UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:811-04409

Eaton Vance Municipals Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617)482-8260

(Registrant’s Telephone Number)

August 31

Date of Fiscal Year End

February 28, 2019

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Municipal Income Funds

Semiannual Report

February 28, 2019

Georgia • Maryland • Missouri • North Carolina • Oregon

South Carolina • Virginia

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (eatonvance.com/funddocuments), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you are a direct investor, you may elect to receive shareholder reports and other communications from the Funds electronically by signing up fore-Delivery at eatonvance.com/edelivery. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you are a direct investor, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-800-262-1122. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Eaton Vance funds held directly or to all funds held through your financial intermediary, as applicable.

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. Each Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Funds nor the adviser with respect to the operation of the Funds is subject to CFTC regulation. Because of its management of other strategies, each Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call1-800-262-1122.

Semiannual ReportFebruary 28, 2019

Eaton Vance

Municipal Income Funds

Table of Contents

| | | | |

Performance and Fund Profile | | | | |

| |

| | | | |

Georgia Municipal Income Fund | | | 2 | |

Maryland Municipal Income Fund | | | 3 | |

Missouri Municipal Income Fund | | | 4 | |

North Carolina Municipal Income Fund | | | 5 | |

Oregon Municipal Income Fund | | | 6 | |

South Carolina Municipal Income Fund | | | 7 | |

Virginia Municipal Income Fund | | | 8 | |

| |

| | | | |

| |

Endnotes and Additional Disclosures | | | 9 | |

| |

Fund Expenses | | | 10 | |

| |

Financial Statements | | | 14 | |

| |

Officers and Trustees | | | 76 | |

| |

Important Notices | | | 77 | |

Eaton Vance

Georgia Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio Manager Adam A. Weigold, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/07/1993 | | | | 12/23/1991 | | | | 2.41 | % | | | 4.17 | % | | | 3.26 | % | | | 4.37 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –2.48 | | | | –0.82 | | | | 2.26 | | | | 3.86 | |

Class C at NAV | | | 04/25/2006 | | | | 12/23/1991 | | | | 2.08 | | | | 3.43 | | | | 2.51 | | | | 3.60 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 1.08 | | | | 2.43 | | | | 2.51 | | | | 3.60 | |

Class I at NAV | | | 03/03/2008 | | | | 12/23/1991 | | | | 2.51 | | | | 4.37 | | | | 3.49 | | | | 4.59 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.70 | % | | | 1.45 | % | | | 0.50 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 2.82 | % | | | 2.13 | % | | | 3.00 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 5.07 | | | | 3.83 | | | | 5.39 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.56 | | | | 0.89 | | | | 1.83 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 2.80 | | | | 1.61 | | | | 3.29 | |

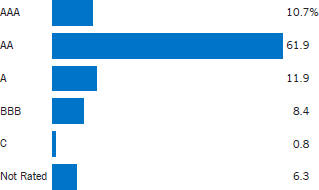

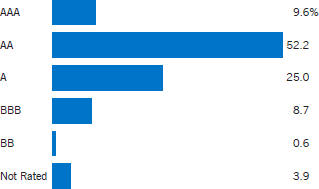

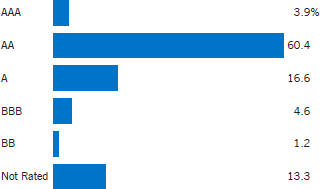

Fund Profile

Credit Quality (% of total investments)6

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

Maryland Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio Manager Craig R. Brandon, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/10/1993 | | | | 02/03/1992 | | | | 1.73 | % | | | 3.07 | % | | | 2.62 | % | | | 4.58 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –3.07 | | | | –1.80 | | | | 1.62 | | | | 4.07 | |

Class C at NAV | | | 05/02/2006 | | | | 02/03/1992 | | | | 1.33 | | | | 2.39 | | | | 1.84 | | | | 3.80 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.33 | | | | 1.39 | | | | 1.84 | | | | 3.80 | |

Class I at NAV | | | 03/03/2008 | | | | 02/03/1992 | | | | 1.83 | | | | 3.27 | | | | 2.82 | | | | 4.81 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.77 | % | | | 1.52 | % | | | 0.57 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 2.78 | % | | | 2.09 | % | | | 2.97 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 4.98 | | | | 3.75 | | | | 5.32 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.74 | | | | 1.08 | | | | 2.02 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 3.11 | | | | 1.93 | | | | 3.62 | |

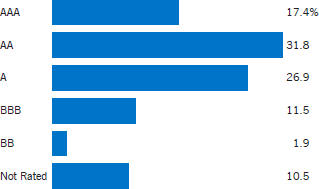

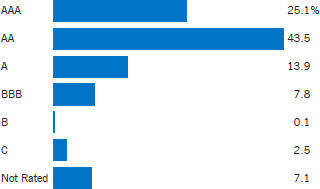

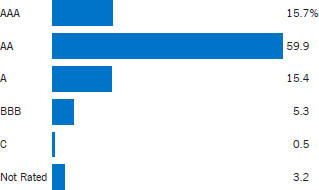

Fund Profile

Credit Quality (% of total investments)6

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

Missouri Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio Manager Cynthia J. Clemson

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/07/1993 | | | | 05/01/1992 | | | | 1.82 | % | | | 3.93 | % | | | 3.46 | % | | | 4.54 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –2.99 | | | | –1.00 | | | | 2.46 | | | | 4.03 | |

Class C at NAV | | | 02/16/2006 | | | | 05/01/1992 | | | | 1.52 | | | | 3.19 | | | | 2.69 | | | | 3.76 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.52 | | | | 2.19 | | | | 2.69 | | | | 3.76 | |

Class I at NAV | | | 08/03/2010 | | | | 05/01/1992 | | | | 1.92 | | | | 4.14 | | | | 3.66 | | | | 4.73 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.70 | % | | | 1.45 | % | | | 0.50 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 3.14 | % | | | 2.45 | % | | | 3.33 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 5.64 | | | | 4.40 | | | | 5.98 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.79 | | | | 1.14 | | | | 2.08 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 3.22 | | | | 2.05 | | | | 3.74 | |

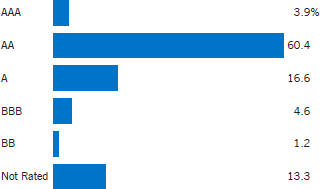

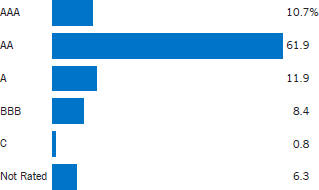

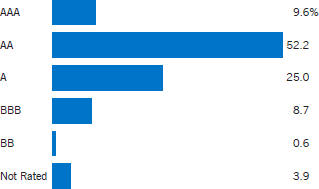

Fund Profile

Credit Quality (% of total investments)6

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

North Carolina Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio ManagerAdam A. Weigold, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/07/1993 | | | | 10/23/1991 | | | | 1.72 | % | | | 3.06 | % | | | 3.17 | % | | | 4.75 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –3.12 | | | | –1.83 | | | | 2.18 | | | | 4.24 | |

Class C at NAV | | | 05/02/2006 | | | | 10/23/1991 | | | | 1.33 | | | | 2.30 | | | | 2.41 | | | | 3.98 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.33 | | | | 1.30 | | | | 2.41 | | | | 3.98 | |

Class I at NAV | | | 03/03/2008 | | | | 10/23/1991 | | | | 1.82 | | | | 3.39 | | | | 3.40 | | | | 4.97 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.80 | % | | | 1.55 | % | | | 0.60 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 2.70 | % | | | 2.01 | % | | | 2.88 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 4.83 | | | | 3.59 | | | | 5.15 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.59 | | | | 0.93 | | | | 1.87 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 2.85 | | | | 1.66 | | | | 3.34 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Leverage5 | | | | | | | | | | | | | | | | | | |

Residual Interest Bond (RIB) Financing | | | | | | | | | | | | | | | | | | | | | | | 3.09 | % |

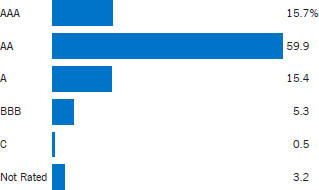

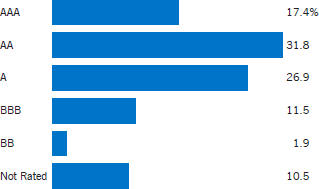

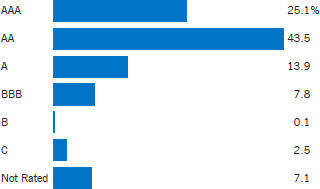

Fund Profile

Credit Quality (% of total investments)6,7

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

Oregon Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio Manager Adam A. Weigold, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/28/1993 | | | | 12/24/1991 | | | | 2.26 | % | | | 4.33 | % | | | 3.76 | % | | | 4.99 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –2.59 | | | | –0.62 | | | | 2.76 | | | | 4.49 | |

Class C at NAV | | | 03/02/2006 | | | | 12/24/1991 | | | | 1.72 | | | | 3.48 | | | | 2.96 | | | | 4.20 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.72 | | | | 2.48 | | | | 2.96 | | | | 4.20 | |

Class I at NAV | | | 08/03/2010 | | | | 12/24/1991 | | | | 2.24 | | | | 4.54 | | | | 3.95 | | | | 5.16 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.82 | % | | | 1.57 | % | | | 0.62 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 3.13 | % | | | 2.44 | % | | | 3.31 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 5.87 | | | | 4.57 | | | | 6.21 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.97 | | | | 1.32 | | | | 2.26 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 3.69 | | | | 2.48 | | | | 4.24 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Leverage5 | | | | | | | | | | | | | | | | | | |

RIB Financing | | | | | | | | | | | | | | | | | | | | | | | 5.51 | % |

Fund Profile

Credit Quality (% of total investments)6,7

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

South Carolina Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio Manager Adam A. Weigold, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 02/14/1994 | | | | 10/02/1992 | | | | 2.16 | % | | | 4.35 | % | | | 3.59 | % | | | 5.00 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –2.66 | | | | –0.61 | | | | 2.59 | | | | 4.49 | |

Class C at NAV | | | 01/12/2006 | | | | 10/02/1992 | | | | 1.64 | | | | 3.50 | | | | 2.81 | | | | 4.22 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.64 | | | | 2.50 | | | | 2.81 | | | | 4.22 | |

Class I at NAV | | | 03/03/2008 | | | | 10/02/1992 | | | | 2.26 | | | | 4.55 | | | | 3.80 | | | | 5.21 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.81 | % | | | 1.57 | % | | | 0.62 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 2.80 | % | | | 2.11 | % | | | 2.98 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 5.09 | | | | 3.83 | | | | 5.41 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.56 | | | | 0.90 | | | | 1.84 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 2.83 | | | | 1.63 | | | | 3.33 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Leverage5 | | | | | | | | | | | | | | | | | | |

RIB Financing | | | | | | | | | | | | | | | | | | | | | | | 2.49 | % |

Fund Profile

Credit Quality (% of total investments)6,7

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

Virginia Municipal Income Fund

February 28, 2019

Performance1,2

Portfolio ManagerAdam A. Weigold, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Class A at NAV | | | 12/17/1993 | | | | 07/26/1991 | | | | 2.08 | % | | | 4.08 | % | | | 2.83 | % | | | 4.21 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | –2.72 | | | | –0.82 | | | | 1.84 | | | | 3.71 | |

Class C at NAV | | | 02/08/2006 | | | | 07/26/1991 | | | | 1.65 | | | | 3.23 | | | | 2.05 | | | | 3.42 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 0.65 | | | | 2.23 | | | | 2.05 | | | | 3.42 | |

Class I at NAV | | | 03/03/2008 | | | | 07/26/1991 | | | | 2.18 | | | | 4.29 | | | | 3.04 | | | | 4.42 | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | — | | | | 2.34 | % | | | 4.13 | % | | | 3.44 | % | | | 4.55 | % |

Bloomberg Barclays 20 Year Municipal Bond Index | | | — | | | | — | | | | 2.29 | | | | 4.59 | | | | 4.53 | | | | 5.82 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | | | | | | | | | | | 0.81 | % | | | 1.56 | % | | | 0.61 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields4 | | | | | | | | | | | Class A | | | Class C | | | Class I | |

Distribution Rate | | | | | | | | | | | | | | | 3.04 | % | | | 2.35 | % | | | 3.22 | % |

Taxable-Equivalent Distribution Rate | | | | | | | | | | | | | | | 5.45 | | | | 4.21 | | | | 5.77 | |

SEC30-day Yield | | | | | | | | | | | | | | | 1.66 | | | | 1.00 | | | | 1.94 | |

Taxable-Equivalent SEC30-day Yield | | | | | | | | | | | | | | | 2.98 | | | | 1.80 | | | | 3.48 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Leverage5 | | | | | | | | | | | | | | | | | | |

RIB Financing | | | | | | | | | | | | | | | | | | | | | | | 4.67 | % |

Fund Profile

Credit Quality (% of total investments)6,7

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recentmonth-end, please refer to eatonvance.com.

Eaton Vance

Municipal Income Funds

February 28, 2019

Endnotes and Additional Disclosures

| 1 | Bloomberg Barclays Municipal Bond Index is an unmanaged index of municipal bonds traded in the U.S. Bloomberg Barclays 20 Year Municipal Bond Index is an unmanaged index of municipal bonds traded in the U.S. with maturities ranging from17-22 years. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. |

| | Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class I for the Eaton Vance Missouri Municipal Income Fund and Eaton Vance Oregon Municipal Income Fund is linked to Class A. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. Performance presented in the Financial Highlights included in the financial statements is not linked. |

| 3 | Source: Fund prospectus. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 4 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes astax-exempt income, qualified andnon-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after eachyear-end. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. Taxable-equivalent performance is based on the highest combined federal and state income tax rates, where applicable. Lower tax rates would result in lowertax-equivalent performance. Actual tax rates will vary depending on your income, exemptions and deductions. Rates do not include local taxes. The SEC Yield is a standardized measure based on the estimated yield to maturity of a fund’s investments over a30-day period and is based on the maximum offer price at the date specified. The SEC Yield is not based on the distributions made by the Fund, which may differ. |

| 5 | Fund employs RIB financing. The leverage created by RIB investments provides an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of NAV). The cost of leverage rises and falls with changes in short-term interest rates. See “Floating Rate Notes Issued in Conjunction with Securities Held” in the notes to the financial statements for more information about RIB financing. RIB leverage represents the amount of Floating Rate Notes outstanding at period end as a percentage of Fund net assets plus Floating Rate Notes. |

| 6 | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

| 7 | The chart includes the municipal bonds held by a trust that issues residual interest bonds, consistent with the Portfolio of Investments. |

| | Fund profiles subject to change due to active management. |

Eaton Vance

Municipal Income Funds

February 28, 2019

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2018 – February 28, 2019).

Actual Expenses: The first section of each table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in each table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

Eaton Vance Georgia Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,024.10 | | | $ | 3.61 | | | | 0.72 | % |

Class C | | $ | 1,000.00 | | | $ | 1,020.80 | | | $ | 7.37 | | | | 1.47 | % |

Class I | | $ | 1,000.00 | | | $ | 1,025.10 | | | $ | 2.61 | | | | 0.52 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,021.20 | | | $ | 3.61 | | | | 0.72 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.35 | | | | 1.47 | % |

Class I | | $ | 1,000.00 | | | $ | 1,022.20 | | | $ | 2.61 | | | | 0.52 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance

Municipal Income Funds

February 28, 2019

Fund Expenses — continued

Eaton Vance Maryland Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,017.30 | | | $ | 3.85 | | | | 0.77 | % |

Class C | | $ | 1,000.00 | | | $ | 1,013.30 | | | $ | 7.59 | | | | 1.52 | % |

Class I | | $ | 1,000.00 | | | $ | 1,018.30 | | | $ | 2.85 | | | | 0.57 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,021.00 | | | $ | 3.86 | | | | 0.77 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.30 | | | $ | 7.60 | | | | 1.52 | % |

Class I | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 2.86 | | | | 0.57 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance Missouri Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 3.65 | | | | 0.73 | % |

Class C | | $ | 1,000.00 | | | $ | 1,015.20 | | | $ | 7.39 | | | | 1.48 | % |

Class I | | $ | 1,000.00 | | | $ | 1,019.20 | | | $ | 2.65 | | | | 0.53 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,021.20 | | | $ | 3.66 | | | | 0.73 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.40 | | | | 1.48 | % |

Class I | | $ | 1,000.00 | | | $ | 1,022.20 | | | $ | 2.66 | | | | 0.53 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance

Municipal Income Funds

February 28, 2019

Fund Expenses — continued

Eaton Vance North Carolina Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,017.20 | | | $ | 4.00 | | | | 0.80 | % |

Class C | | $ | 1,000.00 | | | $ | 1,013.30 | | | $ | 7.74 | | | | 1.55 | % |

Class I | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 3.00 | | | | 0.60 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.80 | | | $ | 4.01 | | | | 0.80 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.10 | | | $ | 7.75 | | | | 1.55 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.80 | | | $ | 3.01 | | | | 0.60 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance Oregon Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,022.60 | | | $ | 4.31 | | | | 0.86 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.20 | | | $ | 8.05 | | | | 1.61 | % |

Class I | | $ | 1,000.00 | | | $ | 1,022.40 | | | $ | 3.31 | | | | 0.66 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.50 | | | $ | 4.31 | | | | 0.86 | % |

Class C | | $ | 1,000.00 | | | $ | 1,016.80 | | | $ | 8.05 | | | | 1.61 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.50 | | | $ | 3.31 | | | | 0.66 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance

Municipal Income Funds

February 28, 2019

Fund Expenses — continued

Eaton Vance South Carolina Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,021.60 | | | $ | 3.91 | | | | 0.78 | % |

Class C | | $ | 1,000.00 | | | $ | 1,016.40 | | | $ | 7.65 | | | | 1.53 | % |

Class I | | $ | 1,000.00 | | | $ | 1,022.60 | | | $ | 2.91 | | | | 0.58 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 3.91 | | | | 0.78 | % |

Class C | | $ | 1,000.00 | | | $ | 1,017.20 | | | $ | 7.65 | | | | 1.53 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.90 | | | $ | 2.91 | | | | 0.58 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance Virginia Municipal Income Fund

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/18) | | | Ending

Account Value

(2/28/19) | | | Expenses Paid

During Period*

(9/1/18 – 2/28/19) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.80 | | | $ | 4.26 | | | | 0.85 | % |

Class C | | $ | 1,000.00 | | | $ | 1,016.50 | | | $ | 8.00 | | | | 1.60 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.80 | | | $ | 3.26 | | | | 0.65 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.26 | | | | 0.85 | % |

Class C | | $ | 1,000.00 | | | $ | 1,016.90 | | | $ | 8.00 | | | | 1.60 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.60 | | | $ | 3.26 | | | | 0.65 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2018. |

Eaton Vance

Georgia Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Investments — 95.5% | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Education — 2.2% | |

| | |

Georgia Private Colleges and Universities Authority, (Emory University), 5.00%, 10/1/31 | | $ | 245 | | | $ | 288,679 | |

| | |

Unified Government of Athens-Clarke County Development Authority, (UGAREF Central Precinct, LLC), 5.00%, 6/15/31 | | | 1,200 | | | | 1,395,852 | |

| |

| | | | $ | 1,684,531 | |

|

| Electric Utilities — 1.4% | |

| | |

Burke County Development Authority, (Oglethorpe Power Corp.), 3.25% to 2/3/25 (Put Date), 11/1/45 | | $ | 1,000 | | | $ | 1,011,630 | |

| |

| | | | $ | 1,011,630 | |

|

| Escrowed / Prerefunded — 10.7% | |

| | |

Forsyth County Hospital Authority, (Georgia Baptist Health Care System), Escrowed to Maturity, 6.375%, 10/1/28 | | $ | 800 | | | $ | 980,136 | |

| | |

Fulton County Development Authority, (Georgia Tech Foundation Campus Recreation Center Project), Prerefunded to 11/1/21, 5.00%, 11/1/30 | | | 750 | | | | 815,070 | |

| | |

Fulton County Development Authority, (Georgia Tech Foundation Technology Square Project), Prerefunded to 5/1/22, 5.00%, 11/1/30 | | | 750 | | | | 827,730 | |

| | |

Gainesville and Hall County Hospital Authority, (Northeast Georgia Health System, Inc.), Prerefunded to 2/15/20, 5.00%, 2/15/33 | | | 1,335 | | | | 1,376,212 | |

| | |

Guam, Limited Obligation Bonds, Prerefunded to 12/1/19, 5.625%, 12/1/29 | | | 205 | | | | 211,209 | |

| | |

Guam, Limited Obligation Bonds, Prerefunded to 12/1/19, 5.75%, 12/1/34 | | | 220 | | | | 226,864 | |

| | |

Jefferson City School District, Prerefunded to 2/1/21, 5.25%, 2/1/33 | | | 1,500 | | | | 1,601,595 | |

| | |

Lincoln County School District, Prerefunded to 4/1/19, 5.50%, 4/1/37 | | | 1,000 | | | | 1,003,000 | |

| | |

Macon-Bibb County Hospital Authority, (The Medical Center of Central Georgia), Prerefunded to 8/1/19, 5.00%, 8/1/35 | | | 1,000 | | | | 1,013,680 | |

| |

| | | | $ | 8,055,496 | |

|

| General Obligations — 18.2% | |

| | |

Bryan County School District, 4.00%, 8/1/33 | | $ | 500 | | | $ | 540,765 | |

| | |

Bryan County School District, 4.00%, 8/1/34 | | | 435 | | | | 466,890 | |

| | |

Cherokee County School System, 5.00%, 2/1/29 | | | 1,000 | | | | 1,165,000 | |

| | |

Columbia County, 5.00%, 1/1/28 | | | 1,000 | | | | 1,216,470 | |

| | |

DeKalb County, (Special Transportation, Parks and Greenspace and Libraries Tax District), 5.00%, 12/1/27 | | | 1,000 | | | | 1,211,650 | |

| | |

Downtown Savannah Authority, 4.00%, 8/1/25 | | | 2,495 | | | | 2,822,194 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| General Obligations (continued) | |

| | |

Forsyth County Public Facilities Authority, (Forsyth County School District), 4.00%, 2/1/31 | | $ | 290 | | | $ | 314,122 | |

| | |

Forsyth County School District, 5.00%, 2/1/32 | | | 1,000 | | | | 1,207,080 | |

| | |

Fulton County, 5.00%, 7/1/31 | | | 1,000 | | | | 1,192,320 | |

| | |

Georgia, 2.00%, 8/1/27 | | | 315 | | | | 313,415 | |

| | |

Georgia, 5.00%, 2/1/28 | | | 1,500 | | | | 1,754,655 | |

| | |

Valdosta School System, 5.00%, 2/1/28 | | | 1,000 | | | | 1,185,980 | |

| | |

Worth County School District, 5.00%, 12/1/37 | | | 235 | | | | 270,664 | |

| |

| | | | $ | 13,661,205 | |

|

| Hospital — 15.1% | |

| | |

Augusta Development Authority, (AU Health System, Inc.), 5.00%, 7/1/29 | | $ | 560 | | | $ | 652,350 | |

| | |

Carroll City-County Hospital Authority, (Tanner Medical Center, Inc.), 5.00%, 7/1/29 | | | 500 | | | | 587,390 | |

| | |

Cedartown Polk County Hospital Authority, (Polk Medical Center), 5.00%, 7/1/39 | | | 850 | | | | 919,241 | |

| | |

Dalton-Whitfield County Joint Development Authority, (Hamilton Health Care System), 4.00%, 8/15/34 | | | 400 | | | | 422,952 | |

| | |

DeKalb County Hospital Authority, (DeKalb Medical Center), Prerefunded to 9/1/20, 6.125%, 9/1/40 | | | 1,000 | | | | 1,063,830 | |

| | |

Fulton County Development Authority, (Children’s Healthcare of Atlanta), 5.25%, 11/15/39 | | | 1,000 | | | | 1,021,380 | |

| | |

Fulton County Development Authority, (Piedmont Healthcare, Inc.), 5.00%, 7/1/32 | | | 1,500 | | | | 1,715,085 | |

| | |

Fulton County Development Authority, (WellStar Health System, Inc.), 5.00%, 4/1/37 | | | 1,250 | | | | 1,388,162 | |

| | |

Gainesville and Hall County Hospital Authority, (Northeast Georgia Health System, Inc.), 5.00%, 2/15/37 | | | 1,000 | | | | 1,115,390 | |

| | |

Glynn-Brunswick Memorial Hospital Authority, (Southeast Georgia Health System), 5.00%, 8/1/28 | | | 650 | | | | 731,887 | |

| | |

Richmond County Hospital Authority, (University Health Services, Inc.), 5.00%, 1/1/31 | | | 1,000 | | | | 1,145,800 | |

| | |

Savannah Hospital Authority, (St. Joseph’s/Candler Health System, Inc.), 5.50%, 7/1/30 | | | 500 | | | | 565,535 | |

| |

| | | | $ | 11,329,002 | |

|

| Industrial Development Revenue — 3.2% | |

| | |

Albany Dougherty Payroll Development Authority, Solid Waste Disposal, (Procter & Gamble), (AMT), 5.20%, 5/15/28 | | $ | 2,000 | | | $ | 2,391,560 | |

| |

| | | | $ | 2,391,560 | |

|

| Insured – Education — 1.6% | |

| | |

Savannah Economic Development Authority, (SSU Community Development I, LLC), (AGM), 5.25%, 6/15/27 | | $ | 1,125 | | | $ | 1,171,631 | |

| |

| | | | $ | 1,171,631 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Georgia Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Insured – Electric Utilities — 5.7% | |

| | |

Griffin, Combined Public Utility Revenue, (AGM), 5.00%, 1/1/28 | | $ | 1,000 | | | $ | 1,099,890 | |

| | |

Newnan, Water, Sewerage and Light Commission, (AMBAC), 5.25%, 1/1/24 | | | 1,040 | | | | 1,185,891 | |

| | |

Puerto Rico Electric Power Authority, (NPFG), 5.25%, 7/1/29 | | | 980 | | | | 1,050,874 | |

| | |

Puerto Rico Electric Power Authority, (NPFG), 5.25%, 7/1/34 | | | 550 | | | | 584,100 | |

| | |

Puerto Rico Electric Power Authority, (NPFG), 5.25%, 7/1/35 | | | 300 | | | | 317,622 | |

| |

| | | | $ | 4,238,377 | |

|

| Insured – Escrowed / Prerefunded — 3.8% | |

| | |

Cobb County Kennestone Hospital Authority, (Wellstar Health System), (AMBAC), Prerefunded to 4/1/20, 5.50%, 4/1/37 | | $ | 1,750 | | | $ | 1,821,085 | |

| | |

Georgia Municipal Association, Inc., Certificates of Participation, (Riverdale), (AGC), Prerefunded to 5/1/19, 5.375%, 5/1/32 | | | 1,000 | | | | 1,006,050 | |

| |

| | | | $ | 2,827,135 | |

|

| Insured – General Obligations — 1.8% | |

| | |

Coweta County, Water and Sewerage Authority, (AGM), 5.00%, 6/1/26 | | $ | 1,135 | | | $ | 1,367,232 | |

| |

| | | | $ | 1,367,232 | |

|

| Insured – Lease Revenue / Certificates of Participation — 3.0% | |

| | |

East Point Building Authority, (Water and Sewer Project), (AGM), 5.00%, 2/1/35 | | $ | 695 | | | $ | 798,506 | |

| | |

Georgia Local Government 1998A Grantor Trust, Certificates of Participation, (NPFG), 4.75%, 6/1/28 | | | 1,326 | | | | 1,437,557 | |

| |

| | | | $ | 2,236,063 | |

|

| Insured – Special Tax Revenue — 1.0% | |

| | |

Metropolitan Atlanta Rapid Transit Authority, (AMBAC), Escrowed to Maturity, 6.25%, 7/1/20 | | $ | 165 | | | $ | 170,678 | |

| | |

Puerto Rico Infrastructure Financing Authority, (AMBAC), 5.50%, 7/1/28 | | | 545 | | | | 600,492 | |

| |

| | | | $ | 771,170 | |

|

| Insured – Water and Sewer — 4.0% | |

| | |

Brunswick-Glynn County Joint Water and Sewer Commission, (AGM), Prerefunded to 6/1/20, 5.00%, 6/1/33 | | $ | 500 | | | $ | 520,365 | |

| | |

DeKalb County, Water and Sewerage Revenue, (AGM), 5.25%, 10/1/32 | | | 1,590 | | | | 1,899,207 | |

| | |

Henry County Water and Sewerage Authority, (NPFG), 5.25%, 2/1/25 | | | 500 | | | | 595,870 | |

| |

| | | | $ | 3,015,442 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Lease Revenue / Certificates of Participation — 2.3% | |

| | |

Atlanta & Fulton County Recreation Authority, (Zoo Atlanta Parking Facility), 5.00%, 12/1/36 | | $ | 1,000 | | | $ | 1,163,480 | |

| | |

Georgia Municipal Association, Inc., Certificates of Participation, (Atlanta Public Safety), 5.00%, 12/1/37 | | | 500 | | | | 572,865 | |

| |

| | | | $ | 1,736,345 | |

|

| Other Revenue — 2.7% | |

| | |

Georgia Municipal Gas Authority, (Gas Portfolio III), 5.00%, 10/1/27 | | $ | 750 | | | $ | 827,415 | |

| | |

Sandy Springs Public Facilities Authority, (City Center Project), 5.00%, 5/1/35 | | | 1,000 | | | | 1,158,300 | |

| |

| | | | $ | 1,985,715 | |

|

| Senior Living / Life Care — 1.3% | |

| | |

Gainesville and Hall County Development Authority, (ACTS Retirement-Life Communities, Inc. Obligated Group), 5.00%, 11/15/33 | | $ | 500 | | | $ | 550,815 | |

| | |

Savannah Economic Development Authority, (Marshes of Skidaway Island), 6.00%, 1/1/24 | | | 420 | | | | 444,398 | |

| |

| | | | $ | 995,213 | |

|

| Special Tax Revenue — 3.3% | |

| | |

Atlanta Development Authority, (New Downtown Atlanta Stadium), 5.00%, 7/1/29 | | $ | 750 | | | $ | 871,193 | |

| | |

Gainesville and Hall County Hospital Authority, (Northeast Georgia Health System, Inc.), 5.00%, 2/15/33 | | | 415 | | | | 425,869 | |

| | |

Unified Government of Athens-Clarke County Development Authority, (Economic Development Projects), 5.00%, 6/1/32 | | | 1,080 | | | | 1,180,904 | |

| |

| | | | $ | 2,477,966 | |

|

| Transportation — 3.9% | |

| | |

Atlanta, Airport Revenue, 5.00%, 1/1/31 | | $ | 1,000 | | | $ | 1,124,010 | |

| | |

Atlanta, Airport Revenue, 5.00%, 1/1/35 | | | 750 | | | | 767,175 | |

| | |

Georgia State Road and Tollway Authority, 5.00%, 6/1/29 | | | 835 | | | | 1,003,645 | |

| |

| | | | $ | 2,894,830 | |

|

| Water and Sewer — 10.3% | |

| | |

Atlanta, Water and Wastewater Revenue, 5.00%, 11/1/29 | | $ | 1,000 | | | $ | 1,214,280 | |

| | |

Atlanta, Water and Wastewater Revenue, 5.25%, 11/1/30 | | | 1,000 | | | | 1,146,180 | |

| | |

Cobb County-Marietta Water Authority, 5.00%, 11/1/28 | | | 375 | | | | 443,700 | |

| | |

Columbus, Water and Sewerage Revenue, 5.00%, 5/1/33 | | | 500 | | | | 568,105 | |

| | |

Columbus, Water and Sewerage Revenue, 5.00%, 5/1/36 | | | 250 | | | | 287,117 | |

| | |

Forsyth County Water and Sewerage Authority, 5.00%, 4/1/27 | | | 1,100 | | | | 1,267,288 | |

| | |

Fulton County, Water and Sewer Revenue, 5.00%, 1/1/33 | | | 1,500 | | | | 1,662,030 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Georgia Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Water and Sewer (continued) | |

| | |

Unified Government of Athens-Clarke County, Water and Sewerage Revenue, 5.00%, 1/1/29 | | $ | 1,000 | | | $ | 1,158,740 | |

| |

| | | | $ | 7,747,440 | |

| |

TotalTax-Exempt Investments — 95.5%

(identified cost $68,265,332) | | | $ | 71,597,983 | |

| |

Other Assets, Less Liabilities — 4.5% | | | $ | 3,402,256 | |

| |

Net Assets — 100.0% | | | $ | 75,000,239 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

The Fund invests primarily in debt securities issued by Georgia municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at February 28, 2019, 21.8% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution or financial guaranty assurance agency ranged from 1.4% to 9.6% of total investments.

Abbreviations:

| | | | |

| | |

| AGC | | – | | Assured Guaranty Corp. |

| | |

| AGM | | – | | Assured Guaranty Municipal Corp. |

| | |

| AMBAC | | – | | AMBAC Financial Group, Inc. |

| | |

| AMT | | – | | Interest earned from these securities may be considered a tax preference item for purposes of the Federal Alternative Minimum Tax. |

| | |

| NPFG | | – | | National Public Finance Guarantee Corp. |

| | | | |

| | 16 | | See Notes to Financial Statements. |

Eaton Vance

Maryland Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Investments — 100.2% | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Education — 9.5% | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Goucher College), 5.00%, 7/1/34 | | $ | 1,000 | | | $ | 1,081,610 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Johns Hopkins University), 5.00%, 7/1/37 | | | 900 | | | | 987,354 | |

| | |

Maryland Industrial Development Financing Authority, (Garrison Forest School, Inc.), 4.00%, 11/1/42 | | | 1,000 | | | | 1,028,110 | |

| | |

Maryland Industrial Development Financing Authority, (McDonogh School), 4.00%, 9/1/43 | | | 1,100 | | | | 1,128,567 | |

| | |

University System of Maryland, 4.00%, 4/1/34 | | | 1,000 | | | | 1,077,550 | |

| |

| | | | $ | 5,303,191 | |

|

| Electric Utilities — 0.9% | |

| | |

Maryland Economic Development Corp., (Constellation Energy Group, Inc.), 2.55% to 6/1/20 (Put Date), 12/1/25 | | $ | 500 | | | $ | 499,685 | |

| |

| | | | $ | 499,685 | |

|

| Escrowed / Prerefunded — 14.0% | |

| | |

Baltimore, Prerefunded to 10/15/22, 5.00%, 10/15/27 | | $ | 150 | | | $ | 167,669 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Anne Arundel Health System), Prerefunded to 7/1/19, 5.00%, 7/1/32 | | | 1,000 | | | | 1,010,780 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Charlestown Community, Inc.), Prerefunded to 1/1/21, 6.125%, 1/1/30 | | | 470 | | | | 506,937 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Johns Hopkins Health Care), Prerefunded to 5/15/20, 5.00%, 5/15/40 | | | 2,000 | | | | 2,079,780 | |

| | |

University of Maryland, Auxiliary Facility and Tuition Revenue, Prerefunded to 4/1/21, 5.00%, 4/1/28 | | | 1,425 | | | | 1,523,781 | |

| | |

Washington Metropolitan Area Transit Authority, Prerefunded to 7/1/19, 5.00%, 7/1/32 | | | 2,500 | | | | 2,528,200 | |

| |

| | | | $ | 7,817,147 | |

|

| General Obligations — 17.9% | |

| | |

Anne Arundel County, 5.00%, 10/1/36 | | $ | 1,000 | | | $ | 1,174,090 | |

| | |

Baltimore County, 4.00%, 3/1/40(1) | | | 1,000 | | | | 1,053,940 | |

| | |

Baltimore, 4.00%, 10/15/25 | | | 1,350 | | | | 1,448,833 | |

| | |

Frederick County, 5.00%, 8/1/24 | | | 1,000 | | | | 1,169,300 | |

| | |

Frederick County, 5.00%, 8/1/31 | | | 675 | | | | 859,086 | |

| | |

Maryland, 5.00%, 11/1/19 | | | 2,000 | | | | 2,044,720 | |

| | |

Maryland, Prerefunded to 8/1/22, 5.00%, 8/1/24 | | | 1,000 | | | | 1,111,270 | |

| | |

Montgomery County, 5.00%, 11/1/29 | | | 1,000 | | | | 1,159,950 | |

| |

| | | | $ | 10,021,189 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Hospital — 12.9% | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Anne Arundel Health System), 5.00%, 7/1/32 | | $ | 1,000 | | | $ | 1,147,190 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Johns Hopkins Health Care), 5.00%, 7/1/33 | | | 1,000 | | | | 1,100,110 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Mercy Medical Center), 5.00%, 7/1/31 | | | 1,000 | | | | 1,063,340 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Peninsula Regional Medical Center), 5.00%, 7/1/45 | | | 1,000 | | | | 1,083,510 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (University of Maryland Medical System), 5.00%, 7/1/29 | | | 1,000 | | | | 1,150,770 | |

| | |

Montgomery County, (Trinity Health Corp.), 5.00%, 12/1/45 | | | 1,500 | | | | 1,675,920 | |

| |

| | | | $ | 7,220,840 | |

|

| Housing — 4.8% | |

| | |

Howard County Housing Commission, (Woodfield Oxford Square Apartments), 5.00%, 12/1/37 | | $ | 1,000 | | | $ | 1,116,490 | |

| | |

Maryland Community Development Administration, 4.10%, 9/1/38 | | | 500 | | | | 514,440 | |

| | |

Maryland Economic Development Corp., (Towson University), 5.00%, 7/1/37 | | | 1,000 | | | | 1,041,940 | |

| |

| | | | $ | 2,672,870 | |

|

| Industrial Development Revenue — 1.2% | |

| | |

Maryland Economic Development Corp., (AFCO Cargo), (AMT), 3.50%, 7/1/24(2) | | $ | 665 | | | $ | 674,742 | |

| |

| | | | $ | 674,742 | |

|

| Insured – Education — 1.0% | |

| | |

Morgan State University, Academic and Auxiliary Facilities, (NPFG), 6.10%, 7/1/20 | | $ | 520 | | | $ | 537,066 | |

| |

| | | | $ | 537,066 | |

|

| Insured – Escrowed / Prerefunded — 6.0% | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Helix Health Issue), (AMBAC), Escrowed to Maturity, 5.00%, 7/1/27 | | $ | 2,960 | | | $ | 3,385,382 | |

| |

| | | | $ | 3,385,382 | |

|

| Insured – Hospital — 6.5% | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Medlantic/Helix Issue), (AMBAC), 5.25%, 8/15/38 | | $ | 3,035 | | | $ | 3,634,261 | |

| |

| | | | $ | 3,634,261 | |

| | | | |

| | 17 | | See Notes to Financial Statements. |

Eaton Vance

Maryland Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Insured – Housing — 0.1% | |

| | |

Maryland Economic Development Corp., (University of Maryland, College Park), (AGM), 5.00%, 6/1/35 | | $ | 75 | | | $ | 85,273 | |

| |

| | | | $ | 85,273 | |

|

| Insured – Water and Sewer — 2.0% | |

| | |

Baltimore, (Wastewater Projects), (NPFG), 5.00%, 7/1/22 | | $ | 470 | | | $ | 499,347 | |

| | |

Baltimore, (Wastewater Projects), (NPFG), 5.65%, 7/1/20 | | | 600 | | | | 619,692 | |

| |

| | | | $ | 1,119,039 | |

|

| Other Revenue — 3.9% | |

| | |

Maryland Transportation Authority, Baltimore-Washington International Airport, Parking Revenues, (AMT), 5.00%, 3/1/23 | | $ | 2,000 | | | $ | 2,176,260 | |

| |

| | | | $ | 2,176,260 | |

|

| Senior Living / Life Care — 6.3% | |

| | |

Howard County, (Vantage House), 5.00%, 4/1/26 | | $ | 1,285 | | | $ | 1,344,495 | |

| | |

Maryland Health and Higher Educational Facilities Authority, (Edenwald), 5.25%, 1/1/37 | | | 500 | | | | 545,480 | |

| | |

Rockville, (Ingleside at King Farm), 5.00%, 11/1/37 | | | 1,000 | | | | 1,053,800 | |

| | |

Washington County, (Diakon Lutheran Social Ministries), 5.00%, 1/1/32 | | | 500 | | | | 568,210 | |

| |

| | | | $ | 3,511,985 | |

|

| Special Tax Revenue — 2.2% | |

| | |

Montgomery County, Department of Liquor Control, 5.00%, 4/1/21 | | $ | 1,000 | | | $ | 1,002,620 | |

| | |

Montgomery County, Department of Liquor Control, 5.00%, 4/1/29 | | | 250 | | | | 250,655 | |

| |

| | | | $ | 1,253,275 | |

|

| Transportation — 8.9% | |

| | |

Maryland Economic Development Corp., (Purple Line Light Rail), (AMT), 5.00%, 3/31/51 | | $ | 1,000 | | | $ | 1,066,770 | |

| | |

Maryland Economic Development Corp., (Transportation Facilities), 5.00%, 6/1/32 | | | 500 | | | | 571,310 | |

| | |

Maryland Economic Development Corp., Parking Facilities Revenue, 5.00%, 6/1/58 | | | 1,000 | | | | 1,078,970 | |

| | |

Maryland Transportation Authority, 4.00%, 7/1/27 | | | 1,000 | | | | 1,065,370 | |

| | |

Washington Metropolitan Area Transit Authority, 5.00%, 7/1/31 | | | 1,000 | | | | 1,188,170 | |

| |

| | | | $ | 4,970,590 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Water and Sewer — 2.1% | |

| | |

Washington Suburban Sanitary District, 5.00%, 6/15/30 | | $ | 1,000 | | | $ | 1,205,480 | |

| |

| | | | $ | 1,205,480 | |

| |

TotalTax-Exempt Investments — 100.2%

(identified cost $54,555,679) | | | $ | 56,088,275 | |

| |

Other Assets, Less Liabilities — (0.2)% | | | $ | (100,568 | ) |

| |

Net Assets — 100.0% | | | $ | 55,987,707 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

The Fund invests primarily in debt securities issued by Maryland municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at February 28, 2019, 15.6% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution or financial guaranty assurance agency ranged from 0.2% to 12.5% of total investments.

| (1) | When-issued security. |

| (2) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At February 28, 2019, the aggregate value of these securities is $674,742 or 1.2% of the Fund’s net assets. |

Abbreviations:

| | | | |

| | |

| AGM | | – | | Assured Guaranty Municipal Corp. |

| | |

| AMBAC | | – | | AMBAC Financial Group, Inc. |

| | |

| AMT | | – | | Interest earned from these securities may be considered a tax preference item for purposes of the Federal Alternative Minimum Tax. |

| | |

| NPFG | | – | | National Public Finance Guarantee Corp. |

| | | | |

| | 18 | | See Notes to Financial Statements. |

Eaton Vance

Missouri Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Municipal Securities — 92.5% | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Education — 6.5% | |

| | |

Missouri Health and Educational Facilities Authority, (Saint Louis University), 5.00%, 10/1/36 | | $ | 1,000 | | | $ | 1,167,010 | |

| | |

Missouri Health and Educational Facilities Authority, (University of Central Missouri), 5.00%, 10/1/34 | | | 1,000 | | | | 1,115,380 | |

| | |

Missouri Health and Educational Facilities Authority, (Washington University), (SPA: JPMorgan Chase Bank, N.A.),

1.71%, 3/1/40(1) | | | 400 | | | | 400,000 | |

| | |

Missouri Health and Educational Facilities Authority, (Washington University), (SPA: U.S. Bank, N.A.), 1.69%, 2/15/33(1) | | | 550 | | | | 550,000 | |

| | |

University of Missouri, 5.00%, 11/1/25 | | | 1,000 | | | | 1,169,290 | |

| |

| | | | $ | 4,401,680 | |

|

| Electric Utilities — 3.3% | |

| | |

Missouri Joint Municipal Electric Utility Commission, (Iatan 2 Project), 5.00%, 1/1/34 | | $ | 1,000 | | | $ | 1,109,520 | |

| | |

Missouri Joint Municipal Electric Utility Commission, (Prairie State Energy Campus), 5.00%, 12/1/31 | | | 1,000 | | | | 1,140,340 | |

| |

| | | | $ | 2,249,860 | |

|

| Escrowed / Prerefunded — 3.6% | |

| | |

Guam, Limited Obligation Bonds, Prerefunded to 12/1/19, 5.625%, 12/1/29 | | $ | 270 | | | $ | 278,178 | |

| | |

Guam, Limited Obligation Bonds, Prerefunded to 12/1/19, 5.75%, 12/1/34 | | | 295 | | | | 304,204 | |

| | |

Missouri Environmental Improvement and Energy Resources Authority, Water Pollution Control and Drinking Water Revenue, (Revolving Funds Program), Prerefunded to 1/1/21, 5.00%, 7/1/30 | | | 970 | | | | 1,027,618 | |

| | |

Missouri Health and Educational Facilities Authority, (Children’s Mercy Hospital), Prerefunded to 5/15/19, 5.625%, 5/15/39 | | | 830 | | | | 836,574 | |

| |

| | | | $ | 2,446,574 | |

|

| General Obligations — 25.3% | |

| | |

Cape Girardeau County Reorganized School DistrictR-II, 5.00%, 3/1/38 | | $ | 750 | | | $ | 870,195 | |

| | |

Columbia School District, 5.00%, 3/1/31 | | | 1,000 | | | | 1,061,320 | |

| | |

Fenton Fire Protection District, 4.00%, 3/1/37(2) | | | 400 | | | | 420,748 | |

| | |

Fenton Fire Protection District, 4.00%, 3/1/38(2) | | | 500 | | | | 523,075 | |

| | |

Fort Zumwalt School District, 5.00%, 3/1/36 | | | 1,000 | | | | 1,153,190 | |

| | |

Greene County Reorganized School District No. 2, 5.00%, 3/1/38 | | | 875 | | | | 996,721 | |

| | |

Hazelwood School District, 5.00%, 3/1/27 | | | 1,000 | | | | 1,210,430 | |

| | |

Independence School District, 5.00%, 3/1/30 | | | 1,000 | | | | 1,031,110 | |

| | |

Independence School District, 5.50%, 3/1/34 | | | 1,000 | | | | 1,204,010 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| General Obligations (continued) | |

| | |

Independence School District, (Direct Deposit Program), 5.00%, 3/1/29 | | $ | 205 | | | $ | 211,378 | |

| | |

Independence School District, (Direct Deposit Program), 5.00%, 3/1/29 | | | 795 | | | | 819,732 | |

| | |

Jefferson City School District, 5.00%, 3/1/36 | | | 1,000 | | | | 1,139,940 | |

| | |

Jefferson City School District, 5.00%, 3/1/38 | | | 500 | | | | 572,610 | |

| | |

Joplin Schools, 5.00%, 3/1/30 | | | 1,000 | | | | 1,190,720 | |

| | |

Kansas City, 5.00%, 2/1/32 | | | 450 | | | | 535,635 | |

| | |

Lake Ozark Osage School, (School Building), 5.00%, 3/1/34 | | | 1,000 | | | | 1,120,570 | |

| | |

Springfield School District No.R-12, 5.00%, 3/1/33 | | | 1,000 | | | | 1,120,260 | |

| | |

University City School District, 0.00%, 2/15/32 | | | 1,000 | | | | 666,660 | |

| | |

University City School District, 0.00%, 2/15/33 | | | 1,000 | | | | 632,910 | |

| | |

WentzvilleR-IV School District, 0.00%, 3/1/27 | | | 805 | | | | 650,625 | |

| |

| | | | $ | 17,131,839 | |

|

| Hospital — 13.5% | |

| | |

Boone County, (Boone Hospital Center), 4.00%, 8/1/38 | | $ | 1,000 | | | $ | 962,460 | |

| | |

Cape Girardeau County Industrial Development Authority, (St. Francis Medical Center), 5.00%, 6/1/37 | | | 1,000 | | | | 1,072,900 | |

| | |

Missouri Health and Educational Facilities Authority, (BJC Health System), 4.15%, 1/1/32 | | | 1,000 | | | | 1,056,440 | |

| | |

Missouri Health and Educational Facilities Authority, (BJC Health System), 5.00%, 1/1/30 | | | 1,000 | | | | 1,116,370 | |

| | |

Missouri Health and Educational Facilities Authority, (Children’s Mercy Hospital), 4.00%, 5/15/42 | | | 1,000 | | | | 1,002,340 | |

| | |

Missouri Health and Educational Facilities Authority, (Children’s Mercy Hospital), 5.625%, 5/15/39 | | | 170 | | | | 171,340 | |

| | |

Missouri Health and Educational Facilities Authority, (Heartland Regional Medical Center), 5.00%, 2/15/37 | | | 1,000 | | | | 1,069,050 | |

| | |

Missouri Health and Educational Facilities Authority, (Mercy Health), 5.00%, 11/15/47 | | | 1,000 | | | �� | 1,118,830 | |

| | |

Missouri Health and Educational Facilities Authority, (Saint Luke’s Health System), 4.00%, 11/15/33 | | | 1,480 | | | | 1,549,441 | |

| |

| | | | $ | 9,119,171 | |

|

| Housing — 1.9% | |

| | |

Missouri Housing Development Commission, SFMR, (FHLMC), (FNMA), (GNMA), 3.75%, 11/1/43 | | $ | 995 | | | $ | 985,498 | |

| | |

Missouri Housing Development Commission, SFMR, (GNMA), (AMT), 4.50%, 9/1/29 | | | 65 | | | | 65,589 | |

| | |

Missouri Housing Development Commission, SFMR, (GNMA), (AMT), 4.70%, 3/1/35 | | | 200 | | | | 202,024 | |

| |

| | | | $ | 1,253,111 | |

| | | | |

| | 19 | | See Notes to Financial Statements. |

Eaton Vance

Missouri Municipal Income Fund

February 28, 2019

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Industrial Development Revenue — 2.8% | |

| | |

Missouri Development Finance Authority, Solid Waste Disposal, (Procter & Gamble Paper Products), (AMT), 5.20%, 3/15/29 | | $ | 1,540 | | | $ | 1,857,794 | |

| |

| | | | $ | 1,857,794 | |

|

| Insured – Electric Utilities — 1.9% | |

| | |

Puerto Rico Electric Power Authority, (NPFG), 5.25%, 7/1/29 | | $ | 950 | | | $ | 1,018,704 | |

| | |

Puerto Rico Electric Power Authority, (NPFG), 5.25%, 7/1/34 | | | 280 | | | | 297,360 | |

| |

| | | | $ | 1,316,064 | |

|

| Insured – Escrowed / Prerefunded — 5.2% | |

| | |

Missouri Health and Educational Facilities Authority, (Lester Cox Medical Center), (NPFG), Escrowed to Maturity, 0.00%, 9/1/20 | | $ | 3,590 | | | $ | 3,495,834 | |

| |

| | | | $ | 3,495,834 | |

|

| Insured – General Obligations — 1.6% | |

| | |

Francis HowellR-III School District, Saint Charles County, (NPFG), 5.25%, 3/1/21 | | $ | 1,000 | | | $ | 1,070,250 | |

| |

| | | | $ | 1,070,250 | |

|

| Insured – Hospital — 3.2% | |

| | |

Missouri Health and Educational Facilities Authority, (Lester Cox Medical Center), (NPFG), 0.00%, 9/1/20 | | $ | 2,250 | | | $ | 2,174,963 | |

| |

| | | | $ | 2,174,963 | |

|

| Insured – Lease Revenue / Certificates of Participation — 6.3% | |

| | |

Jackson County, Leasehold Revenue, (Truman Sports Complex), (AMBAC), 0.00%, 12/1/20 | | $ | 1,000 | | | $ | 958,800 | |

| | |

Kansas City, Leasehold Revenue, (Municipal Assistance), (AMBAC), 0.00%, 4/15/26 | | | 2,170 | | | | 1,796,760 | |

| | |

Kansas City, Leasehold Revenue, (Municipal Assistance), (AMBAC), 0.00%, 4/15/30 | | | 2,105 | | | | 1,485,919 | |

| |

| | | | $ | 4,241,479 | |

|

| Insured – Special Tax Revenue — 4.3% | |

| | |

Bi-State Development Agency, Missouri and Illinois Metropolitan District, (Saint Clair County Metrolink), (AGM), 5.25%, 7/1/28 | | $ | 2,355 | | | $ | 2,929,008 | |

| |

| | | | $ | 2,929,008 | |

|

| Insured – Transportation — 3.4% | |

| | |

Puerto Rico Highway and Transportation Authority, (AGC), 5.25%, 7/1/41 | | $ | 960 | | | $ | 1,042,042 | |

| | |

Saint Louis Airport, (Lambert International Airport), (NPFG), 5.50%, 7/1/30 | | | 1,000 | | | | 1,287,630 | |

| |

| | | | $ | 2,329,672 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Senior Living / Life Care — 4.3% | |

| | |

Missouri Health and Educational Facilities Authority, (Bethesda Health Group, Inc.), 5.00%, 8/1/40 | | $ | 500 | | | $ | 522,325 | |

| | |

Missouri Health and Educational Facilities Authority, (Lutheran Senior Services), 5.00%, 2/1/35 | | | 1,000 | | | | 1,063,510 | |

| | |

Saint Louis County Industrial Development Authority, (Friendship Village of St. Louis), 5.00%, 9/1/37 | | | 500 | | | | 515,700 | |

| | |

Saint Louis County Industrial Development Authority, (Friendship Village of St. Louis), 5.00%, 9/1/38 | | | 250 | | | | 256,653 | |

| | |

Saint Louis County Industrial Development Authority, (St. Andrew’s Resources for Seniors Obligated Group), 5.00%, 12/1/35 | | | 500 | | | | 516,715 | |

| |

| | | | $ | 2,874,903 | |

|

| Water and Sewer — 5.4% | |

| | |

Kansas City, Water Revenue, 5.25%, 12/1/32 | | $ | 1,165 | | | $ | 1,168,239 | |

| | |

Metropolitan St. Louis Sewer District, 5.00%, 5/1/27 | | | 1,000 | | | | 1,098,250 | |

| | |

Metropolitan St. Louis Sewer District, 5.00%, 5/1/30 | | | 1,000 | | | | 1,094,380 | |

| | |

Metropolitan St. Louis Sewer District, 5.00%, 5/1/36 | | | 250 | | | | 291,360 | |

| |

| | | | $ | 3,652,229 | |

| |

TotalTax-Exempt Municipal Securities — 92.5%

(identified cost $59,581,142) | | | $ | 62,544,431 | |

|

| Trust Units — 1.2% | |

| Security | | Notional

Amount

(000’s omitted) | | | Value | |

|

| Insured – Special Tax Revenue — 1.2% | |

| | |

COFINA Series 2007A Senior Bonds Due 2046 National Custodial Trust (taxable), 8/1/46(3) | | $ | 234 | | | $ | 195,151 | |

| | |

COFINA Series 2007A Senior Bonds Due 2046 National Custodial Trust(non-taxable), 8/1/46(3) | | | 712 | | | | 628,234 | |

| |

Total Trust Units — 1.2%

(identified cost $778,445) | | | $ | 823,385 | |

| |

Total Investments — 93.7%

(identified cost $60,359,587) | | | $ | 63,367,816 | |

| |

Other Assets, Less Liabilities — 6.3% | | | $ | 4,242,246 | |

| |

Net Assets — 100.0% | | | $ | 67,610,062 | |