Exhibit (c)(6)

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Project Periwinkle Discussion Materials

Goldman, Sachs & Co. April 28, 2009

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Table of Contents

I. Public Market Update

II. Update on Financial Projections

III. Summary Financial Analysis

IV. Review of Potential Alternatives

V. Pro Forma Impact on Powder

Appendix A: Supplemental Materials

Goldman Sachs does not provide accounting, tax, or legal advice. Notwithstanding anything in this document to the contrary, and

except as required to enable compliance with applicable securities law, you (and each of your employees, representatives, and other

agents) may disclose to any and all persons the US federal income and state tax treatment and tax structure of the transaction and all

materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax

structure, without Goldman Sachs imposing any limitation of any kind.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Disclaimer

Goldman, Sachs & Co. (“GS”) has prepared and provided these materials and GS’s related presentation (the “Confidential Information”) solely for the

information and assistance of the Board of Directors (the "Board") and senior management of Aqua (the "Company") in connection with its

consideration of the matters referred to herein. Without GS’s prior written consent, the Confidential Information may not be circulated or referred to

publicly, disclosed to or relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything hereinto the contrary,

the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein

and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax

structure, without GS imposing any limitation of any kind. The Confidential Information, including this disclaimer, is subject to, and governed by, any

written agreement between the Company, the Board and/or any committee thereof, on the hand, and GS, on the other hand.

GS and its affiliates are engaged in investment banking, commercial banking and financial advisory services, securities trading, investment

management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other

financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, GS and its

affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and

other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, the Company,

any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction for their

own account and for the accounts of their customers.

The Confidential Information has been prepared and based on information obtained by GS from publicly available sources, the Company’s

management and/or other sources. In preparing the Confidential Information, GS has relied upon and assumed, without assuming any responsibility

for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to,

discussed with or reviewed by GS, and GS does not assume any liability for any such information. GS does not provide accounting, tax, legal or

regulatory advice. GS’s role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own

advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of

actual future results, which may be significantly more or less favorable than suggested by these analyses, and GS does not assume responsibility if

future results are materially different from those forecast.

GS has not made an independent evaluation or appraisal of the assets and liabilities of the Company or any other person and has no obligation to

evaluate the solvency of the Company or any person under any law. The analyses in the Confidential Information are not appraisals nor do they

necessarily reflect the prices at which businesses or securities actually may be sold or purchased. The Confidential Information does not address the

underlying business decision of the Company to engage in any transaction, or the relative merits of any strategic alternative referred to herein as

compared to any other alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary,

market and other conditions as in effect on, and the information made available to GS as of, the date of such Confidential Information and GS

assumes no responsibility for updating or revising the Confidential Information.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Public Market Update 4

I. Public Market Update

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Public Market Update 5

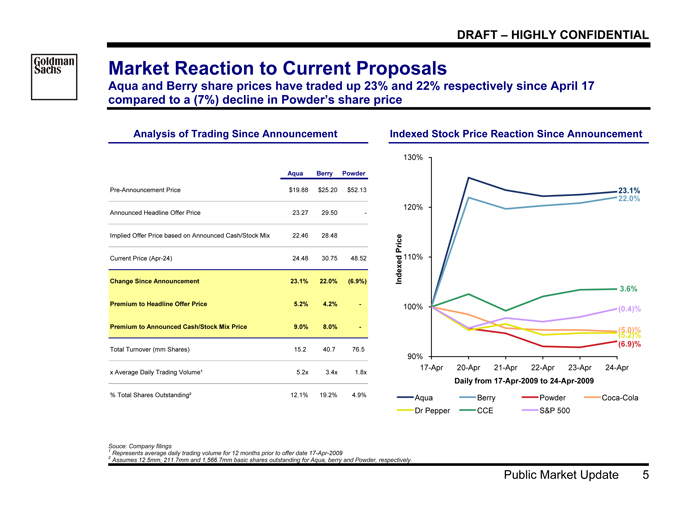

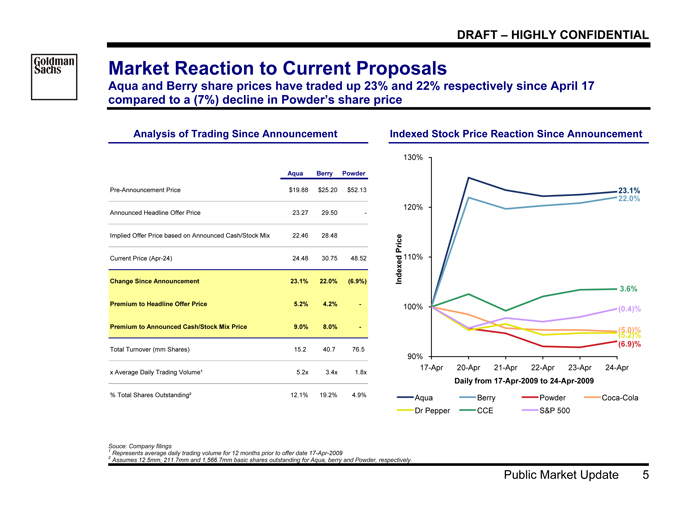

Market Reaction to Current Proposals

Aqua and Berry share prices have traded up 23% and 22% respectively since April 17

compared to a (7%) decline in Powder’s share price12

Analysis of Trading Since Announcement Indexed Stock Price Reaction Since Announcement

Aqua Berry Powder

Pre-Announcement Price $19.88 $25.20 $52.13

Announced Headline Offer Price 23.27 29.50 -

Implied Offer Price based on Announced Cash/Stock Mix 22.46 28.48

Current Price (Apr-24) 24.48 30.75 48.52

Change Since Announcement 23.1% 22.0% (6.9%)

Premium to Headline Offer Price 5.2% 4.2% -

Premium to Announced Cash/Stock Mix Price 9.0% 8.0% -

Total Turnover (mm Shares) 15.2 40.7 76.5

x Average Daily Trading Volume¹ 5.2x 3.4x 1.8x

% Total Shares Outstanding² 12.1% 19.2% 4.9%

90%

100%

110%

120%

130%

17-Apr 20-Apr 21-Apr 22-Apr 23-Apr 24-Apr

Daily from 17-Apr-2009 to 24-Apr-2009

Indexed Price Aqua Berry Powder Coca-Cola

Dr Pepper CCE S&P 500

23.1%

22.0%

(6.9)%

((55.02))%%

3.6%

(0.4)%

Source: Company filings

1 | | Represents average daily trading volume for 12 months prior to offer date 17-Apr-2009 |

2 | | Assumes 12.5mm, 211.7mm and 1,566.7mm basic shares outstanding for Aqua, berry and Powder, respectively. |

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Public Market Update 6

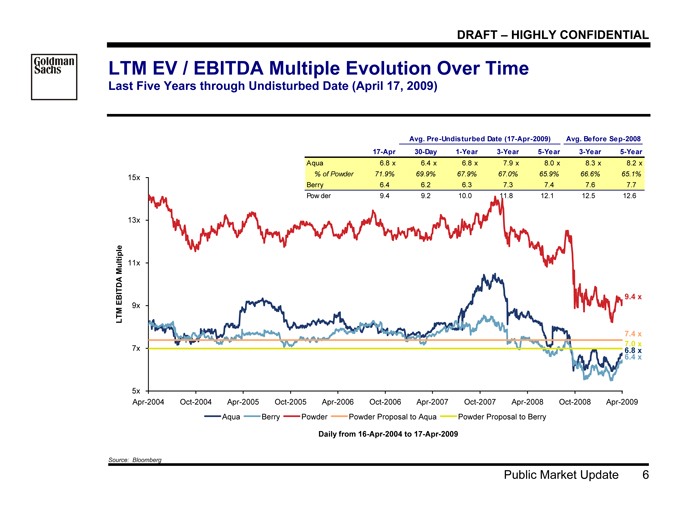

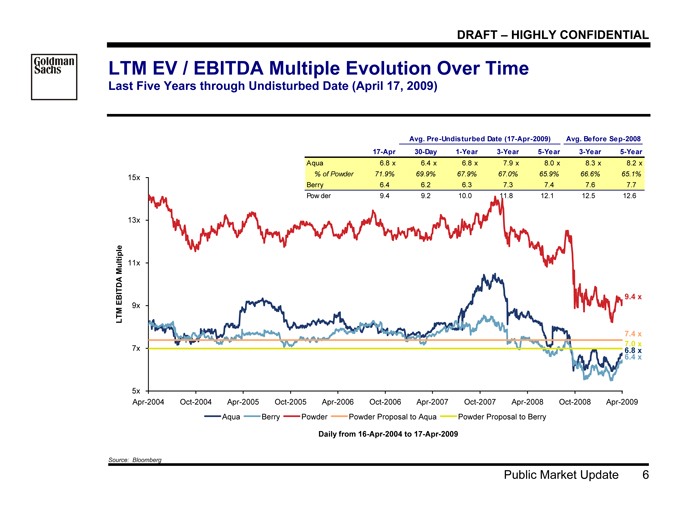

LTM EV / EBITDA Multiple Evolution Over Time

Last Five Years through Undisturbed Date (April 17, 2009)

5x

7x

9x

11x

13x

15x

Apr-2004 Oct-2004 Apr-2005 Oct-2005 Apr-2006 Oct-2006 Apr-2007 Oct-2007 Apr-2008 Oct-2008 Apr-2009

Daily from 16-Apr-2004 to 17-Apr-2009

LTM EBITDA Multiple

Aqua Berry Powder Powder Proposal to Aqua Powder Proposal to Berry

6.8 x

6.4 x

7.4 x

7.0 x

9.4 x

Avg. Pre-Undisturbed Date (17-Apr-2009) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

Aqua 6.8 x 6.4 x 6.8 x 7.9 x 8.0 x 8.3 x 8.2 x

% of Powder 71.9% 69.9% 67.9% 67.0% 65.9% 66.6% 65.1%

Berry 6.4 6.2 6.3 7.3 7.4 7.6 7.7

Powder 9.4 9.2 10.0 11.8 12.1 12.5 12.6

Source: Bloomberg

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Public Market Update 7

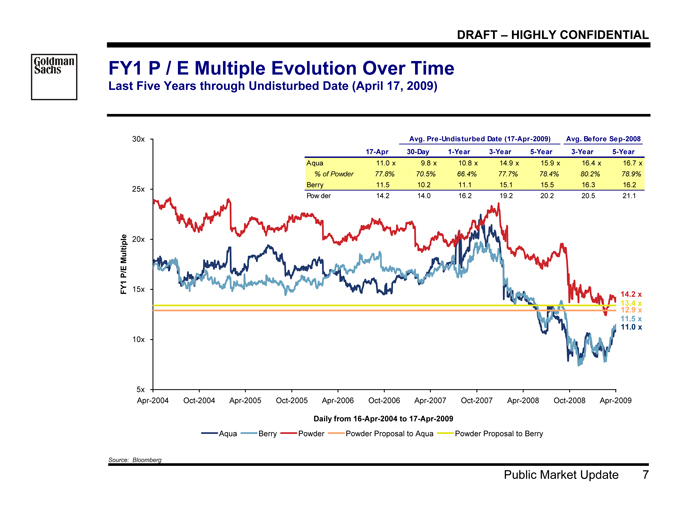

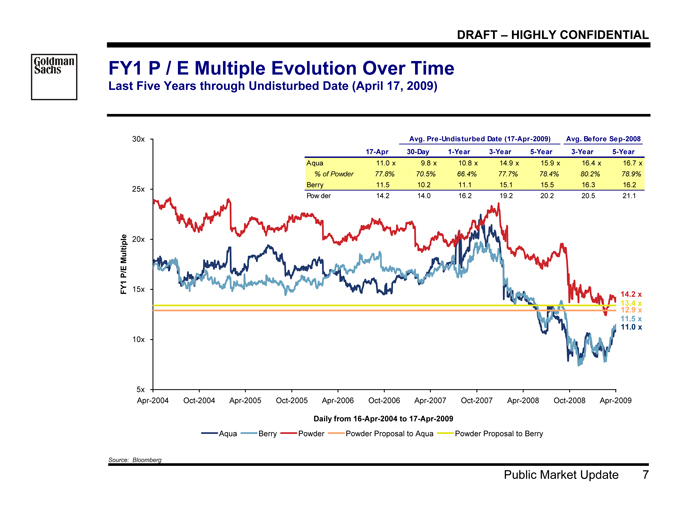

FY1 P / E Multiple Evolution Over Time

Last Five Years through Undisturbed Date (April 17, 2009)

5x

10x

15x

20x

25x

30x

Apr-2004 Oct-2004 Apr-2005 Oct-2005 Apr-2006 Oct-2006 Apr-2007 Oct-2007 Apr-2008 Oct-2008 Apr-2009

Daily from 16-Apr-2004 to 17-Apr-2009

FY1 P/E Multiple

Aqua Berry Powder Powder Proposal to Aqua Powder Proposal to Berry

11.0 x

11.5 x

14.2 x

12.9 x

13.4 x

Avg. Pre-Undisturbed Date (17-Apr-2009) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

Aqua 11.0 x 9.8 x 10.8 x 14.9 x 15.9 x 16.4 x 16.7 x

% of Powder 77.8% 70.5% 66.4% 77.7% 78.4% 80.2% 78.9%

Berry 11.5 10.2 11.1 15.1 15.5 16.3 16.2

Powder 14.2 14.0 16.2 19.2 20.2 20.5 21.1

Source: Bloomberg

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Public Market Update 8

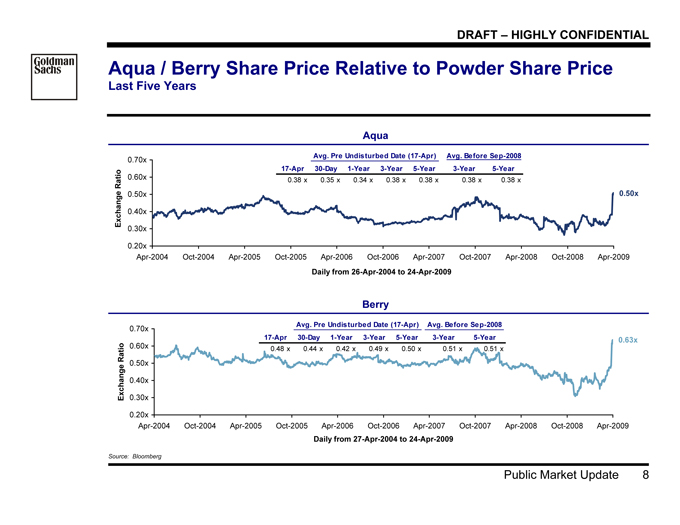

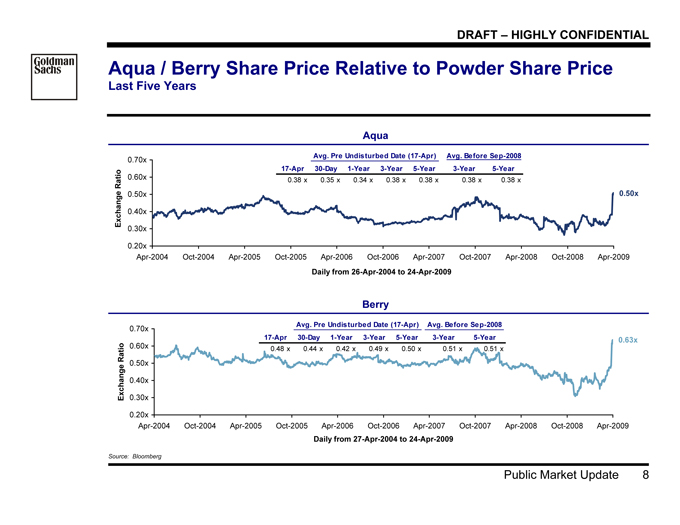

Aqua / Berry Share Price Relative to Powder Share Price

Last Five Years

Aqua

0.50x

0.20x

0.30x

0.40x

0.50x

0.60x

0.70x

Apr-2004 Oct-2004 Apr-2005 Oct-2005 Apr-2006 Oct-2006 Apr-2007 Oct-2007 Apr-2008 Oct-2008 Apr-2009

Daily from 26-Apr-2004 to 24-Apr-2009

Exchange Ratio

Avg. Pre Undisturbed Date (17-Apr) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

0.38 x 0.35 x 0.34 x 0.38 x 0.38 x 0.38 x 0.38 x

Berry

0.63x

0.20x

0.30x

0.40x

0.50x

0.60x

0.70x

Apr-2004 Oct-2004 Apr-2005 Oct-2005 Apr-2006 Oct-2006 Apr-2007 Oct-2007 Apr-2008 Oct-2008 Apr-2009

Daily from 27-Apr-2004 to 24-Apr-2009

Exchange Ratio

Avg. Pre Undisturbed Date (17-Apr) Avg. Before Sep-2008

17-Apr 30-Day 1-Year 3-Year 5-Year 3-Year 5-Year

0.48 x 0.44 x 0.42 x 0.49 x 0.50 x 0.51 x 0.51 x

Source: Bloomberg

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Update on Financial Projections 9

II. Update on Financial Projections

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Update on Financial Projections 10

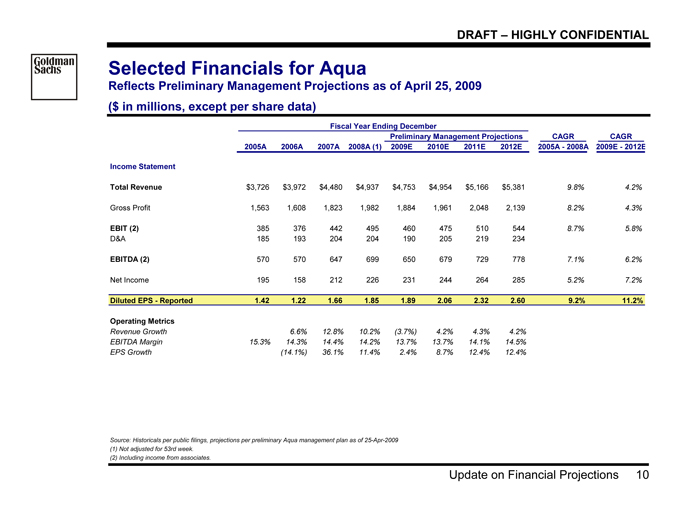

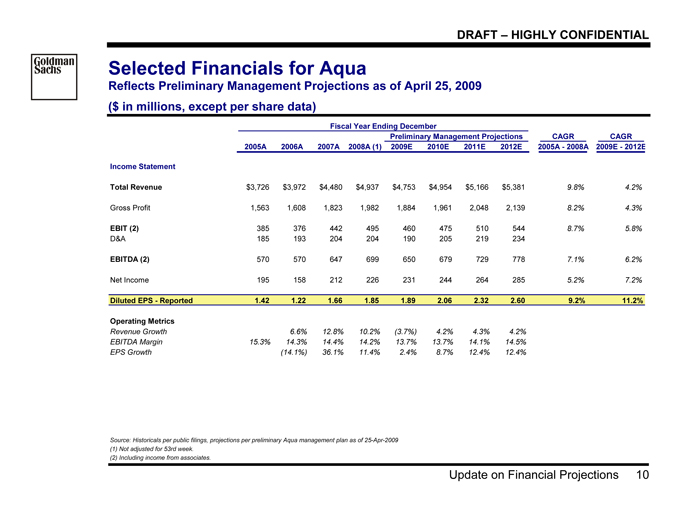

Selected Financials for Aqua

Reflects Preliminary Management Projections as of April 25, 2009

($ in millions, except per share data)

Fiscal Year Ending December

Preliminary Management Projections CAGR CAGR

2005A 2006A 2007A 2008A (1) 2009E 2010E 2011E 2012E 2005A—2008A 2009E—2012E

Income Statement

Total Revenue $3,726 $3,972 $4,480 $4,937 $4,753 $4,954 $5,166 $5,381 9.8% 4.2%

Gross Profit 1,563 1,608 1,823 1,982 1,884 1,961 2,048 2,139 8.2% 4.3%

EBIT (2) 385 376 442 495 460 475 510 544 8.7% 5.8%

D&A 185 193 204 204 190 205 219 234

EBITDA (2) 570 570 647 699 650 679 729 778 7.1% 6.2%

Net Income 195 158 212 226 231 244 264 285 5.2% 7.2%

Diluted EPS—Reported 1.42 1.22 1.66 1.85 1.89 2.06 2.32 2.60 9.2% 11.2%

Operating Metrics

Revenue Growth 6.6% 12.8% 10.2% (3.7%) 4.2% 4.3% 4.2%

EBITDA Margin 15.3% 14.3% 14.4% 14.2% 13.7% 13.7% 14.1% 14.5%

EPS Growth (14.1%) 36.1% 11.4% 2.4% 8.7% 12.4% 12.4%

Source: Historicals per public filings, projections per preliminary Aqua management plan as of 25-Apr-2009

(1) | | Not adjusted for 53rd week. |

(2) | | Including income from associates. |

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Update on Financial Projections 11

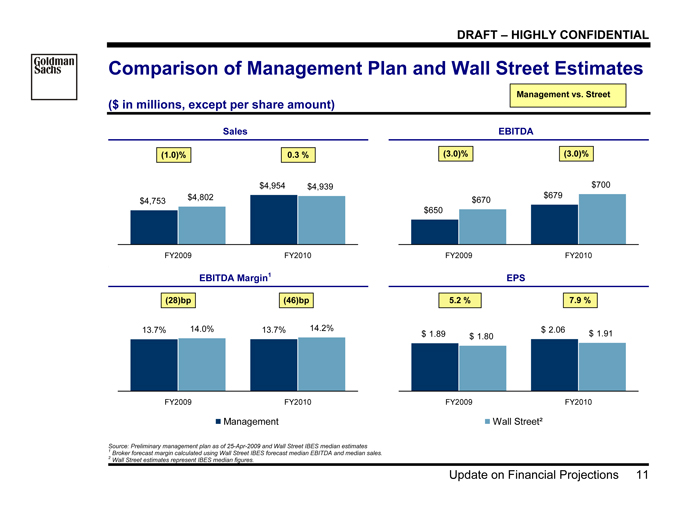

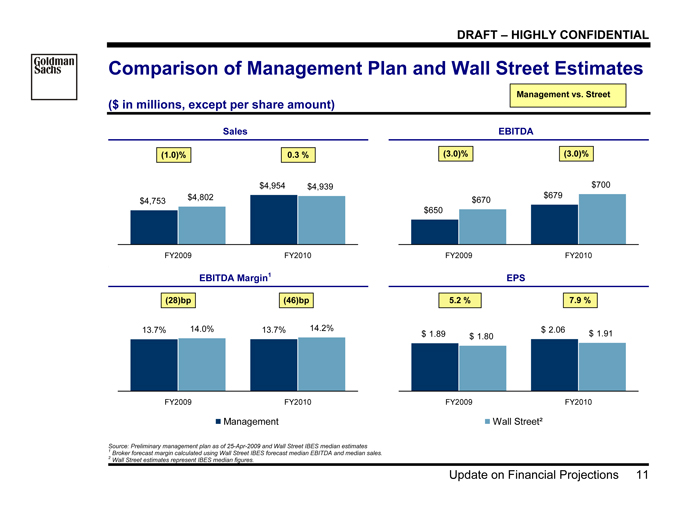

Comparison of Management Plan and Wall Street Estimates

($ in millions, except per share amount)

Sales EBITDA

$4,753

$4,954

$4,802

$4,939

FY2009 FY2010

(1.0)% 0.3 %

$650

$670 $679

$700

FY2009 FY2010

(3.0)% (3.0)%

.

EBITDA Margin1 EPS

13.7% 14.0% 13.7% 14.2%

FY2009 FY2010

(28)bp (46)bp

$ 1.89 $ 2.06

$ 1.80 $ 1.91

FY2009 FY2010

5.2 % 7.9 %

Management Wall Street²

Source: Preliminary management plan as of 25-Apr-2009 and Wall Street IBES median estimates

1 | | Broker forecast margin calculated using Wall Street IBES forecast median EBITDA and median sales. |

2 | | Wall Street estimates represent IBES median figures. |

Management vs. Street

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Update on Financial Projections 12

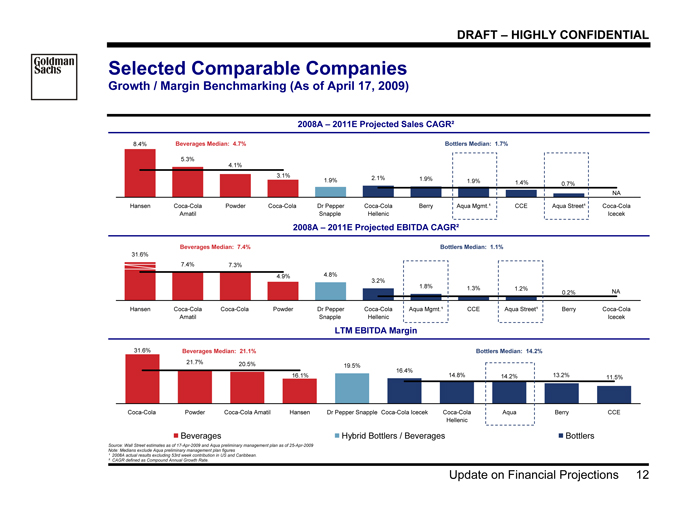

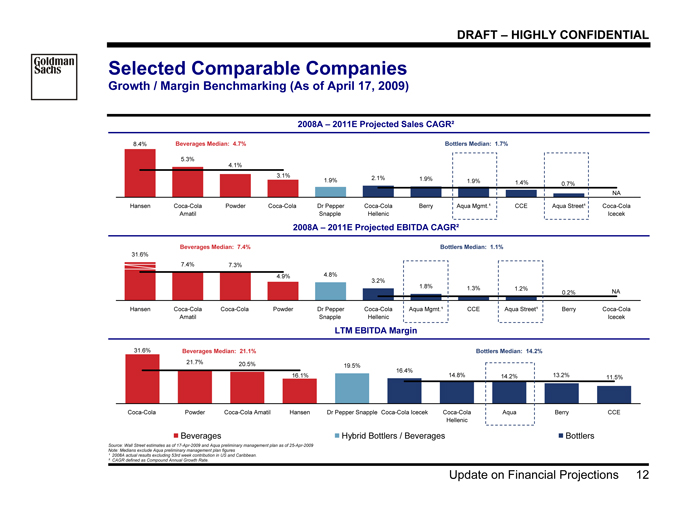

Selected Comparable Companies

Growth / Margin Benchmarking (As of April 17, 2009)

2008A – 2011E Projected Sales CAGR²

8.4%

5.3%

2.1% 1.9%

1.9% 0.7%

NA

1.4%

4.1%

3.1%

1.9%

Hansen Coca-Cola

Amatil

Powder Coca-Cola Dr Pepper

Snapple

Coca-Cola

Hellenic

Berry Aqua Mgmt.¹ CCE Aqua Street¹ Coca-Cola

Icecek

Beverages Median: 4.7% Bottlers Median: 1.7%

2008A – 2011E Projected EBITDA CAGR²

7.4% 7.3%

4.8%

3.2%

1.8% 1.3% 1.2% 0.2% NA

4.9%

31.6%

Hansen Coca-Cola

Amatil

Coca-Cola Powder Dr Pepper

Snapple

Coca-Cola

Hellenic

Aqua Mgmt.¹ CCE Aqua Street¹ Berry Coca-Cola

Icecek

Beverages Median: 7.4% Bottlers Median: 1.1%

LTM EBITDA Margin

31.6%

21.7% 20.5% 19.5%

16.4%

16.1% 14.8% 14.2% 13.2% 11.5%

Coca-Cola Powder Coca-Cola Amatil Hansen Dr Pepper Snapple Coca-Cola Icecek Coca-Cola

Hellenic

Aqua Berry CCE

Beverages Median: 21.1% Bottlers Median: 14.2%

Beverages Hybrid Bottlers / Beverages Bottlers

Source: Wall Street estimates as of 17-Apr-2009 and Aqua preliminary management plan as of 25-Apr-2009

Note: Medians exclude Aqua preliminary management plan figures

¹ 2008A actual results excluding 53rd week contribution in US and Caribbean.

² CAGR defined as Compound Annual Growth Rate.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Summary Financial Analysis 13

III. Summary Financial Analysis

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Summary Financial Analysis 14

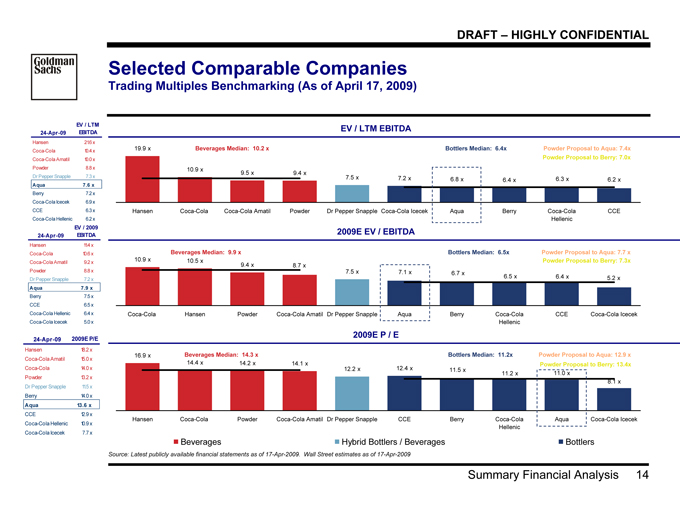

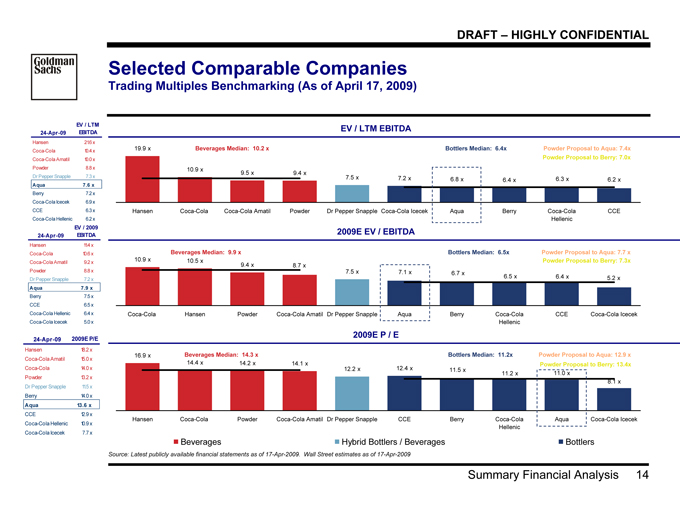

Selected Comparable Companies

Trading Multiples Benchmarking (As of April 17, 2009)

EV / LTM EBITDA

19.9 x

10.9 x 9.5 x 9.4 x

7.5 x 7.2 x 6.8 x 6.4 x 6.3 x 6.2 x

Hansen Coca-Cola Coca-Cola Amatil Powder Dr Pepper Snapple Coca-Cola Icecek Aqua Berry Coca-Cola

Hellenic

CCE

Beverages Median: 10.2 x Bottlers Median: 6.4x Powder Proposal to Aqua: 7.4x

Powder Proposal to Berry: 7.0x

2009E EV / EBITDA

10.9 x 10.5 x

9.4 x

7.5 x

5.2 x

8.7 x

7.1 x 6.7 x 6.5 x 6.4 x

Coca-Cola Hansen Powder Coca-Cola Amatil Dr Pepper Snapple Aqua Berry Coca-Cola

Hellenic

CCE Coca-Cola Icecek

Beverages Median: 9.9 x Bottlers Median: 6.5x Powder Proposal to Aqua: 7.7 x

Powder Proposal to Berry: 7.3x

2009E P / E

16.9 x

14.4 x 14.2 x 14.1 x

12.2 x 12.4 x

8.1 x

11.5 x 11.2 x 11.0 x

Hansen Coca-Cola Powder Coca-Cola Amatil Dr Pepper Snapple CCE Berry Coca-Cola

Hellenic

Aqua Coca-Cola Icecek

Beverages Median: 14.3 x Bottlers Median: 11.2x Powder Proposal to Aqua: 12.9 x

Powder Proposal to Berry: 13.4x

Beverages Hybrid Bottlers / Beverages Bottlers

Source: Latest publicly available financial statements as of 17-Apr-2009. Wall Street estimates as of 17-Apr-2009

24-Apr-09

EV / LTM

EBITDA

Hansen 21.6 x

Coca-Cola 10.4 x

Coca-Cola Amatil 10.0 x

Powder 8.8 x

Dr Pepper Snapple 7.3 x

Aqua 7.6 x

Berry 7.2 x

Coca-Cola Icecek 6.9 x

CCE 6.3 x

Coca-Cola Hellenic 6.2 x

24-Apr-09

EV / 2009

EBITDA

Hansen 11.4 x

Coca-Cola 10.6 x

Coca-Cola Amatil 9.2 x

Powder 8.8 x

Dr Pepper Snapple 7.2 x

Aqua 7.9 x

Berry 7.5 x

CCE 6.5 x

Coca-Cola Hellenic 6.4 x

Coca-Cola Icecek 5.0 x

24-Apr-09 2009E P/E

Hansen 18.2 x

Coca-Cola Amatil 15.0 x

Coca-Cola 14.0 x

Powder 13.2 x

Dr Pepper Snapple 11.5 x

Berry 14.0 x

Aqua 13.6 x

CCE 12.9 x

Coca-Cola Hellenic 10.9 x

Coca-Cola Icecek 7.7 x

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Summary Financial Analysis 15

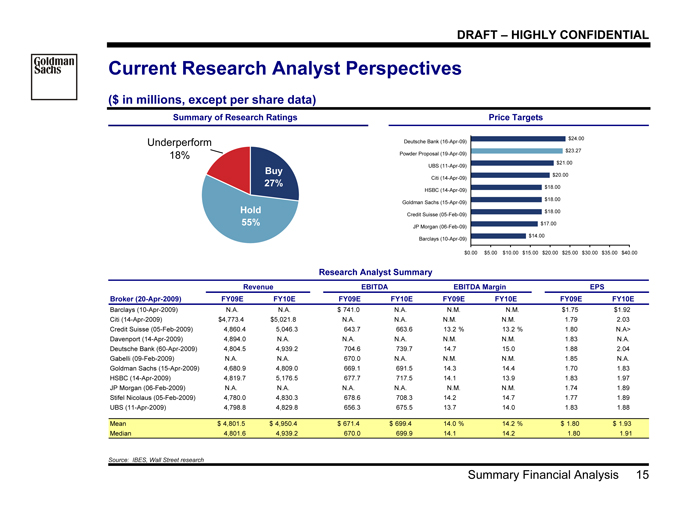

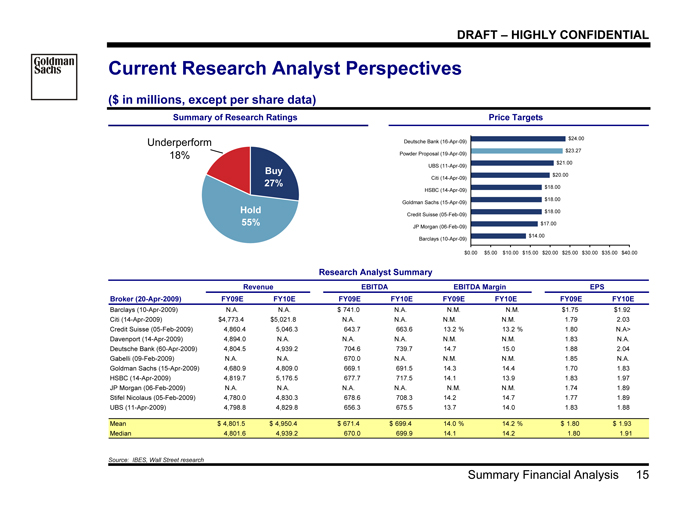

Current Research Analyst Perspectives

($ in millions, except per share data)

Summary of Research Ratings Price Targets

$14.00

$17.00

$18.00

$18.00

$18.00

$20.00

$21.00

$23.27

$24.00

$0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00

Barclays (10-Apr-09)

JP Morgan (06-Feb-09)

Credit Suisse (05-Feb-09)

Goldman Sachs (15-Apr-09)

HSBC (14-Apr-09)

Citi (14-Apr-09)

UBS (11-Apr-09)

Powder Proposal (19-Apr-09)

Deutsche Bank (16-Apr-09)

Research Analyst Summary

Revenue EBITDA EBITDA Margin EPS

Broker (20-Apr-2009) FY09E FY10E FY09E FY10E FY09E FY10E FY09E FY10E

Barclays (10-Apr-2009) N.A. N.A. $ 741.0 N.A. N.M. N.M. $1.75 $1.92

Citi (14-Apr-2009) $4,773.4 $5,021.8 N.A. N.A. N.M. N.M. 1.79 2.03

Credit Suisse (05-Feb-2009) 4,860.4 5,046.3 643.7 663.6 13.2 % 13.2 % 1.80 N.A>

Davenport (14-Apr-2009) 4,894.0 N.A. N.A. N.A. N.M. N.M. 1.83 N.A.

Deutsche Bank (60-Apr-2009) 4,804.5 4,939.2 704.6 739.7 14.7 15.0 1.88 2.04

Gabelli (09-Feb-2009) N.A. N.A. 670.0 N.A. N.M. N.M. 1.85 N.A.

Goldman Sachs (15-Apr-2009) 4,680.9 4,809.0 669.1 691.5 14.3 14.4 1.70 1.83

HSBC (14-Apr-2009) 4,819.7 5,176.5 677.7 717.5 14.1 13.9 1.83 1.97

JP Morgan (06-Feb-2009) N.A. N.A. N.A. N.A. N.M. N.M. 1.74 1.89

Stifel Nicolaus (05-Feb-2009) 4,780.0 4,830.3 678.6 708.3 14.2 14.7 1.77 1.89

UBS (11-Apr-2009) 4,798.8 4,829.8 656.3 675.5 13.7 14.0 1.83 1.88

Mean $ 4,801.5 $ 4,950.4 $ 671.4 $ 699.4 14.0 % 14.2 % $ 1.80 $ 1.93

Median 4,801.6 4,939.2 670.0 699.9 14.1 14.2 1.80 1.91

Source: IBES, Wall Street research

Buy

27%

Underperform

18%

Hold

55%

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

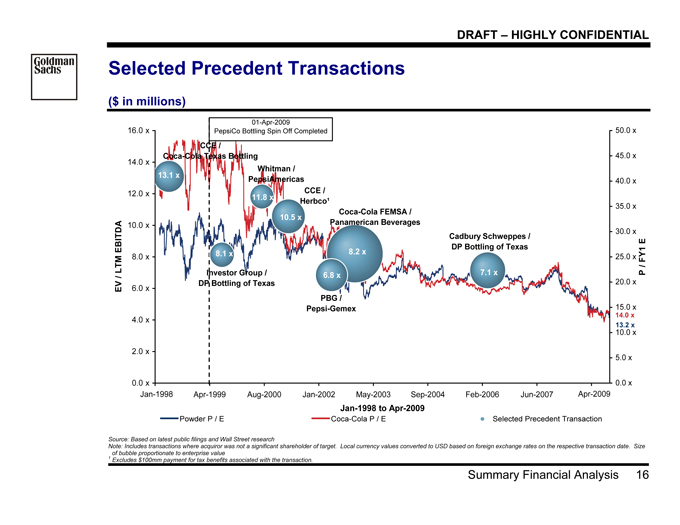

Summary Financial Analysis 16

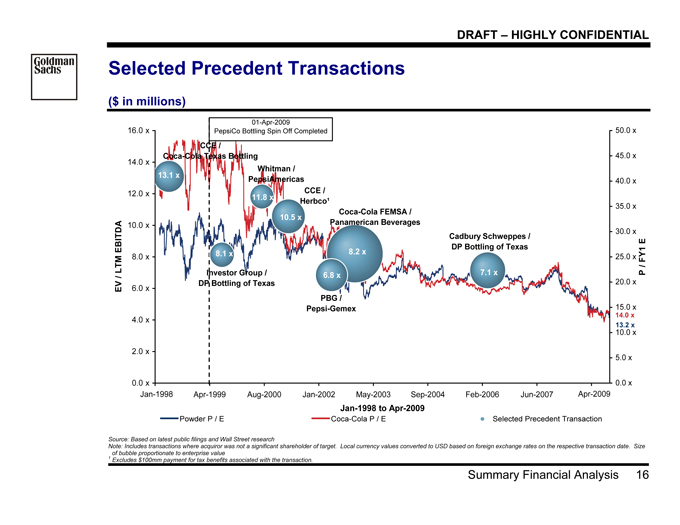

Selected Precedent Transactions

($ in millions)

13.2 x

14.0 x

01-Apr-2009

PepsiCo Bottling Spin Off Completed

Powder P / E Coca-Cola P / E Selected Precedent Transaction

Source: Based on latest public filings and Wall Street research

Note: Includes transactions where acquiror was not a significant shareholder of target. Local currency values converted to USD based on foreign exchange rates on the respective transaction date. Size

of bubble proportionate to enterprise value

1 | | Excludes $100mm payment for tax benefits associated with the transaction. |

0.0 x

2.0 x

4.0 x

6.0 x

8.0 x

10.0 x

12.0 x

14.0 x

16.0 x

Nov-1997 Apr-1999 Aug-2000 Jan-2002 May-2003 Sep-2004 Feb-2006 Jun-2007 Nov-2008

Jan-1998 to Apr-2009

EV / LTM EBITDA

0.0 x

5.0 x

10.0 x

15.0 x

20.0 x

25.0 x

30.0 x

35.0 x

40.0 x

45.0 x

50.0 x

P / FY1 E

Cadbury Schweppes /

DP Bottling of Texas

Coca-Cola FEMSA /

Panamerican Beverages

PBG /

Pepsi-Gemex

CCE /

Herbco¹

Whitman /

PepsiAmericas

Investor Group /

DP Bottling of Texas

CCE /

Coca-Cola Texas Bottling

7.1 x

8.2 x

6.8 x

10.5 x

11.8 x

8.1 x

13.1 x

Jan-1998 Apr-2009

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

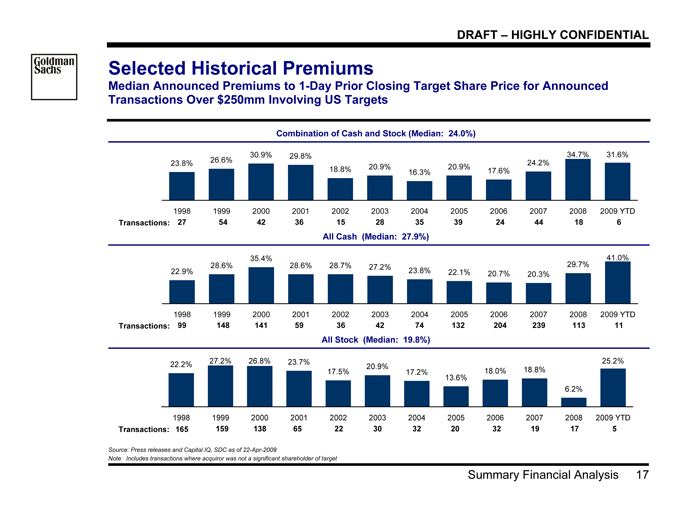

Summary Financial Analysis 17

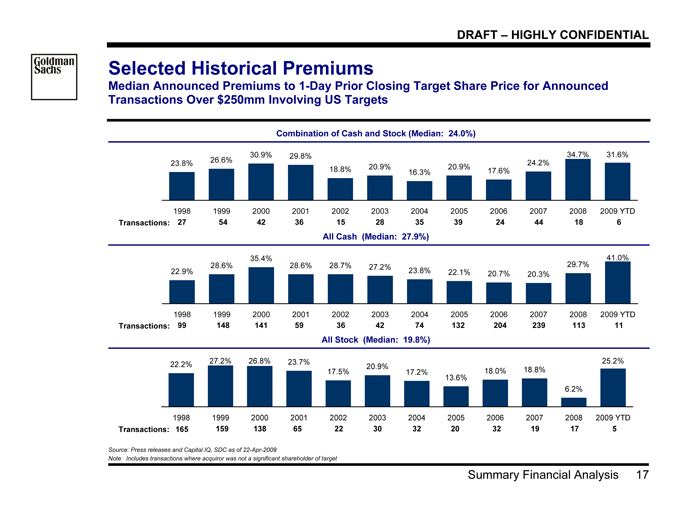

Selected Historical Premiums

Median Announced Premiums to 1-Day Prior Closing Target Share Price for Announced

Transactions Over $250mm Involving US Targets

Combination of Cash and Stock (Median: 24.0%)

23.8% 26.6%

30.9% 29.8%

18.8% 20.9%

16.3%

20.9% 17.6%

24.2%

34.7% 31.6%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 YTD

Transactions: 27 54 42 36 15 28 39 24 44 35 18 6

All Cash (Median: 27.9%)

22.9%

28.6%

35.4%

28.6% 28.7% 27.2% 23.8% 22.1% 20.7% 20.3%

29.7%

41.0%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 YTD

Transactions: 99 148 141 59 36 42 74 132 204 239 113 11

All Stock (Median: 19.8%)

22.2% 27.2% 26.8% 23.7%

17.5%

20.9%

17.2%

13.6%

18.0% 18.8%

6.2%

25.2%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 YTD

Transactions: 165 159 138 65 22 30 32 20 32 19 17 5

Source: Press releases and Capital IQ, SDC as of 22-Apr-2009

Note: Includes transactions where acquiror was not a significant shareholder of target

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

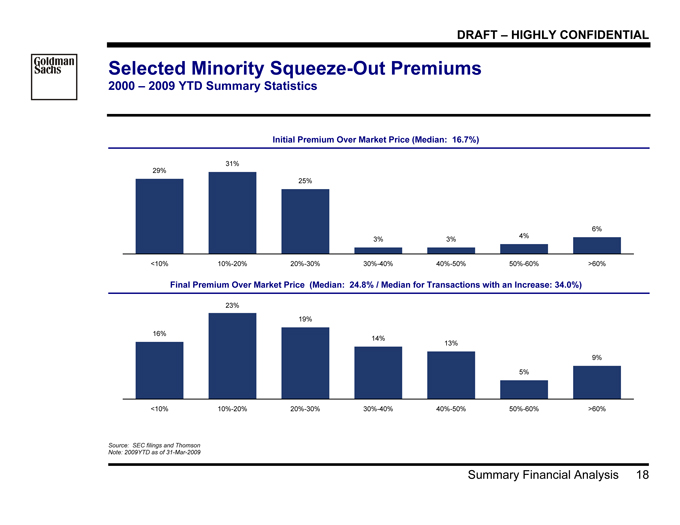

Summary Financial Analysis 18

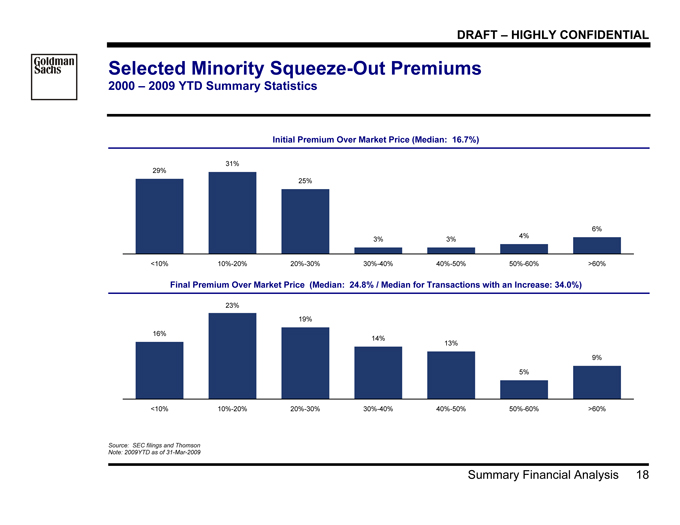

Selected Minority Squeeze-Out Premiums

2000 – 2009 YTD Summary Statistics

Initial Premium Over Market Price (Median: 16.7%)

29%

31%

25%

3% 3% 4%

6%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Final Premium Over Market Price (Median: 24.8% / Median for Transactions with an Increase: 34.0%)

16%

23%

19%

14%

13%

5%

9%

<10% 10%-20% 20%-30% 30%-40% 40%-50% 50%-60% >60%

Source: SEC filings and Thomson

Note: 2009YTD as of 31-Mar-2009

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Summary Financial Analysis 19

Illustrative Present Value of Future Share Price

Street Estimates / Preliminary Management Projections (as of April 17, 2009)

Illustrative Future Value Share Price Per Street Estimates¹ Illustrative Future Value Share Price Per Management Plan

$19.88

$17.19 $18.54

$19.37

$21.09 $22.75 $23.78

$24.83 $26.78 $27.99

$30.90 $32.29

$28.65

Current 2009YE 2010YE 2011YE

$23.41

$20.84

$18.54

$19.88

$22.75

$25.57 $28.73

$30.10 $33.82

$26.78

$30.90

$34.73 $39.02

Current 2009YE 2010YE 2011YE

PV of Future Share Price per Street Estimates² (Discounted @10.5%) PV of Future Share Price per Mgmt. Plan² (Discounted @10.5%)

$26.13

$16.23

$16.49 $16.63

$19.88 $19.60

$20.15 $20.19

$23.64

$22.83

$23.60

$27.22 $27.09

Current 2009YE 2010YE 2011YE

$19.88

$17.74 $18.54

$19.30

$21.68 $22.54 $23.37

$26.38 $27.27

$25.45

$29.30 $30.30 $31.26

Current 2009YE 2010YE 2011YE

9.0x 11.0x 13.0x 15.0x

Source: IBES and Aqua preliminary management plan as of 25-Apr-2009

1 Assumes IBES median estimates for 2009E, 2010E and 2011E. 2012E estimate based on 4.5% IBES median long term growth rate.

2 Present values discount future values at 10.5% cost of equity and include dividends. Present values discounted to 1-May-2009.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

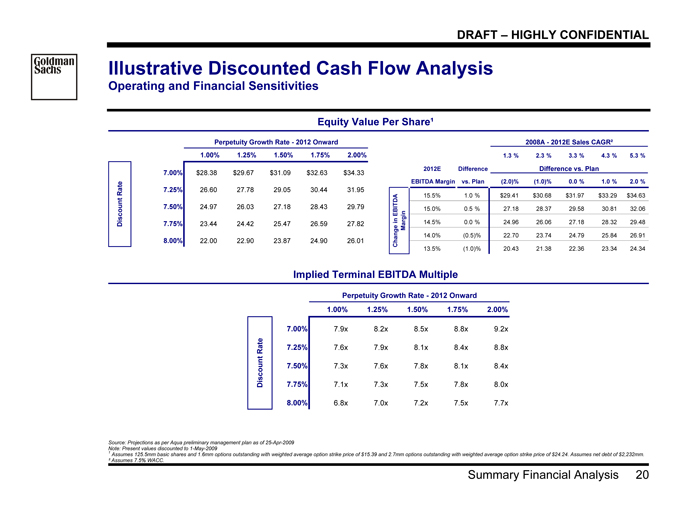

Summary Financial Analysis 20

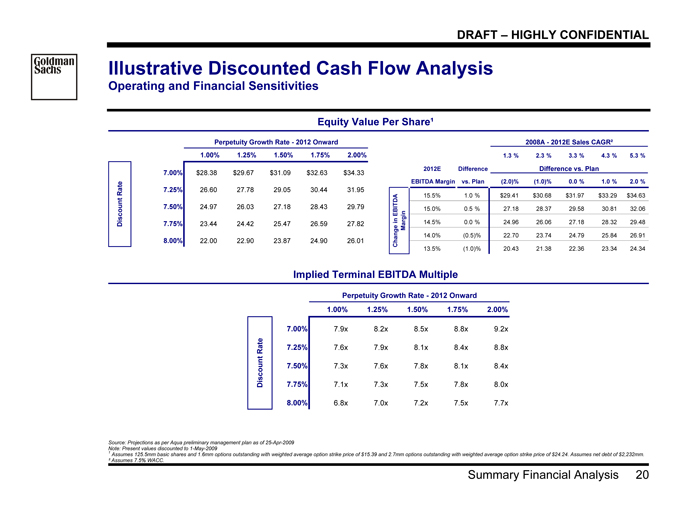

Illustrative Discounted Cash Flow Analysis

Operating and Financial Sensitivities

Equity Value Per Share¹

Perpetuity Growth Rate—2012 Onward

1.00% 1.25% 1.50% 1.75% 2.00%

7.00% $28.38 $29.67 $31.09 $32.63 $34.33

7.25% 26.60 27.78 29.05 30.44 31.95

7.50% 24.97 26.03 27.18 28.43 29.79

7.75% 23.44 24.42 25.47 26.59 27.82

8.00% 22.00 22.90 23.87 24.90 26.01

Discount Rate

2008A—2012E Sales CAGR²

1.3 % 2.3 % 3.3 % 4.3 % 5.3 %

2012E Difference Difference vs. Plan

EBITDA Margin vs. Plan (2.0)% (1.0)% 0.0 % 1.0 % 2.0 %

15.5% 1.0 % $29.41 $30.68 $31.97 $33.29 $34.63

15.0% 0.5 % 27.18 28.37 29.58 30.81 3 2.06

14.5% 0.0 % 24.96 26.06 27.18 28.32 2 9.48

14.0% (0.5)% 22.70 23.74 24.79 25.84 2 6.91

13.5% (1.0)% 20.43 21.38 22.36 23.34 2 4.34

Change in EBITDA

Margin

Implied Terminal EBITDA Multiple

Perpetuity Growth Rate—2012 Onward

1.00% 1.25% 1.50% 1.75% 2.00%

7.00% 7.9x 8.2x 8.5x 8.8x 9.2x

7.25% 7.6x 7.9x 8.1x 8.4x 8.8x

7.50% 7.3x 7.6x 7.8x 8.1x 8.4x

7.75% 7.1x 7.3x 7.5x 7.8x 8.0x

8.00% 6.8x 7.0x 7.2x 7.5x 7.7x

Discount Rate

Source: Projections as per Aqua preliminary management plan as of 25-Apr-2009

Note: Present values discounted to 1-May-2009

1 Assumes 125.5mm basic shares and 1.6mm options outstanding with weighted average option strike price of $15.39 and 2.7mm options outstanding with weighted average option strike price of $24.24. Assumes net debt of $2,232mm.

² Assumes 7.5% WACC.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Review of Potential Alternatives 21

IV. Review of Potential Alternatives

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

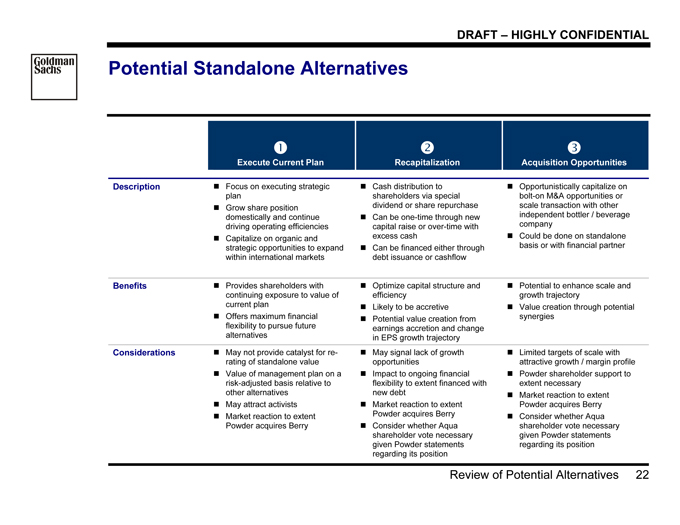

Review of Potential Alternatives 22

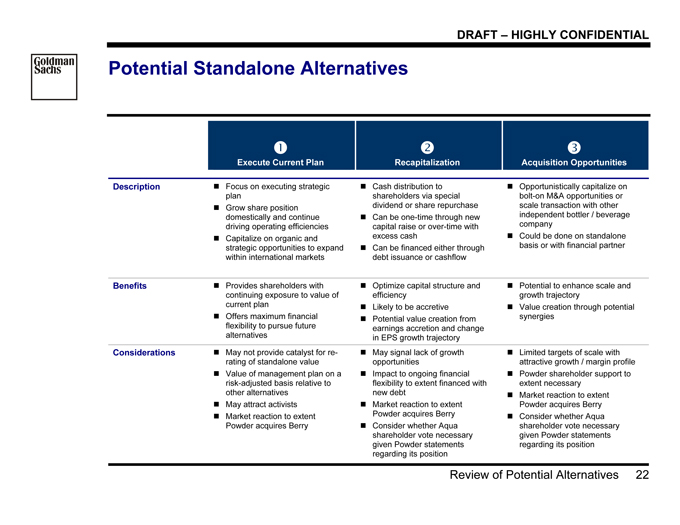

Potential Standalone Alternatives

?

Execute Current Plan

?

Recapitalization

?

Acquisition Opportunities

Description ? Focus on executing strategic

plan

? Grow share position

domestically and continue

driving operating efficiencies

? Capitalize on organic and

strategic opportunities to expand

within international markets

? Cash distribution to

shareholders via special

dividend or share repurchase

? Can be one-time through new

capital raise or over-time with

excess cash

? Can be financed either through

debt issuance or cashflow

? Opportunistically capitalize on

bolt-on M&A opportunities or

scale transaction with other

independent bottler / beverage

company

? Could be done on standalone

basis or with financial partner

Benefits ? Provides shareholders with

continuing exposure to value of

current plan

? Offers maximum financial

flexibility to pursue future

alternatives

? Optimize capital structure and

efficiency

? Likely to be accretive

? Potential value creation from

earnings accretion and change

in EPS growth trajectory

? Potential to enhance scale and

growth trajectory

? Value creation through potential

synergies

Considerations ? May not provide catalyst for rerating

of standalone value

? Value of management plan on a

risk-adjusted basis relative to

other alternatives

? May attract activists

? Market reaction to extent

Powder acquires Berry

? May signal lack of growth

opportunities

? Impact to ongoing financial

flexibility to extent financed with

new debt

? Market reaction to extent

Powder acquires Berry

? Consider whether Aqua

shareholder vote necessary

given Powder statements

regarding its position

? Limited targets of scale with

attractive growth / margin profile

? Powder shareholder support to

extent necessary

? Market reaction to extent

Powder acquires Berry

? Consider whether Aqua

shareholder vote necessary

given Powder statements

regarding its position

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

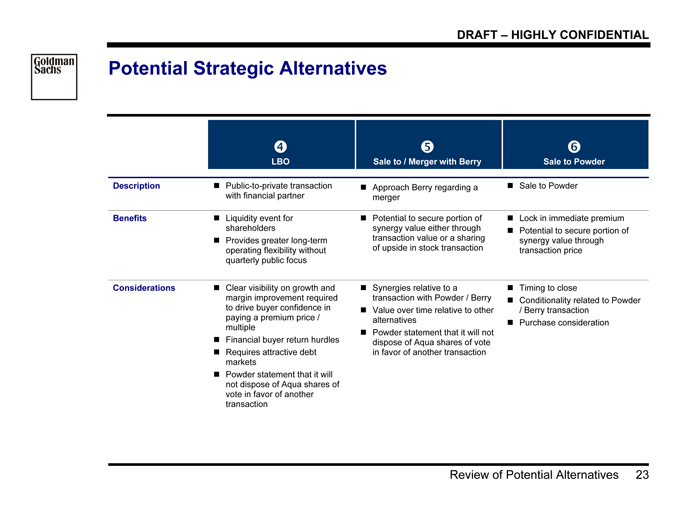

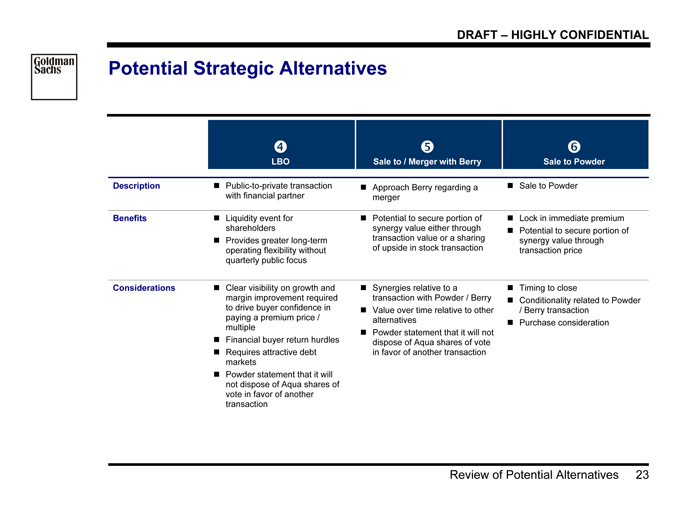

Review of Potential Alternatives 23

Potential Strategic Alternatives

?

LBO

?

Sale to / Merger with Berry

?

Sale to Powder

Description ? Public-to-private transaction

with financial partner

? Approach Berry regarding a

merger

? Sale to Powder

Benefits ? Liquidity event for

shareholders

? Provides greater long-term

operating flexibility without

quarterly public focus

? Potential to secure portion of

synergy value either through

transaction value or a sharing

of upside in stock transaction

? Lock in immediate premium

? Potential to secure portion of

synergy value through

transaction price

Considerations ? Clear visibility on growth and

margin improvement required

to drive buyer confidence in

paying a premium price /

multiple

? Financial buyer return hurdles

? Requires attractive debt

markets

? Powder statement that it will

not dispose of Aqua shares of

vote in favor of another

transaction

? Synergies relative to a

transaction with Powder / Berry

? Value over time relative to other

alternatives

? Powder statement that it will not

dispose of Aqua shares of vote

in favor of another transaction

? Timing to close

? Conditionality related to Powder

/ Berry transaction

? Purchase consideration

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Review of Potential Alternatives 24

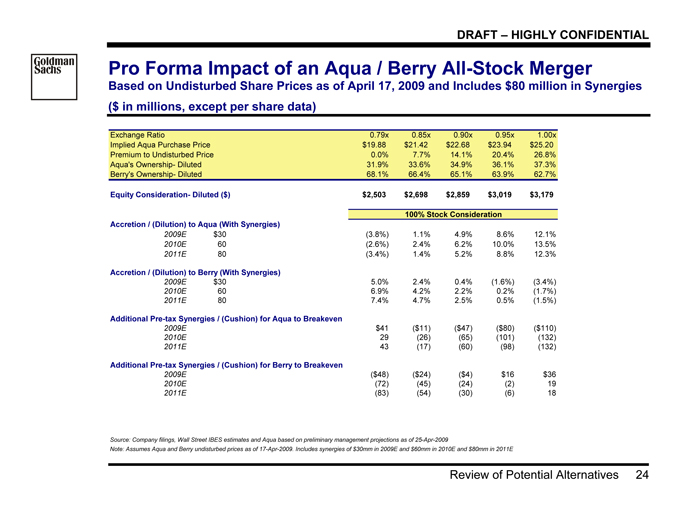

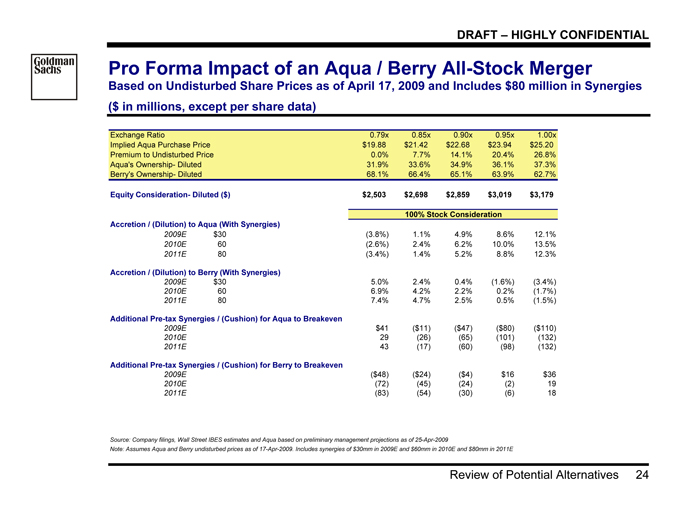

Pro Forma Impact of an Aqua / Berry All-Stock Merger

Based on Undisturbed Share Prices as of April 17, 2009 and Includes $80 million in Synergies

($ in millions, except per share data)

Exchange Ratio 0.79x 0.85x 0.90x 0.95x 1.00x

Implied Aqua Purchase Price $19.88 $21.42 $22.68 $23.94 $25.20

Premium to Undisturbed Price 0.0% 7.7% 14.1% 20.4% 26.8%

Aqua's Ownership- Diluted 31.9% 33.6% 34.9% 36.1% 37.3%

Berry's Ownership- Diluted 68.1% 66.4% 65.1% 63.9% 62.7%

Equity Consideration- Diluted ($) $2,503 $2,698 $2,859 $3,019 $3,179

100% Stock Consideration

Accretion / (Dilution) to Aqua (With Synergies)

2009E $30 (3.8%) 1.1% 4.9% 8.6% 12.1%

2010E 60 (2.6%) 2.4% 6.2% 10.0% 13.5%

2011E 80 (3.4%) 1.4% 5.2% 8.8% 12.3%

Accretion / (Dilution) to Berry (With Synergies)

2009E $30 5.0% 2.4% 0.4% (1.6%) (3.4%)

2010E 60 6.9% 4.2% 2.2% 0.2% (1.7%)

2011E 80 7.4% 4.7% 2.5% 0.5% (1.5%)

Additional Pre-tax Synergies / (Cushion) for Aqua to Breakeven

2009E $41 ($11) ($47) ($80) ($110)

2010E 29 (26) (65) (101) (132)

2011E 43 (17) (60) (98) (132)

Additional Pre-tax Synergies / (Cushion) for Berry to Breakeven

2009E ($48) ($24) ($4) $16 $36

2010E (72) (45) (24) (2) 19

2011E (83) (54) (30) (6) 18

Source: Company filings, Wall Street IBES estimates and Aqua based on preliminary management projections as of 25-Apr-2009

Note: Assumes Aqua and Berry undisturbed prices as of 17-Apr-2009. Includes synergies of $30mm in 2009E and $60mm in 2010E and $80mm in 2011E

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Review of Potential Alternatives 25

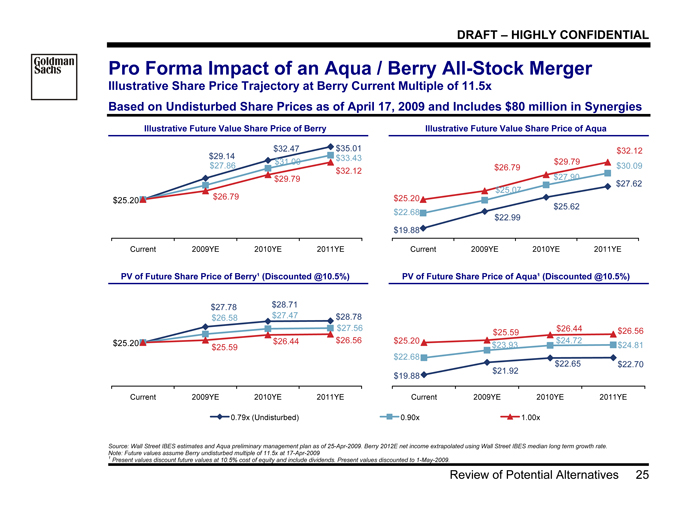

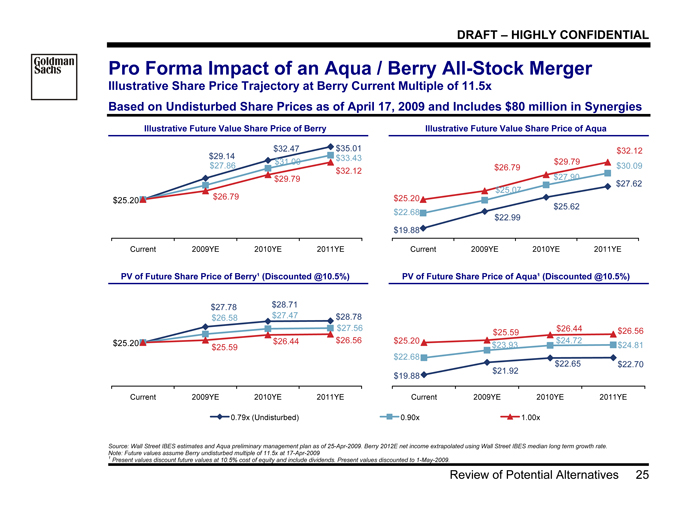

Pro Forma Impact of an Aqua / Berry All-Stock Merger

Illustrative Share Price Trajectory at Berry Current Multiple of 11.5x

Based on Undisturbed Share Prices as of April 17, 2009 and Includes $80 million in Synergies

Illustrative Future Value Share Price of Berry Illustrative Future Value Share Price of Aqua

$25.20

$29.14

$32.47 $35.01

$27.86 $31.00 $33.43

$26.79

$29.79

$32.12

Current 2009YE 2010YE 2011YE

$27.62

$25.62

$22.99

$19.88

$22.68

$25.07

$27.90

$30.09

$25.20

$32.12

$29.79

$26.79

Current 2009YE 2010YE 2011YE

PV of Future Share Price of Berry¹ (Discounted @10.5%) PV of Future Share Price of Aqua¹ (Discounted @10.5%)

$27.56

$28.78

$27.78 $28.71

$25.20

$26.58 $27.47

$25.59

$26.44 $26.56

Current 2009YE 2010YE 2011YE

$22.70

$21.92

$22.65

$19.88

$22.68

$23.93 $24.72 $24.81

$26.44 $26.56

$25.20

$25.59

Current 2009YE 2010YE 2011YE

0.79x (Undisturbed) 0.90x 1.00x

Source: Wall Street IBES estimates and Aqua preliminary management plan as of 25-Apr-2009. Berry 2012E net income extrapolated using Wall Street IBES median long term growth rate.

Note: Future values assume Berry undisturbed multiple of 11.5x at 17-Apr-2009

1 Present values discount future values at 10.5% cost of equity and include dividends. Present values discounted to 1-May-2009.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Review of Potential Alternatives 26

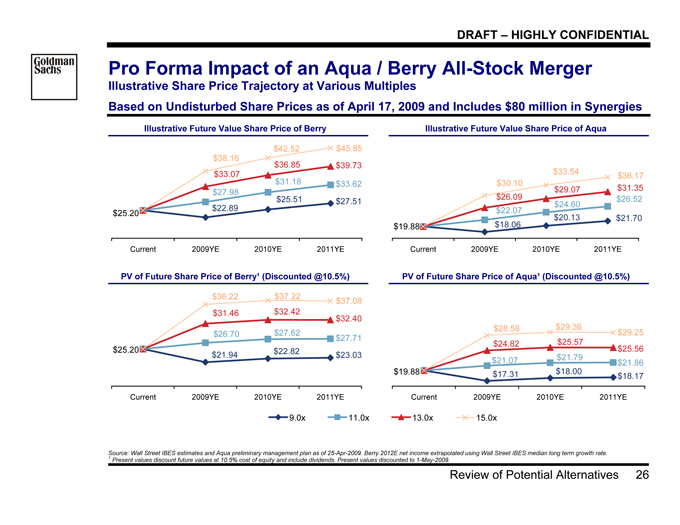

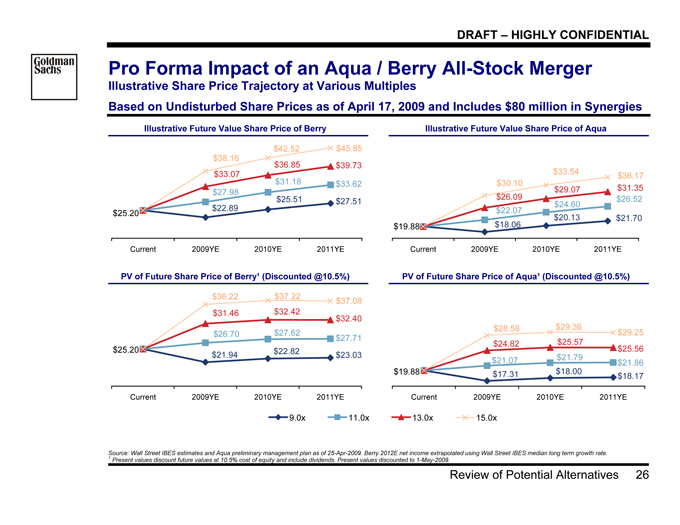

Pro Forma Impact of an Aqua / Berry All-Stock Merger

Illustrative Share Price Trajectory at Various Multiples

Based on Undisturbed Share Prices as of April 17, 2009 and Includes $80 million in Synergies

Illustrative Future Value Share Price of Berry Illustrative Future Value Share Price of Aqua

$45.85

$22.89

$25.51 $27.51

$31.18 $33.62

$27.98

$25.20

$33.07

$36.85 $39.73

$42.52

$38.16

Current 2009YE 2010YE 2011YE

$19.88 $18.06

$20.13 $21.70

$24.60 $26.52

$22.07

$26.09

$29.07 $31.35

$33.54 $36.17

$30.10

Current 2009YE 2010YE 2011YE

PV of Future Share Price of Berry¹ (Discounted @10.5%) PV of Future Share Price of Aqua¹ (Discounted @10.5%)

$37.08

$25.20 $21.94 $22.82 $23.03

$26.70 $27.62 $27.71

$31.46 $32.42

$32.40

$36.22 $37.22

Current 2009YE 2010YE 2011YE

$29.25

$19.88 $17.31 $18.00 $18.17

$21.07 $21.79 $21.86

$24.82 $25.57

$25.56

$28.58 $29.36

Current 2009YE 2010YE 2011YE

9.0x 11.0x 13.0x 15.0x

Source: Wall Street IBES estimates and Aqua preliminary management plan as of 25-Apr-2009. Berry 2012E net income extrapolated using Wall Street IBES median long term growth rate.

1 Present values discount future values at 10.5% cost of equity and include dividends. Present values discounted to 1-May-2009.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Pro Forma Impact on Powder 27

V. Pro Forma Impact on Powder

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Pro Forma Impact on Powder 28

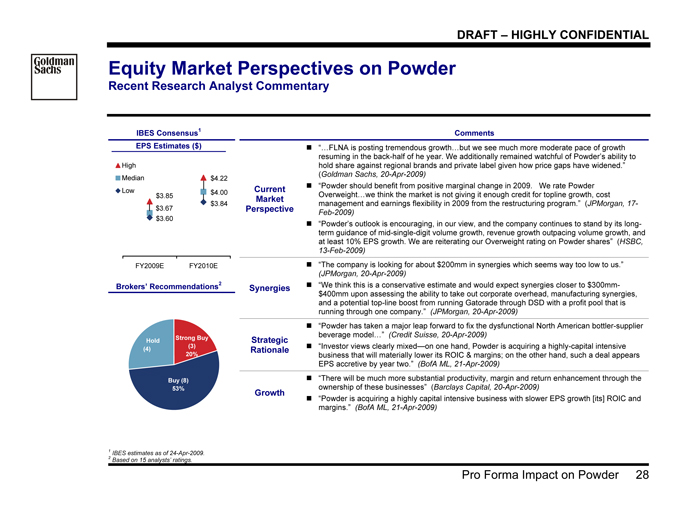

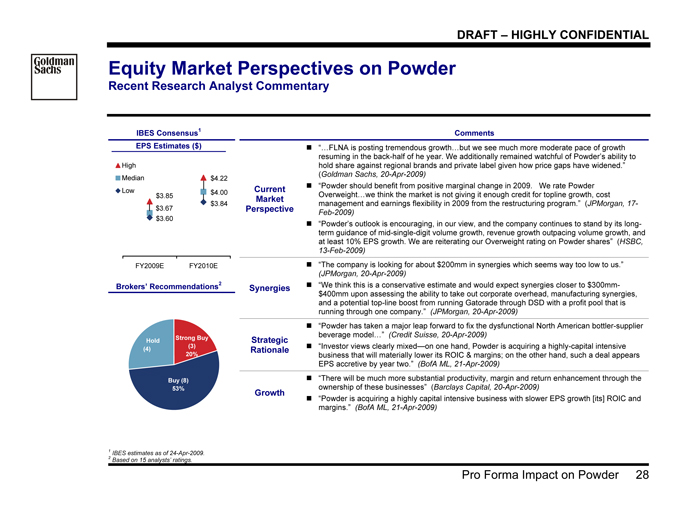

Equity Market Perspectives on Powder

Recent Research Analyst Commentary

IBES Consensus1

EPS Estimates ($)

$3.85

$4.22

$3.67

$4.00

$3.84

$3.60

FY2009E FY2010E

High

Median

Low

Brokers’ Recommendations2

Buy (8)

53%

Hold

Strong Buy

20%

Comments

Current

Market

Perspective

? “…FLNA is posting tremendous growth…but we see much more moderate pace of growth

resuming in the back-half of he year. We additionally remained watchful of Powder’s ability to

hold share against regional brands and private label given how price gaps have widened.”

(Goldman Sachs, 20-Apr-2009)

? “Powder should benefit from positive marginal change in 2009. We rate Powder

Overweight…we think the market is not giving it enough credit for topline growth, cost

management and earnings flexibility in 2009 from the restructuring program.” (JPMorgan, 17-

Feb-2009)

? “Powder’s outlook is encouraging, in our view, and the company continues to stand by its longterm

guidance of mid-single-digit volume growth, revenue growth outpacing volume growth, and

at least 10% EPS growth. We are reiterating our Overweight rating on Powder shares” (HSBC,

13-Feb-2009)

Synergies

? “The company is looking for about $200mm in synergies which seems way too low to us.”

(JPMorgan, 20-Apr-2009)

? “We think this is a conservative estimate and would expect synergies closer to $300mm-

$400mm upon assessing the ability to take out corporate overhead, manufacturing synergies,

and a potential top-line boost from running Gatorade through DSD with a profit pool that is

running through one company.” (JPMorgan, 20-Apr-2009)

Strategic

Rationale

? “Powder has taken a major leap forward to fix the dysfunctional North American bottler-supplier

beverage model…” (Credit Suisse, 20-Apr-2009)

? “Investor views clearly mixed—on one hand, Powder is acquiring a highly-capital intensive

business that will materially lower its ROIC & margins; on the other hand, such a deal appears

EPS accretive by year two.” (BofA ML, 21-Apr-2009)

Growth

? “There will be much more substantial productivity, margin and return enhancement through the

ownership of these businesses” (Barclays Capital, 20-Apr-2009)

? “Powder is acquiring a highly capital intensive business with slower EPS growth [its] ROIC and

margins.” (BofA ML, 21-Apr-2009)

1 | | IBES estimates as of 24-Apr-2009. |

2 | | Based on 15 analysts’ ratings. |

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

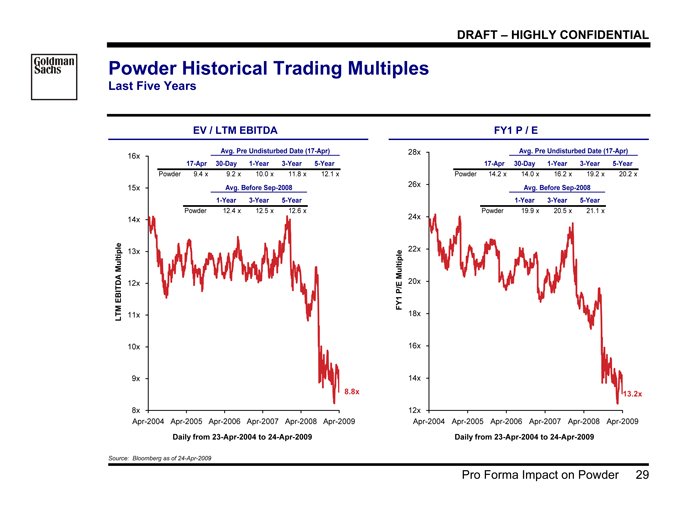

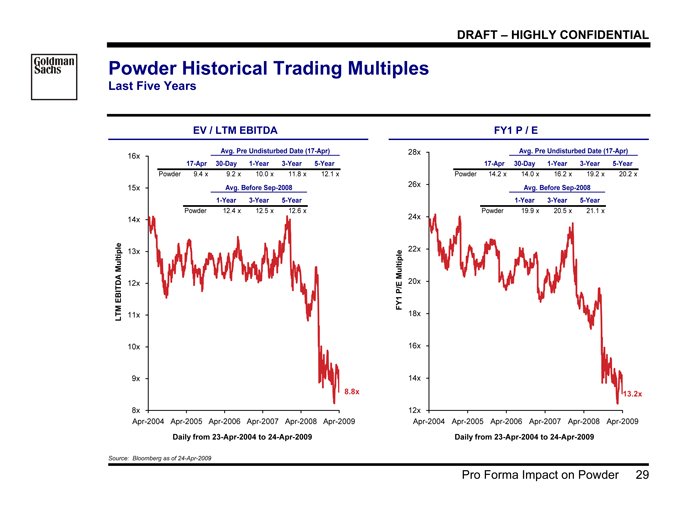

Pro Forma Impact on Powder 29

Powder Historical Trading Multiples

Last Five Years

EV / LTM EBITDA FY1 P / E

8.8x

8x

9x

10x

11x

12x

13x

14x

15x

16x

Apr-2004 Apr-2005 Apr-2006 Apr-2007 Apr-2008 Apr-2009

Daily from 23-Apr-2004 to 24-Apr-2009

LTM EBITDA Multiple

Avg. Pre Undisturbed Date (17-Apr)

17-Apr 30-Day 1-Year 3-Year 5-Year

Powder 9.4 x 9.2 x 10.0 x 11.8 x 12.1 x

Avg. Before Sep-2008

1-Year 3-Year 5-Year

Powder 12.4 x 12.5 x 12.6 x

13.2x

12x

14x

16x

18x

20x

22x

24x

26x

28x

Apr-2004 Apr-2005 Apr-2006 Apr-2007 Apr-2008 Apr-2009

Daily from 23-Apr-2004 to 24-Apr-2009

FY1 P/E Multiple

Avg. Pre Undisturbed Date (17-Apr)

17-Apr 30-Day 1-Year 3-Year 5-Year

Powder 14.2 x 14.0 x 16.2 x 19.2 x 20.2 x

Avg. Before Sep-2008

1-Year 3-Year 5-Year

Powder 19.9 x 20.5 x 21.1 x

Source: Bloomberg as of 24-Apr-2009

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

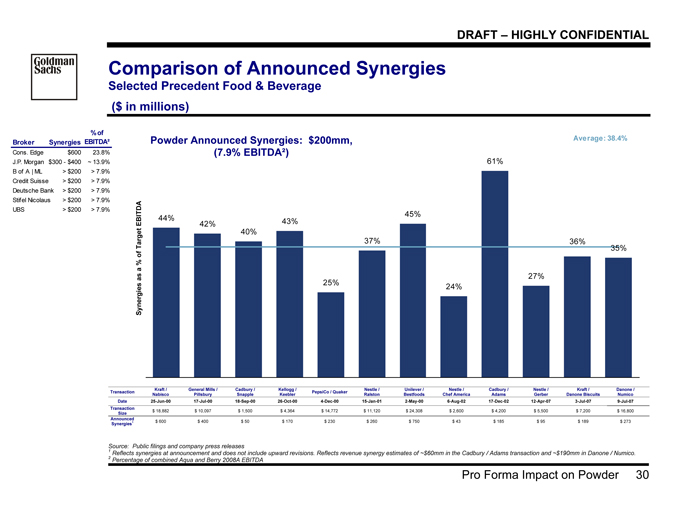

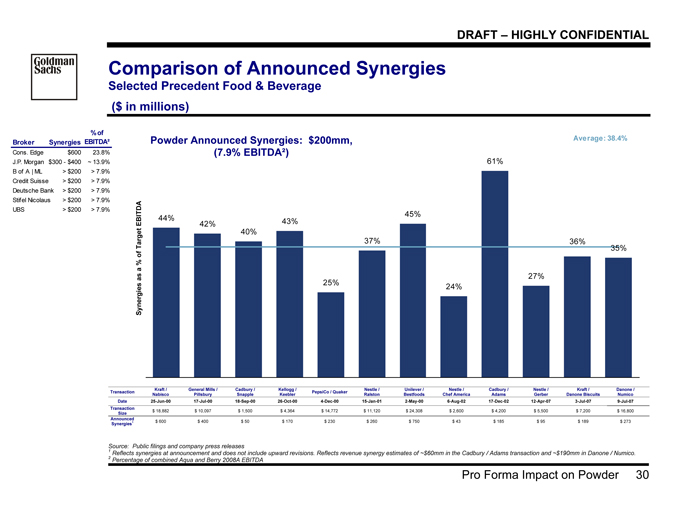

Pro Forma Impact on Powder 30

Comparison of Announced Synergies

Selected Precedent Food & Beverage

($ in millions)

Synergies as a % of Target EBITDA

44%

42%

40%

43%

25%

37%

45%

24%

61%

27%

35%

36%

Average: 38.4%

Transaction Kraft /

Nabisco

General Mills /

Pillsbury

Cadbury /

Snapple

Kellogg /

Keebler PepsiCo / Quaker Nestle /

Ralston

Unilever /

Bestfoods

Nestle /

Chef America

Cadbury /

Adams

Nestle /

Gerber

Kraft /

Danone Biscuits

Danone /

Numico

Date 25-Jun-00 17-Jul-00 18-Sep-00 26-Oct-00 4-Dec-00 15-Jan-01 2-May-00 6-Aug-02 17-Dec-02 12-Apr-07 3-Jul-07 9-Jul-07

Transaction

Size $ 18,882 $ 10,097 $ 1,500 $ 4,364 $ 14,772 $ 11,120 $ 24,308 $ 2,600 $ 4,200 $ 5,500 $ 7,200 $ 16,800

Announced

Synergies1 $ 600 $ 400 $ 50 $ 170 $ 230 $ 260 $ 750 $ 43 $ 185 $ 95 $ 189 $ 273

Source: Public filings and company press releases

1 Reflects synergies at announcement and does not include upward revisions. Reflects revenue synergy estimates of ~$60mm in the Cadbury / Adams transaction and ~$190mm in Danone / Numico.

2 | | Percentage of combined Aqua and Berry 2008A EBITDA |

Broker Synergies

% of

EBITDA²

Cons. Edge > $600 23.8%

J.P. Morgan $300—$400 ~ 13.9%

B of A | ML > $200 > 7.9%

Credit Suisse > $200 > 7.9%

Deutsche Bank > $200 > 7.9%

Stifel Nicolaus > $200 > 7.9%

UBS > $200 > 7.9%

Powder Announced Synergies: $200mm,

(7.9% EBITDA²)

Goldman Sachs

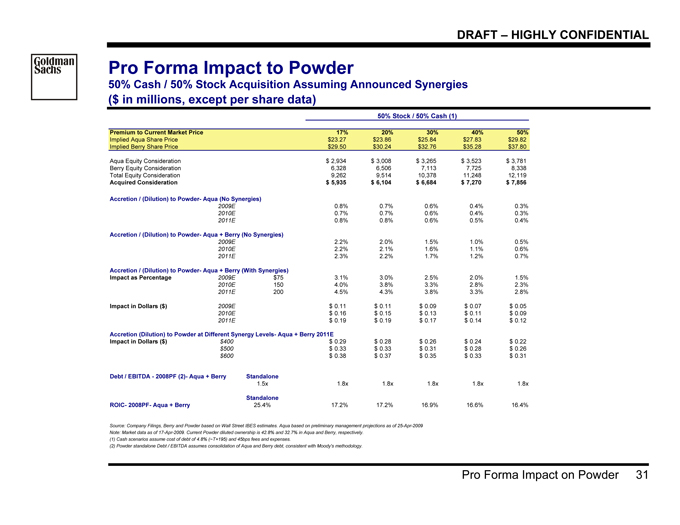

DRAFT – HIGHLY CONFIDENTIAL

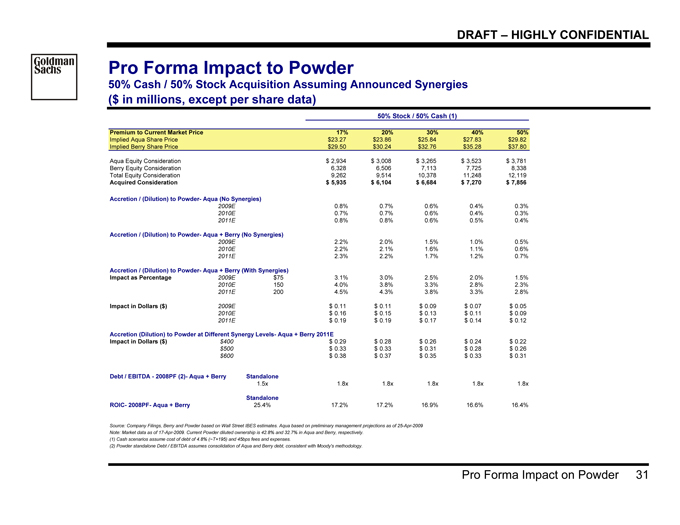

Pro Forma Impact on Powder 31

Pro Forma Impact to Powder

50% Cash / 50% Stock Acquisition Assuming Announced Synergies

($ in millions, except per share data)

50% Stock / 50% Cash (1)

Premium to Current Market Price 17% 20% 30% 40% 50%

Implied Aqua Share Price $23.27 $23.86 $25.84 $27.83 $29.82

Implied Berry Share Price $29.50 $30.24 $32.76 $35.28 $37.80

Aqua Equity Consideration $ 2,934 $ 3,008 $ 3,265 $ 3,523 $ 3,781

Berry Equity Consideration 6,328 6,506 7,113 7,725 8,338

Total Equity Consideration 9,262 9,514 10,378 11,248 12,119

Acquired Consideration $ 5,935 $ 6,104 $ 6,684 $ 7,270 $ 7,856

Accretion / (Dilution) to Powder- Aqua (No Synergies)

2009E 0.8% 0.7% 0.6% 0.4% 0.3%

2010E 0.7% 0.7% 0.6% 0.4% 0.3%

2011E 0.8% 0.8% 0.6% 0.5% 0.4%

Accretion / (Dilution) to Powder- Aqua + Berry (No Synergies)

2009E 2.2% 2.0% 1.5% 1.0% 0.5%

2010E 2.2% 2.1% 1.6% 1.1% 0.6%

2011E 2.3% 2.2% 1.7% 1.2% 0.7%

Accretion / (Dilution) to Powder- Aqua + Berry (With Synergies)

Impact as Percentage 2009E $75 3.1% 3.0% 2.5% 2.0% 1.5%

2010E 150 4.0% 3.8% 3.3% 2.8% 2.3%

2011E 200 4.5% 4.3% 3.8% 3.3% 2.8%

Impact in Dollars ($) 2009E $ 0.11 $ 0.11 $ 0.09 $ 0.07 $ 0.05

2010E $ 0.16 $ 0.15 $ 0.13 $ 0.11 $ 0.09

2011E $ 0.19 $ 0.19 $ 0.17 $ 0.14 $ 0.12

Accretion (Dilution) to Powder at Different Synergy Levels- Aqua + Berry 2011E

Impact in Dollars ($) $400 $ 0.29 $ 0.28 $ 0.26 $ 0.24 $ 0.22

$500 $ 0.33 $ 0.33 $ 0.31 $ 0.28 $ 0.26

$600 $ 0.38 $ 0.37 $ 0.35 $ 0.33 $ 0.31

Debt / EBITDA—2008PF (2)- Aqua + Berry Standalone

1.5x 1.8x 1.8x 1.8x 1.8x 1.8x

Standalone

ROIC- 2008PF- Aqua + Berry 25.4% 17.2% 17.2% 16.9% 16.6% 16.4%

Source: Company Filings, Berry and Powder based on Wall Street IBES estimates. Aqua based on preliminary management projections as of 25-Apr-2009

Note: Market data as of 17-Apr-2009. Current Powder diluted ownership is 42.8% and 32.7% in Aqua and Berry, respectively.

(1) | | Cash scenarios assume cost of debt of 4.8% (~T+195) and 45bps fees and expenses. |

(2) | | Powder standalone Debt / EBITDA assumes consolidation of Aqua and Berry debt, consistent with Moody's methodology. |

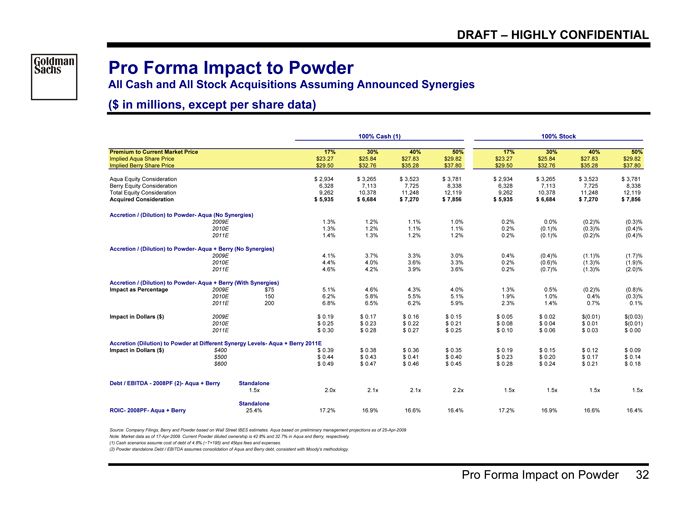

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

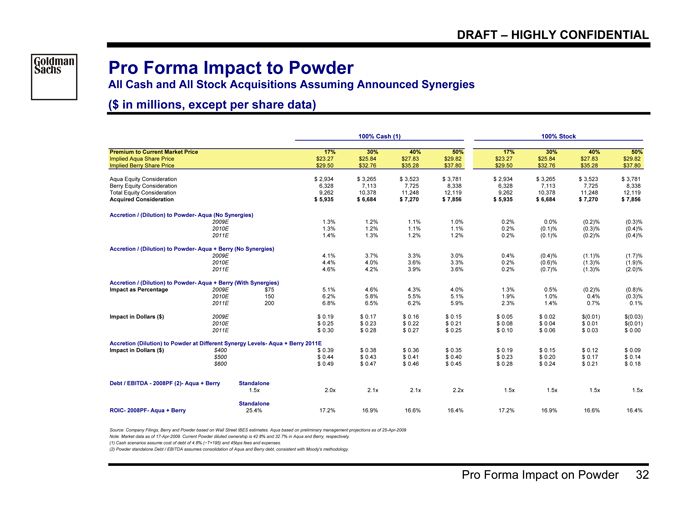

Pro Forma Impact on Powder 32

Pro Forma Impact to Powder

All Cash and All Stock Acquisitions Assuming Announced Synergies

($ in millions, except per share data)

100% Cash (1) 100% Stock

Premium to Current Market Price 17% 30% 40% 50% 17% 30% 40% 50%

Implied Aqua Share Price $23.27 $25.84 $27.83 $29.82 $23.27 $25.84 $27.83 $29.82

Implied Berry Share Price $29.50 $32.76 $35.28 $37.80 $29.50 $32.76 $35.28 $37.80

Aqua Equity Consideration $ 2,934 $ 3,265 $ 3,523 $ 3,781 $ 2,934 $ 3,265 $ 3,523 $ 3,781

Berry Equity Consideration 6,328 7,113 7,725 8,338 6,328 7,113 7,725 8,338

Total Equity Consideration 9,262 10,378 11,248 12,119 9,262 10,378 11,248 12,119

Acquired Consideration $ 5,935 $ 6,684 $ 7,270 $ 7,856 $ 5,935 $ 6,684 $ 7,270 $ 7,856

Accretion / (Dilution) to Powder- Aqua (No Synergies)

2009E 1.3% 1.2% 1.1% 1.0% 0.2% 0.0% (0.2)% (0.3)%

2010E 1.3% 1.2% 1.1% 1.1% 0.2% (0.1)% (0.3)% (0.4)%

2011E 1.4% 1.3% 1.2% 1.2% 0.2% (0.1)% (0.2)% (0.4)%

Accretion / (Dilution) to Powder- Aqua + Berry (No Synergies)

2009E 4.1% 3.7% 3.3% 3.0% 0.4% (0.4)% (1.1)% (1.7)%

2010E 4.4% 4.0% 3.6% 3.3% 0.2% (0.6)% (1.3)% (1.9)%

2011E 4.6% 4.2% 3.9% 3.6% 0.2% (0.7)% (1.3)% (2.0)%

Accretion / (Dilution) to Powder- Aqua + Berry (With Synergies)

Impact as Percentage 2009E $75 5.1% 4.6% 4.3% 4.0% 1.3% 0.5% (0.2)% (0.8)%

2010E 150 6.2% 5.8% 5.5% 5.1% 1.9% 1.0% 0.4% (0.3)%

2011E 200 6.8% 6.5% 6.2% 5.9% 2.3% 1.4% 0.7% 0.1%

Impact in Dollars ($) 2009E $ 0.19 $ 0.17 $ 0.16 $ 0.15 $ 0.05 $ 0.02 $(0.01) $(0.03)

2010E $ 0.25 $ 0.23 $ 0.22 $ 0.21 $ 0.08 $ 0.04 $ 0.01 $(0.01)

2011E $ 0.30 $ 0.28 $ 0.27 $ 0.25 $ 0.10 $ 0.06 $ 0.03 $ 0.00

Accretion (Dilution) to Powder at Different Synergy Levels- Aqua + Berry 2011E

Impact in Dollars ($) $400 $ 0.39 $ 0.38 $ 0.36 $ 0.35 $ 0.19 $ 0.15 $ 0.12 $ 0.09

$500 $ 0.44 $ 0.43 $ 0.41 $ 0.40 $ 0.23 $ 0.20 $ 0.17 $ 0.14

$600 $ 0.49 $ 0.47 $ 0.46 $ 0.45 $ 0.28 $ 0.24 $ 0.21 $ 0.18

Debt / EBITDA—2008PF (2)- Aqua + Berry Standalone

1.5x 2.0x 2.1x 2.1x 2.2x 1.5x 1.5x 1.5x 1.5x

Standalone

ROIC- 2008PF- Aqua + Berry 25.4% 17.2% 16.9% 16.6% 16.4% 17.2% 16.9% 16.6% 16.4%

Source: Company Filings, Berry and Powder based on Wall Street IBES estimates. Aqua based on preliminary management projections as of 25-Apr-2009

Note: Market data as of 17-Apr-2009. Current Powder diluted ownership is 42.8% and 32.7% in Aqua and Berry, respectively.

(1) | | Cash scenarios assume cost of debt of 4.8% (~T+195) and 45bps fees and expenses. |

(2) | | Powder standalone Debt / EBITDA assumes consolidation of Aqua and Berry debt, consistent with Moody's methodology. |

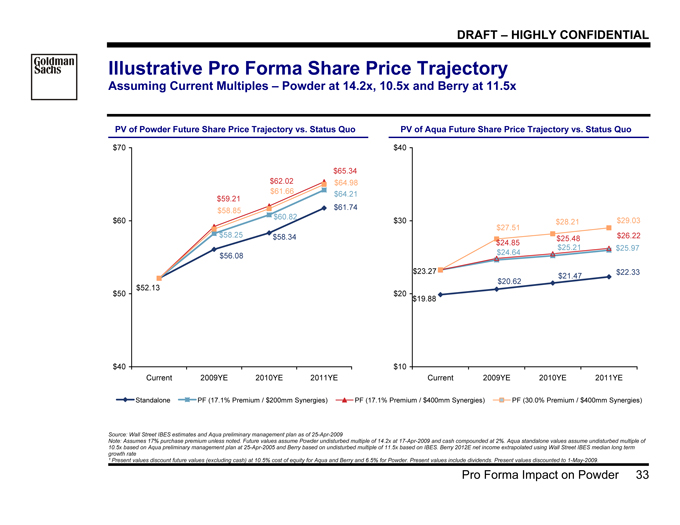

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

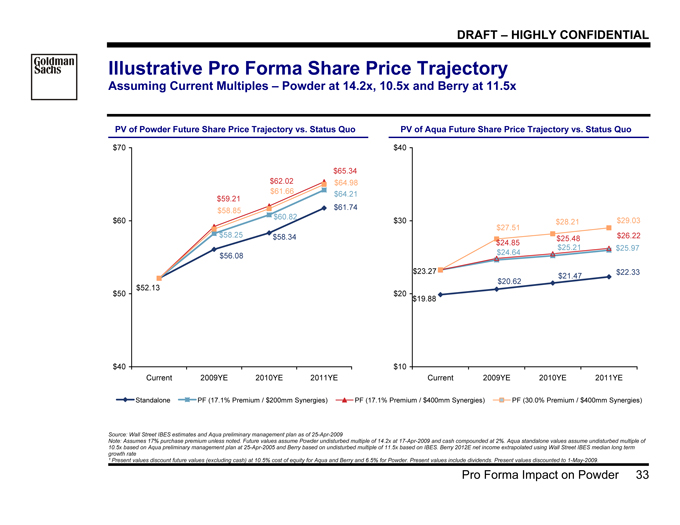

Pro Forma Impact on Powder 33

Illustrative Pro Forma Share Price Trajectory

Assuming Current Multiples – Powder at 14.2x, 10.5x and Berry at 11.5x

PV of Powder Future Share Price Trajectory vs. Status Quo PV of Aqua Future Share Price Trajectory vs. Status Quo

$58.34

$61.74

$56.08

$58.25

$60.82

$64.21

$65.34

$62.02

$59.21

$52.13

$58.85

$61.66

$64.98

$40

$50

$60

$70

Current 2009YE 2010YE 2011YE

$19.88

$21.47 $22.33

$20.62

$24.64 $25.21 $25.97

$26.22

$24.85 $25.48

$23.27

$28.21 $29.03

$27.51

$10

$20

$30

$40

Current 2009YE 2010YE 2011YE

Standalone PF (17.1% Premium / $200mm Synergies) PF (17.1% Premium / $400mm Synergies) PF (30.0% Premium / $400mm Synergies)

Source: Wall Street IBES estimates and Aqua preliminary management plan as of 25-Apr-2009

Note: Assumes 17% purchase premium unless noted. Future values assume Powder undisturbed multiple of 14.2x at 17-Apr-2009 and cash compounded at 2%. Aqua standalone values assume undisturbed multiple of

10.5x based on Aqua preliminary management plan at 25-Apr-2005 and Berry based on undisturbed multiple of 11.5x based on IBES. Berry 2012E net income extrapolated using Wall Street IBES median long term

growth rate

¹ Present values discount future values (excluding cash) at 10.5% cost of equity for Aqua and Berry and 6.5% for Powder. Present values include dividends. Present values discounted to 1-May-2009.

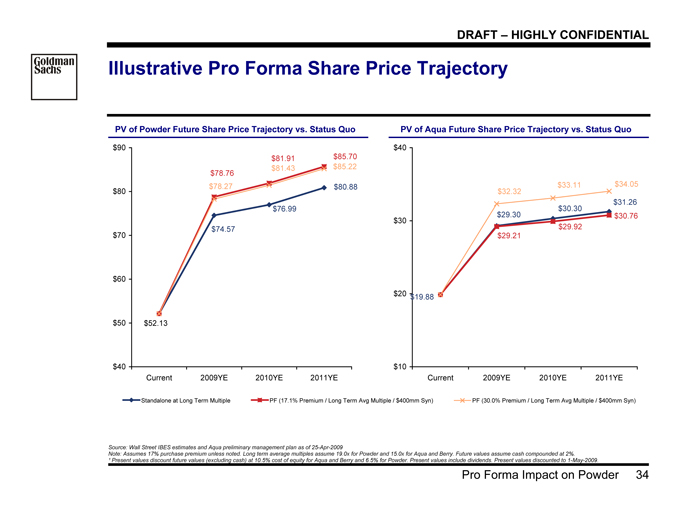

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Pro Forma Impact on Powder 34

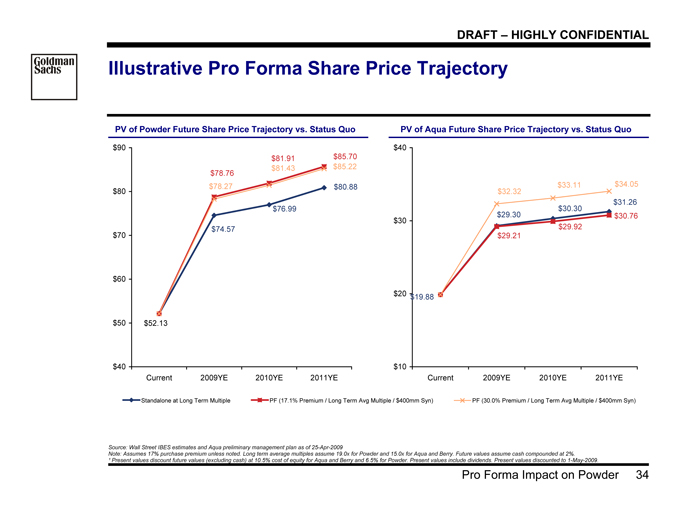

Illustrative Pro Forma Share Price Trajectory

PV of Powder Future Share Price Trajectory vs. Status Quo PV of Aqua Future Share Price Trajectory vs. Status Quo

$74.57

$80.88

$76.99

$52.13

$81.91 $85.70

$78.76

$78.27

$81.43 $85.22

$40

$50

$60

$70

$80

$90

Current 2009YE 2010YE 2011YE

$29.30

$31.26

$30.30

$19.88

$30.76

$29.92

$29.21

$33.11 $34.05

$32.32

$10

$20

$30

$40

Current 2009YE 2010YE 2011YE

Standalone at Long Term Multiple PF (17.1% Premium / Long Term Avg Multiple / $400mm Syn) PF (30.0% Premium / Long Term Avg Multiple / $400mm Syn)

Source: Wall Street IBES estimates and Aqua preliminary management plan as of 25-Apr-2009

Note: Assumes 17% purchase premium unless noted. Long term average multiples assume 19.0x for Powder and 15.0x for Aqua and Berry. Future values assume cash compounded at 2%.

¹ Present values discount future values (excluding cash) at 10.5% cost of equity for Aqua and Berry and 6.5% for Powder. Present values include dividends. Present values discounted to 1-May-2009.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

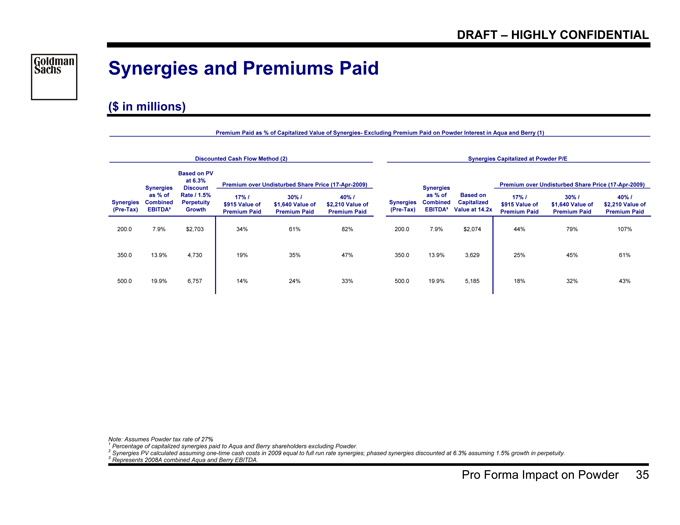

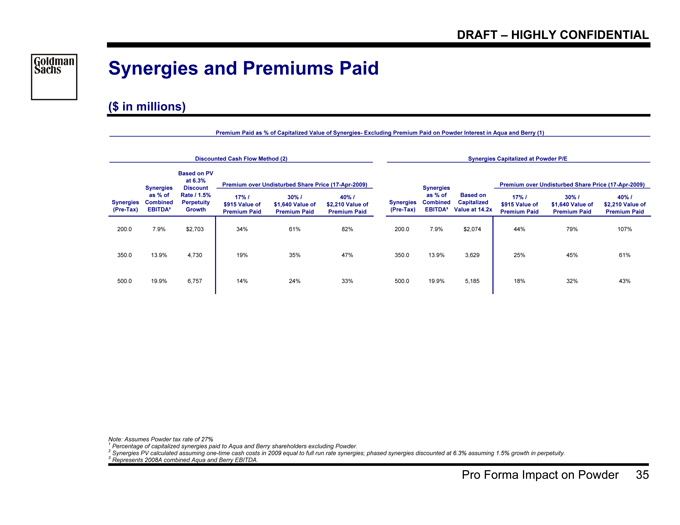

Pro Forma Impact on Powder 35

Synergies and Premiums Paid

($ in millions)123

Premium Paid as % of Capitalized Value of Synergies- Excluding Premium Paid on Powder Interest in Aqua and Berry (1)

Discounted Cash Flow Method (2) Synergies Capitalized at Powder P/E

Premium over Undisturbed Share Price (17-Apr-2009) Premium over Undisturbed Share Price (17-Apr-2009)

17% /

$915 Value of

Premium Paid

30% /

$1,640 Value of

Premium Paid

40% /

$2,210 Value of

Premium Paid

17% /

$915 Value of

Premium Paid

30% /

$1,640 Value of

Premium Paid

40% /

$2,210 Value of

Premium Paid

200.0 7.9% $2,703 34% 61% 82% 200.0 7.9% $2,074 44% 79% 107%

350.0 13.9% 4,730 19% 35% 47% 350.0 13.9% 3,629 25% 45% 61%

500.0 19.9% 6,757 14% 24% 33% 500.0 19.9% 5,185 18% 32% 43%

Synergies

(Pre-Tax)

Based on PV

at 6.3%

Discount

Rate / 1.5%

Perpetuity

Growth

Synergies

(Pre-Tax)

Based on

Capitalized

Value at 14.2x

Synergies

as % of

Combined

EBITDA³

Synergies

as % of

Combined

EBITDA³

Note: Assumes Powder tax rate of 27%

1 | | Percentage of capitalized synergies paid to Aqua and Berry shareholders excluding Powder. |

2 Synergies PV calculated assuming one-time cash costs in 2009 equal to full run rate synergies; phased synergies discounted at 6.3% assuming 1.5% growth in perpetuity.

3 | | Represents 2008A combined Aqua and Berry EBITDA. |

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

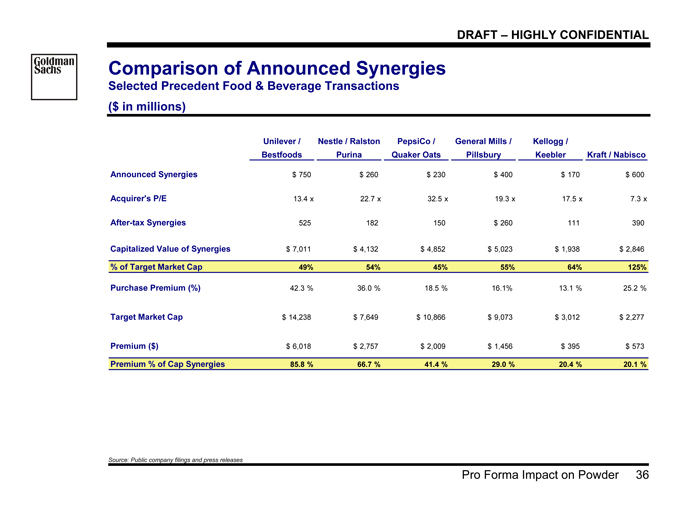

Pro Forma Impact on Powder 36

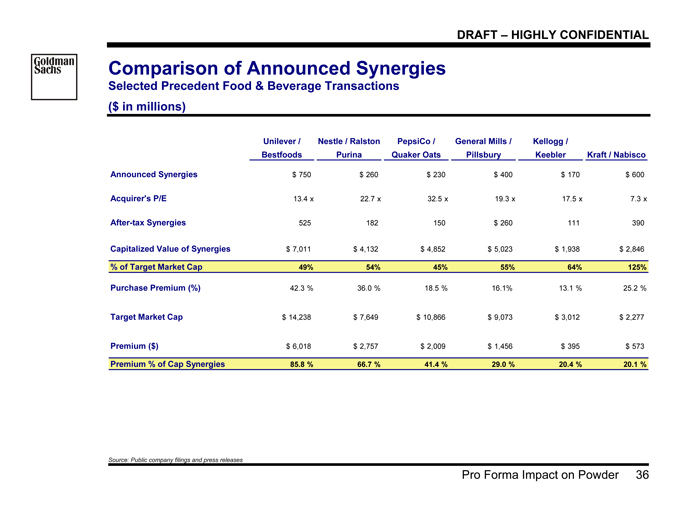

Comparison of Announced Synergies

Selected Precedent Food & Beverage Transactions

($ in millions)

Unilever /

Bestfoods

Nestle / Ralston

Purina

PepsiCo /

Quaker Oats

General Mills /

Pillsbury

Kellogg /

Keebler Kraft / Nabisco

Announced Synergies $ 750 $ 260 $ 230 $ 400 $ 170 $ 600

Acquirer's P/E 13.4 x 22.7 x 32.5 x 19.3 x 17.5 x 7.3 x

After-tax Synergies 525 182 150 $ 260 111 390

Capitalized Value of Synergies $ 7,011 $ 4,132 $ 4,852 $ 5,023 $ 1,938 $ 2,846

% of Target Market Cap 49% 54% 45% 55% 64% 125%

Purchase Premium (%) 42.3 % 36.0 % 18.5 % 16.1% 13.1 % 25.2 %

Target Market Cap $ 14,238 $ 7,649 $ 10,866 $ 9,073 $ 3,012 $ 2,277

Premium ($) $ 6,018 $ 2,757 $ 2,009 $ 1,456 $ 395 $ 573

Premium % of Cap Synergies 85.8 % 66.7 % 41.4 % 29.0 % 20.4 % 20.1 %

Source: Public company filings and press releases

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

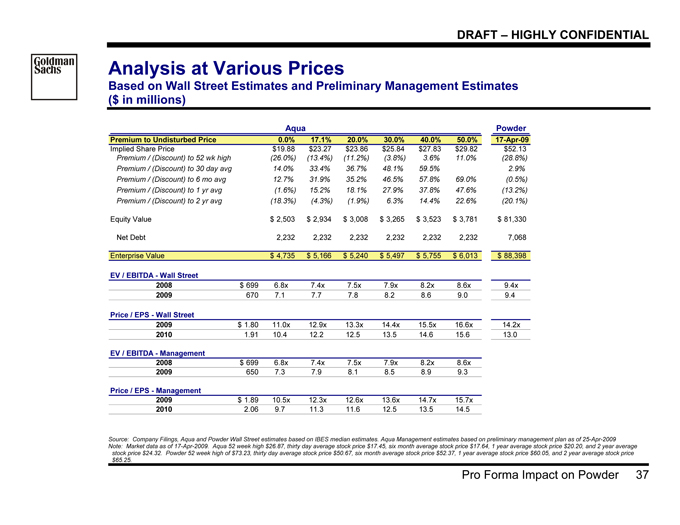

Pro Forma Impact on Powder 37

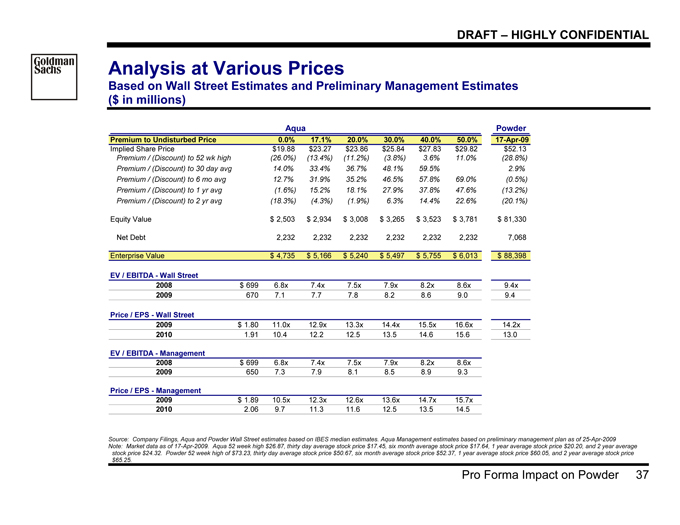

Analysis at Various Prices

Based on Wall Street Estimates and Preliminary Management Estimates

($ in millions)

Aqua Powder

Premium to Undisturbed Price 0.0% 17.1% 20.0% 30.0% 40.0% 50.0% 17-Apr-09

Implied Share Price $19.88 $23.27 $23.86 $25.84 $27.83 $29.82 $52.13

Premium / (Discount) to 52 wk high (26.0%) (13.4%) (11.2%) (3.8%) 3.6% 11.0% (28.8%)

Premium / (Discount) to 30 day avg 14.0% 33.4% 36.7% 48.1% 59.5% 2.9%

Premium / (Discount) to 6 mo avg 12.7% 31.9% 35.2% 46.5% 57.8% 69.0% (0.5%)

Premium / (Discount) to 1 yr avg (1.6%) 15.2% 18.1% 27.9% 37.8% 47.6% (13.2%)

Premium / (Discount) to 2 yr avg (18.3%) (4.3%) (1.9%) 6.3% 14.4% 22.6% (20.1%)

Equity Value $ 2,503 $ 2,934 $ 3,008 $ 3,265 $ 3,523 $ 3,781 $ 81,330

Net Debt 2,232 2,232 2,232 2,232 2,232 2,232 7,068

Enterprise Value $ 4,735 $ 5,166 $ 5,240 $ 5,497 $ 5,755 $ 6,013 $ 88,398

EV / EBITDA—Wall Street

2008 $ 699 6.8x 7.4x 7.5x 7.9x 8.2x 8.6x 9.4x

2009 670 7.1 7.7 7.8 8.2 8.6 9.0 9.4

Price / EPS—Wall Street

2009 $ 1.80 11.0x 12.9x 13.3x 14.4x 15.5x 16.6x 14.2x

2010 1.91 10.4 12.2 12.5 13.5 14.6 15.6 13.0

EV / EBITDA—Management

2008 $ 699 6.8x 7.4x 7.5x 7.9x 8.2x 8.6x

2009 650 7.3 7.9 8.1 8.5 8.9 9.3

Price / EPS—Management

2009 $ 1.89 10.5x 12.3x 12.6x 13.6x 14.7x 15.7x

2010 2.06 9.7 11.3 11.6 12.5 13.5 14.5

Source: Company Filings, Aqua and Powder Wall Street estimates based on IBES median estimates. Aqua Management estimates based on preliminary management plan as of 25-Apr-2009

Note: Market data as of 17-Apr-2009. Aqua 52 week high $26.87, thirty day average stock price $17.45, six month average stock price $17.64, 1 year average stock price $20.20, and 2 year average

stock price $24.32. Powder 52 week high of $73.23, thirty day average stock price $50.67, six month average stock price $52.37, 1 year average stock price $60.05, and 2 year average stock price

$65.25.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Supplemental Materials 38

Appendix A: Supplemental Materials

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

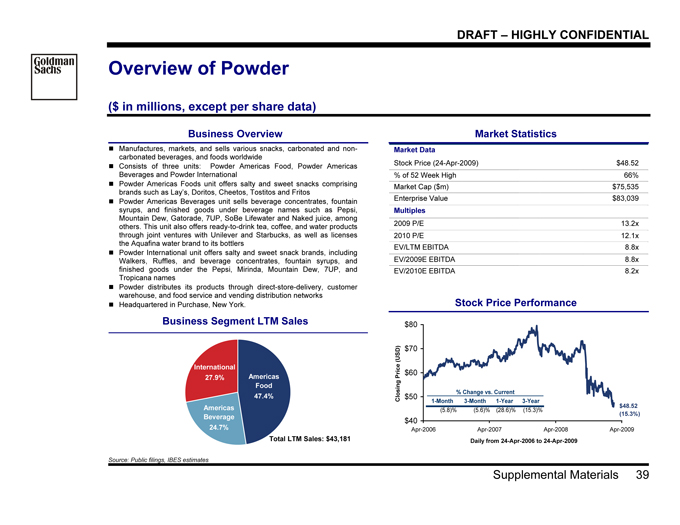

Supplemental Materials 39

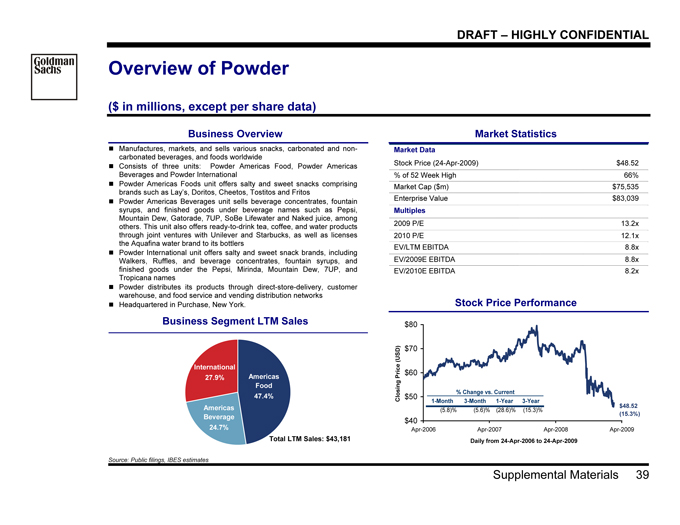

Overview of Powder

($ in millions, except per share data)

Business Overview Market Statistics

Market Data

Stock Price (24-Apr-2009) $48.52

% of 52 Week High 66%

Market Cap ($m) $75,535

Enterprise Value $83,039

Multiples

2009 P/E 13.2x

2010 P/E 12.1x

EV/LTM EBITDA 8.8x

EV/2009E EBITDA 8.8x

EV/2010E EBITDA 8.2x

Stock Price Performance

? Manufactures, markets, and sells various snacks, carbonated and noncarbonated

beverages, and foods worldwide

? Consists of three units: Powder Americas Food, Powder Americas

Beverages and Powder International

? Powder Americas Foods unit offers salty and sweet snacks comprising

brands such as Lay’s, Doritos, Cheetos, Tostitos and Fritos

? Powder Americas Beverages unit sells beverage concentrates, fountain

syrups, and finished goods under beverage names such as Pepsi,

Mountain Dew, Gatorade, 7UP, SoBe Lifewater and Naked juice, among

others. This unit also offers ready-to-drink tea, coffee, and water products

through joint ventures with Unilever and Starbucks, as well as licenses

the Aquafina water brand to its bottlers

? Powder International unit offers salty and sweet snack brands, including

Walkers, Ruffles, and beverage concentrates, fountain syrups, and

finished goods under the Pepsi, Mirinda, Mountain Dew, 7UP, and

Tropicana names

? Powder distributes its products through direct-store-delivery, customer

warehouse, and food service and vending distribution networks

? Headquartered in Purchase, New York.

Business Segment LTM Sales

Americas

Food

47.4%

International

27.9%

Americas

Beverage

24.7%

Total LTM Sales: $43,18 1

$40

$50

$60

$70

$80

Apr-2006 Apr-2007 Apr-2008 Apr-2009

Daily from 24-Apr-2006 to 24-Apr-2009

Closing Price (USD)

$48.52

(15.3%)

% Change vs. Current

1-Month 3-Month 1-Year 3-Year

(5.8)% (5.6)% (28.6)% (15.3)%

Source: Public filings, IBES estimates

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

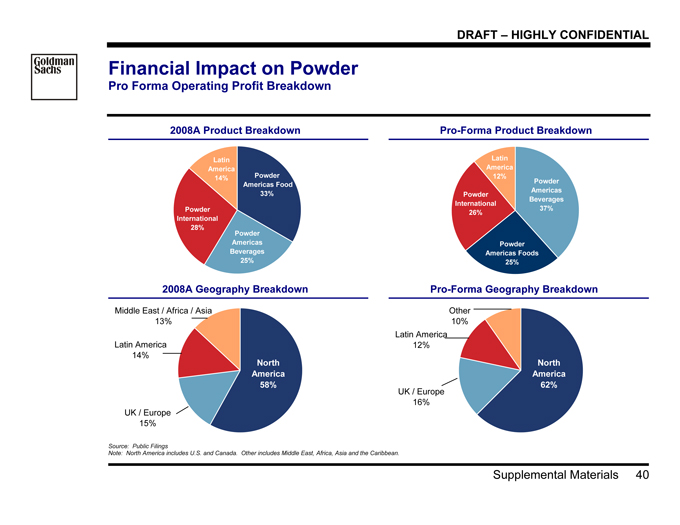

Supplemental Materials 40

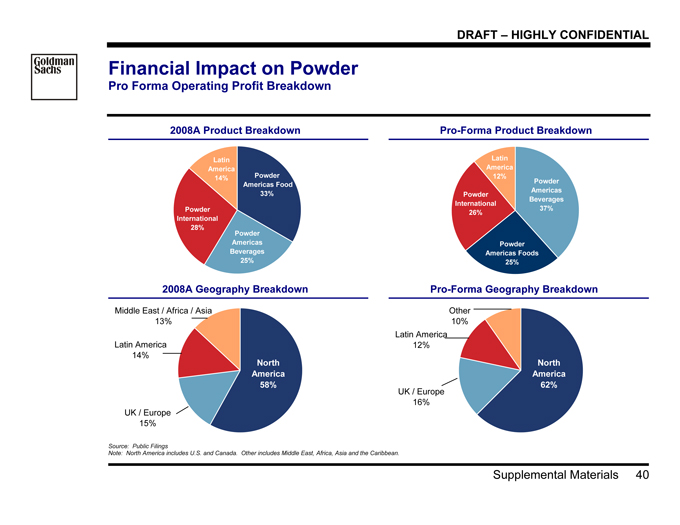

Financial Impact on Powder

Pro Forma Operating Profit Breakdown

2008A Product Breakdown Pro-Forma Product Breakdown

Powder

Americas Food

33%

Powder

Americas

Beverages

25%

Powder

International

28%

Latin

America

14%

Powder

Americas

Beverages

37%

Powder

International

26%

Latin

America

12%

Powder

Americas Foods

25%

2008A Geography Breakdown Pro-Forma Geography Breakdown1

North

America

58%

Latin America

14%

UK / Europe

15%

Middle East / Africa / Asia

13%

North

America

62%

Latin America

12%

UK / Europe

16%

Other

10%

Source: Public Filings

Note: North America includes U.S. and Canada. Other includes Middle East, Africa, Asia and the Caribbean.

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

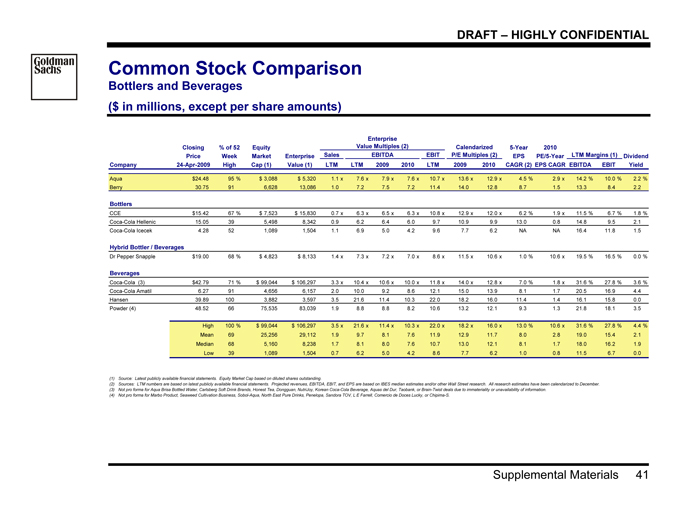

Supplemental Materials 41

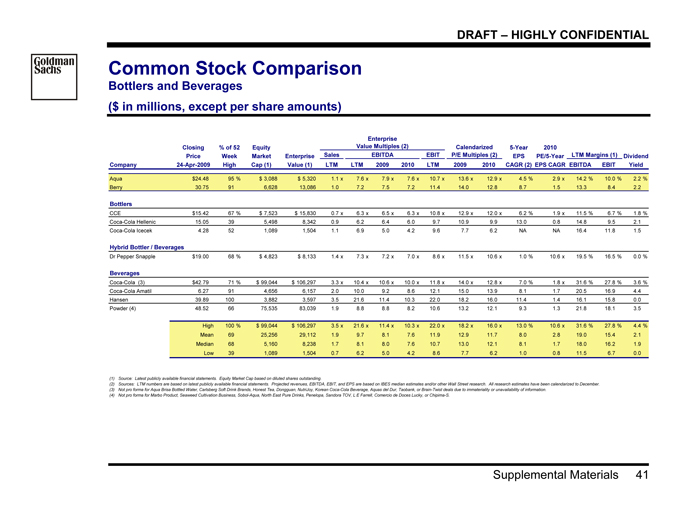

Common Stock Comparison

Bottlers and Beverages

($ in millions, except per share amounts)

Closing % of 52 Equity 5-Year 2010

Price Week Market Enterprise EPS PE/5-Year Dividend

Company 24-Apr-2009 High Cap (1) Value (1) LTM LTM 2009 2010 LTM 2009 2010 CAGR (2) EPS CAGR EBITDA EBIT Yield

Aqua $24.48 95 % $ 3,088 $ 5,320 1.1 x 7.6 x 7.9 x 7.6 x 10.7 x 13.6 x 12.9 x 4.5 % 2.9 x 14.2 % 10.0 % 2.2 %

Berry 30.75 91 6,628 13,086 1.0 7.2 7.5 7.2 11.4 14.0 12.8 8.7 1.5 13.3 8.4 2.2

Bottlers

CCE $15.42 67 % $ 7,523 $ 15,830 0.7 x 6.3 x 6.5 x 6.3 x 10.8 x 12.9 x 12.0 x 6.2 % 1.9 x 11.5 % 6.7 % 1.8 %

Coca-Cola Hellenic 15.05 39 5,498 8,342 0.9 6.2 6.4 6.0 9.7 10.9 9.9 13.0 0.8 14.8 9.5 2.1

Coca-Cola Icecek 4.28 52 1,089 1,504 1.1 6.9 5.0 4.2 9.6 7.7 6.2 NA NA 16.4 11.8 1.5

Hybrid Bottler / Beverages

Dr Pepper Snapple $19.00 68 % $ 4,823 $ 8,133 1.4 x 7.3 x 7.2 x 7.0 x 8.6 x 11.5 x 10.6 x 1.0 % 10.6 x 19.5 % 16.5 % 0.0 %

Beverages

Coca-Cola (3) $42.79 71 % $ 99,044 $ 106,297 3.3 x 10.4 x 10.6 x 10.0 x 11.8 x 14.0 x 12.8 x 7.0 % 1.8 x 31.6 % 27.8 % 3.6 %

Coca-Cola Amatil 6.27 91 4,656 6,157 2.0 10.0 9.2 8.6 12.1 15.0 13.9 8.1 1.7 20.5 16.9 4.4

Hansen 39.89 100 3,882 3,597 3.5 21.6 11.4 10.3 22.0 18.2 16.0 11.4 1.4 16.1 15.8 0.0

Powder (4) 48.52 66 75,535 83,039 1.9 8.8 8.8 8.2 10.6 13.2 12.1 9.3 1.3 21.8 18.1 3.5

High 100 % $ 99,044 $ 106,297 3.5 x 21.6 x 11.4 x 10.3 x 22.0 x 18.2 x 16.0 x 13.0 % 10.6 x 31.6 % 27.8 % 4.4 %

Mean 69 25,256 29,112 1.9 9.7 8.1 7.6 11.9 12.9 11.7 8.0 2.8 19.0 15.4 2.1

Median 68 5,160 8,238 1.7 8.1 8.0 7.6 10.7 13.0 12.1 8.1 1.7 18.0 16.2 1.9

Low 39 1,089 1,504 0.7 6.2 5.0 4.2 8.6 7.7 6.2 1.0 0.8 11.5 6.7 0.0

(1) | | Source: Latest publicly available financial statements. Equity Market Cap based on diluted shares outstanding. |

(2) Sources: LTM numbers are based on latest publicly available financial statements. Projected revenues, EBITDA, EBIT, and EPS are based on IBES median estimates and/or other Wall Street research. All research estimates have been calendarized to December.

(3) Not pro forma for Aqua Brisa Bottled Water, Carlsberg Soft Drink Brands, Honest Tea, Dongguan, NutriJoy, Korean Coca-Cola Beverage, Aquas del Dur, Taobank, or Brain-Twist deals due to immateriality or unavailability of information.

(4) Not pro forma for Marbo Product, Seaweed Cultivation Business, Sobol-Aqua, North East Pure Drinks, Penelopa, Sandora TOV, L E Farrell, Comercio de Doces Lucky, or Chipima-S.

LTM Margins EBITDA (1)

Enterprise

Value Multiples (2)

EBIT P/E Multiples (2)

Calendarized

Sales

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

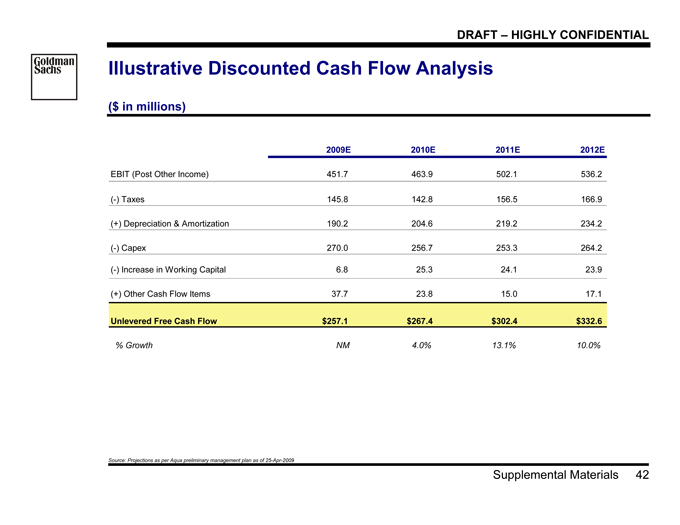

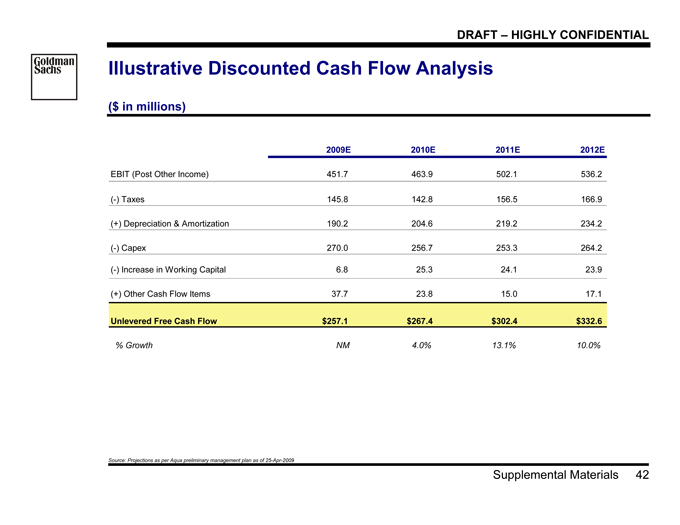

Supplemental Materials 42

Illustrative Discounted Cash Flow Analysis

($ in millions)1

2009E 2010E 2011E 2012E

EBIT (Post Other Income) 451.7 463.9 502.1 536.2

(-) Taxes 145.8 142.8 156.5 166.9

(+) Depreciation & Amortization 190.2 204.6 219.2 234.2

(-) Capex 270.0 256.7 253.3 264.2

(-) Increase in Working Capital 6.8 25.3 24.1 23.9

(+) Other Cash Flow Items 37.7 23.8 15.0 17.1

Unlevered Free Cash Flow $257.1 $267.4 $302.4 $332.6

% Growth NM 4.0% 13.1% 10.0%

Source: Projections as per Aqua preliminary management plan as of 25-Apr-2009

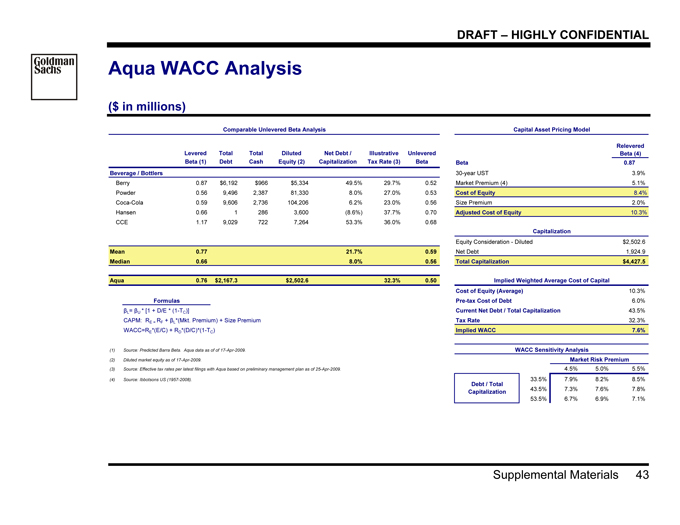

Goldman Sachs

DRAFT – HIGHLY CONFIDENTIAL

Supplemental Materials 43

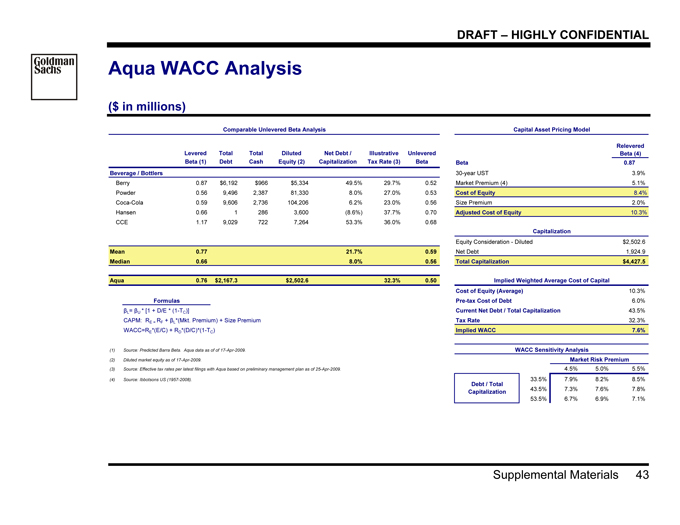

Aqua WACC Analysis

($ in millions)

Comparable Unlevered Beta Analysis Capital Asset Pricing Model

Levered Total Total Diluted Net Debt / Illustrative Unlevered

Beta (1) Debt Cash Equity (2) Capitalization Tax Rate (3) Beta Beta 0.87

Beverage / Bottlers 30-year UST 3.9%

Berry 0 .87 $6,192 $966 $5,334 49.5% 29.7% 0.52 Market Premium (4) 5.1%

Powder 0 .56 9,496 2,387 81,330 8.0% 27.0% 0.53 Cost of Equity 8.4%

Coca-Cola 0 .59 9,606 2,736 104,206 6.2% 23.0% 0.56 Size Premium 2.0%

Hansen 0 .66 1 286 3,600 (8.6%) 37.7% 0.70 Adjusted Cost of Equity 10.3%

CCE 1 .17 9,029 722 7,264 53.3% 36.0% 0.68

Capitalization

Equity Consideration—Diluted $2,502.6

Mean 0 .77 21.7% 0.59 Net Debt 1,924.9

Median 0 .66 8.0% 0.56 Total Capitalization $4,427.5

Aqua 0.76 $2,167.3 $2,502.6 32.3% 0.50 Implied Weighted Average Cost of Capital

Cost of Equity (Average) 10.3%

Formulas Pre-tax Cost of Debt 6.0%

?L= ?U * [1 + D/E * (1-TC)] Current Net Debt / Total Capitalization 43.5%

CAPM: RE = RF + ?L*(Mkt. Premium) + Size Premium Tax Rate 32.3%

WACC=RE*(E/C) + RD*(D/C)*(1-TC) Implied WACC 7.6%

(1) | | Source: Predicted Barra Beta. Aqua data as of of 17-Apr-2009. WACC Sensitivity Analysis |

(2) | | Diluted market equity as of 17-Apr-2009. Market Risk Premium |

(3) Source: Effective tax rates per latest filings with Aqua based on preliminary management plan as of 25-Apr-2009. 7.6% 4.5% 5.0% 5.5%

(4) | | Source: Ibbotsons US (1957-2008). 33.5% 7.9% 8.2% 8.5% |

43.5% 7.3% 7.6% 7.8%

53.5% 6.7% 6.9% 7.1%

Relevered

Beta (4)

Debt / Total

Capitalization