UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-04447

Brandywine Fund, Inc.

(Exact name of registrant as specified in charter)

P.O. Box 4166

Greenville, DE 19807

(Address of principal executive offices) (Zip code)

William F. D’Alonzo

Friess Associates, LLC

P.O. Box 4166

Greenville, Delaware 19807

(Name and address of agent for service)

(302) 656-3017

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: 03/31/2008

Item 1. Reports to Stockholders.

| Managed by Friess Associates, LLC | Semi-Annual Report | March 31, 2008 |

Dear Fellow Shareholders:

The March quarter was ugly. Every major market barometer fell as the Federal Reserve took unprecedented steps to forestall a financial crisis of historic proportion. About the only positive thing to say about the March quarter is that it’s over.

The Brandywine Funds began 2008 riding a string of six consecutive quarters of gains and four straight quarters of beating their benchmarks. Both streaks came to an end as holdings that held up well in the second half of last year were hit hard in the expanding downturn.

Brandywine Fund declined 14.19 percent in the March quarter versus declines in the Russell 3000 and Russell 3000 Growth Indexes of 9.52 and 10.39 percent. Brandywine Blue Fund declined 12.21 percent as the S&P 500, Russell 1000 and Russell 1000 Growth Indexes declined 9.44, 9.48 and 10.18 percent.

Little worked in the March quarter as turmoil in credit markets generated more multibillion-dollar write-downs, stifled new commerce and contributed to the demise of what was America’s fifth-largest investment bank, Bear Stearns. An underlying trend to the generally gloomy climate made things more difficult within the context of our earnings-driven investment approach. Higher earnings growth resulted in poorer share-price performance.

The quintile comprising the fastest-growing companies in the most expansive growth benchmark we use, the Russell 3000 Growth Index, suffered the biggest declines in the quarter. Performance improved sequentially by quintile, with the slowest-growing companies posting the smallest declines.

Strength in homebuilders epitomized this upside-down version of the world as we see it. Homebuilding was the market’s best-performing industry group in the quarter, according to Morningstar. New home sales fell to their lowest level in 13 years in February.

Gains in homebuilding stocks showed investors acting on beliefs in future events without tangible evidence to support them. While there were instances where companies in the Brandywine Funds missed earnings targets, many holdings that hurt performance were deemed damaged based on the market’s worst expectations for the economy rather than their company-specific prospects.

Technology holdings, which represented the largest percentage of assets in Brandywine and Brandywine Blue at the start of the quarter, detracted most from performance. Graphics-chip maker NVIDIA Corp. was the biggest drag on results in both Funds.

NVIDIA exceeded expectations with 39 percent January-quarter earnings growth, capping off a record fiscal year. On its earnings call, the company gave no indication that it believed demand was waning. In fact, NVIDIA said an increase in operating expenses in the quarter reflected its efforts to quickly respond to demand that outstripped supply for a new product. Still, investors turned harshly on the company due to the rise in costs and concerns about competition in the laptop category, prompting us to sell.

| | Brandywine | Brandywine Blue |

| Cumulative Total Return | % Change | % Change |

| Quarter | -14.19 | -12.21 |

| One Year | 1.53 | 5.87 |

| Five Years | 100.43 | 103.79 |

| Ten Years | 95.05 | 104.95 |

| Inception | 1415.27* | 749.97** |

| Five Years | 14.92 | 15.30 |

| Ten Years | 6.91 | 7.44 |

| Inception | 12.99* | 13.23** |

*12/30/85 **1/10/91

| Brandywine | 1.08% |

| Brandywine Blue | 1.12% |

***As stated in the Prospectus dated January 31, 2008

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.brandywinefunds.com.

Communications equipment maker Harris Corp. (Brandywine) also received harsh treatment after guiding earnings expectations to the low end of its previously provided range for its fiscal year ending in June due to cost overruns on commercial satellite projects. Harris offset much of the cost increase by increasing operating earnings guidance, driven by robust growth in its RF Communications segment. What amounted to a net charge of $20 million cost Harris more than $1.3 billion in market value. We capitalized on the sell-off as an opportunity to buy more shares.

Industrial holdings weighed on performance as investors questioned the sector’s ongoing strength amid increasing economic uncertainty. BE Aerospace (Brandywine), Cummins (Brandywine Blue) and Rockwell Collins (both Funds) led the group’s decline.

BE Aerospace beat estimates with 35 percent December-quarter earnings growth, but faced pressure as the deteriorating economic environment stoked concerns about whether airlines would continue to commit to new upgrade projects. Our research prompted us to sell engine maker Cummins two weeks prior to the company reporting December-quarter earnings below expectations due to decreasing production of Dodge Ram pickups. Despite topping earnings estimates with 22 percent growth, Rockwell Collins shares slid on concerns about the business jet market, which we believe remains solid thanks to international demand.

Energy-related holdings were a bright spot, gaining ground in both Funds. Brandywine benefited from coal producers Walter Industries and Alpha Natural Resources as well as Petrohawk Energy, an onshore oil and gas producer, and Superior Energy Services, which provides equipment and services to drillers. New additions funded in part by sales of technology holdings, including Nabors Industries and Denbury Resources, joined Weatherford International, Arch Coal and Consol Energy as positive influences on Brandywine Blue’s results.

For more on the holdings that influenced March-quarter performance, please see Roses & Thorns on page 4 for Brandywine and page 6 for Brandywine Blue.

We send our sincere thanks to Robert Birch, who served on the Brandywine Funds board for more than seven years prior to retiring during the March quarter. Robert was an insightful and dedicated director, and we will miss the regular opportunities to interact with him that his service to shareholders afforded us.

We bolstered your team’s research firepower in the quarter with the additions of Roy Smith and Robert Strauss. Roy most recently managed two portfolios for Pequot Capital Management, a firm with $6.9 billion in assets. Robert came to us by way of Greenville Capital Management, where he served as senior vice president and portfolio manager.

Both Roy and Robert have strong backgrounds in individual-company research that we believe position them to contribute quickly at a time when stock prices represent a compelling value relative to earnings.

While we’re disappointed with results for the quarter, we’re also confident in our ability to navigate the evolving environment by consistently applying our investment strategy. The same strategy that drove market-beating results in the December quarter simply didn’t fare well in the March quarter. Longer-term results for the Brandywine Funds reflect the benefits of sticking to their approach in the face of change.

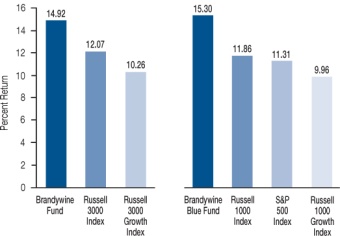

Guided by individual-company earnings trends, Brandywine and Brandywine Blue grew 14.92 and 15.30 percent annualized in the five years through March, outpacing the best of their respective benchmarks by 2.85 and 3.44 percentage points each year on average. Both Funds also led their benchmarks in the corresponding one, three and 10 years.

Five Year Performance

Annualized Total Returns, March 31, 2003 through March 31, 2008.

Troubles in the housing and credit markets remain threats to investor sentiment and the economy. The environment isn’t conducive to acting on best guesses as to what could happen by year’s end or trying to extrapolate a company’s current results into the future. Employing an approach that leads us to start each new day by performing exhaustive research to challenge the assumptions we made the day before enables us to adapt as conditions change.

Thanks for your continued confidence!

|  |

| Bill D’Alonzo | |

| Brandywine Funds President | April 4, 2008 |

Brandywine Fund

Percent Change in Top Ten Holdings From Book Cost

| 1. | | Oracle Corp. | +12.6% | | 6. | | Potash Corporation of Saskatchewan Inc. | +5.8% |

| 2. | | Thermo Fisher Scientific, Inc. | +47.8% | | 7. | | Teva Pharmaceutical Industries Ltd. SP-ADR | +9.3% |

| 3. | | McDermott International, Inc. | +645.8% | | 8. | | Rockwell Collins, Inc. | +6.3% |

| 4. | | The Mosaic Co. | -2.8% | | 9. | | Freeport-McMoRan Copper & Gold, Inc. | -5.5% |

| 5. | | Harris Corp. | +23.0% | | 10. | | Costco Wholesale Corp. | +6.7% |

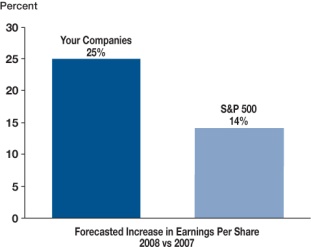

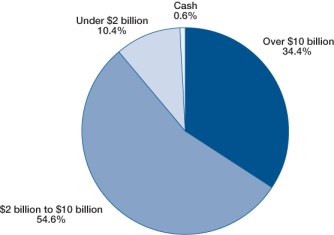

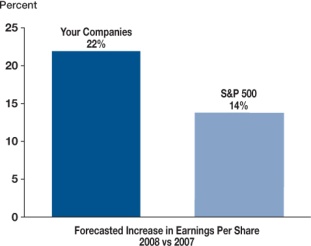

| Earnings Growth | Your Companies’ Market Capitalization |

| |

All figures are dollar weighted and based on data from Baseline. March 31, 2008.

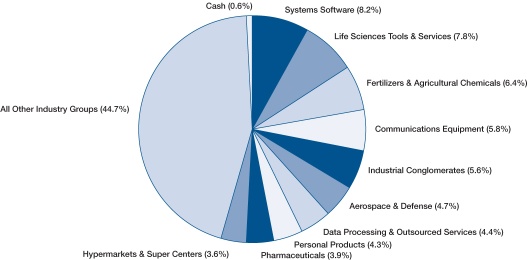

Top Ten Industry Groups

Brandywine Fund

March Quarter “Roses and Thorns”

| | $ Gain | | |

Biggest $ Winners | (in millions) | % Gain | Reason for Move |

| Walter Industries, Inc. | $23.4 | 41.0 | The producer of metallurgical (met) coal for the steel industry beat December-quarter earnings expectations by 10 percent. End-market pricing for met coal is reaching record levels, and Walter Industries benefits from having roughly half of its 2008/2009 contract season production still open to negotiation. Given that coal is U.S. dollar denominated, continued weakness in the dollar also contributes to the company’s favorable position against foreign competitors. |

| Urban Outfitters, Inc. | $14.0 | 11.4 | The style-minded retailer of apparel and home accessories grew January-quarter earnings 52 percent, beating estimates. Despite a tough retail environment, same-store sales for the company’s Urban Outfitters, Anthropologie and Free People divisions grew 6, 18 and 19 percent. Catalog and website sales jumped 39 percent. We sold Urban Outfitters during the quarter when shares reached our target price. |

| Visa Inc. | $10.8 | 41.7 | We purchased shares of the payment-card network operator when they were first offered to the public during the quarter. The company benefits from the increasing use of credit and debit transactions for payment and, importantly, does not absorb the default risk associated with credit transactions. Visa set a record for U.S. initial public offerings by raising $17.9 billion on its first day of trading. |

Potash Corporation of Saskatchewan Inc. | $6.8 | 5.8 | The world’s leading producer of potash, with 22 percent of the total production capacity, grew December-quarter earnings 109 percent to $1.11 per share, beating estimates by 13 percent. Fertilizer-industry fundamentals remain favorable as worldwide demand remains elevated for grains and oilseeds used to produce food and fuel. With global producers at full capacity and limited opportunity for expansion, Potash is in a favorable position to benefit from volume and pricing leverage. |

| Cabot Oil & Gas Corp. | $6.6 | 7.1 | Purchased during the quarter, the independent oil and gas producer grew December-quarter earnings 25 percent, beating estimates. Cabot is leveraged to elevated natural gas prices through continued success with its horizontal drilling program at County Line in east Texas. We also feel its initial successes in Appalachia’s Marcellus shale area are underappreciated, particularly as the company begins drilling horizontal wells. |

| | $ Loss | | |

Biggest $ Losers | (in millions) | % Loss | Reason for Move |

| NVIDIA Corp. | $46.5 | 40.7 | The manufacturer of high-level graphics chips for personal computers and gaming consoles grew January-quarter earnings 39 percent, beating expectations. Despite strong fundamentals and a favorable outlook for the April quarter, shares fell on perceptions that competitor Advanced Micro Devices would gain back market share in the notebook category. We sold NVIDIA as these perceptions and a difficult environment for tech stocks clouded visibility. |

| Harris Corp. | $37.1 | 22.6 | The maker of communications devices used by the military grew December-quarter earnings 28 percent, beating estimates by 7 percent. Although the company’s organic growth and earnings continue to surpass expectations, investors were disappointed by higher costs related to the company’s commercial satellite reflector program. We believe the company’s outlook remains solid, so we added to our position on the weakness. |

| BE Aerospace, Inc. | $36.4 | 34.2 | The world’s largest maker of aircraft cabin interiors grew December-quarter earnings 59 percent, exceeding estimates. The company has not wavered from healthy revenue and earnings guidance and consensus estimates remain unchanged, but shares fell as broad concerns impacted the airline industry. While soaring fuel prices and a slowing economy feed fears that a strong new order cycle for business and commercial aircraft could be cut short, BE Aerospace continues to win new business. |

Suntech Power Holdings Co., Ltd. ADR | $35.9 | 37.4 | The manufacturer of photovoltaic cells and modules used in solar-powered panels grew December-quarter earnings 26 percent. We sold Suntech in January as increasing market volatility and slowing overall economic growth prompted us to reconsider our target price. We locked in a substantial overall gain from our initial purchase despite shares giving up ground this year. |

| Oracle Corp. | $33.9 | 13.4 | The developer of database management systems and enterprise software grew February-quarter earnings 20 percent. Shares fell as lower-than-anticipated growth in new software application licenses created worries that slowing economic growth would weigh on future profitability. We continue to believe that Oracle is better positioned than most software companies to weather near-term challenges because of the way its expansive portfolio of products is integrated into its customers’ operations. |

All gains/losses are calculated on an average cost basis

Brandywine Blue Fund

Percent Change in Top Ten Holdings From Book Cost

| 1. | | The Mosaic Co. | -3.2% | | 6. | | Potash Corporation of Saskatchewan Inc. | +4.2% |

| 2. | | Thermo Fisher Scientific, Inc. | +29.5% | | 7. | | Freeport-McMoRan Copper & Gold, Inc. | -4.0% |

| 3. | | Costco Wholesale Corp. | +4.3% | | 8. | | Gilead Sciences, Inc. | +39.0% |

| 4. | | Teva Pharmaceutical Industries Ltd. SP-ADR | +10.5% | | 9. | | Weatherford International Ltd. | +9.4% |

| 5. | | Oracle Corp. | +5.1% | | 10. | | Avon Products, Inc. | +0.7% |

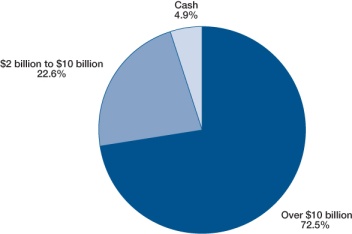

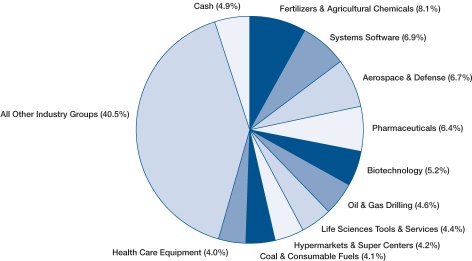

| Earnings Growth | Your Companies’ Market Capitalization |

| |

All figures are dollar weighted and based on data from Baseline. March 31, 2008.

Top Ten Industry Groups

Brandywine Blue Fund

March Quarter “Roses and Thorns”

| | $ Gain | | |

Biggest $ Winners | (in millions) | % Gain | Reason for Move |

| Gilead Sciences, Inc. | $14.1 | 12.6 | The developer of anti-infective drugs, including approved products for the treatment of HIV/AIDS, hepatitis B, fungal infections and influenza, topped December-quarter earnings estimates. Gilead benefits from its dominance in the HIV/AIDS market as the increasing rate of diagnoses for the disease drives sales of its Atripla and Truvada drugs. We expect the Atripla launch in Europe and the launch of Viread for hepatitis to aid top-line growth. |

| Visa Inc. | $9.5 | 41.7 | We purchased shares of the payment-card network operator when they were first offered to the public during the quarter. The company benefits from the increasing use of credit and debit transactions for payment and, importantly, does not absorb the default risk associated with credit transactions. Visa set a record for U.S. initial public offerings by raising $17.9 billion on its first day of trading. |

| ABB Ltd. SP-ADR | $7.1 | 9.6 | The world’s largest maker of electrical power networks grew December-quarter earnings 74 percent. Revenues increased 21 percent as strong order growth was fueled by continuous demand for power transmission and distribution products and systems, particularly from emerging markets. Concerns associated with the departure of ABB’s Chief Executive and rumors of a large acquisition subsided during the quarter, allowing investors to refocus on fundamentals. |

| Celgene Corp. | $6.7 | 11.9 | Purchased during the quarter, the pharmaceutical maker focused on cell-based therapies grew December-quarter earnings 72 percent. The company’s Revlimid drug used to treat multiple myeloma continues to drive results, expand its geographic reach and offer vast potential for additional uses. Celgene’s recent acquisition of Pharmion further solidifies this firm’s strategic focus on blood-related cancer therapies. |

| Nabors Industries Ltd. | $6.7 | 8.5 | We purchased the world’s largest onshore oil and natural gas contract driller on weakness during the quarter. Shares rose on early indications of rig count increases, expanding capital budgets and overall tightening in the market for natural gas. Demand for the company’s high-specification rigs remains solid and international operations continue to show healthy growth. |

| | $ Loss | | |

Biggest $ Losers | (in millions) | % Loss | Reason for Move |

| NVIDIA Corp. | $49.9 | 38.6 | The manufacturer of high-level graphics chips for personal computers and gaming consoles grew January-quarter earnings 39 percent, beating expectations. Despite strong fundamentals and a favorable outlook for the April quarter, shares fell on perceptions that competitor Advanced Micro Devices would gain back market share in the notebook category. We sold NVIDIA as these perceptions and a difficult environment for tech stocks clouded visibility. |

| Apple, Inc. | $38.6 | 27.3 | The maker of personal computing products grew December-quarter earnings 54 percent, beating estimates. Revenue growth of 35 percent also exceeded expectations. Despite solid fundamentals, shares fell as signs of a sluggish economy fueled concerns about discretionary consumer purchases. Your team sold Apple to fund an idea with better near-term earnings visibility. |

| Intel Corp. | $36.5 | 25.7 | The microchip manufacturer grew December-quarter earnings 64 percent, beating estimates. Conservative forward guidance raised concerns that restrained consumer spending could impact demand for Intel’s core computing and flash memory products. We sold Intel to fund an idea with better near-term earnings visibility. |

| Dell Inc. | $32.6 | 19.0 | The maker of computers, servers and software products lost ground as efforts to lower operating expenses and move aggressively into the retail channel coincided with slower economic growth in the U.S. We sold Dell when our research picked up mixed signals from customers and, in particular, evidence of spending cuts by large corporate accounts. |

| Cummins Inc. | $26.5 | 24.7 | The manufacturer of engines used for trucks and electric power generation systems has growth opportunities related to its transition from a North American truck stock to a global leader in power generation and emissions control. Still, shares lost ground in step with the softness in the domestic truck market. We sold Cummins prior to its reporting December-quarter earnings below expectations after our research confirmed decreasing production of Dodge Ram pickups. |

All gains/losses are calculated on an average cost basis

Brandywine Fund, Inc.

Statement of Net Assets

March 31, 2008

(Unaudited)

| Shares | | | | Cost | | | Value | |

Common Stocks - 99.4% (a) | | | | | | |

CONSUMER DISCRETIONARY | | | | | | |

| | | Advertising - 0.1% | | | | | | |

| | 124,800 | | National CineMedia, Inc. | | $ | 2,774,155 | | | $ | 2,805,504 | |

| | | | Apparel Retail - 1.1% | | | | | | | | |

| | 1,657,000 | | Aeropostale, Inc.* | | | 42,255,195 | | | | 44,921,270 | |

| | | | Computer & Electronics Retail - 1.4% | | | | | | | | |

| | 1,119,000 | | GameStop Corp.* | | | 56,003,658 | | | | 57,863,490 | |

| | | | Distributors - 0.3% | | | | | | | | |

| | 465,600 | | LKQ Corp.* | | | 7,254,758 | | | | 10,462,032 | |

| | | | Footwear - 0.3% | | | | | | | | |

| | 665,300 | | Iconix Brand Group, Inc.* | | | 12,526,690 | | | | 11,542,955 | |

| | | | Home Improvement Retail - 0.1% | | | | | | | | |

| | 280,100 | | Lumber Liquidators, Inc.* | | | 3,003,761 | | | | 2,969,060 | |

| | | | Hotels, Resorts & Cruise Lines - 1.8% | | | | | | | | |

| | 2,247,800 | | Royal Caribbean Cruises Ltd. | | | 88,892,584 | | | | 73,952,620 | |

| | | | Movies & Entertainment - 0.1% | | | | | | | | |

| | 85,000 | | Marvel Entertainment, Inc.* | | | 2,320,619 | | | | 2,277,150 | |

| | | | Restaurants - 0.7% | | | | | | | | |

| | 1,051,300 | | Burger King Holdings Inc. | | | 26,273,195 | | | | 29,078,958 | |

| | | | Total Consumer Discretionary | | | 241,304,615 | | | | 235,873,039 | |

| | | | This sector is 2.3% below your Fund’s cost. | | | | | | | | |

CONSUMER STAPLES | | | | | | | | |

| | | | Household Products - 1.6% | | | | | | | | |

| | 1,182,900 | | Church & Dwight Co., Inc. | | | 64,426,094 | | | | 64,160,496 | |

| | | | Hypermarkets & Super Centers - 3.6% | | | | | | | | |

| | 895,700 | | BJ’s Wholesale Club, Inc.* | | | 30,765,345 | | | | 31,967,533 | |

| | 1,754,900 | | Costco Wholesale Corp. | | | 106,846,681 | | | | 114,015,853 | |

| | | | Personal Products - 4.3% | | | | | | | | |

| | 1,749,000 | | Avon Products, Inc. | | | 68,326,056 | | | | 69,155,460 | |

| | 1,874,600 | | Bare Escentuals, Inc.* | | | 49,521,346 | | | | 43,903,132 | |

| | 1,347,000 | | Herbalife Ltd. | | | 64,022,698 | | | | 63,982,500 | |

| | | | Total Consumer Staples | | | 383,908,220 | | | | 387,184,974 | |

| | | | This sector is 0.9% above your Fund’s cost. | | | | | | | | |

ENERGY | | | | | | | | |

| | | | Integrated Oil & Gas - 0.1% | | | | | | | | |

| | 149,000 | | SandRidge Energy Inc.* | | | 3,874,000 | | | | 5,833,350 | |

| | | | Oil & Gas Drilling - 0.1% | | | | | | | | |

| | 82,400 | | Hercules Offshore, Inc.* | | | 2,032,404 | | | | 2,069,888 | |

| | | | Oil & Gas Equipment & Services - 3.6% | | | | | | | | |

| | 1,159,900 | | Acergy SA SP-ADR | | | 24,590,184 | | | | 24,763,865 | |

| | 397,300 | | Core Laboratories N.V.* | | | 44,002,418 | | | | 47,397,890 | |

| | 967,700 | | Oceaneering International, Inc.* | | | 44,801,704 | | | | 60,965,100 | |

| | 402,700 | | Willbros Group, Inc.* | | | 13,683,881 | | | | 12,322,620 | |

| | | | Oil & Gas Exploration & Production - 3.5% | | | | | | | | |

| | 1,952,000 | | Cabot Oil & Gas Corp. | | | 92,661,901 | | | | 99,239,680 | |

| | 1,368,400 | | EXCO Resources, Inc.* | | | 22,891,352 | | | | 25,315,400 | |

| | 922,400 | | Petrohawk Energy Corp.* | | | 13,906,136 | | | | 18,604,808 | |

| | | | Total Energy | | | 262,443,980 | | | | 296,512,601 | |

| | | | This sector is 13.0% above your Fund’s cost. | | | | | | | | |

FINANCIALS | | | | | | | | |

| | | | Investment Banking & Brokerage - 0.7% | | | | | | | | |

| | 487,400 | | GFI Group Inc. | | | 40,847,779 | | | | 27,928,020 | |

| | | | Property & Casualty Insurance - 0.0% | | | | | | | | |

| | 20,900 | | ProAssurance Corp.* | | | 1,024,450 | | | | 1,125,047 | |

| | | | Total Financials | | | 41,872,229 | | | | 29,053,067 | |

| | | | This sector is 30.6% below your Fund’s cost. | | | | | | | | |

HEALTH CARE | | | | | | | | |

| | | | Health Care Equipment - 2.0% | | | | | | | | |

| | 913,500 | | Gen-Probe Inc.* | | | 54,116,678 | | | | 44,030,700 | |

| | 741,300 | | Hospira, Inc.* | | | 29,452,956 | | | | 31,705,401 | |

| | 536,300 | | Thoratec Corp.* | | | 8,842,147 | | | | 7,663,727 | |

| | | | Health Care Facilities - 2.6% | | | | | | | | |

| | 2,552,200 | | Community Health Systems Inc.* | | | 90,629,533 | | | | 85,677,354 | |

| | 649,200 | | Psychiatric Solutions, Inc.* | | | 20,414,239 | | | | 22,020,864 | |

| | | | Health Care Services - 1.2% | | | | | | | | |

| | 716,700 | | Pediatrix Medical Group, Inc.* | | | 46,161,247 | | | | 48,305,580 | |

| | | | Health Care Supplies - 0.7% | | | | | | | | |

| | 283,100 | | DENTSPLY International Inc. | | | 11,620,156 | | | | 10,927,660 | |

| | 798,200 | | Immucor, Inc.* | | | 23,887,320 | | | | 17,033,588 | |

| | | | Life Sciences Tools & Services - 7.8% | | | | | | | | |

| | 1,155,700 | | Charles River Laboratories International, Inc.* | | | 74,528,635 | | | | 68,116,958 | |

| | 484,700 | | Covance Inc.* | | | 41,488,581 | | | | 40,215,559 | |

| | 3,254,600 | | Thermo Fisher Scientific, Inc.* | | | 125,176,979 | | | | 184,991,464 | |

| | 425,200 | | Varian Inc.* | | | 29,219,491 | | | | 24,627,584 | |

| | | | Pharmaceuticals - 3.9% | | | | | | | | |

| | 80,200 | | K-V Pharmaceutical Co.* | | | 1,917,092 | | | | 2,001,792 | |

| | 947,400 | | Perrigo Co. | | | 35,746,411 | | | | 35,745,402 | |

| | 2,630,700 | | Teva Pharmaceutical Industries Ltd. SP-ADR | | | 111,172,334 | | | | 121,512,033 | |

| | | | Total Health Care | | | 704,373,799 | | | | 744,575,666 | |

| | | | This sector is 5.7% above your Fund’s cost. | | | | | | | | |

Brandywine Fund, Inc.

Statement of Net Assets (Continued)

March 31, 2008

(Unaudited)

| Shares | | | | Cost | | | Value | |

Common Stocks - 99.4% (a) (Continued) | | | | | | |

INDUSTRIALS | | | | | | |

| | | Aerospace & Defense - 4.7% | | | | | | |

| | 1,736,400 | | BE Aerospace, Inc.* | | $ | 76,435,713 | | | $ | 60,687,180 | |

| | 253,600 | | DRS Technologies, Inc. | | | 14,450,435 | | | | 14,779,808 | |

| | 2,055,300 | | Rockwell Collins, Inc. | | | 110,468,818 | | | | 117,460,395 | |

| | | | Construction & Engineering - 2.5% | | | | | | | | |

| | 668,600 | | EMCOR Group, Inc.* | | | 20,151,468 | | | | 14,849,606 | |

| | 69,400 | | Fluor Corp. | | | 9,055,839 | | | | 9,796,504 | |

| | 1,601,000 | | Shaw Group Inc.* | | | 94,339,319 | | | | 75,471,140 | |

| | | | Construction & Farm Machinery & Heavy Trucks - 0.6% | | | | | | | | |

| | 643,900 | | Wabtec Corp. d/b/a Westinghouse Air Brake Technologies Corp. | | | 25,652,271 | | | | 24,249,274 | |

| | | | Diversified Commercial & Professional Services - 1.8% | | | | | | | | |

| | 2,140,600 | | Corrections Corporation of America* | | | 57,277,557 | | | | 58,909,312 | |

| | 554,300 | | The Geo Group Inc.* | | | 16,720,399 | | | | 15,764,292 | |

| | | | Environmental & Facilities Services - 1.2% | | | | | | | | |

| | 1,159,650 | | Republic Services, Inc. | | | 31,048,141 | | | | 33,908,166 | |

| | 545,250 | | Waste Connections, Inc.* | | | 12,526,446 | | | | 16,760,985 | |

| | | | Heavy Electrical Equipment - 0.5% | | | | | | | | |

| | 742,200 | | ABB Ltd. SP-ADR | | | 18,098,436 | | | | 19,980,024 | |

| | | | Human Resource & Employment Services - 0.6% | | | | | | | | |

| | 463,900 | | Watson Wyatt Worldwide Inc. | | | 22,558,204 | | | | 26,326,325 | |

| | | | Industrial Conglomerates - 5.6% | | | | | | | | |

| | 2,716,000 | | McDermott International, Inc.* | | | 19,964,788 | | | | 148,891,120 | |

| | 1,282,400 | | Walter Industries, Inc. | | | 54,185,683 | | | | 80,316,712 | |

| | | | Industrial Machinery - 1.6% | | | | | | | | |

| | 293,200 | | Chart Industries, Inc.* | | | 6,230,500 | | | | 9,921,888 | |

| | 303,200 | | Flowserve Corp. | | | 29,731,487 | | | | 31,648,016 | |

| | 205,800 | | Middleby Corp.* | | | 14,782,168 | | | | 12,839,862 | |

| | 382,400 | | Robbins & Myers, Inc. | | | 13,641,069 | | | | 12,485,360 | |

| | | | Marine - 1.3% | | | | | | | | |

| | 364,700 | | Eagle Bulk Shipping Inc. | | | 5,082,250 | | | | 9,394,672 | |

| | 196,400 | | Genco Shipping & Trading Ltd. | | | 11,336,578 | | | | 11,082,852 | |

| | 340,300 | | Kirby Corp.* | | | 12,426,396 | | | | 19,397,100 | |

| | 1,590,300 | | Navios Maritime Holdings, Inc. | | | 22,107,101 | | | | 14,757,984 | |

| | | | Marine Ports & Services - 0.5% | | | | | | | | |

| | 613,800 | | Aegean Marine Petroleum Network Inc. | | | 20,332,965 | | | | 20,998,098 | |

| | | | Total Industrials | | | 718,604,031 | | | | 860,676,675 | |

| | | | This sector is 19.8% above your Fund’s cost. | | | | | | | | |

INFORMATION TECHNOLOGY | | | | | | | | |

| | | | Application Software - 0.6% | | | | | | | | |

| | 1,480,800 | | Nuance Communications, Inc.* | | | 27,008,844 | | | | 25,780,728 | |

| | | | Communications Equipment - 5.8% | | | | | | | | |

| | 4,535,900 | | Corning Inc. | | | 103,602,065 | | | | 109,043,036 | |

| | 2,624,800 | | Harris Corp. | | | 103,574,334 | | | | 127,381,544 | |

| | 105,800 | | Powerwave Technologies, Inc.* | | | 365,698 | | | | 269,790 | |

| | | | Data Processing & Outsourced Services - 4.4% | | | | | | | | |

| | 1,525,300 | | Affiliated Computer Services, Inc.* | | | 77,002,766 | | | | 76,432,783 | |

| | 672,800 | | CyberSource Corp.* | | | 10,670,687 | | | | 9,829,608 | |

| | 1,466,400 | | Fidelity National Information Services, Inc. | | | 55,500,252 | | | | 55,928,496 | |

| | 586,300 | | Visa Inc.* | | | 25,797,200 | | | | 36,561,668 | |

| | | | Electronic Equipment Manufacturers - 1.7% | | | | | | | | |

| | 709,800 | | Mettler-Toledo International Inc.* | | | 79,506,864 | | | | 68,935,776 | |

| | | | Electronic Manufacturing Services - 0.4% | | | | | | | | |

| | 1,019,100 | | Benchmark Electronics, Inc.* | | | 17,337,927 | | | | 18,292,845 | |

| | | | IT Consulting & Other Services - 0.5% | | | | | | | | |

| | 383,800 | | CACI International Inc.* | | | 18,835,821 | | | | 17,482,090 | |

| | 142,300 | | SAIC, Inc.* | | | 2,637,046 | | | | 2,645,357 | |

| | | | Semiconductors - 0.4% | | | | | | | | |

| | 446,000 | | Atheros Communications* | | | 12,965,570 | | | | 9,294,640 | |

| | 237,900 | | Silicon Laboratories Inc.* | | | 7,438,943 | | | | 7,503,366 | |

| | | | Systems Software - 8.2% | | | | | | | | |

| | 365,300 | | BMC Software, Inc.* | | | 12,222,517 | | | | 11,879,556 | |

| | 3,401,000 | | Check Point Software Technologies Ltd.* | | | 74,976,254 | | | | 76,182,400 | |

| | 757,100 | | MICROS Systems, Inc.* | | | 25,781,556 | | | | 25,483,986 | |

| | 11,241,100 | | Oracle Corp.* | | | 195,286,514 | | | | 219,875,916 | |

| | | | Total Information Technology | | | 850,510,858 | | | | 898,803,585 | |

| | | | This sector is 5.7% above your Fund’s cost. | | | | | | | | |

MATERIALS | | | | | | | | |

| | | | Aluminum - 0.9% | | | | | | | | |

| | 537,100 | | Century Aluminum Co.* | | | 34,863,018 | | | | 35,577,504 | |

| | | | Diversified Chemicals - 2.3% | | | | | | | | |

| | 1,702,000 | | FMC Corp. | | | 93,165,367 | | | | 94,443,980 | |

| | | | Diversified Metals & Mining - 2.8% | | | | | | | | |

| | 1,200,900 | | Freeport-McMoRan Copper & Gold, Inc. | | | 122,282,750 | | | | 115,550,598 | |

| | | | Fertilizers & Agricultural Chemicals - 6.4% | | | | | | | | |

| | 1,321,700 | | The Mosaic Co.* | | | 139,561,992 | | | | 135,606,420 | |

| | 803,500 | | Potash Corporation of Saskatchewan Inc. | | | 117,864,475 | | | | 124,711,235 | |

| | | | Metal & Glass Containers - 2.2% | | | | | | | | |

| | 3,601,200 | | Crown Holdings, Inc.* | | | 87,758,623 | | | | 90,606,192 | |

| | | | Total Materials | | | 595,496,225 | | | | 596,495,929 | |

| | | | This sector is 0.2% above your Fund’s cost. | | | | | | | | |

Brandywine Fund, Inc.

Statement of Net Assets (Continued)

March 31, 2008

(Unaudited)

| Shares/Principal Amount | | Cost | | | Value | |

Common Stocks - 99.4% (a) (Continued) | | | | | | |

TELECOMMUNICATION SERVICES | | | | | | |

| | | Wireless Telecommunication Services - 0.3% | | | | | | |

| | 749,500 | | Syniverse Holdings Inc.* | | $ | 13,467,851 | | | $ | 12,486,670 | |

| | | | Total Telecommunication Services | | | 13,467,851 | | | | 12,486,670 | |

| | | | This sector is 7.3% below your Fund’s cost. | | | | | | | | |

| | | | Total common stocks | | | 3,811,981,808 | | | | 4,061,662,206 | |

| | | | | | | | | | | |

Short-Term Investments - 2.0% (a) | | | | | | | | |

| | | | Federal Agencies - 1.9% | | | | | | | | |

| $ | 77,000,000 | | Federal Home Loan Bank, due 4/01/08, | | | | | | | | |

| | | | discount of 1.50% | | | 77,000,000 | | | | 77,000,000 | |

| | | | Variable Rate Demand Note - 0.1% | | | | | | | | |

| | 3,859,363 | | U.S. Bank, N.A., 2.40% | | | 3,859,363 | | | | 3,859,363 | |

| | | | Total short-term investments | | | 80,859,363 | | | | 80,859,363 | |

| | | | Total investments | | $ | 3,892,841,171 | | | | 4,142,521,569 | |

| | | | Liabilities, less cash and | | | | | | | | |

| | | | receivables (1.4%) (a) | | | | | | | (55,495,623 | ) |

| | | | Net Assets | | | | | | $ | 4,087,025,946 | |

| | | | Net Asset Value Per Share | | | | | | | | |

| | | | ($0.01 par value, 500,000,000 | | | | | | | | |

| | | | shares authorized), offering | | | | | | | | |

| | | | and redemption price | | | | | | | | |

| | | | ($4,087,025,946 ÷ 130,211,775 | | | | | | | | |

| | | | shares outstanding) | | | | | | $ | 31.39 | |

| * | Non-dividend paying security. |

| (a) | Percentages for the various classifications relate to net assets. |

ADR - American Depositary Receipts

N.V. - Netherlands Antillies Limited Liability Corp.

The accompanying notes to financial statements are an integral part of this statement.

Brandywine Fund, Inc.

Statement of Operations

For the Six Months Ended March 31, 2008

(Unaudited)

| Income: | | | |

| Dividends | | $ | 11,152,889 | |

| Interest | | | 3,252,384 | |

| Total income | | | 14,405,273 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 22,642,495 | |

| Transfer agent fees | | | 1,120,096 | |

| Administrative and accounting services | | | 238,971 | |

| Printing and postage expense | | | 189,585 | |

| Custodian fees | | | 166,437 | |

| Board of Directors fees and expenses | | | 77,202 | |

| Insurance expense | | | 43,200 | |

| Registration fees | | | 34,481 | |

| Professional fees | | | 34,016 | |

| Other expenses | | | 8,639 | |

| Total expenses | | | 24,555,122 | |

| Net Investment Loss | | | (10,149,849 | ) |

| Net Realized Gain on Investments | | | 93,899,600 | |

| Net Decrease in Unrealized Appreciation on Investments | | | (686,235,143 | ) |

| Net Loss on Investments | | | (592,335,543 | ) |

| Net Decrease in Net Assets Resulting From Operations | | $ | (602,485,392 | ) |

Statements of Changes in Net Assets

For the Six Months Ended March 31, 2008 (Unaudited)

and for the Year Ended September 30, 2007

| | | 2008 | | | 2007 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (10,149,849 | ) | | $ | (23,464,966 | ) |

| Net realized gain on investments | | | 93,899,600 | | | | 571,371,370 | |

| Net (decrease) increase in unrealized appreciation on investments | | | (686,235,143 | ) | | | 531,009,089 | |

| Net (decrease) increase in net assets resulting from operations | | | (602,485,392 | ) | | | 1,078,915,493 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Distributions from net realized gains ($5.22252 and $0.24662 per share, respectively) | | | (628,623,195 | ) | | | (30,419,122 | ) |

Fund Share Activities: | | | | | | | | |

| Proceeds from shares issued (7,615,586 and 9,363,718 shares, respectively) | | | 270,243,292 | | | | 347,355,401 | |

| Net asset value of shares issued in distributions reinvested (15,978,665 and 840,556 shares, respectively) | | | 599,258,536 | | | | 28,878,771 | |

| Cost of shares redeemed (11,771,904 and 17,804,121 shares, respectively) | | | (402,634,908 | ) | | | (639,755,297 | ) |

| Net increase (decrease) in net assets derived from Fund share activities | | | 466,866,920 | | | | (263,521,125 | ) |

| | | | | | | | | |

| Total (Decrease) Increase | | | (764,241,667 | ) | | | 784,975,246 | |

| | | | | | | | | |

| Net Assets at the Beginning of the Period | | | 4,851,267,613 | | | | 4,066,292,367 | |

| Net Assets at the End of the Period | | $ | 4,087,025,946 | | | $ | 4,851,267,613 | |

| (Includes accumulated net investment loss of $0 and $0, respectively) | | | | | | | | |

The accompanying notes to financial statements are an integral part of these statements.

Brandywine Fund, Inc.

Financial Highlights

(Selected data for each share of the Fund outstanding throughout each period)

| | | For the Six Months | | | | | | | | | | | | | | | | |

| | | ended March 31, 2008 | | | Years Ended September 30, | |

| | | (Unaudited) | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 40.98 | | | $ | 32.27 | | | $ | 31.50 | | | $ | 24.19 | | | $ | 21.30 | | | $ | 19.08 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.08 | ) | | | (0.19 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.13 | ) | | | (0.10 | ) |

Net realized and unrealized (losses) gains on investments | | | (4.29 | ) | | | 9.15 | | | | 0.87 | | | | 7.39 | | | | 3.02 | | | | 2.32 | |

| Total from investment operations | | | (4.37 | ) | | | 8.96 | | | | 0.77 | | | | 7.31 | | | | 2.89 | | | | 2.22 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (5.22 | ) | | | (0.25 | ) | | | — | | | | — | | | | — | | | | — | |

| Total from distributions | | | (5.22 | ) | | | (0.25 | ) | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 31.39 | | | $ | 40.98 | | | $ | 32.27 | | | $ | 31.50 | | | $ | 24.19 | | | $ | 21.30 | |

| TOTAL RETURN | | | (12.54 | %)(a) | | | 27.90 | % | | | 2.44 | % | | | 30.22 | % | | | 13.57 | % | | | 11.64 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s $) | | | 4,087,026 | | | | 4,851,268 | | | | 4,066,292 | | | | 3,995,582 | | | | 3,586,793 | | | | 3,385,590 | |

| Ratio of expenses to average net assets | | | 1.09 | %(b) | | | 1.08 | % | | | 1.08 | % | | | 1.08 | % | | | 1.08 | % | | | 1.09 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (0.45 | %)(b) | | | (0.54 | %) | | | (0.31 | %) | | | (0.25 | %) | | | (0.55 | %) | | | (0.53 | %) |

| Portfolio turnover rate | | | 99.1 | %(a) | | | 161.5 | % | | | 199.9 | % | | | 183.4 | % | | | 247.0 | % | | | 279.3 | % |

| (1) | Net investment loss per share was calculated using average shares outstanding. |

The accompanying notes to financial statements are an integral part of this statement.

Definitions and Disclosures Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.brandywinefunds.com. The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment companies, and it may be obtained by calling 1-800-656-3017, or visiting www.brandywinefunds.com. Read it carefully before investing. Fund holdings and sector weightings are subject to change at any time and are not recommendations to buy or sell any securities. Securities discussed were not held by the Funds as of 03/31/08, unless listed in the accompanying financial statements. References to the earnings growth rates of the Funds refer solely to the estimated earnings growth rates of the average investment holding of the Funds based on consensus estimates from Baseline and not to the actual performance of the Funds themselves. Baseline Financial Services, Inc. (Baseline) provides analytical information and services to the investment community. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000 Growth or the Russell 2000 Growth Index. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 Index is a market-value weighted index consisting of 500 U.S. stocks chosen for market size, liquidity and industry group representation. You cannot invest directly in an index. As of March 31, 2008, the Russell 3000 Index’s average annual total returns for 1, 5 and 10 years were -6.06, 12.07 and 3.88 percent; the Russell 3000 Growth Index’s -1.45, 10.26 and 1.29 percent; the Russell 1000 Index’s were -5.40, 11.86 and 3.83 percent; the Russell 1000 Growth Index’s were -0.75, 9.96 and 1.28 percent; and the S&P 500 Index’s were -5.08, 11.31 and 3.50 percent. |

Brandywine Blue Fund

Statement of Net Assets

March 31, 2008

(Unaudited)

| Shares | | | | Cost | | | Value | |

Common Stocks - 95.1% (a) | | | | | | |

CONSUMER DISCRETIONARY | | | | | | |

| | | Apparel Retail - 0.5% | | | | | | |

| | 966,000 | | The Gap, Inc. | | $ | 18,815,709 | | | $ | 19,010,880 | |

| | | | Computer & Electronics Retail - 2.0% | | | | | | | | |

| | 1,389,600 | | GameStop Corp.* | | | 70,873,001 | | | | 71,856,216 | |

| | | | Hotels, Resorts & Cruise Lines - 2.5% | | | | | | | | |

| | 2,703,200 | | Royal Caribbean Cruises Ltd. | | | 108,491,871 | | | | 88,935,280 | |

| | | | Total Consumer Discretionary | | | 198,180,581 | | | | 179,802,376 | |

| | | | This sector is 9.3% below your Fund’s cost. | | | | | | | | |

CONSUMER STAPLES | | | | | | | | |

| | | | Drug Retail - 2.7% | | | | | | | | |

| | 2,421,800 | | CVS Caremark Corp. | | | 98,177,079 | | | | 98,107,118 | |

| | | | Food Retail - 2.4% | | | | | | | | |

| | 3,377,100 | | Kroger Co. | | | 87,034,756 | | | | 85,778,340 | |

| | | | Hypermarkets & Super Centers - 4.2% | | | | | | | | |

| | 2,364,100 | | Costco Wholesale Corp. | | | 147,320,919 | | | | 153,595,577 | |

| | | | Personal Products - 3.1% | | | | | | | | |

| | 2,871,700 | | Avon Products, Inc. | | | 112,752,187 | | | | 113,547,018 | |

| | | | Total Consumer Staples | | | 445,284,941 | | | | 451,028,053 | |

| | | | This sector is 1.3% above your Fund’s cost. | | | | | | | | |

ENERGY | | | | | | | | |

| | | | Coal & Consumable Fuels - 4.1% | | | | | | | | |

| | 1,665,900 | | Arch Coal, Inc. | | | 69,502,922 | | | | 72,466,650 | |

| | 1,462,200 | | Peabody Energy Corp. | | | 78,663,484 | | | | 74,572,200 | |

| | | | Oil & Gas Drilling - 4.6% | | | | | | | | |

| | 2,548,500 | | Nabors Industries Ltd.* | | | 79,341,984 | | | | 86,062,845 | |

| | 601,472 | | Transocean, Inc. | | | 77,121,382 | | | | 81,319,015 | |

| | | | Oil & Gas Equipment & Services - 3.7% | | | | | | | | |

| | 388,100 | | Halliburton Co. | | | 14,012,016 | | | | 15,263,973 | |

| | 1,620,400 | | Weatherford International Ltd.* | | | 107,361,970 | | | | 117,430,388 | |

| | | | Total Energy | | | 426,003,758 | | | | 447,115,071 | |

| | | | This sector is 5.0% above your Fund’s cost. | | | | | | | | |

HEALTH CARE | | | | | | | | |

| | | | Biotechnology - 5.2% | | | | | | | | |

| | 1,038,600 | | Celgene Corp.* | | | 56,912,397 | | | | 63,655,794 | |

| | 2,443,100 | | Gilead Sciences, Inc.* | | | 90,596,845 | | | | 125,892,943 | |

| | | | Health Care Equipment - 4.0% | | | | | | | | |

| | 1,107,290 | | Hospira, Inc.* | | | 44,611,596 | | | | 47,358,793 | |

| | 2,244,500 | | St. Jude Medical, Inc.* | | | 93,109,909 | | | | 96,939,955 | |

| | | | Health Care Supplies - 0.5% | | | | | | | | |

| | 461,800 | | DENTSPLY International Inc. | | | 18,960,363 | | | | 17,825,480 | |

| | | | Life Sciences Tools & Services - 4.4% | | | | | | | | |

| | 2,781,800 | | Thermo Fisher Scientific, Inc.* | | | 122,101,944 | | | | 158,117,512 | |

| | | | Pharmaceuticals - 6.4% | | | | | | | | |

| | 1,497,000 | | Allergan, Inc. | | | 98,110,700 | | | | 84,415,830 | |

| | 3,195,900 | | Teva Pharmaceutical Industries Ltd. SP-ADR | | | 133,649,569 | | | | 147,618,621 | |

| | | | Total Health Care | | | 658,053,323 | | | | 741,824,928 | |

| | | | This sector is 12.7% above your Fund’s cost. | | | | | | | | |

INDUSTRIALS | | | | | | | | |

| | | | Aerospace & Defense - 6.7% | | | | | | | | |

| | 927,000 | | Goodrich Corp. | | | 55,694,842 | | | | 53,311,770 | |

| | 225,100 | | Honeywell International Inc. | | | 12,734,155 | | | | 12,700,142 | |

| | 1,247,500 | | Raytheon Co. | | | 76,367,864 | | | | 80,600,975 | |

| | 1,648,900 | | Rockwell Collins, Inc. | | | 92,601,577 | | | | 94,234,635 | |

| | | | Construction & Engineering - 3.1% | | | | | | | | |

| | 796,600 | | Fluor Corp. | | | 77,394,325 | | | | 112,448,056 | |

| | | | Electrical Components & Equipment - 2.5% | | | | | | | | |

| | 1,788,400 | | Emerson Electric Co. | | | 92,843,977 | | | | 92,031,064 | |

| | | | Heavy Electrical Equipment - 2.2% | | | | | | | | |

| | 3,020,000 | | ABB Ltd. SP-ADR | | | 74,170,191 | | | | 81,298,400 | |

| | | | Industrial Conglomerates - 0.6% | | | | | | | | |

| | 413,000 | | McDermott International, Inc.* | | | 16,986,140 | | | | 22,640,660 | |

| | | | Industrial Machinery - 0.4% | | | | | | | | |

| | 140,200 | | Flowserve Corp. | | | 14,990,803 | | | | 14,634,076 | |

| | | | Railroads - 2.3% | | | | | | | | |

| | 1,307,600 | | Canadian Pacific Railway Ltd. | | | 91,878,304 | | | | 84,065,604 | |

| | | | Total Industrials | | | 605,662,178 | | | | 647,965,382 | |

| | | | This sector is 7.0% above your Fund’s cost. | | | | | | | | |

INFORMATION TECHNOLOGY | | | | | | | | |

| | | | Communications Equipment - 3.6% | | | | | | | | |

| | 4,058,500 | | Corning Inc. | | | 94,054,579 | | | | 97,566,340 | |

| | 685,400 | | Harris Corp. | | | 33,531,867 | | | | 33,262,462 | |

| | | | Data Processing & Outsourced Services - 2.6% | | | | | | | | |

| | 1,644,800 | | Fidelity National Information Services, Inc. | | | 65,960,543 | | | | 62,732,672 | |

| | 516,200 | | Visa Inc.* | | | 22,712,800 | | | | 32,190,232 | |

| | | | IT Consulting & Other Services - 0.1% | | | | | | | | |

| | 125,500 | | SAIC, Inc.* | | | 2,318,265 | | | | 2,333,045 | |

Brandywine Blue Fund

Statement of Net Assets (Continued)

March 31, 2008

(Unaudited)

| Shares/Principal Amount | | Cost | | | Value | |

Common Stocks - 95.1% (a) (Continued) | | | | | | |

| | | Systems Software - 6.9% | | | | | | | | |

| | 411,100 | | BMC Software, Inc.* | | $ | 13,791,335 | | | $ | 13,368,972 | |

| | 3,249,100 | | Microsoft Corp. | | | 104,972,104 | | | | 92,209,458 | |

| | 7,326,900 | | Oracle Corp.* | | | 136,321,620 | | | | 143,314,164 | |

| | | | Total Information Technology | | | 473,663,113 | | | | 476,977,345 | |

| | | | This sector is 0.7% above your Fund’s cost. | | | | | | | | |

MATERIALS | | | | | | | | |

| | | | Diversified Metals & Mining - 3.7% | | | | | | | | |

| | 1,395,000 | | Freeport-McMoRan Copper & Gold, Inc. | | | 139,782,255 | | | | 134,226,900 | |

| | | | Fertilizers & Agricultural Chemicals - 8.1% | | | | | | | | |

| | 1,550,600 | | The Mosaic Co.* | | | 164,417,265 | | | | 159,091,560 | |

| | 867,885 | | Potash Corporation of Saskatchewan Inc. | | | 129,233,796 | | | | 134,704,431 | |

| | | | Metal & Glass Containers - 2.0% | | | | | | | | |

| | 1,311,600 | | Owens-Illinois, Inc.* | | | 73,491,517 | | | | 74,013,588 | |

| | | | Total Materials | | | 506,924,833 | | | | 502,036,479 | |

| | | | This sector is 1.0% below your Fund’s cost. | | | | | | | | |

| | | | Total common stocks | | | 3,313,772,727 | | | | 3,446,749,634 | |

| | | | | | | | | | | |

Short-Term Investments - 5.3% (a) | | | | | | | | |

| | | Federal Agencies - 5.2% | | | | | | | | |

| $ | 187,000,000 | | Federal Home Loan Bank, due 4/01/08, | | | | | | | | |

| | | | discount of 1.50% | | | 187,000,000 | | | | 187,000,000 | |

| | | | Variable Rate Demand Note - 0.1% | | | | | | | | |

| | 4,221,926 | | U.S. Bank, N.A., 2.40% | | | 4,221,926 | | | | 4,221,926 | |

| | | | Total short-term investments | | | 191,221,926 | | | | 191,221,926 | |

| | | | Total investments | | $ | 3,504,994,653 | | | | 3,637,971,560 | |

| | | | Liabilities, less cash and | | | | | | | | |

| | | | receivables (0.4%) (a) | | | | | | | (13,499,771 | ) |

| | | | Net Assets | | | | | | $ | 3,624,471,789 | |

| | | | Net Asset Value Per Share | | | | | | | | |

| | | | ($0.01 par value, 100,000,000 | | | | | | | | |

| | | | shares authorized), offering | | | | | | | | |

| | | | and redemption price | | | | | | | | |

| | | | ($3,624,471,789 ÷ 116,987,247 | | | | | | | | |

| | | | shares outstanding) | | | | | | $ | 30.98 | |

| * | Non-dividend paying security. |

| (a) | Percentages for the various classifications relate to net assets. |

ADR - American Depositary Receipts

Statement of Operations

For the Six Months Ended March 31, 2008

(Unaudited)

| Income: | | | |

| Dividends | | $ | 14,977,872 | |

| Interest | | | 4,583,085 | |

| Total income | | | 19,560,957 | |

| Expenses: | | | | |

| Management fees | | | 17,615,593 | |

| Transfer agent fees | | | 1,252,873 | |

| Printing and postage expense | | | 470,115 | |

| Administrative and accounting services | | | 179,333 | |

| Registration fees | | | 157,582 | |

| Custodian fees | | | 102,054 | |

| Board of Directors fees and expenses | | | 50,354 | |

| Professional fees | | | 33,771 | |

| Insurance expense | | | 24,345 | |

| Other expenses | | | 7,317 | |

| Total expenses | | | 19,893,337 | |

| Net Investment Loss | | | (332,380 | ) |

| Net Realized Loss on Investments | | | (78,585,006 | ) |

| Net Decrease in Unrealized Appreciation on Investments | | | (296,593,606 | ) |

| Net Loss on Investments | | | (375,178,612 | ) |

| Net Decrease in Net Assets Resulting From Operations | | $ | (375,510,992 | ) |

The accompanying notes to financial statements are an integral part of these statements.

Brandywine Blue Fund

Statements of Changes in Net Assets

For the Six Months Ended March 31, 2008 (Unaudited)

and for the Year Ended September 30, 2007

| | | 2008 | | | 2007 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (332,380 | ) | | $ | (1,501,448 | ) |

| Net realized (loss) gain on investments | | | (78,585,006 | ) | | | 310,831,452 | |

| Net (decrease) increase in unrealized appreciation on investments | | | (296,593,606 | ) | | | 291,276,771 | |

| Net (decrease) increase in net assets resulting from operations | | | (375,510,992 | ) | | | 600,606,775 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Distributions from net realized gains ($3.86974 and $1.09995 per share, respectively) | | | (356,221,835 | ) | | | (67,271,293 | ) |

Fund Share Activities: | | | | | | | | |

| Proceeds from shares issued (33,700,339 and 37,213,824 shares, respectively) | | | 1,136,229,519 | | | | 1,262,161,344 | |

| Net asset value of shares issued in distributions reinvested (8,447,066 and 1,820,755 shares, respectively) | | | 303,519,359 | | | | 57,780,654 | |

| Cost of shares redeemed (11,707,873 and 12,076,689 shares, respectively) | | | (387,825,124 | ) | | | (405,492,302 | ) |

| Net increase in net assets derived from Fund share activities | | | 1,051,923,754 | | | | 914,449,696 | |

| Total Increase | | | 320,190,927 | | | | 1,447,785,178 | |

| | | | | | | | | |

| Net Assets at the Beginning of the Period | | | 3,304,280,862 | | | | 1,856,495,684 | |

| Net Assets at the End of the Period | | $ | 3,624,471,789 | | | $ | 3,304,280,862 | |

| (Includes accumulated net investment loss of $0 and $0, respectively) | | | | | | | | |

Financial Highlights

(Selected data for each share of the Fund outstanding throughout each period)

| | | For the Six Months | | | | | | | | | | | | | | | | |

| | | ended March 31, 2008 | | | Years Ended September 30, | |

| | | (Unaudited) | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 38.18 | | | $ | 31.15 | | | $ | 31.33 | | | $ | 25.21 | | | $ | 21.40 | | | $ | 18.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.00 | )* | | | (0.02 | ) | | | (0.00 | )* | | | (0.04 | ) | | | (0.08 | ) | | | (0.08 | ) |

Net realized and unrealized (losses) gains on investments | | | (3.33 | ) | | | 8.15 | | | | 0.96 | | | | 6.16 | | | | 3.89 | | | | 3.18 | |

| Total from investment operations | | | (3.33 | ) | | | 8.13 | | | | 0.96 | | | | 6.12 | | | | 3.81 | | | | 3.10 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (3.87 | ) | | | (1.10 | ) | | | (1.14 | ) | | | — | | | | — | | | | — | |

| Total from distributions | | | (3.87 | ) | | | (1.10 | ) | | | (1.14 | ) | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 30.98 | | | $ | 38.18 | | | $ | 31.15 | | | $ | 31.33 | | | $ | 25.21 | | | $ | 21.40 | |

| TOTAL RETURN | | | (10.02 | %)(a) | | | 26.82 | % | | | 3.47 | % | | | 24.28 | % | | | 17.80 | % | | | 16.94 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s $) | | | 3,624,472 | | | | 3,304,281 | | | | 1,856,496 | | | | 1,230,936 | | | | 531,516 | | | | 312,726 | |

| Ratio of expenses to average net assets | | | 1.13 | %(b) | | | 1.12 | % | | | 1.10 | % | | | 1.12 | % | | | 1.13 | % | | | 1.14 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (0.02 | %)(b) | | | (0.06 | %) | | | (0.02 | %) | | | (0.13 | %) | | | (0.32 | %) | | | (0.41 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 123.0 | %(a) | | | 184.5 | % | | | 207.0 | % | | | 180.5 | % | | | 247.4 | % | | | 300.0 | % |

| (1) | Net investment loss per share was calculated using average shares outstanding. |

| * | Amount less than $0.005 per share. |

The accompanying notes to financial statements are an integral part of these statements.

The Brandywine Funds

Notes to Financial Statements

March 31, 2008 (Unaudited)

| (1) | Summary of Significant Accounting Policies |

| The following is a summary of significant accounting policies of Brandywine Fund, Inc. (the “Brandywine Fund”) and Brandywine Blue Fund (the “Blue Fund,” one of two Funds in a series of the Brandywine Blue Fund, Inc.) (collectively the “Brandywine Funds” or the “Funds”). Each Fund is registered as a diversified open-end management company under the Investment Company Act of 1940, as amended. The assets and liabilities of each Fund are segregated and a shareholder’s interest is limited to the Fund in which the shareholder owns shares. The Brandywine Fund was incorporated under the laws of Maryland on October 9, 1985. The Blue Fund was incorporated under the laws of Maryland on November 13, 1990. The investment objective of each Fund is to produce long-term capital appreciation principally through investing in common stocks. |

| (a) | Each security, excluding short-term investments, is valued at the last sale price reported by the principal security exchange on which the issue is traded. Securities that are traded on the Nasdaq Markets are valued at the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Securities which are traded over-the-counter are valued at the latest bid price. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities has halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. Short-term investments with maturities of 60 days or less are valued at amortized cost which approximates value. For financial reporting purposes, investment transactions are recorded on the trade date; however, for purposes of executing shareholder transactions, the Funds record changes in holdings of portfolio securities no later than the first business day after the trade date in accordance with Rule 2a-4 of the Investment Company Act. Accordingly, certain differences between net asset value for financial reporting and for executing shareholder transactions may arise. |

| | In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this standard relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. The Funds do not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements included within the Statement of Operations for the period. |

| (b) | Net realized gains and losses on sales of securities are computed on the identified cost basis. |

| (c) | Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis. |

| (d) | The Funds have investments in short-term variable rate demand notes, which are unsecured instruments. The Funds may be susceptible to credit risk with respect to these notes to the extent the issuer defaults on its payment obligation. The Funds’ policy is to monitor the creditworthiness of the issuer and nonperformance by these counterparties is not anticipated. |

| (e) | Accounting principles generally accepted in the United States of America (“GAAP”) require that permanent differences between income for financial reporting and tax purposes be reclassified in the capital accounts. |

| (f) | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| (g) | No provision has been made for Federal income taxes since the Funds have elected to be taxed as “regulated investment companies” and intend to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| | Accounting Pronouncements — Effective March 31, 2008, the Funds became subject to FASB interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 requires the evaluation, recognition, measurement, and disclosure in financial statements of tax positions taken on previously filed tax returns or expected to be taken on future returns. Each tax position must meet a recognition threshold that it is “more-likely-than-not” (i.e., has a likelihood of more than 50%), based on the technical merits, that the position will be sustained upon examination by the applicable taxing authority. In evaluating whether a tax position has met the threshold, a Fund must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. A tax position not deemed to meet the “more-likely-than-not” threshold is recorded as a tax expense in the current year. |

| | The Funds have reviewed all taxable years that are open for examination (i.e., not barred by the applicable statute of limitations) by taxing authorities of the major taxing jurisdictions, including the Internal Revenue Service. As of March 31, 2008, open taxable years consisted of the taxable years ended September 30, 2004 through 2007. No examination of either Fund is currently in progress. |

The Brandywine Funds

Notes to Financial Statements (Continued)

March 31, 2008 (Unaudited)

| (1) | Summary of Significant Accounting Policies (Continued) |

| | Each Fund has reviewed all its open taxable years for the major taxing jurisdictions and concluded that application of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on either Fund’s tax return for the taxable year ended September 30, 2007. The Funds are also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

| (2) | Investment Adviser and Management Agreements and Transactions With Related Parties |

| | Each Fund has a management agreement with Friess Associates, LLC (the “Adviser”), with whom certain Officers and Directors of the Funds are affiliated, to serve as investment adviser and manager. Under the terms of the agreements, each Fund will pay the Adviser a monthly management fee at the annual rate of one percent (1%) on the daily net assets of such Fund. |

| | The Adviser entered into sub-advisory agreements with its affiliate, Friess Associates of Delaware, LLC (the “Sub-Adviser”), to assist it in the day-to-day management of each of the Funds. The Adviser and, if so delegated, the Sub-Adviser supervise the investment portfolios of the Funds, directing the purchase and sale of investment securities in the day-to-day management of the Funds. The Adviser pays the Sub-Adviser a fee equal to 110% of the monthly expenses the Sub-Adviser incurs in performing its services as Sub-Adviser. This relationship does not increase the annual management fee the Funds pay to the Adviser. |

| | The Brandywine Fund and Blue Fund pay each of the six independent directors annual fees of $25,000 and $16,000 each, respectively, reinvested in shares of each Fund. The lead independent director and chairman of the audit committee are paid an additional $5,000 annually, reinvested in shares of the Funds, divided proportionately among all the Brandywine Funds. The Funds also reimburse directors for travel costs incurred in order to attend meetings of the Board of Directors. For the six months ended March 31, 2008, the Funds expensed the following directors fees and costs: |

| | Brandywine | Blue |

| | Fund | Fund |

| Directors Fees and Travel Costs Paid during the Period | $77,202 | $50,354 |

| | In the normal course of business the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

| | U.S. Bank, N.A. has made available to each Fund a credit facility pursuant to Credit Agreements effective July 22, 2004, for the purpose of having cash available to cover incoming redemptions. The Brandywine Fund has a $50,000,000 credit facility and the Blue Fund has a $37,500,000 credit facility. Principal and interest of such loan under the Credit Agreements are due not more than 31 days after the date of the loan. Amounts under the credit facilities bear interest at a rate per annum equal to the current prime rate minus one on the amount borrowed. Advances will be collateralized by securities owned by the respective Fund. During the six months ended March 31, 2008, neither Fund borrowed against their Agreement. The Credit Agreements expire on December 18, 2008. |

| (4) | Distributions to Shareholders |

| | Net investment income and net realized gains, if any, are distributed to shareholders at least annually. |

| (5) | Investment Transactions and Related Costs |

| | For the six months ended March 31, 2008, purchases and proceeds of sales of investment securities (excluding short-term investments) for the Funds were as follows: |

| | | Sale | Transaction | Ratio of Cost to |

| | Purchases | Proceeds | Cost | Average Net Assets |

| Brandywine Fund | $4,485,985,415 | $4,432,021,524 | $10,318,164 | 0.23% |

| Blue Fund | 4,915,894,572 | 4,099,335,443 | 8,014,022 | 0.23 |

| | Transaction cost represents the total commissions paid by each Fund on its respective purchases and sales of investment securities. These costs are added to the cost basis of the securities purchased and are deducted from the proceeds of securities sold, thereby reducing the realized gains or increasing the realized losses upon the sale of the securities. |

The Brandywine Funds

Notes to Financial Statements (Continued)

March 31, 2008 (Unaudited)

| (6) | Accounts Payable and Accrued Liabilities |

| | As of March 31, 2008, liabilities of each Fund included the following: |

| | | Brandywine | | | Blue | |

| | | Fund | | | Fund | |

| Payable to brokers for investments purchased | | $ | 80,252,134 | | | $ | 97,991,074 | |

| Payable to Adviser for management fees | | | 3,435,135 | | | | 3,001,702 | |

| Payable to shareholders for redemptions | | | 192,864 | | | | 351,132 | |

| Due to custodian | | | 54,540 | | | | — | |

| Other liabilities | | | 694,242 | | | | 945,387 | |

| | As of March 31, 2008, the sources of net assets were as follows: |

| | | Brandywine | | | Blue | |

| | | Fund | | | Fund | |

| Fund shares issued and outstanding | | $ | 3,851,462,296 | | | $ | 3,621,497,576 | |

| Net unrealized appreciation on investments | | | 249,680,398 | | | | 132,976,907 | |

| Overdistributed net realized gains and accumulated net realized losses, respectively | | | (14,116,748 | ) | | | (130,002,694 | ) |

| | | $ | 4,087,025,946 | | | $ | 3,624,471,789 | |

| (8) | Income Tax Information |

| | The following information for the Funds is presented on an income tax basis as of March 31, 2008: |

| | | | | | Gross | | | Gross | | | Net Unrealized | |

| | | Cost of | | | Unrealized | | | Unrealized | | | Appreciation | |

| | | Investments | | | Appreciation | | | Depreciation | | | on Investments | |

| Brandywine Fund | | $ | 3,893,529,942 | | | $ | 418,999,082 | | | $ | 170,007,455 | | | $ | 248,991,627 | |

| Blue Fund | | | 3,506,444,831 | | | | 231,957,521 | | | | 100,430,792 | | | | 131,526,729 | |

| | The following information for the Funds is presented on an income tax basis as of September 30, 2007: |

| | | | | | Gross | | | Gross | | | Net Unrealized | | | Distributable | | | Distributable | |

| | | Cost of | | | Unrealized | | | Unrealized | | | Appreciation | | | Ordinary | | | Long-Term | |

| | | Investments | | | Appreciation | | | Depreciation | | | on Investments | | | Income | | | Capital Gains | |

| Brandywine Fund | | $ | 3,881,029,985 | | | $ | 979,008,687 | | | $ | 46,213,454 | | | $ | 932,795,233 | | | $ | 194,746,634 | | | $ | 328,980,521 | |

| Blue Fund | | | 2,900,657,778 | | | | 436,756,820 | | | | 7,636,152 | | | | 429,120,668 | | | | 206,976,452 | | | | 98,277,540 | |

| | The difference, if any, between the cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions. |

| | The tax components of dividends paid during the years ended September 30, 2007 and 2006, capital loss carryovers, which may be used to offset future capital gains, subject to Internal Revenue Code limitations as of September 30, 2007, and tax basis post-October losses as of September 30, 2007, which are not recognized for tax purposes until the first day of the following fiscal year are: |

| | | September 30, 2007 | | | September 30, 2006 | |

| | | Ordinary | | | Long-Term | | | Net Capital | | | | | | Ordinary | | | Long-Term | |

| | | Income | | | Capital Gains | | | Loss | | | Post-October | | | Income | | | Capital Gains | |

| | | Distributions | | | Distributions | | | Carryovers | | | Losses | | | Distributions | | | Distributions | |

| Brandywine Fund | | $ | — | | | $ | 30,419,122 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Blue Fund | | | 19,042,368 | | | | 48,228,925 | | | | — | | | | — | | | | 35,062,637 | | | | 11,307,770 | |

| For corporate shareholders in the Blue Fund, the percentage of dividend income distributed for the year ended September 30, 2007, which is designated as qualifying for the dividends received deduction is 67% (unaudited). |

| | For the shareholders in the Blue Fund, the percentage of dividend income distributed for the year ended September 30, 2007, which is designated as qualified dividend income under the Jobs and Growth Tax Relief Act of 2003 is 67% (unaudited). |

| Since there were no ordinary distributions paid for the Brandywine Fund for the year ended September 30, 2007, there were no distributions designated as qualifying for the dividends received deduction for corporate shareholders nor as qualified dividend income under the Jobs and Growth Tax Relief Act of 2003 (unaudited). |

Cost Discussion

Mutual fund shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other fund expenses. Brandywine and Brandywine Blue do not have 12b-1 distribution fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Brandywine Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Funds. To determine your total costs of investing in the Funds, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example below.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2007 through March 31, 2008.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. While the Brandywine Funds currently do not assess sales charges, redemption or exchange fees, other funds do, and those costs will not be reflected in their expense example tables. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period* |

| | 10/01/07 | 3/31/08 | 10/01/07-3/31/08 |

| Brandywine Actual | $1,000.00 | $ 874.60 | $5.11 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.50 | $5.50 |

| Brandywine Blue Actual | $1,000.00 | $ 899.80 | $5.36 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.30 | $5.70 |

| * | Expenses are equal to the Funds’ annualized expense ratios of 1.09% and 1.13%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period between October 1, 2007 and March 31, 2008). |

Additional Director Information, Proxy Voting Policy and Quarterly Portfolio Schedules