UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number811-04550

THE MAINSTAY FUNDS

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)576-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2019

FORMN-CSR

Item 1. Reports to Stockholders.

MainStay MacKay Unconstrained Bond Fund

Message from the President and Annual Report

October 31, 2019

Beginning on January 1, 2021, paper copies of each MainStay Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’ website. You will be notified by mail and provided with a website address to access the report each time a new report is posted to the website.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to MainStayShareholderServices@nylim.com, or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to MainStayShareholderServices@nylim.com. If you hold shares of a MainStay Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial intermediary.

| | | | | | | | |

| | | | | |

| Not FDIC/NCUA Insured | | Not a Deposit | | May Lose Value | | No Bank Guarantee | | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Stock and bond markets generally gained ground during the12-month reporting period ended October 31, 2019, despite concerns regarding slowing U.S. and global economic growth and international trade conflicts.

After trending higher in November 2018, U.S. stocks and bonds dipped sharply in December 2018, over concerns regarding the pace of economic growth, a U.S. government shutdown and the potential impact of trade disputes between the United States and other nations, particularly China. U.S. markets recovered quickly in 2019 as trade tensions eased, the government reopened and the U.S. Federal Reserve Board (“Fed”) adopted a more accommodative tone regarding the future direction of interest rates. A wide spectrum of equity and fixed-income sectors gained ground through April 2019. Mixed macroeconomic signals and the inability of China and the United States to reach a trade agreement caused the market’s recovery to suffer during the spring and summer months of 2019. However, accommodative monetary policies from several central banks, including a series of interest rate cuts by the Fed, along with better-than-expected corporate earnings reassured investors and enabled markets to resume their advance.

Persistent, albeit slow, U.S. economic growth underpinned the U.S. stock market’s advance during the reporting period, positioning major U.S. equity indices to reach record territory by late October 2019. Sector strength shifted as investor sentiment alternated betweenrisk-on andrisk-off positions. In general, for the reporting period, cyclical, growth-oriented stocks outperformed their value-oriented counterparts by a small margin, with the information technology sector leading thelarge-cap S&P 500® Index. However, the traditionally more defensive areas of real estate and utilities generated above-average performance as well. Communication services, consumer discretionary, industrials and consumer staples performed in the middle of the pack, while materials, financials and health care lagged. Only the energy sector suffered declines, undermined by weak oil prices and concerns about future energy demand.

In the fixed-income markets, slowing economic growth, modest inflation and the Fed’s interest rate cuts created an environment of falling yields and rising prices for most bonds, with many areas of the market offering historically low yields by the end of the reporting period. Higher-credit-quality, longer-duration securities generally produced strong returns, with investment-

grade corporates and long-term Treasury bonds delivering particularly strong performance. A similar dynamic characterized the performance of the municipal bond market, with longer-term, higher-grade issues performing relatively well. On average, municipal bonds roughly matched the gains of corporate issues while providingtax-advantaged returns for eligible investors.

International stock and bond markets tended to underperform their U.S. counterparts, constrained by lackluster economic growth in the Eurozone and dramatically slowing growth in China and related parts of Asia amid persistent trade tensions with the United States. Uncertainties surrounding the unending Brexit drama took a further toll on investor confidence, with Britain seemingly unable to resolve its internal conflicts over how, or whether, to exit from the European Union. Nevertheless, on average, international securities delivered modestly positive returns, bolstered by the accommodative monetary policies implemented by European and Asian central banks. Bonds from both emerging and developed markets generally produced stronger returns than equities while repeating the pattern of outperformance by higher-quality, longer-term instruments seen in the United States.

As the economic growth cycle lengthens, investors are left to ponder how best to position their portfolios for an uncertain future. When the yield curve inverted earlier this year prompting concerns of a potential recession, we were reminded that the direction of the economy is continually subject to change, and perceptions of the economy can shift even more rapidly. As a MainStay investor, you can rely on us to manage our Funds with unflagging energy and dedication so that you can remain focused on your long-term objectives in the face of uncertainty and change. Our goal remains to provide you with the consistently reliable financial tools you need to achieve your long-term objectives.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending ane-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at nylinvestments.com/funds. Please read the Summary Prospectus and/or Prospectus carefully before investing.

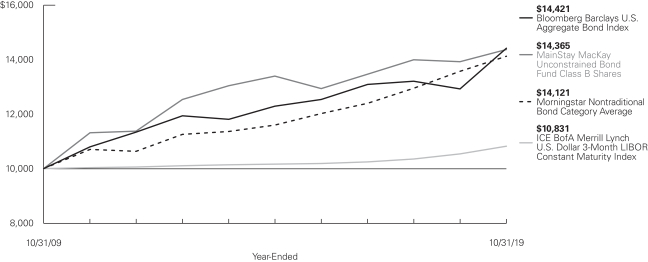

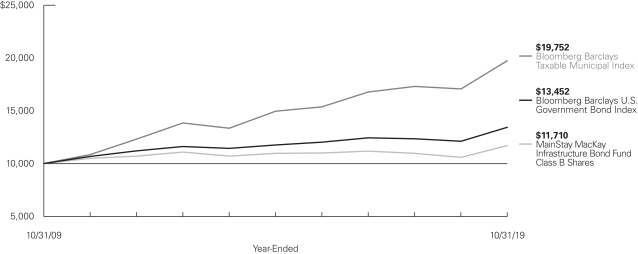

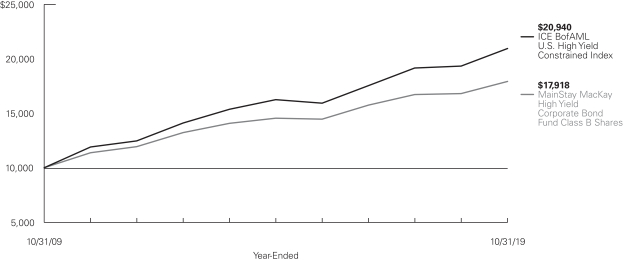

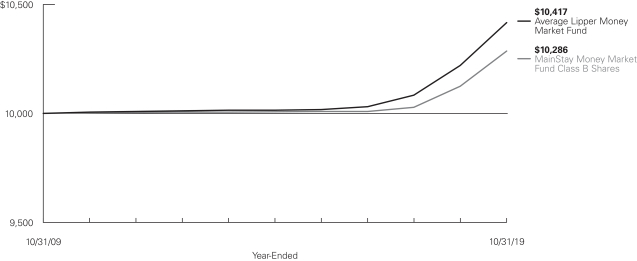

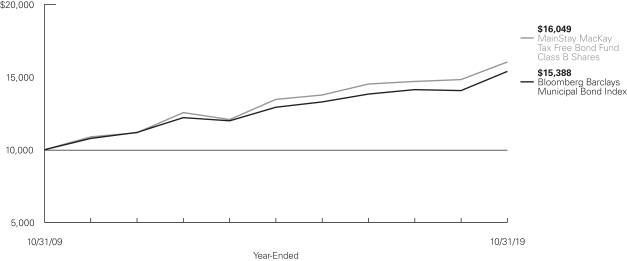

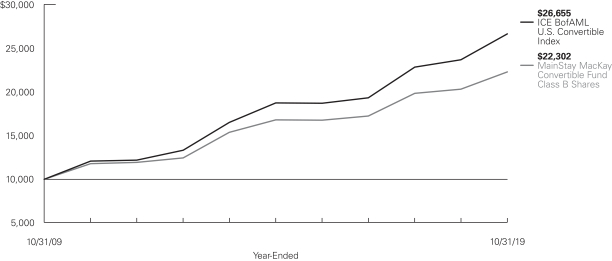

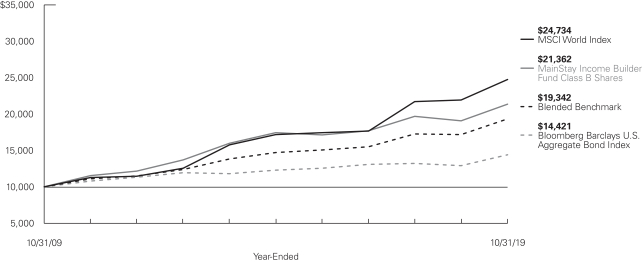

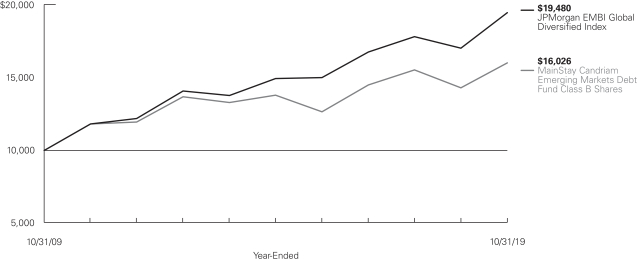

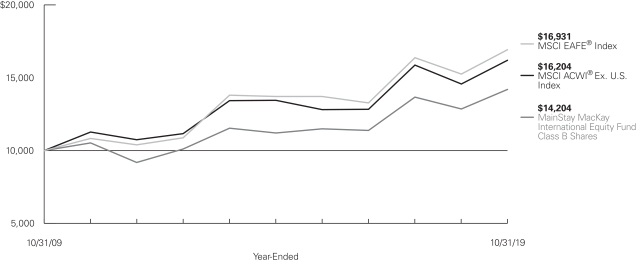

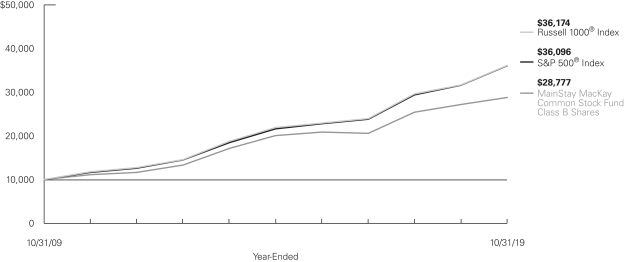

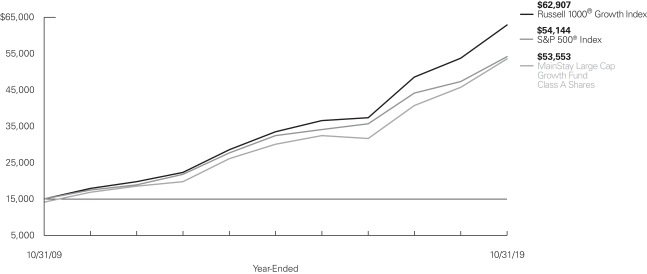

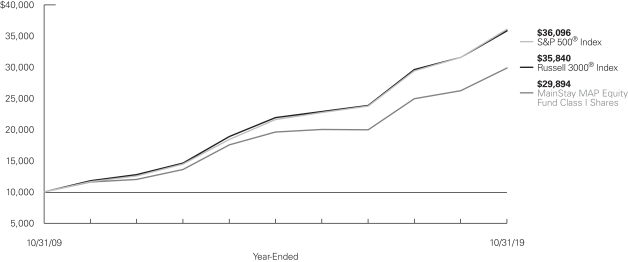

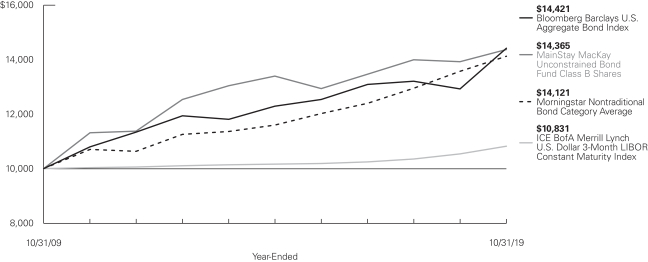

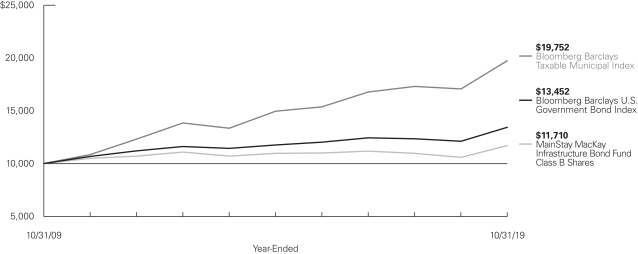

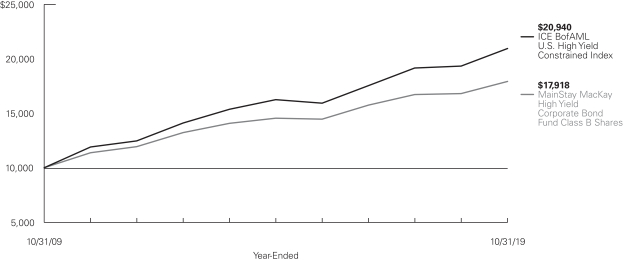

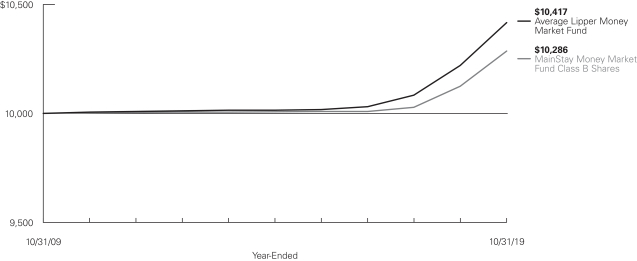

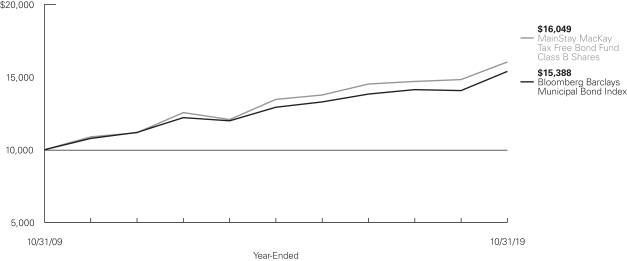

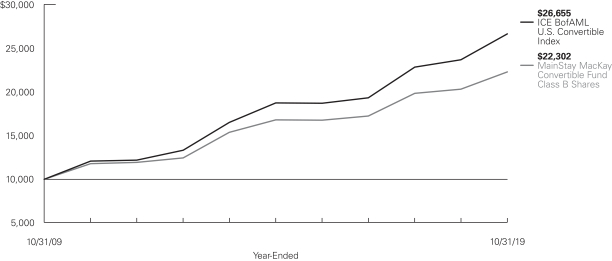

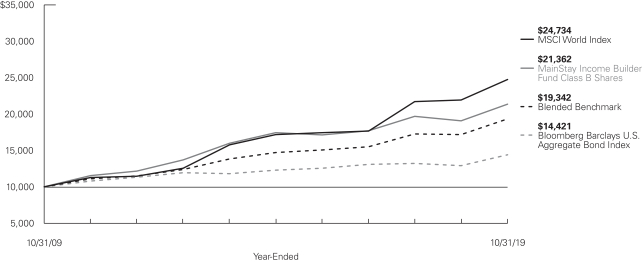

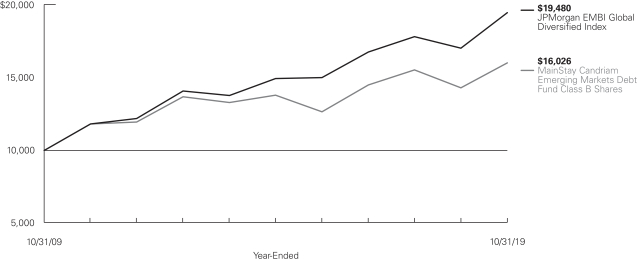

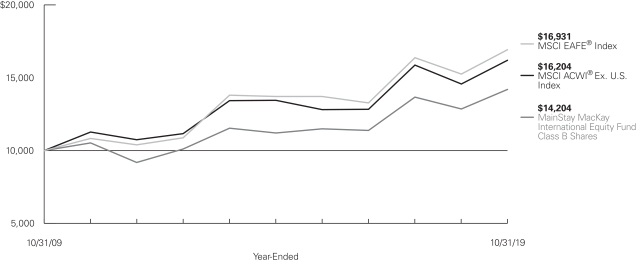

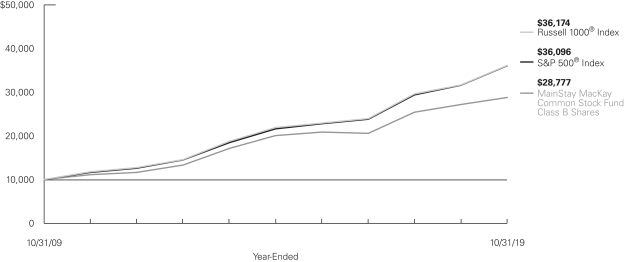

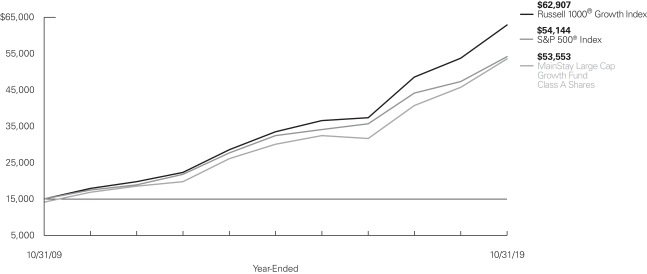

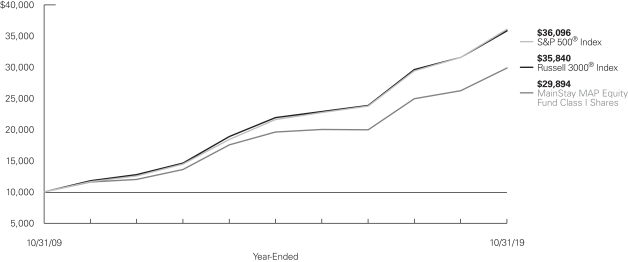

Investment and Performance Comparison1(Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class B shares2 of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit nylinvestments.com/funds.

Average Annual Total Returns for the Year-Ended October 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Inception

Date | | | One

Year | | | Five Years

or Since

Inception | | | Ten Years

or Since

Inception | | | Gross

Expense

Ratio3 | |

| | | | | | | |

| Class A Shares | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | | | 2/28/1997 | | |

| –0.69

3.99 | %

| |

| 1.24

2.18 | %

| |

| 4.07

4.55 | %

| |

| 1.25

1.25 | %

|

| Investor Class Shares | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | | | 2/28/2008 | | |

| –0.75

3.93 |

| |

| 1.23

2.17 |

| |

| 3.97

4.45 |

| |

| 1.27

1.27 |

|

| Class B Shares2 | | Maximum 5% CDSC

if Redeemed Within the First Six Years of Purchase | | With sales charges Excluding sales charges | |

| 2/28/1997

|

| |

| –1.80

3.20 |

| |

| 1.05

1.41 |

| |

| 3.69

3.69 |

| |

| 2.02

2.02 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within

One Year of Purchase | | With sales charges Excluding sales charges | |

| 9/1/1998

|

| |

| 2.21

3.21 |

| |

| 1.41

1.41 |

| |

| 3.68

3.68 |

| |

| 2.02

2.02 |

|

| Class I Shares | | No Sales Charge | | | | | 1/2/2004 | | | | 4.24 | | | | 2.44 | | | | 4.82 | | | | 1.00 | |

| Class R2 Shares | | No Sales Charge | | | | | 2/28/2014 | | | | 3.89 | | | | 2.08 | | | | 2.01 | | | | 1.35 | |

| Class R3 Shares | | No Sales Charge | | | | | 2/29/2016 | | | | 3.63 | | | | 4.74 | | | | N/A | | | | 1.60 | |

| Class R6 Shares | | No Sales Charge | | | | | 2/28/2018 | | | | 4.43 | | | | 2.96 | | | | N/A | | | | 0.83 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have |

| | been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements. |

| 2. | Class B shares are closed to all new purchases as well as additional investments by existing Class B shareholders. |

| 3. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | | | | | | | | | |

| Benchmark Performance | | One

Year | | | Five

Years | | | Ten

Years | |

| | | |

Bloomberg Barclays U.S. Aggregate Bond Index4 | | | 11.51 | % | | | 3.24 | % | | | 3.73 | % |

ICE BofAML U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index5 | | | 2.68 | | | | 1.27 | | | | 0.80 | |

Morningstar Nontraditional Bond Category Average6 | | | 4.03 | | | | 2.31 | | | | 3.51 | |

| 4. | The Bloomberg Barclays U.S. Aggregate Bond Index is the Fund’s primary broad-based securities market index for comparison purposes. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The Fund has selected the ICE BofAML U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index as a secondary benchmark. The ICE BofAML U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index is unmanaged and tracks the performance of a synthetic asset paying London Interbank Offered Rate to a stated maturity. The index is based on the |

| | assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 6. | The Fund has selected the Morningstar Nontraditional Bond Category Average as an additional benchmark. The Morningstar Nontraditional Bond Category Average contains funds that pursue strategies divergent in one or more ways from conventional practice in the broader bond-fund universe. Morningstar category averages are equal-weighted returns based on constituents of the category at the end of the period. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay MacKay Unconstrained Bond Fund |

Cost in Dollars of a $1,000 Investment in MainStay MacKay Unconstrained Bond Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2019, to October 31, 2019, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2019, to October 31, 2019.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2019. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/19 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/19 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/19 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2,3 |

| | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,019.40 | | | $ | 6.46 | | | $ | 1,018.80 | | | $ | 6.46 | | | 1.27% |

| | | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,019.10 | | | $ | 6.57 | | | $ | 1,018.70 | | | $ | 6.56 | | | 1.29% |

| | | | | | |

| Class B Shares | | $ | 1,000.00 | | | $ | 1,016.70 | | | $ | 10.37 | | | $ | 1,014.92 | | | $ | 10.36 | | | 2.04% |

| | | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,015.50 | | | $ | 10.36 | | | $ | 1,014.92 | | | $ | 10.36 | | | 2.04% |

| | | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 5.20 | | | $ | 1,020.06 | | | $ | 5.19 | | | 1.02% |

| | | | | | |

| Class R2 Shares | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 6.98 | | | $ | 1,018.30 | | | $ | 6.97 | | | 1.37% |

| | | | | | |

| Class R3 Shares | | $ | 1,000.00 | | | $ | 1,017.60 | | | $ | 8.24 | | | $ | 1,017.04 | | | $ | 8.24 | | | 1.62% |

| | | | | | |

| Class R6 Shares | | $ | 1,000.00 | | | $ | 1,021.60 | | | $ | 4.28 | | | $ | 1,020.97 | | | $ | 4.28 | | | 0.84% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the six-month period. |

| 3. | Expenses are inclusive of dividends and interest on investments sold short. |

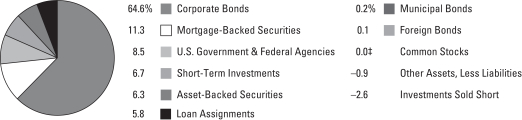

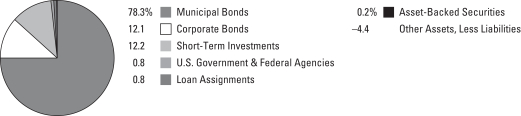

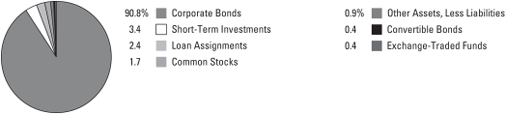

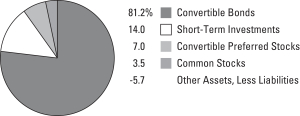

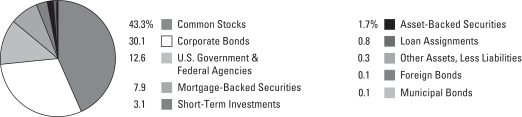

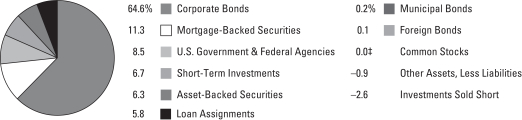

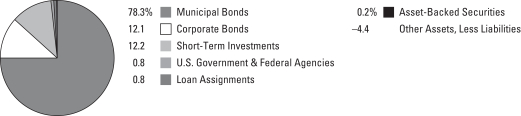

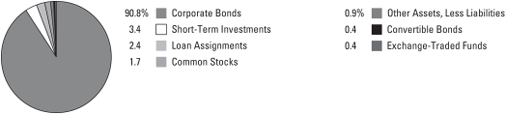

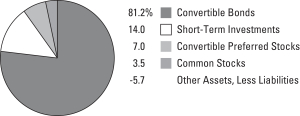

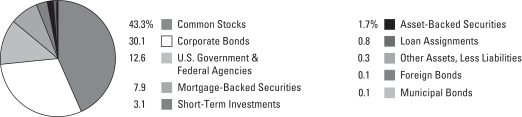

Portfolio Composition as of October 31, 2019(Unaudited)

See Portfolio of Investments beginning on page 11 for specific holdings within these categories. The Fund’s holdings are subject to change.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings or Issuers Held as of October 31, 2019(excludingshort-term investments) (Unaudited)

| 1. | United States Treasury Inflation—Indexed Notes, 0.75%–0.875%, due 7/15/28–1/15/29 |

| 2. | Federal National Mortgage Association (Mortgage Pass-Through Securities), 3.50%–4.50%, due 8/1/48–2/1/49 |

| 3. | Goldman Sachs Group, Inc., 2.35%–5.25%, due 7/27/21–5/15/26 |

| 4. | Morgan Stanley, 3.125%–5.611%, due 1/15/20–1/20/27 |

| 5. | Citigroup, Inc., 2.35%–6.30%, due 8/2/21–7/1/26 |

| 6. | Bank of America Corp., 3.004%–8.57%, due 5/17/22–3/10/26 |

| 7. | Federal Home Loan Mortgage Corporation, 3.00%–3.50%, due 5/25/29–10/25/49 |

| 8. | FREMF Mortgage Trust, 3.499%–4.331%, due 12/25/44–12/25/46 |

| 9. | Federal National Mortgage Association, 3.00%, 5/25/48–10/25/49 |

| 10. | Government National Mortgage Association, 3.00%, due 1/16/40–6/20/49 |

| | |

| 8 | | MainStay MacKay Unconstrained Bond Fund |

Portfolio Management Discussion and Analysis(Unaudited)

Questions answered by portfolio managers Dan Roberts, PhD,1 Joseph Cantwell, Stephen R. Cianci, CFA, Matt Jacob, Neil Moriarty III, andShu-Yang Tan, CFA, of MacKay Shields LLC, the Fund’s Subadvisor.

How did MainStay MacKay Unconstrained Bond Fund perform relative to its benchmarks and peer group during the 12 months ended October 31, 2019?

For the 12 months ended October 31, 2019, Class I shares of MainStay MacKay Unconstrained Bond Fund returned 4.24%, underperforming the 11.51% return of the Fund’s primary benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, and outperforming the 2.68% return of the Fund’s secondary benchmark, the ICE BofAML U.S. Dollar3-Month Deposit Offered Rate Constant Maturity Index. Over the same period, Class I shares outperformed the 4.03% return of the Morningstar Nontraditional Bond Category Average.2

Were there any changes to the Fund during the reporting period?

Effective December 31, 2018, Louis Cohen no longer served as a portfolio manager of the Fund. Dan Roberts,1 Joseph Cantwell, Stephen R. Cianci, Matt Jacob, Neil Moriarty andShu-Yang Tan continue to manage the Fund. For more information about this change refer to the supplement dated October 18, 2018.

What factors affected the Fund’s relative performance during the reporting period?

The reporting period got off to a tumultuous start in large part due to a variety of political and economic developments affecting the market, including, but not limited to, fears of weaker growth in China, Japan and the European Union; restrictive U.S. Federal Reserve (Fed) policy; the U.S. administration’s public criticism of the Fed; trade wars with China; and the uncertainty surrounding the United Kingdom’s Brexit negotiations to separate from the European Union.

At the beginning of 2019, the Fed reversed course on their rate policy and announced that the Fed funds benchmark rate had risen to a level consistent with its policy objectives. The market focused on the fact that not only was the Fed no longer tightening monetary policy, but that it might reverse course and begin to cut rates. Indeed, over the ensuing months, the Fed cut rates three times. In an unusual set of circumstances, both Treasury securities and stocks rallied on the Fed’s pause and eventual loosening stance, reflecting cautious optimism regarding the durability of the current business cycle. Swayed

by similar effects, corporate bond spreads3 tightened during the reporting period, as did spreads of credit-related securitized4 product (asset-backed and commercial mortgage-backed securities).

During the reporting period, the Fund underperformed its primary benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, largely due to underweight exposure to long-maturity Treasuries, which detracted from performance as Treasury yields fell. The Fund outperformed its secondary benchmark, the ICE BofAML U.S. Dollar3-Month Deposit Offered Rate Constant Maturity Index, largely due to the Fund’s overweight exposure to spread product, including high-yield credit, bank loans, investment-grade credit and emerging-market credit.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

Throughout the course of the reporting period, we used futures to manage the Fund’s duration5 profile. Though we extended the Fund’s duration during the reporting period, it remained below that of the Bloomberg Barclays U.S. Aggregate Bond Index, thereby detracting from performance relative to the benchmark.

What was the Fund’s duration strategy during the reporting period?

We gradually extended the Fund’s duration from 1.0 year at the beginning of the reporting period to approximately 1.6 years at the end of the reporting period. Throughout the reporting period, the Fund’s duration remained below that of the Bloomberg Barclays U.S. Aggregate Bond Index. As of October 31, 2019, the benchmark duration was approximately 5.8 years.

During the reporting period, which sectors were the strongest positive contributors to the Fund’s relative performance and which sectors were particularly weak?

Spread product—specifically investment-grade credit, high-yield credit, bank loans and emerging-market debt—performed well during the reporting period and made positive contributions to the Fund’s performance relative to the Bloomberg Barclays U.S. Aggregate Bond Index. (Contributions take weightings and total returns into account.) Emerging markets benefited from

| 1. | Dan Roberts will serve as a portfolio manager of the Fund until January 1, 2020. |

| 2. | See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more information on benchmark and peer group returns. |

| 3. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. |

| 4. | A securitization is a financial instrument created by an issuer by combining a pool of financial assets (such as mortgages). The financial instrument is then marketed to investors, sometimes in tiers. |

| 5. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

renewed risk appetites sparked by dovish central banks. Securitized assets, including residential mortgage-backed securities (RMBS) and consumer-related asset-backed securities (ABS), though positive for the reporting period, lagged the overall return of the benchmark. These securities are generally higher rated and shorter duration in nature.

What were some of the Fund’s largest purchases and sales during the reporting period?

In general terms, as credit spreads narrowed during the reporting period and the compensation for risk compressed, we reduced the Fund’s exposure to credit in the form of high-yield bonds and bank loans. At the same time, we methodically added securitized assets—such as ABS, RMBS and commercial mortgage-backed securities (CMBS)—into the Fund, both to reduce volatility and for diversification purposes.

How did the Fund’s sector weightings change during the reporting period?

We significantly increased the Fund’s exposure to securitized assets, such as RMBS, CMBS and ABS, while reducing the Fund’s exposure to high-yield bonds and bank loans. These transactions improved the liquidity and overall credit quality of the Fund as spreads tightened during the reporting period.

How was the Fund positioned at the end of the reporting period?

Relative to the Bloomberg Barclays U.S. Aggregate Bond Index, the Fund ended the reporting period with overweight exposure to investment-grade corporate bonds, high-yield bonds and bank loans. Conversely, as of October 31, 2019, the Fund held underweight exposure to U.S. Treasury bonds and agency mortgage-backed securities.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | |

| 10 | | MainStay MacKay Unconstrained Bond Fund |

Portfolio of InvestmentsOctober 31, 2019

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 96.8%† Asset-Backed Securities 6.3% | |

Auto Floor Plan Asset-Backed Securities 0.9% | |

Ford Credit Floorplan Master Owner Trust

Series 2018-4, Class A

4.06%, due 11/15/30 | | $ | 4,390,000 | | | $ | 4,873,904 | |

Navistar Financial Dealer Note Master Owner Trust II

Series 2018-1, Class A

2.648% (1 Month LIBOR + 0.63%), due 9/25/23 (a)(b) | | | 3,980,000 | | | | 3,983,697 | |

| | | | | | | | |

| | | | | | | 8,857,601 | |

| | | | | | | | |

Automobile Asset-Backed Securities 0.8% | |

Santander Retail Auto Lease Trust

Series 2019-B, Class A3

2.30%, due 1/20/23 (a) | | | 2,195,000 | | | | 2,210,220 | |

Toyota Auto Loan Extended Note Trust

Series 2019-1A, Class A

2.56%, due 11/25/31 (a) | | | 3,185,000 | | | | 3,260,770 | |

World Omni Auto Receivables Trust

Series 2019-A, Class A3

3.04%, due 5/15/24 | | | 2,355,000 | | | | 2,404,330 | |

| | | | | | | | |

| | | | | | | 7,875,320 | |

| | | | | | | | |

Credit Cards 2.0% | |

American Express Credit Account Master Trust | | | | | | | | |

Series 2018-9, Class A

2.408% (1 Month LIBOR + 0.38%), due 4/15/26 (b) | | | 2,105,000 | | | | 2,103,532 | |

Series 2019-1, Class A

2.87%, due 10/15/24 | | | 2,060,000 | | | | 2,111,126 | |

Capital One Multi-Asset Execution Trust | | | | | | | | |

Series 2019-A3, Class A3

2.06%, due 8/15/28 | | | 3,960,000 | | | | 3,942,184 | |

Series 2019-A1, Class A1

2.84%, due 12/15/24 | | | 3,765,000 | | | | 3,848,938 | |

Citibank Credit Card Issuance Trust

Series 2018-A2, Class A2

2.374% (1 Month LIBOR + 0.33%), due 1/20/25 (b) | | | 4,785,000 | | | | 4,780,695 | |

Discover Card Execution Note Trust

Series 2019-A1, Class A1

3.04%, due 7/15/24 | | | 2,425,000 | | | | 2,487,381 | |

| | | | | | | | |

| | | | | | | 19,273,856 | |

| | | | | | | | |

Home Equity 0.1% | |

First NLC Trust

Series 2007-1, Class A1

2.088% (1 Month LIBOR + 0.07%), due 8/25/37 (a)(b) | | | 311,459 | | | | 195,897 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Home Equity (continued) | |

JPMorgan Mortgage Acquisition Trust

Series 2007-HE1, Class AF1

2.118% (1 Month LIBOR + 0.10%), due 3/25/47 (b) | | $ | 110,099 | | | $ | 76,597 | |

MASTR Asset-Backed Securities Trust

Series 2006-HE4, Class A1

2.068% (1 Month LIBOR + 0.05%), due 11/25/36 (b) | | | 82,944 | | | | 38,011 | |

Morgan Stanley ABS Capital I Trust

Series 2007-HE4, Class A2A

2.128% (1 Month LIBOR + 0.11%), due 2/25/37 (b) | | | 83,907 | | | | 37,671 | |

| | | | | | | | |

| | | | | | | 348,176 | |

| | | | | | | | |

Other Asset-Backed Securities 2.5% | |

CNH Equipment Trust

Series 2019-B, Class A4

2.64%, due 5/15/26 | | | 4,360,000 | | | | 4,453,455 | |

Dell Equipment Finance Trust

Series 2018-2, Class A3

3.37%, due 10/22/23 (a) | | | 4,040,000 | | | | 4,104,629 | |

DLL Securitization Trust

Series 2019-MT3, Class A3

2.08%, due 2/21/23 (a) | | | 3,265,000 | | | | 3,264,022 | |

Hilton Grand Vacations Trust

Series 2019-AA, Class A

2.34%, due 7/25/33 (a) | | | 2,895,082 | | | | 2,902,318 | |

John Deere Owner Trust

Series 2019-B, Class A3

2.21%, due 12/15/23 | | | 4,160,000 | | | | 4,186,480 | |

MVW Owner Trust

Series 2019-2A, Class A

2.22%, due 10/20/38 (a) | | | 2,630,000 | | | | 2,627,948 | |

Sierra Receivables Funding Co.

Series 2019-3A, Class A

2.34%, due 8/15/36 (a) | | | 1,635,000 | | | | 1,634,972 | |

| | | | | | | | |

| | | | | | | 23,173,824 | |

| | | | | | | | |

Student Loans 0.0%‡ | |

KeyCorp Student Loan Trust

Series 2000-A, Class A2

2.841% (3 Month LIBOR + 0.32%), due 5/25/29 (b) | | | 218,618 | | | | 217,684 | |

| | | | | | | | |

Total Asset-Backed Securities

(Cost $58,948,454) | | | | | | | 59,746,461 | |

| | | | | | | | |

|

| Corporate Bonds 64.6% | |

Advertising 0.3% | |

Lamar Media Corp.

5.375%, due 1/15/24 | | | 2,695,000 | | | | 2,761,863 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of InvestmentsOctober 31, 2019 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Aerospace & Defense 1.0% | |

Moog, Inc.

5.25%, due 12/1/22 (a) | | $ | 5,505,000 | | | $ | 5,580,694 | |

Rockwell Collins, Inc.

3.50%, due 3/15/27 | | | 3,350,000 | | | | 3,583,472 | |

| | | | | | | | |

| | | | | | | 9,164,166 | |

| | | | | | | | |

Agriculture 0.6% | |

Altria Group, Inc.

3.80%, due 2/14/24 | | | 3,660,000 | | | | 3,839,862 | |

JBS Investments II GmbH

7.00%, due 1/15/26 (a) | | | 1,915,000 | | | | 2,075,860 | |

| | | | | | | | |

| | | | | | | 5,915,722 | |

| | | | | | | | |

Airlines 1.8% | |

Continental Airlines, Inc. | | | | | | | | |

Series 2007-1, Class A

5.983%, due 10/19/23 | | | 2,517,645 | | | | 2,668,099 | |

Series 2005-ERJ1

9.798%, due 10/1/22 | | | 93,248 | | | | 96,662 | |

Delta Air Lines, Inc. | | | | | | | | |

Series 2019-1, Class AA

3.204%, due 10/25/25 | | | 3,360,000 | | | | 3,514,573 | |

Series 2007-1, Class A

6.821%, due 2/10/24 | | | 1,215,524 | | | | 1,331,533 | |

U.S. Airways Group, Inc.

Series 2010-1, Class A

6.25%, due 10/22/24 | | | 4,625,284 | | | | 5,061,694 | |

United Airlines, Inc.

Series 2014-2, Class B

4.625%, due 3/3/24 | | | 3,875,686 | | | | 3,992,452 | |

| | | | | | | | |

| | | | | | | 16,665,013 | |

| | | | | | | | |

Auto Manufacturers 1.6% | |

Ford Motor Credit Co. LLC | | | | | | | | |

2.681%, due 1/9/20 | | | 3,345,000 | | | | 3,346,260 | |

3.35%, due 11/1/22 | | | 1,115,000 | | | | 1,118,323 | |

4.063%, due 11/1/24 | | | 2,280,000 | | | | 2,287,797 | |

4.25%, due 9/20/22 (c) | | | 860,000 | | | | 884,483 | |

General Motors Financial Co., Inc.

3.45%, due 4/10/22 (c) | | | 4,480,000 | | | | 4,566,563 | |

Volkswagen Group of America Finance LLC

3.875%, due 11/13/20 (a) | | | 2,925,000 | | | | 2,978,131 | |

| | | | | | | | |

| | | | | | | 15,181,557 | |

| | | | | | | | |

Banks 15.3% | |

Bank of America Corp. | | | | | | | | |

3.004%, due 12/20/23 (d) | | | 7,718,000 | | | | 7,894,963 | |

3.30%, due 1/11/23 | | | 510,000 | | | | 528,758 | |

3.499%, due 5/17/22 (c)(d) | | | 5,150,000 | | | | 5,258,394 | |

6.30%, due 3/10/26 (d)(e) | | | 3,570,000 | | | | 4,059,233 | |

8.57%, due 11/15/24 | | | 1,645,000 | | | | 2,076,000 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Banks (continued) | | | | | | | | |

Bank of New York Mellon Corp.

2.661%, due 5/16/23 (d) | | $ | 4,660,000 | | | $ | 4,727,380 | |

Barclays Bank PLC

5.14%, due 10/14/20 | | | 8,037,000 | | | | 8,245,480 | |

Branch Banking & Trust Co.

2.636% (5 Year Treasury Constant Maturity Rate + 1.15%), due 9/17/29 (b) | | | 2,500,000 | | | | 2,493,441 | |

Capital One Financial Corp.

5.55%, due 6/1/20 (d)(e) | | | 1,535,000 | | | | 1,563,121 | |

Citigroup, Inc. | | | | | | | | |

2.35%, due 8/2/21 (c) | | | 5,000,000 | | | | 5,030,380 | |

3.349% (3 Month LIBOR + 1.25%), due 7/1/26 (b) | | | 4,000,000 | | | | 4,062,794 | |

3.352%, due 4/24/25 (d) | | | 1,880,000 | | | | 1,955,876 | |

6.30%, due 5/15/24 (d)(e) | | | 10,800,000 | | | | 11,615,400 | |

Citizens Bank N.A.

3.25%, due 2/14/22 | | | 1,330,000 | | | | 1,364,445 | |

Citizens Financial Group, Inc.

4.15%, due 9/28/22 (a) | | | 2,270,000 | | | | 2,364,973 | |

Goldman Sachs Group, Inc. | | | | | | | | |

2.35%, due 11/15/21 | | | 9,335,000 | | | | 9,368,996 | |

2.908%, due 6/5/23 (d) | | | 4,285,000 | | | | 4,356,051 | |

3.00%, due 4/26/22 | | | 7,000,000 | | | | 7,092,826 | |

3.328% (3 Month LIBOR + 1.17%), due 5/15/26 (b) | | | 3,220,000 | | | | 3,258,737 | |

3.625%, due 1/22/23 | | | 3,227,000 | | | | 3,373,180 | |

5.25%, due 7/27/21 (c) | | | 6,047,000 | | | | 6,374,375 | |

Huntington National Bank

3.125%, due 4/1/22 | | | 4,580,000 | | | | 4,698,049 | |

Lloyds Banking Group PLC | | | | | | | | |

4.582%, due 12/10/25 | | | 1,365,000 | | | | 1,466,140 | |

4.65%, due 3/24/26 | | | 1,985,000 | | | | 2,145,180 | |

Morgan Stanley | | | | | | | | |

3.125%, due 1/23/23 | | | 6,380,000 | | | | 6,564,558 | |

3.625%, due 1/20/27 | | | 6,055,000 | | | | 6,456,912 | |

4.00%, due 7/23/25 | | | 1,920,000 | | | | 2,082,246 | |

4.875%, due 11/1/22 | | | 4,287,000 | | | | 4,598,477 | |

5.00%, due 11/24/25 | | | 2,465,000 | | | | 2,770,996 | |

5.611% (3 Month LIBOR + 3.61%), due 1/15/20 (b)(e) | | | 9,333,000 | | | | 9,388,998 | |

Santander Holdings USA, Inc. | | | | | | | | |

3.40%, due 1/18/23 | | | 1,500,000 | | | | 1,542,014 | |

3.70%, due 3/28/22 | | | 2,000,000 | | | | 2,055,995 | |

Wells Fargo & Co. (d) | | | | | | | | |

3.584%, due 5/22/28 (c) | | | 380,000 | | | | 402,784 | |

5.90%, due 6/15/24 (e) | | | 3,690,000 | | | | 3,985,200 | |

| | | | | | | | |

| | | | | | | 145,222,352 | |

| | | | | | | | |

Beverages 0.3% | |

Anheuser-Busch InBev Worldwide, Inc. | | | | | | | | |

4.15%, due 1/23/25 | | | 885,000 | | | | 967,538 | |

4.75%, due 1/23/29 | | | 1,770,000 | | | | 2,057,105 | |

| | | | | | | | |

| | | | | | | 3,024,643 | |

| | | | | | | | |

| | | | |

| 12 | | MainStay MacKay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Building Materials 0.4% | |

Masco Corp.

7.125%, due 3/15/20 | | $ | 290,000 | | | $ | 295,229 | |

Standard Industries, Inc.

5.375%, due 11/15/24 (a) | | | 3,580,000 | | | | 3,683,104 | |

| | | | | | | | |

| | | | | | | 3,978,333 | |

| | | | | | | | |

Chemicals 1.8% | |

Air Liquide Finance S.A.

1.75%, due 9/27/21 (a) | | | 2,785,000 | | | | 2,774,170 | |

Ashland LLC

4.75%, due 8/15/22 | | | 2,970,000 | | | | 3,111,075 | |

Braskem Netherlands Finance B.V. (a) | | | | | | | | |

3.50%, due 1/10/23 | | | 935,000 | | | | 949,034 | |

4.50%, due 1/10/28 | | | 1,250,000 | | | | 1,254,375 | |

Orbia Advance Corp. S.A.B. de C.V.

4.00%, due 10/4/27 (a) | | | 2,600,000 | | | | 2,639,000 | |

W.R. Grace & Co.

5.125%, due 10/1/21 (a) | | | 6,410,000 | | | | 6,650,375 | |

| | | | | | | | |

| | | | | | | 17,378,029 | |

| | | | | | | | |

Commercial Services 1.9% | |

Ashtead Capital, Inc.

4.25%, due 11/1/29 (a) | | | 2,060,000 | | | | 2,080,600 | |

Herc Holdings, Inc.

5.50%, due 7/15/27 (a) | | | 2,320,000 | | | | 2,404,100 | |

IHS Markit, Ltd. | | | | | | | | |

3.625%, due 5/1/24 | | | 3,710,000 | | | | 3,878,768 | |

4.125%, due 8/1/23 (c) | | | 1,075,000 | | | | 1,135,555 | |

PayPal Holdings, Inc.

2.40%, due 10/1/24 | | | 3,335,000 | | | | 3,357,529 | |

Service Corp. International

5.375%, due 5/15/24 | | | 2,200,000 | | | | 2,268,750 | |

University of Pennsylvania

3.61%, due 12/31/99 | | | 2,315,000 | | | | 2,515,155 | |

| | | | | | | | |

| | | | | | | 17,640,457 | |

| | | | | �� | | | |

Computers 0.7% | |

Dell International LLC / EMC Corp.

4.90%, due 10/1/26 (a)(c) | | | 4,000,000 | | | | 4,339,963 | |

Hewlett Packard Enterprise Co.

4.40%, due 10/15/22 | | | 2,520,000 | | | | 2,671,650 | |

| | | | | | | | |

| | | | | | | 7,011,613 | |

| | | | | | | | |

Cosmetics & Personal Care 0.4% | |

First Quality Finance Co., Inc.

5.00%, due 7/1/25 (a) | | | 3,760,000 | | | | 3,892,352 | |

| | | | | | | | |

|

Distribution & Wholesale 0.1% | |

Performance Food Group, Inc.

5.50%, due 10/15/27 (a) | | | 895,000 | | | | 946,463 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Diversified Financial Services 3.0% | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust | | | | | | | | |

3.50%, due 5/26/22 | | $ | 4,430,000 | | | $ | 4,556,177 | |

4.50%, due 5/15/21 | | | 480,000 | | | | 496,524 | |

Air Lease Corp. | | | | | | | | |

2.125%, due 1/15/20 | | | 3,275,000 | | | | 3,274,476 | |

2.625%, due 7/1/22 | | | 2,040,000 | | | | 2,059,005 | |

3.25%, due 3/1/25 (c) | | | 4,000,000 | | | | 4,110,705 | |

Allied Universal Holdco LLC / Allied Universal Finance Corp.

6.625%, due 7/15/26 (a) | | | 2,130,000 | | | | 2,273,775 | |

Ally Financial, Inc. | | | | | | | | |

5.75%, due 11/20/25 | | | 3,820,000 | | | | 4,254,525 | |

8.00%, due 11/1/31 | | | 3,280,000 | | | | 4,563,300 | |

Capital One Bank USA N.A.

3.375%, due 2/15/23 (c) | | | 3,000,000 | | | | 3,090,906 | |

| | | | | | | | |

| | | | | | | 28,679,393 | |

| | | | | | | | |

Electric 3.5% | |

Appalachian Power Co.

3.30%, due 6/1/27 | | | 1,800,000 | | | | 1,892,777 | |

Baltimore Gas & Electric Co.

2.40%, due 8/15/26 (c) | | | 4,150,000 | | | | 4,155,176 | |

CMS Energy Corp.

3.875%, due 3/1/24 | | | 3,818,000 | | | | 4,025,966 | |

Duke Energy Corp.

4.875% (5 Year Treasury Constant Maturity Rate + 3.388%), due 9/16/24 (b)(e) | | | 2,415,000 | | | | 2,547,825 | |

Entergy Arkansas LLC

3.50%, due 4/1/26 | | | 1,235,000 | | | | 1,313,941 | |

Evergy, Inc.

5.292%, due 6/15/22 (f) | | | 663,000 | | | | 708,908 | |

Florida Power & Light Co.

2.75%, due 6/1/23 | | | 2,680,000 | | | | 2,759,352 | |

Potomac Electric Power Co.

4.15%, due 3/15/43 | | | 1,305,000 | | | | 1,473,067 | |

Public Service Electric & Gas Co.

3.00%, due 5/15/27 | | | 3,405,000 | | | | 3,553,762 | |

Public Service Enterprise Group, Inc.

2.65%, due 11/15/22 (c) | | | 3,500,000 | | | | 3,558,831 | |

WEC Energy Group, Inc. | | | | | | | | |

3.10%, due 3/8/22 | | | 2,345,000 | | | | 2,404,046 | |

4.271% (3 Month LIBOR + 2.113%), due 5/15/67 (b) | | | 5,495,000 | | | | 4,763,246 | |

| | | | | | | | |

| | | | | | | 33,156,897 | |

| | | | | | | | |

Entertainment 0.7% | |

Eldorado Resorts, Inc.

7.00%, due 8/1/23 (c) | | | 4,515,000 | | | | 4,712,531 | |

International Game Technology PLC

6.25%, due 2/15/22 (a) | | | 2,300,000 | | | | 2,420,750 | |

| | | | | | | | |

| | | | | | | 7,133,281 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of InvestmentsOctober 31, 2019 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Environmental Controls 0.4% | |

Waste Management, Inc.

2.40%, due 5/15/23 | | $ | 3,880,000 | | | $ | 3,930,848 | |

| | | | | | | | |

|

Food 2.0% | |

JBS USA LUX S.A. / JBS Food Co. / JBS USA Finance, Inc.

5.50%, due 1/15/30 (a) | | | 1,035,000 | | | | 1,113,919 | |

Kerry Group Financial Services Unlimited Co.

3.20%, due 4/9/23 (a) | | | 4,595,000 | | | | 4,674,691 | |

Mondelez International Holdings Netherlands B.V.

2.125%, due 9/19/22 (a) | | | 3,225,000 | | | | 3,229,179 | |

Smithfield Foods, Inc. (a) | | | | | | | | |

2.70%, due 1/31/20 | | | 4,005,000 | | | | 4,005,362 | |

3.35%, due 2/1/22 | | | 2,490,000 | | | | 2,503,123 | |

Tyson Foods, Inc.

3.95%, due 8/15/24 | | | 2,892,000 | | | | 3,103,737 | |

| | | | | | | | |

| | | | | | | 18,630,011 | |

| | | | | | | | |

Forest Products & Paper 0.4% | |

Georgia-Pacific LLC

8.00%, due 1/15/24 | | | 2,945,000 | | | | 3,611,690 | |

| | | | | | | | |

|

Health Care—Products 1.0% | |

Abbott Laboratories

3.40%, due 11/30/23 | | | 3,520,000 | | | | 3,713,279 | |

Becton Dickinson & Co. | | | | | | | | |

2.675%, due 12/15/19 | | | 1,059,000 | | | | 1,059,328 | |

3.363%, due 6/6/24 | | | 2,860,000 | | | | 2,995,712 | |

Stryker Corp.

2.625%, due 3/15/21 | | | 2,179,000 | | | | 2,199,495 | |

| | | | | | | | |

| | | | | | | 9,967,814 | |

| | | | | | | | |

Holding Company—Diversified 0.4% | |

CK Hutchison International (17) II, Ltd.

3.25%, due 9/29/27 (a) | | | 3,855,000 | | | | 3,962,498 | |

| | | | | | | | |

|

Home Builders 3.0% | |

D.R. Horton, Inc.

5.75%, due 8/15/23 (c) | | | 4,250,000 | | | | 4,717,535 | |

KB Home

8.00%, due 3/15/20 | | | 2,250,000 | | | | 2,295,675 | |

Lennar Corp. | | | | | | | | |

4.50%, due 11/15/19 | | | 4,740,000 | | | | 4,742,370 | |

6.25%, due 12/15/21 | | | 2,875,000 | | | | 3,033,125 | |

8.375%, due 1/15/21 | | | 2,540,000 | | | | 2,705,100 | |

MDC Holdings, Inc.

5.625%, due 2/1/20 | | | 1,608,000 | | | | 1,616,040 | |

Meritage Homes Corp.

7.00%, due 4/1/22 | | | 4,720,000 | | | | 5,156,600 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Home Builders (continued) | | | | | | | | |

Toll Brothers Finance Corp.

5.875%, due 2/15/22 | | $ | 3,735,000 | | | $ | 3,973,106 | |

| | | | | | | | |

| | | | | | | 28,239,551 | |

| | | | | | | | |

Home Furnishing 0.4% | |

Panasonic Corp.

2.536%, due 7/19/22 (a) | | | 3,305,000 | | | | 3,332,515 | |

| | | | | | | | |

|

Insurance 2.7% | |

Lincoln National Corp.

4.481% (3 Month LIBOR + 2.358%), due 5/17/66 (b) | | | 3,537,000 | | | | 2,976,178 | |

MassMutual Global Funding II

2.50%, due 4/13/22 (a) | | | 3,600,000 | | | | 3,647,722 | |

Pricoa Global Funding I

2.55%, due 11/24/20 (a) | | | 2,725,000 | | | | 2,746,786 | |

Protective Life Corp.

8.45%, due 10/15/39 | | | 2,476,000 | | | | 3,899,873 | |

Reliance Standard Life Global Funding II

2.50%, due 10/30/24 (a) | | | 2,900,000 | | | | 2,906,029 | |

Scottish Widows, Ltd.

Series Reg S

5.50%, due 6/16/23 | | | GBP 6,500,000 | | | | 9,379,513 | |

| | | | | | | | |

| | | | | | | 25,556,101 | |

| | | | | | | | |

Internet 1.8% | |

Baidu, Inc.

4.375%, due 5/14/24 | | $ | 2,380,000 | | | | 2,530,314 | |

Booking Holdings, Inc.

3.60%, due 6/1/26 | | | 2,790,000 | | | | 3,020,614 | |

Expedia Group, Inc.

3.25%, due 2/15/30 (a) | | | 3,920,000 | | | | 3,922,671 | |

GrubHub Holdings, Inc.

5.50%, due 7/1/27 (a) | | | 1,895,000 | | | | 1,776,562 | |

Tencent Holdings, Ltd.

3.28%, due 4/11/24 (a) | | | 3,820,000 | | | | 3,933,640 | |

Weibo Corp.

3.50%, due 7/5/24 (c) | | | 1,515,000 | | | | 1,543,695 | |

| | | | | | | | |

| | | | | | | 16,727,496 | |

| | | | | | | | |

Iron & Steel 0.9% | |

ArcelorMittal

4.55%, due 3/11/26 | | | 3,470,000 | | | | 3,669,310 | |

Vale Overseas, Ltd.

6.25%, due 8/10/26 | | | 4,330,000 | | | | 5,045,316 | |

| | | | | | | | |

| | | | | | | 8,714,626 | |

| | | | | | | | |

Lodging 0.7% | |

Marriott International, Inc.

3.75%, due 10/1/25 | | | 5,888,000 | | | | 6,296,002 | |

| | | | | | | | |

| | | | |

| 14 | | MainStay MacKay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Media 0.8% | |

Diamond Sports Group LLC / Diamond Sports Finance Co.

6.625%, due 8/15/27 (a)(g) | | $ | 3,228,000 | | | $ | 3,324,840 | |

Grupo Televisa S.A.B.

5.25%, due 5/24/49 (c) | | | 1,695,000 | | | | 1,854,723 | |

Sky, Ltd.

3.75%, due 9/16/24 (a) | | | 1,480,000 | | | | 1,594,095 | |

Time Warner Entertainment Co., L.P.

8.375%, due 3/15/23 | | | 1,087,000 | | | | 1,294,494 | |

| | | | | | | | |

| | | | | | | 8,068,152 | |

| | | | | | | | |

Mining 0.5% | |

Anglo American Capital PLC

4.875%, due 5/14/25 (a) | | | 3,000,000 | | | | 3,258,213 | |

Corp. Nacional del Cobre de Chile

3.00%, due 9/30/29 (a) | | | 1,890,000 | | | | 1,885,407 | |

| | | | | | | | |

| | | | | | | 5,143,620 | |

| | | | | | | | |

Miscellaneous—Manufacturing 0.7% | |

Siemens Financieringsmaatschappij N.V.

2.70%, due 3/16/22 (a) | | | 3,320,000 | | | | 3,380,523 | |

Textron Financial Corp.

3.893% (3 Month LIBOR + 1.735%), due 2/15/67 (a)(b) | | | 4,350,000 | | | | 3,273,375 | |

| | | | | | | | |

| | | | | | | 6,653,898 | |

| | | | | | | | |

Oil & Gas 3.3% | |

Concho Resources, Inc.

4.30%, due 8/15/28 | | | 2,995,000 | | | | 3,231,933 | |

Gazprom Via Gaz Capital S.A.

7.288%, due 8/16/37 (a) | | | 2,520,000 | | | | 3,402,262 | |

Marathon Petroleum Corp.

5.125%, due 4/1/24 (c) | | | 8,050,000 | | | | 8,288,224 | |

Occidental Petroleum Corp.

(zero coupon), due 10/10/36 | | | 19,735,000 | | | | 9,920,917 | |

Petrobras Global Finance B.V.

7.375%, due 1/17/27 | | | 1,559,000 | | | | 1,887,949 | |

Petroleos Mexicanos

6.75%, due 9/21/47 | | | 4,835,000 | | | | 4,810,825 | |

| | | | | | | | |

| | | | | | | 31,542,110 | |

| | | | | | | | |

Packaging & Containers 1.2% | |

Crown European Holdings S.A.

4.00%, due 7/15/22 (a) | | EUR | 3,540,000 | | | | 4,284,544 | |

Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC

5.125%, due 7/15/23 (a) | | $ | 4,555,000 | | | | 4,673,202 | |

WRKCo, Inc.

3.00%, due 9/15/24 | | | 2,735,000 | | | | 2,799,882 | |

| | | | | | | | |

| | | | | | | 11,757,628 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Pharmaceuticals 1.4% | |

Bausch Health Cos., Inc. (a) | | | | | | | | |

5.50%, due 11/1/25 | | $ | 3,735,000 | | | $ | 3,903,112 | |

5.75%, due 8/15/27 | | | 2,835,000 | | | | 3,078,633 | |

Bristol-Myers Squibb Co.

3.40%, due 7/26/29 (a) | | | 3,115,000 | | | | 3,350,453 | |

Eli Lilly & Co.

2.35%, due 5/15/22 | | | 2,200,000 | | | | 2,230,860 | |

Zoetis, Inc.

3.25%, due 8/20/21 | | | 770,000 | | | | 786,174 | |

| | | | | | | | |

| | | | | | | 13,349,232 | |

| | | | | | | | |

Pipelines 1.3% | |

Enterprise Products Operating LLC | | | | | | | | |

3.125%, due 7/31/29 | | | 2,150,000 | | | | 2,207,362 | |

4.20%, due 1/31/50 | | | 520,000 | | | | 549,907 | |

Kinder Morgan, Inc. | | | | | | | | |

5.625%, due 11/15/23 (a) | | | 2,449,000 | | | | 2,721,877 | |

7.75%, due 1/15/32 | | | 2,035,000 | | | | 2,802,163 | |

MPLX, L.P.

4.00%, due 3/15/28 | | | 560,000 | | | | 582,155 | |

Targa Resources Partners, L.P. / Targa Resources Partners Finance Corp.

5.25%, due 5/1/23 (c) | | | 3,725,000 | | | | 3,738,969 | |

| | | | | | | | |

| | | | | | | 12,602,433 | |

| | | | | | | | |

Private Equity 0.2% | |

Icahn Enterprises L.P. / Icahn Enterprises Finance Corp.

6.25%, due 2/1/22 | | | 1,390,000 | | | | 1,423,013 | |

| | | | | | | | |

|

Real Estate Investment Trusts 1.2% | |

American Tower Corp.

3.00%, due 6/15/23 (c) | | | 5,500,000 | | | | 5,649,441 | |

Digital Realty Trust, L.P.

3.70%, due 8/15/27 | | | 3,605,000 | | | | 3,805,505 | |

GLP Capital, L.P. / GLP Financing II, Inc.

3.35%, due 9/1/24 | | | 1,535,000 | | | | 1,552,652 | |

Host Hotels & Resorts, L.P.

3.75%, due 10/15/23 (c) | | | 472,000 | | | | 492,302 | |

| | | | | | | | |

| | | | | | | 11,499,900 | |

| | | | | | | | |

Retail 1.3% | |

Alimentation Couche-Tard, Inc. (a) | | | | | | | | |

2.35%, due 12/13/19 | | | 3,415,000 | | | | 3,416,263 | |

2.70%, due 7/26/22 | | | 1,500,000 | | | | 1,517,574 | |

CVS Pass-Through Trust

5.789%, due 1/10/26 (a) | | | 44,559 | | | | 48,017 | |

Darden Restaurants, Inc.

3.85%, due 5/1/27 | | | 4,847,000 | | | | 5,106,128 | |

Starbucks Corp.

4.45%, due 8/15/49 | | | 1,970,000 | | | | 2,277,513 | |

| | | | | | | | |

| | | | | | | 12,365,495 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of InvestmentsOctober 31, 2019 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Savings & Loans 0.1% | |

Nationwide Building Society

3.96%, due 7/18/30 (a)(d) | | $ | 1,325,000 | | | $ | 1,422,399 | |

| | | | | | | | |

|

Semiconductors 1.2% | |

Broadcom, Inc.

3.625%, due 10/15/24 (a) | | | 2,040,000 | | | | 2,095,908 | |

NXP B.V. / NXP Funding LLC (a) | | | | | | | | |

4.125%, due 6/1/21 | | | 6,300,000 | | | | 6,473,479 | |

4.625%, due 6/15/22 | | | 2,960,000 | | | | 3,108,911 | |

| | | | | | | | |

| | | | | | | 11,678,298 | |

| | | | | | | | |

Software 0.2% | |

Fiserv, Inc. | | | | | | | | |

2.75%, due 7/1/24 | | | 1,080,000 | | | | 1,104,166 | |

3.20%, due 7/1/26 | | | 685,000 | | | | 715,702 | |

| | | | | | | | |

| | | | | | | 1,819,868 | |

| | | | | | | | |

Telecommunications 4.1% | |

AT&T, Inc. | | | | | | | | |

3.20%, due 3/1/22 | | | 5,840,000 | | | | 5,993,415 | |

3.312% (3 Month LIBOR + 1.18%), due 6/12/24 (b) | | | 2,880,000 | | | | 2,930,046 | |

Crown Castle Towers LLC

4.241%, due 7/15/48 (a) | | | 3,825,000 | | | | 4,212,078 | |

Rogers Communications, Inc.

3.625%, due 12/15/25 | | | 5,635,000 | | | | 6,006,023 | |

Sprint Corp.

7.875%, due 9/15/23 | | | 3,620,000 | | | | 3,995,575 | |

Sprint Spectrum Co. LLC / Sprint Spectrum Co. II LLC / Sprint Spectrum Co. III LLC

4.738%, due 9/20/29 (a) | | | 4,480,000 | | | | 4,776,845 | |

T-Mobile USA, Inc.

6.00%, due 3/1/23 | | | 3,000,000 | | | | 3,060,000 | |

Telefonica Emisiones SAU

5.462%, due 2/16/21 | | | 1,000 | | | | 1,043 | |

VEON Holdings B.V.

4.95%, due 6/16/24 (a) | | | 3,345,000 | | | | 3,560,050 | |

Verizon Communications, Inc. | | | | | | | | |

4.125%, due 3/16/27 | | | 685,000 | | | | 763,883 | |

5.15%, due 9/15/23 | | | 3,573,000 | | | | 3,990,613 | |

| | | | | | | | |

| | | | | | | 39,289,571 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $597,477,962) | | | | | | | 615,336,903 | |

| | | | | | | | |

|

| Foreign Bonds 0.1% | |

Banks 0.1% | |

Barclays Bank PLC

Series Reg S

10.00%, due 5/21/21 | | | GBP 449,000 | | | | 653,530 | |

| | | | | | | | |

Total Foreign Bonds

(Cost $720,496) | | | | | | | 653,530 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Loan Assignments 5.8% (b) | |

Advertising 0.5% | |

Outfront Media Capital LLC

2017 Term Loan B

3.94% (3 Month LIBOR + 2.00%), due 3/18/24 | | $ | 4,746,007 | | | $ | 4,762,818 | |

| | | | | | | | |

|

Commercial Services 0.2% | |

KAR Auction Services, Inc.

2019 Term Loan B6

4.125% (1 Month LIBOR + 2.25%), due 9/19/26 | | | 1,481,776 | | | | 1,486,098 | |

| | | | | | | | |

|

Environmental Controls 0.6% | |

Advanced Disposal Services, Inc. Term Loan B3

4.086% (1 Week LIBOR + 2.25%), due 11/10/23 | | | 5,505,000 | | | | 5,511,804 | |

| | | | | | | | |

|

Food Services 0.1% | |

Aramark Services, Inc.

2018 Term Loan B2

3.536% (1 Month LIBOR + 1.75%), due 3/28/24 | | | 1,102,946 | | | | 1,103,980 | |

| | | | | | | | |

|

Hand & Machine Tools 0.4% | |

Milacron LLC

Amended Term Loan B

4.286% (1 Month LIBOR + 2.50%), due 9/28/23 | | | 4,005,618 | | | | 4,000,611 | |

| | | | | | | | |

|

Health Care—Services 0.4% | |

Syneos Health, Inc.

2018 Term Loan B

3.786% (1 Month LIBOR + 2.00%), due 8/1/24 | | | 3,436,779 | | | | 3,434,631 | |

| | | | | | | | |

|

Household Products & Wares 0.4% | |

Prestige Brands, Inc. Term Loan B4

3.786% (1 Month LIBOR + 2.00%), due 1/26/24 | | | 3,898,047 | | | | 3,898,827 | |

| | | | | | | | |

|

Lodging 0.6% | |

Boyd Gaming Corp. Term Loan B3

3.96% (1 Week LIBOR + 2.25%), due 9/15/23 | | | 305,783 | | | | 305,892 | |

Hilton Worldwide Finance LLC

2019 Term Loan B2

3.573% (1 Month LIBOR + 1.75%), due 6/22/26 | | | 5,324,239 | | | | 5,344,205 | |

| | | | | | | | |

| | | | | | | 5,650,097 | |

| | | | | | | | |

| | | | |

| 16 | | MainStay MacKay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Loan Assignments (continued) | |

Media 0.4% | |

Nielsen Finance LLC Term Loan B4

3.94% (1 Month LIBOR + 2.00%), due 10/4/23 | | $ | 3,865,875 | | | $ | 3,850,172 | |

| | | | | | | | |

|

Pharmaceuticals 0.4% | |

Change Healthcare Holdings, Inc.

2017 Term Loan B

4.286% (1 Month LIBOR + 2.50%), due 3/1/24 | | | 4,273,191 | | | | 4,245,817 | |

| | | | | | | | |

|

Retail 0.2% | |

1011778 B.C. Unlimited Liability Co. Term Loan B3

4.036% (1 Month LIBOR + 2.25%), due 2/16/24 | | | 1,480,559 | | | | 1,481,484 | |

| | | | | | | | |

|

Telecommunications 1.3% | |

Level 3 Financing, Inc.

2017 Term Loan B

4.036% (1 Month LIBOR + 2.25%), due 2/22/24 | | | 4,000,000 | | | | 4,001,000 | |

SBA Senior Finance II LLC

2018 Term Loan B

3.79% (1 Month LIBOR + 2.00%), due 4/11/25 | | | 8,589,723 | | | | 8,607,615 | |

| | | | | | | | |

| | | | | | | 12,608,615 | |

| | | | | | | | |

Transportation 0.3% | |

XPO Logistics, Inc.

2018 Term Loan B

3.786% (1 Month LIBOR + 2.00%), due 2/24/25 | | | 3,285,000 | | | | 3,287,736 | |

| | | | | | | | |

Total Loan Assignments

(Cost $55,272,732) | | | | | | | 55,322,690 | |

| | | | | | | | |

|

| Mortgage-Backed Securities 11.3% | |

Agency (Collateralized Mortgage Obligations) 4.1% | |

Federal Home Loan Mortgage Corporation | | | | | | | | |

REMIC, Series 4908, Class BD

3.00%, due 4/25/49 | | | 2,480,000 | | | | 2,556,502 | |

REMIC, Series 4911, Class MB

3.00%, due 9/25/49 | | | 4,685,000 | | | | 4,798,057 | |

REMIC, Series 4926, Class BP

3.00%, due 10/25/49 (h) | | | 5,000,000 | | | | 5,160,000 | |

Series 2019-1, Class A1

3.50%, due 5/25/29 | | | 2,203,416 | | | | 2,291,090 | |

REMIC Series 4888, Class BA

3.50%, due 9/15/48 | | | 2,047,034 | | | | 2,129,622 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Agency (Collateralized Mortgage Obligations) (continued) | |

Federal National Mortgage Association | | | | | | | | |

Series 2019-25, Class PA

3.00%, due 5/25/48 | | $ | 2,535,738 | | | $ | 2,601,586 | |

REMIC,Series 2019-39, Class LA

3.00%, due 2/25/49 | | | 3,107,973 | | | | 3,186,306 | |

REMIC,Series 2019-58, Class LP

3.00%, due 10/25/49 | | | 5,275,000 | | | | 5,417,311 | |

Government National Mortgage Association | | | | | | | | |

Series 2014-91, Class MA

3.00%, due 1/16/40 | | | 2,683,572 | | | | 2,769,788 | |

Series 2019-29, Class CB

3.00%, due 10/20/48 | | | 2,307,551 | | | | 2,354,557 | |

Series 2019-43, Class PL

3.00%, due 4/20/49 | | | 2,449,698 | | | | 2,529,618 | |

Series 2019-74, Class AT

3.00%, due 6/20/49 | | | 3,262,512 | | | | 3,346,584 | |

| | | | | | | | |

| | | | | | | 39,141,021 | |

| | | | | | | | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) 6.3% | |

Bank | | | | | | | | |

Series 2019-BN21, Class A5

2.851%, due 10/17/52 | | | 5,310,000 | | | | 5,475,428 | |

Series 2019-BN19, Class A2

2.926%, due 8/15/61 | | | 3,520,000 | | | | 3,657,627 | |

Bayview Commercial Asset Trust

Series 2006-4A, Class A1

2.248% (1 Month LIBOR + 0.23%), due 12/25/36 (a)(b) | | | 17,515 | | | | 16,915 | |

Benchmark Mortgage Trust

Series 2019-B12, Class A5

3.116%, due 8/15/52 | | | 3,531,000 | | | | 3,729,715 | |

FREMF Mortgage Trust (a)(i) | | | | | | | | |

Series 2013-K33, Class B

3.499%, due 8/25/46 | | | 2,965,000 | | | | 3,096,799 | |

Series 2013-K30, Class B

3.557%, due 6/25/45 | | | 3,975,000 | | | | 4,156,240 | |

Series 2013-K35, Class B

3.939%, due 12/25/46 | | | 2,230,000 | | | | 2,354,373 | |

Series 2012-K17, Class B

4.331%, due 12/25/44 | | | 2,305,000 | | | | 2,397,133 | |

GS Mortgage Securities Trust | | | | | | | | |

Series 2019-GC42, Class A4

3.001%, due 9/1/52 | | | 1,365,000 | | | | 1,426,904 | |

Series 2019-GC40, Class A4

3.16%, due 7/10/52 | | | 2,560,000 | | | | 2,709,774 | |

Series 2019-BOCA, Class A

3.228% (1 Month LIBOR + 1.20%), due 6/15/38 (a)(b) | | | 4,430,000 | | | | 4,435,531 | |

Hawaii Hotel Trust

Series 2019-MAUI, Class A

3.178% (1 Month LIBOR + 1.15%), due 5/15/38 (a)(b) | | | 2,160,000 | | | | 2,162,037 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of InvestmentsOctober 31, 2019 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Mortgage-Backed Securities (continued) | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) (continued) | |

Hudson Yards Mortgage Trust

Series 2019-30HY, Class A

3.228%, due 7/10/39 (a) | | $ | 2,490,000 | | | $ | 2,649,012 | |

JP Morgan Chase Commercial Mortgage Securities Trust | | | | | | | | |

Series 2018-AON, Class A

4.128%, due 7/5/31 (a) | | | 3,435,000 | | | | 3,672,236 | |

Series 2013-C16, Class A4

4.166%, due 12/15/46 | | | 2,280,000 | | | | 2,453,022 | |

JPMBB Commercial Mortgage Securities Trust

Series 2015-C28, Class A4

3.227%, due 10/15/48 | | | 3,235,000 | | | | 3,392,716 | |

One Bryant Park Trust

Series 2019-OBP, Class A

2.516%, due 9/15/54 (a) | | | 4,825,000 | | | | 4,818,052 | |

Wells Fargo Commercial Mortgage Trust (a)(i) | | | | | | | | |

Series 2018-1745, Class A

3.749%, due 6/15/36 | | | 2,900,000 | | | | 3,180,310 | |

Series 2018-AUS, Class A

4.058%, due 8/17/36 | | | 4,200,000 | | | | 4,669,970 | |

| | | | | | | | |

| | | | | | | 60,453,794 | |

| | | | | | | | |

Residential Mortgage (Collateralized Mortgage Obligation) 0.2% | |

JP Morgan Mortgage Trust

Series 2019-1, Class A3

4.00%, due 5/25/49 (a)(j) | | | 1,461,907 | | | | 1,482,922 | |

| | | | | | | | |

|

Whole Loan (Collateralized Mortgage Obligations) 0.7% | |

Chase Home Lending Mortgage Trust (a)(j) | | | | | | | | |

Series 2019-ATR2, Class A3

3.50%, due 7/25/49 | | | 1,926,714 | | | | 1,955,991 | |

Series 2019-ATR1, Class A4

4.00%, due 4/25/49 | | | 2,600,569 | | | | 2,609,513 | |

Fannie Mae Connecticut Avenue Securities

Series 2016-C06, Class 1M2

6.268% (1 Month LIBOR + 4.25%), due 4/25/29 (b) | | | 1,681,452 | | | | 1,787,040 | |

| | | | | | | | |

| | | | | | | 6,352,544 | |

| | | | | | | | |

Total Mortgage-Backed Securities

(Cost $105,484,535) | | | | | | | 107,430,281 | |

| | | | | | | | |

|

| Municipal Bonds 0.2% | |

New York 0.2% | |

New York State Thruway Authority, Revenue Bonds

Series M

2.90%, due 1/1/35 | | | 1,495,000 | | | | 1,513,329 | |

| | | | | | | | |

Total Municipal Bonds

(Cost $1,495,000) | | | | | | | 1,513,329 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| U.S. Government & Federal Agencies 8.5% | |

Federal Home Loan Mortgage Corporation

(Mortgage Pass-Through Securities) 0.2% | |

4.00%, due 2/1/49 | | $ | 2,340,705 | | | $ | 2,436,049 | |

Federal National Mortgage Association

(Mortgage Pass-Through Securities) 4.0% | |

3.50%, due 9/1/48 TBA (k) | | | 8,782,000 | | | | 9,016,644 | |

4.00%, due 8/1/48 | | | 13,299,085 | | | | 13,833,976 | |

4.00%, due 2/1/49 | | | 5,000,661 | | | | 5,198,064 | |

4.50%, due 1/1/49 | | | 9,210,151 | | | | 9,721,777 | |

| | | | | | | | |

| | | | | | | 37,770,461 | |

| | | | | | | | |

United States Treasury Notes 0.1% | | | | | | | | |

1.625%, due 8/15/29 | | | 720,000 | | | | 715,697 | |

| | | | | | | | |

|

United States Treasury Inflation—Indexed Notes 4.2% (l) | |

0.75%, due 7/15/28 | | | 11,345,088 | | | | 11,940,381 | |

0.875%, due 1/15/29 | | | 26,620,772 | | | | 28,312,468 | |

| | | | | | | | |

| | | | | | | 40,252,849 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $78,327,210) | | | | | | | 81,175,056 | |

| | | | | | | | |

TotalLong-Term Bonds

(Cost $897,726,389) | | | | | | | 921,178,250 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Shares | | | | |

| Common Stocks 0.0%‡ | |

Commercial Services & Supplies 0.0%‡ | |

Quad/Graphics, Inc. | | | 14 | | | | 64 | |

| | | | | | | | |

|

Media 0.0%‡ | |

ION Media Networks, Inc. (h)(m)(n)(o)(p) | | | 22 | | | | 8,726 | |

| | | | | | | | |

|

Tobacco 0.0%‡ | |

Turning Point Brands, Inc. (g) | | | 6,802 | | | | 141,958 | |

| | | | | | | | |

Total Common Stocks

(Cost $0) | | | | | | | 150,748 | |

| | | | | | | | |

|

| Short-Term Investments 6.7% | |

Affiliated Investment Company 5.4% | |

MainStay U.S. Government Liquidity Fund, 1.76% (q) | | | 51,821,778 | | | | 51,821,778 | |

| | | | | | | | |

Total Affiliated Investment Company

(Cost $51,821,778) | | | | | | | 51,821,778 | |

| | | | | | | | |

|

Unaffiliated Investment Company 0.4% | |

State Street Navigator Securities Lending Government Money Market Portfolio, 1.75% (q)(r) | | | 3,432,629 | | | | 3,432,629 | |

| | | | | | | | |

Total Unaffiliated Investment Company

(Cost $3,432,629) | | | | | | | 3,432,629 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | |

| 18 | | MainStay MacKay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| U.S. Government & Federal Agencies 0.9% | |

United States Treasury Bills

1.706%, due 11/26/19 (s) | | $ | 8,550,000 | | | $ | 8,540,025 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $8,540,025) | | | | | | | 8,540,025 | |

| | | | | | | | |

TotalShort-Term Investments

(Cost $63,794,432) | | | | | | | 63,794,432 | |

| | | | | | | | |

Total Investments, Before Investments Sold Short

(Cost $961,520,821) | | | 103.5 | % | | | 985,123,430 | |

| | | | | | | | |

|

Investments Sold Short (2.6%) Corporate Bonds Sold Short (2.6%) | |

Health Care—Services (0.3%) | |

Davita, Inc.

5.00%, due 5/1/25 | | | (2,940,000 | ) | | | (2,969,988 | ) |

| | | | | | | | |

|

Internet (1.1%) | |

Netflix, Inc.

4.375%, due 11/15/26 | | | (10,400,000 | ) | | | (10,585,120 | ) |

| | | | | | | | |

|

Mining (0.6%) | |

FMG Resources (August 2006) Pty, Ltd.

5.125%, due 5/15/24 (a) | | | (5,000,000 | ) | | | (5,250,000 | ) |

| | | | | | | | |

|

Semiconductors (0.6%) | |

Amkor Technology, Inc.

6.625%, due 9/15/27 (a) | | | (5,000,000 | ) | | | (5,475,000 | ) |

| | | | | | | | |

Total Investments Sold Short (Proceeds $23,339,794) | | | | | | | (24,280,108 | ) |

| | | | | | | | |

Total Investments, Net of Investments Sold Short

(Cost $938,181,027) | | | 100.9 | % | | | 960,843,322 | |

Other Assets, Less Liabilities | | | (0.9 | ) | | | (8,777,993 | ) |

Net Assets | | | 100.0 | % | | $ | 952,065,329 | |

| † | Percentages indicated are based on Fund net assets. |

| ‡ | Less than one-tenth of a percent. |

| (a) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (b) | Floating rate—Rate shown was the rate in effect as of October 31, 2019. |

| (c) | Security, or a portion thereof, was maintained in a segregated account at the Fund’s custodian as collateral for securities sold short (See Note 2(N)). |

| (d) | Fixed to floating rate—Rate shown was the rate in effect as of October 31, 2019. |

| (e) | Securities are perpetual and, thus, do not have a predetermined maturity date. The date shown, if applicable, reflects the next call date. |

| (f) | Step coupon—Rate shown was the rate in effect as of October 31, 2019. |

| (g) | All or a portion of this security was held on loan. As of October 31, 2019, the aggregate market value of securities on loan was $3,463,764; the total market value of collateral held by the Fund was $3,554,377. The market value of the collateral held included non-cash collateral in the form of U.S. Treasury securities with a value of $121,748 (See Note 2(O)). |

| (h) | Fair valued security—Represents fair value as measured in good faith under procedures approved by the Board of Trustees. As of October 31, 2019, the total market value of fair valued securities was $5,168,726, which represented 0.5% of the Fund’s net assets. |

| (i) | Collateral strip rate—A bond whose interest was based on the weighted net interest rate of the collateral. The coupon rate adjusts periodically based on a predetermined schedule. Rate shown was the rate in effect as of October 31, 2019. |

| (j) | Coupon rate may change based on changes of the underlying collateral or prepayments of principal. The coupon rate shown represents the rate at period end. |

| (k) | TBA—Securities purchased on a forward commitment basis with an approximate principal amount and maturity date. The actual principal amount and maturity date will be determined upon settlement. As of October 31, 2019, the total net market value of these securities was $9,016,644, which represented 0.9% of the Fund’s net assets. All or a portion of these securities are a part of a mortgage dollar roll agreement. |

| (l) | Treasury Inflation Protected Security—Pays a fixed rate of interest on a principal amount that is continuously adjusted for inflation based on the Consumer Price Index-Urban Consumers. |

| (m) | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (n) | Restricted security. (See Note 5) |

| (o) | Illiquid investment—As of October 31, 2019, the total market value of these illiquid investments was $8,726, which represented less than one-tenth of a percent of the Fund’s net assets. (Unaudited) |

| (p) | Non-income producing security. |

| (q) | Current yield as of October 31, 2019. |

| (r) | Represents security purchased with cash collateral received for securities on loan. |

| (s) | Interest rate shown represents yield to maturity. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Portfolio of InvestmentsOctober 31, 2019 (continued)

Foreign Currency Forward Contracts

As of October 31, 2019, the Fund held the following foreign currency forward contracts1:

| | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | |

USD | | | 4,496,568 | | | EUR | | | 3,979,000 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | $ | 58,791 | |

USD | | | 199,871 | | | EUR | | | 179,000 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | | 232 | |

EUR | | | 3,908,000 | | | USD | | | 4,337,786 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | | 20,805 | |

GBP | | | 8,545,000 | | | USD | | | 10,987,315 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | | 81,453 | |

Total unrealized appreciation | | | | | | | | 161,281 | |

USD | | | 10,356,306 | | | GBP | | | 8,266,000 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | $ | (351,059 | ) |

EUR | | | 250,000 | | | USD | | | 280,736 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | | (1,911 | ) |

USD | | | 348,692 | | | GBP | | | 279,000 | | | JPMorgan Chase Bank N.A. | | 11/1/19 | | | (12,711 | ) |

USD | | | 4,343,276 | | | EUR | | | 3,887,000 | | | JPMorgan Chase Bank N.A. | | 2/3/20 | | | (19,261 | ) |

USD | | | 11,067,514 | | | GBP | | | 8,580,000 | | | JPMorgan Chase Bank N.A. | | 2/3/20 | | | (79,426 | ) |

Total unrealized depreciation | | | | | | | | (464,368 | ) |

Net unrealized depreciation | | | | | | | $ | (303,087 | ) |

| 1. | Foreign Currency Forward Contracts are subject to limitations such that they cannot be “sold or repurchased,” although the Fund would be able to exit the transaction through other means, such as through the execution of an offsetting transaction. |

Futures Contracts

As of October 31, 2019, the Portfolio held the following futures contracts1:

| | | | | | | | | | | | | | | | | | | | |

Type | | Number of

Contracts | | | Expiration

Date | | | Value at

Trade Date | | | Current

Notional

Amount | | | Unrealized

Appreciation

(Depreciation)2 | |

Long Contracts | | | | | | | | | | | | | | | | | | | | |

| 2-Year United States Treasury Note | | | 195 | | | | December 2019 | | | $ | 42,047,252 | | | $ | 42,042,305 | | | $ | (4,947 | ) |

| Euro Bund | | | 20 | | | | December 2019 | | | | 3,934,809 | | | | 3,831,278 | | | | (103,531 | ) |

| United States Treasury Long Bond | | | 16 | | | | December 2019 | | | | 2,611,287 | | | | 2,582,000 | | | | (29,287 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Total Long Contracts | | | | | | | | | | | | | | | | | | | (137,765 | ) |

| | | | | | | | | | | | | | | | | | | | |

Short Contracts | | | | | | | | | | | | | |

| 5-Year United States Treasury Note | | | (725 | ) | | | December 2019 | | | | (86,829,739 | ) | | | (86,422,266 | ) | | | 407,473 | |

| 10-Year United States Treasury Note | | | (265 | ) | | | December 2019 | | | | (34,871,500 | ) | | | (34,528,672 | ) | | | 342,828 | |

| 10-Year United States Treasury Ultra Note | | | (643 | ) | | | December 2019 | | | | (92,494,197 | ) | | | (91,376,328 | ) | | | 1,117,869 | |

| Euro-BTP | | | (24 | ) | | | December 2019 | | | | (3,883,614 | ) | | | (3,867,056 | ) | | | 16,558 | |

| United States Treasury Ultra Bond | | | (11 | ) | | | December 2019 | | | | (2,154,943 | ) | | | (2,087,250 | ) | | | 67,693 | |

| | | | | | | | | | | | | | | | | | | | |

| Total Short Contracts | | | | | | | | | | | | | | | | | | | 1,952,421 | |

| | | | | | | | | | | | | | | | | | | | |

| Net Unrealized Appreciation | | | | | | | | | | | | | | | | | | $ | 1,814,656 | |

| | | | | | | | | | | | | | | | | | | | |

| 1. | As of October 31, 2019, cash in the amount of $2,355,420 was on deposit with a broker or futures commission merchant for futures transactions. |