UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04550

THE MAINSTAY FUNDS

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

FORM N-CSR

| Item 1. | Reports to Stockholders. |

MainStay Candriam Emerging Markets Debt Fund

Message from the President and Annual Report

October 31, 2020

Beginning on January 1, 2021, paper copies of each MainStay Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’ website. You will be notified by mail and provided with a website address to access the report each time a new report is posted to the website.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to MainStayShareholderServices@nylim.com, or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to MainStayShareholderServices@nylim.com. If you hold shares of a MainStay Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial intermediary.

| | | | | | | | |

| Not FDIC/NCUA Insured | | Not a Deposit | | May Lose Value | | No Bank Guarantee | | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Despite historically high levels of volatility generated by the global coronavirus pandemic and a host of other geopolitical and economic uncertainties, most broad U.S. stock and bond markets gained ground during the 12-month reporting period ended October 31, 2020.

The reporting period began on an upswing, with markets rising on generally positive underlying economic trends and the announcement of a U.S.-China trade deal. However, in mid-February 2020, stock and bond indices began to dip as growing numbers of COVID-19 cases appeared in hotspots around the world. By early March, the disease reached pandemic proportions. As governments struggled to support overburdened health care systems by issuing “stay-at-home” orders and other restrictions on nonessential activity, global economic activity slowed, driving most stocks and bonds sharply lower.

The United States was hit particularly hard by the pandemic, with more reported COVID-19 cases and deaths than any other country in the world throughout the second half of the reporting period. As the pandemic deepened, the U.S. Federal Reserve (“Fed”) twice cut interest rates and announced unlimited quantitative easing. The federal government declared a national emergency, and Congress passed and the President signed a $2 trillion stimulus package. Markets responded positively to these measures, as well as to a gradual lessening of restrictions on nonessential businesses, hopes for additional stimulus and apparent progress in the development of a vaccine. By late August, the S&P 500® Index, a widely regarded benchmark of market performance, had not only regained all the ground it lost earlier in the reporting period, the Index had reached new record levels. However, a resurgence of coronavirus cases in many parts of the country and uncertainties related to the November 3, 2020, U.S. presidential election caused markets to falter as the reporting period drew to a close.

Nevertheless, for the reporting period as a whole, U.S. equity indices generally produced moderate gains. Returns proved strongest among large-cap, growth-oriented stocks, while small- and mid-cap issues lagged. Within the S&P 500® Index, the information technology and consumer discretionary sectors produced exceptionally strong gains, buoyed by strong corporate and consumer spending, while the health care sector outperformed by a smaller margin. Materials and consumer staples sectors generated positive returns, but lagged the S&P 500® Index. The industrials, utilities, communication services, financials, real estate and energy sectors ended the reporting period in negative territory, with the energy sector

suffering the steepest losses due to weak global demand. International equities declined sharply in February and March 2020 before recovering somewhat, but tended to lag their U.S. counterparts due to weaker underlying economic growth and somewhat less aggressive monetary and fiscal stimulus. Emerging-market equities tracked the performance of U.S. equity markets more closely, led by relatively strong returns in Asian markets, such as China and South Korea.

Fixed-income markets experienced an environment that tended to favor higher credit quality and longer duration securities. Corporate bonds followed the pattern of equities, with prices declining in March 2020 before subsequently recovering. Relatively speculative high-yield credit was hardest hit during the market sell-off in early 2020 and continued to underperform during the remainder of the reporting period. Similarly, among municipal bond issues, high-grade bonds outperformed, dipping briefly in mid-March before regaining the lost ground. Recognized safe havens, such as U.S. government bonds, attracted increased investment during the height of the market sell-off, driving yields lower and prices higher. As a result, long-term Treasury bonds delivered particularly strong gains for the reporting period as a whole. Emerging-market debt, on the other hand, underperformed most other bond types as investors sought to minimize currency and sovereign risks.

Although the ongoing pandemic continues to change the way that many of us work and live our lives, at New York Life Investments, we remain dedicated to providing you, as a MainStay investor, with products, information and services to help you to navigate today’s rapidly changing investment environment. By taking appropriate steps to minimize community spread of COVID-19 within our organization and despite the challenges posed by the coronavirus pandemic, we continue to innovate with you in mind, introducing new suites of Funds and providing continuous insights into ever-evolving markets and investment strategies. Our goal is to give you the tools you need to build a resilient portfolio in the face of uncertain times.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at newyorklifeinvestments.com. Please read the Summary Prospectus and/or Prospectus carefully before investing.

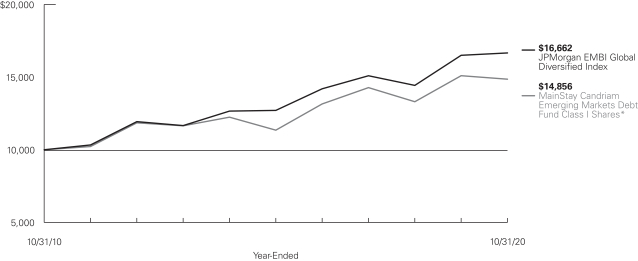

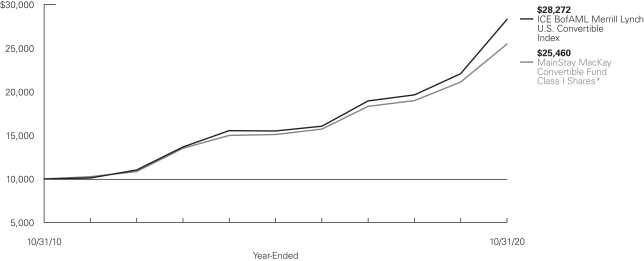

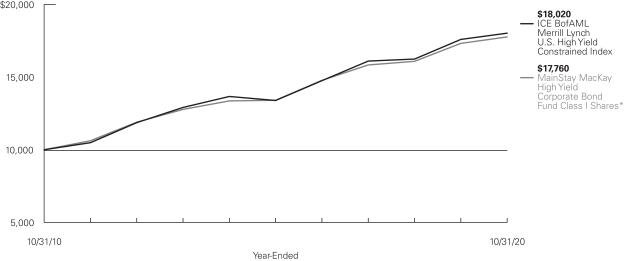

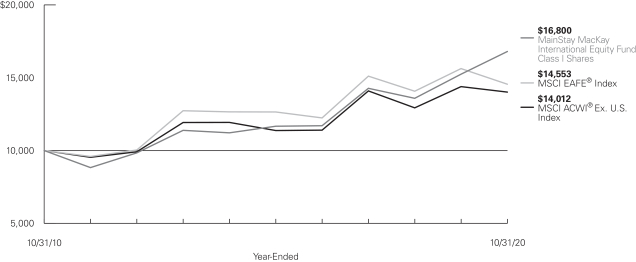

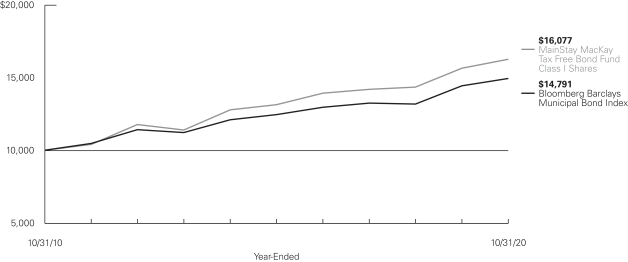

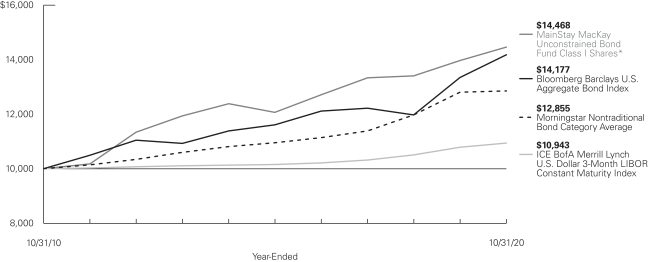

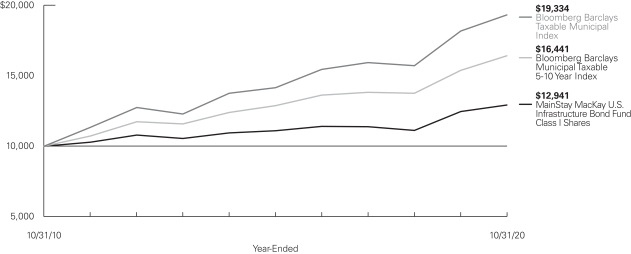

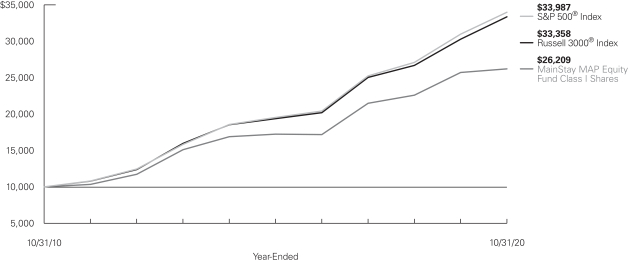

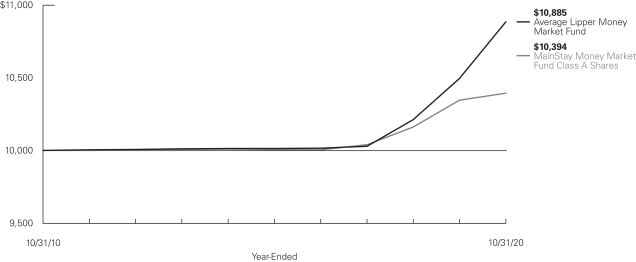

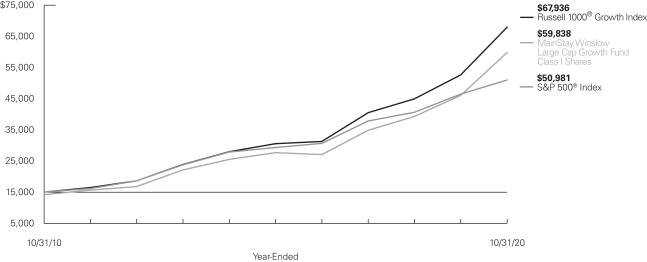

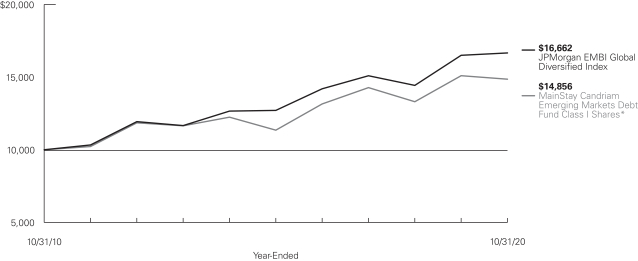

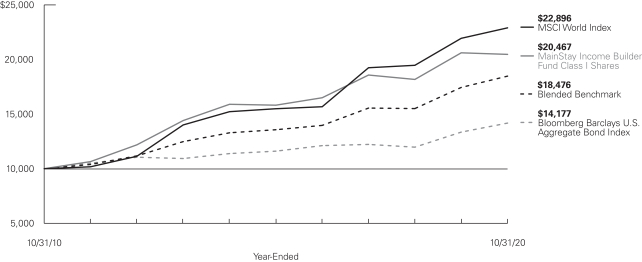

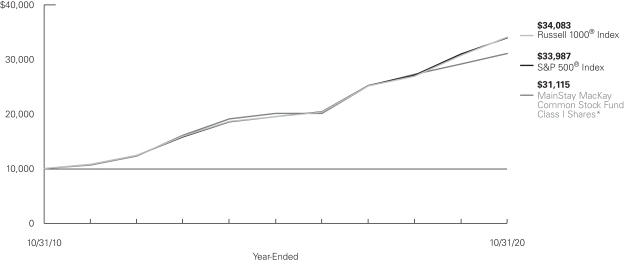

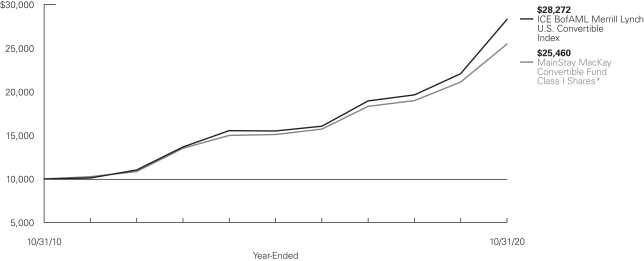

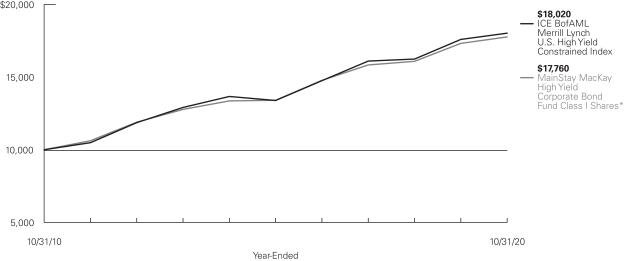

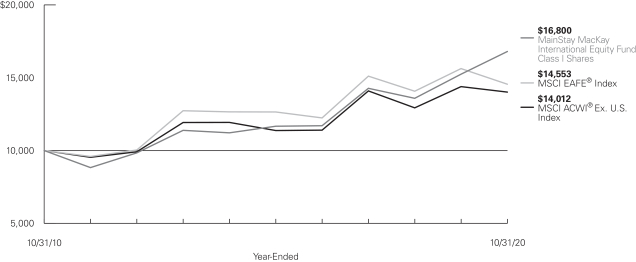

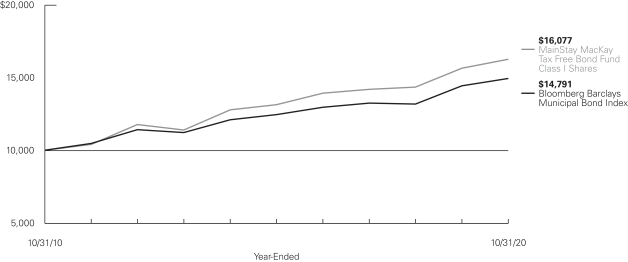

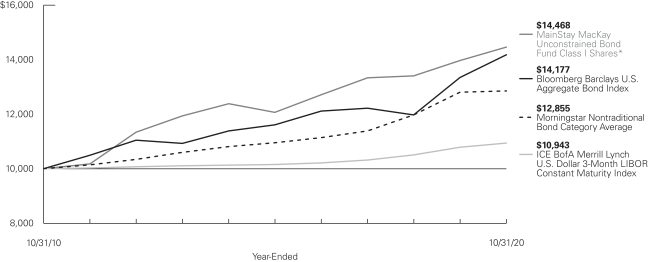

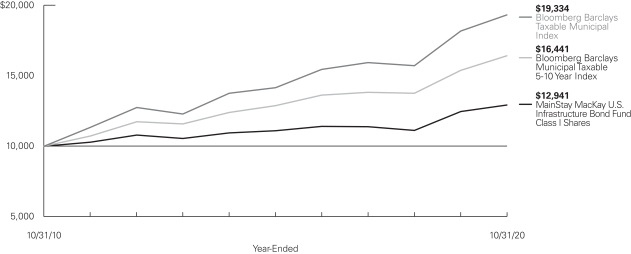

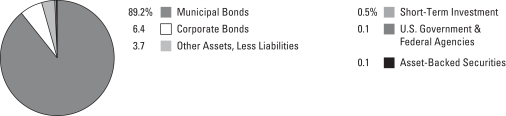

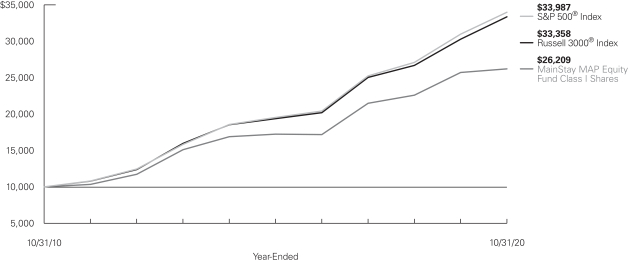

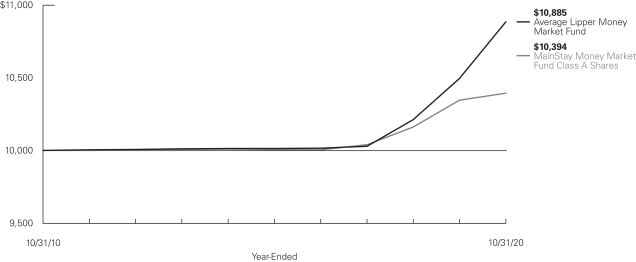

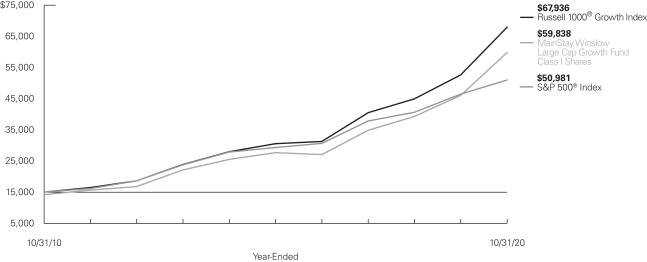

Investment and Performance Comparison1,2 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares* of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit newyorklifeinvestments.com.

Average Annual Total Returns for the Year-Ended October 31, 2020

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Inception

Date | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio3 | |

| | | | | | | |

| Class A Shares | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 6/1/1998

|

| |

| –6.22

–1.80 | %

| |

| 4.30

5.26 | %

| |

| 3.30

3.77 | %

| |

| 1.27

1.27 | %

|

| Investor Class Shares4 | | Maximum 4% Initial Sales Charge | | With sales charges Excluding sales charges | | | 2/28/2008 | | |

| –6.60

–2.19 |

| |

| 4.04

5.00 |

| |

| 3.10

3.57 |

| |

| 1.57

1.57 |

|

| Class B Shares5 | | Maximum 5% CDSC if Redeemed Within the First Six Years of Purchase | | With sales charges Excluding sales charges | | | 6/1/1998 | | |

| –7.59

–2.91 |

| |

| 3.88

4.22 |

| |

| 2.80

2.80 |

| |

| 2.32

2.32 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | | | 9/1/1998 | | |

| –3.74

–2.81 |

| |

| 4.24

4.24 |

| |

| 2.80

2.80 |

| |

| 2.32

2.32 |

|

| Class I Shares | | No Sales Charge | | | | | 8/31/2007 | | | | –1.59 | | | | 5.53 | | | | 4.04 | | | | 1.02 | |

| * | Previously, the chart presented the Fund’s annual returns for Class B shares. Class I shares are presented for consistency across the MainStay Fund complex. |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements. |

| 2. | The Fund replaced MacKay and modified its investment objective and principal investment strategies as of June 21, 2019. The performance in the bar chart and table prior to those dates reflects MacKay’s, investment objective and principal investment strategies. |

| 3. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 4. | Prior to June 30, 2020, the maximum initial sales charge for Investor Class shares was 4.5%, which is reflected in the average annual total return figures shown. |

| 5. | Class B shares are closed to all new purchases as well as additional investments by existing Class B shareholders. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | | | | | | | |

| Benchmark Performance | | One Year | | Five Years | | | Ten Years | |

| | | |

JPMorgan EMBI Global Diversified Index6 | | 0.98% | | | 5.57 | % | | | 5.24 | % |

Morningstar Emerging Markets Bond Category Average7 | | 0.53 | | | 4.77 | | | | 3.95 | |

| 6. | The JPMorgan EMBI Global Diversified Index is the Fund’s primary broad-based securities market index for comparison purposes. The JPMorgan EMBI Global Diversified Index is a market-capitalization weighted, total return index tracking the traded market for U.S. dollar-denominated Brady Bonds, Eurobonds, traded loans and local market debt instruments issued by sovereign and quasi-sovereign entities. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 7. | The Morningstar Emerging Markets Bond Category Average is representative of funds that invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East, and Asia make up the rest. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay Candriam Emerging Markets Debt Fund |

Cost in Dollars of a $1,000 Investment in MainStay Candriam Emerging Markets Debt Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2020, to October 31, 2020, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2020, to October 31, 2020.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2020. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/20 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/20 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/20 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2 |

| | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,154.30 | | | $ | 6.34 | | | $ | 1,019.25 | | | $ | 5.94 | | | 1.17% |

| | | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,151.90 | | | $ | 8.06 | | | $ | 1,017.65 | | | $ | 7.56 | | | 1.49% |

| | | | | | |

| Class B Shares | | $ | 1,000.00 | | | $ | 1,147.40 | | | $ | 12.09 | | | $ | 1,013.88 | | | $ | 11.34 | | | 2.24% |

| | | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,148.40 | | | $ | 12.10 | | | $ | 1,013.88 | | | $ | 11.34 | | | 2.24% |

| | | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,155.70 | | | $ | 4.61 | | | $ | 1,020.86 | | | $ | 4.32 | | | 0.85% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 366 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the six-month period. |

Country Composition as of October 31, 2020 (Unaudited)

| | | | |

| |

| United States | | | 6.4 | % |

| |

| Indonesia | | | 5.0 | |

| |

| Mexico | | | 5.0 | |

| |

| Kazakhstan | | | 4.8 | |

| |

| Philippines | | | 4.7 | |

| |

| Dominican Republic | | | 4.5 | |

| |

| Romania | | | 4.1 | |

| |

| South Africa | | | 4.0 | |

| |

| Brazil | | | 3.9 | |

| |

| United Arab Emirates | | | 3.7 | |

| |

| Qatar | | | 3.1 | |

| |

| Colombia | | | 3.0 | |

| |

| Egypt | | | 2.9 | |

| |

| Chile | | | 2.7 | |

| |

| Panama | | | 2.6 | |

| |

| Croatia | | | 2.5 | |

| |

| Argentina | | | 2.4 | |

| |

| China | | | 2.2 | |

| |

| Uruguay | | | 2.2 | |

| |

| Hungary | | | 2.1 | |

| |

| Jordan | | | 2.1 | |

| |

| Turkey | | | 2.0 | |

| |

| Ghana | | | 1.8 | |

| |

| Kenya | | | 1.8 | |

| |

| Sri Lanka | | | 1.6 | |

| | | | |

| |

| Bahamas | | | 1.5 | % |

| |

| Canada | | | 1.2 | |

| |

| Ecuador | | | 1.2 | |

| |

| India | | | 1.2 | |

| |

| Peru | | | 1.0 | |

| |

| Costa Rica | | | 0.9 | |

| |

| Namibia | | | 0.9 | |

| |

| El Salvador | | | 0.8 | |

| |

| Ukraine | | | 0.8 | |

| |

| Azerbaijan | | | 0.6 | |

| |

| Jamaica | | | 0.6 | |

| |

| Angola | | | 0.5 | |

| |

| Cayman Islands | | | 0.5 | |

| |

| Iraq | | | 0.5 | |

| |

| Ivory Coast | | | 0.5 | |

| |

| Senegal | | | 0.5 | |

| |

| Venezuela | | | 0.5 | |

| |

| Belarus | | | 0.4 | |

| |

| Nigeria | | | 0.4 | |

| |

| Honduras | | | 0.3 | |

| |

| Tunisia | | | 0.3 | |

| |

| Tajikistan | | | 0.2 | |

| |

| Lebanon | | | 0.1 | |

| |

| Other Assets, Less Liabilities | | | 3.5 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 11 for specific holdings within these categories. The Fund’s holdings are subject to change.

Top Ten Issuers Held as of October 31, 2020 (excluding short-term investments) (Unaudited)

| 1. | Philippine Government International Bond, 3.00%–3.75%, due 2/1/28–3/1/41 |

| 2. | Dominican Republic International Bond, 4.50%–6.85%, due 1/25/27–1/30/60 |

| 3. | KazMunayGas National Co. JSC, 3.50%–6.375%, due 4/19/27–10/24/48 |

| 4. | Romanian Government International Bond, 2.75%–6.125%, due 2/26/26–2/14/51 |

| 5. | Petroleos Mexicanos, 5.95%–7.69%, due 10/16/25–1/28/60 |

| 6. | Qatar Government International Bond, 3.75%–5.103%, due 4/16/30–3/14/49 |

| 7. | Pertamina Persero PT, 3.10%–5.625%, due 1/21/30–2/25/60 |

| 8. | Republic of South Africa Government International Bond, 4.85%–6.25%, due 4/14/26–9/30/49 |

| 9. | Colombia Government International Bond, 3.00%–6.125%, due 1/30/30–1/18/41 |

| 10. | Egypt Government International Bond, 5.25%–8.70%, due 10/6/25–3/1/49 |

| | |

| 8 | | MainStay Candriam Emerging Markets Debt Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Diliana Deltcheva, CFA, Magda Branet, CFA, and Christopher Mey, CFA, of Candriam Luxembourg S.C.A., the Fund’s Subadvisor.

How did MainStay Candriam Emerging Markets Debt Fund perform relative to its benchmark and peer group during the 12 months ended October 31, 2020?

For the 12 months ended October 31, 2020, Class I shares of MainStay Candriam Emerging Markets Debt Fund returned –1.59%, underperforming the 0.98% return of the Fund’s primary benchmark, the JPMorgan EMBI Global Diversified Index. Over the same period, Class I shares underperformed the 0.53% return of the Morningstar Emerging Markets Bond Category Average.1

What factors affected the Fund’s relative performance during the reporting period?

The Fund underperformed the JPMorgan EMBI Global Diversified Index during the reporting period largely due to declines in investments during the first quarter of 2020, particularly in March at the height of the pandemic-related market sell-off. Approximately half of the Fund’s relative underperformance resulted from overweight exposure in Ecuador, which failed to make coupon payments on some of its bonds, and in Chile-based Latam Airlines, Latin America’s largest airline, which experienced material deterioration of its credit metrics amid a sharp oil price decline and travel restrictions. Ecuador finalized debt restructuring on $16.5 billion of Eurobond debt in August, offering an average recovery of around 55 cents on a dollar, while Latam Airlines entered a Chapter 11 bankruptcy process in May 2020. The remainder of the Fund’s underperformance was a result of underweight exposure to investment-grade rated credits in China, the Philippines, Russia and Saudi Arabia through some of the reporting period. Investment-grade credits generally rallied in line with defensive U.S. Treasury bonds.

During the reporting period, were there any liquidity events that materially impacted the Fund’s performance?

The global spread of the COVID-19 pandemic from February 2020 onward triggered a coincident global recession and led to a material decline in oil prices with unprecedented consequences for global debt markets. In particular, these circumstances led to a sharp rise in emerging-market debt risk premiums during the first quarter of 2020.

The combined pandemic and oil shocks had a material impact on liquidity and aggregate demand conditions for emerging-

market debt. A number of emerging-market countries lost access to public funding markets and experienced sharp deterioration in their external and fiscal positions. These conditions ultimately led six countries to default on their public debt: Argentina, Lebanon, Ecuador, Belize, Suriname and Zambia. Two of the defaults, those of Argentina and Ecuador, were cured after completion of debt restructurings in August and September.

Furthermore, the majority of emerging-market countries experienced broad-based deteriorations in creditworthiness, with rating agency downgrades running into record highs. Credit rating company Moody’s downgraded the ratings or outlooks of 65 out of the 108 sovereigns they covered, with 43 out of the 65 negative rating actions directly triggered by the pandemic outbreak. Constrained access to financing drove the majority of these downgrades, with lower growth or exposure to tourism, oil and other commodities impacting performance as well.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

The Fund held a long 10-year U.S. Treasury futures position between the end of March and June 2020. However, the Fund’s performance was not materially impacted by investments in derivatives.

What was the Fund’s duration2 strategy during the reporting period?

The Fund’s modified duration fluctuated by 0.9 years, in absolute terms, with the low of 7.72 years reached in May 2020 and the high of 8.89 years reached in August. The Fund’s relative duration position versus the JPMorgan EMBI Global Diversified Index ranged between 1.09 years (March 2020) and zero (May 2020). The Fund’s relative duration exposure remained driven by our views on the expected market for U.S. Treasury securities and the shape of the U.S. Treasury yield curve,3 as well as the availability of emerging-market issuer spread4 curve opportunities. The Fund’s duration strategy added approximately 71 basis points (“bps”) to relative performance over the reporting period. (A basis point is one one-hundredth of a percentage point.)

As of October 31, 2020, the Fund’s absolute and relative modified duration5 positions were 8.37 years and 0.49 years,

| 1. | See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more information on benchmark and peer group returns. |

| 2. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| 3. | The yield curve is a line that plots the yields of various securities of similar quality—typically U.S. Treasury issues—across a range of maturities. The U.S. Treasury yield curve serves as a benchmark for other debt and is used in economic forecasting. |

| 4. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. |

| 5. | Modified duration is inversely related to the approximate percentage change in price for a given change in yield. |

respectively, with a neutral stance on the U.S. Treasury, investment-grade rated proxies, and a small positive bias in select, longer-dated, higher-yielding emerging-market issuers. This positioning reflects our belief that broadening and deepening of the recovery in 2021 may create headwinds for U.S. Treasury securities and lower-yielding emerging-market issuers. However, in the medium term, we expect that core rates will remain anchored by monetary policy accommodation and may remain low until recession and health risks are decisively cleared.

How was the Fund affected by shifting currency values during the reporting period?

The Fund was not affected by shifting currency values over the reporting period. Emerging market currencies added 3 bps to relative performance over the same period.

During the reporting period, which countries and/or sectors were the strongest positive contributors to the Fund’s relative performance and which countries and/or sectors were particularly weak?

The strongest positive contributors to the Fund’s performance relative to the JPMorgan EMBI Global Diversified Index included overweight exposure to debt from Lebanon, which entered debt default on March 6, 2020, and overweight exposure to higher-yielding investment-grade Eastern European credits from countries such as Kazakhstan and Romania, which benefited from the asset class recovery in the second half of the reporting period. (Contributions take weightings and total returns into account.) The Fund’s relatively high cash level in March 2020, when the asset class drawdown was generated, also contributed positively to performance.

What were some of the Fund’s largest purchases and sales during the reporting period?

The Fund’s largest purchases during the reporting period were concentrated in China, the Philippines and Uruguay. All

purchases were targeted at adding exposure to investment-grade rated credits, which typically outperform higher-yielding credits during recessionary periods. The Fund’s largest sales were concentrated in Angola, Ecuador and Latam Airlines (Chile/Brazil). The Fund divested its Latam Airlines position after the company launched Chapter 11 bankruptcy proceedings in May 2020.

How did the Fund’s country and/or sector weightings change during the reporting period?

As volatility increased during the reporting period, the Fund covered its underweight exposures to U.S. Treasury-sensitive, Asian and Latin American investment-grade rated credits from countries such as China, the Philippines and Uruguay. During the second half of the year, the Fund reduced its exposure to what we perceived as weaker sub-Saharan African credits from countries such as Angola, where we believe debt restructuring remains likely, and Ecuador, where general elections planned for February 2021 pose risks to policy continuity.

How was the Fund positioned at the end of the reporting period?

As of October 31, 2020, the Fund held overweight positions in investment-grade credits that we believed offered attractive fundamentals versus valuations characteristics and spread compression upside, including credits from Indonesia, Kazakhstan and Romania. As of the same date, the Fund held underweight exposure to investment-grade rated Russian and Saudi Arabian credits where we expect risk premiums to increase on not-yet-fully priced sanctions and geopolitical risks. The Fund’s current strategy aims to avoid further debt restructurings and defaults. We prefer to stay sidelined on countries where public-debt-to-GDP levels have spiked beyond sustainable levels and which may require some form of debt relief (Angola) or are facing election uncertainty (Ecuador).

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | |

| 10 | | MainStay Candriam Emerging Markets Debt Fund |

Portfolio of Investments October 31, 2020

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 90.1%† Corporate Bonds 23.2% | |

Azerbaijan 0.6% | | | | | | | | |

State Oil Co. of The Azerbaijan Republic

Series Reg S

6.95%, due 3/18/30 | | $ | 600,000 | | | $ | 710,616 | |

| | | | | | | | |

|

Brazil 1.9% | |

Braskem Netherlands Finance B.V. | | | | | | | | |

Series Reg S

4.50%, due 1/10/28 | | | 500,000 | | | | 480,260 | |

Series Reg S

4.50%, due 1/31/30 | | | 700,000 | | | | 646,485 | |

Rede D’or Finance S.A.R.L.

Series Reg S

4.50%, due 1/22/30 | | | 1,000,000 | | | | 983,750 | |

| | | | | | | | |

| | | | | | | 2,110,495 | |

| | | | | | | | |

Canada 1.2% | | | | | | | | |

State Grid Overseas Investment, Ltd.

Series Reg S

1.625%, due 8/5/30 | | | 1,350,000 | | | | 1,301,387 | |

| | | | | | | | |

| | |

Cayman Islands 0.5% | | | | | | | | |

Bioceanico Sovereign Certificate, Ltd.

Series Reg S

(zero coupon), due 6/5/34 | | | 843,648 | | | | 615,863 | |

| | | | | | | | |

|

Chile 2.1% | |

Corp. Nacional del Cobre de Chile | | | | | | | | |

Series Reg S

3.70%, due 1/30/50 | | | 300,000 | | | | 313,270 | |

Series Reg S

4.25%, due 7/17/42 | | | 1,300,000 | | | | 1,450,052 | |

Empresa de los Ferrocarriles del Estado

Series Reg S

3.068%, due 8/18/50 | | | 300,000 | | | | 279,000 | |

Sociedad Quimica y Minera de Chile S.A.

Series Reg S

4.25%, due 1/22/50 | | | 250,000 | | | | 275,000 | |

| | | | | | | | |

| | | | | | | 2,317,322 | |

| | | | | | | | |

China 1.0% | | | | | | | | |

CNPC Global Capital Co.

Series Reg S

2.00%, due 6/23/30 | | | 500,000 | | | | 496,310 | |

Sinopec Group Overseas Development 2018, Ltd. | | | | | | | | |

Series Reg S

2.70%, due 5/13/30 | | | 450,000 | | | | 468,288 | |

Series Reg S

3.35%, due 5/13/50 | | | 200,000 | | | | 213,956 | |

| | | | | | | | |

| | | | | | | 1,178,554 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Colombia 0.5% | | | | | | | | |

Ecopetrol S.A.

5.875%, due 5/28/45 | | $ | 500,000 | | | $ | 545,350 | |

| | | | | | | | |

| | |

Croatia 1.0% | | | | | | | | |

Hrvatska Elektroprivreda

Series Reg S

5.875%, due 10/23/22 | | | 1,000,000 | | | | 1,081,416 | |

| | | | | | | | |

| | |

India 0.3% | | | | | | | | |

Vedanta Resources, Ltd.

6.125%, due 8/9/24 (a) | | | 500,000 | | | | 291,403 | |

| | | | | | | | |

|

Indonesia 3.1% | |

Pertamina Persero PT | | | | | | | | |

Series Reg S

3.10%, due 1/21/30 | | | 500,000 | | | | 515,076 | |

Series Reg S

3.10%, due 8/27/30 | | | 500,000 | | | | 516,819 | |

Series Reg S

4.15%, due 2/25/60 | | | 400,000 | | | | 395,010 | |

Series Reg S

4.175%, due 1/21/50 (b) | | | 600,000 | | | | 598,959 | |

5.625%, due 5/20/43 (a) | | | 1,200,000 | | | | 1,404,000 | |

| | | | | | | | |

| | | | | | | 3,429,864 | |

| | | | | | | | |

Kazakhstan 4.8% | |

KazMunayGas National Co. JSC | | | | | | | | |

Series Reg S

3.50%, due 4/14/33 | | | 1,600,000 | | | | 1,649,926 | |

Series Reg S

4.75%, due 4/19/27 | | | 1,000,000 | | | | 1,126,260 | |

Series Reg S

5.75%, due 4/19/47 | | | 1,000,000 | | | | 1,239,908 | |

Series Reg S

6.375%, due 10/24/48 | | | 600,000 | | | | 797,134 | |

Tengizchevroil Finance Co. International, Ltd.

Series Reg S

2.625%, due 8/15/25 | | | 500,000 | | | | 501,325 | |

| | | | | | | | |

| | | | | | | 5,314,553 | |

| | | | | | | | |

Mexico 5.0% | | | | | | | | |

Cemex S.A.B. de C.V.

Series Reg S

5.20%, due 9/17/30 | | | 600,000 | | | | 633,834 | |

Industrias Penoles S.A.B. de C.V.

Series Reg S

4.75%, due 8/6/50 | | | 700,000 | | | | 735,875 | |

Petroleos Mexicanos | | | | | | | | |

Series Reg S

5.95%, due 1/28/31 | | | 500,000 | | | | 418,500 | |

6.50%, due 3/13/27 | | | 1,000,000 | | | | 928,750 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of Investments October 31, 2020 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Mexico (continued) | | | | | | | | |

Petroleos Mexicanos (continued) | | | | | | | | |

6.75%, due 9/21/47 | | $ | 500,000 | | | $ | 388,145 | |

6.84%, due 1/23/30 | | | 800,000 | | | | 715,200 | |

Series Reg S

6.875%, due 10/16/25 | | | 600,000 | | | | 593,100 | |

6.95%, due 1/28/60 | | | 1,000,000 | | | | 782,000 | |

7.69%, due 1/23/50 | | | 500,000 | | | | 415,465 | |

| | | | | | | | |

| | | | | | | 5,610,869 | |

| | | | | | | | |

Panama 0.3% | | | | | | | | |

Banco Nacional de Panama

Series Reg S

2.50%, due 8/11/30 | | | 300,000 | | | | 298,062 | |

| | | | | | | | |

| | |

United Arab Emirates 0.7% | | | | | | | | |

MDGH-GMTN B.V.

Series Reg S

3.95%, due 5/21/50 | | | 700,000 | | | | 804,706 | |

| | | | | | | | |

|

Venezuela 0.2% | |

Petroleos de Venezuela S.A. (c)(d)(e) | | | | | | | | |

Series Reg S

5.375%, due 4/12/27 | | | 3,000,000 | | | | 102,000 | |

Series Reg S

6.00%, due 5/16/24 | | | 2,500,000 | | | | 90,000 | |

Series Reg S

6.00%, due 11/15/26 | | | 2,500,000 | | | | 85,000 | |

| | | | | | | | |

| | | | | | | 277,000 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $28,636,092) | | | | | | | 25,887,460 | |

| | | | | | | | |

|

| Foreign Government Bonds 66.9% | |

Angola 0.5% | |

Angolan Government International Bond | | | | | | | | |

Series Reg S

9.125%, due 11/26/49 | | | 250,000 | | | | 189,852 | |

Series Reg S

9.375%, due 5/8/48 | | | 500,000 | | | | 381,900 | |

| | | | | | | | |

| | | | | | | 571,752 | |

| | | | | | | | |

Argentina 2.4% | |

Argentine Republic Government International Bond | | | | | | | | |

0.125%, due 7/9/30 (f) | | | 513,757 | | | | 188,549 | |

0.125%, due 7/9/35 (f) | | | 3,366,242 | | | | 1,100,761 | |

1.00%, due 7/9/29 | | | 233,373 | | | | 95,683 | |

Provincia de Buenos Aires

7.875%, due 6/15/27 (a) | | | 4,000,000 | | | | 1,310,000 | |

| | | | | | | | |

| | | | | | | 2,694,993 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Bahamas 1.5% | | | | | | | | |

Bahamas Government International Bond

Series Reg S

6.00%, due 11/21/28 | | $ | 2,000,000 | | | $ | 1,730,000 | |

| | | | | | | | |

|

Belarus 0.4% | |

Republic of Belarus International Bond | | | | | | | | |

7.625%, due 6/29/27 (a) | | | 200,000 | | | | 198,140 | |

Series Reg S

7.625%, due 6/29/27 | | | 200,000 | | | | 198,140 | |

| | | | | | | | |

| | | | | | | 396,280 | |

| | | | | | | | |

Brazil 2.0% | |

Brazilian Government International Bond | | | | | | | | |

2.875%, due 6/6/25 | | | 200,000 | | | | 202,302 | |

3.875%, due 6/12/30 | | | 1,000,000 | | | | 1,012,500 | |

4.75%, due 1/14/50 | | | 1,000,000 | | | | 980,000 | |

| | | | | | | | |

| | | | | | | 2,194,802 | |

| | | | | | | | |

Chile 0.6% | | | | | | | | |

Chile Government International Bond

2.45%, due 1/31/31 | | | 600,000 | | | | 623,250 | |

| | | | | | | | |

|

China 1.2% | |

China Government International Bond | | | | | | | | |

Series Reg S

1.20%, due 10/21/30 | | | 200,000 | | | | 197,578 | |

Series Reg S

2.25%, due 10/21/50 | | | 550,000 | | | | 533,550 | |

Series Reg S

3.50%, due 10/19/28 | | | 500,000 | | | | 581,850 | |

| | | | | | | | |

| | | | | | | 1,312,978 | |

| | | | | | | | |

Colombia 2.5% | |

Colombia Government International Bond | | | | | | | | |

3.00%, due 1/30/30 | | | 1,000,000 | | | | 1,020,000 | |

3.125%, due 4/15/31 | | | 500,000 | | | | 513,250 | |

6.125%, due 1/18/41 | | | 1,000,000 | | | | 1,290,500 | |

| | | | | | | | |

| | | | | | | 2,823,750 | |

| | | | | | | | |

Costa Rica 0.9% | | | | | | | | |

Costa Rica Government International Bond

Series Reg S

7.00%, due 4/4/44 | | | 1,300,000 | | | | 1,017,250 | |

| | | | | | | | |

| | |

Croatia 1.5% | | | | | | | | |

Croatia Government International Bond,

Series Reg S

6.00%, due 1/26/24 | | | 1,500,000 | | | | 1,728,165 | |

| | | | | | | | |

|

Dominican Republic 4.5% | |

Dominican Republic International Bond | | | | | | | | |

Series Reg S

4.50%, due 1/30/30 | | | 600,000 | | | | 604,506 | |

| | | | |

| 12 | | MainStay Candriam Emerging Markets Debt Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Government Bonds (continued) | |

Dominican Republic (continued) | |

Dominican Republic International Bond (continued) | | | | | | | | |

Series Reg S

4.875%, due 9/23/32 | | $ | 600,000 | | | $ | 609,006 | |

Series Reg S

5.875%, due 1/30/60 | | | 800,000 | | | | 764,000 | |

Series Reg S

5.95%, due 1/25/27 | | | 2,250,000 | | | | 2,452,522 | |

Series Reg S

6.85%, due 1/27/45 | | | 500,000 | | | | 535,650 | |

| | | | | | | | |

| | | | | | | 4,965,684 | |

| | | | | | | | |

Ecuador 1.2% | |

Ecuador Government International Bond | | | | | | | | |

Series Reg S

(zero coupon), due 7/31/30 | | | 208,496 | | | | 94,868 | |

Series Reg S

0.50%, due 7/31/35 (f) | | | 1,600,000 | | | | 874,000 | |

Series Reg S

0.50%, due 7/31/40 (f) | | | 862,600 | | | | 426,995 | |

| | | | | | | | |

| | | | | | | 1,395,863 | |

| | | | | | | | |

Egypt 2.9% | |

Egypt Government International Bond | | | | | | | | |

Series Reg S

5.25%, due 10/6/25 | | | 650,000 | | | | 645,255 | |

Series Reg S

6.875%, due 4/30/40 | | | 1,700,000 | | | | 1,583,125 | |

Series Reg S

8.70%, due 3/1/49 | | | 1,000,000 | | | | 1,006,500 | |

| | | | | | | | |

| | | | | | | 3,234,880 | |

| | | | | | | | |

El Salvador 0.8% | |

El Salvador Government International Bond | | | | | | | | |

Series Reg S

5.875%, due 1/30/25 | | | 89,000 | | | | 73,114 | |

Series Reg S

6.375%, due 1/18/27 (b) | | | 90,000 | | | | 73,036 | |

Series Reg S

7.625%, due 2/1/41 | | | 1,000,000 | | | | 763,510 | |

| | | | | | | | |

| | | | | | | 909,660 | |

| | | | | | | | |

Ghana 1.8% | |

Ghana Government International Bond | | | | | | | | |

Series Reg S

7.875%, due 2/11/35 | | | 1,000,000 | | | | 886,250 | |

Series Reg S

8.627%, due 6/16/49 | | | 1,000,000 | | | | 877,500 | |

Series Reg S

8.95%, due 3/26/51 | | | 250,000 | | | | 224,150 | |

| | | | | | | | |

| | | | | | | 1,987,900 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Honduras 0.3% | | | | | | | | |

Honduras Government International Bond

Series Reg S

5.625%, due 6/24/30 | | $ | 350,000 | | | $ | 385,875 | |

| | | | | | | | |

| | |

Hungary 2.1% | | | | | | | | |

Hungary Government International Bond

5.375%, due 3/25/24 | | | 2,000,000 | | | | 2,292,580 | |

| | | | | | | | |

| | |

India 0.9% | | | | | | | | |

Export-Import Bank of India

Series Reg S

3.375%, due 8/5/26 | | | 1,000,000 | | | | 1,054,340 | |

| | | | | | | | |

|

Indonesia 1.9% | |

Indonesia Government International Bond | | | | | | | | |

3.85%, due 10/15/30 | | | 550,000 | | | | 626,719 | |

5.125%, due 1/15/45 (a) | | | 1,000,000 | | | | 1,254,113 | |

Perusahaan Penerbit SBSN Indonesia III

Series Reg S

3.80%, due 6/23/50 | | | 200,000 | | | | 212,096 | |

| | | | | | | | |

| | | | | | | 2,092,928 | |

| | | | | | | | |

Iraq 0.5% | | | | | | | | |

Iraq International Bond

Series Reg S

6.752%, due 3/9/23 | | | 600,000 | | | | 558,000 | |

| | | | | | | | |

| | |

Ivory Coast 0.5% | | | | | | | | |

Ivory Coast Government International Bond

Series Reg S

5.75%, due 12/31/32 (f) | | | 539,500 | | | | 526,741 | |

| | | | | | | | |

| | |

Jamaica 0.6% | | | | | | | | |

Jamaica Government International Bond

7.875%, due 7/28/45 | | | 500,000 | | | | 651,250 | |

| | | | | | | | |

|

Jordan 2.1% | |

Jordan Government International Bond | | | | | | | | |

Series Reg S

4.95%, due 7/7/25 | | | 1,150,000 | | | | 1,169,134 | |

Series Reg S

5.85%, due 7/7/30 | | | 1,150,000 | | | | 1,157,284 | |

| | | | | | | | |

| | | | | | | 2,326,418 | |

| | | | | | | | |

Kenya 1.8% | |

Kenya Government International Bond | | | | | | | | |

7.25%, due 2/28/28 (a) | | | 200,000 | | | | 209,047 | |

Series Reg S

8.00%, due 5/22/32 | | | 1,500,000 | | | | 1,573,680 | |

Series Reg S

8.25%, due 2/28/48 | | | 200,000 | | | | 204,190 | |

| | | | | | | | |

| | | | | | | 1,986,917 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of Investments October 31, 2020 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Government Bonds (continued) | |

Lebanon 0.1% | | | | | | | | |

Lebanon Government International Bond

Series Reg S

6.85%, due 3/23/27 (d)(e) | | $ | 500,000 | | | $ | 70,596 | |

| | | | | | | | |

| | |

Namibia 0.9% | | | | | | | | |

Namibia International Bonds

Series Reg S

5.25%, due 10/29/25 | | | 1,000,000 | | | | 1,011,470 | |

| | | | | | | | |

| | |

Nigeria 0.4% | | | | | | | | |

Nigeria Government International Bond

6.50%, due 11/28/27 (a) | | | 500,000 | | | | 484,906 | |

| | | | | | | | |

|

Panama 2.3% | |

Panama Government International Bond | | | | | | | | |

2.252%, due 9/29/32 | | | 1,000,000 | | | | 1,017,000 | |

3.87%, due 7/23/60 | | | 1,000,000 | | | | 1,126,260 | |

4.50%, due 4/1/56 | | | 300,000 | | | | 369,000 | |

| | | | | | | | |

| | | | | | | 2,512,260 | |

| | | | | | | | |

Peru 1.0% | | | | | | | | |

Peruvian Government International Bond

2.783%, due 1/23/31 | | | 1,000,000 | | | | 1,081,000 | |

| | | | | | | | |

|

Philippines 4.7% | |

Philippine Government International Bond | | | | | | | | |

3.00%, due 2/1/28 | | | 2,000,000 | | | | 2,193,300 | |

3.70%, due 3/1/41 | | | 600,000 | | | | 686,694 | |

3.75%, due 1/14/29 | | | 2,000,000 | | | | 2,315,060 | |

| | | | | | | | |

| | | | | | | 5,195,054 | |

| | | | | | | | |

Qatar 3.1% | |

Qatar Government International Bond | | | | | | | | |

Series Reg S

3.75%, due 4/16/30 | | | 700,000 | | | | 812,694 | |

Series Reg S

4.817%, due 3/14/49 | | | 1,200,000 | | | | 1,597,980 | |

Series Reg S

5.103%, due 4/23/48 | | | 800,000 | | | | 1,102,912 | |

| | | | | | | | |

| | | | | | | 3,513,586 | |

| | | | | | | | |

Romania 4.1% | |

Romanian Government International Bond | | | | | | | | |

Series Reg S

2.75%, due 2/26/26 | | EUR | 750,000 | | | | 943,978 | |

Series Reg S

3.00%, due 2/14/31 | | $ | 1,210,000 | | | | 1,252,970 | |

Series Reg S

3.375%, due 1/28/50 | | EUR | 180,000 | | | | 217,709 | |

Series Reg S

3.624%, due 5/26/30 (b) | | | 400,000 | | | | 534,062 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Romania (continued) | |

Romanian Government International Bond (continued) | | | | | | | | |

Series Reg S

4.00%, due 2/14/51 | | $ | 770,000 | | | $ | 784,448 | |

Series Reg S

5.125%, due 6/15/48 | | | 500,000 | | | | 602,118 | |

Series Reg S

6.125%, due 1/22/44 | | | 190,000 | | | | 255,594 | |

| | | | | | | | |

| | | | | | | 4,590,879 | |

| | | | | | | | |

Senegal 0.5% | | | | | | | | |

Senegal Government International Bond

Series Reg S

6.25%, due 7/30/24 | | | 500,000 | | | | 526,150 | |

| | | | | | | | |

| | |

South Africa 4.0% | | | | | | | | |

Republic of South Africa Government Bond

8.00%, due 1/31/30 | | ZAR | 18,000,000 | | | | 1,017,116 | |

Republic of South Africa Government International Bond | | | | | | | | |

4.85%, due 9/30/29 | | $ | 500,000 | | | | 495,775 | |

4.875%, due 4/14/26 | | | 1,000,000 | | | | 1,036,300 | |

5.75%, due 9/30/49 | | | 1,000,000 | | | | 900,580 | |

6.25%, due 3/8/41 | | | 1,000,000 | | | | 985,080 | |

| | | | | | | | |

| | | | | | | 4,434,851 | |

| | | | | | | | |

Sri Lanka 1.6% | |

Sri Lanka Government International Bond | | | | | | | | |

Series Reg S

6.20%, due 5/11/27 | | | 200,000 | | | | 105,000 | |

Series Reg S

6.75%, due 4/18/28 | | | 800,000 | | | | 420,000 | |

Series Reg S

6.85%, due 11/3/25 | | | 500,000 | | | | 272,469 | |

Series Reg S

7.55%, due 3/28/30 | | | 1,290,000 | | | | 683,585 | |

Series Reg S

7.85%, due 3/14/29 | | | 500,000 | | | | 267,500 | |

| | | | | | | | |

| | | | | | | 1,748,554 | |

| | | | | | | | |

Tajikistan 0.2% | | | | | | | | |

Republic of Tajikistan International Bond

Series Reg S

7.125%, due 9/14/27 | | | 300,000 | | | | 224,784 | |

| | | | | | | | |

| | |

Tunisia 0.3% | | | | | | | | |

Banque Centrale de Tunisie International Bond

Series Reg S

5.75%, due 1/30/25 | | | 400,000 | | | | 336,842 | |

| | | | | | | | |

| | | | |

| 14 | | MainStay Candriam Emerging Markets Debt Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Government Bonds (continued) | |

Turkey 2.0% | |

Turkey Government International Bond | | | | | | | | |

5.25%, due 3/13/30 | | $ | 600,000 | | | $ | 522,000 | |

5.75%, due 5/11/47 | | | 500,000 | | | | 386,960 | |

6.875%, due 3/17/36 | | | 1,500,000 | | | | 1,376,250 | |

| | | | | | | | |

| | | | | | | 2,285,210 | |

| | | | | | | | |

Ukraine 0.8% | | | | | | | | |

Ukraine Government International Bond

Series Reg S

(zero coupon), due 5/31/40 (g) | | | 1,000,000 | | | | 863,760 | |

| | | | | | | | |

| | |

United Arab Emirates 3.0% | | | | | | | | |

Abu Dhabi Government International Bond

Series Reg S

3.125%, due 9/30/49 | | | 400,000 | | | | 421,400 | |

Dubai DOF Sukuk, Ltd.

Series Reg S

2.763%, due 9/9/30 | | | 900,000 | | | | 899,111 | |

Finance Department Government of Sharjah

Series Reg S

4.00%, due 7/28/50 | | | 800,000 | | | | 796,032 | |

Sharjah Sukuk Program, Ltd. | | | | | | | | |

Series Reg S

2.942%, due 6/10/27 | | | 650,000 | | | | 669,305 | |

Series Reg S

3.234%, due 10/23/29 | | | 550,000 | | | | 570,625 | |

| | | | | | | | |

| | | | | | | 3,356,473 | |

| | | | | | | | |

Uruguay 2.2% | |

Uruguay Government International Bond | | | | | | | | |

5.10%, due 6/18/50 | | | 700,000 | | | | 935,207 | |

7.625%, due 3/21/36 | | | 1,000,000 | | | | 1,557,510 | |

| | | | | | | | |

| | | | | | | 2,492,717 | |

| | | | | | | | |

Venezuela 0.3% | | | | | | | | |

Bollivarian Republic of Venezuela

Series Reg S

9.25%, due 5/7/28 (c)(d)(e) | | | 4,095,000 | | | | 374,693 | |

| | | | | | | | |

Total Foreign Government Bonds

(Cost $81,071,339) | | | | | | | 74,566,041 | |

| | | | | | | | |

Total Long-Term Bonds

(Cost $109,707,431) | | | | | | | 100,453,501 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| Short-Term Investments 6.4% | | | | | | | | |

Affiliated Investment Company 5.2% | | | | | | | | |

MainStay U.S. Government Liquidity Fund, 0.02% (h) | | | 5,821,447 | | | $ | 5,821,447 | |

| | | | | | | | |

| | |

Unaffiliated Investment Company 1.2% | | | | | | | | |

State Street Navigator Securities Lending Government Money Market Portfolio, 0.09% (h)(i) | | | 1,346,253 | | | | 1,346,253 | |

| | | | | | | | |

Total Short-Term Investments

(Cost $7,167,700) | | | | | | | 7,167,700 | |

| | | | | | | | |

Total Investments

(Cost $116,875,131) | | | 96.5 | % | | | 107,621,201 | |

Other Assets, Less Liabilities | | | 3.5 | | | | 3,894,985 | |

Net Assets | | | 100.0 | % | | $ | 111,516,186 | |

| † | Percentages indicated are based on Fund net assets. |

| (a) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (b) | All or a portion of this security was held on loan. As of October 31, 2020, the aggregate market value of securities on loan was $1,379,282. The Fund received cash collateral with a value of $1,346,253 (See Note 2(L)). |

| (c) | Illiquid security—As of October 31, 2020, the total market value of these securities deemed illiquid under procedures approved by the Board of Trustees was $651,693, which represented 0.6% of the Fund’s net assets. (Unaudited) |

| (d) | Issue in non-accrual status. |

| (f) | Step coupon—Rate shown was the rate in effect as of October 31, 2020. |

| (g) | Coupon rate may change based on changes of the underlying collateral or prepayments of principal. Rate shown was the rate in effect as of October 31, 2020. |

| (h) | Current yield as of October 31, 2020. |

| (i) | Represents a security purchased with cash collateral received for securities on loan. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of Investments October 31, 2020 (continued)

Foreign Currency Forward Contracts

As of October 31, 2020, the Fund held the following foreign currency forward contracts1:

| | | | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 2,604,655 | | | EUR | | | 2,200,000 | | | JPMorgan Chase Bank N.A. | | 11/18/20 | | | | | | $ | 41,577 | |

| ZAR | | | 10,000,000 | | | USD | | | 588,989 | | | JPMorgan Chase Bank N.A. | | 11/18/20 | | | | | | | 24,430 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total unrealized Appreciation | | | | | | | | | | | | 66,007 | |

| | | | | | | | | | | | | | | | | | | | | | |

| USD | | | 1,620,598 | | | ZAR | | | 27,000,000 | | | JPMorgan Chase Bank N.A. | | 11/18/20 | | | | | | $ | (35,633 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Total unrealized Depreciation | | | | | | | | | | | | (35,633 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Net unrealized Appreciation | | | | | | | | | | | $ | 30,374 | |

| | | | | | | | | | | | | | | | | | | | | | |

| 1. | Foreign Currency Forward Contracts are subject to limitations such that they cannot be “sold or repurchased,” although the Fund would be able to exit the transaction through other means, such as through the execution of an offsetting transaction. |

The following abbreviations are used in the preceding pages:

EUR—Euro

ZAR—South African Rand

USD—United States Dollar

The following is a summary of the fair valuations according to the inputs used as of October 31, 2020, for valuing the Fund’s assets and liabilities:

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| | | | |

Asset Valuation Inputs | | | | | | | | | | | | | | | | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Long-Term Bonds | | | | | | | | | | | | | | | | |

Corporate Bonds | | $ | — | | | $ | 25,887,460 | | | $ | — | | | $ | 25,887,460 | |

Foreign Government Bonds | | | — | | | | 74,566,041 | | | | — | | | | 74,566,041 | |

| | | | | | | | | | | | | | | | |

| Total Long-Term Bonds | | | — | | | | 100,453,501 | | | | — | | | | 100,453,501 | |

| | | | | | | | | | | | | | | | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

Affiliated Investment Company | | | 5,821,447 | | | | — | | | | — | | | | 5,821,447 | |

Unaffiliated Investment Company | | | 1,346,253 | | | | — | | | | — | | | | 1,346,253 | |

| | | | | | | | | | | | | | | | |

| Total Short-Term Investments | | | 7,167,700 | | | | — | | | | — | | | | 7,167,700 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | | 7,167,700 | | | | 100,453,501 | | | | — | | | | 107,621,201 | |

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Foreign Currency Forward Contracts (b) | | | — | | | | 66,007 | | | | — | | | | 66,007 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities and Other Financial Instruments | | $ | 7,167,700 | | | $ | 100,519,508 | | | $ | — | | | $ | 107,687,208 | |

| | | | | | | | | | | | | | | | |

| | | | |

Liability Valuation Inputs | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

Foreign Currency Forward Contracts (b) | | $ | — | | | $ | (35,633 | ) | | $ | — | | | $ | (35,633 | ) |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

| | | | |

| 16 | | MainStay Candriam Emerging Markets Debt Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of October 31, 2020

| | | | |

| Assets | | | | |

Investment in unaffiliated securities, at value

(identified cost $111,053,684) including securities on loan of $1,379,282 | | $ | 101,799,754 | |

Investment in affiliated investment company, at value (identified cost $5,821,447) | | | 5,821,447 | |

Cash at broker | | | 1,414,610 | |

Cash denominated in foreign currencies

(identified cost $1,067,506) | | | 1,055,586 | |

Receivables: | | | | |

Investment securities sold | | | 2,141,866 | |

Dividends and interest | | | 1,490,111 | |

Fund shares sold | | | 214,515 | |

Securities lending | | | 420 | |

Unrealized appreciation on foreign currency forward contracts | | | 66,007 | |

Other assets | | | 37,901 | |

| | | | |

Total assets | | | 114,042,217 | |

| | | | |

| |

| Liabilities | | | | |

Cash collateral received for securities on loan | | | 1,346,253 | |

Payables: | | | | |

Investment securities purchased | | | 571,614 | |

Fund shares redeemed | | | 391,746 | |

Manager (See Note 3) | | | 47,533 | |

Transfer agent (See Note 3) | | | 37,998 | |

NYLIFE Distributors (See Note 3) | | | 27,990 | |

Professional fees | | | 21,645 | |

Shareholder communication | | | 20,236 | |

Custodian | | | 4,849 | |

Trustees | | | 152 | |

Accrued expenses | | | 2,327 | |

Unrealized depreciation on foreign currency forward contracts | | | 35,633 | |

Dividend payable | | | 18,055 | |

| | | | |

Total liabilities | | | 2,526,031 | |

| | | | |

Net assets | | $ | 111,516,186 | |

| | | | |

| |

| Composition of Net Assets | | | | |

Shares of beneficial interest outstanding (par value of $.01 per share) unlimited number of shares authorized | | $ | 113,700 | |

Additional paid-in capital | | | 134,102,073 | |

| | | | |

| | | 134,215,773 | |

Total distributable earnings (loss) | | | (22,699,587 | ) |

| | | | |

Net assets | | $ | 111,516,186 | |

| | | | |

| | | | |

Class A | | | | |

Net assets applicable to outstanding shares | | $ | 82,873,755 | |

| | | | |

Shares of beneficial interest outstanding | | | 8,449,513 | |

| | | | |

Net asset value per share outstanding | | $ | 9.81 | |

Maximum sales charge (4.50% of offering price) | | | 0.46 | |

| | | | |

Maximum offering price per share outstanding | | $ | 10.27 | |

| | | | |

Investor Class | | | | |

Net assets applicable to outstanding shares | | $ | 13,801,413 | |

| | | | |

Shares of beneficial interest outstanding | | | 1,392,340 | |

| | | | |

Net asset value per share outstanding | | $ | 9.91 | |

Maximum sales charge (4.00% of offering price) | | | 0.41 | |

| | | | |

Maximum offering price per share outstanding | | $ | 10.32 | |

| | | | |

Class B | | | | |

Net assets applicable to outstanding shares | | $ | 1,788,830 | |

| | | | |

Shares of beneficial interest outstanding | | | 186,135 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 9.61 | |

| | | | |

Class C | | | | |

Net assets applicable to outstanding shares | | $ | 6,364,700 | |

| | | | |

Shares of beneficial interest outstanding | | | 661,247 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 9.63 | |

| | | | |

Class I | | | | |

Net assets applicable to outstanding shares | | $ | 6,687,488 | |

| | | | |

Shares of beneficial interest outstanding | | | 680,779 | |

| | | | |

Net asset value and offering price per share outstanding | | $ | 9.82 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Statement of Operations for the year ended October 31, 2020

| | | | |

| Investment Income (Loss) | | | | |

Income | | | | |

Interest (a) | | $ | 7,172,280 | |

Dividends-affiliated | | | 18,885 | |

Securities lending | | | 7,336 | |

Other | | | 11,269 | |

| | | | |

Total income | | | 7,209,770 | |

| | | | |

Expenses | | | | |

Manager (See Note 3) | | | 858,687 | |

Distribution/Service—Class A (See Note 3) | | | 215,242 | |

Distribution/Service—Investor Class (See Note 3) | | | 36,512 | |

Distribution/Service—Class B (See Note 3) | | | 21,553 | |

Distribution/Service—Class C (See Note 3) | | | 87,474 | |

Transfer agent (See Note 3) | | | 246,298 | |

Professional fees | | | 95,797 | |

Registration | | | 87,937 | |

Custodian | | | 59,105 | |

Shareholder communication | | | 31,110 | |

Trustees | | | 2,916 | |

Miscellaneous | | | 26,938 | |

| | | | |

Total expenses before waiver/reimbursement | | | 1,769,569 | |

Expense waiver/reimbursement from Manager (See Note 3) | | | (206,021 | ) |

| | | | |

Net expenses | | | 1,563,548 | |

| | | | |

Net investment income (loss) | | | 5,646,222 | |

| | | | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) on: | | | | |

Unaffiliated investment transactions | | | (4,174,202 | ) |

Futures transactions | | | (84,740 | ) |

Foreign currency forward transactions | | | (34,327 | ) |

Foreign currency transactions | | | (215,650 | ) |

| | | | |

Net realized gain (loss) | | | (4,508,919 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Unaffiliated investments | | | (6,100,159 | ) |

Foreign currency forward contracts | | | 30,374 | |

Translation of other assets and liabilities in foreign currencies | | | (53,069 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (6,122,854 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | (10,631,773 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (4,985,551 | ) |

| | | | |

| (a) | Interest recorded net of foreign withholding taxes in the amount of $1,648. |

| | | | |

| 18 | | MainStay Candriam Emerging Markets Debt Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statements of Changes in Net Assets

for the years ended October 31, 2020 and October 31, 2019

| | | | | | | | |

| | | 2020 | | | 2019 | |

| Increase (Decrease) in Net Assets | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 5,646,222 | | | $ | 6,768,376 | |

Net realized gain (loss) | | | (4,508,919 | ) | | | 3,689,881 | |

Net change in unrealized appreciation (depreciation) | | | (6,122,854 | ) | | | 6,599,282 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (4,985,551 | ) | | | 17,057,539 | |

| | | | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (3,904,404 | ) | | | (4,410,178 | ) |

Investor Class | | | (606,354 | ) | | | (730,210 | ) |

Class B | | | (75,657 | ) | | | (121,596 | ) |

Class C | | | (304,393 | ) | | | (581,845 | ) |

Class I | | | (515,800 | ) | | | (1,065,235 | ) |

| | | | |

Total distributions to shareholders | | | (5,406,608 | ) | | | (6,909,064 | ) |

| | | | |

Capital share transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 12,038,594 | | | | 101,839,510 | |

Net asset value of shares issued to shareholders in reinvestment of distributions | | | 5,139,994 | | | | 6,590,775 | |

Cost of shares redeemed | | | (35,678,634 | ) | | | (113,866,471 | ) |

| | | | |

Increase (decrease) in net assets derived from capital share transactions | | | (18,500,046 | ) | | | (5,436,186 | ) |

| | | | |

Net increase (decrease) in net assets | | | (28,892,205 | ) | | | 4,712,289 | |

| | |

| Net Assets | | | | | | | | |

Beginning of year | | | 140,408,391 | | | | 135,696,102 | |

| | | | |

End of year | | $ | 111,516,186 | | | $ | 140,408,391 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year ended October 31, | |

| | | | | |

| Class A | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value at beginning of year | | $ | 10.46 | | | $ | 9.71 | | | $ | 10.88 | | | $ | 10.52 | | | $ | 9.60 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) (a) | | | 0.47 | | | | 0.49 | | | | 0.45 | | | | 0.53 | | | | 0.57 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | (0.65 | ) | | | 0.76 | | | | (1.19 | ) | | | 0.31 | | | | 0.87 | |

| | | | | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | (0.02 | ) | | | 0.00 | ‡ | | | (0.00 | )‡ | | | (0.01 | ) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | (0.20 | ) | | | 1.25 | | | | (0.74 | ) | | | 0.83 | | | | 1.45 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | | (0.45 | ) | | | (0.50 | ) | | | (0.43 | ) | | | (0.36 | ) | | | (0.29 | ) |

| | | | | |

Return of capital | | | — | | | | — | | | | — | | | | (0.11 | ) | | | (0.24 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (0.45 | ) | | | (0.50 | ) | | | (0.43 | ) | | | (0.47 | ) | | | (0.53 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value at end of year | | $ | 9.81 | | | $ | 10.46 | | | $ | 9.71 | | | $ | 10.88 | | | $ | 10.52 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total investment return (b) | | | (1.80 | %) | | | 13.05 | % | | | (6.95 | %) | | | 8.18 | % | | | 15.63 | % |

| | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) | | | 4.70 | % | | | 4.78 | % | | | 4.36 | % | | | 5.04 | % | | | 5.70 | %(c) |

| | | | | |

Net expenses (d) | | | 1.17 | % | | | 1.23 | % | | | 1.26 | % | | | 1.22 | % | | | 1.22 | %(e) |

| | | | | |

Expenses (before waiver/reimbursement) (d) | | | 1.33 | % | | | 1.26 | % | | | 1.26 | % | | | 1.22 | % | | | 1.22 | % |

| | | | | |

Portfolio turnover rate | | | 102 | % | | | 102 | % | | | 44 | % | | | 37 | % | | | 38 | % |

| | | | | |

Net assets at end of year (in 000’s) | | $ | 82,874 | | | $ | 93,472 | | | $ | 86,452 | | | $ | 110,238 | | | $ | 109,657 | |

| ‡ | Less than one cent per share. |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of distributions. For periods of less than one year, total return is not annualized. |

| (c) | Without the custody fee reimbursement, net investment income (loss) would have been 5.69%. |

| (d) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | Without the custody fee reimbursement, net expenses would have been 1.23%. |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year ended October 31, | |

| | | | | |

| Investor Class | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value at beginning of year | | $ | 10.57 | | | $ | 9.80 | | | $ | 10.98 | | | $ | 10.61 | | | $ | 9.68 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) (a) | | | 0.44 | | | | 0.47 | | | | 0.43 | | | | 0.52 | | | | 0.55 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | (0.66 | ) | | | 0.77 | | | | (1.20 | ) | | | 0.31 | | | | 0.88 | |

| | | | | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | (0.02 | ) | | | 0.00 | ‡ | | | (0.00 | )‡ | | | (0.01 | ) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | (0.24 | ) | | | 1.24 | | | | (0.77 | ) | | | 0.82 | | | | 1.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | | (0.42 | ) | | | (0.47 | ) | | | (0.41 | ) | | | (0.35 | ) | | | (0.27 | ) |

| | | | | |

Return of capital | | | — | | | | — | | | | — | | | | (0.10 | ) | | | (0.24 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (0.42 | ) | | | (0.47 | ) | | | (0.41 | ) | | | (0.45 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value at end of year | | $ | 9.91 | | | $ | 10.57 | | | $ | 9.80 | | | $ | 10.98 | | | $ | 10.61 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total investment return (b) | | | (2.20 | %) | | | 12.82 | % | | | (7.18 | %) | | | 7.99 | % | | | 15.38 | % |

| | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) | | | 4.38 | % | | | 4.50 | % | | | 4.15 | % | | | 4.86 | % | | | 5.50 | %(c) |

| | | | | |

Net expenses (d) | | | 1.49 | % | | | 1.52 | % | | | 1.47 | % | | | 1.42 | % | | | 1.42 | %(e) |

| | | | | |

Expenses (before waiver/reimbursement) (d) | | | 1.66 | % | | | 1.56 | % | | | 1.49 | % | | | 1.42 | % | | | 1.42 | % |

| | | | | |

Portfolio turnover rate | | | 102 | % | | | 102 | % | | | 44 | % | | | 37 | % | | | 38 | % |

| | | | | |

Net assets at end of year (in 000’s) | | $ | 13,801 | | | $ | 16,024 | | | $ | 15,911 | | | $ | 18,613 | | | $ | 32,318 | |

| ‡ | Less than one cent per share. |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of distributions. For periods of less than one year, total return is not annualized. |

| (c) | Without the custody fee reimbursement, net investment income (loss) would have been 5.49%. |

| (d) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | Without the custody fee reimbursement, net expenses would have been 1.43%. |

| | | | |

| 20 | | MainStay Candriam Emerging Markets Debt Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year ended October 31, | |

| | | | | |

| Class B | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value at beginning of year | | $ | 10.26 | | | $ | 9.52 | | | $ | 10.69 | | | $ | 10.34 | | | $ | 9.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) (a) | | | 0.36 | | | | 0.38 | | | | 0.34 | | | | 0.43 | | | | 0.47 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | (0.64 | ) | | | 0.75 | | | | (1.18 | ) | | | 0.30 | | | | 0.86 | |

| | | | | |

Net realized and unrealized gain (loss) on foreign currency transactions | | | (0.02 | ) | | | 0.00 | ‡ | | | 0.00 | ‡ | | | (0.01 | ) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | (0.30 | ) | | | 1.13 | | | | (0.84 | ) | | | 0.72 | | | | 1.34 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | | (0.35 | ) | | | (0.39 | ) | | | (0.33 | ) | | | (0.29 | ) | | | (0.20 | ) |

| | | | | |

Return of capital | | | — | | | | — | | | | — | | | | (0.08 | ) | | | (0.24 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (0.35 | ) | | | (0.39 | ) | | | (0.33 | ) | | | (0.37 | ) | | | (0.44 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value at end of year | | $ | 9.61 | | | $ | 10.26 | | | $ | 9.52 | | | $ | 10.69 | | | $ | 10.34 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total investment return (b) | | | (2.91 | %) | | | 12.04 | % | | | (7.98 | %) | | | 7.20 | % | | | 14.60 | % |

| | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss) | | | 3.66 | % | | | 3.76 | % | | | 3.37 | % | | | 4.11 | % | | | 4.78 | %(c) |

| | | | | |

Net expenses (d) | | | 2.24 | % | | | 2.27 | % | | | 2.22 | % | | | 2.17 | % | | | 2.17 | %(e) |

| | | | | |

Expenses (before waiver/reimbursement) (d) | | | 2.40 | % | | | 2.31 | % | | | 2.24 | % | | | 2.17 | % | | | 2.17 | % |

| | | | | |

Portfolio turnover rate | | | 102 | % | | | 102 | % | | | 44 | % | | | 37 | % | | | 38 | % |

| | | | | |

Net assets at end of year (in 000’s) | | $ | 1,789 | | | $ | 2,663 | | | $ | 3,660 | | | $ | 6,012 | | | $ | 7,506 | |

| ‡ | Less than one cent per share. |