UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04550

THE MAINSTAY FUNDS

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

FORM N-CSR

| Item 1. | Reports to Stockholders. |

MainStay Candriam Emerging Markets Debt Fund

Message from the President and Annual Report

October 31, 2022

Sign up for e-delivery of your shareholder reports. For full details on e-delivery, including who can participate and what you can receive via e-delivery,

please log in to newyorklifeinvestments.com/accounts.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

A series of economic and geopolitical challenges undermined equity and fixed-income markets during the 12-month reporting period ended October 31, 2022. Stocks and bonds alike trended lower in the face of sharply rising interest rates, increasing inflationary pressures, slowing economic growth and Russia’s invasion of Ukraine.

The reporting period began on a mixed note, with concerns about the spreading Omicron variant of the COVID-19 virus and increasingly hawkish statements from the U.S. Federal Reserve (the “Fed”) regarding mounting inflation, countered by bullish sentiment stemming from U.S. economic growth and strong corporate earnings. In January 2022, markets turned decisively negative as comments from the Fed raised the likelihood of rate hikes as early as March, and Russia issued increasingly aggressive threats toward Ukraine. The onset of Russia’s invasion in February exacerbated global inflationary pressures while increasing investor uncertainty. Domestic supply shortages, international trade imbalances and rising inflation caused GDP (gross domestic product) to contract in the first and second quarters of the year, although employment and consumer spending proved resilient. Prices for petroleum surged to multi-year highs, while many key agricultural chemicals and industrial metals climbed as well. Accelerating inflationary forces prompted the Fed to implement its most aggressive interest rate increases since the 1980s with a series of five sharp rate hikes, raising the federal funds rate from a range of 0.00% to 0.25% in March to 3.00% to 3.25% in September, with additional rate hikes expected before the end of the year. International central banks generally followed suit, raising rates by varying degrees in efforts to curb local inflation, although most increases remained significantly more modest than those in the United States. Relatively high U.S. interest rates and risk-averse international sentiment pushed U.S. dollar values higher compared to most other currencies, with the ensuing negative impact on global prices for food, fuel and other key, U.S.-dollar-denominated products.

The effects of these interrelated challenges were felt throughout U.S. and international financial markets. The S&P 500® Index, a widely regarded benchmark of U.S. market performance, declined by more than 14% during the reporting period. Although the energy sector generated strong gains, bolstered by elevated oil and gas prices, most other industry areas recorded losses. The more cyclical and growth-oriented sectors of consumer discretionary, real estate and information technology delivered the

weakest returns, while the traditionally defensive and value-oriented consumer staples, utilities and health care sectors outperformed. International stocks lagged compared to their U.S. counterparts, with some emerging markets, such as China, suffering particularly steep losses. A few markets, however, including Brazil, Mexico and the United Arab Emirates, ended the reporting period with little change. Fixed-income markets saw bond prices broadly decline as yields rose along with interest rates. Short-term yields rose faster than long-term yields, producing a yield curve inversion from July through the end of the reporting period, with long-term rates remaining below short-term rates. While floating-rate instruments, which feature variable interest rates that allow investors to benefit from a rising rate environment, provided a degree of insulation from inflation-driven trends, they were not immune to the market’s widespread declines.

While the Fed acknowledges the costs of rising rates in terms of weaker GDP growth and unsettled financial markets over the short term, its primary focus continues to be the longer-term economic impact of inflation. With the latest figures as of the date of this report showing that inflation remains above 8%, versus a target rate of just 2%, the Fed clearly has a distance yet to go, making further rate increases and market volatility more likely in the coming months. The question remains as to whether the Fed and other central banks will manage a so-called “soft landing,” curbing inflation while avoiding a persistent economic slowdown. If they prove successful, we expect that favorable inflation trends and increasingly attractive valuations in both equity and bond markets should eventually translate into sustainable improvements in the investment environment.

Whatever actions the Fed takes and however financial markets react, as a MainStay investor, you can depend on us to continue providing the insight, expertise and service that have long defined New York Life Investments. Thank you for trusting us to help you meet your investment needs.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information, which includes information about The MainStay Funds' Trustees, free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at newyorklifeinvestments.com. Please read the Fund’s Summary Prospectus and/or Prospectus carefully before investing.

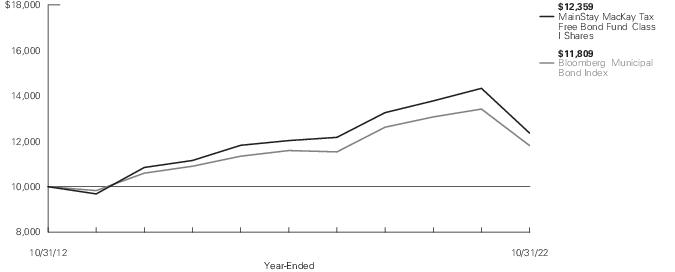

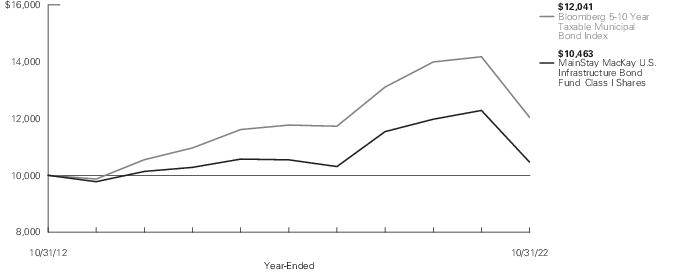

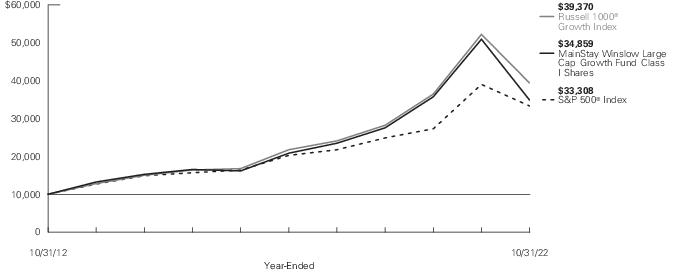

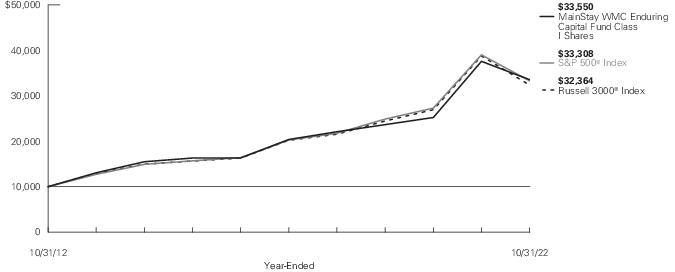

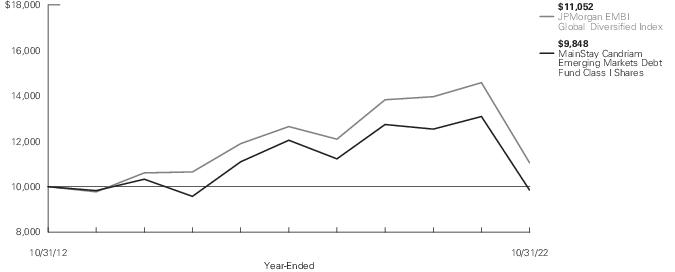

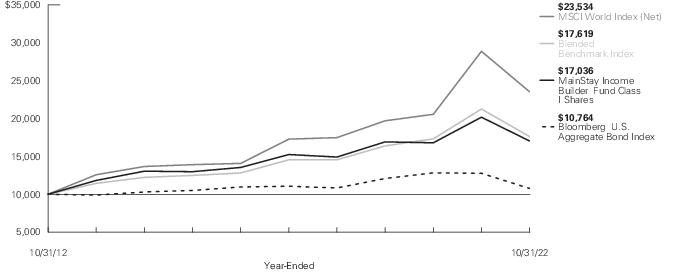

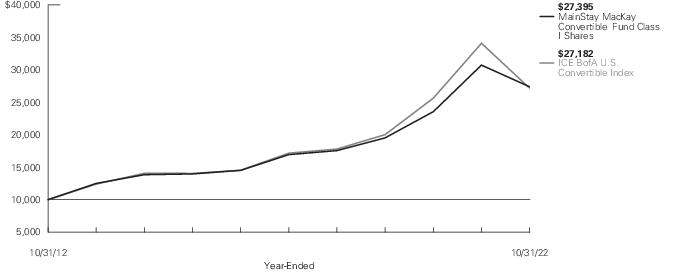

Investment and Performance Comparison (Unaudited)

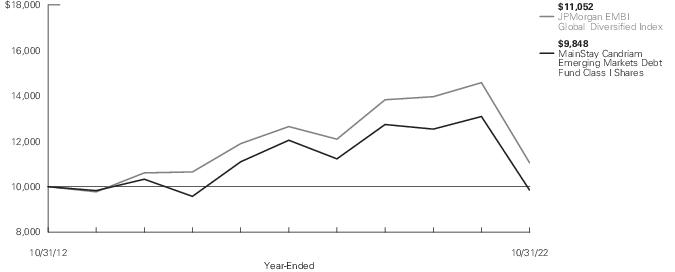

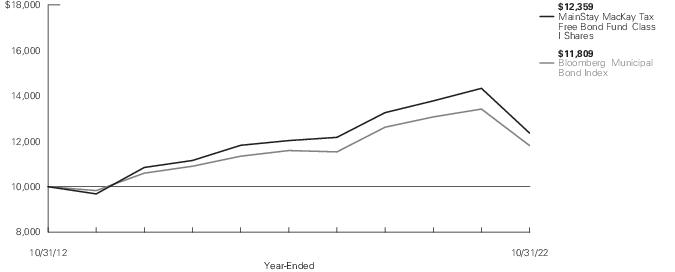

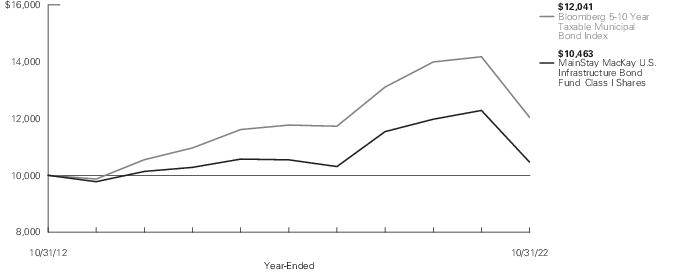

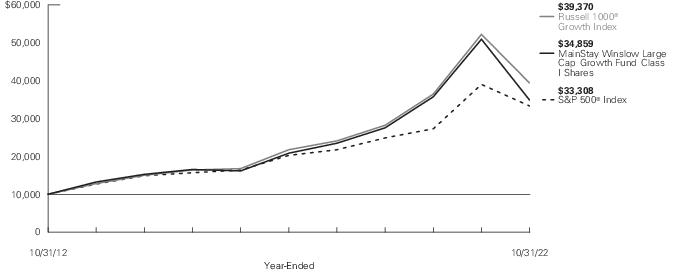

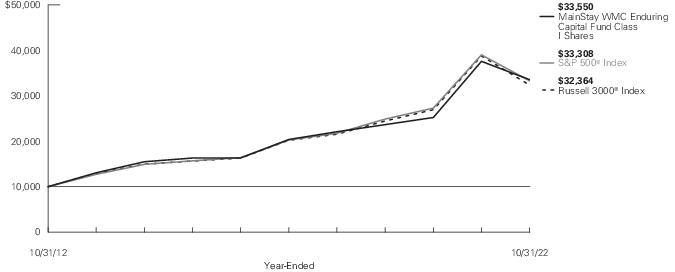

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit newyorklifeinvestments.com.

The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table below, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown below and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

| Average Annual Total Returns for the Year-Ended October 31, 2022 |

| Class | Sales Charge | | Inception

Date1 | One

Year | Five

Years | Ten

Years | Gross

Expense

Ratio2 |

| Class A Shares | Maximum 4.5% Initial Sales Charge | With sales charges | 6/1/1998 | -28.31% | -5.09% | -0.88% | 1.32% |

| | | Excluding sales charges | | -24.93 | -4.21 | -0.42 | 1.32 |

| Investor Class Shares3 | Maximum 4% Initial Sales Charge | With sales charges | 2/28/2008 | -28.26 | -5.39 | -1.13 | 1.70 |

| | | Excluding sales charges | | -25.27 | -4.51 | -0.67 | 1.70 |

| Class B Shares4 | Maximum 5% CDSC | With sales charges | 6/1/1998 | -29.38 | -5.57 | -1.42 | 2.45 |

| | if Redeemed Within the First Six Years of Purchase | Excluding sales charges | | -25.85 | -5.25 | -1.42 | 2.45 |

| Class C Shares | Maximum 1% CDSC | With sales charges | 9/1/1998 | -26.61 | -5.25 | -1.41 | 2.45 |

| | if Redeemed Within One Year of Purchase | Excluding sales charges | | -25.90 | -5.25 | -1.41 | 2.45 |

| Class I Shares | No Sales Charge | | 8/31/2007 | -24.75 | -3.95 | -0.15 | 1.06 |

| 1. | Prior to February 28, 2017, the Fund's primary investment strategies were changed. Effective June 21, 2019, the Fund replaced its prior subadvisor and modified its investment objective and principal investment strategies. The performance in the graph and table prior to those dates reflects its prior subadvisor's, investment objective and principal investment strategies. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| 3. | Prior to June 30, 2020, the maximum initial sales charge was 4.5%, which is reflected in the applicable average annual total return figures shown. |

| 4. | Class B shares are closed to all new purchases as well as additional investments by existing Class B shareholders. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| Benchmark Performance* | One

Year | Five

Years | Ten

Years |

| JPMorgan EMBI Global Diversified Index1 | -24.19% | -2.66% | 1.01% |

| Morningstar Emerging Markets Bond Category Average2 | -21.77 | -2.75 | -0.59 |

| * | Returns for indices reflect no deductions for fees, expenses or taxes, except for foreign withholding taxes where applicable. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 1. | The JPMorgan EMBI Global Diversified Index is the Fund’s primary broad-based securities market index for comparison purposes. The JPMorgan EMBI Global Diversified Index is a market-capitalization weighted, total return index tracking the traded market for U.S. dollar-denominated Brady Bonds, Eurobonds, traded loans and local market debt instruments issued by sovereign and quasi-sovereign entities. |

| 2. | The Morningstar Emerging Markets Bond Category Average is representative of funds that invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East, and Asia make up the rest. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| 6 | MainStay Candriam Emerging Markets Debt Fund |

Cost in Dollars of a $1,000 Investment in MainStay Candriam Emerging Markets Debt Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2022 to October 31, 2022, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2022 to October 31, 2022.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2022. Simply divide your account value by $1,000 (for example, an

$8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning

Account

Value

5/1/22 | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/22 | Expenses

Paid

During

Period1 | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/22 | Expenses

Paid

During

Period1 | Net Expense

Ratio

During

Period2 |

| Class A Shares | $1,000.00 | $878.80 | $ 5.45 | $1,019.41 | $ 5.85 | 1.15% |

| Investor Class Shares | $1,000.00 | $877.00 | $ 7.43 | $1,017.29 | $ 7.98 | 1.57% |

| Class B Shares | $1,000.00 | $873.20 | $11.00 | $1,013.46 | $11.82 | 2.33% |

| Class C Shares | $1,000.00 | $873.40 | $11.00 | $1,013.46 | $11.82 | 2.33% |

| Class I Shares | $1,000.00 | $880.30 | $ 4.03 | $1,020.92 | $ 4.33 | 0.85% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Fund's annualized expense ratio to reflect the six-month period. |

Country Composition as of October 31, 2022 (Unaudited)

| Mexico | 8.6% |

| United States | 7.1 |

| United Arab Emirates | 6.3 |

| Saudi Arabia | 5.4 |

| Chile | 4.8 |

| Indonesia | 4.7 |

| Romania | 4.5 |

| Colombia | 4.4 |

| Brazil | 3.3 |

| Oman | 3.2 |

| South Africa | 3.0 |

| Qatar | 2.9 |

| Dominican Republic | 2.9 |

| Hungary | 2.5 |

| Croatia | 2.4 |

| Egypt | 2.2 |

| Azerbaijan | 2.0 |

| Angola | 1.8 |

| Bahrain | 1.7 |

| Philippines | 1.7 |

| Nigeria | 1.6 |

| Uruguay | 1.5 |

| Ecuador | 1.4 |

| Argentina | 1.4 |

| Ukraine | 1.3 |

| Paraguay | 1.3% |

| Panama | 1.3 |

| El Salvador | 1.0 |

| Republic of the Congo | 1.0 |

| Gabon | 0.9 |

| Peru | 0.9 |

| Tunisia | 0.8 |

| Iraq | 0.8 |

| Ghana | 0.7 |

| Georgia | 0.7 |

| Venezuela | 0.7 |

| Poland | 0.6 |

| Mozambique | 0.6 |

| India | 0.6 |

| Cote D'Ivoire | 0.6 |

| Zambia | 0.4 |

| Bahamas | 0.4 |

| Sri Lanka | 0.3 |

| Senegal | 0.3 |

| Republic Of Serbia | 0.2 |

| Lebanon | 0.2 |

| Pakistan | 0.1 |

| Other Assets, Less Liabilities | 3.0 |

| | 100.0% |

See Portfolio of Investments beginning on page 12 for specific holdings within these categories. The Fund's holdings are subject to change.

Top Ten Holdings and/or Issuers Held as of October 31, 2022 (excluding short-term investments) (Unaudited)

| 1. | Mexico Government Bond, 2.659%-4.75%, due 1/21/26–4/19/71 |

| 2. | Chile Government Bond, 2.55%-4.34%, due 1/27/32–1/22/61 |

| 3. | Abu Dhabi Government Bond, 1.875%-3.875%, due 4/16/25–4/16/50 |

| 4. | Romanian Government Bond, 3.00%-6.00%, due 2/27/27–5/25/34 |

| 5. | Oman Government Bond, 4.875%-7.00%, due 2/1/25–1/25/51 |

| 6. | Colombia Government Bond, 3.125%-6.125%, due 2/26/24–5/15/49 |

| 7. | South Africa Government Bond, 4.30%-7.30%, due 9/16/25–4/20/52 |

| 8. | Qatar Government Bond, 3.40%-4.40%, due 4/16/25–4/16/50 |

| 9. | Dominican Republic Government Bond, 4.875%-5.95%, due 1/27/25–1/30/60 |

| 10. | Hungary Government Bond, 2.125%-3.125%, due 9/22/31–9/21/51 |

| 8 | MainStay Candriam Emerging Markets Debt Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Diliana Deltcheva, CFA, and Christopher Mey, CFA, of Candriam, the Fund’s Subadvisor.

How did MainStay Candriam Emerging Markets Debt Fund perform relative to its benchmark and peer group during the 12 months ended October 31, 2022?

For the 12 months ended October 31, 2022, Class I shares of MainStay Candriam Emerging Markets Debt Fund returned −24.75%, underperforming the −24.19% return of the Fund’s benchmark, the JPMorgan EMBI Global Diversified Index (the "Index"). Over the same period, Class I shares also underperformed the −21.77% return of the Morningstar Emerging Markets Bond Category Average.1

Were there any changes to the Fund during the reporting period?

Effective January 11, 2022, Magda Branet no longer served as a portfolio manager for the Fund. For more information see the prospectus supplement dated January 11, 2022.

What factors affected the Fund’s relative performance during the reporting period?

In the fourth quarter of 2021, emerging-market hard-currency debt optically declined only marginally, as flat Treasury returns, muted spread2 returns and asset class risks progressively rose during the quarter. In November, the discovery of a more contagious Omicron variant of the COVID-19 virus in South Africa accelerated a slight correction in the asset class. The U.S. Federal Reserve (the “Fed”) shifted to an explicitly hawkish stance during the quarter, and market expectations of a rate hike increased significantly. The main detractor from the Fund’s performance relative to the Index during the final two months of 2021 was overweight exposure to idiosyncratic high-yield credits, including Ghana, El Salvador, Ukraine and Venezuela. Underweight positions in rich U.S. Treasury-sensitive emerging-markets investment-grade credits, including Malaysia, Philippines and Qatar—which were supported by the Omicron-driven U.S. Treasury rally towards year end—also detracted from relative performance. The top contributions to the Fund’s relative performance came from underweight positions in distressed and/or nearing default debt of Belarus, Ethiopia and Sri Lanka, as well as overweight positions in Bahamas and Ecuador, which benefited from stabilization of debt sustainability risks. (Contributions take weightings and total returns into account.)

In the first quarter of 2022, emerging-market hard-currency debt posted one of its worst quarters on record as geopolitical risks rose sharply with the Russian invasion of Ukraine on February 24, 2022, adding to already-weak emerging-markets sentiment regarding developed-market monetary policy tightening and

Chinese regulatory activism. Both spread and U.S. Treasury returns rose on higher emerging-markets spreads: spread returns were up 31 basis points (“bps”) and 10-year U.S. Treasury yields were up 83 bps, amid more volatile core rates and emerging-markets risk premiums. (A basis point is one one-hundredth of a percentage point.) The Fund strongly outperformed the Index thanks to underweight positions in Belarus, Kazakhstan and Russia. An outright short 10-year U.S. Treasury futures position also bolstered relative performance, as 10-year U.S. Treasuries sold-off by 83 bps during the quarter. Overweight exposure to energy exporters, including Azerbaijan, Iraq, Nigeria and Venezuela also made positive contributions to relative performance, as oil rallied further following the implementation of Russian sanctions.

Emerging-market hard-currency debt delivered poor returns again in the second quarter of 2022.Tightening global liquidity related to the start of the developed-market central bank hiking cycle, together with surging inflation related to higher commodities prices, China’s “Zero-COVID” policies (which restricted goods supply) and the ongoing war in Ukraine (which pressured energy and agricultural prices) led to a material risky asset market correction. The Fund’s slight underperformance over the quarter (78 bps) was due to underweight exposure to defensive Chinese sovereign and quasi-sovereign debt, which outperformed the Index. Overweight positions in higher beta3 credits, including Egypt, Ghana and Bahrain—which suffered in an environment of tighter global liquidity conditions, high and rising volatility of core rates, and general uncertainties over the global growth outlook—also detracted from returns. However, these negative positions were partially balanced by the positive impact of underweight exposures in Sri Lanka and Kenya. Sri Lanka declared default in May and approached the International Monetary Fund (the “IMF”) for a funding program while Kenya held elections in August and faced rising funding concerns. Overweight exposure in Iraq (an oil exporter with no repayment issues), also contributed to relative performance.

In the third quarter of 2022, elevated U.S. nominal and real rates volatility drove corrections across credit and equity in developed and emerging markets. These corrections were in line with typical asset performance trends at the mature stage of monetary policy normalization and economic contraction. The Fund underperformed the Index by 85 bps over the quarter, due to underweight positions in China and Turkey, as well as overweight positions in Venezuela and Petroleos de Venezuela (PDVSA), the Venezuelan state-owned oil and natural gas company. Security selection in Argentina (with Province of Buenos Aires

| 1. | See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more information on benchmark and peer group returns. |

| 2. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. |

| 3. | Beta is a measure of volatility in relation to the market as a whole. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

outperforming the sovereign) and underweight exposure in Pakistan contributed positively to relative performance, as did the Fund’s higher average cash position and its underweight exposure to U.S. Treasury duration.4

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund held a short 10-year U.S. Treasury futures position from the beginning of 2022 that posted positive performance over the reporting period. The Fund also initiated a short position in the 5-year, versus a long position in the 30-year segment on rising stagflation risks, which was also rewarded.

What was the Fund’s duration strategy during the reporting period?

In the first quarter of 2022, the Fund's absolute duration (−4 bps to 6.57 years) and relative duration (−37 bps to − 0.91 years) declined marginally; we took some profits on the Fund’s 10-year U.S. Treasury position and installed a short 5-year versus 30-year U.S. Treasury yield curve5 position on the basis of rising stagflation risks. Through the second quarter, the Fund’s absolute duration (-42 bps to 6.15 years) and relative duration (-25 bps to -0.66 years) continued to decline as we persisted in our partial profit-taking on the Fund’s short U.S. Treasury position, when 10-year U.S. Treasuries approached 3.5% in mid-June. The Fund’s duration did not change materially through the end of the reporting period, with absolute duration standing at 5.84 years and relative duration standing at -0.73 years.

How was the Fund affected by shifting currency values during the reporting period?

The Fund was not affected by shifting currency values during the reporting period.

During the reporting period, which countries and/or sectors were the strongest positive contributors to the Fund’s relative performance and which countries and/or sectors were particularly weak?

During the last two months of 2021, the main detractors from the Fund’s performance relative to the Index were overweight positions in idiosyncratic high-yield credits, including Ghana, El Salvador, Ukraine and Venezuela. The Fund’s underweight positions in rich U.S. Treasury-sensitive emerging-market investment-grade credits, including Malaysia, Philippines and Qatar, which were supported by the Omicron-driven Treasury rally towards year end, also detracted from relative returns. The

strongest contributors to relative performance were underweight positions in distressed and/or nearing default Belarus, Ethiopia and Sri Lanka, as well as overweight positions in Bahamas and Ecuador, which benefited from stabilization of debt sustainability risks.

During the first ten months of 2022, the main positive contributors included the Fund’s underweight positions in Russia, Belarus and Kazakhstan. The Fund’s underweight exposure to U.S. Treasuries (short positions, both outright and relative) also enhanced relative returns. The main detractors from relative performance were the Fund’s overweight position in Ukraine and underweight positions in certain investment-grade countries when, despite tight spreads, China and Indonesia continued outperforming asset class peers.

What were some of the Fund’s largest purchases and sales during the reporting period?

In the first quarter of 2022, the Fund reduced risk overall across a number of high-yield credits (Argentina, El Salvador, Nigeria, Pakistan and Zambia) that may have been impacted by a rise in asset class uncertainty. When emerging-market spreads widened to 526 bps in the first week of March, we added high-yield risk back into the Fund through energy exporters and Egypt. We added exposure to energy exporters, including Angola, Bahrain, Ecuador and Oman, on the view that oil prices in the $90-$110 range would strengthen their balance sheets and lead to risk premium compression. In Egypt, we covered the Fund’s underweight position and moved to an overweight stance when the country rounded up sizeable Gulf Cooperation Council financing ($12 billion to date) and moved closer to an IMF funding program, after allowing a currency devaluation in excess of 15%. We moved to complete underweight positions in Pakistan and Turkey on the rise of political uncertainty in the former, and given the adverse impact of higher agricultural and energy prices in both countries.

During the second quarter, we continued to reduce the Fund’s risk on the margin and selectively participated in primary market deals. The early-quarter recovery lasted until April 5, 2022, with emerging-market spreads widening by an impressive 155 bps between the low on April 5, 2022, (387 bps) and June 30, 2022. The reductions included vulnerable and higher-beta high-yield credits, including Angola, Bahrain, Colombia, Ecuador, Ghana, Nigeria, Pakistan and Tunisia. In May, we also reduced the Fund’s exposure to longer-dated investment-grade credits in Indonesia, Peru, Romania and UAE that had outperformed their respective 10-year counterparts. Additionally, we exited the Fund’s 30-year, long U.S. Treasury futures position, retaining only the 5-year short U.S. Treasury futures position, as the long end of the U.S. Treasury curve flattened to prior cycle lows.

| 4. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| 5. | The yield curve is a line that plots the yields of various securities of similar quality—typically U.S. Treasury issues—across a range of maturities. The U.S. Treasury yield curve serves as a benchmark for other debt and is used in economic forecasting. |

| 10 | MainStay Candriam Emerging Markets Debt Fund |

In the third quarter of 2022, we continued reducing risk on the margin and selectively participated in primary market deals. Volatility during the third quarter rose materially, with emerging-market spreads rising to 592 bps by mid-July, before recovering 120 bps by mid-August and widening to 559 bps by the end of September 2022, in line with nominal and real U.S. Treasury yields. The reductions spanned BB-rated6 (Azerbaijan, Brazil, Dominican Republic and Serbia) to higher-beta high-yield credits (Bahamas, Ghana, Egypt, Iraq, Nigeria, Oman and Pakistan). We added to the Fund’s Ukraine exposure as Eurobonds traded down to 20 bps after the two-year debt service extension agreed in August. We also increased exposure to Colombia in anticipation of some political risk premium repricing after the presidential election cycle was resolved in mid-June.

How did the Fund’s country and/or sector weightings change during the reporting period?

Early in the reporting period, the buildup of Russian troops around the Russian-Ukraine border intensified. Following failed negotiations between Russia and Ukraine in January 2022 we decided to reduce the Fund’s exposure to Russian short-dated corporates in anticipation of an acceleration of the conflict. We reduced the Fund’s Russian corporate exposure from neutral (approximately 3.1%) to an underweight position of 2.5%, retaining a 0.5% position in Russian fertilizer producer PhosAgro. Once the full Russian invasion of Ukraine started on February 24, 2022, we divested the residual PhosAgro position.

In January 2022, mass protests erupted in Kazakhstan in response to a sudden and sharp increase in gas prices when the government removed a price cap. Eventually the protests turned violent as President Tokayev declared a state of emergency and ordered the use of force, resulting in 160+ civilian deaths. Given the sharp rise of political uncertainty, we fully divested the Fund of any Kazakh sovereign holdings (1% of the Fund), resulting in a full underweight position in Kazakhstan, compared to the Index weighting of 2.5%.

After taking profits in the tactical additions to high-yield-rated energy exporters that the Fund traded between March and April 2022, in May 2022 we covered the Fund’s underweight positions in cheap investment-grade-rated credits, bringing the Fund’s overall investment-grade exposure closer to Index. The additions included Abu Dhabi (1.5%), Chile (1.5%), Hungary (0.5%) and Mexico (1.5%).

In August 2022, we added to the Fund’s Colombia position (+2%), as we expected a decline in political risk premiums following the presidential elections of May 29, 2022, and a run-off on June 19, 2022, were cleared. Colombia screened as the most attractive BB-rated credit globally. We funded the addition to the Fund’s Colombia exposure with reductions in Brazil and the Dominican Republic, and with similarly rated Latin American credits trading well inside Colombia.

How was the Fund positioned at the end of the reporting period?

As of October 31, 2022, the Fund maintains a negative stance on U.S. Treasury-sensitive investment-grade-rated proxies concentrated in Asia (Malaysia, Philippines), the Gulf Cooperation Council (Qatar), and Latin America (Panama, Peru, Uruguay) on the view that investment-grade-rated issuers offer only limited spread cushion versus extended core rate rises. At the same time, we acknowledge that during the current contractionary stage of the business cycle, investment grade is likely to outperform high yield. In response, the Fund retains exposure to select investment-grade-rated credits with attractive valuations, including Chile, Hungary, Mexico, Poland and Romania.

Outside of the oil exporter and investment-grade space, the Fund continues to hold overweight exposure to attractively valued and fundamentally supported emerging market credits across BB-rated and high-yield credits in Africa (Ivory Coast) and Europe (Ukraine). The Fund also continues to hold specific idiosyncratic credits with near-term performance catalysts and distressed valuations, including Argentina, Bahamas, Egypt and Tunisia. We prefer to retain the Fund’s underweight positions in distressed Sri Lanka (where restructuring may deliver recovery values in the low-to-mid-30s) and Pakistan (where floods increased risks for debt renegotiation). The Fund does not hold any Turkish exposure; this reflects our assessment that the government’s policies of foreign exchange (FX) deposit guarantees, targeted at preventing a bank run and deeper currency devaluation are unsustainable, given the country’s deeply negative net FX reserves position, and its excessive sensitivity to higher energy and wheat prices. The Fund does not have any exposure to Belarus, Kazakhstan, Russia, Uzbekistan or Tajikistan on the basis of elevated governance, default and sanctions risks that are not sufficiently compensated by valuations.

| 6. | An obligation rated ‘BB’ by Standard & Poor’s (“S&P”) is deemed by S&P to be less vulnerable to nonpayment than other speculative issues. In the opinion of S&P, however, the obligor faces major ongoing uncertainties or exposure to adverse business, financial or economic conditions which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Portfolio of Investments October 31, 2022†

| | Principal

Amount | Value |

| Long-Term Bonds 89.9% |

| Corporate Bonds 9.1% |

| Brazil 2.4% |

| Arcos Dorados BV | | |

| Series Reg S | | |

| 6.125%, due 5/27/29 | $ 500,000 | $ 460,000 |

| Braskem Netherlands Finance BV | | |

| Series Reg S | | |

| 4.50%, due 1/31/30 | 800,000 | 649,136 |

| Rumo Luxembourg SARL | | |

| Series Reg S | | |

| 4.20%, due 1/18/32 | 500,000 | 378,750 |

| | | 1,487,886 |

| Georgia 0.7% |

| Georgian Railway JSC | | |

| Series Reg S | | |

| 4.00%, due 6/17/28 | 600,000 | 451,548 |

| Mexico 2.2% |

| Alpek SAB de CV | | |

| Series Reg S | | |

| 3.25%, due 2/25/31 (a) | 750,000 | 573,560 |

| Cemex SAB de CV | | |

| Series Reg S | | |

| 3.875%, due 7/11/31 (a) | 500,000 | 380,582 |

| Orbia Advance Corp. SAB de CV | | |

| Series Reg S | | |

| 5.875%, due 9/17/44 | 500,000 | 384,895 |

| | | 1,339,037 |

| Saudi Arabia 2.6% |

| Gaci First Investment Co. | | |

| Series Reg S | | |

| 5.25%, due 10/13/32 | 1,300,000 | 1,269,125 |

| SA Global Sukuk Ltd. | | |

| Series Reg S | | |

| 1.602%, due 6/17/26 | 400,000 | 349,916 |

| | | 1,619,041 |

| United Arab Emirates 1.1% |

| Galaxy Pipeline Assets Bidco Ltd. | | |

| Series Reg S | | |

| 2.625%, due 3/31/36 | 650,000 | 493,660 |

| MDGH GMTN RSC Ltd. | | |

| Series Reg S | | |

| 5.50%, due 4/28/33 | 200,000 | 198,656 |

| | | 692,316 |

| | Principal

Amount | Value |

| |

| Venezuela 0.1% |

| Petroleos de Venezuela SA | | |

| 5.375%, due 4/12/27 (b)(c)(d) | $ 3,000,000 | $ 60,000 |

Total Corporate Bonds

(Cost $7,386,501) | | 5,649,828 |

| Foreign Government Bonds 80.8% |

| Angola 1.8% |

| Angola Government Bond | | |

| Series Reg S | | |

| 8.00%, due 11/26/29 | 400,000 | 324,680 |

| Series Reg S | | |

| 8.75%, due 4/14/32 | 500,000 | 402,750 |

| Series Reg S | | |

| 9.375%, due 5/8/48 | 500,000 | 379,400 |

| | | 1,106,830 |

| Argentina 1.4% |

| Buenos Aires Government Bond | | |

| Series Reg S | | |

| 5.25%, due 9/1/37 (e) | 2,887,805 | 869,652 |

| Azerbaijan 2.0% |

| Southern Gas Corridor CJSC | | |

| Series Reg S | | |

| 6.875%, due 3/24/26 | 700,000 | 687,764 |

| State Oil Co. of the Azerbaijan Republic | | |

| Series Reg S | | |

| 6.95%, due 3/18/30 | 550,000 | 534,094 |

| | | 1,221,858 |

| Bahamas 0.4% |

| Bahamas Government Bond | | |

| Series Reg S | | |

| 6.00%, due 11/21/28 | 400,000 | 252,545 |

| Bahrain 1.7% |

| Bahrain Government Bond | | |

| Series Reg S | | |

| 5.625%, due 5/18/34 | 500,000 | 391,290 |

| Series Reg S | | |

| 6.25%, due 1/25/51 | 300,000 | 210,991 |

| Series Reg S | | |

| 6.75%, due 9/20/29 | 500,000 | 469,170 |

| | | 1,071,451 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 12 | MainStay Candriam Emerging Markets Debt Fund |

| | Principal

Amount | Value |

| Foreign Government Bonds (continued) |

| Brazil 0.9% |

| Brazil Government Bond | | |

| 8.75%, due 2/4/25 | $ 500,000 | $ 533,153 |

| Chile 4.8% |

| Chile Government Bond | | |

| 2.55%, due 1/27/32 (a) | 1,200,000 | 940,047 |

| 2.55%, due 7/27/33 | 1,000,000 | 743,578 |

| 3.10%, due 1/22/61 (a) | 300,000 | 167,723 |

| 3.50%, due 1/31/34 | 400,000 | 322,622 |

| 3.50%, due 4/15/53 (a) | 550,000 | 355,939 |

| 4.34%, due 3/7/42 | 561,000 | 431,414 |

| | | 2,961,323 |

| Colombia 4.4% |

| Colombia Government Bond | | |

| 3.125%, due 4/15/31 | 300,000 | 204,864 |

| 3.25%, due 4/22/32 | 300,000 | 199,096 |

| 4.00%, due 2/26/24 | 800,000 | 766,260 |

| 5.00%, due 6/15/45 | 300,000 | 181,680 |

| 5.20%, due 5/15/49 | 300,000 | 181,888 |

| 6.125%, due 1/18/41 | 500,000 | 355,494 |

| Ecopetrol SA | | |

| 4.625%, due 11/2/31 | 1,200,000 | 826,995 |

| | | 2,716,277 |

| Cote D'Ivoire 0.6% |

| Ivory Coast Government Bond | | |

| Series Reg S | | |

| 5.75%, due 12/31/32 (e) | 125,389 | 110,601 |

| Series Reg S | | |

| 6.125%, due 6/15/33 (a) | 300,000 | 234,000 |

| | | 344,601 |

| Croatia 2.4% |

| Croatia Government Bond | | |

| Series Reg S | | |

| 5.50%, due 4/4/23 | 1,000,000 | 1,000,084 |

| Series Reg S | | |

| 6.00%, due 1/26/24 | 500,000 | 503,301 |

| | | 1,503,385 |

| Dominican Republic 2.9% |

| Dominican Republic Government Bond | | |

| Series Reg S | | |

| 4.875%, due 9/23/32 | 300,000 | 231,152 |

| Series Reg S | | |

| 5.50%, due 1/27/25 | 500,000 | 488,695 |

| | Principal

Amount | Value |

| |

| Dominican Republic (continued) |

Dominican Republic Government Bond

(continued) | | |

| Series Reg S | | |

| 5.50%, due 2/22/29 | $ 300,000 | $ 261,940 |

| Series Reg S | | |

| 5.875%, due 1/30/60 | 500,000 | 328,379 |

| Series Reg S | | |

| 5.95%, due 1/25/27 | 500,000 | 466,998 |

| | | 1,777,164 |

| Ecuador 1.4% |

| Ecuador Government Bond | | |

| Series Reg S | | |

| (zero coupon), due 7/31/30 | 208,496 | 64,807 |

| Series Reg S | | |

| 1.50%, due 7/31/40 (e) | 1,200,000 | 396,207 |

| Series Reg S | | |

| 2.50%, due 7/31/35 (e) | 1,200,000 | 438,595 |

| | | 899,609 |

| Egypt 2.2% |

| Egypt Government Bond | | |

| Series Reg S | | |

| 5.875%, due 2/16/31 | 500,000 | 307,500 |

| Series Reg S | | |

| 6.875%, due 4/30/40 | 300,000 | 172,320 |

| Series Reg S | | |

| 7.30%, due 9/30/33 | 500,000 | 311,876 |

| Series Reg S | | |

| 7.50%, due 2/16/61 | 600,000 | 333,900 |

| Series Reg S | | |

| 8.70%, due 3/1/49 | 400,000 | 238,000 |

| | | 1,363,596 |

| El Salvador 1.0% |

| El Salvador Government Bond | | |

| Series Reg S | | |

| 7.625%, due 2/1/41 | 900,000 | 308,638 |

| Series Reg S | | |

| 8.25%, due 4/10/32 | 500,000 | 198,709 |

| Series Reg S | | |

| 9.50%, due 7/15/52 | 263,000 | 98,636 |

| | | 605,983 |

| Gabon 0.9% |

| Gabon Government Bond | | |

| Series Reg S | | |

| 6.95%, due 6/16/25 | 350,000 | 315,301 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

13

Portfolio of Investments October 31, 2022† (continued)

| | Principal

Amount | Value |

| Foreign Government Bonds (continued) |

| Gabon (continued) |

| Gabon Government Bond (continued) | | |

| Series Reg S | | |

| 7.00%, due 11/24/31 | $ 350,000 | $ 243,442 |

| | | 558,743 |

| Ghana 0.7% |

| Ghana Government Bond | | |

| Series Reg S | | |

| 7.75%, due 4/7/29 (a) | 800,000 | 230,360 |

| Series Reg S | | |

| 7.875%, due 2/11/35 | 500,000 | 140,040 |

| Series Reg S | | |

| 8.627%, due 6/16/49 | 300,000 | 82,080 |

| | | 452,480 |

| Hungary 2.5% |

| Hungary Government Bond | | |

| Series Reg S | | |

| 2.125%, due 9/22/31 | 1,600,000 | 1,143,974 |

| Series Reg S | | |

| 3.125%, due 9/21/51 | 800,000 | 437,565 |

| | | 1,581,539 |

| India 0.6% |

| Export-Import Bank of India | | |

| Series Reg S | | |

| 2.25%, due 1/13/31 | 500,000 | 366,375 |

| Indonesia 4.7% |

| Indonesia Government Bond | | |

| 3.55%, due 3/31/32 (a) | 700,000 | 597,272 |

| 5.45%, due 9/20/52 | 500,000 | 450,000 |

| Pertamina Persero PT | | |

| Series Reg S | | |

| 4.15%, due 2/25/60 | 500,000 | 308,749 |

| 5.625%, due 5/20/43 (a)(f) | 500,000 | 412,500 |

| Series Reg S | | |

| 6.00%, due 5/3/42 | 400,000 | 340,818 |

| Perusahaan Penerbit SBSN Indonesia III | | |

| Series Reg S | | |

| 3.55%, due 6/9/51 | 700,000 | 472,573 |

| Series Reg S | | |

| 4.70%, due 6/6/32 (a) | 350,000 | 327,016 |

| | | 2,908,928 |

| | Principal

Amount | Value |

| |

| Iraq 0.8% |

| Iraq Government Bond | | |

| Series Reg S | | |

| 5.80%, due 1/15/28 | $ 206,250 | $ 175,216 |

| Series Reg S | | |

| 6.752%, due 3/9/23 | 300,000 | 294,750 |

| | | 469,966 |

| Lebanon 0.2% |

| Lebanon Government Bond (b)(c)(d) | | |

| Series Reg S | | |

| 6.65%, due 4/22/24 | 1,200,000 | 70,874 |

| Series Reg S | | |

| 6.85%, due 3/23/27 | 1,000,000 | 59,000 |

| | | 129,874 |

| Mexico 6.4% |

| Comision Federal de Electricidad | | |

| Series Reg S | | |

| 3.875%, due 7/26/33 | 500,000 | 356,250 |

| Series Reg S | | |

| 4.677%, due 2/9/51 | 700,000 | 426,773 |

| Mexico Government Bond | | |

| 2.659%, due 5/24/31 | 500,000 | 387,071 |

| 3.50%, due 2/12/34 | 500,000 | 381,477 |

| 3.75%, due 4/19/71 | 1,000,000 | 578,304 |

| 3.771%, due 5/24/61 | 800,000 | 464,309 |

| 4.125%, due 1/21/26 | 1,000,000 | 962,534 |

| 4.75%, due 4/27/32 (a) | 500,000 | 452,306 |

| | | 4,009,024 |

| Mozambique 0.6% |

| Mozambique Government Bond | | |

| Series Reg S | | |

| 5.00%, due 9/15/31 (e) | 550,000 | 370,563 |

| Nigeria 1.6% |

| Nigeria Government Bond | | |

| Series Reg S | | |

| 7.625%, due 11/21/25 | 500,000 | 429,502 |

| Series Reg S | | |

| 7.625%, due 11/28/47 | 300,000 | 169,800 |

| Series Reg S | | |

| 7.875%, due 2/16/32 | 600,000 | 385,500 |

| Series Reg S | | |

| 8.375%, due 3/24/29 | 27,000 | 19,507 |

| | | 1,004,309 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 14 | MainStay Candriam Emerging Markets Debt Fund |

| | Principal

Amount | Value |

| Foreign Government Bonds (continued) |

| Oman 3.2% |

| Oman Government Bond | | |

| Series Reg S | | |

| 4.875%, due 2/1/25 | $ 1,000,000 | $ 971,490 |

| Series Reg S | | |

| 5.625%, due 1/17/28 | 500,000 | 476,305 |

| Series Reg S | | |

| 7.00%, due 1/25/51 | 600,000 | 511,169 |

| | | 1,958,964 |

| Pakistan 0.1% |

| Pakistan Government Bond | | |

| Series Reg S | | |

| 7.375%, due 4/8/31 | 300,000 | 93,000 |

| Panama 1.3% |

| Aeropuerto Internacional de Tocumen SA | | |

| Series Reg S | | |

| 5.125%, due 8/11/61 | 727,000 | 491,731 |

| Panama Government Bond | | |

| 3.87%, due 7/23/60 | 500,000 | 289,283 |

| | | 781,014 |

| Paraguay 1.3% |

| Paraguay Government Bond | | |

| Series Reg S | | |

| 2.739%, due 1/29/33 | 495,000 | 368,424 |

| Series Reg S | | |

| 5.40%, due 3/30/50 | 600,000 | 460,031 |

| | | 828,455 |

| Peru 0.9% |

| Peruvian Government Bond | | |

| 2.783%, due 1/23/31 (a) | 700,000 | 552,048 |

| Philippines 1.7% |

| Philippine Government Bond | | |

| 3.229%, due 3/29/27 | 300,000 | 276,346 |

| 4.20%, due 3/29/47 | 500,000 | 388,364 |

| 5.609%, due 4/13/33 (a) | 381,000 | 381,061 |

| | | 1,045,771 |

| Poland 0.6% |

| Poland Government Bond | | |

| 3.25%, due 4/6/26 | 200,000 | 187,488 |

| 4.00%, due 1/22/24 | 200,000 | 196,866 |

| | | 384,354 |

| | Principal

Amount | Value |

| |

| Qatar 2.9% |

| Qatar Government Bond | | |

| Series Reg S | | |

| 3.40%, due 4/16/25 | $ 1,000,000 | $ 964,178 |

| Series Reg S | | |

| 4.40%, due 4/16/50 | 1,000,000 | 840,000 |

| | | 1,804,178 |

| Republic Of Serbia 0.2% |

| Serbia Government Bond | | |

| Series Reg S | | |

| 2.125%, due 12/1/30 | 200,000 | 138,238 |

| Republic of the Congo 1.0% |

| Congo Government Bond | | |

| Series Reg S | | |

| 6.00%, due 6/30/29 (e) | 712,500 | 600,637 |

| Romania 4.5% |

| Romanian Government Bond | | |

| Series Reg S | | |

| 3.00%, due 2/27/27 | 900,000 | 771,206 |

| Series Reg S | | |

| 3.00%, due 2/14/31 | 300,000 | 221,592 |

| Series Reg S | | |

| 5.25%, due 11/25/27 | 1,200,000 | 1,100,679 |

| Series Reg S | | |

| 6.00%, due 5/25/34 | 800,000 | 674,112 |

| | | 2,767,589 |

| Saudi Arabia 2.8% |

| Saudi Arabian Oil Co. | | |

| Series Reg S | | |

| 2.25%, due 11/24/30 | 800,000 | 630,907 |

| Series Reg S | | |

| 3.25%, due 11/24/50 | 300,000 | 188,095 |

| Saudi Government Bond | | |

| Series Reg S | | |

| 5.50%, due 10/25/32 | 900,000 | 911,250 |

| | | 1,730,252 |

| Senegal 0.3% |

| Senegal Government Bond | | |

| Series Reg S | | |

| 6.75%, due 3/13/48 | 250,000 | 158,625 |

| South Africa 3.0% |

| South Africa Government Bond | | |

| 4.30%, due 10/12/28 | 500,000 | 426,430 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

15

Portfolio of Investments October 31, 2022† (continued)

| | Principal

Amount | Value |

| Foreign Government Bonds (continued) |

| South Africa (continued) |

| South Africa Government Bond (continued) | | |

| 5.75%, due 9/30/49 | $ 200,000 | $ 132,660 |

| 5.875%, due 9/16/25 | 400,000 | 395,562 |

| 5.875%, due 4/20/32 | 400,000 | 341,728 |

| 6.25%, due 3/8/41 | 300,000 | 228,000 |

| 7.30%, due 4/20/52 | 450,000 | 352,125 |

| | | 1,876,505 |

| Sri Lanka 0.3% |

| Sri Lanka Government Bond | | |

| Series Reg S | | |

| 6.825%, due 7/18/26 (b)(d) | 850,000 | 191,300 |

| Tunisia 0.8% |

| Tunisian Republic | | |

| Series Reg S | | |

| 5.625%, due 2/17/24 | EUR 200,000 | 145,253 |

| Series Reg S | | |

| 5.75%, due 1/30/25 | $ 600,000 | 375,754 |

| | | 521,007 |

| Ukraine 1.3% |

| NPC Ukrenergo | | |

| Series Reg S | | |

| 6.875%, due 11/9/28 (b)(c)(d) | 1,150,000 | 165,647 |

| State Agency of Roads of Ukraine | | |

| Series Reg S | | |

| 6.25%, due 6/24/30 (b)(c)(d) | 2,227,000 | 311,833 |

| Ukraine Government Bond (b)(c)(d) | | |

| Series Reg S | | |

| 7.253%, due 3/15/35 | 1,300,000 | 198,838 |

| Series Reg S | | |

| 7.375%, due 9/25/34 | 1,000,000 | 155,000 |

| | | 831,318 |

| United Arab Emirates 5.2% |

| Abu Dhabi Government Bond | | |

| Series Reg S | | |

| 1.875%, due 9/15/31 | 600,000 | 472,904 |

| Series Reg S | | |

| 2.50%, due 4/16/25 | 1,000,000 | 951,250 |

| Series Reg S | | |

| 3.125%, due 4/16/30 | 600,000 | 537,684 |

| Series Reg S | | |

| 3.125%, due 9/30/49 | 600,000 | 403,524 |

| Series Reg S | | |

| 3.875%, due 4/16/50 | 600,000 | 464,184 |

| | Principal

Amount | Value |

| |

| United Arab Emirates (continued) |

| Finance Department Government of Sharjah | | |

| Series Reg S | | |

| 4.00%, due 7/28/50 | $ 400,000 | $ 230,680 |

| United Arab Emirates Government Bond | | |

| Series Reg S | | |

| 3.90%, due 9/9/50 | 250,000 | 162,743 |

| | | 3,222,969 |

| Uruguay 1.5% |

| Uruguay Government Bond | | |

| 4.975%, due 4/20/55 | 400,000 | 346,586 |

| 5.75%, due 10/28/34 | 600,000 | 610,830 |

| | | 957,416 |

| Venezuela 0.6% |

| Petroleos de Venezuela SA (b)(c)(d) | | |

| Series Reg S | | |

| 6.00%, due 5/16/24 | 2,500,000 | 56,250 |

| Series Reg S | | |

| 6.00%, due 11/15/26 (g) | 2,500,000 | 47,500 |

| Venezuela Government Bond | | |

| Series Reg S | | |

| 9.25%, due 5/7/28 (b)(c)(d) | 4,095,000 | 276,412 |

| | | 380,162 |

| Zambia 0.4% |

| Zambia Government Bond | | |

| Series Reg S | | |

| 8.97%, due 7/30/27 (b)(d) | 700,000 | 275,590 |

Total Foreign Government Bonds

(Cost $71,228,249) | | 50,178,620 |

Total Long-Term Bonds

(Cost $78,614,750) | | 55,828,448 |

| |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 16 | MainStay Candriam Emerging Markets Debt Fund |

| | Shares | | Value |

| Short-Term Investment 7.1% |

| Unaffiliated Investment Company 7.1% |

| United States 7.1% |

| Invesco Government & Agency Portfolio, 3.163% (h)(i) | 4,430,155 | | $ 4,430,155 |

Total Short-Term Investment

(Cost $4,430,155) | | | 4,430,155 |

Total Investments

(Cost $83,044,905) | 97.0% | | 60,258,603 |

| Other Assets, Less Liabilities | 3.0 | | 1,885,773 |

| Net Assets | 100.0% | | $ 62,144,376 |

| † | Percentages indicated are based on Fund net assets. |

| (a) | All or a portion of this security was held on loan. As of October 31, 2022, the aggregate market value of securities on loan was $4,598,470; the total market value of collateral held by the Fund was $4,824,475. The market value of the collateral held included non-cash collateral in the form of U.S. Treasury securities with a value of $394,320. The Fund received cash collateral with a value of $4,430,155. (See Note 2(J)) |

| (b) | Issue in default. |

| (c) | Illiquid security—As of October 31, 2022, the total market value deemed illiquid under procedures approved by the Board of Trustees was $1,401,354, which represented 2.3% of the Fund’s net assets.(Unaudited) |

| (d) | Issue in non-accrual status. |

| (e) | Step coupon—Rate shown was the rate in effect as of October 31, 2022. |

| (f) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (g) | Coupon rate may change based on changes of the underlying collateral or prepayments of principal. Rate shown was the rate in effect as of October 31, 2022. |

| (h) | Current yield as of October 31, 2022. |

| (i) | Represents a security purchased with cash collateral received for securities on loan. |

Futures Contracts

As of October 31, 2022, the Fund held the following futures contracts1:

| Type | Number of

Contracts | Expiration

Date | Value at

Trade Date | Current

Notional

Amount | Unrealized

Appreciation

(Depreciation)2 |

| Long Contracts | | | | | |

| U.S. Treasury Ultra Bonds | 10 | December 2022 | $ 1,275,339 | $ 1,276,563 | $ 1,224 |

| 1. | As of October 31, 2022, cash in the amount of $1,932,182 was on deposit with a broker or futures commission merchant for futures transactions. |

| 2. | Represents the difference between the value of the contracts at the time they were opened and the value as of October 31, 2022. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

17

Portfolio of Investments October 31, 2022† (continued)

The following is a summary of the fair valuations according to the inputs used as of October 31, 2022, for valuing the Fund’s assets:

| Description | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Asset Valuation Inputs | | | | | | | |

| Investments in Securities (a) | | | | | | | |

| Long-Term Bonds | | | | | | | |

| Corporate Bonds | $ — | | $ 5,649,828 | | $ — | | $ 5,649,828 |

| Foreign Government Bonds | — | | 50,178,620 | | — | | 50,178,620 |

| Total Long-Term Bonds | — | | 55,828,448 | | — | | 55,828,448 |

| Short-Term Investment | | | | | | | |

| Unaffiliated Investment Company | 4,430,155 | | — | | — | | 4,430,155 |

| Total Investments in Securities | 4,430,155 | | 55,828,448 | | — | | 60,258,603 |

| Other Financial Instruments | | | | | | | |

| Futures Contracts (b) | 1,224 | | — | | — | | 1,224 |

| Total Investments in Securities and Other Financial Instruments | $ 4,431,379 | | $ 55,828,448 | | $ — | | $ 60,259,827 |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 18 | MainStay Candriam Emerging Markets Debt Fund |

Statement of Assets and Liabilities as of October 31, 2022

| Assets |

Investment in securities, at value

(identified cost $83,044,905) including securities on loan of $4,598,470 | $ 60,258,603 |

| Cash | 3,453,785 |

Cash denominated in foreign currencies

(identified cost $40,683) | 40,779 |

| Cash collateral on deposit at broker for futures contracts | 1,932,182 |

| Due from custodian | 807,076 |

| Receivables: | |

| Interest | 763,851 |

| Investment securities sold | 266,445 |

| Variation margin on futures contracts | 71,500 |

| Fund shares sold | 6,513 |

| Securities lending | 3,532 |

| Other assets | 62,129 |

| Total assets | 67,666,395 |

| Liabilities |

| Cash collateral received for securities on loan | 4,430,155 |

| Payables: | |

| Investment securities purchased | 807,076 |

| Fund shares redeemed | 151,333 |

| Transfer agent (See Note 3) | 30,472 |

| Shareholder communication | 22,105 |

| Manager (See Note 3) | 20,753 |

| NYLIFE Distributors (See Note 3) | 13,803 |

| Custodian | 11,624 |

| Professional fees | 11,183 |

| Trustees | 47 |

| Accrued expenses | 9,849 |

| Distributions payable | 13,619 |

| Total liabilities | 5,522,019 |

| Net assets | $ 62,144,376 |

| Composition of Net Assets |

| Shares of beneficial interest outstanding (par value of $.01 per share) unlimited number of shares authorized | $ 90,231 |

| Additional paid-in-capital | 113,441,531 |

| | 113,531,762 |

| Total distributable earnings (loss) | (51,387,386) |

| Net assets | $ 62,144,376 |

| Class A | |

| Net assets applicable to outstanding shares | $48,053,369 |

| Shares of beneficial interest outstanding | 6,984,655 |

| Net asset value per share outstanding | $ 6.88 |

| Maximum sales charge (4.50% of offering price) | 0.32 |

| Maximum offering price per share outstanding | $ 7.20 |

| Investor Class | |

| Net assets applicable to outstanding shares | $ 8,669,750 |

| Shares of beneficial interest outstanding | 1,245,686 |

| Net asset value per share outstanding | $ 6.96 |

| Maximum sales charge (4.00% of offering price) | 0.29 |

| Maximum offering price per share outstanding | $ 7.25 |

| Class B | |

| Net assets applicable to outstanding shares | $ 426,208 |

| Shares of beneficial interest outstanding | 63,383 |

| Net asset value and offering price per share outstanding | $ 6.72 |

| Class C | |

| Net assets applicable to outstanding shares | $ 1,358,322 |

| Shares of beneficial interest outstanding | 201,655 |

| Net asset value and offering price per share outstanding | $ 6.74 |

| Class I | |

| Net assets applicable to outstanding shares | $ 3,636,727 |

| Shares of beneficial interest outstanding | 527,734 |

| Net asset value and offering price per share outstanding | $ 6.89 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

19

Statement of Operations for the year ended October 31, 2022

| Investment Income (Loss) |

| Income | |

| Interest | $ 4,635,467 |

| Securities lending, net | 21,100 |

| Total income | 4,656,567 |

| Expenses | |

| Manager (See Note 3) | 573,341 |

| Distribution/Service—Class A (See Note 3) | 160,576 |

| Distribution/Service—Investor Class (See Note 3) | 26,582 |

| Distribution/Service—Class B (See Note 3) | 7,990 |

| Distribution/Service—Class C (See Note 3) | 22,716 |

| Transfer agent (See Note 3) | 172,527 |

| Professional fees | 83,134 |

| Registration | 75,730 |

| Custodian | 47,445 |

| Shareholder communication | 7,305 |

| Trustees | 1,508 |

| Miscellaneous | 8,755 |

| Total expenses before waiver/reimbursement | 1,187,609 |

| Expense waiver/reimbursement from Manager (See Note 3) | (178,325) |

| Net expenses | 1,009,284 |

| Net investment income (loss) | 3,647,283 |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on: | |

| Unaffiliated investment transactions | (14,035,936) |

| Futures transactions | 831,068 |

| Foreign currency transactions | (368,963) |

| Foreign currency forward transactions | 418,843 |

| Net realized gain (loss) | (13,154,988) |

| Net change in unrealized appreciation (depreciation) on: | |

| Unaffiliated investments | (13,431,533) |

| Futures contracts | (324,760) |

| Foreign currency forward contracts | (134,512) |

| Translation of other assets and liabilities in foreign currencies | (4,565) |

| Net change in unrealized appreciation (depreciation) | (13,895,370) |

| Net realized and unrealized gain (loss) | (27,050,358) |

| Net increase (decrease) in net assets resulting from operations | $(23,403,075) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 20 | MainStay Candriam Emerging Markets Debt Fund |

Statements of Changes in Net Assets

for the years ended October 31, 2022 and October 31, 2021

| | 2022 | 2021 |

| Increase (Decrease) in Net Assets |

| Operations: | | |

| Net investment income (loss) | $ 3,647,283 | $ 3,880,608 |

| Net realized gain (loss) | (13,154,988) | 262,191 |

| Net change in unrealized appreciation (depreciation) | (13,895,370) | 336,603 |

| Net increase (decrease) in net assets resulting from operations | (23,403,075) | 4,479,402 |

| Distributions to shareholders: | | |

| Class A | (3,612,534) | (4,028,577) |

| Investor Class | (549,300) | (598,582) |

| Class B | (37,561) | (56,287) |

| Class C | (107,128) | (199,315) |

| Class I | (237,169) | (337,673) |

| | (4,543,692) | (5,220,434) |

| Distributions to shareholders from return of capital: | | |

| Class A | (277,063) | — |

| Investor Class | (42,129) | — |

| Class B | (2,881) | — |

| Class C | (8,216) | — |

| Class I | (18,190) | — |

| | (348,479) | — |

| Total distributions to shareholders | (4,892,171) | (5,220,434) |

| Capital share transactions: | | |

| Net proceeds from sales of shares | 12,957,410 | 10,338,246 |

| Net asset value of shares issued to shareholders in reinvestment of distributions | 4,663,688 | 4,945,465 |

| Cost of shares redeemed | (31,448,175) | (21,792,166) |

| Increase (decrease) in net assets derived from capital share transactions | (13,827,077) | (6,508,455) |

| Net increase (decrease) in net assets | (42,122,323) | (7,249,487) |

| Net Assets |

| Beginning of year | 104,266,699 | 111,516,186 |

| End of year | $ 62,144,376 | $104,266,699 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

21

Financial Highlights selected per share data and ratios

| | Year Ended October 31, |

| Class A | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Net asset value at beginning of year | $ 9.73 | | $ 9.81 | | $ 10.46 | | $ 9.71 | | $ 10.88 |

| Net investment income (loss) (a) | 0.38 | | 0.36 | | 0.47 | | 0.49 | | 0.45 |

| Net realized and unrealized gain (loss) | (2.73) | | 0.04 | | (0.67) | | 0.76 | | (1.19) |

| Total from investment operations | (2.35) | | 0.40 | | (0.20) | | 1.25 | | (0.74) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.46) | | (0.48) | | (0.45) | | (0.50) | | (0.43) |

| Return of capital | (0.04) | | — | | — | | — | | — |

| Total distributions | (0.50) | | (0.48) | | (0.45) | | (0.50) | | (0.43) |

| Net asset value at end of year | $ 6.88 | | $ 9.73 | | $ 9.81 | | $ 10.46 | | $ 9.71 |

| Total investment return (b) | (24.93)% | | 4.00% | | (1.80)% | | 13.05% | | (6.95)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 4.53% | | 3.58% | | 4.70% | | 4.78% | | 4.36% |

| Net expenses (c) | 1.15% | | 1.16% | | 1.17% | | 1.23% | | 1.26% |

| Expenses (before waiver/reimbursement) (c) | 1.36% | | 1.31% | | 1.33% | | 1.26% | | 1.26% |

| Portfolio turnover rate | 116% | | 112% | | 102% | | 102% | | 44% |

| Net assets at end of year (in 000’s) | $ 48,053 | | $ 81,092 | | $ 82,874 | | $ 93,472 | | $ 86,452 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Year Ended October 31, |

| Investor Class | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Net asset value at beginning of year | $ 9.84 | | $ 9.91 | | $ 10.57 | | $ 9.80 | | $ 10.98 |

| Net investment income (loss) (a) | 0.35 | | 0.33 | | 0.44 | | 0.47 | | 0.43 |

| Net realized and unrealized gain (loss) | (2.77) | | 0.04 | | (0.68) | | 0.77 | | (1.20) |

| Total from investment operations | (2.42) | | 0.37 | | (0.24) | | 1.24 | | (0.77) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.43) | | (0.44) | | (0.42) | | (0.47) | | (0.41) |

| Return of capital | (0.03) | | — | | — | | — | | — |

| Total distributions | (0.46) | | (0.44) | | (0.42) | | (0.47) | | (0.41) |

| Net asset value at end of year | $ 6.96 | | $ 9.84 | | $ 9.91 | | $ 10.57 | | $ 9.80 |

| Total investment return (b) | (25.27)% | | 3.70% | | (2.20)% | | 12.82% | | (7.18)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 4.14% | | 3.21% | | 4.38% | | 4.50% | | 4.15% |

| Net expenses (c) | 1.56% | | 1.53% | | 1.49% | | 1.52% | | 1.47% |

| Expenses (before waiver/reimbursement) (c) | 1.78% | | 1.70% | | 1.66% | | 1.56% | | 1.49% |

| Portfolio turnover rate | 116% | | 112% | | 102% | | 102% | | 44% |

| Net assets at end of year (in 000's) | $ 8,670 | | $ 12,806 | | $ 13,801 | | $ 16,024 | | $ 15,911 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 22 | MainStay Candriam Emerging Markets Debt Fund |

Financial Highlights selected per share data and ratios

| | Year Ended October 31, |

| Class B | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Net asset value at beginning of year | $ 9.52 | | $ 9.61 | | $ 10.26 | | $ 9.52 | | $ 10.69 |

| Net investment income (loss) (a) | 0.27 | | 0.24 | | 0.36 | | 0.38 | | 0.34 |

| Net realized and unrealized gain (loss) | (2.67) | | 0.04 | | (0.66) | | 0.75 | | (1.18) |

| Total from investment operations | (2.40) | | 0.28 | | (0.30) | | 1.13 | | (0.84) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.37) | | (0.37) | | (0.35) | | (0.39) | | (0.33) |

| Return of capital | (0.03) | | — | | — | | — | | — |

| Total distributions | (0.40) | | (0.37) | | (0.35) | | (0.39) | | (0.33) |

| Net asset value at end of year | $ 6.72 | | $ 9.52 | | $ 9.61 | | $ 10.26 | | $ 9.52 |

| Total investment return (b) | (25.85)% | | 2.87% | | (2.91)% | | 12.04% | | (7.98)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 3.31% | | 2.49% | | 3.66% | | 3.76% | | 3.37% |

| Net expenses (c) | 2.31% | | 2.28% | | 2.24% | | 2.27% | | 2.22% |

| Expenses (before waiver/reimbursement) (c) | 2.52% | | 2.45% | | 2.40% | | 2.31% | | 2.24% |

| Portfolio turnover rate | 116% | | 112% | | 102% | | 102% | | 44% |

| Net assets at end of year (in 000’s) | $ 426 | | $ 1,129 | | $ 1,789 | | $ 2,663 | | $ 3,660 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Year Ended October 31, |

| Class C | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Net asset value at beginning of year | $ 9.54 | | $ 9.63 | | $ 10.27 | | $ 9.54 | | $ 10.70 |

| Net investment income (loss) (a) | 0.27 | | 0.25 | | 0.36 | | 0.38 | | 0.35 |

| Net realized and unrealized gain (loss) | (2.67) | | 0.03 | | (0.66) | | 0.74 | | (1.18) |

| Total from investment operations | (2.40) | | 0.28 | | (0.30) | | 1.12 | | (0.83) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.37) | | (0.37) | | (0.34) | | (0.39) | | (0.33) |

| Return of capital | (0.03) | | — | | — | | — | | — |

| Total distributions | (0.40) | | (0.37) | | (0.34) | | (0.39) | | (0.33) |

| Net asset value at end of year | $ 6.74 | | $ 9.54 | | $ 9.63 | | $ 10.27 | | $ 9.54 |

| Total investment return (b) | (25.90)% | | 2.87% | | (2.81)% | | 11.91% | | (7.88)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 3.31% | | 2.52% | | 3.68% | | 3.78% | | 3.39% |

| Net expenses (c) | 2.31% | | 2.28% | | 2.24% | | 2.27% | | 2.22% |

| Expenses (before waiver/reimbursement) (c) | 2.52% | | 2.45% | | 2.40% | | 2.31% | | 2.24% |

| Portfolio turnover rate | 116% | | 112% | | 102% | | 102% | | 44% |

| Net assets at end of year (in 000’s) | $ 1,358 | | $ 3,511 | | $ 6,365 | | $ 11,150 | | $ 19,246 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

23

Financial Highlights selected per share data and ratios

| | Year Ended October 31, |

| Class I | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Net asset value at beginning of year | $ 9.75 | | $ 9.82 | | $ 10.48 | | $ 9.72 | | $ 10.90 |

| Net investment income (loss) (a) | 0.40 | | 0.39 | | 0.51 | | 0.52 | | 0.48 |

| Net realized and unrealized gain (loss) | (2.74) | | 0.05 | | (0.69) | | 0.76 | | (1.20) |

| Total from investment operations | (2.34) | | 0.44 | | (0.18) | | 1.28 | | (0.72) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.48) | | (0.51) | | (0.48) | | (0.52) | | (0.46) |

| Return of capital | (0.04) | | — | | — | | — | | — |

| Total distributions | (0.52) | | (0.51) | | (0.48) | | (0.52) | | (0.46) |

| Net asset value at end of year | $ 6.89 | | $ 9.75 | | $ 9.82 | | $ 10.48 | | $ 9.72 |

| Total investment return (b) | (24.75)% | | 4.42% | | (1.59)% | | 13.46% | | (6.80)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 4.89% | | 3.86% | | 5.09% | | 4.99% | | 4.60% |

| Net expenses (c) | 0.85% | | 0.85% | | 0.85% | | 0.94% | | 1.01% |

| Expenses (before waiver/reimbursement) (c) | 1.12% | | 1.06% | | 1.07% | | 1.01% | | 1.01% |

| Portfolio turnover rate | 116% | | 112% | | 102% | | 102% | | 44% |

| Net assets at end of year (in 000’s) | $ 3,637 | | $ 5,729 | | $ 6,687 | | $ 17,100 | | $ 10,428 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class I shares are not subject to sales charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 24 | MainStay Candriam Emerging Markets Debt Fund |

Notes to Financial Statements

Note 1-Organization and Business

The MainStay Funds (the “Trust”) was organized on January 9, 1986, as a Massachusetts business trust. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is comprised of twelve funds (collectively referred to as the "Funds"). These financial statements and notes relate to the MainStay Candriam Emerging Markets Debt Fund (the "Fund"), a “diversified” fund, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

The following table lists the Fund's share classes that have been registered and commenced operations:

| Class | Commenced Operations |

| Class A | June 1, 1998 |

| Investor Class | February 28, 2008 |

| Class B | June 1, 1998 |

| Class C | September 1, 1998 |

| Class I | August 31, 2007 |

| Class R6 | N/A* |

| SIMPLE Class | N/A* |

| * | Class R6 shares were registered for sale effective as of February 28, 2017 and SIMPLE Class shares were registered for sale effective as of August 31, 2020 but have not yet commenced operations. |

Class B shares of the MainStay Group of Funds are closed to all new purchases as well as additional investments by existing Class B shareholders. Existing Class B shareholders may continue to reinvest dividends and capital gains distributions, as well as exchange their Class B shares for Class B shares of other funds in the MainStay Group of Funds as permitted by the current exchange privileges. Class B shareholders continue to be subject to any applicable contingent deferred sales charge ("CDSC") at the time of redemption. All other features of the Class B shares, including but not limited to the fees and expenses applicable to Class B shares, remain unchanged. Unless redeemed, Class B shareholders will remain in Class B shares of their respective fund until the Class B shares are converted to Class A or Investor Class shares pursuant to the applicable conversion schedule.