Exhibit (c)(8)

HIGHLY CONFIDENTIAL

Project Periwinkle

Discussion Materials

Goldman, Sachs & Co.

August 4, 2009

Goldman Sachs

HIGHLY CONFIDENTIAL

Table of Contents

I. Summary of Transaction

II. Review of Financial Projections

III. Summary Financial Analysis

IV. Pro Forma Impact on Powder

V. Background Information on Powder

Appendix A: Supplemental Materials

Goldman Sachs does not provide accounting, tax, or legal advice. Notwithstanding anything in this document to the contrary, and

except as required to enable compliance with applicable securities law, you (and each of your employees, representatives, and other

agents) may disclose to any and all persons the US federal income and state tax treatment and tax structure of the transaction and all

materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax

structure, without Goldman Sachs imposing any limitation of any kind.

Goldman Sachs

HIGHLY CONFIDENTIAL

Disclaimer

Goldman, Sachs & Co. (“GS”) has prepared and provided these materials and GS’s related presentation (the “Confidential Information”) solely for the

information and assistance of the Board of Directors (the "Board") and senior management of Aqua (the "Company") in connection with its

consideration of the matters referred to herein. Without GS’s prior written consent, the Confidential Information may not be circulated or referred to

publicly, disclosed to or relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything hereinto the contrary,

the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein

and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax

structure, without GS imposing any limitation of any kind. The Confidential Information, including this disclaimer, is subject to, and governed by, any

written agreement between the Company, the Board and/or any committee thereof, on the hand, and GS, on the other hand.

GS and its affiliates are engaged in investment banking, commercial banking and financial advisory services, securities trading, investment

management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other

financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, GS and its

affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and

other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, the Company,

any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction for their

own account and for the accounts of their customers.

The Confidential Information has been prepared and based on information obtained by GS from publicly available sources, the Company’s

management and/or other sources. In preparing the Confidential Information, GS has relied upon and assumed, without assuming any responsibility

for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to,

discussed with or reviewed by GS, and GS does not assume any liability for any such information. GS does not provide accounting, tax, legal or

regulatory advice. GS’s role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own

advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of

actual future results, which may be significantly more or less favorable than suggested by these analyses, and GS does not assume responsibility if

future results are materially different from those forecast.

GS has not made an independent evaluation or appraisal of the assets and liabilities of the Company or any other person and has no obligation to

evaluate the solvency of the Company or any person under any law. The analyses in the Confidential Information are not appraisals nor do they

necessarily reflect the prices at which businesses or securities actually may be sold or purchased. The Confidential Information does not address the

underlying business decision of the Company to engage in any transaction, or the relative merits of any strategic alternative referred to herein as

compared to any other alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary,

market and other conditions as in effect on, and the information made available to GS as of, the date of such Confidential Information and GS

assumes no responsibility for updating or revising the Confidential Information.

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary of Transaction 4

I. Summary of Transaction

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary of Transaction 5

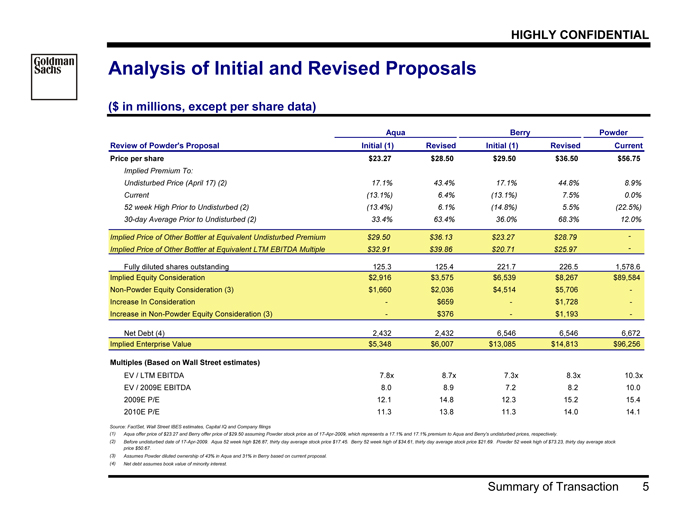

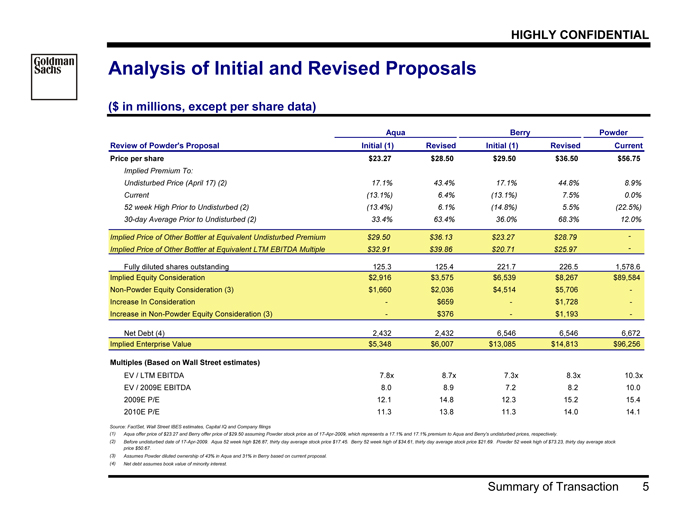

Analysis of Initial and Revised Proposals

($ in millions, except per share data)

Aqua Berry Powder

Review of Powder's Proposal Initial (1) Revised Initial (1) Revised Current

Price per share $23.27 $28.50 $29.50 $36.50 $56.75

Implied Premium To:

Undisturbed Price (April 17) (2) 17.1% 43.4% 17.1% 44.8% 8.9%

Current (13.1%) 6.4% (13.1%) 7.5% 0.0%

52 week High Prior to Undisturbed (2) (13.4%) 6.1% (14.8%) 5.5% (22.5%)

30-day Average Prior to Undisturbed (2) 33.4% 63.4% 36.0% 68.3% 12.0%

Implied Price of Other Bottler at Equivalent Undisturbed Premium $29.50 $36.13 $23.27 $28.79 -

Implied Price of Other Bottler at Equivalent LTM EBITDA Multiple $32.91 $39.86 $20.71 $25.97 -

Fully diluted shares outstanding 125.3 125.4 221.7 226.5 1,578.6

Implied Equity Consideration $2,916 $3,575 $6,539 $8,267 $89,584

Non-Powder Equity Consideration (3) $1,660 $2,036 $4,514 $5,706 -

Increase In Consideration—$659—$1,728 -

Increase in Non-Powder Equity Consideration (3)—$376—$1,193 -

Net Debt (4) 2,432 2,432 6,546 6,546 6,672

Implied Enterprise Value $5,348 $6,007 $13,085 $14,813 $96,256

Multiples (Based on Wall Street estimates)

EV / LTM EBITDA 7.8x 8.7x 7.3x 8.3x 10.3x

EV / 2009E EBITDA 8.0 8.9 7.2 8.2 10.0

2009E P/E 12.1 14.8 12.3 15.2 15.4

2010E P/E 11.3 13.8 11.3 14.0 14.1

Source: FactSet, Wall Street IBES estimates, Capital IQ and Company filings

(4) | | Net debt assumes book value of minority interest. |

Assumes Powder diluted ownership of 43% in Aqua and 31% in Berry based on current proposal.

Aqua offer price of $23.27 and Berry offer price of $29.50 assuming Powder stock price as of 17-Apr-2009, which represents a 17.1% and 17.1% premium to Aqua and Berry's undisturbed prices, respectively.

Before undisturbed date of 17-Apr-2009. Aqua 52 week high $26.87, thirty day average stock price $17.45. Berry 52 week high of $34.61, thirty day average stock price $21.69. Powder 52 week high of $73.23, thirty day average stock

price $50.67.

Goldman Sachs

HIGHLY CONFIDENTIAL

Review of Financial Projections 6

II. Review of Financial Projections

Goldman Sachs

HIGHLY CONFIDENTIAL

Review of Financial Projections 7

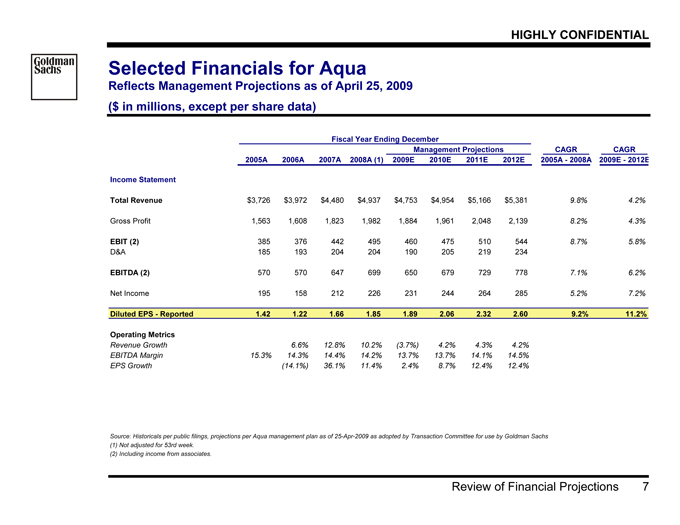

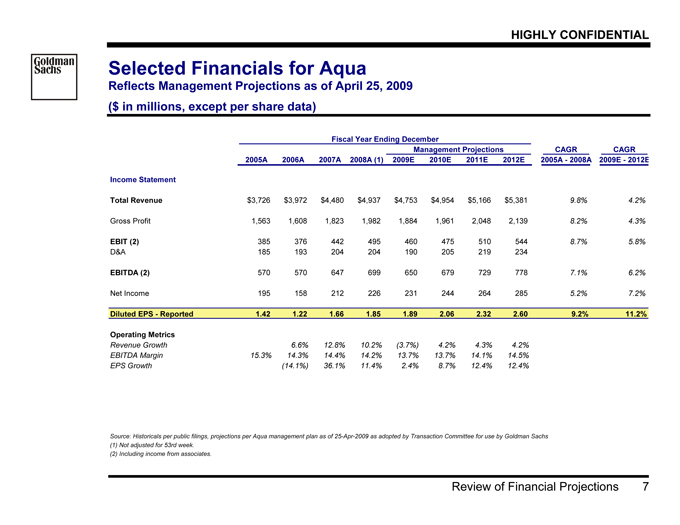

Selected Financials for Aqua

Reflects Management Projections as of April 25, 2009

($ in millions, except per share data)

Fiscal Year Ending December

Management Projections CAGR CAGR

2005A 2006A 2007A 2008A (1) 2009E 2010E 2011E 2012E 2005A—2008A 2009E—2012E

Income Statement

Total Revenue $3,726 $3,972 $4,480 $4,937 $4,753 $4,954 $5,166 $5,381 9.8% 4.2%

Gross Profit 1,563 1,608 1,823 1,982 1,884 1,961 2,048 2,139 8.2% 4.3%

EBIT (2) 385 376 442 495 460 475 510 544 8.7% 5.8%

D&A 185 193 204 204 190 205 219 234

EBITDA (2) 570 570 647 699 650 679 729 778 7.1% 6.2%

Net Income 195 158 212 226 231 244 264 285 5.2% 7.2%

Diluted EPS—Reported 1.42 1.22 1.66 1.85 1.89 2.06 2.32 2.60 9.2% 11.2%

Operating Metrics

Revenue Growth 6.6% 12.8% 10.2% (3.7%) 4.2% 4.3% 4.2%

EBITDA Margin 15.3% 14.3% 14.4% 14.2% 13.7% 13.7% 14.1% 14.5%

EPS Growth (14.1%) 36.1% 11.4% 2.4% 8.7% 12.4% 12.4%

Source: Historicals per public filings, projections per Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs

(1) | | Not adjusted for 53rd week. |

(2) | | Including income from associates. |

Goldman Sachs

HIGHLY CONFIDENTIAL

Review of Financial Projections 8

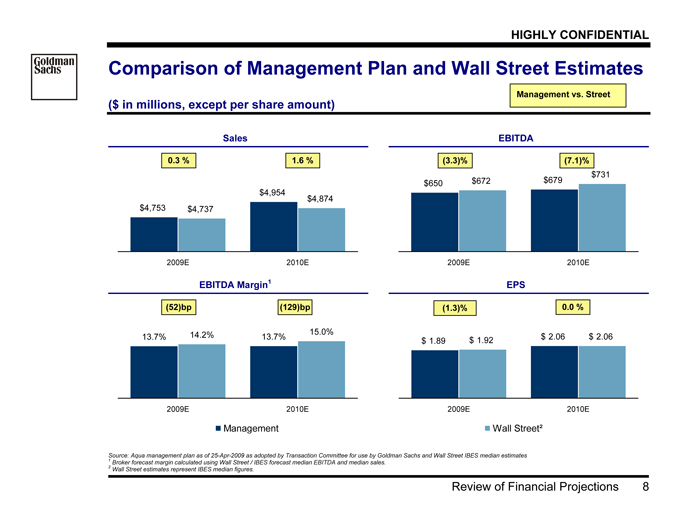

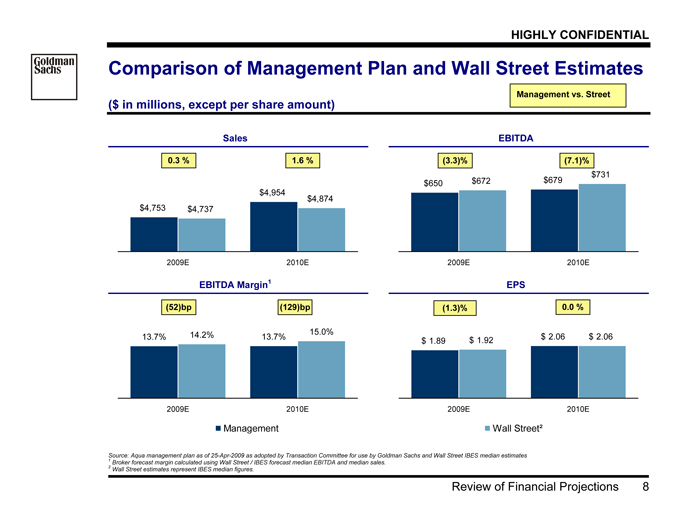

Comparison of Management Plan and Wall Street Estimates

($ in millions, except per share amount)

Sales EBITDA

$4,753

$4,954

$4,737

$4,874

2009E 2010E

0.3 % 1.6 %

$650 $672 $679

$731

2009E 2010E

(3.3)% (7.1)%

.

EBITDA Margin1 EPS

13.7% 14.2% 13.7% 15.0%

2009E 2010E

(52)bp (129)bp

$ 1.89 $ 1.92 $ 2.06 $ 2.06

2009E 2010E

(1.3)% 0.0 %

Management Wall Street²

Source: Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs and Wall Street IBES median estimates

1 | | Broker forecast margin calculated using Wall Street / IBES forecast median EBITDA and median sales. |

2 | | Wall Street estimates represent IBES median figures. |

Management vs. Street

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 9

III. Summary Financial Analysis

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 10

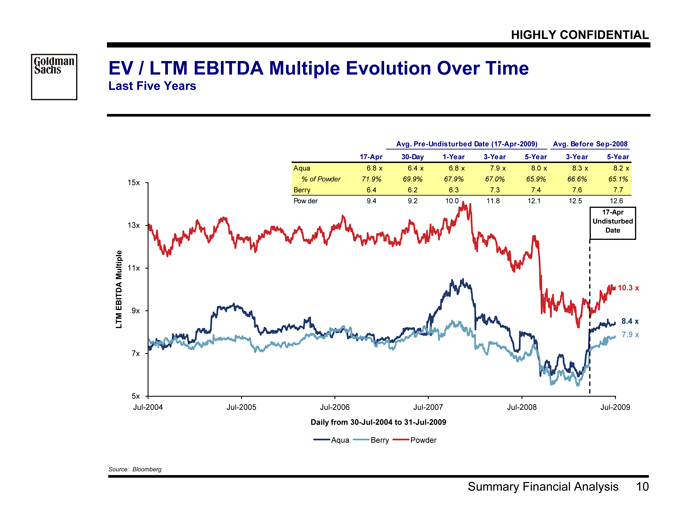

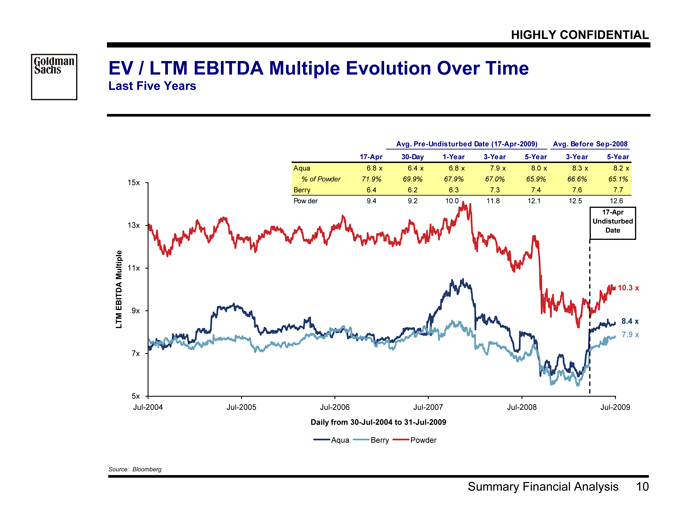

EV / LTM EBITDA Multiple Evolution Over Time

Last Five Years

5x

7x

9x

11x

13x

15x

Jul-2004 Jul-2005 Jul-2006 Jul-2007 Jul-2008 Jul-2009

Daily from 30-Jul-2004 to 31-Jul-2009

LTM EBITDA Multiple

Aqua Berry Powder

8.4 x

7.9 x

10.3 x

Avg. Pre-Undisturbed Date (17-Apr-2009) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

Aqua 6.8 x 6.4 x 6.8 x 7.9 x 8.0 x 8.3 x 8.2 x

% of Powder 71.9% 69.9% 67.9% 67.0% 65.9% 66.6% 65.1%

Berry 6.4 6.2 6.3 7.3 7.4 7.6 7.7

Powder 9.4 9.2 10.0 11.8 12.1 12.5 12.6

17-Apr

Undisturbed

Date

Source: Bloomberg

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 11

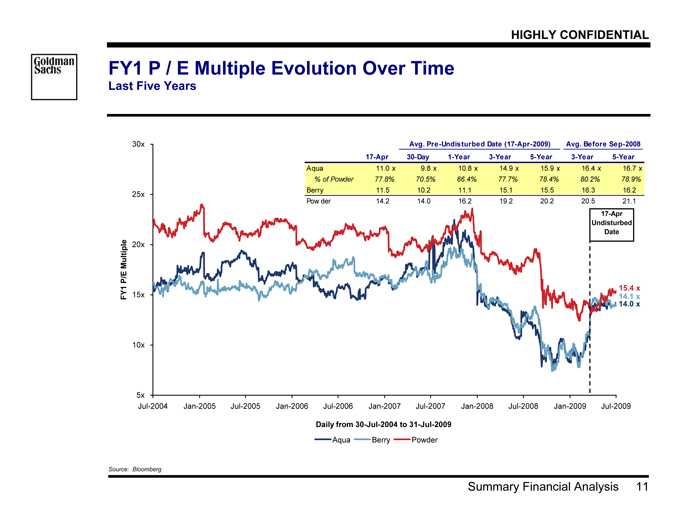

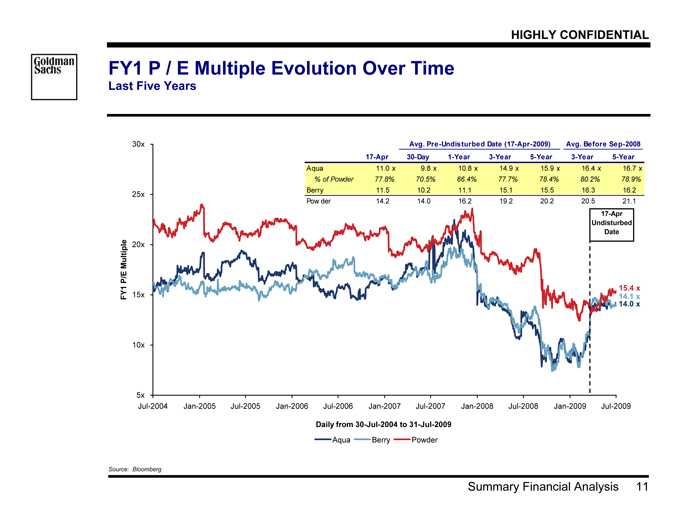

FY1 P / E Multiple Evolution Over Time

Last Five Years

5x

10x

15x

20x

25x

30x

Jul-2004 Jan-2005 Jul-2005 Jan-2006 Jul-2006 Jan-2007 Jul-2007 Jan-2008 Jul-2008 Jan-2009 Jul-2009

Daily from 30-Jul-2004 to 31-Jul-2009

FY1 P/E Multiple

Aqua Berry Powder

14.0 x

14.1 x

15.4 x

Avg. Pre-Undisturbed Date (17-Apr-2009) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

Aqua 11.0 x 9.8 x 10.8 x 14.9 x 15.9 x 16.4 x 16.7 x

% of Powder 77.8% 70.5% 66.4% 77.7% 78.4% 80.2% 78.9%

Berry 11.5 10.2 11.1 15.1 15.5 16.3 16.2

Powder 14.2 14.0 16.2 19.2 20.2 20.5 21.1

17-Apr

Undisturbed

Date

Source: Bloomberg

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 12

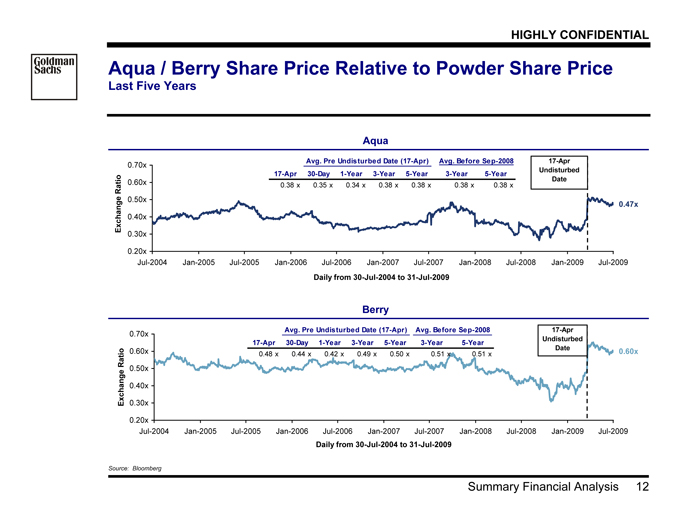

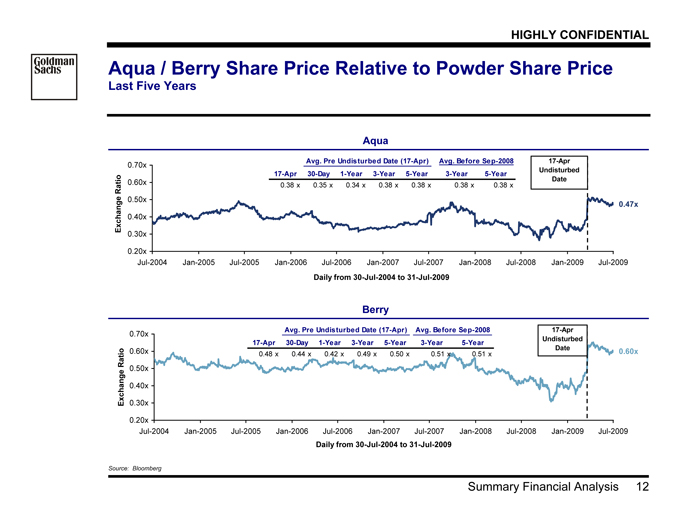

Aqua / Berry Share Price Relative to Powder Share Price

Last Five Years

Aqua

0.47x

0.20x

0.30x

0.40x

0.50x

0.60x

0.70x

Jul-2004 Jan-2005 Jul-2005 Jan-2006 Jul-2006 Jan-2007 Jul-2007 Jan-2008 Jul-2008 Jan-2009 Jul-2009

Daily from 30-Jul-2004 to 31-Jul-2009

Exchange Ratio

Avg. Pre Undisturbed Date (17-Apr) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

0.38 x 0.35 x 0.34 x 0.38 x 0.38 x 0.38 x 0.38 x

17-Apr

Undisturbed

Date

Berry

0.60x

0.20x

0.30x

0.40x

0.50x

0.60x

0.70x

Jul-2004 Jan-2005 Jul-2005 Jan-2006 Jul-2006 Jan-2007 Jul-2007 Jan-2008 Jul-2008 Jan-2009 Jul-2009

Daily from 30-Jul-2004 to 31-Jul-2009

Exchange Ratio

Avg. Pre Undisturbed Date (17-Apr) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

0.48 x 0.44 x 0.42 x 0.49 x 0.50 x 0.51 x 0.51 x

17-Apr

Undisturbed

Date

Source: Bloomberg

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 13

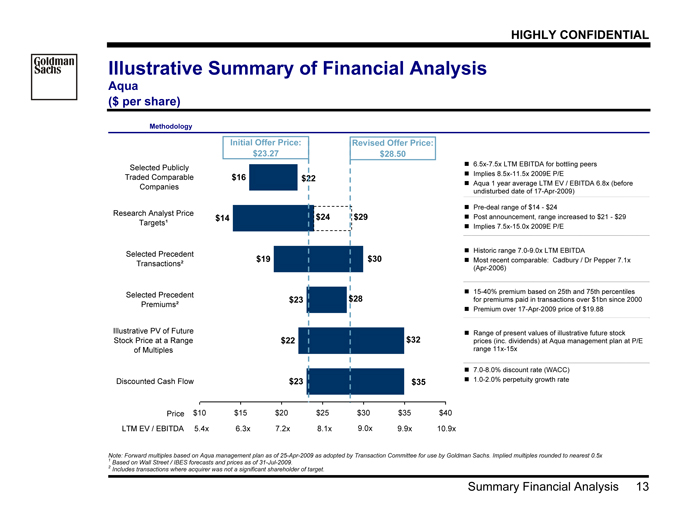

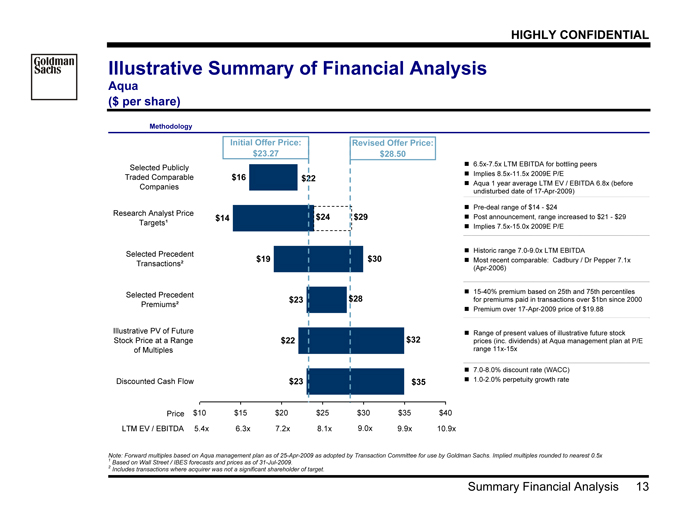

Illustrative Summary of Financial Analysis

Aqua

($ per share)

Note: Forward multiples based on Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs. Implied multiples rounded to nearest 0.5x

1 | | Based on Wall Street / IBES forecasts and prices as of 31-Jul-2009. |

2 | | Includes transactions where acquirer was not a significant shareholder of target. |

Methodology

? 6.5x-7.5x LTM EBITDA for bottling peers

? Implies 8.5x-11.5x 2009E P/E

? Aqua 1 year average LTM EV / EBITDA 6.8x (before

undisturbed date of 17-Apr-2009)

? Pre-deal range of $14—$24

? Post announcement, range increased to $21—$29

? Implies 7.5x-15.0x 2009E P/E

? Historic range 7.0-9.0x LTM EBITDA

? Most recent comparable: Cadbury / Dr Pepper 7.1x

(Apr-2006)

? 15-40% premium based on 25th and 75th percentiles

for premiums paid in transactions over $1bn since 2000

? Premium over 17-Apr-2009 price of $19.88

? Range of present values of illustrative future stock

prices (inc. dividends) at Aqua management plan at P/E

range 11x-15x

$23

$22

$23

$19

$14

$16

$10 $15 $20 $25 $30 $35 $40

Discounted Cash Flow

Illustrative PV of Future

Stock Price at a Range

of Multiples

Selected Precedent

Premiums²

Selected Precedent

Transactions²

Research Analyst Price

Targets¹

Selected Publicly

Traded Comparable

Companies

$35

$32

$28

$30

$22

Revised Offer Price:

$28.50

5.4x 6.3x 7.2x 8.1x 9.0x 9.9x 10.9x

Price

LTM EV / EBITDA

$24 $29

Initial Offer Price:

$23.27

? 7.0-8.0% discount rate (WACC)

? 1.0-2.0% perpetuity growth rate

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 14

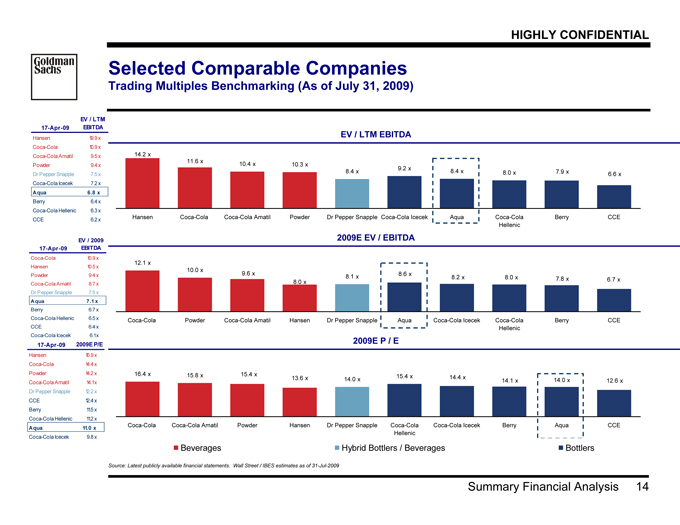

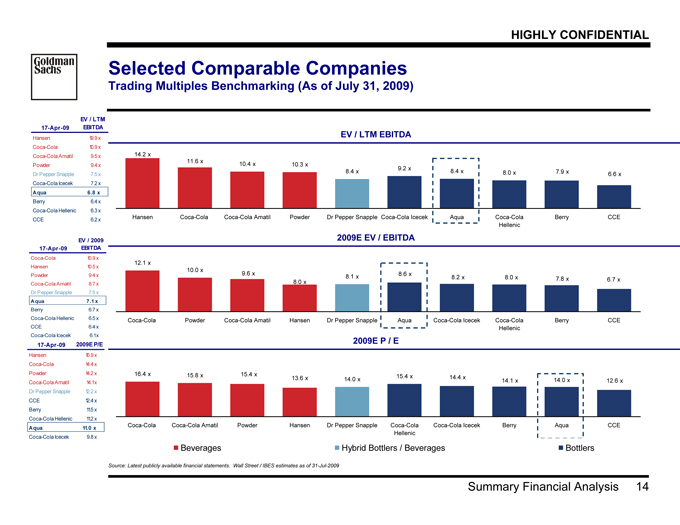

Selected Comparable Companies

Trading Multiples Benchmarking (As of July 31, 2009)

EV / LTM EBITDA

14.2 x

10.4 x 10.3 x

8.4 x 9.2 x 8.4 x 8.0 x

11.6 x

7.9 x 6.6 x

Hansen Coca-Cola Coca-Cola Amatil Powder Dr Pepper Snapple Coca-Cola Icecek Aqua Coca-Cola

Hellenic

Berry CCE

2009E EV / EBITDA

12.1 x

10.0 x

9.6 x 8.1 x

8.0 x 6.7 x

8.6 x 8.2 x 8.0 x 7.8 x

Coca-Cola Powder Coca-Cola Amatil Hansen Dr Pepper Snapple Aqua Coca-Cola Icecek Coca-Cola

Hellenic

Berry CCE

2009E P / E

16.4 x 15.8 x 15.4 x 13.6 x 14.0 x 15.4 x 14.4 x 14.1 x 14.0 x 12.6 x

Coca-Cola Coca-Cola Amatil Powder Hansen Dr Pepper Snapple Coca-Cola

Hellenic

Coca-Cola Icecek Berry Aqua CCE

Beverages Hybrid Bottlers / Beverages Bottlers

Source: Latest publicly available financial statements. Wall Street / IBES estimates as of 31-Jul-2009

17-Apr-09

EV / LTM

EBITDA

Hansen 19.9 x

Coca-Cola 10.9 x

Coca-Cola Amatil 9.5 x

Powder 9.4 x

Dr Pepper Snapple 7.5 x

Coca-Cola Icecek 7.2 x

Aqua 6.8 x

Berry 6.4 x

Coca-Cola Hellenic 6.3 x

CCE 6.2 x

17-Apr-09

EV / 2009

EBITDA

Coca-Cola 10.9 x

Hansen 10.5 x

Powder 9.4 x

Coca-Cola Amatil 8.7 x

Dr Pepper Snapple 7.5 x

Aqua 7.1 x

Berry 6.7 x

Coca-Cola Hellenic 6.5 x

CCE 6.4 x

Coca-Cola Icecek 6.1 x

17-Apr-09 2009E P/E

Hansen 16.9 x

Coca-Cola 14.4 x

Powder 14.2 x

Coca-Cola Amatil 14.1 x

Dr Pepper Snapple 12.2 x

CCE 12.4 x

Berry 11.5 x

Coca-Cola Hellenic 11.2 x

Aqua 11.0 x

Coca-Cola Icecek 9.8 x

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 15

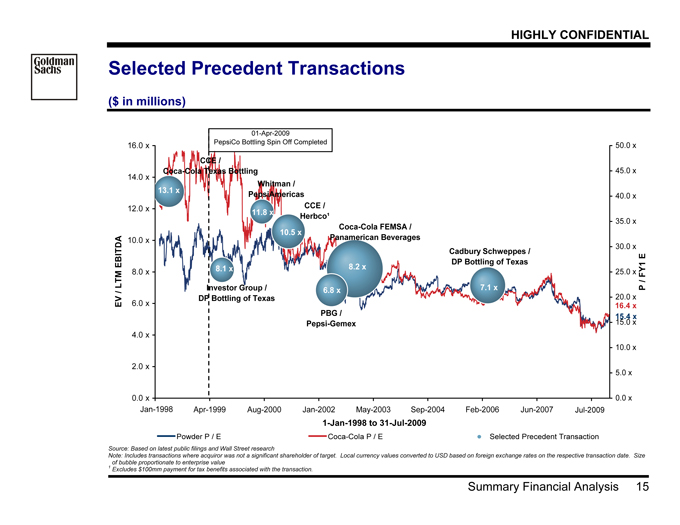

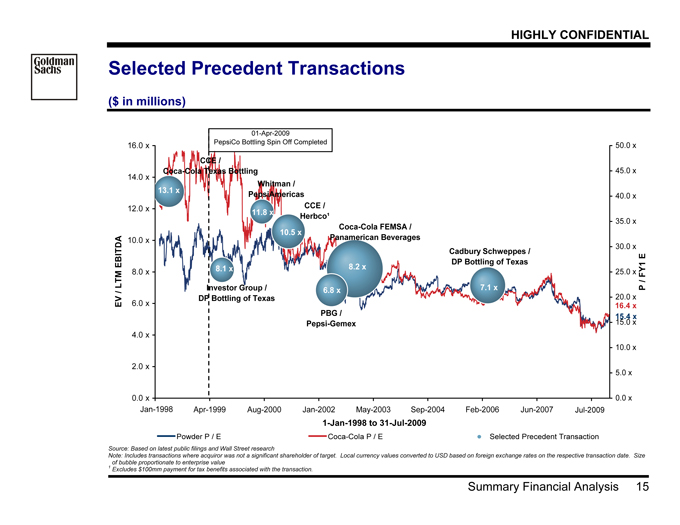

Selected Precedent Transactions

($ in millions)

15.4 x

16.4 x

01-Apr-2009

PepsiCo Bottling Spin Off Completed

Source: Based on latest public filings and Wall Street research

Note: Includes transactions where acquiror was not a significant shareholder of target. Local currency values converted to USD based on foreign exchange rates on the respective transaction date. Size

of bubble proportionate to enterprise value

1 | | Excludes $100mm payment for tax benefits associated with the transaction. |

1-Jan-1998 to 31-Jul-2009

0.0 x

2.0 x

4.0 x

6.0 x

8.0 x

10.0 x

12.0 x

14.0 x

16.0 x

Nov-1997 Apr-1999 Aug-2000 Jan-2002 May-2003 Sep-2004 Feb-2006 Jun-2007 Nov-2008

EV / LTM EBITDA

0.0 x

5.0 x

10.0 x

15.0 x

20.0 x

25.0 x

30.0 x

35.0 x

40.0 x

45.0 x

50.0 x

P / FY1 E

Cadbury Schweppes /

DP Bottling of Texas

Coca-Cola FEMSA /

Panamerican Beverages

PBG /

Pepsi-Gemex

CCE /

Herbco¹

Whitman /

PepsiAmericas

Investor Group /

DP Bottling of Texas

CCE /

Coca-Cola Texas Bottling

7.1 x

8.2 x

6.8 x

10.5 x

11.8 x

8.1 x

13.1 x

Jan-1998 Apr-JJuul-n2-022000900 99

Powder P / E Coca-Cola P / E Selected Precedent Transaction

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 16

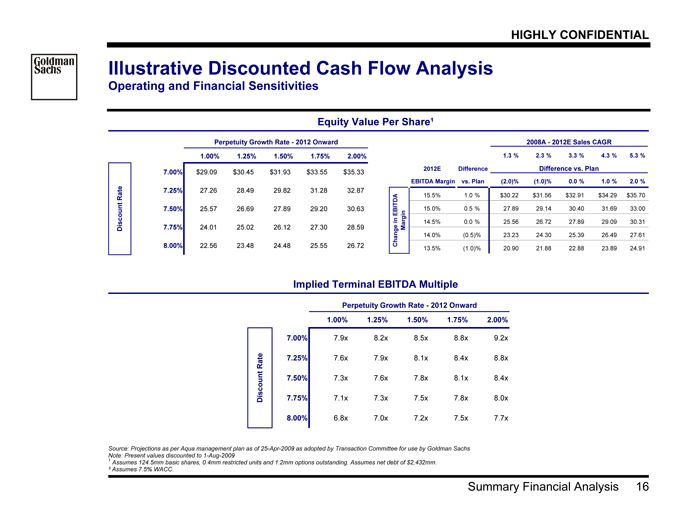

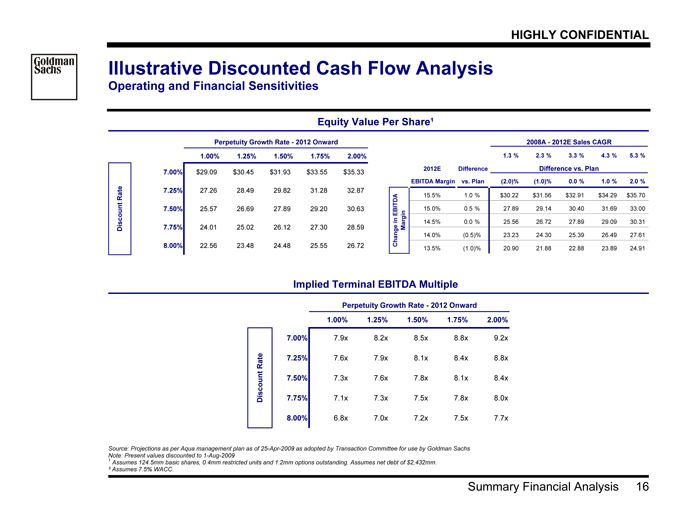

Illustrative Discounted Cash Flow Analysis

Operating and Financial Sensitivities

Equity Value Per Share¹

Perpetuity Growth Rate—2012 Onward

1.00% 1.25% 1.50% 1.75% 2.00%

7.00% $29.09 $30.45 $31.93 $33.55 $35.33

7.25% 27.26 28.49 29.82 31.28 32.87

7.50% 25.57 26.69 27.89 29.20 30.63

7.75% 24.01 25.02 26.12 27.30 28.59

8.00% 22.56 23.48 24.48 25.55 26.72

Discount Rate

2008A—2012E Sales CAGR

1.3 % 2.3 % 3.3 % 4.3 % 5.3 %

2012E Difference Difference vs. Plan

EBITDA Margin vs. Plan (2.0)% (1.0)% 0.0 % 1.0 % 2.0 %

15.5% 1.0 % $30.22 $31.56 $32.91 $34.29 $35.70

15.0% 0.5 % 27.89 29.14 30.40 31.69 3 3.00

14.5% 0.0 % 25.56 26.72 27.89 29.09 3 0.31

14.0% (0.5)% 23.23 24.30 25.39 26.49 2 7.61

13.5% (1.0)% 20.90 21.88 22.88 23.89 2 4.91

Change in EBITDA

Margin

Implied Terminal EBITDA Multiple

Perpetuity Growth Rate—2012 Onward

1.00% 1.25% 1.50% 1.75% 2.00%

7.00% 7.9x 8.2x 8.5x 8.8x 9.2x

7.25% 7.6x 7.9x 8.1x 8.4x 8.8x

7.50% 7.3x 7.6x 7.8x 8.1x 8.4x

7.75% 7.1x 7.3x 7.5x 7.8x 8.0x

8.00% 6.8x 7.0x 7.2x 7.5x 7.7x

Discount Rate

Source: Projections as per Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs

Note: Present values discounted to 1-Aug-2009

1 | | Assumes 124.5mm basic shares, 0.4mm restricted units and 1.2mm options outstanding. Assumes net debt of $2,432mm. |

² Assumes 7.5% WACC.

Goldman Sachs

HIGHLY CONFIDENTIAL

Summary Financial Analysis 17

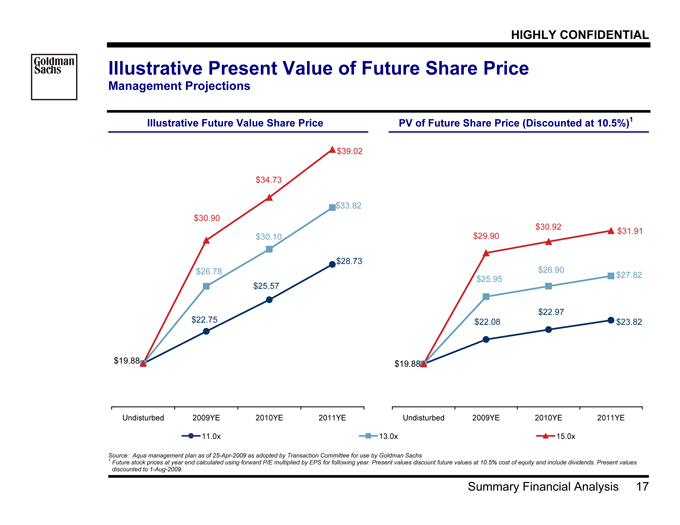

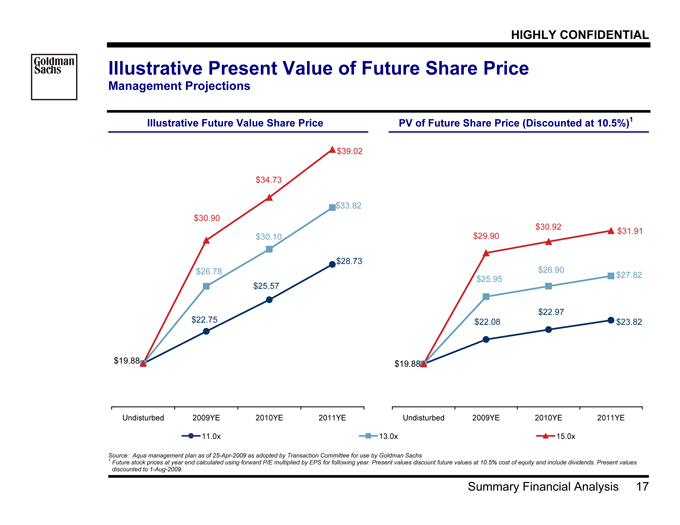

Illustrative Present Value of Future Share Price

Management Projections

Illustrative Future Value Share Price PV of Future Share Price (Discounted at 10.5%)1

$28.73

$25.57

$22.75

$30.10

$26.78

$33.82

$19.88

$30.90

$34.73

$39.02

Undisturbed 2009YE 2010YE 2011YE

$23.82

$22.97

$22.08

$26.90 $27.82

$25.95

$29.90

$30.92 $31.91

$19.88

Undisturbed 2009YE 2010YE 2011YE

11.0x 13.0x 15.0x

Source: Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs

1 Future stock prices at year end calculated using forward P/E multiplied by EPS for following year. Present values discount future values at 10.5% cost of equity and include dividends. Present values

discounted to 1-Aug-2009.

Goldman Sachs

HIGHLY CONFIDENTIAL

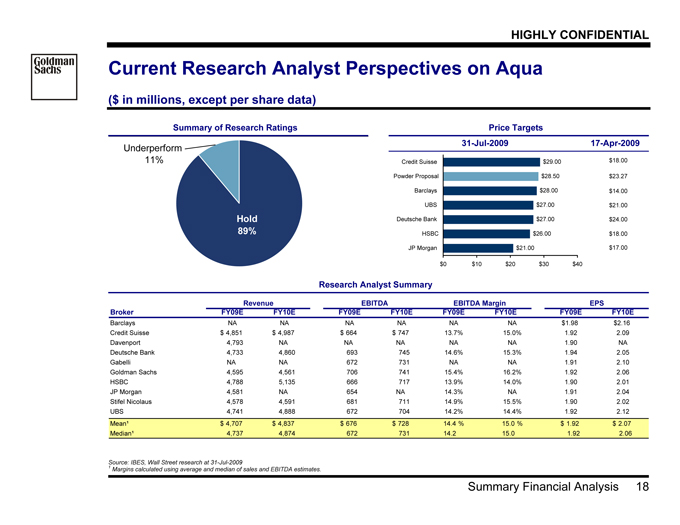

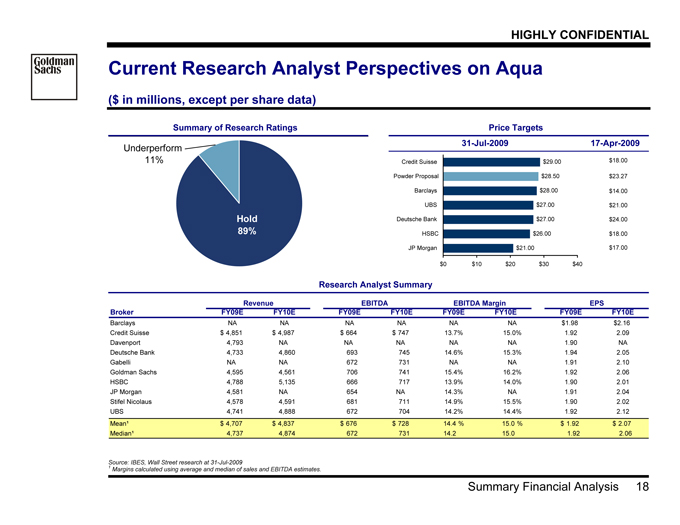

Summary Financial Analysis 18

Current Research Analyst Perspectives on Aqua

($ in millions, except per share data)1

Summary of Research Ratings Price Targets

31-Jul-2009 17-Apr-2009

Hold

89%

Underperform

11%

$21.00

$26.00

$27.00

$27.00

$28.00

$28.50

$29.00

$0 $10 $20 $30 $40

JP Morgan

HSBC

Deutsche Bank

UBS

Barclays

Powder Proposal

Credit Suisse $18.00

$23.27

$14.00

$21.00

$24.00

$18.00

$17.00

Research Analyst Summary

Revenue EBITDA EBITDA Margin EPS

Broker FY09E FY10E FY09E FY10E FY09E FY10E FY09E FY10E

Barclays NA NA NA NA NA NA $1.98 $2.16

Credit Suisse $ 4,851 $ 4,987 $ 664 $ 747 13.7% 15.0% 1.92 2.09

Davenport 4,793 NA NA NA NA NA 1.90 NA

Deutsche Bank 4,733 4,860 693 745 14.6% 15.3% 1.94 2.05

Gabelli NA NA 672 731 NA NA 1.91 2.10

Goldman Sachs 4,595 4,561 706 741 15.4% 16.2% 1.92 2.06

HSBC 4,788 5,135 666 717 13.9% 14.0% 1.90 2.01

JP Morgan 4,581 NA 654 NA 14.3% NA 1.91 2.04

Stifel Nicolaus 4,578 4,591 681 711 14.9% 15.5% 1.90 2.02

UBS 4,741 4,888 672 704 14.2% 14.4% 1.92 2.12

Mean¹ $ 4,707 $ 4,837 $ 676 $ 728 14.4 % 15.0 % $ 1.92 $ 2.07

Median¹ 4,737 4,874 672 731 14.2 15.0 1.92 2.06

Source: IBES, Wall Street research at 31-Jul-2009

1 | | Margins calculated using average and median of sales and EBITDA estimates. |

Goldman Sachs

HIGHLY CONFIDENTIAL

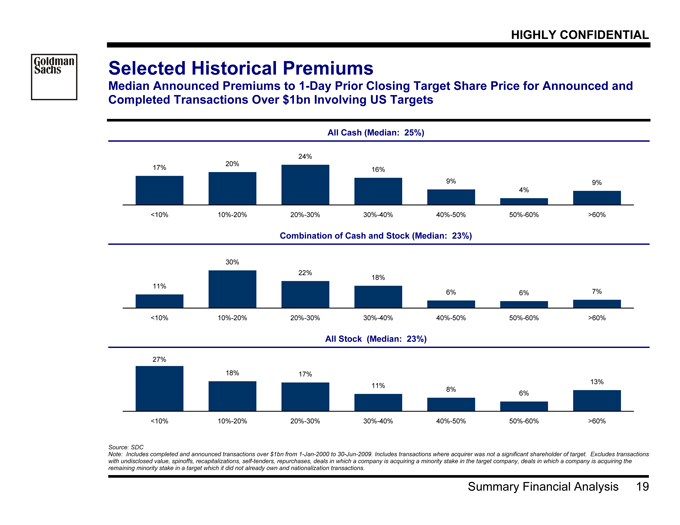

Summary Financial Analysis 19

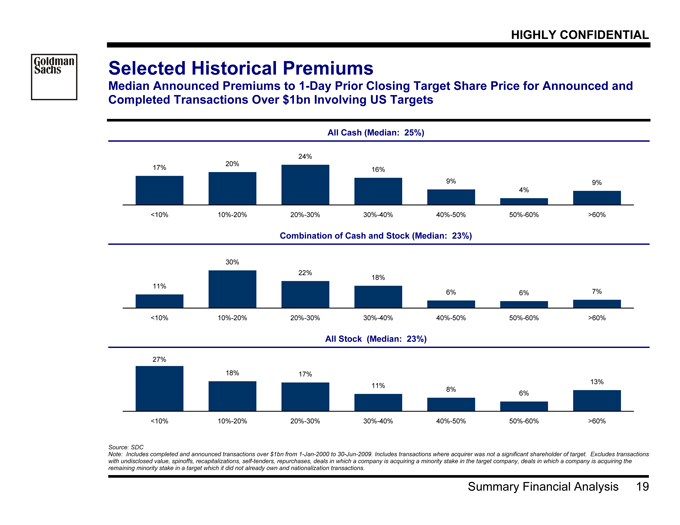

Selected Historical Premiums

Median Announced Premiums to 1-Day Prior Closing Target Share Price for Announced and

Completed Transactions Over $1bn Involving US Targets

All Cash (Median: 25%)

17% 20%

24%

16%

9%

4%

9%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Combination of Cash and Stock (Median: 23%)

11%

30%

22%

18%

6% 6% 7%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

All Stock (Median: 23%)

27%

18% 17%

11% 8% 6%

13%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Source: SDC

Note: Includes completed and announced transactions over $1bn from 1-Jan-2000 to 30-Jun-2009. Includes transactions where acquirer was not a significant shareholder of target. Excludes transactions

with undisclosed value, spinoffs, recapitalizations, self-tenders, repurchases, deals in which a company is acquiring a minority stake in the target company, deals in which a company is acquiring the

remaining minority stake in a target which it did not already own and nationalization transactions.

Goldman Sachs

HIGHLY CONFIDENTIAL

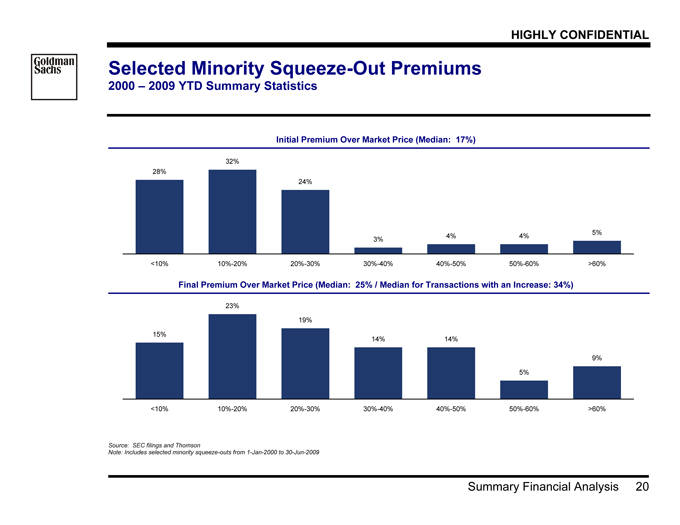

Summary Financial Analysis 20

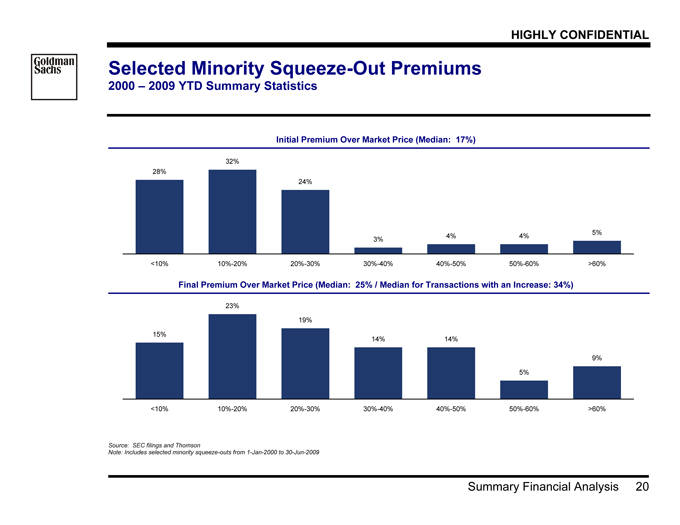

Selected Minority Squeeze-Out Premiums

2000 – 2009 YTD Summary Statistics

Initial Premium Over Market Price (Median: 17%)

28%

32%

24%

3% 4% 4% 5%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Final Premium Over Market Price (Median: 25% / Median for Transactions with an Increase: 34%)

15%

23%

19%

14% 14%

5%

9%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Source: SEC filings and Thomson

Note: Includes selected minority squeeze-outs from 1-Jan-2000 to 30-Jun-2009

Goldman Sachs

HIGHLY CONFIDENTIAL

Pro Forma Impact on Powder 21

IV. Pro Forma Impact on Powder

Goldman Sachs

HIGHLY CONFIDENTIAL

Pro Forma Impact on Powder 22

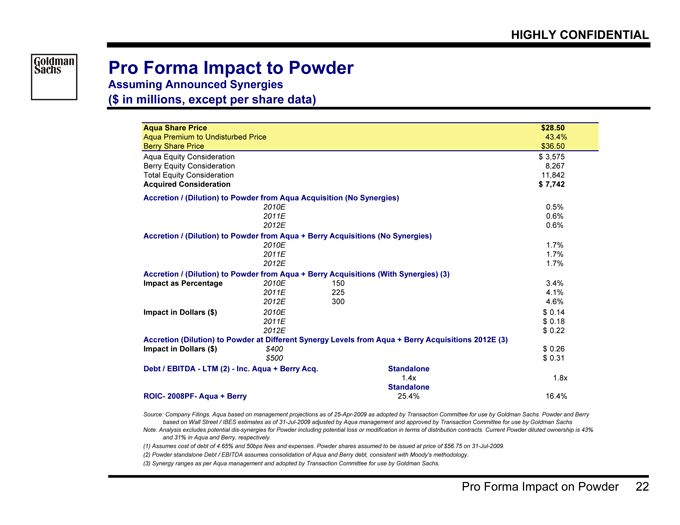

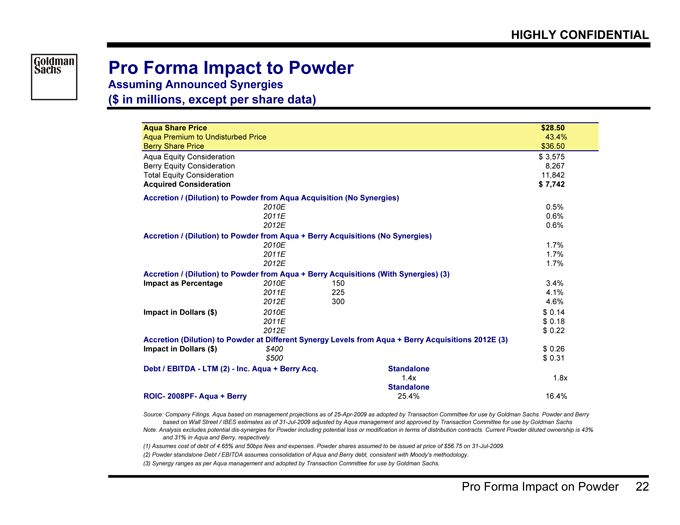

Pro Forma Impact to Powder

Assuming Announced Synergies

($ in millions, except per share data)

Aqua Share Price $28.50

Aqua Premium to Undisturbed Price 43.4%

Berry Share Price $36.50

Aqua Equity Consideration $ 3,575

Berry Equity Consideration 8,267

Total Equity Consideration 11,842

Acquired Consideration $ 7,742

Accretion / (Dilution) to Powder from Aqua Acquisition (No Synergies)

2010E 0.5%

2011E 0.6%

2012E 0.6%

Accretion / (Dilution) to Powder from Aqua + Berry Acquisitions (No Synergies)

2010E 1.7%

2011E 1.7%

2012E 1.7%

Accretion / (Dilution) to Powder from Aqua + Berry Acquisitions (With Synergies) (3)

Impact as Percentage 2010E 150 3.4%

2011E 225 4.1%

2012E 300 4.6%

Impact in Dollars ($) 2010E $ 0.14

2011E $ 0.18

2012E $ 0.22

Accretion (Dilution) to Powder at Different Synergy Levels from Aqua + Berry Acquisitions 2012E (3)

Impact in Dollars ($) $400 $ 0.26

$500 $ 0.31

Debt / EBITDA—LTM (2)—Inc. Aqua + Berry Acq. Standalone

1.4x 1.8x

Standalone

ROIC- 2008PF- Aqua + Berry 25.4% 16.4%

(1) Assumes cost of debt of 4.65% and 50bps fees and expenses. Powder shares assumed to be issued at price of $56.75 on 31-Jul-2009.

(2) | | Powder standalone Debt / EBITDA assumes consolidation of Aqua and Berry debt, consistent with Moody's methodology. |

(3) | | Synergy ranges as per Aqua management and adopted by Transaction Committee for use by Goldman Sachs. |

Source: Company Filings. Aqua based on management projections as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs. Powder and Berry

based on Wall Street / IBES estimates as of 31-Jul-2009 adjusted by Aqua management and approved by Transaction Committee for use by Goldman Sachs

Note: Analysis excludes potential dis-synergies for Powder including potential loss or modification in terms of distribution contracts. Current Powder diluted ownership is 43%

and 31% in Aqua and Berry, respectively.

Goldman Sachs

HIGHLY CONFIDENTIAL

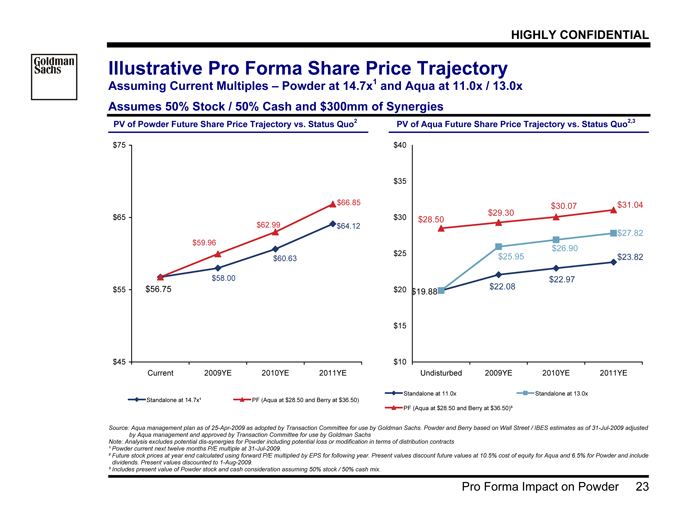

Pro Forma Impact on Powder 23

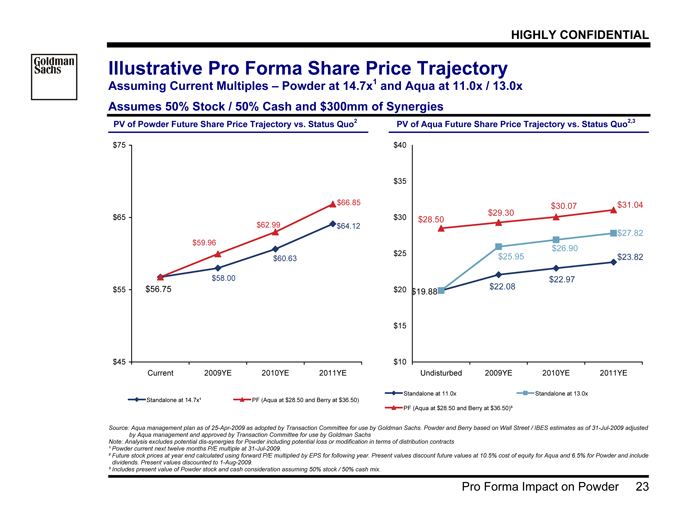

Illustrative Pro Forma Share Price Trajectory

Assuming Current Multiples – Powder at 14.7x1 and Aqua at 11.0x / 13.0x

Assumes 50% Stock / 50% Cash and $300mm of Synergies

PV of Powder Future Share Price Trajectory vs. Status Quo2 PV of Aqua Future Share Price Trajectory vs. Status Quo2,3

$64.12

$60.63

$58.00

$66.85

$62.99

$59.96

$56.75

$45

$55

$65

$75

Current 2009YE 2010YE 2011YE

$23.82

$22.97

$19.88 $22.08

$30.07 $31.04

$29.30

$28.50

$27.82

$26.90

$25.95

$10

$15

$20

$25

$30

$35

$40

Undisturbed 2009YE 2010YE 2011YE

Standalone at 14.7x¹ PF (Aqua at $28.50 and Berry at $36.50)

Standalone at 11.0x Standalone at 13.0x

PF (Aqua at $28.50 and Berry at $36.50)³

Source: Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs. Powder and Berry based on Wall Street / IBES estimates as of 31-Jul-2009 adjusted

by Aqua management and approved by Transaction Committee for use by Goldman Sachs

Note: Analysis excludes potential dis-synergies for Powder including potential loss or modification in terms of distribution contracts

¹ Powder current next twelve months P/E multiple at 31-Jul-2009.

² Future stock prices at year end calculated using forward P/E multiplied by EPS for following year. Present values discount future values at 10.5% cost of equity for Aqua and 6.5% for Powder and include

dividends. Present values discounted to 1-Aug-2009.

³ Includes present value of Powder stock and cash consideration assuming 50% stock / 50% cash mix.

Goldman Sachs

HIGHLY CONFIDENTIAL

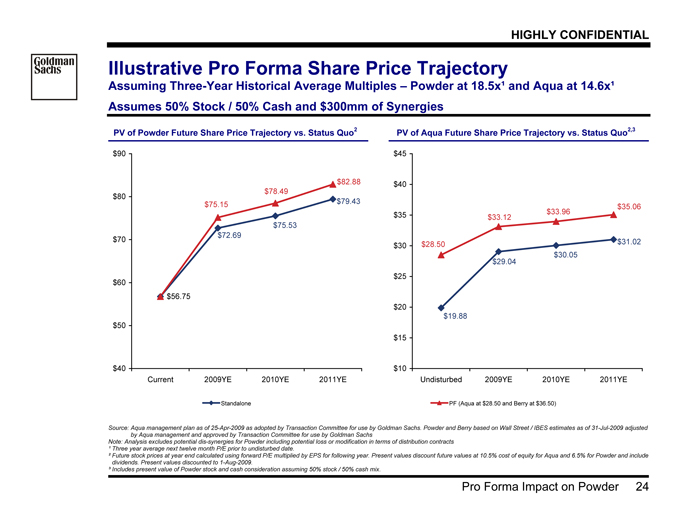

Pro Forma Impact on Powder 24

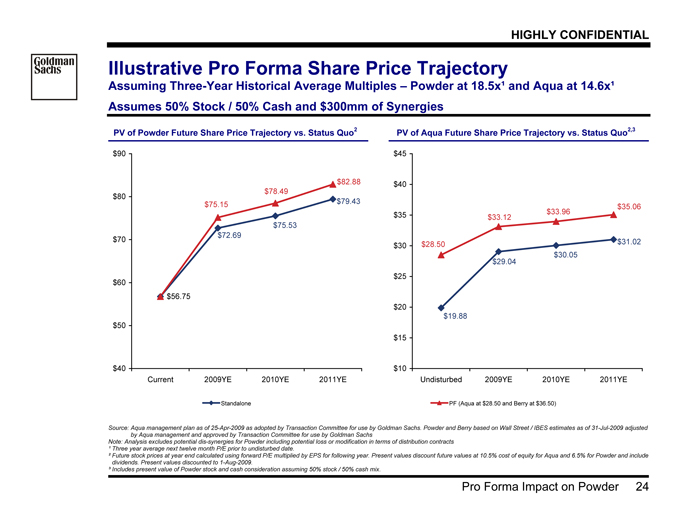

Illustrative Pro Forma Share Price Trajectory

Assuming Three-Year Historical Average Multiples – Powder at 18.5x¹ and Aqua at 14.6x¹

Assumes 50% Stock / 50% Cash and $300mm of Synergies

PV of Powder Future Share Price Trajectory vs. Status Quo2 PV of Aqua Future Share Price Trajectory vs. Status Quo2,3

$79.43

$75.53

$72.69

$82.88

$78.49

$75.15

$56.75

$40

$50

$60

$70

$80

$90

Current 2009YE 2010YE 2011YE

$31.02

$30.05

$29.04

$19.88

$33.96 $35.06

$33.12

$28.50

$10

$15

$20

$25

$30

$35

$40

$45

Undisturbed 2009YE 2010YE 2011YE

Standalone PF (Aqua at $28.50 and Berry at $36.50)

Source: Aqua management plan as of 25-Apr-2009 as adopted by Transaction Committee for use by Goldman Sachs. Powder and Berry based on Wall Street / IBES estimates as of 31-Jul-2009 adjusted

by Aqua management and approved by Transaction Committee for use by Goldman Sachs

Note: Analysis excludes potential dis-synergies for Powder including potential loss or modification in terms of distribution contracts

¹ Three year average next twelve month P/E prior to undisturbed date.

² Future stock prices at year end calculated using forward P/E multiplied by EPS for following year. Present values discount future values at 10.5% cost of equity for Aqua and 6.5% for Powder and include

dividends. Present values discounted to 1-Aug-2009.

³ Includes present value of Powder stock and cash consideration assuming 50% stock / 50% cash mix.

Goldman Sachs

HIGHLY CONFIDENTIAL

Background Information on Powder 25

V. Background Information on Powder

Goldman Sachs

HIGHLY CONFIDENTIAL

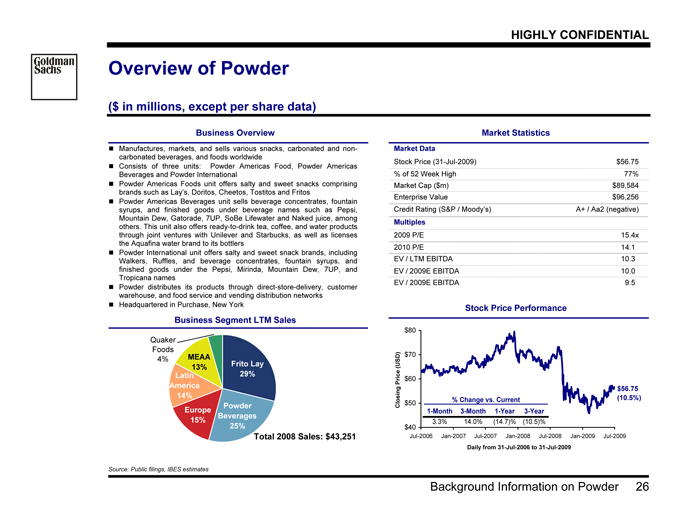

Background Information on Powder 26

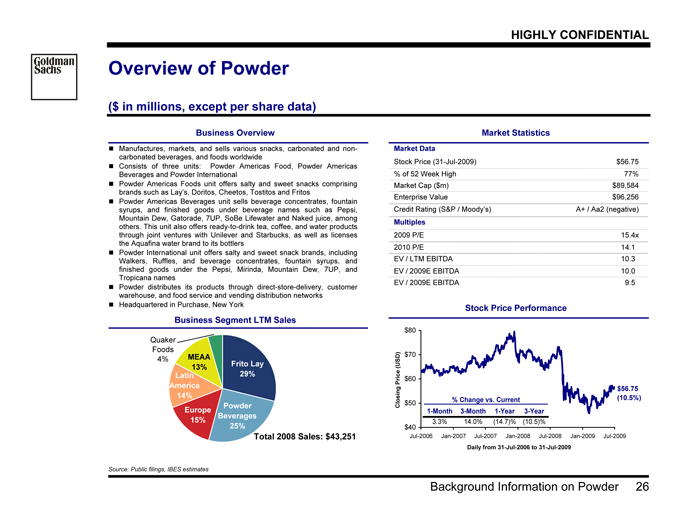

Overview of Powder

($ in millions, except per share data)

Business Overview Market Statistics

Market Data

Stock Price (31-Jul-2009) $56.75

% of 52 Week High 77%

Market Cap ($m) $89,584

Enterprise Value $96,256

Credit Rating (S&P / Moody’s) A+ / Aa2 (negative)

Multiples

2009 P/E 15.4x

2010 P/E 14.1x

EV / LTM EBITDA 10.3x

EV / 2009E EBITDA 10.0x

EV / 2009E EBITDA 9.5x

Stock Price Performance

? Manufactures, markets, and sells various snacks, carbonated and noncarbonated

beverages, and foods worldwide

? Consists of three units: Powder Americas Food, Powder Americas

Beverages and Powder International

? Powder Americas Foods unit offers salty and sweet snacks comprising

brands such as Lay’s, Doritos, Cheetos, Tostitos and Fritos

? Powder Americas Beverages unit sells beverage concentrates, fountain

syrups, and finished goods under beverage names such as Pepsi,

Mountain Dew, Gatorade, 7UP, SoBe Lifewater and Naked juice, among

others. This unit also offers ready-to-drink tea, coffee, and water products

through joint ventures with Unilever and Starbucks, as well as licenses

the Aquafina water brand to its bottlers

? Powder International unit offers salty and sweet snack brands, including

Walkers, Ruffles, and beverage concentrates, fountain syrups, and

finished goods under the Pepsi, Mirinda, Mountain Dew, 7UP, and

Tropicana names

? Powder distributes its products through direct-store-delivery, customer

warehouse, and food service and vending distribution networks

? Headquartered in Purchase, New York

Business Segment LTM Sales

MEAA

13%

Latin

America

14%

Europe

15%

Powder

Beverages

25%

Frito Lay

29%

Quaker

Foods

4%

Total 2008 Sales: $43,251

$40

$50

$60

$70

$80

Jul-2006 Jan-2007 Jul-2007 Jan-2008 Jul-2008 Jan-2009 Jul-2009

Daily from 31-Jul-2006 to 31-Jul-2009

Closing Price (USD)

$56.75

% Change vs. Current (10.5%)

1-Month 3-Month 1-Year 3-Year

3.3% 14.0% (14.7)% (10.5)%

Source: Public filings, IBES estimates

Goldman Sachs

HIGHLY CONFIDENTIAL

Background Information on Powder 27

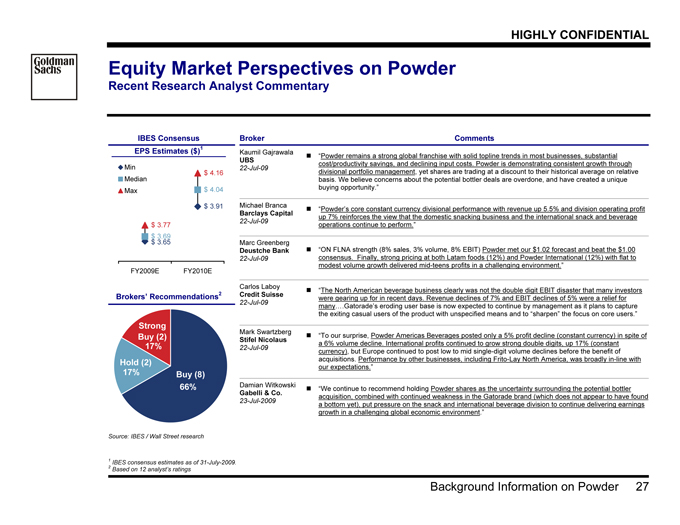

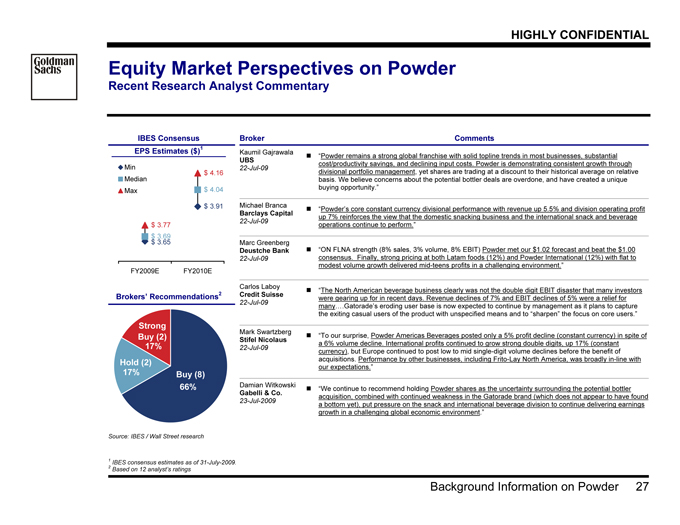

Equity Market Perspectives on Powder

Recent Research Analyst Commentary

IBES Consensus

EPS Estimates ($)1

$ 3.91

$ 3.69

$ 4.04

$ 3.77

$ 4.16

$ 3.65

FY2009E FY2010E

Min

Median

Max

Brokers’ Recommendations2

66%

17%

17% Buy (8)

Hold (2)

Strong

Buy (2)

Broker Comments

Kaumil Gajrawala

UBS

22-Jul-09

? “Powder remains a strong global franchise with solid topline trends in most businesses, substantial

cost/productivity savings, and declining input costs. Powder is demonstrating consistent growth through

divisional portfolio management, yet shares are trading at a discount to their historical average on relative

basis. We believe concerns about the potential bottler deals are overdone, and have created a unique

buying opportunity.”

Michael Branca

Barclays Capital

22-Jul-09

? “Powder’s core constant currency divisional performance with revenue up 5.5% and division operating profit

up 7% reinforces the view that the domestic snacking business and the international snack and beverage

operations continue to perform.”

Marc Greenberg

Deustche Bank

22-Jul-09

? “ON FLNA strength (8% sales, 3% volume, 8% EBIT) Powder met our $1.02 forecast and beat the $1.00

consensus. Finally, strong pricing at both Latam foods (12%) and Powder International (12%) with flat to

modest volume growth delivered mid-teens profits in a challenging environment.”

Carlos Laboy

Credit Suisse

22-Jul-09

? “The North American beverage business clearly was not the double digit EBIT disaster that many investors

were gearing up for in recent days. Revenue declines of 7% and EBIT declines of 5% were a relief for

many….Gatorade’s eroding user base is now expected to continue by management as it plans to capture

the exiting casual users of the product with unspecified means and to “sharpen” the focus on core users.”

Mark Swartzberg

Stifel Nicolaus

22-Jul-09

? “To our surprise, Powder Americas Beverages posted only a 5% profit decline (constant currency) in spite of

a 6% volume decline. International profits continued to grow strong double digits, up 17% (constant

currency), but Europe continued to post low to mid single-digit volume declines before the benefit of

acquisitions. Performance by other businesses, including Frito-Lay North America, was broadly in-line with

our expectations.”

Damian Witkowski

Gabelli & Co.

23-Jul-2009

? “We continue to recommend holding Powder shares as the uncertainty surrounding the potential bottler

acquisition, combined with continued weakness in the Gatorade brand (which does not appear to have found

a bottom yet), put pressure on the snack and international beverage division to continue delivering earnings

growth in a challenging global economic environment.”

Source: IBES / Wall Street research

1 | | IBES consensus estimates as of 31-July-2009. |

2 | | Based on 12 analyst’s ratings |

Goldman Sachs

HIGHLY CONFIDENTIAL

Supplemental Materials 28

Appendix A: Supplemental Materials

Goldman Sachs

HIGHLY CONFIDENTIAL

Supplemental Materials 29

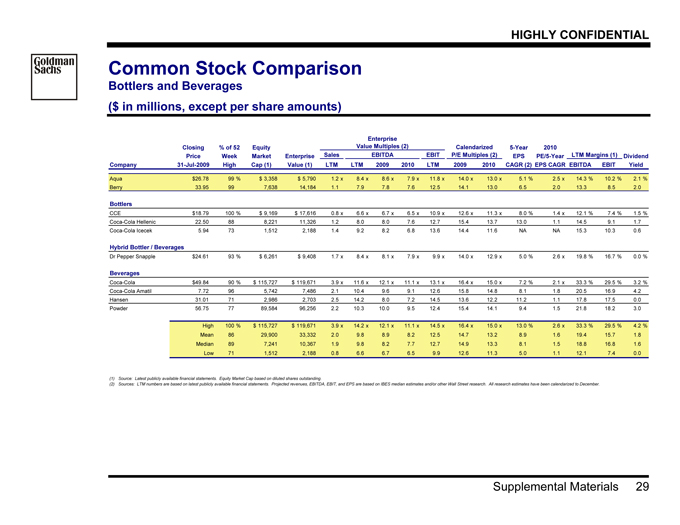

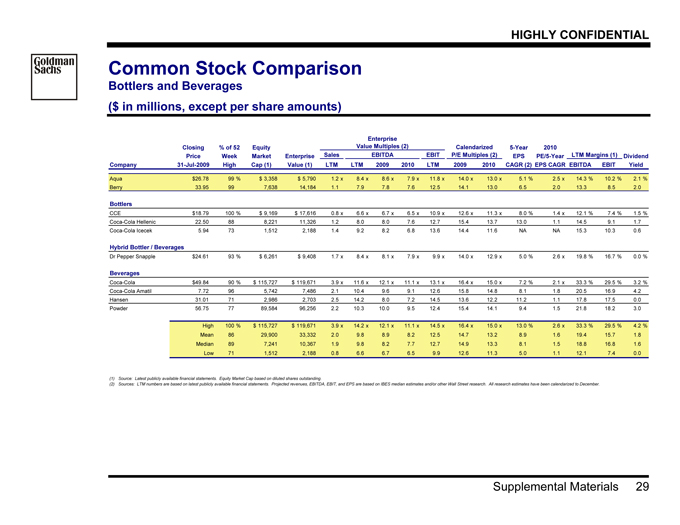

Common Stock Comparison

Bottlers and Beverages

($ in millions, except per share amounts)

Closing % of 52 Equity 5-Year 2010

Price Week Market Enterprise EPS PE/5-Year Dividend

Company 31-Jul-2009 High Cap (1) Value (1) LTM LTM 2009 2010 LTM 2009 2010 CAGR (2) EPS CAGR EBITDA EBIT Yield

Aqua $26.78 99 % $ 3,358 $ 5,790 1.2 x 8.4 x 8.6 x 7.9 x 11.8 x 14.0 x 13.0 x 5.1 % 2.5 x 14.3 % 10.2 % 2.1 %

Berry 33.95 99 7,638 14,184 1.1 7.9 7.8 7.6 12.5 14.1 13.0 6.5 2.0 13.3 8.5 2.0

Bottlers

CCE $18.79 100 % $ 9,169 $ 17,616 0.8 x 6.6 x 6.7 x 6.5 x 10.9 x 12.6 x 11.3 x 8.0 % 1.4 x 12.1 % 7.4 % 1.5 %

Coca-Cola Hellenic 22.50 88 8,221 11,326 1.2 8.0 8.0 7.6 12.7 15.4 13.7 13.0 1.1 14.5 9.1 1.7

Coca-Cola Icecek 5.94 73 1,512 2,188 1.4 9.2 8.2 6.8 13.6 14.4 11.6 NA NA 15.3 10.3 0.6

Hybrid Bottler / Beverages

Dr Pepper Snapple $24.61 93 % $ 6,261 $ 9,408 1.7 x 8.4 x 8.1 x 7.9 x 9.9 x 14.0 x 12.9 x 5.0 % 2.6 x 19.8 % 16.7 % 0.0 %

Beverages

Coca-Cola $49.84 90 % $ 115,727 $ 119,671 3.9 x 11.6 x 12.1 x 11.1 x 13.1 x 16.4 x 15.0 x 7.2 % 2.1 x 33.3 % 29.5 % 3.2 %

Coca-Cola Amatil 7.72 96 5,742 7,486 2.1 10.4 9.6 9.1 12.6 15.8 14.8 8.1 1.8 20.5 16.9 4.2

Hansen 31.01 71 2,986 2,703 2.5 14.2 8.0 7.2 14.5 13.6 12.2 11.2 1.1 17.8 17.5 0.0

Powder 56.75 77 89,584 96,256 2.2 10.3 10.0 9.5 12.4 15.4 14.1 9.4 1.5 21.8 18.2 3.0

High 100 % $ 115,727 $ 119,671 3.9 x 14.2 x 12.1 x 11.1 x 14.5 x 16.4 x 15.0 x 13.0 % 2.6 x 33.3 % 29.5 % 4.2 %

Mean 86 29,900 33,332 2.0 9.8 8.9 8.2 12.5 14.7 13.2 8.9 1.6 19.4 15.7 1.8

Median 89 7,241 10,367 1.9 9.8 8.2 7.7 12.7 14.9 13.3 8.1 1.5 18.8 16.8 1.6

Low 71 1,512 2,188 0.8 6.6 6.7 6.5 9.9 12.6 11.3 5.0 1.1 12.1 7.4 0.0

(1) | | Source: Latest publicly available financial statements. Equity Market Cap based on diluted shares outstanding. |

(2) Sources: LTM numbers are based on latest publicly available financial statements. Projected revenues, EBITDA, EBIT, and EPS are based on IBES median estimates and/or other Wall Street research. All research estimates have been calendarized to December.

LTM Margins EBITDA (1)

Enterprise

Value Multiples (2)

EBIT P/E Multiples (2)

Calendarized

Sales

Goldman Sachs

HIGHLY CONFIDENTIAL

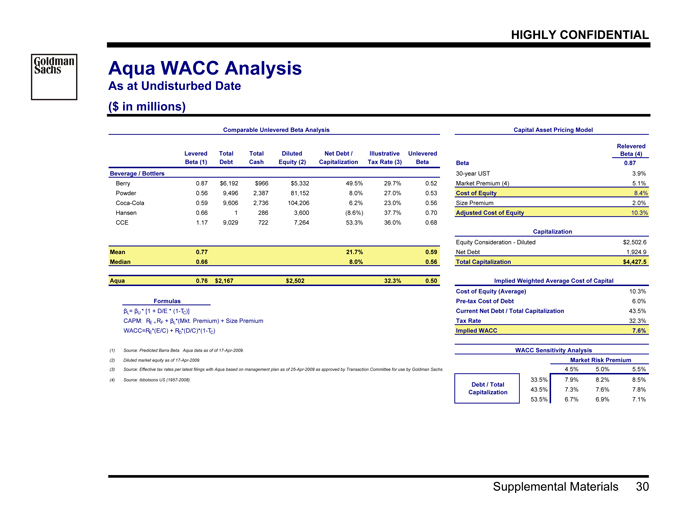

Supplemental Materials 30

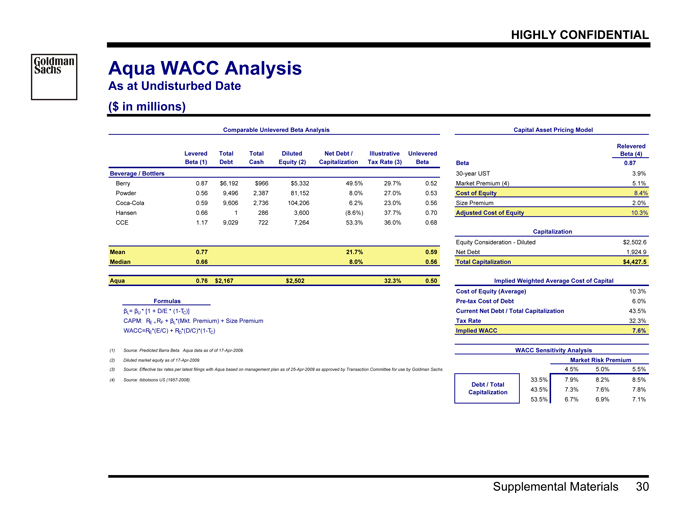

Aqua WACC Analysis

As at Undisturbed Date

($ in millions)

Comparable Unlevered Beta Analysis Capital Asset Pricing Model

Levered Total Total Diluted Net Debt / Illustrative Unlevered

Beta (1) Debt Cash Equity (2) Capitalization Tax Rate (3) Beta Beta 0.87

Beverage / Bottlers 30-year UST 3.9%

Berry 0.87 $6,192 $966 $5,332 49.5% 29.7% 0.52 Market Premium (4) 5.1%

Powder 0.56 9,496 2,387 81,152 8.0% 27.0% 0.53 Cost of Equity 8.4%

Coca-Cola 0.59 9,606 2,736 104,206 6.2% 23.0% 0.56 Size Premium 2.0%

Hansen 0.66 1 286 3,600 (8.6%) 37.7% 0.70 Adjusted Cost of Equity 10.3%

CCE 1.17 9,029 722 7,264 53.3% 36.0% 0.68

Capitalization

Equity Consideration—Diluted $2,502.6

Mean 0.77 21.7% 0.59 Net Debt 1,924.9

Median 0.66 8.0% 0.56 Total Capitalization $4,427.5

Aqua 0.76 $2,167 $2,502 32.3% 0.50 Implied Weighted Average Cost of Capital

Cost of Equity (Average) 10.3%

Formulas Pre-tax Cost of Debt 6.0%

?L = ?U * [1 + D/E * (1-TC )] Current Net Debt / Total Capitalization 43.5%

CAPM: RE = R F + ?L*(Mkt. Premium) + Size Premium Tax Rate 32.3%

WACC=RE *(E/C) + RD *(D/C)*(1-TC) Implied WACC 7.6%

(1) | | Source: Predicted Barra Beta. Aqua data as of of 17-Apr-2009. WACC Sensitivity Analysis |

(2) | | Diluted market equity as of 17-Apr-2009. Market Risk Premium |

(3) Source: Effective tax rates per latest filings with Aqua based on management plan as of 25-Apr-2009 as approved by Transaction Committee for use by Goldman Sachs. 7.6% 4.5% 5.0% 5.5%

(4) | | Source: Ibbotsons US (1957-2008). 33.5% 7.9% 8.2% 8.5% |

43.5% 7.3% 7.6% 7.8%

53.5% 6.7% 6.9% 7.1%

Relevered

Beta (4)

Debt / Total

Capitalization