential Addendum—Detailed deal financials

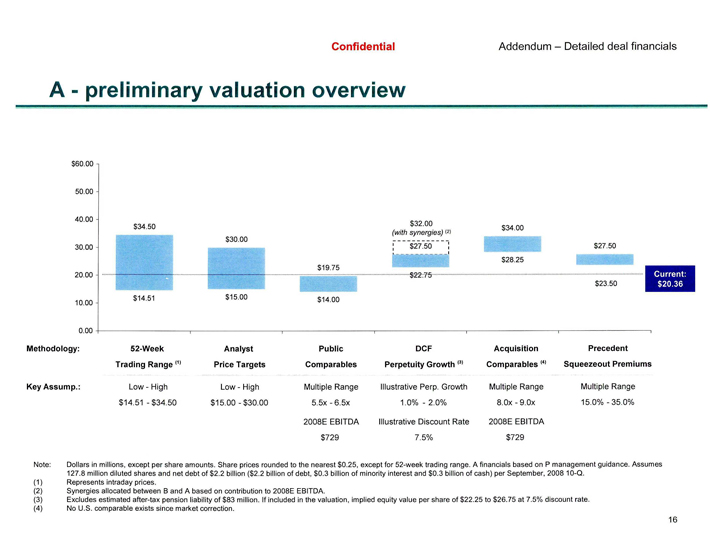

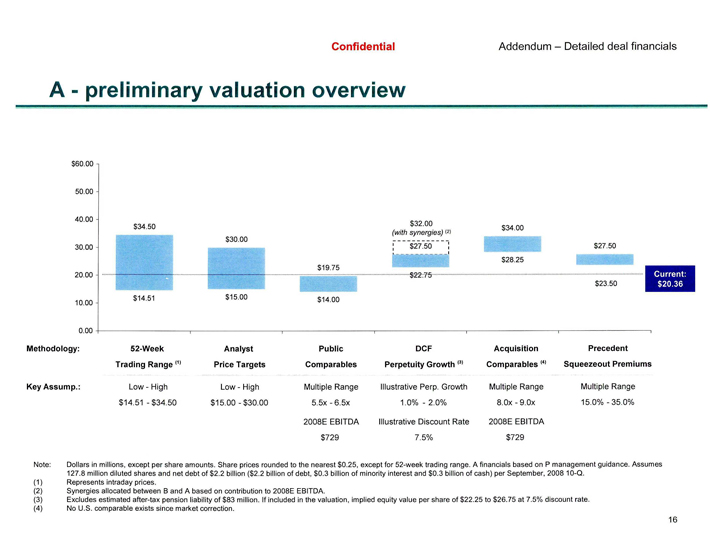

A - preliminary valuation overview

$60.00

50.00

40.00

30.00

20.00

10.00

0.00

$34.50

$14.51

$30.00

$15.00

$19.75

$14.00

$32.00

(with synergies) (2)

$27.50

$22.75

$34.00

$28.25

$27.50

$23.50

Current:

$20.36

Methodology:

Key Assump.:

52-Week Trading Range(1)

Low - High

$14.51 - $34.50

Analyst

Price Targets

Low - High

$15.00 - $30.00

Public Comparables Multiple Range

5.5x - 6.5x 2008E EBITDA $729

DCF

Perpetuity Growth (3)

Illustrative Perp. Growth

1.0% - 2.0% Illustrative Discount Rate

7.5%

Acquisition

Comparables(4)

Multiple Range

8.0x - 9.0x 2008E EBITDA $729

Precedent Squeezeout Premiums Multiple Range

15.0% - 35.0%

Note: Dollars in millions, except per share amounts. Share prices rounded to the nearest $0.25, except for 52-week trading range. A financials based on P management guidance. Assumes 127.8 million diluted shares and net debt of $2.2 billion ($2.2 billion of debt, $0.3 billion of minority interest and $0.3 billion of cash) per September, 2008 10-Q.

(1) Represents intraday prices.

(2) Synergies allocated between B and A based on contribution to 2008E EBITDA.

(3) Excludes estimated after-tax pension liability of $83 million. If included in the valuation, implied equity value per share of $22.25 to $26.75 at 7.5% discount rate.

(4) No U.S. comparable exists since market correction.

16

Confidential Addendum – Detailed deal financials

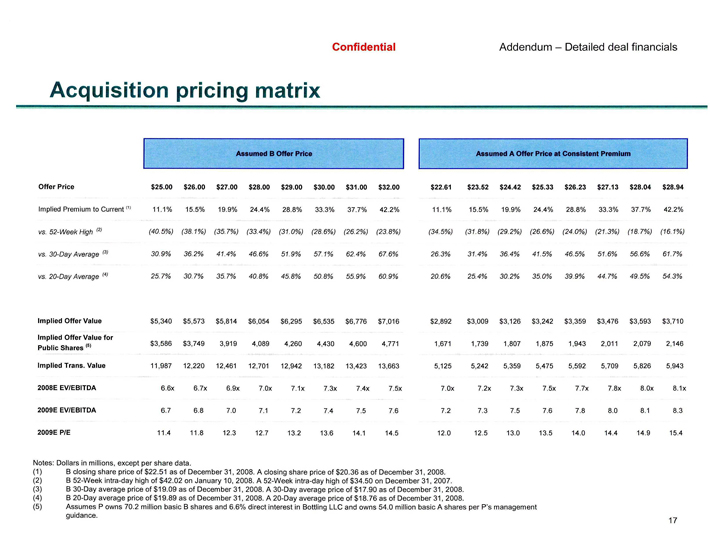

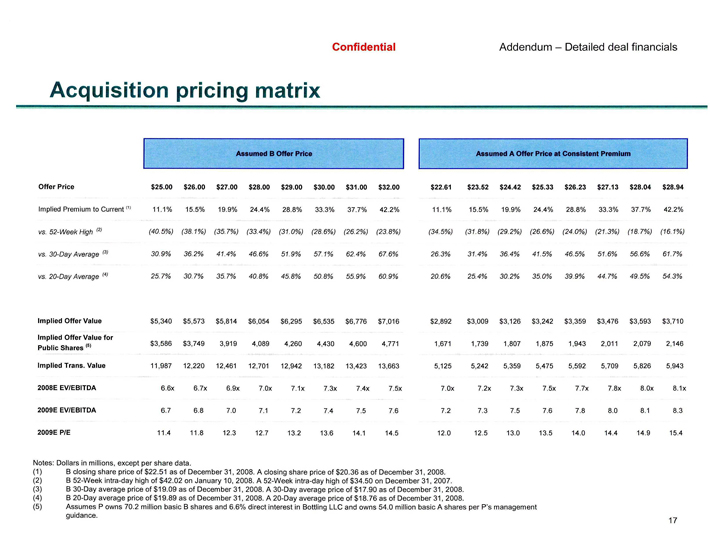

Acquisition pricing matrix

Assumed B Offer Price

Assumed A Offer Price at Consistent Premium

Offer Price $25.00 $26.00 $27.00 $28.00 $29.00 $30.00 $31.00 $32.00 $22.61 $23.52 $24.42 $25.33 $26.23 $27.13 $28.04 $28.94

Implied Premium to Current (1) 11.1% 15.5% 19.9% 24.4% 28.8% 33.3% 37.7% 42.2% 11.1% 15.5% 19.9% 24.4% 28.8% 33.3% 37.7% 42.2%

vs. 52-Week High (2) (40.5%)(38.1%)(35.7%)(33.4%)(31.0%)(28.6%)(26.2%)(23.8%)(34.5%)(31.8%)(29.2%)(26.6%)(24.0%)(21.3%)(18.7%)(16.1%)

vs. 30-Day Average (3) 30.9% 36.2% 41.4% 46.6% 51.9% 57.1% 62.4% 67.6% 26.3% 31.4% 36.4% 41.5% 46.5% 51.6% 56.6% 61.7%

vs. 20-Day Average (4) 25.7% 30.7% 35.7% 40.8% 45.8% 50.8% 55.9% 60.9% 20.6% 25.4% 30.2% 35.0% 39.9% 44.7% 49.5% 54.3%

Implied Offer Value $5,340 $5,573 $5,814 $6,054 $6,295 $6,535 $6,776 $7,016 $2,892 $3,009 $3,126 $3,242 $3,359 $3,476 $3,593 $3,710

Implied Offer Value for Public Shares (5)

$3,586 $3,749 3,919 4,089 4,260 4,430 4,600 4,771 1,671 1,739 1,807 1,875 1,943 2,011 2,079 2,146

Implied Trans. Value 11,987 12,220 12,461 12,701 12,942 13,182 13,423 13,663 5,125 5,242 5,359 5,475 5,592 5,709 5,826 5,943

2008E EV/EBITDA 6.6x 6.7x 6.9x 7.0x 7.1x 7.3x 7.4x 7.5x 7.0x 7.2x 7.3x 7.5x 7.7x 7.8x 8.0x 8.1x

2009E EV/ EBITDA 6.7 6.8 7.0 7.1 7.2 7.4 7.5 7.6 7.2 7.3 7.5 7.6 7.8 8.0 8.1 8.3

2009E P/E 11.4 11.8 12.3 12.7 13.2 13.6 14.1 14.5 12.0 12.5 13.0 13.5 14.0 14.4 14.9 15.4

Notes: Dollars in millions, except per share data.

(1) B closing share price of $22.51 as of December 31, 2008. A closing share price of $20.36 as of December 31, 2008.

(2) B 52-Week intra-day high of $42.02 on January 10, 2008. A 52-Week intra-day high of $34.50 on December 31, 2007.

(3) B 30-Day average price of $19.09 as of December 31, 2008. A 30-Day average price of $17.90 as of December 31, 2008.

(4) B 20-Day average price of $19.89 as of December 31, 2008. A 20-Day average price of $18.76 as of December 31, 2008.

(5) Assumes P owns 70.2 million basic B shares and 6.6% direct interest in Bottling LLC and owns 54.0 million basic A shares per P’s management guidance.

17

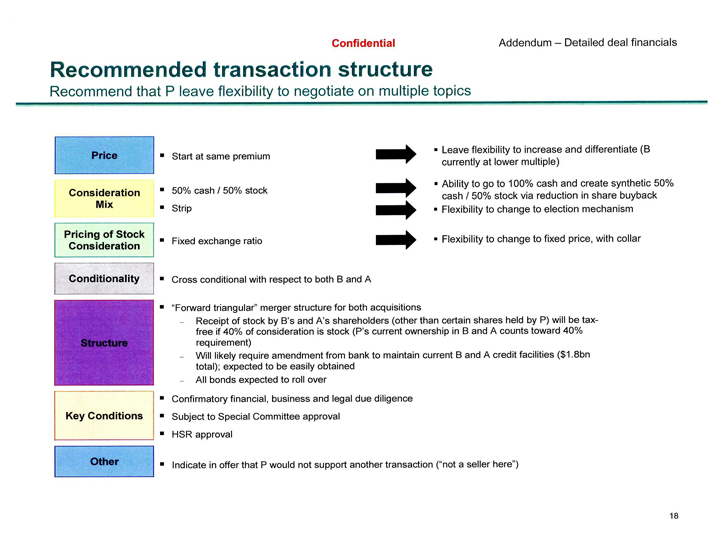

Confidential Addendum – Detailed deal financials

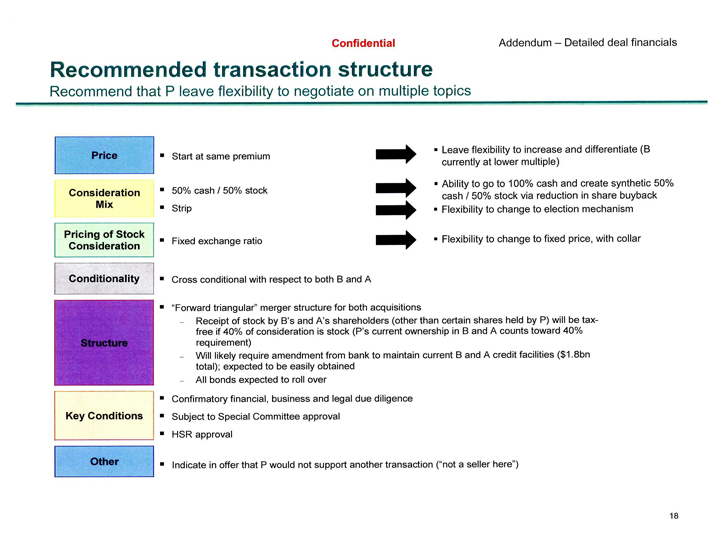

Recommended transaction structure

Recommend that P leave flexibility to negotiate on multiple topics

Price

Consideration Mix

Pricing of Stock Consideration

Conditionality

Structure

Key Conditions

Other

• Start at same premium

• 50% cash / 50% stock

• Strip

• Fixed exchange ratio

• Cross conditional with respect to both B and A

• “Forward triangular” merger structure for both acquisitions

- Receipt of stock by B’s and A’s shareholders (other than certain shares held by P) will be tax-free if 40% of consideration is stock (P’s current ownership in B and A counts toward 40% requirement)

- Will likely require amendment from bank to maintain current B and A credit facilities ($1.8bn total); expected to be easily obtained

- All bonds expected to roll over

• Confirmatory financial, business and legal due diligence

• Subject to Special Committee approval

• HSR approval

• Indicate in offer that P would not support another transaction (“not a seller here”)

• Leave flexibility to increase and differentiate (B currently at lower multiple)

• Ability to go to 100% cash and create synthetic 50% cash / 50% stock via reduction in share buyback

• Flexibility to change to election mechanism

• Flexibility to change to fixed price, with collar

18